UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-05188 |

| | |

| AMERICAN CENTURY VARIABLE PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 12-31 |

| | |

| Date of reporting period: | 12-31-2016 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| | |

| | Annual Report |

| | |

| | December 31, 2016 |

| | |

| | VP Balanced Fund |

|

| | |

| Performance | 2 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

|

| | | | | | |

| Total Returns as of December 31, 2016 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Class I | AVBIX | 6.99% | 8.49% | 5.49% | — | 5/1/91 |

| Blended Index | — | 8.31% | 9.69% | 6.21% | — | — |

| S&P 500 Index | — | 11.96% | 14.64% | 6.94% | — | — |

| Bloomberg Barclays U.S. Aggregate Bond Index | — | 2.65% | 2.23% | 4.34% | — | — |

| Class II | AVBTX | — | — | — | 4.67% | 5/2/16 |

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived. The blended index combines monthly returns of two widely known indices in proportion to the asset mix of the fund. The S&P 500 Index represents 60% of the index and the remaining 40% is represented by the Bloomberg Barclays U.S. Aggregate Bond Index.

The performance information presented does not include charges and deductions imposed by the insurance company separate account under the variable annuity or variable life insurance contracts. The inclusion of such charges could significantly lower performance. Please refer to the insurance company separate account prospectus for a discussion of the charges related to insurance contracts.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-6488 or visit ipro.americancentury.com (for Investment Professionals). For additional information about the fund, please consult the prospectus.

|

|

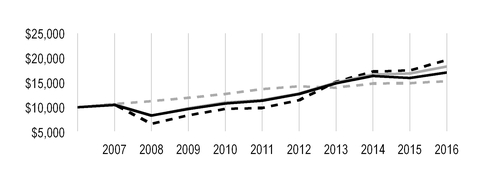

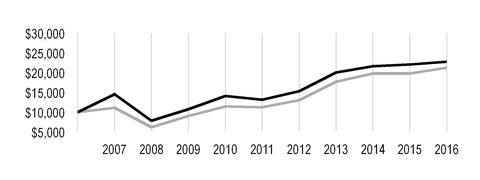

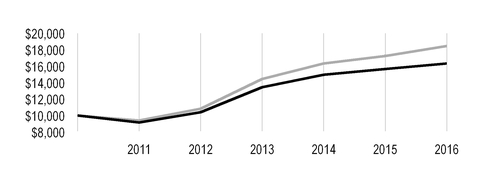

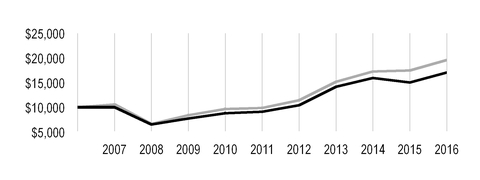

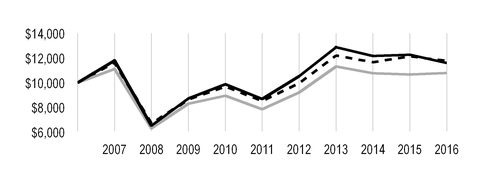

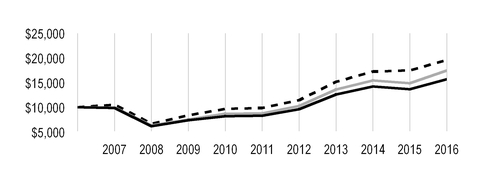

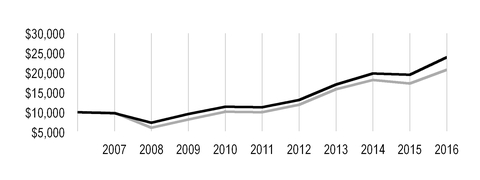

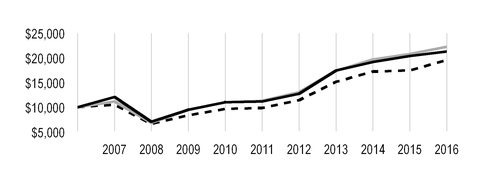

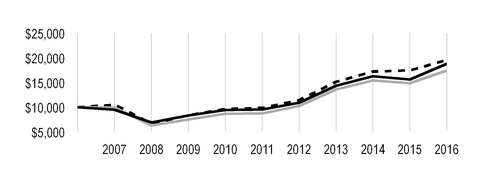

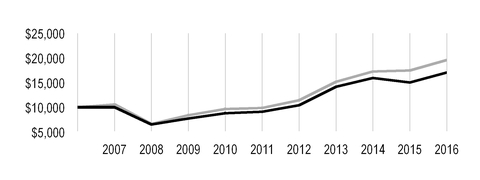

| Growth of $10,000 Over 10 Years |

| $10,000 investment made December 31, 2006 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on December 31, 2016 |

| | Class I — $17,066 |

| |

| | Blended Index — $18,268 |

| |

| | S&P 500 Index — $19,572 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $15,300 |

| |

Ending value of Class I would have been lower if a portion of the fees had not been waived.

|

| |

| Total Annual Fund Operating Expenses |

| Class I | Class II |

| 0.91% | 1.16% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-6488 or visit ipro.americancentury.com (for Investment Professionals). For additional information about the fund, please consult the prospectus.

Equity Portfolio Managers: Claudia Musat and Steven Rossi

Fixed-Income Portfolio Managers: Dave MacEwen, Bob Gahagan, and Brian Howell

In May 2016, portfolio manager Bill Martin left the fund's management team, as an equity portfolio manager. In November 2016, Steven Rossi joined the fund's management team, as an equity portfolio manager.

Performance Summary

VP Balanced returned 6.99%* for the fiscal year ended December 31, 2016. By comparison, the fund’s benchmark (a blended index consisting of 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index) returned 8.31%. The equity portion of VP Balanced underperformed its benchmark, while the fixed-income component slightly outperformed the broad bond market (11.96% return of the S&P 500 Index, and 2.65% return of the Bloomberg Barclays U.S. Aggregate Bond Index).

Energy Stocks Leading Equity Detractors

Investments in the energy sector were a main driver of underperformance, particularly choices among oil, gas, and consumable fuels holdings. Leading detractors included CVR Energy, a portfolio-only investment, which fell on overall sector declines as the price of oil trended downward during the first three months of the fiscal year. The petroleum refiner and nitrogen fertilizer manufacturer’s stock price came under further pressure following a larger-than-predicted loss in the fourth-quarter of 2015, which was reported in 2016’s first quarter. An overweight position, relative to the benchmark, in Tesoro, another oil refiner, also weighed on sector results. The company’s low refining margins, which were attributed to unplanned downtime at its Los Angeles refinery, led to a fourth-quarter 2015 earnings miss, which was reported in January 2016. We eliminated our holding of CVR Energy as it no longer met the fund’s investment criteria. We also no longer hold Tesoro as its growth and quality scores declined significantly.

Financials holdings also pressured relative gains. Our underweight in banks was the key factor driving underperformance in the sector. For example, the portfolio was underweight Bank of America and JPMorgan Chase. The results of November’s presidential election caused bank stocks to soar, reflecting the sharp post-election rise in interest rates and Trump’s vow to deregulate banking and cut taxes. Our positioning is justified given that the growth, quality, and sentiment profile of both companies remains weak.

The real estate sector was also an area of relative weakness, especially positioning in real estate management and development companies. Our portfolio-only allocation to commercial real estate services firm Jones Lang LaSalle was a leading detractor. Concerns that the commercial real estate business is near another peak weighed on the shares. In addition, the company’s earnings for 2015’s fourth quarter fell short of expectations, largely due to foreign currency headwinds, as more than half the company’s revenues are sourced outside the U.S. We subsequently exited the position as the company’s growth, sentiment, and quality factors weakened considerably.

Information Technology Stocks Led Relative Equity Contributors

The leading contribution to relative results came from the information technology sector, thanks to positioning in the semiconductor industry and stock selection among software and IT services

*All fund returns referenced in this commentary are for Class I shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Class I performance exceeds that of the fund's benchmark, other share classes may not. See page 2 for returns for all share classes.

firms. An overweight position in Applied Materials benefited results. The semiconductor maker beat earnings-per-share estimates in its second and third fiscal quarters. Management also provided an upbeat outlook. A portfolio-only position in VMware, a provider of virtualization infrastructure solutions, also added value. The shares rallied after the company’s earnings and revenues repeatedly exceeded analyst estimates. Management also raised its full-year guidance. We continue to favor both stocks based on their attractive measures across all profiles.

Investments in the materials sector also benefited relative performance. In metals and mining, Newmont Mining was a top contributor. The gold and silver miner benefited from rising precious metals prices. We maintain our positioning in Newmont due to its strong quality, sentiment, and growth scores.

Strong stock selection in consumer discretionary also aided results, particularly among specialty retailers. An overweight in consumer electronics chain Best Buy was a leading contributor. The shares rallied strongly in August and November driven by better-than-forecast earnings and revenues in its second and third fiscal quarters. Management’s earnings guidance throughout the year was also positive. We maintain our position in Best Buy based on its strong scores across all profiles.

Fixed-Income Portion Advanced

In fixed income, 2016 provided a favorable environment for U.S. bonds for the first nine months, starting with the stock and oil market volatility during the first six weeks of the year and extending after Brexit (the U.K.’s vote to leave the European Union). Expectations that the Federal Reserve (the Fed) would follow its interest rate hike in December 2015 with more rate hikes in 2016 were quickly replaced with uncertainty about when the Fed would move again. Meanwhile, other major central banks in Europe and Japan continued to apply monetary stimulus to their stagnant economies, pushing their interest rates into negative territory and keeping an effective lid on global rates. The resulting very low non-U.S. yields drove demand for relatively higher U.S. yields, boosting U.S. bond performance for much of the year. That began to change in October, as Fed rate hike expectations returned on signs of global economic stabilization and as the U.S. exhibited signs of stronger growth and higher inflation. U.S. government bonds later sold off sharply following the election of Donald Trump, whose policy proposals further raised growth and inflation expectations, but the sell-off wasn’t enough to completely erase earlier U.S. bond index gains for the year. The fixed income portfolio largely tracked its benchmark index, and benefited in particular from a non-index overweight in BB-rated corporate bonds, which outperformed the broad market.

Outlook

Growth expectations have improved in the U.S., the U.K., and the eurozone, which has been reflected in recent market performance. However, post-election risks remain. The U.K.’s exit from the European Union has been delayed and most of Trump’s proposals are still being processed and debated. How they, and other changes from populist movements, actually play out remains to be seen. It is possible that increased government spending and tax cuts in an economy that already features a tightening labor market and significant monetary stimulus could push growth higher. The global impact of a stronger dollar and higher tariffs could offset other U.S. economic benefits from Trump’s proposals. The prospect of rising interest rates also creates economic risks. Higher rates could impact consumer and corporate borrowing and spending behavior. For example, there are signs the housing market may have peaked for this cycle. We believe that our disciplined, objective, and systematic investment strategy, for both the equity and fixed-income components of the portfolio, is particularly beneficial during periods of volatility. We adhere to our process regardless of the market environment, allowing us to take advantage of opportunities presented by market inefficiencies.

|

| |

| DECEMBER 31, 2016 |

| Top Ten Common Stocks | % of net assets |

| Apple, Inc. | 2.0% |

| Alphabet, Inc., Class A | 2.0% |

| Microsoft Corp. | 1.9% |

| Amazon.com, Inc. | 1.4% |

| Facebook, Inc., Class A | 1.2% |

| Citigroup, Inc. | 1.1% |

| Exxon Mobil Corp. | 1.1% |

| Intel Corp. | 1.0% |

| PepsiCo, Inc. | 1.0% |

| Merck & Co., Inc. | 1.0% |

| | |

| Top Five Common Stocks Industries | % of net assets |

| Software | 3.8% |

| Internet Software and Services | 3.2% |

| Biotechnology | 3.1% |

| Semiconductors and Semiconductor Equipment | 2.9% |

| Health Care Equipment and Supplies | 2.8% |

| | |

| Key Fixed-Income Portfolio Statistics |

| Average Duration (effective) | 5.9 years |

| Weighted Average Life | 7.9 years |

| | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 58.3% |

| Exchange-Traded Funds | 0.6% |

| Total Equity Exposure | 58.9% |

| U.S. Treasury Securities | 14.1% |

| Corporate Bonds | 12.2% |

| U.S. Government Agency Mortgage-Backed Securities | 10.3% |

| Collateralized Mortgage Obligations | 1.9% |

| Commercial Mortgage-Backed Securities | 1.8% |

| Asset-Backed Securities | 1.3% |

| U.S. Government Agency Securities | 0.5% |

| Municipal Securities | 0.5% |

| Sovereign Governments and Agencies | 0.5% |

| Temporary Cash Investments | 3.0% |

| Other Assets and Liabilities | (5.0)%* |

*Amount relates primarily to payable for investments purchased, but not settled, at period end.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2016 to December 31, 2016.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

7/1/16 | Ending

Account Value

12/31/16 | Expenses Paid

During Period(1)

7/1/16 - 12/31/16 | Annualized

Expense Ratio(1) |

| Actual |

| Class I (after waiver) | $1,000 | $1,038.00 | $4.15 | 0.81% |

| Class I (before waiver) | $1,000 | $1,038.00(2) | $4.61 | 0.90% |

| Class II (after waiver) | $1,000 | $1,036.70 | $5.43 | 1.06% |

| Class II (before waiver) | $1,000 | $1,036.70(2) | $5.89 | 1.15% |

| Hypothetical | | | | |

| Class I (after waiver) | $1,000 | $1,021.06 | $4.12 | 0.81% |

| Class I (before waiver) | $1,000 | $1,020.61 | $4.57 | 0.90% |

| Class II (after waiver) | $1,000 | $1,019.81 | $5.38 | 1.06% |

| Class II (before waiver) | $1,000 | $1,019.36 | $5.84 | 1.15% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. |

| |

| (2) | Ending account value assumes the return earned after waiver and would have been lower if a portion of the fees had not been waived. |

DECEMBER 31, 2016

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| COMMON STOCKS — 58.3% | | | |

| Aerospace and Defense — 1.5% | | | |

| Boeing Co. (The) | | 6,881 |

| $ | 1,071,234 |

|

| United Technologies Corp. | | 8,727 |

| 956,654 |

|

| | | | 2,027,888 |

|

| Airlines — 1.2% | | | |

Hawaiian Holdings, Inc.(1) | | 5,706 |

| 325,242 |

|

JetBlue Airways Corp.(1) | | 22,998 |

| 515,615 |

|

United Continental Holdings, Inc.(1) | | 11,552 |

| 841,910 |

|

| | | | 1,682,767 |

|

| Auto Components — 0.6% | | | |

| LCI Industries | | 633 |

| 68,206 |

|

| Lear Corp. | | 5,330 |

| 705,532 |

|

| | | | 773,738 |

|

| Automobiles — 0.4% | | | |

| Ford Motor Co. | | 50,169 |

| 608,550 |

|

| Banks — 2.5% | | | |

| Bank of America Corp. | | 10,775 |

| 238,128 |

|

| BB&T Corp. | | 16,866 |

| 793,039 |

|

| Citigroup, Inc. | | 25,594 |

| 1,521,051 |

|

| East West Bancorp, Inc. | | 916 |

| 46,560 |

|

| JPMorgan Chase & Co. | | 5,815 |

| 501,776 |

|

| Wells Fargo & Co. | | 5,859 |

| 322,890 |

|

| | | | 3,423,444 |

|

| Beverages — 1.0% | | | |

| Coca-Cola Co. (The) | | 1,794 |

| 74,379 |

|

| PepsiCo, Inc. | | 12,968 |

| 1,356,842 |

|

| | | | 1,431,221 |

|

| Biotechnology — 3.1% | | | |

| AbbVie, Inc. | | 17,351 |

| 1,086,520 |

|

| Amgen, Inc. | | 8,064 |

| 1,179,037 |

|

Biogen, Inc.(1) | | 3,322 |

| 942,053 |

|

Celgene Corp.(1) | | 3,703 |

| 428,622 |

|

| Gilead Sciences, Inc. | | 8,640 |

| 618,710 |

|

| | | | 4,254,942 |

|

| Building Products — 0.7% | | | |

| Owens Corning | | 14,371 |

| 740,969 |

|

USG Corp.(1) | | 8,398 |

| 242,534 |

|

| | | | 983,503 |

|

| Capital Markets — 1.8% | | | |

| Eaton Vance Corp. | | 14,050 |

| 588,414 |

|

| Evercore Partners, Inc., Class A | | 4,265 |

| 293,006 |

|

| Franklin Resources, Inc. | | 9,254 |

| 366,273 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Goldman Sachs Group, Inc. (The) | | 4,544 |

| $ | 1,088,061 |

|

| State Street Corp. | | 2,893 |

| 224,844 |

|

| | | | 2,560,598 |

|

| Chemicals — 2.0% | | | |

| Air Products & Chemicals, Inc. | | 6,037 |

| 868,241 |

|

| Cabot Corp. | | 13,129 |

| 663,540 |

|

| Celanese Corp. | | 1,533 |

| 120,709 |

|

| Dow Chemical Co. (The) | | 12,941 |

| 740,484 |

|

| E.I. du Pont de Nemours & Co. | | 3,751 |

| 275,323 |

|

| Monsanto Co. | | 1,170 |

| 123,096 |

|

| | | | 2,791,393 |

|

| Communications Equipment — 0.5% | | | |

| Cisco Systems, Inc. | | 24,292 |

| 734,104 |

|

| Construction and Engineering — 0.1% | | | |

AECOM(1) | | 4,466 |

| 162,384 |

|

| Diversified Financial Services — 0.4% | | | |

Berkshire Hathaway, Inc., Class B(1) | | 3,422 |

| 557,718 |

|

| Diversified Telecommunication Services — 0.6% | | | |

| AT&T, Inc. | | 14,707 |

| 625,489 |

|

| Verizon Communications, Inc. | | 4,614 |

| 246,295 |

|

| | | | 871,784 |

|

| Electric Utilities — 0.3% | | | |

| PPL Corp. | | 11,407 |

| 388,408 |

|

| Electrical Equipment — 0.4% | | | |

| Eaton Corp. plc | | 7,892 |

| 529,474 |

|

| Energy Equipment and Services — 1.4% | | | |

| Baker Hughes, Inc. | | 11,488 |

| 746,375 |

|

Dril-Quip, Inc.(1) | | 5,681 |

| 341,144 |

|

FMC Technologies, Inc.(1) | | 22,120 |

| 785,924 |

|

| Rowan Cos. plc | | 4,811 |

| 90,880 |

|

| | | | 1,964,323 |

|

| Equity Real Estate Investment Trusts (REITs) — 0.9% | | | |

| American Tower Corp. | | 7,575 |

| 800,526 |

|

| Lamar Advertising Co., Class A | | 1,051 |

| 70,669 |

|

| WP Carey, Inc. | | 5,521 |

| 326,236 |

|

| | | | 1,197,431 |

|

| Food and Staples Retailing — 1.2% | | | |

| CVS Health Corp. | | 3,854 |

| 304,119 |

|

| Wal-Mart Stores, Inc. | | 16,581 |

| 1,146,079 |

|

| Walgreens Boots Alliance, Inc. | | 1,829 |

| 151,368 |

|

| | | | 1,601,566 |

|

| Food Products — 1.5% | | | |

| General Mills, Inc. | | 2,055 |

| 126,937 |

|

| Hormel Foods Corp. | | 18,851 |

| 656,203 |

|

| Ingredion, Inc. | | 4,533 |

| 566,444 |

|

| J.M. Smucker Co. (The) | | 562 |

| 71,970 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Tyson Foods, Inc., Class A | | 11,217 |

| $ | 691,865 |

|

| | | | 2,113,419 |

|

| Gas Utilities — 0.4% | | | |

| ONE Gas, Inc. | | 4,098 |

| 262,108 |

|

| Southwest Gas Corp. | | 2,984 |

| 228,634 |

|

| | | | 490,742 |

|

| Health Care Equipment and Supplies — 2.8% | | | |

| Becton Dickinson and Co. | | 4,511 |

| 746,796 |

|

Boston Scientific Corp.(1) | | 19,487 |

| 421,504 |

|

| C.R. Bard, Inc. | | 1,606 |

| 360,804 |

|

| Danaher Corp. | | 8,801 |

| 685,070 |

|

Hologic, Inc.(1) | | 6,712 |

| 269,285 |

|

| Medtronic plc | | 14,108 |

| 1,004,913 |

|

| Zimmer Biomet Holdings, Inc. | | 4,224 |

| 435,917 |

|

| | | | 3,924,289 |

|

| Health Care Providers and Services — 0.8% | | | |

| UnitedHealth Group, Inc. | | 7,111 |

| 1,138,044 |

|

| Health Care Technology — 0.3% | | | |

Cerner Corp.(1) | | 9,381 |

| 444,378 |

|

| Hotels, Restaurants and Leisure — 0.9% | | | |

| Carnival Corp. | | 7,229 |

| 376,342 |

|

| Darden Restaurants, Inc. | | 10,992 |

| 799,338 |

|

| | | | 1,175,680 |

|

| Household Products — 2.1% | | | |

| Church & Dwight Co., Inc. | | 10,074 |

| 445,170 |

|

| Kimberly-Clark Corp. | | 6,509 |

| 742,807 |

|

| Procter & Gamble Co. (The) | | 15,726 |

| 1,322,242 |

|

| Spectrum Brands Holdings, Inc. | | 3,876 |

| 474,151 |

|

| | | | 2,984,370 |

|

| Industrial Conglomerates — 1.4% | | | |

| 3M Co. | | 4,194 |

| 748,923 |

|

| Carlisle Cos., Inc. | | 6,115 |

| 674,423 |

|

| General Electric Co. | | 17,877 |

| 564,913 |

|

| | | | 1,988,259 |

|

| Insurance — 2.0% | | | |

| Aflac, Inc. | | 10,303 |

| 717,089 |

|

| Allied World Assurance Co. Holdings AG | | 1,301 |

| 69,877 |

|

| Aon plc | | 966 |

| 107,738 |

|

| Aspen Insurance Holdings Ltd. | | 1,181 |

| 64,955 |

|

| Everest Re Group Ltd. | | 747 |

| 161,651 |

|

| MetLife, Inc. | | 4,259 |

| 229,518 |

|

| Primerica, Inc. | | 2,043 |

| 141,273 |

|

| Principal Financial Group, Inc. | | 2,805 |

| 162,297 |

|

| Prudential Financial, Inc. | | 700 |

| 72,842 |

|

| Reinsurance Group of America, Inc. | | 5,357 |

| 674,071 |

|

| Validus Holdings Ltd. | | 7,626 |

| 419,506 |

|

| | | | 2,820,817 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Internet and Direct Marketing Retail — 1.4% | | | |

Amazon.com, Inc.(1) | | 2,521 |

| $ | 1,890,422 |

|

| Internet Software and Services — 3.2% | | | |

Alphabet, Inc., Class A(1) | | 3,435 |

| 2,722,066 |

|

Facebook, Inc., Class A(1) | | 15,232 |

| 1,752,441 |

|

| | | | 4,474,507 |

|

| IT Services — 1.0% | | | |

| International Business Machines Corp. | | 7,941 |

| 1,318,127 |

|

| Leisure Products — 0.6% | | | |

| Brunswick Corp. | | 8,929 |

| 486,988 |

|

| Hasbro, Inc. | | 5,135 |

| 399,451 |

|

| | | | 886,439 |

|

| Life Sciences Tools and Services — 0.3% | | | |

| Thermo Fisher Scientific, Inc. | | 3,118 |

| 439,950 |

|

| Machinery — 2.2% | | | |

| Cummins, Inc. | | 3,725 |

| 509,096 |

|

| Fortive Corp. | | 1,696 |

| 90,957 |

|

| Ingersoll-Rand plc | | 10,699 |

| 802,853 |

|

| Oshkosh Corp. | | 2,711 |

| 175,158 |

|

| Parker-Hannifin Corp. | | 725 |

| 101,500 |

|

| Snap-on, Inc. | | 2,726 |

| 466,882 |

|

| Stanley Black & Decker, Inc. | | 1,628 |

| 186,715 |

|

| Timken Co. (The) | | 2,756 |

| 109,413 |

|

| Toro Co. (The) | | 11,851 |

| 663,063 |

|

| | | | 3,105,637 |

|

| Media — 0.8% | | | |

| Omnicom Group, Inc. | | 4,612 |

| 392,527 |

|

| Time Warner, Inc. | | 3,446 |

| 332,642 |

|

| Twenty-First Century Fox, Inc., Class A | | 14,414 |

| 404,169 |

|

| | | | 1,129,338 |

|

| Metals and Mining — 1.1% | | | |

| Barrick Gold Corp. | | 39,207 |

| 626,528 |

|

| Newmont Mining Corp. | | 2,083 |

| 70,968 |

|

| Nucor Corp. | | 11,503 |

| 684,658 |

|

| Reliance Steel & Aluminum Co. | | 2,579 |

| 205,134 |

|

| | | | 1,587,288 |

|

| Mortgage Real Estate Investment Trusts (REITs) — 0.1% | | | |

| Blackstone Mortgage Trust, Inc., Class A | | 2,766 |

| 83,174 |

|

Multi-Utilities† | | | |

| CenterPoint Energy, Inc. | | 1,750 |

| 43,120 |

|

| Multiline Retail — 0.5% | | | |

| Target Corp. | | 10,182 |

| 735,446 |

|

| Oil, Gas and Consumable Fuels — 2.6% | | | |

| Chevron Corp. | | 8,011 |

| 942,895 |

|

| Exxon Mobil Corp. | | 16,390 |

| 1,479,361 |

|

| Kinder Morgan, Inc. | | 24,113 |

| 499,380 |

|

| Williams Cos., Inc. (The) | | 9,547 |

| 297,294 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| World Fuel Services Corp. | | 8,619 |

| $ | 395,698 |

|

| | | | 3,614,628 |

|

Personal Products† | | | |

| Nu Skin Enterprises, Inc., Class A | | 891 |

| 42,572 |

|

| Pharmaceuticals — 1.7% | | | |

| Johnson & Johnson | | 6,417 |

| 739,303 |

|

| Merck & Co., Inc. | | 22,788 |

| 1,341,529 |

|

| Pfizer, Inc. | | 7,632 |

| 247,887 |

|

| | | | 2,328,719 |

|

Professional Services† | | | |

FTI Consulting, Inc.(1) | | 1,222 |

| 55,088 |

|

| Real Estate Management and Development — 0.1% | | | |

| Realogy Holdings Corp. | | 6,212 |

| 159,835 |

|

| Semiconductors and Semiconductor Equipment — 2.9% | | | |

| Applied Materials, Inc. | | 24,325 |

| 784,968 |

|

| Broadcom Ltd. | | 545 |

| 96,340 |

|

| Intel Corp. | | 38,402 |

| 1,392,840 |

|

| Lam Research Corp. | | 576 |

| 60,900 |

|

| NVIDIA Corp. | | 3,889 |

| 415,112 |

|

| QUALCOMM, Inc. | | 15,654 |

| 1,020,641 |

|

| Texas Instruments, Inc. | | 3,933 |

| 286,991 |

|

| | | | 4,057,792 |

|

| Software — 3.8% | | | |

Adobe Systems, Inc.(1) | | 6,739 |

| 693,780 |

|

| Microsoft Corp. | | 42,693 |

| 2,652,943 |

|

| Oracle Corp. | | 28,769 |

| 1,106,168 |

|

Synopsys, Inc.(1) | | 1,593 |

| 93,764 |

|

VMware, Inc., Class A(1) | | 9,511 |

| 748,801 |

|

| | | | 5,295,456 |

|

| Specialty Retail — 0.5% | | | |

| Best Buy Co., Inc. | | 14,550 |

| 620,849 |

|

Urban Outfitters, Inc.(1) | | 4,319 |

| 123,005 |

|

| | | | 743,854 |

|

| Technology Hardware, Storage and Peripherals — 2.2% | | | |

| Apple, Inc. | | 23,780 |

| 2,754,200 |

|

| HP, Inc. | | 18,091 |

| 268,470 |

|

| | | | 3,022,670 |

|

| Thrifts and Mortgage Finance — 0.5% | | | |

Essent Group Ltd.(1) | | 20,933 |

| 677,601 |

|

TOTAL COMMON STOCKS

(Cost $67,659,426) | | | 81,316,897 |

|

| U.S. TREASURY SECURITIES — 14.1% | | | |

| U.S. Treasury Bonds, 3.50%, 2/15/39 | | $ | 350,000 |

| 382,178 |

|

| U.S. Treasury Bonds, 4.375%, 11/15/39 | | 310,000 |

| 382,108 |

|

| U.S. Treasury Bonds, 3.125%, 11/15/41 | | 50,000 |

| 50,657 |

|

| U.S. Treasury Bonds, 2.75%, 11/15/42 | | 650,000 |

| 612,791 |

|

| U.S. Treasury Bonds, 2.875%, 5/15/43 | | 450,000 |

| 433,844 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| U.S. Treasury Bonds, 3.125%, 8/15/44 | | $ | 270,000 |

| $ | 272,728 |

|

| U.S. Treasury Bonds, 3.00%, 11/15/44 | | 180,000 |

| 177,458 |

|

| U.S. Treasury Bonds, 2.50%, 2/15/45 | | 1,360,000 |

| 1,208,899 |

|

| U.S. Treasury Inflation Indexed Notes, 0.125%, 7/15/26 | | 302,508 |

| 292,652 |

|

| U.S. Treasury Notes, 0.75%, 10/31/17 | | 550,000 |

| 549,563 |

|

| U.S. Treasury Notes, 1.00%, 2/15/18 | | 470,000 |

| 470,211 |

|

| U.S. Treasury Notes, 1.00%, 3/15/18 | | 1,950,000 |

| 1,951,109 |

|

| U.S. Treasury Notes, 2.625%, 4/30/18 | | 85,000 |

| 86,812 |

|

| U.S. Treasury Notes, 1.375%, 7/31/18 | | 1,200,000 |

| 1,205,364 |

|

| U.S. Treasury Notes, 1.375%, 9/30/18 | | 1,100,000 |

| 1,104,115 |

|

| U.S. Treasury Notes, 1.25%, 11/15/18 | | 400,000 |

| 400,593 |

|

| U.S. Treasury Notes, 1.00%, 11/30/18 | | 1,000,000 |

| 996,708 |

|

U.S. Treasury Notes, 1.125%, 12/31/18(2) | | 1,100,000 |

| 1,100,976 |

|

| U.S. Treasury Notes, 1.625%, 7/31/19 | | 1,550,000 |

| 1,560,507 |

|

U.S. Treasury Notes, 1.50%, 10/31/19(3) | | 150,000 |

| 150,316 |

|

| U.S. Treasury Notes, 1.50%, 11/30/19 | | 450,000 |

| 450,751 |

|

| U.S. Treasury Notes, 1.25%, 1/31/20 | | 200,000 |

| 198,453 |

|

| U.S. Treasury Notes, 1.375%, 2/29/20 | | 150,000 |

| 149,226 |

|

| U.S. Treasury Notes, 1.375%, 3/31/20 | | 200,000 |

| 198,866 |

|

| U.S. Treasury Notes, 1.375%, 4/30/20 | | 200,000 |

| 198,619 |

|

| U.S. Treasury Notes, 1.125%, 8/31/21 | | 250,000 |

| 241,354 |

|

| U.S. Treasury Notes, 2.00%, 10/31/21 | | 1,730,000 |

| 1,733,605 |

|

| U.S. Treasury Notes, 1.50%, 2/28/23 | | 400,000 |

| 384,338 |

|

| U.S. Treasury Notes, 1.375%, 6/30/23 | | 1,840,000 |

| 1,746,024 |

|

| U.S. Treasury Notes, 1.25%, 7/31/23 | | 640,000 |

| 601,862 |

|

| U.S. Treasury Notes, 2.00%, 11/15/26 | | 350,000 |

| 336,254 |

|

TOTAL U.S. TREASURY SECURITIES

(Cost $19,883,536) | | | 19,628,941 |

|

| CORPORATE BONDS — 12.2% | | | |

| Aerospace and Defense — 0.1% | | | |

| Boeing Co. (The), 2.20%, 10/30/22 | | 30,000 |

| 29,379 |

|

| Lockheed Martin Corp., 4.25%, 11/15/19 | | 30,000 |

| 31,957 |

|

| Lockheed Martin Corp., 3.80%, 3/1/45 | | 20,000 |

| 18,981 |

|

| United Technologies Corp., 6.05%, 6/1/36 | | 20,000 |

| 25,059 |

|

| United Technologies Corp., 5.70%, 4/15/40 | | 20,000 |

| 24,456 |

|

| United Technologies Corp., 3.75%, 11/1/46 | | 20,000 |

| 19,042 |

|

| | | | 148,874 |

|

| Automobiles — 0.3% | | | |

American Honda Finance Corp., 1.50%, 9/11/17(4) | | 10,000 |

| 10,026 |

|

| American Honda Finance Corp., 2.125%, 10/10/18 | | 20,000 |

| 20,158 |

|

| Ford Motor Credit Co. LLC, 5.875%, 8/2/21 | | 50,000 |

| 55,226 |

|

| General Motors Co., 5.00%, 4/1/35 | | 30,000 |

| 29,297 |

|

| General Motors Financial Co., Inc., 3.25%, 5/15/18 | | 60,000 |

| 60,797 |

|

| General Motors Financial Co., Inc., 3.10%, 1/15/19 | | 10,000 |

| 10,108 |

|

| General Motors Financial Co., Inc., 3.20%, 7/6/21 | | 20,000 |

| 19,836 |

|

| General Motors Financial Co., Inc., 5.25%, 3/1/26 | | 125,000 |

| 131,696 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

Jaguar Land Rover Automotive plc, 4.125%, 12/15/18(4) | | $ | 30,000 |

| $ | 30,937 |

|

| | | | 368,081 |

|

| Banks — 1.9% | | | |

| Bank of America Corp., 5.75%, 12/1/17 | | 50,000 |

| 51,801 |

|

| Bank of America Corp., 5.70%, 1/24/22 | | 40,000 |

| 44,937 |

|

| Bank of America Corp., 4.10%, 7/24/23 | | 30,000 |

| 31,350 |

|

| Bank of America Corp., MTN, 4.00%, 4/1/24 | | 70,000 |

| 72,224 |

|

| Bank of America Corp., MTN, 4.20%, 8/26/24 | | 30,000 |

| 30,574 |

|

| Bank of America Corp., MTN, 4.00%, 1/22/25 | | 80,000 |

| 80,137 |

|

| Bank of America Corp., MTN, 5.00%, 1/21/44 | | 20,000 |

| 21,944 |

|

| Bank of America N.A., 5.30%, 3/15/17 | | 240,000 |

| 241,870 |

|

| Barclays plc, MTN, VRN, 2.625%, 11/11/20 | EUR | 100,000 |

| 104,612 |

|

| Branch Banking & Trust Co., 3.625%, 9/16/25 | | $ | 17,000 |

| 17,280 |

|

| Branch Banking & Trust Co., 3.80%, 10/30/26 | | 20,000 |

| 20,547 |

|

| Capital One Financial Corp., 4.20%, 10/29/25 | | 200,000 |

| 200,765 |

|

| Citigroup, Inc., 1.75%, 5/1/18 | | 90,000 |

| 89,825 |

|

| Citigroup, Inc., 4.50%, 1/14/22 | | 90,000 |

| 95,971 |

|

| Citigroup, Inc., 4.05%, 7/30/22 | | 20,000 |

| 20,703 |

|

| Citigroup, Inc., 3.20%, 10/21/26 | | 125,000 |

| 119,595 |

|

| Citigroup, Inc., 4.45%, 9/29/27 | | 130,000 |

| 132,448 |

|

| Cooperatieve Rabobank UA, 3.875%, 2/8/22 | | 80,000 |

| 84,440 |

|

| Fifth Third Bancorp, 4.30%, 1/16/24 | | 95,000 |

| 97,818 |

|

| Huntington Bancshares, Inc., 2.30%, 1/14/22 | | 40,000 |

| 38,802 |

|

| JPMorgan Chase & Co., 2.55%, 3/1/21 | | 60,000 |

| 59,789 |

|

| JPMorgan Chase & Co., 4.625%, 5/10/21 | | 160,000 |

| 172,233 |

|

| JPMorgan Chase & Co., 3.25%, 9/23/22 | | 40,000 |

| 40,438 |

|

| JPMorgan Chase & Co., 3.875%, 9/10/24 | | 70,000 |

| 70,860 |

|

| JPMorgan Chase & Co., 3.125%, 1/23/25 | | 70,000 |

| 68,413 |

|

| JPMorgan Chase & Co., 4.95%, 6/1/45 | | 20,000 |

| 21,335 |

|

| KeyCorp, MTN, 2.30%, 12/13/18 | | 40,000 |

| 40,249 |

|

| Kreditanstalt fuer Wiederaufbau, 2.00%, 10/4/22 | | 50,000 |

| 49,047 |

|

| Santander Issuances SAU, MTN, 2.50%, 3/18/25 | EUR | 100,000 |

| 103,743 |

|

| U.S. Bancorp, MTN, 3.00%, 3/15/22 | | $ | 20,000 |

| 20,385 |

|

| U.S. Bancorp, MTN, 3.60%, 9/11/24 | | 50,000 |

| 50,943 |

|

| Wells Fargo & Co., 4.125%, 8/15/23 | | 50,000 |

| 51,726 |

|

| Wells Fargo & Co., 3.00%, 4/22/26 | | 50,000 |

| 47,702 |

|

| Wells Fargo & Co., MTN, 2.60%, 7/22/20 | | 40,000 |

| 40,222 |

|

| Wells Fargo & Co., MTN, 4.10%, 6/3/26 | | 80,000 |

| 81,035 |

|

| Wells Fargo & Co., MTN, 4.65%, 11/4/44 | | 25,000 |

| 24,616 |

|

| Wells Fargo & Co., MTN, 4.75%, 12/7/46 | | 30,000 |

| 30,353 |

|

| | | | 2,570,732 |

|

| Beverages — 0.3% | | | |

| Anheuser-Busch InBev Finance, Inc., 3.30%, 2/1/23 | | 155,000 |

| 157,797 |

|

| Anheuser-Busch InBev Finance, Inc., 3.65%, 2/1/26 | | 30,000 |

| 30,466 |

|

| Anheuser-Busch InBev Finance, Inc., 4.90%, 2/1/46 | | 60,000 |

| 64,679 |

|

| Anheuser-Busch InBev Worldwide, Inc., 7.75%, 1/15/19 | | 40,000 |

| 44,561 |

|

| Anheuser-Busch InBev Worldwide, Inc., 2.50%, 7/15/22 | | 50,000 |

| 49,219 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Molson Coors Brewing Co., 3.00%, 7/15/26 | | $ | 65,000 |

| $ | 61,479 |

|

| | | | 408,201 |

|

| Biotechnology — 0.4% | | | |

| AbbVie, Inc., 2.90%, 11/6/22 | | 40,000 |

| 39,517 |

|

| AbbVie, Inc., 3.60%, 5/14/25 | | 30,000 |

| 29,729 |

|

| AbbVie, Inc., 4.40%, 11/6/42 | | 30,000 |

| 28,276 |

|

| AbbVie, Inc., 4.45%, 5/14/46 | | 10,000 |

| 9,595 |

|

| Amgen, Inc., 1.85%, 8/19/21 | | 50,000 |

| 48,181 |

|

Amgen, Inc., 4.66%, 6/15/51(4) | | 46,000 |

| 44,516 |

|

| Biogen, Inc., 3.625%, 9/15/22 | | 50,000 |

| 51,333 |

|

| Celgene Corp., 3.25%, 8/15/22 | | 30,000 |

| 30,273 |

|

| Celgene Corp., 3.625%, 5/15/24 | | 60,000 |

| 60,319 |

|

| Celgene Corp., 3.875%, 8/15/25 | | 70,000 |

| 71,036 |

|

| Gilead Sciences, Inc., 4.40%, 12/1/21 | | 50,000 |

| 53,777 |

|

| Gilead Sciences, Inc., 3.65%, 3/1/26 | | 110,000 |

| 111,505 |

|

| | | | 578,057 |

|

Building Products† | | | |

| Masco Corp., 4.45%, 4/1/25 | | 20,000 |

| 20,400 |

|

| Chemicals — 0.1% | | | |

| Ashland LLC, 4.75%, 8/15/22 | | 30,000 |

| 31,237 |

|

| Dow Chemical Co. (The), 4.25%, 11/15/20 | | 13,000 |

| 13,770 |

|

| Eastman Chemical Co., 3.60%, 8/15/22 | | 15,000 |

| 15,384 |

|

| Ecolab, Inc., 4.35%, 12/8/21 | | 30,000 |

| 32,425 |

|

| LyondellBasell Industries NV, 4.625%, 2/26/55 | | 20,000 |

| 18,599 |

|

| Mosaic Co. (The), 5.625%, 11/15/43 | | 20,000 |

| 19,307 |

|

| | | | 130,722 |

|

| Commercial Services and Supplies — 0.1% | | | |

| Covanta Holding Corp., 5.875%, 3/1/24 | | 30,000 |

| 28,950 |

|

| Republic Services, Inc., 3.55%, 6/1/22 | | 50,000 |

| 51,949 |

|

| Waste Management, Inc., 4.10%, 3/1/45 | | 70,000 |

| 69,421 |

|

| | | | 150,320 |

|

Communications Equipment† | | | |

| Cisco Systems, Inc., 5.90%, 2/15/39 | | 20,000 |

| 25,408 |

|

Construction Materials† | | | |

| Owens Corning, 4.20%, 12/15/22 | | 30,000 |

| 31,162 |

|

| Consumer Finance — 0.3% | | | |

| American Express Co., 1.55%, 5/22/18 | | 20,000 |

| 19,965 |

|

| American Express Credit Corp., 2.60%, 9/14/20 | | 65,000 |

| 65,529 |

|

| American Express Credit Corp., MTN, 2.25%, 5/5/21 | | 40,000 |

| 39,515 |

|

| CIT Group, Inc., 4.25%, 8/15/17 | | 80,000 |

| 81,100 |

|

| CIT Group, Inc., 5.00%, 8/15/22 | | 20,000 |

| 20,900 |

|

| Equifax, Inc., 3.30%, 12/15/22 | | 30,000 |

| 30,506 |

|

| GLP Capital LP / GLP Financing II, Inc., 4.875%, 11/1/20 | | 20,000 |

| 21,100 |

|

| PNC Bank N.A., 6.00%, 12/7/17 | | 80,000 |

| 83,117 |

|

| Synchrony Financial, 2.60%, 1/15/19 | | 20,000 |

| 20,104 |

|

| Synchrony Financial, 3.00%, 8/15/19 | | 10,000 |

| 10,131 |

|

| | | | 391,967 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Containers and Packaging — 0.1% | | | |

| Ball Corp., 4.00%, 11/15/23 | | $ | 30,000 |

| $ | 29,512 |

|

| Crown Americas LLC / Crown Americas Capital Corp. IV, 4.50%, 1/15/23 | | 50,000 |

| 51,250 |

|

| WestRock RKT Co., 3.50%, 3/1/20 | | 20,000 |

| 20,507 |

|

| WestRock RKT Co., 4.00%, 3/1/23 | | 40,000 |

| 41,320 |

|

| | | | 142,589 |

|

Diversified Consumer Services† | | | |

| Catholic Health Initiatives, 2.95%, 11/1/22 | | 20,000 |

| 19,462 |

|

| George Washington University (The), 3.55%, 9/15/46 | | 15,000 |

| 12,812 |

|

| | | | 32,274 |

|

| Diversified Financial Services — 1.2% | | | |

| Ally Financial, Inc., 2.75%, 1/30/17 | | 50,000 |

| 50,019 |

|

| Ally Financial, Inc., 3.50%, 1/27/19 | | 20,000 |

| 20,150 |

|

| BNP Paribas SA, MTN, 2.375%, 2/17/25 | EUR | 100,000 |

| 106,882 |

|

| Citigroup, Inc., 2.90%, 12/8/21 | | $ | 30,000 |

| 29,924 |

|

| GE Capital International Funding Co. Unlimited Co., 2.34%, 11/15/20 | | 200,000 |

| 199,651 |

|

| Goldman Sachs Group, Inc. (The), 2.30%, 12/13/19 | | 220,000 |

| 219,950 |

|

| Goldman Sachs Group, Inc. (The), 5.75%, 1/24/22 | | 30,000 |

| 33,732 |

|

| Goldman Sachs Group, Inc. (The), 4.00%, 3/3/24 | | 50,000 |

| 51,893 |

|

| Goldman Sachs Group, Inc. (The), 3.50%, 1/23/25 | | 140,000 |

| 138,202 |

|

| Goldman Sachs Group, Inc. (The), 4.25%, 10/21/25 | | 20,000 |

| 20,327 |

|

| Goldman Sachs Group, Inc. (The), 3.50%, 11/16/26 | | 30,000 |

| 29,446 |

|

| Goldman Sachs Group, Inc. (The), 5.15%, 5/22/45 | | 10,000 |

| 10,537 |

|

| Goldman Sachs Group, Inc. (The), MTN, 4.80%, 7/8/44 | | 40,000 |

| 42,074 |

|

| HSBC Holdings plc, 2.95%, 5/25/21 | | 200,000 |

| 199,872 |

|

| Morgan Stanley, 5.00%, 11/24/25 | | 140,000 |

| 149,633 |

|

| Morgan Stanley, MTN, 6.625%, 4/1/18 | | 90,000 |

| 95,193 |

|

| Morgan Stanley, MTN, 5.625%, 9/23/19 | | 80,000 |

| 86,732 |

|

| Morgan Stanley, MTN, 2.50%, 4/21/21 | | 180,000 |

| 178,069 |

|

| Morgan Stanley, MTN, 3.70%, 10/23/24 | | 40,000 |

| 40,495 |

|

| S&P Global, Inc., 3.30%, 8/14/20 | | 10,000 |

| 10,197 |

|

| | | | 1,712,978 |

|

| Diversified Telecommunication Services — 0.6% | | | |

| AT&T, Inc., 5.00%, 3/1/21 | | 40,000 |

| 43,026 |

|

| AT&T, Inc., 3.60%, 2/17/23 | | 30,000 |

| 30,265 |

|

| AT&T, Inc., 4.45%, 4/1/24 | | 20,000 |

| 20,857 |

|

| AT&T, Inc., 3.40%, 5/15/25 | | 100,000 |

| 96,429 |

|

| AT&T, Inc., 6.55%, 2/15/39 | | 42,000 |

| 48,700 |

|

| AT&T, Inc., 4.30%, 12/15/42 | | 40,000 |

| 35,874 |

|

| British Telecommunications plc, 5.95%, 1/15/18 | | 40,000 |

| 41,694 |

|

| CenturyLink, Inc., Series Q, 6.15%, 9/15/19 | | 30,000 |

| 32,250 |

|

Deutsche Telekom International Finance BV, 2.25%, 3/6/17(4) | | 20,000 |

| 20,029 |

|

| Deutsche Telekom International Finance BV, 6.75%, 8/20/18 | | 30,000 |

| 32,357 |

|

| Frontier Communications Corp., 8.50%, 4/15/20 | | 20,000 |

| 21,075 |

|

| Orange SA, 4.125%, 9/14/21 | | 40,000 |

| 42,243 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Verizon Communications, Inc., 2.45%, 11/1/22 | | $ | 40,000 |

| $ | 38,644 |

|

| Verizon Communications, Inc., 5.15%, 9/15/23 | | 60,000 |

| 66,370 |

|

| Verizon Communications, Inc., 2.625%, 8/15/26 | | 20,000 |

| 18,422 |

|

| Verizon Communications, Inc., 5.05%, 3/15/34 | | 130,000 |

| 137,093 |

|

| Verizon Communications, Inc., 4.86%, 8/21/46 | | 37,000 |

| 37,566 |

|

| Verizon Communications, Inc., 5.01%, 8/21/54 | | 21,000 |

| 21,005 |

|

| | | | 783,899 |

|

Energy Equipment and Services† | | | |

| Halliburton Co., 3.80%, 11/15/25 | | 30,000 |

| 30,492 |

|

| Equity Real Estate Investment Trusts (REITs) — 0.4% | | | |

| American Tower Corp., 5.05%, 9/1/20 | | 20,000 |

| 21,465 |

|

| American Tower Corp., 3.375%, 10/15/26 | | 50,000 |

| 47,361 |

|

| AvalonBay Communities, Inc., MTN, 2.90%, 10/15/26 | | 20,000 |

| 18,922 |

|

| Boston Properties LP, 3.65%, 2/1/26 | | 10,000 |

| 9,880 |

|

| Crown Castle International Corp., 5.25%, 1/15/23 | | 30,000 |

| 32,400 |

|

| Crown Castle International Corp., 4.45%, 2/15/26 | | 60,000 |

| 62,106 |

|

| DDR Corp., 4.75%, 4/15/18 | | 50,000 |

| 51,432 |

|

| DDR Corp., 3.625%, 2/1/25 | | 20,000 |

| 19,356 |

|

| Essex Portfolio LP, 3.625%, 8/15/22 | | 30,000 |

| 30,704 |

|

| Essex Portfolio LP, 3.25%, 5/1/23 | | 10,000 |

| 9,967 |

|

| Hospitality Properties Trust, 4.65%, 3/15/24 | | 70,000 |

| 69,796 |

|

| Host Hotels & Resorts LP, 3.75%, 10/15/23 | | 20,000 |

| 19,642 |

|

| Kilroy Realty LP, 3.80%, 1/15/23 | | 30,000 |

| 30,222 |

|

| Kimco Realty Corp., 2.80%, 10/1/26 | | 40,000 |

| 37,248 |

|

| Simon Property Group LP, 3.25%, 11/30/26 | | 20,000 |

| 19,622 |

|

| Ventas Realty LP, 4.125%, 1/15/26 | | 20,000 |

| 20,456 |

|

| VEREIT Operating Partnership LP, 4.125%, 6/1/21 | | 40,000 |

| 40,800 |

|

| Welltower, Inc., 3.75%, 3/15/23 | | 20,000 |

| 20,410 |

|

| | | | 561,789 |

|

| Food and Staples Retailing — 0.2% | | | |

| CVS Health Corp., 3.50%, 7/20/22 | | 40,000 |

| 41,107 |

|

| CVS Health Corp., 2.75%, 12/1/22 | | 35,000 |

| 34,486 |

|

| CVS Health Corp., 5.125%, 7/20/45 | | 20,000 |

| 22,332 |

|

| Dollar General Corp., 3.25%, 4/15/23 | | 40,000 |

| 39,486 |

|

| Kroger Co. (The), 3.30%, 1/15/21 | | 50,000 |

| 51,383 |

|

| Kroger Co. (The), 3.875%, 10/15/46 | | 20,000 |

| 18,246 |

|

| Sysco Corp., 3.30%, 7/15/26 | | 10,000 |

| 9,819 |

|

| Target Corp., 2.50%, 4/15/26 | | 30,000 |

| 28,614 |

|

| Wal-Mart Stores, Inc., 4.30%, 4/22/44 | | 80,000 |

| 84,457 |

|

| | | | 329,930 |

|

| Food Products — 0.1% | | | |

| Kraft Heinz Foods Co., 3.95%, 7/15/25 | | 30,000 |

| 30,405 |

|

| Kraft Heinz Foods Co., 5.20%, 7/15/45 | | 20,000 |

| 20,976 |

|

| Kraft Heinz Foods Co., 4.375%, 6/1/46 | | 20,000 |

| 18,858 |

|

| | | | 70,239 |

|

| Gas Utilities — 0.5% | | | |

| Enbridge Energy Partners LP, 6.50%, 4/15/18 | | 30,000 |

| 31,574 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Enbridge, Inc., 4.00%, 10/1/23 | | $ | 20,000 |

| $ | 20,312 |

|

| Enbridge, Inc., 4.50%, 6/10/44 | | 20,000 |

| 18,629 |

|

| Energy Transfer Equity LP, 7.50%, 10/15/20 | | 30,000 |

| 33,600 |

|

| Energy Transfer Partners LP, 4.15%, 10/1/20 | | 40,000 |

| 41,427 |

|

| Energy Transfer Partners LP, 3.60%, 2/1/23 | | 30,000 |

| 29,516 |

|

| Energy Transfer Partners LP, 4.90%, 3/15/35 | | 10,000 |

| 9,359 |

|

| Energy Transfer Partners LP, 6.50%, 2/1/42 | | 20,000 |

| 21,642 |

|

| Enterprise Products Operating LLC, 4.85%, 3/15/44 | | 80,000 |

| 80,920 |

|

| Enterprise Products Operating LLC, VRN, 7.03%, 1/15/18 | | 20,000 |

| 20,517 |

|

| Kinder Morgan Energy Partners LP, 6.50%, 4/1/20 | | 30,000 |

| 33,210 |

|

| Kinder Morgan Energy Partners LP, 5.30%, 9/15/20 | | 20,000 |

| 21,485 |

|

| Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | | 50,000 |

| 54,982 |

|

| Kinder Morgan, Inc., 5.55%, 6/1/45 | | 10,000 |

| 10,537 |

|

| Magellan Midstream Partners LP, 6.55%, 7/15/19 | | 20,000 |

| 22,137 |

|

| MPLX LP, 4.875%, 12/1/24 | | 20,000 |

| 20,603 |

|

| MPLX LP, 4.875%, 6/1/25 | | 50,000 |

| 51,430 |

|

| Plains All American Pipeline LP / PAA Finance Corp., 3.65%, 6/1/22 | | 40,000 |

| 40,228 |

|

| Sunoco Logistics Partners Operations LP, 3.45%, 1/15/23 | | 40,000 |

| 39,089 |

|

| Sunoco Logistics Partners Operations LP, 3.90%, 7/15/26 | | 10,000 |

| 9,684 |

|

| Williams Cos., Inc. (The), 3.70%, 1/15/23 | | 20,000 |

| 19,400 |

|

| Williams Cos., Inc. (The), 5.75%, 6/24/44 | | 10,000 |

| 9,750 |

|

| Williams Partners LP, 4.125%, 11/15/20 | | 30,000 |

| 31,193 |

|

| Williams Partners LP, 5.40%, 3/4/44 | | 40,000 |

| 38,834 |

|

| | | | 710,058 |

|

| Health Care Equipment and Supplies — 0.3% | | | |

| Abbott Laboratories, 3.75%, 11/30/26 | | 80,000 |

| 79,567 |

|

| Becton Dickinson and Co., 3.73%, 12/15/24 | | 70,000 |

| 71,641 |

|

| Medtronic, Inc., 2.50%, 3/15/20 | | 20,000 |

| 20,222 |

|

| Medtronic, Inc., 3.50%, 3/15/25 | | 90,000 |

| 92,653 |

|

| Medtronic, Inc., 4.375%, 3/15/35 | | 40,000 |

| 42,331 |

|

| St. Jude Medical, Inc., 2.00%, 9/15/18 | | 10,000 |

| 10,016 |

|

| Thermo Fisher Scientific, Inc., 3.60%, 8/15/21 | | 25,000 |

| 25,842 |

|

| Thermo Fisher Scientific, Inc., 3.30%, 2/15/22 | | 9,000 |

| 9,145 |

|

| Thermo Fisher Scientific, Inc., 2.95%, 9/19/26 | | 20,000 |

| 18,873 |

|

| Thermo Fisher Scientific, Inc., 5.30%, 2/1/44 | | 20,000 |

| 22,419 |

|

| Zimmer Biomet Holdings, Inc., 2.70%, 4/1/20 | | 20,000 |

| 20,005 |

|

| | | | 412,714 |

|

| Health Care Providers and Services — 0.3% | | | |

| Aetna, Inc., 2.75%, 11/15/22 | | 30,000 |

| 29,478 |

|

| Aetna, Inc., 4.375%, 6/15/46 | | 20,000 |

| 20,124 |

|

| Ascension Health, 3.95%, 11/15/46 | | 10,000 |

| 9,552 |

|

| CHS / Community Health Systems, Inc., 5.125%, 8/15/18 | | 9,000 |

| 8,843 |

|

| Express Scripts Holding Co., 4.50%, 2/25/26 | | 40,000 |

| 41,199 |

|

| Express Scripts Holding Co., 3.40%, 3/1/27 | | 50,000 |

| 46,872 |

|

| HCA, Inc., 3.75%, 3/15/19 | | 60,000 |

| 61,800 |

|

| Johns Hopkins Health System Corp. (The), 3.84%, 5/15/46 | | 15,000 |

| 14,230 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

Mylan NV, 3.95%, 6/15/26(4) | | $ | 20,000 |

| $ | 18,727 |

|

| NYU Hospitals Center, 4.43%, 7/1/42 | | 20,000 |

| 19,125 |

|

| UnitedHealth Group, Inc., 2.875%, 12/15/21 | | 30,000 |

| 30,401 |

|

| UnitedHealth Group, Inc., 2.875%, 3/15/22 | | 40,000 |

| 40,500 |

|

| UnitedHealth Group, Inc., 3.75%, 7/15/25 | | 40,000 |

| 41,400 |

|

Universal Health Services, Inc., 4.75%, 8/1/22(4) | | 20,000 |

| 20,350 |

|

| | | | 402,601 |

|

| Hotels, Restaurants and Leisure — 0.1% | | | |

Hilton Domestic Operating Co., Inc., 4.25%, 9/1/24(4) | | 25,000 |

| 24,375 |

|

| Royal Caribbean Cruises Ltd., 5.25%, 11/15/22 | | 30,000 |

| 32,213 |

|

| Wyndham Worldwide Corp., 2.95%, 3/1/17 | | 10,000 |

| 10,010 |

|

| | | | 66,598 |

|

| Household Durables — 0.2% | | | |

| D.R. Horton, Inc., 3.625%, 2/15/18 | | 40,000 |

| 40,500 |

|

| Lennar Corp., 4.75%, 12/15/17 | | 30,000 |

| 30,600 |

|

| Lennar Corp., 4.75%, 4/1/21 | | 30,000 |

| 31,125 |

|

| Lennar Corp., 4.75%, 5/30/25 | | 10,000 |

| 9,800 |

|

| M.D.C. Holdings, Inc., 5.50%, 1/15/24 | | 20,000 |

| 20,750 |

|

| Newell Brands, Inc., 4.20%, 4/1/26 | | 20,000 |

| 20,871 |

|

| Newell Brands, Inc., 5.50%, 4/1/46 | | 40,000 |

| 45,939 |

|

| Toll Brothers Finance Corp., 6.75%, 11/1/19 | | 30,000 |

| 32,962 |

|

| TRI Pointe Group, Inc. / TRI Pointe Homes, Inc., 4.375%, 6/15/19 | | 10,000 |

| 10,225 |

|

| | | | 242,772 |

|

| Industrial Conglomerates — 0.2% | | | |

| General Electric Co., 2.70%, 10/9/22 | | 70,000 |

| 69,963 |

|

| General Electric Co., 4.125%, 10/9/42 | | 30,000 |

| 30,428 |

|

| General Electric Co., MTN, 2.30%, 4/27/17 | | 60,000 |

| 60,231 |

|

| General Electric Co., MTN, 4.65%, 10/17/21 | | 20,000 |

| 21,933 |

|

| Ingersoll-Rand Luxembourg Finance SA, 3.55%, 11/1/24 | | 30,000 |

| 30,456 |

|

| | | | 213,011 |

|

| Insurance — 0.7% | | | |

| Allianz Finance II BV, MTN, VRN, 5.75%, 7/8/21 | EUR | 100,000 |

| 122,684 |

|

| Allstate Corp. (The), 4.20%, 12/15/46 | | $ | 10,000 |

| 10,227 |

|

| Allstate Corp. (The), VRN, 5.75%, 8/15/23 | | 20,000 |

| 20,716 |

|

| American International Group, Inc., 4.125%, 2/15/24 | | 105,000 |

| 109,296 |

|

| American International Group, Inc., 4.50%, 7/16/44 | | 20,000 |

| 19,760 |

|

| Berkshire Hathaway Finance Corp., 4.25%, 1/15/21 | | 30,000 |

| 32,324 |

|

| Berkshire Hathaway Finance Corp., 3.00%, 5/15/22 | | 20,000 |

| 20,372 |

|

| Berkshire Hathaway, Inc., 4.50%, 2/11/43 | | 50,000 |

| 53,187 |

|

| Chubb INA Holdings, Inc., 3.15%, 3/15/25 | | 40,000 |

| 39,847 |

|

| Chubb INA Holdings, Inc., 3.35%, 5/3/26 | | 20,000 |

| 20,253 |

|

| Hartford Financial Services Group, Inc. (The), 5.95%, 10/15/36 | | 10,000 |

| 11,444 |

|

| International Lease Finance Corp., 6.25%, 5/15/19 | | 120,000 |

| 129,300 |

|

Liberty Mutual Group, Inc., 4.95%, 5/1/22(4) | | 20,000 |

| 21,826 |

|

Liberty Mutual Group, Inc., 4.85%, 8/1/44(4) | | 20,000 |

| 19,828 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Lincoln National Corp., 6.25%, 2/15/20 | | $ | 10,000 |

| $ | 11,045 |

|

| Markel Corp., 4.90%, 7/1/22 | | 40,000 |

| 43,158 |

|

| Markel Corp., 3.625%, 3/30/23 | | 10,000 |

| 10,030 |

|

| MetLife, Inc., 4.125%, 8/13/42 | | 20,000 |

| 19,691 |

|

| MetLife, Inc., 4.875%, 11/13/43 | | 20,000 |

| 21,662 |

|

| Principal Financial Group, Inc., 3.30%, 9/15/22 | | 10,000 |

| 10,122 |

|

| Prudential Financial, Inc., 5.625%, 5/12/41 | | 40,000 |

| 46,206 |

|

| Prudential Financial, Inc., MTN, 5.375%, 6/21/20 | | 60,000 |

| 65,729 |

|

TIAA Asset Management Finance Co. LLC, 4.125%, 11/1/24(4) | | 20,000 |

| 20,210 |

|

| Travelers Cos., Inc. (The), 4.30%, 8/25/45 | | 10,000 |

| 10,363 |

|

| Voya Financial, Inc., 5.70%, 7/15/43 | | 20,000 |

| 21,858 |

|

| WR Berkley Corp., 4.625%, 3/15/22 | | 20,000 |

| 21,396 |

|

| WR Berkley Corp., 4.75%, 8/1/44 | | 10,000 |

| 9,796 |

|

| | | | 942,330 |

|

| IT Services — 0.1% | | | |

| Fidelity National Information Services, Inc., 3.50%, 4/15/23 | | 30,000 |

| 30,396 |

|

| Fidelity National Information Services, Inc., 3.00%, 8/15/26 | | 55,000 |

| 51,751 |

|

| Hewlett Packard Enterprise Co., 3.60%, 10/15/20 | | 60,000 |

| 61,046 |

|

| Hewlett Packard Enterprise Co., 4.90%, 10/15/25 | | 20,000 |

| 20,586 |

|

| Xerox Corp., 2.95%, 3/15/17 | | 10,000 |

| 10,030 |

|

| | | | 173,809 |

|

Machinery† | | | |

| Oshkosh Corp., 5.375%, 3/1/22 | | 50,000 |

| 52,125 |

|

| Media — 0.7% | | | |

| 21st Century Fox America, Inc., 3.70%, 10/15/25 | | 20,000 |

| 20,253 |

|

| 21st Century Fox America, Inc., 6.90%, 8/15/39 | | 20,000 |

| 25,155 |

|

| 21st Century Fox America, Inc., 4.75%, 9/15/44 | | 10,000 |

| 10,015 |

|

| CBS Corp., 3.50%, 1/15/25 | | 20,000 |

| 19,820 |

|

| CBS Corp., 4.85%, 7/1/42 | | 10,000 |

| 9,807 |

|

| Charter Communications Operating LLC / Charter Communications Operating Capital, 4.91%, 7/23/25 | | 185,000 |

| 195,067 |

|

| Charter Communications Operating LLC / Charter Communications Operating Capital, 6.48%, 10/23/45 | | 10,000 |

| 11,581 |

|

| Comcast Corp., 6.40%, 5/15/38 | | 70,000 |

| 89,665 |

|

| Discovery Communications LLC, 5.625%, 8/15/19 | | 25,000 |

| 27,013 |

|

| Discovery Communications LLC, 3.25%, 4/1/23 | | 30,000 |

| 29,258 |

|

| Discovery Communications LLC, 4.90%, 3/11/26 | | 20,000 |

| 21,071 |

|

| Interpublic Group of Cos., Inc. (The), 4.00%, 3/15/22 | | 20,000 |

| 20,692 |

|

| Lamar Media Corp., 5.375%, 1/15/24 | | 30,000 |

| 31,200 |

|

| NBCUniversal Media LLC, 4.375%, 4/1/21 | | 60,000 |

| 64,803 |

|

| NBCUniversal Media LLC, 2.875%, 1/15/23 | | 55,000 |

| 54,858 |

|

Nielsen Finance LLC / Nielsen Finance Co., 5.00%, 4/15/22(4) | | 30,000 |

| 30,637 |

|

| Omnicom Group, Inc., 3.60%, 4/15/26 | | 40,000 |

| 39,608 |

|

| TEGNA, Inc., 5.125%, 7/15/20 | | 57,000 |

| 59,209 |

|

| Time Warner Cable LLC, 6.75%, 7/1/18 | | 20,000 |

| 21,357 |

|

| Time Warner Cable LLC, 5.50%, 9/1/41 | | 10,000 |

| 10,183 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Time Warner Cable LLC, 4.50%, 9/15/42 | | $ | 10,000 |

| $ | 9,073 |

|

| Time Warner, Inc., 4.70%, 1/15/21 | | 30,000 |

| 32,070 |

|

| Time Warner, Inc., 3.60%, 7/15/25 | | 30,000 |

| 29,847 |

|

| Time Warner, Inc., 3.80%, 2/15/27 | | 30,000 |

| 29,798 |

|

| Time Warner, Inc., 5.35%, 12/15/43 | | 20,000 |

| 21,191 |

|

| Viacom, Inc., 3.125%, 6/15/22 | | 30,000 |

| 29,094 |

|

| Viacom, Inc., 4.25%, 9/1/23 | | 30,000 |

| 30,034 |

|

| Walt Disney Co. (The), MTN, 1.85%, 7/30/26 | | 30,000 |

| 27,027 |

|

| Walt Disney Co. (The), MTN, 4.125%, 6/1/44 | | 20,000 |

| 20,686 |

|

| | | | 1,020,072 |

|

| Metals and Mining — 0.1% | | | |

| Barrick North America Finance LLC, 5.75%, 5/1/43 | | 10,000 |

| 10,530 |

|

Glencore Finance Canada Ltd., 4.95%, 11/15/21(4) | | 20,000 |

| 21,423 |

|

| Southern Copper Corp., 5.25%, 11/8/42 | | 20,000 |

| 18,392 |

|

Steel Dynamics, Inc., 5.00%, 12/15/26(4) | | 50,000 |

| 49,937 |

|

| Vale Overseas Ltd., 5.625%, 9/15/19 | | 25,000 |

| 26,475 |

|

| | | | 126,757 |

|

| Multi-Utilities — 0.7% | | | |

| AmeriGas Partners LP / AmeriGas Finance Corp., 5.625%, 5/20/24 | | 30,000 |

| 30,825 |

|

| Berkshire Hathaway Energy Co., 3.50%, 2/1/25 | | 30,000 |

| 30,608 |

|

| CenterPoint Energy Houston Electric LLC, 3.55%, 8/1/42 | | 10,000 |

| 9,411 |

|

| CMS Energy Corp., 8.75%, 6/15/19 | | 40,000 |

| 46,196 |

|

| Consolidated Edison Co. of New York, Inc., 3.95%, 3/1/43 | | 20,000 |

| 19,365 |

|

| Constellation Energy Group, Inc., 5.15%, 12/1/20 | | 32,000 |

| 34,598 |

|

| Dominion Resources, Inc., 2.75%, 9/15/22 | | 70,000 |

| 68,898 |

|

| Dominion Resources, Inc., 3.625%, 12/1/24 | | 30,000 |

| 30,201 |

|

| Dominion Resources, Inc., 4.90%, 8/1/41 | | 20,000 |

| 21,034 |

|

| Duke Energy Corp., 3.55%, 9/15/21 | | 20,000 |

| 20,706 |

|

| Duke Energy Corp., 2.65%, 9/1/26 | | 70,000 |

| 65,370 |

|

| Duke Energy Florida LLC, 6.35%, 9/15/37 | | 20,000 |

| 25,780 |

|

| Duke Energy Florida LLC, 3.85%, 11/15/42 | | 20,000 |

| 19,186 |

|

| Duke Energy Progress LLC, 4.15%, 12/1/44 | | 20,000 |

| 19,879 |

|

| Edison International, 3.75%, 9/15/17 | | 40,000 |

| 40,629 |

|

| Exelon Corp., 4.45%, 4/15/46 | | 20,000 |

| 19,618 |

|

| Exelon Generation Co. LLC, 4.25%, 6/15/22 | | 20,000 |

| 20,705 |

|

| Exelon Generation Co. LLC, 5.60%, 6/15/42 | | 10,000 |

| 9,274 |

|

| FirstEnergy Corp., 2.75%, 3/15/18 | | 20,000 |

| 20,185 |

|

| FirstEnergy Corp., 4.25%, 3/15/23 | | 30,000 |

| 31,025 |

|

| Florida Power & Light Co., 4.125%, 2/1/42 | | 20,000 |

| 20,522 |

|

| Georgia Power Co., 4.30%, 3/15/42 | | 10,000 |

| 10,212 |

|

| IPALCO Enterprises, Inc., 5.00%, 5/1/18 | | 40,000 |

| 41,500 |

|

| MidAmerican Energy Co., 4.40%, 10/15/44 | | 60,000 |

| 63,759 |

|

| NextEra Energy Capital Holdings, Inc., VRN, 7.30%, 9/1/17 | | 40,000 |

| 40,060 |

|

| NiSource Finance Corp., 5.65%, 2/1/45 | | 20,000 |

| 23,363 |

|

| Pacific Gas & Electric Co., 4.00%, 12/1/46 | | 20,000 |

| 19,767 |

|

| Potomac Electric Power Co., 3.60%, 3/15/24 | | 20,000 |

| 20,675 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Progress Energy, Inc., 3.15%, 4/1/22 | | $ | 20,000 |

| $ | 20,184 |

|

| Sempra Energy, 2.875%, 10/1/22 | | 40,000 |

| 39,625 |

|

| Southern Co. Gas Capital Corp., 3.95%, 10/1/46 | | 10,000 |

| 9,273 |

|

| Southern Power Co., 5.15%, 9/15/41 | | 10,000 |

| 10,089 |

|

| Virginia Electric & Power Co., 3.45%, 2/15/24 | | 30,000 |

| 30,842 |

|

| Virginia Electric & Power Co., 4.45%, 2/15/44 | | 10,000 |

| 10,519 |

|

| Xcel Energy, Inc., 3.35%, 12/1/26 | | 20,000 |

| 20,029 |

|

| Xcel Energy, Inc., 4.80%, 9/15/41 | | 10,000 |

| 10,674 |

|

| | | | 974,586 |

|

Multiline Retail† | | | |

| Macy's Retail Holdings, Inc., 2.875%, 2/15/23 | | 30,000 |

| 28,562 |

|

| Oil, Gas and Consumable Fuels — 0.8% | | | |

| Anadarko Petroleum Corp., 5.55%, 3/15/26 | | 40,000 |

| 44,792 |

|

| Anadarko Petroleum Corp., 6.45%, 9/15/36 | | 20,000 |

| 23,839 |

|

Antero Resources Corp., 5.00%, 3/1/25(4) | | 50,000 |

| 49,150 |

|

| Apache Corp., 4.75%, 4/15/43 | | 40,000 |

| 41,279 |

|

| BP Capital Markets plc, 4.50%, 10/1/20 | | 30,000 |

| 32,185 |

|

| BP Capital Markets plc, 2.75%, 5/10/23 | | 20,000 |

| 19,631 |

|

| Chevron Corp., 2.10%, 5/16/21 | | 40,000 |

| 39,647 |

|

| Cimarex Energy Co., 4.375%, 6/1/24 | | 30,000 |

| 31,211 |

|

| CNOOC Nexen Finance 2014 ULC, 4.25%, 4/30/24 | | 30,000 |

| 30,744 |

|

| Concho Resources, Inc., 6.50%, 1/15/22 | | 10,000 |

| 10,348 |

|

| Concho Resources, Inc., 5.50%, 4/1/23 | | 50,000 |

| 52,065 |

|

| Concho Resources, Inc., 4.375%, 1/15/25 | | 30,000 |

| 30,090 |

|

| ConocoPhillips Holding Co., 6.95%, 4/15/29 | | 10,000 |

| 12,583 |

|

| Ecopetrol SA, 4.125%, 1/16/25 | | 10,000 |

| 9,390 |

|

| Encana Corp., 6.50%, 2/1/38 | | 20,000 |

| 21,665 |

|

| EOG Resources, Inc., 5.625%, 6/1/19 | | 30,000 |

| 32,424 |

|

| EOG Resources, Inc., 4.10%, 2/1/21 | | 20,000 |

| 21,080 |

|

| Exxon Mobil Corp., 2.71%, 3/6/25 | | 40,000 |

| 38,929 |

|

| Exxon Mobil Corp., 3.04%, 3/1/26 | | 50,000 |

| 49,919 |

|

| Hess Corp., 6.00%, 1/15/40 | | 30,000 |

| 30,997 |

|

| Marathon Oil Corp., 3.85%, 6/1/25 | | 30,000 |

| 29,106 |

|

| Newfield Exploration Co., 5.75%, 1/30/22 | | 20,000 |

| 21,175 |

|

| Noble Energy, Inc., 4.15%, 12/15/21 | | 50,000 |

| 52,131 |

|

| Petroleos Mexicanos, 6.00%, 3/5/20 | | 40,000 |

| 42,290 |

|

| Petroleos Mexicanos, 4.875%, 1/24/22 | | 70,000 |

| 70,385 |

|

| Petroleos Mexicanos, 3.50%, 1/30/23 | | 10,000 |

| 9,205 |

|

| Petroleos Mexicanos, 6.625%, 6/15/35 | | 10,000 |

| 9,900 |

|

| Phillips 66, 4.30%, 4/1/22 | | 50,000 |

| 53,695 |

|

| Shell International Finance BV, 2.375%, 8/21/22 | | 20,000 |

| 19,635 |

|

| Shell International Finance BV, 3.25%, 5/11/25 | | 20,000 |

| 19,979 |

|

| Shell International Finance BV, 3.625%, 8/21/42 | | 40,000 |

| 36,178 |

|

| Statoil ASA, 2.45%, 1/17/23 | | 40,000 |

| 39,038 |

|

| Statoil ASA, 3.95%, 5/15/43 | | 20,000 |

| 19,085 |

|

| Suburban Propane Partners LP / Suburban Energy Finance Corp., 7.375%, 8/1/21 | | 30,000 |

| 31,125 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Total Capital Canada Ltd., 2.75%, 7/15/23 | | $ | 20,000 |

| $ | 19,788 |

|

| Total Capital SA, 2.125%, 8/10/18 | | 20,000 |

| 20,154 |

|

| | | | 1,114,837 |

|

| Paper and Forest Products — 0.1% | | | |

Georgia-Pacific LLC, 2.54%, 11/15/19(4) | | 40,000 |

| 40,358 |

|

Georgia-Pacific LLC, 5.40%, 11/1/20(4) | | 60,000 |

| 65,971 |

|

| International Paper Co., 6.00%, 11/15/41 | | 10,000 |

| 11,249 |

|

| International Paper Co., 4.40%, 8/15/47 | | 30,000 |

| 28,409 |

|

| | | | 145,987 |

|

| Pharmaceuticals — 0.3% | | | |

| Actavis Funding SCS, 3.85%, 6/15/24 | | 34,000 |

| 34,318 |

|

| Actavis Funding SCS, 4.55%, 3/15/35 | | 20,000 |

| 19,826 |

|

| Actavis, Inc., 1.875%, 10/1/17 | | 40,000 |

| 40,082 |

|

| Actavis, Inc., 3.25%, 10/1/22 | | 30,000 |

| 29,883 |

|

| Actavis, Inc., 4.625%, 10/1/42 | | 10,000 |

| 9,702 |

|

Forest Laboratories LLC, 4.875%, 2/15/21(4) | | 60,000 |

| 64,466 |

|

| GlaxoSmithKline Capital plc, 2.85%, 5/8/22 | | 35,000 |

| 35,270 |

|

| Merck & Co., Inc., 2.40%, 9/15/22 | | 70,000 |

| 68,597 |

|

| Merck & Co., Inc., 3.70%, 2/10/45 | | 10,000 |

| 9,540 |

|

Roche Holdings, Inc., 3.35%, 9/30/24(4) | | 20,000 |

| 20,468 |

|

| Shire Acquisitions Investments Ireland DAC, 2.40%, 9/23/21 | | 130,000 |

| 125,598 |

|

| | | | 457,750 |

|

| Road and Rail — 0.2% | | | |

| Burlington Northern Santa Fe LLC, 3.60%, 9/1/20 | | 39,000 |

| 40,838 |

|

| Burlington Northern Santa Fe LLC, 4.45%, 3/15/43 | | 50,000 |

| 52,421 |

|

| Burlington Northern Santa Fe LLC, 4.15%, 4/1/45 | | 10,000 |

| 10,145 |

|

| CSX Corp., 3.40%, 8/1/24 | | 30,000 |

| 30,572 |

|

| CSX Corp., 3.80%, 11/1/46 | | 20,000 |

| 18,582 |

|

| Norfolk Southern Corp., 5.75%, 4/1/18 | | 10,000 |

| 10,502 |

|

| Norfolk Southern Corp., 3.25%, 12/1/21 | | 40,000 |

| 41,087 |

|

Penske Truck Leasing Co. LP / PTL Finance Corp., 2.875%, 7/17/18(4) | | 10,000 |

| 10,131 |

|

| Union Pacific Corp., 4.00%, 2/1/21 | | 20,000 |

| 21,189 |

|

| Union Pacific Corp., 4.75%, 9/15/41 | | 10,000 |

| 10,872 |

|

| Union Pacific Corp., 3.35%, 8/15/46 | | 10,000 |

| 8,962 |

|

| | | | 255,301 |

|

Semiconductors and Semiconductor Equipment† | | | |

| Lam Research Corp., 2.80%, 6/15/21 | | 50,000 |

| 49,738 |

|

| Software — 0.3% | | | |

Activision Blizzard, Inc., 2.30%, 9/15/21(4) | | 30,000 |

| 29,280 |

|

| Intuit, Inc., 5.75%, 3/15/17 | | 75,000 |

| 75,668 |

|

| Microsoft Corp., 2.70%, 2/12/25 | | 70,000 |

| 68,572 |

|

| Microsoft Corp., 3.125%, 11/3/25 | | 20,000 |

| 20,219 |

|

| Microsoft Corp., 3.45%, 8/8/36 | | 50,000 |

| 47,535 |

|

| Oracle Corp., 2.50%, 10/15/22 | | 25,000 |

| 24,724 |

|

| Oracle Corp., 3.625%, 7/15/23 | | 30,000 |

| 31,435 |

|

| Oracle Corp., 2.65%, 7/15/26 | | 80,000 |

| 75,916 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| Oracle Corp., 4.30%, 7/8/34 | | $ | 20,000 |

| $ | 20,686 |

|

| Oracle Corp., 4.00%, 7/15/46 | | 20,000 |

| 19,138 |

|

| | | | 413,173 |

|

| Specialty Retail — 0.1% | | | |

| Home Depot, Inc. (The), 2.625%, 6/1/22 | | 30,000 |

| 30,135 |

|

| Home Depot, Inc. (The), 3.35%, 9/15/25 | | 20,000 |

| 20,513 |

|

| Home Depot, Inc. (The), 3.00%, 4/1/26 | | 40,000 |

| 39,913 |

|

| Home Depot, Inc. (The), 5.95%, 4/1/41 | | 40,000 |

| 50,869 |

|

| United Rentals North America, Inc., 4.625%, 7/15/23 | | 20,000 |

| 20,475 |

|

| | | | 161,905 |

|

| Technology Hardware, Storage and Peripherals — 0.2% | | | |

| Apple, Inc., 1.00%, 5/3/18 | | 30,000 |

| 29,889 |

|

| Apple, Inc., 2.85%, 5/6/21 | | 30,000 |

| 30,695 |

|

| Apple, Inc., 2.50%, 2/9/25 | | 110,000 |

| 105,675 |

|

| Apple, Inc., 4.65%, 2/23/46 | | 20,000 |

| 21,606 |

|

Diamond 1 Finance Corp. / Diamond 2 Finance Corp., 6.02%, 6/15/26(4) | | 70,000 |

| 75,867 |

|

| Seagate HDD Cayman, 4.75%, 6/1/23 | | 40,000 |

| 39,675 |

|

| | | | 303,407 |

|

Textiles, Apparel and Luxury Goods† | | | |

| PVH Corp., 4.50%, 12/15/22 | | 30,000 |

| 30,600 |

|

| Tobacco — 0.1% | | | |

| Altria Group, Inc., 2.85%, 8/9/22 | | 40,000 |

| 40,056 |

|

| Philip Morris International, Inc., 4.125%, 5/17/21 | | 40,000 |

| 42,708 |

|

| Reynolds American, Inc., 4.45%, 6/12/25 | | 20,000 |

| 21,126 |

|

| | | | 103,890 |

|

| Wireless Telecommunication Services — 0.1% | | | |

Sprint Communications, Inc., 9.00%, 11/15/18(4) | | 40,000 |

| 44,200 |

|

| T-Mobile USA, Inc., 6.46%, 4/28/19 | | 40,000 |

| 40,750 |

|

| | | | 84,950 |

|

TOTAL CORPORATE BONDS

(Cost $16,867,866) | | | 16,975,647 |

|

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES(5) — 10.3% | |

| Adjustable-Rate U.S. Government Agency Mortgage-Backed Securities — 1.2% | |

| FHLMC, VRN, 1.81%, 1/15/17 | | 21,026 |

| 21,681 |

|

| FHLMC, VRN, 1.91%, 1/15/17 | | 31,145 |

| 32,036 |

|

| FHLMC, VRN, 1.99%, 1/15/17 | | 25,753 |

| 26,617 |

|

| FHLMC, VRN, 2.31%, 1/15/17 | | 76,932 |

| 77,551 |

|

| FHLMC, VRN, 2.39%, 1/15/17 | | 210,163 |

| 212,990 |

|

| FHLMC, VRN, 2.51%, 1/15/17 | | 96,526 |

| 99,164 |

|

| FHLMC, VRN, 2.59%, 1/15/17 | | 116,108 |

| 118,244 |

|

| FHLMC, VRN, 2.68%, 1/15/17 | | 41,314 |

| 43,662 |

|

| FHLMC, VRN, 2.78%, 1/15/17 | | 90,505 |

| 95,687 |

|

| FHLMC, VRN, 2.81%, 1/15/17 | | 43,137 |

| 45,526 |

|

| FHLMC, VRN, 2.84%, 1/15/17 | | 21,120 |

| 22,375 |

|

| FHLMC, VRN, 2.87%, 1/15/17 | | 51,756 |

| 53,185 |

|

| FHLMC, VRN, 3.01%, 1/15/17 | | 7,332 |

| 7,769 |

|

|

| | | | | | | |

| | | Shares/

Principal Amount | Value |

| FHLMC, VRN, 3.09%, 1/15/17 | | $ | 14,780 |

| $ | 15,635 |

|

| FHLMC, VRN, 3.14%, 1/15/17 | | 21,866 |

| 23,049 |

|

| FHLMC, VRN, 3.67%, 1/15/17 | | 16,422 |

| 16,970 |

|

| FHLMC, VRN, 4.07%, 1/15/17 | | 23,503 |

| 24,304 |

|

| FHLMC, VRN, 4.24%, 1/15/17 | | 28,507 |

| 29,669 |

|

| FHLMC, VRN, 4.71%, 1/15/17 | | 12,246 |

| 12,755 |

|

| FHLMC, VRN, 5.14%, 1/15/17 | | 7,722 |

| 8,000 |

|