UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number 811-5018 |

Smith Barney Investment Series

|

| (Exact name of registrant as specified in charter) |

| | |

| 125 Broad Street, New York, NY 10004 |

| (Address of principal executive offices) (Zip code) |

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place, 4th Floor

Stamford, CT 06902

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: October 31

Date of reporting period: October 31, 2005

| ITEM 1. | REPORT TO STOCKHOLDERS. |

| | The Annual Report to Stockholders is filed herewith. |

EXPERIENCE

ANNUAL REPORT

OCTOBER 31, 2005

Smith Barney

International Fund

INVESTMENT PRODUCTS: NOT FDIC INSURED Ÿ NO BANK GUARANTEE Ÿ MAY LOSE VALUE

Smith Barney International Fund

Annual Report • October 31, 2005

What’s

Inside

Fund Objective

The Fund seeks long-term capital growth. Dividend income, if any, is incidental to this goal. It seeks to achieve this objective by investing primarily in the common stocks of foreign companies that the Fund’s manager believes have above-average prospects for growth, including companies in emerging markets.

Under a licensing agreement between Citigroup and Legg Mason, the names of funds, the names of any classes of shares of funds, and the names of investment advisers of funds, as well as all logos, trademarks and service marks related to Citigroup or any of its affiliates (“Citi Marks”) are licensed for use by Legg Mason. CitiMarks include, but are not limited to, “Smith Barney,” “Salomon Brothers,” “Citi,” “Citigroup Asset Management,” and “Davis Skaggs Investment Management”. Legg Mason and its affiliates, as well as the Fund’s investment manager, are not affiliated with Citigroup.

All Citi Marks are owned by Citigroup, and are licensed for use until no later than one year after the date of the licensing agreement.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

The U.S. economy was surprisingly resilient during the fiscal year. While surging oil prices, rising interest rates, and the impact of Hurricanes Katrina and Rita threatened to derail the economic expansion, growth remained solid throughout the period. After a 3.3% advance in the second quarter of 2005, third quarter gross domestic product (“GDP”)i growth grew to 4.3%, marking the tenth consecutive quarter in which GDP growth grew 3.0% or more.

As expected, the Federal Reserve Board (“Fed”)ii continued to raise interest rates in an attempt to ward off inflation. After raising rates three times from June 2004 through September 2004, the Fed increased its target for the federal funds rateiii in 0.25% increments eight additional times over the reporting period. The Fed again raised rates in early November, after the Fund’s reporting period had ended. All told, the Fed’s twelve rate hikes have brought the target for the federal funds rate from 1.00% to 4.00%. This represents the longest sustained Fed tightening cycle since 1976-1979.

During the 12-month period covered by this report, the U.S. stock market generated solid results, with the S&P 500 Indexiv returning 8.72%. Generally positive economic news, relatively benign core inflation, and strong corporate profits supported the market during much of the period.

Looking at the fiscal year as a whole, mid-cap stocks generated superior returns, with the Russell Midcapv, Russell 1000vi, and Russell 2000vii Indexes returning 18.09%, 10.47%, and 12.08%, respectively. From a market style perspective, value-oriented stocks significantly outperformed their growth counterparts, with the Russell 3000 Valueviii and Russell 3000 Growthix Indexes returning 11.96% and 8.99%, respectively.

Smith Barney International Fund 1

Please read on for a more detailed look at prevailing economic and market conditions during the Fund’s fiscal year and to learn how those conditions have affected Fund performance.

Special Shareholder Notice

On December 1, 2005, Citigroup Inc. (“Citigroup”) completed the sale of substantially all of its asset management business, Citigroup Asset Management (“CAM”), to Legg Mason, Inc. (“Legg Mason”). As a result, the Fund’s investment manager (the “Manager”), previously an indirect wholly-owned subsidiary of Citigroup, has become a wholly-owned subsidiary of Legg Mason. Completion of the sale caused the Fund’s existing investment management contract and sub-advisory contract to terminate. The Fund’s shareholders approved a new investment management contract between the Fund and the Manager (and a new sub-advisory contract) which became effective on December 19, 2005.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Fund’s Manager and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the Manager and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Fund and its Manager with regard to recent regulatory developments is contained in the Notes to Financial Statements included in this report.

2 Smith Barney International Fund

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

December 1, 2005

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

| i | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| ii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iv | | The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. Please note that an investor cannot invest directly in an index. |

| v | | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index whose average market capitalization was approximately $4.7 billion as of 6/24/05. |

| vi | | The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. |

| vii | | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. |

| viii | | The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| ix | | The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

Smith Barney International Fund 3

Manager Overview

Q. What were the overall market conditions during the Fund’s reporting period?

A. During the period, returns from the international stock markets were strong in local terms but these gains were tempered for U.S. investors due to the weakness of the yen and euro versus the dollar. Japan was the best performing region for the period overall. Its market rallied sharply during the summer of 2005 when the Liberal Democratic Party secured a landslide election victory and overseas investors stepped up their purchases of Japanese equities. The scale of Prime Minister Koizumi’s victory has expected to make it possible for the government to implement more radical reforms than it previously achieved. In addition, economic data signaled that deflation has come to an end in Japan, which also boosted investor confidence. The stock markets in Europe were also strong. The decline in the value of the euro helped the region’s exporters, while high oil prices led to a rise in many energy-related stocks. The steady improvement in macroeconomic data, combined with a resurgence in merger and acquisition activity towards the end of the period, also supported European equities.

Performance Review

For the 12 months ended October 31, 2005, Class A shares of the Smith Barney International Fund, excluding sales charges, returned 13.88%. These shares underperformed the Lipper International Multi-Cap Growth Funds Category Average1, which increased 17.54%. The Fund’s unmanaged benchmark, the MSCI EAFE Indexi, returned 18.09% for the same period.

| 1 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 180 funds in the Fund’s Lipper category, and excluding sales charges. |

4 Smith Barney International Fund 2005 Annual Report

| | | | |

| Fund Performance as of October 31, 2005 (excluding sales charges) (unaudited) |

| | |

| | | 6 Months | | 12 Months |

| | | | | |

International Fund — Class A Shares | | 6.59% | | 13.88% |

|

MSCI EAFE Index | | 8.63% | | 18.09% |

|

Lipper International Multi-Cap Growth Funds Category Average | | 9.68% | | 17.54% |

|

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com. |

| Current reimbursements and/or fee waivers are voluntary, and may be reduced or terminated at any time. Absent these reimbursements or waivers, the performance would have been lower. |

| All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on Fund distributions. Excluding sales charges, Class 1 shares returned 6.71%, Class B shares returned 6.23% and Class C shares returned 6.34% over the six months ended October 31, 2005. Excluding sales charges, Class 1 shares returned 14.18%, Class B shares returned 13.05% and Class C shares returned 13.43% over the twelve months ended October 31, 2005. |

| Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the period ended October 31, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 188 funds for the six-month period and among the 180 funds for the 12-month period in the Fund’s Lipper category and excluding sales charges. |

Q. What were the most significant factors affecting Fund performance?

What were the leading contributors to performance?

A. During the reporting period, the leading contributors to the Fund were in the telecommunication services and utilities sectors. In utilities, we held German utilities RWE AG and E.On AG, both of which performed extremely well. We subsequently reduced our positions due to their high valuations. The Fund’s holding in Spanish utility Endesa SA also enhanced results as its share price was boosted by a takeover bid from Gas Natural. In telecommunications services, we successfully identified companies whose valuations reflected their ability to preserve their cash flows. Examples of holdings in this area that aided the Fund were Telenor ASA, Koninklijke KPN NV and TDC A/S. Elsewhere, in the consumer staples sector, British American Tobacco PLC performed well, due to its large cash generation and execution on its margin expansion targets. In energy, the Fund’s holding in Eni SpA was a leading contributor to performance. In Japan, the Fund benefited from several holdings that saw price appreciation, including industrial conglomerate Mitsubishi Electric Corp., which experienced strong demand for its factory automation products from China. In addition, the company is seeing its margins increase as a result of restructuring some of its lower margin businesses. Similarly, Sumitomo Corp. benefited from its exposure to commodities and energy related projects, as well as improving investor demand for Japanese stocks.

Smith Barney International Fund 2005 Annual Report 5

What were the leading detractors from performance?

A. In consumer staples, the Fund’s position in German retailer Metro AG hurt performance, as a result of weak German consumer confidence and a more competitive domestic environment. In financials, the Fund was underweight Japanese banks, which were very strong performers over the period. However, this was somewhat mitigated by the Fund’s holding in Mitsui Sumitomo Insurance Co., Ltd., which generated solid results. In information technology, the Fund’s exposure to Nintendo Co., Ltd. and Ricoh Co., Ltd. were detrimental to performance as their profits lagged due to a more competitive environment for their products. In materials, the Fund was underweight in mining stocks, which were boosted by the sharp rise in the price of coal, iron ore, and other commodities. Additionally, the Fund’s exposure to lower valuation basic materials stocks had a detrimental effect on performance as their profits, overall, were weak.

Q. Were there any significant changes to the Fund during the reporting period?

A. While there were changes to the portfolio over the reporting period, our overall investment strategy remained the same.

Thank you for your investment in the Smith Barney International Fund. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

The International Portfolio Management Team

December 1, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: Vodafone Group PLC (3.8%), Eni SpA (3.0%), Mitsui Sumitomo Insurance Co. Ltd. (3.0%), Total SA (2.8%), BP PLC (2.7%), BNP Paribas SA (2.6%), Australia & New Zealand Banking Group Ltd. (2.4%), Credit Agricole SA (2.2%), Credit Suisse Group (2.1%) and Royal Bank of Scotland Group PLC (2.1%). Please refer to pages 12 through 14 for a list and percentage breakdown of the Fund’s holdings.

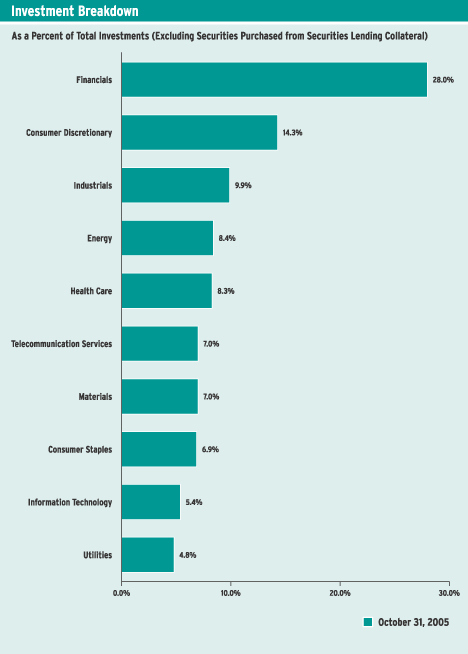

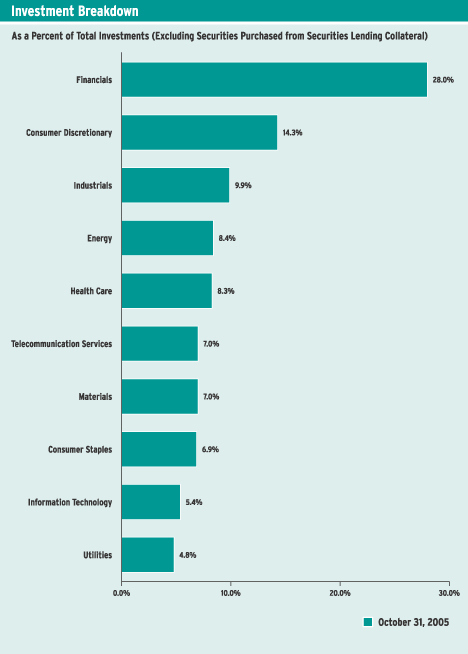

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Financials (28.1%), Consumer Discretionary (14.3%), Industrials (9.9%), Energy (8.4%) and Health Care (8.3%). The Fund’s portfolio composition is subject to change at any time.

RISKS: Keep in mind that the Fund is subject to risks associated with overseas investing, which could result in significant market fluctuations. These risks include currency fluctuations, changes in political and economic conditions, differing securities regulations and periods of illiquidity, and are heightened for investments in the securities of issuers located in emerging markets. These risks are magnified in emerging markets. The Fund may engage in active and frequent trading, resulting in increased transaction costs, which could detract from the Fund’s performance. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an Index.

| i | | The MSCI EAFE Index is an unmanaged index of common stocks of companies located in Europe, Australasia and the Far East. |

6 Smith Barney International Fund 2005 Annual Report

Fund at a Glance (unaudited)

Smith Barney International Fund 2005 Annual Report 7

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on May 1, 2005 and held for the six months ended October 31, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) |

| | | | | |

| | | Actual Total Return Without Sales Charges(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses Paid During the Period(3) |

Class 1 | | 6.71 | % | | $ | 1,000.00 | | $ | 1,067.10 | | 1.74 | % | | $ | 9.07 |

|

Class A | | 6.59 | | | | 1,000.00 | | | 1,065.90 | | 2.00 | | | | 10.41 |

|

Class B | | 6.23 | | | | 1,000.00 | | | 1,062.30 | | 2.75 | | | | 14.29 |

|

Class C | | 6.34 | | | | 1,000.00 | | | 1,063.40 | | 2.46 | | | | 12.79 |

|

| (1) | | For the six months ended October 31, 2005. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class 1 and A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses (net of voluntary expense reimbursements) are equal to each class’ respective annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

8 Smith Barney International Fund 2005 Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

Class 1 | | 5.00 | % | | $ | 1,000.00 | | $ | 1,016.43 | | 1.74 | % | | $ | 8.84 |

|

Class A | | 5.00 | | | | 1,000.00 | | | 1,015.12 | | 2.00 | | | | 10.16 |

|

Class B | | 5.00 | | | | 1,000.00 | | | 1,011.34 | | 2.75 | | | | 13.94 |

|

Class C | | 5.00 | | | | 1,000.00 | | | 1,012.80 | | 2.46 | | | | 12.48 |

|

| (1) | | For the six months ended October 31, 2005. |

| (2) | | Expenses (net of voluntary expense reimbursements) are equal to each class’ respective annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Smith Barney International Fund 2005 Annual Report 9

Fund Performance

| | | | | | | | | | | | |

| Average Annual Total Returns(1) (unaudited) | | | | | | | |

| |

| | | Without Sales Charges(2)

| |

| | | Class 1 | | | Class A | | | Class B | | | Class C | |

Twelve Months Ended 10/31/05 | | 14.18 | % | | 13.88 | % | | 13.05 | % | | 13.43 | % |

|

|

Five Years Ended 10/31/05 | | (10.78 | ) | | (11.31 | ) | | (12.06 | ) | | (11.20 | ) |

|

|

Ten Years Ended 10/31/05 | | N/A | | | 5.28 | | | 4.45 | | | N/A | |

|

|

Inception* through 10/31/05 | | 4.59 | | | 6.46 | | | 5.62 | | | (12.70 | ) |

|

|

| |

| | | With Sales Charges(3)

| |

| | | Class 1 | | | Class A | | | Class B | | | Class C | |

Twelve Months Ended 10/31/05 | | 4.47 | % | | 8.21 | % | | 8.05 | % | | 12.43 | % |

|

|

Five Years Ended 10/31/05 | | (12.35 | ) | | (12.22 | ) | | (12.24 | ) | | (11.20 | ) |

|

|

Ten Years Ended 10/31/05 | | N/A | | | 4.74 | | | 4.45 | | | N/A | |

|

|

Inception* through 10/31/05 | | 3.59 | | | 5.94 | | | 5.62 | | | (12.70 | ) |

|

|

| | | | | | | | | | | |

| Cumulative Total Returns(1) (unaudited) | | | | | | | | | |

| |

| | | Without Sales Charges(2) |

Class 1 (Inception* through 10/31/05) | | | | | | 51.36 | % | | | | |

|

Class A (10/31/95 through 10/31/05) | | | | | | 67.21 | | | | | |

|

Class B (10/31/95 through 10/31/05) | | | | | | 54.52 | | | | | |

|

Class C(3) (Inception* through 10/31/05) | | | | | | (50.18 | ) | | | | |

|

| (1) | | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of Fund shares. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class 1 and A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. |

| (3) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class 1 and A shares reflect the deduction of the maximum initial sales charges of 8.50% and, 5.00%, respectively. Class B shares reflect the deduction of a 5.00% CDSC, which applies if shares are redeemed within one year from purchase payment. Thereafter, the CDSC declines by 1.00% per year until no CDSC is incurred. Class C shares reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| * | | Inception date for Class 1 shares is August 8, 1996. Inception date for Class A and B shares is March 17, 1995. Inception date for Class C shares is September 13, 2000. |

10 Smith Barney International Fund 2005 Annual Report

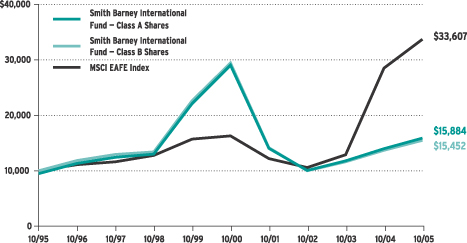

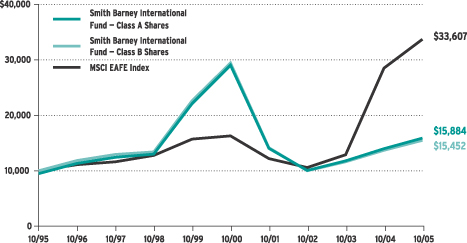

Historical Performance (unaudited)

Value of $10,000 Invested in Class A and B Shares of the Smith Barney International Fund vs. MSCI EAFE Index† (October 1995 — October 2005)

| † | | Hypothetical illustration of $10,000 invested in Class A and B shares on October 31, 1995, assuming deduction of the maximum 5.00% sales charge at the time of investment for Class A shares. It also assumes reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2005. The Morgan Stanley Capital International Europe, Australasia and the Far East Index (“MSCI EAFE”) is a composite portfolio consisting of equity total returns for the countries of Europe, Australasia and the Far East. The Index is unmanaged and is not subject to the same management and trading expenses of a mutual fund. The performance of the Fund’s other classes may be greater or less than the performance of Class A and B shares as indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

All figures represent past performance and are not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower.

Smith Barney International Fund 2005 Annual Report 11

Schedule of Investments (October 31, 2005)

SMITH BARNEY INTERNATIONAL FUND

| | | | | |

| | |

| Shares | | Security | | Value |

| COMMON STOCKS — 100.3% |

| Australia† — 3.2% | | | |

| 163,371 | | Australia & New Zealand Banking Group Ltd. | | $ | 2,885,425 |

| 35,414 | | National Australia Bank Ltd. (a) | | | 876,396 |

|

| | | Total Australia | | | 3,761,821 |

|

| Belgium† — 0.7% | | | |

| 27,476 | | Fortis (a) | | | 783,026 |

|

| Denmark† — 0.4% | | | |

| 8,500 | | TDC A/S | | | 476,190 |

|

| Finland† — 3.3% | | | |

| 73,720 | | Nokia Oyj | | | 1,238,113 |

| 106,058 | | Stora Enso Oyj, Class R Shares | | | 1,358,878 |

| 70,317 | | UPM-Kymmene Oyj | | | 1,359,008 |

|

| | | Total Finland | | | 3,955,999 |

|

| France — 11.7% | | | |

| 16,993 | | Accor SA (a)† | | | 848,802 |

| 40,510 | | BNP Paribas SA (a)† | | | 3,073,943 |

| 87,181 | | Credit Agricole SA (a)† | | | 2,557,351 |

| 11,690 | | European Aeronautic Defence & Space Co. | | | 405,091 |

| 27,590 | | France Telecom SA (a)† | | | 717,816 |

| 20,840 | | Peugeot SA (a)† | | | 1,266,362 |

| 12,323 | | Pinault Printemps Redoute SA (a)† | | | 1,295,724 |

| 4,913 | | Schneider Electric SA (a)† | | | 403,762 |

| 13,013 | | Total SA (a)† | | | 3,279,679 |

|

| | | Total France | | | 13,848,530 |

|

| Germany† — 8.5% | | | |

| 21,850 | | Altana AG (a) | | | 1,231,933 |

| 34,931 | | Bayer AG (a) | | | 1,213,888 |

| 38,367 | | DaimlerChrysler AG (a) | | | 1,922,415 |

| 14,603 | | Deutsche Bank AG (a) | | | 1,368,883 |

| 69,381 | | Epcos AG (a)* | | | 837,965 |

| 35,448 | | Metro AG | | | 1,613,610 |

| 30,764 | | Schering AG | | | 1,902,362 |

|

| | | Total Germany | | | 10,091,056 |

|

| Hong Kong† — 0.7% | | | |

| 193,000 | | Henderson Land Development Co., Ltd. | | | 862,162 |

|

| Ireland† — 0.2% | | | |

| 12,505 | | Allied Irish Banks PLC | | | 262,101 |

|

| Italy† — 5.4% | | | |

| 130,626 | | Eni SpA (a) | | | 3,496,902 |

| 20,392 | | Fondiaria Sai Spa | | | 564,224 |

| 49,182 | | Indesit Co. (a) | | | 531,060 |

| 122,077 | | SanPaolo IMI SpA (a) | | | 1,762,257 |

|

| | | Total Italy | | | 6,354,443 |

|

See Notes to Financial Statements.

12 Smith Barney International Fund 2005 Annual Report

Schedule of Investments (October 31, 2005) (continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| Japan† — 24.2% | | | |

| 43,000 | | Bridgestone Corp. | | $ | 880,394 |

| 22,000 | | Canon Inc. | | | 1,164,608 |

| 29,000 | | Daiichi Sankyo* | | | 525,823 |

| 97 | | East Japan Railway Co. | | | 578,409 |

| 32,700 | | Fuji Photo Film Co., Ltd. | | | 1,044,559 |

| 108,000 | | Fujitsu Ltd. | | | 716,094 |

| 20,700 | | Honda Motor Co., Ltd. | | | 1,150,071 |

| 89,000 | | Itochu Corp (a) | | | 611,866 |

| 63,000 | | Kao Corp. | | | 1,505,049 |

| 58,000 | | Koyo Seiko Co (a) | | | 934,508 |

| 284,000 | | Mitsubishi Electric Corp. (a) | | | 1,709,230 |

| 270,000 | | Mitsui Sumitomo Insurance Co., Ltd. | | | 3,487,041 |

| 9,700 | | Nintendo Co., Ltd. | | | 1,089,172 |

| 124,000 | | Nippon Steel Corp. (a) | | | 442,178 |

| 321 | | NTT DoCoMo Inc. | | | 555,825 |

| 3,300 | | Obic Co., Ltd. (a) | | | 539,253 |

| 41,200 | | Pioneer Corp. (a) | | | 518,942 |

| 89,000 | | Ricoh Co., Ltd. | | | 1,410,513 |

| 162,000 | | Sumitomo Chemical Co., Ltd. (a) | | | 956,701 |

| 155,000 | | Sumitomo Corp. | | | 1,744,907 |

| 39,000 | | Takeda Pharmaceutical Co., Ltd. | | | 2,145,259 |

| 16,850 | | Takefuji Corp. | | | 1,184,538 |

| 24,000 | | THK Co., Ltd. (a) | | | 544,221 |

| 48,000 | | Toppan Printing Co., Ltd. (a) | | | 463,998 |

| 41,100 | | Toyota Motor Corp. | | | 1,908,781 |

| 199 | | West Japan Railway Co. | | | 707,685 |

|

| | | Total Japan | | | 28,519,625 |

|

| Luxembourg† — 1.6% | | | |

| 77,303 | | Arcelor (a) | | | 1,837,185 |

|

| Netherlands† — 4.4% | | | |

| 15,898 | | DSM NV | | | 571,296 |

| 13,386 | | ING Groep NV, CVA | | | 386,382 |

| 148,166 | | Koninklijke KPN NV | | | 1,406,872 |

| 82,271 | | TNT NV | | | 1,943,730 |

| 13,143 | | Unilever NV, CVA (a) | | | 925,802 |

|

| | | Total Netherlands | | | 5,234,082 |

|

| Norway† — 0.6% | | | |

| 68,600 | | Telenor ASA | | | 671,060 |

|

| Spain† — 1.4% | | | |

| 64,334 | | Endesa SA (a) | | | 1,601,468 |

|

| Switzerland† — 8.1% | | | |

| 41,628 | | Clariant AG* | | | 555,242 |

| 57,271 | | Credit Suisse Group | | | 2,532,411 |

| 6,603 | | Nestle SA (a) | | | 1,964,644 |

| 5,956 | | Swiss Life Holding | | | 920,865 |

| 25,507 | | Swiss Reinsurance | | | 1,721,614 |

| 11,076 | | Zurich Financial Services AG* | | | 1,888,569 |

|

| | | Total Switzerland | | | 9,583,345 |

|

See Notes to Financial Statements.

Smith Barney International Fund 2005 Annual Report 13

Schedule of Investments (October 31, 2005) (continued)

| | | | | | |

| | |

| Shares | | Security | | Value | |

| United Kingdom† — 25.9% | | | | |

| 45,830 | | AstraZeneca PLC | | $ | 2,055,734 | |

| 194,573 | | Barclays PLC | | | 1,926,643 | |

| 289,063 | | BP PLC | | | 3,197,467 | |

| 76,923 | | British American Tobacco PLC | | | 1,691,864 | |

| 138,807 | | Diageo PLC | | | 2,050,563 | |

| 74,435 | | FirstGroup PLC | | | 431,641 | |

| 196,465 | | GKN PLC | | | 967,202 | |

| 76,031 | | GlaxoSmithKline PLC | | | 1,976,877 | |

| 24,721 | | GUS PLC | | | 368,481 | |

| 114,182 | | HBOS PLC | | | 1,684,806 | |

| 303,425 | | International Power PLC | | | 1,245,466 | |

| 128,581 | | National Grid PLC | | | 1,175,027 | |

| 21,249 | | Next PLC | | | 501,179 | |

| 439,678 | | Rentokil Initial PLC | | | 1,194,087 | |

| 89,285 | | Royal Bank of Scotland Group PLC | | | 2,470,557 | |

| 144,207 | | Sage Group PLC | | | 547,894 | |

| 568,015 | | Signet Group PLC | | | 1,021,764 | |

| 148,055 | | United Utilities PLC | | | 1,632,290 | |

| 1,712,743 | | Vodafone Group PLC | | | 4,492,476 | |

|

|

| | | Total United Kingdom | | | 30,632,018 | |

|

|

| | | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENT

(Cost — $97,812,549) | | | 118,474,111 | |

|

|

| SHORT-TERM INVESTMENT — 23.7% | |

| Securities Purchased From Securities Lending Collateral — 23.7% | | | | |

| 28,019,311 | | State Street Navigator Securities Lending Trust Prime Portfolio (Cost — $28,019,311) | | | 28,019,311 | |

|

|

| | | TOTAL INVESTMENTS — 124.0% (Cost — $125,831,860#) | | | 146,493,422 | |

| | | Liabilities in Excess of Other Assets — (24.0)% | | | (28,418,297 | ) |

|

|

| | | TOTAL NET ASSETS — 100.0% | | $ | 118,075,125 | |

|

|

| * | | Non-income producing security. |

| (a) | | All or a portion of this security is on loan (See Notes 1 and 3). |

| # | | Aggregate cost for federal income tax purposes is $125,889,014. |

| † | | Securities are fair valued at October 31, 2005, in accordance with the policies adopted by the Board of Trustees (See Note 1). |

| | | |

| Summary of Investments by Sector* | | | |

Financials | | 28.0 | % |

Consumer Discretionary | | 14.3 | |

Industrials | | 9.9 | |

Energy | | 8.4 | |

Health Care | | 8.3 | |

Telecommunication Services | | 7.0 | |

Materials | | 7.0 | |

Consumer Staples | | 6.9 | |

Information Technology | | 5.4 | |

Utilities | | 4.8 | |

|

|

| | | 100.0 | % |

|

|

| * | | As a percent of total investments (excluding securities purchased from securities lending collateral). |

See Notes to Financial Statements.

14 Smith Barney International Fund 2005 Annual Report

Statement of Assets and Liabilities (October 31, 2005)

| | | | |

| ASSETS: | | | | |

Investments, at value (Cost — $125,831,860) | | $ | 146,493,422 | |

Foreign currency, at value (Cost — $82,840) | | | 82,227 | |

Dividends receivable | | | 197,029 | |

Receivable for Fund shares sold | | | 79,818 | |

Prepaid expenses | | | 18,451 | |

|

|

Total Assets | | | 146,870,947 | |

|

|

| LIABILITIES: | | | | |

Payable for loaned securities collateral (Notes 1 and 3) | | | 28,019,311 | |

Transfer agent fees payable | | | 370,629 | |

Management fee payable | | | 135,170 | |

Payable for Fund shares repurchased | | | 98,648 | |

Trustees’ retirement plan | | | 36,945 | |

Due to custodian | | | 21,418 | |

Distribution fees payable | | | 8,599 | |

Trustees’ fees payable | | | 2,467 | |

Accrued expenses | | | 102,635 | |

|

|

Total Liabilities | | | 28,795,822 | |

|

|

Total Net Assets | | $ | 118,075,125 | |

|

|

| NET ASSETS: | | | | |

Par value (Note 5) | | $ | 54 | |

Paid-in capital in excess of par value | | | 186,754,854 | |

Undistributed net investment income | | | 984,448 | |

Accumulated net realized loss on investments and foreign currency transactions | | | (90,328,089 | ) |

Net unrealized appreciation on investments and foreign currency transactions | | | 20,663,858 | |

|

|

Total Net Assets | | $ | 118,075,125 | |

|

|

Shares Outstanding: | | | | |

Class 1 | | | 138,658 | |

| |

Class A | | | 2,733,632 | |

| |

Class B | | | 2,415,228 | |

| |

Class C | | | 78,385 | |

| |

Net Asset Value: | | | | |

Class 1 (and redemption price) | | | $23.84 | |

| |

Class A (and redemption price) | | | $22.81 | |

| |

Class B * | | | $20.96 | |

| |

Class C * | | | $22.98 | |

| |

Maximum Public Offering Price Per Share: | | | | |

Class 1 (based on maximum sales charge of 8.50%) | | | $26.05 | |

| |

Class A (based on maximum sales charge of 5.00%) | | | $24.01 | |

|

|

| * | | Redemption price is NAV of Class B and C shares reduced by a 5.00% and 1.00% CDSC, respectively, if shares are redeemed within one year from purchase payment (See Note 2). |

See Notes to Financial Statements.

Smith Barney International Fund 2005 Annual Report 15

Statement of Operations (For the year ended October 31, 2005)

| | | | |

| INVESTMENT INCOME: | | | | |

Dividends | | $ | 4,057,007 | |

Income from securities lending | | | 120,132 | |

Interest | | | 14,845 | |

Less: Foreign taxes withheld | | | (389,934 | ) |

|

|

Total Investment Income | | | 3,802,050 | |

|

|

| EXPENSES: | | | | |

Transfer agent fees (Notes 2 and 4) | | | 1,171,181 | |

Management fee (Note 2) | | | 998,849 | |

Distribution fees (Notes 2 and 4) | | | 686,364 | |

Custody fees | | | 100,702 | |

Shareholder reports (Note 4) | | | 46,221 | |

Registration fees | | | 34,696 | |

Legal fees | | | 34,654 | |

Audit and tax | | | 29,315 | |

Insurance | | | 7,805 | |

Trustees’ fees | | | 6,628 | |

Miscellaneous expenses | | | 11,953 | |

|

|

Total Expenses | | | 3,128,368 | |

Less: Expense reimbursement (Note 2) | | | (393,553 | ) |

|

|

Net Expenses | | | 2,734,815 | |

|

|

Net Investment Income | | | 1,067,235 | |

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

AND FOREIGN CURRENCY TRANSACTIONS

(NOTES 1 AND 3): | | | | |

Net Realized Gain (Loss) From: | | | | |

Investments | | | 9,159,781 | |

Foreign currency transactions | | | (82,556 | ) |

|

|

Net Realized Gain | | | 9,077,225 | |

|

|

Change in Net Unrealized Appreciation/Depreciation From: | | | | |

Investments | | | 4,543,258 | |

Foreign currency transactions | | | (15,439 | ) |

|

|

Change in Net Unrealized Appreciation/Depreciation From Investments | | | 4,527,819 | |

|

|

Net Gain on Investments and Foreign Currency Transactions | | | 13,605,044 | |

|

|

Increase in Net Assets From Operations | | $ | 14,672,279 | |

|

|

See Notes to Financial Statements.

16 Smith Barney International Fund 2005 Annual Report

Statements of Changes in Net Assets (For the years ended October 31,)

| | | | | | | | |

| | |

| | | 2005 | | | 2004 | |

| OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 1,067,235 | | | $ | (580,136 | ) |

Net realized gain | | | 9,077,225 | | | | 12,995,932 | |

Change in net unrealized appreciation/depreciation | | | 4,527,819 | | | | 5,412,418 | |

|

|

Increase in Net Assets From Operations | | | 14,672,279 | | | | 17,828,214 | |

|

|

| FUND SHARE TRANSACTIONS (NOTE 5): | | | | | | | | |

Net proceeds from sale of shares | | | 14,961,550 | | | | 14,283,959 | |

Cost of shares repurchased | | | (22,888,590 | ) | | | (20,669,359 | ) |

|

|

Decrease in Net Assets From Fund Share Transactions | | | (7,927,040 | ) | | | (6,385,400 | ) |

|

|

Increase in Net Assets | | | 6,745,239 | | | | 11,442,814 | |

| NET ASSETS: | | | | | | | | |

Beginning of year | | | 111,329,886 | | | | 99,887,072 | |

|

|

End of year* | | $ | 118,075,125 | | | $ | 111,329,886 | |

|

|

* Includes undistributed net investment income and accumulated net investment loss, respectively, of: | | | $984,448 | | | | $(231) | |

|

|

See Notes to Financial Statements.

Smith Barney International Fund 2005 Annual Report 17

Financial Highlights

For a share of each class of beneficial interest outstanding throughout each year ended October 31:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Class 1 Shares(1) | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 20.88 | | | $ | 17.50 | | | $ | 14.83 | | | $ | 20.58 | | | $ | 42.17 | |

|

|

Income (Loss) From Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.35 | | | | 0.09 | | | | (0.00 | )(2) | | | (0.19 | ) | | | (0.24 | ) |

Net realized and unrealized gain (loss) | | | 2.61 | | | | 3.29 | | | | 2.67 | | | | (5.56 | ) | | | (21.35 | ) |

|

|

Total Income (Loss) From Operations | | | 2.96 | | | | 3.38 | | | | 2.67 | | | | (5.75 | ) | | | (21.59 | ) |

|

|

Net Asset Value, End of Year | | $ | 23.84 | | | $ | 20.88 | | | $ | 17.50 | | | $ | 14.83 | | | $ | 20.58 | |

|

|

Total Return(3) | | | 14.18 | % | | | 19.31 | % | | | 18.00 | % | | | (27.94 | )% | | | (51.20 | )% |

|

|

Net Assets, End of Year (millions) | | | $3 | | | | $3 | | | | $3 | | | | $3 | | | | $4 | |

|

|

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.71 | % | | | 1.99 | % | | | 2.45 | % | | | 2.02 | % | | | 1.54 | % |

Net expenses | | | 1.71 | (4) | | | 1.89 | (5) | | | 2.45 | | | | 2.02 | | | | 1.54 | |

Net investment income (loss) | | | 1.53 | | | | 0.47 | | | | (0.03 | ) | | | (1.00 | ) | | | (0.82 | ) |

|

|

Portfolio Turnover Rate | | | 30 | % | | | 56 | % | | | 153 | % | | | 24 | % | | | 24 | % |

|

|

| (1) | | Per share amounts have been calculated using the average shares method. |

| (2) | | Amount represents less than $0.01 per share. |

| (3) | | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (4) | | Effective November 1, 2004, as a result of a voluntary expense limitation, the ratio of expenses to average net assets of the Fund will not exceed 1.75%. |

| (5) | | The investment manager voluntarily waived a portion of its fees. Such waivers are voluntary and may be reduced or terminated at any time. |

See Notes to Financial Statements.

18 Smith Barney International Fund 2005 Annual Report

Financial Highlights (continued)

For a share of each class of beneficial interest outstanding throughout each year ended October 31:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Class A Shares(1) | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 20.03 | | | $ | 16.89 | | | $ | 14.42 | | | $ | 20.15 | | | $ | 41.57 | |

|

|

Income (Loss) From Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.27 | | | | (0.02 | ) | | | (0.12 | ) | | | (0.30 | ) | | | (0.40 | ) |

Net realized and unrealized gain (loss) | | | 2.51 | | | | 3.16 | | | | 2.59 | | | | (5.43 | ) | | | (21.02 | ) |

|

|

Total Income (Loss) From Operations | | | 2.78 | | | | 3.14 | | | | 2.47 | | | | (5.73 | ) | | | (21.42 | ) |

|

|

Net Asset Value, End of Year | | $ | 22.81 | | | $ | 20.03 | | | $ | 16.89 | | | $ | 14.42 | | | $ | 20.15 | |

|

|

Total Return(2) | | | 13.88 | % | | | 18.59 | % | | | 17.13 | % | | | (28.44 | )% | | | (51.53 | )% |

|

|

Net Assets, End of Year (millions) | | | $62 | | | | $56 | | | | $49 | | | | $40 | | | | $53 | |

|

|

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.33 | % | | | 2.59 | % | | | 3.21 | % | | | 2.72 | % | | | 2.17 | % |

Net expenses | | | 2.00 | (3)(4) | | | 2.49 | (4) | | | 3.21 | | | | 2.72 | | | | 2.17 | |

Net investment income (loss) | | | 1.23 | | | | (0.13 | ) | | | (0.77 | ) | | | (1.67 | ) | | | (1.44 | ) |

|

|

Portfolio Turnover Rate | | | 30 | % | | | 56 | % | | | 153 | % | | | 24 | % | | | 24 | % |

|

|

| (1) | | Per share amounts have been calculated using the average shares method. |

| (2) | | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Effective November 1, 2004, as a result of a voluntary expense limitation, the ratio of expenses to average net assets of the Fund will not exceed 2.00%. |

| (4) | | The investment manager voluntarily waived a portion of its fees and/or reimbursed expenses. Such waivers and/or reimbursements are voluntary and may be reduced or terminated at any time. |

See Notes to Financial Statements.

Smith Barney International Fund 2005 Annual Report 19

Financial Highlights (continued)

For a share of each class of beneficial interest outstanding throughout each year ended October 31:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Class B Shares(1) | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 18.54 | | | $ | 15.78 | | | $ | 13.60 | | | $ | 19.18 | | | $ | 39.86 | |

|

|

Income (Loss) From Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.10 | | | | (0.19 | ) | | | (0.24 | ) | | | (0.44 | ) | | | (0.59 | ) |

Net realized and unrealized gain (loss) | | | 2.32 | | | | 2.95 | | | | 2.42 | | | | (5.14 | ) | | | (20.09 | ) |

|

|

Total Income (Loss) From Operations | | | 2.42 | | | | 2.76 | | | | 2.18 | | | | (5.58 | ) | | | (20.68 | ) |

|

|

Net Asset Value, End of Year | | $ | 20.96 | | | $ | 18.54 | | | $ | 15.78 | | | $ | 13.60 | | | $ | 19.18 | |

|

|

Total Return(2) | | | 13.05 | % | | | 17.49 | % | | | 16.03 | % | | | (29.09 | )% | | | (51.88 | )% |

|

|

Net Assets, End of Year (millions) | | | $51 | | | | $50 | | | | $46 | | | | $43 | | | | $65 | |

|

|

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 3.13 | % | | | 3.53 | % | | | 4.15 | % | | | 3.60 | % | | | 2.90 | % |

Net expenses | | | 2.75 | (3)(4) | | | 3.43 | (4) | | | 4.15 | | | | 3.60 | | | | 2.90 | |

Net investment income (loss) | | | 0.49 | | | | (1.07 | ) | | | (1.73 | ) | | | (2.57 | ) | | | (2.18 | ) |

|

|

Portfolio Turnover Rate | | | 30 | % | | | 56 | % | | | 153 | % | | | 24 | % | | | 24 | % |

|

|

| (1) | | Per share amounts have been calculated using the average shares method. |

| (2) | | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Effective November 1, 2004, as a result of a voluntary expense limitation, the ratio of expenses to average net assets of the Fund will not exceed 2.75%. |

| (4) | | The investment manager voluntarily waived a portion of its fees and/or reimbursed expenses. Such waivers and/or reimbursements are voluntary and may be reduced or terminated at any time. |

See Notes to Financial Statements.

20 Smith Barney International Fund 2005 Annual Report

Financial Highlights (continued)

For a share of each class of beneficial interest outstanding throughout each year ended October 31:

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Class C Shares(1)(2) | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

Net Asset Value, Beginning of Year | | $ | 20.26 | | | $ | 17.03 | | | $ | 14.42 | | | $ | 20.13 | | | $ | 41.61 | |

|

|

Income (Loss) From Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.19 | | | | 0.02 | | | | (0.01 | ) | | | (0.30 | ) | | | (0.43 | ) |

Net realized and unrealized gain (loss) | | | 2.53 | | | | 3.21 | | | | 2.62 | | | | (5.41 | ) | | | (21.05 | ) |

|

|

Total Income (Loss) From Operations | | | 2.72 | | | | 3.23 | | | | 2.61 | | | | (5.71 | ) | | | (21.48 | ) |

|

|

Net Asset Value, End of Year | | $ | 22.98 | | | $ | 20.26 | | | $ | 17.03 | | | $ | 14.42 | | | $ | 20.13 | |

|

|

Total Return(3) | | | 13.43 | % | | | 18.97 | % | | | 18.10 | % | | | (28.37 | )% | | | (51.62 | )% |

|

|

Net Assets, End of Year (millions) | | | $2 | | | | $2 | | | | $2 | | | | $2 | | | | $4 | |

|

|

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.36 | % | | | 2.34 | % | | | 2.41 | % | | | 2.63 | % | | | 2.49 | % |

Net expenses | | | 2.36 | (4) | | | 2.24 | (5) | | | 2.41 | | | | 2.63 | | | | 2.49 | |

Net investment income (loss) | | | 0.84 | | | | 0.11 | | | | (0.06 | ) | | | (1.65 | ) | | | (1.60 | ) |

|

|

Portfolio Turnover Rate | | | 30 | % | | | 56 | % | | | 153 | % | | | 24 | % | | | 24 | % |

|

|

| (1) | | Per share amounts have been calculated using the average shares method. |

| (2) | | On April 29, 2004, Class L shares were renamed as Class C shares. |

| (3) | | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (4) | | Effective November 1, 2004, as a result of a voluntary expense limitation, the ratio of expenses to average net assets of the Fund will not exceed 2.75%. |

| (5) | | The investment manager voluntarily waived a portion of its fees. Such waivers are voluntary and may be reduced or terminated at any time. |

See Notes to Financial Statements.

Smith Barney International Fund 2005 Annual Report 21

Notes to Financial Statements

| 1. | Organization and Significant Accounting Policies |

The Smith Barney International Fund (the “Fund”) is a separate investment fund of the Smith Barney Investment Series (“Trust”). The Trust, a Massachusetts business trust, is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified, open-end management investment company.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment Valuation. Equity securities for which market quotations are available are valued at the last sale price or official closing price on the primary market or exchange on which they trade. Debt securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various relationships between securities. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. Short-term obligations maturing within 60 days are valued at amortized cost, which approximates market value.

(b) Forward Foreign Currency Contracts. The Fund may enter into forward foreign currency contracts to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of foreign currency denominated portfolio transactions. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price on a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. When a forward foreign currency contract is extinguished, through either delivery or offset by entering into another forward foreign currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was extinguished.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected in the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(c) Lending of Portfolio Securities. The Fund has an agreement with its custodian whereby the custodian may lend securities owned by the Fund to brokers, dealers and other

22 Smith Barney International Fund 2005 Annual Report

Notes to Financial Statements (continued)

financial organizations. In exchange for lending securities under the terms of the agreement with its custodian, the Fund receives a lender’s fee. Fees earned by the Fund on securities lending are recorded as securities lending income. Loans of securities by the Fund are collateralized by cash, U.S. government securities or high quality money market instruments that are maintained at all times in an amount at least equal to the current market value of the loaned securities, plus a margin which varies depending on the type of securities loaned. The custodian establishes and maintains the collateral in a segregated account. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

The Fund maintains the risk of any loss on the securities on loan as well as the potential loss on investments purchased with cash collateral received from securities lending.

(d) Security Transactions and Investment Income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practical after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(e) Foreign Currency Translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities, at the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(f) Foreign Risk. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign

Smith Barney International Fund 2005 Annual Report 23

Notes to Financial Statements (continued)

currencies and may require settlement in foreign currencies and pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investment may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(g) Distributions to Shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(h) Class Accounting. Investment income, common expenses and realized/unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that class.

(i) Federal and Other Taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains on investments, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Fund’s financial statements. Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(j) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | | | | | | |

| | |

| | | Undistributed Net

Investment

Income | | | Accumulated Net

Realized Losses |

(a) | | $ | (82,556 | ) | | $ | 82,556 |

|

| (a) | | Reclassifications are primarily due to foreign currency transactions treated as ordinary income for tax purposes. |

| 2. | Management Agreement and Other Transactions with Affiliates |

Smith Barney Fund Management LLC (“SBFM”), an indirect wholly-owned subsidiary of Citigroup Inc. (“Citigroup”), acts as the investment manager to the Fund. The Fund pays SBFM a management fee calculated at an annual rate of 0.85% of the Fund’s average daily net assets. This fee is calculated daily and paid monthly.

Effective October 1, 2005, the following breakpoints were applied to the management fee:

| | | |

| |

| Average Daily Net Assets | | Management

Fee Rate | |

First $1 billion | | 0.850 | % |

|

|

Next $1 billion | | 0.825 | % |

|

|

Next $3 billion | | 0.800 | % |

|

|

Next $5 billion | | 0.775 | % |

|

|

Over $10 billion | | 0.750 | % |

|

|

24 Smith Barney International Fund 2005 Annual Report

Notes to Financial Statements (continued)

Effective November 1, 2004, SBFM imposed a voluntary expense limitation of 1.75%, 2.00%, 2.75% and 2.75% for Class 1, Class A, Class B and Class C, respectively. During the year ended October 31, 2005, SBFM voluntarily reimbursed expenses in the amount of $393,553 for certain classes of shares.

SBFM entered into a sub-advisory agreement with Citigroup Asset Management Ltd. (“CAM Ltd.”). Pursuant to the sub-advisory agreement, the sub-adviser is responsible for the day-to-day operations and investment decisions of the Fund. SBFM pays CAM Ltd. a sub-advisory fee calculated at an annual rate of 0.70% of the aggregate assets of the Fund allocated to the sub-adviser.

Citicorp Trust Bank, fsb. (“CTB”), another subsidiary of Citigroup, acts as the Fund’s transfer agent. PFPC Inc. (“PFPC”) and Primerica Shareholder Services (“PSS”), another subsidiary of Citigroup, act as the Fund’s sub-transfer agents. CTB receives account fees and asset-based fees that vary according to the size and type of account. PFPC and PSS are responsible for shareholder recordkeeping and financial processing for all shareholder accounts and are paid by CTB. For the year ended October 31, 2005, the Fund paid transfer agent fees of $725,173 to CTB. In addition, for the year ended October 31, 2005, the Fund also paid $198 to other Citigroup affiliates for shareholder recordkeeping and services.

Citigroup Global Markets Inc. (“CGM”) and PFS Distributors, Inc., both of which are subsidiaries of Citigroup, act as the Fund’s distributors.

There are maximum sales charges of 8.50% and 5.00% for Class 1 and A shares, respectively. There is a contingent deferred sales charge (“CDSC”) of 5.00% on Class B shares, which applies if redemption occurs within one year from purchase payment and declines by 1.00% per year until no CDSC is incurred. Class C shares have a 1.00% CDSC which applies if redemption occurs within one year from purchase payment. In certain cases, Class A shares have a 1.00% CDSC, which applies if redemption occurs within one year from purchase payment. This CDSC only applies to those purchases of Class A shares, which, when combined with current holdings of Class A shares, equal or exceed $1,000,000 in the aggregate. These purchases do not incur a sales charge.

For the year ended October 31, 2005, CGM and its affiliates received sales charges of approximately $5,000 and $273,000 on the sale of the Fund’s Class 1 shares and Class A shares, respectively. In addition, for the year ended October 31, 2005, CDSCs paid to CGM and its affiliates were approximately $83,000 for Class B shares.

Certain officers and one Trustee of the Trust are employees of Citigroup or its affiliates and do not receive compensation from the Trust.

The Trustees of the Fund have adopted a Retirement Plan (“Plan”) for all Trustees who are not “interested persons” of the Fund, within the meaning of the 1940 Act. Under the Plan, all Trustees are required to retire from the Board as of the last day of the calendar year in which the applicable Trustee attains age 75. Trustees may retire under the Plan before attaining the mandatory retirement age. Trustees who have served as Trustee of the Trust or any of the investment companies associated with the Manager for at least ten years when they retire are eligible to receive the maximum retirement benefit under the Plan. The maximum retirement benefit is an amount equal to five times the amount of retainer and regular meeting fees payable to a Trustee during the entirety of the calendar year of the Trustee’s retirement (assuming no change in relevant facts for the balance of

Smith Barney International Fund 2005 Annual Report 25

Notes to Financial Statements (continued)

the year following the Trustee’s retirement). Amounts under the Plan may be paid in installments or in a lump sum (discounted to present value). Benefits under the Plan are unfunded. Three former Trustees are currently receiving payments under the Plan. In addition, two other Trustees elected to receive a lump sum payment from this Plan.

Certain of the Trustees are also covered by a prior retirement plan. Under the prior plan, retirement benefits are payable for a ten-year period following retirement, with the annual payment to be based upon the Trustee’s compensation from the Trust during calendar year 2000. Trustees with more than five but less than ten years of service at retirement will receive a prorated benefit. In order to receive benefits under the current Plan, a Trustee must waive all rights under the prior plan prior to receiving payment under either plan. At October 31, 2005, $36,945 is accrued in connection with these plans.

During the year ended October 31, 2005, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

| | | |

Purchases | | $ | 35,297,059 |

|

Sales | | | 42,298,304 |

|

At October 31, 2005, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| | | | |

Gross unrealized appreciation | | $ | 21,647,858 | |

Gross unrealized depreciation | | | (1,043,450 | ) |

|

|

Net unrealized appreciation | | $ | 20,604,408 | |

|

|

At October 31, 2005, the Fund loaned securities having a market value of $26,661,729. The Fund received cash collateral amounting to $28,019,311, which was invested into the State Street Navigator Securities Lending Trust Prime Portfolio, a Rule 2a-7 money market fund, registered under the 1940 Act.

| 4. | Class Specific Expenses |

Pursuant to a Distribution Plan, the Fund pays a distribution/service fee with respect to its Class A, B and C shares calculated at the annual rate of 0.25% of the average daily net assets with respect to Class A shares and at the annual rate of 1.00% of the respective average daily net assets of Class B and C shares. For the year ended October 31, 2005, total Distribution fees, which are accrued daily and paid monthly, were as follows:

| | | | | | | | | |

| | | |

| | | Class A | | Class B | | Class C |

Distribution Fees | | $ | 151,534 | | $ | 515,198 | | $ | 19,632 |

|

26 Smith Barney International Fund 2005 Annual Report

Notes to Financial Statements (continued)

For the year ended October 31, 2005, total Transfer Agent fees were as follows:

| | | | | | | | | | | | |

| | | | |

| | | Class 1 | | Class A | | Class B | | Class C |

Transfer Agent Fees | | $ | 20,998 | | $ | 603,294 | | $ | 542,000 | | $ | 4,889 |

|

For the year ended October 31, 2005, total Shareholder Reports expenses were as follows:

| | | | | | | | | | | | |

| | | | |

| | | Class 1 | | Class A | | Class B | | Class C |

Shareholder Reports Expenses | | $ | 1,861 | | $ | 24,000 | | $ | 18,999 | | $ | 1,361 |

|

5. Shares of Beneficial Interest

At October 31, 2005, the Fund had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. The Fund has the ability to issue multiple classes of shares. Each share of a class represents an identical interest in the Fund and has the same rights, except that each class bears certain direct expenses, including those specifically related to the distribution of its shares.

Transactions in shares of each class were as follows:

| | | | | | | | | | | | | | |

| | |

| | | Year Ended

October 31, 2005

| | | Year Ended

October 31, 2004

| |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Class 1 | | | | | | | | | | | | | | |

Shares sold | | 12,231 | | | $ | 281,074 | | | 10,157 | | | $ | 200,620 | |

Shares repurchased | | (35,497 | ) | | | (808,567 | ) | | (28,012 | ) | | | (552,228 | ) |

|

|

Net Decrease | | (23,266 | ) | | $ | (527,493 | ) | | (17,855 | ) | | $ | (351,608 | ) |

|

|

Class A | | | | | | | | | | | | | | |

Shares sold | | 454,284 | | | $ | 9,935,355 | | | 471,297 | | | $ | 8,838,905 | |

Shares repurchased | | (528,425 | ) | | | (11,539,470 | ) | | (557,128 | ) | | | (10,520,113 | ) |

|

|

Net Decrease | | (74,141 | ) | | $ | (1,604,115 | ) | | (85,831 | ) | | $ | (1,681,208 | ) |

|

|

Class B | | | | | | | | | | | | | | |

Shares sold | | 233,692 | | | $ | 4,702,432 | | | 294,081 | | | $ | 5,144,737 | |

Shares repurchased | | (491,729 | ) | | | (9,913,605 | ) | | (518,234 | ) | | | (9,086,233 | ) |

|

|

Net Decrease | | (258,037 | ) | | $ | (5,211,173 | ) | | (224,153 | ) | | $ | (3,941,496 | ) |

|

|

Class C* | | | | | | | | | | | | | | |

Shares sold | | 1,915 | | | $ | 42,689 | | | 5,272 | | | $ | 99,697 | |

Shares repurchased | | (28,577 | ) | | | (626,948 | ) | | (26,613 | ) | | | (510,785 | ) |

|

|

Net Decrease | | (26,662 | ) | | $ | (584,259 | ) | | (21,341 | ) | | $ | (411,088 | ) |

|

|

| * | On April 29, 2004, Class L shares were renamed as Class C shares. |

Smith Barney International Fund 2005 Annual Report 27

Notes to Financial Statements (continued)

| 6. | Income Tax Information and Distributions to Shareholders |

For the years ended October 31, 2005 and 2004, the Fund did not make any distributions.

As of October 31, 2005, the components of accumulated earnings on a tax basis were as follows:

| | | | |

Undistributed ordinary income — net | | $ | 984,448 | |

|

|

Total undistributed earnings | | $ | 984,448 | |

Capital loss carryforward(*) | | | (90,270,935 | ) |

Unrealized appreciation(a) | | | 20,606,704 | |

|

|

Total accumulated earnings/(losses) — net | | $ | (68,679,783 | ) |

|

|

| (*) | | During the taxable year ended October 31, 2005, the Fund utilized $9,159,781 of its capital loss carryover available from prior years. As of October 31, 2005, the Fund had the following net capital loss carryforwards remaining: |

| | | | |

Year of Expiration

| | Amount

| |

10/31/2008 | | $ | (569,980 | ) |

10/31/2009 | | | (16,130,189 | ) |

10/31/2010 | | | (43,173,297 | ) |

10/31/2011 | | | (30,397,469 | ) |

| | |

|

|

|

| | | $ | (90,270,935 | ) |

| | |

|

|

|

These amounts will be available to offset any future taxable capital gains.

| (a) | | The difference between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales. |

On May 31, 2005, the U.S. Securities and Exchange Commission (“SEC”) issued an order in connection with the settlement of an administrative proceeding against SBFM and CGM relating to the appointment of an affiliated transfer agent for the Smith Barney family of mutual funds (the “Funds”).

The SEC order finds that SBFM and CGM willfully violated Section 206(1) of the Investment Advisers Act of 1940 (“Advisers Act”). Specifically, the order finds that SBFM and CGM knowingly or recklessly failed to disclose to the boards of the Funds in 1999 when proposing a new transfer agent arrangement with an affiliated transfer agent that: First Data Investors Services Group (“First Data”), the Funds’ then-existing transfer agent, had offered to continue as transfer agent and do the same work for substantially less money than before; and that Citigroup Asset Management (“CAM”), the Citigroup business unit that, at the time, included the fund’s investment manager and other investment advisory companies, had entered into a side letter with First Data under which CAM agreed to recommend the appointment of First Data as sub-transfer agent to the affiliated transfer agent in exchange for, among other things, a guarantee by First Data of specified amounts of asset management and investment banking fees to CAM and CGM. The order also finds that SBFM and CGM willfully violated Section 206(2) of the Advisers Act by virtue of the omissions discussed above and other misrepresentations and omissions in the materials provided to the Funds’ boards, including the failure to make clear that the affiliated transfer agent would earn a high profit for performing limited functions while First Data continued to perform almost all of the transfer agent functions, and the suggestion that the proposed arrangement was in the Funds’ best interests and that no viable alternatives existed. SBFM

28 Smith Barney International Fund 2005 Annual Report

Notes to Financial Statements (continued)

and CGM do not admit or deny any wrongdoing or liability. The settlement does not establish wrongdoing or liability for purposes of any other proceeding.

The SEC censured SBFM and CGM and ordered them to cease and desist from violations of Sections 206(1) and 206(2) of the Advisers Act. The order requires Citigroup to pay $208.1 million, including $109 million in disgorgement of profits, $19.1 million in interest, and a civil money penalty of $80 million. Approximately $24.4 million has already been paid to the Funds, primarily through fee waivers. The remaining $183.7 million, including the penalty, has been paid to the U.S. Treasury and will be distributed pursuant to a plan prepared and submitted for approval by the SEC. The order also requires that transfer agency fees received from the Funds since December 1, 2004 less certain expenses be placed in escrow and provides that a portion of such fees may be subsequently distributed in accordance with the terms of the order.

The order required SBFM to recommend a new transfer agent contract to the Fund boards within 180 days of the entry of the order; if a Citigroup affiliate submitted a proposal to serve as transfer agent or sub-transfer agent, SBFM and CGM would have been required, at their expense, to engage an independent monitor to oversee a competitive bidding process. On November 21, 2005, and within the specified timeframe, the Fund’s Board selected a new transfer agent for the Fund. No Citigroup affiliate submitted a proposal to serve as transfer agent. Under the order, SBFM also must comply with an amended version of a vendor policy that Citigroup instituted in August 2004.

At this time, there is no certainty as to how the proceeds of the settlement will be distributed, to whom such distributions will be made, the methodology by which such distributions will be allocated, and when such distributions will be made. Although there can be no assurance, SBFM does not believe that this matter will have a material adverse effect on the Funds.