UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5032

BARON INVESTMENT FUNDS TRUST f/k/a BARON ASSET FUND

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Investment Funds Trust

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code): 212-583-2000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2022

| Item 1. | Reports to Stockholders. |

Baron Asset Fund

Baron Growth Fund

Baron Small Cap Fund

Baron Opportunity Fund

Baron Fifth Avenue Growth Fund

Baron Discovery Fund

Baron Durable Advantage Fund

Baron Funds®

Baron Investment Funds Trust

Semi-Annual Financial Report

DEAR BARON INVESTMENT FUNDS SHAREHOLDER:

In this report, you will find unaudited financial statements for Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund, and Baron Durable Advantage Fund (the “Funds”) for the six months ended March 31, 2022. The U.S. Securities and Exchange Commission (the “SEC”) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer May 27, 2022 | | Linda S. Martinson Chairman, President and Chief Operating Officer May 27, 2022 | | Peggy Wong Treasurer and Chief Financial Officer May 27, 2022 |

This Semi-Annual Financial Report is for the Baron Investment Funds Trust, which currently has seven series: Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund, and Baron Durable Advantage Fund. If you are interested in Baron Select Funds, which contains the Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron WealthBuilder Fund, Baron Health Care Fund, Baron FinTech Fund, Baron New Asia Fund, and Baron Technology Fund series, please visit the Funds’ website at www.BaronFunds.com or contact us at 1-800-99BARON.

The Funds’ Proxy Voting Policy is available without charge and can be found on the Funds’ website at www.BaronFunds.com, by clicking on the “Regulatory Documents” link at the bottom left corner of the homepage or by calling 1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website.

Some of the comments contained in this report are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan” and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to www.BaronFunds.com for a prospectus or summary prospectus. Read them carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus or summary prospectus.

| | |

| Baron Asset Fund (Unaudited) | | March 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON ASSET FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(June 12,

1987) | |

Baron Asset Fund — Retail Shares1, 2 | | | (10.32)% | | | | (1.59)% | | | | 13.96% | | | | 15.31% | | | | 13.83% | | | | 11.81% | |

Baron Asset Fund — Institutional Shares1, 2, 4 | | | (10.21)% | | | | (1.34)% | | | | 14.26% | | | | 15.60% | | | | 14.14% | | | | 11.92% | |

Baron Asset Fund — R6 Shares1, 2, 4 | | | (10.21)% | | | | (1.34)% | | | | 14.26% | | | | 15.60% | | | | 14.13% | | | | 11.92% | |

Russell Midcap Growth Index1 | | | (10.09)% | | | | (0.89)% | | | | 14.81% | | | | 15.10% | | | | 13.52% | | | | 10.57% | 3 |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.99% | | | | 14.64% | | | | 10.48% | |

| † | The Fund’s 1-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The Russell MidcapTM Growth Index measures the performance of medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | For the period June 30, 1987 to March 31, 2022. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| | |

| March 31, 2022 (Unaudited) | | Baron Asset Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Net Assets | |

Gartner, Inc. | | | 8.0% | |

IDEXX Laboratories, Inc. | | | 6.8% | |

Mettler-Toledo International, Inc. | | | 5.0% | |

Verisk Analytics, Inc. | | | 3.8% | |

ANSYS, Inc. | | | 3.4% | |

Bio-Techne Corporation | | | 3.2% | |

West Pharmaceutical Services, Inc. | | | 3.1% | |

CoStar Group, Inc. | | | 3.0% | |

FactSet Research Systems, Inc. | | | 3.0% | |

Vail Resorts, Inc. | | | 2.9% | |

| |

| | | | 42.2% | |

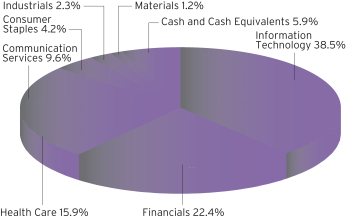

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Asset Fund1 declined 10.32%, while the Russell Midcap Growth Index fell 10.09% and the S&P 500 Index increased 5.92%.

Baron Asset Fund invests primarily in medium-sized growth companies for the long term, using a value-oriented purchase discipline. The Fund purchases companies that we believe have sustainable competitive advantages, strong financial characteristics, and exceptional management; and operate in industries with favorable growth characteristics.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. A wave of COVID spurred China to renew lockdown measures. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

Financials holding contributed slightly. Information Technology, Health Care, and Consumer Discretionary investments detracted the most.

Specialty insurer Arch Capital Group, Ltd. was the top contributor on robust earnings and growth in book value per share. Pricing trends remain favorable in the property & casualty insurance market, and margins for the mortgage insurance business improved substantially as delinquencies decline. We continue to own the stock due to Arch’s strong management team and our expectation of solid growth in earnings and book value.

Ceridian HCM Holding, Inc. was the top detractor. Shares of this payroll software vendor fell as valuations for high-growth technology stocks compressed. We retain conviction. Growth in Ceridian’s flagship Dayforce platform is reaccelerating, helped by share gains, a move up-market, and the employment recovery. We expect Ceridian’s growth to be amplified by its Wallet suite, which allows all employees to request and receive wages as they are earned at no cost.

The economic and investment outlook remains uncertain. Headwinds, including supply-chain disruptions, workforce shortages, rising interest rates, and inflation, seem less likely to resolve quickly. The Federal Reserve has embarked on a less accommodating monetary policy. While this is unnerving, and causing the market to trade down, there is a lot that is still not certain. Against this, we believe that, for the most part, our holdings will weather any potentially challenging conditions well.

We continue to adhere to our longstanding investment methodology while working hard to identify beneficiaries of secular trends in technology and consumer preferences, many of which have been accelerated by the pandemic. We remain optimistic this approach will generate strong performance regardless of the economic climate.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

3

| | |

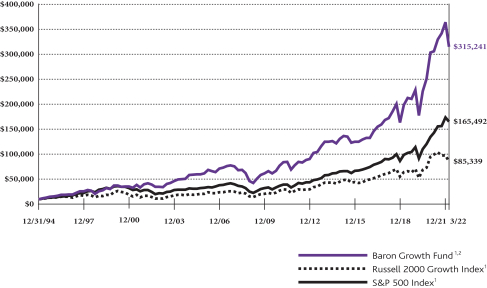

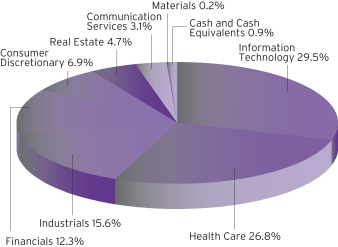

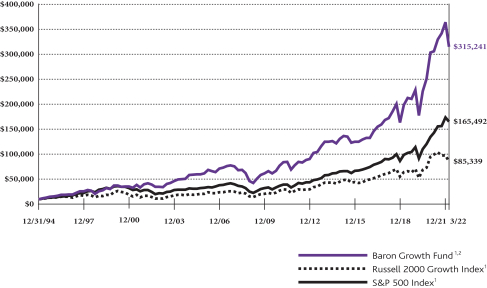

| Baron Growth Fund (Unaudited) | | March 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

1994) | |

Baron Growth Fund — Retail Shares1, 2 | | | (7.77)% | | | | 2.90% | | | | 16.66% | | | | 16.63% | | | | 14.06% | | | | 13.50% | |

Baron Growth Fund — Institutional Shares1, 2, 3 | | | (7.65)% | | | | 3.17% | | | | 16.96% | | | | 16.93% | | | | 14.35% | | | | 13.64% | |

Baron Growth Fund — R6 Shares1, 2, 3 | | | (7.66)% | | | | 3.16% | | | | 16.96% | | | | 16.93% | | | | 14.35% | | | | 13.64% | |

Russell 2000 Growth Index1 | | | (12.62)% | | | | (14.33)% | | | | 9.88% | | | | 10.33% | | | | 11.21% | | | | 8.19% | |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.99% | | | | 14.64% | | | | 10.85% | |

| 1 | The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| | |

| March 31, 2022 (Unaudited) | | Baron Growth Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Total Investments | |

MSCI, Inc. | | | 9.9% | |

FactSet Research Systems, Inc. | | | 6.3% | |

Vail Resorts, Inc. | | | 6.3% | |

Gartner, Inc. | | | 5.6% | |

Arch Capital Group Ltd. | | | 5.4% | |

Choice Hotels International, Inc. | | | 5.2% | |

IDEXX Laboratories, Inc. | | | 4.3% | |

Bio-Techne Corporation | | | 4.3% | |

CoStar Group, Inc. | | | 4.3% | |

ANSYS, Inc. | | | 4.1% | |

| |

| | | | 55.7% | |

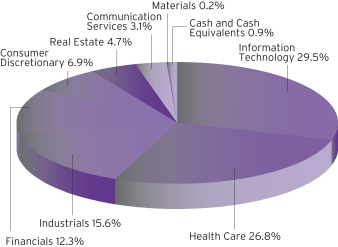

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of total investments)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Growth Fund1 declined 7.77%, while the Russell 2000 Growth Index fell 12.62% and the S&P 500 Index increased 5.92%.

Baron Growth Fund invests primarily in small-sized U.S. growth companies for the long term. Through independent research, we utilize an investment approach that we believe allows us to look at a business’s fundamental characteristics and beyond the current market environment. We invest based on the potential profitability of a business at what we believe are attractive valuations.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. A wave of COVID spurred China to renew lockdown measures. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

Real Estate holdings contributed slightly. Consumer Discretionary, Industrials, and Health Care detracted the most.

Specialty insurer Arch Capital Group, Ltd. was the top contributor on robust earnings and growth in book value per share. Pricing trends remain favorable in the property & casualty insurance market, and margins for the mortgage insurance business improved substantially as delinquencies decline. We continue to own the stock due to Arch’s strong management team and our expectation of solid growth in earnings and book value.

MSCI, Inc. was the top detractor. Shares of this leading provider of investment decision support tools fell in concert with the broader market rotation out of high-growth technology-related stocks. We retain long-term conviction as MSCI owns strong, “all weather” franchises and is positioned to benefit from numerous secular tailwinds in the investment community.

The economic and investment outlook remains uncertain. Headwinds, including supply-chain disruptions, workforce shortages, rising interest rates, and inflation, seem less likely to resolve quickly. The Federal Reserve has embarked on a less accommodating monetary policy. While this is unnerving, and causing the market to trade down, there is a lot that is still not certain. Against this, we believe that, for the most part, our holdings will weather any potentially challenging conditions well.

We continue to adhere to our longstanding investment methodology while working hard to identify beneficiaries of secular trends in consumer preferences and technology, many of which have been positively impacted by the pandemic. We remain optimistic that this approach will generate strong performance for our portfolio, regardless of the economic climate.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

5

| | |

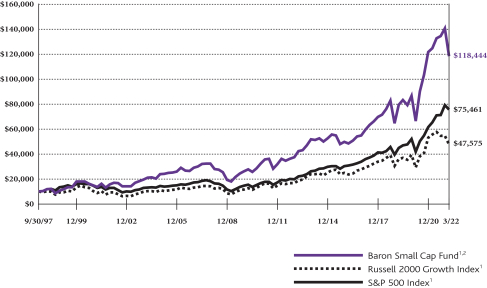

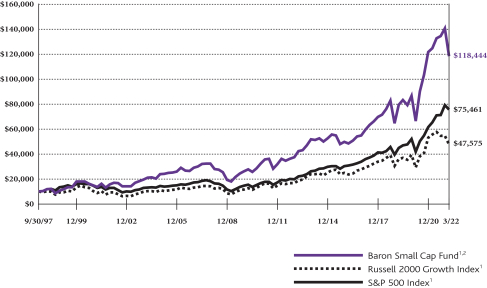

| Baron Small Cap Fund (Unaudited) | | March 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON SMALL CAP FUND (RETAIL SHARES)

IN RELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(September 30,

1997) | |

Baron Small Cap Fund — Retail Shares1, 2 | | | (11.83)% | | | | (5.11)% | | | | 14.30% | | | | 14.81% | | | | 12.63% | | | | 10.62% | |

Baron Small Cap Fund — Institutional Shares1, 2, 3 | | | (11.73)% | | | | (4.87)% | | | | 14.59% | | | | 15.10% | | | | 12.92% | | | | 10.76% | |

Baron Small Cap Fund — R6 Shares1, 2, 3 | | | (11.71)% | | | | (4.87)% | | | | 14.59% | | | | 15.10% | | | | 12.92% | | | | 10.76% | |

Russell 2000 Growth Index1 | | | (12.62)% | | | | (14.33)% | | | | 9.88% | | | | 10.33% | | | | 11.21% | | | | 6.57% | |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.99% | | | | 14.64% | | | | 8.60% | |

| 1 | The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| | |

| March 31, 2022 (Unaudited) | | Baron Small Cap Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Net Assets | |

Gartner, Inc. | | | 5.7% | |

ASGN Incorporated | | | 3.9% | |

ICON Plc | | | 3.7% | |

Aspen Technology, Inc. | | | 2.9% | |

SiteOne Landscape Supply, Inc. | | | 2.6% | |

Installed Building Products, Inc. | | | 2.5% | |

Guidewire Software, Inc. | | | 2.5% | |

Kinsale Capital Group, Inc. | | | 2.5% | |

Red Rock Resorts, Inc. | | | 2.4% | |

Floor & Decor Holdings, Inc. | | | 2.2% | |

| |

| | | | 30.9% | |

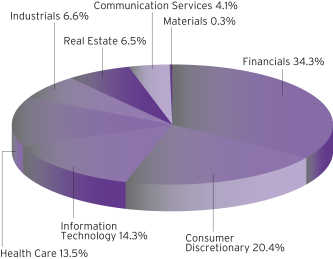

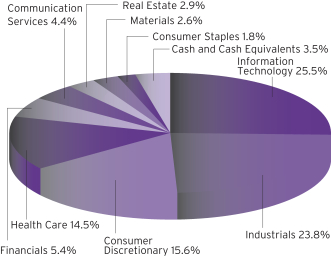

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Small Cap Fund1 declined 11.83%, while the Russell 2000 Growth Index fell 12.62% and the S&P 500 Index increased 5.92%.

Baron Small Cap Fund invests primarily in small-cap growth companies for the long term. The Fund invests in what we believe are well-run small-cap growth businesses that can be purchased at prices that represent a significant discount to our assessment of future value.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. A wave of COVID spurred China to renew lockdown measures. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

Communication Services holdings contributed slightly. Information Technology, Industrials, and Consumer Discretionary holdings detracted the most.

Process automation software company Aspen Technology, Inc. was the top contributor after it announced a transformative deal with industrial equipment manufacturer Emerson. We expect management to improve the growth, profitability, and cash flow of the acquired businesses by converting them to recurring revenue models while leveraging Emerson’s vast sales force to boost growth.

Vertiv Holdings, LLC was the top detractor. Shares of this provider of digital infrastructure and continuity solutions fell on disappointing earnings and 2022 guidance. A misstep involving insufficient price increases in the inflationary environment pressured profitability. The company has rectified the mistake and is on track to reach its original target margins by the second half of the year.

The economic and investment outlook remains uncertain. Headwinds, including supply-chain disruptions, workforce shortages, rising interest rates, and inflation, seem less likely to resolve quickly. The Federal Reserve has embarked on a less accommodating monetary policy. While this is unnerving, and causing the market to trade down, there is a lot that is still not certain. Against this, we believe that, for the most part, our holdings will weather any potentially challenging conditions well.

Even when the macroeconomic picture gets confusing, we stay focused on the actual performance of our holdings. We think our companies can handle near-term cost pressures and profits will revert to uptrends. None of the current macro uncertainty should obscure the fact that we are in an era of great opportunity, and we believe our companies will thrive and grow their value.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

7

| | |

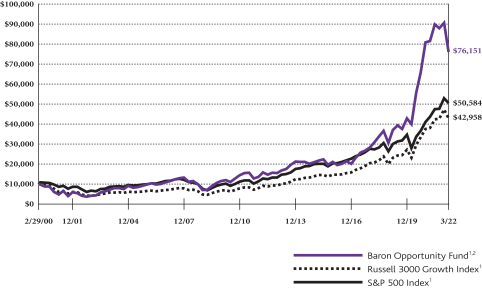

| Baron Opportunity Fund (Unaudited) | | March 31, 2022 |

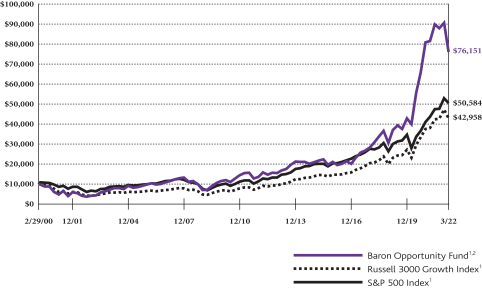

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON OPPORTUNITY FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 3000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(February 29,

2000) | |

Baron Opportunity Fund — Retail Shares1, 2 | | | (13.48)% | | | | (6.77)% | | | | 27.06% | | | | 26.86% | | | | 16.95% | | | | 9.63% | |

Baron Opportunity Fund — Institutional Shares1, 2, 3 | | | (13.37)% | | | | (6.52)% | | | | 27.39% | | | | 27.19% | | | | 17.26% | | | | 9.80% | |

Baron Opportunity Fund — R6 Shares1, 2, 3 | | | (13.35)% | | | | (6.51)% | | | | 27.40% | | | | 27.20% | | | | 17.27% | | | | 9.80% | |

Russell 3000 Growth Index1 | | | 0.63% | | | | 12.86% | | | | 22.68% | | | | 20.16% | | | | 16.64% | | | | 6.82% | |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.99% | | | | 14.64% | | | | 7.62% | |

| † | The Fund’s 1-, 3-, 5-, and 10-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The Russell 3000® Growth Index measures the performance of those companies classified as growth among the largest 3,000 U.S. companies, and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2032, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

8

| | |

| March 31, 2022 (Unaudited) | | Baron Opportunity Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Net Assets | |

Microsoft Corporation | | | 11.9% | |

Alphabet Inc. | | | 8.5% | |

Amazon.com, Inc. | | | 6.3% | |

Tesla, Inc. | | | 4.5% | |

NVIDIA Corporation | | | 4.2% | |

Rivian Automotive, Inc. | | | 3.8% | |

ZoomInfo Technologies Inc. | | | 3.7% | |

Gartner, Inc. | | | 2.9% | |

argenx SE | | | 2.7% | |

Visa, Inc. | | | 2.5% | |

| |

| | | | 51.0% | |

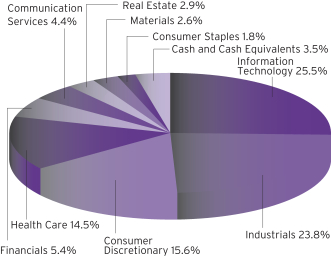

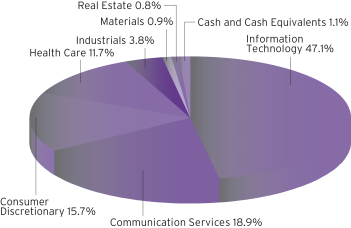

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Opportunity Fund1 declined 13.48%, while the Russell 3000 Growth Index increased 0.63% and the S&P 500 Index increased 5.92%.

Baron Opportunity Fund invests primarily in U.S. growth companies that we believe are driving or benefiting from innovation through development of pioneering, transformative, or technologically advanced products and services. The Fund invests in high-growth businesses of any market capitalization, selected for their capital appreciation potential.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. A wave of COVID spurred China to renew lockdown measures. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

No sector contributed. Information Technology, Health Care, and Consumer Discretionary holdings detracted the most.

Tesla, Inc. contributed the most. Shares of this electric vehicle company increased on continued strong growth and record profitability. Robust demand and operational optimization allowed Tesla to offset inflationary pressure, and vertical integration enabled flexibility around supply bottlenecks.

Rivian Automotive, Inc. detracted the most. Shares of this electric vehicle company fell as industry-wide supply-chain issues resulted in a slowed production ramp. In addition, Rivian launched a poorly communicated price increase plan that met with significant customer dissatisfaction. We expect management’s vision, product position, and liquidity to help overcome current challenges.

This continues to be a time of significant unknowns. However, we don’t have to answer the unanswerable to deliver strong investment returns. Rather, we are focusing our research, analysis, and investment decisions, as we always do, on what we can know and what matters: identifying the durable secular growth trends we believe will drive long-term economic growth and the companies with competitive advantages, profitable business models, and long-term-oriented managers driving or riding these trends. We establish and monitor short- and long-term price targets for holdings and target companies using projections of revenues, earnings, and free cash flow and appropriate multiples, and we buy or add to our shares at prices where we believe we can deliver substantial returns.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

9

| | |

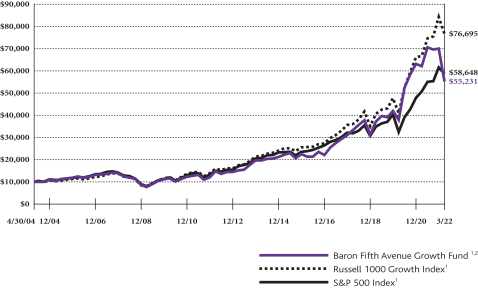

| Baron Fifth Avenue Growth Fund (Unaudited) | | March 31, 2022 |

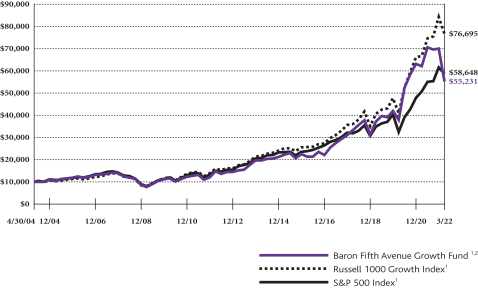

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FIFTH AVENUE GROWTH FUND†

(RETAIL SHARES)INRELATIONTOTHE RUSSELL 1000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(April 30,

2004) | |

Baron Fifth Avenue Growth Fund — Retail Shares1, 2 | | | (20.56)% | | | | (10.97)% | | | | 14.15% | | | | 16.86% | | | | 14.18% | | | | 10.01% | |

Baron Fifth Avenue Growth Fund — Institutional Shares1, 2, 3 | | | (20.46)% | | | | (10.75)% | | | | 14.43% | | | | 17.15% | | | | 14.48% | | | | 10.21% | |

Baron Fifth Avenue Growth Fund — R6 Shares1, 2, 3 | | | (20.45)% | | | | (10.73)% | | | | 14.44% | | | | 17.15% | | | | 14.48% | | | | 10.21% | |

Russell 1000 Growth Index1 | | | 1.54% | | | | 14.98% | | | | 23.60% | | | | 20.88% | | | | 17.04% | | | | 12.04% | |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.99% | | | | 14.64% | | | | 10.38% | |

| † | The Fund’s 1- and 3-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The Russell 1000® Growth Index measures the performance of large-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2032, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

10

| | |

| March 31, 2022 (Unaudited) | | Baron Fifth Avenue Growth Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Net Assets | |

Amazon.com, Inc. | | | 9.2% | |

Alphabet Inc. | | | 8.0% | |

NVIDIA Corporation | | | 5.9% | |

ServiceNow, Inc. | | | 5.5% | |

Mastercard Incorporated | | | 5.3% | |

CrowdStrike, Inc. | | | 4.5% | |

Rivian Automotive, Inc. | | | 4.5% | |

Snowflake Inc. | | | 4.1% | |

Shopify Inc. | | | 4.0% | |

Tesla, Inc. | | | 4.0% | |

| |

| | | | 55.0% | |

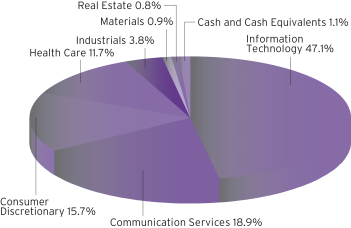

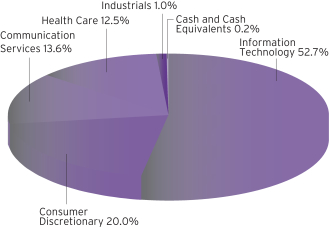

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Fifth Avenue Growth Fund1 declined 20.56%, while the Russell 1000 Growth Index increased 1.54% and the S&P 500 Index increased 5.92%.

Baron Fifth Avenue Growth Fund focuses on identifying and investing in what we believe are unique companies with sustainable competitive advantages and the ability to redeploy capital at high rates of return. The portfolio is constructed on a bottom-up basis, with the quality of ideas and conviction level the most important determinants of the size of each investment.

We expect our highest conviction businesses to have meaningful weight in the portfolio. Sector weightings are incidental to portfolio construction, and sector exposure is a result of stock selection.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. A wave of COVID spurred China to renew lockdown measures. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

Real Estate holdings contributed slightly. Information Technology, Consumer Discretionary, and Health Care holdings detracted the most.

Tesla, Inc. was the top contributor. Shares of this electric vehicle company increased on continued strong growth and record profitability. Robust demand and operational optimization allowed Tesla to offset inflationary pressure, and vertical integration enabled flexibility around supply bottlenecks.

Rivian Automotive, Inc. detracted the most. Shares of this electric vehicle company fell as industry-wide supply-chain issues resulted in a slowed production ramp. In addition, Rivian launched a poorly communicated price increase plan that met with significant customer dissatisfaction. We expect management’s vision, product position, and liquidity to help overcome current challenges.

The economic and investment outlook remains uncertain. Headwinds, including supply-chain disruptions, workforce shortages, rising interest rates, and inflation, seem less likely to resolve quickly. The Federal Reserve has embarked on a less accommodating monetary policy. While this is unnerving, and causing the market to trade down, there is a lot that is still not certain. Against this, we believe that, for the most part, our holdings will weather any potentially challenging conditions well.

Our goal remains to maximize long-term returns without taking significant risks of a permanent loss of capital. We are optimistic about the prospects of our investments and continue searching for new ideas while remaining patient and investing only when we believe companies are trading significantly below their intrinsic values.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

11

| | |

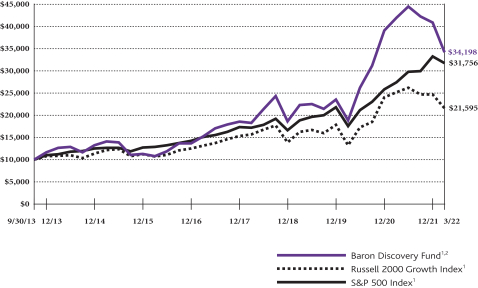

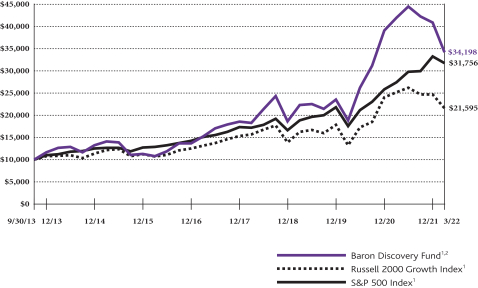

| Baron Discovery Fund (Unaudited) | | March 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON DISCOVERY FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2000 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception

(September 30,

2013) | |

Baron Discovery Fund — Retail Shares1, 2 | | | (19.05)% | | | | (18.55)% | | | | 15.30% | | | | 17.45% | | | | 15.56% | |

Baron Discovery Fund — Institutional Shares1, 2 | | | (18.94)% | | | | (18.31)% | | | | 15.62% | | | | 17.76% | | | | 15.86% | |

Baron Discovery Fund — R6 Shares1, 2, 3 | | | (18.94)% | | | | (18.33)% | | | | 15.62% | | | | 17.76% | | | | 15.86% | |

Russell 2000 Growth Index1 | | | (12.62)% | | | | (14.33)% | | | | 9.88% | | | | 10.33% | | | | 9.48% | |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.99% | | | | 14.56% | |

| † | The Fund’s 3- and 5-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The Russell 2000® Growth Index measures the performance of small-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. The indexes and the Fund are with dividends reinvested, which positively impact the performance results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2032, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares. |

12

| | |

| March 31, 2022 (Unaudited) | | Baron Discovery Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Net Assets | |

Mercury Systems, Inc. | | | 3.8% | |

Kinsale Capital Group, Inc. | | | 3.7% | |

Rexford Industrial Realty, Inc. | | | 3.1% | |

Boyd Gaming Corporation | | | 2.8% | |

Progyny, Inc. | | | 2.7% | |

Axonics, Inc. | | | 2.6% | |

Endava plc | | | 2.6% | |

Clearwater Analytics Holdings, Inc. | | | 2.4% | |

Advanced Energy Industries, Inc. | | | 2.4% | |

SailPoint Technologies Holdings, Inc. | | | 2.3% | |

| |

| | | | 28.4% | |

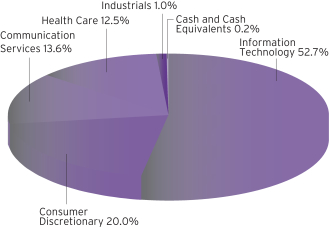

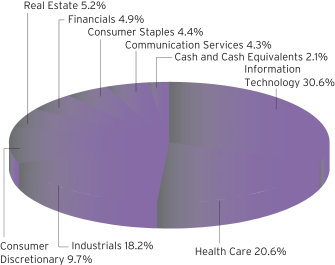

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Discovery Fund1 declined 19.05%, while the Russell 2000 Growth Index fell 12.62% and the S&P 500 Index increased 5.92%.

Baron Discovery Fund invests primarily in small-sized U.S. companies which at time of purchase have market capitalizations up to the largest market cap stock in the Russell 2000 Growth Index at June 30, or companies with market capitalizations up to $2.5 billion, whichever is larger.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. A wave of COVID spurred China to renew lockdown measures. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

Financials and Real Estate holdings contributed. Information Technology, Health Care, and Communication Services holdings detracted the most.

Specialty insurer Kinsale Capital Group, Inc. contributed the most on strong financial results. Market conditions remained favorable with rate increases well above loss cost trends, leading to better margins and favorable reserve development. We believe Kinsale is well managed and has a long runway for growth in an attractive segment of the insurance market.

S4 Capital plc detracted the most. Shares of this global marketing services business were down on broader concerns about a weakening advertising environment. The company’s auditor, PwC, said it could not complete the work needed for S4 to release 2021 results. We believe the delay will not be material to S4’s long-term growth opportunities.

The economic and investment outlook remains uncertain. Headwinds, including supply-chain disruptions, workforce shortages, rising interest rates, and inflation, seem less likely to resolve quickly. The Federal Reserve has embarked on a less accommodating monetary policy. While this is unnerving, and causing the market to trade down, there is a lot that is still not certain. Against this, we believe that, for the most part, our holdings will weather any potentially challenging conditions well.

Over the longer term, we remain encouraged by the prospects for our investments. We try not to be sidetracked by the macro “noise” and instead focus our energies on managing our existing investments and finding new ones. We continue to find high-quality, fast-growing small companies with significant stock appreciation potential.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

13

| | |

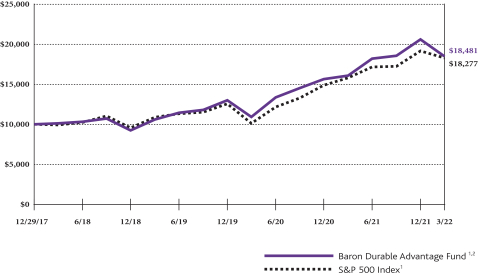

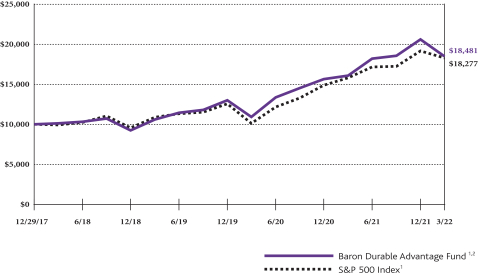

| Baron Durable Advantage Fund (Unaudited) | | March 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON DURABLE ADVANTAGE FUND

(RETAIL SHARES)INRELATIONTOTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED MARCH 31, 2022 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Since

Inception

(December 29,

2017) | |

Baron Durable Advantage Fund — Retail Shares1,2 | | | (0.46)% | | | | 14.81% | | | | 20.29% | | | | 15.55% | |

Baron Durable Advantage Fund — Institutional Shares1,2 | | | (0.35)% | | | | 15.07% | | | | 20.57% | | | | 15.81% | |

Baron Durable Advantage Fund — R6 Shares1,2 | | | (0.35)% | | | | 15.07% | | | | 20.57% | | | | 15.81% | |

S&P 500 Index1 | | | 5.92% | | | | 15.65% | | | | 18.92% | | | | 15.25% | |

| 1 | The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. The index and the Fund are with dividends reinvested, which positively impact the performance results. The index is unmanaged. The index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2032, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

14

| | |

| March 31, 2022 (Unaudited) | | Baron Durable Advantage Fund |

TOP TEN HOLDINGSASOF MARCH 31, 2022

| | | | |

| | | Percent of

Net Assets | |

Microsoft Corporation | | | 9.3% | |

Alphabet Inc. | | | 8.6% | |

Arch Capital Group Ltd. | | | 5.2% | |

S&P Global Inc. | | | 5.1% | |

UnitedHealth Group Incorporated | | | 4.9% | |

Mastercard Incorporated | | | 4.7% | |

Accenture plc | | | 4.5% | |

Thermo Fisher Scientific Inc. | | | 4.0% | |

Danaher Corporation | | | 3.9% | |

Visa, Inc. | | | 3.8% | |

| |

| | | | 54.0% | |

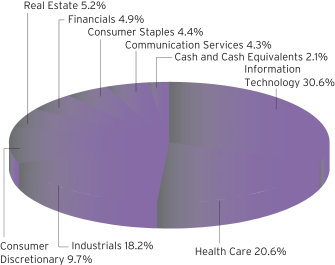

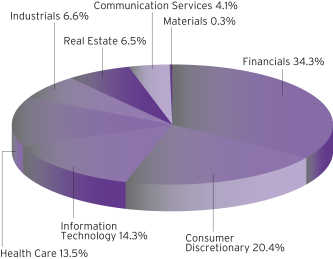

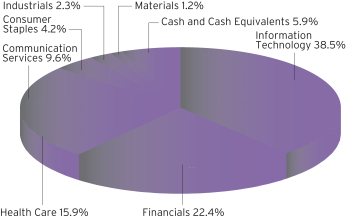

SECTOR BREAKDOWNASOF MARCH 31, 2022†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended March 31, 2022, Baron Durable Advantage Fund1 declined 0.46%, while the S&P 500 Index increased 5.92%.

Baron Durable Advantage Fund invests mainly in large-sized U.S. companies with competitive advantages and market capitalizations no smaller than the top 90th percentile by market capitalization of the S&P 500 Index at June 30, or companies with market capitalizations above $10 billion, whichever is smaller. The Fund emphasizes businesses with excess free cash flow that can be returned to shareholders.

The market continued its rally through mid-November 2021, when rapidly increasing inflation, rising rates, the regulatory crackdown in China, and the geopolitical crisis culminating with Russia’s invasion of Ukraine led to a dramatic shift in investors’ risk tolerance and time horizons. Inflation accelerated to 40-year highs, caused largely by an imbalance of supply and demand. Prior expansionary fiscal and monetary policies and pent-up post-COVID spending desires caused demand to surge against supply constrained by supply-chain issues, tight labor markets, and shortages of housing and goods. Russia’s late-February 2022 invasion of Ukraine caused a spike in energy, commodity, and food prices. The Federal Reserve shifted to a more aggressive stance, signaling multiple rate hikes to come. All these factors led to a highly uncertain setting fraught with hard-to-measure risks, and investors rushed to the safety of defensive asset classes, sectors, and styles.

Financials, Consumer Staples, and Information Technology holdings contributed the most. Communication Services, Materials, and Industrials holdings detracted.

UnitedHealth Group Incorporated was the top contributor. Shares of this leading health insurer increased on robust earnings and guidance. We believe UnitedHealth leads the industry in innovation and execution, as evidenced by its Medicare Advantage share gains, cost controls, and leadership in the shift to value-based care.

Meta Platforms, Inc. was the top detractor. Shares of the owner of Facebook, Instagram, and WhatsApp fell on Apple’s new privacy changes that make it more difficult to measure advertising effectiveness. Management estimated a $10 billion revenue impact for the year. We are evaluating Facebook’s ability to hold its leadership in mobile and provide targeted advertising at scale.

The economic and investment outlook remains uncertain. Headwinds, including supply-chain disruptions, workforce shortages, rising interest rates, and inflation, seem less likely to resolve quickly. The Federal Reserve has embarked on a less accommodating monetary policy. While unnerving, and causing the market to trade down, there is much that is still not certain. Against this, we believe that, for the most part, our holdings will weather any potentially challenging conditions well.

We believe investing in great businesses at attractive valuations will enable us to earn excess risk-adjusted returns over the long term. We look for companies with strong and durable competitive advantages, track records of successful capital allocation, high returns on invested capital, and high free cash flow generation, a significant portion of which is returned to shareholders as dividends or share repurchases. We are optimistic about the prospects of the companies we own while continuing to search for new ideas.

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

15

| | |

| Baron Asset Fund | | March 31, 2022 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (97.32%) | |

| Communication Services (3.09%) | |

| | | | Cable & Satellite (0.59%) | | | | | | | | |

| | 235,000 | | | Liberty Broadband Corporation, Cl C1 | | $ | 16,481,956 | | | $ | 31,800,200 | |

| | | |

| | | | Interactive Media & Services (2.50%) | | | | | | | | |

| | 1,127,141 | | | Tripadvisor, Inc.1 | | | 38,751,807 | | | | 30,568,064 | |

| | 1,735,709 | | | ZoomInfo Technologies Inc., Cl A1 | | | 43,840,818 | | | | 103,691,256 | |

| | | | | | | | | | | | |

| | | | | | | 82,592,625 | | | | 134,259,320 | |

| | | | | | | | | | | | |

| | Total Communication Services | | | 99,074,581 | | | | 166,059,520 | |

| | | | | | | | | | | | |

|

| Consumer Discretionary (6.19%) | |

| | | | Automobile Manufacturers (0.40%) | | | | | | | | |

| | 425,305 | | | Rivian Automotive, Inc., Cl A1 | | | 33,173,790 | | | | 21,367,323 | |

| | | |

| | | | Education Services (0.37%) | | | | | | | | |

| | 150,000 | | | Bright Horizons Family

Solutions, Inc.1 | | | 16,921,054 | | | | 19,903,500 | |

| | | |

| | | | Hotels, Resorts & Cruise Lines (2.41%) | | | | | | | | |

| | 546,442 | | | Choice Hotels International, Inc. | | | 5,198,084 | | | | 77,463,618 | |

| | 543,233 | | | Hyatt Hotels Corp., Cl A1 | | | 16,817,762 | | | | 51,851,590 | |

| | | | | | | | | | | | |

| | | | | | | 22,015,846 | | | | 129,315,208 | |

| | | |

| | | | Leisure Facilities (2.92%) | | | | | | | | |

| | 603,538 | | | Vail Resorts, Inc. | | | 11,683,688 | | | | 157,082,835 | |

| | | |

| | | | Specialty Stores (0.09%) | | | | | | | | |

| | 150,000 | | | Warby Parker, Inc., Cl A1 | | | 4,661,403 | | | | 5,071,500 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 88,455,781 | | | | 332,740,366 | |

| | | | | | | | | | | | |

|

| Financials (12.30%) | |

| | | | Asset Management & Custody Banks (0.67%) | | | | | | | | |

| | 237,514 | | | T. Rowe Price Group, Inc. | | | 5,729,987 | | | | 35,909,742 | |

| | | |

| | | | Financial Exchanges & Data (5.44%) | | | | | | | | |

| | 370,725 | | | FactSet Research Systems, Inc. | | | 19,898,420 | | | | 160,950,259 | |

| | 257,267 | | | MarketAxess Holdings, Inc. | | | 31,487,484 | | | | 87,522,233 | |

| | 30,000 | | | MSCI, Inc. | | | 7,783,774 | | | | 15,086,400 | |

| | 326,189 | | | Tradeweb Markets, Inc., Cl A | | | 11,978,713 | | | | 28,662,228 | |

| | | | | | | | | | | | |

| | | | | | | 71,148,391 | | | | 292,221,120 | |

| | | |

| | | | Insurance Brokers (0.70%) | | | | | | | | |

| | 158,421 | | | Willis Towers Watson plc2 | | | 19,439,430 | | | | 37,422,209 | |

| | | |

| | | | Investment Banking & Brokerage (2.86%) | | | | | | | | |

| | 1,825,936 | | | The Charles Schwab Corp. | | | 1,609,715 | | | | 153,944,664 | |

| | | |

| | | | Property & Casualty Insurance (1.98%) | | | | | | | | |

| | 2,203,444 | | | Arch Capital Group Ltd.1,2 | | | 7,933,936 | | | | 106,690,758 | |

| | | |

| | | | Regional Banks (0.65%) | | | | | | | | |

| | 216,421 | | | First Republic Bank | | | 5,518,736 | | | | 35,081,844 | |

| | | | | | | | | | | | |

| | Total Financials | | | 111,380,195 | | | | 661,270,337 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Health Care (26.77%) | |

| | | | Biotechnology (0.34%) | | | | | | | | |

| | 58,366 | | | argenx SE, ADR1,2 | | $ | 18,854,201 | | | $ | 18,403,383 | |

| | | |

| | | | Health Care Equipment (9.91%) | | | | | | | | |

| | 173,000 | | | DexCom, Inc.1 | | | 55,276,880 | | | | 88,506,800 | |

| | 673,630 | | | IDEXX Laboratories, Inc.1 | | | 12,186,829 | | | | 368,516,028 | |

| | 213,644 | | | Teleflex, Inc. | | | 47,613,406 | | | | 75,807,300 | |

| | | | | | | | | | | | |

| | | | | | | 115,077,115 | | | | 532,830,128 | |

| | | |

| | | | Health Care Supplies (1.67%) | | | | | | | | |

| | 215,418 | | | The Cooper Companies, Inc. | | | 36,713,299 | | | | 89,956,403 | |

| | | |

| | | | Health Care Technology (1.82%) | | | | | | | | |

| | 459,386 | | | Veeva Systems, Inc., Cl A1 | | | 27,115,596 | | | | 97,601,150 | |

| | | |

| | | | Life Sciences Tools & Services (13.03%) | | | | | | | | |

| | 399,986 | | | Bio-Techne Corporation | | | 39,595,545 | | | | 173,209,937 | |

| | 314,000 | | | Guardant Health, Inc.1,4 | | | 27,540,662 | | | | 20,799,360 | |

| | 212,552 | | | Illumina, Inc.1 | | | 9,061,707 | | | | 74,265,669 | |

| | 194,117 | | | Mettler-Toledo International, Inc.1 | | | 11,674,111 | | | | 266,559,523 | |

| | 404,404 | | | West Pharmaceutical Services, Inc. | | | 17,498,069 | | | | 166,092,767 | |

| | | | | | | | | | | | |

| | | | | | | 105,370,094 | | | | 700,927,256 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 303,130,305 | | | | 1,439,718,320 | |

| | | | | | | | | | | | |

|

| Industrials (14.62%) | |

| | | | Environmental & Facilities Services (1.07%) | | | | | | | | |

| | 1,643,418 | | | Rollins, Inc. | | | 24,597,482 | | | | 57,601,801 | |

| | | |

| | | | Industrial Conglomerates (2.26%) | | | | | | | | |

| | 257,192 | | | Roper Technologies, Inc. | | | 26,184,327 | | | | 121,453,778 | |

| | | |

| | | | Industrial Machinery (1.22%) | | | | | | | | |

| | 340,760 | | | IDEX Corporation | | | 24,525,881 | | | | 65,333,915 | |

| | | |

| | | | Research & Consulting Services (10.07%) | | | | | | | | |

| | 1,480,474 | | | Clarivate Plc1,2 | | | 23,687,584 | | | | 24,812,744 | |

| | 2,439,930 | | | CoStar Group, Inc.1 | | | 59,005,227 | | | | 162,523,737 | |

| | 1,453,500 | | | TransUnion | | | 78,426,049 | | | | 150,204,690 | |

| | 951,206 | | | Verisk Analytics, Inc. | | | 23,582,787 | | | | 204,157,344 | |

| | | | | | | | | | | | |

| | | | | | | 184,701,647 | | | | 541,698,515 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 260,009,337 | | | | 786,088,009 | |

| | | | | | | | | | | | |

|

| Information Technology (29.45%) | |

| | | | Application Software (14.00%) | | | | | | | | |

| | 571,856 | | | ANSYS, Inc.1 | | | 20,310,482 | | | | 181,650,058 | |

| | 395,300 | | | Aspen Technology, Inc.1 | | | 40,628,908 | | | | 65,370,761 | |

| | 400,000 | | | Avalara, Inc.1 | | | 57,489,016 | | | | 39,804,000 | |

| | 1,636,093 | | | Ceridian HCM Holding, Inc.1 | | | 64,026,866 | | | | 111,843,317 | |

| | 924,656 | | | Clearwater Analytics Holdings, Inc., Cl A1 | | | 20,534,625 | | | | 19,417,776 | |

| | 150,000 | | | Fair Isaac Corp.1 | | | 63,616,939 | | | | 69,969,000 | |

| | 1,421,809 | | | Guidewire Software, Inc.1 | | | 77,473,157 | | | | 134,531,568 | |

| | 65,861 | | | HubSpot, Inc.1 | | | 39,133,172 | | | | 31,280,023 | |

| | 771,076 | | | SS&C Technologies Holdings, Inc. | | | 20,933,204 | | | | 57,846,122 | |

| | 594,000 | | | The Trade Desk, Inc., Cl A1 | | | 11,554,017 | | | | 41,134,500 | |

| | | | | | | | | | | | |

| | | | | | | 415,700,386 | | | | 752,847,125 | |

| | |

| 16 | | See Notes to Financial Statements. |

| | |

| March 31, 2022 | | Baron Asset Fund |

STATEMENT OF NET ASSETS (Unaudited) (Continued)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

|

| Information Technology (continued) | |

| | | |

| | | | Data Processing & Outsourced Services (1.10%) | | | | | | | | |

| | 589,217 | | | Fidelity National Information Services, Inc. | | $ | 33,648,187 | | | $ | 59,169,171 | |

| | | |

| | | | Electronic Components (1.26%) | | | | | | | | |

| | 900,000 | | | Amphenol Corp., Cl A | | | 42,881,684 | | | | 67,815,000 | |

| | | |

| | | | Internet Services & Infrastructure (3.16%) | | | | | | | | |

| | 592,103 | | | Verisign, Inc.1 | | | 27,318,889 | | | | 131,719,233 | |

| | 365,000 | | | Wix.com Ltd.1,2 | | | 30,731,208 | | | | 38,127,900 | |

| | | | | | | | | | | | |

| | | | | | | 58,050,097 | | | | 169,847,133 | |

| | | |

| | | | IT Consulting & Other Services (8.61%) | | | | | | | | |

| | 115,000 | | | EPAM Systems, Inc.1 | | | 64,962,944 | | | | 34,110,150 | |

| | 1,441,323 | | | Gartner, Inc.1 | | | 31,107,253 | | | | 428,735,940 | |

| | | | | | | | | | | | |

| | | | | | | 96,070,197 | | | | 462,846,090 | |

| | | |

| | | | Technology Distributors (1.32%) | | | | | | | | |

| | 397,363 | | | CDW Corp. | | | 26,228,965 | | | | 71,084,267 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 672,579,516 | | | | 1,583,608,786 | |

| | | | | | | | | | | | |

|

| Materials (0.21%) | |

| | | | Specialty Chemicals (0.21%) | | | | | | | | |

| | 1,503,529 | | | Diversey Holdings Ltd.1,2 | | | 22,552,935 | | | | 11,381,715 | |

| | | | | | | | | | | | |

|

| Real Estate (4.69%) | |

| | | | Real Estate Services (0.92%) | | | | | | | | |

| | 542,323 | | | CBRE Group, Inc., Cl A1 | | | 6,067,334 | | | | 49,633,401 | |

| | | |

| | | | Specialized REITs (3.77%) | | | | | | | | |

| | 205,000 | | | Alexandria Real Estate Equities, Inc.4 | | | 30,958,643 | | | | 41,256,250 | |

| | 75,416 | | | Equinix, Inc. | | | 4,951,691 | | | | 55,930,014 | |

| | 306,856 | | | SBA Communications Corp. | | | 7,734,438 | | | | 105,589,149 | |

| | | | | | | | | | | | |

| | | | | | | 43,644,772 | | | | 202,775,413 | |

| | | | | | | | | | | | |

| | Total Real Estate | | | 49,712,106 | | | | 252,408,814 | |

| | | | | | | | | | | | |

| | Total Common Stocks | | | 1,606,894,756 | | | | 5,233,275,867 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | |

| Private Common Stocks (0.71%) | | | | | | |

| Consumer Discretionary (0.71%) | |

| | | | Internet & Direct Marketing Retail (0.71%) | | | | | | | | |

| | 197,613 | | | StubHub Holdings, Inc., Cl A1,3,4,6 | | | 50,000,041 | | | | 38,285,543 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | |

| Private Preferred Stocks (1.03%) | | | | | | |

| Industrials (1.03%) | |

| | | | Aerospace & Defense (1.03%) | | | | | | | | |

| | 96,298 | | | Space Exploration Technologies Corp., Cl N1,3,4,6 | | | 26,000,460 | | | | 55,285,163 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| Principal Amount | | Cost | | | Value | |

| Short Term Investments (0.65%) | |

| | $35,076,597 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 3/31/2022, 0.00% due 4/1/2022; Proceeds at maturity - $35,076,597; (Fully collateralized by $35,907,200 U.S. Treasury Note, 2.375% due 03/31/2029 Market value - $35,778,150)5 | | $ | 35,076,597 | | | $ | 35,076,597 | |

| | | | | | | | | | | | |

| | Total Investments (99.71%) | | $ | 1,717,971,854 | | | | 5,361,923,170 | |

| | | | | | | | | | | | |

| | Cash and Other Assets Less Liabilities (0.29%) | | | | 15,610,357 | |

| | | | | | | | | | | | |

| | Net Assets | | | $ | 5,377,533,527 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $100.34 per share

based on 24,409,186 shares outstanding) |

| | $ | 2,449,152,376 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $105.75 per share

based on 26,052,993 shares outstanding) |

| | $ | 2,754,993,423 | |

| | | | | | | | | | | | |

| R6 Shares (Equivalent to $105.72 per share

based on 1,639,993 shares outstanding) |

| | $ | 173,387,728 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At March 31, 2022, the market value of restricted and fair valued securities amounted to $93,570,706 or 1.74% of net assets. These securities are not deemed liquid. See Note 6 regarding Restricted Securities. |

| 4 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI (unaudited). |

| 5 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 6 | Level 3 security. See Note 7 regarding Fair Value Measurements. |

| ADR | American Depositary Receipt. |

All securities are Level 1, unless otherwise noted.

| | |

| See Notes to Financial Statements. | | 17 |

| | |

| Baron Growth Fund | | March 31, 2022 |

STATEMENT OF NET ASSETS (Unaudited)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (100.01%) | |

| Communication Services (4.11%) | |

| | | | Alternative Carriers (3.88%) | | | | | | | | |

| | 7,900,000 | | | Iridium Communications, Inc.1,4 | | $ | 48,702,979 | | | $ | 318,528,000 | |

| | | |

| | | | Movies & Entertainment (0.23%) | | | | | | | | |

| | 1,297,110 | | | Manchester United plc, Cl A2 | | | 17,077,993 | | | | 18,769,182 | |

| | | | | | | | | | | | |

| | Total Communication Services | | | 65,780,972 | | | | 337,297,182 | |

| | | | | | | | | | | | |

|

| Consumer Discretionary (20.47%) | |

| | | | Casinos & Gaming (4.27%) | | | | | | | | |

| | 440,000 | | | Boyd Gaming Corporation | | | 11,056,072 | | | | 28,943,200 | |

| | 5,650,000 | | | Penn National Gaming, Inc.1 | | | 70,123,607 | | | | 239,673,000 | |

| | 1,695,000 | | | Red Rock Resorts, Inc., Cl A | | | 31,464,689 | | | | 82,309,200 | |

| | | | | | | | | | | | |

| | | | | | | 112,644,368 | | | | 350,925,400 | |

| | | |

| | | | Education Services (2.12%) | | | | | | | | |

| | 1,310,000 | | | Bright Horizons Family Solutions, Inc.1 | | | 41,415,154 | | | | 173,823,900 | |

| | | |

| | | | Hotels, Resorts & Cruise Lines (7.59%) | | | | | | | | |

| | 3,000,000 | | | Choice Hotels International, Inc.4 | | | 72,782,127 | | | | 425,280,000 | |

| | 1,255,000 | | | Marriott Vacations Worldwide Corp. | | | 67,098,661 | | | | 197,913,500 | |

| | | | | | | | | | | | |

| | | | | | | 139,880,788 | | | | 623,193,500 | |

| | | |

| | | | Leisure Facilities (6.34%) | | | | | | | | |

| | 2,000,000 | | | Vail Resorts, Inc. | | | 56,102,209 | | | | 520,540,000 | |

| | | |

| | | | Restaurants (0.15%) | | | | | | | | |

| | 600,000 | | | Krispy Kreme, Inc. | | | 10,015,645 | | | | 8,910,000 | |

| | 100,000 | | | Sweetgreen, Inc., Cl A1 | | | 2,839,373 | | | | 3,199,000 | |

| | | | | | | | | | | | |

| | | | | | | 12,855,018 | | | | 12,109,000 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 362,897,537 | | | | 1,680,591,800 | |

| | | | | | | | | | | | |

|

| Financials (34.49%) | |

| | | | Asset Management & Custody Banks (3.12%) | | | | | | | | |

| | 1,900,000 | | | The Carlyle Group, Inc. | | | 38,825,707 | | | | 92,929,000 | |

| | 1,900,000 | | | Cohen & Steers, Inc. | | | 41,176,154 | | | | 163,191,000 | |

| | | | | | | | | | | | |

| | | | | | | 80,001,861 | | | | 256,120,000 | |

| | | |

| | | | Financial Exchanges & Data (19.50%) | | | | | | | | |

| | 1,200,000 | | | FactSet Research Systems, Inc. | | | 59,954,575 | | | | 520,980,000 | |

| | 960,000 | | | Morningstar, Inc. | | | 19,610,765 | | | | 262,243,200 | |

| | 1,625,000 | | | MSCI, Inc. | | | 30,348,303 | | | | 817,180,000 | |

| | | | | | | | | | | | |

| | | | | | | 109,913,643 | | | | 1,600,403,200 | |

| | | |

| | | | Investment Banking & Brokerage (0.77%) | | | | | | | | |

| | 450,000 | | | Houlihan Lokey, Inc. | | | 19,625,873 | | | | 39,510,000 | |

| | 500,000 | | | Moelis & Co., Cl A | | | 9,070,381 | | | | 23,475,000 | |

| | | | | | | | | | | | |

| | | | | | | 28,696,254 | | | | 62,985,000 | |

| | | |

| | | | Life & Health Insurance (2.67%) | | | | | | | | |

| | 1,600,000 | | | Primerica, Inc. | | | 33,522,261 | | | | 218,912,000 | |

| |

| | | | Property & Casualty Insurance (8.17%) | |

| | 9,150,000 | | | Arch Capital Group Ltd.1,2 | | | 28,563,829 | | | | 443,043,000 | |

| | 1,000,000 | | | Kinsale Capital Group, Inc. | | | 35,007,763 | | | | 228,020,000 | |

| | | | | | | | | | | | |

| | | | | | | 63,571,592 | | | | 671,063,000 | |

| |

| | | | Thrifts & Mortgage Finance (0.26%) | |

| | 520,000 | | | Essent Group Ltd.2 | | | 14,300,210 | | | | 21,429,200 | |

| | | | | | | | | | | | |

| | Total Financials | | | 330,005,821 | | | | 2,830,912,400 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Health Care (13.59%) | |

| | | | Biotechnology (0.14%) | | | | | | | | |

| | 350,000 | | | Denali Therapeutics, Inc.1 | | $ | 6,236,522 | | | $ | 11,259,500 | |

| | | |

| | | | Health Care Equipment (4.36%) | | | | | | | | |

| | 655,000 | | | IDEXX Laboratories, Inc.1 | | | 9,242,525 | | | | 358,324,300 | |

| | | |

| | | | Health Care Supplies (0.43%) | | | | | | | | |

| | 1,147,434 | | | Neogen Corp.1 | | | 13,141,410 | | | | 35,386,865 | |

| | | |

| | | | Health Care Technology (0.10%) | | | | | | | | |

| | 250,000 | | | Schrödinger, Inc.1 | | | 2,785,688 | | | | 8,530,000 | |

| | | |

| | | | Life Sciences Tools & Services (8.17%) | | | | | | | | |

| | 820,000 | | | Bio-Techne Corporation | | | 43,273,300 | | | | 355,092,800 | |

| | 80,000 | | | Mettler-Toledo International, Inc.1 | | | 3,660,212 | | | | 109,855,200 | |

| | 500,000 | | | West Pharmaceutical Services, Inc. | | | 17,009,689 | | | | 205,355,000 | |

| | | | | | | | | | | | |

| | | | | | | 63,943,201 | | | | 670,303,000 | |

| | | |

| | | | Pharmaceuticals (0.39%) | | | | | | | | |

| | 598,076 | | | Dechra Pharmaceuticals PLC (United Kingdom)2,6 | | | 18,422,044 | | | | 31,753,082 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 113,771,390 | | | | 1,115,556,747 | |

| | | | | | | | | | | | |

|

| Industrials (6.44%) | |

| | | | Building Products (1.23%) | | | | | | | | |

| | 1,550,000 | | | Trex Company, Inc.1 | | | 13,965,800 | | | | 101,261,500 | |

| | | |

| | | | Environmental & Facilities Services (0.21%) | | | | | | | | |

| | 1,253,077 | | | BrightView Holdings, Inc.1 | | | 15,579,166 | | | | 17,054,378 | |

| | | |

| | | | Industrial Machinery (0.68%) | | | | | | | | |

| | 4,275,000 | | | Marel hf (Netherlands)2,6 | | | 18,281,670 | | | | 24,925,616 | |

| | 239,507 | | | Velo3D, Inc.1 | | | 1,943,249 | | | | 2,229,810 | |

| | 3,303,044 | | | Velo3D, Inc. PIPE1,3,7 | | | 33,030,440 | | | | 28,934,665 | |

| | | | | | | | | | | | |

| | | | | | | 53,255,359 | | | | 56,090,091 | |

| | | |

| | | | Research & Consulting Services (4.32%) | | | | | | | | |

| | 5,320,000 | | | CoStar Group, Inc.1 | | | 22,233,732 | | | | 354,365,200 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 105,034,057 | | | | 528,771,169 | |

| | | | | | | | | | | | |

|

| Information Technology (14.38%) | |

| | | | Application Software (8.40%) | | | | | | | | |

| | 725,000 | | | Altair Engineering, Inc., Cl A1 | | | 11,330,019 | | | | 46,690,000 | |

| | 1,075,000 | | | ANSYS, Inc.1 | | | 24,674,410 | | | | 341,473,750 | |

| | 1,025,000 | | | Guidewire Software, Inc.1 | | | 31,789,104 | | | | 96,985,500 | |

| | 1,000,000 | | | Pegasystems, Inc. | | | 13,997,009 | | | | 80,650,000 | |

| | 1,650,000 | | | SS&C Technologies Holdings, Inc. | | | 12,506,469 | | | | 123,783,000 | |

| | | | | | | | | | | | |

| | | | | | | 94,297,011 | | | | 689,582,250 | |

| | | |

| | | | Electronic Components (0.18%) | | | | | | | | |

| | 60,000 | | | Littelfuse, Inc. | | | 6,452,400 | | | | 14,964,600 | |

| | | |

| | | | Electronic Equipment & Instruments (0.15%) | | | | | | | | |

| | 1,500,000 | | | Mirion Technologies, Inc.1 | | | 15,000,000 | | | | 12,105,000 | |

| | | |

| | | | IT Consulting & Other Services (5.65%) | | | | | | | | |

| | 1,560,000 | | | Gartner, Inc.1 | | | 21,805,590 | | | | 464,037,600 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 137,555,001 | | | | 1,180,689,450 | |

| | | | | | | | | | | | |

| | |

| 18 | | See Notes to Financial Statements. |

| | |

| March 31, 2022 | | Baron Growth Fund |

STATEMENT OF NET ASSETS (Unaudited) (Continued)

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Real Estate (6.53%) | |

| | | | Diversified REITs (0.09%) | | | | | | | | |

| | 200,000 | | | American Assets Trust, Inc. | | $ | 3,437,271 | | | $ | 7,578,000 | |

| | | |

| | | | Office REITs (1.51%) | | | | | | | | |

| | 3,700,000 | | | Douglas Emmett, Inc. | | | 39,249,426 | | | | 123,654,000 | |

| | | |

| | | | Specialized REITs (4.93%) | | | | | | | | |

| | 750,000 | | | Alexandria Real Estate Equities, Inc.5 | | | 26,054,963 | | | | 150,937,500 | |

| | 5,400,000 | | | Gaming and Leisure Properties, Inc. | | | 114,745,147 | | | | 253,422,000 | |

| | | | | | | | | | | | |

| | | | | | | 140,800,110 | | | | 404,359,500 | |

| | | | | | | | | | | | |

| | Total Real Estate | | | 183,486,807 | | | | 535,591,500 | |

| | | | | | | | | | | | |

| | Total Common Stocks | | | 1,298,531,585 | | | | 8,209,410,248 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Private Convertible Preferred Stocks (0.48%) | |

| Industrials (0.21%) | |

| | | | Electrical Components & Equipment (0.21%) | | | | | �� | | | |

| | 59,407,006 | | | Northvolt AB, Series E (Sweden)2,3,5,7 | | | 9,374,988 | | | | 17,142,426 | |

| | | | | | | | | | | | |

|

| Materials (0.27%) | |

| | | | Fertilizers & Agricultural Chemicals (0.27%) | | | | | | | | |

| | 341,838 | | | Farmers Business Network, Inc., Series F1,3,5,7 | | | 11,300,002 | | | | 18,120,833 | |

| | 80,440 | | | Farmers Business Network, Inc., Series G1,3,5,7 | | | 5,000,000 | | | | 4,338,129 | |

| | | | | | | | | | | | |

| | Total Materials | | | 16,300,002 | | | | 22,458,962 | |

| | | | | | | | | | | | |

| | Total Private Convertible Preferred Stocks | | | 25,674,990 | | | | 39,601,388 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Warrants (0.01%) | |

| Consumer Discretionary (0.01%) | |

| | | | Hotels, Resorts & Cruise Lines (0.01%) | | | | | | | | |

| | 96,515 | | | OneSpaWorld Holdings Ltd.

Warrants, Exp 3/19/20241,2,5 | | $ | 0 | | | $ | 289,545 | |

| | | | | | | | | | | | |

| | Total Investments (100.50%) | | $ | 1,324,206,575 | | | | 8,249,301,181 | |

| | | | | | | | | | | | |

| | Liabilities Less Cash and Other Assets (-0.50%) | | | | (40,860,649 | ) |

| | | | | | | | | | | | |

| | Net Assets | | | $ | 8,208,440,532 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $100.60 per share

based on 26,454,457 shares outstanding) |

| | $ | 2,661,340,041 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $105.43 per share

based on 50,629,807 shares outstanding) |

| | $ | 5,338,023,364 | |

| | | | | | | | | | | | |

| R6 Shares (Equivalent to $105.44 per share

based on 1,982,845 shares outstanding) |

| | $ | 209,077,127 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At March 31, 2022, the market value of restricted and fair valued securities amounted to $68,536,053 or 0.83% of net assets. These securities are not deemed liquid. See Note 6 regarding Restricted Securities. |