|

| |

NOTES TO FINANCIAL STATEMENTS |

(continued) |

months ended June 30, 2009, the Adviser waived management fees in the amount of $38,098. Certain of the officers and trustees of the Trust are officers, directors or stockholders of the Adviser and Van Eck Securities Corporation, the Distributor.

Note 4—Investments—For the six months ended June 30, 2009, there were no purchases and proceeds from sales of investments-other than short-term obligations aggregated $6,024,513.

Note 5—Income Taxes—For Federal income tax purposes, the identified cost of investments owned at June 30, 2009 was $36,033,365 and net unrealized appreciation aggregated $7,585,757 of which $8,103,509 related to appreciated securities and $517,752 related to depreciated securities.

The tax character of dividends paid to shareholders during the six months ended June 30, 2009 and the year ended December 31, 2008 consisted of ordinary income of $1,745,016 and $4,628,895, respectively.

The Financial Accounting Standards Board Interpretation No. 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained by the applicable tax authority, and is applicable to all open tax years (tax years ended December 31, 2005-2008). The Fund evaluated the tax positions taken and to be taken, and concluded that no provision for income tax is required in the Fund’s financial statements.

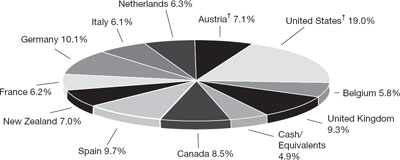

Note 6—Concentration of Risk—The Fund invests in foreign securities. Investments in foreign securities may involve a greater degree of risk than investments in domestic securities due to political, economic or social instability. Foreign investments may also be subject to foreign taxes and settlement delays. Since the Fund may have significant investments in foreign debt securities it may be subject to greater credit and interest risks and greater currency fluctuations than portfolios with significant investments in domestic debt securities.

At June 30, 2009, the aggregate shareholder accounts of two insurance companies own approximately 78% and 15% of the Initial Class Shares and one of whom owns approximately 100% of the Class R1 Shares.

Note 7—Forward Foreign Currency Contracts—The Fund is subject to foreign currency risk in the normal course of pursuing its investment objectives. The Fund may buy and sell forward foreign currency contracts to settle purchases and sales of foreign denominated securities or to hedge foreign denominated assets. The Fund may incur additional risk from investments in forward foreign currency contracts if the counterparty is unable to fulfill its

obligation or there are unanticipated movements of the foreign currency relative to the U.S. dollar. At June 30, 2009, the Fund had no outstanding forward foreign currency contracts.

Note 8—Trustee Deferred Compensation Plan—The Trust has a Deferred Compensation Plan (the “Plan”) for Trustees under which the Trustees can elect to defer receipt of their Trustee fees until retirement, disability or termination from the Board of Trustees. The fees otherwise payable to the participating Trustees are deemed invested in shares of the Van Eck Funds (another registered investment company managed by the Adviser) as directed by the Trustees.

The expense for the deferred compensation plan is included in “Trustees’ fees and expenses” in the Statement of Operations. The liability for the deferred compensation plan is shown as “Deferred Trustee fees” in the Statement of Assets and Liabilities.

Note 9—Custodian Fees—The Fund has entered into an expense offset agreement with its custodian wherein it receives credit toward the reduction of custodian fees whenever there are uninvested cash balances. For the six months ended June 30, 2009, there were no offsets of custodial fees.

Note 10—Bank Line of Credit—The Trust may participate with the Van Eck Funds (together the “Funds”) in a $10 million committed credit facility (“Facility”) to be utilized for temporary financing until the settlement of sales or purchases of portfolio securities, the repurchase or redemption of shares of the Funds, including the Fund, at the request of the shareholders and other temporary or emergency purposes. The Funds have agreed to pay commitment fees, pro rata, based on the unused but available balance. Interest is charged to the Funds at rates based on prevailing market rates in effect at the time of borrowings. During the period ended June 30, 2009, the Fund borrowed under this Facility. The average daily balance during the 53 day period during which the loan was outstanding amounted to $391,835 and the weighted average interest rate was 0.84%. At June 30, 2009, there were no outstanding borrowings by the Fund under the Facility.

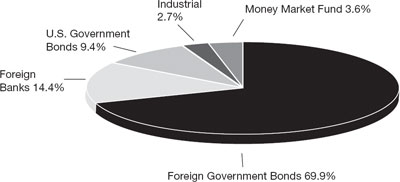

Note 11—Securities Lending—To generate additional income, the Fund may lend its securities pursuant to a securities lending agreement with State Street Bank & Trust Co., the securities lending agent and also the Fund’s custodian. The Fund may lend up to 50% of its investments requiring that the loan be continuously collateralized by cash, U.S. government or U.S. government agency securities, shares of an investment trust or mutual fund, or any combination of cash and such securities as collateral at all times to at least 102% (105% for foreign securities) of the market value plus accrued interest on

|

| |

NOTES TO FINANCIAL STATEMENTS |

(continued) |

the securities loaned. During the term of the loan, the Fund will continue to receive any interest or amounts equivalent thereto, on the securities while receiving a fee from the borrower or earning interest on the investment of the cash collateral. Securities lending income is disclosed as such in the Statement of Operations. The collateral for securities loaned is recognized in the Schedule of Investments and the Statement of Assets and Liabilities. The cash collateral is maintained on the Fund’s behalf by the lending agent and is invested in a money market portfolio. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the lender securities identical to the securities loaned. The Fund may pay reasonable finders’, administrative and custodial fees in connection with a loan of its securities and shares the interest earned on the collateral with the securities lending agent. The Fund bears the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially. For the six months ended June 30, 2009, there was no securities lending activity.

Subsequent Event Review—The Fund has adopted FASB Statement No.165, Subsequent Events (“FAS 165”) which was issued in May 2009 and is effective for fiscal years and interim periods ending after June 15, 2009. FAS 165, requires evaluation of subsequent events through the date of financial statement issuance. Subsequent events for the Fund have been evaluated through August 17, 2009, and there were no material subsequent events requiring disclosure.

|

| |

APPROVAL OF ADVISORY AGREEMENT |

The Investment Company Act of 1940, as amended, provides, in substance, that each investment advisory agreement between a fund and its investment advisers will continue in effect from year to year only if its continuance is approved at least annually by the Board of Trustees (the “Board”), including by a vote of a majority of the Trustees who are not “interested persons” of the Fund (“Independent Trustees”), cast in person at a meeting called for the purpose of considering such approval.

In considering the renewal of the Fund’s investment advisory agreement, the Board, which is comprised exclusively of Independent Trustees, reviewed and considered information that had been provided by the Adviser throughout the year at regular Board meetings, as well as information requested by the Board and furnished by the Adviser for the meetings of the Board held on May 19, 2009 and June 3 and 4, 2009 to specifically consider the renewal of the Fund’s investment advisory agreement. This information included, among other things, the following:

| | |

| • | Information about the overall organization of the Adviser and the Adviser’s short-term and long-term business plan with respect to its mutual fund operations; |

| | |

| • | The Adviser’s consolidated financial statements for the past three fiscal years; |

| | |

| • | A description of the advisory agreement with the Fund, its terms and the services provided thereunder; |

| | |

| • | Descriptions of the qualifications, education and experience of the individual investment professionals whose responsibilities include portfolio management and investment research for the Fund, and information relating to their compensation and responsibilities with respect to managing other mutual funds and investment accounts; |

| | |

| • | Presentations by the Adviser’s key investment personnel with respect to the Adviser’s investment strategies and general investment outlook in relevant markets, and the resources available to support the implementation of such investment strategies; |

| | |

| • | An independently prepared report comparing the management fees and non-investment management expenses of the Fund during its fiscal year ended December 31, 2008 with those of (i) the universe of funds with a similar investment strategy, offered in connection with variable insurance products (the “Expense Universe”), and (ii) a sub-group of the Expense Universe consisting of funds of comparable size and fees and expense structure (the “Peer Group”); |

|

| |

APPROVAL OF ADVISORY AGREEMENT |

(continued) |

| | |

| • | An independently prepared report comparing the Fund’s annualized investment performance for the one- through five-year periods ended December 31, 2008 with those of (i) the universe of funds with a similar investment strategy, offered in connection with variable insurance products (the “Performance Universe”), (ii) its Peer Group, and (iii) appropriate benchmark indices as identified by an independent data provider; |

| | |

| • | An analysis of the profitability of the Adviser with respect to the services it provides to the Fund and the Van Eck complex of mutual funds as a whole; |

| | |

| • | Information regarding other accounts and investment vehicles managed by the Adviser, their investment strategy, the net assets under management in each such account and vehicle, and the individuals that are performing investment management functions with respect to each such account and vehicle; |

| | |

| • | Information concerning the Adviser’s compliance program, the resources devoted to compliance efforts undertaken by the Adviser and its affiliates on behalf of the Fund, and reports regarding a variety of compliance-related issues; |

| | |

| • | Reports with respect to the Adviser’s brokerage practices, including the benefits received by the Adviser from research acquired with soft dollars; and |

| | |

| • | Other information provided by the Adviser in its response to a comprehensive questionnaire prepared by independent legal counsel on behalf of the Independent Trustees. |

In considering whether to approve the investment advisory agreement, the Board evaluated the following factors: (1) the quality, nature, cost and character of the investment management as well as the administrative and other non-investment management services provided by the Adviser and its affiliates; (2) the nature, quality and extent of the services performed by the Adviser in interfacing with, and monitoring the services performed by, third parties, such as the Fund’s custodian, transfer agent, sub-accounting agent and independent auditors, and the Adviser’s commitment and efforts to review the quality and pricing of third party service providers to the Fund with a view to reducing non-management expenses of the Fund; (3) the terms of the advisory agreement and the reasonableness and appropriateness of the particular fee paid by the Fund for the services described therein; (4) the Adviser’s willingness to reduce the cost of the Fund to shareholders from time to time by means of waiving a portion of its management fees or paying expenses of the Fund or by reducing fees

from time to time; (5) the services, procedures and processes used to determine the value of Fund assets, and the actions taken to monitor and test the effectiveness of such services, procedures and processes; (6) the ongoing efforts of, and resources devoted by, the Adviser with respect to the development of a comprehensive compliance program and written compliance policies and procedures, and the implementation of recommendations of independent consultants with respect to a variety of compliance issues; (7) the responsiveness of the Adviser and its affiliated companies to inquiries from, and examinations by, regulatory agencies such as the Securities and Exchange Commission; (8) the Adviser’s record of compliance with its policies and procedures; and (9) the ability of the Adviser to attract and retain quality professional personnel to perform investment advisory and administrative services for the Fund.

The Board considered the fact that the Adviser is managing other investment products and vehicles, including exchange-traded funds, hedge funds and separate accounts, that invest in the same financial markets and are managed by the same investment professionals according to a similar investment strategy as the Fund. The Board concluded that the management of these products contributes to the Adviser’s financial stability and is helpful to the Adviser in attracting and retaining quality portfolio management personnel for the Fund. In addition, the Board concluded that the Adviser has established appropriate procedures to monitor conflicts of interest involving the management of the Fund and the other products and for resolving any such conflicts of interest in a fair and equitable manner.

In evaluating the investment performance of the Fund, the Board noted that the Fund had outperformed, on an annualized basis, its Performance Universe average and its benchmark index for the one- through five-year periods ended December 31, 2008. The Board concluded that the performance of the Fund is satisfactory. When considering the fees and expenses of the Fund, the Board noted that, during 2008, the expense ratio, net of waivers, for the Fund, although higher than the median for its Expense Universe, was not unreasonable in view of the relatively small size of the Fund and the nature of the global investment strategy used to pursue the Fund’s objective. The Board further noted that the Adviser has agreed to waive or to reimburse expenses through April 2010 to the extent necessary to maintain an agreed upon expense ratio. The Board concluded that the management fee charged to the Fund for advisory and related services is reasonable and that the total expense ratio of the Fund is reasonable.

|

| |

APPROVAL OF ADVISORY AGREEMENT |

(continued) |

The Board considered the profits, if any, realized by the Adviser from managing the Fund, in light of the services rendered and the costs associated with providing such services, and concluded that the profits realized by the Adviser from managing the Fund are not excessive. In this regard, the Board also considered the extent to which the Adviser may realize economies of scale as the Fund grows, and whether the Fund’s fee reflects these economies of scale for the benefit of shareholders. The Board concluded that the advisory fee breakpoints in place will allow the Fund to share the benefits of economies of scale as it grows in a fair and equitable manner.

The Board did not consider any single factor as controlling in determining whether or not to renew the investment advisory agreement. Nor are the items described herein all of the matters considered by the Board. Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, and assisted by the advice of its independent counsel, the Board concluded that the renewal of the investment advisory agreement, including the fee structure (described herein) is in the interests of shareholders, and accordingly, the Board approved the continuation of the advisory agreement for an additional one-year period.

[This page intentionally left blank]

[This page intentionally left blank]

|

|

This report must be preceded or accompanied by a Van Eck Worldwide Insurance Trust (the “Trust”) Prospectus, which includes more complete information. An investor should consider the investment objective, risks, and charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the investment company. Please read the prospectus carefully before investing. |

|

Additional information about the Trust’s Board of Trustees/Officers and a description of the policies and procedures the Trust uses to determine how to vote proxies relating to portfolio securities are provided in the Statement of Additional Information and information regarding how the Trust voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available, without charge, by calling 1.800.826.2333, or by visiting vaneck.com, or on the Securities and Exchange Commission’s website at http://www.sec.gov. |

|

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Form N-Qs are available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1.202.942.8090. The Fund’s complete schedule of portfolio holdings is also available by calling 1.800.826.2333 or by visiting vaneck.com. |

|

Investment Adviser: Van Eck Associates Corporation |

|

Distributor:Van Eck Securities Corporation | 335 Madison Avenue | New York, NY 10017 | www.vaneck.com

Account Assistance: 1.800.544.4653 |

|

|

Item 2. CODE OF ETHICS.

Not applicable.

Item 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

Item 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

Item 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

Item 6. SCHEDULE OF INVESTMENTS.

Information included in Item 1.

Item 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

Item 8. PORTFOLIO MANAGER OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

Item 9. PURCHASE OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT

COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

Item 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No changes.

Item 11. CONTROLS AND PROCEDURES.

(a) The Chief Executive Officer and the Chief Financial Officer have concluded

that the Worldwide Bond Fund disclosure controls and procedures (as defined

in Rule 30a-3(c) under the Investment Company Act) provide reasonable

assurances that material information relating to the Worldwide Bond Fund is

made known to them by the appropriate persons, based on their evaluation of

these controls and procedures as of a date within 90 days of the filing

date of this report.

(b) There were no significant changes in the registrant's internal controls

over financial reporting or in other factors that could significantly

affect these controls over financial reporting subsequent to the date of

our evaluation.

Item 12. EXHIBITS.

(a)(1) Not applicable.

(a)(2) A separate certification for each principal executive officer and

principal financial officer of the registrant as required by Rule 30a-2

under the Act (17 CFR 270.30a-2) is attached as Exhibit 99.CERT.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is

furnished as Exhibit 99.906CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) WORLDWIDE INSURANCE TRUST - WORLDWIDE BOND FUND

By (Signature and Title) /s/ Bruce J. Smith, SVP and CFO

-------------------------------

Date August 27, 2009

---------------

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title) /s/ Derek S. van Eck, CEO

--------------------------

Date August 27, 2009

---------------

By (Signature and Title) /s/ Bruce J. Smith, CFO

---------------------------

Date August 27, 2009

---------------