UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2019

Date of reporting period: September 30, 2019

Item 1.Reports to Stockholders

The following annual reports are attached hereto, in order:

Thornburg Low Duration Municipal Fund

Thornburg Limited Term Municipal Fund

Thornburg Intermediate Municipal Fund

Thornburg Strategic Municipal Income Fund

Thornburg California Limited Term Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Limited Term U.S. Government Fund

Thornburg Limited Term Income Fund

Thornburg Low Duration Income Fund

Thornburg Strategic Income Fund

Thornburg Value Fund

Thornburg International Value Fund

Thornburg Core Growth Fund

Thornburg International Growth Fund

Thornburg Investment Income Builder Fund

Thornburg Global Opportunities Fund

Thornburg Developing World Fund

Thornburg Better World International Fund

Thornburg Capital Management Fund

Thornburg Long/Short Equity Fund

Thornburg Summit Fund

Annual Report

September 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by going to thornburg.com/edelivery.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling 800.847.0200 or your financial intermediary directly. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

At Thornburg, we believe unconstrained investing leads to better outcomes for our clients. Our investment solutions are highly active, high conviction, and benchmark agnostic. When it comes to finding economic opportunity for clients, it’s more than what we do.

It’s how we do it. Active Asbottom-up, fundamental, active managers, we look beyond conventional benchmarks. Long Term We take a long-term view in how we manage our firm and our portfolios. Benchmark Agnostic Investment strategies should have the flexibility to pursue solutions for clients, not stay within the conventional confines of benchmarks. Flexible Perspective Our approach to portfolio construction is guided by our convictions rather than convention. High Conviction We focus our attention and capital on thoroughly researched, well-understood positions. The best form of risk management is to know what you own, and why. Repeatable & Robust Our long-term outperformance of benchmarks verifies that our process works and outperforms conventional thinking. Independent We are independently owned and far from the herd of other investment managers. Investment Driven All members of the investment team are resources for all of our strategies. Collaborative Our team collaborates on opportunities across geography, sector, or asset class.

Thornburg Low Duration Municipal Fund

Annual Report | September 30, 2019

Table of Contents

| SHARE CLASS | NASDAQ SYMBOL | CUSIP |

| Class A | TLMAX | 885-216-788 |

| Class I | TLMIX | 885-216-770 |

Minimum investments for Class I shares may be higher than those for Class A. Class I shares may not be available to all investors.

Investments carry risks, including possible loss of principal. Portfolios investing in bonds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Please see the Fund’s prospectus for a discussion of the risks associated with an investment in the Fund. Investments in the Funds are not FDIC insured, nor are they bank deposits or guaranteed by a bank or any other entity.

The laddering strategy does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Letter to Shareholders

Thornburg Low Duration Municipal Fund | September 30, 2019 (Unaudited)

October 18, 2019

Dear Fellow Shareholder:

We are pleased to present the annual report for the Thornburg Low Duration Municipal Fund. The net asset value (NAV) of the Class I shares increased 9 cents to $12.36 per share during the fiscal year ended September 30, 2019. The Class I shares of your Fund underperformed the index with a 2.22% total return for the fiscal year ended September 30, 2019, compared to the 3.12% total return for the ICE BofA Merrill Lynch 1-3 Year Municipal Securities Index.

The drivers of the Fund’s total return relative to its benchmark include its interest rate sensitivity, as measured by the Fund’s duration, differing maturity allocations and other risk factors. The impact of the Fund’s 0.81 years shorter duration detracted 0.036%. The Fund’s sector allocations contributed 0.055%, while other risk factors detracted 0.354%. The Fund’s expenses and residuals accounted for the remainder of the performance differential.

Since the last annual letter published in November 2018, the municipal market and its investors have experienced one of the great rallies in the market’s history, driven by the largest amount of inflows into municipal bond mutual funds on record. Mutual funds have experienced positive inflows every week of 2019, with the aggregate amounting to more than $70 billion. During that time, the 10-year Thomson Reuters Municipal Market Data (MMD) AAA Curve has fallen from a high of 2.80% in early November 2018 to an all-time low of 1.22% in late August 2019, only to settle around 1.45% at the time of this writing. The decrease in yields and the insatiable demand from retail mutual fund investors has led to appreciating bond prices that have accounted for a large portion of the returns the market inked over the last 12 months.

While the increase in the price of the investments has been great to watch, municipal investors find themselves in a tough situation. Does one sell the bonds at high prices? Is it best to pay a capital gain and look for reinvestment opportunities? Or does one hold the bonds? Collect a coupon and reinvest the proceeds knowing that the premium could evaporate if yields spike?

In many cases the answer is contingent on investor goals and risk tolerance. So instead of providing an answer, we would like to present an analysis of market risks that will allow investors to draw their own conclusions.

Municipal Bond Supply and Demand

Municipal investors tend to be overly sensitive to supply trends. The common refrain is that a big supply year is bearish for bond prices and vice versa. While that is generally true, it negates the other half of the equation. Demand, not supply, can be a large driver of total return, and that is exactly what the market has experienced throughout 2019. $70 billion has poured into the municipal market through the end of September 2019, the largest amount of annual inflows on record.

That $70 billion represents roughly 10% of all assets in municipal bond mutual funds. So technical demand, not fundamentals, has been the key driver of asset appreciation. That should be troubling. As investors, we like fundamentals to move asset prices. If you were to invest in Apple, and Apple sells more iPhones, and the firm’s stock appreciates, we would consider that being for the right reasons. When price is driven by factors other than fundamental value, the potential for a reversal tends to be high. Therefore, we would recommend caution when investing in a market where fundamental improvement isn’t the reason for price appreciation.

Municipal Bond Credit Risk

Credit spreads, much like triple-A bond insurers, have all but disappeared from the muni market. That is somewhat of an overstatement, but for some time now credit spreads, especially across the plain vanilla investment grade space, have become virtually commoditized. At the same time, while much has been said surrounding the covenant-lite status of recent corporate debt issuance, little has been said about the phenomenon in the municipal bond market. Credit security packages are getting weaker. Net revenue covenants, liquidity covenants, additional bonds tests and other protections granted to municipal investors are weakening. It is undeniable that municipal investors are taking on more and more credit risk for less and less yield.

State and Local Tax Deduction (SALT)

At least part of the increase in demand for municipal paper has been driven by the changes to the SALT deduction cap. The cap of $10,000 in state and local taxes that are deductible from federal taxes was part of the tax changes that were passed by the Trump administration at the end of 2017. It is estimated that over 10 million taxpayers were unable to write-off some $320 billion in state and local taxes, effectively increasing their tax liability despite a reduction in marginal personal income tax rates. The impact has been the most severe in states with high local and state taxes.

Faced with an ever-increasing tax bill, investors in these high-tax states have flocked to the municipal bond market. In no place is that truer than California. For many investors in the state, investments in the California municipal bond market no longer make economic sense. After adjusting yields for state and local taxes, many California investors would be better off investing in U.S. Treasuries due to the higher after-tax yield. Yet, money continues to flow into the California municipal bond market as investors make these non-economic decisions. Non-economic decision-making is not isolated to the California market, though. It’s evident in many high-tax states.

The Federal Reserve and Monetary Policy

As recently as December 2018, the Federal Reserve seemed bound and determined to push interest rates higher. It took only a few angry tweets and some stock market volatility in the fourth quarter of 2018 for the Fed to put its interest rate hikes

Letter to Shareholders, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019 (Unaudited)

on pause, and only seven months for a complete reversal of course. Since the 25 basis point (bps) rate cut in July, the Fed cut again in September and the market is pricing in one more cut before year end.

While monetary policy has been the elixir of choice for a decade running, it has also created a host of problems for fixed income investors. By keeping yields low for the last decade, fixed income investors have been driven out the risk spectrum in search of their income goals. Many have taken on additional duration risk by buying longer-dated bonds, making them more susceptible to interest rate movements.

Other fixed income investors have taken on more credit risk, making them more susceptible to a slowing economy. Others have been forced out of the fixed income market and into the equity markets, which completely changes the risk profile of their investments. This is all being done at a time of all-time low yields and all-time low credit spreads. This situation is hardly sustainable.

The highlighted risks have led us to maintain our present course. The Fund remains higher in credit quality and cash with durations at lower levels. While the latter has impacted total returns as price appreciation has driven total return, the distribution yield, or tax-free monthly income, has held up nicely. Cash has been allowed to build given the flatness of the

yield curve and the trade-off in investing in the variable rate demand note (VRDN) market. When opportunities arise, we have ample dry powder to take advantage of dislocations. Until those conditions are met, we are content to manage the Fund in a more conservative fashion commensurate with the risk profile of a municipal bond investor.

Thank you for your continued trust and support.

Sincerely,

|

|

Christopher Ryon,cfa

Portfolio Manager

Managing Director | Nicholos Venditti,cfa

Portfolio Manager

Managing Director |

| |

David Ashley,cfa

Portfolio Manager

Managing Director | |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance Summary

Thornburg Low Duration Municipal Fund | September 30, 2019 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| | 1-YR | 3-YR | 5-YR | SINCE

INCEP. |

| Class A Shares(Incep: 12/30/13) | | | | |

| Without sales charge | 2.02% | 1.00% | 0.68% | 0.66% |

| With sales charge | 0.46% | 0.49% | 0.37% | 0.39% |

| Class I Shares(Incep: 12/30/13) | 2.22% | 1.20% | 0.87% | 0.85% |

30-DAY YIELDS, A SHARES(with sales charge)

| Annualized Distribution Yield | 1.21% |

| SEC Yield | 0.85% |

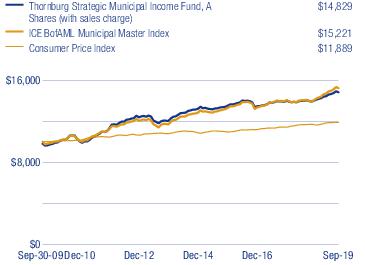

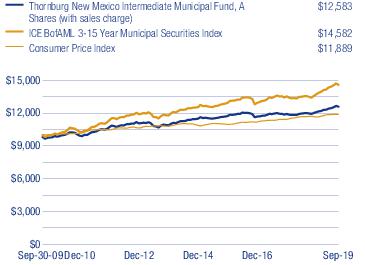

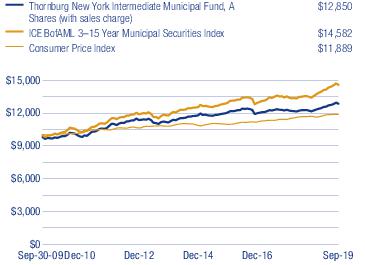

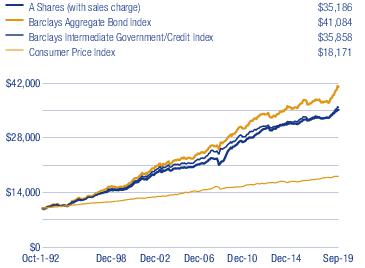

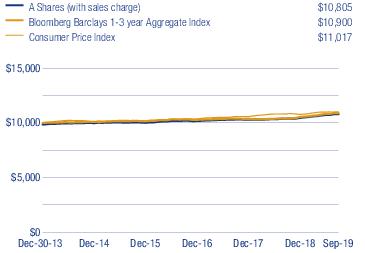

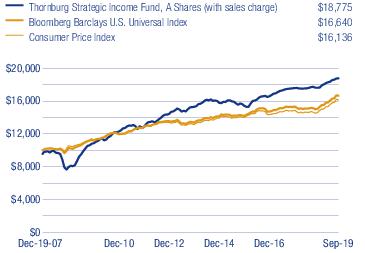

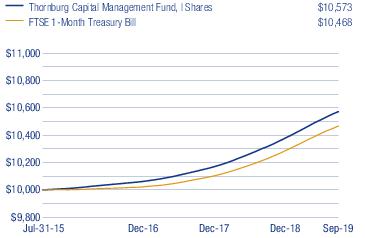

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 1.50%. There is no sales charge for Class I shares. As disclosed in the most recent prospectus, the total annual fund operating expenses before fee waivers and expense reimbursements are as follows: A shares, 1.06%; I shares, 0.64%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2020, for some of the share classes, resulting in net expense ratios of the following: A shares, 0.70%; I shares, 0.50%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus. Without the fee waivers and expense reimbursements, the Annualized Distribution yield would have been 0.86%, and the SEC yield would have been 0.50%.

The ICE index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Thornburg Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See www.thornburg.com/indices for a full copy of the Disclaimer.

TheICE BofAML 1-3 Year Municipal Securities Index is a subset of the ICE BofAML Municipal Securities Index including all securities with a remaining term to final maturity greater than or equal to 1 year and less than 3 years.

The performance of any index is not indicative of the performance of any particular investment. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Bond Credit Ratings (Credit Quality) – A bond credit rating assesses the financial ability of a debt issuer to make timely payments of principal and interest. Ratings of AAA (the highest), AA, A, and BBB are investment-grade quality. Ratings of BB, B, CCC, CC, C and D (the lowest) are considered below investment grade, speculative grade, or junk bonds.

Duration – A bond’s sensitivity to interest rates. Bonds with longer durations experience greater price volatility than bonds with shorter durations. Effective duration incorporates a bond’s embedded option features, such as call provisions.

Yield Curve – A line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates.

Thomson Reuters Municipal Market Data (MMD) AAA Curve - Thomson Reuters Municipal Market Data (MMD) AAA Curve is a proprietary yield curve that provides the offer-side of “AAA” rated state general obligation bonds, as determined by the MMD analyst team. The MMD AAA curve represents the MMD analyst team’s opinion of AAA valuation, based on institutional block size ($2 million+) market activity in both the primary and secondary municipal bond market. In the interest of transparency, MMD publishes extensive yield curve assumptions relating to various structural criteria which are used in filtering market information for the purpose of benchmark yield curve creation.

Fund Summary

Thornburg Low Duration Municipal Fund | September 30, 2019 (Unaudited)

OBJECTIVES AND STRATEGIES

The Fund seeks current income exempt from federal income tax, consistent with preservation of capital (may be subject to Alternative Minimum Tax).

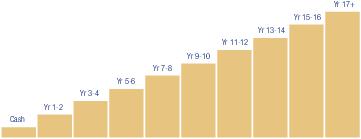

This Fund invests principally in a laddered portfolio of municipal bonds with a dollar-weighted average duration of normally no more than three years. Laddering involves building a portfolio of bonds with staggered maturities so that a portion of the portfolio matures each year. Cash from maturing bonds, if not needed for other purposes, is typically invested in bonds with longer maturities at the far end of the ladder. We regard the strategy as a good compromise for managing different types of risk.

LONG-TERM STABILITY OF PRINCIPAL

Net Asset Value History of A Shares

| KEY PORTFOLIO ATTRIBUTES | |

| Number of Bonds | 159 |

| Effective Duration | 0.9 Yrs |

| Average Maturity | 1.5 Yrs |

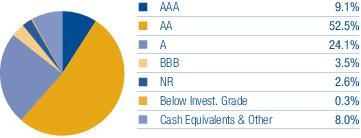

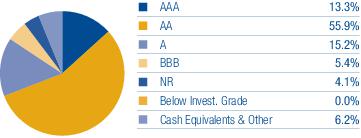

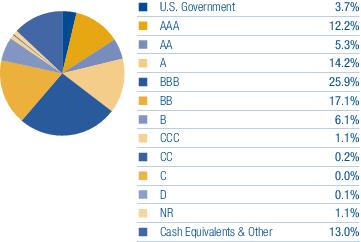

SECURITY CREDIT RATINGS

A bond credit rating assesses the financial ability of a debt issuer to make timely payments of principal and interest. Ratings of AAA (the highest), AA, A, and BBB are investment-grade quality. Ratings of BB, B, CCC, CC, C and D (the lowest) are considered below investment grade, speculative grade, or junk bonds.

Unrated pre-refunded and escrowed-to-maturity bonds are included in the not rated category.

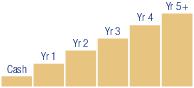

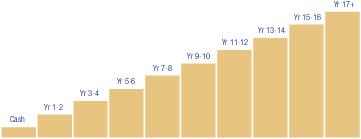

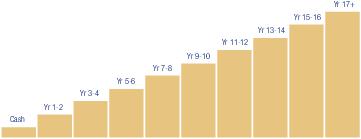

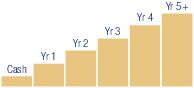

PORTFOLIO LADDER

Percent of portfolio maturing in each year. Cash includes cash equivalents and other.

There is no guarantee that the Fund will meet its investment objectives.

All data is subject to change. Charts may not add up to 100% due to rounding.

Schedule of Investments

Thornburg Low Duration Municipal Fund | September 30, 2019

| | | PRINCIPAL

AMOUNT | VALUE |

| | Municipal Bonds — 95.3% | | |

| | Alabama — 0.8% | | |

| a | City of Mobile Industrial Development Board (Alabama Power Company Barry Plant), 1.85% due 6/1/2034 (put 3/24/2020) | $1,000,000 | $ 1,001,090 |

| | Southeast Alabama Gas Supply District, Series A, 4.00% due 6/1/2020 | 1,000,000 | 1,015,840 |

| | Alaska — 2.3% | | |

| | Alaska Industrial Development & Export Authority, Series A, 5.25% due 4/1/2024 (pre-refunded 4/1/2020) (put 10/1/2019) | 3,780,000 | 3,851,480 |

| | City of Valdez (BP Pipelines (Alaska), Inc. Project), Series B, 5.00% due 1/1/2021 | 1,725,000 | 1,799,503 |

| | Arizona — 1.6% | | |

| b | Arizona (Banner Health Obligated Group; LOC Bank of America, N.A.) HFA, Series C, 1.77% due 1/1/2046 (put 10/1/2019) | 800,000 | 800,000 |

| c | Maricopa County (Banner Health Obligated Group) IDA, Series B, 1.96% (MUNIPSA + 0.38%) due 1/1/2035 (put 10/18/2022) | 2,000,000 | 2,003,660 |

| d | Mesa Utility System Revenue, 4.00% due 7/1/2020 | 915,000 | 933,639 |

| | California — 2.5% | | |

| c | California Infrastructure and Economic Development Bank (California Academy of Sciences), Series D, 1.806% (LIBOR 1 Month + 0.38%) due 8/1/2047 (put 8/1/2021) | 2,000,000 | 2,000,060 |

| c | California Infrastructure and Economic Development Bank (Los Angeles County Museum of Art), Series A, 2.088% (LIBOR 1 Month + 0.65%) due 12/1/2050 (put 2/1/2021) | 1,000,000 | 1,002,730 |

| a,e | California Municipal Finance Authority, Series A, 2.00% due 2/1/2039 (put 2/3/2020) | 2,000,000 | 2,003,320 |

| | California Statewide Communities Development Authority (Irvine East Campus Apartments), 5.00% due 5/15/2020 | 565,000 | 577,633 |

| | State of California GO, 2.00% due 12/1/2019 | 500,000 | 500,715 |

| | Colorado — 5.4% | | |

| | City & County of Denver (SPA JPMorgan Chase Bank, N.A.), | | |

| b | Series A1, 1.75% due 12/1/2029 (put 10/1/2019) | 4,370,000 | 4,370,000 |

| b | Series A3, 1.75% due 12/1/2031 (put 10/1/2019) | 3,070,000 | 3,070,000 |

| | City of Aurora (Sports Park and E-911 Projects) COP, 5.00% due 12/1/2019 | 365,000 | 367,227 |

| | Colorado (Catholic Health Initiatives) HFA ETM, Series A, 5.00% due 2/1/2020 | 2,885,000 | 2,919,245 |

| | Interlocken Metropolitan District (Insured: AGM) GO, Series A-1, 5.00% due 12/1/2020 - 12/1/2023 | 2,000,000 | 2,212,191 |

| | Connecticut — 1.5% | | |

| | State of Connecticut GO, | | |

| | Series C, 5.00% due 6/15/2022 | 1,715,000 | 1,877,685 |

| | Series F, 5.00% due 9/15/2023 | 1,000,000 | 1,134,970 |

| | State of Connecticut Special Tax Revenue, Series B, 5.00% due 10/1/2021 | 525,000 | 561,346 |

| | Florida — 5.5% | | |

| | City of Jacksonville, Series C, 5.00% due 10/1/2019 - 10/1/2020 | 1,500,000 | 1,536,440 |

| | City of Orlando (Insured: AGM), Series A, 4.00% due 11/1/2021 | 900,000 | 947,664 |

| | City of Orlando (Senior Tourist Development; Insured: AGM), Series A, 4.00% due 11/1/2020 | 850,000 | 872,865 |

| a,f | Escambia County (International Paper Co.) 2.00% due 11/1/2033 (put 10/1/2024) | 775,000 | 776,038 |

| b | Manatee County (Florida Power & Light Co.), 1.78% due 9/1/2024 (put 10/1/2019) | 4,300,000 | 4,300,000 |

| b | Miami-Dade County (Florida Power & Light Co.) IDA, 1.78% due 6/1/2021 (put 10/1/2019) | 4,800,000 | 4,800,000 |

| | Georgia — 3.4% | | |

| | City of Atlanta (Atlantic Station Project), 5.00% due 12/1/2019 - 12/1/2021 | 1,000,000 | 1,048,332 |

| | Main Street Natural Gas, Inc, Series A, 5.00% due 5/15/2022 | 1,000,000 | 1,082,050 |

| a | Monroe County Development Authority (Gulf Power Co.), 2.00% due 9/1/2037 (put 6/25/2020) | 3,000,000 | 3,008,220 |

| c | Private Colleges & Universities Authority (Emory University), Series B, 2.00% (MUNIPSA + 0.42%) due 10/1/2039 (put 8/16/2022) | 3,000,000 | 3,005,910 |

| | Guam — 0.5% | | |

| | Guam Power Authority (Electric Power System; Insured: AGM), Series A, 5.00% due 10/1/2019 - 10/1/2020 | 1,200,000 | 1,210,143 |

| | Hawaii — 0.4% | | |

| c | City and County of Honolulu (Rail Transit Project) GO, 1.90% (MUNIPSA + 0.32%) due 9/1/2028 (put 9/1/2020) | 1,000,000 | 1,000,080 |

| | Illinois — 7.8% | | |

| | Chicago Park District (Capital Improvement Plan) GO, Series D, 5.00% due 1/1/2020 | 500,000 | 504,175 |

| | Chicago Park District GO, Series B, 5.00% due 1/1/2022 | 400,000 | 427,248 |

| | City of Chicago (Water System), | | |

| | 5.00% due 11/1/2020 | 600,000 | 621,762 |

| | Series 2017-2, 5.00% due 11/1/2019 - 11/1/2022 | 2,200,000 | 2,263,664 |

| | Series A, 5.00% due 11/1/2019 | 3,250,000 | 3,258,807 |

| | City of Chicago ETM, 5.00% due 1/1/2020 | 600,000 | 605,400 |

| | Cook County Community College District No. 508 (City Colleges of Chicago) GO, 5.00% due 12/1/2023 | 500,000 | 547,035 |

| | Cook County School District No. 170 Chicago Heights (Insured: AGM) GO, Series D, 5.00% due 12/1/2022 | 1,500,000 | 1,628,955 |

| | County of Cook (Capital Improvement Plan) GO, Series A, 5.00% due 11/15/2019 | 615,000 | 617,552 |

| | County of Cook GO, Series C, 4.25% due 11/15/2019 | 200,000 | 200,652 |

| | Du Page County High School District No. 88 (Addison Trail and Willowbrook High Schools GO, 3.00% due 1/15/2020 | 1,245,000 | 1,250,752 |

Schedule of Investments, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

| | | PRINCIPAL

AMOUNT | VALUE |

| a | Illinois Finance Authority (Peoples Gas Light & Coke Co.), Series B, 1.875% due 2/1/2033 (put 8/1/2020) | $3,600,000 | $ 3,604,248 |

| | State of Illinois (Build Illinois Program), 5.00% due 6/15/2020 | 535,000 | 546,283 |

| | State of Illinois (State Facilities Improvements) GO, | | |

| | 5.00% due 7/1/2021 - 3/1/2022 | 1,575,000 | 1,660,116 |

| | Series A, 5.00% due 10/1/2022 | 1,000,000 | 1,078,350 |

| | Indiana — 3.9% | | |

| b | Indiana Finance Authority (Franciscan Alliance, Inc. Obligated Group; LOC Barclays Bank Plc), 1.77% due 11/1/2037 (put 10/1/2019) | 4,700,000 | 4,700,000 |

| c | Indiana Finance Authority (Indiana University Health, Inc. Obligated Group), Series L, 2.13% (MUNIPSA + 0.55%) due 12/1/2046 (put 7/2/2021) | 4,800,000 | 4,801,296 |

| | Kentucky — 1.6% | | |

| | Commonwealth of Kentucky State Property and Buildings Commission (Project No. 112), Series B, 5.00% due 11/1/2019 - 11/1/2021 | 2,600,000 | 2,718,522 |

| a | Louisville/Jefferson County Metropolitan Government (Louisville Gas & Electric Co.), 1.85% due 10/1/2033 (put 4/1/2021) | 1,200,000 | 1,207,260 |

| | Louisiana — 2.8% | | |

| | Louisiana Energy & Power Authority (Rodemacher Unit No. 2 Power), 5.00% due 1/1/2021 | 600,000 | 624,090 |

| a | Parish of St. Charles (Valero Energy Corp. Refinery), 4.00% due 12/1/2040 (put 6/1/2022) | 1,925,000 | 2,028,988 |

| | Shreveport Water & Sewer Revenue (Insured: BAM), Series C, 5.00% due 12/1/2023 | 860,000 | 977,519 |

| | State of Louisiana GO, Series C, 5.00% due 8/1/2021 | 2,960,000 | 3,154,650 |

| | Maryland — 0.3% | | |

| | Washington County (Diakon Lutheran Social Ministries Obligated Group), Series B, 5.00% due 1/1/2020 - 1/1/2023 | 770,000 | 820,455 |

| | Massachusetts — 1.3% | | |

| a | Commonwealth of Massachusetts GO, Series D-1, 1.05% due 8/1/2043 (put 7/1/2020) | 2,000,000 | 1,993,920 |

| | Massachusetts Development Finance Agency (Beth Israel Lahey Health Obligated Group) 3.00% due 7/1/2020 | 1,000,000 | 1,011,840 |

| | Michigan — 3.4% | | |

| | Detroit Downtown Development Authority (Catalyst Development Project; Insured: AGM), Series A, 5.00% due 7/1/2021 - 7/1/2022 | 500,000 | 537,971 |

| | Detroit Sewage Disposal System Revenue (Great Lakes Water Authority Sewage Disposal System Revenue; Insured: AGM), Series A, 5.25% due 7/1/2020 | 2,800,000 | 2,879,800 |

| | Livonia Public Schools School District (Insured: BAM) GO, 5.00% due 5/1/2021 - 5/1/2022 | 985,000 | 1,054,882 |

| | Michigan Strategic Fund (Detroit Edison Company; Insured: AMBAC), 7.00% due 5/1/2021 | 2,000,000 | 2,166,880 |

| | Northern Michigan University, Series A, 5.00% due 12/1/2019 - 12/1/2021 | 1,535,000 | 1,592,720 |

| | Minnesota — 1.9% | | |

| b | City of Minneapolis/St. Paul Housing & Redevelopment Authority (Allina Health Obligated Group; LOC JPMorgan Chase Bank, N.A.), Series B-2, 1.77% due 11/15/2035 (put 10/1/2019) | 2,400,000 | 2,400,000 |

| c | Minnesota Housing Finance Agency (Residential Single Family Development; Collateralized: GNMA, FNMA, FHLMC), 2.13% (MUNIPSA + 0.55%) due 7/1/2041 (put 12/12/2023) | 2,150,000 | 2,148,796 |

| | Mississippi — 0.5% | | |

| | Mississippi Development Bank (Jackson Public School District), 4.00% due 10/1/2019 | 750,000 | 750,000 |

| | Mississippi Development Bank (Jackson Public School District; Insured: BAM), 5.00% due 10/1/2022 | 375,000 | 413,550 |

| | Montana — 0.3% | | |

| | Montana Facility Finance Authority (Sisters of Charity of Leavenworth Health System, Inc.) Series B, 5.00% due 1/1/2021 | 800,000 | 807,304 |

| | Nebraska — 0.9% | | |

| a | Central Plains Energy Project, 5.00% due 3/1/2050 (put 1/1/2024) | 2,000,000 | 2,236,520 |

| | Nevada — 1.0% | | |

| | Clark County Department of Aviation, Series A, 5.00% due 7/1/2021 | 2,000,000 | 2,127,380 |

| | Clark County School District (School Facilities Improvements) GO, Series C, 5.00% due 6/15/2021 | 250,000 | 265,088 |

| | New Hampshire — 2.0% | | |

| b | New Hampshire Health and Education Facilities Authority Act (University System of New Hampshire; SPA Wells Fargo Bank, N.A.), Series B-1, 1.77% due 7/1/2033 (put 10/1/2019) | 4,700,000 | 4,700,000 |

| | New Jersey — 3.0% | | |

| | City of Trenton (Various Capital Improvements; Insured: AGM) (State Aid Withholding) GO, 5.00% due 7/15/2020 | 500,000 | 513,735 |

| | Hudson County Improvement Authority GO, Series B-1, 3.00% due 5/22/2020 | 1,350,000 | 1,363,999 |

| | New Jersey (School Facilities Construction; Insured: AMBAC) EDA, Series K, 5.50% due 12/15/2019 | 200,000 | 201,542 |

| | New Jersey Transportation Trust Fund Authority (State Transportation System Improvements), 5.00% due 6/15/2020 | 500,000 | 511,965 |

| | New Jersey Transportation Trust Fund Authority (State Transportation System Improvements; Insured: Natl-Re), Series B, 5.50% due 12/15/2020 | 2,000,000 | 2,091,020 |

| | Passaic Valley Sewer Commissioners (Sewer System) GO, Series G, 5.75% due 12/1/2021 | 500,000 | 543,855 |

| | Tobacco Settlement Financing Corp., Series A, 5.00% due 6/1/2021 | 1,790,000 | 1,891,511 |

| | New Mexico — 2.7% | | |

| a | City of Farmington (Southern California Edison Co.-Four Corners Project), 2.125% due 6/1/2040 (put 6/1/2022) | 2,500,000 | 2,521,700 |

| b | New Mexico Hospital Equipment Loan Council (Presbyterian Healthcare Services Obligated Group; SPA Wells Fargo Bank, N.A.), Series D, 1.77% due 8/1/2034 (put 10/1/2019) | 2,175,000 | 2,175,000 |

| | New Mexico Municipal Energy Acquisition Authority, Series A, 4.00% due 11/1/2021 - 11/1/2022 | 1,750,000 | 1,860,597 |

Schedule of Investments, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

| | | PRINCIPAL

AMOUNT | VALUE |

| | New York — 10.0% | | |

| b | City of New York (SPA Barclays Bank plc) GO, Series B-4, 1.77% due 10/1/2046 (put 10/1/2019) | $ 500,000 | $ 500,000 |

| b | City of New York, (SPA JPMorgan Chase Bank, N.A.) GO, Series 1, 1.75% due 3/1/2040 (put 10/1/2019) | 2,000,000 | 2,000,000 |

| | Metropolitan Transportation Authority (Transit and Commuter System), Series C-1, 5.00% due 9/1/2020 | 2,350,000 | 2,425,012 |

| | Metropolitan Transportation Authority, | | |

| | Series A, 4.00% due 2/3/2020 | 1,000,000 | 1,008,700 |

| | Series D-1, 5.00% due 9/1/2022 | 3,000,000 | 3,285,600 |

| | New York City Housing Development Corp., 2.00% due 11/1/2020 | 2,500,000 | 2,500,550 |

| b | New York City Transitional Finance Authority Future Tax Secured Revenue, (SPA JPMorgan Chase Bank, N.A.), Series 1, 1.75% due 11/1/2022 (put 10/1/2019) | 4,600,000 | 4,600,000 |

| b | New York City Water & Sewer System, (SPA JPMorgan Chase Bank, N.A.), 1.75% due 6/15/2050 (put 10/1/2019) | 1,505,000 | 1,505,000 |

| | New York State Dormitory Authority (NYSARC, Inc. Developmental Disability Programs; Insured: State Intercept), Series A, 5.00% due 7/1/2020 | 1,175,000 | 1,207,559 |

| b | New York State Housing Finance Agency (160 Madison Ave, LLC; LOC Lands Bank Hessen-Thrgn) 1.76% due 11/1/2046 (put 10/1/2019) | 400,000 | 400,000 |

| | Tobacco Settlement Asset Securitization Corp., Series A, 5.00% due 6/1/2021 | 1,000,000 | 1,057,880 |

| | Town of Oyster Bay GO, Series B, 3.00% due 2/1/2020 - 3/13/2020 | 3,150,000 | 3,165,511 |

| | Westchester County Local Development Corp. (Miriam Osborn Memorial Home Assoc.), 5.00% due 7/1/2023 | 425,000 | 479,498 |

| | North Carolina — 0.4% | | |

| | North Carolina Turnpike Authority, | | |

| | 4.00% due 1/1/2020 | 400,000 | 402,308 |

| | 5.00% due 1/1/2021 - 1/1/2022 | 415,000 | 439,100 |

| | North Dakota — 1.6% | | |

| | County of McKenzie, 5.00% due 8/1/2022 | 2,000,000 | 2,190,320 |

| | Ward County (Insured: AGM), 3.00% due 4/1/2021 | 1,680,000 | 1,691,357 |

| | Ohio — 2.5% | | |

| | City of Cleveland (Parking Facility; Insured: AGM), 5.25% due 9/15/2021 | 500,000 | 536,145 |

| a | County of Franklin (Trinity Health Corp. Obligated Group), 1.35% due 12/1/2046 (put 11/1/2019) | 2,000,000 | 1,999,700 |

| | County of Scioto (Southern Ohio Medical Center), 5.00% due 2/15/2022 - 2/15/2023 | 3,130,000 | 3,437,383 |

| | Pennsylvania — 1.6% | | |

| | City of Philadelphia (Pennsylvania Gas Works), 5.00% due 10/1/2020 | 500,000 | 518,270 |

| | Coatesville Area School District (Insured: AGM) (State Aid Withholding) GO, 5.00% due 8/1/2021 | 1,000,000 | 1,061,070 |

| | East Penn School District (State Aid Withholding) GO, 2.00% due 9/15/2020 | 555,000 | 555,283 |

| | Luzerne County Industrial Development Authority (Insured: AGM) GO, 5.00% due 12/15/2019 - 12/15/2020 | 1,000,000 | 1,020,655 |

| | Philadelphia Authority for Industrial Development, 5.00% due 5/1/2020 - 5/1/2022 | 745,000 | 788,121 |

| | Rhode Island — 0.7% | | |

| | State of Rhode Island and Providence Plantations (Training School) COP, Series B, 5.00% due 10/1/2019 | 1,575,000 | 1,575,000 |

| | South Carolina — 1.0% | | |

| c | City of Charleston Waterworks & Sewer System Revenue (Capital Improvement), Series B, 1.807% (LIBOR 1 Month + 0.37%) due 1/1/2035 (put 1/1/2022) | 2,500,000 | 2,502,250 |

| | Tennessee — 0.6% | | |

| | Tennessee Energy Acquisition Corp. (The Gas Project), Series C, 5.00% due 2/1/2023 | 1,310,000 | 1,439,323 |

| | Texas — 17.6% | | |

| | City of Brownsville (Water, Wastewater & Electric Utilities Systems), 5.00% due 9/1/2020 | 1,000,000 | 1,032,750 |

| | City of Dallas (Trinity River Corridor Infrastructure) GO, 5.00% due 2/15/2021 | 1,000,000 | 1,050,750 |

| c | City of Houston (Combined Utility System), Series C, 1.792% (LIBOR 1 Month + 0.36%) due 5/15/2034 (put 8/1/2021) | 3,200,000 | 3,200,160 |

| | City of Olmos Park Higher Education Facilities Corp. (University of the Incarnate Word), 5.00% due 12/1/2022 | 1,000,000 | 1,098,520 |

| | City of San Antonio (Electric and Gas Systems), | | |

| a | Series A, 2.25% due 2/1/2033 (put 12/1/2019) | 1,000,000 | 1,001,290 |

| a | Series C, 3.00% due 12/1/2045 (put 12/1/2019) | 265,000 | 265,665 |

| | City of Texas City Industrial Development Corp. (ARCO Pipe Line Co. Project), 7.375% due 10/1/2020 | 1,000,000 | 1,057,520 |

| | County of La Salle (Insured: AGM) GO, 5.00% due 3/1/2020 - 3/1/2021 | 1,900,000 | 1,962,387 |

| a | Cypress-Fairbanks Independent School District (Insured: PSF-GTD), Series B, 1.25% due 2/15/2036 (put 8/15/2022) | 4,425,000 | 4,396,459 |

| a | Dallas Independent School District (School District Buildings Renovations; Insured: PSF-GTD) GO, Series B-4, 5.00% due 2/15/2036 (put 2/15/2020) | 325,000 | 329,144 |

| c,e | Harris County Cultural Education Facilities Finance Corp. (Memorial Hermann Health System), Series B-REM, 1.955% (MUNIPSA + 0.38%) due 6/1/2032 (put 4/1/2021) | 4,825,000 | 4,823,166 |

| | Harris County Cultural Education Facilities Finance Corp. (Texas Medical Center Central Heating & Cooling Service Corp.), 5.00% due 11/15/2020 | 1,145,000 | 1,189,953 |

| | Harris County Cultural Education Facilities Finance Corp. (Texas Medical Center; LOC JPMorgan Chase Bank, N.A.), | | |

| b | Series A, 1.77% due 9/1/2031 (put 10/1/2019) | 1,350,000 | 1,350,000 |

| b | Series B-1, 1.77% due 9/1/2031 (put 10/1/2019) | 2,315,000 | 2,315,000 |

| | Houston Airport System Revenue, Series B, 5.00% due 7/1/2022 - 7/1/2023 | 780,000 | 862,035 |

| a | Houston Independent School District (Insured: PSF-GTD) GO, Series B-REM, 2.40% due 6/1/2036 (put 6/1/2021) | 3,275,000 | 3,323,241 |

| | North Texas Tollway Authority, Series A, 5.00% due 1/1/2022 | 1,000,000 | 1,081,700 |

| | Red River Authority (Insured: Natl-Re), 4.45% due 6/1/2020 | 2,650,000 | 2,697,488 |

Schedule of Investments, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

| | | PRINCIPAL

AMOUNT | VALUE |

| | Sam Rayburn Municipal Power Agency, 5.00% due 10/1/2021 | $ 510,000 | $ 544,078 |

| | State of Texas (Trans), 4.00% due 8/27/2020 | 4,000,000 | 4,095,760 |

| b | Tarrant County Cultural Education Facilities Finance Corp. (Baylor Scott & White Health Obligated Group; LOC TD Bank, N.A.), 1.77% due 11/15/2050 (put 10/1/2019) | 4,800,000 | 4,800,000 |

| | Utah — 1.0% | | |

| b | City of Murray (IHC Health Services, Inc. Obligated Group; SPA JPMorgan Chase Bank, N.A.), Series A, 1.75% due 5/15/2037 (put 10/1/2019) | 2,400,000 | 2,400,000 |

| | West Virginia — 1.0% | | |

| | Mason County (Appalachian Power Co.), Series L, 2.75% due 10/1/2022 | 1,000,000 | 1,032,910 |

| a | West Virginia Economic Development Authority, (Appalachian Power Co.), Series A, 2.625% due 12/1/2042 (put 6/1/2022) | 1,425,000 | 1,465,413 |

| | Total Investments — 95.3%(Cost $228,436,868) | | $229,866,414 |

| | Other Assets Less Liabilities — 4.7% | | 11,375,359 |

| | Net Assets — 100.0% | | $241,241,773 |

| Footnote Legend |

| a | Variable Rate Demand Obligations are instruments whose interest rates change on a mandatory date (demand date) or whose interest rates will vary with changes in a designated base rate. The rate disclosed is the rate at September 30, 2019. |

| b | Variable Rate Demand Notes are instruments whose interest rates change on a specific date (such as coupon date or interest payment date) or whose interest rates vary with changes in a designated base rate (such as the prime interest rate). This instrument is payable on demand and is secured by letters of credit or other credit support agreements from major banks. |

| c | Floating Rate Security. Stated interest/floor rate was in effect at September 30, 2019. |

| d | Segregated as collateral for a when-issued security. |

| e | Securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities are restricted and may only be resold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2019, the aggregate value of these securities in the Fund’s portfolio was $6,826,486, representing 2.83% of the Fund’s net assets. |

| f | When-issued security. |

Portfolio Abbreviations

To simplify the listings of securities, abbreviations are used per the table below:

| AGM | Insured by Assured Guaranty Municipal Corp. |

| AMBAC | Insured by American Municipal Bond Assurance Corp. |

| BAM | Insured by Build America Mutual Insurance Co. |

| COP | Certificates of Participation |

| EDA | Economic Development Authority |

| ETM | Escrowed to Maturity |

| FHLMC | Insured by Federal Home Loan Mortgage Corp. |

| FNMA | Collateralized by Federal National Mortgage Association |

| GNMA | Collateralized by Government National Mortgage Association |

| GO | General Obligation |

| HFA | Health Facilities Authority |

| IDA | Industrial Development Authority |

| LIBOR | London Interbank Offered Rates |

| LOC | Letter of Credit |

| MUNIPSA | Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index |

| Natl-Re | Insured by National Public Finance Guarantee Corp. |

| SPA | Stand-by Purchase Agreement |

See notes to financial statements.

Statement of Assets and Liabilities

Thornburg Low Duration Municipal Fund | September 30, 2019

| ASSETS | |

| Investments at value (cost $228,436,868) (Note 3) | $ 229,866,414 |

| Cash | 39,495 |

| Receivable for investments sold | 10,154,838 |

| Interest receivable | 2,011,023 |

| Prepaid expenses and other assets | 134,925 |

| Total Assets | 242,206,695 |

| Liabilities | |

| Payable for investments purchased | 775,000 |

| Payable for fund shares redeemed | 38,214 |

| Payable to investment advisor and other affiliates (Note 4) | 56,857 |

| Accounts payable and accrued expenses | 84,990 |

| Dividends payable | 9,861 |

| Total Liabilities | 964,922 |

| Net Assets | $ 241,241,773 |

| NET ASSETS CONSIST OF | |

| Distributable earnings | $ 1,208,081 |

| Net capital paid in on shares of beneficial interest | 240,033,692 |

| | $ 241,241,773 |

| NET ASSET VALUE | |

| Class A Shares: | |

Net asset value and redemption price per share

($16,898,465 applicable to 1,366,876 shares of beneficial interest outstanding - Note 5) | $ 12.36 |

| Maximum sales charge, 1.50% of offering price | 0.19 |

| Maximum offering price per share | $ 12.55 |

| Class I Shares: | |

Net asset value, offering and redemption price per share

($224,343,308 applicable to 18,152,714 shares of beneficial interest outstanding - Note 5) | $ 12.36 |

See notes to financial statements.

Statement of Operations

Thornburg Low Duration Municipal Fund | Year Ended September 30, 2019

| INVESTMENT INCOME | |

| Interest income (net of premium amortized of $2,908,970) | $ 4,364,265 |

| EXPENSES | |

| Investment advisory fees (Note 4) | 885,421 |

| Administration fees (Note 4) | |

| Class A Shares | 18,237 |

| Class I Shares | 176,209 |

| Distribution and service fees (Note 4) | |

| Class A Shares | 41,555 |

| Transfer agent fees | |

| Class A Shares | 34,276 |

| Class I Shares | 171,306 |

| Registration and filing fees | |

| Class A Shares | 18,097 |

| Class I Shares | 32,696 |

| Custodian fees | 36,987 |

| Professional fees | 45,196 |

| Trustee and officer fees (Note 4) | 9,317 |

| Other expenses | 26,367 |

| Total Expenses | 1,495,664 |

| Less: | |

| Expenses reimbursed by investment advisor (Note 4) | (347,334) |

| Net Expenses | 1,148,330 |

| Net Investment Income | $ 3,215,935 |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on investments | (169,603) |

| Net change in unrealized appreciation (depreciation) on investments | 1,829,461 |

| Net Realized and Unrealized Gain | 1,659,858 |

| Net Increase in Net Assets Resulting from Operations | $ 4,875,793 |

See notes to financial statements.

Statements of Changes in Net Assets

Thornburg Low Duration Municipal Fund

| | Year Ended

September 30, 2019 | Year Ended

September 30, 2018 |

| INCREASE (DECREASE) IN NET ASSETS FROM | | |

| OPERATIONS | | |

| Net investment income | $ 3,215,935 | $ 1,224,067 |

| Net realized gain (loss) on investments | (169,603) | (10,655) |

| Net change in unrealized appreciation (depreciation) on investments | 1,829,461 | (744,589) |

| Net Increase in Net Assets Resulting from Operations | 4,875,793 | 468,823 |

| DIVIDENDS TO SHAREHOLDERS | | |

| From distributable earnings | | |

| Class A Shares | (262,793) | (166,761) |

| Class I Shares | (2,953,142) | (1,057,306) |

| FUND SHARE TRANSACTIONS (NOTE 5) | | |

| Class A Shares | (2,770,805) | 3,245,973 |

| Class I Shares | 60,596,807 | 109,088,169 |

| Net Increase in Net Assets | 59,485,860 | 111,578,898 |

| NET ASSETS | | |

| Beginning of Year | 181,755,913 | 70,177,015 |

| End of Year | $ 241,241,773 | $ 181,755,913 |

See notes to financial statements.

Notes to Financial Statements

Thornburg Low Duration Municipal Fund | September 30, 2019

NOTE 1 – ORGANIZATION

Thornburg Low Duration Municipal Fund (the “Fund”) is a diversified series of Thornburg Investment Trust (the “Trust”). The Trust was organized as a Massachusetts business trust under a Declaration of Trust dated June 3, 1987 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act"). The Fund is currently one of twenty-two separate series of the Trust. Each series is considered to be a separate entity for financial reporting and tax purposes and bears expenses directly attributable to it. The Fund’s investment objective is to seek current income exempt from federal income tax, consistent with preservation of capital.

The Fund currently offers two classes of shares of beneficial interest: Class A and Institutional Class (“Class I”) shares. Each class of shares of the Fund represents an interest in the same portfolio of investments, except that (i) Class A shares are sold subject to a front-end sales charge collected at the time the shares are purchased and bear a service fee, (ii) Class I shares are sold at net asset value without a sales charge at the time of purchase and may be subject to a service fee, and (iii) the respective classes may have different reinvestment privileges and conversion rights. Additionally, the Fund may allocate among its classes certain expenses, to the extent allocable to specific classes, including administration fees, transfer agent fees, government registration fees, certain printing and postage costs, and administrative and legal expenses. Currently, class specific expenses of the Fund are limited to service and distribution fees and certain registration and transfer agent expenses.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund prepares its financial statements in conformity with United States generally accepted accounting principles (“GAAP”), including investment company accounting and reporting guidance in the Financial Accounting Standards Board (the “FASB”) Accounting Standard Codification Topic 946.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Security Valuation: All investments in securities held by the Fund are valued as described in Note 3.

Allocation of Income, Gains, Losses and Expenses: Net investment income (other than class specific expenses) and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net asset value of outstanding shares (or the value of the dividend-eligible shares, as appropriate) of each class of shares at the beginning of the day (after adjusting for the current capital shares activity of the respective class). Expenses common to all Funds are allocated among the Funds comprising the Trust based upon their relative net asset values or other appropriate allocation methods. Operating expenses directly attributable to a specific class are charged against the operating income of that class.

Dividends and Distributions to Shareholders: Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and may differ from GAAP, are recorded on the ex-dividend date. Ordinary income dividends, if any, are declared daily and paid monthly. Capital gain distributions, if any, are declared and paid annually and more often if deemed necessary by Thornburg Investment Management, Inc., the Trust’s investment advisor (the “Advisor”). Dividends and distributions are paid and are reinvested in additional shares of the Fund at net asset value per share at the close of business on the ex-dividend date, or at the shareholder’s option, paid in cash.

Investment Income: Interest income is accrued as earned. Premiums and discounts are amortized and accreted, respectively, to first call dates or maturity dates using the effective yield method of the respective investments. These amounts are included in Investment Income in the Statement of Operations.

Investment Transactions: Investment transactions are accounted for on a trade date basis. Realized gains and losses from the sale of investments are recorded on an identified cost basis.

When-Issued and Delayed Delivery Transactions: The Fund may engage in when-issued or delayed delivery transactions. To the extent the Fund engages in such transactions, it will do so for the purpose of acquiring portfolio investments consistent with the Fund’s investment objectives and not for the purpose of investment leverage or to speculate on interest rate or market changes. At the time the Fund makes a commitment to purchase an investment on a when-issued or delayed delivery basis, the Fund will record the transaction and reflect the value in determining its net asset value. When effecting such transactions, assets of an amount sufficient to make payment for the portfolio investments to be purchased will be segregated on the Fund’s records on the trade date. Investments purchased on a when-issued or delayed delivery basis do not earn interest until the settlement date. The values of these securities held at September 30, 2019 are detailed in the Schedule of Investments.

Guarantees and Indemnifications: Under the Trust’s organizational documents (and under separate agreements with the independent Trustees), its officers and Trustees are provided with an indemnification against certain liabilities arising out of the performance of their duties to the Fund. In the normal course of business the Trust may also enter into contracts with service providers that contain general

Notes to Financial Statements, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

indemnifications. The Trust’s maximum exposure under these arrangements is unknown. However, based on experience, the Trust expects the risk of loss to be remote.

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases (decreases) in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes: It is the policy of the Trust to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders substantially all investment company taxable income including net realized gains on investments (if any), and tax exempt income of the Fund. Therefore, no provision for federal income or excise tax is required.

The Fund files income tax returns in United States federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three years following a return’s filing date. The Fund has analyzed each uncertain tax position believed to be material in the preparation of the Fund’s financial statements for the fiscal year ended September 30, 2019, including open tax years, to assess whether it is more likely than not that the position would be sustained upon examination, based on the technical merits of the position. The Fund has not identified any such position for which an asset or liability must be reflected in the Statement of Assets and Liabilities.

At September 30, 2019, information on the tax components of capital was as follows:

| Cost of investments for tax purposes | $ 228,436,869 |

| Gross unrealized appreciation on a tax basis | 1,497,420 |

| Gross unrealized depreciation on a tax basis | (67,875) |

| Net unrealized appreciation (depreciation) on investments (tax basis) | $ 1,429,545 |

At September 30, 2019, the Fund had deferred tax basis capital losses occurring subsequent to October 31, 2018 through September 30, 2019 of $169,603. For tax purposes, such losses will be recognized in the year ending September 30, 2020.

At September 30, 2019, the Fund had cumulative tax basis capital losses of $51,861 (of which $9,613 are short-term and $42,248 are long-term), which may be carried forward to offset future capital gains. To the extent such carryforwards are used, capital gain distributions may be reduced to the extent provided by regulations. Such capital loss carryforwards do not expire.

At September 30, 2019, the Fund had $9,861 of undistributed net tax-exempt income, no undistributed tax basis net ordinary income and no undistributed tax basis capital gains.

Distributions from tax exempt income paid by the Fund for the year ended September 30, 2019 and September 30, 2018 are excludable by shareholders from gross income for Federal income tax purposes.

The tax character of distributions paid during the year ended September 30, 2019, and September 30, 2018, was as follows:

| | 2019 | 2018 |

| Distributions from: | | |

| Tax exempt income | $ 3,204,635 | $ 1,219,984 |

| Ordinary income | 11,300 | 4,083 |

| Total | $ 3,215,935 | $ 1,224,067 |

NOTE 3 – SECURITY VALUATION

Valuation of the Fund’s portfolio investment securities is performed in accordance with policies and procedures adopted by and under the oversight of the Trustees.

The Trustees of the Trust have appointed the Advisor to assist the Trustees with obtaining fair market values for portfolio investments, evaluating and monitoring professional pricing service providers appointed by the Trustees’ Audit Committee (the “Audit Committee”) to assist in determining fair values for portfolio investments, assisting in calculating fair values for portfolio investments in certain circumstances, and performing other functions in connection with the valuation of investments. The Advisor acts through its Valuation and Pricing Committee (the “Committee”) and other employees of the Advisor. The Committee regularly reviews its own valuation calculations, reviews the valuations, valuation techniques and services furnished by pricing service providers, considers circumstances which may

Notes to Financial Statements, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

require valuation calculations by the Committee, and reviews previous valuation calculations. The Committee reports to the Audit Committee on the Committee’s activities, the performance of pricing service providers, and other matters relating to valuation of portfolio investments.

In those instances when the Committee assists in calculating a fair value for a portfolio investment, the Committee seeks to determine the price that the Fund would reasonably expect to receive upon a sale of the investment in an orderly transaction between market participants on the valuation date. The Committee customarily utilizes quotations from securities broker dealers in calculating valuations, but also may utilize prices obtained from pricing service providers or other methods approved by the Audit Committee. Because fair values calculated by the Committee are estimates, the calculation of a value for an investment may differ from the price that would be realized by the Fund upon a sale of the investment, and the difference could be material to the Fund’s financial statements. The Committee’s calculation of a fair value for an investment may also differ from the prices obtained by other persons (including other mutual funds) for the investment.

Valuation of Securities: Debt obligations held by the Fund which are not listed or traded on exchanges or for which no reported market exists are ordinarily valued at the valuation obtained from a pricing service provider approved by the Audit Committee.

In any case when a pricing service provider fails to provide a valuation for a debt obligation held by the Fund, the Committee calculates a fair value for the obligation using alternative methods under procedures approved by the Audit Committee. Additionally, in cases when management believes that a valuation obtained from a pricing service provider is stale, does not reflect material factors affecting the valuation of the investment, is significantly different than the value the Fund is likely to obtain if it sought a bid for the investment, or is otherwise unreliable, the Committee calculates a fair value for the obligation using an alternative method approved by the Audit Committee.

Valuation Hierarchy: The Fund categorizes its investments based upon the inputs used in valuing those investments, according to a three-level hierarchy established in guidance from the FASB. Categorization of investments using this hierarchy is intended by the FASB to maximize the use of observable inputs in valuing investments and minimize the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in valuing an investment based on available market information. Unobservable inputs are those that reflect assumptions about the information market participants would use in valuing an investment. An investment’s level within the hierarchy is based on the lowest level input that is deemed significant to the valuation. The methodologies and inputs used to value investments are not necessarily indications of the risk or liquidity associated with those investments.

Various inputs are used in calculating valuations for the Fund’s investments. These inputs are generally summarized according to the three-level hierarchy below:

Level 1: Quoted prices in active markets for identical investments.

Level 2: Other direct or indirect significant observable inputs (including quoted prices for similar investments in active markets and other observable inputs, such as interest rates, prepayment rates, credit ratings, etc.).

Level 3: Significant unobservable inputs (including the Committee’s own assumptions in calculating the fair values of investments).

Valuations for debt obligations held by the Fund are typically calculated by pricing service providers approved by the Audit Committee and are generally characterized as Level 2 within the valuation hierarchy.

In a limited number of cases the Committee calculates a fair value for investments using broker quotations or other methods approved by the Audit Committee. When the Committee uses a single broker quotation to calculate a fair value for an investment without other significant observable inputs, or if a fair value is calculated using other significant inputs that are considered unobservable, the investment is characterized as Level 3 within the hierarchy. Other significant unobservable inputs used to calculate a fair value in these instances might include an income-based valuation approach which considers discounted anticipated future cash flows from the investment and application of discounts due to the nature or duration of any restrictions on the disposition of the investment.

Valuations based upon the use of inputs from Levels 1, 2 or 3 may not represent the actual price received upon the disposition of an investment, and a Fund may receive a price that is lower than the valuation based upon these inputs when it sells the investment.

Notes to Financial Statements, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

The following table displays a summary of the fair value hierarchy measurements of the Fund’s investments as of September 30, 2019:

| | Fair Value Measurements at September 30, 2019 |

| | TOTAL | LEVEL 1 | LEVEL 2 | LEVEL 3 |

| Assets | | | | |

| Investments in Securities | | | | |

| Municipal Bonds | $ 229,866,414 | $ — | $ 229,866,414 | $ — |

| Total Investments in Securities | $229,866,414 | $— | $229,866,414 | $— |

| Total Assets | $229,866,414 | $— | $229,866,414 | $— |

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an investment advisory agreement, the Advisor serves as the investment advisor and performs services for the Fund for which the fees are payable at the end of each month. Under the investment advisory agreement, the Fund pays the Advisor a management fee based on the average daily net assets of the Fund at an annual rate as shown in the following table:

| Management Fee Schedule |

| DAILY NET ASSETS | FEE RATE |

| Up to $1 billion | 0.400% |

| Next $500 million | 0.300 |

| Next $500 million | 0.250 |

| Over $2 billion | 0.225 |

The Fund’s effective management fee for the year ended September 30, 2019 was 0.40% of the Fund’s average daily net assets. Total management fees incurred by the Fund for the year ended September 30, 2019 are set forth in the Statement of Operations.

The Trust has entered into an administrative services agreement with the Advisor, whereby the Advisor will perform certain administrative services related to each class of the Fund’s shares. The fees are computed as an annual percentage of the aggregate average daily net assets of all shares classes of all Funds in the Trust as follows:

| Administration Fee Schedule |

| Daily Net Assets | Fee Rate |

| Up to $20 billion | 0.100% |

| $20 billion to $40 billion | 0.075 |

| $40 billion to $60 billion | 0.040 |

| Over $60 billion | 0.030 |

The aggregate fee amount is allocated on a daily basis to each Fund based on net assets and subsequently allocated to each class of shares of the Fund. Total administrative service fees incurred by each class of shares of the Fund for the year ended September 30, 2019, are set forth in the Statement of Operations.

The Trust has an underwriting agreement with Thornburg Securities Corporation (the “Distributor”), an affiliate of the Advisor, which acts as the distributor of the Fund’s shares. For the year ended September 30, 2019, the Distributor has advised the Fund that it earned no net commissions from the sale of Class A shares.

Pursuant to a service plan under Rule 12b-1 of the 1940 Act, the Fund may pay to the Distributor or securities dealers and other financial institutions at the Distributor’s direction an amount not to exceed .20 of 1% per annum of the average daily net assets attributable to Class A shares of the Fund to obtain various shareholder and distribution related services. For the year ended September 30, 2019, there were no 12b-1 service plan fees charged for Class I shares. The Advisor and Distributor each may pay out of its own resources additional expenses for distribution of the Fund’s shares and shareholder services.

Total fees incurred for the year ended September 30, 2019 are set forth in the Statement of Operations.

The Advisor has contractually agreed to waive fees and reimburse expenses incurred by the Fund so that actual expenses of certain share classes do not exceed levels as specified in each Fund’s most recent prospectus (Class A shares, 0.70%; Class I shares, 0.50%). The agreement may be terminated by the Fund at any time, but may not be terminated by the Advisor before February 1, 2020, unless the

Notes to Financial Statements, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

Advisor ceases to be the investment advisor to the Fund prior to that date. The Advisor may recoup amounts waived or reimbursed during the fiscal year ended September 30, 2019 if, during that year, expenses fall below the contractual limit that was in place at the time those fees and expenses were waived or reimbursed. The Advisor will not recoup fees or expenses as described in the preceding sentence if that recoupment would cause the Fund’s total annual operating expenses (after the recoupment is taken into account) to exceed the lesser of: (a) the expense cap that was in place at the time the waiver or reimbursement occurred; or (b) the expense cap that is in place at the time of the recoupment.

For the year ended September 30, 2019, the Advisor contractually reimbursed certain class specific expenses and distribution fees of $60,879 for Class A shares and $286,455 for Class I shares.

Certain officers and Trustees of the Trust are also officers or directors of the Advisor and Distributor. The compensation of the independent Trustees is borne by the Trust. The Trust also pays a portion of the Chief Compliance Officer’s compensation. These amounts are reflected as Trustee and officer fees in the Statement of Operations.

The percentage of direct investments in the Fund held by the Trustees, officers of the Trust, and the Advisor is approximately 31.34%.

The Fund may purchase or sell securities from or to an affiliated fund, provided the affiliation is due solely to having a common investment advisor, common officers, or common trustees, and provided that all such transactions will comply with Rule 17a-7 under the 1940 Act. For the year ended September 30, 2019, the Fund had transactions with affiliated funds of $34,636,088 in purchases and $11,275,000 in sales generating no realized gains or losses.

NOTE 5 – SHARES OF BENEFICIAL INTEREST

At September 30, 2019, there were an unlimited number of shares with no par value of beneficial interest authorized. Transactions in shares of beneficial interest were as follows:

| | YEAR ENDED

September 30, 2019 | YEAR ENDED

September 30, 2018 |

| | SHARES | AMOUNT | SHARES | AMOUNT |

| Class A Shares | | | | |

| Shares sold | 985,212 | $ 12,093,230 | 1,063,545 | $ 13,097,781 |

Shares issued to shareholders in

reinvestment of dividends | 21,204 | 261,359 | 12,892 | 158,574 |

| Shares repurchased | (1,228,414) | (15,125,394) | (813,563) | (10,010,382) |

| Net increase (decrease) | (221,998) | $ (2,770,805) | 262,874 | $ 3,245,973 |

| Class I Shares | | | | |

| Shares sold | 8,234,527 | $ 101,374,617 | 10,776,875 | $ 132,406,952 |

Shares issued to shareholders in

reinvestment of dividends | 230,292 | 2,839,589 | 82,245 | 1,011,086 |

| Shares repurchased | (3,539,014) | (43,617,399) | (1,977,745) | (24,329,869) |

| Net increase | 4,925,805 | $ 60,596,807 | 8,881,375 | $ 109,088,169 |

NOTE 6 – INVESTMENT TRANSACTIONS

For the year ended September 30, 2019, the Fund had purchase and sale transactions of investments (excluding short-term investments) of $113,845,977 and $48,413,836, respectively.

NOTE 7 – RECENT ACCOUNTING PRONOUNCEMENTS

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Changes to the Disclosure Requirements for Fair Value Measurement, which adds, removes, and modifies certain aspects of the fair value disclosure. ASU 2018-13 is effective for annual periods beginning after December 15, 2019, and early adoption is permitted. The Funds have elected to early adopt, and had applied ASU 2018-13 for the fiscal year ended September 30, 2019. The adoption of this accounting guidance did not have a material impact on the Funds’ financial statements.

In March 2017, the FASB issued Accounting Standards Update (ASU) 2017-08, Premium Amortization of Purchased Callable Debt Securities. The amendments in the ASU shorten the premium amortization period on a purchased callable debt security from the security’s

Notes to Financial Statements, Continued

Thornburg Low Duration Municipal Fund | September 30, 2019

contractual life to the earliest call date. It is anticipated that this change will enhance disclosures by reducing losses recognized when a security is called on an earlier date. This ASU is effective for fiscal years beginning after December 15, 2018. Management has evaluated the implications of these changes and the amendments will have no material effect on the Funds’ net assets or results of operations.

OTHER NOTES

Risks: The Fund’s investments subject it to risks including, but not limited to, management risk, interest rate risk, credit risk, market and economic risk, and liquidity risk. Please see the Fund’s prospectus for a discussion of the risks associated with an investment in the Fund.

Subsequent Events: Fund management believes no events have occurred between September 30, 2019 and the date of issuance of the financial statements that require adjustment to or disclosure in the accompanying financial statements.

This page intentionally left blank.

Financial Highlights

Thornburg Low Duration Municipal Fund

| | PER SHARE PERFORMANCE (FOR A SHARE OUTSTANDING THROUGHOUT THE YEAR) |

UNLESS OTHERWISE

NOTED, PERIODS ARE

FISCAL YEARS ENDED

SEPTEMBER 30, | Net Asset

Value,

Beginning of

YEAR | Net

Investment

Income

(Loss)+ | Net Realized &

Unrealized Gain

(Loss) on

Investments | Total from

Investment

Operations | Dividends

from Net

Investment

Income | Dividends

from Net

Realized

Gains | Total

Dividends | Net Asset

Value,

End of YEAR |

| CLASS A SHARES(b) |

| 2019 | $ 12.27 | 0.16 | 0.09 | 0.25 | (0.16) | — | (0.16) | $ 12.36 |

| 2018 | $ 12.38 | 0.11 | (0.11) | —(c) | (0.11) | — | (0.11) | $ 12.27 |

| 2017 | $ 12.34 | 0.08 | 0.04 | 0.12 | (0.08) | — | (0.08) | $ 12.38 |

| 2016 | $ 12.35 | 0.03 | (0.01) | 0.02 | (0.03) | — | (0.03) | $ 12.34 |

| 2015 | $ 12.34 | 0.02 | 0.01 | 0.03 | (0.02) | — | (0.02) | $ 12.35 |

| CLASS I SHARES |

| 2019 | $ 12.27 | 0.18 | 0.09 | 0.27 | (0.18) | — | (0.18) | $ 12.36 |

| 2018 | $ 12.37 | 0.14 | (0.10) | 0.04 | (0.14) | — | (0.14) | $ 12.27 |

| 2017 | $ 12.34 | 0.10 | 0.03 | 0.13 | (0.10) | — | (0.10) | $ 12.37 |

| 2016 | $ 12.35 | 0.05 | (0.01) | 0.04 | (0.05) | — | (0.05) | $ 12.34 |

| 2015 | $ 12.34 | 0.04 | 0.01 | 0.05 | (0.04) | — | (0.04) | $ 12.35 |

| (a) | Not annualized for periods less than one year. |

| (b) | Sales loads are not reflected in computing total return. |

| (c) | Total from investment operations was less than $0.01 per share. |

| + | Based on weighted average shares outstanding. |

See notes to financial statements.

Financial Highlights, Continued

Thornburg Low Duration Municipal Fund

| RATIOS TO AVERAGE NET ASSETS | | SUPPLEMENTAL DATA |

Net Investment

Income (Loss) (%) | Expenses, After

Expense

Reductions (%) | Expenses,

Before Expense

Reductions (%) | | Total

Return (%)(a) | Portfolio

Turnover

Rate (%)(a) | Net Assets

at End of YEAR

(Thousands) |

| |

| 1.26 | 0.70 | 0.99 | | 2.02 | 33.60 | $ 16,899 |

| 0.92 | 0.70 | 1.06 | | 0.02 | 35.36 | $ 19,497 |

| 0.72 | 0.67 | 1.16 | | 0.98 | 42.94 | $ 16,412 |

| 0.24 | 0.70 | 2.19 | | 0.15 | 21.17 | $ 4,241 |

| 0.15 | 0.67 | 2.85 | | 0.22 | 15.75 | $ 3,273 |

| |

| 1.47 | 0.50 | 0.64 | | 2.22 | 33.60 | $ 224,343 |

| 1.12 | 0.50 | 0.64 | | 0.30 | 35.36 | $ 162,259 |

| 0.85 | 0.49 | 0.67 | | 1.09 | 42.94 | $ 53,765 |

| 0.43 | 0.50 | 0.72 | | 0.36 | 21.17 | $ 38,572 |

| 0.32 | 0.50 | 0.82 | | 0.40 | 15.75 | $ 41,755 |

Report of Independent Registered Public Accounting Firm

Thornburg Low Duration Municipal Fund

To the Board of Trustees of Thornburg Investment Trust and Shareholders of

Thornburg Low Duration Municipal Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Thornburg Low Duration Municipal Fund (one of the funds constituting Thornburg Investment Trust, referred to hereafter as the "Fund") as of September 30, 2019, the related statement of operations for the year ended September 30, 2019, the statements of changes in net assets for each of the two years in the period ended September 30, 2019, including the related notes, and the financial highlights for each of the five years in the period ended September 30, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended September 30, 2019 and the financial highlights for each of the five years in the period ended September 30, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2019 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

New York, New York

November 22, 2019

We have served as the auditor of one or more investment companies in Thornburg Investment Trust since 1999.

Expense Example

Thornburg Low Duration Municipal Fund | September 30, 2019 (Unaudited)

As a shareholder of the Fund, you incur two types of costs:

| (1) | transaction costs, including |

| (a) | sales charges (loads) on purchase payments, for Class A shares; |

| (b) | a deferred sales charge on redemptions of any part or all of a purchase of $1 million of Class A shares within 12 months of purchase; |

| (2) | ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. |

This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on a $1,000 investment beginning on April 1, 2019, and held until September 30, 2019.

| | BEGINNING

ACCOUNT VALUE

4/1/19 | ENDING

ACCOUNT VALUE

9/30/19 | EXPENSES PAID

DURING PERIOD†

4/1/19—9/30/19 |

| CLASS A SHARES |

| Actual | $1,000.00 | $1,008.03 | $3.52 |

| Hypothetical* | $1,000.00 | $1,021.56 | $3.55 |

| CLASS I SHARES |

| Actual | $1,000.00 | $1,009.87 | $2.52 |

| Hypothetical* | $1,000.00 | $1,022.56 | $2.54 |

| † | Expenses are equal to the annualized expense ratio for each class (A: 0.70%; I: 0.50%) multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| * | Hypothetical assumes a rate of return of 5% per year before expenses. |

ACTUAL EXPENSES