UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number | | 811-5125 |

Dreyfus Variable Investment Fund

(Exact name of Registrant as specified in charter) |

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code) |

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 12/31 | | |

| Date of reporting period: | | 12/31/08 | | |

| | | | | |

| Item 1. | | Reports to Stockholders. |

-2-

| | Dreyfus Variable

Investment Fund,

Appreciation Portfolio |

| | ANNUAL REPORT December 31, 2008 |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

| | Contents |

| |

| | THE PORTFOLIO |

| |

| 2 | A Letter from the CEO |

| |

| 3 | Discussion of Performance |

| |

| 6 | Portfolio Performance |

| |

| 8 | Understanding Your Portfolio’s Expenses |

| |

| 8 | Comparing Your Portfolio’s Expenses With Those of Other Funds |

| |

| 9 | Statement of Investments |

| |

| 12 | Statement of Assets and Liabilities |

| |

| 13 | Statement of Operations |

| |

| 14 | Statement of Changes in Net Assets |

| |

| 16 | Financial Highlights |

| |

| 18 | Notes to Financial Statements |

| |

| 27 | Report of Independent Registered Public Accounting Firm |

| |

| 28 | Important Tax Information |

| |

| 29 | Board Members Information |

| |

| 32 | Officers of the Fund |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

Dreyfus Variable Investment Fund,

Appreciation Portfolio |

The Portfolio

A LETTER FROM THE CEO

Dear Shareholder: |

We present to you this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2008, through December 31, 2008.

2008 was the most difficult year in decades for the economy and stock market.A credit crunch that originated in 2007 in the U.S. sub-prime mortgage market exploded in mid-2008 into a global financial crisis, resulting in the failures of major financial institutions, a deep and prolonged recession and lower investment values across a broad range of asset classes. Governments and regulators throughout the world moved aggressively to curtail the damage, implementing unprecedented reductions of short-term interest rates, massive injections of liquidity into the banking system, government bailouts of struggling companies and plans for massive economic stimulus programs.

Although we expect the U.S. and global economies to remain weak until longstanding imbalances have worked their way out of the system, the financial markets currently appear to have priced in investors’ generally low expectations. In previous recessions, however, the markets have tended to anticipate economic improvement before it occurs, potentially leading to major rallies when few expected them.That’s why it makes sense to remain disciplined, maintain a long-term perspective and adopt a consistent asset allocation strategy that reflects one’s future goals and attitudes toward risk.As always, we urge you to consult with your financial advisor, who can recommend the course of action that is right for you.

For information about how the portfolio performed during the reporting period, as well as market perspectives, we have provided a Discussion of Performance given by the Portfolio Manager.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chief Executive Officer

The Dreyfus Corporation

January 15, 2009 |

2

DISCUSSION OF PERFORMANCE

For the period of January 1, 2008, through December 31, 2008, as provided by Fayez Sarofim, of Fayez Sarofim & Co., Sub-Investment Adviser

Portfolio and Market Performance

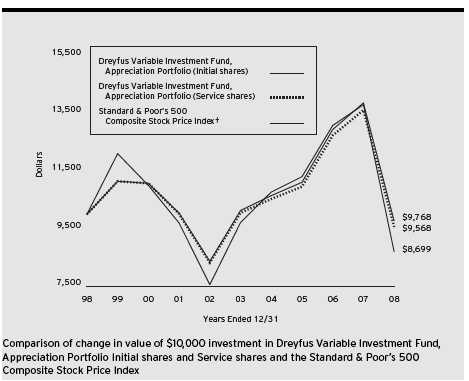

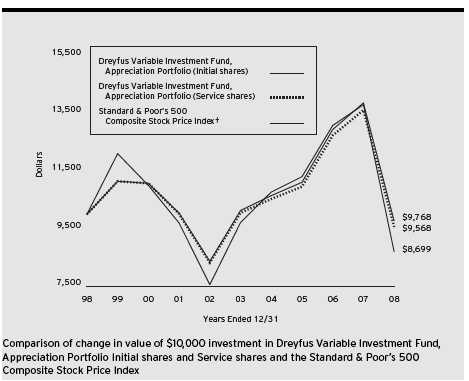

For the 12-month period ended December 31, 2008, Dreyfus Variable Investment Fund,Appreciation Portfolio’s Initial shares produced a total return of –29.55%, and its Service shares produced a total return of –29.72% .1 In comparison, the total return of the portfolio’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), was –36.99% for the same period.2

2008 proved to be a highly challenging year for most investments, including large-cap stocks.A global economic slowdown and an intensifying financial crisis created a wave of selling pressure that produced negative returns in every economic sector represented in the S&P 500 Index. Although we are never satisfied with negative absolute returns, we nonetheless are pleased that the fund produced better results than its benchmark, which we attribute mainly to our longstanding focus on high-quality companies and an effective sector allocation strategy.

The Portfolio’s Investment Approach

The portfolio normally invests at least 80% of its assets in common stocks. The portfolio focuses on large, well-established multinational growth companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence and the potential to achieve predictable above-average earnings growth. We focus on purchasing reasonably priced growth stocks of fundamentally sound companies in economic sectors that we believe will expand over the next three to five years or longer.

Extreme Volatility Roiled the Financial Markets

After producing relatively modest declines over the first half of 2008, stocks tumbled during the second half, producing losses for the S&P 500 Index that have not been seen during a single calendar year since the early 1930s.The bear market was triggered by an intensification of a credit crisis that began in 2007 and mushroomed in September 2008

The Portfolio 3

| DISCUSSION OF PERFORMANCE (continued) |

with the failures of several major financial institutions.These developments exacerbated an ongoing economic slowdown, as lenders grew reluctant to extend credit even to some of their most trusted customers, causing consumer spending and business investment to decline sharply and commodity prices to retreat from previous record levels. In early December, the National Bureau of Economic Research confirmed that the U.S. economy was mired in its first recession since 2001.

Not surprisingly, the financial crisis was particularly hard on financial stocks, which posted greater losses, on average, than any of the S&P 500 Index’s other economic sectors. The industrials and consumer discretionary areas, which historically have been relatively sensitive to economic changes, also were among the more severely affected areas, as were businesses that tend to be sensitive to commodity prices, such as producers of energy and basic materials. Conversely, traditionally defensive areas, such as the health care and consumer staples sectors, generally posted more mild losses.

Avoiding Troubled Financial Companies

The portfolio’s focus on quality sheltered it from the full brunt of the bear market. Our security selection and sector allocation strategies were particularly effective in the financials sector, where we maintained a substantially underweighted position and were early in eliminating some of the financial giants at the epicenter of the financial crisis, including American International Group, Citigroup, Merrill Lynch & Co. and SunTrust Banks.

Instead, we focused on the traditionally defensive consumer staples sector, where overweighted exposure and strong stock selections helped the portfolio participate in relative strength among companies with positive cash flows, low debt levels and steady customer demand. Some of the portfolio’s better performers included brewer Anheuser-Busch, retailer Wal-Mart Stores and restaurant chain McDonald’s, all of which produced positive absolute returns in 2008. Other consumer staples holdings declined more modestly than market averages, including food giant Nestle, household goods producer Procter & Gamble and beverages leader Coca-Cola.The portfolio’s investments in the energy sector also fared relatively well, as integrated energy producers Exxon Mobil,

4

Chevron and ConocoPhillips held up better than most oil services and exploration-and-production specialists.

Of course, the portfolio also held its share of disappointments in 2008. For example, industrial giant General Electric suffered due to its exposure to the credit markets and slowing economy, and semiconductor maker Intel encountered softer demand for microchips.The fund also held no utilities or telecommunications services stocks, which generally produced above-average results.

Economic Weakness Likely to Persist

The stock market has remained volatile, staging a rally in the final month of the year that offset a portion of its earlier losses. However, we have maintained a defensive investment posture, as we expect the U.S. economy to continue to contract over the next several months.

Still, we remain optimistic over the longer term. The sharp decline in energy prices and an expected stimulus package from the federal government may put more cash in consumer’s pockets later in the year, while historically low interest rates could help reduce business costs. Therefore, we have remained invested in fundamentally strong large-cap companies that, in our analysis, could be among the first to rebound in an eventual market recovery.

January 15, 2009

The portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the portfolio directly. A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals.The investment objective and policies of Dreyfus Variable Investment Fund, Appreciation Portfolio made available through insurance products may be similar to other funds/portfolios managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio.

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio’s performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. |

| 2 | | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends and, where |

| | | applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is |

| | | a widely accepted, unmanaged index of U.S. stock market performance. |

The Portfolio 5

PORTFOLIO PERFORMANCE

| Average Annual Total Returns as of 12/31/08 | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

|

| Initial shares | | (29.55)% | | (0.73)% | | (0.23)% |

| Service shares | | (29.72)% | | (0.98)% | | (0.44)% |

The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth results would have been lower. See notes below.

† Source: Lipper Inc.

Past performance is not predictive of future performance.The portfolio’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares.

The portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts which will reduce returns.

The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment Fund, Appreciation Portfolio on 12/31/98 to a $10,000 investment made in the Standard & Poor’s 500 Composite Stock Price Index (the “Index”) on that date.

6

The portfolio’s Initial shares are not subject to a Rule 12b-1 fee.The portfolio’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the portfolio’s Initial shares from their inception date through December 30, 2000, and the performance of the portfolio’s Service shares from December 31, 2000 (inception date of Service shares) to December 31, 2008 (blended performance figures).The blended performance figures have not been adjusted to reflect the higher operating expenses of the Service shares. If these expenses had been reflected, the blended performance figures would have been lower. All dividends and capital gain distributions are reinvested.

The portfolio’s performance shown in the line graph takes into account all applicable portfolio fees and expenses.The Index is a widely accepted, unmanaged index of U.S. stock market performance. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to portfolio performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Portfolio 7

| | UNDERSTANDING YOUR

PORTFOLIO’S EXPENSES (Unaudited) |

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees,which are not shown in this section and would have resulted in higher total expenses. For more information, see your portfolio’s prospectus or talk to your financial adviser.

Review your portfolio’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund,Appreciation Portfolio from July 1, 2008 to December 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2008 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000† | | $ 3.66 | | $ 4.77 |

| Ending value (after expenses) | | $773.40 | | $772.50 |

COMPARING YOUR PORTFOLIO’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your portfolio’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the portfolio with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2008 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000† | | $ 4.17 | | $ 5.43 |

| Ending value (after expenses) | | $1,021.01 | | $1,019.76 |

| | † Expenses are equal to the portfolio’s annualized expense ratio of .82% for Initial shares and 1.07% for Service shares,

multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

December 31, 2008 |

| Common Stocks—98.7% | | Shares | | Value ($) |

| |

| |

|

| Beverages—9.9% | | | | |

| Coca-Cola | | 524,700 | | 23,753,169 |

| PepsiCo | | 220,900 | | 12,098,693 |

| | | | | 35,851,862 |

| Consumer Discretionary—9.0% | | | | |

| Christian Dior | | 72,700 a | | 4,067,522 |

| McDonald’s | | 178,700 | | 11,113,353 |

| McGraw-Hill | | 216,500 | | 5,020,635 |

| News, Cl. A | | 529,836 | | 4,816,209 |

| News, Cl. B | | 8,600 | | 82,388 |

| Polo Ralph Lauren | | 34,900 a | | 1,584,809 |

| Target | | 179,500 | | 6,198,135 |

| | | | | 32,883,051 |

| Consumer Staples—24.7% | | | | |

| Altria Group | | 542,000 | | 8,162,520 |

| Estee Lauder, Cl. A | | 56,800 | | 1,758,528 |

| Nestle, ADR | | 449,000 | | 17,825,300 |

| Philip Morris International | | 542,000 | | 23,582,420 |

| Procter & Gamble | | 319,200 | | 19,732,944 |

| SYSCO | | 87,400 | | 2,004,956 |

| Wal-Mart Stores | | 92,300 | | 5,174,338 |

| Walgreen | | 442,300 | | 10,911,541 |

| Whole Foods Market | | 61,200 a | | 577,728 |

| | | | | 89,730,275 |

| Energy—22.0% | | | | |

| Chevron | | 250,000 | | 18,492,500 |

| ConocoPhillips | | 187,800 | | 9,728,040 |

| Exxon Mobil | | 392,164 | | 31,306,452 |

| Halliburton | | 87,400 | | 1,588,932 |

| Occidental Petroleum | | 122,300 | | 7,336,777 |

| Royal Dutch Shell, Cl. A, ADR | | 72,200 | | 3,822,268 |

| Total, ADR | | 104,800 | | 5,795,440 |

| Transocean | | 36,675 b | | 1,732,894 |

| | | | | 79,803,303 |

| Financial—2.6% | | | | |

| American Express | | 95,600 | | 1,773,380 |

| Bank of America | | 200,716 | | 2,826,081 |

The Portfolio 9

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Financial (continued) | | | | |

| HSBC Holdings, ADR | | 43,700 a | | 2,126,879 |

| JPMorgan Chase & Co. | | 87,500 | | 2,758,875 |

| | | | | 9,485,215 |

| Health Care—11.6% | | | | |

| Abbott Laboratories | | 245,200 | | 13,086,324 |

| Johnson & Johnson | | 305,200 | | 18,260,116 |

| Medtronic | | 56,800 | | 1,784,656 |

| Merck & Co. | | 152,300 | | 4,629,920 |

| Roche Holding, ADR | | 55,900 | | 4,279,145 |

| | | | | 42,040,161 |

| Industrial—6.6% | | | | |

| Caterpillar | | 43,700 | | 1,952,079 |

| Emerson Electric | | 199,100 | | 7,289,051 |

| Fluor | | 69,800 | | 3,131,926 |

| General Dynamics | | 18,000 | | 1,036,620 |

| General Electric | | 447,300 | | 7,246,260 |

| United Technologies | | 64,000 | | 3,430,400 |

| | | | | 24,086,336 |

| Information Technology—10.3% | | | | |

| Apple | | 50,000 b | | 4,267,500 |

| Automatic Data Processing | | 94,800 | | 3,729,432 |

| Cisco Systems | | 222,200 b | | 3,621,860 |

| Intel | | 921,500 | | 13,509,190 |

| Microsoft | | 357,000 | | 6,940,080 |

| QUALCOMM | | 78,600 | | 2,816,238 |

| Texas Instruments | | 164,700 | | 2,556,144 |

| | | | | 37,440,444 |

| Materials—2.0% | | | | |

| Freeport-McMoRan Copper & Gold | | 25,000 | | 611,000 |

| Praxair | | 105,700 | | 6,274,352 |

| Rio Tinto, ADR | | 5,000 a | | 444,550 |

| | | | | 7,329,902 |

| Total Common Stocks | | | | |

| (cost $315,127,167) | | | | 358,650,549 |

10

| Other Investment—.6% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $2,000,000) | | 2,000,000 c | | 2,000,000 |

| |

| |

|

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—2.2% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Cash | | | | |

| Advantage Fund | | | | |

| (cost $8,054,859) | | 8,054,859 c | | 8,054,859 |

| |

| |

|

| |

| Total Investments (cost $325,182,026) | | 101.5% | | 368,705,408 |

| Liabilities, Less Cash and Receivables | | (1.5%) | | (5,316,926) |

| Net Assets | | 100.0% | | 363,388,482 |

| ADR—American Depository Receipts |

| a All or a portion of these securities are on loan. At December 31, 2008, the total market value of the portfolio’s |

| securities on loan is $7,792,022 and the total market value of the collateral held by the portfolio is $8,054,859. |

| b Non-income producing security. |

| c Investment in affiliated money market mutual fund. |

| Portfolio Summary (Unaudited)† | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Consumer Staples | | 24.7 | | Industrial | | 6.6 |

| Energy | | 22.0 | | Money Market Investments | | 2.8 |

| Health Care | | 11.6 | | Financial | | 2.6 |

| Information Technology | | 10.3 | | Materials | | 2.0 |

| Beverages | | 9.9 | | | | |

| Consumer Discretionary | | 9.0 | | | | 101.5 |

| |

| † Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

The Portfolio 11

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2008 |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement | | | | |

| of Investments (including securities on loan, | | | | |

| valued at $7,792,022)—Note 1(c): | | | | |

| Unaffiliated issuers | | 315,127,167 | | 358,650,549 |

| Affiliated issuers | | 10,054,859 | | 10,054,859 |

| Cash | | | | 236,692 |

| Receivable for shares of Beneficial Interest subscribed | | | | 1,797,715 |

| Dividends and interest receivable | | | | 987,551 |

| Receivable for investment securities sold | | | | 263,839 |

| Prepaid expenses | | | | 33,272 |

| | | | | 372,024,477 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | | 182,507 |

| Due to Fayez Sarofim & Co. | | | | 74,362 |

| Liability for securities on loan—Note 1(c) | | | | 8,054,859 |

| Payable for shares of Beneficial Interest redeemed | | | | 194,234 |

| Interest payable—Note 2 | | | | 37,043 |

| Accrued expenses | | | | 92,990 |

| | | | | 8,635,995 |

| |

| |

|

| Net Assets ($) | | | | 363,388,482 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 284,588,914 |

| Accumulated undistributed investment income—net | | | | 9,101,859 |

| Accumulated net realized gain (loss) on investments | | | | 26,171,622 |

| Accumulated net unrealized appreciation (depreciation) | | | | |

| on investments and foreign currency transactions | | | | 43,526,087 |

| |

| |

|

| Net Assets ($) | | | | 363,388,482 |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Net Assets ($) | | 274,782,083 | | 88,606,399 |

| Shares Outstanding | | 9,515,930 | | 3,087,806 |

| |

| |

|

| Net Asset Value Per Share ($) | | 28.88 | | 28.70 |

| See notes to financial statements. | | | | |

12

| STATEMENT OF OPERATIONS | | |

| Year Ended December 31, 2008 | | |

| |

|

| |

| |

| |

| |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $218,533 foreign taxes withheld at source): | | |

| Unaffiliated issuers | | 13,256,826 |

| Affiliated issuers | | 79,129 |

| Income from securities lending | | 169,877 |

| Total Income | | 13,505,832 |

| Expenses: | | |

| Investment advisory fee—Note 3(a) | | 2,370,590 |

| Sub-investment advisory fee—Note 3(a) | | 1,470,590 |

| Distribution fees—Note 3(b) | | 269,613 |

| Prospectus and shareholders’ reports | | 118,737 |

| Professional fees | | 48,489 |

| Custodian fees—Note 3(b) | | 47,773 |

| Trustees’ fees and expenses—Note 3(c) | | 37,947 |

| Shareholder servicing costs—Note 3(b) | | 11,298 |

| Loan commitment fees—Note 2 | | 5,481 |

| Interest expense—Note 2 | | 2,525 |

| Miscellaneous | | 22,390 |

| Total Expenses | | 4,405,433 |

| Less—reduction in fees due to earnings credits—Note 1(c) | | (164) |

| Net Expenses | | 4,405,269 |

| Investment Income—Net | | 9,100,563 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments | | |

| and foreign currency transactions | | 26,188,537 |

| Net unrealized appreciation (depreciation) | | |

| on investments and foreign currency transactions | | (201,060,241) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (174,871,704) |

| Net (Decrease) in Net Assets Resulting from Operations | | (165,771,141) |

| |

| See notes to financial statements. | | |

The Portfolio 13

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| | |

|

| | | 2008 | | 2007 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 9,100,563 | | 11,118,540 |

| Net realized gain (loss) on investments | | 26,188,537 | | 56,502,140 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (201,060,241) | | (16,029,486) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | (165,771,141) | | 51,591,194 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Initial Shares | | (9,323,702) | | (10,305,011) |

| Service Shares | | (1,793,974) | | (1,592,630) |

| Net realized gain on investments: | | | | |

| Initial Shares | | (34,731,092) | | — |

| Service Shares | | (7,782,917) | | — |

| Total Dividends | | (53,631,685) | | (11,897,641) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Initial Shares | | 28,676,825 | | 41,265,860 |

| Service Shares | | 26,240,401 | | 33,395,223 |

| Dividends reinvested: | | | | |

| Initial Shares | | 44,054,794 | | 10,305,011 |

| Service Shares | | 9,576,891 | | 1,592,630 |

| Cost of shares redeemed: | | | | |

| Initial Shares | | (194,271,606) | | (197,317,992) |

| Service Shares | | (21,914,014) | | (34,288,008) |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | | (107,636,709) | | (145,047,276) |

| Total Increase (Decrease) in Net Assets | | (327,039,535) | | (105,353,723) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 690,428,017 | | 795,781,740 |

| End of Period | | 363,388,482 | | 690,428,017 |

| Undistributed investment income—net | | 9,101,859 | | 11,117,042 |

14

| | | Year Ended December 31, |

| | |

|

| | | 2008 | | 2007 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Initial Shares | | | | |

| Shares sold | | 851,136 | | 948,930 |

| Shares issued for dividends reinvested | | 1,140,366 | | 247,360 |

| Shares redeemed | | (5,170,023) | | (4,506,835) |

| Net Increase (Decrease) in Shares Outstanding | | (3,178,521) | | (3,310,545) |

| |

| |

|

| Service Shares | | | | |

| Shares sold | | 748,259 | | 754,362 |

| Shares issued for dividends reinvested | | 249,009 | | 38,386 |

| Shares redeemed | | (623,234) | | (790,386) |

| Net Increase (Decrease) in Shares Outstanding | | 374,034 | | 2,362 |

| |

| See notes to financial statements. | | | | |

The Portfolio 15

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single portfolio share.Total return shows how much your investment in the portfolio would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the portfolio’s financial statements.

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Initial Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 44.86 | | 42.55 | | 37.11 | | 35.56 | | 34.42 |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | | .67 | | .66 | | .61 | | .54 | | .56 |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | (13.01) | | 2.32 | | 5.42 | | 1.02 | | 1.18 |

| Total from Investment Operations | | (12.34) | | 2.98 | | 6.03 | | 1.56 | | 1.74 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.77) | | (.67) | | (.59) | | (.01) | | (.60) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (2.87) | | — | | — | | — | | — |

| Total Distributions | | (3.64) | | (.67) | | (.59) | | (.01) | | (.60) |

| Net asset value, end of period | | 28.88 | | 44.86 | | 42.55 | | 37.11 | | 35.56 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | (29.55) | | 7.14 | | 16.48 | | 4.38 | | 5.05 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .81 | | .80 | | .82 | | .80 | | .79 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | .81b | | .80 | | .82b | | .80 | | .79 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.82 | | 1.52 | | 1.58 | | 1.48 | | 1.60 |

| Portfolio Turnover Rate | | 3.41 | | 5.17 | | 3.86 | | 2.67 | | 1.64 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 274,782 | | 569,422 | | 681,035 | | 683,667 | | 766,169 |

| a | | Based on average shares outstanding at each month end. |

| b | | Expense waivers and/or reimbursements amounted to less than .01%. |

| See notes to financial statements. |

16

| | | | | Year Ended December 31, | | |

| | |

| |

| |

|

| Service Shares | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 44.59 | | 42.32 | | 36.92 | | 35.46 | | 34.31 |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | | .58 | | .56 | | .51 | | .45 | | .46 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (12.94) | | 2.30 | | 5.41 | | 1.01 | | 1.19 |

| Total from Investment Operations | | (12.36) | | 2.86 | | 5.92 | | 1.46 | | 1.65 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.66) | | (.59) | | (.52) | | — | | (.50) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (2.87) | | — | | — | | — | | — |

| Total Distributions | | (3.53) | | (.59) | | (.52) | | — | | (.50) |

| Net asset value, end of period | | 28.70 | | 44.59 | | 42.32 | | 36.92 | | 35.46 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | (29.72) | | 6.85 | | 16.21 | | 4.12 | | 4.80 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.06 | | 1.05 | | 1.07 | | 1.05 | | 1.04 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.06b | | 1.05 | | 1.07b | | 1.05 | | 1.04 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.61 | | 1.27 | | 1.33 | | 1.24 | | 1.34 |

| Portfolio Turnover Rate | | 3.41 | | 5.17 | | 3.86 | | 2.67 | | 1.64 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 88,606 | | 121,006 | | 114,746 | | 101,172 | | 80,529 |

| a | | Based on average shares outstanding at each month end. |

| b | | Expense waivers and/or reimbursements amounted to less than .01%. |

| See notes to financial statements. |

The Portfolio 17

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Variable Investment Fund (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company, operating as a series company currently offering seven series, including the Appreciation Portfolio (the “portfolio”). The portfolio is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The portfolio is a diversified series. The portfolio’s investment objective is to provide long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the portfolio’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the portfolio’s sub-investment adviser.

Effective July 1, 2008, BNY Mellon reorganized and consolidated a number of its banking and trust company subsidiaries.As a result of the reorganization, any services previously provided to the portfolio by Mellon Bank, N.A. or Mellon Trust of New England, N.A. are now provided by The Bank of New York Mellon (formerly, The Bank of New York).

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the portfolio’s shares, which are sold without a sales charge.The portfolio is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

18

The fund accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The portfolio’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifica-tions.The portfolio’s maximum exposure under these arrangements is unknown. The portfolio does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or official closing pric es are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the portfolio calculates its net asset value, the portfolio may value these investments at fair value as

The Portfolio 19

| NOTES TO FINANCIAL STATEMENTS (continued) |

determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. For other securities that are fair valued by the Board ofTrustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

The portfolio adopted Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the portfolio’s investments relating to FAS 157.These inputs are summarized in the three broad levels listed below.

| | Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted

prices for similar securities, interest rates, prepayment speeds, credit

risk, etc.).

Level 3—significant unobservable inputs (including the portfolio’s

own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

20

The following is a summary of the inputs used as of December 31, 2008 in valuing the portfolio’s investments carried at fair value:

| | | Investments in | | Other Financial |

| Valuation Inputs | | Securities ($) | | Instruments ($)† |

| |

| |

|

| Level 1—Quoted Prices | | 346,600,963 | | 0 |

| Level 2—Other Significant | | | | |

| Observable Inputs | | 22,104,445 | | 0 |

| Level 3—Significant | | | | |

| Unobservable Inputs | | 0 | | 0 |

| Total | | 368,705,408 | | 0 |

| † | | Other financial instruments include derivative instruments, such as futures, forward currency |

| | | exchange contracts and swap contracts, which are valued at the unrealized appreciation |

| | | (depreciation) on the instrument and written options contracts which are shown at value. |

(b) Foreign currency transactions: The portfolio does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the portfolio’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses

The Portfolio 21

| NOTES TO FINANCIAL STATEMENTS (continued) |

from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The portfolio has arrangements with the custodian and cash management banks whereby the portfolio may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the portfolio includes net earnings credits as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the portfolio may lend securities to qualified institutions. It is the portfolio’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, U.S. Government and Agency securities or letters of credit.The portfolio is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the portfolio bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended December 31, 2008, The Bank of New York Mellon earned $72,804 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains are normally declared and paid annually, but

22

the portfolio may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the portfolio not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the portfolio to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2008, the portfolio did not have any liabilities for any unrecognized tax positions.The portfolio recognizes interest and penalties, if any, related to unrecognized tax positions as income tax expense in the Statement of Operations. During the period, the portfolio did not incur any interest or penalties.

Each of the tax years in the four-year period ended December 31, 2008 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2008, the components of accumulated earnings on a tax basis were as follows: ordinary income $9,225,592, undistributed capital gains $27,234,546 and unrealized appreciation $42,339,430.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2008 and December 31, 2007 were as follows: undistributed ordinary income $11,221,296 and $11,897,641 and long-term capital gains $42,410,389 and $0, respectively.

During the period ended December 31, 2008, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency exchange gains and losses, the portfolio increased accumu-

The Portfolio 23

| NOTES TO FINANCIAL STATEMENTS (continued) |

lated undistributed investment income-net by $1,930 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

Prior to October 15, 2008, the portfolio participated with other Dreyfus-managed funds in a $350 million redemption credit facility. Effective October 15, 2008, the portfolio participates with other Dreyfus-managed funds in a $145 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the portfolio has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the portfolio based on prevailing market rates in effect at the time of borrowing.

The average daily amount of borrowings outstanding under the Facilities during the period ended December 31, 2008 was approximately $114,500, with a related weighted average annualized interest rate of 2.21% .

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Advisory Agreement with Dreyfus, the investment advisory fee is based on the value of the portfolio’s average daily net assets and is computed at the following annual rates: .55% of the first $150 million; .50% of the next $150 million; and .375% over $300 million. The fee is payable monthly. Pursuant to a Sub-Investment Advisory Agreement with Sarofim & Co., the sub-investment advisory fee is based upon the value of the portfolio’s average daily net assets and is computed at the following annual rates: .20% of the first $150 million; ..25% of the next $150 million; and .375% over $300 million.The fee is payable monthly.

24

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing their shares, for servicing and/or maintaining Service shares shareholder accounts and for advertising and marketing for Service shares.The Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets.The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products.The fees payable under the Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2008, Service shares were charged $269,613 pursuant to the Plan.

The portfolio compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the portfolio. During the period ended December 31, 2008, the portfolio was charged $1,285 pursuant to the transfer agency agreement.

The portfolio compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to portfolio subscriptions and redemptions. During the period ended December 31, 2008, the portfolio was charged $164 pursuant to the cash management agreement.

The portfolio compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the portfolio. During the period ended December 31, 2008, the portfolio was charged $47,773 pursuant to the custody agreement.

During the period ended December 31, 2008, the portfolio was charged $5,403 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advi-

The Portfolio 25

| NOTES TO FINANCIAL STATEMENTS (continued) |

sory fees $150,591, Rule 12b-1 distribution plan fees $17,933, custodian fees $12,591, chief compliance officer fees $1,197 and transfer agency per account fees $195.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2008, amounted to $17,500,208 and $170,427,062, respectively.

At December 31, 2008, the cost of investments for federal income tax purposes was $326,368,683; accordingly, accumulated net unrealized appreciation on investments was $42,336,725, consisting of $96,193,330 gross unrealized appreciation and $53,856,605 gross unrealized depreciation.

In March 2008, the Financial Accounting Standards Boards released Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments, and disclosures about credit-risk-related contingent features in derivative agreements. The application of FAS 161 is required for fiscal years and interim periods beginning after November 15, 2008.At this time, management is evaluating the implications of FAS 161 and its impact on the financial statements and the accompanying notes has not yet been determined.

26

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Trustees

Dreyfus Variable Investment Fund, Appreciation Portfolio

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the series comprising Dreyfus Variable Investment Fund) as of December 31, 2008, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statemen ts and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2008 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of DreyfusVariable Investment Fund,Appreciation Portfolio at December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U. S. generally accepted accounting principles.

New York, New York

February 10, 2009 |

The Portfolio 27

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the portfolio hereby designates $2.8650 per share as a long-term capital gain distribution and $.0070 per share as a short-term capital gain distribution paid on March 26, 2008 and also the portfolio hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2008 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in January 2009 of the percentage applicable to the preparation of their 2008 income tax returns.

28

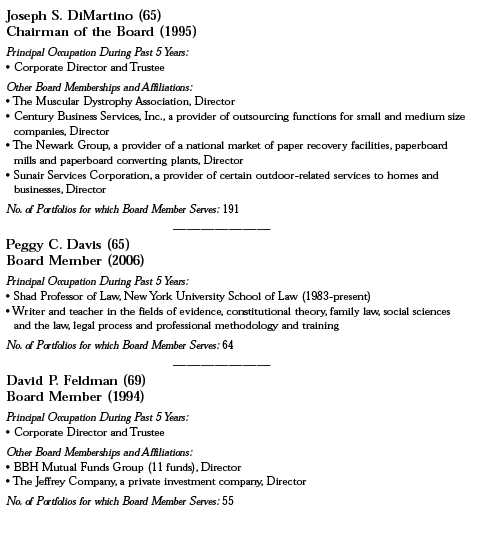

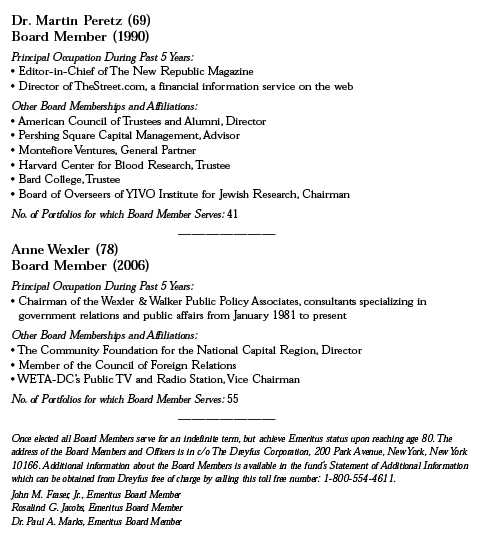

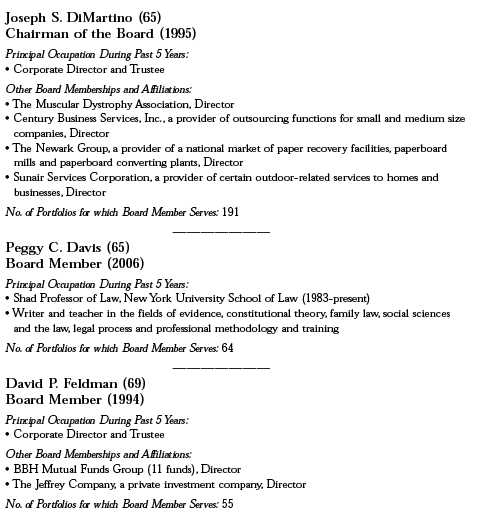

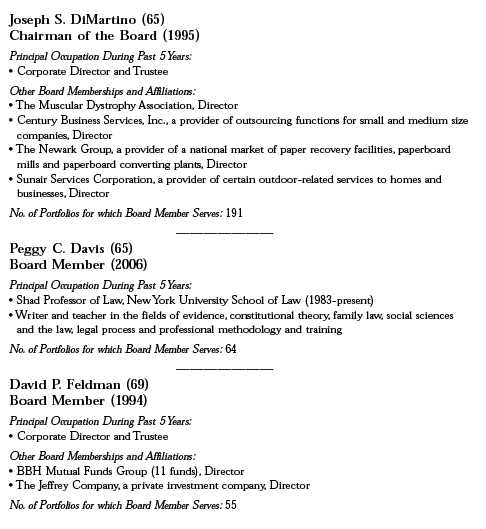

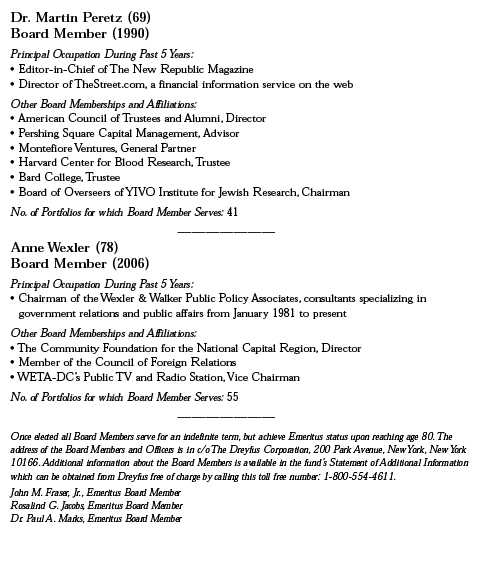

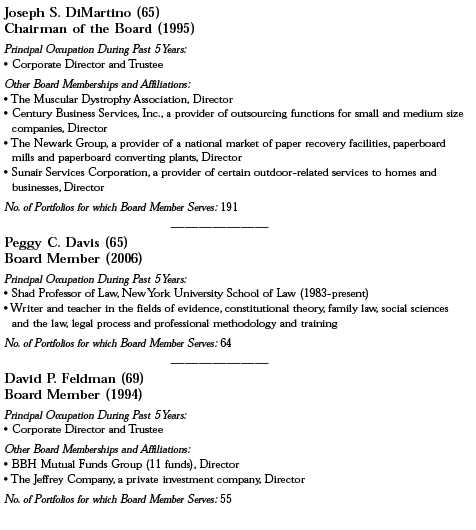

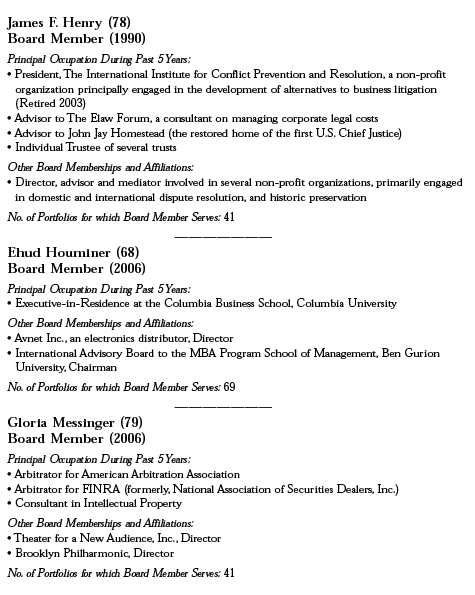

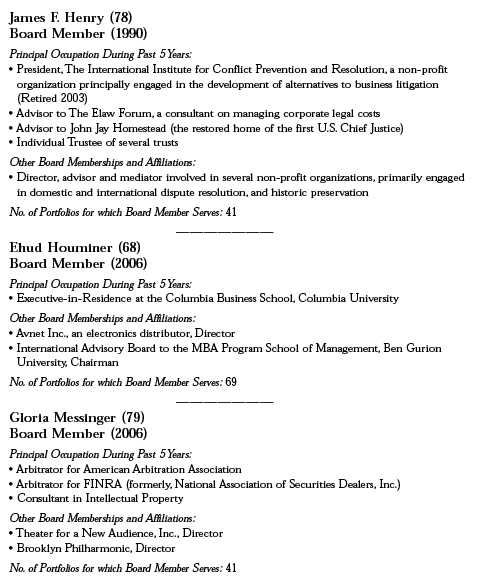

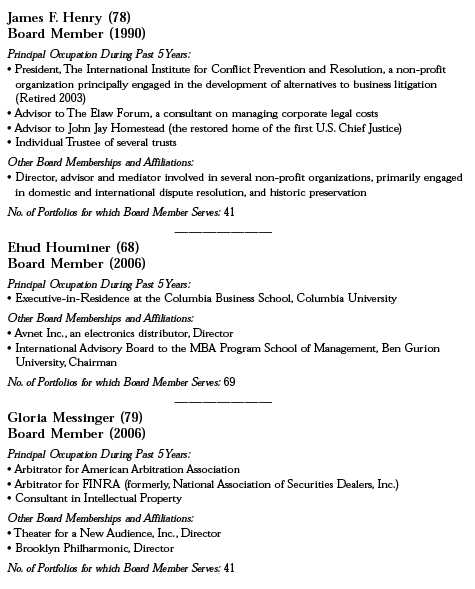

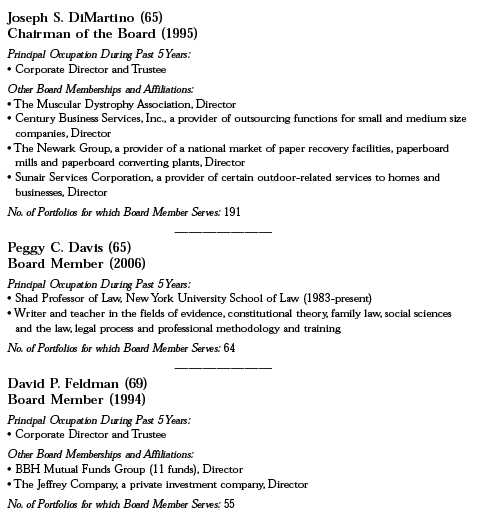

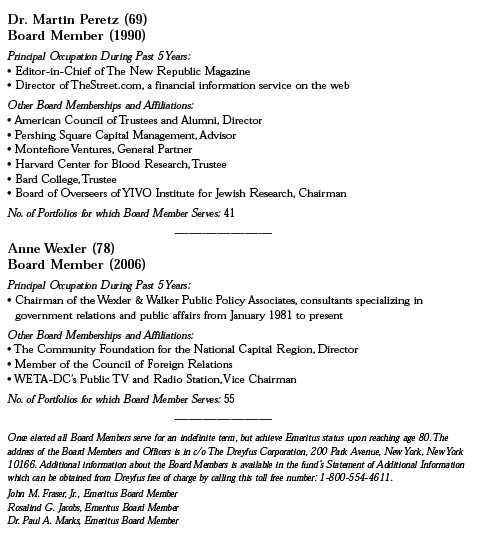

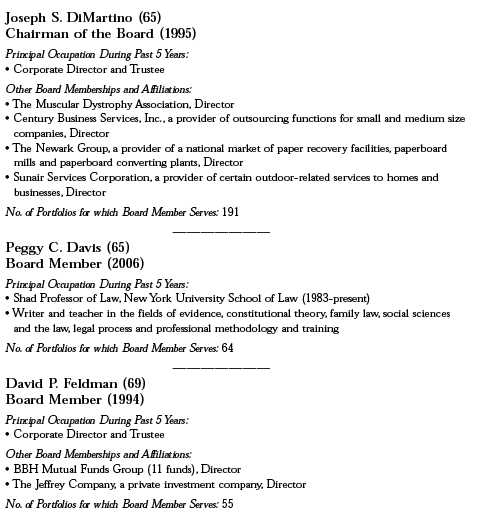

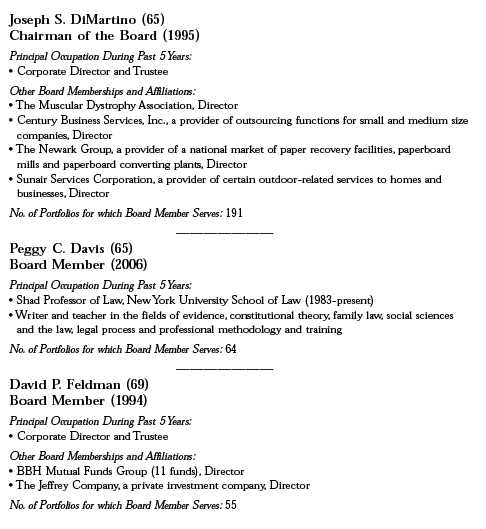

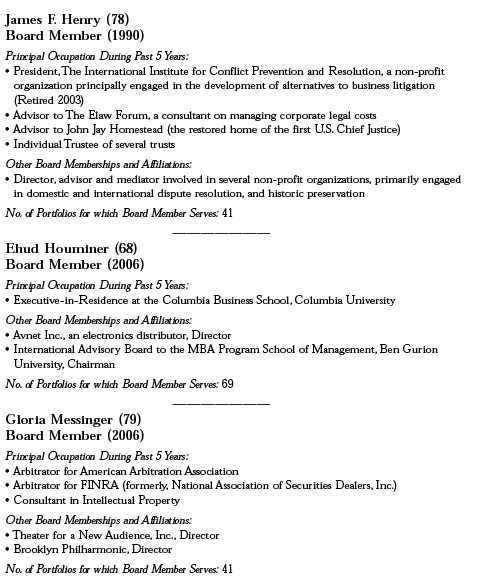

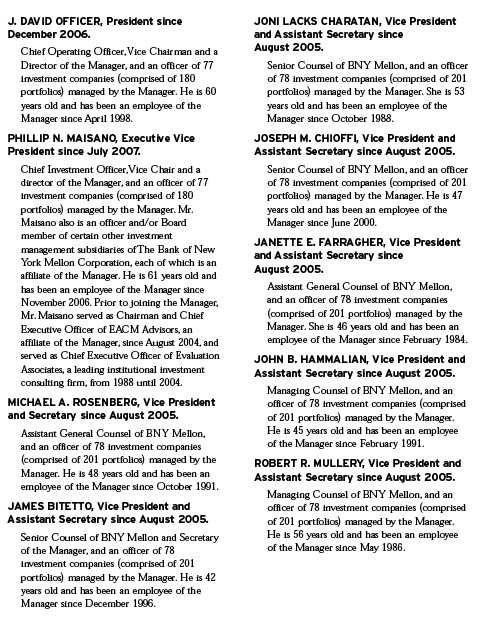

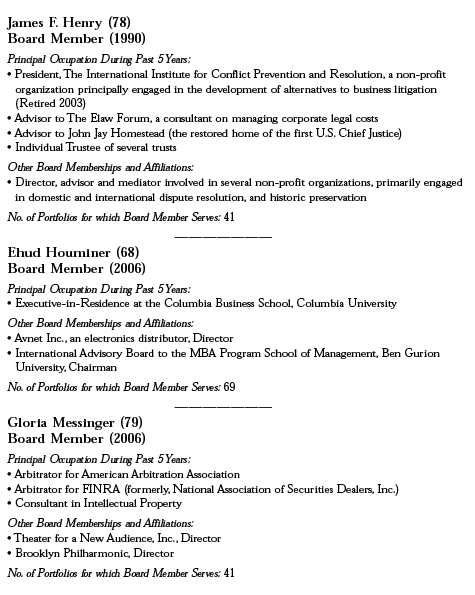

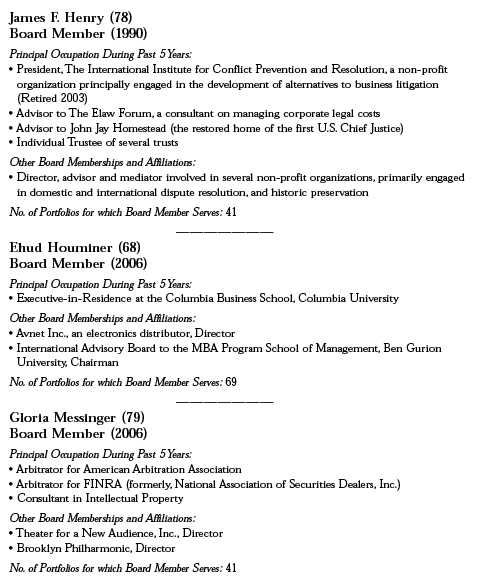

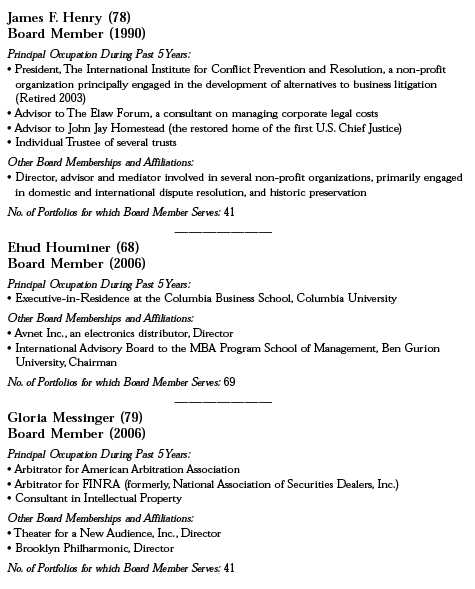

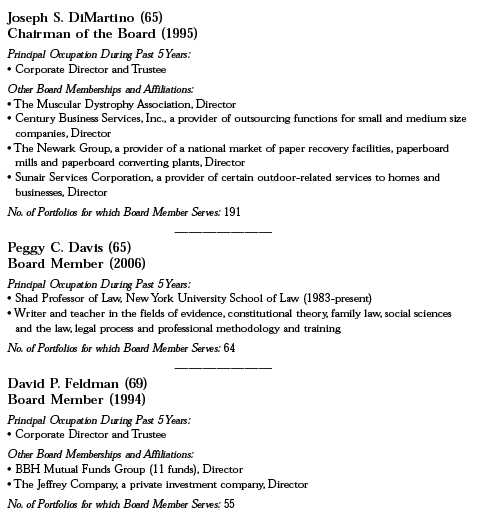

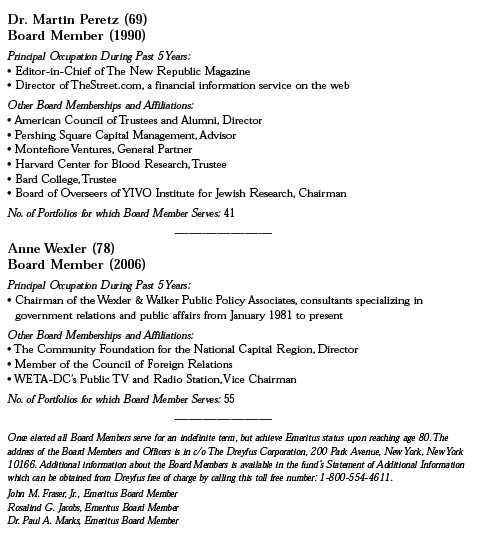

BOARD MEMBERS INFORMATION (Unaudited)

The Portfolio 29

BOARD MEMBERS INFORMATION (Unaudited) (continued)

30

The Portfolio 31

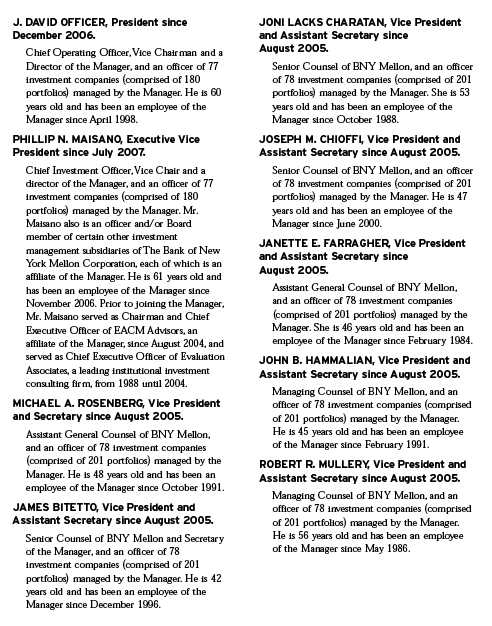

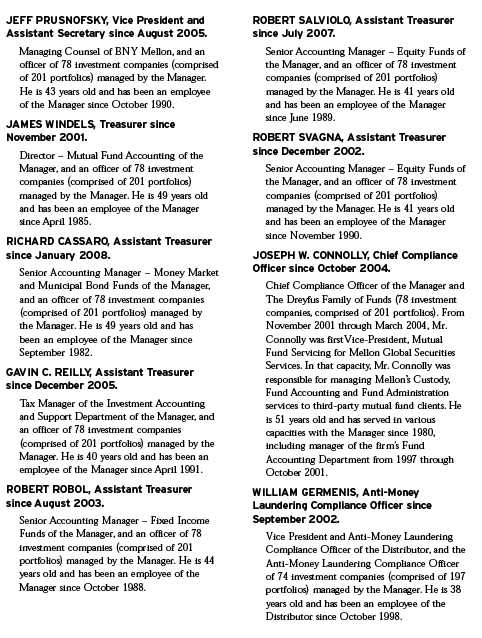

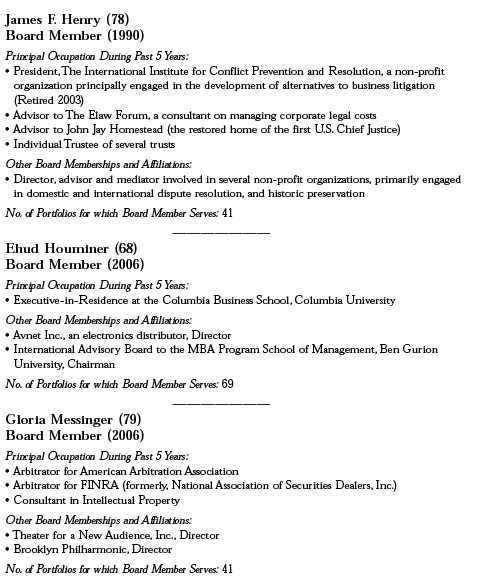

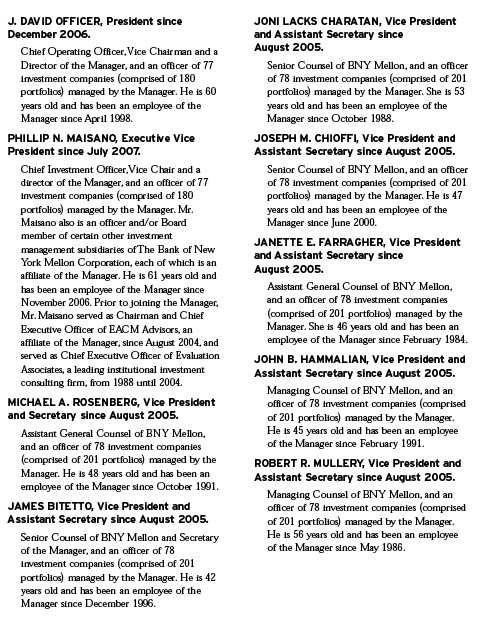

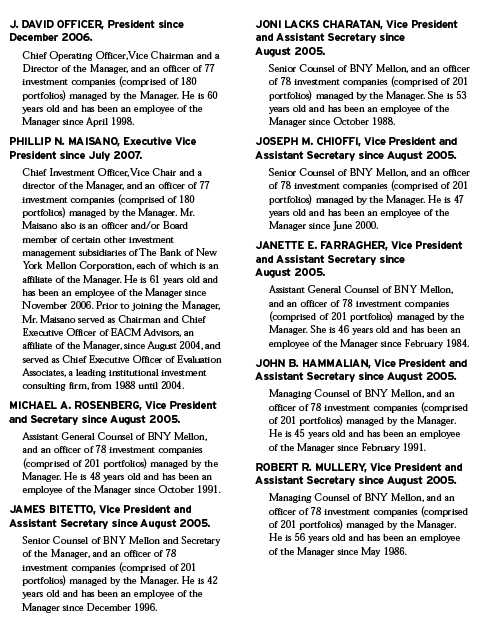

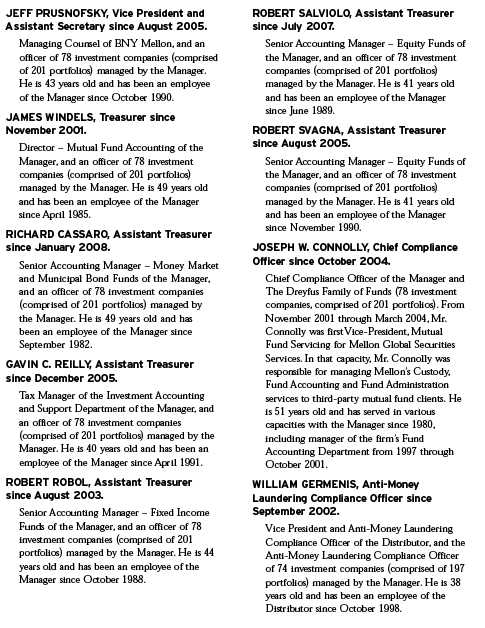

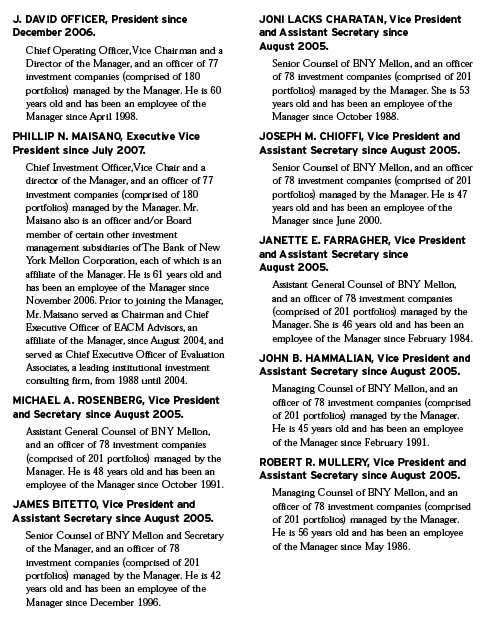

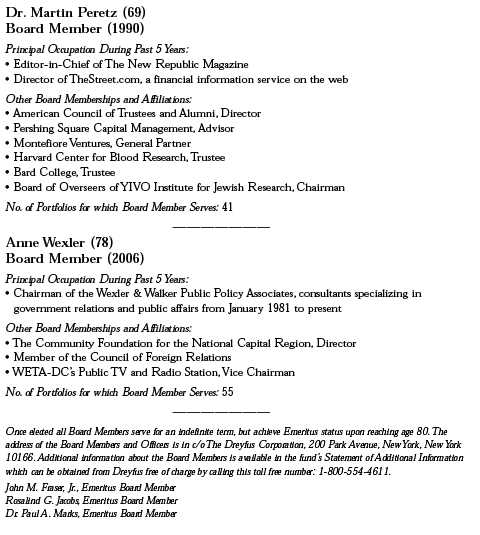

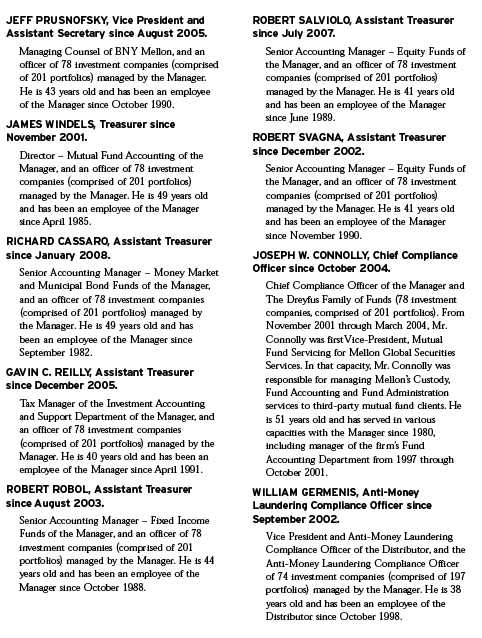

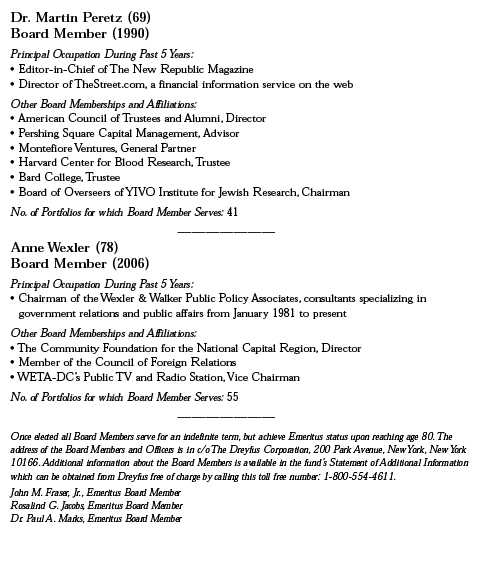

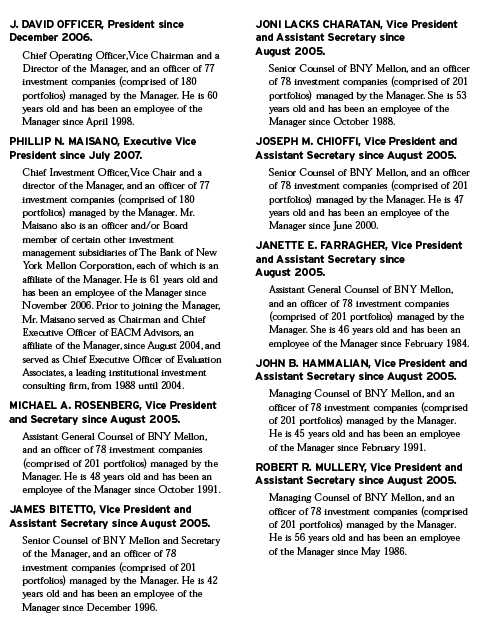

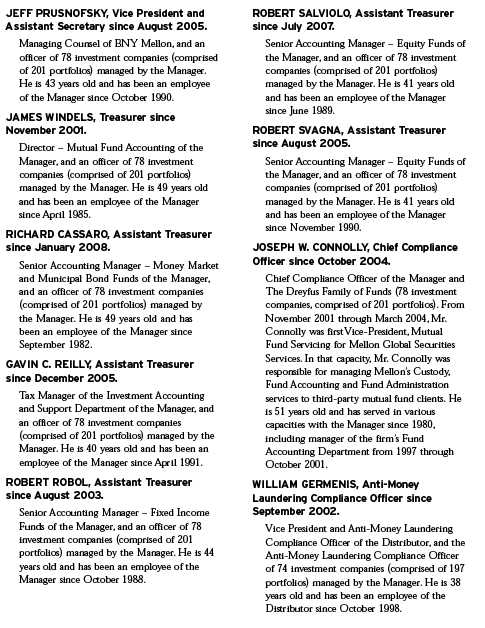

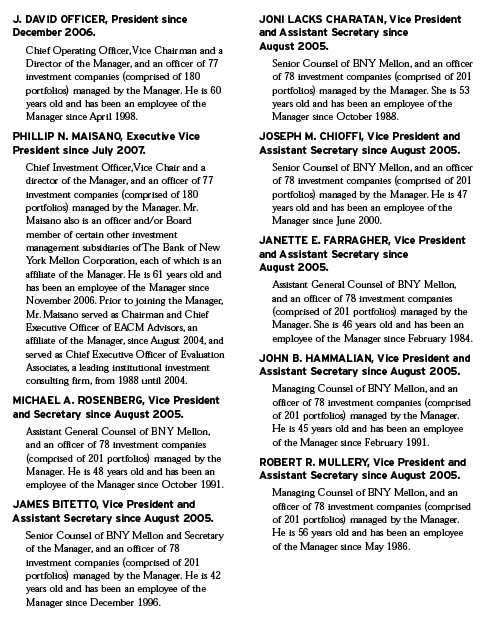

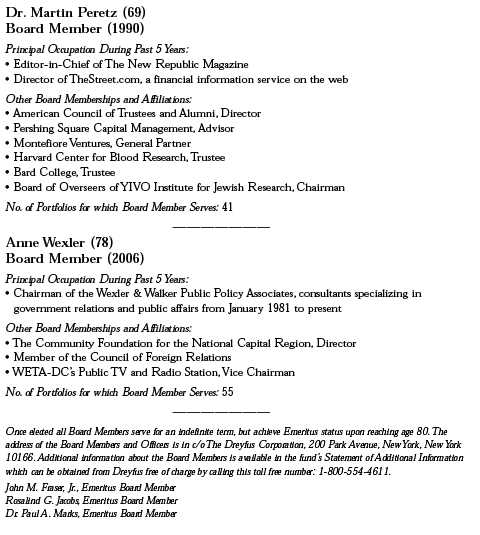

OFFICERS OF THE FUND (Unaudited)

32

The Portfolio 33

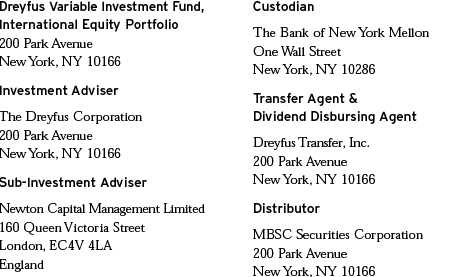

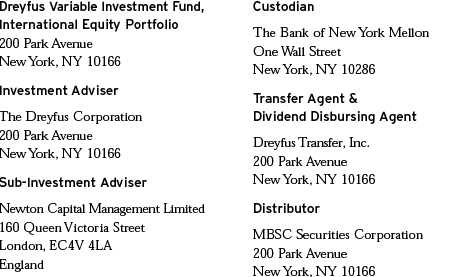

For More Information

Telephone 1-800-554-4611 or 516-338-3300

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 Attn: Investments Division

The portfolio files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The portfolio’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the portfolio uses to determine how to vote proxies relating to portfolio securities, and information regarding how the portfolio voted these proxies for the 12-month period ended June 30, 2008, is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

| © 2009 MBSC Securities Corporation |

| | Dreyfus Variable

Investment Fund,

Developing Leaders

Portfolio |

| | ANNUAL REPORT December 31, 2008 |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

| | Contents |

| |

| | THE PORTFOLIO |

| |

| 2 | A Letter from the CEO |

| |

| 3 | Discussion of Performance |

| |

| 6 | Portfolio Performance |

| |

| 8 | Understanding Your Portfolio’s Expenses |

| |

| 8 | Comparing Your Portfolio’s Expenses With Those of Other Funds |

| |

| 9 | Statement of Investments |

| |

| 18 | Statement of Assets and Liabilities |

| |

| 19 | Statement of Operations |

| |

| 20 | Statement of Changes in Net Assets |

| |

| 22 | Financial Highlights |

| |

| 24 | Notes to Financial Statements |

| |

| 33 | Report of Independent Registered Public Accounting Firm |

| |

| 34 | Important Tax Information |

| |

| 35 | Board Members Information |

| |

| 38 | Officers of the Fund |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

Dreyfus Variable Investment Fund,

Developing Leaders Portfolio |

The Portfolio

A LETTER FROM THE CEO

Dear Shareholder: |

We present to you this annual report for Dreyfus Variable Investment Fund, Developing Leaders Portfolio covering the 12-month period from January 1, 2008, through December 31, 2008.

2008 was the most difficult year in decades for the economy and stock market.A credit crunch that originated in 2007 in the U.S. sub-prime mortgage market exploded in mid-2008 into a global financial crisis, resulting in the failures of major financial institutions, a deep and prolonged recession and lower investment values across a broad range of asset classes. Governments and regulators throughout the world moved aggressively to curtail the damage, implementing unprecedented reductions of short-term interest rates, massive injections of liquidity into the banking system, government bailouts of struggling companies and plans for massive economic stimulus programs.

Although we expect the U.S. and global economies to remain weak until longstanding imbalances have worked their way out of the system, the financial markets currently appear to have priced in investors’ generally low expectations. In previous recessions, however, the markets have tended to anticipate economic improvement before it occurs, potentially leading to major rallies when few expected them. That’s why it makes sense to remain disciplined, maintain a long-term perspective and adopt a consistent asset allocation strategy that reflects one’s future goals and attitudes toward risk. As always, we urge you to consult with your financial advisor, who can recommend the course of action that is right for you.

For information about how the portfolio performed during the reporting period, as well as market perspectives, we have provided a Discussion of Performance given by the Portfolio Managers.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chief Executive Officer

The Dreyfus Corporation

January 15, 2009 |

2

DISCUSSION OF PERFORMANCE

For the period of January 1, 2008, through December 31, 2008, as provided by Oliver Buckley, Langton C. Garvin and Kristin Crawford, Portfolio Managers

Portfolio and Market Performance Overview

For the 12-month period ended December 31, 2008, DreyfusVariable Investment Fund, Developing Leaders Portfolio’s Initial shares produced a total return of –37.59%, and its Service shares produced a total return of –37.77% .1 In comparison, the Russell 2000 Index (the “Index”), the portfolio’s benchmark, produced a total return of –33.79% for the same period.2

After a choppy start to the year, stock markets plummeted during the second half of 2008 due to an intensifying financial crisis and slowing economic growth. All market capitalization ranges fell sharply, but small-cap stocks generally suffered slightly less precipitous declines than their larger-cap counterparts. The portfolio’s performance was negatively affected by several individual stock selections, which caused its returns to underperform the benchmark.

The Portfolio’s Investment Approach

We select small-cap stocks through a “bottom-up” approach that seeks to identify undervalued securities using a quantitative screening process. This process is driven by a proprietary quantitative model, which measures more than 40 stock characteristics to identify and rank stocks. Over time, we attempt to construct a portfolio that has exposure to industries and market capitalizations generally similar to the portfolio’s benchmark. Within each sector, we seek to overweight the most attractive stocks and underweight or not hold the stocks that have been ranked least attractive.

Investor Sentiment Overwhelmed Company Fundamentals

Rapidly changing economic and geopolitical forces produced exceptionally volatile market shifts during 2008. Over the first half of the year, robust global demand drove prices for petroleum and many other key industrial commodities sharply higher.At the same time, a credit crunch that began in 2007 produced massive losses for highly leveraged institutional investors, who were compelled to raise cash by selling their more liquid and creditworthy holdings, putting downward pressure on a broad

The Portfolio 3

| DISCUSSION OF PERFORMANCE (continued) |

range of financial assets. During these six months, although the portfolio’s value-related analytical factors correlated poorly with performance, momentum-related metrics worked reasonably well.

As the second half of 2008 unfolded, housing prices deflated, unemployment rates rose, credit markets seized, a number of major financial institutions teetered on the brink of insolvency and commodity prices plunged, forcing businesses and consumers to curtail spending and driving the U.S. economy deeper into recession. In the face of these developments, investors increasingly reacted to short-term events rather than investing on the basis of long-term company fundamentals.The portfolio’s momentum metrics began to subtract from its relative performance, while value factors worked only slightly better.As a result, our quantitative, bottom-up stock selection approach proved relatively ineffective during the second half of the year.

Deteriorating Economic Conditions Produced Disappointments

Most of the portfolio’s weaker holdings were caught up in the sweep of negative economic news, with particularly disappointing relative returns in the basic materials, energy and industrials sectors. Coal mining company Alpha Natural Resources fell along with other commodity stocks shortly after the portfolio initiated its position in June 2008. Offshore oil and gas services provider Trico Marine Services declined after a series of weaker-than-expected earnings announcements, and it lost additional ground when commodity prices plunged. Automobile anti-theft device maker LoJack, which was sold during the reporting period, was undermined by weak U.S. car sales. Other notably poor performers included information technology services provider COMSYS IT Partners, which was also sold during the reporting period; banking company Oriental Financial Group; beverage distributor Central European Distribution; and wireless communications company iPCS, all of which were hurt by deteriorating business conditions.

On a more positive note, several holdings outperformed their industry peers,with some contributing positively to the portfolio’s relative returns. Biotechnology developer ViroPharma rose sharply due to increasing revenues and new product development. Surgical equipment maker CONMED posted consistently higher earnings and revenues despite budget tightening by hospitals, enabling the stock to hold its ground. Business process outsourcing provider Sykes Enterprises achieved mild

4

gains on the strength of steadily rising revenues and better-than-expected earnings. Investment advisory firm Greenhill & Co., which was sold during the reporting period, advanced on the growth of its asset management business in the face of a steep downturn affecting much of the financial sector. Finally, alternative fuel systems designer Fuel Systems Solutions fell by a relatively mild margin compared to other automobile equipment makers by delivering stronger-than-predicted earnings and revenue increases.

Emphasizing Companies with Healthy Balance Sheets

As economic conditions deteriorated and credit availability tightened, we have taken steps in an attempt to cushion the portfolio from certain foreseeable market risks. As of year-end, we have emphasized investments in higher-quality companies that we believe offer good prospects for consistent profitability despite the recessionary environment.We also have focused on companies that exhibit relatively little sensitivity to tight credit markets because they hold little debt or have the ability to service their debt independently. By using our quantitative process to identify the individual stocks with attractive value, momentum and quality characteristics in each sector and industry, we believe we can position the portfolio to perform relatively well even in these challenging times.

January 15, 2009

The portfolio is only available as a funding vehicle under various life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the portfolio directly.A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. The investment objective and policies of Dreyfus Variable Investment Fund, Developing Leaders Portfolio made available through insurance products may be similar to other funds/portfolios managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio.

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio’s performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. Return figures provided reflect the |

| | | absorption of certain portfolio expenses by The Dreyfus Corporation pursuant to an agreement in |

| | | effect through May 1, 2009, at which time it may be extended, terminated or modified. Had |

| | | these expenses not been absorbed, the portfolio’s returns would have been lower. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Russell 2000 Index is an unmanaged index of small-cap stock performance |

| | | and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 |

| | | Index is composed of the 3,000 largest U.S. companies based on total market capitalization. |

The Portfolio 5

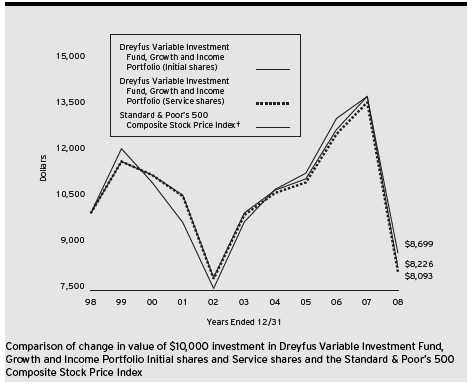

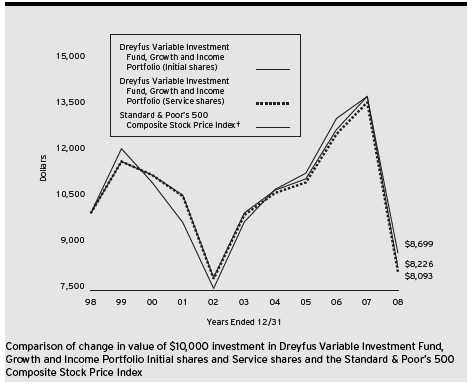

| Average Annual Total Returns as of 12/31/08 | | | | |

| | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

|

| Initial shares | | (37.59)% | | (7.46)% | | (0.55)% |

| Service shares | | (37.77)% | | (7.70)% | | (0.76)% |

The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth results would have been lower. See notes below.

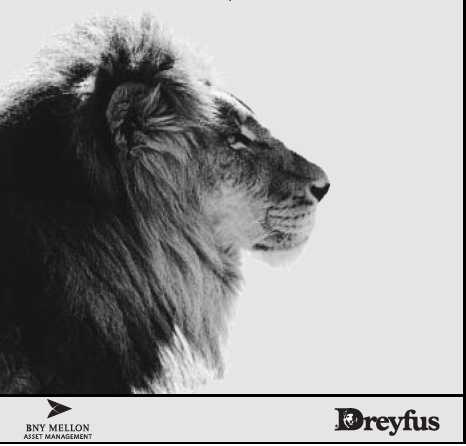

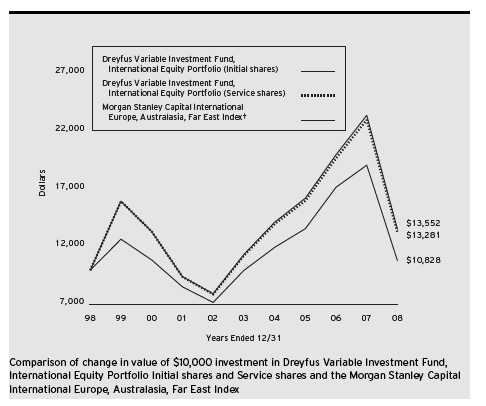

† Source: Lipper Inc.

Past performance is not predictive of future performance.The portfolio’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares.

The portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts which will reduce returns.

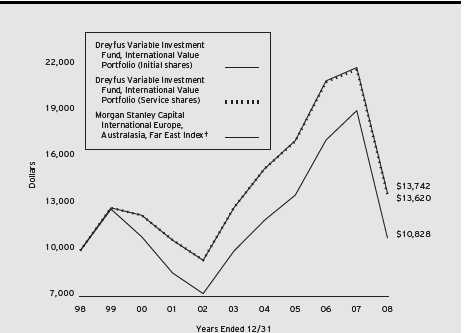

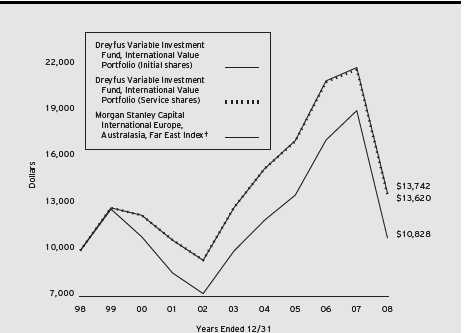

The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment Fund, Developing Leaders Portfolio on 12/31/98 to a $10,000 investment made in the Russell 2000 Index (the “Index”) on that date.

6

The portfolio’s Initial shares are not subject to a Rule 12b-1 fee.The portfolio’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the portfolio’s Initial shares from their inception date through December 30, 2000, and the performance of the portfolio’s Service shares from December 31, 2000 (inception date of Service shares) to December 31, 2008 (blended performance figures).The blended performance figures have not been adjusted to reflect the higher operating expenses of the Service shares. If these expenses had been reflected, the blended performance figures would have been lower. All dividends and capital gain distributions are reinvested.

The portfolio’s performance shown in the line graph takes into account all applicable portfolio fees and expenses.The Index is an unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 Index is composed of 3,000 of the largest U.S. companies by market capitalization. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to portfolio performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Portfolio 7

UNDERSTANDING YOUR

PORTFOLIO’S EXPENSES (Unaudited) |

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees,which are not shown in this section and would have resulted in higher total expenses. For more information, see your portfolio’s prospectus or talk to your financial adviser.

Review your portfolio’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund, Developing Leaders Portfolio from July 1, 2008 to December 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2008 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000† | | $ 3.05 | | $ 4.10 |

| Ending value (after expenses) | | $683.80 | | $682.80 |

| | COMPARING YOUR PORTFOLIO’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your portfolio’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the portfolio with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2008 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000† | | $ 3.66 | | $ 4.93 |

| Ending value (after expenses) | | $1,021.52 | | $1,020.26 |

| † Expenses are equal to the portfolio’s annualized expense ratio of .72% for Initial shares and .97% for Service shares, |

| multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

December 31, 2008 |

| Common Stocks—99.4% | | Shares | | Value ($) |

| |

| |

|

| Commercial & Professional Services—8.1% | | | | |

| Anixter International | | 20,300 a | | 611,436 |

| Applied Industrial Technologies | | 36,400 a | | 688,688 |

| ATC Technology | | 15,100 b | | 220,913 |

| Beacon Roofing Supply | | 45,500 a,b | | 631,540 |

| Concur Technologies | | 16,200 a,b | | 531,684 |

| Cross Country Healthcare | | 84,900 a,b | | 746,271 |

| Gartner | | 35,800 a,b | | 638,314 |

| MPS Group | | 139,800 a,b | | 1,052,694 |

| MWI Veterinary Supply | | 6,500 b | | 175,240 |

| Nash Finch | | 12,800 a | | 574,592 |

| On Assignment | | 45,300 b | | 256,851 |

| PSS World Medical | | 35,800 a,b | | 673,756 |

| ScanSource | | 51,800 a,b | | 998,186 |

| School Specialty | | 11,400 a,b | | 217,968 |

| Standard Register | | 46,400 a | | 414,352 |

| Sykes Enterprises | | 97,700 b | | 1,868,024 |

| TeleTech Holdings | | 125,000 b | | 1,043,750 |

| Viad | | 25,500 | | 630,870 |

| VistaPrint | | 16,300 b | | 303,343 |

| Watson Wyatt Worldwide, Cl. A | | 3,600 a | | 172,152 |

| World Fuel Services | | 4,000 | | 148,000 |

| | | | | 12,598,624 |

| Communications—2.7% | | | | |

| iPCS | | 56,700 b | | 388,962 |

| NTELOS Holdings | | 59,700 | | 1,472,202 |

| Starent Networks | | 107,200 a,b | | 1,278,896 |

| Syniverse Holdings | | 36,000 b | | 429,840 |

| USA Mobility | | 45,500 b | | 526,435 |

| | | | | 4,096,335 |

| Consumer Durables—3.2% | | | | |

| Fossil | | 77,000 a,b | | 1,285,900 |

| Fuel Systems Solutions | | 33,200 a,b | | 1,087,632 |

| M/I Homes | | 15,300 | | 161,262 |

| Meritage Homes | | 12,000 b | | 146,040 |

| Mine Safety Appliances | | 7,800 | | 186,498 |

The Portfolio 9

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Consumer Durables (continued) | | | | |

| Polaris Industries | | 34,200 a | | 979,830 |

| WMS Industries | | 43,000 a,b | | 1,156,700 |

| | | | | 5,003,862 |

| Consumer Non-Durables—4.2% | | | | |

| American Greetings, Cl. A | | 89,500 | | 677,515 |

| Cal-Maine Foods | | 54,100 a | | 1,552,670 |

| Central European Distribution | | 23,600 b | | 464,920 |

| Chattem | | 5,500 a,b | | 393,415 |

| M & F Worldwide | | 40,600 a,b | | 627,270 |

| Oxford Industries | | 66,600 | | 584,082 |

| Perry Ellis International | | 58,300 b | | 369,622 |

| True Religion Apparel | | 26,200 b | | 325,928 |

| Universal | | 37,400 a | | 1,117,138 |

| Warnaco Group | | 15,600 b | | 306,228 |

| | | | | 6,418,788 |

| Consumer Services—3.4% | | | | |

| Bally Technologies | | 17,100 a,b | | 410,913 |

| Bidz.com | | 60,200 a,b | | 276,920 |

| Cox Radio, Cl. A | | 33,100 a,b | | 198,931 |

| Fisher Communications | | 5,100 a | | 105,264 |

| Jack in the Box | | 62,600 a,b | | 1,382,834 |

| P.F. Chang’s China Bistro | | 18,800 a,b | | 393,672 |

| Peet’s Coffee & Tea | | 24,500 b | | 569,625 |

| Pre-Paid Legal Services | | 27,600 a,b | | 1,029,204 |

| Priceline.com | | 10,800 a,b | | 795,420 |

| Red Robin Gourmet Burgers | | 10,100 b | | 169,983 |

| | | | | 5,332,766 |

| Electronic Technology—7.6% | | | | |

| Anaren | | 33,900 b | | 405,105 |

| Avocent | | 21,000 b | | 376,110 |

| Cognex | | 85,100 | | 1,259,480 |

| Comtech Telecommunications | | 6,500 b | | 297,830 |

| CTS | | 61,500 | | 338,865 |

| Daktronics | | 11,800 | | 110,448 |

| Dionex | | 16,900 b | | 757,965 |

| EMS Technologies | | 9,400 b | | 243,178 |

| Intevac | | 80,900 b | | 410,163 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Electronic Technology (continued) | | | | |

| Methode Electronics | | 41,200 | | 277,688 |

| Multi-Fineline Electronix | | 50,200 a,b | | 586,838 |

| OmniVision Technologies | | 75,800 b | | 397,950 |

| Oplink Communications | | 61,400 b | | 528,040 |

| Orbital Sciences | | 91,900 b | | 1,794,807 |

| Pericom Semiconductor | | 147,900 b | | 810,492 |

| Polycom | | 38,000 b | | 513,380 |

| Rackable Systems | | 35,400 b | | 139,476 |

| Semtech | | 44,700 a,b | | 503,769 |

| Skyworks Solutions | | 93,600 a,b | | 518,544 |