Exhibit 99.1

GOVERNMENT OF ALBERTA

Annual Report

Government of Alberta

2019-2020

| ● | Consolidated Financial Statements |

This is the report to Albertans on Budget 2019: A plan for jobs and the economy.

It is a permanent public record of the revenue, expense and results achieved by the Government of Alberta for the 2019 –20 fiscal year.

The Government of Alberta 2019 –20 Annual Report consists of three parts:

| | · | | Budget 2019 Key Results, which provide a description and variance analysis of government’s revenue, spending, assets and liabilities. |

| | · | | Consolidated Financial Statements, which provide an overall accounting of the government’s revenue and spending, and assets and liabilities. |

| | · | | Measuring Up, which reports on the progress that has been made towards achieving the government’s goals. |

Annual reports for each ministry have also been published, providing additional detailed information on performance and financial results.

Copyright © 2020

Government of Alberta 2019 –20 Annual Report

ISBN 978-1-4601-4812-9 (PDF)

ISSN 2291-6431 (online)

www.alberta.ca

Preface

The Public Accounts of Alberta are prepared in accordance with the Financial Administration Act and the Fiscal Planning and Transparency Act. The Public Accounts consist of the Annual Report of the Government of Alberta and the annual reports of each of the 20 ministries.

This Annual Report of the Government of Alberta contains Budget 2019 Key Results, the audited

Consolidated Financial Statements and Measuring Up, which compares actual performance results to desired results set out in the government’s strategic plan.

The annual reports of ministries are released concurrently with the Annual Report of the Government of Alberta. The ministry annual reports contain the financial information of the ministries and a comparison of actual performance results to desired results set out in the ministries’ business plans. Each ministry annual report also includes:

| | · | | Financial statements of entities making up the ministry which includes regulated funds, provincial agencies and Crown-controlled corporations for which the minister is responsible; |

| | · | | Other financial information as required by the Financial Administration Act and the Fiscal Planning and Transparency Act, as separate reports, to the extent that the ministry has anything to report; |

| | · | | Financial information relating to accountable organizations and trust funds. |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 1 |

Table of Contents

| | | | | | | | |

| | |

Preface | | | 1 | | | |

| | |

Table of Contents | | | 2 | | | |

| | |

Budget 2019 Key Results | | | 5 | | | |

| | |

Financial Highlights | | | 7 | | | |

| | |

Fiscal Summary | | | 7 | | | |

| | |

Revenue Highlights | | | 8 | | | |

| | |

Expense Highlights | | | 9 | | | |

| | |

Statement of Financial Position | | | 10 | | | |

| | |

Financial Indicators and Risks | | | 11 | | | |

| | |

Historical Fiscal Summary 2008-09 to 2019-20 | | | 12 | | | |

| | |

Consolidated Financial Statements of the Province of Alberta | | | 13 | | | |

| | |

Table of Contents | | | 15 | | | |

| | |

Management’s Responsibility for the Consolidated Financial Statements | | | 17 | | | |

| | |

Independent Auditor’s Report | | | 18 | | | |

| | |

Consolidated Statement of Operations | | | 21 | | | |

| | |

Consolidated Statement of Financial Position | | | 22 | | | |

| | |

Consolidated Statement of Change in Net Debt | | | 23 | | | |

| | |

Consolidated Statement of Cash Flows | | | 24 | | | |

| | |

Notes to the Consolidated Financial Statements | | | 25 | | | |

1 | | Summary of Significant Accounting Policies and Reporting Practices | | | 25 | | | |

2 | | Valuation of Financial Assets and Liabilities | | | 33 | | | |

3 | | Financial Risk Management and Derivatives | | | 34 | | | |

4 | | Contractual Rights | | | 37 | | | |

5 | | Contingent Assets | | | 37 | | | |

6 | | Contractual Obligations and Commitments | | | 38 | | | |

7 | | Contingent Liabilities | | | 39 | | | |

8 | | Trust and Other Funds Under Administration | | | 41 | | | |

9 | | Subsequent Event | | | 42 | | | |

10 | | Comparative Figures | | | 42 | | | |

| | |

| | |

| 2 | | Government of Alberta | Annual Report 2019 – 2020 |

Table of Contents

| | | | | | | | |

Schedules to the Consolidated Financial Statements | | | 43 | | | |

1 | | Revenues | | | 43 | | | |

2 | | Revenues by Source by Ministry | | | 44 | | | |

3 | | Expenses by Object by Ministry | | | 45 | | | |

4 | | Cash and Cash Equivalents | | | 46 | | | |

5 | | Accounts Receivable | | | 46 | | | |

6 | | Portfolio Investments | | | 47 | | | |

7 | | Endowment Funds | | | 48 | | | |

8 | | Equity in Government Business Enterprises | | | 49 | | | |

9 | | Loans and Advances | | | 56 | | | |

10 | | Accounts Payable and Other Accrued Liabilities | | | 57 | | | |

11 | | Debt | | | 57 | | | |

12 | | Pension Plans and Other Defined Benefit Plans | | | 62 | | | |

13 | | Deferred Contributions | | | 68 | | | |

14 | | Tangible Capital Assets | | | 69 | | | |

15 | | Adjustments to Net Assets | | | 70 | | | |

16 | | Over-expenditure of Spending Authorities | | | 71 | | | |

17 | | Listing of Organizations | | | 72 | | | |

| | |

Glossary (Unaudited) | | | 77 | | | |

| | |

Measuring Up | | | 84 | | | |

| | |

Management’s Responsibility for Reporting | | | 84 | | | |

| | |

Executive Overview | | | 85 | | | |

| | |

Measuring Up 2020 Reader’s Guide | | | 87 | | | |

| | |

Priority One: Getting Alberta back to work | | | 89 | | | |

| | |

Priority Two: Making life better for Albertans | | | 105 | | | |

| | |

Priority Three: Standing up for Alberta | | | 120 | | | |

| | |

Performance Indicators – Sources and Notes | | | 127 | | | |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 3 |

| | |

| | |

| 4 | | Government of Alberta | Annual Report 2019 – 2020 |

Budget 2019 Key Results

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 5 |

| | | | | | |

Table of Contents | | | | | | |

| | |

| Budget 2019 Key results | | | | | | |

| | |

Financial Highlights | | | 7 | | | |

| | |

Fiscal Summary | | | 7 | | | |

| | |

Revenue Highlights | | | 8 | | | |

| | |

Expense Highlights | | | 9 | | | |

| | |

Statement of Financial Position | | | 10 | | | |

| | |

Financial Indicators and Risks | | | 11 | | | |

| | |

Historical Fiscal Summary, 2008-09 to 2019-20 | | | 12 | | | |

| | |

| | |

| 6 | | Government of Alberta | Annual Report 2019 – 2020 |

Financial Highlights

A budget was not passed prior to Alberta’s general election, held April 16, 2020. Special warrants were used to continue operations. Following the election, a blue ribbon panel - the MacKinnon Panel - was commissioned to review the government’s finances, delaying Budget 2019 until October. An updated 2019-20 forecast was included in Budget 2020, which was tabled in February, 2020. On March 11, 2020 the World Health Organization declared a global pandemic. COVID-19 has significantly impacted Alberta and the 2019-20 results.

The deficit in 2019-20 was $12.2 billion. This was $5.4 billion higher than the 2018-19 deficit, and $3.4 billion more than estimated in Budget 2019.

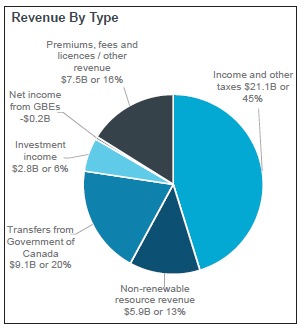

Total Revenue was $46.2 billion in 2019-20, a decrease of $3.3 billion from 2018-19, and down $3.7 billion from budget.

Change from 2018-19. Decreases of $2.8 billion from government business enterprise net income (GBEs) and $2.6 billion in taxes and other revenue, were partly offset by increases of $1.1 billion in federal government transfers, $0.5 billion in resource revenue and $0.5 billion in investment income.

Change from Budget. Decreases of $2.6 billion from GBEs, $0.8 billion in taxes, $0.6 billion in resource revenue and $0.1 billion in federal transfers were partly offset by $0.4 billion in increased investment income and other revenue.

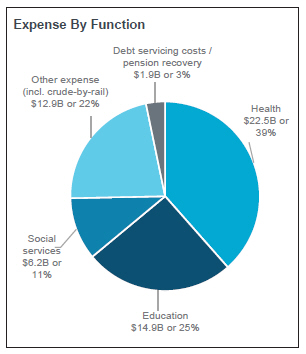

Total Expense was $58.4 billion, up $2.1 billion from 2018-19, but down $0.3 billion from budget.

Change from 2018-19. Increases of $0.6 billion in health expense, $0.4 billion in social services, $0.8 billion in crude-by-rail, and $0.4 billion in debt servicing costs and other expense, were partly offset by a $0.1 billion increase in pension recoveries.

Change from Budget. Increases of $0.3 billion in health, $0.3 billion in education, were partly offset by a decrease of $0.1 billion in social services, $0.6 billion in crude-by-rail and $0.2 billion other expense.

Net Financial Debt. At March 31, 2020, net financial debt was $40.1 billion, an increase of nearly $13 billion from March 31, 2019.

| | | | | | | | | | | | | | | | | | | | |

| Fiscal Summary | | | | | | | | | | |

| (millions of dollars) | | | | | | | | Change from |

| | | | | | | | | | | | | | | | |

| | | 2019-20 | | 2018-19 | | | | 2018-19 |

| | | | | | | | | | | | |

| | | Budget | | Actual | | Actual | | Budget | | Actual |

| |

Revenue | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Income and other taxes | | | 21,933 | | | | 21,098 | | | | 23,578 | | | | (835 | ) | | | (2,480 | ) |

Non-renewable resource revenue | | | 6,527 | | | | 5,937 | | | | 5,429 | | | | (590 | ) | | | 508 | |

Transfers from Government of Canada | | | 9,200 | | | | 9,072 | | | | 8,013 | | | | (128 | ) | | | 1,059 | |

Investment income | | | 2,585 | | | | 2,828 | | | | 2,349 | | | | 243 | | | | 479 | |

Net income from government business enterprises | | | 2,417 | | | | (225 | ) | | | 2,585 | | | | (2,642 | ) | | | (2,810) | |

Other revenue (incl. premiums, fees and licences) | | | 7,308 | | | | 7,514 | | | | 7,618 | | | | 206 | | | | (104) | |

| | | | |

Total Revenue | | | 49,970 | | | | 46,224 | | | | 49,572 | | | | (3,746 | ) | | | (3,348 | ) |

| | | | |

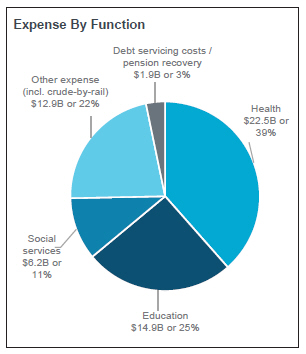

Expense by Function | | | | | | | | | | | | | | | | | | | | |

Health | | | 22,153 | | | | 22,477 | | | | 21,921 | | | | 324 | | | | 556 | |

Education | | | 14,541 | | | | 14,879 | | | | 14,848 | | | | 338 | | | | 31 | |

Social Services | | | 6,304 | | | | 6,248 | | | | 5,867 | | | | (56 | ) | | | 381 | |

Other expense (includes contingency) 1 | | | 12,248 | | | | 12,005 | | | | 11,860 | | | | (243 | ) | | | 145 | |

| | | | |

Total Program Expense | | | 55,246 | | | | 55,609 | | | | 54,496 | | | | 363 | | | | 1,113 | |

| | | | |

Debt servicing costs | | | 2,265 | | | | 2,235 | | | | 1,971 | | | | (30 | ) | | | 264 | |

Pension provisions / (recovery) | | | (337 | ) | | | (334 | ) | | | (190 | ) | | | 3 | | | | (144) | |

Crude-by-rail | | | 1,500 | | | | 866 | | | | 6 | | | | (634 | ) | | | 860 | |

| | | | |

Total Expense | | | 58,674 | | | | 58,376 | | | | 56,283 | | | | (298 | ) | | | 2,093 | |

Surplus / (Deficit) | | | (8,703 | ) | | | (12,152 | ) | | | (6,711 | ) | | | (3,449 | ) | | | (5,441 | ) |

| | | | | |

Net Financial Debt | | | (36,626 | ) | | | (40,144 | ) | | | (27,477 | ) | | | (3,518 | ) | | | (12,667 | ) |

| 1 | Other expense by function are identified in the Statement of Operations on page 19 in the Consolidated Financial Statements. |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 7 |

Revenue Highlights

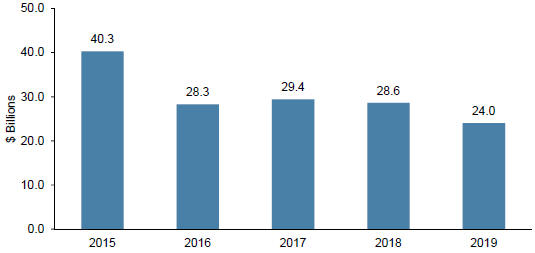

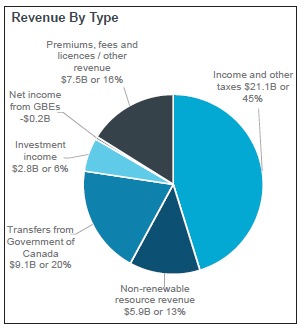

| • | Total 2019-20 revenue was $46.2 billion, a decrease of $3.3 billion from 2018-19 and of $3.7 billion from Budget 2019. About 65 per cent of the decrease from budget was due to a provision required for Alberta Petroleum Marketing Commission related to the Sturgeon Refinery Processing Agreement. |

| • | Although the COVID-19 pandemic was not declared until March, it had a material impact on 2019-20 income taxes, as they are calculated on a calendar-year basis. This means 2019-20 revenue includes a quarter of 2020 estimated revenue, which has been significantly impacted by COVID-19 and the associated global economic deterioration. 2019-20 income tax revenue was $15.4 billion, comprising $11.2 billion in personal (PIT) and $4.1 billion in corporate income tax (CIT). PIT was down $0.7 billion from budget and $0.6 billion from 2018-19 mainly due to the impact that the COVID-19 pandemic has had on employment and household incomes in 2020. CIT was $0.8 billion lower than 2018-19 and $0.1 billion lower than budget mainly due to the impact on corporate profits of COVID-19 along with the collapse in oil prices. |

| • | Other tax revenue of $5.7 billion comprised: $2.5 billion in education property tax (2019 requisition mill rates were frozen at 2018 rates), $1.4 billion in fuel tax revenue and $1.9 billion in other taxes. Other tax revenue was close to budget, but $1.1 billion lower than 2018-19, primarily due to carbon tax elimination, which Albertans ceased paying on May 30, 2019. |

| • | Non-renewable resource revenue was $5.9 billion, a $0.5 billion increase from 2018-19, but a $0.6 billion decrease from budget. The decline from budget was primarily due to the global impact of COVID-19 on oil demand and prices, exacerbated by the temporary disagreement on oil supply management between Saudi Arabia and Russia. The West Texas Intermediate (WTI) oil price averaged US$54.85 per barrel (/bbl) in 2019-20, down $7.92 from 2018-19 and about $2 from budget. The light-heavy differential averaged US$14.82/bbl in 2019-20, US62¢ wider than budget and $8.49 narrower than in |

| | 2018-19, but the lower WTI oil price muted the positive impacts of the narrower differential. |

| • | Government of Canada transfers in 2019-20 were $9.1 billion, an increase of $1.1 billion from 2018-19, mainly due to a one-time Gas Tax Fund top-up of $230 million and a fiscal stabilization payment of $251 million related to 2016-17 revenue. The decrease of $0.1 billion from budget was primarily due to re-profiling federal infrastructure funding to future years. |

| • | Investment income was $2.8 billion, $0.5 billion more than 2018-19 and $0.2 billion higher than budget, due mainly to strong equity markets through the first 11 months of the fiscal year. |

| • | Government business enterprise net income was negative $0.2 billion, $2.8 billion lower than 2018-19, primarily due to a $2.5 billion provision for an onerous contract for the Sturgeon Refinery and a $0.2 billion loss in Alberta Petroleum Marketing Commission operations. Revenue from gaming and liquor, ATB Financial, and the Balancing Pool are also lower due to the economic impact of COVID-19 and lower electricity prices. |

| • | Other revenue totalled $7.5 billion in 2019-20, down $0.1 billion from 2018-19, primarily due to lower compliance payments to the Technology Innovation and Emissions Reduction Fund. |

| | |

| | |

| 8 | | Government of Alberta | Annual Report 2019 – 2020 |

Expense Highlights

| • | Total expense in 2019-20 was $58.4 billion, including $0.9 billion in costs of, and to divest the crude-by-rail program. |

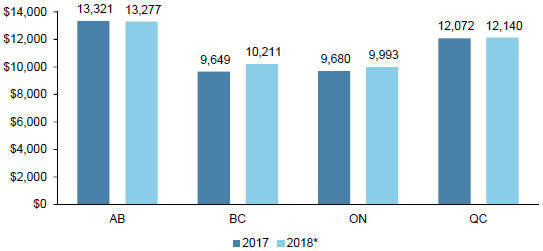

| • | Health function expense was $22.5 billion in 2019-20, up $0.6 billion from 2018-19. Increases included $0.1 billion for the COVID-19 response (emergency self-isolation, shelters, not-for-profit organizations), $0.1 billion for drug costs, due to new cancer drugs and growth in number of seniors, $0.1 billion for physician compensation, reflecting higher service volumes, and $0.3 billion for information technology (e.g. connect care), community care and other health initiatives. Health function expense increased by $0.3 billion from budget primarily due to the $0.2 billion mentioned above for COVID-19 and drug costs, and another $0.1 billion for higher acute care demand and consequential staffing needs. Efforts to contain costs included replacing high cost drugs with biosimilars whenever possible and expanding some health professionals’ scope of practice. |

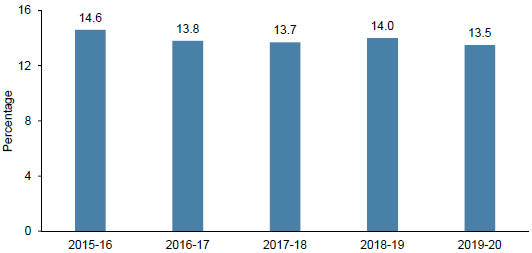

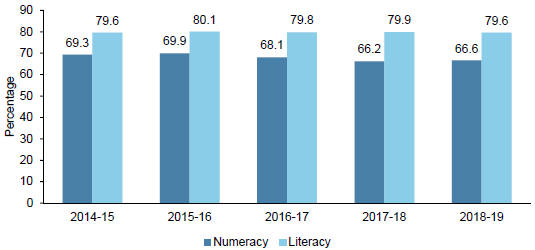

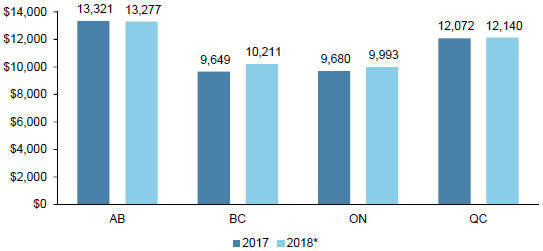

| • | Total 2019-20 education function expense was $14.9 billion, comprising $8.6 billion for the K-12 system and $6.3 billion for post-secondary education, including skills and training programs. This was up $0.3 billion from budget, but virtually unchanged from 2018-19. The increase from budget reflects higher post-secondary research activities and severance costs, the latter related to addressing the MacKinnon Panel’s recommendation to bring administrative costs in line with other comparator jurisdictions. Relative to 2018-19, the increases for severance in post-secondary institutions were more than offset by hiring restraint in the K-12 system. |

| • | Social services expense was $6.2 billion, an increase of $0.4 billion from 2018-19, but a decrease of $0.1 billion from budget. The increase from 2018-19 was due to caseload growth in programs for income support, child care, child intervention, seniors and disabled individuals. The $0.1 billion decrease from budget was primarily due to lower-than-expected demand for child care subsidies and Alberta Child Benefit. |

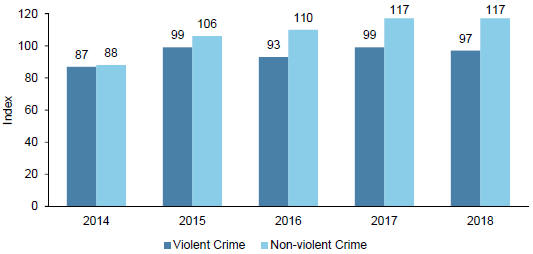

| • | Other expense was $12 billion, $224 million lower than budget. Increases for disaster assistance, which totaled $1.4 billion, and of $0.1 billion accrued for the payment to WCB for the COVID-related waiver of premiums for small and medium-sized businesses, were offset by lower capital grants and various savings initiatives. Other expense was $0.2 billion higher than 2018-19 mainly due to $0.8 billion in increased support for wildfires and agriculture disasters, and $0.1 billion for the WCB payment, partly offset by decreases of $0.7 billion from eliminating carbon tax rebates and various savings initiatives. |

| • | Expense related to crude-by-rail and divestment was $0.9 billion. This was a $0.6 billion decrease from budget as not all the crude-by-rail contracts were assigned as planned. |

| • | Debt servicing costs were $2.2 billion, an increase of $0.3 billion from 2018-19 but essentially unchanged from budget, reflecting higher borrowing, though much was undertaken in the last quarter of the fiscal year. |

| • | Public sector pension plan liabilities decreased by $0.3 billion to $8.9 billion, in line with the budget estimate. This liability reduction is reported as a negative expense. |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 9 |

Statement of

Financial Position

| • | At March 31, 2020, financial and non-financial assets exceeded liabilities by $11.4 billion. This was $11.8 billion lower than 2019, mainly due to an increase in debt. |

| • | Financial assets were $76.4 billion, $0.6 billion higher than March 31, 2019, mainly due to debt issuance proceeds partly offset by a net GBE equity decrease of $2 billion from the $2.5 billion provision for an onerous contract for the Sturgeon Refinery. |

| • | Liabilities were $116.5 billion, up $13.3 billion from 2018-19 mainly due to an increase in debt. Total taxpayer-supported debt was $74.1 billion, up $11.5 billion from 2018-19. The remaining $18.1 billion in debt relates to the Alberta Capital Finance Authority and Agriculture Financial Services Corporation, which on-lend to local authorities and the agriculture sector, and report offsetting assets (loans receivable). |

| • | Capital / other non-financial assets net of deferred capital contributions was $51.6 billion, $0.8 billion above 2018-19, due to $3.9 billion in capital asset acquisition, a $0.3 billion decrease in pre-paid expense, less $2.7 billion in amortization and asset disposals. Major capital investment included: |

| • | $1.2 billion for Alberta’s highway network, inlcuding: $0.5 billion for Calgary’s ring road, with the final, southwest portion about 75 per cent complete; $0.2 billion for highway twinning, widening and expansion; and another $0.4 billion for highway rehabilitation. |

| • | $1.1 billion for health facilities and equipment. Completed projects included: Red Deer’s Secure Detoxification and Residential Treatment Facility for the Protection of Children Abusing Drugs; Northern Lights Regional Health Centre repairs; Stollery Children’s Hospital Critical Care Program phase two; 7 projects adding 438 affordable supportive living and long-term care spaces. |

| • | $0.5 billion for schools and other capital assets in the K-12 education system, including $0.4 billion for school construction and modernization and $0.1 billion for maintenance and renewal. Nineteen school projects were completed. |

| • | $0.6 billion for post-secondary projects, including funding of $177 million for expansion and upgrading, and $377 million in projects self-funded by institutions and donations. Major projects included University of Calgary MacKimmie Complex, University of Alberta Dentistry / Pharmacy, University of Lethbridge Destination project, and Northern Lakes College High Prairie consolidation. |

| | | | | | | | | | | | |

Summary Statement of Financial Position | | | | | | | | | | | | |

| (millions of dollars) | | at March 31 | |

| | 2020 Actual | | | 2019 Actual | | | Change from

2019 | |

Financial Assets | | | | | | | | | | | | |

Cash and cash equivalents | | | 15,325 | | | | 14,391 | | | | 934 | |

Portfolio investments | | | 31,014 | | | | 31,261 | | | | (247 | ) |

Equity in government business enterprises | | | 1,105 | | | | 3,062 | | | | (1,957 | ) |

Other | | | 28,937 | | | | 27,029 | | | | 1,908 | |

| | | 76,381 | | | | 75,743 | | | | 638 | |

Liabilities | | | | | | | | | | | | |

Debt | | | 92,438 | | | | 81,019 | | | | 11,419 | |

Pension liabilities | | | 8,918 | | | | 9,252 | | | | (334 | ) |

Other | | | 15,169 | | | | 12,949 | | | | 2,220 | |

| | | | 116,525 | | | | 103,220 | | | | 13,305 | |

Net Financial Debt | | | (40,144 | ) | | | (27,477 | ) | | | (12,667 | ) |

Capital / Other Non-financial Assets | | | 54,801 | | | | 53,908 | | | | 893 | |

Spent deferred capital contributions | | | (3,231 | ) | | | (3,164 | ) | | | (67 | ) |

Net Assets | | | 11,426 | | | | 23,267 | | | | (11,841 | ) |

Change in Net Assets | | | (11,841 | ) | | | (6,404 | ) | | | | |

| | |

| | |

| 10 | | Government of Alberta | Annual Report 2019 – 2020 |

Financial Indicators and Risks

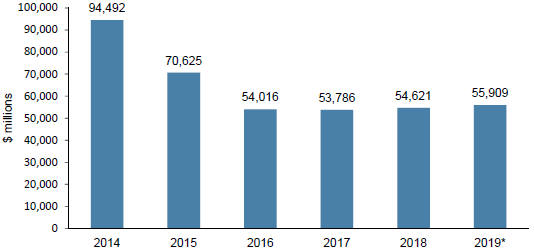

| • | Net debt on March 31, 2020 was $40.1 billion, or $9,100 per person. This is a deterioration of $53.2 billion since March 31, 2015, when net financial assets were $13.1 billion. |

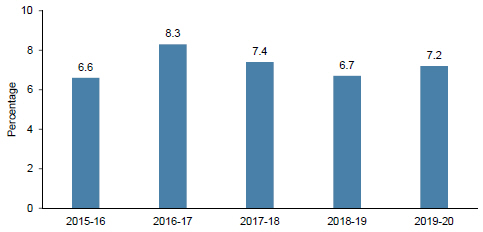

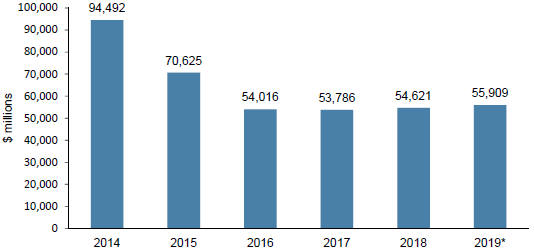

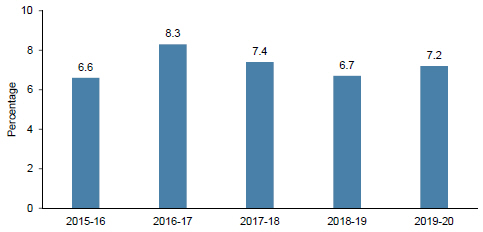

| • | Between 2014-15 and 2019-20, revenue has declined by a total of 6.6 per cent. Revenue has been quite volatile over this period, from a high of $49.6 billion in 2018-19 to a low of $42.3 billion in 2016-17. |

| • | Over the same period, expense has grown by a total of 20.7 per cent. Expense varies by program, with many demand-driven (e.g. enrolment growth, physician costs) and others driven by emergencies such as wildfires and floods. |

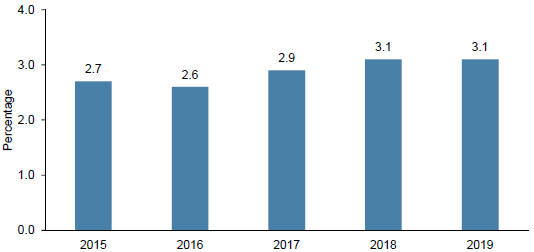

| • | Alberta relies heavily on revenue that is volatile and unpredictable, including non-renewable resources, corporate income tax and investment income. Since 2004-05, these have accounted for up to 55 per cent of total revenue, while over the last 5 years they have averaged 27 per cent. Revenue volatility is linked to numerous factors, some of which are described below. |

| • | Oil prices are impacted by global supply and demand. Factors influencing demand include economic growth, pipeline or refinery outages, and speculative market activities by traders. Supply is mainly impacted by production levels agreed upon by OPEC, and more recently, by changes in production from non-OPEC countries such as Russia and the US in response to price swings. Other factors include drilling and investment decisions, geopolitical events, economic sanctions, or weather related disruptions. The West Texas Intermediate (WTI) price averaged US$58 per barrel (/bbl) for the first ten months of 2019-20, before dropping to an average of $40/bbl in the last two months, due to the impact on the global economy of the COVID-19 shut-down and travel restrictions, and the temporary disagreement on oil supply management between Saudi Arabia and Russia. The differential hovered around US$12/bbl for the first eight months, due in part to government production curtailment, before widening to around $20 for the remaining four months with curtailment easing and TC Energy’s Keystone pipeline outage in November 2019. |

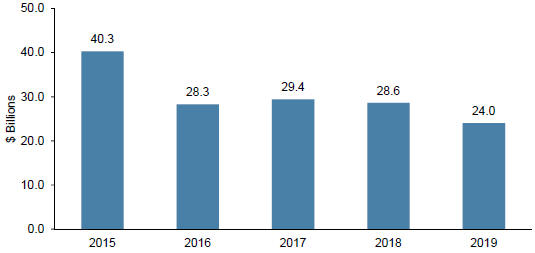

Oil and Natural Gas Prices 2015-20

| • | Weaker-than-forecast global and US growth harms Alberta’s revenue, as oil prices are lower. |

| • | Lower interest rates typically encourage business investment, which boosts tax revenue and decreases debt servicing costs. Ten-year Canada bonds were down ten basis points from budget. |

| • | A higher exchange rate decreases the value of exports and negatively impacts government revenue. The exchange rate was virtually unchanged from the budget estimate. |

| • | Equity markets are affected by a wide range of factors, such as global economic conditions, fluctuations in commodity prices, and interest rates. Investment income increased from 2018-19 and the budget estimate as markets were quite strong in 2019. |

| • | Deterioration in corporate profits decreases revenue, but the impact can be difficult to predict as taxable income can vary significantly from corporate profits due to various discretionary deductions, or the ability to carry prior-year losses forward or back. |

| • | To address revenue and expense uncertainty, Budget 2019 introduced a contingency and provided alternative revenue scenarios. The contingency included funding for emergencies and disasters at a higher rate than previous budgets, more in-line with historical averages. |

| • | These highlights should be read in conjunction with the budget and quarterly updates www.alberta.ca/budget-documents.aspx. |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 11 |

Historical Fiscal Summary, 2008-09 to 2019-20 a

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2008-09 | | | 2009-10 | | | 2010-11 | | | 2011-12 | | | 2012-13 | | | 2013-14 | | | 2014-15 | | | 2015-16 | | | 2016-17 | | | 2017-18 | | | 2018-19 | | | 2019-20 | |

Income Statement | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | Personal income tax | | | 8,708 | | | | 7,877 | | | | 7,631 | | | | 8,563 | | | | 9,621 | | | | 10,537 | | | | 11,042 | | | | 11,357 | | | | 10,763 | | | | 10,775 | | | | 11,874 | | | | 11,244 | |

| 2 | | Corporate income tax | | | 4,252 | | | | 4,754 | | | | 3,334 | | | | 3,678 | | | | 4,756 | | | | 5,488 | | | | 5,796 | | | | 4,195 | | | | 3,769 | | | | 3,448 | | | | 4,871 | | | | 4,107 | |

| 3 | | Other tax revenue | | | 3,817 | | | | 3,746 | | | | 3,820 | | | | 4,099 | | | | 4,333 | | | | 4,500 | | | | 4,598 | | | | 5,168 | | | | 5,649 | | | | 6,538 | | | | 6,833 | | | | 5,747 | |

| 4 | | Resource revenue | | | 11,915 | | | | 6,768 | | | | 8,428 | | | | 11,636 | | | | 7,779 | | | | 9,578 | | | | 8,948 | | | | 2,789 | | | | 3,097 | | | | 4,980 | | | | 5,429 | | | | 5,937 | |

| 5 | | Investment income | | | (1,888 | ) | | | 3,541 | | | | 2,486 | | | | 2,168 | | | | 2,595 | | | | 3,423 | | | | 3,113 | | | | 2,544 | | | | 3,698 | | | | 3,126 | | | | 2,349 | | | | 2,828 | |

| 6 | | Premiums, fees and licences | | | 3,356 | | | | 2,857 | | | | 2,922 | | | | 2,931 | | | | 3,184 | | | | 3,437 | | | | 2,665 | | | | 3,574 | | | | 3,701 | | | | 3,839 | | | | 3,911 | | | | 3,929 | |

| 7 | | Other own-source revenue | | | 4,587 | | | | 4,627 | | | | 4,903 | | | | 5,128 | | | | 5,234 | | | | 5,412 | | | | 7,337 | | | | 5,850 | | | | 3,637 | | | | 6,982 | | | | 6,292 | | | | 3,360 | |

| 8 | | Total own-source revenue | | | 34,747 | | | | 34,170 | | | | 33,524 | | | | 38,203 | | | | 37,502 | | | | 42,375 | | | | 43,499 | | | | 35,477 | | | | 34,314 | | | | 39,688 | | | | 41,559 | | | | 37,152 | |

| 9 | | Federal transfers | | | 4,578 | | | | 5,342 | | | | 5,452 | | | | 5,192 | | | | 5,042 | | | | 7,059 | | | | 5,982 | | | | 7,142 | | | | 7,979 | | | | 7,606 | | | | 8,013 | | | | 9,072 | |

| 10 | | Total Revenue | | | 39,325 | | | | 39,512 | | | | 38,976 | | | | 43,395 | | | | 42,544 | | | | 49,434 | | | | 49,481 | | | | 42,619 | | | | 42,293 | | | | 47,295 | | | | 49,572 | | | | 46,224 | |

| | Expense by Function | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 11 | | Health | | | 13,674 | | | | 14,636 | | | | 15,393 | | | | 16,284 | | | | 17,254 | | | | 17,967 | | | | 19,366 | | | | 20,115 | | | | 20,687 | | | | 21,239 | | | | 21,921 | | | | 22,477 | |

| 12 | | Basic / advanced education | | | 10,438 | | | | 11,067 | | | | 11,362 | | | | 11,951 | | | | 12,394 | | | | 12,782 | | | | 13,103 | | | | 13,673 | | | | 14,110 | | | | 14,471 | | | | 14,848 | | | | 14,879 | |

| 13 | | Social services | | | 3,417 | | | | 3,807 | | | | 4,129 | | | | 4,278 | | | | 4,641 | | | | 4,668 | | | | 4,548 | | | | 4,752 | | | | 5,198 | | | | 5,592 | | | | 5,867 | | | | 6,248 | |

| 14 | | Other program expense | | | 10,386 | | | | 9,834 | | | | 9,443 | | | | 9,853 | | | | 10,528 | | | | 12,970 | | | | 11,031 | | | | 10,375 | | | | 12,607 | | | | 13,189 | | | | 11,866 | | | | 12,891 | |

| 15 | | Total program expense | | | 37,915 | | | | 39,344 | | | | 40,327 | | | | 42,366 | | | | 44,817 | | | | 48,387 | | | | 48,048 | | | | 48,915 | | | | 52,602 | | | | 54,491 | | | | 54,502 | | | | 56,475 | |

| 16 | | Debt servicing costs | | | 208 | | | | 214 | | | | 472 | | | | 509 | | | | 530 | | | | 601 | | | | 722 | | | | 776 | | | | 1,018 | | | | 1,420 | | | | 1,971 | | | | 2,235 | |

| 17 | | Pension provisions | | | 2,133 | | | | 430 | | | | 439 | | | | 634 | | | | 296 | | | | 748 | | | | (404 | ) | | | (630 | ) | | | (543 | ) | | | (593 | ) | | | (190 | ) | | | (334 | ) |

| 18 | | Total Expense | | | 40,256 | | | | 39,988 | | | | 41,238 | | | | 43,509 | | | | 45,643 | | | | 49,736 | | | | 48,366 | | | | 49,061 | | | | 53,077 | | | | 55,318 | | | | 56,283 | | | | 58,376 | |

| 19 | | Surplus / (Deficit) | | | (931 | ) | | | (476 | ) | | | (2,262 | ) | | | (114 | ) | | | (3,099 | ) | | | (302 | ) | | | 1,115 | | | | (6,442 | ) | | | (10,784 | ) | | | (8,023 | ) | | | (6,711 | ) | | | (12,152 | ) |

| Capital Plan b | | | 7,943 | | | | 8,000 | | | | 7,544 | | | | 6,884 | | | | 6,062 | | | | 5,770 | | | | 6,181 | | | | 6,558 | | | | 6,578 | | | | 9,021 | | | | 6,180 | | | | 5,564 | |

| | | | | | | | | | | | |

| Balance Sheet (at March 31) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 20 | | Heritage / endowment funds | | | 16,900 | | | | 17,077 | | | | 17,500 | | | | 17,936 | | | | 18,176 | | | | 18,562 | | | | 18,860 | | | | 19,262 | | | | 19,836 | | | | 20,306 | | | | 20,716 | | | | 20,672 | |

| 21 | | Contingency Account | | | 16,822 | | | | 14,983 | | | | 11,192 | | | | 7,497 | | | | 3,326 | | | | 4,658 | | | | 6,529 | | | | 3,625 | | | | 2,399 | | | | 1,661 | | | | 6,342 | | | | - | |

| 22 | | Other financial assets | | | 28,868 | | | | 30,338 | | | | 30,799 | | | | 32,972 | | | | 34,734 | | | | 40,039 | | | | 40,688 | | | | 40,990 | | | | 44,052 | | | | 49,010 | | | | 48,685 | | | | 55,709 | |

| 23 | | Capital Plan liabilities | | | (880 | ) | | | (2,888 | ) | | | (3,199 | ) | | | (3,442 | ) | | | (4,594 | ) | | | (8,724 | ) | | | (11,922 | ) | | | (19,040 | ) | | | (23,769 | ) | | | (29,339 | ) | | | (33,597 | ) | | | (37,207 | ) |

| 24 | | Fiscal Plan liabilities (borrowing / pre-1992 TPP) | | | 0 | | | | (1,187 | ) | | | (1,187 | ) | | | (1,187 | ) | | | (1,187 | ) | | | (1,187 | ) | | | (943 | ) | | | (944 | ) | | | (9,529 | ) | | | (14,023 | ) | | | (26,374 | ) | | | (36,935 | ) |

| 25 | | Pension obligations | | | (10,239 | ) | | | (9,483 | ) | | | (9,922 | ) | | | (10,556 | ) | | | (10,852 | ) | | | (11,600 | ) | | | (11,196 | ) | | | (10,566 | ) | | | (10,023 | ) | | | (9,430 | ) | | | (9,240 | ) | | | (8,918 | ) |

| 26 | | Other liabilities | | | (19,770 | ) | | | (21,523 | ) | | | (23,530 | ) | | | (24,229 | ) | | | (25,148 | ) | | | (28,716 | ) | | | (28,962 | ) | | | (29,408 | ) | | | (31,867 | ) | | | (37,529 | ) | | | (34,009 | ) | | | (33,465 | ) |

| 27 | | Net Financial Assets / (Debt) | | | 31,701 | | | | 27,317 | | | | 21,653 | | | | 18,991 | | | | 14,455 | | | | 13,032 | | | | 13,054 | | | | 3,919 | | | | (8,901 | ) | | | (19,344 | ) | | | (27,477 | ) | | | (40,144 | ) |

| 28 | | Capital (net of defer. Contrib.) / non-fin. assets | | | 30,275 | | | | 34,217 | | | | 37,607 | | | | 40,122 | | | | 39,517 | | | | 40,839 | | | | 42,197 | | | | 44,623 | | | | 46,622 | | | | 49,015 | | | | 50,744 | | | | 51,570 | |

| 29 | | Net Assets c | | | 61,976 | | | | 61,534 | | | | 59,260 | | | | 59,113 | | | | 53,972 | | | | 53,871 | | | | 55,251 | | | | 48,542 | | | | 37,721 | | | | 29,671 | | | | 23,267 | | | | 11,426 | |

| a | Numbers are not strictly comparable due to numerous accounting policy changes over time. Examples include reporting certain items (transfers through the tax system, crude oil marketing and transportation costs, allowance for corporate income tax doubtful accounts) as expense, instead of netting the amounts from related revenue, increasing both revenue and expense, but not impacting the surplus / (deficit). 2018-19 revenue and expense have been decreased by $52 million to report revenue net of third party investment management costs, instead of reporting the costs in expense and grossing up revenue. There is no impact on the deficit or debt. |

| b | Reflects capital grants and other support included in expense, and capital investment in government-owned assets not included in expense. Capital investment adds to capital assets, which are depreciated over time through amortization expense. Numbers for 2008-09 to 2013-14 are estimates as details required to consolidate SUCH sector capital spending with full accuracy are not readily available. |

| c | The change in net assets / (debt) year over year does not match the surplus / (deficit) exactly in most years, due to various balance sheet adjustments, most of which are minor. A significant adjustment reducing net assets by $2 billion was made in 2012-13, to recognize the accumulated deferred capital contribution liability when the accounting standard was adopted. |

| | |

| | |

| 12 | | Government of Alberta | Annual Report 2019 – 2020 |

Consolidated Financial Statements

CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents

| | | | | | | | | | |

| | |

CONSOLIDATED FINANCIAL STATEMENTS OF THE PROVINCE OF ALBERTA | | | | | | |

| | |

Table of Contents | | | | | | |

| | |

Management’s Responsibility for the Consolidated Financial Statements | | | 17 | | | |

| | |

Independent Auditor’s Report | | | 18 | | | |

| | |

Consolidated Statement of Operations | | | 21 | | | |

| | |

Consolidated Statement of Financial Position | | | 22 | | | |

| | |

Consolidated Statement of Change in Net Debt | | | 23 | | | |

| | |

Consolidated Statement of Cash Flows | | | 24 | | | |

| | |

Notes to the Consolidated Financial Statements | | | | | | |

| | | | |

| | 1 | | Summary of Significant Accounting Policies and Reporting Practices | | | 25 | | | |

| | | | |

| | 2 | | Valuation of Financial Assets and Liabilities | | | 33 | | | |

| | | | |

| | 3 | | Financial Risk Management and Derivatives | | | 34 | | | |

| | | | |

| | 4 | | Contractual Rights | | | 37 | | | |

| | | | |

| | 5 | | Contingent Assets | | | 37 | | | |

| | | | |

| | 6 | | Contractual Obligations and Commitments | | | 38 | | | |

| | | | |

| | 7 | | Contingent Liabilities | | | 39 | | | |

| | | | |

| | 8 | | Trust and Other Funds Under Administration | | | 41 | | | |

| | | | |

| | 9 | | Subsequent Event | | | 42 | | | |

| | | | |

| | 10 | | Comparative Figures | | | 42 | | | |

| | |

Schedules to the Consolidated Financial Statements | | | | | | |

| | | | |

| | 1 | | Revenues | | | 43 | | | |

| | | | |

| | 2 | | Revenues by Source by Ministry | | | 44 | | | |

| | | | |

| | 3 | | Expenses by Object by Ministry | | | 45 | | | |

| | | | |

| | 4 | | Cash and Cash Equivalents | | | 46 | | | |

| | | | |

| | 5 | | Accounts Receivable | | | 46 | | | |

| | | | |

| | 6 | | Portfolio Investments | | | 47 | | | |

| | | | |

| | 7 | | Endowment Funds | | | 48 | | | |

| | | | |

| | 8 | | Equity in Government Business Enterprises | | | 49 | | | |

| | | | |

| | 9 | | Loans and Advances | | | 56 | | | |

| | | | |

| | 10 | | Accounts Payable and Other Accrued Liabilities | | | 57 | | | |

| | | | |

| | 11 | | Debt | | | 57 | | | |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 15 |

CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents, continued

| | | | | | | | | | |

| | |

Schedules to the Consolidated Financial Statements (continued) | | | | | | |

| | | | |

| | 12 | | Pension Plans and Other Defined Benefit Plans | | | 61 | | | |

| | | | |

| | 13 | | Deferred Contributions | | | 68 | | | |

| | | | |

| | 14 | | Tangible Capital Assets | | | 69 | | | |

| | | | |

| | 15 | | Adjustments to Net Assets | | | 70 | | | |

| | | | |

| | 16 | | Over-expenditure of Spending Authorities | | | 71 | | | |

| | | | |

| | 17 | | Listing of Organizations | | | 72 | | | |

| | |

Glossary (Unaudited) | | | 77 | | | |

| | |

| | |

| 16 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

Management’s Responsibility

for the Consolidated Financial Statements

The consolidated financial statements are prepared by the Controller under the general direction of the Deputy Minister of Treasury Board and Finance as authorized by the President of Treasury Board and Minister of Finance pursuant to the Financial Administration Act. The consolidated financial statements are prepared in accordance with Canadian Public Sector Accounting Standards, and of necessity include some amounts that are based on estimates and judgments. As required by the Fiscal Planning and Transparency Act, the consolidated financial statements are included in the consolidated annual report of the Province of Alberta that forms part of the Public Accounts.

To fulfill its accounting and reporting responsibilities, management maintains systems of financial management and internal control which give consideration to costs, benefits and risks, and which are designed to:

| ● | Provide reasonable assurance that transactions are properly authorized, executed in accordance with prescribed legislation and regulations, and properly recorded so as to maintain accountability for public money, and |

| ● | Safeguard the assets and properties of the Province of Alberta under government administration. |

Under the Financial Administration Act, deputy heads are responsible for the collection of revenue payable to the Crown, and for making and controlling disbursements with respect to their departments. They are also responsible for prescribing the accounting systems to be used in their departments. In order to meet government accounting and reporting requirements, the Controller obtains information relating to departments, regulated funds, provincial agencies, Crown-controlled corporations, schools, universities, colleges, technical institutes, Alberta Health Services and other health entities from ministries as necessary.

The consolidated financial statements are reviewed by the Audit Committee established under the Auditor General Act. The Audit Committee advises the Lieutenant Governor in Council on the scope and results of the Auditor General’s audit of the consolidated financial statements of the Province.

The Auditor General of Alberta provides an independent opinion on the consolidated financial statements. The duties of the Auditor General in that respect are contained in the Auditor General Act.

Annually, the consolidated annual report is tabled in the Legislature as a part of the Public Accounts and is referred to the Standing Committee on Public Accounts of the Legislative Assembly.

Approved by:

Athana Mentzelopoulos

Deputy Minister of Treasury Board and Finance

Dan Stadlwieser, CPA, CA

Controller

Edmonton, Alberta

July 29, 2020

| | |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 17 |

CONSOLIDATED FINANCIAL STATEMENTS

| | |

| Independent Auditor’s Report | |  |

To the Members of the Legislative Assembly

Report on the Consolidated Financial Statements

Opinion

I have audited the consolidated financial statements of the Province of Alberta, which comprise the consolidated statement of financial position as at March 31, 2020, and the consolidated statements of operations, change in net debt, and cash flows for the year then ended, and notes and schedules to the consolidated financial statements, including a summary of significant accounting policies.

In my opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Province of Alberta as at March 31, 2020, and the results of its operations, its changes in net debt, and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Basis for opinion

I conducted my audit in accordance with Canadian generally accepted auditing standards. My responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of my report. I am independent of the Province of Alberta in accordance with the ethical requirements that are relevant to my audit of the consolidated financial statements in Canada, and I have fulfilled my other ethical responsibilities in accordance with these requirements. I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Other information

Management is responsible for the other information. The other information comprises the information included in the 2019-20 Government of Alberta Annual Report (but does not include the consolidated financial statements and my auditor’s report thereon), and the 2019-20 Final Results Year-end Report.

My opinion on the consolidated financial statements does not cover the other information identified above and I do not and will not express any form of assurance conclusion thereon. In connection with my audit of the consolidated financial statements, my responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or my knowledge obtained in the audit, or otherwise appears to be materially misstated.

I obtained the 2019-20 Government of Alberta Annual Report prior to the date of my auditor’s report. If, based on the work I have performed on this other information that I obtained prior to the date of

| | |

| | |

| 18 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

my auditor’s report, I conclude that there is a material misstatement of this other information, I am required to report that fact. I have nothing to report in this regard.

The 2019-20 Final Results Year-end Report is expected to be made available to me after the date of my auditor’s report. If, based on the work I will perform on this other information, I conclude that there is a material misstatement of this other information, I am required to report that fact to those charged with governance.

Responsibilities of management and those charged with governance for the consolidated financial statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of the consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Province of Alberta’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern, and using the going concern basis of accounting unless an intention exists to liquidate or to cease operations, or there is no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Province of Alberta’s financial reporting process.

Auditor’s responsibilities for the audit of the consolidated financial statements

My objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes my opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, I exercise professional judgment and maintain professional skepticism throughout the audit. I also:

| · | | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for my opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| · | | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Province of Alberta’s internal control. |

| · | | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| | |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 19 |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

| · | | Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Province of Alberta’s ability to continue as a going concern. If I conclude that a material uncertainty exists, I am required to draw attention in my auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify my opinion. My conclusions are based on the audit evidence obtained up to the date of my auditor’s report. However, future events or conditions may cause the Province of Alberta to cease to continue as a going concern. |

| · | | Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| · | | Obtain sufficient appropriate audit evidence regarding the financial information of the entities and business activities within the consolidated financial statements, to express an opinion on the consolidated financial statements. I am responsible for the direction, supervision and performance of the group audit. I remain solely responsible for my audit opinion. |

I communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that I identify during my audit.

I also provide those charged with governance with a statement that I have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on my independence, and where applicable, related safeguards.

In accordance with the Auditor General Act, I am responsible to report the independent opinion on the consolidated financial statements of the Province of Alberta completed by my office.

[Original signed by W. Doug Wylie FCPA, FCMA, ICD.D]

Auditor General

July 29, 2020

Edmonton, Alberta

| | |

| | |

| 20 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Operations

| | | | | | | | | | | | |

| Year Ended March 31 | | | | | | |

| | | 2020 | | | 2019 | |

| | | Budget | | | | | | Actual | |

| | | Restated | | | Actual | | | Restated | |

| | | (Notes 1 (c), (e)) | | | | | | (Note 1 (e)) | |

| | | In millions | | | | |

| | | |

Revenues (Schedules 1 and 2) | | | | | | | | | | | | |

| | | |

Income taxes | | $ | 16,167 | | | $ | 15,351 | | | $ | 16,745 | |

| | | |

Other taxes | | | 5,766 | | | | 5,747 | | | | 6,833 | |

| | | |

Non-renewable resource revenue | | | 6,527 | | | | 5,937 | | | | 5,429 | |

| | | |

Transfers from Government of Canada | | | 9,200 | | | | 9,072 | | | | 8,013 | |

| | | |

Net income/(loss) from government business enterprises (Schedule 8) | | | 2,417 | | | | (225 | ) | | | 2,585 | |

| | | |

Investment income | | | 2,585 | | | | 2,828 | | | | 2,349 | |

| | | |

Premiums, fees and licences | | | 3,872 | | | | 3,929 | | | | 3,909 | |

| | | |

Other | | | 3,436 | | | | 3,585 | | | | 3,709 | |

| | | |

| | | 49,970 | | | | 46,224 | | | | 49,572 | |

| | | |

Expenses by function (Schedule 3) | | | | | | | | | | | | |

| | | |

Health | | | 22,153 | | | | 22,477 | | | | 21,921 | |

| | | |

Education | | | 14,541 | | | | 14,879 | | | | 14,848 | |

| | | |

Social services | | | 6,304 | | | | 6,248 | | | | 5,867 | |

| | | |

Agriculture, resource management and economic development | | | 1,986 | | | | 2,700 | | | | 2,313 | |

| | | |

Crude by Rail | | | 1,500 | | | | 866 | | | | 6 | |

| | | |

General government | | | 2,604 | | | | 2,659 | | | | 2,565 | |

| | | |

Protection of persons and property | | | 3,094 | | | | 2,337 | | | | 2,021 | |

| | | |

Transportation, communications and utilities | | | 1,690 | | | | 1,487 | | | | 1,696 | |

| | | |

Regional planning and development | | | 1,425 | | | | 1,384 | | | | 1,207 | |

| | | |

Environment | | | 884 | | | | 799 | | | | 1,299 | |

| | | |

Recreation and culture | | | 369 | | | | 387 | | | | 458 | |

| | | |

Housing | | | 196 | | | | 252 | | | | 301 | |

| | | |

Debt servicing costs | | | 2,265 | | | | 2,235 | | | | 1,971 | |

| | | |

Pension recovery (Schedule 12) | | | (337 | ) | | | (334 | ) | | | (190 | ) |

| | | |

| | | 58,674 | | | | 58,376 | | | | 56,283 | |

| | | |

Annual deficit | | | (8,704 | ) | | | (12,152 | ) | | | (6,711 | ) |

| | | |

Net assets at beginning of year – as previously reported | | | 23,267 | | | | 23,267 | | | | 29,671 | |

| | | |

Adjustments to net assets (Schedule 15) | | | - | | | | 311 | | | | 307 | |

| | | |

Net assets at end of year | | $ | 14,563 | | | $ | 11,426 | | | $ | 23,267 | |

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 21 |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Financial Position

| | | | | | | | |

| As at March 31 | | | | | | |

| | | 2020 | | | 2019 | |

| | | In | | | millions | |

| | |

Financial assets | | | | | | | | |

| | |

Cash and cash equivalents (Schedule 4) | | $ | 15,325 | | | | $ 14,391 | |

| | |

Accounts receivable (Schedule 5) | | | 8,730 | | | | 6,764 | |

| | |

Portfolio investments (Schedule 6) | | | | | | | | |

| | |

Operating | | | 28,403 | | | | 28,689 | |

| | |

Endowments (Schedule 7) | | | 2,611 | | | | 2,572 | |

| | |

Equity in government business enterprises (Schedule 8) | | | 1,105 | | | | 3,062 | |

| | |

Loans and advances (Schedule 9) | | | 20,174 | | | | 20,231 | |

| | |

Inventories for resale and other | | | 33 | | | | 34 | |

| | |

| | | 76,381 | | | | 75,743 | |

| | |

Liabilities | | | | | | | | |

| | |

Accounts payable and other accrued liabilities (Schedule 10) | | | 13,877 | | | | 11,574 | |

| | |

Debt (Schedule 11) | | | 92,438 | | | | 81,019 | |

| | |

Pension liabilities (Schedule 12) | | | 8,918 | | | | 9,252 | |

| | |

Unspent deferred contributions (Schedule 13) | | | 1,292 | | | | 1,375 | |

| | |

| | | 116,525 | | | | 103,220 | |

| | |

Net debt | | | (40,144 | ) | | | (27,477 | ) |

| | |

Non-financial assets | | | | | | | | |

| | |

Tangible capital assets (Schedule 14) | | | 54,066 | | | | 52,925 | |

| | |

Prepaid expenses | | | 358 | | | | 618 | |

| | |

Inventories of supplies and other | | | 377 | | | | 365 | |

| | |

| | | 54,801 | | | | 53,908 | |

| | |

Net assets before spent deferred capital contributions | | | 14,657 | | | | 26,431 | |

| | |

Spent deferred capital contributions (Schedule 13) | | | 3,231 | | | | 3,164 | |

| | |

Net assets | | $ | 11,426 | | | | $ 23,267 | |

Contractual rights and obligations (Notes 4 and 6)

Contingent assets and liabilities (Notes 5 and 7)

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| 22 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Change in Net Debt

| | | | | | | | | | | | |

| Year Ended March 31 | | | | | | | | | |

| | | 2020 | | | 2019 | |

| | | Budget | | | Actual | | | Actual | |

| | | | | | In millions | | | | |

| | | |

Annual deficit | | $ | (8,704 | ) | | $ | (12,152 | ) | | $ | (6,711 | ) |

| | | |

Acquisition of tangible capital assets | | | (4,006 | ) | | | (3,677 | ) | | | (3,837 | ) |

| | | |

Additions to public private partnerships, capital leases, donated capital assets and other | | | (113 | ) | | | (189 | ) | | | (268 | ) |

| | | |

Amortization of tangible capital assets | | | 2,556 | | | | 2,578 | | | | 2,472 | |

| | | |

Net loss/(gain) on disposal and adjustments of tangible capital assets | | | - | | | | 122 | | | | (13 | ) |

| | | |

Proceeds on sale of tangible capital assets | | | - | | | | 25 | | | | 120 | |

| | | |

Decrease/(increase) in inventory of supplies | | | 6 | | | | (12 | ) | | | (24 | ) |

| | | |

Decrease/(increase) in prepaid expenses | | | - | | | | 260 | | | | (334 | ) |

| | | |

(Decrease)/increase in spent deferred capital contributions | | | (60 | ) | | | 67 | | | | 155 | |

| | | |

Change in accumulated unrealized gains (Schedule 8) | | | - | | | | 349 | | | | 166 | |

| | | |

Other (Schedule 15) | | | - | | | | (38 | ) | | | 141 | |

| | | |

Increase in net debt | | | (10,321 | ) | | | (12,667 | ) | | | (8,133 | ) |

| | | |

Net debt at beginning of year | | | (27,477 | ) | | | (27,477 | ) | | | (19,344 | ) |

| | | |

Net debt at end of year | | $ | (37,798 | ) | | $ | (40,144 | ) | | $ | (27,477 | ) |

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 23 |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Cash Flows

| | | | | | | | |

| Year Ended March 31 | | | | | | |

| | | 2020 | | | 2019 | |

| | | In | | | millions | |

| | |

Operating transactions | | | | | | | | |

| | |

Annual deficit | | $ | (12,152 | ) | | | $ (6,711 | ) |

| | |

Non-cash items | | | | | | | | |

| | |

Amortization of tangible capital assets | | | 2,578 | | | | 2,472 | |

| | |

Deferred contributions recognized as revenue | | | (1,941 | ) | | | (1,652 | ) |

| | |

Pension recovery | | | (334 | ) | | | (190 | ) |

| | |

Net loss/(income) from government business enterprises | | | 225 | | | | (2,585 | ) |

| | |

Other non-cash items included in annual deficit | | | (291 | ) | | | (122 | ) |

| | |

| | | (11,915 | ) | | | (8,788 | ) |

| | |

Decrease/(increase) in accounts receivable, inventories, prepaids and other assets | | | 571 | | | | (1,219 | ) |

| | |

Increase/(decrease) in accounts payable and other accrued liabilities | | | 2,283 | | | | (1,544 | ) |

| | |

Distribution from government business enterprises | | | 2,129 | | | | 2,165 | |

| | |

Cash applied to operating transactions | | | (6,932 | ) | | | (9,386 | ) |

| | |

Capital transactions | | | | | | | | |

| | |

Acquisition of tangible capital assets | | | (3,677 | ) | | | (3,837 | ) |

| | |

Proceeds on sale of tangible capital assets | | | 25 | | | | 120 | |

| | |

Cash applied to capital transactions | | | (3,652 | ) | | | (3,717 | ) |

| | |

Investing transactions | | | | | | | | |

| | |

Purchases of portfolio investments | | | (9,463 | ) | | | (8,589 | ) |

| | |

Disposals of portfolio investments | | | 10,185 | | | | 8,638 | |

| | |

Loans made | | | (2,285 | ) | | | (2,482 | ) |

| | |

Repayment of loans | | | 2,245 | | | | 1,576 | |

| | |

Cash provided by/(applied to) investing transactions | | | 682 | | | | (857 | ) |

| | |

Financing transactions | | | | | | | | |

| | |

Retirement of direct borrowings | | | (33,513 | ) | | | (36,932 | ) |

| | |

Issuance of direct borrowings | | | 42,382 | | | | 51,036 | |

| | |

Contributions restricted for capital and operations | | | 2,032 | | | | 1,942 | |

| | |

Repayment of liabilities under capital leases and public private partnerships | | | (65 | ) | | | (86 | ) |

| | |

Cash provided by financing transactions | | | 10,836 | | | | 15,960 | |

| | |

Increase in cash and cash equivalents | | | 934 | | | | 2,000 | |

| | |

Cash and cash equivalents at beginning of year | | | 14,391 | | | | 12,391 | |

| | |

Cash and cash equivalents at end of year | | $ | 15,325 | | | | $ 14,391 | |

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| | |

| 24 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

Notes to the Consolidated Financial Statements

| | |

| NOTE 1 | | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND REPORTING PRACTICES |

These consolidated financial statements are prepared in accordance with Canadian Public Sector Accounting Standards (PSAS).

The consolidated financial statements of the Province of Alberta (Province) include the accounts of organizations that meet the criteria of control as established under PSAS. The consolidated financial statements also include the accounts of the Offices of the Legislative Assembly.

A list of organizations included in these consolidated financial statements can be found in Schedule 17.

| | (b) | METHOD OF CONSOLIDATION |

The accounts of government sector entities, except those designated as government business enterprises, are consolidated using the line-by-line method. Under this method, accounting policies of the consolidated entities are adjusted to conform to government accounting policies and the results of each line item in their financial statements (revenue, expense, assets and liabilities) are included in the Province’s results. Revenue, expense, capital, investing and financing transactions, as well as related asset and liability balances between consolidated entities have been eliminated.

Schools and some post-secondary institutions, government business enterprises and government organizations have year ends that are other than March 31. The significant transactions of these organizations that have occurred during the period between their year ends and the Province’s year end of March 31, 2020, have been recorded in these financial statements. Organizations that the Province controls for reporting purposes through its consolidated organizations, but that do not meet the materiality threshold of $6 million in assets, liabilities, revenues or expenses after eliminating inter-entity transactions and balances, are not consolidated in these financial statements. These organizations are reviewed annually to determine if they meet the materiality threshold and after two years of exceeding the threshold will be considered for consolidation.

The accounts of provincial agencies designated as government business enterprises (Schedule 8) are accounted for on the modified equity basis, with the equity being computed in accordance with International Financial Reporting Standards (IFRS). Under the modified equity method, the accounting policies of government business enterprises are not adjusted to conform to those of the government sector entities. Inter-entity revenue and expense transactions and related asset and liability balances are not eliminated except for inter-entity gains and losses, which are eliminated on assets and liabilities remaining within the government reporting entity at the financial statement date.

| | (c) | BUDGET AND LEGISLATIVE AUTHORITY |

PSAS require that financial statements contain a comparison of the actual and budgeted results for the year. The Province’s fiscal plan is prepared in accordance with the Fiscal Planning and Transparency Act consistent with the scope and accounting policies used in the Province’s consolidated financial statements. The Fiscal Plan documents, which describe the Province’s budget for the 2020 fiscal year, were tabled in the Legislature on October 24, 2019.

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 25 |

CONSOLIDATED FINANCIAL STATEMENTS

| | (d) | FUTURE CHANGES IN ACCOUNTING STANDARDS |

The Public Sector Accounting Board has extended the effective dates for the adoption of the accounting standards in response to the COVID-19 pandemic. The effective dates of PS 3450 Financial Instruments and PS 3280 Asset Retirement Obligations have been extended to April 1, 2022, and the effective date of PS 3400 Revenue has been extended to April 1, 2023. The Province has not yet adopted these standards. The Province is currently assessing the impact of these standards on the consolidated financial statements.

PS 3450 Financial Instruments

Adoption of this standard requires corresponding adoption of PS 2601 Foreign Currency Translation, PS 1201 Financial Statement Presentation and PS 3041 Portfolio Investments in the same fiscal period. These standards provide guidance on: recognition, measurement and disclosure of financial instruments; standards on how to account for and report transactions that are denominated in a foreign currency; general reporting principles and standards for the disclosure of information in financial statements; and how to account for and report portfolio investments. The Public Sector Accounting Board issued an exposure draft in January 2019 and proposed narrow scope amendments to this standard. The exposure draft was approved by the Board on December 13, 2019. The amendments include changes to the accounting treatment of bond repurchase transactions, transitional provisions, and other minor improvements.

The Province, including all government components, except for government organizations and some regulated funds that manage their investments on a fair value basis, have not yet adopted this standard.

Items within the scope of the financial instruments section are assigned to one of the following measurement categories: fair value, cost or amortized cost. Fair value measurement will apply to derivatives and portfolio investments in equity instruments that are quoted in an active market. Also, when groups of financial assets and financial liabilities are managed on a fair value basis, they may be reported on that basis. Other financial assets and financial liabilities will generally be measured at cost or amortized cost. Until an item is derecognized, gains and losses arising due to fair value remeasurement will be reported in the Consolidated Statement of Remeasurement Gains and Losses.

PS 3280 Asset Retirement Obligations

This standard provides guidance on how to account for and report liabilities for retirement of tangible capital assets.

PS 3400 Revenue

This standard provides guidance on how to account for and report revenue, and specifically, it differentiates between revenue arising from exchange and non-exchange transactions.

| | (e) | CHANGE IN ACCOUNTING POLICY |

The Province retroactively changed its accounting policy for reporting of third-party investment costs to align expense reporting with peers and better reflect costs associated with management of investments. This change had no impact to the annual deficit or net assets. Comparative figures have been restated to present actuals on the same basis with current year figures. As a result of this change, the Province’s planned results for total revenues and total expenses have been reduced by $46 million from that reported in the 2019-23 Fiscal Plan, with no overall impact to the annual deficit. The effect of these changes has been reported on the Consolidated Statement of Operations and Schedules 1, 2 and 3.

| | |

| | |

| 26 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

| | (f) | BASIS OF FINANCIAL REPORTING |

Revenues

All revenues are reported on the accrual basis of accounting. Cash received for which goods or services have not been provided by year end is recognized as unearned revenue and recorded in accounts payable and other accrued liabilities.

The provincial tax system is predicated on self-assessment where taxpayers are expected to understand the tax laws and comply with them. This has an impact on the completeness of tax revenues when taxpayers fail to comply with tax laws, for example, if they do not report all of their income. The Province has implemented systems and controls in order to detect and correct situations where taxpayers are not complying with the various Acts it administers. These systems and controls include performing audits of taxpayer records when determined necessary. However, such procedures cannot identify all sources of unreported income or other cases of non-compliance with tax laws. The Province does not estimate the amount of unreported tax.

Tax revenues are reported net of applicable tax concessions. Tax concessions are defined as tax credits that provide relief to taxpayers from taxes previously paid or currently owing.

Tax credits that provide a financial benefit through the tax system but do not change a taxpayer’s tax liability amount are defined as transfers through the tax system and reported as expenses.

Personal income tax is recognized on an accrual basis based on an economic estimate of the various components of personal income tax for the fiscal year. Gross personal income growth for the taxation year is a key component of the estimate for the fiscal year.

Corporate income tax revenue is recognized when installments are received from taxpayer corporations. A receivable is established for tax assessments that are outstanding. Revenue and tax receivables will be adjusted in the year in which any additional information becomes available from resulting audits, appeals and court decisions. Corporate income tax refunds payable are accrued based primarily on the prior year’s corporate income tax refunds paid on assessments. Corporate income tax receipts from corporations in anticipation of an upward reassessment of Alberta income tax payable are described as corporate income tax receipts in abeyance and recognized as accounts payable and other accrued liabilities.

The Province calculates an allowance for corporate income taxes based on the difference between the actual corporate income tax receivable and the estimate of the collectability. The adjustment to the allowance is recorded as an expense. The adjustment may increase or decrease the allowance as tax receivables are revalued in subsequent years based on resulting audits, appeals and court decisions.

Other taxes are recognized during the period in which the taxable event occurs and when authorized by legislation.

The provincial royalty system is predicated on self-reporting where the petroleum and natural gas industry is expected to understand the relevant energy legislation (statutes and regulations) and comply with them. This has an impact on the completeness of revenue when the petroleum and natural gas industry does not fully meet the legislative requirements, for example, by reporting inaccurate or incomplete production data. The Province has implemented systems and controls in order to detect and correct situations where the petroleum and natural gas industry has not complied with the various Acts and Regulations the Province administers. These systems and controls, based on areas of highest risk, include performing audits of the petroleum and natural gas industry records when determined necessary. The Province does not estimate the effect of misreported revenue. Any impacts on revenue of refiling by industry are recognized in the year of refiling.

| | |

| Government of Alberta | Annual Report 2019 – 2020 | | 27 |

CONSOLIDATED FINANCIAL STATEMENTS

Royalty revenues are reported net of expenses incurred by provincial oil and gas royalty reduction programs. These programs aim to encourage industry to produce from wells which otherwise would not be economically productive.

Bitumen royalty is determined based on revenues from production sold by projects less the costs of that production and costs of selling the Crown’s royalty share. Crude oil and natural gas royalties are determined based on monthly production. Revenue is recognized when the resource is produced by the mineral right holders. Revenue from bonuses and sales of Crown leases is recognized when the Crown leases are sold.

Transfers from the Government of Canada include grants and entitlements. Grants for capital purposes and donated assets with restrictions for their use are recognized as deferred capital contributions. Grants for operating purposes with stipulations for their use are recognized as deferred operating contributions. Entitlements relate to significant intergovernmental transfers where authorization and eligibility criteria have been met by March 31 and amounts can be reasonably estimated. Entitlements with restrictions for their use that create an obligation are recognized as deferred contributions. Deferred contributions are recognized as revenue in the Consolidated Statement of Operations based on relevant stipulations of the transfer taken together with the actions and communications of the Province. All other grants and entitlements, without stipulations for their use, are recognized as revenue in the Consolidated Statement of Operations when authorized and eligibility criteria, if any, are met.

Endowment contributions, matching contributions and associated investment income allocated for preservation of endowment capital purchasing power are recognized as other revenue in the Consolidated Statement of Operations in the period in which they are received.

Expenses

Expenses represent the cost of resources consumed during the year on government operations. Expenses include amortization of tangible capital assets, debt servicing costs and expenses incurred in accordance with the terms of approved grant programs. Grants are recognized as expenses when authorized, eligibility criteria, if any, are met and a reasonable estimate of the amounts can be made.

Pension expenses comprise the cost of pension benefits earned by employees during the year, interest on the Province’s share of the unfunded pension liabilities, and the amortization of deferred adjustments arising from experience gains and losses and changes in actuarial assumptions over the expected average remaining service life of employees. Pension recovery represents the change in pension liabilities. Schedule 12 provides additional information on the components of pension expenses and liabilities.

In the Consolidated Statement of Operations, pension costs of government sector entities which are funded are included in expenses by function and costs which have not been funded are recognized as pension provisions.

Costs arising from obligations under guarantees and indemnities are recognized as expenses when management determines that the Province will likely be called upon to make payment. The expense represents management’s best estimate of future payments less recoveries.

The estimated increase or decrease for the year in accrued employee vacation entitlements is recognized in the related expense function.

| | |

| | |

| 28 | | Government of Alberta | Annual Report 2019 – 2020 |

CONSOLIDATED FINANCIAL STATEMENTS

Financial Assets

Financial assets are the Province’s financial claims on external organizations and individuals, as well as cash and inventories for resale at year end.

Cash includes deposits in banks and cash-in-transit. Cash equivalents include directly held interest-bearing securities with terms to maturity of primarily less than three months.

Accounts receivable is recognized at the lower of cost or net recoverable value. A valuation allowance is recognized when recovery is uncertain.

Portfolio investments are recognized at cost. Cost includes the amortization of a discount or premium using the straight-line method over the life of the investments. Realized gains and losses on disposal of these investments are included in calculating the net operating results for the year. If an investment loses value that is other than a temporary decline, its recognized value is reduced to reflect the loss. The reduced value is deemed to be the new cost.

Portfolio investments restricted for endowments (Schedule 7) are from donors who have placed restrictions on their contributions to the endowment funds, for example, capital preservation. The principal restriction is that the original contribution should be maintained intact in perpetuity. Other restrictions may include spending investment income earned by endowments for specific operational or capital purposes, or capitalizing a certain amount of investment income to maintain and grow the real value of endowments.

Loans are recognized at cost less any discounts and allowance for credit loss. Where there is no longer reasonable assurance of timely collection of the full amount of principal and interest of a loan, a provision for credit loss is made and the carrying amount of the loan is reduced to its estimated realizable amount.

Inventories for resale representing the Province’s share of royalty oil in feeder and trunk pipelines are recognized at the lower of cost or net realizable value. Other inventories for resale are valued at the lower of cost, determined on a first-in, first-out basis, and estimated net realizable value.

Liabilities

Liabilities represent present obligations of the Province to external organizations and individuals arising from past transactions or events occurring before year end, the settlement of which is expected to result in the future sacrifice of economic benefits. They are recognized when there is an appropriate basis of measurement and management can reasonably estimate the amount.

Coal phase-out agreements liabilities are valued at the net present value of the future payments, discounted using the Province’s borrowing rate for long term debt at the time of signing the agreements.

Debentures included in debt are recognized at the face amount of the issue less unamortized discount, which includes issuance and hedging costs.

Income or expense on derivatives used to manage interest rate or foreign currency exposure is recognized as an adjustment to debt servicing costs.