UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

Item 1.Reports to Stockholders

The following Semi-annual reports are attached hereto, in order:

Thornburg Short Duration Municipal Fund

Thornburg Limited Term Municipal Fund

Thornburg Intermediate Municipal Fund

Thornburg Strategic Municipal Income Fund

Thornburg California Limited Term Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Limited Term U.S. Government Fund

Thornburg Limited Term Income Fund

Thornburg Low Duration Income Fund

Thornburg Strategic Income Fund

Thornburg Value Fund

Thornburg International Value Fund

Thornburg Core Growth Fund

Thornburg International Growth Fund

Thornburg Investment Income Builder Fund

Thornburg Global Opportunities Fund

Thornburg Developing World Fund

Thornburg Better World International Fund

Thornburg Capital Management Fund

Thornburg Long/Short Equity Fund

Thornburg Summit Fund

| THORNBURG EQUITY FUNDS |

| Multi Asset |

| Thornburg Investment Income Builder Fund |

| Thornburg Summit Fund |

| Global Equity |

| Thornburg Global Opportunities Fund |

| International Equity |

| Thornburg International Value Fund |

| Thornburg Better World International Fund |

| Thornburg International Growth Fund |

| Thornburg Developing World Fund |

| Domestic Equity |

| Thornburg Value Fund |

| Thornburg Core Growth Fund |

| Alternatives |

| Thornburg Long/Short Equity Fund |

At Thornburg, we believe unconstrained investing leads to better outcomes for our clients. Our investment solutions are highly active, high conviction, and benchmark agnostic. When it comes to finding economic opportunity for clients, it’s more than what we do.

It’s how we do it. Active Asbottom-up, fundamental, active managers, we look beyond conventional benchmarks. Long Term We take a long-term view in how we manage our firm and our portfolios. Benchmark Agnostic Investment strategies should have the flexibility to pursue solutions for clients, not stay within the conventional confines of benchmarks. Flexible Perspective Our approach to portfolio construction is guided by our convictions rather than convention. High Conviction We focus our attention and capital on thoroughly researched, well-understood positions. The best form of risk management is to know what you own, and why. Repeatable & Robust Our long-term outperformance of benchmarks verifies that our process works and outperforms conventional thinking. Independent We are independently owned and far from the herd of other investment managers. Investment Driven All members of the investment team are resources for all of our strategies. Collaborative Our team collaborates on opportunities across geography, sector, or asset class.

| 4 | |

| 12 | |

| 18 | |

| 20 | |

| Schedule of Investments | |

| 38 | |

| 46 | |

| 53 | |

| 56 | |

| 59 | |

| 62 | |

| 65 | |

| 68 | |

| 71 | |

| 73 | |

| 78 | |

| 82 | |

| 86 | |

| 91 | |

| 92 | |

| 116 | |

| 136 | |

| 139 | |

| 140 |

March 31, 2020 (Unaudited)

| |

| Jason Brady,cfa Portfolio Manager CEO, President, and Managing Director |

March 31, 2020 (Unaudited)

March 31, 2020 (Unaudited)

March 31, 2020 (Unaudited)

March 31, 2020 (Unaudited)

|  |

| Brian McMahon Portfolio Manager Chief Investment Strategist and Managing Director | Jason Brady,cfa Portfolio Manager CEO, President, and Managing Director |

|  |

| Ben Kirby,cfa Portfolio Manager Head of Investments and Managing Director | Matt Burdett Portfolio Manager and Managing Director |

March 31, 2020 (Unaudited)

March 31, 2020 (Unaudited)

March 31, 2020 (Unaudited)

|  |

| Brian McMahon Portfolio Manager Chief Investment Strategist and Managing Director | Miguel Oleaga Portfolio Manager and Managing Director |

March 31, 2020 (Unaudited)

| THORNBURG INVESTMENT INCOME BUILDER FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 12/24/02) | |||||

| Without sales charge | -18.64% | -2.76% | -0.91% | 3.90% | 7.27% |

| With sales charge | -22.30% | -4.25% | -1.82% | 3.42% | 6.98% |

| Class C Shares(Incep: 12/24/02) | |||||

| Without sales charge | -19.29% | -3.49% | -1.64% | 3.16% | 6.59% |

| With sales charge | -20.07% | -3.49% | -1.64% | 3.16% | 6.59% |

| Class I Shares(Incep: 11/3/03) | -18.46% | -2.48% | -0.62% | 4.23% | 6.60% |

| Class R3 Shares(Incep: 2/1/05) | -18.93% | -3.07% | -1.23% | 3.58% | 5.01% |

| Class R4 Shares(Incep: 2/1/08) | -18.86% | -3.01% | -1.16% | 3.69% | 2.91% |

| Class R5 Shares(Incep: 2/1/07) | -18.51% | -2.60% | -0.74% | 4.10% | 3.81% |

| Class R6 Shares(Incep: 4/10/17) | -18.37% | - | - | - | -2.33% |

| MSCI World Net Total Return USD Index(Since 12/24/02) | -10.39% | 1.92% | 3.25% | 6.57% | 7.10% |

| THORNBURG INVESTMENT INCOME BUILDER FUND | FINAL VALUE |

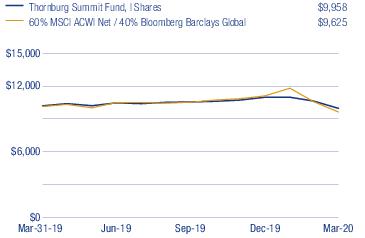

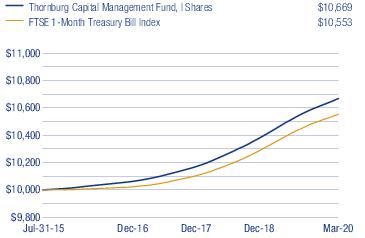

| THORNBURG SUMMIT FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class I Shares(Incep: 3/1/19) | -2.28% | - | - | - | -0.39% |

| 60% MSCI ACWI Net / 40% Bloomberg Barclays Global(Since 3/1/19) | -4.94% | - | - | - | -3.62% |

| THORNBURG SUMMIT FUND | FINAL VALUE |

March 31, 2020 (Unaudited)

| THORNBURG GLOBAL OPPORTUNITIES FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 7/28/06) | |||||

| Without sales charge | -14.10% | -4.66% | -1.82% | 5.76% | 6.60% |

| With sales charge | -17.97% | -6.11% | -2.72% | 5.28% | 6.25% |

| Class C Shares(Incep: 7/28/06) | |||||

| Without sales charge | -14.75% | -5.39% | -2.55% | 4.96% | 5.79% |

| With sales charge | -15.59% | -5.39% | -2.55% | 4.96% | 5.79% |

| Class I Shares(Incep: 7/28/06) | -13.88% | -4.37% | -1.50% | 6.18% | 7.06% |

| Class R3 Shares(Incep: 2/1/08) | -14.33% | -4.86% | -2.00% | 5.64% | 3.49% |

| Class R4 Shares(Incep: 2/1/08) | -14.23% | -4.77% | -1.91% | 5.74% | 3.58% |

| Class R5 Shares(Incep: 2/1/08) | -13.91% | -4.39% | -1.51% | 6.17% | 4.02% |

| Class R6 Shares(Incep: 4/10/17) | -13.76% | - | - | - | -4.46% |

| MSCI AC World Net Total Return USD Index(Since 7/28/06) | -11.26% | 1.50% | 2.85% | 5.88% | 4.37% |

| THORNBURG GLOBAL OPPORTUNITIES FUND | FINAL VALUE |

| THORNBURG INTERNATIONAL VALUE FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 5/28/98) | |||||

| Without sales charge | -10.39% | -1.07% | -0.10% | 2.63% | 6.13% |

| With sales charge | -14.42% | -2.58% | -1.02% | 2.16% | 5.91% |

| Class C Shares(Incep: 5/28/98) | |||||

| Without sales charge | -11.03% | -1.81% | -0.83% | 1.87% | 5.31% |

| With sales charge | -11.87% | -1.81% | -0.83% | 1.87% | 5.31% |

| Class I Shares(Incep: 3/30/01) | -10.13% | -0.75% | 0.25% | 3.01% | 5.76% |

| Class R3 Shares(Incep: 7/1/03) | -10.60% | -1.26% | -0.27% | 2.45% | 6.38% |

| Class R4 Shares(Incep: 2/1/07) | -10.42% | -1.05% | -0.08% | 2.65% | 1.87% |

| Class R5 Shares(Incep: 2/1/05) | -10.19% | -0.80% | 0.19% | 2.93% | 4.79% |

| Class R6 Shares(Incep: 5/1/12) | -10.04% | -0.62% | 0.40% | - | 2.95% |

| MSCI EAFE Net Total Return USD Index(Since 5/28/98) | -14.38% | -1.82% | -0.62% | 2.72% | 3.11% |

| MSCI AC World ex USA Net Total Return USD Index(Since 5/28/98) | -15.57% | -1.96% | -0.64% | 2.05% | 3.53% |

| THORNBURG INTERNATIONAL VALUE FUND | FINAL VALUE |

March 31, 2020 (Unaudited)

| THORNBURG BETTER WORLD INTERNATIONAL FUND | 1-YR | 3-YR | SINCE INCEPTION |

| Class A Shares(Incep: 10/1/15) | |||

| Without sales charge | -9.50% | -0.36% | 3.26% |

| With sales charge | -13.59% | -1.88% | 2.21% |

| Class C Shares(Incep: 10/1/15) | |||

| Without sales charge | -10.01% | -0.91% | 2.69% |

| With sales charge | -10.91% | -0.91% | 2.69% |

| Class I Shares(Incep: 10/1/15) | -8.86% | 0.37% | 4.03% |

| MSCI AC World ex USA Net Total Return USD Index(Since 10/1/15) | -15.57% | -1.96% | 2.07% |

| THORNBURG BETTER WORLD INTERNATIONAL FUND | FINAL VALUE |

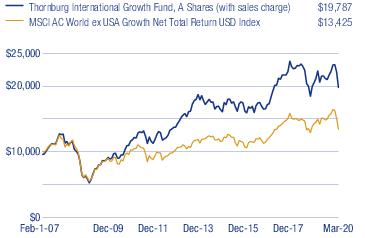

| THORNBURG INTERNATIONAL GROWTH FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 2/1/07) | |||||

| Without sales charge | -6.63% | 2.62% | 2.89% | 7.41% | 5.69% |

| With sales charge | -10.83% | 1.05% | 1.94% | 6.92% | 5.32% |

| Class C Shares(Incep: 2/1/07) | |||||

| Without sales charge | -7.34% | 1.84% | 2.10% | 6.59% | 4.94% |

| With sales charge | -8.26% | 1.84% | 2.10% | 6.59% | 4.94% |

| Class I Shares(Incep: 2/1/07) | -6.35% | 2.97% | 3.27% | 7.86% | 6.19% |

| Class R3 Shares(Incep: 2/1/08) | -6.80% | 2.45% | 2.75% | 7.31% | 4.58% |

| Class R4 Shares(Incep: 2/1/08) | -6.72% | 2.55% | 2.84% | 7.42% | 4.68% |

| Class R5 Shares(Incep: 2/1/08) | -6.33% | 2.97% | 3.27% | 7.85% | 5.10% |

| Class R6 Shares(Incep: 2/1/13) | -6.23% | 3.07% | 3.38% | - | 5.01% |

| MSCI AC World ex USA Growth Net Total Return USD Index(Since 2/1/07) | -7.31% | 2.53% | 2.10% | 3.91% | 2.26% |

| THORNBURG INTERNATIONAL GROWTH FUND | FINAL VALUE |

March 31, 2020 (Unaudited)

| THORNBURG DEVELOPING WORLD FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 12/16/09) | |||||

| Without sales charge | -15.30% | 0.92% | -0.24% | 3.36% | 3.84% |

| With sales charge | -19.11% | -0.61% | -0.16% | 2.89% | 3.38% |

| Class C Shares(Incep: 12/16/09) | |||||

| Without sales charge | -15.90% | 0.17% | -1.00% | 2.61% | 3.09% |

| With sales charge | -16.74% | 0.17% | -1.00% | 2.61% | 3.09% |

| Class I Shares(Incep: 12/16/09) | -14.96% | 1.32% | 0.17% | 3.84% | 4.34% |

| Class R5 Shares(Incep: 2/1/13) | -15.00% | 1.32% | 0.18% | - | 0.65% |

| Class R6 Shares(Incep: 2/1/13) | -14.92% | 1.41% | 0.27% | - | 0.75% |

| MSCI Emerging Markets Net Total Return USD Index(Since 12/16/09) | -17.69% | -1.62% | -0.37% | 0.68% | 1.06% |

| THORNBURG DEVELOPING WORLD FUND | FINAL VALUE |

| THORNBURG VALUE FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 10/2/95) | |||||

| Without sales charge | -16.62% | -0.62% | 2.42% | 6.11% | 8.45% |

| With sales charge | -20.38% | -2.14% | 1.48% | 5.62% | 8.25% |

| Class C Shares(Incep: 10/2/95) | |||||

| Without sales charge | -17.27% | -1.43% | 1.62% | 5.29% | 7.62% |

| With sales charge | -18.10% | -1.43% | 1.62% | 5.29% | 7.62% |

| Class I Shares(Incep: 11/2/98) | -16.35% | -0.28% | 2.80% | 6.51% | 6.43% |

| Class R3 Shares(Incep: 7/1/03) | -16.64% | -0.64% | 2.43% | 6.11% | 6.22% |

| Class R4 Shares(Incep: 2/1/07) | -16.57% | -0.54% | 2.53% | 6.22% | 3.90% |

| Class R5 Shares(Incep: 2/1/05) | -16.36% | -0.28% | 2.80% | 6.49% | 6.10% |

| S&P 500 Total Return Index (Since 10/2/95) | -6.98% | 5.10% | 6.73% | 10.53% | 8.32% |

| THORNBURG VALUE FUND | FINAL VALUE |

March 31, 2020 (Unaudited)

| THORNBURG CORE GROWTH FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class A Shares(Incep: 12/27/00) | |||||

| Without sales charge | -4.71% | 7.54% | 5.63% | 9.97% | 6.18% |

| With sales charge | -8.99% | 5.91% | 4.66% | 9.46% | 5.93% |

| Class C Shares(Incep: 12/27/00) | |||||

| Without sales charge | -5.45% | 6.67% | 4.79% | 9.13% | 5.34% |

| With sales charge | -6.29% | 6.67% | 4.79% | 9.13% | 5.34% |

| Class I Shares(Incep: 11/3/03) | -4.38% | 7.93% | 6.03% | 10.43% | 8.40% |

| Class R3 Shares(Incep: 7/1/03) | -4.85% | 7.39% | 5.49% | 9.87% | 8.49% |

| Class R4 Shares(Incep: 2/1/07) | -4.75% | 7.51% | 5.60% | 9.98% | 5.32% |

| Class R5 Shares(Incep: 10/3/05) | -4.38% | 7.93% | 6.03% | 10.43% | 7.43% |

| Russell 3000 Total Return Growth Index(Since 12/27/00) | -0.44% | 10.54% | 9.74% | 12.68% | 5.85% |

| THORNBURG CORE GROWTH FUND | FINAL VALUE |

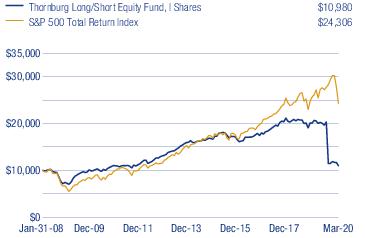

| THORNBURG LONG/SHORT EQUITY FUND* | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION |

| Class I Shares(Incep: 12/30/16) | -7.40% | 1.63% | 2.06% | 6.57% | 5.48% |

| S&P 500 Total Return Index | -6.98% | 5.10% | 6.73% | 7.57% | 7.57% |

| THORNBURG LONG/SHORT EQUITY FUND | FINAL VALUE |

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| RUSSELL 1000 INDEX | RUSSELL 2000 INDEX | |

| Real Estate | 27% | 31% |

| Financials | 21% | 27% |

| Consumer Discretionary | 19% | 10% |

| Energy | 18% | 15% |

| Industrials | 4% | 6% |

| Materials | 4% | 2% |

| Consumer Staples | 2% | 1% |

| Information Technology | 2% | 1% |

| Communication Services | 2% | 6% |

| Utilities | 1% | 1% |

| Health Care | 0% | 0% |

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Orange SA | 5.4% |

| China Mobile Ltd. | 4.3% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 3.9% |

| Roche Holding AG | 3.4% |

| Deutsche Telekom AG | 3.3% |

| CME Group, Inc. | 2.9% |

| TOTAL S.A. | 2.8% |

| Merck & Co., Inc. | 2.8% |

| Walgreens Boots Alliance, Inc. | 2.7% |

| JPMorgan Chase & Co. | 2.7% |

| SECTOR EXPOSURE (percent of equity holdings) | |

| Financials | 20.7% |

| Communication Services | 20.0% |

| Health Care | 14.1% |

| Information Technology | 11.7% |

| Energy | 8.6% |

| Consumer Staples | 5.2% |

| Utilities | 5.2% |

| Real Estate | 4.1% |

| Materials | 4.0% |

| Industrials | 3.2% |

| Consumer Discretionary | 3.2% |

| COUNTRY EXPOSURE * (percent of Fund) | |

| United States | 38.1% |

| France | 11.5% |

| Switzerland | 8.7% |

| Netherlands | 6.0% |

| United Kingdom | 5.9% |

| Italy | 5.0% |

| China | 4.4% |

| Taiwan | 3.9% |

| Germany | 3.7% |

| South Korea | 3.5% |

| Russian Federation | 2.2% |

| Spain | 1.4% |

| Singapore | 0.9% |

| Australia | 0.7% |

| South Africa | 0.4% |

| Ireland | 0.3% |

| Jamaica | 0.3% |

| Colombia | 0.3% |

| Canada | 0.2% |

| Brazil | 0.1% |

| Cayman Islands | 0.1% |

| Japan | 0.1% |

| Belgium | 0.1% |

| Mexico | 0.0%** |

| Saint Lucia | 0.0%** |

| Other Assets Less Liabilities | 2.2% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| ** | Country percentage was less than 0.1%. |

| QUARTERLY DIVIDEND HISTORY, CLASS A | |||||

| YEAR | Q1 | Q2 | Q3 | Q4 | TOTAL |

| 2003 | 9.2¢ | 11.2¢ | 12.4¢ | 17.5¢ | 50.3¢ |

| 2004 | 10.2¢ | 12.5¢ | 15.0¢ | 21.8¢ | 59.5¢ |

| 2005 | 11.0¢ | 13.6¢ | 17.4¢ | 29.0¢ | 71.0¢ |

| 2006 | 12.5¢ | 16.0¢ | 19.2¢ | 33.0¢ | 80.7¢ |

| 2007 | 14.2¢ | 18.5¢ | 21.5¢ | 36.8¢ | 91.0¢ |

| 2008 | 17.9¢ | 21.8¢ | 26.0¢ | 36.8¢ | 102.5¢ |

| 2009 | 18.0¢ | 24.2¢ | 28.0¢ | 34.5¢ | 104.7¢ |

| 2010 | 19.8¢ | 25.0¢ | 32.0¢ | 36.0¢ | 112.8¢ |

| 2011 | 21.0¢ | 26.0¢ | 32.0¢ | 37.5¢ | 116.5¢ |

| 2012 | 21.5¢ | 26.0¢ | 28.5¢ | 36.0¢ | 112.0¢ |

| 2013 | 21.5¢ | 25.3¢ | 25.0¢ | 24.5¢ | 96.3¢ |

| 2014 | 22.5¢ | 24.0¢ | 27.0¢ | 26.0¢ | 99.5¢ |

| 2015 | 16.5¢ | 20.0¢ | 20.0¢ | 25.3¢ | 81.8¢ |

| 2016 | 17.0¢ | 18.5¢ | 19.5¢ | 21.5¢ | 76.5¢ |

| 2017 | 17.0¢ | 20.0¢ | 26.0¢ | 29.5¢ | 92.5¢ |

| 2018 | 18.0¢ | 20.0¢ | 24.0¢ | 28.0¢ | 90.0¢ |

| 2019 | 19.0¢ | 21.5¢ | 25.0¢ | 30.0¢ | 95.5¢ |

| 2020 | 19.0¢ | ||||

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| As of 3/31/2020 | |

| Telecommunication Services | 20.0% |

| Pharmaceuticals, Biotechnology & Life Sciences | 14.1% |

| Diversified Financials | 10.3% |

| Semiconductors & Semiconductor Equipment | 9.2% |

| Energy | 8.6% |

| Banks | 5.6% |

| Utilities | 5.2% |

| Insurance | 4.6% |

| Real Estate | 4.1% |

| Materials | 4.0% |

| As of 12/31/2019 | |

| Telecommunication Services | 15.5% |

| Diversified Financials | 13.6% |

| Energy | 12.9% |

| Pharmaceuticals, Biotechnology & Life Sciences | 9.6% |

| Semiconductors & Semiconductor Equipment | 9.5% |

| Banks | 6.0% |

| Materials | 5.4% |

| Utilities | 4.7% |

| Real Estate | 3.9% |

| Insurance | 3.0% |

| As of 9/30/2019 | |

| Telecommunication Services | 15.8% |

| Diversified Financials | 15.7% |

| Energy | 12.7% |

| Pharmaceuticals, Biotechnology & Life Sciences | 9.1% |

| Semiconductors & Semiconductor Equipment | 8.5% |

| Banks | 5.5% |

| Materials | 5.3% |

| Utilities | 4.7% |

| Real Estate | 4.1% |

| Insurance | 3.0% |

| As of 6/30/2019 | |

| Telecommunication Services | 17.3% |

| Diversified Financials | 15.1% |

| Energy | 13.1% |

| Pharmaceuticals, Biotechnology & Life Sciences | 7.9% |

| Semiconductors & Semiconductor Equipment | 7.8% |

| Banks | 5.9% |

| Materials | 5.1% |

| Utilities | 4.7% |

| Real Estate | 3.9% |

| Transportation | 3.9% |

| THORNBURG INVESTMENT INCOME BUILDER FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | TIBAX | 885-215-558 |

| Class C | TIBCX | 885-215-541 |

| Class I | TIBIX | 885-215-467 |

| Class R3 | TIBRX | 885-215-384 |

| Class R4 | TIBGX | 885-215-186 |

| Class R5 | TIBMX | 885-215-236 |

| Class R6 | TIBOX | 885-216-663 |

Thornburg Summit Fund | March 31, 2020 (Unaudited)

| SECTOR EXPOSURE (percent of equity holdings) | |

| Information Technology | 26.2% |

| Consumer Discretionary | 19.4% |

| Financials | 17.2% |

| Communication Services | 10.9% |

| Health Care | 7.6% |

| Energy | 6.7% |

| Consumer Staples | 5.4% |

| Industrials | 2.8% |

| Utilities | 2.4% |

| Materials | 1.4% |

Thornburg Summit Fund | March 31, 2020 (Unaudited)

| COUNTRY EXPOSURE * (percent of Fund) | |

| United States | 64.2% |

| Netherlands | 4.6% |

| France | 3.3% |

| Japan | 3.0% |

| India | 2.4% |

| China | 2.4% |

| Taiwan | 2.1% |

| Switzerland | 1.6% |

| Germany | 1.5% |

| Hong Kong | 1.2% |

| United Kingdom | 1.2% |

| Australia | 1.0% |

| Argentina | 1.0% |

| United Arab Emirates | 0.6% |

| Canada | 0.5% |

| Ireland | 0.5% |

| Brazil | 0.5% |

| Mexico | 0.1% |

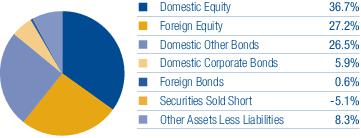

| Other Assets Less Liabilities | 8.3% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| TOP TEN LONG HOLDINGS | |

| Visa, Inc. Class A | 3.1% |

| Microsoft Corp. | 3.1% |

| JPMorgan Chase & Co. | 2.5% |

| CME Group, Inc. | 2.4% |

| Facebook, Inc. Class A | 2.1% |

| Amazon.com, Inc. | 2.0% |

| Royal Dutch Shell plc Class A | 1.9% |

| HDFC Bank Ltd. ADR | 1.8% |

| Estee Lauder Cos, Inc. | 1.8% |

| Alphabet, Inc. Class A | 1.7% |

| THORNBURG SUMMIT FUND | NASDAQ SYMBOLS | CUSIPS |

| Class I | TSUMX | 885-216-580 |

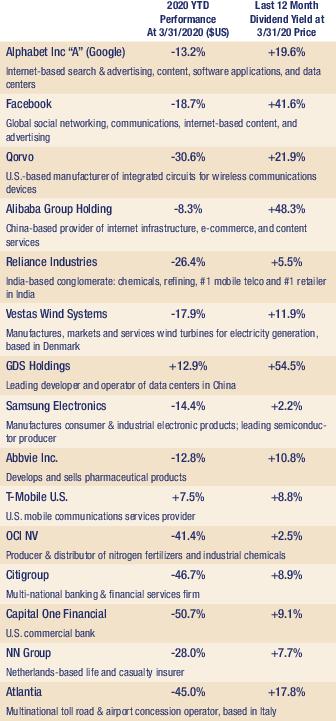

Thornburg Global Opportunities Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Alphabet, Inc. Class A | 5.6% |

| Facebook, Inc. Class A | 5.4% |

| Qorvo, Inc. | 5.2% |

| Alibaba Group Holding Ltd. | 5.1% |

| Reliance Industries Ltd. | 5.0% |

| Vestas Wind Systems A/S | 4.7% |

| GDS Holdings Ltd. ADR | 4.6% |

| Samsung Electronics Co. Ltd. | 4.2% |

| OCI N.V. | 4.0% |

| AbbVie, Inc. | 3.9% |

| SECTOR EXPOSURE | |

| Communication Services | 20.1% |

| Information Technology | 15.8% |

| Financials | 13.0% |

| Industrials | 12.4% |

| Health Care | 9.2% |

| Materials | 8.6% |

| Consumer Discretionary | 7.1% |

| Energy | 5.0% |

| Consumer Staples | 2.5% |

| Utilities | 0.1% |

| Other Assets Less Liabilities | 6.2% |

Thornburg Global Opportunities Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS | |

| Media & Entertainment | 13.3% |

| Materials | 8.6% |

| Semiconductors & Semiconductor Equipment | 6.9% |

| Pharmaceuticals, Biotechnology & Life Sciences | 6.8% |

| Telecommunication Services | 6.8% |

| Transportation | 6.8% |

| Capital Goods | 5.6% |

| Diversified Financials | 5.7% |

| Retailing | 5.1% |

| Energy | 5.0% |

| COUNTRY EXPOSURE * (percent of equity holdings) | |

| United States | 42.4% |

| China | 13.5% |

| Netherlands | 8.0% |

| India | 5.3% |

| Denmark | 5.0% |

| South Korea | 4.5% |

| Taiwan | 4.2% |

| United Kingdom | 4.2% |

| Italy | 3.7% |

| Switzerland | 2.9% |

| Australia | 2.6% |

| Ireland | 2.1% |

| Macao | 1.5% |

| France | 0.1% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| THORNBURG GLOBAL OPPORTUNITIES FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | THOAX | 885-215-343 |

| Class C | THOCX | 885-215-335 |

| Class I | THOIX | 885-215-327 |

| Class R3 | THORX | 885-215-145 |

| Class R4 | THOVX | 885-215-137 |

| Class R5 | THOFX | 885-215-129 |

| Class R6 | THOGX | 885-216-655 |

Thornburg International Value Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Telefonaktiebolaget LM Ericsson Class B | 3.2% |

| Alibaba Group Holding Ltd. | 3.0% |

| Lonza Group AG | 2.9% |

| Tencent Holdings Ltd. | 2.8% |

| Ferrovial S.A. | 2.8% |

| Nintendo Co. Ltd. | 2.7% |

| Vinci S.A. | 2.7% |

| BAE Systems plc | 2.7% |

| adidas AG | 2.7% |

| Meituan Dianping Class B | 2.6% |

| SECTOR EXPOSURE | |

| Industrials | 19.5% |

| Information Technology | 12.5% |

| Consumer Staples | 12.1% |

| Communication Services | 12.0% |

| Financials | 11.2% |

| Consumer Discretionary | 9.3% |

| Utilities | 6.1% |

| Health Care | 5.0% |

| Materials | 3.4% |

| Energy | 2.8% |

| Other Assets Less Liabilities | 6.1% |

Thornburg International Value Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS | |

| Capital Goods | 14.5% |

| Food, Beverage & Tobacco | 8.7% |

| Media & Entertainment | 8.1% |

| Utilities | 6.1% |

| Retailing | 5.6% |

| Banks | 5.0% |

| Semiconductors & Semiconductor Equipment | 4.5% |

| Technology Hardware & Equipment | 4.4% |

| Insurance | 4.0% |

| Pharmaceuticals, Biotechnology & Life Sciences | 4.0% |

| COUNTRY EXPOSURE * (percent of equity holdings) | |

| China | 20.8% |

| Switzerland | 14.7% |

| France | 14.2% |

| Japan | 9.3% |

| Germany | 8.2% |

| Spain | 7.3% |

| United Kingdom | 6.9% |

| Netherlands | 5.6% |

| Sweden | 3.4% |

| Canada | 2.6% |

| Italy | 2.0% |

| South Korea | 1.9% |

| India | 1.0% |

| Taiwan | 0.9% |

| United States | 0.7% |

| Hong Kong | 0.5% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| THORNBURG INTERNATIONAL VALUE FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | TGVAX | 885-215-657 |

| Class C | THGCX | 885-215-640 |

| Class I | TGVIX | 885-215-566 |

| Class R3 | TGVRX | 885-215-525 |

| Class R4 | THVRX | 885-215-269 |

| Class R5 | TIVRX | 885-215-368 |

| Class R6 | TGIRX | 885-216-804 |

Thornburg Better World International Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Alibaba Group Holding Ltd. | 4.6% |

| Tencent Holdings Ltd. | 4.5% |

| Sony Corp. | 3.5% |

| AIA Group Ltd. | 3.3% |

| Enel S.p.A. | 3.0% |

| Nomad Foods Ltd. | 2.7% |

| Fresenius Medical Care AG & Co. KGaA | 2.7% |

| Takeda Pharmaceutical Co. Ltd. | 2.2% |

| Kao Corp. | 2.1% |

| Reckitt Benckiser Group plc | 2.1% |

| SECTOR EXPOSURE | |

| Consumer Discretionary | 17.3% |

| Health Care | 14.3% |

| Information Technology | 12.3% |

| Financials | 11.0% |

| Communication Services | 10.7% |

| Consumer Staples | 9.8% |

| Industrials | 9.6% |

| Materials | 5.9% |

| Utilities | 3.5% |

| Real Estate | 0.9% |

| Other Assets Less Liabilities | 4.7% |

Thornburg Better World International Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS | |

| Retailing | 8.9% |

| Consumer Durables & Apparel | 8.4% |

| Capital Goods | 8.1% |

| Health Care Equipment & Services | 7.5% |

| Media & Entertainment | 7.4% |

| Insurance | 7.0% |

| Pharmaceuticals, Biotechnology & Life Sciences | 6.8% |

| Materials | 5.9% |

| Household & Personal Products | 5.6% |

| Semiconductors & Semiconductor Equipment | 5.3% |

| COUNTRY EXPOSURE * (percent of equity holdings) | |

| China | 14.6% |

| Japan | 14.1% |

| Germany | 13.3% |

| France | 11.7% |

| United Kingdom | 9.6% |

| United States | 6.7% |

| Italy | 5.6% |

| Switzerland | 5.2% |

| Netherlands | 5.1% |

| Hong Kong | 3.4% |

| Denmark | 2.6% |

| Ireland | 2.2% |

| Taiwan | 2.0% |

| Norway | 1.3% |

| Sweden | 1.2% |

| Spain | 0.7% |

| Brazil | 0.7% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| BETTER WORLD INTERNATIONAL FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | TBWAX | 885-216-721 |

| Class C | TBWCX | 885-216-713 |

| Class I | TBWIX | 885-216-697 |

Thornburg International Growth Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Alibaba Group Holding Ltd. | 6.0% |

| Tencent Holdings Ltd. | 4.9% |

| AstraZeneca plc | 4.1% |

| Wirecard AG | 3.3% |

| Lonza Group AG | 3.2% |

| Activision Blizzard, Inc. | 3.0% |

| Adyen N.V. | 2.9% |

| Kerry Group plc Class A | 2.7% |

| adidas AG | 2.7% |

| SK Hynix, Inc. | 2.5% |

| SECTOR EXPOSURE | |

| Information Technology | 25.4% |

| Consumer Discretionary | 19.4% |

| Communication Services | 16.9% |

| Health Care | 13.0% |

| Consumer Staples | 7.6% |

| Financials | 3.9% |

| Industrials | 3.8% |

| Energy | 1.9% |

| Other Assets Less Liabilities | 8.1% |

Thornburg International Growth Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS | |

| Software & Services | 18.7% |

| Media & Entertainment | 16.9% |

| Retailing | 11.0% |

| Pharmaceuticals, Biotechnology & Life Sciences | 9.1% |

| Food, Beverage & Tobacco | 6.8% |

| Semiconductors & Semiconductor Equipment | 6.7% |

| Consumer Durables & Apparel | 4.3% |

| Consumer Services | 4.1% |

| Diversified Financials | 3.9% |

| Health Care Equipment & Services | 3.9% |

| COUNTRY EXPOSURE * (percent of equity holdings) | |

| China | 16.9% |

| United States | 11.4% |

| France | 10.8% |

| Germany | 10.8% |

| United Kingdom | 8.8% |

| Netherlands | 7.0% |

| Japan | 6.9% |

| Australia | 3.6% |

| Switzerland | 3.5% |

| Ireland | 2.9% |

| South Korea | 2.8% |

| Taiwan | 2.7% |

| Mexico | 2.0% |

| Russian Federation | 1.9% |

| Israel | 1.9% |

| United Arab Emirates | 1.7% |

| Sweden | 1.7% |

| Argentina | 1.6% |

| Macao | 1.0% |

| Brazil | 0.1% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| THORNBURG INTERNATIONAL GROWTH FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | TIGAX | 885-215-319 |

| Class C | TIGCX | 885-215-293 |

| Class I | TINGX | 885-215-244 |

| Class R3 | TIGVX | 885-215-178 |

| Class R4 | TINVX | 885-215-160 |

| Class R5 | TINFX | 885-215-152 |

| Class R6 | THGIX | 885-216-820 |

Thornburg Developing World Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Alibaba Group Holding Ltd. | 9.3% |

| Tencent Holdings Ltd. | 7.6% |

| Samsung Electronics Co. Ltd. | 6.0% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.9% |

| AIA Group Ltd. | 4.4% |

| HDFC Bank Ltd. | 3.3% |

| Ping An Insurance Group Co. of China Ltd. Class H | 3.2% |

| Unilever N.V. | 3.0% |

| Reliance Industries Ltd. | 2.6% |

| Shenzhou International Group Holdings Ltd. | 2.5% |

| SECTOR EXPOSURE | |

| Financials | 25.7% |

| Consumer Discretionary | 18.7% |

| Information Technology | 17.1% |

| Communication Services | 11.5% |

| Consumer Staples | 6.9% |

| Energy | 4.7% |

| Industrials | 3.3% |

| Materials | 3.3% |

| Utilities | 2.4% |

| Health Care | 1.5% |

| Other Assets Less Liabilities | 4.9% |

Thornburg Developing World Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS | |

| Banks | 12.9% |

| Retailing | 10.6% |

| Media & Entertainment | 9.5% |

| Semiconductors & Semiconductor Equipment | 7.8% |

| Insurance | 7.6% |

| Technology Hardware & Equipment | 7.7% |

| Diversified Financials | 5.2% |

| Energy | 4.7% |

| Consumer Services | 4.3% |

| Consumer Durables & Apparel | 3.8% |

| COUNTRY EXPOSURE * (percent of equity holdings) | |

| China | 36.6% |

| India | 10.2% |

| Taiwan | 6.9% |

| South Korea | 6.3% |

| Russian Federation | 6.0% |

| Hong Kong | 5.8% |

| Brazil | 4.3% |

| United States | 4.1% |

| United Kingdom | 3.2% |

| Indonesia | 2.8% |

| Mexico | 2.5% |

| Peru | 2.3% |

| Chile | 2.3% |

| Macao | 2.1% |

| United Arab Emirates | 1.9% |

| France | 1.4% |

| Philippines | 1.3% |

| Vietnam | 0.0%** |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| ** | Country percentage was less than 0.1%. |

| THORNBURG DEVELOPING WORLD FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | THDAX | 885-216-408 |

| Class C | THDCX | 885-216-507 |

| Class I | THDIX | 885-216-606 |

| Class R5 | THDRX | 885-216-846 |

| Class R6 | TDWRX | 885-216-838 |

Thornburg Value Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Thermo Fisher Scientific, Inc. | 6.1% |

| Alphabet, Inc. Class C | 5.5% |

| Nomad Foods Ltd. | 4.8% |

| Crown Holdings, Inc. | 4.6% |

| JPMorgan Chase & Co. | 4.5% |

| China Mobile Ltd. | 4.0% |

| Comcast Corp. Class A | 3.8% |

| Facebook, Inc. Class A | 3.7% |

| Activision Blizzard, Inc. | 3.6% |

| Alibaba Group Holding Ltd. | 3.4% |

| SECTOR EXPOSURE | |

| Communication Services | 23.7% |

| Financials | 15.8% |

| Health Care | 14.8% |

| Consumer Discretionary | 11.0% |

| Consumer Staples | 9.3% |

| Information Technology | 7.3% |

| Materials | 6.6% |

| Energy | 4.3% |

| Utilities | 1.8% |

| Industrials | 1.1% |

| Other Assets Less Liabilities | 4.3% |

| TOP TEN INDUSTRY GROUPS | |

| Media & Entertainment | 19.7% |

| Pharmaceuticals, Biotechnology & Life Sciences | 10.2% |

| Retailing | 7.3% |

| Banks | 6.8% |

| Materials | 6.6% |

| Diversified Financials | 6.3% |

| Food, Beverage & Tobacco | 6.3% |

| Technology Hardware & Equipment | 6.3% |

| Health Care Equipment & Services | 4.6% |

| Energy | 4.3% |

| THORNBURG VALUE FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | TVAFX | 885-215-731 |

| Class C | TVCFX | 885-215-715 |

| Class I | TVIFX | 885-215-632 |

| Class R3 | TVRFX | 885-215-533 |

| Class R4 | TVIRX | 885-215-277 |

| Class R5 | TVRRX | 885-215-376 |

Thornburg Core Growth Fund | March 31, 2020 (Unaudited)

| TOP TEN EQUITY HOLDINGS | |

| Amazon.com, Inc. | 6.7% |

| Microsoft Corp. | 6.1% |

| Apple, Inc. | 5.2% |

| Alphabet, Inc. Class C | 4.9% |

| Activision Blizzard, Inc. | 4.4% |

| DaVita, Inc. | 3.5% |

| salesforce.com, Inc. | 3.4% |

| Netflix, Inc. | 3.2% |

| Visa, Inc. Class A | 3.1% |

| Comcast Corp. Class A | 3.0% |

| SECTOR EXPOSURE | |

| Information Technology | 46.9% |

| Communication Services | 17.4% |

| Consumer Discretionary | 11.2% |

| Health Care | 8.7% |

| Financials | 4.7% |

| Consumer Staples | 4.3% |

| Industrials | 1.6% |

| Other Assets Less Liabilities | 5.2% |

| TOP TEN INDUSTRY GROUPS | |

| Software & Services | 38.0% |

| Media & Entertainment | 17.4% |

| Retailing | 11.2% |

| Health Care Equipment & Services | 7.0% |

| Technology Hardware & Equipment | 5.2% |

| Diversified Financials | 4.7% |

| Food, Beverage & Tobacco | 4.3% |

| Semiconductors & Semiconductor Equipment | 3.7% |

| Pharmaceuticals, Biotechnology & Life Sciences | 1.7% |

| Capital Goods | 1.1% |

| COUNTRY EXPOSURE * (percent of equity holdings) | |

| United States | 91.0% |

| Ireland | 2.7% |

| Israel | 2.2% |

| Mexico | 1.9% |

| China | 1.2% |

| Argentina | 1.0% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| THORNBURG CORE GROWTH FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | THCGX | 885-215-582 |

| Class C | TCGCX | 885-215-574 |

| Class I | THIGX | 885-215-475 |

| Class R3 | THCRX | 885-215-517 |

| Class R4 | TCGRX | 885-215-251 |

| Class R5 | THGRX | 885-215-350 |

Thornburg Long/Short Equity Fund | March 31, 2020 (Unaudited)

| SECTOR EXPOSURE | |

| Health Care | 18.7% |

| Communication Services | 14.8% |

| Materials | 5.3% |

| Financials | 5.0% |

| Consumer Staples | 6.7% |

| Energy | 1.1% |

| Consumer Discretionary | -1.6% |

| Real Estate | -3.2% |

| Information Technology | -3.5% |

| Industrials | -7.3% |

| Other Assets Less Liabilities | 64.1% |

| PORTFOLIO EXPOSURE | ||

| 1Q20 | 4Q19 | |

| Gross Long | 109.1% | 111.7% |

| Gross Short | -73.3% | -79.3% |

| Net Equity | 35.9% | 32.3% |

| ASSETS BY GEOGRAPHY | ||

| Long | Short | |

| United States | 56.1% | 43.9% |

| Ex-U.S | 71.9% | 28.1% |

| TOP TEN LONG HOLDINGS | |

| Thermo Fisher Scientific, Inc. | 5.9% |

| China Mobile Ltd. | 5.2% |

| Alphabet, Inc. Class C | 5.0% |

| Cooper Companies, Inc. | 4.6% |

| Netflix, Inc. | 4.5% |

| Comcast Corp. Class A | 4.4% |

| Starbucks Corp. | 4.3% |

| Nomad Foods Ltd. | 4.2% |

| Amazon.com, Inc. | 4.0% |

| Medtronic plc | 4.0% |

| THORNBURG LONG/SHORT EQUITY FUND | NASDAQ SYMBOLS | CUSIPS |

| Class I | THLSX | 885-216-689 |

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Common Stock — 88.1% | |||

| Automobiles & Components — 0.1% | |||

| Automobiles — 0.1% | |||

| Fiat Chrysler Automobiles N.V. | 1,817,794 | $ 12,976,759 | |

| 12,976,759 | |||

| Banks — 4.9% | |||

| Banks — 4.9% | |||

| BNP Paribas S.A. | 2,069,472 | 60,418,683 | |

| DBS Group Holdings Ltd. | 2,266,000 | 29,567,108 | |

| ING Groep N.V. | 10,446,600 | 53,529,347 | |

| JPMorgan Chase & Co. | 3,027,000 | 272,520,810 | |

| Regions Financial Corp. | 9,100,000 | 81,627,000 | |

| 497,662,948 | |||

| Capital Goods — 1.0% | |||

| Aerospace & Defense — 0.5% | |||

| BAE Systems plc | 7,389,500 | 47,477,690 | |

| Construction & Engineering — 0.5% | |||

| ACS Actividades de Construccion y Servicios S.A. | 795,049 | 15,789,157 | |

| Vinci S.A. | 474,819 | 38,797,101 | |

| 102,063,948 | |||

| Diversified Financials — 9.1% | |||

| Capital Markets — 4.8% | |||

| a | Apollo Investment Corp. | 4,902,600 | 33,092,550 |

| CME Group, Inc. | 1,718,000 | 297,059,380 | |

| a | Solar Capital Ltd. | 4,607,900 | 53,635,956 |

| UBS Group AG | 11,662,172 | 106,896,765 | |

| Diversified Financial Services — 3.0% | |||

| Equitable Holdings, Inc. | 11,740,292 | 169,647,219 | |

| b | M&G plc | 93,224,000 | 129,675,232 |

| Mortgage Real Estate Investment Trusts — 1.3% | |||

| Chimera Investment Corp. | 8,623,507 | 78,473,914 | |

| Granite Point Mortgage Trust, Inc. | 1,417,500 | 7,186,725 | |

| a | MFA Financial, Inc. | 32,720,000 | 50,716,000 |

| 926,383,741 | |||

| Energy — 7.5% | |||

| Oil, Gas & Consumable Fuels — 7.5% | |||

| China Petroleum & Chemical Corp. Class H | 11,705,000 | 5,719,141 | |

| Eni SpA | 8,220,252 | 81,688,462 | |

| LUKOIL PJSC Sponsored ADR | 603,100 | 35,541,708 | |

| b,c | Malamute Energy, Inc. | 12,439 | 130,610 |

| Repsol S.A. | 2,508,054 | 22,374,973 | |

| Royal Dutch Shell plc Sponsored ADR Class A | 6,339,000 | 221,167,710 | |

| TOTAL S.A. | 7,645,800 | 288,084,370 | |

| Valero Energy Corp. | 2,435,000 | 110,451,600 | |

| 765,158,574 | |||

| Food & Staples Retailing — 2.8% | |||

| Food & Staples Retailing — 2.8% | |||

| Koninklijke Ahold Delhaize N.V. | 444,000 | 10,343,665 | |

| Walgreens Boots Alliance, Inc. | 6,023,000 | 275,552,250 | |

| 285,895,915 | |||

| Food, Beverage & Tobacco — 1.8% | |||

| Food Products — 0.5% | |||

| Nestle S.A. | 493,100 | 50,477,555 | |

| Tobacco — 1.3% | |||

| KT&G Corp. | 2,192,054 | 134,213,429 |

| 38 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| 184,690,984 | |||

| Insurance — 4.1% | |||

| Insurance — 4.1% | |||

| Assicurazioni Generali SpA | 725,047 | $ 9,820,607 | |

| AXA S.A. | 1,567,000 | 26,532,343 | |

| Legal & General Group plc | 7,920,800 | 18,714,460 | |

| NN Group N.V. | 8,095,300 | 219,995,762 | |

| Swiss Re AG | 609,000 | 46,892,334 | |

| Zurich Insurance Group AG | 264,200 | 92,815,200 | |

| 414,770,706 | |||

| Materials — 3.5% | |||

| Chemicals — 0.8% | |||

| LyondellBasell Industries N.V. Class A | 1,593,700 | 79,095,331 | |

| Metals & Mining — 2.7% | |||

| Glencore plc | 60,788,800 | 92,006,742 | |

| MMC Norilsk Nickel PJSC ADR | 7,491,100 | 185,557,019 | |

| 356,659,092 | |||

| Pharmaceuticals, Biotechnology & Life Sciences — 12.5% | |||

| Biotechnology — 2.1% | |||

| AbbVie, Inc. | 2,812,994 | 214,322,013 | |

| Pharmaceuticals — 10.4% | |||

| AstraZeneca plc | 1,630,300 | 145,257,930 | |

| Merck & Co., Inc. | 3,697,000 | 284,447,180 | |

| Novartis AG | 1,612,500 | 133,029,282 | |

| Pfizer, Inc. | 4,303,000 | 140,449,920 | |

| Roche Holding AG | 1,085,300 | 349,186,439 | |

| 1,266,692,764 | |||

| Real Estate — 3.7% | |||

| Equity Real Estate Investment Trusts — 3.7% | |||

| Crown Castle International Corp. | 1,253,881 | 181,060,417 | |

| Lamar Advertising Co. Class A | 1,621,351 | 83,142,879 | |

| Outfront Media, Inc. | 3,016,100 | 40,657,028 | |

| Washington Real Estate Investment Trust | 2,726,000 | 65,069,620 | |

| 369,929,944 | |||

| Retailing — 2.7% | |||

| Specialty Retail — 2.7% | |||

| Home Depot, Inc. | 1,457,100 | 272,055,141 | |

| 272,055,141 | |||

| Semiconductors & Semiconductor Equipment — 8.2% | |||

| Semiconductors & Semiconductor Equipment — 8.2% | |||

| Broadcom, Inc. | 987,900 | 234,231,090 | |

| QUALCOMM, Inc. | 2,950,000 | 199,567,500 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 43,972,000 | 395,849,616 | |

| 829,648,206 | |||

| Technology Hardware & Equipment — 2.2% | |||

| Technology Hardware, Storage & Peripherals — 2.2% | |||

| Samsung Electronics Co. Ltd. | 5,764,300 | 224,124,557 | |

| 224,124,557 | |||

| Telecommunication Services — 17.6% | |||

| Diversified Telecommunication Services — 10.4% | |||

| b | Deutsche Telekom AG | 26,262,600 | 339,192,560 |

| Koninklijke KPN N.V. | 42,170,400 | 100,846,631 | |

| Orange S.A. | 45,652,780 | 552,738,901 | |

| Singapore Telecommunications Ltd. | 33,698,000 | 60,074,192 | |

| Wireless Telecommunication Services — 7.2% |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 39 |

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| China Mobile Ltd. | 58,587,774 | $ 439,073,219 | |

| MTN Group Ltd. | 16,320,361 | 43,760,698 | |

| Vodafone Group plc | 177,755,924 | 245,915,330 | |

| 1,781,601,531 | |||

| Transportation — 1.8% | |||

| Transportation Infrastructure — 1.8% | |||

| Atlantia SpA | 12,104,678 | 150,369,826 | |

| Sydney Airport | 9,548,656 | 32,991,545 | |

| 183,361,371 | |||

| Utilities — 4.6% | |||

| Electric Utilities — 4.6% | |||

| Electricite de France S.A. | 26,360,784 | 206,128,224 | |

| Enel SpA | 37,943,171 | 261,725,947 | |

| 467,854,171 | |||

| Total Common Stock(Cost $9,862,028,191) | 8,941,530,352 | ||

| Preferred Stock — 0.4% | |||

| Banks — 0.1% | |||

| Banks — 0.1% | |||

| d,e,f | First Horizon Bank, 3.75% (LIBOR 3 Month + 0.85%) | $ 12,000 | 7,920,000 |

| 7,920,000 | |||

| Diversified Financials — 0.0% | |||

| Capital Markets — 0.0% | |||

| e,f | Morgan Stanley, Series A, 4.00% (LIBOR 3 Month + 0.70%) | 120,000 | 2,298,000 |

| 2,298,000 | |||

| Energy — 0.1% | |||

| Oil, Gas & Consumable Fuels — 0.1% | |||

| e | Crestwood Equity Partners L.P., 9.25% | 2,166,596 | 8,233,065 |

| 8,233,065 | |||

| Miscellaneous — 0.1% | |||

| U.S. Government Agencies — 0.1% | |||

| e | Farm Credit Bank of Texas, Series 1, 10.00% | 9,000 | 9,085,500 |

| 9,085,500 | |||

| Telecommunication Services — 0.1% | |||

| Diversified Telecommunication Services — 0.1% | |||

| d,g | Centaur Funding Corp., 9.08%, 4/21/2020 | 15,000 | 14,932,500 |

| 14,932,500 | |||

| Total Preferred Stock(Cost $59,796,152) | 42,469,065 | ||

| Asset Backed Securities — 0.1% | |||

| Other Asset Backed — 0.1% | |||

| d | CFG Investments Ltd., Series 2019-1 Class A, 5.56%, 8/15/2029 | 13,500,000 | 9,580,364 |

| c,d,f | Northwind Holdings, LLC, Series 2007-1A Class A1, 2.36% (LIBOR 3 Month + 0.78%), 12/1/2037 | 568,750 | 553,394 |

| 10,133,758 | |||

| Total Asset Backed Securities(Cost $14,006,379) | 10,133,758 | ||

| Corporate Bonds — 8.3% | |||

| Automobiles & Components — 0.0% | |||

| Auto Components — 0.0% | |||

| d,g | Nexteer Automotive Group Ltd., 5.875%, 11/15/2021 | 4,300,000 | 4,304,538 |

| 4,304,538 | |||

| Capital Goods — 0.1% |

| 40 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Machinery — 0.1% | |||

| Mueller Industries, Inc., 6.00%, 3/1/2027 | $ 7,679,000 | $ 6,930,298 | |

| 6,930,298 | |||

| Commercial & Professional Services — 0.5% | |||

| Commercial Services & Supplies — 0.5% | |||

| d,g | Cimpress plc, 7.00%, 6/15/2026 | 33,804,000 | 29,747,520 |

| d | Nielsen Finance, LLC / Nielsen Finance Co., 5.00%, 4/15/2022 | 18,018,000 | 16,609,353 |

| d | ServiceMaster Co., LLC, 5.125%, 11/15/2024 | 2,480,000 | 2,449,000 |

| 48,805,873 | |||

| Consumer Durables & Apparel — 0.2% | |||

| Leisure Products — 0.2% | |||

| Vista Outdoor, Inc., 5.875%, 10/1/2023 | 18,815,000 | 15,565,838 | |

| 15,565,838 | |||

| Consumer Services — 0.1% | |||

| Hotels, Restaurants & Leisure — 0.1% | |||

| d | Nathan’s Famous, Inc., 6.625%, 11/1/2025 | 6,188,000 | 5,754,840 |

| 5,754,840 | |||

| Diversified Financials — 0.5% | |||

| Capital Markets — 0.2% | |||

| d | Compass Group Diversified Holdings, LLC, 8.00%, 5/1/2026 | 16,141,000 | 15,495,360 |

| c,d | JPR Royalty Sub, LLC, 14.00%, 9/1/2020 | 5,000,000 | 500,000 |

| Consumer Finance — 0.1% | |||

| d | FirstCash, Inc., 5.375%, 6/1/2024 | 7,500,000 | 7,181,250 |

| Diversified Financial Services — 0.2% | |||

| d | Antares Holdings L.P., 6.00%, 8/15/2023 | 18,000,000 | 18,540,045 |

| e,f | JPMorgan Chase & Co., Series I, 5.24% (LIBOR 3 Month + 3.47%), 4/30/2020 | 7,334,000 | 6,547,502 |

| 48,264,157 | |||

| Energy — 2.4% | |||

| Energy Equipment & Services — 0.1% | |||

| Odebrecht Offshore Drilling Finance Ltd., | |||

| d,g | 6.72%, 12/1/2022 | 3,424,639 | 2,739,711 |

| d,g,h | 7.72%, 12/1/2026 PIK | 16,901,555 | 1,690,156 |

| d,e,g | Odebrecht Oil & Gas Finance Ltd. (Guaranty: Odebrecht Oleo e Gas S.A.), Zero Coupon, 12/31/2099 | 2,337,727 | 19,871 |

| b,d,g,i | Schahin II Finance Co. SPV Ltd., 5.875%, 9/25/2023 | 11,640,134 | 727,508 |

| Oil, Gas & Consumable Fuels — 2.3% | |||

| d | Citgo Holding, Inc., 9.25%, 8/1/2024 | 22,226,000 | 18,114,190 |

| f | Energy Transfer Operating L.P., 4.781% (LIBOR 3 Month + 3.02%), 11/1/2066 | 13,820,000 | 6,184,450 |

| f | Enterprise TE Partners L.P., Series 1, 4.358% (LIBOR 3 Month + 2.78%), 6/1/2067 | 7,000,000 | 3,780,000 |

| Kinder Morgan Energy Partners L.P., | |||

| 5.00%, 3/1/2043 | 10,000,000 | 9,479,973 | |

| 5.80%, 3/15/2035 | 10,000,000 | 10,625,154 | |

| Kinder Morgan, Inc., | |||

| 5.30%, 12/1/2034 | 23,630,000 | 22,746,779 | |

| 5.55%, 6/1/2045 | 5,000,000 | 5,096,147 | |

| b,c,d,i | Linc USA GP / Linc Energy Finance USA, Inc., 9.625%, 10/31/2017 | 14,991,164 | 299,823 |

| ONEOK Partners L.P., 4.90%, 3/15/2025 | 9,544,000 | 8,343,803 | |

| d | Par Petroleum, LLC / Par Petroleum Finance Corp., 7.75%, 12/15/2025 | 1,672,000 | 1,049,180 |

| d,g | Petroleos Mexicanos, 5.95%, 1/28/2031 | 7,820,000 | 5,423,326 |

| b,i | RAAM Global Energy Co., 12.50%, 10/1/2015 | 15,000,000 | 72,000 |

| c,d,g,h | Schahin II Finance Co. SPV Ltd., 8.00%, 5/25/2020 PIK | 707,365 | 837,520 |

| Summit Midstream Holdings, LLC / Summit Midstream Finance Corp., 5.50%, 8/15/2022 | 7,497,000 | 1,349,460 | |

| e,f | Summit Midstream Partners L.P., Series A, 9.50% (LIBOR 3 Month + 7.43%), 12/15/2022 | 27,036,000 | 388,507 |

| Transcontinental Gas Pipe Line Co., LLC, 7.85%, 2/1/2026 | 32,700,000 | 37,230,144 | |

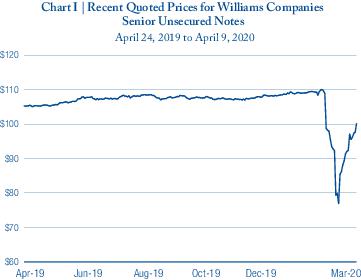

| Williams Companies, Inc., | |||

| 3.70%, 1/15/2023 | 29,129,000 | 26,931,512 | |

| 4.55%, 6/24/2024 | 69,318,000 | 63,375,095 | |

| 5.75%, 6/24/2044 | 14,198,000 | 14,800,236 | |

| 241,304,545 |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 41 |

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Food & Staples Retailing — 0.1% | |||

| Food & Staples Retailing — 0.1% | |||

| d | KeHE Distributors, LLC / KeHE Finance Corp, 8.625%, 10/15/2026 | $ 5,852,000 | $ 5,881,260 |

| 5,881,260 | |||

| Food, Beverage & Tobacco — 0.5% | |||

| Food Products — 0.1% | |||

| B&G Foods, Inc., 5.25%, 9/15/2027 | 5,000,000 | 4,875,000 | |

| Tobacco — 0.4% | |||

| Vector Group Ltd., | |||

| d | 6.125%, 2/1/2025 | 8,826,000 | 8,031,660 |

| d | 10.50%, 11/1/2026 | 43,420,000 | 36,255,700 |

| 49,162,360 | |||

| Health Care Equipment & Services — 0.2% | |||

| Health Care Providers & Services — 0.2% | |||

| d | Tenet Healthcare Corp., 6.25%, 2/1/2027 | 23,500,000 | 22,912,500 |

| 22,912,500 | |||

| Insurance — 0.6% | |||

| Insurance — 0.6% | |||

| d,e,f,g | Dai-ichi Life Insurance Co. Ltd., 7.25% (LIBOR 3 Month + 4.56%), 7/25/2021 | 9,000,000 | 9,360,000 |

| d | MetLife, Inc., 9.25%, 4/8/2038 | 12,000,000 | 15,000,000 |

| d,f,g | QBE Insurance Group Ltd., 7.50% (USSW10 + 6.03%), 11/24/2043 | 40,000,000 | 37,200,000 |

| 61,560,000 | |||

| Materials — 0.4% | |||

| Chemicals — 0.1% | |||

| d,g | Consolidated Energy Finance S.A., 6.875%, 6/15/2025 | 13,000,000 | 11,245,000 |

| Construction Materials — 0.1% | |||

| d,g | InterCement Financial Operations B.V., 5.75%, 7/17/2024 | 8,000,000 | 4,580,080 |

| Containers & Packaging — 0.1% | |||

| d | Matthews International Corp., 5.25%, 12/1/2025 | 13,975,000 | 12,368,154 |

| Metals & Mining — 0.0% | |||

| d | Cleveland-Cliffs, Inc., 6.75%, 3/15/2026 | 5,000,000 | 4,450,000 |

| Paper & Forest Products — 0.1% | |||

| d | Neenah, Inc., 5.25%, 5/15/2021 | 7,470,000 | 7,283,250 |

| 39,926,484 | |||

| Media & Entertainment — 0.2% | |||

| Media — 0.2% | |||

| d | CCO Holdings, LLC / CCO Holdings Capital Corp., 5.375%, 6/1/2029 | 4,390,000 | 4,511,164 |

| d | CSC Holdings LLC, 6.50%, 2/1/2029 | 4,000,000 | 4,313,960 |

| d | Salem Media Group, Inc., 6.75%, 6/1/2024 | 7,920,000 | 6,573,600 |

| d,g | Telenet Finance Luxembourg Notes Sarl, 5.50%, 3/1/2028 | 10,000,000 | 9,300,000 |

| 24,698,724 | |||

| Real Estate — 0.3% | |||

| Equity Real Estate Investment Trusts — 0.3% | |||

| CoreCivic, Inc., | |||

| 4.625%, 5/1/2023 | 11,364,000 | 10,341,240 | |

| 4.75%, 10/15/2027 | 23,901,000 | 17,925,750 | |

| 28,266,990 | |||

| Retailing — 0.1% | |||

| Specialty Retail — 0.1% | |||

| d | Michaels Stores, Inc., 8.00%, 7/15/2027 | 20,055,000 | 14,840,700 |

| 14,840,700 | |||

| Software & Services — 0.0% | |||

| Information Technology Services — 0.0% | |||

| d | Vericast Corp., 8.375%, 8/15/2022 | 6,500,000 | 5,013,125 |

| 42 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| 5,013,125 | |||

| Technology Hardware & Equipment — 0.1% | |||

| Communications Equipment — 0.1% | |||

| Anixter, Inc. (Guaranty: Anixter International, Inc.), 6.00%, 12/1/2025 | $ 8,000,000 | $ 7,830,000 | |

| 7,830,000 | |||

| Telecommunication Services — 2.0% | |||

| Diversified Telecommunication Services — 1.7% | |||

| g | Deutsche Telekom International Finance B.V. (Guaranty: Deutsche Telekom AG), 8.75%, 6/15/2030 | 26,150,000 | 35,301,559 |

| d,g | Digicel Ltd., 6.00%, 4/15/2021 | 51,737,000 | 27,873,826 |

| Qwest Corp., 6.75%, 12/1/2021 | 9,000,000 | 9,326,700 | |

| g | Telefonica Emisiones SAU (Guaranty: Telefonica S.A.), 7.045%, 6/20/2036 | 85,390,000 | 101,745,880 |

| Wireless Telecommunication Services — 0.3% | |||

| d,g | Digicel International Finance Ltd., 8.75%, 5/25/2024 | 4,300,000 | 3,848,500 |

| d,g | Millicom International Cellular S.A., 6.00%, 3/15/2025 | 28,423,000 | 27,464,008 |

| 205,560,473 | |||

| Transportation — 0.0% | |||

| Airlines — 0.0% | |||

| American Airlines Pass Through Trust, Series 2013-2 Class A, 4.95%, 7/15/2024 | 2,512,418 | 2,553,296 | |

| US Airways Pass Through Trust, Series 2010-1 Class A, 6.25%, 10/22/2024 | 1,353,742 | 1,393,090 | |

| 3,946,386 | |||

| Total Corporate Bonds(Cost $920,748,527) | 840,529,091 | ||

| Municipal Bonds — 0.0% | |||

| San Bernardino County Redevelopment Agency Successor Agency, Series A, 8.45%, 9/1/2030 | 2,555,000 | 2,604,822 | |

| Total Municipal Bonds(Cost $2,514,818) | 2,604,822 | ||

| Other Government — 0.0% | |||

| Brazilian Government International Bond (BRL), 12.50%, 1/5/2022 | 20,000,000 | 4,202,729 | |

| Total Other Government(Cost $12,446,979) | 4,202,729 | ||

| Mortgage Backed — 0.0% | |||

| f | Bear Stearns ARM Trust, Whole Loan Securities Trust CMO, Series 2003-6 Class 2B1, 4.774%, 8/25/2033 | 51,147 | 44,637 |

| f | Citigroup Mortgage Loan Trust, Inc., Whole Loan Securities Trust CMO, Series 2004-HYB2 Class B1, 4.05%, 3/25/2034 | 329,133 | 260,188 |

| f | Merrill Lynch Mortgage Investors Trust, Whole Loan Securities Trust CMO, Series 2004-A4 Class M1, 4.322%, 8/25/2034 | 1,951,197 | 1,533,217 |

| Total Mortgage Backed(Cost $2,403,572) | 1,838,042 | ||

| Loan Participations — 0.9% | |||

| Commercial & Professional Services — 0.4% | |||

| Professional Services — 0.4% | |||

| j | Par Pacific Holdings, Inc., 8.60% (LIBOR 3 Month + 6.75%), 1/12/2026 | 14,052,598 | 9,555,766 |

| j | R.R. Donnelley & Sons Company, 5.989% (LIBOR 1 Month + 5.00%), 1/15/2024 | 16,787,500 | 14,521,188 |

| RGIS Services, LLC, | |||

| j | 8.95% (LIBOR 3 Month + 7.50%), 3/31/2023 | 7,908,804 | 5,377,987 |

| j | 9.119% (LIBOR 3 Month + 7.50%), 3/31/2023 | 3,918,296 | 2,664,441 |

| j | 9.277% (LIBOR 3 Month + 7.50%), 3/31/2023 | 3,438,610 | 2,338,255 |

| j | Vericast Corp., 6.463% (LIBOR 3 Month + 4.75%), 11/3/2023 | 12,672,230 | 7,631,090 |

| 42,088,727 | |||

| Energy — 0.0% | |||

| Energy Equipment & Services — 0.0% | |||

| McDermott Technology Americas, Inc., | |||

| j | 10.647% (LIBOR 3 Month + 9.00%), 10/22/2020 | 3,201,241 | 2,890,721 |

| j | 10.806% (LIBOR 3 Month + 9.00%), 10/21/2020 | 606,597 | 547,757 |

| j | 10.647% (LIBOR 3 Month + 9.00%), 10/21/2020 | 716,887 | 647,349 |

| Oil, Gas & Consumable Fuels — 0.0% | |||

| c,h,j | Malamute Energy, Inc., 2.95% (LIBOR 3 Month + 1.50% PIK), 11/22/2022 | 316,081 | 316,081 |

| 4,401,908 |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 43 |

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Real Estate — 0.2% | |||

| Equity Real Estate Investment Trusts — 0.2% | |||

| j | CoreCivic, Inc., 5.50% (LIBOR 1 Month + 4.50%), 12/12/2024 | $ 13,923,750 | $ 12,113,662 |

| j | GEO Group, Inc., 2.99% (LIBOR 1 Month + 2.00%), 3/22/2024 | 7,917,593 | 6,448,563 |

| 18,562,225 | |||

| Retailing — 0.0% | |||

| Specialty Retail — 0.0% | |||

| j | Office Depot, Inc., 6.25% (LIBOR 1 Month + 5.25%), 11/8/2022 | 2,325,589 | 2,209,310 |

| 2,209,310 | |||

| Software & Services — 0.2% | |||

| Internet Software & Services — 0.2% | |||

| j | Dun & Bradstreet Corporation (The), 4.959% (LIBOR 1 Month + 4.00%), 2/6/2026 | 16,910,000 | 15,155,587 |

| 15,155,587 | |||

| Transportation — 0.1% | |||

| Airlines — 0.1% | |||

| c,j | Wheels Up Partners, LLC, 8.08% (LIBOR 3 Month + 6.50%), 8/17/2025 | 10,676,522 | 8,850,837 |

| 8,850,837 | |||

| Total Loan Participations(Cost $112,500,281) | 91,268,594 | ||

| Short-Term Investments — 1.3% | |||

| a | Thornburg Capital Management Fund | 13,013,685 | 130,136,853 |

| Total Short-Term Investments(Cost $130,136,853) | 130,136,853 | ||

| Total Investments — 99.1%(Cost $11,116,581,752) | $10,064,713,306 | ||

| Other Assets Less Liabilities — 0.9% | 88,103,084 | ||

| Net Assets — 100.0% | $10,152,816,390 |

| Outstanding Forward Currency Contracts To Buy Or Sell At March 31, 2020 | |||||||

| Contract Description | Contract Party* | Buy/Sell | Contract Amount | Contract Value Date | Value USD | Unrealized Appreciation | Unrealized Depreciation |

| Great Britain Pound | SSB | Sell | 442,246,700 | 4/14/2020 | 549,430,569 | $ 31,040,337 | $ — |

| Swiss Franc | SSB | Sell | 42,771,000 | 4/23/2020 | 44,483,731 | — | (30,856) |

| Chinese Yuan Renminbi | SSB | Sell | 1,464,706,400 | 4/29/2020 | 206,456,898 | 4,970,617 | — |

| Korean Won | SSB | Sell | 185,829,326,300 | 4/29/2020 | 152,777,452 | 4,999,187 | — |

| Euro | SSB | Sell | 1,445,177,000 | 5/18/2020 | 1,596,714,915 | — | (20,821,655) |

| Total | $41,010,141 | $(20,852,511) | |||||

| Net unrealized appreciation (depreciation) | $20,157,630 | ||||||

| * | Counterparty includes State Street Bank and Trust Company ("SSB"). |

| 44 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Footnote Legend | |

| a | Investment in Affiliates. |

| b | Non-income producing. |

| c | Security currently fair valued by the Valuation and Pricing Committee using procedures approved by the Trustees’ Audit Committee. |

| d | Securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities are restricted but liquid and may only be resold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2020, the aggregate value of these securities in the Fund’s portfolio was $442,775,936, representing 4.36% of the Fund’s net assets. |

| e | Securities are perpetual and, thus, do not have a predetermined maturity date. The date shown, if applicable, reflects the next call date. |

| f | Variable, floating, step, or fixed to floating rate securities are securities for which interest rate changes are based on changes in a designated base rate or on a predetermined schedule. The rates shown are those in effect on March 31, 2020. |

| g | Yankee bond denominated in U.S. dollars and is issued in the U.S. by foreign banks and corporations. |

| h | Pay-In-Kind Payments (PIK). The issuer may pay cash interest and/or interest in additional debt securities. Rates shown are the rates in effect at March 31, 2020. |

| i | Bond in default. |

| j | The stated coupon rate represents the greater of the LIBOR or the LIBOR floor rate plus a spread at March 31, 2020. |

To simplify the listings of securities, abbreviations are used per the table below:

| ADR | American Depositary Receipt |

| ARM | Adjustable Rate Mortgage |

| BRL | Denominated in Brazilian Real |

| CMO | Collateralized Mortgage Obligation |

| LIBOR | London Interbank Offered Rates |

| MFA | Mortgage Finance Authority |

| SPV | Special Purpose Vehicle |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 45 |

Thornburg Summit Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Common Stock — 60.4% | |||

| Banks — 4.3% | |||

| Banks — 4.3% | |||

| HDFC Bank Ltd. ADR | 15,844 | $ 609,360 | |

| a | JPMorgan Chase & Co. | 9,190 | 827,376 |

| 1,436,736 | |||

| Capital Goods — 2.3% | |||

| Aerospace & Defense — 2.0% | |||

| Northrop Grumman Corp. | 1,498 | 453,220 | |

| Safran S.A. | 2,510 | 222,379 | |

| Trading Companies & Distributors — 0.3% | |||

| MonotaRO Co. Ltd. | 4,200 | 110,970 | |

| 786,569 | |||

| Consumer Durables & Apparel — 3.3% | |||

| Household Durables — 0.7% | |||

| Sony Corp. | 3,879 | 229,767 | |

| Textiles, Apparel & Luxury Goods — 2.6% | |||

| adidas AG | 1,025 | 227,578 | |

| Hermes International | 281 | 191,195 | |

| b | Lululemon Athletica, Inc. | 551 | 104,442 |

| LVMH Moet Hennessy Louis Vuitton SE | 1,013 | 371,519 | |

| 1,124,501 | |||

| Consumer Services — 2.0% | |||

| Diversified Consumer Services — 0.9% | |||

| Service Corp. International/US | 8,156 | 318,981 | |

| Hotels, Restaurants & Leisure — 1.1% | |||

| a | Starbucks Corp. | 5,429 | 356,903 |

| 675,884 | |||

| Diversified Financials — 4.1% | |||

| Capital Markets — 2.9% | |||

| B3 S.A. - Brasil Bolsa Balcao | 22,771 | 157,325 | |

| a | CME Group, Inc. | 4,691 | 811,121 |

| Consumer Finance — 1.2% | |||

| a | Capital One Financial Corp. | 8,276 | 417,276 |

| 1,385,722 | |||

| Energy — 3.7% | |||

| Oil, Gas & Consumable Fuels — 3.7% | |||

| a | Enterprise Products Partners L.P. | 13,287 | 190,004 |

| Reliance Industries Ltd. | 13,816 | 198,981 | |

| Royal Dutch Shell plc Class A | 37,807 | 656,847 | |

| Valero Energy Corp. | 4,614 | 209,291 | |

| 1,255,123 | |||

| Health Care Equipment & Services — 1.6% | |||

| Health Care Equipment & Supplies — 1.5% | |||

| b | Boston Scientific Corp. | 15,636 | 510,202 |

| Health Care Providers & Services — 0.1% | |||

| NMC Health plc | 13,900 | 18,070 | |

| 528,272 | |||

| Household & Personal Products — 3.0% | |||

| Personal Products — 3.0% | |||

| Estee Lauder Cos, Inc. Class A | 3,807 | 606,607 | |

| Unilever N.V. | 7,991 | 392,768 | |

| 999,375 | |||

| Insurance — 1.2% |

| 46 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Insurance — 1.2% | |||

| AIA Group Ltd. | 44,100 | $ 394,899 | |

| 394,899 | |||

| Materials — 0.8% | |||

| Chemicals — 0.3% | |||

| LyondellBasell Industries N.V. Class A | 2,113 | 104,868 | |

| Containers & Packaging — 0.5% | |||

| b | Crown Holdings, Inc. | 2,700 | 156,708 |

| 261,576 | |||

| Media & Entertainment — 6.4% | |||

| Entertainment — 1.9% | |||

| Nintendo Co. Ltd. | 677 | 263,118 | |

| b | Sea Ltd. ADR | 8,473 | 375,439 |

| Interactive Media & Services — 4.5% | |||

| a,b | Alphabet, Inc. Class A | 498 | 578,651 |

| b | Cargurus, Inc. | 13,082 | 247,773 |

| b | Facebook, Inc. Class A | 4,248 | 708,567 |

| 2,173,548 | |||

| Pharmaceuticals, Biotechnology & Life Sciences — 2.6% | |||

| Biotechnology — 1.0% | |||

| CSL Ltd. | 1,955 | 354,386 | |

| Pharmaceuticals — 1.6% | |||

| Roche Holding AG | 1,656 | 532,805 | |

| 887,191 | |||

| Retailing — 5.9% | |||

| Internet & Direct Marketing Retail — 4.6% | |||

| a,b | Alibaba Group Holding Ltd. Sponsored ADR | 2,758 | 536,376 |

| a,b | Amazon.com, Inc. | 355 | 692,150 |

| b | MercadoLibre, Inc. | 670 | 327,349 |

| Multiline Retail — 0.6% | |||

| Dollarama, Inc. | 6,600 | 183,091 | |

| Specialty Retail — 0.7% | |||

| Home Depot, Inc. | 1,272 | 237,495 | |

| 1,976,461 | |||

| Semiconductors & Semiconductor Equipment — 2.3% | |||

| Semiconductors & Semiconductor Equipment — 2.3% | |||

| ASML Holding N.V. | 1,685 | 444,191 | |

| a | Taiwan Semiconductor Manufacturing Co. Ltd. Sponsored ADR | 7,018 | 335,390 |

| 779,581 | |||

| Software & Services — 12.3% | |||

| Information Technology Services — 5.5% | |||

| b,c | Adyen N.V. | 542 | 460,643 |

| b | FleetCor Technologies, Inc. | 726 | 135,428 |

| b,c | Network International Holdings plc | 41,191 | 200,288 |

| a | Visa, Inc. Class A | 6,528 | 1,051,791 |

| Software — 6.8% | |||

| a | Microsoft Corp. | 6,609 | 1,042,305 |

| b | salesforce.com, Inc. | 3,894 | 560,658 |

| SAP SE | 2,403 | 268,290 | |

| a,b | ServiceNow, Inc. | 1,474 | 422,419 |

| 4,141,822 | |||

| Technology Hardware & Equipment — 1.2% | |||

| Electronic Equipment, Instruments & Components — 1.2% | |||

| Keyence Corp. | 1,246 | 400,604 | |

| 400,604 |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 47 |

Thornburg Summit Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Telecommunication Services — 2.1% | |||

| Diversified Telecommunication Services — 1.0% | |||

| Orange S.A. | 28,659 | $ 346,987 | |

| Wireless Telecommunication Services — 1.1% | |||

| China Mobile Ltd. | 49,500 | 370,967 | |

| 717,954 | |||

| Utilities — 1.3% | |||

| Electric Utilities — 1.3% | |||

| a | NextEra Energy, Inc. | 1,832 | 440,816 |

| 440,816 | |||

| Total Common Stock(Cost $21,097,862) | 20,366,634 | ||

| Asset Backed Securities — 10.9% | |||

| Asset-Backed - Finance & Insurance — 4.4% | |||

| c | Aqua Finance Trust, Series 2019-A Class A, 3.14%, 7/16/2040 | $ 84,716 | 86,397 |

| c | Conn’s Receivables Funding, LLC, Series 2018-A Class B, 4.65%, 1/15/2023 | 162,553 | 156,136 |

| Freed ABS Trust, | |||

| c | Series 2019-1 Class B, 3.87%, 6/18/2026 | 275,000 | 224,233 |

| c | Series 2019-1 Class-A, 3.42%, 6/18/2026 | 33,807 | 33,668 |

| c | MelTel Land Funding, LLC, Series 2019-1A Class A, 3.768%, 4/15/2049 | 100,000 | 79,233 |

| c | New Residential Advance Receivables Trust Advance Receivables Backed, Series 2019-T3 Class DT3, 3.055%, 9/15/2052 | 100,000 | 100,303 |

| c | NRZ Advance Receivables Trust , Series 2019-T1 Class AT1, 2.59%, 7/15/2052 | 175,000 | 167,032 |

| c,d | SBA Tower Trust, Series 2014-2A Class C, 3.869%, 10/15/2049 | 30,000 | 30,361 |

| c | SCF Equipment Leasing, LLC, Series 2019-1A Class A1, 3.04%, 3/20/2023 | 98,799 | 96,430 |

| c | Sierra Timeshare Receivables Funding, LLC, Series 2019-1A Class A, 3.20%, 1/20/2036 | 57,477 | 56,919 |

| c | SoFi Consumer Loan Program Trust, Series 2019-2 Class A, 3.01%, 4/25/2028 | 210,418 | 204,159 |

| c,d | Towd Point Mortgage Trust, Series 2018-5 Class A1, 3.25%, 7/25/2058 | 122,501 | 118,250 |

| c | Upstart Securitization Trust, Series 2019-1 Class B, 4.19%, 4/20/2026 | 150,000 | 136,902 |

| 1,490,023 | |||

| Auto Receivables — 2.3% | |||

| c | Avid Automobile Receivables Trust, Series 2019-1 Class A, 2.62%, 2/15/2024 | 224,393 | 217,464 |

| c | CarNow Auto Receivables Trust, Series 2017-1A Class B, 4.35%, 9/15/2022 | 75,693 | 74,109 |

| c | CIG Auto Receivables Trust, Series 2017-1A Class A, 2.71%, 5/15/2023 | 23,655 | 23,088 |

| c | CPS Auto Receivables Trust, Series 2020-A Class A, 2.09%, 5/15/2023 | 250,086 | 243,738 |

| c | Flagship Credit Auto Trust, Series 2018-3 Class A, 3.07%, 2/15/2023 | 35,227 | 34,888 |

| c,d | Navistar Financial Dealer Note Master Owner Trust II, Series 2018-1 Class D, 2.497% (LIBOR 1 Month + 1.55%), 9/25/2023 | 175,000 | 171,808 |

| 765,095 | |||

| Other Asset Backed — 3.1% | |||

| c | Avant Loans Funding Trust, Series 2019-A Class A, 3.48%, 7/15/2022 | 39,593 | 38,944 |

| c | AXIS Equipment Finance Receivables VI, LLC, Series 2018-2A Class A2, 3.89%, 7/20/2022 | 0 | 0 |

| c | Consumer Loan Underlying Bond Credit Trust, Series 2019-A Class A, 3.52%, 4/15/2026 | 37,945 | 36,829 |

| c | Diamond Resorts Owner Trust, Series 2018-1 Class A, 3.70%, 1/21/2031 | 45,835 | 46,600 |

| c,e | ECAF I Ltd., Series 2015-1A Class A2, 4.947%, 6/15/2040 | 196,172 | 167,122 |

| c | Foundation Finance Trust, Series 2019-1A Class A, 3.86%, 11/15/2034 | 136,617 | 130,634 |

| c | Marlette Funding Trust, Series 2019-3A Class A, 2.69%, 9/17/2029 | 185,321 | 175,024 |

| c | Ocwen Master Advance Receivables Trust, Series 2019-T1 Class AT1, 2.514%, 8/15/2050 | 200,000 | 199,427 |

| c | Sofi Consumer Loan Program, LLC, Series 2016-3 Class A, 3.05%, 12/26/2025 | 132,940 | 130,468 |

| c | SPS Servicer Advance Receivables Trust Advance Receivables Backed Notes, Series 2019-T2 Class AT2, 2.32%, 10/15/2052 | 121,000 | 116,850 |

| 1,041,898 | |||

| Student Loan — 1.1% | |||

| c,d | Earnest Student Loan Program, LLC, Series 2016-B Class A1, 2.997% (LIBOR 1 Month + 2.05%), 2/26/2035 | 206,394 | 193,913 |

| c,d | Navient Private Education Refinance Loan Trust, Series 2019-D Class A2B, 1.755% (LIBOR 1 Month + 1.05%), 12/15/2059 | 100,000 | 81,035 |

| c | SMB Private Education Loan Trust, Series 2015-C Class A2A, 2.75%, 7/15/2027 | 74,226 | 71,322 |

| c | SoFi Professional Loan Program, LLC, Series 2015-B Class A2, 2.51%, 9/27/2032 | 35,961 | 35,300 |

| 381,570 | |||

| Total Asset Backed Securities(Cost $3,828,138) | 3,678,586 | ||

| Corporate Bonds — 5.9% |

| 48 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Commercial & Professional Services — 0.5% | |||

| Commercial Services & Supplies — 0.5% | |||

| c | Nielsen Finance, LLC / Nielsen Finance Co., 5.00%, 4/15/2022 | $ 168,000 | $ 154,866 |

| 154,866 | |||

| Diversified Financials — 1.1% | |||

| Capital Markets — 0.7% | |||

| Ares Capital Corp., 3.25%, 7/15/2025 | 120,000 | 95,239 | |

| c | Ares Finance Co., LLC, 4.00%, 10/8/2024 | 140,000 | 138,318 |

| Main Street Capital Corp., 5.20%, 5/1/2024 | 11,000 | 10,410 | |

| Diversified Financial Services — 0.4% | |||

| d | Morgan Stanley, 1.613% (SOFR + 0.70%), 1/20/2023 | 130,000 | 121,011 |

| 364,978 | |||

| Energy — 0.3% | |||

| Oil, Gas & Consumable Fuels — 0.3% | |||

| ONEOK Partners L.P., 4.90%, 3/15/2025 | 100,000 | 87,425 | |

| 87,425 | |||

| Food, Beverage & Tobacco — 0.7% | |||

| Tobacco — 0.7% | |||

| c | Vector Group Ltd., 10.50%, 11/1/2026 | 280,000 | 233,800 |

| 233,800 | |||

| Insurance — 0.4% | |||

| Insurance — 0.4% | |||

| c,d | Metropolitan Life Global Funding, 0.58% (SOFR + 0.57%), 9/7/2020 | 150,000 | 148,393 |

| 148,393 | |||

| Materials — 0.3% | |||

| Paper & Forest Products — 0.3% | |||

| c | Neenah, Inc., 5.25%, 5/15/2021 | 100,000 | 97,500 |

| 97,500 | |||

| Real Estate — 0.7% | |||

| Equity Real Estate Investment Trusts — 0.7% | |||

| CoreCivic, Inc., 4.75%, 10/15/2027 | 80,000 | 60,000 | |

| GEO Group, Inc., 6.00%, 4/15/2026 | 250,000 | 162,344 | |

| Service Properties Trust, 4.95%, 2/15/2027 | 40,000 | 30,311 | |

| 252,655 | |||

| Technology Hardware & Equipment — 0.6% | |||

| Office Electronics — 0.6% | |||

| Xerox Corp., 4.50%, 5/15/2021 | 200,000 | 197,240 | |

| 197,240 | |||

| Telecommunication Services — 1.1% | |||

| Diversified Telecommunication Services — 0.1% | |||

| c | GTT Communications, Inc., 7.875%, 12/31/2024 | 60,000 | 38,700 |

| Wireless Telecommunication Services — 1.0% | |||

| Sprint Communications, Inc., 9.25%, 4/15/2022 | 310,000 | 331,700 | |

| 370,400 | |||

| Transportation — 0.2% | |||

| Airlines — 0.2% | |||

| c | American Airlines Pass Through Trust, Series 2013-2 Class B, 5.60%, 7/15/2022 | 71,390 | 70,854 |

| 70,854 | |||

| Total Corporate Bonds(Cost $2,164,388) | 1,978,111 | ||

| Convertible Bonds — 0.7% | |||

| Diversified Financials — 0.5% | |||

| Consumer Finance — 0.5% |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 49 |

Thornburg Summit Fund | March 31, 2020 (Unaudited)

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| EZCORP, Inc., 2.375%, 5/1/2025 | $ 230,000 | $ 170,257 | |

| 170,257 | |||

| Food, Beverage & Tobacco — 0.2% | |||

| Tobacco — 0.2% | |||

| d | Vector Group Ltd., 1.75%, 4/15/2020 | 80,000 | 79,840 |

| 79,840 | |||

| Total Convertible Bonds(Cost $253,731) | 250,097 | ||

| Other Government — 0.1% | |||

| Mexican Bonos, 8.00%, 12/7/2023 | 750,000 | 33,152 | |

| Total Other Government(Cost $38,750) | 33,152 | ||

| U.S. Treasury Securities — 9.4% | |||

| United States Treasury Notes Inflationary Index, | |||

| 0.50%, 1/15/2028 | 1,171,184 | 1,218,097 | |

| 0.875%, 1/15/2029 | 1,302,451 | 1,413,013 | |

| 3.625%, 4/15/2028 | 424,209 | 545,186 | |

| Total U.S. Treasury Securities(Cost $3,007,512) | 3,176,296 | ||

| Mortgage Backed — 5.7% | |||

| c,d | Angel Oak Mortgage Trust I, LLC, Whole Loan Securities Trust CMO, Series 2019-2 Class A1, 3.628%, 3/25/2049 | 117,167 | 114,906 |

| Arroyo Mortgage Trust, Whole Loan Securities Trust CMO, | |||

| c,d | Series 2019-1 Class A1, 3.805%, 1/25/2049 | 129,868 | 123,263 |

| c,d | Series 2019-3 Class A1, 2.962%, 10/25/2048 | 164,898 | 151,096 |

| c | Bravo Residential Funding Trust, Whole Loan Securities Trust CMO, Series 2019-1 Class A1C, 3.50%, 3/25/2058 | 233,646 | 230,147 |

| c,d | CSMLT Mortgage Trust, Whole Loan Securities Trust CMO, Series 2015-3 Class B1, 3.692%, 11/25/2045 | 233,227 | 231,394 |

| Federal Home Loan Mtg Corp., Seasoned Credit Risk Transfer, Whole Loan Securities Trust CMO, Series 2019-1 Class MA, 3.50%, 7/25/2058 | 103,864 | 109,755 | |

| Federal Home Loan Mtg Corp., Whole Loan Securities Trust CMO, Series 2017-SC02 Class 1A, 3.00%, 5/25/2047 | 288,886 | 286,130 | |

| c,d | FWD Securitization Trust, Whole Loan Securities Trust CMO, Series 2019-INV1 Class A1, 2.81%, 6/25/2049 | 169,349 | 158,673 |

| c,d | Homeward Opportunities Fund I Trust, Whole Loan Securities Trust CMO, Series 2019-1 Class A1, 3.454%, 1/25/2059 | 116,217 | 114,465 |

| JPMorgan Mortgage Trust, Whole Loan Securities Trust CMO, | |||

| c,d | Series 2017-6 Class A5, 3.50%, 12/25/2048 | 50,163 | 50,778 |

| c,d | Series 2018-6 Class 1A4, 3.50%, 12/25/2048 | 9,970 | 9,722 |

| c,d | Metlife Securitization Trust, Whole Loan Securities Trust CMO, Series 2019-1A Class A1A, 3.75%, 4/25/2058 | 167,685 | 165,945 |

| New Residential Mortgage Loan Trust, Whole Loan Securities Trust CMO, | |||

| c,d | Series 2017-4 Class A1, 3.60%, 4/25/2049 | 85,697 | 84,551 |

| c,d | Series 2017-4A Class A1, 4.00%, 5/25/2057 | 95,530 | 99,050 |

| Total Mortgage Backed(Cost $1,949,369) | 1,929,875 | ||

| Loan Participations — 0.2% | |||

| Real Estate — 0.2% | |||

| Equity Real Estate Investment Trusts — 0.2% | |||

| f | CoreCivic, Inc., 5.50% (LIBOR 1 Month + 4.50%), 12/12/2024 | 79,000 | 68,730 |

| 68,730 | |||

| Total Loan Participations(Cost $75,113) | 68,730 | ||

| Exchange-Traded Funds — 3.0% | |||

| a | Invesco DB Agriculture Fund | 11,207 | 157,682 |

| a | Invesco DB Base Metals Fund | 40,003 | 494,037 |

| a,b | SPDR Gold Shares Fund | 2,516 | 372,494 |

| Total Exchange-Traded Funds(Cost $1,108,872) | 1,024,213 | ||

| Investment Company — 0.5% | |||

| b | United States Oil Fund L.P. | 37,786 | 159,079 |

| Total Investment Company(Cost $410,823) | 159,079 | ||

| Total Long-Term Investments — 96.8%(Cost $33,934,558) | 32,664,773 |

| 50 | Thornburg Equity Funds Semi-Annual Report | See notes to financial statements. |

| Issuer-Description | SHARES/ PRINCIPAL AMOUNT | VALUE | |

| Short-Term Investments — 7.6% | |||

| g | Thornburg Capital Management Fund | 255,332 | $ 2,553,322 |

| Total Short-Term Investments(Cost $2,553,322) | 2,553,322 | ||

| Total Investments — 104.4%(Cost $36,487,880) | $35,218,095 | ||

| Liabilities Net of Other Assets — (4.4)% | (1,470,209) | ||

| Common Stock Sold Short — (5.1)% | |||

| Commercial & Professional Services — (0.8)% | |||

| Professional Services — (0.8)% | |||

| b | FTI Consulting, Inc. | (2,189) | (262,176) |

| (262,176) | |||

| Media & Entertainment — (1.6)% | |||

| Entertainment — (0.7)% | |||

| b | Roku, Inc. | (1,656) | (144,867) |

| b | Tencent Music Entertainment Group ADR | (9,891) | (99,503) |

| Media — (0.9)% | |||

| b | Discovery, Inc., Class A | (4,091) | (79,529) |

| New York Times Co., Class A | (7,319) | (224,767) | |

| (548,666) | |||

| Retailing — (0.5)% | |||

| Specialty Retail — (0.5)% | |||

| Rent-A-Center, Inc. | (7,887) | (111,522) | |

| b | Sleep Number Corp. | (2,377) | (45,543) |

| (157,065) | |||

| Software & Services — (1.3)% | |||

| Information Technology Services — (0.9)% | |||

| Western Union Co. | (16,775) | (304,131) | |

| Software — (0.4)% | |||

| Blackbaud, Inc. | (2,338) | (129,876) | |

| (434,007) | |||

| Telecommunication Services — (0.9)% | |||

| Diversified Telecommunication Services — (0.9)% | |||

| Cogent Communications Holdings, Inc. | (3,772) | (309,191) | |

| (309,191) | |||

| Total Common Stock Sold Short(Proceeds $2,006,098) | (1,711,105) | ||

| Net Assets — 100.0% | $33,747,886 |

| See notes to financial statements. | Thornburg Equity Funds Semi-Annual Report | 51 |

Thornburg Summit Fund | March 31, 2020 (Unaudited)

| Footnote Legend | |