| | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-02280) | |

| |

| Exact name of registrant as specified in charter: | Putnam Convertible Securities Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | 800 Boylston Street |

| | Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: October 31, 2010 | | |

| |

| Date of reporting period: November 1, 2009 — October 31, 2010 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam

Convertible

Securities Fund

Annual report

10 | 31 | 10

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio managers | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 13 | | |

| | |

| Terms and definitions | 15 | | |

| | |

| Trustee approval of management contract | 16 | | |

| | |

| Other information for shareholders | 20 | | |

| | |

| Financial statements | 21 | | |

| | |

| Federal tax information | 44 | | |

| | |

| Shareholder meeting results | 45 | | |

| | |

| About the Trustees | 46 | | |

| | |

| Officers | 48 | | |

| | |

Message from the Trustees

Dear Fellow Shareholder:

Stock markets around the world rallied strongly over the past few months, riding a rising tide of strengthening investor confidence and slowly improving economic and corporate data. Indeed, U.S. stocks delivered their best September in 71 years, and continued to add to those gains in October. Bond markets also have generated positive results for much of 2010 and continue to be a source of refuge for risk-averse investors.

It is important to recognize, however, that we may see periods of heightened market volatility as markets and economies seek more solid ground. The slow pace of the U.S. economic recovery and ongoing European sovereign debt concerns have made markets more susceptible to disappointing news. We believe, however, that Putnam’s research-intensive, actively managed investment approach is well suited for this environment.

In developments affecting oversight of your fund, Barbara M. Baumann has been elected to the Board of Trustees of the Putnam Funds, effective July 1, 2010. Ms. Baumann is president and owner of Cross Creek Energy Corporation of Denver, Colorado, a strategic consultant to domestic energy firms and direct investor in energy assets. We also want to thank Elizabeth T. Kennan, who has retired from the Board of Trustees, for her many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Seeking undervalued companies before their potential is recognized

The differences between bonds and stocks seem fairly clear-cut. Stocks provide an ownership stake in a company; bonds provide a claim on the interest paid by a company or other entity on its debt. The value of stocks rises and falls with factors such as investor sentiment, company news, and economic conditions; bonds are issued by a government, agency, company, or public utility that typically promises to pay the bearer a fixed rate of interest at specified intervals and to return a set amount of money at a specified end date (the maturity date). A bond’s yield and its price are often influenced by interest-rate levels and the issuer’s credit quality.

A third type of security is a hybrid of a stock and a bond. Like a bond, a convertible security offers a set rate of interest, but unlike a bond, it has a built-in option that, under certain circumstances, allows the investor to exchange (or convert) the security for a fixed number of shares of stock. This feature of fers the potential for capital appreciation, since the preset conversion price does not change as the underlying stock price increases or decreases.

Convertibles are issued by companies and can offer greater returns than high-quality bonds — but they also carry greater risk potential, such as the risk of default or periodic illiquidity. Issuers range from large, well-known S&P 500 corporations and small, rapidly growing companies, to companies in cyclically depressed industries.

Constructing a portfolio that maintains an appropriate balance of risk and return potential requires intensive research and analysis. Putnam’s analysts conduct rigorous fundamental research, seeking to determine the true worth of the issuing company’s business. Putnam Convertible Securities Fund's portfolio managers then construct a portfolio that they believe offers the best return potential without undue risk.

Consider these risks before investing:

The fund may invest a portion of its assets in small and/or midsize companies. Such investments increase the risk of greater price fluctuations. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

The “busted” convertible

One kind of security in which your fund may invest is the “busted” convertible. “Busted” refers to a security whose underlying stock price has fallen significantly below the conversion price. It becomes much less sensitive to the volatility of the underlying stock and is more bond-like, responding to interest-rate changes. A busted convertible may pay a higher yield than other convertibles, but may also carry a higher level of risk. (Some companies in this situation may eventually default on their bonds.)

The objective of buying a busted convertible is to take advantage of a company’s eventual turnaround despite its present challenges. For example, a company undergoing management turmoil may draw negative investor reactions, causing its stock price to tumble. However, if intens ive research determines that the management crisis is likely to be resolved, the fund manager could buy the security at a steep discount. The goal is to sell the security at a higher price when the credit improves or when the stock revives.

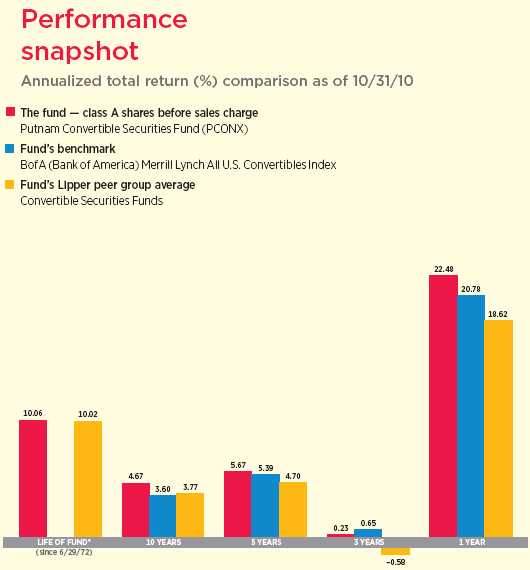

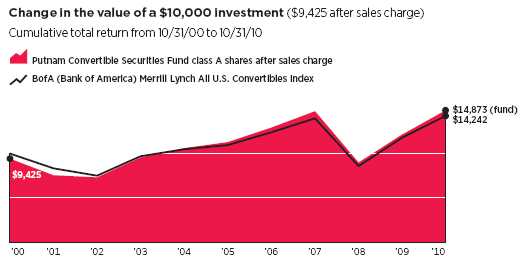

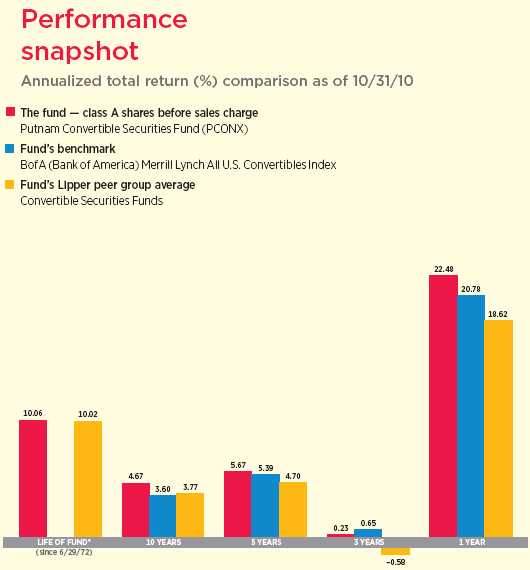

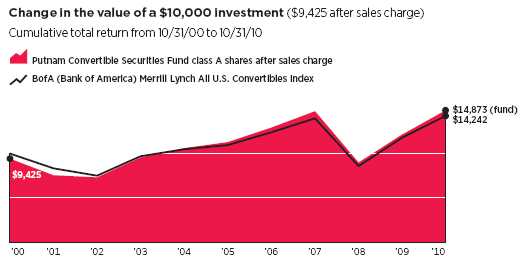

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the BofA (Bank of America) Merrill Lynch All U.S. Convertibles Index, was introduced on 12/31/87, which post-dates the inception of the fund’s class A shares.

4

Interview with your fund’s portfolio managers

Eric Harthun and Robert Salvin

How did the fund perform for the year ended October 31, 2010?

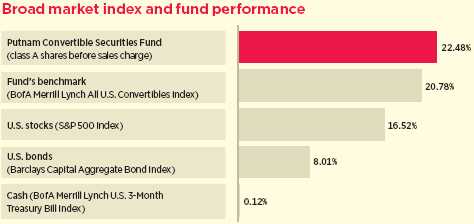

Eric: I’m pleased to report that Putnam Convertible Securities Fund’s class A shares returned 22.48%, outperforming both its benchmark, the BofA Merrill Lynch All U.S. Convertibles Index, which advanced 20.78%, and the average return of its Lipper peer group, Convertible Securities Funds, which finished at 18.62%.

How would you characterize the market environment during this period?

Rob: Supportive equity and fixed-income markets buoyed convertible securities during the past 12 months. Despite bouts of volatility, major U.S. stock market indexes recorded double-digit gains during the period, lifted by economic optimism, encouraging earnings reports, and a wave of corporate mergers. Aside from a January dip, stocks trended upward for the first half of the period amid indications that the Great Recession was over. However, in April, lingering high unemployment and heightened concern over European sovereign debt sent equities falling. Markets regrouped in July, but fell again in August on mixed economic data. The final two months of the period brought renewed optimism, with the S&P 500 Index posting its best September/October performance since 1998. For the period, mid- and small - -cap stocks outpaced large caps, which benefited the fund, given its bias toward smaller and midsize companies.

Corporate credit spreads — or the yield advantage corporate bonds offer over U.S. Treasuries — narrowed during the period as bond prices rose. Corporate bonds in both the investment-grade and high-yield markets were helped by better profitability, stronger balance sheets, and improved borrowing conditions for corporations.

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 10/31/10. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 15.

5

In the convertibles market, the rally by lower-credit-quality issuers that began in 2009 continued throughout this period. We believed that some of the greatest inefficiencies were in this area of the market, and as a result, the fund benefited from our holdings in several companies with below-investment-grade credit ratings. In addition, given the combination of equity-market appreciation and tightening yield spreads, the trade-off between yield and equity sensitivity — always a significant investment dynamic with convertibles — was more balanced than it had been prior to this period. Market liquidity improved as convertibles continued to attract “crossover” equity and corporate bond investors seeking higher yields, while also benefiting from strong demand from traditional investors in the sector.

What were the key factors that enabled the fund to outperform?

Eric: Solid security selection in four primary sectors — technology, energy, capital goods, and communication services — drove the fund’s outperformance. The top individual contributor was an out-of-benchmark investment in Virgin Media, a provider of cable television, broadband Internet, and telephone services in the United Kingdom. Like many other holdings in the fund, Virgin’s convertibles rebounded strongly from the depths of the recession. In addition, the company’s fortunes benefited from a U.K. economy that is slowly improving as the effects of fiscal austerity begin to take hold.

An overweight position in Safeguard Scientifics was another leading contributor. Safeguard is a private equity and venture capital firm specializing in expansion and early-stage financing, and growth capital for technology companies. Safeguard began to reap the benefits from many of the companies it has helped finance, and the cash flows it received from its investments boosted the company’s credit profile and its securities.

Interpublic Group, one of the world’s largest organizations of advertising agencies and

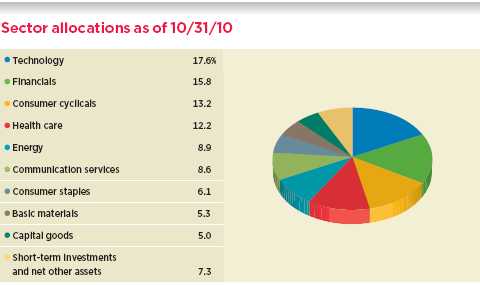

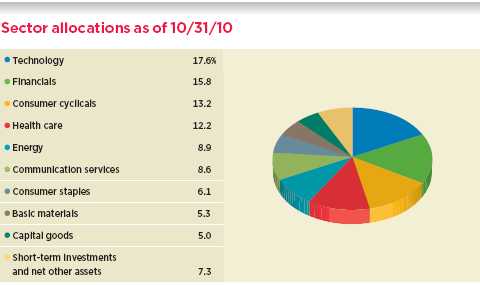

Allocations are represented as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

6

marketing communications companies, also aided results. Demand for the company’s convertibles grew, thanks to operational improvements and the cyclical recovery in advertising spending.

Overweighting convertibles issued by ADC Telecommunications proved to be the right strategy as the supplier of fiber optics, network equipment, software, and integration services for broadband and multi-service networks agreed to be acquired by Tyco Electronics. Consequently, we sold the position during the period.

Underweighting convertibles issued by Transocean, the world’s largest offshore drilling company, also helped. Transocean’s stock and convertibles plummeted from late April until early June as its Deepwater Horizon rig burned and sank in the Gulf of Mexico. We liquidated the fund’s position during the period.

Underweighting biotechnology giant Amgen was another helpful decision. The company’s convertibles underperformed due to investors’ concern that changes in government reimbursement policies resulting from U.S. health-care reform could negatively affect Amgen’s revenues and profitability.

Which positions weren’t as productive?

Rob: A key tenet in our strategy has been to seek to control the fund’s risk by keeping the portfolio broadly diversified. This approach typically prevents us from taking index-sized positions in many of the benchmark’s largest constituents. For example, we held a significantly underweighted stake in the convertibles of Ford Motor. Ford’s convertible shares — whose prices advanced substantially during the period — are heavily represented in the index, and therefore

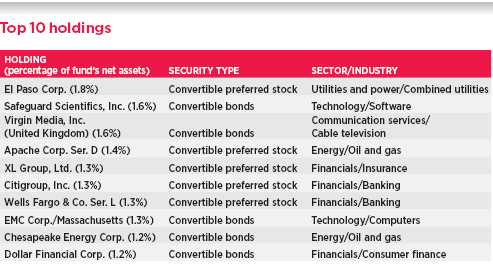

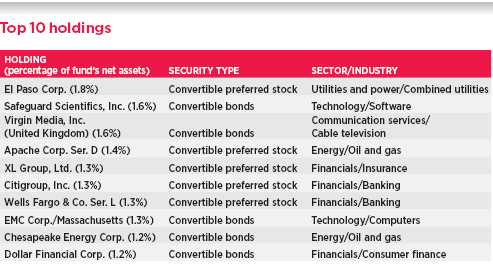

This table shows the fund’s top 10 individual holdings and the percentage of the fund’s net assets that each represented as of 10/31/10. Short-term holdings are excluded. Holdings will vary over time.

7

our underweighted exposure detracted from performance.

Underweighting United Continental Holdings, the parent company of United Airlines and Continental Airlines — which merged during the period — also hurt. Airlines were one of the best-performing industries in the convertibles market during this period, due in part to merger-related transactions. However, we maintained a cautious approach to airlines, given their capital-intensive, high-cost business models, and the shifting influence of fuel costs on their profitability. We sold United Continental during the period.

An overweight position in Dole Food disappointed. Despite favorable expectations for the securities of this producer and marketer of fresh fruits and vegetables, Dole’s business fundamentals did not materialize as we had hoped. Specifically, adverse trends in banana pricing weighed on the company’s bottom line.

Largely avoiding Gilead Sciences, a biotechnology firm focusing on AIDS drugs, also detracted, as did underweighting Host Hotels & Resorts, which operates luxury and upscale hotels. We steered clear of Gilead and underweighted Host because we believed their securities did not offer favorable risk/reward trade-offs.

What is your outlook for the economy, the convertibles market, and the fund over the coming months?

Eric: Following the September/October rally, we believe the upward momentum in U.S. stocks can continue. Our indicators suggest that domestic equities remain fairly but not excessively valued in absolute terms, and compare favorably with bonds in relative terms.

With respect to convertibles, we evaluate the market by looking at three key factors: fundamentals, valuation, and “technicals,” or the balance of supply and demand. As of now, we are positive on fundamentals and technicals, and neutral on valuation.

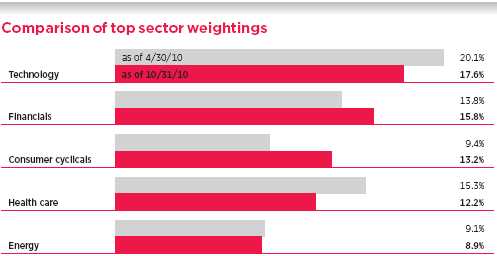

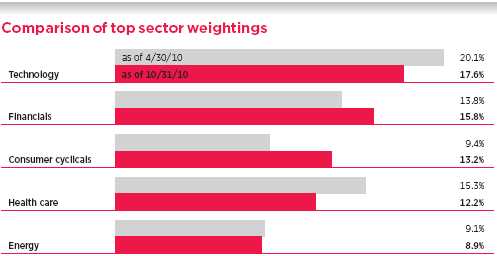

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

Data in the chart reflect a new calculation methodology placed in effect within the past six months.

8

Looking first at fundamentals, we believe the U.S. economy will continue to slowly improve, and we anticipate that corporate earnings will continue to benefit from the stringent cost-cutting measures implemented in 2009, combined with recovering demand.

Regarding technicals, in our view, the environment remains supportive. Convertibles continued to attract equity and fixed-income investors seeking better risk-adjusted total returns, while the supply of new securities remains constrained.

As for valuation, convertibles have advanced markedly from the historically cheap valuations reached during the height of the credit crisis. So, while convertible valuations are somewhat higher, we believe there are still pockets of value to be uncovered due to ongoing inefficiencies in the market. And it’s these inefficiencies that provide us with a continual stream of investment opportunities that we seek to capitalize on through our bottom-up research process that combines equity, fixed-income, and structural analysis.

Thanks for bringing us up to date, gentlemen.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Eric Harthun has an M.B.A. from The University of Chicago Booth School of Business and a B.S. from San Diego State University. A CFA charterholder, Eric joined Putnam in 2000 and has been in the investment industry since 1994.

Portfolio Manager Robert Salvin has an M.B.A. from The University of Chicago Booth School of Business and a B.S. from the Wharton School of the University of Pennsylvania. He joined Putnam in 2000 and has been in the investment industry since 1986.

IN THE NEWS

The Federal Reserve’s “QE2” has set sail. In light of what has been a tepid economic recovery, in October the Fed announced a second round of monetary stimulus via quantitative easing — dubbed QE2 by the media — involving the purchase of an additional $600 billion of U.S. Treasury bonds through the end of June 2011. The Fed has suggested in recent months that it is particularly concerned about the prospect of deflation, which has plagued the Japanese economy for the better part of the past decade. By purchasing Treasuries, the central bank could drive down already low yields by injecting about $75 billion a month into the capital markets. The idea behind QE2 is that the money would then be reinvested, and the expected upward pressure on asset prices could create inflationary expectations sufficient to prevent deflation from becoming a problem.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended October 31, 2010, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 10/31/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (6/29/72) | (7/15/93) | (7/26/99) | (3/13/95) | (12/1/03) | (12/30/98) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 10.06% | 9.89% | 9.10% | 9.10% | 9.23% | 9.23% | 9.38% | 9.28% | 9.78% | 10.14% |

|

| 10 years | 57.83 | 48.73 | 46.38 | 46.38 | 46.37 | 46.37 | 50.08 | 44.84 | 53.94 | 61.76 |

| Annual average | 4.67 | 4.05 | 3.88 | 3.88 | 3.88 | 3.88 | 4.14 | 3.77 | 4.41 | 4.93 |

|

| 5 years | 31.78 | 24.17 | 26.88 | 24.88 | 26.96 | 26.96 | 28.57 | 24.05 | 30.13 | 33.42 |

| Annual average | 5.67 | 4.42 | 4.88 | 4.54 | 4.89 | 4.89 | 5.15 | 4.40 | 5.41 | 5.94 |

|

| 3 years | 0.70 | –5.07 | –1.57 | –4.30 | –1.52 | –1.52 | –0.81 | –4.28 | –0.07 | 1.43 |

| Annual average | 0.23 | –1.72 | –0.53 | –1.45 | –0.51 | –0.51 | –0.27 | –1.45 | –0.02 | 0.47 |

|

| 1 year | 22.48 | 15.45 | 21.52 | 16.52 | 21.58 | 20.57 | 21.85 | 17.55 | 22.12 | 22.73 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund may have had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the fund’s prospectus.

10

Comparative index returns For periods ended 10/31/10

| | |

| | BofA (Bank of America) | Lipper Convertible Securities |

| | Merrill Lynch All U.S. Convertibles Index | Funds category average* |

|

| Annual average (life of fund) | —† | 10.02% |

|

| 10 years | 42.42% | 45.75 |

| Annual average | 3.60 | 3.77 |

|

| 5 years | 30.01 | 26.17 |

| Annual average | 5.39 | 4.70 |

|

| 3 years | 1.96 | –1.57 |

| Annual average | 0.65 | –0.58 |

|

| 1 year | 20.78 | 18.62 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 10/31/10, there were 66, 54, 49, 42, and 2 funds, respectively, in this Lipper category.

† The fund’s benchmark, the BofA (Bank of America) Merrill Lynch All U.S. Convertibles Index, was introduced on 12/31/87, which post-dates the inception of the fund’s class A shares.

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $14,638 and $14,637, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $14,484 at public offering price. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $15,394 and $16,176, respectively.

11

Fund price and distribution information For the 12-month period ended 10/31/10

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 4 | 4 | 4 | 4 | 4 | 4 |

|

| Income | $0.568 | $0.430 | $0.432 | $0.475 | $0.524 | $0.614 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.568 | $0.430 | $0.432 | $0.475 | $0.524 | $0.614 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 10/31/09 | $16.27 | $17.26 | $16.01 | $16.12 | $16.13 | $16.72 | $16.22 | $16.27 |

|

| 10/31/10 | 19.31 | 20.49 | 18.99 | 19.13 | 19.14 | 19.83 | 19.24 | 19.30 |

|

| Current yield (end of period) | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| Current dividend rate 1 | 2.94% | 2.77% | 2.23% | 2.24% | 2.47% | 2.38% | 2.72% | 3.19% |

|

| Current 30-day SEC yield 2 | N/A | 2.63 | 2.05 | 2.05 | N/A | 2.22 | 2.54 | 3.03 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter

Total return for periods ended 9/30/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (6/29/72) | (7/15/93) | (7/26/99) | (3/13/95) | (12/1/03) | (12/30/98) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 10.01% | 9.84% | 9.05% | 9.05% | 9.18% | 9.18% | 9.33% | 9.23% | 9.73% | 10.09% |

|

| 10 years | 48.41 | 39.85 | 37.59 | 37.59 | 37.57 | 37.57 | 41.13 | 36.16 | 44.79 | 52.09 |

| Annual average | 4.03 | 3.41 | 3.24 | 3.24 | 3.24 | 3.24 | 3.51 | 3.13 | 3.77 | 4.28 |

|

| 5 years | 25.87 | 18.61 | 21.16 | 19.15 | 21.14 | 21.14 | 22.69 | 18.39 | 24.28 | 27.43 |

| Annual average | 4.71 | 3.47 | 3.91 | 3.57 | 3.91 | 3.91 | 4.17 | 3.43 | 4.44 | 4.97 |

|

| 3 years | –0.21 | –5.94 | –2.47 | –5.17 | –2.47 | –2.47 | –1.72 | –5.16 | –0.97 | 0.51 |

| Annual average | –0.07 | –2.02 | –0.83 | –1.75 | –0.83 | –0.83 | –0.58 | –1.75 | –0.32 | 0.17 |

|

| 1 year | 16.93 | 10.23 | 15.99 | 10.99 | 16.01 | 15.01 | 16.28 | 12.19 | 16.64 | 17.17 |

|

12

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 10/31/09* | 1.23% | 1.98% | 1.98% | 1.73% | 1.48% | 0.98% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 10/31/10† | 1.17% | 1.92% | 1.92% | 1.67% | 1.42% | 0.92% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Reflects projected expenses under a new management contract effective 1/1/10 and a new expense arrangement.

† For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

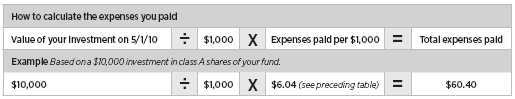

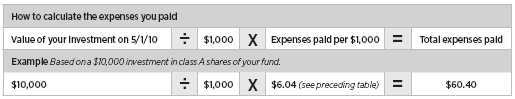

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in Putnam Convertible Securities Fund from May 1, 2010, to October 31, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.04 | $9.90 | $9.90 | $8.61 | $7.33 | $4.75 |

|

| Ending value (after expenses) | $1,049.40 | $1,044.90 | $1,045.80 | $1,046.60 | $1,047.80 | $1,050.30 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended October 31, 2010, use the following calculation method. To find the value of your investment on May 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.96 | $9.75 | $9.75 | $8.49 | $7.22 | $4.69 |

|

| Ending value (after expenses) | $1,019.31 | $1,015.53 | $1,015.53 | $1,016.79 | $1,018.05 | $1,020.57 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 10/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

14

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch All U.S.

Convertibles Index is an unmanaged index of high-yield U.S. convertible securities.

BofA (Bank of America) Merrill Lynch U.S.

3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

15

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2010, the Contract Committee met on a number of occasions with representatives of Putnam Management and in executive session to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. At the Trustees’ June 11, 2010 meeting, the Contract Committee recommended, and the Independent Trustees appro ved, the continuance of your fund’s management contract, and sub-management contracts, effective July 1, 2010. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing such services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in prior years.

Consideration of implementation of strategic pricing initiative

The Trustees were mindful that new management contracts had been implemented for all but a few funds at the beginning of 2010 as part of Putnam Management’s strategic pricing initiative. These new management contracts reflected the implementation of more competitive fee levels for many funds,

16

complex-wide breakpoints for the open-end funds and performance fees for some funds. The Trustees had approved these new management contracts on July 10, 2009 and submitted them to shareholder meetings of the affected funds in late 2009, where the contracts were in all cases approved by overwhelming majorities of the shares voted.

Because the management contracts had been implemented only recently, the Contract Committee had limited practical experience with the operation of the new fee structures. The financial data available to the Committee reflected actual operations under the prior contracts; information was also available on a pro forma basis, adjusted to reflect the fees payable under the new management contracts. In light of the limited information available regarding operations under the new management contracts, in recommending the continuation of the new management contracts in June 2010, the Contract Committee relied to a considerable extent on its review of the financial information and analysis that formed the basis of the Board’s approval of the new management contracts on July 10, 2009.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

As in the past, the Trustees continued to focus on the competitiveness of the total expense ratio of each fund. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement certain expense limitations. Most funds, including your fund, had sufficiently low expenses that these expense limitations did not apply. The expense limitations were: (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, taxes, brokerage commissions and extraordinary expenses). These expense limitations serve in particular to maintain competitive expense levels for fun ds with large numbers of small shareholder accounts and funds with relatively small net assets.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 3rd quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 3rd quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2009 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The Trustees also considered that your fund ranked in the 3rd quintile in effective management fees, on a pro forma basis adjusted to reflect

17

the impact of the strategic pricing initiative discussed above, as of December 31, 2009.

Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee observed that the complex-wide breakpoints of the open-end funds have only been in place for a short while, and the Trustees will examine the operation of this new breakpoint structure in future years in light of actual experience.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at c urrent asset levels, the fee schedules currently in place represented an appropriate sharing of economies of scale at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of such fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset clas ses are typically higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients, and did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which met on a regular basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable invest ment results for every fund in every time period. The Trustees

18

considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Committee noted the substantial improvement in the performance of most Putnam funds during 2009. The Committee also noted the disappointing investment performance of a number of the funds for periods ended December 31, 2009 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve performance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (Lipper Convertible Securities Funds) for the one-year, three-year and five-year periods ended December 31, 2009 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| | | |

| One-year period | 1st | | |

| | |

| Three-year period | 3rd | | |

| | |

| Five-year period | 2nd | | |

| | |

Over the one-year, three-year and five-year periods ended December 31, 2009, there were 62, 51 and 48 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered a change made, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policies commencing in 2010, which increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees noted that a portion of available soft dollars continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management contract, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

19

Other information for shareholders

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section at putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of October 31, 2010, Putnam employees had approximately $324,000,000 and the Trustees had approximately $68,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

20

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

21

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam Convertible Securities Fund:

We have audited the accompanying statement of assets and liabilities of Putnam Convertible Securities Fund (formerly Putnam Convertible Income-Growth Trust) (the fund), including the fund’s portfolio, as of October 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2010 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam Convertible Securities Fund as of October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

December 13, 2010

22

The fund’s portfolio 10/31/10

| | |

| CONVERTIBLE BONDS AND NOTES (69.5%)* | Principal amount | Value |

|

| Aerospace and defense (1.4%) | | |

| AAR CORP. 144A cv. sr. unsec. notes 2 1/4s, 2016 | $5,600,000 | $5,124,000 |

|

| Triumph Group, Inc. 144A cv. sr. sub. notes 2 5/8s, 2026 | 2,700,000 | 4,218,750 |

|

| | | 9,342,750 |

| Automotive (2.0%) | | |

| Ford Motor Co. cv. sr. unsec. notes 4 1/4s, 2016 | 4,290,000 | 7,461,597 |

|

| TRW Automotive, Inc. 144A cv. company | | |

| guaranty sr. notes 3 1/2s, 2015 | 3,500,000 | 5,985,000 |

|

| | | 13,446,597 |

| Beverage (0.8%) | | |

| Molson Coors Brewing Co. cv. company guaranty sr. unsec. | | |

| unsub. notes 2 1/2s, 2013 | 4,700,000 | 5,275,750 |

|

| | | 5,275,750 |

| Biotechnology (3.7%) | | |

| Amgen, Inc. cv. sr. unsec. notes 3/8s, 2013 | 4,400,000 | 4,411,000 |

|

| Amylin Pharmaceuticals, Inc. cv. sr. unsec. notes 3s, 2014 | 5,300,000 | 4,571,250 |

|

| Dendreon Corp. 144A cv. sr. unsec. sub. notes 4 3/4s, 2014 | 565,000 | 2,073,550 |

|

| Kendle International, Inc. cv. sr. unsec. notes 3 3/8s, 2012 | 3,800,000 | 3,491,250 |

|

| United Therapeutics Corp. cv. sr. unsec. notes 1/2s, 2011 | 500,000 | 805,625 |

|

| United Therapeutics Corp. 144A cv. sr. unsec. notes 1/2s, 2011 | 3,500,000 | 5,639,375 |

|

| Viropharma, Inc. cv. sr. unsec. notes 2s, 2017 | 3,000,000 | 3,330,000 |

|

| | | 24,322,050 |

| Broadcasting (0.9%) | | |

| XM Satellite Radio Holdings, Inc. 144A cv. sr. unsec. | | |

| sub. notes 7s, 2014 | 4,728,000 | 5,618,282 |

|

| | | 5,618,282 |

| Cable television (1.6%) | | |

| Virgin Media, Inc. cv. sr. unsec. notes 6 1/2s, 2016 | | |

| (United Kingdom) | 6,400,000 | 10,208,000 |

|

| | | 10,208,000 |

| Coal (2.4%) | | |

| International Coal Group, Inc. cv. company guaranty | | |

| sr. unsec. notes 4s, 2017 | 3,243,000 | 3,973,648 |

|

| James River Coal Co. 144A cv. sr. unsec. notes 4 1/2s, 2015 | 3,249,000 | 3,270,119 |

|

| Peabody Energy Corp. cv. jr. unsec. sub. debs. 4 3/4s, 2041 | 3,000,000 | 3,566,250 |

|

| Penn Virginia Corp. cv. sr. unsec. sub. notes 4 1/2s, 2012 | 4,890,000 | 4,792,200 |

|

| | | 15,602,217 |

| Commercial and consumer services (3.6%) | | |

| Alliance Data Systems Corp. cv. sr. unsec. notes 1 3/4s, 2013 | 6,300,000 | 6,378,750 |

|

| CBIZ, Inc. 144A cv. sr. sub. notes 4 7/8s, 2015 | 2,162,000 | 2,322,799 |

|

| Icahn Enterprises LP 144A cv. sr. unsec. notes FRN 4s, 2013 | 5,400,000 | 5,130,000 |

|

| Icahn Enterprises LP/Icahn Enterprises Finance Corp. | | |

| cv. sr. unsec. notes FRN 4s, 2013 | 765,000 | 726,750 |

|

| Live Nation Entertainment, Inc. cv. sr. unsec. notes 2 7/8s, 2027 | 2,700,000 | 2,328,750 |

|

| Live Nation Entertainment, Inc. 144A cv. sr. notes 2 7/8s, 2027 | 4,000,000 | 3,450,000 |

|

| Priceline.com, Inc. 144A cv. sr. unsec. notes 1 1/4s, 2015 | 2,519,000 | 3,621,063 |

|

| | | 23,958,112 |

| Communications equipment (0.8%) | | |

| ARRIS Group, Inc. cv. sr. unsec. notes 2s, 2026 | 5,000,000 | 4,946,875 |

|

| | | 4,946,875 |

23

| | |

| CONVERTIBLE BONDS AND NOTES (69.5%)* cont. | Principal amount | Value |

|

| Computers (2.5%) | | |

| EMC Corp./Massachusetts cv. sr. unsec. notes 1 3/4s, 2013 | $2,040,000 | $2,909,550 |

|

| EMC Corp./Massachusetts 144A cv. sr. unsec. notes 1 3/4s, 2013 | 5,800,000 | 8,272,250 |

|

| TeleCommunication Systems, Inc. 144A cv. sr. unsec. | | |

| notes 4 1/2s, 2014 | 5,205,000 | 4,970,775 |

|

| | | 16,152,575 |

| Conglomerates (0.5%) | | |

| Textron, Inc. cv. sr. unsec. notes Ser. TXT, 4 1/2s, 2013 | 1,800,000 | 3,100,320 |

|

| | | 3,100,320 |

| Consumer (1.0%) | | |

| Stanley Black & Decker, Inc. cv. sr. unsec. unsub. notes | | |

| FRN zero %, 2012 | 5,701,000 | 6,568,692 |

|

| | | 6,568,692 |

| Consumer finance (1.2%) | | |

| Dollar Financial Corp. cv. sr. notes 3s, 2028 | 6,900,000 | 7,814,250 |

|

| | | 7,814,250 |

| Consumer services (1.7%) | | |

| Avis Budget Group, Inc. cv. sr. notes 3 1/2s, 2014 | 4,105,000 | 4,325,644 |

|

| Hertz Global Holdings, Inc. cv. sr. unsec. notes 5 1/4s, 2014 | 4,445,000 | 6,923,088 |

|

| | | 11,248,732 |

| Containers (0.7%) | | |

| Owens Brockway Glass Container, Inc. 144A cv. company | | |

| guaranty sr. unsec. notes 3s, 2015 | 4,931,000 | 4,916,207 |

|

| | | 4,916,207 |

| Distribution (0.5%) | | |

| Spartan Stores, Inc. cv. sr. unsec. notes 3 3/8s, 2027 | 3,297,000 | 3,070,331 |

|

| | | 3,070,331 |

| Electrical equipment (0.7%) | | |

| WESCO International, Inc. cv. company guaranty sr. unsec. | | |

| notes 6s, 2029 | 2,484,000 | 4,301,294 |

|

| | | 4,301,294 |

| Electronics (3.5%) | | |

| Advanced Micro Devices, Inc. cv. sr. unsec. notes 6s, 2015 | 1,811,000 | 1,799,681 |

|

| EnerSys cv. sr. unsec. notes stepped-coupon 3 3/8s (zero %, | | |

| 6/1/15) 2038 †† | 3,617,000 | 3,743,595 |

|

| Intel Corp. cv. jr. sub. notes 3 1/4s, 2039 | 5,265,000 | 6,265,350 |

|

| Micron Technology, Inc. cv. sr. unsec. unsub. notes 1 7/8s, 2014 | 5,000,000 | 4,787,500 |

|

| TTM Technologies, Inc. cv. sr. unsec. notes 3 1/4s, 2015 | 6,300,000 | 6,323,940 |

|

| | | 22,920,066 |

| Energy (oil field) (0.9%) | | |

| Helix Energy Solutions Group, Inc. cv. sr. unsec. | | |

| unsub. notes 3 1/4s, 2025 | 3,600,000 | 3,429,000 |

|

| Global Industries, Ltd. 144A cv. unsec. notes 2 3/4s, 2027 | 3,000,000 | 2,175,000 |

|

| | | 5,604,000 |

| Energy (other) (0.5%) | | |

| Covanta Holding Corp. cv. sr. unsec. notes 3 1/4s, 2014 | 3,000,000 | 3,393,750 |

|

| | | 3,393,750 |

| Financial (1.2%) | | |

| CapitalSource, Inc. cv. company guaranty sr. unsec. | | |

| sub. notes 7 1/4s, 2037 | 2,700,000 | 2,727,000 |

|

| Digital Realty Trust LP 144A cv. sr. unsec. notes 5 1/2s, 2029 R | 2,300,000 | 3,441,375 |

|

| MGIC Investment Corp. cv. sr. notes 5s, 2017 | 1,698,000 | 1,893,440 |

|

| | | 8,061,815 |

24

| | |

| CONVERTIBLE BONDS AND NOTES (69.5%)* cont. | Principal amount | Value |

|

| Gaming and lottery (0.7%) | | |

| International Game Technology 144A cv. sr. unsec. | | |

| notes 3 1/4s, 2014 | $3,970,000 | $4,423,771 |

|

| | | 4,423,771 |

| Health-care services (2.8%) | | |

| Fisher Scientific International, Inc. cv. company | | |

| guaranty sr. sub. notes 3 1/4s, 2024 | 3,400,000 | 4,505,000 |

|

| Health Management Associates, Inc. | | |

| 144A cv. sr. sub. notes 3 3/4s, 2028 | 4,600,000 | 4,933,500 |

|

| LifePoint Hospitals, Inc. cv. sr. sub. notes 3 1/2s, 2014 | 3,300,000 | 3,279,375 |

|

| Omnicare, Inc. cv. company guaranty sr. unsec. debs | | |

| Ser. OCR, 3 1/4s, 2035 | 3,690,000 | 3,288,713 |

|

| Providence Service Corp. (The) cv. sr. unsec. | | |

| sub. notes 6 1/2s, 2014 | 2,493,000 | 2,477,419 |

|

| | | 18,484,007 |

| Insurance (1.5%) | | |

| American Equity Investment Life Holding Co. | | |

| 144A cv. sr. unsec. notes 3 1/2s, 2015 | 3,074,000 | 3,269,968 |

|

| Old Republic International Corp. cv. sr. unsec. | | |

| unsub. notes 8s, 2012 | 5,285,000 | 6,665,706 |

|

| | | 9,935,674 |

| Investment banking/Brokerage (0.5%) | | |

| KKR Financial Holdings, LLC cv. sr. unsec. notes 7 1/2s, 2017 | 2,600,000 | 3,427,125 |

|

| | | 3,427,125 |

| Lodging/Tourism (0.5%) | | |

| Host Hotels & Resorts LP 144A cv. company | | |

| guaranty sr. unsec. notes 2 1/2s, 2029 R | 2,465,000 | 3,238,394 |

|

| | | 3,238,394 |

| Manufacturing (2.2%) | | |

| General Cable Corp. cv. unsec. sub. notes stepped-coupon | | |

| 4 1/2s (2 1/4s, 11/15/19) 2029 †† | 6,580,000 | 6,793,850 |

|

| Griffon Corp. 144A cv. sub. notes 4s, 2017 | 2,658,000 | 2,754,485 |

|

| Teleflex, Inc. cv. sr. unsec. sub. notes 3 7/8s, 2017 | 4,415,000 | 4,839,944 |

|

| | | 14,388,279 |

| Media (0.8%) | | |

| Liberty Media, LLC cv. sr. unsec. unsub. notes 3 1/2s, 2031 | 10,300,000 | 5,550,155 |

|

| | | 5,550,155 |

| Medical technology (3.2%) | | |

| China Medical Technologies, Inc. cv. sr. unsec. | | |

| bonds Ser. CMT, 4s, 2013 (China) | 4,100,000 | 3,290,250 |

|

| Hologic, Inc. cv. sr. unsec. unsub. notes stepped-coupon 2s | | |

| (zero %, 12/15/13) 2037 †† | 5,400,000 | 5,089,500 |

|

| Life Technologies Corp. cv. sr. unsec. unsub. notes 1 1/2s, 2024 | 5,900,000 | 6,866,125 |

|

| Medtronic, Inc. cv. sr. unsec. notes 1 5/8s, 2013 | 3,600,000 | 3,622,500 |

|

| Medtronic, Inc. 144A cv. sr. unsec. notes 1 5/8s, 2013 | 1,900,000 | 1,911,875 |

|

| | | 20,780,250 |

| Metals (3.6%) | | |

| Goldcorp, Inc. cv. sr. notes 2s, 2014 (Canada) | 5,727,000 | 7,058,528 |

|

| Newmont Mining Corp. cv. company | | |

| guaranty sr. unsub. notes 1 5/8s, 2017 | 3,900,000 | 5,616,000 |

|

| Steel Dynamics, Inc. cv. sr. notes 5 1/8s, 2014 | 4,260,000 | 4,899,000 |

|

| U.S. Steel Corp. cv. sr. unsec. notes 4s, 2014 | 2,820,000 | 4,289,925 |

|

| USEC, Inc. cv. sr. unsec. notes 3s, 2014 | 2,000,000 | 1,680,000 |

|

| | | 23,543,453 |

25

| | |

| CONVERTIBLE BONDS AND NOTES (69.5%)* cont. | Principal amount | Value |

|

| Oil and gas (2.9%) | | |

| Carrizo Oil & Gas, Inc. cv. sr. unsec. unsub. notes 4 3/8s, 2028 | $6,200,000 | $6,161,250 |

|

| Chesapeake Energy Corp. cv. sr. unsec. notes company | | |

| guaranty 2 1/2s, 2037 | 9,400,000 | 8,095,750 |

|

| SM Energy Co. cv. sr. unsec. notes 3 1/2s, 2027 | 4,500,000 | 4,798,125 |

|

| | | 19,055,125 |

| Pharmaceuticals (1.7%) | | |

| Teva Pharmaceutical Finance, LLC cv. company | | |

| guaranty sr. unsec. debs Ser. C, 1/4s, 2026 (Israel) | 5,400,000 | 6,358,500 |

|

| Valeant Pharmaceuticals International, Inc. | | |

| 144A cv. sr. notes 5 3/8s, 2014 (Canada) | 2,300,000 | 4,510,875 |

|

| | | 10,869,375 |

| Real estate (1.1%) | | |

| Annaly Capital Management, Inc. cv. sr. unsec. | | |

| unsub. notes 4s, 2015 R | 3,200,000 | 3,568,000 |

|

| General Growth Properties, Inc. 144A cv. sr. notes 3.98s, | | |

| 2027 (In default) † R | 3,600,000 | 3,870,000 |

|

| | | 7,438,000 |

| Retail (2.1%) | | |

| Charming Shoppes, Inc. cv. sr. unsec. notes 1 1/8s, 2014 | 4,100,000 | 3,403,000 |

|

| Iconix Brand Group, Inc. cv. sr. sub. notes 1 7/8s, 2012 | 3,200,000 | 3,108,000 |

|

| Pantry, Inc. (The) cv. company guaranty sr. unsec. | | |

| sub. notes 3s, 2012 | 4,300,000 | 4,095,750 |

|

| Pantry, Inc. (The) 144A cv. sr. sub. notes 3s, 2012 | 500,000 | 476,250 |

|

| Rite Aid Corp. cv. sr. unsec. unsub. notes 8 1/2s, 2015 | 3,185,000 | 2,985,938 |

|

| | | 14,068,938 |

| Semiconductor (1.1%) | | |

| Linear Technology Corp. cv. sr. unsec. unsub. notes Ser. A, | | |

| 3s, 2027 | 6,700,000 | 6,934,500 |

|

| | | 6,934,500 |

| Shipping (0.7%) | | |

| Genco Shipping & Trading, Ltd. cv. sr. unsec. notes 5s, 2015 | 4,400,000 | 4,862,000 |

|

| | | 4,862,000 |

| Software (5.4%) | | |

| Cadence Design Systems, Inc. cv. sr. unsec. notes 1 1/2s, 2013 | 500,000 | 461,250 |

|

| Cadence Design Systems, Inc. 144A cv. sr. unsec. | | |

| notes 1 1/2s, 2013 | 3,100,000 | 2,859,750 |

|

| Microsoft Corp. 144A cv. sr. unsec. notes zero %, 2013 | 3,961,000 | 4,149,148 |

|

| Rovi Corp. 144A cv. sr. unsec. unsub. notes 2 5/8s, 2040 | 4,240,000 | 5,339,750 |

|

| Safeguard Scientifics, Inc. cv. sr. unsec. | | |

| sub. notes 10 1/8s, 2014 | 8,600,000 | 10,750,000 |

|

| Symantec Corp. cv. sr. unsec. notes 1s, 2013 | 5,000,000 | 5,606,250 |

|

| SYNNEX Corp. 144A cv. sr. notes 4s, 2018 | 5,845,000 | 6,970,163 |

|

| | | 36,136,311 |

| Technology (2.0%) | | |

| CACI International, Inc. cv. sr. unsec. sub. notes 2 1/8s, 2014 | 2,100,000 | 2,367,750 |

|

| CACI International, Inc. 144A cv. sr. unsec. sub. notes 2 1/8s, 2014 | 3,720,000 | 4,194,300 |

|

| ON Semiconductor Corp. cv. company guaranty sr. unsec. | | |

| sub. notes 2 5/8s, 2026 | 785,000 | 820,325 |

|

| ON Semiconductor Corp. 144A cv. company guaranty sr. unsec. | | |

| sub. notes 2 5/8s, 2026 | 5,300,000 | 5,538,500 |

|

| | | 12,920,875 |

26

| | |

| CONVERTIBLE BONDS AND NOTES (69.5%)* cont. | Principal amount | Value |

|

| Technology services (1.0%) | | |

| CSG Systems International, Inc. 144A cv. sr. unsec. | | |

| sub. notes 3s, 2017 | $3,138,000 | $3,243,908 |

|

| Salesforce.com, Inc. 144A cv. sr. unsec. unsub. notes 3/4s, 2015 | 2,100,000 | 3,134,040 |

|

| | | 6,377,948 |

| Telecommunications (2.9%) | | |

| Cogent Communication Group, Inc. cv. sr. unsec. notes 1s, 2027 | 3,563,000 | 2,975,105 |

|

| Level 3 Communications, Inc. cv. sr. unsec. | | |

| unsub. notes 3 1/2s, 2012 | 7,675,000 | 7,147,344 |

|

| NII Holdings, Inc. 144A cv. sr. unsec. notes 3 1/8s, 2012 | 2,600,000 | 2,535,000 |

|

| SBA Communications Corp. cv. sr. unsec. notes 1 7/8s, 2013 | 5,800,000 | 6,416,250 |

|

| | | 19,073,699 |

| Telephone (0.7%) | | |

| Leap Wireless International, Inc. cv. sr. unsec. | | |

| notes 4 1/2s, 2014 | 5,110,000 | 4,605,388 |

|

| | | 4,605,388 |

| Total convertible bonds and notes (cost $403,073,538) | | $455,985,932 |

| | | |

| | |

| CONVERTIBLE PREFERRED STOCKS (20.9%)* | Shares | Value |

|

| Automotive (0.8%) | | |

| Ford Motor Co. Capital Trust II $3.25 cum. cv. pfd. S | 99,040 | $4,933,430 |

|

| | | 4,933,430 |

| Banking (4.2%) | | |

| Bank of America Corp. Ser. L, 7.25% cv. pfd. | 7,925 | 7,489,125 |

|

| Citigroup, Inc. $7.50 cv. pfd. | 69,000 | 8,524,260 |

|

| Huntington Bancshares Ser. A, 8.50% cv. pfd. | 3,200 | 3,221,600 |

|

| Wells Fargo & Co. Ser. L, 7.50% cv. pfd. | 8,425 | 8,425,000 |

|

| | | 27,659,985 |

| Combined utilities (1.8%) | | |

| El Paso Corp. 4.99% cv. pfd. | 10,200 | 12,099,743 |

|

| | | 12,099,743 |

| Consumer goods (0.4%) | | |

| Newell Financial Trust I $2.625 cum. cv. pfd. | 58,712 | 2,465,904 |

|

| | | 2,465,904 |

| Electric utilities (2.1%) | | |

| Great Plains Energy, Inc. $6.00 cv. pfd. | 118,674 | 7,563,094 |

|

| PPL Corp. $4.75 cv. pfd. | 113,845 | 6,402,643 |

|

| | | 13,965,737 |

| Financial (0.5%) | | |

| AMG Capital Trust II $2.575 cv. pfd. | 87,115 | 3,353,928 |

|

| | | 3,353,928 |

| Food (1.3%) | | |

| Bunge, Ltd. $4.875 cv. pfd. | 43,885 | 3,927,708 |

|

| Dole Food Automatic Exchange 144A 7.00% cv. pfd. | 510,505 | 4,870,218 |

|

| | | 8,797,926 |

| Insurance (2.9%) | | |

| Assured Guaranty, Ltd. $4.25 cv. pfd. (Bermuda) | 51,500 | 4,093,220 |

|

| Hartford Financial Services Group, Inc. (The) | | |

| $1.182 cv. pfd. S | 245,423 | 6,035,884 |

|

| XL Group, Ltd. $2.688 cv. pfd. | 295,455 | 8,822,286 |

|

| | | 18,951,390 |

| Investment banking/Brokerage (—%) | | |

| Lehman Brothers Holdings, Inc. Ser. P, | | |

| 7.25% cv. pfd. (In default) † | 13,400 | 12,060 |

|

| | | 12,060 |

27

| | |

| CONVERTIBLE PREFERRED STOCKS (20.9%)* cont. | Shares | Value |

|

| Lodging/Tourism (0.1%) | | |

| FelCor Lodging Trust, Inc. Ser. A, $0.488 cum. cv. pfd. R | 18,304 | $434,149 |

|

| | | 434,149 |

| Media (1.1%) | | |

| Interpublic Group of Cos., Inc. (The) Ser. B, 5.25% cv. pfd. | 7,165 | 7,227,694 |

|

| | | 7,227,694 |

| Metals (1.1%) | | |

| Vale Capital II $3.375 cv. pfd. (Cayman Islands) | 81,200 | 7,358,750 |

|

| | | 7,358,750 |

| Oil and gas (1.4%) | | |

| Apache Corp. Ser. D, $3.00 cv. pfd. S | 159,446 | 9,313,241 |

|

| | | 9,313,241 |

| Power producers (0.4%) | | |

| AES Trust III $3.375 cv. pfd. | 59,600 | 2,886,875 |

|

| | | 2,886,875 |

| Real estate (1.6%) | | |

| Alexandria Real Estate Equities, Inc. Ser. D, $1.75 cv. pfd. | 170,550 | 4,135,838 |

|

| Entertainment Properties Trust Ser. C, $1.438 cum. cv. pfd. | 314,100 | 6,223,703 |

|

| | | 10,359,541 |

| Telecommunications (1.2%) | | |

| Crown Castle International Corp. $3.125 cum. cv. pfd. | 126,241 | 7,669,141 |

|

| | | 7,669,141 |

| Total convertible preferred stocks (cost $135,061,588) | | $137,489,494 |

| | | |

| | |

| COMMON STOCKS (5.5%)* | Shares | Value |

|

| Banking (0.3%) | | |

| Wells Fargo & Co. | 78,700 | $2,052,496 |

|

| | | 2,052,496 |

| Biotechnology (0.1%) | | |

| Dendreon Corp. † | 15,400 | 562,100 |

|

| | | 562,100 |

| Cable television (0.5%) | | |

| DIRECTV Class A † | 76,500 | 3,324,690 |

|

| | | 3,324,690 |

| Chemicals (0.3%) | | |

| Celanese Corp. Ser. A | 49,524 | 1,765,531 |

|

| | | 1,765,531 |

| Computers (0.3%) | | |

| Hewlett-Packard Co. | 40,800 | 1,716,048 |

|

| | | 1,716,048 |

| Consumer goods (0.3%) | | |

| Newell Rubbermaid, Inc. | 98,100 | 1,731,465 |

|

| | | 1,731,465 |

| Energy (other) (—%) | | |

| Brazil Ethanol, Inc. 144A (Unit) † | 312,500 | 3,125 |

|

| | | 3,125 |

| Insurance (0.5%) | | |

| Aflac, Inc. | 62,300 | 3,481,947 |

|

| | | 3,481,947 |

| Medical technology (0.5%) | | |

| Medtronic, Inc. | 96,500 | 3,397,765 |

|

| | | 3,397,765 |

| Metals (0.3%) | | |

| Freeport-McMoRan Copper & Gold, Inc. Class B | 22,658 | 2,145,259 |

|

| | | 2,145,259 |

| Oil and gas (0.8%) | | |

| EOG Resources, Inc. | 53,200 | 5,092,304 |

|

| | | 5,092,304 |

28

| | |

| COMMON STOCKS (5.5%)* cont. | Shares | Value |

|

| Retail (0.5%) | | |

| Bed Bath & Beyond, Inc. † | 74,915 | $3,288,769 |

|

| | | 3,288,769 |

| Telecommunications (0.9%) | | |

| NII Holdings, Inc. † | 78,000 | 3,261,180 |

|

| Sprint Nextel Corp. † | 638,500 | 2,630,620 |

|

| | | 5,891,800 |

| Telephone (0.2%) | | |

| Leap Wireless International, Inc. † | 133,500 | 1,523,235 |

|

| | | 1,523,235 |

| Total common stocks (cost $35,722,554) | | $35,976,534 |

| | | |

| | |

| CORPORATE BONDS AND NOTES (2.4%)* | Principal amount | Value |

|

| Affinion Group Holdings, Inc. 144A company | | |

| guaranty sr. notes 11 5/8s, 2015 | $1,585,000 | $1,630,569 |

|

| Clearwire Communications, LLC/Clearwire Finance, Inc. 144A | | |

| company guaranty sr. notes 12s, 2015 | 1,290,000 | 1,428,675 |

|

| Integra Telecom Holdings, Inc. 144A sr. notes 10 3/4s, 2016 | 1,310,000 | 1,385,325 |

|

| Intelsat Luxembourg SA company guaranty sr. unsec. | | |

| notes 11 1/4s, 2017 (Luxembourg) | 1,265,000 | 1,355,131 |

|

| Jazz Technologies, Inc. 144A notes 8s, 2015 F | 4,020,000 | 3,457,200 |

|

| Provident Funding Associates 144A sr. notes 10 1/4s, 2017 | 1,305,000 | 1,357,200 |

|

| Surgical Care Affiliates, Inc. 144A sr. sub. notes 10s, 2017 | 1,320,000 | 1,359,600 |

|

| Unisys Corp. 144A company guaranty sr. sub. notes 14 1/4s, 2015 | 2,900,000 | 3,509,000 |

|

| Total corporate bonds and notes (cost $14,773,555) | | $15,482,700 |

| | | |