UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-05075 |

Thrivent Mutual Funds

(Exact name of registrant as specified in charter)

| | |

625 Fourth Avenue South Minneapolis, Minnesota | | 55415 |

| (Address of principal executive offices) | | (Zip code) |

John L. Sullivan

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-5704

Date of fiscal year end: December 31

Date of reporting period: December 31, 2009

| Item 1. | Report to Stockholders |

Table of Contents

| | |

| | Dear Shareholder: |

It has truly been a tale of two markets over the 12 months ended December 31, 2009. The same types of investments that were shunned in the panic environment of early 2009 were aggressively snapped up from March through December as the markets rebounded strongly from early March lows. While it is no great surprise that the stock market was due for a recovery, the speed and extent of the rally should give us pause.

In weighing future investment choices, risks and opportunities, it is worth considering and debating two prevailing (though somewhat extreme) views on where the U.S. economy and markets go from here.

What goes down, will go up

Historically, bull markets rise from the ashes of bear markets, and this past fiscal year’s terrible sell-off will likely be no different. Sharp recoveries typically follow sharp declines. Optimists point to unprecedented global stimulus, healing credit markets, rising leading economic indicators and stronger corporate profits as evidence there will be a traditional “V-shaped” recovery.

We have unprecedented global stimulus in terms of a very low federal funds rate—0.25%—and members of the Federal Reserve noted in September that economic conditions were likely to warrant exceptionally low interest rate levels for an extended time. This makes the cost of borrowing and financing very low and nurtures conditions for improved economic growth. Perhaps more important to the investment markets were the Fed’s extraordinary measures to expand its balance sheet and inject massive liquidity into the financial system, including buying large amounts of agency mortgage-backed and Treasury securities. Considering that the bulk of federal stimulus and government spending has yet to take effect, much fuel for the U.S. economic growth engine appears available.

Inflation increased modestly during the period as the recession continued to restrain wages and spending. The Consumer Price Index (CPI) increased 2.7% during the 12 months through December 2009, while the core CPI (minus the prices of energy and food) increased 1.8%.1 As inflation remains tame, no Fed action to raise short-term interest rates appears imminent. Stronger growth proponents would point to the declining U.S. dollar and rising gold prices as evidence that the market believes future inflation to be more of a worry than a “slow or no-growth” deflationary state.

Could it be different this time?

Diverging from the more optimistic assessments of where the U.S. economy and markets may be headed is what I term the “subdued or slow-growth” view. This perspective is based primarily on concerns with the U.S. consumer and aggressive government actions. Burdened by a still fundamentally weak national housing market, higher debt levels and pervasive anxiety over joblessness, the U.S. consumer—responsible for approximately 70% of the nation’s gross domestic product (GDP)2—may no longer be able to contribute as much to the overall economic equation. If that is the case, who or what will take up the slack?

Right now the government is filling the gap, but many would call this short-term “medication” for our recovering economy. Arguably, the government cannot continue to spend and issue Treasury debt at its current pace and soon will likely have to wrestle, along with the Federal Reserve, with how to pull some of the “fuel” out of the system. Businesses may not be able to come to the rescue as continued tight lending standards, especially for small businesses, limit access to capital and therefore crimp business investment and hiring. Larger companies have seen credit conditions improve, but access to capital remains more challenging for small businesses. These smaller businesses account for a good part of our nation’s total employment. Proponents of this view may point to the fact that, despite the resumption of economic growth, the nation’s job market continues to struggle, prompting uncertainty about the pace of the recovery. Employers cut just over 4 million jobs in 2009, and the U.S. unemployment rate jumped to 10% in December.3 We expect unemployment to improve only slowly.

What’s next? Our view

The unprecedented amount of government stimulus in the economy should fuel growth in 2010, but we believe activity will remain below trend and unemployment will stay high for the foreseeable future. Under such a scenario, the Federal Reserve will likely keep short-term interest rates at record low levels at least into early 2010. The more pessimistic view I shared earlier is largely predicated on the current economic snapshot and may not materialize given the massive fiscal and monetary stimuli at work. Betting against this liquidity and a corresponding economic recovery has historically been unwise.

Even so, these pessimistic conclusions are worthy of thought. We remain concerned about the threats to growth posed by continued problems in the housing and credit markets, rising unemployment and weak consumer and business spending. The Federal Reserve will have to walk a tightrope in knowing when and how to remove some of the monetary stimulus in the system or run the

2

risk of runaway inflation or another economic downturn. Government policy, legislative risk, increased regulation and taxes will also weigh on the extent and trajectory of the economic recovery.

As always, we will monitor the economy and markets closely and work hard to provide ongoing value to you. Thank you for continuing to turn to us for your financial options.

|

| Sincerely, |

|

|

Russell W. Swansen |

President Thrivent Mutual Funds |

| 1 | U.S. Department of Commerce, Bureau of Economic Analysis |

| 2 | Bureau of Economic Statistics |

| 3 | U.S. Department of Labor, Bureau of Labor Statistics |

3

| | |

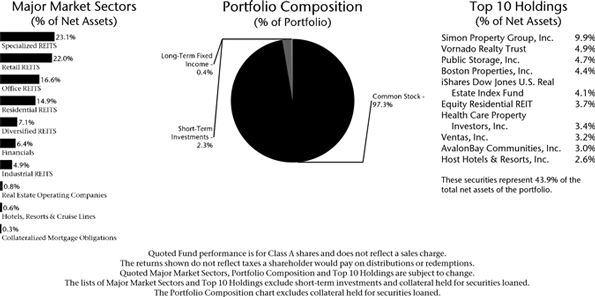

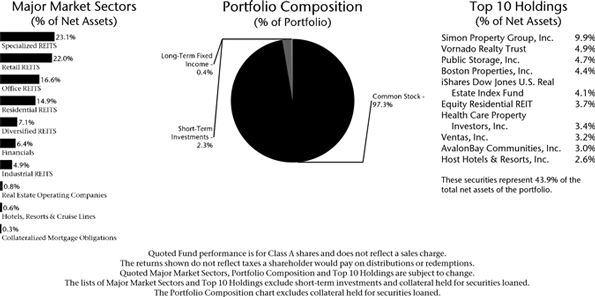

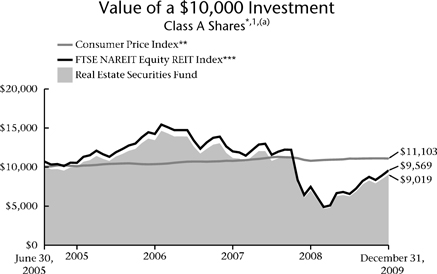

| | Thrivent Real Estate Securities Fund Reginald L. Pfeifer, CFA, Portfolio Manager Thrivent Real Estate Securities Fund seeks to provide long-term capital appreciation and high current income. The Fund is subject to risks arising from the fact that it invests, under normal circumstances, at least 80% of its total assets in securities of companies that are primarily engaged in the real estate industry. Portfolio security prices are influenced by the underlying value of properties owned by the issuer, which may be influenced by the supply and demand for space and other factors. The real estate industry is cyclical, and securities issued by companies doing business in the real estate industry may fluctuate in value. These and other risks are described in the Fund’s prospectus. |

How did the Fund perform during the 12-month period ended December 31, 2009?

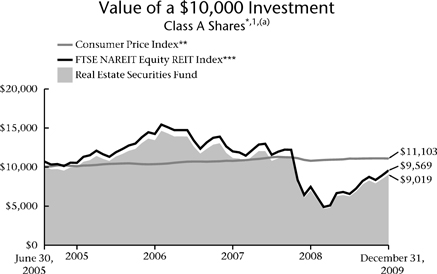

Thrivent Real Estate Securities Fund earned a return of 28.55% as compared to the median return of its peer group, the Lipper Real Estate category, of 29.22%. The Fund’s market benchmark, the FTSE NAREIT Equity REIT Index, earned a return of 27.99%.

What factors affected the Fund’s performance?

Real estate investment trust (REIT) stocks staged a significant rebound in 2009, after reaching their lowest levels in 15 years in early March. This recovery occurred primarily because REITs were able to raise more than $20 billion in new equity to reduce leverage and repay current or near-term debt maturities. REITs also raised approximately $14 billion in the public real estate debt market to refinance or extend debt maturities. In general, REITs were able to maintain reasonable occupancy levels due to their high-quality portfolios and experienced management teams. Nonetheless, 2009 was a difficult year that could have been significantly worse without U.S. government support for both the economy and capital markets.

The best performing sectors in the Fund were lodging, apartments and office REITs. The worst performing were shopping center, self storage and industrial properties.

The Fund’s largest positive contributors to performance were Simon Property Group, which owns and manages regional malls, outlet centers and community shopping centers in the U.S. and internationally; Digital Realty Trust, which specializes in data centers and technology-related real estate in the U.S. and Europe; and AvalonBay Communities, which develops and manages upscale apartment communities in high barrier-to-entry U.S. housing markets.

What is your outlook?

We expect the U.S. economy to experience gradual improvement in 2010. As a result, the commercial real estate sector is likely to improve in 2010 as well. Construction activity has been extremely low, and new supply is expected to be limited over the next few years. However, job growth is necessary in order for vacancy rates to begin declining. This process may take more time than historical U.S. cyclical recoveries. However, we believe that economic improvement will likely begin to benefit commercial real estate vacancy rates in 2010, and then rental rates. We expect that most property sectors should see improvement during the year. The sectors that are likely to recover most quickly are those property types that have short-term leases, specifically lodging, multifamily apartment and self-storage properties.

4

Property sectors that have longer-term leases, such as office buildings, shopping centers and industrial properties, are unlikely to see an immediate rebound in rental rates, but should benefit from a gradual improvement in occupancy rates. The Fund has exposure to companies within each property sector, with the largest concentration being in large-cap REITs with strong management teams. These companies have demonstrated the ability to access debt and equity capital in the public and private markets, which we believe remains critical in the current environment. In addition, we also maintain exposure in mid- and small-cap REITs that we believe offer attractive relative value and long-term growth potential. During 2010, we will seek to make adjustments as changes occur in either the economy or the various property sectors in which the Fund invests.

Portfolio Facts

As of December 31, 2009

| | | | |

| | | Class A | | Institutional Class |

Ticker | | TREFX | | TREIX |

Transfer Agent ID | | 069 | | 469 |

Net Assets | | $10,840,055 | | $80,242,033 |

NAV | | $7.79 | | $7.80 |

NAV - High† | | 12/28/2009 -$8.11 | | 12/28/2009 -$8.11 |

NAV - Low† | | 3/6/2009 -$3.74 | | 3/6/2009 -$3.74 |

Number of Holdings: 97 | | | | |

| | † | For the year ended December 31, 2009 |

Average Annual Total Returns1

As of December 31, 2009

| | | | |

Class A2 | | 1-Year | | From Inception

6/30/2005 |

without sales charge | | 28.55% | | -1.03% |

with sales charge | | 21.46% | | -2.26% |

| | |

Institutional Class3 | | 1-Year | | From Inception

6/30/2005 |

Net Asset Value | | 28.97% | | -0.66% |

| 1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser may have waived its management fee and/or reimbursed Fund expenses. If this were the case, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

| 2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

| 3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

| (a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

| * | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index and the FTSE NAREIT Equity REIT Index do not reflect any such charges. If you were to purchase any of the above individual stocks or funds represented in the Index, any charges you would pay would reduce your total return as well. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

| *** | The FTSE NAREIT Equity REIT Index is an unmanaged capitalization-weighted index of all equity real estate investment trusts. It is not possible to invest directly in this Index. The performance of this Index does not reflect deductions for fees, expenses or taxes. |

5

| | | | |

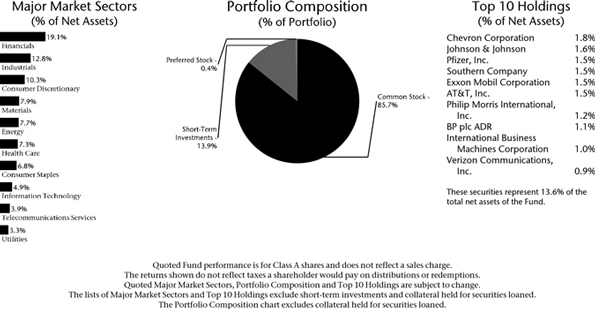

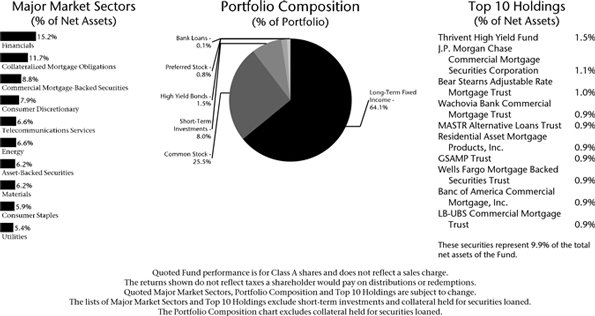

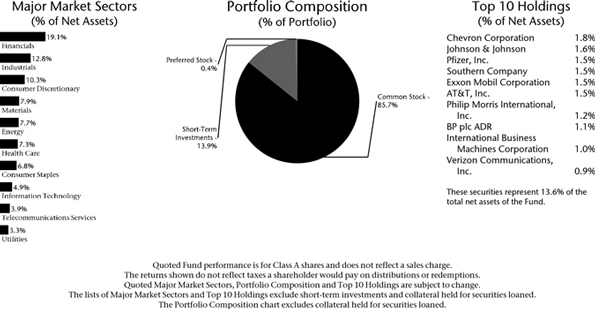

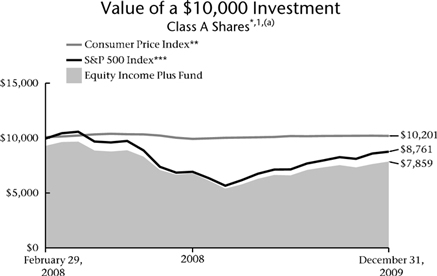

| | Thrivent Equity Income Plus Fund David R. Spangler, CFA and Kevin R. Brimmer, FSA, Portfolio Co-Managers The Fund seeks income plus long-term capital growth. The Fund may invest in, among others, REITs, preferred stocks and foreign (including emerging market) stocks. These investments are subject to unique risks. The Fund may also sell covered options on any securities in which the Fund invests. Successful use of this strategy can augment portfolio return but can also magnify losses if executed incorrectly. These and other risks are described in the Fund’s prospectus. | |  |

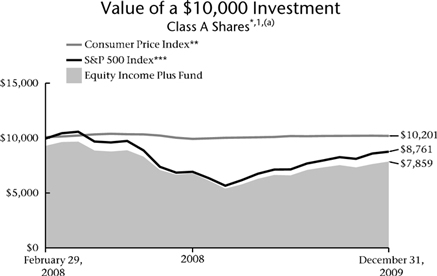

How did the Fund perform during the 12-month period ended December 31, 2009?

Thrivent Equity Income Plus Fund earned a return of 15.74% as compared to the median return of its peer group, the Lipper Equity Income category, of 22.55%. The Fund’s market benchmark, the S&P 500 Index, earned a return of 26.47%.

What factors affected the Fund’s performance?

Following the dramatic declines in stocks in the second half of 2008, the U.S. stock market posted one of the sharpest rebounds in history. The return to riskier assets included small caps outperforming large caps, growth over value, lower-quality over higher-quality, higher beta over lower beta and nondividend payers over dividend payers. Overall, the Fund maintained a higher-quality, lower-risk positioning in dividend-paying stocks, which contributed to the Fund lagging behind the market in 2009.

Security selection was the major contributor to underperformance, with weak performance in all but one sector due to the Fund’s positioning in higher-quality securities when the market rewarded lower-quality. Sector allocation was modestly positive for the year, with positive contribution coming from the materials, technology, health care and consumer discretionary sectors, but negative contribution coming from the energy and financial sectors. The Fund’s options buy-write strategy added value by generating premiums and moderating volatility.

What is your outlook?

It is expected that the economy will transition from early expansion to later expansion during 2010. At year-end 2009, Fund sectors were positioned with overweighting to economically sensitive securities in the financial, materials, industrials and consumer discretionary sectors, and underweighting to more counter-cyclical sectors such as consumer staples, utilities and health care. However, as the economy moves to later expansion (as we expect), it is expected that the Fund will be positioned to sectors such as health care, consumer staples, energy, materials and industrials, with underweighting to consumer discretionary, financials and technology. The Fund intends to maintain its options buy-write strategy.

6

Portfolio Facts

As of December 31, 2009

| | | | |

| | | Class A | | Institutional Class |

Ticker | | TEIAX | | TEIIX |

Transfer Agent ID | | 033 | | 050 |

Net Assets | | $4,092,064 | | $24,686,268 |

NAV | | $7.98 | | $7.98 |

NAV - High† | | 12/28/2009 - $8.10 | | 12/28/2009 - $8.12 |

NAV - Low† | | 3/9/2009 - $5.15 | | 3/9/2009 - $5.16 |

Number of Holdings: 138 | | | | |

| | † | For the year ended December 31, 2009 |

Average Annual Total Returns1

As of December 31, 2009

| | | | |

Class A2 | | 1-Year | | From Inception

2/29/2008 |

without sales charge | | 15.74% | | -9.54% |

with sales charge | | 9.36% | | -12.27% |

| | |

Institutional Class3 | | 1-Year | | From Inception

2/29/2008 |

Net Asset Value | | 15.97% | | -9.28% |

| 1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser may have waived its management fee and/or reimbursed Fund expenses. If this were the case, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

| 2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

| 3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

| (a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

| * | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index and the S&P 500 Index do not reflect any such charges. If you were to purchase any of the above individual stocks or funds represented in the Index, any charges you would pay would reduce your total return as well. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

| *** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

7

| | | | | | | | |

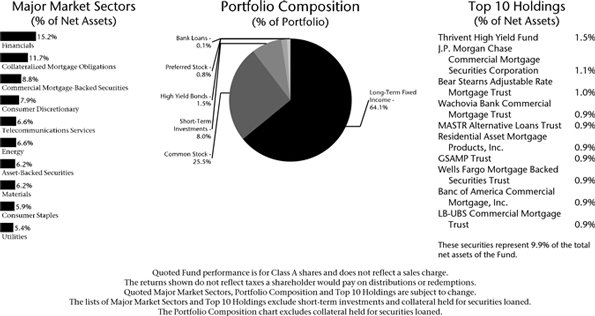

| |  | | Thrivent Diversified Income Plus Fund Mark L. Simenstad, CFA, Paul J. Ocenasek, CFA, Kevin R. Brimmer, FSA and David R. Spangler, CFA, Portfolio Co-Managers | |  | |  |

Thrivent Diversified Income Plus Fund seeks to maximize income while maintaining prospects for capital appreciation.

The Fund may invest in debt or equity securities. Debt securities include high-yield, high-risk securities commonly known as “junk bonds.” High-yield securities are subject to greater price fluctuations and increased risk of loss of principal than investment grade bonds. Equity securities include securities of REITs, which are subject to the risk that changes in real estate values or economic downturns can have a negative effect on issuers in the real estate industry. These and other risks are described in the Fund’s prospectus.

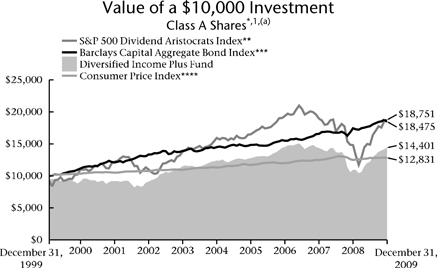

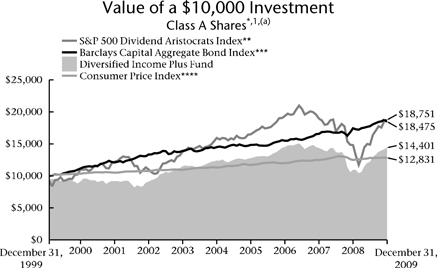

How did the Fund perform during the 12-month period ended December 31, 2009?

Thrivent Diversified Income Plus Fund earned a total return of 31.50%. This compares with the Fund’s market benchmarks, the S&P 500 Dividend Aristocrats Index and the Barclays Capital Aggregate Bond Index, which returned 26.56% and 5.93%, respectively.

What factors affected the Fund’s performance?

Riskier sectors of the credit market reversed course early in the period and rallied strongly as investors increasingly believed that government bailouts and liquidity programs would revive the economy and markets. The yield premium, or “spread,” that riskier bonds offered over Treasury securities narrowed dramatically.

High-yield, investment-grade corporate and mortgage-related bonds were among the best-performing sectors, while the prices of U.S. government securities fell. In the U.S. equities markets, real estate investment trusts (REITs) were strong performers after a previous pullback.

The Fund’s favorable performance relative to its benchmark indexes was due to several factors, including an overweighted position in high-yield bonds; a large position in non-agency mortgage bonds; a meaningful allocation to preferred stocks; and—to a lesser degree—a focus on REIT bonds rather than REIT stocks.

What is your outlook?

We believe that the recession is over and that economic growth will continue into 2010, still fueled largely by an array of government stimulus programs. We expect the pace of growth to pick up early in the year, though it will likely remain more subdued than investors would like. Unemployment will likely remain high, necessitating the Federal Reserve to keep short-term interest rates at current low levels at least through the first half of the year.

While we expect the bond and stock markets to continue returning toward normalcy, we don’t expect a repeat any time soon of 2009’s outsized returns from either type of asset. Rather, combined returns should be more muted—in the single to low double digits. On the bond side, we would hope to earn coupon payments that offset potentially falling securities prices if the Federal Reserve begins to raise interest rates.

8

Going forward, we expect to keep the Fund at roughly one-third high-yield bonds, one-third investment-grade bonds, and one-third dividend-paying stocks. As always, we will continue to monitor the economy and markets closely and watch for opportunities to add value to the Fund.

Portfolio Facts

As of December 31, 2009

| | | | |

| | | Class A | | Institutional Class |

Ticker | | AAHYX | | THYFX |

Transfer Agent ID | | 025 | | 095 |

Net Assets | | $135,181,696 | | $6,672,795 |

NAV | | $5.83 | | $5.81 |

NAV - High† | | 12/29/2009 - $5.86 | | 12/29/2009 - $5.85 |

NAV - Low† | | 3/9/2009 - $4.20 | | 3/9/2009 - $4.19 |

Number of Holdings: 385 | | | | |

| | † | For the year ended December 31, 2009 |

Average Annual Total Returns1,2

As of December 31, 2009

| | | | | | |

Class A3 | | 1-Year | | 5 Years | | 10 Years |

without sales charge | | 31.50% | | 3.04% | | 4.19% |

with sales charge | | 25.60% | | 2.09% | | 3.72% |

| | | |

Institutional Class4 | | 1-Year | | 5 Years | | 10 Years |

Net Asset Value | | 31.97% | | 3.47% | | 4.61% |

| 1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser may have waived its management fee and/or reimbursed Fund expenses. If this were the case, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

| 2 | Prior to July 3, 2006, the Fund invested primarily in junk bonds. |

| 3 | Class A performance with sales charge reflects the maximum sales charge of 4.5%. |

| 4 | Institutional Class shares have no sales load and are for institutional shareholders only. |

| (a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

| * | As you compare performance, please note that the Fund’s performance reflects the maximum 4.5% sales charge, while the S&P 500 Dividend Aristocrats Index, the Barclays Capital Aggregate Bond Index and the Consumer Price Index do not reflect any such charges. If you were to purchase any of the above individual stocks or funds represented in the S&P and Barclays Capital Indexes, any charges you would pay would reduce your total return as well. |

| ** | The S&P 500 Dividend Aristocrats Index is an index which measures the performance of large-capitalization companies within the S&P 500 Index that have followed a managed dividends policy of consistently increasing dividends every year for at least 25 years. The Index has both capital growth and dividend income characteristics, is equal-weighted and is broadly diversified across sectors. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in each Index. The performance of each Index does not reflect deductions for fees, expenses or taxes. |

| *** | The Barclays Capital Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| **** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

9

Shareholder Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2009 through December 31, 2009.

Actual Expenses

In the table below, the first section, labeled “Actual,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number from the appropriate Class line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid. A small account fee of $12 may be charged to Class A shareholder accounts if the value falls below the stated account minimum of $1,000. This fee is not included in the table below. If it were, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Hypothetical Example for Comparison Purposes

In the table below, the second section, labeled “Hypothetical,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small account fee of $12 may be charged to Class A shareholder accounts if the value falls below the stated account minimum of $1,000. This fee is not included in the table below. If it were, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value

7/1/2009 | | Ending

Account

Value

12/31/2009 | | Expenses

Paid

During

Period

7/1/2009-

12/31/2009* | | Annualized

Expense

Ratio | |

Thrivent Real Estate Securities Fund | | | | | | | | | | | | |

Actual | | | | | | | | | | | | |

Class A | | $ | 1,000 | | $ | 1,443 | | $ | 7.70 | | 1.25 | % |

Institutional Class | | $ | 1,000 | | $ | 1,447 | | $ | 6.01 | | 0.97 | % |

Hypothetical** | | | | | | | | | | | | |

Class A | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 | | 1.25 | % |

Institutional Class | | $ | 1,000 | | $ | 1,020 | | $ | 4.96 | | 0.97 | % |

Thrivent Equity Income Plus Fund | | | | | | | | | | | | |

Actual | | | | | | | | | | | | |

Class A | | $ | 1,000 | | $ | 1,190 | | $ | 6.35 | | 1.15 | % |

Institutional Class | | $ | 1,000 | | $ | 1,192 | | $ | 4.42 | | 0.80 | % |

Hypothetical** | | | | | | | | | | | | |

Class A | | $ | 1,000 | | $ | 1,019 | | $ | 5.85 | | 1.15 | % |

Institutional Class | | $ | 1,000 | | $ | 1,021 | | $ | 4.08 | | 0.80 | % |

Thrivent Diversified Income Plus Fund | | | | | | | | | | | | |

Actual | | | | | | | | | | | | |

Class A | | $ | 1,000 | | $ | 1,181 | | $ | 6.23 | | 1.13 | % |

Institutional Class | | $ | 1,000 | | $ | 1,184 | | $ | 4.12 | | 0.75 | % |

Hypothetical** | | | | | | | | | | | | |

Class A | | $ | 1,000 | | $ | 1,019 | | $ | 5.77 | | 1.13 | % |

Institutional Class | | $ | 1,000 | | $ | 1,021 | | $ | 3.81 | | 0.75 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| ** | Assuming 5% total return before expenses. |

10

| | | | |

| | | | PricewaterhouseCoopers LLP 225 South Sixth Street Suite 1400 Minneapolis, MN 55402 Telephone (612) 596 6000 |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Trustees of

the Thrivent Mutual Funds:

In our opinion, the accompanying statements of assets and liabilities, including the schedules of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Thrivent Real Estate Securities Fund, Thrivent Diversified Income Plus Fund and Thrivent Equity Income Plus Fund (hereafter referred to as the “Funds”) at December 31, 2009, and the results of each of their operations in the year then ended, changes in each of their net assets and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2009 by correspondence with the custodian, brokers, and transfer agent, provide a reasonable basis for our opinion.

February 18, 2010

11

Real Estate Securities Fund

Schedule of Investments as of December 31, 2009

| | | | | | | |

Shares | | Common Stock (96.7%) | | Value |

Diversified REITS (7.1%) | | | |

| 11,919 | | Colonial Properties Trust | | $ | 139,810 |

| 3,042 | | Cousins Properties, Inc. | | | 23,211 |

| 40,138 | | Liberty Property Trust | | | 1,284,817 |

| 5,400 | | PS Business Parks, Inc. | | | 270,270 |

| 63,247 | | Vornado Realty Trust | | | 4,423,495 |

| 11,380 | | Washington Real Estate | | | |

| | Investment Trust | | | 313,519 |

| | | | | | | |

| | Total Diversified REITS | | | 6,455,122 |

| | | | | | | |

| | |

Financials (6.4%) | | | | | |

| 80,363 | | iShares Dow Jones U.S. Real Estate Index Fund | | | 3,690,269 |

| 2,000 | | Pebblebrook Hotel Trusta | | | 44,020 |

| 47,022 | | Vanguard REIT ETF | | | 2,103,764 |

| | | | | | | |

| | Total Financials | | | 5,838,053 |

| | | | | | | |

| | |

Hotels, Resorts & Cruise Lines (0.6%) | | | | | |

| 1,000 | | Hyatt Hotels Corporationa | | | 29,810 |

| 14,479 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 529,497 |

| | | | | | | |

| | Total Hotels, Resorts & Cruise Lines | | | 559,307 |

| | | | | | | |

| | |

Industrial REITS (4.9%) | | | | | |

| 55,543 | | AMB Property Corporation | | | 1,419,124 |

| 78,382 | | DCT Industrial Trust, Inc. | | | 393,477 |

| 9,225 | | DuPont Fabros Technology, Inc. | | | 165,958 |

| 9,500 | | EastGroup Properties, Inc. | | | 363,660 |

| 6,100 | | First Potomac Realty Trust | | | 76,677 |

| 148,423 | | ProLogis | | | 2,031,911 |

| | | | | | | |

| | Total Industrial REITS | | | 4,450,807 |

| | | | | | | |

| | |

Mortgage REITS (0.3%) | | | | | |

| 8,987 | | Annaly Capital Management, Inc. | | | 155,924 |

| 4,500 | | Anworth Mortgage Asset Corporation | | | 31,500 |

| 8,000 | | MFA Mortgage Investments, Inc. | | | 58,800 |

| 2,400 | | Resource Capital Corporation | | | 11,808 |

| | | | | | | |

| | Total Mortgage REITS | | | 258,032 |

| | | | | | | |

| | |

Office REITS (16.6%) | | | | | |

| 19,250 | | Alexandria Real Estate Equities, Inc. | | | 1,237,583 |

| 31,353 | | BioMed Realty Trust, Inc. | | | 494,750 |

| 59,800 | | Boston Properties, Inc. | | | 4,010,786 |

| 56,246 | | Brandywine Realty Trust | | | 641,204 |

| 26,095 | | Corporate Office Properties Trust | | | 955,860 |

| 44,525 | | Digital Realty Trust, Inc. | | | 2,238,717 |

| 46,793 | | Douglas Emmett, Inc. | | | 666,800 |

| 64,600 | | Duke Realty Corporation | | | 786,182 |

| 23,431 | | Highwoods Properties, Inc. | | | 781,424 |

| 19,540 | | HRPT Properties Trust | | | 126,424 |

| 20,070 | | Kilroy Realty Corporation | | | 615,547 |

| 30,325 | | Mack-Cali Realty Corporation | | | 1,048,335 |

| 30,642 | | SL Green Realty Corporation | | | 1,539,454 |

| | | | | | | |

| | Total Office REITS | | | 15,143,066 |

| | | | | | | |

| | |

Real Estate Operating Companies (0.8%) | | | | | |

| 40,000 | | Brookfield Properties Corporation | | | 484,800 |

| 21,439 | | Forest City Enterprises, Inc.a | | | 252,551 |

| | | | | | | |

| | Total Real Estate Operating Companies | | | 737,351 |

| | | | | | | |

| |

Residential REITS (14.9%) | | |

| 24,550 | | American Campus Communities, Inc. | | | | | 689,855 |

| 44,849 | | Apartment Investment & Management Company | | 713,996 |

| 33,653 | | AvalonBay Communities, Inc. | | 2,763,248 |

| 18,300 | | BRE Properties, Inc. | | 605,364 |

| 27,540 | | Camden Property Trust | | 1,166,870 |

| 7,550 | | Education Realty Trust, Inc. | | 36,542 |

| 15,640 | | Equity Lifestyle Properties, Inc. | | 789,351 |

| 100,794 | | Equity Residential REIT | | 3,404,821 |

| 15,600 | | Essex Property Trust, Inc. | | 1,304,940 |

| 12,200 | | Home Properties, Inc. | | 582,062 |

| 11,188 | | Mid-America Apartment Communities, Inc. | | 540,156 |

| 15,588 | | Post Properties, Inc. | | 305,525 |

| 42,313 | | UDR, Inc. | | 695,626 |

| | | | | | | |

| | Total Residential REITS | | 13,598,356 |

| | | | | | | |

| |

Retail REITS (22.0%) | | |

| 17,076 | | Acadia Realty Trust | | 288,072 |

| 38,418 | | CBL & Associates Properties, Inc. | | 371,502 |

| 30,071 | | Developers Diversified Realty Corporation | | 278,457 |

| 9,519 | | Equity One, Inc. | | 153,922 |

| 31,680 | | Federal Realty Investment Trust | | 2,145,370 |

| 15,000 | | Inland Real Estate Corporation | | 122,250 |

| 117,967 | | Kimco Realty Corporation | | 1,596,094 |

| 12,500 | | Kite Realty Group Trust | | 50,875 |

| 43,686 | | Macerich Company | | 1,570,512 |

| 28,000 | | National Retail Properties, Inc. | | 594,160 |

| 4,884 | | Ramco-Gershenson Properties Trust | | 46,593 |

| 13,075 | | Realty Income Corporation | | 338,773 |

| 40,400 | | Regency Centers Corporation | | 1,416,424 |

| 2,900 | | Saul Centers, Inc. | | 95,004 |

| 113,226 | | Simon Property Group, Inc. | | 9,035,435 |

| 16,749 | | Tanger Factory Outlet Centers, Inc. | | 653,044 |

| 21,700 | | Taubman Centers, Inc. | | 779,247 |

| 23,700 | | Weingarten Realty Investors | | 469,023 |

| | | | | | | |

| | Total Retail REITS | | 20,004,757 |

| | | | | | | |

| |

Specialized REITS (23.1%) | | |

| 28,202 | | DiamondRock Hospitality Company | | 238,871 |

| 12,440 | | Entertainment Properties Trust | | 438,759 |

| 34,955 | | Extra Space Storage, Inc. | | 403,730 |

| 100,771 | | Health Care Property Investors, Inc. | | 3,077,546 |

| 38,326 | | Health Care REIT, Inc. | | 1,698,608 |

| 17,500 | | Healthcare Realty Trust, Inc. | | 375,550 |

| 23,548 | | Hospitality Properties Trust | | 558,323 |

| 199,296 | | Host Hotels & Resorts, Inc.a | | 2,325,784 |

| 18,300 | | LaSalle Hotel Properties | | 388,509 |

| 4,229 | | LTC Properties, Inc. | | 113,126 |

| 7,587 | | Medical Properties Trust, Inc. | | 75,870 |

| 44,675 | | Nationwide Health Properties, Inc. | | 1,571,667 |

| 23,730 | | Omega Healthcare Investors, Inc. | | 461,549 |

| 15,902 | | Plum Creek Timber Company, Inc. | | 600,460 |

| 52,210 | | Public Storage, Inc. | | 4,252,505 |

| 5,000 | | Rayonier, Inc. REIT | | 210,800 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

12

Real Estate Securities Fund

Schedule of Investments as of December 31, 2009

| | | | | |

Shares | | Common Stock (96.7%) | | Value |

Specialized REITS (23.1%) - continued | | | |

| 41,644 | | Senior Housing Property Trust | | $ | 910,754 |

| 3,300 | | Sovran Self Storage, Inc. | | | 117,909 |

| 24,415 | | Sunstone Hotel Investors, Inc.a | | | 216,805 |

| 15,825 | | U-Store-It Trust | | | 115,839 |

| 66,941 | | Ventas, Inc. | | | 2,927,999 |

| | | | | |

| | Total Specialized REITS | | | 21,080,963 |

| | | | | |

| | Total Common Stock (cost $101,029,747) | | | 88,125,814 |

| | | | | |

| | |

Principal

Amount | | Long-Term Fixed Income (0.4%) | | |

Asset-Backed Securities (0.1%) | | | |

| | Residential Funding Mortgage Securities | | | |

| 58,666 | | 4.470%, 7/25/2018b | | | 56,075 |

| | | | | |

| | Total Asset-Backed Securities | | | 56,075 |

| | | | | |

| |

| Collateralized Mortgage Obligations (0.3%) | | | |

| | Countrywide Home Loans, Inc. | | | |

| 83,755 | | 5.447%, 3/20/2036 | | | 78,805 |

| | Deutsche Alt-A Securities, Inc. | | | |

| 75,881 | | 5.888%, 6/25/2036 | | | 71,636 |

| | Impac Secured Assets Corporation | | | |

| 91,425 | | 0.311%, 1/25/2010c | | | 50,584 |

| 61,537 | | 0.341%, 1/25/2010c | | | 23,769 |

| | J.P. Morgan Alternative Loan Trust | | | |

| 70,394 | | 0.311%, 1/25/2010c | | | 67,768 |

| | | | | |

| | Total Collateralized Mortgage Obligations | | | 292,562 |

| | | | | |

| | Total Long-Term Fixed Income (cost $404,207) | | | 348,637 |

| | | | | |

| | |

| | | Short-Term Investments (2.3%)d | | |

| | Federal Home Loan Bank Discount Notes | | | |

| 1,000,000 | | 0.040%, 1/15/2010 | | | 999,985 |

| 1,000,000 | | 0.050%, 2/3/2010 | | | 999,954 |

| | Federal National Mortgage Association Discount Notes | | | |

| 100,000 | | 0.010%, 2/1/2010 | | | 99,999 |

| | | | | |

| | Total Short-Term Investments (at amortized cost) | | | 2,099,938 |

| | | | | |

| | Total Investments (cost $103,533,892) 99.4% | | $ | 90,574,389 |

| | | | | |

| | Other Assets and Liabilities, Net 0.6% | | | 507,699 |

| | | | | |

| | Total Net Assets 100.0% | | $ | 91,082,088 |

| | | | | |

| a | Non-income producing security. |

| b | All or a portion of the security is insured or guaranteed. |

| c | Denotes variable rate obligations for which the current coupon rate and next scheduled reset date are shown. |

| d | The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase. |

Definitions:

| | | | |

REIT | | - | | Real Estate Investment Trust, is a company that buys, develops, manages and/or sells real estate assets. |

ETF | | - | | Exchange Traded Fund. |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes, were as follows:

| | | | |

Gross unrealized appreciation | | $ | 5,562,415 | |

Gross unrealized depreciation | | | (22,844,966 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | (17,282,551 | ) |

| |

Cost for federal income tax purposes | | $ | 107,856,940 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

13

Real Estate Securities Fund

Schedule of Investments as of December 31, 2009

Fair Valuation Measurements

The following table is a summary of the inputs used, as of December 31, 2009, in valuing Real Estate Securities Fund's assets carried at fair value as discussed in the Notes to Financial Statements.

| | | | | | | | | | | | |

Investments in Securities | | Total | | Level 1 | | Level 2 | | Level 3 |

Common Stock | | | | | | | | | | | | |

Diversified REITS | | | 6,455,122 | | | 6,455,122 | | | — | | | — |

Financials | | | 5,838,053 | | | 5,838,053 | | | — | | | — |

Hotels, Resorts & Cruise Lines | | | 559,307 | | | 559,307 | | | — | | | — |

Industrial REITS | | | 4,450,807 | | | 4,450,807 | | | — | | | — |

Mortgage REITS | | | 258,032 | | | 258,032 | | | — | | | — |

Office REITS | | | 15,143,066 | | | 15,143,066 | | | — | | | — |

Real Estate Operating Companies | | | 737,351 | | | 737,351 | | | — | | | — |

Residential REITS | | | 13,598,356 | | | 13,598,356 | | | — | | | — |

Retail REITS | | | 20,004,757 | | | 20,004,757 | | | — | | | — |

Specialized REITS | | | 21,080,963 | | | 21,080,963 | | | — | | | — |

Long-Term Fixed Income | | | | | | | | | | | | |

Asset-Backed Securities | | | 56,075 | | | — | | | 56,075 | | | — |

Collateralized Mortgage Obligations | | | 292,562 | | | — | | | 292,562 | | | — |

Short-Term Investments | | | 2,099,938 | | | — | | | 2,099,938 | | | — |

| | | | | | | | | | | | |

Total | | $ | 90,574,389 | | $ | 88,125,814 | | $ | 2,448,575 | | $ | — |

| | | | | | | | | | | | |

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund's holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, or any affiliated mutual fund.

A summary of transactions for the fiscal year to date, in Real Estate Securities Fund, is as follows:

| | | | | | | | | | | | | | | | | |

Fund | | Value

December 31, 2008 | | Gross

Purchases | | Gross

Sales | | Shares Held at

December 31, 2009 | | Value

December 31, 2009 | | Income Earned

January 1, 2009 -

December 31, 2009 |

Money Market | | $ | 1,785,067 | | $ | 11,558,988 | | $ | 13,344,055 | | — | | $ | — | | $ | 5,960 |

Thrivent Financial Securities Lending Trust | | | 6,258,786 | | | 81,522,218 | | | 87,781,004 | | — | | | — | | | 48,167 |

Total Value and Income Earned | | | 8,043,853 | | | | | | | | | | | | | | 54,127 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

14

Equity Income Plus Fund

Schedule of Investments as of December 31, 2009

| | | | | | | |

Shares | | Common Stock (83.6%) | | Value |

Consumer Discretionary (10.3%) | | | |

| 6,700 | | Aaron’s, Inc. | | $ | 185,791 |

| 4,300 | | Advance Auto Parts, Inc. | | | 174,064 |

| 11,500 | | Comcast Corporationa | | | 193,890 |

| 7,800 | | Gap, Inc. | | | 163,410 |

| 5,600 | | Garmin, Ltd. | | | 171,920 |

| 4,500 | | Guess ?, Inc.a | | | 190,350 |

| 6,600 | | Interactive Data Corporation | | | 166,980 |

| 9,900 | | Jones Apparel Group, Inc. | | | 158,994 |

| 8,600 | | Leggett & Platt, Inc. | | | 175,440 |

| 5,600 | | McGraw-Hill Companies, Inc. | | | 187,656 |

| 8,200 | | Men’s Wearhouse, Inc. | | | 172,692 |

| 11,600 | | Newell Rubbermaid, Inc. | | | 174,116 |

| 2,200 | | Polo Ralph Lauren Corporation | | | 178,156 |

| 3,800 | | Ross Stores, Inc. | | | 162,298 |

| 4,400 | | TJX Companies, Inc. | | | 160,820 |

| 2,300 | | VF Corporation | | | 168,452 |

| 6,600 | | Wolverine World Wide, Inc. | | | 179,652 |

| | | | | | | |

| | Total Consumer Discretionary | | | 2,964,681 |

| | | | | | | |

| | |

Consumer Staples (6.8%) | | | | | |

| 5,500 | | Casey’s General Stores, Inc. | | | 175,560 |

| 16,000 | | Del Monte Foods Companya | | | 181,440 |

| 4,700 | | Hershey Company | | | 168,213 |

| 4,700 | | J & J Snack Foods Corporation | | | 187,812 |

| 3,500 | | Lancaster Colony Corporation | | | 173,950 |

| 3,700 | | Molson Coors Brewing Company | | | 167,092 |

| 6,300 | | Nu Skin Enterprises, Inc. | | | 169,281 |

| 7,100 | | Philip Morris International, Inc. | | | 342,149 |

| 6,200 | | SYSCO Corporation | | | 173,228 |

| 3,800 | | Wal-Mart Stores, Inc. | | | 203,110 |

| | | | | | | |

| | Total Consumer Staples | | | 1,941,835 |

| | | | | | | |

| | |

Energy (7.7%) | | | | | |

| 5,300 | | BP plc ADR | | | 307,241 |

| 6,800 | | Chevron Corporation | | | 523,532 |

| 2,500 | | ConocoPhillips | | | 127,675 |

| 3,800 | | ENSCO International plc ADR | | | 151,772 |

| 6,300 | | Exxon Mobil Corporationa | | | 429,597 |

| 4,100 | | Noble Corporation | | | 166,870 |

| 3,800 | | Peabody Energy Corporation | | | 171,798 |

| 13,100 | | Tesoro Corporation | | | 177,505 |

| 6,300 | | World Fuel Services Corporation | | | 168,777 |

| | | | | | | |

| | Total Energy | | | 2,224,767 |

| | | | | | | |

| | |

Financials (18.9%) | | | | | |

| 10,300 | | Acadia Realty Trust | | | 173,761 |

| 3,400 | | ACE, Ltd.b | | | 171,360 |

| 6,900 | | American Financial Group, Inc. | | | 172,155 |

| 9,100 | | Annaly Capital Management, Inc. | | | 157,885 |

| 6,500 | | Aspen Insurance Holdings, Ltd. | | | 165,425 |

| 5,500 | | Assurant, Inc. | | | 162,140 |

| 3,700 | | Bank of Hawaii Corporationa | | | 174,122 |

| 9,400 | | Brown & Brown, Inc. | | | 168,918 |

| 3,300 | | Chubb Corporation | | | 162,294 |

| 3,900 | | Commerce Bancshares, Inc. | | | 151,008 |

| 21,700 | | CVB Financial Corporationa | | | 187,488 |

| 7,700 | | Delphi Financial Group, Inc. | | | 172,249 |

| 10,900 | | Discover Financial Services | | | 160,339 |

| 2,000 | | Everest Re Group, Ltd. | | | 171,360 |

| 6,500 | | Federated Investors, Inc. | | | 178,750 |

| 12,600 | | First Financial Bancorpa | | | 183,456 |

| 1,000 | | Goldman Sachs Group, Inc. | | | 168,840 |

| 6,400 | | HCC Insurance Holdings, Inc.a | | 179,008 |

| 27,300 | | HRPT Properties Trust | | 176,631 |

| 7,500 | | Itau Unibanco Holding SA ADR | | 171,300 |

| 4,000 | | J.P. Morgan Chase & Company | | 166,680 |

| 5,900 | | Legg Mason, Inc. | | 177,944 |

| 5,500 | | Mack-Cali Realty Corporation | | 190,135 |

| 7,400 | | Marsh & McLennan Companies, Inc. | | 163,392 |

| 2,200 | | PartnerRe, Ltd. | | 164,252 |

| 10,200 | | Protective Life Corporation | | 168,810 |

| 2,100 | | Public Storage, Inc. | | 171,045 |

| 9,600 | | SEI Investments Company | | 168,192 |

| 3,100 | | Transatlantic Holdings, Inc. | | 161,541 |

| 3,200 | | Travelers Companies, Inc. | | 159,552 |

| 8,800 | | Unum Group | | 171,776 |

| 6,000 | | Wells Fargo & Company | | 161,940 |

| | | | | | | |

| | Total Financials | | 5,433,748 |

| | | | | | | |

| |

| Health Care (7.3%) | | |

| 2,100 | | Abbott Laboratoriesa | | 113,379 |

| 3,700 | | AstraZeneca plc ADR | | 173,678 |

| 7,100 | | Johnson & Johnson | | 457,311 |

| 5,500 | | Merck & Company, Inc. | | 200,970 |

| 50 | | Novartis AG ADR | | 2,722 |

| 4,200 | | Perrigo Company | | 167,328 |

| 24,459 | | Pfizer, Inc. | | 444,909 |

| 5,200 | | STERIS Corporation | | 145,444 |

| 800 | | Teva Pharmaceutical Industries, Ltd. ADR | | 44,944 |

| 5,900 | | UnitedHealth Group, Inc. | | 179,832 |

| 6,000 | | Universal Health Services, Inc. | | 183,000 |

| | | | | | | |

| | Total Health Care | | 2,113,517 |

| | | | | | | |

| |

| Industrials (12.8%) | | |

| 2,200 | | 3M Company | | 181,874 |

| 4,000 | | A.O. Smith Corporation | | 173,560 |

| 9,150 | | ABB, Ltd. ADRb | | 174,765 |

| 3,200 | | Bucyrus International, Inc.a | | 180,384 |

| 5,200 | | Carlisle Companies, Inc. | | 178,152 |

| 6,000 | | Crane Companya | | 183,720 |

| 2,400 | | Danaher Corporationa | | 180,480 |

| 13,000 | | Deluxe Corporationa | | 192,270 |

| 1,700 | | Flowserve Corporation | | 160,701 |

| 3,700 | | Hubbell, Inc. | | 175,010 |

| 3,200 | | ITT Corporation | | 159,168 |

| 3,100 | | Joy Global, Inc. | | 159,929 |

| 2,100 | | L-3 Communications Holdings, Inc. | | 182,595 |

| 3,100 | | Parker Hannifin Corporation | | 167,028 |

| 7,300 | | Pitney Bowes, Inc. | | 166,148 |

| 3,500 | | Regal-Beloit Corporation | | 181,790 |

| 4,200 | | Toro Company | | 175,602 |

| 4,700 | | Universal Forest Products, Inc. | | 173,007 |

| 2,200 | | Valmont Industries, Inc. | | 172,590 |

| 1,700 | | W.W. Grainger, Inc. | | 164,611 |

| 7,200 | | Woodward Governor Company | | 185,544 |

| | | | | | | |

| | Total Industrials | | 3,668,928 |

| | | | | | | |

| |

| Information Technology (4.9%) | | |

| 8,000 | | Altera Corporationa | | 181,040 |

| 2,800 | | Hewlett-Packard Company | | 144,228 |

| 2,200 | | International Business Machines Corporation | | 287,980 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

15

Equity Income Plus Fund

Schedule of Investments as of December 31, 2009

| | | | | |

Shares | | Common Stock (83.6%) | | Value |

Information Technology (4.9%) - continued | | | |

| 4,000 | | Lender Processing Services, Inc. | | $ | 162,640 |

| 5,300 | | Microsoft Corporation | | | 161,597 |

| 3,100 | | QUALCOMM, Inc. | | | 143,406 |

| 4,400 | | Syntel, Inc. | | | 167,332 |

| 9,100 | | Western Union Company | | | 171,535 |

| | | | | |

| | Total Information Technology | | | 1,419,758 |

| | | | | |

| |

| Materials (7.9%) | | | |

| 5,600 | | Celanese Corporationa | | | 179,760 |

| 4,100 | | International Flavors & Fragrances, Inc. | | | 168,674 |

| 6,600 | | International Paper Company | | | 176,748 |

| 2,300 | | Lubrizol Corporation | | | 167,785 |

| 1,600 | | NewMarket Corporation | | | 183,632 |

| 4,100 | | Reliance Steel & Aluminum Company | | | 177,202 |

| 3,700 | | Rock-Tenn Company | | | 186,517 |

| 8,600 | | RPM International, Inc. | | | 174,838 |

| 3,100 | | Silgan Holdings, Inc. | | | 179,428 |

| 2,700 | | Stepan Company | | | 174,987 |

| 6,400 | | Valspar Corporation | | | 173,696 |

| 2,400 | | Walter Energy, Inc. | | | 180,744 |

| 6,400 | | Westlake Chemical Corporation | | | 159,552 |

| | | | | |

| | Total Materials | | | 2,283,563 |

| | | | | |

| |

Telecommunications Services (3.9%) | | | |

| 14,800 | | AT&T, Inc.a | | | 414,844 |

| 13,000 | | Chunghwa Telecom Company, Ltd. ADRa | | | 241,410 |

| 46,000 | | Qwest Communications International, Inc. | | | 193,660 |

| 8,000 | | Verizon Communications, Inc. | | | 265,040 |

| | | | | |

| | Total Telecommunications Services | | | 1,114,954 |

| | | | | |

| |

Utilities (3.1%) | | | |

| 3,300 | | Consolidated Edison, Inc. | | | 149,919 |

| 200 | | Dominion Resources, Inc. | | | 7,784 |

| 6,500 | | Duke Energy Corporation | | | 111,865 |

| 2,200 | | PG&E Corporation | | | 98,230 |

| 800 | | Progress Energy, Inc. | | | 32,808 |

| 13,000 | | Southern Company | | | 433,160 |

| 2,600 | | Xcel Energy, Inc. | | | 55,198 |

| | | | | |

| | Total Utilities | | | 888,964 |

| | | | | |

| | |

| | Total Common Stock (cost $23,447,434) | | | 24,054,715 |

| | | | | |

| | |

| | | Preferred Stock (0.4%) | | |

| Financials (0.2%) | | | |

| 2,000 | | U.S. Bancorp | | | 55,600 |

| | | | | |

| | Total Financials | | | 55,600 |

| | | | | |

| Utilities (0.2%) | | | |

| 1,720 | | Xcel Energy, Inc. | | | 45,752 |

| | | | | |

| | Total Utilities | | | 45,752 |

| | | | | |

| | |

| | Total Preferred Stock (cost $93,886) | | | 101,352 |

| | | | | |

| | | | | |

Principal Amount | | Short-Term Investments (13.5%)c | | |

| | Federal Home Loan Bank Discount Notes | | | |

| 2,000,000 | | 0.040%, 1/15/2010d | | | 1,999,969 |

| 600,000 | | 0.020%, 2/2/2010 | | | 599,989 |

| 300,000 | | 0.200%, 3/17/2010d | | | 299,877 |

| | Federal National Mortgage Association Discount Notes | | | |

| 1,000,000 | | 0.030%, 2/4/2010 | | | 999,972 |

| | | | | |

| | Total Short-Term Investments (at amortized cost) | | | 3,899,807 |

| | | | | |

| | Total Investments (cost $27,441,127) 97.5% | | $ | 28,055,874 |

| | | | | |

| | Other Assets and Liabilities, Net 2.5% | | | 722,458 |

| | | | | |

| | Total Net Assets 100.0% | | $ | 28,778,332 |

| | | | | |

| a | All or a portion of the security was earmarked to cover written options. |

| b | Non-income producing security. |

| c | The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase. |

| d | At December 31, 2009, $399,876 of investments were held on deposit with the counterparty and pledged as the initial margin deposit for open futures contracts. |

Definitions:

| | | | |

| ADR | | - | | American Depositary Receipt, which are certificates for an underlying foreign security's shares held by an issuing U.S. depository bank. |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes, were as follows:

| | | | |

Gross unrealized appreciation | | $ | 678,966 | |

Gross unrealized depreciation | | | (318,948 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | 360,018 | |

| |

Cost for federal income tax purposes | | $ | 27,695,856 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

16

Equity Income Plus Fund

Schedule of Investments as of December 31, 2009

Fair Valuation Measurements

The following table is a summary of the inputs used, as of December 31, 2009, in valuing Equity Income Plus Fund’s assets carried at fair value as discussed in the Notes to Financial Statements.

| | | | | | | | | | | | |

Investments in Securities | | Total | | Level 1 | | Level 2 | | Level 3 |

Common Stock | | | | | | | | | | | | |

Consumer Discretionary | | | 2,964,681 | | | 2,964,681 | | | — | | | — |

Consumer Staples | | | 1,941,835 | | | 1,941,835 | | | — | | | — |

Energy | | | 2,224,767 | | | 2,224,767 | | | — | | | — |

Financials | | | 5,433,748 | | | 5,433,748 | | | — | | | — |

Health Care | | | 2,113,517 | | | 2,113,517 | | | — | | | — |

Industrials | | | 3,668,928 | | | 3,668,928 | | | — | | | — |

Information Technology | | | 1,419,758 | | | 1,419,758 | | | — | | | — |

Materials | | | 2,283,563 | | | 2,283,563 | | | — | | | — |

Telecommunications Services | | | 1,114,954 | | | 1,114,954 | | | — | | | — |

Utilities | | | 888,964 | | | 888,964 | | | — | | | — |

Preferred Stock | | | | | | | | | | | | |

Financials | | | 55,600 | | | 55,600 | | | — | | | — |

Utilities | | | 45,752 | | | 45,752 | | | — | | | — |

Short-Term Investments | | | 3,899,807 | | | — | | | 3,899,807 | | | — |

| | | | | | | | | | | | |

Total | | $ | 28,055,874 | | $ | 24,156,067 | | $ | 3,899,807 | | $ | — |

| | | | | | | | | | | | |

Other Financial Instruments* | | $ | 41,159 | | $ | 41,159 | | $ | — | | $ | — |

| | | | | | | | | | | | |

| * | Other Financial Instruments include Futures, Forwards, Written Options and Swap agreements. |

| | | | | | | | | | | | | | | |

Futures Contracts | | Number of

Contracts

Long/(Short) | | Expiration

Date | | Notional

Principal

Amount | | Value | | | Unrealized

Gain/(Loss) |

S&P 500 Index Mini-Futures | | 62 | | | March 2010 | | $ | 3,406,056 | | $ | 3,443,171 | | | $ | 37,115 |

Total Futures Contracts | | | | | | | | | | | | | | $ | 37,115 |

| | | | | |

Call Options Written | | Number of

Contracts | | Exercise

Price | | Expiration

Date | | Value | | | Unrealized

Gain/(Loss) |

S&P 500 Index Mini-Futures | | 15 | | $ | 1,130.00 | | | January 2010 | | | ($5,400 | ) | | $ | 202 |

S&P 500 Index Mini-Futures | | 10 | | | 1,140.00 | | | January 2010 | | | (2,200 | ) | | | 1,273 |

S&P 500 Index Mini-Futures | | 15 | | | 1,125.00 | | | January 2010 | | | (6,750 | ) | | | 510 |

S&P 500 Index Mini-Futures | | 15 | | | 1,135.00 | | | January 2010 | | | (4,275 | ) | | | 2,059 |

Total Call Options Written | | | | | | | | | | | ($18,625 | ) | | $ | 4,044 |

The following table summarizes the fair value and Statement of Assets and Liabilities location, as of December 31, 2009, for Equity Income Plus Fund's investments in financial derivative instruments by primary risk exposure as discussed under item (2) Significant Accounting Policies of the Notes to Financial Statements.

| | | | | |

Derivatives by risk category | | Statement of Assets and Liabilities Location | | Fair Value |

Asset Derivatives | | | | | |

Equity Contracts | | | | | |

Options Written | | Net Assets - Net unrealized appreciation/(depreciation) on Written option contracts | | | 4,044 |

Futures* | | Net Assets - Net unrealized appreciation/(depreciation) on Futures contracts | | | 37,115 |

Total Equity Contracts | | | | | 41,159 |

| | | | | |

Total Asset Derivatives | | | | $ | 41,159 |

| | | | | |

| * | Includes cumulative appreciation/depreciation of futures contracts as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

The accompanying Notes to Financial Statements are an integral part of this schedule.

17

Equity Income Plus Fund

Schedule of Investments as of December 31, 2009

The following table summarizes the net realized gains/(losses) and Statement of Operations location, for the period ended December 31, 2009, for Equity Income Plus Fund’s investments in financial derivative instruments by primary risk exposure.

| | | | | | |

Derivatives by risk category | | Statement of Operations Location | | Realized Gains/(Losses)

recognized in Income | |

Equity Contracts | | | | | | |

Options Written | | Net realized gains/(losses) on Written option contracts | | | (25,434 | ) |

Futures | | Net realized gains/(losses) on Futures contracts | | | 598,930 | |

Total Equity Contracts | | | | | 573,496 | |

| | | | | | |

Total | | | | $ | 573,496 | |

| | | | | | |

The following table summarizes the change in net unrealized appreciation/(depreciation) and Statement of Operations location, for the period ended December 31, 2009, for Equity Income Plus Fund’s investments in financial derivative instruments by primary risk exposure.

| | | | | | |

Derivatives by risk category | | Statement of Operations Location | | Change in unrealized

appreciation/(depreciation)

recognized in Income | |

Equity Contracts | | | | | | |

Options Written | | Change in net unrealized appreciation/(depreciation) on Written option contracts | | | 3,152 | |

Futures | | Change in net unrealized appreciation/(depreciation) on Futures contracts | | | (35,308 | ) |

Total Equity Contracts | | | | | (32,156 | ) |

| | | | | | |

Total | | | | ($ | 32,156 | ) |

| | | | | | |

The following table presents Equity Income Plus Fund’s average daily volume of derivative activity during the period ended December 31, 2009.

| | | | | | | | |

Derivative Risk Category | | Futures

(Notional*) | | Futures

(Percentage of

Average Net Assets) | | | Options

(Contracts) |

Equity Contracts | | $ | 2,559,888 | | 10.8 | % | | 36 |

| * | Notional amount represents long or short, or both, derivative positions held by the fund. |

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, or any affiliated mutual fund.

A summary of transactions for the fiscal year to date, in Equity Income Plus Fund, is as follows:

| | | | | | | | | | | | | | | | | |

Fund | | Value

December 31, 2008 | | Gross

Purchases | | Gross

Sales | | Shares Held at

December 31, 2009 | | Value

December 31, 2009 | | Income Earned

January 1, 2009-

December 31, 2009 |

Money Market | | $ | 1,634,430 | | $ | 13,743,995 | | $ | 15,378,425 | | — | | $ | — | | $ | 11,667 |

Total Value and Income Earned | | | 1,634,430 | | | | | | | | | | | | | | 11,667 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

18

Diversified Income Plus Fund

Schedule of Investments as of December 31, 2009

| | | | | |

Principal

Amount | | Bank Loans (0.1%)a | | Value |

Financials (0.1%) | | | |

| | Nuveen Investments, Inc., Term Loan | | | |

| $140,000 | | 12.500%, 7/31/2015 | | $ | 143,920 |

| | | | | |

| | Total Financials | | | 143,920 |

| | | | | |

| | |

| | Total Bank Loans (cost $126,744) | | | 143,920 |

| | | | | |

| | |

| | | Long-Term Fixed Income (63.5%) | | |

| Asset-Backed Securities (6.2%) | | | |

| | Americredit Automobile Receivables Trust | | | |

| 595,681 | | 5.490%, 7/6/2012b | | | 603,661 |

| | GAMUT Reinsurance, Ltd. | | | |

| 850,000 | | 7.281%, 2/1/2010c,d | | | 851,955 |

| 250,000 | | 15.281%, 2/1/2010c,d | | | 190,000 |

| | GMAC Mortgage Corporation Loan Trust | | | |

| 987,141 | | 6.180%, 5/25/2036b | | | 888,984 |

| | GSAMP Trust | | | |

| 1,722,363 | | 0.411%, 1/25/2010d | | | 1,258,498 |

| | Merna Reinsurance, Ltd. | | | |

| 600,000 | | 2.001%, 3/31/2010c,d | | | 591,060 |

| 600,000 | | 3.001%, 3/31/2010c,d | | | 593,520 |

| | Renaissance Home Equity Loan Trust | | | |

| 874,932 | | 5.746%, 5/25/2036 | | | 662,576 |

| 1,000,000 | | 6.011%, 5/25/2036 | | | 560,617 |

| 1,450,000 | | 5.797%, 8/25/2036 | | | 931,613 |

| | Residential Asset Mortgage Products, Inc. | | | |

| 1,450,207 | | 4.547%, 12/25/2034 | | | 1,286,725 |

| | Residential Funding Mortgage Securities | | | |

| 351,999 | | 4.470%, 7/25/2018b | | | 336,447 |

| | | | | |

| | Total Asset-Backed Securities | | | 8,755,656 |

| | | | | |

| |

| Basic Materials (2.7%) | | | |

| | ArcelorMittal | | | |

| 600,000 | | 6.125%, 6/1/2018 | | | 619,102 |

| | Arch Western Finance, LLC | | | |

| 220,000 | | 6.750%, 7/1/2013 | | | 218,350 |

| | Domtar Corporation | | | |

| 285,000 | | 7.125%, 8/15/2015 | | | 286,425 |

| | Dow Chemical Company | | | |

| 600,000 | | 8.550%, 5/15/2019 | | | 715,887 |

| | Drummond Company, Inc. | | | |

| 320,000 | | 7.375%, 2/15/2016c | | | 312,800 |

| | FMG Finance, Pty., Ltd. | | | |

| 320,000 | | 10.625%, 9/1/2016c | | | 354,000 |

| | Graphic Packaging International, Inc. | | | |

| 300,000 | | 9.500%, 8/15/2013 | | | 309,750 |

| | Griffin Coal Mining Company, Pty., Ltd. | | | |

| 230,000 | | 9.500%, 12/1/2016c,e | | | 135,987 |

| | Jefferson Smurfit Corporation | | | |

| 100,000 | | 8.250%, 10/1/2012f,g | | | 88,000 |

| | Smurfit-Stone Container Enterprises, Inc. | | | |

| 240,000 | | 8.000%, 3/15/2017f,g | | | 211,500 |

| | Steel Dynamics, Inc. | | | |

| 250,000 | | 8.250%, 4/15/2016 | | | 260,313 |

| | Teck Resources, Ltd. | | | |

| 150,000 | | 10.250%, 5/15/2016 | | | 174,750 |

| 150,000 | | 10.750%, 5/15/2019 | | | 179,250 |

| | | | | |

| | Total Basic Materials | | | 3,866,114 |

| | | | | |

| |

| Capital Goods (2.4%) | | | |

| | Associated Materials, LLC | | | |

| 40,000 | | 9.875%, 11/15/2016c | | | 42,200 |

| | Berry Plastics Escrow Corporation | | | |

| 130,000 | | 8.875%, 9/15/2014c | | | 126,425 |

| | Case New Holland, Inc. | | | |

| 290,000 | | 7.125%, 3/1/2014 | | | 294,350 |

| | General Cable Corporation, Convertible | | | |

| 129,000 | | 4.500%, 11/15/2019h | | | 132,709 |

| | Graham Packaging Company, LP/GPC Capital Corporation I | | | |

| 160,000 | | 8.250%, 1/1/2017c | | | 158,000 |

| | L-3 Communications Corporation | | | |

| 390,000 | | 5.875%, 1/15/2015 | | | 389,512 |

| | Leucadia National Corporation | | | |

| 370,000 | | 7.125%, 3/15/2017 | | | 349,650 |

| | Norcraft Companies, LP/Norcraft Finance Corporation | | | |

| 90,000 | | 10.500%, 12/15/2015c | | | 92,250 |

| | Owens-Illinois, Inc. | | | |

| 320,000 | | 7.800%, 5/15/2018 | | | 322,400 |

| | RBS Global, Inc./Rexnord Corporation | | | |

| 290,000 | | 9.500%, 8/1/2014 | | | 290,725 |

| 60,000 | | 11.750%, 8/1/2016 | | | 59,400 |

| | SPX Corporation | | | |

| 295,000 | | 7.625%, 12/15/2014 | | | 303,850 |

| | Textron, Inc. | | | |

| 450,000 | | 7.250%, 10/1/2019 | | | 465,782 |

| | TransDigm, Inc. | | | |

| 150,000 | | 7.750%, 7/15/2014 | | | 151,875 |

| | United Rentals North America, Inc. | | | |

| 150,000 | | 10.875%, 6/15/2016 | | | 163,125 |

| | | | | |

| | Total Capital Goods | | | 3,342,253 |

| | | | | |

| |

| Collateralized Mortgage Obligations (11.7%) | | | |

| | Bear Stearns Adjustable Rate Mortgage Trust | | | |

| 1,744,575 | | 4.625%, 8/25/2010d | | | 1,484,251 |

| | Citigroup Mortgage Loan Trust, Inc. | | | |

| 1,120,807 | | 5.500%, 11/25/2035 | | | 801,688 |

| | Citimortgage Alternative Loan Trust | | | |

| 1,521,361 | | 5.750%, 4/25/2037 | | | 1,122,258 |

| | Countrywide Alternative Loan Trust | | | |

| 1,059,575 | | 6.000%, 4/25/2036 | | | 959,067 |

| 675,447 | | 6.000%, 1/25/2037 | | | 467,529 |

| | Deutsche Alt-A Securities, Inc. | | | |

| 2,258,073 | | 1.001%, 1/1/2010d | | | 1,221,931 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

19

Diversified Income Plus Fund

Schedule of Investments as of December 31, 2009

| | | | | | |

Principal

Amount | | Long-Term Fixed Income (63.5%) | | Value |

| | Collateralized Mortgage Obligations (11.7%) - continued | | | |

| $ | 772,157 | | 5.500%, 10/25/2021 | | $ | 584,909 |

| | | First Horizon Mortgage Pass-Through Trust | | | |

| | 1,114,695 | | 5.845%, 8/25/2037 | | | 792,286 |

| | | GSR Mortgage Loan Trust | | | |

| | 1,343,035 | | 0.421%, 1/25/2010d | | | 963,238 |

| | | J.P. Morgan Alternative Loan Trust | | | |

| | 430,618 | | 0.301%, 1/25/2010d | | | 395,224 |

| | | J.P. Morgan Mortgage Trust | | | |

| | 483,924 | | 6.500%, 1/25/2035 | | | 445,664 |

| | 922,195 | | 5.994%, 10/25/2036 | | | 767,274 |

| | | MASTR Alternative Loans Trust | | | |

| | 1,422,491 | | 6.500%, 5/25/2034 | | | 1,310,027 |

| | 647,241 | | 6.500%, 7/25/2034 | | | 615,486 |

| | | Structured Adjustable Rate Mortgage Loan Trust | | | |

| | 902,284 | | 5.917%, 9/25/2036 | | | 233,007 |

| | | WaMu Mortgage Pass Through Certificates | | | |

| | 1,169,658 | | 5.606%, 11/25/2036 | | | 965,850 |

| | 921,030 | | 5.838%, 8/25/2046 | | | 778,939 |

| | | Washington Mutual Mortgage Pass-Through Certificates | | | |

| | 2,040,946 | | 1.294%, 1/1/2010d | | | 872,682 |

| | | Wells Fargo Mortgage Backed Securities Trust | | | |

| | 2,209,988 | | 6.026%, 9/25/2036 | | | 548,201 |

| | 1,522,818 | | 6.000%, 7/25/2037 | | | 1,232,056 |

| | | | | | |

| | | Total Collateralized Mortgage Obligations | | | 16,561,567 |

| | | | | | |

| |

| | Commercial Mortgage-Backed Securities (8.8%) | | | |

| | | Banc of America Commercial Mortgage, Inc. | | | |

| | 1,250,000 | | 5.928%, 5/10/2045 | | | 1,228,409 |

| | 1,250,000 | | 5.356%, 10/10/2045i | | | 1,120,595 |

| | | Bear Stearns Commercial Mortgage Securities, Inc. | | | |

| | 1,200,000 | | 5.694%, 6/11/2050 | | | 1,050,692 |

| | | Commercial Mortgage Pass-Through Certificates | | | |

| | 1,000,000 | | 0.413%, 1/15/2010d,j | | | 826,971 |

| | | Credit Suisse Mortgage Capital Certificates | | | |

| | 1,250,000 | | 5.467%, 9/15/2039 | | | 1,070,654 |

| | | Greenwich Capital Commercial Funding Corporation | | | |

| | 1,250,000 | | 5.867%, 12/10/2049i | | | 959,355 |

| | | J.P. Morgan Chase Commercial Mortgage Securities Corporation | | | |

| | 1,750,000 | | 5.336%, 5/15/2047 | | | 1,517,717 |

| | | LB-UBS Commercial Mortgage Trust | | | |

| | 1,250,000 | | 4.568%, 1/15/2031 | | | 1,222,706 |

| | 1,200,000 | | 5.866%, 9/15/2045 | | | 1,053,252 |

| | | Wachovia Bank Commercial Mortgage Trust | | | |

| | 2,000,000 | | 0.353%, 1/15/2010d,j | | | 1,357,666 |

| | 1,250,000 | | 5.765%, 7/15/2045 | | | 1,132,179 |

| | | | | | |

| | | Total Commercial Mortgage-Backed Securities | | | 12,540,196 |

| | | | | | |

| |

| | Communications Services (5.5%) | | | |

| | | CBS Corporation | | | |

| | 450,000 | | 8.875%, 5/15/2019 | | | 538,346 |

| | | Cequel Communications Holdings I, LLC | | | |

| | 420,000 | | 8.625%, 11/15/2017c,i | | | 424,200 |

| | | Charter Communications Operating, LLC | | | |

| | 300,000 | | 8.375%, 4/30/2014c,g | | | 308,250 |

| | | Cricket Communications, Inc. | | | |

| | 295,000 | | 9.375%, 11/1/2014 | | | 296,475 |

| | | CSC Holdings, Inc. | | | |

| | 150,000 | | 8.500%, 4/15/2014c | | | 159,750 |

| | | Dex Media West, LLC/Dex Media West Finance Company | | | |

| | 99,000 | | 9.875%, 8/15/2013g | | | 31,185 |

| | | DISH DBS Corporation | | | |

| | 285,000 | | 6.625%, 10/1/2014 | | | 287,494 |

| | | Frontier Communications Corporation | | | |

| | 150,000 | | 8.125%, 10/1/2018 | | | 151,875 |

| | | GCI, Inc. | | | |

| | 240,000 | | 8.625%, 11/15/2019c | | | 242,100 |

| | | Intelsat Subsidiary Holding Company, Ltd. | | | |

| | 240,000 | | 8.500%, 1/15/2013 | | | 244,800 |

| | 295,000 | | 8.875%, 1/15/2015 | | | 305,325 |

| | | Level 3 Communications, Inc., Convertible | | | |

| | 50,000 | | 5.250%, 12/15/2011 | | | 47,438 |

| | 60,000 | | 3.500%, 6/15/2012 | | | 52,500 |

| | | Level 3 Financing, Inc. | | | |

| | 470,000 | | 9.250%, 11/1/2014 | | | 444,150 |

| | | Nielsen Finance, LLC/Nielsen Finance Company | | | |

| | 150,000 | | 10.000%, 8/1/2014 | | | 156,375 |

| | | PAETEC Holding Corporation | | | |

| | 50,000 | | 9.500%, 7/15/2015 | | | 48,125 |

| | 180,000 | | 8.875%, 6/30/2017 | | | 182,250 |

| | | Quebecor Media, Inc. | | | |

| | 420,000 | | 7.750%, 3/15/2016 | | | 418,950 |

| | | Qwest Communications International, Inc. | | | |

| | 280,000 | | 7.250%, 2/15/2011 | | | 281,400 |

| | | R.H. Donnelley Corporation | | | |

| | 300,000 | | 6.875%, 1/15/2013g | | | 28,125 |

| | | R.H. Donnelley, Inc. | | | |

| | 9,000 | | 11.750%, 5/15/2015c,g | | | 7,425 |

| | | Sprint Capital Corporation | | | |

| | 290,000 | | 8.375%, 3/15/2012 | | | 300,150 |

| | | Sprint Nextel Corporation | | | |

| | 230,000 | | 8.375%, 8/15/2017 | | | 234,600 |

| | | Time Warner Cable, Inc. | | | |

| | 450,000 | | 8.250%, 4/1/2019 | | | 535,992 |

| | | Videotron Ltee | | | |

| | 390,000 | | 6.875%, 1/15/2014 | | | 391,950 |

| | | Virgin Media Finance plc | | | |

| | 240,000 | | 9.125%, 8/15/2016 | | | 252,900 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

20

Diversified Income Plus Fund

Schedule of Investments as of December 31, 2009

| | | | | | |

Principal

Amount | | Long-Term Fixed Income (63.5%) | | Value |

| | Communications Services (5.5%) - continued | | | |

| $ | 90,000 | | 8.375%, 10/15/2019 | | $ | 92,587 |

| | | Wind Acquisition Finance SA | | | |

| | 180,000 | | 11.750%, 7/15/2017c | | | 196,650 |

| | | Wind Acquisition Holdings Finance SPA | | | |

| | 110,000 | | 12.250%, 7/15/2017c | | | 108,350 |

| | | Windstream Corporation | | | |

| | 1,000,000 | | 7.875%, 11/1/2017c,f | | | 987,500 |

| | | | | | |

| | | Total Communications Services | | | 7,757,217 |

| | | | | | |

| |