| | | | |

OMB APPROVAL |

| OMB Number: | | 3235-0570 |

| Expires: | | June 30, 2017 |

| Estimated average burden |

Hours per response | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5032

BARON INVESTMENT FUNDS TRUST f/k/a

BARON ASSET FUND

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Investment Funds Trust

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code): 212-583-2000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 5th Street, NW, Washington, D.C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

SEC 2569 (5-07)

Item 1. Report to Stockholders.

Baron Asset Fund

Baron Growth Fund

Baron Small Cap Fund

Baron Opportunity Fund

Baron Fifth Avenue Growth Fund

Baron Discovery Fund

March 31, 2017

Baron Funds®

Semi-Annual Financial Report

DEAR BARON FUNDS SHAREHOLDER:

In this report, you will find unaudited financial statements for Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund and Baron Discovery Fund (the “Funds”) for the six months ended March 31, 2017. The U.S. Securities and Exchange Commission (the “SEC”) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer and Chief Investment Officer May 19, 2017 | | Linda S. Martinson Chairman, President and Chief Operating Officer May 19, 2017 | | Peggy Wong Treasurer and Chief Financial Officer May 19, 2017 |

This Semi-Annual Financial Report is for the Baron Investment Funds Trust, which currently has six series: Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund and Baron Discovery Fund. If you are interested in the Baron Select Funds, which contains the Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Energy and Resources Fund and Baron Global Advantage Fund series, please visit the Funds’ website at www.BaronFunds.com or contact us at 1-800-99BARON.

The Funds’ Proxy Voting Policy is available without charge and can be found on the Funds’ website at www.BaronFunds.com, by clicking on the “Legal Notices” link at the bottom left corner of the homepage or by calling 1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Funds’ Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-202-551-8090. A copy of the Funds’ Forms N-Q may also be obtained upon request by calling 1-800-99BARON. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website.

Some of the comments contained in this report are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan” and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to www.BaronFunds.com for a prospectus or summary prospectus. Read them carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus or summary prospectus.

| | |

| Baron Asset Fund (Unaudited) | | March 31, 2017 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON ASSET FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2017 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(June 12,

1987) | |

Baron Asset Fund — Retail Shares1,2 | | | 10.08% | | | | 18.82% | | | | 8.34% | | | | 12.37% | | | | 7.25% | | | | 11.23% | |

Baron Asset Fund — Institutional Shares1,2,4 | | | 10.24% | | | | 19.15% | | | | 8.64% | | | | 12.69% | | | | 7.48% | | | | 11.31% | |

Baron Asset Fund — R6 Shares1,2,4 | | | 10.22% | | | | 19.13% | | | | 8.63% | | | | 12.68% | | | | 7.48% | | | | 11.31% | |

Russell Midcap Growth Index1 | | | 7.38% | | | | 14.07% | | | | 7.88% | | | | 11.95% | | | | 8.13% | | | | 9.83% | 3 |

S&P 500 Index1 | | | 10.12% | | | | 17.17% | | | | 10.37% | | | | 13.30% | | | | 7.51% | | | | 9.59% | |

| 1 | The indexes are unmanaged. The Russell MidcapTM Growth Index measures the performance of medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | For the period June 30, 1987 to March 31, 2017. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| | |

| March 31, 2017 (Unaudited) | | Baron Asset Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2017

| | | | |

| | | Percent of Net Assets | |

IDEXX Laboratories, Inc. | | | 6.7% | |

Gartner, Inc. | | | 6.2% | |

Vail Resorts, Inc. | | | 5.2% | |

Arch Capital Group Ltd. | | | 4.5% | |

Mettler-Toledo International, Inc. | | | 4.5% | |

Verisk Analytics, Inc. | | | 3.9% | |

The Charles Schwab Corp. | | | 3.7% | |

FactSet Research Systems, Inc. | | | 2.7% | |

SBA Communications Corp. | | | 2.6% | |

Guidewire Software, Inc. | | | 2.6% | |

| | | | 42.6% | |

SECTOR BREAKDOWNASOF MARCH 31, 2017†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six-month period ended March 31, 2017, Baron Asset Fund1 increased 10.08%, while the Russell Midcap Growth Index gained 7.38% and the S&P 500 Index gained 10.12%.

Baron Asset Fund invests primarily in medium-sized growth companies for the long term, using a value-oriented purchase discipline. The Fund purchases companies that we believe have sustainable competitive advantages, strong financial characteristics, and exceptional management; and operate in industries with favorable growth characteristics.

The market’s reaction to the November 8 U.S. presidential election results dominated the period. After moving mostly sideways in September and October, equities embarked on a strong rally in early November, with major U.S. stock indexes establishing record highs in the period. Beneath the surface, the market experienced a significant rotation among sectors and investment approaches. Initially, the market responded to the possibility that the policies of a Trump administration would lead to increased infrastructure spending, higher inflation, higher interest rates, lower corporate taxes, and ultimately accelerated economic growth. Financials acted best, as those businesses benefit from higher interest rates. Industrials and Energy sectors rose as presumed beneficiaries of faster growth. Value outpaced growth. Early in 2017, leaders and laggards swapped positions. Information Technology, Health Care, and Consumer Discretionary led the markets, taking over from the prior sector leaders. In a reversal of the first half of the six-month period, growth stocks also outperformed value stocks.

The Fund’s investments in Health Care, Financials, and Consumer Discretionary contributed the most to performance. The Telecommunication Services and Energy sectors were modest detractors in the period.

Veterinary diagnostics leader IDEXX Laboratories, Inc. was the top contributor. The stock rallied on strong financial results and multiple expansion throughout the six-month period. Competitive trends are strong and improving, highlighted by instrument revenue growth, domestic lab growth, rising sales productivity, and stability in rapid assays. We believe that IDEXX’s direct go-to-market model coupled with research and development-driven product enhancements will put steady upward pressure on organic revenue and earnings growth over time.

The top detractor was FleetCor Technologies, Inc. Shares of this global payment processing services provider fell on disappointing results and a modest reduction in revenue guidance. Investors expected an acceleration in the second half of 2016, but organic growth modestly decelerated. Sentiment was also hit after a large contract loss and intensifying forex market headwinds. We expect these headwinds to abate and strong earnings growth to persist.

We continue to believe that mid-sized growth stocks represent an attractive investment opportunity. The U.S. economy remains among the world’s healthiest, its equity market multiples remain within the range of their long-term historic averages, and interest rates continue to be quite low by historic standards. We believe our diversified portfolio of fast growing, well managed, competitively advantaged businesses will continue to perform well in this environment. There is, of course, no guarantee that this will be the case.

| † | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

3

| | |

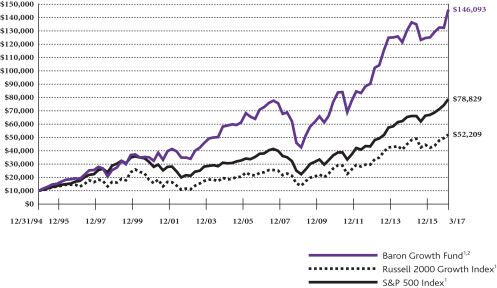

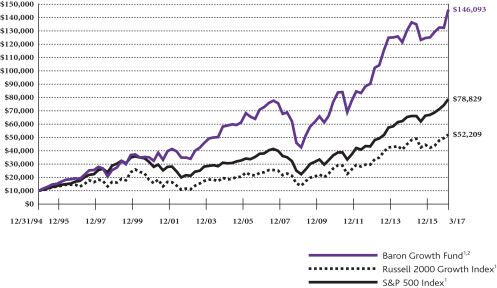

| Baron Growth Fund (Unaudited) | | March 31, 2017 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2017 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

1994) | |

Baron Growth Fund — Retail Shares1,2 | | | 10.18% | | | | 16.70% | | | | 5.27% | | | | 11.54% | | | | 7.19% | | | | 12.81% | |

Baron Growth Fund — Institutional Shares1,2,3 | | | 10.32% | | | | 17.01% | | | | 5.54% | | | | 11.83% | | | | 7.40% | | | | 12.91% | |

Baron Growth Fund — R6 Shares1,2,3 | | | 10.32% | | | | 16.99% | | | | 5.54% | | | | 11.83% | | | | 7.40% | | | | 12.91% | |

Russell 2000 Growth Index1 | | | 9.11% | | | | 23.03% | | | | 6.72% | | | | 12.10% | | | | 8.06% | | | | 7.71% | |

S&P 500 Index1 | | | 10.12% | | | | 17.17% | | | | 10.37% | | | | 13.30% | | | | 7.51% | | | | 9.72% | |

| 1 | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| | |

| March 31, 2017 (Unaudited) | | Baron Growth Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2017

| | | | |

| | | Percent of Net Assets | |

Vail Resorts, Inc. | | | 7.1% | |

Arch Capital Group Ltd. | | | 6.1% | |

Gartner, Inc. | | | 4.4% | |

FactSet Research Systems, Inc. | | | 3.9% | |

IDEXX Laboratories, Inc. | | | 3.9% | |

CoStar Group, Inc. | | | 3.4% | |

Choice Hotels International, Inc. | | | 3.2% | |

SS&C Technologies Holdings, Inc. | | | 3.2% | |

MSCI, Inc. | | | 3.1% | |

Gaming and Leisure Properties, Inc. | | | 3.1% | |

| | | | 41.4% | |

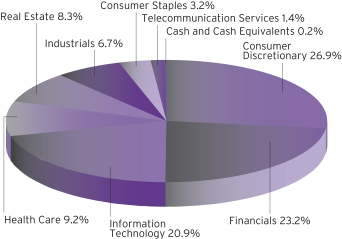

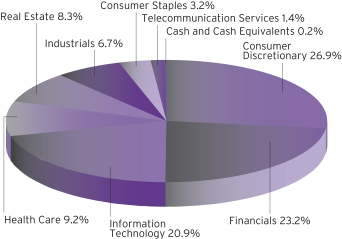

SECTOR BREAKDOWNASOF MARCH 31, 2017†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six-month period ended March 31, 2017, Baron Growth Fund1 gained 10.18%, while the Russell 2000 Growth Index gained 9.11% and the S&P 500 Index gained 10.12%.

Baron Growth Fund invests primarily in small-sized U.S. growth companies for the long term. Through independent research, we utilize an investment approach that we believe allows us to look at a business’s fundamental characteristics and beyond the current market environment. We invest based on the potential profitability of a business at what we believe are attractive valuations.

The market’s reaction to the November 8 U.S. presidential election results dominated the period. After moving mostly sideways in September and October, equities embarked on a strong rally in early November, with major U.S. stock indexes establishing record highs in the period. Beneath the surface, the market experienced a significant rotation among sectors and investment approaches. Initially, the market responded to the possibility that the policies of a Trump administration would lead to increased infrastructure spending, higher inflation, higher interest rates, lower corporate taxes, and ultimately accelerated economic growth. Financials acted best, as those businesses benefit from higher interest rates. Industrials and Energy sectors rose as presumed beneficiaries of faster growth. Value outpaced growth. Early in 2017, leaders and laggards swapped positions. Information Technology, Health Care, and Consumer Discretionary led the markets, taking over from the prior sector leaders. In a reversal of the first half of the six-month period, growth stocks also outperformed value stocks.

Financials, Consumer Discretionary, and Information Technology were the top contributing sectors in the period. Holdings in the Consumer Staples sector detracted slightly.

Vail Resorts, Inc. was the top contributor in the period. Shares of this operator of ski resorts in the U.S., Canada, and Australia increased on strong earnings growth due to increased visitation and spend levels in a strong ski season. We believe Vail’s recent acquisitions of Whistler Blackcomb, Park City in Utah, Perisher in Australia, and most recently, Stowe in Vermont, continue to help drive season pass sales and visitation, which, in turn, help insulate earnings from poor snowfall seasons and improve cash flow.

The top detractor was Under Armour, Inc. Shares of this athletic apparel company declined on reported earnings and guidance that missed Street expectations. Increased promotional activity, improved competitor positioning, and a key distributor’s bankruptcy lowered revenue. The company is attempting to diversify its wholesale distribution domestically while growing into other geographies and categories. We believe many of these issues are temporary and the long-term demand and earnings potential remain relatively intact.

The Fund continues to invest in a portfolio of businesses that have better financial characteristics than the benchmark index against which it is compared. These businesses have higher operating profit margins, net margins, EBITDA margins, return on invested capital, return on equity, return on assets, and lower standard deviations of earnings growth. While we do not try to predict short-term macro developments or current events, we believe conditions remain favorable for the U.S. economy and equity markets.

| † | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

5

| | |

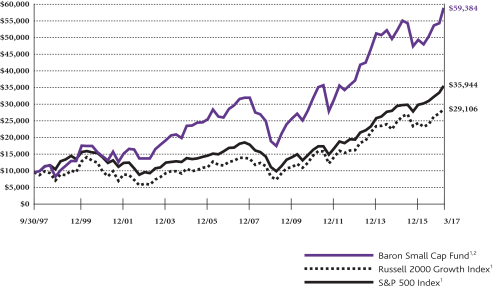

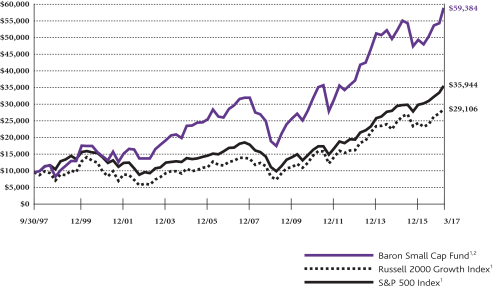

| Baron Small Cap Fund (Unaudited) | | March 31, 2017 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON SMALL CAP FUND (RETAIL SHARES)IN RELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2017 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(September 30,

1997) | |

Baron Small Cap Fund — Retail Shares1,2 | | | 9.90% | | | | 22.74% | | | | 5.09% | | | | 10.50% | | | | 7.03% | | | | 9.57% | |

Baron Small Cap Fund — Institutional Shares1,2,3 | | | 10.05% | | | | 23.07% | | | | 5.36% | | | | 10.78% | | | | 7.25% | | | | 9.68% | |

Baron Small Cap Fund — R6 Shares1,2,3 | | | 10.05% | | | | 23.07% | | | | 5.36% | | | | 10.78% | | | | 7.25% | | | | 9.68% | |

Russell 2000 Growth Index1 | | | 9.11% | | | | 23.03% | | | | 6.72% | | | | 12.10% | | | | 8.06% | | | | 5.63% | |

S&P 500 Index1 | | | 10.12% | | | | 17.17% | | | | 10.37% | | | | 13.30% | | | | 7.51% | | | | 6.78% | |

| 1 | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| | |

| March 31, 2017 (Unaudited) | | Baron Small Cap Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2017

| | | | |

| | | Percent of Net Assets | |

Gartner, Inc. | | | 4.6% | |

Waste Connections, Inc. | | | 3.8% | |

IDEXX Laboratories, Inc. | | | 3.8% | |

Bright Horizons Family Solutions, Inc. | | | 3.8% | |

TransDigm Group, Inc. | | | 3.6% | |

SBA Communications Corp. | | | 2.9% | |

On Assignment, Inc. | | | 2.9% | |

Acuity Brands, Inc. | | | 2.7% | |

Guidewire Software, Inc. | | | 2.7% | |

Cognex Corp. | | | 2.5% | |

| | | | 33.3% | |

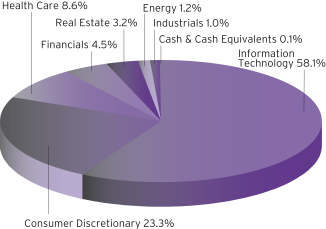

SECTOR BREAKDOWNASOF MARCH 31, 2017†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six-month period ended March 31, 2017, Baron Small Cap Fund1 gained 9.90%, while the Russell 2000 Growth Index increased 9.11% and the S&P 500 Index increased 10.12%.

Baron Small Cap Fund invests primarily in small-cap growth companies for the long term. The Fund invests in what we believe are well-run small-cap growth businesses that can be purchased at prices that represent a significant discount to our assessment of future value.

The market’s reaction to the November 8 U.S. presidential election results dominated the period. After moving mostly sideways in September and October, equities embarked on a strong rally in early November, with major U.S. stock indexes establishing record highs in the period. Beneath the surface, the market experienced a significant rotation among sectors and investment approaches. Initially, the market responded to the possibility that the policies of a Trump administration would lead to increased infrastructure spending, higher inflation, higher interest rates, lower corporate taxes, and ultimately accelerated economic growth. Financials acted best, as those businesses benefit from higher interest rates. Industrials and Energy sectors rose as presumed beneficiaries of faster growth. Value outpaced growth. Early in 2017, leaders and laggards swapped positions. Information Technology, Health Care, and Consumer Discretionary led the markets, taking over from the prior sector leaders. In a reversal of the first half of the six-month period, growth stocks also outperformed value stocks.

Investments in Consumer Discretionary, Information Technology, and Industrials were the top contributors to performance. Holdings in Telecommunication Services detracted slightly.

Veterinary diagnostics leader IDEXX Laboratories, Inc. was the top contributor. The stock rallied on strong financial results and multiple expansion. Competitive trends are strong and improving, highlighted by instrument revenue growth, domestic lab growth, rising sales productivity, and stability in rapid assays. We believe that IDEXX’s direct go-to-market model coupled with research and development-driven product enhancements will put steady upward pressure on organic revenue and earnings growth over time.

Aircraft parts supplier TransDigm Group, Inc. was the top detractor. Shares fell due to a short seller report accusing the company of improper government contracting practices. Our analysis indicates that no actual infractions likely occurred; but if they did, they were minor missteps affecting a small part of the business and any penalties will likely be minimal. Meanwhile, the company continued to execute its unique, proprietary, protected aircraft parts franchise at a high level of profitability.

Baron Small Cap Fund invests primarily in classic growth stocks that we believe have significant long-term growth prospects and can be purchased at what we believe are attractive prices because their prospects have not yet been appreciated by investors. We also invest in fallen angels, which are companies that we believe have strong long-term franchises but have disappointed investors with short-term results, creating what we believe is a buying opportunity. A third category of investments is special situations, including spin-offs and recapitalizations, where lack of investor awareness creates opportunities to purchase what we believe are strong businesses at attractive prices.

| † | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

7

| | |

| Baron Opportunity Fund (Unaudited) | | March 31, 2017 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON OPPORTUNITY FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 3000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2017 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(February 29,

2000) | |

Baron Opportunity Fund — Retail Shares1,2 | | | 7.95% | | | | 18.72% | | | | 3.18% | | | | 7.82% | | | | 7.23% | | | | 5.04% | |

Baron Opportunity Fund — Institutional Shares1,2,3 | | | 8.12% | | | | 19.09% | | | | 3.47% | | | | 8.10% | | | | 7.46% | | | | 5.17% | |

Baron Opportunity Fund — R6 Shares1,2,3 | | | 8.12% | | | | 19.16% | | | | 3.49% | | | | 8.11% | | | | 7.46% | | | | 5.18% | |

Russell 3000 Growth Index1 | | | 9.94% | | | | 16.27% | | | | 10.90% | | | | 13.22% | | | | 9.04% | | | | 3.21% | |

S&P 500 Index1 | | | 10.12% | | | | 17.17% | | | | 10.37% | | | | 13.30% | | | | 7.51% | | | | 5.28% | |

| † | The Fund’s historical performance was impacted by gains from IPOs and/or secondary offerings. There is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs and secondary offerings will be the same in the future. |

| 1 | The indexes are unmanaged. The Russell 3000® Growth Index measures the performance of those companies classified as growth among the largest 3,000 U.S. companies, and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

8

| | |

| March 31, 2017 (Unaudited) | | Baron Opportunity Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2017

| | | | |

| | | Percent of Net Assets | |

Amazon.com, Inc. | | | 7.2% | |

CoStar Group, Inc. | | | 5.9% | |

Guidewire Software, Inc. | | | 5.4% | |

Gartner, Inc. | | | 5.2% | |

Tesla, Inc. | | | 5.0% | |

Alphabet Inc. | | | 4.3% | |

Acxiom Corporation | | | 3.8% | |

Visa, Inc. | | | 3.0% | |

Netflix, Inc. | | | 2.9% | |

ServiceNow, Inc. | | | 2.6% | |

| | | | 45.3% | |

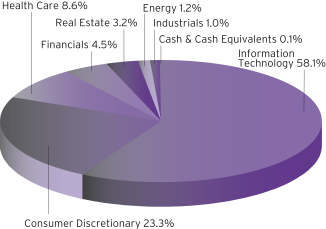

SECTOR BREAKDOWNASOF MARCH 31, 2017†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six-month period ended March 31, 2017, Baron Opportunity Fund1 gained 7.95%, while the Russell 3000 Growth Index gained 9.94% and the S&P 500 Index gained 10.12%.

Baron Opportunity Fund invests primarily in U.S. growth companies that we believe are driving or benefiting from innovation, through development of pioneering, transformative, or technologically advanced products and services. The Fund invests in high growth businesses of any market capitalization, selected for their capital appreciation potential.

The market’s reaction to the November 8 U.S. presidential election results dominated the period. After moving mostly sideways in September and October, equities embarked on a strong rally in early November, with major U.S. stock indexes establishing record highs in the period. Beneath the surface, the market experienced a significant rotation among sectors and investment approaches. Initially, the market responded to the possibility that the policies of a Trump administration would lead to increased infrastructure spending, higher inflation, higher interest rates, lower corporate taxes, and ultimately accelerated economic growth. Financials acted best, as those businesses benefit from higher interest rates. Industrials and Energy sectors rose as presumed beneficiaries of faster growth. Value outpaced growth. Early in 2017, leaders and laggards swapped positions. Information Technology, Health Care, and Consumer Discretionary led the markets, taking over from the prior sector leaders. In a reversal of the first half of the six-month period, growth stocks also outperformed value stocks.

Investments in Consumer Discretionary, Information Technology, and Health Care contributed to the Fund’s performance during the period. Energy and Telecommunication Services holdings detracted slightly.

The top contributor to Fund performance was electric vehicle company Tesla, Inc. Shares rose following the company’s launch of GigaFactory, one of the world’s largest manufacturing facilities, which will potentially drive significant cost reduction. Tesla is on target for a 2017 launch of its mass market Model 3, potentially the largest product cycle in history. Additionally, the company’s SolarCity merger is on track, showing less cash drain than initially feared by investors. We believe a pro-U.S. jobs administration is a tailwind for Tesla as it is one of North America’s fastest growing employers.

The top detractor was benefits software vendor Benefitfocus, Inc. Shares were down after the company reported 2017 guidance that was lower than analysts expected. We see several short-term headwinds, including longer implementation periods for national accounts, slower employer signings because of a sales restructuring, and a revenue share of BenefitStore commissions. While we believe these headwinds will weigh on reported growth through mid-2017, we don’t believe they impact the significant long-term opportunity.

We remain focused on finding unique businesses across different segments of the economy that we believe offer long-term secular growth, sustainable competitive advantages, high-quality management teams, and attractive stock prices. We believe that investment returns for stocks are driven by earnings growth, and therefore direct our research towards understanding the drivers of business profit and projecting future profit growth as accurately as we can.

| † | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

9

| | |

| Baron Fifth Avenue Growth Fund (Unaudited) | | March 31, 2017 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FIFTH AVENUE GROWTH FUND (RETAIL SHARES)INRELATIONTOTHE RUSSELL 1000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2017 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(April 30,

2004) | |

Baron Fifth Avenue Growth Fund — Retail Shares1,2 | | | 7.75% | | | | 18.67% | | | | 8.93% | | | | 11.57% | | | | 6.71% | | | | 7.47% | |

Baron Fifth Avenue Growth Fund — Institutional Shares1,2,3 | | | 7.90% | | | | 19.00% | | | | 9.20% | | | | 11.87% | | | | 6.92% | | | | 7.63% | |

Baron Fifth Avenue Growth Fund — R6 Shares1,2,3 | | | 7.90% | | | | 19.06% | | | | 9.21% | | | | 11.88% | | | | 6.92% | | | | 7.63% | |

Russell 1000 Growth Index1 | | | 10.01% | | | | 15.76% | | | | 11.27% | | | | 13.32% | | | | 9.13% | | | | 8.80% | |

S&P 500 Index1 | | | 10.12% | | | | 17.17% | | | | 10.37% | | | | 13.30% | | | | 7.51% | | | | 8.28% | |

| 1 | The indexes are unmanaged. The Russell 1000® Growth Index measures the performance of large-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

10

| | |

| March 31, 2017 (Unaudited) | | Baron Fifth Avenue Growth Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2017

| | | | |

| | | Percent of Net Assets | |

Amazon.com, Inc. | | | 15.6% | |

Alibaba Group Holding Limited | | | 6.6% | |

Alphabet Inc. | | | 6.6% | |

Facebook, Inc. | | | 6.1% | |

Equinix, Inc. | | | 5.2% | |

The Priceline Group, Inc. | | | 5.1% | |

Visa, Inc. | | | 4.9% | |

Mastercard Incorporated | | | 4.8% | |

Illumina, Inc. | | | 3.5% | |

Apple, Inc. | | | 3.5% | |

| | | | 61.9% | |

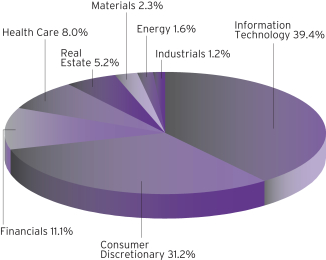

SECTOR BREAKDOWNASOF MARCH 31, 2017†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six-month period ended March 31, 2017, Baron Fifth Avenue Growth Fund1 gained 7.75%, while the Russell 1000 Growth Index gained 10.01% and the S&P 500 Index gained 10.12%.

Baron Fifth Avenue Growth Fund focuses on identifying and investing in what we believe are unique companies with sustainable competitive advantages that have the ability to redeploy capital at high rates of return. The portfolio is constructed on a bottom-up basis, with the quality of ideas and conviction level the most important determinants of the size of

each investment. We expect our highest conviction businesses to have meaningful weight in the portfolio. Sector weightings are incidental to portfolio construction, and exposure to any sector is a result of stock selection.

The market’s reaction to the November 8 U.S. presidential election results dominated the period. After moving mostly sideways in September and October, equities embarked on a strong rally in early November, with major U.S. stock indexes establishing record highs in the period. Beneath the surface, the market experienced a significant rotation among sectors and investment approaches. Initially, the market responded to the possibility that the policies of a Trump administration would lead to increased infrastructure spending, higher inflation, higher interest rates, lower corporate taxes, and ultimately accelerated economic growth. Financials acted best, as those businesses benefit from higher interest rates. Industrials and Energy sectors rose as presumed beneficiaries of faster growth. Value outpaced growth. Early in 2017, leaders and laggards swapped positions. Information Technology, Health Care, and Consumer Discretionary led the markets, taking over from the prior sector leaders. In a reversal of the first half of the six-month period, growth stocks also outperformed value stocks.

Information Technology, Financials, and Consumer Discretionary were the top contributing sectors in the period. The Health Care and Energy sectors detracted.

The top contributor to Fund performance was Mobileye N.V. Shares of this designer and manufacturer of vision-based advanced driver assistance systems increased after Intel made an offer to buy the company. We have long believed in the potential for Mobileye to become the “Intel Inside” of the future of cars. We think Mobileye’s entrepreneurial management team has clear goals that can benefit society, and we look forward to its product development around semi-autonomous and autonomous driving.

Shares of athletic apparel company Under Armour, Inc. fell due to several challenges, including increased competition, weak consumer dynamics, and decreased distribution as a result of retailer bankruptcies. The company has lowered 2017 earnings guidance as it plans to increase spending to drive sales growth. We exited our position.

The Fund seeks to manage risk by focusing on business risk (competition, management, regulations), valuation risk (purchase price providing a large enough margin of safety), financial risk (leverage and capital structure), and analysis risk (our assumptions). Our objective is not to predict how markets may perform in a given year. Instead, we aim to create a portfolio of unique companies with different end markets because, in our experience, this is the best way to manage market risk over time.

| † | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

11

| | |

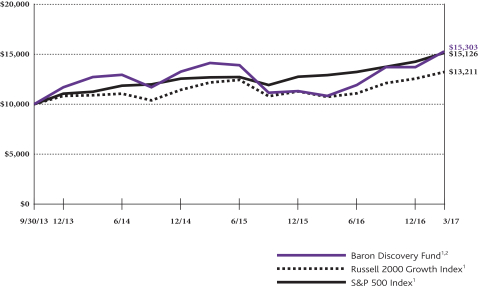

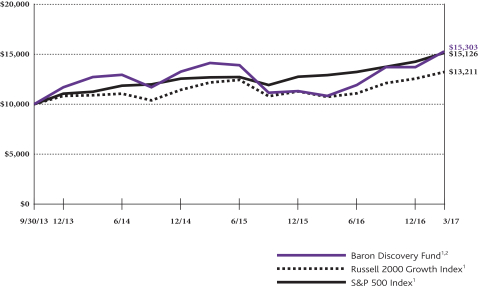

| Baron Discovery Fund (Unaudited) | | March 31, 2017 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON DISCOVERY FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2017 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Since

Inception

(September 30,

2013) | |

Baron Discovery Fund — Retail Shares1,2 | | | 11.49% | | | | 41.47% | | | | 6.36% | | | | 12.91% | |

Baron Discovery Fund — Institutional Shares1,2 | | | 11.63% | | | | 41.89% | | | | 6.61% | | | | 13.18% | |

Baron Discovery Fund — R6 Shares1,2,3 | | | 11.70% | | | | 41.98% | | | | 6.63% | | | | 13.20% | |

Russell 2000 Growth Index1 | | | 9.11% | | | | 23.03% | | | | 6.72% | | | | 8.28% | |

S&P 500 Index1 | | | 10.12% | | | | 17.17% | | | | 10.37% | | | | 12.55% | |

| † | The Fund’s historical performance was impacted by gains from IPOs and/or secondary offerings. There is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs and secondary offerings will be the same in the future. |

| 1 | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares. |

12

| | |

| March 31, 2017 (Unaudited) | | Baron Discovery Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2017

| | | | |

| | | Percent of Net Assets | |

Qualys, Inc. | | | 3.9% | |

Mercury Systems, Inc. | | | 3.8% | |

MACOM Technology Solutions Holdings, Inc. | | | 3.7% | |

Red Rock Resorts, Inc. | | | 3.1% | |

Wingstop Inc. | | | 2.8% | |

The Trade Desk, Inc. | | | 2.7% | |

Liberty Expedia Holdings, Inc. | | | 2.7% | |

Impinj, Inc. | | | 2.5% | |

Varonis Systems, Inc. | | | 2.4% | |

Flexion Therapeutics Inc. | | | 2.4% | |

| | | | 30.0% | |

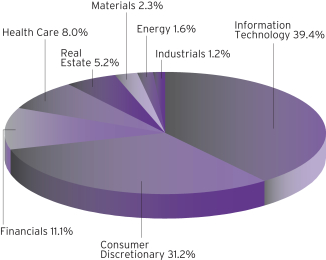

SECTOR BREAKDOWNASOF MARCH 31, 2017†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six-month period ended March 31, 2017, Baron Discovery Fund1 increased 11.49%, while the Russell 2000 Growth Index gained 9.11% and the S&P 500 Index gained 10.12%.

Baron Discovery Fund invests primarily in small-sized U.S. companies with significant growth potential and market capitalizations up to the weighted median market capitalization of the Russell 2000 Growth Index at reconstitution, or companies with market capitalizations up to $1.5 billion, whichever is larger. The Fund invests for the long term at attractive valuations in appropriately capitalized companies with, in our view, open-ended growth opportunities, exceptional leadership, and sustainable competitive advantages.

The market’s reaction to the November 8 U.S. presidential election results dominated the period. After moving mostly sideways in September and October, equities embarked on a strong rally in early November, with major U.S. stock indexes establishing record highs in the period. Beneath the surface, the market experienced a significant rotation among sectors and investment approaches. Initially, the market responded to the possibility that the policies of a Trump administration would lead to increased infrastructure spending, higher inflation, higher interest rates, lower corporate taxes, and ultimately accelerated economic growth. Financials acted best, as those businesses benefit from higher interest rates. Industrials and Energy sectors rose as presumed beneficiaries of faster growth. Value outpaced growth. Early in 2017, leaders and laggards swapped positions. Information Technology, Health Care, and Consumer Discretionary led the markets, taking over from the prior sector leaders. In a reversal of the first half of the six-month period, growth stocks also outperformed value stocks.

The Industrials, Information Technology, and Health Care sectors contributed the most in the period. Real Estate and Materials detracted.

The top contributor in the period was Mercury Systems, Inc., a provider of complex electronic subsystems to major defense contractors. Shares were up in the period as Mercury continued to win contract awards and completed a successful secondary offering to provide funding for accretive future acquisitions. We believe defense spending and outsourcing will continue to grow under the new presidential administration, which could benefit Mercury.

The top detractor was medical imaging company Novadaq Technologies Inc. Shares declined due to what we think was a misunderstanding regarding the halting of a clinical trial in colon resection. Novadaq’s devices, which show blood flow, have been clinically proven to dramatically improve outcomes in many types of surgeries. We believe that revenue will continue to grow by close to 30%, and that at the current valuation the company is a potentially great investment.

We think the long-term fundamentals of our companies remain strong. We believe the companies we own are high quality, innovative and run by excellent management teams. We are optimistic that they will be significantly bigger next year than they are today and that this growth can continue for years after. There is, of course, no guarantee that this will be the case.

| † | Industry sector group levels are provided by the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

13

| | |

| Baron Asset Fund | | March 31, 2017 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (98.77%) | |

| Consumer Discretionary (13.38%) | |

| | | | Automotive Retail (1.36%) | | | | | | | | |

| | 92,000 | | | Advance Auto Parts, Inc. | | $ | 15,941,373 | | | $ | 13,639,920 | |

| | 388,000 | | | CarMax, Inc.1 | | | 4,415,017 | | | | 22,977,360 | |

| | | | | | | | | | | | |

| | | | | | | 20,356,390 | | | | 36,617,280 | |

| | | |

| | | | Hotels, Resorts & Cruise Lines (2.23%) | | | | | | | | |

| | 525,400 | | | Choice Hotels International, Inc. | | | 2,254,244 | | | | 32,890,040 | |

| | 500,000 | | | Hyatt Hotels Corp., Cl A1 | | | 13,523,436 | | | | 26,990,000 | |

| | | | | | | | | | | | |

| | | | | | | 15,777,680 | | | | 59,880,040 | |

| | | |

| | | | Internet & Direct Marketing Retail (3.12%) | | | | | | | | |

| | 212,000 | | | Expedia, Inc. | | | 25,262,837 | | | | 26,748,040 | |

| | 32,000 | | | The Priceline Group, Inc.1 | | | 5,125,131 | | | | 56,959,040 | |

| | | | | | | | | | | | |

| | | | | | | 30,387,968 | | | | 83,707,080 | |

| | | |

| | | | Leisure Facilities (5.18%) | | | | | | | | |

| | 725,000 | | | Vail Resorts, Inc. | | | 14,063,109 | | | | 139,127,500 | |

| | | |

| | | | Specialty Stores (1.49%) | | | | | | | | |

| | 260,000 | | | Tiffany & Co. | | | 8,018,828 | | | | 24,778,000 | |

| | 220,000 | | | Tractor Supply Co. | | | 6,736,191 | | | | 15,173,400 | |

| | | | | | | | | | | | |

| | | | | | | 14,755,019 | | | | 39,951,400 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 95,340,166 | | | | 359,283,300 | |

| | | | | | | | | | | | |

|

| Energy (0.52%) | |

| | | | Oil & Gas Exploration & Production (0.52%) | | | | | | | | |

| | 107,500 | | | Concho Resources, Inc.1 | | | 4,595,625 | | | | 13,796,550 | |

| | | | | | | | | | | | |

|

| Financials (17.10%) | |

| | | | Asset Management & Custody Banks (0.63%) | | | | | | | | |

| | 250,000 | | | T. Rowe Price Group, Inc. | | | 6,031,231 | | | | 17,037,500 | |

| | | |

| | | | Financial Exchanges & Data (4.28%) | | | | | | | | |

| | 435,000 | | | FactSet Research Systems, Inc. | | | 23,564,473 | | | | 71,735,850 | |

| | 230,000 | | | MarketAxess Holdings, Inc. | | | 25,489,330 | | | | 43,122,700 | |

| | | | | | | | | | | | |

| | | | | | | 49,053,803 | | | | 114,858,550 | |

| | | |

| | | | Insurance Brokers (2.31%) | | | | | | | | |

| | 475,000 | | | Willis Towers Watson plc2 | | | 58,514,776 | | | | 62,172,750 | |

| | | |

| | | | Investment Banking & Brokerage (3.72%) | | | | | | | | |

| | 2,450,000 | | | The Charles Schwab Corp. | | | 2,351,369 | | | | 99,984,500 | |

| | | |

| | | | Property & Casualty Insurance (4.50%) | | | | | | | | |

| | 1,275,000 | | | Arch Capital Group Ltd.1,2 | | | 13,874,064 | | | | 120,831,750 | |

| | | |

| | | | Regional Banks (1.66%) | | | | | | | | |

| | 475,000 | | | First Republic Bank | | | 15,197,602 | | | | 44,559,750 | |

| | | | | | | | | | | | |

| | Total Financials | | | 145,022,845 | | | | 459,444,800 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Health Care (22.06%) | |

| | | | Health Care Distributors (2.13%) | | | | | | | | |

| | 337,000 | | | Henry Schein, Inc.1 | | $ | 9,010,382 | | | $ | 57,279,890 | |

| | | | Health Care Equipment (7.47%) | | | | | | | | |

| | 1,161,000 | | | IDEXX Laboratories, Inc.1 | | | 22,010,924 | | | | 179,502,210 | |

| | 110,000 | | | Teleflex, Inc. | | | 17,089,386 | | | | 21,310,300 | |

| | | | | | | | | | | | |

| | | | | | | 39,100,310 | | | | 200,812,510 | |

| | | |

| | | | Health Care Facilities (0.69%) | | | | | | | | |

| | 148,000 | | | Universal Health Services, Inc., Cl B | | | 8,389,889 | | | | 18,418,600 | |

| | | |

| | | | Health Care Supplies (3.64%) | | | | | | | | |

| | 240,000 | | | The Cooper Companies, Inc. | | | 30,555,224 | | | | 47,973,600 | |

| | 610,000 | | | West Pharmaceutical Services, Inc. | | | 26,714,894 | | | | 49,782,100 | |

| | | | | | | | | | | | |

| | | | | | | 57,270,118 | | | | 97,755,700 | |

| | | |

| | | | Life Sciences Tools & Services (8.13%) | | | | | | | | |

| | 380,000 | | | Bio-Techne Corporation | | | 36,982,041 | | | | 38,627,000 | |

| | 352,000 | | | Illumina, Inc.1 | | | 15,181,108 | | | | 60,065,280 | |

| | 250,000 | | | Mettler-Toledo International, Inc.1 | | | 15,496,167 | | | | 119,727,500 | |

| | | | | | | | | | | | |

| | | | | | | 67,659,316 | | | | 218,419,780 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 181,430,015 | | | | 592,686,480 | |

| | | | | | | | | | | | |

|

| Industrials (15.26%) | |

| | | | Aerospace & Defense (0.45%) | | | | | | | | |

| | 255,000 | | | BWX Technologies, Inc. | | | 12,127,190 | | | | 12,138,000 | |

| | | |

| | | | Building Products (0.61%) | | | | | | | | |

| | 320,000 | | | AO Smith Corp. | | | 15,918,938 | | | | 16,371,200 | |

| | | |

| | | | Construction Machinery & Heavy Trucks (1.86%) | | | | | | | | |

| | 90,000 | | | WABCO Holdings, Inc.1 | | | 10,455,704 | | | | 10,567,800 | |

| | 505,000 | | | Westinghouse Air Brake Technologies Corporation | | | 33,676,456 | | | | 39,390,000 | |

| | | | | | | | | | | | |

| | | | | | | 44,132,160 | | | | 49,957,800 | |

| | | |

| | | | Electrical Components & Equipment (0.72%) | | | | | | | | |

| | 95,000 | | | Acuity Brands, Inc. | | | 19,770,549 | | | | 19,380,000 | |

| | | |

| | | | Environmental & Facilities Services (0.80%) | | | | | | | | |

| | 581,087 | | | Rollins, Inc. | | | 16,726,225 | | | | 21,575,760 | |

| | | |

| | | | Industrial Conglomerates (1.85%) | | | | | | | | |

| | 240,000 | | | Roper Technologies, Inc. | | | 20,050,484 | | | | 49,557,600 | |

| | | |

| | | | Industrial Machinery (2.61%) | | | | | | | | |

| | 430,000 | | | IDEX Corporation | | | 31,397,849 | | | | 40,209,300 | |

| | 220,000 | | | The Middleby Corp.1 | | | 10,736,494 | | | | 30,019,000 | |

| | | | | | | | | | | | |

| | | | | | | 42,134,343 | | | | 70,228,300 | |

| | |

| 14 | | See Notes to Financial Statements. |

| | |

| March 31, 2017 | | Baron Asset Fund |

STATEMENT OF NET ASSETS (Unaudited) (Continued)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Industrials (continued) | |

| | | | Research & Consulting Services (5.07%) | | | | | | | | |

| | 740,000 | | | Nielsen Holdings PLC2 | | $ | 17,543,972 | | | $ | 30,569,400 | |

| | 1,300,000 | | | Verisk Analytics, Inc.1 | | | 33,418,943 | | | | 105,482,000 | |

| | | | | | | | | | | | |

| | | | | | | 50,962,915 | | | | 136,051,400 | |

| | | |

| | | | Trading Companies & Distributors (1.29%) | | | | | | | | |

| | 675,000 | | | Fastenal Co. | | | 11,933,597 | | | | 34,762,500 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 233,756,401 | | | | 410,022,560 | |

| | | | | | | | | | | | |

| Information Technology (22.58%) | |

| | | | Application Software (7.37%) | | | | | | | | |

| | 550,000 | | | ANSYS, Inc.1 | | | 14,771,001 | | | | 58,778,500 | |

| | 220,000 | | | CDK Global, Inc. | | | 10,973,416 | | | | 14,302,200 | |

| | 1,220,000 | | | Guidewire Software, Inc.1 | | | 58,902,936 | | | | 68,722,600 | |

| | 285,000 | | | Mobileye N.V.1,2 | | | 7,329,168 | | | | 17,499,000 | |

| | 919,000 | | | SS&C Technologies Holdings, Inc. | | | 25,120,157 | | | | 32,532,600 | |

| | 32,000 | | | The Ultimate Software Group, Inc.1 | | | 6,098,077 | | | | 6,246,720 | |

| | | | | | | | | | | | |

| | | | | | | 123,194,755 | | | | 198,081,620 | |

| | | |

| | | | Data Processing & Outsourced Services (4.22%) | | | | | | | | |

| | 277,000 | | | FleetCor Technologies, Inc.1 | | | 10,071,962 | | | | 41,946,110 | |

| | 400,000 | | | MAXIMUS, Inc. | | | 20,233,990 | | | | 24,880,000 | |

| | 725,000 | | | Vantiv, Inc., Cl A1 | | | 39,304,846 | | | | 46,487,000 | |

| | | | | | | | | | | | |

| | | | | | | 69,610,798 | | | | 113,313,110 | |

| | | |

| | | | Internet Software & Services (4.76%) | | | | | | | | |

| | 200,000 | | | CoStar Group, Inc.1 | | | 34,528,695 | | | | 41,444,000 | |

| | 650,000 | | | Verisign, Inc.1 | | | 31,889,164 | | | | 56,621,500 | |

| | 270,872 | | | Zillow Group, Inc., Cl A1 | | | 7,666,898 | | | | 9,158,183 | |

| | 614,000 | | | Zillow Group, Inc., CI C1 | | | 15,676,412 | | | | 20,673,380 | |

| | | | | | | | | | | | |

| | | | | | | 89,761,169 | | | | 127,897,063 | |

| | | |

| | | | IT Consulting & Other Services (6.23%) | | | | | | | | |

| | 1,550,000 | | | Gartner, Inc.1 | | | 33,739,350 | | | | 167,384,500 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 316,306,072 | | | | 606,676,293 | |

| | | | | | | | | | | | |

|

| Real Estate (7.87%) | |

| | | | Office REITs (1.00%) | | | | | | | | |

| | 62,000 | | | Alexander’s, Inc.3 | | | 2,779,303 | | | | 26,775,320 | |

| | | |

| | | | Real Estate Services (2.07%) | | | | | | | | |

| | 1,600,000 | | | CBRE Group, Inc., Cl A1 | | | 19,628,157 | | | | 55,664,000 | |

| | | |

| | | | Specialized REITs (4.80%) | | | | | | | | |

| | 144,505 | | | Equinix, Inc. | | | 9,802,123 | | | | 57,855,467 | |

| | 590,000 | | | SBA Communications Corp.1 | | | 16,542,706 | | | | 71,018,300 | |

| | | | | | | | | | | | |

| | | | | | | 26,344,829 | | | | 128,873,767 | |

| | | | | | | | | | | | |

| | Total Real Estate | | | 48,752,289 | | | | 211,313,087 | |

| | | | | | | | | | | | |

| | Total Common Stocks | | | 1,025,203,413 | | | | 2,653,223,070 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Private Equity Investments (0.12%) | |

| Financials (0.12%) | |

| | | | Asset Management & Custody Banks (0.12%) | | | | | | | | |

| | 7,056,223 | | | Windy City Investments Holdings, L.L.C.1,3,4,6 | | $ | 0 | | | $ | 3,245,862 | |

| | | | | | | | | | | | |

| Principal Amount | | | | | | |

| Short Term Investments (0.95%) | |

| | $25,551,931 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 3/31/2017, 0.09% due 4/3/2017; Proceeds at maturity - $25,552,122; (Fully collateralized by $26,440,000 U.S. Treasury Inflation Indexed Note, 0.125% due 7/15/2026; Market value - $26,063,732)5 | | | 25,551,931 | | | | 25,551,931 | |

| | | | | | | | | | | | |

| | Total Investments (99.84%) | | $ | 1,050,755,344 | | | | 2,682,020,863 | |

| | | | | | | | | | | | |

| | Cash and Other Assets Less Liabilities (0.16%) | | | | 4,384,921 | |

| | | | | | | | | | | | |

| | Net Assets | | | $ | 2,686,405,784 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $63.73 per share

based on 29,087,303 shares outstanding) |

| | $ | 1,853,709,690 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $65.62 per share

based on 12,557,782 shares outstanding) |

| | $ | 824,077,418 | |

| | | | | | | | | | | | |

| R6 Shares (Equivalent to $65.61 per share

based on 131,357 shares outstanding) |

| | $ | 8,618,676 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 4 | At March 31, 2017, the market value of restricted and fair valued securities amounted to $3,245,862 or 0.12% of net assets. This security is not deemed liquid. See Note 6 regarding Restricted Securities. |

| 5 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 6 | Level 3 security. See Note 7 regarding Fair Value Measurements. |

All securities are Level 1, unless otherwise noted.

| | |

| See Notes to Financial Statements. | | 15 |

| | |

| Baron Growth Fund | | March 31, 2017 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (99.58%) | |

| Consumer Discretionary (26.89%) | |

| | | | Apparel, Accessories & Luxury Goods (2.15%) | | | | | | | | |

| | 3,475,000 | | | Under Armour, Inc., Cl A1 | | $ | 13,912,447 | | | $ | 68,735,500 | |

| | 3,190,000 | | | Under Armour, Inc., Cl C1 | | | 12,023,168 | | | | 58,377,000 | |

| | | | | | | | | | | | |

| | | | | | | 25,935,615 | | | | 127,112,500 | |

| | | |

| | | | Casinos & Gaming (2.83%) | | | | | | | | |

| | 4,155,000 | | | Penn National Gaming, Inc.1 | | | 36,915,622 | | | | 76,576,650 | |

| | 2,625,000 | | | Pinnacle Entertainment, Inc.1 | | | 29,435,112 | | | | 51,240,000 | |

| | 1,760,582 | | | Red Rock Resorts, Inc., Cl A | | | 34,437,581 | | | | 39,049,709 | |

| | | | | | | | | | | | |

| | | | | | | 100,788,315 | | | | 166,866,359 | |

| | | |

| | | | Education Services (3.48%) | | | | | | | | |

| | 1,985,000 | | | Bright Horizons Family Solutions, Inc.1 | | | 64,647,112 | | | | 143,892,650 | |

| | 2,423,500 | | | Nord Anglia Education, Inc.1,2 | | | 45,906,790 | | | | 61,411,490 | |

| | | | | | | | | | | | |

| | | | | | | 110,553,902 | | | | 205,304,140 | |

| | | |

| | | | Hotels, Resorts & Cruise Lines (5.90%) | | | | | | | | |

| | 3,007,500 | | | Choice Hotels International, Inc.4 | | | 73,061,456 | | | | 188,269,500 | |

| | 1,600,000 | | | Marriott Vacations Worldwide Corp.4 | | | 87,504,361 | | | | 159,888,000 | |

| | | | | | | | | | | | |

| | | | | | | 160,565,817 | | | | 348,157,500 | |

| | | |

| | | | Internet & Direct Marketing Retail (0.34%) | | | | | | | | |

| | 11,704,702 | | | AO World plc (United Kingdom)1,2 | | | 26,353,820 | | | | 19,797,516 | |

| | | |

| | | | Leisure Facilities (7.44%) | | | | | | | | |

| | 1,100,000 | | | ClubCorp Holdings, Inc. | | | 19,230,077 | | | | 17,655,000 | |

| | 2,196,993 | | | Vail Resorts, Inc.4 | | | 80,228,702 | | | | 421,602,957 | |

| | | | | | | | | | | | |

| | | | | | | 99,458,779 | | | | 439,257,957 | |

| | | |

| | | | Movies & Entertainment (1.56%) | | | | | | | | |

| | 5,450,018 | | | Manchester United plc, Cl A2 | | | 77,159,985 | | | | 92,105,304 | |

| | | |

| | | | Restaurants (2.00%) | | | | | | | | |

| | 450,000 | | | Panera Bread Co., Cl A1 | | | 15,602,751 | | | | 117,841,500 | |

| | | |

| | | | Specialty Stores (1.19%) | | | | | | | | |

| | 1,450,000 | | | Dick’s Sporting Goods, Inc. | | | 22,908,317 | | | | 70,557,000 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 639,327,301 | | | | 1,586,999,776 | |

| | | | | | | | | | | | |

|

| Consumer Staples (3.19%) | |

| | | | Food Distributors (0.45%) | | | | | | | | |

| | 1,105,000 | | | Performance Food Group Co.1 | | | 20,995,000 | | | | 26,299,000 | |

| | | |

| | | | Food Retail (0.43%) | | | | | | | | |

| | 2,100,000 | | | Smart & Final Stores, Inc.1 | | | 35,919,688 | | | | 25,410,000 | |

| | | |

| | | | Household Products (1.48%) | | | | | | | | |

| | 1,750,000 | | | Church & Dwight Co., Inc. | | | 15,890,587 | | | | 87,272,500 | |

| | | |

| | | | Packaged Foods & Meats (0.83%) | | | | | | | | |

| | 580,000 | | | TreeHouse Foods, Inc.1 | | | 19,567,560 | | | | 49,102,800 | |

| | | | | | | | | | | | |

| | Total Consumer Staples | | | 92,372,835 | | | | 188,084,300 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Financials (23.20%) | |

| | | | Asset Management & Custody Banks (4.63%) | | | | | | | | |

| | 1,500,000 | | | The Carlyle Group | | $ | 32,844,320 | | | $ | 23,925,000 | |

| | 2,140,000 | | | Cohen & Steers, Inc. | | | 54,011,768 | | | | 85,535,800 | |

| | 2,250,000 | | | Financial Engines, Inc. | | | 63,928,705 | | | | 97,987,500 | |

| | 1,455,195 | | | Oaktree Capital Group, LLC | | | 65,648,565 | | | | 65,920,333 | |

| | | | | | | | | | | | |

| | | | | | | 216,433,358 | | | | 273,368,633 | |

| | | |

| | | | Financial Exchanges & Data (8.56%) | | | | | | | | |

| | 1,395,000 | | | FactSet Research Systems, Inc. | | | 70,024,081 | | | | 230,049,450 | |

| | 1,185,000 | | | Morningstar, Inc. | | | 30,128,461 | | | | 93,141,000 | |

| | 1,875,000 | | | MSCI, Inc. | | | 35,989,456 | | | | 182,231,250 | |

| | | | | | | | | | | | |

| | | | | | | 136,141,998 | | | | 505,421,700 | |

| | | |

| | | | Investment Banking & Brokerage (0.58%) | | | | | | | | |

| | 775,000 | | | Moelis & Co., Cl A | | | 22,607,788 | | | | 29,837,500 | |

| | 250,000 | | | Virtu Financial, Inc., Cl A | | | 4,750,000 | | | | 4,250,000 | |

| | | | | | | | | | | | |

| | | | | | | 27,357,788 | | | | 34,087,500 | |

| | | |

| | | | Life & Health Insurance (3.01%) | | | | | | | | |

| | 2,160,000 | | | Primerica, Inc. | | | 47,146,305 | | | | 177,552,000 | |

| | | |

| | | | Property & Casualty Insurance (6.18%) | | | | | | | | |

| | 3,800,000 | | | Arch Capital Group Ltd.1,2 | | | 36,852,471 | | | | 360,126,000 | |

| | 147,000 | | | Kinsale Capital Group, Inc. | | | 4,042,500 | | | | 4,709,880 | |

| | | | | | | | | | | | |

| | | | | | | 40,894,971 | | | | 364,835,880 | |

| | | |

| | | | Thrifts & Mortgage Finance (0.24%) | | | | | | | | |

| | 400,000 | | | Essent Group, Ltd.1,2 | | | 9,483,065 | | | | 14,468,000 | |

| | | | | | | | | | | | |

| | Total Financials | | | 477,457,485 | | | | 1,369,733,713 | |

| | | | | | | | | | | | |

|

| Health Care (9.17%) | |

| | | | Health Care Equipment (4.15%) | | | | | | | | |

| | 348,374 | | | Glaukos Corporation1 | | | 11,729,755 | | | | 17,871,586 | |

| | 1,470,000 | | | IDEXX Laboratories, Inc.1 | | | 22,572,748 | | | | 227,276,700 | |

| | | | | | | | | | | | |

| | | | | | | 34,302,503 | | | | 245,148,286 | |

| | | |

| | | | Health Care Supplies (1.62%) | | | | | | | | |

| | 365,038 | | | Neogen Corp.1 | | | 8,075,677 | | | | 23,928,241 | |

| | 875,000 | | | West Pharmaceutical Services, Inc. | | | 30,383,156 | | | | 71,408,750 | |

| | | | | | | | | | | | |

| | | | | | | 38,458,833 | | | | 95,336,991 | |

| | | |

| | | | Health Care Technology (0.51%) | | | | | | | | |

| | 2,395,957 | | | Inovalon Holdings, Inc., CI A1 | | | 53,135,542 | | | | 30,189,058 | |

| | | |

| | | | Life Sciences Tools & Services (2.89%) | | | | | | | | |

| | 875,000 | | | Bio-Techne Corporation | | | 46,302,066 | | | | 88,943,750 | |

| | 170,000 | | | Mettler-Toledo International, Inc.1 | | | 7,810,313 | | | | 81,414,700 | |

| | | | | | | | | | | | |

| | | | | | | 54,112,379 | | | | 170,358,450 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 180,009,257 | | | | 541,032,785 | |

| | | | | | | | | | | | |

| | |

| 16 | | See Notes to Financial Statements. |

| | |

| March 31, 2017 | | Baron Growth Fund |

STATEMENT OF NET ASSETS (Unaudited) (Continued)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Industrials (6.70%) | |

| | | | Building Products (4.14%) | | | | | | | | |

| | 2,000,000 | | | CaesarStone Ltd.1,2,4 | | $ | 39,958,972 | | | $ | 72,500,000 | |

| | 1,380,000 | | | Masonite International Corp.1,2 | | | 76,932,413 | | | | 109,365,000 | |

| | 900,000 | | | Trex Company, Inc.1 | | | 32,905,548 | | | | 62,451,000 | |

| | | | | | | | | | | | |

| | | | | | | 149,796,933 | | | | 244,316,000 | |

| | | |

| | | | Industrial Machinery (1.91%) | | | | | | | | |

| | 825,000 | | | The Middleby Corp.1 | | | 23,225,508 | | | | 112,571,250 | |

| | | |

| | | | Trading Companies & Distributors (0.65%) | | | | | | | | |

| | 1,000,000 | | | Air Lease Corp. | | | 23,203,508 | | | | 38,750,000 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 196,225,949 | | | | 395,637,250 | |

| | | | | | | | | | | | |

|

| Information Technology (20.90%) | |

| | | | Application Software (7.93%) | | | | | | | | |

| | 1,600,000 | | | ANSYS, Inc.1 | | | 37,902,179 | | | | 170,992,000 | |

| | 1,190,000 | | | Guidewire Software, Inc.1 | | | 38,711,926 | | | | 67,032,700 | |

| | 1,000,000 | | | Pegasystems, Inc. | | | 13,997,009 | | | | 43,850,000 | |

| | 5,265,000 | | | SS&C Technologies Holdings, Inc. | | | 43,555,278 | | | | 186,381,000 | |

| | | | | | | | | | | | |

| | | | | | | 134,166,392 | | | | 468,255,700 | |

| | | |

| | | | Data Processing & Outsourced Services (2.50%) | | | | | | | | |

| | 2,375,000 | | | MAXIMUS, Inc. | | | 44,768,159 | | | | 147,725,000 | |

| | | |

| | | | Electronic Components (0.76%) | | | | | | | | |

| | 280,000 | | | Littelfuse, Inc. | | | 31,472,950 | | | | 44,774,800 | |

| | | |

| | | | Internet Software & Services (4.70%) | | | | | | | | |

| | 2,324,374 | | | Benefitfocus, Inc.1,4 | | | 86,529,482 | | | | 64,966,253 | |

| | 975,000 | | | CoStar Group, Inc.1 | | | 42,637,436 | | | | 202,039,500 | |

| | 156,672 | | | Wix.com Ltd.1,2 | | | 7,560,889 | | | | 10,638,029 | |

| | | | | | | | | | | | |

| | | | | | | 136,727,807 | | | | 277,643,782 | |

| | | |

| | | | IT Consulting & Other Services (5.01%) | | | | | | | | |

| | 950,000 | | | Booz Allen Hamilton Holding Corp. | | | 10,162,552 | | | | 33,620,500 | |

| | 2,425,000 | | | Gartner, Inc.1 | | | 37,453,863 | | | | 261,875,750 | |

| | | | | | | | | | | | |

| | | | | | | 47,616,415 | | | | 295,496,250 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 394,751,723 | | | | 1,233,895,532 | |

| | | | | | | | | | | | |

|

| Real Estate (8.31%) | |

| | | | Diversified REITs (0.50%) | | | | | | | | |

| | 710,000 | | | American Assets Trust, Inc. | | | 13,409,206 | | | | 29,706,400 | |

| | | |

| | | | Office REITs (3.35%) | | | | | | | | |

| | 124,000 | | | Alexander’s, Inc.5 | | | 23,989,393 | | | | 53,550,640 | |

| | 3,750,000 | | | Douglas Emmett, Inc. | | | 50,560,518 | | | | 144,000,000 | |

| | | | | | | | | | | | |

| | | | | | | 74,549,911 | | | | 197,550,640 | |

| | | |

| | | | Specialized REITs (4.46%) | | | | | | | | |

| | 750,000 | | | Alexandria Real Estate Equities, Inc.5 | | | 27,827,790 | | | | 82,890,000 | |

| | 5,400,000 | | | Gaming and Leisure Properties, Inc. | | | 119,506,198 | | | | 180,468,000 | |

| | | | | | | | | | | | |

| | | | | | | 147,333,988 | | | | 263,358,000 | |

| | | | | | | | | | | | |

| | Total Real Estate | | | 235,293,105 | | | | 490,615,040 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Telecommunication Services (1.22%) | |

| | | | Alternative Carriers (1.22%) | | | | | | | | |

| | 7,493,437 | | | Iridium Communications, Inc.1,4 | | $ | 45,709,971 | | | $ | 72,311,667 | |

| | | | | | | | | | | | |

| | Total Common Stocks | | | 2,261,147,626 | | | | 5,878,310,063 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Preferred Stocks (0.24%) | |

| Telecommunication Services (0.24%) | |

| | | | Alternative Carriers (0.24%) | | | | | | | | |

| | 41,074 | | | Iridium Communications, Inc., Series B, 6.75%4,6 | | | 10,268,500 | | | | 14,098,651 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Private Equity Investments (0.02%) | |

| Financials (0.02%) | |

| | | | Asset Management & Custody Banks (0.02%) | | | | | | | | |

| | 2,375,173 | | | Windy City Investments Holdings, L.L.C.1,3,5,7 | | | 0 | | | | 1,092,580 | |

| | | | | | | | | | | | |

| | Total Investments (99.84%) | | $ | 2,271,416,126 | | | | 5,893,501,294 | |

| | | | | | | | | | | | |

| | Cash and Other Assets Less Liabilities (0.16%) | | | | 9,357,514 | |

| | | | | | | | | | | | |

| | Net Assets | | | $ | 5,902,858,808 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $65.64 per share

based on 41,672,320 shares outstanding) |

| | $ | 2,735,249,812 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $67.15 per share

based on 47,135,693 shares outstanding) |

| | $ | 3,164,956,909 | |

| | | | | | | | | | | | |

| R6 Shares (Equivalent to $67.15 per share

based on 39,494 shares outstanding) |

| | $ | 2,652,087 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At March 31, 2017, the market value of restricted and fair valued securities amounted to $1,092,580 or 0.02% of net assets. This security is not deemed liquid. See Note 6 regarding Restricted Securities. |

| 4 | See Note 10 regarding “Affiliated” companies. |

| 5 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 6 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 7 | Level 3 security. See Note 7 regarding Fair Value Measurements. |

All securities are Level 1, unless otherwise noted.

| | |

| See Notes to Financial Statements. | | 17 |

| | |

| Baron Small Cap Fund | | March 31, 2017 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (98.76%) | |

| Consumer Discretionary (18.64%) | |

| | | | Automotive Retail (1.05%) | | | | | | | | |

| | 1,100,000 | | | Camping World Holdings, Inc., Cl A | | $ | 25,857,601 | | | $ | 35,464,000 | |

| | | |

| | | | Cable & Satellite (3.26%) | | | | | | | | |

| | 100,000 | | | Liberty Broadband Corporation, Cl A1 | | | 404,823 | | | | 8,509,000 | |

| | 300,000 | | | Liberty Broadband Corporation, Cl C1 | | | 1,184,602 | | | | 25,920,000 | |

| | 150,000 | | | Liberty SiriusXM Group, Cl A1 | | | 305,046 | | | | 5,838,000 | |

| | 1,200,000 | | | Liberty SiriusXM Group, Cl C1 | | | 2,632,540 | | | | 46,536,000 | |

| | 1,000,000 | | | MSG Networks Inc., Cl A1 | | | 7,003,117 | | | | 23,350,000 | |

| | | | | | | | | | | | |

| | | | | | | 11,530,128 | | | | 110,153,000 | |

| | | |

| | | | Casinos & Gaming (1.15%) | | | | | | | | |

| | 1,750,000 | | | Red Rock Resorts, Inc., Cl A | | | 35,354,171 | | | | 38,815,000 | |

| | | |

| | | | Education Services (6.09%) | | | | | | | | |

| | 1,750,000 | | | Bright Horizons Family Solutions, Inc.1 | | | 57,731,206 | | | | 126,857,500 | |

| | 3,100,000 | | | Nord Anglia Education, Inc.1,2 | | | 56,903,384 | | | | 78,554,000 | |

| | | | | | | | | | | | |

| | | | | | | 114,634,590 | | | | 205,411,500 | |

| | | |

| | | | Internet & Direct Marketing Retail (1.15%) | | | | | | | | |

| | 850,000 | | | Liberty Expedia Holdings, Inc., Cl A1 | | | 36,289,832 | | | | 38,658,000 | |

| | | |

| | | | Movies & Entertainment (2.24%) | | | | | | | | |

| | 750,000 | | | Liberty Media Corporation - Liberty Formula One, Cl C (formerly, Liberty Media Group, Cl C)1 | | | 10,168,679 | | | | 25,612,500 | |

| | 250,000 | | | The Madison Square Garden Company, Cl A1 | | | 13,336,230 | | | | 49,927,500 | |

| | | | | | | | | | | | |

| | | | | | | 23,504,909 | | | | 75,540,000 | |

| | | |

| | | | Restaurants (2.76%) | | | | | | | | |

| | 500,000 | | | BJ’s Restaurants, Inc.1 | | | 16,384,828 | | | | 20,200,000 | |

| | 500,000 | | | The Cheesecake Factory, Inc. | | | 9,055,187 | | | | 31,680,000 | |

| | 850,000 | | | Wingstop Inc.1 | | | 20,620,955 | | | | 24,038,000 | |

| | 934,569 | | | Zoe’s Kitchen, Inc.1 | | | 23,954,573 | | | | 17,289,527 | |

| | | | | | | | | | | | |

| | | | | | | 70,015,543 | | | | 93,207,527 | |

| | | |

| | | | Specialty Stores (0.94%) | | | | | | | | |

| | 2,250,000 | | | Party City Holdco, Inc.1 | | | 32,984,775 | | | | 31,612,500 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 350,171,549 | | | | 628,861,527 | |

| | | | | | | | | | | | |

|

| Consumer Staples (0.62%) | |

| | | | Food Distributors (0.62%) | | | | | | | | |

| | 1,500,000 | | | The Chefs’ Warehouse, Inc.1,3 | | | 22,433,215 | | | | 20,850,000 | |

| | | | | | | | | | | | |

|

| Energy (2.28%) | |

| | | | Oil & Gas Storage & Transportation (2.28%) | | | | | | | | |

| | 400,000 | | | Dominion Midstream Partners, L.P. | | | 8,400,000 | | | | 12,780,000 | |

| | 800,000 | | | PBF Logistics LP | | | 20,465,744 | | | | 17,240,000 | |

| | 2,500,000 | | | Scorpio Tankers Inc.2 | | | 20,750,000 | | | | 11,100,000 | |

| | 745,500 | | | Valero Energy Partners LP | | | 20,810,301 | | | | 35,716,905 | |

| | | | | | | | | | | | |

| | Total Energy | | | 70,426,045 | | | | 76,836,905 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Financials (2.63%) | |

| | | | Asset Management & Custody Banks (1.29%) | | | | | | | | |

| | 1,000,000 | | | Financial Engines, Inc. | | $ | 14,907,587 | | | $ | 43,550,000 | |