UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

Mutual Fund and Variable Insurance Trust

(Exact name of registrant as specified in charter)

36 North New York Avenue

Huntington, NY 11743

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporate Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-631-629-4237

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

| Item 1. | Reports to Shareholders. |

Annual Shareholder Report

December 31, 2021

INSTITUTIONAL SHARES

CLASS A SHARES

CLASS C SHARES

unaudited

December 31, 2021

Rational Equity Armor Fund

Dear Fellow Shareholders,

The Rational Equity Armor Fund (HDCTX and the “Fund”) seeks total return on investment, with dividend income an important component of that return. The Fund seeks to achieve this goal by investing in two baskets, a long equity portfolio and a volatility hedge overlay. The Fund seeks to achieve its investment objective by investing primarily in common stock of dividend paying companies included within the S&P 500 Index. The Fund also invests a portion of its assets in futures contracts on the Cboe Volatility Index in cash as a hedge against the common stock held in the Fund’s portfolio.

Since the liquidity crisis of 2008, the Fed has made it clear to traders, should the market falter, the Fed would step up with additional stimulus. While this factor, known as the “Fed Put”, creates challenging market conditions for hedged equity funds like HDCTX, where the Fund is invested in stocks and a long volatility hedge, the Fund has managed to provide an attractive risk-adjusted return.

In 2021 we saw volatility and implied volatility, as measured by the VIX, move significantly lower as the Fed pumped liquidity into the markets. 2021 was a year when equities rose on lower volatility. During the year, the Fund was roughly invested 85% in stocks and 12% in our proprietary volatility hedge. Which makes it difficult to match the performance of any equity index or benchmark in a particularly strong year for stocks combined with low volatility. Despite this headwind, we were able to provide our investors double digit returns while taking significantly reduced market risk.

We believe that 2022 will be a challenging year for investors. The Fed is poised to pull back on its bond buying and shrink its balance sheet. We have already seen the 10-year rate rise from 1.35 to 1.80 (+22%) in less than a month. We believe core inflation is running at well above what the Fed has claimed and will continue to stay elevated for the next 12 to 18 months. The Nasdaq Index is trading around a 36 multiple, and the last time inflation was this high, it traded around a 22 multiple. Over 50% of the SPX Index is comprised of Nasdaq stocks and the top 5 stocks in the SPX had a combined +28% return. Valuations are high, market returns are concentrated, and there likely will be no rising tide that lifts all boats in 2022.

Risk managers need to be cognizant of the change 2022 will bring. Low inflation of the past 20 years has given a false sense of security. When inflation is high, the Fed cannot print its way out of a problem. Stock selection, nimble portfolio management, and rebalancing will be key in 2022 as we believe investors will see a return of “normalized volatility” to the markets where macroeconomic factors and good old-fashioned stock valuations and balance-sheet discipline will rule markets again.

We believe the Fund is well positioned to meet the challenges of the year ahead with its hedged investment strategy and experienced management team, which has over 80 years of combined experience in equity and equity derivatives markets. Our CEO, Luke Rahbari, ran the largest options pit by volume in the United States during the 90s Dot.com era. He later ran a large Equity Derivatives desk trading in the multiple billions in notional value. Our CIO, Brian Stutland, was in the CBOE pits when VIX options started trading and was at one time the largest electronic market-maker in the VIX options. Our other portfolio manager, Joe Tigay, started his career with Brian and has traded multiple instruments including the VIX, SPX and NDX to name a few.

We thank you for your trust in us and will strive to continue to deliver outstanding risk adjusted returns to you.

Sincerely,

Joe Tigay

Brian Stutland

Luke Rahbari

The Fund’s total annualized returns through December 31, 2021 as compared to the S&P 500 Value TR Index were as follows:

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception* |

| Institutional Class | 14.52% | 13.88% | 4.97% | 6.78% | 6.01% |

| Class A | 14.11% | 13.61% | 4.71% | 6.51% | 5.75% |

| Class C** | 13.40% | 12.715 | 4.01% | 5.85% | 4.88% |

| Class A w/ Sales Charge | 8.64% | 11.77 | 3.69% | 6.00% | 5.50% |

| S&P 500 Value TR Index (1) | 24.90% | 18.65% | 11.90% | 13.29% | 7.12% |

| ** | Class C Shares commenced operations on January 3, 2014. Returns prior to that date are of the Institutional Shares, adjusted for expenses of Class C Shares. Institutional Shares would have had substantially similar annual returns because the shares are invested in the same portfolio. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Value Total Return Index® (“S&P 500 Value TR”) is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. |

5189-NLD-0128-2022

Rational Equity Armor Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

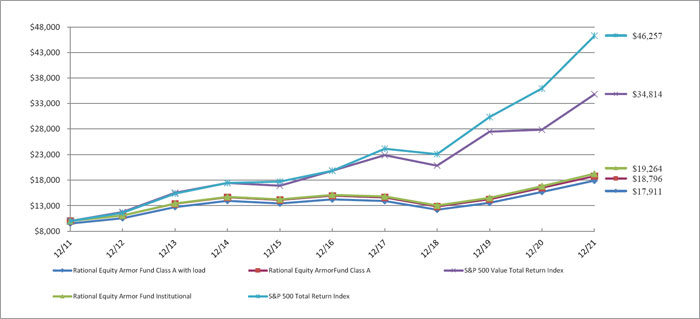

The Fund’s performance figures* for each of the periods ended December 31, 2021, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 14.52% | 4.97% | 6.78% | 6.01% | N/A |

| Class A | 14.11% | 4.71% | 6.51% | 5.75% | N/A |

| Class A with load | 8.64% | 3.69% | 6.00% | 5.50% | N/A |

| Class C | 13.40% | 4.01% | N/A | N/A | 3.80% |

| S&P 500 Value Total Return Index (c) | 24.90% | 11.90% | 13.29% | 7.12% | 10.73% |

| S&P 500 Total Return Index (d) | 28.71% | 18.47% | 16.55% | 8.78% | 14.92% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2021 prospectus, the total annual operating expense are 1.33% for Institutional shares, 1.70% for A shares and 2.40% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 2019 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is March 1, 2001 for Class A, Institutional and the benchmarks. |

| (b) | Inception date is January 3, 2014 for Class C and the benchmarks. |

| (c) | The S&P 500 Value Total Return Index uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. Investors cannot invest directly in an Index. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

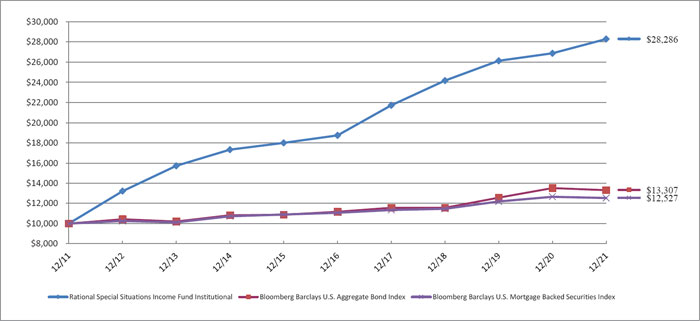

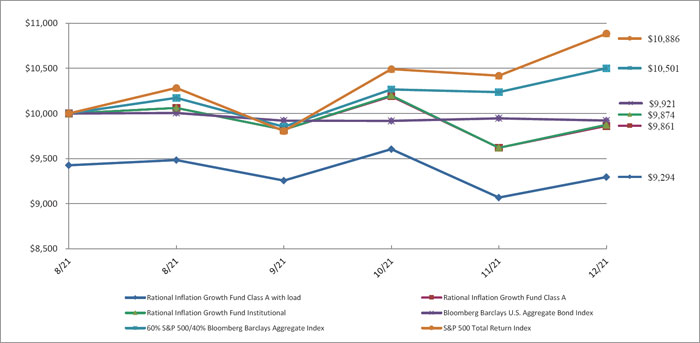

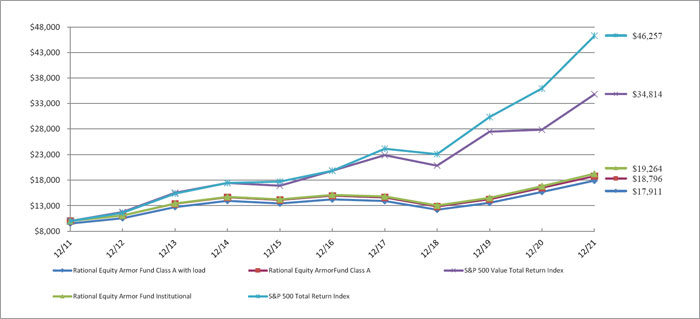

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry ^ | | % of Net Assets | |

| Banking | | | 10.1 | % |

| Institutional Financial Services | | | 7.0 | % |

| Oil & Gas Producers | | | 6.3 | % |

| Biotech & Pharma | | | 5.8 | % |

| Machinery | | | 5.2 | % |

| Wholesale - Consumer Staples | | | 4.9 | % |

| Food | | | 4.6 | % |

| Home Construction | | | 4.1 | % |

| Reits | | | 4.1 | % |

| Semiconductors | | | 3.9 | % |

| Other/Short-Term Investments | | | 44.0 | % |

| | | | 100.0 | % |

| ^ | Does not include derivatives in which the Fund invests. |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

December 31, 2021

Rational Tactical Return Fund

Dear Fellow Shareholders,

The Rational Tactical Return Fund (the “Fund”) seeks total return consisting of capital appreciation and income by making investments in long and short call and put options on futures contracts on the S&P 500 Index, as well as cash, and cash equivalents. For the year, the Fund posted a +3.94% (Class I) return versus +28.71% for the S&P 500 TR Index (S&P).

Investment Strategy

The Sub Advisor’s strategy seeks to achieve its investment objective in three ways: (1) Premium Collection – the Fund collects premiums on options it sells; (2) Volatility Trading – the Fund may enter into positions designed to hedge or profit from either an increase or a decrease in Index volatility; and (3) Trend Following – the Fund may increase or decrease the balance of puts and calls based on trending market direction. The Fund is designed to produce returns that are not correlated with equity market returns. The Fund employs strict risk management procedures, supported by both technical and fundamental analysis, that are intended to provide consistency of returns and to mitigate the extent of losses.

Fund Performance

The Fund’s stated objective is “to seek total return consisting of capital appreciation and income.” While many will compare the Fund to the S&P, as we trade options on that index, our goal is to have low correlation to that benchmark. In this light, our objective is to provide positive, risk adjusted absolute returns to our investors. When those returns are additionally weighed against the volatility endured to produce such returns, with extremely low standard deviation on a daily, monthly, and yearly timeframe, the Fund has delivered results at the top of its peer group. We also continue to provide excellent downside protection during periods of great stress on the benchmark. For these reasons we believe the Fund has performed well and has met its objective.

In looking at the Morningstar ranking and return data for the category in which the strategy is placed, “Options Trading,” the category is extremely broad with all options traders, many of whom take extreme risk collecting premiums during periods of positive index performance and may at times outperform but suffer in periods of rising volatility. That can be seen when looking at the recent 1 and 3-month performance where the Fund significantly outperformed both the Index and category. When looking at the Morningstar Risk evaluations for the most recent 3-year period, the Fund has provided multiples of Alpha when compared to the index and category. Also, the Fund produced a Sharpe ratio more than double the index and triple the category, at a volatility (Std Dev) of 1.6 vs 7.6 and 9.6 for the index and category.

While the overall market performed well during 2021, under the surface, the characteristics of volatility presented some challenges and opportunities for the Fund. Historically high levels of the volatility of volatility itself (the VVIX) meant that the market would oscillate between low and high volatility levels very quickly. This allowed us to monetize positions on a number of occasions but also led to more frequent hedging of the portfolio. We anticipate this environment to continue and will seek to take advantage of this conditions in the future.

The Fund’s total annualized returns through December 31, 2021 as compared to the S&P 500 TR Index (S&P) benchmark were as follows:

| | 1 Year | 3 Years | Since

12/5/17 | 5 Years | 10 Years | Since

Inception

(05/02/07) * |

| Class I | 3.94% | 4.95% | 6.24% | 5.58% | 1.46% | -0.87% |

| Class A | 3.75% | 4.74% | 6.01% | 5.43% | 1.30% | -1.05% |

| Class C | 2.94% | 3.88% | 5.28% | 4.64% | n/a | 5.15% |

| Class A with Sales Charge | -1.26% | 3.06% | 4.75% | 4.39% | 0.81% | -1.38% |

| S&P 500 Total Return Index (1) | 28.71% | 26.07% | 17.83% | n/a** | n/a** | n/a** |

| * | Inception: 05/02/2007 (Class A & Inst.), 05/31/2016 (Class C). Prior to 12/5/2017, the Rational Tactical Return Fund was named the Rational Real Strategies Fund, which was managed by a different sub-advisor and implemented a different investment strategy. |

| ** | S&P 500 TR Index not relevant to strategy prior to 12/5/2017 strategy change. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

In its fourth full year as the Fund’s Sub Advisor, Warrington has continued to provide strong absolute and relative returns, while consistently managing market risks. The Fund’s assets grew significantly in 2021, and we seek to continue to manage that growth carefully as equity markets have become richly valued in recent months, increasing the likelihood of future market volatility and heightened risk. In volatile markets, Warrington ensures that risk management is paramount, while concurrently evaluating the risk / reward relationship of the opportunities presented by volatile markets.

Sincerely,

Scott Kimple and Mark Adams

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Tactical Return Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

1150-NLD-01272022

Rational Tactical Return Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

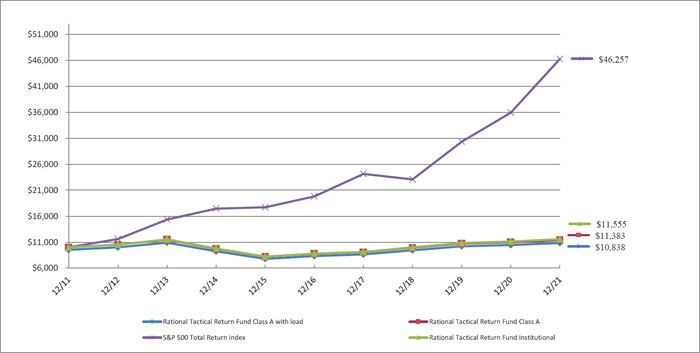

The Fund’s performance figures* for each of the periods ended December 31, 2021, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 3.94% | 5.58% | 1.46% | (0.87)% | N/A |

| Class A | 3.75% | 5.43% | 1.30% | (1.05)% | N/A |

| Class A with load | (1.26)% | 4.39% | 0.81% | (1.38)% | N/A |

| Class C | 2.94% | 4.64% | N/A | N/A | 5.15% |

| S&P 500 Total Return Index (c) | 28.71% | 18.47% | 16.55% | 10.52% | 18.02% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2021 prospectus, the total annual operating expense are 2.10% for Institutional Class shares, 2.38% for Class A shares and 3.09% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 2017 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is May 1, 2007 for Class A, Institutional and the benchmark. |

| (b) | Inception date is May 31, 2016 for Class C and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

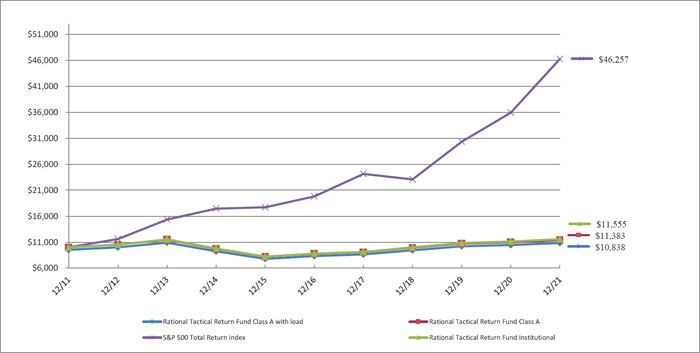

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Asset Type ^ | | % of Net Assets | |

| Short-Term Investments | | | 65.2 | % |

| Other/Cash & Equivalents | | | 34.8 | % |

| | | | 100.0 | % |

| ^ | Does not include derivatives in which the Fund invests. |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

December 31, 2021

Rational Dynamic Brands Fund (HSUAX | HSUCX | HSUTX) vert

Dear Investors,

Happy New Year! If you are an avid mountain biker and thrill-seeker and get to Lake Tahoe, you will absolutely want to ride Mr. Toad’s Wild Ride. We bring this up because that’s how we would describe equity markets in 2021. Our Investor Update last year started by asking the market gods for a “healthy dose of normal” across markets for 2021. As we write this year’s annual letter, we can definitively say, the market gods ignored our request in favor of a wild ride worthy of Mr. Toad’s. In hindsight, investing in stage one of a global pandemic is a lot simpler than investing in stage two. In stage two, human beings and investors must deal with all the distortions that are created by the crisis, as well as the responses to the crisis by policy makers and politicians. As we start 2022, we are extremely excited about the current portfolio holdings and their ability to generate a relatively stable stream of revenue, free cash flow, and actual earnings. Remember “earnings”? For the last five years, actual profits were not required to generate strong returns in growth stocks. We think it’s safe to say, profits and revenue growth and generating free cash flow are the hallmarks of solid long-term businesses, generally more stable stock price movements and solid long-term returns. That’s our focus as we start 2022 as the 2-year Covid distortions begin to normalize.

We all like investing in calm markets with high certainty, but the reality is, the best returns often happen when fear is everywhere and there is a very high wall of worry to climb. That’s where we are today in markets, Fed policy, and the economy. Here’s the positive disconnect between the narrative and the business fundamentals of our companies: we see tremendous value across important global consumption categories, particularly in the services sector. Overall, stocks and bonds are expensive relative to history, but we urge investors to be careful about broad-based market narratives. No matter what market or economic environment we are in, there’s always a sub-segment of the market that appears attractive for investment. We own a focused basket of highly relevant brands, most of which are trading at very reasonable valuations, hold strong recovery potential, and are operating at the center of significant secular growth tailwinds. In 2020, work from home, e-commerce, and high growth, profitless businesses worked the best. 2021 was the year where indexes held up well, but the average stock experienced significant volatility and rolling corrections. The second and third-tier businesses (we tend not to traffic in this group) that survived the global economic shutdowns experienced monumental snapbacks as bankruptcies were avoided. Suffice it to say, the lowest quality, least competitive, least profitable businesses only outperform once in a very long time. Our approach is to anchor to the most relevant and innovative brands across important spending categories, and those businesses, on average, outperform low quality companies more often than not. In 2022, our team has high confidence that a return to quality stocks with superior pricing power and high profitability will occur and that these companies offer the best opportunity for attractive total returns. We couldn’t be more excited about the current group of brands we own in the Fund. And the best part for investors is that the market is putting them on sale right now. Buying low (fear), selling high (euphoria) will never go out of style. The short-term uncertainty caused by Omicron, the Fed normalization process and inflation are offering solid entry points for long-term investors.

As a reminder, global consumer spending is a $40+ trillion per year phenomenon that, given its size and scope, warrants dedication in a portfolio. Most portfolios still do not hold sufficient exposure to a stable, predictable theme like consumer spending. That’s why the Dynamic Brands strategy was created and why we took over the Rational Dynamic Brands (HSUTX) Fund in October 2017. In a world with so many complex equity strategies, our thesis is likely the simplest to understand. At the center of this fund is logic, commonsense and risk management:

If consumption is the core of the economy at 70% of GDP,

shouldn’t the most powerful brands serving this theme be the core holding in your portfolio?

COMMENTARY

When high quality stocks go on sale and underperform, we thank our lucky stars and build bigger positions. We have relatively modest exposure to the highest valuation, lowest profitability, growth stocks in favor of owning a high profitability, high quality and a travel recovery barbell. At one end of the barbell, we own a core group of exceptionally high-quality brands serving important “every-day” spending & investing categories like saving for retirement, e-commerce, athleisure, credit card payments, home improvements & luxury home furnishings, home building, real estate platforms, brick-and-mortar mass market retail, video streaming, consumer healthcare, electric & traditional luxury vehicles, cloud computing, luxury apparel and accessories, and healthy fast casual restaurants. At the opposite end of the barbell, we have a basket of travel and recreation platforms via Expedia, Airbnb, and Caesar’s, a leader in Vegas entertainment & sports betting. Our exposure to Visa, Mastercard, PayPal, and Google serve both masters with key exposure to both portions of the thematic barbell. Dynamic Brands will always be a diverse, thematic consumer trends fund that holds baskets of great brands serving a differentiated group of sub-themes within the global consumption primary opportunity. As consumer trends & habits evolve, so too will the portfolio of brands we own. We are absolutely thrilled to be the only fund and management team investing across lifetime spending categories and through a dedication to highly relevant, strong brands. These intangible assets continue to be misunderstood and largely ignored by most investors.

The chart below highlights a tale of two markets in 2021. On the surface, the markets were solid and quiet, but under the surface there was massive volatility, wild sector rotations and a rolling correction that was quite severe. Most indexes performed strongly, most stocks inside these indexes lagged. The vast majority of returns came from the largest stocks in the indexes which was driven by a historic amount of money flowing into the largest, most liquid market cap weighted ETF’s. In 2021, the ETF effect was in full force. The good news for investors: we now have a better base to build from and valuations and expectations have largely been re-set. Here’s how crazy the market was in 2021: as of 12/20/21, >90% of the S&P 500 and Nasdaq Index stocks were at least 10% away from their 52-week highs and 68% of the Nasdaq holdings had at least a 25% pullback from their highs. This kind of variance between the index performance and the average stock performance is very rare. Between hedge fund redemptions, algo-traders that use short-term momentum signals for decision making, tax-loss selling, cap gains being pulled forward, Covid variants spiking, and nervousness about current & future monetary policy, 2021 truly was a year like few others. We feel confident you will hear this story across most of the letters you read.

| | S&P 500 | NASDAQ 100 | NASDAQ

Composite | Russell 2000 |

| | | | | |

| % Of Members With At Least 25% Correction From YTD High* | 20% | 35% | 68% | 66% |

| | | | | |

| | | | | |

| % Of Members With At Least 20% Correction From YTD High* | 37% | 54% | 74% | 78% |

| | | | | |

| | | | | |

| % Of Members With At Least 10% Correction From YTD High* | 91% | 94% | 89% | 98% |

| | | | | |

| | | | | |

| Average % Price Decline From YTD High* | -19% | -25% | -43% | -39% |

| | | | | |

| * As of 12/20/2021; source: Bloomberg | © Alpine Macro 2021 |

Here’s another fascinating statistic: if you removed the largest 5 stocks from the Nasdaq Composite Index (Apple, Microsoft, Amazon, Google, Tesla), the 2021 return of the index would be negative on the year. Like every year, 2022 will have its ups and downs, but on the margin, we think the supply chain issues & clogged port issues will begin to normalize, albeit slowly, while labor shortages and high wage inflation could stay present for longer. The pent-up demand for being out and about and traveling around the world has never been greater so we continue to like the service & leisure sector rebound. Our stock selection is centered around the brands with high demand for their products/services, with sustainable pricing power because of strong brand love and loyalty, and a tilt towards asset-light business models with lower labor costs given our view that wage pressure will linger for quite a while.

THE CONSUMER IS STILL SPENDING WELL

At 70% of total GDP, consumption spending really matters. Regardless of the current narrative, the consumer is still very healthy, home prices are high, and the wealth effect is very strong. Having a solid job with good wage growth, lower credit card debt outstanding, higher savings & money market balances and easily being able to upgrade your job & salary, all feed into our collective consumption capacity readings. The path we see currently out the front of the windshield is currently quite positive and sustainable from a consumption perspective. In a world filled with uncertainty, the predictability of consumer spending given there’s still roughly $3 trillion in excess savings, makes us feel quite good about the prospects for the most important brands serving key consumption industries. Yes, the cost of everything we want/need has gone up, year over year, and a portion of the population is feeling a new pinch in their wallets. Consumer behavior is very likely to change in 2022 and that’s where stock picking can add a significant amount of value to a portfolio. When the price of everything is high and stubborn, the masses tend to start prioritizing their spending while deferring other, non-core spending. That process is what will drive continued earnings and revenue beats or misses in the coming quarters.

The most beloved brands selling the most in-demand products and services will continue to thrive, the second-tier brands in non-critical spending categories could see demand erosion if the price to value ratio is not attractive. The current dynamic portfolio construction reflects the brands and spending categories we believe are most important to consumers today. When the number of categories and brands that are thriving moves down, the portfolio gets more concentrated. The portfolio is simply a reflection of the opportunities we see across the wide spectrum of consumer spending and business investment.

2022: SHIFT FURTHER UP IN QUALITY, LOWER THE NUMBER OF BRANDS, & UTILIZE PORTFOLIO FLEXIBILITY.

The distortions created through global policy mistakes have created a very compelling investment opportunity across high quality brands. Consumer favorites like Amazon, Visa, Mastercard, PayPal, and Netflix have largely underperformed the market since mid-2020. That’s an opportunity, particularly now that their stock and valuations have moved to the lower end of their historic ranges versus the index. These are strong businesses utilized by global consumers and they have very loyal customers and high brand love. History suggests when they go out of favor, you overweight them, and that’s exactly what we have done in the portfolio. Visa, Mastercard, and PayPal, in particular, are buying stock back aggressively while the stocks are low. What happens when business trends return to normal, and the number of outstanding shares have been aggressively reduced? Earnings beats. That’s what we see for many of the brands we own in the portfolio.

When our team wrote the Brands Fund prospectus, we wanted to have wide flexibility to deal with whatever market environment we had at any part of the business cycle. As we enter 2022, we think portfolio flexibility will be a key factor driving the returns for the year. Having the ability to use cash to our advantage, actively trade if/when volatility is stubbornly high, and play offense and defense offers investors more ways to win. If you have been in this business for many decades, you know that there are very few equity funds with wide latitude in the prospectus. Whether it’s the Brands Fund or others, we urge you to seek exposure to flexible strategies given how many uncertainties there are around the globe. Our strong return in 2020 highlights our ability and interest in using volatility to our advantage. Just a reminder: if you seek attractive returns, you must be willing to ride through the occasional bout of volatility. Market returns do not happen in a linear fashion, they often come in a more volatile fashion. It’s just the nature of the beast.

DYNAMIC BRANDS: The Fund that reflects your life-time spending interests.

Advisors and clients have repeatedly told us how secure they feel about holding companies they know, trust and love. That’s why a brand-centric portfolio is the ideal core equity allocation for investors. Staying invested through the tough times is a key attribute for long-term success and understanding and having an emotional connection to our favorite brands goes a long way in helping people stay engaged.

When we feel panic and fear and objectively assess the health of the companies we spend our time and money on, our panic often turns to excitement and opportunity and that’s an exciting nuance that can drive success as an investor. Think about how you spend your time and money. What brands do you have emotional connections to? Which brands are you fiercely loyal to? Which brands are part of your mind and wallet share on a very regular basis? The brands the masses favor the most tend to be terrifically profitable businesses & have strong performance track records over time. Dynamic Brands is filled with the brands we turn to for our most important spending needs.

With your investment in the Brands Fund, you currently have ownership in some of the most iconic, most profitable and beloved brands ever created:

| ● | Video streaming: Netflix, Amazon Prime Video, AppleTV |

| ● | Online & in-person shopping: Amazon, Target, Costco, Nike, Lululemon, Home Depot, Lowes. |

| ● | Travel & recreation: home sharing and travel platform use via AirBnb, VRBO, Expedia, and Caesar’s in Vegas. |

| ● | FinTech & Payment of all purchases versus using cash: Visa, Mastercard, Paypal & Venmo, Square & Cash App. |

| ● | Consumer electronics: Apple iPhones, iPads, AirPods, Microsoft X-Box, Office365 |

| ● | Healthy fast casual dining: Chipotle. |

| ● | Cloud computing: Amazon AWS, Google Cloud, Microsoft Azure. |

| ● | Luxury goods: Louis Vuitton brands (Tiffany, Dior, Sephora), Estee Lauder (Clinique, MAC Cosmetics, Aveda) |

| ● | Luxury auto’s: Tesla, Ferrari, VW to gain access to Porsche, Audi, Bentley, Lamborghini, Ducati Motorcycles |

| ● | Investments in private equity, infrastructure, real estate: Blackstone & KKR – the smartest investors in the world. |

| ● | Advertising & Internet Search: Google and You-Tube, plus all their “other bets” like Waymo self-driving . |

| ● | Household formation as Millennials start families: Lennar, one of the largest homebuilders & Zillow Marketplace |

| ● | Luxury home furnishings: RH (Restoration Hardware) serving the world’s wealthy consumers. |

| ● | Health & Wellness: Abbott Labs |

Here’s the link to the Dynamic Brands Fund portfolio, we will be making ongoing comments about each brand we own so you can follow along. Dynamic Brands Portfolio-Click each logo for recent updates

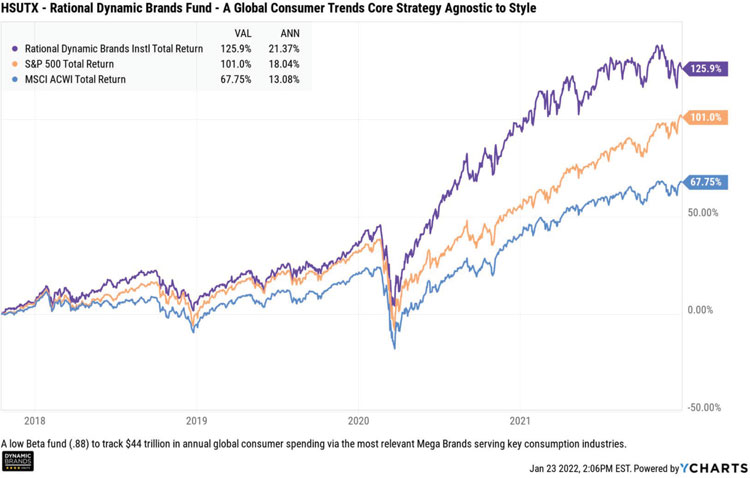

PERFORMANCE

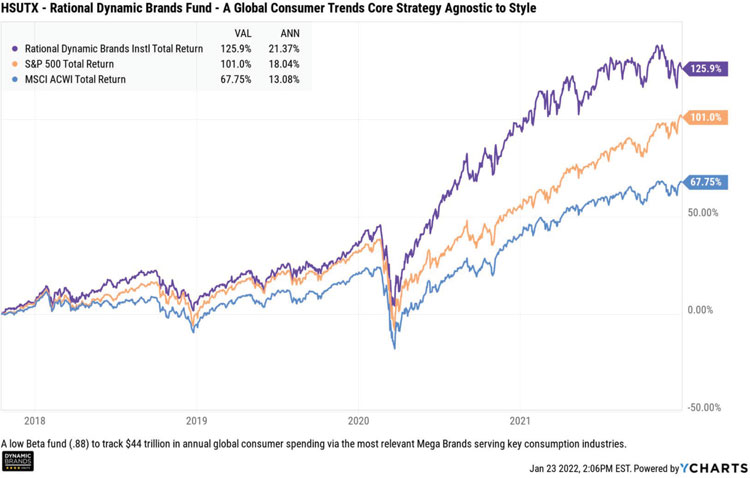

No investor has a playbook for investing in and through a global pandemic. In early 2020 if I told you the world’s economies would grind to a halt because of a global virus and that the policies surrounding that pandemic would create massive supply chain disruptions, shipping delays, an inflation spike, an epic labor shortage, tremendous uncertainties and volatility spasms, mass human suffering, extensive hedge fund redemptions, a pulling forward of capital losses and gains in anticipation of higher tax rates going forward, and the virtual halting of many businesses in the services sector, would you have guessed that the average annual return for the 2 year period from 2020 to 2021 for stocks would have been average (~10%), below average or above average? I suspect we all would have guessed the returns would have been below the long-term average of roughly 10%. Here’s the two-year stack of performance for the S&P 500, the Dynamic Brands Fund, and the MSCI All Country World Index. The last 2 years were among the wildest I’ve ever witnessed.

Suffice to say, most investments generated returns well above the long-term averages and certainly better than any of us would have expected given a global pandemic, high inflation and multiple start/stops for the global economy. We are looking forward to getting back to more normal central bank policies, a real economy, and back to live as we have always known it. We think many of the distortions that have occurred because of Covid are already in the process of normalizing and earnings variability should begin to revert to more normal levels. For the first half of 2022, we could still see some lingering concern due to the uncertainty in Federal Reserve policy and inflation expectations as well as more earnings volatility around companies that pulled forward 3+ years of revenue from the “digitization of everything” theme. Many of these great

businesses pulled forward strong returns so valuations are still quite high. Once these high comparisons fade, these secular growers should see much more stable price movements.

The Dynamic Brands Fund underperformed the S&P 500 in 2021 but our return remained well above the long-term average market return. In fact, since 2017, the two years the Fund has lagged the market were both periods in which the market generated outsized gains and the Brands Fund generated returns well above “normal”.

Our focus on stability and predictability often generates outperformance in more difficult, sub-par years for the indexes because money tends to rotate to mega brands for their relative safety and predictability. Importantly, the Fund has performed strongly over the 2-year Covid Pandemic period. Last year’s underperformance came largely from our anchoring to two key consumption trends we think have enormous opportunities for the foreseeable future (a return to normal travel & recreation trends and the death of cash in favor of using credit card payments & rewards programs). The return to cross-border travel straddles both these themes.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

We took advantage of short-term dislocations in both industries to add to these positions on dips because we have a high degree of confidence in their revival in 2022. Sometimes, when there’s wonderful opportunities in the short-term, you have to be willing to ride through the short-term volatility to hope to receive a long-term benefit. Like we stated earlier in this update, the average stock has already experienced a significant correction. Corrections never feel good when they are happening, but they tend to offer much more attractive entry points for attractive, long-term gains.

As we kick off 2022, we expect the road to normal Fed policy will create periodic bouts of volatility, but this normalization is very healthy for markets and the economy. 2022 should be less about the index and more about active stock picking as the economy normalizes and companies get back to more typical operating environments. Concentrated portfolios should outperform investments that own thousands of stocks. Quality & profitability should lead low quality and highly levered balance sheets and pent-up demand industries like services should have much smoother quarterly consumption trends.

We thank you for your loyalty to the Rational Dynamic Brands Fund and for appreciating the value of investing in the $44 trillion global consumption theme through the brands that make a difference in all our lives. Investing in the brands that build innovative and necessity-based products and services is a timeless approach to long-term investing.

Reminder: the holdings and allocation weights will change over time according to the opportunities we see in the marketplace. Fund holdings are subject to change and should not be considered investment advice.

Sincerely,

The Accuvest Dynamic Brands Team: Eric Clark, Dave Garff, James Calhoun

| | | | | | Previous Strategy |

| | | | | | |

| Share Class/Benchmark | YTD | 1 Year | 3 Years | Since

10/16/171 | 5 Years | 10 Years | Since

Inception* |

| Class I | 14.97 | 14.97 | 28.50 | 21.31 | 19.63 | 14.29 | 12.44 |

| S&P 500 TR Index | 28.71 | 28.71 | 26.07 | 18.08 | 18.47 | 16.55 | 11.73 |

| Class A | 14.59 | 14.59 | 28.15 | 20.98 | 19.34 | 13.99 | 12.15 |

| Class A w/ Sales Charge | 9.16 | 9.16 | 26.08 | 19.59 | 18.18 | 13.44 | 11.87 |

| | | | | | | | |

| * Inception: 09/27/2002 |

| 1 | Prior to 10/17/2017, Rational Dynamic Brands Fund was named the Rational Defensive Growth Fund, which had a different investment strategy and sub-advisor. |

The maximum sales charge for Class “A” Shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.RationalMF.com.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

As of December 31, 2021, the Fund’s top 10 holdings were:

| RH | 7.72% |

| | |

| Visa Inc | 5.28% |

| | |

| Alphabet Inc | 5.25% |

| | |

| KKR & Co Inc | 5.18% |

| | |

| Blackstone Inc | 5.03% |

| | |

| Microsoft Corp | 4.86% |

| | |

| PayPal Holdings Inc | 4.81% |

| | |

| Apple Inc | 4.65% |

| | |

| Netflix Inc | 4.33% |

| | |

| Amazon.com Inc | 4.16% |

| | |

Portfolio holdings are subject to change and should not be considered investment advice.

This report is intended for the Fund’s shareholders. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Dynamic Brands Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index.

1142-NLD-01262022

Rational Dynamic Brands Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

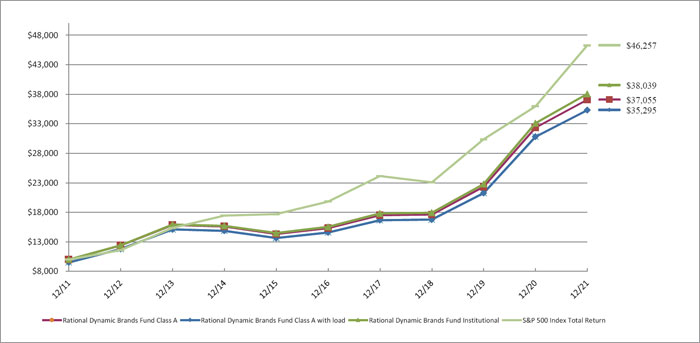

The Fund’s performance figures* for each of the periods ended December 31, 2021, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 14.97% | 19.63% | 14.29% | 12.44% | N/A |

| Class A | 14.59% | 19.34% | 13.99% | 12.15% | N/A |

| Class A with load | 9.16% | 18.18% | 13.44% | 11.87% | N/A |

| Class C | 13.85% | 18.57% | N/A | N/A | 10.69% |

| S&P 500 Total Return Index (c) | 28.71% | 18.47% | 16.55% | 11.73% | 14.92% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2021 prospectus, the total annual operating expense are 1.26% for Institutional shares, 1.53% for Class A shares and 2.42% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to October 2017 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is September 27, 2002, for Class A, Institutional and the benchmark. |

| (b) | Inception date is January 2, 2014 for Class C and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

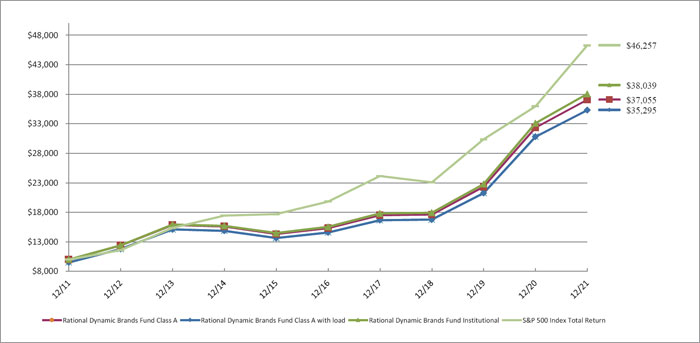

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | | % of Net Assets | |

| Retail - Discretionary | | | 18.5 | % |

| Internet Media & Services | | | 16.1 | % |

| Technology Services | | | 15.4 | % |

| Asset Management | | | 10.3 | % |

| Apparel & Textile Products | | | 8.2 | % |

| Leisure Facilities & Services | | | 5.0 | % |

| Software | | | 4.9 | % |

| Technology Hardware | | | 4.7 | % |

| Automotive | | | 4.4 | % |

| E-Commerce Discretionary | | | 4.2 | % |

| Other/Short-Term Investments | | | 8.3 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

December 31, 2021

Rational Strategic Allocation Fund

Dear Fellow Shareholders,

The Rational Strategic Allocation Fund (the “Fund”) seeks current income and moderate appreciation of capital by implementing a distinct “index plus” strategy that provides investors exposure to a non-traditional fixed income portfolio with an S&P 500 Index equity overlay. During 2021, the Fund outperformed the S&P 500 Total Return Index (1) with a +33.57% (Class A) return versus +28.71% for the S&P 500 Total Return Index. The Fund benefited from its allocations to futures contracts on the S&P 500 Index and fixed income funds.

Investment Strategy

The Fund invests in a portfolio of futures contracts on the S&P 500 Index and income-oriented mutual funds typically representing non-traditional fixed income asset classes. We select underlying funds using a fundamental research process, including a top-down analysis of market conditions and investment category historical performance during various market conditions. We also perform a bottom-up analysis of each potential fund for investment, including investment allocations, investment valuations and characteristics, positioning, historical performance during various market conditions and each fund’s portfolio manager’s outlook. The Fund typically maintains 70% to 100% notional exposure to the S&P 500 Index and 70% to 100% notional exposure to the fixed income portfolio.

Fund Performance

The Fund performed in-line with our expectations. Our exposure to S&P 500 Index futures contracts allowed us to participate in the upswings of the equity markets while our non-traditional fixed income portfolio served to provide current income and support the goal of moderate capital appreciation by buffering the impact of downside equity market volatility. Throughout 2021, we were able to maintain our targeted notional exposure of 70% to 100% to the S&P 500 Index.

The majority of the holdings performed to our expectations. The top performing funds held in the portfolio during 2021 were: The AlphaCentric Income Opportunities Fund (IOFIX +14.92%), The Rational/Pier 88 Convertible Securities Fund (PBXIX +10.21%) and The Rational Special Situations Fund (RFXIX +5.30%). The weakest performing fund held in the portfolio during 2021 was: The Catalyst/Stone Beach Income Opportunity Fund (IOXIX -4.31%).

The Fund’s total annualized returns through December 31, 2021 as compared to the S&P 500 Total Return Index were as follows:

| | 1 Year | 3 Years | 5 Years | Since Inception

(07/30/09) |

| Class A | 33.57% | 13.21% | 9.44% | 7.45% |

| Class A with Sales Charge | 27.20% | 11.38% | 8.38% | 7.03% |

| S&P 500 Total Return Index (1) | 28.71% | 26.07% | 18.47% | 15.82% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Sincerely,

David Miller

Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

1149-NLD-01272022

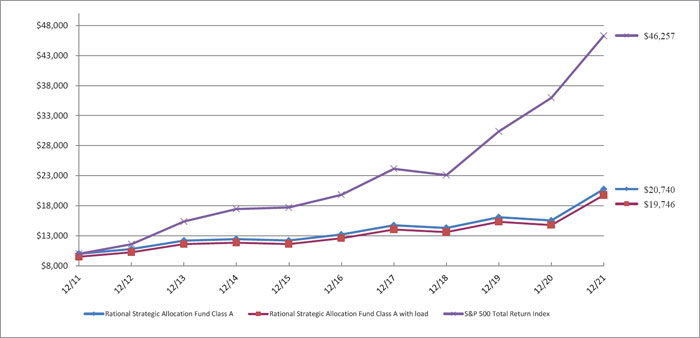

Rational Strategic Allocation Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

The Fund’s performance figures* for each of the periods ended December 31, 2021, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | 33.94% | 9.71% | N/A | N/A | 9.62% |

| Class A | 33.57% | 9.44% | 7.57% | 7.45% | N/A |

| Class A with load | 27.20% | 8.38% | 7.04% | 7.03% | N/A |

| Class C | 32.60% | 8.62% | N/A | N/A | 8.54% |

| S&P 500 Total Return Index (c) | 28.71% | 18.47% | 16.55% | 15.82% | 18.02% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2021 prospectus, the total annual operating expense are 2.45% for Institutional shares, 2.79% for Class A shares and 3.47% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to January 2016 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is July 30, 2009 for Class A and the benchmark. |

| (b) | Inception date is May 31, 2016 for Class C, Institutional and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

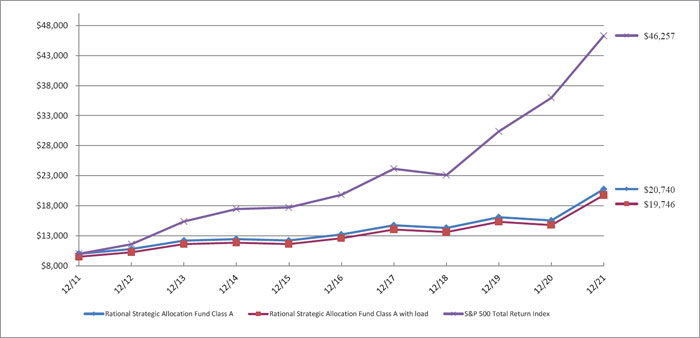

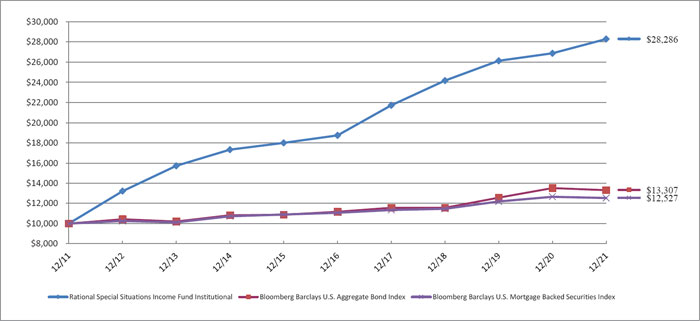

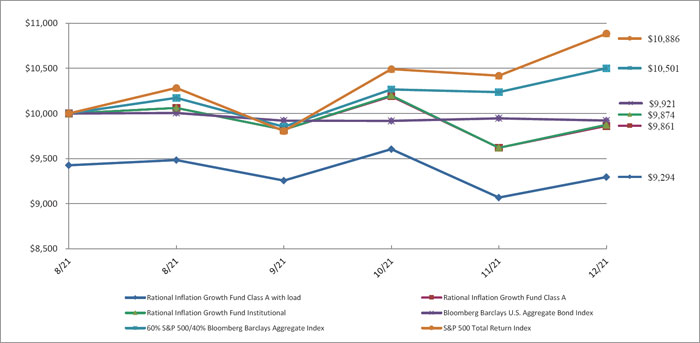

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Asset Type ^ | | % of Net Assets | |

| Fixed Income | | | 72.9 | % |

| Alternative | | | 9.8 | % |

| Other/Short-Term Investments | | | 17.3 | % |

| | | | 100.0 | % |

| ^ | Does not include derivatives in which the Fund invests. |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s total investments.

unaudited

December 31, 2021

Rational ReSolve Adaptive Asset Allocation Fund

Dear Shareholders,

The Rational ReSolve Adaptive Asset Allocation Fund (the “Fund”) commenced trading on March 16, 2018, when ReSolve Asset Management officially replaced the previous manager as sub-advisor.

ReSolve’s Adaptive Asset Allocation1 methodology uses proprietary quantitative and machine learning innovations that emphasize characteristics such as, but not limited to, total return momentum, trends, seasonal patterns, carry measures, mean reversion and others, while simultaneously maximizing diversification based on changing estimates of volatility and correlations across a global universe of futures markets consisting of stock and bond indices, commodities, and currencies.

Portfolio Review

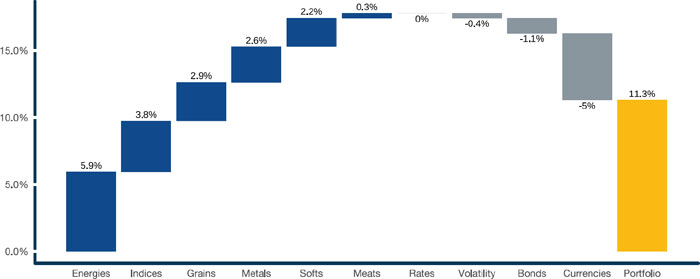

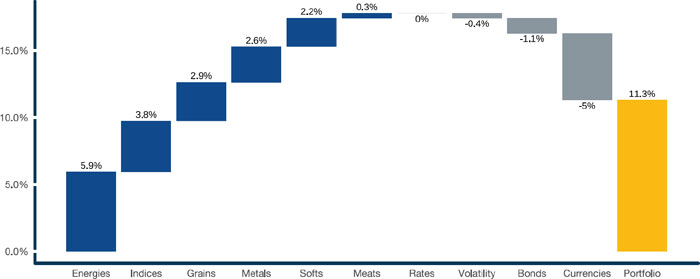

In 2021, the first calendar year after the innovations deployed in September 20202, the Fund (RDMIX) delivered a solid +11.28% return. More importantly, it displayed the very diversified set of return streams that it seeks to provide.

Energies drove the largest share of P&L, mostly from longs in crude oil and gasoil. Carbon emissions and natural gas also contributed on the long side. Our systems were agile in reducing exposure and avoiding the brunt of the November selloff in the sector.

Equities benefited primarily from long positions in the Nasdaq, UK FTSE, and Canadian TSX. Other meaningful contributions were drawn from longs in the Dutch AEX, Dow Jones, and Spanish IBEX.

Grains were a close third best sector, stemming largely from longs in corn and milling wheat. Bean oil, soybeans and wheat offered modest positive returns. Active trading protected gains when volatility spiked in the second half.

Metals also provided important contributions; copper was the main highlight. Platinum was a close second, with active trading and profitable long and short positions that flipped several times throughout the year.

Softs were not far behind, with the lion’s share of positive returns coming from long cotton. Cocoa and coffee provided incremental gains.

Currencies were by far the largest detractors, mostly led by longs in the Swiss Franc, Japanese Yen, and the New Zealand Dollar.

Bonds suffered from offside long exposure to the Canadian 10-year bonds and 5-year Treasuries, which were partially offset by being long 30-year Treasuries during its April through July recovery rally.

| 1 | For our 10-year track record, please visit: https://investresolve.com/strategies/resolve-adaptive-asset-allocation-cad-8-volatility/ |

| 2 | For more information, please refer to the Fund’s 2020 commentary. |

Figure 1. 2021 Return Attribution

Source: ReSolve Asset Management. Results may differ due to rounding. Performance is expressed in USD. Strategy attribution is a best efforts approximation, net of all applicable borrowing costs, fees and fund accruals for the period. Indicated returns of one year or more are annualized. Past performance is not indicative of future performance.

The Fund’s total annualized returns through December 31, 2021 as compared to the Barclay Hedge CTA Index(4) and the S&P 500 Total Return Index were as follows:

| | | | | | Previous Manager |

| | YTD | 1Yr | 3yrs | Since 02/28/2018 | 5YRS | 10YRS | Incep |

| | | | | | | | |

| Institutional Class | 11.28 | 11.28 | 9.84 | 4.76 | 4.91 | 4.24 | 6.16 |

| | | | | | | | |

| Barclay Hedge CTA Index4 | 5.21 | 5.21 | 5.27 | 3.56 | 2.61 | 1.44 | 4.29 |

| | | | | | | | |

| S&P 500 TR Index3 | 28.71 | 28.71 | 26.07 | 17.89 | 18.47 | 16.55 | 10.82 |

| | | | | | | | |

| Class A | 10.99 | 10.99 | 9.55 | 4.48 | 4.65 | 3.97 | 5.89 |

| | | | | | | | |

| Class C | 10.18 | 10.18 | 8.76 | 3.73 | 3.88 | 3.22 | 5.11 |

| | | | | | | | |

| Class A w/ Sales Charge | 4.61 | 4.61 | 7.41 | 2.89 | 3.42 | 3.97 | 5.89 |

| | | | | | | | |

| * | Inception: 02/01/1994. The performance shown prior to September 30, 2016 is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class. |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information please call the Fund, toll free at 1-800-253-0412.

The Fund acquired all of the assets and liabilities of Chesapeake Fund, LLC (the “Predecessor Fund”) in a tax free reorganization on December 31, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional Shares of the Fund. At the time of the reorganization, the Predecessor Fund had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. Effective February 27, 2018, the Fund’s investment strategy changed, and a new Sub Advisor replaced the prior sub-advisor. Consequently, prior performance may not reflect the Fund’s current operations.

General Market Review

Investor sentiment and risk appetite continued to be dominated by the news flow surrounding the pandemic and its repercussions. The first half of the year saw renewed optimism with the successful rollout of vaccination campaigns – initially in the US and UK, followed by Europe – leading to a significant decrease in infection rates across western countries. The signing of an historic USD 1.9 trillion stimulus package in the US, the size and scope of which go beyond any other fiscal outlay since the beginning of the pandemic, was the other major driver of the economic recovery.

The case for more persistent inflation gathered steam throughout the year. Data from the United Nations pointed to a whopping 31 percent rise in global food prices for the 12-month period ending July 2021. Food prices in the US jumped by 8 percent over a similar period, driven largely by imports, while gas lines in Britain and other shortages in developed economies captured headlines across much of the world. Supply-chain disruptions became the most overused catchphrase in recent memory.

Though the Fed had been trying to ignite inflation since 2009, it began to indicate discomfort as inflation readings remained higher than expected throughout the second half of 2021. Aside from supply-demand mismatches, the major inflationary thrust was exacerbated by expansionary fiscal policy directed at the population at large, associated with their higher propensity to spend it. Stubbornly low labor participation was another important variable, which appears to be swinging the bargaining pendulum away from capital in the form of higher wages. By mid-December, the Federal Open Market Committee (FOMC) voted to accelerate the pace of asset purchase tapering and signaled as many as three rate hikes may be warranted in 2022.

Commodities were the best performing asset-class, led by the incredible rally in the energy sector, where the price of UK natural gas rose four-fold, carbon emissions doubled, and crude oil and distillates increased between 50 and 80 percent, approximately. While copper and other base metals enjoyed double-digit gains, precious metals – including gold, silver, platinum and palladium, were down for the year. Agricultural commodities also saw huge gains, led by oils (palm, canola and bean), along with coffee, corn, cotton, sugar and wheat. Global equities experienced another strong year, led by US, European and Canadian stocks. Japanese shares had modest gains, while Chinese indices suffered from government intervention and were broadly down. Government bonds were also largely in negative territory in the wake of rising inflation, while the US Dollar strengthened against most major and emerging market currencies.

For the past decade, investors have shifted focus from the macroeconomic data itself, to an emphasis on how the data might affect Fed policy. Apart from the Fed’s recent promise to “remove the party’s punch bowl” sooner than expected, most other central banks have indicated loose monetary conditions for the foreseeable future. And even though, as of the writing of this commentary, markets are once again throwing a tantrum given the more hawkish tone in recently released FOMC minutes, there are reasons to doubt whether the Fed may be willing, or perhaps even able, to follow through. For one, higher inflation for a prolonged period would eventually erode, in real terms, part of the enormous debt pile that has dragged on growth for years. This suggests that, despite tough rhetoric, inflation might in fact be a feature, and not a bug, of the current policy agenda.

Further, the apparent demise of Biden’s Build Back Better fiscal package removes an important tailwind for the economy just as the effects of COVID-relief legislation begin to fade. Recent evidence points to a slowdown in activity, not only in the US but also in much of the world. The Chinese economy is particularly concerning given recent draconian lockdown measures in some regions, not to mention the yet unknown knock-on effects of the likely collapse of its largest real-estate developer. Investors should expect no respite from the heightened uncertainty they’ve had to endure in the last few years.

Sincerely,

ReSolve Asset Management

Strategy Sub-Advisor

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (3) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Adaptive Asset Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

| (4) | The Barclay Hedge CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 510 programs included in the calculation of the Barclay CTA Index for 2020. The Index is equally weighted and rebalanced at the beginning of each year. |

8023-NLD-1/31/2022

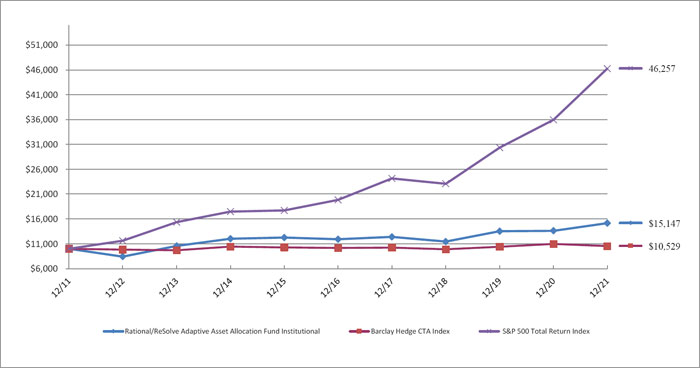

Rational/ReSolve Adaptive Asset Allocation Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

The Fund’s performance figures* for each of the periods ended December 31, 2021, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional (c) | 11.28% | 4.91% | 4.24% | N/A | 6.16% |

| Class A | 10.99% | 4.65% | N/A | 3.86% | N/A |

| Class A with load | 4.61% | 3.42% | N/A | 2.69% | N/A |

| Class C | 10.18% | 3.88% | N/A | 5.11% | N/A |

| S&P 500 Total Return Index (d) | 28.71% | 18.47% | 16.55% | 18.36% | 10.82% |

| Barclay Hedge CTA Index (e) | 5.21% | 2.61% | 1.44% | 2.27% | 4.29% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1 , 2021 prospectus, the total annual operating expense are 2.29% for Institutional shares, 2.58% for Class A shares and 3.46% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. |

Class A shares are subject to a maximum load of 5.75%.

Performance information for the period prior to February 2018 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is September 30, 2016 for Class A, Class C and the benchmarks. |

| (b) | Inception date is February 28, 1994 for Institutional and the benchmarks. |

| (c) | The Fund acquired all of the assets and liabilities of Chesapeake Fund LLC (the “Predecessor Fund”) in a tax-free reorganization on September 30, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional shares of the Fund, so the Predecessor Fund became the Institutional shares of the Fund. The Fund’s investment objective, policies and guidelines are, in all material respects, equivalent to the Predecessor Fund’s investment objectives, policies and guidelines. The Predecessor Fund commenced operations on February 28,1994. Updated performance information will be available at no cost by calling 1-800-253-0412 or visiting the Fund’s website at www.RationalMF.com. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (e) | The Barclay Hedge CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. |

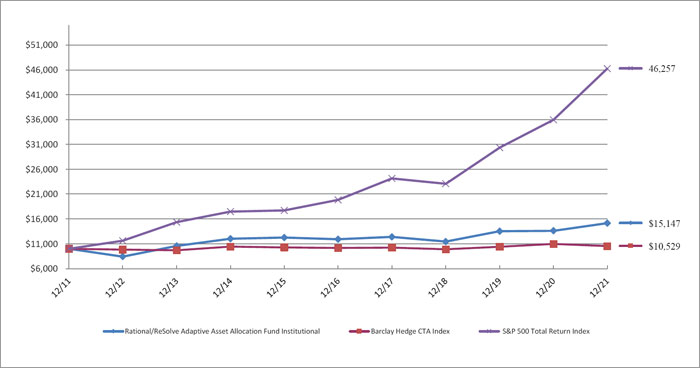

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Type ^ | | % of Net Assets | |

| Short-Term Investments | | | 93.2 | % |

| Other/Cash & Equivalents | | | 6.8 | % |

| | | | 100.0 | % |

| ^ | Does not include derivatives in which the Fund invests. |

Please refer to the Consolidated Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

January 17, 2022

Rational/Pier 88 Convertible Securities Fund

Dear Fellow Shareholders,

The Rational/Pier 88 Convertible Securities Fund (the “Fund”) seeks total return consisting of capital appreciation and income, offering a “call option” on fast growing businesses by investing primarily in convertible securities, which offer equity participation with the added benefit of a bond floor component. The Fund maintains an average investment grade rating with the goal of providing additional downside risk management. The Pier 88 approach to managing the convertible bond asset class can be characterized by the word “balance.” We endeavor to take a balanced view of risk versus reward. The team is cognizant that all investments present a plethora of risk including macroeconomic, market and idiosyncratic. Our portfolio remains diversified from a sector, market capitalization and style perspective.

During 2021, the Fund (PBXIX) returned +10.21% versus +12.49% for the ICE BofAML Investment Grade US Convertible Index. The Fund benefited from strong stock selection in Technology, Healthcare and Industrials. Conversely, the Fund primarily underperformed based on its underweight position in energy and the large reversion in the sector post the 2020 sell off. Given the massive growth to value rotation in the public market that started in November 2020 and continued throughout 2021, we think it is important to examine the past 24 months of performance for context.

In 2020, the outperformance of over 1,000 basis points to the comparable convertible index was attributable to both sector allocation coupled with strong security selection. The Fund benefited from overweight positions in technology and consumer discretionary, specifically software, semi-conductors and internet-related retail focused sub-sectors. Moreover, the Fund’s material underweight in utilities and financials added to overall outperformance during that period. As the market experienced a growth to value rotation, secular growth names in the portfolio began to underperform while more cyclical names levered to the re-opening of the economy recovered. The ICE BofAML Investment Grade US Convertible Index has broader exposure to value-oriented sectors like energy and financials. Given this value tilt, one would typically expect the Index to outperform the Fund as investors sold the underlying securities of growth companies to buy the securities of value companies. Nevertheless, our security selection and risk management process helped blunt the impacts of the rotation. In 2021, investors preferred cyclical companies like semiconductors, e-commerce, energy and travel at the expense of more secular names like software and digital learning. Semiconductor-related and cybersecurity names were solid contributors to the Fund as underlying company fundamentals remained very strong.

Investment Strategy

The Fund seeks to achieve its objective by investing in convertible securities, which are “hybrid” securities that possess both fixed income and equity characteristics. The convertible securities asset class is often overlooked because of its unique profile and often trades at a discount to its pari-passu fixed income counterparts. As equity sensitivity has been the primary driver of returns of the asset class, our investment team employs an equity analysis perspective for investment decisions.

Fund Performance

Although the Fund benefitted from a healthy yield, the majority of the return came from capital appreciation. Full year 2021 saw strong positive returns for the convertible asset class across multiple industry sectors. Information Technology Healthcare and Financials delivered the strongest positive returns with sub-sectors of cyber security, semi-conductors, lifesciences, biotechnology and private equity driving the bulk of stock selection. The Fund benefitted from exposure to fast growing businesses which saw increased demand from rebounding economies, continued demand for technologies to fight new cyberattacks, and new innovations in life sciences and biotechnology. We remain bullish on the fundamentals underlying many of our companies; our secular growth stories have years to expand their business, while our blue-chip franchises are well capitalized and possess the stability to fund their yields.

Summary

The Rational/Pier 88 Convertible Securities Fund delivered strong positive returns in 2021 following high double digit returns in 2020. The Fund outperformed the broad fixed income index (The Barclays US Aggregate Bond Index), which was negative, while lagging the broader S&P. The majority of the holdings performed to our expectations and the Fund benefitted from rigorous security selection and solid risk management. We believe investing on behalf of others is a privilege we must earn everyday through adherence to a disciplined investment process. Thank you for your support.

Sincerely,

Frank Timons

Portfolio Manager

The Fund’s total annualized returns through 12/31/21 as compared to its benchmark were as follows:

| | QTD | 1 Year | 3 Years | Inception* |

| Class I | 5.20 | 10.21 | 15.56 | 11.38 |

| Bloomberg Barclays US Aggregate TR Index1 | 0.01 | -1.54 | 4.79 | 3.63 |

| S&P 500 TR Index | 11.03 | 28.71 | 26.07 | 17.41 |

| ICE BofAML Investment Grade US Convertible 5% Constrained Index | 5.10 | 12.49 | 13.68 | 11.73 |

| Class A | 5.15 | 9.97 | 15.32 | 11.14 |

| Class C | 4.89 | 9.11 | 14.54 | 10.34 |

| Class A w/ Load | 0.12 | 4.77 | 13.45 | 10.03 |

| * | Inception: 03/01/2017. The performance shown prior to December 6, 2019 is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class. |

S&P 500 is the primary benchmark.

Maximum sales charge for Class A is 4.75%. Maximum Deferred Sales Charge of 1.00% on Class C Shares applies to shares sold within 12 months of purchase. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Results shown reflect the waiver, without which the results could have been lower. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.RationalMF.com.

Gross expense ratios are 1.41%, 2.14%, and 1.26% for Class A, C and I shares. Net expense ratios are 1.25%, 2.00%, and 1.00% for Class A, C and I shares. Expense limitation is 0.99%, 1.24% and 1.99% for the Institutional class, Class A and Class C respectively and is contractually agreed upon through April 30, 2022

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

8016-NLD-1/26/2022

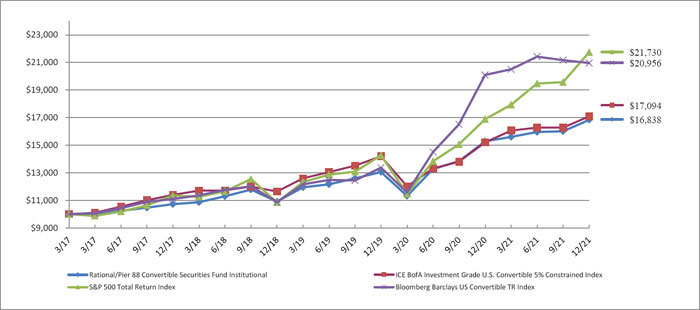

Rational/Pier 88 Convertible Securities Fund

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

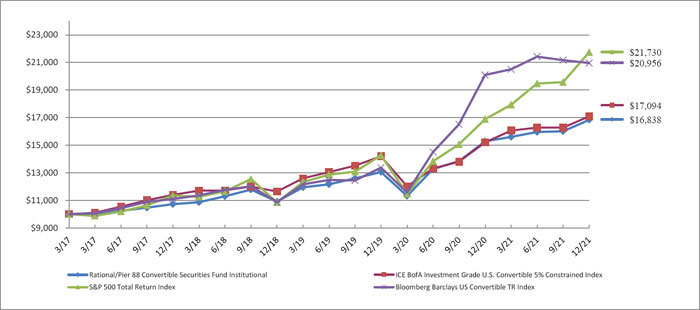

The Fund’s performance figures* for each of the periods ended December 31, 2021, compared to its benchmarks:

| | | Annualized | Annualized |

| | 1 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional (c) | 10.21% | N/A | 11.38% |

| Class A | 9.97% | 13.87% | N/A |

| Class A with load | 4.77% | 11.22% | N/A |

| Class C | 9.11% | 13.14% | N/A |

| S&P 500 Total Return Index (d) | 28.71% | 24.24% | 17.41% |

| Bloomberg Barclays US Convertible TR Index (e) | 4.32% | 25.33% | 16.52% |

| ICE BofA Investment Grade U.S. Convertible 5% Constrained Index (f) | 12.49% | 9.39% | 11.73% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2021 prospectus, the total annual operating expense are 1.26% for Institutional shares, 1.41% for Class A shares and 2.14% for Class C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is December 6, 2019 for Class A, Class C and the benchmark. |

| (b) | Inception date is March 1, 2017 for Institutional and the benchmark. |

| (c) | The Fund acquired all of the assets and liabilities of Lake Como Convertible Bond Fund L.P. (the “Predecessor Fund”) in a tax-free reorganization on December 6, 2019. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional shares of the Fund, so the Predecessor Fund became the Institutional shares of the Fund. The Fund’s investment objective, policies and guidelines are, in all material respects, equivalent to the Predecessor Fund’s investment objectives, policies and guidelines. The Predecessor Fund commenced operations in March 2017. Updated performance information will be available at no cost by calling 1-800-253-0412 or visiting the Fund’s website at www.rationalmf.com. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (e) | The Bloomberg Barclays US Convertible TR Index: An index used to represent the US convertible bond asset class |