| | | | |

OMB APPROVAL |

| OMB Number: | | 3235-0570 |

| Expires: | | August 31, 2020 |

| Estimated average burden |

| Hours per response ......... | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-5032

BARON INVESTMENT FUNDS TRUST f/k/a

BARON ASSET FUND

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Investment Funds Trust

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code):212-583-2000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17CRF270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 5th Street, NW, Washington, D.C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

SEC 2569(5-07)

| Item 1. | Reports to Stockholders. |

Baron Asset Fund

Baron Growth Fund

Baron Small Cap Fund

Baron Opportunity Fund

Baron Fifth Avenue Growth Fund

Baron Discovery Fund

Baron Durable Advantage Fund

Baron Funds®

Baron Investment Funds Trust

Semi-Annual Financial Report

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from Baron Funds (“Baron”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Baron website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from Baron or your financial intermediary electronically by contacting your financial intermediary or going toicsdelivery.com/baronfunds.

You may elect to receive all future reports in paper free of charge. You can inform Baron or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions included on the envelope or slip inserted with this disclosure. Your election to receive reports in paper will apply to all funds held with Baron or your financial intermediary.

DEAR BARON INVESTMENT FUNDS SHAREHOLDER:

In this report, you will find unaudited financial statements for Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund and Baron Durable Advantage Fund (the “Funds”) for the six months ended March 31, 2019. The U.S. Securities and Exchange Commission (the “SEC”) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer and Chief Investment Officer May 28, 2019 | | Linda S. Martinson Chairman, President and Chief Operating Officer May 28, 2019 | | Peggy Wong Treasurer and Chief Financial Officer May 28, 2019 |

This Semi-Annual Financial Report is for the Baron Investment Funds Trust, which currently has seven series: Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund and Baron Durable Advantage Fund. If you are interested in Baron Select Funds, which contains the Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron WealthBuilder Fund and Baron Health Care Fund series, please visit the Funds’ website at www.BaronFunds.com or contact us at1-800-99BARON.

The Funds’ Proxy Voting Policy is available without charge and can be found on the Funds’ website at www.BaronFunds.com, by clicking on the “Legal Notices” link at the bottom left corner of the homepage or by calling1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website.

Some of the comments contained in this report are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan” and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to www.BaronFunds.com for a prospectus or summary prospectus. Read them carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus or summary prospectus.

| | |

| Baron Asset Fund(Unaudited) | | March 31, 2019 |

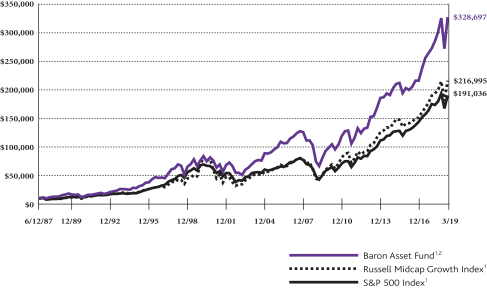

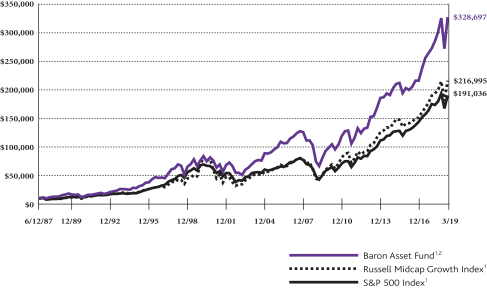

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON ASSET FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(June 12,

1987) | |

Baron Asset Fund — Retail Shares1,2 | | | 0.59% | | | | 14.88% | | | | 17.84% | | | | 11.86% | | | | 17.20% | | | | 11.61% | |

Baron Asset Fund — Institutional Shares1,2,4 | | | 0.72% | | | | 15.16% | | | | 18.15% | | | | 12.16% | | | | 17.51% | | | | 11.70% | |

Baron Asset Fund — R6 Shares1,2,4 | | | 0.72% | | | | 15.18% | | | | 18.15% | | | | 12.15% | | | | 17.50% | | | | 11.70% | |

Russell Midcap Growth Index1 | | | 0.49% | | | | 11.51% | | | | 15.06% | | | | 10.89% | | | | 17.60% | | | | 10.18% | 3 |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 13.51% | | | | 10.91% | | | | 15.92% | | | | 9.72% | |

| 1 | The indexes are unmanaged. The Russell MidcapTM Growth Index measures the performance of medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | For the period June 30, 1987 to March 31, 2019. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| | |

| March 31, 2019 (Unaudited) | | Baron Asset Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Gartner, Inc. | | | 5.8% | |

IDEXX Laboratories, Inc. | | | 5.4% | |

Mettler-Toledo International, Inc. | | | 4.5% | |

Verisk Analytics, Inc. | | | 4.4% | |

Vail Resorts, Inc. | | | 3.5% | |

Guidewire Software, Inc. | | | 3.4% | |

Verisign, Inc. | | | 3.2% | |

ANSYS, Inc. | | | 2.8% | |

FactSet Research Systems, Inc. | | | 2.7% | |

CoStar Group, Inc. | | | 2.5% | |

| |

| | | | 38.2% | |

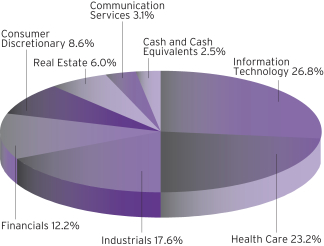

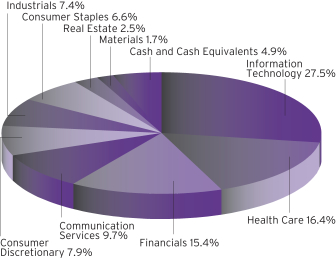

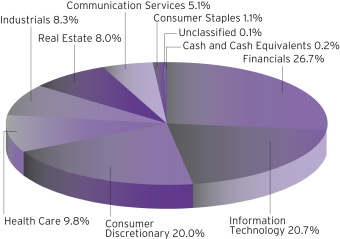

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Asset Fund1 increased 0.59%, while the Russell Midcap Growth Index gained 0.49% and the S&P 500 Index declined 1.72%.

Baron Asset Fund invests primarily inmedium-sized growth companies for the long term, using a value-oriented purchase discipline. The Fund purchases companies that we believe have sustainable competitive advantages, strong financial characteristics, and exceptional management; and operate in industries with favorable growth characteristics.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress on U.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

Information Technology, Financials, and Real Estate were the top contributing sectors in the period. Consumer Discretionary and Health Care were the top detractors.

Weighing instruments manufacturer Mettler-Toledo International, Inc. was the top contributor due to strong sales and earnings growth and solid 2019 guidance. Management commentary regarding the company’s demand environment was positive. Mettler has not seen a slowdown in China and has taken steps to mitigate the impact of tariffs, although the company still stands to benefit from their reduction or removal. Mettler’s board authorized an increase in balance sheet leverage to repurchase stock.

The top detractor was Vail Resorts, Inc., a global operator of ski resorts, due to destination visitation that missed investor expectations. The company also lowered its 2019 guidance by 4.5%. We retain conviction. Business improved over the holiday season and Vail continues to lock up 50% of its lift ticket revenue before the ski season starts and generate strong cash flow.

We continue to believe thatmid-sized growth stocks represent an attractive investment opportunity. The U.S. economy remains among the world’s healthiest, its equity market multiples remain within the range of their long-term historic averages, and interest rates continue to be quite low by historic standards. We believe our diversified portfolio of fast growing, well managed, competitively advantaged businesses will continue to perform well in this environment. There is, of course, no guarantee that this will be the case.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

3

| | |

| Baron Growth Fund(Unaudited) | | March 31, 2019 |

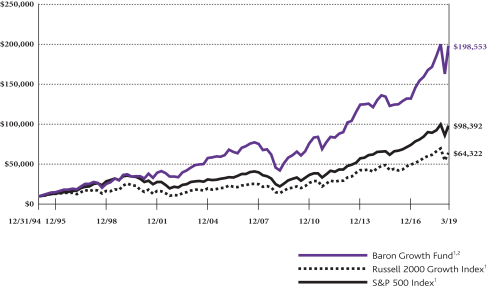

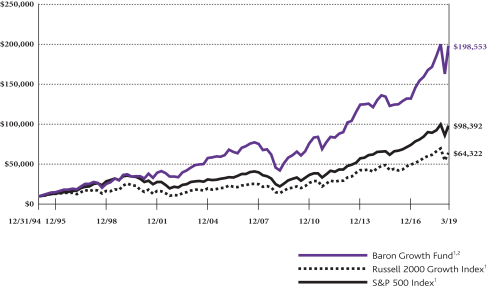

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

1994) | |

Baron Growth Fund — Retail Shares1,2 | | | (0.99)% | | | | 15.27% | | | | 16.62% | | | | 9.66% | | | | 16.63% | | | | 13.12% | |

Baron Growth Fund — Institutional Shares1,2,3 | | | (0.87)% | | | | 15.57% | | | | 16.92% | | | | 9.94% | | | | 16.92% | | | | 13.23% | |

Baron Growth Fund — R6 Shares1,2,3 | | | (0.87)% | | | | 15.56% | | | | 16.92% | | | | 9.94% | | | | 16.92% | | | | 13.23% | |

Russell 2000 Growth Index1 | | | (8.22)% | | | | 3.85% | | | | 14.87% | | | | 8.41% | | | | 16.52% | | | | 7.98% | |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 13.51% | | | | 10.91% | | | | 15.92% | | | | 9.89% | |

| 1 | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| | |

| March 31, 2019 (Unaudited) | | Baron Growth Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Vail Resorts, Inc. | | | 7.0% | |

CoStar Group, Inc. | | | 6.1% | |

MSCI, Inc. | | | 5.5% | |

Gartner, Inc. | | | 5.2% | |

Arch Capital Group Ltd. | | | 4.9% | |

FactSet Research Systems, Inc. | | | 4.7% | |

ANSYS, Inc. | | | 4.2% | |

IDEXX Laboratories, Inc. | | | 3.8% | |

SS&C Technologies Holdings, Inc. | | | 3.6% | |

Iridium Communications Inc. | | | 3.6% | |

| |

| | | | 48.6% | |

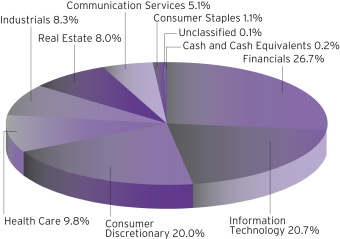

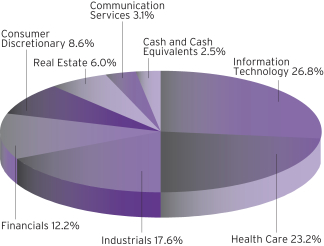

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Growth Fund1 declined 0.99%, outperforming the Russell 2000 Growth Index, which declined 8.22% and the S&P 500 Index, which declined 1.72%.

Baron Growth Fund invests primarily insmall-sized U.S. growth companies for the long term. Through independent research, we utilize an investment approach that we believe allows us to look at a business’s fundamental characteristics and beyond the current market environment. We invest based on the potential profitability of a business at what we believe are attractive valuations.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress on U.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

Financials and Real Estate were the top contributing sectors in the period. Holdings in Consumer Discretionary, Health Care, and Industrials detracted.

MSCI, Inc., a leading provider of investment decision support tools, was the top contributor to performance due to solid earnings results and an upbeat investor day presentation in which management presented an optimistic long-term financial model. We retain conviction in MSCI because we believe the company owns strong franchises and stands to benefit from several prominent tailwinds.

The top detractor was Vail Resorts, Inc., a global operator of ski resorts, due to destination visitation that missed investor expectations. The company also lowered its 2019 guidance by 4.5%. We retain conviction. Business improved over the holiday season and Vail continues to lock up 50% of its lift ticket revenue before the ski season starts and generate strong cash flow.

The Fund continues to invest in a portfolio of businesses that have better financial characteristics than the benchmark index against which it is compared. These businesses have higher operating profit margins, net margins, EBITDA margins, return on invested capital, return on equity, return on assets, and lower standard deviations of earnings growth. While we do not try to predict short-term macro developments or current events, we believe conditions remain favorable for the U.S. economy and equity markets.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

5

| | |

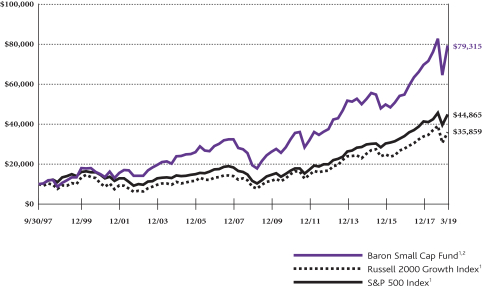

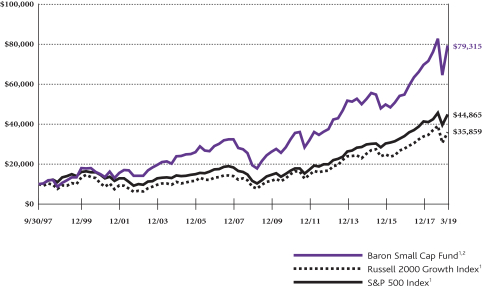

| Baron Small Cap Fund(Unaudited) | | March 31, 2019 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON SMALL CAP FUND (RETAIL SHARES)

IN RELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since Inception

(September 30,

1997) | |

Baron Small Cap Fund — Retail Shares1,2 | | | (4.10)% | | | | 10.84% | | | | 17.91% | | | | 9.16% | | | | 16.08% | | | | 10.11% | |

Baron Small Cap Fund — Institutional Shares1,2,3 | | | (3.94)% | | | | 11.20% | | | | 18.23% | | | | 9.45% | | | | 16.37% | | | | 10.24% | |

Baron Small Cap Fund — R6 Shares1,2,3 | | | (3.95)% | | | | 11.17% | | | | 18.22% | | | | 9.45% | | | | 16.37% | | | | 10.24% | |

Russell 2000 Growth Index1 | | | (8.22)% | | | | 3.85% | | | | 14.87% | | | | 8.41% | | | | 16.52% | | | | 6.12% | |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 13.51% | | | | 10.91% | | | | 15.92% | | | | 7.23% | |

| 1 | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| | |

| March 31, 2019 (Unaudited) | | Baron Small Cap Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Gartner, Inc. | | | 4.3% | |

Guidewire Software, Inc. | | | 3.9% | |

TransDigm Group, Inc. | | | 3.1% | |

Waste Connections, Inc. | | | 3.0% | |

The Trade Desk | | | 2.8% | |

ASGN Incorporated | | | 2.7% | |

SBA Communications Corp. | | | 2.7% | |

IDEXX Laboratories, Inc. | | | 2.7% | |

Bright Horizons Family Solutions, Inc. | | | 2.6% | |

PRA Health Sciences, Inc. | | | 2.4% | |

| |

| | | | 30.2% | |

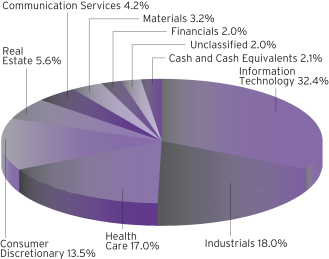

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Small Cap Fund1declined 4.10%, outperforming the Russell 2000 Growth Index, which declined 8.22% and underperforming the S&P 500 Index, which fell 1.72%.

Baron Small Cap Fund invests 80% of its net assets in equity securities of small-sized growth companies with market capitalizations up to

the largest market cap stock in the Russell 2000 Growth Index at reconstitution, or companies with market capitalizations up to $2.5 billion, whichever is larger. The Fund invests in what we believe arewell-runsmall-cap growth businesses that can be purchased at prices that represent a significant discount to our assessment of future value.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress on U.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

Real Estate was the top contributor to performance. Holdings in Health Care, Industrials, and Information Technology were the top detractors.

The Trade Desk, a leading internet advertising demand-side platform, was the top contributor. The company enables agencies to efficiently purchase digital advertising through PC, mobile, and online video channels. Shares rose on robust financial results, with particular strength in international markets and the fast-growing connected TV business. We remain positive on the company given its technology, scale, and estimated 10% share in the $10 billion programmatic advertising market.

Teladoc Health, Inc., the U.S.’s largest telehealth company, was the top detractor. Its stock fell in concert with the broader market retreat in the first three months of the period, which was particularly brutal for high-growth stocks. Thesell-off also reflected news of the resignation of the CFO/COO. We believe the incident will not stall Teladoc’s substantial momentum in the rapidly expanding telehealth space, where it is the dominant player. Guidance was reiterated and the CFO/COO’s acting replacement is well known and respected by investors.

Baron Small Cap Fund invests primarily in classic growth stocks that we believe have significant long-term growth prospects and can be purchased at what we believe are attractive prices because their prospects have not yet been appreciated by investors. We also invest in fallen angels, which are companies that we believe have strong long-term franchises but have disappointed investors with short-term results, creating what we believe is a buying opportunity. A third category of investment is special situations, including spin-offs and recapitalizations, where lack of investor awareness creates opportunities to purchase what we believe are strong businesses at attractive prices.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

7

| | |

| Baron Opportunity Fund(Unaudited) | | March 31, 2019 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON OPPORTUNITY FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 3000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(February 29,

2000) | �� |

Baron Opportunity Fund — Retail Shares1,2 | | | 1.23% | | | | 20.10% | | | | 23.89% | | | | 11.97% | | | | 17.68% | | | | 7.12% | |

Baron Opportunity Fund — Institutional Shares1,2,3 | | | 1.41% | | | | 20.46% | | | | 24.24% | | | | 12.27% | | | | 17.99% | | | | 7.26% | |

Baron Opportunity Fund — R6 Shares1,2,3 | | | 1.36% | | | | 20.43% | | | | 24.27% | | | | 12.29% | | | | 18.00% | | | | 7.27% | |

Russell 3000 Growth Index1 | | | (2.80)% | | | | 12.06% | | | | 16.40% | | | | 13.10% | | | | 17.44% | | | | 4.52% | |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 13.51% | | | | 10.91% | | | | 15.92% | | | | 5.94% | |

| 1 | The indexes are unmanaged. The Russell 3000® Growth Index measures the performance of those companies classified as growth among the largest 3,000 U.S. companies, and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Baron Fund expenses pursuant to a contract expiring on August 29, 2030, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

8

| | |

| March 31, 2019 (Unaudited) | | Baron Opportunity Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Amazon.com, Inc. | | | 5.9% | |

Microsoft Corporation | | | 5.5% | |

Guidewire Software, Inc. | | | 5.2% | |

Alphabet Inc. | | | 5.1% | |

Gartner, Inc. | | | 4.5% | |

argenx SE | | | 2.6% | |

Tesla, Inc. | | | 2.5% | |

CoStar Group, Inc. | | | 2.5% | |

Sage Therapeutics, Inc. | | | 2.4% | |

Electronic Arts Inc. | | | 2.4% | |

| |

| | | | 38.6% | |

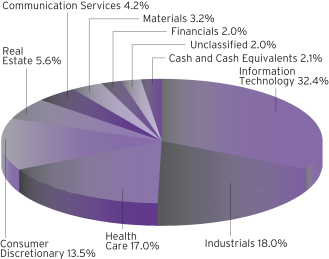

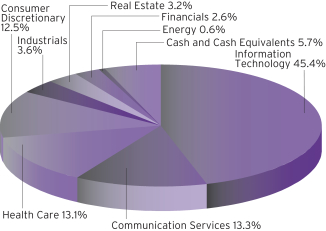

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Opportunity Fund1 increased 1.23%, while the Russell 3000 Growth Index declined 2.80% and the S&P 500 Index declined 1.72%.

Baron Opportunity Fund invests primarily in U.S. growth companies that we believe are driving or benefiting from innovation, through development of pioneering, transformative, or technologically advanced products and services. The Fund invests in high growth businesses of any market capitalization, selected for their capital appreciation potential.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress on U.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

Investments in Information Technology and Health Care contributed the most during the period. Communication Services and Consumer Discretionary detracted the most.

The top contributor was argenx SE, a Belgian/Dutch biotechnology company developing innovative antibody therapies for cancer and autoimmune diseases. Strong performance was driven by a previously undisclosed milestone payment from AbbVie on an underfollowed asset in argenx’s pipeline and an exclusive licensing deal with Halozyme to utilize its subcutaneous technology that we believe practically assures argenx’s lead in the neonatal Fc receptor (“FcRn”) market. We believe argenx’s FcRn platform is one of the most valuable assets in the biotechnology development space.

Apple, Inc., a technology company known for its iconic iPhone, was the top detractor in the period. Shares detracted for the period held due to the company’spre-announced revenue, which was lower than its historical guidance range due to declining iPhone sales. We sold our position in the company, as we no longer view Apple as a growth-oriented investment.

We remain focused on finding unique businesses across different segments of the economy that we believe offer long-term secular growth, sustainable competitive advantages, high-quality management teams, and attractive stock prices. We believe that investment returns for stocks are driven by earnings growth, and therefore direct our research towards understanding the drivers of business profit and projecting future profit growth as accurately as we can.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

9

| | |

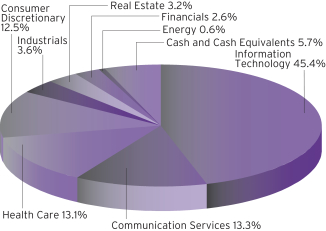

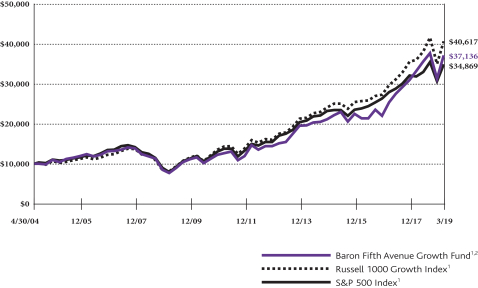

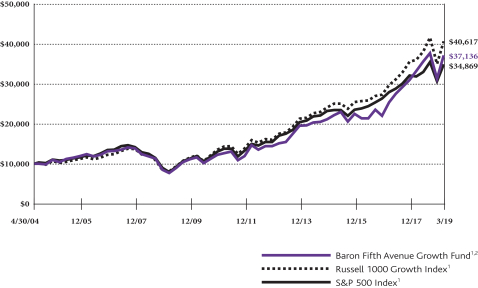

| Baron Fifth Avenue Growth Fund(Unaudited) | | March 31, 2019 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FIFTH AVENUE GROWTH FUND

(RETAIL SHARES)INRELATIONTOTHE RUSSELL 1000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(April 30,

2004) | |

Baron Fifth Avenue Growth Fund — Retail Shares1,2 | | | (1.48)% | | | | 11.82% | | | | 20.25% | | | | 13.63% | | | | 17.04% | | | | 9.19% | |

Baron Fifth Avenue Growth Fund — Institutional Shares1,2,3 | | | (1.36)% | | | | 12.07% | | | | 20.57% | | | | 13.91% | | | | 17.33% | | | | 9.38% | |

Baron Fifth Avenue Growth Fund — R6 Shares1,2,3 | | | (1.36)% | | | | 12.07% | | | | 20.58% | | | | 13.92% | | | | 17.33% | | | | 9.38% | |

Russell 1000 Growth Index1 | | | (2.34)% | | | | 12.75% | | | | 16.53% | | | | 13.50% | | | | 17.52% | | | | 9.85% | |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 13.51% | | | | 10.91% | | | | 15.92% | | | | 8.73% | |

| 1 | The indexes are unmanaged. The Russell 1000® Growth Index measures the performance of large-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Baron Fund expenses pursuant to a contract expiring on August 29, 2030, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

10

| | |

| March 31, 2019 (Unaudited) | | Baron Fifth Avenue Growth Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Amazon.com, Inc. | | | 13.2% | |

Alibaba Group Holding Limited | | | 5.8% | |

Mastercard Incorporated | | | 5.4% | |

Alphabet Inc. | | | 5.0% | |

Visa, Inc. | | | 4.6% | |

Veeva Systems Inc. | | | 4.4% | |

Intuitive Surgical, Inc. | | | 4.3% | |

Illumina, Inc. | | | 4.2% | |

Worldpay, Inc. | | | 3.8% | |

Facebook, Inc. | | | 3.5% | |

| |

| | | | 54.2% | |

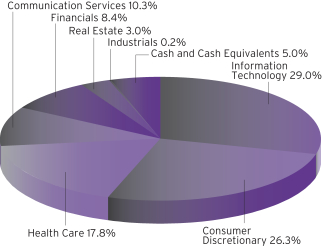

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Fifth Avenue Growth Fund1 declined 1.48%, outperforming the Russell 1000 Growth Index, which fell 2.34% and the S&P 500 Index, which declined 1.72%.

Baron Fifth Avenue Growth Fund invests in large-sized growth companies, at the time of purchase, with market capitalizations no smaller than the top 85th percentile by total market capitalization of the Russell 1000 Growth Index at June 30, or companies with

market capitalizations above $10 billion, whichever is smaller. The Fund focuses on identifying and investing in what we believe are unique companies with sustainable competitive advantages that have the ability to redeploy capital at high rates of return. The portfolio is constructed on abottom-up basis, with the quality of ideas and conviction level the most important determinants of the size of each investment. We expect our highest conviction businesses to have meaningful weight in the portfolio. Sector weightings are incidental to portfolio construction, and exposure to any sector is a result of stock selection.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress on U.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

Information Technology and Health Care were the top contributing sectors in the period. The Communication Services, Consumer Discretionary, and Financials sectors detracted.

Cloud software provider Veeva Systems Inc. was the top contributor due to sustainable growth in its CRM business and rapid growth in in its newer Vault business. New product development, maturing product offerings, and a loyal customer base are adding confidence in Veeva’s unique position and in its ability to support growth while generating significant free cash flow.

e-commerce leader Amazon.com, Inc. was the top detractor. Shares fell on softer revenue growth, but the company remains one of the Fund’s highest conviction investment ideas. While penetration ofe-commerce is rising rapidly, Amazon continues to grow its total addressable market at an unprecedented pace. We believe Amazon’s advertising business has the potential to generate $30 billion in the next four years and the ability to substantially improve Amazon’s core margins. AWS is also the leader in the cloud infrastructure market by a wide margin.

The Fund seeks to manage risk by focusing on business risk (competition, management, regulations), valuation risk (purchase price providing a large enough margin of safety), financial risk (leverage and capital structure), and analysis risk (our assumptions). Our objective is not to predict how markets may perform in a given year. Instead, we aim to create a portfolio of unique companies with different end markets because, in our experience, this is the best way to manage market risk over time.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

11

| | |

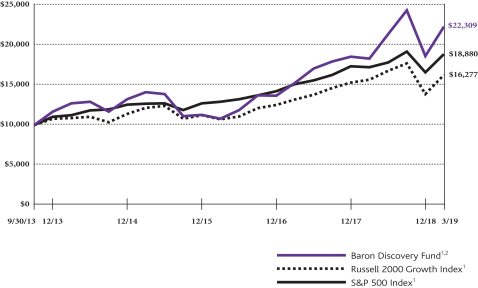

| Baron Discovery Fund(Unaudited) | | March 31, 2019 |

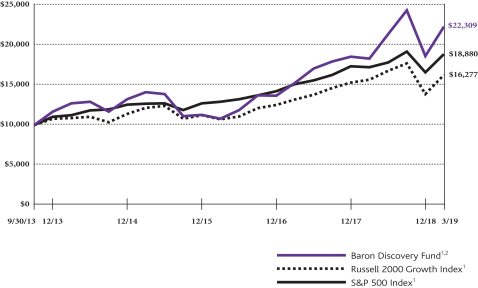

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON DISCOVERY FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Since Inception

(September 30,

2013) | |

Baron Discovery Fund — Retail Shares1,2 | | | (8.34)% | | | | 21.78% | | | | 27.32% | | | | 11.91% | | | | 15.71% | |

Baron Discovery Fund — Institutional Shares1,2 | | | (8.25)% | | | | 22.08% | | | | 27.65% | | | | 12.18% | | | | 15.99% | |

Baron Discovery Fund — R6 Shares1,2,3 | | | (8.25)% | | | | 22.15% | | | | 27.66% | | | | 12.18% | | | | 15.99% | |

Russell 2000 Growth Index1 | | | (8.22)% | | | | 3.85% | | | | 14.87% | | | | 8.41% | | | | 9.26% | |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 13.51% | | | | 10.91% | | | | 12.25% | |

| † | The Fund’s historical performance was impacted by gains from IPOs and/or secondary offerings. There is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs and secondary offerings will be the same in the future. |

| 1 | The indexes are unmanaged. The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Baron Fund expenses pursuant to a contract expiring on August 29, 2030, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares. |

12

| | |

| March 31, 2019 (Unaudited) | | Baron Discovery Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Mercury Systems, Inc. | | | 3.4% | |

Myriad Genetics, Inc. | | | 3.3% | |

Americold Realty Trust | | | 2.7% | |

SiteOne Landscape Supply, Inc. | | | 2.7% | |

Yext, Inc. | | | 2.5% | |

RIB Software SE | | | 2.5% | |

The Trade Desk | | | 2.5% | |

Intersect ENT, Inc. | | | 2.4% | |

Sientra, Inc. | | | 2.4% | |

2U, Inc. | | | 2.3% | |

| |

| | | | 26.7% | |

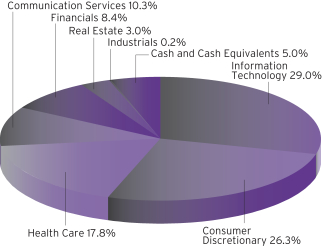

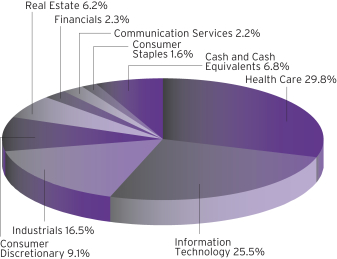

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Discovery Fund1 declined 8.34%%, underperforming the Russell 2000 Growth Index, which fell 8.22% and the S&P 500 Index, which declined 1.72%.

Baron Discovery Fund invests primarily insmall-sized U.S. companies, at time of purchase, with market capitalizations up to the largest market cap stock in the Russell 2000 Growth Index at June 30, or companies with market capitalizations up to $2.5 billion,

whichever is larger, so long as the purchase of those securities would not cause the Fund’s weighted average market capitalization to exceed that of the Russell 2000 Growth Index. If at any time, the Fund’s weighted average market capitalization exceeds that of the Russell 2000 Growth Index, the Fund may only purchase securities with market capitalizations up to the weighted average market capitalization of the Russell 2000 Growth Index. The Fund invests in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress on U.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

The Real Estate and Information Technology sectors were the top contributors. Health Care, Consumer Discretionary, and Industrials were the top detractors.

Gaming operator Boyd Gaming Corporation contributed the most, as concerns over weather impacting visitation to its casinos proved unfounded. The company is seeing strong growth in spend per visit at most casinos, as the Las Vegas and regional economies remain strong. Boyd continues to generate robust free cash flow, pay down debt on its balance sheet, and improve its financial positioning. Its five recent acquisitions are also showing growth and remain on track with their synergy targets. Boyd expects to be within its targeted range of between 4 times to 5 times EBITDA by year end.

Medical device company Sientra, Inc. was the top detractor due to the company’s delay in ramping up a breast implant facility and industry concerns over textured implant safety that have dampened overall procedure volume. The FDA has convened a panel to examine rare incidences of cancer involving textured implants. We are not overly concerned, as Sientra’s textured implants have far fewer incidents per implant than competitors, and the textured business represents only about 1% to 2% of Sientra’s sales.

We think the long-term fundamentals of our companies remain strong. The companies we own are, in our view, high quality, innovative and run by excellent management teams. We are optimistic that they will be significantly bigger next year than they are today and that this growth can continue for years after. There is, of course, no guarantee that this will be the case.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

13

| | |

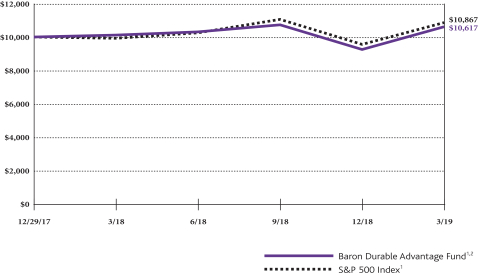

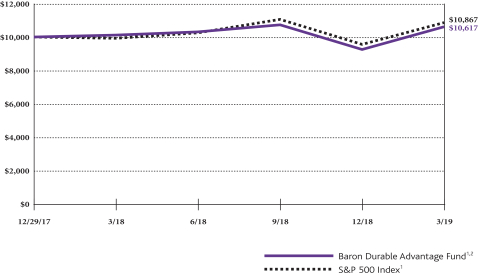

| Baron Durable Advantage Fund | | March 31, 2019 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON DURABLE ADVANTAGE FUND

(RETAIL SHARES)INRELATIONTOTHE S&P 500 INDEX

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2019 | |

| | | Six

Months* | | | One

Year | | | Since

Inception

(December 29,

2017) | |

Baron Durable Advantage Fund — Retail Shares1,2 | | | (1.14)% | | | | 4.81% | | | | 4.91% | |

Baron Durable Advantage Fund — Institutional Shares1,2 | | | (1.05)% | | | | 5.10% | | | | 5.14% | |

Baron Durable Advantage Fund — R6 Shares1,2 | | | (0.96)% | | | | 5.10% | | | | 5.14% | |

S&P 500 Index1 | | | (1.72)% | | | | 9.50% | | | | 6.87% | |

| 1 | The index is unmanaged. The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. The index and Baron Durable Advantage Fund are with dividends reinvested, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Baron Fund expenses pursuant to a contract expiring on August 29, 2030, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

14

| | |

| March 31, 2019 (Unaudited) | | Baron Durable Advantage Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2019

| | | | |

| | | Percent of

Net Assets | |

Microsoft Corporation | | | 5.2% | |

Mastercard Incorporated | | | 5.1% | |

Danaher Corporation | | | 4.7% | |

Moody’s Corporation | | | 4.6% | |

UnitedHealth Group Incorporated | | | 4.5% | |

S&P Global Inc. | | | 4.3% | |

Alphabet Inc. | | | 4.3% | |

Apple, Inc. | | | 4.1% | |

LVMH Moet Hennessy Louis Vuitton SE | | | 3.5% | |

Accenture plc | | | 3.4% | |

| |

| | | | 43.7% | |

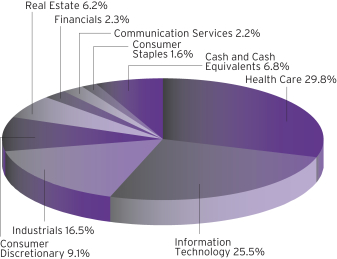

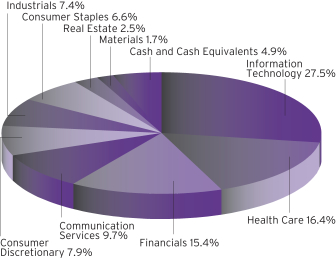

SECTOR BREAKDOWNASOF MARCH 31, 2019†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For thesix-month period ended March 31, 2019, Baron Durable Advantage Fund1 declined 1.14%, outperforming the S&P 500 Index, which fell 1.72%.

Baron Durable Advantage Fund invests primarily inlarge-sized U.S. companies with market capitalizations no smaller than the top 90th percentile by market capitalization of the S&P 500 Index at June 30, or companies with market capitalizations above $10 billion, whichever is smaller. The Fund emphasizes competitively advantaged businesses with excess free cash flow that can be returned to shareholders.

Thesix-month period was a roller coaster ride for the markets. The first three months were exceptionally volatile, culminating with a steep slide in December that took most indexes into bear market territory. Projections of a slowdown in economic momentum and corporate earnings growth coupled with rising interest rates spurred therisk-off behavior. The U.S.-China trade dispute and partial federal government shutdown also pressured equities. In January, the market abruptly reversed course, and over the next three months, recovered almost all the decline as it shrugged off many of the concerns that had roiled stocks over the prior three months. Investors cheered perceived progress onU.S.-China trade negotiations, attractive stock valuations, and indications that Federal Reserve policies would become more dovish. On top of that, near-term recession fears appeared to moderate.

Holdings in Health Care, Financials, and Industrials contributed most to performance. Communication Services, Consumer Staples, and Consumer Discretionary were the top detracting sectors.

Life sciences tools company Danaher Corporation was the top contributor. Shares appreciated after the company announced the acquisition of GE’s bioproduction business for $21 billion. The newly acquired business is a leader in the fast-growing, attractive bioproduction market, and the transaction brings scale to Danaher’s existing bioproduction business. We expect the transaction to elevate Danaher’s growth rate and to be accretive to earnings, and it increases our conviction in our investment thesis.

Video game publisher Activision Blizzard, Inc. was the top detractor due to questions around the company’s launch slate for 2019 and broad negative sentiment across the video game sector. While the near-term environment is challenging, we retain long-term conviction in Activision due to a long track record of success and industry tailwinds that should benefit the company going forward, including the shift to digital,in-game monetization, mobile gaming, advertising, and eSports.

Our goal is to invest inlarge-cap companies that we believe have strong and durable competitive advantages, proven track records of successful capital allocation, high returns on invested capital, and high free cash flow generation, a significant portion of which is regularly returned to the shareholders in the form of either dividends or share repurchases. We hope to maximize long-term returns without taking significant risks of permanent loss of capital. We are optimistic about the prospects of the companies in which we are invested and will always continue to search for new ideas and opportunities.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

15

| | |

| Baron Asset Fund | | March 31, 2019 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (97.48%) | |

| Communication Services (3.07%) | |

| | | | Cable & Satellite (0.97%) | | | | | | | | |

| | 425,000 | | | Liberty Broadband

Corporation, Cl C1 | | $ | 32,000,689 | | | $ | 38,989,500 | |

| | |

| | | | Interactive Media & Services (2.10%) | | | | | |

| | 1,183,000 | | | ANGI Homeservices, Inc., Cl A1 | | | 19,691,754 | | | | 18,265,520 | |

| | 176,000 | | | IAC/InterActiveCorp.1 | | | 36,585,523 | | | | 36,979,360 | |

| | 836,374 | | | Zillow Group, Inc., CI C1 | | | 23,438,376 | | | | 29,055,633 | |

| | | | | | | | | | | | |

| | | | 79,715,653 | | | | 84,300,513 | |

| | | | | | | | | | | | |

| | Total Communication Services | | | 111,716,342 | | | | 123,290,013 | |

| | | | | | | | | | | | |

|

| Consumer Discretionary (8.56%) | |

| | | | Hotels, Resorts & Cruise Lines (2.06%) | | | | | |

| | 556,442 | | | Choice Hotels International, Inc. | | | 5,979,508 | | | | 43,257,801 | |

| | 543,233 | | | Hyatt Hotels Corp., Cl A | | | 16,817,762 | | | | 39,422,419 | |

| | | | | | | | | | | | |

| | | | 22,797,270 | | | | 82,680,220 | |

| | | |

| | | | Internet & Direct Marketing Retail (1.97%) | | | | | | | | |

| | 25,759 | | | Booking Holdings, Inc.1 | | | 4,113,567 | | | | 44,947,137 | |

| | 288,627 | | | Expedia Group, Inc. | | | 35,637,276 | | | | 34,346,613 | |

| | | | | | | | | | | | |

| | | | 39,750,843 | | | | 79,293,750 | |

| | | |

| | | | Leisure Facilities (3.46%) | | | | | | | | |

| | 639,538 | | | Vail Resorts, Inc. | | | 12,388,781 | | | | 138,971,607 | |

| | | |

| | | | Specialty Stores (1.07%) | | | | | | | | |

| | 406,117 | | | Tiffany & Co. | | | 23,045,345 | | | | 42,865,649 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 97,982,239 | | | | 343,811,226 | |

| | | | | | | | | | | | |

|

| Financials (12.20%) | |

| | | | Asset Management & Custody Banks (0.77%) | | | | | | | | |

| | 307,514 | | | T. Rowe Price Group, Inc. | | | 11,188,453 | | | | 30,788,302 | |

| | | |

| | | | Financial Exchanges & Data (4.29%) | | | | | | | | |

| | 438,725 | | | FactSet Research Systems, Inc. | | | 30,500,158 | | | | 108,922,256 | |

| | 257,267 | | | MarketAxess Holdings, Inc. | | | 31,487,484 | | | | 63,308,263 | |

| | | | | | | | | | | | |

| | | | 61,987,642 | | | | 172,230,519 | |

| | | |

| | | | Insurance Brokers (1.68%) | | | | | | | | |

| | 385,421 | | | Willis Towers Watson plc2 | | | 48,903,637 | | | | 67,699,199 | |

| | | |

| | | | Investment Banking & Brokerage (2.26%) | | | | | | | | |

| | 2,125,936 | | | The Charles Schwab Corp. | | | 1,921,092 | | | | 90,905,023 | |

| | | |

| | | | Property & Casualty Insurance (1.93%) | | | | | | | | |

| | 2,393,444 | | | Arch Capital Group Ltd.1,2 | | | 8,625,560 | | | | 77,356,110 | |

| | | |

| | | | Regional Banks (1.27%) | | | | | | | | |

| | 506,421 | | | First Republic Bank | | | 18,557,404 | | | | 50,875,054 | |

| | | | | | | | | | | | |

| | Total Financials | | | 151,183,788 | | | | 489,854,207 | |

| | | | | | | | | | | | |

|

| Health Care (23.21%) | |

| | | | Biotechnology (0.90%) | | | | | | | | |

| | 226,658 | | | Sage Therapeutics, Inc.1 | | | 35,684,955 | | | | 36,049,955 | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

|

| Health Care (continued) | |

| | | |

| | | | Health Care Equipment (7.23%) | | | | | | | | |

| | 99,000 | | | DexCom, Inc.1 | | $ | 12,763,833 | | | $ | 11,790,900 | |

| | 976,630 | | | IDEXX Laboratories, Inc.1 | | | 18,197,737 | | | | 218,374,468 | |

| | 199,644 | | | Teleflex, Inc. | | | 40,334,965 | | | | 60,324,431 | |

| | | | | | | | | | | | |

| | | | 71,296,535 | | | | 290,489,799 | |

| | | |

| | | | Health Care Supplies (3.89%) | | | | | | | | |

| | 93,360 | | | Align Technology, Inc.1 | | | 15,256,103 | | | | 26,545,049 | |

| | 215,418 | | | The Cooper Companies, Inc. | | | 36,713,299 | | | | 63,800,349 | |

| | 598,404 | | | West Pharmaceutical Services, Inc. | | | 26,107,582 | | | | 65,944,120 | |

| | | | | | | | | | | | |

| | | | 78,076,984 | | | | 156,289,518 | |

| | | |

| | | | Health Care Technology (1.53%) | | | | | | | | |

| | 484,386 | | | Veeva Systems, Inc., Cl A1 | | | 30,296,950 | | | | 61,449,208 | |

| | | |

| | | | Life Sciences Tools & Services (9.65%) | | | | | | | | |

| | 431,986 | | | Bio-Techne Corporation | | | 45,942,864 | | | | 85,770,820 | |

| | 302,552 | | | Illumina, Inc.1 | | | 13,002,071 | | | | 93,999,881 | |

| | 251,117 | | | Mettler-Toledo International, Inc.1 | | | 26,581,877 | | | | 181,557,591 | |

| | 104,000 | | | Waters Corp.1 | | | 21,564,959 | | | | 26,177,840 | |

| | | | | | | | | | | | |

| | | | 107,091,771 | | | | 387,506,132 | |

| | | |

| | | | Pharmaceuticals (0.01%) | | | | | | | | |

| | 8,340 | | | Elanco Animal Health, Inc.1 | | | 200,160 | | | | 267,464 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 322,647,355 | | | | 932,052,076 | |

| | | | | | | | | | | | |

|

| Industrials (17.65%) | |

| | | | Aerospace & Defense (0.73%) | | | | | | | | |

| | 588,082 | | | BWX Technologies, Inc. | | | 29,416,776 | | | | 29,157,106 | |

| | | |

| | | | Agricultural & Farm Machinery (1.04%) | | | | | | | | |

| | 607,045 | | | The Toro Co. | | | 37,800,467 | | | | 41,788,978 | |

| | | |

| | | | Building Products (0.75%) | | | | | | | | |

| | 569,158 | | | AO Smith Corp. | | | 29,825,518 | | | | 30,347,505 | |

| | | |

| | | | Construction Machinery & Heavy Trucks (0.38%) | | | | | | | | |

| | 205,740 | | | Wabtec Corp. | | | 13,120,881 | | | | 15,167,153 | |

| | | |

| | | | Environmental & Facilities Services (1.10%) | | | | | | | | |

| | 1,060,612 | | | Rollins, Inc. | | | 23,392,873 | | | | 44,142,671 | |

| | | |

| | | | Industrial Conglomerates (2.23%) | | | | | | | | |

| | 262,192 | | | Roper Technologies, Inc. | | | 27,831,603 | | | | 89,661,798 | |

| | | |

| | | | Industrial Machinery (1.74%) | | | | | | | | |

| | 460,760 | | | IDEX Corporation | | | 36,231,831 | | | | 69,915,722 | |

| | | |

| | | | Research & Consulting Services (9.23%) | | | | | | | | |

| | 219,493 | | | CoStar Group, Inc.1 | | | 44,044,864 | | | | 102,375,925 | |

| | 1,393,500 | | | TransUnion | | | 70,501,013 | | | | 93,141,540 | |

| | 1,316,206 | | | Verisk Analytics, Inc. | | | 43,847,924 | | | | 175,055,398 | |

| | | | | | | | | | | | |

| | | | | | | 158,393,801 | | | | 370,572,863 | |

| | | |

| | | | Trading Companies & Distributors (0.45%) | | | | | | | | |

| | 281,117 | | | Fastenal Co. | | | 6,165,826 | | | | 18,078,634 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 362,179,576 | | | | 708,832,430 | |

| | | | | | | | | | | | |

| | |

| 16 | | See Notes to Financial Statements. |

| | |

| March 31, 2019 | | Baron Asset Fund |

STATEMENT OF NET ASSETS (Unaudited) (Continued)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Information Technology (26.80%) | |

| | | | Application Software (11.27%) | | | | | | | | |

| | 611,856 | | | ANSYS, Inc.1 | | $ | 26,567,864 | | | $ | 111,792,210 | |

| | 350,000 | | | Aspen Technology, Inc.1 | | | 30,714,066 | | | | 36,491,000 | |

| | 1,284,093 | | | Ceridian HCM Holding, Inc.1 | | | 44,181,333 | | | | 65,873,971 | |

| | 1,406,809 | | | Guidewire Software, Inc.1 | | | 76,200,081 | | | | 136,685,563 | |

| | 1,042,076 | | | SS&C Technologies Holdings, Inc. | | | 32,682,577 | | | | 66,369,820 | |

| | 58,000 | | | The Trade Desk, Inc., Cl A1 | | | 11,795,322 | | | | 11,481,100 | |

| | 72,134 | | | The Ultimate Software Group, Inc.1 | | | 13,782,618 | | | | 23,813,597 | |

| | | | | | | | | | | | |

| | | | | | | 235,923,861 | | | | 452,507,261 | |

| | | |

| | | | Data Processing & Outsourced Services (4.17%) | | | | | | | | |

| | 213,448 | | | FleetCor Technologies, Inc.1 | | | 11,616,151 | | | | 52,634,142 | |

| | 290,986 | | | MAXIMUS, Inc. | | | 14,227,799 | | | | 20,654,186 | |

| | 829,350 | | | Worldpay, Inc., Cl A1 | | | 48,700,893 | | | | 94,131,225 | |

| | | | | | | | | | | | |

| | | | 74,544,843 | | | | 167,419,553 | |

| | | |

| | | | Internet Services & Infrastructure (4.57%) | | | | | | | | |

| | 699,103 | | | Verisign, Inc.1 | | | 42,196,951 | | | | 126,929,141 | |

| | 468,000 | | | Wix.com Ltd.1,2 | | | 41,821,919 | | | | 56,548,440 | |

| | | | | | | | | | | | |

| | | | 84,018,870 | | | | 183,477,581 | |

| | | |

| | | | IT Consulting & Other Services (5.81%) | | | | | | | | |

| | 1,538,323 | | | Gartner, Inc.1 | | | 33,456,031 | | | | 233,332,833 | |

| | | |

| | | | Technology Distributors (0.98%) | | | | | | | | |

| | 407,363 | | | CDW Corp. | | | 27,215,415 | | | | 39,257,572 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 455,159,020 | | | | 1,075,994,800 | |

| | | | | | | | | | | | |

|

| Real Estate (5.99%) | |

| | | | Office REITs (0.49%) | | | | | | | | |

| | 52,548 | | | Alexander’s, Inc.4 | | | 2,289,268 | | | | 19,766,981 | |

| | | |

| | | | Real Estate Services (1.53%) | | | | | | | | |

| | 1,243,323 | | | CBRE Group, Inc., Cl A1 | | | 19,021,762 | | | | 61,482,322 | |

| | | |

| | | | Specialized REITs (3.97%) | | | | | | | | |

| | 133,416 | | | Equinix, Inc. | | | 12,783,698 | | | | 60,458,795 | |

| | 494,856 | | | SBA Communications Corp.1 | | | 19,122,141 | | | | 98,802,949 | |

| | | | | | | | | | | | |

| | | | 31,905,839 | | | | 159,261,744 | |

| | | | | | | | | | | | |

| | Total Real Estate | | | 53,216,869 | | | | 240,511,047 | |

| | | | | | | | | | | | |

| | Total Common Stocks | | | 1,554,085,189 | | | | 3,914,345,799 | |

| | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Private Partnerships (0.00%) | |

| Financials (0.00%) | |

| | | | Asset Management & Custody Banks (0.00%) | | | | | | | | |

| | 7,056,223 | | | Windy City Investments Holdings, L.L.C.1,3,4,6 | | $ | 0 | | | $ | 190,518 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | |

| Principal Amount | | | | | | |

| Short Term Investments (2.47%) | |

| | $99,184,488 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 3/29/2019, 0.50% due 4/1/2019; Proceeds at maturity - $99,188,620; (Fully collateralized by $98,150,000 U.S. Treasury Note, 2.75% due 5/31/2023; Market value - $101,172,726)5 | | | 99,184,488 | | | | 99,184,488 | |

| | | | | | | | | | | | |

| | Total Investments (99.95%) | | $ | 1,653,269,677 | | | | 4,013,720,805 | |

| | | | | | | | | | | | |

| | Cash and Other Assets Less Liabilities (0.05%) | | | | 1,858,330 | |

| | | | | | | | | | | | |

| | Net Assets | | | $ | 4,015,579,135 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $76.79 per share

based on 28,162,119 shares outstanding) |

| | $ | 2,162,499,400 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $79.84 per share

based on 22,260,010 shares outstanding) |

| | $ | 1,777,292,876 | |

| | | | | | | | | | | | |

| R6 Shares (Equivalent to $79.83 per share

based on 949,349 shares outstanding) |

| | $ | 75,786,859 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At March 31, 2019, the market value of restricted and fair valued securities amounted to $190,518 or 0.00 % of net assets. This security is not deemed liquid. See Note 6 regarding Restricted Securities. |

| 4 | The Adviser has reclassified/classified certain securities in or out of thissub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 5 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 6 | Level 3 security. See Note 7 regarding Fair Value Measurements. |

All securities are Level 1, unless otherwise noted.

| | |

| See Notes to Financial Statements. | | 17 |

| | |

| Baron Growth Fund | | March 31, 2019 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (99.11%) | |

| Communication Services (4.50%) | |

| | | | Alternative Carriers (3.03%) | | | | | | | | |

| | 7,488,437 | | | Iridium Communications, Inc.1,4 | | $ | 45,679,471 | | | $ | 197,994,274 | |

| | | |

| | | | Movies & Entertainment (1.47%) | | | | | | | | |

| | 5,000,000 | | | Manchester United plc, Cl A2 | | | 70,291,779 | | | | 96,100,000 | |

| | | | | | | | | | | | |

| | Total Communication Services | | | 115,971,250 | | | | 294,094,274 | |

| | | | | | | | | | | | |

|

| Consumer Discretionary (20.15%) | |

| | | | Apparel, Accessories & Luxury Goods (0.24%) | | | | | | | | |

| | 750,000 | | | Under Armour, Inc., Cl A1 | | | 2,350,032 | | | | 15,855,000 | |

| | | |

| | | | Casinos & Gaming (3.17%) | | | | | | | | |

| | 725,000 | | | Boyd Gaming Corp. | | | 18,479,841 | | | | 19,836,000 | |

| | 5,289,000 | | | Penn National Gaming, Inc.1 | | | 70,102,132 | | | | 106,308,900 | |

| | 3,131,887 | | | Red Rock Resorts, Inc., Cl A | | | 66,868,262 | | | | 80,959,279 | |

| | | | | | | | | | | | |

| | | | 155,450,235 | | | | 207,104,179 | |

| | | |

| | | | Education Services (3.30%) | | | | | | | | |

| | 1,700,000 | | | Bright Horizons Family Solutions, Inc.1 | | | 54,460,676 | | | | 216,087,000 | |

| | | |

| | | | General Merchandise Stores (0.40%) | | | | | | | | |

| | 310,000 | | | Ollie’s Bargain Outlet Holdings, Inc.1 | | | 14,541,755 | | | | 26,452,300 | |

| | | |

| | | | Hotels, Resorts & Cruise Lines (5.90%) | | | | | | | | |

| | 3,000,000 | | | Choice Hotels International, Inc.4 | | | 72,782,127 | | | | 233,220,000 | |

| | 1,550,000 | | | Marriott Vacations Worldwide Corp. | | | 84,292,546 | | | | 144,925,000 | |

| | 555,000 | | | OneSpaWorld Holdings Ltd.1,2,3,5,6 | | | 5,550,000 | | | | 7,486,950 | |

| | | | | | | | | | | | |

| | | | 162,624,673 | | | | 385,631,950 | |

| | | |

| | | | Leisure Facilities (6.98%) | | | | | | | | |

| | 2,100,000 | | | Vail Resorts, Inc.4 | | | 65,291,780 | | | | 456,330,000 | |

| | | |

| | | | Specialty Stores (0.16%) | | | | | | | | |

| | 275,000 | | | Dick’s Sporting Goods, Inc. | | | 3,967,433 | | | | 10,122,750 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 458,686,584 | | | | 1,317,583,179 | |

| | | | | | | | | | | | |

|

| Consumer Staples (1.09%) | |

| | | | Food Distributors (0.60%) | | | | | | | | |

| | 1,000,000 | | | Performance Food Group Co.1 | | | 19,000,000 | | | | 39,640,000 | |

| | | |

| | | | Household Products (0.49%) | | | | | | | | |

| | 450,000 | | | Church & Dwight Co., Inc. | | | 4,043,693 | | | | 32,053,500 | |

| | | | | | | | | | | | |

| | Total Consumer Staples | | | 23,043,693 | | | | 71,693,500 | |

| | | | | | | | | | | | |

|

| Financials (26.67%) | |

| | | | Asset Management & Custody Banks (3.06%) | | | | | | | | |

| | 2,400,000 | | | The Carlyle Group | | | 51,254,887 | | | | 43,872,000 | |

| | 2,000,000 | | | Cohen & Steers, Inc. | | | 49,208,575 | | | | 84,540,000 | |

| | 1,450,000 | | | Oaktree Capital Group, LLC | | | 65,375,827 | | | | 71,992,500 | |

| | | | | | | | | | | | |

| | | | 165,839,289 | | | | 200,404,500 | |

| | | |

| | | | Financial Exchanges & Data (12.45%) | | | | | | | | |

| | 1,250,000 | | | FactSet Research Systems, Inc. | | | 62,536,096 | | | | 310,337,500 | |

| | 1,150,000 | | | Morningstar, Inc. | | | 27,237,863 | | | | 144,888,500 | |

| | 1,805,000 | | | MSCI, Inc. | | | 34,379,398 | | | | 358,906,200 | |

| | | | | | | | | | | | |

| | | | 124,153,357 | | | | 814,132,200 | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

|

| Financials (continued) | |

| | | |

| | | | Investment Banking & Brokerage (0.81%) | | | | | | | | |

| | 450,000 | | | Houlihan Lokey, Inc. | | $ | 19,625,873 | | | $ | 20,632,500 | |

| | 775,000 | | | Moelis & Co., Cl A | | | 21,734,239 | | | | 32,247,750 | |

| | | | | | | | | | | | |

| | | | 41,360,112 | | | | 52,880,250 | |

| | | |

| | | | Life & Health Insurance (3.50%) | | | | | | | | |

| | 1,875,000 | | | Primerica, Inc. | | | 40,103,890 | | | | 229,031,250 | |

| | | |

| | | | Property & Casualty Insurance (5.96%) | | | | | | | | |

| | 9,975,000 | | | Arch Capital Group Ltd.1,2 | | | 31,574,822 | | | | 322,392,000 | |

| | 978,449 | | | Kinsale Capital Group, Inc. | | | 32,761,205 | | | | 67,092,248 | |

| | | | | | | | | | | | |

| | | | 64,336,027 | | | | 389,484,248 | |

| | |

| | | | Thrifts & Mortgage Finance (0.89%) | | | | | |

| | 525,000 | | | Essent Group Ltd.1,2 | | | 14,507,434 | | | | 22,811,250 | |

| | 100,059 | | | LendingTree, Inc.1 | | | 24,206,736 | | | | 35,176,742 | |

| | | | | | | | | | | | |

| | | | 38,714,170 | | | | 57,987,992 | |

| | | | | | | | | | | | |

| | Total Financials | | | 474,506,845 | | | | 1,743,920,440 | |

| | | | | | | | | | | | |

|

| Health Care (9.68%) | |

| | | | Biotechnology (0.24%) | | | | | | | | |

| | 678,051 | | | Denali Therapeutics, Inc.1 | | | 12,825,338 | | | | 15,744,344 | |

| | | |

| | | | Health Care Equipment (3.78%) | | | | | | | | |

| | 1,105,000 | | | IDEXX Laboratories, Inc.1 | | | 16,367,967 | | | | 247,078,000 | |

| | | |

| | | | Health Care Supplies (1.54%) | | | | | | | | |

| | 548,717 | | | Neogen Corp.1 | | | 11,540,855 | | | | 31,490,869 | |

| | 625,000 | | | West Pharmaceutical Services, Inc. | | | 21,442,434 | | | | 68,875,000 | |

| | | | | | | | | | | | |

| | | | 32,983,289 | | | | 100,365,869 | |

| | | |

| | | | Life Sciences Tools & Services (3.96%) | | | | | | | | |

| | 850,000 | | | Bio-Techne Corporation | | | 44,923,357 | | | | 168,767,500 | |

| | 125,000 | | | Mettler-Toledo International, Inc.1 | | | 5,724,401 | | | | 90,375,000 | |

| | | | | | | | | | | | |

| | | | 50,647,758 | | | | 259,142,500 | |

| | | |

| | | | Pharmaceuticals (0.16%) | | | | | | | | |

| | 300,000 | | | Dechra Pharmaceuticals plc (United Kingdom)2,6 | | | 8,518,489 | | | | 10,555,784 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 121,342,841 | | | | 632,886,497 | |

| | | | | | | | | | | | |

|

| Industrials (8.34%) | |

| | | | Building Products (1.40%) | | | | | | | | |

| | 1,490,000 | | | Trex Company, Inc.1 | | | 27,131,528 | | | | 91,664,800 | |

| | | |

| | | | Electrical Components & Equipment (0.36%) | | | | | | | | |

| | 1,800,000 | | | Bloom Energy Corp., Cl A1,5 | | | 34,451,023 | | | | 23,256,000 | |

| | | |

| | | | Environmental & Facilities Services (0.08%) | | | | | | | | |

| | 376,108 | | | BrightView Holdings, Inc.1 | | | 4,489,364 | | | | 5,415,956 | |

| | | |

| | | | Industrial Machinery (0.07%) | | | | | | | | |

| | 65,507 | | | Albany International Corp., Cl A | | | 4,417,079 | | | | 4,689,646 | |

| | | |

| | | | Research & Consulting Services (6.06%) | | | | | | | | |

| | 850,000 | | | CoStar Group, Inc.1 | | | 36,184,525 | | | | 396,457,000 | |

| | | |

| | | | Trading Companies & Distributors (0.37%) | | | | | | | | |

| | 700,000 | | | Air Lease Corp. | | | 16,086,660 | | | | 24,045,000 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 122,760,179 | | | | 545,528,402 | |

| | | | | | | | | | | | |

| | |

| 18 | | See Notes to Financial Statements. |

| | |

| March 31, 2019 | | Baron Growth Fund |

STATEMENT OF NET ASSETS (Unaudited) (Continued)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Information Technology (20.69%) | |

| | | | Application Software (13.62%) | | | | | | | | |

| | 850,000 | | | 2U, Inc.1 | | $ | 45,703,927 | | | $ | 60,222,500 | |

| | 725,000 | | | Altair Engineering, Inc., Cl A1 | | | 11,330,019 | | | | 26,687,250 | |

| | 1,500,000 | | | ANSYS, Inc.1 | | | 35,363,292 | | | | 274,065,000 | |

| | 2,200,000 | | | Benefitfocus, Inc.1,4 | | | 83,233,571 | | | | 108,944,000 | |

| | 100,000 | | | Cision Ltd.1,2 | | | 1,517,355 | | | | 1,377,000 | |

| | 1,190,000 | | | Guidewire Software, Inc.1 | | | 38,711,926 | | | | 115,620,400 | |

| | 1,000,000 | | | Pegasystems, Inc. | | | 13,997,009 | | | | 65,000,000 | |

| | 3,750,000 | | | SS&C Technologies Holdings, Inc. | | | 29,603,660 | | | | 238,837,500 | |

| | | | | | | | | | | | |

| | | | | | | 259,460,759 | | | | 890,753,650 | |

| | | |

| | | | Data Processing & Outsourced Services (0.33%) | | | | | | | | |

| | 300,000 | | | MAXIMUS, Inc. | | | 5,432,144 | | | | 21,294,000 | |

| | | |

| | | | Electronic Components (0.77%) | | | | | | | | |

| | 275,000 | | | Littelfuse, Inc. | | | 30,870,720 | | | | 50,182,000 | |

| | | |

| | | | Internet Services & Infrastructure (0.81%) | | | | | | | | |

| | 438,207 | | | Wix.com Ltd.1,2 | | | 28,664,771 | | | | 52,948,552 | |

| | | |

| | | | IT Consulting & Other Services (5.16%) | | | | | | | | |

| | 2,225,000 | | | Gartner, Inc.1 | | | 33,772,978 | | | | 337,488,000 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 358,201,372 | | | | 1,352,666,202 | |

| | | | | | | | | | | | |

|

| Real Estate (7.99%) | |

| | | | Diversified REITs (0.32%) | | | | | | | | |

| | 460,135 | | | American Assets Trust, Inc. | | | 8,503,418 | | | | 21,101,791 | |

| | | |

| | | | Office REITs (2.85%) | | | | | | | | |

| | 92,000 | | | Alexander’s, Inc.5 | | | 11,873,304 | | | | 34,607,640 | |

| | 3,750,000 | | | Douglas Emmett, Inc. | | | 46,426,704 | | | | 151,575,000 | |

| | | | | | | | | | | | |

| | | | 58,300,008 | | | | 186,182,640 | |

| | | |

| | | | Specialized REITs (4.82%) | | | | | | | | |

| | 750,000 | | | Alexandria Real Estate

Equities, Inc.5 | | | 26,517,362 | | | | 106,920,000 | |

| | 5,400,000 | | | Gaming and Leisure Properties, Inc. | | | 118,252,553 | | | | 208,278,000 | |

| | | | | | | | | | | | |

| | | | 144,769,915 | | | | 315,198,000 | |

| | | | | | | | | | | | |

| | Total Real Estate | | | 211,573,341 | | | | 522,482,431 | |

| | | | | | | | | | | | |

| | Total Common Stocks | | | 1,886,086,105 | | | | 6,480,854,925 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Preferred Stocks (0.57%) | |