UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 05202 |

| |

| The Dreyfus/Laurel Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 8/31 | |

Date of reporting period: | 8/31/11 | |

| | | | | | | |

The following Form N-CSR relates only to Dreyfus Core Equity Fund, a series of the Registrant, and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different Form N-CSR reporting requirements. A separate Form N-CSR will be filed for those series, as appropriate.

FORM N-CSR

Item 1. Reports to Stockholders.

ANNUAL REPORT August 31, 2011

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 12 | Statement of Assets and Liabilities |

| 13 | Statement of Operations |

| 14 | Statement of Changes in Net Assets |

| 16 | Financial Highlights |

| 20 | Notes to Financial Statements |

| 31 | Report of Independent Registered Public Accounting Firm |

| 32 | Important Tax Information |

| 33 | Board Members Information |

| 35 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

Core Equity Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Core Equity Fund, covering the 12-month period from September 1, 2010, through August 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Although stocks rallied strongly through the first quarter of 2011 due to expectations of a more robust economic recovery, the reporting period ended amid sharply deteriorating investor sentiment due to disappointing economic data, an escalating sovereign debt crisis in Europe and a contentious debate regarding taxes, spending and borrowing in the United States. In the final month of the reporting period, a major credit rating agency downgraded U.S. long-term debt, marking the first time in history that U.S.Treasury securities were not assigned the highest possible credit rating. Stocks proved volatile in this tumultuous environment, as the stalled economy caused most market sectors to give back many of the reporting period’s previous gains.

The economic outlook currently is clouded by heightened market volatility and political infighting, but we believe that a sustained, moderate global expansion is more likely than a double-dip recession. Inflationary pressures appear to be waning in most countries, including the United States, as energy prices have retreated from their highs.The Federal Reserve Board has signaled its intention to maintain an aggressively accommodative monetary policy, which may help offset the financial stresses caused by recent fiscal policy choices in the United States and Europe. To assess how these and other developments may affect your investments, we encourage you, as always, to speak with your financial advisor.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

September 15, 2011

2

DISCUSSION OF FUND PERFORMANCE

For the period of September 1, 2010, through August 31, 2011, as provided by Fayez Sarofim, Portfolio Manager of Fayez Sarofim & Co., Sub-Investment Adviser

Fund and Market Performance Overview

For the 12-month period ended August 31, 2011, Dreyfus Core Equity Fund’s Class A shares produced a total return of 21.74%, Class B shares returned 20.83%, Class C shares returned 20.88% and Class I shares returned 22.00%.1 For the same period, the fund’s benchmark, the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), produced a 18.48% total return.2

Stocks rallied strongly through the first quarter of 2011 amid expectations of continued economic recovery. However, several macroeconomic disappointments later derailed investor sentiment, erasing some of the market’s previous gains. The fund produced higher returns than its benchmark as investors favored large, multinational companies during turbulent market conditions over the reporting period’s second half.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in common stocks of U.S. and foreign companies with market capitalizations exceeding $5 billion at the time of purchase, including multinational companies.

In choosing stocks, the fund first identifies economic sectors that it believes will expand over the next three to five years or longer. Using fundamental analysis, the fund then seeks companies within these sectors that have dominant positions in their industries and that have demonstrated sustained patterns of profitability, strong balance sheets and expanding global presence and the potential to achieve predictable, above-average earnings growth. The fund is also alert to companies which it considers undervalued in terms of current earnings, assets or growth prospects.

DISCUSSION OF FUND PERFORMANCE (continued)

The fund employs a “buy-and-hold” investment strategy, which generally has resulted in an annual portfolio turnover of below 15%.3 As a result, the fund invests for long-term growth rather than short-term profits.

Shifting Sentiment Sparked Heightened Volatility

Investors’ outlooks began to improve dramatically at the start of the reporting period when the Federal Reserve Board announced a second round of quantitative easing to jump-start the U.S. economy. Subsequent improvements in economic data and corporate earnings helped support rising stock prices. However, the rally was interrupted in February 2011 when political unrest in the Middle East led to sharply rising crude oil prices, and again in March when devastating natural and nuclear disasters in Japan threatened one of the world’s largest economies.

In late April, investor sentiment began to deteriorate in earnest when Greece again appeared headed for default on its sovereign debt, economic data proved disappointing and a contentious debate regarding U.S. government spending and borrowing intensified. Stocks suffered bouts of heightened volatility as newly risk-averse investors shifted their focus to industry groups that historically have held up well under uncertain economic conditions.The reporting period ended on a pessimistic note after a major credit-rating agency downgraded U.S. Treasury bonds despite the eventual passage of an increase in the nation’s debt ceiling.

Quality Bias Supported Fund Performance

Our longstanding focus on blue-chip companies with globally diversified markets, healthy balance sheets and strong income characteristics enabled the fund to hold up better than market averages over the second half of the reporting period. For example, in the consumer staples sector, successful stock selections included luxury goods provider Estee Lauder, which gained value as it enhanced productivity and profit margins at the same time that higher-end consumers spent more freely. Tobacco producer Philip Morris International was able to raise prices and boost earnings as it gained market share in the world’s emerging markets. Beverage giant Coca-Cola achieved higher margins in overseas markets while engineering a turnaround in its North American bottling operations.

The fund also benefited from underweighted exposure to the financials sector, particularly among banks that were adversely affected by

4

Europe’s sovereign debt crisis and a more stringent regulatory environment. The fund scored individual successes in the information technology sector, where consumer electronics innovator Apple and consulting services leader International Business Machines continued to post higher earnings.

Laggards during the reporting period were concentrated in the health care sector, where large pharmaceutical developers struggled with weak new-product pipelines and an unfavorable European pricing environment. Merck & Co. produced particularly disappointing results due to the withdrawal of a new drug from the regulatory approval process and an unfavorable litigation ruling. Other large pharmaceutical companies, such as Johnson & Johnson and Abbott Laboratories, also lagged market averages due to concerns surrounding the impact of regulatory reforms on future earnings.

New Opportunities in a Choppy Economic Recovery

We expect the U.S. economic rebound to persist fitfully amid significant headwinds over the remainder of 2011, leading us to conclude that investors will continue to favor large, multinational companies with solid business fundamentals and generous dividend yields.When adjusting to the new market environment, we identified a number of new opportunities in the energy, industrials, financials and consumer staples sectors.

September 15, 2011

| |

| | Equity funds are subject generally to market, market sector, market liquidity, issuer and investment |

| | style risks, among other factors, to varying degrees, all of which are more fully described in the |

| | fund’s prospectus. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | consideration the maximum initial sales charge in the case of Class A shares, or the applicable |

| | contingent deferred sales charges imposed on redemptions in the case of Class B and Class C |

| | shares. Had these charges been reflected, returns would have been lower. Past performance is no |

| | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | fund shares may be worth more or less than their original cost. Return figures provided reflect the |

| | absorption of certain fund expenses by The Dreyfus Corporation, pursuant to an agreement that |

| | was in effect, which has been terminated. Had these expenses not been absorbed, the fund’s returns |

| | would have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends and, where |

| | applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is |

| | a widely accepted, unmanaged index of U.S. stock market performance. Investors cannot invest |

| | directly in any index. |

| 3 | Portfolio turnover rates are subject to change. Portfolio turnover rates alone do not automatically |

| | result in high or low distribution levels.There can be no guarantee that the fund will generate any |

| | specific level of distributions annually. |

FUND PERFORMANCE

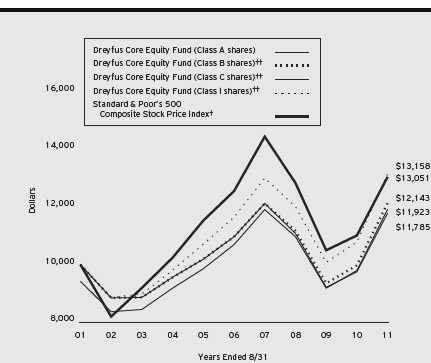

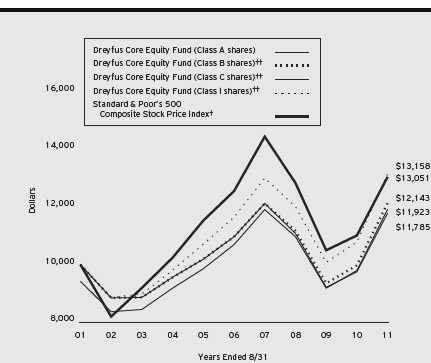

Comparison of change in value of $10,000 investment in Dreyfus Core Equity Fund Class A shares, Class B shares, Class C shares and Class I shares and the Standard & Poor’s 500 Composite Stock Price Index

| |

| † | Source: Lipper Inc. |

| †† | The total return figures presented for Class B and Class C shares of the fund reflect the performance of the fund’s |

| | Class A shares for the period prior to April 15, 2002 (the inception date for Class B and Class C shares |

| | respectively), adjusted to reflect the applicable sales load for each share class.The total return figures presented for Class |

| | I shares of the fund reflect the performance of the fund’s Class A shares for the period prior to April 15, 2002 (the |

| | inception date for Class I shares). |

| Past performance is not predictive of future performance. |

| The above graph compares a $10,000 investment made in each of the Class A, Class B, Class C and Class I shares of |

| Dreyfus Core Equity Fund on 8/31/01 to a $10,000 investment made in the Standard & Poor’s 500 Composite |

| Stock Price Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested. |

| The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A |

| shares and all other applicable fees and expenses on all classes. Performance for Class B shares assumes the conversion of |

| Class B shares to Class A shares at the end of the sixth year following the date of purchase.The Index is a widely |

| accepted, unmanaged index of U.S. stock market performance. Unlike a mutual fund, the Index is not subject to charges, |

| fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, |

| including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and |

| elsewhere in this report. |

6

| | | | | | | |

| Average Annual Total Returns as of 8/31/11 | | | |

| |

| Inception |

| | Date | 1Year | 5 Years | 10 Years |

| Class A shares | | | | |

| with maximum sales charge (5.75%) | 9/30/98 | 14.70% | 1.01% | 1.78% |

| without sales charge | 9/30/98 | 21.74% | 2.21% | 2.38% |

| Class B shares | | | | |

| with applicable redemption charge † | 4/15/02 | 16.83% | 1.05% | 1.96%††† |

| without redemption | 4/15/02 | 20.83% | 1.43% | 1.96%††† |

| Class C shares | | | | |

| with applicable redemption charge †† | 4/15/02 | 19.88% | 1.45% | 1.66%††† |

| without redemption | 4/15/02 | 20.88% | 1.45% | 1.66%††† |

| Class I shares | 4/15/02 | 22.00% | 2.47% | 2.78%††† |

| Standard & Poor’s 500 | | | | |

| Composite Stock Price Index | | 18.48% | 0.78% | 2.70% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| |

| † | The maximum contingent deferred sales charge for Class B shares is 4%.After six years Class B shares convert to |

| | Class A shares. |

| †† | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | date of purchase. |

| ††† | The total return performance figures presented for Class B and Class C shares of the fund reflect the performance of |

| | the fund’s Class A shares for the period prior to April 15, 2002 (the inception date for Class B and Class C |

| | shares respectively), adjusted to reflect the applicable sales load for each share class.The total return performance |

| | figures presented for Class I shares of the fund reflect the performance of the fund’s Class A shares for the period |

| | prior to April 15, 2002 (the inception date for Class I shares). |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Core Equity Fund from March 1, 2011 to August 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended August 31, 2011

| | | | | | | | |

| | | Class A | | Class B | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 6.73 | $ | 10.45 | $ | 10.45 | $ | 5.49 |

| Ending value (after expenses) | $ | 977.40 | $ | 973.90 | $ | 974.00 | $ | 978.50 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended August 31, 2011

| | | | | | | | |

| | | Class A | | Class B | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 6.87 | $ | 10.66 | $ | 10.66 | $ | 5.60 |

| Ending value (after expenses) | $ | 1,018.40 | $ | 1,014.62 | $ | 1,014.62 | $ | 1,019.66 |

|

| † Expenses are equal to the fund’s annualized expense ratio of 1.35% for Class A, 2.10% for Class B, 2.10% for |

| Class C and 1.10% for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to |

| reflect the one-half year period). |

8

|

| STATEMENT OF INVESTMENTS |

| August 31, 2011 |

| | | | |

| Common Stocks—93.7% | Shares | | | Value ($) |

| Consumer Discretionary—10.6% | | | | |

| Arcos Dorados Holdings, Cl. A | 50,000 | | | 1,378,500 |

| McDonald’s | 80,000 | | | 7,236,800 |

| McGraw-Hill | 58,500 | | | 2,463,435 |

| News, Cl. A | 170,200 | | | 2,939,354 |

| Target | 95,500 | | | 4,934,485 |

| Wal-Mart Stores | 80,000 | | | 4,256,800 |

| Walt Disney | 69,500 | a | | 2,367,170 |

| | | | | 25,576,544 |

| Consumer Staples—24.9% | | | | |

| Altria Group | 175,000 | | | 4,758,250 |

| Coca-Cola | 150,000 | | | 10,567,500 |

| Estee Lauder, Cl. A | 25,000 | | | 2,441,500 |

| Kraft Foods, Cl. A | 65,000 | | | 2,276,300 |

| Nestle, ADR | 150,125 | | | 9,319,009 |

| PepsiCo | 80,000 | | | 5,154,400 |

| Philip Morris International | 180,000 | | | 12,477,600 |

| Procter & Gamble | 112,000 | | | 7,132,160 |

| Walgreen | 135,000 | | | 4,753,350 |

| Whole Foods Market | 15,000 | | | 990,450 |

| | | | | 59,870,519 |

| Energy—20.6% | | | | |

| Apache | 15,000a | | 1,546,050 |

| Chevron | 97,000 | | | 9,594,270 |

| ConocoPhillips | 80,000 | | | 5,445,600 |

| Exxon Mobil | 170,560 | | | 12,628,262 |

| Imperial Oil | 60,000 | | | 2,458,800 |

| Occidental Petroleum | 70,000 | | | 6,071,800 |

| Royal Dutch Shell, Cl. A, ADR | 90,000 | | | 6,034,500 |

| Total, ADR | 118,000 | | | 5,786,720 |

| | | | | 49,566,002 |

| Financial—4.8% | | | | |

| American Express | 32,500 | | | 1,615,575 |

| Franklin Resources | 20,000 | a | | 2,398,400 |

| HSBC Holdings, ADR | 49,583 | a | | 2,159,836 |

| JPMorgan Chase & Co. | 144,000 | | | 5,408,640 |

| | | | | 11,582,451 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Common Stocks (continued) | Shares | | | Value ($) |

| Health Care—9.2% | | | | |

| Abbott Laboratories | 90,000 | | | 4,725,900 |

| Becton Dickinson & Co. | 13,000 | | | 1,057,940 |

| Intuitive Surgical | 5,000 | b | | 1,906,750 |

| Johnson & Johnson | 100,000 | | | 6,580,000 |

| Medtronic | 35,000 | | | 1,227,450 |

| Merck & Co. | 70,000 | | | 2,318,400 |

| Novo Nordisk, ADR | 28,000 | | | 2,986,480 |

| Roche Holding, ADR | 30,000 | | | 1,312,500 |

| | | | | 22,115,420 |

| Industrials—5.1% | | | | |

| Caterpillar | 55,000 | a | | 5,005,000 |

| General Electric | 204,000 | | | 3,327,240 |

| United Technologies | 52,000 | | | 3,861,000 |

| | | | | 12,193,240 |

| Information Technology—12.7% | | | | |

| Apple | 30,000b | | 11,544,900 |

| Automatic Data Processing | 53,000 | | | 2,651,590 |

| Intel | 305,000 | | | 6,139,650 |

| International Business Machines | 35,000 | | | 6,016,850 |

| QUALCOMM | 25,000 | | | 1,286,500 |

| Texas Instruments | 115,000 | | | 3,014,150 |

| | | | | 30,653,640 |

| Materials—5.8% | | | | |

| Air Products & Chemicals | 25,000 | | | 2,046,750 |

| Freeport-McMoRan Copper & Gold | 100,000 | | | 4,714,000 |

| Praxair | 40,000 | | | 3,939,600 |

| Rio Tinto, ADR | 55,000 | | | 3,363,800 |

| | | | | 14,064,150 |

| Total Common Stocks | | | | |

| (cost $172,995,780) | | | | 225,621,966 |

10

| | | | |

| Other Investment—7.1% | Shares | Value ($) |

| Registered Investment Company; | | |

| Dreyfus Institutional Preferred | | |

| Plus Money Market Fund | | |

| (cost $17,136,000) | 17,136,000c | 17,136,000 |

| |

| Investment of Cash Collateral | | |

| for Securities Loaned—3.2% | | |

| Registered Investment Company; | | |

| Dreyfus Institutional Cash Advantage Fund | | |

| (cost $7,825,747) | 7,825,747c | 7,825,747 |

| |

| Total Investments (cost $197,957,527) | 104.0% | 250,583,713 |

| Liabilities, Less Cash and Receivables | (4.0%) | (9,729,568) |

| Net Assets | 100.0% | 240,854,145 |

ADR—American Depository Receipts

|

| a Security, or portion thereof, on loan.At August 31, 2011, the value of the fund’s securities on loan was $7,753,640 |

| and the value of the collateral held by the fund was $7,825,747. |

| b Non-income producing security. |

| c Investment in affiliated money market mutual fund. |

| | | |

| Portfolio Summary (Unaudited)† | | |

| |

| | Value (%) | | Value (%) |

| |

| Consumer Staples | 24.9 | Health Care | 9.2 |

| Energy | 20.6 | Materials | 5.8 |

| Information Technology | 12.7 | Industrials | 5.1 |

| Consumer Discretionary | 10.6 | Financial | 4.8 |

| Money Market Investments | 10.3 | | 104.0 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

|

| STATEMENT OF ASSETS AND LIABILITIES |

| August 31, 2011 |

| | | | | |

| | | | Cost | Value |

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments (including | | |

| securities on loan, valued at $7,753,640)—Note 1(b): | | | |

| Unaffiliated issuers | | | 172,995,780 | 225,621,966 |

| Affiliated issuers | | | 24,961,747 | 24,961,747 |

| Cash | | | | 703,942 |

| Receivable for shares of Capital Stock subscribed | | | 1,243,239 |

| Dividends and interest receivable | | | | 666,948 |

| | | | | 253,197,842 |

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | 308,083 |

| Liability for securities on loan—Note 1(b) | | | 7,825,747 |

| Payable for investment securities purchased | | | 4,099,073 |

| Payable for shares of Capital Stock redeemed | | | 110,794 |

| | | | | 12,343,697 |

| Net Assets ($) | | | | 240,854,145 |

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 192,639,290 |

| Accumulated undistributed investment income—net | | | 1,865,202 |

| Accumulated net realized gain (loss) on investments | | | (6,276,533) |

| Accumulated net unrealized appreciation | | | |

| (depreciation) on investments | | | | 52,626,186 |

| Net Assets ($) | | | | 240,854,145 |

| |

| |

| Net Asset Value Per Share | | | | |

| | Class A | Class B | Class C | Class I |

| Net Assets ($) | 112,102,897 | 1,141,643 | 96,429,027 | 31,180,578 |

| Shares Outstanding | 6,806,187 | 69,544 | 5,979,988 | 1,854,998 |

| Net Asset Value Per Share ($) | 16.47 | 16.42 | 16.13 | 16.81 |

| |

| See notes to financial statements. | | | | |

12

|

| STATEMENT OF OPERATIONS |

| Year Ended August 31, 2011 |

| | |

| Investment Income ($): | |

| Income: | |

| Cash dividends (net of $129,834 foreign taxes withheld at source): | |

| Unaffiliated issuers | 5,070,360 |

| Affiliated issuers | 9,138 |

| Income from securities lending—Note 1(b) | 20,697 |

| Total Income | 5,100,195 |

| Expenses: | |

| Management fee—Note 3(a) | 2,129,695 |

| Distribution and service fees—Note 3(b) | 1,127,585 |

| Directors’ fees—Note 3(a) | 15,068 |

| Loan commitment fees—Note 2 | 1,764 |

| Total Expenses | 3,274,112 |

| Less—reduction in management fee due to undertaking—Note 3(a) | (55,213) |

| Less—Directors’ fees reimbursed by the Manager—Note 3(a) | (15,068) |

| Net Expenses | 3,203,831 |

| Investment Income—Net | 1,896,364 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments | (3,922,369) |

| Net unrealized appreciation (depreciation) on investments | 32,654,689 |

| Net Realized and Unrealized Gain (Loss) on Investments | 28,732,320 |

| Net Increase in Net Assets Resulting from Operations | 30,628,684 |

| |

| See notes to financial statements. | |

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Year Ended August 31, |

| | 2011 | 2010 |

| Operations ($): | | |

| Investment income—net | 1,896,364 | 1,563,905 |

| Net realized gain (loss) on investments | (3,922,369) | (141,169) |

| Net unrealized appreciation | | |

| (depreciation) on investments | 32,654,689 | 7,278,271 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 30,628,684 | 8,701,007 |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Class A Shares | (976,260) | (1,076,942) |

| Class B Shares | — | (20,226) |

| Class C Shares | (464,515) | (592,640) |

| Class I Shares | (81,502) | (60,960) |

| Total Dividends | (1,522,277) | (1,750,768) |

| Capital Stock Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Class A Shares | 45,422,024 | 20,047,009 |

| Class B Shares | 114,623 | 247,493 |

| Class C Shares | 29,532,414 | 20,832,821 |

| Class I Shares | 28,877,652 | 5,600,643 |

| Dividends reinvested: | | |

| Class A Shares | 817,890 | 920,299 |

| Class B Shares | — | 14,804 |

| Class C Shares | 206,577 | 270,487 |

| Class I Shares | 41,831 | 12,726 |

| Cost of shares redeemed: | | |

| Class A Shares | (16,544,232) | (23,469,135) |

| Class B Shares | (1,665,942) | (5,757,767) |

| Class C Shares | (13,297,752) | (17,820,563) |

| Class I Shares | (3,283,597) | (1,299,008) |

| Increase (Decrease) in Net Assets | | |

| from Capital Stock Transactions | 70,221,488 | (400,191) |

| Total Increase (Decrease) in Net Assets | 99,327,895 | 6,550,048 |

| Net Assets ($): | | |

| Beginning of Period | 141,526,250 | 134,976,202 |

| End of Period | 240,854,145 | 141,526,250 |

| Undistributed investment income—net | 1,865,202 | 1,491,115 |

14

| | | | |

| | Year Ended August 31, |

| | 2011 | 2010 |

| Capital Share Transactions: | | |

| Class Aa | | |

| Shares sold | 2,802,958 | 1,432,817 |

| Shares issued for dividends reinvested | 52,161 | 64,537 |

| Shares redeemed | (1,015,205) | (1,663,461) |

| Net Increase (Decrease) in Shares Outstanding | 1,839,914 | (166,107) |

| Class Ba | | |

| Shares sold | 7,405 | 17,443 |

| Shares issued for dividends reinvested | — | 1,040 |

| Shares redeemed | (103,560) | (414,813) |

| Net Increase (Decrease) in Shares Outstanding | (96,155) | (396,330) |

| Class C | | |

| Shares sold | 1,861,352 | 1,491,558 |

| Shares issued for dividends reinvested | 13,388 | 19,238 |

| Shares redeemed | (831,925) | (1,275,008) |

| Net Increase (Decrease) in Shares Outstanding | 1,042,815 | 235,788 |

| Class I | | |

| Shares sold | 1,688,264 | 389,188 |

| Shares issued for dividends reinvested | 2,620 | 876 |

| Shares redeemed | (192,830) | (90,231) |

| Net Increase (Decrease) in Shares Outstanding | 1,498,054 | 299,833 |

|

| a During the period ended August 31, 2011, 22,114 Class B shares representing $354,231 were automatically |

| converted to 22,030 Class A shares and during the period ended August 31, 2010, 99,509 Class B shares |

| representing $1,373,959 were automatically converted to 98,696 Class A shares. |

See notes to financial statements.

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | Year Ended August 31, | |

| Class A Shares | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 13.69 | 13.03 | 15.81 | 17.56 | 15.94 |

| Investment Operations: | | | | | |

| Investment income—neta | .21 | .20 | .23 | .20 | .18 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.76 | .68 | (2.84) | (1.54) | 1.63 |

| Total from Investment Operations | 2.97 | .88 | (2.61) | (1.34) | 1.81 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.19) | (.22) | (.17) | (.21) | (.19) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | — | (.20) | — |

| Total Distributions | (.19) | (.22) | (.17) | (.41) | (.19) |

| Net asset value, end of period | 16.47 | 13.69 | 13.03 | 15.81 | 17.56 |

| Total Return (%)b | 21.74 | 6.67 | (16.33) | (7.86) | 11.39 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 1.36 | 1.36 | 1.36 | 1.36 | 1.35 |

| Ratio of net expenses | | | | | |

| to average net assets | 1.32 | 1.25 | 1.25 | 1.25 | 1.25 |

| Ratio of net investment income | | | | | |

| to average net assets | 1.31 | 1.44 | 1.90 | 1.19 | 1.07 |

| Portfolio Turnover Rate | 4.08 | 2.09 | 6.99 | 8.27 | 5.10 |

| Net Assets, end of period ($ x 1,000) | 112,103 | 68,009 | 66,857 | 73,223 | 87,341 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

16

| | | | | | | | | |

| | | Year Ended August 31, | |

| Class B Shares | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 13.59 | 12.88 | 15.52 | 17.24 | 15.65 |

| Investment Operations: | | | | | |

| Investment income—neta | .08 | .09 | .13 | .07 | .05 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.75 | .67 | (2.76) | (1.53) | 1.60 |

| Total from Investment Operations | 2.83 | .76 | (2.63) | (1.46) | 1.65 |

| Distributions: | | | | | |

| Dividends from investment income—net | — | (.05) | (.01) | (.06) | (.06) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | — | (.20) | — |

| Total Distributions | — | (.05) | (.01) | (.26) | (.06) |

| Net asset value, end of period | 16.42 | 13.59 | 12.88 | 15.52 | 17.24 |

| Total Return (%)b | 20.83 | 5.88 | (16.96) | (8.60) | 10.56 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 2.11 | 2.11 | 2.11 | 2.11 | 2.10 |

| Ratio of net expenses | | | | | |

| to average net assets | 2.06 | 2.00 | 2.00 | 2.00 | 2.00 |

| Ratio of net investment income | | | | | |

| to average net assets | .54 | .65 | 1.12 | .45 | .32 |

| Portfolio Turnover Rate | 4.08 | 2.09 | 6.99 | 8.27 | 5.10 |

| Net Assets, end of period ($ x 1,000) | 1,142 | 2,252 | 7,238 | 23,104 | 36,510 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | Year Ended August 31, | |

| Class C Shares | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 13.42 | 12.79 | 15.49 | 17.21 | 15.64 |

| Investment Operations: | | | | | |

| Investment income—neta | .09 | .10 | .13 | .07 | .05 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.71 | .66 | (2.77) | (1.51) | 1.59 |

| Total from Investment Operations | 2.80 | .76 | (2.64) | (1.44) | 1.64 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.09) | (.13) | (.06) | (.08) | (.07) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | — | (.20) | — |

| Total Distributions | (.09) | (.13) | (.06) | (.28) | (.07) |

| Net asset value, end of period | 16.13 | 13.42 | 12.79 | 15.49 | 17.21 |

| Total Return (%)b | 20.88 | 5.88 | (16.96) | (8.59) | 10.60 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 2.11 | 2.11 | 2.11 | 2.11 | 2.10 |

| Ratio of net expenses | | | | | |

| to average net assets | 2.07 | 2.00 | 2.00 | 2.00 | 2.00 |

| Ratio of net investment income | | | | | |

| to average net assets | .56 | .70 | 1.15 | .45 | .32 |

| Portfolio Turnover Rate | 4.08 | 2.09 | 6.99 | 8.27 | 5.10 |

| Net Assets, end of period ($ x 1,000) | 96,429 | 66,280 | 60,123 | 63,332 | 75,646 |

| |

| a | Based on average shares outstanding at each month |

| b | Exclusive of sales charge. |

See notes to financial statements.

18

| | | | | | | | | | |

| | | Year Ended August 31, | |

| Class I Shares | 2011 | 2010 | 2009 | 2008 | 2007a |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 13.97 | 13.28 | 16.12 | 17.90 | 16.24 |

| Investment Operations: | | | | | |

| Investment income—netb | .26 | .26 | .25 | .25 | .23 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 2.80 | .68 | (2.88) | (1.58) | 1.66 |

| Total from Investment Operations | 3.06 | .94 | (2.63) | (1.33) | 1.89 |

| Distributions: | | | | | |

| Dividends from investment income—net | (.22) | (.25) | (.21) | (.25) | (.23) |

| Dividends from net realized | | | | | |

| gain on investments | — | — | — | (.20) | — |

| Total Distributions | (.22) | (.25) | (.21) | (.45) | (.23) |

| Net asset value, end of period | 16.81 | 13.97 | 13.28 | 16.12 | 17.90 |

| Total Return (%) | 22.00 | 7.01 | (16.11) | (7.63) | 11.69 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 1.11 | 1.12 | 1.12 | 1.11 | 1.10 |

| Ratio of net expenses | | | | | |

| to average net assets | 1.09 | 1.01 | 1.01 | 1.00 | 1.00 |

| Ratio of net investment income | | | | | |

| to average net assets | 1.59 | 1.77 | 2.09 | 1.46 | 1.33 |

| Portfolio Turnover Rate | 4.08 | 2.09 | 6.99 | 8.27 | 5.10 |

| Net Assets, end of period ($ x 1,000) | 31,181 | 4,985 | 758 | 142 | 125 |

| |

| a | Effective June 1, 2007, Class R shares were redesignated as Class I shares. |

| b | Based on average shares outstanding at each month end. |

See notes to financial statements.

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Core Equity Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds, Inc. (the “Company”) which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering ten series, including the fund.The fund’s investment objective is to seek long-term capital appreciation. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Fayez Sarofim & Co. (“Sarofim & Co.”) serves as the fund’s sub-investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares.The fund is authorized to issue 500 million shares of $.001 par value Capital Stock.The fund currently offers four classes of shares: Class A (200 million shares authorized), Class B (100 million shares authorized), Class C (100 million shares authorized) and Class I (100 million shares authorized). Class A, Class B and Class C shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A shares are sold with a front-end sales charge. Class B and Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class B shares automatically convert to Class A shares after six years.The fund no longer offers Class B shares, except in connection with dividend reinvestment and permitted exchanges of Class B shares. Class I shares are sold primarily to bank trust departments and other financial service providers, including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, acting on behalf of customers having a qualified trust or investment account or relationship at such institution and bear no distribution or shareholder services fees. Class I shares are offered without

20

a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

NOTES TO FINANCIAL STATEMENTS (continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All preceding securities are categorized as Level 1 in the hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

22

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

The following is a summary of the inputs used as of August 31, 2011 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Equity Securities— | | | | |

| Domestic† | 190,821,821 | — | — | 190,821,821 |

| Equity Securities— | | | | |

| Foreign† | 34,800,145 | — | — | 34,800,145 |

| Mutual Funds | 24,961,747 | — | — | 24,961,747 |

| † See Statement of Investments for additional detailed categorizations. | |

In January 2010, FASB issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about FairValue Measurements” (“ASU 2010-06”). The portions of ASU 2010-06 which require

NOTES TO FINANCIAL STATEMENTS (continued)

reporting entities to prepare new disclosures surrounding amounts and reasons for significant transfers in and out of Level 1 and Level 2 fair value measurements as well as inputs and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3 have been adopted by the fund. No significant transfers between Level 1 or Level 2 fair value measurements occurred at August 31, 2011.

In May 2011, FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in GAAP and International Financial Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS.ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments is recognized on the accrual basis.

Pursuant to a securities lending agreement withThe Bank of NewYork Mellon, the fund may lend securities to qualified institutions. It is the

24

fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction.Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended August 31, 2011, The Bank of NewYork Mellon earned $8,870, from lending portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended August 31, 2011 were as follows:

| | | | | | |

| Affiliated | | | | | | |

| Investment | Value | | | | Value | Net |

| Company | 8/31/2010 | ($) | Purchases ($) | Sales | ($) 8/31/2011 ($) | Assets (%) |

| Dreyfus | | | | | | |

| Institutional | | | | | | |

| Preferred | | | | | | |

| Plus Money | | | | | | |

| Market | | | | | | |

| Fund | 3,916,000 | | 68,275,000 | 55,055,000 | 17,136,000 | 7.1 |

| Dreyfus | | | | | | |

| Institutional | | | | | | |

| Cash | | | | | | |

| Advantage | | | | | | |

| Fund† | 2,111,200 | | 57,113,671 | 51,399,124 | 7,825,747 | 3.2 |

| Total | 6,027,200 | | 125,388,671 | 106,454,124 | 24,961,747 | 10.3 |

| | |

| |

| † | On June 7, 2011, Dreyfus Institutional Cash Advantage Plus Fund was acquired by the |

| | Dreyfus Institutional Cash Advantage Fund, resulting in a transfer of shares. |

NOTES TO FINANCIAL STATEMENTS (continued)

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2011, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended August 31, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2011, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $1,865,202, accumulated capital losses $5,056,614 and unrealized appreciation $52,626,186. In addition, the fund had $1,219,919 of capital losses realized after October 31, 2010, which were deferred for tax purposes to the first day of the following fiscal year.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to August 31, 2011. If not applied, $2,212,995 of the carryover expires in fiscal 2017 and $2,843,619 expires in fiscal 2019.

26

Under the recently enacted Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for the unlimited period. However, the 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act.As a result of this ordering rule, capital loss carry forwards related to taxable years beginning prior to the effective date of the 2010 Act may be more likely to expire unused.

The tax character of distributions paid to shareholders during the fiscal periods ended August 31, 2011 and August 31, 2010 were as follows: ordinary income $1,522,277 and $1,750,768, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended August 31, 2011, the fund did not borrow under the Facilities.

NOTE 3—Investment Management Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an investment management agreement with Dreyfus, Dreyfus provides or arranges for one or more third parties and/or affiliates to provide investment advisory, administrative, custody, fund accounting and transfer agency services to the fund. Dreyfus also directs the investments of the fund in accordance with its investment objective, policies and limitations. For these services, the fund is contractually obligated to pay Dreyfus a fee, calculated daily and paid monthly, at the annual rate of 1.10% of the value of the fund’s average

NOTES TO FINANCIAL STATEMENTS (continued)

daily net assets. Dreyfus had undertaken from September 1, 2010 through January 1, 2011, to waive a portion of the fund’s management fee in the amount of .10% of the fund’s average daily net assets. The reduction in management fee, pursuant to the undertaking, amounted to $55,213 during the period ended August 31, 2011.

Pursuant to a sub-investment advisory agreement between Dreyfus and Sarofim & Co., Dreyfus pays Sarofim & Co. a monthly fee at an annual rate of .2175% of the value of the fund’s average daily net assets.

Out of its fee, Dreyfus pays all of the expenses of the fund except brokerage fees, taxes, interest, commitment fees, Rule 12b-1 distribution fees and expenses, fees and expenses of non-interested Directors (including counsel fees) and extraordinary expenses. In addition, Dreyfus is required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Directors (including counsel fees). The Company,The Dreyfus/Laurel Tax-Free Municipal Funds,The Dreyfus/Laurel Funds Trust, Dreyfus Investment Funds and Dreyfus Funds, Inc. (collectively, the “Board Group Open-End Funds”) pay each Board member who is not an “interested person” of the Company (as defined in the Act) $60,000 per annum, plus $7,000 per joint Board Group Open-End Funds Board meeting attended, $2,500 for separate in-person committee meetings attended which are not held in conjunction with a regularly scheduled Board meeting and $2,000 for Board meetings and separate committee meetings attended that are conducted by telephone.The Board Group Open-End Funds also reimburse each Board member who is not an “interested person” of the Company (as defined in the Act) for travel and out-of-pocket expenses. With respect to Board meetings, the Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts).The Chair of each of the Board’s committees, unless the Chair also serves as Chair of the Board, receives $1,350 per applicable committee meeting. In the event that there is an in-person joint committee

28

meeting or a joint telephone meeting of the Board Group Open-End Funds and Dreyfus HighYield Strategies Fund, the $2,500 or $2,000 fee, is allocated between the Board Group Open-End Funds and Dreyfus High Yield Strategies Fund.The Company’s portion of these fees and expenses are charged and allocated to each series based on net assets. Amounts required to be paid by the Company directly to the non-interested Directors, that would be applied to offset a portion of the management fee payable to Dreyfus, are in fact paid directly by Dreyfus to the non-interested Directors.

During the period ended August 31, 2011, the Distributor retained $62,237 from commissions earned on sales of the fund’s Class A shares and $1,525 and $21,080 from CDSCs on redemptions of the fund’s Class B and Class C shares, respectively.

(b) Under separate Distribution Plans (the “Plans”) adopted pursuant to Rule 12b-1 under the Act, Class A shares may pay annually up to .25% of the value of its average daily net assets to compensate the Distributor for shareholder servicing activities and expenses primarily intended to result in the sale of Class A shares. Class B and Class C shares pay the Distributor for distributing their shares at an aggregate annual rate of .75% of the value of the average daily net assets of Class B and Class C shares. Class B and Class C shares are also subject to a service plan adopted pursuant to Rule 12b-1 (the “Service Plan”), under which Class B and Class C pay the Distributor for providing certain services to the holders of their shares a fee at the annual rate of .25% of the value of the average daily net assets of Class B and Class C shares. During the period ended August 31, 2011, Class A, Class B and Class C shares were charged $230,136, $13,402 and $659,685, respectively, pursuant to their respective Plans. During the period ended August 31, 2011, Class B and Class C shares were charged $4,467 and $219,895, respectively, pursuant to the Service Plan.

NOTES TO FINANCIAL STATEMENTS (continued)

Under their terms, the Plans and Service Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of majority of those Directors who are not “interested persons” of the Company and who have no direct or indirect financial interest in the operation of or in any agreement related to the Plans or Service Plan.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $207,296, Rule 12b-1 distribution plan fees $80,978 and shareholder services plan fees $19,809.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2011, amounted to $67,323,886 and $7,651,603, respectively.

At August 31, 2011, the cost of investments for federal income tax purposes was $197,957,527; accordingly, accumulated net unrealized appreciation on investments was $52,626,186, consisting of $62,047,979 gross unrealized appreciation and $9,421,793 gross unrealized depreciation.

30

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders of

The Dreyfus/Laurel Funds, Inc.

We have audited the accompanying statement of assets and liabilities of Dreyfus Core Equity Fund (the “Fund”), a series of The Dreyfus/Laurel Funds, Inc., including the statement of investments as of August 31, 2011, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audit in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2011, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received.An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Core Equity Fund as of August 31, 2011, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 26, 2011

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund designates the maximum amount allowable, but not less than $1,522,277 as ordinary income dividends paid during the year ended August 31, 2011 as qualified dividend income in accordance with Section 854(b)(1)(B) of the Internal Revenue Code. Also, the fund designates 100% of ordinary income dividends paid during the year ended August 31, 2011 as eligible for the corporate dividends received deduction provided under Section 243 of the Internal Revenue Code in accordance with Section 854(b)(1)(A) of the Internal Revenue Code. Shareholders will receive notification in early 2012 of the percentage applicable to the preparation of their 2011 income tax returns.

32

BOARD MEMBERS INFORMATION (Unaudited)

|

| Joseph S. DiMartino (67) |

| Chairman of the Board (1999) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director (1997-present) |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director (2005-2009) |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director (2000-2010) |

| No. of Portfolios for which Board Member Serves: 167 |

| ——————— |

| James M. Fitzgibbons (76) |

| Board Member (1994) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • Bill Barrett Corporation, an oil and natural gas exploration company, Director (2004-present) |

| No. of Portfolios for which Board Member Serves: 33 |

| ——————— |

| Kenneth A. Himmel (65) |

| Board Member (1994) |

| Principal Occupation During Past 5Years: |

| • President and CEO, Related Urban Development, a real estate development company (1996-present) |

| • President and CEO, Himmel & Company, a real estate development company (1980-present) |

| • CEO,American Food Management, a restaurant company (1983-present) |

| No. of Portfolios for which Board Member Serves: 33 |

BOARD MEMBERS INFORMATION (Unaudited) (continued)

|

| Stephen J. Lockwood (64) |

| Board Member (1994) |

| Principal Occupation During Past 5Years: |

| • Chairman of the Board, Stephen J. Lockwood and Company LLC, a real estate investment |

| company (2000-present) |

| No. of Portfolios for which Board Member Serves: 33 |

| ——————— |

| Roslyn M. Watson (61) |

| Board Member (1994) |

| Principal Occupation During Past 5Years: |

| • Principal,Watson Ventures, Inc., a real estate investment company (1993-present) |

| No. of Portfolios for which Board Member Serves: 43 |

| ——————— |

| Benaree Pratt Wiley (65) |

| Board Member (1998) |

| Principal Occupation During Past 5Years: |

| • Principal,TheWiley Group, a firm specializing in strategy and business development (2005-present) |

| Other Public Company Board Memberships During Past 5Years: |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director (2008-present) |

| No. of Portfolios for which Board Member Serves: 68 |

| ——————— |

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork 10166.Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

J.Tomlinson Fort, Emeritus Board Member

34

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 75 investment companies (comprised of 167 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since February 1988.

MICHAEL A. ROSENBERG, Vice President and Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since October 1991.

KIESHA ASTWOOD, Vice President and Assistant Secretary since January 2010.

Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 38 years old and has been an employee of the Manager since July 1995.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 55 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since June 2000.

KATHLEEN DENICHOLAS, Vice President and Assistant Secretary since January 2010.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 36 years old and has been an employee of the Manager since February 2001.

JANETTE E. FARRAGHER, Vice President and Assistant Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 48 years old and has been an employee of the Manager since February 1984.

JOHN B. HAMMALIAN, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since February 1991.

M. CRISTINA MEISER, Vice President and Assistant Secretary since January 2010.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 41 years old and has been an employee of the Manager since August 2001.

OFFICERS OF THE FUND (Unaudited) (continued)

ROBERT R. MULLERY, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since May 1986.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since April 1991.

ROBERT ROBOL, Assistant Treasurer since December 2002.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since November 1990.

36

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (76 investment companies, comprised of 192 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 54 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

STEPHEN J. STOREN, Anti-Money Laundering Compliance Officer since May 2011.

Chief Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 72 investment companies (comprised of 188 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Distributor since October 1999.

For More Information

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There have been no amendments to, or waivers in connection with, the Code of Ethics during the period covered by this Report.

Item 3. Audit Committee Financial Expert.

The Registrant's Board has determined that Joseph S. DiMartino, a member of the Audit Committee of the Board, is an audit committee financial expert as defined by the Securities and Exchange Commission (the "SEC"). Joseph S. DiMartino is "independent" as defined by the SEC for purposes of audit committee financial expert determinations.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant (the "Auditor") for the audit of the Registrant's annual financial statements or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $ 28,580 in 2011 and $29,150 in 2011.

(b) Audit-Related Fees. The aggregate fees billed in the Reporting Periods for assurance and related services by the Auditor that are reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4 were $4,300 in 2010 and $4,390 in 2011. These services consisted of one or more of the following: (i) agreed upon procedures related to compliance with Internal Revenue Code section 817(h), (ii) security counts required by Rule 17f-2 under the Investment Company Act of 1940, as amended, (iii) advisory services as to the accounting or disclosure treatment of Registrant transactions or events and (iv) advisory services to the accounting or disclosure treatment of the actual or potential impact to the Registrant of final or proposed rules, standards or interpretations by the Securities and Exchange Commission, the Financial Accounting Standards Boards or other regulatory or standard-setting bodies.

The aggregate fees billed in the Reporting Periods for non-audit assurance and related services by the Auditor to the Registrant's investment adviser (not including any sub-investment adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant ("Service Affiliates"), that were reasonably related to the performance of the annual audit of the Service Affiliate, which required pre-approval by the Audit Committee were $0 in 2010 and $0 in 2011.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance, tax advice, and tax planning ("Tax Services") were $2,370 in 2010 and $2,480 in 2011. These services consisted of: (i) review or preparation of U.S. federal, state, local and excise tax returns. The aggregate fees billed in the Reporting Periods for Tax Services by the Auditor to Service Affiliates, which required pre-approval by the Audit Committee were $0 in 2010 and $0 in 2011.

(d) All Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2010 and $0 in 2011.

The aggregate fees billed in the Reporting Periods for Non-Audit Services by the Auditor to Service Affiliates, other than the services reported in paragraphs (b) through (c) of this Item, which required pre-approval by the Audit Committee, were $0 in 2009 and $0 in 2010.

(e)(1) Audit Committee Pre-Approval Policies and Procedures. The Registrant's Audit Committee has established policies and procedures (the "Policy") for pre-approval (within specified fee limits) of the Auditor's engagements for non-audit services to the Registrant and Service Affiliates without specific case-by-case consideration. The pre-approved services in the Policy can include pre-approved audit services, pre-approved audit-related services, pre-approved tax services and pre-approved all other services. Pre-approval considerations include whether the proposed services are compatible with maintaining the Auditor's independence. Pre-approvals pursuant to the Policy are considered annually.

(e)(2) Note: None of the services described in paragraphs (b) through (d) of this Item 4 were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) None of the hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal account's full-time, permanent employees.

Non-Audit Fees. The aggregate non-audit fees billed by the Auditor for services rendered to the Registrant, and rendered to Service Affiliates, for the Reporting Periods were $4,710,000 in 2010 and $12,003,000 in 2011.