UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 5125 |

| |

| DREYFUS VARIABLE INVESTMENT FUND | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Janette E. Farragher, Esq. 200 Park Avenue New York, New York 10 166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 12/31 | |

Date of reporting period: | 12/31/2011 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

|

| Dreyfus Variable |

| Investment Fund, |

| Appreciation Portfolio |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

|

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 12 | Statement of Assets and Liabilities |

| 13 | Statement of Operations |

| 14 | Statement of Changes in Net Assets |

| 16 | Financial Highlights |

| 18 | Notes to Financial Statements |

| 29 | Report of Independent Registered Public Accounting Firm |

| 30 | Important Tax Information |

| 31 | Board Members Information |

| 33 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus Variable Investment Fund,

Appreciation Portfolio

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We present to you this annual report for Dreyfus Variable Investment Fund, Appreciation Portfolio, covering the 12-month period from January 1, 2011, through December 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The generally mild returns produced by the U.S. stock market in 2011 belie the pronounced volatility affecting equities over much of the year. Day-to-day market movements were often tumultuous, driven by macroeconomic developments ranging from catastrophic natural disasters in Japan to an unprecedented downgrade of long-term U.S. debt securities and the resurgence of a sovereign debt crisis in Europe. Still, U.S. corporations achieved record-setting profits, on average, even as market valuations dropped below historical norms.A fundamentals-based investment approach proved relatively ineffective in a market fueled mainly by emotion, causing most active portfolio managers to lag market averages.

We are hopeful that equity investors will adopt a more rational perspective in 2012. Our economic forecast calls for a mild acceleration of the U.S. recovery as the domestic banking system regains strength, credit conditions loosen and housing markets begin a long-awaited convalescence. Of course, we encourage you to talk with your financial adviser to help ensure that your investment objectives are properly aligned with your risk tolerance in pursuing potential market opportunities in 2012.

Thank you for your continued confidence and support.

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2011, through December 31, 2011, as provided by Fayez Sarofim, Portfolio Manager of Fayez Sarofim & Co., Sub-InvestmentAdviser

Fund and Market Performance Overview

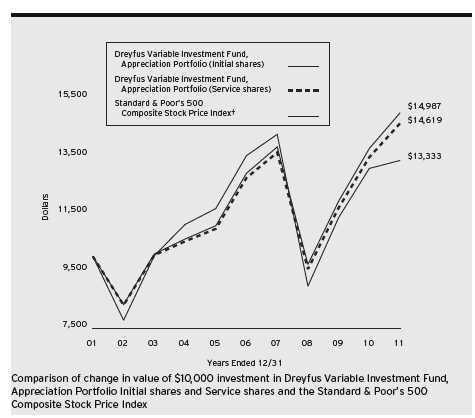

For the 12-month period ended December 31, 2011, DreyfusVariable Investment Fund, Appreciation Portfolio’s Initial shares produced a total return of 9.01%, and its Service shares produced a total return of 8.74%.1 In comparison, the total return of the fund’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), was 2.09% for the same period.2

Macroeconomic disappointments throughout the world weighed on equity markets during much of 2011, but rallies in the first and fourth quarters enabled the S&P 500 Index to end the year in positive territory. The fund produced higher returns than its benchmark as risk-averse investors turned to the kinds of large, multinational companies that the fund favors.

The Fund’s Investment Approach

The fund seeks long-term capital growth consistent with the preservation of capital. Its secondary goal is current income. To pursue these goals, the fund normally invests at least 80% of its assets in common stocks. The fund focuses on blue-chip companies with total market capitalizations of more than $5 billion at the time of purchase, including multinational companies. These are established companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence and the potential to achieve predictable, above-average earnings growth.

In choosing stocks, the fund first identifies economic sectors it believes will expand over the next three to five years or longer. Using fundamental analysis, the fund then seeks companies within these sectors that have proven track records and dominant positions in their industries. The fund employs a “buy-and-hold” investment strategy, which generally has resulted in an annual portfolio turnover of below 15%.A low portfolio turnover rate helps reduce the fund’s trading costs and minimizes tax liability by limiting the distribution of capital gains.3

DISCUSSION OF FUND PERFORMANCE (continued)

Global Economic Developments Roiled Equity Markets

Improvements in U.S. economic data supported stock prices at the start of 2011, but political unrest in the Middle East and catastrophic natural and nuclear disasters in Japan soon interrupted the rally. Nonetheless, investors continued to look forward to better business conditions, and stocks rebounded from these unexpected shocks by the end of the first quarter.

Investors’ hopes for a more robust recovery were dashed in late April, when Greece appeared headed for default on its sovereign debt and the crisis spread to other European nations. In addition, U.S. economic data proved more disappointing than expected, and investors reacted cautiously to a contentious political debate regarding U.S. government spending and borrowing. Consequently, newly risk-averse investors moved away from more speculative investments and toward traditionally defensive industries and companies. Market declines were particularly severe in August and September, after a major credit-rating agency downgraded its assessment of long-term U.S. government debt. In contrast, the market rebounded from October through December when U.S. economic data improved and European policymakers made some progress in addressing the region’s problems.

Multinational Leaders Buoyed Fund Performance

In the turbulent market environment, skittish investors flocked to blue-chip companies with generous dividend yields, a presence in global markets and strong balance sheets.The fund particularly benefited from underweighted exposure to the financials sector, which helped it avoid weakness among banks affected by Europe’s debt crisis and a stricter U.S. regulatory environment. In the consumer staples sector, tobacco producer Philip Morris International encountered rising global demand, while Altria Group and Coca-Cola benefited from renewed investor interest in traditionally defensive companies with substantially positive cash flows. Industry giants Apple and International Business Machines fared well in the information technology sector. Other top performers included casual dining chain McDonald’s and large integrated energy companies Exxon Mobil and Chevron.

The materials sector fared less well during the reporting period, as metal producers Freeport-McMoRan Copper & Gold and Rio Tinto

4

suffered amid falling industrial commodity prices. The fund held no exposure to the utilities and telecommunications services sectors, which generally beat market averages despite growth characteristics that did not meet our investment criteria. Banking giant JPMorgan Chase & Co. was hurt by industry-wide concerns stemming from Europe’s debt crisis, and luxury goods purveyor Christian Dior suffered despite strong business fundamentals due to worries over the European financial crisis and potential contagion.

Investors Remain Focused on High-Quality Companies

We expect the global economic rebound to persist fitfully amid significant headwinds, leading us to conclude that investors are likely to continue to favor large, multinational companies with solid business fundamentals and strong income characteristics. Indeed, corporate earnings in 2011 generally remained robust despite the economic downturn, while equity valuations have become more attractive.When adjusting to the changing market environment, we identified a number of new opportunities among multinational companies with healthy balance sheets, ample cash reserves and a presence in growing markets, and we eliminated some older positions to make room for these opportunities.

January 17, 2012

| |

| | Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment |

| | style risks, among other factors, to varying degrees, all of which are more fully described in the |

| | fund’s prospectus. |

| | Fund shares are only available as a funding vehicle under variable life insurance policies or variable |

| | annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund |

| | directly.A variable annuity is an insurance contract issued by an insurance company that enables |

| | investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | guarantee of future results. Share price and investment return fluctuate such that upon redemption |

| | fund shares may be worth more or less than their original cost.The fund’s performance does not |

| | reflect the deduction of additional charges and expenses imposed in connection with investing in |

| | variable insurance contracts, which will reduce returns. |

| 2 | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends and, where |

| | applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is |

| | a widely accepted, unmanaged index of U.S. stock market performance. Investors cannot invest |

| | directly in an index. |

| 3 | Achieving tax efficiency is not a part of the fund’s investment objective, and there can be no |

| | guarantee that the fund will achieve any particular level of taxable distributions in future years. In |

| | periods when the manager has to sell significant amounts of securities (e.g., during periods of |

| | significant net redemptions or changes in index components) funds can be expected to be less tax |

| | efficient than during periods of more stable market conditions and asset flows. |

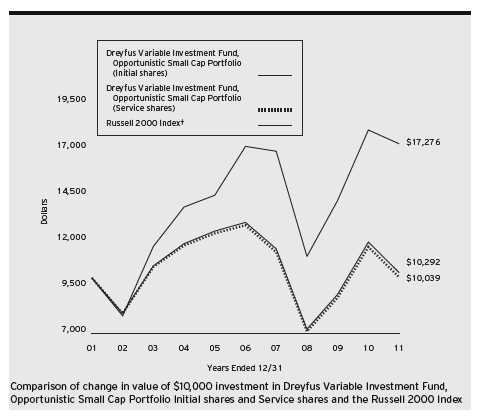

FUND PERFORMANCE

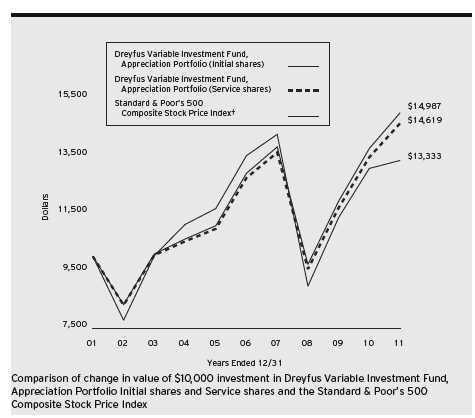

| | | | | | |

| Average Annual Total Returns as of 12/31/11 | | | |

| | 1Year | 5 Years | 10 Years |

| Initial shares | 9.01% | 3.06% | 4.13% |

| Service shares | 8.74% | 2.80% | 3.87% |

| Standard & Poor’s 500 | | | |

| Composite Stock Price Index | 2.09% | –0.25% | 2.92% |

|

| † Source: Lipper Inc. |

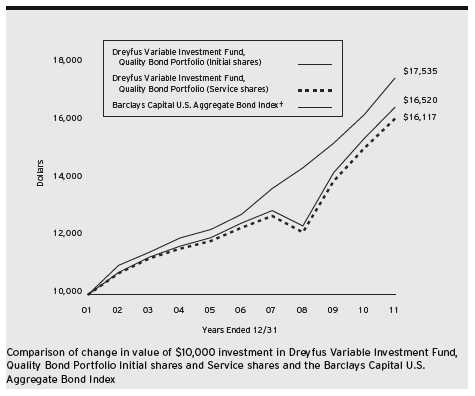

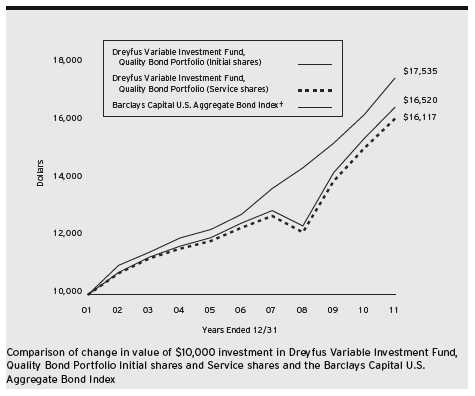

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection |

| with investing in variable insurance contracts which will reduce returns. |

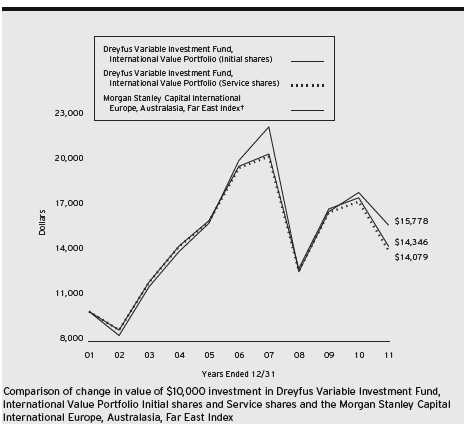

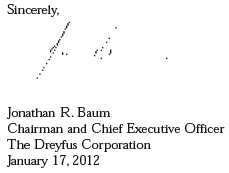

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund,Appreciation Portfolio on 12/31/01 to a $10,000 investment made in the Standard & Poor’s 500 Composite |

| Stock Price Index (the “Index”) on that date. |

6

The fund’s Initial shares are not subject to a Rule 12b-1 fee.The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fund fees and expenses.The Index is a widely accepted, unmanaged index of U.S. stock market performance. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund,Appreciation Portfolio from July 1, 2011 to December 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2011

| | | | |

| | | Initial Shares | | Service Shares |

| Expenses paid per $1,000† | | $4.06 | | $5.33 |

| Ending value (after expenses) | | $1,013.40 | | $1,012.10 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2011

| | | | |

| | | Initial Shares | | Service Shares |

| Expenses paid per $1,000† | | $4.08 | | $5.35 |

| Ending value (after expenses) | | $1,021.17 | | $1,019.91 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .80% for Initial Shares and 1.05% for Service Shares, |

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

|

| STATEMENT OF INVESTMENTS |

| December 31, 2011 |

| | | | |

| Common Stocks—98.1% | Shares | | | Value ($) |

| Consumer Discretionary—11.4% | | | | |

| Arcos Dorados Holdings, Cl. A | 110,000 | | | 2,258,300 |

| McDonald’s | 170,900 | | | 17,146,397 |

| McGraw-Hill | 107,100 | | | 4,816,287 |

| News, Cl. A | 308,136 | | | 5,497,146 |

| News, Cl. B | 7,700 | | | 139,986 |

| Target | 189,700 | | | 9,716,434 |

| Time Warner Cable | 45,000 | | | 2,860,650 |

| Wal-Mart Stores | 171,600 | | | 10,254,816 |

| Walt Disney | 120,000 | | | 4,500,000 |

| | | | | 57,190,016 |

| Consumer Staples—33.1% | | | | |

| Altria Group | 488,100 | | | 14,472,165 |

| Christian Dior | 65,500 | | | 7,766,071 |

| Coca-Cola | 472,600 | | | 33,067,822 |

| Estee Lauder, Cl. A | 64,200 | | | 7,210,944 |

| Green Mountain Coffee Roasters | 30,000 a,b | | | 1,345,500 |

| Kraft Foods, Cl. A | 160,000 | | | 5,977,600 |

| Nestle, ADR | 317,400 | | | 18,317,154 |

| PepsiCo | 142,900 | | | 9,481,415 |

| Philip Morris International | 488,100 | | | 38,306,088 |

| Procter & Gamble | 255,000 | | | 17,011,050 |

| Walgreen | 294,300 | | | 9,729,558 |

| Whole Foods Market | 45,100 | | | 3,138,058 |

| | | | | 165,823,425 |

| Energy—19.7% | | | | |

| Chevron | 190,900 | | | 20,311,760 |

| ConocoPhillips | 165,100 | | | 12,030,837 |

| Exxon Mobil | 321,364 | | | 27,238,813 |

| Imperial Oil | 85,000 a | | | 3,780,800 |

| Occidental Petroleum | 133,100 | | | 12,471,470 |

| Royal Dutch Shell, Cl. A, ADR | 172,500 | | | 12,608,025 |

| Total, ADR | 199,400a | | 10,191,334 |

| | | | | 98,633,039 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Common Stocks (continued) | Shares | | | Value ($) |

| Financial—3.3% | | | | |

| BlackRock | 20,000 | | | 3,564,800 |

| Franklin Resources | 41,000 | | | 3,938,460 |

| JPMorgan Chase & Co. | 267,300 | | | 8,887,725 |

| | | | | 16,390,985 |

| Health Care—9.7% | | | | |

| Abbott Laboratories | 176,800 | | | 9,941,464 |

| Intuitive Surgical | 12,000 b | | | 5,556,120 |

| Johnson & Johnson | 212,900 | | | 13,961,982 |

| Medtronic | 90,200 | | | 3,450,150 |

| Merck & Co. | 143,200 | | | 5,398,640 |

| Novo Nordisk, ADR | 33,300 | | | 3,838,158 |

| Roche Holding, ADR | 150,700 | | | 6,412,285 |

| | | | | 48,558,799 |

| Industrial—3.2% | | | | |

| Caterpillar | 84,400 | | | 7,646,640 |

| General Electric | 214,800 | | | 3,847,068 |

| United Technologies | 59,000 | | | 4,312,310 |

| | | | | 15,806,018 |

| Information Technology—13.0% | | | | |

| Apple | 61,000b | | 24,705,000 |

| Automatic Data Processing | 85,400 | | | 4,612,454 |

| Intel | 592,900 | | | 14,377,825 |

| International Business Machines | 67,000 | | | 12,319,960 |

| QUALCOMM | 50,800 | | | 2,778,760 |

| Texas Instruments | 213,300 | | | 6,209,163 |

| | | | | 65,003,162 |

| Materials—4.7% | | | | |

| Air Products & Chemicals | 20,000 | | | 1,703,800 |

| Freeport-McMoRan Copper & Gold | 185,000 | | | 6,806,150 |

| Praxair | 95,200 | | | 10,176,880 |

| Rio Tinto, ADR | 100,000 | | | 4,892,000 |

| | | | | 23,578,830 |

| Total Common Stocks | | | | |

| (cost $304,209,663) | | | | 490,984,274 |

10

| | | | |

| Other Investment—1.5% | Shares | Value ($) |

| Registered Investment Company; | | |

| Dreyfus Institutional Preferred | | |

| Plus Money Market Fund | | |

| (cost $7,593,542) | 7,593,542c | 7,593,542 |

| |

| Investment of Cash Collateral | | |

| for Securities Loaned—.5% | | |

| Registered Investment Company; | | |

| Dreyfus Institutional Cash Advantage Fund | | |

| (cost $2,642,191) | 2,642,191c | 2,642,191 |

| |

| Total Investments (cost $314,445,396) | 100.1% | 501,220,007 |

| Liabilities, Less Cash and Receivables | (.1%) | (615,493) |

| Net Assets | 100.0% | 500,604,514 |

ADR—American Depository Receipts

|

| a Security, or portion thereof, on loan.At December 31, 2011, the value of the fund’s securities on loan was |

| $2,592,538 and the value of the collateral held by the fund was $2,642,191. |

| b Non-income producing security. |

| c Investment in affiliated money market mutual fund. |

| | | |

| Portfolio Summary (Unaudited)† | | |

| |

| | Value (%) | | Value (%) |

| Consumer Staples | 33.1 | Materials | 4.7 |

| Energy | 19.7 | Financial | 3.3 |

| Information Technology | 13.0 | Industrial | 3.2 |

| Consumer Discretionary | 11.4 | Money Market Investments | 2.0 |

| Health Care | 9.7 | | 100.1 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

|

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2011 |

| | | |

| | Cost | Value |

| Assets ($): | | |

| Investments in securities—See Statement of Investments (including | | |

| securities on loan, valued at $2,592,538)—Note 1(c): | | |

| Unaffiliated issuers | 304,209,663 | 490,984,274 |

| Affiliated issuers | 10,235,733 | 10,235,733 |

| Cash | | 1,696,633 |

| Dividends and securities lending income receivable | | 1,184,021 |

| Receivable for shares of Beneficial Interest subscribed | | 1,173,575 |

| Prepaid expenses | | 15,657 |

| | | 505,289,893 |

| Liabilities ($): | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 276,702 |

| Due to Fayez & Sarofim & Co. | | 90,106 |

| Liability for securities on loan—Note 1(c) | | 2,642,191 |

| Payable for investment securities purchased | | 1,347,028 |

| Payable for shares of Beneficial Interest redeemed | | 286,373 |

| Accrued expenses | | 42,979 |

| | | 4,685,379 |

| Net Assets ($) | | 500,604,514 |

| Composition of Net Assets ($): | | |

| Paid-in capital | | 307,637,163 |

| Accumulated undistributed investment income—net | | 8,843,223 |

| Accumulated net realized gain (loss) on investments | | (2,650,483) |

| Accumulated net unrealized appreciation | | |

| (depreciation) on investments | | 186,774,611 |

| Net Assets ($) | | 500,604,514 |

| |

| |

| Net Asset Value Per Share | | |

| | Initial Shares | Service Shares |

| Net Assets ($) | 326,444,707 | 174,159,807 |

| Shares Outstanding | 8,591,846 | 4,615,304 |

| Net Asset Value Per Share ($) | 37.99 | 37.74 |

| |

| See notes to financial statements. | | |

12

|

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2011 |

| | |

| Investment Income ($): | |

| Income: | |

| Cash dividends (net of $371,041 foreign taxes withheld at source): | |

| Unaffiliated issuers | 12,846,031 |

| Affiliated issuers | 4,870 |

| Income from securities lending—Note 1(c) | 76,748 |

| Total Income | 12,927,649 |

| Expenses: | |

| Investment advisory fee—Note 3(a) | 2,460,928 |

| Sub-investment advisory fee—Note 3(a) | 1,005,168 |

| Distribution fees—Note 3(b) | 359,542 |

| Professional fees | 73,685 |

| Prospectus and shareholders’ reports | 64,725 |

| Custodian fees—Note 3(b) | 37,863 |

| Trustees’ fees and expenses—Note 3(c) | 32,703 |

| Shareholder servicing costs—Note 3(b) | 14,644 |

| Loan commitment fees—Note 2 | 7,494 |

| Miscellaneous | 21,679 |

| Total Expenses | 4,078,431 |

| Less—reduction in fees due to earnings credits—Note 3(b) | (7) |

| Net Expenses | 4,078,424 |

| Investment Income—Net | 8,849,225 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments | (368,068) |

| Net unrealized appreciation (depreciation) on investments | 31,468,680 |

| Net Realized and Unrealized Gain (Loss) on Investments | 31,100,612 |

| Net Increase in Net Assets Resulting from Operations | 39,949,837 |

| |

| See notes to financial statements. | |

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Year Ended December 31, |

| | 2011 | 2010 |

| Operations ($): | | |

| Investment income—net | 8,849,225 | 7,352,431 |

| Net realized gain (loss) on investments | (368,068) | (586,025) |

| Net unrealized appreciation | | |

| (depreciation) on investments | 31,468,680 | 51,126,895 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 39,949,837 | 57,893,301 |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Initial Shares | (5,339,622) | (6,320,853) |

| Service Shares | (2,014,556) | (1,386,410) |

| Total Dividends | (7,354,178) | (7,707,263) |

| Beneficial Interest Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Initial Shares | 46,939,033 | 27,881,230 |

| Service Shares | 64,879,366 | 75,657,393 |

| Dividends reinvested: | | |

| Initial Shares | 5,339,622 | 6,320,853 |

| Service Shares | 2,014,556 | 1,386,410 |

| Cost of shares redeemed: | | |

| Initial Shares | (58,474,591) | (48,910,102) |

| Service Shares | (28,370,572) | (38,807,049) |

| Increase (Decrease) in Net Assets from | | |

| Beneficial Interest Transactions | 32,327,414 | 23,528,735 |

| Total Increase (Decrease) in Net Assets | 64,923,073 | 73,714,773 |

| Net Assets ($): | | |

| Beginning of Period | 435,681,441 | 361,966,668 |

| End of Period | 500,604,514 | 435,681,441 |

| Undistributed investment income—net | 8,843,223 | 7,349,430 |

14

| | | | |

| | Year Ended December 31, |

| | 2011 | 2010 |

| Capital Share Transactions: | | |

| Initial Shares | | |

| Shares sold | 1,285,530 | 864,720 |

| Shares issued for dividends reinvested | 147,422 | 199,459 |

| Shares redeemed | (1,599,685) | (1,544,798) |

| Net Increase (Decrease) in Shares Outstanding | (166,733) | (480,619) |

| Service Shares | | |

| Shares sold | 1,791,766 | 2,347,577 |

| Shares issued for dividends reinvested | 55,897 | 43,916 |

| Shares redeemed | (789,159) | (1,138,271) |

| Net Increase (Decrease) in Shares Outstanding | 1,058,504 | 1,253,222 |

| |

| See notes to financial statements. | | |

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | Year Ended December 31, | |

| Initial Shares | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 35.44 | 31.40 | 28.88 | 44.86 | 42.55 |

| Investment Operations: | | | | | |

| Investment income—neta | .73 | .64 | .63 | .67 | .66 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.42 | 4.09 | 4.95 | (13.01) | 2.32 |

| Total from Investment Operations | 3.15 | 4.73 | 5.58 | (12.34) | 2.98 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.60) | (.69) | (.78) | (.77) | (.67) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | (2.28) | (2.87) | — |

| Total Distributions | (.60) | (.69) | (3.06) | (3.64) | (.67) |

| Net asset value, end of period | 37.99 | 35.44 | 31.40 | 28.88 | 44.86 |

| Total Return (%) | 9.01 | 15.32 | 22.56 | (29.55) | 7.14 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | .80 | .81 | .80 | .81 | .80 |

| Ratio of net expenses | | | | | |

| to average net assets | .80 | .81 | .80 | .81 | .80 |

| Ratio of net investment income | | | | | |

| to average net assets | 1.99 | 2.01 | 2.31 | 1.82 | 1.52 |

| Portfolio Turnover Rate | 4.24 | 11.90 | 1.49 | 3.41 | 5.17 |

| Net Assets, end of period ($ x 1,000) | 326,445 | 310,385 | 290,073 | 274,782 | 569,422 |

| |

| a Based on average shares outstanding at each month end. | | | | |

| See notes to financial statements. | | | | | |

16

| | | | | | | | | | |

| | | Year Ended December 31, | |

| Service Shares | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 35.23 | 31.21 | 28.70 | 44.59 | 42.32 |

| Investment Operations: | | | | | |

| Investment income—neta | .63 | .58 | .59 | .58 | .56 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.42 | 4.05 | 4.89 | (12.94) | 2.30 |

| Total from Investment Operations | 3.05 | 4.63 | 5.48 | (12.36) | 2.86 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.54) | (.61) | (.69) | (.66) | (.59) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | (2.28) | (2.87) | — |

| Total Distributions | (.54) | (.61) | (2.97) | (3.53) | (.59) |

| Net asset value, end of period | 37.74 | 35.23 | 31.21 | 28.70 | 44.59 |

| Total Return (%) | 8.74 | 15.04 | 22.23 | (29.72) | 6.85 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 1.05 | 1.06 | 1.05 | 1.06 | 1.05 |

| Ratio of net expenses | | | | | |

| to average net assets | 1.05 | 1.06 | 1.05 | 1.06 | 1.05 |

| Ratio of net investment income | | | | | |

| to average net assets | 1.75 | 1.74 | 2.15 | 1.61 | 1.27 |

| Portfolio Turnover Rate | 4.24 | 11.90 | 1.49 | 3.41 | 5.17 |

| Net Assets, end of period ($ x 1,000) | 174,160 | 125,296 | 71,893 | 88,606 | 121,006 |

| a Based on average shares outstanding at each month end. | | | | |

| See notes to financial statements. | | | | | |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Variable Investment Fund (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company, operating as a series company currently offering seven series, including the Appreciation Portfolio (the “fund”). The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The fund is a diversified series.The fund’s investment objective is to seek long-term capital growth consistent with the preservation of capital.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of NewYork Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the fund’s sub-investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares, which are sold without a sales charge.The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

18

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund���s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

NOTES TO FINANCIAL STATEMENTS (continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.All preceding securities are categorized within Level 1 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

20

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of December 31, 2011 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Equity Securities— | | | | |

| Domestic† | 420,920,147 | — | — | 420,920,147 |

| Equity Securities— | | | | |

| Foreign† | 70,064,127 | — | — | 70,064,127 |

| Mutual Funds | 10,235,733 | — | — | 10,235,733 |

| † See Statement of Investments for additional detailed categorizations. | |

In May 2011, FASB issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common FairValue Measurement and Disclosure Requirements in GAAP and International Financial

NOTES TO FINANCIAL STATEMENTS (continued)

Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements.The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign cur-

22

rency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement withThe Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended December 31, 2011, The Bank of New York Mellon earned $32,892 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

NOTES TO FINANCIAL STATEMENTS (continued)

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended December 31, 2011 were as follows:

| | | | | |

| Affiliated | | | | | |

| Investment | Value | | | Value | Net |

| Company | 12/31/2010 ($) | Purchases ($) | Sales ($) | 12/31/2011 ($) | Assets (%) |

| Dreyfus | | | | | |

| Institutional | | | | | |

| Preferred | | | | | |

| Plus Money | | | | | |

| Market | | | | | |

| Fund | 28,098,000 | 60,247,792 | 80,75C2,250 | 7,593,542 | 1.5 |

| Dreyfus | | | | | |

| Institutional | | | | | |

| Cash | | | | | |

| Advantage | | | | | |

| Fund | 9,340,956 | 354,198,748 | 360,897,513 | 2,642,191 | .5 |

| Total | 37,438,956 | 414,446,540 | 441,649,763 | 10,235,733 | 2.0 |

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2011, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

24

Each of the tax years in the four-year period ended December 31, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2011, the components of accumulated earnings on a tax basis were as follows: ordinary income $8,843,223, accumulated capital losses $1,621,087 and unrealized appreciation $185,882,506. In addition, the fund had $137,291 of capital losses realized after October 31, 2011, which were deferred for tax purposes to the first day of the following fiscal year.

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Post-enactment capital loss carryovers will retain their character as either short-term or long-term capital losses rather than be considered short-term as they were under previous statute. However, the 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”). As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2011. If not applied, $658,768 of the carryover expires in fiscal 2017, $732,796 expires in fiscal 2018 and $229,523 of post-enactment long-term capital losses can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2011 and December 31, 2010 were as follows: ordinary income $7,354,178 and $7,707,263, respectively.

During the period ended December 31, 2011, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency exchange gains and losses, the fund decreased

NOTES TO FINANCIAL STATEMENTS (continued)

accumulated undistributed investment income-net by $1,254 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended December 31, 2011, the fund did not borrow under the Facilities.

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an investment advisory agreement with Dreyfus, the investment advisory fee is computed at the annual rate of .5325% of the value of the fund’s average daily net assets. Pursuant to a sub-investment advisory agreement with Sarofim & Co., the fund pays Sarofim & Co. a monthly sub-investment advisory fee at the annual rate of .2175% of the value of the fund’s average daily net assets. Both fees are payable monthly.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing its shares, for servicing and/or maintaining Service shares’ shareholder accounts and for advertising and marketing for Service shares.The Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets.The Distributor may make

26

payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products.The fees payable under the Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2011, Service shares were charged $359,542 pursuant to the Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended December 31, 2011, the fund was charged $1,506 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under cash management agreements for performing cash management services related to fund subscriptions and redemptions. During the period ended December 31, 2011, the fund was charged $227 pursuant to the cash management agreements, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $7.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended December 31, 2011, the fund was charged $37,863 pursuant to the custody agreement.

During the period ended December 31, 2011, the fund was charged $6,402 for services performed by the Chief Compliance Officer.

NOTES TO FINANCIAL STATEMENTS (continued)

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $220,603, Rule 12b-1 distribution plan fees $35,578, custodian fees $15,003, chief compliance officer fees $5,295 and transfer agency per account fees $223.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2011, amounted to $48,582,853 and $19,558,921, respectively.

At December 31, 2011, the cost of investments for federal income tax purposes was $315,337,501; accordingly, accumulated net unrealized appreciation on investments was $185,882,506, consisting of $199,694,157 gross unrealized appreciation and $13,811,651 gross unrealized depreciation.

28

|

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Trustees

Dreyfus Variable Investment Fund, Appreciation Portfolio

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the series comprising Dreyfus Variable Investment Fund) as of December 31, 2011, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Variable Investment Fund, Appreciation Portfolio at December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

|

| New York, New York |

| February 10, 2012 |

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2011 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in early 2012 of the percentage applicable to the preparation of their 2011 income tax returns.

30

BOARD MEMBERS INFORMATION (Unaudited)

|

| Joseph S. DiMartino (68) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director (1997-present) |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director (2005-2009) |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director (2000-2010) |

| No. of Portfolios for which Board Member Serves: 164 |

| ——————— |

| Peggy C. Davis (68) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Shad Professor of Law, New York University School of Law |

| • Writer and teacher in the fields of evidence, constitutional theory, family law, social sciences |

| and the law, legal process and professional methodology and training |

| No. of Portfolios for which Board Member Serves: 53 |

| ——————— |

| David P. Feldman (72) |

| Board Member (1994) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • BBH Mutual Funds Group (4 registered mutual funds), Director (1992-present) |

| • QMed, Inc. a healthcare company, Director (1999-2007) |

| No. of Portfolios for which Board Member Serves: 49 |

BOARD MEMBERS INFORMATION (Unaudited) (continued)

|

| Ehud Houminer (71) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Executive-in-Residence at the Columbia Business School, Columbia University (1992-present) |

| Other Public Company Board Memberships During Past 5Years: |

| • Avnet Inc., an electronics distributor, Director (1993-present) |

| No. of Portfolios for which Board Member Serves: 63 |

| ——————— |

| Dr. Martin Peretz (72) |

| Board Member (1990) |

| Principal Occupation During Past 5Years: |

| • Editor-in-Chief Emeritus of The New Republic Magazine (2010-present) (previously, Editor- |

| in-Chief, 1974-2010) |

| • Director of TheStreet.com, a financial information service on the web (1996-present) |

| No. of Portfolios for which Board Member Serves: 35 |

| ——————— |

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork 10166.Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James F. Henry, Emeritus Board Member

Rosalind G. Jacobs, Emeritus Board Member

Dr. Paul A. Marks, Emeritus Board Member

Gloria Messinger, Emeritus Board Member

32

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 75 investment companies (comprised of 163 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since February 1988.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. She is 49 years old and has been an employee of the Manager since February 1984.

KIESHA ASTWOOD, Vice President and Assistant Secretary since January 2010.

Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. She is 38 years old and has been an employee of the Manager since July 1995.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. She is 56 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since June 2000.

KATHLEEN DENICHOLAS, Vice President and Assistant Secretary since January 2010.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. She is 37 years old and has been an employee of the Manager since February 2001.

JOHN B. HAMMALIAN, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since February 1991.

M. CRISTINA MEISER, Vice President and Assistant Secretary since January 2010.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. She is 41 years old and has been an employee of the Manager since August 2001.

ROBERT R. MULLERY, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since May 1986.

OFFICERS OF THE FUND (Unaudited) (continued)

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2003.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 189 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (76 investment companies, comprised of 189 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 54 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

STEPHEN J. STOREN, Anti-Money Laundering Compliance Officer since May 2011.

Chief Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 72 investment companies (comprised of 185 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Distributor since October 1999.

34

For More Information

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the most recent 12-month period ended June 30 is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-DREYFUS.

|

| Dreyfus Variable |

| Investment Fund, |

| Growth and Income |

| Portfolio |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

|

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

| |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 9 | Statement of Investments |

| 15 | Statement of Assets and Liabilities |

| 16 | Statement of Operations |

| 17 | Statement of Changes in Net Assets |

| 19 | Financial Highlights |

| 21 | Notes to Financial Statements |

| 33 | Report of Independent Registered |

| | Public Accounting Firm |

| 34 | Important Tax Information |

| 35 | Board Members Information |

| 37 | Officers of the Fund |

|

| FOR MORE INFORMATION |

| Back Cover |

Dreyfus Variable Investment Fund,

Growth and Income Portfolio

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We present to you this annual report for Dreyfus Variable Investment Fund, Growth and Income Portfolio, covering the 12-month period from January 1, 2011, through December 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The generally mild returns produced by the U.S. stock market in 2011 belie the pronounced volatility affecting equities over much of the year. Day-to-day market movements were often tumultuous, driven by macroeconomic developments ranging from catastrophic natural disasters in Japan to an unprecedented downgrade of long-term U.S. debt securities and the resurgence of a sovereign debt crisis in Europe. Still, U.S. corporations achieved record-setting profits, on average, even as market valuations dropped below historical norms.A fundamentals-based investment approach proved relatively ineffective in a market fueled mainly by emotion, causing most active portfolio managers to lag market averages.

We are hopeful that equity investors will adopt a more rational perspective in 2012. Our economic forecast calls for a mild acceleration of the U.S. recovery as the domestic banking system regains strength, credit conditions loosen and housing markets begin a long-awaited convalescence. Of course, we encourage you to talk with your financial adviser to help ensure that your investment objectives are properly aligned with your risk tolerance in pursuing potential market opportunities in 2012.

Thank you for your continued confidence and support.

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2011, through December 31, 2011, as provided by John Bailer and Elizabeth Slover, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended December 31, 2011, Dreyfus Variable Investment Fund, Growth and Income Portfolio’s Initial shares achieved a –2.79% total return, and its Service shares achieved a total return of –2.99%.1 In comparison, the fund’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), produced a total return of 2.09% for the same period.2

Macroeconomic disappointments throughout the world weighed on equity markets during much of 2011, but rallies in the first and fourth quarters enabled the S&P 500 Index to end the year in positive territory. The fund produced lower returns than its benchmark, primarily due to shortfalls in our stock selection strategy in the industrials, consumer discretionary and materials sectors.

The Fund’s Investment Approach

The fund seeks long-term capital growth, current income and growth of income consistent with reasonable investment risk. To pursue this goal, the fund invests primarily in stocks of domestic and foreign issuers.We seek to create a portfolio that includes a blend of growth and dividend-paying stocks, as well as other investments that provide income.We choose stocks through a disciplined investment process that combines computer modeling techniques, “bottom-up” fundamental analysis and risk management. The investment process is designed to provide investors with investment exposure to sector weightings and risk characteristics similar to those of the S&P 500 Index.

Global Economic Developments Roiled Equity Markets

Improvements in U.S. economic data supported stock prices at the start of 2011, but political unrest in the Middle East and catastrophic natural and nuclear disasters in Japan soon interrupted the rally. Nonetheless, investors continued to look forward to better business conditions, and stocks generally rebounded from these unexpected shocks by the end of the first quarter.

Investors’ hopes for a more robust recovery were dashed in late April, when Greece teetered on the brink of default on its sovereign debt and

DISCUSSION OF FUND PERFORMANCE (continued)

the crisis spread to other European nations. In addition, U.S. economic data proved more disappointing than expected, and investors reacted cautiously to a contentious political debate regarding U.S. government spending and borrowing. Consequently, newly risk-averse investors shifted their focus toward traditionally defensive industries and companies, particularly well-known businesses with consistent earnings.

Market declines were particularly severe in August and September, after a major credit-rating agency downgraded its assessment of long-term U.S. government debt. In contrast, the market rebounded to a degree from October through December, when U.S. economic data improved and European policymakers made some progress in addressing the region’s problems.

Stock Selections Dampened Relative Performance

The fund’s results compared to the benchmark in 2011 were hurt by a tilt toward companies that tend to be more sensitive to economic conditions. In the industrials sector, a number of fundamentally sound companies saw their stock prices fall when investor sentiment deteriorated, including Caterpillar, Ingersoll-Rand, Eaton and Cummins. In the consumer discretionary sector, cruise operator Carnival was hurt by elevated fuel costs and the need to reroute itineraries to avoid political unrest in North Africa. Office supplies retailer Staples lost value after reporting disappointing sales and earnings stemming from lackluster employment gains among its corporate customers. Among materials companies, metals producer Freeport-McMoRan Copper & Gold was undermined by reduced demand from the emerging markets. Specialty chemicals maker Eastman Chemical also suffered from reduced end-market demand. Finally, overweighted exposure to oil services provider Schlumberger proved counterproductive when a number of international projects were delayed due to the struggling global economy.

The fund achieved better results from individual holdings across several different industry groups. Pharmaceutical giant Pfizer posted better-than-expected earnings based on strong results in Japan, and investors responded positively to good news regarding new products under development. Media conglomerate Time Warner reported higher earnings due to record results in its film and entertainment division. Grocery chain Whole Foods Market captured market share from more traditional competitors and achieved stronger sales of premium brands to a relatively affluent customer base.The fund also

4

benefited from underweighted exposure to Bank of America, avoiding the brunt of weakness stemming from negative headlines and concerns regarding mortgage liabilities.

Finally, the fund benefited from our options strategy, in which we sold call options on stocks nearing our price targets. This strategy resulted in additional income, boosting the fund’s total return for the reporting period.

Stocks Have Become More Attractively Valued

Despite ongoing headwinds, we believe the economic expansion is likely to persist. Indeed, for much of 2011, the stock market seemed to react more to macroeconomic developments than to the fundamental strengths and weaknesses of individual companies. Consequently, in our analysis, many stocks have declined to lower valuations than are warranted by their fundamentals. Our bottom-up security selection process has identified a number of opportunities in the consumer discretionary sector, especially among media companies poised for increased advertising spending in an election year. Conversely, we have found fewer opportunities meeting our investment criteria in the utilities sector, where stocks generally appear more expensive.

January 17, 2012

| |

| | Please note, the position in any security highlighted in italicized typeface was sold during the |

| | reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, issuer and investment |

| | style risks, among other factors, to varying degrees, all of which are more fully described in the |

| | fund’s prospectus. |

| | The use of derivatives involves risks different from, or possibly greater than, the risks associated |

| | with investing directly in the underlying assets. Derivatives can be highly volatile, illiquid, and |

| | difficult to value and there is the risk that changes in the value of a derivative held by the fund |

| | will not correlate with the underlying instruments or the fund’s other investments. |

| | The fund is only available as a funding vehicle under variable life insurance policies or variable |

| | annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund |

| | directly.A variable annuity is an insurance contract issued by an insurance company that enables |

| | investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | fund shares may be worth more or less than their original cost.The fund’s performance does not |

| | reflect the deduction of additional charges and expenses imposed in connection with investing in |

| | variable insurance contracts, which will reduce returns. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, capital |

| | gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted, |

| | unmanaged index of U.S. stock market performance. Investors cannot invest directly in an index. |

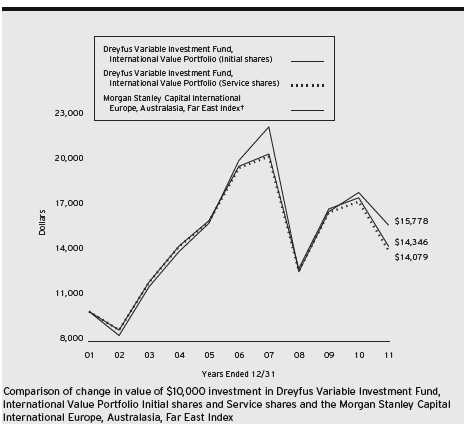

FUND PERFORMANCE

| | | | | | |

| Average Annual Total Returns as of 12/31/11 | | |

| | 1Year | 5 Years | 10 Years |

| Initial shares | –2.79% | –0.82% | 1.44% |

| Service shares | –2.99% | –1.05% | 1.23% |

| Standard & Poor’s 500 | | | |

| Composite Stock Price Index | 2.09% | –0.25% | 2.92% |

|

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection |

| with investing in variable insurance contracts which will reduce returns. |

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund, Growth and Income Portfolio on 12/31/01 to a $10,000 investment made in the Standard & Poor’s 500 |

| Composite Stock Price Index (the “Index”) on that date. |

6

The fund’s Initial shares are not subject to a Rule 12b-1 fee.The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.All dividends and capital gain distributions are reinvested.