The Portfolio's Investment Objective is to seek capital growth.

The table below shows the fees and expenses that you may pay if you invest in shares of the Portfolio. The table does not include Contract charges. Because Contract charges are not included, the total fees and expenses that you will incur will be higher than the fees and expenses set forth in the table. See your Contract prospectus for more information about Contract charges.

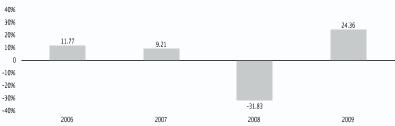

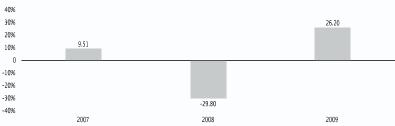

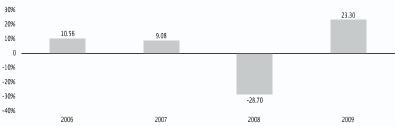

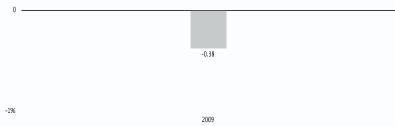

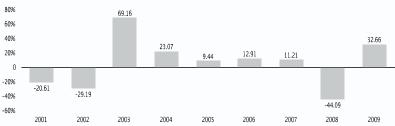

The annual returns and average annual returns shown in the chart and table are after deduction of expenses and do not include Contract charges. If Contract charges were included, the returns shown would have been lower than those shown. Consult your Contract prospectus for information about Contract charges.

The table also demonstrates how the Portfolio's average annual returns compare to the returns of a secondary index which reflects the Portfolio's investment policies and strategies.

Contract owners should consult their Contract prospectus for information on the federal tax consequences to them. In addition, Contract owners may wish to consult with their own tax advisors as to the tax consequences of investments in the Contracts and the Portfolio, including the application of state and local taxes. The Portfolio currently intends to be treated as a partnership for federal income tax purposes. As a result, the Portfolio's income, gains, losses, deductions, and credits are "passed through" pro rata directly to the participating insurance companies and retain the same character for federal income tax purposes.

If you purchase your Contract through a broker-dealer or other financial intermediary (such as a bank), the issuing insurance company, the Portfolio or their related companies may pay the intermediary for the sale of the Contract, the selection of the Portfolio and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Contract over another investment or insurance product, or to recommend the Portfolio over another investment option under the Contract. Ask your salesperson or visit your financial intermediary's website for more information.

Although we try to invest wisely, all investments involve risk. Like any mutual fund, an investment in a Portfolio could lose value, and you could lose money. The preceding summary section for each Portfolio identifies the principal risks that apply to each Portfolio. Set out below is more detailed information about these risks. If a principal risk is not identified as a principal risk in a Portfolio's summary section then that risk is not a principal risk for the Portfolio and the below disclosure does not apply to that Portfolio.

Asset-backed securities risk. Asset-backed securities are fixed income securities that represent an interest in an underlying pool of assets, such as credit card receivables. Like traditional fixed income securities, asset-backed securities are subject to interest rate risk, credit risk and liquidity risk. Certain asset-backed securities may also be subject to the risk of prepayment. In a period of declining interest rates, borrowers may pay what they owe on the underlying assets more quickly than anticipated, which may require the Portfolio to reinvest the repayment proceeds in securities that pay lower interest rates. Asset-backed securities may also be subject to extension risk, which is the risk that, in a period of rising interest rates, prepayments may occur at a slower rate than expected, which may prevent the Portfolio from reinvesting repayment proceeds in securities that pay higher interest rates. The more a Portfolio invests in longer-term securities, the more likely it will be affected by changes in interest rates.

Asset transfer program risk. Each Target Maturity Portfolio is used in connection with certain benefit programs under Prudential variable annuity contracts, including certain "guaranteed minimum accumulation benefit" programs and certain "guaranteed minimum withdrawal benefit" programs. In order for Prudential to manage the guarantees offered in connection with these benefit programs, Prudential generally requires contract owners to participate in certain specialized asset transfer programs under which Prudential will monitor each contract owner's account value and, if necessary, will systematically transfer amounts between the selected sub-accounts and sub-accounts investing in the Target Maturity Portfolios. The transfers are based on mathematical formulas which generally focus on the amounts guaranteed at specific future dates or the present value of the estimated lifetime payments to be made.

As an example of how these asset transfer programs will operate under certain market environments, a downturn in the equity markets (i.e., a reduction in a contract owner's account value within the selected sub-accounts) and certain market return scenarios involving "flat" returns over a period of time may cause Prudential to transfer some or all of such contract owner's account value to a Target Maturity Portfolio sub-account. In general terms, such transfers are designed to ensure that an appropriate percentage of the projected guaranteed amounts are offset by certain fixed income investments.

The asset transfers may, however, result in large-scale asset flows into and out of the Target Maturity Portfolios and subject the Target Maturity Portfolios to certain risks. The asset transfers could adversely affect a Target Maturity Portfolio's investment performance by requiring the Subadviser to purchase and sell securities at inopportune times and by otherwise limiting the Subadviser's ability to fully implement the Target Maturity Portfolio's investment strategies. In addition, these asset transfers may result in relatively small asset bases and relatively high operating expense ratios for the Target Maturity Portfolios compared to other similar funds.

For more information on the benefit programs and asset transfer programs, please see your contract prospectus.

Derivatives risk. A derivative is a financial contract, the value of which depends upon, or is derived from, the value of an underlying asset, reference rate, or index, and may relate to stocks, bonds, interest rates, currencies, or currency exchange rates, and related indexes. Derivatives in which the Portfolios may invest include exchange-traded instruments as well as privately negotiated instruments, also called over-the-counter instruments. Examples of derivatives include options, futures, forward agreements, interest rate swap agreements, credit default swap agreements, and credit-linked securities. A Portfolio may, but is not required to, use derivatives to earn income or enhance returns, manage or adjust its risk profile, replace more traditional direct investments, or obtain exposure to certain markets. The use of derivatives to seek to earn income or enhance returns may be considered speculative.

The use of derivatives involves a variety of risks, including:

- Counterparty credit risk. There is a risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable to honor its financial obligation to the Portfolio. This risk is especially important in the context of privately negotiated instruments. For example, a Portfolio would be exposed to counterparty credit risk to the extent it enters into a credit default swap, that is, it purchases protection against a default by a debt issuer, and the swap counterparty does not maintain adequate reserves to cover such a default.

- Leverage risk. Certain derivatives and related trading strategies create debt obligations similar to borrowings, and therefore create, leverage. Leverage can result in losses to a Portfolio that exceed the amount the Portfolio originally invested. See "To mitigate leverage risk, a Portfolio may segregate liquid assets or otherwise cover the transactions that may give rise to such risk. The use of leverage may cause a Portfolio to liquidate Portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation or coverage requirements.verage risk," below.

- Liquidity and valuation risk. Certain exchange-traded derivatives may be difficult or impossible to buy or sell at the time that the seller would like, or at the price that the seller believes the derivative is currently worth. Privately negotiated derivatives may be difficult to terminate, and from time to time, a Portfolio may find it difficult to enter into a transaction that would offset the losses incurred by another derivative that it holds. Derivatives, and especially privately negotiated derivatives, also involve the risk of incorrect valuation (that is, the value assigned to the derivative may not always reflect its risks or potential rewards). See "Liquidity and valuation risk," below.

- Hedging risk. Hedging is a strategy in which a Portfolio uses a derivative to offset the risks associated with its other holdings. While hedging can reduce losses, it can also reduce or eliminate gains or cause losses if the market moves in a manner different from that anticipated by the Portfolio. Hedging also involves the risk that changes in the value of the derivative will not match the value of the holdings being hedged as expected by the Portfolio, in which case any losses on the holdings being hedged may not be reduced and in fact may be increased. No assurance can be given that any hedging strategy will reduce risk or that hedging transactions will be either available or cost effective. A Portfolio is not required to use hedging and may choose not to do so.

- Commodity risk. A commodity-linked derivative instrument is an financial instrument, the value of which is determined by the value of one or more commodities, such as precious metals and agricultural products, or an index of various commodities. The prices of these instruments historically have been affected by, among other things, overall market movements and changes in interest and exchange rates and have may be volatile than the prices of investments in traditional equity and debt securities.

Equity securities risk. There is the risk that the value or price of a particular stock or other equity or equity-related security owned by a Portfolio could go down and you could lose money. In addition to an individual stock losing value, the value of the equity markets or a sector of those markets in which a Portfolio invests could go down. A Portfolio's holdings can vary from broad market indexes, and the performance of a Portfolio can deviate from the performance of such indexes. Different parts of a market can react differently to adverse issuer, market, regulatory, political and economic developments.

Expense risk. Your actual cost of investing in a Portfolio may be higher than the expenses shown in "Annual Portfolio Operating Expenses," above for a variety of reasons. For example, fund operating expense ratios may be higher than those shown if a Portfolio's average net assets decrease. Net assets are more likely to decrease and Portfolio expense ratios are more likely to increase when markets are volatile. In addition, because the Portfolios are used as Underlying Portfolios for certain asset allocation Portfolios, a large-scale purchase and redemption activity by the asset allocation Portfolios could increase expenses of the Underlying Portfolios.

Fixed income securities risk. Investment in fixed income securities involves a variety of risks, including credit risk, liquidity risk and interest rate risk.

- Credit risk. Credit risk is the risk that an issuer or guarantor of a security will be unable to pay principal and interest when due, or that the value of the security will suffer because investors believe the issuer is less able to make required principal and interest payments. Credit ratings are intended to provide a measure of credit risk. However, ratings are only the opinions of the agencies issuing them and are not guarantees as to quality. The lower the rating of a debt security held by a Portfolio, the greater the degree of credit risk that is perceived to exist by the rating agency with respect to that security. Some but not all U.S. government securities are insured or guaranteed by the U.S. government, while others are only insured or guaranteed by the issuing agency, which must rely on its own resources to repay the debt. Although credit risk may be lower for U.S. government securities than for other investment-grade securities, the return may be lower.

- Liquidity risk. Liquidity risk is the risk that the Portfolio may not be able to sell some or all of the securities its holds, either at the price it values the security or at any price. Liquidity risk also includes the risk that there may be delays in selling a security, if it can be sold at all. See "Liquidity and valuation risk," below.

- Interest rate risk. Interest rate risk is the risk that the rates of interest income generated by the fixed income investments of a Portfolio may decline due to a decrease in market interest rates and that the market prices of the fixed income investments of a Portfolio may decline due to an increase in market interest rates. Generally, the longer the maturity of a fixed income security, the greater is the decline in its value when rates increase. As a result, funds with longer durations and longer weighted average maturities generally have more volatile share prices than funds with shorter durations and shorter weighted average maturities. The prices of fixed income securities generally move in the opposite direction to that of market interest rates. Certain securities acquired by a Portfolio may pay interest at a variable rate or the principal amount of the security periodically adjusts according to the rate of inflation or other measure. In either case, the interest rate at issuance is generally lower than the fixed interest rate of bonds of similar seniority from the same issuer; however, variable interest rate securities generally are subject to a lower risk that their value will decrease during periods of increasing interest rates and increasing inflation.

Foreign investment risk. Investment in foreign securities generally involve more risk than investing in securities of U.S. issuers. Foreign investment risk includes the following risks:

- Currency risk. Changes in currency exchange rates may affect the value of foreign securities held by a Portfolio. Currency exchange rates can be volatile and affected by, among other factors, the general economic conditions of a country, the actions of the U.S. and non-U.S. governments or central banks, the imposition of currency controls, and speculation. A security may be denominated in a currency that is different from the currency of the country where the issuer is domiciled. Changes in currency exchange rates may affect the value of foreign securities held by a Portfolio. If a foreign currency grows weaker relative to the U.S. dollar, the value of securities denominated in that foreign currency generally decreases in terms of U.S. dollars. If a Portfolio does not correctly anticipate changes in exchange rates, its share price could decline as a result. A Portfolio may from time to time attempt to hedge a portion of its currency risk using a variety of techniques, including currency futures, forwards, and options. However, these instruments may not always work as intended, and in certain cases the Portfolio may be worse off than if it had not used a hedging instrument. For most emerging market currencies, suitable hedging instruments may not be available.

- Emerging market risk. Countries in emerging markets (e.g., South America, Eastern and Central Europe, Africa and the Pacific Basin countries) may have relatively unstable governments, economies based on only a few industries and securities markets that trade a limited number of securities. Securities of issuers located in these countries tend to have volatile prices and offer the potential for substantial loss as well as gain. In addition, these securities may be less liquid than investments in more established markets as a result of inadequate trading volume or restrictions on trading imposed by the governments of such countries. Emerging markets may also have increased risks associated with clearance and settlement. Delays in settlement could result in periods of uninvested assets, missed investment opportunities or losses for a Portfolio.

- Foreign market risk. Foreign markets tend to be more volatile than U.S. markets and are generally not subject to regulatory requirements comparable to those in the U.S. In addition, foreign markets are subject to differing custody and settlement practices. Foreign markets are subject to bankruptcy laws different than those in the United States, which may result in lower recoveries for investors.

- Information risk. Financial reporting standards for companies based in foreign markets usually differ from those in the U.S.

- Liquidity and valuation risk. Stocks that trade less frequently can be more difficult or more costly to buy, or to sell, than more liquid or active stocks. This liquidity risk is a factor of the trading volume of a particular stock, as well as the size and liquidity of the entire local market. On the whole, foreign exchanges are smaller and less liquid than the U.S. market. This can make buying and selling certain shares more difficult and costly. Relatively small transactions in some instances can have a disproportionately large effect on the price and supply of shares. In certain situations, it may become virtually impossible to sell a stock in an orderly fashion at a price that approaches an estimate of its value.

- Political risk. Political developments may adversely affect the value of a Portfolio's foreign securities. In addition, some foreign governments have limited the outflow of profits to investors abroad, extended diplomatic disputes to include trade and financial relations, and imposed high taxes on corporate profits.

- Regulatory risk. Some foreign governments regulate their exchanges less stringently than the U.S., and the rights of shareholders may not be as firmly established as in the U.S.

- Taxation risk. Many foreign markets are not as open to foreign investors as U.S. markets. A Portfolio may be required to pay special taxes on gains and distributions that are imposed on foreign investors. Payment of these foreign taxes may reduce the investment performance of a Portfolio.

Fund of funds risk. Each Asset Allocation Portfolio is structured as a "fund of funds," which means that it invests primarily in other Portfolios, which we refer to as "Underlying Portfolios." In addition to the risks associated with the indirect investment in the Underlying Portfolios, each Asset Allocation Portfolio is subject to the following additional risks:

- To the extent that an Asset Allocation Portfolio concentrates its assets among Underlying Portfolios that invest principally in one or several asset classes, the Asset Allocation Portfolio may from time to time underperform mutual funds exposed primarily to other asset classes. For example, an Asset Allocation Portfolio may be overweighed in the equity asset class when the stock market is falling and the fixed income market is rising. Likewise, an Asset Allocation Portfolio may be overweighted in the fixed income asset class when the fixed income market is falling and the stock market is rising.

- The ability of an Asset Allocation Portfolio to achieve its investment objective depends on the ability of the selected Underlying Portfolios to achieve their investment objectives. There is a risk that the selected Underlying Portfolios will underperform relevant markets, relevant indices, or other funds with similar investment objectives and strategies.

- The performance of an Asset Allocation Portfolio may be affected by large purchases and redemptions of Underlying Portfolio shares. For example, large purchases and redemptions may cause an Underlying Portfolio to hold a greater percentage of its assets in cash than other funds pursuing similar strategies, and large redemptions may cause an Underlying Portfolio to sell assets at inopportune times. Underlying Portfolios that have experienced significant redemptions may, as a result, have higher expense ratios than other funds pursuing similar strategies. PI and the Portfolio's Subadviser (s) seek to minimize the impact of large purchases and redemptions of Underlying Portfolio shares, but their abilities to do so may be limited.

- There is a potential conflict of interest between an Asset Allocation Portfolio and its advisers, PI and the Portfolio's Subadviser(s). Because the amount of the investment management fees to be retained by PI and its affiliates may differ depending upon which Underlying Portfolios are used in connection with the Asset Allocation Portfolios, there is a potential conflict of interest for PI and the Portfolio's Subadviser(s) in selecting the Underlying Portfolios. In addition, PI and the Portfolio's Subadviser(s) may have an incentive to take into account the effect on an Underlying Portfolio in which an Asset Allocation Portfolio may invest in determining whether, and under what circumstances, to purchase or sell shares in that Underlying Portfolio. Although PI and the Portfolio's Subadviser(s) take steps to address the potential conflicts of interest, it is possible that the conflicts could impact the Asset Allocation Portfolios.

Growth style risk. There is a risk that the growth investment style may be out of favor for a period of time. Investors often expect growth companies to increase their earnings at a certain rate. If these expectations are not met, share prices may decline significantly, even if earnings do increase.

High-yield risk. Investments in high-yield securities and unrated securities of similar credit quality (commonly known as "junk bonds") may be subject to greater levels of interest rate, credit and liquidity risk than investments in investment grade securities. High-yield securities are considered predominantly speculative with respect to the issuer's continuing ability to make principal and interest payments. An economic downturn or period of rising interest rates could adversely affect the market for high-yield securities and reduce a Portfolio's ability to sell its high-yield securities (liquidity risk). In addition, the market for lower-rated bonds may be thinner and less active than the market for higher-rated bonds, and the prices of lower-rated bonds may fluctuate more than the prices of higher-rated bonds, particularly in times of market stress.

Industry/sector risk. A Portfolio that invests in a single market sector or industry can accumulate larger positions in a single issuer or an industry sector. As a result, the Portfolio's performance may be tied more directly to the success or failure of a smaller group of portfolio holdings.

Leverage risk. Leverage is the investment of borrowed cash. When using leverage, a Portfolio receives any profit or loss on the amount borrowed and invested, but remains obligated to repay the amount borrowed plus interest. The effect of using leverage is to amplify the Portfolio's gains and losses in comparison to the amount of the Portfolio's assets (that is, assets other than borrowed assets) at risk, thus causing the Portfolio to be more volatile. Certain transactions may give rise to a form of leverage. Examples of such transactions include borrowing, reverse repurchase agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment contracts. To mitigate leverage risk, a Portfolio may segregate liquid assets or otherwise cover the transactions that may give rise to such risk. The use of leverage may cause a Portfolio to liquidate Portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation or coverage requirements.

License risk. A Portfolio or an adviser may rely on licenses from third parties that permit it to use the intellectual property in connection with the investment strategies for the Portfolio. Such licenses may be terminated by the licensors under certain circumstances, and, as a result, a Portfolio may have to change its investment strategy. Accordingly, the termination of a license may have a significant effect on the operation of the affected Portfolio.

Liquidity and valuation risk. From time to time, a Portfolio may hold one or more securities for which there are no or few buyers and sellers or the securities are subject to limitations on transfer. In those cases, the Portfolio may have difficulty determining the values of those securities for the purpose of determining the Portfolio's net asset value. A Portfolio also may have difficulty disposing of those securities at the values determined by the Portfolio for the purpose of determining the Portfolio's net asset value, especially during periods of significant net redemptions of Portfolio shares. Portfolios with principal investment strategies that involve foreign securities, private placement investments, derivatives or securities with substantial market and/or credit risk tend to have the greatest exposure to liquidity and valuation risk.

Liquidity and valuation risk of private real estate-related investments. Private real estate-related investments are generally considered illiquid and generally cannot be readily sold. As a result, private real estate-related investments owned by the Global Real Estate Portfolio will be valued at fair value pursuant to guidelines established by the Fund's Board of Trustees. The guidelines incorporate periodic independent appraised value of the properties, but an appraisal is only an estimate of market value. No assurance can be given that the fair value prices accurately reflect the price a Portfolio would receive upon the sale of the investment.

Market and management risk. Market risk is the risk that the markets in which the Portfolios invest will experience market volatility and go down in value, including the possibility that a market will go down sharply and unpredictably. All markets go through cycles, and market risk involves being on the wrong side of a cycle. Factors affecting market risk include political events, broad economic and social changes, and the mood of the investing public. If investor sentiment turns gloomy, the price of all securities may decline. Management risk is the risk that an adviser's investment strategy will not work as intended. All decisions by an adviser require judgment and are based on imperfect information. In addition, Portfolios managed using an investment model designed by an adviser are subject to the risk that the investment model may not perform as expected.

Mid-capitalization company risk. The shares of mid-sized companies tend to trade less frequently than those of larger, more established companies, which can have an adverse effect on the pricing of these securities and on a Portfolio's ability to sell the securities. Changes in the demand for these securities generally have a disproportionate effect on their market price, tending to make prices rise more in response to buying demand and fall more in response to selling pressure. Such investments also may be more volatile than investments in larger companies, as intermediate capitalization size companies generally experience higher growth and failure rates, and typically have less access to capital.

Mortgage-backed securities risk. A mortgage-backed security is a specific type of asset-backed security - one backed by mortgage loans on residential and/or commercial real estate. Therefore, they have many of the risk characteristics of asset-backed securities, including prepayment and extension risks, as well as interest rate, credit and liquidity risk. Because they are backed by mortgage loans, mortgage-backed securities also have risks related to real estate, including significant sensitivity to changes in real estate prices and interest rates and, in the case of commercial mortgages, office and factory occupancy rates. Many mortgage-backed securities are issued by federal government agencies such as Ginnie Mae, or by government-sponsored enterprises such as Freddie Mac or Fannie Mae. Currently, Freddie Mac and Fannie Mae are in government conservatorship.

Non-diversification risk. A Portfolio is considered "diversified" if, with respect to 75 percent of its total assets, it invests no more than 5 percent of its total assets in the securities of one issuer, and its investments in such issuer represent no more than 10 percent of that issuer's outstanding voting securities. To the extent that a Portfolio is not diversified, there is a risk that the Portfolio may be adversely affected by the performance of relatively few securities or the securities of a single issuer.

Real estate risk. Investments in REITs and real estate-linked derivative instruments will subject a Portfolio to risks similar to those associated with direct ownership of real estate, including losses from casualty or condemnation, and changes in local and general economic conditions, supply and demand, interest rates, zoning laws, regulatory limitations on rents, property taxes, and operating expenses. An investment in a real estate-linked derivative instrument that is linked to the value of a REIT is subject to additional risks, such as poor performance by the manager of the REIT, adverse changes to the tax laws, or failure by the REIT to qualify for tax-free pass-through of income under the tax laws. In addition, some REITs have limited diversification because they invest in a limited number of properties, a narrow geographic area, or a single type of property.

Short sale risk. A Portfolio that sells a security short in effect borrows and then sells the security with the expectation that it will later repurchase the security at a lower price and then return the amount borrowed with interest. In contrast, when a Portfolio buys a security long, it purchases the security with cash with the expectation that it later will sell the security at a higher price. A Portfolio that enters into short sales exposes the Portfolio to the risk that it will be required to buy the security sold short (also known as "covering" the short position) at a time when the security has appreciated in value, thus resulting in a loss to the Portfolio. Theoretically, the amount of these losses can be unlimited, although for fixed income securities an interest rate of 0% forms an effective limit on how high a security's price would be expected to rise. Although a Portfolio may try to reduce risk by holding both long and short positions at the same time, it is possible that the Portfolio's securities held long will decline in value at the same time that the value of the Portfolio's securities sold short increases, thereby increasing the potential for loss.

Value style risk. There is a risk that the value investment style may be out of favor for a period of time, that the market will not recognize a security's intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Historically, value stocks have performed best during periods of economic recovery.

Small company risk. The shares of small companies tend to trade less frequently than those of larger, more established companies, which can have an adverse effect on the pricing of these securities and on a Portfolio's ability to sell these securities. Changes in the demand for these securities generally have a disproportionate effect on their market price, tending to make prices rise more in response to buying demand and fall more in response to selling pressure. Such investments also may be more volatile than investments in larger companies, as smaller companies generally experience higher growth and failure rates, and typically have less access to capital. In the case of small cap technology companies, the risks associated with technology company stocks, which tend to be more volatile than other sectors, are magnified.

We describe each Portfolio's investment objective and policies on the following pages. We describe certain investment instruments that appear below in the section entitled More Detailed Information About Other Investments and Strategies Used by the Portfolios.

Although we make every effort to achieve each Portfolio's objective, we can't guarantee success and it is possible that you could lose money. Unless otherwise stated, each Portfolio's investment objective is a non-fundamental investment policy and, therefore, may be changed by the Board of Trustees of Advanced Series Trust without shareholder approval.

An investment in a Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

A change in the securities held by a Portfolio is known as "portfolio turnover." A Portfolio may engage in active and frequent trading to try to achieve its investment objective and may have a portfolio turnover rate of over 100% annually. Increased portfolio turnover may result in higher brokerage fees or other transaction costs, which can reduce performance. If a Portfolio realizes capital gains when it sells investments, it generally must pay those gains to shareholders, increasing its taxable distributions. The Financial Highlights tables at the end of this prospectus show each Portfolio's portfolio turnover rate during the past fiscal years.

In response to adverse market conditions or when restructuring a Portfolio, we may temporarily invest up to 100% of the Portfolio's total assets in money market instruments. Investing heavily in money market securities limits our ability to achieve our investment objective, but can help to preserve the value of the Portfolio's assets when markets are unstable.

AST Academic Strategies Asset Allocation Portfolio

Investment Objective: The investment objective of the Portfolio is to seek long-term capital appreciation. This investment objective is a non-fundamental investment policy of the Portfolio and may be changed by the Board without shareholder approval. No guarantee can be given that the Portfolio will achieve its investment objective, and the Portfolio may lose money.

Principal Investment Policies

The Portfolio will be a multi-asset class fund that pursues both top-down asset allocation strategies and bottom-up selection of securities, investment managers, and mutual funds. Under normal circumstances, it is currently expected that approximately 60% of the Portfolio's assets will be allocated to traditional asset classes and approximately 40% of the Portfolio's assets will be allocated to non-traditional asset classes. Those percentages are subject to change by the Investment Managers.

The overall asset allocation strategy for the Portfolio is determined by QMA and the Investment Managers in consultation with the Consultant, a consultant that has been retained by AST. The assets of the Portfolio may, but are not required to, be allocated among various traditional and non-traditional asset classes and the related investment categories and strategies as shown below.

Traditional Asset Classes | | |

U.S. Large- Cap Equity | | |

U.S. Mid-Cap Equity | | |

U.S. Small-Cap Equity | | - Growth

- Value

- Developed Markets Value

- Emerging Markets

|

International Equity | | - Developed Markets Growth

- International (Un-hedged)

- Emerging Markets

|

Fixed-Income | | - U.S. Investment Grade

- U.S. High-Yield

|

Non-Traditional Asset Classes | | |

Real Estate | | - U.S. Real Estate

- International Real Estate

|

Real Return* | | - Commodities

- Inflation-Indexed Securities

- Global Infrastructure

|

Alternative | | - Long/Short Market-Neutral

- Global Tactical Asset Allocation

- Hedge Fund Replication

- Overlay

- Long/Short Equity

- Event Driven

- Distressed Debt

- Currency

- Private Equity

|

The Consultant is expected to use academic research on asset allocation along with various quantitative and qualitative research methods to produce a proposed strategic allocation for the Portfolio among the various traditional and non-traditional asset classes and the related investment categories and strategies. QMA and the Investment Managers are then expected to review the proposed strategic allocation from the Consultant. QMA and the Investment Managers will adjust the proposed strategic allocation based upon their own: (i) forward-looking assessment of global macroeconomic, market, financial, currency, security valuation, and other factors and (ii) quantitative and qualitative evaluation of the risks associated with investments in the relevant investment categories and strategies. PI will then: (i) identify other pooled investment vehicles, including, without limitation, open-end or closed-end investment companies, exchange-traded funds, unit investment trusts, domestic or foreign private investment pools (including investment companies not registered under the 1940 Act, such as "hedge funds") (collectively referred to herein as Underlying Portfolios) that may be used as fulfillment options for the specific investment categories or strategies and (ii) establish specific weighted combinations of Underlying Funds that are consistent with the Portfolio's then-current asset allocation. PI will also seek to identify and retain Subadvisers to directly manage all or a portion of the assets that are allocated to a particular investment category or strategy. Under normal circumstances, the Portfolio will invest approximately 65% of its assets in other portfolios of the Fund (collectively, the Underlying Fund Portfolios). The Subadvisers directly manage the remaining 35% of the Portfolio's assets under normal circumstances. Those percentages are subject to change by the Investment Managers and QMA.

PI will monitor the amount of active risk taken within the various investment categories and strategies by conducting holdings-based and returns-based analyses of the Portfolio's direct and indirect portfolio holdings. QMA and the Investment Managers also expect to meet periodically with the Consultant. QMA and the Investment Managers, in consultation with the Consultant, will seek to opportunistically modify the allocations among the various investment categories and strategies, the Underlying Funds, and the Subadvisers based upon the latest academic research and their ongoing assessment of the above-referenced factors. The extent to which any recommendations from the Consultant are adopted is determined solely by the Investment Managers and QMA.

Other Investments. As set forth above, it is currently expected that the Portfolio will invest a substantial portion of its assets in Underlying Fund Portfolios. It is currently further expected the Subadvisers will directly manage the remaining portion of the Portfolio's assets. Under the 1940 Act, the Subadvisers may invest Portfolio assets in "securities" (e.g. common stocks, bonds, etc.) and futures contracts, options on futures contracts, swap agreements, and other financial and derivative instruments that are not "securities" within the meaning of the 1940 Act (collectively, Other Investments).

Investments in Traditional Asset Classes. With the exception of the International (Un-Hedged) and Emerging Markets investment categories within the Fixed-Income asset class, it is currently expected that exposure to all of the remaining traditional investment categories will be obtained through investments in Underlying Trust Funds. PIMCO will serve as the Subadviser to the International (Un-Hedged) and Emerging Markets investment categories.

Underlying Fund Portfolios. The principal investments of the Underlying Fund Portfolios that are currently expected to be used in connection with the traditional asset classes are described below. Consistent with the investment objectives and policies of the Portfolio, other Underlying Fund Portfolios from time to time may be added to, or removed from, the list of Underlying Fund Portfolios that may be used in connection with the Portfolio.

Underlying Fund Portfolio | Principal Investments | Traditional Investment Category |

AST Marsico Capital Growth | Invests primarily in common stocks, with the majority of the Portfolio's assets in large capitalization stocks | Domestic Large- Cap Equity Growth |

AST T. Rowe Price Large- Cap Growth | Invests predominantly in the equity securities of a limited number of large, high-quality U.S. companies | Domestic Large- Cap Equity Growth |

AST QMA US Equity Alpha | The Portfolio will use a long/short investment strategy. This means the Portfolio shorts a portion of the Portfolio and uses the proceeds of the shorts, or other borrowings, to purchase additional stocks long. Primarily invests at least 80% of its net assets plus borrowings, if any, for investment purposes in equity and equity-related securities of U.S. issuers. | Domestic Large- Cap Equity Core |

AST AllianceBernstein Growth & Income | Invests primarily in common stocks that are believed to be selling at reasonable valuations in relation to their fundamental business prospects | Domestic Large- Cap Equity Value |

AST Large-Cap Value | Invests primarily in common stocks and securities convertible into common stocks of large cap companies | Domestic Large- Cap Equity Value |

AST Neuberger Berman Mid-Cap Growth | Invests primarily in common stocks of medium capitalization companies | Domestic Mid-Cap Equity Growth |

AST Mid-Cap Value | Invests primarily in mid capitalization stocks that appear to be undervalued | Domestic Mid-Cap Equity Value |

AST Federated Aggressive Growth | Invests primarily in the stocks of small companies that are traded on national exchanges, NASDAQ stock exchange and the over-the-counter market | Domestic Small- Cap Equity Growth |

AST Small-Cap Value | Invests primarily in stocks and equity-related securities of small capitalization companies that appear to be undervalued | Domestic Small- Cap Equity Value |

AST International Growth | Invests primarily in equity securities of foreign companies | International Equity: Developed Markets Growth |

AST International Value | Invests primarily in equity securities of foreign companies | International Equity: Developed Markets Value |

AST Parametric Emerging Markets Equity | Invests primarily in equity securities of issuers located in emerging market countries or included (or considered for inclusion) as emerging market issuers in one or more broad-based market indices. | International Equity: Emerging Markets |

AST PIMCO Total Return Bond | Invests primarily in fixed-income securities of varying maturities | Domestic Investment Grade Fixed-Income |

AST Western Asset Core Plus Bond | Invests primarily in a portfolio of fixed-income and debt securities of various maturities | Domestic Investment Grade Fixed-Income |

AST PIMCO Limited Maturity Bond | Invests primarily in fixed-income securities of varying maturities, so that the Portfolio's expected average duration will be from one to there years. | Domestic Investment Grade Fixed-Income |

AST High Yield | Invests primarily in fixed-income investments that, at the time of purchase, are rated below investment grade | High-Yield Debt |

Taxable Money Market Series of Dryden Core Investment Fund | Invests primarily in short-term money market instruments issued by the U.S. Government, its agencies and instrumentalities, commercial paper, asset-backed securities, funding agreements, variable rate demand notes, bills, notes and other obligations issued by banks, corporations and other companies, and obligations issued by foreign banks, companies or governments | Money Market |

International Fixed-Income (Un-Hedged) (PIMCO). Under normal circumstances, PIMCO will invest at least 80% of the net assets attributable to this investment category in fixed income instruments that are economically tied to foreign (non-U.S.) countries, representing at least three foreign countries, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. PIMCO will select the foreign country and currency compositions for this investment category based on an evaluation of various factors, including, but not limited to relative interest rates, exchange rates, monetary and fiscal policies, trade and current account balances. The average duration of the assets attributable to this investment category will normally vary within two years (plus or minus) of the duration of the JPMorgan GBI Global ex-U.S. FX NY Index Unhedged in USD. PIMCO will invest primarily in investment grade debt securities but may invest up to 10% of the total assets attributable to this investment category in high yield securities (also referred to as "junk bonds") rated B or higher by Moody's Investors Service Inc. (Moody's), or equivalently rated by Standard Poor's (S&P) or Fitch Ratings Ltd. (Fitch), or, if unrated, determined by PIMCO to be of comparable quality. PIMCO may invest up to 15% of the total assets attributable to this investment category in securities and instruments that are economically tied to emerging market countries. For purposes of this investment category, an emerging market country shall be any country defined as an emerging or developing economy by the World Bank or its related organizations, or the United Nations or its authorities, or if the country is considered an emerging market country for purposes of constructing emerging markets indices. PIMCO may concentrate the assets attributable to this investment category in a relatively small number of issuers. Also, PIMCO may invest up to 10% of the total assets attributable to this investment category in preferred stocks.

Emerging Markets Fixed-Income (PIMCO). For purposes of this investment category, an emerging market country shall be any country defined as an emerging or developing economy by the World Bank or its related organizations, or the United Nations or its authorities, or if the country is considered an emerging market country for purposes of constructing emerging markets indices. Under normal circumstances, PIMCO will invest at least 80% of the net assets attributable to this investment category in fixed income instruments that are economically tied to emerging market countries, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. Such instruments may be denominated in non- U.S. currencies and the U.S. dollar. The average duration of the assets attributable to this investment category will normally vary within two years (plus or minus) of the duration of the JPMorgan Emerging Markets Bond Index. PIMCO will emphasize countries with relatively low gross national product per capita and with the potential for rapid economic growth. PIMCO will select the country and currency composition for this investment category based on its evaluation of relative interest rates, inflation rates, exchange rates, monetary and fiscal policies, trade and current account balances, and any other specific factors PIMCO believes to be relevant. PIMCO likely will concentrate the investment of assets attributable to this investment category in Asia, Africa, the Middle East, Latin America and the developing countries of Europe. Also, PIMCO may invest up to 10% of the total assets attributable to this investment category in preferred stocks.

PIMCO may invest all of the assets attributable to this investment category in "junk bonds", subject to a maximum of 15% of such total assets in securities rated below B by Moody's, or equivalently rated by S&P or Fitch, or, if unrated, determined by PIMCO to be of comparable quality. PIMCO may concentrate the assets attributable to this investment category in a relatively small number of issuers.

Investments in Non-Traditional Asset Classes. With the exception of the U.S. Real Estate and International Real Estate investment categories within the Real Estate asset class, it is expected that exposure to the remaining non-traditional investment categories will be obtained primarily through the allocation of Portfolio assets to certain Subadvisers. Consistent with the investment objectives and policies of the Portfolio, Underlying Fund Portfolios from time to time may be added to, or removed from, the Portfolio's list of available investment options.

Real Estate. As of January 31, 2009, exposure to the U.S. real estate and international real estate investment categories will be obtained through investments in the AST Cohen Steers Real Estate Portfolio and the AST Global Real Estate Portfolio, respectively. The principal investments of these Underlying Fund Portfolios are described below.

Underlying Fund Portfolio | Principal Investments | Traditional Investment Category |

AST Cohen & Steers Real Estate | Invests primarily in equity securities of real estate companies | Domestic Real Estate |

AST Global Real Estate | Invests primarily in equity securities of real estate companies on a global basis | Global Real Estate |

The Investment Managers have retained the Subadvisers listed below to directly manage the assets allocated to the indicated nontraditional investment categories and strategies.

Subadvisers | | | Investment Categories and Strategies |

Prudential Bache Asset Management (Bache) | | | Commodities |

Pacific Investment Management Company LLC (PIMCO) | | | Inflation-Indexed Securities |

| | | | International Fixed- Income (Un-Hedged) |

| | | | Emerging Markets Fixed-Income |

Jennison Associates LLC (Jennison) | | | Global Infrastructure |

QMA | | | Long/Short Market Neutral |

| | | | Overlay |

Mellon Capital Management Corporation (Mellon Capital) | | | Global Tactical Asset Allocation |

First Quadrant, L.P. | | | Global Macro |

AlphaSimplex Group LLC | | | Hedge Fund Replication |

Commodities (Bache). Bache will seek to track the performance of the Bache Commodity IndexSM (the BCISM), a dynamic, long-only measure of the price behavior of various commodities traded in major exchanges worldwide. The primary objective of the BCISM is to provide broad-based exposure to global commodity markets. There are additional objectives of the BCI'sSM dynamic asset allocation methodology.

The first of these additional objectives is to provide broad, long-term diversified exposure to individual commodities within each major commodity sector (i.e., energy, metals, and agriculture) consistent with their overall importance to that sector as well as their market liquidity. The second additional objective is to ensure that the BCISM does not become dominated by a single commodity sector or by several commodities within a commodity sector. This is accomplished by employing upper and lower bounds on the market and commodity weights, and by frequent rebalancings of the weights of the individual commodities that comprise the BCISM . The third objective is to moderate the volatility inherent in the major commodity market sectors. This is accomplished by considering the optimized weights derived from the risk/return profiles of mean-variance efficient portfolios that can be created with the three major commodity sectors. Additional risk reduction factors considered in the BCISM methodology include systematically: (i) reducing near-term exposure to commodity markets that are experiencing price declines and increasing allocations to cash and cash equivalents and (ii) reducing the pricing impact that BCISM -linked investment products will have on the underlying commodity markets. This is accomplished through a precise roll methodology. Lastly, given the dynamic nature of commodity markets, overall construction of the BCISM is monitored by an advisory committee. The advisory committee, which meets annually (and otherwise as necessary), may recommend changes in BCISM components as well as its methodology. The methodology of, and intellectual property rights in, the Bache Commodity IndexSM are proprietary to, and owned by, PFDS Holdings, LLC, a Prudential Financial company.

Inflation-Indexed Securities (PIMCO). Under normal circumstances, PIMCO will invest at least 80% of the net assets attributable to this investment category in inflation-indexed bonds of varying maturities issued by the U.S. government and non-U.S. governments, their agencies or instrumentalities, and corporations, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. Assets not invested in inflation-indexed bonds may be invested in other types of fixed income instruments. Inflation-indexed bonds are fixed income securities that are structured to provide protection against inflation. The value of the bond's principal or the interest income paid on the bond is adjusted to track changes in an official inflation measure. The U.S. Treasury uses the Consumer Price Index for Urban Consumers as the inflation measure. Inflation-indexed bonds issued by a foreign government are generally adjusted to reflect a comparable inflation index, calculated by that government. "Real return" equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure. Effective duration takes into account that for certain bonds expected cash flows will fluctuate as interest rates change and is defined in nominal yield terms, which is market convention for most bond investors and managers. Durations for real return bonds, which are based on real yields, are converted to nominal durations through a conversion factor, typically between 20% and 90% of the respective real duration. All security holdings will be measured in effective (nominal) duration terms. Similarly, the effective duration of the Barclays Capital U.S. TIPS Index will be calculated using the same conversion factors. The effective duration of the assets attributable to this investment category will normally vary within three years (plus or minus) of the duration of the Barclays Capital U.S. TIPS Index.

PIMCO will invest the assets attributable to this investment category primarily in investment grade securities, but may invest up to 10% of the total assets attributable to this investment category in high yield securities ("junk bonds") rated B or higher by Moody's, or equivalently rated by S&P or Fitch, or, if unrated, determined by PIMCO to be of comparable quality. PIMCO also may invest up to 80% of the total assets attributable to this investment category in securities denominated in foreign currencies, and may invest beyond this limit in U.S. dollar denominated securities of foreign issuers. PIMCO may invest up to 10% of the total assets attributable to this investment category in securities and instruments that are economically tied to emerging market countries. PIMCO will normally limit the foreign currency exposure (from non- U.S. dollar-denominated securities or currencies) for this investment category to 20% of its total assets. PIMCO may concentrate the assets attributable to this investment category in a relatively small number of issuers.

PIMCO may all of the assets attributable to this investment category in derivative instruments, such as options, futures contracts or swap agreements, or in mortgage- or asset-backed securities. PIMCO may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as buy backs or dollar rolls). Also, PIMCO may invest up to 10% of the total assets attributable to this investment category in preferred stocks.

Global Infrastructure (Jennison). The Jennison Global Infrastructure strategy is a multi-cap, core strategy with an absolute return focus. This strategy focuses on investments in infrastructure companies and infrastructure-related companies located throughout the world. Infrastructure companies are involved in providing the foundation of basic services, facilities and institutions upon which the growth and development of a community depends. Infrastructure-related companies include wireless telecom firms that may or may not own the tower and companies involved in transport (shipping and trucking), construction, equipment manufacturing, and materials and aggregates. Assets held by infrastructure companies and infrastructure-related companies may include toll roads, airports, rail track, shipping ports, telecom infrastructure, hospitals, schools and utilities such as electricity, gas distribution networks and water. While Jennison believes its proprietary, fundamental research is critical for successful stock selection, Jennison also focuses on macroeconomic trends that may affect the companies in which it invests.

Long/Short Market Neutral (QMA). QMA's Long/Short Market Neutral strategy will use an objective, quantitative approach designed to exploit persistent mispricings among stocks and other related securities. The objective of this investment strategy is to provide consistent performance that is uncorrelated with the performance of the stock market. The portfolio holdings for this investment strategy will consist primarily of a broad universe of stocks. In general, this investment strategy will have long positions in companies that QMA deems relatively attractive and short positions in companies that QMA deems relatively unattractive, while also managing the overall risk of the assets attributable to this investment strategy.

Global Tactical Asset Allocation (Mellon Capital). This investment strategy will seek total return. To pursue this goal, Mellon Capital will normally utilize long and short positions in futures, options, or forward contracts to achieve timely and cost-effective investment exposure to global equity, bond, and currency markets, and in fixed-income securities. Mellon Capital will focus its investments among the major developed capital markets of the world, such as the U.S., Canada, Japan, Australia, and Western Europe. Mellon Capital will ordinarily invest in at least three countries. Although this strategy will focus on the world's major developed capital markets, Mellon Capital may invest up to 20% of the assets attributable to this investment strategy in emerging market countries. Mellon Capital also will invest in fixed-income securities, such as bonds, notes and money market instruments, to provide exposure to bond markets and for liquidity and income.

Mellon Capital's portfolio management team will seek to deliver alpha by applying a systematic, quantitative investment approach designed to identify and exploit relative misvaluations across and within global capital markets. Alpha is a measure of the risk-adjusted performance of an investment that factors in the individual risk of the security and not overall market risk. Alpha is often described as "stock specific return." Active investment decisions to take long or short positions in individual country, equity, bond, and currency markets are driven by this quantitative investment process and seek to capitalize on alpha generating opportunities within and among the major developed capital markets of the world. Mellon Capital's portfolio management team will analyze the valuation signals and estimate the expected returns from distinct sources of alpha—country equity markets, country bond markets, stock versus bond markets, and currency allocation—to construct a portfolio of long and short positions allocated across individual country, equity, bond, and currency markets. Because there is generally no limitation as to the amount of assets that are required to be invested in any one asset class, the holdings for this investment strategy generally will not have the same characteristics as the benchmark index that Mellon Capital will generally use to evaluate investment performance.

Global Macro (First Quadrant). This is a global macro strategy that seeks to add value through a risk controlled, disciplined, active quantitative investment process. The strategy invests in five independent alpha categories (comprised of 26 largely uncorrelated strategies)

that are long/short and span a wide variety of asset classes. Global Macro tactically allocates risk between the different categories of the strategy to take advantage of inefficiencies when there is the greatest opportunity for gains.

The five alpha-categories are:

- Global Asset Class Selection

- Stock Country Selection

- Bond Country Selection

- Currency Selection

- Volatility Management

Hedge Fund Replication (AlphaSimplex). AlphaSimplex seeks to achieve long and short exposure to global equity, bond, currency and commodity markets through a wide range of derivative instruments and direct investments. Under normal market conditions, AlphaSimplex typically will make extensive use of derivative instruments, in particular futures and forward contracts on global equity and fixed-income securities, securities indices (including both broad- and narrow-based securities indices), currencies, commodities and other instruments. These investments are intended to provide risk and return characteristics similar to those of a diversified portfolio of hedge funds.

AlphaSimplex seeks to generate absolute returns over time rather than track the performance of any particular index of hedge fund returns. In selecting investments, AlphaSimplex uses quantitative models to estimate the market exposures that drive the aggregate returns of a diverse set of hedge funds. These market exposures may include, for example, exposures to the returns of stocks, fixed-income securities (including U.S. and non-U.S. government securities), currencies and commodities. In estimating these market exposures, AlphaSimplex analyzes the returns of hedge funds included in one or more commercially available databases (for example, the Lipper TASS hedge fund database), and seeks to use a variety of derivative instruments to capture such exposures in the aggregate while adding value through dynamic allocation among market exposures and volatility management. AlphaSimplex will have great flexibility to allocate the strategy's derivatives exposure among various securities, indices, currencies, commodities and other instruments, and the amount of the assets that may be allocated to derivative strategies and among these various instruments is expected to vary over time. Whereas AlphaSimplex will not invest directly in hedge funds, it may invest in non-U.S. securities and instruments and securities and instruments traded outside the United States and expects to engage in non-U.S. currency transactions.

AlphaSimplex may engage in active and frequent trading of securities and other instruments. Frequent trading may produce high transaction costs, which may lower the strategy's return. As a temporary defensive measure, AlphaSimplex may hold any portion of its assets in cash and/or invest in money market instruments or high quality debt securities and take other defensive positions as it deems appropriate. AlphaSimplex may miss certain investment opportunities if it uses defensive strategies and thus may not achieve its investment goal.

Overlay (QMA). Up to approximately 10% of the Portfolio's net assets will be allocated to the Overlay investment category subadvised by QMA. Up to approximately 50% of the assets attributable to this investment category will be used to take long and short positions in ETFs, exchange-traded notes, various futures contracts and other publicly-traded securities. QMA will analyze the publicly available holdings of the Portfolio and use a top-down approach to establish long and short tactical allocations among various components of the capital markets, including equities, fixed-income, and non-traditional assets. As such, this portion of the Overlay investment category is intended to function as an overlay for the entire Portfolio. The remaining assets attributable to this investment category may be allocated to: (i) index futures, other futures contracts, ETFs, and options thereon to provide liquid exposure to their respective equity and fixed-income benchmark indices and (ii) cash, money market equivalents, short-term debt instruments, money market funds, and short-term debt funds to satisfy all applicable margin requirements for the futures contracts and to provide additional portfolio liquidity to satisfy large-scale redemptions and any variation margin calls with respect to the futures contracts.

It is currently expected that exposure to some or all of the remaining non-traditional investment categories and strategies will be obtained through investments in Underlying Non-Prudential Portfolios. A general description of funds that pursue these types of investment strategies is provided below. The Investment Managers from time to time may: (i) seek exposure to additional non-traditional investment categories or strategies or (ii) retain additional Subadvisers to directly manage Portfolio assets to gain exposure to the then-available non-traditional investment categories or strategies. The Fund may, with Board approval, enter into or amend agreements with unaffiliated Subadvisers without shareholder approval pursuant to an exemptive order received by the Investment Managers and the Fund.

Long/Short Equity. Long/Short Equity funds invest on both long and short sides of equity markets, generally focusing on diversifying or hedging across particular sectors, regions, or market capitalizations. Fund managers generally have the flexibility to shift from value to growth investment styles; small to medium to large capitalization stocks; and net long to net short positions. Fund managers can also trade equity futures and options as well as equity related securities and debt or build portfolios that are more concentrated in sectors and/or industries than traditional long-only equity funds. Long/Short Equity funds generally tend to be more exposed to market risk (i.e., have a higher beta) than Long/Short Market Neutral funds.

Event Driven. Event Driven funds invest in various asset classes and seek to profit from the potential mispricing of securities related to a specific corporate or market event. Such events may include: mergers, bankruptcies, financial or operational stress, restructurings, asset sales, recapitalizations, spin-offs, litigation, regulatory and legislative changes as well as other types of corporate events. Event Driven funds can invest in equities, fixed-income instruments (e.g., investment grade debt, high-yield debt, bank debt, and convertible debt) options and various other derivatives. Many fund managers use a combination of strategies and adjust exposures based on the opportunity sets in each sub-sector.

Distressed Debt. Event Driven funds that focus on distressed situations invest across the capital structure of companies subject to financial or operational distress or bankruptcy proceedings. Such distressed securities tend to trade at substantial discounts to intrinsic value due to difficulties in assessing their proper value, lack of research coverage, or an inability of traditional investors to continue holding them. This strategy is generally long-biased in nature, but fund managers may take outright long, hedged, or outright short positions. The managers of distressed debt funds typically attempt to profit on the issuer's ability to improve its operation or the success of the bankruptcy process that ultimately leads to an exit strategy.

Currencies. Currency funds make investments that provide long and/or short exposure to selected currencies, including the U.S. dollar. These funds may actually hold currencies or gain long or short exposure to currencies through the use of options contracts and Other Investments.

Private Equity. Private equity funds make investments in private companies (or private investments in public companies) in connection with the organization or restructuring of companies, including so-called leveraged buy-outs and management buy-outs.

Investments in Underlying Portfolios. Under normal conditions, the Portfolio will invest approximately 65% of its assets in Underlying Trust Funds. An additional portion of the Portfolio's may be invested in Underlying Fund Portfolios and Underlying Non-Prudential Funds to the extent the Investment Managers and QMA would like to gain exposure to certain asset classes or investment strategies but the Investment Managers have not retained a Subadviser to directly manage Portfolio assets for those asset classes or investment strategies.

Strategic Allocations and Asset Allocation Ranges. Under normal circumstances, the Portfolio's assets agre generally allocated in accordance with the strategic allocations and approximate asset allocation ranges set forth in the table below. Such strategic allocations and asset allocation ranges are approximate and subject to change from time to time.

The Academic Strategies Portfolio may not invest in Other Investments until issuance of the requested exemptive relief or adoption of final rules by the SEC. To the extent a New Subadviser's investment strategy relies on the use of Other Investments to a significant extent, the New Subadviser may not be able to implement that investment strategy, in whole or in part, prior to the issuance of the requested exemptive relief or the adoption of final rules by the SEC. In that event, the Investment Managers may: (i) have the New Subadviser implement that strategy in part; (ii) invest Portfolio assets in Underlying Trust Funds or Underlying Non-Prudential Funds in an attempt to (a) replicate that New Subadviser's investment strategy, (b) replicate exposure to the relevant asset class, or (c) provide exposure to different investment strategies or different asset classes; and/or (iii) increase the portion of the Portfolio's assets that are allocated to another New Subadviser.

| | | Minimum Exposure | Strategic Allocation | Maximum Exposure |

Domestic Equity | | 10% | 20% | 30% |

International Equity | | 10% | 20% | 30% |

Fixed-Income | | 20% | 25% | 35% |

Real Estate | | 0% | 10% | 20% |

Commodities | | 5% | 10% | 15% |

Alternative Investments | | 5% | 15% | 25% |

AST Advanced Strategies Portfolio

Investment Objective: to seek a high level of absolute return by using traditional and non-traditional investment strategies and by investing in domestic and foreign equity and fixed-income securities, derivative instruments and exchange-traded funds.

Principal Investment Policies and Risks:

General. QMA allocates the net assets of the Portfolio across different investment categories and different Subadvisers. QMA also directly manages a portion of the assets of the Portfolio. Certain investment categories will contain sub-categories. The Subadviser for a category or sub-category will employ a specific investment strategy for that category or sub-category.

QMA employs a two-tiered approach to allocating Portfolio assets across the various investment categories, sub-categories, and the Subadvisers. First, QMA will analyze the macro-economic landscape, the capital markets, and the related implications for investment strategy. Second, PI draws on its understanding of the strategies used by the other Subadvisers to determine which advisers are expected to perform best under the prevailing macro-economic landscape. The allocations will be reviewed by QMA periodically and may be altered or adjusted by QMA without prior notice. Such adjustments will be reflected in the annual update to the prospectus.

The Portfolio may use derivative instruments to gain exposure to certain commodity and real estate related indices. The Portfolio may engage in short sales and may invest in fixed-income securities that are rated below investment grade by the major ratings services (Ba or lower by Moody's Investors Service, Inc., or equivalently rated by Standard & Poor's Ratings Services, or Fitch Ratings Ltd., or, if unrated, considered to be of comparable quality, in connection with these investment strategies. Fixed-income debt obligations rated below investment grade by the major ratings services or, if unrated, considered to be of comparable quality, are commonly referred to as "junk bonds" and are regarded as having predominantly speculative characteristics with respect to capacity to pay principal and interest. The Portfolio is prohibited from investing more than 10% of its total assets in other mutual funds, including exchange traded funds.

Overall, the Advanced Strategies Portfolio will pursue a combination of traditional and non-traditional investment strategies. It is expected that the approximate allocation across the various investment categories, sub-categories, and investment advisers will be as follows:

Investment Subadviser | Approximate Allocation | Investment Category | Sub-category |

Marsico Capital Management LLC | 17.00% | U.S. Large-Cap Growth | N/A |

T. Rowe Price Associates, Inc. | 17.00% | U.S. Large-Cap Value | N/A |

William Blair & Company LLC | 8.50% | International Growth | N/A |

LSV Asset Management | 8.50% | International Value | N/A |

Pacific Investment Management Company LLC (PIMCO) | 12.75% | U.S. Fixed-Income | N/A |

PIMCO | 8.50% | Hedged International Bond | Developed Markets |

PIMCO | 4.25% | | Emerging Markets |

PIMCO | 2.84% | Advanced Strategies I | Commodities Real Return |

PIMCO | 2.83% | | Real Return |

PIMCO | 2.83% | | Real Estate Real Return |

QMA | 15.00% | Advanced Strategies II | N/A |

TOTAL | 100.00% | | |

The asset allocation generally provides for an allotment of approximately 60% of Portfolio assets to a combination of domestic and international equity strategies and an allotment of approximately 40% of Portfolio assets to a combination of U.S. fixed-income, hedged international bond, real return and exchange-traded fund investment strategies. The Portfolio will use derivative instruments to gain exposure to certain commodity and real estate related indices along with high yield bonds (also referred to as "junk" bonds) in connection with these investment strategies. The asset allocations described above are subject to change at any time without notice at the sole discretion of the Investment Managers.

Description of Traditional Investment Categories and Sub-categories. The investment categories and sub-categories for which the applicable Subadvisers will pursue traditional investment strategies include the following:

- U.S. Large-Cap Growth;

- U.S. Large-Cap Value;

- International Growth;

- International Value;

- U.S. Fixed-Income; and

- Hedged International Bond

- Developed Markets sub-category

- Emerging Markets sub-category

Brief descriptions of the investment strategies to be used by the Subadvisers are set forth below:

U.S. Large-Cap Growth (Marsico). Marsico will invest primarily in the common stocks of large U.S. companies (typically companies that have a market capitalization in the range of $5 billion or more) that are selected for their growth potential. Marsico will normally hold a core position of between 35 and 50 common stocks. Marsico also may invest up to 15% of the assets attributable to this investment category in foreign securities, which are those securities denominated in a foreign currency. American Depositary Receipts (ADRs) may be purchased for the Portfolio and will not be considered foreign securities for the purposes of the 15% limitation stated above. In selecting investments for the Portfolio, Marsico uses an approach that combines "top-down" macro-economic analysis with "bottom-up" stock selection.

The "top-down" approach may take into consideration macro-economic factors such as, without limitation, interest rates, inflation, demographics, the regulatory environment, and the global competitive landscape. In addition, Marsico may also examine other factors that may include, without limitation, the most attractive global investment opportunities, industry consolidation, and the sustainability of financial trends observed. As a result of the "top-down" analysis, Marsico seeks to identify sectors, industries and companies that may benefit from the overall trends Marsico has observed. Marsico then looks for individual companies or securities with earnings growth potential that may not be recognized by the market at large. In determining whether a particular company or security may be a suitable investment, Marsico may focus on any of a number of different attributes that may include, without limitation, the company's specific market expertise or dominance; its franchise durability and pricing power; solid fundamentals (e.g., a strong balance sheet, improving returns on equity, the ability to generate free cash flow, apparent use of conservative accounting standards, and transparent financial disclosure); strong and ethical management; commitment to shareholder interests; reasonable valuations in the context of projected growth rates; and other indications that a company or security may be an attractive investment prospect. This process is called "bottom-up" stock selection. As part of this fundamental, "bottom-up" research, Marsico may visit with various levels of a company's management, as well as with its customers and (as relevant) suppliers, distributors, and competitors. Marsico also may prepare detailed earnings and cash flow models of companies. These models may assist Marsico in projecting potential earnings growth and other important company financial characteristics under different scenarios. Each model is typically customized to follow a particular company and is generally intended to replicate and describe a company's past, present and potential future performance. The models may include quantitative information and detailed narratives that reflect updated interpretations of corporate data and company and industry developments.

Marsico may reduce or sell portfolio securities if, in its opinion, a company's fundamentals change substantially, its stock price appreciates excessively in relation to fundamental earnings growth prospects, the company appears not to realize its growth potential, or there are more attractive investment opportunities elsewhere.