UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

Mutual Fund and Variable Insurance Trust

(Exact name of registrant as specified in charter)

36 North New York Avenue

Huntington, NY 11743

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporate Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-631-629-4237

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

| Item 1. | Reports to Shareholders. |

|

| |

| |

| |

| |

| |

| |

| |

| Annual Shareholder Report |

| |

| |

| |

| |

| |

| |

| |

| D e c e m b e r 3 1 , 2 0 2 0 |

| INSTITUTIONAL SHARES |

| CLASS A SHARES |

| CLASS C SHARES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

December 31, 2020

Rational Equity Armor Fund

Dear Fellow Shareholders,

The Rational Equity Armor Fund (the “Fund”) seeks total return on investment, with dividend income an important component of that return. The Fund seeks to achieve this goal by investing in two baskets, a long equity portfolio and a volatility hedge overlay. Prior to December 13, 2019, the Fund was managed by another sub-advisor with a different investment strategy. The Fund is now managed by Equity Armor Investments and its investment strategy is the Equity Armor Hedged Dividend Strategy.

Fund Performance

2020 is a year which will have a lasting impact. The disruption to our lives caused by a pandemic changed how the economy works, advanced some technology faster, and adjusted the way we view volatility and the markets. As a new manager implementing a new strategy in the Fund as of December 12, 2019, Equity Armor’s proprietary long volatility Hedge (EAVOL), was challenged to prove it worked right away. We felt the same about investing in 2019 as we do now, and we are still poised to take advantage of the new economy, and the new world of investing characterized by higher valuations, lower bond yields, and lower liquidity. Using volatility, to both limit the downside risk to owning equities, and, to add alpha in times of volatility, the Rational Equity Armor Fund stood out in a year when many funds struggled to manage risks.

For the fiscal year ending December 31, 2020, the Fund returned +15.85% (Institutional Class), while the S&P 500 Value TR Index benchmark returned +1.36%. Prior to December 13, 2019, the Fund had a different sub-advisor that implemented a different strategy.

The Fund’s total annualized returns through December 31, 2020 as compared to the S&P 500 Value TR Index were as follows:

| | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

| Institutional Class | 15.85% | 4.33% | 3.39% | 5.96% | 5.60% |

| Class A | 15.74% | 4.10% | 3.15% | 5.70% | 5.35% |

| Class C** | 14.88% | 3.31% | 2.48% | 5.00% | 4.47% |

| Class A w/ Sales Charge | 10.17% | 2.42% | 2.15% | 5.19% | 5.09% |

| S&P 500 Value TR Index (1) | 1.36% | 6.78% | 10.52% | 10.74% | 6.29% |

| | | | | | |

| ** | Class C Shares commenced operations on January 3, 2014. Returns prior to that date are of the Institutional Shares, adjusted for expenses of Class C Shares. Institutional Shares would have had substantially similar annual returns because the shares are invested in the same portfolio. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Volatility Conditions

The Fund’s goal is to take advantage of the historical mean reversion of volatility by (a) using the Equity Armor Investments, VOL365 Index (EAVOL) to provide a volatility overlay as a hedge for downside equity risk exposure, and (b) to add alpha to equity portfolios by rebalancing equity to EAVOL index weightings in times of dislocation.

The EAVOL Index is a dynamic VIX futures trading system, which analyzes the market and selects the optimal VIX positions to hold to take advantage of shifts in the volatility futures expiration curve.

Going forward in 2021, we continue to see value in holding a long volatility hedge. It allows us to take advantage of market fluctuations like February and March of 2020. Our proprietary model allows us to harvest volatility when it increases and put it back to work by buying stocks which are correspondingly down. EAVOL is a rule based quantitative strategy implemented to own volatility and reduce the drag associated with owning volatility as insurance. Our equities are selected based upon an economically driven model which allows us to find value within the economy, rather than company specific information. Together with daily rebalancing of the volatility overlay, which is the most efficient way to trade long volatility as it allows the Fund to hold defense.

Summary

As experienced investors and traders, we at Equity Armor Investments note two typical patterns in the stock market that given a long enough period, S&P 500 stocks have gone higher while stocks have experienced major corrections along the way. We are going into our 12th year in the current bull market, and along the way each time the VIX has neared the 11 level (plus or minus 20%), we see the volatility pendulum swing back to the other extreme within a few months. The Fund’s constant volatility overlay provides consistent positioning and diversity that seeks to avoid wishing or jumping on momentum. We cannot say for certain when the next correction will come, but we believe the Fund invests in a prudent and effective manner to weather any storm, while potentially increasing wealth over time. We believe that employing an investment strategy that is data-driven; seeks to invest in stocks and that should experience less volatility than the market on down days by maintaining a volatility overlay should enable the Fund both to seek capital appreciation and take advantage of volatility in the market over a full market cycle.

Sincerely,

Joe Tigay

Brian Stutland

Luke Rahbari

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Value Total Return Index® (“S&P 500 Value TR”) is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. For additional disclosure relating to the S&P 500 Value TR and S&P 500 TR, please see “Additional Disclaimers” in the Fund’s Prospectus. 2. The Price-to-Earnings Ratio (“P/E Ratio”) measures the current share price relative to the per-share earnings. |

4269-NLD-2/5/2021

| Rational Equity Armor Fund |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

| |

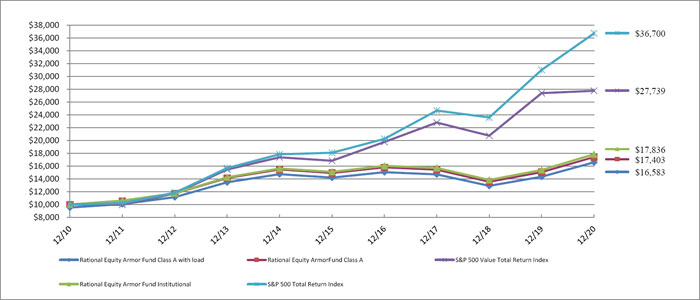

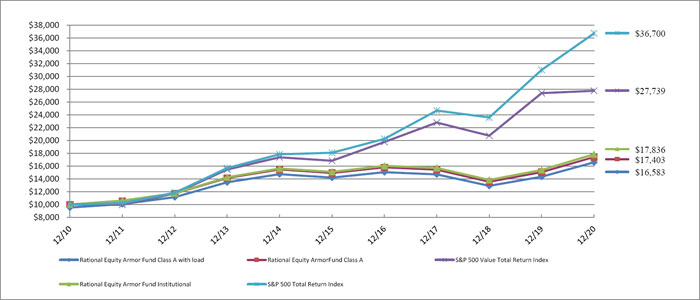

The Fund’s performance figures* for each of the periods ended December 31, 2020, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 15.85% | 3.39% | 5.96% | 5.60% | N/A |

| Class A | 15.74% | 3.15% | 5.70% | 5.35% | N/A |

| Class A with load | 10.17% | 2.15% | 5.19% | 5.09% | N/A |

| Class C | 14.88% | 2.48% | N/A | N/A | 2.49% |

| S&P 500 Value Total Return Index (c) | 1.36% | 10.52% | 10.74% | 6.88% | 8.84% |

| S&P 500 Total Return Index (d) | 18.40% | 15.22% | 13.88% | 7.86% | 13.08% |

| | | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2020 prospectus, the total annual operating expense are 1.77% for Institutional shares, 2.02% for A shares and 2.77% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 2019 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is February 28, 2001 for Class A, Institutional and the benchmarks. |

| (b) | Inception date is January 2, 2014 for Class C and the benchmarks. |

| (c) | The S&P 500 Value Total Return Index uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. Investors cannot invest directly in an Index. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

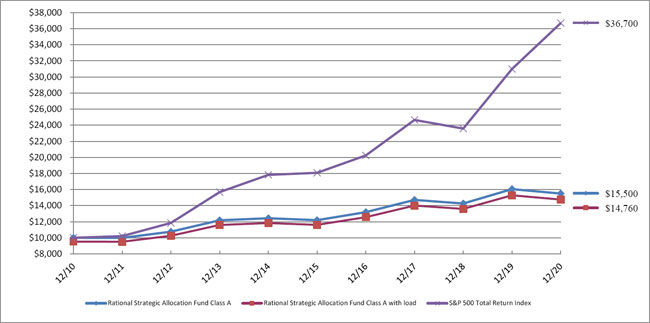

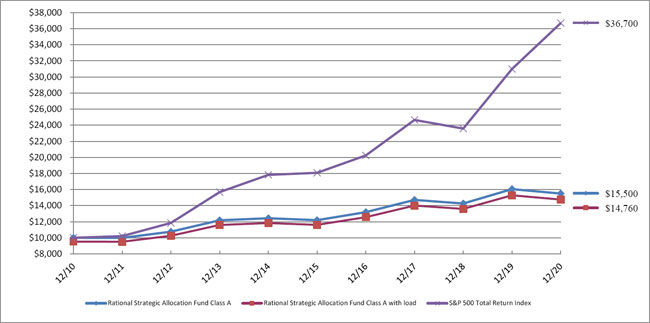

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry ^ | | % of Net Assets | |

| Biotech & Pharma | | | 10.5 | % |

| Banking | | | 9.0 | % |

| Software | | | 5.2 | % |

| Machinery | | | 4.8 | % |

| Institutional Financial Services | | | 4.5 | % |

| Transportation & Logistics | | | 4.5 | % |

| Semiconductors | | | 4.4 | % |

| Electric Utilities | | | 3.9 | % |

| Technology Hardware | | | 3.9 | % |

| Retail - Discrectionary | | | 3.8 | % |

| Other/Short-Term Investments | | | 45.5 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

December 31, 2020

Rational Tactical Return Fund

Dear Fellow Shareholders,

The Rational Tactical Return Fund (the “Fund”) seeks total return consisting of capital appreciation and income by making investments in long and short call and put options on futures contracts on the S&P 500 Index, as well as cash, and cash equivalents. 2020 was the third full year for Warrington to be the Sub Advisor for the Rational Tactical Return Fund. For the year, the Fund posted a +2.65% (Class I) return versus the +18.40% for the S&P 500 TR Index (S&P).

Investment Strategy

The Sub Advisor’s strategy seeks to achieve its investment objective in three ways: (1) Premium Collection – the Fund collects premiums on options it sells; (2) Volatility Trading – the Fund may enter into positions designed to hedge or profit from either an increase or a decrease in Index volatility; and (3) Trend Following – the Fund may increase or decrease the balance of puts and calls based on trending market direction. The Fund is designed to produce returns that are not correlated with equity market returns. The Fund employs strict risk management procedures, supported by both technical and fundamental analysis, that are intended to provide consistency of returns and to mitigate the extent of losses.

Fund Performance

The Tactical Return Fund generated a 2020 return of +2.65% (Class I), versus +18.40% for its S&P 500 TR Index (S&P) benchmark.

As other competitors in the Fund’s Morningstar category are more closely correlated with equity markets, the Fund lagged some of those competitors. Outperforming equity markets is not the target of the Fund, but rather the goal is to achieve consistent positive returns in a variety of market environments. Using both quantitative and fundamental indicators to ascertain near-term market movements, Warrington has been able to navigate the markets and minimize losses during volatile periods due to stringent risk management, while concurrently seeking profit opportunities. That balanced approach with a healthy respect for risk management may have caused the Fund to lag category leaders, but the same approach helps protect the Fund during volatile periods.

The Fund’s total annualized returns through December 31, 2020 as compared to the S&P 500 TR Index (S&P) benchmark were as follows:

| | | | | | | Since |

| | | Since | | | | Inception |

| | 1 Year | 12/5/17 | 3 Years | 5 Years | 10 Years | (05/02/07) * |

| Class I | 2.65% | 7.00% | 6.84% | 6.23% | 0.04% | -1.21% |

| Class A | 2.45% | 6.75% | 6.62% | 6.05% | -0.11% | -1.39% |

| Class C | 1.77% | 6.05% | 5.76% | n/a | n/a | 5.64% |

| Class A with Sales Charge | -2.35% | 5.07% | 4.91% | 5.03% | -0.60% | -1.74% |

| S&P 500 Total Return Index (1) | 18.40% | 14.49% | n/a** | n/a** | n/a** | n/a** |

| | | | | | | |

| * | Inception: 05/02/2007 (Class A & Inst.), 05/31/2016 (Class C). Prior to 12/5/2017, the Rational Tactical Return Fund was named the Rational Real Strategies Fund, which was managed by a different sub-advisor and implemented a different investment strategy. |

| ** | S&P 500 TR Index not relevant to strategy prior to 12/5/2017 strategy change. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

In its third full year as the Fund’s Sub Advisor, Warrington continued to provide strong absolute and relative returns, while consistently managing market risks. The Fund’s assets grew significantly in 2020, and we seek to continue that growth as equity markets have become richly valued in recent months, increasing the likelihood of future market volatility and heightened risk. In volatile markets, Warrington ensures that risk management is paramount, while concurrently evaluating the risk / reward relationship of the opportunities presented by those volatile markets.

Sincerely,

Scott Kimple and Mark Adams

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Tactical Return Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

4270-NLD-2/5/2021

| Rational Tactical Return Fund |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

| |

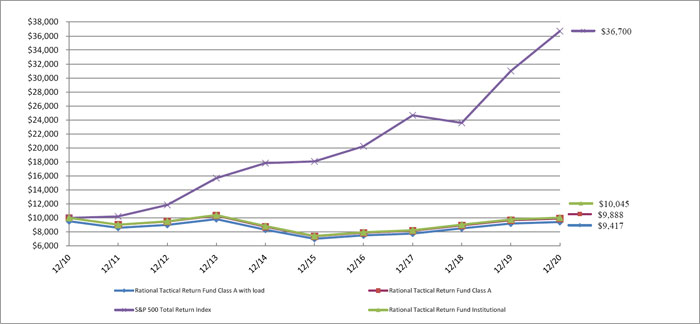

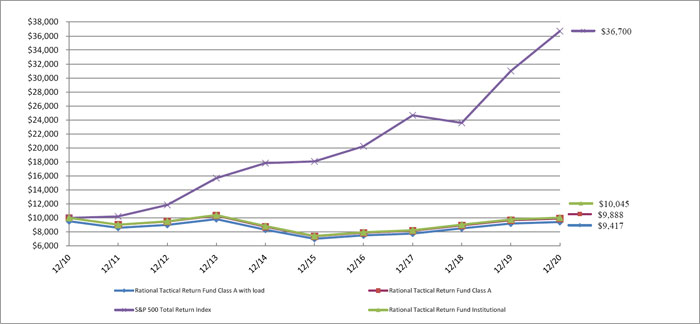

The Fund’s performance figures* for each of the periods ended December 31, 2020, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 2.65% | 6.23% | 0.04% | (1.21)% | N/A |

| Class A | 2.45% | 6.05% | (0.11)% | (1.39)% | N/A |

| Class A with load | (2.35)% | 5.03% | (0.60)% | (1.74)% | N/A |

| Class C | 1.77% | N/A | N/A | N/A | 5.64% |

| S&P 500 Total Return Index (c) | 18.40% | 15.22% | 13.88% | 9.29% | 15.81% |

| | | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2020 prospectus, the total annual operating expense are 2.20% for Institutional Class shares, 2.56% for Class A shares and 3.16% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 2017 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is May 1, 2007 for Class A, Institutional and the benchmark. |

| (b) | Inception date is May 31, 2016 for Class C and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a 10,000 Investment

| Top Holdings by Asset Type ^ | | % of Net Assets | |

| Short-Term Investments | | | 34.1 | % |

| Other/Cash & Equivalents | | | 65.9 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

December 31, 2020

Rational Dynamic Brands Fund

Dear Fellow Shareholders,

The Rational Dynamic Brands Fund (the “Fund”) seeks long-term capital appreciation by investing in a focused group (25-50 holdings) of the most attractive & relevant brands contained in the Alpha Brands Consumer Spending Index (the “Index”) which has 200 constituents. Security selection is driven by a combination of fundamental and technical factors as well as using a proprietary brand relevancy scoring system that pulls from >40 business assessment factors using a qualitative and quantitative approach. In times of economic turmoil or unusually high equity valuations where equity risk is deemed high, the Fund may also invest in cash and cash equivalents and in asset classes that have historically been safe havens when equities were experiencing drawdowns. De-risking is designed to happen in stages. Risk management decisions are guided by: relative strength leadership, economic growth trajectory, the Fund management team’s assessment of the dominant equity trend, economic growth profile, consumer health, equity valuations, technical analysis, FED policy, investor sentiment, and changes in interest rates, credit spreads, and asset class volatility trends.

I think I speak for everyone when I say 2020 was a year unlike any other. I think a healthy dose of “normal” would make us all happy. Though the journey in 2021 will likely have the normal bumps along the way, our team at Accuvest is excited for what’s to come in 2021.

When our team created the Dynamic Brands strategy and took over as the new sub-advisor for HSUTX on October 17, 2017, our goal was to offer every investor the opportunity to invest easily in the most important and powerful theme driving every major economy, household & business spending. As a reminder, this important theme is a $40+ trillion per year phenomenon that, given its size & scope, warrants allocation in a portfolio. Our logic is rooted in common sense yet sometimes the most obvious decisions get over-shadowed by a quest to find the latest and greatest fad. Nothing is more predictable than a consumer’s propensity to spend.

If consumption drives the global economy, shouldn’t the most powerful brands serving this theme be the ideal core equity holding?

The Rational Dynamic Brands Fund (HSUTX) returned 45.3% for 2020, which significantly outperformed the S&P 500 Index return of +18.4%.

The Fund’s total annualized returns through December 31, 2020 as compared to the S&P 500 Total Return Index were as follows. Reminder, the Fund was converted to the Dynamic Brands Equity Strategy on 10/17/17:

| | 1 Year | 5 Years | 10 Years | Since Inception

(09/30/02) * |

| Class I | 45.28% | 17.97% | 12.33% | 12.30% |

| Class A | 44.91% | 17.69% | 12.04% | 12.02% |

| Class C | 45.28% | 17.97% | 12.33% | 12.30% |

| Class A with Sales Charge | 38.03% | 16.55% | 11.49% | 11.72% |

| S&P 500 Total Return Index (1) | 18.40% | 15.22% | 13.88% | 10.87% |

| | | | | |

| * | Inception: 09/30/2002 (Class A & I), 01/03/2014 (Class C). Prior to 10/17/2017, Rational Dynamic Brands Fund was named the Rational Defensive Growth Fund, which implemented a different investment strategy. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Commentary:

The wild ride our economy and equity markets took in 2020 has been heavily chronicled so I won’t bore you with more of the details. Very few investors would have expected the yearly investment outcome we received when looking through a lens last March. 2020 was a year where growth-focused investors generated strong returns and everyone else lagged in general. Some sectors and industries delivered an outright negative return. The main question investors should ask: how many of my top performing funds or ETF’s were lucky to be in the right place at the right time and which ones made active decisions to be in the right place at the right time? The answer to that question should help you allocate in 2021. We are not growth-stock dedicated investors. We are opportunistically focused investors. In 2020, growth was where the opportunities lived. In 2021 we suspect the opportunities will be more diverse. If we are correct, our more diverse portfolio should fare better than the typical growth strategy, which is forced to invest in growth no matter the opportunities.

We side with famed investor Charlie Munger from Berkshire Hathaway… “fish where the fish are.” Our style-factor radar helps us understand where the fish are gathering today and where new momentum might be gathering.

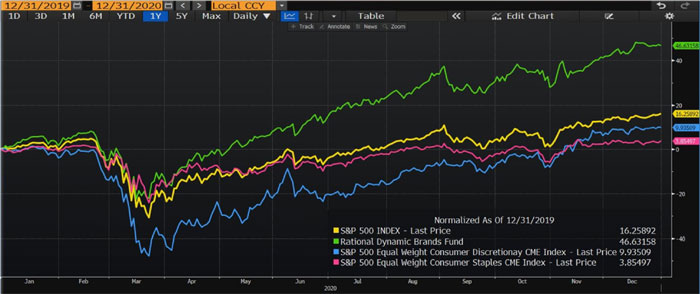

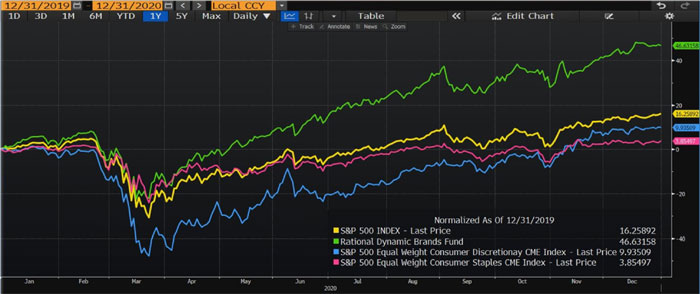

The Dynamic Brands Fund performed well in a year when its primary market, the global consumer, did rather poorly (see below for the returns of various equal-weighted indices). As the global economy experienced rolling lockdowns, consumer spending became very narrow and for a few months, it fell off a cliff. Consumers spent their money on fewer spending categories and with fewer brands. As an active investor without biases, the number of stocks we held shrank with the opportunities we saw for part of the year. A key differentiator for the Fund is having the ability to assess, pivot, and adapt to changing market conditions. The team designed the Fund’s strategy to offer maximum flexibility to manage through whatever storms emerge in global equity markets. Understanding no two bear markets or corrections are ever the same, our goal is to have a full toolbox of risk management tools that could help mitigate the volatility felt during periods of high stress. Over the last 3+ years and in 2020, we are proud to say having these tools and using them prudently has offered attractive returns and a smoother ride along the way.

2020: What drove the outperformance?

Flexibility.

You have to trade the market you have not the one you want. As thematic investors we are generally focused on identifying important sub-themes within the global consumer spending secular theme. In 2020 our investment focus was largely on e-commerce, streaming media, digital payments, and work from home beneficiaries. Many of the biggest winners are some of the most admired brands on the planet. Because of our diverse 200 stock investment universe (Alpha Brands Consumer Spending Index) and no matter the environment, we should always have great brands to invest in. After seeing how 2020 played out, we simply cannot imagine being forced to stay in a style-box to own companies or industries that do not seem well positioned for the current environment. As our goal is to provide attractive long-term returns while offering investors a smoother ride along the way, having as much flexibility as possible is the only way to survive and thrive in a chaotic market.

Volatility management is a key differentiator of our investment process. When uncertainty & volatility arrive, we like to add a tactical trading component to the investment process to take advantage of irrational markets. The combination of long-term investing and active trading combined with the ability to hold excess cash reserves allowed our team to navigate the turmoil earlier this past year; be opportunistic into the panic bottom of late March; and generate a solid excess return in 2020. The flexibility of our strategy is a key to our ability to manage through multi-month periods of high volatility. I’m not sure there is a better 3-year period to assess a manager’s acumen to manage through good times and bad than the last 3 years.

2021: A mean reversion back towards normal.

As stated above, the Fund performed exceptionally well in a year when the typical consumer stock lagged badly. Below is a chart of the S&P 500 Index plotted with the Rational Dynamic Brands Fund, the S&P Equal Weighted Consumer Discretionary Index, and the S&P Equal Weighted Consumer Staples Index for 2020. As you can see, the two consumer indices lagged the market rather severely which is quite logical given how badly consumer spending dropped off in March-May of this year. With some parts of the economy back to normal and the hope for vaccine adoption high, there is significant pent-up demand building in a few key segments of household spending. It’s in categories like travel, personal services, physical retail, and social experiences that our excitement is highest for 2021. The most relevant brands serving these industries generated sub-par returns in 2020 but we think 2021 will offer a quite different and positive result.

For more information on what parts of the economy and spending we think have strong snap-back potential, here’s our two-part blog post last December:

Part 1: 2021 – An end to the social gathering recession https://catalyst-insights.com/brands-expert-calls-it-the-social-gathering-recession/

Part 2: 2021 – Massive spending potential could be unleashed https://catalyst-insights.com/2021-massive-spending-potential-could-be-unleashed/

In the first part of 2021, we expect to see a continuation of the short-term volatility spasms we saw in 2020 until we get more clarity on vaccines, election run-offs, and stimulus longevity. The economy will not heal in a linear fashion. We expect it to be lumpy, so equity markets could respond in-kind for a while longer. On the positive side, Central Banks around the world are about as accommodative as they have ever been and fiscal stimulus efforts appear to be evolving, albeit slowly. We are watching the 20 level on the Volatility Index (VIX) for clues that a broad-based,up-trending market will return. Once the VIX Index falls below the magic 20 level, more systematic investors with massive amounts of investment capital and a rabid hunger to get more invested, will get more engaged in stocks. The combination of these investors, the cash on the sidelines currently and the wall of fixed income money that’s seeking a better potential return with rates close to zero, we expect strong demand for equities in 2021 even if we see short term drawdowns along the way.

Over the last few months, we have been trimming or selling some of our big winners in 2020 and have begun building positions across important laggard spending categories like travel, physical retail, healthcare, mobility, and social gathering. The Fund is more balanced across spending categories than it has ever been. Below, we have highlighted what consumption themes the Fund’s current holdings give investors access to. In aggregate, the current portfolio of Iconic Brands spans all market caps (small, mid, large), style boxes (value, core, growth) and

geographies (U.S., developed international and emerging markets) for a diverse collection of great businesses indeed.

For now, we are avoiding many of the most crowded and expensive stocks. Many of which were last year’s top winners. Why? Many of these great companies have market valuations that reflect a decade or more of perfect business execution. For more information on what we see for this group of expensive, popular stocks, here’s our last blog post of 2020 entitled, “2021: A Consumption Trend Change”. https://catalyst-insights.com/2021-consumption-trend-change/

The Fund’s portfolio as we enter 2021:

| 1. | Mega Brands – the Mega Brands basket will typically be the largest portion of the Fund. These are many of the world’s most admired companies. They are often highly recognized businesses with strong and stable business models and high quality balance sheets. Think of this core group of brands as being the chassis of the car, or the foundation of a house. This group of industry leaders typically makes up approximately 70% of the total portfolio. Here is a snapshot of the blue chip, mega brands our investors have a small ownership stake in: Amazon, Apple, Tencent (China), Nike, Lululemon, Nintendo, Microsoft, Costco, Mastercard, Google, Visa, Salesforce, Chipotle, Spotify, Shopify, Target, Adidas, Johnson & Johnson, Sherwin Williams, CBRE (global real estate), PayPal, Goldman Sachs, Ferrari, Pfizer, and United Healthcare. |

| 2. | Innovator/Disruptor Brands – these great companies are often satellite positions around the Mega Brands names but could offer significantly more upside potential because they are disrupting their industries; offer superior products and services; and have much higher top-line revenue growth along with other impressive financial metrics. This group of innovators will typically make up approximately 15-30% of the total |

| | portfolio. The current roster of innovators in the Fund are: Rocket Companies (mortgages), RH (Restoration Hardware), Mercado Libre, Teledoc, Nvidia (semiconductors), Square, Zoom, Airbnb, Jumia (Africa e-commerce), Afterpay (buy now, pay in installments provider), and Uber. |

| 3. | Tactical, Contrarian Brands – every so often an investment opportunity arises because of a positive business or industry inflection, mean reversion, or a deeply oversold trading opportunity. The timing of these opportunities is always difficult to predict, but, when they are presented to us, we enjoy taking advantage of a market that does not see what we see. Tactical opportunities will typically be roughly 10-20% of the total portfolio. The brands owned here are: Southwest Airlines, Shake Shack, Medifast (weight loss nutrition), Royal Caribbean, Norwegian Cruises, Hilton, Marriot, Expedia, Booking Holdings, Live Nation, Capri Holdings (Michael Kors, Jimmy Chu, Versace), and medical science leader Regeneron. |

Reminder: the holdings and allocation weights will change over time according to the opportunities we see in the marketplace.

We thank you for your loyalty to the Dynamic Brands Fund and for appreciating the value of investing in the $44 trillion global consumption theme.

Sincerely,

David Garff, Eric Clark, and James Calhoun

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Value Total Return Index® (“S&P 500 Value TR”) is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. For additional disclosure relating to the S&P 500 Value TR and S&P 500 TR, please see “Additional Disclaimers” in the Fund’s Prospectus. |

4387-NLD-2/24/2021

| Rational Dynamic Brands Fund |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

| |

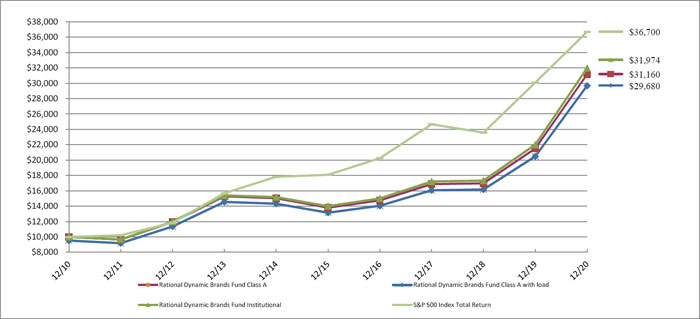

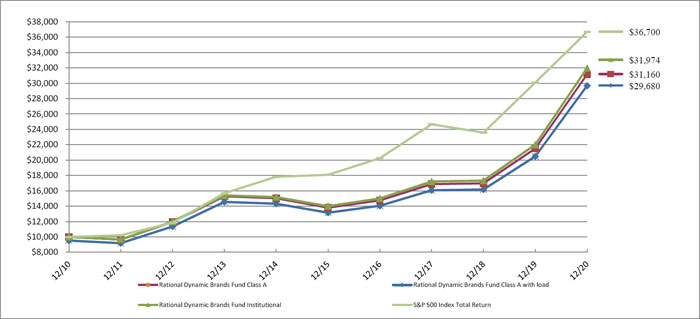

The Fund’s performance figures* for each of the periods ended December 31, 2020, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 45.28% | 17.97% | 12.33% | 12.30% | N/A |

| Class A | 44.91% | 17.69% | 12.04% | 12.02% | N/A |

| Class A with load | 38.03% | 16.55% | 11.49% | 11.72% | N/A |

| Class C | 43.80% | 16.93% | N/A | N/A | 10.25% |

| S&P 500 Total Return Index (c) | 18.40% | 15.22% | 13.88% | 10.87% | 13.08% |

| | | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2020 prospectus, the total annual operating expense are 1.46% for Institutional shares, 1.75% for Class A shares and 2.69% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to October 2017 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is September 27, 2002, for Class A, Institutional and the benchmark. |

| (b) | Inception date is January 2, 2014 for Class C and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | | % of Net Assets | |

| Internet Media & Services | | | 15.6 | % |

| Technology Hardware | | | 10.4 | % |

| Technology Services | | | 10.4 | % |

| E-Commerce Discretionary | | | 8.3 | % |

| Leisure Facilities & Services | | | 8.3 | % |

| Software | | | 7.9 | % |

| Apparel & Textile Products | | | 6.5 | % |

| Retail - Discretionary | | | 6.4 | % |

| Retail - Consumer Staples | | | 4.7 | % |

| Biotech & Pharmaceuticals | | | 3.1 | % |

| Other/Short-Term Investments | | | 18.4 | % |

| | | | 100.0 | % |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

December 31, 2020

Rational Strategic Allocation Fund

Dear Fellow Shareholders,

The Rational Strategic Allocation Fund (the “Fund”) seeks current income and moderate appreciation of capital by implementing a distinct “index plus” strategy that provides investors exposure to a non-traditional fixed income portfolio with an S&P 500 Index equity overlay. During 2020, the Fund underperformed the S&P 500 Total Return Index (1) with a -3.42% (Class A) return versus +18.40% for the S&P 500 Total Return Index. The Fund benefited from its allocations to fixed income funds. The Fund underperformed its benchmark, however, as a result of taking a defensive position during the year and removing our futures exposure to the S&P 500 for several months.

Investment Strategy

The Fund invests in a portfolio of futures contracts on the S&P 500 Index and income-oriented mutual funds typically representing non-traditional fixed income asset classes. We select underlying funds using a fundamental research process, including a top-down analysis of market conditions and investment category historical performance during various market conditions. We also perform a bottom-up analysis of each potential fund for investment, including investment allocations, investment valuations and characteristics, positioning, historical performance during various market conditions and each fund’s portfolio manager’s outlook. The Fund typically maintains 70% to 100% notional exposure to the S&P 500 Index and 70% to 100% notional exposure to the fixed income portfolio.

Fund Performance

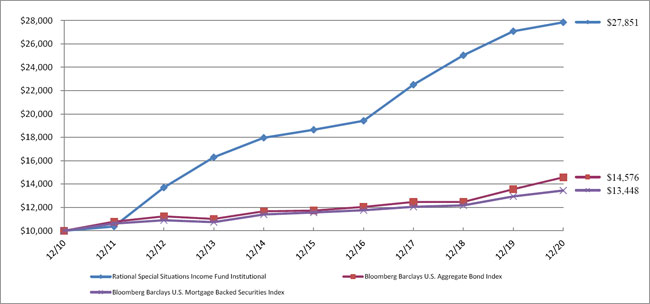

During 2020, the Fund returned -3.42% (Class A), trailing its S&P 500 benchmark’s return of +18.40%. Towards the end of 2019, the fund underwent a change in its methodology, shifting the focus of the Fund to an “index plus” strategy, as described above. On January 10th, we fully entered into our futures position related to the S&P 500. We remained at our target allocation until the end of February, which is when the effects of the COVID-19 outbreak were beginning to be felt within the U.S. equity markets. At that time, we felt it was best for our shareholders to assume a defensive position by reducing our futures position amid all of the uncertainty in the equity market. We believed the risk associated with remaining fully allocated was too high and felt it was best to remain defensive until we had a clearer picture of how the pandemic would affect markets. We maintained this defensive position until the beginning of September, at which time we reallocated back to our target notional exposure. As a result of our defensive positioning, we missed a lot of the upside of the equity market recovery, but we did position the Fund to avoid significant losses had the stock market returns reflected the reality of what was occurring throughout the summer, something we believed was prudent in a balanced allocation strategy. Our fixed income sleeve of the portfolio held up well throughout the pandemic, recovering nicely across the board after initial dislocations in pricing related to our RMBS strategies in March.

The majority of the holdings performed to our expectations. The top performing funds held in the portfolio during 2020 were: The Rational/Pier 88 Convertible Securities Fund (PBXIX +17.09%), the Catalyst Insider Income Fund (IIXIX +6.57%), and the Catalyst Enhanced Income Fund (EIXIX +6.16%). The weakest performing funds held in the portfolio during 2020 were: The AlphaCentric Income Opportunities Fund (IOFIX -10.58%) and the Rational Special Situations Fund (RFXIX +2.83%).

The Fund’s total annualized returns through December 31, 2020 as compared to the S&P 500 Total Return Index were as follows:

| | 1 Year | 3 Years | 5 Years | Since Inception

(07/30/09) |

| Class A | -3.42% | 1.75% | 4.92% | 5.42% |

| Class A with Sales Charge | -8.01% | 0.11% | 3.90% | 4.97% |

| S&P 500 Total Return Index (1) | 18.40% | 14.18% | 15.22% | 14.75% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Sincerely,

David Miller

Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

4338-NLD-2/16/2021

| Rational Strategic Allocation Fund |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

| |

The Fund’s performance figures* for each of the periods ended December 31, 2020, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | (3.19)% | N/A | N/A | N/A | 4.93% |

| Class A | (3.42)% | 4.92% | 4.48% | 5.42% | N/A |

| Class A with load | (8.01)% | 3.90% | 3.97% | 4.97% | N/A |

| Class C | (4.13)% | N/A | N/A | N/A | 3.91% |

| S&P 500 Total Return Index (c) | 18.40% | 15.22% | 13.88% | 14.75% | 15.81% |

| | | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2020 prospectus, the total annual operating expense are 2.46% for Institutional shares, 2.83% for Class A shares and 3.50% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to January 2016 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is July 30, 2009 for Class A and the benchmark. |

| (b) | Inception date is May 31, 2016 for Class C, Institutional and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

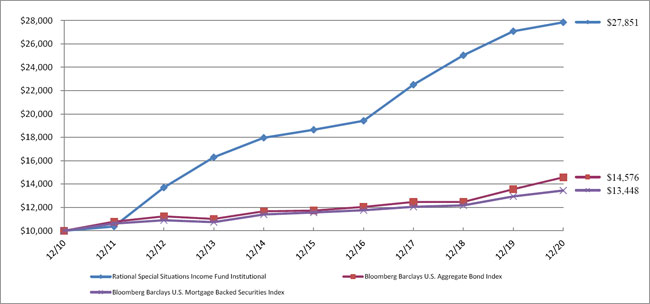

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Asset Type ^ | | % of Net Assets | |

| Mutual Funds | | | 84.8 | % |

| Other/Short-Term Investments | | | 15.2 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s total investments.

December 31, 2020

Rational/ReSolve Adaptive Asset Allocation Fund

Dear Fellow Shareholders,

The Rational/ReSolve Adaptive Asset Allocation Fund (“the Fund”) commenced trading on March 16th, 2018, when ReSolve Asset Management officially replaced the previous manager as sub-advisor.

ReSolve’s Adaptive Asset Allocation1 methodology uses proprietary quantitative and machine learning innovations that emphasize characteristics such as, but not limited to, total return momentum, trends, seasonal patterns, carry measures, mean reversion and others, while simultaneously maximizing diversification based on changing estimates of volatility and correlations across a global universe of futures markets consisting of stock and bond indices, commodities, and currencies.

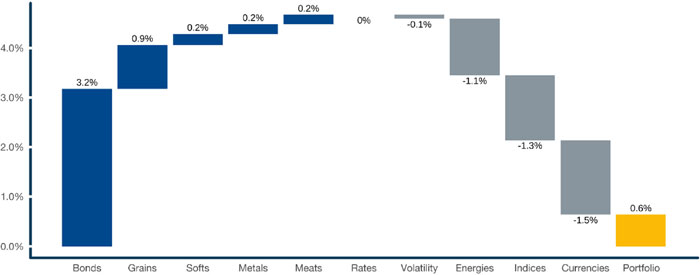

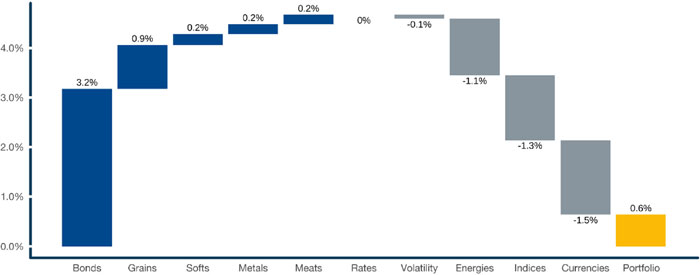

Portfolio Review

The Fund endured the year’s most intense period – from January through August – under a strategy design informed by an ensemble of short-, medium- and longer-term factor sleeves. While the systems that focused on shorter time frames navigated February and March quite well, other systems struggled with the unprecedented speed during the acute phase of the pandemic induced crash. This dynamic also played out during the aggressive recovery of April and May. Despite these challenges, the strategy managed to produce a small +0.65% gain for the year.

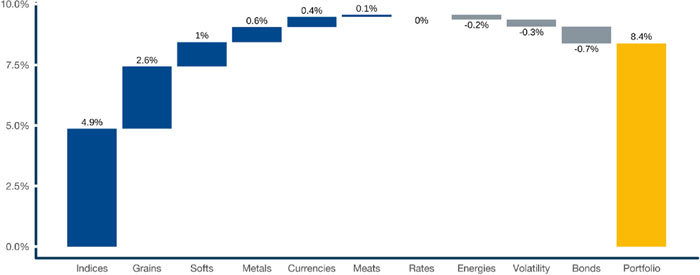

Bonds, led by 10-year US Treasuries and German Bunds, were the main source of positive returns. Grains also offered some ballast, mainly through soymeal and soybeans, while softs (cocoa and coffee), metals (copper and gold) and meats (lean hogs) provided marginal gains. Most losses came from currencies (mainly the Canadian dollar and Sterling), equity markets (Canadian TSX, Aussie 200, German DAX and UK FTSE100) and energies (crude oil, RBOB and heating oil).

| 1 | For our 8-year track record, please visit: https://investresolve.com/strategies/resolve-adaptive-asset-allocation-cad-8-volatility/ |

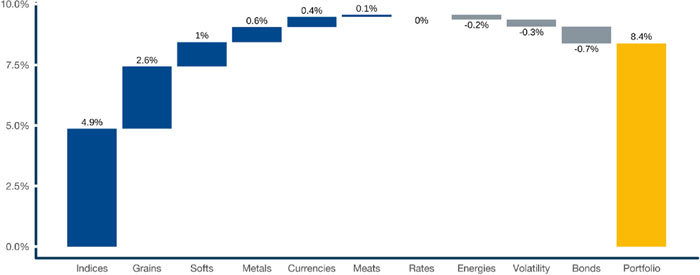

Figure 1. 2020 Return Attribution

Source: ReSolve Asset Management. Results may differ due to rounding. Performance is expressed in USD. Strategy attribution is a best efforts approximation, net of all applicable borrowing costs, fees and Fund accruals for the period. Indicated returns of one year or more are annualized. Past performance is not indicative of future performance.

The Fund’s total annualized returns through December 31, 2020 as compared to the BarclayHedge CTA Index(2) and the S&P 500 Total Return Index were as follows:

| | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception (3) |

| Class I | 0.65% | 3.22% | 2.14% | 2.46% | 5.97% |

| BarclayHedge CTA Index (2) | 3.66% | 1.82% | 0.98% | 0.44% | 4.19% |

| S&P 500 Total Return Index (1) | 18.40% | 14.18% | 15.22% | 13.88% | 10.21% |

| Class A | 0.38% | 2.97% | n/a | n/a | 5.70% |

| Class C | -0.35% | 2.21% | n/a | n/a | 4.93% |

| Class A w/ Sales Charge | -5.37% | 0.96% | n/a | n/a | 5.70% |

| | | | | | |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

The Fund acquired all of the assets and liabilities of Chesapeake Fund, LLC (the “Predecessor Fund”) in a tax free reorganization on December 31, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional Shares of the Fund. At the time of the reorganization, the Predecessor Fund had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. Effective February 27, 2018, the Fund’s investment strategy changed, and a new Sub Advisor replaced the prior sub-advisor. Consequently, prior performance may not reflect the Fund’s current operations.

Risk Management at a Glance

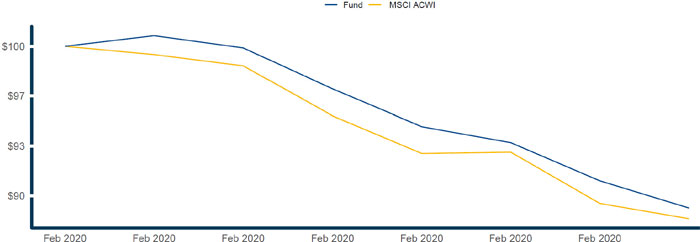

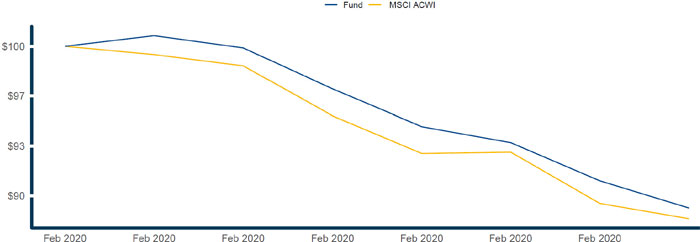

The Fund began the year with a large exposure to global risk assets – global equities in particular – as it transitioned away from dominant positions in US and global sovereign bonds that dominated in 2019. This allocation led to an early outperformance (+14.6%) against the MSCI All Country World Index (ACWI, +2.2%) through February 20th. When news of the global pandemic finally caught up with equity markets, the abrupt selloff led the MSCI ACWI to a -33.5% peak-to-trough loss, while the Fund experienced a more manageable -19.9% loss over the same period. Gains accumulated by the Fund up until that moment were particularly important to soften the overall blow, as the strategy was never down by more than -8% during the pandemic-led crash in the first quarter.

To better understand how the strategy navigated the fastest market correction in history, it is useful to examine three distinct moments:

| ● | First, the initial shock phase – from the Fund’s peak on February 19th to February 28th the Fund exhibited a very similar correction to that of the MSCI ACWI, losing approximately -10% and -11%, respectively. The unprecedented speed of the first leg of the correction posed a challenge given our relative higher weight to equities. |

Figure 2. Fund vs MSCI ACWI Returns – February 19th – 28th, 2020

Source: ReSolve Asset Management. Data from CSI. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

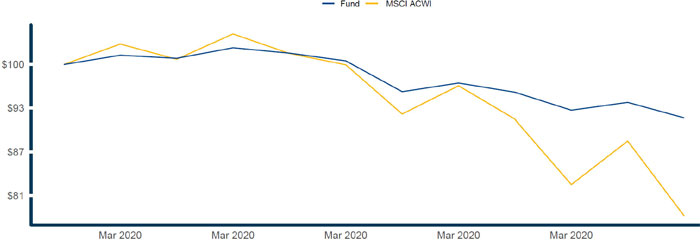

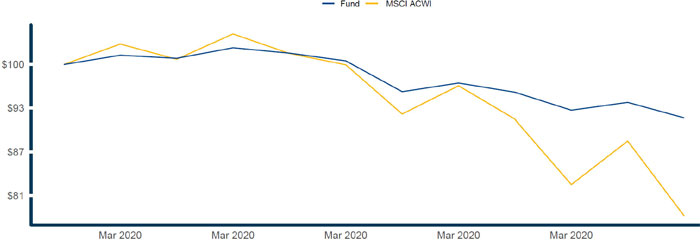

| ● | Second, the volatility adjustment phase – from February 28th to March 16th, the strategy dramatically reduced overall exposure in order to control portfolio volatility and avoided a significant portion of the losses experienced by global equities during the most acute phase of the selloff (losing -8.1% vs the ACWI’s - 21.3%). Even though the portfolio was still in the midst of rebalancing into the safety of gold and sovereign bonds, the reduction in exposure by itself led to a fraction of the losses experienced by risk assets over the same period. |

Figure 3. Fund vs MSCI ACWI Returns – February 28th – March 16th, 2020

Source: ReSolve Asset Management. Data from CSI. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| ● | The third and final phase of the correction – from March 16th to March 23rd, the Fund had transitioned into a more neutral asset-allocation stance. This allowed the strategy to produce a small positive return of +0.5% while global stocks endured yet another -4.4% downward leg. |

Figure 4. Fund vs MSCI ACWI Returns – March 16th – 23rd, 2020

Source: ReSolve Asset Management. Data from CSI. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Despite the unprecedented speed of the market crash in late February and March, the strategy’s risk management protocols responded precisely as they were designed, quickly reducing exposure while simultaneously shifting its allocation towards asset classes that offered safety (and even positive returns). Had equity markets continued to spiral downwards, the Fund was positioned defensively, and had the potential to deliver material gains.

Previous Recoveries

V-shaped recoveries are particularly challenging to risk management protocols, as evidenced by the Fund’s performance since mid-March. Rebalancing towards a more neutral stance prevented the Fund from enduring what might have been a significant loss, but as a result returns temporarily flat-lined, while equities (particularly mega-cap US companies) rallied aggressively.

This is not the first time we have seen this lag. In December 2018, the strategy protected and profited during the sharp -14% market correction as the underlying indicators had produced a relatively neutral allocation. Back then, flattish performance (slightly upward trending, in reality) was positively perceived in comparison to the sell-off in global equities (as can be seen in the first section of Figure 5 below).

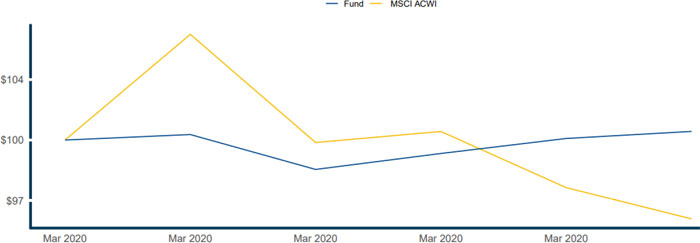

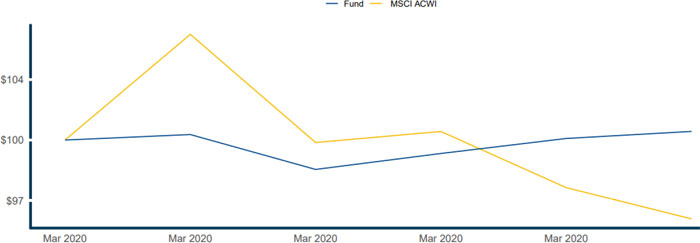

Figure 5. Fund vs MSCI ACWI Returns – December 1st, 2018 – December 31st, 2020

Source: ReSolve Asset Management. Data from CSI. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Diversification works, even when you would rather it didn’t.

Because of the larger magnitude and unprecedented velocity of this most recent event, the consolidation period has lasted commensurately longer. The strategy moved away from its more defensive positions and took on more risk in Q3, rising approximately 9 percent in the final two months of the year.

It is useful to remember that the strategy is directional in nature and has a low, yet conditional, correlation to global equity markets. This means that at times we may profit when stocks crash, but in other instances we may also endure some of that pain, depending on our asset-allocation mix coming into these events.

From a diversification standpoint, the Fund remains an attractive component to any portfolio that seeks a risk balanced exposure to traditional and non-traditional global asset classes while maintaining a low correlation to global equity markets in the medium-term. In particular, given the wide variety of global commodities markets in its investment universe, the Fund may be well positioned to take advantage of any shift toward non-US equity markets and inflation assets in the coming months and years.

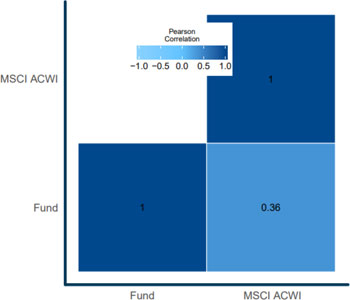

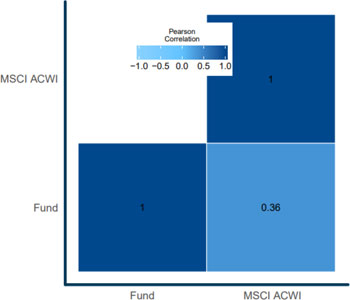

Figure 6. Daily Correlation between the Fund and MSCI ACWI – December 1st, 2018 – December 31st, 2020

Source: ReSolve Asset Management. Data from CSI. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Research and Innovation

“When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

ReSolve has always based its investment philosophy on two overarching principles: relentless risk management and seeking excess returns (i.e. alpha) in areas where most investors cannot participate, whether due to structural limitations or lack of expertise. The notion of avoiding the crowds guided us, from our founding days, to focus on asset-classes as opposed to security selection – which also served a meaningful role in risk management given the structurally diverse nature of global asset-classes.

Our pursuit of alpha, initially through the herding behavior – represented by the Trend and Momentum factors – and then additionally via other well-established edges, always sought diverse ways of measuring and harvesting these phenomena. Ensemble methods, considered best practices in fields as diverse as operations research and data science, triangulate across multiple datapoints with the explicit goal of finding signals that are broadly correct, while avoiding reliance on any single measure that could be specifically wrong.

While this approach has served us well for several years, we had been noticing a decrease in the availability of excess return in these factors in the last few years, even when using ensembles. This was most likely due to the overgrazing of these edges, and we found evidence that pointed to a massive increase in the amount of dollars chasing these strategies2. It also became obvious to us, and possibly to many of you, that the speed and intensity of movements in global asset classes has increased significantly.

| 2 | For more on this, please watch this short video: https://www.youtube.com/watch?v=GO8bvCJNxYE&t=235s |

Our research team has spent the better part of the last two years developing state-of-the-art technology to improve our ability to generate consistent returns in this environment, while effectively managing the risk of sustained losses. We have developed a machine learning engine that takes a bespoke approach to analyzing patterns in individual asset-classes while enhancing portfolio agility and flexibility.

Since these improvements were rolled out in the Fund at the beginning of September; it is useful to highlight the Fund’s performance during the final quarter of the year:

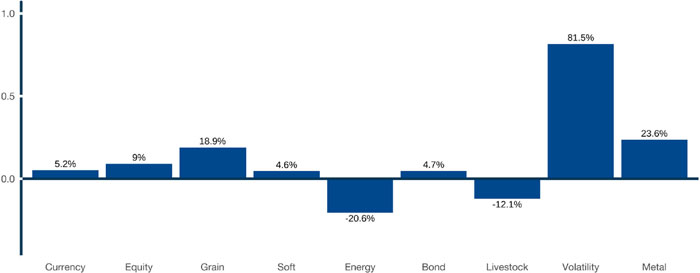

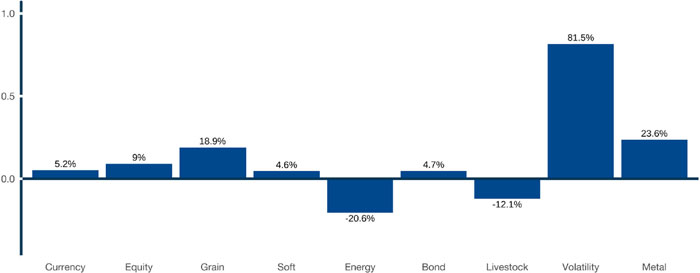

Figure 7. Q4 Return Attribution

Source: ReSolve Asset Management. Results may differ due to rounding. Performance is expressed in USD. Strategy attribution is a best efforts approximation, net of all applicable borrowing costs, fees and Fund accruals for the period. Indicated returns of one year or more are annualized. Past performance is not indicative of future performance.

Though the lion’s share of fourth quarter gains stemmed from the explosive rally in equities, both international (led by the Aussie 200, Italy’s MIB, Hong Kong’s Hang-Seng, and Japanese Nikkei and Topix indices) and US (S&P 500 & Nasdaq), the strategy drew returns from a diverse group of asset-classes. Grains (soy meal, soybeans, corn and wheat), softs (cotton and cocoa), metals (copper) and currencies (Swiss Franc, Euro and Japanese Yen) also offered a meaningful contribution.

General Market Review

It was a year like no other in living memory. The outbreak of a new coronavirus in a central Chinese province during the final months of 2019 morphed into a global pandemic of proportions not since seen the 1918 Spanish Influenza. As cases spread through all corners of the globe and threatened to overwhelm healthcare systems, major cities – and in some cases entire countries – were placed under varying forms of lockdown. By the early days of March much of the planet had come to a halt. Airports, retail centers and most communal spaces became practically (and in some cases completely) deserted. The mass shutdown of businesses – many of which will never reopen – brought about a huge spike in unemployed, a collapse in inflation and growth, and the deepest global recession since World War II3.

The ensuing correction in global risk assets was comparable to, and in some instances exceeded, the throes of 2008’s Global Financial Crisis. Equity markets experienced their fastest 30% decline in history4. Emerging Markets were

| 3 | https://www.worldbank.org/en/news/press-release/2020/06/08/covid-19-to-plunge-global-economy-into-worst-recession-since-world-war-ii |

| 4 | https://www.cnbc.com/2020/03/23/this-was-the-fastest-30percent-stock-market-decline-ever.html |

amongst the worst affected, especially given their dependency on commodities, which suffered some of the largest drawdowns. The most remarkable story was in crude oil, where a price war aggravated a backdrop of plummeting demand and limited storage capacity, leading to the implausible episode of negative prices for a few North American energy contracts. Investors sought refuge in the US dollar, the Japanese Yen, the Swiss Franc and a handful of sovereign bonds as most yields contracted to all-time lows. Gold also offered protection, though other precious metals sustained double-digit losses. The VIX (CBOE Volatility Index) rose approximately fourfold and closed at almost 83 on March 16th, its highest recorded level.

Policymakers responded with colossal firepower, with an almost USD 3 trillion fiscal package from the US and trillions more from European and Asian economies. The IMF estimated, as of the end of May, that approximately USD 9 trillion had been deployed by governments around the world in emergency relief. Central banks also mustered their collective toolkits, bringing (or keeping) policy rates close to zero and restarting (or expanding) their quantitative easing programs. In addition, the Fed joined the ECB and Bank of Japan in buying corporate bonds in the secondary market through a special purpose vehicle – essentially circumventing the law in support of credit markets. The definition of whatever it takes increased by a few orders of magnitude.

But few anticipated what followed. Vast government stimuli combined with a surge in demand for services catering to the stay-at-home economy – from online retail and social media, to video conferencing and streaming – turned the fastest bear market in history into the shortest. Led by its dominant technology sector, the S&P500 rallied 55% and broke new highs by August. What many believed would be another Great Depression became the shortest recession in US history. History neither repeated nor rhymed.

Though global asset classes continued their recovery into the very end of the year, the ride was anything but smooth. After a quiet summer, the virus resurged in September and new restrictive measures were once again imposed across much of the world. This resulted in an increasingly bifurcated, K-shaped recovery, where large companies – and much of their now remote workforce – were able to adapt (and even thrive), while small businesses, gig-workers and much of the general population appeared largely left behind.

A highly polarized and contentious US presidential election was yet another source of volatility, culminating in the victory of Democrat Joe Biden over the Republican incumbent Donald Trump. Geopolitical tensions between the US and China also intensified across multiple fronts including corporate espionage, the crackdown in Hong Kong, and accusations over the origins and fallout of the pandemic.

The final two months of the year saw successful trials followed by approvals of several different vaccines, an extraordinary feat of ingenuity and collective effort, especially given the speed with which it was accomplished. A massive rally in risk assets ensued, led by raw materials (particularly energies) and global equities, some of which had their largest monthly gains in over 30 years. By the time the long awaited additional fiscal relief package was approved by the US Congress and an initial Brexit trade deal was signed, they were basically icing on the cake.

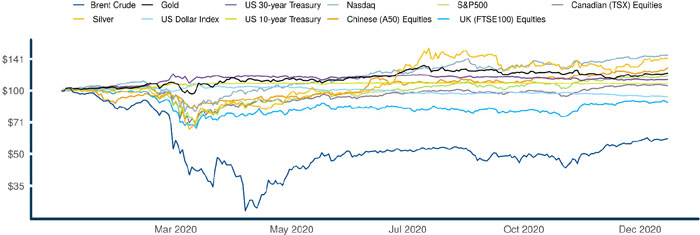

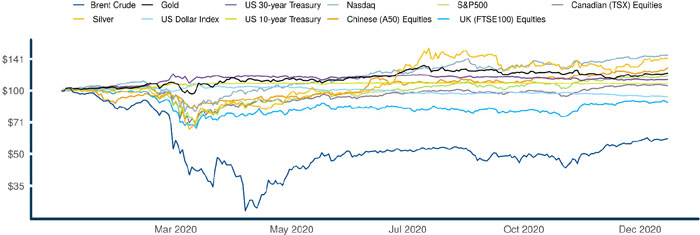

Figure 8. Global Asset Classes – Performance per Sector in 2020

Source: ReSolve Asset Management. Data from CSI. Each sector is built using the following futures contracts, assembled in inverse-volatility weight:

Currency: Australian Dollar, British Pound, Canadian Dollar, Euro, Japanese Yen, New Zealand Dollar, Swiss Franc

Equity: CAC40, DJIA, AEX, S&P 500, DAX, Hang Seng, IBEX, MSCI EM, SGX Nifty, NASDAQ, Nikkei 225, S&P/TSX 60, Russell 2000, FTSE/MIB, Topix, EStoxx 50, Aussie 200, ChinaA50, FTSE

Grain: Bean Oil, Corn, Mill Wheat, KC Wheat, Soybean, Soy Meal, Wheat

Soft: Cocoa, Cotton, Coffee, Sugar

Energy: WTI Crude, Brent Crude, UK Nat Gas, Heating Oil, C Emissions, Nat Gas, Gasoil, RBOB

Bond (Sovereigns): Canadian 10y, US 5y, UK Gilts, Italian 10y, Japanese 10y, French 10y, German 5y, German 10y, US 10y, German LT, US 30y

Livestock: Feeder Cattle, Live Cattle, Lean Hogs

Volatility: Mini VSTOXX and VIX

Metal: Gold, Copper, Platinum, Silver

Figure 9. 2020 Asset-Class Highlights

Source: ReSolve Asset Management. Data from CSI, using continuous futures contracts.

| | Nasdaq

100 | Silver | Chinese

(A50)

Equities | Gold | S&P500 | US 30-year

Treasury | US

10-year

Treasury | Canadian

(TSX)

Equities | US Dollar

Index | UK

(FTSE100)

Equities | Brent Crude |

| Annualized Return | 45.78% | 40.62% | 27.66% | 20.17% | 17.00% | 12.56% | 7.96% | 4.95% | -6.01% | -12.14% | -39.84% |

| Annualized Volatility | 35.10% | 45.00% | 23.50% | 20.80% | 33.70% | 12.30% | 5.00% | 33.40% | 7.30% | 28.70% | 64.90% |

| Maximum Peak to Trough Loss | -28.60% | -37.80% | -19.00% | -14.00% | -34.20% | -9.50% | -3.80% | -35.60% | -13.40% | -35.10% | -74.00% |

Source: ReSolve Asset Management. Data from CSI, using continuous futures contracts.

Do Valuations Still Matter?

While markets rose steadily through December, a new and more contagious strain of the coronavirus was discovered, leading to renewed and, in some cases, stricter lockdown measures in many countries. Not only does it remain unclear whether the various vaccines are effective against this new mutation (several labs have claimed “confidence” that they will be), but questions also arose whether inoculated individuals might be protected against severe illness but could still transmit the virus. Tensions also increased on the geopolitical front as reports emerged of a massive cybersecurity breach across multiple US government agencies. According to experts, the highly sophisticated nature of the attack bears the signs of state-sponsored espionage and appears to have lasted for several months.

The aggressive recovery and performance of equity markets in 2020 has shocked many investors, some of whom have described this as the biggest asset bubble in history. Others have retorted that this is just the natural consequence of the actions of policymakers; not only eliminating any meaningful opportunity cost for capital (left with no alternative but to chase stocks higher) but also encouraging increased risk-taking by delivering on the promise to always be there to rescue shareholders (the infamous Fed Put).

Some observers have also pointed to the relentless growth of passive investment vehicles, many of which track popular market-cap weighted indices, and their simplistic reaction function: buy stocks when money flows in, sell when it flows out. This price-insensitive dynamic leads to an overallocation to ever-larger mega-cap stocks (think Big Tech), while little to no capital is directed to smaller, and largely cheaper, peers. As money continues to flow towards these index-tracking funds, and away from active equity managers (many of whom would tend to buy the cheap and sell/short the expensive companies), the gap between prices and what historically have been considered sound, long-term fundamentals, may continue to widen.

Yet there are signs that markets may have begun to price in some of these imbalances and underlying risks in the system. A plunging US dollar and strong appreciation of gold and other precious metals – not to mention the meteoric rise in Bitcoin and other crypto-assets – are suggestive of concerns that the US and other countries might seek to debase their currencies in order to inflate away an unsustainable global debt-load. Meanwhile, the possibility of a major regulatory clampdown on both sides of the Atlantic hangs over technology giants, which could overwhelm equity markets.

As elevated uncertainty continues to set the tone and investors grow more accustomed to prices divorced from valuations, they should consider whether there are any risks beyond the powers of almighty policymakers.

Sincerely,

ReSolve Asset Management

Fund Sub-Advisor

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Adaptive Asset Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (2) | The Barclay Hedge CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 510 programs included in the calculation of the Barclay CTA Index for 2020. The Index is equally weighted and rebalanced at the beginning of each year. |

| (3) | Inception: Institutional 02/01/1994, Class A & C 09/30/2016. Performance shown before 09/30/2016 is for the Fund’s predecessor, the Rational Dynamic Momentum Fund. |

4183-NLD-1/27/2021

| Rational/ReSolve Adaptive Asset Allocation Fund |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

| |

The Fund’s performance figures* for each of the periods ended December 31, 2020, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional (c) | 0.65% | 2.14% | 2.46% | N/A | 5.97% |

| Class A | 0.38% | N/A | N/A | 2.25% | N/A |

| Class A with load | (5.37)% | N/A | N/A | 0.83% | N/A |

| Class C | (0.35)% | N/A | N/A | 1.53% | N/A |

| S&P 500 Total Return Index (d) | 18.40% | 15.22% | 13.88% | 16.05% | 10.21% |

| Barclay Hedge CTA Index (e) | 3.66% | 0.98% | 0.44% | 2.38% | 4.19% |

| | | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1 , 2020 prospectus, the total annual operating expense are 2.45% for Institutional shares, 2.73% for Class A shares and 3.50% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 5.75%. |

Performance information for the period prior to February 2018 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is September 30, 2016 for Class A, Class C and the benchmarks. |

| (b) | Inception date is February 28, 1994 for Institutional and the benchmarks. |

| (c) | The Fund acquired all of the assets and liabilities of Chesapeake Fund LLC (the “Predecessor Fund”) in a tax-free reorganization on September 30, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional shares of the Fund, so the Predecessor Fund became the Institutional shares of the Fund. The Fund’s investment objective, policies and guidelines are, in all material respects, equivalent to the Predecessor Fund’s investment objectives, policies and guidelines. The Predecessor Fund commenced operations on February 28,1994. Updated performance information will be available at no cost by calling 1-800-253-0412 or visiting the Fund’s website at www.RationalMF.com. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (e) | The Barclay Hedge CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. |

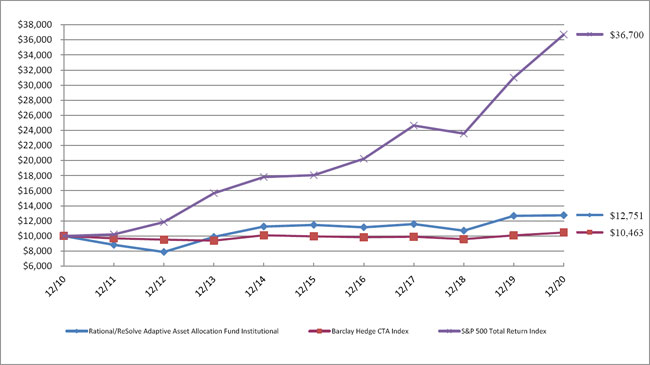

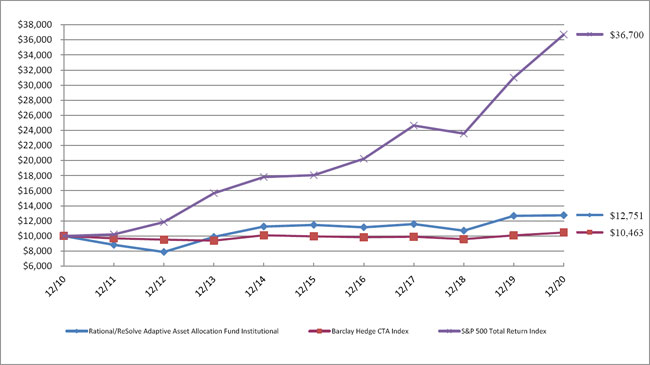

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Type ^ | | % of Net Assets | |

| Short-Term Investments | | | 89.7 | % |

| Other/Cash & Equivalents | | | 10.3 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. |

| | | | | |

Please refer to the Consolidated Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

December 31, 2020

Rational/Pier 88 Convertible Securities Fund

Dear Fellow Shareholders,

The Rational/Pier 88 Convertible Securities Fund (the “Fund”) seeks total return consisting of capital appreciation and income, offering a “call option” on fast growing businesses by investing primarily in convertible securities, which offer equity participation with the added benefit of a bond floor component. The Fund maintains an average investment grade rating with the goal of providing additional downside risk management The Pier 88 approach to managing the convertible bond asset class can be characterized by the word “balance”. We endeavor to take a balanced view of risk versus reward. The team is cognizant that all investments present a plethora of risk including macroeconomic, market and idiosyncratic. Our portfolio remains diversified from a sector, market cap and style perspective.

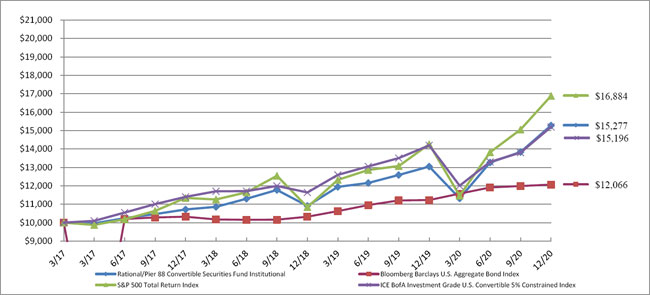

During 2020, the Fund returned 17.08% versus 7.05% for the ICE BofAML Investment Grade US Convertible Index, and 18.40% for the broader S&P market. The outperformance of over 1,000 basis points to the comparable convertible index was attributable to both sector allocation coupled with security selection. The Fund benefited from overweight positions in technology and consumer discretionary, specifically software, semi-conductors and internet related retail focused sub-sectors. Moreover, the Fund’s material under-weight in utilities and financials added to overall outperformance during the period.

Investment Strategy

The Fund seeks to achieve its objective by investing in convertible securities, which are “hybrid” securities that possess both fixed income and equity characteristics. The convertible securities asset class is often overlooked because of its unique profile and often trades at a discount to its pari-passu fixed income counterparts. As equity sensitivity has been the primary driver of returns of the asset class, our investment team employs an equity analysis perspective for investment decisions.

Fund Performance

Although the Fund benefitted from a healthy yield, the majority of the return came from capital appreciation. 2020 saw strong positive returns for the convertible asset class across multiple industry sectors. Information Technology delivered the strongest positive returns with sub-sectors of software, semi-conductors and internet related retail driving the bulk of stock selection. The Fund benefitted from exposure to fast growing businesses which saw incremental demand in a COVID-19 world, like next generation healthcare testing, ecommerce, on-line education, and work-from-home technologies. We remain bullish on the fundamentals underlying many of our companies; our secular growth stories have years to expand their business, while our blue-chip franchises are well capitalized and possess the stability to fund their yields.

Summary

The Rational/Pier 88 Convertible Securities Fund delivered high double digit returns in 2020. The Fund nicely outperformed the broad fixed income index (The Barclays US Aggregate Bond Index), while slightly lagging the broader S&P (but with 93% of S&P upside) . The majority of the holdings performed to our expectations and the Fund benefitted from rigorous security selection and solid risk management. We believe investing on behalf of others is a privilege we must earn everyday through adherence to a disciplined investment process. Thank you for your support.

Sincerely,

Frank Timons

Portfolio Manager

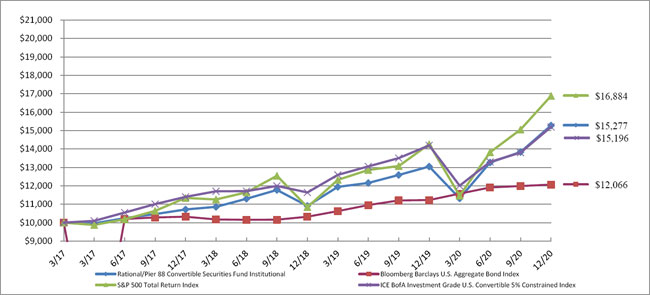

The Fund’s total annualized returns through 12/31/20 as compared to its benchmark were as follows:

| | QTD | 1 Year | 3 Years | Inception* |

| Class I | 10.41% | 17.08% | 12.54% | 11.64% |