UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| |

| Investment Company Act file number | 811-5125 |

Dreyfus Variable Investment Fund

(Exact name of Registrant as specified in charter)

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code)

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service)

| | |

| Registrant's telephone number, including area code: | (212) 922-6000 |

| Date of fiscal year end: | 12/31 | |

| Date of reporting period: | 12/31/09 | |

FORM N-CSR

| |

| Item 1. | Reports to Stockholders. |

|

| Dreyfus Variable |

| Investment Fund, |

| Appreciation Portfolio |

ANNUAL REPORT December 31, 2009

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 12 | Statement of Assets and Liabilities |

| 13 | Statement of Operations |

| 14 | Statement of Changes in Net Assets |

| 16 | Financial Highlights |

| 18 | Notes to Financial Statements |

| 27 | Report of Independent Registered Public Accounting Firm |

| 28 | Important Tax Information |

| 29 | Information About the Review and Approval of the Fund’s Investment Advisory Agreement |

| 32 | Board Members Information |

| 34 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus Variable Investment Fund,

Appreciation Portfolio

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2009, through December 31, 2009.

The U.S stock market ended 2009 with a healthy annual gain, but market indices across all capitalization ranges and investment styles remained well below the peaks reached in the fall of 2007.The equity market’s advance was driven by improving investor sentiment as the U.S. economy staged a gradual, but sustained, recovery from the recession and banking crisis that had depressed stock prices at the beginning of the year. After four consecutive quarters of contraction, the U.S. economy returned to growth during the third quarter of 2009, buoyed by greater manufacturing activity to replenish depleted inventories and satisfy export demand. The slumping housing market also showed signs of renewed life later in the year when home sales and prices rebounded modestly. However, economic headwinds remain, including a high unemployment rate and the prospect of anemic consumer spending.

As 2010 begins, our Chief Economist, as well as many securities analysts and portfolio managers have continued to find opportunities and survey potential challenges across a variety of asset classes, including equities. While no one can predict the future, we believe that the 2010 investment environment will likely require a broader range of investment considerations relative to last year. As always, your financial adviser can help you determine the mix of investments that may be best suited to helping you achieve your goals at a level of risk that is comfortable for you.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Performance.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

January 15, 2010

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2009, through December 31, 2009, as provided by Fayez Sarofim, Portfolio Manager of Fayez Sarofim & Co., Sub-Investment Adviser

Fund and Market Performance Overview

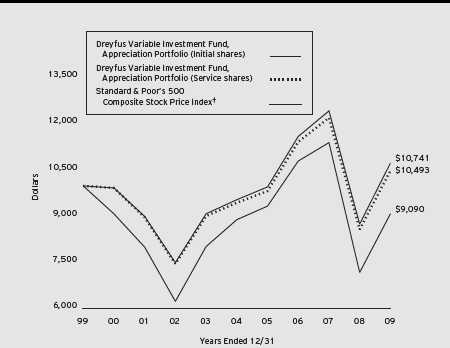

For the 12-month period ended December 31, 2009, Dreyfus Variable Investment Fund,Appreciation Portfolio’s Initial shares produced a total return of 22.56%, and its Service shares produced a total return of 22.23%.1 In comparison, the total return of the fund’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”), was 26.47% for the same period.2

A recession and banking crisis continued to depress stock prices in early 2009, but a sustained rally in anticipation of an economic recovery fueled gains over the remainder of the year. The fund’s returns were lower than its benchmark, due to the fund’s focus on blue-chip stocks at a time when lower quality companies led the rally.

The Fund’s Investment Approach

The fund seeks long-term capital growth consistent with the preservation of capital.Its secondary goal is current income.To pursue these goals, the fund normally invests at least 80% of its assets in common stocks.The fund focuses on blue-chip companies with total market capitalizations of more than $5 billion at the time of purchase, including multinational companies. These are established companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence and the potential to achieve predictable, above-average earnings growth.

In choosing stocks, the fund first identifies economic sectors it believes will expand over the next three to five years or longer. Using fundamental analysis, the fund then seeks companies within these sectors that have proven track records and dominant positions in their industries. The fund employs a “buy-and-hold” investment strategy, which generally has resulted in an annual portfolio turnover of below 15%.A low portfolio turnover rate helps reduce the fund’s trading costs and minimizes tax liability by limiting the distribution of capital gains.3

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

Equity Markets Rebounded Sharply

As 2009 began, a financial crisis, rising unemployment, plunging housing prices and depressed consumer confidence had exacerbated the worst economic downturn since the 1930s.These influences drove stock market averages to multi-year lows during the first quarter of the year. Market sentiment began to improve in early March, as aggressive remedial measures adopted by government and monetary authorities gained traction. Soon thereafter, evidence of economic stabilization supported a sustained market rally through year-end.The rebound was especially robust among more speculative stocks, suggesting to us that bargain hunters were taking advantage of beaten-down stock prices rather than responding to improving fundamentals.

Quality Bias Dampened Relative Performance

The fund participated in the market rally to a significant degree despite generally lagging returns from blue-chip companies. Nonetheless, performance shortfalls relative to the S&P 500 Index were especially pronounced in the energy sector, where an overweighted position magnified the effects of volatile commodity prices, and in the technology sector where the fund maintained underweighted exposure during the reporting period. Finally, blue-chip companies in the health care sector suffered amid uncertainty surrounding proposed health care reform legislation.

The fund achieved better results in other areas. Most notably, the fund held no stocks in the utilities and telecommunications services sectors, enabling it to avoid relative weakness in those groups. Although the financials sector rebounded in 2009, mildly underweighted exposure to the sector helped bolster the fund’s relative results. Among individual stocks, the fund received strong contributions to performance from electronics innovator Apple, where the success of the iPhone supported sales of personal computers. Semiconductor giant Intel fared well amid expectations of rising customer demand in the early stages of economic recovery. Beverage producer Coca-Cola gained value due to robust growth in overseas markets. Pharmacy chain Walgreen bounced back after addressing operational issues.

Changes to the fund included establishing a position in medical equipment supplier Becton, Dickinson & Co., whose relatively low-cost

4

products seem likely to survive industry-wide cost-cutting efforts.Also in the health care sector, diabetes specialist Novo Nordisk appears to us to be well positioned to treat the burgeoning disease.We sold financial company American Express due to persistent weakness in the credit card and travel industries; industrial firm Emerson Electric amid expectations of a muted recovery in key markets; oil rig provider Transocean on a slowdown in energy exploration and production activity; and apparel maker Polo Ralph Lauren as a result of sluggish consumer spending on luxury items.

Blue-Chip Companies Poised for a Return to Favor

Although we have seen some economic stabilization, a number of head-winds remain, including tight credit conditions, high unemployment rates and sluggish consumer spending. Consequently, we believe that investors are likely to turn away from the more speculative stocks that led the rally, instead favoring large, financially sound companies with diversified revenue streams from global markets. In our view, the fund’s investment approach may be particularly well suited to such an environment.

January 15, 2010

The Fund 5

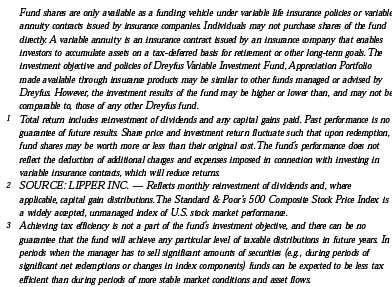

FUND PERFORMANCE

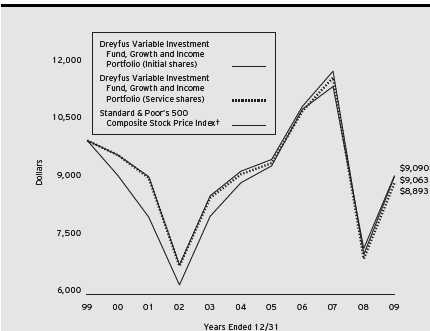

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Appreciation Portfolio Initial shares and Service shares and the Standard & Poor’s 500 Composite Stock Price Index

| | | |

| Average Annual Total Returns as of 12/31/09 | | | |

| | 1 Year | 5 Years | 10 Years |

| Initial shares | 22.56% | 2.38% | 0.72% |

| Service shares | 22.23% | 2.12% | 0.48% |

|

| The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 |

| (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth |

| results would have been lower. See notes below. |

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection |

| with investing in variable insurance contracts which will reduce returns. |

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund, Appreciation Portfolio on 12/31/99 to a $10,000 investment made in the Standard & Poor’s 500 Composite |

| Stock Price Index (the “Index”) on that date. |

6

The fund’s Initial shares are not subject to a Rule 12b-1 fee.The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the fund’s Initial shares from their inception date through December 30, 2000, and the performance of the fund’s Service shares from December 31, 2000 (inception date of Service shares) to December 31, 2009 (blended performance figures).The blended performance figures have not been adjusted to reflect the higher operating expenses of the Service shares. If these expenses had been reflected, the blended performance figures would have been lower. All dividends and capital gain distributions are reinvested.The fund’s performance shown in the line graph takes into account all applicable fund fees and expenses.The Index is a widely accepted, unmanaged index of U.S. stock market performance. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund,Appreciation Portfolio from July 1, 2009 to December 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

|

| Expenses and Value of a $1,000 Investment |

| assuming actual returns for the six months ended December 31, 2009 |

| | | | |

| | | Initial Shares | | Service Shares |

| Expenses paid per $1,000† | $ | 4.39 | $ | 5.77 |

| Ending value (after expenses) | $ | 1,202.60 | $ | 1,200.80 |

|

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

|

| Expenses and Value of a $1,000 Investment |

| assuming a hypothetical 5% annualized return for the six months ended December 31, 2009 |

| | | | |

| | | Initial Shares | | Service Shares |

| Expenses paid per $1,000† | $ | 4.02 | $ | 5.30 |

| Ending value (after expenses) | $ | 1,021.22 | $ | 1,019.96 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .79% for Initial Shares and 1.04% for Service Shares, |

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

|

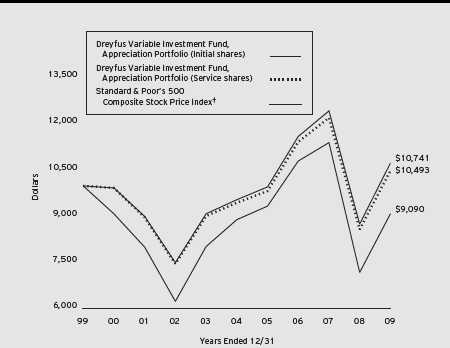

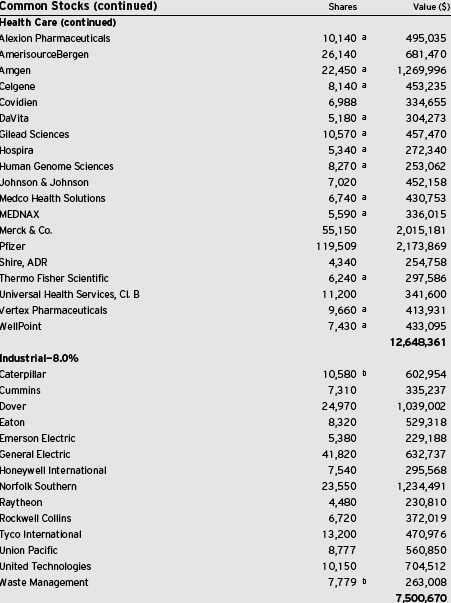

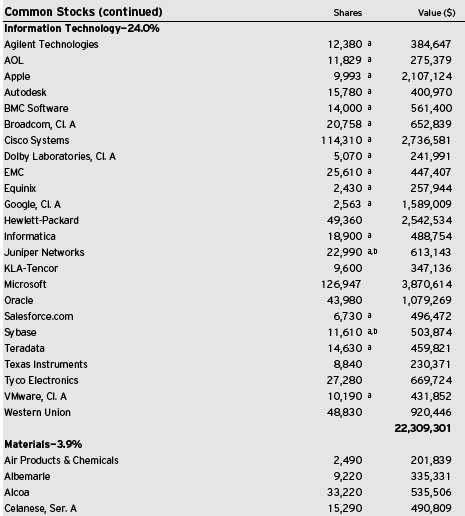

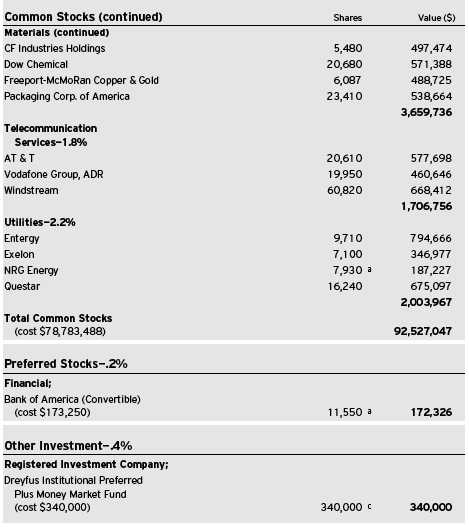

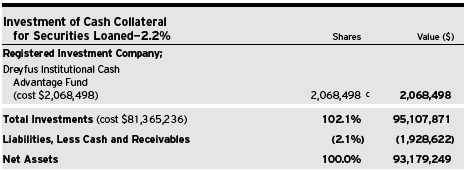

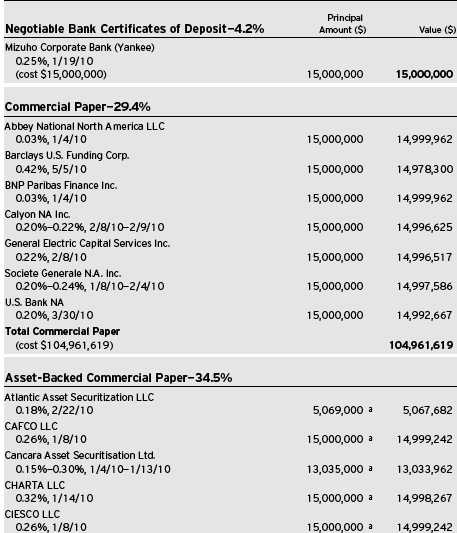

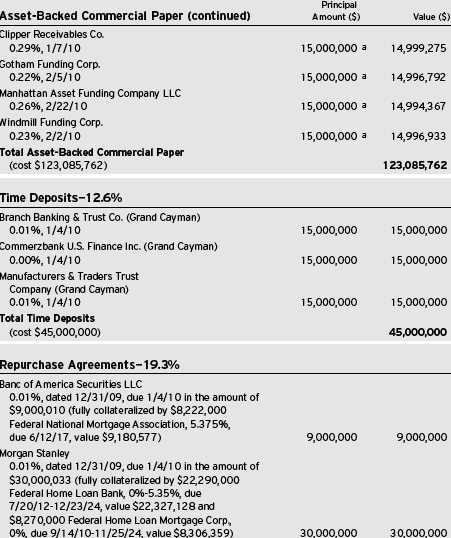

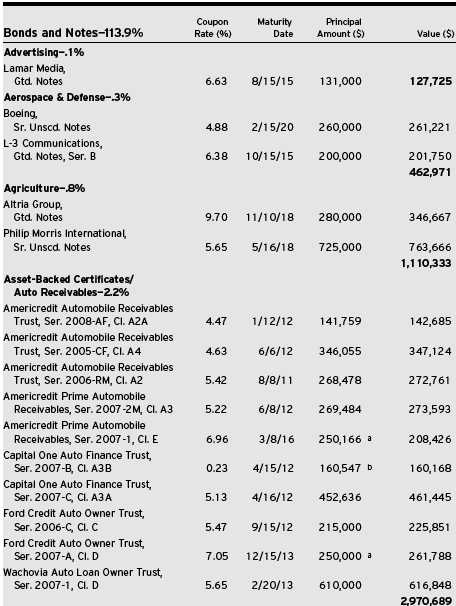

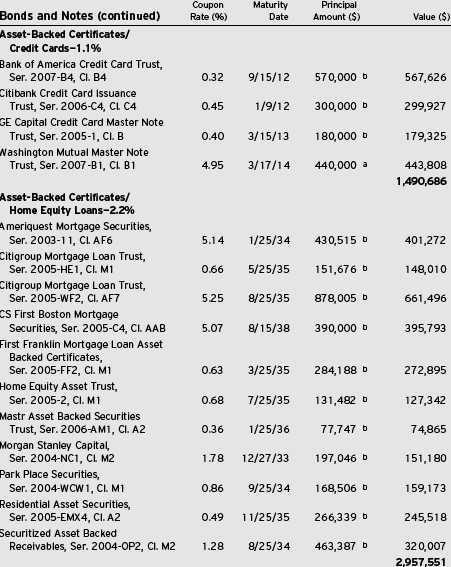

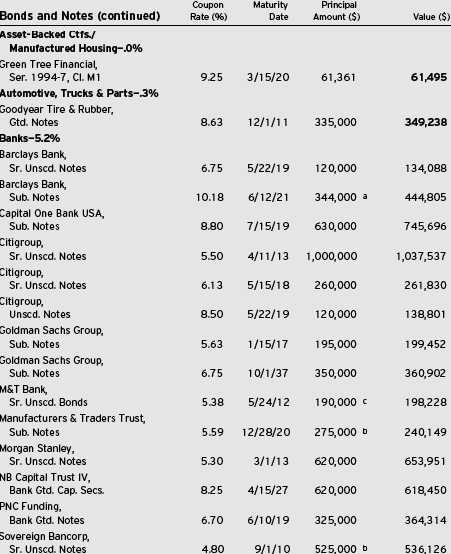

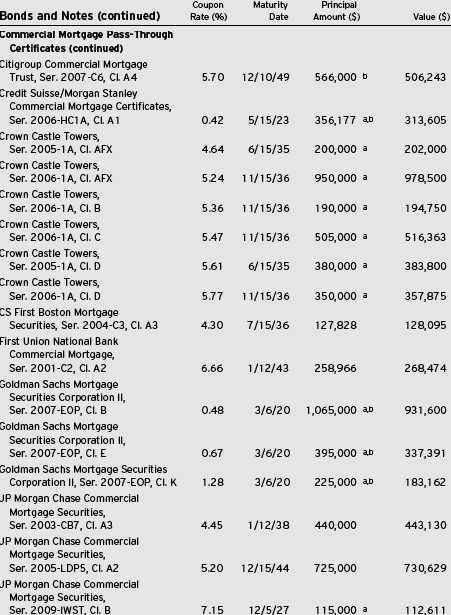

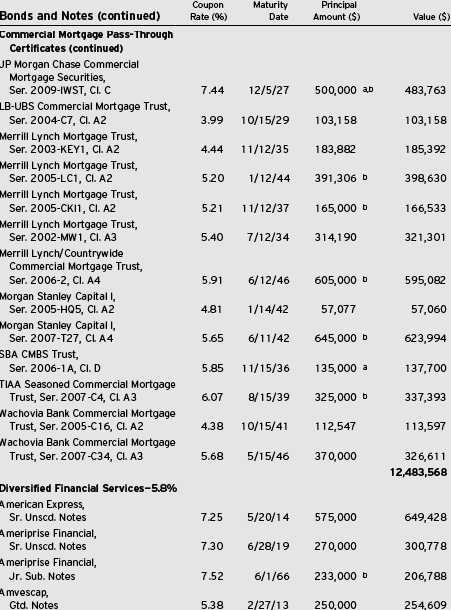

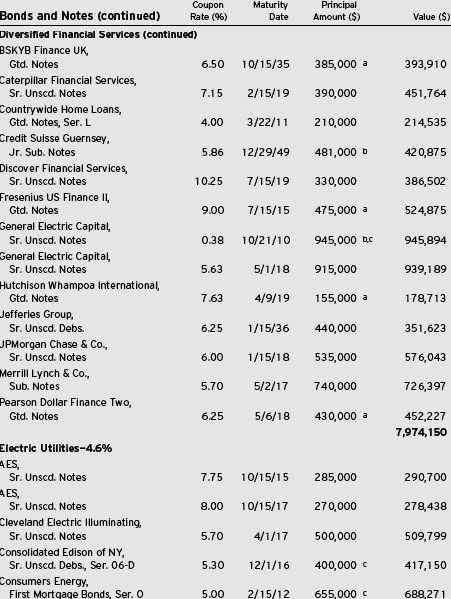

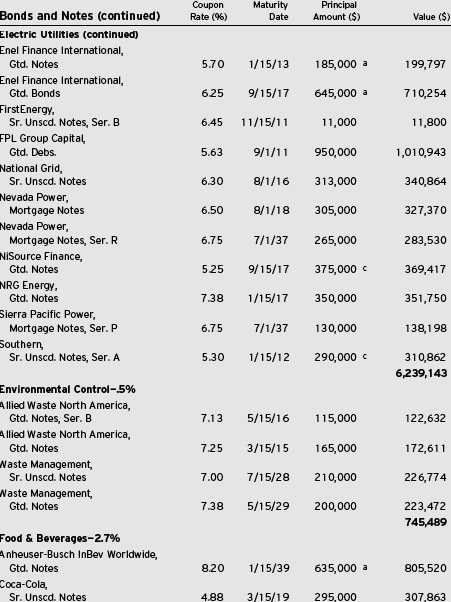

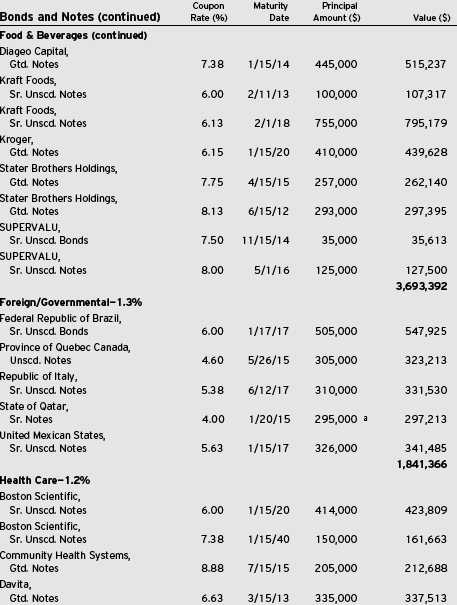

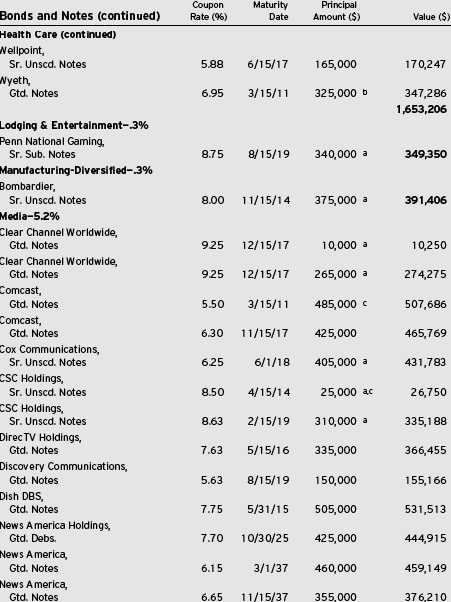

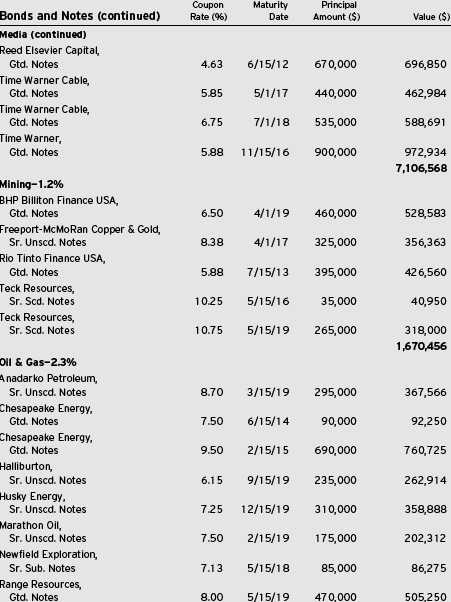

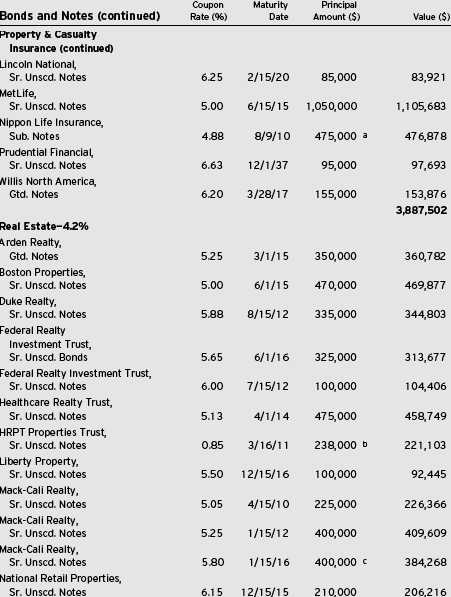

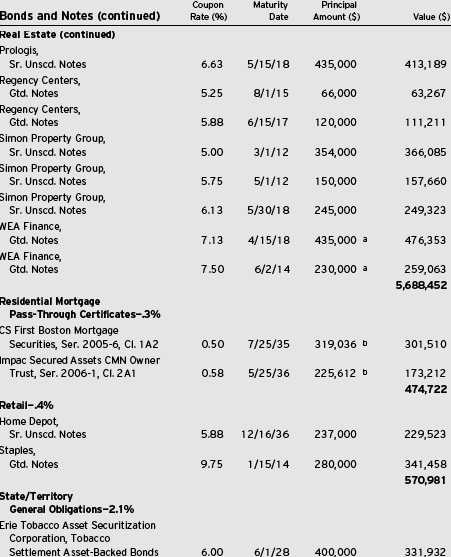

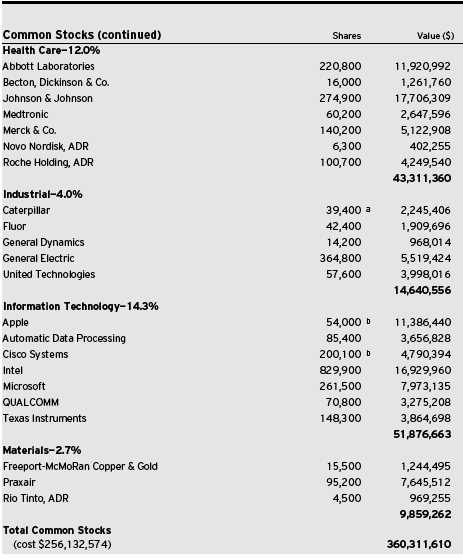

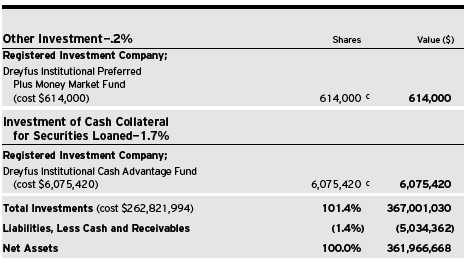

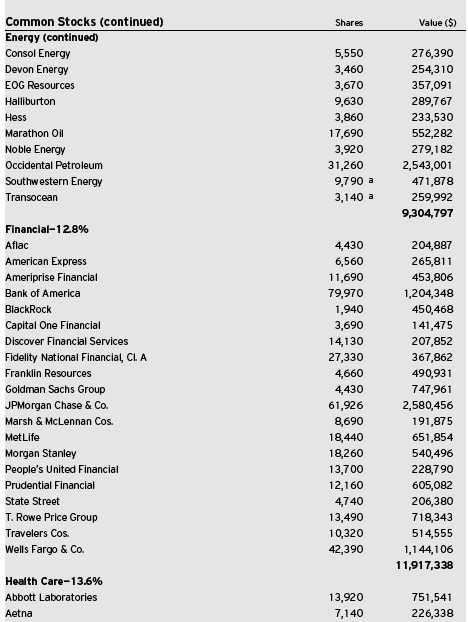

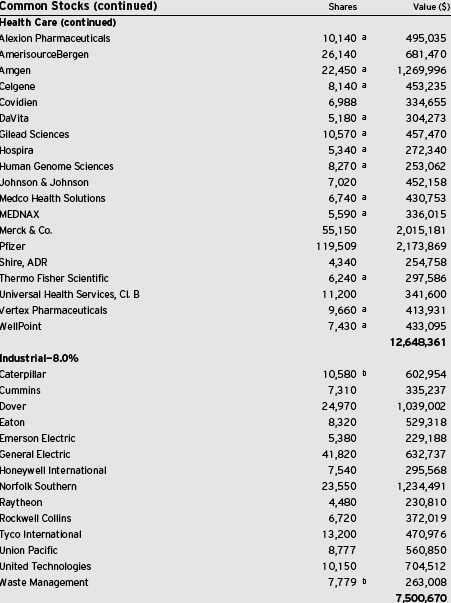

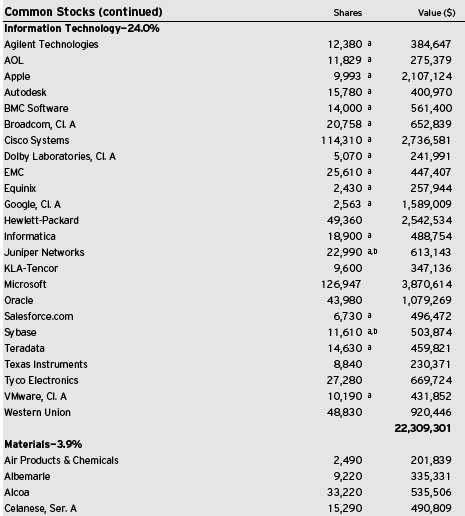

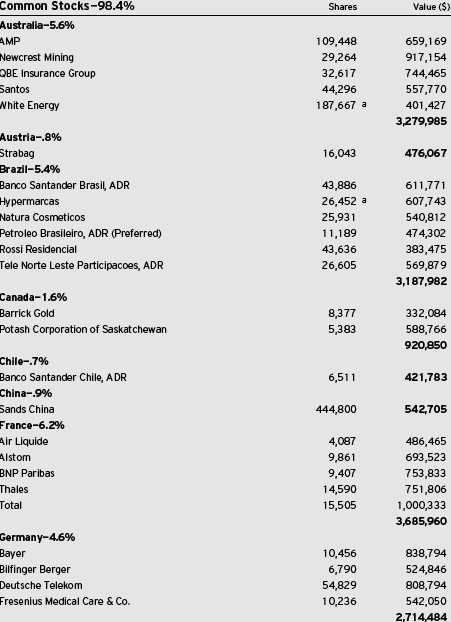

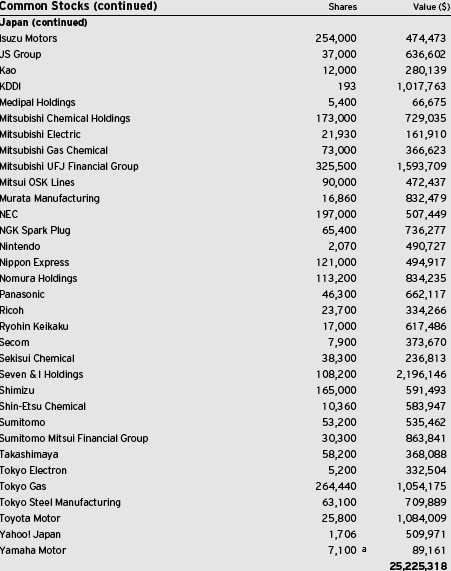

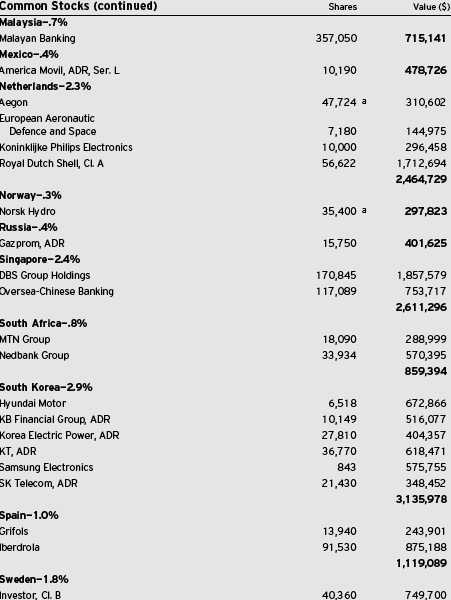

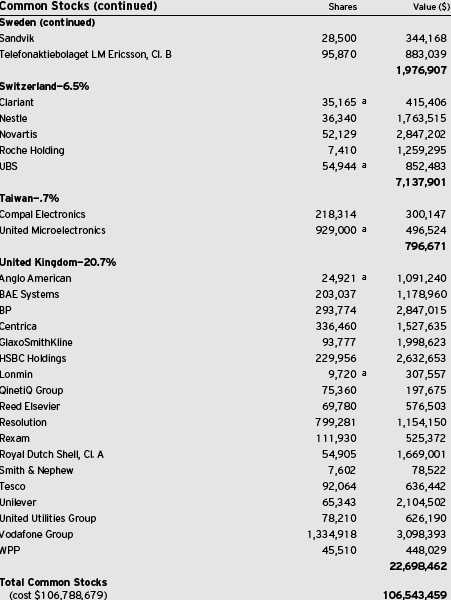

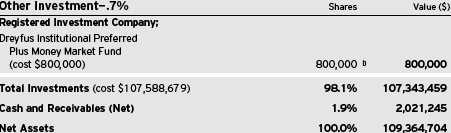

| STATEMENT OF INVESTMENTS |

| December 31, 2009 |

The Fund 9

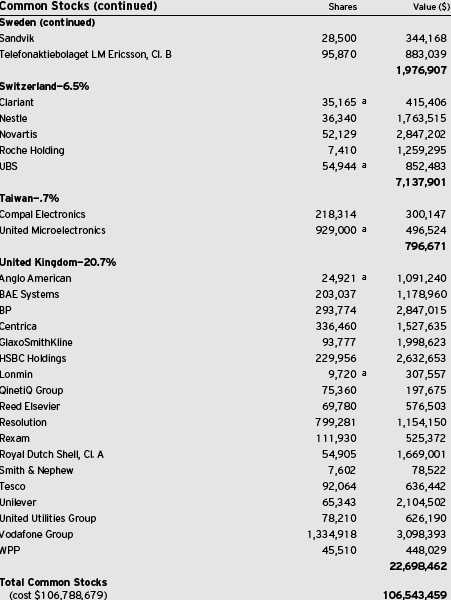

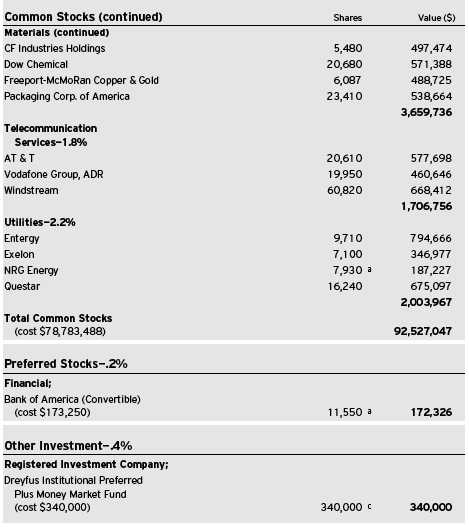

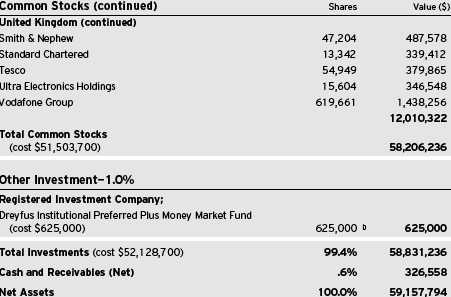

STATEMENT OF INVESTMENTS (continued)

10

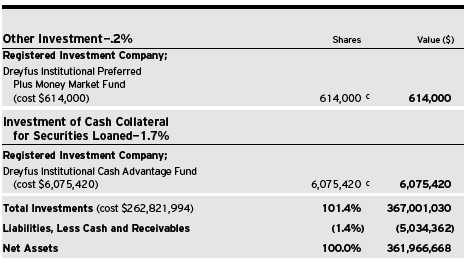

ADR—American Depository Receipts

|

| a Security, or portion thereof, on loan. At December 31, 2009, the total market value of the fund’s securities on loan is |

| $5,860,890, and the total market value of the collateral held by the fund is $6,075,420. |

| b Non-income producing security. |

| c Investment in affiliated money market mutual fund. |

|

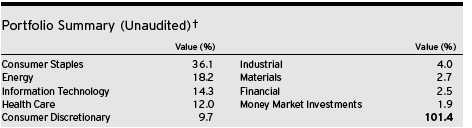

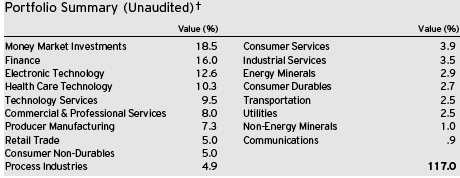

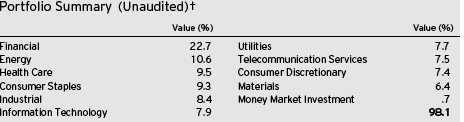

| † Based on net assets. |

| See notes to financial statements. |

The Fund 11

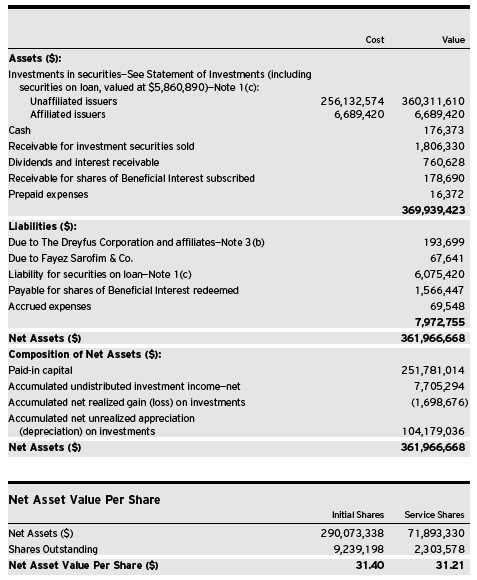

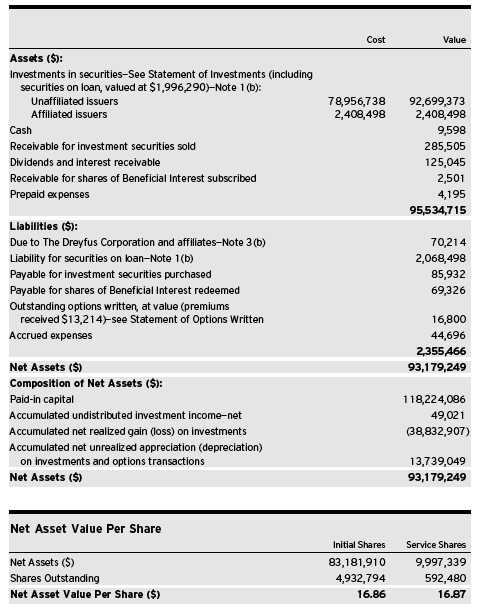

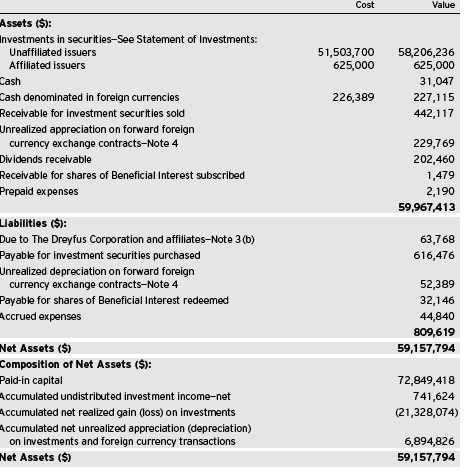

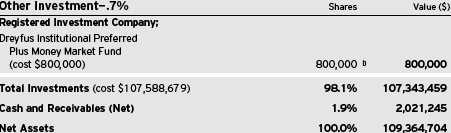

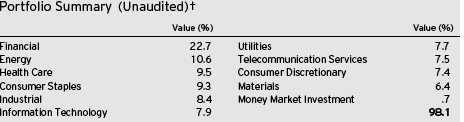

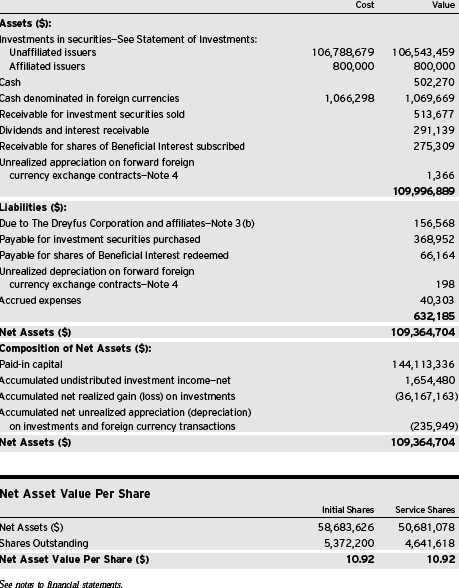

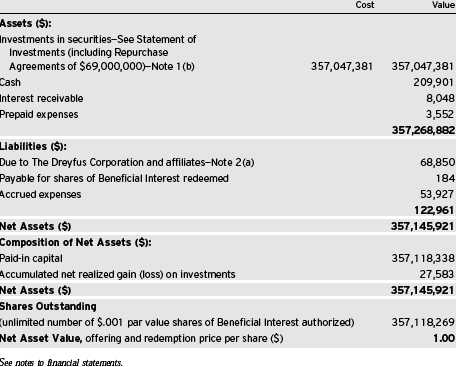

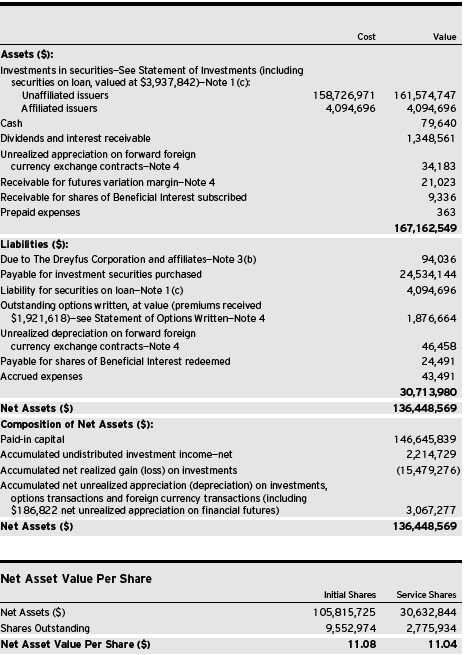

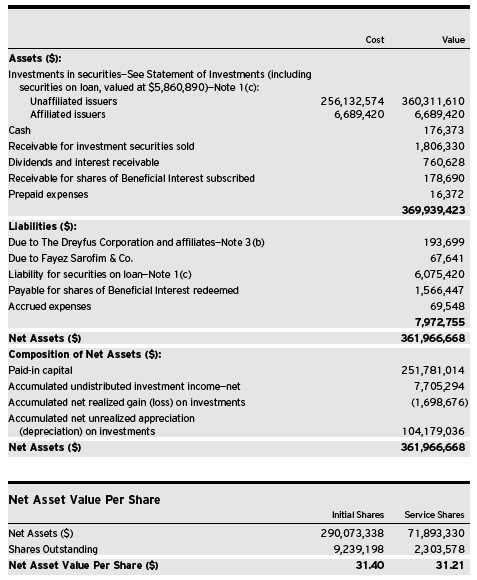

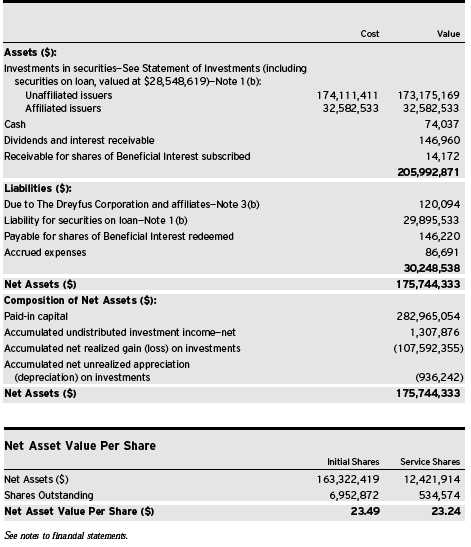

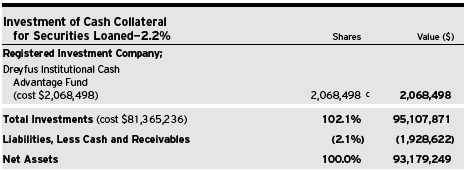

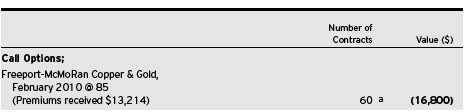

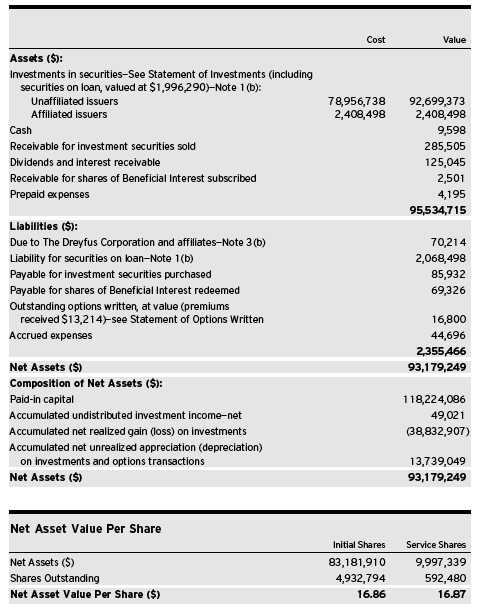

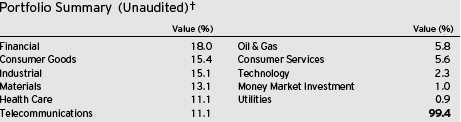

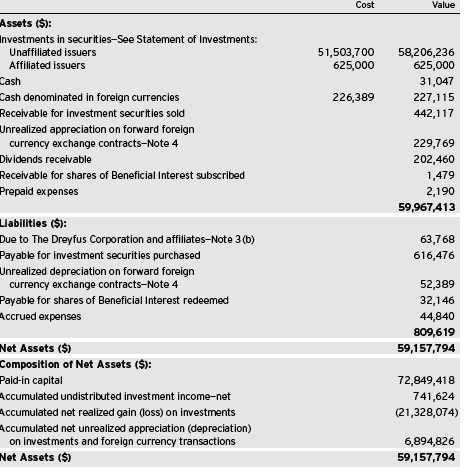

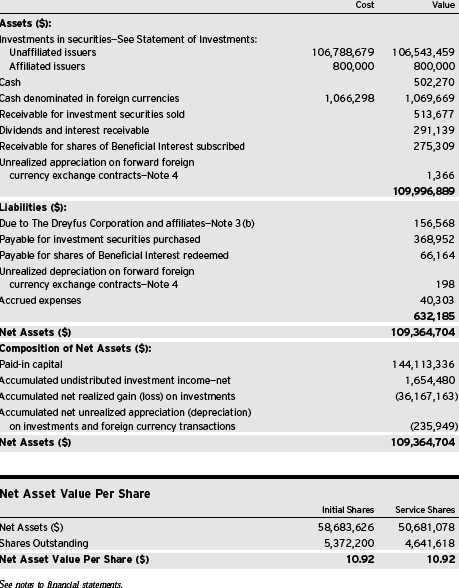

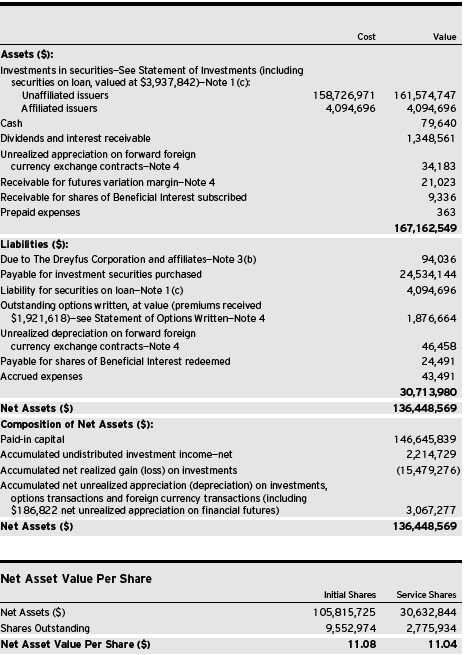

|

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2009 |

See notes to financial statements.

12

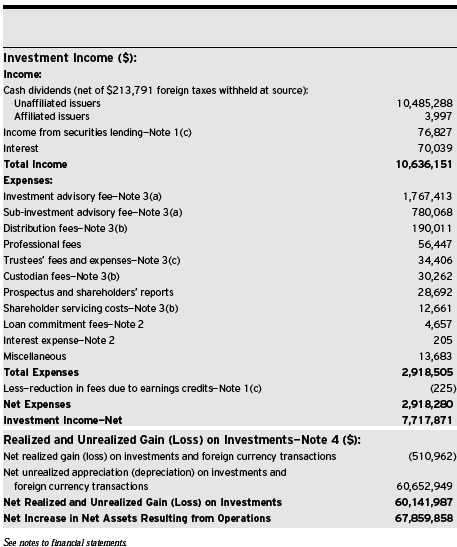

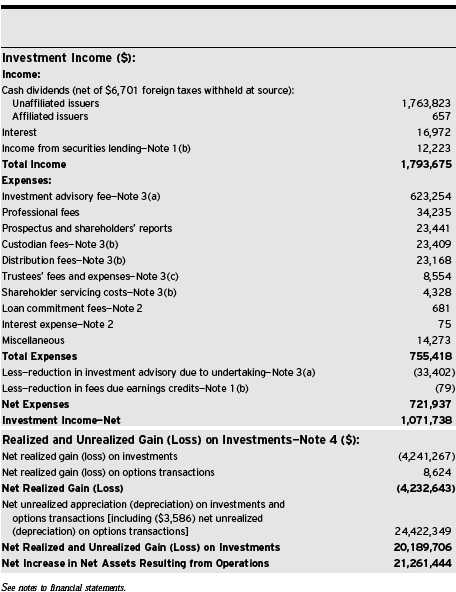

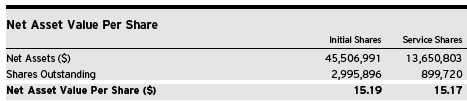

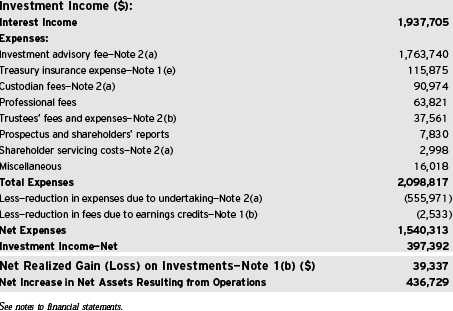

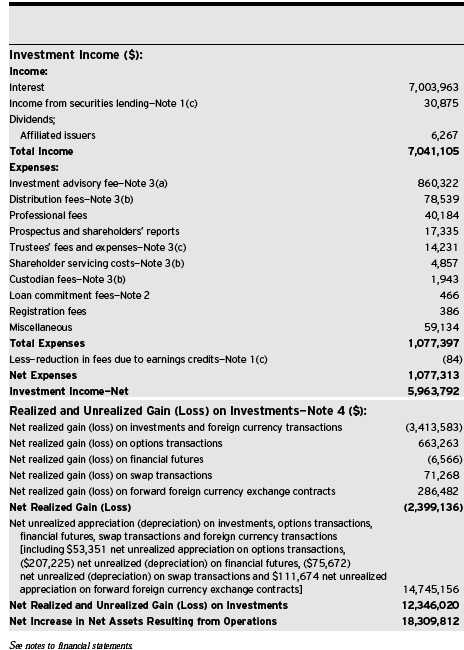

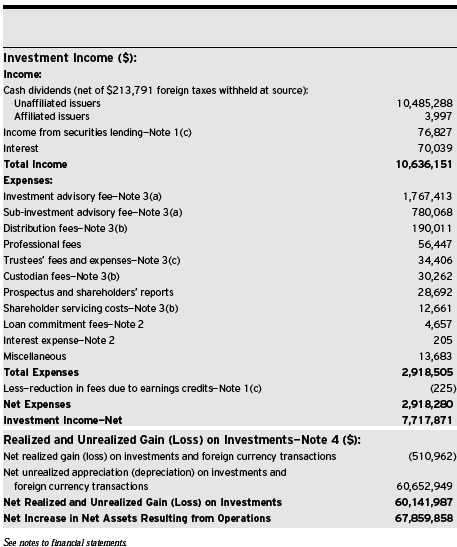

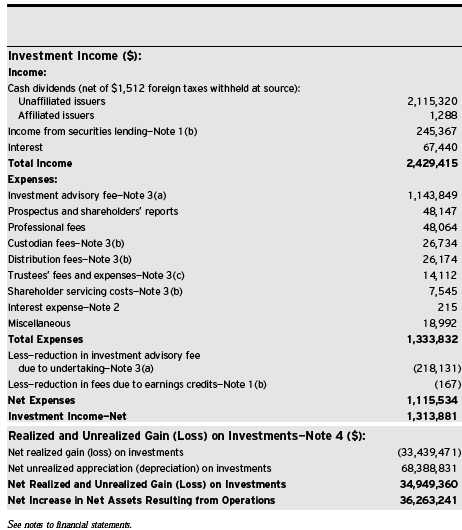

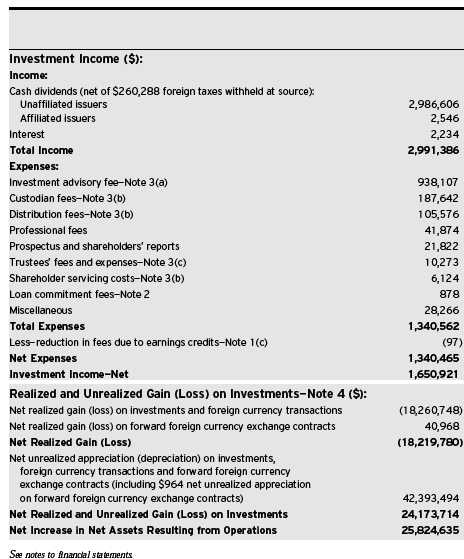

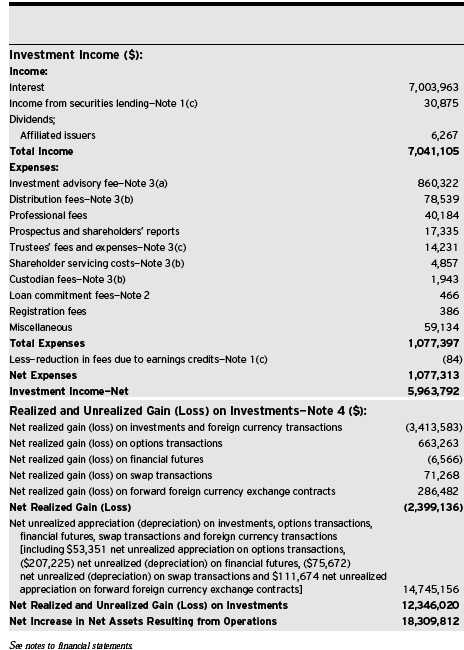

|

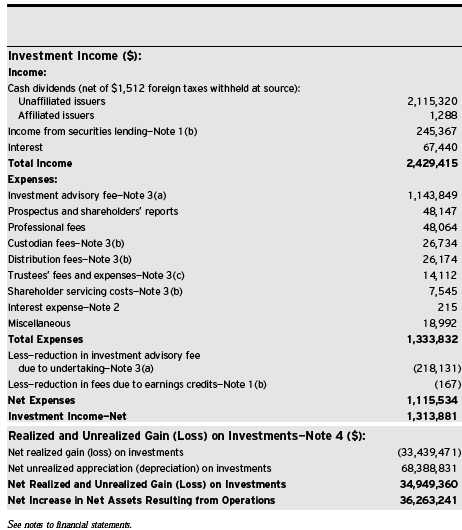

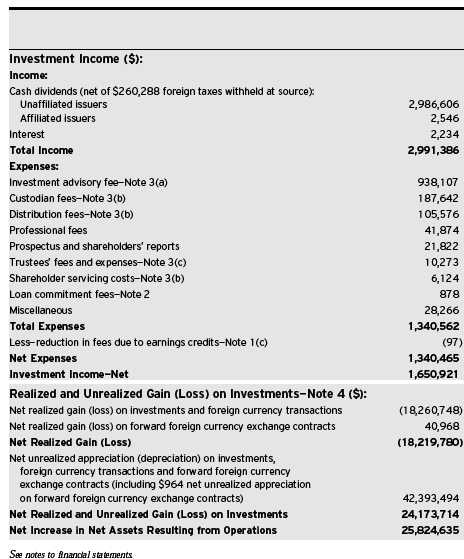

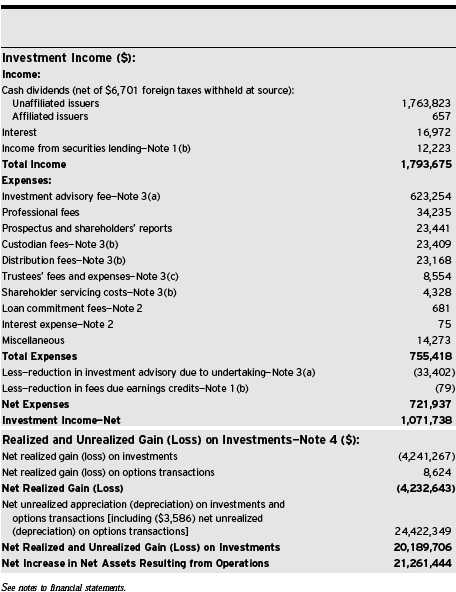

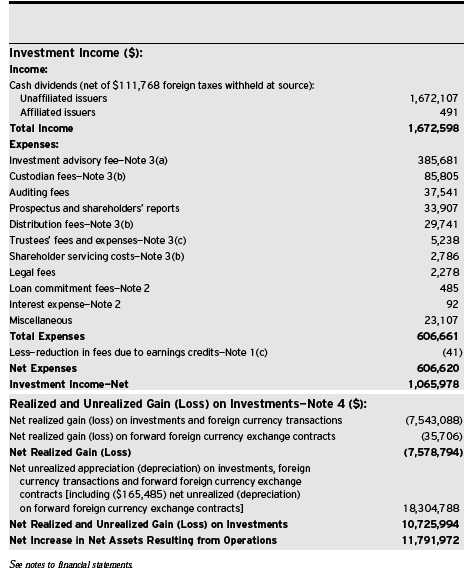

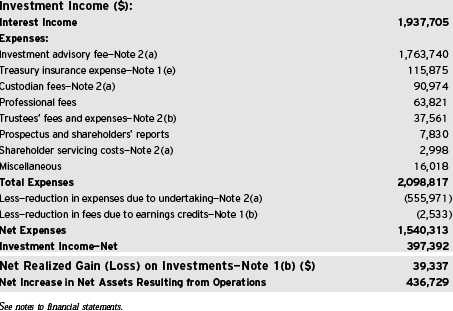

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2009 |

The Fund 13

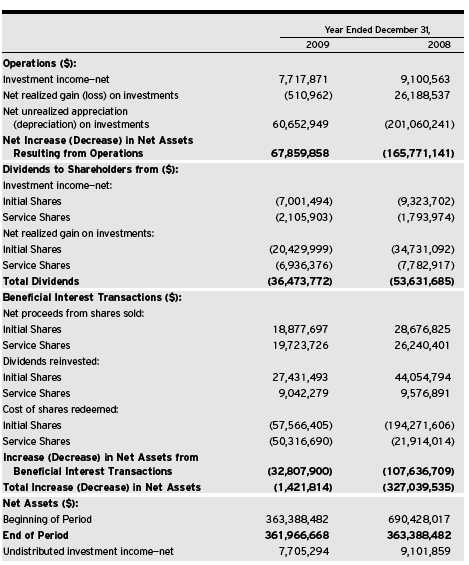

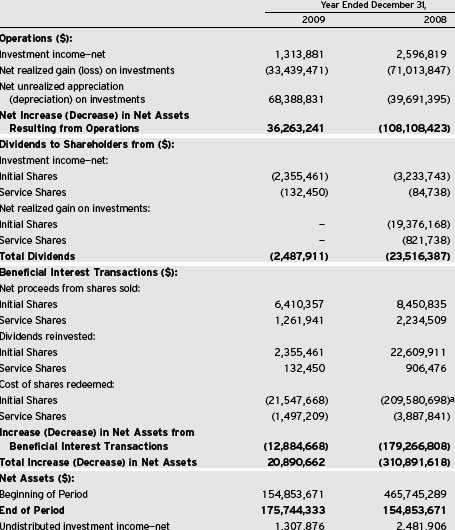

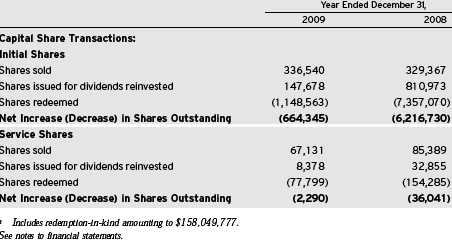

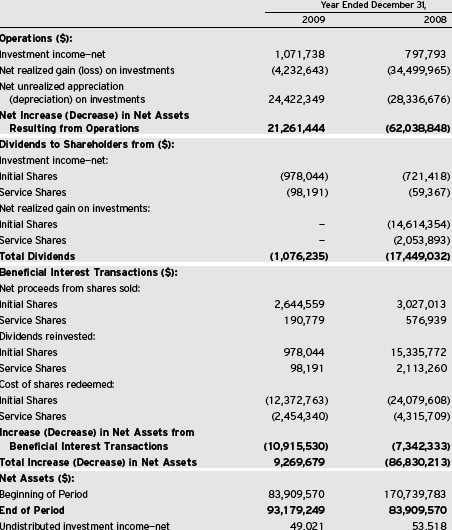

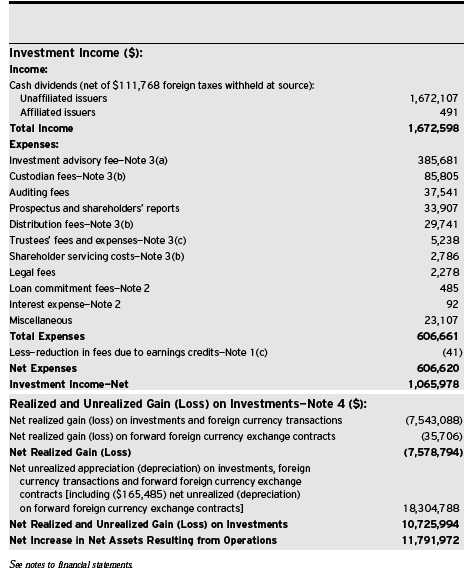

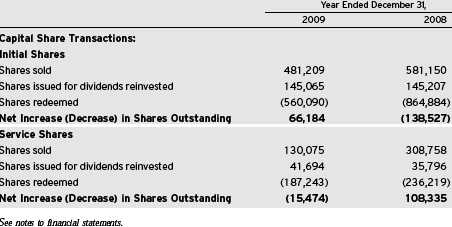

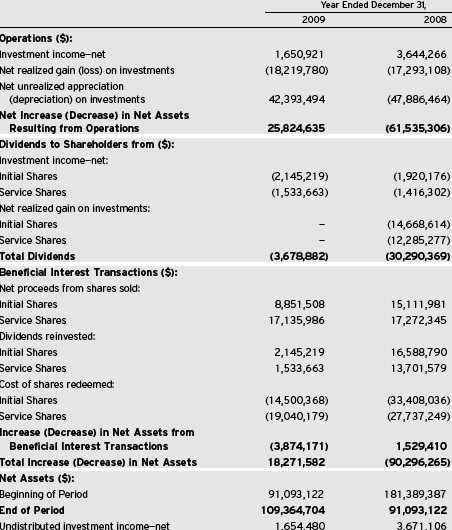

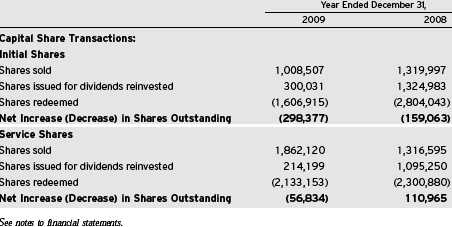

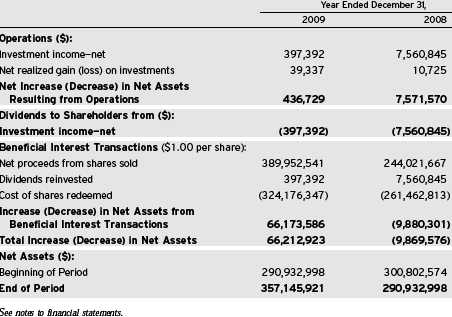

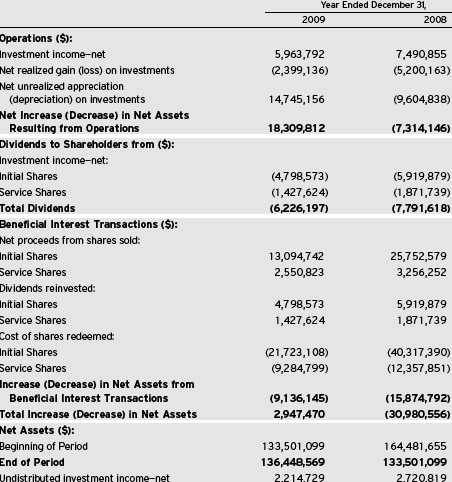

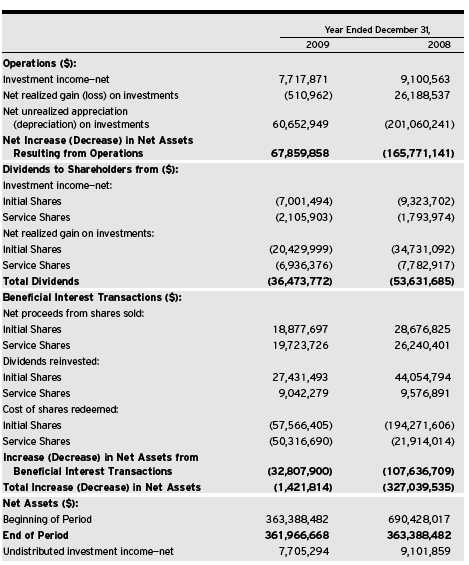

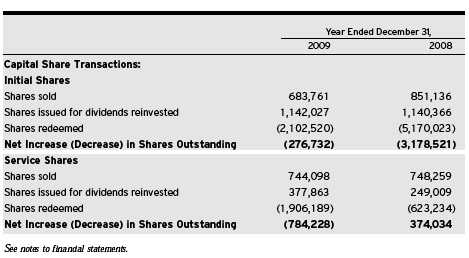

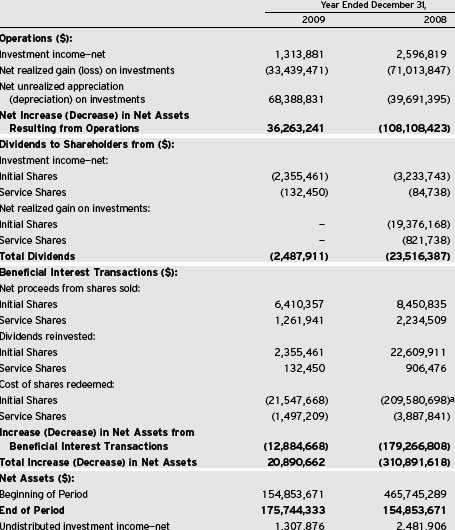

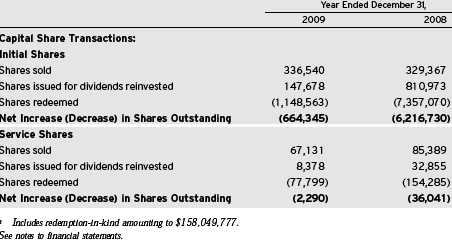

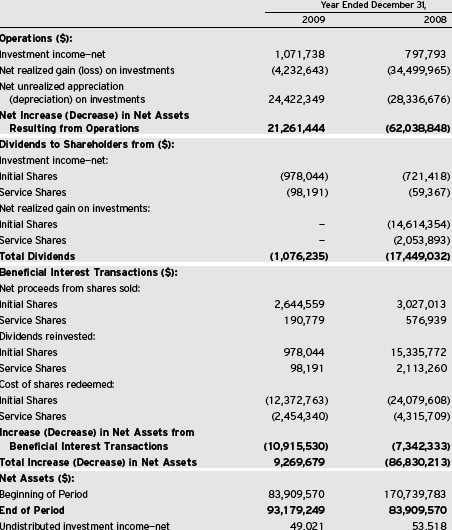

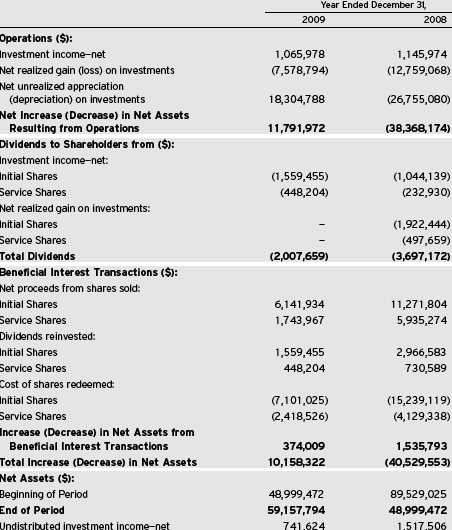

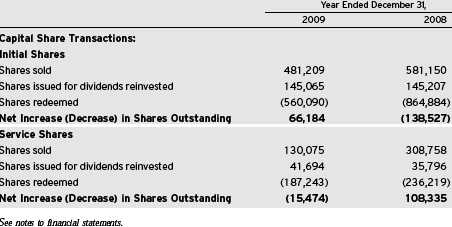

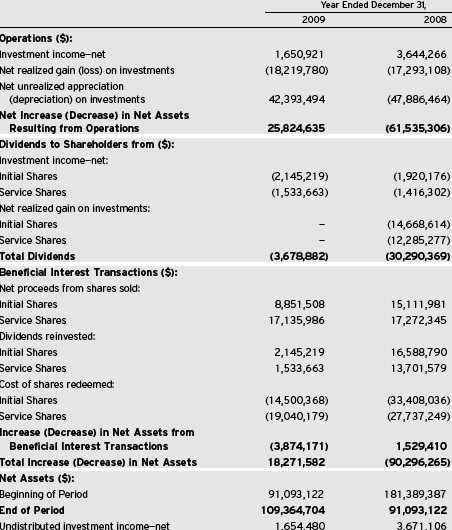

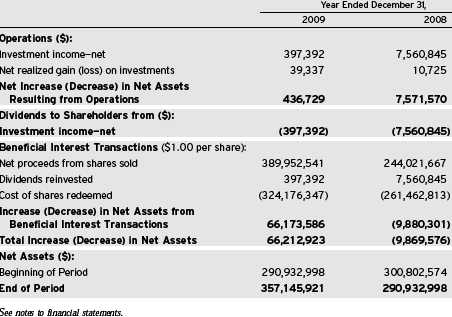

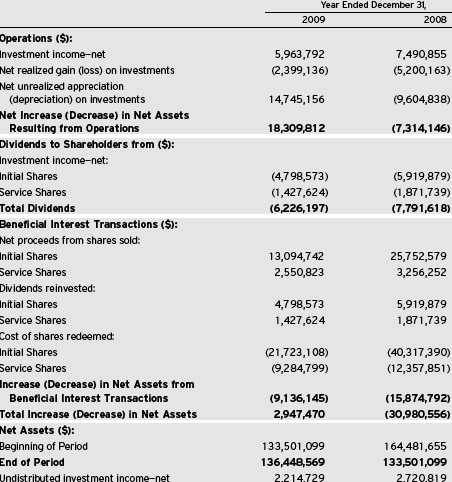

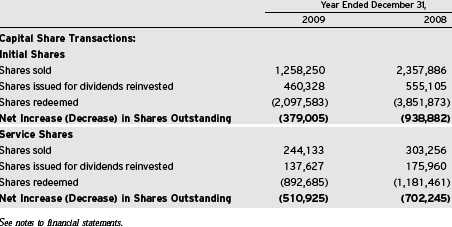

STATEMENT OF CHANGES IN NET ASSETS

14

The Fund 15

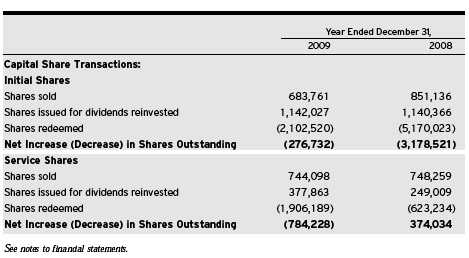

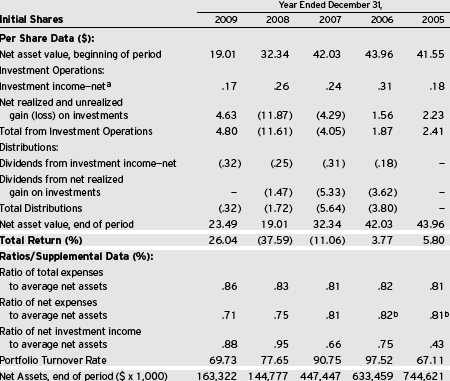

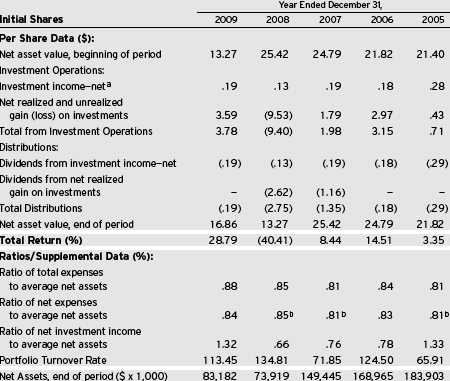

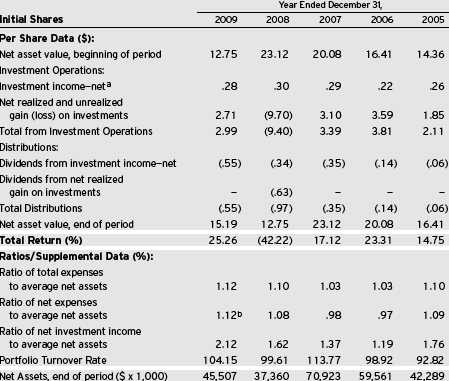

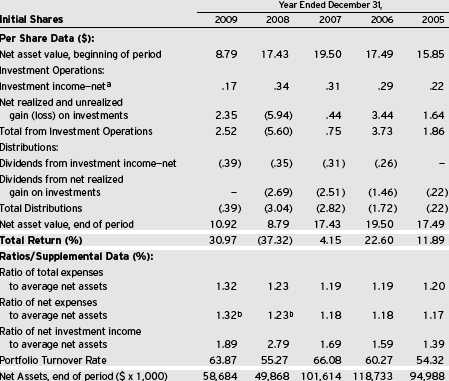

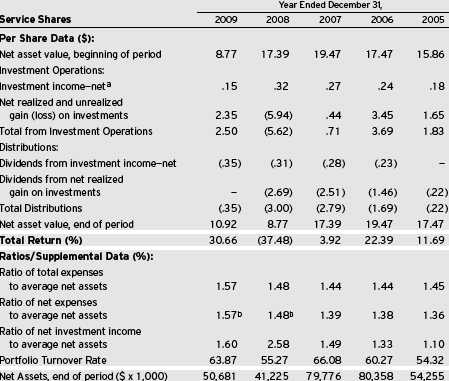

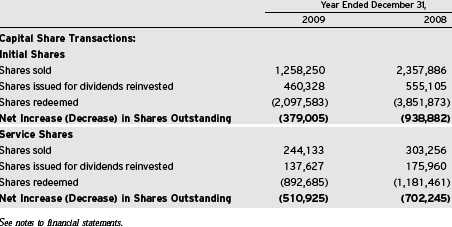

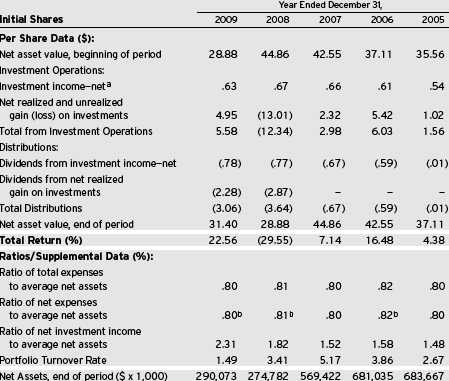

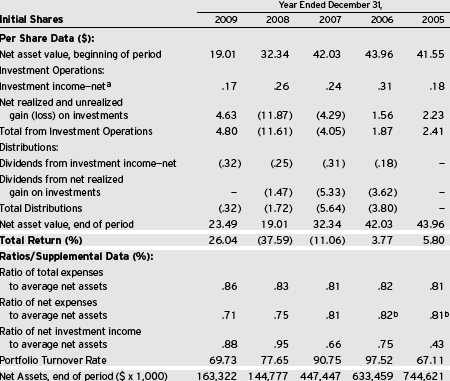

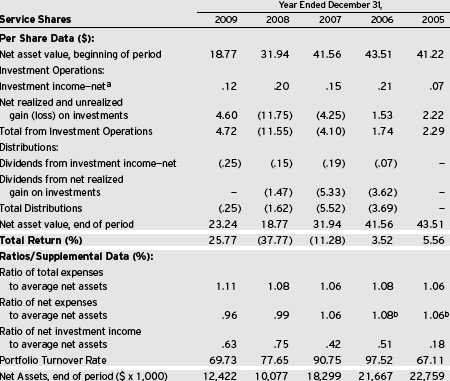

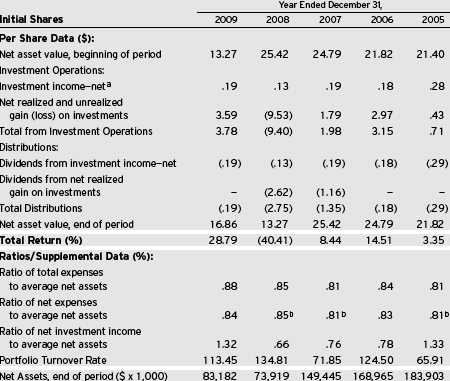

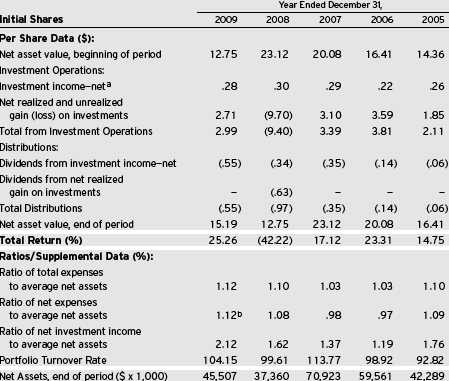

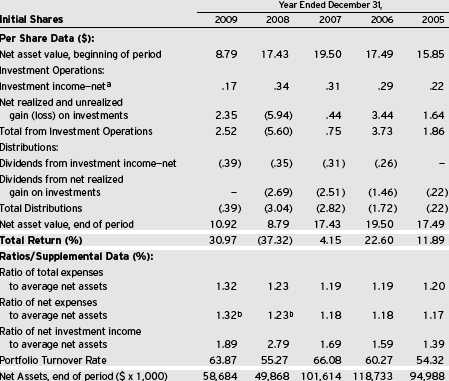

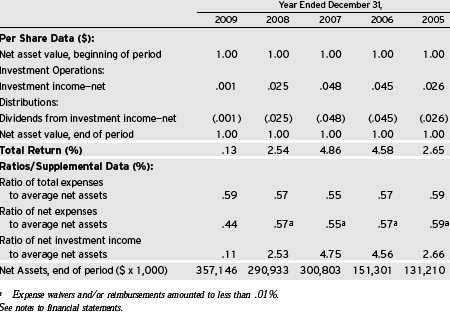

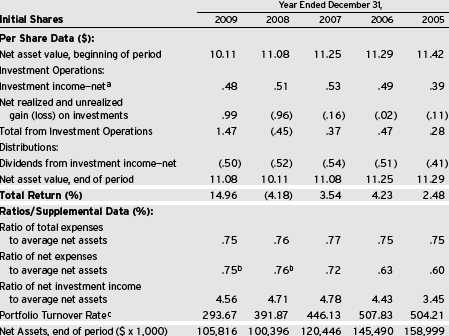

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts.These figures have been derived from the fund’s financial statements.

| a | Based on average shares outstanding at each month end. |

| b | Expense waivers and/or reimbursements amounted to less than .01%. |

See notes to financial statements.

16

| |

| a | Based on average shares outstanding at each month end. |

| b | Expense waivers and/or reimbursements amounted to less than .01%. |

See notes to financial statements.

The Fund 17

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

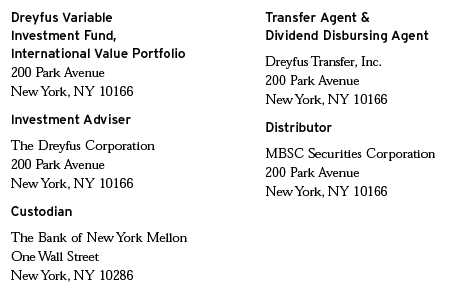

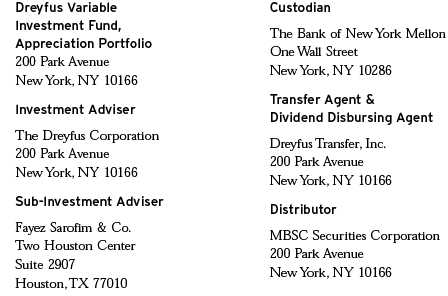

Dreyfus Variable Investment Fund (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company, operating as a series company currently offering seven series, including the Appreciation Portfolio (the “fund”). The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The fund is a diversified series.The fund’s investment objective is to provide long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary ofThe Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the fund’s sub-investment advi ser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares, which are sold without a sales charge.The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan, the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) has become the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities.

18

Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The ASC has superseded all existing non-SEC accounting and reporting standards. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or officia l closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs

The Fund 19

NOTES TO FINANCIAL STATEMENTS (continued)

and futures contracts. For other securities that are fair valued by the Board ofTrustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own

assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

20

The following is a summary of the inputs used as of December 31, 2009 in valuing the fund’s investments:

| |

| † | See Statement of Investments for industry classification. |

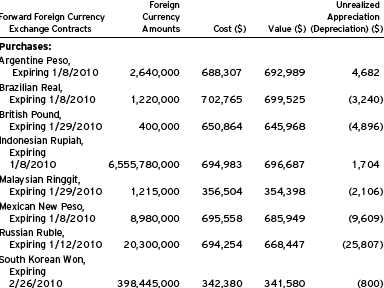

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies,currency gains or losses realized on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments, resulting from changes in exchange rates. Foreign currency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The Fund 21

NOTES TO FINANCIAL STATEMENTS (continued)

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended December 31, 2009, The Bank of New York Mellon earned $32,926 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

22

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2009, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended December 31, 2009 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2009, the components of accumulated earnings on a tax basis were as follow: ordinary income $7,705,294, accumulated capital losses $658,768 and unrealized appreciation $103,286,931. In addition, the fund had $147,803 of capital losses realized after October 31, 2009, which were deferred for tax purposes to the first day of the following fiscal year.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2009. If not applied, the carryover expires in fiscal 2017.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2009 and December 31, 2008 were as follows: undistributed ordinary income $9,239,227 and $11,221,296 and long-term capital gains $27,234,545 and $42,410,389, respectively.

During the period ended December 31, 2009, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency exchange gains and losses and dividend reclassification, the fund decreased accumulated undistributed investment income-net by $7,039 and increased accumulated net realized gain

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

(loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended December 31, 2009, was approximately $13,000, with a related weighted average annualized interest rate of 1.57%.

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an investment advisory agreement with Dreyfus, the investment advisory fee was based on the value of the fund’s average daily net assets and was computed at the following annual rates: .55% of the first $150 million; .50% of the next $150 million; and .375% over $300 million. Effective August 3, 2009, the annual rate of the investment advisory fee is .5325% of the value of the fund’s average daily net assets.The fee is payable monthly. Pursuant to a sub-investment advisory agreement with Sarofim & Co., the sub-investment advisory fee was based upon the value of the fund’s average daily net assets and is computed at the following annual rates: .20% of the first $150 million; .25% of the next $150 million; and .375% over $300 million. Effective August 3, 2009, the annual rate of the sub-investment advisory fee is .2175% of the value of the fund’s average daily net assets.The fee is payable monthly.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing

24

their shares, for servicing and/or maintaining Service shares’ shareholder accounts and for advertising and marketing for Service shares.The Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets.The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance prod-ucts.The fees payable under the Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2009, Service shares were charged $190,011 pursuant to the Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended December 31, 2009, the fund was charged $1,251 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended December 31, 2009, the fund was charged $225 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations. These fees were offset by earnings credits pursuant to the cash management agreement.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended December 31, 2009, the fund was charged $30,262 pursuant to the custody agreement.

During the period ended December 31, 2009, the fund was charged $6,681 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $165,604, Rule 12b-1 distribution plan fees $15,197, custodian fees $7,691, chief compliance officer fees $5,011 and transfer agency per account fees $196.

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2009, amounted to $4,992,352 and $63,196,642, respectively.

The fund adopted the provisions of ASC Topic 815 “Derivatives and Hedging” which requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The fund held no derivatives during the period ended December 31, 2009. These disclosures did not impact the notes to the financial statements.

At December 31, 2009, the cost of investments for federal income tax purposes was $263,714,099; accordingly, accumulated net unrealized appreciation on investments was $103,286,931, consisting of $121,486,066 gross unrealized appreciation and $18,199,135 gross unrealized depreciation.

NOTE 5—Subsequent Events Evaluation:

Dreyfus has evaluated the need for disclosures and/or adjustments resulting from subsequent events through February 10, 2010, the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

26

|

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

|

| Shareholders and Board of Trustees |

| Dreyfus Variable Investment Fund, Appreciation Portfolio |

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the series comprising Dreyfus Variable Investment Fund) as of December 31, 2009, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting.Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances,but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting.Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used an d significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2009 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Variable Investment Fund, Appreciation Portfolio at December 31,2009,the results of its operations for the year then ended,the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U. S. generally accepted accounting principles.

The Fund 27

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates $2.2654 per share as a long-term capital gain distribution and $.0106 per share as a short-term capital gain distribution paid on March 26, 2009 and also the fund hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2009 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in early 2010 of the percentage applicable to the preparation of their 2009 income tax returns.

28

|

| INFORMATION ABOUT THE REVIEW AND |

| APPROVAL OF THE FUND’S INVESTMENT |

| ADVISORY AGREEMENT (Unaudited) |

At a meeting of the fund’s Board held on June 30, 2009, the Board unanimously approved amendment, effective August 3, 2009, of the fund’s Investment Advisory Agreement with Dreyfus and the Sub-Investment Advisory Agreement between the fund and Fayez Sarofim & Co. (“Sarofim”) (together, the “Agreements”).The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel. In approving the amendment of the Agreements, the Board considered all factors that it believed to be relevant, including, among other things, the factors discussed below. Since the Board had renewed the Agreements at a meeting held on March 3, 2009 (the “March Meeting”) for one-year terms ending March 31, 2010, and, other than as discussed below, there had been no material changes in t he information presented, the Board addressed many of the relevant considerations by reference to their considerations and determinations at the March Meeting.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The nature, extent and quality of services provided to the fund by Dreyfus and Sarofim had been considered at the March Meeting, and there had been no material changes in this information. Dreyfus representatives stated, and the Board considered, that Sarofim, subject to Dreyfus’ supervision, would continue to provide the day-to-day management of the fund’s investments in accordance with the fund’s investment objective, policies and limitations as set forth in the fund’s prospectus and statement of additional information; Dreyfus would continue to supervise Sarofim in its sub-investment advisory role for the fund; Dreyfus does not believe that the proposed amendments to the Agreements would have any adverse impact on the scope or quality of the services provided to the fund by Dreyfus or Sarofim; and the proposed amendments also would not result in any change to the investment management of the fund.

The Fund 29

|

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S |

| INVESTMENT ADVISORY AGREEMENT (Unaudited) (continued) |

Comparative Analysis of the Fund’s Performance, Management Fee and Expense Ratio. The Board considered the fund’s performance, management fee and expense ratio at the March Meeting.The Board did not consider the period of time since the March Meeting to be an adequate period of time for reconsideration of performance in connection with approving the amendments to the Agreements. The Board also considered that the amendments would not change the aggregate management fees paid by the fund or the fund’s expense ratio. As a result, the Board did not reconsider comparative fee and expense information, including fees paid to Dreyfus or Sarofim by mutual funds and/or separate accounts with similar investment objectives, policies and strategies as the fund.

Analysis of Profitability and Economies of Scale. The Board had considered profitability, economies of scale and potential benefits to Dreyfus or Sarofim from acting as investment adviser and sub-investment adviser, respectively, at the March Meeting.As a result, the Board did not reconsider economies of scale and potential benefits, which would not change under the amendments from those considered at the March Meeting. In addition, since the increase in Drefyus’ fee that would result from the amendments was not believed to be material, and since future profitability is difficult to estimate, the Board did not reconsider profitability, which would be considered in connection with the Agreements’ renewal.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to amendment of the fund’s Agreements. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

30

- The Board concluded that the nature, extent and quality of the ser- vices provided by Dreyfus and Sarofim continued to be adequate and appropriate.

- The Board concluded that the fees to be paid to Dreyfus and Sarofim, which were not changing in aggregate amount paid by the fund, continued to be reasonable.

The Board members considered these conclusions and determinations and, in light of the conclusions and determinations at the March Meeting and without any one factor being dispositive, the Board determined that amendment of the fund’s Agreements was in the best interests of the fund and its shareholders.

The Fund 31

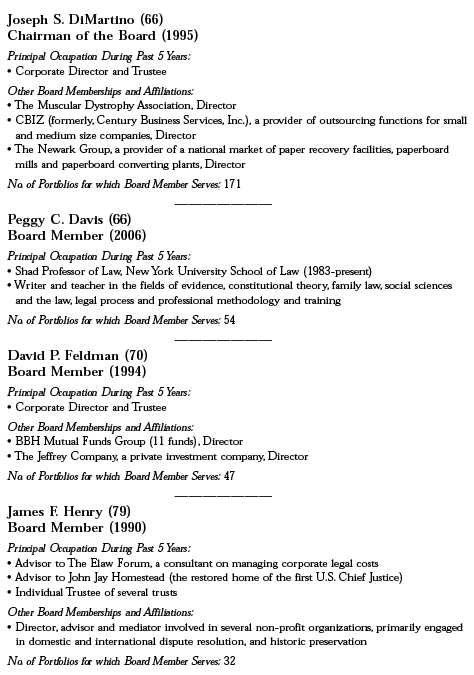

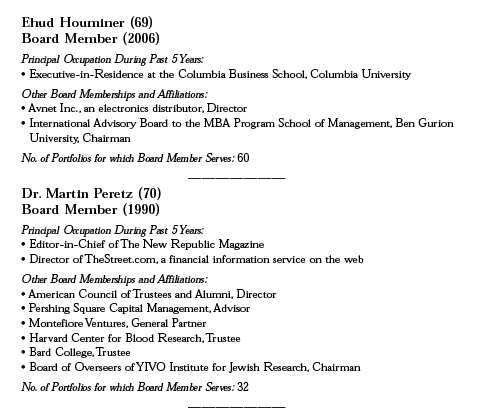

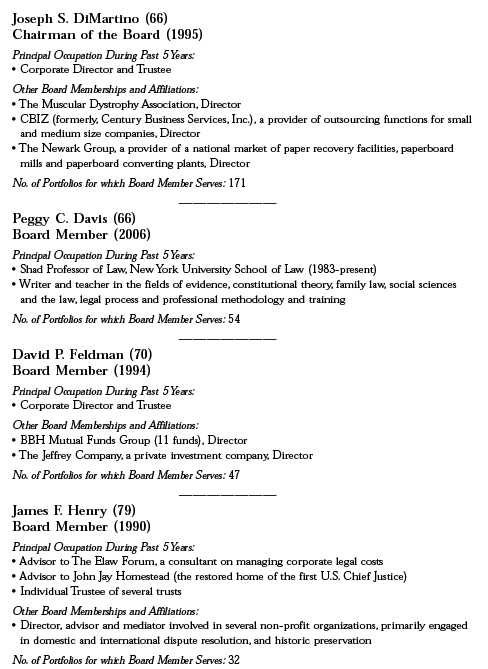

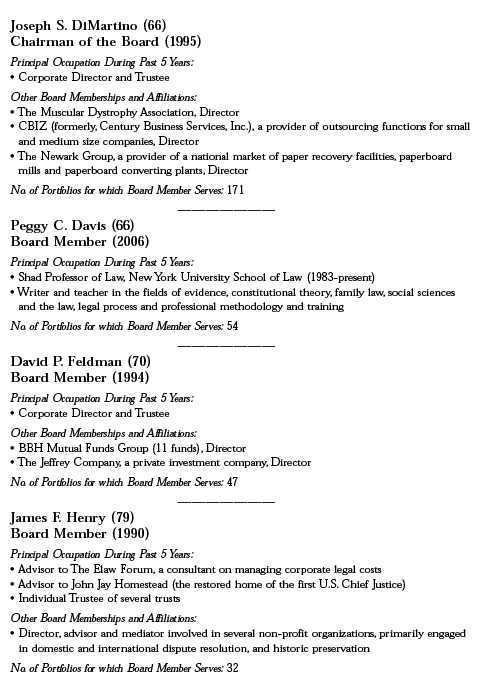

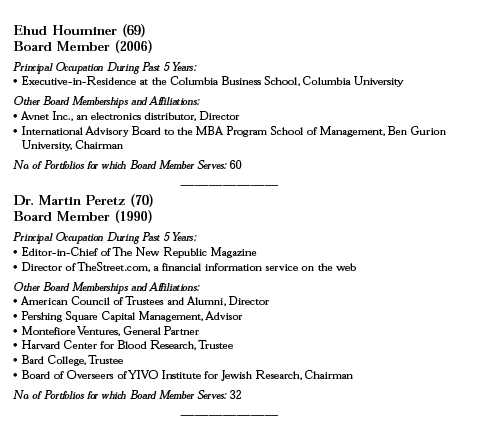

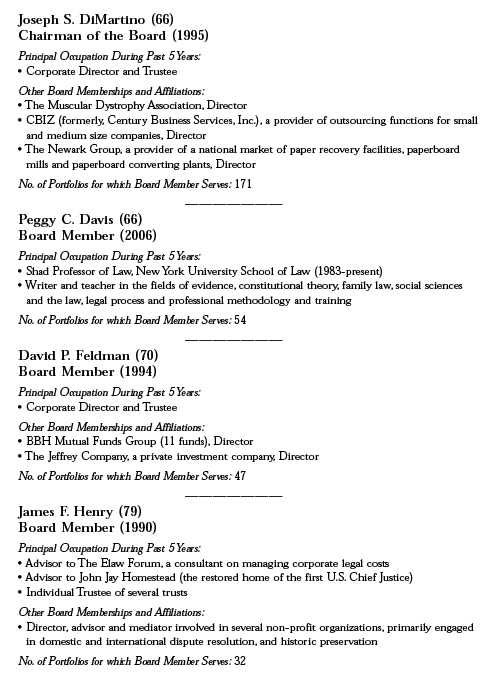

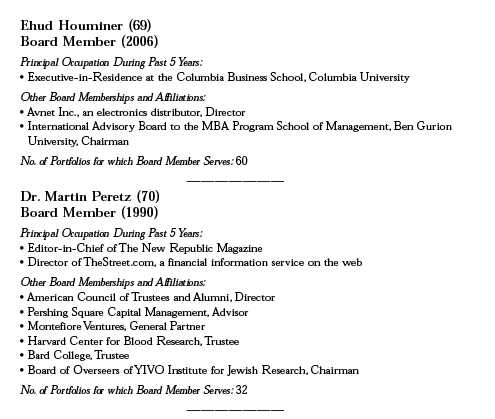

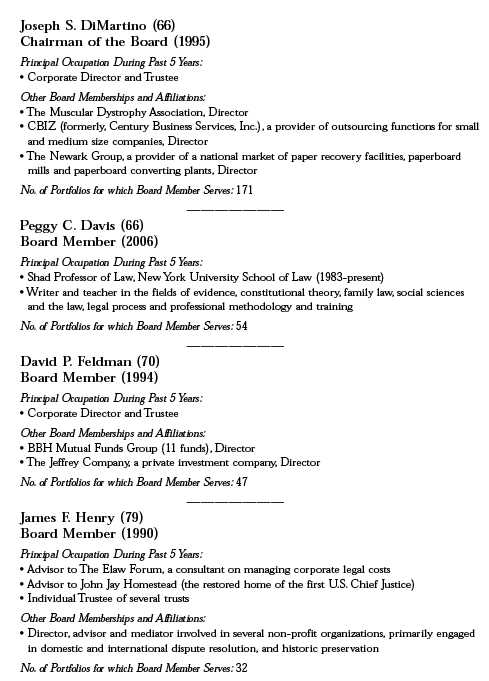

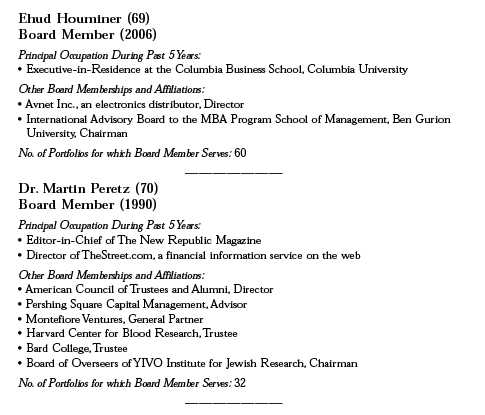

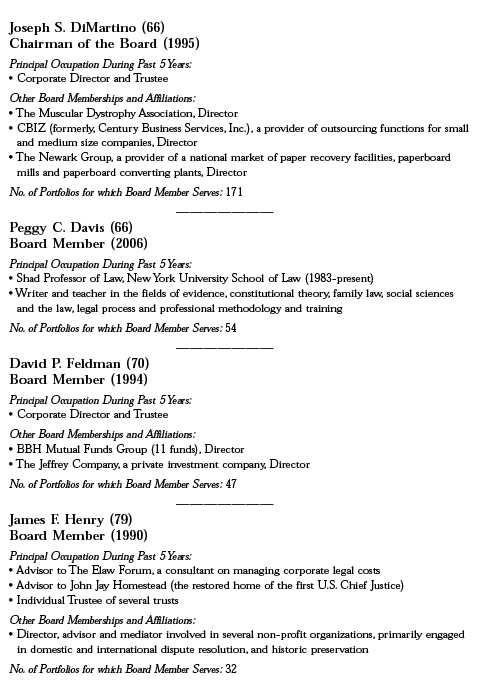

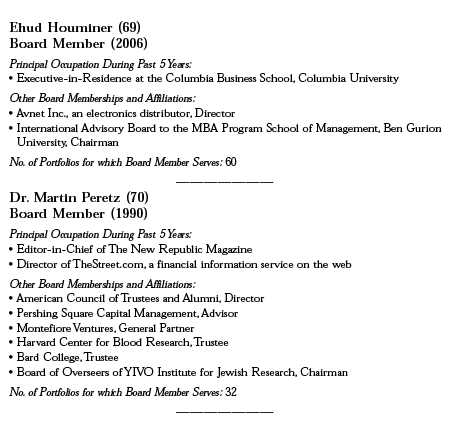

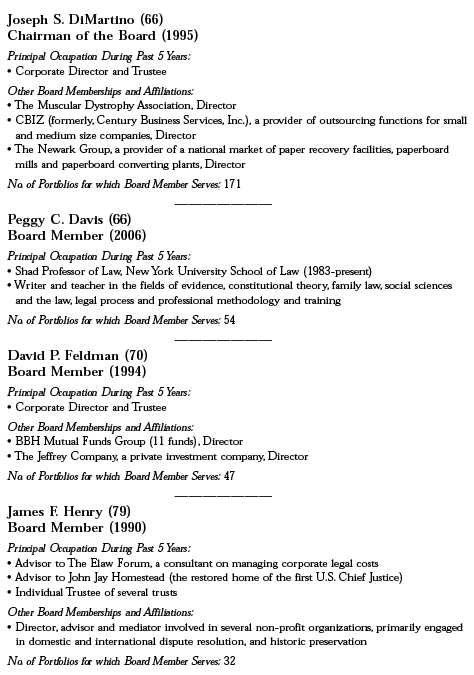

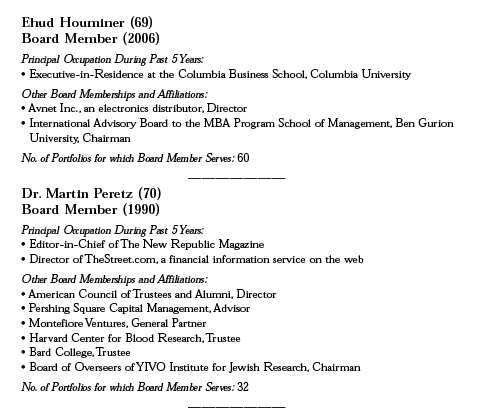

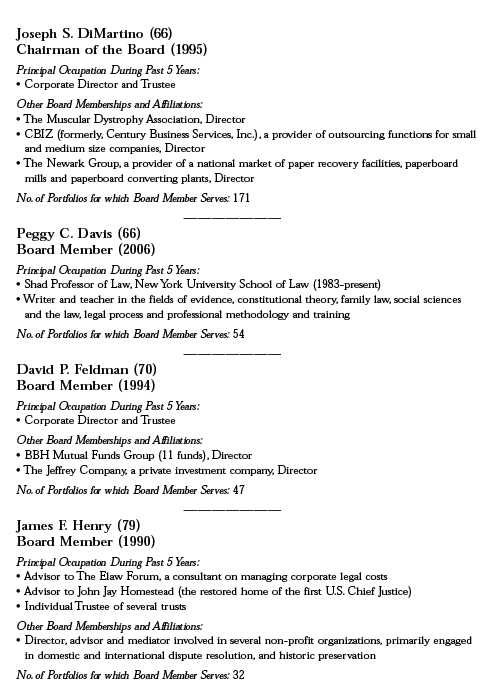

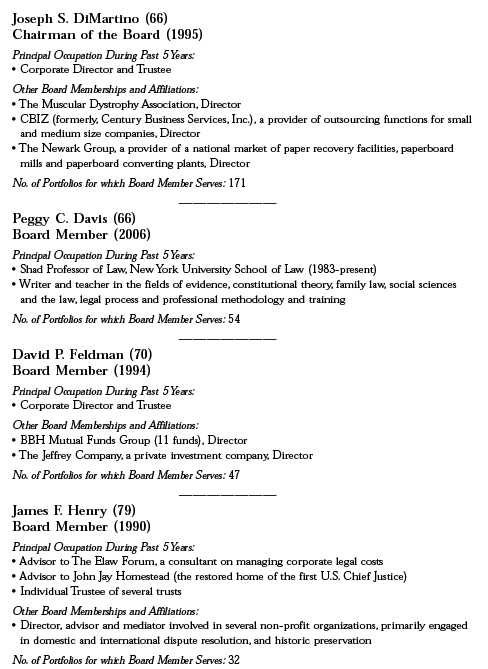

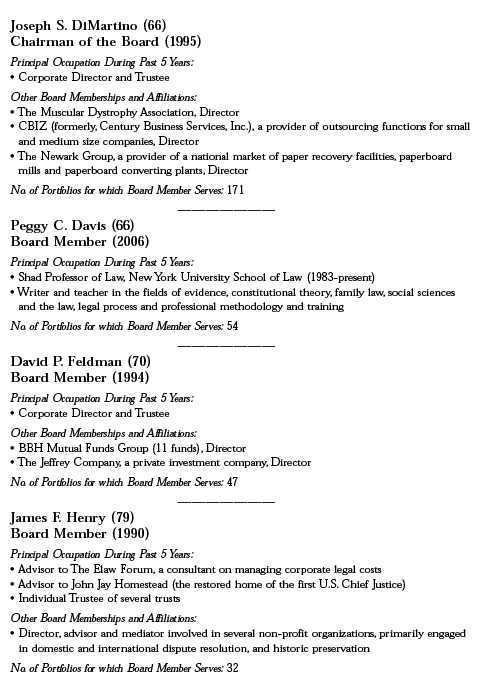

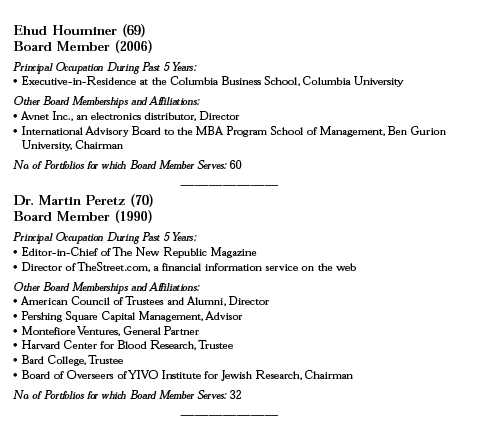

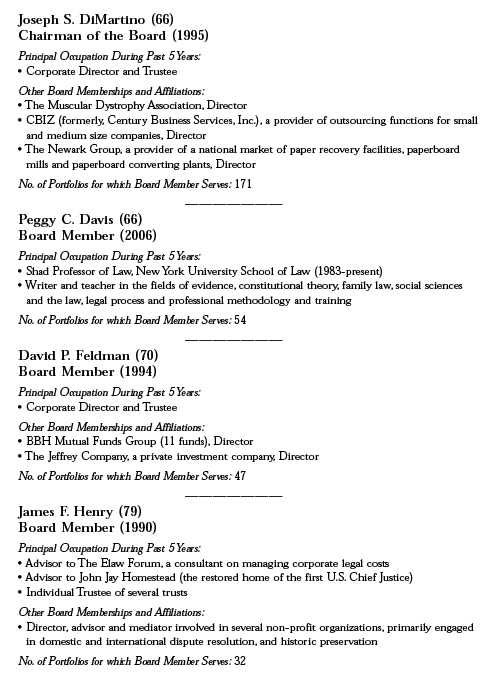

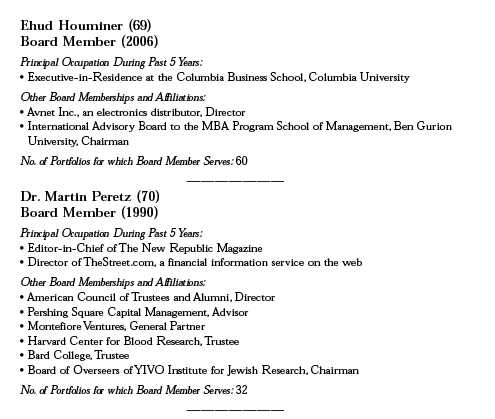

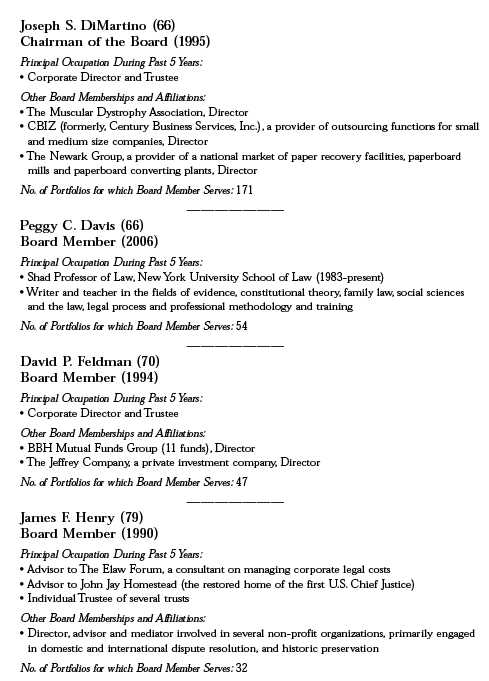

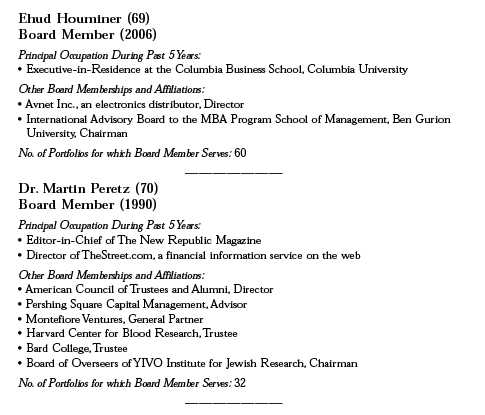

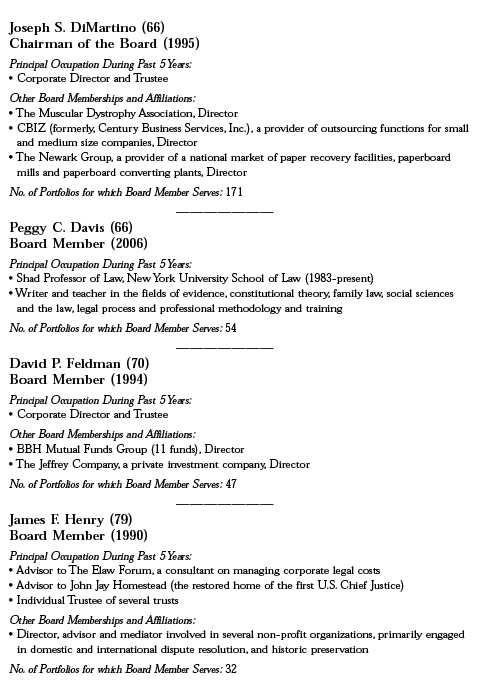

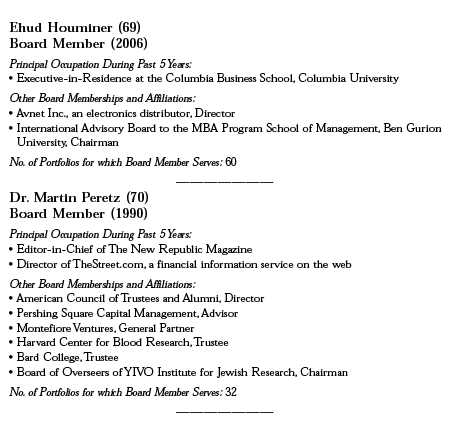

BOARD MEMBERS INFORMATION (Unaudited)

32

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

John M. Fraser, Jr., Emeritus Board Member

Rosalind G. Jacobs, Emeritus Board Member

Dr. Paul A. Marks, Emeritus Board Member

Gloria Messinger, Emeritus Board Member

The Fund 33

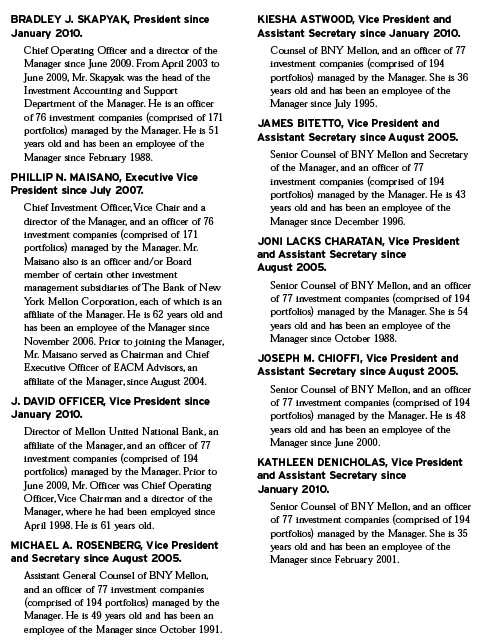

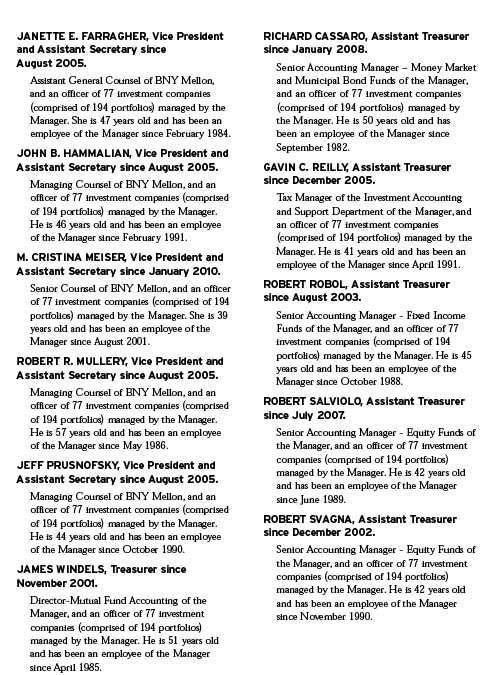

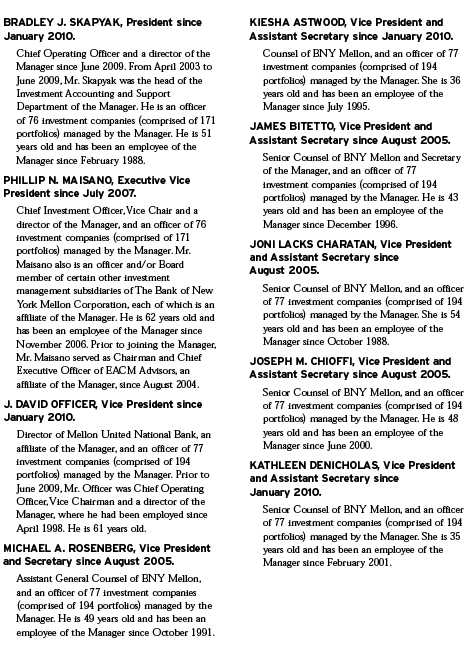

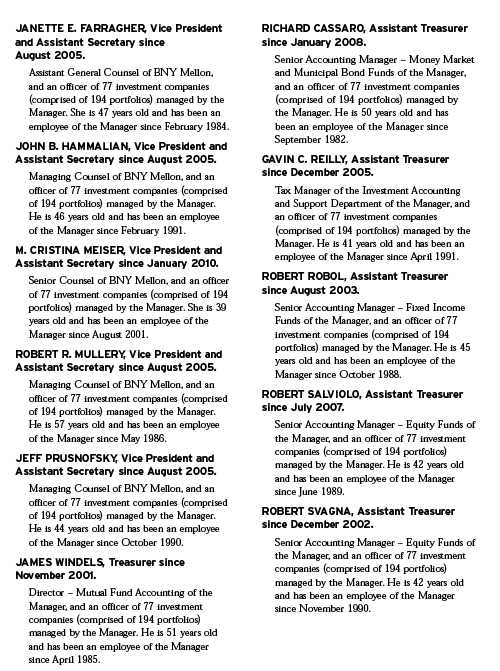

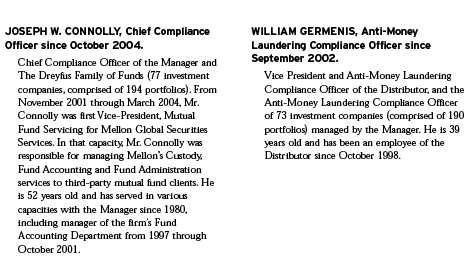

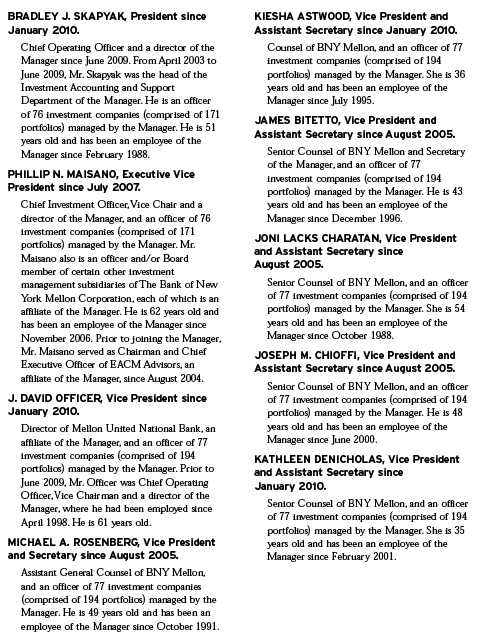

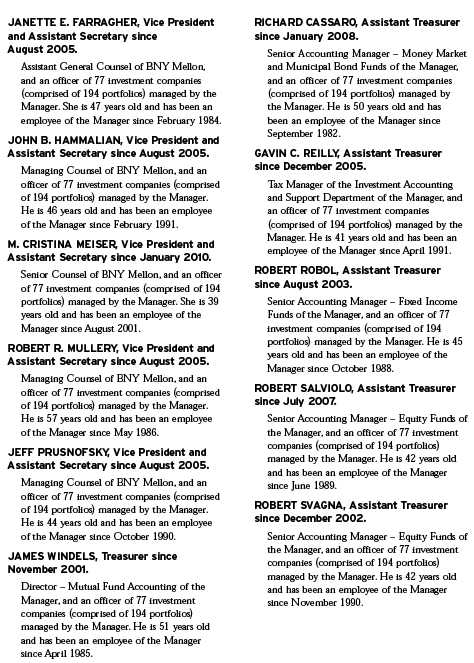

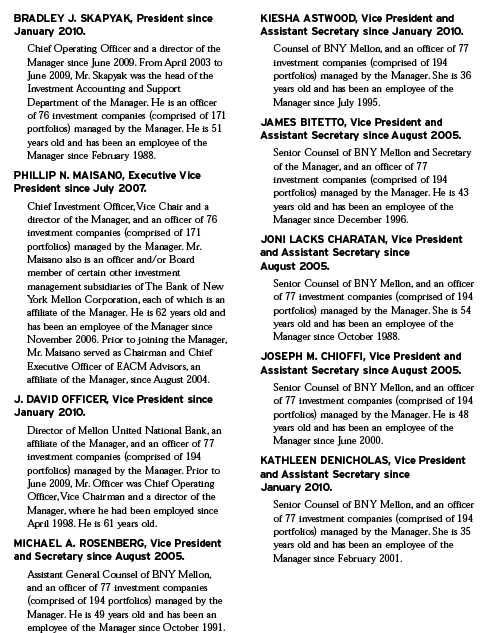

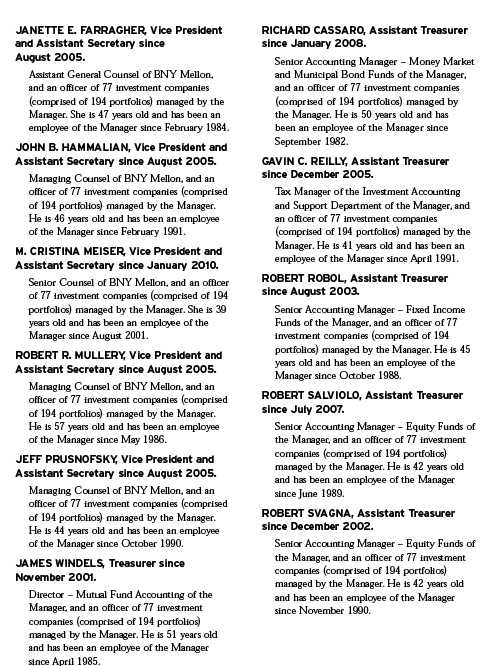

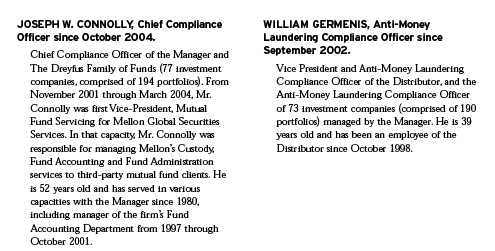

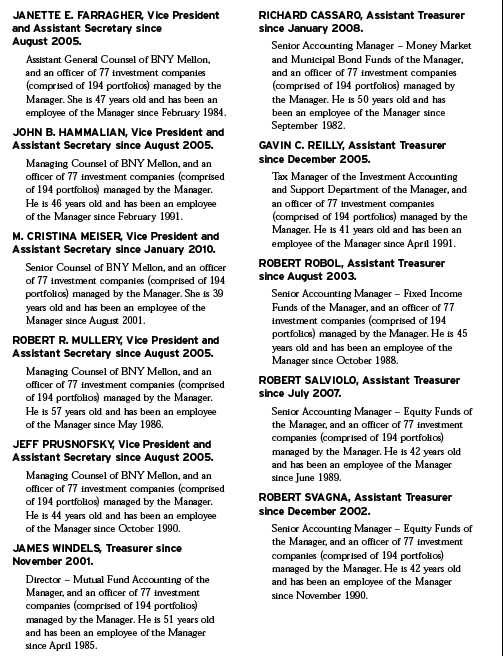

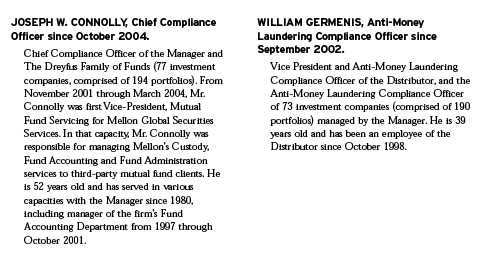

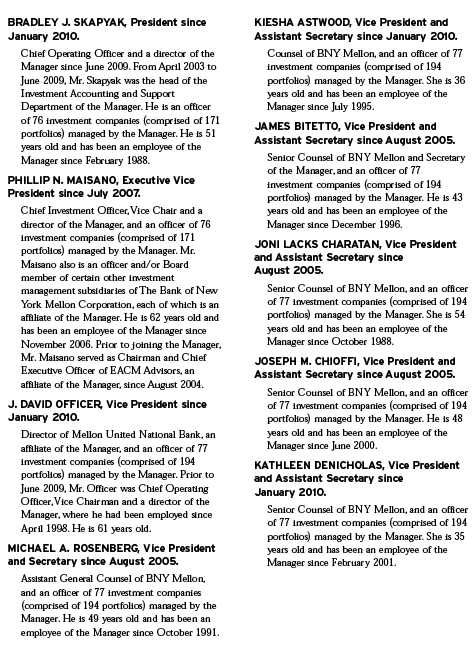

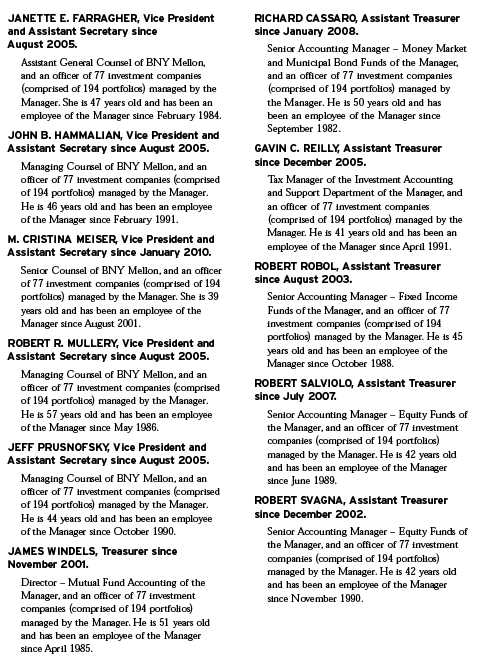

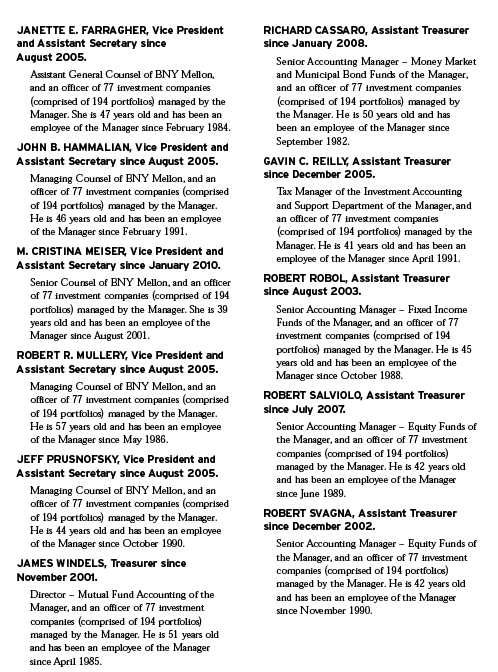

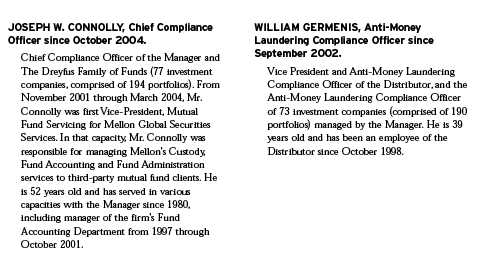

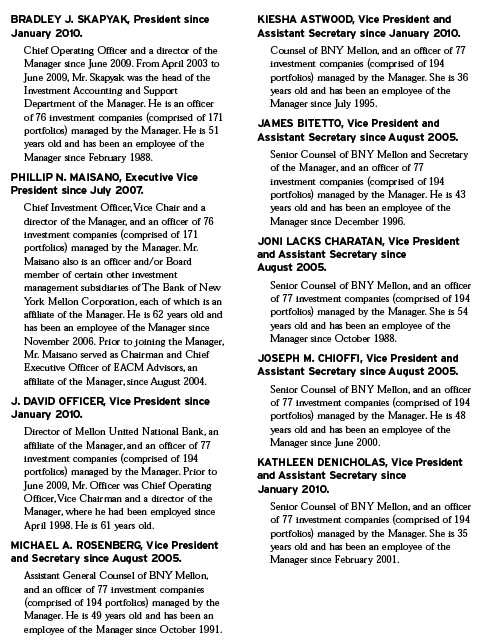

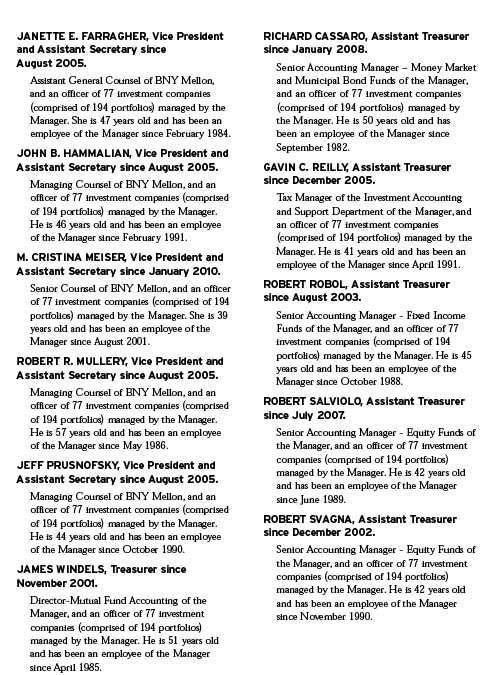

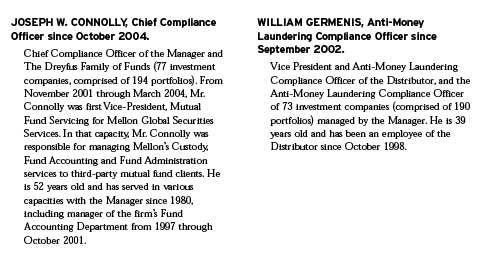

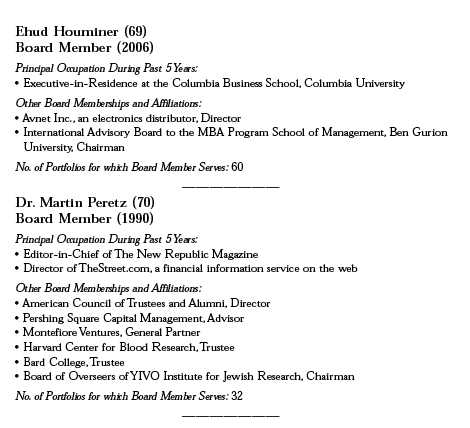

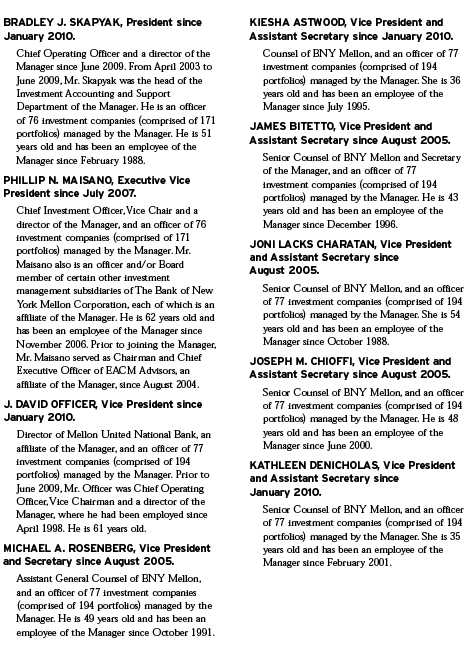

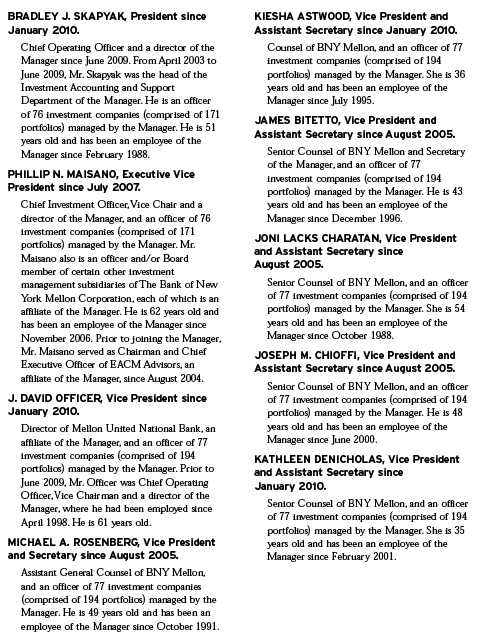

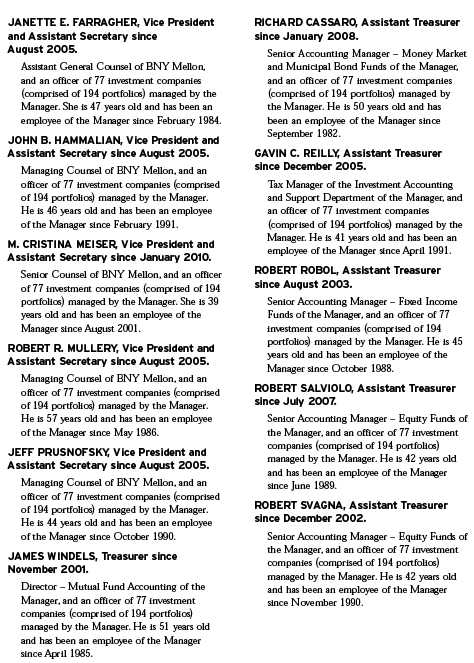

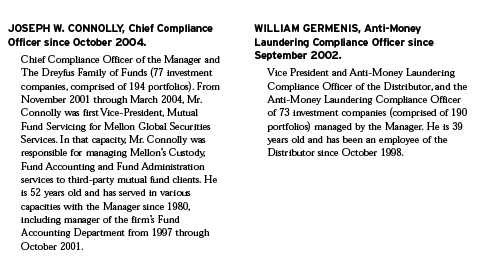

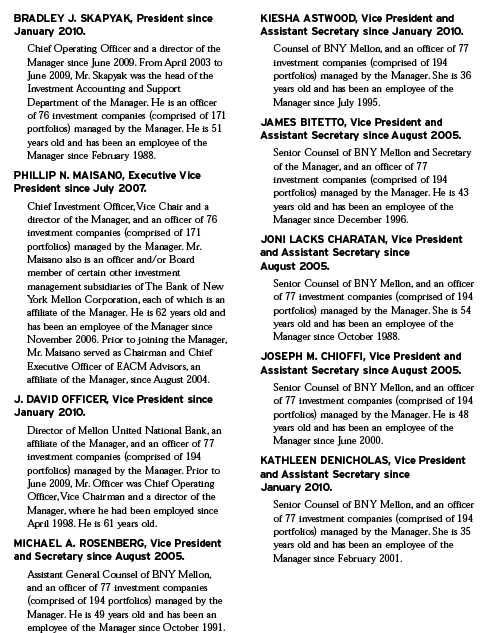

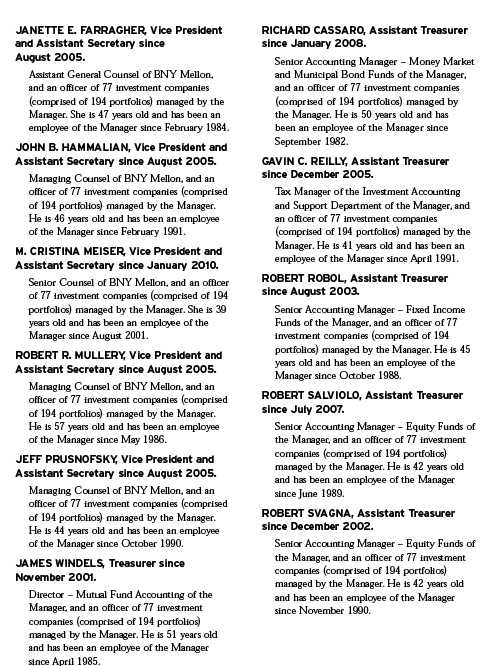

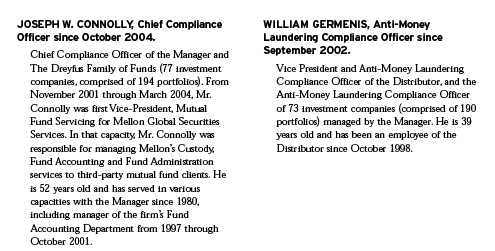

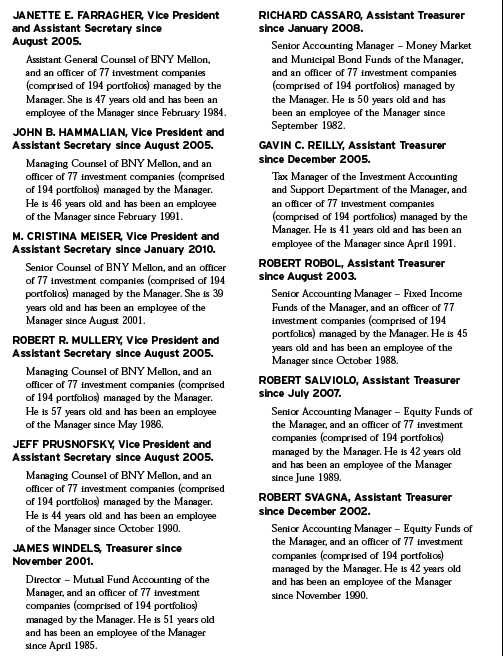

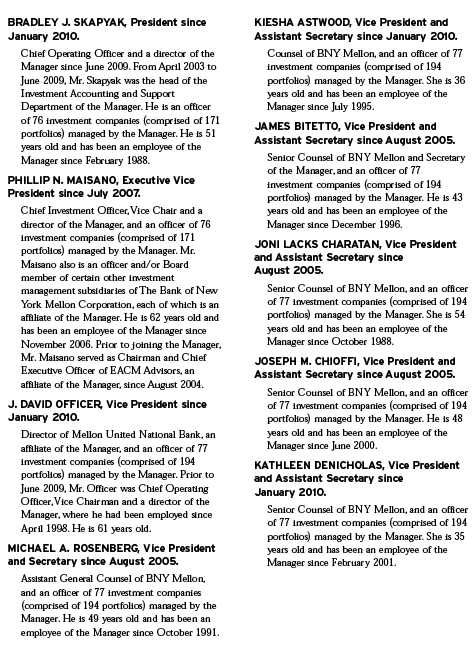

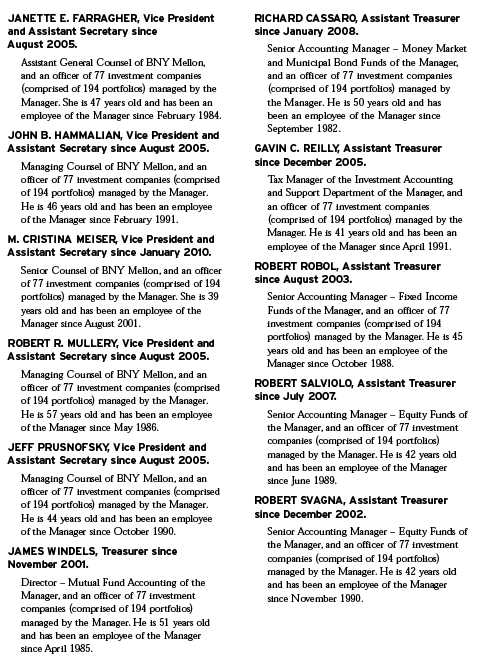

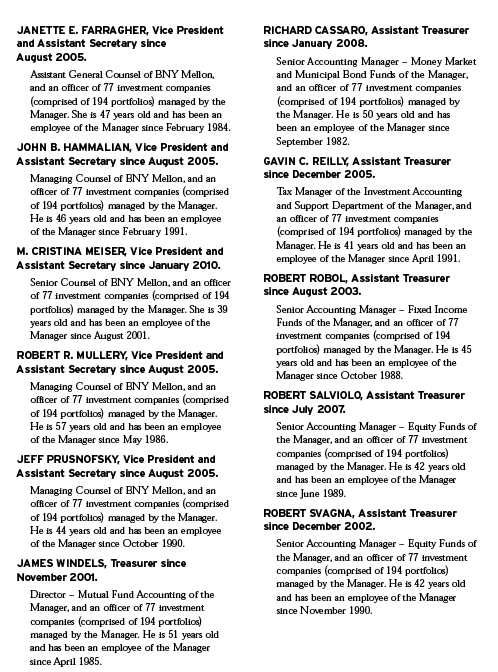

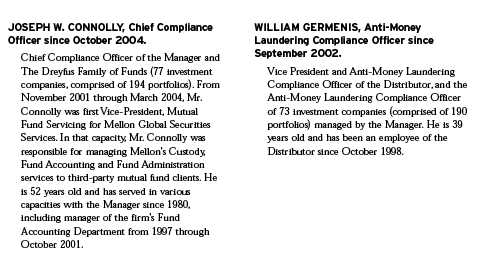

OFFICERS OF THE FUND (Unaudited)

34

The Fund 35

OFFICERS OF THE FUND (Unaudited) (continued)

36

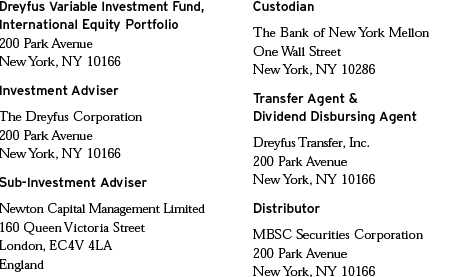

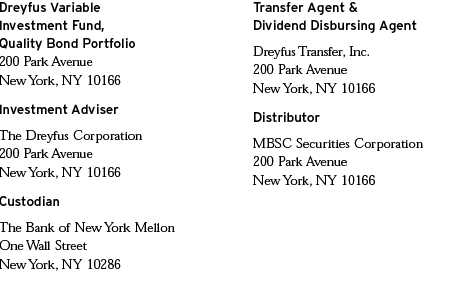

For More Information

|

| Telephone 1-800-554-4611 or 1-516-338-3300 |

| Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 |

| Attn: Investments Division |

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the most recent 12-month period ended June 30 is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

|

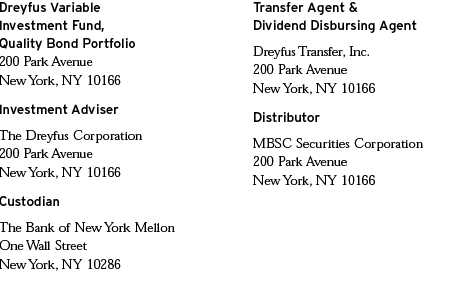

| Dreyfus Variable |

| Investment Fund, |

| Developing Leaders |

| Portfolio |

ANNUAL REPORT December 31, 2009

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 19 | Statement of Assets and Liabilities |

| 20 | Statement of Operations |

| 21 | Statement of Changes in Net Assets |

| 23 | Financial Highlights |

| 25 | Notes to Financial Statements |

| 34 | Report of Independent Registered Public Accounting Firm |

| 35 | Important Tax Information |

| 36 | Information About the Review and Approval of the Fund’s Investment Advisory Agreement |

| 41 | Board Members Information |

| 43 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus Variable Investment Fund,

Developing Leaders Portfolio

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Developing Leaders Portfolio, a series of Dreyfus Variable Investment Fund, covering the 12-month period from January 1, 2009, through December 31, 2009.

The U.S. stock market ended 2009 with a healthy annual gain, but market indices across all capitalization ranges and investment styles remained well below the peaks reached in the fall of 2007.The equity market’s advance was driven by improving investor sentiment as the U.S. economy staged a gradual, but sustained, recovery from the recession and banking crisis that had depressed stock prices at the beginning of the year. After four consecutive quarters of contraction, the U.S. economy returned to growth during the third quarter of 2009, buoyed by greater manufacturing activity to replenish depleted inventories and satisfy export demand. The slumping housing market also showed signs of renewed life later in the year when home sales and prices rebounded modestly. However, economic headwinds remain, including a high unemployment rate and the prospect of anemic consumer spending.

As 2010 begins, our Chief Economist, as well as many securities analysts and portfolio managers have continued to find opportunities and survey potential challenges across a variety of asset classes, including equities. While no one can predict the future, we believe that the 2010 investment environment will likely require a broader range of investment considerations relative to last year. As always, your financial adviser can help you determine the mix of investments that may be best suited to helping you achieve your goals at a level of risk that is comfortable for you.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

January 15, 2010

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2009, through December 31, 2009, as provided by Oliver Buckley, Langton C. Garvin and Kristin Crawford, Portfolio Managers

Fund and Market Performance Overview

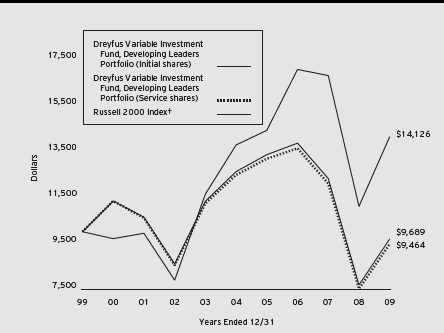

For the 12-month period ended December 31, 2009, Developing Leaders Portfolio,a series of Dreyfus Variable Investment Fund, produced a total return of 26.04% for its Initial shares, and its Service shares returned 25.77%.1 In comparison, the Russell 2000 Index (the “Index”), the fund’s benchmark, produced a total return of 27.17% for the same period.2

Following a recession-related slide during January and February 2009, stocks broadly rebounded as investors looked forward to better economic times. On average, small-cap stocks performed roughly on a par with their large-cap counterparts, and the fund participated in the market’s advance to a significant degree. However, underweighted exposure to highly leveraged, previously beaten down stocks during a time when investors favored such shares caused the fund’s returns to trail slightly behind the benchmark.

The Fund’s Investment Approach

We select small-cap stocks through a “bottom-up” approach that seeks to identify undervalued securities using a quantitative screening process. This process is driven by a proprietary quantitative model, which measures approximately 40 stock characteristics to identify and rank stocks. Over time, we attempt to construct a portfolio that has exposure to industries and market capitalizations generally similar to the fund’s benchmark.Within each sector, we seek to overweight the most attractive stocks and underweight or not hold the stocks that have been ranked least attractive.

Positive Investor Sentiment Fueled Market Rally

The first two months of 2009 saw more of the recession-related market declines that had characterized the second half of 2008 as a global recession and financial crisis continued to take its toll. During the first quarter of the year, most major stock market indices hit multi-year lows amid fears of frozen credit markets and depressed business conditions.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

However, stock prices began to rebound in March due to signs that aggressive remedial programs implemented by government and monetary authorities—including historically low short-term interest rates and a massive economic stimulus package—were gaining traction.

As the possibility of widespread bankruptcies receded, previously beaten-down companies with weak balance sheets and high degrees of leverage enjoyed especially robust gains. Conversely, stocks exhibiting several traditionally favorable qualities—such as consistently high levels of profitability and a consistent ability to pay interest on outstanding debt—significantly underperformed market averages. This trend persisted until the fourth quarter, when mounting evidence of sustainable economic improvement prompted an increasing number of investors to place greater emphasis on long-term growth prospects, management quality and valuations.

Performance Metrics Produced Some Successes

The market’s bias in favor of lower-quality stocks during much of the year generally worked in favor of the fund’s valuation metrics. At the same time, these same factors caused momentum metrics to detract from fund performance. As a result, stocks exhibiting good value and good momentum characteristics underperformed those exhibiting good value and weaker momentum.

The impact of this trend was most starkly apparent in the financials sector, where many firms that had appeared to be headed for bankruptcy in early 2009 multiplied in value after investors grew more confident of their survival.The fund invested in few such companies because they did not meet our investment criteria.Nevertheless,the fund participated substantially in the market’s surge, underperforming its benchmark by only a narrow margin. During the latter part of the year, as investors increasingly factored longer-term profitability and management quality into their calculations, the fund’s relative performance improved significantly.

Stock Selection Strategy Drove Fund Performance

Individual stock selections were the primary drivers of fund returns. Several outstanding performers doubled or tripled in value on the strength of better-than-expected earnings, far outpacing their sector and industry counterparts. Top holdings included greeting card publisher American Greetings, mobile communications equipment maker Starent Networks (which was sold during the period), business services provider

4

M & F Worldwide and customer relations servicer TeleTech Holdings. The fund also derived notably strong returns from bank holding company SVB Financial Group and dental equipment makers Sirona Dental Systems (also sold during the reporting period) and Align Technology.

On a more negative note, several biotechnology stocks produced significant disappointments.These included Martek Biosciences,ViroPharma and Myriad Genetics. Biotechnology-related returns also suffered from the fund’s lack of exposure to Human Genome Sciences, a benchmark holding that shot up after announcing successful results of new drug trial.Timing of the purchase and sale of shipping services provider Pacer International further detracted from the fund’s relative performance.

Staying the Course

As of the end of the reporting period, we are encouraged by a broadly based return of market sentiment to more rational and balanced investment criteria.The fund is structured to continue benefiting from market conditions that reward companies exhibiting strong momentum and valuation characteristics.While temporary market influences may undermine the effectiveness of our approach for brief periods, we believe that our consistent, disciplined stock selection process positions the fund to outperform its benchmark over the long term.

January 15, 2010

| |

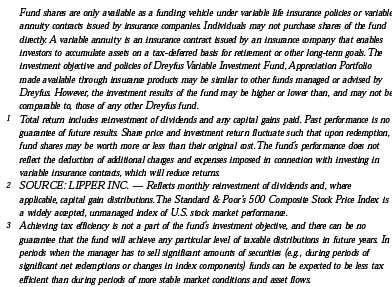

| | The fund is only available as a funding vehicle under various life insurance policies or variable |

| | annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund |

| | directly. A variable annuity is an insurance contract issued by an insurance company that enables |

| | investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals.The |

| | investment objective and policies of Developing Leaders Portfolio, a series of Dreyfus Variable |

| | Investment Fund, made available through insurance products may be similar to other funds |

| | managed or advised by Dreyfus. However, the investment results of the fund may be higher or |

| | lower than, and may not be comparable to, those of any other Dreyfus fund. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | fund shares may be worth more or less than their original cost.The fund’s performance does not |

| | reflect the deduction of additional charges and expenses imposed in connection with investing in |

| | variable insurance contracts, which will reduce returns. Return figures provided reflect the absorption |

| | of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through |

| | May 1, 2010, at which time it may be extended, terminated or modified. Had these expenses not |

| | been absorbed, the fund’s returns would have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | gain distributions.The Russell 2000 Index is an unmanaged index of small-cap stock performance |

| | and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 |

| | Index is composed of the 3,000 largest U.S. companies based on total market capitalization. |

The Fund 5

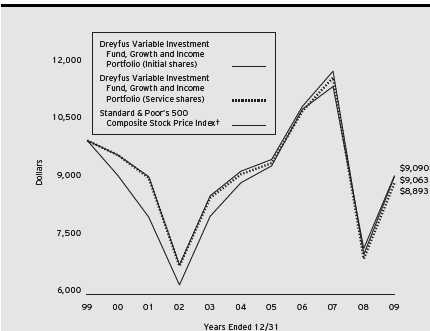

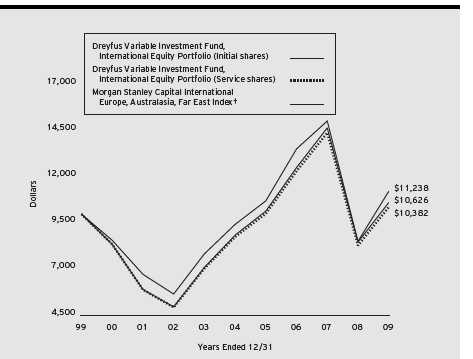

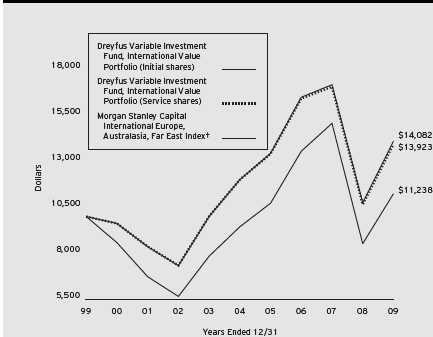

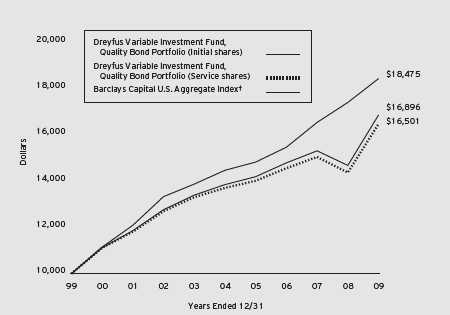

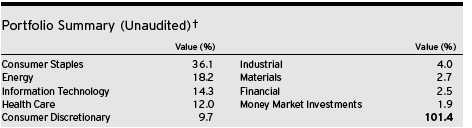

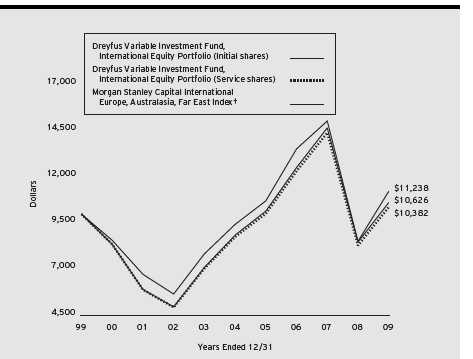

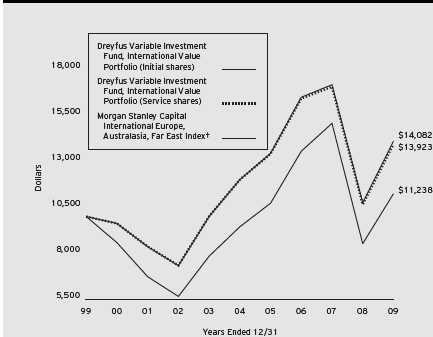

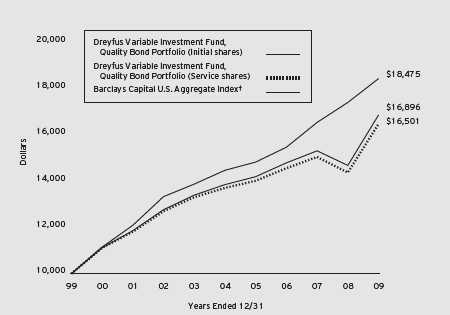

FUND PERFORMANCE

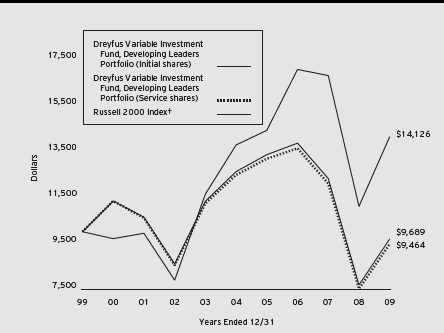

Comparison of change in value of $10,000 investment in Dreyfus Variable Investment Fund, Developing Leaders Portfolio Initial shares and Service shares and the Russell 2000 Index

| | | | | | |

| Average Annual Total Returns as of 12/31/09 | | | | | | |

| | 1 Year | 5 Years | 10 Years |

| Initial shares | 26.04% | –5.14% | –0.32% |

| Service shares | 25.77% | –5.37% | –0.55% |

|

| The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 |

| (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth |

| results would have been lower. See notes below. |

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection |

| with investing in variable insurance contracts which will reduce returns. |

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund, Developing Leaders Portfolio on 12/31/99 to a $10,000 investment made in the Russell 2000 Index (the |

| “Index”) on that date. |

6

The fund’s Initial shares are not subject to a Rule 12b-1 fee.The fund’s Service shares are subject to a 0.25% annual

Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the fund’s Initial shares from their

inception date through December 30, 2000, and the performance of the fund’s Service shares from December 31, 2000

(inception date of Service shares) to December 31, 2009 (blended performance figures).The blended performance figures

have not been adjusted to reflect the higher operating expenses of the Service shares. If these expenses had been reflected, the

blended performance figures would have been lower.All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph takes into account all applicable fund fees and expenses.The Index is an

unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000

Index is composed of 3,000 of the largest U.S. companies by market capitalization. Unlike a mutual fund, the Index is

not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating

to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of

the prospectus and elsewhere in this report.

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund, Developing Leaders Portfolio from July 1, 2009 to December 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

|

| Expenses and Value of a $1,000 Investment |

| assuming actual returns for the six months ended December 31, 2009 |

| | | | |

| | | Initial Shares | | Service Shares |

| Expenses paid per $1,000† | $ | 3.95 | $ | 5.36 |

| Ending value (after expenses) | $ | 1,240.90 | $ | 1,239.50 |

|

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

|

| Expenses and Value of a $1,000 Investment |

| assuming a hypothetical 5% annualized return for the six months ended December 31, 2009 |

| | | | |

| | | Initial Shares | | Service Shares |

| Expenses paid per $1,000† | $ | 3.57 | $ | 4.84 |

| Ending value (after expenses) | $ | 1,021.68 | $ | 1,020.42 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .70% for Initial Shares and .95% for Service Shares, |

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

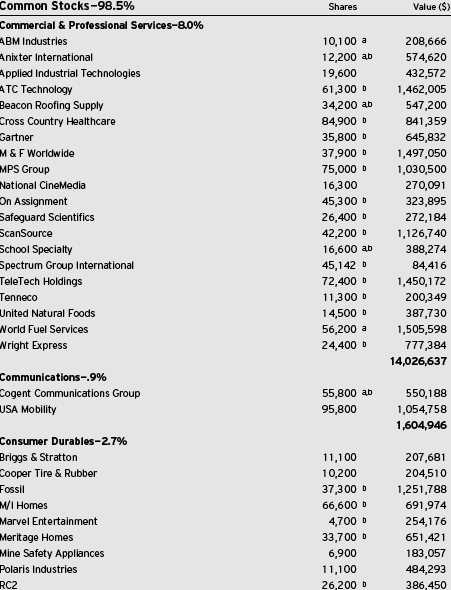

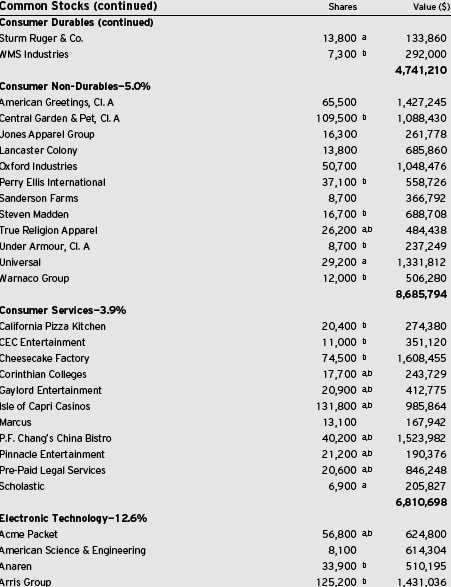

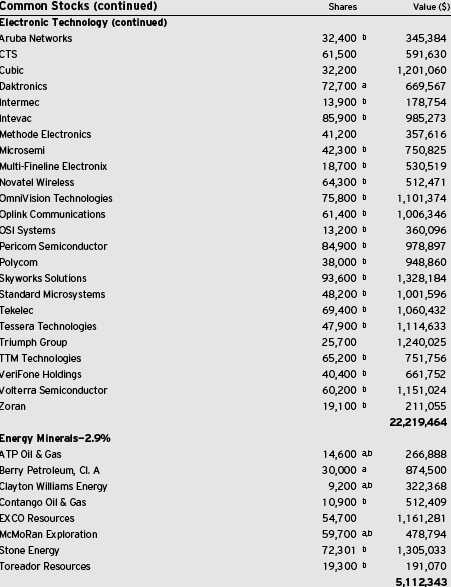

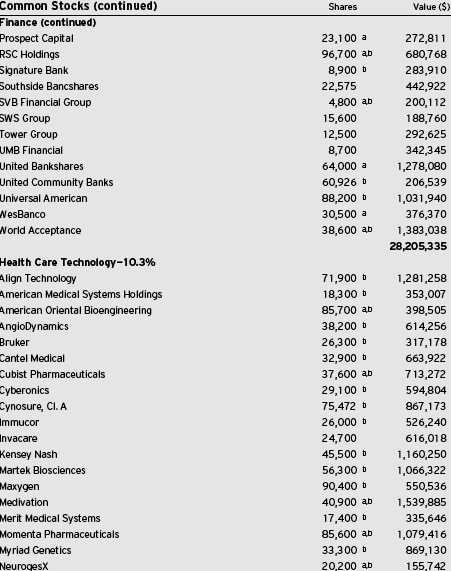

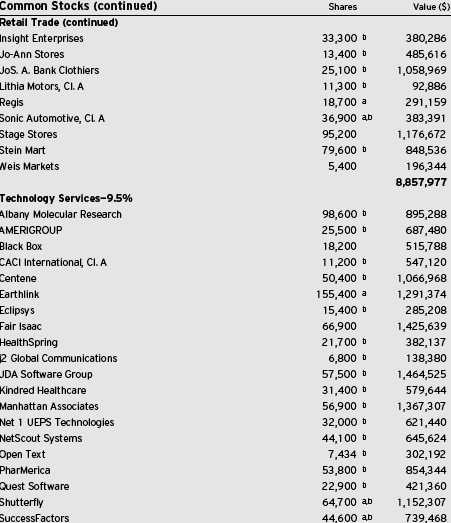

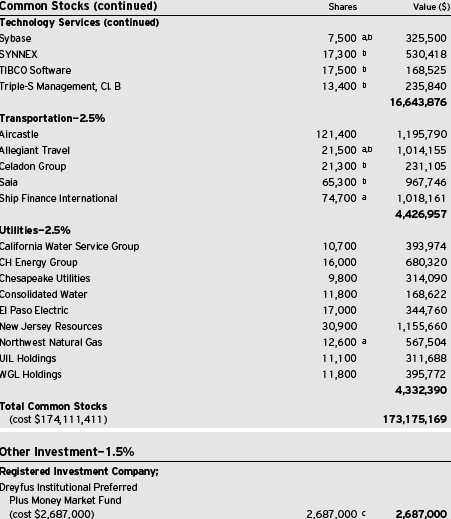

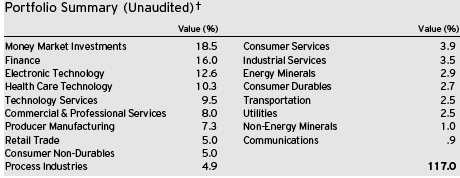

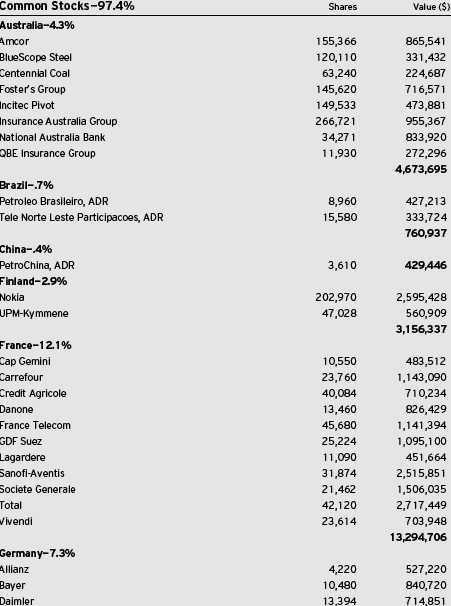

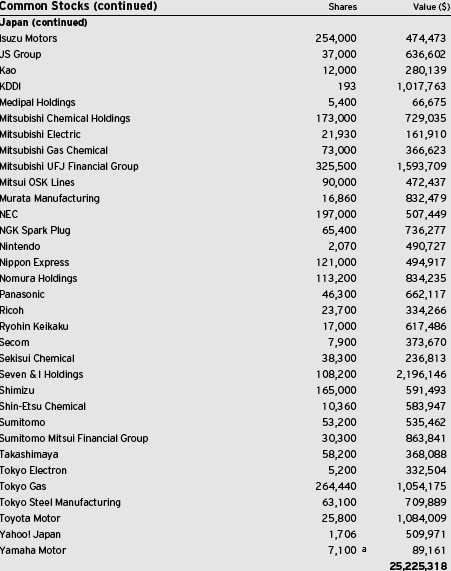

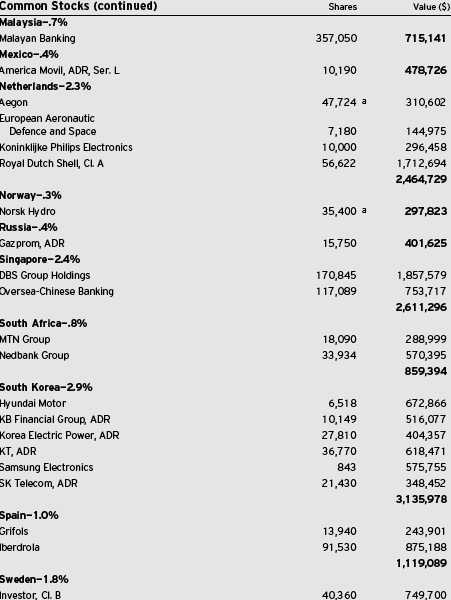

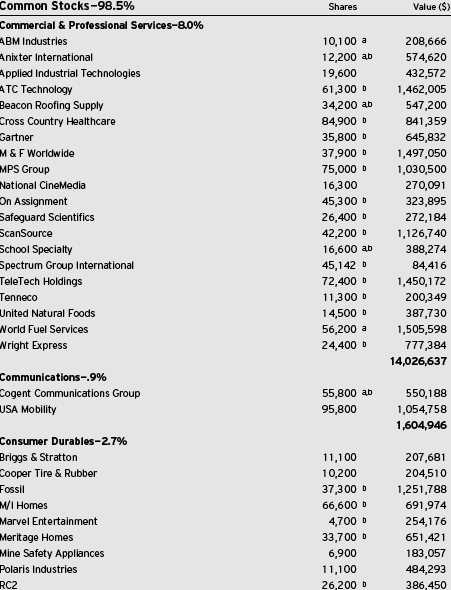

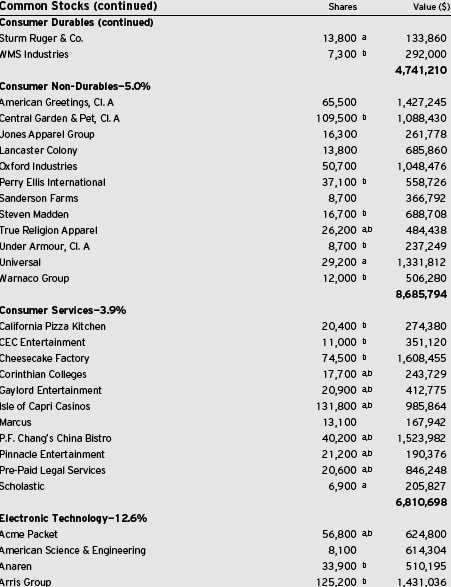

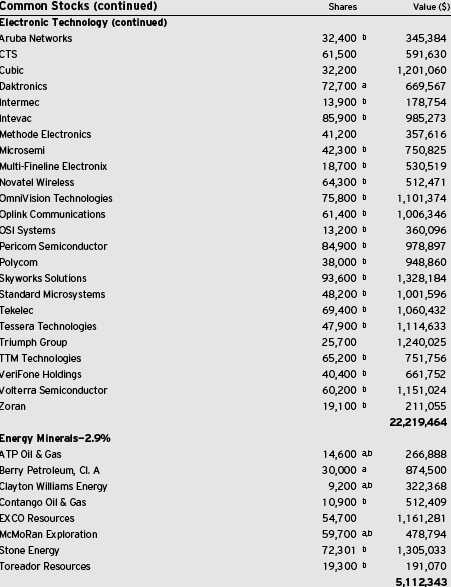

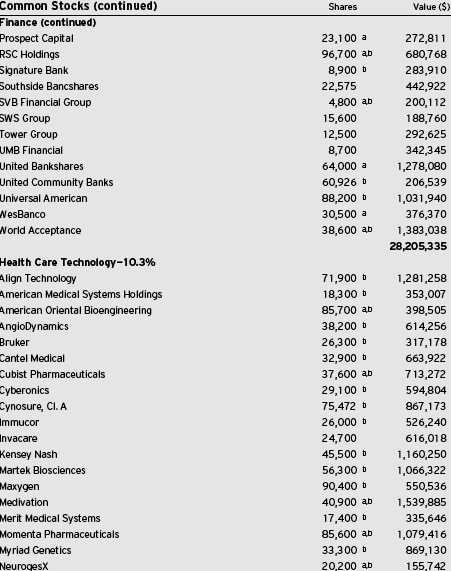

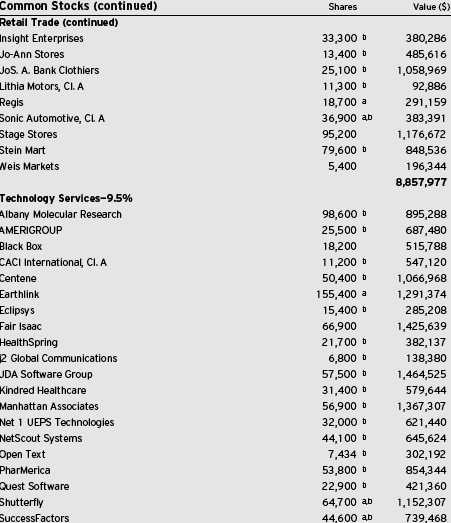

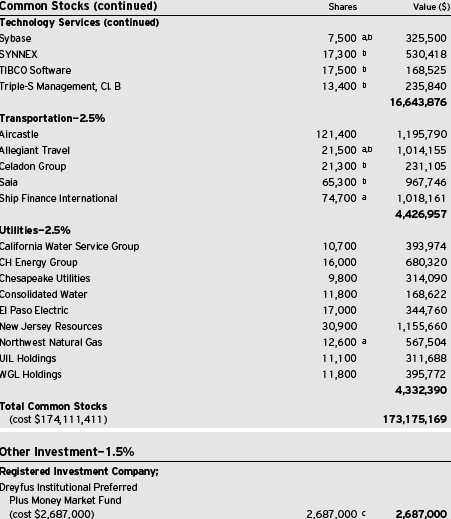

STATEMENT OF INVESTMENTS

December 31, 2009

The Fund 9

STATEMENT OF INVESTMENTS (continued)

10

The Fund 11

STATEMENT OF INVESTMENTS (continued)

12

The Fund 13

STATEMENT OF INVESTMENTS (continued)

14

The Fund 15

STATEMENT OF INVESTMENTS (continued)

16

The Fund 17

STATEMENT OF INVESTMENTS (continued)

|

| a Security, or portion thereof, on loan. At December 31, 2009, the total market value of the fund’s securities on loan is |

| $28,548,619 and the total market value of the collateral held by the fund is $29,895,533. |

| b Non-income producing security. |

| c Investment in affiliated money market mutual fund. |

|

| † Based on net assets. |

| See notes to financial statements. |

18

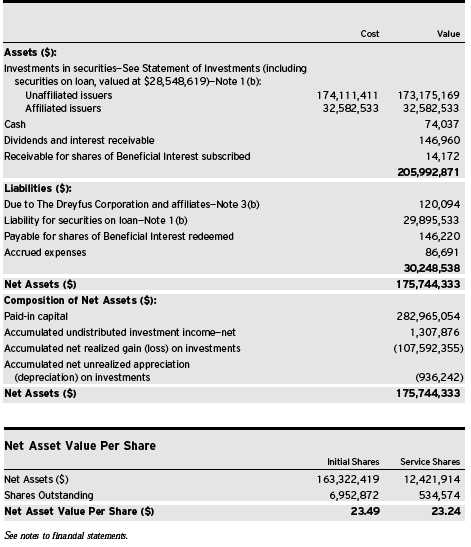

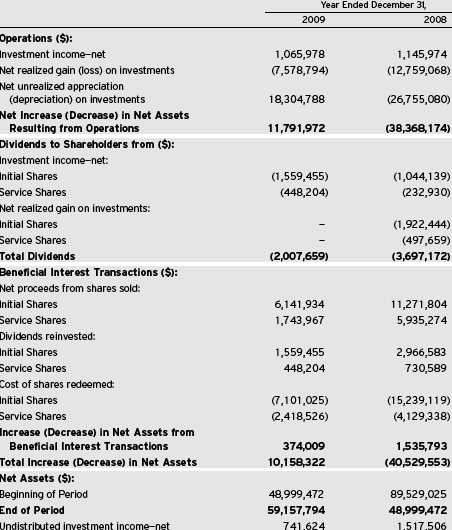

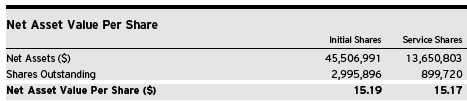

|

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2009 |

The Fund 19

|

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2009 |

20

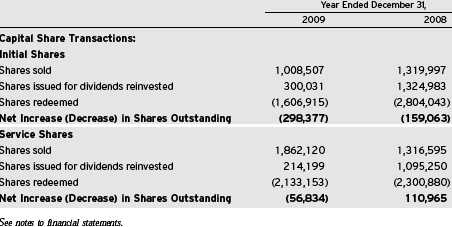

STATEMENT OF CHANGES IN NET ASSETS

The Fund 21

STATEMENT OF CHANGES IN NET ASSETS (continued)

22

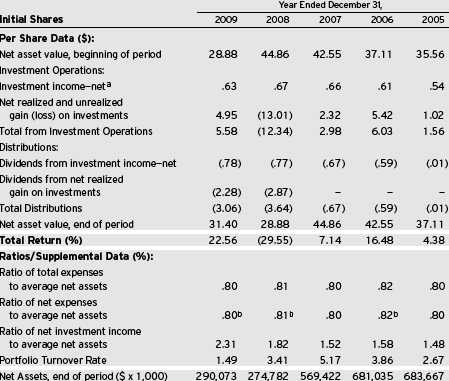

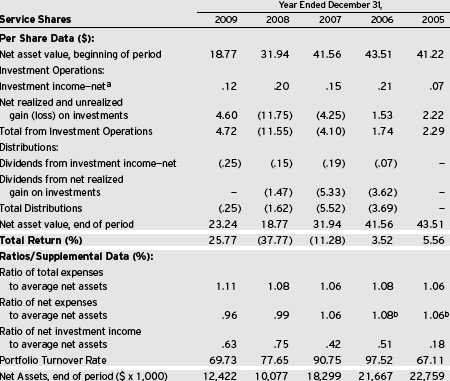

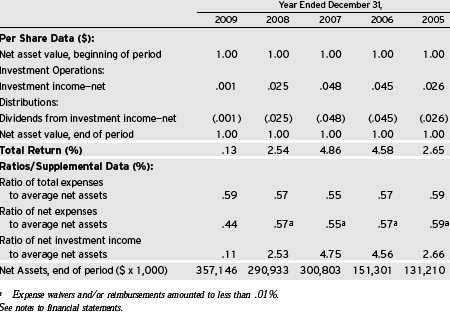

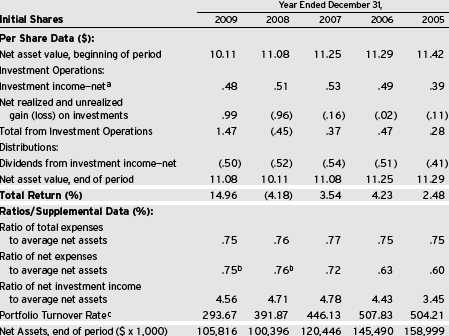

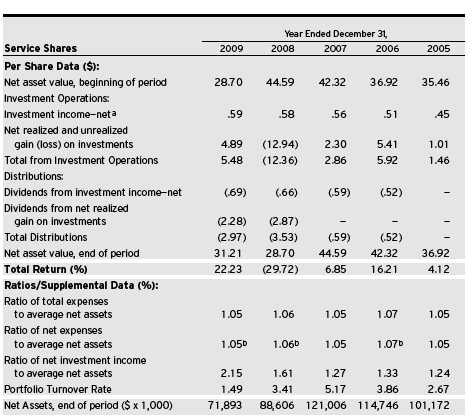

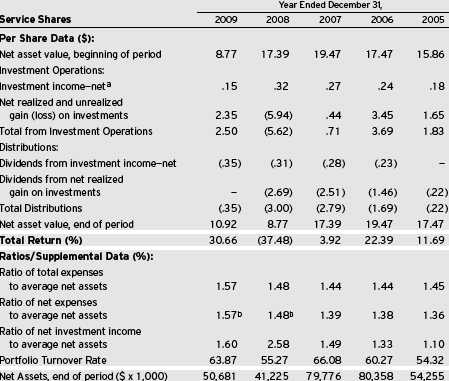

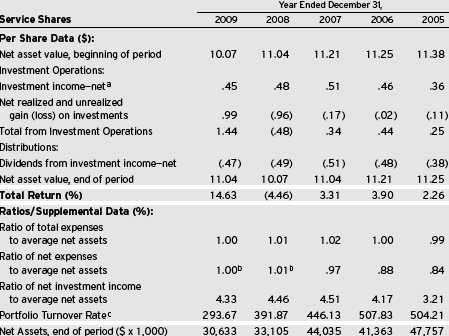

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts.These figures have been derived from the fund’s financial statements.

| |

| a | Based on average shares outstanding at each month end. |

| b | Expense waivers and/or reimbursements amounted to less than .01%. |

See notes to financial statements.

The Fund 23

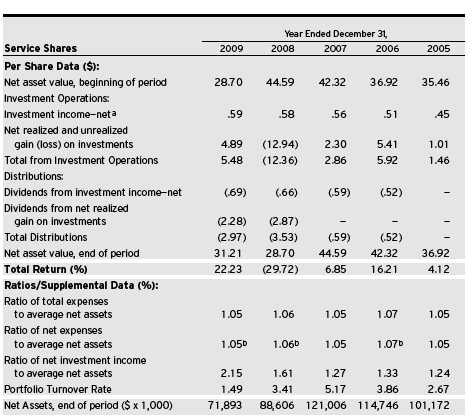

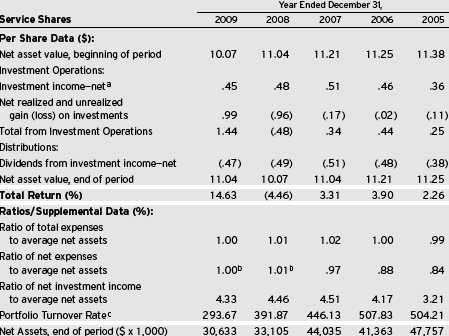

FINANCIAL HIGHLIGHTS (continued)

| |

| a | Based on average shares outstanding at each month end. |

| b | Expense waivers and/or reimbursements amounted to less than .01%. |

See notes to financial statements.

24

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

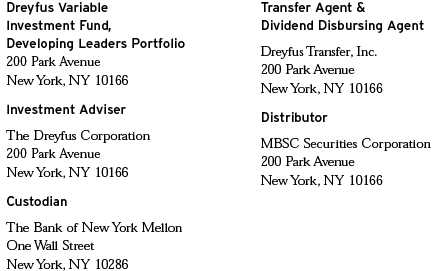

DreyfusVariable Investment Fund (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company, operating as a series company currently offering seven series, including the Developing Leaders Portfolio (the “fund”). The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The fund is a diversified series.The fund’s investment objective is capital growth.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) has become the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

of authoritative GAAP for SEC registrants. The ASC has superseded all existing non-SEC accounting and reporting standards. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or officia l closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may

26

be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own

assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

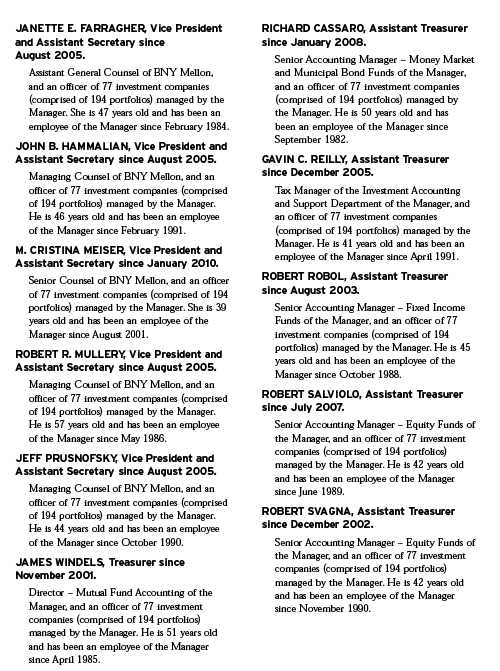

The following is a summary of the inputs used as of December 31, 2009 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Equity Securities— | | | | |

| Domestic† | 170,639,792 | — | — | 170,639,792 |

| Equity Securities— | | | | |

| Foreign† | 2,535,377 | — | — | 2,535,377 |

| Mutual Funds | 32,582,533 | — | — | 32,582,533 |

| |

| † | See Statement of Investments for industry classification. |

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all

28

income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended December 31, 2009,The Bank of New York Mellon earned $105,157 from lending portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2009, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended December 31, 2009 remains subject to examination by the Internal Revenue Service and state taxing authorities.

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2009, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $1,355,392, accumulated capital losses $107,316,986 and unrealized depreciation $983,761. In addition, the fund had $275,366 of capital losses realized after October 31, 2009 which were deferred for tax purposes to the first day of the following fiscal year.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2009. If not applied, $56,692,295 of the carryover expires in fiscal 2016 and $50,624,691 expires in fiscal 2017.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2009 and December 31, 2008, were as follows: ordinary income $2,487,911 and $9,843,199 and long-term capital gains $0 and $13,673,188, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended December 31, 2009, was approximately $13,900, with a related weighted average annualized interest rate of 1.55%.

NOTE 3—Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an investment advisory agreement with the Manager, the investment advisory fee is computed at the annual rate of .75% of the value of the fund’s average daily net assets and is payable monthly.

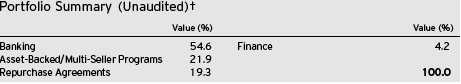

30