UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-5021 |

| |

| Dreyfus Premier Short-Intermediate Municipal Bond Fund | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Janette Farragher, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 3/31 | |

Date of reporting period: | 3/31/12 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

|

| Dreyfus |

| Short-Intermediate |

| Municipal Bond Fund |

ANNUAL REPORT March 31, 2012

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

|

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 28 | Statement of Assets and Liabilities |

| 29 | Statement of Operations |

| 30 | Statement of Changes in Net Assets |

| 32 | Financial Highlights |

| 35 | Notes to Financial Statements |

| 44 | Report of Independent Registered Public Accounting Firm |

| 45 | Important Tax Information |

| 46 | Board Members Information |

| 48 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

Short-Intermediate

Municipal Bond Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

This annual report for Dreyfus Short-Intermediate Municipal Bond Fund covers the 12-month period from April 1, 2011, through March 31, 2012. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Municipal bonds continued to benefit from positive supply-and-demand factors during the last six-month period, which enabled them to avoid some of the volatility affecting their taxable fixed-income counterparts as economic sentiment changed. The supply of newly issued tax-exempt bonds remained muted when issuers responded to political pressure by reducing spending and borrowing, while demand remained robust from individual and institutional investors seeking high current after-tax yields in a low interest-rate environment. Consequently, municipal bonds produced higher total returns, on average, than most other fixed-income market sectors for the reporting period.

Our economic forecast calls for near-trend growth in 2012, and we expect the United States to continue to post better economic data than most of the rest of the developed world.An aggressively accommodative monetary policy, pent-up demand in several industry groups and gradual improvement in housing prices appear likely to offset risks stemming from the ongoing European debt crisis and volatile energy prices. As always, we encourage you to talk with your financial adviser about how these developments may affect your investments.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

April 16, 2012

2

DISCUSSION OF FUND PERFORMANCE

For the period of April 1, 2011, through March 31, 2012, as provided by Thomas Casey and Jeffrey Burger, Primary Portfolio Managers

Fund and Market Performance Overview

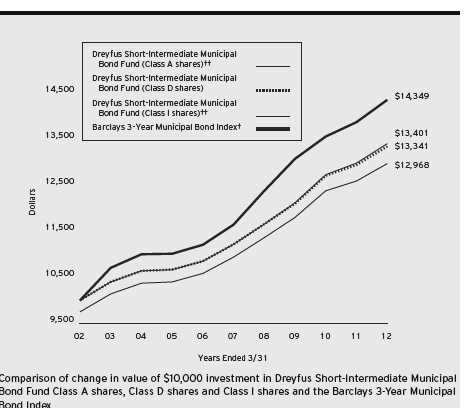

For the 12-month period ended March 31, 2012, Dreyfus Short-Intermediate Municipal Bond Fund’s Class A shares produced a total return of 3.02%, Class D shares returned 3.10% and Class I shares returned 3.26%.1 In comparison, the fund’s benchmark, the Barclays 3-Year Municipal Bond Index (the “Index”), produced a total return of 3.44% for the reporting period.2

Falling long-term interest rates and favorable supply-and-demand factors helped fuel strong performance among municipal bonds in a volatile market environment over the reporting period. The fund produced lower returns than its benchmark, mainly due to underweighted exposure to callable and general obligation bonds over the reporting period’s second half.

The Fund’s Investment Approach

The fund seeks to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital.To pursue this goal, the fund normally invests substantially all of its assets in municipal bonds that provide income exempt from federal personal income tax.The fund will invest only in municipal bonds rated investment grade or the unrated equivalent as determined by Dreyfus, but may continue to hold bonds which are subsequently downgraded to below investment grade.The fund invests primarily in municipal bonds with remaining maturities of five years or less and generally maintains a dollar-weighted average portfolio maturity of two to three years.

The portfolio managers focus on identifying undervalued sectors and securities, and minimizing the use of interest rate forecasting. The portfolio managers select municipal bonds by using fundamental credit analysis to estimate the relative value and attractiveness of various sectors and securities and to exploit pricing inefficiencies in the municipal bond market. They also actively trade among various sectors, such as pre-

DISCUSSION OF FUND PERFORMANCE (continued)

refunded, general obligation and revenue, based on their apparent relative values.The fund seeks to invest in several of these sectors.

Municipal Bonds Rallied as Economic Concerns Eased

The reporting period began in the midst of heightened turmoil in the financial markets sparked by a sovereign debt crisis in Europe and a contentious debate in the United States regarding government spending and borrowing. Market turbulence intensified over the summer of 2011, when a major credit-rating agency downgraded its assessment of long-term U.S. government debt and worries mounted regarding the sustainability of the U.S. economic recovery.

The Federal Reserve Board (the “Fed”) responded to these concerns in the fall with OperationTwist, in which the central bank sold short-term U.S.Treasury securities and purchased long-term bonds, driving longer-term interest rates lower. Longer-term municipal bonds benefited from this development more than shorter-term securities. In addition, better economic data soon encouraged investors to become more tolerant of risks.As a result, municipal bonds that had been punished during the downturn rallied through the reporting period’s end, while higher-quality bonds generally lagged market averages.

Positive supply-and-demand forces also buoyed municipal bond prices. New issuance volumes fell sharply in 2011 after a flood of new supply in late 2010, and political pressure also led to reduced borrowing. Meanwhile, demand remained robust from individuals seeking higher levels of current income in a low interest rate environment. From a credit-quality perspective, many states and municipalities cut spending, helping to ease fiscal concerns.

Defensive Posture Dampened Relative Performance

Early in the reporting period, we positioned the fund more defensively in seeking to mute the potentially damaging effects of heightened market volatility. While this posture helped bolster relative performance during the downturn, it limited the fund’s participation in the subsequent rally. Underweighted exposure to general obligation bonds and bonds with early redemption provisions proved to be a drag on relative results. In addition, the fund held greater exposure than the

4

benchmark to municipal bonds with maturities of two years and less, a segment that lagged market averages.

The fund achieved better relative performance among revenue bonds, particularly those backed by waterworks, sewer facilities, utilities and transportation projects. Overweighted exposure to municipal bonds with A ratings also contributed positively to the fund’s results compared to the benchmark.

Adjusting to a Changing Market Environment

We are encouraged by recently improved U.S. economic data, but we believe the recovery remains vulnerable to unexpected shocks and uncertainty regarding future Fed policy. Consequently, we expect market volatility to remain elevated.

Therefore, we have maintained the fund’s higher-quality bias and emphasis on revenue bonds from essential services facilities. We also have made an effort to prepare the fund for seasonal changes in issuance and maturity patterns that historically have tended to cause municipal bonds to exhibit weakness in the spring and greater strength in the summer. In our judgment, these are prudent strategies after a prolonged market rally lifted valuations to richer levels.

April 16, 2012

Bond funds are subject generally to interest rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest rate changes, and rate increases can cause price declines.

| |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | consideration the maximum initial sales charge in the case of Class A shares. Had this charge been |

| | reflected, returns would have been lower. Class D and I shares are not subject to any initial or |

| | deferred sales charge. Past performance is no guarantee of future results. Share price, yield and |

| | investment return fluctuate such that upon redemption, fund shares may be worth more or less |

| | than their original cost. |

| | Income may be subject to state and local taxes, and some income may be subject to the federal |

| | alternative minimum tax (AMT) for certain investors. Capital gains, if any, are taxable. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | gain distributions.The Barclays 3-Year Municipal Bond Index is an unmanaged total return |

| | performance benchmark for the investment-grade, geographically unrestricted 3-year tax-exempt |

| | bond market, consisting of municipal bonds with maturities of 2-4 years. Index returns do not |

| | reflect the fees and expenses associated with operating a mutual fund. |

| | Investors cannot invest directly in any index. |

FUND PERFORMANCE

| |

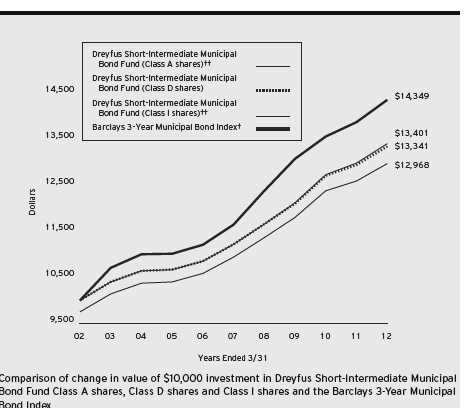

| † | Source: Lipper Inc. |

| †† | The total return figures presented for Class A shares of the fund reflect the performance of the fund’s Class D shares |

| | for the period prior to 8/3/09 (the inception date for Class A shares), adjusted to reflect the applicable sales load for |

| | this share class. |

| | The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class D shares |

| | for the period prior to 12/15/08 (the inception date for Class I shares). |

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class D and Class I shares of Dreyfus Short-Intermediate Municipal Bond Fund on 3/31/02 to a $10,000 investment made in the Barclays 3-Year Municipal Bond Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

The fund invests primarily in short-intermediate term municipal securities and maintains a portfolio with a weighted average maturity ranging between 2 and 3 years.The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is an unmanaged total return performance benchmark for the investment-grade, geographically unrestricted 3-year tax-exempt bond market, consisting of municipal bonds with maturities of 2-4 years. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | | | |

| Average Annual Total Returns as of 3/31/12 | | | |

| Inception |

| | Date | 1Year | 5 Years | 10 Years |

| Class A shares | | | | |

| with maximum sales charge (2.5%) | 8/3/09 | 0.41% | 2.95%† | 2.63%† |

| without sales charge | 8/3/09 | 3.02% | 3.46%† | 2.89%† |

| Class D shares | 4/30/87 | 3.10% | 3.53% | 2.92% |

| Class I shares | 12/15/08 | 3.26% | 3.62%† | 2.97%† |

| Barclays 3-Year | | | | |

| Municipal Bond Index | | 3.44% | 4.26% | 3.68% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

| † The total return performance figures presented for Class A shares of the fund reflect the performance of the fund’s |

| Class D shares for the period prior to 8/3/09 (the inception date for Class A shares), adjusted to reflect the |

| applicable sales load for this share class. |

| The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s |

| Class D shares for the period prior to 12/15/08 (the inception date for Class I shares). |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Short-Intermediate Municipal Bond Fund from October 1, 2011 to March 31, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended March 31, 2012

| | | | | | |

| | | Class A | | Class D | | Class I |

| Expenses paid per $1,000† | $ | 4.22 | $ | 3.46 | $ | 2.96 |

| Ending value (after expenses) | $ | 1,008.00 | $ | 1,008.00 | $ | 1,009.30 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended March 31, 2012

| | | | | | |

| | | Class A | | Class D | | Class I |

| Expenses paid per $1,000† | $ | 4.24 | $ | 3.49 | $ | 2.98 |

| Ending value (after expenses) | $ | 1,020.80 | $ | 1,021.55 | $ | 1,022.05 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .84% for Class A, .69% for Class D and .59% |

| for Class I, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half |

| year period). |

8

| | | | |

| STATEMENT OF INVESTMENTS | | | |

| March 31, 2012 | | | | |

| |

| |

| |

| |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments—98.5% | Rate (%) | Date | Amount ($) | Value ($) |

| Alabama—1.1% | | | | |

| Alabama Public School and | | | | |

| College Authority, Capital | | | | |

| Improvement Revenue | 5.00 | 5/1/16 | 2,500,000 | 2,909,750 |

| Alabama Public School and | | | | |

| College Authority, Capital | | | | |

| Improvement Revenue | 5.00 | 12/1/16 | 1,000,000 | 1,183,330 |

| Auburn University, | | | | |

| General Fee Revenue | 4.00 | 6/1/15 | 1,690,000 | 1,864,898 |

| Alaska—.6% | | | | |

| Alaska Industrial Development and | | | | |

| Export Authority, Revolving | | | | |

| Fund Revenue | 5.00 | 4/1/14 | 3,000,000 | 3,240,030 |

| Arizona—2.0% | | | | |

| Pima County, | | | | |

| Sewer System | | | | |

| Revenue Obligations | 5.00 | 7/1/16 | 2,000,000 | 2,297,560 |

| Regional Public Transportation | | | | |

| Authority, Transportation | | | | |

| Excise Tax Revenue | | | | |

| (Maricopa County Public | | | | |

| Transportation Fund) | 5.00 | 7/1/13 | 4,590,000 | 4,846,719 |

| Rio Nuevo Multipurpose Facilities | | | | |

| District, Subordinate Lien Excise | | | | |

| Tax Revenue (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.50 | 7/15/14 | 3,770,000 | 4,131,694 |

| California—8.8% | | | | |

| California, | | | | |

| GO | 5.00 | 9/1/16 | 2,500,000 | 2,886,450 |

| California Department of Water | | | | |

| Resources, Power Supply Revenue | 5.00 | 5/1/15 | 2,550,000 | 2,892,720 |

| California Department of Water | | | | |

| Resources, Water System | | | | |

| Revenue (Central Valley Project) | 5.00 | 12/1/15 | 2,695,000 | 3,120,972 |

| California Housing Finance Agency, | | | | |

| Home Mortgage Revenue | | | | |

| (Insured; FGIC) | 4.15 | 8/1/14 | 3,625,000 | 3,710,006 |

| California State Public Works | | | | |

| Board, LR (Judicial Council of | | | | |

| California) (Various Judicial | | | | |

| Council Projects) | 5.00 | 12/1/15 | 7,335,000 | 8,262,364 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| California (continued) | | | | |

| California State Public Works | | | | |

| Board, LR (The Regents of the | | | | |

| Univeristy of California) | | | | |

| (Various Univeristy of | | | | |

| California Projects) | 5.00 | 12/1/15 | 5,000,000 | 5,725,550 |

| California State Public Works | | | | |

| Board, LR (Various | | | | |

| Capital Projects) | 4.00 | 10/1/16 | 2,000,000 | 2,191,760 |

| California Statewide Communities | | | | |

| Development Authority, Revenue | | | | |

| (Kaiser Permanente) | 5.00 | 4/1/14 | 4,000,000 | 4,328,120 |

| Los Angeles County Metropolitan | | | | |

| Transportation Authority, | | | | |

| General Revenue (Union Station | | | | |

| Gateway Project) | 5.00 | 7/1/13 | 1,150,000 | 1,216,711 |

| Los Angeles County Metropolitan | | | | |

| Transportation Authority, | | | | |

| Proposition A First Tier | | | | |

| Senior Sales Tax Revenue | 5.00 | 7/1/14 | 5,000,000 | 5,526,600 |

| Los Angeles County Metropolitan | | | | |

| Transportation Authority, | | | | |

| Proposition C Sales Tax Revenue | 5.00 | 7/1/14 | 2,000,000 | 2,206,340 |

| Modesto Irrigation District, | | | | |

| Electric System Revenue | 5.00 | 7/1/16 | 2,250,000 | 2,580,728 |

| Southern California Public Power | | | | |

| Authority, Transmission | | | | |

| Project Subordinate Revenue | | | | |

| (Southern Transmission Project) | 5.00 | 7/1/14 | 3,000,000 | 3,303,450 |

| Southern California Public Power | | | | |

| Authority, Transmission | | | | |

| Project Subordinate Revenue | | | | |

| (Southern Transmission Project) | 4.00 | 7/1/16 | 2,000,000 | 2,246,960 |

| Colorado—.1% | | | | |

| Black Hawk, | | | | |

| Device Tax Revenue | 5.00 | 12/1/12 | 760,000 | 775,170 |

| Connecticut—1.5% | | | | |

| Connecticut, | | | | |

| Special Tax Obligation | | | | |

| Revenue (Transportation | | | | |

| Infrastructure Purposes) | 5.00 | 12/1/15 | 7,500,000 | 8,682,525 |

10

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| District of Columbia—1.6% | | | | |

| District of Columbia, | | | | |

| Income Tax Secured Revenue | 5.00 | 12/1/13 | 5,000,000 | 5,391,050 |

| Metropolitan Washington | | | | |

| Airports Authority, | | | | |

| Airport System Revenue | 5.00 | 10/1/13 | 3,300,000 | 3,520,770 |

| Florida—9.0% | | | | |

| Citizens Property Insurance | | | | |

| Corporation, Coastal Account | | | | |

| Senior Secured Revenue | 5.00 | 6/1/15 | 2,000,000 | 2,215,640 |

| Citizens Property Insurance | | | | |

| Corporation, High-Risk Account | | | | |

| Senior Secured Revenue | 5.00 | 6/1/14 | 5,500,000 | 5,948,250 |

| Florida State Board of Education, | | | | |

| Lottery Revenue | 5.00 | 7/1/14 | 2,500,000 | 2,754,050 |

| Florida State Board of Education, | | | | |

| Lottery Revenue | 5.00 | 7/1/14 | 5,375,000 | 5,921,208 |

| Florida State Board of Education, | | | | |

| Lottery Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.00 | 7/1/14 | 2,265,000 | 2,495,169 |

| Florida Water Pollution Control | | | | |

| Financing Corporation, Water | | | | |

| Pollution Control Revenue | 5.00 | 7/15/15 | 4,315,000 | 4,925,270 |

| Highlands County Health Facilities | | | | |

| Authority, HR (Adventist | | | | |

| Health System/Sunbelt | | | | |

| Obligated Group) | 5.00 | 11/15/13 | 1,000,000 | 1,069,990 |

| Hillsborough County Industrial | | | | |

| Development Authority, PCR | | | | |

| (Tampa Electric Company Project) | 5.10 | 10/1/13 | 1,855,000 | 1,887,741 |

| Kissimmee Utility Authority, | | | | |

| Electric System Revenue | 4.00 | 10/1/15 | 1,850,000 | 2,027,489 |

| Lakeland, | | | | |

| Energy System Revenue | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 5.00 | 10/1/15 | 3,150,000 | 3,563,437 |

| Lee County, | | | | |

| Airport Revenue (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.00 | 10/1/14 | 3,000,000 | 3,239,640 |

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| Florida (continued) | | | | | |

| Miami-Dade County, | | | | | |

| Aviation Revenue (Miami | | | | | |

| International Airport) | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 5.25 | 10/1/14 | 1,000,000 | | 1,085,980 |

| Miami-Dade County School Board, | | | | | |

| COP (Master Lease Purchase | | | | | |

| Agreement) (Insured; AMBAC) | 5.00 | 8/1/14 | 2,010,000 | | 2,159,283 |

| Orlando-Orange County Expressway | | | | | |

| Authority, Revenue (Insured; | | | | | |

| Assured Guaranty Municipal Corp.) | 5.00 | 7/1/14 | 2,000,000 | | 2,181,960 |

| Saint Petersburg, | | | | | |

| Public Utility Revenue | 5.00 | 10/1/13 | 2,435,000 | | 2,596,367 |

| Sarasota County School Board, | | | | | |

| COP (Master Lease | | | | | |

| Purchase Agreement) | 5.00 | 7/1/14 | 1,365,000 | | 1,474,364 |

| South Miami Health Facilities | | | | | |

| Authority, HR (Baptist Health | | | | | |

| South Florida Obligated Group) | 5.00 | 8/15/14 | 1,500,000 | | 1,643,250 |

| Tampa, | | | | | |

| Solid Waste System Revenue | | | | | |

| (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) | 4.00 | 10/1/14 | 1,715,000 | | 1,800,167 |

| Tampa Bay Water, A Regional | | | | | |

| Water Supply Authority, | | | | | |

| Utility System Revenue | 5.00 | 10/1/15 | 2,080,000 | | 2,390,898 |

| Georgia—2.5% | | | | | |

| Gwinnett County Development | | | | | |

| Authority, COP (Gwinnett | | | | | |

| County Public Schools Project) | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | | | | | |

| (Prerefunded) | 5.25 | 1/1/14 | 2,100,000 | a | 2,279,844 |

| Gwinnett County School District, | | | | | |

| GO Sales Tax Bonds | 4.00 | 10/1/16 | 5,000,000 | | 5,689,600 |

| Municipal Electric Authority of | | | | | |

| Georgia, Revenue (Combined | | | | | |

| Cycle Project) | 5.00 | 11/1/16 | 2,500,000 | | 2,902,625 |

| Private Colleges and Universities | | | | | |

| Authority, Revenue | | | | | |

| (Emory University) | 5.00 | 9/1/16 | 1,000,000 | | 1,178,910 |

12

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| Georgia (continued) | | | | | |

| Public Gas Partners, Inc., | | | | | |

| Gas Project Revenue (Gas | | | | | |

| Supply Pool Number 1) | 5.00 | 10/1/16 | 1,800,000 | | 2,040,552 |

| Hawaii—1.1% | | | | | |

| Hawaii, | | | | | |

| Airports System Revenue | 5.00 | 7/1/14 | 5,575,000 | | 6,073,851 |

| Illinois—5.6% | | | | | |

| Chicago, | | | | | |

| General Airport Third Lien | | | | | |

| Revenue (Chicago O’Hare | | | | | |

| International Airport) | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 5.25 | 1/1/16 | 3,575,000 | | 4,028,167 |

| Chicago, | | | | | |

| GO (Insured; Assured Guaranty | | | | | |

| Municipal Corp.) (Prerefunded) | 5.00 | 1/1/14 | 2,700,000 | a | 2,917,944 |

| Chicago, | | | | | |

| Passenger Facility Charge | | | | | |

| Revenue (Chicago O’Hare | | | | | |

| International Airport) | 5.00 | 1/1/15 | 1,000,000 | | 1,097,290 |

| Cook County, | | | | | |

| GO Capital Equipment Bonds | 5.00 | 11/15/13 | 2,000,000 | | 2,151,740 |

| Illinois, | | | | | |

| GO | 5.00 | 1/1/14 | 7,300,000 | | 7,793,407 |

| Illinois, | | | | | |

| GO | 5.00 | 1/1/15 | 2,665,000 | | 2,919,721 |

| Illinois, | | | | | |

| Sales Tax Revenue | 5.00 | 6/15/14 | 2,340,000 | | 2,565,833 |

| Illinois, | | | | | |

| Sales Tax Revenue | 4.00 | 6/15/16 | 2,750,000 | | 3,077,057 |

| Railsplitter Tobacco Settlement | | | | | |

| Authority, Tobacco | | | | | |

| Settlement Revenue | 4.00 | 6/1/13 | 1,200,000 | | 1,241,520 |

| Railsplitter Tobacco Settlement | | | | | |

| Authority, Tobacco | | | | | |

| Settlement Revenue | 5.00 | 6/1/14 | 3,800,000 | | 4,095,906 |

| Indiana—1.8% | | | | | |

| Indiana Finance Authority, | | | | | |

| Revenue (Trinity Health | | | | | |

| Credit Group) | 5.00 | 12/1/13 | 2,045,000 | | 2,191,749 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Indiana (continued) | | | | |

| Indianapolis, | | | | |

| Thermal Energy System First | | | | |

| Lien Revenue (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.00 | 10/1/15 | 2,000,000 | 2,258,100 |

| Indianapolis Local Public | | | | |

| Improvement Bond Bank, Revenue | | | | |

| (Indianapolis Airport Authority | | | | |

| Project) (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.63 | 1/1/14 | 2,230,000 | 2,302,051 |

| Rockport, | | | | |

| PCR (Indiana Michigan Power | | | | |

| Company Project) | 6.25 | 6/2/14 | 3,000,000 | 3,287,640 |

| Kansas—.4% | | | | |

| Wyandotte County/Kansas City | | | | |

| Unified Government Board of | | | | |

| Public Utilities, Utility | | | | |

| System Revenue | 5.00 | 9/1/14 | 2,060,000 | 2,258,440 |

| Louisiana—1.1% | | | | |

| Parish of Orleans Parishwide | | | | |

| School District, GO | | | | |

| (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 4.00 | 9/1/14 | 5,885,000 | 6,276,470 |

| Maryland—3.1% | | | | |

| Baltimore County, | | | | |

| GO (Consolidated | | | | |

| Public Improvement) | 5.00 | 8/1/13 | 1,000,000 | 1,063,870 |

| Baltimore County, | | | | |

| GO (Consolidated | | | | |

| Public Improvement) | 5.00 | 11/1/15 | 5,600,000 | 6,478,248 |

| Maryland, | | | | |

| GO (State and Local | | | | |

| Facilities Loan) | 5.00 | 8/1/15 | 3,435,000 | 3,940,185 |

| Montgomery County, | | | | |

| GO (Consolidated | | | | |

| Public Improvement) | 5.00 | 7/1/16 | 5,105,000 | 6,007,870 |

| Massachusetts—2.6% | | | | |

| Massachusetts, | | | | |

| GO (Consolidated Loan) | 5.00 | 12/1/16 | 5,000,000 | 5,944,100 |

14

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Massachusetts (continued) | | | | |

| Massachusetts Development | | | | |

| Finance Agency, Revenue | | | | |

| (Boston College Issue) | 5.00 | 7/1/15 | 2,000,000 | 2,282,680 |

| Massachusetts Development | | | | |

| Finance Agency, Revenue | | | | |

| (Tufts Medical Center Issue) | 5.00 | 1/1/16 | 650,000 | 703,352 |

| Massachusetts Health and | | | | |

| Educational Facilities Authority, | | | | |

| Revenue (Northeastern | | | | |

| University Issue) | 5.00 | 10/1/14 | 1,300,000 | 1,431,508 |

| Massachusetts Municipal Wholesale | | | | |

| Electric Company, Power Supply | | | | |

| Project Revenue (Project | | | | |

| Number 6 Issue) | 5.00 | 7/1/16 | 3,700,000 | 4,265,360 |

| Michigan—3.8% | | | | |

| Detroit, | | | | |

| Sewage Disposal System Senior | | | | |

| Lien Revenue (Insured; National | | | | |

| Public Finance Guarantee Corp.) | 5.50 | 7/1/14 | 3,125,000 | 3,357,125 |

| Detroit, | | | | |

| Water Supply System Senior | | | | |

| Lien Revenue | 5.00 | 7/1/15 | 1,000,000 | 1,093,160 |

| Detroit, | | | | |

| Water Supply System Senior | | | | |

| Lien Revenue | 5.00 | 7/1/16 | 1,000,000 | 1,108,540 |

| Kent Hospital Finance Authority, | | | | |

| Revenue (Spectrum | | | | |

| Health System) | 5.50 | 1/15/15 | 4,300,000 | 4,817,419 |

| Michigan Finance Authority, | | | | |

| Clean Water Revolving | | | | |

| Fund Revenue | 5.00 | 10/1/15 | 5,000,000 | 5,769,900 |

| Royal Oak Hospital Finance | | | | |

| Authority, HR (William Beaumont | | | | |

| Hospital Obligated Group) | 6.25 | 9/1/14 | 2,500,000 | 2,746,625 |

| Wayne County Airport Authority, | | | | |

| Airport Revenue (Detroit | | | | |

| Metropolitan Wayne | | | | |

| County Airport) | 5.00 | 12/1/14 | 2,500,000 | 2,691,500 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Minnesota—.6% | | | | |

| Saint Paul Independent School | | | | |

| District Number 625, GO School | | | | |

| Building Bonds (Minnesota | | | | |

| School District Credit | | | | |

| Enhancement Program) | 5.00 | 2/1/14 | 1,415,000 | 1,531,200 |

| University of Minnesota Regents, | | | | |

| GO | 5.00 | 12/1/16 | 1,520,000 | 1,805,319 |

| Missouri—.6% | | | | |

| Missouri Board of Public | | | | |

| Buildings, Special | | | | |

| Obligation Revenue | 4.00 | 10/1/15 | 3,000,000 | 3,350,250 |

| Nebraska—.8% | | | | |

| Omaha Public Power District, | | | | |

| Electric System Revenue | 5.00 | 2/1/16 | 3,770,000 | 4,373,162 |

| Nevada—.9% | | | | |

| Clark County School District, | | | | |

| Limited Tax GO (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.00 | 6/15/14 | 1,000,000 | 1,097,910 |

| Clark County School District, | | | | |

| Limited Tax GO (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.50 | 6/15/14 | 2,650,000 | 2,921,810 |

| Clark County School District, | | | | |

| Limited Tax GO (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.25 | 6/15/14 | 1,005,000 | 1,059,089 |

| New Jersey—2.6% | | | | |

| New Jersey Economic Development | | | | |

| Authority, School Facilities | | | | |

| Construction Revenue | 5.00 | 9/1/15 | 5,000,000 | 5,662,500 |

| New Jersey Health Care Facilities | | | | |

| Financing Authority, Revenue | | | | |

| (Holy Name Medical Center Issue) | 5.00 | 7/1/14 | 1,795,000 | 1,882,758 |

| New Jersey Higher Education | | | | |

| Student Assistance Authority, | | | | |

| Student Loan Revenue | 5.00 | 12/1/14 | 1,660,000 | 1,807,159 |

| New Jersey Transportation | | | | |

| Trust Fund Authority | | | | |

| (Transportation System) | | | | |

| (Insured; National Public | | | | |

| Finance Guarantee Corp.) | 5.25 | 12/15/13 | 215,000 | 233,116 |

16

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New Jersey (continued) | | | | |

| New Jersey Transportation Trust | | | | |

| Fund Authority (Transportation | | | | |

| System) (Insured; National | | | | |

| Public Finance Guarantee Corp.) | 5.25 | 12/15/13 | 4,785,000 | 5,171,102 |

| New Mexico—1.3% | | | | |

| Gallup, | | | | |

| PCR (Tri-State Generation and | | | | |

| Transmission Association, Inc. | | | | |

| Project) (Insured; AMBAC) | 5.00 | 8/15/14 | 3,785,000 | 4,099,193 |

| New Mexico Hospital Equipment | | | | |

| Loan Council, Hospital System | | | | |

| Revenue (Presbyterian | | | | |

| Healthcare Services) | 5.25 | 8/1/14 | 3,000,000 | 3,247,740 |

| New York—7.6% | | | | |

| Erie County Industrial Development | | | | |

| Agency, School Facility | | | | |

| Revenue (City School District | | | | |

| of the City of Buffalo Project) | 5.00 | 5/1/14 | 1,750,000 | 1,904,875 |

| Metropolitan Transportation | | | | |

| Authority, Dedicated Tax | | | | |

| Fund Revenue | 5.00 | 11/15/14 | 2,120,000 | 2,360,260 |

| Metropolitan Transportation | | | | |

| Authority, Dedicated Tax | | | | |

| Fund Revenue | 5.00 | 11/1/15 | 2,750,000 | 3,166,460 |

| Metropolitan Transportation | | | | |

| Authority, Transportation Revenue | 5.00 | 11/15/13 | 2,880,000 | 3,090,931 |

| Metropolitan Transportation | | | | |

| Authority, Transportation | | | | |

| Revenue (Insured; National | | | | |

| Public Finance Guarantee Corp.) | 5.00 | 11/15/15 | 2,645,000 | 3,015,617 |

| New York City, | | | | |

| GO | 5.00 | 8/1/15 | 2,000,000 | 2,277,240 |

| New York City, | | | | |

| GO | 5.00 | 8/1/16 | 5,725,000 | 6,675,980 |

| New York City Health and | | | | |

| Hospitals Corporation, | | | | |

| Health System Revenue | 5.00 | 2/15/15 | 2,000,000 | 2,216,700 |

| New York City Transitional Finance | | | | |

| Authority, Future Tax Secured | | | | |

| Subordinate Revenue | 5.00 | 11/1/13 | 4,105,000 | 4,409,427 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| New York (continued) | | | | |

| New York City Transitional Finance | | | | |

| Authority, Revenue (New York | | | | |

| City Recovery Bonds) | 5.00 | 11/1/14 | 3,000,000 | 3,348,150 |

| New York State Dormitory | | | | |

| Authority, Revenue (Mount | | | | |

| Sinai School of Medicine of | | | | |

| New York University) | 5.00 | 7/1/15 | 1,000,000 | 1,115,250 |

| New York State Thruway Authority, | | | | |

| Second General Highway and | | | | |

| Bridge Trust Fund Bonds | 5.00 | 4/1/14 | 3,535,000 | 3,853,079 |

| New York State Thruway Authority, | | | | |

| Second General Highway and | | | | |

| Bridge Trust Fund Bonds | 5.00 | 4/1/16 | 5,000,000 | 5,801,000 |

| North Carolina—.6% | | | | |

| Mecklenburg County Public | | | | |

| Facilities Corporation, | | | | |

| Limited Obligation Bonds | 5.00 | 3/1/14 | 3,000,000 | 3,267,180 |

| Ohio—.2% | | | | |

| Ohio State University, | | | | |

| General Receipts Bonds | 5.00 | 12/1/14 | 1,265,000 | 1,415,611 |

| Oklahoma—1.6% | | | | |

| Tulsa County Industrial Authority, | | | | |

| Capital Improvements Revenue | 5.00 | 5/15/14 | 6,000,000 | 6,546,960 |

| Tulsa County Industrial Authority, | | | | |

| Educational Facilities Lease | | | | |

| Revenue (Broken Arrow Public | | | | |

| Schools Project) | 4.00 | 9/1/15 | 2,100,000 | 2,305,674 |

| Oregon—1.4% | | | | |

| Oregon, | | | | |

| GO (State Property— | | | | |

| Various Projects) | 5.00 | 5/1/16 | 1,750,000 | 2,033,535 |

| Oregon Department of | | | | |

| Administrative Services, COP | 5.00 | 11/1/13 | 5,565,000 | 5,970,355 |

| Pennsylvania—5.9% | | | | |

| Adams County Industrial | | | | |

| Development Authority, Revenue | | | | |

| (Gettysburg College) | 5.00 | 8/15/14 | 1,000,000 | 1,089,040 |

18

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Pennsylvania (continued) | | | | |

| Allegheny County Airport | | | | |

| Authority, Airport Revenue | | | | |

| (Pittsburgh International | | | | |

| Airport) (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.00 | 1/1/15 | 1,000,000 | 1,089,060 |

| Allegheny County Higher Education | | | | |

| Building Authority, Revenue | | | | |

| (Carnegie Mellon University) | 5.00 | 3/1/15 | 3,400,000 | 3,827,210 |

| Beaver County Hospital Authority, | | | | |

| Revenue (Heritage Valley | | | | |

| Health System, Inc.) | 5.00 | 5/15/15 | 1,000,000 | 1,111,240 |

| Pennsylvania, | | | | |

| GO | 5.00 | 7/15/14 | 3,000,000 | 3,318,120 |

| Pennsylvania, | | | | |

| GO (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 5.00 | 9/1/14 | 1,200,000 | 1,333,728 |

| Pennsylvania Economic Development | | | | |

| Financing Authority, SWDR | | | | |

| (Waste Management, Inc. Project) | 4.70 | 11/1/14 | 3,500,000 | 3,758,055 |

| Pennsylvania Higher Educational | | | | |

| Facilities Authority, Health | | | | |

| System Revenue (The University | | | | |

| of Pennsylvania) | 5.00 | 8/15/13 | 3,000,000 | 3,177,600 |

| Pennsylvania Turnpike Commission, | | | | |

| Turnpike Revenue (Insured; | | | | |

| National Public Finance | | | | |

| Guarantee Corp.) | 5.50 | 12/1/13 | 2,620,000 | 2,836,805 |

| Pennsylvania Turnpike Commission, | | | | |

| Turnpike Subordinate Revenue | 5.00 | 6/1/14 | 5,600,000 | 6,050,632 |

| Philadelphia School District, | | | | |

| GO | 5.00 | 9/1/14 | 4,230,000 | 4,634,726 |

| Philadelphia School District, | | | | |

| GO | 5.00 | 9/1/15 | 1,200,000 | 1,352,220 |

| South Carolina—3.5% | | | | |

| Charleston, | | | | |

| Waterworks and Sewer System | | | | |

| Capital Improvement Revenue | 5.13 | 1/1/15 | 1,680,000 | 1,888,942 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| South Carolina (continued) | | | | |

| Columbia, | | | | |

| Waterworks and Sewer | | | | |

| System Revenue | 4.00 | 2/1/15 | 1,000,000 | 1,097,330 |

| Renewable Water Resources, | | | | |

| Sewer System Revenue | 5.00 | 1/1/14 | 1,000,000 | 1,076,690 |

| South Carolina Public Service | | | | |

| Authority, Revenue Obligations | | | | |

| (Santee Cooper) | 5.00 | 1/1/14 | 1,000,000 | 1,080,350 |

| South Carolina Public Service | | | | |

| Authority, Revenue Obligations | | | | |

| (Santee Cooper) | 5.00 | 1/1/14 | 3,595,000 | 3,883,858 |

| South Carolina Transportation | | | | |

| Infrastructure Bank, Revenue | 5.00 | 10/1/13 | 10,000,000 | 10,654,900 |

| Tennessee—1.0% | | | | |

| Memphis, | | | | |

| Electric System | | | | |

| Subordinate Revenue | 5.00 | 12/1/14 | 5,000,000 | 5,595,300 |

| Texas—9.5% | | | | |

| Clear Creek Independent School | | | | |

| District, Unlimited Tax | | | | |

| Schoolhouse Bonds (Permanent | | | | |

| School Fund Guarantee Program) | 5.00 | 2/15/15 | 1,500,000 | 1,690,950 |

| Copperas Cove Independent School | | | | |

| District, Unlimited Tax School | | | | |

| Building Bonds (Permanent | | | | |

| School Fund Guarantee Program) | 5.00 | 8/15/16 | 1,250,000 | 1,420,200 |

| Cypress-Fairbanks Independent | | | | |

| School District, Unlimited Tax | | | | |

| Schoolhouse Bonds (Permanent | | | | |

| School Fund Guarantee Program) | 5.25 | 2/15/15 | 1,500,000 | 1,701,645 |

| Fort Worth, | | | | |

| Water and Sewer System | | | | |

| Improvement Revenue | 5.00 | 2/15/16 | 2,115,000 | 2,450,439 |

| Garland Independent School | | | | |

| District, Unlimited Tax School | | | | |

| Building Bonds (Permanent | | | | |

| School Fund Guarantee Program) | 5.00 | 2/15/15 | 1,815,000 | 2,046,049 |

| Houston, | | | | |

| Combined Utility System | | | | |

| First Lien Revenue | 5.00 | 11/15/14 | 2,785,000 | 3,115,524 |

20

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Texas (continued) | | | | |

| Houston Convention and | | | | |

| Entertainment Facilities | | | | |

| Department, Hotel Occupancy | | | | |

| Tax and Special Revenue | 5.00 | 9/1/15 | 2,800,000 | 3,131,212 |

| Katy Independent School District, | | | | |

| Unlimited Tax Bonds (Permanent | | | | |

| School Fund Guarantee Program) | 5.00 | 2/15/15 | 1,625,000 | 1,831,862 |

| Lower Colorado River Authority, | | | | |

| Revenue | 5.00 | 5/15/14 | 5,000 | 5,478 |

| Lower Colorado River Authority, | | | | |

| Revenue | 5.00 | 5/15/14 | 5,000 | 5,487 |

| Lower Colorado River Authority, | | | | |

| Revenue | 5.00 | 5/15/14 | 990,000 | 1,080,446 |

| Lubbock, | | | | |

| Tax and Waterworks System | | | | |

| Surplus Revenue (Certificates | | | | |

| of Obligation) | 5.00 | 2/15/14 | 3,630,000 | 3,941,091 |

| Mission Economic Development | | | | |

| Corporation, SWDR (Waste | | | | |

| Management, Inc. Project) | 6.00 | 8/1/13 | 2,500,000 | 2,657,600 |

| North East Independent School | | | | |

| District, Unlimited Tax Bonds | | | | |

| (Permanent School Fund | | | | |

| Guarantee Program) | 5.25 | 8/1/14 | 2,315,000 | 2,575,970 |

| Pflugerville Independent School | | | | |

| District, Unlimited Tax | | | | |

| Refunding Bonds (Permanent | | | | |

| School Fund Guarantee Program) | 5.25 | 8/15/13 | 1,465,000 | 1,565,851 |

| San Antonio, | | | | |

| Airport System Revenue | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 6.00 | 7/1/13 | 705,000 | 752,207 |

| San Antonio, | | | | |

| Airport System Revenue | | | | |

| (Insured; Assured Guaranty | | | | |

| Municipal Corp.) | 6.00 | 7/1/13 | 2,295,000 | 2,448,260 |

| San Antonio, | | | | |

| Electric and Gas Systems | | | | |

| Revenue (Insured; Assured | | | | |

| Guaranty Municipal Corp.) | 5.38 | 2/1/14 | 3,000,000 | 3,275,430 |

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| Texas (continued) | | | | | |

| Texas A&M University System | | | | | |

| Board of Regents, Financing | | | | | |

| System Revenue | 5.00 | 5/15/14 | 4,835,000 | | 5,307,089 |

| Texas Public Finance Authority, | | | | | |

| Revenue (Building and | | | | | |

| Procurement Commission | | | | | |

| Projects) (Insured; AMBAC) | 5.00 | 2/1/14 | 2,500,000 | | 2,706,125 |

| Texas State University System | | | | | |

| Board of Regents, Financing | | | | | |

| System Revenue | 5.00 | 3/15/14 | 1,000,000 | | 1,090,360 |

| University of Houston System | | | | | |

| Board of Regents, | | | | | |

| Consolidated Revenue | 5.00 | 2/15/16 | 4,415,000 | | 5,117,073 |

| University of Texas System | | | | | |

| Board of Regents, Financing | | | | | |

| System Revenue | 5.00 | 8/15/15 | 1,900,000 | | 2,170,655 |

| University of Texas System | | | | | |

| Board of Regents, Financing | | | | | |

| System Revenue | 5.00 | 8/15/16 | 1,120,000 | | 1,312,606 |

| Waco, | | | | | |

| GO | 4.00 | 2/1/16 | 1,000,000 | | 1,114,620 |

| Utah—.3% | | | | | |

| Utah Board of Regents, | | | | | |

| University of Utah HR | | | | | |

| (Insured; National Public | | | | | |

| Finance Guarantee Corp.) | 5.00 | 8/1/14 | 1,500,000 | | 1,637,745 |

| Virginia—4.3% | | | | | |

| Virginia College Building | | | | | |

| Authority, Educational | | | | | |

| Facilities Revenue (21st | | | | | |

| Century College and | | | | | |

| Equipment Programs) | | | | | |

| (Prerefunded) | 5.00 | 2/1/14 | 1,975,000 | a | 2,143,231 |

| Virginia Commonwealth | | | | | |

| Transportation Board, Federal | | | | | |

| Transportation Grant | | | | | |

| Anticipation Revenue Notes | 5.00 | 9/15/16 | 3,195,000 | | 3,764,030 |

| Virginia Housing Development | | | | | |

| Authority, Commonwealth | | | | | |

| Mortgage Revenue | 4.20 | 1/1/14 | 4,500,000 | | 4,647,870 |

22

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| Virginia (continued) | | | | | |

| Virginia Housing Development | | | | | |

| Authority, Commonwealth | | | | | |

| Mortgage Revenue | 4.20 | 7/1/14 | 1,500,000 | | 1,558,020 |

| Virginia Public Building | | | | | |

| Authority, Public | | | | | |

| Facilities Revenue | 5.00 | 8/1/13 | 3,250,000 | | 3,452,085 |

| Virginia Public Building | | | | | |

| Authority, Public | | | | | |

| Facilities Revenue | 5.00 | 8/1/14 | 2,000,000 | | 2,209,400 |

| Virginia Public Building | | | | | |

| Authority, Public | | | | | |

| Facilities Revenue | 5.00 | 8/1/14 | 2,000,000 | | 2,209,400 |

| Virginia Public School Authority, | | | | | |

| School Financing Bonds | 5.00 | 8/1/14 | 3,865,000 | | 4,284,005 |

| Washington—4.9% | | | | | |

| Chelan County Public Utility | | | | | |

| District Number 1, Consolidated | | | | | |

| System Revenue | 5.00 | 7/1/15 | 1,500,000 | | 1,679,490 |

| FYI Properties, | | | | | |

| LR (State of Washington | | | | | |

| Department of Information | | | | | |

| Services Project) | 5.00 | 6/1/14 | 1,700,000 | | 1,847,883 |

| Greater Wenatchee Regional Events | | | | | |

| Center Public Facilities District, | | | | | |

| Revenue and Special Tax BAN | 5.25 | 12/1/11 | 3,000,000 | b | 2,235,000 |

| King County, | | | | | |

| Sewer Revenue | 5.00 | 1/1/16 | 5,000,000 | | 5,763,750 |

| Port of Seattle, | | | | | |

| Intermediate Lien Revenue | 3.00 | 8/1/15 | 2,400,000 | | 2,521,584 |

| Port of Seattle, | | | | | |

| Limited Tax GO | 5.00 | 12/1/15 | 1,050,000 | | 1,183,518 |

| Seattle, | | | | | |

| Municipal Light and Power | | | | | |

| Improvement Revenue | 5.00 | 2/1/14 | 4,500,000 | | 4,883,130 |

| Seattle, | | | | | |

| Municipal Light and Power | | | | | |

| Improvement Revenue | 5.00 | 2/1/15 | 1,500,000 | | 1,687,710 |

| Washington, | | | | | |

| GO (Various Purpose) | 5.00 | 7/1/16 | 5,000,000 | | 5,863,700 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Wisconsin—1.2% | | | | |

| Wisconsin, | | | | |

| GO | 5.00 | 5/1/16 | 1,500,000 | 1,750,455 |

| Wisconsin, | | | | |

| Petroleum Inspection | | | | |

| Fee Revenue | 5.00 | 7/1/14 | 3,250,000 | 3,570,645 |

| Wisconsin Health and Educational | | | | |

| Facilities Authority, Revenue | | | | |

| (Aurora Health Care, Inc.) | 5.00 | 4/15/14 | 1,390,000 | 1,494,278 |

| U.S. Related—3.0% | | | | |

| Puerto Rico Commonwealth, | | | | |

| Public Improvement GO | 5.25 | 7/1/14 | 2,300,000 | 2,463,783 |

| Puerto Rico Electric Power | | | | |

| Authority, Power Revenue | | | | |

| (Insured; National Public | | | | |

| Finance Guarantee Corp.) | 5.00 | 7/1/15 | 1,000,000 | 1,098,670 |

| Puerto Rico Government | | | | |

| Development Bank, Senior Notes | 5.25 | 1/1/15 | 5,000,000 | 5,333,800 |

| Puerto Rico Infrastructure | | | | |

| Financing Authority, Special | | | | |

| Tax Revenue (Insured; AMBAC) | 5.50 | 7/1/13 | 1,760,000 | 1,842,157 |

| Puerto Rico Infrastructure | | | | |

| Financing Authority, Special | | | | |

| Tax Revenue (Insured; AMBAC) | 5.50 | 7/1/14 | 5,000,000 | 5,384,700 |

| Virgin Islands Public Finance | | | | |

| Authority, Revenue (Virgin | | | | |

| Islands Matching Fund Loan | | | | |

| Notes) (Senior Lien) | 5.00 | 10/1/13 | 1,000,000 | 1,042,830 |

| Total Long-Term Municipal Investments | | | |

| (cost $546,014,536) | | | | 558,691,735 |

24

| | | | | | |

| Short-Term Municipal | Coupon | Maturity | Principal | | | |

| Investments—.7% | Rate (%) | Date | Amount ($) | | | Value ($) |

| California—.3% | | | | | | |

| California, | | | | | | |

| GO Notes | | | | | | |

| (Kindergarten-University) | | | | | | |

| (LOC: California State | | | | | | |

| Teachers Retirement | | | | | | |

| System and Citibank NA) | 0.16 | 4/1/12 | 1,700,000 c | | | 1,700,000 |

| New York—.4% | | | | | | |

| New York City, | | | | | | |

| GO Notes (LOC; JPMorgan | | | | | | |

| Chase Bank) | 0.17 | 4/1/12 | 2,200,000 c | | | 2,200,000 |

| Total Short-Term Municipal Investments | | | | | |

| (cost $3,900,000) | | | | | | 3,900,000 |

| |

| Total Investments (cost $549,914,536) | | | 99.2 | % | | 562,591,735 |

| Cash and Receivables (Net) | | | .8 | % | | 4,715,665 |

| Net Assets | | | 100.0 | % | | 567,307,400 |

|

| a These securities are prerefunded; the date shown represents the prerefunded date. Bonds which are prerefunded are |

| collateralized by U.S. Government securities which are held in escrow and are used to pay principal and interest on |

| the municipal issue and to retire the bonds in full at the earliest refunding date. |

| b Non-income producing—security in default. |

| c Variable rate demand note—rate shown is the interest rate in effect at March 31, 2012. Maturity date represents the |

| next demand date, or the ultimate maturity date if earlier. |

STATEMENT OF INVESTMENTS (continued)

| | | |

| Summary of Abbreviations | | |

| |

| ABAG | Association of Bay Area Governments | ACA | American Capital Access |

| AGC | ACE Guaranty Corporation | AGIC | Asset Guaranty Insurance Company |

| AMBAC | American Municipal Bond | ARRN | Adjustable Rate |

| | Assurance Corporation | | Receipt Notes |

| BAN | Bond Anticipation Notes | BPA | Bond Purchase Agreement |

| CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

| CP | Commercial Paper | DRIVERS | Derivative Inverse |

| | | | Tax-Exempt Receipts |

| EDR | Economic Development | EIR | Environmental Improvement |

| | Revenue | | Revenue |

| FGIC | Financial Guaranty | FHA | Federal Housing |

| | Insurance Company | | Administration |

| FHLB | Federal Home | FHLMC | Federal Home Loan Mortgage |

| | Loan Bank | | Corporation |

| FNMA | Federal National | GAN | Grant Anticipation Notes |

| | Mortgage Association | | |

| GIC | Guaranteed Investment | GNMA | Government National Mortgage |

| | Contract | | Association |

| GO | General Obligation | HR | Hospital Revenue |

| IDB | Industrial Development Board | IDC | Industrial Development Corporation |

| IDR | Industrial Development Revenue | LOC | Letter of Credit |

| LOR | Limited Obligation Revenue | LR | Lease Revenue |

| MERLOTS | Municipal Exempt Receipt | MFHR | Multi-Family Housing |

| | Liquidity Option Tender | | Revenue |

| MFMR | Multi-Family Mortgage Revenue | PCR | Pollution Control Revenue |

| PILOT | Payment in Lieu of Taxes | P-FLOATS Puttable Floating Option |

| | | | Tax-Exempt Receipts |

| PUTTERS | Puttable Tax-Exempt Receipts | RAC | Revenue Anticipation Certificates |

| RAN | Revenue Anticipation Notes | RAW | Revenue Anticipation Warrants |

| ROCS | Reset Options Certificates | RRR | Resources Recovery Revenue |

| SAAN | State Aid Anticipation Notes | SBPA | Standby Bond Purchase Agreement |

| SFHR | Single Family Housing Revenue | SFMR | Single Family Mortgage Revenue |

| SONYMA | State of New York Mortgage Agency | SWDR | Solid Waste Disposal Revenue |

| TAN | Tax Anticipation Notes | TAW | Tax Anticipation Warrants |

| TRAN | Tax and Revenue Anticipation Notes | XLCA | XL Capital Assurance |

26

| | | | | |

| Summary of Combined Ratings (Unaudited) | |

| |

| Fitch | or | Moody’s | or | Standard & Poor’s | Value (%)† |

| AAA | | Aaa | | AAA | 18.0 |

| AA | | Aa | | AA | 52.9 |

| A | | A | | A | 22.9 |

| BBB | | Baa | | BBB | 5.4 |

| F1 | | MIG1/P1 | | SP1/A1 | .7 |

| Not Ratedd | | Not Ratedd | | Not Ratedd | .1 |

| | | | | | 100.0 |

|

| † Based on total investments. |

| d Securities which, while not rated by Fitch, Moody’s and Standard & Poor’s, have been determined by the Manager to |

| be of comparable quality to those rated securities in which the fund may invest. |

See notes to financial statements.

|

| STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2012 |

| | | |

| | | Cost | Value |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments | 549,914,536 | 562,591,735 |

| Cash | | | 551,088 |

| Interest receivable | | | 6,821,021 |

| Receivable for shares of Beneficial Interest subscribed | | 1,206,065 |

| Prepaid expenses | | | 36,018 |

| | | | 571,205,927 |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 324,684 |

| Payable for investment securities purchased | | | 2,262,960 |

| Payable for shares of Beneficial Interest redeemed | | | 1,229,474 |

| Accrued expenses | | | 81,409 |

| | | | 3,898,527 |

| Net Assets ($) | | | 567,307,400 |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | | 552,923,010 |

| Accumulated undistributed investment income—net | | | 20,917 |

| Accumulated net realized gain (loss) on investments | | | 1,686,274 |

| Accumulated net unrealized appreciation | | | |

| (depreciation) on investments | | | 12,677,199 |

| Net Assets ($) | | | 567,307,400 |

| |

| |

| Net Asset Value Per Share | | | |

| | Class A | Class D | Class I |

| Net Assets ($) | 47,010,568 | 488,869,446 | 31,427,386 |

| Shares Outstanding | 3,540,877 | 36,827,243 | 2,366,778 |

| Net Asset Value Per Share ($) | 13.28 | 13.27 | 13.28 |

| |

| See notes to financial statements. | | | |

28

| | |

| STATEMENT OF OPERATIONS | |

| Year Ended March 31, 2012 | |

| |

| |

| |

| |

| Investment Income ($): | |

| Interest Income | 12,634,453 |

| Expenses: | |

| Management fee—Note 3(a) | 2,739,028 |

| Distribution fees—Note 3(b) | 472,299 |

| Shareholder servicing costs—Note 3(c) | 310,197 |

| Registration fees | 80,858 |

| Professional fees | 78,650 |

| Custodian fees—Note 3(c) | 47,505 |

| Prospectus and shareholders’ reports | 27,674 |

| Trustees’ fees and expenses—Note 3(d) | 8,163 |

| Loan commitment fees—Note 2 | 8,150 |

| Interest expense—Note 2 | 141 |

| Miscellaneous | 55,700 |

| Total Expenses | 3,828,365 |

| Less—reduction in expenses due to undertaking—Note 3(a) | (88) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (152) |

| Net Expenses | 3,828,125 |

| Investment Income—Net | 8,806,328 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments | 3,272,971 |

| Net unrealized appreciation (depreciation) on investments | 4,665,401 |

| Net Realized and Unrealized Gain (Loss) on Investments | 7,938,372 |

| Net Increase in Net Assets Resulting from Operations | 16,744,700 |

| |

| See notes to financial statements. | |

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | | Year Ended March 31, |

| | 2012a | 2011 |

| Operations ($): | | |

| Investment income—net | 8,806,328 | 11,239,779 |

| Net realized gain (loss) on investments | 3,272,971 | 1,064,567 |

| Net unrealized appreciation | | |

| (depreciation) on investments | 4,665,401 | (2,019,366) |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 16,744,700 | 10,284,980 |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Class A Shares | (637,290) | (768,058) |

| Class B Shares | (82) | (2,050) |

| Class D Shares | (7,573,029) | (9,859,387) |

| Class I Shares | (541,088) | (521,417) |

| Total Dividends | (8,751,489) | (11,150,912) |

| Beneficial Interest Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Class A Shares | 22,841,290 | 39,813,394 |

| Class B Shares | 12,609 | 32,186 |

| Class D Shares | 128,415,342 | 195,678,503 |

| Class I Shares | 26,414,127 | 18,350,408 |

| Dividends reinvested: | | |

| Class A Shares | 499,131 | 562,370 |

| Class B Shares | 78 | 2,036 |

| Class D Shares | 6,846,475 | 8,936,840 |

| Class I Shares | 201,156 | 24,540 |

| Cost of shares redeemed: | | |

| Class A Shares | (23,988,244) | (26,331,763) |

| Class B Shares | (87,730) | (381,820) |

| Class D Shares | (130,073,732) | (253,648,064) |

| Class I Shares | (16,858,738) | (24,036,260) |

| Increase (Decrease) in Net Assets from | | |

| Beneficial Interest Transactions | 14,221,764 | (40,997,630) |

| Total Increase (Decrease) in Net Assets | 22,214,975 | (41,863,562) |

| Net Assets ($): | | |

| Beginning of Period | 545,092,425 | 586,955,987 |

| End of Period | 567,307,400 | 545,092,425 |

| Undistributed investment income—net | 20,917 | — |

30

| | | | |

| | | Year Ended March 31, |

| | 2012a | 2011 |

| Capital Share Transactions: | | |

| Class A | | |

| Shares sold | 1,723,495 | 3,017,415 |

| Shares issued for dividends reinvested | 37,711 | 42,755 |

| Shares redeemed | (1,813,882) | (2,006,522) |

| Net Increase (Decrease) in Shares Outstanding | (52,676) | 1,053,648 |

| Class Bb | | |

| Shares sold | 948 | 2,374 |

| Shares issued for dividends reinvested | 6 | 155 |

| Shares redeemed | (6,610) | (29,009) |

| Net Increase (Decrease) in Shares Outstanding | (5,656) | (26,480) |

| Class Db | | |

| Shares sold | 9,697,569 | 14,874,283 |

| Shares issued for dividends reinvested | 517,313 | 678,961 |

| Shares redeemed | (9,841,518) | (19,318,772) |

| Net Increase (Decrease) in Shares Outstanding | 373,364 | (3,765,528) |

| Class I | | |

| Shares sold | 2,004,688 | 1,392,450 |

| Shares issued for dividends reinvested | 15,189 | 1,867 |

| Shares redeemed | (1,273,554) | (1,830,056) |

| Net Increase (Decrease) in Shares Outstanding | 746,323 | (435,739) |

|

| a Effective as of the close of business on March 13, 2012, the fund no longer offers Class B shares. |

| b During the period ended March 31, 2012, 2,730 Class B shares representing $36,287 were automatically converted |

| to 2,728 Class D shares and during the period ended March 31, 2011, 3,818 Class B shares representing |

| $50,547 were automatically converted to 3,818 Class D shares. |

See notes to financial statements.

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | |

| | | Year Ended March 31, |

| Class A Shares | 2012 | 2011 | 2010a |

| Per Share Data ($): | | | |

| Net asset value, beginning of period | 13.08 | 13.09 | 12.94 |

| Investment Operations: | | | |

| Investment income—netb | .19 | .23 | .14 |

| Net realized and unrealized | | | |

| gain (loss) on investments | .20 | (.01) | .17 |

| Total from Investment Operations | .39 | .22 | .31 |

| Distributions: | | | |

| Dividends from investment income—net | (.19) | (.23) | (.16) |

| Net asset value, end of period | 13.28 | 13.08 | 13.09 |

| Total Return (%)c | 3.02 | 1.68 | 2.43d |

| Ratios/Supplemental Data (%): | | | |

| Ratio of total expenses to average net assets | .84 | .84 | .86e |

| Ratio of net expenses to average net assets | .84 | .84 | .85e |

| Ratio of net investment income | | | |

| to average net assets | 1.47 | 1.75 | 1.81e |

| Portfolio Turnover Rate | 30.99 | 20.09 | 10.06 |

| Net Assets, end of period ($ x 1,000) | 47,011 | 47,008 | 33,246 |

| |

| a | From August 3, 2009 (commencement of initial offering) to March 31, 2010. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

See notes to financial statements.

32

| | | | | | | | | | |

| | | Year Ended March 31, | |

| Class D Shares | 2012 | 2011 | 2010 | 2009 | 2008 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 13.08 | 13.09 | 12.75 | 12.71 | 12.63 |

| Investment Operations: | | | | | |

| Investment income—neta | .21 | .25 | .28 | .43 | .41 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | .19 | (.01) | .35 | .05 | .08 |

| Total from Investment Operations | .40 | .24 | .63 | .48 | .49 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.21) | (.25) | (.29) | (.43) | (.41) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | — | (.01) | — |

| Total Distributions | (.21) | (.25) | (.29) | (.44) | (.41) |

| Net asset value, end of period | 13.27 | 13.08 | 13.09 | 12.75 | 12.71 |

| Total Return (%) | 3.10 | 1.84 | 4.98 | 3.85 | 3.90 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | .69 | .70 | .72 | .77 | .77 |

| Ratio of net expenses | | | | | |

| to average net assets | .69 | .70 | .72 | .77 | .77 |

| Ratio of net investment income | | | | | |

| to average net assets | 1.61 | 1.92 | 2.17 | 3.45 | 3.23 |

| Portfolio Turnover Rate | 30.99 | 20.09 | 10.06 | 36.97 | 62.90 |

| Net Assets, end of period ($ x 1,000) | 488,869 | 476,809 | 526,370 | 217,715 | 136,999 |

| |

| a Based on average shares outstanding at each month end. | | | | |

| See notes to financial statements. | | | | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | |

| | | Year Ended March 31, | |

| Class I Shares | 2012 | 2011 | 2010 | 2009a |

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | 13.08 | 13.09 | 12.76 | 12.54 |

| Investment Operations: | | | | |

| Investment income—netb | .23 | .27 | .28 | .08 |

| Net realized and unrealized | | | | |

| gain (loss) on investments | .19 | (.01) | .36 | .27 |

| Total from Investment Operations | .42 | .26 | .64 | .35 |

| Distributions: | | | | |

| Dividends from investment income—net | (.22) | (.27) | (.31) | (.13) |

| Net asset value, end of period | 13.28 | 13.08 | 13.09 | 12.76 |

| Total Return (%) | 3.26 | 1.96 | 5.03 | 2.83c |

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | .60 | .57 | .59 | .82d |

| Ratio of net expenses to average net assets | .60 | .57 | .59 | .65d |

| Ratio of net investment income | | | | |

| to average net assets | 1.70 | 2.04 | 2.07 | 3.51d |

| Portfolio Turnover Rate | 30.99 | 20.09 | 10.06 | 36.97 |

| Net Assets, end of period ($ x 1,000) | 31,427 | 21,201 | 26,920 | 110 |

| |

| a | From December 15, 2008 (commencement of initial offering) to March 31, 2009. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

34

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Short-Intermediate Municipal Bond Fund (the “fund”) is the sole series of Dreyfus Premier Short-Intermediate Municipal Bond Fund (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as a non-diversified open-end management investment company. The fund’s investment objective is to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

Class B shares were subject to a contingent deferred sales charge (“CDSC”) imposed on Class B share redemptions made within six years of purchase and automatically converted to Class D shares after six years. The fund no longer offers B shares. Effective March 13, 2012, all outstanding Class B shares were automatically converted to Class D shares.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares.The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class D and Class I. Class A shares are subject to a sales charge imposed at the time of purchase. Class D shares are sold at net asset value per share directly by Dreyfus and through certain banks and fund supermarkets, and as a part of certain wrap-fee programs. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services

NOTES TO FINANCIAL STATEMENTS (continued)

offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

36

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the Board of Trustees. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market con-ditions.All of the preceding securities are categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board of Trustees.

NOTES TO FINANCIAL STATEMENTS (continued)

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of March 31, 2012 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Municipal Bonds | — | 562,591,735 | — | 562,591,735 |

In May 2011, FASB issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common FairValue Measurement and Disclosure Requirements in GAAP and International Financial Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair

38

value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value mea-surements.The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when issued or delayed delivery basis may be settled a month or more after the trade date.