UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-05162 |

| | | |

| Exact name of registrant as specified in charter: | | Delaware VIP® Trust |

| | | |

| Address of principal executive offices: | | 610 Market Street |

| | Philadelphia, PA 19106 |

| | | |

| Name and address of agent for service: | | David F. Connor, Esq. |

| | 610 Market Street |

| | Philadelphia, PA 19106 |

| | | |

| Registrant’s telephone number, including area code: | | (800) 523-1918 |

| | | |

| Date of fiscal year end: | | December 31 |

| | | |

| Date of reporting period: | | December 31, 2020 |

Item 1. Reports to Stockholders

Delaware VIP® Trust

Delaware VIP Diversified Income Series

December 31, 2020

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Series’ shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Series or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Series that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800 523-1918. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary. |

Table of contents

| Portfolio management review | | 1 |

| Performance summary | | 3 |

| Disclosure of Series expenses | | 6 |

| Security type / sector allocation | | 7 |

| Schedule of investments | | 8 |

| Statement of assets and liabilities | | 34 |

| Statement of operations | | 35 |

| Statements of changes in net assets | | 36 |

| Financial highlights | | 37 |

| Notes to financial statements | | 39 |

| Report of independent registered public accounting firm | | 53 |

| Other Series information | | 54 |

| Board of trustees / directors and officers addendum | | 57 |

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Series is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of December 31, 2020, and subject to change for events occurring after such date.

The Series is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

The Series is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

This material may be used in conjunction with the offering of shares in Delaware VIP® Diversified Income Series only if preceded or accompanied by the Series’ current prospectus or the summary prospectus.

© 2021 Macquarie Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

Portfolio management review

Delaware VIP® Trust — Delaware VIP Diversified Income Series

January 12, 2021 (Unaudited)

The investment objective of the Series is to seek maximum long-term total return, consistent with reasonable risk.

For the fiscal year ended December 31, 2020, Delaware VIP Diversified Income Series (the “Series”) Standard Class shares gained 11.04%. The Series Service Class shares gained 10.69%. Both figures reflect all distributions reinvested. For the same period, the Series’ benchmark, the Bloomberg Barclays US Aggregate Index, advanced 7.51%.

As 2020 began, the economy appeared to be entering a mature credit cycle, and investors were concerned with the possibility of a mild recession. Instead, the coronavirus pandemic struck and spread rapidly. The global community was unprepared. Initial uncertainty was quickly followed by an extreme market selloff and global economic collapse.

Governments and central banks applied lessons learned from the recession of 2008-2009, and in March they intervened with substantial monetary- and fiscal-policy measures. The effective use of global fiscal and monetary support defined how the economy and the financial markets would evolve in 2020.

Investors’ uncertainty in March 2020 provoked a risk-premium explosion in the market and economic shutdowns. However, backstopped by the US Federal Reserve’s unprecedented, aggressive asset-purchase programs, which included purchasing corporate bonds, some confidence returned to markets. As the world began to understand how the virus behaved and to help bring it under control, the US and global economies began to reopen. Credit markets, which had widened substantially as markets collapsed, started to compress, bolstered by now dual Fed and Congressional puts. Then came the race to develop vaccines, along with a better understanding of how to manage the virus.

Although the markets and parts of the economy generally adapted quickly, COVID-19-affected sectors, particularly services, experienced extreme distress. These included transportation and other consumer-related areas such as retail. Damage to labor markets was significant, with unemployment still higher than 6% at year end. However, with monetary and fiscal policy in place and a clear commitment to support the economy for as long as it would take, the path to the other side of the pandemic became clearer.

We viewed 2020 from the prism of different market regimes, each of which called for a distinct approach to managing risk. Entering the year, because compensation for risk was poor, we cut back on the Series’ risk exposure and built a capital reserve to spend as opportunities arose. The year became a litmus test for managing risk, and we believe our agile approach to risk management was critical in helping the Series significantly outperform its benchmark for the 12-month period.

With the Series’ capital reserve in hand, we looked for investment opportunities created by market dislocations in the initial phase of the pandemic. We focused on issuers that we assessed would more likely survive the pandemic. Accordingly, we began to spend the Series’ liquid capital reserve, initially selecting high-quality investment grade issuers, including JP Morgan Chase & Co. and Bank of America Corp., which we felt offered attractive compensation for the underlying risk.

As visibility gradually increased, we expanded our search for opportunities to traditionally higher-beta (more volatile) parts of the market, including areas within high yield and emerging markets that had experienced dislocations. We added to issuers that we felt were the strongest within COVID-19-sensitive areas, such as Delta Air Lines Inc. We viewed Delta as well positioned to survive the pandemic while offering historically high yields. In emerging markets, we sought issuers that had benefited from government support and could benefit from pandemic-related outcomes, such as a construction company in Indonesia. For the rest of the year, we continued to assess opportunities on a bond-by-bond basis.

While security selection overall was additive, some individual securities did suffer amid the significant uncertainty. Among emerging market bonds, the Series had exposure to Aerovias de Mexico SA de CV, which filed for voluntary Chapter 11 restructuring in the second quarter of 2020. It was hurt as coronavirus-related travel restrictions and fear of the virus drove down passenger volumes significantly. However, the Series participated in financing after the Chapter 11 filing, and the Series maintains exposure to the name from a secured position.

In summary, investment grade, high yield, and emerging market bonds added the most value in both our sector allocation to these areas and our security selection within them. Overall, the Series’ positioning also benefited from two other meaningful new strategies. Early in the year, we added duration to help mitigate risk, assuming that a high degree of uncertainty was likely to result in a dramatic decline in interest rates as the Fed intervened. That willingness to dynamically manage interest rate risk paid off.

1

Portfolio management review

Delaware VIP® Trust — Delaware VIP Diversified Income Series

Additionally, before the pandemic manifested itself, inflationary expectations began to decline dramatically. Because we felt that investors were starting to overprice inflation, we added some exposure to Treasury inflation-protected securities (TIPS). As time passed and investors began to price in higher inflation, the Series’ allocation to TIPS contributed to returns.

There were few detractors from the Series’ benchmark-relative returns for the fiscal year. An underweight to mortgage-backed securities (MBS) detracted marginally; however, the Series’ was better compensated within investment grade bonds. The Series’ allocation to bank loans, which remained static throughout the year, moderately detracted from returns.

Early on, we focused on areas within investment grade, in particular those higher-quality issuers in whose business models we had greater confidence. By summer, as visibility improved, we also added exposure to the higher yielding areas of the fixed income market, such as emerging markets debt, where we increased the Series’ allocation from approximately 7% to 11%, and high yield bonds, which we increased from 4% to 11% by fiscal year end.

As we enter 2021, COVID-19 vaccines’ high efficacy and their production and distribution have redefined the outlook for the pandemic and the global economy. Nonetheless, the near-term reality is that the virus is still raging, and mutations could make the virus more resistant to vaccines. On the political front, Democrats control both houses of Congress and the White House, increasing the possibility of additional fiscal stimulus, which would support an economic recovery.

Consistent with our outlook, we have already cut back on some credit allocations, including utilities and senior financials, and replaced them with agency MBS, in particular. We have retained exposure to the reflationary theme, including airlines and certain consumer goods, and we continue to search for areas where we believe there is potential to capture yield without altering the Series’ risk exposure.

Finally, from a risk perspective, the Series remains driven by a fundamental, bond-by-bond investment approach. Our goal is to construct the Series’ portfolio comprising issuers that have a business model, liquidity, and adequate debt leverage profile with the potential to perform well regardless of the degree of volatility we may experience.

The Series used derivatives during the fiscal year, primarily for risk management purposes, including the use of interest rate futures to manage yield-curve risk and broader portfolio risks. The Series used currency forwards to hedge non-US-dollar risk back to US dollars. The Series also used foreign exchange (FX) forwards to gain access to a given currency, though we generally do this more directly through the bond market. The Series also used credit default swaps to manage credit risk. Overall, these derivatives had a positive effect that was generally not material to the Series’ performance.

2 Unless otherwise noted, views expressed herein are current as of December 31, 2020, and subject to change.

Performance summary (Unaudited)

Delaware VIP® Trust — Delaware VIP Diversified Income Series

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Carefully consider the Series’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Series’ prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/vip/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

| Series and benchmark performance | | Average annual total returns through December 31, 2020 |

| | 1 year | | 3 year | | 5 year | | 10 year | | Lifetime |

| Standard Class shares (commenced operations on | | | | | | | | | | |

| May 16, 2003) | | +11.04% | | +6.27% | | +5.51% | | +4.37% | | +5.68% |

| Service Class shares (commenced operations on | | | | | | | | | | |

| May 16, 2003) | | +10.69% | | +5.99% | | +5.22% | | +4.10% | | +5.41% |

| Bloomberg Barclays US Aggregate Index | | +7.51% | | +5.34% | | +4.44% | | +3.84% | | — |

Returns reflect the reinvestment of all distributions. Please see page 5 for a description of the index.

As described in the Series’ most recent prospectus, the net expense ratio for Service Class shares of the Series was 0.90%, while total operating expenses for Standard Class and Service Class shares were 0.60% and 0.90%, respectively. The management fee for Standard Class and Service Class shares was 0.58%. The Series’ investment manager, Delaware Management Company (Manager), has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent annual series operating expenses from exceeding 0.60% of the Series’ average daily net assets from January 1, 2020 through December 31, 2020.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

Earnings from a variable annuity or variable life investment compound tax-free until withdrawal, and as a result, no adjustments were made for income taxes.

Expense limitations were in effect for both classes during certain periods shown in the Series performance table on the previous page and in the Performance of a $10,000 Investment graph below.

Performance data do not reflect insurance fees related to a variable annuity or variable life investment or the deferred sales charge that would apply to certain withdrawals of investments held for fewer than eight years. Performance shown here would have been reduced if such fees were included and the expense limitation removed. For more information about fees, consult your variable annuity or variable life prospectus.

Investments in variable products involve risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Series may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

The Series may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

3

Performance summary (Unaudited)

Delaware VIP® Trust — Delaware VIP Diversified Income Series

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Series to obtain precise valuations of the high yield securities in its portfolio.

The Series may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

If and when the Series invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Series will be subject to special risks, including counterparty risk.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Series from executing advantageous investment decisions in a timely manner and could negatively impact the Series’ ability to achieve its investment objective and the value of the Series’ investments.

Please read both the contract and underlying prospectus for specific details regarding the product’s risk profile.

____________________

| * | The aggregate contractual waiver period covering this report is from May 1, 2019 through April 30, 2021. |

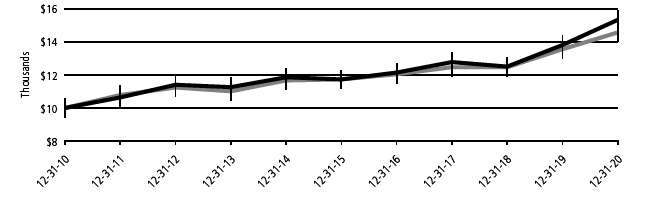

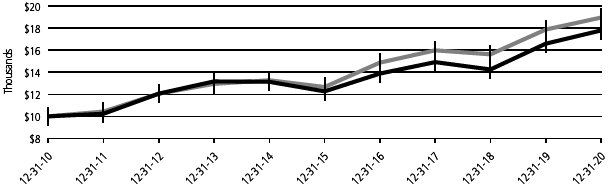

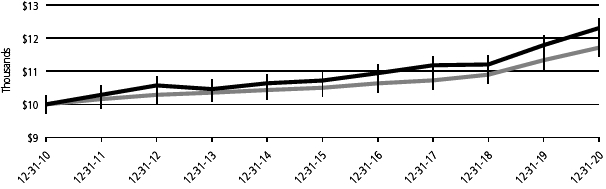

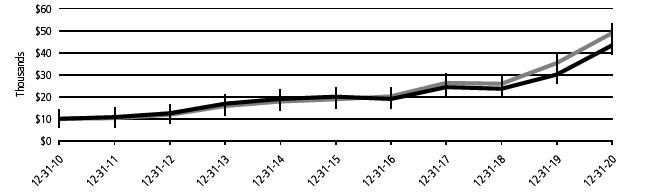

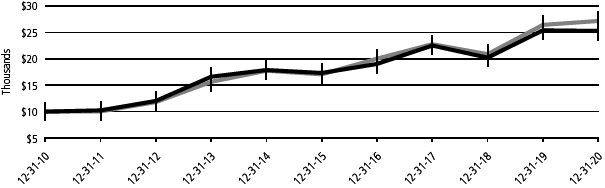

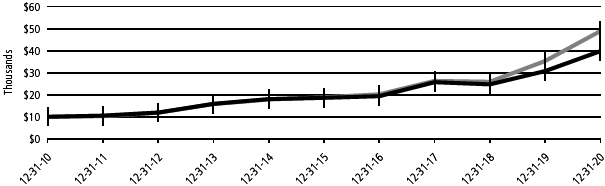

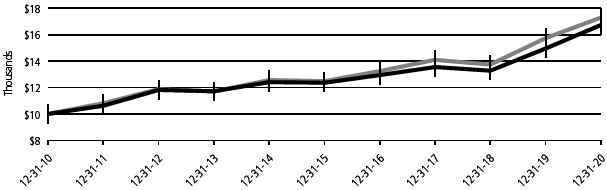

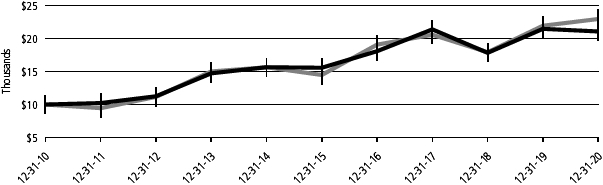

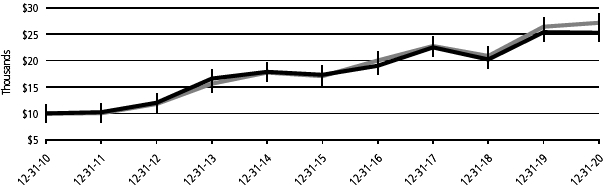

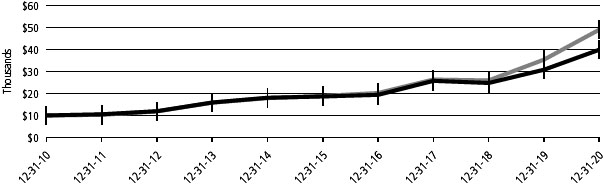

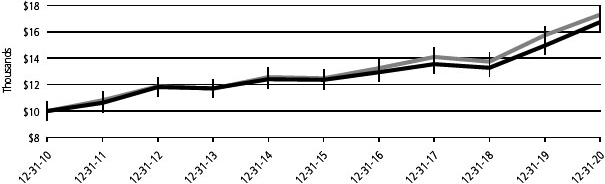

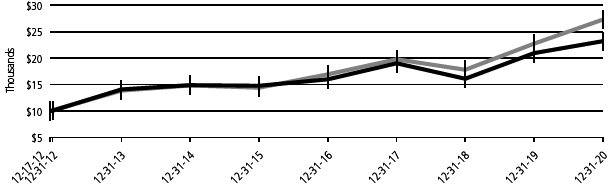

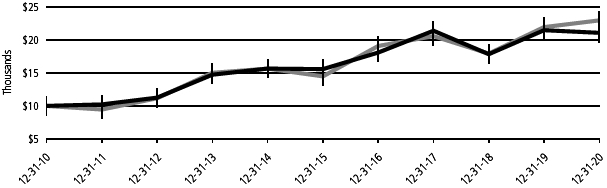

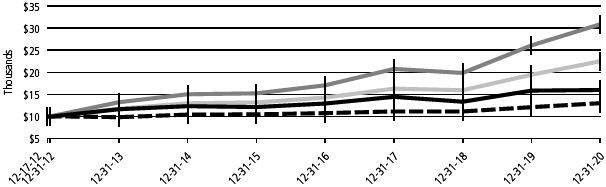

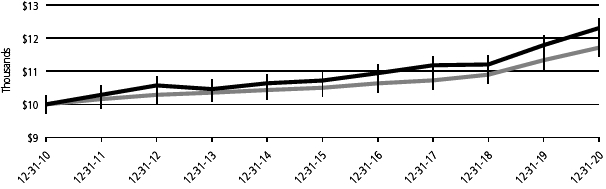

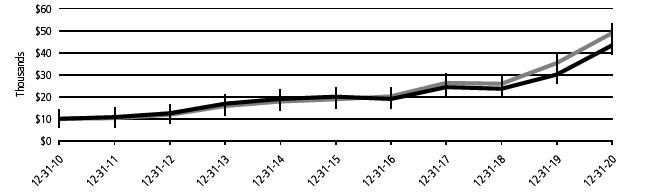

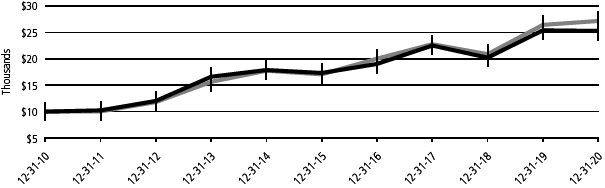

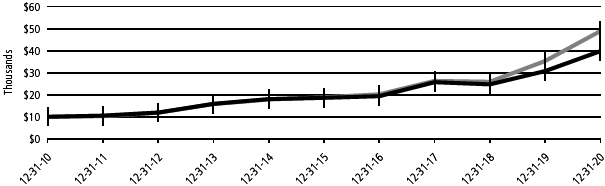

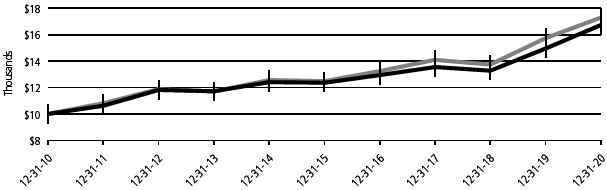

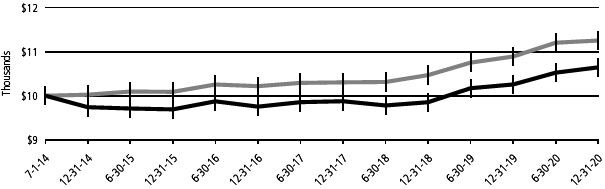

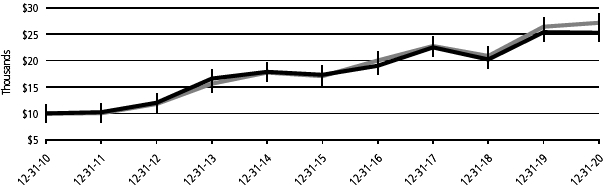

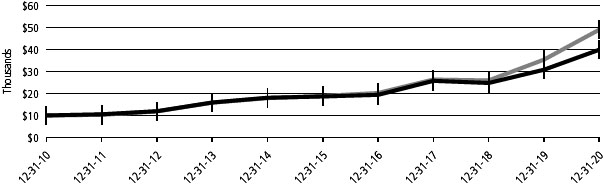

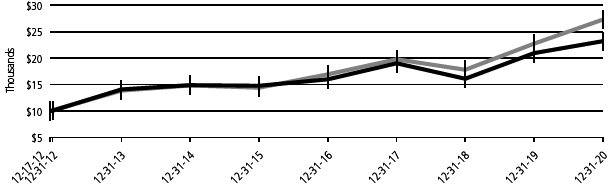

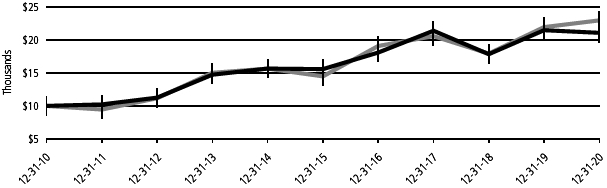

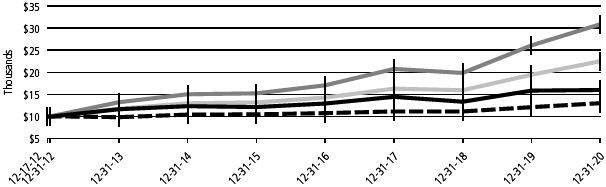

Performance of a $10,000 Investment

For period beginning December 31, 2010 through December 31, 2020

4

| For period beginning December 31, 2010 through December 31, 2020 | | Starting value | | Ending value |

| Delaware VIP Diversified Income Series — Standard Class shares | | $10,000 | | $15,337 |

| Bloomberg Barclays US Aggregate Index | | $10,000 | | $14,576 |

The graph shows a $10,000 investment in the Delaware VIP Diversified Income Series Standard Class shares for the period from December 31, 2010 through December 31, 2020.

The graph also shows $10,000 invested in the Bloomberg Barclays US Aggregate Index for the period from December 31, 2010 through December 31, 2020. The Bloomberg Barclays US Aggregate Index is a broad composite that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Performance of Service Class shares will vary due to different charges and expenses.

Past performance is not a guarantee of future results.

5

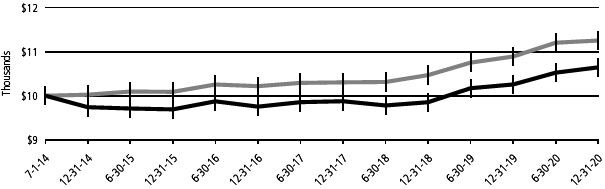

Disclosure of Series expenses

For the six-month period from July 1, 2020 to December 31, 2020 (Unaudited)

As a shareholder of the Series, you incur ongoing costs, which may include management fees; distribution and service (12b-1) fees; and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from July 1, 2020 to December 31, 2020.

Actual expenses

The first section of the table shown, “Actual Series return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. As a shareholder of the Series, you do not incur any transaction costs, such as sales charges (loads), redemption fees or exchange fees, but shareholders of other funds may incur such costs. Also, the fees related to the variable annuity investment or the deferred sales charge that could apply have not been included. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The Series’ expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

Expense analysis of an investment of $1,000

| | | | | | | | | | | | Expenses |

| | | | | | | | | | | | Paid |

| | Beginning | | Ending | | | | During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 7/1/20 to |

| | | 7/1/20 | | | | 12/31/20 | | | Ratio | | 12/31/20* |

| Actual Series return† | | | | | | | | | | | |

| Standard Class | | $ | 1,000.00 | | | $ | 1,050.00 | | | 0.60% | | $ | 3.09 | |

| Service Class | | | 1,000.00 | | | | 1,049.40 | | | 0.90% | | | 4.64 | |

| Hypothetical 5% return (5% return before expenses) | | | | |

| Standard Class | | $ | 1,000.00 | | | $ | 1,022.12 | | | 0.60% | | $ | 3.05 | |

| Service Class | | | 1,000.00 | | | | 1,020.61 | | | 0.90% | | | 4.57 | |

| * | “Expenses Paid During Period” are equal to the Series’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Series’ expenses reflected above, the Series also indirectly bears its portion of the fees and expenses of the investment companies (Underlying Funds) in which it invests. The table above does not reflect the expenses of the Underlying Funds.

6

Security type / sector allocation

Delaware VIP® Trust — Delaware VIP Diversified Income Series

As of December 31, 2020 (Unaudited)

Sector designations may be different than the sector designations presented in other Series materials. The sector designations may represent the investment manager’s internal sector classifications.

| | Percentage |

| Security type / sector | | of net assets |

| Agency Asset-Backed Security | | 0.00 | % |

| Agency Collateralized Mortgage Obligations | | 1.73 | % |

| Agency Commercial Mortgage-Backed | | | |

| Securities | | 0.71 | % |

| Agency Mortgage-Backed Securities | | 15.16 | % |

| Collateralized Debt Obligations | | 1.76 | % |

| Corporate Bonds | | 46.40 | % |

| Banking | | 8.04 | % |

| Banks | | 0.15 | % |

| Basic Industry | | 4.40 | % |

| Brokerage | | 0.46 | % |

| Capital Goods | | 2.28 | % |

| Communications | | 7.58 | % |

| Consumer Cyclical | | 2.68 | % |

| Consumer Non-Cyclical | | 4.74 | % |

| Electric | | 3.61 | % |

| Energy | | 6.49 | % |

| Finance Companies | | 1.20 | % |

| Insurance | | 0.89 | % |

| Natural Gas | | 0.12 | % |

| Real Estate Investment Trusts | | 0.47 | % |

| Technology | | 1.30 | % |

| Transportation | | 1.53 | % |

| Utilities | | 0.46 | % |

| Municipal Bonds | | 0.02 | % |

| Non-Agency Asset-Backed Securities | | 1.16 | % |

| Non-Agency Collateralized Mortgage | | | |

| Obligations | | 1.90 | % |

| Non-Agency Commercial Mortgage-Backed | | | |

| Securities | | 7.67 | % |

| Loan Agreements | | 4.76 | % |

| Sovereign Bonds | | 2.59 | % |

| Supranational Banks | | 0.06 | % |

| US Treasury Obligations | | 13.47 | % |

| Common Stock | | 0.00 | % |

| Preferred Stock | | 0.01 | % |

| Short-Term Investments | | 5.92 | % |

| Total Value of Securities | | 103.32 | % |

| Liabilities Net of Receivables and Other | | | |

| Assets | | (3.32 | %) |

| Total Net Assets | | 100.00 | % |

7

Schedule of investments

Delaware VIP® Trust — Delaware VIP Diversified Income Series

December 31, 2020

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Agency Asset-Backed Security — 0.00% | | | |

| Fannie Mae REMIC Trust | | | | | |

| Series 2002- | | | | | |

| W11 AV1 0.446% | | | | | |

| (LIBOR01M + 0.34%, | | | | | |

| Floor 0.34%) | | | | | |

| 11/25/32 ● | | 568 | | $ | 556 |

| Total Agency Asset-Backed Security | | | |

| (cost $568) | | | | | 556 |

| |

| Agency Collateralized Mortgage Obligations — 1.73% |

| Fannie Mae Connecticut | | | | | |

| Avenue Securities | | | | | |

| Series 2017- | | | | | |

| C03 1M2 3.148% | | | | | |

| (LIBOR01M + 3.00%) | | | | | |

| 10/25/29 ● | | 2,728,803 | | | 2,759,262 |

| Series 2017- | | | | | |

| C04 2M2 2.998% | | | | | |

| (LIBOR01M + 2.85%) | | | | | |

| 11/25/29 ● | | 854,535 | | | 859,924 |

| Series 2018- | | | | | |

| C01 1M2 2.398% | | | | | |

| (LIBOR01M + 2.25%, | | | | | |

| Floor 2.25%) 7/25/30 ● | | 1,822,446 | | | 1,813,302 |

| Series 2018- | | | | | |

| C02 2M2 2.348% | | | | | |

| (LIBOR01M + 2.20%, | | | | | |

| Floor 2.20%) 8/25/30 ● | | 998,664 | | | 992,324 |

| Series 2018- | | | | | |

| C03 1M2 2.298% | | | | | |

| (LIBOR01M + 2.15%, | | | | | |

| Floor 2.15%) | | | | | |

| 10/25/30 ● | | 1,294,042 | | | 1,291,578 |

| Series 2018- | | | | | |

| C05 1M2 2.498% | | | | | |

| (LIBOR01M + 2.35%, | | | | | |

| Floor 2.35%) 1/25/31 ● | | 1,019,496 | | | 1,020,791 |

| Fannie Mae Grantor Trust | | | | | |

| Series 1999- | | | | | |

| T2 A1 7.50% 1/19/39 ● | | 209 | | | 228 |

| Series 2004- | | | | | |

| T1 1A2 6.50% 1/25/44 | | 2,977 | | | 3,507 |

| Fannie Mae REMIC Trust | | | | | |

| Series 2002- | | | | | |

| W6 2A1 7.00% | | | | | |

| 6/25/42 ● | | 10,012 | | | 11,401 |

| Series 2004- | | | | | |

| W11 1A2 6.50% | | | | | |

| 5/25/44 | | 16,404 | | | 19,445 |

| Fannie Mae REMICs | | | | | |

| Series 2010-116 Z | | | | | |

| 4.00% 10/25/40 | | 14,380 | | | 15,948 |

| Fannie Mae REMICs | | | | | |

| Series 2013-44 Z 3.00% | | | | | |

| 5/25/43 | | 89,524 | | | 89,302 |

| Series 2017-40 GZ | | | | | |

| 3.50% 5/25/47 | | 918,469 | | | 1,011,648 |

| Series 2017-77 HZ | | | | | |

| 3.50% 10/25/47 | | 1,312,976 | | | 1,384,967 |

| Series 2017-94 CZ | | | | | |

| 3.50% 11/25/47 | | 823,250 | | | 884,884 |

| Freddie Mac REMICs | | | | | |

| Series 4676 KZ 2.50% | | | | | |

| 7/15/45 | | 887,675 | | | 929,517 |

| Freddie Mac Structured | | | | | |

| Agency Credit Risk Debt | | | | | |

| Notes | | | | | |

| Series 2017- | | | | | |

| DNA1 M2 3.398% | | | | | |

| (LIBOR01M + 3.25%, | | | | | |

| Floor 3.25%) 7/25/29 ● | | 2,162,970 | | | 2,214,241 |

| Series 2017- | | | | | |

| DNA3 M2 2.648% | | | | | |

| (LIBOR01M + 2.50%) | | | | | |

| 3/25/30 ● | | 6,530,000 | | | 6,619,199 |

| Series 2017- | | | | | |

| HQA2 M2AS 1.198% | | | | | |

| (LIBOR01M + 1.05%) | | | | | |

| 12/25/29 ● | | 598,975 | | | 603,624 |

| Series 2018- | | | | | |

| HQA1 M2 2.448% | | | | | |

| (LIBOR01M + 2.30%) | | | | | |

| 9/25/30 ● | | 1,578,477 | | | 1,572,476 |

| Freddie Mac Structured | | | | | |

| Agency Credit Risk | | | | | |

| REMIC Trust | | | | | |

| Series 2019- | | | | | |

| DNA4 M2 144A | | | | | |

| 2.098% (LIBOR01M + | | | | | |

| 1.95%) 10/25/49 #, ● | | 2,939,267 | | | 2,934,604 |

| Series 2019- | | | | | |

| HQA4 M2 144A | | | | | |

| 2.198% (LIBOR01M + | | | | | |

| 2.05%) 11/25/49 #, ● | | 3,570,346 | | | 3,559,818 |

| Series 2020- | | | | | |

| DNA2 M1 144A | | | | | |

| 0.898% (LIBOR01M + | | | | | |

| 0.75%, Floor 0.75%) | | | | | |

| 2/25/50 #, ● | | 1,518,225 | | | 1,519,679 |

| Series 2020- | | | | | |

| DNA2 M2 144A | | | | | |

| 1.998% (LIBOR01M + | | | | | |

| 1.85%, Floor 1.85%) | | | | | |

| 2/25/50 #, ● | | 1,700,000 | | | 1,689,568 |

8

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Agency Collateralized Mortgage Obligations (continued) |

| Freddie Mac Structured | | | | | |

| Agency Credit Risk | | | | | |

| REMIC Trust | | | | | |

| Series 2020- | | | | | |

| DNA6 M2 144A | | | | | |

| 2.077% (SOFR + | | | | | |

| 2.00%) 12/25/50 #, ● | | 6,500,000 | | $ | 6,489,933 |

| Series 2020- | | | | | |

| HQA2 M1 144A | | | | | |

| 1.248% (LIBOR01M + | | | | | |

| 1.10%) 3/25/50 #, ● | | 2,847,762 | | | 2,849,560 |

| Freddie Mac Structured | | | | | |

| Agency Credit Risk Trust | | | | | |

| Series 2018- | | | | | |

| HQA2 M1 144A | | | | | |

| 0.898% (LIBOR01M + | | | | | |

| 0.75%) 10/25/48 #, ● | | 463,715 | | | 463,715 |

| Freddie Mac Structured | | | | | |

| Pass Through | | | | | |

| Certificates | | | | | |

| Series T-54 2A 6.50% | | | | | |

| 2/25/43 ◆ | | 8,211 | | | 10,003 |

| Series T-58 2A 6.50% | | | | | |

| 9/25/43 ◆ | | 2,567 | | | 2,984 |

| GNMA | | | | | |

| Series 2013-113 LY | | | | | |

| 3.00% 5/20/43 | | 378,000 | | | 409,790 |

| Series 2017-130 YJ | | | | | |

| 2.50% 8/20/47 | | 665,000 | | | 719,717 |

| Series 2017-34 DY | | | | | |

| 3.50% 3/20/47 | | 2,067,000 | | | 2,293,667 |

| Series 2018-34 TY | | | | | |

| 3.50% 3/20/48 | | 476,000 | | | 510,160 |

| Total Agency Collateralized Mortgage | | | |

| Obligations | | | | | |

| (cost $45,665,477) | | | | | 47,550,766 |

| |

| Agency Commercial Mortgage-Backed Securities — 0.71% |

| Freddie Mac Multifamily | | | | | |

| Structured Pass Through | | | | | |

| Certificates | | | | | |

| Series X3FX A2FX | | | | | |

| 3.00% 6/25/27 ◆ | | 2,545,000 | | | 2,800,430 |

| FREMF Mortgage Trust | | | | | |

| Series 2011-K15 B | | | | | |

| 144A 4.965% | | | | | |

| 8/25/44 #, ● | | 195,000 | | | 198,801 |

| Series 2012-K18 B | | | | | |

| 144A 4.224% | | | | | |

| 1/25/45 #, ● | | 2,000,000 | | | 2,064,361 |

| Series 2012-K22 B | | | | | |

| 144A 3.685% | | | | | |

| 8/25/45 #, ● | | 1,730,000 | | | 1,809,887 |

| FREMF Mortgage Trust | | | | | |

| Series 2013-K25 C | | | | | |

| 144A 3.619% | | | | | |

| 11/25/45 #, ● | | 1,500,000 | | | 1,557,401 |

| Series 2013-K28 B | | | | | |

| 144A 3.49% | | | | | |

| 6/25/46 #, ● | | 2,400,000 | | | 2,523,385 |

| Series 2014-K37 B | | | | | |

| 144A 4.56% | | | | | |

| 1/25/47 #, ● | | 1,500,000 | | | 1,653,021 |

| Series 2014-K717 B | | | | | |

| 144A 3.63% | | | | | |

| 11/25/47 #, ● | | 3,205,000 | | | 3,252,736 |

| Series 2014-K717 C | | | | | |

| 144A 3.63% | | | | | |

| 11/25/47 #, ● | | 1,055,000 | | | 1,066,942 |

| Series 2016-K53 B | | | | | |

| 144A 4.021% | | | | | |

| 3/25/49 #, ● | | 530,000 | | | 585,963 |

| Series 2016-K722 B | | | | | |

| 144A 3.845% | | | | | |

| 7/25/49 #, ● | | 580,000 | | | 614,618 |

| Series 2017-K71 B | | | | | |

| 144A 3.753% | | | | | |

| 11/25/50 #, ● | | 1,175,000 | | | 1,302,067 |

| Total Agency Commercial Mortgage- | | | |

| Backed Securities | | | | | |

| (cost $18,567,966) | | | | | 19,429,612 |

| |

| Agency Mortgage-Backed Securities — 15.16% | |

| Fannie Mae S.F. 30 yr | | | | | |

| 2.00% 11/1/50 | | 8,829,401 | | | 9,196,188 |

| 2.00% 1/1/51 | | 3,005,000 | | | 3,125,345 |

| 2.50% 11/1/50 | | 20,285,869 | | | 21,412,620 |

| 3.00% 10/1/46 | | 11,439,907 | | | 12,244,867 |

| 3.00% 4/1/47 | | 1,369,046 | | | 1,441,852 |

| 3.00% 11/1/48 | | 3,999,125 | | | 4,192,811 |

| 3.00% 10/1/49 | | 6,581,559 | | | 6,914,048 |

| 3.00% 12/1/49 | | 17,948,799 | | | 19,201,069 |

| 3.00% 3/1/50 | | 4,469,412 | | | 4,718,882 |

| 3.00% 7/1/50 | | 8,263,417 | | | 8,672,276 |

| 3.50% 7/1/47 | | 6,385,130 | | | 6,914,968 |

| 3.50% 2/1/48 | | 4,382,673 | | | 4,761,350 |

| 3.50% 3/1/48 | | 2,589,254 | | | 2,739,535 |

| 3.50% 7/1/48 | | 926,990 | | | 980,518 |

| 3.50% 11/1/48 | | 4,868,765 | | | 5,142,718 |

| 3.50% 11/1/49 | | 2,975,234 | | | 3,142,624 |

| 3.50% 1/1/50 | | 9,772,273 | | | 10,323,733 |

| 3.50% 3/1/50 | | 4,269,799 | | | 4,600,456 |

| 4.00% 4/1/47 | | 1,860,004 | | | 2,051,252 |

| 4.00% 6/1/48 | | 6,242,446 | | | 6,857,656 |

9

Schedule of investments

Delaware VIP® Trust — Delaware VIP Diversified Income Series

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Agency Mortgage-Backed Securities (continued) |

| Fannie Mae S.F. 30 yr | | | | | |

| 4.00% 9/1/48 | | 560,048 | | $ | 605,962 |

| 4.00% 10/1/48 | | 8,335,224 | | | 9,179,054 |

| 4.00% 6/1/49 | | 2,162,807 | | | 2,367,983 |

| 4.50% 6/1/40 | | 464,220 | | | 513,561 |

| 4.50% 7/1/40 | | 586,056 | | | 639,858 |

| 4.50% 2/1/41 | | 2,109,013 | | | 2,356,992 |

| 4.50% 8/1/41 | | 1,422,808 | | | 1,611,505 |

| 4.50% 10/1/45 | | 2,102,728 | | | 2,347,964 |

| 4.50% 5/1/46 | | 736,710 | | | 823,288 |

| 4.50% 4/1/48 | | 618,899 | | | 693,911 |

| 4.50% 12/1/48 | | 164,196 | | | 178,047 |

| 4.50% 1/1/49 | | 12,508,735 | | | 13,842,761 |

| 4.50% 1/1/50 | | 3,558,756 | | | 3,887,108 |

| 5.00% 7/1/47 | | 1,424,277 | | | 1,653,873 |

| 5.00% 7/1/49 | | 3,833,939 | | | 4,295,600 |

| 5.50% 5/1/44 | | 14,847,750 | | | 17,426,623 |

| 6.00% 6/1/41 | | 3,298,773 | | | 3,961,922 |

| 6.00% 7/1/41 | | 16,811,966 | | | 20,269,897 |

| 6.00% 1/1/42 | | 2,793,128 | | | 3,331,784 |

| Fannie Mae S.F. 30 yr TBA | | | | | |

| 2.00% 1/1/50 | | 53,486,000 | | | 55,552,245 |

| 2.50% 1/1/50 | | 52,756,000 | | | 55,603,932 |

| Freddie Mac S.F. 30 yr | | | | | |

| 2.50% 11/1/50 | | 12,507,111 | | | 13,211,891 |

| 3.00% 11/1/49 | | 9,636,724 | | | 10,114,031 |

| 3.00% 12/1/49 | | 3,275,498 | | | 3,464,693 |

| 3.00% 1/1/50 | | 2,378,175 | | | 2,531,222 |

| 3.50% 11/1/48 | | 5,074,940 | | | 5,545,075 |

| 4.00% 12/1/45 | | 2,514,363 | | | 2,784,344 |

| 4.00% 7/1/47 | | 724,700 | | | 778,421 |

| 4.00% 10/1/47 | | 6,411,386 | | | 6,872,881 |

| 4.50% 7/1/45 | | 4,217,128 | | | 4,729,356 |

| 4.50% 1/1/49 | | 2,366,917 | | | 2,630,729 |

| 4.50% 3/1/49 | | 838,845 | | | 915,862 |

| 4.50% 4/1/49 | | 3,378,324 | | | 3,711,948 |

| 4.50% 8/1/49 | | 6,407,591 | | | 7,110,190 |

| 5.50% 6/1/41 | | 2,850,287 | | | 3,351,446 |

| 5.50% 9/1/41 | | 5,173,728 | | | 6,081,072 |

| GNMA I S.F. 30 yr | | | | | |

| 3.00% 3/15/50 | | 2,690,506 | | | 2,824,006 |

| GNMA II S.F. 30 yr | | | | | |

| 5.50% 5/20/37 | | 176,209 | | | 204,018 |

| Total Agency Mortgage-Backed | | | |

| Securities | | | | | |

| (cost $406,038,896) | | | | | 416,639,823 |

| | | | |

| Collateralized Debt Obligations — 1.76% | | | |

| Apex Credit CLO | | | | | |

| Series 2017-1A | | | | | |

| A1 144A 1.685% | | | | | |

| (LIBOR03M + 1.47%, | | | | | |

| Floor 1.47%) | | | | | |

| 4/24/29 #, ● | | 3,334,905 | | | 3,330,857 |

| Series 2018-1A | | | | | |

| A2 144A 1.245% | | | | | |

| (LIBOR03M + 1.03%) | | | | | |

| 4/25/31 #, ● | | 6,200,000 | | | 6,019,524 |

| Atlas Senior Loan Fund X | | | | | |

| Series 2018-10A A | | | | | |

| 144A 1.327% | | | | | |

| (LIBOR03M + 1.09%) | | | | | |

| 1/15/31 #, ● | | 3,339,487 | | | 3,316,915 |

| CFIP CLO | | | | | |

| Series 2017-1A A 144A | | | | | |

| 1.438% (LIBOR03M + | | | | | |

| 1.22%) 1/18/30 #, ● | | 6,300,000 | | | 6,303,616 |

| Galaxy XXI CLO | | | | | |

| Series 2015-21A AR | | | | | |

| 144A 1.238% | | | | | |

| (LIBOR03M + 1.02%) | | | | | |

| 4/20/31 #, ● | | 3,000,000 | | | 2,970,918 |

| KKR Financial CLO | | | | | |

| Series 2013-1A A1R | | | | | |

| 144A 1.527% | | | | | |

| (LIBOR03M + 1.29%) | | | | | |

| 4/15/29 #, ● | | 3,000,000 | | | 2,997,105 |

| Man GLG US CLO | | | | | |

| Series 2018-1A A1R | | | | | |

| 144A 1.358% | | | | | |

| (LIBOR03M + 1.14%) | | | | | |

| 4/22/30 #, ● | | 8,200,000 | | | 8,081,412 |

| Mariner CLO 5 | | | | | |

| Series 2018-5A A 144A | | | | | |

| 1.325% (LIBOR03M + | | | | | |

| 1.11%, Floor 1.11%) | | | | | |

| 4/25/31 #, ● | | 4,600,000 | | | 4,587,755 |

| Midocean Credit CLO IX | | | | | |

| Series 2018-9A | | | | | |

| A1 144A 1.368% | | | | | |

| (LIBOR03M + 1.15%, | | | | | |

| Floor 1.15%) | | | | | |

| 7/20/31 #, ● | | 3,000,000 | | | 2,984,757 |

| Midocean Credit CLO VIII | | | | | |

| Series 2018-8A | | | | | |

| A1 144A 1.374% | | | | | |

| (LIBOR03M + 1.15%) | | | | | |

| 2/20/31 #, ● | | 3,000,000 | | | 2,987,982 |

| Saranac CLO VII | | | | | |

| Series 2014-2A A1AR | | | | | |

| 144A 1.454% | | | | | |

| (LIBOR03M + 1.23%) | | | | | |

| 11/20/29 #, ● | | 2,951,849 | | | 2,934,932 |

10

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Collateralized Debt Obligations (continued) | | | |

| Steele Creek CLO | | | | | |

| Series 2017-1A A 144A | | | | | |

| 1.487% (LIBOR03M + | | | | | |

| 1.25%) 10/15/30 #, ● | | 2,000,000 | | $ | 1,997,498 |

| Total Collateralized Debt Obligations | | | |

| (cost $48,929,073) | | | | | 48,513,271 |

| |

| Corporate Bonds — 46.40% | | | | | |

| Banking — 8.04% | | | | | |

| Akbank T.A.S. 144A 6.80% | | | | | |

| 2/6/26 # | | 1,135,000 | | | 1,204,802 |

| Banco Continental 144A | | | | | |

| 2.75% 12/10/25 # | | 1,695,000 | | | 1,690,762 |

| Banco de Credito del Peru | | | | | |

| 144A 2.70% 1/11/25 # | | 1,500,000 | | | 1,567,890 |

| Banco del Estado de Chile | | | | | |

| 144A 2.704% 1/9/25 # | | 530,000 | | | 560,812 |

| Banco Mercantil del Norte | | | | | |

| 144A 8.375% #, µ, ψ | | 880,000 | | | 1,051,829 |

| Banco Nacional de Panama | | | | | |

| 144A 2.50% 8/11/30 # | | 1,130,000 | | | 1,132,825 |

| Banco Santander Mexico | | | | | |

| 144A 5.95% | | | | | |

| 10/1/28 #, µ | | 660,000 | | | 725,588 |

| Bancolombia 3.00% | | | | | |

| 1/29/25 | | 1,215,000 | | | 1,264,754 |

| Bangkok Bank 144A | | | | | |

| 3.733% 9/25/34 #, µ | | 735,000 | | | 766,711 |

| Banistmo 144A 4.25% | | | | | |

| 7/31/27 # | | 1,460,000 | | | 1,570,376 |

| Bank Leumi Le-Israel 144A | | | | | |

| 3.275% 1/29/31 #, µ | | 4,375,000 | | | 4,523,750 |

| Bank of America | | | | | |

| 1.898% 7/23/31 µ | | 5,600,000 | | | 5,659,559 |

| 1.922% 10/24/31 µ | | 2,140,000 | | | 2,168,938 |

| 2.676% 6/19/41 µ | | 8,655,000 | | | 9,031,269 |

| 2.831% 10/24/51 µ | | 720,000 | | | 751,053 |

| Bank of China 144A | | | | | |

| 5.00% 11/13/24 # | | 1,120,000 | | | 1,258,369 |

| Bank of Georgia 144A | | | | | |

| 6.00% 7/26/23 # | | 1,360,000 | | | 1,445,000 |

| Bank of Montreal 1.85% | | | | | |

| 5/1/25 | | 65,000 | | | 68,268 |

| Bank of New York Mellon | | | | | |

| 4.70% µ, ψ | | 4,870,000 | | | 5,382,811 |

| Barclays 5.20% 5/12/26 | | 5,663,000 | | | 6,608,551 |

| BBVA Bancomer | | | | | |

| 144A 1.875% | | | | | |

| 9/18/25 # | | 785,000 | | | 793,831 |

| 144A 5.125% | | | | | |

| 1/18/33 #, µ | | 590,000 | | | 636,610 |

| 144A 6.75% 9/30/22 # | | 610,000 | | | 660,020 |

| BBVA USA | | | | | |

| 2.875% 6/29/22 | | 3,505,000 | | | 3,633,385 |

| 3.875% 4/10/25 | | 2,530,000 | | | 2,838,243 |

| BDO Unibank 2.125% | | | | | |

| 1/13/26 | | 1,465,000 | | | 1,510,589 |

| BOC Aviation 144A | | | | | |

| 2.625% 9/17/30 # | | 1,075,000 | | | 1,088,481 |

| Citizens Financial Group | | | | | |

| 5.65% µ, ψ | | 2,015,000 | | | 2,267,278 |

| Credit Suisse Group | | | | | |

| 144A 2.593% | | | | | |

| 9/11/25 #, µ | | 3,660,000 | | | 3,852,702 |

| 144A 4.194% 4/1/31 #, | | | | | |

| µ | | 3,035,000 | | | 3,572,175 |

| 144A 4.50% #, µ, ψ | | 1,565,000 | | | 1,576,581 |

| 144A 5.25% #, µ, ψ | | 1,670,000 | | | 1,770,200 |

| 144A 6.25% #, µ, ψ | | 8,870,000 | | | 9,728,731 |

| 144A 7.25% #, µ, ψ | | 2,585,000 | | | 2,910,525 |

| DBS Group Holdings 144A | | | | | |

| 4.52% 12/11/28 #, µ | | 1,175,000 | | | 1,286,865 |

| Deutsche Bank | | | | | |

| 2.222% 9/18/24 µ | | 2,670,000 | | | 2,748,344 |

| 3.547% 9/18/31 µ | | 5,030,000 | | | 5,466,021 |

| Development Bank of | | | | | |

| Mongolia 144A 7.25% | | | | | |

| 10/23/23 # | | 1,520,000 | | | 1,631,856 |

| Emirates NBD Bank | | | | | |

| 2.625% 2/18/25 | | 930,000 | | | 981,615 |

| Fifth Third Bancorp | | | | | |

| 2.55% 5/5/27 | | 3,205,000 | | | 3,491,709 |

| 3.65% 1/25/24 | | 820,000 | | | 894,700 |

| 3.95% 3/14/28 | | 2,985,000 | | | 3,510,104 |

| ICICI Bank 144A 4.00% | | | | | |

| 3/18/26 # | | 1,180,000 | | | 1,289,280 |

| JPMorgan Chase & Co. | | | | | |

| 2.522% 4/22/31 µ | | 2,905,000 | | | 3,124,643 |

| 3.109% 4/22/41 µ | | 1,290,000 | | | 1,444,107 |

| 3.109% 4/22/51 µ | | 1,935,000 | | | 2,154,575 |

| 3.702% 5/6/30 µ | | 230,000 | | | 266,874 |

| 4.023% 12/5/24 µ | | 8,915,000 | | | 9,824,389 |

| 4.60% µ, ψ | | 2,405,000 | | | 2,486,169 |

| 5.00% µ, ψ | | 2,495,000 | | | 2,626,962 |

| Morgan Stanley | | | | | |

| 1.794% 2/13/32 µ | | 175,000 | | | 176,138 |

| 2.188% 4/28/26 µ | | 6,680,000 | | | 7,060,120 |

| 5.00% 11/24/25 | | 6,125,000 | | | 7,332,057 |

| Natwest Group 8.625% | | | | | |

| µ, ψ | | 6,095,000 | | | 6,339,592 |

| PNC Bank | | | | | |

| 2.70% 11/1/22 | | 490,000 | | | 510,641 |

| 4.05% 7/26/28 | | 4,705,000 | | | 5,576,500 |

11

Schedule of investments

Delaware VIP® Trust — Delaware VIP Diversified Income Series

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Banking (continued) | | | | | |

| PNC Financial Services | | | | | |

| Group 2.60% 7/23/26 | | 5,655,000 | | $ | 6,211,424 |

| Popular 6.125% 9/14/23 | | 680,000 | | | 736,879 |

| QNB Finance | | | | | |

| 2.625% 5/12/25 | | 1,410,000 | | | 1,487,738 |

| 3.50% 3/28/24 | | 1,175,000 | | | 1,262,957 |

| Shinhan Financial Group | | | | | |

| 144A 3.34% | | | | | |

| 2/5/30 #, µ | | 890,000 | | | 945,334 |

| Truist Bank | | | | | |

| 2.25% 3/11/30 | | 4,195,000 | | | 4,404,156 |

| 2.636% 9/17/29 µ | | 10,165,000 | | | 10,758,104 |

| Truist Financial 4.95% | | | | | |

| µ, ψ | | 2,750,000 | | | 3,031,902 |

| UBS Group | | | | | |

| 144A 1.364% | | | | | |

| 1/30/27 #, µ | | 760,000 | | | 768,892 |

| 144A 4.125% | | | | | |

| 9/24/25 # | | 5,765,000 | | | 6,607,053 |

| 6.875% µ, ψ | | 5,110,000 | | | 5,170,783 |

| 7.125% µ, ψ | | 785,000 | | | 809,531 |

| US Bancorp | | | | | |

| 1.45% 5/12/25 | | 2,975,000 | | | 3,090,045 |

| 3.10% 4/27/26 | | 195,000 | | | 217,289 |

| 3.375% 2/5/24 | | 4,245,000 | | | 4,623,267 |

| 3.60% 9/11/24 | | 2,640,000 | | | 2,921,087 |

| 3.95% 11/17/25 | | 4,130,000 | | | 4,772,712 |

| US Bank 3.40% 7/24/23 | | 2,360,000 | | | 2,536,403 |

| USB Capital IX 3.50% | | | | | |

| (LIBOR03M + 1.02%) | | | | | |

| ψ, ● | | 2,470,000 | | | 2,432,950 |

| Wells Fargo & Co. 3.068% | | | | | |

| 4/30/41 µ | | 1,325,000 | | | 1,443,506 |

| Woori Bank 144A 4.75% | | | | | |

| 4/30/24 # | | 1,250,000 | | | 1,393,576 |

| | | | | | 221,122,117 |

| Banks — 0.15% | | | | | |

| Morgan Stanley 1.433% | | | | | |

| LIBOR03M + 1.22% | | | | | |

| 5/8/24 ● | | 3,945,000 | | | 4,022,445 |

| | | | | | 4,022,445 |

| Basic Industry — 4.40% | | | | | |

| AngloGold Ashanti | | | | | |

| Holdings 3.75% | | | | | |

| 10/1/30 | | 1,105,000 | | | 1,189,495 |

| Avient 144A 5.75% | | | | | |

| 5/15/25 # | | 3,214,000 | | | 3,418,892 |

| Bioceanico Sovereign | | | | | |

| Certificate 144A | | | | | |

| 2.884% 6/5/34 #, ^ | | 1,421,989 | | | 1,095,643 |

| Chemours 7.00% 5/15/25 | | 2,306,000 | | | 2,392,636 |

| Corp Nacional del Cobre | | | | | |

| de Chile | | | | | |

| 144A 3.15% 1/14/30 # | | 5,270,000 | | | 5,756,764 |

| 144A 4.25% 7/17/42 # | | 200,000 | | | 234,570 |

| CSN Inova Ventures 144A | | | | | |

| 6.75% 1/28/28 # | | 640,000 | | | 693,760 |

| CSN Islands XII 144A | | | | | |

| 7.00% #, ψ | | 545,000 | | | 541,417 |

| Equate Petrochemical | | | | | |

| 144A 4.25% 11/3/26 # | | 820,000 | | | 916,379 |

| First Quantum Minerals | | | | | |

| 144A 6.875% | | | | | |

| 10/15/27 # | | 670,000 | | | 727,787 |

| 144A 7.50% 4/1/25 # | | 4,595,000 | | | 4,790,287 |

| Freeport-McMoRan | | | | | |

| 4.125% 3/1/28 | | 2,445,000 | | | 2,568,778 |

| 4.25% 3/1/30 | | 2,451,000 | | | 2,643,256 |

| 4.625% 8/1/30 | | 1,345,000 | | | 1,478,525 |

| 5.45% 3/15/43 | | 3,255,000 | | | 4,058,529 |

| Fresnillo 144A 4.25% | | | | | |

| 10/2/50 # | | 700,000 | | | 769,825 |

| Georgia-Pacific | | | | | |

| 144A 1.75% 9/30/25 # | | 1,770,000 | | | 1,851,382 |

| 144A 2.10% 4/30/27 # | | 1,405,000 | | | 1,484,024 |

| 144A 2.30% 4/30/30 # | | 3,765,000 | | | 4,028,177 |

| 8.00% 1/15/24 | | 5,305,000 | | | 6,477,598 |

| Gold Fields Orogen | | | | | |

| Holdings BVI 144A | | | | | |

| 6.125% 5/15/29 # | | 1,755,000 | | | 2,136,712 |

| Hudbay Minerals | | | | | |

| 144A 6.125% 4/1/29 # | | 400,000 | | | 432,000 |

| 144A 7.625% | | | | | |

| 1/15/25 # | | 2,030,000 | | | 2,112,469 |

| ICL Group 144A 6.375% | | | | | |

| 5/31/38 # | | 2,630,000 | | | 3,484,750 |

| Indika Energy Capital IV | | | | | |

| 144A 8.25% | | | | | |

| 10/22/25 # | | 730,000 | | | 791,299 |

| Inversiones CMPC 144A | | | | | |

| 4.75% 9/15/24 # | | 1,075,000 | | | 1,192,245 |

| Klabin Austria 144A | | | | | |

| 7.00% 4/3/49 # | | 1,010,000 | | | 1,295,335 |

| LYB International Finance | | | | | |

| III 2.875% 5/1/25 | | 5,939,000 | | | 6,478,107 |

| Methanex 5.25% | | | | | |

| 12/15/29 | | 5,515,000 | | | 5,987,056 |

| Metinvest | | | | | |

| 144A 7.65% 10/1/27 # | | 623,000 | | | 683,742 |

| 144A 8.50% 4/23/26 # | | 695,000 | | | 783,612 |

| Minera Mexico 144A | | | | | |

| 4.50% 1/26/50 # | | 1,445,000 | | | 1,674,769 |

12

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Basic Industry (continued) | | | | | |

| Newmont | | | | | |

| 2.25% 10/1/30 | | 5,170,000 | | $ | 5,447,271 |

| 2.80% 10/1/29 | | 7,585,000 | | | 8,291,242 |

| Nutrition & Biosciences | | | | | |

| 144A 3.268% | | | | | |

| 11/15/40 # | | 6,330,000 | | | 6,802,468 |

| OCP 144A 4.50% | | | | | |

| 10/22/25 # | | 1,614,000 | | | 1,762,083 |

| Olin | | | | | |

| 5.00% 2/1/30 | | 3,705,000 | | | 3,954,402 |

| 5.625% 8/1/29 | | 1,415,000 | | | 1,538,820 |

| Phosagro OAO via | | | | | |

| Phosagro Bond Funding | | | | | |

| DAC 144A 3.949% | | | | | |

| 4/24/23 # | | 705,000 | | | 739,982 |

| PowerTeam Services 144A | | | | | |

| 9.033% 12/4/25 # | | 3,210,000 | | | 3,579,503 |

| Sasol Financing USA | | | | | |

| 5.875% 3/27/24 | | 6,295,000 | | | 6,705,749 |

| Sociedad Quimica y Minera | | | | | |

| de Chile 144A 3.625% | | | | | |

| 4/3/23 # | | 665,000 | | | 700,016 |

| Syngenta Finance | | | | | |

| 144A 3.933% | | | | | |

| 4/23/21 # | | 1,615,000 | | | 1,625,933 |

| 144A 4.441% | | | | | |

| 4/24/23 # | | 960,000 | | | 1,008,039 |

| Vale Overseas 3.75% | | | | | |

| 7/8/30 | | 3,180,000 | | | 3,540,962 |

| Vedanta Resources Finance | | | | | |

| II | | | | | |

| 144A 9.25% 4/23/26 # | | 960,000 | | | 729,600 |

| 144A 13.875% | | | | | |

| 1/21/24 # | | 440,000 | | | 465,685 |

| | | | | | 121,061,575 |

| Brokerage — 0.46% | | | | | |

| Banco BTG Pactual 144A | | | | | |

| 4.50% 1/10/25 # | | 970,000 | | | 1,037,909 |

| Charles Schwab | | | | | |

| 4.00% µ, ψ | | 1,570,000 | | | 1,660,275 |

| 5.375% µ, ψ | | 4,755,000 | | | 5,307,769 |

| Jefferies Group | | | | | |

| 4.15% 1/23/30 | | 2,135,000 | | | 2,492,012 |

| 6.45% 6/8/27 | | 893,000 | | | 1,133,277 |

| 6.50% 1/20/43 | | 750,000 | | | 1,031,593 |

| | | | | | 12,662,835 |

| Capital Goods — 2.28% | | | | | |

| ARD Finance PIK 144A | | | | | |

| 6.50% 6/30/27 #, > | | 2,220,000 | | | 2,372,625 |

| Ashtead Capital 144A | | | | | |

| 5.25% 8/1/26 # | | 885,000 | | | 939,206 |

| Boise Cascade 144A | | | | | |

| 4.875% 7/1/30 # | | 3,411,000 | | | 3,698,803 |

| Bombardier 144A 6.00% | | | | | |

| 10/15/22 # | | 685,000 | | | 674,143 |

| Caterpillar 2.60% 4/9/30 | | 50,000 | | | 55,155 |

| Cemex 144A 7.375% | | | | | |

| 6/5/27 # | | 1,020,000 | | | 1,162,035 |

| Covanta Holding 5.00% | | | | | |

| 9/1/30 | | 1,115,000 | | | 1,194,374 |

| General Electric | | | | | |

| 3.45% 5/1/27 | | 1,490,000 | | | 1,682,759 |

| 3.625% 5/1/30 | | 2,435,000 | | | 2,784,751 |

| 4.35% 5/1/50 | | 4,675,000 | | | 5,685,754 |

| GFL Environmental 144A | | | | | |

| 3.75% 8/1/25 # | | 1,365,000 | | | 1,394,859 |

| Grupo Cementos de | | | | | |

| Chihuahua 144A 5.25% | | | | | |

| 6/23/24 # | | 855,000 | | | 888,050 |

| HTA Group 144A 7.00% | | | | | |

| 12/18/25 # | | 1,395,000 | | | 1,509,251 |

| Hutama Karya Persero | | | | | |

| 144A 3.75% 5/11/30 # | | 4,760,000 | | | 5,338,344 |

| L3Harris Technologies | | | | | |

| 2.90% 12/15/29 | | 2,905,000 | | | 3,214,262 |

| 3.85% 6/15/23 | | 1,425,000 | | | 1,539,994 |

| Mauser Packaging | | | | | |

| Solutions Holding 144A | | | | | |

| 5.50% 4/15/24 # | | 4,995,000 | | | 5,100,844 |

| Otis Worldwide | | | | | |

| 3.112% 2/15/40 | | 2,354,000 | | | 2,565,110 |

| 3.362% 2/15/50 | | 406,000 | | | 470,583 |

| Reynolds Group Issuer | | | | | |

| 144A 4.00% | | | | | |

| 10/15/27 # | | 5,165,000 | | | 5,300,581 |

| Standard Industries | | | | | |

| 144A 3.375% | | | | | |

| 1/15/31 # | | 2,045,000 | | | 2,057,781 |

| 144A 5.00% 2/15/27 # | | 609,000 | | | 637,547 |

| TransDigm | | | | | |

| 5.50% 11/15/27 | | 2,235,000 | | | 2,353,008 |

| 144A 6.25% 3/15/26 # | | 1,583,000 | | | 1,687,882 |

| Turkiye Sise ve Cam | | | | | |

| Fabrikalari 144A 6.95% | | | | | |

| 3/14/26 # | | 1,065,000 | | | 1,187,475 |

| United Rentals North | | | | | |

| America 3.875% | | | | | |

| 2/15/31 | | 3,160,000 | | | 3,320,923 |

| WESCO Distribution 144A | | | | | |

| 7.25% 6/15/28 # | | 3,310,000 | | | 3,769,080 |

| | | | | | 62,585,179 |

13

Schedule of investments

Delaware VIP® Trust — Delaware VIP Diversified Income Series

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Communications — 7.58% | | | | | |

| Altice Financing 144A | | | | | |

| 5.00% 1/15/28 # | | 3,540,000 | | $ | 3,631,863 |

| Altice France Holding | | | | | |

| 144A 6.00% 2/15/28 # | | 2,400,000 | | | 2,435,004 |

| 144A 10.50% | | | | | |

| 5/15/27 # | | 3,665,000 | | | 4,120,834 |

| Amazon.com | | | | | |

| 1.20% 6/3/27 | | 1,155,000 | | | 1,179,632 |

| 1.50% 6/3/30 | | 1,865,000 | | | 1,895,599 |

| 2.50% 6/3/50 | | 1,230,000 | | | 1,276,281 |

| American Tower 1.875% | | | | | |

| 10/15/30 | | 3,255,000 | | | 3,285,772 |

| AT&T | | | | | |

| 3.10% 2/1/43 | | 1,540,000 | | | 1,562,475 |

| 3.50% 6/1/41 | | 3,991,000 | | | 4,309,108 |

| 144A 3.50% 9/15/53 # | | 1,710,000 | | | 1,710,094 |

| 3.65% 6/1/51 | | 1,635,000 | | | 1,712,079 |

| B2W Digital 144A 4.375% | | | | | |

| 12/20/30 # | | 1,370,000 | | | 1,419,663 |

| C&W Senior Financing | | | | | |

| 144A 7.50% | | | | | |

| 10/15/26 # | | 2,705,000 | | | 2,885,626 |

| Charter Communications | | | | | |

| Operating | | | | | |

| 3.70% 4/1/51 | | 4,060,000 | | | 4,224,005 |

| 4.464% 7/23/22 | | 5,555,000 | | | 5,857,745 |

| 4.80% 3/1/50 | | 1,635,000 | | | 1,954,109 |

| 4.908% 7/23/25 | | 760,000 | | | 883,529 |

| 5.05% 3/30/29 | | 5,770,000 | | | 7,017,116 |

| Clear Channel Worldwide | | | | | |

| Holdings 9.25% | | | | | |

| 2/15/24 | | 1,780,000 | | | 1,806,887 |

| Comcast | | | | | |

| 3.20% 7/15/36 | | 3,455,000 | | | 3,930,465 |

| 3.70% 4/15/24 | | 7,050,000 | | | 7,758,873 |

| 3.75% 4/1/40 | | 835,000 | | | 1,006,099 |

| Connect Finco 144A | | | | | |

| 6.75% 10/1/26 # | | 3,520,000 | | | 3,796,566 |

| Crown Castle International | | | | | |

| 3.80% 2/15/28 | | 5,075,000 | | | 5,853,855 |

| 4.30% 2/15/29 | | 2,155,000 | | | 2,559,974 |

| 5.25% 1/15/23 | | 2,190,000 | | | 2,396,984 |

| CSC Holdings | | | | | |

| 144A 3.375% | | | | | |

| 2/15/31 # | | 1,370,000 | | | 1,346,025 |

| 144A 4.625% | | | | | |

| 12/1/30 # | | 1,680,000 | | | 1,755,827 |

| Digicel Group 0.5 PIK | | | | | |

| 10.00% 4/1/24 * | | 745,187 | | | 668,805 |

| Discovery Communications | | | | | |

| 4.125% 5/15/29 | | 11,195,000 | | | 13,080,023 |

| 5.20% 9/20/47 | | 2,760,000 | | | 3,595,493 |

| Frontier Communications | | | | | |

| 144A 5.875% | | | | | |

| 10/15/27 # | | 2,305,000 | | | 2,496,603 |

| Gray Television 144A | | | | | |

| 4.75% 10/15/30 # | | 885,000 | | | 899,934 |

| IHS Netherlands Holdco | | | | | |

| 144A 7.125% | | | | | |

| 3/18/25 # | | 1,275,000 | | | 1,341,938 |

| Level 3 Financing 144A | | | | | |

| 3.625% 1/15/29 # | | 2,200,000 | | | 2,198,625 |

| Meituan 144A 3.05% | | | | | |

| 10/28/30 # | | 1,450,000 | | | 1,508,870 |

| Millicom International | | | | | |

| Cellular 144A 4.50% | | | | | |

| 4/27/31 # | | 760,000 | | | 821,750 |

| Nexstar Broadcasting 144A | | | | | |

| 4.75% 11/1/28 # | | 3,840,000 | | | 4,024,800 |

| Ooredoo International | | | | | |

| Finance 144A 5.00% | | | | | |

| 10/19/25 # | | 605,000 | | | 706,909 |

| Prosus 144A 3.832% | | | | | |

| 2/8/51 # | | 1,150,000 | | | 1,129,578 |

| Sable International Finance | | | | | |

| 144A 5.75% 9/7/27 # | | 545,000 | | | 581,684 |

| Sprint Spectrum 144A | | | | | |

| 4.738% 3/20/25 # | | 2,130,000 | | | 2,313,638 |

| Telefonica Celular del | | | | | |

| Paraguay 144A 5.875% | | | | | |

| 4/15/27 # | | 870,000 | | | 928,073 |

| Terrier Media Buyer 144A | | | | | |

| 8.875% 12/15/27 # | | 4,411,000 | | | 4,871,398 |

| Time Warner Cable 7.30% | | | | | |

| 7/1/38 | | 5,775,000 | | | 8,568,129 |

| Time Warner Entertainment | | | | | |

| 8.375% 3/15/23 | | 2,495,000 | | | 2,917,982 |

| T-Mobile USA | | | | | |

| 144A 1.50% 2/15/26 # | | 1,520,000 | | | 1,559,132 |

| 144A 2.55% 2/15/31 # | | 1,070,000 | | | 1,124,912 |

| 144A 3.00% 2/15/41 # | | 2,650,000 | | | 2,752,277 |

| 144A 3.50% 4/15/25 # | | 1,750,000 | | | 1,935,465 |

| 144A 3.75% 4/15/27 # | | 2,405,000 | | | 2,741,219 |

| 144A 3.875% | | | | | |

| 4/15/30 # | | 6,025,000 | | | 6,984,542 |

| 6.50% 1/15/26 | | 1,110,000 | | | 1,150,238 |

| Turk Telekomunikasyon | | | | | |

| 144A 6.875% | | | | | |

| 2/28/25 # | | 1,720,000 | | | 1,903,438 |

14

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Communications (continued) | | | | | |

| Turkcell Iletisim Hizmetleri | | | | | |

| 144A 5.80% 4/11/28 # | | 1,300,000 | | $ | 1,385,415 |

| VEON Holdings 144A | | | | | |

| 4.00% 4/9/25 # | | 1,482,000 | | | 1,571,179 |

| Verizon Communications | | | | | |

| 2.65% 11/20/40 | | 655,000 | | | 662,456 |

| 4.00% 3/22/50 | | 650,000 | | | 788,537 |

| 4.50% 8/10/33 | | 12,400,000 | | | 15,638,093 |

| ViacomCBS | | | | | |

| 4.375% 3/15/43 | | 5,775,000 | | | 6,822,798 |

| 4.95% 1/15/31 | | 4,620,000 | | | 5,792,687 |

| Vmed O2 UK Financing I | | | | | |

| 144A 4.25% 1/31/31 # | | 3,560,000 | | | 3,645,938 |

| Vodafone Group | | | | | |

| 4.25% 9/17/50 | | 2,090,000 | | | 2,593,584 |

| 4.875% 6/19/49 | | 8,605,000 | | | 11,504,602 |

| Zayo Group Holdings 144A | | | | | |

| 6.125% 3/1/28 # | | 1,465,000 | | | 1,551,757 |

| | | | | | 208,334,590 |

| Consumer Cyclical — 2.68% | | | | | |

| Allison Transmission 144A | | | | | |

| 5.875% 6/1/29 # | | 2,445,000 | | | 2,711,175 |

| Aramark Services 144A | | | | | |

| 5.00% 2/1/28 # | | 2,365,000 | | | 2,495,075 |

| Boyd Gaming 4.75% | | | | | |

| 12/1/27 | | 4,435,000 | | | 4,615,992 |

| Caesars Entertainment | | | | | |

| 144A 6.25% 7/1/25 # | | 2,670,000 | | | 2,846,901 |

| Carnival 144A 7.625% | | | | | |

| 3/1/26 # | | 3,339,000 | | | 3,644,068 |

| Ford Motor Credit 4.542% | | | | | |

| 8/1/26 | | 8,815,000 | | | 9,421,031 |

| Future Retail 144A 5.60% | | | | | |

| 1/22/25 # | | 1,250,000 | | | 1,057,812 |

| General Motors | | | | | |

| 5.00% 10/1/28 | | 2,289,000 | | | 2,724,419 |

| 5.40% 10/2/23 | | 1,300,000 | | | 1,456,503 |

| 6.125% 10/1/25 | | 1,300,000 | | | 1,577,853 |

| General Motors Financial | | | | | |

| 5.20% 3/20/23 | | 2,455,000 | | | 2,692,868 |

| 5.25% 3/1/26 | | 5,505,000 | | | 6,494,171 |

| 5.70% µ, ψ | | 2,175,000 | | | 2,403,375 |

| Hyundai Capital America | | | | | |

| 144A 3.50% 11/2/26 # | | 955,000 | | | 1,056,213 |

| JD.com 3.875% 4/29/26 | | 980,000 | | | 1,097,243 |

| JSM Global 144A 4.75% | | | | | |

| 10/20/30 # | | 2,755,000 | | | 2,970,262 |

| Lowe’s | | | | | |

| 3.00% 10/15/50 | | 2,875,000 | | | 3,076,919 |

| 4.05% 5/3/47 | | 925,000 | | | 1,157,988 |

| MGM China Holdings | | | | | |

| 144A 5.25% 6/18/25 # | | 1,055,000 | | | 1,099,521 |

| MGM Resorts International | | | | | |

| 4.75% 10/15/28 | | 2,290,000 | | | 2,458,876 |

| Murphy Oil USA 5.625% | | | | | |

| 5/1/27 | | 775,000 | | | 822,321 |

| Prime Security Services | | | | | |

| Borrower | | | | | |

| 144A 5.75% 4/15/26 # | | 185,000 | | | 202,806 |

| 144A 6.25% 1/15/28 # | | 4,610,000 | | | 4,955,750 |

| Sands China | | | | | |

| 144A 3.80% 1/8/26 # | | 750,000 | | | 802,845 |

| 144A 4.375% | | | | | |

| 6/18/30 # | | 940,000 | | | 1,049,952 |

| Scientific Games | | | | | |

| International 144A | | | | | |

| 8.25% 3/15/26 # | | 2,875,000 | | | 3,103,002 |

| Shimao Group Holdings | | | | | |

| 5.60% 7/15/26 | | 1,315,000 | | | 1,442,599 |

| Six Flags Entertainment | | | | | |

| 144A 4.875% | | | | | |

| 7/31/24 # | | 2,345,000 | | | 2,355,599 |

| Wynn Macau 144A | | | | | |

| 5.625% 8/26/28 # | | 820,000 | | | 860,943 |

| Yuzhou Group Holdings | | | | | |

| 7.70% 2/20/25 | | 945,000 | | | 1,013,516 |

| | | | | | 73,667,598 |

| Consumer Non-Cyclical — 4.74% | | | | | |

| AbbVie | | | | | |

| 2.95% 11/21/26 | | 5,100,000 | | | 5,645,969 |

| 4.05% 11/21/39 | | 6,371,000 | | | 7,707,373 |

| Anheuser-Busch InBev | | | | | |

| Worldwide | | | | | |

| 4.15% 1/23/25 | | 3,430,000 | | | 3,906,962 |

| 4.50% 6/1/50 | | 4,090,000 | | | 5,155,405 |

| Auna 144A 6.50% | | | | | |

| 11/20/25 # | | 1,280,000 | | | 1,360,512 |

| BAT Capital 2.259% | | | | | |

| 3/25/28 | | 2,835,000 | | | 2,945,421 |

| BAT International Finance | | | | | |

| 1.668% 3/25/26 | | 2,005,000 | | | 2,053,384 |

| Bausch Health 144A | | | | | |

| 6.25% 2/15/29 # | | 6,130,000 | | | 6,667,540 |

| Biogen 3.15% 5/1/50 | | 5,985,000 | | | 6,212,246 |

| Centene | | | | | |

| 3.375% 2/15/30 | | 1,980,000 | | | 2,086,237 |

| 144A 5.375% | | | | | |

| 8/15/26 # | | 1,645,000 | | | 1,741,644 |

15

Schedule of investments

Delaware VIP® Trust — Delaware VIP Diversified Income Series

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Consumer Non-Cyclical (continued) | | | | | |

| Cigna | | | | | |

| 1.127% LIBOR03M + | | | | | |

| 0.89% 7/15/23 ● | | 1,770,000 | | $ | 1,790,913 |

| 2.40% 3/15/30 | | 1,360,000 | | | 1,450,452 |

| 3.20% 3/15/40 | | 1,295,000 | | | 1,422,165 |

| 4.125% 11/15/25 | | 3,899,000 | | | 4,492,234 |

| CVS Health | | | | | |

| 1.875% 2/28/31 | | 615,000 | | | 622,696 |

| 3.75% 4/1/30 | | 1,535,000 | | | 1,787,548 |

| 4.30% 3/25/28 | | 9,949,000 | | | 11,849,503 |

| 4.78% 3/25/38 | | 2,055,000 | | | 2,596,294 |

| 5.05% 3/25/48 | | 65,000 | | | 88,101 |

| DP World 144A 5.625% | | | | | |

| 9/25/48 # | | 485,000 | | | 619,927 |

| Encompass Health | | | | | |

| 4.50% 2/1/28 | | 2,065,000 | | | 2,161,415 |

| 4.75% 2/1/30 | | 1,053,000 | | | 1,129,806 |

| 5.75% 9/15/25 | | 610,000 | | | 631,350 |

| Energizer Holdings 144A | | | | | |

| 4.375% 3/31/29 # | | 2,299,000 | | | 2,384,109 |

| Gilead Sciences 4.15% | | | | | |

| 3/1/47 | | 6,535,000 | | | 7,983,209 |

| HCA 7.58% 9/15/25 | | 80,000 | | | 96,800 |

| JBS Investments II 144A | | | | | |

| 5.75% 1/15/28 # | | 845,000 | | | 905,743 |

| JBS USA LUX 144A 5.75% | | | | | |

| 6/15/25 # | | 1,015,000 | | | 1,050,525 |

| Kernel Holding 144A | | | | | |

| 6.50% 10/17/24 # | | 855,000 | | | 909,506 |

| MHP 144A 7.75% | | | | | |

| 5/10/24 # | | 965,000 | | | 1,063,305 |

| New York and Presbyterian | | | | | |

| Hospital 4.063% | | | | | |

| 8/1/56 | | 1,630,000 | | | 2,137,185 |

| Pilgrim’s Pride 144A | | | | | |

| 5.875% 9/30/27 # | | 3,182,000 | | | 3,455,207 |

| Post Holdings | | | | | |

| 144A 4.625% | | | | | |

| 4/15/30 # | | 2,147,000 | | | 2,261,242 |

| 144A 5.75% 3/1/27 # | | 720,000 | | | 763,650 |

| Primo Water Holdings | | | | | |

| 144A 5.50% 4/1/25 # | | 645,000 | | | 666,769 |

| Rede D’or Finance 144A | | | | | |

| 4.50% 1/22/30 # | | 1,245,000 | | | 1,300,402 |

| Regeneron | | | | | |

| Pharmaceuticals 1.75% | | | | | |

| 9/15/30 | | 1,555,000 | | | 1,533,080 |

| Royalty Pharma | | | | | |

| 144A 1.20% 9/2/25 # | | 1,925,000 | | | 1,956,192 |

| 144A 1.75% 9/2/27 # | | 1,285,000 | | | 1,323,279 |

| Takeda Pharmaceutical | | | | | |

| 2.05% 3/31/30 | | 2,480,000 | | | 2,539,122 |

| 3.025% 7/9/40 | | 1,845,000 | | | 1,947,897 |

| 3.175% 7/9/50 | | 1,845,000 | | | 1,966,565 |

| Tenet Healthcare | | | | | |

| 5.125% 5/1/25 | | 3,982,000 | | | 4,064,587 |

| 144A 6.125% | | | | | |

| 10/1/28 # | | 2,760,000 | | | 2,885,663 |

| Teva Pharmaceutical | | | | | |

| Finance Netherlands III | | | | | |

| 6.75% 3/1/28 | | 2,071,000 | | | 2,346,598 |

| Ulker Biskuvi Sanayi 144A | | | | | |

| 6.95% 10/30/25 # | | 2,005,000 | | | 2,175,064 |

| Universal Health Services | | | | | |

| 144A 5.00% 6/1/26 # | | 485,000 | | | 502,489 |

| Viatris | | | | | |

| 144A 1.65% 6/22/25 # | | 595,000 | | | 615,518 |

| 144A 2.30% 6/22/27 # | | 495,000 | | | 527,547 |

| 144A 2.70% 6/22/30 # | | 3,640,000 | | | 3,863,552 |

| 144A 4.00% 6/22/50 # | | 845,000 | | | 968,152 |

| | | | | | 130,318,054 |

| Electric — 3.61% | | | | | |

| Adani Electricity Mumbai | | | | | |

| 144A 3.949% | | | | | |

| 2/12/30 # | | 980,000 | | | 1,041,946 |

| AES Gener 144A 7.125% | | | | | |

| 3/26/79 #, µ | | 1,115,000 | | | 1,240,438 |

| American Transmission | | | | | |

| Systems 144A 5.25% | | | | | |

| 1/15/22 # | | 3,930,000 | | | 4,097,010 |

| Calpine | | | | | |

| 144A 4.50% 2/15/28 # | | 896,000 | | | 933,184 |

| 144A 5.00% 2/1/31 # | | 2,905,000 | | | 3,040,082 |

| 144A 5.125% | | | | | |

| 3/15/28 # | | 855,000 | | | 900,644 |

| CenterPoint Energy | | | | | |

| 3.85% 2/1/24 | | 1,645,000 | | | 1,800,782 |

| 4.25% 11/1/28 | | 5,198,000 | | | 6,160,305 |

| Centrais Eletricas | | | | | |

| Brasileiras | | | | | |

| 144A 3.625% 2/4/25 # | | 226,000 | | | 234,760 |

| 144A 4.625% 2/4/30 # | | 950,000 | | | 1,009,385 |

| Cikarang Listrindo 144A | | | | | |

| 4.95% 9/14/26 # | | 1,190,000 | | | 1,243,550 |

| CLP Power Hong Kong | | | | | |

| Financing 2.875% | | | | | |

| 4/26/23 | | 545,000 | | | 569,771 |

16

| | | | Principal | | | |

| | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Electric (continued) | | | | | |

| Comision Federal de | | | | | |

| Electricidad | | | | | |

| 144A 4.75% 2/23/27 # | | 2,366,000 | | $ | 2,693,833 |

| 144A 4.875% | | | | | |

| 1/15/24 # | | 251,000 | | | 278,900 |

| Duke Energy 4.875% µ, ψ | | 4,665,000 | | | 5,063,064 |

| Duke Energy Indiana | | | | | |

| 3.25% 10/1/49 | | 2,480,000 | | | 2,808,893 |

| Engie Energia Chile 144A | | | | | |

| 4.50% 1/29/25 # | | 710,000 | | | 788,686 |

| Entergy Arkansas 4.20% | | | | | |

| 4/1/49 | | 1,930,000 | | | 2,498,710 |

| Entergy Louisiana 4.95% | | | | | |

| 1/15/45 | | 545,000 | | | 601,660 |

| Entergy Mississippi 3.85% | | | | | |

| 6/1/49 | | 3,060,000 | | | 3,724,074 |

| Entergy Texas 3.55% | | | | | |

| 9/30/49 | | 1,380,000 | | | 1,596,428 |

| Evergy 4.85% 6/1/21 | | 535,000 | | | 538,672 |

| Evergy Kansas Central | | | | | |

| 3.45% 4/15/50 | | 2,250,000 | | | 2,656,841 |

| FirstEnergy Transmission | | | | | |

| 144A 4.55% 4/1/49 # | | 1,675,000 | | | 1,956,202 |

| Israel Electric 144A 5.00% | | | | | |

| 11/12/24 # | | 1,110,000 | | | 1,256,748 |

| Kallpa Generacion 144A | | | | | |

| 4.125% 8/16/27 # | | 1,894,000 | | | 2,043,626 |

| Louisville Gas and Electric | | | | | |

| 4.25% 4/1/49 | | 5,265,000 | | | 6,798,187 |

| Mong Duong Finance | | | | | |

| Holdings 144A 5.125% | | | | | |

| 5/7/29 # | | 1,897,000 | | | 1,997,093 |

| National Rural Utilities | | | | | |

| Cooperative Finance | | | | | |

| 4.75% 4/30/43 µ | | 1,090,000 | | | 1,149,078 |

| Pacific Gas and Electric | | | | | |

| 2.10% 8/1/27 | | 925,000 | | | 940,048 |

| 2.50% 2/1/31 | | 1,365,000 | | | 1,368,449 |

| 3.30% 8/1/40 | | 2,275,000 | | | 2,273,319 |

| Perusahaan Listrik Negara | | | | | |

| 144A 4.125% | | | | | |

| 5/15/27 # | | 475,000 | | | 526,566 |

| 144A 5.25% 5/15/47 # | | 528,000 | | | 626,628 |

| PG&E 5.25% 7/1/30 | | 4,830,000 | | | 5,319,037 |

| Saudi Electricity Global | | | | | |

| Sukuk Co. 4 4.222% | | | | | |

| 1/27/24 | | 1,135,000 | | | 1,237,998 |

| Southern California Edison | | | | | |

| 3.65% 2/1/50 | | 3,245,000 | | | 3,689,284 |

| 4.00% 4/1/47 | | 1,745,000 | | | 2,049,764 |

| 4.875% 3/1/49 | | 4,680,000 | | | 6,181,468 |

| Southwestern Electric | | | | | |

| Power 4.10% 9/15/28 | | 8,995,000 | | | 10,579,762 |

| Vistra Operations 144A | | | | | |

| 5.50% 9/1/26 # | | 3,547,000 | | | 3,701,117 |

| | | | | | 99,215,992 |

| Energy — 6.49% | | | | | |

| Abu Dhabi Crude Oil | | | | | |

| Pipeline 144A 4.60% | | | | | |

| 11/2/47 # | | 780,000 | | | 971,911 |

| BP Capital Markets | | | | | |

| 4.875% µ, ψ | | 4,840,000 | | | 5,412,088 |

| CNX Resources 144A | | | | | |

| 6.00% 1/15/29 # | | 5,325,000 | | | 5,465,367 |

| Crestwood Midstream | | | | | |

| Partners 6.25% 4/1/23 | | 1,030,000 | | | 1,034,506 |

| Ecopetrol | | | | | |

| 5.375% 6/26/26 | | 665,000 | | | 766,758 |

| 6.875% 4/29/30 | | 605,000 | | | 781,962 |

| Energy Transfer Operating | | | | | |

| 5.25% 4/15/29 | | 3,485,000 | | | 4,069,849 |

| 6.25% 4/15/49 | | 8,940,000 | | | 10,813,857 |

| EnfraGen Energia Sur 144A | | | | | |

| 5.375% 12/30/30 # | | 3,640,000 | | | 3,785,600 |

| Enterprise Products | | | | | |

| Operating 3.20% | | | | | |

| 2/15/52 | | 8,295,000 | | | 8,459,163 |

| Equinor 1.75% 1/22/26 | | 1,235,000 | | | 1,297,664 |

| Galaxy Pipeline Assets | | | | | |

| Bidco | | | | | |

| 144A 1.75% 9/30/27 # | | 2,630,000 | | | 2,676,065 |

| 144A 2.625% | | | | | |

| 3/31/36 # | | 3,945,000 | | | 4,102,631 |

| Gazprom via Gaz Finance | | | | | |

| 144A 3.25% 2/25/30 # | | 1,055,000 | | | 1,092,957 |

| Geopark | | | | | |

| 144A 5.50% 1/17/27 # | | 1,195,000 | | | 1,197,999 |

| 144A 6.50% 9/21/24 # | | 330,000 | | | 343,200 |

| Greenko Solar Mauritius | | | | | |

| 144A 5.95% 7/29/26 # | | 1,185,000 | | | 1,285,822 |

| India Green Energy | | | | | |

| Holdings 144A 5.375% | | | | | |

| 4/29/24 # | | 760,000 | | | 805,255 |

| KazMunayGas National | | | | | |

| JSC 144A 6.375% | | | | | |

| 10/24/48 # | | 481,000 | | | 693,099 |

| KazTransGas JSC 144A | | | | | |

| 4.375% 9/26/27 # | | 4,507,000 | | | 5,194,092 |

| Lukoil Securities 144A | | | | | |

| 3.875% 5/6/30 # | | 4,025,000 | | | 4,359,598 |

| Marathon Oil 4.40% | | | | | |

| 7/15/27 | | 14,575,000 | | | 16,205,009 |

17

Schedule of investments

Delaware VIP® Trust — Delaware VIP Diversified Income Series

| | | Principal | | | |

| | | | amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Energy (continued) | | | | | |

| MPLX | | | | | |

| 1.75% 3/1/26 | | 1,290,000 | | $ | 1,335,688 |

| 2.65% 8/15/30 | | 1,240,000 | | | 1,300,975 |

| 4.00% 3/15/28 | | 720,000 | | | 828,563 |

| 4.125% 3/1/27 | | 3,915,000 | | | 4,517,310 |

| 4.70% 4/15/48 | | 1,420,000 | | | 1,686,760 |

| 5.50% 2/15/49 | | 4,900,000 | | | 6,452,651 |

| Murphy Oil 5.875% | | | | | |

| 12/1/27 | | 4,950,000 | | | 4,880,403 |

| Noble Energy 3.90% | | | | | |

| 11/15/24 | | 2,320,000 | | | 2,588,963 |

| NuStar Logistics | | | | | |

| 5.625% 4/28/27 | | 420,000 | | | 448,272 |

| 6.375% 10/1/30 | | 4,436,000 | | | 5,033,418 |

| Oil and Gas Holding 144A | | | | | |

| 7.625% 11/7/24 # | | 404,000 | | | 454,157 |

| Oleoducto Central 144A | | | | | |

| 4.00% 7/14/27 # | | 1,175,000 | | | 1,276,649 |

| ONEOK 7.50% 9/1/23 | | 5,305,000 | | | 6,142,543 |

| PDC Energy 5.75% | | | | | |

| 5/15/26 | | 2,280,000 | | | 2,358,375 |

| Pertamina Persero 144A | | | | | |

| 3.65% 7/30/29 # | | 410,000 | | | 458,175 |

| Petrobras Global Finance | | | | | |

| 5.093% 1/15/30 | | 4,010,000 | | | 4,486,187 |

| 6.75% 6/3/50 | | 880,000 | | | 1,094,500 |

| Petroleos Mexicanos | | | | | |

| 5.95% 1/28/31 | | 820,000 | | | 819,385 |

| 6.50% 3/13/27 | | 244,000 | | | 257,405 |

| 6.50% 1/23/29 | | 3,984,000 | | | 4,125,472 |

| 6.75% 9/21/47 | | 576,000 | | | 540,924 |

| Petronas Capital 144A | | | | | |

| 3.50% 4/21/30 # | | 500,000 | | | 575,727 |

| Pioneer Natural Resources | | | | | |

| 1.90% 8/15/30 | | 3,390,000 | | | 3,360,544 |

| Precision Drilling 144A | | | | | |

| 7.125% 1/15/26 # | | 195,000 | | | 170,344 |

| PTTEP Treasury Center | | | | | |

| 144A 2.587% | | | | | |

| 6/10/27 # | | 1,230,000 | | | 1,286,723 |

| ReNew Power 144A | | | | | |

| 5.875% 3/5/27 # | | 390,000 | | | 414,609 |

| Sabine Pass Liquefaction | | | | | |

| 5.625% 3/1/25 | | 3,420,000 | | | 3,990,271 |

| 5.75% 5/15/24 | | 5,868,000 | | | 6,710,817 |

| Saudi Arabian Oil | | | | | |

| 144A 1.625% | | | | | |

| 11/24/25 # | | 580,000 | | | 594,620 |

| 144A 3.50% | | | | | |

| 11/24/70 # | | 935,000 | | | 946,644 |

| 144A 4.25% 4/16/39 # | | 1,280,000 | | | 1,503,930 |

| Schlumberger Holdings | | | | | |

| 144A 4.30% 5/1/29 # | | 4,475,000 | | | 5,232,880 |

| Sinopec Group Overseas | | | | | |

| Development 2018 | | | | | |

| 144A 2.50% 8/8/24 # | | 600,000 | | | 623,537 |

| Southwestern Energy | | | | | |

| 7.75% 10/1/27 | | 4,000,000 | | | 4,326,300 |

| Targa Resources Partners | | | | | |