See accompanying notes to financial statements.

| Statement of | | |

| | Assets and Liabilities | February 29, 2016 |

| | | | California | | | California | | California AMT- | |

| | | | Value | | | Value 2 | | | Free Income | |

| | | | (NCA | ) | | (NCB | ) | | (NKX | ) |

| Assets | | | | | | | | | | |

| Long-term investments, at value (cost $245,270,711, $45,099,563 and $954,948,829, respectively) | | $ | 276,770,929 | | $ | 53,712,138 | | $ | 1,079,765,036 | |

| Cash | | | 4,824,462 | | | 481,030 | | | — | |

| Receivable for: | | | | | | | | | | |

| Common shares sold | | | 185,022 | | | — | | | — | |

| Interest | | | 2,654,349 | | | 618,163 | | | 12,816,201 | |

| Investments sold | | | 1,083,258 | | | 2,130,000 | | | 14,392,134 | |

| Deferred offering costs | | | — | | | — | | | 2,626,873 | |

| Other assets | | | 30,867 | | | 461 | | | 330,740 | |

| Total assets | | | 285,548,887 | | | 56,941,792 | | | 1,109,930,984 | |

| Liabilities | | | | | | | | | | |

| Cash overdraft | | | — | | | — | | | 6,424,942 | |

| Floating rate obligations | | | 4,490,000 | | | — | | | 390,000 | |

| Payable for dividends | | | 963,437 | | | 203,818 | | | 3,288,288 | |

| Institutional MuniFund Term Preferred ("iMTP") Shares, at liquidation preference | | | — | | | — | | | 36,000,000 | |

| Variable Rate Demand Preferred ("VRDP") Shares, at liquidation preference | | | — | | | — | | | 291,600,000 | |

| Accrued expenses: | | | | | | | | | | |

| Management fees | | | 114,798 | | | 28,095 | | | 531,198 | |

| Directors/Trustees fees | | | 30,874 | | | 244 | | | 104,634 | |

| Professional fees | | | 24,893 | | | 23,672 | | | 33,534 | |

| Other | | | 44,393 | | | 12,485 | | | 92,099 | |

| Total liabilities | | | 5,668,395 | | | 268,314 | | | 338,464,695 | |

| Net assets applicable to common shares | | $ | 279,880,492 | | $ | 56,673,478 | | $ | 771,466,289 | |

| Common shares outstanding | | | 26,499,126 | | | 3,288,461 | | | 47,708,456 | |

| Net asset value ("NAV") per common share outstanding | | $ | 10.56 | | $ | 17.23 | | $ | 16.17 | |

| Net assets applicable to common shares consist of: | | | | | | | | | | |

| Common shares, $0.01 par value per share | | $ | 264,991 | | $ | 32,885 | | $ | 477,085 | |

| Paid-in surplus | | | 250,922,912 | | | 46,977,517 | | | 640,399,730 | |

| Undistributed (Over-distribution of) net investment income | | | 568,478 | | | 751,985 | | | 4,026,162 | |

| Accumulated net realized gain (loss) | | | (3,376,107 | ) | | 298,516 | | | 1,747,105 | |

| Net unrealized appreciation (depreciation) | | | 31,500,218 | | | 8,612,575 | | | 124,816,207 | |

| Net assets applicable to common shares | | $ | 279,880,492 | | $ | 56,673,478 | | $ | 771,466,289 | |

| Authorized shares: | | | | | | | | | | |

| Common | | | 250,000,000 | | | Unlimited | | | Unlimited | |

| Preferred | | | N/A | | | N/A | | | Unlimited | |

| N/A – Fund is not authorized to issue Preferred shares. | | | | | | | | | | |

See accompanying notes to financial statements.

Statement of Assets and Liabilities (continued) |

| | | | California | | | California | | | California | |

| | | | Dividend | | | Dividend | | | Dividend | |

| | | | Advantage | | | Advantage 2 | | | Advantage 3 | |

| | | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Assets | | | | | | | | | | |

| Long-term investments, at value (cost $2,174,696,806, $301,835,208 and $452,963,292 respectively) | | $ | 2,454,303,724 | | $ | 332,114,577 | | $ | 505,230,200 | |

| Cash | | | — | | | 552,063 | | | — | |

| Receivable for: | | | | | | | | | | |

| Common shares sold | | | — | | | — | | | — | |

| Interest | | | 31,817,757 | | | 4,186,775 | | | 6,806,442 | |

| Investments sold | | | 31,737,207 | | | 10,000 | | | 14,525,000 | |

| Deferred offering costs | | | 3,606,367 | | | 324,025 | | | 225,276 | |

| Other assets | | | 841,702 | | | 126,064 | | | 193,337 | |

| Total assets | | | 2,522,306,757 | | | 337,313,504 | | | 526,980,255 | |

| Liabilities | | | | | | | | | | |

| Cash overdraft | | | 6,847,614 | | | — | | | 3,869,736 | |

| Floating rate obligations | | | 81,490,000 | | | 965,000 | | | 845,000 | |

| Payable for dividends | | | 7,788,718 | | | 980,144 | | | 1,581,603 | |

| Institutional MuniFund Term Preferred ("iMTP") Shares, at liquidation preference | | | — | | | — | | | — | |

| Variable Rate Demand Preferred ("VRDP") Shares, at liquidation preference | | | 699,600,000 | | | 98,000,000 | | | 160,000,000 | |

| Accrued expenses: | | | | | | | | | | |

| Management fees | | | 1,177,961 | | | 165,267 | | | 259,414 | |

| Directors/Trustees fees | | | 329,406 | | | 45,328 | | | 70,413 | |

| Professional fees | | | 43,372 | | | 28,413 | | | 30,011 | |

| Other | | | 284,116 | | | 31,263 | | | 39,736 | |

| Total liabilities | | | 797,561,187 | | | 100,215,415 | | | 166,695,913 | |

| Net assets applicable to common shares | | $ | 1,724,745,570 | | $ | 237,098,089 | | $ | 360,284,342 | |

| Common shares outstanding | | | 107,383,777 | | | 14,760,104 | | | 24,151,884 | |

| Net asset value ("NAV") per common share outstanding | | $ | 16.06 | | $ | 16.06 | | $ | 14.92 | |

| Net assets applicable to common shares consist of: | | | | | | | | | | |

| Common shares, $0.01 par value per share | | $ | 1,073,838 | | $ | 147,601 | | $ | 241,519 | |

| Paid-in surplus | | | 1,454,675,843 | | | 207,962,588 | | | 333,101,519 | |

| Undistributed (Over-distribution of) net investment income | | | 9,020,920 | | | 1,014,086 | | | 2,243,808 | |

| Accumulated net realized gain (loss) | | | (19,631,949 | ) | | (2,305,555 | ) | | (27,569,412 | ) |

| Net unrealized appreciation (depreciation) | | | 279,606,918 | | | 30,279,369 | | | 52,266,908 | |

| Net assets applicable to common shares | | $ | 1,724,745,570 | | $ | 237,098,089 | | $ | 360,284,342 | |

| Authorized shares: | | | | | | | | | | |

| Common | | | Unlimited | | | Unlimited | | | Unlimited | |

| Preferred | | | Unlimited | | | Unlimited | | | Unlimited | |

See accompanying notes to financial statements.

| Statement of | | |

| | Operations | Year Ended February 29, 2016 |

| | | | California | | | California | | California AMT- | |

| | | | Value | | | Value 2 | | | Free Income | |

| | | | (NCA | ) | | (NCB | ) | | (NKX | ) |

| Investment Income | | $ | 13,443,379 | | $ | 3,127,251 | | $ | 50,437,367 | |

| Expenses | | | | | | | | | | |

| Management fees | | | 1,397,303 | | | 353,649 | | | 6,606,749 | |

| Interest expense and amortization of offering costs | | | 29,100 | | | — | | | 858,800 | |

| Liquidity fees | | | — | | | — | | | 2,484,830 | |

| Remarketing fees | | | — | | | — | | | 292,775 | |

| Custodian fees | | | 36,452 | | | 14,497 | | | 118,007 | |

| Directors/Trustees fees | | | 7,435 | | | 1,561 | | | 33,194 | |

| Professional fees | | | 108,460 | | | 25,820 | | | 256,272 | |

| Shareholder reporting expenses | | | 68,005 | | | 8,946 | | | 41,658 | |

| Shareholder servicing agent fees | | | 21,609 | | | 203 | | | 16,270 | |

| Stock exchange listing fees | | | 7,954 | | | 786 | | | 16,955 | |

| Investor relations expenses | | | 12,578 | | | 4,934 | | | 29,016 | |

| Other | | | 31,304 | | | 9,524 | | | 404,909 | |

| Total expenses | | | 1,720,200 | | | 419,920 | | | 11,159,435 | |

| Net investment income (loss) | | | 11,723,179 | | | 2,707,331 | | | 39,277,932 | |

| Realized and Unrealized Gain (Loss) | | | | | | | | | | |

| Net realized gain (loss) from investments | | | (136,942 | ) | | 439,298 | | | 6,736,377 | |

| Change in net unrealized appreciation (depreciation) of investments | | | 1,023,386 | | | (590,186 | ) | | 6,110,249 | |

| Net realized and unrealized gain (loss) | | | 886,444 | | | (150,888 | ) | | 12,846,626 | |

| Net increase (decrease) in net assets applicable to common shares from operations | | $ | 12,609,623 | | $ | 2,556,443 | | $ | 52,124,558 | |

See accompanying notes to financial statements.

Statement of Operations (continued)

| | | | California | | | California | | | California | |

| | | | Dividend | | | Dividend | | | Dividend | |

| | | | Advantage | | | Advantage 2 | | | Advantage 3 | |

| | | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Investment Income | | $ | 118,818,811 | | $ | 15,483,288 | | $ | 25,549,659 | |

| Expenses | | | | | | | | | | |

| Management fees | | | 14,626,844 | | | 2,044,512 | | | 3,215,037 | |

| Interest expense and amortization of offering costs | | | 1,596,545 | | | 146,847 | | | 204,621 | |

| Liquidity fees | | | 5,802,339 | | | 913,289 | | | 1,455,550 | |

| Remarketing fees | | | 711,262 | | | 99,634 | | | 162,668 | |

| Custodian fees | | | 231,337 | | | 42,115 | | | 57,224 | |

| Directors/Trustees fees | | | 67,526 | | | 9,078 | | | 14,126 | |

| Professional fees | | | 164,011 | | | 39,585 | | | 60,705 | |

| Shareholder reporting expenses | | | 104,442 | | | 16,433 | | | 28,677 | |

| Shareholder servicing agent fees | | | 57,975 | | | 1,222 | | | 1,938 | |

| Stock exchange listing fees | | | 38,305 | | | 3,528 | | | 5,774 | |

| Investor relations expenses | | | 82,586 | | | 8,678 | | | 19,221 | |

| Other | | | 502,462 | | | 40,870 | | | 47,360 | |

| Total expenses | | | 23,985,634 | | | 3,365,791 | | | 5,272,901 | |

| Net investment income (loss) | | | 94,833,177 | | | 12,117,497 | | | 20,276,758 | |

| Realized and Unrealized Gain (Loss) | | | | | | | | | | |

| Net realized gain (loss) from investments | | | 14,266,694 | | | 1,846,986 | | | 134,264 | |

| Change in net unrealized appreciation (depreciation) of investments | | | 1,798,438 | | | 1,949,294 | | | 4,404,759 | |

| Net realized and unrealized gain (loss) | | | 16,065,132 | | | 3,796,280 | | | 4,539,023 | |

| Net increase (decrease) in net assets applicable to common shares from operations | | $ | 110,898,309 | | $ | 15,913,777 | | $ | 24,815,781 | |

See accompanying notes to financial statements.

| Statement of | |

| | Changes in Net Assets |

| | | | California Value (NCA) | | | California Value 2 (NCB) | | California AMT-Free Income (NKX) | |

| | | | Year | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | | 2/29/16 | | | 2/28/15 | | | 2/29/16 | | | 2/28/15 | | | 2/29/16 | | | 2/28/15 | |

| Operations | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 11,723,179 | | $ | 11,562,715 | | $ | 2,707,331 | | $ | 2,753,431 | | $ | 39,277,932 | | $ | 39,291,713 | |

| Net realized gain (loss) from Investments | | | (136,942 | ) | | 196,175 | | | 439,298 | | | 1,166,712 | | | 6,736,377 | | | 127,614 | |

| Change in net unrealized appreciation (depreciation) of Investments | | | 1,023,386 | | | 12,999,135 | | | (590,186 | ) | | 1,327,324 | | | 6,110,249 | | | 65,081,303 | |

| Net increase (decrease) in net assets applicable to common shares from operations | | | 12,609,623 | | | 24,758,025 | | | 2,556,443 | | | 5,247,467 | | | 52,124,558 | | | 104,500,630 | |

| Distributions to Common Shareholders | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (12,188,914 | ) | | (11,841,485 | ) | | (2,659,984 | ) | | (2,583,303 | ) | | (41,444,335 | ) | | (38,337,336 | ) |

| From accumulated net realized gains | | | — | | | — | | | (765,094 | ) | | (367,916 | ) | | — | | | — | |

| Decrease in net assets applicable to common shares from distributions to common shareholders | | | (12,188,914 | ) | | (11,841,485 | ) | | (3,425,078 | ) | | (2,951,219 | ) | | (41,444,335 | ) | | (38,337,336 | ) |

| Capital Share Transactions | | | | | | | | | | | | | | | | | | | |

| Common shares: | | | | | | | | | | | | | | | | | | | |

| Issued in the reorganizations | | | — | | | — | | | — | | | — | | | — | | | 87,770,468 | |

| Proceeds from shelf offering, net of offering costs | | | 11,081,737 | | | 1,321,449 | | | — | | | — | | | — | | | — | |

| Net proceeds from shares issued to shareholders due to reinvestment of distributions | | | 328,525 | | | 173,032 | | | 9,662 | | | — | | | — | | | — | |

| Net increase (decrease) in net assets applicable to common shares from capital share transactions | | | 11,410,262 | | | 1,494,481 | | | 9,662 | | | — | | | — | | | 87,770,468 | |

| Net increase (decrease) in net assets applicable to common shares | | | 11,830,971 | | | 14,411,021 | | | (858,973 | ) | | 2,296,248 | | | 10,680,223 | | | 153,933,762 | |

| Net assets applicable to common shares at the beginning of period | | | 268,049,521 | | | 253,638,500 | | | 57,532,451 | | | 55,236,203 | | | 760,786,066 | | | 606,852,304 | |

| Net assets applicable to common shares at the end of period | | $ | 279,880,492 | | $ | 268,049,521 | | $ | 56,673,478 | | $ | 57,532,451 | | $ | 771,466,289 | | $ | 760,786,066 | |

| Undistributed (Over-distribution of) net investment income at the end of period | | $ | 568,478 | | $ | 1,122,565 | | $ | 751,985 | | $ | 731,470 | | $ | 4,026,162 | | $ | 5,736,445 | |

See accompanying notes to financial statements.

Statement of Changes in Net Assets (continued)

| | | California Dividend Advantage (NAC) | | California Dividend Advantage 2 (NVX) | | California Dividend Advantage 3 (NZH) | |

| | | | Year | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | | 2/29/16 | | | 2/28/15 | | | 2/29/16 | | | 2/28/15 | | | 2/29/16 | | | 2/28/15 | |

| Operations | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 94,833,177 | | $ | 78,459,234 | | $ | 12,117,497 | | $ | 11,909,502 | | $ | 20,276,758 | | $ | 20,379,779 | |

| Net realized gain (loss) from Investments | | | 14,266,694 | | | 4,648,813 | | | 1,846,986 | | | (208,468 | ) | | 134,264 | | | 2,904,836 | |

| Change in net unrealized appreciation (depreciation) of Investments | | | 1,798,438 | | | 82,447,263 | | | 1,949,294 | | | 15,230,559 | | | 4,404,759 | | | 25,190,058 | |

| Net increase (decrease) in net assets applicable to common shares from operations | | | 110,898,309 | | | 165,555,310 | | | 15,913,777 | | | 26,931,593 | | | 24,815,781 | | | 48,474,673 | |

| Distributions to Common Shareholders | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (99,781,005 | ) | | (69,293,415 | ) | | (12,264,985 | ) | | (12,619,148 | ) | | (19,492,986 | ) | | (19,461,588 | ) |

| From accumulated net realized gains | | | — | | | — | | | — | | | — | | | — | | | — | |

| Decrease in net assets applicable to common shares from distributions to common shareholders | | | (99,781,005 | ) | | (69,293,415 | ) | | (12,264,985 | ) | | (12,619,148 | ) | | (19,492,986 | ) | | (19,461,588 | ) |

| Capital Share Transactions | | | | | | | | | | | | | | | | | | | |

| Common shares: | | | | | | | | | | | | | | | | | | | |

| Issued in the reorganizations | | | — | | | 1,271,903,837 | | | — | | | — | | | — | | | — | |

| Proceeds from shelf offering, net of offering costs | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net proceeds from shares issued to shareholders due to reinvestment of distributions | | | — | | | — | | | 13,967 | | | — | | | — | | | — | |

| Net increase (decrease) in net assets applicable to common shares from capital share transactions | | | — | | | 1,271,903,837 | | | 13,967 | | | — | | | — | | | — | |

| Net increase (decrease) in net assets applicable to common shares | | | 11,117,304 | | | 1,368,165,732 | | | 3,662,759 | | | 14,312,445 | | | 5,322,795 | | | 29,013,085 | |

| Net assets applicable to common shares at the beginning of period | | | 1,713,628,266 | | | 345,462,534 | | | 233,435,330 | | | 219,122,885 | | | 354,961,547 | | | 325,948,462 | |

| Net assets applicable to common shares at the end of period | | $ | 1,724,745,570 | | $ | 1,713,628,266 | | $ | 237,098,089 | | $ | 233,435,330 | | $ | 360,284,342 | | $ | 354,961,547 | |

| Undistributed (Over-distribution of) net investment income at the end of period | | $ | 9,020,920 | | $ | 13,917,924 | | $ | 1,014,086 | | $ | 1,271,425 | | $ | 2,243,808 | | $ | 1,496,207 | |

See accompanying notes to financial statements.

| Statement of | | |

| | Cash Flows | Year Ended February 29, 2016 |

| | | | California | | | California | | | California | | | California | |

| | | | AMT- | | | Dividend | | | Dividend | | | Dividend | |

| | | | Free Income | | | Advantage | | | Advantage 2 | | | Advantage 3 | |

| | | | (NKX | ) | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Cash Flows from Operating Activities: | | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Applicable to Common Shares from Operations | | $ | 52,124,558 | | $ | 110,898,309 | | $ | 15,913,777 | | $ | 24,815,781 | |

| Adjustments to reconcile the net increase (decrease) in net assets applicable to common shares from operations to net cash provided by (used in) operating activities: | | | | | | | | | | | | | |

| Purchases of investments | | | (210,596,889 | ) | | (374,550,863 | ) | | (61,217,728 | ) | | (91,024,304 | ) |

| Proceeds from sales and maturities of investments | | | 210,556,260 | | | 389,509,288 | | | 56,742,209 | | | 91,161,106 | |

| Proceeds from (Purchases of) short-term investments, net | | | 8,645,000 | | | 20,710,000 | | | 1,645,000 | | | 4,490,000 | |

| Taxes paid | | | (77 | ) | | (249 | ) | | (26 | ) | | (188 | ) |

| Amortization (Accretion) of premiums and discounts, net | | | (1,337,302 | ) | | 797,787 | | | (10,392 | ) | | 737,619 | |

| Amortization of deferred offering costs | | | 186,543 | | | 445,503 | | | 11,840 | | | 60,428 | |

| (Increase) Decrease in: | | | | | | | | | | | | | |

| Receivable for interest | | | 761,384 | | | 1,234,304 | | | 230,079 | | | 272,051 | |

| Receivable for investments sold | | | (4,590,441 | ) | | (28,021,007 | ) | | 540,750 | | | (13,681,450 | ) |

| Other assets | | | (26,684 | ) | | (89,262 | ) | | (11,824 | ) | | (10,957 | ) |

| Increase (Decrease) in: | | | | | | | | | | | | | |

| Accrued management fees | | | 14,548 | | | 43,363 | | | 7,138 | | | 11,059 | |

| Accrued Directors/Trustees fees | | | 84,081 | | | 66,602 | | | 9,246 | | | 13,980 | |

| Accrued professional fees | | | 2,521 | | | (131,507 | ) | | 619 | | | 967 | |

| Accrued other expenses | | | (206,095 | ) | | (189,587 | ) | | (38,369 | ) | | (41,322 | ) |

| Net realized (gain) loss from investments | | | (6,736,377 | ) | | (14,266,694 | ) | | (1,846,986 | ) | | (134,264 | ) |

| Change in net unrealized (appreciation) depreciation of investments | | | (6,110,249 | ) | | (1,798,438 | ) | | (1,949,294 | ) | | (4,404,759 | ) |

| Net cash provided by (used in) operating activities | | | 42,770,781 | | | 104,657,549 | | | 10,026,039 | | | 12,265,747 | |

| Cash Flows from Financing Activities | | | | | | | | | | | | | |

| Increase (Decrease) in: | | | | | | | | | | | | | |

| Cash overdraft | | | 5,097,437 | | | 6,847,614 | | | — | | | 3,869,736 | |

| Floating rate obligations | | | (6,365,000 | ) | | (11,505,000 | ) | | — | | | — | |

| Payable for offering costs | | | (64,213 | ) | | (287,852 | ) | | — | | | (50,405 | ) |

| Cash distribution paid to common shareholders | | | (41,439,005 | ) | | (100,160,840 | ) | | (12,289,102 | ) | | (19,497,077 | ) |

| Net cash provided by (used in) financing activities | | | (42,770,781 | ) | | (105,106,078 | ) | | (12,289,102 | ) | | (15,677,746 | ) |

| Net Increase (Decrease) in Cash | | | — | | | (448,529 | ) | | (2,263,063 | ) | | (3,411,999 | ) |

| Cash at the beginning of period | | | — | | | 448,529 | | | 2,815,126 | | | 3,411,999 | |

| Cash at the end of period | | $ | — | | $ | — | | $ | 552,063 | | $ | — | |

| | | | California | | | California | | | California | | | California | |

| | | | AMT- | | | Dividend | | | Dividend | | | Dividend | |

| | | | Free Income | | | Advantage | | | Advantage 2 | | | Advantage 3 | |

| Supplemental Disclosures of Cash Flow Information | | | (NKX | ) | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Cash paid for interest (excluding amortization of offering costs) | | $ | 608,525 | | $ | 1,438,894 | | $ | 135,007 | | $ | 194,598 | |

| Non-cash financing activities not included herein consists of reinvestments of common share distributions | | | — | | | — | | | 13,967 | | | — | |

See accompanying notes to financial statements.

Selected data for a common share outstanding throughout each period:

| | | Investment Operations | | Less Distributions

to Common Shareholders | | Common Share | |

| | | Beginning

Common

Share

NAV | | Net

Investment

Income

(Loss | ) | Net

Realized/

Unrealized

Gain (Loss | ) | Total | | From

Net

Investment

Income | | From

Accumu-

lated Net

Realized

Gains | | Total | | Premium

per

Share

Sold through

Shelf

Offering | | Ending

NAV | | Ending

Share

Price | |

| California Value (NCA) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 2/28–2/29: | | | | | | | | | | | | | | | | | | | | | | | | | |

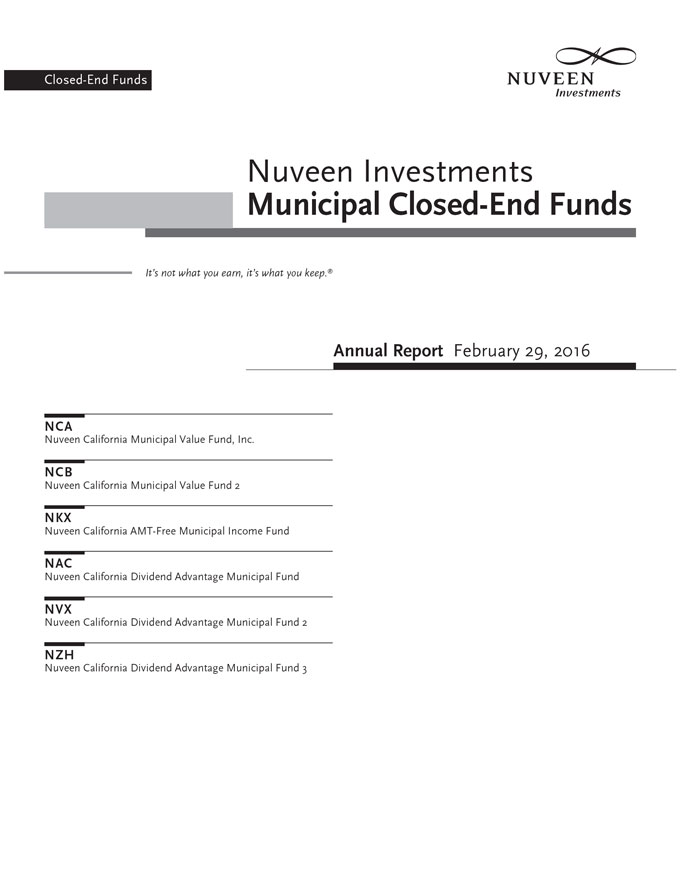

| 2016 | | $ | 10.54 | | $ | 0.45 | | $ | 0.03 | | $ | 0.48 | | $ | (0.47 | ) | $ | — | | $ | (0.47 | ) | $ | 0.01 | | $ | 10.56 | | $ | 10.79 | |

| 2015 | | | 10.03 | | | 0.46 | | | 0.51 | | | 0.97 | | | (0.47 | ) | | — | | | (0.47 | ) | | 0.01 | | | 10.54 | | | 10.64 | |

| 2014 | | | 10.45 | | | 0.47 | | | (0.42 | ) | | 0.05 | | | (0.47 | ) | | — | | | (0.47 | ) | | — | | | 10.03 | | | 9.57 | |

| 2013 | | | 10.08 | | | 0.47 | | | 0.37 | | | 0.84 | | | (0.47 | ) | | — | | | (0.47 | ) | | — | | | 10.45 | | | 10.45 | |

| 2012 | | | 9.07 | | | 0.48 | | | 0.99 | | | 1.47 | | | (0.46 | ) | | — | | | (0.46 | ) | | — | | | 10.08 | | | 10.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| California Value 2 (NCB) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 2/28–2/29: | | | | | | | | | | | | | | | | | | | | | | | | | |

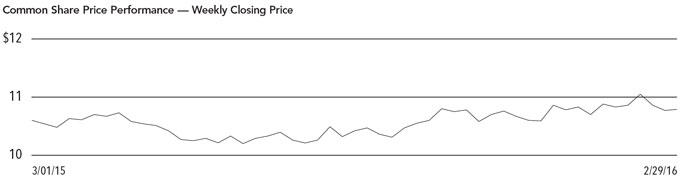

| 2016 | | | 17.50 | | | 0.82 | | | (0.05 | ) | | 0.77 | | | (0.81 | ) | | (0.23 | ) | | (1.04 | ) | | — | | | 17.23 | | | 17.70 | |

| 2015 | | | 16.80 | | | 0.84 | | | 0.76 | | | 1.60 | | | (0.79 | ) | | (0.11 | ) | | (0.90 | ) | | — | | | 17.50 | | | 16.68 | |

| 2014 | | | 17.57 | | | 0.83 | | | (0.82 | ) | | 0.01 | | | (0.78 | ) | | — | | | (0.78 | ) | | — | | | 16.80 | | | 15.53 | |

| 2013 | | | 16.66 | | | 0.83 | | | 0.89 | | | 1.72 | | | (0.80 | ) | | (0.01 | ) | | (0.81 | ) | | — | | | 17.57 | | | 16.86 | |

| 2012 | | | 14.88 | | | 0.84 | | | 1.76 | | | 2.60 | | | (0.80 | ) | | (0.02 | ) | | (0.82 | ) | | — | | | 16.66 | | | 16.33 | |

| (a) | Total Return Based on Common Share NAV is the combination of changes in common share NAV, reinvested dividend income at NAV and reinvested capital gains distributions at NAV, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending NAV. The actual reinvest price for the last dividend declared in the period may often be based on the Fund's market price (and not its NAV), and therefore may be different from the price used in the calculation. Total returns are not annualized. |

| | Total Return Based on Common Share Price is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized. |

| | | | Common Share Supplemental Data/

Ratios Applicable to Common Shares | |

| | Common Share

Total Returns | | | | | | Ratios to Average Net Assets | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | Based | | | Ending | | | | | | | | | | |

| | Based | | | on | | | Net | | | | | | Net | | | Portfolio | |

| | on | | | Share | | | Assets | | | | | | Investment | | | Turnover | |

| | NAV | (a) | | Price | (a) | | (000) | | | Expenses | (b) | | Income (Loss | ) | | Rate | (d) |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | 4.81 | % | | 6.08 | % | $ | 279,880 | | | 0.64 | % | | 4.35 | % | | 10 | % |

| | 9.91 | | | 16.36 | | | 268,050 | | | 0.64 | (c) | | 4.41 | (c) | | 13 | |

| | 0.62 | | | (3.80 | ) | | 253,639 | | | 0.62 | | | 4.73 | | | 20 | |

| | 8.48 | | | 7.99 | | | 264,094 | | | 0.64 | | | 4.55 | | | 16 | |

| | 16.58 | | | 27.44 | | | 254,563 | | | 0.65 | | | 4.98 | | | 8 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | 4.57 | | | 12.91 | | | 56,673 | | | 0.74 | | | 4.78 | | | 8 | |

| | 9.68 | | | 13.41 | | | 57,532 | | | 0.75 | | | 4.84 | | | 7 | |

| | 0.22 | | | (3.08 | ) | | 55,236 | | | 0.76 | | | 5.00 | | | 12 | |

| | 10.54 | | | 8.39 | | | 57,769 | | | 0.74 | | | 4.81 | | | 7 | |

| | 17.97 | | | 26.50 | | | 54,772 | | | 0.77 | | | 5.41 | | | 4 | |

| (b) | The expense ratios reflect, among other things, the interest expense deemed to have been paid by the Fund on the floating rate certificates issued by the special purpose trusts for the self-deposited inverse floaters held by the Fund, (as described in Note 3 – Portfolio Securities and Investments in Derivatives, Inverse Floating Rate Securities), where applicable, as follows: |

| California Value (NCA) | | | | |

| Year Ended 2/28–2/29: | | | | |

| 2016 | | | 0.01 | % |

| 2015 | | | 0.01 | |

| 2014 | | | 0.01 | |

| 2013 | | | 0.01 | |

| 2012 | | | 0.01 | |

| California Value 2 (NCB) | | | | |

| Year Ended 2/28–2/29: | | | | |

| 2016 | | | — | % |

| 2015 | | | — | |

| 2014 | | | — | |

| 2013 | | | — | |

| 2012 | | | — | |

| (c) | During the fiscal year ended February 28, 2015, the Adviser voluntarily reimbursed the Fund for certain expenses incurred in connection with its common shares equity shelf program. As a result the expenses and net investment income (loss) ratios to average net assets applicable to common shares reflect the voluntary expense reimbursement from Adviser as described in Note 4 – Fund Shares, Common Shares Equity Shelf Programs and Offering Costs. The expenses and net investment income (loss) ratios to average net assets applicable to common shares excluding this expense reimbursement from Adviser are as follows: |

| | | | | | Net Investment | |

| California Value (NCA) | | | Expenses | | | Income (Loss | ) |

| Year Ended 2/28-2/29: | | | | | | | |

| 2015 | | | 0.67 | % | | 4.38 | % |

| (d) | Portfolio Turnover Rate is calculated based on the lesser of long-term purchases or sales (as disclosed in Note 5 – Investment Transactions) divided by the average long-term market value during the period. |

See accompanying notes to financial statements.

Financial Highlights (continued)

Selected data for a common share outstanding throughout each period:

| | | | | Investment Operations | | Less Distributions

to Common Shareholders | | Common Share | |

| | | Beginning

Common

Share

NAV | | Net

Investment

Income

(Loss | ) | Net

Realized/

Unrealized

Gain (Loss | ) | Distributions

from Net

Investment

Income to

ARPS

Shareholders | (a) | Distributions

from

Accumulated

Net

Realized

Gains to

ARPS

Shareholders | (a) | Total | | From

Net

Investment

Income | | From

Accumu-

lated

Net

Realized

Gains | | Total | | Ending

NAV | | Ending

Share

Price | |

| California AMT-Free Income (NKX) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | | | | | | | | | | | | | |

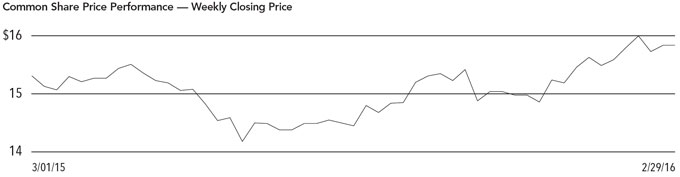

| 2016 | | $ | 15.95 | | $ | 0.82 | | $ | 0.27 | | $ | — | | $ | — | | $ | 1.09 | | $ | (0.87 | ) | $ | — | | $ | (0.87 | ) | $ | 16.17 | | $ | 15.63 | |

| 2015 | | | 14.50 | | | 0.85 | | | 1.45 | | | — | | | — | | | 2.30 | | | (0.85 | ) | | — | | | (0.85 | ) | | 15.95 | | | 14.67 | |

| 2014 | | | 15.57 | | | 0.84 | | | (1.06 | ) | | — | | | — | | | (0.22 | ) | | (0.84 | ) | | (0.01 | ) | | (0.85 | ) | | 14.50 | | | 13.25 | |

| 2013 | | | 14.73 | | | 0.77 | | | 0.97 | | | — | | | — | | | 1.74 | | | (0.88 | ) | | (0.02 | ) | | (0.90 | ) | | 15.57 | | | 15.12 | |

| 2012 | | | 12.82 | | | 0.83 | | | 1.91 | | | — | | | — | | | 2.74 | | | (0.83 | ) | | — | | | (0.83 | ) | | 14.73 | | | 15.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| California Dividend Advantage (NAC) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2016 | | | 15.96 | | | 0.88 | | | 0.15 | | | — | | | — | | | 1.03 | | | (0.93 | ) | | — | | | (0.93 | ) | | 16.06 | | | 15.84 | |

| 2015 | | | 14.68 | | | 0.87 | | | 1.34 | | | — | | | — | | | 2.21 | | | (0.93 | ) | | — | | | (0.93 | ) | | 15.96 | | | 15.34 | |

| 2014 | | | 15.90 | | | 0.84 | | | (1.17 | ) | | — | | | — | | | (0.33 | ) | | (0.89 | ) | | — | | | (0.89 | ) | | 14.68 | | | 14.07 | |

| 2013 | | | 14.87 | | | 0.84 | | | 1.11 | | | — | | | — | | | 1.95 | | | (0.92 | ) | | — | | | (0.92 | ) | | 15.90 | | | 15.81 | |

| 2012 | | | 12.68 | | | 0.94 | | | 2.17 | | | (0.01 | ) | | — | | | 3.10 | | | (0.91 | ) | | — | | | (0.91 | ) | | 14.87 | | | 15.14 | |

| (a) | The amounts shown for Auction Rate Preferred Shares ("ARPS") are based on common share equivalents. |

| (b) | Total Return Based on Common Share NAV is the combination of changes in common share NAV, reinvested dividend income at NAV and reinvested capital gains distributions at NAV, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending NAV. The actual reinvest price for the last dividend declared in the period may often be based on the Fund's market price (and not its NAV), and therefore may be different from the price used in the calculation. Total returns are not annualized. |

| | Total Return Based on Common Share Price is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized. |

| (c) | Ratios do not reflect the effect of dividend payments to ARPS shareholders, during periods when ARPS were outstanding; Net Investment Income (Loss) ratios reflect income earned and expenses incurred on assets attributable to ARPS and other subsequent forms of preferred shares issued by the Fund, where applicable. |

| | | | | Common Share Supplemental Data/

Ratios Applicable to Common Shares | |

| | Common Share

Total Returns | | | | | | Ratios to Average Net Assets(c) | | | | |

| | | | | Based | | | | | | | | | | | | | |

| | Based | | | on | | | Ending | | | | | | Net | | | Portfolio | |

| | on | | | Share | | | Net | | | | | | Investment | | | Turnover | |

| | NAV | (b) | | Price | (b) | | Assets (000) | | | Expenses | (d) | | Income (Loss) | | | Rate | (f) |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | 7.09 | % | | 12.93 | % | $ | 771,466 | | | 1.48 | % | | 5.22 | % | | 20 | % |

| | 16.16 | | | 17.55 | | | 760,786 | | | 1.62 | (e) | | 5.53 | (e) | | 13 | |

| | (1.10 | ) | | (6.39 | ) | | 606,852 | | | 1.64 | | | 5.93 | | | 32 | |

| | 12.08 | | | 6.53 | | | 651,402 | | | 1.64 | | | 5.48 | | | 20 | |

| | 21.95 | | | 36.10 | | | 86,731 | | | 1.90 | | | 6.03 | | | 7 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | 6.73 | | | 9.79 | | | 1,724,746 | | | 1.42 | | | 5.62 | | | 15 | |

| | 15.39 | | | 16.21 | | | 1,713,628 | | | 1.50 | (e) | | 5.97 | (e) | | 9 | |

| | (1.81 | ) | | (4.95 | ) | | 345,463 | | | 1.86 | | | 5.79 | | | 25 | |

| | 13.39 | | | 10.80 | | | 374,096 | | | 1.60 | | | 5.44 | | | 12 | |

| | 25.30 | | | 32.82 | | | 349,203 | | | 1.50 | | | 6.84 | | | 13 | |

| (d) | The expense ratios reflect, among other things, all interest expense and other costs related to preferred shares (as described in Note 4 – Fund Shares, Preferred Shares) and/or the interest expense deemed to have been paid by the Fund on the floating rate certificates issued by the special purpose trusts for the self-deposited inverse floaters held by the Fund (as described in Note 3 – Portfolio Securities and Investments in Derivatives, Inverse Floating Rate Securities), where applicable, as follows: |

| California AMT-Free Income (NKX) | | | | |

| Year Ended 2/28-2/29: | | | | |

| 2016 | | | 0.48 | % |

| 2015 | | | 0.57 | |

| 2014 | | | 0.62 | |

| 2013 | | | 0.59 | |

| 2012 | | | 0.67 | |

| California Dividend Advantage (NAC) | | | | |

| Year Ended 2/28-2/29: | | | | |

| 2016 | | | 0.48 | % |

| 2015 | | | 0.50 | |

| 2014 | | | 0.61 | |

| 2013 | | | 0.61 | |

| 2012 | | | 0.46 | |

| (e) | During the fiscal year ended February 28, 2015, the Adviser voluntarily reimbursed the Fund for certain expenses incurred in connection with its common shares equity shelf program as described in Note 4 – Fund Shares, Common Shares Equity Shelf Programs and Offering Costs. The expenses and net investment income (loss) ratios to average net assets applicable to common shares excluding this expense reimbursement from Adviser are as follows: |

| | | | | | Net Investment | |

| California AMT-Free Income (NKX) | | | Expenses | | | Income (Loss | ) |

| Year Ended 2/28-2/29: | | | | | | | |

| 2015 | | | 1.63 | % | | 5.51 | % |

| | | | | | Net Investment | |

| California Dividend Advantage (NAC) | | | Expenses | | | Income (Loss | ) |

| Year Ended 2/28-2/29: | | | | | | | |

| 2015 | | | 1.53 | % | | 5.95 | % |

| (f) | Portfolio Turnover Rate is calculated based on the lesser of long-term purchases or sales (as disclosed in Note 5 – Investment Transactions) divided by the average long-term market value during the period. |

See accompanying notes to financial statements.

Financial Highlights (continued)

Selected data for a common share outstanding throughout each period:

| | | | | Investment Operations | | Less Distributions

to Common Shareholders | | Common Share | |

| | | Beginning

Common

Share

NAV | | Net

Investment

Income

(Loss) | | Net

Realized/

Unrealized

Gain (Loss) | | Distributions

from Net

Investment

Income to

ARPS

Shareholders | (a) | Distributions

from

Accumulated

Net

Realized

Gains to

ARPS

Shareholders | (a) | Total | | From

Net

Investment

Income | | From

Accumu-

lated

Net

Realized

Gains | | Total | | Ending

NAV | | Ending

Share

Price | |

| California Dividend Advantage 2 (NVX) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2016 | | $ | 15.82 | | $ | 0.82 | | $ | 0.25 | | $ | — | | $ | — | | $ | 1.07 | | $ | (0.83 | ) | $ | — | | $ | (0.83 | ) | $ | 16.06 | | $ | 15.62 | |

| 2015 | | | 14.85 | | | 0.81 | | | 1.02 | | | — | | | — | | | 1.83 | | | (0.86 | ) | | — | | | (0.86 | ) | | 15.82 | | | 14.59 | |

| 2014 | | | 16.35 | | | 0.80 | | | (1.40 | ) | | — | | | — | | | (0.60 | ) | | (0.90 | ) | | — | | | (0.90 | ) | | 14.85 | | | 13.75 | |

| 2013 | | | 15.49 | | | 0.85 | | | 0.96 | | | — | | | — | | | 1.81 | | | (0.95 | ) | | — | | | (0.95 | ) | | 16.35 | | | 16.30 | |

| 2012 | | | 13.47 | | | 0.90 | | | 2.08 | | | — | * | | — | | | 2.98 | | | (0.96 | ) | | — | | | (0.96 | ) | | 15.49 | | | 15.58 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| California Dividend Advantage 3 (NZH) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2016 | | | 14.70 | | | 0.84 | | | 0.19 | | | — | | | — | | | 1.03 | | | (0.81 | ) | | — | | | (0.81 | ) | | 14.92 | | | 14.56 | |

| 2015 | | | 13.50 | | | 0.84 | | | 1.17 | | | — | | | — | | | 2.01 | | | (0.81 | ) | | — | | | (0.81 | ) | | 14.70 | | | 13.63 | |

| 2014 | | | 14.71 | | | 0.74 | | | (1.15 | ) | | — | | | — | | | (0.41 | ) | | (0.80 | ) | | — | | | (0.80 | ) | | 13.50 | | | 12.24 | |

| 2013 | | | 13.91 | | | 0.75 | | | 0.90 | | | — | | | — | | | 1.65 | | | (0.85 | ) | | — | | | (0.85 | ) | | 14.71 | | | 14.25 | |

| 2012 | | | 12.13 | | | 0.82 | | | 1.86 | | | — | * | | — | | | 2.68 | | | (0.90 | ) | | — | | | (0.90 | ) | | 13.91 | | | 14.35 | |

| (a) | The amounts shown for ARPS are based on common share equivalents. |

| (b) | Total Return Based on Common Share NAV is the combination of changes in common share NAV, reinvested dividend income at NAV and reinvested capital gains distributions at NAV, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending NAV. The actual reinvest price for the last dividend declared in the period may often be based on the Fund's market price (and not its NAV), and therefore may be different from the price used in the calculation. Total returns are not annualized. |

| | Total Return Based on Common Share Price is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized. |

| * | Rounds to less than $0.01 per share. |

| | | | Common Share Supplemental Data/

Ratios Applicable to Common Shares | |

Common Share

Total Returns | | | | | | Ratios to Average Net Assets

Before Reimbursement(c) | | | Ratios to Average Net Assets

After Reimbursement(c)(d) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Based | | | | | | | | | Net | | | | | | Net | | | | |

| Based | | | on | | | Ending | | | | | | Investment | | | | | | Investment | | | Portfolio | |

| on | | | Share | | | Net | | | | | | Income | | | | | | Income | | | Turnover | |

| NAV | (b) | | Price | (b) | | Assets (000) | | | Expenses | (e) | | (Loss) | | | Expenses | (e) | | (Loss) | | | Rate | (f) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 7.03 | % | | 13.22 | % | $ | 237,098 | | | 1.46 | % | | 5.25 | % | | N/A | | | N/A | | | 17 | % |

| 12.57 | | | 12.72 | | | 233,435 | | | 1.50 | | | 5.23 | | | N/A | | | N/A | | | 14 | |

| (3.42 | ) | | (9.86 | ) | | 219,123 | | | 2.24 | | | 5.43 | | | N/A | | | N/A | | | 39 | |

| 11.94 | | | 11.03 | | | 241,237 | | | 2.19 | | | 5.29 | | | N/A | | | N/A | | | 23 | |

| 22.90 | | | 30.01 | | | 228,474 | | | 2.30 | | | 6.29 | | | 2.30 | % | | 6.30 | % | | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 7.26 | | | 13.31 | | | 360,284 | | | 1.50 | | | 5.77 | | | N/A | | | N/A | | | 18 | |

| 15.18 | | | 18.47 | | | 354,962 | | | 1.56 | | | 5.93 | | | N/A | | | N/A | | | 15 | |

| (2.50 | ) | | (8.23 | ) | | 325,948 | | | 2.42 | | | 5.57 | | | N/A | | | N/A | | | 41 | |

| 12.15 | | | 5.41 | | | 355,163 | | | 2.53 | | | 5.22 | | | N/A | | | N/A | | | 20 | |

| 22.89 | | | 31.93 | | | 335,830 | | | 2.56 | | | 6.28 | | | 2.52 | | | 6.33 | | | 18 | |

| (c) | Ratios do not reflect the effect of dividend payments to ARPS shareholders, during periods when ARPS were outstanding; Net Investment Income (Loss) ratios reflect income earned and expenses incurred on assets attributable to ARPS and other subsequent forms of preferred shares issued by the Fund, where applicable. |

| (d) | After expense reimbursement from the Adviser, where applicable. As of March 31, 2011 and September 30, 2011, the Adviser is no longer reimbursing California Dividend Advantage 2 (NVX) and California Dividend Advantage 3 (NZH), respectively, for any fees or expenses. |

| (e) | The expense ratios reflect, among other things, all interest expense and other costs related to preferred shares (as described in Note 4 – Fund Shares, Preferred Shares) and/or the interest expense deemed to have been paid by the Fund on the floating rate certificates issued by the special purpose trusts for the self-deposited inverse floaters held by the Fund (as described in Note 3 – Portfolio Securities and Investments in Derivatives, Inverse Floating Rate Securities), where applicable, as follows: |

| California Dividend Advantage 2 (NVX) | | | | |

| Year Ended 2/28-2/29: | | | | |

| 2016 | | | 0.50 | % |

| 2015 | | | 0.51 | |

| 2014 | | | 1.18 | |

| 2013 | | | 1.15 | |

| 2012 | | | 1.25 | |

| California Dividend Advantage 3 (NZH) | | | | |

| Year Ended 2/28-2/29: | | | | |

| 2016 | | | 0.52 | % |

| 2015 | | | 0.54 | |

| 2014 | | | 1.37 | |

| 2013 | | | 1.47 | |

| 2012 | | | 1.49 | |

| (f) | Portfolio Turnover Rate is calculated based on the lesser of long-term purchases or sales (as disclosed in Note 5 – Investment Transactions) divided by the average long-term market value during the period. |

| N/A | Fund no longer has a contractual reimbursement agreement with the Adviser. |

See accompanying notes to financial statements.

Financial Highlights (continued)

| | | iMTP Shares at the End of Period | | VRDP Shares at the End of Period | | iMTP and

VRDP Shares at

the End of Period | |

| | | | Aggregate | | | Asset | | | Aggregate | | | Asset | | Asset Coverage | |

| | | | Amount | | | Coverage | | | Amount | | | Coverage | | | Per $1 | |

| | | | Outstanding | | | Per $5,000 | | | Outstanding | | | Per $100,000 | | | Liquidation | |

| | | | (000 | ) | | Share | | | (000 | ) | | Share | | | Preference | |

| California AMT-Free Income (NKX) | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | | | | |

| 2016 | | $ | 36,000 | | $ | 16,775 | | $ | 291,600 | | $ | 335,490 | | $ | 3.35 | |

| 2015(a) | | | 36,000 | | | 16,612 | | | 291,600 | | | 332,230 | | | 3.32 | |

| 2014 | | | — | | | — | | | 291,600 | | | 308,111 | | | — | |

| 2013 | | | — | | | — | | | 291,600 | | | 323,389 | | | — | |

| 2012 | | | — | | | — | | | 35,500 | | | 344,312 | | | — | |

| | | | | | | | | | | | | | | | | |

| California Dividend Advantage (NAC) | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | | | | |

| 2016 | | | — | | | — | | | 699,600 | | | 346,533 | | | — | |

| 2015 | | | — | | | — | | | 699,600 | | | 344,944 | | | — | |

| 2014 | | | — | | | — | | | 136,200 | | | 353,644 | | | — | |

| 2013 | | | — | | | — | | | 136,200 | | | 374,666 | | | — | |

| 2012 | | | — | | | — | | | 136,200 | | | 356,390 | | | — | |

| (a) | The Ending and Average Market Value Per Share for each Series of the Fund's MTP Shares were as follows: |

| | | | 2015 | |

| California AMT-Free Income (NKX) | | | | |

| Series 2015 (NKX PRC) | | | | |

| Ending Market Value per Share | | $ | — | |

| Average Market Value per Share | | | 10.03 | Ω |

| Ω | For the period June 9, 2014 (effective date of the Reorganizations) through December 29, 2014. |

See accompanying notes to financial statements.

| | | VRDP Shares at the End of Period | | MTP Shares at the End of Period (a) | |

| | | | Aggregate | | | Asset | | | Aggregate | | | Asset | |

| | | | Amount | | | Coverage | | | Amount | | | Coverage | |

| | | | Outstanding | | | Per $100,000 | | | Outstanding | | | Per $10 | |

| | | | (000 | ) | | Share | | | (000 | ) | | Share | |

| California Dividend Advantage 2 (NVX) | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | |

| 2016 | | $ | 98,000 | | $ | 341,937 | | $ | — | | $ | — | |

| 2015 | | | 98,000 | | | 338,199 | | | — | | | — | |

| 2014 | | | 98,000 | | | 323,595 | | | — | | | — | |

| 2013 | | | — | | | — | | | 97,846 | | | 34.65 | |

| 2012 | | | — | | | — | | | 97,846 | | | 33.35 | |

| | | | | | | | | | | | | | |

| California Dividend Advantage 3 (NZH) | | | | | | | | | | | | | |

| Year Ended 2/28-2/29: | | | | | | | | | | | | | |

| 2016 | | | 160,000 | | | 325,178 | | | — | | | — | |

| 2015 | | | 160,000 | | | 321,851 | | | — | | | — | |

| 2014 | | | 160,000 | | | 303,718 | | | — | | | — | |

| 2013 | | | — | | | — | | | 159,545 | | | 32.26 | |

| 2012 | | | — | | | — | | | 159,545 | | | 31.05 | |

| (a) | The Ending and Average Market Value Per Share for each Series of the Fund's MTP Shares were as follows: |

| | | | 2014 | | | 2013 | | | 2012 | |

| California Dividend Advantage 2 (NVX) | | | | | | | | | | |

| Series 2014 (NVX PRA) | | | | | | | | | | |

| Ending Market Value per Share | | $ | — | | $ | 10.05 | | $ | 10.11 | |

| Average Market Value per Share | | | 10.03 | Δ | | 10.07 | | | 10.093 | Ω |

| Series 2015 (NVX PRC) | | | | | | | | | | |

| Ending Market Value per Share | | | — | | | 10.05 | | | 10.01 | |

| Average Market Value per Share | | | 10.02 | Δ | | 10.04 | | | 9.89 | |

| California Dividend Advantage 3 (NZH) | | | | | | | | | | |

| Series 2014 (NZH PRA) | | | | | | | | | | |

| Ending Market Value per Share | | | — | | | 10.05 | | | 10.17 | |

| Average Market Value per Share | | | 10.04 | ΔΔ | | 10.09 | | | 10.11 | ΩΩ |

| Series 2014-1 (NZH PRB) | | | | | | | | | | |

| Ending Market Value per Share | | | — | | | 10.05 | | | 10.15 | |

| Average Market Value per Share | | | 10.03 | ΔΔ | | 10.08 | | | 10.12 | ΩΩΩ |

| Series 2015 (NZH PRC) | | | | | | | | | | |

| Ending Market Value per Share | | | — | | | 10.14 | | | 10.18 | |

| Average Market Value per Share | | | 10.07 | ΔΔ | | 10.13 | | | 10.11 | |

| Ω | For the period March 29, 2011 (first issuance date of shares) through February 29, 2012. |

| ΩΩ | For the period April 11, 2011 (first issuance date of shares) through February 29, 2012. |

| ΩΩΩ | For the period June 6, 2011 (first issuance date of shares) through February 29, 2012. |

| Δ | For the period March 1, 2013 through September 9, 2013. |

| ΔΔ | For the period March 1, 2013 through October 7, 2013. |

See accompanying notes to financial statements.

Notes to Financial Statements

1. General Information and Significant Accounting Policies

General Information

Fund Information

The funds covered in this report and their corresponding New York Stock Exchange ("NYSE") or NYSE MKT symbols are as follows (each a "Fund" and collectively, the "Funds"):

| | • | Nuveen California Municipal Value Fund, Inc. (NCA) ("California Value (NCA)") |

| | • | Nuveen California Municipal Value Fund 2 (NCB) ("California Value 2 (NCB)") |

| | • | Nuveen California AMT-Free Municipal Income Fund (NKX) ("California AMT-Free Income (NKX)") |

| | • | Nuveen California Dividend Advantage Municipal Fund (NAC) ("California Dividend Advantage (NAC)") |

| | • | Nuveen California Dividend Advantage Municipal Fund 2 (NVX) ("California Dividend Advantage 2 (NVX)") |

| | • | Nuveen California Dividend Advantage Municipal Fund 3 (NZH) ("California Dividend Advantage 3 (NZH)") |

The Funds are registered under the Investment Company Act of 1940, as amended, as diversified closed-end management investment companies. Common shares of California Value (NCA), California AMT-Free Income (NKX) and California Dividend Advantage (NAC) are traded on the NYSE (Common shares of California AMT-Free Income (NKX) were formerly traded on the NYSE MKT). Common shares of California Value 2 (NCB), California Dividend Advantage 2 (NVX) and California Dividend Advantage 3 (NZH) are traded on the NYSE MKT. California Value (NCA) was incorporated under the state laws of Minnesota on July 15, 1987. California Value 2 (NCB), California AMT-Free Income (NKX), California Dividend Advantage (NAC), California Dividend Advantage 2 (NVX) and California Dividend Advantage 3 (NZH) were organized as Massachusetts business trusts on January 26, 2009, July 29, 2002, December 1, 1998, June 1, 1999 and April 6, 2001, respectively.

The end of the reporting period for the Funds is February 29, 2016, and the period covered by these Notes to Financial Statements is the fiscal year ended February 29, 2016 (the "current fiscal period").

Investment Adviser

The Funds' investment adviser is Nuveen Fund Advisors, LLC (the "Adviser"), a wholly-owned subsidiary of Nuveen Investments, Inc. ("Nuveen"). The Adviser is responsible for each Fund's overall investment strategy and asset allocation decisions. The Adviser has entered into sub-advisory agreements with Nuveen Asset Management, LLC, (the "Sub-Adviser"), a subsidiary of the Adviser, under which the Sub-Adviser manages the investment portfolios of the Funds.

Investment Objectives and Principal Investment Strategies

Each Fund seeks to provide current income exempt from both regular federal and California state income taxes, and in the case of California AMT-Free Income (NKX) the alternative minimum tax applicable to individuals, by investing primarily in a portfolio of municipal obligations issued by state and local government authorities within the state of California or certain U.S. territories.

Significant Accounting Policies

Each Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 946 "Financial Services – Investment Companies." The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements in accordance with U.S. generally accepted accounting principles ("U.S. GAAP").

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from investment transactions are determined on the specific identification method, which is the same basis used for federal income tax purposes. Investments purchased on a when-issued/delayed delivery basis may have extended settlement periods. Any investments so purchased are subject to market fluctuation during this period. The Funds have earmarked securities in their portfolios with a current value at least equal to the amount of the when-issued/delayed delivery purchase commitments.

As of the end of the reporting period, the Funds did not have any outstanding when-issued/delayed delivery purchase commitments.

Investment Income

Investment income, which reflects the amortization of premiums and accretion of discounts for financial reporting purposes, is recorded on an accrual basis. Investment income also reflects paydown gains and losses, if any.

Professional Fees

Professional fees presented on the Statement of Operations consist of legal fees incurred in the normal course of operations, audit fees, tax consulting fees and, in some cases, workout expenditures. Workout expenditures are incurred in an attempt to protect or enhance an investment or to pursue other claims or legal actions on behalf of Fund shareholders. If a refund is received for workout expenditures paid in a prior reporting period, such amounts will be recognized as "Legal fee refund" on the Statement of Operations.

Dividends and Distributions to Common Shareholders

Dividends from net investment income are declared monthly. Net realized capital gains and/or market discount from investment transactions, if any, are distributed to shareholders at least annually. Furthermore, capital gains are distributed only to the extent they exceed available capital loss carryforwards. Distributions to common shareholders of net investment income, net realized capital gains and/or market discount, if any, are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

Indemnifications

Under the Funds' organizational documents, their officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Funds enter into contracts that provide general indemnifications to other parties. The Funds' maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, the Funds have not had prior claims or losses pursuant to these contracts and expect the risk of loss to be remote.

Netting Agreements

In the ordinary course of business, the Funds may enter into transactions subject to enforceable International Swaps and Derivative Association, Inc. ("ISDA") master agreements or other similar arrangements ("netting agreements"). Generally, the right to offset in netting agreements allows each Fund to offset certain securities and derivatives with a specific counterparty as well as any collateral received or delivered to that counterparty based on the terms of the agreements. Generally, each Fund manages its cash collateral and securities collateral on a counterparty basis.

The Funds' investments subject to netting agreements as of the end of the reporting period, if any, are further described in Note 3 – Portfolio Securities and Investments in Derivatives.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets applicable to common shares from operations during the reporting period. Actual results may differ from those estimates.

2. Investment Valuation and Fair Value Measurements

The fair valuation input levels as described below are for fair value measurement purposes.

Fair value is defined as the price that would be received upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The following is a summary of the three-tiered hierarchy of valuation input levels.

| Level 1 – | Inputs are unadjusted and prices are determined using quoted prices in active markets for identical securities. |

| Level 2 – | Prices are determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 – | Prices are determined using significant unobservable inputs (including management's assumptions in determining the fair value of investments). |

Notes to Financial Statements (continued)

Prices of fixed income securities are provided by an independent pricing service approved by the Funds' Board of Directors/Trustees (the "Board"). The pricing service establishes a security's fair value using methods that may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor's credit characteristics considered relevant. These securities are generally classified as Level32. In pricing certain securities, particularly less liquid and lower quality securities, the pricing service may consider information about a security, its issuer or market activity, provided by the Adviser. These securities are generally classified as Level 2 or Level 3 depending on the priority of the significant inputs.

Certain securities may not be able to be priced by the pre-established pricing methods as described above. Such securities may be valued by the Board and/or its appointee at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; debt securities that have gone into default and for which there is no current market quotation; a security whose market price is not available from a pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of a Fund's NAV (as may be the case in non-U.S. markets on which the security is primarily traded) or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, is not deemed to reflect the security's fair value. As a general principle, the fair value of a security would appear to be the amount that the owner might reasonably expect to receive for it in a current sale. A variety of factors may be considered in determining the fair value of such securities, which may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor's credit characteristics considered relevant. These securities are generally classified as Level 2 or Level 3 depending on the priority of the significant inputs. Regardless of the method employed to value a particular security, all valuations are subject to review by the Board and/or its appointee.

The inputs or methodologies used for valuing securities are not an indication of the risks associated with investing in those securities. The following is a summary of each Fund's fair value measurements as of the end of the reporting period:

| California Value (NCA) | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Long-Term Investments*: | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | $ | 276,770,929 | | $ | — | | $ | 276,770,929 | |

| California Value 2 (NCB) | | | | | | | | | | | | | |

| Long-Term Investments*: | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | $ | 53,712,138 | | $ | — | | $ | 53,712,138 | |

| California AMT-Free Income (NKX) | | | | | | | | | | | | | |

| Long-Term Investments*: | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | $ | 1,079,765,036 | | $ | — | | $ | 1,079,765,036 | |

| California Dividend Advantage (NAC) | | | | | | | | | | | | | |

| Long-Term Investments*: | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | $ | 2,454,303,724 | | $ | — | | $ | 2,454,303,724 | |

| California Dividend Advantage 2 (NVX) | | | | | | | | | | | | | |

| Long-Term Investments*: | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | $ | 332,114,577 | | $ | — | | $ | 332,114,577 | |

| California Dividend Advantage 3 (NZH) | | | | | | | | | | | | | |

| Long-Term Investments*: | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | $ | 505,230,200 | | $ | — | | $ | 505,230,200 | |

| * | Refer to the Fund's Portfolio of Investments for industry classifications. |

The Board is responsible for the valuation process and has appointed the oversight of the daily valuation process to the Adviser's Valuation Committee. The Valuation Committee, pursuant to the valuation policies and procedures adopted by the Board, is responsible for making fair value determinations, evaluating the effectiveness of the Funds' pricing policies and reporting to the Board. The Valuation Committee is aided in its efforts by the Adviser's dedicated Securities Valuation Team, which is responsible for administering the daily valuation process and applying fair value methodologies as approved by the Valuation Committee. When determining the reliability of independent pricing services for investments owned by the Funds, the Valuation Committee, among other things, conducts due diligence reviews of the pricing services and monitors the quality of security prices received through various testing reports conducted by the Securities Valuation Team.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making a fair value determination, based on the facts and circumstances specific to the portfolio instrument. Fair value determinations generally will be derived as follows, using public or private market information:

| | (i) | If available, fair value determinations shall be derived by extrapolating from recent transactions or quoted prices for identical or comparable securities. |

| | | |

| | (ii) | If such information is not available, an analytical valuation methodology may be used based on other available information including, but not limited to: analyst appraisals, research reports, corporate action information, issuer financial statements and shelf registration statements. Such analytical valuation methodologies may include, but are not limited to: multiple of earnings, discount from market value of a similar freely-traded security, discounted cash flow analysis, book value or a multiple thereof, risk premium/yield analysis, yield to maturity and/or fundamental investment analysis. |

The purchase price of a portfolio instrument will be used to fair value the instrument only if no other valuation methodology is available or deemed appropriate, and it is determined that the purchase price fairly reflects the instrument's current value.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such testing and fair valuation occurrences are reported to the Board.

3. Portfolio Securities and Investments in Derivatives

Portfolio Securities

Inverse Floating Rate Securities

Each Fund is authorized to invest in inverse floating rate securities. An inverse floating rate security is created by depositing a municipal bond (referred to as an "Underlying Bond"), typically with a fixed interest rate, into a special purpose tender option bond ("TOB") trust (referred to as the "TOB Trust") created by or at the direction of one or more Funds. In turn, the TOB Trust issues (a) floating rate certificates (referred to as "Floaters"), in face amounts equal to some fraction of the Underlying Bond's par amount or market value, and (b) an inverse floating rate certificate (referred to as an "Inverse Floater") that represents all remaining or residual interest in the TOB Trust. Floaters typically pay short-term tax-exempt interest rates to third parties who are also provided a right to tender their certificate and receive its par value, which may be paid from the proceeds of a remarketing of the Floaters, by a loan to the TOB Trust from a third party liquidity provider ("Liquidity Provider"), or by the sale of assets from the TOB Trust. The Inverse Floater is issued to a long term investor, such as one or more of the Funds. The income received by the Inverse Floater holder varies inversely with the short-term rate paid to holders of the Floaters, and in most circumstances the Inverse Floater holder bears substantially all of the Underlying Bond's downside investment risk and also benefits disproportionately from any potential appreciation of the Underlying Bond's value. The value of an Inverse Floater will be more volatile than that of the Underlying Bond because the interest rate is dependent on not only the fixed coupon rate of the Underlying Bond but also on the short-term interest paid on the Floaters, and because the Inverse Floater essentially bears the risk of loss (and possible gain) of the greater face value of the Underlying Bond.

The Inverse Floater held by a Fund gives the Fund the right to (a) cause the holders of the Floaters to tender their certificates at par (or slightly more than par in certain circumstances), and (b) have the trustee of the TOB Trust (the "Trustee") transfer the Underlying Bond held by the TOB Trust to the Fund, thereby collapsing the TOB Trust.

The Fund may acquire an Inverse Floater in a transaction where it (a) transfers an Underlying Bond that it owns to a TOB Trust created by a third party or (b) transfers an Underlying Bond that it owns, or that it has purchased in a secondary market transaction for the purpose of creating an Inverse Floater, to a TOB Trust created at its direction, and in return receives the Inverse Floater of the TOB Trust (referred to as a "self-deposited Inverse Floater"). A Fund may also purchase an Inverse Floater in a secondary market transaction from a third party creator of the TOB Trust without first owning the Underlying Bond (referred to as an "externally-deposited Inverse Floater").

Notes to Financial Statements (continued)

An investment in a self-deposited Inverse Floater is accounted for as a "financing" transaction (i.e., a secured borrowing). For a self-deposited Inverse Floater, the Underlying Bond deposited into the TOB Trust is identified in the Fund's Portfolio of Investments as "(UB) – Underlying bond of an inverse floating rate trust reflected as a financing transaction," with the Fund recognizing as liabilities, labeled "Floating rate obligations" on the Statement of Assets and Liabilities, (a) the liquidation value of Floaters issued by the TOB Trust, and (b) the amount of any borrowings by the TOB Trust from a Liquidity Provider to enable the TOB Trust to purchase outstanding Floaters in lieu of a remarketing. In addition, the Fund recognizes in "Investment Income" the entire earnings of the Underlying Bond, and recognizes (a) the interest paid to the holders of the Floaters or on the TOB Trust's borrowings, and (b) other expenses related to remarketing, administration, trustee, liquidity and other services to a TOB Trust, as a component of "Interest expense and amortization of offering costs" on the Statement of Operations.

In contrast, an investment in an externally-deposited Inverse Floater is accounted for as a purchase of the Inverse Floater and is identified in the Fund's Portfolio of Investments as "(IF) – Inverse floating rate investment." For an externally-deposited Inverse Floater, a Fund's Statement of Assets and Liabilities recognizes the Inverse Floater and not the Underlying Bond as an asset, and the Fund does not recognize the Floaters, or any related borrowings from a Liquidity Provider, as a liability. Additionally, the Fund reflects in "Investment Income" only the net amount of earnings on the Inverse Floater (net of the interest paid to the holders of the Floaters or the Liquidity Provider as lender, and the expenses of the Trust), and does not show the amount of that interest paid or the expenses of the TOB Trust as described above as interest expense on the Statement of Operations.

Fees paid upon the creation of a TOB Trust for self-deposited Inverse Floaters and externally-deposited Inverse Floaters are recognized as part of the cost basis of the Inverse Floater and are capitalized over the term of the TOB Trust.

As of the end of the reporting period, the aggregate value of Floaters issued by each Fund's TOB Trust for self-deposited Inverse Floaters and externally-deposited Inverse Floaters was as follows:

| | | | | | | | | | California | | | California | | | California | | | California | |

| | | | California | | | California | | | AMT-Free | | | Dividend | | | Dividend | | | Dividend | |

| | | | Value | | | Value 2 | | | Income | | | Advantage | | Advantage 2 | | Advantage 3 | |

| Floating Rate Obligations Outstanding | | (NCA | ) | | (NCB | ) | | (NKX | ) | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Floating rate obligations: self-deposited Inverse Floaters | | $ | 4,490,000 | | $ | — | | $ | 390,000 | | $ | 81,490,000 | | $ | 965,000 | | $ | 845,000 | |

| Floating rate obligations: externally-deposited Inverse Floaters | | | — | | | 5,990,000 | | | 41,148,500 | | | 131,640,500 | | | 9,075,000 | | | 53,741,500 | |

| Total | | $ | 4,490,000 | | $ | 5,990,000 | | $ | 41,538,500 | | $ | 213,130,500 | | $ | 10,040,000 | | $ | 54,586,500 | |

During the current fiscal period, the average amount of Floaters (including any borrowings from a Liquidity Provider) outstanding, and the average annual interest rate and fees related to self-deposited Inverse Floaters, were as follows:

| | | | | | | | | | California | | | California | | | California | | | California | |

| | | | California | | | California | | | AMT-Free | | | Dividend | | | Dividend | | | Dividend | |

| | | | Value | | | Value 2 | | | Income | | | Advantage | | Advantage 2 | | Advantage 3 | |

| Self-Deposited Inverse Floaters | | | (NCA | ) | | (NCB | ) | | (NKX | ) | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Average floating rate obligations outstanding | | $ | 4,490,000 | | $ | — | | $ | 5,966,803 | | $ | 91,653,607 | | $ | 965,000 | | $ | 845,000 | |

| Average annual interest rate and fees | | | 0.65 | % | | — | % | | 0.66 | % | | 0.64 | % | | 0.60 | % | | 0.60 | % |

TOB Trusts are supported by a liquidity facility provided by a Liquidity Provider pursuant to which the Liquidity Provider agrees, in the event that Floaters are (a) tendered to the Trustee for remarketing and the remarketing does not occur, or (b) subject to mandatory tender pursuant to the terms of the TOB Trust agreement, to either purchase Floaters or to provide the Trustee with an advance from a loan facility to fund the purchase of Floaters by the TOB Trust. In certain circumstances, the Liquidity Provider may otherwise elect to have the Trustee sell the Underlying Bond to retire the Floaters that were tendered and not remarketed prior to providing such a loan. In these circumstances, the Liquidity Provider remains obligated to provide a loan to the extent that the proceeds of the sale of the Underlying Bond is not sufficient to pay the purchase price of the Floaters.

The size of the commitment under the loan facility for a given TOB Trust is at least equal to the balance of that TOB Trust's outstanding Floaters plus any accrued interest. In consideration of the loan facility, fee schedules are in place and are charged by the Liquidity Provider(s). Any loans made by the Liquidity Provider will be secured by the purchased Floaters held by the TOB Trust. Interest paid on any outstanding loan balances will be effectively borne by the Fund that owns the Inverse Floaters of the TOB Trust that has incurred the borrowing and may be at a rate that is greater than the rate that would have been paid had the Floaters been successfully remarketed.

As described above, any amounts outstanding under a liquidity facility are recognized as a component of "Floating rate obligations" on the Statement of Assets and Liabilities by the Fund holding the corresponding Inverse Floaters issued by the borrowing TOB Trust. As of the end of the reporting period, there were no loans outstanding under any such facility.

Each Fund may also enter into shortfall and forbearance agreements (sometimes referred to as a "recourse arrangement" or "credit recovery swap") (TOB Trusts involving such agreements are referred to herein as "Recourse Trusts"), under which a Fund agrees to reimburse the Liquidity Provider for the Trust's Floaters, in certain circumstances, for the amount (if any) by which the liquidation value of the Underlying Bond held by the TOB Trust may

fall short of the sum of the liquidation value of the Floaters issued by the TOB Trust plus any amounts borrowed by the TOB Trust from the Liquidity Provider, plus any shortfalls in interest cash flows. Under these agreements, a Fund's potential exposure to losses related to or on an Inverse Floater may increase beyond the value of the Inverse Floater as a Fund may potentially be liable to fulfill all amounts owed to holders of the Floaters or the Liquidity Provider. Any such shortfall amount in the aggregate is recognized as "Unrealized depreciation on Recourse Trusts" on the Statement of Assets and Liabilities.

As of the end of the reporting period, each Fund's maximum exposure to the Floaters issued by Recourse Trusts for self-deposited Inverse Floaters and externally-deposited Inverse Floaters was as follows:

| | | | | | | | | | California | | | California | | | California | | | California | |

| | | | California | | | California | | | AMT-Free | | | Dividend | | | Dividend | | | Dividend | |

| | | | Value | | | Value 2 | | | Income | | | Advantage | | Advantage 2 | | Advantage 3 | |

| Floating Rate Obligations – Recourse Trusts | | (NCA | ) | | (NCB | ) | | (NKX | ) | | (NAC | ) | | (NVX | ) | | (NZH | ) |

| Maximum exposure to Recourse Trusts: self-deposited Inverse Floaters | | $ | — | | $ | — | | $ | — | | $ | 18,060,000 | | $ | — | | $ | — | |

| Maximum exposure to Recourse Trusts: externally-deposited Inverse Floaters | | | — | | | — | | | 13,260,000 | | | 50,700,000 | | | 3,480,000 | | | 37,765,000 | |

| Total | | $ | — | | $ | — | | $ | 13,260,000 | | $ | 68,760,000 | | $ | 3,480,000 | | $ | 37,765,000 | |

Zero Coupon Securities

A zero coupon security does not pay a regular interest coupon to its holders during the life of the security. Income to the holder of the security comes from accretion of the difference between the original purchase price of the security at issuance and the par value of the security at maturity and is effectively paid at maturity. The market prices of zero coupon securities generally are more volatile than the market prices of securities that pay interest periodically.

Investments in Derivatives

In addition to the inverse floating rate securities in which each Fund may invest, which are considered portfolio securities for financial reporting purposes, each Fund is authorized to invest in certain other derivative instruments such as futures, options and swap contracts. Each Fund limits its investments in futures, options on futures and swap contracts to the extent necessary for the Adviser to claim the exclusion from registration by the Commodity Futures Trading Commission as a commodity pool operator with respect to the Fund. The Funds record derivative instruments at fair value, with changes in fair value recognized on the Statement of Operations, when applicable. Even though the Funds' investments in derivatives may represent economic hedges, they are not considered to be hedge transactions for financial reporting purposes.

Although the Funds are authorized to invest in derivative instruments and may do so in future, they did not make any such investments during the current fiscal period.

Market and Counterparty Credit Risk