UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

Mutual Fund and Variable Insurance Trust

(Exact name of registrant as specified in charter)

36 North New York Avenue

Huntington, NY 11743

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporate Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-631-629-4237

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

| Item 1. | Reports to Shareholders. |

Annual Shareholder Report

December 31, 2022

INSTITUTIONAL SHARES

CLASS A SHARES

CLASS C SHARES

unaudited

December 31, 2022

Rational Equity Armor Fund (HDCAX, HDCEX, HDCTX)

Dear Fellow Shareholders,

The Rational Equity Armor Fund (the “Fund”) seeks total return on investment, with dividend income being an important component of that return. The Fund seeks to achieve this goal by investing in two baskets – a long equity portfolio and a volatility hedge overlay. The Fund seeks to achieve its investment objective by investing primarily in common stock of dividend paying companies included within the S&P 500 Index (the “S&P 500”). The Fund also invests a portion of its assets in exchange-traded volatility index futures contracts and in cash and cash equivalents as a hedge against the common stock held in the Fund’s portfolio.

In the past 50 years, the yield curve has inverted seven times. Seven out of seven times there was a recession. In 2022 we first saw the 2 year yield higher than the 10 year yield for the first time April, and the three-month over the ten-year in October, which were two signals of a recession and one of the main reasons stocks struggled in 2022. While stocks struggled, volatility as measured by the VIX Index and the SPIKES Volatility Index did not have its normal opposing run. This led to many hedged equity funds underperforming the S&P 500. During the reporting period, the Fund outperformed the S&P 500 and did so with lower volatility.

The Fund is long volatility and equities. In the first quarter of 2022, the VIX Index was up 19% while the S&P 500 was down 5%. This negative correlation allowed the Fund to have a positive first quarter, up 1%. Historically, the negative correlation provides a tailwind to the fund. The second, third, and fourth quarters of 2022 did not have a similar volatility peak, thus our fund experienced a headwind, overall a challenging environment for all hedged equity funds. The Fund still succeeded in those quarters, outperforming the S&P 500 by roughly 5% for the calendar year and doing so with lower volatility.

We enter 2023 full of uncertainties. Since the Great Financial Crisis, market participants have come to rely on extreme levels of liquidity supplied to the market by the Federal Reserve. This led to the inflation problem we saw dominate the market in 2022. This year, to the extent that inflation comes down, we believe that economic growth will slow down with it. If that economic slowdown occurs, the Fed will have fewer tools at its disposal to stimulate growth.

We at Equity Armor believe that this type of market environment is one where our team and asset allocation/trading strategy can create alpha for investors. In the last 10 years, we have observed that most asset classes have moved in unison with each other, particularly for most large equity-based indices. However, as liquidity is drawn out of the market, it is our view that there will be no rising tide to lift all boats. We believe that in this environment, stock picking and sector rotation will be key. In addition, with a return to a “normalized Fed” we expect a return to normalized volatility in the markets. Our strategy

is designed to harvest some of this normalized volatility in the market to help buffer the portfolio from market downturns and also to help provide an optimized hedge while continuing to be invested in the stock market.

We thank you for your trust in us as we strive to continue to deliver outstanding risk adjusted returns.

Sincerely,

Joe Tigay

Brian Stutland

Luke Rahbari

The Fund’s total annualized returns through December 31, 2022 as compared to the S&P 500 Value TR Index and S&P 500 TR Index were as follows:

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception* |

| Institutional Class* | -10.68 | 5.82 | 3.04 | 4.49 | 5.18 |

| Class A* | -10.86 | 5.59 | 2.79 | 4.23 | 4.93 |

| Class C** | -11.51 | 4.85 | 2.04 | 3.60 | 4.07 |

| Class A w/ Sales Charge* | -15.12 | 3.87 | 1.79 | 3.73 | 4.69 |

| S&P 500 Value TR Index (1) | -5.22 | 6.26 | 7.58 | 10.86 | 6.52 |

| S&P 500 TR Index (2) | -18.11 | 7.66 | 9.42 | 12.56 | 7.37 |

| ** | Class C Shares commenced operations on January 2, 2014. Returns prior to that date are of the Institutional Shares, adjusted for expenses of Class C Shares. Institutional Shares would have had substantially similar annual returns because the shares are invested in the same portfolio. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Value Total Return Index® (“S&P 500 Value TR”) is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. |

| (2) | The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. |

5169-NLD-01312023

Rational Equity Armor Fund

PORTFOLIO REVIEW (Unaudited)

December 31. 2022

The Fund’s performance figures* for each of the periods ended December 31, 2022, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | (10.68)% | 3.04% | 4.49% | 5.18% | N/A |

| Class A | (10.86)% | 2.79% | 4.23% | 4.93% | N/A |

| Class A with load | (15.12)% | 1.79% | 3.73% | 4.69% | N/A |

| Class C | (11.51)% | 2.04% | N/A | N/A | 1.97% |

| S&P 500 Value Total Return Index (c) | (5.22)% | 7.58% | 10.86% | 7.05% | 8.83% |

| S&P 500 Total Return Index (d) | (18.11)% | 9.42% | 12.56% | 7.37% | 7.05% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2022 prospectus, the total annual operating expense are 1.17% for Institutional shares, 1.42% for A shares and 2.17% for C shares before fee waivers and/or expense reimbursements, if any. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 13, 2019 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is March 1, 2001 for Class A, Institutional and the benchmarks. |

| (b) | Inception date is January 3, 2014 for Class C and the benchmarks. |

| (c) | The S&P 500 Value Total Return Index uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. Investors cannot invest directly in an Index. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry ^ | | % of Net Assets | |

| Equity | | | 15.7 | % |

| Biotech & Pharma | | | 9.2 | % |

| Insurance | | | 7.7 | % |

| Heath Care Facilities & Services | | | 5.9 | % |

| Software | | | 4.7 | % |

| Electric Utilities | | | 3.8 | % |

| Technology Hardware | | | 3.5 | % |

| Retail - Consumer Staples | | | 3.4 | % |

| Aerospace & Defense | | | 3.3 | % |

| Beverages | | | 3.2 | % |

| Other/Short-Term Investments | | | 39.6 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. | |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

December 31, 2022

Rational Tactical Return Fund (HRSAX, HRSFX, HRSTX)

Dear Fellow Shareholders,

The Rational Tactical Return Fund (the “Fund”) seeks total return consisting of long-term capital appreciation and income by making investments in long and short call and put options on futures contracts on the S&P 500 Index, as well as cash and cash equivalents. For the year ended December 31, 2022, the Fund posted a -0.30% (Class I) return versus -18.11% for the S&P 500 TR Index (the “S&P 500 Index”).

Investment Strategy

Warrington Asset Management, LLC’s (the “Sub-Advisor”) strategy seeks to achieve the Fund’s investment objective in three ways: (1) Premium Collection – the Fund collects premiums on options it sells; (2) Volatility Trading – the Fund may enter into positions designed to hedge or profit from either an increase or a decrease in S&P 500 Index volatility; and (3) Trend Following – the Fund may increase or decrease the balance of puts and calls based on trending market direction. The Fund is designed to produce returns that are not correlated with equity market returns. The Fund employs strict risk management procedures, supported by both technical and fundamental analysis, that are intended to provide consistency of returns and to mitigate the extent of losses.

Fund Performance

While the Fund trades options on the S&P 500 Index, the Sub-Advisor’s goal is to have low correlation to that benchmark. In this regard, the Sub-Advisor’s objective is to provide positive, risk adjusted absolute returns to our investors. When those returns are additionally weighed against the volatility endured to produce such returns, with low standard deviation on a daily, monthly, and yearly timeframe, we believe the Fund has performed well and has achieved its objective.

The equity and fixed income markets performed poorly in 2022, highlighting the need for uncorrelated assets. While volatility, as measured by the VIX Index, was low throughout the year, the equity markets themselves presented extreme challenges for most market participants. We believe we were able to navigate these difficult markets and capture trading gains, where possible, while seeking to protect capital when opportunity sets were limited. In looking at the Morningstar ranking and return data for the category in which the Fund’s strategy is placed, “Options Trading,” we believe the category is extremely broad with all options traders, many of whom, in our view, take extreme risk collecting premiums during periods of positive index performance and may at times outperform, but underperform in periods of rising volatility. According to Morningstar, in 2022, the Fund finished in the top 4% of the 258 constituents, which we would attribute to our distinct investment approach. Additionally, since Sub-Advisor inception, the Fund’s Morningstar rating is now at four stars, which we believe is reflective of the Fund’s performance and minimal standard deviation (the five-year standard deviation for the Fund is 1.79 vs 9.85 for the Morningstar category). This wide disparity leads to a Sharpe ratio of 1.92 for the Fund vs. 0.27 for the Morningstar category, underscoring how we have sought to add significant shareholder value using our approach. The flexibility in the tactical trading methodology utilized for the Fund, coupled with stringent risk parameters, is designed to provide the ability to react quickly to an ever-changing market environment in search of profits while also remaining focused on avoiding potentially treacherous market conditions.

The Fund’s total annualized returns through December 31, 2022, as compared to the S&P 500 TR Index (S&P) benchmark were as follows:

| | 1 Year | 3 Years | 5 Years | Since

12/5/17 | 10 Years | Since

Inception

(05/01/07) * |

| Class I | -0.30% | 2.08% | 4.80% | 4.92% | 0.91% | -0.84% |

| Class A | -0.53% | 1.87% | 4.58% | 4.68% | 0.76% | -1.01% |

| Class C | -1.33% | 1.11% | 3.74% | 3.94% | n/a | 4.14% |

| Class A with Sales Charge | -5.28% | 0.24% | 3.57% | 3.68% | 0.27% | -1.32% |

| S&P 500 Total Return Index (1) | -18.11% | 7.66% | 9.42% | 9.67% | n/a** | n/a** |

| * | Inception: 05/01/2007 (Class A & Inst.), 05/31/2016 (Class C). Prior to 12/5/2017, the Rational Tactical Return Fund was named the Rational Real Strategies Fund, which was managed by a different sub-advisor and implemented a different investment strategy. |

| ** | S&P 500 TR Index not relevant to strategy prior to 12/5/2017 strategy change. |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

In another year as the Fund’s Sub Advisor, Warrington has continued to provide strong absolute and relative returns, while consistently managing market risks. We seek to continue asset growth as weak equity markets have highlighted the need for non-correlated assets. In volatile markets, Warrington ensures that risk management is paramount, while concurrently evaluating the risk/reward relationship of the opportunities presented by those volatile markets.

Sincerely,

Scott Kimple and Mark Adams

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| 1 | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Tactical Return Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

5147-NLD-01262023

Rational Tactical Return Fund

PORTFOLIO REVIEW (Unaudited)

December 31. 2022

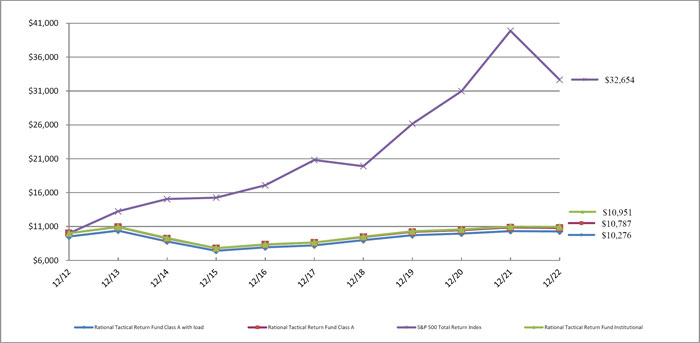

The Fund’s performance figures* for each of the periods ended December 31, 2022, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | (0.30)% | 4.80% | 0.91% | (0.84)% | N/A |

| Class A | (0.53)% | 4.58% | 0.76% | (1.01)% | N/A |

| Class A with load | (5.28)% | 3.57% | 0.27% | (1.32)% | N/A |

| Class C | (1.33)% | 3.74% | N/A | N/A | 4.14% |

| S&P 500 Total Return Index (c) | (18.11)% | 9.42% | 12.56% | 8.42% | 11.65% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2022 prospectus, the total annual operating expense are 2.10% for Institutional Class shares, 2.35% for Class A shares and 3.06% for Class C shares before fee waivers and/or expense reimbursements, if any. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 5, 2017 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is May 1, 2007 for Class A, Institutional and the benchmark. |

| (b) | Inception date is May 31, 2016 for Class C and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

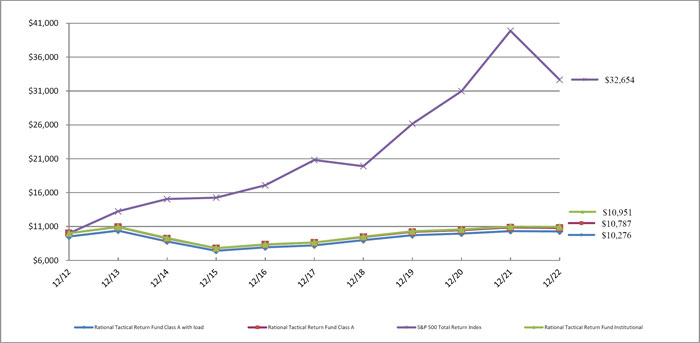

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Asset Type ^ | | % of Net Assets | |

| U.S. Treasury Bills | | | 76.9 | % |

| Other/Cash & Equivalents | | | 23.1 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. | |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets.

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

Investor Update Q4 2022: Rational Dynamic Brands Fund (HSUAX | HSUCX | HSUTX)

2022: The Year When Business Fundamentals Did Not Matter

Dear Investors,

2022 was a very difficult year for investors. The year was filled with fear, uncertainty, and doubt around geopolitics, Fed Policy, rising rates, and high inflation across wages, rents, energy, agriculture, food, and services. Cross-asset volatility was persistently high as investors and traders focused on the macro environment over each corporations’ micro fundamentals. For investors of high quality, profitable growth companies, it was even more difficult as multiples re-rated across the board.

The Dynamic Brands fund returned -35.41% for 2022, a return we are quite disappointed with but one we feel was completely disconnected from the fundamentals of the businesses we own. For comparison purposes, the S&P 500 return for the year was -18.17% and the Russell 1000 Growth Index return was -29.14%. The Brands fund is managed to look very different than the broad market. Over the long-term, the fund should be expected to have heavy exposure to two of the best performing sectors going back many decades, Consumer Discretionary & Technology. It’s these two sectors where the most dominant, growth-oriented brands live. The Tech sector index return for 2022 was -28.26% and the Consumer Discretionary index had a difficult year at -37.1%. In addition, our overweight position to Real Assets and Private Equity leaders Blackstone and KKR were big detractors to performance. That said, we could not be more bullish about their prospects going forward. These companies have roughly $300 billion of dry powder to put to work across the globe so any further distress will have them buying great assets at cheaper prices. Defensive brands generally held up much better than high quality growth-oriented brands as money rotated to the perceived safety of staples, healthcare, and energy stocks. As we begin 2023, most of these stocks are much more expensive than their growth counterparts, generate much less free cash, and grow at a fraction of the more cyclical brands in the portfolio.

We have preached “wide lens investing” since our team took over the fund on 10/17/2017. Our flexible mandate allows us to invest across style boxes and geographies. After a very difficult 2022, it is worth reviewing our most key investment thesis – consumption in the global economy. The global economy is driven by household consumption, at roughly 60% of world GDP. That’s over $40 trillion in annual household spending, making this theme an ideal core equity choice. To assume a difficult year in the stocks of great businesses implies the theme is not investable would be a mistake. For perspective, the Brands Fund from inception 10/17/2021 to the peak of the Funds NAV on November 16, 2021 significantly outperformed the broad market as measured by the S&P 500 by about 500bps annualized. The cumulative return for the fund over this period was 137.9% versus 97.29% (source Ycharts). The fund had strong returns for the first four years and a difficult one year in 2022. When looking back in time, underperforming years for the top consumer & consumer-related tech brands tend to be wonderful buying opportunities. More on that later in this note.

Ironically, the actual businesses of the companies we own turned in solid years. With few exceptions, if one looked at the business success of our companies, they would have expected the stocks to have had a strong year of performance. The market has clearly been looking forward to a slower economic environment, courtesy of the Federal Reserve and our man-made inflation. Historically speaking, rising rates are not generally a problem for stocks but when the trajectory of the rates rising is as steep as it was in 2022, stocks struggle mightily.

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

Over the long-term, equity markets are positive roughly 80% of the time. That is a statistic worthy of holding on to in our opinion. History shows those that are willing to look through short-term noise and take advantage of large sales tend to get rewarded over time.

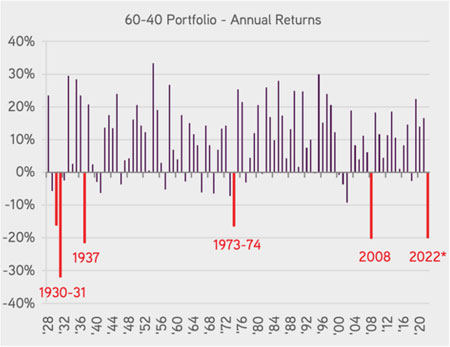

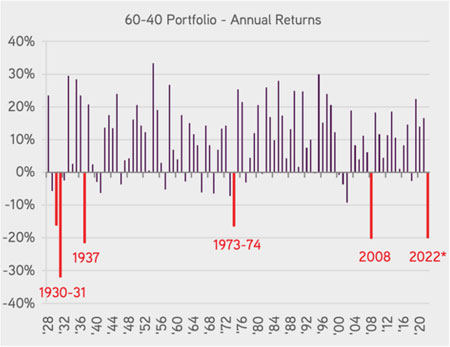

Consumer Sentiment has been poor the entire year. When the price of goods are higher than normal, that tends to happen. 2022 will go down as one of the worst years ever for 60/40 portfolios. Bonds and stocks were dreadful performers which means the average portfolio disappointed investors. As the chart below from KKR highlights, 2022 was on par with 2008 and the only back-to-back down year for the 60/40 portfolio was about 90 years ago (1930-1931).

|

| |

| Before 1977: Using S&P500, and 50% US T.Bond and 50% Baa Corp Bond (NYU Stern) for bonds. After 1977: Using S&P 500, and Barclays U.S. Aggregate for bonds. Assuming yearly rebalancing. *2022 return corresponds to annualized YTD return. Data as at October 31, 2022. |

Though 2023 may continue to be volatile as project “Fed normalization” continues, we expect a much better portfolio outcome than what we experienced in 2022. Traditional fixed income offers attractive yields and the possibility of capital appreciation if a slowing economy brings down rates. High quality companies, with superior balance sheets and high operating margins are cheaper than they have been in a long time. As opportunists, we are excited to build bigger positions in our favorite global brands and we are increasingly comfortable navigating the inevitable volatility created by a Fed who has kept monetary policy easy for too long. Volatility is the friend of the long-term investor. This is not just an adage; it is timeless mental wiring for a successful investor.

To be clear, our crystal ball is no better than anyone else’s, and 2023 is different than 2019, the Fed is still not our friend, but they are moving much closer to the endpoint of their policy adjustments. With high inflation (coming down slowly), a historically hawkish Federal Reserve over-reacting, and the remnants of a 13 year “free money, zero interest rate” bonanza floating to the surface almost daily, why would anyone have a spring in their step and want to own stocks?

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

To answer that, I’ll use a quote from one of the most successful investors of all time, Stan Druckenmiller:

“It doesn’t matter what a company is earning today, or what they have earned in the past, you have to visualize the situation 18 months from now – that’s where the price will be.”

Dynamic Brands Take Advantage of Chaos.

Even the best public companies get dragged down when markets fall. Growth does not always happen in a linear fashion, sometimes the macro environment makes the growth a bit choppier. 2022 was the year where company multiples contracted because of higher rates and inflation. 2023 will be the year we all get to see who has a lasting and strong economic moat and who was simply riding a wave of free money and strong equity markets. As Buffet likes to say, we get to see who is naked when the tide goes out. The tide has been going out for a year now and we see zombie companies everywhere. When you traffic in high quality, profitable businesses, sleeping at night gets a lot easier.

When we look at our concentrated basket of top global brands, we feel confident in each business moat and in their ability to take market share because of strong balance sheets and high customer loyalty. Experiencing big drawdowns like we saw in 2022 is never fun, but it offers the opportunist a chance to build bigger positions in the highest conviction brands.

In our calls with our investors, one question rose to the top so we thought we would address it in the annual letter:

“Some of the most popular and best run brands have seen large drawdowns in 2022, has something changed or is this an opportunity?”

To answer this important question, one must separate the stock from the actual business. Public markets have become more casino-oriented than ever before so public market investors must stomach much more day-to-day volatility than the underlying businesses they own will ever experience. It’s during these times, when prices get disconnected from business fundamentals, that the opportunist must take advantage. In this spirit, I looked back at how some of the best brands in the world performed after a weak calendar performance to see if there were any patterns we could anchor to. As you might imagine, when great businesses have a big annual drawdown, generally, they tend to offer attractive returns for those that can stomach short-term volatility and who do not panic sell after the drawdown.

The Dynamic Brands Fund owns many of these great companies and we are analyzing a handful of others for future purchases.

We chose 20 popular, leading brands from the U.S. and other foreign markets for this exercise. The concept of buying more great companies when they go on sale is rewarded in most periods one could analyze. Here’s some data to back that thesis up:

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

| Brand | All-time

returns as of

12/31/2022 | S&P 500

Return Same

Period | 2022 Return | Avg. Return

in Negative

Years | Number of

Down Years

Total | Fwd. Avg.

Return Next 3

Cal. Years |

| Amazon | 85660% | 638% | -49.60% | -32.9% | 8 | 56.10% |

| Apple | 40840% | 2120% | -26.40% | -28.1% | 15 | 48.20% |

| Google (Alphabet) | 3420% | 414% | -39.09% | -20.3% | 4 | 36.17% |

| Estee Lauder | 3650% | 978% | -32.32% | -22.1% | 7 | 24.40% |

| Intuit | 16080% | 1400% | -39.11% | -36.0% | 5 | 29.57% |

| Nike | 21270% | 2110% | -29.04% | -26.1% | 9 | 32% |

| LVMH | 2690% | 534% | -10.87% | -16.0% | 6 | 26.50% |

| Lululemon | 2190% | 241% | -18.16% | -27.40% | 5 | 71.30% |

| Microsoft | 94470% | 2115% | -28.02% | -19.60% | 9 | 30% |

| Domino’s Pizza | 5320% | 399.70% | -37.88% | -35.0% | 3 | 38% |

| Costco | 6240% | 2124% | -19.06% | -21.0% | 8 | 13.50% |

| Target | 5240% | 2122% | -34.27% | -19.0% | 15 | 26.00% |

| Williams-Sonoma | 4680% | 2110% | -30.48% | -27.9% | 12 | 36.10% |

TenCent Holdings

China | 3002% | 436% | -25.31% | -20.0% | 4 | 38.00% |

Mercado Libre

Latin America | 2960% | 258% | -37.24% | -25.0% | 6 | 65% |

| Thermo Fisher | 6650% | 2110% | -17.30% | -22.50% | 15 | 33.40% |

| Lowe’s | 30230% | 2110% | -21.50% | -18.40% | 15 | 18.70% |

| Accenture | 1970% | 498% | -34.70% | -16.50% | 5 | 24.00% |

| Nvidia | 38720% | 380.60% | -50% | -39.70% | 7 | 49.70% |

| Netflix | 24550% | 428.20% | -51% | -35.60% | 5 | 68.70% |

Data source: Morningstar, Ycharts & Accuvest Global Advisors.

The green vertical column shows how each leader performed since going public. The next column shows how the S&P 500 performed over the same period. The next column shows the 2022 stock return. Moving right, the next column shows the average negative return in all years the stock had a negative calendar year. Next, we show how many negative calendar years each brand had since inception. The last column is the most important; we average the 3 calendar years following a negative year to highlight any potential opportunities after a poor return year. The future does not have to look like the past, but there seems to be a willingness on the part of buyers to step-in and own great companies after negative years. The most important thing to remember; even the greatest companies do not go up every year, sometimes they even go down two years in a row but for those with duration, big sale years have tended to offer strong buying opportunities. Exceptional long-term returns can only be created if investors stay the course. Their experience can be amplified when they become opportunists in a sea of pessimism.

The Brands Portfolio

The current Dynamic Brands portfolio continues to be described as a high conviction basket of iconic brands. In times of uncertainty, less companies will thrive, less companies have sustainable pricing power and less companies have strong end-demand. Being more concentrated in our investment process and using a scalpel versus a shovel continues to be warranted.

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

If markets get meaningfully weaker sometime in 2023, we expect to pivot from a more concentrated approach and into a more broadly diversified portfolio to gain more exposure to attractive sectors and industries on sale.

We have our wish list ready, and we will take advantage of irrational markets for the benefit of clients. Here’s a snapshot of the brands portfolio as we start 2023. The holdings can change without notice as general market conditions evolve:

In aggregate, this continues to be a very high-quality portfolio with attractive sales and earnings growth projections and one that is filled with free cash flow generators that have strong histories of compounding those investments at a highly attractive rate. The portfolio of brands has strong pricing power, high brand love, and generates strong free cash flows, which can be used for buybacks, dividend payments, and future growth initiatives. As owners of this portfolio ourselves, we sleep very well at night no matter what the macro market brings.

We urge you to begin building your cost averaging strategy, the current opportunities are strong, and any further weakness simply offers wide-lens investors even better entry points.

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

We thank you for your loyalty to the Rational Dynamic Brands Fund and for appreciating the value of investing in the $40+ trillion global consumption theme through the brands that make a difference in all our lives. Investing in the brands that build innovative and necessity-based products and services is a timeless approach to long-term investing.

As of December 31, 2022, the Fund’s top 10 holdings were:

| Blackstone | 11.8% |

| KKR & Co | 9.1% |

| Lululemon | 5.0% |

| Visa | 4.9% |

| LVMH Moet Hennessy | 4.9% |

| Thermo Fisher Scientific | 4.8% |

| Mastercard | 4.5% |

| Nike | 4.2% |

| Microsoft | 4.0% |

| Apple | 4.0% |

Number of holdings: 27 Brands

% of assets in Top 10 holdings: 28.14%

Sector Allocations (vs. S&P500):

| Sector | HSUTX | SPY | +/- |

| Consumer Discretionary | 33.05 | 9.77 | 23.27 |

| Financials | 21.02 | 11.63 | 9.39 |

| Communication Services | 8.36 | 7.26 | 1.1 |

| Energy | 5.98 | 5.21 | 0.77 |

| Consumer Staples | 7.4 | 7.17 | 0.23 |

| Not Classified | 0.02 | 0.41 | -0.39 |

| Real Estate | 0 | 2.69 | -2.69 |

| Materials | 0 | 2.73 | -2.73 |

| Utilities | 0 | 3.17 | -3.17 |

| Information Technology | 19.27 | 25.66 | -6.39 |

| Industrials | 0 | 8.52 | -8.52 |

| Health Care | 4.9 | 15.77 | -10.87 |

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

YTD RETURNS

HSUTX: -35.41%

SPY (S&P500 ETF): -18.17%

XLY (S&P500 Consumer Discretionary ETF): -36.27%

TOP CONTRIBUTORS YTD:

| Brand | Average Weight % | Return | Contribution to Return |

| Exxon Mobil | 1.68% | 18.28% | 0.59% |

| Chevron | 1.52% | 14.16% | 0.43% |

| Mastercard | 2.52% | 1.89% | 0.25% |

| Meta Platforms | 0.19% | 12.76% | 0.11% |

| Booking Holdings | 0.02% | 7.09% | 0.07% |

| Domino’s Pizza | 0.37% | 5.64% | 0.07% |

| Thermo Fisher | 2.25% | 1.98% | 0.05% |

| Spotify | 0.09% | 11.12% | 0.05% |

| Ferrari | 0.50% | 1.34% | 0.04% |

| Deckers Outdoor | 0.13% | 4.09% | 0.04% |

TOP DETRACTORS YTD:

| | Average | | Contribution to |

| Brand | Weight % | Return | Return |

| Blackstone | 11.47% | -39.97% | -4.41% |

| Restoration Hardware | 4.12% | -50.15% | -3.65% |

| Netflix | 1.36% | -70.59% | -3.25% |

| KKR & Co | 6.92% | -37.01% | -2.20% |

| Expedia Group | 1.96% | -50.51% | -2.16% |

| Amazon.com | 4.21% | -49.62% | -2.13% |

| Alphabet | 4.07% | -39.09% | -1.61% |

| NVidia | 1.82% | -31.51% | -1.56% |

| Tesla | 2.08% | -58.46% | -1.47% |

| Nike | 4.23% | -29.04% | -1.38% |

PERFORMANCE ATTRIBUTION ANALYSIS:

Positive Attribution Effects (vs. S&P500):

| ● | Underweight Allocation to Technology |

| ● | Underweight Allocation to Communications |

| ● | Overweight Allocation to Cash |

| ● | Overweight Allocation to Financials |

| ● | Security Selection within Consumer Discretionary |

| ● | Security Selection within Energy |

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

Negative Attribution Effects:

| ● | Overweight Allocation to Consumer Discretionary |

| ● | Security Selection within Financials |

| ● | Underweight Allocation to Healthcare |

| ● | Underweight Allocation to Industrials |

| ● | Underweight Allocation to Energy |

| ● | Underweight Allocation to Materials |

| ● | Security Selection within Communications |

| ● | Security Selection within Technology |

Reminder: the holdings and allocation weights will change over time according to the opportunities we see in the marketplace. Fund holdings are subject to change and should not be considered investment advice.

Sincerely,

The Accuvest Dynamic Brands Team: Eric Clark, Dave Garff, James Calhoun

| Share Class/Benchmark | YTD | 1 Year | 3 Years | Since

10/16/171 | 5 Years | 10 Years | Since

Inception* |

| Class l | -35.41 | -35.41 | 2.56 | 7.48 | 6.66 | 7.07 | 9.40 |

| S&P 500 TR Index | -18.11 | -18.11 | 7.66 | 10.06 | 9.42 | 12.56 | 10.03 |

| Class A | -35.58 | -35.58 | 2.27 | 7.19 | 6.41 | 6.78 | 9.12 |

| Class Aw/ Sales Charge | -38.64 | -38.64 | 0.63 | 6.19 | 5.38 | 6.27 | 8.86 |

| |

| * Inception: 09/27/2002 |

The maximum sales charge for Class “A” Shares is 4.75%. In the case of investments of $1 million or more (where you do not pay an initial sales charge), a 1.00% contingent deferred sales charge (CDSC) may be assessed on shares redeemed within two years of purchase. The gross expense ratios were 1.75%, 2.69%, and 1.46% for the Class A, C, and I share, respectively per the recent prospectus. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.RationalMF.com.

There is no assurance that the Fund will achieve its investment objective

Important Risk Considerations:

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. These factors may

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

| | |

| | Rational Advisors LLC | Ph: (646) 757-8063 |

| | | |

affect the value of your investment. Investments in international markets present special risks including currency fluctuation, the potential for diplomatic and political instability, regulatory and liquidity risks, foreign taxations and differences in auditing and other financial standards. Risks of foreign investing are generally intensified for investment in emerging markets. Emerging market securities tend to be more volatile and less liquid than securities traded in developed countries.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.RationalMF.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. is not affiliated with Northern Lights Distributors, LLC.

1171-NLD-02032023

| | 36 N New York Avenue, Floor 3, Huntington, NY 11743 | Rationalmf.com |

Rational Dynamic Brands Fund

PORTFOLIO REVIEW (Unaudited)

December 31. 2022

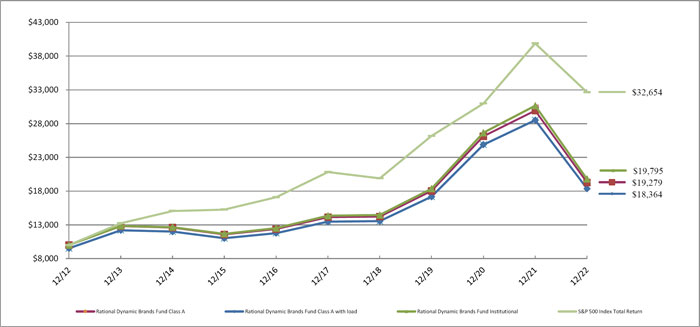

The Fund’s performance figures* for each of the periods ended December 31, 2022, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | (35.41)% | 6.66% | 7.07% | 9.40% | N/A |

| Class A | (35.58)% | 6.41% | 6.78% | 9.12% | N/A |

| Class A with load | (38.64)% | 5.38% | 6.27% | 8.86% | N/A |

| Class C | (36.02)% | 5.63% | N/A | N/A | 4.15% |

| S&P 500 Total Return Index (c) | (18.11)% | 9.42% | 12.56% | 10.03% | 10.67% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2022 prospectus, the total annual operating expense are 1.10% for Institutional shares, 1.37% for Class A shares and 2.08% for Class C shares before fee waivers and/or expense reimbursements, if any. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to October 17, 2017 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is September 27, 2002, for Class A, Institutional and the benchmark. |

| (b) | Inception date is January 2, 2014 for Class C and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

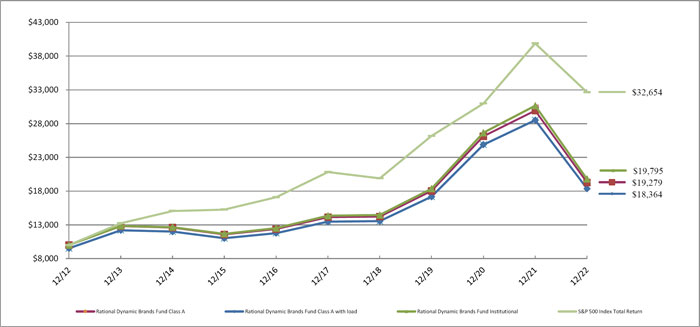

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | | % of Net Assets | |

| Asset Management | | | 22.0 | % |

| Apparel & Textile Products | | | 13.3 | % |

| Retail - Discretionary | | | 11.5 | % |

| Technology Services | | | 11.4 | % |

| Internet Media & Services | | | 8.8 | % |

| Oil & Gas Producers | | | 6.3 | % |

| E-Commerce Discretionary | | | 5.6 | % |

| Medical Equipment & Devices | | | 5.1 | % |

| Technology Hardware | | | 4.5 | % |

| Software | | | 4.3 | % |

| Other/Short-Term Investments | | | 7.2 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

December 31, 2022

Rational Strategic Allocation Fund (RHSAX, RHSCX, RHSIX)

Dear Fellow Shareholders,

The Rational Strategic Allocation Fund (the “Fund”) seeks current income and moderate appreciation of capital by implementing a distinct “index plus” strategy that provides investors exposure to a non-traditional fixed income portfolio with an S&P 500 Index equity overlay. During 2022, the Fund returned -28.04% for Class A compared to the S&P 500 Total Return Index 1 which returned -18.11%. Given the difficult market environment the Fund lagged as a result of its allocations to futures contracts on the S&P 500 Index and fixed income funds.

Investment Strategy

The Fund invests in a portfolio of futures contracts on the S&P 500 Index and income-oriented mutual funds typically representing non-traditional fixed income asset classes. We select underlying funds using a fundamental research process, including a top-down analysis of market conditions and investment category historical performance during various market conditions. We also perform a bottom-up analysis of each potential fund for investment, including investment allocations, investment valuations and characteristics, positioning, historical performance during various market conditions and each fund’s portfolio manager’s outlook. The Fund typically maintains 70% to 100% notional exposure to the S&P 500 Index and 70% to 100% notional exposure to the fixed income portfolio.

Fund Performance

During 2022, the Fund returned -28.04% (Class A) compared to -18.11% for the S&P 500 Total Return Index. The Fund performed in-line with our expectations in the volatile and adverse market conditions during the year. Our equity exposure obtained through allocations to futures contracts on the S&P 500 Index performed how we expected throughout the year. Our allocation to non-traditional fixed income funds was an additional source of negative performance and contributed to the Fund’s overall underperformance as compared to the S&P 500 TR Index. Throughout 2022, we were able to maintain our targeted notional exposure of 70% to 100% to the S&P 500 Index.

2022 was the worst performing year for the traditional “60/40” portfolio (60% in equities and 40% in bonds) in the last 45 years. In a year as difficult as 2022 where equities and fixed income were both down over double digits, this is how we would expect the Fund to perform. In looking a bit deeper into the two sections of the Fund, our S&P 500 futures contracts served its purpose and performed roughly in-line with the S&P 500 Total Return Index. In terms of the fixed income sleeve, our non-traditional holdings returned -7.12% in 2022, outperforming the Bloomberg U.S. Agg Index by close to over 580 bps.

The majority of the holdings performed to our expectations given the challenging market environment. The top performing funds held in the portfolio during 2022 were: Rational Special Situations Fund (RFXIX -0.85%) and Catalyst/CIFC Floating Rate Income Fund (CFRIX -2.34%). The weakest performing fund held in the portfolio during 2022 was: AlphaCentric Income Opportunities Fund (IOFIX -21.68%).

The Fund’s total annualized returns through December 31, 2022 as compared to the S&P 500 Total Return Index were as follows:

| | 1 Year | 3 Years | 5 Years | Since Inception

(07/30/09) |

| Class A | -28.04% | -2.45% | 0.25% | 4.29% |

| Class A with Sales Charge | -31.43% | -4.02% | -0.72% | 3.91% |

| S&P 500 Total Return Index (1) | -18.11% | 7.66% | 9.42% | 12.87% |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

The views expressed in this letter were those as of December 31, 2022 and may not necessarily reflect views on the date this letter is first published or anytime thereafter. These views are intended to help shareholders in understanding the Fund’s present investment methodology and do not constitute investment advice.

Sincerely,

David Miller

Portfolio Manager

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| 1 | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

5168-NLD-01312023

Rational Strategic Allocation Fund

PORTFOLIO REVIEW (Unaudited)

December 31. 2022

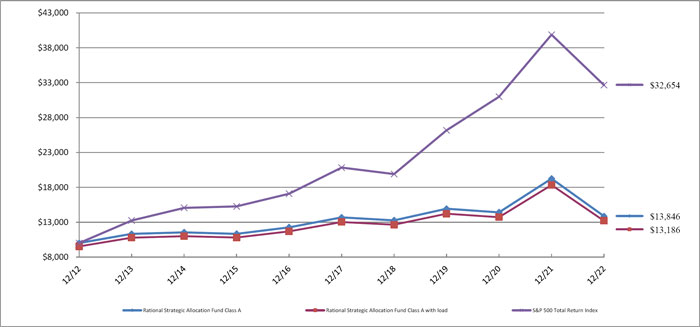

The Fund’s performance figures* for each of the periods ended December 31, 2022, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional | (27.87)% | 0.48% | N/A | N/A | 2.87% |

| Class A | (28.04)% | 0.25% | 3.31% | 4.29% | N/A |

| Class A with load | (31.43)% | (0.72)% | 2.80% | 3.91% | N/A |

| Class C | (28.55)% | (0.51)% | N/A | N/A | 1.87% |

| S&P 500 Total Return Index (c) | (18.11)% | 9.42% | 12.56% | 12.87% | 11.65% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2022 prospectus, the total annual operating expense are 2.21% for Institutional shares, 2.57% for Class A shares and 3.34% for Class C shares before fee waivers and/or expense reimbursements, if any. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

Performance information for the period prior to December 13, 2019 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is July 30, 2009 for Class A and the benchmark. |

| (b) | Inception date is May 31, 2016 for Class C, Institutional and the benchmark. |

| (c) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

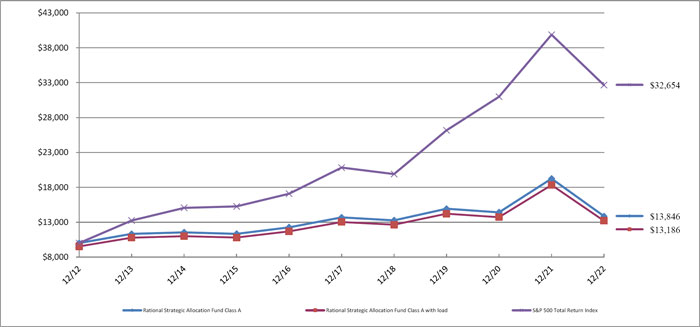

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings by Asset Type ^ | | % of Net Assets | |

| Fixed Income | | | 71.9 | % |

| Alternative | | | 11.7 | % |

| Other/Short-Term Investments | | | 16.4 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. | |

Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s total investments.

unaudited

December 31, 2022

Rational/ReSolve Adaptive Asset Allocation Fund (RDMAX, RDMCX, RDMIX)

Dear Shareholders,

The Rational/ReSolve Adaptive Asset Allocation Fund (“the Fund”) commenced trading on March 16th, 2018, when ReSolve Asset Management officially replaced the previous manager as sub-advisor.

ReSolve’s Adaptive Asset Allocation1 methodology uses proprietary quantitative and machine learning innovations that emphasize characteristics such as, but not limited to, total return momentum, trends, seasonal patterns, carry measures, mean reversion and others, while simultaneously maximizing diversification based on changing estimates of volatility and correlations across a global universe of futures markets consisting of stock and bond indices, commodities, and currencies.

Portfolio Review

The strategy experienced two very distinct semesters in 2022, with strong returns between January and June, driven by the alpha portion of the strategy, offset by a challenging second half of the year for both the alpha and beta sleeves.

Energies provided the best source of positive returns, led by long positions in gasoline, heating oil, natural gas and diesel. Despite detracting from performance in the second semester, the sector sidestepped huge losses experienced in these markets via tight risk controls and agile portfolio rebalancing.

Metals also delivered important gains, stemming primarily from short exposure to copper. Silver offered opportunities for profits from both long and short positions, while long platinum also contributed to performance.

Grains were the other meaningful positive contributors, with longs in corn, soybeans and bean oil, and short wheat.

Bonds were by far the largest detractors, primarily from long exposure to the German sovereign complex (especially the long-duration Buxl), while short 5- and 10-year Treasuries offered important offsetting gains.

Softs also struggled, with losses from long coffee and cocoa, and cotton (both long and short).

Equity indices also contributed negatively, primarily from long positions in the Japanese Nikkei, Dutch AEX and Italian MIB. Profitable shorts in the S&P 500 and German DAX, and active trading in the British FTSE offered a partial counterbalance.

Currencies suffered in the second half from short exposure to the Japanese Yen, Australian Dollar, and Swiss Franc, though active trading in the Euro and long Kiwi Dollar provided some gains.

| 1 | An 11-year track record for the AAA methodology is available upon request. |

Figure 1. 2022 Return Attributions

| Sector | 1st Semester | 2nd Semester | 2022 |

| Bonds | -2.2% | -3.3% | -5.5% |

| Currencies | 0.5% | -2.5% | -2.1% |

| Energies | 7.6% | -1.4% | 6.0% |

| Grains | 2.0% | -1.2% | 0.8% |

| Indices | -0.8% | 0.1% | -0.8% |

| Volatility | -0.1% | -0.1% | -0.2% |

| Meats | 0.0% | 0.0% | 0.0% |

| Metals | 3.3% | -0.8% | 2.4% |

| Softs | -1.7% | -1.6% | -3.3% |

| | | | |

| Total | 8.6% | -10.8% | -3.1% |

Past performance is not indicative of future results.

Note: Results may differ due to rounding. Performance is expressed in USD. Strategy attribution is a best-efforts approximation, net of all applicable borrowing costs, fees and fund accruals for the period. Indicated returns of one year or more are annualized.

The Fund’s total annualized returns through December 31, 2022 as compared to the BarclayHedge CTA Index4 and the S&P 500 Total Return Index5 were as follows:

| | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception 2 |

| Class I | -3.06% | 2.78% | 3.48% | 5.72% | 5.82% |

| BarclayHedge CTA Index 4 | 7.46% | 5.97% | 3.92% | 2.33% | 4.39% |

| S&P 500 Total Return Index 5 | -18.11% | 7.66% | 9.42% | 12.56% | 9.67% |

| Class A | -3.30% | 2.52% | 3.22% | 5.45% | 5.56% |

| Class C | -4.01% | 1.77% | 2.46% | 4.69% | 4.78% |

| Class A w/ Sales Charge | -8.84% | 0.52% | 2.01% | 5.45% | 5.56% |

The Fund’s maximum sales charge for Class “A” shares is 5.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information please call the Fund, toll free at 1-800-253-0412.

The Fund acquired all of the assets and liabilities of Chesapeake Fund, LLC (the “Predecessor Fund”) in a tax free reorganization on September 30, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional Shares of the Fund. At the time of the reorganization, the Predecessor Fund had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. Effective February 27, 2018, the Fund’s investment strategy changed, and a new Sub Advisor replaced the prior sub-advisor. Consequently, prior performance may not reflect the Fund’s current operations.

General Market Review

2022 was shaped by global tectonic shifts on several fronts including the economy, finance, geopolitics, and societies at large, in what many believe to be the early stages of a major paradigm shift which effects are likely to last several years. Led by the Federal Reserve, central banks around the world have begun to unwind their balance sheets and raise interest rates to fight inflationary pressures that reached multi-decade highs. Tightening liquidity led to the heaviest capital market losses since the 2007-2009 Great Financial Crisis, with an estimated USD $30 trillion3 wiped out across global stocks and bonds.

Global equities experienced huge losses, led by double-digit declines in major US equities. Sovereigns had their worst year in living memory, with the longest duration bonds falling between 20 and almost 40 percent on both sides of the

| 3 | https://www.ft.com/content/87ed8ea6-4913-4452-9135-498040ad338f |

Atlantic. The US dollar strengthened against its major peers but depreciated against some important emerging market currencies. Industrial metals fell, though precious metals proved more resilient, helped by a large rebound in December. Most energies, grains, and several soft commodities saw enormous price increases on extremely volatile trading: heating oil and gasoil practically doubled, while crude oil, RBOB, corn, milling wheat, soybeans, and sugar rose by double-digits.

The first semester was marked by the regrettable invasion of Ukraine by Russian forces in the final week of February, marking the start of the largest conflict on European soil in decades. Though many believed it would be a quick victory for the invading forces, they were met with fierce and heroic opposition by Ukrainian military and civilian forces. The U.S. and NATO allies responded with tens of billions of dollars in military and economic aid, as well as the largest sanctions in history against the Russian regime, including the freezing of approximately two-thirds of Russia’s central bank assets and cutting banks’ access to the international SWIFT system.

The first few months of the war also had profound consequences on commodity prices, from energies to crops such as corn, soybeans and especially wheat, as much of the fighting has taken place in a region commonly referred to as Europe’s breadbasket. In addition to worsening inflation across the globe, the conflict also continues to threaten the availability of fertilizers, with huge implications for food security – especially in poorer countries. As of this writing, neither side has signaled an intention to sue for peace, though a UN-brokered agreement has allowed grains to be shipped from ports in the Black Sea.

China’s zero-Covid policy was another important variable, disrupting the supply of large amounts of export goods and drastically curbing demand from one of the largest consumer markets. Following the reappointment of Xi Jinping to an unprecedented third term as president (essentially cementing lifetime leadership) and amid growing protests across many regions, the country began to relax restrictions and reopen its borders.

Outlook

The Bank of Japan’s decision to widen the interest rate band under its yield curve control (YCC) policy in December weighed on global markets and contributed to the cancellation of equities’ ‘Christmas rally’, increasing the opportunity cost for one of the world’s largest exporters of capital and further fueling a recent dynamic referred to by some as a ‘reverse currency war’. The European Central Bank warned of ’significantly’ more to come after raising interest rates once again in its latest meeting, likely setting the tone for the new year.

On the geopolitical front, a successful counteroffensive by Ukrainian forces recaptured large swathes of territory while raising fears that the conflict could escalate further (and even lead to the use of nuclear weapons). Deglobalization was one of the major themes of 2022, with several events compounding towards this dynamic: the weaponization of the U.S. dollar and other precedents set by sanctions; the U.S.’ decision to ban exports of advanced semiconductors (and the technology to produce them) to China; the ‘reshoring’ of critical supply-chains away from would-be adversaries; and the deterioration of U.S.-Saudi relationships stand out.

A new global order seems to be emerging, where U.S. hegemony gives way to a more fractured, multi-polar world. This would have profound implications for growth, inflation, liquidity, and by extension asset prices worldwide. It is likely that traditional stock-bond portfolios, which have thrived beyond most investors’ wildest dreams in the previous regime, will face great challenges in the coming years.

Sincerely,

ReSolve Asset Management SEZC (Cayman)

Trading Adviser

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| 2 | Inception: Institutional 02/01/1994, Class A & C 09/30/2016. Performance shown before 09/30/2016 is for the Fund’s predecessor, the Rational Dynamic Momentum Fund. |

| 4 | The Barclay Hedge CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 510 programs included in the calculation of the Barclay CTA Index for 2020. The Index is equally weighted and rebalanced at the beginning of each year. |

| 5 | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Adaptive Asset Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

6041-NLD-01312023

Rational/ReSolve Adaptive Asset Allocation Fund

PORTFOLIO REVIEW (Unaudited)

December 31. 2022

The Fund’s performance figures* for each of the periods ended December 31, 2022, compared to its benchmarks:

| | | Annualized | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since Inception(a) | Since Inception(b) |

| Institutional (c) | (3.06)% | 3.48% | 5.72% | N/A | 5.82% |

| Class A | (3.30)% | 3.22% | N/A | 2.68% | N/A |

| Class A with load | (8.84)% | 2.01% | N/A | 1.71% | N/A |

| Class C | (4.01)% | 2.46% | N/A | 1.95% | N/A |

| S&P 500 Total Return Index (d) | (18.11)% | 9.42% | 12.56% | 11.59% | 9.67% |

| Barclay Hedge CTA Index (e) | 7.55% | 3.93% | 2.34% | 3.05% | 4.39% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2022 prospectus, the total annual operating expense are 2.26% for Institutional shares, 2.45% for Class A shares and 3.27% for Class C shares before fee waivers and/or expense reimbursements, if any. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 5.75%. |

Performance information for the period prior to February 27, 2018 does not reflect the Fund’s current strategy and the Fund’s portfolio was not managed by the Fund’s current Sub-Advisor.

| (a) | Inception date is September 30, 2016 for Class A, Class C and the benchmarks. |

| (b) | Inception date is February 28, 1994 for Institutional and the benchmarks. |

| (c) | The Fund acquired all of the assets and liabilities of Chesapeake Fund LLC (the “Predecessor Fund”) in a tax-free reorganization on September 30, 2016. In connection with this acquisition, shares of the Predecessor Fund were exchanged for Institutional shares of the Fund. At the time of the reorganization, the Fund’s investment objective, policies and guidelines were, in all material respects, equivalent to the Predecessor Fund’s investment objectives, policies and guidelines. The Predecessor Fund commenced operations on February 28,1994. Updated performance information is available at no cost by calling 1-800-253-0412 or visiting the Fund’s website at www.RationalMF.com. |

| (d) | The S&P 500 Total Return Index, a registered trademark of S&P Global., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (e) | The Barclay Hedge CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. |

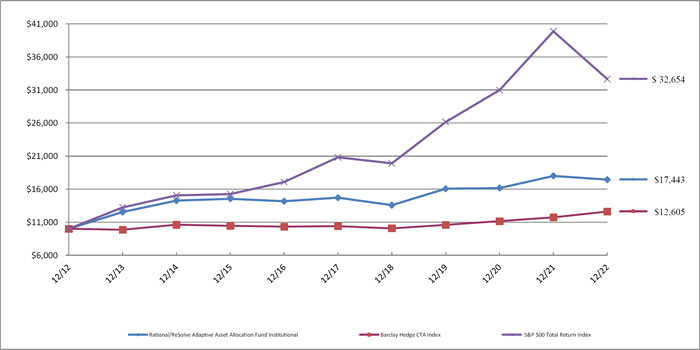

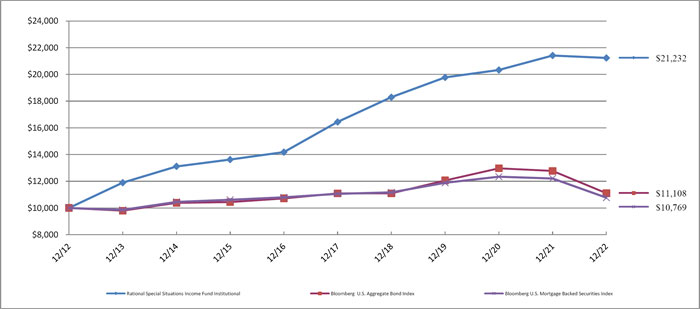

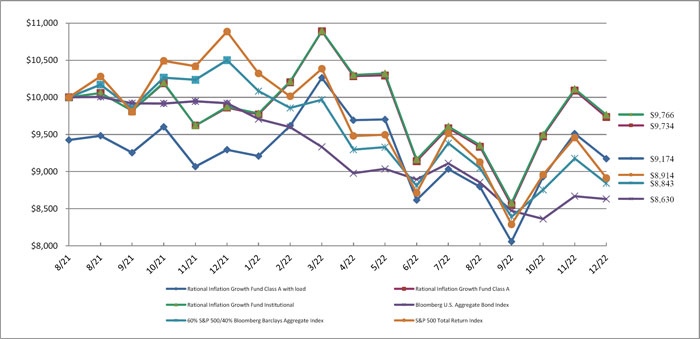

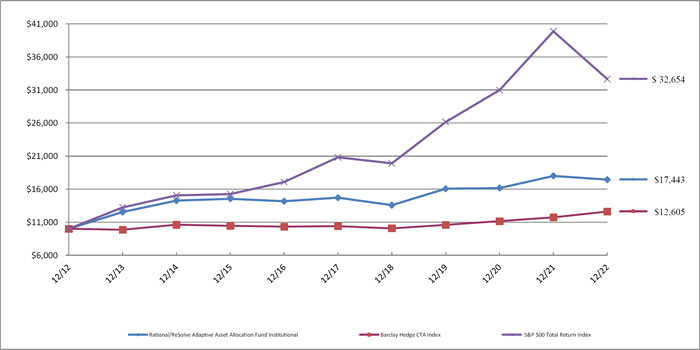

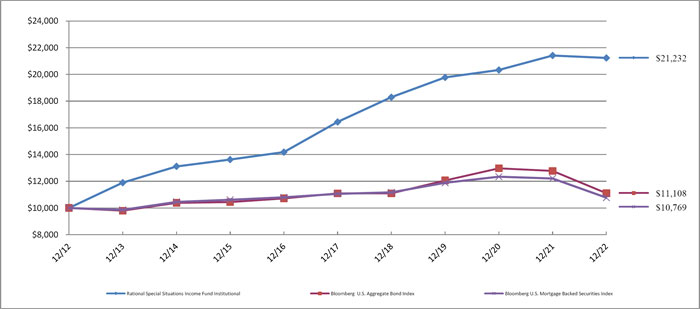

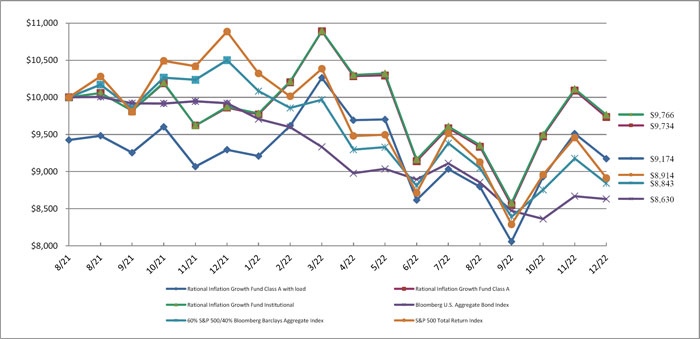

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Type ^ | | % of Net Assets | |

| U.S. Treasury Bills | | | 64.1 | % |

| Other/Cash & Equivalents | | | 35.9 | % |

| | | | 100.0 | % |

| | | | | |

| ^ Does not include derivatives in which the Fund invests. | |

Please refer to the Consolidated Schedule of Investments for a more detailed breakdown of the Fund’s assets.

unaudited

December 31, 2022

Rational/Pier 88 Convertible Securities Fund (PBXAX, PBXCX, PBXIX)

Dear Fellow Shareholders,

2022 has been a challenging market for equity and bond investors. Throughout the year, corporate earnings reports were generally as expected across industries and market caps, but markets focused on inflation, rising interest rates, and heightened geopolitical risks. The recent volatility in the markets has showcased the need for rigorous risk management.

The Rational/Pier 88 Convertible Securities Fund (the “Fund”) seeks total return consisting of capital appreciation and income by investing primarily in convertible securities, which offer equity participation with the added benefit of a bond floor component. The Fund maintains an average investment grade rating with the goal of providing additional downside risk management. Solid risk management and diligent portfolio management helped the Fund mitigate some of the market volatility in 2022. The sell-off in growth stocks has resulted in the convertibles of many secular growth businesses trading below par, which we view as an opportunity for longer-term investors. Moreover, the Fund seeks to provide a way for investors to gain exposure to high quality secular growth companies with less downside than a traditional equity portfolio with similar names.

In our view, the Fund has proven more defensive than the equity markets during the year given that convertibles are higher in the capital structure for companies and offer some fixed income characteristics. Moreover, the Fund has outperformed the Morningstar Convertible Index and Morningstar Convertible Security Peers, which we would attribute to a strong risk management process, and a general focus on companies of higher credit quality.

In analyzing the risk appetite of investors, we think a review of fixed income returns is informative. The table below details year-to-date performance for a group of fixed income asset classes we routinely review.

| Ticker | Index | YTD Performance through 12/31/22 |

| LGTRTRUU Index | Global Aggregate - Treasuries | -17.4734% |

| LUMSTRUU Index | U.S. Mortgage Backed Securities | -11.8106% |

| LG30TRUU Index | Global High Yield | -12.7052% |

| LEGATRUU Index | Global Aggregate | -16.2485% |

| LF98TRUU Index | U.S. Corporate High Yield | -11.1886% |

| LD08TRUU Index | U.S. Aggregate: Government-Related | -11.0857% |

| LUATTRUU Index | U.S. Treasury | -12.4627% |

| LBEATREU Index | Euro-Aggregate | -17.1750% |

| LC07TRUU Index | U.S. Universal | -12.9924% |

| LBUSTRUU Index | U.S. Aggregate | -13.0103% |

| EMUSTRUU Index | EM USD Aggregate | -15.2612% |

| LP06TREU Index | Pan-Euro Aggregate | -18.9335% |

| LF94TRUU Index | Global Inflation- Linked | -22.9489% |

| LUGCTRUU Index | U.S. Gov/Credit | -13.5761% |

| LGDRTRUU Index | Global Aggregate - Credit | -16.9623% |

| LUACTRUU Index | U.S.Corporate Investment Grade | -15.7616% |

| VX5C Index | All US IG With Cap 5% | -6.2584% |

| VXAO Index | U.S. Conv Index | -18.7090% |

| | | |

| Source: Bloomberg | |

The Fund’s performance compares favorably to many of the above fixed income categories over the past year.

On a go forward basis, we believe that the Fund offers a compelling risk/reward from current levels as the convertible bonds of many growth companies are now trading below par and close to a theoretical bond floor.

The following chart of secular growth companies held in the Fund as of December 31, 222 is illustrative.

| Sector | Company Focus | % of Par |

| Technology | Big Data & Analytics | 83% |

| Technology | Document Management Software | 94% |

| Technology | Cyber Security | 83% |

| Technology | Real-time Pricing Software | 92% |

| Technology | Machine Learning & Artifical Intelligence | 84% |

| Fin Tech | Payments | 94% |

| Consumer | Digital Education | 78% |

| Consumer | E-commerce | 87% |

| Consumer | On-line Travel | 86% |

| Healthcare | Medical Device | 97% |

| | | |

| Source: Bloomberg & Pier 88 |

The chart details 10 convertible bonds of companies levered to multi-year secular growth opportunities in the Technology, Fin Tech, Consumer, and Healthcare sectors where the bonds are trading at a discount to par. Given the below par prices, we believe downside from current levels ought to be fairly limited, unless the companies experience dramatic deterioration of business fundamentals. Assuming the business trends remain stable, it is our view that each of the above bonds should trade at least back to par as the issues mature. If the market begins to favor growth stocks over value stocks and the equities re-rate higher, then we believe the convertible bonds of these companies can trade above par. In our view, convertible bonds, like the examples above, are a defensive way to gain exposure to secular growth companies.

Every industry sector has seen a decline in 2022, with the exception of Energy and Utilities. Energy stocks rallied as the price of oil increased due to numerous factors, including increased demand from a re-opening economy, a lack of refining capacity, the conflict in Ukraine and disruption of European energy markers, and supply shocks in the U.S. due to new Federal policies. Other than the Energy Sector, markets were volatile due to concerns over inflation and a possible recession. We remained underweight in these high premium names, as in our view, a recession would ultimately cause the Energy Sector to buckle as well. Utilities, known as a defensive sector, eked out modest gains this year as investors gravitated toward defensive business models with stable dividends. Other sectors did not fare so well.

The decline in equity prices weighed on the prices of convertible bonds which impacted the performance of positions in the Fund. Companies were not reporting poor fundamentals or missing numbers; rather, most of our companies delivered earnings and outlooks which met or exceeded Street expectations; nevertheless, many positions sold off, which we attribute to multiple compression.

The following breakdown of S&P sector performance is informative.

| 2022 S&P 500 Return Attribution |

| | Weight | | Basis points |

| | at start | 2022 | of S&P 500 |

| Sector | of 2022 | return | return |

| Energy | 3% | 66% | 176 bp |

| Utilities | 2 | 2 | 4 |

| Cons. Staples | 6 | (1) | (4) |

| Health Care | 13 | (2) | (26) |

| Materials | 3 | (12) | (31) |

| Industrials | 8 | (5) | (43) |

| Real Estate | 3 | (26) | (72) |

| Financials | 11 | (11) | (113) |

| Comm. Services | 10 | (40) | (405) |

| Cons. Discretionary | 13 | (37) | (464) |

| Info Tech | 29 | (28) | (822) |

| S&P 500 | 100% | (18)% | (1811) bp |

Source: Goldman Sachs; FactSet

As the chart above details, Energy was the one bright spot this year as fears of constrained supplies of oil helped drive up the price of oil and highly correlated stocks of energy companies. We think the performance of the Discretionary, Technology and Communication Services sectors is more telling. Recessionary-like price declines of these sectors happened without what we have historically viewed as a typical 30% corresponding decline in earnings. On the contrary, most of the companies in these sectors grew revenue and earnings this year. We believe the multiple compression is tied to a general fear of the prospect of future slower growth and negative revisions. The convertible bonds protected as the equities sold off.

Fixed income markets in general provided no safety as bonds sold off in response to inflation fears. Bonds typically are exposed to interest rate, credit, liquidity, and market risks. This year’s volatility was more a reflection of interest rate and market risk than credit risks. Convertibles and the Fund share risk of market exposure but our active management aims to mitigate credit and liquidity risk.

Pier 88 seeks to employ a “balanced” approach to managing the convertible bond asset class. We endeavor to take a balanced view of risk versus reward. The team is cognizant that all investments present a plethora of risk including macroeconomic, market and idiosyncratic. Our portfolio remains diversified from a sector, market cap, and style perspective. We remain bullish on the fundamentals underlying many of our companies; we believe our secular growth stories have years to expand their business, while our blue-chip franchises are well capitalized and possess the stability to fund their yields.

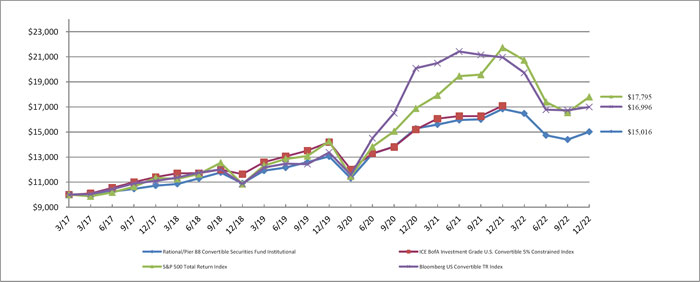

The Rational/Pier 88 Convertible Securities Fund delivered strong positive returns in 2020 and 2021 and has offered downside protection during the fixed income and equity market declines in 2022. On a multi-year basis, the Fund has outperformed the broad fixed income index (the Barclays US Aggregate Bond Index), as well as a variety of other fixed income categories and Morningstar Convertible Peers. The majority of the holdings performed to our expectations and the Fund benefitted from rigorous security selection and solid risk management. We believe investing on behalf of others is a privilege we must earn everyday through adherence to a disciplined investment process. Thank you for your support.

Sincerely,

Frank Timons

Portfolio Manager

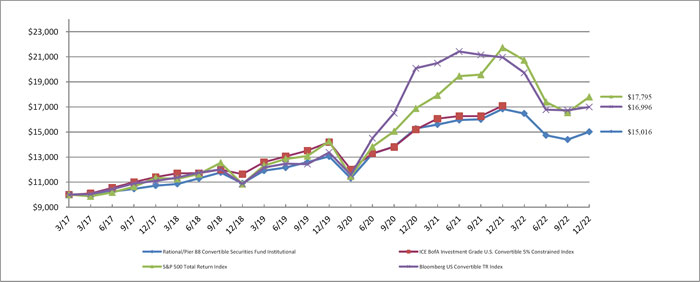

The Fund’s total annualized returns through 12/31/22 as compared to its benchmark were as follows:

| | QTD | 1 Year | 3 Years | Since

Inception

(12/06/19) * |

| Class I | 4.35% | -10.82% | 4.79% | 7.21% |

| Class A | 4.28% | -11.04% | 4.60% | 6.98% |

| Class C | 4.19% | -11.63% | 3.90% | 6.22% |

| Class A with Sales Charge | -0.63% | -15.28% | 2.91% | 6.10% |

| S&P 500 TR Index | 7.56% | -18.11% | 7.66% | 10.64% |

| ICE BofA Investment Grade US Convertible 5% Constrained Index | 4.16% | -6.25% | 4.12% | 8.42% |

| Bloomberg US Aggregate TR Index (1) | 1.87% | -13.01% | -2.71% | 0.57% |

| * | Inception: 03/01/2017. The performance shown prior to December 6, 2019 is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class. |

S&P 500 is the primary benchmark.