UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-05162 |

| | |

| Exact name of registrant as specified in charter: | Delaware VIP® Trust |

| | |

| Address of principal executive offices: | 610 Market Street

Philadelphia, PA 19106 |

| | |

| Name and address of agent for service: | David F. Connor, Esq.

610 Market Street

Philadelphia, PA 19106 |

| | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| | |

| Date of fiscal year end: | December 31 |

| | |

| Date of reporting period: | December 31, 2022 |

Item 1. Reports to Stockholders

| Delaware VIP® Trust Delaware VIP Emerging Markets Series December 31, 2022 | |

Table of contents

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Series is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of December 31, 2022, and subject to change for events occurring after such date.

The Series is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

The Series is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

This material may be used in conjunction with the offering of shares in Delaware VIP® Emerging Markets Series only if preceded or accompanied by the Series’ current prospectus or the summary prospectus.

© 2023 Macquarie Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

Portfolio management review

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

December 31, 2022 (Unaudited)

The investment objective of the Series is to seek long-term capital appreciation.

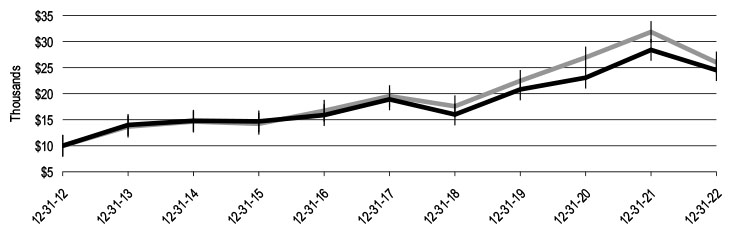

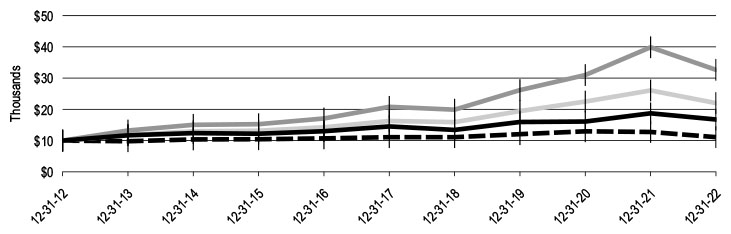

For the fiscal year ended December 31, 2022, Delaware VIP Emerging Markets Series (the “Series”) Standard Class shares fell 27.58%. The Series Service Class shares fell 27.81%. Both returns reflect reinvestment of all dividends. By comparison, the Series’ benchmark, the MSCI Emerging Markets Index, fell 20.09% (net) and 19.74% (gross) for the same period. Past performance does not guarantee future results. For complete, annualized performance of Delaware VIP Emerging Markets Series, please see the table on page 3. Please see page 4 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Market review

The MSCI Emerging Markets Index declined 20% during the fiscal year ended December 31, 2022, lagging developed markets. Several factors influenced performance. First, geopolitical tensions between Russia and Ukraine escalated to a full-scale military conflict. As events unfolded, the US and the European Union imposed sanctions on certain Russian entities, corporations, and individuals, and MSCI eliminated all Russian stocks from the benchmark at a de minimis price. Second, China maintained its stringent stance on COVID-19 through most of the year, imposing lockdowns in major metropolitan areas, further dampening the economic outlook. Third, the US Federal Reserve quickened its pace of monetary tightening to combat inflationary pressures, contributing to rising US bond yields and a strengthening US dollar.

Amid volatile market conditions, returns across countries and sectors diverged significantly. Among geographic regions, Latin America outperformed the most. Equities in Brazil and Peru posted returns exceeding 9% in US dollar terms, buoyed by rising commodities’ prices and currency appreciation. Mexico also outperformed with notable strength in the financials and industrials sectors. Excluding the impact of Russia’s removal from the MSCI Emerging Markets Index, markets in the Europe, Middle East, and Africa (EMEA) region also outperformed. Rising energy prices supported equities in the Middle East, while in South Africa, the energy, industrials, and consumer discretionary sectors bolstered performance. In Turkey, equities rallied amid high inflation.

In contrast, Asia relatively lagged, particularly the North Asian markets. In China, concern about slowing economic growth weighed on consumer-related stocks. Moreover, lingering uncertainty in the regulatory environment, both in China and the US, contributed to underperformance in the technology, communication services, and healthcare sectors. In Taiwan and South Korea, technology stocks underperformed as demand weakness appeared to spread beyond consumer-related applications to other end markets. Elsewhere, equities in South and Southeast Asia outperformed as domestic demand helped insulate these economies from slowing global growth. Indonesia and Thailand outperformed the most among Asian markets.

In terms of sectors, utilities, financials, consumer staples, and industrials relatively outperformed. In contrast, energy and technology underperformed the most.

Within the Series

Among countries, Russia detracted the most from relative performance. The Series’ investment process centers on identifying individual companies that we believe possess sustainable franchises and favorable long-term growth prospects, and that trade at significant discounts to their intrinsic value. Historically, we have found selective Russian companies attractive from a fundamental perspective. For example, in the energy sector, we believe that the oil resources of Rosneft Oil Co. PJSC have some of the lowest extraction costs globally and that the company’s long-term growth opportunities and valuation compare favorably to peers. However, we have also recognized heightened risks associated with these investments and have sought to manage such risks through enhanced valuation discounts and limits to position sizes. On balance, the Series has maintained a measured overweight position in Russia relative to its country weighting in the benchmark. As tensions between Russia and Ukraine ratcheted up in late 2021 and early 2022, we closely monitored the situation, but in our assessment at that time, the likelihood of a full-scale invasion appeared low.

In the wake of Russia’s incursion into Ukraine and the swift application of sanctions against certain Russian entities, trading on Moscow’s stock exchange was halted on February 28, 2022. Several Russian stocks listed offshore continued to trade but plunged in value before being suspended for trading on or around March 2, 2022. As of December 31, 2022, trading in Russian stocks remained suspended for foreign investors. Considering these trading suspensions and the ongoing geopolitical uncertainty, the value of the Series’ Russian holdings has been written down based on fair valuation protocols.

Portfolio management review

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

Outside of Russia, the Series’ stock selection in South Korea and Taiwan was unfavorable. The Series holds large overweight positions in semiconductor stocks including MediaTek Inc., SK hynix Inc., Taiwan Semiconductor Manufacturing Co. Ltd., and Samsung Electronics Co. Ltd. These stocks underperformed as deterioration in the demand outlook heightened investors’ concerns about rising inventories, price declines for semiconductor chips, and downward earnings-estimate revisions.

On the positive side, the Series’ position in Reliance Industries Ltd. in India outperformed as domestic consumption recovered. In China, favorable stock selection contributed to relative performance.

The prevailing sources of uncertainty – including inflation, rising interest rates, energy markets, and a potential slowdown of global growth – are unlikely to abate in the near term, in our view. As such, we expect market conditions to remain volatile. Nonetheless, we do not believe these uncertainties have derailed long-term growth opportunities underpinned by secular trends such as digitalization and consumption premiumization (consumers’ preference for high-quality, healthy, and premium products). Furthermore, we believe that equity valuations across several pockets of the emerging markets universe appear attractive.

Among countries, we currently hold overweight positions in South Korea, Taiwan, and Mexico. Conversely, we are currently underweight relative to the benchmark the Middle East, Southeast Asia, and South Africa. Sectors we currently favor include technology, consumer staples, and energy (largely due to the Series’ holding in Reliance Industries). The Series is most underweight financials, industrials, and materials.

The Series used foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

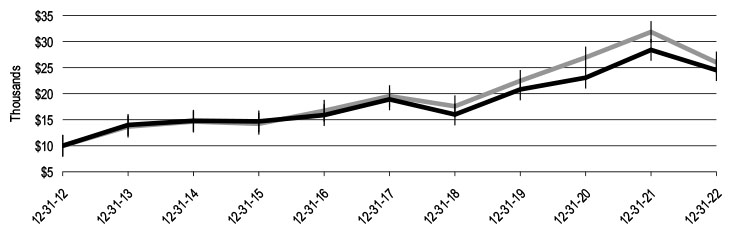

Performance summary (Unaudited)

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Carefully consider the Series’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Series’ prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/vip/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

| Series and benchmark performance | | Average annual total returns through December 31, 2022 |

| | | 1 year | | 3 year | | 5 year | | 10 year |

| Standard Class shares (commenced operations on May 1, 1997) | | -27.58% | | -4.17% | | -1.90% | | +2.34% |

| Service Class shares (commenced operations on May 1, 2000) | | -27.81% | | -4.46% | | -2.19% | | +2.06% |

| MSCI Emerging Markets Index (net) | | -20.09% | | -2.69% | | -1.40% | | +1.44% |

| MSCI Emerging Markets Index (gross) | | -19.74% | | -2.34% | | -1.03% | | +1.81% |

Returns reflect the reinvestment of all distributions. Please see page 4 for a description of the index.

As described in the Series’ most recent prospectus, the net expense ratios for Standard Class and Service Class shares of the Series were 1.18% and 1.48%, respectively, while total operating expenses for Standard Class and Service Class shares were 1.33% and 1.63%, respectively. The management fee for Standard Class and Service Class shares was 1.23%, and the annual distribution and service (12b-1) fee for Service Class shares was 0.30% of average daily net assets. The expense ratios may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios.

Earnings from a variable annuity or variable life investment compound tax-free until withdrawal, and as a result, no adjustments were made for income taxes.

Expense limitations were in effect for both classes during some or all of the periods shown in the “Series and benchmark performance” table above and in the “Performance of a $10,000 investment” graph on the next page. Performance would have been lower had expense limitations not been in effect.

Performance data do not include any fees or sales charges imposed by variable insurance contracts. This fund doesn’t have any deferred sales charges. Performance shown here would have been reduced if such fees were included. For more information about fees, consult your variable annuity or variable life prospectus.

Investments in variable products involve risk.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

Investments in small- and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Series from executing advantageous investment decisions in a timely manner and could negatively impact the Series’ ability to achieve its investment objective and the value of the Series’ investments.

Performance summary (Unaudited)

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

Please read both the contract and underlying prospectus for specific details regarding the product’s risk profile.

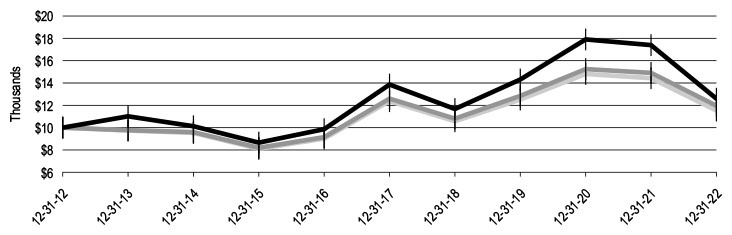

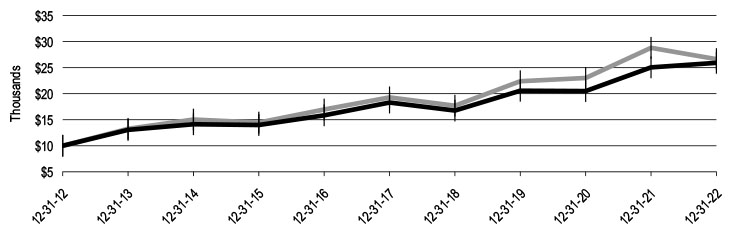

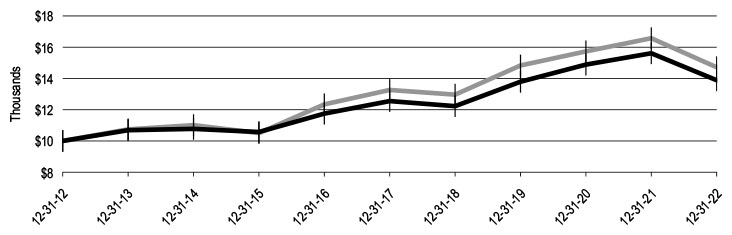

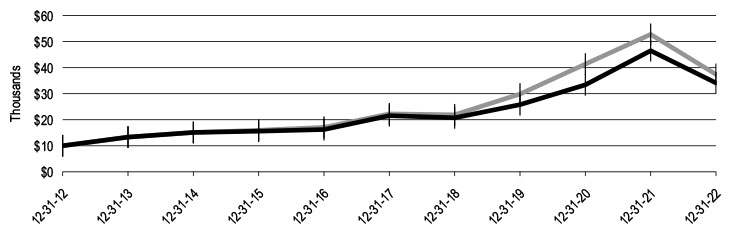

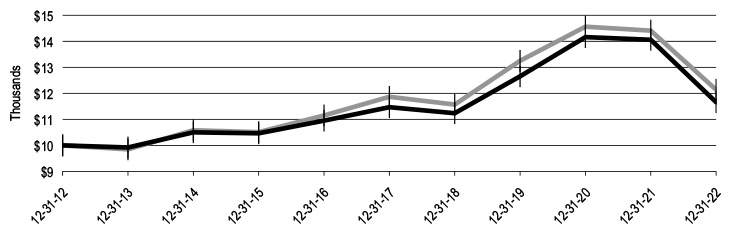

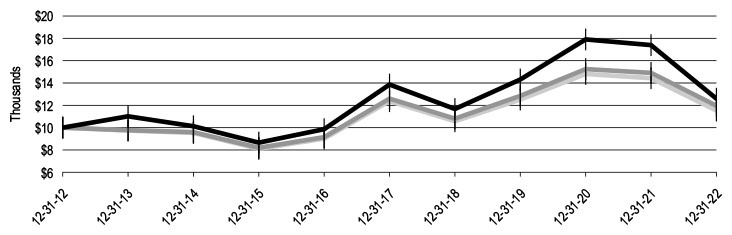

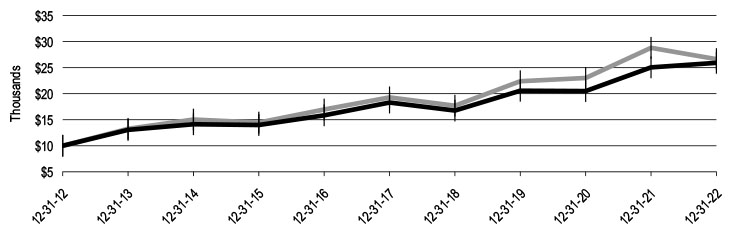

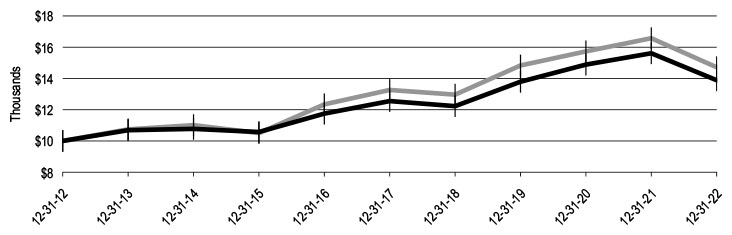

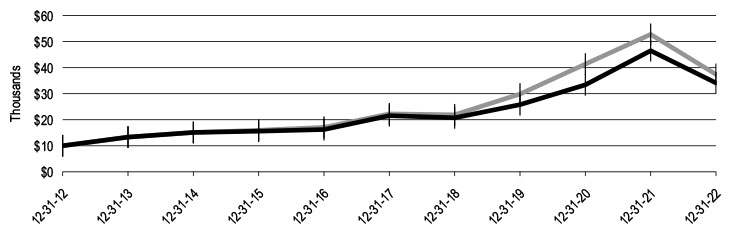

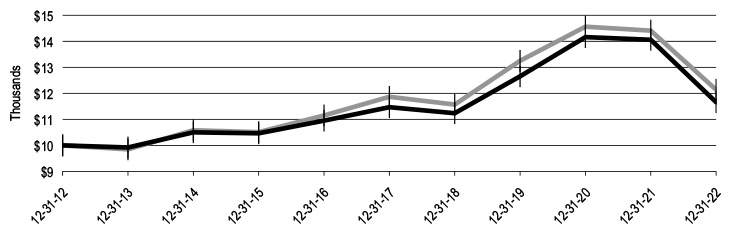

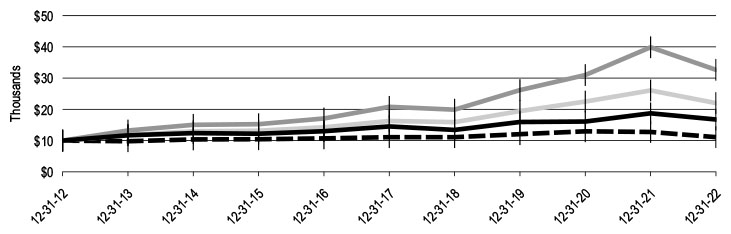

Performance of a $10,000 investment1

For the period December 31, 2012 through December 31, 2022

| | | | Starting value | | Ending value |

| Delaware VIP Emerging Markets Series — Standard Class shares | | $10,000 | | $12,597 |

| MSCI Emerging Markets Index (gross) | | $10,000 | | $11,965 |

| MSCI Emerging Markets Index (net) | | $10,000 | | $11,533 |

The graph shows a $10,000 investment in Delaware VIP Emerging Markets Series Standard Class shares for the period from December 31, 2012 through December 31, 2022.

The graph also shows $10,000 invested in the MSCI Emerging Markets Index for the period from December 31, 2012 through December 31, 2022.

The MSCI Emerging Markets Index represents large- and mid-cap stocks across emerging market countries worldwide. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Performance of Service Class shares will vary due to different charges and expenses.

Past performance does not guarantee future results.

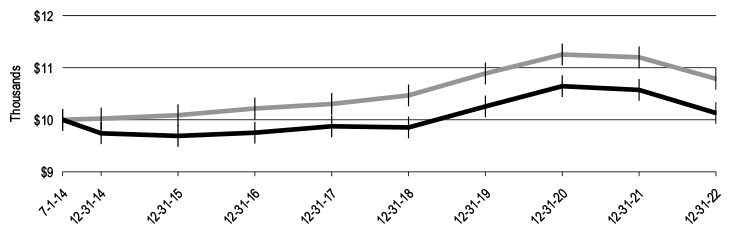

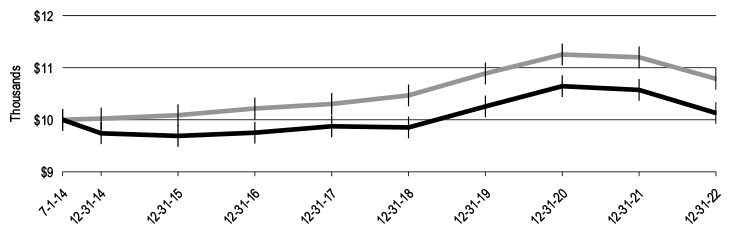

Disclosure of Series expenses

For the six-month period from July 1, 2022 to December 31, 2022 (Unaudited)

As a shareholder of the Series, you incur ongoing costs, which may include management fees; distribution and service (12b-1) fees; and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from July 1, 2022 to December 31, 2022.

Actual expenses

The first section of the table shown, “Actual Series return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. As a shareholder of the Series, you do not incur any transaction costs, such as sales charges (loads), redemption fees or exchange fees, but shareholders of other funds may incur such costs. Also, the fees related to the variable annuity investment or the deferred sales charge that could apply have not been included. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The Series’ expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

| Expense analysis of an investment of $1,000 | | |

| | | Beginning

Account

Value

7/1/22 | | | Ending

Account

Value

12/31/22 | | | Annualized

Expense

Ratio | | Expenses Paid During Period

7/1/22 to

12/31/22* |

| Actual Series return† | | | | | | | |

| Standard Class | | $ | 1,000.00 | | | $ | 936.70 | | | 1.19% | | $5.81 |

| Service Class | | | 1,000.00 | | | | 935.20 | | | 1.49% | | 7.27 |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | |

| Standard Class | | $ | 1,000.00 | | | $ | 1,019.21 | | | 1.19% | | $6.06 |

| Service Class | | | 1,000.00 | | | | 1,017.69 | | | 1.49% | | 7.58 |

| * | “Expenses Paid During Period” are equal to the Series’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Series’ expenses reflected above, the Series also indirectly bears its portion of the fees and expenses of any investment companies (Underlying Funds) in which it invests. The table above does not reflect the expenses of any Underlying Funds.

Security type / country and sector allocations

Delaware VIP Emerging Markets Series

As of December 31, 2022 (Unaudited)

Sector designations may be different from the sector designations presented in other Series materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different from another fund’s sector designations.

| Security type / country | | Percentage

of net assets |

| Common Stocks by Country | | 93.62 | % |

| Argentina | | 1.46 | % |

| Australia | | 0.45 | % |

| Bahrain | | 0.24 | % |

| Brazil | | 5.21 | % |

| Chile | | 1.46 | % |

| China/Hong Kong | | 31.26 | % |

| India | | 12.94 | % |

| Indonesia | | 1.24 | % |

| Japan | | 0.54 | % |

| Malaysia | | 0.05 | % |

| Mexico | | 4.18 | % |

| Peru | | 0.49 | % |

| Republic of Korea | | 15.73 | % |

| Russia | | 0.00 | % |

| South Africa | | 0.08 | % |

| Taiwan | | 16.51 | % |

| Turkey | | 1.51 | % |

| United Kingdom | | 0.27 | % |

| Convertible Preferred Stock | | 0.04 | % |

| Preferred Stocks | | 4.67 | % |

| Rights | | 0.00 | % |

| Warrants | | 0.03 | % |

| Participation Notes | | 0.00 | % |

| Short-Term Investments | | 1.36 | % |

| Total Value of Securities | | 99.72 | % |

| Receivables and Other Assets Net of Liabilities | | 0.28 | % |

| Total Net Assets | | 100.00 | % |

| Common stock, participation notes, and preferred stock by sector | | Percentage

of net assets |

| Communication Services | | 13.29 | % |

| Consumer Discretionary | | 12.07 | % |

| Consumer Staples | | 14.24 | % |

| Energy | | 10.42 | % |

| Financials | | 4.22 | % |

| Healthcare | | 0.77 | % |

| Industrials | | 1.65 | % |

| Information Technology* | | 35.39 | % |

| Materials | | 4.85 | % |

| Real Estate | | 0.53 | % |

| Utilities | | 0.86 | % |

| Total | | 98.29 | % |

| * | To monitor compliance with the Series’ concentration guidelines as described in the Series’ Prospectus and Statement of Additional Information, the Information Technology sectors (as disclosed herein for financial reporting purposes) is subdivided into a variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940, as amended). The Information Technology sector consisted of Computers, Electronics, Electronic Components-Semiconductor, Internet, Investment Companies, Semiconductor Components-Integrated Circuits, and Software. As of December 31, 2022, such amounts, as a percentage of total net assets were 2.04%, 2.31%,17.15%, 1.08%, 1.53%, 10.56%, and 0.72%, respectively. The percentage in any such single industry will comply with the Series’ concentration policy even if the percentage in the Information Technology sector for financial reporting purposes may exceed 25%. |

Schedule of investments

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

December 31, 2022

| | | Number of

shares | | | Value

(US $) | |

| Common Stocks — 93.62%∆ | | | | | | | | |

| Argentina — 1.46% | | | | | | | | |

| Arcos Dorados Holdings Class A | | | 280,478 | | | $ | 2,344,796 | |

| Cablevision Holding GDR | | | 262,838 | | | | 820,895 | |

| Cresud ADR | | | 326,731 | | | | 2,185,831 | |

| Grupo Clarin GDR Class B 144A #, † | | | 77,680 | | | | 89,329 | |

| IRSA Inversiones y Representaciones ADR | | | 535,335 | | | | 2,558,901 | |

| | | | | | | | 7,999,752 | |

| Australia — 0.45% | | | | | | | | |

| BHP Group ADR | | | 39,700 | | | | 2,463,385 | |

| | | | | | | | 2,463,385 | |

| Bahrain — 0.24% | | | | | | | | |

| Aluminium Bahrain GDR 144A # | | | 91,200 | | | | 1,318,935 | |

| | | | | | | | 1,318,935 | |

| Brazil — 5.21% | | | | | | | | |

| AES Brasil Energia | | | 310,668 | | | | 568,408 | |

| Americanas | | | 1,560,623 | | | | 2,852,410 | |

| Banco Bradesco ADR | | | 1,749,871 | | | | 5,039,628 | |

| Banco Santander Brasil ADR | | | 53,466 | | | | 288,182 | |

| BRF ADR † | | | 788,900 | | | | 1,246,462 | |

| Itau Unibanco Holding ADR | | | 1,049,325 | | | | 4,942,321 | |

| Rumo | | | 217,473 | | | | 766,546 | |

| Telefonica Brasil ADR | | | 272,891 | | | | 1,951,171 | |

| TIM ADR | | | 155,003 | | | | 1,805,785 | |

| Vale | | | 149,527 | | | | 2,517,157 | |

| Vale ADR | | | 363,623 | | | | 6,170,682 | |

| XP Class A † | | | 24,226 | | | | 371,627 | |

| | | | | | | | 28,520,379 | |

| Chile — 1.46% | | | | | | | | |

| Sociedad Quimica y Minera de Chile ADR | | | 100,000 | | | | 7,984,000 | |

| | | | | | | | 7,984,000 | |

| China/Hong Kong — 31.26% | | | | | | | | |

| Alibaba Group Holding † | | | 827,100 | | | | 9,139,432 | |

| Alibaba Group Holding ADR † | | | 143,800 | | | | 12,667,342 | |

| ANTA Sports Products | | | 268,400 | | | | 3,517,711 | |

| Baidu ADR † | | | 49,719 | | | | 5,686,859 | |

| BeiGene † | | | 167,800 | | | | 2,885,005 | |

| DiDi Global ADR † | | | 81,500 | | | | 259,170 | |

| Hengan International Group | | | 260,500 | | | | 1,383,357 | |

| iQIYI ADR † | | | 59,542 | | | | 315,573 | |

| JD.com Class A | | | 34,285 | | | | 967,216 | |

| JD.com ADR | | | 350,000 | | | | 19,645,500 | |

| Joinn Laboratories China Class H 144A # | | | 9,604 | | | | 49,156 | |

| Kunlun Energy | | | 3,360,900 | | | | 2,398,352 | |

| Kweichow Moutai Class A | | | 111,913 | | | | 27,802,372 | |

| New Oriental Education & Technology Group ADR † | | | 16,190 | | | | 563,736 | |

| Ping An Insurance Group Co. of China Class H | | | 585,000 | | | | 3,871,045 | |

| Sohu.com ADR † | | | 429,954 | | | | 5,894,669 | |

| TAL Education Group ADR † | | | 50,701 | | | | 357,442 | |

| Tencent Holdings | | | 753,900 | | | | 32,259,844 | |

| Tencent Music Entertainment Group ADR † | | | 159 | | | | 1,317 | |

| Tianjin Development Holdings | | | 35,950 | | | | 6,909 | |

| Tingyi Cayman Islands Holding | | | 1,582,000 | | | | 2,792,915 | |

| Trip.com Group ADR † | | | 120,588 | | | | 4,148,227 | |

| Tsingtao Brewery Class H | | | 797,429 | | | | 7,876,775 | |

| Uni-President China Holdings | | | 2,800,000 | | | | 2,801,632 | |

| Weibo Class A † | | | 65,500 | | | | 1,233,561 | |

| Weibo ADR † | | | 40,000 | | | | 764,800 | |

| Wuliangye Yibin Class A | | | 837,792 | | | | 21,776,060 | |

| | | | | | | | 171,065,977 | |

| India — 12.94% | | | | | | | | |

| HCL Technologies | | | 312,400 | | | | 3,924,541 | |

| Indiabulls Real Estate GDR † | | | 44,628 | | | | 43,749 | |

| Infosys | | | 285,200 | | | | 5,199,307 | |

| Natco Pharma | | | 185,519 | | | | 1,259,480 | |

| Reliance Industries | | | 859,880 | | | | 26,475,116 | |

| Reliance Industries GDR 144A # | | | 452,657 | | | | 27,838,405 | |

| Sify Technologies ADR † | | | 91,200 | | | | 105,792 | |

| Tata Consultancy Services | | | 151,800 | | | | 5,975,669 | |

| | | | | | | | 70,822,059 | |

| Indonesia — 1.24% | | | | | | | | |

| Astra International | | | 18,590,600 | | | | 6,806,900 | |

| | | | | | | | 6,806,900 | |

| Japan — 0.54% | | | | | | | | |

| Renesas Electronics † | | | 324,700 | | | | 2,928,089 | |

| | | | | | | | 2,928,089 | |

| Malaysia — 0.05% | | | | | | | | |

| UEM Sunrise † | | | 4,748,132 | | | | 274,864 | |

| | | | | | | | 274,864 | |

| Mexico — 4.18% | | | | | | | | |

| America Movil ADR Class L | | | 162,815 | | | | 2,963,233 | |

| Banco Santander Mexico ADR | | | 276,900 | | | | 1,669,707 | |

| Becle | | | 1,571,000 | | | | 3,430,377 | |

| Cemex ADR † | | | 469,537 | | | | 1,901,625 | |

| Coca-Cola Femsa ADR | | | 75,784 | | | | 5,144,218 | |

| Fomento Economico Mexicano ADR | | | 19,186 | | | | 1,498,810 | |

| Grupo Financiero Banorte Class O | | | 440,979 | | | | 3,173,628 | |

| Grupo Televisa ADR | | | 656,458 | | | | 2,993,448 | |

Schedule of investments

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

| | | Number of

shares | | | Value

(US $) | |

| Common Stocks∆ (continued) | | | | | | |

| Mexico (continued) | | | | | | | | |

| Sitios Latinoamerica † | | | 162,815 | | | $ | 76,869 | |

| | | | | | | | 22,851,915 | |

| Peru — 0.49% | | | | | | | | |

| Cia de Minas Buenaventura ADR | | | 356,605 | | | | 2,656,707 | |

| | | | | | | | 2,656,707 | |

| Republic of Korea — 15.73% | | | | | | | | |

| Fila Holdings | | | 101,760 | | | | 2,684,602 | |

| LG Uplus | | | 250,922 | | | | 2,197,406 | |

| Samsung Electronics | | | 671,359 | | | | 29,468,124 | |

| Samsung Life Insurance | | | 66,026 | | | | 3,707,699 | |

| SK Hynix | | | 360,000 | | | | 21,479,058 | |

| SK Square † | | | 315,059 | | | | 8,386,405 | |

| SK Telecom | | | 159,405 | | | | 5,979,896 | |

| SK Telecom ADR | | | 590,316 | | | | 12,154,606 | |

| | | | | | | | 86,057,796 | |

| Russia — 0.00% | | | | | | | | |

| ENEL RUSSIA PJSC =, † | | | 755,050 | | | | 0 | |

| Etalon Group GDR 144A #, = | | | 354,800 | | | | 0 | |

| Gazprom PJSC = | | | 2,087,800 | | | | 0 | |

| Rosneft Oil PJSC = | | | 1,449,104 | | | | 0 | |

| Sberbank of Russia PJSC =, † | | | 2,058,929 | | | | 0 | |

| Surgutneftegas PJSC ADR =, † | | | 294,652 | | | | 0 | |

| T Plus PJSC =, † | | | 25,634 | | | | 0 | |

| VK GDR =, † | | | 71,300 | | | | 0 | |

| Yandex Class A =, † | | | 101,902 | | | | 0 | |

| | | | | | | | 0 | |

| South Africa — 0.08% | | | | | | | | |

| Sun International | | | 210,726 | | | | 428,986 | |

| Tongaat Hulett =, † | | | 182,915 | | | | 0 | |

| | | | | | | | 428,986 | |

| Taiwan — 16.51% | | | | | | | | |

| Hon Hai Precision Industry | | | 3,881,564 | | | | 12,616,299 | |

| MediaTek | | | 1,125,000 | | | | 22,876,641 | |

| Taiwan Semiconductor Manufacturing | | | 3,756,864 | | | | 54,821,086 | |

| | | | | | | | 90,314,026 | |

| Turkey — 1.51% | | | | | | | | |

| D-MARKET Elektronik Hizmetler ve Ticaret ADR † | | | 15,200 | | | | 10,032 | |

| Turkcell Iletisim Hizmetleri | | | 677,165 | | | | 1,371,547 | |

| Turkiye Sise ve Cam Fabrikalari | | | 3,008,750 | | | | 6,904,813 | |

| | | | | | | | 8,286,392 | |

| United Kingdom — 0.27% | | | | | | | | |

| Griffin Mining † | | | 1,642,873 | | | | 1,493,586 | |

| | | | | | | | 1,493,586 | |

Total Common Stocks

(cost $506,606,644) | | | | | | | 512,273,748 | |

| | | | | | | | | |

| Convertible Preferred Stock — 0.04% | | | | | | | | |

| Republic of Korea — 0.04% | | | | | | | | |

| CJ 3.07% | | | 4,204 | | | | 243,087 | |

Total Convertible Preferred Stock

(cost $470,723) | | | | | | | 243,087 | |

| | | | | | | | | |

| Preferred Stocks — 4.67% | | | | | | | | |

| Brazil — 0.81% | | | | | | | | |

| Centrais Eletricas Brasileiras Class B 3.76% ω | | | 216,779 | | | | 1,774,962 | |

| Petroleo Brasileiro ADR 44.73% ω | | | 285,509 | | | | 2,652,379 | |

| | | | | | | | 4,427,341 | |

| Republic of Korea — 3.86% | | | | | | | | |

| CJ 4.81% ω | | | 28,030 | | | | 1,089,895 | |

| Samsung Electronics 1.97% ω | | | 499,750 | | | | 20,026,660 | |

| | | | | | | | 21,116,555 | |

| Russia — 0.00% | | | | | | | | |

| Transneft PJSC =, ω | | | 3,606 | | | | 0 | |

| | | | | | | | 0 | |

Total Preferred Stocks

(cost $16,880,353) | | | | | | | 25,543,896 | |

| | | | | | | | | |

| Rights — 0.00% | | | | | | | | |

| Brazil — 0.00% | | | | | | | | |

| AES Brasil Energia SA † | | | 1,671 | | | | 79 | |

Total Rights

(cost $0) | | | | | | | 79 | |

| | | | | | | | | |

| Warrants — 0.03% | | | | | | | | |

| Argentina — 0.03% | | | | | | | | |

| IRSA Inversiones y Representaciones exercise price $0.25, expiration date 3/5/26 † | | | 594,450 | | | | 147,037 | |

Total Warrants

(cost $0) | | | | | | | 147,037 | |

| | | | | | | | | |

| Participation Notes — 0.00% | | | | | | | | |

| Lehman Indian Oil CW 12 LEPO =, † | | | 100,339 | | | | 0 | |

| | | Number of

shares | | Value

(US $) |

| Participation Notes (continued) | | | | |

| Lehman Oil & Natural Gas CW 12 LEPO =, † | | | 146,971 | | | $ | 0 | |

Total Participation Notes

(cost $4,952,197) | | | | | | | 0 | |

| | | | | | | | | |

| Short-Term Investments — 1.36% | | | | | | | | |

| Money Market Mutual Funds — 1.36% | | | | | | | | |

BlackRock Liquidity FedFund –

Institutional Shares (seven-day effective yield 4.03%) | | | 1,862,045 | | | | 1,862,045 | |

Fidelity Investments Money Market Government Portfolio –

Class I (seven-day effective yield 4.06%) | | | 1,862,045 | | | | 1,862,045 | |

Goldman Sachs Financial Square Government Fund –

Institutional Shares (seven-day effective yield 4.23%) | | | 1,862,045 | | | | 1,862,045 | |

Morgan Stanley Institutional Liquidity Funds Government Portfolio –

Institutional Class (seven-day effective yield 4.11%) | | | 1,862,044 | | | | 1,862,044 | |

Total Short-Term Investments

(cost $7,448,179) | | | | | | | 7,448,179 | |

Total Value of Securities — 99.72%

(cost $536,358,096) | | | | | | $ | 545,656,026 | |

| ∆ | Securities have been classified by country of risk. Aggregate classification by business sector has been presented on page 6 in “Security type / country and sector allocations.” |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At December 31, 2022, the aggregate value of Rule 144A securities was $29,295,825, which represents 5.35% of the Series’ net assets. See Note 10 in “Notes to financial statements.” |

| † | Non-income producing security. |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security. |

| ω | Perpetual security with no stated maturity date. |

Summary of abbreviations:

ADR – American Depositary Receipt

GDR – Global Depositary Receipt

LEPO – Low Exercise Price Option

PJSC – Private Joint Stock Company

See accompanying notes, which are an integral part of the financial statements.

Statement of assets and liabilities

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

December 31, 2022

| Assets: | | | |

| Investments, at value* | | $ | 545,656,026 | |

| Cash | | | 60,922 | |

| Foreign currencies, at value∆ | | | 3,085,901 | |

| Dividends and interest receivable | | | 1,314,379 | |

| Foreign tax reclaims receivable | | | 160,965 | |

| Receivable due from Advisor | | | 37,176 | |

| Receivable for series shares sold | | | 10,923 | |

| Other assets | | | 4,951 | |

| Total Assets | | | 550,331,243 | |

| Liabilities: | | | | |

| Accrued capital gains taxes on appreciated securities | | | 1,561,228 | |

| Other accrued expenses | | | 1,072,713 | |

| Payable for series shares redeemed | | | 353,541 | |

| Distribution fees payable to affiliates | | | 147,263 | |

| Administration expenses payable to affiliates | | | 16,364 | |

| Total Liabilities | | | 3,151,109 | |

| Total Net Assets | | $ | 547,180,134 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 539,550,070 | |

| Total distributable earnings (loss) | | | 7,630,064 | |

| Total Net Assets | | $ | 547,180,134 | |

| | | | | |

| Net Asset Value | | | | |

| Standard Class: | | | | |

| Net assets | | $ | 294,243,578 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 14,937,833 | |

| Net asset value per share | | $ | 19.70 | |

| Service Class: | | | | |

| Net assets | | $ | 252,936,556 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 12,885,035 | |

| Net asset value per share | | $ | 19.63 | |

| | | | | |

| * | Investments, at cost | | $ | 536,358,096 | |

| ∆ | Foreign currencies, at cost | | | 3,119,307 | |

See accompanying notes, which are an integral part of the financial statements.

Statement of operations

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

Year ended December 31, 2022

| Investment Income: | | | |

| Dividends | | $ | 18,982,191 | |

| Foreign tax withheld | | | (2,373,877 | ) |

| | | | 16,608,314 | |

| Expenses: | | | | |

| Management fees | | | 7,400,513 | |

| Distribution expenses — Service Class | | | 850,918 | |

| Custodian fees | | | 447,082 | |

| Dividend disbursing and transfer agent fees and expenses | | | 183,641 | |

| Accounting and administration expenses | | | 115,858 | |

| Reports and statements to shareholders expenses | | | 103,318 | |

| Audit and tax fees | | | 40,260 | |

| Trustees’ fees and expenses | | | 37,098 | |

| Legal fees | | | 34,192 | |

| Other | | | 61,116 | |

| | | | 9,273,996 | |

| Less expenses waived | | | (1,281,000 | ) |

| Less expenses paid indirectly | | | (2 | ) |

| Total operating expenses | | | 7,992,994 | |

| Net Investment Income (Loss) | | | 8,615,320 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments1 | | | (1,336,076 | ) |

| Foreign currencies | | | (53,781 | ) |

| Foreign currency exchange contracts | | | (18,308 | ) |

| Net realized gain (loss) | | | (1,408,165 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments1 | | | (210,249,045 | ) |

| Foreign currencies | | | (54,566 | ) |

| Net change in unrealized appreciation (depreciation) | | | (210,303,611 | ) |

| Net Realized and Unrealized Gain (Loss) | | | (211,711,776 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | (203,096,456 | ) |

| 1 | Includes $(4,498) capital gains tax paid and $(1,561,228) capital gains tax accrued. |

See accompanying notes, which are an integral part of the financial statements.

Statements of changes in net assets

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

| | | Year ended | |

| | | 12/31/22 | | | 12/31/21 | |

| Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 8,615,320 | | | $ | 23,672,695 | |

| Net realized gain (loss) | | | (1,408,165 | ) | | | (6,830,787 | ) |

| Net change in unrealized appreciation (depreciation) | | | (210,303,611 | ) | | | (37,897,681 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (203,096,456 | ) | | | (21,055,773 | ) |

| | | | | | | | | |

| Dividends and Distributions to Shareholders from: | | | | | | | | |

| Distributable earnings: | | | | | | | | |

| Standard Class | | | (13,031,896 | ) | | | (2,707,604 | ) |

| Service Class | | | (10,983,197 | ) | | | (1,921,987 | ) |

| | | | (24,015,093 | ) | | | (4,629,591 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Standard Class | | | 46,742,952 | | | | 77,991,728 | |

| Service Class | | | 25,911,033 | | | | 37,115,785 | |

| | | | | | | | | |

| Net asset value of shares issued upon reinvestment of dividends and distributions: | | | | | | | | |

| Standard Class | | | 13,031,896 | | | | 2,707,604 | |

| Service Class | | | 10,983,197 | | | | 1,921,987 | |

| | | | 96,669,078 | | | | 119,737,104 | |

| Cost of shares redeemed: | | | | | | | | |

| Standard Class | | | (24,919,016 | ) | | | (29,293,517 | ) |

| Service Class | | | (35,086,446 | ) | | | (45,809,192 | ) |

| | | | (60,005,462 | ) | | | (75,102,709 | ) |

| Increase in net assets derived from capital share transactions | | | 36,663,616 | | | | 44,634,395 | |

| Net Increase (Decrease) in Net Assets | | | (190,447,933 | ) | | | 18,949,031 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 737,628,067 | | | | 718,679,036 | |

| End of year | | $ | 547,180,134 | | | $ | 737,628,067 | |

See accompanying notes, which are an integral part of the financial statements.

Financial highlights

Delaware VIP® Emerging Markets Series Standard Class

Selected data for each share of the Series outstanding throughout each period were as follows:

| | | Year ended | |

| | | 12/31/22 | | | 12/31/21 | | | 12/31/20 | | | 12/31/19 | | | 12/31/18 | |

| Net asset value, beginning of period | | $ | 28.37 | | | $ | 29.42 | | | $ | 24.27 | | | $ | 20.36 | | | $ | 25.06 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | | 0.35 | | | | 1.00 | | | | 0.10 | | | | 0.19 | | | | 0.16 | |

| Net realized and unrealized gain (loss) | | | (8.06 | ) | | | (1.81 | ) | | | 5.65 | | | | 4.35 | | | | (3.98 | ) |

| Total from investment operations | | | (7.71 | ) | | | (0.81 | ) | | | 5.75 | | | | 4.54 | | | | (3.82 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less dividends and distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.96 | ) | | | (0.10 | ) | | | (0.18 | ) | | | (0.15 | ) | | | (0.80 | ) |

| Net realized gain | | | — | | | | (0.14 | ) | | | (0.42 | ) | | | (0.48 | ) | | | (0.08 | ) |

| Total dividends and distributions | | | (0.96 | ) | | | (0.24 | ) | | | (0.60 | ) | | | (0.63 | ) | | | (0.88 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 19.70 | | | $ | 28.37 | | | $ | 29.42 | | | $ | 24.27 | | | $ | 20.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return2 | | | (27.58 | )%3 | | | (2.84 | )%3 | | | 25.09 | %3 | | | 22.63 | %3 | | | (15.81 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 294,244 | | | $ | 377,296 | | | $ | 339,348 | | | $ | 328,524 | | | $ | 236,592 | |

| Ratio of expenses to average net assets4 | | | 1.20 | % | | | 1.25 | % | | | 1.28 | % | | | 1.30 | % | | | 1.34 | % |

| Ratio of expenses to average net assets prior to fees waived4 | | | 1.41 | % | | | 1.34 | % | | | 1.36 | % | | | 1.34 | % | | | 1.34 | % |

| Ratio of net investment income to average net assets | | | 1.59 | % | | | 3.34 | % | | | 0.44 | % | | | 0.86 | % | | | 0.71 | % |

| Ratio of net investment income to average net assets prior to fees waived | | | 1.38 | % | | | 3.25 | % | | | 0.36 | % | | | 0.82 | % | | | 0.71 | % |

| Portfolio turnover | | | 2 | % | | | 2 | % | | | 3 | % | | | 20 | % | | | 11 | % |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return does not include fees, charges, or expenses imposed by the variable annuity and life insurance contracts for which Delaware VIP Trust serves as an underlying investment vehicle. |

| 3 | Total return during the period reflects waivers by the manager. Performance would have been lower had the waivers not been in effect. |

| 4 | Expense ratios do not include expenses of any investment companies in which the Series invests. |

See accompanying notes, which are an integral part of the financial statements.

Financial highlights

Delaware VIP® Emerging Markets Series Service Class

Selected data for each share of the Series outstanding throughout each period were as follows:

| | | Year ended | |

| | | 12/31/22 | | | 12/31/21 | | | 12/31/20 | | | 12/31/19 | | | 12/31/18 | |

| Net asset value, beginning of period | | $ | 28.25 | | | $ | 29.31 | | | $ | 24.17 | | | $ | 20.28 | | | $ | 24.97 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | | 0.28 | | | | 0.90 | | | | 0.03 | | | | 0.12 | | | | 0.10 | |

| Net realized and unrealized gain (loss) | | | (8.03 | ) | | | (1.80 | ) | | | 5.64 | | | | 4.34 | | | | (3.97 | ) |

| Total from investment operations | | | (7.75 | ) | | | (0.90 | ) | | | 5.67 | | | | 4.46 | | | | (3.87 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less dividends and distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.87 | ) | | | (0.02 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.74 | ) |

| Net realized gain | | | — | | | | (0.14 | ) | | | (0.42 | ) | | | (0.48 | ) | | | (0.08 | ) |

| Total dividends and distributions | | | (0.87 | ) | | | (0.16 | ) | | | (0.53 | ) | | | (0.57 | ) | | | (0.82 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 19.63 | | | $ | 28.25 | | | $ | 29.31 | | | $ | 24.17 | | | $ | 20.28 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return2 | | | (27.81 | )% | | | (3.13 | )% | | | 24.69 | % | | | 22.25 | % | | | (16.03 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 252,936 | | | $ | 360,332 | | | $ | 379,331 | | | $ | 358,165 | | | $ | 323,530 | |

| Ratio of expenses to average net assets3 | | | 1.50 | % | | | 1.55 | % | | | 1.58 | % | | | 1.60 | % | | | 1.62 | % |

| Ratio of expenses to average net assets prior to fees waived3 | | | 1.71 | % | | | 1.64 | % | | | 1.66 | % | | | 1.64 | % | | | 1.64 | % |

| Ratio of net investment income to average net assets | | | 1.29 | % | | | 3.04 | % | | | 0.14 | % | | | 0.56 | % | | | 0.43 | % |

| Ratio of net investment income to average net assets prior to fees waived | | | 1.08 | % | | | 2.95 | % | | | 0.06 | % | | | 0.52 | % | | | 0.41 | % |

| Portfolio turnover | | | 2 | % | | | 2 | % | | | 3 | % | | | 20 | % | | | 11 | % |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during the period shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. Total return does not include fees, charges, or expenses imposed by the variable annuity and life insurance contracts for which Delaware VIP Trust serves as an underlying investment vehicle. |

| 3 | Expense ratios do not include expenses of any investment companies in which the Series invests. |

See accompanying notes, which are an integral part of the financial statements.

Notes to financial statements

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

December 31, 2022

Delaware VIP Trust (Trust) is organized as a Delaware statutory trust. The Trust consists of 12 series, each of which is treated as a separate entity for certain matters under the Investment Company Act of 1940, as amended (1940 Act). These financial statements and the related notes pertain to Delaware VIP Emerging Markets Series (Series). The Trust is an open-end investment company. The Series is considered diversified under the 1940 Act and offers Standard Class and Service Class shares. The Standard Class shares do not carry a distribution and service (12b-1) fee and the Service Class shares carry a 12b-1 fee. The shares of the Series are sold only to separate accounts of life insurance companies.

1. Significant Accounting Policies

The Series follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Series.

Security Valuation — Equity securities and exchange-traded funds (ETFs), except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange on the valuation date. Equity securities and ETF traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security or ETF does not trade, the mean between the bid and the ask prices will be used, which approximates fair value. Equity securities listed on a foreign exchange are normally valued at the last quoted sales price on the valuation date. Open-end investment companies, other than ETFs, are valued at their published net asset value (NAV). Foreign currency exchange contracts and foreign cross currency exchange contracts are valued at the mean between the bid and the ask prices, which approximates fair value. Interpolated values are derived when the settlement date of the contract is an interim date for which quotations are not available. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Series’ valuation designee, Delaware Management Company (DMC). Subject to the oversight of the Series’ Board of Trustees (Board), DMC, as valuation designee, has adopted policies and procedures to fair value securities for which market quotations are not readily available consistent with the requirements of Rule 2a-5 under the 1940 Act. In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. Restricted securities and private placements are valued at fair value.

Federal and Foreign Income Taxes — No provision for federal income taxes has been made as the Series intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Series evaluates tax positions taken or expected to be taken in the course of preparing the Series’ tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Series’ tax positions taken or expected to be taken on the Series’ federal income tax returns through the year ended December 31, 2022, and for all open tax years (years ended December 31, 2019–December 31, 2021), and has concluded that no provision for federal income tax is required in the Series’ financial statements. In regard to foreign taxes only, the Series has open tax years in certain foreign countries in which it invests that may date back to the inception of the Series. If applicable, the Series recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in “Other” on the “Statement of operations.” During the year ended December 31, 2022, the Series did not incur any interest or tax penalties.

Class Accounting — Investment income, common expenses, and realized and unrealized gain (loss) on investments are allocated to the classes of the Series on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Foreign Currency Transactions — Transactions denominated in foreign currencies are recorded at the prevailing exchange rates on the valuation date in accordance with the Series’ prospectus. The value of all assets and liabilities denominated in foreign currencies is translated daily into US dollars at the exchange rate of such currencies against the US dollar. Transaction gains or losses resulting from changes in exchange rates during the reporting period or upon settlement of the foreign currency transaction are reported in operations for the current period. The Series generally does not bifurcate that portion of realized gains and losses on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices. These gains and losses are included on the “Statement of operations” under “Net realized gain (loss) on investments.” The Series reports certain foreign currency related transactions as components of realized gains (losses) for financial reporting purposes, whereas such components are treated as ordinary income (loss) for federal income tax purposes.

Notes to financial statements

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

1. Significant Accounting Policies (continued)

Derivative Financial Instruments — The Series may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Series must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Series’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Series can realize on an investment and/or may result in lower distributions paid to shareholders. The Series’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

Segregation and Collateralizations — In certain cases, based on requirements and agreements with certain exchanges and third-party broker-dealers, the Series may deliver or receive collateral in connection with certain investments (e.g., futures contracts, foreign currency exchange contracts, options written, securities with extended settlement periods, and swaps). Certain countries require that cash reserves be held while investing in companies incorporated in that country. These cash reserves and cash collateral that has been pledged/received to cover obligations of the Series under derivative contracts, if any, will be reported separately on the “Statement of assets and liabilities” as cash collateral due to/from broker. Securities collateral pledged for the same purpose, if any, is noted on the “Schedule of investments.”

Use of Estimates — The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Series are charged directly to the Series. Other expenses common to various funds within the Delaware Funds by Macquarie® (Delaware Funds) are generally allocated among such funds on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Taxable non-cash dividends are recorded as dividend income. Foreign dividends are also recorded on the ex-dividend date or as soon after the ex-dividend date that the Series is aware of such dividends, net of all tax withholdings, a portion of which may be reclaimable. Withholding taxes and reclaims on foreign dividends have been recorded in accordance with the Series’ understanding of the applicable country’s tax rules and rates. Income and capital gain distributions from any Underlying Funds in which the Series invests are recorded on the ex-dividend date. The Series may pay foreign capital gains taxes on certain foreign securities held, which are reported as components of realized losses for financial reporting purposes, whereas such components are treated as ordinary loss for federal income tax purposes. The Series declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, following the close of the fiscal year. The Series may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Series receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expenses paid under this arrangement are included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expenses offset included under “Less expenses paid indirectly.”

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Series pays DMC, a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rates of 1.25% on the first $500 million of average daily net assets of the Series, 1.20% on the next $500 million, 1.15% on the next $1.5 billion, and 1.10% on average daily net assets in excess of $2.5 billion.

DMC has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations), in order to prevent total annual series operating expenses from exceeding 1.18% of the Series’ average daily net assets for the Standard Class and the Service Class from April 29, 2022 through December 31, 2022.* From January 1, 2022 through April 28, 2022, DMC contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses in order to prevent total annual series operating expenses from exceeding 1.23% of the Series’ average daily net assets for the Standard Class and the Service Class. These waivers and reimbursements may only be terminated by agreement of DMC and the Series. The waivers and reimbursements are accrued daily and received monthly.

DMC may permit its affiliates, Macquarie Investment Management Global Limited (MIMGL) and Macquarie Funds Management Hong Kong Limited (together, the “Affiliated Sub-Advisors”), to execute Series equity security trades on its behalf. DMC may also seek quantitative support from MIMGL. Although the Affiliated Sub-Advisors serve as sub-advisors, DMC has ultimate responsibility for all investment advisory services. For these services, DMC, not the Series, may pay each Affiliated Sub-Advisor a portion of its investment management fee.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administrative oversight services to the Series. For these services, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rates: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; 0.0025% of the next $45 billion; and 0.0015% of aggregate average daily net assets in excess of $90 billion (Total Fee). Each fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative NAV basis. This amount is included on the “Statement of operations” under “Accounting and administration expenses.” For the year ended December 31, 2022, the Series paid $29,118 for these services.

DIFSC is also the transfer agent and dividend disbursing agent of the Series. For these services, DIFSC’s fees are calculated daily and paid monthly, at the annual rate of 0.0075% of the Series’ average daily net assets. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” For the year ended December 31, 2022, the Series paid $45,733 for these services. Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Series. Sub-transfer agency fees are paid by the Series and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” The fees that are calculated daily and paid as invoices are received on a monthly or quarterly basis.

Pursuant to a distribution agreement and distribution plan, the Series pays Delaware Distributors, L.P. (DDLP), the distributor and an affiliate of DMC, an annual 12b-1 fee of 0.30% of the average daily net assets of the Service Class shares. The fees are calculated daily and paid monthly. Standard Class shares do not pay 12b-1 fees.

As provided in the investment management agreement, the Series bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal and regulatory reporting services to the Series. For the year ended December 31, 2022, the Series paid $24,310 for internal legal and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

Trustees’ fees include expenses accrued by the Series for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Series.

In addition to the management fees and other expenses of the Series, the Series indirectly bears the investment management fees and other expenses of any Underlying Funds including ETFs in which it invests. The amount of these fees and expenses incurred indirectly by the Series will vary based upon the expense and fee levels of any Underlying Funds and the number of shares that are owned of any Underlying Funds at different times.

| * | The aggregate contractual waiver period covering this report is from April 30, 2021 through April 29, 2023. |

Notes to financial statements

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

3. Investments

For the year ended December 31, 2022, the Series made purchases and sales of investment securities other than short-term investments as follows:

| Purchases | | $ | 25,828,614 | |

| Sales | | | 10,322,715 | |

The tax cost of investments and derivatives includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be the final tax cost basis adjustments but which approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. At December 31, 2022, the cost and unrealized appreciation (depreciation) of investments and derivatives for federal income tax purposes for the Series were as follows:

| Cost of investments | | $ | 536,404,053 | |

| Aggregate unrealized appreciation of investments | | $ | 201,565,815 | |

| Aggregate unrealized depreciation of investments | | | (192,313,842 | ) |

| Net unrealized appreciation of investments | | $ | 9,251,973 | |

US GAAP defines fair value as the price that the Series would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the circumstances. The Series’ investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized as follows:

| Level 1 − | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, and exchange-traded options contracts) |

| Level 2 − | Other observable inputs, including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, and default rates) or other market-corroborated inputs. (Examples: debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, broker-quoted securities, and fair valued securities) |

| Level 3 − | Significant unobservable inputs, including the Series’ own assumptions used to determine the fair value of investments. (Examples: broker-quoted securities and fair valued securities) |

Level 3 investments are valued using significant unobservable inputs. The Series may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may also be based upon current market prices of securities that are comparable in coupon, rating, maturity, and industry. The derived value of a Level 3 investment may not represent the value which is received upon disposition and this could impact the results of operations.

The following table summarizes the valuation of the Series’ investments by fair value hierarchy levels as of December 31, 2022:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Securities | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Argentina | | $ | 7,089,528 | | | $ | 910,224 | | | $ | — | | | $ | 7,999,752 | |

| Australia | | | 2,463,385 | | | | — | | | | — | | | | 2,463,385 | |

| Bahrain | | | 1,318,935 | | | | — | | | | — | | | | 1,318,935 | |

| Brazil | | | 28,520,379 | | | | — | | | | — | | | | 28,520,379 | |

| Chile | | | 7,984,000 | | | | — | | | | — | | | | 7,984,000 | |

| China/Hong Kong | | | 171,065,977 | | | | — | | | | — | | | | 171,065,977 | |

| India | | | 70,778,310 | | | | 43,749 | | | | — | | | | 70,822,059 | |

| Indonesia | | | 6,806,900 | | | | — | | | | — | | | | 6,806,900 | |

| Japan | | | 2,928,089 | | | | — | | | | — | | | | 2,928,089 | |

| Malaysia | | | 274,864 | | | | — | | | | — | | | | 274,864 | |

| Mexico | | | 22,851,915 | | | | — | | | | — | | | | 22,851,915 | |

| Peru | | | 2,656,707 | | | | — | | | | — | | | | 2,656,707 | |

| Republic of Korea | | | 12,154,606 | | | | 73,903,190 | | | | — | | | | 86,057,796 | |

| Russia | | | — | | | | — | | | | — | 1,2 | | | — | |

| South Africa | | | 428,986 | | | | — | | | | — | | | | 428,986 | |

| Taiwan | | | 90,314,026 | | | | — | | | | — | | | | 90,314,026 | |

| Turkey | | | 8,286,392 | | | | — | | | | — | | | | 8,286,392 | |

| United Kingdom | | | 1,493,586 | | | | — | | | | — | | | | 1,493,586 | |

| Convertible Preferred Stock | | | — | | | | 243,087 | | | | — | | | | 243,087 | |

| Participation Notes | | | — | | | | — | | | | — | 2 | | | — | |

| Preferred Stocks3 | | | 4,427,341 | | | | 21,116,555 | | | | — | 2 | | | 25,543,896 | |

| Rights | | | 79 | | | | — | | | | — | | | | 79 | |

| Warrants | | | 147,037 | | | | — | | | | — | | | | 147,037 | |

| Short-Term Investments | | | 7,448,179 | | | | — | | | | — | | | | 7,448,179 | |

| Total Value of Securities | | $ | 449,439,221 | | | $ | 96,216,805 | | | $ | — | | | $ | 545,656,026 | |

| 1 | The value represents valuations of Russian Common Stocks for which Management has determined include significant unobservable inputs as of December 31, 2022. |

| 2 | The security that has been valued at zero on the “Schedule of investments” is considered to be Level 3 investments in this table. |

| 3 | Security type is valued across multiple levels. Level 1 investments represent exchange-traded investments, Level 2 investments represent investments with observable inputs or matrix-priced investments, and Level 3 investments represent investments without observable inputs. The amounts attributed to Level 1 investments, Level 2 investments, and Level 3 investments represent the following percentages of the total market value of these security types: |

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Preferred Stock | | 17.33% | | 82.67% | | — | | 100.00% | |

As a result of utilizing international fair value pricing at December 31, 2022, a portion of the common stock in the portfolio was categorized as Level 2.

The securities that have been valued at zero on the “Schedule of investments” are considered to be Level 3 investments in this table.

During the year ended December 31, 2022, there were no transfers into or out of Level 3 investments. The Series’ policy is to recognize transfers into or out of Level 3 investments based on fair value at the beginning of the reporting period.

Notes to financial statements

Delaware VIP® Trust — Delaware VIP Emerging Markets Series

3. Investments (continued)

A reconciliation of Level 3 investments is presented when the Series has a significant amount of Level 3 investments at the beginning or end of the period in relation to the Series’ net assets. Management has determined not to provide a reconciliation of Level 3 investments as the Level 3 investments were not considered significant to the Series’ net assets at the beginning or end of the period. Management has determined not to provide additional disclosure on Level 3 inputs since the Level 3 investments were not considered significant to the Series’ net assets at the end of the year.

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from US GAAP. Additionally, distributions from net gains on foreign currency transactions and net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. The tax character of dividends and distributions paid during the years ended December 31, 2022 and 2021 were as follows:

| | | Year ended | |

| | | 12/31/22 | | | 12/31/21 | |

| Ordinary income | | $ | 24,015,093 | | | $ | 1,339,848 | |

| Long-term capital gains | | | — | | | | 3,289,743 | |

| Total | | $ | 24,015,093 | | | $ | 4,629,591 | |

5. Components of Net Assets on a Tax Basis

As of December 31, 2022, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | | $ | 539,550,070 | |

| Undistributed ordinary income | | | 8,062,950 | |

| Capital loss carryforwards | | | (8,069,189 | ) |

| Unrealized appreciation (depreciation) of investments and foreign currencies | | | 7,636,303 | |

| Net assets | | $ | 547,180,134 | |

Differences between components of net assets unrealized and tax cost unrealized may arise due to certain foreign currency transactions and/or foreign capital gains taxes.

The differences between book basis and tax basis components of net assets are primarily attributable to tax deferral of losses on wash sales.

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Results of operations and net assets were not affected by these reclassifications. For the year ended December 31, 2022, the Series had no reclassifications.

For federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains.

At December 31, 2022, capital loss carryforwards available to offset future realized capital gains were as follows:

| | Loss carryforward character | | | | |

| | Short-term | | | Long-term | | | Total | |

| | $ | 1,258,686 | | | $ | 6,810,503 | | | $ | 8,069,189 | |

6. Capital Shares

Transactions in capital shares were as follows:

| | | Year ended | |

| | | 12/31/22 | | | 12/31/21 | |

| Shares sold: | | | | | | | | |

| Standard Class | | | 2,192,970 | | | | 2,643,070 | |

| Service Class | | | 1,192,323 | | | | 1,257,728 | |

| | | | | | | | | |

| Shares issued upon reinvestment of dividends and distributions: | | | | | | | | |

| Standard Class | | | 581,781 | | | | 88,920 | |

| Service Class | | | 490,980 | | | | 63,265 | |

| | | | 4,458,054 | | | | 4,052,983 | |

| Shares redeemed: | | | | | | | | |

| Standard Class | | | (1,136,299 | ) | | | (966,708 | ) |

| Service Class | | | (1,553,673 | ) | | | (1,507,444 | ) |

| | | | (2,689,972 | ) | | | (2,474,152 | ) |

| Net increase | | | 1,768,082 | | | | 1,578,831 | |

7. Line of Credit

The Series, along with certain other funds in the Delaware Funds (Participants), was a participant in a $355,000,000 revolving line of credit (Agreement) intended to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. Under the Agreement, the Participants were charged an annual commitment fee of 0.15%, which was allocated across the Participants based on a weighted average of the respective net assets of each Participant. The Participants were permitted to borrow up to a maximum of one-third of their net assets under the Agreement. Each Participant was individually, and not jointly, liable for its particular advances, if any, under the line of credit. The line of credit available under the Agreement expired on October 31, 2022.

On October 31, 2022, the Series, along with the other Participants, entered into an amendment to the Agreement for a $355,000,000 revolving line of credit to be used as described above. It operates in substantially the same manner as the original Agreement. Under the amendment to the Agreement, the Participants are charged an annual commitment fee of 0.15%, which is allocated across the Participants based on a weighted average of the respective net assets of each Participant. The line of credit available under the Agreement expires on October 30, 2023.

The Series had no amounts outstanding as of December 31, 2022, or at any time during the year then ended.

8. Derivatives

US GAAP requires disclosures that enable investors to understand: (1) how and why an entity uses derivatives; (2) how they are accounted for; and (3) how they affect an entity’s results of operations and financial position.