UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-05002

Deutsche DWS Variable Series II

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-2500

Diane Kenneally

1 International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 6/30/2018 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

June 30, 2018

Semiannual Report

Deutsche DWS Variable Series II

(formerly Deutsche Variable Series II)

DWS Alternative Asset Allocation VIP

(formerly Deutsche Alternative Asset Allocation VIP)

Contents

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Although allocation among different asset categories generally limits risk, portfolio management may favor an asset category that underperforms other assets or markets as a whole. The Fund expects to invest in underlying funds that emphasize alternatives or non-traditional asset categories or investment strategies, and as a result, it is subject to the risk factors of those underlying funds. Some of those risks include: stock market risk; the political, general economic, liquidity and currency risks of foreign investments, which may be particularly significant for emerging markets; credit and interest rate risk; floating rate loan risk; volatility in commodity prices, infrastructure and high-yield debt securities; market direction risk (market advances when short, market declines when long); and short sales risk. Because Exchange Traded Funds (ETFs) trade on a securities exchange, their shares may trade at a premium or discount to their net asset value. ETFs also incur fees and expenses so they may not fully match the performance of the indexes they are designed to track. Because Exchange Traded Notes (ETNs) are senior, unsecured, unsubordinated debt securities of an issuer (typically a bank or bank holding company), ETNs are subject to the credit risk of the issuer and may lose value due to a downgrade in the issuer’s credit rating. The returns of an ETN are linked to the performance of an underlying instrument (typically an index), minus applicable fees. ETNs typically do not make periodic interest payments and principal typically is not protected. The value of an ETN may fluctuate based on factors such as time to maturity, level of supply and demand for the ETN, volatility and lack of liquidity in the underlying assets, changes in the applicable interest rates, and economic, legal, political or geographic events that affect the underlying assets. The Fund bears its proportionate share of any fees and expenses borne by the ETN. Because ETNs trade on a securities exchange, their shares may trade at a premium or discount to their net asset value. The Fund may use derivatives, including as part of its currency and interest-rate strategies. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The success of the Fund’s currency and interest-rate strategies are dependent, in part, on the effectiveness and implementation of portfolio management’s proprietary models. As part of these strategies, the Fund’s exposure to foreign currencies could cause lower returns or even losses because foreign currency rates may fluctuate significantly over short periods of time for a number of reasons. The risk of loss is heightened during periods of rapid rises in interest rates. In addition, the notional amount of the Fund’s aggregate currency and interest-rate exposure resulting from these strategies may significantly exceed the net assets of the Fund. Please read prospectus for additional risks and specific details regarding the Fund’s risk profile.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

DWS Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | | | | | |

| | 2 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

| | |

| Performance Summary | | June 30, 2018 (Unaudited) |

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund’s most recent month-end performance. Performance does not reflect charges and fees (“contract charges”) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. While all share classes have the same underlying portfolio, their performance will differ.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2018 are 1.36% and 1.65% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. These expense ratios include net expenses of the underlying funds in which the Fund invests.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

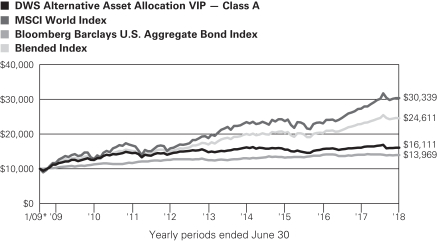

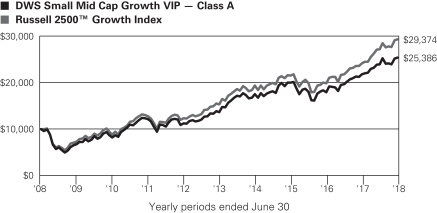

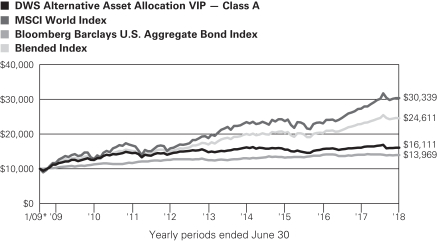

Growth of an Assumed $10,000 Investment in DWS Alternative Asset Allocation VIP from 2/2/09 to 6/30/18

| | |

| | The Morgan Stanley Capital International (MSCI) World Index captures large and mid cap representation across 23 Developed Market countries. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. The Blended Index is calculated using the performance of two unmanaged indices, representative of stocks (the MSCI World Index (70%)) and bonds (the Bloomberg Barclays U.S. Aggregate Bond Index (30%)). These results are summed to produce the aggregate benchmark. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| | | | | | | | | | | | |

| Comparative Results | | | | | | | | | | | | |

| | | | | | |

DWS Alternative Asset

Allocation VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | Life of Fund* |

| Class A | | Growth of $10,000 | | $9,612 | | $10,009 | | $10,338 | | $10,860 | | $16,111 |

| | | Average annual total return | | –3.88% | | 0.09% | | 1.11% | | 1.66% | | 5.20% |

| MSCI World Index | | Growth of $10,000 | | $10,043 | | $11,109 | | $12,765 | | $16,061 | | $30,339 |

| | | Average annual total return | | 0.43% | | 11.09% | | 8.48% | | 9.94% | | 12.52% |

| Bloomberg Barclays U.S. Aggregate Bond Index | | Growth of $10,000 | | $9,838 | | $9,960 | | $10,525 | | $11,189 | | $13,969 |

| | Average annual total return | | –1.62% | | –0.40% | | 1.72% | | 2.27% | | 3.62% |

| Blended Index | | Growth of $10,000 | | $9,988 | | $10,760 | | $12,092 | | $14,492 | | $24,611 |

| | | Average annual total return | | –0.12% | | 7.60% | | 6.54% | | 7.70% | | 10.04% |

The growth of $10,000 is cumulative.

| * | The Fund commenced offering Class A shares on February 2, 2009. The performance shown for each index is for the time period of January 31, 2009 through June 30, 2018, which is based on the performance period of the life of the Fund. |

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 3 |

| | | | | | | | | | | | |

| | | | | | |

DWS Alternative Asset

Allocation VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | Life of Class** |

| Class B | | Growth of $10,000 | | $9,605 | | $9,980 | | $10,246 | | $10,708 | | $14,460 |

| | | Average annual total return | | –3.95% | | –0.20% | | 0.81% | | 1.38% | | 4.13% |

| MSCI World Index | | Growth of $10,000 | | $10,043 | | $11,109 | | $12,765 | | $16,061 | | $27,335 |

| | | Average annual total return | | 0.43% | | 11.09% | | 8.48% | | 9.94% | | 11.66% |

| Bloomberg Barclays U.S. Aggregate Bond Index | | Growth of $10,000 | | $9,838 | | $9,960 | | $10,525 | | $11,189 | | $13,647 |

| | Average annual total return | | –1.62% | | –0.40% | | 1.72% | | 2.27% | | 3.47% |

| Blended Index | | Growth of $10,000 | | $9,988 | | $10,760 | | $12,092 | | $14,492 | | $21,818 |

| | | Average annual total return | | –0.12% | | 7.60% | | 6.54% | | 7.70% | | 8.97% |

The growth of $10,000 is cumulative.

| ** | The Fund commenced offering Class B shares on May 18, 2009. The performance shown for each index is for the time period of May 31, 2009 through June 30, 2018, which is based on the performance period of the life of Class B. |

| ‡ | Total returns shown for periods less than one year are not annualized. |

| | | | | | |

| | 4 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

| | |

| Portfolio Summary | | (Unaudited) |

| | | | | | | | |

| Asset Allocation* (As a % of Investment Portfolio excluding Cash Equivalents) | | 6/30/18 | | | 12/31/17 | |

Real Asset | | | 52% | | | | 49% | |

DWS Enhanced Commodity Strategy Fund | | | 19% | | | | 14% | |

iShares Global Infrastructure ETF | | | 10% | | | | 10% | |

DWS RREEF Real Estate Securities Fund | | | 9% | | | | 4% | |

DWS RREEF Global Real Estate Securities Fund | | | 7% | | | | 9% | |

DWS RREEF Global Infrastructure Fund | | | 7% | | | | 12% | |

| | |

Alternative Fixed Income | | | 22% | | | | 25% | |

DWS Floating Rate Fund | | | 14% | | | | 8% | |

DWS Emerging Markets Fixed Income Fund | | | 8% | | | | 9% | |

VanEck Vectors JPMorgan EM Local Currency Bond ETF | | | — | | | | 4% | |

iShares JPMorgan USD Emerging Markets Bond ETF | | | — | | | | 4% | |

| | |

Alternative Equity | | | 22% | | | | 20% | |

SPDR Bloomberg Barclays Convertible Securities ETF | | | 17% | | | | 15% | |

iShares U.S. Preferred Stock ETF | | | 5% | | | | 5% | |

| | |

Absolute Return | | | 4% | | | | 6% | |

Invesco DB U.S. Dollar Index Bullish Fund | | | 4% | | | | — | |

DWS Global Macro Fund | | | 0% | | | | — | |

VelocityShares Daily Inverse VIX Short Term ETN | | | — | | | | 3% | |

PowersShares DB U.S. Dollar Index Bullish Fund | | | — | | | | 2% | |

ProShares Short VIX Short-Term Futures ETF | | | — | | | | 1% | |

| | | | 100% | | | | 100% | |

| * | During the periods indicated, asset categories and investment strategies represented in the Fund’s portfolio fell into the following categories: Real Assets, Alternative Fixed Income, Alternative Equity, and Absolute Return. Real Asset investments have a tangible or physical aspect such as real estate or commodities. Alternative Fixed Income investments seek to offer exposure to categories generally not included in investors’ allocations and to foreign investments, many of which are not denominated in US dollars. Alternative Equity investments are investments primarily in convertible and preferred instruments that offer equity exposure. Absolute Return investments seek positive returns in all market environments or seek to increase the diversification or liquidity of the Fund’s portfolio. |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 6.

Following the Fund’s fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC’s Web site at sec.gov, and it also may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) SEC-0330. The Fund’s portfolio holdings are also posted on dws.com from time to time. Please see the Fund’s current prospectus for more information.

Portfolio Management Team

Pankaj Bhatnagar, PhD, Managing Director

Darwei Kung, Managing Director

Portfolio Managers

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 5 |

| | |

| Investment Portfolio | | June 30, 2018 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| Mutual Funds 59.6% | | | | | | | | |

DWS Emerging Markets Fixed Income Fund “Institutional” (a) | | | 1,762,721 | | | | 15,511,944 | |

DWS Enhanced Commodity Strategy Fund “Institutional” (a) | | | 2,976,965 | | | | 35,425,879 | |

DWS Floating Rate Fund “Institutional” (a) | | | 3,180,042 | | | | 26,012,745 | |

DWS Global Infrastructure Fund “Institutional” (a) | | | 917,295 | | | | 13,172,365 | |

DWS Global Macro Fund “Institutional”* (a) | | | 54,415 | | | | 528,912 | |

DWS Global Real Estate Securities Fund “Institutional” (a) | | | 1,564,437 | | | | 13,892,205 | |

DWS Real Estate Securities Fund “Institutional” (a) | | | 802,650 | | | | 16,301,818 | |

Total Mutual Funds

(Cost $120,023,055) | | | | | | | 120,845,868 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| Exchange-Traded Funds 34.5% | |

iShares Global Infrastructure ETF | | | 437,235 | | | | 18,787,988 | |

iShares U.S. Preferred Stock ETF | | | 289,140 | | | | 10,903,469 | |

Invesco DB U.S. Dollar Index Bullish Fund* | | | 318,413 | | | | 7,941,220 | |

SPDR Bloomberg Barclays Convertible Securities ETF | | | 607,510 | | | | 32,210,180 | |

Exchange-Traded Funds (Cost $68,016,225) | | | | | | | 69,842,857 | |

| | |

| Cash Equivalents 7.9% | | | | | | | | |

DWS Central Cash Management Government Fund, 1.85% (a) (Cost $16,043,829) | | | 16,043,829 | | | | 16,043,829 | |

| | |

| | | % of Net

Assets | | | Value ($) | |

Total Investment Portfolio (Cost $204,083,109) | | | 102.0 | | | | 206,732,554 | |

| Other Assets and Liabilities, Net | | | (2.0 | ) | | | (3,958,301 | ) |

| Net Assets | | | 100.0 | | | | 202,774,253 | |

A summary of the Fund’s transactions with affiliated Underlying DWS Funds during the period ended June 30, 2018 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value ($) at

12/31/2017 | | Purchases

Cost ($) | | | Sales

Proceeds ($) | | | Net

Realized

Gain/

(Loss) ($) | | | Net

Change in

Unrealized

Appreciation

(Depreciation) ($) | | | Income ($) | | | Capital

Gain

Distributions ($) | | | Number of

Shares at

6/30/2018 | | | Value ($) at

6/30/2018 | |

Mutual Funds 59.6% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DWS Emerging Markets Fixed Income Fund “Institutional” (a) | |

| 16,551,326 | | | 333,572 | | | | — | | | | — | | | | (1,372,954 | ) | | | 333,572 | | | | — | | | | 1,762,721 | | | | 15,511,944 | |

| DWS Enhanced Commodity Strategy Fund “Institutional” (a) | |

| 25,128,692 | | | 10,478,939 | | | | — | | | | — | | | | (181,752 | ) | | | 108,939 | | | | — | | | | 2,976,965 | | | | 35,425,879 | |

| DWS Floating Rate Fund “Institutional” (a) | |

| 13,334,203 | | | 12,846,207 | | | | — | | | | — | | | | (167,665 | ) | | | 355,207 | | | | — | | | | 3,180,042 | | | | 26,012,745 | |

| DWS Global Infrastructure Fund “Institutional” (a) | |

| 20,825,265 | | | 149,112 | | | | 6,879,000 | | | | (79,375 | ) | | | (843,637 | ) | | | 149,113 | | | | — | | | | 917,296 | | | | 13,172,365 | |

| DWS Global Macro Fund “Institutional” (a) | |

| — | | | 530,000 | | | | — | | | | — | | | | (1,088 | ) | | | — | | | | — | | | | 54,415 | | | | 528,912 | |

| DWS Global Real Estate Securities Fund “Institutional” (a) | |

| 14,968,792 | | | 1,687,879 | | | | 2,200,000 | | | | (144,866 | ) | | | (419,600 | ) | | | 606,879 | | | | — | | | | 1,564,437 | | | | 13,892,205 | |

| DWS Real Estate Securities Fund “Institutional” (a) | |

| 7,376,866 | | | 9,945,243 | | | | 1,220,000 | | | | (233,409 | ) | | | 433,118 | | | | 107,513 | | | | 67,729 | | | | 802,650 | | | | 16,301,818 | |

Cash Equivalents 7.9% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DWS Central Cash Management Government Fund, 1.85% (a) | |

| 12,941,460 | | | 42,717,421 | | | | 39,615,052 | | | | — | | | | — | | | | 95,872 | | | | — | | | | 16,043,829 | | | | 16,043,829 | |

| 111,126,604 | | | 78,688,373 | | | | 49,914,052 | | | | (457,650 | ) | | | (2,553,578 | ) | | | 1,757,095 | | | | 67,729 | | | | 27,302,355 | | | | 136,889,697 | |

| * | Non-income producing security. |

| (a) | Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

SPDR: Standard & Poor’s Depositary Receipt

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 6 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2018 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Mutual Funds | | $ | 120,845,868 | | | $ | — | | | $ | — | | | $ | 120,845,868 | |

| Exchange-Traded Funds | | | 69,842,857 | | | | — | | | | — | | | | 69,842,857 | |

| Short-Term Investment | | | 16,043,829 | | | | — | | | | — | | | | 16,043,829 | |

| Total | | $ | 206,732,554 | | | $ | — | | | $ | — | | | $ | 206,732,554 | |

There have been no transfers between fair value measurement levels during the period ended June 30, 2018.

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 7 |

Statement of Assets and Liabilities

| | | | |

| as of June 30, 2018 (Unaudited) | | | | |

| |

| Assets | | | | |

| Investments in affiliated Underlying Funds, at value (cost $136,066,884) | | $ | 136,889,697 | |

| Investments in non-affiliated Underlying Funds, at value (cost $68,016,225) | | | 69,842,857 | |

| Cash | | | 10,000 | |

| Receivable for investments sold | | | 2,098,861 | |

| Receivable for Fund shares sold | | | 238,386 | |

| Interest receivable | | | 17,513 | |

| Other assets | | | 1,915 | |

| Total assets | | | 209,099,229 | |

| |

| Liabilities | | | | |

| Payable for investments purchased | | | 6,171,261 | |

| Payable for Fund shares redeemed | | | 49,682 | |

| Accrued Trustees’ fees | | | 2,636 | |

| Other accrued expenses and payables | | | 101,397 | |

| Total liabilities | | | 6,324,976 | |

| Net assets, at value | | $ | 202,774,253 | |

| |

| Net Assets Consist of | | | | |

| Undistributed net investment income | | | 2,522,987 | |

| Net unrealized appreciation (depreciation) on investments | | | 2,649,445 | |

| Accumulated net realized gain (loss) | | | (13,304,222 | ) |

| Paid-in capital | | | 210,906,043 | |

| Net assets, at value | | $ | 202,774,253 | |

Class A | | | | |

| Net Asset Value, offering and redemption price per share ($27,287,891 ÷ 2,131,306 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | | $ | 12.80 | |

Class B | | | | |

| Net Asset Value, offering and redemption price per share ($175,486,362 ÷ 13,698,639 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | | $ | 12.81 | |

Statement of Operations

| | | | |

| for the six months ended June 30, 2018 (Unaudited) | |

| |

| Investment Income | | | | |

| Income: | | | | |

Income distributions from affiliated

Underlying Funds | | $ | 1,757,095 | |

| Dividends | | | 1,081,746 | |

| Total income | | | 2,838,841 | |

| Expenses: | | | | |

| Management fee | | | 542,098 | |

| Administration fee | | | 94,072 | |

| Record keeping fees (Class B) | | | 62,468 | |

| Services to shareholders | | | 1,697 | |

| Distribution service fee (Class B) | | | 201,733 | |

| Custodian fee | | | 3,169 | |

| Professional fees | | | 36,528 | |

| Reports to shareholders | | | 21,563 | |

| Registration fees | | | 20 | |

| Trustees’ fees and expenses | | | 8,574 | |

| Other | | | 2,882 | |

| Total expenses before expense reductions | | | 974,804 | |

| Expense reductions | | | (599,686 | ) |

| Total expenses after expense reductions | | | 375,118 | |

| Net investment income (loss) | | | 2,463,723 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) from: | | | | |

| Sale of affiliated Underlying Funds | | | (457,650 | ) |

| Sale of non-affiliated Underlying Funds | | | (6,362,026 | ) |

Capital gain distributions from affiliated

Underlying Funds | | | 67,729 | |

| | | | (6,751,947 | ) |

| Change in net unrealized appreciation (depreciation) on investments | | | | |

| Affiliated Underlying Funds | | | (2,553,578 | ) |

| Non-affiliated Underlying Funds | | | (470,209 | ) |

| | | | (3,023,787 | ) |

| Net gain (loss) | | | (9,775,734 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | (7,312,011 | ) |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 8 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

Statements of Changes in Net Assets

| | | | | | | | |

| Increase (Decrease) in Net Assets | | Six Months

Ended

June 30, 2018

(Unaudited) | | | Year Ended

December 31,

2017 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 2,463,723 | | | $ | 3,728,776 | |

| Net realized gain (loss) | | | (6,751,947 | ) | | | (2,891,098 | ) |

| Change in net unrealized appreciation (depreciation) | | | (3,023,787 | ) | | | 10,090,153 | |

| Net increase (decrease) in net assets resulting from operations | | | (7,312,011 | ) | | | 10,927,831 | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income: | | | | | | | | |

Class A | | | (576,122 | ) | | | (586,944 | ) |

Class B | | | (3,035,192 | ) | | | (2,539,240 | ) |

| Total distributions | | | (3,611,314 | ) | | | (3,126,184 | ) |

| Fund share transactions: | | | | | | | | |

Class A | | | | | | | | |

| Proceeds from shares sold | | | 2,408,187 | | | | 4,259,606 | |

| Reinvestment of distributions | | | 576,122 | | | | 586,944 | |

| Payments for shares redeemed | | | (1,047,392 | ) | | | (3,329,766 | ) |

| Net increase (decrease) in net assets from Class A share transactions | | | 1,936,917 | | | | 1,516,784 | |

Class B | | | | | | | | |

| Proceeds from shares sold | | | 31,477,774 | | | | 53,356,061 | |

| Reinvestment of distributions | | | 3,035,192 | | | | 2,539,240 | |

| Payments for shares redeemed | | | (6,596,449 | ) | | | (12,561,333 | ) |

| Net increase (decrease) in net assets from Class B share transactions | | | 27,916,517 | | | | 43,333,968 | |

| Increase (decrease) in net assets | | | 18,930,109 | | | | 52,652,399 | |

| Net assets at beginning of period | | | 183,844,144 | | | | 131,191,745 | |

| Net assets at end of period (including undistributed net investment income of $2,522,987 and $3,670,578, respectively) | | $ | 202,774,253 | | | $ | 183,844,144 | |

| | |

| Other Information | | | | | | | | |

Class A | | | | | | | | |

| Shares outstanding at beginning of period | | | 1,982,448 | | | | 1,866,984 | |

| Shares sold | | | 183,571 | | | | 321,873 | |

| Shares issued to shareholders in reinvestment of distributions | | | 45,507 | | | | 45,046 | |

| Shares redeemed | | | (80,220 | ) | | | (251,455 | ) |

| Net increase (decrease) in Class A shares | | | 148,858 | | | | 115,464 | |

| Shares outstanding at end of period | | | 2,131,306 | | | | 1,982,448 | |

Class B | | | | | | | | |

| Shares outstanding at beginning of period | | | 11,540,895 | | | | 8,257,413 | |

| Shares sold | | | 2,417,908 | | | | 4,038,118 | |

| Shares issued to shareholders in reinvestment of distributions | | | 239,557 | | | | 194,727 | |

| Shares redeemed | | | (499,721 | ) | | | (949,363 | ) |

| Net increase (decrease) in Class B shares | | | 2,157,744 | | | | 3,283,482 | |

| Shares outstanding at end of period | | | 13,698,639 | | | | 11,540,895 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 9 |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended 6/30/18 | | | Years Ended December 31, | |

| Class A | | (Unaudited) | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 13.61 | | | $ | 12.97 | | | $ | 12.60 | | | $ | 13.88 | | | $ | 13.75 | | | $ | 13.90 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomea | | | .18 | | | | .33 | | | | .35 | | | | .29 | | | | .36 | | | | .26 | |

Net realized and unrealized gain (loss) | | | (.71 | ) | | | .62 | | | | .31 | | | | (1.13 | ) | | | .13 | | | | (.13 | ) |

Total from investment operations | | | (.53 | ) | | | .95 | | | | .66 | | | | (.84 | ) | | | .49 | | | | .13 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.28 | ) | | | (.31 | ) | | | (.29 | ) | | | (.41 | ) | | | (.27 | ) | | | (.28 | ) |

Net realized gains | | | — | | | | — | | | | — | | | | (.03 | ) | | | (.09 | ) | | | — | |

Total distributions | | | (.28 | ) | | | (.31 | ) | | | (.29 | ) | | | (.44 | ) | | | (.36 | ) | | | (.28 | ) |

| Net asset value, end of period | | $ | 12.80 | | | $ | 13.61 | | | $ | 12.97 | | | $ | 12.60 | | | $ | 13.88 | | | $ | 13.75 | |

| Total Return (%)b,c | | | (3.88 | )** | | | 7.41 | | | | 5.30 | | | | (6.29 | ) | | | 3.50 | | | | .93 | |

| | | | | | |

| Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | | 27 | | | | 27 | | | | 24 | | | | 21 | | | | 20 | | | | 15 | |

| Ratio of expenses before expense reductions (%)d,e | | | .76 | * | | | .64 | | | | .56 | | | | .53 | | | | .56 | | | | .64 | |

| Ratio of expenses after expense reductions (%)d,e | | | .15 | * | | | .19 | | | | .27 | | | | .33 | | | | .32 | | | | .27 | |

| Ratio of net investment income (%) | | | 2.81 | * | | | 2.50 | | | | 2.70 | | | | 2.19 | | | | 2.54 | | | | 1.86 | |

| Portfolio turnover rate (%) | | | 23 | ** | | | 55 | | | | 51 | | | | 21 | | | | 28 | | | | 40 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended 6/30/18 | | | Years Ended December 31, | |

| Class B | | (Unaudited) | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 13.59 | | | $ | 12.96 | | | $ | 12.59 | | | $ | 13.87 | | | $ | 13.74 | | | $ | 13.88 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomea | | | .17 | | | | .31 | | | | .31 | | | | .25 | | | | .31 | | | | .22 | |

Net realized and unrealized gain (loss) | | | (.71 | ) | | | .59 | | | | .31 | | | | (1.12 | ) | | | .14 | | | | (.11 | ) |

Total from investment operations | | | (.54 | ) | | | .90 | | | | .62 | | | | (.87 | ) | | | .45 | | | | .11 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.24 | ) | | | (.27 | ) | | | (.25 | ) | | | (.38 | ) | | | (.23 | ) | | | (.25 | ) |

Net realized gains | | | — | | | | — | | | | — | | | | (.03 | ) | | | (.09 | ) | | | — | |

Total distributions | | | (.24 | ) | | | (.27 | ) | | | (.25 | ) | | | (.41 | ) | | | (.32 | ) | | | (.25 | ) |

| Net asset value, end of period | | $ | 12.81 | | | $ | 13.59 | | | $ | 12.96 | | | $ | 12.59 | | | $ | 13.87 | | | $ | 13.74 | |

| Total Return (%)b,c | | | (3.95 | )** | | | 7.01 | | | | 4.99 | | | | (6.54 | ) | | | 3.24 | | | | .75 | |

| | | | | | |

| Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | | 175 | | | | 157 | | | | 107 | | | | 88 | | | | 94 | | | | 84 | |

| Ratio of expenses before expense reductions (%)d,e | | | 1.08 | * | | | .93 | | | | .85 | | | | .83 | | | | .86 | | | | .93 | |

| Ratio of expenses after expense reductions (%)d,e | | | .44 | * | | | .48 | | | | .57 | | | | .62 | | | | .57 | | | | .52 | |

| Ratio of net investment income (%) | | | 2.59 | * | | | 2.31 | | | | 2.45 | | | | 1.84 | | | | 2.22 | | | | 1.57 | |

| Portfolio turnover rate (%) | | | 23 | ** | | | 55 | | | | 51 | | | | 21 | | | | 28 | | | | 40 | |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| d | The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| e | Expense ratio does not reflect charges and fees associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 10 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

| | |

| Notes to Financial Statements | | (Unaudited) |

A. Organization and Significant Accounting Policies

DWS Alternative Asset Allocation VIP (formerly Deutsche Alternative Asset Allocation VIP) (the “Fund”) is a diversified series of Deutsche DWS Variable Series II (formerly Deutsche Variable Series II) (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company organized as a Massachusetts business trust. The Fund mainly invests in other affiliated DWS funds (i.e., mutual funds, exchange-traded funds and other pooled investment vehicles managed by DWS Investment Management Americas, Inc. or one of its affiliates, together the “Underlying DWS Funds”), non-affiliated exchange-traded funds (“Non-affiliated ETFs”), non-affiliated exchange-traded notes (“Non-affiliated ETNs”) and derivative investments. Non-affiliated ETFs, Non-affiliated ETNs and Underlying DWS Funds are collectively referred to as “Underlying Funds.” During the six months ended June 30, 2018, the Fund primarily invested in Underlying DWS Funds and non-affiliated ETFs. Each Underlying DWS Fund’s accounting policies and investment holdings are outlined in the Underlying DWS Funds’ financial statements and are available upon request.

Multiple Classes of Shares of Beneficial Interest. The Fund offers two classes of shares (Class A shares and Class B shares). Sales of Class B shares are subject to recordkeeping fees up to 0.15% and Rule 12b-1 fees under the 1940 Act equal to an annual rate of 0.25% of the average daily net assets of the Class B shares of the Fund. Class A shares are not subject to such fees.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares except that each class bears certain expenses unique to that class (including the applicable Rule 12b-1 fee). Differences in class-level expenses may result in payment of different per share dividends by class. All shares have equal rights with respect to voting subject to class-specific arrangements.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Investments in mutual funds are valued at the net asset value per share of each class of the Underlying DWS Funds and are categorized as Level 1.

ETFs and ETNs are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. ETFs and ETNs for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. ETFs and ETNs securities are generally categorized as Level 1.

Disclosure about the classification of fair value measurements is included in a table following the Fund’s Investment Portfolio.

Federal Income Taxes. The Fund’s policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders.

At December 31, 2017, the Fund had approximately $3,706,000 of long-term tax basis capital loss carryforwards, which may be applied against realized net taxable capital gains indefinitely.

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 11 |

At December 31, 2017, the aggregate cost of investments for federal income tax purposes was $186,290,624. The net unrealized appreciation for all investments based on tax cost was $2,826,696. This consisted of aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost of $7,332,590 and aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value of $4,505,894.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2017 and has determined that no provision for income tax and/or uncertain tax positions is required in the Fund’s financial statements. The Fund’s federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss and capital gain distributions from Underlying Funds. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Trust arising in connection with a specific fund are allocated to that fund. Other Trust expenses which cannot be directly attributed to a fund are apportioned among the funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend Income is recorded on the ex-dividend date. Distributions of income and capital gains from the Underlying Funds are recorded on the ex-dividend date. Realized gains and losses from investment transactions are recorded on an identified cost basis.

B. Purchases and Sales of Securities

During the six months ended June 30, 2018, purchases and sales of affiliated Underlying Funds (excluding money market funds) aggregated $35,970,952 and $10,299,000, respectively. Purchases and sales of Non-affiliated ETFs aggregated $28,935,846 and $31,070,391, respectively.

C. Related Parties

Management Agreement. Under the Investment Management Agreement with DWS Investment Management Americas, Inc. (formerly Deutsche Investment Management Americas Inc.) (“DIMA” or the “Advisor”), an indirect, wholly owned subsidiary of DWS Group GmbH & Co. KGaA (“DWS Group”), the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments in Underlying Funds to be purchased, sold or entered into by the Fund or delegates such responsibility to the Fund’s subadvisors.

RREEF America L.L.C. (“RREEF”), an indirect, wholly owned subsidiary of DWS Group, acts as an investment subadvisor to the Fund. As an investment subadvisor to the Fund, RREEF provides investment management services to the portions of the Fund’s portfolio allocated to direct investments in global real estate and global infrastructure securities. RREEF is paid by the Advisor for the services RREEF provides to the Fund. As of the date of this report, the Fund obtained its exposure to global real estate and global infrastructure securities indirectly through investments in other Underlying DWS Funds.

| | | | | | |

| | 12 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

The Fund does not invest in the Underlying DWS Funds for the purpose of exercising management or control; however, investments within the set limits may represent 5% or more of an Underlying DWS Fund’s outstanding shares. At June 30, 2018, the Fund held approximately 20% of DWS Emerging Markets Fixed Income Fund and 8% of DWS Floating Rate Fund. Pursuant to the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund’s average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| | | | |

| On assets invested in other DWS Funds | | | .20 | % |

| On assets invested in all other assets not considered DWS Funds | | | 1.20 | % |

Accordingly, for the six months ended June 30, 2018, the fee pursuant to the Investment Management Agreement was equivalent to an annualized rate (exclusive of any applicable waivers/reimbursements) of 0.58% of the Fund’s average daily net assets.

In addition, the Advisor will receive management fees from managing the Underlying DWS Funds in which the Fund invests.

For the period from January 1, 2018 through September 30, 2018, the Advisor has contractually agreed to waive its fees and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and Underlying Funds) of each class as follows:

| | | | |

| Class A | | | .23 | % |

| Class B | | | .53 | % |

In addition, the Advisor has contractually agreed to waive its fees and/or reimburse fund expenses for the period January 1, 2018 through September 30, 2018 to the extent necessary to maintain the fund’s total annual operating expenses (including indirect expenses of Underlying Funds and excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest expenses) of each class as follows:

| | | | |

| Class A | | | .86 | % |

| Class B | | | 1.15 | % |

For the six months ended June 30, 2018, the Advisor has voluntarily agreed to waive 0.15% of its management fee.

For the six months ended June 30, 2018, fees waived and/or expenses reimbursed for each class are as follows:

| | | | |

| Class A | | $ | 81,068 | |

| Class B | | | 518,618 | |

| | | $ | 599,686 | |

The Fund indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which it is invested.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays DIMA an annual fee (“Administration Fee”) of 0.10% of the Fund’s average daily net assets, computed and accrued daily and payable monthly. For the six months ended June 30, 2018, the Administration Fee was $94,072, of which $16,409 is unpaid.

Service Provider Fees. DWS Service Company (“DSC”), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DSC and DST Systems, Inc. (“DST”), DSC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DSC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended June 30, 2018, the amounts charged to the Fund by DSC were as follows:

| | | | | | | | |

| Services to Shareholders | | Total

Aggregated | | | Unpaid at

June 30, 2018 | |

| Class A | | $ | 65 | | | $ | 21 | |

| Class B | | | 121 | | | | 39 | |

| | | $ | 186 | | | $ | 60 | |

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 13 |

Distribution Service Agreement. Under the Fund’s Class B 12b-1 plan, DWS AM Distributors, Inc. (“DDI”) received a fee (“Distribution Service Fee”) of 0.25% of average daily net assets of Class B shares. For the six months ended June 30, 2018, the Distribution Service Fee aggregated $201,733, of which $35,433 is unpaid.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing certain pre-press and regulatory filing services to the Fund. For the six months ended June 30, 2018, the amount charged to the Fund by DIMA included in the Statement of Operations under “Reports to shareholders” aggregated $5,838, of which $5,091 is unpaid.

Trustees’ Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

Affiliated Cash Management Vehicles. The Fund may invest uninvested cash balances in DWS Central Cash Management Government Fund and DWS Variable NAV Money Fund, affiliated money market funds which are managed by the Advisor. Each affiliated money market fund is managed in accordance with Rule 2a-7 under the 1940 Act, which governs the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest. DWS Central Cash Management Government Fund seeks to maintain a stable net asset value, and DWS Variable NAV Money Fund maintains a floating net asset value. The Fund indirectly bears its proportionate share of the expenses of each affiliated money market fund in which it invests. DWS Central Cash Management Government Fund does not pay the Advisor an investment management fee.

D. Ownership of the Fund

At June 30, 2018, one participating insurance company was the owner of record of 10% or more of the total outstanding Class A shares of the Fund, owning 88%. Three participating insurance companies were the owner of record of 10% or more of the total outstanding Class B shares of the Fund, each owning 54%, 31% and 10%, respectively.

E. Name Changes

In connection with adoption of the DWS brand, effective July 2, 2018, Deutsche Investment Management Americas Inc., the Advisor, was renamed to DWS Investment Management Americas, Inc. In addition, the “Deutsche Funds” became known as the “DWS Funds.” As a result, Deutsche Variable Series II was renamed Deutsche DWS Variable Series II and Deutsche Alternative Asset Allocation VIP was renamed DWS Alternative Asset Allocation VIP.

| | | | | | |

| | 14 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

| | |

| Information About Your Fund’s Expenses | | (Unaudited) |

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include contract charges, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. In addition to the ongoing expenses which the Fund bears directly, the Fund’s shareholders indirectly bear the expense of the Underlying Funds in which the Fund invests. These expenses are not included in the Fund’s annualized expense ratios used to calculate the expense estimate in the tables. In the most recent six-month period, the Fund limited the ongoing expenses the Fund bears directly; had it not done so, expenses would have been higher. The examples in the table are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (January 1, 2018 to June 30, 2018).

The tables illustrate your Fund’s expenses in two ways:

| – | | Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund’s actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Expenses Paid per $1,000” line under the share class you hold. |

| – | | Hypothetical 5% Fund Return. This helps you to compare your Fund’s ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund’s actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical Fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. |

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The “Expenses Paid per $1,000” line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. If these transaction costs had been included, your costs would have been higher.

| | | | | | | | |

| Expenses and Value of a $1,000 Investment for the six months ended June 30, 2018 | |

| | |

| Actual Fund Return | | Class A | | | Class B | |

| Beginning Account Value 1/1/18 | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/18 | | $ | 961.20 | | | $ | 960.50 | |

| Expenses Paid per $1,000* | | $ | .73 | | | $ | 2.14 | |

| | |

| Hypothetical 5% Fund Return | | | Class A | | | | Class B | |

| Beginning Account Value 1/1/18 | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/18 | | $ | 1,024.05 | | | $ | 1,022.61 | |

| Expenses Paid per $1,000* | | $ | .75 | | | $ | 2.21 | |

| * | Expenses are equal to the Fund’s annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 181 (the number of days in the most recent six-month period), then divided by 365. |

| | | | | | | | |

| Annualized Expense Ratios** | | Class A | | | Class B | |

| Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | .15 | % | | | .44 | % |

| ** | The Fund invests in other funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. These ratios do not include these indirect fees and expenses. |

For more information, please refer to the Fund’s prospectus.

These tables do not reflect charges and fees (“contract charges”) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option.

For an analysis of the fees associated with an investment in the Fund or similar funds, please refer to the current and hypothetical expense calculators for Variable Insurance Products which can be found at dws.com/calculators.

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 15 |

Proxy Voting

The Trust’s policies and procedures for voting proxies for portfolio securities and information about how the Trust voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 are available on our Web site — dws.com/en-us/resources/proxy-voting — or on the SEC’s Web site — sec.gov. To obtain a written copy of the Trust’s policies and procedures without charge, upon request, call us toll free at (800) 728-3337.

| | | | | | |

| | 16 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

Advisory Agreement Board Considerations and Fee Evaluation

The Board of Trustees (hereinafter referred to as the “Board” or “Trustees”) approved the renewal of Deutsche Alternative Asset Allocation VIP’s (now known as DWS Alternative Asset Allocation VIP) (the “Fund”) investment management agreement (the “Agreement”) with Deutsche Investment Management Americas Inc. (now known as DWS Investment Management Americas, Inc.) (“DIMA”) and sub-advisory agreement (the “Sub-Advisory Agreement” and together with the Agreement, the “Agreements”) between DIMA and RREEF America L.L.C. (“RREEF”), an affiliate of DIMA, in September 2017.

In terms of the process that the Board followed prior to approving the Agreements, shareholders should know that:

| – | | During the entire process, all of the Fund’s Trustees were independent of DIMA and its affiliates (the “Independent Trustees”). |

| – | | The Board met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board’s Contract Committee reviewed extensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of the Fund’s performance, fees and expenses, and profitability from a fee consultant retained by the Fund’s Independent Trustees (the “Fee Consultant”). Based on its evaluation of the information provided, the Contract Committee presented its findings and recommendations to the Board. The Board then reviewed the Contract Committee’s findings and recommendations. |

| – | | The Board also received extensive information throughout the year regarding performance of the Fund. |

| – | | The Independent Trustees regularly met privately with counsel to discuss contract review and other matters. In addition, the Independent Trustees were advised by the Fee Consultant in the course of their review of the Fund’s contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations. |

| – | | In connection with reviewing the Agreements, the Board also reviewed the terms of the Fund’s Rule 12b-1 plan, distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements. |

In connection with the contract review process, the Contract Committee and the Board considered the factors discussed below, among others. The Board also considered that DIMA has managed the Fund since its inception, and the Board believes that a long-term relationship with a capable, conscientious advisor is in the best interests of the Fund. The Board considered, generally, that shareholders chose to invest or remain invested in the Fund knowing that DIMA managed the Fund. DIMA and RREEF are part of Deutsche Bank AG’s (“Deutsche Bank”) Asset Management (“Deutsche AM”) division. Deutsche AM is a global asset management business that offers a wide range of investing expertise and resources, including research capabilities in many countries throughout the world.

As part of the contract review process, the Board carefully considered the fees and expenses of each Deutsche fund overseen by the Board in light of the fund’s performance. In many cases, this led to the negotiation and implementation of expense caps. As part of these negotiations, the Board indicated that it would consider relaxing these caps in future years following sustained improvements in performance, among other considerations.

While shareholders may focus primarily on fund performance and fees, the Fund’s Board considers these and many other factors, including the quality and integrity of DIMA’s and RREEF’s personnel and administrative support services provided by DIMA, such as back-office operations, fund valuations, and compliance policies and procedures.

Nature, Quality and Extent of Services. The Board considered the terms of the Agreements, including the scope of advisory services provided under the Agreements. The Board noted that, under the Agreements, DIMA and RREEF provide portfolio management services to the Fund and that, pursuant to a separate administrative services agreement, DIMA provides administrative services to the Fund. The Board considered the experience and skills of senior management and investment personnel and the resources made available to such personnel. Throughout the course of the year, the Board also received information regarding DIMA’s oversight of fund sub-advisers, including RREEF. The Board reviewed the Fund’s performance over short-term and long-term periods and compared those returns to various agreed-upon performance measures, including market index(es) and a peer universe compiled using information supplied by Morningstar Direct (“Morningstar”), an independent fund data service. The Board also noted that it has

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 17 |

put into place a process of identifying “Funds in Review” (e.g., funds performing poorly relative to a peer universe), and receives additional reporting from DIMA regarding such funds and, where appropriate, DIMA’s plans to address underperformance. The Board believes this process is an effective manner of identifying and addressing underperforming funds. Based on the information provided, the Board noted that, for the one-, three- and five-year periods ended December 31, 2016, the Fund’s performance (Class A shares) was in the 1st quartile, 2nd quartile and 1st quartile, respectively, of the applicable Morningstar universe (the 1st quartile being the best performers and the 4th quartile being the worst performers). The Board also observed that the Fund has underperformed its benchmark in the one-, three- and five-year periods ended December 31, 2016.

Fees and Expenses. The Board considered the Fund’s investment management fee schedule, sub-advisory fee schedule, operating expenses and total expense ratios, and comparative information provided by Broadridge Financial Solutions, Inc. (“Broadridge”) and the Fee Consultant regarding investment management fee rates paid to other investment advisors by similar funds (1st quartile being the most favorable and 4th quartile being the least favorable). With respect to management fees paid to other investment advisors by similar funds, the Board noted that the contractual fee rates paid by the Fund, which include a 0.10% fee paid to DIMA under the Fund’s administrative services agreement, were higher than the median (3rd quartile) of the applicable Broadridge peer group (based on Broadridge data provided as of December 31, 2016). The Board noted that, since inception, DIMA has waived voluntarily a portion (0.15%) of the Fund’s management fee. With respect to any sub-advisory fee paid to RREEF, the Board noted that the fee is paid by DIMA out of its fee and not directly by the Fund. The Board noted the Fund’s total (net) operating expenses and noted that the expense limitations agreed to by DIMA were expected to help the Fund’s total (net) operating expenses remain competitive. The Board considered the Fund’s management fee rate as compared to fees charged by DIMA to comparable Deutsche U.S. registered funds (“Deutsche Funds”) and considered differences between the Fund and the comparable Deutsche Funds. The information requested by the Board as part of its review of fees and expenses also included information about institutional accounts (including any sub-advised funds and accounts) and funds offered primarily to European investors (“Deutsche Europe funds”) managed by Deutsche AM. The Board noted that DIMA indicated that Deutsche AM does not manage any institutional accounts or Deutsche Europe funds comparable to the Fund.

On the basis of the information provided, the Board concluded that management fees were reasonable and appropriate in light of the nature, quality and extent of services provided by DIMA and RREEF.

Profitability. The Board reviewed detailed information regarding revenues received by DIMA from advising the Deutsche Funds along with the estimated costs to DIMA, and pre-tax profits realized by DIMA, from advising the Deutsche Funds. The Board also received information regarding the estimated enterprise-wide profitability of DIMA and its affiliates with respect to all fund services in totality. The Board did not receive profitability information with respect to the Fund, but did receive such information with respect to the funds in which the Fund invests. The Board also reviewed certain publicly available information regarding the profitability of certain similar investment management firms. The Board noted that, while information regarding the profitability of such firms is limited (and in some cases is not necessarily prepared on a comparable basis), DIMA and its affiliates’ overall profitability with respect to the Deutsche Funds (after taking into account distribution and other services provided to the funds by DIMA and its affiliates) was lower than the overall profitability levels of most comparable firms for which such data was available.

Economies of Scale. The Board considered whether there are economies of scale with respect to the management of the Fund and whether the Fund benefits from any economies of scale. In this regard, the Board observed that while the Fund’s current investment management fee schedule does not include breakpoints, the Fund’s fee schedule represents an appropriate sharing between the Fund and DIMA of such economies of scale as may exist in the management of the Fund at current asset levels.

Other Benefits to DIMA and Its Affiliates. The Board also considered the character and amount of other incidental benefits received by DIMA and its affiliates, including any fees received by DIMA for administrative services provided to the Fund, any fees received by an affiliate of DIMA for transfer agency services provided to the Fund and any fees received by an affiliate of DIMA for distribution services. The Board also considered benefits to DIMA related to brokerage and soft-dollar allocations, including allocating brokerage to pay for research generated by parties other than the executing broker dealers, which pertain primarily to funds investing in equity securities. In addition, the Board considered the incidental public relations benefits to DIMA related to Deutsche Funds advertising and cross-selling opportunities among DIMA products and services. The Board considered these benefits in reaching its conclusion that the Fund’s management fees were reasonable.

| | | | | | |

| | 18 | | | | | | Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP |

Compliance. The Board considered the significant attention and resources dedicated by DIMA to documenting and enhancing its compliance processes in recent years. The Board noted in particular (i) the experience, seniority and time commitment of the individuals serving as DIMA’s and the Fund’s chief compliance officers; (ii) the large number of DIMA compliance personnel; and (iii) the substantial commitment of resources by DIMA and its affiliates to compliance matters.

Based on all of the information considered and the conclusions reached, the Board unanimously determined that the continuation of the Agreements is in the best interests of the Fund. In making this determination, the Board did not give particular weight to any single factor identified above. The Board considered these factors over the course of numerous meetings, certain of which were in executive session with only the Independent Trustees and counsel present. It is possible that individual Independent Trustees may have weighed these factors differently in reaching their individual decisions to approve the continuation of the Agreements.

| | | | |

Deutsche DWS Variable Series II — DWS Alternative Asset Allocation VIP | | | | | 19 |

| | |

| | |

VS2AAA-3 (R-028379-7 8/18) | | |

June 30, 2018

Semiannual Report

Deutsche DWS Variable Series II

(formerly Deutsche Variable Series II)

DWS CROCI® U.S. VIP

(formerly Deutsche CROCI® U.S. VIP)

Contents

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

The Fund will be managed using the CROCI® Investment Process which is based on portfolio management’s belief that, over time, stocks which display more favorable financial metrics (for example, the CROCI® Economic P/E Ratio) as generated by this process may outperform stocks which display less favorable metrics. This premise may not prove to be correct and prospective investors should evaluate this assumption prior to investing in the Fund. Stocks may decline in value. The Fund may lend securities to approved institutions. Please read the prospectus for details.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

DWS Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | | | | | |

| | 2 | | | | | | Deutsche DWS Variable Series II — DWS CROCI® U.S. VIP |

| | |

| Performance Summary | | June 30, 2018 (Unaudited) |

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund’s most recent month-end performance. Performance does not reflect charges and fees (“contract charges”) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. While all share classes have the same underlying portfolio, their performance will differ.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2018 are 0.82% and 1.15% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

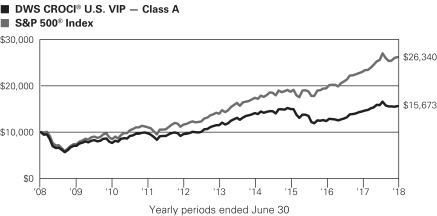

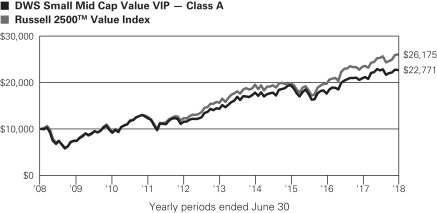

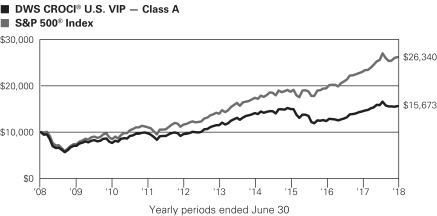

Growth of an Assumed $10,000 Investment in DWS CROCI® U.S. VIP

| | |

| | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. Prior to October 3, 2016, the Fund had a team that operated with a different investment strategy. Performance would have been different if the Fund’s current strategy had been in effect. |

| | | | | | | | | | | | |

| Comparative Results | | | | | | | | | | | | |

| | | | | | |

| DWS CROCI® U.S. VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class A | | Growth of $10,000 | | $9,855 | | $10,817 | | $10,438 | | $13,647 | | $15,673 |

| | | Average annual total return | | –1.45% | | 8.17% | | 1.44% | | 6.42% | | 4.60% |

| S&P 500® Index | | Growth of $10,000 | | $10,265 | | $11,437 | | $14,023 | | $18,770 | | $26,340 |

| | Average annual total return | | 2.65% | | 14.37% | | 11.93% | | 13.42% | | 10.17% |

| | | | | | |

| DWS CROCI® U.S. VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class B | | Growth of $10,000 | | $9,842 | | $10,780 | | $10,352 | | $13,450 | | $15,207 |

| | | Average annual total return | | –1.58% | | 7.80% | | 1.16% | | 6.11% | | 4.28% |

| S&P 500® Index | | Growth of $10,000 | | $10,265 | | $11,437 | | $14,023 | | $18,770 | | $26,340 |

| | Average annual total return | | 2.65% | | 14.37% | | 11.93% | | 13.42% | | 10.17% |

The growth of $10,000 is cumulative.

| ‡ | Total returns shown for periods less than one year are not annualized. |

| | | | |

Deutsche DWS Variable Series II — DWS CROCI® U.S. VIP | | | | | 3 |

| | |

| Portfolio Summary | | (Unaudited) |

| | | | | | | | |

| Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | | 6/30/18 | | | 12/31/17 | |

| Common Stocks | | | 99% | | | | 99% | |

| Cash Equivalent | | | 1% | | | | 1% | |

| | | | 100% | | | | 100% | |

| | |

Sector Diversification (As a % of Investment Portfolio excluding Cash Equivalents and Securities Lending Collateral) | | 6/30/18 | | | 12/31/17 | |

| Utilities | | | 25% | | | | 14% | |

| Financials | | | 17% | | | | 18% | |

| Health Care | | | 16% | | | | 15% | |

| Consumer Staples | | | 11% | | | | 10% | |

| Consumer Discretionary | | | 10% | | | | 15% | |

| Industrials | | | 10% | | | | 15% | |

| Information Technology | | | 8% | | | | 8% | |

| Materials | | | 2% | | | | 5% | |

| Telecommunication Services | | | 1% | | | | — | |

| Total | | | 100% | | | | 100% | |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 5.

Following the Fund’s fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC’s Web site at sec.gov, and it also may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) SEC-0330. The Fund’s portfolio holdings are also posted on dws.com from time to time. Please see the Fund’s current prospectus for more information.

Portfolio Management Team

Di Kumble, CFA, Managing Director

John Moody, Vice President

Portfolio Managers

| | | | | | |

| | 4 | | | | | | Deutsche DWS Variable Series II — DWS CROCI® U.S. VIP |

| | |

| Investment Portfolio | | June 30, 2018 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| Common Stocks 98.5% | |

| Consumer Discretionary 10.3% | |

Automobiles 2.6% | |

General Motors Co. | | | 98,183 | | | | 3,868,410 | |

|

Household Durables 7.7% | |

D.R. Horton, Inc. | | | 90,128 | | | | 3,695,248 | |

Garmin Ltd. | | | 62,600 | | | | 3,818,600 | |

Mohawk Industries, Inc.* | | | 17,594 | | | | 3,769,867 | |

| | | | | | | | |

| | | | | | | 11,283,715 | |

|

| Consumer Staples 10.7% | |

Beverages 5.4% | |

Coca-Cola Co. | | | 88,385 | | | | 3,876,566 | |

PepsiCo, Inc. | | | 38,149 | | | | 4,153,282 | |

| | | | | | | | |

| | | | | | | 8,029,848 | |

|

Food Products 2.6% | |

Tyson Foods, Inc. “A” | | | 55,327 | | | | 3,809,264 | |

|

Household Products 2.7% | |

Procter & Gamble Co. | | | 50,917 | | | | 3,974,581 | |

|

| Financials 16.8% | |

Banks 7.2% | |

Citigroup, Inc. | | | 52,645 | | | | 3,523,003 | |

JPMorgan Chase & Co. | | | 33,242 | | | | 3,463,816 | |

U.S. Bancorp. | | | 73,143 | | | | 3,658,613 | |

| | | | | | | | |

| | | | | | | 10,645,432 | |

|

Consumer Finance 9.6% | |

American Express Co. | | | 36,847 | | | | 3,611,006 | |

Capital One Financial Corp. | | | 38,548 | | | | 3,542,561 | |

Discover Financial Services | | | 48,009 | | | | 3,380,314 | |

Synchrony Financial | | | 105,347 | | | | 3,516,483 | |

| | | | | | | | |

| | | | | | | 14,050,364 | |

|

| Health Care 15.6% | |

Biotechnology 7.9% | |

Amgen, Inc. | | | 21,199 | | | | 3,913,123 | |

Biogen, Inc.* | | | 13,225 | | | | 3,838,424 | |

Gilead Sciences, Inc. | | | 55,017 | | | | 3,897,404 | |

| | | | | | | | |

| | | | | | | 11,648,951 | |

|

Pharmaceuticals 7.7% | |

Johnson & Johnson | | | 30,081 | | | | 3,650,029 | |

Merck & Co., Inc. | | | 63,050 | | | | 3,827,135 | |

Pfizer, Inc. | | | 104,697 | | | | 3,798,407 | |

| | | | | | | | |

| | | | | | | 11,275,571 | |

|

| Industrials 9.5% | |

Airlines 2.4% | |

Southwest Airlines Co. | | | 70,980 | | | | 3,611,463 | |

|

Industrial Conglomerates 2.5% | |

Honeywell International, Inc. | | | 25,240 | | | | 3,635,822 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Machinery 2.3% | | | | | | | | |

Cummins, Inc. | | | 24,995 | | | | 3,324,335 | |

| | |

Professional Services 2.3% | | | | | | | | |

ManpowerGroup, Inc. | | | 39,354 | | | | 3,386,805 | |

| |

| Information Technology 7.6% | | | | | |

IT Services | | | | | | | | |

Amdocs Ltd. | | | 56,804 | | | | 3,759,857 | |

Cognizant Technology Solutions Corp. “A” | | | 48,859 | | | | 3,859,372 | |

International Business Machines Corp. | | | 25,782 | | | | 3,601,745 | |

| | | | | | | | |

| | | | | | | 11,220,974 | |

| | |

| Materials 2.4% | | | | | | | | |

Chemicals | | | | | | | | |

LyondellBasell Industries NV “A” | | | 31,974 | | | | 3,512,344 | |

|

| Telecommunication Services 1.3% | |

Diversified Telecommunication Services | | | | | |

AT&T, Inc. | | | 57,561 | | | | 1,848,284 | |

| | |

| Utilities 24.3% | | | | | | | | |

Electric Utilities 13.4% | | | | | | | | |

American Electric Power Co., Inc. | | | 56,979 | | | | 3,945,796 | |

Exelon Corp. | | | 94,185 | | | | 4,012,281 | |

NextEra Energy, Inc. | | | 23,767 | | | | 3,969,802 | |

PPL Corp. | | | 138,653 | | | | 3,958,543 | |

Xcel Energy, Inc. | | | 84,676 | | | | 3,868,000 | |

| | | | | | | | |

| | | | | | | 19,754,422 | |

| | |

Multi-Utilities 10.9% | | | | | | | | |

CMS Energy Corp. | | | 84,103 | | | | 3,976,390 | |

Consolidated Edison, Inc. | | | 50,094 | | | | 3,906,330 | |

DTE Energy Co. | | | 37,210 | | | | 3,856,072 | |

Sempra Energy | | | 36,481 | | | | 4,235,809 | |

| | | | | | | | |

| | | | | | | | 15,974,601 | |

| Total Common Stocks (Cost $144,300,767) | | | | 144,855,186 | |

| | |

| Cash Equivalent 1.4% | | | | | | | | |

DWS Central Cash Management Government Fund, 1.85% (a) (Cost $1,989,206) | | | 1,989,206 | | | | 1,989,206 | |

| | |

| | | % of Net

Assets | | | Value ($) | |

Total Investment Portfolio (Cost $146,289,973) | | | 99.9 | | | | 146,844,392 | |

| Other Assets and Liabilities, Net | | | 0.1 | | | | 163,908 | |

| Net Assets | | | 100.0 | | | | 147,008,300 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series II — DWS CROCI® U.S. VIP | | | | | 5 |

A summary of the Fund’s transactions with affiliated investments during the period ended June 30, 2018 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value ($) at

12/31/2017 | | Purchases

Cost ($) | | | Sales

Proceeds ($) | | | Net

Realized

Gain/

(Loss) ($) | | | Net Change in

Unrealized

Appreciation

(Depreciation) ($) | | | Income ($) | | | Capital Gain