We are pleased to present this annual report for BNY Mellon Floating Rate Income Fund, formerly Dreyfus Floating Rate Income Fund, covering the 12-month period from September 1, 2018 through August 31, 2019. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

After a strong summer, equity markets weakened in the fourth quarter of 2018, as concerns about rising interest rates, trade tensions and slowing global growth provided downward pressure on returns. In December 2018, stocks experienced a sharp sell-off, as it appeared that the U.S. Federal Reserve (the “Fed”) would maintain its hawkish stance on monetary policy. In January 2019, the Fed commented that it would slow the pace of interest-rate increases, which helped stimulate a rebound across equity markets that continued into the second quarter. Escalating trade tensions disrupted equity markets again in May. The dip was short-lived, as markets rose once again in June. However, despite continued supportive central bank policies, pockets of volatility persisted through the end of the period.

In fixed-income markets, returns were hampered early in the reporting period by rising interest rates and accelerating inflation. With the return of stock market volatility in October 2018, a flight to quality led to a rise in prices for U.S. Treasuries that continued through the end of the year, leading to a flattening yield curve. After the Fed’s supportive statements in January 2019, other developed market central banks followed suit and reiterated their abilities to bolster flagging growth by continuing supportive policies. This helped to further buoy fixed-income instrument prices. At the end of July, the Fed cut the federal funds rate by 25 basis points. Both the U.S. and Global Bloomberg Barclays Aggregate Bond indices produced strong returns for the 12 months.

We believe that over the near term, the outlook for the U.S. remains positive, but we will monitor relevant data for any signs of a change. As always, we encourage you to discuss the risks and opportunities in today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

DISCUSSION OF FUND PERFORMANCE(Unaudited)

For the period from September 1, 2018 through August 31, 2019, as provided by the fund’s primary portfolio managers, Kevin Cronk, Chris Barris and Leland Hart of Alcentra NY, LLC, Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended August 31, 2019, BNY Mellon Floating Rate Income Fund’s (formerly, Dreyfus Floating Rate Income Fund) Class A shares produced a total return of 1.59%, Class C shares returned 0.82%, Class I shares returned 1.78%, and Class Y shares returned 1.90%.1 Effective December 31, 2018, the fund’s benchmark changed to the Credit Suisse Leveraged Loan Index (the “Index”), which produced a total return of 3.38% for the same period. The fund’s former benchmark, the S&P/LSTA U.S. Leveraged Loan Index, produced a total return of 3.31% for the 12 months.2, 3

Floating-rate loans generally produced positive total returns over the reporting period, amid pockets of interest-rate volatility and slowing growth. The fund lagged the Index primarily due to credit and sector selection during the reporting period.

The Fund’s Investment Approach

The fund seeks high current income. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in floating-rate loans and other floating-rate securities. These investments should enable the fund to effectively achieve a floating rate of income. The fund currently intends to invest principally in floating-rate loans and other floating-rate securities of U.S. issuers, but may invest up to 30% of its net assets in securities of foreign issuers.

We buy and sell securities through a value-oriented, bottom-up research process that incorporates a top-down overlay. We use fundamental credit analysis to identify favorable and unfavorable risk/reward opportunities across quality segments, industries and credits, while seeking to mitigate downside risk. Fundamental analysis is complemented by our top-down outlook, which considers market fundamentals, technicals and valuations.

A Tale of Two Markets

Over the reporting period, several shifts in investor sentiment and behavior occurred. During the month of September 2018, markets were still enjoying momentum from strong summer 2018 returns. However, in the final three months of 2018, concerns over slowing global growth, trade disputes, and a continued hawkish trajectory by the U.S. Federal Reserve (the “Fed”) led to a sharp change in sentiment as investors fled risk assets. During this volatility, redemptions from U.S. bank-loan mutual funds accelerated, with December seeing record outflows. Higher-quality BB rated loans, which are typically larger and more liquid, underperformed during this period of mutual fund selling.

Investor sentiment and market performance shifted once again in January 2019 as investors became more comfortable with slowing growth and began to anticipate more accommodative Fed policy. Prices of fixed-income instruments continued to rally throughout much of the latter half of the reporting period on declining interest rates. In this environment, floating-rate bank loans trailed most fixed-income assets. Higher-quality BB rated loans outperformed the broader market while low-quality CCC loans lagged. At its July 2019 meeting, the Fed continued its accommodative policies by cutting the federal funds rate by 25 basis points. Throughout much of the latter half of the period, rates generally fell, and the Treasury yield curve flattened.

Sector Allocation and Credit Selection Dampen Performance

The fund’s performance compared to the Index was constrained over the reporting period by sector allocation and credit selection. Relative overweights in two commodity sectors, energy and metals & mining, contributed to the underperformance. They were among the worst-performing sectors during the 12 months and provided a headwind to returns. This was partially offset by a beneficial underweight position in the retail sector, another lagging industry. Within credit selection, choices

3

DISCUSSION OF FUND PERFORMANCE(Unaudited) (continued)

within the health care, energy, leisure and services sectors were among the top detractors from results. In particular, bonds from Envision Healthcare, Gavilan Resources,NPC International and Constellis Holdings were the most challenged. We have since exited our position inNPC International. Credit selection within the financials and other media sectors benefited performance as the position in York Risk Services appreciated in price and the fund exited underperformingDeluxe Entertainment loans.

The fund achieved better results through other strategies. Quality selection was positive for the period. The fund was underweight to CCC rated securities, which benefited portfolio results as this lower-quality debt underperformed throughout the period. The fund’s underweight to BBs was helpful in the fourth quarter of 2018 but detracted from returns in 2019. In addition, high yield bond holdings in the fund aided performance, especially as interest rates declined in 2019.

Positioned for Moderating Economic Growth

We believe global growth is facing headwinds generated by trade disputes and slowing economies in the euro zone. U.S. growth has also begun to moderate, led by a reduction in corporate spending. Many companies have pulled back capital expenditures due to uncertainty regarding the economic outlook. However, these cutbacks are partially offset by strong consumer spending, bolstered by continuing strength in the U.S. jobs market.

Given this outlook, we are cautious about low-quality CCC and cyclical credits and industries. We have pared back exposure to cyclical sectors, such as automotive, chemicals, and commodities, while favoring more defensive sectors, like cable and certain health care subsectors.

We are maintaining our overweight to B rated securities and underweight to low-yielding BBs. We have reduced our exposure to second lien loans and CLOs but continue to hold select high yield bonds. We expect to actively manage the fund’s quality, sector, and credit exposures as we navigate the evolving credit cycle.

September 16, 2019

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by the fund’s investment adviser pursuant to an agreement in effect through December 31, 2019, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Morningstar – The Credit Suisse Leveraged Loan Index is a monthly rebalanced index. It is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. Investors cannot invest directly in any index.

3 Source: Lipper Inc. The S&P/LSTA U.S. Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in any index.

Floating-rate loans are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

The risks of an investment in a collateralized loan obligation (CLO) depend largely on the type of the collateral and the tranche of the CLO in which the fund invests. CLO tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default, market anticipation of defaults, as well as aversion to CLO securities as an asset class.

High yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity.

The fund may use derivative instruments, such as options, futures, options on futures, forward contracts, and swaps. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

4

FUND PERFORMANCE(Unaudited)

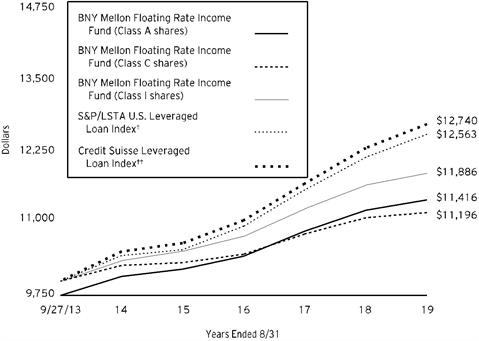

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon Floating Rate Income Fund with a hypothetical investment of $10,000 in the Credit Suisse Leveraged Loan Index and, the fund’s benchmark prior to December 31, 2018, the S&P/LSTA U.S. Leveraged Loan Index

† Source: Lipper Inc.

†† Source: Morningstar

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class A, Class C and Class I shares of BNY Mellon Floating Rate Income Fund on9/27/13 (inception date) to a hypothetical investment of $10,000 made in the Credit Suisse Leveraged Loan Index and S&P/LSTA U.S. Leveraged Loan Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Credit Suisse Leveraged Loan Index is an unmanaged index designed to track the performance of the investable universe of the U.S. dollar denominated leveraged loan market. The S&P/LSTA U.S. Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Unlike a mutual fund, the Indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained inthe Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE(Unaudited) (continued)

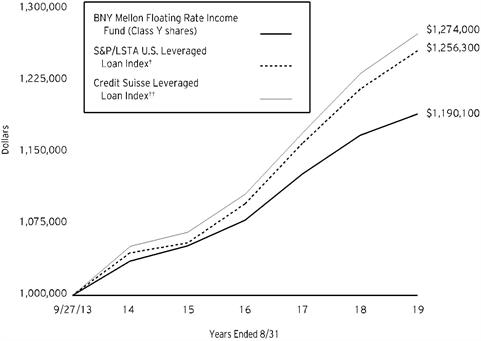

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Floating Rate Income Fund with a hypothetical investment of $1,000,000 in the Credit Suisse Leveraged Loan Index and, the fund’s benchmark prior to December 31, 2018, the S&P/LSTA U.S. Leveraged Loan Index

† Source: Lipper Inc.

†† Source: Morningstar

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Floating Rate Income Fund on9/27/13 (inception date) to a hypothetical investment of $1,000,000 made in the Credit Suisse Leveraged Loan Index and S&P/LSTA U.S. Leveraged Loan Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class Y shares and all other applicable fees and expenses on all classes. The Credit Suisse Leveraged Loan Index is an unmanaged index designed to track the performance of the investable universe of the U.S. dollar denominated leveraged loan market. The S&P/LSTA U.S. Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Unlike a mutual fund, the Indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 8/31/19 | | | |

| Inception

Date | 1 Year | 5 Years | From

Inception |

Class A shares | | | | |

with maximum sales charge (2.50%) | 9/27/13 | -0.95% | 2.01% | 2.26% |

without sales charge | 9/27/13 | 1.59% | 2.52% | 2.69% |

Class C shares | | | | |

with applicable redemption charge† | 9/27/13 | -0.14% | 1.74% | 1.92% |

without redemption | 9/27/13 | 0.82% | 1.74% | 1.92% |

Class I shares | 9/27/13 | 1.78% | 2.79% | 2.96% |

Class Y shares | 9/27/13 | 1.90% | 2.81% | 2.98% |

Credit Suisse Leveraged Loan Index | 9/30/13 | 3.38% | 3.91% | 4.12%†† |

S&P/LSTA U.S. Leveraged Loan Index | 9/30/13 | 3.31% | 3.76% | 3.93%†† |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† For comparative purposes, the value of the Index on 9/30/13 is used as the beginning value on 9/27/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES(Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Floating Rate Income Fund from March 1, 2019 to August 31, 2019. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended August 31, 2019 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expense paid per $1,000† | $5.07 | $8.86 | $3.81 | $3.65 | |

Ending value (after expenses) | $1,012.80 | $1,008.90 | $1,013.40 | $1,013.60 | |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS(Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended August 31, 2019 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expense paid per $1,000† | $5.09 | $8.89 | $3.82 | $3.67 | |

Ending value (after expenses) | $1,020.16 | $1,016.38 | $1,021.42 | $1,021.58 | |

† Expenses are equal to the fund‘s annualized expense ratio of 1.00% for Class A, 1.75% for Class C, .75% for Class I and .72% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

August 31, 2019

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($)

| a | Value ($) | |

Bonds and Notes - 5.9% | | | | | |

Collateralized Loan Obligations Debt - 3.7% | | | | | |

Babson CLO , Ser. 2015-1A, Cl. ER, 3 Month LIBOR +5.50% | | 7.78 | | 1/20/2031 | | 3,000,000 | b,c | 2,566,689 | |

Babson Euro CLO, Ser. 2014-2A, Cl. FR, 3 Month EURIBOR +7.00% @ Floor | EUR | 7.00 | | 11/25/2029 | | 2,000,000 | b,c | 2,048,862 | |

Barings CLO, Ser. 2018-1A, Cl. D, 3 Month LIBOR +5.50% | | 7.80 | | 4/15/2031 | | 2,900,000 | b,c | 2,626,409 | |

Carlyle Global Market Strategies CLO, Ser. 2014-1A, Cl. ER, 3 Month LIBOR +5.40% | | 7.70 | | 4/17/2031 | | 4,000,000 | b,c | 3,494,863 | |

Catamaran CLO, Ser. 2015-1A, Cl. E, 3 Month LIBOR +5.15% | | 7.43 | | 4/22/2027 | | 3,000,000 | b,c | 2,851,880 | |

CIFC Funding, Ser. 2012-2RA, Cl. D, 3 Month LIBOR +5.45% | | 7.73 | | 1/20/2028 | | 1,000,000 | b,c | 951,451 | |

Dryden 37 Senior Loan Fund, Ser. 2015-37A, Cl. ER, 3 Month LIBOR +5.15% | | 7.45 | | 1/15/2031 | | 5,000,000 | b,c | 4,455,141 | |

Goldentree Loan Management US CLO 2, Ser. 2017-2A, Cl. E, 3 Month LIBOR +4.70% | | 6.98 | | 11/28/2030 | | 1,984,000 | b,c | 1,776,056 | |

Marble Point CLO XII, Ser. 2018-1A, Cl. E, 3 Month LIBOR +6.00% | | 8.32 | | 7/16/2031 | | 1,250,000 | b,c | 1,090,372 | |

OCP CLO, Ser. 2014-6A, Cl. DR, 3 Month LIBOR +6.52% | | 8.82 | | 10/17/2030 | | 2,000,000 | b,c | 1,832,412 | |

OZLM VI, Ser. 2014-6A, Cl. DS, 3 Month LIBOR +6.05% | | 8.35 | | 4/17/2031 | | 4,000,000 | b,c | 3,617,632 | |

Rockford Tower CLO, Ser. 2018-1A, Cl. E, 3 Month LIBOR +5.85% | | 7.99 | | 5/20/2031 | | 1,500,000 | b,c | 1,386,462 | |

Sounds Point CLO IV-R, Ser. 2013-3RA, Cl. E, 3 Month LIBOR +6.25% | | 8.55 | | 4/18/2031 | | 3,000,000 | b,c | 2,701,029 | |

Vibrant CLO III, Ser. 2015-3A, Cl. DRR, 3 Month LIBOR +6.35% | | 8.63 | | 10/20/2031 | | 2,000,000 | b,c | 1,851,481 | |

| | 33,250,739 | |

Commercial & Professional Services - .2% | | | | | |

Verscend Escrow, Sr. Unscd. Notes | | 9.75 | | 8/15/2026 | | 2,000,000 | c | 2,148,660 | |

Diversified Financials - .3% | | | | | |

Nationstar Mortgage, Gtd. Notes | | 6.50 | | 7/1/2021 | | 3,000,000 | | 3,011,250 | |

Health Care - .2% | | | | | |

Polaris Intermediate, Sr. Unscd. Notes | | 8.50 | | 12/1/2022 | | 2,000,000 | c | 1,690,000 | |

Materials - .8% | | | | | |

ARD Securities Finance, Sr. Scd. Notes | | 8.75 | | 1/31/2023 | | 3,291,599 | c | 3,423,263 | |

Peabody Energy, Sr. Scd. Notes | | 6.38 | | 3/31/2025 | | 2,000,000 | c | 2,088,750 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 5.9% (continued) | | | | | |

Materials - .8% (continued) | | | | | |

Trivium Packaging Finance, Sr. Scd. Notes | | 5.50 | | 8/15/2026 | | 1,550,000 | c | 1,643,000 | |

| | 7,155,013 | |

Media - .2% | | | | | |

Scripps Escrow, Sr. Unscd. Notes | | 5.88 | | 7/15/2027 | | 2,000,000 | c | 2,022,500 | |

Real Estate - .2% | | | | | |

Greystar Real Estate Partners, Sr. Scd. Notes | | 5.75 | | 12/1/2025 | | 1,250,000 | c | 1,284,813 | |

Retailing - .3% | | | | | |

Staples, Sr. Scd. Notes | | 7.50 | | 4/15/2026 | | 3,000,000 | c | 3,037,500 | |

TotalBonds and Notes

(cost $56,857,049) | | 53,600,475 | |

| | | | | | | | | |

Floating Rate Loan Interests - 91.2% | | | | | |

Advertising - 1.6% | | | | | |

ABG Intermediate Holdings 2, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 9/29/2024 | | 5,003,782 | b | 5,003,782 | |

Clear Channel Outdoor Holdings, Term B Loan, 1 Month LIBOR +3.50% | | 5.67 | | 8/9/2026 | | 3,658,537 | b | 3,660,823 | |

Red Ventures, First Lien Term B-1 Loan, 1 Month LIBOR +3.00% | | 5.11 | | 11/8/2024 | | 5,766,534 | b | 5,771,494 | |

| | 14,436,099 | |

Automobiles & Components - 1.4% | | | | | |

Dealer Tire, Initial Term Loan, 1-3 Month LIBOR +5.50% | | 7.72 | | 12/19/2025 | | 4,438,875 | b | 4,466,618 | |

Panther BF Aggregator 2, First Lien Initial Dollar Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 4/30/2026 | | 1,854,608 | b | 1,831,426 | |

Panther BF Aggregator 2, First Lien Initial Euro Term Loan, 1 Month EURIBOR +3.75% @ Floor | EUR | 3.75 | | 4/30/2026 | | 3,000,000 | b | 3,305,096 | |

UOS, Initial Term Loan, 3 Month LIBOR +5.50% | | 7.83 | | 4/18/2023 | | 2,715,027 | b | 2,742,178 | |

| | 12,345,318 | |

Building Materials - 1.8% | | | | | |

Forterra Finance, Replacement Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 10/25/2023 | | 5,287,948 | b | 4,970,671 | |

NCI Building Systems, Initial Term Loan, 1 Month LIBOR +3.75% | | 5.95 | | 4/12/2025 | | 5,939,508 | b | 5,798,445 | |

Tamko Building Products, Initial Term Loan, 3 Month LIBOR +3.25% | | 5.48 | | 5/31/2026 | | 5,794,549 | b | 5,809,035 | |

| | 16,578,151 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Chemicals - 2.4% | | | | | |

AgroFresh, Term Loan, 2-3 Month LIBOR +4.75% | | 7.19 | | 7/31/2021 | | 1,876,692 | b | 1,787,549 | |

Colouroz Investment 2, First Lien Initial Term B-2 Loan, 3 Month LIBOR +3.00% | | 5.29 | | 9/7/2021 | | 4,100,717 | b | 3,280,573 | |

Cyanco Intermediate, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 3/16/2025 | | 3,473,917 | b | 3,468,845 | |

Encapsys, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 11/7/2024 | | 4,490,323 | b | 4,496,879 | |

Flint Group, First Lien Initial Term C Loan, 3 Month LIBOR +3.00% | | 5.29 | | 9/7/2021 | | 728,388 | b | 582,711 | |

OCI Partners, Initial Term Loan, 3 Month LIBOR +4.00% | | 6.33 | | 3/13/2025 | | 4,660,714 | b | 4,654,888 | |

Polar US Borrower, Initial Term Loan, 3 Month LIBOR +4.75% | | 7.07 | | 10/16/2025 | | 3,535,995 | b | 3,407,815 | |

| | 21,679,260 | |

Commercial & Professional Services - 8.4% | | | | | |

AVSC Holding, Initial Term Loan, 1-3 Month LIBOR +3.25% | | 5.48 | | 3/1/2025 | | 5,847,559 | b | 5,686,751 | |

AVSC Holding, Second Lien Initial Loan, 3 Month LIBOR +7.25% | | 9.50 | | 9/1/2025 | | 1,061,750 | b | 1,021,934 | |

Camelot Finance, 2017-2 Refinancing Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 10/3/2023 | | 7,546 | b | 7,579 | |

Cast & Crew Payroll, First Lien Initial Term Loan, 1 Month LIBOR +4.00% | | 6.12 | | 2/7/2026 | | 1,374,339 | b | 1,382,070 | |

CHG Healthcare Services, New Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 6/7/2023 | | 4,134,969 | b | 4,109,125 | |

Constellis Holdings, First Lien Initial Term B Loan, 2-3 Month LIBOR +5.00% | | 7.26 | | 4/21/2024 | | 5,243,000 | b | 3,691,963 | |

Creative Artists Agency, Amendment No 7 Refinancing Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 2/15/2024 | | 5,056,420 | b | 5,064,636 | |

Electro Rent, First Lien Initial Term Loan, 3 Month LIBOR +5.00% | | 7.29 | | 1/31/2024 | | 2,475,629 | b | 2,487,239 | |

Employbridge, Refinancing Term Loan, 3 Month LIBOR +4.50% | | 6.83 | | 4/18/2025 | | 2,925,134 | b | 2,922,692 | |

Fort Dearborn Holding, First Lien Initial Term Loan, 1-3 Month LIBOR +4.00% | | 6.29 | | 10/19/2023 | | 2,464,307 | b | 2,424,262 | |

Legalzoom.com, 2018 Term Loan, 1 Month LIBOR +4.50% | | 6.61 | | 11/21/2024 | | 2,388,000 | b | 2,404,418 | |

Lineage Logistics, Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 2/27/2025 | | 3,329,980 | b | 3,325,834 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Commercial & Professional Services - 8.4% (continued) | | | | | |

National Intergovernmental, First Lien Initial Term Loan, 3 Month LIBOR +3.75% | | 6.08 | | 5/23/2025 | | 4,073,632 | b | 4,032,896 | |

Parexel International, Initial Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 9/27/2024 | | 3,638,401 | b | 3,437,961 | |

Pi Lux Finco, Facility B-2 Term Loan, 1 Month EURIBOR +3.00% @ Floor | EUR | 3.00 | | 1/1/2025 | | 2,000,000 | b | 2,186,010 | |

Pi Lux Finco, Second Lien Facility 1 Term Loan, 1 Month LIBOR +7.25% | | 9.36 | | 1/1/2026 | | 1,250,000 | b | 1,218,750 | |

Pre-Paid Legal Services, First Lien Initial Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 5/1/2025 | | 3,788,036 | b | 3,773,831 | |

Swordfish Merger Sub., First Lien Initial Term Loan, 1 Month LIBOR +3.00% | | 5.21 | | 2/1/2025 | | 4,727,028 | b | 4,549,765 | |

Transaction Network Services, Initial Term Loan, 3 Month LIBOR +4.00% | | 6.26 | | 2/14/2020 | | 3,618,472 | b | 3,576,625 | |

USS Ultimate Holdings, First Lien Initial Term Loan, 3 Month LIBOR +3.75% | | 6.01 | | 8/25/2024 | | 3,704,937 | b | 3,702,640 | |

Verscend Holding, Term B Loan, 1 Month LIBOR +4.50% | | 6.61 | | 8/27/2025 | | 4,474,342 | b | 4,496,714 | |

Wand NewCo 3, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.71 | | 2/5/2026 | | 5,590,000 | b | 5,618,816 | |

Weight Watchers International, Initial Term Loan, 1-3 Month LIBOR +4.75% | | 7.03 | | 11/29/2024 | | 5,562,816 | b | 5,583,677 | |

| | 76,706,188 | |

Consumer Discretionary - 3.7% | | | | | |

Ap Gaming, First Lien Incremental Term B Loan, 1 Month LIBOR +3.50% | | 5.61 | | 2/15/2024 | | 5,593,586 | b | 5,511,416 | |

Compuware, Senior Secured Term Loan, 1 Month LIBOR +4.00% | | 6.11 | | 8/23/2025 | | 3,560,837 | b | 3,578,641 | |

Hayward Industries, Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 8/4/2024 | | 5,413,334 | b | 5,217,101 | |

Scientific Games International, Initial Term B-5 Loan, 1-2 Month LIBOR +2.75% | | 4.87 | | 8/14/2024 | | 4,481,099 | b | 4,435,347 | |

Stars Group Holdings, USD Term Loan, 3 Month LIBOR +3.50% | | 5.83 | | 7/10/2025 | | 4,482,904 | b | 4,502,203 | |

UFC Holdings, Term B Loan, 1 Month LIBOR +3.25% | | 5.37 | | 4/29/2026 | | 3,355,622 | b | 3,364,011 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Consumer Discretionary - 3.7% (continued) | | | | | |

Varsity Brands Holding, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 12/15/2024 | | 3,886,171 | b | 3,792,125 | |

William Morris Endeavor, New Term B-1 Loan, 1 Month LIBOR +2.75% | | 4.87 | | 5/29/2025 | | 3,222,230 | b | 3,143,285 | |

| | 33,544,129 | |

Consumer Staples - .4% | | | | | |

Kik Custom Products, Term B-3 Loan, 3 Month LIBOR +4.00% | | 6.26 | | 5/15/2023 | | 4,100,000 | b | 3,901,827 | |

Diversified Financials - 2.5% | | | | | |

Blackhawk Network Holdings, First Lien Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 6/15/2025 | | 6,170,864 | b | 6,134,240 | |

Capital Automotive, Second Lien Initial Tranche B Term Loan, 1 Month LIBOR +6.00% | | 8.12 | | 3/24/2025 | | 1,638,556 | b | 1,648,806 | |

HNC Holdings, Initial Term Loan, 1 Month LIBOR +4.00% | | 6.11 | | 10/5/2023 | | 2,345,939 | b | 2,348,144 | |

Masergy Communications, 2017 First Lien Replacement Term Loan, 3 Month LIBOR +3.25% | | 5.58 | | 12/15/2023 | | 2,789,956 | b | 2,751,594 | |

PGX Holdings, First Lien Initial Term Loan, 1 Month LIBOR +5.25% | | 7.37 | | 9/29/2020 | | 1,635,723 | b | 1,521,222 | |

Pi US Mergerco, Facility B-1 Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 1/1/2025 | | 2,699,469 | b | 2,676,416 | |

VFH Parent, Initial Term Loan, 6 Month LIBOR +3.50% | | 6.04 | | 3/1/2026 | | 5,413,961 | b | 5,432,341 | |

| | 22,512,763 | |

Energy - 4.7% | | | | | |

Blackstone CQP Holdco, Initial Term Loan, 3 Month LIBOR +3.50% | | 5.89 | | 6/20/2024 | | 2,807,775 | b | 2,812,170 | |

Brazos Delaware II, Initial Term Loan, 1 Month LIBOR +4.00% | | 6.17 | | 5/29/2025 | | 4,096,557 | b | 3,700,543 | |

Gavilan Resources, Second Lien Initial Term Loan, 1 Month LIBOR +6.00% | | 8.11 | | 3/1/2024 | | 2,684,000 | b | 1,201,090 | |

GIP III Stetson I, Initial Term Loan, 1 Month LIBOR +4.25% | | 6.43 | | 7/18/2025 | | 5,448,649 | b | 5,257,946 | |

Granite Acquisition, First Lien Term B Loan, 3 Month LIBOR +3.50% | | 5.82 | | 12/17/2021 | | 5,313,397 | b | 5,339,964 | |

Granite Acquisition, First Lien Term C Loan, 3 Month LIBOR +3.50% | | 5.83 | | 12/17/2021 | | 407,516 | b | 409,554 | |

Granite Acquisition, Second Lien Term B Loan, 3 Month LIBOR +7.25% | | 9.58 | | 12/19/2022 | | 469,111 | b | 469,846 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Energy - 4.7% (continued) | | | | | |

Lower Cadence Holdings, Initial Term Loan, 1 Month LIBOR +4.00% | | 6.15 | | 5/8/2026 | | 6,133,792 | b | 5,997,714 | |

Lucid Energy Group II, Initial Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 2/18/2025 | | 5,923,767 | b | 5,490,592 | |

Natgasoline, Initial Term Loan, 3 Month LIBOR +3.50% | | 5.81 | | 11/14/2025 | | 3,537,653 | b | 3,555,342 | |

Prairie Eci Acquiror, Initial Term Loan, 3 Month LIBOR +4.75% | | 7.08 | | 3/11/2026 | | 4,802,963 | b | 4,704,502 | |

WaterBridge Midstream Operating, Initial Term Loan, 3 Month LIBOR +5.75% | | 8.14 | | 6/21/2026 | | 3,890,000 | b | 3,734,400 | |

| | 42,673,663 | |

Environmental Control - 2.5% | | | | | |

EnergySolutions, Initial Term Loan, 3 Month LIBOR +3.75% | | 6.08 | | 5/11/2025 | | 4,964,478 | b | 4,710,048 | |

Filtration Group, Initial Dollar Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 3/29/2025 | | 4,633,356 | b | 4,640,607 | |

GFL Environmental, 2018 Incremental Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 5/31/2025 | | 6,939,358 | b | 6,884,711 | |

Packers Holdings, Initial Term Loan, 6 Month LIBOR +3.00% | | 5.32 | | 12/4/2024 | | 5,671,193 | b | 5,600,303 | |

US Ecology, Term B Loan, 3 Month LIBOR +2.50% | | 4.79 | | 8/14/2026 | | 731,982 | b | 735,872 | |

| | 22,571,541 | |

Food Products - .7% | | | | | |

Albertson's, 2019-1 Term B-7 Loan, 1 Month LIBOR +2.75% | | 4.86 | | 11/17/2025 | | 3,746,241 | b | 3,763,810 | |

UTZ Quality Foods, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 11/21/2024 | | 2,955,000 | b | 2,950,449 | |

| | 6,714,259 | |

Food Service - .7% | | | | | |

TKC Holdings, First Lien Initial Term Loan, 1 Month LIBOR +3.75% | | 5.87 | | 2/1/2023 | | 4,918,676 | b | 4,814,154 | |

TKC Holdings, Second Lien Initial Term Loan, 1 Month LIBOR +8.00% | | 10.12 | | 2/1/2024 | | 1,224,564 | b | 1,203,141 | |

| | 6,017,295 | |

Forest Products & Other - .0% | | | | | |

Dunn Paper, First Lien Term Loan, 1 Month LIBOR +4.75% | | 6.88 | | 8/26/2022 | | 372,544 | b | 370,448 | |

Health Care - 10.9% | | | | | |

Agiliti Health, Term Loan, 1 Month LIBOR +3.00% | | 5.25 | | 1/4/2026 | | 5,908,281 | b | 5,930,437 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Health Care - 10.9% (continued) | | | | | |

Air Medical Group Holdings, 2018 Term Loan, 1 Month LIBOR +3.25% | | 5.43 | | 4/28/2022 | | 6,591,391 | b | 6,245,343 | |

Air Methods, Initial Term Loan, 3 Month LIBOR +3.50% | | 5.83 | | 4/21/2024 | | 5,465,492 | b | 4,543,190 | |

Albany Molecular Research, First Lien Initial Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 8/31/2024 | | 6,532,970 | b | 6,315,226 | |

Alphabet Holding Company, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 9/28/2024 | | 3,733,500 | b | 3,485,390 | |

Alphabet Holding Company, Second Lien Initial Term Loan, 1 Month LIBOR +7.75% | | 9.86 | | 8/15/2025 | | 1,600,000 | b | 1,408,800 | |

Auris Luxembourg III, Facility B2 Term Loan, 1 Month LIBOR +3.75% | | 5.87 | | 2/21/2026 | | 6,633,375 | b | 6,567,705 | |

Avantor Funding, Initial B-2 Dollar Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 11/21/2024 | | 1,809,176 | b | 1,827,648 | |

Bausch Health Americas, First Incremental Term Loan, 1 Month LIBOR +2.75% | | 4.95 | | 11/27/2025 | | 2,507,795 | b | 2,509,989 | |

Bausch Health Americas, Initial Term Loan, 1 Month LIBOR +3.00% | | 5.20 | | 6/1/2025 | | 924,055 | b | 926,832 | |

Dentalcorp Perfect Smile, Initial Term Loan, 1 Month LIBOR +3.75% | | 5.86 | | 6/6/2025 | | 4,510,587 | b | 4,426,014 | |

Envision Healthcare, Initial Term Loan, 1 Month LIBOR +3.75% | | 5.86 | | 10/10/2025 | | 9,822,144 | b | 7,644,231 | |

Femur Buyer, First Lien Initial Term Loan, 3 Month LIBOR +4.50% | | 6.98 | | 3/5/2026 | | 1,402,313 | b | 1,405,819 | |

Immucor, Term Loan B-3, 3 Month LIBOR +5.00% | | 7.33 | | 6/15/2021 | | 4,967,595 | b | 4,960,168 | |

Jaguar Holding Company II, 2018 Term Loan, 1 Month LIBOR +2.50% | | 4.61 | | 8/18/2022 | | 2,238,342 | b | 2,229,019 | |

MED ParentCo, Delayed Draw Term Loan, 3 Month LIBOR +4.25% | | 6.55 | | 8/2/2026 | | 732,739 | b,d | 726,632 | |

MED ParentCo, Term B Loan, 3 Month LIBOR +4.25% | | 6.55 | | 8/2/2026 | | 2,934,428 | b | 2,909,970 | |

MPH Acquisition Holdings, Initial Term Loan, 3 Month LIBOR +2.75% | | 5.08 | | 6/7/2023 | | 3,157,295 | b | 2,944,178 | |

NVA Holdings, First Lien Term B-3 Loan, 1 Month LIBOR +2.75% | | 4.86 | | 2/2/2025 | | 3,024,638 | b | 3,024,698 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Health Care - 10.9% (continued) | | | | | |

Ortho-Clinical Diagnostics, Refinancing Term Loan, 3 Month LIBOR +3.25% | | 5.56 | | 6/1/2025 | | 6,113,250 | b | 5,782,768 | |

Petvet Care Centers, Delayed Draw First Lien Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 2/14/2025 | | 900,396 | b,d | 871,696 | |

Petvet Care Centers, First Lien Initial Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 2/14/2025 | | 3,042,647 | b | 2,945,663 | |

Petvet Care Centers, Second Lien Initial Term Loan, 1 Month LIBOR +6.25% | | 8.36 | | 2/15/2026 | | 1,488,652 | b | 1,451,436 | |

Sound Inpatient Physicians, First Lien Initial Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 6/28/2025 | | 447,468 | b | 444,392 | |

Surgery Center Holdings, Initial Term Loan, 1 Month LIBOR +3.25% | | 5.37 | | 8/31/2024 | | 7,167,896 | b | 6,863,261 | |

US Anesthesia Partners, First Lien Initial Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 6/23/2024 | | 4,854,760 | b | 4,671,493 | |

Wink Holdco, First Lien Initial Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 12/1/2024 | | 5,719,062 | b | 5,583,263 | |

| | 98,645,261 | |

Industrials - 5.5% | | | | | |

AI Alpine US Bidco, Facility B Term Loan, 1 Month LIBOR +2.75% | | 4.99 | | 11/6/2025 | | 5,591,719 | b | 5,465,905 | |

Brand Industrial Service, Initial Term Loan, 2-3 Month LIBOR +4.25% | | 6.53 | | 6/21/2024 | | 5,692,956 | b | 5,408,308 | |

Brookfield WEC Holdings, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 8/1/2025 | | 248,590 | b | 249,212 | |

Dynasty Acquisition Company I, Initial Term B-1 Loan, 3 Month LIBOR +4.00% | | 6.33 | | 4/8/2026 | | 2,466,463 | b | 2,470,212 | |

Dynasty Acquisition Company I, Initial Term B-2 Loan, 3 Month LIBOR +4.00% | | 6.33 | | 4/4/2026 | | 1,326,055 | b | 1,328,071 | |

Engineered Machinery Holdings , First Lien Initial Term Loan, 3 Month LIBOR +3.25% | | 5.58 | | 7/19/2024 | | 2,738,325 | b | 2,657,886 | |

North American Lifting Holdings, First Lien Initial Term Loan, 3 Month LIBOR +4.50% | | 6.83 | | 11/27/2020 | | 2,820,828 | b | 2,631,310 | |

Restaurant Technologies, First Lien Initial Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 10/1/2025 | | 2,316,037 | b | 2,318,932 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Industrials - 5.5% (continued) | | | | | |

Titan Acquisition, Initial Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 3/28/2025 | | 6,024,941 | b | 5,794,005 | |

Travelport Finance, First Lien Initial Term Loan, 3 Month LIBOR +5.00% | | 7.54 | | 5/30/2026 | | 5,608,163 | b | 5,179,139 | |

USIC Holdings, Term B Loan, 1 Month LIBOR +3.00% | | 5.11 | | 12/9/2023 | | 3,041,187 | b,d | 3,009,498 | |

VAC Germany Holding, Term B Loan, 3 Month LIBOR +4.00% | | 6.33 | | 3/18/2025 | | 3,061,250 | b | 3,045,944 | |

Ventia Deco, 2019 Refinancing Term B Loan, 3 Month LIBOR +3.50% | | 5.84 | | 5/21/2026 | | 1,567,568 | b | 1,569,527 | |

Verra Mobility, First Lien Initial Term Loan, 1 Month LIBOR +3.75% | | 5.86 | | 2/28/2025 | | 4,301,781 | b | 4,323,290 | |

Yak Access, First Lien Initial Term Loan, 1 Month LIBOR +5.00% | | 7.11 | | 7/11/2025 | | 5,200,625 | b | 4,823,580 | |

| | 50,274,819 | |

Information Technology - 8.4% | | | | | |

Boxer Parent Company, Initial Dollar Term Loan, 3 Month LIBOR +4.25% | | 6.58 | | 10/2/2025 | | 4,848,306 | b | 4,605,891 | |

Capri Acquisitions BidCo, Initial Dollar Term Loan, 3 Month LIBOR +3.25% | | 5.51 | | 11/30/2024 | | 4,573,361 | b | 4,493,350 | |

Dcert Buyer, Term Loan, 3 Month LIBOR +4.00% | | 6.26 | | 8/8/2026 | | 5,274,115 | b | 5,263,119 | |

Digicert Holdings, First Lien Term Loan, 1 Month LIBOR +4.00% | | 6.11 | | 10/31/2024 | | 6,392,518 | b | 6,402,107 | |

Dun & Bradstreet, Initial Term Loan, 1 Month LIBOR +5.00% | | 7.15 | | 2/8/2026 | | 6,303,322 | b | 6,327,621 | |

Dynatrace, Senior Secured First Lien Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 8/23/2025 | | 828,422 | b | 829,975 | |

Emerald TopCo, First Lien Initial Term Loan, 1 Month LIBOR +3.50% | | 5.73 | | 7/26/2026 | | 1,556,357 | b | 1,550,847 | |

Finastra USA, First Lien Dollar Term Loan, 6 Month LIBOR +3.50% | | 5.70 | | 6/16/2024 | | 6,825,224 | b | 6,599,616 | |

Greeneden US Holdings II, Tranche B-3 Dollar Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 12/1/2023 | | 8,204,626 | b | 8,130,784 | |

Hyland Software, 2018 Refinancing Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 7/1/2024 | | 6,080,588 | b | 6,067,301 | |

Hyland Software, Senior Secured Second Lien Initial Term Loan, 1 Month LIBOR +7.00% | | 9.11 | | 7/10/2025 | | 1,375,000 | b | 1,383,168 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Information Technology - 8.4% (continued) | | | | | |

Marcel Bidco, Facility B1 Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 3/15/2026 | | 2,862,802 | b | 2,821,650 | |

Mitchell International, First Lien Initial Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 12/1/2024 | | 4,196,505 | b | 3,942,617 | |

Quest Software US Holdings, First Lien Initial Term Loan, 3 Month LIBOR +4.25% | | 6.51 | | 5/18/2025 | | 7,071,225 | b | 6,905,511 | |

RP Crown Parent, Initial Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 10/12/2023 | | 2,828,525 | b | 2,827,818 | |

SCS Holdings I, Initial Term Loan, 3 Month LIBOR +4.25% | | 6.57 | | 7/3/2026 | | 4,820,943 | b | 4,828,463 | |

Ultimate Software Group, First Lien Initial Term Loan, 3 Month LIBOR +3.75% | | 6.08 | | 5/3/2026 | | 3,503,641 | b | 3,516,780 | |

| | 76,496,618 | |

Insurance - 5.7% | | | | | |

Alliant Holdings Intermediate, 2018 Initial Term Loan, 1 Month LIBOR +3.00% | | 5.15 | | 5/10/2025 | | 4,511,606 | b | 4,410,095 | |

AssuredPartners, 2017 September Refinancing Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 10/22/2024 | | 6,567,184 | b | 6,546,070 | |

Asurion, New B-7 Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 11/3/2024 | | 1,738,712 | b | 1,741,607 | |

Asurion, Replacement B-6 Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 11/3/2023 | | 997,763 | b | 999,454 | |

Asurion, Second Lien Replacement B-2 Term Loan, 1 Month LIBOR +6.50% | | 8.61 | | 8/4/2025 | | 8,722,453 | b | 8,865,894 | |

HUB International , Initial Term Loan, 3 Month LIBOR +3.00% | | 5.27 | | 4/25/2025 | | 5,502,044 | b | 5,401,989 | |

Mayfield Agency Borrower, First Lien Term B Loan, 1 Month LIBOR +4.50% | | 6.61 | | 2/28/2025 | | 5,823,928 | b | 5,576,411 | |

Mayfield Agency Borrower, Second Lien Term B Loan, 1 Month LIBOR +8.50% | | 10.61 | | 2/28/2026 | | 1,891,367 | b | 1,861,814 | |

Sedgwick Cms, Term B Loan, 3 Month LIBOR +4.00% | | 6.26 | | 8/8/2026 | | 1,283,784 | b | 1,285,389 | |

Sedgwick Cms, Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 12/31/2025 | | 5,623,183 | b | 5,466,549 | |

USI, Term B Loan, 3 Month LIBOR +3.00% | | 5.33 | | 5/16/2024 | | 5,212,506 | b | 5,097,414 | |

York Risk Services Holding, Term Loan, 1 Month LIBOR +3.75% | | 5.86 | | 10/1/2021 | | 4,217,510 | b | 4,216,181 | |

| | 51,468,867 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Internet Software & Services - 2.8% | | | | | |

ION Trading Finance, Initial Dollar Term Loan, 3 Month LIBOR +4.00% | | 6.65 | | 11/21/2024 | | 3,495,199 | b | 3,369,966 | |

ION Trading Finance, Initial Euro Term Loan, 3 Month EURIBOR +3.25% | EUR | 4.25 | | 11/21/2024 | | 1,662,461 | b | 1,800,406 | |

Rodan & Fields, Closing Date Term Loan, 1 Month LIBOR +4.00% | | 6.20 | | 6/7/2025 | | 5,338,323 | b | 4,663,025 | |

Trader, Senior Secured First Lien Term Loan, 1 Month LIBOR +3.00% | | 5.15 | | 9/28/2023 | | 5,429,841 | b | 5,375,543 | |

Web.com Group, First Lien Initial Term Loan, 1 Month LIBOR +3.75% | | 5.95 | | 10/11/2025 | | 5,475,163 | b | 5,415,839 | |

Web.com Group, Second Lien Initial Term Loan, 1 Month LIBOR +7.75% | | 9.95 | | 10/11/2026 | | 675,516 | b | 663,131 | |

WeddingWire, First Lien Initial Term Loan, 1 Month LIBOR +4.50% | | 6.61 | | 12/21/2025 | | 3,794,267 | b | 3,803,752 | |

| | 25,091,662 | |

Materials - 6.5% | | | | | |

Ball Metalpack Finco, First Lien Initial Term Loan, 1 Month LIBOR +4.50% | | 6.62 | | 7/31/2025 | | 4,880,013 | b | 4,751,912 | |

Berlin Packaging, First Lien Initial Term Loan, 1-3 Month LIBOR +3.00% | | 5.22 | | 11/7/2025 | | 5,919,525 | b | 5,830,732 | |

BWAY, Initial Term Loan, 3 Month LIBOR +3.25% | | 5.59 | | 4/3/2024 | | 2,879,485 | b | 2,806,000 | |

Charter NEX US, Incremental Term Loan, 1 Month LIBOR +3.50% | | 5.61 | | 5/16/2024 | | 5,531,978 | b | 5,534,578 | |

Circor international, Initial Term Loan, 1 Month LIBOR +3.50% | | 5.70 | | 12/11/2024 | | 4,544,232 | b | 4,528,145 | |

Flex Acquisition Company, Incremental B-2018 Term Loan, 3 Month LIBOR +3.25% | | 5.57 | | 6/29/2025 | | 3,804,856 | b | 3,643,149 | |

Form Technologies, First Lien Term B-1 Loan, 3 Month LIBOR +3.25% | | 5.58 | | 1/28/2022 | | 4,752,566 | b | 4,574,345 | |

LABL, Initial Dollar Term Loan, 1 Month LIBOR +4.50% | | 6.73 | | 7/2/2026 | | 3,041,601 | b | 3,041,601 | |

Murray Energy, Superpriority Term B-2 Loan, 1 Month LIBOR +7.25% | | 9.36 | | 10/17/2022 | | 4,156,377 | b | 2,060,379 | |

Oxbow Carbon , First Lien Tranche B Term Loan, 1 Month LIBOR +3.75% | | 5.86 | | 1/4/2023 | | 3,843,871 | b | 3,836,664 | |

19

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Materials - 6.5% (continued) | | | | | |

Plaze, Initial Term Loan, 1 Month LIBOR +3.50% | | 5.73 | | 8/3/2026 | | 1,793,807 | b | 1,789,448 | |

Reynolds Group Holdings, Incremental U.S. Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 2/5/2023 | | 4,979,579 | b | 4,982,691 | |

Tecomet, 2017 First Lien Term Loan, 1 Month LIBOR +3.25% | | 5.45 | | 5/1/2024 | | 6,298,875 | b | 6,255,602 | |

TricorBraun, First Lien Closing Date Term Loan, 2-3 Month LIBOR +3.75% | | 6.07 | | 11/30/2023 | | 5,814,998 | b | 5,684,161 | |

| | 59,319,407 | |

Media - 6.0% | | | | | |

CSC Holdings, February 2019 Incremental Term Loan, 1 Month LIBOR +3.00% | | 5.20 | | 4/15/2027 | | 5,920,058 | b | 5,950,398 | |

CSC Holdings, October 2018 Incremental Term Loan, 1 Month LIBOR +2.25% | | 4.45 | | 1/15/2026 | | 1,915,188 | b | 1,909,605 | |

Diamond Sports Group, Term Loan, 1 Month LIBOR +3.25% | | 5.42 | | 8/24/2026 | | 3,855,585 | b | 3,864,414 | |

EW Scripps, Tranche B-1 Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 5/1/2026 | | 2,121,499 | b | 2,125,265 | |

ION Media Networks, Term B-4 Loan, 1 Month LIBOR +3.00% | | 5.13 | | 12/18/2024 | | 4,900,000 | b | 4,898,751 | |

NEP Group, First Lien Initial Dollar Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 10/20/2025 | | 4,434,350 | b | 4,339,012 | |

NEP Group, Second Lien Initial Loan, 1 Month LIBOR +7.00% | | 9.11 | | 10/19/2026 | | 1,158,101 | b | 1,140,729 | |

Nexstar Broadcasting, Term B Loan, 3 Month LIBOR +2.75% | | 4.87 | | 6/20/2026 | | 6,311,856 | b | 6,323,122 | |

Radiate Holdco, Closing Date Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 2/1/2024 | | 7,839,443 | b | 7,777,394 | |

Townsquare Media, Facility B Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 4/1/2022 | | 3,791,591 | b | 3,791,591 | |

Univision Communications, 2017 Replacement Term Loan, 1 Month LIBOR +2.75% | | 4.86 | | 3/15/2024 | | 6,337,680 | b | 6,100,017 | |

WideOpenWest Finance, Refinancing Term B Loan, 3 Month LIBOR +3.25% | | 5.40 | | 8/19/2023 | | 6,232,727 | b | 6,014,581 | |

| | 54,234,879 | |

Metals & Mining - .4% | | | | | |

Big River Steel, Closing Date Term Loan, 3 Month LIBOR +5.00% | | 7.33 | | 8/23/2023 | | 3,353,764 | b | 3,368,436 | |

20

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Real Estate - .9% | | | | | |

DTZ US Borrower, Closing Date Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 8/21/2025 | | 4,664,750 | b | 4,577,286 | |

Ggp Nimbus, Initial Term B Loan, 1 Month LIBOR +2.50% | | 4.61 | | 8/24/2025 | | 3,907,159 | b | 3,814,364 | |

| | 8,391,650 | |

Retailing - 2.6% | | | | | |

Bass Pro Group, Initial Term Loan, 1 Month LIBOR +5.00% | | 7.11 | | 9/25/2024 | | 6,517,156 | b | 6,232,030 | |

Comfort Holding, First Lien Initial Term Loan, 1 Month LIBOR +4.75% | | 6.86 | | 2/3/2024 | | 2,688,125 | b | 2,667,964 | |

EG America, Additional Facility Loan, 3 Month LIBOR +4.00% | | 6.33 | | 2/5/2025 | | 1,739,812 | b | 1,719,430 | |

Foundation Building Materials, Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 8/13/2025 | | 3,928,941 | b | 3,928,960 | |

Leslie's Poolmart, Tranche B-2 Term Loan, 2 Month LIBOR +3.50% | | 5.76 | | 8/16/2023 | | 2,449,731 | b | 2,300,456 | |

SRS Distribution, Initial Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 5/24/2025 | | 3,890,700 | b | 3,785,651 | |

Staples, 2019 Refinancing New Term B-1 Loan, 1 Month LIBOR +5.00% | | 7.20 | | 4/12/2026 | | 938,481 | b | 905,635 | |

Talbots, First Lien Initial Term Loan, 3 Month LIBOR +7.00% | | 9.33 | | 11/28/2022 | | 1,833,680 | b | 1,778,670 | |

| | 23,318,796 | |

Semiconductors & Semiconductor Equipment - .4% | | | | | |

Natel Engineering, Initial Term Loan, 1 Month LIBOR +5.00% | | 7.12 | | 4/30/2026 | | 3,364,937 | b | 3,373,350 | |

Technology Hardware & Equipment - 3.4% | | | | | |

Everi Payments, New Term Loan B, 1 Month LIBOR +3.00% | | 5.11 | | 5/9/2024 | | 7,296,031 | b | 7,306,975 | |

Mcafee, Second Lien Initial Loan, 1 Month LIBOR +8.50% | | 10.62 | | 9/28/2025 | | 1,742,045 | b | 1,765,459 | |

McAfee, Term B USD Loan, 1 Month LIBOR +3.75% | | 5.87 | | 9/29/2024 | | 5,743,022 | b | 5,764,558 | |

Perforce Software, First Lien Term Loan, 1 Month LIBOR +4.50% | | 6.61 | | 7/8/2026 | | 2,900,000 | b | 2,892,765 | |

Sandvine, First Lien Initial Term Loan, 1 Month LIBOR +4.50% | | 6.61 | | 11/2/2025 | | 4,151,975 | b | 4,141,595 | |

Tempo Acquisition, Initial Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 5/1/2024 | | 5,181,287 | b | 5,188,851 | |

21

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 91.2%(continued) | | | | | |

Technology Hardware & Equipment - 3.4% (continued) | | | | | |

VeriFone Systems, First Lien Initial Term Loan, 3 Month LIBOR +4.00% | | 6.14 | | 8/20/2025 | | 4,228,697 | b | 4,065,892 | |

| | 31,126,095 | |

Telecommunication Services - 4.5% | | | | | |

Altice France, Incremental Term B-13 Loan, 1 Month LIBOR +4.00% | | 6.20 | | 8/14/2026 | | 8,351,054 | b | 8,330,177 | |

CenturyLink, Initial Term A Loan, 1 Month LIBOR +2.75% | | 4.86 | | 9/30/2022 | | 2,083,265 | b | 2,086,848 | |

CenturyLink, Initial Term B Loan, 1 Month LIBOR +2.75% | | 4.86 | | 1/31/2025 | | 3,972,317 | b | 3,922,048 | |

CommScope, Initial Term Loan, 1 Month LIBOR +3.25% | | 5.36 | | 4/4/2026 | | 4,105,043 | b | 4,093,077 | |

Cyxtera DC Holdings, First Lien Initial Term Loan, 1 Month LIBOR +3.00% | | 5.21 | | 5/1/2024 | | 3,890,076 | b | 3,656,672 | |

Intelsat Jackson Holdings, Tranche B-3 Term Loan, 1 Month LIBOR +3.75% | | 5.90 | | 11/27/2023 | | 2,230,000 | b | 2,232,788 | |

Intelsat Jackson Holdings, Tranche B-4 Term Loan, 1 Month LIBOR +4.50% | | 6.65 | | 1/2/2024 | | 3,619,048 | b | 3,649,031 | |

MTN Infrastructure TopCo , Initial Term Loan, 1 Month LIBOR +3.00% | | 5.11 | | 11/17/2024 | | 3,527,068 | b | 3,472,698 | |

Tech Finance & Company, First Incremental U.S. Term Loan, 3 Month LIBOR +2.75% | | 4.87 | | 12/31/2023 | | 2,340,000 | b | 2,097,225 | |

West, Initial Term Loan B, 1 Month LIBOR +4.00% | | 6.11 | | 10/10/2024 | | 8,014,704 | b | 7,200,370 | |

| | 40,740,934 | |

Utilities - 2.4% | | | | | |

Eastern Power, Term B Loan, 1 Month LIBOR +3.75% | | 5.86 | | 10/2/2023 | | 7,523,754 | b | 7,559,529 | |

EFS Cogen Holdings I, Advance Term Loan B, 1-3 Month LIBOR +3.25% | | 5.48 | | 6/28/2023 | | 5,037,674 | b | 5,027,599 | |

Helix Gen Funding, Term Loan, 1 Month LIBOR +3.75% | | 5.86 | | 6/3/2024 | | 6,961,994 | b | 6,681,321 | |

Pike, 2019 New Term Loan, 3 Month LIBOR +3.25% | | 5.40 | | 7/24/2026 | | 2,661,902 | b | 2,666,879 | |

| | 21,935,328 | |

TotalFloating Rate Loan Interests

(cost $847,783,018) | | 827,837,043 | |

22

| | | | | | | | | | |

| |

Description | 1-Day

Yield (%) | | | | Shares | | Value ($) | |

Investment Companies - 3.4% | | | | | |

Registered Investment Companies - 3.4% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund

(cost $30,794,018) | | 2.09 | | | | 30,794,018 | e | 30,794,018 | |

Total Investments(cost $935,434,085) | | 100.5% | 912,231,536 | |

Liabilities, Less Cash and Receivables | | (0.5%) | (4,420,547) | |

Net Assets | | 100.0% | 907,810,989 | |

EURIBOR—Euro Interbank Offered Rate

LIBOR—London Interbank Offered Rate

EUR—Euro

a Amount stated in U.S. Dollars unless otherwise noted above.

b Variable rate security—rate shown is the interest rate in effect at period end.

c Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At August 31, 2019, these securities were valued at $50,589,225 or 5.57% of net assets.

d Investment, or portion of investment, represents an unfunded floating note loan interest outstanding.

e Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited)† | Value (%) |

Consumer, Non-cyclical | 20.9 |

Industrial | 15.7 |

Communications | 15.0 |

Technology | 12.2 |

Financial | 9.6 |

Consumer, Cyclical | 8.6 |

Energy | 5.6 |

Collateralized Loan Obligations | 3.7 |

Investment Companies | 3.4 |

Basic Materials | 2.8 |

Utilities | 2.4 |

Diversified | .6 |

| | 100.5 |

† Based on net assets.

See notes to financial statements.

23

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Investment Companies | Value

8/31/18 ($) | Purchases ($) | Sales ($) | Value

8/31/19 ($) | Net

Assets (%) | Dividends/

Distributions ($) |

Registered Investment Companies; | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund | 123,778,748 | 477,168,137 | 570,152,867 | 30,794,018 | 3.4 | 653,523 |

See notes to financial statements.

24

STATEMENT OF FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTSAugust 31, 2019

| | | | | | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation ($) |

Citigroup | | | |

United States Dollar | 11,251,327 | Euro | 10,055,000 | 9/19/19 | 183,500 |

Gross Unrealized Appreciation | | | 183,500 |

See notes to financial statements.

25

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2019

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments | | | |

Unaffiliated issuers | 904,640,067 | | 881,437,518 | |

Affiliated issuers | | 30,794,018 | | 30,794,018 | |

Cash | | | | | 2,610,966 | |

Cash denominated in foreign currency | | | 69,000 | | 68,244 | |

Receivable for investment securities sold | | 14,791,507 | |

Interest receivable | | 3,376,782 | |

Receivable for shares of Common Stock subscribed | | 577,661 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | 183,500 | |

Prepaid expenses | | | | | 75,665 | |

| | | | | 933,915,861 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 515,305 | |

Payable for investment securities purchased | | 22,134,393 | |

Payable for shares of Common Stock redeemed | | 3,323,139 | |

Unrealized depreciation on foreign currency transactions | | 36,263 | |

Directors fees and expenses payable | | 14,330 | |

Other accrued expenses | | | | | 81,442 | |

| | | | | 26,104,872 | |

Net Assets ($) | | | 907,810,989 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 982,160,616 | |

Total distributable earnings (loss) | | | | | (74,349,627) | |

Net Assets ($) | | | 907,810,989 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 26,637,273 | 1,745,188 | 89,077,745 | 790,350,783 | |

Shares Outstanding | 2,288,271 | 150,044 | 7,667,840 | 68,121,168 | |

Net Asset Value Per Share ($) | 11.64 | 11.63 | 11.62 | 11.60 | |

| | | | | |

See notes to financial statements. | | | | | |

26

STATEMENT OF OPERATIONS

Year Ended August 31, 2019

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest | | | 64,499,007 | |

Dividends: | |

Unaffiliated issuers | | | 469,308 | |

Affiliated issuers | | | 653,523 | |

Total Income | | | 65,621,838 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 6,790,087 | |

Shareholder servicing costs—Note 3(c) | | | 215,177 | |

Professional fees | | | 190,076 | |

Loan commitment fees—Note 2 | | | 187,462 | |

Registration fees | | | 115,689 | |

Directors’ fees and expenses—Note 3(d) | | | 85,962 | |

Interest expense—Note 2 | | | 60,184 | |

Prospectus and shareholders’ reports | | | 43,629 | |

Distribution fees—Note 3(b) | | | 14,499 | |

Custodian fees—Note 3(c) | | | 2,117 | |

Miscellaneous | | | 155,920 | |

Total Expenses | | | 7,860,802 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (82,883) | |

Net Expenses | | | 7,777,919 | |

Investment Income—Net | | | 57,843,919 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | (30,279,123) | |

Net realized gain (loss) on forward foreign currency exchange contracts | 2,748,542 | |

Net Realized Gain (Loss) | | | (27,530,581) | |

Net change in unrealized appreciation (depreciation) on investments

and foreign currency transactions | (18,957,354) | |

Net change in unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | (57,656) | |

Net Change in Unrealized Appreciation (Depreciation) | | | (19,015,010) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (46,545,591) | |

Net Increase in Net Assets Resulting from Operations | | 11,298,328 | |

| | | | | | |

See notes to financial statements. | | | | | |

27

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2019 | | 2018 | a |

Operations ($): | | | | | | | | |

Investment income—net | | | 57,843,919 | | | | 46,324,063 | |

Net realized gain (loss) on investments | | (27,530,581) | | | | (2,954,359) | |

Net change in unrealized appreciation

(depreciation) on investments | | (19,015,010) | | | | (6,417,711) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 11,298,328 | | | | 36,951,993 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (1,679,274) | | | | (726,137) | |

Class C | | | (85,597) | | | | (68,485) | |

Class I | | | (4,688,673) | | | | (884,361) | |

Class Y | | | (51,412,650) | | | | (40,747,816) | |

Total Distributions | | | (57,866,194) | | | | (42,426,799) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 34,374,692 | | | | 12,526,410 | |

Class C | | | 329,060 | | | | 431,944 | |

Class I | | | 132,123,681 | | | | 30,962,912 | |

Class Y | | | 252,993,193 | | | | 352,642,182 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 1,545,400 | | | | 712,848 | |

Class C | | | 78,330 | | | | 65,581 | |

Class I | | | 4,587,775 | | | | 762,556 | |

Class Y | | | 16,002,358 | | | | 12,908,518 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (27,121,646) | | | | (8,449,840) | |

Class C | | | (758,678) | | | | (974,115) | |

Class I | | | (63,298,464) | | | | (31,783,402) | |

Class Y | | | (557,482,921) | | | | (116,114,361) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (206,627,220) | | | | 253,691,233 | |

Total Increase (Decrease) in Net Assets | (253,195,086) | | | | 248,216,427 | |

Net Assets ($): | |

Beginning of Period | | | 1,161,006,075 | | | | 912,789,648 | |

End of Period | | | 907,810,989 | | | | 1,161,006,075 | |

28

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2019 | | 2018 | a |

Capital Share Transactions (Shares): | |

Class Ab,c | | | | | | | | |

Shares sold | | | 2,870,308 | | | | 1,033,381 | |

Shares issued for distributions reinvested | | | 131,536 | | | | 58,986 | |

Shares redeemed | | | (2,300,930) | | | | (698,732) | |

Net Increase (Decrease) in Shares Outstanding | 700,914 | | | | 393,635 | |

Class Cc | | | | | | | | |

Shares sold | | | 28,089 | | | | 35,761 | |

Shares issued for distributions reinvested | | | 6,673 | | | | 5,430 | |

Shares redeemed | | | (64,354) | | | | (80,554) | |

Net Increase (Decrease) in Shares Outstanding | (29,592) | | | | (39,363) | |

Class Ib | | | | | | | | |

Shares sold | | | 11,156,737 | | | | 2,559,900 | |

Shares issued for distributions reinvested | | | 392,325 | | | | 63,235 | |

Shares redeemed | | | (5,398,520) | | | | (2,632,716) | |

Net Increase (Decrease) in Shares Outstanding | 6,150,542 | | | | (9,581) | |

Class Yb | | | | | | | | |

Shares sold | | | 21,482,432 | | | | 29,213,576 | |

Shares issued for distributions reinvested | | | 1,365,469 | | | | 1,071,834 | |

Shares redeemed | | | (47,909,547) | | | | (9,627,009) | |

Net Increase (Decrease) in Shares Outstanding | (25,061,646) | | | | 20,658,401 | |

| | | | | | | | | |

a Distributions to shareholders include only distributions from net investment income. Undistributed investment income-net was $7,396,559 in 2018 and is no longer presented as a result of the adoption of SEC’s Disclosure Update and Simplification Rule. | |

b During the period ended August 31, 2019, 973,505 Class Y shares representing $11,473,584 were exchanged for 973,158 Class I shares, 986 Class A shares representing $11,661 were exchanged for 988 Class I shares and during the period ended August 31, 2018, 833,605 Class Y shares representing $10,051,397 were exchanged for 832,612 Class I shares. | |

c During the period ended August 31, 2018, 2,502 Class C shares representing $30,272 were automatically converted to 2,498 Class A shares. | |

See notes to financial statements.

| | | | | | | | |

29

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | |

| | | Year Ended August 31, |

Class A Shares | | 2019 | 2018 | 2017 | 2016 | 2015 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.07 | 12.13 | 12.06 | 12.29 | 12.64 |

Investment Operations: | | | | | | |

Investment income—neta | | .65 | .51 | .44 | .47 | .48 |

Net realized and unrealized

gain (loss) on investments | | (.47) | (.11) | .05 | (.21) | (.33) |

Total from Investment Operations | | .18 | .40 | .49 | .26 | .15 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.61) | (.46) | (.42) | (.49) | (.48) |

Dividends from net realized

gain on investments | | - | - | - | - | (.02) |

Total Distributions | | (.61) | (.46) | (.42) | (.49) | (.50) |

Net asset value, end of period | | 11.64 | 12.07 | 12.13 | 12.06 | 12.29 |

Total Return (%)b | | 1.59 | 3.38 | 4.14 | 2.23 | 1.28 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.12 | .99 | 1.02 | 1.04 | 1.04 |

Ratio of net expenses

to average net assets | | 1.02 | .99 | 1.02 | 1.04 | 1.04 |

Ratio of net investment income

to average net assets | | 5.26 | 4.19 | 3.61 | 3.98 | 3.88 |

Portfolio Turnover Rate | | 86.44 | 91.78 | 97.82 | 66.45 | 76.63 |

Net Assets, end of period ($ x 1,000) | | 26,637 | 19,165 | 14,483 | 7,210 | 7,824 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

30

| | | | | | | |

| | | |

| | | Year Ended August 31, |

Class C Shares | | 2019 | 2018 | 2017 | 2016 | 2015 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.06 | 12.11 | 12.04 | 12.28 | 12.63 |

Investment Operations: | | | | | | |

Investment income—neta | | .54 | .41 | .35 | .38 | .39 |

Net realized and unrealized

gain (loss) on investments | | (.45) | (.10) | .05 | (.22) | (.33) |

Total from Investment Operations | | .09 | .31 | .40 | .16 | .06 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.52) | (.36) | (.33) | (.40) | (.39) |

Dividends from net realized

gain on investments | | - | - | - | - | (.02) |

Total Distributions | | (.52) | (.36) | (.33) | (.40) | (.41) |

Net asset value, end of period | | 11.63 | 12.06 | 12.11 | 12.04 | 12.28 |

Total Return (%)b | | .82 | 2.62 | 3.38 | 1.43 | .47 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.80 | 1.78 | 1.81 | 1.84 | 1.84 |

Ratio of net expenses

to average net assets | | 1.77 | 1.75 | 1.78 | 1.80 | 1.80 |

Ratio of net investment income

to average net assets | | 4.52 | 3.40 | 2.85 | 3.22 | 3.11 |

Portfolio Turnover Rate | | 86.44 | 91.78 | 97.82 | 66.45 | 76.63 |

Net Assets, end of period ($ x 1,000) | | 1,745 | 2,166 | 2,652 | 1,952 | 803 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

31

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended August 31, |

Class I Shares | | 2019 | 2018 | 2017 | 2016 | 2015 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.05 | 12.11 | 12.05 | 12.28 | 12.62 |

Investment Operations: | | | | | | |

Investment income—neta | | .68 | .54 | .47 | .50 | .56 |

Net realized and unrealized

gain (loss) on investments | | (.47) | (.10) | .05 | (.20) | (.36) |

Total from Investment Operations | | .21 | .44 | .52 | .30 | .20 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.64) | (.50) | (.46) | (.53) | (.52) |

Dividends from net realized

gain on investments | | - | - | - | - | (.02) |

Total Distributions | | (.64) | (.50) | (.46) | (.53) | (.54) |

Net asset value, end of period | | 11.62 | 12.05 | 12.11 | 12.05 | 12.28 |

Total Return (%) | | 1.78 | 3.68 | 4.47 | 2.49 | 1.58 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .82 | .77 | .80 | .81 | .77 |

Ratio of net expenses

to average net assets | | .77 | .75 | .78 | .80 | .77 |

Ratio of net investment income

to average net assets | | 5.58 | 4.45 | 3.87 | 4.22 | 4.19 |

Portfolio Turnover Rate | | 86.44 | 91.78 | 97.82 | 66.45 | 76.63 |

Net Assets, end of period ($ x 1,000) | | 89,078 | 18,280 | 18,492 | 12,845 | 10,187 |

a Based on average shares outstanding.

See notes to financial statements.

32

| | | | | | | |

| | | |

| | | Year Ended August 31, |

Class Y Shares | | 2019 | 2018 | 2017 | 2016 | 2015 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.03 | 12.09 | 12.03 | 12.27 | 12.63 |

Investment Operations: | | | | | | |

Investment income—neta | | .66 | .54 | .47 | .51 | .51 |

Net realized and unrealized

gain (loss) on investments | | (.44) | (.10) | .05 | (.22) | (.32) |

Total from Investment Operations | | .22 | .44 | .52 | .29 | (.19) |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.65) | (.50) | (.46) | (.53) | (.53) |

Dividends from net realized

gain on investments | | - | - | - | - | (.02) |

Total Distributions | | (.65) | (.50) | (.46) | (.53) | (.55) |

Net asset value, end of period | | 11.60 | 12.03 | 12.09 | 12.03 | 12.27 |

Total Return (%) | | 1.90 | 3.60 | 4.51 | 2.54 | 1.56 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .73 | .72 | .74 | .76 | .75 |

Ratio of net expenses

to average net assets | | .73 | .72 | .74 | .76 | .75 |

Ratio of net investment income

to average net assets | | 5.55 | 4.46 | 3.91 | 4.27 | 4.14 |

Portfolio Turnover Rate | | 86.44 | 91.78 | 97.82 | 66.45 | 76.63 |

Net Assets, end of period ($ x 1,000) | | 790,351 | 1,121,392 | 877,163 | 481,579 | 490,699 |

a Based on average shares outstanding.

See notes to financial statements.

33

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Floating Rate Income Fund (the “fund”) is a separate non-diversified series of BNY Mellon Investment Fund IV, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering six series, including the fund. The fund’s investment objective is to seek high current income. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Alcentra NY, LLC (the “Sub-Adviser”), a wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s sub-investment adviser.

Effective June 3, 2019, the fund changed its name from Dreyfus Floating Rate Income Fund to BNY Mellon Floating Rate Income Fund and the Company changed its name from The Dreyfus/Laurel Funds, Inc. to BNY Mellon Investment Fund IV, Inc. In addition, The Dreyfus Corporation, the fund’s investment adviser, changed its name to “BNY Mellon Investment Adviser, Inc.”, MBSC Securities Corporation, the fund’s distributor, changed its name to “BNY Mellon Securities Corporation” and Dreyfus Transfer, Inc., the fund’s transfer agent, changed its name to “BNY Mellon Transfer, Inc.”

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 500 million shares of $.001 par value Common Stock. The fund currently has authorized five classes of shares: Class A (75 million shares authorized), Class C (75 million shares authorized), Class I (75 million shares authorized), Class T (75 million shares authorized) and Class Y (200 million shares authorized). Class A, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A and Class T shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares ten years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of the Adviser, and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share

34

generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. As of the date of this report, the fund did not offer Class T shares for purchase. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

35

NOTES TO FINANCIAL STATEMENTS(continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).