UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01716

AB CAP FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: June 30, 2020

Date of reporting period: June 30, 2020

ITEM 1. REPORTS TO STOCKHOLDERS.

JUN 06.30.20

ANNUAL REPORT

AB CONCENTRATED GROWTH FUND

Beginning January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund at (800) 221 5672.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at (800) 221 5672. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Mutual Funds you hold.

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-PORT may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We are pleased to provide this report for AB Concentrated Growth Fund (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

As always, AB strives to keep clients ahead of what’s next by:

| + | | Transforming uncommon insights into uncommon knowledge with a global research scope |

| + | | Navigating markets with seasoned investment experience and sophisticated solutions |

| + | | Providing thoughtful investment insights and actionable ideas |

Whether you’re an individual investor or a multi-billion-dollar institution, we put knowledge and experience to work for you.

AB’s global research organization connects and collaborates across platforms and teams to deliver impactful insights and innovative products. Better insights lead to better opportunities—anywhere in the world.

For additional information about AB’s range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in the AB Mutual Funds.

Sincerely,

Robert M. Keith

President and Chief Executive Officer, AB Mutual Funds

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 1 |

ANNUAL REPORT

August 11, 2020

This report provides management’s discussion of fund performance for AB Concentrated Growth Fund for the annual reporting period ended June 30, 2020.

The Fund’s investment objective is long-term growth of capital.

NAV RETURNS AS OF JUNE 30, 2020 (unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB CONCENTRATED GROWTH FUND | | | | | | | | |

| | |

| Class A Shares | | | -2.41% | | | | 6.84% | |

| | |

| Class C Shares | | | -2.78% | | | | 6.01% | |

| | |

| Advisor Class Shares1 | | | -2.30% | | | | 7.09% | |

| | |

| Class R Shares1 | | | -2.59% | | | | 6.48% | |

| | |

| Class K Shares1 | | | -2.43% | | | | 6.78% | |

| | |

| Class I Shares1 | | | -2.30% | | | | 7.10% | |

| | |

| Class Z Shares1 | | | -2.28% | | | | 7.13% | |

| | |

| S&P 500 Index | | | -3.08% | | | | 7.51% | |

| 1 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its benchmark, the Standard & Poor’s (“S&P”) 500 Index, for the six- and 12-month periods ended June 30, 2020.

All share classes underperformed the benchmark for the 12-month period, but outperformed for the six-month period, before sales charges. In both periods, having less exposure to areas of the market that underperformed, such as energy and financials, was most beneficial to relative performance. At the security level, selection within consumer discretionary and technology detracted, while selection within industrials and communication services contributed.

For the 12-month period, the top absolute detractors were ULTA Beauty, Booking Holdings and Charles Schwab. The top contributors included Microsoft, Alphabet, Inc. and Mastercard. For the six-month period, the top absolute contributors included Microsoft, Verisk Analytics and Facebook. The top absolute detractors were Charles Schwab, Allegion and Booking Holdings.

| | |

| |

| 2 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

The Fund did not utilize derivatives during the six- or 12-month periods.

MARKET REVIEW AND INVESTMENT STRATEGY

US equity markets posted positive absolute results over the 12-month period ended June 30, 2020 but became challenged in the face of the COVID-19 outbreak, which occurred early in the first quarter of 2020. Six-month performance was much more volatile. The period produced the quickest bear market ever, followed by the fastest bull market in history. US equities ended the six-month period lower as the S&P 500 Index declined 3.08%, but advanced 7.51% over the 12-month period.

During both periods, the Fund benefited from specific style factors in the market. The Fund’s high-quality growth focus added to performance, as value and companies that carried higher debt loads were more adversely impacted and lagged. Market leadership was consistent over both periods, led by technology, while energy was the worst-performing sector.

In this challenging environment, the Fund’s Senior Investment Management Team remains focused on sustainably growing the underlying earnings power of the Fund and believes the Fund is well positioned for the current environment.

INVESTMENT POLICIES

The Adviser seeks to achieve the Fund’s investment objective of long-term growth of capital by investing primarily in common stocks of listed US companies. The Adviser employs an appraisal method that attempts to measure each prospective company’s quality and growth rate by numerous factors. Such factors include: a company’s record and projections of profit and earnings growth, accuracy and availability of information with respect to the company, success and experience of management, accessibility of management to the Fund’s Adviser, product lines and competitive position both in the United States and abroad, lack of cyclicality, large market capitalization and liquidity of the company’s securities. The Adviser compares these results to the general stock markets to determine the relative attractiveness of each company at a given time. The Adviser weighs economic, political and market factors in making investment decisions; this appraisal technique attempts to measure each investment candidate not only against other stocks of the same industry group, but also against a broad spectrum of investments. While the Fund primarily invests in companies that have market capitalizations of $5 billion or more, it may invest in companies that have market capitalizations of $3 billion to $5 billion.

(continued on next page)

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 3 |

The Fund invests in a relatively small number of individual stocks. The Fund is considered to be “non-diversified”, which means that the securities laws do not limit the percentage of its assets that it may invest in any one company (subject to certain limitations under the Internal Revenue Code of 1986, as amended).

| | |

| |

| 4 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

The S&P 500® Index is unmanaged and does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The S&P 500 Index includes 500 US stocks and is a common representation of the performance of the overall US stock market. An investor cannot invest directly in an index or average, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the bond or stock market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness), that affect large portions of the market.

Focused Portfolio Risk: Investments in a limited number of companies may have more risk because changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value (“NAV”).

Sector Risk: The Fund may have more risk because it may invest to a significant extent in one or more particular market sectors, such as the information-technology or health-care sector. To the extent it does so, market or economic factors affecting the relevant sector(s) could have a major effect on the value of the Fund’s investments.

Capitalization Risk: Investments in mid-capitalization companies may be more volatile and less liquid than investments in large-capitalization companies.

Non-Diversification Risk: The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s NAV.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 5 |

DISCLOSURES AND RISKS (continued)

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

Effective as of the close of business on February 28, 2014, the W.P. Stewart Growth Fund, Inc. (the “Predecessor Fund”) was converted into the Fund and the Predecessor Fund’s shares were converted into Advisor Class shares of the Fund. The inception date for Class A, C, R, K, I and Z shares is February 28, 2014. The inception date of the Predecessor Fund is February 28, 1994.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

Please note: References to specific securities are presented to illustrate the Fund’s investment philosophy and are not to be considered advice or recommendations. This information reflects prevailing market conditions and the Adviser’s judgments as of the date indicated, which are subject to change. In preparing this report, the Adviser has relied upon and assumed without independent verification, the accuracy and completeness of all information available from third-party sources. It should not be assumed that any investments made in the future will be profitable or will equal the performance of the selected investments referenced herein.

| | |

| |

| 6 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

HISTORICAL PERFORMANCE

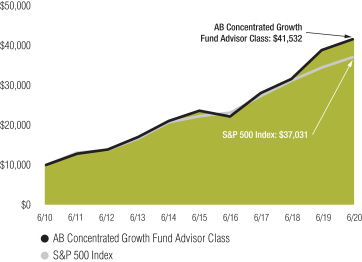

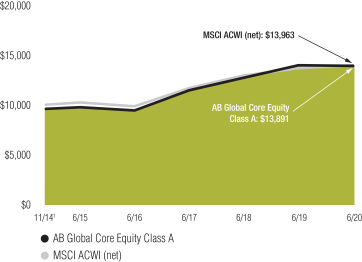

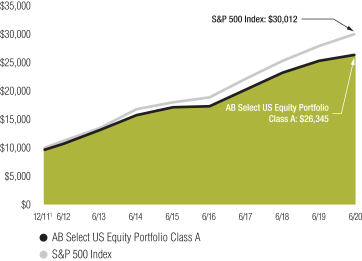

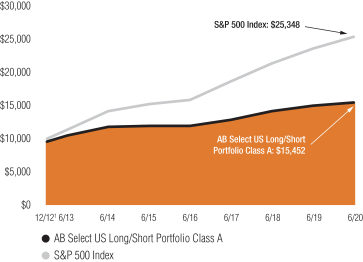

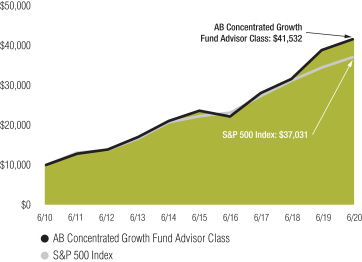

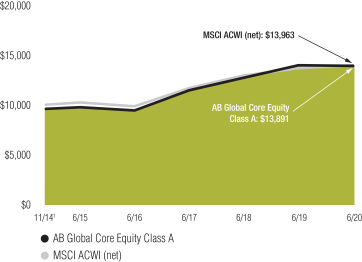

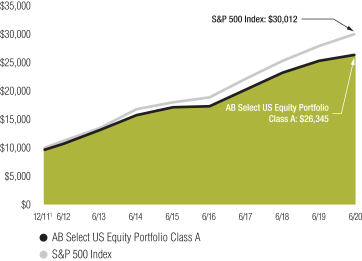

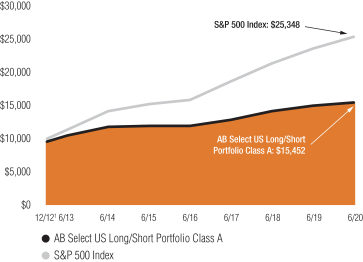

GROWTH OF A $10,000 INVESTMENT IN THE FUND (unaudited)

6/30/2010 TO 6/30/2020

This chart illustrates the total value of an assumed $10,000 investment in AB Concentrated Growth Fund Advisor Class shares (from 6/30/2010 to 6/30/2020) as compared to the performance of the Fund’s benchmark. The chart assumes the reinvestment of dividends and capital gains distributions.

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 7 |

HISTORICAL PERFORMANCE (continued)

AVERAGE ANNUAL RETURNS AS OF JUNE 30, 2020 (unaudited)

| | | | | | | | |

| | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | |

| | |

| CLASS A SHARES | | | | | | | | |

| | |

| 1 Year | | | 6.84% | | | | 2.29% | |

| | |

| 5 Years | | | 11.67% | | | | 10.70% | |

| | |

| Since Inception1 | | | 12.06% | | | | 11.30% | |

| | |

| CLASS C SHARES | | | | | | | | |

| | |

| 1 Year | | | 6.01% | | | | 5.01% | |

| | |

| 5 Years | | | 10.83% | | | | 10.83% | |

| | |

| Since Inception1 | | | 11.23% | | | | 11.23% | |

| | |

| ADVISOR CLASS SHARES2 | | | | | | | | |

| | |

| 1 Year | | | 7.09% | | | | 7.09% | |

| | |

| 5 Years | | | 11.95% | | | | 11.95% | |

| | |

| 10 Years | | | 15.30% | | | | 15.30% | |

| | |

| CLASS R SHARES2 | | | | | | | | |

| | |

| 1 Year | | | 6.48% | | | | 6.48% | |

| | |

| 5 Years | | | 11.38% | | | | 11.38% | |

| | |

| Since Inception1 | | | 11.77% | | | | 11.77% | |

| | |

| CLASS K SHARES2 | | | | | | | | |

| | |

| 1 Year | | | 6.78% | | | | 6.78% | |

| | |

| 5 Years | | | 11.66% | | | | 11.66% | |

| | |

| Since Inception1 | | | 12.06% | | | | 12.06% | |

| | |

| CLASS I SHARES2 | | | | | | | | |

| | |

| 1 Year | | | 7.10% | | | | 7.10% | |

| | |

| 5 Years | | | 11.97% | | | | 11.97% | |

| | |

| Since Inception1 | | | 12.36% | | | | 12.36% | |

| | |

| CLASS Z SHARES2 | | | | | | | | |

| | |

| 1 Year | | | 7.13% | | | | 7.13% | |

| | |

| 5 Years | | | 11.98% | | | | 11.98% | |

| | |

| Since Inception1 | | | 12.36% | | | | 12.36% | |

The Fund’s prospectus fee table shows the Fund’s total annual operating expense ratios as 1.04%, 1.79%, 0.79%, 1.29%, 1.05%, 0.77% and 0.77% for Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| 1 | Inception date: 2/28/2014. |

| 2 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| | |

| |

| 8 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

JUNE 30, 2020 (unaudited)

| | | | |

| |

| | | SEC Returns (reflects applicable

sales charges) | |

| |

| CLASS A SHARES | | | | |

| |

| 1 Year | | | 2.29% | |

| |

| 5 Years | | | 10.70% | |

| |

| Since Inception1 | | | 11.30% | |

| |

| CLASS C SHARES | | | | |

| |

| 1 Year | | | 5.01% | |

| |

| 5 Years | | | 10.83% | |

| |

| Since Inception1 | | | 11.23% | |

| |

| ADVISOR CLASS SHARES2 | | | | |

| |

| 1 Year | | | 7.09% | |

| |

| 5 Years | | | 11.95% | |

| |

| 10 Years | | | 15.30% | |

| |

| CLASS R SHARES2 | | | | |

| |

| 1 Year | | | 6.48% | |

| |

| 5 Years | | | 11.38% | |

| |

| Since Inception1 | | | 11.77% | |

| |

| CLASS K SHARES2 | | | | |

| |

| 1 Year | | | 6.78% | |

| |

| 5 Years | | | 11.66% | |

| |

| Since Inception1 | | | 12.06% | |

| |

| CLASS I SHARES2 | | | | |

| |

| 1 Year | | | 7.10% | |

| |

| 5 Years | | | 11.97% | |

| |

| Since Inception1 | | | 12.36% | |

| |

| CLASS Z SHARES2 | | | | |

| |

| 1 Year | | | 7.13% | |

| |

| 5 Years | | | 11.98% | |

| |

| Since Inception1 | | | 12.36% | |

| 1 | Inception date: 2/28/2014. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 9 |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

January 1, 2020 | | | Ending

Account Value

June 30, 2020 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 975.90 | | | $ | 5.35 | | | | 1.09 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.44 | | | $ | 5.47 | | | | 1.09 | % |

| | |

| |

| 10 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

EXPENSE EXAMPLE (continued)

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

January 1, 2020 | | | Ending

Account Value

June 30, 2020 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 972.20 | | | $ | 9.02 | | | | 1.84 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,015.71 | | | $ | 9.22 | | | | 1.84 | % |

| Advisor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 977.00 | | | $ | 4.13 | | | | 0.84 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.69 | | | $ | 4.22 | | | | 0.84 | % |

| Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 974.10 | | | $ | 6.97 | | | | 1.42 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.80 | | | $ | 7.12 | | | | 1.42 | % |

| Class K | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 975.70 | | | $ | 5.60 | | | | 1.14 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.19 | | | $ | 5.72 | | | | 1.14 | % |

| Class I | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 977.00 | | | $ | 4.08 | | | | 0.83 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.74 | | | $ | 4.17 | | | | 0.83 | % |

| Class Z | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 977.20 | | | $ | 3.93 | | | | 0.80 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.89 | | | $ | 4.02 | | | | 0.80 | % |

| * | Expenses are equal to the classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 11 |

PORTFOLIO SUMMARY

June 30, 2020 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $768.9

TEN LARGEST HOLDINGS2

| | | | | | | | |

| | |

| Company | | U.S. $ Value | | | Percent of

Net Assets | |

| | |

| Microsoft Corp. | | $ | 72,476,423 | | | | 9.4 | % |

| | |

| Mastercard, Inc. – Class A | | | 62,509,797 | | | | 8.1 | |

| | |

| IQVIA Holdings, Inc. | | | 60,958,600 | | | | 7.9 | |

| | |

| Abbott Laboratories | | | 58,210,373 | | | | 7.6 | |

| | |

| Zoetis, Inc. | | | 42,002,349 | | | | 5.5 | |

| | |

| Amphenol Corp. – Class A | | | 37,049,056 | | | | 4.8 | |

| | |

| Facebook, Inc. – Class A | | | 36,816,676 | | | | 4.8 | |

| | |

| International Flavors & Fragrances, Inc. | | | 35,930,866 | | | | 4.7 | |

| | |

| Stericycle, Inc. | | | 35,696,263 | | | | 4.6 | |

| | |

| TJX Cos., Inc. (The) | | | 35,367,023 | | | | 4.6 | |

| | |

| | $ | 477,017,426 | | | | 62.0 | % |

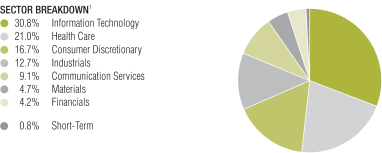

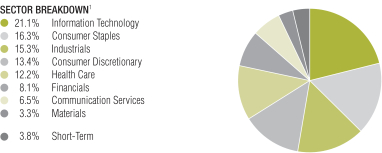

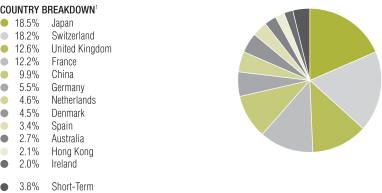

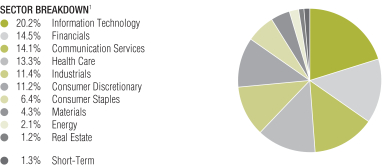

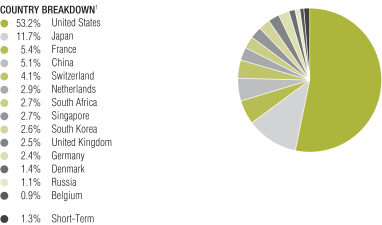

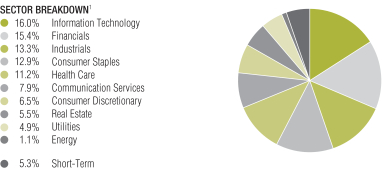

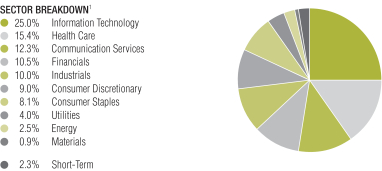

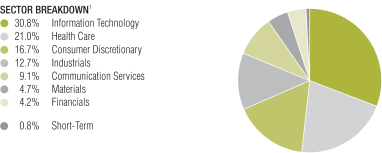

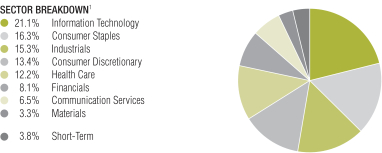

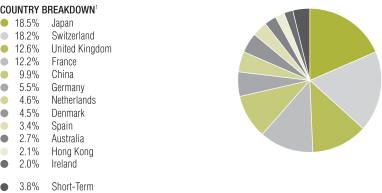

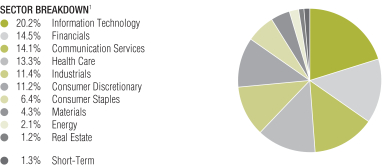

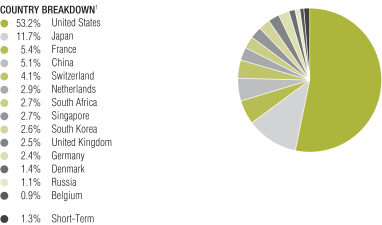

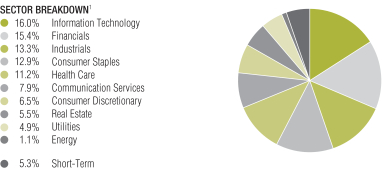

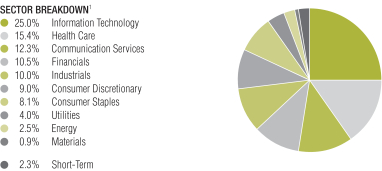

| 1 | All data are as of June 30, 2020. The Fund’s sector breakdown is expressed as a percentage of total investments and may vary over time. |

Please note: The sector classifications presented herein are based on the Global Industry Classification Standard (GICS) which was developed by Morgan Stanley Capital International and Standard & Poor’s. The components are divided into sector, industry group, and industry sub-indices as classified by the GICS for each of the market capitalization indices in the broad market. These sector classifications are broadly defined. The “Portfolio of Investments” section of the report reflects more specific industry information and is consistent with the investment restrictions discussed in the Fund’s prospectus.

| | |

| |

| 12 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS

June 30, 2020

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

COMMON STOCKS – 99.2% | | | | | | | | |

Information Technology – 30.8% | | | | | | | | |

Electronic Equipment, Instruments & Components – 9.3% | | | | | | | | |

Amphenol Corp. – Class A | | | 386,693 | | | $ | 37,049,056 | |

CDW Corp./DE | | | 298,102 | | | | 34,633,491 | |

| | | | | | | | |

| | | | | | | 71,682,547 | |

| | | | | | | | |

IT Services – 12.1% | | | | | | | | |

Automatic Data Processing, Inc. | | | 203,718 | | | | 30,331,573 | |

Mastercard, Inc. – Class A | | | 211,396 | | | | 62,509,797 | |

| | | | | | | | |

| | | | | | | 92,841,370 | |

| | | | | | | | |

Software – 9.4% | | | | | | | | |

Microsoft Corp. | | | 356,132 | | | | 72,476,423 | |

| | | | | | | | |

| | | | | | | 237,000,340 | |

| | | | | | | | |

Health Care – 21.0% | | | | | | | | |

Health Care Equipment & Supplies – 7.6% | | | | | | | | |

Abbott Laboratories | | | 636,666 | | | | 58,210,373 | |

| | | | | | | | |

| | |

Life Sciences Tools & Services – 7.9% | | | | | | | | |

IQVIA Holdings, Inc.(a) | | | 429,649 | | | | 60,958,600 | |

| | | | | | | | |

| | |

Pharmaceuticals – 5.5% | | | | | | | | |

Zoetis, Inc. | | | 306,497 | | | | 42,002,349 | |

| | | | | | | | |

| | | | | | | 161,171,322 | |

| | | | | | | | |

Consumer Discretionary – 16.7% | | | | | | | | |

Auto Components – 4.5% | | | | | | | | |

Aptiv PLC | | | 443,038 | | | | 34,521,521 | |

| | | | | | | | |

| | |

Specialty Retail – 7.9% | | | | | | | | |

TJX Cos., Inc. (The) | | | 699,506 | | | | 35,367,023 | |

Ulta Beauty, Inc.(a) | | | 126,064 | | | | 25,643,939 | |

| | | | | | | | |

| | | | | | | 61,010,962 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods – 4.3% | | | | | | | | |

NIKE, Inc. – Class B | | | 334,893 | | | | 32,836,259 | |

| | | | | | | | |

| | | | | | | 128,368,742 | |

| | | | | | | | |

Industrials – 12.7% | | | | | | | | |

Building Products – 3.6% | | | | | | | | |

Allegion PLC | | | 270,312 | | | | 27,631,292 | |

| | | | | | | | |

| | |

Commercial Services & Supplies – 4.6% | | | | | | | | |

Stericycle, Inc.(a)(b) | | | 637,661 | | | | 35,696,263 | |

| | | | | | | | |

| | |

Professional Services – 4.5% | | | | | | | | |

Verisk Analytics, Inc. – Class A | | | 201,259 | | | | 34,254,282 | |

| | | | | | | | |

| | | | | | | 97,581,837 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 13 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Communication Services – 9.1% | | | | | | | | |

Interactive Media & Services – 9.1% | | | | | | | | |

Alphabet, Inc. – Class C(a) | | | 23,660 | | | $ | 33,446,012 | |

Facebook, Inc. – Class A(a) | | | 162,138 | | | | 36,816,676 | |

| | | | | | | | |

| | | | | | | 70,262,688 | |

| | | | | | | | |

Materials – 4.7% | | | | | | | | |

Chemicals – 4.7% | | | | | | | | |

International Flavors & Fragrances, Inc. | | | 293,409 | | | | 35,930,866 | |

| | | | | | | | |

| | |

Financials – 4.2% | | | | | | | | |

Capital Markets – 4.2% | | | | | | | | |

Charles Schwab Corp. (The) | | | 954,669 | | | | 32,210,532 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost $590,857,775) | | | | | | | 762,526,327 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS – 0.7% | | | | | | | | |

Investment Companies – 0.7% | | | | | | | | |

AB Fixed Income Shares, Inc. –

Government Money Market Portfolio –

Class AB, 0.13%(c)(d)(e)

(cost $5,874,639) | | | 5,874,639 | | | | 5,874,639 | |

| | | | | | | | |

| | |

Total Investments – 99.9%

(cost $596,732,414) | | | | | | | 768,400,966 | |

Other assets less liabilities – 0.1% | | | | | | | 467,419 | |

| | | | | | | | |

| | |

Net Assets – 100.0% | | | | | | $ | 768,868,385 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Represents entire or partial securities out on loan. See Note E for securities lending information. |

| (c) | Affiliated investments. |

| (d) | The rate shown represents the 7-day yield as of period end. |

| (e) | To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s website at www.sec.gov, or call AB at (800) 227-4618. |

See notes to financial statements.

| | |

| |

| 14 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

STATEMENT OF ASSETS & LIABILITIES

June 30, 2020

| | | | |

| Assets | | | | |

Investments in securities, at value | | | | |

Unaffiliated issuers (cost $590,857,775) | | $ | 762,526,327 | (a) |

Affiliated issuers (cost $5,874,639) | | | 5,874,639 | |

Cash | | | 86,500 | |

Receivable for capital stock sold | | | 1,542,045 | |

Unaffiliated dividends receivable | | | 579,890 | |

Affiliated dividends receivable | | | 1,220 | |

| | | | |

Total assets | | | 770,610,621 | |

| | | | |

| Liabilities | | | | |

Payable for capital stock redeemed | | | 1,170,388 | |

Advisory fee payable | | | 412,981 | |

Distribution fee payable | | | 31,512 | |

Administrative fee payable | | | 17,935 | |

Transfer Agent fee payable | | | 4,114 | |

Accrued expenses and other liabilities | | | 105,306 | |

| | | | |

Total liabilities | | | 1,742,236 | |

| | | | |

Net Assets | | $ | 768,868,385 | |

| | | | |

| Composition of Net Assets | | | | |

Capital stock, at par | | $ | 1,819 | |

Additional paid-in capital | | | 565,425,393 | |

Distributable earnings | | | 203,441,173 | |

| | | | |

| | $ | 768,868,385 | |

| | | | |

Net Asset Value Per Share—33 billion shares of capital stock authorized, $.0001 par value

| | | | | | | | | | | | |

| Class | | Net Assets | | | Shares

Outstanding | | | Net Asset

Value | |

| |

| A | | $ | 37,614,778 | | | | 902,087 | | | $ | 41.70 | * |

| |

| C | | $ | 28,209,797 | | | | 713,686 | | | $ | 39.53 | |

| |

| Advisor | | $ | 699,504,309 | | | | 16,489,686 | | | $ | 42.42 | |

| |

| R | | $ | 34,327 | | | | 838.61 | | | $ | 40.93 | |

| |

| K | | $ | 1,480,152 | | | | 35,505 | | | $ | 41.69 | |

| |

| I | | $ | 17,804 | | | | 418.92 | | | $ | 42.50 | |

| |

| Z | | $ | 2,007,218 | | | | 47,245 | | | $ | 42.49 | |

| |

| (a) | Includes securities on loan with a value of $2,077,698 (see Note E). |

| * | The maximum offering price per share for Class A shares was $43.55 which reflects a sales charge of 4.25%. |

See notes to financial statements.

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 15 |

STATEMENT OF OPERATIONS

Year Ended June 30, 2020

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends | | | | | | | | |

Unaffiliated issuers | | $ | 5,701,351 | | | | | |

Affiliated issuers | | | 190,983 | | | | | |

Securities lending income | | | 24,194 | | | $ | 5,916,528 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Advisory fee (see Note B) | | | 5,176,955 | | | | | |

Distribution fee—Class A | | | 82,549 | | | | | |

Distribution fee—Class C | | | 244,483 | | | | | |

Distribution fee—Class R | | | 107 | | | | | |

Distribution fee—Class K | | | 2,233 | | | | | |

Transfer agency—Class A | | | 15,385 | | | | | |

Transfer agency—Class C | | | 11,529 | | | | | |

Transfer agency—Advisor Class | | | 282,961 | | | | | |

Transfer agency—Class R | | | 24 | | | | | |

Transfer agency—Class K | | | 805 | | | | | |

Transfer agency—Class I | | | 6 | | | | | |

Transfer agency—Class Z | | | 342 | | | | | |

Registration fees | | | 136,072 | | | | | |

Custody and accounting | | | 133,773 | | | | | |

Administrative | | | 74,328 | | | | | |

Printing | | | 46,284 | | | | | |

Audit and tax | | | 39,717 | | | | | |

Legal | | | 37,576 | | | | | |

Directors’ fees | | | 24,452 | | | | | |

Miscellaneous | | | 20,459 | | | | | |

| | | | | | | | |

Total expenses | | | 6,330,040 | | | | | |

Less: expenses waived and reimbursed by the Adviser (see Notes B & E) | | | (186,167 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 6,143,873 | |

| | | | | | | | |

Net investment loss | | | | | | | (227,345 | ) |

| | | | | | | | |

| Realized and Unrealized Gain on Investment Transactions | | | | | | | | |

Net realized gain on investment transactions | | | | | | | 44,854,273 | |

Net change in unrealized appreciation/depreciation of investments | | | | | | | 5,016,995 | |

| | | | | | | | |

Net gain on investment transactions | | | | | | | 49,871,268 | |

| | | | | | | | |

Contributions from Affiliates (see Note B) | | | | | | | 319 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 49,644,242 | |

| | | | | | | | |

See notes to financial statements.

| | |

| |

| 16 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

June 30,

2020 | | | Year Ended

June 30,

2019 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment loss | | $ | (227,345 | ) | | $ | (583,869 | ) |

Net realized gain on investment transactions | | | 44,854,273 | | | | 26,442,826 | |

Net change in unrealized appreciation/depreciation of investments | | | 5,016,995 | | | | 74,701,123 | |

Contributions from Affiliates (see Note B) | | | 319 | | | | – 0 | – |

| | | | | | | | |

Net increase in net assets from operations | | | 49,644,242 | | | | 100,560,080 | |

Distributions to Shareholders | | | | | | | | |

Class A | | | (1,116,096 | ) | | | (1,607,170 | ) |

Class C | | | (837,819 | ) | | | (1,347,233 | ) |

Advisor Class | | | (20,178,205 | ) | | | (27,894,149 | ) |

Class R | | | (621 | ) | | | (1,045 | ) |

Class K | | | (25,331 | ) | | | (42,507 | ) |

Class I | | | (589 | ) | | | (8,711 | ) |

Class Z | | | (59,792 | ) | | | (48,301 | ) |

| Capital Stock Transactions | | | | | | | | |

Net increase | | | 151,214,048 | | | | 105,119,056 | |

| | | | | | | | |

Total increase | | | 178,639,837 | | | | 174,730,020 | |

| Net Assets | | | | | | | | |

Beginning of period | | | 590,228,548 | | | | 415,498,528 | |

| | | | | | | | |

End of period | | $ | 768,868,385 | | | $ | 590,228,548 | |

| | | | | | | | |

See notes to financial statements.

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 17 |

NOTES TO FINANCIAL STATEMENTS

June 30, 2020

NOTE A

Significant Accounting Policies

AB Cap Fund, Inc. (the “Company”), which is a Maryland corporation, is registered under the Investment Company Act of 1940 as an open-end management investment company. The Company operates as a series company currently comprised of 15 portfolios. Each portfolio is considered to be a separate entity for financial reporting and tax purposes. This report relates only to the AB Concentrated Growth Fund (the “Fund”), a non-diversified portfolio. The Fund has authorized the issuance of Class A, Class B, Class C, Advisor Class, Class R, Class K, Class I, Class Z, Class T, Class 1 and Class 2 shares. Class B, Class T, Class 1 and Class 2 shares have not been issued. Class A shares are sold with a front-end sales charge of up to 4.25% for purchases not exceeding $1,000,000. With respect to purchases of $1,000,000 or more, Class A shares redeemed within one year of purchase may be subject to a contingent deferred sales charge of 1%. Class C shares are subject to a contingent deferred sales charge of 1% on redemptions made within the first year after purchase, and 0% after the first year of purchase. Class C shares will automatically convert to Class A shares ten years after the end of the calendar month of purchase. Class R and Class K shares are sold without an initial or contingent deferred sales charge. Advisor Class, Class I and Class Z shares are sold without an initial or contingent deferred sales charge and are not subject to ongoing distribution expenses. All eleven classes of shares have identical voting, dividend, liquidation and other rights, except that the classes bear different distribution and transfer agency expenses. Each class has exclusive voting rights with respect to its distribution plan. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Company’s Board of Directors (the “Board”).

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national

| | |

| |

| 18 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Adviser will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Valuation Committee (the “Committee”) must reasonably conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Such factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Adviser may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Adviser. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 19 |

NOTES TO FINANCIAL STATEMENTS (continued)

pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Fund generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values as described in Note A.1 above). Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Where readily available market prices or relevant bid prices are not available for certain equity investments, such investments may be valued based on similar publicly traded investments, movements in relevant indices since last available prices or based upon underlying company fundamentals and comparable company data (such as multiples to earnings or other multiples to equity). Where an investment is valued using an observable input, such as another publicly traded security, the investment will be classified as Level 2. If management determines that an adjustment is appropriate based on restrictions on resale, illiquidity or uncertainty, and such adjustment is a significant component of the valuation, the investment will be

| | |

| |

| 20 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

classified as Level 3. An investment will also be classified as Level 3 where management uses company fundamentals and other significant inputs to determine the valuation.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of June 30, 2020:

| | | | | | | | | | | | | | | | |

Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Common Stocks(a) | | $ | 762,526,327 | | | $ | – 0 | – | | $ | – 0 | – | | $ | 762,526,327 | |

Short-Term Investments | | | 5,874,639 | | | | – 0 | – | | | – 0 | – | | | 5,874,639 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 768,400,966 | | | | – 0 | – | | | – 0 | – | | | 768,400,966 | |

Other Financial Instruments(b) | | | – 0 | – | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | | | | | |

Total | | $ | 768,400,966 | | | $ | – 0 | – | | $ | – 0 | – | | $ | 768,400,966 | |

| | | | | | | | | | | | | | | | |

| (a) | See Portfolio of Investments for sector classifications. |

| (b) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation/(depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, options written and swaptions written which are valued at market value. |

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean of the quoted bid and ask prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation of foreign currency denominated assets and liabilities.

4. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 21 |

NOTES TO FINANCIAL STATEMENTS (continued)

are required. The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and net unrealized appreciation/depreciation as such income and/or gains are earned.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

5. Investment Income and Investment Transactions

Dividend income is recorded on the ex-dividend date or as soon as the Fund is informed of the dividend. Interest income is accrued daily and includes amortization of premiums and accretions of discounts as adjustments to interest income. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. The Fund amortizes premiums and accretes discounts as adjustments to interest income.

6. Class Allocations

All income earned and expenses incurred by the Fund are borne on a pro-rata basis by each outstanding class of shares, based on the proportionate interest in the Fund represented by the net assets of such class, except for class specific expenses which are allocated to the respective class. Expenses of the Company are charged proportionately to each portfolio or based on other appropriate methods. Realized and unrealized gains and losses are allocated among the various share classes based on respective net assets.

7. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Advisory Fee and Other Transactions with Affiliates

Effective May 7, 2020, under the terms of the investment advisory agreement, the Fund pays the Adviser an advisory fee at an annual rate of .65% of the Fund’s average daily net assets. Prior to May 7, 2020, the investment advisory agreement provided for the payment of an advisory fee at

| | |

| |

| 22 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

an annual rate of .80% of the Fund’s average daily net assets. For the period from March 2, 2020 until May 6, 2020, the Adviser waived a portion of the advisory fee in order to reduce the advisory fee rate from .80% to .65% of the Fund’s average daily net assets; such waiver amounted to $172,557. The Adviser has agreed to waive its fees and bear certain expenses to the extent necessary to limit total operating expenses (excluding expenses associated with acquired fund fees and expenses other than the advisory fees of any AB mutual funds in which the Fund may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs) on an annual basis (the “Expense Caps”) to 1.24%, 1.99%, .99%, 1.49%, 1.24%, .99% and .99% of daily average net assets for Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively. For the year ended June 30, 2020, there was no such reimbursement. The Expense Caps may not be terminated by the Adviser prior to October 31, 2020.

Pursuant to the investment advisory agreement, the Fund may reimburse the Adviser for certain legal and accounting services provided to the Fund by the Adviser. For the year ended June 30, 2020, the reimbursement for such services amounted to $74,328.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. ABIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. Such compensation retained by ABIS amounted to $138,371 for the year ended June 30, 2020.

AllianceBernstein Investments, Inc. (the “Distributor”), a wholly-owned subsidiary of the Adviser, serves as the distributor of the Fund’s shares. The Distributor has advised the Fund that it has retained front-end sales charges of $18,412 from the sale of Class A shares and received $756 and $4,183 in contingent deferred sales charges imposed upon redemptions by shareholders of Class A and Class C shares, respectively, for the year ended June 30, 2020.

The Fund may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual advisory fee rate of .20% of the portfolio’s average daily net assets and bears its own expenses. The Adviser has contractually agreed to waive .10% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .10%) until August 31, 2021. In connection with the investment by the Fund in Government Money Market Portfolio, the Adviser has contractually agreed to waive its advisory fee from the Fund in an amount equal to the Fund’s pro rata share of the effective advisory fee

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 23 |

NOTES TO FINANCIAL STATEMENTS (continued)

of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. For the year ended June 30, 2020, such waiver amounted to $12,547.

A summary of the Fund’s transactions in AB mutual funds for the year ended June 30, 2020 is as follows:

| | | | | | | | | | | | | | | | | | | | |

Fund | | Market Value

6/30/19

(000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Market Value

6/30/20

(000) | | | Dividend

Income

(000) | |

Government Money Market Portfolio | | $ | 16,602 | | | $ | 195,129 | | | $ | 205,856 | | | $ | 5,875 | | | $ | 180 | |

Government Money Market Portfolio* | | | 151 | | | | 28,427 | | | | 28,578 | | | | – 0 | – | | | 11 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | $ | 5,875 | | | $ | 191 | |

| | | | | | | | | | | | | | | | | | | | |

| * | Investments of cash collateral for securities lending transactions (see Note E). |

During the year ended June 30, 2020, the Adviser reimbursed the Fund $319 for trading losses incurred due to a trade entry error.

During the second quarter of 2018, AXA S.A. (“AXA”), a French holding company for the AXA Group, completed the sale of a minority stake in its subsidiary, AXA Equitable Holdings, Inc. (now named Equitable Holdings, Inc.) (“Equitable”), through an initial public offering. Equitable is the holding company for a diverse group of financial services companies, including an approximately 65.2% economic interest in the Adviser and a 100% interest in AllianceBernstein Corporation, the general partner of the Adviser. Since the initial sale, AXA has completed additional offerings, most recently during the fourth quarter of 2019. As a result, AXA currently owns less than 10% of the outstanding shares of common stock of Equitable, and no longer owns a controlling interest in Equitable. AXA previously announced its intention to sell its entire interest in Equitable over time, subject to market conditions and other factors (the “Plan”). Most of AXA’s remaining Equitable shares are to be delivered on redemption of AXA bonds mandatorily exchangeable into Equitable shares and maturing in May 2021. AXA retains sole discretion to determine the timing of any future sales of its remaining shares of Equitable common stock.

Sales under the Plan that were completed on November 13, 2019 resulted in the indirect transfer of a “controlling block” of voting securities of the Adviser (a “Change of Control Event”) and may have been deemed to have been an “assignment” causing a termination of the Fund’s investment advisory and administration agreements. In order to ensure that investment

| | |

| |

| 24 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

advisory and administration services could continue uninterrupted in the event of a Change of Control Event, the Board previously approved new investment advisory and administration agreements with the Adviser, and shareholders of the Fund subsequently approved the new investment advisory agreement. These agreements became effective on November 13, 2019.

NOTE C

Distribution Services Agreement

The Fund has adopted a Distribution Services Agreement (“the Agreement”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 for Class A, Class C, Class R and Class K. Under the Agreement, the Fund pays distribution and servicing fees to the Distributor at an annual rate of up to .25% of the Fund’s average daily net assets attributable to Class A shares, 1% of the Fund’s average daily net assets attributable to Class C shares, .50% of the Fund’s average daily net assets attributable to Class R shares, and .25% of the Fund’s average daily net assets attributable to Class K shares. There are no distribution and servicing fees on the Advisor Class, Class I and Class Z shares. The fees are accrued daily and paid monthly. Since the commencement of the Fund’s operations, the Distributor has incurred expenses in excess of the distribution costs reimbursed by the Fund in the amounts of $256,642, $0 and $0 for Class C, Class R and Class K shares, respectively. The Agreement provides that the Distributor will use such payments in their entirety for distribution assistance and promotional activities. While such costs may be recovered from the Fund in future periods so long as the Agreement is in effect, the rate of the distribution and servicing fees payable under the Agreement may not be increased without a shareholder vote. In accordance with the Agreement, there is no provision for recovery of unreimbursed distribution costs incurred by the Distributor beyond the current fiscal year for Class A shares. The Agreement also provides that the Adviser may use its own resources to finance the distribution of the Fund’s shares.

NOTE D

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the year ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding U.S. government securities) | | $ | 289,863,041 | | | $ | 149,014,486 | |

U.S. government securities | | | – 0 | – | | | – 0 | – |

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 25 |

NOTES TO FINANCIAL STATEMENTS (continued)

The cost of investments for federal income tax purposes, gross unrealized appreciation and unrealized depreciation are as follows:

| | | | |

Cost | | $ | 598,277,553 | |

| | | | |

Gross unrealized appreciation | | $ | 185,988,582 | |

Gross unrealized depreciation | | | (15,865,169 | ) |

| | | | |

Net unrealized appreciation | | $ | 170,123,413 | |

| | | | |

1. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The Fund did not engage in derivatives transactions for the year ended June 30, 2020.

2. Currency Transactions

The Fund may invest in non-U.S. Dollar-denominated securities on a currency hedged or unhedged basis. The Fund may seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives, including forward currency exchange contracts, futures and options on futures, swaps, and other options. The Fund may enter into transactions for investment opportunities when it anticipates that a foreign currency will appreciate or depreciate in value but securities denominated in that currency are not held by the Fund and do not present attractive investment opportunities. Such transactions may also be used when the Adviser believes that it may be more efficient than a direct investment in a foreign currency-denominated security. The Fund may also conduct currency exchange contracts on a spot basis (i.e., for cash at the spot rate prevailing in the currency exchange market for buying or selling currencies).

NOTE E

Securities Lending

The Fund may enter into securities lending transactions. Under the Fund’s securities lending program, all loans of securities will be collateralized continually by cash collateral and/or non-cash collateral. Non-cash collateral will include only securities issued or guaranteed by the U.S. government or its agencies or instrumentalities. The Fund cannot sell or repledge any non-cash collateral, such collateral will not be reflected in the portfolio of investments. If a loan is collateralized by cash, the Fund will be compensated for the loan from a portion of the net return from the income earned on cash collateral after a rebate is paid to the borrower (in some cases, this rebate may be a “negative rebate” or fee paid by the borrower to the

| | |

| |

| 26 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

Fund in connection with the loan), and payments are made for fees of the securities lending agent and for certain other administrative expenses. If the Fund receives non-cash collateral, the Fund will receive a fee from the borrower generally equal to a negotiated percentage of the market value of the loaned securities. The Fund will have the right to call a loan and obtain the securities loaned at any time on notice to the borrower within the normal and customary settlement time for the securities. While the securities are on loan, the borrower is obligated to pay the Fund amounts equal to any income or other distributions from the securities. The Fund will not be able to exercise voting rights with respect to any securities during the existence of a loan, but will have the right to regain ownership of loaned securities in order to exercise voting or other ownership rights. Collateral received and securities loaned are marked to market daily to ensure that the securities loaned are secured by collateral. The lending agent currently invests the cash collateral received in Government Money Market Portfolio, an eligible money market vehicle, in accordance with the investment restrictions of the Fund, and as approved by the Board. The collateral received on securities loaned is recorded as an asset as well as a corresponding liability in the statement of assets and liabilities. The collateral will be adjusted the next business day to maintain the required collateral amount. The amounts of securities lending income from the borrowers and Government Money Market Portfolio are reflected in the statement of operations. When the Fund earns net securities lending income from Government Money Market Portfolio, the income is inclusive of a rebate expense paid to the borrower. In connection with the cash collateral investment by the Fund in Government Money Market Portfolio, the Adviser has agreed to waive a portion of the Fund’s share of the advisory fees of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. When the Fund lends securities, its investment performance will continue to reflect changes in the value of the securities loaned. A principal risk of lending portfolio securities is that the borrower may fail to return the loaned securities upon termination of the loan and that the collateral will not be sufficient to replace the loaned securities. The lending agent has agreed to indemnify the Fund in the case of default of any securities borrower.

A summary of the Fund’s transactions surrounding securities lending for the year ended June 30, 2020 is as follows:

| | | | | | | | | | | | | | | | | | | | | | |

Market Value

of Securities

on Loan* | | | Cash

Collateral* | | | Market Value of

Non-Cash

Collateral* | | | Income from

Borrowers | | | Government Money

Market Portfolio | |

| | Income

Earned | | | Advisory Fee

Waived | |

| $ | 2,077,698 | | | $ | – 0 | – | | $ | 2,156,924 | | | $ | 24,194 | | | $ | 10,953 | | | $ | 1,063 | |

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 27 |

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE F

Capital Stock

Each class consists of 3,000,000,000 authorized shares. Transactions in capital shares for each class were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares | | | | | | Amount | | | | |

| | | Year Ended

June 30,

2020 | | | Year Ended

June 30, 2019 | | | | | | Year Ended

June 30,

2020 | | | Year Ended

June 30,

2019 | | | | |

| | | | | | | | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 522,248 | | | | 233,180 | | | | | | | $ | 20,962,145 | | | $ | 8,527,311 | | | | | |

| | | | | |

Shares issued in reinvestment of distributions | | | 23,397 | | | | 43,192 | | | | | | | | 982,194 | | | | 1,447,354 | | | | | |

| | | | | |

Shares converted from Class C | | | 8,817 | | | | 2,205 | | | | | | | | 355,025 | | | | 81,423 | | | | | |

| | | | | |

Shares redeemed | | | (362,635 | ) | | | (327,801 | ) | | | | | | | (14,248,341 | ) | | | (12,160,078 | ) | | | | |

| | | | | |

Net increase (decrease) | | | 191,827 | | | | (49,224 | ) | | | | | | $ | 8,051,023 | | | $ | (2,103,990 | ) | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 283,215 | | | | 136,057 | | | | | | | $ | 10,556,925 | | | $ | 4,725,917 | | | | | |

| | | | | |

Shares issued in reinvestment of distributions | | | 18,072 | | | | 36,915 | | | | | | | | 722,159 | | | | 1,188,284 | | | | | |

| | | | | |

Shares converted to Class A | | | (9,245 | ) | | | (2,297 | ) | | | | | | | (355,025 | ) | | | (81,423 | ) | | | | |

| | | | | |

Shares redeemed | | | (156,489 | ) | | | (122,750 | ) | | | | | | | (5,610,758 | ) | | | (4,386,660 | ) | | | | |

| | | | | |

Net increase | | | 135,553 | | | | 47,925 | | | | | | | $ | 5,313,301 | | | $ | 1,446,118 | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 7,470,217 | | | | 4,895,058 | | | | | | | $ | 301,380,259 | | | $ | 183,674,681 | | | | | |

| | | | | |

Shares issued in reinvestment of distributions | | | 355,218 | | | | 655,960 | | | | | | | | 15,150,069 | | | | 22,269,839 | | | | | |

| | | | | |

Shares redeemed | | | (4,467,123 | ) | | | (2,718,811 | ) | | | | | | | (180,222,446 | ) | | | (100,310,424 | ) | | | | |

| | | | | |

Net increase | | | 3,358,312 | | | | 2,832,207 | | | | | | | $ | 136,307,882 | | | $ | 105,634,096 | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 436 | | | | 0 | (a) | | | | | | $ | 15,655 | | | $ | 5 | | | | | |

| | | | | |

Shares issued in reinvestment of distributions | | | 1 | | | | 0 | (a) | | | | | | | 51 | | | | 0 | (b) | | | | |

| | | | | |

Shares redeemed | | | (1 | ) | | | – 0 | – | | | | | | | (26 | ) | | | – 0 | – | | | | |

| | | | | |

Net increase | | | 436 | | | | 0 | (a) | | | | | | $ | 15,680 | | | $ | 5 | | | | | |

| | | | | |

| | |

| |

| 28 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares | | | | | | Amount | | | | |

| | | Year Ended

June 30,

2020 | | | Year Ended

June 30,

2019 | | | | | | Year Ended

June 30,

2020 | | | Year Ended

June 30,

2019 | | | | |

| | | | | | | | |

Class K | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 20,463 | | | | 2,458 | | | | | | | $ | 757,910 | | | $ | 92,575 | | | | | |

| | | | | |

Shares issued in reinvestment of distributions | | | 590 | | | | 1,237 | | | | | | | | 24,759 | | | | 41,462 | | | | | |

| | | | | |

Shares redeemed | | | (3,897 | ) | | | (1,096 | ) | | | | | | | (163,652 | ) | | | (36,571 | ) | | | | |

| | | | | |

Net increase | | | 17,156 | | | | 2,599 | | | | | | | $ | 619,017 | | | $ | 97,466 | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 5 | | | | 3,136 | | | | | | | $ | 190 | | | $ | 117,021 | | | | | |

| | | | | |

Shares issued in reinvestment of distributions | | | 0 | (a) | | | 225 | | | | | | | | 13 | | | | 7,657 | | | | | |

| | | | | |

Shares redeemed | | | (2 | ) | | | (3,526 | ) | | | | | | | (80 | ) | | | (130,695 | ) | | | | |

| | | | | |

Net increase (decrease) | | | 3 | | | | (165 | ) | | | | | | $ | 123 | | | $ | (6,017 | ) | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class Z | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 27,974 | | | | 13,049 | | | | | | | $ | 1,091,486 | | | $ | 457,789 | | | | | |

| | | | | |

Shares issues in reinvestment of distributions | | | 1,308 | | | | 1,208 | | | | | | | | 55,837 | | | | 41,059 | | | | | |

| | | | | |

Shares redeemed | | | (6,189 | ) | | | (12,751 | ) | | | | | | | (240,301 | ) | | | (447,470 | ) | | | | |

| | | | | |

Net increase | | | 23,093 | | | | 1,506 | | | | | | | $ | 907,022 | | | $ | 51,378 | | | | | |

| | | | | |

| (a) | Amount is less than one share. |

| (b) | Amount is less than $.50. |

NOTE G

Risks Involved in Investing in the Fund

Market Risk—The value of the Fund’s assets will fluctuate as the bond or stock market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness), that affect large portions of the market.

Focused Portfolio Risk—Investments in a limited number of companies may have more risk because changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s net asset value, or NAV.

Sector Risk—The Fund may have more risk because it may invest to a significant extent in one or more particular market sectors, such as the information technology or health care sector. To the extent it does so,

| | |

| |

| abfunds.com | | AB CONCENTRATED GROWTH FUND | 29 |

NOTES TO FINANCIAL STATEMENTS (continued)

market or economic factors affecting the relevant sector(s) could have a major effect on the value of the Fund’s investments.

Capitalization Risk—Investments in mid-capitalization companies may be more volatile and less liquid than investments in large-capitalization companies.

Non-Diversification Risk—The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s NAV.

LIBOR Risk—The Fund may invest in certain debt securities, derivatives or other financial instruments that utilize the London Interbank Offered Rate, or “LIBOR,” as a “benchmark” or “reference rate” for various interest rate calculations. In July 2017, the United Kingdom Financial Conduct Authority, which regulates LIBOR, announced a desire to phase out the use of LIBOR by the end of 2021. Although financial regulators and industry working groups have suggested alternative reference rates, such as European Interbank Offer Rate (“EURIBOR”), Sterling Overnight Interbank Average Rate (“SONIA”) and Secured Overnight Financing Rate (“SOFR”), global consensus on alternative rates is lacking and the process for amending existing contracts or instruments to transition away from LIBOR is underway but remains unclear. The elimination of LIBOR or changes to other reference rates or any other changes or reforms to the determination or supervision of reference rates could have an adverse impact on the market for, or value of, any securities or payments linked to those reference rates, which may adversely affect the Fund’s performance and/or net asset value. Uncertainty and risk also remain regarding the willingness and ability of issuers and lenders to include revised provisions in new and existing contracts or instruments. Consequently, the transition away from LIBOR to other reference rates may lead to increased volatility and illiquidity in markets that are tied to LIBOR, fluctuations in values of LIBOR-related investments or investments in issuers that utilize LIBOR, increased difficulty in borrowing or refinancing and diminished effectiveness of hedging strategies, adversely affecting the Fund’s performance. Furthermore, the risks associated with the expected discontinuation of LIBOR and transition may be exacerbated if the work necessary to effect an orderly transition to an alternative reference rate is not completed in a timely manner. Because the usefulness of LIBOR as a benchmark could deteriorate during the transition period, these effects could occur prior to the end of 2021.

| | |

| |

| 30 | AB CONCENTRATED GROWTH FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)