| OMB APPROVAL |

| OMB Number: 3235-0570 |

| Expires: January 31, 2014 |

Estimated average burden

Hours per response . . . . . . . . . . 20.6 |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, DC 20549 |

|

|

| | FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | Investment Company Act file number: 811-5032 |

| | BARON INVESTMENT FUNDS TRUST f/k/a |

| BARON ASSET FUND |

|

| (Exact Name of Registrant as Specified in Charter) |

| | 767 Fifth Avenue, 49th Floor |

| New York, NY 10153 |

| (Address of Principal Executive Offices) (Zip Code) |

|

|

| | Patrick M. Patalino, General Counsel |

| c/o Baron Investment Funds Trust |

| 767 Fifth Avenue, 49th Floor |

| New York, NY 10153 |

| (Name and Address of Agent for Service) |

|

| (Registrant’s Telephone Number, including Area Code): 212-583-2000 |

Date of fiscal year end: September 30

Date of reporting period: September 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 5th Street, NW, Washington, D.C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

SEC 2569 (5-07)

| | | | | |

| | | | | |

| | Baron Asset Fund | | | Baron Funds® |

| | Baron Growth Fund | | |

| | Baron Small Cap Fund | | |

| | Baron Opportunity Fund | | |

| | Baron Fifth Avenue Growth Fund | | |

| | | | |

| | | | | |

| | | | | |

| | September 30, 2012 | | | Annual Financial Report |

| | | | | |

| | | | | |

DEAR BARON FUNDS SHAREHOLDER: In this report you will find audited financial statements for Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund and Baron Fifth Avenue Growth Fund (the “Funds”) for the fiscal year ended September 30, 2012. The Securities and Exchange Commission (the “SEC”) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful. We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence. Sincerely, |

| |  | |  |

| | | | | |

| Ronald Baron | | Linda S. Martinson | | Peggy Wong |

| Chief Executive Officer and | | Chairman, President and | | Treasurer and |

| Chief Investment Officer | | Chief Operating Officer | | Chief Financial Officer |

| November 27, 2012 | | November 27, 2012 | | November 27, 2012 |

| | | | | | |

This Annual Financial Report is for the Baron Investment Funds Trust, which currently has five series: Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund and Baron Fifth Avenue Growth Fund. If you are interested in the Baron Select Funds, which contains the Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Energy and Resources Fund and Baron Global Advantage Fund series, please visit the Funds’ website at www.BaronFunds.com or contact us at 1-800-99BARON. A description of the Funds’ proxy voting policies and procedures is available without charge on the Funds’ website, www.BaronFunds.com, or by calling 1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website. The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Funds’ Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-202-551-8090. A copy of the Funds’ Forms N-Q may also be obtained upon request by calling 1-800-99BARON. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website. Some of the comments are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan” and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled. |

The views expressed in this report reflect those of the BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to www.baronfunds.com for a prospectus. Read it carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus. | |  |

| Baron Asset Fund (Unaudited) | | September 30, 2012 |

| |

| |

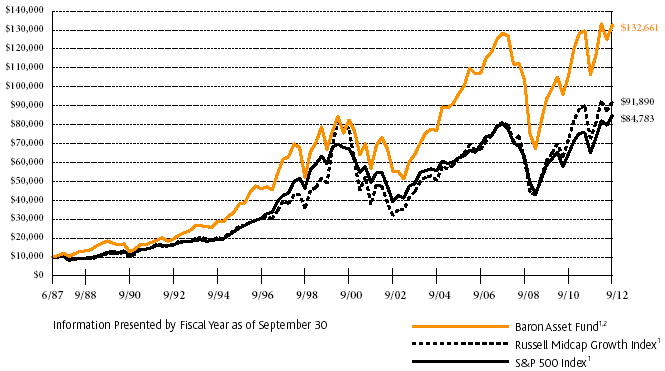

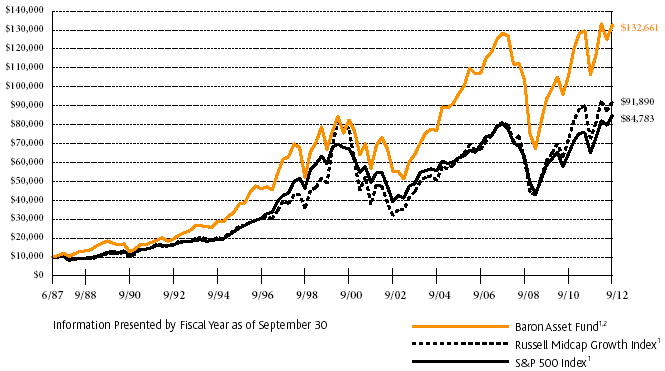

COMPARISON OF THE CHANGE IN VALUE OF $10,000 INVESTMENT IN BARON ASSET FUND (RETAIL SHARES)

IN RELATION TO THE RUSSELL MIDCAP GROWTH INDEX AND THE S&P 500 INDEX |

| | | | | | | | | | | | | | | | | | |

|

| |

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED SEPTEMBER 30, 2012

| | | | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(June 12,

1987) |

| Baron Asset Fund — Retail Shares1, 2 | | | | | | | 24.65 | % | | | 12.40 | % | | | 0.69 | % | | | 9.14 | % | | | 10.76 | % |

| Baron Asset Fund — Institutional Shares1, 2, 4 | | | | | | | 24.99 | % | | | 12.70 | % | | | 0.86 | % | | | 9.24 | % | | | 10.80 | % |

| Russell Midcap Growth Index1 | | | | | | | 26.69 | % | | | 14.73 | % | | | 2.54 | % | | | 11.11 | % | | | 9.18 | %3 |

| S&P 500 Index1 | | | | | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 8.82 | % |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | | The indexes are unmanaged. The Russell MidcapTM Growth Index measures the performance of medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large-cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| | | | | | | | | | | | | | | | | | | |

| 2 | | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| | | | | | | | | | | | | | | | | | | |

| 3 | | For the period June 30, 1987 to September 30, 2012. |

| | | | | | | | | | | | | | | | | | | |

| 4 | | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| September 30, 2012 (Unaudited) | Baron Asset Fund |

| TOP TEN HOLDINGS AS OF SEPTEMBER 30, 2012 |

| | | Percent of | |

| | | Net Assets | |

| Equinix, Inc. | | 4.1% | |

| |

| Gartner, Inc. | | 4.0% | |

| |

| SBA Communications Corp. | | 3.9% | |

| |

| IDEXX Laboratories, Inc. | | 3.8% | |

| |

| Verisk Analytics, Inc. | | 3.4% | |

| |

| Arch Capital Group Ltd. | | 3.4% | |

| |

| Fastenal Co. | | 3.0% | |

| |

| Ralph Lauren Corp. | | 2.9% | |

| |

| Mettler-Toledo International, Inc. | | 2.7% | |

| |

| Discovery Communications, Inc. | | 2.7% | |

| | | 33.9% | |

| |

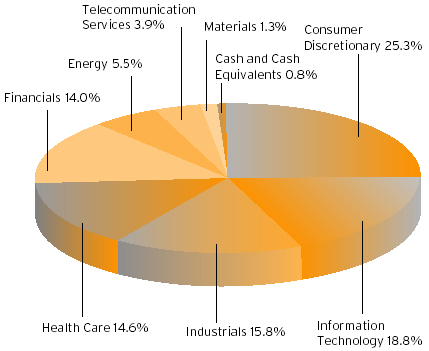

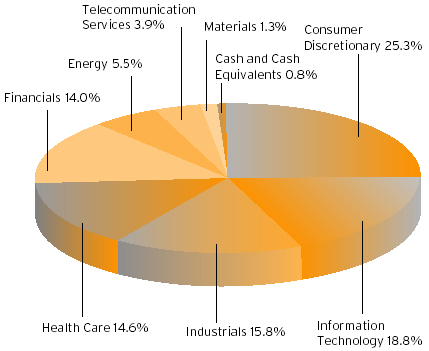

SECTOR BREAKDOWN AS OF SEPTEMBER 30, 2012†

(as a percentage of net assets) |

| |

|

| |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| |

For the 12-month period ended September 30, 2012, Baron Asset Fund‡ gained 24.65%, while the Russell Midcap Growth Index gained 26.69% and the S&P 500 Index gained 30.20%.

Baron Asset Fund invests primarily in medium-sized growth companies for the long term, using a value-oriented purchase discipline.1 The Fund purchases companies that we believe have sustainable competitive advantages, strong financial characteristics, exceptional management, and operate in industries with favorable growth characteristics. |

| The U.S. equity markets posted strong gains over the last 12 months. These gains were achieved despite heightened concerns over the European debt crisis and China’s economic slowdown, which caused market volatility and a temporary pullback in the U.S. markets during the spring and summer. Oil prices also experienced sharp declines in the June quarter. Many individual businesses performed well through this period, as the U.S. economy slowly improved and interest rates remained low. Even the U.S. housing market, a significant part of the economy, appeared to have bottomed out. |

| |

| The Fund’s investments in the Information Technology (IT), Consumer Discretionary, and Health Care sectors were the largest contributors to performance. Investments in these sectors can be broadly characterized as operating in attractive growth markets, having unique assets or brands that provide competitive advantages, with recurring revenue streams and positive operating leverage. In Health Care particularly, the companies in which we have invested are meeting our country’s critical need to reduce costs and improving efficiency in our health care system. |

| |

| IT holding Equinix, Inc. was the leading contributor to Fund performance for the 12-month period. Equinix is a network-neutral operator of state-of-the-art data centers across North America, Europe, and Asia-Pacific. During the period, Equinix experienced healthy pricing and demand trends, announced its first share buyback in November, and began considering converting to a real estate investment trust (REIT) in February—a move its Board approved this past September. The possibility of a REIT conversion has probably had the largest impact on Equinix’s share price. REITs typically trade at significantly higher multiples, and investors have revalued Equinix’s shares higher to close that gap. In addition, the growth of wireless data and Internet traffic create a more appealing demand picture for data center operators than for many slower growing, more cyclical REIT businesses. The second largest contributor to portfolio returns was Telecommunication Services holding SBA Communications, Inc., another company whose shares significantly appreciated due to its planned REIT conversion. |

| |

| The Fund purchased Netflix, Inc., the global leader in online TV and movie content streaming at the end of January. For the period held, it was the largest detractor from Fund performance. Shares came under pressure this year as U.S. subscriber additions slowed, competition heated up, and Netflix’s international expansion strategy raised concerns with some investors. The price dropped 25% in one day of trading in July as a result of these developments. We re-evaluated our assessment of the company’s long-term growth prospects and competitive positioning and exited the position. |

| |

| We continue to believe that current stock market valuations remain compelling. In our view, U.S. interest rates remain near historically low levels, and the fixed income markets offer limited inflation-adjusted returns. We believe the Fund is well positioned to benefit from a market that rewards high-quality companies with predictable and fast-growing earnings streams. We expect to continue to invest in companies that, in our opinion, are undervalued relative to their long-term growth prospects, and have the ability to sustain superior levels of profitability. |

| |

|

| † | | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| |

| ‡ | | Performance information reflects results of the Retail Shares. |

| |

| 1 | | Prior to February 15, 2007, the Fund’s strategy was to invest primarily in small- and mid-sized growth companies. |

3

| Baron Growth Fund (Unaudited) | | September 30, 2012 |

| |

| |

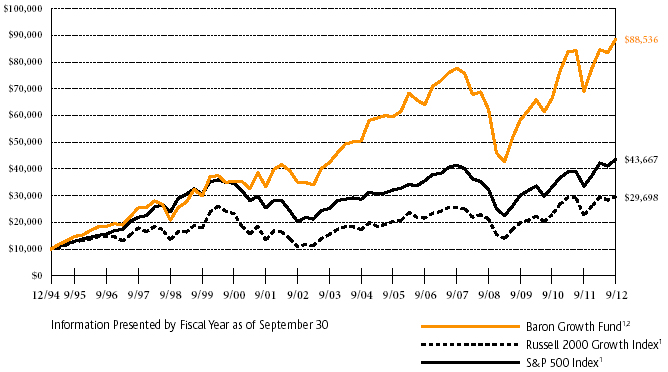

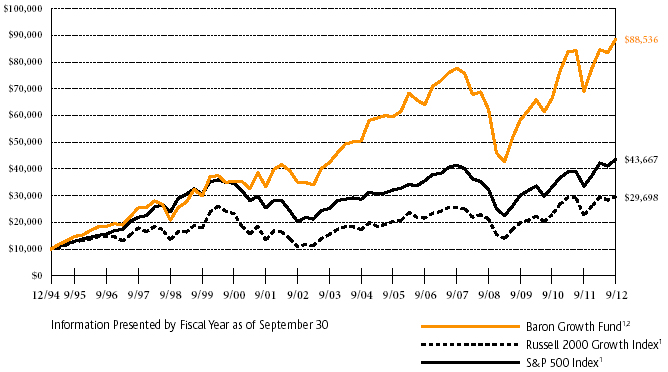

COMPARISON OF THE CHANGE IN VALUE OF $10,000 INVESTMENT IN BARON GROWTH FUND (RETAIL SHARES)

IN RELATION TO THE RUSSELL 2000 GROWTH INDEX AND THE S&P 500 INDEX |

| | | | | | | | | | | | | | | | | | |

|

| |

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED SEPTEMBER 30, 2012

| | | | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(December 31,

1994) |

| Baron Growth Fund — Retail Shares1, 2 | | | | | | | 28.12 | % | | | 14.90 | % | | | 2.65 | % | | | 9.74 | % | | | 13.07 | % |

| Baron Growth Fund — Institutional Shares1, 2, 3 | | | | | | | 28.45 | % | | | 15.21 | % | | | 2.83 | % | | | 9.83 | % | | | 13.13 | % |

| Russell 2000 Growth Index1 | | | | | | | 31.18 | % | | | 14.19 | % | | | 2.96 | % | | | 10.55 | % | | | 6.32 | % |

| S&P 500 Index1 | | | | | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 8.66 | % |

|

| 1 | | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large-cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| | | |

| 2 | | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| | | |

| 3 | | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| September 30, 2012 (Unaudited) | Baron Growth Fund |

| TOP TEN HOLDINGS AS OF SEPTEMBER 30, 2012 |

| | | Percent of | |

| | | Net Assets | |

| Dick’s Sporting Goods, Inc. | | 3.7% | |

| |

| Arch Capital Group Ltd. | | 3.0% | |

| |

| ITC Holdings Corp. | | 2.9% | |

| |

| ANSYS, Inc. | | 2.8% | |

| |

| LKQ Corp. | | 2.7% | |

| |

| FactSet Research Systems, Inc. | | 2.7% | |

| |

| Under Armour, Inc. | | 2.5% | |

| |

| Genesee & Wyoming, Inc. | | 2.3% | |

| |

| Gartner, Inc. | | 2.3% | |

| |

| Community Health Systems, Inc. | | 2.2% | |

| | | 27.1% | |

| |

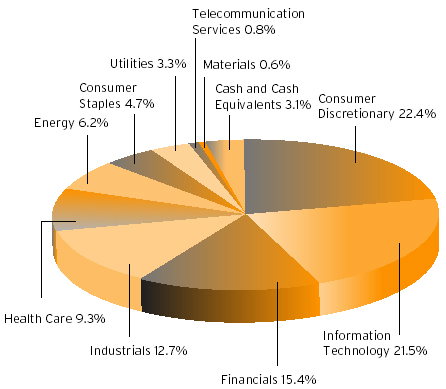

SECTOR BREAKDOWN AS OF SEPTEMBER 30, 2012†

(as a percentage of net assets) |

| |

|

| |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| |

For the 12-month period ended September 30, 2012, Baron Growth Fund‡ gained 28.12%, while the Russell 2000 Growth Index gained 31.18% and the S&P 500 Index gained 30.20%.

Baron Growth Fund invests primarily in small-sized U.S. growth companies for the long term. Through independent research, we utilize an investment approach that we believe allows us to look at a business’ fundamental characteristics and beyond the current market |

| environment. We invest based on the potential profitability of a business at what we believe are attractive valuations. |

| |

| The U.S. equity markets posted strong gains over the last 12 months. These gains were achieved despite heightened concerns over the European debt crisis and China’s economic slowdown. Oil prices also experienced sharp declines in the June quarter. The U.S. housing market appears to have bottomed out. We expect a U.S. housing recovery to have a number of important spillover effects on both consumer confidence and the broader economy. Other encouraging news came in September, when the Federal Reserve announced its intention to purchase $40 billion of mortgage debt per month and to keep interest rates low. |

| |

| The Fund’s investments in the Consumer Discretionary, Information Technology, and Health Care sectors were the strongest contributors to performance, while the Fund’s investments in the Consumer Staples sector slightly detracted. |

| |

| Within Health Care, leading Medicaid HMO AMERIGROUP Corp. was the largest contributor to Fund performance in the period. The Fund first purchased AMERIGROUP in November 2002 because we believed managed care programs could produce better health outcomes with greater cost efficiency. Over the past 10 years, AMERIGROUP’s revenue grew from $1 billion to $6 billion. On July 9th, WellPoint, Inc. bid $4.9 billion in cash, or $92 per share, for AMERIGROUP, a 43% premium to the prior day’s close. We exited our position on this news. |

| |

| The Fund’s investments in the Information Technology and Consumer Discretionary sectors have substantial recurring revenue streams, organic growth opportunities, pricing power, and positive operating leverage. Data centers such as Equinix, Inc. combine the stability of traditional real estate with the fast growth of Internet traffic and wireless data. Tower operator, SBA Communications, Inc., another portfolio holding, has similar characteristics. Both stocks appreciated significantly over the period as a result of their planned real estate investment trust (REIT) conversions. In lodging and leisure, supply growth is significantly below long-term averages, so we have seen increases in occupancy and pricing during the recovery. |

| |

Snack food manufacturer and distributor Diamond Foods, Inc. was the largest detractor from Fund performance in the period. Diamond Foods’ shares declined significantly in November of last year when questions arose concerning payments made to walnut farmers. It was initially charged, and later confirmed, that these payments were not properly accounted for. As a result, Diamond Foods’ pending acquisition of Pringles was first delayed and subsequently canceled. As these events unfolded, we exited our position. Two other stocks, DeVry, Inc. and CARBO Ceramics, Inc., also detracted from performance during the period. Together, these three positions account for the majority of the Fund’s underperformance during the period.

The Fund continues to invest in a portfolio of businesses that have significantly better financial characteristics than the benchmark index against which it is compared. These businesses have significantly higher growth rates, operating profit margins, net margins, EBITDA margins, return on invested capital, return on equity, return on assets, and lower standard deviations of earnings growth. |

| |

|

| † | | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| |

| ‡ | | Performance information reflects results of the Retail Shares. |

5

| Baron Small Cap Fund (Unaudited) | | September 30, 2012 |

| |

| |

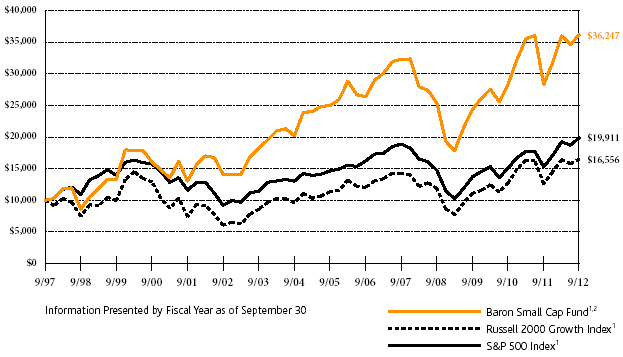

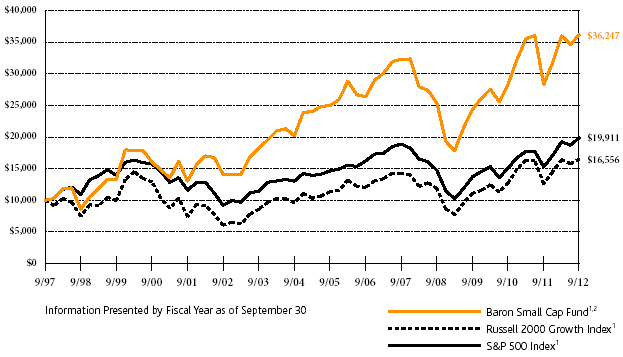

COMPARISON OF THE CHANGE IN VALUE OF $10,000 INVESTMENT IN BARON SMALL CAP FUND (RETAIL SHARES)

IN RELATION TO THE RUSSELL 2000 GROWTH INDEX AND THE S&P 500 INDEX |

| | | | | | | | | | | | | | | | | | |

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED SEPTEMBER 30, 2012

| | | | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(September 30,

1997) |

| Baron Small Cap Fund — Retail Shares1, 2 | | | | | 28.09 | % | | | 14.12 | % | | | 2.32 | % | | | 9.91 | % | | | 8.97 | % |

| Baron Small Cap Fund — Institutional Shares1, 2, 3 | | | | | 28.41 | % | | | 14.41 | % | | | 2.49 | % | | | 10.00 | % | | | 9.03 | % |

| Russell 2000 Growth Index1 | | | | | 31.18 | % | | | 14.19 | % | | | 2.96 | % | | | 10.55 | % | | | 3.42 | % |

| S&P 500 Index1 | | | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 4.70 | % |

|

| 1 | | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large-cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| | | |

| 2 | | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| | | |

| 3 | | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| September 30, 2012 (Unaudited) | Baron Small Cap Fund |

| TOP TEN HOLDINGS AS OF SEPTEMBER 30, 2012 |

| | | Percent of | |

| | | Net Assets | |

| Equinix, Inc. | | 4.3% | |

| |

| SBA Communications Corp. | | 4.1% | |

| |

| TransDigm Group, Inc. | | 3.4% | |

| |

| Penn National Gaming, Inc. | | 3.1% | |

| |

| Liberty Media Corp. | | 3.1% | |

| |

| Gartner, Inc. | | 2.5% | |

| |

| The Ultimate Software Group, Inc. | | 2.0% | |

| |

| Waste Connections, Inc. | | 1.8% | |

| |

| Intuitive Surgical, Inc. | | 1.8% | |

| |

| Brookdale Senior Living, Inc. | | 1.7% | |

| | | 27.8% | |

| |

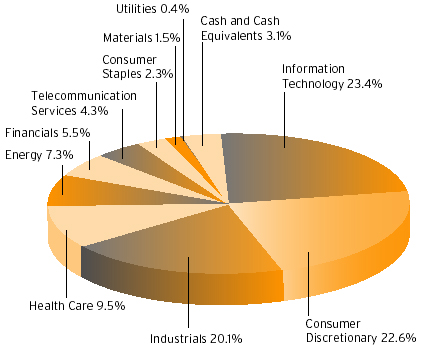

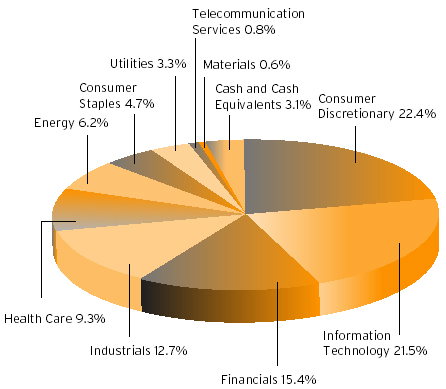

SECTOR BREAKDOWN AS OF SEPTEMBER 30, 2012†

(as a percentage of net assets) |

| |

|

| |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| |

For the 12-month period ended September 30, 2012, Baron Small Cap Fund‡ gained 28.09%, while the Russell 2000 Growth Index gained 31.18% and the S&P 500 Index gained 30.20%.

Baron Small Cap Fund invests primarily in small-cap growth companies for the long term. The Fund invests in what we believe are well-run small-cap growth businesses that can be purchased at prices that represent a significant discount to our assessment of future value. |

| The U.S. equity markets posted strong gains over the last 12 months. These gains were achieved despite heightened concerns over the European debt crisis and China’s economic slowdown. Oil prices also experienced sharp declines in the June quarter. Many individual businesses performed well through this period, as the U.S. economy slowly improved, interest rates remained low, the unemployment rate in the U.S. declined, consumer confidence ticked up, and housing began to recover. Many economic reports are encouraging, which indicates the economic malaise might improve, yet uncertainty about the “fiscal cliff” and the Presidential election constrained corporate investment and consumer spending. The Federal Reserve announced QE3 and extended its asset purchases indefinitely until the economic recovery strengthens. In the minds of many, this creates support for equity prices. |

| |

| The Fund’s investments in the Information Technology (IT), Consumer Discretionary, and Industrials sectors were the strongest contributors to performance. |

| |

| IT holding Equinix, Inc. was the leading contributor to Fund performance for the 12-month period. Equinix is a network-neutral operator of state-of-the-art data centers across North America, Europe, and Asia-Pacific. Equinix experienced healthy pricing and demand trends, announced its first share buyback in November, and began considering converting to a real estate investment trust (REIT) in February, a move its Board approved this past September. The possibility of a REIT conversion has probably had the largest impact on Equinix’s share price. REITs typically trade at significantly higher multiples, and investors have revalued Equinix’s shares higher to close that gap. In addition, the growth of wireless data and Internet traffic create a more appealing demand picture for data center operators than for many slower growing, more cyclical REIT businesses. |

| |

| Polypore International, Inc. was the largest detractor to Fund performance for the period. Polypore is a leading producer of microporous membranes that are used in batteries, and in industrial and health care applications including dialysis. Below-expectation sales of electric vehicles hurt Polypore’s lithium-ion separator sales during the period. However, our research indicates that while the market for electric vehicles has been slow to grow, all major manufacturers are committed to selling these types of vehicles. We continue to be positive on the future for electric drive vehicles. |

| |

| Baron Small Cap Fund’s investments fall into three categories: classic growth stocks, fallen angels, and special situations. The Fund intends to continue to invest predominantly in classic growth stocks that we believe have significant long-term growth prospects and can be purchased at what we believe are attractive prices because their prospects have not yet been appreciated by investors. Fallen angels are companies that we believe have strong long-term franchises but have disappointed investors with short-term results, creating what we believe is a buying opportunity. Special situations include spin-offs and recapitalizations, where lack of investor awareness creates opportunities to purchase what we believe are strong businesses at attractive prices. |

| |

|

| † | | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| |

| ‡ | | Performance information reflects results of the Retail Shares. |

7

| Baron Opportunity Fund (Unaudited) | | September 30, 2012 |

| |

| |

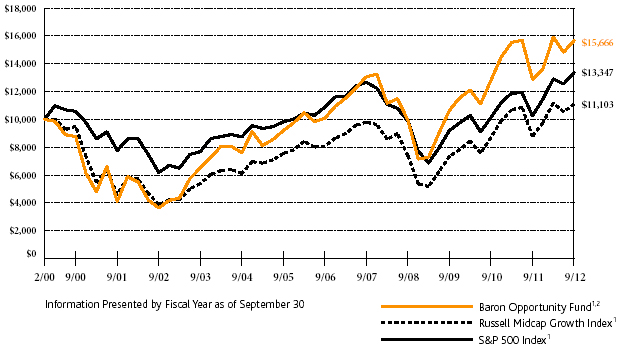

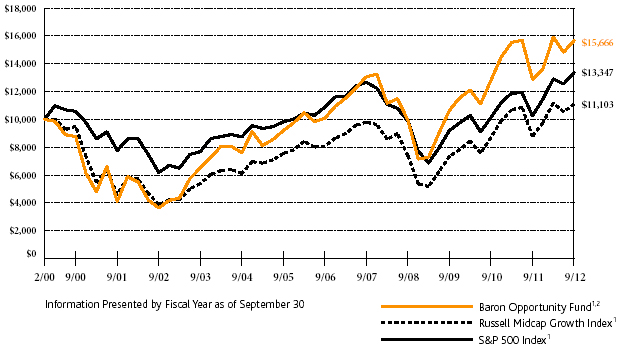

COMPARISON OF THE CHANGE IN VALUE OF $10,000 INVESTMENT IN BARON OPPORTUNITY FUND (RETAIL SHARES)

IN RELATION TO THE RUSSELL MIDCAP GROWTH INDEX AND THE S&P 500 INDEX |

| | | | | | | | | | | | | | | | | | |

|

| |

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED SEPTEMBER 30, 2012

| | | | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception

(February 29,

2000) |

| Baron Opportunity Fund — Retail Shares1, 2 | | | | | 21.67 | % | | | 13.74 | % | | | 3.71 | % | | | 15.70 | % | | | 3.63 | % |

| Baron Opportunity Fund — Institutional Shares1, 2, 3 | | | | | 22.00 | % | | | 14.04 | % | | | 3.90 | % | | | 15.81 | % | | | 3.71 | % |

| Russell Midcap Growth Index1 | | | | | 26.69 | % | | | 14.73 | % | | | 2.54 | % | | | 11.11 | % | | | 0.84 | % |

| S&P 500 Index1 | | | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 2.32 | % |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | | The indexes are unmanaged. The Russell MidcapTM Growth Index measures the performance of medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large-cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| | | | | | | | | | | | | | | | | | | |

| 2 | | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| | | | | | | | | | | | | | | | | | | |

| 3 | | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

8

| September 30, 2012 (Unaudited) | Baron Opportunity Fund |

| TOP TEN HOLDINGS AS OF SEPTEMBER 30, 2012 |

| | | Percent of | |

| | | Net Assets | |

| Equinix, Inc. | | 4.1% | |

| |

| SBA Communications Corp. | | 4.0% | |

| |

| ANSYS, Inc. | | 3.1% | |

| |

| RealPage, Inc. | | 3.0% | |

| |

| Gartner, Inc. | | 2.9% | |

| |

| Liberty Media Corp. | | 2.7% | |

| |

| Polypore International, Inc. | | 2.6% | |

| |

| Verisk Analytics, Inc. | | 2.6% | |

| |

| Rackspace Hosting, Inc. | | 2.5% | |

| |

| Discovery Communications, Inc. | | 2.5% | |

| | | 30.0% | |

| |

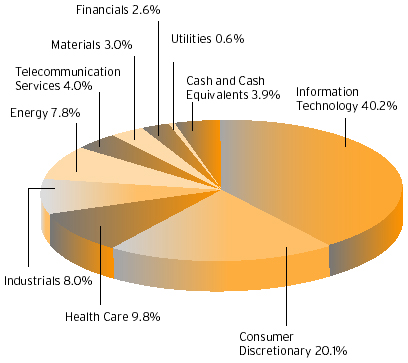

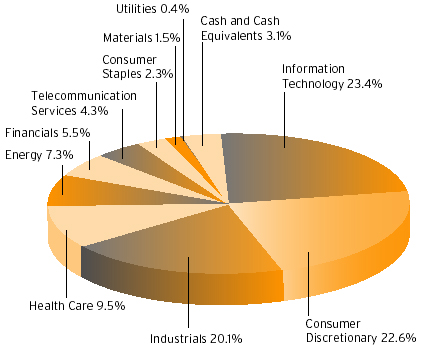

SECTOR BREAKDOWN AS OF SEPTEMBER 30, 2012†

(as a percentage of net assets) |

| |

|

| |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| |

For the 12-month period ended September 30, 2012, Baron Opportunity Fund‡ gained 21.67%, while the Russell Midcap Growth Index gained 26.69% and the S&P 500 Index gained 30.20%.

Baron Opportunity Fund primarily invests in U.S. mid-cap growth companies that we believe are driving or benefiting from innovation, through development of pioneering, transformative, or technologically advanced products and services.

The U.S. equity markets posted strong gains over the last 12 months. Coordinated central bank actions on both sides of the Atlantic spurred |

| investors to focus on attractive equity valuations in the context of historically low U.S. and global interest rates. The Federal Reserve announced QE3, an intention to purchase $40 billion of mortgage debt per month, in order to facilitate U.S. growth and employment. For its part, the European Central Bank pledged to buy the sovereign debt of troubled European economies, particularly Spain, if each government agreed to meet certain conditions. Moreover, the U.S. housing recovery continued to pick up steam, with important spillover effects on consumer confidence and the broader economy. |

| |

| There is significant growth taking place all around us. It just isn’t reflected in GDP or industry growth figures, which suffer from being averages, pulled down by the slow-growers and decliners. In building our portfolios, we ignore the averages and hone in on those secular growth themes capable of driving strong multi-year growth regardless of the ups and downs of the economic cycle. On a trailing five-year basis, our portfolio companies have averaged a little over 16% revenue growth, about double the pace of the companies in the Russell Midcap Growth Index. We expect our portfolio companies to exhibit similar growth going forward. |

| |

| The Fund’s investments in the Information Technology (IT) sector delivered most of the contribution to Fund performance for the period. Fund performance was also positively impacted by participation in IPOs, which contributed 2.47% to the Fund’s 12-month returns. There is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs and/or secondary offerings will be the same in the future. |

| |

| IT holding Equinix, Inc. was the leading contributor to Fund performance for the 12-month period. Equinix is a network-neutral operator of state-of-the-art data centers across North America, Europe, and Asia-Pacific. Equinix experienced healthy pricing and demand trends, announced its first share buyback in November, and began considering converting to a real estate investment trust (REIT) in February, a move its Board approved this past September. The possibility of a REIT conversion has probably had the largest impact on Equinix’s share price. REITs typically trade at significantly higher multiples, and investors have revalued Equinix’s shares higher to close that gap. In addition, the growth of wireless data and Internet traffic create a more appealing demand picture for data center operators than for many slower growing, more cyclical REIT businesses. |

| |

| Polypore International, Inc. was the largest detractor to Fund performance for the period. Polypore is a leading producer of microporous membranes that are used in batteries, and in industrial and health care applications including dialysis. Below-expectation sales of electric vehicles hurt Polypore’s lithium-ion separator sales during the period. However, our research indicates that while the market for electric vehicles has been slow to grow, all major manufacturers are committed to selling these types of vehicles. We continue to be positive on the future for electric drive vehicles. |

| |

| We remain focused on finding unique businesses across different segments of the economy that we believe offer long-term secular growth, sustainable competitive advantages, high-quality management teams, and attractive stock prices. We believe that investment returns for stocks are driven by earnings growth, and therefore direct our research towards understanding the drivers of business profit and projecting future profit growth as accurately as we can. |

| |

|

| † | | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| |

| ‡ | | Performance information reflects results of the Retail Shares. |

9

| Baron Fifth Avenue Growth Fund (Unaudited) | | September 30, 2012 |

| |

| |

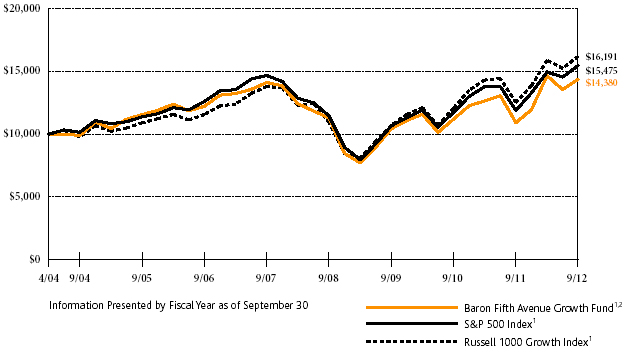

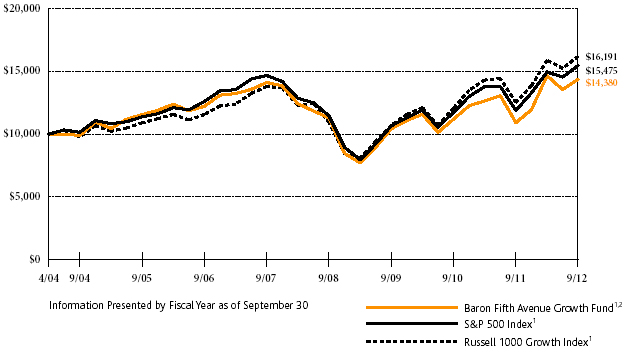

COMPARISON OF THE CHANGE IN VALUE OF $10,000 INVESTMENT IN BARON FIFTH AVENUE GROWTH FUND (RETAIL SHARES)

IN RELATION TO THE S&P 500 INDEX AND THE RUSSELL 1000 GROWTH INDEX |

| | | | | | | | | | | | | | | |

|

| |

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED SEPTEMBER 30, 2012

| | | | | One

Year | | Three

Years | | Five

Years | | Since

Inception

(April 30,

2004) |

| Baron Fifth Avenue Growth Fund — Retail Shares1, 2 | | | | | 31.74 | % | | | 11.31 | % | | | 0.37 | % | | | 4.41 | % |

| Baron Fifth Avenue Growth Fund — Institutional Shares1, 2, 3 | | | | | 32.11 | % | | | 11.57 | % | | | 0.53 | % | | | 4.51 | % |

| S&P 500 Index1 | | | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 5.32 | % |

| Russell 1000 Growth Index1 | | | | | 29.19 | % | | | 14.73 | % | | | 3.24 | % | | | 5.89 | % |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | | The indexes are unmanaged. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies and the Russell 1000® Growth Index of large-sized U.S. companies that are classified as growth. The indexes and the Fund are with dividends, which positively impact the performance results. |

| | | | | | | | | | | | | | | | |

| 2 | | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| | | | | | | | | | | | | | | | |

| 3 | | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

10

| September 30, 2012 (Unaudited) | Baron Fifth Avenue Growth Fund |

| TOP TEN HOLDINGS AS OF SEPTEMBER 30, 2012 |

| | | Percent of | |

| | | Net Assets | |

| Apple, Inc. | | 8.5% | |

| |

| Google, Inc. | | 5.7% | |

| |

| Amazon.com, Inc. | | 5.0% | |

| |

| Equinix, Inc. | | 4.1% | |

| |

| Visa, Inc. | | 3.7% | |

| |

| CME Group, Inc. | | 3.6% | |

| |

| Monsanto Co. | | 3.4% | |

| |

| Brookfield Asset Management, Inc. | | 3.4% | |

| |

| Illumina, Inc. | | 3.3% | |

| |

| Liberty Media Corp. | | 3.2% | |

| | | 43.9% | |

| |

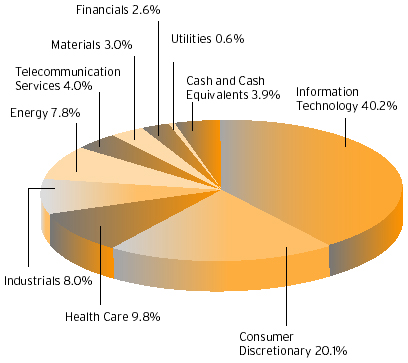

SECTOR BREAKDOWN AS OF SEPTEMBER 30, 2012†

(as a percentage of net assets) |

| |

|

| |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| |

For the 12-month period ended September 30, 2012, Baron Fifth Avenue Growth Fund‡ gained 31.74%, while the S&P 500 Index gained 30.20% and the Russell 1000 Growth Index gained 29.19%.

Alex Umansky became the Fund’s new portfolio manager on November 1, 2011. He has revamped the portfolio while adhering to Baron’s investment philosophy and process. We focus on identifying and investing in unique companies with sustainable competitive |

| advantages that we believe have the ability to redeploy capital at high rates of return. The Fund’s portfolio is constructed on a bottom-up basis, with the quality of ideas and conviction level being the most important determinants of the size of each investment. When we develop high conviction in a particular business, we expect it to have a meaningful weight in the portfolio. We expect top 10 holdings to be in the range of 35% to 45% of the Fund. The Fund’s sector weightings are incidental to portfolio construction, and exposure to any sector is a result of our stock selection. |

| |

| The U.S. equity markets posted strong gains over the last 12 months. These gains were achieved despite heightened concerns over the European debt crisis and China’s economic slowdown. Oil prices also experienced sharp declines in the June quarter. Many individual businesses performed well through this period, as the U.S. economy slowly improved and interest rates remained low. Encouraging news came in September, when the Federal Reserve announced its intention to purchase $40 billion of mortgage debt per month and to keep interest rates low. |

| |

| The Fund’s investments in the Information Technology (IT), Consumer Discretionary, and Industrials sectors were the strongest contributors to performance. There were no sectors that detracted from Fund performance for the period. |

| |

| Apple, Inc., a market-leading innovator, was the leading contributor to Fund performance in the period. Revenues and earnings grew significantly and Apple’s shares hit an all-time high of $702.10 on September 19, driven by the launch of the iPhone 5 on September 21. |

| |

| IT holding Equinix, Inc., a network-neutral operator of data centers, was the second leading contributor to Fund performance. Equinix experienced healthy pricing and demand trends, announced its first share buyback in November, and began considering converting to a real estate investment trust (REIT) in February, a move its Board approved this past September. The possibility of a REIT conversion has probably had the largest impact on Equinix’s share price. REITs typically trade at significantly higher multiples, and investors have revalued Equinix’s shares higher to close that gap. |

| |

Molycorp Inc., owner of the largest rare earth deposits outside of China, was the largest detractor from Fund performance. Rare earths are the 17 metals (or chemical elements), which are necessary for many of today’s new technologies such as hybrid/electric vehicles and turbines. Ninety-seven percent of these elements are located in China, where the government has been reducing export quotas to ensure adequate domestic supply. We underestimated the effect the global economic slowdown would have on rare earth demand and prices. Based on these developments, we exited our position.

The Fund seeks to manage risk by focusing on business risk (competition, management, regulations), valuation risk (purchase price at what we believe provides a large enough margin of safety), financial risk (leverage and capital structure), and analysis risk (our assumptions). Our objective is not to predict how markets may perform in a given year. Instead, we aim to create a portfolio of unique companies with different end markets because, in our experience, this is the best way to manage market risk over time. |

| |

|

| † | | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| |

| ‡ | | Performance information reflects results of the Retail Shares. |

11

| Baron Asset Fund | September 30, 2012 |

| STATEMENT OF NET ASSETS |

| |

| |

| SEPTEMBER 30, 2012 |

| |

| Shares | | | Cost | | | | Value | |

| |

| Common Stocks (97.72%) |

| |

| Consumer Discretionary (24.89%) |

| | | Apparel, Accessories & Luxury Goods (4.11%) | | | | | | | | |

| 325,000 | | Fossil, Inc.1 | | $ | 26,556,203 | | | $ | 27,527,500 | |

| 425,000 | | Ralph Lauren Corp. | | | 7,872,679 | | | | 64,272,750 | |

| | | | | | | | | |

| | | | | | 34,428,882 | | | | 91,800,250 | |

| | | Automotive Retail (0.95%) | | | | | | | | |

| 750,000 | | CarMax, Inc.1 | | | 14,772,082 | | | | 21,225,000 | |

| | | Broadcasting (3.30%) | | | | | | | | |

| 1,000,000 | | Discovery Communications, Inc., Cl A1 | | | 26,436,248 | | | | 59,630,000 | |

| 135,000 | | Liberty Media Corp., Cl A1 | | | 10,649,939 | | | | 14,062,950 | |

| | | | | | | | | |

| | | | | | 37,086,187 | | | | 73,692,950 | |

| | | Casinos & Gaming (2.46%) | | | | | | | | |

| 475,000 | | Wynn Resorts Ltd. | | | 1,577,883 | | | | 54,834,000 | |

| | | Education Services (0.33%) | | | | | | | | |

| 325,000 | | DeVry, Inc. | | | 546,016 | | | | 7,397,000 | |

| | | Hotels, Resorts & Cruise Lines (2.86%) | | | | | | | | |

| 800,000 | | Choice Hotels International, Inc. | | | 3,917,852 | | | | 25,592,000 | |

| 950,000 | | Hyatt Hotels Corp., Cl A1 | | | 27,999,257 | | | | 38,142,500 | |

| | | | | | | | | |

| | | | | | 31,917,109 | | | | 63,734,500 | |

| | | Internet Retail (3.79%) | | | | | | | | |

| 1,102,295 | | HomeAway, Inc.1 | | | 29,580,281 | | | | 25,848,818 | |

| 95,000 | | priceline.com, Inc.1 | | | 15,427,152 | | | | 58,779,350 | |

| | | | | | | | | |

| | | | | | 45,007,433 | | | | 84,628,168 | |

| | | Leisure Facilities (2.58%) | | | | | | | | |

| 1,000,000 | | Vail Resorts, Inc. | | | 19,491,425 | | | | 57,650,000 | |

| | | Specialty Stores (4.51%) | | | | | | | | |

| 800,000 | | Dick’s Sporting Goods, Inc. | | | 21,892,096 | | | | 41,480,000 | |

| 500,000 | | Tiffany & Co. | | | 15,543,940 | | | | 30,940,000 | |

| 285,000 | | Tractor Supply Co. | | | 18,855,913 | | | | 28,183,650 | |

| | | | | | | | | |

| | | | | | 56,291,949 | | | | 100,603,650 | |

| | | | | | | | | |

| Total Consumer Discretionary | | | 241,118,966 | | | | 555,565,518 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Energy (5.49%) |

| | | Oil & Gas Drilling (1.23%) | | | | | | | | |

| 575,000 | | Helmerich & Payne, Inc. | | | 17,283,720 | | | | 27,375,750 | |

| | | Oil & Gas Equipment & Services (2.08%) | | | | | | | | |

| 235,000 | | Core Laboratories N.V.2 | | | 16,127,180 | | | | 28,547,800 | |

| 225,000 | | Oil States International, Inc.1 | | | 15,532,494 | | | | 17,878,500 | |

| | | | | | | | | |

| | | | | | 31,659,674 | | | | 46,426,300 | |

| | | Oil & Gas Exploration & Production (2.18%) | | | | | | | | |

| 264,500 | | Concho Resources, Inc.1 | | | 11,663,100 | | | | 25,061,375 | |

| 500,000 | | Whiting Petroleum Corp.1 | | | 16,936,666 | | | | 23,690,000 | |

| | | | | | | | | |

| | | | | | 28,599,766 | | | | 48,751,375 | |

| | | | | | | | | |

| Total Energy | | | 77,543,160 | | | | 122,553,425 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Financials (12.90%) |

| | | Asset Management & Custody Banks (1.41%) | | | | | | | | |

| 375,000 | | Eaton Vance Corp. | | | 6,710,440 | | | | 10,860,000 | |

| 325,000 | | T. Rowe Price Group, Inc. | | | 7,848,785 | | | | 20,572,500 | |

| | | | | | | | | |

| | | | | | 14,559,225 | | | | 31,432,500 | |

| | | Investment Banking & Brokerage (2.15%) | | | | | | | | |

| 3,750,000 | | The Charles Schwab Corp. | | | 5,193,364 | | | | 47,962,500 | |

| Shares | | | Cost | | | | Value | |

| |

| Common Stocks (continued) |

| |

| Financials (continued) |

| | | Office REITs (1.92%) | | | | | | | | |

| 100,000 | | Alexander’s, Inc.4 | | $ | 4,948,507 | | | $ | 42,749,000 | |

| | | Property & Casualty Insurance (3.36%) | | | | | | | | |

| 1,800,000 | | Arch Capital Group Ltd.1,2 | | | 19,762,437 | | | | 75,024,000 | |

| | | Real Estate Services (1.77%) | | | | | | | | |

| 2,150,000 | | CBRE Group, Inc., Cl A1 | | | 29,247,253 | | | | 39,581,500 | |

| | | Regional Banks (0.69%) | | | | | | | | |

| 450,000 | | First Republic Bank | | | 11,878,902 | | | | 15,507,000 | |

| | | Specialized Finance (1.60%) | | | | | | | | |

| 1,000,000 | | MSCI, Inc.1 | | | 29,310,561 | | | | 35,790,000 | |

| | | | | | | | | |

| Total Financials | | | 114,900,249 | | | | 288,046,500 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Health Care (14.56%) |

| | | Health Care Distributors (1.24%) | | | | | | | | |

| 350,000 | | Henry Schein, Inc.1 | | | 9,382,832 | | | | 27,744,500 | |

| | | Health Care Equipment (5.49%) | | | | | | | | |

| 860,000 | | IDEXX Laboratories, Inc.1 | | | 33,855,475 | | | | 85,441,000 | |

| 75,000 | | Intuitive Surgical, Inc.1 | | | 10,179,705 | | | | 37,172,250 | |

| | | | | | | | | |

| | | | | | 44,035,180 | | | | 122,613,250 | |

| | | Health Care Technology (1.48%) | | | | | | | | |

| 425,000 | | Cerner Corp.1 | | | 20,277,843 | | | | 32,899,250 | |

| | | Life Sciences Tools & Services (4.19%) | | | | | | | | |

| 700,000 | | Illumina, Inc.1 | | | 30,936,268 | | | | 33,740,000 | |

| 350,000 | | Mettler-Toledo International, Inc.1 | | | 23,777,639 | | | | 59,759,000 | |

| | | | | | | | | |

| | | | | | 54,713,907 | | | | 93,499,000 | |

| | | Pharmaceuticals (2.16%) | | | | | | | | |

| 415,000 | | Perrigo Co. | | | 32,939,584 | | | | 48,210,550 | |

| | | | | | | | | |

| Total Health Care | | | 161,349,346 | | | | 324,966,550 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Industrials (15.81%) |

| | | Air Freight & Logistics (1.31%) | | | | | | | | |

| 500,000 | | C.H. Robinson Worldwide, Inc. | | | 9,138,251 | | | | 29,275,000 | |

| | | Diversified Support Services (0.44%) | | | | | | | | |

| 508,873 | | Ritchie Bros.Auctioneers, Inc.2 | | | 11,647,311 | | | | 9,785,628 | |

| | | Electrical Components & Equipment (1.55%) | | | | | | | | |

| 315,000 | | Roper Industries, Inc. | | | 27,132,157 | | | | 34,615,350 | |

| | | Environmental & Facilities Services (1.72%) | | | | | | | | |

| 425,000 | | Stericycle, Inc.1 | | | 12,054,212 | | | | 38,471,000 | |

| | | Industrial Machinery (1.48%) | | | | | | | | |

| 900,000 | | Colfax Corp.1 | | | 28,585,762 | | | | 33,003,000 | |

| | | Research & Consulting Services (6.32%) | | | | | | | | |

| 175,000 | | IHS, Inc., Cl A1 | | | 16,776,265 | | | | 17,036,250 | |

| 1,600,000 | | Nielsen Holdings N.V.1,2 | | | 40,612,243 | | | | 47,968,000 | |

| 1,600,000 | | Verisk Analytics, Inc., Cl A1 | | | 42,492,692 | | | | 76,176,000 | |

| | | | | | | | | |

| | | | | | 99,881,200 | | | | 141,180,250 | |

| | | Trading Companies & Distributors (2.99%) | | | | | | | | |

| 1,550,000 | | Fastenal Co. | | | 28,686,798 | | | | 66,634,500 | |

| | | | | | | | | |

| Total Industrials | | | 217,125,691 | | | | 352,964,728 | |

| | | | | | | | | |

| 12 | | See Notes to Financial Statements. |

| September 30, 2012 | Baron Asset Fund |

| STATEMENT OF NET ASSETS (Continued) |

| |

| |

| SEPTEMBER 30, 2012 |

| |

| | | | | | | | | |

| Shares | | | Cost | | | | Value | |

| |

| Common Stocks (continued) |

| |

| Information Technology (18.84%) |

| | | Application Software (5.80%) | | | | | | | | |

| 800,000 | | ANSYS, Inc.1 | | $ | 26,291,690 | | | $ | 58,720,000 | |

| 525,000 | | FactSet Research Systems, Inc. | | | 28,837,256 | | | | 50,620,500 | |

| 550,000 | | Splunk, Inc.1 | | | 16,126,466 | | | | 20,196,000 | |

| | | | | | | | | |

| | | | | | 71,255,412 | | | | 129,536,500 | |

| | | Data Processing & Outsourced Services (1.46%) | | | | | | | | |

| 725,000 | | FleetCor Technologies, Inc.1 | | | 26,676,932 | | | | 32,480,000 | |

| | | Internet Software & Services (2.02%) | | | | | | | | |

| 250,000 | | LinkedIn Corp., Cl A1 | | | 16,334,647 | | | | 30,100,000 | |

| 225,000 | | Rackspace Hosting, Inc.1 | | | 10,003,387 | | | | 14,870,250 | |

| | | | | | | | | |

| | | | | | 26,338,034 | | | | 44,970,250 | |

| | | IT Consulting & Other Services (8.13%) | | | | | | | | |

| 445,000 | | Equinix, Inc.1,4 | | | 34,821,001 | | | | 91,692,250 | |

| 1,950,000 | | Gartner, Inc.1 | | | 43,568,196 | | | | 89,875,500 | |

| | | | | | | | | |

| | | | | | 78,389,197 | | | | 181,567,750 | |

| | | Systems Software (1.43%) | | | | | | | | |

| 650,000 | | MICROS Systems, Inc.1 | | | 31,951,081 | | | | 31,928,000 | |

| | | | | | | | | |

| Total Information Technology | | | 234,610,656 | | | | 420,482,500 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Materials (1.29%) |

| | | Industrial Gases (1.29%) | | | | | | | | |

| 350,000 | | Airgas, Inc. | | | 23,451,908 | | | | 28,805,000 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Telecommunication Services (3.94%) |

| | | Wireless Telecommunication Services (3.94%) | | | | | | | | |

| 1,400,000 | | SBA Communications Corp., Cl A1 | | | 45,258,201 | | | | 88,060,000 | |

| | | | | | | | | |

| Total Common Stocks | | | 1,115,358,177 | | | | 2,181,444,221 | |

| | | | | | | | | |

| | | | | | | | | | | |

| |

| Private Equity Investments (1.46%) |

| |

| Consumer Discretionary (0.40%) |

| | | Hotels, Resorts & Cruise Lines (0.40%) | | | | | | | | |

| 5,200,000 | | Kerzner International Holdings Ltd., Cl A1,2,3,4,6 | | | 52,000,000 | | | | 8,944,000 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Financials (1.06%) |

| | | Asset Management & Custody Banks (1.06%) | | | | | | | | |

| 7,056,223 | | Windy City Investments Holdings, L.L.C.1,3,4,6 | | | 34,581,904 | | | | 23,708,908 | |

| | | | | | | | | |

| Total Private Equity Investments | | | 86,581,904 | | | | 32,652,908 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Principal | | | | | | | | |

| Amount | | | Cost | | | | Value | |

| |

| Short Term Investments (1.27%) |

| |

| $28,268,278 | | Repurchase Agreement with | | | | | | | | |

| | | Fixed Income Clearing Corp., | | | | | | | | |

| | | dated 9/28/2012, 0.01% due | | | | | | | | |

| | | 10/1/2012; Proceeds at | | | | | | | | |

| | | maturity - $28,268,301; (Fully | | | | �� | | | | |

| | | collateralized by $28,200,000 | | | | | | | | |

| | | U.S. Treasury Note, 1.75% | | | | | | | | |

| | | due 5/15/2022; | | | | | | | | |

| | | Market value - $28,834,500)5 | | $ | 28,268,278 | | | $ | 28,268,278 | |

| | | | | | | | | |

| Total Investments (100.45%) | | $ | 1,230,208,359 | | | | 2,242,365,407 | |

| | | | | | | | | | |

| Liabilities Less Cash and Other Assets (-0.45%) | | | | | | | (10,035,953 | ) |

| | | | | | | | | | |

| Net Assets | | | | | | $ | 2,232,329,454 | |

| | | | | | | | | | |

| Retail Shares (Equivalent to $52.03 per share | | | | | | | | |

based on 35,470,011 shares outstanding) | | | | | | $ | 1,845,659,948 | |

| | | | | | | | | | |

| Institutional Shares (Equivalent to $52.55 | | | | | | | | |

per share based on 7,357,842 shares | | | | | | | | |

outstanding) | | | | | | $ | 386,669,506 | |

| | | | | | | | | | |

| | |

| % | | Represents percentage of net assets. |

| 1 | | Non-income producing securities. |

| 2 | | Foreign corporation. |

| 3 | | At September 30, 2012, the market value of restricted and fair valued securities amounted to $32,652,908 or 1.46% of net assets. None of these securities are deemed liquid. See Note 6 regarding Restricted Securities. |

| 4 | | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 5 | | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 6 | | Level 3 security. See Note 7 regarding Fair Value Measurements. |

| | | | |

| | | All securities are Level 1, unless otherwise noted. |

| See Notes to Financial Statements. | | 13 |

| Baron Growth Fund | September 30, 2012 |

| STATEMENT OF NET ASSETS |

| |

| |

| SEPTEMBER 30, 2012 |

| |

| Shares | | | | | Cost | | | | Value | |

| Common Stocks (96.06%) | | | | | | | | |

| Consumer Discretionary (22.20%) | | | | | | | | |

| | | Apparel Retail (0.57%) | | | | | | | | |

| 1,464,900 | | Cia. Hering SA (Brazil)2 | | $ | 21,638,953 | | | $ | 33,116,965 | |

| | | Apparel, Accessories & Luxury Goods (2.54%) | | | | | | | | |

| 2,650,000 | | Under Armour, Inc., Cl A1 | | | 42,798,596 | | | | 147,949,500 | |

| | | Automotive Retail (0.39%) | | | | | | | | |

| 750,000 | | Penske Automotive Group, Inc. | | | 13,032,060 | | | | 22,567,500 | |

| | | Casinos & Gaming (2.59%) | | | | | | | | |

| 2,000,000 | | Ameristar Casinos, Inc.4 | | | 37,023,539 | | | | 35,600,000 | |

| 2,669,200 | | Penn National Gaming, Inc.1 | | | 75,092,649 | | | | 115,042,520 | |

| | | | | | | | | |

| | | | | | 112,116,188 | | | | 150,642,520 | |

| | | Distributors (2.67%) | | | | | | | | |

| 8,400,000 | | LKQ Corp.1 | | | 55,029,388 | | | | 155,400,000 | |

| | | Education Services (1.59%) | | | | | | | | |

| 3,275,000 | | DeVry, Inc.4 | | | 53,578,543 | | | | 74,539,000 | |

| 282,426 | | Strayer Education, Inc. | | | 18,872,932 | | | | 18,174,113 | |

| | | | | | | | | |

| | | | | | 72,451,475 | | | | 92,713,113 | |

| | | Home Improvement Retail (1.03%) | | | | | | | | |

| 1,180,000 | | Lumber Liquidators Holdings, Inc.1 | | | 27,982,186 | | | | 59,802,400 | |

| | | Hotels, Resorts & Cruise Lines (2.06%) | | | | | | | | |

| 3,007,500 | | Choice Hotels International, Inc.4 | | | 74,341,448 | | | | 96,209,925 | |

| 1,258,504 | | Interval Leisure Group, Inc. | | | 22,148,090 | | | | 23,823,481 | |

| | | | | | | | | |

| | | | | | 96,489,538 | | | | 120,033,406 | |

| | | Internet Retail (0.10%) | | | | | | | | |

| 150,000 | | Blue Nile, Inc.1 | | | 3,719,156 | | | | 5,563,500 | |

| | | Leisure Facilities (2.26%) | | | | | | | | |

| 2,005,750 | | Vail Resorts, Inc.4 | | | 56,368,636 | | | | 115,631,487 | |

| 1,333,700 | | Whistler Blackcomb Holdings, Inc. (Canada) 2 | | | 15,242,539 | | | | 15,669,042 | |

| | | | | | | | | |

| | | | | | 71,611,175 | | | | 131,300,529 | |

| | | Publishing (1.34%) | | | | | | | | |

| 1,250,000 | | Morningstar, Inc. | | | 27,384,748 | | | | 78,300,000 | |

| | | Restaurants (1.32%) | | | | | | | | |

| 450,000 | | Panera Bread Co., Cl A1 | | | 15,602,751 | | | | 76,900,500 | |

| | | Specialty Stores (3.74%) | | | | | | | | |

| 4,200,000 | | Dick’s Sporting Goods, Inc. | | | 71,202,267 | | | | 217,770,000 | |

| | | | | | | | | |

Total Consumer Discretionary | | | 631,058,481 | | | | 1,292,059,933 | |

| | | | | | | | | |

| | | | | | | | | | | |

Consumer Staples (4.75%) | | | | | | | | |

| | | Food Distributors (2.04%) | | | | | | | | |

| 2,032,844 | | United Natural Foods, Inc.1 | | | 86,173,290 | | | | 118,819,732 | |

| | | Household Products (1.39%) | | | | | | | | |

| 1,500,000 | | Church & Dwight Co., Inc. | | | 27,340,828 | | | | 80,985,000 | |

| | | Packaged Foods & Meats (1.32%) | | | | | | | | |

| 500,000 | | Dole Food Company, Inc.1 | | | 5,824,595 | | | | 7,015,000 | |

| 1,325,000 | | TreeHouse Foods, Inc.1 | | | 52,766,413 | | | | 69,562,500 | |

| | | | | | | | | |

| | | | | | 58,591,008 | | | | 76,577,500 | |

| | | | | | | | | |

| Total Consumer Staples | | | 172,105,126 | | | | 276,382,232 | |

| | | | | | | | | |

| Shares | | | | | Cost | | | | Value | |

| Common Stocks (continued) | | | | | | | | |

| Energy (6.19%) | | | | | | | | |

| | | Coal & Consumable Fuels (0.11%) | | | | | | | | |

| 1,150,000 | | Ceres, Inc.1 | | $ | 14,950,000 | | | $ | 6,532,000 | |

| | | Oil & Gas Drilling (0.74%) | | | | | | | | |

| 900,000 | | Helmerich & Payne, Inc. | | | 20,239,977 | | | | 42,849,000 | |

| | | Oil & Gas Equipment & Services (3.60%) | | | | | | | | |

| 694,500 | | CARBO Ceramics, Inc. | | | 45,852,022 | | | | 43,697,940 | |

| 800,000 | | Core Laboratories N.V.2 | | | 19,051,024 | | | | 97,184,000 | |

| 825,000 | | SEACOR Holdings, Inc.1 | | | 53,205,863 | | | | 68,772,000 | |

| | | | | | | | | |

| | | | | | 118,108,909 | | | | 209,653,940 | |

| | | Oil & Gas Exploration & Production (0.68%) | | | | | | | | |

| 500,000 | | Denbury Resources, Inc.1 | | | 2,806,886 | | | | 8,080,000 | |

| 247,191 | | Oasis Petroleum, Inc.1 | | | 3,460,674 | | | | 7,284,719 | |

| 450,000 | | SM Energy Co. | | | 15,049,961 | | | | 24,349,500 | |

| | | | | | | | | |

| | | | | | 21,317,521 | | | | 39,714,219 | |

| | | Oil & Gas Storage & Transportation (1.06%) | | | | | | | | |

| 1,228,082 | | Targa Resources Corp. | | | 37,352,560 | | | | 61,821,648 | |

| | | | | | | | | |

Total Energy | | | 211,968,967 | | | | 360,570,807 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Financials (15.25%) | | | | | | | | |

| | | Asset Management & Custody Banks (3.90%) | | | | | | | | |

| 1,994,899 | | The Carlyle Group LP | | | 43,767,989 | | | | 52,346,150 | |

| 2,016,034 | | Cohen & Steers, Inc. | | | 55,133,349 | | | | 59,714,927 | |

| 1,450,000 | | Eaton Vance Corp. | | | 25,648,439 | | | | 41,992,000 | |

| 1,199,681 | | Financial Engines, Inc.1 | | | 18,866,956 | | | | 28,588,398 | |

| 610,000 | | Manning & Napier, Inc. | | | 7,338,907 | | | | 7,435,900 | |

| 903,253 | | Oaktree Capital Group, LLC | | | 37,686,392 | | | | 37,033,373 | |

| | | | | | | | | |

| | | | | | 188,442,032 | | | | 227,110,748 | |

| | | Diversified REITs (0.33%) | | | | | | | | |

| 712,000 | | American Assets Trust, Inc. | | | 14,309,605 | | | | 19,074,480 | |

| | | Investment Banking & Brokerage (0.17%) | | | | | | | | |

| 700,000 | | Jefferies Group, Inc. | | | 6,723,959 | | | | 9,583,000 | |

| | | Life & Health Insurance (1.13%) | | | | | | | | |

| 2,300,000 | | Primerica, Inc. | | | 50,679,918 | | | | 65,872,000 | |

| | | Office REITs (2.34%) | | | | | | | | |

| 135,000 | | Alexander’s, Inc.5 | | | 28,435,048 | | | | 57,711,150 | |

| 3,400,000 | | Douglas Emmett, Inc. | | | 47,518,561 | | | | 78,438,000 | |

| | | | | | | | | |

| | | | | | 75,953,609 | | | | 136,149,150 | |

| | | Property & Casualty Insurance (3.01%) | | | | | | | | |

| 4,200,000 | | Arch Capital Group Ltd.1,2 | | | 41,487,457 | | | | 175,056,000 | |

| | | Real Estate Services (0.36%) | | | | | | | | |

| 497,568 | | Zillow, Inc., Cl A1 | | | 13,879,991 | | | | 20,987,418 | |

| | | Residential REITs (0.47%) | | | | | | | | |

| 625,000 | | American Campus Communities, Inc. | | | 17,129,104 | | | | 27,425,000 | |

| | | Specialized Finance (2.15%) | | | | | | | | |

| 3,500,000 | | MSCI, Inc.1 | | | 75,747,280 | | | | 125,265,000 | |

| | | Specialized REITs (1.39%) | | | | | | | | |

| 775,000 | | Alexandria Real Estate Equities, Inc.5 | | | 29,669,521 | | | | 56,978,000 | |

| 900,000 | | LaSalle Hotel Properties | | | 20,685,153 | | | | 24,021,000 | |

| | | | | | | | | |

| | | | | | 50,354,674 | | | | 80,999,000 | |

| | | | | | | | | |

| Total Financials | | | 534,707,629 | | | | 887,521,796 | |

| | | | | | | | | |

| 14 | | See Notes to Financial Statements. |

| September 30, 2012 | Baron Growth Fund |

| STATEMENT OF NET ASSETS (Continued) |

| |

| |

| SEPTEMBER 30, 2012 |

| |

| Shares | | | | | Cost | | | | Value | |

| Common Stocks (continued) | | | | | | | | |

| Health Care (9.19%) | | | | | | | | |

| | | Health Care Equipment (2.46%) | | | | | | | | |

| 500,000 | | Edwards Lifesciences Corp.1 | | $ | 6,708,289 | | | $ | 53,685,000 | |

| 900,000 | | IDEXX Laboratories, Inc.1 | | | 28,558,026 | | | | 89,415,000 | |

| | | | | | | | | |

| | | | | | 35,266,315 | | | | 143,100,000 | |

| | | Health Care Facilities (2.40%) | | | | | | | | |

| 300,000 | | Brookdale Senior Living, Inc.1 | | | 5,976,500 | | | | 6,966,000 | |

| 4,400,000 | | Community Health Systems, Inc.1 | | | 87,741,084 | | | | 128,216,000 | |

| 225,000 | | VCA Antech, Inc.1 | | | 4,667,365 | | | | 4,439,250 | |

| | | | | | | | | |

| | | | | | 98,384,949 | | | | 139,621,250 | |

| | | Health Care Services (0.12%) | | | | | | | | |

| 150,000 | | IPC The Hospitalist Co., Inc.1 | | | 3,121,417 | | | | 6,855,000 | |

| | | Health Care Supplies (0.13%) | | | | | | | | |

| 175,000 | | Neogen Corp.1 | | | 3,887,774 | | | | 7,472,500 | |

| | | Health Care Technology (0.08%) | | | | | | | | |

| 50,000 | | athenahealth, Inc.1 | | | 2,445,038 | | | | 4,588,500 | |

| | | Life Sciences Tools & Services (2.77%) | | | | | | | | |

| 575,000 | | Mettler-Toledo International, Inc.1 | | | 29,177,373 | | | | 98,175,500 | |

| 880,943 | | TECHNE Corp. | | | 46,631,249 | | | | 63,375,039 | |

| | | | | | | | | |

| | | | | | 75,808,622 | | | | 161,550,539 | |

| | | Pharmaceuticals (1.23%) | | | | | | | | |

| 3,037,400 | | CFR Pharmaceuticals SA,144A, ADR2,6 | | | 70,243,684 | | | | 71,713,014 | |

| | | | | | | | | |

Total Health Care | | | 289,157,799 | | | | 534,900,803 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Industrials (12.72%) | | | | | | | | |

| | | Diversified Support Services (1.90%) | | | | | | | | |

| 4,000,000 | | Copart, Inc.1 | | | 49,463,498 | | | | 110,920,000 | |

| | | Electrical Components & Equipment (1.33%) | | | | | | | | |

| 3,380,000 | | Generac Holdings, Inc.1 | | | 29,374,310 | | | | 77,368,200 | |

| | | Environmental & Facilities Services (0.45%) | | | | | | | | |

| 1,000,000 | | Tetra Tech, Inc.1 | | | 20,855,699 | | | | 26,260,000 | |

| | | Industrial Machinery (4.05%) | | | | | | | | |

| 2,315,480 | | Colfax Corp.1 | | | 53,608,386 | | | | 84,908,652 | |

| 850,000 | | The Middleby Corp.1 | | | 74,456,718 | | | | 98,294,000 | |

| 400,000 | | Valmont Industries, Inc. | | | 32,589,034 | | | | 52,600,000 | |

| | | | | | | | | |

| | | | | | 160,654,138 | | | | 235,802,652 | |

| | | Railroads (2.30%) | | | | | | | | |

| 2,000,000 | | Genesee & Wyoming, Inc., Cl A1 | | | 32,221,169 | | | | 133,720,000 | |

| | | Research & Consulting Services (0.87%) | | | | | | | | |

| 375,000 | | IHS, Inc., Cl A1 | | | 15,320,116 | | | | 36,506,250 | |

| 600,000 | | Mistras Group, Inc.1 | | | 7,563,468 | | | | 13,920,000 | |

| | | | | | | | | |

| | | | | | 22,883,584 | | | | 50,426,250 | |

| | | Trading Companies & Distributors (1.44%) | | | | | | | | |

| 2,500,000 | | Air Lease Corp.1 | | | 59,847,177 | | | | 51,000,000 | |

| 485,000 | | MSC Industrial Direct Co., Inc. Cl A | | | 17,282,737 | | | | 32,718,100 | |

| | | | | | | | | |

| | | | | | 77,129,914 | | | | 83,718,100 | |

| | | Trucking (0.38%) | | | | | | | | |

| 475,000 | | Landstar System, Inc. | | | 11,073,375 | | | | 22,458,000 | |

| | | | | | | | | |

| Total Industrials | | | 403,655,687 | | | | 740,673,202 | |

| | | | | | | | | |

| Shares | | | | | Cost | | | | Value | |

| Common Stocks (continued) | | | | | | | | |

| Information Technology (21.52%) | | | | | | | | |

| | | Application Software (10.15%) | | | | | | | | |

| 2,000,000 | | Advent Software, Inc.1 | | $ | 41,747,215 | | | $ | 49,140,000 | |

| 2,200,000 | | ANSYS, Inc.1 | | | 53,447,672 | | | | 161,480,000 | |

| 825,000 | | Concur Technologies, Inc.1 | | | 18,214,873 | | | | 60,827,250 | |

| 1,600,000 | | FactSet Research Systems, Inc. | | | 80,624,740 | | | | 154,272,000 | |

| 500,000 | | Guidewire Software, Inc.1 | | | 13,062,157 | | | | 15,525,000 | |

| 1,600,000 | | Pegasystems, Inc. | | | 49,240,202 | | | | 46,464,000 | |

| 1,125,000 | | RealPage, Inc.1 | | | 27,700,372 | | | | 25,425,000 | |

| 3,087,713 | | SS&C Technologies Holdings, Inc.1 | | | 52,369,849 | | | | 77,841,245 | |

| | | | | | | | | |

| | | | | | 336,407,080 | | | | 590,974,495 | |

| | | Electronic Equipment & Instruments (0.60%) | | | | | | | | |

| 650,000 | | FEI Company | | | 24,367,636 | | | | 34,775,000 | |

| | | Internet Software & Services (1.63%) | | | | | | | | |

| 999,653 | | CoStar Group, Inc.1 | | | 44,116,616 | | | | 81,511,706 | |

| 728,366 | | LivePerson, Inc.1 | | | 10,597,891 | | | | 13,190,708 | |

| | | | | | | | | |

| | | | | | 54,714,507 | | | | 94,702,414 | |

| | | IT Consulting & Other Services (6.30%) | | | | | | | | |

| 5,608,007 | | Booz Allen Hamilton Holding Corp. | | | 78,341,564 | | | | 77,670,897 | |

| 325,000 | | Equinix, Inc.1,5 | | | 9,364,597 | | | | 66,966,250 | |

| 2,850,000 | | Gartner, Inc.1 | | | 45,787,107 | | | | 131,356,500 | |

| 1,525,000 | | MAXIMUS, Inc. | | | 58,567,377 | | | | 91,073,000 | |

| | | | | | | | | |

| | | | | | 192,060,645 | | | | 367,066,647 | |

| | | Semiconductor Equipment (1.42%) | | | | | | | | |

| 1,615,769 | | Cymer, Inc.1,4 | | | 80,921,954 | | | | 82,501,165 | |

| | | Systems Software (1.42%) | | | | | | | | |

| 3,975,000 | | TOTVS SA (Brazil)2 | | | 54,339,175 | | | | 82,568,627 | |

| | | | | | | | | |

Total Information Technology | | | 742,810,997 | | | | 1,252,588,348 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Materials (0.57%) | | | | | | | | |

| | | Construction Materials (0.22%) | | | | | | | | |

| 898,903 | | CaesarStone Sdot-Yam Ltd.1,2 | | | 10,091,500 | | | | 12,674,532 | |

| | | Fertilizers & Agricultural Chemicals (0.35%) | | | | | | | | |

| 1,476,518 | | Agrinos AS (Mexico)1,2 | | | 11,031,310 | | | | 11,597,918 | |

| 425,000 | | Intrepid Potash, Inc.1 | | | 12,327,019 | | | | 9,129,000 | |

| | | | | | | | | |

| | | | | | 23,358,329 | | | | 20,726,918 | |

| | | | | | | | | |

Total Materials | | | 33,449,829 | | | | 33,401,450 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Telecommunication Services (0.76%) | | | | | | | | |

| | | Wireless Telecommunication Services (0.76%) | | | | | | | | |

| 700,000 | | SBA Communications Corp., Cl A1 | | | 2,584,866 | | | | 44,030,000 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Utilities (2.91%) | | | | | | | | |

| | | Electric Utilities (2.91%) | | | | | | | | |

| 2,245,000 | | ITC Holdings Corp. | | | 69,683,650 | | | | 169,677,100 | |

| | | | | | | | | |

| Total Common Stocks | | | 3,091,183,031 | | | | 5,591,805,671 | |

| | | | | | | | | |

| See Notes to Financial Statements. | | 15 |

| Baron Growth Fund | September 30, 2012 |

| STATEMENT OF NET ASSETS (Continued) |

| |

| |

| SEPTEMBER 30, 2012 |

| |

| Shares | | | | | Cost | | | | Value | |

| Private Equity Investments (0.82%) | | | | | | | | |

| Consumer Discretionary (0.22%) | | | | | | | | |

| | | Hotels, Resorts & Cruise Lines (0.22%) | | | | | | | | |

| 7,400,000 | | Kerzner International Holdings Ltd., Cl A1,2,3,5,7 | | $ | 74,000,000 | | | $ | 12,728,000 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Financials (0.14%) | | | | | | | | |

| | | Asset Management & Custody Banks (0.14%) | | | | | | | | |

| 2,375,173 | | Windy City Investments Holdings, L.L.C.1,3,5,7 | | | 8,630,998 | | | | 7,980,583 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Health Care (0.09%) | | | | | | | | |

| | | Health Care Technology (0.09%) | | | | | | | | |

| 828,286 | | Castlight Health, Inc.1,3,5,7 | | | 4,999,998 | | | | 4,999,998 | |

| | | | | | | | | |

| | | | | | | | | | | |

| Utilities (0.37%) | | | | | | | | |

| | | Independent Power Producers & Energy Traders (0.37%) | | | | | | | | |

| 4,811,674 | | Better Place, Inc., Series C Preferred1,2,3,5,7 | | | 21,845,000 | | | | 21,845,000 | |

| | | | | | | | | |

Total Private Equity Investments | | | 109,475,996 | | | | 47,553,581 | |

| | | | | | | | | |

| | | | | | | | | | | |

| | |

| Principal | | | | | | | | |

| Amount | | | | | | | | |

| | |

| Short Term Investments (3.73%) | | | | | | | | |

| | |

| $217,095,122 | | Repurchase Agreement with Fixed Income Clearing Corp., dated 9/28/2012, 0.01% due 10/1/2012; Proceeds at maturity - $217,095,303; (Fully collateralized by $212,815,000 U.S. Treasury Note, 1.25% due 4/30/2019; Market value - $218,135,375 and $3,135,000 U.S. Treasury Note, 2.00% due 11/15/2021; Market value - $3,301,697)6 | | | 217,095,122 | | | | 217,095,122 | |

| | | | | | | | | |

| Total Investments (100.61%) | | $ | 3,417,754,149 | | | | 5,856,454,374 | |

| | | | | | | | | | |

| Liabilities Less Cash and Other Assets (-0.61%) | | | | | | | (35,682,281 | ) |

| | | | | | | | | | |

| Net Assets | | | | | | $ | 5,820,772,093 | |

| | | | | | | | | | |

Retail Shares (Equivalent to $58.19 per share based on 70,002,569 shares outstanding) | | | | | | $ | 4,073,520,668 | |

| | | | | | | | | | |

Institutional Shares (Equivalent to $58.70 per share based on 29,764,909 shares outstanding) | | | | | | $ | 1,747,251,425 | |

| | | | | | | | | | |

| | |

| % | | Represents percentage of net assets. |

| 1 | | Non-income producing securities. |

| 2 | | Foreign corporation. |

| 3 | | At September 30, 2012, the market value of restricted and fair valued securities amounted to $47,553,581 or 0.82% of net assets. None of these securities are deemed liquid. See Note 6 regarding Restricted Securities. |

| 4 | | See Note 9 regarding “Affiliated” companies. |

| 5 | | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 6 | | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 7 | | Level 3 security. See Note 7 regarding Fair Value Measurements. |

| ADR | | American Depositary Receipt. |

| 144A | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to policies and procedures approved by the Board of Trustees, unless otherwise noted. At September 30, 2012, the market value of Rule 144A securities amounted to $71,713,014 or 1.23% of net assets. |

| | | |

| | | All securities are Level 1, unless otherwise noted. |

| 16 | | See Notes to Financial Statements. |

| September 30, 2012 | Baron Small Cap Fund |

| STATEMENT OF NET ASSETS |

| |

| |

| SEPTEMBER 30, 2012 |

| |

| Shares | | | | | Cost | | | | Value | |

| Common Stocks (96.66%) | | | | | | | | |

| Consumer Discretionary (22.37%) | | | | | | | | |

| | | Advertising (0.78%) | | | | | | | | |

| 2,000,000 | | National CineMedia, Inc. | | $ | 33,889,974 | | | $ | 32,740,000 | |

| | | Apparel, Accessories & Luxury Goods (4.09%) | | | | | | | | |

| 750,000 | | Fossil, Inc.1 | | | 18,631,305 | | | | 63,525,000 | |

| 2,800,000 | | Iconix Brand Group, Inc.1 | | | 42,475,669 | | | | 51,072,000 | |

| 6,500,000 | | Quiksilver, Inc.1 | | | 21,245,177 | | | | 21,580,000 | |

| 1,500,000 | | Tumi Holdings, Inc.1 | | | 29,373,217 | | | | 35,310,000 | |

| | | | | | | | | |

| | | | | | 111,725,368 | | | | 171,487,000 | |

| | | Broadcasting (3.10%) | | | | | | | | |

| 1,250,000 | | Liberty Media Corp., Cl A1 | | | 18,535,651 | | | | 130,212,500 | |

| | | Casinos & Gaming (4.11%) | | | | | | | | |

| 3,064,000 | | Penn National Gaming, Inc.1 | | | 79,972,017 | | | | 132,058,400 | |

| 350,000 | | Wynn Resorts Ltd. | | | 3,263,528 | | | | 40,404,000 | |

| | | | | | | | | |

| | | | | | 83,235,545 | | | | 172,462,400 | |

| | | Education Services (0.46%) | | | | | | | | |

| 300,000 | | Strayer Education, Inc. | | | 25,970,513 | | | | 19,305,000 | |

| | | Footwear (0.66%) | | | | | | | | |

| 1,700,000 | | Crocs, Inc.1 | | | 30,966,021 | | | | 27,557,000 | |

| | | Home Improvement Retail (1.39%) | | | | | | | | |

| 1,150,000 | | Lumber Liquidators Holdings, Inc.1 | | | 24,079,432 | | | | 58,282,000 | |

| | | Homefurnishing Retail (0.84%) | | | | | | | | |

| 1,250,000 | | Mattress Firm Holding Corp.1 | | | 30,943,654 | | | | 35,187,500 | |

| | | Hotels, Resorts & Cruise Lines (0.59%) | | | | | | | | |

| 17,028,000 | | Mandarin Oriental Int’l Ltd. (Singapore)2 | | | 34,275,510 | | | | 24,605,460 | |

| | | Internet Retail (1.61%) | | | | | | | | |

| 2,000,000 | | HomeAway, Inc.1 | | | 48,464,917 | | | | 46,900,000 | |

| 3,035,227 | | Vitacost.com, Inc.1,4 | | | 28,626,533 | | | | 20,578,839 | |

| | | | | | | | | |

| | | | | | 77,091,450 | | | | 67,478,839 | |

| | | Movies & Entertainment (1.44%) | | | | | | | | |