Exhibit 99.1

Committed to our communities, our local families and businesses, our employees and our shareholdersliving our values every day CITIZENS & NORTHERN CORPORATION 2015 Annual Highlights

living our values every dayOn the cover Inside this report In March of 2015 Citizens & Northern Bank launched its Giving Back, Giving Together Community Involvement Initiative. By Giving Together as employees of Citizens & Northern Bank we were able to raise more than $50,000 in support of 22 local food pantries in our communities. In addition, 6,583 food items were collected during quarterly food drives in our offices and our employees volunteered at food pantries 111 times. Throughout this year's Annual Highlights we'll share remarks from our customers, employees and community organizations. We wanted to know why they bank at, partner with and work for C&N and if they feel we live our values. Their answers were so gratifying we wanted to share them with you. Also throughout the year, C&N contributed thousands of dollars to other local non-profit organizations. This dedication to the communities we serve is just a part of how the C&N team lives our values - every day. "Everything showed an amazing amount of teamwork" This year, Citizens & Northern Bank took huge strides in fighting hunger in their communities. After meeting with a few staff members, I realized that I was working with an engaged, enthusiastic and committed group of individuals, that would make any endeavor a success! We were able to bring more awareness to the hunger issues in our communities through the campaign they ran throughout their service territory. We also were incredibly grateful for their food and financial donations. Citizens & Northern Bank certainly lives up to their values. Everything that was done this year for the Central Pennsylvania Food Bank showed an amazing amount of teamwork. Jamie Caputo, Development and Community Relations Director - Northern Tier, Central PA Food Bank Jamie Caputo, left, of the Central PA Food Bank and Liz: Johnson, Regional Community Office Manager, Sayre, ready a box of donated items lor distribution. Member FDIC teamwork excellence respect responsibility and accountability integrity client-focus fun

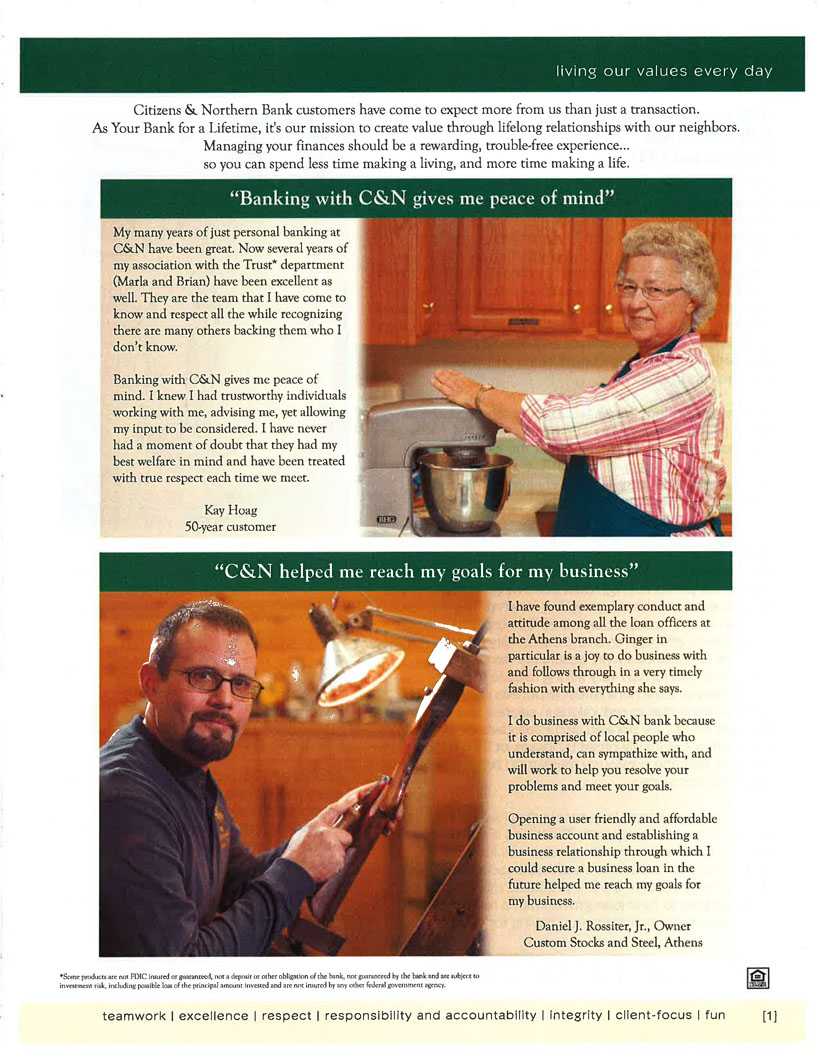

living our values every dayCitizens & Northern Bank customers have come to expect more from us than just a transaction. As Your Bank for a Lifetime, it's our mission to create value through lifelong relationships with our neighbors. Managing your finances should be a rewarding, trouble-free experience... so you can spend less time making a living, and more time making a life. "Banking with C&N gives me peace of mind" My many years of just personal banking at C&N have been great. Now several years of my association with the Trust* department (Marla and Brian) have been excellent as well. They are the team that I have come to know and respect all the while recognizing there are many others backing them who I don't know. Banking with C&N gives me peace of mind. I knew I had trustworthy individuals working with me, advising me, yet allowing my input to be considered. I have never had a moment of doubt that they had my best welfare in mind and have been treated with true respect each time we meet. Kay Hoag 50-year customer "C&N helped me reach my goals for my business" I have found exemplary conduct and attitude among all the loan officers at the Athens branch. Ginger in particular is a joy to do business with and follows through in a very timely fashion with everything she says. I do business with C&N bank because it is comprised of local people who understand, can sympathize with, and will work to help you resolve your problems and meet your goals. Opening a user friendly and affordable business account and establishing a business relationship through which I could secure a business loan in the future helped me reach my goals for my business. Daniel J. Rossiter, Jr., Owner Custom Stocks and Steel, Athens 'Some products are not FDIC insured or guaranteed, not a deposit or other obligation of the bank, not guaranteed by the bank and are subject to investment risk, including possible loss of the principal amount invested and are not insured by any other federal government agency. teamwork excellence respect responsibility and accountability integrity client-focus fun [1]

living our values every dayA Message from Our President J. Bradley Scovill President and CEO 2015 was a year of alignment and progress at C&N. Your Company produced very solid financial results in an environment where the continuing themes of modest economic growth, persistently low interest rates, and increasing regulation were complemented by major upheaval in the energy markets, a political/budget impasse in the state of Pennsylvania, and the early stages of a very unusual presidential election cycle. While all of these issues affect us in some way, the impact of advancing technology on delivery of financial services and new types of competition is providing opportunities and challenges for our bank and industry. Citizens & Northern Bank's Net income for the year was $16.5 million compared to $17.1 million in 2014. Earnings per share were $1.35 and $1.38 for the same periods. Return on average equity for 2015 was 8.72% and return on average assets was 1.32%, very strong measures relative to our peers in the industry. Earnings per share fell by 2% in 2015 as compared to 2014. While net interest income declined by 2.4%, strong loan growth provided some support and we prepaid a substantial portion of high cost borrowings during the year that will enhance the margin going forward. The provision for loan losses increased nearly 80% in order to support loan growth, although overall credit quality remains strong. Non margin revenues were essentially flat in most categories, but remain very strong relative to peer performance. Core noninterest expenses decreased by 3.5% primarily due to reductions in salaries and employee benefits. Finally, we booked securities gains of $2.9 million that were substantially offset by losses of $2.6 million resulting from the previously mentioned prepayment of high cost borrowings. On the balance sheet, total assets declined by 1.5% due to a 3.3% reduction in deposits. There was a significant shift in our asset mix as the growth in loans was funded by a reduction in the volume of investment securities. While these changes create a more profitable mix in the near term, we plan to fund loan growth with a renewed emphasis on deposit gathering moving forward. Capital remains very strong and provides us with the capacity to support our plans for growth and expansion. Capital remains very strong and provides us with the capacity to support our plans for growth and expansion. CZNC stock ended the year at $21.00, an increase of 1.6% for the year. CZNC stock ended the year at $21.00 an increase of 1.6% for the year, and dividends per share were $1.04 producing a yield of 4.95% on the December 31, 2015 market price. Additionally, we made progress on the 5% share repurchase plan that was announced in July 2014. At year-end, a total of 435,200 of the 622,500 shares approved under the plan had been repurchased at an average price of $19.34 per share. We will continue to focus on efforts that position the stock to be fairly valued for our current and future investors. President's message continued Page 3 [2] teamwork excellence respect responsibility and accountability integrity client-focus fun

living our values every day A Message from Our PresidentContinued from Page 2 "Your Bank for a Lifetime" is the tagline we use in branding C&N and it reflects the mission of our company which is "Creating Value Through Lifelong Relationships". We have a combination of banking and wealth management skills that are unique in our market and that position us to deliver on this promise. Our team of experienced professionals use our scale and strong capital base to provide you with sophisticated solutions to your financial needs and grow the organization. While in recent years our growth has stalled, 2015 was a year of progress as we focused our efforts on re-energizing and aligning the C&N Team to drive profitable growth. Throughout the year, we built and maintained momentum in expanding customer relationships as evidenced by loan growth totaling $74 million, which included increases in all loan categories. Each new loan involves a customer relationship that can be enhanced by the value delivered through our team of professional bankers and wealth managers. To reinforce this focus, our entire Team is engaged in implementing a sales/relationship management system that aligns all business activities to deliver value for our customers. We believe that this model will improve our ability to drive revenue growth across all business lines. Inherent in this alignment is investment in technology that contributes to an improved customer experience and enhanced productivity. We completed work on a new website that was rolled out late January 2016. This site now serves as the foundation for enhancing on-line services moving forward that will simplify and provide greater access to our customers. This access will connect with in-branch, call center, and mobile delivery channels as we coordinate our "high touch" experience with the "high tech" tools that our customers increasingly demand. To be successful, we are making substantial investments in equipping our people with the skills required to bring value to each customer relationship. The environment and industry remain very dynamic and requires that each member of the Team is developing their capabilities. The pace of change continues to accelerate and is reflected by a renewed sense of urgency at C&N. We have a very engaged staff that is excited by the opportunities that are open to the Team moving forward. Finally, we remain committed to the values that serve as the foundation for building relationships both inside C&N and with our communities, customers, and shareholders. Teamwork, Excellence, Respect, Responsibility and Accountability, Integrity, Client-focus and Having Fun, are part of the daily conversation at C&N. The results of our "Giving Back, Giving Together" initiative for 2015 to support the local food banks throughout our markets were outstanding. Not only because we collectively raised over $50,000 to help meet the need, but we also established many relationships throughout our communities that will endure. We will be working to support volunteer emergency services in a similar fashion during 2016. As you read this Annual Review, note how our Mission and Values come together to create valued relationships with our customers as we work to become their "Bank for a Lifetime". We made great progress during 2015 with this mission, helping our customers, and positioning C&N to pursue profitable growth in a very dynamic industry. We will continue to invest and align everything we do to create value for customers and our Team, and are confident in our capacity to create long term value for our shareholders. We thank our shareholders for your investment and ongoing support. "Your Bank for a Lifetime" is the tagline we use in branding C&N and it reflects the mission of our company which is "Creating Value Through Lifelong Relationships". We have a combination of banking and wealth management skills that are unique in our market and that positions us to deliver on this promise." teamwork excellence respect responsibility and accountability integrity client-focus fun [3]

living our values every dayFive Year Comparison NET INCOME in thousands CASH DIVIDENDS DECLARED DEPOSITS in thousands PER SHARE 2015 $16,471 2015 1.04 2015 $935,615 2014 $17,086 2014 1.04 2014 8967,989 2013 $18,594 2013 1.00 2013 $954,516 2012 $22,705 2012 0.84 2012 $1,006,106 2011 $23,368 2011 0.58 2011 $1,018,206 GROSS LOANS In thousands TOTAL ASSETS in thousands TOTAL SHAREHOLDERS' EQUITY in thousands 2015 $704,880 2015 $1,223,417 2015 $187,487 2014 $630,545 2014 $1,241,963 2014 $188,362 2013 $644,303 2013 $1,237,695 2013 $179,472 2012 $683,910 2012 $1,286,907 2012 $182,786 2011 $708,315 2011 $1,323,735 2011 $167,385 Total Return Performance Period Ending Index 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 C&N Corp 100.00 128.69 137.49 157.68 166.63 178.31 Russell 2000 100.00 95.82 111.49 154.78 162.35 155.18 CZNC Peer 100.00 93.86 112 37 140.86 154.64 162.21 Group Index* *CZNC Peer Group Index (Pennsylvania Bank and Thrift Companies with Total Assets between $700M-$2B as of 9/30/2015). This graph was obtained from SNL Financial LC, Charlottesville VA ©2016 This chart compares the Corporation's cumulative return to stockholders against the cumulative return of the Russell 2000 and a Peer Group Index of similar banking organizations selected by the Corporation for the five-year period commencing December 31, 2010 and ended December 31, 2015. The index values are market-weighted dividend-reinvestment numbers, which measure the total return for investing $100.00 five years ago. This meets Securities & Exchange Commission requirements for showing dividend reinvestment share performance over a five-year period and measures the return to an investor for placing $100 00 Into a group of bank stocks and reinvesting any and all dividends into the purchase of more of the same stock for which dividends were paid. A listing of companies comprising the peer group is provided in the Corporation's Annual Report on Form 10-K. [4] teamwork excellence respect responsibility and accountability integrity client-focus fun

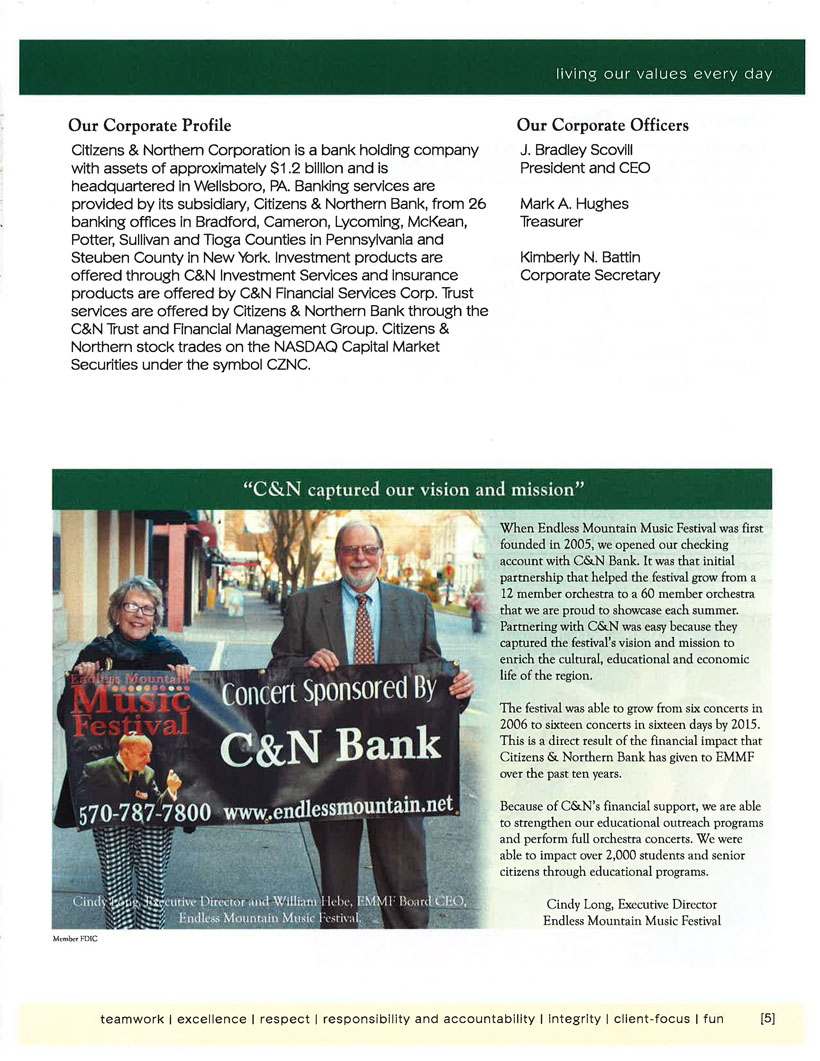

living our values every dayOur Corporate Profile Citizens & Northern Corporation is a bank holding company with assets of approximately $1.2 billion and is headquartered in Wellsboro, PA. Banking services are provided by its subsidiary, Citizens & Northern Bank, from 26 banking offices in Bradford, Cameron, Lycoming, McKean, Potter, Sullivan and Tioga Counties in Pennsylvania and Steuben County in New York. Investment products are offered through C&N Investment Services and insurance products are offered by C&N Financial Services Corp. Trust services are offered by Citizens & Northern Bank through the C&N Trust and Financial Management Group. Citizens & Northern stock trades on the NASDAQ Capital Market Securities under the symbol CZNC. Our Corporate Officers J. Bradley Scovill President and CEO Mark A. Hughes Treasurer Kimberly N. Battin Corporate Secretary "C&N captured our vision and mission" When Endless Mountain Music Festival was first founded in 2005, we opened our checking account with C&N Bank. It was that initial partnership that helped the festival grow from a 12 member orchestra to a 60 member orchestra that we are proud to showcase each summer. Partnering with C&N was easy because they captured the festival's vision and mission to enrich the cultural, educational and economic life of the region. The festival was able to grow from six concerts in 2006 to sixteen concerts in sixteen days by 2015. This is a direct result of the financial impact that Citizens & Northern Bank has given to EMMF over the past ten years. Because of C&N's financial support, we are able to strengthen our educational outreach programs and perform full orchestra concerts. We were able to impact over 2,000 students and senior citizens through educational programs. Cindy Long, Executive Director Endless Mountain Music Festival teamwork excellence respect responsibility and accountability integrity client-focus fun [5]

living our values every dayQuarterly Share Data Trades of the Corporation's stock are executed through various brokers who maintain a market in the Corporation's stock. The Corporation's stock is listed on NASDAQ Capital Market Securities with the trading symbol CZNC. The following tables show the approximate high and low sales price of the common stock during 2015 and 2014. 2015 High Low Dividend declared per Quarter First Quarter $21.50 $19.01 $0.26 Second Quarter $21.17 $19.16 $0.26 Third Quarter $20.73 $19.25 $0.26 Fourth Quarter $21.45 $19.07 $0.26 2014 High Low Dividend declared per Quarter First Quarter $20.74 $18.19 $0.26 Second Quarter $20.10 $17.94 $0.26 Third Quarter $20.10 $18.50 $0.26 Fourth Quarter $21.49 $18.83 $0.26 "We're very happy with C&N and the services they provide" Lucille Gale Knapp, who was once a resident of Galeton, established the William and L. R. Gale Community Foundation also known as the Galeton Foundation in 1988. I have worked with Brian Tevlin, Marla McIlvain and Mike Charles and many of the other Trust employees over the years. We've worked on scholarships, gas leases, IRS 501(c) (3) IRS applications, and tax issues and have been impressed by the good service we've received. Over the years we've been approached to change banks but we're very happy with C&N and the expertise and services they provide. Henry Lush, Gale Foundation *Some products are not FDIC insured or guaranteed, not a deposit or other obligation of the bank, not guaranteed by the bank and are subject to investment risk, including possible loss of the principal amount invested and are not insured by any other federal government agency. [6] teamwork excellence respect responsibility and accountability integrity client-focus fun

living our values every dayCommon Stock and Per Share Data (Per common share) 2015 2014 2013 2012 2011 Basic earnings per share $1.35 $1.38 $1.51 $1.86 $1.92 Diluted earnings per share 1.35 1.38 1.50 1.85 1.92 Cash dividends per share 1.04 1.04 1.00 0.84 0.58 Book value per share at period end 15.39 15.34 14.49 14.89 13.77 Tangible book value at period end 14.41 14.36 13.51 13.91 12.77 Weighted average common shares outstanding - basic 12,211,941 12,390,067 12,352,383 12,235,748 12,162,045 Weighted average common shares outstanding - diluted 12,233,773 12,412,050 12,382,790 12,260,208 12,166,768 Balance sheet at year-end (In thousands) 2015 2014 2013 2012 2011 Available-for-sale securities $420,290 $516,807 $482,658 $472,577 $481,685 Gross loans 704,880 630,545 644,303 683,910 708,315 Allowance for loan losses 7,889 7,336 8,663 6,857 7,705 Total Assets 1,223,417 1,241,963 1,237,695 1,286,907 1,323,735 Deposits 935,615 967,989 954,516 1,006,106 1,018,206 Borrowings 92,263 78,597 96,723 89,379 130,313 Stockholders' equity 187,487 188,362 179,472 182,786 167,385 Common shares outstanding 12,180,623 12,279,980 12,390,063 12,274,035 12,155,529 "We have been impressed by the good service" We chose C&N Bank over the competition because of their great service. Their employees are always positive with quick replies and helpful, reliable information. C&N created a 401(K) plan for our business creating a smoother and better environment for our staff. We would recommend C&N Bank for their excellent service and the quality of their staff. C&N lives up to its values every day. Dave Murdock and Dave Schall, co-owners Keystone Leather, Williamsport *Some products arc not FDIC insured or guaranteed, not a deposit or other obligation of the bank, not guaranteed by the bank and are subject to investment risk, including possible loss of the principal amount invested and are not insured by any other federal government agency. teamwork excellence respect responsibility and accountability integrity client-focus fun [7]

living our values every dayFive-year summary of operations Income statement (in thousands) As of or for the year ended December 31, 2015 2014 2013 2012 2011 Interest and fee income $44,519 $46,009 $48,914 $56,632 $61,256 Interest expense 4,602 5,122 5,765 9,031 13,556 Net interest income 39,917 40,887 43,149 47,601 47,700 Provision (credit) for loan losses 845 476 2,047 288 (285) Net interest income after provision (credit) for loan losses 39,072 40,411 41,102 47,313 47,985 Noninterest income excluding securities gains 15,404 15,420 16,451 16,383 13,897 Net impairment losses recognized In earnings from available-for-sale securities 0 0 (25) (67) 0 Net realized gains on available-for-sale securities 2,861 1,104 1,743 2,749 2,216 Loss on prepayment of debt 2,573 0 1,023 2,333 0 Noninterest expense excluding loss on prepayment of debt 32,956 34,157 33,471 32,914 32,016 Income before income tax provision 21,808 22,778 24,777 31,131 32,082 Income tax provision 5,337 5,692 6,183 8,426 8,714 Net income 16,471 17,086 18,594 22,705 23,368 U.S. Treasury preferred dividends 0 0 0 0 0 Net income available to common shareholders $16,471 $17,086 $18,594 $22,705 $23,368 "We were treated as valued customers" We value your customer service and willingness to help us at any time. Stacey Sickler, mortgage lender for Citizens & Northern, has devoted much time and effort throughout the years to help us reach many of our financial goals. Citizens & Northern has provided us with excellent service and more importantly tendered to our individual needs. We were treated as valued customers. Through the help of Citizens & Northern, we were able to build the home of our dreams and pay off all of our student loans. We were also provided with the opportunity to lower our percentage rates for our home mortgage loan decreasing the amount of years on our mortgage. This is a bank that will care about your needs and listen to your dreams. It is a bank that you can trust and will help you make good financial decisions for your family. Brett and Tiffany Owen [8] teamwork excellence respect responsibility and accountability integrity client-focus fun

living our values every dayFive-year summary of operations As of or for the year ended December 31, Average balance sheet (in thousands) 2015 2014 2013 2012 2011 Total assets $1,243,209 $1,239,897 $1,237,096 $1,305,163 $1,313,445 Earning assets 1,159,298 1,155,401 1,145,340 1,199,538 1,208,584 Gross loans 657,727 627,753 656,495 700,241 714,421 Deposits 968,201 965,418 964,031 1,008,469 1,001,125 Stockholders' equity 188,905 185,469 181,412 175,822 152,718 Key Ratios Return on average assets 1.32% 1.38% 1.50% 1.74% 1.78% Return on average equity 8.72% 9.21 % 10.25% 12.91 % 15.30% Average equity to average assets 15.19% 14.96% 14.66% 13.47% 11.63% Net interest margin (1) 3.69% 3.80% 4.05% 4.26% 4.22% Efficiency (2) 56.60% 57.59% 53.27% 48.82% 49.37% Cash dividends as a percentage of diluted earnings per share 77.04% 75.36% 66.67% 45.41 % 30.21% Tier 1 leverage 14.31% 13.89% 13.78% 12.53% 10.93% her 1 risk-based capital 23.40% 26.26% 25.15% 22.86% 19.95% Total risk-based capital 24.45% 27.60% 26.60% 24.01% 21.17% Tangible common equity/tangible assets 14.49% 14.34% 13.66% 13.39% 11.84% Nonperforming assets/total assets 1.31 % 1.34% 1.53% 0.82% 0.73% Nonperforming loans/total loans 2.09% 2.45% 2.80% 1.41% 1.19% Allowance for loan losses/total loans 1.12% 1.16% 1.34% 1.00% 1.09% Net charge-offs/average loans 0.04% 0.29% 0.04% 0.16% 0.16% (1) Rates of return on tax-exempt securities and loans are calculated on a fully-taxable equivalent basis. (2) The efficiency ratio is calculated by dividing: (a) total noninterest expense excluding losses from prepayment of debt, by (b) the sum of net interest income (including income from tax-exempt securities and loans on a fully-taxable equivalent basis) and noninterest income excluding securities gains or losses. teamwork excellence respect responsibility and accountability integrity client-focus fun [9]

living our values every dayQuarterly financial data The following table presents summarized financial data for 2015 and 2014 (unaudited, in thousands, except per share) 2015 quarter ended March 31 June 30 Sept. 30 Dec. 31 Interest Income $11,163 $11,186 $11,134 $11,036 Interest expense 1,213 1,176 1,126 1,087 Net interest income 9,950 10,010 10,008 9,949 Provision for loan losses 3 221 302 319 Net interest income after provision for loan losses 9,947 9,789 9,706 9,630 Other income 3,487 3,962 3,961 3,994 Net gains on available-for-sale securities 74 932 79 1,776 Loss on prepayment of borrovvings 0 910 0 1,663 Other expenses 8,464 7,964 8,117 8,411 Income before income tax provision 5,044 5,809 5,629 5,326 Income tax provision 1,229 1,452 1,395 1,261 Net Income $3,815 $4,357 $4,423 $4,065 Net Income per share - basic $ 0.31 $ 0.36 S 0.35 $ 0.33 Net income per share - diluted $ 0.31 $ 0.36 $ 0.35 $ 0.33 2014 quarter ended March 31 June 30 Sept. 30 Dec. 31 Interest income $11,406 $11,563 $11,572 $11,468 Interest expense 1,288 1,290 1,287 1,257 Net interest income 10,118 10,273 10,285 10,211 (Credit) Provision for loan losses (311) 446 218 123 Net interest income after (credit) provision for loan losses 10,429 9,827 10,067 10,088 Other income 3,751 3,980 3,887 3,802 Net gains on available-for-sale securities 31 103 760 210 Other expenses 8,524 8,347 9,036 8,250 Income before income tax provision 5,687 5,563 5,678 5,850 Income tax provision 1,399 1,400 1,411 1,482 Net income $4,288 $4,163 $4,267 $4,368 Net income per share - basic $ 0.35 $ 0.33 $ 0.34 $ 0.36 Net income per share - diluted $ 0.34 $ 0.33 $ 0.34 $ 0.35 [10] teamwork excellence respect responsibility and accountability integrity client-focus fun

living our values every dayTrust and Financial Management Group Five-Year Comparison (in thousands) 2015 2014 2013 2012 2011 Assets $814,788 $825,918 $796,115 $707,912 $634,782 Revenue 4,626 4,490 4,087 3,847 3,472 The composition of Trust assets under management as of Dec. 31, 2015, 2014 and 2013 follow: Accounts (in thousands) 2015 2014 2013 Pension/profit sharing $339,953 $345,772 $325,413 Investment management 211,645 211,699 196,544 Trusts 1 66,433 171,934 173,429 Custody 92,451 92,236 94,642 Estates 1,874 2,344 4,159 Guardianships 2,432 1,933 1,928 Total $814,788 $825,918 $796,115 Investments (in thousands) 2015 2014 2013 Mutual funds $458,942 $456,375 $426,816 Stocks 167,098 178,636 165,766 Bonds 88,471 95,674 101,107 Savings and Money Market funds 90,038 85,629 93,545 Miscellaneous 7,216 6,588 6,639 Real estate 2,827 2,810 1,814 Mortgages 196 206 428 Total $814,788 $825,918 $796,115 "We feel that we are "people" to C&N" We started banking with C&N with our first home loan in 2009 with Kelly Fasse, C&N mortgage lender. We eventually transferred our personal banking to C&N due to how comfortable we felt with the bank and the attention to detail we noticed with every question and transaction we had involving anybody at C&N. We now work with Linda Gordner for our current home loan. Linda has been wonderful answering all of our questions promptly and continuing our confidence in C&N. Angela and Tyler Rhone teamwork excellence respect responsibility and accountability integrity client-focus fun [11]

living our values every day2015 Board of Directors Citizens & Northern Corporation Citizens & Northern Bank Leo F. Lambert, Chairman President/GM, Fitzpatrick & Lambert, Inc. Dennis F. Beardslee Owner, Terrace Lanes Bowling Center Jan E. Fisher Executive Vice President/COO Susquehanna Health System R. Bruce Haner Retired auto buyer for new car dealers Susan E. Hartley Attorney At Law Edward H. Owlett, Ill President and CEO, Putnam Company J. Bradley Scovill President and CEO Leonard Simpson Attorney At Law and Sullivan County District Attorney James E. Towner Retired General Manager, The Scranton Times Ann M. Tyler CPA, Ann M. Tyler CPA 2015 Executive Team J. Bradley Scovill President and CEO Shelley L. D'Haene EVP and Senior Operations Officer Stan Dunsmore EVP and Chief Credit Officer Harold F. Hoose, Ill EVP and Director of Lending Division Mark A. Hughes EVP and Director of Finance Division John M. Reber EVP and Director of Risk Management Thomas L. Rudy, Jr. EVP and Director of Branch Delivery Deborah E. Scott EVP and Director of Trust Division “I like to create a true win-win relationship” I didn't choose C&N Bank for any one particular reason; it was really a combination of several reasons. Price was certainly important, but definitely not more important than delivery, service and quality. When I do business I like to create a true win-win relationship. It's all but impossible to create a win-win relationship if you're focused solely on price. C&N is definitely competitive. They have to be, but they shine delivering the whole package. A few years ago I had an opportunity to start a business that I was quite confident could be a great investment. The catch was that it was going to take significant capital and I needed it quickly. My C&N relationship managers didn't hold back. They asked the tough questions that needed to be asked. I value their input. The bottom line was we worked together to manage the risk and get me the capital I needed; another win-win for me and C&N Bank. Tony Mosso, Owner, Automax, Wellsboro [12] teamwork excellence respect responsibility and accountability integrity client-focus fun

living our values every day2015 Advisory Boards We thank our Advisory Board members who give us valuable insight into the communities we serve. Athens/Sayre/East Smithfield Warren J. Croft, Max P. Gannon, Jr., L. Joseph Tomasso, Jr. Canisteo/Hornell William Hatch Coudersport/Emporium/Port Allegany Peter Fragale, Patrice D. Lavavasseur, Edwin M. Schott, Robert C. Smith, Edwin W. Tompkins Ill. Dushore/Laporte Ronald A. Gutosky, William B. Saxe. Elkland/Knoxville/Tioga Brian Bicksler, Mark R. Howe, John C. Kenyon, Leisa L. LaVancher, Mary C. Owlett, William W. Roosa. Mansfield/Wellsboro Donald R. Abplanalp, Craig Eccher, Scott Lewis, Lawrence B. Mansfield. Ralston/Liberty Lawrence J. Connolly, Stephen L. Davis, Ronald W. Roan, James H. Route, Jr., Ray E. Wheeland. Jersey Shore/Muncy/Old Lycoming/South Williamsport/Williamsport Thomas F. Charles, John M. Confer, Thomas D. Hess, Roger D. Jarrett, Daniel K. Mathers, Frank G. Pellegrino, David Schall, Louis Terry Waldman. Towanda/Monroeton/Wysox/Troy Gary Baker, James A. Bowen, Robert L. Fulmer, James E. Parks, Mark W. Smith, Evan S. Williams Ill. "I appreciated the kindness shown to me" I initially chose Citizens & Northern Bank on the recommendation of my realtor. While price was important, service was equally so. At the time of a deep personal loss and being alone, Stacy Elliott of the Old Lycoming Township branch of C&N Bank was very kind and helpful in guiding me through the process of obtaining my mortgage. Thank you Stacy! Kenneth Staib teamwork excellence respect responsibility and accountability integrity client-focus fun [13]

living our values every day2015 Retirements We said goodbye to five C&N employees who retired in 2015. Together they had 73 years of service to Citizens & Northern. Barbara Clinger Customer Service Representative 21 years Susan Gardner Customer Service Representative 10 years George Raup EVP/ Chief Information Officer 36 years James Seltzer Resource Recovery Officer4.7 years Paula Vogt Customer Transaction Specialist 2 years 2015 Service Awards Last year Citizens & Northern employees were recognized for more than 600 years of service to the financial institution. Employees were honored at luncheons hosted by the President and CEO. 40 Years Nola Gross, Community Office Manager, Coudersport 35 Years Joan Rohe, Staff Accountant, Towanda Mark Miller, MIS Network Administrator, Wellsboro Teresa Mitchell, Staff Accountant, Wellsboro 25 Years Brenda Whiteley, Mortgage Loan Sales Officer, Dushore Kathleen Heimbach, Business Development Sales Officer, Troy Lynn Errico, Accounts Payable Specialist, Wellsboro 20 Years Joanna Mason, Customer Service Representative, Emporium Karen Blackwell, Quality Control Specialist, Wellsboro Kimberlea Whiting, Mortgage Loan Sales Officer, Emporium 15 Years Courtney Baker, Community Office Manager, Ralston Dawn Shoemaker, Customer Service Representative, Dushore Denise Mattison, Deposit Operations Representative, Wellsboro Janelle Tombs, Credit Analyst Team Leader, Wellsboro Janice Wilcox, MIS PC Technician, Wellsboro Janis Bartlett, Customer Service Representative, Muncy Jennifer Schultz, Trust Account Administrator, Sayre Laura Losinger, Customer Service Specialist, Knoxville Mark Hughes, Director of Finance Division, Wellsboro Melanie Kellogg, Customer Service Representative, Athens Michael Wetzel, Senior Commercial Loan Sales Officer, Coudersport Philip Prough, Director Financial Services Delivery, Wellsboro Roberta Dieffenbach, Customer Transaction Specialist, Wellsboro Ruth Wilkinson, New Employee & HR Technician, Wellsboro Stacey Keener, Customer Service Representative, Sayre Thomas Rudy, Director Branch Delivery, Wellsboro 10 Years Amy Haskins, Customer Service Representative, Knoxville Anna Phelps, Customer Service Representative, Liberty Bonnie Hargarther, Staff Auditor, Wellsboro Brandi Nowakowski, Loan Processor - Collateral Specialist, Wellsboro Brian Tevlin, Regional Manager of Financial Services Delivery, Wellsboro Carol Ellenberger, Customer Service Representative, Canisteo Christina Merwine, Compliance Officer, Wellsboro Cody Bowen, Trainer, Wellsboro Ellen Black, Customer Transaction Specialist, Ralston Kevin Dougherty, Senior Commercial Loan Sales Officer, Sayre Linda Macensky, Community Office Manager, Wellsboro Marlene King, Customer Transaction Specilaist, Knoxville Samantha Pecynski Deposit Operations Specialist, Wellsboro Sara Jennings, Trust Administrative Assistant, Sayre Stacy Elliott, Regional Community Office Manager, Old Lycoming [14] teamwork excellence respect responsibility and accountability integrity client-focus fun

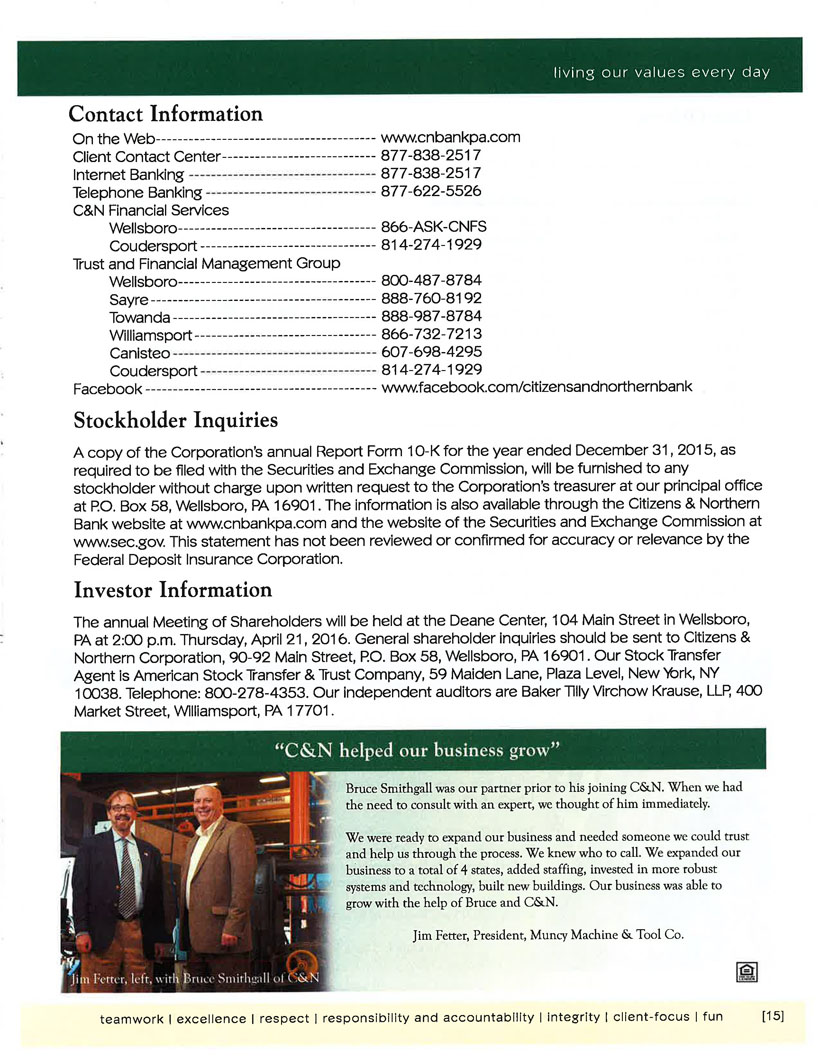

living our values every dayContact Information On the Web www.cnbankpa.com Client Contact Center 877-838-2517 Internet Banking 877-838-2517 Telephone Banking 877-622-5526 C&N Financial Services Wellsboro 866-ASK-CNFS Coudersport 814-274-1929 Trust and Financial Management Group Wellsboro 800-487-8784 Sayre 888-760-8192 Towanda 888-987-8784 Williamsport 866-732-7213 Canisteo 607-698-4295 Coudersport 814-274-1929 Facebook www.facebook.com/citizensandnorthernbank Stockholder Inquiries A copy of the Corporation's annual Report Form 10-K for the year ended December 31, 2015, as required to be filed with the Securities and Exchange Commission, will be furnished to any stockholder without charge upon written request to the Corporation's treasurer at our principal office at P.O. Box 58, Wellsboro, PA 16901. The information is also available through the Citizens & Northern Bank website at www.cnbankpa.com and the website of the Securities and Exchange Commission at www.sec.gov. This statement has not been reviewed or confirmed for accuracy or relevance by the Federal Deposit Insurance Corporation. Investor Information The annual Meeting of Shareholders will be held at the Deane Center, 104 Main Street in Wellsboro, PA at 2:00 p.m. Thursday, April 21, 2016. General shareholder inquiries should be sent to Citizens & Northern Corporation, 90-92 Main Street, P.O. Box 58, Wellsboro, PA 16901. Our Stock Transfer Agent is American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, NY 10038. Telephone: 800-278-4353. Our independent auditors are Baker -Tilly Virchow Krause, LLP, 400 Market Street, Williamsport, PA 17701. "C&N helped our business grow" Bruce Smithgall was our partner prior to his joining C&N. When we had the need to consult with an expert, we thought of him immediately. We were ready to expand our business and needed someone we could trust and help us through the process. We knew who to call. We expanded our business to a total of 4 states, added staffing, invested in more robust systems and technology, built new buildings. Our business was able to grow with the help of Bruce and C&N. Jim Fetter, President, Muncy Machine & Tool Co. teamwork excellence respect responsibility and accountability integrity client-focus fun [15]

living our values every dayOur Offices Athens 428 South Main Street Canisteo 3 Main Street Coudersport 10 North Main Street Dushore 111 West Main Street East Smithfield 563 Main Street Elkland 104 West Main Street Emporium 135 East Fourth Street Hornell 6250 County Route 64 Jersey Shore 230 Railroad Street Knoxville 102 East Main Street Laporte 514 Main Street Liberty 4534 Williamson Trail Mansfield 1085 South Main Street Monroeton 612 James Monroe Avenue Muncy 3461 Route 405 Highway Old Lycoming 1510 Dewey Avenue Port Allegany 100 Maple Street Ralston 24 Thompson Street Sayre 1827 Elmira Street South Williamsport 2 East Mountain Avenue Tioga 41 North Main Street Towanda 428 Main Street Troy 64 Elmira Street Wellsboro 90-92 Main Street Williamsport 130 Court Street Wysox 1467 Golden Mile Road Toll-free: 877-838-2517 Our Client Contact Center is available to help you Monday-Thursday 8:00 a.m.-5:00 p.m.; Friday 8:00 a.m. - 6:00 p.m. and Saturday 8:00 a.m.-noon. "I chose C&N because of its services; I stay because of its people" Gimmicks do not draw my attention; service does. My banking needs are numerous, specific, and sometimes complicated. When I evaluated C&N Bank nearly a decade ago toward its potential to meet my banking needs, here is what I found: Convenient locations. Check. Weekend hours. Check. Drive-through banking. Check. Widely available ATM services. Check. Online banking. Check. Electronic monthly statements. Check. Fast, efficient loan-application processing. Check. Friendly, capable people. Check, check. More important, though, are the congenial and helpful C&N Bank employees whom I have met at my local C&N branch. Ginger, Mel, Sheila, Beth, and all of the other capable and efficient C&N Bank employees with whom I have interacted over the years are also knowledgeable, reliable, and supportive. We even share an occasional story and a laugh. I chose C&N Bank because of its services; I stay because of its people. Theodore F. Them, MD,MS,PhD,MPH,FACOEM, Athens [16] teamwork excellence respect responsibility and accountability integrity client-focus fun

living our values every day"My passion is doing what's right for people" One of the primary motivating factors that prompted me to pursue financial advising as a career was my strong belief in giving unbiased financial advice regardless of whether it generated maximum revenue to my employer or me. As a young man I had seen my family adversely affected by a particular life insurance agent, and I was pretty sure her advice was strictly driven by how much money she would make. In my tenure at C&N, I have never once had anyone attempt to quell that passion to do what is right for people. In fact, that passion is shared by everyone. For my team "superior service" means getting to know our clients, understanding what is truly important to them, and helping them put a plan together to accomplish those very personal desires. Larry Alderson, Regional Manager of Financial Services Delivery - Sayre "We all strive to work as a team" Every time I come to work I am a part of a team. I have two branches that depend on me to do my job so that they can do theirs. That is one of the nice things about working for Citizens & Northern Bank, we all strive to work as a team. We all have different strengths which we can call upon to do the best for our clients and make us successful. Penny Barr, Regional Community Office Manager Port Allegany “I am proud to be a member of C&N every day” I enjoy the people that I work with, the opportunities that we have for personal career development and the teamwork involved in helping to grow the bank and be successful. I also enjoy helping small businesses grow their companies and being a trusted advisor to assist them with exceeding their goals. The bank has a great group of employees who are devoted to making C&N the Only Bank You Need by providing superior customer service and helping our clients out in any way possible. Ryan Satalin Senior Commercial Loan Sales Officer - Wellsboro teamwork excellence respect responsibility and accountability integrity client-focus fun

Committed to our communities, our local families and businesses, our employees and our shareholders living our values every day CITIZENS & NORTHERN CORPORATION 2015 Annual Highlights