| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-00058) |

| | |

| Exact name of registrant as specified in charter: | George Putnam Balanced Fund |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | July 31, 2017 |

| | |

| Date of reporting period: | August 1, 2016 — January 31, 2017 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

George Putnam

Balanced

Fund

Semiannual report

1 | 31 | 17

Consider these risks before investing: Stock and bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, factors related to a specific issuer or industry and, with respect to bond prices, changing market perceptions of the risk of default and changes in government intervention. These factors may also lead to increased volatility and reduced liquidity in the bond markets. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. You can lose money by investing in the fund.

Message from the Trustees

March 15, 2017

Dear Fellow Shareholder:

In the early weeks of 2017, investor sentiment generally brightened at the prospect of moving beyond the challenges of the past year, when political uncertainty, among other issues, tested global financial markets. As stock markets delivered modest gains, the exuberance that greeted the new year calmed somewhat as investors reconsidered a number of ongoing macroeconomic risks. In addition, many bond investors remained cautious as the potential for inflation increased.

As always, we believe investors should continue to focus on time-tested strategies: maintain a well-diversified portfolio, keep a long-term view, and do not overreact to short-term market fluctuations. To help ensure that your portfolio is aligned with your individual goals, time horizon, and tolerance for risk, we also believe it is a good idea to speak regularly with your financial advisor.

In today’s environment, we favor the investment approach practiced at Putnam — active strategies based on fundamental research. Putnam portfolio managers, backed by a network of global analysts, bring years of experience to navigating changing market conditions and pursuing investment opportunities. In the following pages, you will find an overview of your fund’s performance for the reporting period ended January 31, 2017, as well as an outlook for the coming months.

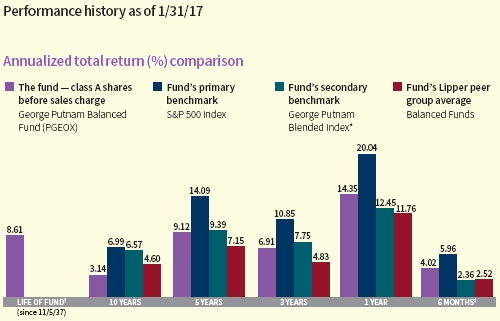

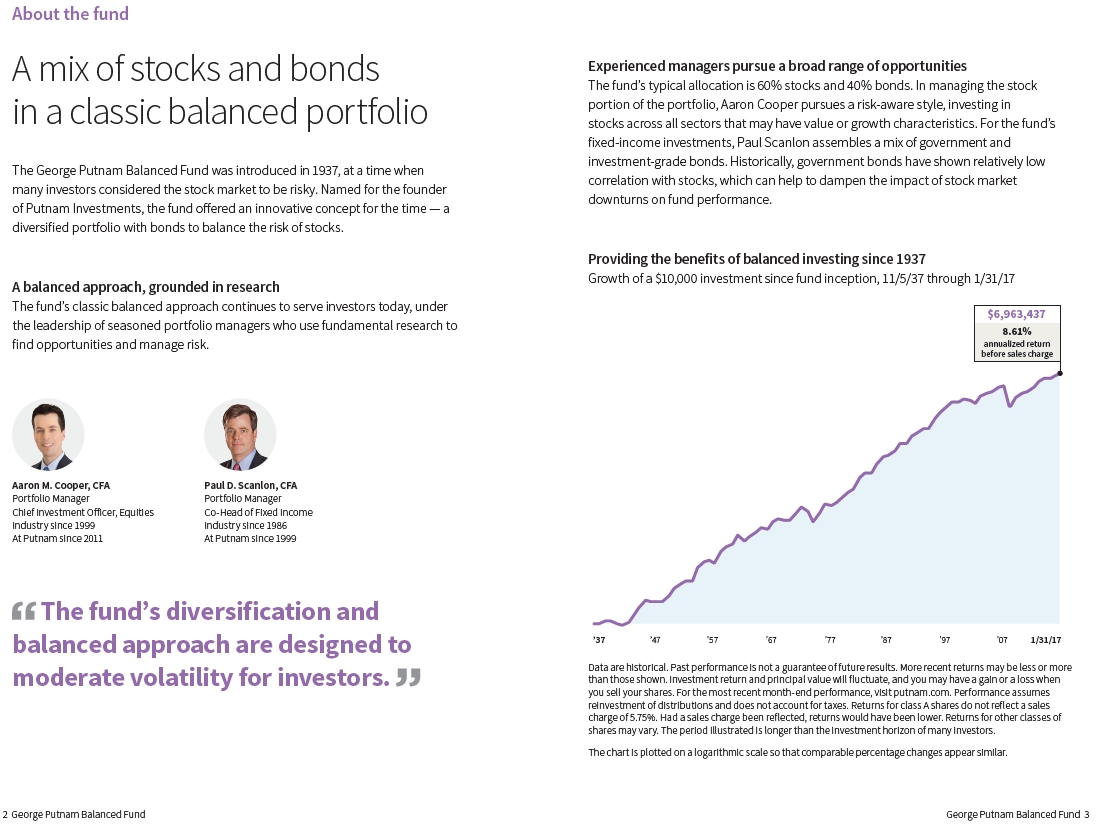

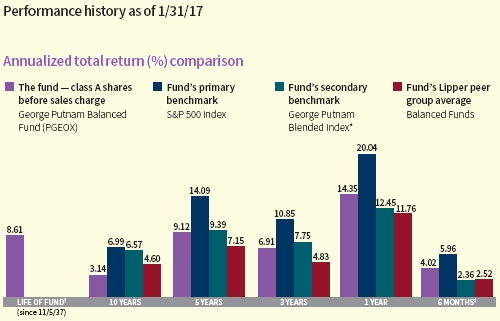

Thank you for investing with Putnam.

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 3 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* George Putnam Blended Index is an unmanaged index administered by Putnam Management, 60% of which is the S&P 500 Index and 40% of which is the Bloomberg Barclays U.S. Aggregate Bond Index.

† The fund’s benchmarks (S&P 500 Index and George Putnam Blended Index) were introduced on 12/31/69 and 12/31/78, respectively, and its Lipper group (Balanced Funds) was introduced on 12/31/59; they all post-date the inception of the fund’s class A shares.

‡ Returns for the six-month period are not annualized, but cumulative.

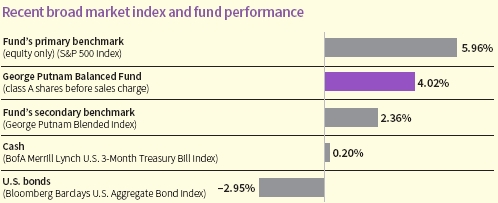

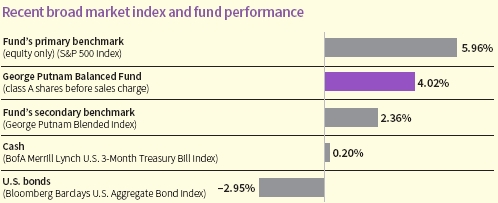

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/17. See above and pages 3 and 10–12 for additional fund performance information. Index descriptions can be found on page 15.

|

| 4 George Putnam Balanced Fund |

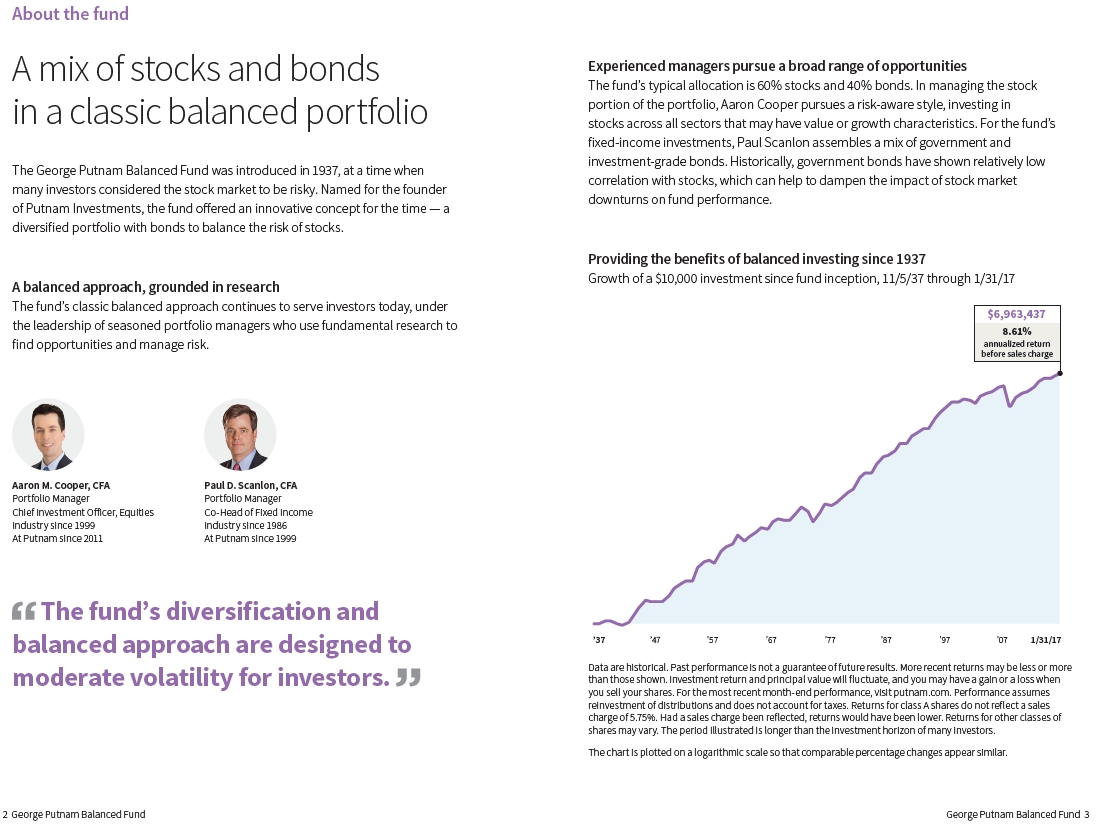

Aaron is Chief Investment Officer, Equities, at Putnam. He holds an A.B. from Harvard University. Aaron joined Putnam in 2011 and has been in the investment industry since 1999.

Paul is Co-Head of Fixed Income at Putnam. He has an M.B.A. from the University of Chicago Booth School of Business and a B.A. from Colgate University. Paul joined Putnam in 1999 and has been in the investment industry since 1986.

How would you describe the market environment during the six-month period ended January 31, 2017?

AARON At the outset of the period, we began to see the bubbling up of inflationary pressures, including from wage inflation and rising commodity prices. These conditions generally set a benign backdrop for stocks through the summer months. Then, in the weeks leading up to the U.S. presidential election, we saw the market shift its focus from stable-seeming stocks to sectors that could be beneficiaries of a reflationary macroeconomic trend, including riskier-seeming sectors such as financials, industrials, and natural resources. Technology stocks, interestingly, lost some of their luster with investors as they began to feel comfortable seeking growth in other areas of the market.

In the wake of the U.S. election, equity performance soared in anticipation of a new business-friendly administration. Led by energy, financials, and telecommunications, most non-defensive sectors turned in double-digit returns during the final calendar quarter of 2016, while major U.S. equity indexes hit record highs and delivered solid positive returns for the year overall. In the final month

|

| George Putnam Balanced Fund 5 |

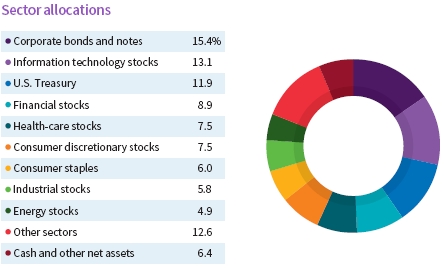

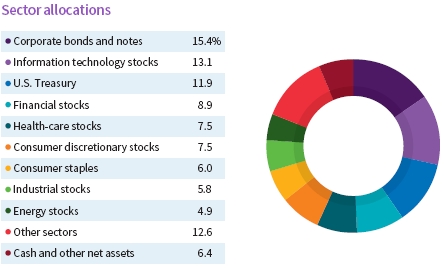

Allocations are shown as a percentage of the fund’s net assets as of 1/31/17. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

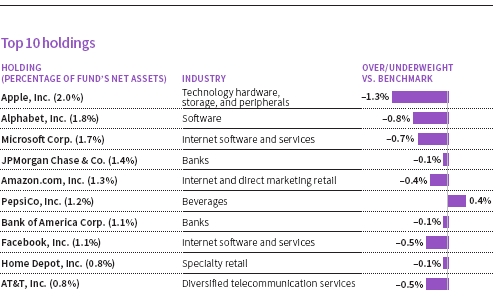

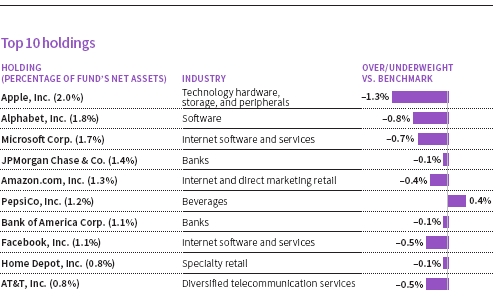

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 1/31/17. Short-term investments and derivatives, if any, are excluded. Holdings may vary over time.

|

| 6 George Putnam Balanced Fund |

of the period, investor optimism continued to fuel the market’s performance, particularly in eager anticipation of the Trump administration making good on promises for tax reform, infrastructure development, and financial market deregulation.

In this context, how did George Putnam Balanced Fund perform?

AARON We are pleased to report that the fund outperformed its blended stock/bond secondary benchmark, the George Putnam Blended Index, for the six-month reporting period. We attribute this result primarily to positive stock selection outcomes across a wide range of sectors — from energy and financials to health care, information technology, and telecommunications. Relative to the fund’s all-equity primary benchmark, the S&P 500 Index, the fund fell short of the mark. In light of the strong stock market rally that occurred in the last months of the period, this underperformance was not unexpected given that the fund balances its investments between stocks and bonds.

How did the fund’s corporate bond allocation perform?

PAUL Our corporate-credit investment strategy generally performed well during the period, buoyed by solid fundamentals among investment-grade bonds. Demand for these bonds was robust during the period, particularly on the part of international investors. While this led valuation to become tighter toward the end of 2016, it was not exceptionally so versus historical trends. Importantly for investment-grade bonds, we see the current environment as providing tailwinds for financials, in particular, which comprises a large segment of the opportunity set.

Within different sectors, how would you characterize the fund’s positioning during the reporting period?

AARON Within a variety of sectors, George Putnam Balanced Fund has been positioned with a modestly pro-cyclical bias, which means that some parts of the portfolio were positioned to perform in line with the overall economy. In financials, for example, the fund was biased toward more interest-rate-sensitive stocks, which we thought would benefit if interest rates should rise — which they did do through much of the period. In natural resources, the fund had a pro-cyclical tilt as well, and we believe this may continue to offer characteristics of relative strength as the Trump administration seeks to establish its policy agenda in the coming months.

How would you describe U.S. corporate health at period-end?

AARON U.S. corporations generally appeared to have turned a corner during the period. A telling signal in this regard can be seen in corporate earnings growth in the fourth calendar quarter of 2016. At 8% for the market overall — and a notch above the third-quarter result of 6% (ex energy) — corporate earnings growth showed undeniable strength as the year came to a close. When we consider corporate prospects for 2017, we expect that continued solid underlying growth in the U.S. economy, augmented by generally higher energy prices than we saw at the start of 2016, could lead to double-digit earnings growth for the U.S. market overall.

What were some of the stocks that contributed most to the fund’s relative performance?

AARON In the wake of the U.S. election on November 8, 2016, the stock markets strongly favored more cyclical and industrial areas of the market, and one of the leading sectors was financials. Consequently, our larger-than-benchmark positions in Bank of America, Keycorp, and Charles Schwab produced strong relative results for the fund. Generally speaking, investors anticipated that higher interest rates and the increased likelihood of financial market deregulation under President Trump would provide a strong boost to the bottom lines of financial companies.

|

| George Putnam Balanced Fund 7 |

Our decision to hold a smaller-than-benchmark position in the stock of Johnson & Johnson (J&J) gave another boost to relative results. This stock generally declined during the period, as investors appeared to lose interest in businesses like J&J that are perceived by investors to be safe and stable, with predictable, but often sluggish, earnings growth. We viewed many of these stocks, including J&J, as too expensive and maintained underweight exposure to them through the period.

A third contributor was the stock of Charter Communications, one of the largest cable TV operators and telephone line providers in the United States. Shortly before the period began, Charter acquired Time Warner Cable and Bright House Networks for a combined $65.5 billion, making Charter the third-largest pay television company in the United States. We believe Charter is also well positioned to add mobile technologies to its platform. If and when that happens, we think Charter stands to do well against a competitor like Verizon Communications and other providers who still rely on a DSL platform, which we believe is inferior to cable and fiber networks.

Which stocks or strategies detracted from the fund’s relative performance?

AARON The largest detractor for the period was the stock of Allergan. The stock’s decline was due almost entirely to ongoing investor disappointment after Allergan’s planned merger with U.S. pharmaceutical giant Pfizer was terminated in April 2016. Toward the end of the period, we became less convinced that Allergan’s drug pipeline could support strong growth prospects for the company over the long term. Consequently, we sold the stock.

In line with the late-period rally in financial stocks, the stock of Citigroup performed well for the period overall. However, because we held a smaller-than-benchmark position in this stock, that detracted from benchmark-relative performance.

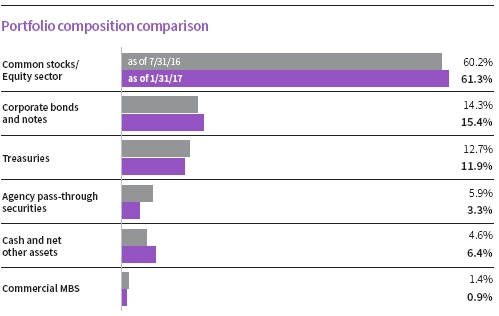

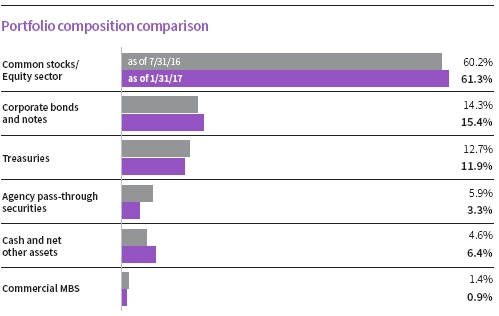

This chart shows how the fund’s top weightings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

|

| 8 George Putnam Balanced Fund |

Our benchmark-relative overweight position in the stock of Coty, a large-cap beauty products manufacturer, also detracted from the fund’s relative performance result. We had been encouraged by what we perceived to be the company’s effective cost-cutting strategies, and in late 2015, Coty bought the beauty brands of Procter & Gamble. While we believe this deal will be beneficial for Coty’s profitability over time, the company has struggled with the acquisition, which is now estimated to cost considerably more than investors initially anticipated. We sold the stock by the end of the period.

What is your outlook for the bond market?

PAUL Looking forward, we think that strong U.S. corporate fundamentals may support the profit margins of investment-grade companies. Moreover, for the financials sector, the combination of potentially less onerous regulation and a potential increase in interest rates may bolster fundamentals. Overall, we have found current spread levels — or the general yield advantage offered by investment-grade bonds over Treasuries of similar maturity — to be modestly attractive versus their underlying risks.

What is your outlook for U.S. stocks?

AARON We are optimistic about a number of business-building initiatives that President Trump has claimed will be priorities under his administration. At this early stage, we think it is likely that U.S. consumers will benefit from tax reform, and we believe that we can expect to see some measure of infrastructure spending get under way. We also believe that a number of promised reductions in regulatory burdens could give a boost to several areas, most notably financials. Overall, we think the regime change from President Obama to President Trump will shift the market in favor of sectors that may stand to benefit from pro-growth policies, higher interest rates, and inflationary conditions.

That said, in our view there are heightened risks related to the new administration and whether the legislative agenda will be executed according to well-laid plans or delayed due to a variety of potential complexities. In our view, tax reform is likely, but important details are in question. Moreover, a foreign policy misstep, while not the most likely case, in our view, is a risk factor. Finally, the market has digested much early political uncertainty in stride, but valuations on a near-term basis have been getting richer and, consequently, in our view, leave less margin for error.

Thank you, Aaron and Paul, for this update on the fund.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

|

| George Putnam Balanced Fund 9 |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2017, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R5, R6, and Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 1/31/17

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

|

| Class A (11/5/37) | | | | | | | | | |

| Before sales charge | 8.61% | 36.25% | 3.14% | 54.69% | 9.12% | 22.21% | 6.91% | 14.35% | 4.02% |

|

| After sales charge | 8.53 | 28.42 | 2.53 | 45.79 | 7.83 | 15.18 | 4.82 | 7.78 | –1.97 |

|

| Class B (4/27/92) | | | | | | | | | |

| Before CDSC | 8.50 | 28.15 | 2.51 | 49.00 | 8.30 | 19.48 | 6.11 | 13.47 | 3.62 |

|

| After CDSC | 8.50 | 28.15 | 2.51 | 47.00 | 8.01 | 16.48 | 5.22 | 8.47 | –1.38 |

|

| Class C (7/26/99) | | | | | | | | | |

| Before CDSC | 7.80 | 26.38 | 2.37 | 49.00 | 8.30 | 19.47 | 6.11 | 13.49 | 3.54 |

|

| After CDSC | 7.80 | 26.38 | 2.37 | 49.00 | 8.30 | 19.47 | 6.11 | 12.49 | 2.54 |

|

| Class M (12/1/94) | | | | | | | | | |

| Before sales charge | 7.89 | 29.63 | 2.63 | 50.88 | 8.57 | 20.38 | 6.38 | 13.80 | 3.70 |

|

| After sales charge | 7.84 | 25.09 | 2.26 | 45.60 | 7.80 | 16.17 | 5.12 | 9.81 | 0.07 |

|

| Class R (1/21/03) | | | | | | | | | |

| Net asset value | 8.34 | 32.98 | 2.89 | 52.76 | 8.84 | 21.29 | 6.64 | 14.09 | 3.86 |

|

| Class R5 (12/2/13) | | | | | | | | | |

| Net asset value | 8.69 | 39.76 | 3.40 | 56.65 | 9.39 | 23.15 | 7.19 | 14.61 | 4.08 |

|

| Class R6 (12/2/13) | | | | | | | | | |

| Net asset value | 8.70 | 40.25 | 3.44 | 57.19 | 9.47 | 23.50 | 7.29 | 14.77 | 4.20 |

|

| Class Y (3/31/94) | | | | | | | | | |

| Net asset value | 8.69 | 39.72 | 3.40 | 56.60 | 9.39 | 23.12 | 7.18 | 14.65 | 4.07 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance reflects conversion to class A shares after eight years.

|

| 10 George Putnam Balanced Fund |

Comparative index returns For periods ended 1/31/17

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

|

| S&P 500 Index | —* | 96.46% | 6.99% | 93.28% | 14.09% | 36.20% | 10.85% | 20.04% | 5.96% |

|

| Bloomberg | | | | | | | | | |

| Barclays U.S. | | | | | | | | | |

| Aggregate Bond | —* | 53.37 | 4.37 | 10.92 | 2.09 | 7.99 | 2.59 | 1.45 | –2.95 |

| Index | | | | | | | | | |

|

| George Putnam | | | | | | | | | |

| Blended Index† | —* | 88.98 | 6.57 | 56.63 | 9.39 | 25.09 | 7.75 | 12.45 | 2.36 |

|

| Lipper Balanced | | | | | | | | | |

| Funds category | —* | 57.62 | 4.60 | 41.66 | 7.15 | 15.29 | 4.83 | 11.76 | 2.52 |

| average‡ | | | | | | | | | |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* The fund’s benchmarks (S&P 500 Index and George Putnam Blended Index) were introduced on 12/31/69 and 12/31/78, respectively, the Bloomberg Barclays U.S. Aggregate Bond Index was introduced on 12/31/75, and the fund’s Lipper group (Balanced Funds) was introduced on 12/31/59; they all post-date the inception of the fund’s class A shares.

† George Putnam Blended Index is an unmanaged index administered by Putnam Management, 60% of which is the S&P 500 Index and 40% of which is the Bloomberg Barclays U.S. Aggregate Bond Index.

‡ Over the 6-month, 1-year, 3-year, 5-year, and 10-year periods ended 1/31/17, there were 647, 635, 595, 540, and 443 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 1/31/17

| | | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | ClassR5 | ClassR6 | Class Y |

|

| Number | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

|

| Income | $0.104 | $0.040 | $0.039 | $0.062 | $0.086 | $0.128 | $0.137 | $0.126 |

|

| Capital gains | — | — | — | — | — | — | — | — |

|

| Total | $0.104 | $0.040 | $0.039 | $0.062 | $0.086 | $0.128 | $0.137 | $0.126 |

|

| | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value | value |

|

| 7/31/16 | $17.38 | $18.44 | $17.18 | $17.26 | $17.15 | $17.77 | $17.33 | $17.45 | $17.45 | $17.45 |

|

| 1/31/17 | 17.97 | 19.07 | 17.76 | 17.83 | 17.72 | 18.36 | 17.91 | 18.03 | 18.04 | 18.03 |

|

| Current rate | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| (end of | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| period) | charge | charge | value | value | charge | charge | value | value | value | value |

|

| Current | | | | | | | | | | |

| dividend rate1 | 1.16% | 1.09% | 0.45% | 0.45% | 0.70% | 0.68% | 0.94% | 1.42% | 1.53% | 1.42% |

|

| Current | | | | | | | | | | |

| 30-day SEC | | | | | | | | | | |

| yield2 | N/A | 1.01 | 0.33 | 0.33 | N/A | 0.56 | 0.82 | 0.91 | 1.44 | 1.31 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

|

| George Putnam Balanced Fund 11 |

Fund performance as of most recent calendar quarter Total return for periods ended 12/31/16

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

|

| Class A (11/5/37) | | | | | | | | | |

| Before sales charge | 8.59% | 35.00% | 3.05% | 56.03% | 9.30% | 17.92% | 5.65% | 7.93% | 4.77% |

|

| After sales charge | 8.51 | 27.24 | 2.44 | 47.05 | 8.02 | 11.14 | 3.58 | 1.72 | –1.26 |

|

| Class B (4/27/92) | | | | | | | | | |

| Before CDSC | 8.48 | 27.01 | 2.42 | 50.26 | 8.49 | 15.22 | 4.84 | 7.08 | 4.31 |

|

| After CDSC | 8.48 | 27.01 | 2.42 | 48.26 | 8.19 | 12.22 | 3.92 | 2.08 | –0.69 |

|

| Class C (7/26/99) | | | | | | | | | |

| Before CDSC | 7.78 | 25.28 | 2.28 | 50.34 | 8.50 | 15.30 | 4.86 | 7.06 | 4.35 |

|

| After CDSC | 7.78 | 25.28 | 2.28 | 50.34 | 8.50 | 15.30 | 4.86 | 6.06 | 3.35 |

|

| Class M (12/1/94) | | | | | | | | | |

| Before sales charge | 7.87 | 28.49 | 2.54 | 52.16 | 8.76 | 16.16 | 5.12 | 7.31 | 4.45 |

|

| After sales charge | 7.82 | 24.00 | 2.17 | 46.83 | 7.99 | 12.10 | 3.88 | 3.56 | 0.80 |

|

| Class R (1/21/03) | | | | | | | | | |

| Net asset value | 8.32 | 31.83 | 2.80 | 54.04 | 9.03 | 17.00 | 5.37 | 7.66 | 4.67 |

|

| Class R5 (12/2/13) | | | | | | | | | |

| Net asset value | 8.67 | 38.48 | 3.31 | 58.00 | 9.58 | 18.84 | 5.92 | 8.19 | 4.89 |

|

| Class R6 (12/2/13) | | | | | | | | | |

| Net asset value | 8.68 | 38.88 | 3.34 | 58.46 | 9.64 | 19.19 | 6.03 | 8.28 | 4.95 |

|

| Class Y (3/31/94) | | | | | | | | | |

| Net asset value | 8.67 | 38.44 | 3.31 | 57.96 | 9.57 | 18.81 | 5.91 | 8.16 | 4.88 |

See the discussion following the fund performance table on page 10 for information about the calculation of fund performance.

|

| 12 George Putnam Balanced Fund |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Total annual operating | | | | | | | | |

| expenses for the fiscal year | | | | | | | | |

| ended 7/31/16 | 1.02%* | 1.77%* | 1.77%* | 1.52%* | 1.27%* | 0.73% | 0.63% | 0.77%* |

|

| Annualized expense ratio for | | | | | | | | |

| the six-month period ended | | | | | | | | |

| 1/31/17 | 1.01% | 1.76% | 1.76% | 1.51% | 1.26% | 0.73% | 0.63% | 0.76% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Restated to reflect current fees resulting from a change to the fund’s investor servicing arrangements effective September 1, 2016.

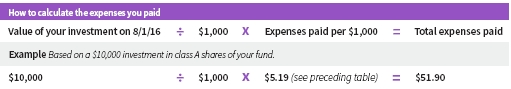

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 8/1/16 to 1/31/17. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $5.19 | $9.03 | $9.03 | $7.75 | $6.47 | $3.76 | $3.24 | $3.91 |

|

| Ending value (after expenses) | $1,040.20 | $1,036.20 | $1,035.40 | $1,037.00 | $1,038.60 | $1,040.80 | $1,042.00 | $1,040.70 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/17. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

|

| George Putnam Balanced Fund 13 |

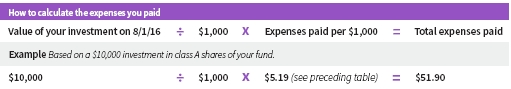

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 1/31/17, use the following calculation method. To find the value of your investment on 8/1/16, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $5.14 | $8.94 | $8.94 | $7.68 | $6.41 | $3.72 | $3.21 | $3.87 |

|

| Ending value (after expenses) | $1,020.11 | $1,016.33 | $1,016.33 | $1,017.59 | $1,018.85 | $1,021.53 | $1,022.03 | $1,021.37 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/17. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

|

| 14 George Putnam Balanced Fund |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current rate is the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge and may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R5 and R6 shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to employer-sponsored retirement plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

George Putnam Blended Index is an unmanaged index administered by Putnam Management, LLC, 60% of which is the S&P 500 Index and 40% of which is the Bloomberg Barclays U.S. Aggregate Bond Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not

|

| George Putnam Balanced Fund 15 |

reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2016, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Form N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of January 31, 2017, Putnam employees had approximately $465,000,000 and the Trustees had approximately $135,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

|

| 16 George Putnam Balanced Fund |

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

|

| George Putnam Balanced Fund 17 |

The fund’s portfolio 1/31/17 (Unaudited)

| | |

| COMMON STOCKS (60.6%)* | Shares | Value |

|

| Basic materials (2.2%) | | |

|

| Air Products & Chemicals, Inc. | 8,902 | $1,244,144 |

|

| Albemarle Corp. | 21,117 | 1,956,279 |

|

| ArcelorMittal SA (France) † | 47,846 | 372,265 |

|

| Axalta Coating Systems, Ltd. † | 27,037 | 784,073 |

|

| Barrick Gold Corp. (Canada) | 11,461 | 211,341 |

|

| CF Industries Holdings, Inc. S | 60,825 | 2,146,514 |

|

| Dow Chemical Co. (The) | 29,696 | 1,770,772 |

|

| E. I. du Pont de Nemours & Co. | 7,796 | 588,598 |

|

| Fortune Brands Home & Security, Inc. | 19,842 | 1,093,889 |

|

| Freeport-McMoRan, Inc. (Indonesia) † | 21,714 | 361,538 |

|

| KapStone Paper and Packaging Corp. | 68,121 | 1,633,542 |

|

| LANXESS AG (Germany) | 14,158 | 1,026,523 |

|

| Martin Marietta Materials, Inc. | 4,231 | 971,438 |

|

| Newmont Mining Corp. | 20,724 | 751,867 |

|

| Nucor Corp. | 10,228 | 594,145 |

|

| RPC Group PLC (United Kingdom) | 51,019 | 688,092 |

|

| Sealed Air Corp. | 33,842 | 1,641,337 |

|

| Sherwin-Williams Co. (The) | 11,607 | 3,526,323 |

|

| Sociedad Quimica y Minera de Chile SA ADR (Chile) | 25,428 | 821,833 |

|

| Steel Dynamics, Inc. | 4,634 | 156,676 |

|

| Syngenta AG (Switzerland) | 2,547 | 1,082,791 |

|

| United States Steel Corp. | 6,957 | 227,563 |

|

| W.R. Grace & Co. | 18,166 | 1,259,630 |

|

| Yara International ASA (Norway) | 2,032 | 85,827 |

|

| | | 24,997,000 |

|

| Capital goods (3.9%) | | |

|

| Airbus Group SE (France) | 60,916 | 4,136,618 |

|

| Ball Corp. | 11,693 | 891,708 |

|

| Dover Corp. | 39,300 | 3,055,575 |

|

| Fortive Corp. | 74,200 | 4,104,002 |

|

| Johnson Controls International PLC | 159,087 | 6,996,646 |

|

| KION Group AG (Germany) | 34,776 | 2,115,240 |

|

| Komatsu, Ltd. (Japan) | 181,700 | 4,335,310 |

|

| Northrop Grumman Corp. | 23,373 | 5,354,287 |

|

| Raytheon Co. | 38,021 | 5,481,107 |

|

| Stericycle, Inc. † | 12,988 | 1,001,894 |

|

| United Technologies Corp. | 37,611 | 4,124,798 |

|

| Waste Connections, Inc. (Canada) | 50,051 | 4,019,095 |

|

| | | 45,616,280 |

|

| Communication services (3.4%) | | |

|

| American Tower Corp. R | 22,539 | 2,332,787 |

|

| AT&T, Inc. | 227,433 | 9,588,575 |

|

| Charter Communications, Inc. Class A † | 17,142 | 5,553,151 |

|

| Comcast Corp. Class A | 113,539 | 8,563,111 |

|

| DISH Network Corp. Class A † | 30,419 | 1,799,892 |

|

| Equinix, Inc. R | 5,251 | 2,021,530 |

|

| T-Mobile US, Inc. † | 92,579 | 5,764,894 |

|

|

| 18 George Putnam Balanced Fund |

| | |

| COMMON STOCKS (60.6%)* cont. | Shares | Value |

|

| Communication services cont. | | |

|

| Verizon Communications, Inc. | 45,537 | $2,231,768 |

|

| Zayo Group Holdings, Inc. † | 46,761 | 1,494,482 |

|

| | | 39,350,190 |

|

| Communications equipment (0.2%) | | |

|

| Cisco Systems, Inc. | 90,637 | 2,784,369 |

|

| | | 2,784,369 |

|

| Components (0.2%) | | |

|

| Oclaro, Inc. † | 222,508 | 2,182,803 |

|

| | | 2,182,803 |

|

| Computers (2.3%) | | |

|

| Apple, Inc. | 194,632 | 23,618,593 |

|

| Castlight Health, Inc. Class B † S | 77,337 | 239,745 |

|

| HP, Inc. | 59,487 | 895,279 |

|

| ServiceNow, Inc. † | 10,742 | 973,440 |

|

| Western Digital Corp. | 9,900 | 789,327 |

|

| | | 26,516,384 |

|

| Conglomerates (0.9%) | | |

|

| Danaher Corp. | 51,639 | 4,333,545 |

|

| Siemens AG (Germany) † | 44,864 | 5,626,379 |

|

| | | 9,959,924 |

|

| Consumer cyclicals (6.7%) | | |

|

| Amazon.com, Inc. † | 18,670 | 15,374,372 |

|

| Brunswick Corp. | 18,086 | 1,082,628 |

|

| CaesarStone Sdot-Yam, Ltd. (Israel) † | 12,944 | 392,850 |

|

| Criteo SA ADR (France) † S | 17,698 | 797,649 |

|

| Ctrip.com International, Ltd. ADR (China) † S | 50,918 | 2,200,167 |

|

| Expedia, Inc. | 16,756 | 2,037,362 |

|

| Five Below, Inc. † S | 24,076 | 959,429 |

|

| Hanesbrands, Inc. | 127,208 | 3,016,102 |

|

| Hilton Worldwide Holdings, Inc. | 41,725 | 2,402,526 |

|

| Home Depot, Inc. (The) | 71,822 | 9,881,271 |

|

| Live Nation Entertainment, Inc. † | 91,593 | 2,621,392 |

|

| MasterCard, Inc. Class A | 36,748 | 3,907,415 |

|

| O’Reilly Automotive, Inc. † S | 11,486 | 3,012,433 |

|

| Penn National Gaming, Inc. † | 135,642 | 1,869,147 |

|

| Priceline Group, Inc. (The) † | 2,966 | 4,671,836 |

|

| Rollins, Inc. S | 85,828 | 3,026,295 |

|

| TJX Cos., Inc. (The) | 54,084 | 4,051,973 |

|

| United Rentals, Inc. † | 24,412 | 3,088,362 |

|

| Vulcan Materials Co. | 8,075 | 1,036,265 |

|

| Wal-Mart Stores, Inc. | 32,156 | 2,146,091 |

|

| Walt Disney Co. (The) | 82,267 | 9,102,844 |

|

| Wynn Resorts, Ltd. S | 17,946 | 1,820,263 |

|

| | | 78,498,672 |

|

| Consumer staples (6.3%) | | |

|

| Altria Group, Inc. | 71,427 | 5,084,174 |

|

| Bright Horizons Family Solutions, Inc. † | 20,499 | 1,452,559 |

|

| Campbell Soup Co. | 42,839 | 2,665,871 |

|

| Costco Wholesale Corp. | 31,549 | 5,172,459 |

|

|

| George Putnam Balanced Fund 19 |

| | |

| COMMON STOCKS (60.6%)* cont. | Shares | Value |

|

| Consumer staples cont. | | |

|

| CVS Health Corp. | 37,923 | $2,988,712 |

|

| Delivery Hero Holding GmbH (acquired 6/12/15 cost $446,716) (Private) | | |

| (Germany) † ∆∆ F | 58 | 385,647 |

|

| Dr. Pepper Snapple Group, Inc. | 62,965 | 5,742,408 |

|

| Edgewell Personal Care Co. † | 4,469 | 352,336 |

|

| JM Smucker Co. (The) | 11,266 | 1,530,486 |

|

| Kraft Heinz Co. (The) | 75,649 | 6,754,699 |

|

| Kroger Co. (The) | 76,998 | 2,614,852 |

|

| LKQ Corp. † | 22,530 | 718,932 |

|

| Mead Johnson Nutrition Co. | 9,517 | 670,568 |

|

| Molson Coors Brewing Co. Class B | 48,210 | 4,653,229 |

|

| Mondelez International, Inc. Class A | 45,583 | 2,018,415 |

|

| Monster Beverage Corp. † | 17,802 | 758,365 |

|

| Nomad Foods, Ltd. (United Kingdom) † | 55,541 | 570,406 |

|

| PepsiCo, Inc. | 136,123 | 14,126,845 |

|

| Philip Morris International, Inc. | 19,141 | 1,840,024 |

|

| Pinnacle Foods, Inc. | 10,368 | 551,474 |

|

| Procter & Gamble Co. (The) | 39,463 | 3,456,959 |

|

| Restaurant Brands International, Inc. (Canada) S | 29,747 | 1,459,983 |

|

| Walgreens Boots Alliance, Inc. | 76,934 | 6,303,972 |

|

| Yum China Holdings, Inc. (China) † | 29,688 | 815,826 |

|

| | | 72,689,201 |

|

| Electronics (2.9%) | | |

|

| Agilent Technologies, Inc. | 50,345 | 2,465,395 |

|

| Analog Devices, Inc. | 11,375 | 852,443 |

|

| Broadcom, Ltd. | 25,825 | 5,152,088 |

|

| Micron Technology, Inc. † | 68,939 | 1,662,119 |

|

| NVIDIA Corp. | 10,778 | 1,176,742 |

|

| NXP Semiconductor NV † | 18,324 | 1,793,003 |

|

| Qorvo, Inc. † S | 111,700 | 7,172,257 |

|

| Qualcomm, Inc. | 30,631 | 1,636,614 |

|

| Rockwell Automation, Inc. | 19,349 | 2,863,459 |

|

| Skyworks Solutions, Inc. | 16 | 1,468 |

|

| Sumco Corp. (Japan) | 35,200 | 552,114 |

|

| Texas Instruments, Inc. | 71,719 | 5,417,653 |

|

| Xilinx, Inc. | 45,208 | 2,631,106 |

|

| | | 33,376,461 |

|

| Energy (4.8%) | | |

|

| Anadarko Petroleum Corp. | 86,638 | 6,023,940 |

|

| Arch Coal, Inc. Class A † | 1,631 | 117,416 |

|

| Baker Hughes, Inc. | 16,923 | 1,067,503 |

|

| Cenovus Energy, Inc. (Canada) | 141,800 | 1,935,345 |

|

| Cheniere Energy, Inc. † | 70,172 | 3,343,696 |

|

| Chevron Corp. | 18,900 | 2,104,515 |

|

| Cimarex Energy Co. | 4,026 | 544,355 |

|

| ConocoPhillips | 128,370 | 6,259,321 |

|

| Devon Energy Corp. | 8,115 | 369,557 |

|

| EnCana Corp. (Canada) | 90,629 | 1,156,847 |

|

| EOG Resources, Inc. | 37,530 | 3,812,297 |

|

|

| 20 George Putnam Balanced Fund |

| | |

| COMMON STOCKS (60.6%)* cont. | Shares | Value |

|

| Energy cont. | | |

|

| Exxon Mobil Corp. | 24,337 | $2,041,631 |

|

| Halliburton Co. | 106,797 | 6,041,506 |

|

| Hess Corp. | 10,145 | 549,656 |

|

| Keane Group, Inc. † | 28,557 | 630,824 |

|

| Marathon Oil Corp. | 60,637 | 1,015,670 |

|

| Noble Energy, Inc. | 74,926 | 2,979,058 |

|

| ONEOK, Inc. | 7,665 | 422,418 |

|

| Pioneer Natural Resources Co. | 11,799 | 2,126,534 |

|

| Plains All American Pipeline LP | 42,879 | 1,345,972 |

|

| Royal Dutch Shell PLC Class A (United Kingdom) | 165,480 | 4,487,876 |

|

| Schlumberger, Ltd. | 37,597 | 3,147,245 |

|

| Seven Generations Energy, Ltd. (Canada) † | 48,773 | 974,898 |

|

| Suncor Energy, Inc. (Canada) | 101,518 | 3,148,716 |

|

| Williams Cos., Inc. (The) | 18,990 | 547,672 |

|

| | | 56,194,468 |

|

| Financials (10.0%) | | |

|

| American International Group, Inc. | 92,480 | 5,942,765 |

|

| Assured Guaranty, Ltd. | 167,174 | 6,504,740 |

|

| AvalonBay Communities, Inc. R | 10,450 | 1,811,090 |

|

| Bank of America Corp. | 578,442 | 13,095,927 |

|

| Boston Properties, Inc. R | 13,993 | 1,831,684 |

|

| CBRE Group, Inc. Class A † | 18,900 | 573,804 |

|

| Charles Schwab Corp. (The) | 157,389 | 6,490,722 |

|

| Chubb, Ltd. | 38,462 | 5,057,368 |

|

| Douglas Emmett, Inc. R | 16,256 | 615,127 |

|

| E*Trade Financial Corp. † | 47,865 | 1,792,544 |

|

| Equity Lifestyle Properties, Inc. R | 13,205 | 976,378 |

|

| Essex Property Trust, Inc. R | 3,207 | 719,330 |

|

| Federal Realty Investment Trust R | 6,122 | 859,712 |

|

| Gaming and Leisure Properties, Inc. R | 41,120 | 1,300,626 |

|

| GGP, Inc. R | 45,812 | 1,137,970 |

|

| Goldman Sachs Group, Inc. (The) | 32,842 | 7,531,327 |

|

| Gores Holdings II, Inc. (Units) † | 51,253 | 528,418 |

|

| Hartford Financial Services Group, Inc. (The) | 52,189 | 2,542,126 |

|

| Invesco, Ltd. | 102,991 | 2,978,500 |

|

| JPMorgan Chase & Co. | 186,373 | 15,772,747 |

|

| KeyCorp | 284,207 | 5,107,200 |

|

| Kimco Realty Corp. R | 14,396 | 358,316 |

|

| KKR & Co. LP | 281,172 | 4,881,146 |

|

| MetLife, Inc. | 92,218 | 5,017,581 |

|

| Oportun Financial Corp. (acquired 6/23/15, cost $386,984) (Private) † ∆∆ F | 135,784 | 348,286 |

|

| Pebblebrook Hotel Trust R S | 15,122 | 452,299 |

|

| Prudential PLC (United Kingdom) | 278,475 | 5,383,663 |

|

| Public Storage R | 7,613 | 1,636,795 |

|

| Simon Property Group, Inc. R | 10,471 | 1,924,256 |

|

| Synchrony Financial | 154,111 | 5,520,256 |

|

| Visa, Inc. Class A | 92,495 | 7,650,261 |

|

| | | 116,342,964 |

|

| George Putnam Balanced Fund 21 |

| | |

| COMMON STOCKS (60.6%)* cont. | Shares | Value |

|

| Health care (7.2%) | | |

|

| Abbott Laboratories | 19,503 | $814,640 |

|

| Aetna, Inc. | 5,143 | 610,011 |

|

| Allergan PLC † | 34,499 | 7,551,486 |

|

| Amgen, Inc. | 42,014 | 6,582,754 |

|

| Becton Dickinson and Co. | 18,057 | 3,201,326 |

|

| Biogen, Inc. † | 16,838 | 4,668,167 |

|

| Boston Scientific Corp. † | 105,965 | 2,549,518 |

|

| Bristol-Myers Squibb Co. | 59,368 | 2,918,531 |

|

| C.R. Bard, Inc. | 11,166 | 2,650,027 |

|

| Cardinal Health, Inc. | 3,574 | 267,907 |

|

| Celgene Corp. † | 66,957 | 7,777,056 |

|

| Cigna Corp. | 22,042 | 3,222,981 |

|

| Edwards Lifesciences Corp. † | 2,349 | 226,068 |

|

| Eli Lilly & Co. | 51,471 | 3,964,811 |

|

| Express Scripts Holding Co. † | 17,399 | 1,198,443 |

|

| Gilead Sciences, Inc. | 91,585 | 6,635,333 |

|

| Henry Schein, Inc. † | 5,781 | 924,151 |

|

| HTG Molecular Diagnostics, Inc. † | 6,668 | 11,669 |

|

| Humana, Inc. | 10,572 | 2,098,542 |

|

| Illumina, Inc. † | 7,103 | 1,137,190 |

|

| Intuitive Surgical, Inc. † S | 3,520 | 2,438,269 |

|

| Jazz Pharmaceuticals PLC † | 5,799 | 707,014 |

|

| Johnson & Johnson | 26,218 | 2,969,189 |

|

| Medtronic PLC | 19,908 | 1,513,406 |

|

| Merck & Co., Inc. | 87,502 | 5,424,249 |

|

| Mylan NV † | 52,096 | 1,982,253 |

|

| Pfizer, Inc. | 169,464 | 5,377,093 |

|

| Service Corp. International/US | 85,415 | 2,488,139 |

|

| UnitedHealth Group, Inc. | 4,954 | 803,043 |

|

| Ventas, Inc. R | 24,176 | 1,490,934 |

|

| | | 84,204,200 |

|

| Miscellaneous (0.1%) | | |

|

| Conyers Park Acquisition Corp. (Units) † | 63,307 | 688,147 |

|

| | | 688,147 |

|

| Semiconductor (0.4%) | | |

|

| Applied Materials, Inc. | 135,505 | 4,641,046 |

|

| | | 4,641,046 |

|

| Software (2.6%) | | |

|

| Activision Blizzard, Inc. | 6,463 | 259,877 |

|

| Adobe Systems, Inc. † | 36,629 | 4,152,978 |

|

| Electronic Arts, Inc. † | 28,749 | 2,398,529 |

|

| Everbridge, Inc. † | 22,866 | 422,335 |

|

| Microsoft Corp. | 332,066 | 21,468,067 |

|

| Tencent Holdings, Ltd. (China) | 60,681 | 1,598,577 |

|

| | | 30,300,363 |

|

| Technology services (3.9%) | | |

|

| Alibaba Group Holding, Ltd. ADR (China) † S | 28,050 | 2,841,746 |

|

| Alphabet, Inc. Class A † | 24,047 | 19,723,109 |

|

| Cognizant Technology Solutions Corp. Class A † | 12,264 | 644,964 |

|

|

| 22 George Putnam Balanced Fund |

| | |

| COMMON STOCKS (60.6%)* cont. | Shares | Value |

|

| Technology services cont. | | |

|

| Computer Sciences Corp. | 42,481 | $2,642,318 |

|

| Facebook, Inc. Class A † | 97,497 | 12,705,809 |

|

| Fidelity National Information Services, Inc. | 39,652 | 3,149,162 |

|

| GoDaddy, Inc. Class A † S | 33,337 | 1,191,131 |

|

| salesforce.com, Inc. † | 25,138 | 1,988,416 |

|

| Wix.com, Ltd. (Israel) † | 19,052 | 1,001,183 |

|

| | | 45,887,838 |

|

| Transportation (0.6%) | | |

|

| American Airlines Group, Inc. S | 28,598 | 1,265,462 |

|

| Norfolk Southern Corp. | 33,752 | 3,964,510 |

|

| United Parcel Service, Inc. Class B | 11,830 | 1,291,008 |

|

| | | 6,520,980 |

|

| Utilities and power (2.0%) | | |

|

| Ameren Corp. | 25,507 | 1,342,944 |

|

| American Electric Power Co., Inc. | 22,585 | 1,446,795 |

|

| American Water Works Co., Inc. | 31,670 | 2,325,845 |

|

| Calpine Corp. † | 158,733 | 1,873,049 |

|

| Edison International | 29,564 | 2,154,624 |

|

| Exelon Corp. | 109,663 | 3,934,708 |

|

| Kinder Morgan, Inc. | 39,461 | 881,559 |

|

| NextEra Energy, Inc. | 17,246 | 2,133,675 |

|

| NRG Energy, Inc. | 201,108 | 3,326,326 |

|

| PG&E Corp. | 53,014 | 3,281,036 |

|

| Sempra Energy | 9,156 | 937,483 |

|

| | | 23,638,044 |

|

| Total common stocks (cost $627,455,887) | | $704,389,334 |

|

| | |

| U.S. GOVERNMENT AND AGENCY | Principal | |

| MORTGAGE OBLIGATIONS (12.7%)* | amount | Value |

|

| U.S. Government Guaranteed Mortgage Obligations (1.9%) | | |

|

| Government National Mortgage Association Pass-Through Certificates | | |

|

| 4.50%, TBA, 2/1/47 | $7,000,000 | $7,509,141 |

|

| 3.50%, with due dates from 2/20/43 to 11/20/45 | 3,746,598 | 3,885,359 |

|

| 3.50%, TBA, 2/1/47 | 3,000,000 | 3,108,281 |

|

| 3.00%, with due dates from 8/20/46 to 10/20/46 | 1,986,656 | 2,004,071 |

|

| 3.00%, TBA, 2/1/47 | 5,000,000 | 5,042,188 |

|

| | | 21,549,040 |

|

| U.S. Government Agency Mortgage Obligations (10.8%) | | |

|

| Federal Home Loan Mortgage Corporation Pass-Through Certificates | | |

|

| 6.00%, 3/1/35 | 1,980 | 2,259 |

|

| 4.00%, with due dates from 7/1/42 to 9/1/45 | 5,073,441 | 5,351,067 |

|

| 3.50%, with due dates from 12/1/42 to 4/1/43 | 700,543 | 722,244 |

|

| 3.00%, with due dates from 3/1/43 to 7/1/43 | 2,455,046 | 2,439,286 |

|

| Federal National Mortgage Association Pass-Through Certificates | | |

|

| 5.50%, with due dates from 7/1/33 to 11/1/38 | 2,605,359 | 2,907,377 |

|

| 5.00%, with due dates from 8/1/33 to 1/1/39 | 710,666 | 780,944 |

|

| 4.50%, 11/1/44 | 6,403,743 | 6,980,330 |

|

| 4.50%, TBA, 3/1/47 | 13,000,000 | 13,957,226 |

|

| 4.50%, TBA, 2/1/47 | 13,000,000 | 13,980,078 |

|

|

| George Putnam Balanced Fund 23 |

| | |

| U.S. GOVERNMENT AND AGENCY | Principal | |

| MORTGAGE OBLIGATIONS (12.7%)* cont. | amount | Value |

|

| U.S. Government Agency Mortgage Obligations cont. | | |

|

| Federal National Mortgage Association Pass-Through Certificates | | |

|

| 4.00%, 9/1/45 | $2,795,780 | $2,962,871 |

|

| 3.50%, with due dates from 5/1/43 to 1/1/47 | 7,168,324 | 7,353,575 |

|

| 3.50%, TBA, 3/1/47 | 27,000,000 | 27,536,836 |

|

| 3.50%, TBA, 2/1/47 | 29,000,000 | 29,636,640 |

|

| 3.00%, with due dates from 2/1/43 to 6/1/46 | 3,425,186 | 3,402,963 |

|

| 3.00%, TBA, 3/1/47 | 4,000,000 | 3,951,094 |

|

| 3.00%, TBA, 2/1/47 | 4,000,000 | 3,958,750 |

|

| | | 125,923,540 |

|

| Total U.S. government and agency mortgage obligations (cost $147,938,610) | $147,472,580 |

|

| | |

| | Principal | |

| U.S. TREASURY OBLIGATIONS (11.8%)* | amount | Value |

|

| U.S. Treasury Bonds 2.75%, 8/15/42 ∆ | $19,090,000 | $18,093,741 |

|

| U.S. Treasury Notes | | |

|

| 2.00%, 2/15/22 ∆ | 5,880,000 | 5,896,423 |

|

| 2.00%, 11/30/20 | 44,660,000 | 45,144,543 |

|

| 1.875%, 11/30/21 | 6,480,000 | 6,470,445 |

|

| 1.375%, 9/30/18 | 23,230,000 | 23,332,540 |

|

| 1.125%, 3/31/20 | 7,770,000 | 7,675,303 |

|

| 1.125%, 12/31/19 | 31,470,000 | 31,173,125 |

|

| Total U.S. treasury obligations (cost $138,847,759) | | $137,786,120 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (15.8%)* | amount | Value |

|

| Basic materials (0.8%) | | |

|

| Agrium, Inc. sr. unsec. unsub. notes 7.125%, 5/23/36 (Canada) | $182,000 | $230,247 |

|

| Celanese US Holdings, LLC company guaranty sr. unsec. unsub. | | |

| notes 4.625%, 11/15/22 (Germany) | 668,000 | 703,070 |

|

| Cytec Industries, Inc. sr. unsec. unsub. notes 3.50%, 4/1/23 | 215,000 | 214,230 |

|

| Eastman Chemical Co. sr. unsec. notes 3.80%, 3/15/25 | 235,000 | 238,586 |

|

| Freeport-McMoRan, Inc. 144A company guaranty sr. unsec. notes | | |

| 6.75%, 2/1/22 (Indonesia) | 95,000 | 99,038 |

|

| Georgia-Pacific, LLC sr. unsec. unsub. notes 7.75%, 11/15/29 | 850,000 | 1,141,935 |

|

| Glencore Funding, LLC 144A company guaranty sr. unsec. unsub. | | |

| notes 4.625%, 4/29/24 | 941,000 | 973,700 |

|

| Glencore Funding, LLC 144A company guaranty sr. unsec. unsub. | | |

| notes 4.00%, 4/16/25 | 638,000 | 634,927 |

|

| International Paper Co. sr. unsec. notes 8.70%, 6/15/38 | 10,000 | 14,377 |

|

| INVISTA Finance, LLC 144A company guaranty sr. notes | | |

| 4.25%, 10/15/19 | 356,000 | 357,866 |

|

| LyondellBasell Industries NV sr. unsec. unsub. notes | | |

| 4.625%, 2/26/55 | 515,000 | 482,255 |

|

| Union Carbide Corp. sr. unsec. unsub. bonds 7.75%, 10/1/96 | 180,000 | 223,005 |

|

| Westlake Chemical Corp. 144A company guaranty sr. unsec. | | |

| unsub. bonds 3.60%, 8/15/26 | 1,610,000 | 1,561,679 |

|

| WestRock MWV, LLC company guaranty sr. unsec. unsub. notes | | |

| 8.20%, 1/15/30 | 1,265,000 | 1,693,671 |

|

| WestRock MWV, LLC company guaranty sr. unsec. unsub. notes | | |

| 7.95%, 2/15/31 | 187,000 | 247,764 |

|

|

| 24 George Putnam Balanced Fund |

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (15.8%)* cont. | amount | Value |

|

| Basic materials cont. | | |

|

| WestRock RKT Co. company guaranty sr. unsec. unsub. notes | | |

| 4.45%, 3/1/19 | $168,000 | $175,095 |

|

| Weyerhaeuser Co. sr. unsec. unsub. notes 7.375%, 3/15/32 R | 553,000 | 713,806 |

|

| | | 9,705,251 |

|

| Capital goods (0.4%) | | |

|

| L3 Technologies, Inc. company guaranty sr. unsec. bonds | | |

| 3.85%, 12/15/26 | 235,000 | 235,593 |

|

| Legrand France SA sr. unsec. unsub. notes 8.50%, 2/15/25 (France) | 767,000 | 986,793 |

|

| Medtronic, Inc. company guaranty sr. unsec. sub. notes | | |

| 4.375%, 3/15/35 | 307,000 | 321,106 |

|

| Medtronic, Inc. company guaranty sr. unsec. sub. notes | | |

| 3.50%, 3/15/25 | 327,000 | 334,206 |

|

| Northrop Grumman Systems Corp. company guaranty sr. unsec. | | |

| unsub. notes 7.875%, 3/1/26 | 265,000 | 351,298 |

|

| Parker Hannifin Corp. sr. unsec. unsub. notes Ser. MTN, | | |

| 6.25%, 5/15/38 | 975,000 | 1,242,703 |

|

| Republic Services, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5.50%, 9/15/19 | 240,000 | 260,927 |

|

| United Technologies Corp. sr. unsec. unsub. notes 5.70%, 4/15/40 | 100,000 | 122,576 |

|

| United Technologies Corp. sr. unsec. unsub. notes 4.50%, 6/1/42 | 225,000 | 236,675 |

|

| | | 4,091,877 |

|

| Communication services (1.1%) | | |

|

| America Movil SAB de CV company guaranty sr. unsec. unsub. | | |

| notes 6.125%, 3/30/40 (Mexico) | 200,000 | 226,703 |

|

| American Tower Corp. sr. unsec. notes 4.00%, 6/1/25 R | 335,000 | 335,648 |

|

| American Tower Corp. sr. unsec. notes 3.40%, 2/15/19 R | 735,000 | 753,135 |

|

| American Tower Corp. sr. unsec. unsub. bonds 3.375%, 10/15/26 R | 500,000 | 474,363 |

|

| AT&T, Inc. sr. unsec. unsub. notes 4.75%, 5/15/46 | 122,000 | 111,437 |

|

| CC Holdings GS V, LLC/Crown Castle GS III Corp. company guaranty | | |

| sr. notes 3.849%, 4/15/23 | 240,000 | 245,375 |

|

| Charter Communications Operating, LLC/Charter | | |

| Communications Operating Capital Corp. company guaranty sr. | | |

| sub. bonds 6.484%, 10/23/45 | 1,159,000 | 1,317,491 |

|

| Charter Communications Operating, LLC/Charter | | |

| Communications Operating Capital Corp. company guaranty sr. | | |

| sub. notes 4.908%, 7/23/25 | 356,000 | 374,338 |

|

| Comcast Cable Communications Holdings, Inc. company | | |

| guaranty sr. unsec. notes 9.455%, 11/15/22 | 645,000 | 868,607 |

|

| Comcast Corp. company guaranty sr. unsec. unsub. notes | | |

| 6.50%, 11/15/35 | 268,000 | 344,590 |

|

| Comcast Corp. company guaranty sr. unsec. unsub. notes | | |

| 3.15%, 3/1/26 | 610,000 | 596,773 |

|

| Crown Castle International Corp. sr. unsec. notes 5.25%, 1/15/23 R | 75,000 | 81,473 |

|

| Crown Castle International Corp. sr. unsec. notes 4.875%, 4/15/22 R | 313,000 | 336,475 |

|

| Crown Castle Towers, LLC 144A company guaranty sr. notes | | |

| 4.883%, 8/15/20 | 710,000 | 756,417 |

|

| NBCUniversal Media, LLC company guaranty sr. unsec. unsub. | | |

| notes 6.40%, 4/30/40 | 380,000 | 488,414 |

|

| Rogers Communications, Inc. company guaranty sr. unsec. bonds | | |

| 8.75%, 5/1/32 (Canada) | 95,000 | 129,196 |

|

|

| George Putnam Balanced Fund 25 |

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (15.8%)* cont. | amount | Value |

|

| Communication services cont. | | |

|

| Rogers Communications, Inc. company guaranty sr. unsec. unsub. | | |

| notes 4.50%, 3/15/43 (Canada) | $215,000 | $214,617 |

|

| Sprint Spectrum Co., LLC/Sprint Spectrum Co. II, LLC/ | | |

| Sprint Spectrum Co. III, LL 144A company guaranty sr. notes | | |

| 3.36%, 9/20/21 | 955,000 | 956,194 |

|

| Telecom Italia SpA 144A sr. unsec. notes 5.303%, 5/30/24 (Italy) | 1,000,000 | 1,005,500 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. unsub. | | |

| notes 7.045%, 6/20/36 (Spain) | 355,000 | 416,030 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes 5.90%, | | |

| 2/15/54 (units) | 5,200 | 136,968 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes | | |

| 5.05%, 3/15/34 | 270,000 | 277,123 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes | | |

| 4.522%, 9/15/48 | 982,000 | 892,242 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes | | |

| 4.40%, 11/1/34 | 595,000 | 567,213 |

|

| Verizon New Jersey, Inc. company guaranty sr. unsec. unsub. | | |

| bonds 8.00%, 6/1/22 | 770,000 | 931,154 |

|

| | | 12,837,476 |

|

| Conglomerates (0.1%) | | |

|

| General Electric Co. jr. unsec. sub. FRB Ser. D, 5.00%, | | |

| perpetual maturity | 1,111,000 | 1,158,218 |

|

| | | 1,158,218 |

|

| Consumer cyclicals (1.7%) | | |

|

| 21st Century Fox America, Inc. company guaranty sr. unsec. notes | | |

| 7.85%, 3/1/39 | 190,000 | 256,537 |

|

| 21st Century Fox America, Inc. company guaranty sr. unsec. notes | | |

| 7.75%, 1/20/24 | 1,045,000 | 1,292,182 |

|

| Autonation, Inc. company guaranty sr. unsec. notes 4.50%, 10/1/25 | 330,000 | 336,161 |

|

| Autonation, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5.50%, 2/1/20 | 847,000 | 913,102 |

|

| CBS Corp. company guaranty sr. unsec. debs. 7.875%, 7/30/30 | 579,000 | 778,577 |

|

| CBS Corp. company guaranty sr. unsec. unsub. bonds | | |

| 2.90%, 1/15/27 | 851,000 | 780,985 |

|

| Dollar General Corp. sr. unsec. sub. notes 3.25%, 4/15/23 | 625,000 | 619,355 |

|

| Expedia, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5.00%, 2/15/26 | 375,000 | 393,291 |

|

| Ford Motor Co. sr. unsec. unsub. notes 9.98%, 2/15/47 | 135,000 | 202,485 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.75%, 6/15/43 | 1,290,000 | 1,619,587 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.45%, 7/16/31 | 24,000 | 30,047 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.40%, 11/1/46 | 200,000 | 258,124 |

|

| Ford Motor Credit Co., LLC sr. unsec. unsub. notes 5.875%, 8/2/21 | 318,000 | 353,734 |

|

| Ford Motor Credit Co., LLC sr. unsec. unsub. notes 4.134%, 8/4/25 | 477,000 | 476,430 |

|

| General Motors Co. sr. unsec. notes 5.20%, 4/1/45 | 844,000 | 830,162 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| notes 4.00%, 10/6/26 | 680,000 | 658,891 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| unsub. notes 4.30%, 7/13/25 | 395,000 | 393,613 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| unsub. notes 4.00%, 1/15/25 | 250,000 | 246,830 |

|

|

| 26 George Putnam Balanced Fund |

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (15.8%)* cont. | amount | Value |

|

| Consumer cyclicals cont. | | |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| unsub. notes 3.45%, 4/10/22 | $900,000 | $896,992 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| unsub. notes 3.45%, 1/14/22 | 200,000 | 199,744 |

|

| Grupo Televisa SAB sr. unsec. unsub. bonds 6.625%, | | |

| 1/15/40 (Mexico) | 300,000 | 312,075 |

|

| Grupo Televisa SAB sr. unsec. unsub. notes 5.00%, 5/13/45 (Mexico) | 355,000 | 303,640 |

|

| Hilton Domestic Operating Co., Inc. 144A sr. unsec. sub. notes | | |

| 4.25%, 9/1/24 | 205,000 | 201,156 |

|

| Historic TW, Inc. company guaranty sr. unsec. unsub. bonds | | |

| 9.15%, 2/1/23 | 460,000 | 594,399 |

|

| Host Hotels & Resorts LP sr. unsec. unsub. notes 6.00%, 10/1/21 R | 320,000 | 356,740 |

|

| Host Hotels & Resorts LP sr. unsec. unsub. notes 5.25%, 3/15/22 R | 150,000 | 162,270 |

|

| Hyatt Hotels Corp. sr. unsec. unsub. notes 3.375%, 7/15/23 | 200,000 | 199,542 |

|

| L Brands, Inc. company guaranty sr. unsec. notes 6.625%, 4/1/21 | 435,000 | 476,869 |

|

| Lear Corp. company guaranty sr. unsec. unsub. notes | | |

| 5.375%, 3/15/24 | 375,000 | 394,688 |

|

| NVR, Inc. sr. unsec. notes 3.95%, 9/15/22 | 435,000 | 447,920 |

|

| O’Reilly Automotive, Inc. company guaranty sr. unsec. notes | | |

| 3.85%, 6/15/23 | 195,000 | 200,829 |

|

| O’Reilly Automotive, Inc. company guaranty sr. unsec. sub. notes | | |

| 3.55%, 3/15/26 | 480,000 | 475,278 |

|

| Omnicom Group, Inc. company guaranty sr. unsec. unsub. notes | | |

| 3.60%, 4/15/26 | 540,000 | 535,179 |

|

| Owens Corning company guaranty sr. unsec. sub. notes | | |

| 9.00%, 6/15/19 | 880,000 | 999,841 |

|

| Priceline Group, Inc. (The) sr. unsec. notes 3.65%, 3/15/25 | 164,000 | 163,445 |

|

| QVC, Inc. company guaranty sr. notes 4.85%, 4/1/24 | 390,000 | 392,361 |

|

| S&P Global, Inc. company guaranty sr. unsec. unsub. notes | | |

| 4.40%, 2/15/26 | 670,000 | 702,372 |

|

| Tiffany & Co. sr. unsec. unsub. notes 4.90%, 10/1/44 | 460,000 | 425,744 |

|

| Time Warner, Inc. company guaranty sr. unsec. unsub. bonds | | |

| 2.95%, 7/15/26 | 79,000 | 72,933 |

|

| Vulcan Materials Co. sr. unsec. unsub. notes 4.50%, 4/1/25 | 175,000 | 183,628 |

|

| | | 19,137,738 |

|

| Consumer staples (1.3%) | | |

|

| Anheuser-Busch InBev Finance, Inc. company guaranty sr. unsec. | | |

| unsub. bonds 4.90%, 2/1/46 | 1,947,000 | 2,083,494 |

|

| Anheuser-Busch InBev Finance, Inc. company guaranty sr. unsec. | | |

| unsub. bonds 3.65%, 2/1/26 | 428,000 | 429,226 |

|

| Anheuser-Busch InBev Worldwide, Inc. company guaranty sr. | | |

| unsec. unsub. bonds 4.95%, 1/15/42 | 200,000 | 217,163 |

|

| Anheuser-Busch InBev Worldwide, Inc. company guaranty sr. | | |

| unsec. unsub. notes 8.20%, 1/15/39 | 165,000 | 250,815 |

|

| Bacardi, Ltd. 144A unsec. notes 4.50%, 1/15/21 (Bermuda) | 495,000 | 526,109 |

|

| Constellation Brands, Inc. company guaranty sr. unsec. unsub. | | |

| bonds 3.70%, 12/6/26 | 525,000 | 519,850 |

|

| CVS Health Corp. sr. unsec. notes 4.75%, 12/1/22 | 715,000 | 776,965 |

|

| CVS Pass-Through Trust 144A sr. mtge. notes 7.507%, 1/10/32 | 637,681 | 777,273 |

|

| CVS Pass-Through Trust 144A sr. mtge. notes 4.704%, 1/10/36 | 641,478 | 675,623 |

|

|

| George Putnam Balanced Fund 27 |

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (15.8%)* cont. | amount | Value |

|

| Consumer staples cont. | | |

|

| Diageo Investment Corp. company guaranty sr. unsec. notes | | |

| 8.00%, 9/15/22 | $820,000 | $1,025,590 |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. notes | | |

| 7.00%, 10/15/37 | 1,434,000 | 1,819,002 |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. notes | | |

| 5.625%, 3/15/42 | 553,000 | 609,483 |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. notes | | |

| 3.85%, 11/15/24 | 211,000 | 214,329 |

|

| Grupo Bimbo SAB de CV 144A company guaranty sr. unsec. unsub. | | |

| notes 4.875%, 6/27/44 (Mexico) | 350,000 | 320,989 |

|

| Kraft Heinz Foods Co. company guaranty sr. unsec. notes | | |

| Ser. 144A, 6.875%, 1/26/39 | 625,000 | 794,943 |

|

| Kraft Heinz Foods Co. company guaranty sr. unsec. unsub. notes | | |

| 6.50%, 2/9/40 | 309,000 | 378,180 |

|

| Kraft Heinz Foods Co. company guaranty sr. unsec. bonds | | |

| 4.375%, 6/1/46 | 670,000 | 626,371 |

|

| Lamb Weston Holdings, Inc. 144A company guaranty sr. unsec. | | |

| unsub. notes 4.875%, 11/1/26 | 1,166,000 | 1,167,458 |

|

| Newell Brands, Inc. sr. unsec. unsub. notes 4.20%, 4/1/26 | 1,030,000 | 1,066,934 |

|

| Tyson Foods, Inc. company guaranty sr. unsec. bonds | | |

| 4.875%, 8/15/34 | 134,000 | 137,037 |

|

| Walgreens Boots Alliance, Inc. sr. unsec. bonds 3.45%, 6/1/26 | 765,000 | 745,832 |

|

| | | 15,162,666 |

|

| Energy (1.2%) | | |

|

| BG Energy Capital PLC 144A company guaranty sr. unsec. unsub. | | |

| notes 4.00%, 10/15/21 (United Kingdom) | 250,000 | 265,318 |

|

| BP Capital Markets PLC company guaranty sr. unsec. bonds | | |

| 3.119%, 5/4/26 (United Kingdom) | 670,000 | 648,336 |

|

| Concho Resources, Inc. company guaranty sr. unsec. notes | | |

| 4.375%, 1/15/25 | 925,000 | 945,813 |

|

| DCP Midstream Operating LP company guaranty sr. unsec. notes | | |

| 2.70%, 4/1/19 | 225,000 | 222,188 |

|

| Devon Energy Corp. sr. unsec. unsub. notes 3.25%, 5/15/22 | 276,000 | 276,946 |

|

| EOG Resources, Inc. sr. unsec. unsub. notes 5.625%, 6/1/19 | 205,000 | 222,116 |

|

| EQT Midstream Partners LP company guaranty sr. unsec. sub. | | |

| notes 4.00%, 8/1/24 | 575,000 | 570,559 |

|

| Hess Corp. sr. unsec. unsub. notes 7.30%, 8/15/31 | 388,000 | 462,697 |

|

| Kerr-McGee Corp. company guaranty sr. unsec. unsub. notes | | |

| 7.875%, 9/15/31 | 1,070,000 | 1,386,129 |

|

| Lukoil International Finance BV 144A company guaranty sr. unsec. | | |

| notes 4.563%, 4/24/23 (Russia) | 315,000 | 317,363 |

|

| Marathon Petroleum Corp. sr. unsec. unsub. notes 6.50%, 3/1/41 | 175,000 | 190,123 |

|

| Nabors Industries, Inc. company guaranty sr. unsec. unsub. notes | | |

| 4.625%, 9/15/21 | 600,000 | 612,000 |

|

| Noble Holding International, Ltd. company guaranty sr. unsec. | | |

| unsub. notes 6.05%, 3/1/41 | 390,000 | 302,250 |

|

| Petroleos Mexicanos company guaranty sr. unsec. unsub. notes | | |

| 4.50%, 1/23/26 (Mexico) | 535,000 | 486,583 |

|

| Pride International, Inc. company guaranty sr. unsec. unsub. notes | | |

| 7.875%, 8/15/40 | 760,000 | 712,500 |

|

| Sabine Pass Liquefaction, LLC 144A sr. bonds 5.00%, 3/15/27 | 1,280,000 | 1,342,400 |

|

|

| 28 George Putnam Balanced Fund |

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (15.8%)* cont. | amount | Value |

|

| Energy cont. | | |

|

| Spectra Energy Capital, LLC company guaranty sr. unsec. sub. | | |

| notes 6.20%, 4/15/18 | $580,000 | $607,157 |

|

| Spectra Energy Capital, LLC company guaranty sr. unsec. unsub. | | |

| notes 8.00%, 10/1/19 | 820,000 | 928,691 |

|

| Statoil ASA company guaranty sr. unsec. notes 5.10%, | | |

| 8/17/40 (Norway) | 480,000 | 540,908 |

|

| Tosco Corp. company guaranty sr. unsec. notes 8.125%, 2/15/30 | 600,000 | 823,451 |

|

| Valero Energy Partners LP sr. unsec. unsub. notes | | |