The Initial Class shares of the Worldwide Multi-Manager Alternatives Fund gained 9.85% for the six months ended June 30, 2009. In comparison, the S&P® 500 Index1 rose 3.19%, and the HFRX Global Hedge Fund Index2 gained 5.56% for the six-month period.

Effective May 1, 2009, the Worldwide Absolute Return Fund changed its name to the Worldwide Multi-Manager Alternatives Fund to better reflect the nature of its principal investment strategies. The Fund’s investment objective is fundamental and did not change.

We continue to believe that a combination of alternative, unconstrained investment strategies can offer an attractive investment vehicle. The Fund has outperformed the S&P 500 Index by 4.03% and the HFRXGL Index by 2.29% each year for the five years ended June 30, 2009. The Fund had an annualized return of 1.79% for the five years ended June 30, 2009, as compared to the -2.24% and - -0.50% returns of the S&P 500 Index and HFRXGL Index, respectively, for the same period.

The Fund achieved this outperformance with an average volatility* of 7%— much less than that of the broad equity market—and an average beta* to the S&P 500 Index of approximately 0.30. The Fund had a high correlation* to the equity market over the recent past due to its market exposures, but never fell more than - -19.29% for the five years ended June 30, 2009, compared to the -50.92% drawdown of the S&P 500 Index for the same period.

Market and Economic Review

The first half of 2009 saw the equity market rebound after a volatile move to 10-year lows in early March. During the first quarter of the year, the equity market suffered a sharp sell off, and volatility spiked, although not anywhere near the unprecedented levels of late 2008. Reacting to unprecedented government stimulus, equities then rebounded dramatically. The rally continued through most of the second quarter, spurred by increased confidence that economic deterioration had slowed and some economic indicators actually showing signs of modest improvement.

Credit markets were generally stronger during the first half of the year as well. Corporate bonds that were trading at near-bankruptcy valuations moved higher on the perception that the economy was improving. U.S. Treasury security prices remained rather range-bound, with interest rates ending the period somewhat higher. The Federal Reserve Board (the “Fed”) maintained its highly accommodative stance by keeping the federal funds target rate anchored between 0% and 0.25% with no indication that it would raise rates any time soon.

1

Importantly, the major steps to change the complexion of the Fund that our management team took during the fourth quarter of 2008 substantially reduced the Fund’s volatility and positioned the Fund well to benefit from the financial market recovery.

Fund Review

Overall, we believed that fixed income securities represented a more attractive investment opportunity compared to equities during the semi-annual period. We therefore increased the Fund’s exposure to fixed income securities through a series of closed-end funds and by allocating a percentage of Fund net assets to one new subadviser. We also augmented the Fund’s exposure to the long/short equity strategy by adding two long/short equity mutual funds. We maintained a portion of the Fund’s net assets in a market neutral equity allocation managed by Analytic Investors, LLC (“Analytic”) and a portion in a directional global asset allocation strategy managed by Lazard Asset Management, LLC (“Lazard”).

Distressed Fixed Income Strategy

Having built just over half of the Fund’s distressed debt position in late October 2008, we continued to add to the position in early 2009. We selected closed-end funds as vehicles for this strategy, as they provide liquidity and diversification. Also, closed-end funds continued to sell at significant discounts, in many cases at 20% to 40% discounts from their net asset value. Even if net asset values continued to decline, which they did, we felt that the discounts would narrow, helping to support prices. The damage to fixed income markets had been so widespread that we bought “oversold debt” in a variety of markets through a number of closed-end funds.

The first area of “oversold debt” in which we invested was government-related bonds, specifically municipal bonds and emerging market sovereign debt. We also added Fund exposure to a spectrum of corporate credit-senior debt, leveraged loans, high yield securities and convertible securities. Toward the end of the semi-annual period, we hired Clutterbuck Capital Management, LLC (“Clutterbuck”) to manage a long/short corporate credit strategy. Clutterbuck focuses on the disparity within a company’s capital structure. Clutterbuck has produced attractive risk-adjusted performance since coming on board with the Fund. Corporate credit was among the best performing fixed income sectors during the period, as investor risk aversion ebbed. Clutterbuck continues to believe there is strong upside potential in the debt of select stressed and distressed companies. With the debt of General Electric and Berkshire Hathaway both joining the ranks of distressed companies during the period, the vast majority of worldwide companies now fit this category.

2

Long/Short Equity Strategy

The Fund invested in two long/short equity mutual funds. The TFS Market Neutral Fund (11.6% of Fund net assets†) also includes a bit of fixed income and some futures exposure. The Caldwell & Orkin Market Opportunity Fund (11.4% of Fund net assets†) also includes some fixed income exposure.

Market Neutral Equity Strategy

Throughout the first half of 2009, the Fund’s market neutral equity allocation was with Analytic. Analytic’s investment process is based on the fundamental belief that there is persistency in the types of stock characteristics investors prefer, and it believes that portfolios that reflect these biases will add value in the long term. During the semi-annual period, an emphasis on companies with attractive asset utilization and predicted earnings-to-price ratios performed well, as investors rewarded these characteristics. In addition, having only a modest exposure to companies with above average price momentum and high financial leverage contributed positively to performance, as investors penalized these measures. Conversely, having a significant allocation to companies with above average historical earnings-to-price ratios and growth in valuation and only a moderate position in companies with above average trading volume and growth in market detracted from performance.

Analytic had strong stock selection within a majority of economic sectors, with consumer discretionary and materials being the strongest. Among the best performing stocks for this portion of the Fund were long positions in giant auto manufacturer Ford Motor Company (sold at half year), specialty glass and ceramics maker Corning (+0.8% of Fund net assets†), investment firm Janus Capital Group (+0.1% of Fund net assets†) and semiconductor and computer technology developer/manufacturer Texas Instruments (+0.9% of Fund net assets†). Stock selection was weak within the financial and health care sectors. Detracting from this portion of the Fund’s performance were short positions in bank holding company Capital One Financial (-0.2% of Fund net assets†) and supplemental insurance provider Aflac (sold at half year) and a long position in H&R Block (+0.2% of Fund net assets†).

Global Macro Strategy

Lazard’s global macro strategy seeks to take advantage of broad capital market opportunities on both a long and short position basis, with all decisions made in the context of a global macroeconomic viewpoint. The strategy is comprised of two components: long alpha4 generating ideas and short global market exposure. This portion of the Fund began 2009 weighted approximately 38% to equities, 33% to fixed income and 28% to cash with a (15%) short position in global equities. This was a historically defensive stance, as Lazard’s typical equity weighting up until the

3

beginning of the financial crisis in 2008 was 60%. Although the financial crisis continued into 2009, Lazard believed that unprecedented policy response by governments and central banks would lead to a successful revaluation policy intended to prop up asset prices in both equity and fixed income markets. Indeed, the financial picture improved from stubbornly dire to distinctly more promising over the last four months of the semi-annual period. By the end of the period, it appeared that stocks had moved safely off of a bottom established in early March. Coinciding with this turnaround was a flow of reasonably good domestic economic data.

Lazard’s portion of the Fund participated in the market revaluation that began in early March by maintaining equity allocations and selectively adding to risk in sectors and regions, particularly reflationary-oriented investments. In this portion of the Fund, what Lazard refers to as “thematic investments”, or those in sectors that may grow in relative terms at faster rates than the overall economy, were the greatest contributors to returns during the first half of the year. More specifically, investments in oil services, Brazil and natural gas helped the most. Contrarian investments, driven by steel and global materials, were also solid contributors for the period. Lazard considers contrarian investments those that seek to take advantage of market anomalies and that are attractively valued and/or out of favor with current investor fashions. By the end of the period, as market conditions shifted, Lazard shifted away from thematic investments and toward diversifying investments, or those uncorrelated to the overall equity market or possess attractive absolute return-oriented characteristics. Lazard seeks out the areas of the global capital markets where risk is attractively priced on a forward-looking, top-down view.

* * *

Going forward, our management team believes that emerging countries may outperform domestic equity markets, given our belief that the U.S. economy will likely be stuck in a sideways trend due to fiscal and economic policies and the potential for a weaker U.S. dollar. The potential for the return of inflation is also a concern. Given this view, we are carefully considering new allocations to various investment styles, as we continue to analyze new hedged strategies that might fit into the Fund’s investment objective. As the Fund continues to grow, we may seek to further diversify Fund assets among sub-advisers as appropriate.

You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program rather than a complete program. Because the Fund implements a fund-of-funds strategy, an investor in the Fund will bear the operating expenses of the “Underlying Funds” in which the Fund invests. The total expenses borne by an investor in the Fund will be higher than if the investor invested directly in the

4

Underlying Funds, and the returns may therefore be lower. The Fund, the Sub-Advisers and the Underlying Funds may use aggressive investment strategies, including absolute return strategies, which are riskier than those used by typical mutual funds. If the Fund and Sub-Advisers are unsuccessful in applying these investment strategies, the Fund and you may lose more money than if you had invested in another fund that did not invest aggressively. The Fund is subject to risks associated with the Sub-Advisers making trading decisions independently, investing in other investment companies, using a particular style or set of styles, basing investment decisions on historical relationships and correlations, trading frequently, using leverage, making short sales, being non-diversified and investing in securities with low correlation to the market. The Fund is also subject to risks associated with investments in foreign markets, emerging market securities, small cap companies, debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities and CMOs.

5

We appreciate your continued investment in the Worldwide Multi-Manager Alternatives Fund, and we look forward to helping you meet your investment goals in the future.

Investment Team Members:

| | | | |

| |

| |

|

|

| |

| |

|

Jan F. van Eck | | Hao-Hung (Peter) Liao | | Michael F. Mazier |

|

July 27, 2009 | | | | |

6

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted. Performance information reflects temporary waivers of expenses and/or fees and does not include insurance/annuity fees and expenses. Investment returns would have been reduced had these fees/expenses been included. Investment return and the value of the shares of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Net asset value (“NAV”) returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Index returns assume that dividends of the Index constituents in the Index have been reinvested. Performance information current to the most recent month end is available by calling 1.800.826.2333.

The Fund is only available to life insurance and annuity companies to fund their variable annuity and variable life insurance products. These contracts offer life insurance and tax benefits to the beneficial owners of the Fund. Your insurance or annuity company’s charges, fees and expenses for these benefits are not reflected in this report or in the Fund’s performance, since they are not direct expenses of the Fund. Had these fees been included, returns would have been lower. For insurance products, performance figures do not reflect the cost for insurance and if they did, the performance shown would be significantly lower. A review of your particular life and/or annuity contract will provide you with much greater detail regarding these costs and benefits.

| |

† | All Fund assets referenced are Total Net Assets as of June 30, 2009. |

* | Volatility is the annualized standard deviation of monthly returns. Beta is a measure of sensitivity to market movements. Correlation describes a complementary or parallel relationship between two investments. The correlation coefficient is a measure that determines the degree to which two variables’ movements are associated and will vary from -1.0 to 1.0. -1.0 indicates perfect negative correlation, and 1.0 indicates perfect positive correlation. |

| All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made. |

1 | The S&P® 500 Index consists of 500 widely held common stocks, covering industrials, utility, financial and transportation sectors. |

2 | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

3 | The Barclays Capital U.S. Aggregate Bond Index covers the U.S. dollar-denominated, investment grade, fixed rate, taxable bond market of SEC-registered securities. The Index includes bonds from the Treasury, government-related, corporate, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities sectors. |

4 | Alpha is a measure of volatility where the reasons for the volatility have to do with the inherent characteristics of a particular security as distinguished from market conditions. A stock with an alpha factor of 1.25 is projected to rise by 25% in a year on the strength of its inherent values such as growth in earnings per share and regardless of the performance of the market as a whole. |

7

|

| |

|

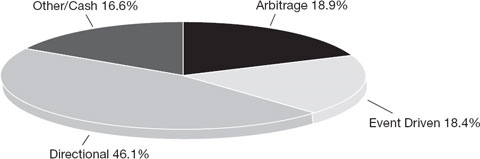

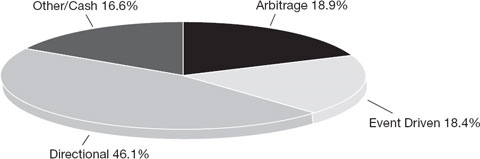

FUND ALLOCATION BY STRATEGY |

(unaudited) |

| | | | | | | | | | | | | |

Investment Strategy | | 6/30/2009

Allocation

(%) | | 3/31/2009

Allocation

(%) | | 12/31/2008

Allocation

(%) | | Implementation | | |

| | | | | | | | | | | |

Arbitrage | | | | | | | | | | | | | |

Market neutral | | 18.9 | % | | 38.5 | % | | 39 | % | | Sub-advisor | | |

| | | | | | | | | | | | | | |

Event driven | | | | | | | | | | | | | |

Distressed debt | | 18.4 | % | | 17.3 | % | | 19 | % | | Closed-end funds, ETFs | | |

| | | | | | | | | | | | | | |

Directional/tactical | | | | | | | | | | | | | |

Global macro | | 10.4 | % | | 22.2 | % | | 24 | % | | Sub-adviser | | |

Long/short equity | | 25.5 | % | | 6.8 | % | | 7 | % | | Open-end funds | | |

Long/short fixed income | | 10.2 | % | | — | | | — | | | Sub-adviser | | |

| | | | | | | | | | | | | | |

Other | | 13.4 | % | | 3.4 | % | | 4 | % | | — | | |

| | | | | | | | | | | | | | |

Cash | | 3.2 | % | | 11.8 | % | | 7 | % | | — | | |

| | | | | | | | | | | | | | |

Total | | 100 | % | | 100 | % | | 100 | % | | — | | |

| | | | | | | | | | | | | | |

8

|

| |

|

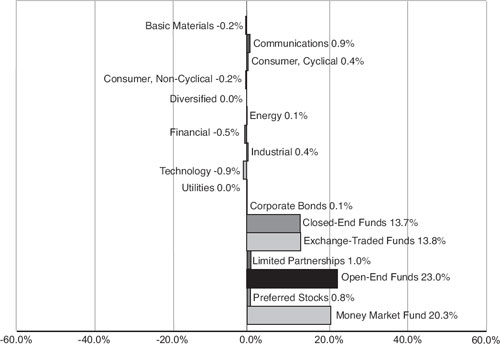

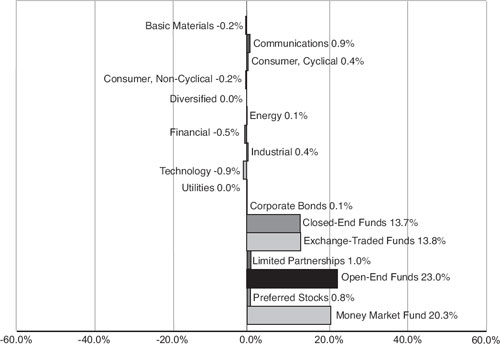

SECTOR WEIGHTING NET EXPOSURE* |

(unaudited) |

| | |

| | |

|

* | Net exposure was calculated by adding long and short positions.

Percentage of net assets. Portfolio is subject to change. |

9

|

| |

|

EXPLANATION OF EXPENSES |

(unaudited) |

Hypothetical $1,000 investment at beginning of period

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2009 to June 30, 2009.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as program fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | | Beginning

Account Value

January 1, 2009 | | Ending

Account Value

June 30, 2009 | | Expenses Paid

During Period*

January 1, 2009-

June 30, 2009 | |

| | | | | | | | | | |

Initial Class | | Actual | | $1,000.00 | | $1,098.50 | | $14.55 | |

| | Hypothetical** | | $1,000.00 | | $1,010.93 | | $13.94 | |

| | | | | | | | | | |

| |

* | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2009) of 2.80%, multiplied by the average account value over the period, multiplied by 181 and divided by 365 (to reflect the one-half year period) |

| |

** | Assumes annual return of 5% before expenses. |

10

|

| |

|

SCHEDULE OF INVESTMENTS |

June 30, 2009 (unaudited) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

COMMON STOCKS: 16.7% | | | | |

Basic Materials: 0.1% | | | | |

| 75 | | Cliffs Natural Resources, Inc. | | $ | 1,835 | |

| 120 | | Terra Industries Inc. | | | 2,907 | |

| | | | | | | |

| | | | | | 4,742 | |

| | | | | | | |

Communications: 2.6% | | | | |

| 2,789 | | Comcast Corp. (Class A) | | | 40,413 | |

| 3,999 | | Corning, Inc. | | | 64,224 | |

| 1,565 | | DISH Network Corp. (Class A) * | | | 25,369 | |

| 723 | | eBay Inc. * | | | 12,385 | |

| 286 | | Liberty Global, Inc. * | | | 4,545 | |

| 1,791 | | Motorola, Inc. | | | 11,874 | |

| 1,230 | | NII Holdings, Inc. * | | | 23,456 | |

| 5,764 | | Sprint Nextel Corp. * | | | 27,725 | |

| 10 | | US Cellular Corp. * | | | 385 | |

| 9 | | WebMD Health Corp. * | | | 269 | |

| | | | | | | |

| | | | | | 210,645 | |

| | | | | | | |

Consumer, Cyclical: 1.6% | | | | |

| 477 | | Big Lots, Inc. * | | | 10,031 | |

| 316 | | BJ’s Wholesale Club, Inc. * | | | 10,185 | |

| 257 | | Brinker International, Inc. | | | 4,377 | |

| 91 | | Copa Holdings S.A. | | | 3,715 | |

| 111 | | Guess?, Inc. | | | 2,862 | |

| 268 | | Ingram Micro, Inc. * | | | 4,690 | |

| 1,520 | | Las Vegas Sands Corp. * | | | 11,947 | |

| 154 | | RadioShack Corp. | | | 2,150 | |

| 4,213 | | Southwest Airlines Co. | | | 28,354 | |

| 1,123 | | Tech Data Corp. * | | | 36,733 | |

| 197 | | WABCO Holdings, Inc. | | | 3,487 | |

| 405 | | Warner Music Group Corp. * | | | 2,369 | |

| 361 | | Williams-Sonoma, Inc. | | | 4,285 | |

| | | | | | | |

| | | | | | 125,185 | |

| | | | | | | |

Consumer, Non-cyclical: 3.4% | | | | |

| 3,077 | | AmerisourceBergen Corp. | | | 54,586 | |

| 24 | | Biogen Idec, Inc. * | | | 1,084 | |

| 226 | | Bunge Ltd. | | | 13,617 | |

| 534 | | Coventry Health Care, Inc. * | | | 9,991 | |

| 16 | | Forest Laboratories, Inc. * | | | 402 | |

| 800 | | H&R Block, Inc. | | | 13,784 | |

| 919 | | Health Net, Inc. * | | | 14,291 | |

| 180 | | Hewitt Associates * | | | 5,360 | |

| 973 | | Hill-Rom Holdings, Inc. | | | 15,782 | |

| 7 | | Humana, Inc. * | | | 226 | |

| 4 | | Illumina, Inc. * | | | 156 | |

| 45 | | Mastercard, Inc. | | | 7,529 | |

| 630 | | McKesson Corp. | | | 27,720 | |

| 134 | | SEI Investments Co. | | | 2,417 | |

See Notes to Financial Statements

11

|

| |

|

SCHEDULE OF INVESTMENTS |

(unaudited) (continued) |

| | | | | | | |

Number

of Shares | | | | Value | |

| | | | | | |

Consumer, Non-cyclical (continued) | | | | |

| 3,465 | | Tenet Healthcare Corp. * | | $ | 9,771 | |

| 4,430 | | Tyson Foods, Inc. | | | 55,862 | |

| 632 | | Visa, Inc. | | | 39,348 | |

| 139 | | Western Union Co. | | | 2,280 | |

| | | | | | | |

| | | | | | 274,206 | |

| | | | | | | |

Energy: 1.1% | | | | |

| 28 | | Continental Resources, Inc. * | | | 777 | |

| 696 | | Hess Corp. | | | 37,410 | |

| 677 | | Murphy Oil Corp. | | | 36,775 | |

| 90 | | Occidental Petroleum Corp. | | | 5,923 | |

| 130 | | Oil States International, Inc. * | | | 3,147 | |

| 244 | | Pioneer Natural Resources Co. | | | 6,222 | |

| | | | | | | |

| | | | | | 90,254 | |

| | | | | | | |

Financial: 4.0% | | | | |

| 121 | | Alexandria Real Estate Equities, Inc. | | | 4,331 | |

| 856 | | American Financial Group, Inc. | | | 18,473 | |

| 1,492 | | Bank of Hawaii Corp. | | | 53,458 | |

| 597 | | Bank of New York Mellon Corp. | | | 17,498 | |

| 79 | | BlackRock, Inc. | | | 13,858 | |

| 299 | | BOK Financial Corp. | | | 11,263 | |

| 3,052 | | Charles Schwab Co. | | | 53,532 | |

| 264 | | Developers Diversified Realty Corp. | | | 1,288 | |

| 2,125 | | Discover Financial Services | | | 21,824 | |

| 351 | | Franklin Resources, Inc. | | | 25,276 | |

| 76 | | Hospitality Properties Trust | | | 904 | |

| 98 | | Invesco Ltd. | | | 1,746 | |

| 454 | | Investment Technology Group, Inc. * | | | 9,257 | |

| 705 | | Janus Capital Group, Inc. | | | 8,037 | |

| 1,052 | | MBIA, Inc. * | | | 4,555 | |

| 94 | | Northern Trust Corp. | | | 5,046 | |

| 1 | | SL Green Realty Corp. | | | 23 | |

| 1,106 | | T Rowe Price Group, Inc. | | | 46,087 | |

| 583 | | Torchmark Corp. | | | 21,594 | |

| 376 | | U.S. Bancorp Inc. | | | 6,738 | |

| | | | | | | |

| | | | | | 324,788 | |

| | | | | | | |

Industrial: 1.8% | | | | |

| 613 | | AGCO Corp. * | | | 17,820 | |

| 980 | | Fluor Corp. | | | 50,264 | |

| 136 | | Harsco Corp. | | | 3,849 | |

| 2,945 | | KBR, Inc. | | | 54,306 | |

| 598 | | Shaw Group, Inc. * | | | 16,391 | |

| | | | | | | |

| | | | | | 142,630 | |

| | | | | | | |

See Notes to Financial Statements

12

| | | | | | | |

| |

|

Number

of Shares | | | | Value | |

| | | | | | |

Technology: 1.2% | | | | |

| 535 | | Electronic Arts, Inc. * | | $ | 11,620 | |

| 1,084 | | Lexmark International, Inc. * | | | 17,181 | |

| 3,247 | | Texas Instruments, Inc. | | | 69,161 | |

| 1,277 | | Unisys Corp. * | | | 1,928 | |

| | | | | | | |

| | | | | | 99,890 | |

| | | | | | | |

Utilities: 0.9% | | | | |

| 1,068 | | Energen Corp. | | | 42,613 | |

| 1,040 | | NRG Energy, Inc. * | | | 26,998 | |

| | | | | | | |

| | | | | | 69,611 | |

| | | | | | | |

Total Common Stocks

(Cost: $1,117,591)(a) | | | 1,341,951 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

CORPORATE BONDS: 0.1% | | | | |

(Cost: $7,880)(a) | | | | |

| 12,000 | | USEC, Inc. Convertible Bonds, 3.00%, 10/1/2014 | | | 7,800 | |

| | | | | | | |

| | | | | | | |

Number

of Shares | | | | | | |

| | | | | | | | |

CLOSED-END FUNDS: 13.7% | | | | |

| 4,225 | | Eaton Vance Limited Duration Income Fund | | | 54,122 | |

| 11,000 | | Global Convertible Securities & Income Fund | | | 72,050 | |

| 17,000 | | ING Prime Rate Trust | | | 70,550 | |

| 9,325 | | MFS Intermediate Income Trust | | | 61,545 | |

| 10,400 | | MFS Multimarket Income Trust | | | 59,592 | |

| 24,952 | | Nicholas-Applegate Global Equity & Convertible Income Fund | | | 285,700 | |

| 31,800 | | Nuveen Senior Income Fund | | | 148,824 | |

| 15,500 | | Templeton Emerging Markets Income Fund | | | 178,095 | |

| 52,000 | | Van Kampen Senior Income Trust | | | 166,400 | |

| | | | | | | |

Total Closed-End Funds | | | | |

(Cost: $984,205)(a) | | | 1,096,878 | |

| | | | | | | |

EXCHANGE TRADED FUNDS: 15.0% | | | | |

| 355 | | iShares COMEX Gold Trust * | | | 32,390 | |

| 170 | | iShares DJ STOXX 600 Automobiles & Parts (EUR) | | | 5,156 | |

| 4,430 | | iShares iBoxx $ Invest Grade Corp Bond Fund | | | 444,240 | |

| 365 | | iShares iBoxx High Yield Corp Bond Fund | | | 29,094 | |

| 220 | | iShares Lehman 20+Yr Treasury Bond Fund | | | 20,805 | |

| 1,245 | | iShares MSCI All Country Asia ex Japan Index Fund | | | 54,506 | |

| 500 | | iShares MSCI Brazil Index Fund | | | 26,485 | |

| 835 | | iShares S&P Global Consumer Discretionary Index Fund | | | 29,459 | |

| 1,120 | | iShares S&P Global Consumer Staple Index Fund | | | 52,562 | |

| 1,140 | | iShares S&P Global Healthcare Sector ETF | | | 49,191 | |

| 1,580 | | iShares S&P Global Materials Index Fund | | | 73,517 | |

| 410 | | iShares S&P National Muni Bond Fund | | | 40,859 | |

| 505 | | Market Vectors Agribusiness ETF (b) | | | 17,397 | |

| 1,525 | | Market Vectors Global Alternative Energy ETF (b) | | | 37,134 | |

See Notes to Financial Statements

13

|

| |

SCHEDULE OF INVESTMENTS |

(unaudited) (continued) |

| | | | | | | |

| Number

of Shares | | | | Value | |

| |

EXCHANGE TRADED FUNDS (continued) | | | | |

| 495 | | Market Vectors Steel ETF (b) | | $ | 20,854 | |

| 27 | | Nomura Next Funds Topix-17

Automobiles & Transportation Equipment ETF (JPY) | | | 3,332 | |

| 1,115 | | PowerShares Dynamic Oil & Gas Portfolio | | | 15,197 | |

| 1,530 | | PowerShares Global Nuclear Energy Portfolio | | | 26,188 | |

| 2,240 | | PowerShares Water Resources Portfolio | | | 32,973 | |

| 170 | | Rydex Inverse 2X S&P 500 ETF | | | 15,115 | |

| 1,740 | | Rydex S&P Equal Weight ETF | | | 53,609 | |

| 355 | | SPDR Gold Trust * | | | 32,369 | |

| 1,485 | | Vanguard Information Technology ETF | | | 63,231 | |

| 625 | | Vanguard Pacific ETF | | | 28,900 | |

| | | | | | | |

Total Exchange Traded Funds | | | | |

(Cost: $1,153,409)(a) | | | 1,204,563 | |

| | | | |

LIMITED PARTNERSHIPS: 1.0% | | | | |

| 1,620 | | K-SEA Transportation Partners LP | | | 31,768 | |

| 3,575 | | US Natural Gas Fund LP * | | | 49,585 | |

| | | | | | | |

Total Limited Partnership Funds | | | | |

(Cost: $87,865)(a) | | | 81,353 | |

| | | | |

OPEN-END FUNDS: 23.0% | | | | |

| 42,622 | | Caldwell & Orkin Market Opportunity Fund | | | 911,263 | |

| 65,117 | | TFS Market Neutral Fund * | | | 929,874 | |

| | | | | | | |

Total Open-End Funds | | | | |

(Cost: $1,857,529) | | | 1,841,137 | |

| | | | |

PREFERRED STOCKS: 0.8% | | | | |

| 1,750 | | Citigroup, Inc 8.125% Series AA | | | 32,690 | |

| 1,800 | | KeyCorp Capital IX 6.75% | | | 30,546 | |

| | | | | | | |

Total Preferred Stocks | | | | |

(Cost: $65,076)(a) | | | 63,236 | |

| | | | |

MONEY MARKET FUND: 20.3% | | | | |

(Cost: $1,632,273) | | | | |

| 1,632,273 | | AIM Treasury Portfolio - Institutional Class | | | 1,632,273 | |

| | | | | | | |

Total Investments: 90.6% | | | | |

(Cost: $6,905,828) | | | 7,269,191 | |

Other assets less liabilities: 9.4% | | | 756,105 | |

| | | | |

NET ASSETS: 100.0% | | $ | 8,025,296 | |

| | | | |

See Notes to Financial Statements

14

| | | | | | | |

Number

of Shares | | | | Value | |

| |

SECURITIES SOLD SHORT: (17.9)% | | | | |

COMMON STOCKS: (16.7)% | | | | |

Basic Materials: (0.3)% | | | | |

| (286 | ) | Century Aluminum Co. * | | $ | (1,782 | ) |

| (110 | ) | Freeport-McMoRan Copper & Gold, Inc. | | | (5,512 | ) |

| (212 | ) | Nucor Corp. | | | (9,419 | ) |

| (252 | ) | Weyerhaeuser Co. | | | (7,668 | ) |

| | | | | | | |

| | | | | | (24,381 | ) |

| | | | | | | |

Communications: (1.7)% | | | | |

| (2,026 | ) | Ciena Corp. * | | | (20,969 | ) |

| (164 | ) | F5 Networks, Inc. * | | | (5,673 | ) |

| (100 | ) | HLTH Corp. * | | | (1,310 | ) |

| (173 | ) | Juniper Networks, Inc. * | | | (4,083 | ) |

| (302 | ) | Leap Wireless International, Inc. * | | | (9,945 | ) |

| (1,884 | ) | Liberty Media Corp * | | | (50,397 | ) |

| (813 | ) | Liberty Media Holdings Corp. - Capital * | | | (11,024 | ) |

| (1,023 | ) | SBA Communications Corp. * | | | (25,104 | ) |

| (676 | ) | Symantec Corp. * | | | (10,519 | ) |

| | | | | | | |

| | | | | | (139,024 | ) |

| | | | | | | |

Consumer, Cyclical: (1.2)% | | | | |

| (1,918 | ) | AMR Corp. * | | | (7,710 | ) |

| (250 | ) | AutoZone, Inc. * | | | (37,777 | ) |

| (997 | ) | Delta Air Lines, Inc. * | | | (5,773 | ) |

| (129 | ) | Goodyear Tire & Rubber Co. * | | | (1,453 | ) |

| (689 | ) | O’Reilly Automotive, Inc. * | | | (26,237 | ) |

| (10 | ) | Oshkosh Corp. | | | (145 | ) |

| (887 | ) | Toll Brothers, Inc. * | | | (15,052 | ) |

| | | | | | | |

| | | | | | (94,147 | ) |

| | | | | | | |

Consumer, Non-cyclical: (3.6)% | | | | |

| (697 | ) | Clorox Co. | | | (38,914 | ) |

| (614 | ) | Davita Inc. * | | | (30,368 | ) |

| (211 | ) | Dr. Pepper Snapple Group, Inc. * | | | (4,471 | ) |

| (102 | ) | FTI Consulting, Inc. * | | | (5,173 | ) |

| (275 | ) | General Mills Inc. | | | (15,405 | ) |

| (62 | ) | H.J. Heinz Co. | | | (2,213 | ) |

| (2,306 | ) | Hologic, Inc. * | | | (32,814 | ) |

| (275 | ) | Inverness Medical Innovations, Inc., * | | | (9,785 | ) |

| (135 | ) | Iron Mountain Inc. * | | | (3,881 | ) |

| (780 | ) | Jarden Corp. * | | | (14,625 | ) |

| (752 | ) | JM Smucker Co. | | | (36,592 | ) |

| (416 | ) | Kinetic Concepts, Inc. * | | | (11,336 | ) |

| (3,141 | ) | King Pharmaceuticals, Inc. * | | | (30,248 | ) |

| (1,045 | ) | Vertex Pharmaceuticals, Inc. * | | | (37,244 | ) |

| (471 | ) | Weight Watchers International, Inc. | | | (12,138 | ) |

| | | | | | | |

| | | | | | (285,207 | ) |

| | | | | | | |

See Notes to Financial Statements

15

|

| |

SCHEDULE OF INVESTMENTS |

(unaudited) (continued) |

| | | | | | | |

Number

of Shares | | | | Value | |

| |

Diversified: (0.0)% | | | | |

| (173 | ) | Leucadia National Corp. * | | $ | (3,649 | ) |

| | | | | | | |

Energy: (1.0)% | | | | |

| (298 | ) | Chesapeake Energy Corp. | | | (5,909 | ) |

| (3,617 | ) | El Paso Corp. | | | (33,385 | ) |

| (156 | ) | Newfield Exploration Co. * | | | (5,097 | ) |

| (1,131 | ) | Plains Exploration & Production Co. * | | | (30,944 | ) |

| (713 | ) | Quicksilver Resources, Inc. * | | | (6,624 | ) |

| | | | | | | |

| | | | | | (81,959 | ) |

| | | | | | | |

Financial: (4.5)% | | | | |

| (21 | ) | Affiliated Managers Group, Inc. * | | | (1,222 | ) |

| (1,124 | ) | Allstate Corp. | | | (27,426 | ) |

| (2 | ) | AmeriCredit Corp. * | | | (27 | ) |

| (892 | ) | Ameriprise Financial, Inc. | | | (21,649 | ) |

| (624 | ) | Capital One Financial Corp. | | | (13,653 | ) |

| (609 | ) | CB Richard Ellis Group, Inc. (Class A) * | | | (5,700 | ) |

| (519 | ) | Comerica, Inc. | | | (10,977 | ) |

| (228 | ) | Everest Re Group Ltd. | | | (16,318 | ) |

| (1 | ) | Fidelity National Title Group * | | | (14 | ) |

| (177 | ) | First Horizon National Corp. * | | | (2,124 | ) |

| (1,996 | ) | Genworth Financial, Inc. | | | (13,952 | ) |

| (313 | ) | Goldman Sachs Group, Inc. | | | (46,149 | ) |

| (1,615 | ) | Hartford Financial Services Group, Inc. | | | (19,170 | ) |

| (1,555 | ) | Huntington Bancshares, Inc. | | | (6,500 | ) |

| (420 | ) | Jefferies Group, Inc. * | | | (8,959 | ) |

| (568 | ) | JPMorgan Chase & Co. | | | (19,374 | ) |

| (439 | ) | KeyCorp. | | | (2,300 | ) |

| (148 | ) | Lazard Ltd. | | | (3,984 | ) |

| (805 | ) | Legg Mason, Inc. | | | (19,626 | ) |

| (50 | ) | Markel Corp. * | | | (14,085 | ) |

| (594 | ) | Morgan Stanley | | | (16,935 | ) |

| (555 | ) | Prologis | | | (4,473 | ) |

| (401 | ) | Protective Life Corp. | | | (4,587 | ) |

| (473 | ) | Prudential Financial, Inc. | | | (17,605 | ) |

| (1,629 | ) | Regions Financial Corp. | | | (6,581 | ) |

| (207 | ) | RenaissanceRe Holdings Ltd. | | | (9,634 | ) |

| (2,469 | ) | SLM Corp. * | | | (25,357 | ) |

| (779 | ) | Synovus Financial Corp. | | | (2,329 | ) |

| (20 | ) | Taubman Centers, Inc. | | | (537 | ) |

| (247 | ) | Vornado Realty Trust | | | (11,122 | ) |

| (927 | ) | XL Capital Ltd. (Class A) | | | (10,623 | ) |

| (42 | ) | Zions Bancorp. | | | (486 | ) |

| | | | | | | |

| | | | | | (363,478 | ) |

| | | | | | | |

Industrial: (1.4)% | | | | |

| (833 | ) | Boeing Co. | | | (35,402 | ) |

| (578 | ) | Caterpillar, Inc. | | | (19,097 | ) |

| (244 | ) | Deere & Co. | | | (9,748 | ) |

See Notes to Financial Statements

16

| | | | | | | |

Number

of Shares | | | | Value | |

| |

Industrial: (continued) | | | | |

| (146 | ) | Energizer Holdings, Inc. * | | $ | (7,627 | ) |

| (355 | ) | General Electric Co. | | | (4,161 | ) |

| (631 | ) | Ingersoll-Rand Co. (Class A) | | | (13,188 | ) |

| (147 | ) | Itron, Inc. * | | | (8,095 | ) |

| (1,811 | ) | Manitowoc Co., Inc. | | | (9,526 | ) |

| (461 | ) | Owens Corning, Inc. * | | | (5,892 | ) |

| | | | | | | |

| | | | | | (112,736 | ) |

| | | | | | | |

Technology: (2.1)% | | | | |

| (10 | ) | Apple, Inc. * | | | (1,424 | ) |

| (1,118 | ) | Brocade Communications Systems, Inc. * | | | (8,743 | ) |

| (199 | ) | Cadence Design Systems, Inc. * | | | (1,174 | ) |

| (2,660 | ) | Cypress Semiconductor Corp. * | | | (24,472 | ) |

| (124 | ) | Dun & Bradstreet Corp. | | | (10,070 | ) |

| (576 | ) | Fiserv, Inc. * | | | (26,323 | ) |

| (432 | ) | International Rectifier Corp. * | | | (6,398 | ) |

| (72 | ) | Intuit, Inc. * | | | (2,028 | ) |

| (538 | ) | Kla-Tencor Corp. | | | (13,585 | ) |

| (811 | ) | Lam Research Corp. * | | | (21,086 | ) |

| (1,058 | ) | Linear Technology Corp. | | | (24,704 | ) |

| (1,506 | ) | Nuance Communications, Inc. * | | | (18,208 | ) |

| (573 | ) | Rambus, Inc. * | | | (8,876 | ) |

| | | | | | | |

| | | | | | (167,091 | ) |

| | | | | | | |

Utilities: (0.9)% | | | | |

| (3,264 | ) | American Water Works Co., Inc. | | | (62,375 | ) |

| (114 | ) | Consolidated Edison, Inc. | | | (4,266 | ) |

| (13 | ) | Entergy Corp. | | | (1,008 | ) |

| | | | | | | |

| | | | | | (67,649 | ) |

| | | | | | | |

Total Common Stocks Sold Short | | | | |

(Proceeds: $1,394,868) | | | (1,339,321 | ) |

| | | | |

EXCHANGE TRADED FUNDS: (1.2)% | | | | |

| (1,160 | ) | iShares MSCI EAFE Index Fund | | | (53,140 | ) |

| (450 | ) | SPDR Trust, Series 1 | | | (41,377 | ) |

| | | | | | | |

Total Exchange Traded Funds Sold Short | | | | |

(Proceeds: $154,571) | | | (94,517 | ) |

| | | | |

Total Securities Sold Short | | | | |

(Proceeds: $1,549,439) | | $ | (1,433,838 | ) |

| | | | |

| | |

| | |

EUR | — Euro Dollar |

JPY | — Japanese Yen |

| |

* | Non-income producing |

(a) | Securities segregated for securities sold short with a market value of $3,795,781. |

(b) | Affiliated issuer — as defined under the Investment Company Act of 1940 (Van Eck Associates Corp. is the distributor and investment manager of the Market Vectors ETF Trust). |

See Notes to Financial Statements

17

|

| |

STATEMENT OF ASSETS AND LIABILITIES |

June 30, 2009 (unaudited) |

| | | | |

Assets: | | | | |

Investments at value: | | | | |

Unaffiliated issuers (Cost $6,849,026) | | | $7,193,806 | |

Affiliated issuers (Cost $56,802) | | | 75,385 | |

Receivables: | | | | |

Securities sold short | | | 1,396,684 | |

Investment securities sold | | | 57,330 | |

Shares of beneficial interest sold | | | 798,852 | |

Dividends and interest | | | 8,973 | |

| | | | |

Total assets | | | 9,531,030 | |

| | | | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Securities purchased | | | 8,638 | |

Securities sold short (proceeds $1,549,439) | | | 1,433,838 | |

Dividends on securities sold short | | | 1,912 | |

Shares of beneficial interest redeemed | | | 177 | |

Due to Adviser | | | 3,787 | |

Deferred Trustee fees | | | 1,099 | |

Accrued expenses | | | 56,283 | |

| | | | |

Total liabilities | | | 1,505,734 | |

| | | | |

NET ASSETS | | | $8,025,296 | |

| | | | |

Shares of beneficial interest outstanding | | | 862,126 | |

| | | | |

Net asset value, redemption and offering price per share | | | $9.31 | |

| | | | |

| | | | |

Net Assets consist of: | | | | |

Aggregate paid in capital | | | $8,390,256 | |

Unrealized appreciation of investments and securities sold short | | | 479,001 | |

Undistributed net investment income | | | 32,617 | |

Accumulated net realized loss on investments, securities sold short and capital gain distributions received from other investment companies | | | (876,578 | ) |

| | | | |

| | | $8,025,296 | |

| | | | |

See Notes to Financial Statements

18

|

STATEMENT OF OPERATIONS |

Six Months Ended June 30, 2009 (unaudited) |

| | | | | | | |

Income: | | | | | | | |

Dividends | | | | | | $125,555 | |

Interest | | | | | | 14 | |

Total income | | | | | | 125,569 | |

| | | | | | | |

Expenses: | | | | | | | |

Management fees | | | $85,433 | | | | |

Dividends on securities sold short | | | 26,364 | | | | |

Reports to shareholders | | | 27,858 | | | | |

Transfer agent fees | | | 7,144 | | | | |

Professional fees | | | 7,596 | | | | |

Custodian fees | | | 9,696 | | | | |

Insurance | | | 1,810 | | | | |

Trustees’ fees and expenses | | | 402 | | | | |

Other | | | 858 | | | | |

Total expenses | | | 167,161 | | | | |

Waiver of management fees | | | (71,615 | ) | | | |

Net expenses | | | | | | 95,546 | |

Net investment income | | | | | | 30,023 | |

| | | | | | | |

| | | | | | | |

Realized and Unrealized Gain (Loss) on Investments: | | | | | | | |

Net realized loss on investments sold | | | | | | (460,530 | ) |

Net realized gain on securities sold short | | | | | | 280,680 | |

Net change in unrealized appreciation (depreciation) of investments | | | | | | 1,552,611 | |

Net change in unrealized appreciation (depreciation) on securities sold short | | | | | | (736,261 | ) |

Net realized and unrealized gain on investments | | | | | | 636,500 | |

Net Increase in Net Assets Resulting from Operations | | | | | | $666,523 | |

See Notes to Financial Statements

19

|

STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | |

| | Six Months

Ended June 30,

2009 | | Year Ended

December 31,

2008 | |

| | (unaudited) | | | | |

Operations: | | | | | | | |

Net investment income | | $ | 30,023 | | $ | 1,425 | |

Net realized gain (loss) on investments, securities sold short and capital gain distributions received from other investment companies | | | (179,850 | ) | | (263,787 | ) |

Net change in unrealized appreciation (depreciation) of investments and securities sold short | | | 816,350 | | | (783,513 | ) |

Net increase (decrease) in net assets resulting from operations | | | 666,523 | | | (1,045,875 | ) |

| | | | | | | |

Dividends and distributions to shareholders: | | | | | | | |

Dividends from net investment income | | | (17,446 | ) | | (7,822 | ) |

Distributions from net realized capital gains | | | (366,357 | ) | | (250,305 | ) |

Total dividends and distributions | | | (383,803 | ) | | (258,127 | ) |

| | | | | | | |

Share transactions*: | | | | | | | |

Proceeds from sales of shares | | | 3,415,287 | | | 2,671,014 | |

Reinvestment of dividends and distributions | | | 383,803 | | | 258,127 | |

Cost of shares redeemed | | | (2,235,835 | ) | | (2,914,657 | ) |

Net increase in net assets resulting from share transactions | | | 1,563,255 | | | 14,484 | |

Total increase (decrease) in net assets | | | 1,845,975 | | | (1,289,518 | ) |

| | | | | | | |

Net Assets: | | | | | | | |

Beginning of period | | | 6,179,321 | | | 7,468,839 | |

End of period (including undistributed net investment income of $32,617 and $20,040, respectively) | | $ | 8,025,296 | | $ | 6,179,321 | |

| | | | | | | |

* Shares of beneficial interest issued, reinvested and redeemed

(unlimited number of $.001 par value shares authorized): | | | | | | | |

Shares sold | | | 385,114 | | | 269,585 | |

Shares reinvested | | | 44,065 | | | 25,813 | |

Shares redeemed | | | (253,258 | ) | | (305,537 | ) |

Net increase (decrease) | | | 175,921 | | | (10,139 | ) |

See Notes to Financial Statements

20

|

STATEMENT OF CASH FLOWS |

Six Months Ended June 30, 2009 (unaudited) |

| | | | |

Cash flows from operating activities | | | | |

Net increase in net assets resulting from operations | | $ | 666,523 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

Purchases of long term securities | | | (6,429,750 | ) |

Proceeds from sale of long term securities | | | 7,427,855 | |

Purchase of short term investments | | | (1,098,216 | ) |

Proceeds of short sales of long term securities | | | 2,769,806 | |

Purchases of short sale covers of long term securities | | | (4,464,301 | ) |

(Increase) in receivable from broker | | | (48,377 | ) |

Decrease in receivable from securities sold short | | | 1,352,284 | |

Decrease in dividends and interest receivable | | | 58,640 | |

(Decrease) in dividends payable on securities sold short | | | (4,864 | ) |

Increase in accrued expenses | | | 12,808 | |

Increase in deferred Trustee fees | | | 505 | |

Increase in due to Adviser | | | 13,188 | |

Net realized loss from investments and securities sold short | | | 179,850 | |

Change in unrealized depreciation of investments | | | (816,350 | ) |

Net cash used in operating activities | | | (380,399 | ) |

| | | | |

Cash flows from financing activities | | | | |

Proceeds from sales of shares | | | 2,631,986 | |

Cost of shares reacquired | | | (2,240,243 | ) |

Net cash provided from financing activities | | | 391,743 | |

Net increase in cash | | | 11,344 | |

Cash, beginning of year | | | (11,344 | ) |

Cash, end of year | | $ | — | |

| | | | |

Supplemental disclosure of cash flow information: | | | | |

Short sale dividends paid during the year | | $ | 31,228 | |

See Notes to Financial Statements

21

For a share outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | |

| | Six Months

Ended

June 30,

2009 | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | (unaudited) | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | $ | 9.01 | | | $ | 10.73 | | $ | 10.63 | | $ | 9.85 | | $ | 9.84 | | $ | 10.02 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | | 0.03 | | | | 0.00 | (e) | | (0.06 | ) | | 0.08 | | | (0.01 | ) | | (0.14 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | | | 0.82 | | | | (1.39 | ) | | 0.52 | | | 0.77 | | | 0.02 | | | 0.11 | |

Total from Investment Operations | | | | 0.85 | | | | (1.39 | ) | | 0.46 | | | 0.85 | | | 0.01 | | | (0.03 | ) |

Less: | | | | | | | | | | | | | | | | | | | | | |

Dividends from Net Investment Income | | | | (0.02 | ) | | | (0.01 | ) | | (0.08 | ) | | — | | | — | | | — | |

Distributions from Net Realized Capital Gains | | | | (0.53 | ) | | | (0.32 | ) | | (0.28 | ) | | (0.07 | ) | | — | | | (0.15 | ) |

Total Dividends and Distributions | | | | (0.55 | ) | | | (0.33 | ) | | (0.36 | ) | | (0.07 | ) | | — | | | (0.15 | ) |

Net Asset Value, End of Period | | | $ | 9.31 | | | $ | 9.01 | | $ | 10.73 | | $ | 10.63 | | $ | 9.85 | | $ | 9.84 | |

Total Return (a) | | | | 9.85 | %(d) | | | (13.26 | )% | | 4.35 | % | | 8.76 | % | | 0.10 | % | | (0.30 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplementary Data | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000) | | | $ | 8,025 | | | $ | 6,179 | | $ | 7,468 | | $ | 7,226 | | $ | 6,138 | | $ | 5,469 | |

Ratio of Gross Expenses to Average Net Assets | | | | 4.89 | %(c) | | | 4.73 | % | | 5.32 | % | | 3.72 | % | | 4.64 | % | | 5.00 | % |

Ratio of Net Expenses to Average Net Assets (b) | | | | 2.80 | %(c) | | | 3.24 | % | | 4.13 | % | | 3.16 | % | | 3.47 | % | | 3.46 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | | 0.88 | %(c) | | | 0.02 | % | | (0.50 | )% | | 0.72 | % | | (0.08 | )% | | (1.45 | )% |

Portfolio Turnover Rate | | | | 128 | %(d) | | | 249 | % | | 207 | % | | 182 | % | | 140 | % | | 126 | % |

| | |

| | | |

(a) | Total return is calculated assuming an initial investment of $10,000 made at the net asset value at the beginning of the period, reinvestment of any dividends and distributions at net asset value on the dividend/distribution payment date and a redemption on the last day of the period. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends/distributions or the redemption of Fund shares. |

(b) | Excluding dividends on securities sold short, the ratio of net expenses to average net assets would be 2.02%, 2.14%, 2.50%, 2.48%, 2.50%, and 2.50% for the period ended June 30, 2009, December 31, 2008, December 31, 2007, December 31, 2006, December 31, 2005, and December 31, 2004, respectively. |

(c) | Annualized |

(d) | Not annualized |

(e) | Amount represents less than $0.005 per share. |

See Notes to Financial Statements

22

| |

NOTES TO FINANCIAL STATEMENTS |

June 30, 2009 (unaudited) |

Note 1—Fund Organization—Van Eck Worldwide Insurance Trust (the “Trust”), is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on January 7, 1987. The Worldwide Multi-Manager Alternatives Fund (the “Fund”) is a non-diversified series of the Trust and seeks to achieve consistent absolute (positive) returns in various market cycles.

Note 2—Significant Accounting Policies—The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that effect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

| |

A. | Security Valuation—Securities traded on national exchanges or on the NASDAQ National Market System are valued at the last sales price as reported at the close of each business day. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ official closing price. Over-the-counter securities not included in the NASDAQ National Market System and listed securities for which no sale was reported are valued at the mean of the bid and ask prices. Investments in open-end funds are valued at their closing net asset values each business day. Short-term obligations purchased with more than sixty days remaining to maturity are valued at market value. Money market funds are valued at net asset value. Short-term obligations purchased with sixty days or less to maturity are valued at amortized cost, which with accrued interest approximates market value. Futures contracts are valued using the closing price reported at the close of the respective exchange. Securities for which quotations are not available are stated at fair value as determined by a Pricing Committee of the Adviser appointed by the Board of Trustees. Certain factors such as economic conditions, political events, market trends and security specific information are used to determine the fair value for these securities. |

| |

| In accordance with Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 157 Fair Value Measurements (FAS 157), the Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. FAS 157 establishes a hierarchy that prioritizes inputs to valuation methods used to measure fair value. The hierarchy gives highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1 measurements) and |

23

|

| |

NOTES TO FINANCIAL STATEMENTS |

(continued) |

| | |

| the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under FAS 157 are described below: |

| | |

| Level 1 — | Quoted prices in active markets for identical securities. |

| | |

| Level 2 — | Significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | |

| Level 3 — | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

| | |

| In April 2009, FASB Staff Position No. 157-4, Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly, (“Position 157-4”) was issued and is effective for fiscal years and interim periods ending after June 15, 2009. Position 157-4 provides additional guidance for estimating fair value in accordance with FAS 157 when the volume and level of activity for the asset or liability have significantly decreased and also includes guidance on identifying circumstances that indicate a transaction is not orderly. Position 157-4 also requires additional disclosures on fair valuation inputs and techniques and requires expanded fair value hierarchy disclosures by each major security type. The Funds have adopted Position 157-4 effective June 30, 2009. |

| | |

| The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of June 30, 2009: |

| | |

| | | | | | |

Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Market

Value of

Investments |

| | | | | | | |

Long Positions* | | | | | | |

$7,269,191 | | None | | None | | $7,269,191 |

| | | | | | |

Short Positions* | | | | | | |

$1,433,838 | | None | | None | | $1,433,838 |

| |

| *See Schedule of Investments for industry sector breakouts |

| |

B. | Federal Income Taxes—It is the Fund’s policy to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required. |

| |

C. | Dividends and Distributions to Shareholders—Dividends from net investment income and distributions from net realized capital gains, if any, are |

24

| |

| |

| |

| declared and paid annually. Income dividends and capital gain distributions are determined in accordance with income tax regulations, which may differ from such amounts determined in accordance with U.S. generally accepted accounting principles. |

| |

D. | Securities Sold Short—A short sale occurs when the Fund sells a security, which it does not own, by borrowing it from a broker. Proceeds from securities sold short are reported as liabilities on the Statement of Assets and Liabilities and are marked to market daily. Gains and losses are classified as realized when short positions are closed. In the event that the value of the security that the Fund sold short declines, the Fund will gain as it repurchases the security in the market at the lower price. If the price of the security increases, the Fund will suffer a loss, as it will have to repurchase the security at the higher price. Short sales may incur higher transaction costs than regular securities transactions. Dividends on short sales are recorded as an expense by the Fund on the ex-dividend date. Cash is deposited in a segregated account with brokers, maintained by the Fund, for its open short sales. Securities sold short at June 30, 2009, are reflected in the Schedule of Investments. Until the Fund replaces the borrowed security, the Fund maintains securities or permissible liquid assets in a segregated account with a broker or custodian sufficient to cover its short positions. |

| |

E. | Currency Translation—Assets and liabilities denominated in foreign currencies and commitments under forward foreign currency contracts are translated into U.S. dollars at the closing prices of such currencies each business day. Purchases and sales of investments are translated at the exchange rates prevailing when such investments are acquired or sold. Income and expenses are translated at the exchange rates prevailing when accrued. The portion of realized and unrealized gains and losses on investments that result from fluctuations in foreign currency exchange rates is not separately disclosed. Recognized gains or losses attributable to foreign currency fluctuations on foreign currency denominated assets, other than investments, and liabilities are recorded as net realized gains and losses from foreign currency transactions. |

| |

F. | Other—Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premiums and discounts, is accrued as earned. Realized gains and losses are calculated on the identified cost basis. |

| |

G. | Use of Derivative Instruments—In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”), which is effective |

25

|

| |

NOTES TO FINANCIAL STATEMENTS |

(continued) |

| |

| for fiscal years and interim periods beginning after November 15, 2008. FAS 161 changes the disclosure requirements for derivative instruments and hedging activities requiring that: (1) the objectives for using derivative instruments be disclosed in terms of underlying risk and accounting designation, (2) the fair values of derivative instruments and their gains and losses be disclosed in a tabular format, and (3) information be disclosed about credit-risk contingent features of derivatives contracts. The Fund adopted FAS 161 January 1, 2009. The Fund did not utilize derivative instruments during the six months ended June 30, 2009. |

| |

Note 3—Management Fees—Van Eck Associates Corporation (the “Adviser”) is the investment adviser to the Fund. The Adviser receives a management fee, calculated daily and payable monthly based on an annual rate of 2.50% of the Fund’s average daily net assets. For the period May 1, 2008 through April 30, 2009, the Adviser has agreed to waive management fees and/or assume expenses, excluding interest, taxes, dividends on securities sold short and extraordinary expenses, exceeding 1.95% of average daily net assets. For the period May 1, 2009 through April 30, 2010, the waiver was for expenses exceeding 2.15% of average daily net assets. In addition, the Adviser has agreed to waive its management fee with respect to any portion of the Fund’s assets invested directly by the Adviser in an Underlying Fund (Exchange Traded Funds or Open-End Funds) excluding money market funds. For the year ended June 30, 2009, the Adviser waived management fees in the amount of $47,673 related to the 2.50% expense waiver and $23,942 related to the Underlying Fund waiver. Certain of the officers and trustees of the Trust are officers, directors or stockholders of the Adviser and Van Eck Securities Corporation, the Distributor. |

| |

As of June 30, 2009, the Fund had three sub-advisers, Analytic Investors, Inc. (“Analytic”), Clutterbuck Capital Management LLC (Clutterbuck) and Lazard Asset Management LLC (Lazard). The Adviser directly paid sub-advisory fees to Analytic and Lazard at a rate of 1.00% of the portion of the average daily net assets of the Fund managed by Analytic, Clutterbuck and Lazard. |

| |

Note 4—Investments—For the six months ended June 30, 2009, the cost of purchases and proceeds from sales of investments other than U.S. government securities and short-term obligations aggregated $6,429,750 and $7,427,855, respectively. For the six months ended June 30, 2009, proceeds of short sales and the cost of purchases of short sale covers aggregated $2,769,806 and $4,464,301, respectively. |

| |

Note 5—Income Taxes—For Federal income tax purposes, the identified cost of investments owned at June 30, 2009 was $7,454,975 and net unrealized |

26

depreciation aggregated $185,784 of which $476,423 related to appreciated securities and $662,207 related to depreciated securities.

The tax character of dividends and distributions paid to shareholders was as follows:

| | | | | | | | | | | |

| | Six Months Ended

June 30,

2009 | | Year Ended

December 31,

2008 | |

| | | | | |

Ordinary income | | | $ | 383,803 | | | | $ | 13,228 | | |

Long term capital gains | | | | — | | | | | 244,899 | | |

| | | | | | | | | | | |

Total | | | $ | 383,803 | | | | $ | 258,127 | | |

| | | | | | | | | | | |

The Financial Accounting Standards Board Interpretation No. 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained by the applicable tax authority, and is applicable to all open tax years (tax years ended December 31, 2005-2008). The Fund evaluated the tax positions taken and to be taken, and concluded that no provision for income tax is required in the Fund’s financial statements.

Note 6—Concentration of Risk—The Fund may invest in debt securities which are rated as below investment grade by rating agencies. Such securities involve more risk of default than do higher rated securities and are subject to greater price variability.

At June 30, 2009, Van Eck Securities Corp. owned approximately 19% of the outstanding shares of beneficial interest of the Fund. Additionally, the aggregate shareholder accounts of three insurance companies own approximately 33%, 27%, and 16% of the outstanding shares of beneficial interest of the Fund.

Note 7—Trustee Deferred Compensation Plan—The Trust has established a Deferred Compensation Plan (the “Plan”) for Trustees under which the Trustees can elect to defer receipt of their Trustee fees until retirement, disability or termination from the Board of Trustees. The fees otherwise payable to the participating Trustees are deemed invested in shares of the Van Eck Funds (another registered investment company managed by the Adviser) as directed by the Trustees.

The expense for the deferred compensation plan is included in “Trustees’ fees and expenses” in the Statement of Operations. The liability for the deferred compensation plan is shown as “Deferred Trustee fees” in the Statement of Assets and Liabilities.

Note 8—Custodian Fees—The Fund has entered into an expense offset agreement with its custodian wherein it receives credit toward the reduction of

27

|

| |

NOTES TO FINANCIAL STATEMENTS |

(continued) |

custodian fees whenever there are uninvested cash balances. For the six months ended June 30, 2009, there were no offsets of custodial fees.

Note 9—Name Change—On May 1, 2009, the name of the Fund was changed from the Worldwide Absolute Return Fund to the Worldwide Multi-Manager Alternatives Fund.

Note 10—Subsequent Event Review—The Fund has adopted FASB Statement No.165, Subsequent Events (“FAS 165”) which was issued in May 2009 and is effective for fiscal years and interim periods ending after June 15, 2009. FAS 165, requires evaluation of subsequent events through the date of financial statement issuance. Subsequent events for the Fund have been evaluated through August 17, 2009, and there are no material subsequent events requiring disclosure.

28

|

| |

APPROVAL OF ADVISORY AND SUB-ADVISORY AGREEMENTS |

The Investment Company Act of 1940, as amended, provides, in substance, that each investment advisory agreement between a fund and its investment advisers will be entered into only if it is approved, and will continue in effect from year to year, after an initial two-year period, only if its continuance is approved at least annually, by the Board of Trustees (the “Board”), including by a vote of a majority of the Trustees who are not “interested persons” of the Fund (“Independent Trustees”), cast in person at a meeting called for the purpose of considering such approval.

Approval of Advisory and Sub-Advisory Agreements

In considering the renewal of the Fund’s existing investment advisory and sub-advisory agreements, the Board reviewed and considered information that had been provided by the Adviser and the Fund’s existing sub-advisers, which consist of the following: Analytic Investors, LLC (“Analytic”), Lazard Asset Management LLC (“LAM”), Martingale Asset Management, L.P. (“Martingale”) and PanAgora Asset Management LLC (“PanAgora,” and, collectively with Analytic, LAM and Martingale, the “Existing Sub-Advisers”). Such information had been provided throughout the year at regular Board meetings, as well as information requested by the Board and furnished by the Adviser and the Existing Sub-Advisers for the meetings of the Board held on May 19, 2009 and June 3 and 4, 2009 to specifically consider the renewal of the Fund’s investment advisory agreements. This information included, among other things, the following:

| | |

| • | Information about the overall organization of the Adviser and the Adviser’s short-term and long-term business plan with respect to its mutual fund operations; |

| | |

| • | The Adviser’s consolidated financial statements for the past three fiscal years; |

| | |

| • | A description of the advisory and sub-advisory agreements with the Fund, their terms and the services provided thereunder; |

| | |

| • | Information regarding each Existing Sub-Adviser’s organization, personnel, investment strategies and key compliance procedures; |

| | |

| • | Information concerning the Adviser’s compliance program, the resources devoted to compliance efforts undertaken by the Adviser and its affiliates on behalf of the Fund, and reports regarding a variety of compliance-related issues; |

| | |

| • | An independently prepared report comparing the management fees and non-investment management expenses of the Fund during its fiscal year ended December 31, 2008 with those of (i) the universe |

29

|

| |

APPROVAL OF ADVISORY AND SUB-ADVISORY AGREEMENTS |

(continued) |

| | |

| | of funds with a similar investment strategy, offered in connection with variable insurance products (the “Expense Universe”), and (ii) a sub-group of the Expense Universe consisting of funds of comparable size and fees and expense structure (the “Peer Group”); |

| | |

| • | An independently prepared report comparing the Fund’s annualized investment performance for the one- through five-year periods ended December 31, 2008 with those of (i) the universe of funds with a similar investment strategy and with at least one year of performance history, offered in connection with variable insurance products (the “Performance Universe”), (ii) its Peer Group, and (iii) appropriate benchmark indices as identified by an independent data provider; |

| | |

| • | Additional comparative information prepared by the Adviser concerning the performance and fees and expenses of the Fund and of relevant peer funds with a management structure and investment strategies and techniques comparable to those of the Fund; |

| | |

| • | Information regarding the performance results of the Fund’s sub-advisers in managing their respective portions of the Fund’s assets; |

| | |

| • | An analysis of the profitability of the Adviser with respect to the services it provides to the Fund and the Van Eck complex of mutual funds as a whole; |

| | |

| • | Reports with respect to the Adviser’s brokerage practices, including the benefits received by the Adviser from research acquired with soft dollars; and |

| | |

| • | Other information provided by the Adviser and each Existing Sub-Adviser in response to a comprehensive questionnaire prepared by independent legal counsel on behalf of the Independent Trustees. |

In considering whether to approve the investment advisory and sub-advisory agreements, the Board evaluated the following factors: (1) the quality, nature, cost and character of the investment management services provided by the Existing Sub-Advisers; (2) the capabilities and background of the Existing Sub-Advisers’ investment personnel, and the overall capabilities, experience, resources and strengths of each Existing Sub-Adviser and its affiliates in managing investment companies and other accounts utilizing similar investment strategies; (3) the quality, nature, cost and character of the administrative and other services provided by the Adviser and its affiliates, including its services in overseeing the services provided by each Existing Sub-Adviser; (4) the quality, nature and extent of

30

the services performed by the Adviser in interfacing with, and monitoring the services performed by, third parties, such as the Fund’s custodian, transfer agent, sub-accounting agent and independent auditors, and the Adviser’s commitment and efforts to review the quality and pricing of third party service providers to the Fund with a view to reducing non-management expenses of the Fund; (5) the terms of the advisory and sub-advisory agreements and the reasonableness and appropriateness of the particular fee paid by the Fund for the services described therein; (6) the profits, if any, realized by the Adviser from managing the Fund, in light of the services rendered and the costs associated with providing such services; (7) the Adviser’s willingness to reduce the cost of the Fund to shareholders from time to time by means of waiving a portion of its management fees or paying expenses of the Fund or by reducing fees from time to time; (8) the services, procedures and processes used to determine the value of Fund assets, and the actions taken to monitor and test the effectiveness of such services, procedures and processes; (9) the ongoing efforts of, and resources devoted by, the Adviser with respect to the development of a comprehensive compliance program and written compliance policies and procedures, and the implementation of recommendations of independent consultants with respect to a variety of compliance issues; (10) the responsiveness of the Adviser and its affiliated companies to inquiries from, and examinations by, regulatory agencies such as the Securities and Exchange Commission; (11) the Adviser’s record of compliance with its policies and procedures; and (12) the ability of the Adviser and each Existing Sub-Adviser to attract and retain quality professional personnel to perform a variety of investment advisory and administrative services for the Fund.

The Board considered the fact that the Adviser is managing other investment products and vehicles, including exchange-traded funds, hedge funds and separate accounts, that invest in the same financial markets and are managed by the same investment professionals according to a similar investment strategy as the Fund. The Board concluded that the management of these products contributes to the Adviser’s financial stability and is helpful to the Adviser in attracting and retaining quality portfolio management personnel for the Fund. In addition, the Board concluded that the Adviser has established appropriate procedures to monitor conflicts of interest involving the management of the Fund and the other products and for resolving any such conflicts of interest in a fair and equitable manner.

31

|

| |

APPROVAL OF ADVISORY AND SUB-ADVISORY AGREEMENTS |

(continued) |

In evaluating the investment performance of the Fund, the Board noted that the Fund had outperformed, on an annualized basis, its Performance Universe average and its benchmark index for the one- through four-year periods ended December 31, 2008. The Board concluded that the performance of the Fund is satisfactory. When considering the fees and expenses of the Fund, the Board noted that, during 2008, the expense ratio, net of waivers, for the Fund was within the range of expense ratios for its Expense Universe. The Board also noted that that the Fund is unique in its structure and investment strategy, and that the Adviser has agreed to waive or to reimburse expenses through April 2010 to the extent necessary to maintain an agreed upon expense ratio. The Board concluded that the management fee charged to the Fund for advisory, sub-advisory and related services is reasonable and that the total expense ratio of the Fund is reasonable.

The Board noted that the Fund commenced its operations on May 1, 2003, and that the Adviser has not realized any profits with respect to the Fund since its commencement, and may not realize profits in the coming year. In view of the small size of the Fund and the fact that none of the Existing Sub-Advisers is affiliated with the Adviser, the Board concluded that the profitability of the Existing Sub-Advisers was not a relevant factor in its renewal deliberations regarding the Existing Sub-Advisers. Similarly, the Board concluded that the Fund does not have sufficient assets for the Adviser or any Existing or New Sub-Adviser to realize economies of scale for the foreseeable future, and, therefore, that the implementation of breakpoints would not be warranted at this time.

The Board concluded that each of the Existing Sub-Advisers continues to be qualified to manage the Fund’s assets in accordance with its respective investment objectives and policies, that each Existing Sub-Adviser’s investment strategy is appropriate for pursuing the Fund’s investment objectives, and that the respective strategies of all the Existing and New Sub-Advisers would be complementary in pursuing the Fund’s investment objective.

The Board did not consider any single factor as controlling in determining whether or not to renew the investment advisory agreement. Nor are the items described herein all of the matters considered by the Board. Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, and assisted by the advice of its independent counsel, the Board concluded that the renewal of the investment advisory agreements, including the fee structures

32

(described herein) is in the interests of shareholders, and accordingly, the Board approved the continuation of the advisory agreements for an additional one-year period.

A description of the Board’s considerations in approving agreements with other sub-advisers during in-person meetings held on June 11-12, 2008 and December 3-4, 2008 is contained in the Fund’s annual report dated December 31, 2008. Of the sub-advisers approved at such meetings, the Adviser and the Fund have entered into sub-advisory agreements with respect to the Fund with Clutterbuck Capital Management LLC, Columbus Circle Investors, LP, Dix Hills Partners, LLC, Explorer Alternative Management, LLC and Tetra Capital Management, LLC, but have not entered into sub-advisory agreements with Glazer Capital, LLC or Stonebrook Capital Management, LLC.

33

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

|

|

This report must be preceded or accompanied by a Van Eck Worldwide Insurance Trust (the “Trust”) Prospectus, which includes more complete information. An investor should consider the investment objective, risks, and charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the investment company. Please read the prospectus carefully before investing. |

|

Additional information about the Trust’s Board of Trustees/Officers and a description of the policies and procedures the Trust uses to determine how to vote proxies relating to portfolio securities are provided in the Statement of Additional Information and information regarding how the Trust voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available, without charge, by calling 1.800.826.2333, or by visiting www.vaneck.com, or on the Securities and Exchange Commission’s website at http://www.sec.gov. |

|