| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 5125 |

| |

| Dreyfus Variable Investment Fund |

| (Exact name of Registrant as specified in charter) |

| |

| |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael A. Rosenberg, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: (212) 922-6000

| Date of fiscal year end: | | 12/31 |

| Date of reporting period: | | 12/31/07 |

FORM N-CSR

Item 1. Reports to Stockholders.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | THE PORTFOLIO |

| |

|

| 2 | | A Letter from the CEO |

| 3 | | Discussion of Performance |

| 6 | | Portfolio Performance |

| 8 | | Understanding Your Portfolio’s Expenses |

| 8 | | Comparing Your Portfolio’s Expenses |

| | | With Those of Other Funds |

| 9 | | Statement of Investments |

| 12 | | Statement of Assets and Liabilities |

| 13 | | Statement of Operations |

| 14 | | Statement of Changes in Net Assets |

| 16 | | Financial Highlights |

| 18 | | Notes to Financial Statements |

| 26 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 27 | | Important Tax Information |

| 28 | | Board Members Information |

| 31 | | Officers of the Fund |

| FOR MORE INFORMATION |

|

| | | Back Cover |

The Portfolio

| Dreyfus Variable Investment Fund, |

| Appreciation Portfolio |

A LETTER FROM THE CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund,Appreciation Portfolio, covering the 12-month period from January 1, 2007, through December 31, 2007.

Looking back, 2007 was a year of significant change for the stock market.Turmoil in the sub-prime mortgage market, declining housing values and soaring energy prices sparked a “flight to quality”in which investors reassessed their attitudes toward risk. As a result, smaller, more speculative companies that had led the stock market over the past several years lost value over the second half of the year, while shares of larger, multinational growth companies returned to favor. Many financial services and consumer discretionary companies were hurt by repercussions from the sub-prime lending crisis and economic downturn, but energy and basic materials producers generally moved higher along with underlying commodity prices.

The turbulence of 2007 reinforced a central principle of successful investing: diversification. Investors with broad exposure to the world’s stock and bond markets were better protected from the full impact of market volatility in areas that, earlier in the year, were among the bright spots at the time. As we look ahead, we believe that now is the perfect time to meet with your financial advisor, who can help you plan and diversify your investment portfolio in a way that manages the potential opportunities and risks that may continue to arise in 2008.

For information about how the portfolio performed during the reporting period, as well as market perspectives, we have provided a Discussion of Performance given by the Portfolio Manager.

Thank you for your continued confidence and support.

| Thomas F. Eggers |

| Chief Executive Officer |

| The Dreyfus Corporation |

| January 15, 2008 |

2

DISCUSSION OF PERFORMANCE

For the period of January 1, 2007, through December 31, 2007, as provided by Fayez Sarofim, of Fayez Sarofim & Co., Sub-Investment Adviser

Portfolio and Market Performance

After posting gains during the first half of 2007, stocks generally moved lower over the second half of the year when the U.S. economy weakened and a credit crunch spread from the sub-prime mortgage sector of the bond market to other areas of the financial markets. As investors grew more risk averse,they began to turn toward the types of large-cap growth stocks in which the portfolio invests. As a result, the portfolio produced higher returns than its benchmark for the reporting period overall.

For the 12-month period ended December 31, 2007, Dreyfus Variable Investment Fund, Appreciation Portfolio’s Initial shares produced a total return of 7.14%, and its Service shares produced a total return of 6.85% ..1 In comparison, the total return of the portfolio’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), was 5.49% for the same period.2

The Portfolio’s Investment Approach

The portfolio normally invests at least 80% of its assets in common stocks. The portfolio focuses on large, well-established multinational growth companies that have demonstrated sustained patterns of profitability, strong balance sheets, an expanding global presence and the potential to achieve predictable above-average earnings growth. We focus on purchasing reasonably priced growth stocks of fundamentally sound companies in economic sectors that we believe will expand over the next three to five years or longer.

Large-Cap Growth Stocks Returned to Favor in 2007

U.S. stocks, as defined by the S&P 500 Index, posted positive absolute returns in 2007 despite a downturn in the U.S. economy and the effects of a credit crunch emanating from the sub-prime mortgage market over the second half of the year. Concerns regarding declining housing prices, higher energy costs and their potential influence on

The Portfolio 3

D I S C U S S I O N O F P E R F O R M A N C E (continued)

consumer spending weighed on the U.S. economy and parts of the stock market. The Federal Reserve Board attempted to promote greater market liquidity and forestall a potential recession by reducing the overnight federal funds rate three times between September and December, driving its target for short-term interest rates from 5.25% to 4.25% by the reporting period’s end.

In contrast to the flagging U.S. economy, global economic growth remained robust. Consequently, some of the year’s stronger gains stemmed from large domestic companies with overseas operations. For example, energy stocks ranked among the top contributors to the S&P 500 Index’s results for 2007, with major energy producers benefiting from powerful overseas demand and rising commodity prices. Similarly, materials stocks advanced amid persistently high demand for construction materials in emerging markets, such as China and India. Conversely, U.S. banks, broker-dealers and bond insurers posted sharp declines as they announced substantial sub-prime-related losses. Consumer discretionary stocks also suffered as investors shied away from companies that might be sensitive to slower consumer spending.

Stock Selection Strategy Produced Positive Results

As investors grew increasingly risk averse, they turned away from the smaller, more speculative stocks that led in the market in previous reporting periods. Instead, they began to favor multinational growth companies with a track record of consistent earnings growth across full economic cycles. The portfolio was well positioned for this development. The portfolio’s consumer staples stocks, which historically have tended to hold up well when the economy slows, fared particularly well. For example, tobacco giant Altria Group benefited from its spin-off of Kraft Foods and plans to separate from its international tobacco division. Beverage leaders Coca-Cola and PepsiCo achieved robust growth in overseas markets, as did household goods provider Procter & Gamble. Overweighted exposure to energy stocks, such as Exxon Mobil, also boosted the portfolio’s relative performance.

Disappointments during 2007 proved to be relatively mild. An underweighted position in information technology stocks prevented the portfolio from participating as fully as the benchmark in the sector’s

gains, but strong stock selections helped offset a portion of any allocation-related weakness. Similarly, the portfolio held no utilities and missed out on that relatively small sector’s advance. Although financial stocks — including some of the banks and brokers ensnared in the sub-prime mortgage debacle — produced negative absolute returns, our stock selection strategy enabled the portfolio’s financial holdings to outperform the benchmark’s financials component.

New Holdings Expected to Benefit from Ongoing Trends

We added a number of new positions to the portfolio during the reporting period that we believe will help it participate more fully in certain secular growth trends. For example, we added global energy services provider Haliburton to complement existing holdings of integrated oil producers as the major energy companies intensify their search for new sources of production. In the information technology area, Cisco Systems, QUALCOMM and Texas Instruments may give the portfolio greater exposure to rising demand for Internet bandwidth and the rising popularity of wireless “smartphone” products. Among industrial companies, Caterpillar and United Technologies are expected to benefit from the construction boom in overseas markets. In our judgment, economic and market conditions currently are ripe for large-cap growth stocks such as these.

January 15, 2008

| | | The portfolio is only available as a funding vehicle under variable life insurance policies or variable |

| | | annuity contracts issued by insurance companies. Individuals may not purchase shares of the |

| | | portfolio directly. A variable annuity is an insurance contract issued by an insurance company that |

| | | enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term |

| | | goals.The investment objective and policies of Dreyfus Variable Investment Fund, Appreciation |

| | | Portfolio made available through insurance products may be similar to other funds/portfolios |

| | | managed or advised by Dreyfus. However, the investment results of the portfolio may be higher or |

| | | lower than, and may not be comparable to, those of any other Dreyfus fund/portfolio. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio’s performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. |

| 2 | | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends and, where |

| | | applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is |

| | | a widely accepted, unmanaged index of U.S. stock market performance. |

The Portfolio 5

PORTFOLIO PERFORMANCE

| Average Annual Total Returns | | as of 12/31/07 | | | | | | |

| | | | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

| |

|

| Initial shares | | | | 7.14% | | 10.64% | | 6.09% |

| Service shares | | | | 6.85% | | 10.36% | | 5.89% |

| The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 |

| (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth |

| results would have been lower. See notes below. |

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The portfolio’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. |

| The portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in |

| connection with investing in variable insurance contracts which will reduce returns. |

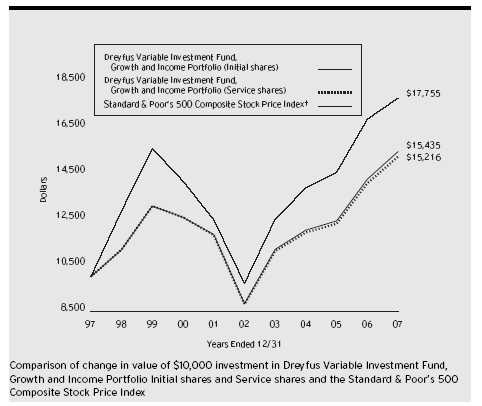

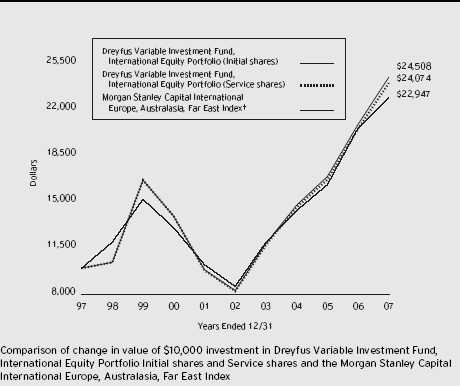

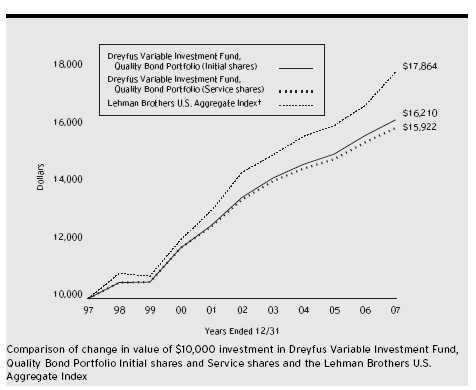

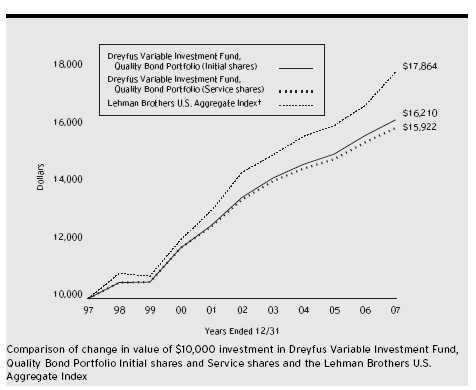

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund, Appreciation Portfolio on 12/31/97 to a $10,000 investment made in the Standard & Poor’s 500 Composite |

| Stock Price Index (the “Index”) on that date. |

6

The portfolio’s Initial shares are not subject to a Rule 12b-1 fee.The portfolio’s Service shares are subject to a 0.25% annual Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the portfolio’s Initial shares from their inception date through December 30, 2000, and the performance of the portfolio’s Service shares from December 31, 2000 (inception date of Service shares) to December 31, 2007 (blended performance figures).The blended performance figures have not been adjusted to reflect the higher operating expenses of the Service shares. If these expenses had been reflected, the blended performance figures would have been lower. All dividends and capital gain distributions are reinvested.

The portfolio’s performance shown in the line graph takes into account all applicable portfolio fees and expenses.The Index is a widely accepted, unmanaged index of U.S. stock market performance. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to portfolio performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Portfolio 7

| UNDERSTANDING YOUR |

| PORTFOLIO’S EXPENSES (Unaudited) |

As a mutual fund investor,you pay ongoing expenses,such as management fees and other expenses.Using the information below,you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses,including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your portfolio’s prospectus or talk to your financial adviser.

Review your portfolio’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Variable Investment Fund,Appreciation Portfolio from July 1, 2007 to December 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | |

| assuming actual returns for the six months ended December 31, 2007 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.07 | | $ 5.34 |

| Ending value (after expenses) | | $1,017.30 | | $1,015.90 |

| COMPARING YOUR PORTFOLIO’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your portfolio’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the portfolio with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | | |

| assuming a hypothetical 5% annualized return for the six months ended December 31, 2007 |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.08 | | $ 5.35 |

| Ending value (after expenses) | | $1,021.17 | | $1,019.91 |

| † Expenses are equal to the portfolio’s annualized expense ratio of .80% for Initial shares and 1.05% for Service shares, |

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

| STATEMENT OF INVESTMENTS |

| D e c e m b e r 3 1 , 2 0 0 7 |

| Common Stocks—99.4% | | Shares | | Value ($) |

| |

| |

|

| Agriculture—6.8% | | | | |

| Altria Group | | 620,400 | | 46,889,832 |

| Consumer Discretionary—9.4% | | | | |

| Christian Dior | | 72,700 a | | 9,540,859 |

| McDonald’s | | 204,500 | | 12,047,095 |

| McGraw-Hill Cos. | | 403,600 | | 17,681,716 |

| News, Cl. A | | 606,436 | | 12,425,874 |

| News, Cl. B | | 9,800 | | 208,250 |

| Polo Ralph Lauren | | 40,000 | | 2,471,600 |

| Target | | 216,900 | | 10,845,000 |

| | | | | 65,220,394 |

| Consumer Staples—23.4% | | | | |

| Anheuser-Busch Cos. | | 130,100 | | 6,809,434 |

| Coca-Cola | | 610,500 | | 37,466,385 |

| Estee Lauder Cos., Cl. A | | 65,000 | | 2,834,650 |

| Nestle, ADR | | 217,000 | | 24,894,240 |

| PepsiCo | | 318,900 | | 24,204,510 |

| Procter & Gamble | | 410,000 | | 30,102,200 |

| SYSCO | | 100,000 | | 3,121,000 |

| Wal-Mart Stores | | 115,700 | | 5,499,221 |

| Walgreen | | 624,900 | | 23,796,192 |

| Whole Foods Market | | 70,000 a | | 2,856,000 |

| | | | | 161,583,832 |

| Energy—20.0% | | | | |

| BP, ADR | | 75,000 | | 5,487,750 |

| Chevron | | 303,300 | | 28,306,989 |

| ConocoPhillips | | 215,000 | | 18,984,500 |

| Exxon Mobil | | 530,064 | | 49,661,696 |

| Halliburton | | 100,000 | | 3,791,000 |

| Occidental Petroleum | | 140,000 | | 10,778,600 |

| Royal Dutch Shell, ADR | | 59,800 | | 5,035,160 |

| Total, ADR | | 120,000 | | 9,912,000 |

| Transocean | | 41,975 a,b | | 6,008,721 |

| | | | | 137,966,416 |

The Portfolio 9

| | S TAT E M E N T O F I N V E S T M E N T S (continued)

|

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Financial—11.3% | | | | |

| American Express | | 145,500 | | 7,568,910 |

| American International Group | | 90,920 | | 5,300,636 |

| Ameriprise Financial | | 61,500 | | 3,389,265 |

| Bank of America | | 291,216 | | 12,015,572 |

| Citigroup | | 521,524 | | 15,353,666 |

| HSBC Holdings, ADR | | 50,000 a | | 4,185,500 |

| JPMorgan Chase & Co. | | 345,100 | | 15,063,615 |

| Merrill Lynch & Co. | | 145,500 | | 7,810,440 |

| SunTrust Banks | | 116,600 | | 7,286,334 |

| | | | | 77,973,938 |

| Health Care—9.1% | | | | |

| Abbott Laboratories | | 284,100 | | 15,952,215 |

| Eli Lilly & Co. | | 80,000 | | 4,271,200 |

| Johnson & Johnson | | 355,000 | | 23,678,500 |

| Medtronic | | 65,000 | | 3,267,550 |

| Merck & Co. | | 180,000 | | 10,459,800 |

| Roche Holding, ADR | | 64,000 | | 5,523,200 |

| | | | | 63,152,465 |

| Industrial—8.4% | | | | |

| Caterpillar | | 50,000 | | 3,628,000 |

| Emerson Electric | | 279,800 | | 15,853,468 |

| Fluor | | 40,000 a | | 5,828,800 |

| General Electric | | 745,700 | | 27,643,099 |

| United Technologies | | 64,000 | | 4,898,560 |

| | | | | 57,851,927 |

| Information Technology—9.4% | | | | |

| Automatic Data Processing | | 120,000 | | 5,343,600 |

| Cisco Systems | | 185,000 b | | 5,007,950 |

| Intel | | 1,054,700 | | 28,118,302 |

| Microsoft | | 477,300 | | 16,991,880 |

| QUALCOMM | | 90,000 | | 3,541,500 |

| Texas Instruments | | 188,500 | | 6,295,900 |

| | | | | 65,299,132 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Materials—1.6% | | | | |

| Praxair | | 121,000 | | 10,733,910 |

| Total Common Stocks | | | | |

| (cost $442,085,497) | | | | 686,671,846 |

| |

| |

|

| |

| Other Investment—.1% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $416,000) | | 416,000 c | | 416,000 |

| |

| |

|

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—3.8% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Cash | | | | |

| Advantage Fund | | | | |

| (cost $26,302,278) | | 26,302,278 c | | 26,302,278 |

| |

| |

|

| |

| Total Investments (cost $468,803,775) | | 103.3% | | 713,390,124 |

| Liabilities, Less Cash and Receivables | | (3.3%) | | (22,962,107) |

| Net Assets | | 100.0% | | 690,428,017 |

| ADR—American Depository Receipts |

| a All or a portion of these securities are on loan. At December 31, 2007, the total market value of the portfolio’s |

| securities on loan is $25,274,401 and the total market value of the collateral held by the portfolio is $26,302,278. |

| b Non-income producing security. |

| c Investment in affiliated money market mutual fund. |

| Portfolio Summary | | (Unaudited) † | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Consumer Staples | | 23.4 | | Industrial | | 8.4 |

| Energy | | 20.0 | | Agriculture | | 6.8 |

| Financial | | 11.3 | | Money Market Investments | | 3.9 |

| Information Technology | | 9.4 | | Materials | | 1.6 |

| Consumer Discretionary | | 9.4 | | | | |

| Health Care | | 9.1 | | | | 103.3 |

| † Based on net assets. |

| See notes to financial statements. |

The Portfolio 11

| STATEMENT OF ASSETS AND LIABILITIES |

| D e c e m b e r 3 1 , 2 0 0 7 |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of | | |

| Investments (including securities on loan, | | |

| valued at $25,274,401)—Note 1(c): | | |

| Unaffiliated issuers | | 442,085,497 | | 686,671,846 |

| Affiliated issuers | | 26,718,278 | | 26,718,278 |

| Cash | | | | 223,253 |

| Receivable for investment securities sold | | 11,882,974 |

| Receivable for shares of Beneficial Interest subscribed | | 1,223,884 |

| Dividends and interest receivable | | | | 1,076,603 |

| Prepaid expenses | | | | 25,506 |

| | | | | 727,822,344 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 321,814 |

| Due to Fayez Sarofim & Co. | | | | 188,039 |

| Liability for securities on loan—Note 1(c) | | 26,302,278 |

| Payable for shares of Beneficial Interest redeemed | | 10,460,372 |

| Interest payable—Note 2 | | | | 55,160 |

| Accrued expenses | | | | 66,664 |

| | | | | 37,394,327 |

| |

| |

|

| Net Assets ($) | | | | 690,428,017 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 392,225,623 |

| Accumulated undistributed investment income—net | | 11,117,042 |

| Accumulated net realized gain (loss) on investments | | 42,499,024 |

| Accumulated net unrealized appreciation (depreciation) | | |

| on investments and foreign currency transactions | | 244,586,328 |

| |

|

| Net Assets ($) | | | | 690,428,017 |

| Net Asset Value Per Share | | | | |

| | | Initial Shares | | Service Shares |

| |

| |

|

| Net Assets ($) | | 569,422,233 | | 121,005,784 |

| Shares Outstanding | | 12,694,451 | | 2,713,772 |

| |

| |

|

| Net Asset Value Per Share ($) | | 44.86 | | 44.59 |

See notes to financial statements.

12

| STATEMENT OF OPERATIONS |

| Ye a r E n d e d D e c e m b e r 3 1 , 2 0 0 7 |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $206,896 foreign taxes withheld at source): |

| Unaffiliated issuers | | 17,263,293 |

| Affiliated issuers | | 51,114 |

| Income from securities lending | | 88,253 |

| Total Income | | 17,402,660 |

| Expenses: | | |

| Investment advisory fee—Note 3(a) | | 3,265,105 |

| Sub-investment advisory fee—Note 3(a) | | 2,365,105 |

| Distribution fees—Note 3(b) | | 297,138 |

| Prospectus and shareholders’ reports | | 107,379 |

| Custodian fees—Note 3(b) | | 61,027 |

| Interest expense—Note 2 | | 58,307 |

| Professional fees | | 52,990 |

| Trustees’ fees and expenses—Note 3(c) | | 39,642 |

| Loan commitment fees—Note 2 | | 5,925 |

| Shareholder servicing costs—Note 3(b) | | 5,693 |

| Miscellaneous | | 25,809 |

| Total Expenses | | 6,284,120 |

| Investment Income—Net | | 11,118,540 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 56,502,140 |

| Net unrealized appreciation (depreciation) on | | |

| investments and foreign currency transactions | | (16,029,486) |

| Net Realized and Unrealized Gain (Loss) on Investments | | 40,472,654 |

| Net Increase in Net Assets Resulting from Operations | | 51,591,194 |

See notes to financial statements.

The Portfolio 13

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| |

|

| | | 2007 | | 2006 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 11,118,540 | | 11,899,481 |

| Net realized gain (loss) on investments | | 56,502,140 | | 26,807,980 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (16,029,486) | | 78,292,140 |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 51,591,194 | | 116,999,601 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Initial Shares | | (10,305,011) | | (10,501,808) |

| Service Shares | | (1,592,630) | | (1,443,242) |

| Total Dividends | | (11,897,641) | | (11,945,050) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Initial Shares | | 41,265,860 | | 69,395,793 |

| Service Shares | | 33,395,223 | | 40,577,961 |

| Dividends reinvested: | | | | |

| Initial Shares | | 10,305,011 | | 10,501,808 |

| Service Shares | | 1,592,630 | | 1,443,242 |

| Cost of shares redeemed: | | | | |

| Initial Shares | | (197,317,992) | | (174,553,296) |

| Service Shares | | (34,288,008) | | (41,477,673) |

| Increase (Decrease) in Net Assets from | | | | |

| Beneficial Interest Transactions | | (145,047,276) | | (94,112,165) |

| Total Increase (Decrease) in Net Assets | | (105,353,723) | | 10,942,386 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 795,781,740 | | 784,839,354 |

| End of Period | | 690,428,017 | | 795,781,740 |

| Undistributed investment income—net | | 11,117,042 | | 11,896,886 |

14

| | | Year Ended December 31, |

| |

|

| | | 2007 | | 2006 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Initial Shares | | | | |

| Shares sold | | 948,930 | | 1,796,884 |

| Shares issued for dividends reinvested | | 247,360 | | 280,272 |

| Shares redeemed | | (4,506,835) | | (4,494,201) |

| Net Increase (Decrease) in Shares Outstanding | | (3,310,545) | | (2,417,045) |

| |

| |

|

| Service Shares | | | | |

| Shares sold | | 754,362 | | 1,029,879 |

| Shares issued for dividends reinvested | | 38,386 | | 38,651 |

| Shares redeemed | | (790,386) | | (1,097,163) |

| Net Increase (Decrease) in Shares Outstanding | | 2,362 | | (28,633) |

See notes to financial statements.

The Portfolio 15

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single portfolio share.Total return shows how much your investment in the portfolio would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the portfolio’s financial statements.

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Initial Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 42.55 | | 37.11 | | 35.56 | | 34.42 | | 28.79 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .66 | | .61 | | .54 | | .56 | | .43 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.32 | | 5.42 | | 1.02 | | 1.18 | | 5.64 |

| Total from Investment Operations | | 2.98 | | 6.03 | | 1.56 | | 1.74 | | 6.07 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.67) | | (.59) | | (.01) | | (.60) | | (.44) |

| Net asset value, end of period | | 44.86 | | 42.55 | | 37.11 | | 35.56 | | 34.42 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 7.14 | | 16.48 | | 4.38 | | 5.05 | | 21.17 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .80 | | .82 | | .80 | | .79 | | .80 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.52 | | 1.58 | | 1.48 | | 1.60 | | 1.41 |

| Portfolio Turnover Rate | | 5.17 | | 3.86 | | 2.67 | | 1.64 | | 4.60 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 569,422 | | 681,035 | | 683,667 | | 766,169 | | 821,319 |

| a Based on average shares outstanding at each month end. |

| See notes to financial statements. |

16

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Service Shares | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 42.32 | | 36.92 | | 35.46 | | 34.31 | | 28.71 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .56 | | .51 | | .45 | | .46 | | .36 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.30 | | 5.41 | | 1.01 | | 1.19 | | 5.61 |

| Total from Investment Operations | | 2.86 | | 5.92 | | 1.46 | | 1.65 | | 5.97 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.59) | | (.52) | | — | | (.50) | | (.37) |

| Net asset value, end of period | | 44.59 | | 42.32 | | 36.92 | | 35.46 | | 34.31 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 6.85 | | 16.21 | | 4.12 | | 4.80 | | 20.83 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.05 | | 1.07 | | 1.05 | | 1.04 | | 1.05 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.27 | | 1.33 | | 1.24 | | 1.34 | | 1.16 |

| Portfolio Turnover Rate | | 5.17 | | 3.86 | | 2.67 | | 1.64 | | 4.60 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 121,006 | | 114,746 | | 101,172 | | 80,529 | | 89,121 |

| a Based on average shares outstanding at each month end. |

| See notes to financial statements. |

The Portfolio 17

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Variable Investment Fund (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company, operating as a series company currently offering seven series, including the Appreciation Portfolio (the “portfolio”). The portfolio is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies.The portfolio is a diversified series.The portfolio’s investment objective is to provide long-term capital growth consistent with the preservation of capital. The Dreyfus Corporation (“the Manager” or “Dreyfus”) serves as the portfolio’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the portfolio’s sub-investment adviser.

On July 1, 2007, Mellon Financial Corporation and The Bank of New York Company, Inc. merged, forming The Bank of New York Mellon Corporation (“BNY Mellon”). As part of this transaction, Dreyfus became a wholly-owned subsidiary of BNY Mellon.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the portfolio’s shares, which are sold without a sales charge.The portfolio is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the distribution plan and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The fund accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

18

The portfolio’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifica-tions.The portfolio’s maximum exposure under these arrangements is unknown. The portfolio does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered open-end investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the portfolio calculates its net asset value, the portfolio may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such

The Portfolio 19

N O T E S T O F I N A N C I A L S TAT E M E N T S (continued)

as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

The Financial Accounting Standards Board (“FASB”) released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements.The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the portfolio.

(b) Foreign currency transactions: The portfolio does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the portfolio’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gains or losses on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis.

20

Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The portfolio has an arrangement with the custodian bank whereby the portfolio receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the portfolio includes net earnings credits, if any, as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with Mellon Bank, N.A. (“Mellon Bank”), an affiliate of Dreyfus, the portfolio may lend securities to qualified institutions. It is the portfolio’s policy, that at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collaterals are either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, U.S. Government and Agency securities or Letters of Credit. The portfolio is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the portfolio bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended December 31, 2007, Mellon Bank earned $37,823 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually,

The Portfolio 21

N O T E S T O F I N A N C I A L S TAT E M E N T S (continued)

but the portfolio may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the portfolio not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the portfolio to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

During the current year, the portfolio adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the portfolio’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year.The adoption of FIN 48 had no impact on the operations of the portfolio for the period ended December 31, 2007.

The portfolio is not subject to examination by U.S. Federal, State and City tax authorities for the tax years before 2004.

At December 31, 2007, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $11,212,115, undistributed capital gains $42,403,965 and unrealized appreciation $244,586,314.

22

The tax characters of distributions paid to shareholders during the fiscal periods ended December 31, 2007 and December 31, 2006 were as follows: ordinary income $11,897,641 and $11,945,050, respectively.

During the period ended December 31, 2007, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency exchange gains and losses, the portfolio decreased accumulated undistributed investment income-net by $743 and increased accumulated net realized gain (loss) on investments by the same amount.Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

The portfolio participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the portfolio has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the portfolio at rates based on prevailing market rates in effect at the time of borrowing.

The average daily amount of borrowings outstanding under the Facility during the period ended December 31, 2007 was approximately $1,027,500, with a related weighted average annualized interest rate of 5.67% .

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Advisory Agreement with Dreyfus, the investment advisory fee is based on the value of the portfolio’s average daily net assets and is computed at the following annual rates: .55% of the first $150 million; .50% of the next $150 million; and .375% over $300 million.The fee is payable monthly. Pursuant to a Sub-Investment Advisory Agreement with Sarofim & Co., the sub-investment advisory fee is based upon the value of the portfolio’s average daily net assets and

The Portfolio 23

N O T E S T O F I N A N C I A L S TAT E M E N T S (continued)

is computed at the following annual rates: .20% of the first $150 million; .25% of the next $150 million; and .375% over $300 million.The fee is payable monthly.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing their shares, for servicing and/or maintaining Service shares shareholder accounts and for advertising and marketing for Service shares.The Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets.The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products.The fees payable under the Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2007, Service shares were charged $297,138 pursuant to the Plan.

The portfolio compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the portfolio. During the period ended December 31, 2007, the portfolio was charged $1,265 pursuant to the transfer agency agreement.

The portfolio compensates Mellon Bank, an affiliate of Dreyfus, under a custody agreement for providing custodial services for the portfolio. During the period ended December 31, 2007, the portfolio was charged $61,027 pursuant to the custody agreement.

During the period ended December 31, 2007, the portfolio was charged $4,821 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $264,477, Rule 12b-1 distribution plan fees $27,878, custodian fees $25,648, chief compliance officer fees $3,616 and transfer agency per account fees $195.

24

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2007, amounted to $38,697,804 and $186,205,298, respectively.

At December 31, 2007, the cost of investments for federal income tax purposes was $468,803,789; accordingly, accumulated net unrealized appreciation on investments was $244,586,335, consisting of $251,391,508 gross unrealized appreciation and $6,805,173 gross unrealized depreciation.

The Portfolio 25

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

| Shareholders and Board of Trustees |

| Dreyfus Variable Investment Fund, Appreciation Portfolio |

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Variable Investment Fund, Appreciation Portfolio (one of the funds comprising Dreyfus Variable Investment Fund) as of December 31, 2007, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting.Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances,but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting.Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2007 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Variable Investment Fund, Appreciation Portfolio at December 31,2007,the results of its operations for the year then ended,the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U. S. generally accepted accounting principles.

| New York, New York |

| February 8, 2008 |

26

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the portfolio hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2007 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in January 2008 of the percentage applicable to the preparation of their 2007 income tax returns.

The Portfolio 27

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (64) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

Other Board Memberships and Affiliations:

- The Muscular Dystrophy Association, Director

- Century Business Services, Inc., a provider of outsourcing functions for small and medium size companies, Director

- The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director

- Sunair Services Corporation, a provider of certain outdoor-related services to homes and businesses, Director

No. of Portfolios for which Board Member Serves: 163 ———————

| Peggy C. Davis (64) |

| Board Member (2006) |

Principal Occupation During Past 5 Years:

- Shad Professor of Law, New York University School of Law (1983-present)

- Writer and teacher in the fields of evidence, constitutional theory, family law, social sciences and the law, legal process and professional methodology and training

No. of Portfolios for which Board Member Serves: 64 ———————

| David P. Feldman (68) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

Other Board Memberships and Affiliations:

- BBH Mutual Funds Group (11 funds), Director

- The Jeffrey Company, a private investment company, Director

No. of Portfolios for which Board Member Serves: 50

28

| James F. Henry (77) |

| Board Member (1990) |

- President,The International Institute for Conflict Prevention and Resolution, a non- profit organization principally engaged in the development of alternatives to business litigation (Retired 2003)

- Advisor to The Elaw Forum, a consultant on managing corporate legal costs

- Advisor to John Jay Homestead (the restored home of the first U.S. Chief Justice)

- Individual Trustee of several trusts

Other Board Memberships and Affiliations:

- Director, advisor and mediator involved in several non-profit organizations, primarily engaged in domestic and international dispute resolution, and historic preservation

No. of Portfolios for which Board Member Serves: 41 ———————

| Ehud Houminer (67) |

| Board Member (2006) |

| Principal Occupation During Past 5 Years: |

| • Executive-in-Residence at the Columbia Business School, Columbia University |

Other Board Memberships and Affiliations:

- Avnet Inc., an electronics distributor, Director

- International Advisory Board to the MBA Program School of Management, Ben Gurion University, Chairman

No. of Portfolios for which Board Member Serves: 67 ———————

| Gloria Messinger (78) |

| Board Member (2006) |

Principal Occupation During Past 5 Years:

- Arbitrator for American Arbitration Association and National Association of Securities Dealers, Inc.

- Consultant in Intellectual Property

Other Board Memberships and Affiliations:

- Theater for a New Audience, Inc., Director

- Brooklyn Philharmonic, Director

No. of Portfolios for which Board Member Serves: 41

The Portfolio 29

B O A R D M E M B E R S I N F O R M AT I O N ( U n a u d i t e d ) (continued)

| Dr. Martin Peretz (68) |

| Board Member (1990) |

Principal Occupation During Past 5 Years:

- Editor-in-Chief of The New Republic Magazine

- Lecturer in Social Studies at Harvard University (1965-2002)

- Director of TheStreet.com, a financial information service on the web

Other Board Memberships and Affiliations:

- American Council of Trustees and Alumni, Director

- Pershing Square Capital Management, Advisor

- Montefiore Ventures, General Partner

- Harvard Center for Blood Research,Trustee

- Bard College,Trustee

- Board of Overseers of YIVO Institute for Jewish Research, Chairman

No. of Portfolios for which Board Member Serves: 41 ———————

| Anne Wexler (77) |

| Board Member (2006) |

Principal Occupation During Past 5 Years:

- Chairman of the Wexler & Walker Public Policy Associates, consultants specializing in government relations and public affairs from January 1981 to present

Other Board Memberships and Affiliations:

- Wilshire Mutual Funds (5 funds), Director

- The Community Foundation for the National Capital Region, Director

- Member of the Council of Foreign Relations

- Member of the National Park Foundation

No. of Portfolios for which Board Member Serves: 50 ———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

| John M. Fraser, Jr., Emeritus Board Member |

| Rosalind G. Jacobs, Emeritus Board Member |

| Dr. Paul A. Marks, Emeritus Board Member |

30

OFFICERS OF THE FUND (Unaudited)

| J. DAVID OFFICER, President since |

| December 2006. |

Chief Operating Officer,Vice Chairman and a Director of the Manager, and an officer of 78 investment companies (comprised of 163 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since April 1998.

| PHILLIP N. MAISANO, Executive Vice |

| President since July 2007. |

Chief Investment Officer,Vice Chair and a director of the Manager, and an officer of 78 investment companies (comprised of 163 portfolios) managed by the Manager. Mr. Maisano also is an officer and/or Board member of certain other investment management subsidiaries of The Bank of New York Mellon Corporation, each of which is an affiliate of the Manager. He is 60 years old and has been an employee of the Manager since November 2006. Prior to joining the Manager, Mr. Maisano served as Chairman and Chief Executive Officer of EACM Advisors, an affiliate of the Manager, since August 2004, and served as Chief Executive Officer of Evaluation Associates, a leading institutional investment consulting firm, from 1988 until 2004.

| MICHAEL A. ROSENBERG, Vice President |

| and Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since October 1991.

| JAMES BITETTO, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel and Secretary of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 41 years old and has been an employee of the Manager since December 1996.

| JONI LACKS CHARATAN, Vice President |

| and Assistant Secretary since |

| August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. She is 52 years old and has been an employee of the Manager since October 1988.

| JOSEPH M. CHIOFFI, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since June 2000.

| JANETTE E. FARRAGHER, Vice President |

| and Assistant Secretary since |

| August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. She is 45 years old and has been an employee of the Manager since February 1984.

| JOHN B. HAMMALIAN, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since February 1991.

| ROBERT R. MULLERY, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 55 years old and has been an employee of the Manager since May 1986.

The Portfolio 31

O F F I C E R S O F T H E F U N D ( U n a u d i t e d ) (continued)

| JEFF PRUSNOFSKY, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 42 years old and has been an employee of the Manager since October 1990.

| JAMES WINDELS, Treasurer since |

| November 2001. |

Director – Mutual Fund Accounting of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since April 1985.

| ROBERT ROBOL, Assistant Treasurer |

| since August 2003. |

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since October 1988.

| ROBERT SALVIOLO, Assistant Treasurer |

| since July 2007. |

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 40 years old and has been an employee of the Manager since June 1989.

| ROBERT SVAGNA, Assistant Treasurer |

| since December 2002. |

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 40 years old and has been an employee of the Manager since November 1990.

| GAVIN C. REILLY, Assistant Treasurer |

| since December 2005. |

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 79 investment companies (comprised of 180 portfolios) managed by the Manager. He is 39 years old and has been an employee of the Manager since April 1991.

| JOSEPH W. CONNOLLY, Chief Compliance |

| Officer since October 2004. |

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (79 investment companies, comprised of 180 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 50 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

| WILLIAM GERMENIS, Anti-Money |

| Laundering Compliance Officer since |

| September 2002. |

Vice President and Anti-Money Laundering Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 75 investment companies (comprised of 176 portfolios) managed by the Manager. He is 37 years old and has been an employee of the Distributor since October 1998.

32

Telephone 1-800-554-4611 or 516-338-3300

| Mail | | The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 |

| | | Attn: Investments Division |

The portfolio files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The portfolio’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090.

A description of the policies and procedures that the portfolio uses to determine how to vote proxies relating to portfolio securities, and information regarding how the portfolio voted these proxies for the 12-month period ended June 30, 2007, is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

© 2008 MBSC Securities Corporation

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization.Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus portfolio are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus portfolio.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | THE PORTFOLIO |

| |

|

| 2 | | A Letter from the CEO |

| 3 | | Discussion of Performance |

| 6 | | Portfolio Performance |

| 8 | | Understanding Your Portfolio’s Expenses |

| 8 | | Comparing Your Portfolio’s Expenses |

| | | With Those of Other Funds |

| 9 | | Statement of Investments |

| 17 | | Statement of Assets and Liabilities |

| 18 | | Statement of Operations |

| 19 | | Statement of Changes in Net Assets |

| 21 | | Financial Highlights |

| 23 | | Notes to Financial Statements |

| 30 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 31 | | Important Tax Information |

| 32 | | Board Members Information |

| 35 | | Officers of the Fund |

| FOR MORE INFORMATION |

|

| | | Back Cover |

The Portfolio

| Dreyfus Variable Investment Fund, |

| Developing Leaders Portfolio |

A LETTER FROM THE CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Variable Investment Fund, Developing Leaders Portfolio, covering the 12-month period from January 1, 2007, through December 31, 2007.

Looking back, 2007 was a year of significant change for the stock market.Turmoil in the sub-prime mortgage market, declining housing values and soaring energy prices sparked a “flight to quality” in which investors reassessed their attitudes toward risk. As a result, smaller, more speculative companies that had led the stock market over the past several years lost value over the second half of the year, while shares of larger, multinational growth companies returned to favor. Many financial services and consumer discretionary companies were hurt by repercussions from the sub-prime lending crisis and economic downturn, but energy and basic materials producers generally moved higher along with underlying commodity prices.

The turbulence of 2007 reinforced a central principle of successful investing: diversification. Investors with broad exposure to the world’s stock and bond markets were better protected from the full impact of market volatility in areas that, earlier in the year, were among the bright spots at the time. As we look ahead, we believe that now is the perfect time to meet with your financial advisor, who can help you plan and diversify your investment portfolio in a way that manages the potential opportunities and risks that may continue to arise in 2008.

For information about how the portfolio performed during the reporting period, as well as market perspectives, we have provided a Discussion of Performance given by the Portfolio Managers.

Thank you for your continued confidence and support.

Thomas F. Eggers

Chief Executive Officer

The Dreyfus Corporation

January 15, 2008

|

DISCUSSION OF PERFORMANCE

For the reporting period of January 1, 2007, through December 31, 2007, as provided by Franklin Portfolio Associates Smallcap Team, Portfolio Managers

Market and Portfolio Performance Overview

Shifting economic conditions led to heightened market volatility in 2007. Stocks generally rose during the first half of the year in response to global economic expansion, but declined over the second half under pressure from slowing U.S. growth and a credit crunch emanating from the troubled subprime mortgage market. Small-cap stocks generally underperformed their large-cap counterparts as market strength rotated from small-cap and value-oriented stocks toward larger, more growth-oriented shares.The portfolio underperformed its benchmark, primarily due to the weak performance of several stocks that ranked high on our valuation-related metrics.

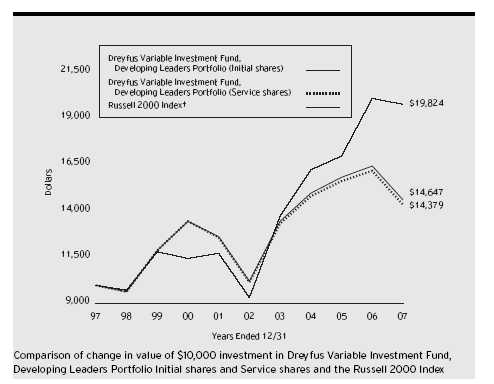

For the 12-month period ended December 31, 2007, Dreyfus Variable Investment Fund, Developing Leaders Portfolio produced total returns of –11.06% for its Initial shares and –11.28% for its Service shares.1 In comparison, the Russell 2000 Index (the “Index”), the portfolio’s benchmark, produced a total return of –1.57% for the same period.2

The Portfolio’s Investment Approach

We select small-cap stocks through a “bottom-up” approach that seeks to identify undervalued securities using a quantitative screening process. This process is driven by a proprietary quantitative model, which measures more than 40 stock characteristics to identify and rank stocks based on fundamental momentum, relative value, future value, long-term growth and other factors. Over time, we attempt to construct a portfolio that has exposure to industries and market capitalizations generally similar to the portfolio’s benchmark. Within each sector, we seek to overweight the most attractive stocks and underweight or not hold the stocks that have been ranked least attractive.

The Portfolio 3

DISCUSSION OF PERFORMANCE (continued)

Our Valuation Metrics Underperformed Market Averages

During the reporting period, the market tended to reward relatively high-priced stocks that exhibited strong growth characteristics, while disregarding many of the valuation metrics on which the portfolio relies. As a result, several holdings that appeared to us to be attractively valued significantly underperformed the benchmark. In some cases, these stocks suffered as a direct result of clear economic trends. For example, financial services providers Ocwen Financial, BankUnited Financial and Fremont General declined as a result of their exposure to the sub-prime loan market. Similarly, consumer-related holdings, such as restaurant chain Ruby Tuesday and discount retailer Big Lots, were hurt by declining consumer confidence. Other firms, such as plastics maker Spartech, suffered from the decline in residential construction during the reporting period.

In other instances, company-specific issues were primarily responsible for a holding’s negative performance. Cosmetic laser system developer Palomar Medical Technologies slipped after reporting disappointing earnings and revenues. Independent oil refiner Western Refining lost ground during the second half of 2007 due to rising operational and maintenance costs. Digital media products and services provider RealNetworks was undermined by broad economic weakness and the highly competitive environment in which it operates.

On the other hand, the portfolio benefited from certain investments in global companies with a significant presence in overseas markets.Two of the portfolio’s top performers, agricultural basic materials producers CF Industries Holdings and Terra Industries, each advanced by roughly 300%, primarily on the strength of higher agricultural commodity prices and strong global demand for fertilizers. GrafTech International, a producer of graphite and carbon-based products used in a wide range of industries around the world, rose after announcing sharply higher earnings per share for the first quarter of 2007 than for the same period in 2006, and significantly increasing its forward-looking sales growth guidance. Internet-based travel services provider Priceline.com climbed throughout the reporting period, bolstered by impressive European growth and improving domestic performance.

Staying the Course in a Turbulent Market

The market’s recent shift from value toward growth/momentum may have been exacerbated by negative developments in the sub-prime lending market. Nevertheless, we believe these developments represent the kind of cyclical market shift we have seen many times in the past and will no doubt encounter again. During such turbulent times, we think it more important than ever to maintain a consistent, disciplined investment approach. We also believe it is important to maintain a blend of holdings that appear attractive from both valuation and momentum perspectives, as we believe that over the long run it is these stocks that have the best opportunity to outperform, regardless of whether we return to a more value-led market or whether we move into a broader, more traditional growth cycle. Accordingly, as of the end of the reporting period, we have remained fully committed to our disciplined, quantitative investment approach, which balances growth and value factors to identify the most attractive opportunities in the small-cap market.

January 15, 2008

| | | The portfolio is only available as a funding vehicle under various life insurance policies or variable |

| | | annuity contracts issued by insurance companies. Individuals may not purchase shares of the |

| | | portfolio directly. A variable annuity is an insurance contract issued by an insurance company that |

| | | enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term |

| | | goals.The investment objective and policies of Dreyfus Variable Investment Fund, Developing |

| | | Leaders Portfolio made available through insurance products may be similar to other |

| | | funds/portfolios managed or advised by Dreyfus. However, the investment results of the portfolio |

| | | may be higher or lower than, and may not be comparable to, those of any other Dreyfus |

| | | fund/portfolio. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | portfolio shares may be worth more or less than their original cost.The portfolio’s performance does |

| | | not reflect the deduction of additional charges and expenses imposed in connection with investing |

| | | in variable insurance contracts, which will reduce returns. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Russell 2000 Index is an unmanaged index of small-cap stock |

| | | performance and is composed of the 2,000 smallest companies in the Russell 3000 Index.The |

| | | Russell 3000 Index is composed of the 3,000 largest U.S. companies based on total market |

| | | capitalization. |

| | | Franklin Portfolio Associates is a wholly-owned subsidiary of The Bank of New York Mellon |

| | | Corporation. Franklin Portfolio Associates has no affiliation to the Franklin Templeton Group of |

| | | Funds or Franklin Resources, Inc.The portfolio’s managers are dual employees of Franklin |

| | | Portfolio Associates and Dreyfus. |

The Portfolio 5

PORTFOLIO PERFORMANCE

| Average Annual Total Returns | | as of 12/31/07 | | | | | | |

| | | | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

| |

|

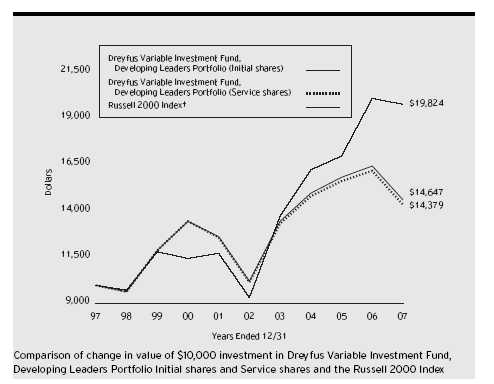

| Initial shares | | | | (11.06)% | | 7.44% | | 3.89% |

| Service shares | | | | (11.28)% | | 7.18% | | 3.70% |

| The data for Service shares includes the results of Initial shares for the period prior to December 31, 2000 |

| (inception date of Service shares). Actual Service shares’ average annual total return and hypothetical growth |

| results would have been lower. See notes below. |

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The portfolio’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. |

| The portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in |

| connection with investing in variable insurance contracts which will reduce returns. |

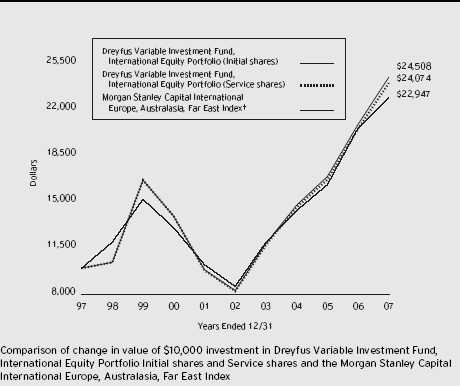

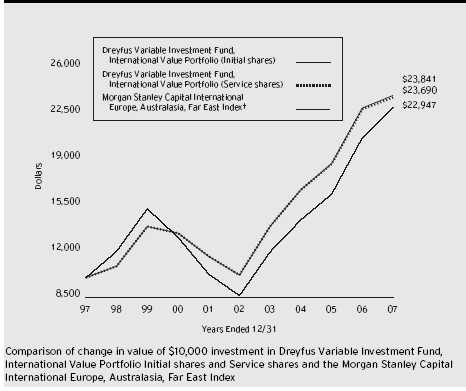

| The above graph compares a $10,000 investment made in Initial and Service shares of Dreyfus Variable Investment |

| Fund, Developing Leaders Portfolio on 12/31/97 to a $10,000 investment made in the Russell 2000 Index (the |

| “Index”) on that date. |

6

| The portfolio’s Initial shares are not subject to a Rule 12b-1 fee.The portfolio’s Service shares are subject to a 0.25% |

| annual Rule 12b-1 fee.The performance figures for Service shares reflect the performance of the portfolio’s Initial shares |

| from their inception date through December 30, 2000, and the performance of the portfolio’s Service shares from |

| December 31, 2000 (inception date of Service shares) to December 31, 2007 (blended performance figures).The |

| blended performance figures have not been adjusted to reflect the higher operating expenses of the Service shares. If these |

| expenses had been reflected, the blended performance figures would have been lower. All dividends and capital gain |

| distributions are reinvested. |

| The portfolio’s performance shown in the line graph takes into account all applicable portfolio fees and expenses.The Index |

| is an unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 |

| Index is composed of 3,000 of the largest U.S. companies by market capitalization. Unlike a mutual fund, the Index is |

| not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to |