| | |

OMB APPROVAL |

OMB Number: | | 3235 - 0570 |

Expires: | | August 31, 2010 |

Estimated average burden |

hours per response . . . | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: 811-5032 | | |

BARON INVESTMENT FUNDS TRUST f/k/a

BARON ASSET FUND

|

| (Exact name of registrant as specified in charter) |

| | |

| 767 Fifth Avenue, 49th Floor | | New York, NY 10153 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Patrick M. Patalino, Esq.

c/o Baron Investment Funds Trust

767 Fifth Avenue, 49th Floor

New York, NY 10153

|

| (Name and Address of Agent for Service) |

Registrant’s Telephone Number, including Area Code: 212-583-2000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 5th Street, NW, Washington, D.C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

SEC 2569 (5-07)

Item 1. Reports to Stockholders.

Baron Investment Funds Trust Annual Report for the period ended September 30, 2009.

Baron Asset Fund

Baron Growth Fund

Baron Small Cap Fund

Baron iOpportunity Fund

Baron Fifth Avenue Growth Fund

September 30, 2009

Baron Funds®

Annual Financial Report

DEAR BARON FUNDS SHAREHOLDER:

In this report you will find audited financial statements for Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron iOpportunity Fund and Baron Fifth Avenue Growth Fund (the “Funds”) for the fiscal year ended September 30, 2009. The Securities and Exchange Commission requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer and Chief Investment Officer November 23, 2009 | | Linda S. Martinson President and Chief Operating Officer November 23, 2009 | | Peggy Wong Treasurer and Chief Financial Officer November 23, 2009 |

This Annual Financial Report is for the Baron Investment Funds Trust, which currently has five series: Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron iOpportunity Fund and Baron Fifth Avenue Growth Fund. If you are interested in the Baron Select Funds, which contains the Baron Partners Fund, Baron Retirement Income Fund and Baron International Growth Fund series, please visit the Funds’ website at www.BaronFunds.com or contact us at 1-800-99BARON.

A description of the Funds’ proxy voting policies and procedures is available without charge on the Funds’ website, www.BaronFunds.com, or by calling 1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website at www.BaronFunds.com and on the SEC’s website at www.sec.gov.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Funds’ Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. A copy of the Funds’ Forms N-Q may also be obtained upon request by calling 1-800-99BARON. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website at www.BaronFunds.com.

Some of the comments are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan” and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of the BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call or write for a prospectus. Read it carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus.

767 Fifth Avenue

NY, NY 10153

212-583-2100

| | |

| Baron Asset Fund | | September 30, 2009 |

| | | | |

Baron Asset Fund | | | | |

| | |

Ticker Symbols: | | | | |

Retail Shares: BARAX | | | | |

Institutional Shares: BARIX | | | | |

Performance | | 2 | | |

Top Ten Holdings | | 3 | | |

Sector Breakdown | | 3 | | |

Management’s Discussion of Fund Performance | | 3 | | |

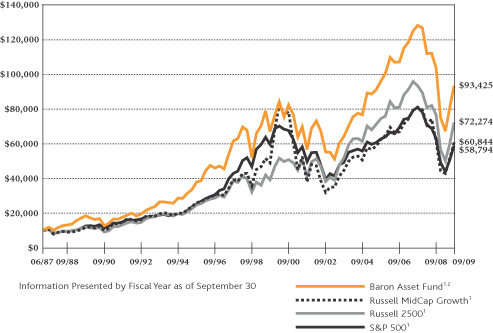

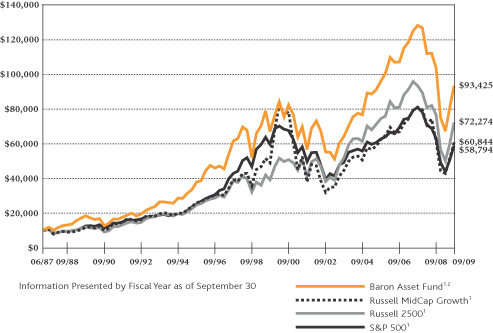

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON ASSET FUND†INRELATIONTOTHE RUSSELL MIDCAP GROWTH,THE RUSSELL 2500,ANDTHE S&P 500 INDEXES

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED SEPTEMBER 30, 2009

| | | | | | | | | | | | | |

| | | | | | | | | | | Retail Shares | | | Institutional

Shares* |

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(June 12,

1987) | | | Since

Inception

(May 29,

2009) |

Baron Asset Fund — Retail Shares1,2 | | –9.88% | | –4.49% | | 4.00% | | 3.37% | | 10.54% | | | N/A |

Baron Asset Fund — Institutional Shares1,2 | | N/A | | N/A | | N/A | | N/A | | N/A | | | 16.77% |

Russell MidCap Growth1 | | –0.40% | | –3.10% | | 3.75% | | 2.18% | | 8.45% | 3 | | 18.13% |

Russell 25001 | | –5.68% | | –3.78% | | 3.29% | | 6.28% | | 9.27% | | | 21.42% |

S&P 5001 | | –6.87% | | –5.44% | | 1.01% | | –0.17% | | 8.27% | | | 15.88% |

| 1 | Since converting to a mid-cap fund, Baron Asset Fund no longer considers the Russell 2500 an appropriate benchmark index. The Russell 2500 is included in the table above for comparison purposes for the period before Baron Asset Fund converted to a mid-cap fund. Prior to February 15, 2007, the Fund’s strategy was to invest primarily in small and mid-sized growth companies. The S&P 500, the Russell MidCap Growth and the Russell 2500 are unmanaged indexes. The S&P 500 measures the performance of larger cap equities in the stock market in general. The Russell MidCap Growth measures the performance of mid-sized companies that are classified as growth. The Russell 2500 measures the performance of small to mid-sized companies. The indexes and the Baron Asset Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions, or redemption of Fund shares. |

| 3 | For the period June 30, 1987 to September 30, 2009. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99.BARON

www.BaronFunds.com

©2009 All Rights Reserved

2

| | |

| September 30, 2009 | | Baron Asset Fund |

TOP TEN HOLDINGSASOF SEPTEMBER 30, 2009

| | |

| Baron Asset Fund | | % of Net

Assets |

Charles Schwab Corp. | | 4.8% |

C.H. Robinson Worldwide, Inc. | | 3.2% |

XTO Energy, Inc. | | 3.1% |

DeVry, Inc. | | 2.9% |

Vail Resorts, Inc. | | 2.7% |

IDEXX Laboratories, Inc. | | 2.7% |

Polo Ralph Lauren Corp., Cl A | | 2.6% |

Arch Capital Group, Ltd. | | 2.5% |

Equinix, Inc. | | 2.4% |

FactSet Research Systems, Inc. | | 2.2% |

| | | 29.1% |

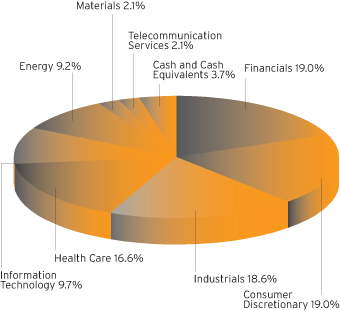

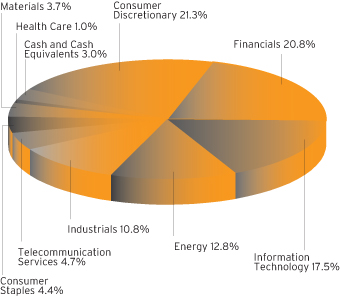

SECTOR BREAKDOWNASOF SEPTEMBER 30, 20092

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron Asset Fund’s performance† was disappointing for the fiscal year ended September 30, 2009, losing 9.88% and underperforming its benchmarks. The S&P 500 lost 6.87%, and the Russell MidCap Growth lost 0.40%.

Baron Asset Fund invests primarily in medium-sized growth companies for the long-term while using value-oriented purchase and sell disciplines1. The Fund purchases companies that we believe have sustainable competitive advantages and strong financial characteristics, operating in industries with favorable macroeconomic trends led by strong management teams.

The Fund’s underperformance relative to the Russell MidCap Growth Index was attributable to several factors. Most notable was the Fund’s significant underweighting in the Information Technology sector, which was the best-performing sector within that Index. The Fund’s exposure to this sector averaged approximately 8% during the period, and the weighting in the Index averaged approximately 20%.

Other areas with poor performance included companies dependent upon business travel and discretionary travel, which both fell substantially as a result of the global economic recession. These included casino operator Wynn Resorts, Ltd., which owns properties in Las Vegas and Macau, China. It also included Gartner, Inc., a technology research firm, which also operates a unit that organizes exhibitions and forums for technology companies and IT executives.

In addition, the Fund reduced its carrying value for two investments in private companies with leveraged balance sheets, Windy City Investment Holdings LLC (the holding company for asset manager John Nuveen), and Kerzner International Holdings (which operates casinos and destination resorts). Both these businesses had their cash flows negatively impacted by the recession, and this was exacerbated by their need to service large debt burdens.

Lastly, relative to the Russell MidCap Growth Index, the Fund was overweighted in the Financials sector. This was the second worst-performing sector within that Index, largely as a result of the credit crisis, volatile financial markets and the global recession. Among the Fund’s Financial holdings, the most negative performers included Alexander’s, Inc., a REIT that primarily owns Manhattan office space; brokerage firm Charles Schwab Corp.; and specialty insurance company Assurant, Inc.

Although the Fund was underweighted in the Information Technology sector, several of the companies it did own within that area performed well. These included, Equinix, which operates data centers; FactSet Research Systems, which provides data and financial analytics to investment managers; and ANSYS, a software company.

Many of the Fund’s consumer discretionary investments also performed well. These included its retail investments, Polo Ralph Lauren, Urban Outfitters and Dick’s Sporting Goods; hotel company Choice Hotels; and restaurant operator Cheesecake Factory.

The past year was difficult for virtually all investors. Nonetheless, we believe that our investment process, with its focus on research and long-term investing, will enable the Fund to take advantage of opportunities as they arise throughout the economic recovery. We expect to continue to invest in companies that, in our opinion, are undervalued relative to their long-term growth prospects and have the ability to sustain superior levels of profitability. We expect the Fund will remain diversified not only by industry and investment theme, but also by external factors we believe could affect company performance. This approach to investing in companies, not trading of stocks, we believe will allow the Fund to produce above-average rates of return.

| 1 | Prior to February 15, 2007, the Fund’s strategy was also to invest primarily in small- and mid-sized growth companies. |

| 2 | Industry sector or sub-industry group levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”), unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “As Is” with no warranties. |

| † | Performance information reflects results of the Retail Shares. |

3

| | |

| Baron Growth Fund | | September 30, 2009 |

| | | | |

Baron Growth Fund | | | | |

| | |

Ticker Symbols: | | | | |

Retail Shares: BGRFX | | | | |

Institutional Shares: BGRIX | | | | |

Performance | | 4 | | |

Top Ten Holdings | | 5 | | |

Sector Breakdown | | 5 | | |

Management’s Discussion of

Fund Performance | | 5 | | |

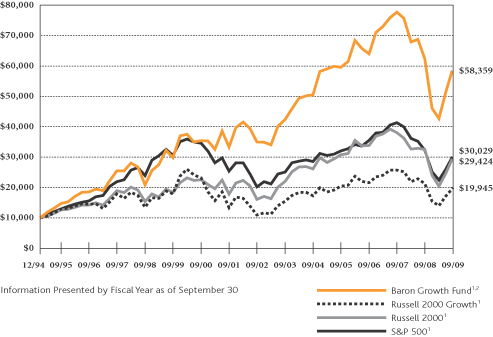

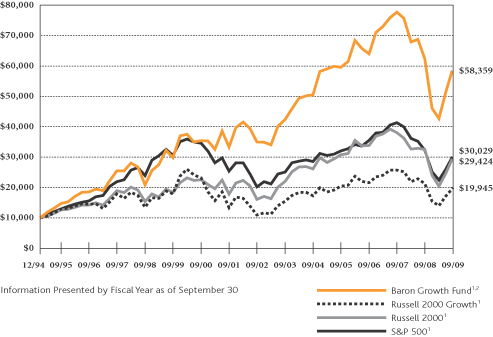

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GROWTH FUND†INRELATIONTOTHE RUSSELL 2000 GROWTH,THE RUSSELL 2000ANDTHE S&P 500 INDEXES

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED SEPTEMBER 30, 2009

| | | | | | | | | | | | |

| | | | | | | | | | | Retail Shares | | Institutional

Shares* |

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(December 31,

1994) | | Since

Inception

(May 29,

2009) |

Baron Growth Fund — Retail Shares1,2 | | –6.34% | | –3.02% | | 2.95% | | 6.93% | | 12.70% | | N/A |

Baron Growth Fund — Institutional Shares1,2 | | N/A | | N/A | | N/A | | N/A | | N/A | | 15.78% |

Russell 2000 Growth1 | | –6.32% | | –2.60% | | 2.91% | | 1.10% | | 4.79% | | 19.71% |

Russell 20001 | | –9.55% | | –4.57% | | 2.41% | | 4.88% | | 7.59% | | 21.04% |

S&P 5001 | | –6.87% | | –5.44% | | 1.01% | | –0.17% | | 7.74% | | 15.88% |

| 1 | The S&P 500, the Russell 2000 and the Russell 2000 Growth are unmanaged indexes. The S&P 500 measures the performance of larger cap equities in the stock market in general. The Russell 2000 measures the performance of 2,000 small companies. The Russell 2000 Growth measures the performance of those Russell 2000 companies classified as growth. These indexes and the Baron Growth Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions, or redemption of Fund shares. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99 BARON

www.BaronFunds.com

©2009 All Rights Reserved

4

| | |

| September 30, 2009 | | Baron Growth Fund |

TOP TEN HOLDINGSASOF SEPTEMBER 30, 2009

| | |

| Baron Growth Fund | | % of Net

Assets |

DeVry, Inc. | | 3.8% |

Strayer Education, Inc. | | 2.9% |

Edwards Lifesciences Corp. | | 2.7% |

Community Health Systems, Inc. | | 2.4% |

Dick’s Sporting Goods, Inc. | | 2.1% |

MSCI, Inc., Cl A | | 2.1% |

Mettler-Toledo International, Inc. | | 2.1% |

J. Crew Group, Inc. | | 2.1% |

FactSet Research Systems, Inc. | | 2.1% |

Arch Capital Group, Ltd. | | 2.0% |

| | | 24.3% |

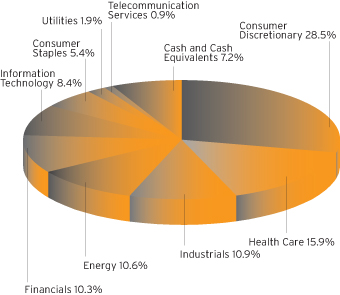

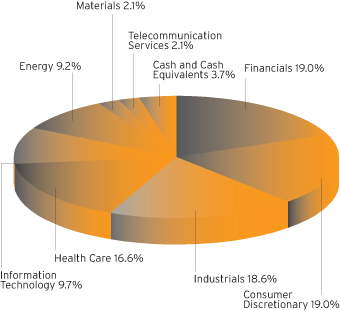

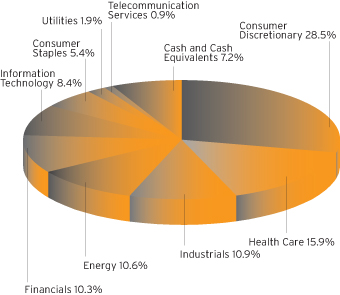

SECTOR BREAKDOWNASOF SEPTEMBER 30, 20091

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron Growth Fund’s performance† was disappointing in the fiscal year ended September 30, 2009, losing 6.34%. The Fund was on par with the Russell 2000 Growth, which lost 6.32%, and the S&P 500, which lost 6.87%.

Baron Growth Fund is a long-term investor in primarily small-sized growth companies. We utilize an investment approach, through our independent research of companies, that we believe allows us to look beyond the current market environment and invest based upon the potential profitability of a business, and therefore its value in the future.

The Fund’s losses were sustained mainly during the prolonged market crash in the fourth quarter of 2008 extending into February, 2009. Among the worst performers in that period were Consumer Discretionary businesses, including sporting goods retailer Dick’s Sporting Goods, Inc., apparel retailer J. Crew, Inc., on-line diamond merchant Blue Nile, Inc. and travel and leisure business, Vail Resorts. Stocks of Financial companies, including Jefferies Group, Inc., MSCI, Inc., FactSet Research Systems, Inc., Morningstar, Inc. and Advent Software, Inc. were also adversely affected by the economic downturn and credit crisis. As the markets recovered in 2009, these businesses contributed strongly to the Fund’s performance.

Additionally, some of the highly-leveraged and cyclical companies that had been the worst performers in 2008 became the best performers in 2009. Companies with fragile balance sheets that had been teetering on the edge of bankruptcy when credit was tight rallied sharply as credit eased and investors showed renewed appetite for risk. During the nine months ended September 30, 2009, eight of the Fund’s holdings more than doubled, 19 additional companies gained more than 50% and 15 gained more than 30% (the Fund had 90 equity positions as of September 30, 2009).

Those stocks that continue to lag include companies in the Industrial and Financial sectors and education companies DeVry, Inc. and Strayer Education, Inc., which have been investing in their facilities and growing enrollments. The prospects for these businesses, we believe, are excellent, yet the market has not yet taken notice. Similarly Ritchie Bros. Auctioneers, Inc., an auctioneer of industrial equipment, and Tetra Tech, Inc., an environmental engineering company, have yet to benefit from the stimulus package due to what we believe are soon-to-be-resolved government administrative problems. We believe that those companies that underperformed throughout 2009, about 40% of the portfolio, represent significant potential growth in the months and years to come.

The past year was difficult for virtually all investors. Nonetheless, we believe that our investment process, with its focus on research and long-term investing, will enable the Fund to take advantage of opportunities as they arise throughout the economic recovery. We intend to continue to invest in small businesses that we believe have the potential to grow substantially in the years ahead. We expect the Fund will remain diversified not only by industry and investment theme, but also by external factors we believe could affect company performance. This approach to investing in companies, not trading of stocks, we believe will allow the Fund to produce above-average rates of return.

| 1 | Industry sector or sub-industry group levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”), unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “As Is” with no warranties. |

| † | Performance information reflects results of the Retail Shares. |

5

| | |

| Baron Small Cap Fund | | September 30, 2009 |

| | | | |

Baron Small Cap Fund | | | | |

| | |

Ticker Symbols: | | | | |

Retail Shares: BSCFX | | | | |

Institutional Shares: BSFIX | | | | |

Performance | | 6 | | |

Top Ten Holdings | | 7 | | |

Sector Breakdown | | 7 | | |

Management’s Discussion of Fund Performance | | 7 | | |

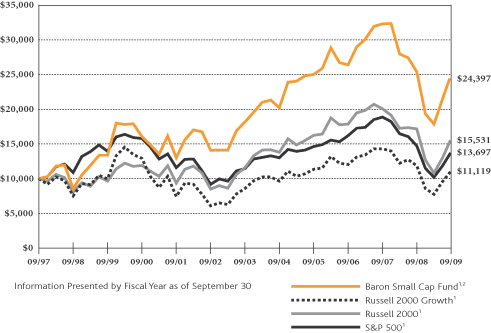

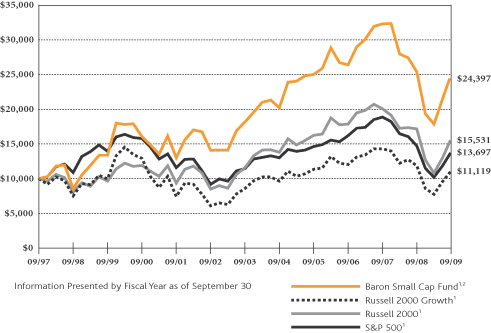

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON SMALL CAP FUND†INRELATIONTOTHE RUSSELL 2000 GROWTH,THE RUSSELL 2000ANDTHE S&P 500 INDEXES

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED SEPTEMBER 30, 2009

| | | | | | | | | | | | |

| | | | | | | | | | | Retail Shares | | Institutional

Shares* |

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(September 30,

1997) | | Since

Inception

(May 29,

2009) |

Baron Small Cap Fund — Retail Shares1,2 | | –3.95% | | –2.58% | | 3.81% | | 6.20% | | 7.72% | | N/A |

Baron Small Cap Fund — Institutional Shares1,2 | | N/A | | N/A | | N/A | | N/A | | N/A | | 15.79% |

Russell 2000 Growth1 | | –6.32% | | –2.60% | | 2.91% | | 1.10% | | 0.89% | | 19.71% |

Russell 20001 | | –9.55% | | –4.57% | | 2.41% | | 4.88% | | 3.74% | | 21.04% |

S&P 5001 | | –6.87% | | –5.44% | | 1.01% | | –0.17% | | 2.66% | | 15.88% |

| 1 | The S&P 500, the Russell 2000 and the Russell 2000 Growth are unmanaged indexes. The S&P 500 measures the performance of larger cap equities in the stock market in general. The Russell 2000 measures the performance of 2,000 small companies. The Russell 2000 Growth measures the performance of those Russell 2000 companies classified as growth. These indexes and the Baron Small Cap Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions, or redemption of Fund shares. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99 BARON

www.BaronFunds.com

©2009 All Rights Reserved

6

| | |

| September 30, 2009 | | Baron Small Cap Fund |

TOP TEN HOLDINGSASOF SEPTEMBER 30, 2009

| | |

| Baron Small Cap Fund | | % of Net

Assets |

Equinix, Inc. | | 2.9% |

SBA Communications Corp., Cl A | | 2.6% |

TransDigm Group, Inc. | | 2.5% |

Strayer Education, Inc. | | 2.4% |

Penn National Gaming, Inc. | | 2.3% |

J. Crew Group, Inc. | | 2.3% |

Covanta Holding Corp. | | 2.1% |

Waste Connections, Inc. | | 2.1% |

Atlas Energy, Inc. | | 2.0% |

CB Richard Ellis Group, Inc., Cl A | | 1.9% |

| | | 23.1% |

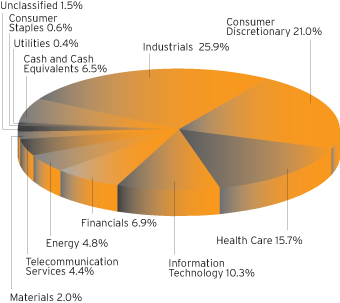

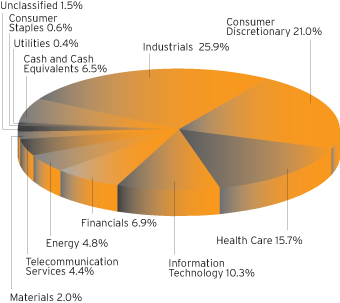

SECTOR BREAKDOWNASOF SEPTEMBER 30, 20091

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron Small Cap Fund† lost 3.95% in the fiscal year ended September 30, 2009, outperforming the Russell 2000 Growth index of small-cap stocks, which lost 6.32%, and the S&P 500, which lost 6.87%.

Baron Small Cap Fund invests primarily in small-cap growth companies. The Fund is a long-term investor in what we believe are well-run small-cap growth businesses that can be purchased at prices that represent a significant discount to our assessment of true value.

Baron Small Cap Fund’s good relative performance to its peers was due in part to its strong showing over the latter half of the year ended September 30, 2009. Despite the recession, which had a negative impact on many consumer companies, the Fund’s investments in Penn National Gaming, Inc., J. Crew Group, Inc. and National CineMedia, Inc. all did well. While gaming in Las Vegas and Atlantic City suffered, Penn’s focus on small, regional markets paid off. J. Crew, which had been hard hit earlier in the year, rebounded nicely as sales improved.

Investments in the Health Care and Industrials sectors, however, were largely responsible for the Fund’s losses. SunPower Corp., Covanta Holding Corp., and Actuant Corp. were the poorest performers in the Industrials sector. Immucor and Masimo, two underperforming stocks in the Health Care sector, are developing diagnostic tests and equipment that may lead to improvements in medical outcomes while lowering costs, while our Industrials will benefit, we believe, from the country’s renewed focus on developing alternative energy sources.

The past year was difficult for virtually all investors. Nonetheless, we believe that our investment process, with its focus on research and long-term investing, will enable the Fund to take advantage of opportunities as they arise throughout the economic recovery. Baron Small Cap’s investments fall into three categories: Growth Stocks, Fallen Angels and Special Situations. The Fund intends to continue to invest in “Growth Stocks” that we believe have significant long-term growth prospects and can be purchased at what we believe are attractive prices because their prospects have not yet been appreciated by investors. “Fallen Angels” are companies that we believe have strong long-term franchises but have disappointed investors with short-term results, creating what we believe is a buying opportunity. “Special Situations” include spin-offs and recapitalizations, where lack of investor awareness creates opportunities to purchase what we believe are strong businesses at attractive prices.

| 1 | Industry sector or sub-industry group levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”), unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “As Is” with no warranties. |

| † | Performance information reflects results of the Retail Shares. |

7

| | |

| Baron iOpportunity Fund | | September 30, 2009 |

| | | | |

Baron iOpportunity Fund | | | | |

| | |

Ticker Symbols: | | | | |

Retail Shares: BIOPX | | | | |

Institutional Shares: BIOIX | | | | |

Performance | | 8 | | |

Top Ten Holdings | | 9 | | |

Sector Breakdown | | 9 | | |

Management’s Discussion of Fund Performance | | 9 | | |

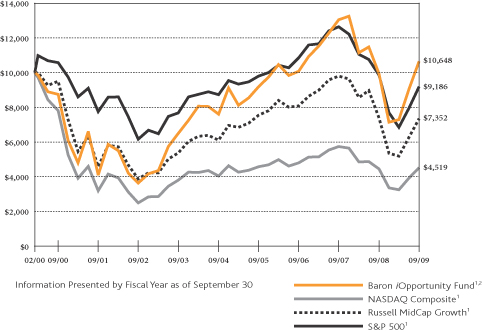

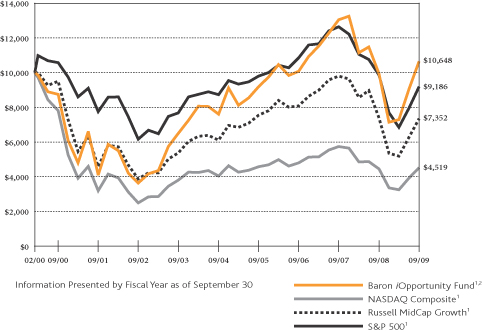

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON IOPPORTUNITY FUND†INRELATIONTOTHE NASDAQ COMPOSITE,THE RUSSELL MIDCAP GROWTHANDTHE S&P 500 INDEXES

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED SEPTEMBER 30, 2009

| | | | | | | | | | |

| | | | | | | | | Retail Shares | | Institutional

Shares* |

| | | One

Year | | Three

Years | | Five

Years | | Since

Inception

(February 29,

2000) | | Since

Inception

(May 29,

2009) |

Baron iOpportunity Fund — Retail Shares1,2 | | 7.17% | | 1.82% | | 6.96% | | 0.66% | | N/A |

Baron iOpportunity Fund — Institutional Shares1,2 | | N/A | | N/A | | N/A | | N/A | | 19.59% |

NASDAQ Composite1 | | 1.46% | | –2.05% | | 2.27% | | –7.95% | | 19.62% |

Russell MidCap Growth1 | | –0.40% | | –3.10% | | 3.75% | | –3.16% | | 18.13% |

S&P 5001 | | –6.87% | | –5.44% | | 1.01% | | –0.88% | | 15.88% |

| 1 | The NASDAQ Composite, the Russell MidCap Growth and the S&P 500 are unmanaged indexes. The NASDAQ Composite tracks the performance of market-value weighted common stocks listed on NASDAQ. The S&P 500 measures the performance of larger cap equities in the stock market in general. The Russell MidCap Growth measures the performance of mid-sized companies that are classified as growth. The NASDAQ Composite is without dividends. The S&P 500, the Russell MidCap Growth and the Baron iOpportunity Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions, or redemption of Fund shares. Performance data also does not reflect the imposition of a short-term trading fee of 1% on redemption of shares held less than six months. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99.BARON

www.BaronFunds.com

©2009 All Rights Reserved

8

| | |

| September 30, 2009 | | Baron iOpportunity Fund |

TOP TEN HOLDINGSASOF SEPTEMBER 30, 2009

| | |

| Baron iOpportunity Fund | | % of Net

Assets |

Equinix, Inc. | | 5.5% |

NII Holdings, Inc. | | 4.4% |

SBA Communications Corp., Cl A | | 4.1% |

Apple, Inc. | | 3.7% |

American Tower Corp., Cl A | | 3.5% |

MSCI, Inc., Cl A | | 2.8% |

TechTarget, Inc. | | 2.7% |

Google, Inc., Cl A | | 2.4% |

Charles Schwab Corp. | | 2.3% |

IHS, Inc., Cl A | | 2.2% |

| | | 33.6% |

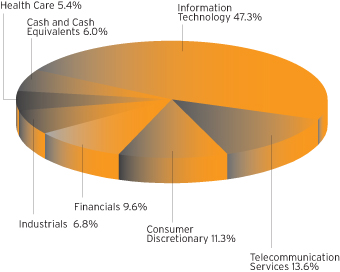

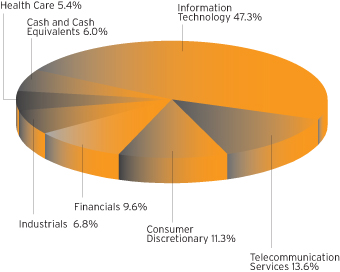

SECTOR BREAKDOWNASOF SEPTEMBER 30, 2009 1

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron iOpportunity Fund† gained 7.17% in the fiscal year ended September 30, 2009, outperforming both its comparative benchmarks. The S&P 500, down 6.87%, and the NASDAQ Composite was up 1.46%.

Baron iOpportunity Fund, like the other Baron Funds, utilizes value purchase disciplines while investing in growth companies that we believe have significant long-term information technology opportunities.

The strength of the Information Technology sector enabled the Fund to turn in a solid overall performance for the year ended September 30, 2009 despite a drag on performance from the Fund’s investments in the Financials sector.

Apple, Inc., Equinix, Inc. and Concur Technologies, Inc. were the strongest performing Information Technology holdings in the Fund. The introduction of new iPhone models provided a strong boost to Apple, while overall strength of technology businesses helped data-center operator Equinix. The desire to cut costs and control expenses helped Concur, which markets expense reporting and tracking software. Even with their recent outperformance, we believe that these and other innovative companies in our portfolio will continue to excel.

The generally weak economy and the credit crisis in particular led to losses in the Fund’s Financials holdings, which included Charles Schwab Corp., CME Group, Inc. and FCStone Group. As the economy improves and credit availability eases, we believe that these holdings will once again contribute to the Fund’s performance.

While this past year was difficult for virtually all investors, Baron iOpportunity Fund, with its focus on innovative companies, posted a good absolute return that compared very favorably to its benchmarks. We believe that our investment process, with its focus on research and long-term investing, will enable the Fund to continue taking advantage of opportunities as they arise throughout the economic recovery. We expect to continue to invest in high-growth businesses of all market capitalizations in any sector or industry that we believe will benefit from innovations and advances in technology.

| 1 | Industry sector or sub-industry group levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”), unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “As Is” with no warranties. |

| † | Performance information reflects results of the Retail Shares. |

9

| | |

| Baron Fifth Avenue Growth Fund | | September 30, 2009 |

| | | | |

Baron Fifth Avenue Growth Fund | | |

| | |

Ticker Symbols: | | | | |

Retail Shares: BFTHX | | | | |

Institutional Shares: BFTIX | | | | |

Performance | | 10 | | |

Top Ten Holdings | | 11 | | |

Sector Breakdown | | 11 | | |

Management’s Discussion of Fund Performance | | 11 | | |

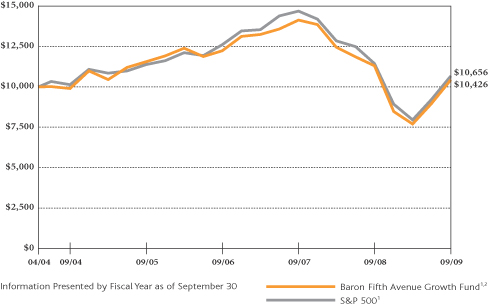

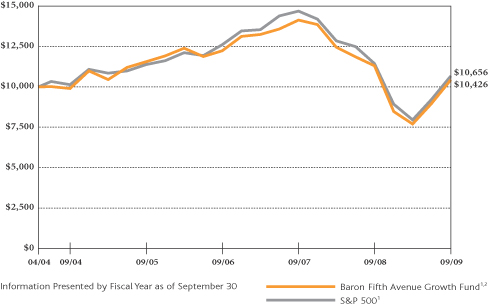

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FIFTH AVENUE GROWTH FUND†INRELATIONTOTHE S&P 500 INDEX

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED SEPTEMBER 30, 2009

| | | | | | | | | | |

| | | | | | | | | Retail

Shares | | Institutional

Shares* |

| | | One

Year | | Three

Years | | Five

Years | | Since

Inception

(April 30,

2004) | | Since

Inception

(May 29,

2009) |

Baron Fifth Avenue Growth Fund — Retail Shares1,2 | | –7.75% | | –5.15% | | 1.06% | | 0.77% | | N/A |

Baron Fifth Avenue Growth Fund — Institutional Shares1,2 | | N/A | | N/A | | N/A | | N/A | | 14.19% |

S&P 5001 | | –6.87% | | –5.44% | | 1.01% | | 1.18% | | 15.88% |

| 1 | The S&P 500 is an unmanaged index. The S&P 500 measures the performance of larger cap equities in the stock market in general. The index and the Baron Fifth Avenue Growth Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions, or redemption of Fund shares. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99 BARON

www.BaronFunds.com

©2009 All Rights Reserved

10

| | |

| September 30, 2009 | | Baron Fifth Avenue Growth Fund |

TOP TEN HOLDINGSASOF SEPTEMBER 30, 2009

| | |

| Baron Fifth Avenue Growth Fund | | % of Net

Assets |

JP Morgan Chase & Co. | | 4.3% |

Target Corp. | | 4.2% |

Equinix, Inc. | | 3.7% |

Toll Brothers, Inc. | | 3.6% |

Apple, Inc. | | 3.5% |

Transocean, Ltd. | | 3.4% |

XTO Energy, Inc. | | 3.4% |

Diamond Offshore Drilling, Inc. | | 3.4% |

American Tower Corp., Cl A | | 3.4% |

Home Depot, Inc. | | 3.3% |

| | | 36.2% |

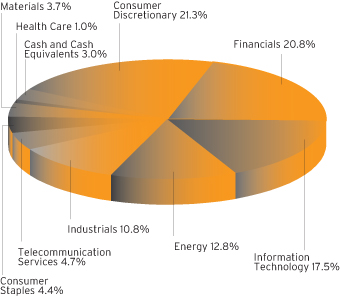

SECTOR BREAKDOWNASOF SEPTEMBER 30, 20091

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron Fifth Avenue Growth Fund† declined 7.75% for the fiscal year ended September 30, 2009. The Fund underperformed its relative index, the S&P 500, which declined 6.87% for the same time period. For the three and five year periods, the Fund outperformed the S&P 500. For the three year period, the Fund was down 5.15% and the S&P 500 was down 5.44%. For the five year period, the Fund was up 1.06% and the S&P 500, was up 1.01%.

Baron Fifth Avenue Growth Fund focuses on the long-term fundamental prospects of the businesses in which it invests. This contrasts with other investors’ focus on historical operating results or current earnings expectations. We believe that historical results and the outlook for near-term earnings are often not indicative of superior longer-term prospects that can be identified through research efforts.

The Fund benefitted from its investments in the Information Technology, Industrials and Materials sectors for the year ended September 30, 2009. Many of the companies in these three sectors are not directly tied to a weak economy or the ongoing credit crisis and as a result, they actually increased in value while the broader market averages lost value. Within the Information Technology sector, Apple, Inc., Equinix, Inc. and QUALCOMM, Inc. positively contributed to the Fund’s performance. Within the Industrials sector, Burlington Northern Santa Fe Corp., Republic Services, Inc. and FedEx Corp. also recorded gains. Lastly, within the Materials sector, both Monsanto Co. and Ecolab, Inc. positively contributed to our performance for the one year period.

Unfortunately, the weak economy and the ongoing credit crisis did hurt our performance for the year ended September 30, 2009. Specifically, the Fund was hurt by many of our holdings within the Financials, Energy and Consumer Staples sectors. Within the Financials sector, Wells Fargo & Co., Charles Schwab Corp. and Berkshire Hathaway lost value during the period. Fears of a complete financial meltdown put pressure on many of our holdings, specifically the bank stocks in late 2008 and early 2009. While these stocks recovered in the second half of Fiscal 2009, it was not enough to make up for the earlier losses. Within the Consumer Staples sector, Danone S.A., Diageo PLC., Proctor & Gamble and PepsiCo lost value as many of the non-economically sensitive stocks were unable to keep pace with the broader market averages as it was the higher-beta stocks that led the market higher once the market bottomed back in March 2009. Lastly, within the Energy sector, Transocean Ltd., Devon Energy Corp. and XTO Energy, Inc. hurt our performance for the year.

The past year was difficult for virtually all investors. Nonetheless, we believe that our investment process, with its focus on research and long-term investing, will enable the Fund to take advantage of opportunities as they arise throughout the economic recovery. The Fund is positioned, in our view, in blue-chip, best-of-breed growth companies with a strong emphasis on quality to reduce risk. We believe the key to long-term stock appreciation is consistent earnings growth. We invest in those companies that are market-share leaders that dominate their industry, companies with strong franchises and a strong brand name, avoiding fads and other short-term, unsustainable trends. We target companies that are the low-cost operators in their industry with, in our view, high barriers to entry. We also try to invest in growth companies that are positioned in industries that are themselves growing as opposed to industries that are stagnant or structurally challenged. We believe this approach to investing will enable the Fund to achieve an above-average rate of return.

| 1 | Industry sector or sub-industry group levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”), unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “As Is” with no warranties. |

| † | Performance information reflects results of the Retail Shares. |

11

| | |

| Baron Asset Fund | | September 30, 2009 |

STATEMENT OF NET ASSETS

SEPTEMBER 30, 2009

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (95.12%) | | | |

Consumer Discretionary (18.21%) | | | |

| | Advertising (1.41%) |

| 1,400,000 | | Lamar Advertising Co., Cl A1 | | $ | 77,994,690 | | $ | 38,416,000 |

| |

| | Apparel Retail (1.02%) |

| 925,000 | | Urban Outfitters, Inc.1 | | | 15,117,011 | | | 27,907,250 |

| |

| | Apparel, Accessories &

Luxury Goods (2.59%) |

| 925,000 | | Polo Ralph Lauren Corp., Cl A | | | 18,090,944 | | | 70,873,500 |

| |

| | Automotive Retail (0.38%) |

| 500,000 | | CarMax, Inc.1 | | | 5,701,415 | | | 10,450,000 |

| |

| | Broadcasting (0.53%) |

| 500,000 | | Discovery Communications,

Inc., Cl A1 | | | 11,279,563 | | | 14,445,000 |

| |

| | Casinos & Gaming (2.07%) |

| 800,000 | | Wynn Resorts, Ltd.1 | | | 2,657,487 | | | 56,712,000 |

| |

| | Education Services (2.93%) |

| 1,450,000 | | DeVry, Inc. | | | 15,178,463 | | | 80,214,000 |

| |

| | Homebuilding (0.23%) |

| 325,000 | | Toll Brothers, Inc.1 | | | 6,525,291 | | | 6,350,500 |

| |

| | Hotels, Resorts &

Cruise Lines (0.97%) |

| 850,000 | | Choice Hotels Intl., Inc. | | | 4,185,563 | | | 26,401,000 |

| |

| | Internet Retail (0.52%) |

| 85,000 | | priceline.com, Inc.1 | | | 13,897,954 | | | 14,094,700 |

| |

| | Leisure Facilities (2.74%) |

| 2,236,741 | | Vail Resorts, Inc.1,4 | | | 44,707,481 | | | 75,020,293 |

| |

| | Restaurants (0.32%) |

| 475,000 | | Cheesecake Factory, Inc.1 | | | 9,655,454 | | | 8,797,000 |

| |

| | Specialty Stores (2.50%) |

| 1,250,000 | | Dick’s Sporting Goods, Inc.1 | | | 35,113,986 | | | 28,000,000 |

| 1,050,000 | | Tiffany & Co. | | | 33,710,690 | | | 40,456,500 |

| | | | | | | | |

| | | 68,824,676 | | | 68,456,500 |

| | | | | | | | |

Total Consumer Discretionary | | | 293,815,992 | | | 498,137,743 |

| | | | | | | | |

| | | | | | | | |

Energy (9.19%) |

| | Oil & Gas Drilling (1.52%) |

| 1,050,000 | | Helmerich & Payne, Inc. | | | 33,232,083 | | | 41,506,500 |

| |

| | Oil & Gas Equipment &

Services (2.32%) |

| 220,000 | | Core Laboratories N.V.2 | | | 30,622,516 | | | 22,679,800 |

| 500,000 | | SEACOR Holdings, Inc.1 | | | 14,322,278 | | | 40,815,000 |

| | | | | | | | |

| | | 44,944,794 | | | 63,494,800 |

| |

| | Oil & Gas Exploration &

Production (3.60%) |

| 300,000 | | Ultra Petroleum Corp.1,2 | | | 11,627,899 | | | 14,688,000 |

| 2,025,000 | | XTO Energy, Inc. | | | 10,318,772 | | | 83,673,000 |

| | | | | | | | |

| | | 21,946,671 | | | 98,361,000 |

| |

| | Oil & Gas Storage &

Transportation (1.75%) |

| 2,300,000 | | Southern Union Co. | | | 30,218,480 | | | 47,817,000 |

| | | | | | | | |

Total Energy | | | 130,342,028 | | | 251,179,300 |

| | | | | | | | |

| | | | | | | | |

Financials (18.60%) | | | | | | |

| | Asset Management & Custody

Banks (3.56%) |

| 2,089,799 | | Eaton Vance Corp. | | | 54,642,488 | | | 58,493,474 |

| 850,000 | | T. Rowe Price Group, Inc. | | | 23,450,029 | | | 38,845,000 |

| | | | | | | | |

| | | 78,092,517 | | | 97,338,474 |

| |

| | Insurance Brokers (0.84%) |

| 1,200,000 | | Brown & Brown, Inc. | | | 24,223,877 | | | 22,992,000 |

| |

| | Investment Banking &

Brokerage (4.76%) |

| 6,800,000 | | Charles Schwab Corp. | | | 14,411,775 | | | 130,220,000 |

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (continued) | | | | | | |

Financials (continued) | | | | | | |

| | Office REIT’s (2.00%) |

| 184,700 | | Alexander’s, Inc.1,5 | | $ | 10,860,022 | | $ | 54,649,036 |

| |

| | Real Estate Services (1.70%) |

| 3,975,000 | | CB Richard Ellis Group,

Inc., Cl A1 | | | 61,995,665 | | | 46,666,500 |

| |

| | Reinsurance (2.47%) |

| 1,000,000 | | Arch Capital Group, Ltd.1,2 | | | 33,841,383 | | | 67,540,000 |

| |

| | Specialized Finance (3.27%) |

| 165,000 | | CME Group, Inc., Cl A | | | 11,663,277 | | | 50,851,350 |

| 1,300,000 | | MSCI, Inc., Cl A1 | | | 39,123,416 | | | 38,506,000 |

| | | | | | | | |

| | | 50,786,693 | | | 89,357,350 |

| | | | | | | | |

Total Financials | | | 274,211,932 | | | 508,763,360 |

| | | | | | | | |

| | | | | | | | |

Health Care (16.63%) |

| | Health Care Distributors (1.66%) |

| 825,000 | | Henry Schein, Inc.1 | | | 24,134,881 | | | 45,300,750 |

| |

| | Health Care Equipment (3.75%) |

| 1,450,000 | | IDEXX Laboratories, Inc.1 | | | 60,164,185 | | | 72,500,000 |

| 115,000 | | Intuitive Surgical, Inc.1 | | | 13,186,811 | | | 30,158,750 |

| | | | | | | | |

| | | 73,350,996 | | | 102,658,750 |

| |

| | Health Care Facilities (3.44%) |

| 1,450,000 | | Community Health

Systems, Inc.1 | | | 44,168,918 | | | 46,298,500 |

| 1,775,000 | | VCA Antech, Inc.1 | | | 59,687,071 | | | 47,729,750 |

| | | | | | | | |

| | | 103,855,989 | | | 94,028,250 |

| |

| | Health Care Services (0.15%) |

| 250,000 | | Emdeon, Inc., Cl A1 | | | 4,033,180 | | | 4,050,000 |

| |

| | Health Care Supplies (1.75%) |

| 1,150,000 | | DENTSPLY

International, Inc. | | | 25,389,865 | | | 39,721,000 |

| 200,000 | | Gen-Probe, Inc.1,5 | | | 8,252,158 | | | 8,288,000 |

| | | | | | | | |

| | | 33,642,023 | | | 48,009,000 |

| |

| | Life Sciences Tools &

Services (5.88%) |

| 1,025,000 | | Covance, Inc.1 | | | 59,353,059 | | | 55,503,750 |

| 400,000 | | Mettler-Toledo

International, Inc.1 | | | 26,298,875 | | | 36,236,000 |

| 275,000 | | Millipore Corp.1 | | | 18,299,594 | | | 19,340,750 |

| 200,000 | | Techne Corp. | | | 10,271,256 | | | 12,510,000 |

| 850,000 | | Thermo Fisher

Scientific, Inc.1 | | | 24,522,276 | | | 37,119,500 |

| | | | | | | | |

| | | 138,745,060 | | | 160,710,000 |

| | | | | | | | |

Total Health Care | | | 377,762,129 | | | 454,756,750 |

| | | | | | | | |

| | | | | | | | |

Industrials (18.57%) |

| | Aerospace & Defense (0.84%) |

| 225,000 | | Precision Castparts Corp. | | | 14,063,935 | | | 22,920,750 |

| |

| | Air Freight &

Logistics (4.90%) |

| 1,500,000 | | C. H. Robinson

Worldwide, Inc. | | | 27,854,391 | | | 86,625,000 |

| 1,350,000 | | Expeditors International of

Washington, Inc. | | | 38,607,965 | | | 47,452,500 |

| | | | | | | | |

| | | 66,462,356 | | | 134,077,500 |

| |

| | Construction &

Engineering (1.52%) |

| 272,015 | | AECOM Technology Corp.1 | | | 6,790,653 | | | 7,382,487 |

| 1,550,000 | | Quanta Services, Inc.1 | | | 39,711,495 | | | 34,301,500 |

| | | | | | | | |

| | | 46,502,148 | | | 41,683,987 |

| |

| | Diversified Support

Services (3.79%) |

| 1,150,000 | | Copart, Inc.1 | | | 42,059,264 | | | 38,191,500 |

| 1,100,000 | | Iron Mountain, Inc.1 | | | 20,210,446 | | | 29,326,000 |

| 1,472,043 | | Ritchie Bros. Auctioneers, Inc.2 | | | 36,592,917 | | | 36,123,935 |

| | | | | | | | |

| | | 98,862,627 | | | 103,641,435 |

| | |

| 12 | | See Notes to Financial Statements. |

| | |

| September 30, 2009 | | Baron Asset Fund |

STATEMENT OF NET ASSETS (Continued)

SEPTEMBER 30, 2009

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (continued) | | | |

Industrials (continued) |

| | Environmental & Facilities

Services (2.50%) | | | | | | |

| 1,250,000 | | Covanta Holding Corp.1 | | $ | 28,928,444 | | $ | 21,250,000 |

| 975,000 | | Stericycle, Inc.1 | | | 28,948,289 | | | 47,238,750 |

| | | | | | | | |

| | | 57,876,733 | | | 68,488,750 |

| | Human Resource &

Employment Services (0.96%) |

| 1,050,000 | | Robert Half Intl., Inc. | | | 1,048,912 | | | 26,271,000 |

| |

| | Research & Consulting

Services (1.07%) |

| 1,000,000 | | Equifax, Inc. | | | 34,475,520 | | | 29,140,000 |

| |

| | Security & Alarm

Services (0.25%) |

| 300,532 | | Corrections Corp.

of America1 | | | 1,002 | | | 6,807,050 |

| |

| | Trading Companies &

Distributors (2.74%) |

| 1,400,000 | | Fastenal Co. | | | 56,021,319 | | | 54,180,000 |

| 475,000 | | MSC Industrial Direct

Co., Inc., Cl A | | | 22,407,294 | | | 20,700,500 |

| | | | | | | | |

| | | 78,428,613 | | | 74,880,500 |

| | | | | | | | |

Total Industrials | | | 397,721,846 | | | 507,910,972 |

| | | | | | | | |

| | | | | | | | |

Information Technology (9.70%) | | | |

| | Application

Software (3.17%) |

| 575,000 | | ANSYS, Inc.1 | | | 15,734,803 | | | 21,545,250 |

| 100,000 | | Citrix Systems, Inc.1 | | | 3,872,654 | | | 3,923,000 |

| 925,000 | | FactSet

Research

Systems, Inc. | | | 53,842,905 | | | 61,272,000 |

| | | | | | | | |

| | | 73,450,362 | | | 86,740,250 |

| |

| | Electronic Equipment &

Instruments (0.87%) |

| 850,000 | | FLIR Systems, Inc.1 | | | 18,928,164 | | | 23,774,500 |

| |

| | IT Consulting &

Other

Services (5.66%) |

| 700,000 | | Equinix, Inc.1,5 | | | 56,983,955 | | | 64,400,000 |

| 2,450,000 | | Gartner, Inc.1 | | | 59,722,058 | | | 44,761,500 |

| 2,600,000 | | SAIC, Inc.1 | | | 46,193,972 | | | 45,604,000 |

| | | | | | | | |

| | | 162,899,985 | | | 154,765,500 |

| | | | | | | | |

Total Information Technology | | | 255,278,511 | | | 265,280,250 |

| | | | | | | | |

| | | | | | | | |

Materials (2.15%) | | | | | | |

| | Industrial Gases (0.88%) |

| 500,000 | | Airgas, Inc. | | | 20,142,639 | | | 24,185,000 |

| |

| | Specialty

Chemicals (1.27%) |

| 750,000 | | Ecolab, Inc. | | | 25,931,428 | | | 34,672,500 |

| | | | | | | | |

Total Materials | | | 46,074,067 | | | 58,857,500 |

| | | | | | | | |

| | | | | | | | |

Telecommunication Services (2.07%) | | | |

| | Wireless

Telecommunication

Services (2.07%) |

| 425,000 | | NII Holdings, Inc.1 | | | 17,553,240 | | | 12,741,500 |

| 1,625,000 | | SBA Communications

Corp., Cl A1 | | | 53,434,220 | | | 43,923,750 |

| | | | | | | | |

Total

Telecommunication

Services | | | 70,987,460 | | | 56,665,250 |

| | | | | | | | |

Total Common Stocks | | | 1,846,193,965 | | | 2,601,551,125 |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | Cost | | Value |

Private Equity Investments (1.17%) | | | |

Consumer Discretionary (0.76%) | | | |

| | Education Services (0.00%) |

| 105,264 | | Apollo International,

Inc. S-A Conv. Pfd.1,3,4,5 | | $ | 800,006 | | $ | 0 |

| | | |

| | Hotels, Resorts &

Cruise Lines (0.76%) | | | | | | |

| 5,200,000 | | Kerzner Intl. Holdings, Ltd.,

Cl A1,2,3,5 | | | 52,000,000 | | | 20,800,000 |

| | | | | | | | |

Total Consumer Discretionary | | | 52,800,006 | | | 20,800,000 |

| | | | | | | | |

| | | | | | | | |

Financials (0.41%) | | | | | | |

| | Asset Management &

Custody Banks (0.41%) | | | | | | |

| 5,600,004 | | Windy City Investments Holdings LLC1,3,5 | | | 31,960,710 | | | 11,200,007 |

| | | | | | | | |

Total Private Equity Investments | | | 84,760,716 | | | 32,000,007 |

| | | | | | | | |

| | | | | | | | |

Warrants (0.00%) | | | | | | |

Consumer Discretionary (0.00%) | | | |

| | Restaurants (0.00%) | | | |

| 48,071 | | Krispy Kreme Doughnuts, Inc. Warrants, Exp 03/02/20121 | | | 0 | | | 0 |

| | | | | | | | |

| | | | | | | | |

Principal

Amount | | | | |

Short Term Investments (3.49%) | | | |

| $95,366,596 | | Repurchase Agreement with Fixed Income Clearing Corp., dated 09/30/2009, 0.01% due 10/01/2009; Proceeds at maturity - $95,366,622; (Fully collateralized by U.S. Treasury Note, 1.75% due 01/31/2014; Market value - $100,138,500) | | | 95,366,596 | | | 95,366,596 |

| | | | | | | | |

Total Investments (99.78%) | | $ | 2,026,321,277 | | | 2,728,917,728 |

| | | | | | | | |

Cash and Other Assets Less Liabilities (0.22%) | | | 5,973,640 |

| | | | | | | | |

Net Assets | | | | | $ | 2,734,891,368 |

| | | | | | | | |

Retail Shares (Equivalent to $43.62 per share based on 60,807,434 shares outstanding) | | | | | $ | 2,652,640,154 |

| | | | | | | | |

Institutional Shares (Equivalent to $43.65 per share based on 1,884,332 shares outstanding) | | | | | $ | 82,251,214 |

| | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At September 30, 2009, the market value of restricted and fair valued securities amounted to $32,000,007 or 1.17% of Net Assets. None of these securities are deemed liquid. See Note 7. |

| 4 | See Note 10 regarding “Affiliated” companies. |

| 5 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| | |

| See Notes to Financial Statements. | | 13 |

| | |

| Baron Growth Fund | | September 30, 2009 |

STATEMENT OF NET ASSETS

SEPTEMBER 30, 2009

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (91.60%) | | | | | | |

Consumer Discretionary (27.39%) | | | | | | |

| | Advertising (0.96%) | | | | | | |

| 1,850,000 | | Lamar Advertising Co.,

Cl A1 | | $ | 25,633,314 | | $ | 50,764,000 |

| | | |

| | Apparel Retail (2.05%) | | | | | | |

| 3,024,902 | | J. Crew Group, Inc.1 | | | 95,586,620 | | | 108,351,990 |

| |

| | Apparel, Accessories & Luxury

Goods (1.10%) |

| 2,090,000 | | Under Armour, Inc., Cl A1 | | | 76,271,084 | | | 58,164,700 |

| | | |

| | Automotive Retail (1.53%) | | | | | | |

| 693,100 | | CarMax, Inc.1 | | | 6,766,040 | | | 14,485,790 |

| 3,450,000 | | Penske Automotive

Group, Inc. | | | 67,638,212 | | | 66,171,000 |

| | | | | | | | |

| | | | | 74,404,252 | | | 80,656,790 |

| | | |

| | Casinos & Gaming (1.62%) | | | | | | |

| 2,575,000 | | Penn National

Gaming, Inc.1 | | | 72,452,253 | | | 71,224,500 |

| 200,000 | | Wynn Resorts, Ltd.1 | | | 3,210,220 | | | 14,178,000 |

| | | | | | | | |

| | | | | 75,662,473 | | | 85,402,500 |

| | |

| | Distributors (1.92%) | | | |

| 5,450,010 | | LKQ Corp.1 | | | 75,949,765 | | | 101,043,185 |

| | |

| | Education Services (6.72%) | | | |

| 3,650,000 | | DeVry, Inc.4 | | | 61,225,398 | | | 201,918,000 |

| 700,000 | | Strayer Education, Inc.4 | | | 57,859,739 | | | 152,376,000 |

| | | | | | | | |

| | | 119,085,137 | | | 354,294,000 |

| | |

| | Home Furnishings (0.77%) | | | |

| 850,000 | | Mohawk Industries, Inc.1 | | | 24,825,295 | | | 40,536,500 |

| | |

| | Hotels, Resorts & Cruise Lines (1.77%) | | | |

| 3,000,000 | | Choice Hotels Intl., Inc. | | | 74,119,736 | | | 93,180,000 |

| | |

| | Internet Retail (0.94%) | | | |

| 800,000 | | Blue Nile, Inc.1,4 | | | 23,190,334 | | | 49,696,000 |

| | | |

| | Leisure Facilities (1.21%) | | | | | | |

| 1,900,000 | | Vail Resorts, Inc.1,4 | | | 51,691,238 | | | 63,726,000 |

| | | |

| | Publishing (2.36%) | | | | | | |

| 750,000 | | Interactive Data Corp. | | | 17,054,327 | | | 19,657,500 |

| 2,154,552 | | Morningstar, Inc.1 | | | 62,871,270 | | | 104,625,045 |

| | | | | | | | |

| | | | | 79,925,597 | | | 124,282,545 |

| | | |

| | Restaurants (1.81%) | | | | | | |

| 550,000 | | Cheesecake Factory, Inc.1 | | | 10,914,838 | | | 10,186,000 |

| 950,000 | | Panera Bread Co., Cl A1 | | | 36,153,944 | | | 52,250,000 |

| 700,000 | | Peet’s Coffee & Tea, Inc.1,4 | | | 15,273,681 | | | 19,761,000 |

| 1,200,000 | | Sonic Corp.1 | | | 24,979,672 | | | 13,272,000 |

| | | | | | | | |

| | | | | 87,322,135 | | | 95,469,000 |

| | | |

| | Specialty Stores (2.63%) | | | | | | |

| 5,000,000 | | Dick’s Sporting Goods, Inc.1 | | | 86,074,246 | | | 112,000,000 |

| 700,000 | | Tiffany & Co. | | | 13,504,094 | | | 26,971,000 |

| | | | | | | | |

| | | | | 99,578,340 | | | 138,971,000 |

| | | | | | | | |

Total Consumer Discretionary | | | 983,245,320 | | | 1,444,538,210 |

| | | | | | | | |

| | | | | | | | |

Consumer Staples (5.38%) | | | | | | |

| | Food Retail (1.91%) | | | | | | |

| 3,300,000 | | Whole Foods Market, Inc.1 | | | 35,877,628 | | | 100,617,000 |

| | | |

| | Household

Products (1.70%) | | | | | | |

| 1,575,000 | | Church & Dwight Co., Inc. | | | 58,038,014 | | | 89,365,500 |

| | | |

| | Packaged Foods &

Meats (1.77%) | | | | | | |

| 1,400,000 | | Ralcorp Holdings, Inc.1 | | | 53,671,573 | | | 81,858,000 |

| 200,000 | | Seneca Foods Corp., Cl A1 | | | 4,400,000 | | | 5,480,000 |

| 175,000 | | TreeHouse Foods, Inc.1 | | | 5,333,795 | | | 6,242,250 |

| | | | | | | | |

| | | | | 63,405,368 | | | 93,580,250 |

| | | | | | | | |

Total Consumer Staples | | | 157,321,010 | | | 283,562,750 |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (continued) | | | | | | |

Energy (10.58%) | | | | | | |

| | Oil & Gas Drilling (0.90%) | | | | | | |

| 1,200,000 | | Helmerich & Payne, Inc. | | $ | 27,232,555 | | $ | 47,436,000 |

| | | |

| | Oil & Gas Equipment &

Services (4.98%) | | | | | | |

| 660,300 | | Core Laboratories N.V.2 | | | 39,388,993 | | | 68,070,327 |

| 2,000,000 | | FMC Technologies, Inc.1 | | | 21,044,749 | | | 104,480,000 |

| 1,100,000 | | SEACOR Holdings, Inc.1,4 | | | 79,415,883 | | | 89,793,000 |

| | | | | | | | |

| | | | | 139,849,625 | | | 262,343,327 |

| | |

| | Oil & Gas Exploration &

Production (3.28%) | | | |

| 597,000 | | Atlas Energy, Inc. (formerly

Atlas America, Inc.) | | | 14,920,800 | | | 16,160,790 |

| 775,463 | | Concho Resources, Inc.1 | | | 22,257,149 | | | 28,164,816 |

| 2,800,000 | | Encore Acquisition Co.1,4 | | | 46,692,595 | | | 104,720,000 |

| 487,500 | | Range Resources Corp. | | | 8,333,342 | | | 24,063,000 |

| | | | | | | | |

| | | | | 92,203,886 | | | 173,108,606 |

| | | |

| | Oil & Gas Storage &

Transportation (1.42%) | | | | | | |

| 3,600,000 | | Southern Union Co. | | | 48,544,865 | | | 74,844,000 |

| | | | | | | | |

Total Energy | | | 307,830,931 | | | 557,731,933 |

| | | | | | | | |

| | | | | | | | |

Financials (10.21%) | | | |

| | Asset Management &

Custody Banks (1.15%) | | | |

| 500,000 | | Cohen & Steers, Inc. | | | 6,508,019 | | | 12,000,000 |

| 1,750,000 | | Eaton Vance Corp. | | | 31,702,091 | | | 48,982,500 |

| | | | | | | | |

| | | 38,210,110 | | | 60,982,500 |

| | |

| | Investment Banking &

Brokerage (1.23%) | | | |

| 175,000 | | Greenhill & Co., Inc. | | | 13,286,675 | | | 15,676,500 |

| 1,800,000 | | Jefferies Group, Inc.1 | | | 18,429,351 | | | 49,014,000 |

| | | | | | | | |

| | | 31,716,026 | | | 64,690,500 |

| | |

| | Office REIT’s (1.03%) | | | |

| 136,838 | | Alexander’s, Inc.1,5 | | | 29,189,317 | | | 40,487,627 |

| 1,125,000 | | Douglas Emmett, Inc. | | | 9,868,661 | | | 13,815,000 |

| | | | | | | | |

| | | 39,057,978 | | | 54,302,627 |

| | |

| | Real Estate Services (0.49%) | | | |

| 2,200,000 | | CB Richard Ellis Group, Inc.,

Cl A1 | | | 13,827,634 | | | 25,828,000 |

| | |

| | Reinsurance (2.05%) | | | |

| 1,600,000 | | Arch Capital Group, Ltd.1,2 | | | 49,270,622 | | | 108,064,000 |

| | |

| | Specialized Finance (2.81%) | | | |

| 3,771,933 | | MSCI, Inc., Cl A1 | | | 82,675,301 | | | 111,724,656 |

| 2,500,000 | | RiskMetrics Group, Inc.1,5 | | | 52,397,200 | | | 36,550,000 |

| | | | | | | | |

| | | 135,072,501 | | | 148,274,656 |

| | |

| | Specialized REIT’s (1.45%) | | | |

| 775,000 | | Alexandria Real Estate

Equities, Inc.5 | | | 29,669,521 | | | 42,121,250 |

| 750,000 | | Digital Realty Trust, Inc.5 | | | 26,268,348 | | | 34,282,500 |

| | | | | | | | |

| | | 55,937,869 | | | 76,403,750 |

| | | | | | | | |

Total Financials | | | 363,092,740 | | | 538,546,033 |

| | | | | | | | |

| | | | | | | | |

Health Care (15.86%) | | | |

| | Health Care Distributors (0.17%) | | | |

| 400,000 | | PSS World Medical, Inc.1 | | | 8,010,336 | | | 8,732,000 |

| | |

| | Health Care Equipment (3.81%) | | | |

| 2,000,000 | | Edwards Lifesciences Corp.1 | | | 59,602,586 | | | 139,820,000 |

| 1,225,000 | | IDEXX Laboratories, Inc.1 | | | 41,842,292 | | | 61,250,000 |

| | | | | | | | |

| | | 101,444,878 | | | 201,070,000 |

| | |

| 14 | | See Notes to Financial Statements. |

| | |

| September 30, 2009 | | Baron Growth Fund |

STATEMENT OF NET ASSETS (Continued)

SEPTEMBER 30, 2009

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (continued) | | | | | | |

Health Care (continued) | | | |

| | Health Care Facilities (3.90%) | | | |

| 4,000,000 | | Community Health

Systems, Inc.1 | | $ | 81,148,924 | | $ | 127,720,000 |

| 600,000 | | Skilled Healthcare Group, Inc., Cl A1 | | | 9,215,682 | | | 4,818,000 |

| 1,300,000 | | Sun Healthcare Group, Inc.1 | | | 16,193,038 | | | 11,232,000 |

| 2,300,000 | | VCA Antech, Inc.1 | | | 64,291,084 | | | 61,847,000 |

| | | | | | | | |

| | | 170,848,728 | | | 205,617,000 |

| | |

| | Health Care Services (0.69%) | | | |

| 600,000 | | Chemed Corp. | | | 21,302,478 | | | 26,334,000 |

| 375,000 | | Emdeon, Inc., Cl A1 | | | 6,150,957 | | | 6,075,000 |

| 125,000 | | IPC The Hospitalist Co., Inc.1 | | | 2,062,500 | | | 3,931,250 |

| | | | | | | | |

| | | 29,515,935 | | | 36,340,250 |

| | |

| | Health Care Supplies (0.92%) | | | |

| 1,175,000 | | Gen-Probe, Inc.1,5 | | | 49,063,566 | | | 48,692,000 |

| | |

| | Health Care Technology (0.06%) | | | |

| 226,315 | | HLTH Corp.1 | | | 2,461,661 | | | 3,306,462 |

| | |

| | Life Sciences Tools & Services (5.21%) | | | |

| 1,600,000 | | Charles River Laboratories

Intl., Inc.1 | | | 45,694,611 | | | 59,168,000 |

| 950,000 | | Covance, Inc.1 | | | 35,390,335 | | | 51,442,500 |

| 1,200,000 | | Mettler-Toledo

International, Inc.1 | | | 73,415,860 | | | 108,708,000 |

| 880,943 | | Techne Corp. | | | 46,631,249 | | | 55,102,985 |

| | | | | | | | |

| | | 201,132,055 | | | 274,421,485 |

| | |

| | Managed Health Care (1.10%) | | | |

| 2,625,000 | | AMERIGROUP Corp.1,4 | | | 45,833,394 | | | 58,196,250 |

| | | | | | | | |

Total Health Care | | | 608,310,553 | | | 836,375,447 |

| | | | | | | | |

| | | | | | | | |

Industrials (10.94%) | | | |

| | Aerospace & Defense (0.26%) | | | |

| 525,000 | | Stanley, Inc.1 | | | 13,496,743 | | | 13,503,000 |

| | |

| | Construction & Engineering (1.80%) | | | |

| 3,500,000 | | AECOM

Technology Corp.1 | | | 78,998,559 | | | 94,990,000 |

| | |

| | Construction & Farm Machinery &

Heavy Trucks (0.05%) | | | |

| 234,399 | | American Railcar Industries, Inc. | | | 5,090,540 | | | 2,486,973 |

| | |

| | Diversified Support Services (3.26%) | | | |

| 2,725,000 | | Copart, Inc.1 | | | 69,029,357 | | | 90,497,250 |

| 3,320,227 | | Ritchie Bros. Auctioneers, Inc.2 | | | 76,748,114 | | | 81,478,371 |

| | | | | | | | |

| | | | | 145,777,471 | | | 171,975,621 |

| | | |

| | Environmental & Facilities Services (1.23%) | | | | | | |

| 2,450,000 | | Tetra Tech, Inc.1 | | | 61,402,913 | | | 64,998,500 |

| | | |

| | Industrial

Machinery (1.24%) | | | | | | |

| 400,000 | | Kennametal, Inc. | | | 6,905,007 | | | 9,844,000 |

| 650,000 | | Valmont Industries, Inc. | | | 53,758,838 | | | 55,367,000 |

| | | | | | | | |

| | | | | 60,663,845 | | | 65,211,000 |

| | | |

| | Railroads (1.15%) | | | | | | |

| 2,000,000 | | Genesee & Wyoming, Inc., Cl A1 | | | 32,221,169 | | | 60,640,000 |

| | | |

| | Research & Consulting

Services (1.11%) | | | | | | |

| 925,000 | | CoStar Group, Inc.1 | | | 39,770,735 | | | 38,128,500 |

| 400,000 | | IHS, Inc., Cl A1 | | | 16,387,387 | | | 20,452,000 |

| | | | | | | | |

| | | | | 56,158,122 | | | 58,580,500 |

| | | |

| | Trading Companies & Distributors (0.50%) | | | | | | |

| 600,000 | | MSC Industrial Direct Co., Inc., Cl A | | | 21,427,055 | | | 26,148,000 |

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (continued) | | | |

Industrials (continued) | | | |

| | Trucking (0.34%) | | | | | | |

| 475,000 | | Landstar System, Inc. | | $ | 11,073,375 | | $ | 18,078,500 |

| | | | | | | | |

Total Industrials | | | 486,309,792 | | | 576,612,094 |

| | | | | | | | |

| | | | | | | | |

Information Technology (8.40%) | | | |

| | Application

Software (5.02%) | | | | | | |

| 700,000 | | Advent Software, Inc.1 | | | 26,532,888 | | | 28,175,000 |

| 2,250,000 | | ANSYS, Inc.1 | | | 54,764,729 | | | 84,307,500 |

| 1,100,000 | | Concur

Technologies, Inc.1 | | | 24,703,047 | | | 43,736,000 |

| 1,635,000 | | FactSet Research Systems, Inc. | | | 82,436,633 | | | 108,302,400 |

| | | | | | | | |

| | | | | 188,437,297 | | | 264,520,900 |

| | | |

| | Internet Software &

Services (0.58%) | | | | | | |

| 928,953 | | WebMD Health Corp.,

Cl A1 | | | 24,910,460 | | | 30,766,923 |

| | | |

| | IT Consulting & Other

Services (2.80%) | | | | | | |

| 1,029,268 | | Equinix, Inc.1,5 | | | 33,364,684 | | | 94,692,656 |

| 2,900,000 | | Gartner, Inc.1 | | | 47,347,692 | | | 52,983,000 |

| | | | | | | | |

| | | | | 80,712,376 | | | 147,675,656 |

| | | | | | | | |

Total Information Technology | | | 294,060,133 | | | 442,963,479 |

| | | | | | | | |

| | | | | | | | |

Telecommunication Services (0.90%) | | | |

| | Wireless Telecommunication Services (0.90%) | | | | | | |

| 1,765,015 | | SBA Communications Corp.,

Cl A1 | | | 7,768,187 | | | 47,708,356 |

| | | | | | | | |

| | | | | | | | |

Utilities (1.94%) | | | | | | |

| | Electric Utilities (1.94%) | | | | | | |

| 2,250,000 | | ITC Holdings Corp. | | | 69,934,399 | | | 102,262,500 |

| | | | | | | | |

Total Common Stocks | | | 3,277,873,065 | | | 4,830,300,802 |

| | | | | | | | |

| | | | | | | | |

Private Equity Investments (0.63%) | | | |

Consumer Discretionary (0.56%) | | | |

| | Hotels, Resorts & Cruise

Lines (0.56%) | | | | | | |

| 7,400,000 | | Kerzner Intl. Holdings, Ltd.,

Cl A1,2,3,5 | | | 74,000,000 | | | 29,600,000 |

| | | | | | | | |

| | | | | | | | |

Financials (0.07%) | | | | | | |

| | Asset Management & Custody Banks (0.07%) | | | | | | |

| 1,885,000 | | Windy City Investments

Holdings LLC1,3,5 | | | 7,748,686 | | | 3,770,000 |

| | | | | | | | |

Total Private Equity Investments | | | 81,748,686 | | | 33,370,000 |

| | | | | | | | |

| | | | | | | | |

Warrants (0.00%) | | | | | | |

Consumer Discretionary (0.00%) | | | |

| | Restaurants (0.00%) | | | |

| 82,905 | | Krispy Kreme Doughnuts, Inc. Warrants, Exp 03/02/20121 | | | 0 | | | 0 |

| | | | | | | | |

| | |

| See Notes to Financial Statements. | | 15 |

| | |

| Baron Growth Fund | | September 30, 2009 |

STATEMENT OF NET ASSETS (Continued)

SEPTEMBER 30, 2009

| | | | | | | | |

Principal

Amount | | Cost | | Value |

Convertible Bonds (0.08%) | | | | | | |

Consumer Discretionary (0.08%) | | | | | | |

| | Automotive Retail (0.08%) | | | |

| $4,100,000 | | Penske Automotive Group, Inc., 3.50% due 04/01/20265 | | $ | 2,706,181 | | $ | 4,335,750 |

| | | | | | | | |

| | | | | | | | |

Corporate Bonds (0.46%) | | | | | | |

Consumer Discretionary (0.46%) | | | | | | |

| | Casinos & Gaming (0.46%) | | | |

| 23,694,000 | | Wynn Las Vegas, LLC, AD7, 6.625% due 12/01/20145 | | | 21,891,094 | | | 22,983,180 |

| 1,050,000 | | Wynn Las Vegas, LLC, AK1, 6.625% due 12/01/20145 | | | 969,840 | | | 1,005,375 |

| | | | | | | | |

Total Corporate Bonds | | | 22,860,934 | | | 23,988,555 |

| | | | | | | | |

| | | | | | | | |

Short Term Investments (7.17%) | | | |

| 377,809,009 | | Repurchase Agreement with Fixed Income Clearing Corp., dated 09/30/2009, 0.01% due 10/01/2009; Proceeds at maturity - $377,809,114; (Fully collateralized by U.S. Treasury Note, 3.125% due 08/31/2013; Market value - $156,235,524 and U.S. Treasury Note, 2.75% due 10/31/2013; Market value - $156,285,000 and U.S. Treasury Note, 1.75% due 01/31/2014; Market value - $84,179,700) | | | 377,809,009 | | | 377,809,009 |

| | | | | | | | |

Total Investments (99.94%) | | $ | 3,762,997,875 | | | 5,269,804,116 |

| | | | | | | | |

Cash and Other Assets Less

Liabilities (0.06%) | | | 3,420,400 |

| | | | | | | | |

Net Assets | | | | | $ | 5,273,224,516 |

| | | | | | | | |

Retail Shares (Equivalent to $39.00 per share based on 129,087,811 shares outstanding) | | | | | $ | 5,034,502,843 |

| | | | | | | | |

Institutional Shares (Equivalent to $39.03 per share based on 6,116,149 shares outstanding) | | | | | $ | 238,721,673 |

| | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At September 30, 2009, the market value of restricted and fair valued securities amounted to $33,370,000 or 0.63% of Net Assets. None of these securities are deemed liquid. See Note 7. |

| 4 | See Note 10 regarding “Affiliated” companies. |

| 5 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| | |

| 16 | | See Notes to Financial Statements. |

| | |

| September 30, 2009 | | Baron Small Cap Fund |

STATEMENT OF NET ASSETS

SEPTEMBER 30, 2009

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (93.04%) |

Consumer Discretionary (20.48%) | | | |

| | Advertising (1.45%) | | | |

| 2,400,000 | | National CineMedia, Inc.4 | | $ | 51,159,417 | | $ | 40,728,000 |

| | |

| | Apparel Retail (3.10%) | | | |

| 1,800,000 | | J. Crew Group, Inc.1 | | | 50,045,221 | | | 64,476,000 |

| 750,000 | | Urban Outfitters, Inc.1 | | | 10,990,210 | | | 22,627,500 |

| | | | | | | | |

| | | 61,035,431 | | | 87,103,500 |

| | |

| | Apparel, Accessories &

Luxury Goods (2.83%) | | | |

| 1,150,000 | | Fossil, Inc.1 | | | 27,172,482 | | | 32,717,500 |

| 3,750,000 | | Iconix Brand Group, Inc.1,4,5 | | | 60,541,075 | | | 46,762,500 |

| | | | | | | | |

| | | 87,713,557 | | | 79,480,000 |

| | |

| | Casinos & Gaming (3.32%) | | | |

| 2,350,000 | | Penn National Gaming, Inc.1 | | | 60,841,363 | | | 65,001,000 |

| 400,000 | | Wynn Resorts, Ltd.1 | | | 4,213,528 | | | 28,356,000 |

| | | | | | | | |

| | | 65,054,891 | | | 93,357,000 |

| | |

| | Computer & Electronics Retail (0.81%) | | | |

| 1,350,000 | | hhgregg, Inc.1 | | | 23,126,212 | | | 22,869,000 |

| | |

| | Education Services (3.98%) | | | |

| 600,000 | | American Public

Education, Inc.1 | | | 19,348,177 | | | 20,844,000 |

| 350,000 | | Capella Education Co.1 | | | 12,268,802 | | | 23,569,000 |

| 308,808 | | Strayer Education, Inc. | | | 27,539,086 | | | 67,221,325 |

| | | | | | | | |

| | | 59,156,065 | | | 111,634,325 |

| | |

| | Hotels, Resorts & Cruise Lines (1.80%) | | | |

| 650,000 | | Gaylord Entertainment Co.1 | | | 18,665,588 | | | 13,065,000 |

| 3,060,000 | | Great Wolf Resorts, Inc.1,4 | | | 55,012,502 | | | 10,924,200 |

| 20,000,000 | | Mandarin Oriental International, Ltd.2 | | | 40,047,095 | | | 26,600,000 |

| | | | | | | | |

| | | 113,725,185 | | | 50,589,200 |

| | |

| | Internet Retail (0.31%) | | | |

| 800,000 | | Vitacost.com, Inc.1 | | | 9,570,584 | | | 8,736,000 |

| | |

| | Movies & Entertainment (1.27%) | | | |

| 1,105,453 | | Liberty Media Corp. – Capital, Series A1 | | | 15,318,471 | | | 23,126,077 |

| 250,000 | | Marvel Entertainment, Inc.1 | | | 4,681,550 | | | 12,405,000 |

| | | | | | | | |

| | | 20,000,021 | | | 35,531,077 |

| | |

| | Restaurants (1.61%) | | | |

| 1,000,000 | | Cheesecake Factory, Inc.1 | | | 19,997,482 | | | 18,520,000 |

| 2,500,000 | | Texas Roadhouse, Inc., Cl A1 | | | 29,521,460 | | | 26,550,000 |

| | | | | | | | |

| | | 49,518,942 | | | 45,070,000 |

| | | | | | | | |

Total Consumer Discretionary | | | 540,060,305 | | | 575,098,102 |

| | | | | | | | |

| | | | | | | | |

Consumer Staples (0.57%) | | | | | | |

| | Soft Drinks (0.57%) | | | |

| 3,500,000 | | Heckmann Corp.1 | | | 27,464,082 | | | 16,030,000 |

| | | | | | | | |

| | | | | | | | |

Energy (4.82%) | | | | | | |

| | Oil & Gas Equipment &

Services (1.72%) | | | |

| 300,000 | | Core Laboratories N.V.2 | | | 23,095,109 | | | 30,927,000 |

| 857,500 | | PHI, Inc.1 | | | 24,669,136 | | | 17,390,100 |

| | | | | | | | |

| | | 47,764,245 | | | 48,317,100 |

| | |

| | Oil & Gas Exploration &

Production (3.10%) | | | |

| 2,067,520 | | Atlas Energy, Inc.

(formerly Atlas

America, Inc.) | | | 51,822,719 | | | 55,967,766 |

| 859,443 | | Concho Resources, Inc.1 | | | 24,277,012 | | | 31,214,970 |

| | | | | | | | |

| | | 76,099,731 | | | 87,182,736 |

| | | | | | | | |

Total Energy | | | 123,863,976 | | | 135,499,836 |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | Cost | | Value |

Common Stocks (continued) |

Financials (6.95%) | | | | | | |

| | Office REIT’s (1.48%) | | | |

| 950,000 | | SL Green Realty Corp. | | $ | 23,268,870 | | $ | 41,657,500 |

| | |

| | Real Estate Services (1.88%) | | | |

| 4,500,000 | | CB Richard Ellis Group,

Inc., Cl A1 | | | 34,462,412 | | | 52,830,000 |

| | |

| | Reinsurance (0.48%) | | | |

| 200,000 | | Arch Capital Group, Ltd.1,2 | | | 5,515,966 | | | 13,508,000 |

| | |

| | Specialized Finance (1.48%) | | | |

| 912,000 | | MSCI, Inc., Cl A1 | | | 19,063,408 | | | 27,013,440 |

| 1,000,000 | | RiskMetrics Group, Inc.1,5 | | | 17,515,916 | | | 14,620,000 |

| | | | | | | | |

| | | 36,579,324 | | | 41,633,440 |

| | |

| | Specialized REIT’s (1.63%) | | | |

| 1,000,000 | | Digital Realty Trust, Inc.5 | | | 35,600,658 | | | 45,710,000 |

| | | | | | | | |

Total Financials | | | 135,427,230 | | | 195,338,940 |

| | | | | | | | |

| | | | | | | | |

Health Care (15.67%) | | | | | | |

| | Health Care Equipment (4.77%) | | | |

| 900,000 | | IDEXX Laboratories, Inc.1 | | | 29,711,915 | | | 45,000,000 |

| 175,000 | | Intuitive Surgical, Inc.1 | | | 2,537,500 | | | 45,893,750 |

| 1,325,000 | | Masimo Corp.1 | | | 30,033,725 | | | 34,715,000 |

| 544,392 | | Natus Medical, Inc.1 | | | 5,387,546 | | | 8,399,969 |

| | | | | | | | |

| | | 67,670,686 | | | 134,008,719 |

| | |

| | Health Care Facilities (3.74%) | | | |

| 2,750,000 | | Brookdale Senior Living, Inc. | | | 55,455,764 | | | 49,857,500 |

| 1,525,000 | | Emeritus Corp.1 | | | 46,025,139 | | | 33,473,750 |

| 2,700,000 | | Skilled Healthcare Group,

Inc., Cl A1 | | | 37,304,785 | | | 21,681,000 |

| | | | | | | | |

| | | 138,785,688 | | | 105,012,250 |

| | |

| | Health Care Services (0.14%) | | | |

| 900,000 | | Clarient, Inc.1 | | | 3,150,000 | | | 3,789,000 |

| | |

| | Health Care Supplies (3.43%) | | | |

| 750,000 | | Gen-Probe, Inc.1,5 | | | 31,517,367 | | | 31,080,000 |

| 1,500,000 | | Immucor, Inc.1 | | | 16,581,987 | | | 26,550,000 |

| 1,000,000 | | Inverness Medical

Innovations, Inc.1 | | | 42,391,327 | | | 38,730,000 |

| | | | | | | | |

| | | 90,490,681 | | | 96,360,000 |

| | |

| | Life Sciences Tools & Services (3.59%) | | | |

| 900,000 | | Covance, Inc.1 | | | 33,410,943 | | | 48,735,000 |

| 575,000 | | Mettler-Toledo

International, Inc.1 | | | 36,666,021 | | | 52,089,250 |

| | | | | | | | |

| | | 70,076,964 | | | 100,824,250 |

| | | | | | | | |

Total Health Care | | | 370,174,019 | | | 439,994,219 |

| | | | | | | | |

| | | | | | | | |

Industrials (25.92%) | | | | | | |

| | Aerospace & Defense (5.93%) | | | |

| 1,000,000 | | AeroVironment, Inc.1 | | | 22,804,292 | | | 28,090,000 |

| 1,000,000 | | HEICO Corp., Cl A | | | 25,494,867 | | | 33,910,000 |

| 1,350,000 | | Stanley, Inc.1,4 | | | 27,051,567 | | | 34,722,000 |

| 1,400,000 | | TransDigm Group, Inc.1 | | | 36,859,086 | | | 69,734,000 |

| | | | | | | | |

| | | 112,209,812 | | | 166,456,000 |

| | |

| | Construction & Engineering (1.96%) | | | |

| 1,200,000 | | AECOM Technology Corp.1 | | | 29,450,937 | | | 32,568,000 |

| 1,100,000 | | Orion Marine Group, Inc.1 | | | 14,920,988 | | | 22,594,000 |

| | | | | | | | |

| | | 44,371,925 | | | 55,162,000 |

| | |

| | Construction & Farm Machinery &

Heavy Trucks (1.33%) | | | |

| 150,000 | | Joy Global, Inc. | | | 3,662,936 | | | 7,341,000 |

| 800,000 | | Wabtec Corp. | | | 26,493,459 | | | 30,024,000 |

| | | | | | | | |

| | | 30,156,395 | | | 37,365,000 |