We are pleased to present this annual report for Dreyfus Floating Rate Income Fund, covering the 12-month period from September 1, 2017 through August 31, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The 12-month period started on solid footing which gave way to a shifting landscape. Through February of 2018, major global economies appeared to be in lock-step as they moved towards less accommodative monetary policy and concurrent growth. In the equity markets, both U.S. and non-U.S. markets enjoyed an upward trek across sectors and market caps. Interest rates rose across the curve putting pressure on bond prices, but sectors such as investment grade and high yield corporates, non-U.S. dollar denominated bonds and emerging market debt, were able to outperform like-duration U.S. Treasuries.

In February, the first rumblings of discontent shook equity markets. Global growth and monetary policy paths began to diverge. Non-U.S. economies weakened. Momentum sputtered, and equities began to struggle. Emerging market debt, non-U.S. denominated bonds and corporate debt gave up much of the performance earned earlier in the period. Long-term U.S. interest rates started to fall. The shockwave ended in April and pressure on U.S. equity markets eased, allowing U.S. equity markets to end the 12-month period with double-digit gains.

Despite new concerns regarding trade, U.S. inflationary pressures and global growth, we are optimistic that U.S. consumer spending, corporate earnings, and economic data will remain strong in the near term. However, we will stay attentive to signs that might signal possible changes on the horizon. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from September 1, 2017 through August 31, 2018, as provided by the fund’s primary portfolio managers, Kevin Cronk, Chris Barris, and Leland Hart of Alcentra NY, LLC, Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended August 31, 2018, Dreyfus Floating Rate Income Fund’s Class A shares produced a total return of 3.38%, Class C shares returned 2.62%, Class I shares returned 3.68%, and Class Y shares returned 3.60%.1 The fund’s benchmark, The S&P/LSTA U.S. Leveraged Loan Index (the “Index”), produced a total return of 4.88% for the same period.2

Floating rate notes generally produced positive total returns over the reporting period amid rising interest rates and low defaults. The fund lagged the Index, partially due to underweighted exposure to low-quality CCC-rated loans.

The Fund’s Investment Approach

The fund seeks high current income. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in floating-rate loans and other floating-rate securities. These investments effectively should enable the fund to achieve a floating rate of income. The fund currently intends to invest principally in floating-rate loans and other floating-rate securities of U.S. issuers, but may invest up to 30% of its net assets in securities of foreign issuers.

We buy and sell securities through a value-oriented, bottom-up research process that incorporates a top-down overlay. We use fundamental credit analysis to identify favorable and unfavorable risk/reward opportunities across quality segments, industries, and credits while seeking to mitigate downside risk.

Interest Rates Fluctuate in a Growing Economy

In late 2017, the U.S. Federal Reserve (the “Fed”) began to unwind its balance sheet through sales of U.S. government securities and started to raise the overnight target federal funds rate by 25 basis points at approximately every other meeting. Longer-term interest rates climbed during the first portion of the reporting period. Corporate and emerging market debt soundly outperformed like-duration Treasuries. However, market volatility appeared in February and a paradigm shift occurred. Concerns over high U.S. inflation sprouted, and while the U.S. economy continued to strengthen, the rest of the world softened. Corporates and emerging market debt gave up much of their earlier return. In a flight to quality, long-term U.S. Treasury rates declined as well. When coupled with the Fed’s rate hikes which boost the short end of the curve, the U.S. yield curve began a flattening trend that would last through the end of the period. In general, securities with a high degree of interest-rate sensitivity lost value during the period, while those with less fared better.

In this environment, demand for floating-rate investments increased as investors looked for insulation against rising rates. Senior loans outpaced the broader markets with the best performances coming from the lowest-quality segments. During the period, loan spreads narrowed, but was more than offset by a nearly 1% increase in the three-month London Interbank Offered Rate (LIBOR).

Distressed Debt Outperforms Broader Market

The fund’s performance compared to the Index was constrained over the reporting period by several factors. First, the fund maintained underweighted exposure to CCC-rated loans, which lie toward the bottom of the credit-quality spectrum. These loans rallied as investors disregarded certain risks and reached for higher yields, but the fund did not participate fully in those gains. From a sector allocation perspective, an overweight position in the consumer sectors weighed on relative performance, as did underweighted exposure to loans issued to retailers. Our security selection strategy also produced some

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

disappointments in the retail and health care sectors, as well as in the automotive industry group. Finally, the fund’s cash reserves and holdings of high yield bonds, which are maintained for liquidity purposes, did not keep pace with the floating-rate loan market.

The fund achieved better results through other strategies. The fund’s relatively large overweight to B-rated debt, which occupies a middle tier of the credit-quality spectrum, and underweight to high-quality low-spread BB-rated loans, was additive. In addition, an overweight exposure to the metals and mining industry also helped boost relative results as commodity prices and global economic activity recovered. Security selection within the telecom services industry also contributed to positive performance as did the fund’s collateralized loan obligation (CLO) holdings.

At times during the reporting period, we employed forward contracts to hedge the fund’s positons in instruments denominated in foreign currencies.

Positioned for Continued Economic Growth

We remain optimistic regarding the prospects for senior loans. Business fundamentals remain strong, global economic growth has continued, corporate earnings are rising, and default rates have stayed low. In addition, supply-and-demand dynamics have been supported by robust demand for senior loans from CLOs and moderate retail fund inflows. Most analysts expect additional short-term interest-rate hikes by the Fed, which could translate into higher yields on floating-rate instruments.

Therefore, we have maintained overweight exposure to B-rated loans, and we have continued to participate in carefully selected CCC-rated loans. We continue to avoid the most distressed areas of the market. We’re maintaining our underweight to high-quality, low-yielding BB-rated loans. In this environment, we continue to favor debt from cyclical industries such as services, commodities, and chemicals. We have found fewer loans meeting our investment criteria among loans issued to companies in the fixed-line telecommunications and retail industries. While we maintain a favorable outlook on market fundamentals and technicals, we have noticed some erosion in quality which we will continue to monitor closely.

September 17, 2018

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by the fund’s investment adviser pursuant to an agreement in effect through December 31, 2018, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. – The S&P/LSTA U.S. Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads, and interest payments. Investors cannot invest directly in any index.

Floating-rate loans are subject generally to interest-rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus.

The risks of an investment in a collateralized loan obligation (CLO) depend largely on the type of the collateral and the tranche of the CLO in which the fund invests. CLO tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default, market anticipation of defaults, as well as aversion to CLO securities as an asset class.

The fund may use derivative instruments, such as options, futures, options on futures, forward contracts, and swaps. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

High yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity.

4

FUND PERFORMANCE (Unaudited)

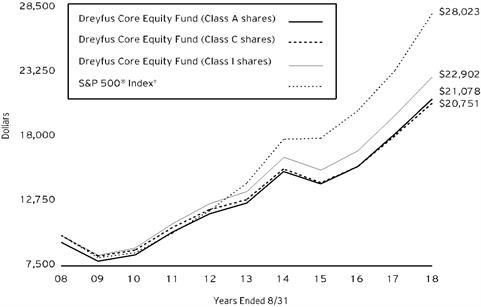

Comparison of change in value of $10,000 investment in Dreyfus Floating Rate Income Fund Class A shares, Class C shares, Class I shares and Class Y shares and the S&P/LSTA U.S. Leveraged Loan Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Floating Rate Income Fund on 9/27/13 (inception date) to a $10,000 investment made in the Index. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

| | | | | |

Average Annual Total Returns as of 8/31/18 | | | |

| Inception Date | 1 Year | From

Inception | |

Class A shares | | | | |

with maximum sales charge (2.50%) | 9/27/13 | 0.80% | 2.39% | |

without sales charge | 9/27/13 | 3.38% | 2.92% | |

Class C shares | | | | |

with applicable redemption charge† | 9/27/13 | 1.63% | 2.15% | |

without redemption | 9/27/13 | 2.62% | 2.15% | |

Class I shares | 9/27/13 | 3.68% | 3.20% | |

Class Y shares | 9/27/13 | 3.60% | 3.20% | |

S&P/LSTA U.S. Leveraged Loan Index | 9/30/13 | 4.88% | 21.60%†† | |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† For comparative purposes, the value of the Index on 9/30/13 is used as the beginning value on 9/27/13.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Floating Rate Income Fund from March 1, 2018 to August 31, 2018. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended August 31, 2018 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $5.02 | | $8.87 | | $3.81 | | $3.66 |

Ending value (after expenses) | | $1,013.10 | | $1,009.80 | | $1,015.30 | | $1,014.50 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended August 31, 2018 | |

| | | Class A | Class C | | Class I | Class Y |

Expenses paid per $1,000† | | $5.04 | | $8.89 | | $3.82 | | $3.67 |

Ending value (after expenses) | | $1,020.21 | | $1,016.38 | | $1,021.42 | | $1,021.58 |

† Expenses are equal to the fund’s annualized expense ratio of .99% for Class A, 1.75% for Class C, .75% for Class I and .72% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

7

STATEMENT OF INVESTMENTS

August 31, 2018

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 6.0% | | | | | |

Collateralized Loan Obligations Debt - 4.4% | | | | | |

Arrowpoint CLO,

Ser. 2015-4A, Cl. D, 3 Month LIBOR + 4.50% | | 6.83 | | 4/18/27 | | 2,000,000 | b,c,d | 2,030,869 | |

Babson CLO,

Ser. 2015-1A, Cl. ER, 3 Month LIBOR + 5.50% | | 7.85 | | 1/20/31 | | 3,000,000 | b,c,d | 2,984,781 | |

Babson Euro CLO,

Ser. 2014-2X, Cl. FR, 3 Month EURIBOR + .70% | EUR | 7.00 | | 11/25/29 | | 2,000,000 | b,c,d | 2,268,930 | |

Barings CLO,

Ser. 2018-1A, Cl. D, 3 Month LIBOR + 5.50% | | 7.84 | | 4/15/31 | | 2,900,000 | b,c,d | 2,884,720 | |

Battalion CLO VII,

Ser. 2014-7A, Cl. DRR, 3 Month LIBOR + 6.31% | | 8.65 | | 7/17/28 | | 2,000,000 | b,c,d | 2,005,562 | |

Carlyle Global Market Strategies CLO,

Ser. 2014-1A, Cl. ER, 3 Month LIBOR + 5.40% | | 7.74 | | 4/17/31 | | 4,000,000 | b,c,d | 3,969,716 | |

Catamaran CLO,

Ser. 2015-1A, Cl. E, 3 Month LIBOR + 5.15% | | 7.50 | | 4/22/27 | | 3,000,000 | b,c,d | 2,948,358 | |

CIFC Funding CLO,

Ser. 2012-2RA, Cl. D, 3 Month LIBOR + 5.45% | | 7.80 | | 1/20/28 | | 1,000,000 | b,c,d | 1,000,462 | |

Crown Point CLO IV,

Ser. 2018-4A, Cl. D, 3 Month LIBOR + 2.75% | | 5.10 | | 4/20/31 | | 5,000,000 | b,c,d | 4,964,090 | |

Dryden Senior Loan Fund CLO,

Ser. 2015-37A, Cl. ER, 3 Month LIBOR + 5.15% | | 7.49 | | 1/15/31 | | 5,000,000 | b,c,d | 4,940,865 | |

Goldentree Loan Management US CLO 2,

Ser. 2017-2A, Cl. E, 3 Month LIBOR + 4.70% | | 7.05 | | 11/28/30 | | 1,984,000 | b,c,d | 1,926,809 | |

Marathon CLO X,

Ser. 2017-10A, Cl.D, 3 Month LIBOR + 6.37% | | 8.68 | | 11/15/29 | | 2,500,000 | b,c,d | 2,513,173 | |

Marble Point CLO XII,

Ser. 2018-1A, Cl. E, 3 Month LIBOR + 6.00% | | 8.07 | | 7/16/31 | | 1,250,000 | b,c,d | 1,255,990 | |

OZLM VI CLO,

Ser. 2014-6A, Cl. E, 3 Month LIBOR + 6.05% | | 8.39 | | 4/17/31 | | 4,000,000 | b,c,d | 4,002,144 | |

Parallel CLO,

Ser. 2018-1A, Cl. C, 3 Month LIBOR + 2.80% | | 4.85 | | 4/20/31 | | 1,800,000 | b,c,d | 1,786,919 | |

8

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 6.0% (continued) | | | | | |

Collateralized Loan Obligations Debt - 4.4% (continued) | | | | | |

Rockford Tower CLO,

Ser. 2018-1A, Cl. E, 3 Month LIBOR + 5.85% | | 8.11 | | 5/20/31 | | 1,500,000 | b,c,d | 1,491,924 | |

TICP CLO IX,

Ser. 2017-9A, Cl. E, 3 Month LIBOR + 5.60% | | 7.95 | | 1/20/31 | | 5,000,000 | b,c,d | 4,872,028 | |

TICP CLO X,

Ser. 2018-10A, Cl. E, 3 Month LIBOR + 5.50% | | 7.85 | | 4/20/31 | | 3,000,000 | b,c,d | 2,963,631 | |

| | 50,810,971 | |

Energy - .6% | | | | | |

Alta Mesa Housings,

Gtd. Notes | | 7.88 | | 12/15/24 | | 2,000,000 | | 1,972,500 | |

Genesis Energy,

Gtd. Bonds | | 5.63 | | 6/15/24 | | 2,000,000 | | 1,875,000 | |

Sanchez Energy,

Gtd. Notes | | 6.13 | | 1/15/23 | | 2,350,000 | | 1,338,678 | |

SRC Energy,

Sr. Unscd. Notes | | 6.25 | | 12/1/25 | | 2,000,000 | | 1,950,000 | |

| | 7,136,178 | |

Health Care - .3% | | | | | |

Polaris Intermediate,

Sr. Unscd. Notes | | 8.50 | | 12/1/22 | | 3,000,000 | c | 3,108,750 | |

Materials - .7% | | | | | |

ARD Finance,

Sr. Scd. Notes | | 7.13 | | 9/15/23 | | 3,000,000 | | 3,048,750 | |

ARD Securities Finance,

Sr. Scd. Notes | | 8.75 | | 1/31/23 | | 1,542,399 | c | 1,546,255 | |

Bway Holding,

Sr. Unscd. Notes | | 7.25 | | 4/15/25 | | 2,000,000 | c | 1,955,000 | |

W/S Packaging Holdings,

Sr. Scd. Notes | | 9.00 | | 4/15/23 | | 1,600,000 | c | 1,640,000 | |

| | 8,190,005 | |

Total Bonds and Notes

(cost $70,085,539) | | 69,245,904 | |

| | | | | | | | | |

Floating Rate Loan Interests - 88.0% | | | | | |

Advertising - 1.8% | | | | | |

ABG Intermediate Holdings 2,

First Lien Initial Term Loan, 1 Month LIBOR + 3.50% | | 5.85 | | 9/29/24 | | 3,991,737 | b | 4,004,211 | |

ABG Intermediate Holdings 2,

Second Lien Initial Term Loan, 1 Month LIBOR + 7.75% | | 10.10 | | 9/29/25 | | 325,000 | b,d | 327,031 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Advertising - 1.8% (continued) | | | | | |

Advantageles & Marketing,

First Lien Initial Term Loan, 1 Month LIBOR + 3.25% | | 5.58 | | 7/25/21 | | 5,699,604 | b | 5,345,174 | |

Information Resources,

First Lien Initial Term Loan, 3 Month LIBOR + 4.25% | | 6.60 | | 1/18/24 | | 474,000 | b | 477,356 | |

Information Resources,

Second Lien Term Loan, 3 Month LIBOR + 8.25% | | 10.60 | | 1/20/25 | | 2,745,000 | b | 2,772,450 | |

Polyconcept North America Holdings,

First Lien Closing Date Term Loan, 1 Month LIBOR + 3.75% | | 6.07 | | 8/16/23 | | 1,847,288 | b,d | 1,861,724 | |

Red Ventures,

Second Lien Term Loan, 1 Month LIBOR + 8.00% | | 10.34 | | 11/8/25 | | 1,500,000 | b | 1,537,500 | |

Red Ventures,

Term Loan, 1 Month LIBOR + 4.00% | | 6.34 | | 11/8/24 | | 4,359,303 | b | 4,411,985 | |

| | 20,737,431 | |

Aerospace & Defense - .6% | | | | | |

Transdigm,

2018 New Term F Loan, 1 Month LIBOR + 2.50% | | 4.82 | | 6/9/23 | | 6,861,915 | b | 6,856,460 | |

Automobiles & Components - .7% | | | | | |

CH Hold,

First Lien Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.35 | | 2/1/24 | | 245,432 | b | 246,736 | |

CH Hold,

Second Lien Initial Term Loan, 1 Month LIBOR + 7.25% | | 9.60 | | 2/3/25 | | 175,000 | b,d | 177,625 | |

Dealer Tire,

Refinancing Term Loan, 3 Month LIBOR + 3.25% | | 5.58 | | 12/22/21 | | 2,148,070 | b,d | 2,083,628 | |

Innovative Xcessories & Services,

Term Loan, 1 Month LIBOR + 4.75% | | 7.07 | | 11/29/22 | | 4,616,907 | b,d | 4,611,136 | |

UOS,

Initial Term Loan, 1 Month LIBOR + 5.50% | | 7.85 | | 4/7/23 | | 1,476,564 | b,d | 1,509,787 | |

| | 8,628,912 | |

Building Materials - .8% | | | | | |

Forterra Finance,

Replacement Term Loan, 1 Month LIBOR + 3.00% | | 5.35 | | 10/25/23 | | 3,292,335 | b | 3,092,523 | |

LSF10 XL BIdco SCA,

Facility B Term Loan, 3 Month LIBOR + 4.00% | EUR | 4.00 | | 3/13/24 | | 2,500,000 | b | 2,889,179 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Building Materials - .8% (continued) | | | | | |

Quikrete Holdings,

Tranche B Term Loan, 1 Month LIBOR + 2.75% | | 5.07 | | 11/15/23 | | 3,419,985 | b | 3,421,233 | |

| | 9,402,935 | |

Chemicals - 4.7% | | | | | |

AgroFresh,

Term Loan, 2 Month LIBOR + 4.75% | | 7.10 | | 7/31/21 | | 1,896,241 | b | 1,886,759 | |

Albaugh,

2017 Refinancing Term Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 12/21/24 | | 2,338,250 | b | 2,329,482 | |

Allnex,

Term B-2 Loan, 1-3 Month LIBOR + 3.25% | | 5.59 | | 9/13/23 | | 2,472,243 | b,d | 2,490,785 | |

Allnex,

Tranche B-3 Term Loan, 1-3 Month LIBOR + 3.25% | | 5.59 | | 9/13/23 | | 1,862,642 | b,d | 1,876,612 | |

Colouroz Investment 1,

First Lien Term C Loan, 3 Month LIBOR + 3.00% | | 5.84 | | 9/7/21 | | 428,419 | b | 406,141 | |

Colouroz Midco,

First Lien Term B-1 Loan, 3 Month LIBOR + 3.00% | | 5.81 | | 9/7/21 | | 2,591,581 | b | 2,456,819 | |

Cyanco Intermediate 2,

First Lien Initial Term Loan, 1 Month LIBOR + 3.50% | | 5.83 | | 3/16/25 | | 3,585,475 | b | 3,616,848 | |

Encapsys,

First Lien Initial Term Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 10/27/24 | | 3,866,855 | b | 3,883,792 | |

Encapsys,

Second Lien Initial Term Loan, 1 Month LIBOR + 7.50% | | 9.84 | | 10/27/25 | | 1,419,000 | b,d | 1,428,756 | |

Novacap Group Bidco,

Facility B, 3 Month LIBOR + 3.50% | EUR | 3.50 | | 6/22/23 | | 1,500,000 | b | 1,733,290 | |

OCI Partners,

Term Loan, 3 Month LIBOR + 4.00% | | 6.58 | | 3/13/25 | | 4,707,911 | b | 4,784,485 | |

Omnova Solutions,

Term B-2 Loan, 1 Month LIBOR + 3.25% | | 5.57 | | 8/26/23 | | 2,878,370 | b,d | 2,896,360 | |

Oxea,

Term B-1 Loan, 3 Month LIBOR + 3.75% | EUR | 3.75 | | 10/12/24 | | 2,000,000 | b | 2,328,755 | |

Oxea,

Term B-2 Loan, 3 Month LIBOR + 3.50% | | 5.84 | | 10/12/24 | | 2,992,462 | b,d | 3,013,050 | |

Polar US Borrower,

First Lien Term Loan, 3 Month LIBOR + 4.75% | | 7.09 | | 8/21/25 | | 5,903,764 | b | 5,815,207 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Chemicals - 4.7% (continued) | | | | | |

Road Infrastructure Investment Holdings,

First Lien Term Loan, 1 Month LIBOR + 3.50% | | 6.33 | | 6/9/23 | | 2,824,688 | b | 2,831,749 | |

Solenis International,

First Lien Initial Dollar Term Loan, 1-3 Month LIBOR + 4.00% | | 6.34 | | 12/26/23 | | 4,219,048 | b | 4,245,459 | |

Tronox Finance,

Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 9/22/24 | | 1,856,022 | b | 1,865,302 | |

Tronox Finance,

Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 9/22/24 | | 4,283,128 | b | 4,304,544 | |

| | 54,194,195 | |

Commercial & Professional Services - 10.0% | | | | | |

AlixPartners,

2017 Refinancing Term Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 4/4/24 | | 3,113,533 | b | 3,126,516 | |

AVSC Holding,

Second Lien Initial Loan, 3 Month LIBOR + 7.25% | | 9.57 | | 9/1/25 | | 1,061,750 | b | 1,051,796 | |

AVSC Holding,

Term Loan, 2-3 Month LIBOR + 3.25% | | 5.59 | | 3/1/25 | | 6,911,812 | b | 6,858,522 | |

Blitz F18 675,

New Facility B-2, 2 Month LIBOR + 3.75% | EUR | 3.75 | | 8/1/25 | | 2,500,000 | b | 2,913,773 | |

Camelot US Acquisition I,

2017-2 Refinancing Term Loan, 1 Month LIBOR + 3.25% | | 5.56 | | 10/3/23 | | 3,519,872 | b | 3,521,702 | |

Cast & Crew Payroll,

Term Loan, 1 Month LIBOR + 2.75% | | 5.33 | | 9/27/24 | | 2,952,962 | b | 2,952,976 | |

CHG Healthcare Services,

New Term Loan, 1-3 Month LIBOR + 3.00% | | 5.33 | | 6/7/23 | | 7,135,016 | b | 7,161,237 | |

Constellis Holdings,

First Lien Initial Term B Loan, 3 Month LIBOR + 5.00% | | 7.34 | | 4/21/24 | | 5,296,500 | b | 5,336,224 | |

Creative Artists Agency,

Amendment No 7 Refinancing Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 2/15/24 | | 6,110,273 | b | 6,134,469 | |

Electro Rent,

Tranche B Term Loan, 1-2 Month LIBOR + 5.00% | | 7.35 | | 1/31/24 | | 3,501,007 | b | 3,531,640 | |

Employbridge,

Term Loan, 3 Month LIBOR + 5.00% | | 7.35 | | 4/18/25 | | 3,077,570 | b | 3,119,887 | |

Fort Dearborn Holding,

First Lien Initial Term Loan, 3 Month LIBOR + 4.00% | | 6.35 | | 10/19/23 | | 3,658,516 | b,d | 3,512,175 | |

Lineage Logistics,

Term Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 2/27/25 | | 5,378,852 | b | 5,359,811 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Commercial & Professional Services - 10.0% (continued) | | | | | |

National Intergovernmental Purchasing Alliance,

First Lien Term Loan, 2-3 Month LIBOR + 3.75% | | 6.07 | | 5/23/25 | | 3,142,469 | b,d | 3,150,325 | |

Obol France 3S,

Facility B Term Loan, 3 Month LIBOR + 3.75% | EUR | 3.75 | | 4/12/23 | | 2,500,000 | b | 2,912,104 | |

Packers Holdings,

Term Loan, 1 Month LIBOR + 3.25% | | 5.57 | | 12/4/24 | | 4,726,250 | b | 4,728,235 | |

Parexel International,

Term Loan B, 1 Month LIBOR + 2.75% | | 5.09 | | 9/27/24 | | 4,515,875 | b | 4,519,826 | |

Pi US Borrowerco,

Second Lien Facility 1, 1 Month LIBOR + 7.25% | | 9.58 | | 1/1/26 | | 1,250,000 | b,d | 1,237,500 | |

Pi US Mergerco,

Facility B-1, 3 Month LIBOR + 3.50% | | 5.82 | | 12/20/24 | | 5,236,875 | b | 5,216,425 | |

Pre Paid Legal Services,

First Lien Initial Term Loan, 1 Month LIBOR + 3.25% | | 5.60 | | 4/13/25 | | 3,043,810 | b | 3,058,389 | |

Prime Security Services Borrower,

2016-2 Refinancing Term B1 Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 5/2/22 | | 3,597,060 | b | 3,610,765 | |

Safe Fleet Holdings,

Term Loan, 1 Month LIBOR + 3.00% | | 5.35 | | 2/1/25 | | 4,774,897 | b | 4,745,054 | |

Team Health Holdings,

Term Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 2/6/24 | | 6,195,030 | b | 5,944,658 | |

Transaction Network Services,

First Lien Initial Term Loan, 3 Month LIBOR + 4.00% | | 6.32 | | 2/14/20 | | 3,618,472 | b,d | 3,634,883 | |

US Security Associates Holdings,

Term Loan, 3 Month LIBOR + 3.50% | | 5.84 | | 7/28/23 | | 1,523,153 | b | 1,526,961 | |

USS Ultimate Holdings,

Tranche B Term Loan, 1 Month LIBOR + 3.75% | | 6.08 | | 8/10/24 | | 3,078,516 | b | 3,097,756 | |

Verscend Holding,

Term B Loan, 3 Month LIBOR + 4.50% | | 6.82 | | 8/27/25 | | 6,480,716 | b | 6,533,405 | |

Wand Intermediate I,

Refinancing Term B Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 9/17/21 | | 1,904,379 | b | 1,908,550 | |

Weight Watchers International,

Term B Loan, 1-3 Month LIBOR + 4.75% | | 7.07 | | 11/29/24 | | 5,624,280 | b | 5,699,870 | |

| | 116,105,434 | |

Consumer Discretionary - 6.0% | | | | | |

Alpha Topco,

2018 Incremental New Facility B-3 Loan, 1 Month LIBOR + 2.50% | | 4.85 | | 2/1/24 | | 2,814,722 | b | 2,797,833 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Consumer Discretionary - 6.0% (continued) | | | | | |

Crown Finance US,

Initial Euro Term Loan, 1 Month LIBOR + 2.625% | EUR | 2.63 | | 2/28/25 | | 3,117,187 | b | 3,617,190 | |

Deluxe Entertainment Services Group,

Initial Term Loan, 3 Month LIBOR + 5.50% | | 7.85 | | 2/28/20 | | 1,474,479 | b | 1,386,011 | |

FPC Holdings,

First Lien Term B-1 Loan, 1 Month LIBOR + 4.50% | | 6.84 | | 11/19/22 | | 2,878,249 | b | 2,911,824 | |

FPC Holdings,

Second Lien Term B-1 Loan, 1 Month LIBOR + 9.00% | | 11.34 | | 5/19/23 | | 1,018,519 | b,d | 1,015,127 | |

Golden Entertainment,

First Lien Term B Facility Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 8/15/24 | | 4,552,125 | b | 4,561,616 | |

Greektown Holdings,

Term Loan, 1 Month LIBOR + 2.75% | | 5.34 | | 3/20/24 | | 3,564,000 | b | 3,571,431 | |

GVC Holdings,

Facility B-1, 3 Month LIBOR + 2.75% | EUR | 2.75 | | 3/2/23 | | 1,500,000 | b | 1,736,772 | |

GVC Holdings,

Facility B-2 (Eur), 3 Month LIBOR + 2.75% | EUR | 2.75 | | 3/16/24 | | 1,500,000 | b | 1,738,626 | |

Hayward Industries,

Term Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 7/18/24 | | 3,101,563 | b | 3,115,520 | |

Hercules Achievement,

First Lien Term Loan, 1 Month LIBOR + 3.50% | | 5.83 | | 12/7/24 | | 3,731,250 | b | 3,740,578 | |

Scientific Games International,

Initial Term B-5 Loan, 1 Month LIBOR + 2.75% | | 5.07 | | 8/14/24 | | 7,611,798 | b | 7,600,228 | |

SESAC Holdco II,

First Lien Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.56 | | 2/13/24 | | 2,962,500 | b | 2,942,133 | |

SMG US Midco 2,

Second Lien Term Loan, 1 Month LIBOR + 7.00% | | 9.34 | | 1/23/26 | | 233,918 | b | 236,550 | |

SMG US Midco 2,

Term Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 1/23/25 | | 578,211 | b | 580,258 | |

Stars Group Holdings,

Euro Term Loan, 3 Month LIBOR + 3.75% | EUR | 3.75 | | 7/10/25 | | 4,000,000 | b | 4,687,990 | |

Stars Group Holdings,

Term Loan, 3 Month LIBOR + 3.50% | | 5.84 | | 7/10/25 | | 8,735,215 | b | 8,814,967 | |

Technicolor,

First Incremental Term Loan, 3 Month LIBOR + 2.75% | | 5.09 | | 12/31/23 | | 2,364,000 | b | 2,254,677 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Consumer Discretionary - 6.0% (continued) | | | | | |

Travel Leaders Group,

2018 Refinancing Term Loan, 1 Month LIBOR + 4.00% | | 6.34 | | 1/25/24 | | 3,802,911 | b,d | 3,848,090 | |

William Morris Endeavor Entertainment,

New Term B Loan-1, 1 Month LIBOR + 2.75% | | 5.06 | | 5/18/25 | | 4,675,526 | b | 4,659,466 | |

Yak Access,

First Lien Initial Term Loan, 1 Month LIBOR + 5.00% | | 7.34 | | 7/11/25 | | 4,000,000 | b,d | 3,880,000 | |

| | 69,696,887 | |

Consumer Staples - .7% | | | | | |

Carlisle Foodservice Products,

First Lien Delayed Draw Term Loan, 1 Month LIBOR + 3.00% | | 5.33 | | 3/20/25 | | 609,317 | b,e | 604,939 | |

Carlisle Foodservice Products,

First Lien Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.33 | | 3/20/25 | | 2,694,553 | b | 2,675,192 | |

Kronos Acquisition Holdings,

Term B-3 Loan, 1 Month LIBOR + 4.00% | | 6.32 | | 5/15/23 | | 4,400,000 | b | 4,372,852 | |

| | 7,652,983 | |

Diversified Financials - 1.2% | | | | | |

Blackhawk Network Holdings,

First Lien Term Loan, 2 Month LIBOR + 3.00% | | 5.33 | | 5/22/25 | | 5,531,278 | b | 5,557,801 | |

Capital Automotive,

Second Lien Intial Term B Loan, 1 Month LIBOR + 6.00% | | 8.34 | | 3/24/25 | | 2,308,166 | b,d | 2,362,985 | |

Citco Funding ,

2017 Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 3/31/22 | | 4,660,000 | b | 4,683,323 | |

PGX Holdings,

First Lien Term B Loan, 1 Month LIBOR + 5.25% | | 7.59 | | 9/29/20 | | 1,924,144 | b | 1,884,459 | |

| | 14,488,568 | |

Electronic Components - .3% | | | | | |

Oberthur Technologies,

Facility B Term Loan, 3 Month LIBOR + 3.75% | EUR | 3.75 | | 1/10/24 | | 2,500,000 | b | 2,904,661 | |

Oberthur Technologies Of America,

Facility B Term Loan, 3 Month LIBOR + 3.75% | | 6.07 | | 12/15/23 | | 617,188 | b | 620,813 | |

| | 3,525,474 | |

Energy - 4.6% | | | | | |

Brazos Delaware II,

Term Loan, 1 Month LIBOR + 4.00% | | 6.31 | | 5/16/25 | | 5,398,387 | b,d | 5,361,273 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Energy - 4.6% (continued) | | | | | |

California Resource,

Term Loan, 1 Month LIBOR + 10.38% | | 12.69 | | 12/31/21 | | 3,000,000 | b | 3,322,515 | |

California Resources,

Term 11/17 Loan, 1 Month LIBOR + 4.75% | | 7.06 | | 12/31/22 | | 2,864,815 | b | 2,917,642 | |

Chesapeake Energy,

Term A Loan, 1 Month LIBOR + 7.50% | | 9.81 | | 8/23/21 | | 2,375,000 | b | 2,484,214 | |

Gavilan Resources,

Second Lien Term Loan, 1 Month LIBOR + 6.00% | | 8.32 | | 3/1/24 | | 4,935,000 | b | 4,808,541 | |

GIP III Stetson I,

Term Loan, 3 Month LIBOR + 4.25% | | 6.60 | | 7/18/25 | | 5,504,231 | b | 5,557,567 | |

Granite Acquisition,

First Lien Term B Loan, 3 Month LIBOR + 3.50% | | 6.33 | | 12/17/21 | | 3,614,660 | b | 3,649,831 | |

Granite Acquisition,

First Lien Term C Loan, 3 Month LIBOR + 3.50% | | 6.33 | | 12/17/21 | | 164,382 | b | 165,982 | |

Granite Acquisition,

Second Lien Term B Loan, 3 Month LIBOR + 7.25% | | 9.58 | | 12/19/22 | | 471,490 | b | 476,208 | |

HFOTCO,

7 Year Term B Loan, 3 Month LIBOR + 2.75% | | 5.09 | | 6/26/25 | | 3,097,166 | b | 3,103,469 | |

Keane Group Holdings,

Term Loan, 1 Month LIBOR + 3.75% | | 6.07 | | 5/18/25 | | 3,602,500 | b,d | 3,597,997 | |

Lucid Energy Group II Borrower,

Term Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 2/18/25 | | 5,557,500 | b,d | 5,484,558 | |

Navios Maritime Midstream Partners,

Term Loan, 3 Month LIBOR + 4.50% | | 6.83 | | 6/12/20 | | 1,258,668 | b,d | 1,230,355 | |

Oryx Southern Delaware Holdings,

Term Loan, 1 Month LIBOR + 3.25% | | 5.57 | | 2/28/25 | | 5,268,054 | b,d | 5,172,570 | |

Oxbow Carbon ,

First Lien Term B Loan, 1 Month LIBOR + 3.75% | | 6.09 | | 1/4/23 | | 3,487,687 | b,d | 3,518,221 | |

Oxbow Carbon ,

Second Lien Term Loan, 1 Month LIBOR + 7.50% | | 9.84 | | 1/4/24 | | 2,107,143 | b,d | 2,149,286 | |

| | 53,000,229 | |

Environmental Control - 1.2% | | | | | |

EnergySolutions,

Term Loan, 3 Month LIBOR + 3.75% | | 6.07 | | 5/11/25 | | 5,014,624 | b,d | 5,058,502 | |

Filtration Group,

Initial Dollar Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 3/29/25 | | 5,860,937 | b | 5,889,655 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Environmental Control - 1.2% (continued) | | | | | |

GFL Environmental,

2018 Incremental Term Loan, 3 Month LIBOR + 2.75% | | 5.07 | | 5/31/25 | | 2,488,964 | b,d | 2,480,153 | |

GFL Environmental,

Delayed Draw Term Loan, 3 Month LIBOR + 2.75% | | 5.07 | | 5/31/25 | | 309,188 | b,d,e | 308,093 | |

| | 13,736,403 | |

Financials - .3% | | | | | |

IBC Capital,

First Lien Term B-1 Loan, 3 Month LIBOR + 3.75% | | 6.08 | | 9/18/23 | | 3,591,000 | b | 3,614,934 | |

Food Products - 1.1% | | | | | |

Albertson's,

Replacement 2017-1 Term B-4 Loan, 1 Month LIBOR + 2.75% | | 5.08 | | 8/25/21 | | 1,364,398 | b | 1,363,477 | |

Albertson's,

Replacement 2017-1 Term B-5 Loan, 3 Month LIBOR + 3.00% | | 5.33 | | 12/21/22 | | 1,414,286 | b | 1,412,299 | |

Albertson's,

Replacement 2017-1 Term B-6 Loan, 3 Month LIBOR + 3.00% | | 5.33 | | 6/22/23 | | 6,987,386 | b | 6,969,917 | |

UTZ Quality Foods,

First Lien Term Loan, 1 Month LIBOR + 3.50% | | 5.83 | | 11/21/24 | | 2,985,000 | b | 3,002,716 | |

| | 12,748,409 | |

Forest Products & Other - .2% | | | | | |

Dunn Paper,

First Lien Term Loan, 1 Month LIBOR + 4.75% | | 7.09 | | 8/26/22 | | 2,091,402 | b,d | 2,114,930 | |

Health Care - 8.7% | | | | | |

Air Medical Group Holdings,

2018 Term Loan, 1 Month LIBOR + 3.25% | | 5.57 | | 4/28/22 | | 6,658,308 | b | 6,552,907 | |

Air Methods,

Term Loan, 3 Month LIBOR + 3.50% | | 5.83 | | 4/13/24 | | 5,552,409 | b | 5,110,521 | |

Albany Molecular Research,

First Lien Initial Term Loan, 1 Month LIBOR + 3.25% | | 5.57 | | 7/28/24 | | 3,389,698 | b | 3,391,817 | |

Alphabet Holding,

First Lien Initial Term Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 8/15/24 | | 3,771,500 | b | 3,592,354 | |

Alphabet Holding,

Second Lien Initial Term Loan, 1 Month LIBOR + 7.75% | | 10.09 | | 8/15/25 | | 1,600,000 | b | 1,437,000 | |

Auris LuxCo,

First Lien Term B Loan, 3 Month LIBOR + 4.00% | EUR | 4.00 | | 7/24/25 | | 1,250,000 | b | 1,459,498 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Health Care - 8.7% (continued) | | | | | |

Auris Luxembourg III,

Facility B7 Term Loan, 3 Month LIBOR + 3.00% | | 5.32 | | 1/17/22 | | 1,451,362 | b | 1,464,062 | |

Avantor,

Initial Dollar Term Loan, 1 Month LIBOR + 4.00% | | 6.31 | | 11/22/24 | | 4,721,174 | b | 4,782,290 | |

Avantor,

Initial Euro Term Loan, 1 Month LIBOR + 4.25% | EUR | 4.25 | | 11/22/24 | | 2,493,734 | b | 2,917,339 | |

Bausch Health,

Initial Term B Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 6/1/25 | | 6,218,027 | b | 6,247,935 | |

Change Healthcare Holdings,

Closing Date Term Loan, 1 Month LIBOR + 2.75% | | 5.07 | | 3/1/24 | | 3,887,829 | b | 3,894,321 | |

CVS Holdings I,

First Lien Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 2/6/25 | | 5,247,562 | b,d | 5,241,029 | |

Dentalcorp Perfect Smile ULC,

Delayed Draw Term Loan, 1-3 Month LIBOR + 3.75% | | 6.08 | | 6/6/25 | | 910,565 | b,d,e | 916,634 | |

Dentalcorp Perfect Smile ULC,

Term Loan, 1 Month LIBOR + 3.75% | | 6.08 | | 6/6/25 | | 3,642,261 | b | 3,666,536 | |

Elsan SAS,

Facility B2 Term Loan, 3 Month LIBOR + 3.75% | EUR | 3.75 | | 10/30/22 | | 2,500,000 | b | 2,922,188 | |

Immucor,

Term Loan B-3, 2 Month LIBOR + 5.00% | | 7.34 | | 6/15/21 | | 3,702,487 | b | 3,753,396 | |

MPH Acquisition Holdings,

Initial Term Loan, 3 Month LIBOR + 2.75% | | 5.33 | | 6/7/23 | | 3,510,491 | b | 3,511,966 | |

NVA Holdings,

First Lien Term B-3 Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 1/30/25 | | 4,657,260 | b | 4,647,084 | |

Ortho Clinical Diagnostics,

Refinancing Term Loan, 1 Month LIBOR + 3.25% | | 5.58 | | 6/1/25 | | 5,330,000 | b | 5,336,183 | |

Pearl Intermediate Parent,

First Lien Delayed Draw Term Loan, 3 Month LIBOR + 2.75% | | 5.06 | | 2/14/25 | | 906,224 | b,d,e | 891,072 | |

Pearl Intermediate Parent,

First Lien Term Loan, 1 Month LIBOR + 2.75% | | 5.06 | | 2/14/25 | | 3,073,459 | b,d | 3,022,070 | |

Pearl Intermediate Parent,

Second Lien Term Loan, 1 Month LIBOR + 6.25% | | 8.56 | | 2/1/26 | | 1,488,652 | b | 1,485,861 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Health Care - 8.7% (continued) | | | | | |

PharMerica,

First Lien Term Loan, 1 Month LIBOR + 3.50% | | 5.83 | | 12/6/24 | | 5,628,645 | b | 5,671,761 | |

PharMerica,

Second Lien Term Loan, 1 Month LIBOR + 7.75% | | 10.08 | | 12/7/25 | | 1,500,000 | b,d | 1,500,000 | |

Sam Bidco,

Facility B-2, 3 Month LIBOR + 3.50% | | 5.83 | | 10/24/24 | | 2,075,000 | b | 2,062,031 | |

Surgery Center Holdings,

Term B Loan, 3 Month LIBOR + 3.25% | | 5.57 | | 6/20/24 | | 6,195,834 | b | 6,197,754 | |

U.S. Anesthesia Partners,

First Lien Term Loan, 1 Month LIBOR + 3.00% | | 5.59 | | 6/23/24 | | 4,407,970 | b | 4,422,671 | |

Wink Holdco,

First Lien Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 12/1/24 | | 4,530,000 | b | 4,525,470 | |

| | 100,623,750 | |

Industrials - 3.9% | | | | | |

American Traffic Solutions,

First Lien Initial Term Loan, 1 Month LIBOR + 3.75% | | 6.07 | | 2/28/25 | | 4,397,075 | b | 4,431,416 | |

Brand Energy & Infrastructure Services,

Term Loan, 3 Month LIBOR + 4.25% | | 6.59 | | 6/21/24 | | 7,756,111 | b | 7,805,401 | |

DG Investment Intermediate Holdings 2,

First Lien First Amendment Incremental Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 2/1/25 | | 112,500 | b | 111,832 | |

Engineered Machinery Holdings ,

First Lien Initial Term Loan, 3 Month LIBOR + 3.25% | | 5.58 | | 7/25/24 | | 2,766,125 | b | 2,767,854 | |

Engineered Machinery Holdings ,

Second Lien Initial Term Loan, 3 Month LIBOR + 7.25% | | 9.58 | | 7/25/25 | | 1,774,277 | b | 1,783,148 | |

Gates Global,

Initial B-2 Dollar Term Loan, 3 Month LIBOR + 2.75% | | 5.06 | | 3/31/24 | | 5,020,846 | b | 5,051,046 | |

Loparex International,

Term B Loan, 3 Month LIBOR + 4.25% | | 6.59 | | 4/11/25 | | 4,260,452 | b,d | 4,303,056 | |

New VAC US,

Term B Loan, 3 Month LIBOR + 4.00% | | 6.33 | | 3/18/25 | | 3,092,250 | b,d | 3,117,375 | |

North American Lifting Holdings,

First Lien Term Loan, 3 Month LIBOR + 4.50% | | 6.82 | | 11/27/20 | | 1,480,643 | b | 1,438,696 | |

Pisces Midco,

Term Loan, 3 Month LIBOR + 3.75% | | 6.09 | | 4/12/25 | | 6,999,491 | b | 7,034,488 | |

Titan Acquisition,

Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 3/28/25 | | 5,600,962 | b | 5,323,911 | |

19

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Industrials - 3.9% (continued) | | | | | |

USIC Holdings,

Term B Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 12/9/23 | | 1,781,496 | b | 1,793,192 | |

| | 44,961,415 | |

Information Technology - 8.8% | | | | | |

Applied Systems,

First Lien Term Loan, 3 Month LIBOR + 3.00% | | 5.33 | | 9/19/24 | | 6,644,738 | b | 6,681,184 | |

Ascend Learning,

Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 7/12/24 | | 4,342,187 | b | 4,341,514 | |

BMC Software Finance,

Initial B-2 US Term Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 9/10/22 | | 7,508,357 | b | 7,524,199 | |

Capri Acquisitions BidCo,

Initial Dollar Term Loan, 3 Month LIBOR + 3.25% | | 5.60 | | 11/1/24 | | 3,233,750 | b | 3,227,687 | |

Compuware,

Senior Secured Term Loan, 1 Month LIBOR + 3.50% | | 5.81 | | 8/23/25 | | 4,270,977 | b | 4,304,354 | |

Compuware,

Term B-3 Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 12/15/21 | | 1,200,000 | b | 1,204,638 | |

Cypress Intermediate Holdings III,

First Lien Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 3/31/24 | | 3,267,000 | b | 3,270,316 | |

DigiCert Holdings,

First Lien Term Loan, 1 Month LIBOR + 5.25% | | 7.10 | | 10/31/24 | | 5,693,120 | b | 5,725,173 | |

Dynatrace,

Senior Secured First Lien Term Loan, 3 Month LIBOR + 3.25% | | 5.56 | | 8/23/25 | | 2,552,271 | b | 2,566,104 | |

Dynatrace,

Senior Secured Second Lien Term Loan, 3 Month LIBOR + 7.00% | | 9.31 | | 8/23/26 | | 435,185 | b | 439,174 | |

Greeneden US Holdings II,

Dollar Term B-3 Loan, 1 Month LIBOR + 3.50% | | 5.82 | | 12/1/23 | | 7,271,987 | b | 7,299,257 | |

Hyland Software,

First Lien Term Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 7/1/22 | | 4,837,181 | b | 4,872,855 | |

Hyland Software,

Second Lien Term Loan, 1 Month LIBOR + 7.00% | | 9.34 | | 5/23/25 | | 1,000,000 | b | 1,017,190 | |

Kronosorporated,

2018 New Incremental Term Loan, 2-3 Month LIBOR + 3.00% | | 5.34 | | 11/1/23 | | 5,568,526 | b | 5,590,104 | |

Mitchell International,

First Lien Term Loan, 1 Month LIBOR + 3.25% | | 5.57 | | 11/30/24 | | 5,480,750 | b | 5,477,900 | |

20

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Information Technology - 8.8% (continued) | | | | | |

Mitchell International,

Second Lien Term Loan, 1 Month LIBOR + 7.25% | | 9.57 | | 11/30/25 | | 1,265,000 | b | 1,271,325 | |

Press Ganey Holdings,

First Lien Initial Term Loan, 1 Month LIBOR + 2.75% | | 5.08 | | 10/23/23 | | 4,491,149 | b | 4,506,577 | |

Press Ganey Holdings,

Second Lien Term Loan, 1 Month LIBOR + 6.50% | | 8.84 | | 10/23/25 | | 269,664 | b | 273,372 | |

Quest Software US Holdings,

First Lien Term Loan, 3 Month LIBOR + 4.25% | | 6.56 | | 5/17/25 | | 6,124,660 | b | 6,111,247 | |

Riverbed Technology,

First Lien Term Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 4/24/22 | | 3,181,844 | b | 3,169,594 | |

Rocket Software,

First Lien Term Loan, 3 Month LIBOR + 3.75% | | 6.09 | | 10/1/23 | | 3,242,374 | b | 3,269,123 | |

Rocket Software,

Second Lien Term Loan, 3 Month LIBOR + 9.50% | | 11.84 | | 10/14/24 | | 575,000 | b,d | 577,875 | |

RP Crown Parent,

Term Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 10/12/23 | | 8,032,379 | b | 8,062,501 | |

Sophia,

Tranche B Term Loan, 3 Month LIBOR + 3.25% | | 5.59 | | 9/30/22 | | 6,652,072 | b | 6,676,186 | |

Sound Inpatient Physicians,

First Lien Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 6/28/25 | | 2,027,566 | b | 2,036,437 | |

Sound Inpatient Physicians,

Second Lien Initial Loan, 1 Month LIBOR + 6.75% | | 9.09 | | 6/28/26 | | 2,974,297 | b,d | 2,992,887 | |

| | 102,488,773 | |

Insurance - 5.3% | | | | | |

Alliant Holdings Intermediate,

2018 Initial Term Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 5/10/25 | | 6,936,556 | b | 6,944,498 | |

AssuredPartners,

2017 September Refinancing Term Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 10/22/24 | | 3,997,440 | b | 4,000,438 | |

Asurion,

Amendment No. 14 Replacement B-4 Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 8/4/22 | | 1,400,404 | b | 1,408,863 | |

Asurion,

Replacement B-6 Term Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 11/3/23 | | 4,162,757 | b | 4,180,240 | |

21

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Insurance - 5.3% (continued) | | | | | |

Asurion,

Second Lien Replacement B-2 Term Loan, 1 Month LIBOR + 6.50% | | 8.83 | | 7/14/25 | | 12,537,453 | b | 12,923,982 | |

HUB International,

Term Loan, 2-3 Month LIBOR + 3.00% | | 5.34 | | 4/25/25 | | 7,550,000 | b | 7,550,491 | |

Mayfield Agency Borrower,

First Lien Term B Loan, 1 Month LIBOR + 4.50% | | 6.82 | | 1/31/25 | | 5,322,523 | b | 5,369,095 | |

Mayfield Agency Borrower,

Second Lien Term B Loan, 1 Month LIBOR + 8.50% | | 10.82 | | 1/31/26 | | 1,310,367 | b,d | 1,300,539 | |

Sedgwick Claims Management Services,

First Lien Term Loan, 1 Month LIBOR + 2.75% | | 5.08 | | 2/28/21 | | 2,696,941 | b | 2,694,689 | |

Sedgwick Claims Management Services,

First Lien Term Loan, 1-3 Month LIBOR + 0% | | 8.08 | | 2/28/22 | | 5,640,556 | b | 5,673,468 | |

USI,

Term B Loan, 3 Month LIBOR + 3.00% | | 5.32 | | 4/5/24 | | 5,265,559 | b | 5,259,530 | |

York Risk Services Holding (Onex York Finance),

Initial Term Loan, 1 Month LIBOR + 3.75% | | 6.09 | | 10/1/21 | | 4,074,353 | b | 3,955,749 | |

| | 61,261,582 | |

Internet Software & Services - 1.2% | | | | | |

Infinitas Learning Holding,

Facility B-3 Term Loan, 3 Month LIBOR + 3.75% | EUR | 3.75 | | 5/31/24 | | 2,000,000 | b | 2,323,311 | |

Ion Trading Finance,

Initial Dollar Term Loan, 1 Month LIBOR + 4.00% | | 6.31 | | 11/21/24 | | 1,100,000 | b | 1,096,739 | |

Ion Trading Finance,

Initial Euro Term Loan, 1 Month LIBOR + 3.25% | EUR | 4.25 | | 11/21/24 | | 1,203,522 | b | 1,385,854 | |

Rodan & Fields,

Closing Date Term Loan, 1 Month LIBOR + 4.00% | | 6.33 | | 6/7/25 | | 4,592,245 | b | 4,631,004 | |

Trader,

Senior Secured First Lien Term Loan, 1 Month LIBOR + 3.00% | | 5.32 | | 9/28/23 | | 4,429,841 | b | 4,443,707 | |

| | 13,880,615 | |

Materials - 5.0% | | | | | |

Albea Beauty Holdings,

Facility B-2 - Euro, 6 Month LIBOR + 3.25% | EUR | 3.25 | | 4/12/24 | | 2,000,000 | b | 2,329,335 | |

Albea Beauty Holdings,

Facility Term B-2 Loan, 3-6 Month LIBOR + 3.00% | | 5.33 | | 4/12/24 | | 2,714,671 | b | 2,692,044 | |

22

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Materials - 5.0% (continued) | | | | | |

Ball Metalpack Finco,

First Lien Initial Term Loan, 1 Month LIBOR + 4.50% | | 6.85 | | 7/31/25 | | 3,785,703 | b | 3,830,659 | |

BWay Holding,

Term Loan, 3 Month LIBOR + 3.25% | | 5.57 | | 4/3/24 | | 9,248,500 | b | 9,225,379 | |

Circor International,

Term Loan, 1 Month LIBOR + 3.50% | | 5.83 | | 12/11/24 | | 4,789,025 | b | 4,811,486 | |

Dynacast International,

First Lien B1 Term Loan, 3 Month LIBOR + 3.25% | | 5.59 | | 1/28/22 | | 6,040,225 | b | 6,025,124 | |

Klockner Pentaplast of America,

Euro Term Loan, 3 Month EURIBOR + 4.75% | EUR | 4.75 | | 6/29/22 | | 3,586,881 | b | 3,979,010 | |

Murray Energy,

Superpriority Term B-2 Loan, 1 Month LIBOR + 7.25% | | 9.59 | | 10/17/22 | | 5,182,553 | b | 4,858,643 | |

Peabody Energy,

2018 Refinancing Term Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 3/31/25 | | 2,025,424 | b | 2,028,807 | |

Penn Engineering & Manufacturing.,

Term B Loan, 1 Month LIBOR + 2.75% | | 5.08 | | 6/13/24 | | 1,930,500 | b | 1,940,761 | |

Reynolds Group Holdings,

Incremental Term Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 2/5/23 | | 5,494,606 | b | 5,518,644 | |

TecoStar Holdings,

2017 First Lien Term Loan, 1 Month LIBOR + 3.50% | | 5.82 | | 5/1/24 | | 5,363,150 | b | 5,387,472 | |

TricorBraun Holdings,

First Lien Closing Date Term Loan, 3 Month LIBOR + 3.75% | | 6.07 | | 11/30/23 | | 5,336,850 | b | 5,373,541 | |

TricorBraun Holdings,

First Lien Delayed Draw Term Loan, 3 Month LIBOR + 3.75% | | 6.07 | | 11/30/23 | | 537,749 | b | 541,446 | |

| | 58,542,351 | |

Media - 4.6% | | | | | |

Altice Financing,

2017 Term Loan, 1 Month LIBOR + 2.75% | | 5.06 | | 1/31/26 | | 2,575,689 | b | 2,496,487 | |

CBS Radio,

Term B Loan-1, 1-3 Month LIBOR + 2.75% | | 5.06 | | 11/18/24 | | 2,783,160 | b | 2,764,262 | |

Ion Media Networks,

Term B Loan-3, 1 Month LIBOR + 2.75% | | 5.08 | | 12/18/20 | | 5,961,648 | b | 5,998,909 | |

Meredith,

Term Loan, 1 Month LIBOR + 3.00% | | 5.35 | | 1/31/25 | | 4,832,967 | b | 4,852,420 | |

23

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Media - 4.6% (continued) | | | | | |

Numericable U.S.,

Incremental Term B Loan-13, 3 Month LIBOR + 4.00% | | 6.33 | | 1/31/26 | | 7,216,667 | b | 7,038,162 | |

Radiate Holdco,

Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 2/1/24 | | 9,424,718 | b | 9,382,307 | |

Springer Science & Business Media Deutschland,

Initial Term B-12 Loan, 3 Month LIBOR + 3.25% | EUR | 3.75 | | 8/24/22 | | 2,926,011 | b | 3,397,132 | |

Townsquare Media,

Term B Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 4/1/22 | | 3,791,591 | b | 3,799,895 | |

Tribune Media,

Tranche C Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 1/27/24 | | 3,395,981 | b | 3,409,259 | |

Univision Communications,

2017 Replacement Term Loan, 1 Month LIBOR + 2.75% | | 5.08 | | 3/15/24 | | 5,326,588 | b | 5,125,509 | |

WideOpenWest Finance,

Refinancing Term B Loan, 1 Month LIBOR + 3.25% | | 5.59 | | 8/6/23 | | 5,519,294 | b | 5,395,110 | |

| | 53,659,452 | |

Metals & Mining - 1.5% | | | | | |

Aleris International,

First Lien Initial Term Loan, 1 Month LIBOR + 4.75% | | 7.09 | | 2/27/23 | | 5,225,000 | b | 5,307,477 | |

Big River Steel,

Closing Date Term Loan, 3 Month LIBOR + 5.00% | | 7.31 | | 8/15/23 | | 4,390,424 | b | 4,472,744 | |

Covia Holdings,

Term Loan, 3 Month LIBOR + 3.75% | | 6.07 | | 5/21/25 | | 3,964,961 | b | 3,927,790 | |

Phoenix Services International,

Term B Loan, 1 Month LIBOR + 3.75% | | 6.07 | | 1/30/25 | | 3,493,651 | b | 3,515,487 | |

| | 17,223,498 | |

Real Estate - .8% | | | | | |

DTZ US Borrower,

Closing Date Term Loan, 1 Month LIBOR + 3.25% | | 5.56 | | 8/21/25 | | 7,700,000 | b | 7,683,175 | |

Flamingo LUX II,

Senior Facility B-3, 3 Month LIBOR + 3.25% | EUR | 3.25 | | 8/1/23 | | 1,482,447 | b | 1,724,192 | |

| | 9,407,367 | |

Registered Investment Companies - .9% | | | | | |

Masergy Holdings,

2017 Replacement First Lien Term Loan, 3 Month LIBOR + 3.25% | | 5.56 | | 12/15/23 | | 3,692,405 | b | 3,700,104 | |

24

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Registered Investment Companies - .9% (continued) | | | | | |

TKC Holdings,

First Lien Term Loan, 1 Month LIBOR + 3.75% | | 6.08 | | 2/1/23 | | 4,577,062 | b | 4,583,859 | |

TKC Holdings,

Second Lien Term Loan, 1 Month LIBOR + 8.00% | | 10.33 | | 2/1/24 | | 2,075,000 | b | 2,077,417 | |

| | 10,361,380 | |

Retailing - 4.6% | | | | | |

Atkins Nutritionals,

Term Loan, 3 Month LIBOR + 3.50% | | 5.83 | | 7/7/24 | | 3,382,000 | b,d | 3,420,047 | |

Comfort Holding,

Term Loan, 1 Month LIBOR + 4.75% | | 7.09 | | 2/3/24 | | 2,715,625 | b | 2,596,816 | |

CWGS Group,

Term Loan, 1 Month LIBOR + 2.75% | | 5.09 | | 11/8/23 | | 3,132,084 | b | 3,095,282 | |

Douglas,

Term B-7 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 47,166 | b | 45,606 | |

Douglas Holdings,

Term B-1 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 379,473 | b | 366,914 | |

Douglas Holdings,

Term B-2 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 113,228 | b | 109,481 | |

Douglas Holdings,

Term B-3 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 349,253 | b | 337,694 | |

Douglas Holdings,

Term B-4 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 130,804 | b | 126,475 | |

Douglas Holdings,

Term B-5 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 9,627 | b | 9,309 | |

Douglas Holdings,

Term B-6 Loan, 3 Month EURIBOR + 3.50% | EUR | 3.50 | | 8/13/22 | | 158,902 | b | 153,643 | |

EG America,

Additional Facility Loan, 3 Month LIBOR + 4.00% | | 6.34 | | 2/6/25 | | 1,757,423 | b | 1,761,816 | |

Foundation Building Materials Holding,

Term Loan, 3 Month LIBOR + 3.25% | | 5.59 | | 7/30/25 | | 3,948,684 | b | 3,961,024 | |

Kirk Beauty One - Douglas,

Facility B8, 3 Month LIBOR + 3.25% | EUR | 3.25 | | 8/13/22 | | 2,811,546 | b | 2,718,498 | |

Leslie's Poolmart,

Term B-2 Loan, 2 Month LIBOR + 3.50% | | 5.82 | | 8/16/23 | | 4,072,779 | b | 4,077,035 | |

Men's Wearhouse,

Term B-2 Loan, 1 Month LIBOR + 3.50% | | 5.83 | | 4/9/25 | | 3,631,750 | b | 3,661,258 | |

25

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Retailing - 4.6% (continued) | | | | | |

Neiman Marcus Group ,

Term Loan, 1 Month LIBOR + 3.25% | | 5.58 | | 10/25/20 | | 3,751,674 | b | 3,493,747 | |

NPC International ,

First Lien Term Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 4/3/24 | | 3,390,750 | b | 3,418,317 | |

Peer Holding III,

Facility B, 3 Month LIBOR + 3.50% | EUR | 3.50 | | 3/8/25 | | 2,000,000 | b | 2,289,301 | |

Serta Simmons Bedding,

First Lien Initial Term Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 11/8/23 | | 3,250,500 | b | 2,804,905 | |

SRS Distribution,

Term Loan, 2 Month LIBOR + 3.25% | | 5.57 | | 5/18/25 | | 5,400,000 | b | 5,284,764 | |

Staples,

Term Loan, 3 Month LIBOR + 4.00% | | 6.33 | | 8/15/24 | | 5,511,791 | b | 5,505,894 | |

Tacala Investment,

First Lien Term Loan, 1 Month LIBOR + 3.25% | | 5.60 | | 2/1/25 | | 4,282,828 | b | 4,301,565 | |

| | 53,539,391 | |

Semiconductors & Semiconductor Equipment - .6% | | | | | |

Bright Bidco,

2018 Refinancing Term B Loan, 1-3 Month LIBOR + 3.50% | | 5.82 | | 6/30/24 | | 6,541,605 | b | 6,491,202 | |

Technology Hardware & Equipment - 3.0% | | | | | |

BMC Software Finance,

Term Loan, 1 Month LIBOR + 4.25% | | 6.56 | | 10/2/25 | | 9,075,000 | b | 9,094,874 | |

Everi Payments,

New Term B Loan, 1 Month LIBOR + 3.00% | | 5.81 | | 5/9/24 | | 5,648,744 | b | 5,681,112 | |

Harland Clarke Holdings,

Term Loan, 3 Month LIBOR + 4.75% | | 7.09 | | 11/3/23 | | 4,649,565 | b | 4,388,027 | |

McAfee,

Tranche B Term Loan, 1 Month LIBOR + 4.50% | | 6.84 | | 9/29/24 | | 6,897,048 | b | 6,962,570 | |

Tempo Acquisition,

Term Loan, 1 Month LIBOR + 3.00% | | 5.35 | | 5/1/24 | | 7,741,752 | b | 7,768,732 | |

VeriFone Systems,

First Lien Initial Term Loan, 3 Month LIBOR + 4.00% | | 6.31 | | 8/20/25 | | 704,120 | b | 706,584 | |

| | 34,601,899 | |

Telecommunication Services - 2.5% | | | | | |

CenturyLink,

Initial Term A Loan, 1 Month LIBOR + 2.75% | | 5.10 | | 10/31/21 | | 3,208,861 | b | 3,210,866 | |

Colorado Buyer,

Second Lien Initial Term Loan, 1 Month LIBOR + 7.25% | | 9.60 | | 3/15/25 | | 2,775,000 | b | 2,784,255 | |

26

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | a | Value ($) | |

Floating Rate Loan Interests - 88.0% (continued) | | | | | |

Telecommunication Services - 2.5% (continued) | | | | | |

Consolidated Communications,

Term Loan, 1 Month LIBOR + 3.00% | | 5.34 | | 10/5/23 | | 3,327,791 | b | 3,279,622 | |

GTT Communications,

EMEA Term Loan, 1 Month LIBOR + 3.25% | EUR | 3.25 | | 5/31/25 | | 2,500,000 | b | 2,869,229 | |

Intelsat Jackson Holdings,

Term B4 Loan, 1 Month LIBOR + 4.50% | | 6.84 | | 1/2/24 | | 3,619,048 | b | 3,808,306 | |

IPC,

First Lien Term B-1 Loan, 3 Month LIBOR + 4.50% | | 6.84 | | 8/6/21 | | 773,537 | b | 756,136 | |

MTN Infrastructure TopCo ,

Term Loan, 1 Month LIBOR + 3.00% | | 5.31 | | 11/17/24 | | 4,492,875 | b | 4,518,844 | |

West,

Term Loan B, 1 Month LIBOR + 4.00% | | 6.34 | | 10/10/24 | | 8,101,123 | b | 8,082,125 | |

| | 29,309,383 | |

Transportation - .5% | | | | | |

Kenan Advantage Group,

Initial U.S. Term Loan, 1 Month LIBOR + 3.00% | | 5.33 | | 7/31/22 | | 2,061,791 | b | 2,055,358 | |

Kenan Canada GP,

Initial Canadian Term Loan, 1 Month LIBOR + 3.00% | | 5.35 | | 7/31/22 | | 626,746 | b | 624,791 | |

PODS,

Term B4 Loan, 1 Month LIBOR + 2.75% | | 5.08 | | 11/21/24 | | 3,354,661 | b | 3,365,665 | |

| | 6,045,814 | |

Utilities - 1.9% | | | | | |

Eastern Power,

Term Loan, 3 Month LIBOR + 3.75% | | 6.06 | | 10/2/23 | | 8,078,920 | b | 8,090,675 | |

EFS Cogen Holdings I,

Term B Advance, 3 Month LIBOR + 3.25% | | 5.59 | | 6/28/23 | | 4,391,063 | b | 4,389,702 | |

Helix Gen Funding,

Term Loan, 1 Month LIBOR + 3.75% | | 6.07 | | 6/2/24 | | 6,382,850 | b | 6,169,025 | |

Pike,

2018 Initial Term Loan, 1 Month LIBOR + 3.50% | | 5.84 | | 3/23/25 | | 3,686,049 | b | 3,718,301 | |

| | 22,367,703 | |

Total Floating Rate Loan Interests

(cost $1,025,009,643) | | 1,021,269,759 | |

| | | | | | Shares | | | |

Exchange-Traded Funds - 1.8% | | | | | |

Registered Investment Companies - 1.8% | | | | | |

Invesco Senior Loan ETF

(cost $21,658,817) | | | | | | 936,972 | | 21,606,574 | |

27

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | 7-Day

Yield (%) | | | | Shares | | Value ($) | |

Investment Companies - 10.7% | | | | | |

Registered Investment Companies - 10.7% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund

(cost $123,778,748) | | 1.91 | | | | 123,778,748 | f | 123,778,748 | |

Total Investments (cost $1,240,532,747) | | 106.5% | 1,235,900,985 | |

Liabilities, Less Cash and Receivables | | (6.5%) | (74,894,910) | |

Net Assets | | 100.0% | 1,161,006,075 | |

ETF—Exchange-Traded Fund

EURIBOR—Euro Interbank Offered Rate

LIBOR—London Interbank Offered Rate

EUR—Euro

a Amount stated in U.S. Dollars unless otherwise noted above.

b Variable rate security—rate shown is the interest rate in effect at period end.

c Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At August 31, 2018, these securities were valued at $59,060,976 or 5.09% of net assets.

d These securities are deemed Illiquid security by Board. At the period end, the value of these securities amounted to $159,487,072 or 13.74% of net assets.

e Investment, or portion of investment, represents an unfunded floating note loan interest outstanding.

f Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the respective investment company’s prospectus.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Consumer, Non-cyclical | 20.4 |

Industrial | 12.8 |

Investment Companies | 12.5 |

Technology | 12.4 |

Consumer, Cyclical | 11.7 |

Communications | 10.1 |

Financial | 8.2 |

Basic Materials | 6.3 |

Energy | 5.8 |

Collateralized Loan Obligations | 4.4 |

Utilities | 1.9 |

| | 106.5 |

† Based on net assets.

See notes to financial statements.

28

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Registered Investment Company | Value

8/31/17 ($) | Purchases ($) | Sales ($) | Value

8/31/18 ($) | Net

Assets (%) | Dividends/

Distributions ($) |

Dreyfus Institutional Preferred Government Plus Money Market Fund | 94,487,366 | 463,407,402 | 434,116,020 | 123,778,748 | 10.7 | 1,474,160 |

See notes to financial statements.

29

STATEMENT OF FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS August 31, 2018

| | | | | | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation ($) |

Credit Suisse International | | | |

United States Dollar | 36,682,857 | Euro | 31,285,000 | 10/16/18 | 241,156 |

Gross Unrealized Appreciation | | | 241,156 |

See notes to financial statements.

30

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2018

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments: | | | |

Unaffiliated issuers | 1,116,753,999 | | 1,112,122,237 | |

Affiliated issuers | | 123,778,748 | | 123,778,748 | |

Cash | | | | | 6,863,561 | |

Cash denominated in foreign currency | | | 3,367,035 | | 3,367,035 | |

Receivable for investment securities sold | | 18,297,761 | |

Interest receivable | | 3,952,128 | |

Receivable for shares of Common Stock subscribed | | 2,568,184 | |

Unrealized appreciation on foreign currency transactions | | 349,548 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | 241,156 | |

Prepaid expenses | | | | | 73,613 | |

| | | | | 1,271,613,971 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | 647,124 | |

Payable for investment securities purchased | | 102,841,681 | |

Payable for shares of Common Stock redeemed | | 1,805,444 | |

Directors fees and expenses payable | | 16,680 | |

Interest payable—Note 2 | | 2,019 | |

Accrued expenses and other liabilities | | | | | 5,294,948 | |

| | | | | 110,607,896 | |

Net Assets ($) | | | 1,161,006,075 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 1,188,787,836 | |

Accumulated undistributed investment income—net | | 7,396,559 | |

Accumulated net realized gain (loss) on investments | | | | | (31,137,262) | |

Accumulated net unrealized appreciation (depreciation)

on investments and foreign currency transactions | | (4,041,058) | |

Net Assets ($) | | | 1,161,006,075 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 19,165,168 | 2,166,417 | 18,280,209 | 1,121,394,281 | |

Shares Outstanding | 1,587,357 | 179,636 | 1,517,298 | 93,182,814 | |

Net Asset Value Per Share ($) | 12.07 | 12.06 | 12.05 | 12.03 | |

| | | | | | |

See notes to financial statements. | | | | | |

31

STATEMENT OF OPERATIONS

Year Ended August 31, 2018

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest | | | 51,858,571 | |

Dividends: | |

Unaffiliated issuers | | | 534,446 | |

Affiliated issuers | | | 1,474,160 | |

Total Income | | | 53,867,177 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 6,757,426 | |

Professional fees | | | 141,627 | |

Loan commitment fees—Note 2 | | | 92,387 | |

Directors’ fees and expenses—Note 3(d) | | | 81,147 | |

Registration fees | | | 79,436 | |

Shareholder servicing costs—Note 3(c) | | | 70,685 | |

Distribution fees—Note 3(b) | | | 17,205 | |

Custodian fees—Note 3(c) | | | 10,694 | |

Prospectus and shareholders’ reports | | | 2,493 | |

Miscellaneous | | | 300,077 | |

Total Expenses | | | 7,553,177 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (5,543) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (4,520) | |

Net Expenses | | | 7,543,114 | |

Investment Income—Net | | | 46,324,063 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | (3,853,562) | |

Net realized gain (loss) on forward foreign currency exchange contracts | 899,203 | |

Net Realized Gain (Loss) | | | (2,954,359) | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | (6,863,649) | |

Net unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | | | 445,938 | |

Net Unrealized Appreciation (Depreciation) | | | (6,417,711) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (9,372,070) | |

Net Increase in Net Assets Resulting from Operations | | 36,951,993 | |

| | | | | | | |

See notes to financial statements. | | | | | |

32

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2018 | | 2017 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 46,324,063 | | | | 27,904,856 | |

Net realized gain (loss) on investments | | (2,954,359) | | | | (3,244,557) | |

Net unrealized appreciation (depreciation)

on investments | | (6,417,711) | | | | 3,976,756 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 36,951,993 | | | | 28,637,055 | |

Distributions to Shareholders from ($): | |

Investment income—net: | | | | | | | | |

Class A | | | (726,137) | | | | (439,124) | |

Class C | | | (68,485) | | | | (76,376) | |

Class I | | | (884,361) | | | | (779,372) | |

Class Y | | | (40,747,816) | | | | (25,202,771) | |

Total Distributions | | | (42,426,799) | | | | (26,497,643) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 12,526,410 | | | | 12,313,342 | |

Class C | | | 431,944 | | | | 1,469,121 | |

Class I | | | 30,962,912 | | | | 48,823,802 | |

Class Y | | | 352,642,182 | | | | 469,824,657 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 712,848 | | | | 418,239 | |

Class C | | | 65,581 | | | | 73,719 | |

Class I | | | 762,556 | | | | 661,698 | |

Class Y | | | 12,908,518 | | | | 9,010,491 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (8,449,840) | | | | (5,523,110) | |

Class C | | | (974,115) | | | | (856,786) | |

Class I | | | (31,783,402) | | | | (43,917,071) | |

Class Y | | | (116,114,361) | | | | (85,234,090) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | 253,691,233 | | | | 407,064,012 | |

Total Increase (Decrease) in Net Assets | 248,216,427 | | | | 409,203,424 | |

Net Assets ($): | |

Beginning of Period | | | 912,789,648 | | | | 503,586,224 | |

End of Period | | | 1,161,006,075 | | | | 912,789,648 | |

Undistributed investment income—net | 7,396,559 | | | | 1,778,815 | |

33

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2018 | | 2017 | |

Capital Share Transactions (Shares): | |

Class Aa | | | | | | | | |

Shares sold | | | 1,033,381 | | | | 1,016,419 | |

Shares issued for distributions reinvested | | | 58,986 | | | | 34,514 | |

Shares redeemed | | | (698,732) | | | | (454,952) | |

Net Increase (Decrease) in Shares Outstanding | 393,635 | | | | 595,981 | |

Class Ca | | | | | | | | |

Shares sold | | | 35,761 | | | | 121,518 | |

Shares issued for distributions reinvested | | | 5,430 | | | | 6,094 | |

Shares redeemed | | | (80,554) | | | | (70,735) | |

Net Increase (Decrease) in Shares Outstanding | (39,363) | | | | 56,877 | |

Class Ib | | | | | | | | |

Shares sold | | | 2,559,900 | | | | 4,030,579 | |

Shares issued for distributions reinvested | | | 63,235 | | | | 54,699 | |

Shares redeemed | | | (2,632,716) | | | | (3,624,840) | |

Net Increase (Decrease) in Shares Outstanding | (9,581) | | | | 460,438 | |

Class Yb | | | | | | | | |

Shares sold | | | 29,213,576 | | | | 38,800,687 | |

Shares issued for distributions reinvested | | | 1,071,834 | | | | 746,227 | |

Shares redeemed | | | (9,627,009) | | | | (7,048,673) | |

Net Increase (Decrease) in Shares Outstanding | 20,658,401 | | | | 32,498,241 | |

| | | | | | | | | | |

a | During the period ended August 31, 2018, 2,502 Class C shares representing $30,272 were automatically converted to 2,498 Class A shares. | |

b | During the period ended August 31, 2018, 833,605 Class Y shares representing $10,051,397 were exchanged for 832,612 Class I shares and during the period ended August 31, 2017, 871,441 Class Y shares representing $10,544,135 were exchanged for 870,512 Class I shares. | |

See notes to financial statements. | | | | | | | | |

34

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | | | |

| | | Year Ended August 31, |

Class A Shares | 2018 | 2017 | 2016 | 2015 | 2014a |

Per Share Data ($): | | | | | |

Net asset value, beginning of period | 12.13 | 12.06 | 12.29 | 12.64 | 12.50 |

Investment Operations: | | | | | |

Investment income—net b | .51 | .44 | .47 | .48 | .38 |

Net realized and unrealized

gain (loss) on investments | (.11) | .05 | (.21) | (.33) | .05 |

Total from Investment Operations | .40 | .49 | .26 | .15 | .43 |

Distributions: | | | | | |

Dividends from investment income—net | (.46) | (.42) | (.49) | (.48) | (.29) |

Dividends from net realized gain on investments | - | - | - | (.02) | - |

Total Distributions | (.46) | (.42) | (.49) | (.50) | (.29) |

Net asset value, end of period | 12.07 | 12.13 | 12.06 | 12.29 | 12.64 |

Total Return (%)c | 3.38 | 4.14 | 2.23 | 1.28 | 3.39d |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses to average net assets | .99 | 1.02 | 1.04 | 1.04 | 1.13e |

Ratio of net expenses to average net assets | .99 | 1.02 | 1.04 | 1.04 | 1.03e |

Ratio of net investment income

to average net assets | 4.19 | 3.61 | 3.98 | 3.88 | 3.17e |

Portfolio Turnover Rate | 91.78 | 97.82 | 66.45 | 76.63 | 51.30d |

Net Assets, end of period ($ x 1,000) | 19,165 | 14,483 | 7,210 | 7,824 | 4,402 |

a From September 27, 2013 (commencement of operations) to August 31, 2014.

b Based on average shares outstanding.

c Exclusive of sales charge.

d Not annualized.

e Annualized.

See notes to financial statements.

35

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | |

| | | | | | |

| | Year Ended August 31, |

Class C Shares | 2018 | 2017 | 2016 | 2015 | 2014a |

Per Share Data ($): | | | | | |

Net asset value, beginning of period | 12.11 | 12.04 | 12.28 | 12.63 | 12.50 |

Investment Operations: | | | | | |

Investment income—netb | .41 | .35 | .38 | .39 | .28 |

Net realized and unrealized

gain (loss) on investments | (.10) | .05 | (.22) | (.33) | .06 |

Total from Investment Operations | .31 | .40 | .16 | .06 | .34 |

Distributions: | | | | | |

Dividends from investment income—net | (.36) | (.33) | (.40) | (.39) | (.21) |

Dividends from net realized gain on investments | - | - | - | (.02) | - |

Total Distributions | (.36) | (.33) | (.40) | (.41) | (.21) |