ADVANCED SERIES TRUST

Gateway Center Three, 4th floor

100 Mulberry Street

Newark, New Jersey 07102-4077

March 23, 2010

Sally Samuels

Office of Insurance Products

Division of Investment Management

Securities and Exchange Commission

450 Fifth Street, N.W.

Washington, D.C. 20549

Re: Advanced Series Trust (the “Fund”)

Post-Effective Amendment to Registration Statement on Form N-1A

Registration No’s. 33-24962 and 811-5186

Dear Ms. Samuels:

I am writing in response to comments which you provided to me on behalf of the Commission staff by telephone on March 18, 2010 regarding the Fund’s submission of a Post-Effective Amendment to its Registration Statement on Form N-1A pursuant to Rule 485(a) under the Securities Act of 1933. As noted previously, the purpose for the submission of the Post-Effective Amendment under Rule 485(a) was to conform the Fund’s Registration Statement to the requirements of the summary prospectus rules promulgated by the Commission. On or about April 15, 2010, the Fund intends to file an amendment to its Registration Statement on

Form N-1A pursuant to Rule 485(b) under the Securities Act of 1933 (the “Amendment”) to revise certain disclosures in response to the staff’s comments, to update its financial statements and to make other non-material updating revisions.

For your convenience, your comments are presented in summary form below and each comment is followed by our response. Additionally, we have attached, as a sample, the revised summary section for the Fund’s AST Academic Strategies Portfolio, which reflects and incorporates the comments that you provided.

General Comments:

Comment: To the extent that any of the comments provided by the Commission staff on a specific portfolio of the Fund are globally and/or universally applicable to another portfolio, please revise the disclosure of the other portfolios of the Fund as applicable.

Response: The Fund has considered the comments provided by the Commission staff on each specific portfolio of the Fund as applying globally and/or universally applicable to the other Fund portfolios and has revised the disclosure accordingly, as relevant.

Comment: When filing the Amendment please make sure that the updated financial information that is provided complies with Form N-1A.

Response: The updated financial information in the Amendment will comply with Form N-1A.

Comment: Please provide the disclosure required by Item 4(b)(1)(iv) for any portfolio that is non-diversified.

Response: The Fund confirms that the summary section for each portfolio that is non-diversified provides the disclosure required by Item 4(b)(1)(iv).

Comment: Whenever using defined terms in the summary section, please make sure the term is defined the first time it is used.

Response: Each portfolio has revised its disclosure as requested by the staff.

Comment: On the front cover page of the prospectus, please include each portfolio’s name and the classes to which the prospectus relates.

Response: The front cover page has been revised as requested by the staff.

Comment: If the Fund later decides to distribute only the prospectus summary, then the front cover must delete the information provided about the participating insurance companies and the order from the Commission since these disclosures are neither required nor permitted in a prospectus summary.

Response: The Fund currently is not utilizing the prospectus summary and therefore, respectfully submits that no additional revisions are required.

Comment: In the section entitled “Investment Objective” in the summary sections of each portfolio, please delete as applicable (a) any bold formatting and (b) any disclosure in addition to the investment objective.

Response: Each portfolio has revised its disclosure as requested by the staff.

Comment: In the fee table contained in the section entitled “Portfolio Fees and Expenses” in the summary sections of each portfolio, please revise the fee table to match the fee table presentation in Item 3.

Response: Each portfolio has revised its disclosure as requested by the staff

Comment: In the section entitled “Portfolio Fees and Expenses-Example” in the summary sections of each portfolio, please delete the term “expense” from the heading to the example table.

Response: Each portfolio has revised its disclosure as requested by the staff.

Comment: In the section entitled “Portfolio Fees and Expenses-Portfolio Turnover” in the summary sections of each portfolio, please delete the statement “Future portfolio turnover could be higher or lower” since such disclosure is neither required nor permitted by the Item 3.

Response: Each portfolio has revised its disclosure as requested by the staff.

Comment: In the section entitled “Investments, Risks and Performance-Principal Investment Strategies” in the summary sections of each portfolio, please delete any disclosure not required by Item 4(a). For example, delete any risk disclosure and consider whether disclosure relates to a principal strategy.

Response: Each portfolio has revised its disclosure as requested by the staff.

Comment: In the section entitled “Investments, Risks and Performance-Principal Risks of Investing in the Portfolio” in the summary sections of each portfolio, please (a) delete the statement “Please remember that an investment in the Portfolio is not guaranteed to achieve its investment objective,” (b) disclose in this section that loss of money is a risk (c) if a portfolio is not advised or sold through an insured depository institution delete the disclosure that an investment in a portfolio “is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency,” (d) in the risk factor for mortgage-backed securities, if appropriate add sub-prime disclosure, (e) in the expense risk factor, revise the disclosure to be specific to each portfolio (i.e., if a portfolio does not have a voluntary waiver the risk disclosure relating to voluntary waivers should be deleted), (f) the risk disclosure for short sales is unclear, please revise, (g) revise the risk disclosure for market and management risk to delete the risks that do not apply to a specific portfolio (i.e., delete the risk disclosure about investment models if not used by a specific portfolio), and (h) delete the last sentence of this section since this type of cross reference is not permitted.

Response: In response to the above comments, (a) each applicable portfolio has deleted the stated disclosure, (b) each applicable portfolio has clarified the current loss of money disclosure, (c) since the Fund and its portfolios are sold through certain insured depository institutions the disclosure has not been deleted, (d) the risks presented by investments in sub-prime mortgage-backed securities are not principal risks of any portfolio, thus no additional disclosure is necessary, (e) each applicable portfolio has revised the expense risk factor disclosure, (f) each applicable portfolio has revised the short sales risk factor disclosure, (g) each applicable portfolio has revised the market and management risk factor disclosure, and (h) the portfolios have deleted the cross reference disclosure.

Comment: In the section entitled “Investments, Risks and Performance-Past Performance” in the summary sections of each portfolio, please (a) revise the disclosure before the bar chart to conform to Item 4(b)(2)(i), (b) if a portfolio uses a secondary index, please provide the disclosure required pursuant to Instruction 2(b) to Item 4, (c) revise the disclosure to be specific to a portfolio (i.e., delete references to waivers if not applicable to a portfolio), (d) revise the heading to the table to state “Average Annual Total Returns (for the periods ended 12/31/09)” and (e) in the Average Annual Total Returns table for each portfolio, for the indexes please state “(reflects no deduction for fees, expenses or taxes)”.

Response: In response to the above comments, each applicable portfolio has revised the disclosure as requested by the staff.

Comment: In the section entitled “Management of the Portfolio” in the summary sections of each portfolio, please provide and missing service dates for portfolio managers.

Response: Each portfolio has revised the disclosure as requested by the staff.

Comment: In the summary for each portfolio, please delete all cross-references to other sections of the prospectus, and the cross-references to the Statement of Additional Information (SAI), since cross-references are not permitted.

Response: All cross-references have been deleted as requested.

Comments Relating to a Specific Portfolio:

Comment: In the AST Academic Strategies Portfolio summary section, the discussion of principal investment strategies includes disclosures relating to risk and portfolio managers which do not appear to be relevant to the Portfolio’s principal investment strategies. In addition, some of the discussion appears to be overly detailed for the summary section, particularly the table relating to sleeve allocations. Please revise accordingly.

Response: The discussion of principal investment strategies has been revised to respond to the staff’s comments.

Comment: In the AST Advanced Strategies Portfolio summary section, the discussion of principal investment strategies includes disclosures relating to risk and portfolio managers which do not appear to be relevant to the Portfolio’s principal investment strategies. The term “Subadviser” is utilized in what appears to be a defined term, but the term is not defined. In addition, some of the discussion appears to be overly detailed for the summary section, particularly the table relating to sleeve allocations. Please revise accordingly.

Response: The discussion of principal investment strategies has been revised to respond to the staff’s comments.

Comment: In the AST Balanced Asset Allocation Portfolio summary section, the discussion of principal investment strategies appears to include disclosure which is not related to investment strategies, and is therefore not permitted. Please revise accordingly.

Response: The discussion has of principal investment strategies has been revised to respond to the staff’s comments.

Comment: In the summary section of each of the AST Bond Portfolios (2015-2021), the footnote discussing the contractual fee waiver / expense cap is not permitted, because the contractual period does not extend for the life of the prospectus.

Response: The contractual fee waiver / expense cap extends to May 1, 2012. The footnotes have been revised to so state.

Comment: In the summary section of each of the AST Bond Portfolios (2015-2021), the discussion of principal investment strategies includes the statement that the portfolio’s investment objective “is a non-fundamental policy of the Portfolio and may be changed by the Board without shareholder approval.” This statement should be deleted, since it is not related to the portfolio’s principal investment strategies.

Response: The sentence has been deleted.

Comment: In the summary section of the AST Bond Portfolio 2015, no benchmark index is disclosed.

Response: The benchmark index has been included, and appears within the average annual total returns table.

Comment: In the summary section for the AST Federated Aggressive Growth Portfolio, the discussion of principal investment strategies includes a discussion of how the portfolio defines foreign securities. This discussion should be deleted, since it is not part of the portfolio’s principal investment strategies.

Response: The discussion has been revised.

Comment: In the section entitled “Principal Risks”, please (a) consider moving this section to after the Item 9 information, (b) consider reorganizing the risks in a way to clarify to investors which risks apply to a specific portfolio, (c) please delete any duplicative disclosures, (d) for derivatives risk, please revise to discuss a portfolio’s obligations to cover assets, (e) revise the expense risk to delete references that are generic, such as voluntary waivers disclosure, (f) define the term “Asset Allocation Portfolio” in the fund of fund risk factor, and (g) discuss (if necessary) any sub-prime exposure in mortgage backed and real estate risk factors.

Response: (a) The Fund considered moving the “Principal Risks” section as proposed by the staff, however, the Fund believes that the current presentation of the section is appropriate and is not confusing to investors. (b) The Fund has revised the introductory paragraph to this section to help clarify which risks apply to a portfolio. The new disclosure states:

“Although we try to invest wisely, all investments involve risk. Like any mutual fund, an investment in a Portfolio could lose value, and you could lose money. The preceding summary section for each Portfolio identifies the principal risks that apply to each Portfolio. Set out below is more detailed information about these risks. If a principal risk is not identified as a principal risk in a Portfolio’s summary section then that risk is not a principal risk for the Portfolio.”

(c) The duplicative disclosures have been removed. (d) The derivatives disclosure has been revised as requested. (e) The expense disclosure has been revised as requested. (f) The term has been defined as requested. (g) The risks presented by investments in sub-prime mortgage-backed securities are not principal risks of any portfolio, thus no additional disclosure is necessary.

Comment: In the section entitled “More Detailed Information on How the Portfolios Invest-Investment Objectives & Policies”, please (a) delete any duplicative disclosures that are not necessary, (b) please include frequent trading disclosures, (c) please include discussion of temporary defensive disclosure, and (d) delete the last sentence of this section.

Response: (a) The Fund has reviewed and revised this section to delete any unnecessary duplication. (b) and (c) Both disclosures already appeared in this section, however, we have re-formatted the discussions to make it easier for investors to locate these discussions. (d) Since the Fund is sold through an insured depository institution, we did not delete the disclosure.

Comment: In the section entitled “Net Asset Value”, clarify the following sentence since its confusing to investors: “The Fund does not price, and investors will not be able to purchase or redeem, the Fund’s shares on days when the NYSE is closed but the primary markets for the Fund’s foreign securities are open, even though the value of these securities may have changed”.

Response: The last two sentences of that section have been replaced with the following disclosure: “The Fund does not price, and investors will not be able to purchase or redeem, the Fund’s shares on any day that the NYSE is closed for regular trading (even if the primary markets for the Fund’s foreign securities may be open on that day).”

Statement of Additional Information (SAI):

Comment: On the front cover page of the SAI, please include each portfolio’s name and the classes to which the SAI relates.

Response: The front cover page has been revised as requested by the staff.

Comment: The SAI does not include the new required disclosures pertaining to qualifications of board members, board structure, and risk oversight by the board.

Response: This disclosure was not available at the time the registration statement was filed. The disclosure has since been finalized, and will be included in the Amendment.

The Fund acknowledges that (i) should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; (ii) the action of the Commission or the staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Fund from its full responsibility for the adequacy and accuracy of the disclosure in the Registration Statement; and (iii) the Fund may not assert a declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Any questions or comments with respect to the Registration Statement may be communicated to the undersigned (973-802-6469).

Very truly yours,

/s/ Jonathan Shain

Jonathan Shain

cc: Sally Samuels

(Securities and Exchange Commission)

The investment objective of the Portfolio is to seek long-term capital appreciation.

The table below shows the fees and expenses that you may pay if you invest in shares of the Portfolio. The table does not include Contract charges. Because Contract charges are not included, the total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | |

Management Fees | | .72% | | | |

Distribution (12b-1) Fees | | None | | | |

Other Expenses | | .08% | | | |

Dividend Expense on Short Sales | | .02% | | | |

Broker Fees and Expenses on Short Sales | | None | | | |

Acquired Fund Fees & Expenses | | .75% | | | |

Total Annual Portfolio Operating Expenses | | 1.57% | | | |

Example. The following example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The table does not include contract charges. Because contract charges are not included, the total fees and expenses that you will incur will be higher than the fees and expenses set forth in the example. See your contract prospectus for more information about contract charges.

The example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Portfolio's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

AST Academic Strategies Asset Allocation | $160 | $496 | $855 | $1,867 |

Portfolio Turnover. The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the example, affect the Portfolio's performance. During the most recent fiscal year ended December 31, the Portfolio's turnover rate was 78% of the average value of its portfolio.

Principal Investment Strategies. Under normal circumstances, approximately 60% of the Portfolio's assets are allocated to traditional asset classes and approximately 40% of the Portfolio's assets are allocated to non-traditional asset classes and investment strategies. The traditional asset classes include U.S. and foreign equity and fixed-income securities. The non-traditional asset classes include real estate, commodities, and global infrastructure. The non-traditional investment strategies include long/short market neutral, global macro, hedge fund replication, and global tactical asset allocation strategies.

The Portfolio gains exposure to these traditional and non-traditional asset classes and investment strategies by investing in varying combinations of: (i) other pooled investment vehicles, including, other portfolios of the Fund, other open-end or closed-end investment companies, exchange-traded funds (ETFs), unit investment trusts, and domestic or foreign private investment pools (collectively referred to as Underlying Portfolios); (ii) securities such as common stocks, preferred stocks, and bonds; and (iii) certain financial and derivative instruments. Under normal circumstances, the Portfolio invests approximately 65% of its assets in Underlying Portfolios.

Principal Risks of Investing in the Portfolio. All investments have risks to some degree. An investment in the Portfolio is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. While we make every effort to achieve our objective, we can't guarantee success and it is possible that you could lose money.

Fund of funds risk. In addition to the risks associated with the indirect investment in the Underlying Portfolios, the Portfolio is subject to the following additional risks: to the extent the Portfolio concentrates its assets among Underlying Portfolios that invest principally in one or several asset classes, the Portfolio may from time to time underperform mutual funds exposed primarily to other asset classes; the ability of the Portfolio to achieve its investment objective depends on the ability of the selected Underlying Portfolios to achieve their investment objectives; the performance of the Portfolio may be affected by large purchases and redemptions of Underlying Portfolio shares; and there is a potential conflict of interest between the Portfolio and its advisers, PI and QMA, which could impact the Portfolio.

Asset Transfer Program Risk. The Portfolio is used in connection with certain benefit programs under Prudential variable annuity contracts, including, certain "guaranteed minimum accumulation benefit" programs and certain "guaranteed minimum withdrawal benefit" programs. In order for Prudential to manage the guarantees offered in connection with these benefit programs, Prudential will monitor each contract owner's account value from time to time and will systematically transfer amounts between the Portfolio and certain bond funds (or, for one guaranteed minimum withdrawal benefit program, the insurer's general account) as required by certain non-discretionary mathematical formulas. Such pre-determined mathematical formulas may, however, result in large-scale asset flows into and out of the Portfolio and subject the Portfolio to certain risks. Such pre-determined mathematical formulas could adversely affect a Portfolio's investment performance by requiring the Subadviser to purchase and sell securities at inopportune times and by otherwise limiting the Subadviser's ability to fully implement the Portfolio's investment strategies. In addition, these pre-determined mathematical formulas may result in relatively small asset bases and relatively high operating expense ratios for the Portfolios compared to other similar funds.

Equity securities risk. There is the risk that the value or price of a particular stock or other equity or equity-related security owned by a Portfolio could go down and you could lose money. In addition to an individual stock losing value, the value of the equity markets or a sector of those markets in which a Portfolio invests could go down.

Foreign investment risk. Investment in foreign securities generally involve more risk than investing in securities of U.S. issuers. Foreign investment risk includes: Changes in currency exchange rates may affect the value of foreign securities held by a Portfolio; securities of issuers located in emerging markets tend to have volatile prices and may be less liquid than investments in more established markets; foreign markets generally are more volatile than U.S. markets, are not subject to regulatory requirements comparable to those in the U.S, and are subject to differing custody and settlement practices; foreign financial reporting standards usually differ from those in the U.S.; foreign exchanges are smaller and less liquid than the U.S. market; political developments may adversely affect the value of a Portfolio's foreign securities; and foreign holdings may be subject to special taxation and limitations on repatriating investment proceeds.

Fixed income securities risk. Investment in fixed income securities involves a variety of risks, including the risk that an issuer or guarantor of a security will be unable to pay some or all of the principal and interest when due (credit risk); the risk that the Portfolio may not be able to sell some or all of the securities its holds, either at the price it values the security or at any price (liquidity risk); and the risk that the rates of interest income generated by the fixed income investments of a Portfolio may decline due to a decrease in market interest rates and that the market prices of the fixed income investments of a Portfolio may decline due to an increase in market interest rates (interest rate risk).

High-yield risk. Investments in fixed-income securities rated below investment grade and unrated securities of similar credit quality (commonly known as "junk bonds") may be subject to greater levels of interest rate, credit and liquidity risk than investments in investment grade securities. High-yield securities are considered predominantly speculative with respect to the issuer's continuing ability to make principal and interest payments.

Asset-backed securities risk. Asset-backed securities are fixed income securities that represent an interest in an underlying pool of assets, such as credit card receivables. Like traditional fixed income securities, asset-backed securities are subject to interest rate risk, credit risk and liquidity risk. When the underlying pools of assets consist of debt obligations, there is a risk that those obligations will be repaid sooner than expected (prepayment risk) or later than expected (extension risk), both of which may result in lower than expected returns.

Mortgage-backed securities risk. A mortgage-backed security is a specific type of asset-backed security - one backed by mortgage loans on residential and/or commercial real estate. Therefore, they have many of the risk characteristics of asset-backed securities, including prepayment and extension risks, as well as interest rate, credit and liquidity risk. Because they are backed by mortgage loans, mortgage-backed securities also have risks related to real estate, including significant sensitivity to changes in real estate prices and interest rates and, in the case of commercial mortgages, office and factory occupancy rates.

Market and management risk. Markets in which the Portfolio invests may experience volatility and go down in value, and possibly sharply and unpredictably. All decisions by an adviser require judgment and are based on imperfect information. Additionally, the investment techniques, risk analysis and investment strategies used by an adviser in making investment decisions for the Portfolio may not produce the desired results.

Real estate risk. Investments in real estate investment trusts (REITs) and real estate-linked derivative instruments will subject the Portfolio to risks similar to those associated with direct ownership of real estate, including losses from casualty or condemnation, changes in local and general economic conditions, supply and demand for real estate and office space, interest rates, zoning laws, regulatory limitations on rents, property taxes, and operating expenses. An investment in a derivative instrument that is linked to the value of a REIT is subject to additional risks, such as poor performance by the manager of the REIT, adverse changes to the tax laws, or failure by the REIT to qualify for favorable tax treatment under current tax laws. In addition, some REITs have limited diversification because they invest in a limited number of properties, a narrow geographic area, or a single type of property.

Liquidity and valuation risk. From time to time, the Portfolio may hold one or more securities for which there are no or few buyers and sellers or which are subject to limitations on transfer. A Portfolio also may have difficulty disposing of those securities at the values determined by the Portfolio for the purpose of determining the Portfolio's net asset value, especially during periods of significant net redemptions of Portfolio shares.

Leverage risk. Leverage is the investment of borrowed cash. The effect of using leverage is to amplify the Portfolio's gains and losses in comparison to the amount of the Portfolio's assets (that is, assets other than borrowed assets) at risk, thus causing the Portfolio to be more volatile.

Derivatives risk. A derivative is a financial contract, the value of which depends upon, or is derived from, the value of an underlying asset, reference rate, or index. The use of derivatives involves a variety of risks, including: the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable to honor its financial obligation to the Portfolio; certain derivatives and related trading strategies create debt obligations similar to borrowings, and therefore create, leverage, which can result in losses to a Portfolio that exceed the amount the Portfolio originally invested; certain exchange-traded derivatives may be difficult or impossible to buy or sell at the time that the seller would like, or at the price that the seller believes the derivative is currently worth, and privately negotiated derivatives may be difficult to terminate or otherwise offset; derivatives used for hedging may reduce losses but also reduce or eliminate gains or cause losses if the market moves in a manner different from that anticipated by the Portfolio; and commodity-linked derivative instruments may be more volatile than the prices of investments in traditional equity and debt securities.

Short sale risk. The Portfolio's short sales are subject to special risks. A short sale involves the sale by the Portfolio of a security that it does not own with the hope of purchasing the same security at a later date at a lower price. Subject to the issuance of the above-referenced exemptive relief or final rules by the SEC, the Portfolio may also enter into a short derivative position through a futures contract or swap agreement. If the price of the security or derivative has increased during this time, then the Portfolio will incur a loss equal to the increase in price from the time that the short sale was entered into plus any premiums and interest paid to the third party. Theoretically, the amount of these losses can be unlimited, although for fixed-income securities an interest rate of 0% forms an effective limit on how high a securities' price would be expected to rise. Although certain investment strategies pursued by the Portfolio may try to reduce risk by holding both long and short positions at the same time, it is possible that the Portfolio's securities held long will decline in value at the same time that the value of the Portfolio's securities sold short increases, thereby increasing the potential for loss. In addition, there is the risk that the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund.

Expense risk. Your actual cost of investing in a Portfolio may be higher than the expenses shown in "Annual Portfolio Operating Expenses," above for a variety of reasons, including, for example, if a Portfolio's average net assets decreases significantly, such as significant redemptions by another Portfolio that may invest in your Portfolio.

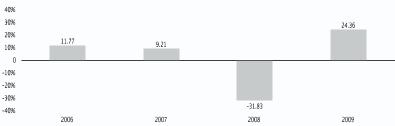

Past Performance. A number of factors, including risk, can affect how the Portfolio performs. The bar chart and table demonstrate the risk of investing in the Portfolio by showing how returns can change from year to year and by showing how the Portfolio's average annual returns compare with a group of similar mutual funds. Past performance does not mean that the Portfolio will achieve similar results in the future.

The annual returns and average annual returns shown in the chart and table are after deduction of expenses and do not include Contract charges. If Contract charges were included, the returns shown would have been lower than those shown. Consult your Contract prospectus for information about Contract charges.

The table also demonstrates how the Portfolio's average annual returns compare to the returns of a custom blended stock index which reflects the Portfolio's investment policies and strategies.

Note: Prior to July 21, 2008, the Portfolio was known as the AST Balanced Asset Allocation Portfolio. Effective July 21, 2008, the Portfolio added new subadvisers, changed its investment objective, policies, strategy, and expense structure. The performance figures furnished below prior to July 21, 2008 reflects the investment performance, investment operations, investment policies, investment strategies, and expense structure of the former AST Balanced Asset Allocation Portfolio and is not representative of the current subadvisers or investment objective, polices, strategy, and expense structure.

Annual Total Returns | | |

| | Best Quarter:

2nd Quarter of 2009

14.94%Worst Quarter:

4th Quarter of 2008

-16.24% |

Average Annual Total Returns (For the periods ended December 31, 2009) | | |

| | 1 year | Since Inception (12/5/05) |

Portfolio | 24.36% | .92% |

Index (reflects no deduction for fees, expenses or taxes) | | |

Standard & Poor's 500 Index | 26.47 | -.65 |

Primary Blended Index | 19.22 | 2.81 |

Secondary Blended Index | 18.40 | 2.21 |

Investment Managers | Subadviser | Portfolio Managers | Title | Service Date |

Prudential Investments LLC | | Brian Ahrens | Senior VP - Strategic Investment Research Group | July 2008 |

AST Investment Services, Inc. | Quantitative Management Associates LLC (QMA) | Ted Lockwood | Portfolio Manager, Managing Director of QMA | July 2008 |

| | | Marcus M. Perl | VP, Portfolio Manager of QMA | July 2008 |

| | | Edward L. Campbell, CFA | VP, Portfolio Manager of QMA | July 2008 |

| | | Edward F. Keon | Portfolio Manager, Managing Director of QMA | July 2008 |

Contract owners should consult their Contract prospectus for information on the federal tax consequences to them. In addition, Contract owners may wish to consult with their own tax advisors as to the tax consequences of investments in the Contracts and the Portfolio, including the application of state and local taxes. The Portfolio currently intends to be treated as a partnership for federal income tax purposes. As a result, the Portfolio's income, gains, losses, deductions, and credits are "passed through" pro rata directly to the participating insurance companies and retain the same character for federal income tax purposes.

If you purchase your Contract through a broker-dealer or other financial intermediary (such as a bank), the issuing insurance company, the Portfolio or their related companies may pay the intermediary for the sale of the Contract, the selection of the Portfolio and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Contract over another investment or insurance product, or to recommend the Portfolio over another investment option under the Contract. Ask your salesperson or visit your financial intermediary's website for more information.