UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05083

WORLDWIDE INSURANCE TRUST - WORLDWIDE ABSOLUTE RETURN FUND

(Exact name of registrant as specified in charter)

99 Park Avenue, New York, NY 10016

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

99 PARK AVENUE, NEW YORK, NY 10016

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 687-5200

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2008

Item 1. REPORT TO SHAREHOLDERS.

SEMI-ANNUAL REPORT

J U N E 3 0 , 2 0 0 8

( u n a u d i t e d )

Worldwide Insurance Trust

WORLDWIDE ABSOLUTE RETURN FUND

The information in the shareholder letter represents the personal opinions of the management team members and may differ from those of other portfolio managers or of the firm as a whole. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the views of the management team members are as of June 30, 2008, and are subject to change.

Dear Shareholder:

The Initial Class shares of the Van Eck Worldwide Absolute Return Fund produced a total return of 0.22% for the six months ended June 30, 2008. In comparison, the Fund’s benchmark, the Citigroup Three-Month U.S. Treasury Bill Index,1 returned 1.11% for the same period.

The first half of 2008 was extremely volatile for economies and financial markets worldwide, driven by continued weakness in the housing and credit markets, fallout from the subprime mortgage crisis and record-breaking oil prices. Global inflation, due in large part to commodity price increases, a weak U.S. dollar and troubles in the financial sector also contributed to the downturn. The financial sector’s troubles were perhaps seen most dramatically in the headlines made by Bear Stearns and Countrywide Financial, but were felt as well by a slate of other major Wall Street players and European banks.

In the U.S., equity markets rode something of a roller coaster over the six months, ending June with double-digit declines. The U.S. Federal Reserve Board (“the Fed”) attempted to reinvigorate the U.S. economy by reducing the targeted federal funds rate four times over the period by a total of 2.25%. This brought the targeted federal funds rate to 2.00% by the end of April. The Fed announced at its subsequent meetings that it was holding the targeted federal funds rate steady, a statement widely considered to signal an end to the Fed’s easing cycle. Despite the Fed’s efforts, the housing and credit markets remained weak, which led to hundreds of billions of dollars of write-downs in the financial sector. At the same time, increasing demand for energy and raw materials worldwide, coupled with a weak U.S. dollar vs. most other major currencies, drove commodity prices higher. The European equity markets closely followed the U.S. equity market due to similar concerns in that region, including high exposure to the U.S. subprime mortgage market at many large European banks. Among emerging equity markets, China and India each lost more significant ground, due partly to the slowdown of U.S. and European markets, downturns in local exuberance and interest rate increases by their respective central banks in response to inflation and overheating local economies. Russia’s equity market was down far more modestly, given

the energy market boom that pushed the Russian economy higher during the period. Under such challenging market conditions, the Fund’s sub-advisers, as always, sought to find opportunities to exploit pricing disparities, market inefficiencies, anticipated securities price movements and/or cyclical relationships.

Market and Economic Review

The Fund’s major allocations were to U.S. equity market neutral and global asset allocation strategies. This section discusses market conditions for these investment areas.

Equity Market Neutral

During the first half of 2008, investors favored companies with attractive cash-flow-to-price and historical-earnings-to-price ratios, while avoiding companies with above-average trading volume. Companies with higher price momentum outperformed during the period, while those with above-average financial leverage as well as above-average dividend yields underperformed.

Global Asset Allocation

Impacting the investment markets most during the period was the ongoing global credit crisis, which, having entered its second summer, made investor optimism hard to find. More than $400 billion in write-downs and credit losses were recorded by banks since the subprime mortgage contamination appeared last year. By some estimates, financial institutions were more than halfway through the process of repair by the end of June, but it is still too early to say they are out of the woods. Soaring energy prices, declining housing values, higher unemployment and inflation worries also weighed on the global financial markets during the period. In fact, the Consumer Price Index (CPI) was measured at 5.0% year over year at June 30, 2008, the highest rate since May 1991. With this confluence of concerns, consumer confidence continued on its downward trend, recording its lowest level in 16 years.

The financial crisis clearly proved stubborn and self-reinforcing, and remained a major drag on global economic performance. At the same time—and for the record—global economies showed an admirable degree of resilience. Indeed, despite all the media commentary about the U.S. either being in, or entering, a recession, the domestic economy

1

continued to defy critics. First-quarter U.S. GDP stood at an annualized rate of 0.9%. This is lackluster growth, no doubt, but it is not recessionary. To compare, GDP growth in the Eurozone came in at an annualized rate of 2.1% in the first quarter of 2008. While superior to the U.S., the region’s economy was still impacted by the global credit crunch and by the strong euro. Faltering consumer demand amid soaring inflation, and the ripple effects of the U.S. slowdown followed the subprime crisis. Japanese GDP growth was a robust 4.0% for the first quarter of 2008 on an annualized basis. However, the world’s second-largest economy is widely anticipated to slow substantially in coming months as surging raw material prices, a 27-year high in its wholesale inflation, and the global economic slowdown take their toll.

From an investment perspective, fixed income investments significantly outperformed equities in this economic environment during the first half of 2008. Indeed, equity markets both in the U.S. and internationally, continued to experience great volatility. The fixed income market also gave investors a wild ride over the first half of 2008, as, for example, U.S. Treasury interest rates fell significantly during the first quarter only to retain its course in the second quarter. However, as the credit crisis flared and the U.S. economy slowed, investors heavily favored the safest of fixed income assets.

Manager Review

During the semi-annual period, assets were allocated to two of our five qualified sub-advisers, namely Analytic Investors and Lazard Asset Management. For the six month period ending June 30, Analytic Investors ranked in the middle of its equity market neutral peers and made a positive contribution to the Fund. Lazard Asset Management ranked in the top percentile of its global asset allocation peers but posted a modestly negative absolute return. Nevertheless, the Fund gained modest ground in absolute terms for the semi-annual period. The Fund, however, lagged its benchmark index on a relative basis. This section discusses both sub-advisers’ strategies and positioning during the semi-annual period.

Analytic Investors—Equity Market Neutral Strategy Analytic Investors’ process is based on the fundamental belief that there is persistency in the types of stock characteristics investors prefer. It also believes that portfolios that reflect these biases will add value in the long run. Investor behavior observed during the first six months of 2008 was consistent with that seen over recent years. As a result, Analytic’s investment process was effective, boosted primarily by an emphasis on companies with attractive valuation characteristics, such as above-average cash-flow-to-price ratios and relative earning yields. These companies generally performed well through the first half of the year. On the other hand, an emphasis on companies with above-average projected earnings yield dampened performance over the period, as investors penalized this growth characteristic.

For the semi-annual period, Analytic had strong stock selection within a majority of economic areas including energy, materials, industrials, consumer discretionary and consumer staples. Among the best performing stocks for this portion of the Fund was a short position in Bear Stearns (0.0% of Fund net assets as of June 30†). Shares of the financial services firm plunged to their lowest level in more than five years after suffering significant losses from the subprime mortgage crisis. Such losses brought Bear Stearns to the brink of bankruptcy before ultimately being acquired by JPMorgan Chase in a deal brokered by the Federal Reserve Board. A long position in Big Lots (1.8% of Fund net assets†) also contributed positively, as its shares jumped after the company raised its profit forecast. A short position in Apollo Group (0.9% of Fund net assets†), a for-profit education group, also added value to the Fund for the period, as the stock declined, following the broader market on General Electric’s lower-than-expected first quarter profit.

Another notable long position adding value to the Fund was Electronic Data Systems (EDS) (1.5% of Fund net assets†), a global business and technology services company. Its shares rallied after Hewlett-Packard announced that it had reached a deal with EDS to acquire the company for $25 a share; or a total of $13.9 billion.

2

Stock selection was weak within the utilities and telecommunication services sectors. Detracting from this portion of the Fund’s performance was a short position in chewing gum manufacturing leader Wm. Wrigley Jr. (0.0% of Fund net assets†). The company’s shares rose when confectionary giant Mars announced that it would be teaming up with billionaire Warren Buffet to purchase Wm. Wrigley Jr. A long position in Humana (0.7% of Fund net assets†), a Fortune 500 company that markets and administers health benefit consumer services, also negatively impacted performance during the semi-annual period. Humana’s share price dropped on news that the U.S. House of Representatives had approved a bill that would shave billions of dollars from health plans that contract with the federal Medicare program. A long position in Sun Microsystems (1.9% of Fund net assets†) further detracted from Fund performance. The multinational vendor of computer software and information technology services reported a net loss of $34 million and announced that it may cut up to 2,500 jobs.

Analytic intends to continue to emphasize stocks with attractive cash-flow-to-price ratios. Analytic also intends to focus on select companies with above-average five-month returns, while de-emphasizing companies with higher-than-average dividend yields. Analytic further anticipates continuing to seek to emphasize companies with above-average price momentum, while moving away from companies with high financial leverage and above-average trading volume.

Lazard Asset Management—

Global Asset Allocation Strategy

Lazard’s global asset allocation strategy seeks to take advantage of broad capital market opportunities on both a long and short position basis, with all decisions made in the context of a global macroeconomic viewpoint. The strategy is comprised of two components: 1) long alpha2 generating ideas and 2) short global market exposure. For the first half of 2008, Lazard’s strategy led to slightly negative absolute returns but enabled its portion of the Fund to perform well compared to its peers. Globally diversified in equity and fixed income markets primarily through exchange-traded funds (ETFs) and closed-end funds, this portion of the Fund was more heavily

weighted in global equities than in fixed income during the period. Lazard believed global equities were more attractive than fixed income securities from a total rate of return perspective.

Within this portion of the Fund’s equity exposure, the portfolio had an emphasis on clean and alternative energy, water infrastructure and commodities sectors. Overall, this strategy generated mixed results, as long positions in global water were down 3.0% for the semi-annual period, in clean energy were down 29.4% and in oil & gas services were up 21.1%. Long positions in the agribusiness industry performed well, up 7.8% for the six months ended June 30, 2008, but long positions in aerospace and defense were down 17.5% and in technology fell 10.6%. To the benefit of the Fund, the portfolio had limited exposure to the financials and consumer discretionary sectors, which lagged for the year.

More specifically, short positions in iShares MSCI EAFE Index Fund (1.9% of Fund net assets†) and in SPDR Trust Series 1 (1.9% of Fund net assets†) helped performance, as these ETFs were down 10.9% and 11.6%, respectively, for the period. The SPDR Trust holds all of the common stocks of the S&P 500 Index.3 In addition, long positions in MFS Intermediate Income Trust (1.4% of Fund net assets†), a closed-end bond fund, and in iShares Lehman MBS Fixed-Rate Bond Fund (1.4% of Fund net assets†), an investment grade agency mortgage-backed securities ETF, helped; they were up 7.6% and 1.3%, respectively, for the period. Hard and soft asset-related equity sector holdings were the star performers for the first half. Namely, long positions in DWS Global Commodities Stock Fund (up 15.3% for the six months ended June 30; 1.4% of Fund net assets†), First Trust ISE-Revere Natural Gas Index Fund (up 41.8%; 1.6% of Fund net assets†), iShares S&P North American Natural Resources Sector Index Fund (up 14.4%; 0.4% of Fund net assets†), Market Vectors-Agribusiness ETF (up 7.8%; 1.1% of Fund net assets†) and PowerShares Dynamic Oil & Gas Services Portfolio (up 21.1%; 1.9% of Fund net assets†) contributed most.

Detracting from this portion of the Fund’s performance were long positions in Market Vectors-Global Alternative Energy ETF (down 14.6%; 1.2% of Fund net assets†), PowerShares WilderHill Clean Energy ETF (down 29.4%; 1.1% of Fund net assets†)

3

and The China Fund, Inc. (down 19.7%; 0.8% of Fund net assets†). The China Fund is a closed-end management investment company investing primarily in companies and other entities with significant assets, investments, production activities, trading or other business interests in China, or which derive a significant part of their revenue from China.

During the period, Lazard did not change its investment biases dramatically, maintaining relatively neutral allocations across all major asset choices, a decision it considered sensible in a challenging global environment. That said, Lazard did make several measured adjustments geared to capture as much market upside as possible. Lazard remained slightly biased toward equities over fixed income and, within equities, biased toward growth stocks over value stocks. Lazard did not favor any particular segment across the capitalization spectrum. For the near term, Lazard intends to pursue opportunities to add value primarily on a regional and sector basis. Regionally, Lazard intends to reduce exposure to Europe, where policy advances in one set of EU countries have been regularly offset by policy deterioration in others. Asia, however, appears to be a relative bright spot. Focusing on the nations that are best suited to support China’s reconstruction, Lazard intends to increase its allocation to the region. Japan, by nature of the size of its economy and developed market strength, tops this list, although South Korea and Taiwan stand to benefit as well.

High-inflation commodity-exporting nations are attractive for their tendency to be faster-growing nations. Many Asian countries fit this bill, further supporting Lazard’s emphasis on the region. But several frontier markets are a fit here, too. The frontier markets of Vietnam, Bulgaria, Romania and many of the oil-exporting Persian Gulf countries are relatively illiquid and relatively high risk, but they can potentially offer a significant upside, a feature currently lacking in broader markets.

In terms of sectors, Lazard believes energy is a prudent choice. On the one hand, carbon-based fuels are in high demand and will likely continue to fetch a high price. On the other hand, the pending global move away from carbon-based fuels elevates the attractiveness of alternative energy investments, including nuclear, wind and solar. The “Catch 22”

here is that while persistent high oil prices elevate demand for newer energy technologies, there will be less demand to finance this transition during a global economic slowdown. Also, in partnership with the China reconstruction theme, the sub-adviser believes the materials, industrials and utilities sectors are relatively attractive. Financials also deserve notice. While the portfolio has had an underweighted exposure to financials, Lazard is alert to the scenario of a rebound in this sector once the credit crisis abates. As always, Lazard seeks absolute returns without attempting to minimize or eliminate market risk. Rather, Lazard seeks out the areas of the global capital markets where risk is attractively priced on a forward-looking, top-down view.

* * *

Going forward, our management team intends to continue analyzing new hedged strategies that might fit into the Fund’s absolute return objective, while carefully examining their suitability during current market cycles. As the Fund grows, we will seek to further diversify Fund assets among sub-advisers and seek to introduce event-driven, global overlay and arbitrage strategies as appropriate.

Since the sub-advisers will seek to employ aggressive investment strategies and techniques that may each be considered inherently risky and may employ techniques, strategies and analyses based on historic relationships, correlations, assumptions or the occurrence of certain events that may be disrupted, fail to exist or materialize, the Fund and you may lose money. In addition, a sub-adviser may incorrectly assess relative values or the relative values of securities may be affected by factors or events the sub-adviser failed to consider or anticipate.

Although the Fund believes that its policy of using multiple investment sub-advisers (rather than a single firm) that employ various absolute return strategies may mitigate losses in generally declining markets, there can be no assurance that losses will be avoided. You can lose money by investing in the Fund. Any investment in the Fund should be a part of an overall investment program rather than a complete program. The Fund and its sub-advisers will use aggressive investment strategies that are riskier than those used by traditional mutual funds. As a result, the Fund is subject to risks associated

4

with investments in foreign markets, emerging market securities, small cap companies, debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities, CMOs and other investment companies. The Fund is subject to risks associated with the sub-advisers making trading decisions independently, using a particular style or set of styles, basing investment decisions on historical relationships and correlations, trading frequently, using leverage, making short sales, being non-diversified and investing in securities with low correlation to the market. Please see the prospectus for information on these and other risk considerations.

We appreciate your continued investment in Van Eck Worldwide Absolute Return Fund, and we look forward to helping you meet your investment goals in the future.

Jan F. van Eck Investment Team Member |  Hao-Hung (Peter) Liao Investment Team Member |

July 22, 2008

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted. Investment return and value of shares of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the redemption of Fund shares. These returns do not take variable annuity/life fees and expenses into account. Performance information current to the most recent month end is available by calling 1.800.826.2333.

The Fund is only available to life insurance and annuity companies to fund their variable annuity and variable life insurance products. These contracts offer life insurance and tax benefits to the beneficial owners of the Fund. Your insurance or annuity company’s charges, fees and expenses for these benefits are not reflected in this report or in the Fund’s performance, since they are not direct expenses of the Fund. Had these fees been included, returns would have been lower. For insurance products, performance figures do not reflect the cost for insurance and if they did, the performance shown would be significantly lower. A review of your particular life and/or annuity contract will provide you with much greater detail regarding these costs and benefits

† All Fund assets referenced are Total Net Assets as of June 30, 2008.

All indices listed are unmanaged indices and do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

1 The Citigroup Three-Month U.S. Treasury Bill Index measures monthly return equivalents of yield averages that are not marked to the market. The Index represents an average of the last three three-month Treasury Bill issues, and returns are calculated on a monthly basis.

2 Alpha is a measure of volatility where the reasons for the volatility have to do with the inherent characteristics of a particular security as distinguished from market conditions. A stock with an alpha factor of 1.25 is projected to rise by 25% in a year on the strength of its inherent values such as growth in earnings per share and regardless of the performance of the market as a whole.

3 The S&P (Standard & Poor’s) 500 Index is calculated with dividends reinvested. The Index consists of 500 widely held common stocks covering industrial, utility, financial and transportation sectors.

5

| |

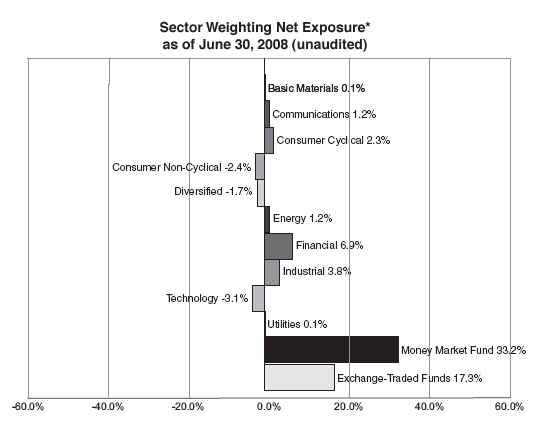

| * | Net exposure was calculated by adding long and short positions. |

6

Explanation of Expenses (unaudited)

Hypothetical $1,000 investment at beginning of period

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2008 to June 30, 2008.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as program fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Expenses Paid | |||||||||

| Beginning | Ending | During Period* | |||||||

| Account Value | Account Value | January 1, 2008- | |||||||

| January 1, 2008 | June 30, 2008 | June 30, 2008 | |||||||

| Initial Class | Actual | $1,000.00 | $1,002.20 | $16.86 | |||||

| Hypothetical** | $1,000.00 | $1,008.03 | $16.90 |

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2008) of 3.39%, multiplied by the average account value over the period, multiplied by 182 and divided by 366 (to reflect the one-half year period) |

| |

| ** | Assumes annual return of 5% before expenses. |

7

Schedule of Investments

June 30, 2008 (unaudited)

| Number | |||||

| of Shares | Value | ||||

| COMMON STOCKS: 52.3% | |||||

| Basic Materials 1.8% | |||||

| 1,842 | Ashland, Inc. | $ | 88,784 | ||

| 111 | Cabot Corp. | 2,698 | |||

| 1,164 | Rayonier, Inc. | 49,423 | |||

| 140,905 | |||||

| Communications: 4.2% | |||||

| 4,063 | Corning, Inc. | 93,652 | |||

| 727 | HLTH Corp. * | 8,230 | |||

| 12,046 | Interpublic Group of Cos, Inc. * | 103,596 | |||

| 1,954 | News Corp. * | 29,388 | |||

| 105 | Telephone & Data | ||||

| Systems, Inc. | 4,963 | ||||

| 1,511 | US Cellular Corp. * | 85,447 | |||

| 325,276 | |||||

| Consumer Cyclical: 7.4% | |||||

| 4,508 | Big Lots, Inc. * | 140,830 | |||

| 22,050 | Ford Motor Co. * | 106,061 | |||

| 669 | Hanesbrands, Inc. * | 18,157 | |||

| 618 | Ingram Micro, Inc. * | 10,970 | |||

| 22,947 | Rite Aid Corp. * | 36,486 | |||

| 7,037 | Southwest Airlines Co. | 91,762 | |||

| 371 | Steelcase, Inc. | 3,721 | |||

| 2,094 | Tech Data Corp. * | 70,966 | |||

| 2,342 | TRW Automotive Holdings | ||||

| Corp. * | 43,257 | ||||

| 3,325 | Wyndham Worldwide Corp. | 59,551 | |||

| 581,761 | |||||

Consumer Non-Cyclical: 11.0% | |||||

| 3,581 | AmerisourceBergen Corp. | 143,204 | |||

| 1,361 | Convergys Corp. * | 20,224 | |||

| 897 | H&R Block, Inc. | 19,196 | |||

| 1,142 | Health Management | ||||

| Associates, Inc. * | 7,434 | ||||

| 910 | Hertz Global Holdings, Inc. * | 8,736 | |||

| 1,463 | Humana, Inc. * | 58,184 | |||

| 1,672 | Manpower, Inc. | 97,377 | |||

| 349 | Mastercard, Inc. | 92,666 | |||

| 815 | McKesson Corp. | 45,567 | |||

| 1,426 | Medco Health Solutions, Inc. * | 67,307 | |||

| 1,691 | Quanta Services, Inc. * | 56,260 | |||

| 11,452 | Tenet Healthcare Corp. * | 63,673 | |||

| 12,246 | Tyson Foods, Inc. | 182,955 | |||

| 862,783 | |||||

| Number | |||||

| of Shares | Value | ||||

Energy: 1.3% | |||||

| 646 | Noble Energy, Inc. | $ | 64,962 | ||

| 409 | Pioneer Natural Resources Co. | 32,017 | |||

| 189 | Quicksilver Resources, Inc. * | 7,303 | |||

| 104,282 | |||||

Financial: 15.1% | |||||

| 14 | Alleghany Corp. * | 4,649 | |||

| 103 | AvalonBay Communities, Inc. | 9,184 | |||

| 1,428 | Boston Properties, Inc. | 128,834 | |||

| 10,068 | Charles Schwab Co. | 206,797 | |||

| 2,075 | China Fund, Inc. | 63,329 | |||

| 502 | Colonial Properties Trust | 10,050 | |||

| 789 | Discover Financial Services | 10,391 | |||

| 5,300 | DWS Global Commodities | ||||

| Stock Fund, Inc. | 107,590 | ||||

| 7,425 | Eaton Vance Limited Duration | ||||

| Income Fund | 107,440 | ||||

| 7 | First Citizens Bancorporation, | ||||

| Inc. | 976 | ||||

| 728 | GLG Partners, Inc. | 5,678 | |||

| 3,908 | Janus Capital Group, Inc. * | 103,445 | |||

| 346 | Jones Lang LaSalle, Inc. | 20,826 | |||

| 17,925 | MFS Intermediate Income Trust | 111,852 | |||

| 39,850 | MFS Multimarket Income Trust | 227,144 | |||

| 1,154 | NASDAQ OMX Group, Inc. * | 30,639 | |||

| 759 | NYSE Euronext, Inc. | 38,451 | |||

| 6 | Service Corp. International | 59 | |||

| 1,187,334 | |||||

Industrial: 5.6% | |||||

| 691 | Applera Corp-Applied | ||||

| Biosystems Group | 23,135 | ||||

| 413 | Arrow Electronics, Inc. * | 12,687 | |||

| 109 | Avnet, Inc. * | 2,974 | |||

| 1,327 | Boeing Co. | 87,210 | |||

| 1,012 | C.H. Robinson Worldwide, Inc. | 55,498 | |||

| 615 | Crown Holdings, Inc. * | 15,984 | |||

| 580 | FedEx Corp. | 45,698 | |||

| 1,783 | KBR, Inc. | 62,245 | |||

| 225 | Molex, Inc. | 5,492 | |||

| 4,505 | Nalco Holding Co. | 95,281 | |||

| 283 | Snap-On, Inc. | 14,719 | |||

| 157 | Timken Co. | 5,172 | |||

| 1,566 | Vishay Intertechnology, Inc. * | 13,890 | |||

| 439,985 | |||||

See Notes to Financial Statements

8

Schedule of Investments

June 30, 2008 (unaudited) (continued)

| Number | |||||

| of Shares | Value | ||||

Technology: 4.3% | |||||

| 4,695 | Electronic Data Systems Corp. | $ | 115,685 | ||

| 13,647 | Sun Microsystems, Inc. * | 148,479 | |||

| 564 | Synopsis, Inc. * | 13,485 | |||

| 135 | Texas Instruments, Inc. | 3,802 | |||

| 13,731 | Unisys Corp. * | 54,237 | |||

| 335,688 | |||||

| Transportation: 0.0% | |||||

| 155 | UTI Worldwide, Inc. | 3,092 | |||

Utilities: 1.6% | |||||

| 5,778 | Reliant Energy, Inc. * | 122,898 | |||

| Total Common Stocks | |||||

| (Cost: $4,353,000)(a) | 4,104,004 | ||||

| EXCHANGE TRADED FUNDS: 21.1% | |||||

| 3,925 | First Trust ISE-Revere Natural | ||||

| Gas Index Fund | 123,638 | ||||

| 2,625 | iShares DJ Select Dividend | ||||

| Index Fund | 69,773 | ||||

| 950 | iShares iBoxx High Yield | ||||

| Corporate Bond Fund | 89,300 | ||||

| 1,100 | iShares Lehman MBS | ||||

| Fixed-Rate Bond Fund | 111,342 | ||||

| 1,075 | iShares MSCI Brazil Index | ||||

| Fund | 96,309 | ||||

| 400 | iShares S&P Global Materials | ||||

| Index Fund | 33,188 | ||||

| 225 | iShares S&P North America | ||||

| Natural Resources Sector | |||||

| Index Fund | 34,479 | ||||

| 900 | iShares S&P National Muni | ||||

| Bond Fund | 89,541 | ||||

| 1,425 | Market Vectors Agribusiness | ||||

| ETF * | 88,279 | ||||

| 1,875 | Market Vectors Global | ||||

| Alternative Energy ETF * | 96,056 | ||||

| 4,625 | PowerShares Aerospace & | ||||

| Defense Portfolio | 86,164 | ||||

| 4,400 | PowerShares Dynamic Oil & | ||||

| Gas Services Portfolio | 147,795 | ||||

| 4,000 | PowerShares Dynamic | ||||

| Technology Sector Portfolio * | 97,640 | ||||

| 4,025 | PowerShares Global Nuclear | ||||

| Energy Portfolio * | 110,688 | ||||

| 4,700 | PowerShares Water | ||||

| Resources Portfolio | 97,760 | ||||

| 4,550 | Powershares WilderHill Clean | ||||

| Energy ETF * | 88,953 | ||||

| Number | ||||||

| of Shares | Value | |||||

| EXCHANGE TRADED FUNDS: (continued) | ||||||

| 3,625 | SPDR Financial Select Sector | |||||

| Fund | $ | 73,442 | ||||

| 1,600 | SPDR Lehman International | |||||

| Treasury Bond ETF | 88,160 | |||||

| 575 | Vanguard Pacific Stock ETF | 36,104 | ||||

| Total Exchange Traded Funds | ||||||

| (Cost: $1,620,868)(a) | 1,658,611 | |||||

| MONEY MARKET FUND: 33.2% | ||||||

| (Cost: $2,608,798) | ||||||

| AIM Treasury Portfolio - | ||||||

| 2,608,798 | Institutional Class | 2,608,798 | ||||

| Total Investments: 106.6% | 8,371,413 | |||||

| (Cost $8,582,666) | ||||||

| Other assets less liabilities: (6.6)% | (515,415 | ) | ||||

| NET ASSETS: 100.0% | $ | 7,855,998 | ||||

| SECURITIES SOLD SHORT: (47.7)% | ||||||

| COMMON STOCKS: (43.9)% | ||||||

| Basic Materials (1.7)% | ||||||

| (6,781 | ) | Louisiana-Pacific Corp. | $ | (57,571 | ) | |

| (325 | ) | Southern Copper Corp. | (34,655 | ) | ||

| (750 | ) | Weyerhaeuser Co. | (38,355 | ) | ||

| (130,581 | ) | |||||

| Communication (3.0)% | ||||||

| (1,732 | ) | Central European Media | ||||

| Enterprise Ltd. * | (156,798 | ) | ||||

| (431 | ) | Discover Holding Co. | ||||

| (Class A) * | (9,465 | ) | ||||

| (6,020 | ) | Sprint Nextel Corp. | (57,190 | ) | ||

| (835 | ) | Windstream Corp. | (10,304 | ) | ||

| (233,757 | ) | |||||

| Consumer Cyclical (5.1)% | ||||||

| (490 | ) | Abercrombie & Fitch Co. | (30,713 | ) | ||

| (2,669 | ) | AMR Corp. * | (13,665 | ) | ||

| (9,575 | ) | Circuit City Stores, Inc. | (27,672 | ) | ||

| (1,823 | ) | Copa Holdings S.A. | (51,336 | ) | ||

| (210 | ) | Copart, Inc. * | (8,992 | ) | ||

| (1,983 | ) | D.R.Horton, Inc. | (21,516 | ) | ||

| (269 | ) | Dick’s Sporting Goods, Inc. * | (4,772 | ) | ||

| (875 | ) | DreamWorks Animation | ||||

| SKG, Inc. * | (26,084 | ) | ||||

| (2,366 | ) | General Motors Corp. | (27,209 | ) | ||

| (2,636 | ) | KB Home | (44,627 | ) | ||

| (168 | ) | Las Vegas Sands Corp. * | (7,970 | ) | ||

| (1,596 | ) | Ryland Group, Inc. | (34,809 | ) | ||

| (4,174 | ) | The Home Depot, Inc. | (97,755 | ) | ||

| (397,120 | ) | |||||

See Notes to Financial Statements

9

Schedule of Investments

June 30, 2008 (unaudited) (continued)

| Number | ||||||

of Shares | Value | |||||

Consumer Non-Cyclical (13.4)% | ||||||

| (287 | ) | Alliance Data Systems Corp. * | $ | (16,230 | ) | |

| (1,529 | ) | Apollo Group, Inc. * | (67,674 | ) | ||

| (267 | ) | Brookdale Senior Living, Inc. | (5,436 | ) | ||

| (866 | ) | Cephalon, Inc. * | (57,754 | ) | ||

| (711 | ) | Clorox Co. | (37,114 | ) | ||

| (349 | ) | Colgate-Palmolive Co. | (24,116 | ) | ||

| (1,105 | ) | Cooper Cos, Inc. | (41,051 | ) | ||

| (1,671 | ) | Corporate Executive Board Co. | (70,266 | ) | ||

| (1,059 | ) | Dr. Pepper Snapple Group, Inc. * | (22,218 | ) | ||

| (1,618 | ) | H.J. Heinz Co. | (77,421 | ) | ||

| (73 | ) | Hansen Natural Corp. * | (2,104 | ) | ||

| (1,261 | ) | Hershey Co. | (41,335 | ) | ||

| (162 | ) | ITT Educational Services, Inc. * | (13,386 | ) | ||

| (673 | ) | Kellogg Co. | (32,317 | ) | ||

| (2,257 | ) | LifePoint Hospitals, Inc. * | (63,873 | ) | ||

| (142 | ) | Lorillard, Inc. * | (9,821 | ) | ||

| (2,187 | ) | Merck & Co., Inc. | (82,428 | ) | ||

| (13,422 | ) | Mylan, Inc. | (162,003 | ) | ||

| (2,840 | ) | Paychex, Inc. | (88,835 | ) | ||

| (296 | ) | UST, Inc. | (16,164 | ) | ||

| (800 | ) | Weight Watchers International, | ||||

| Inc. | (28,488 | ) | ||||

| (375 | ) | Whole Foods Market, Inc. | (8,884 | ) | ||

| (1,733 | ) | Wyeth | (83,115 | ) | ||

| (1,052,033 | ) | |||||

Diversified (1.7)% | ||||||

| (2,895 | ) | Leucadia National Corp. | (135,891 | ) | ||

Energy (0.1)% | ||||||

| (32 | ) | First Solar, Inc. * | (8,730 | ) | ||

Financial (8.2)% | ||||||

| (2,620 | ) | American International Group, | ||||

| Inc. | (69,325 | ) | ||||

| (1,083 | ) | CapitalSource, Inc. | (12,000 | ) | ||

| (4,728 | ) | Citigroup, Inc. | (79,241 | ) | ||

| (280 | ) | Conseco, Inc. * | (2,778 | ) | ||

| (1,785 | ) | Fannie Mae | (34,825 | ) | ||

| (3,433 | ) | First Horizon National Corp. | (25,507 | ) | ||

| (3,304 | ) | Jefferies Group, Inc. | (55,573 | ) | ||

| (2,125 | ) | Lehman Brothers Holdings, Inc. | (42,096 | ) | ||

| (4,491 | ) | MBIA, Inc. * | (19,715 | ) | ||

| (3,003 | ) | Merrill Lynch & Co., Inc. | (95,225 | ) | ||

| (1,757 | ) | Morgan Stanley | (63,375 | ) | ||

| (3,363 | ) | PMI Group, Inc. | (6,558 | ) | ||

| (3,688 | ) | SLM Corp. * | (71,363 | ) | ||

| (2,693 | ) | Sovereign Bancorp, Inc. | (19,820 | ) | ||

| (249 | ) | Ventas, Inc. | (10,600 | ) | ||

| (4,582 | ) | Washington Mutual, Inc. | (22,589 | ) | ||

| (485 | ) | XL Capital Ltd. (Class A) | (9,972 | ) | ||

| (640,562 | ) | |||||

| Number | ||||||

of Shares | Value | |||||

Industrial (1.8)% | ||||||

| (102 | ) | Aircastle, Ltd. | $ | (858 | ) | |

| (142 | ) | Alliant Techsystems, Inc. * | (14,439 | ) | ||

| (319 | ) | Eagle Materials Inc. | (8,080 | ) | ||

| (44 | ) | Foster Wheeler Ltd. * | (3,219 | ) | ||

| (4,737 | ) | Gentex Corp. | (68,402 | ) | ||

| (134 | ) | Packaging Corp. of America | (2,882 | ) | ||

| (232 | ) | Stericycle, Inc. * | (11,994 | ) | ||

| (462 | ) | Teekay Corp. | (20,873 | ) | ||

| (81 | ) | Waters Corp. * | (5,224 | ) | ||

| (277 | ) | Zebra Technologies Corp. * | (9,041 | ) | ||

| (145,012 | ) | |||||

Technology (7.4)% | ||||||

| (948 | ) | Apple Computers, Inc. * | (158,733 | ) | ||

| (77 | ) | Diebold, Inc. | (2,740 | ) | ||

| (51 | ) | Dun & Bradstreet Corp. | (4,470 | ) | ||

| (321 | ) | Fiserv, Inc. * | (14,564 | ) | ||

| (2,338 | ) | Lam Research Corp. * | (84,519 | ) | ||

| (5,266 | ) | Linear Technology Corp. | (171,514 | ) | ||

| (23 | ) | MEMC Electronic Materials, | ||||

| Inc. * | (1,415 | ) | ||||

| (3,559 | ) | Pitney Bowes, Inc. | (121,362 | ) | ||

| (1,204 | ) | Seagate Technology | (23,033 | ) | ||

| (582,350 | ) | |||||

Utilities (1.5)% | ||||||

| (1,228 | ) | Mirant Corp. * | (48,076 | ) | ||

| (1,313 | ) | PPL Corp. | (68,630 | ) | ||

| (116,706 | ) | |||||

| Total Common Stocks Sold Short | ||||||

| (Proceeds: $4,016,627) | (3,442,742 | ) | ||||

EXCHANGE TRADED FUNDS: (3.8)% | ||||||

| (2,125 | ) | iShares MSCI EAFE Index | ||||

| Fund | (145,924 | ) | ||||

| (1,175 | ) | SPDR Trust, Series 1 | (150,377 | ) | ||

| Total Exchange Traded Funds Sold Short | (296,301 | ) | ||||

| (Proceeds: $328,124) | ||||||

| Total Securities Sold Short | ||||||

| (Proceeds: $4,344,751) | $ | (3,739,043 | ) | |||

| * | Non-income producing |

| (a) | Securities segregated for securities sold short with a market value of $5,762,615. |

See Notes to Financial Statements

10

Statement of Assets and Liabilities

June 30, 2008 (unaudited)

| Assets: | ||||

| Investments at value (Cost: $8,582,666) | $ | 8,371,413 | ||

| Receivables: | ||||

| Securities sold short | 3,295,463 | |||

| Investment securities sold | 22,954 | |||

| Shares of beneficial interest sold | 167 | |||

| Dividends and interest | 2,716 | |||

| Prepaid expenses | 2,135 | |||

| Total assets | 11,694,848 | |||

| Liabilities: | ||||

| Payables: | ||||

| Securities sold short (proceeds $4,344,751) | 3,739,043 | |||

| Dividends on securities sold short | 3,788 | |||

| Shares of beneficial interest redeemed | 43,735 | |||

| Due to Adviser | 9,368 | |||

| Deferred Trustee fees | 681 | |||

| Accrued expenses | 42,235 | |||

| Total liabilities | 3,838,850 | |||

| NET ASSETS | $ | 7,855,998 | ||

| Shares of beneficial interest outstanding | 754,754 | |||

| Net asset value, redemption and offering price per share | $10.41 | |||

| Net Assets consist of: | ||||

| Aggregate paid in capital | $ | 7,433,349 | ||

| Unrealized appreciation of investments and securities sold short | 394,455 | |||

| Accumulated net investment loss | (14,364 | ) | ||

| Undistributed net realized gain on investments and securities sold short | 42,558 | |||

| $ | 7,855,998 |

See Notes to Financial Statements

11

Statement of Operations

Six Months Ended June 30, 2008 (unaudited)

| Income: | ||||||||

| Dividends | $ | 41,804 | ||||||

| Interest | 73,191 | |||||||

| Total income | 114,995 | |||||||

| Expenses: | ||||||||

| Management fees | $ | 98,313 | ||||||

| Dividends on securities sold short | 41,948 | |||||||

| Professional fees | 9,244 | |||||||

| Reports to shareholders | 6,722 | |||||||

| Transfer agent fees | 6,326 | |||||||

| Custodian fees | 2,889 | |||||||

| Insurance | 1,820 | |||||||

| Trustees’ fees and expenses | 344 | |||||||

| Other | 1,292 | |||||||

| Total expenses | 168,898 | |||||||

| Waiver of management fees | (32,822 | ) | ||||||

| Expense offset arising from credits on cash balances maintained with custodian | (2,889 | ) | ||||||

| Net expenses | 133,187 | |||||||

| Net investment loss | (18,192 | ) | ||||||

| Realized and Unrealized Gain (Loss) on Investments: | ||||||||

| Net realized loss on investments sold | (186,939 | ) | ||||||

| Net realized gain on securities sold short | 281,294 | |||||||

| Net change in unrealized appreciation (depreciation) of investments | (388,237 | ) | ||||||

| Net change in unrealized appreciation (depreciation) on securities sold short | 336,527 | |||||||

| Net realized and unrealized gain on investments | 42,645 | |||||||

| Net Increase in Net Assets Resulting from Operations | $ | 24,453 | ||||||

See Notes to Financial Statements

12

Statements of Changes in Net Assets

Six Months | Year | |||||||

Ended | Ended | |||||||

June 30, | December 31, | |||||||

2008 | 2007 | |||||||

(unaudited) | ||||||||

| Operations: | ||||||||

| Net investment loss | $ | (18,192 | ) | $ | (40,162 | ) | ||

| Net realized gain on investments and securities sold short | 94,355 | 301,743 | ||||||

| Net change in unrealized appreciation (depreciation) of investments and | ||||||||

| securities sold short | (51,710 | ) | 18,463 | |||||

| Net increase in net assets resulting from operations | 24,453 | 280,044 | ||||||

| Dividends and distributions to shareholders: | ||||||||

| Dividends from net investment income | (7,822 | ) | (55,418 | ) | ||||

| Distributions from net realized capital gains | (250,305 | ) | (190,499 | ) | ||||

| Total dividends and distributions | (258,127 | ) | (245,917 | ) | ||||

| Share transactions*: | ||||||||

| Proceeds from sales of shares | 1,481,377 | 2,645,220 | ||||||

| Reinvestment of dividends and distributions | 258,127 | 245,917 | ||||||

| Cost of shares redeemed | (1,118,671 | ) | (2,682,757 | ) | ||||

| Net increase in net assets resulting from share transactions | 620,833 | 208,380 | ||||||

| Total increase in net assets | 387,159 | 242,507 | ||||||

| Net Assets: | ||||||||

| Beginning of period | 7,468,839 | 7,226,332 | ||||||

| End of period (including undistributed (accumulated) net investment | ||||||||

| income (loss) of $(14,364) and $11,650, respectively) | $ | 7,855,998 | $ | 7,468,839 | ||||

| * Shares of beneficial interest issued, reinvested and redeemed | ||||||||

| (unlimited number of $.001 par value shares authorized): | ||||||||

| Shares sold | 142,195 | 245,586 | ||||||

| Shares reinvested | 25,813 | 23,376 | ||||||

| Shares redeemed | (109,599 | ) | (252,129 | ) | ||||

| Net increase | 58,409 | 16,833 | ||||||

See Notes to Financial Statements

13

Statement of Cash Flows

Six Months Ended June 30, 2008 (unaudited)

| Cash flows from operating activities | ||||

| Net increase in net assets resulting from operations | $ | 24,453 | ||

| Adjustments to reconcile net increase in net assets resulting from operations | ||||

| to net cash used in operating activities: | ||||

| Purchases of long term securities | (5,909,194 | ) | ||

| Proceeds from sale of long term securities | 5,416,649 | |||

| Purchase of short term investments | (1,321,168 | ) | ||

| Proceeds of short sales of long term securities | 5,272,599 | |||

| Purchases of short sale covers of long term securities | (4,938,195 | ) | ||

| Increase in receivable from broker | (334,646 | ) | ||

| Decrease in dividends and interest receivable | 79,333 | |||

| Increase in prepaid expenses and other assets | (246 | ) | ||

| Decrease in dividends payable on securities sold short | (9,824 | ) | ||

| Decrease in accrued expenses | (7,002 | ) | ||

| Increase in deferred Trustee fees | 167 | |||

| Increase in due to Adviser | 2,327 | |||

| Net realized gain from investments and securities sold short | (94,355 | ) | ||

| Change in unrealized appreciation of investments | 51,710 | |||

| Net cash used in operating activities | (1,767,392 | ) | ||

| Cash flows from financing activities | ||||

| Proceeds from sales of shares | 1,481,224 | |||

| Cost of shares reacquired | (1,120,014 | ) | ||

| Net cash provided by financing activities | 361,210 | |||

| Net decrease in cash | (1,406,182 | ) | ||

| Cash, beginning of period | 1,406,182 | |||

| Cash, end of period | $ | 0 | ||

| Supplemental disclosure of cash flow information: | ||||

| Short sale dividends paid during the period | $ | 51,772 | ||

See Notes to Financial Statements

14

Financial Highlights

For a share outstanding throughout the period:

| Six Months | ||||||||||||||||||||||||||

Ended | May 1, 2003* | |||||||||||||||||||||||||

June 30, | Year Ended December 31, | to | ||||||||||||||||||||||||

2008 | December 31, | |||||||||||||||||||||||||

(unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 10.73 | $ | 10.63 | $ | 9.85 | $ | 9.84 | $ | 10.02 | $ | 10.00 | ||||||||||||||

| Income (Loss) from Investment | ||||||||||||||||||||||||||

| Operations: | ||||||||||||||||||||||||||

| Net Investment Income (Loss) | (0.03 | ) | (0.06 | ) | 0.08 | (0.01 | ) | (0.14 | ) | (0.03 | ) | |||||||||||||||

| Net Realized and Unrealized | ||||||||||||||||||||||||||

| Gain on Investments | 0.04 | 0.52 | 0.77 | 0.02 | 0.11 | 0.05 | ||||||||||||||||||||

| Total from Investment Operations | 0.01 | 0.46 | 0.85 | 0.01 | (0.03 | ) | 0.02 | |||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Dividends from Net Investment | ||||||||||||||||||||||||||

| Income | (0.01 | ) | (0.08 | ) | — | — | — | — | ||||||||||||||||||

| Distributions from Net Realized | ||||||||||||||||||||||||||

| Capital Gains | (0.32 | ) | (0.28 | ) | (0.07 | ) | — | (0.15 | ) | — | ||||||||||||||||

| Total Dividends and Distributions | (0.33 | ) | (0.36 | ) | (0.07 | ) | — | (0.15 | ) | — | ||||||||||||||||

| Net Asset Value, End of Period | $ | 10.41 | $ | 10.73 | $ | 10.63 | $ | 9.85 | $ | 9.84 | $ | 10.02 | ||||||||||||||

| Total Return (a) | 0.22 | %(d) | 4.35 | % | 8.76 | % | 0.10 | % | (0.30 | )% | 0.20 | %(d) | ||||||||||||||

| Ratios/Supplementary Data | ||||||||||||||||||||||||||

| Net Assets, End of Period (000) | $ | 7,856 | $ | 7,468 | $ | 7,226 | $ | 6,138 | $ | 5,469 | $ | 5,922 | ||||||||||||||

| Ratio of Gross Expenses to Average | ||||||||||||||||||||||||||

| Net Assets | 4.29 | %(c) | 5.32 | % | 3.72 | % | 4.64 | % | 5.00 | % | 7.06 | %(c) | ||||||||||||||

| Ratio of Net Expenses to Average | ||||||||||||||||||||||||||

| Net Assets (b) | 3.39 | %(c) | 4.13 | % | 3.16 | % | 3.47 | % | 3.46 | % | 3.09 | %(c) | ||||||||||||||

| Ratio of Net Investment Income (Loss) | ||||||||||||||||||||||||||

| to Average Net Assets | (0.46 | )%(c) | (0.50 | )% | 0.72 | % | (0.08 | )% | (1.45 | )% | (0.57 | )%(c) | ||||||||||||||

| Portfolio Turnover Rate | 110 | %(d) | 207 | % | 187 | % | 140 | % | 126 | % | 63 | %(d) | ||||||||||||||

| |

| (a) | Total return is calculated assuming an initial investment of $10,000 made at the net asset value at the beginning of the period, reinvestment of any dividends and distributions at net asset value on the dividend/distribution payment date and a redemption on the last day of the period. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends/distributions or the redemption of Fund shares. |

| (b) | Excluding dividends on securities sold short, the ratio of net expenses to average net assets would be 2.32%, 2.50%, 2.48%, 2.50%, 2.50% and 2.23% for the periods ended June 30, 2008, December 31, 2007, December 31, 2006, December 31, 2005, December 31, 2004 and December 31, 2003, respectively. |

| (c) | Annualized |

| (d) | Not annualized |

| * | Commencement of operations |

See Notes to Financial Statements

15

Notes To Financial Statements

June 30, 2008 (unaudited)

Note 1—Fund Organization—Van Eck Worldwide Insurance Trust (the “Trust”), is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on January 7, 1987. The Worldwide Absolute Return Fund (the “Fund”) is a non-diversified series of the Trust and seeks to achieve consistent absolute (positive) returns in various market cycles.

Note 2—Significant Accounting Policies—The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that effect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

A. Security Valuation—Securities traded on national exchanges or on the NASDAQ National Market System are valued at the last sales price as reported at the close of each business day. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ official closing price. Over-the-counter securities not included in the NASDAQ National Market System and listed securities for which no sale was reported are valued at the mean of the bid and ask prices. Short-term obligations purchased with more than sixty days remaining to maturity are valued at market value. Short-term obligations purchased with sixty days or less to maturity are valued at amortized cost, which with accrued interest approximates market value. Futures contracts are valued using the closing price reported at the close of the respective exchange. Securities for which quotations are not available are stated at fair value as determined by a Pricing Committee of the Adviser appointed by the Board of Trustees. Certain factors such as economic conditions, political events, market trends and security specific information are used to determine the fair value for these securities.

Adoption of Statement of Financial Accounting Standards No. 157 Fair Value Measurements (FAS 157) – In September 2006, the Financial Accounting Standards Board issued FAS 157 effective for fiscal years beginning after November 15, 2007. This standard clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements. The Fund has adopted FAS 157 as of January 1, 2008. The three levels of the fair value hierarchy under FAS 157 are described below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used to value the Fund’s investments as of June 30, 2008 is as follows:

| Level 2 | Level 3 | |||||

| Level 1 | Significant | Significant | Market | |||

| Quoted | Observable | Unobservable | Value of | |||

| Prices | Inputs | Inputs | Investments | |||

| $8,371,413 | None | None | $8,371,413 |

B. Federal Income Taxes—It is the Fund’s policy to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

C. Dividends and Distributions to Shareholders—Dividends from net investment income and distributions from net realized capital gains, if any, are declared and paid annually. Income dividends and capital gain distributions are determined in accordance with income tax regulations, which may differ from such amounts determined in accordance with U.S. generally accepted accounting principles.

D. Securities Sold Short—A short sale occurs when the Fund sells a security, which it does not own, by borrowing it from a broker. Proceeds from securities sold short are reported as liabilities on the Statement of Assets and Liabilities and are marked to market daily. Gains and losses are classified as realized when short positions are closed. In the event that the value of the security that the Fund sold short declines, the Fund will gain as it repurchases the security in the market at the lower price. If the price of the security increases, the Fund will suffer a loss, as it will have to repurchase the security at the higher price. Short sales may incur higher transaction costs than regular securities transactions. Dividends on short sales are recorded as an expense by the Fund on the ex-dividend date. Cash is deposited in a segregated account with brokers, maintained by the Fund, for its open short sales. Securities sold short at June 30, 2008 are reflected in the Schedule of Investments. Until the Fund replaces the borrowed security, the Fund maintains securities or permissible liquid assets in a segregated account with a broker or custodian sufficient to cover its short positions.

E. Other—Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premiums and discounts, is accrued as earned. Realized gains and losses are calculated on the identified cost basis.

16

Notes To Financial Statements (continued)

Note 3—Management Fees—Van Eck Associates Corporation (the “Adviser”) is the investment adviser to the Fund. The Adviser receives a management fee, calculated daily and payable monthly based on an annual rate of 2.50% of the Fund’s average daily net assets. For the period May 1, 2008 through April 30, 2009, the Adviser has agreed to waive management fees and/or assume expenses, excluding interest, taxes, dividends on securities sold short and extraordinary expenses, exceeding 1.95% of average daily net assets. For the period May 1, 2007 through April 30, 2008, the waiver was for expenses exceeding 2.50% of average daily net assets. For the six months ended June 30, 2008, the Adviser waived management fees in the amount of $32,822. Certain of the officers and trustees of the Trust are officers, directors or stockholders of the Adviser and Van Eck Securities Corporation, the Distributor.

As of June 30, 2008, the Fund had two sub-advisers, Analytic Investors, Inc. (“Analytic”) and Lazard Asset Management LLC (Lazard). The Adviser directly paid sub-advisory fees to Analytic and Lazard at a rate of 1.00% of the portion of the average daily net assets of the Fund managed by Analytic and Lazard.

Note 4—Investments—For the six months ended June 30, 2008, the cost of purchases and proceeds from sales of investments other than U.S. government securities and short-term obligations aggregated $5,909,194 and $5,416,649, respectively. For the six months ended June 30, 2008, proceeds of short sales and the cost of purchases of short sale covers aggregated $5,272,599 and $4,938,195, respectively.

Note 5—Income Taxes—For Federal income tax purposes, the identified cost of investments owned at June 30, 2008 was $8,629,059 and net unrealized depreciation aggregated $257,646 of which $309,666 related to appreciated securities and $567,312 related to depreciated securities.

The tax character of dividends and distributions paid to shareholders was as follows:

During the | During the | |||||||||

Six Months | Year | |||||||||

Ended | Ended | |||||||||

June 30, | December 31, | |||||||||

2008 | 2007 | |||||||||

| Ordinary income | $ | 7,822 | $ | 141,762 | ||||||

| Long term capital gains | 250,305 | 104,155 | ||||||||

| Total | $ | 258,127 | $ | 245,917 | ||||||

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how certain tax provisions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained by the applicable tax authority, and is applicable to all open tax years (tax

years ended December 31, 2005-2007). The Fund adopted the provisions of FIN 48, evaluated the tax positions taken and to be taken, and concluded that no provision for income tax is required in the Fund’s financial statements.

Note 6—Concentration of Risk—The Fund may invest in debt securities which are rated as below investment grade by rating agencies. Such securities involve more risk of default than do higher rated securities and are subject to greater price variability.

At June 30, 2008, Van Eck Securities Corp. owned approximately 18% of the outstanding shares of beneficial interest of the Fund. Additionally, the aggregate shareholder accounts of four insurance companies owned approximately 36%, 22%, 11% and 9% of the outstanding shares of beneficial interest of the Fund.

Note 7—Trustee Deferred Compensation Plan—The Trust has established a Deferred Compensation Plan (the “Plan”) for Trustees under which the Trustees can elect to defer receipt of their Trustee fees until retirement, disability or termination from the Board of Trustees. The fees otherwise payable to the participating Trustees are deemed invested in shares of the Van Eck Funds (another registered investment company managed by the Adviser) as directed by the Trustees.

The expense for the deferred compensation plan is included in “Trustees’ fees and expenses” in the Statement of Operations. The liability for the deferred compensation plan is shown as “Deferred Trustee fees” in the Statement of Assets and Liabilities.

Note 8—Regulatory Matters—In July 2004, the Adviser received a “Wells Notice” from the SEC in connection with the SEC’s investigation of market-timing activities. This Wells Notice informed the Adviser that the SEC staff was considering recommending that the SEC bring a civil or administrative action alleging violations of U.S. securities laws against the Adviser and two of its senior officers. Under SEC procedures, the Adviser has an opportunity to respond to the SEC staff before the staff makes a formal recommendation. The time period for the Adviser’s response has been extended until further notice from the SEC and, to the best knowledge of the Adviser, no formal recommendation has been made to the SEC to date. There cannot be any assurance that, if the SEC were to assess sanctions against the Adviser, such sanctions would not materially and adversely affect the Adviser. If it is determined that the Adviser or its affiliates engaged in improper or wrongful activity that caused a loss to a Fund, the Board of Trustees of the Funds will determine the amount of restitution that should be made to a Fund or its shareholders. At the present time, the amount of such restitution, if any, has not been determined. The Board and the Adviser are currently working to resolve outstanding issues relating to these matters.

17

WORLDWIDE ABSOLUTE RETURN FUND

Approval of Advisory and

Sub-Advisory Agreements

The Investment Company Act of 1940, as amended (the “1940 Act”), provides, in substance, that each investment advisory agreement between a fund and its investment adviser will continue in effect from year to year only if its continuance is approved at least annually by the Board of Trustees (the “Board”), including by a vote of a majority of the Trustees who are not “interested persons” of the Fund (“Independent Trustees”), cast in person at a meeting called for the purpose of considering such approval.

In considering the renewal of the investment advisory agreements, the Board, comprised exclusively of Independent Trustees, reviewed and considered information that had been provided by Van Eck Associates Corporation, the Fund’s Adviser (the “Adviser”) and the Fund’s sub-advisers (the “Sub-Advisers”), throughout the year at regular Board meetings, as well as information requested by the Board and furnished by the Adviser and the Sub-Advisers for the meetings of the Board held on June 11 and 12, 2008 (the “Meeting”) to specifically consider the renewal of the Fund’s investment advisory agreements. This information included, among other things, the following:

Information about the overall organization of the Adviser and the Adviser’s short-term and long-term business plan with respect to its mutual fund operations;

The Adviser’s consolidated financial statements for the past three fiscal years;

A description of the advisory and sub-advisory agreements with the Fund, their terms and the services provided thereunder;

Information regarding each Sub-Adviser’s organization, personnel, investment strategies and key compliance procedures;

Information concerning the Adviser’s compliance program, the resources devoted to compliance efforts undertaken by the Adviser and its affiliates on behalf of the Fund, and reports regarding a variety of compliance-related issues;

Comparative information concerning the fees and expenses of relevant peer funds with a management structure and investment strategies and techniques comparable to those of the Fund;

An analysis of the profitability of the Adviser with respect to the services it provides to the Fund and the Van Eck complex of mutual funds as a whole;

Reports with respect to the Adviser’s brokerage practices, including the benefits received by the Adviser from research acquired with soft dollars; and

Other information provided by the Adviser and each Sub-Adviser in response to a comprehensive questionnaire prepared by independent legal counsel on behalf of the Independent Trustees.

In considering whether to approve the investment advisory and sub-advisory agreements, the Board evaluated the following factors: (1) the quality, nature, cost and character of the investment management

services provided by the Sub-Advisers; (2) the capabilities and background of the Sub-Advisers’ investment personnel, and the overall capabilities, experience, resources and strengths of each Sub-Adviser and its affiliates in managing investment companies and other accounts utilizing similar investment strategies; (3) the quality, nature, cost and character of the administrative and other services provided by the Adviser and its affiliates, including its services in overseeing the services provided by each Sub-Adviser; (4) the quality, nature and extent of the services performed by the Adviser in interfacing with, and monitoring the services performed by, third parties, such as the Fund’s custodian, transfer agent, sub-accounting agent and independent auditors, and the Adviser’s commitment and efforts to review the quality and pricing of third party service providers to the Fund with a view to reducing non-management expenses of the Fund; (5) the terms of the advisory and sub-advisory agreements and the reasonableness and appropriateness of the particular fee paid by the Fund for the services described therein; (6) the profits, if any, realized by the Adviser from managing the Fund, in light of the services rendered and the costs associated with providing such services; (7) the Adviser’s willingness to reduce the cost of the Fund to shareholders from time to time by means of waiving a portion of its management fees or paying expenses of the Fund or by reducing fees from time to time; (8) the services, procedures and processes used to determine the value of Fund assets, and the actions taken to monitor and test the effectiveness of such services, procedures and processes; (9) the ongoing efforts of, and resources devoted by, the Adviser with respect to the development of a comprehensive compliance program and written compliance policies and procedures, and the implementation of recommendations of independent consultants with respect to a variety of compliance issues; (10) the responsiveness of the Adviser and its affiliated companies to inquiries from, and examinations by, regulatory agencies such as the Securities and Exchange Commission (“SEC”); (11) the Adviser’s record of compliance with its policies and procedures; and (12) the ability of the Adviser and each Sub-Adviser to attract and retain quality professional personnel to perform a variety of investment advisory and administrative services for the Fund.

The Board considered the fact that the Adviser had received in 2004 a Wells Notice from the SEC, as well as a request for information from the Office of the New York State Attorney General (“NYAG”), in connection with investigations concerning market timing and related matters. The Board determined that the Adviser has cooperated with the Board in connection with these matters and that the Adviser has taken appropriate steps to implement policies and procedures reasonably designed to prevent harmful market timing activities by investors in the Funds. In addition, the Board concluded that the Adviser has acted in good faith in providing undertakings to the Board to make restitution of damages, if any, that may have resulted from any prior wrongful actions of the Adviser.

The Board considered the fact that the Adviser is managing other investment products and vehicles, including exchange-traded funds, hedge funds and separate accounts, that invest in the same financial markets and are managed by the same investment professionals according to a similar investment strategy as certain of the Funds. The Board concluded that the management of these products contributes to the Adviser’s financial stability and is helpful to the Adviser in

18

attracting and retaining quality portfolio management personnel for the Funds. In addition, the Board concluded that the Adviser has established appropriate procedures to monitor conflicts of interest involving the management of the Funds and the other products and for resolving any such conflicts of interest in a fair and equitable manner.

In evaluating the investment performance of the Fund, the Board noted that the Fund had outperformed its benchmark index, on an annualized basis, for the two- and three-year periods ended December 31, 2007. On the basis of the foregoing and other relevant considerations, the Board concluded that the performance of the Fund was satisfactory.

When considering the fees and expenses of the Fund, the Board noted that the Fund’s expense ratio, net of waivers, was comparable to the expense ratios of relevant peer funds with a management structure and investment strategies and techniques similar to those of the Fund. The Board also noted that that the Fund is unique in its structure and investment strategy, and that the Adviser has agreed to waive and will continue to waive through April 2009 a portion of its management fee to limit the total expenses of the Fund. The Board concluded that the management fee charged to the Fund for advisory, sub-advisory and related services is reasonable and that the total expense ratio of the Fund is reasonable.

The Board noted that the Fund commenced its operations on May 1, 2003, and that the Adviser has not realized any profits with respect to the Fund since its commencement, and may not realize profits in the coming year. In view of the small size of the Fund and the fact that none of the Sub-Advisers is affiliated with the Adviser, the Board concluded that the profitability of the Sub-Advisers was not a relevant factor in its renewal deliberations regarding the Sub-Advisers. Similarly, the Board concluded that the Fund does not have sufficient assets for the Adviser or any Sub-Adviser to realize economies of scale for the foreseeable future, and, therefore, that the implementation of breakpoints would not be warranted at this time.

The Board considered additional factors with respect to Analytic Investors, Inc. (“Analytic”), Lazard Asset Management LLC (“Lazard”), Martingale Asset Management, L.P. and PanAgora Asset Management, Inc., the Fund’s Sub-Advisers. The Board noted that only Analytic and Lazard are currently managing a portion of the Fund’s assets. The Board concluded that each of the Sub-Advisers is qualified to manage the Fund’s assets in accordance with its respective investment objectives and policies, that each Sub-Adviser’s investment strategy is appropriate for pursuing the Fund’s investment objectives, and that the respective strategies of all the Sub-Advisers would be complementary in pursuing the Fund’s investment objective.

The Board also considered entering into a sub-advisory agreement with Stonebrook Capital Management, LLC (“Stonebrook”) to serve as an additional Sub-Adviser to the Fund. The Board reviewed and considered information that had been provided by the Adviser and Stonebrook at the Meeting. This information included, among other things, information about the Adviser’s short-term and long-term business plans with respect to the Fund; a description of the sub-advisory agreement with Stonebrook, its terms, and the services to be provided and fee to be paid to Stonebrook thereunder; and information regarding Stonebrook’s organization, personnel, investment strategies and key compliance procedures.

In considering whether to approve the sub-advisory agreement with Stonebrook, the Board evaluated the following factors: (1) the nature, extent and quality of the services to be provided by Stonebrook; (2) the capabilities and background of Stonebrook’s investment personnel, and the overall capabilities, experience, resources and strengths of Stonebrook in managing other accounts utilizing similar investment strategies; (3) the terms of the sub-advisory agreement with Stonebrook and the reasonableness and appropriateness of the particular fee to be paid for the services described therein; (4) the scalability of Stonebrook’s processes and procedures over time; and (5) the Fund’s structure and the manner in which Stonebrook’s investment strategy will assist the Fund in pursuing its investment objectives. The Board considered additional factors with respect to the Fund and its other Sub-Advisers. The Board concluded that it would be in the interest of the Fund to expand the range of allowable investments and Sub-Advisers for the Fund in pursuing its investment objective.

The Board concluded that Stonebrook is qualified to manage a portion of the Fund’s assets in accordance with its investment objectives and policies, and that Stonebrook’s investment strategy is appropriate for pursuing the Fund’s investment objectives.

The Board did not consider any single factor as controlling in determining whether or not to renew the investment advisory agreement. Nor are the items described herein all of the matters considered by the Board. Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, and assisted by the advice of its independent counsel, the Board concluded that the renewal of the investment advisory agreements, including the fee structures (described herein) is in the interests of shareholders, and accordingly, the Board approved the continuation of the advisory agreements for an additional one-year period.

19

| Investment Adviser: | Van Eck Associates Corporation | |

| Distributor: | Van Eck Securities Corporation | |

| 99 Park Avenue, New York, NY 10016 | ||

| www.vaneck.com | ||

| Account Assistance: | (800) 544-4653 |

This report must be preceded or accompanied by a Van Eck Worldwide Insurance Trust (the “Trust”) Prospectus, which includes more complete information. An investor should consider the investment objective, risks, and charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the investment company. Please read the prospectus carefully before investing.

Additional information about the Trust’s Board of Trustees/Officers and a description of the policies and procedures the Trust uses to determine how to vote proxies relating to portfolio securities are provided in the Statement of Additional Information. The Statement of Additional Information and information regarding how the Trust voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available, without charge, by calling 1.800.826.2333, or by visiting www.vaneck.com, or on the Securities and Exchange Commission’s website at http://www.sec.gov.

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Form N-Qs are available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1.800.SEC.0330. The Fund’s complete schedule of portfolio holdings is also available by calling 1.800.826.2333 or by visiting www.vaneck.com.

Item 2. CODE OF ETHICS.

Not applicable.

Item 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

Item 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

Item 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

Item 6. SCHEDULE OF INVESTMENTS.

Information included in Item 1.

Item 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

Item 8. PORTFOLIO MANAGER OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

Item 9. PURCHASE OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT

COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

Item 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No changes.

Item 11. CONTROLS AND PROCEDURES.

(a) The Chief Executive Officer and the Chief Financial Officer have concluded

that the Worldwide Absolute Return Fund disclosure controls and procedures

(as defined in Rule 30a-3(c) under the Investment Company Act) provide

reasonable assurances that material information relating to the Worldwide

Absolute Return Fund is made known to them by the appropriate persons,

based on their evaluation of these controls and procedures as of a date

within 90 days of the filing date of this report.

(b) There were no significant changes in the registrant's internal controls

over financial reporting or in other factors that could significantly

affect these controls over financial reporting subsequent to the date of

our evaluation.

Item 12. EXHIBITS.

(a)(1) Not applicable.

(a)(2) A separate certification for each principal executive officer and

principal financial officer of the registrant as required by Rule 30a-2

under the Act (17 CFR 270.30a-2) is attached as Exhibit 99.CERT.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is

furnished as Exhibit 99.906CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) WORLDWIDE INSURANCE TRUST - WORLDWIDE ABSOLUTE RETURN FUND

By (Signature and Title) /s/ Bruce J. Smith, SVP & CFO

-----------------------------

Date August 28, 2008

-------------------

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title) /s/ Keith J. Carlson, CEO

--------------------------

Date August 28, 2008

-------------------

By (Signature and Title) /s/ Bruce J. Smith, CFO

------------------------

Date August 28, 2008

-------------------