UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-05202 |

| |

| The Dreyfus/Laurel Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 10/31 | |

Date of reporting period: | 10/31/18 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

Dreyfus Bond Market Index Fund

Dreyfus Disciplined Stock Fund

Dreyfus Institutional S&P 200 Stock Index Fund

Dreyfus Tax Managed Growth Fund

Dreyfus Unconstrained Bond Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Bond Market Index Fund

| | | |

| | ANNUAL REPORT October 31, 2018 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

| | | | |

| |

Dreyfus Bond Market Index Fund

| | The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Bond Market Index Fund, covering the 12-month period from November 1, 2017 through October 31, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Markets began the reporting period on solid footing as major global economies experienced above-trend growth across the board. In the United States, the Federal Reserve continued to move away from its accommodative monetary policy while other major central banks also began to consider monetary tightening. In the equity markets, both U.S. and non-U.S. markets enjoyed an upward trend, though investor concerns about volatility and inflation later began to weigh on returns. Interest rates rose across the curve, putting pressure on bond prices.

Later in the reporting period, global growth trends began to diverge. While a strong economic performance continued to bolster U.S. equity markets, slower growth and political concerns pressured markets in the Eurozone. Emerging markets also came under pressure as weakness in their currencies added to investors’ uneasiness. Fixed income markets continued to struggle as interest rates rose; the yield on the benchmark 10-year Treasury bond surged late in the reporting period, but growing investor concerns about global growth helped keep it from rising further.

Despite continuing doubts regarding trade, U.S. inflationary pressures, and global growth, we are optimistic that the U.S. economy will remain strong in the near term. However, we will stay attentive to signs that signal potential changes on the horizon. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

November 15, 2018

2

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2017 through October 31, 2018, as provided by Nancy G. Rogers, CFA, Paul Benson, CFA, and Stephanie Shu, CFA, Portfolio Managers

Market and Fund Performance Overview

For the 12-month period ended October 31, 2018, Dreyfus Bond Market Index Fund’s Class I shares produced a total return of -2.27%, and its Investor shares produced a total return of -2.42%.1 In comparison, the Bloomberg Barclays U.S. Aggregate Bond Index (the ��Index”) achieved a total return of -2.05% for the same period.2

Investment-grade U.S. fixed-income securities produced negative returns, on average, over the reporting period in an environment of economic growth and rising interest rates. The difference in returns between the fund and the Index was primarily the result of operating expenses that are not reflected in the Index’s results.

The Fund’s Investment Approach

The fund seeks to match the total return of the Index. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in bonds that are included in the Index (or other instruments with similar economic characteristics). To maintain liquidity, the fund may invest up to 20% of its assets in various short-term, fixed-income securities and money market instruments.

The fund’s investments are selected by a “sampling” process, which is a statistical process used to select bonds so that the fund has investment characteristics that closely approximate those of the Index. By using this sampling process, the fund typically will not invest in all of the securities in the Index.

Rising Interest Rates and Volatility Dampened U.S. Bond Returns

In general, investment-grade debt lost varying degrees of value over the period. In late 2017, the U.S. Federal Reserve (the “Fed”) began to unwind its balance sheet through a reduction in purchases of mortgage-backed securities. Longer-term interest rates climbed during this time. Corporate debt soundly outperformed like-duration Treasuries. A shift occurred early in 2018. While the U.S. economy continued to strengthen, other developed countries started to slow. Equity markets corrected, spooked by rising rates and talk of potential changes to trade policies. The volatility caused concern, sparking a flight to quality. Corporate debt gave up some of its earlier return. However, some asset classes, such as corporate high-yield debt, recovered and outperformed during the last half of the period. At the end of the 12 months, despite the strong fundamentals of the broader market, investment-grade corporate debt, depressed by increased volatility from trade disputes and rising rates, lagged in performance.

During the period, the Fed increased rates four times. Each time, an increase of 25 basis points was instituted. Over the 12 months, the interest rates on the 2-, 10-, and 30-year Treasuries rose from 1.61%, 2.37%, and 2.85% on November 1, 2017, to 2.87%, 3.15%, and 3.39%, respectively, on October 31, 2018. While rates across all maturities rose during the period, the yield curve flattened.

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

Corporate Bonds Hurt by Trade Uncertainty

Most bond market sectors, including corporate-backed securities, produced negative returns over the reporting period. Corporate bonds experienced some weakness later in the reporting period, when yield differences widened across the market’s credit-quality range, due to rate increases and uncertainty surrounding trade tariffs. These developments more than offset more positive influences, including lower corporate tax rates, rising earnings, and favorable business conditions in the constructive economy. As a result, most industry groups within the corporate bond market—with the notable exception of the energy and communications industries—underperformed broader market averages.

Some asset-backed securities eked out a small positive return during the reporting period, such as commercial mortgage-backed securities (CMBS). They are only a small part of the Index. Mortgage-backed securities have been directional with Treasuries over the period. Their prices have been under pressure due to supply-and-demand dynamics.

Replicating the Index’s Composition

As an index fund, we attempt to match closely the returns of the Index by approximating its composition and credit quality.

We expect additional, short-term interest-rate hikes from the Fed over the remainder of 2018 and into 2019, as monetary policymakers respond to economic growth.

November 15, 2018

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Investors cannot invest directly in any index.

Bonds are subject generally to interest-rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

Indexing does not attempt to manage market volatility, use defensive strategies, or reduce the effects of any long-term periods of poor index performance. The correlation between fund and index performance may be affected by the fund’s expenses and use of sampling techniques, changes in securities markets, changes in the composition of the index, and the timing of purchases and redemptions of fund shares.

4

FUND PERFORMANCE (Unaudited)

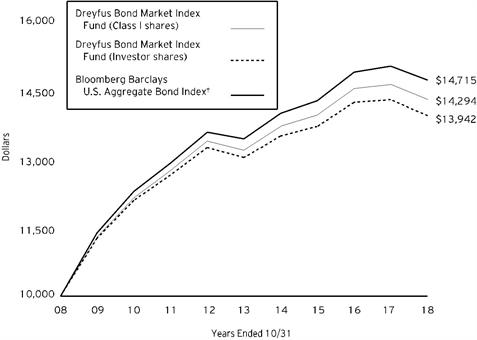

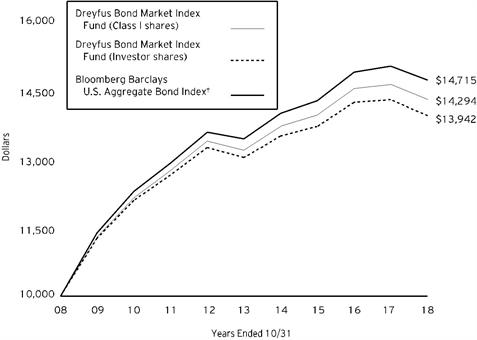

Comparison of change in value of $10,000 investment in Dreyfus Bond Market Index Fund Investor shares and Class I shares and the Bloomberg Barclays U.S. Aggregate Bond Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Investor and Class I shares of Dreyfus Bond Market Index Fund on 10/31/08 to a $10,000 investment made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Class I and Investor shares. The Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

| | | | |

Average Annual Total Returns as of 10/31/18 |

| 1 Year | 5 Years | 10 Years |

Class I shares | -2.27% | 1.62% | 3.64% |

Investor shares | -2.42% | 1.37% | 3.38% |

Bloomberg Barclays U.S. Aggregate Bond Index | -2.05% | 1.83% | 3.94% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Bond Market Index Fund from May 1, 2018 to October 31, 2018. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended October 31, 2018 | |

| | | | Investor Shares | Class I |

Expenses paid per $1,000† | | | $2.01 | | $.76 |

Ending value (after expenses) | | | $996.60 | | $997.80 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended October 31, 2018 |

| | | | Investor Shares | Class I |

Expenses paid per $1,000† | | | $2.04 | | $.77 |

Ending value (after expenses) | | | $1,023.19 | | $1,024.45 |

† Expenses are equal to the fund’s annualized expense ratio of .40% for Investor shares and .15% for Class I shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

7

STATEMENT OF INVESTMENTS

October 31, 2018

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% | | | | | |

Advertising - .2% | | | | | |

Interpublic Group of Companies,

Sr. Unscd. Notes | | 3.50 | | 10/1/2020 | | 300,000 | | 299,784 | |

Interpublic Group of Companies,

Sr. Unscd. Notes | | 3.75 | | 10/1/2021 | | 300,000 | | 300,063 | |

Interpublic Group of Companies,

Sr. Unscd. Notes | | 4.20 | | 4/15/2024 | | 500,000 | | 497,427 | |

Interpublic Group of Companies,

Sr. Unscd. Notes | | 4.65 | | 10/1/2028 | | 300,000 | | 296,215 | |

Interpublic Group of Companies,

Sr. Unscd. Notes | | 5.40 | | 10/1/2048 | | 300,000 | | 283,514 | |

Omnicom Group,

Sr. Unscd. Notes | | 3.63 | | 5/1/2022 | | 500,000 | | 494,328 | |

WPP Finance 2010,

Gtd. Notes | | 3.75 | | 9/19/2024 | | 350,000 | | 333,854 | |

| | 2,505,185 | |

Aerospace & Defense - .4% | | | | | |

Harris,

Sr. Unscd. Notes | | 5.05 | | 4/27/2045 | | 350,000 | | 361,130 | |

Lockheed Martin,

Sr. Unscd. Bonds | | 3.60 | | 3/1/2035 | | 500,000 | | 453,650 | |

Lockheed Martin,

Sr. Unscd. Notes | | 3.55 | | 1/15/2026 | | 235,000 | | 229,747 | |

Lockheed Martin,

Sr. Unscd. Notes | | 4.07 | | 12/15/2042 | | 500,000 | | 467,117 | |

Northrop Grumman,

Sr. Unscd. Notes | | 3.50 | | 3/15/2021 | | 200,000 | | 200,202 | |

Northrop Grumman,

Sr. Unscd. Notes | | 4.03 | | 10/15/2047 | | 160,000 | | 143,915 | |

Northrop Grumman Systems,

Gtd. Notes | | 7.75 | | 2/15/2031 | | 500,000 | | 653,709 | |

Raytheon,

Sr. Unscd. Debs. | | 7.20 | | 8/15/2027 | | 150,000 | | 185,434 | |

United Technologies,

Sr. Unscd. Notes | | 3.10 | | 6/1/2022 | | 600,000 | | 589,246 | |

United Technologies,

Sr. Unscd. Notes | | 3.13 | | 5/4/2027 | | 110,000 | | 101,368 | |

United Technologies,

Sr. Unscd. Notes | | 3.65 | | 8/16/2023 | | 225,000 | | 222,719 | |

United Technologies,

Sr. Unscd. Notes | | 4.13 | | 11/16/2028 | | 210,000 | | 207,075 | |

United Technologies,

Sr. Unscd. Notes | | 4.50 | | 6/1/2042 | | 380,000 | | 361,492 | |

United Technologies,

Sr. Unscd. Notes | | 4.63 | | 11/16/2048 | | 105,000 | | 101,169 | |

8

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Aerospace & Defense - .4% (continued) | | | | | |

United Technologies,

Sr. Unscd. Notes | | 5.70 | | 4/15/2040 | | 300,000 | | 328,966 | |

United Technologies,

Sr. Unscd. Notes | | 6.70 | | 8/1/2028 | | 50,000 | | 58,689 | |

| | 4,665,628 | |

Agriculture - .3% | | | | | |

Altria Group,

Gtd. Notes | | 2.85 | | 8/9/2022 | | 500,000 | | 486,196 | |

Altria Group,

Gtd. Notes | | 4.25 | | 8/9/2042 | | 500,000 | | 441,612 | |

BAT Capital,

Gtd. Notes | | 2.76 | | 8/15/2022 | | 350,000 | a | 335,340 | |

BAT Capital,

Gtd. Notes | | 3.22 | | 8/15/2024 | | 310,000 | a | 292,944 | |

BAT Capital,

Gtd. Notes | | 3.56 | | 8/15/2027 | | 310,000 | a | 284,778 | |

BAT Capital,

Gtd. Notes | | 4.39 | | 8/15/2037 | | 180,000 | a | 161,131 | |

Philip Morris International,

Sr. Unscd. Notes | | 2.50 | | 8/22/2022 | | 600,000 | | 576,404 | |

Philip Morris International,

Sr. Unscd. Notes | | 4.50 | | 3/20/2042 | | 650,000 | | 612,038 | |

Reynolds American,

Gtd. Notes | | 5.70 | | 8/15/2035 | | 240,000 | | 247,015 | |

| | 3,437,458 | |

Airlines - .1% | | | | | |

American Airlines,

Scd. Notes, Ser. AA | | 3.58 | | 7/15/2029 | | 492,885 | | 477,723 | |

United Airlines,

Pass Thru Certs., Ser. 2013-1, Cl. A | | 4.30 | | 8/15/2025 | | 802,487 | | 816,618 | |

| | 1,294,341 | |

Asset-Backed Ctfs./Auto Receivables - .3% | | | | | |

BMW Vehicle Owner Trust,

Ser. 2018-A | | 2.51 | | 6/25/2024 | | 1,000,000 | | 982,181 | |

GM Financial Automobile Leasing,

Ser. 2018-A, Cl. A3 | | 2.61 | | 1/20/2021 | | 500,000 | | 497,159 | |

Nissan Auto Receivables Owner Trust,

Ser. 2017-B, Cl. A3 | | 1.75 | | 10/15/2021 | | 1,000,000 | | 985,553 | |

Toyota Auto Receivables Owner Trust,

Ser. 2016-C, Cl. A4 | | 1.32 | | 11/15/2021 | | 1,000,000 | | 979,671 | |

| | 3,444,564 | |

Asset-Backed Ctfs./Credit Cards - .3% | | | | | |

Capital One Multi-Asset Execution Trust,

Ser. 2017-A3, Cl. A3 | | 2.43 | | 1/15/2025 | | 280,000 | | 273,054 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Asset-Backed Ctfs./Credit Cards - .3% (continued) | | | | | |

Capital One Multi-Asset Execution Trust,

Ser. 2017-A4, Cl. A4 | | 1.99 | | 7/17/2023 | | 500,000 | | 489,345 | |

Chase Issuance Trust,

Ser. 2017-A4, Cl. A4 | | 1.84 | | 4/15/2022 | | 500,000 | | 491,163 | |

Citibank Credit Card Issuance Trust,

Ser. 2014-A5, Cl. A5 | | 2.68 | | 6/7/2023 | | 500,000 | | 492,864 | |

Discover Card Execution Note Trust,

Ser. 2017-A2, Cl. A2 | | 2.39 | | 7/15/2024 | | 1,250,000 | | 1,217,204 | |

| | 2,963,630 | |

Automobiles & Components - .5% | | | | | |

American Honda Finance,

Sr. Unscd. Bonds, Ser. A | | 2.15 | | 3/13/2020 | | 350,000 | | 345,104 | |

Aptiv,

Gtd. Notes | | 4.25 | | 1/15/2026 | | 400,000 | | 393,263 | |

BorgWarner,

Sr. Unscd. Notes | | 3.38 | | 3/15/2025 | | 500,000 | | 479,614 | |

Daimler Finance North America,

Gtd. Notes | | 8.50 | | 1/18/2031 | | 200,000 | | 273,111 | |

Ford Motor,

Sr. Unscd. Bonds | | 6.63 | | 10/1/2028 | | 400,000 | | 410,553 | |

Ford Motor,

Sr. Unscd. Notes | | 5.29 | | 12/8/2046 | | 160,000 | | 134,444 | |

Ford Motor Credit,

Sr. Unscd. Notes | | 3.20 | | 1/15/2021 | | 750,000 | | 732,287 | |

Ford Motor Credit,

Sr. Unscd. Notes | | 4.38 | | 8/6/2023 | | 400,000 | | 389,734 | |

Ford Motor Credit,

Sr. Unscd. Notes | | 8.13 | | 1/15/2020 | | 571,000 | | 598,621 | |

General Motors,

Sr. Unscd. Notes | | 4.20 | | 10/1/2027 | | 180,000 | | 164,830 | |

General Motors,

Sr. Unscd. Notes | | 5.15 | | 4/1/2038 | | 90,000 | | 79,757 | |

General Motors,

Sr. Unscd. Notes | | 5.20 | | 4/1/2045 | | 340,000 | | 296,161 | |

General Motors Financial,

Gtd. Notes | | 3.20 | | 7/13/2020 | | 500,000 | | 495,875 | |

General Motors Financial,

Gtd. Notes | | 4.30 | | 7/13/2025 | | 500,000 | | 478,925 | |

Toyota Motor,

Sr. Unscd. Bonds | | 3.67 | | 7/20/2028 | | 200,000 | b | 195,656 | |

Toyota Motor Credit,

Sr. Unscd. Notes | | 2.15 | | 3/12/2020 | | 500,000 | | 494,567 | |

Toyota Motor Credit,

Sr. Unscd. Notes | | 2.63 | | 1/10/2023 | | 500,000 | | 482,891 | |

| | 6,445,393 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% | | | | | |

Australia & New Zealand Banking Group,

Sr. Unscd. Notes | | 2.30 | | 6/1/2021 | | 350,000 | | 339,321 | |

Banco Santander,

Sr. Unscd. Notes | | 3.80 | | 2/23/2028 | | 400,000 | | 356,128 | |

Bank of America,

Sr. Unscd. Bonds | | 2.63 | | 4/19/2021 | | 610,000 | | 598,814 | |

Bank of America,

Sr. Unscd. Notes | | 2.37 | | 7/21/2021 | | 500,000 | | 490,544 | |

Bank of America,

Sr. Unscd. Notes | | 3.00 | | 12/20/2023 | | 744,000 | | 716,749 | |

Bank of America,

Sr. Unscd. Notes | | 3.50 | | 4/19/2026 | | 1,030,000 | | 980,853 | |

Bank of America,

Sr. Unscd. Notes | | 3.82 | | 1/20/2028 | | 310,000 | | 297,520 | |

Bank of America,

Sr. Unscd. Notes | | 3.86 | | 7/23/2024 | | 150,000 | | 149,020 | |

Bank of America,

Sr. Unscd. Notes | | 3.95 | | 1/23/2049 | | 75,000 | | 65,853 | |

Bank of America,

Sr. Unscd. Notes | | 3.97 | | 3/5/2029 | | 150,000 | | 144,589 | |

Bank of America,

Sr. Unscd. Notes | | 4.13 | | 1/22/2024 | | 500,000 | | 503,335 | |

Bank of America,

Sr. Unscd. Notes | | 4.24 | | 4/24/2038 | | 160,000 | | 151,148 | |

Bank of America,

Sr. Unscd. Notes | | 4.27 | | 7/23/2029 | | 180,000 | | 177,735 | |

Bank of America,

Sr. Unscd. Notes | | 5.00 | | 1/21/2044 | | 500,000 | | 512,386 | |

Bank of America,

Sr. Unscd. Notes | | 5.63 | | 7/1/2020 | | 800,000 | | 830,391 | |

Bank of America,

Sub. Notes, Ser. L | | 4.18 | | 11/25/2027 | | 500,000 | | 481,072 | |

Bank of Montreal,

Sr. Unscd. Notes | | 2.10 | | 12/12/2019 | | 500,000 | | 494,559 | |

Bank of Nova Scotia,

Sr. Unscd. Notes | | 2.80 | | 7/21/2021 | | 600,000 | | 590,345 | |

Bank of Nova Scotia,

Sub. Notes | | 4.50 | | 12/16/2025 | | 500,000 | | 495,149 | |

Barclays,

Sr. Unscd. Notes | | 3.20 | | 8/10/2021 | | 500,000 | | 489,319 | |

Barclays,

Sr. Unscd. Notes | | 4.34 | | 1/10/2028 | | 200,000 | | 186,869 | |

Barclays,

Sr. Unscd. Notes | | 4.38 | | 1/12/2026 | | 200,000 | | 192,157 | |

Barclays Bank,

Sub. Notes | | 5.14 | | 10/14/2020 | | 500,000 | | 511,405 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

BB&T,

Sr. Unscd. Notes | | 2.45 | | 1/15/2020 | | 1,000,000 | | 991,219 | |

BB&T,

Sr. Unscd. Notes | | 3.70 | | 6/5/2025 | | 300,000 | | 297,107 | |

BNP Paribas,

Gtd. Notes | | 5.00 | | 1/15/2021 | | 500,000 | | 516,076 | |

BPCE,

Gtd. Notes | | 4.00 | | 4/15/2024 | | 200,000 | | 200,393 | |

Capital One Financial,

Sr. Unscd. Notes | | 4.75 | | 7/15/2021 | | 300,000 | | 308,917 | |

Capital One Financial,

Sub. Notes | | 3.75 | | 7/28/2026 | | 750,000 | | 691,063 | |

Citigroup,

Sr. Unscd. Bonds | | 2.90 | | 12/8/2021 | | 500,000 | | 488,806 | |

Citigroup,

Sr. Unscd. Bonds | | 4.28 | | 4/24/2048 | | 480,000 | b | 441,661 | |

Citigroup,

Sr. Unscd. Notes | | 2.40 | | 2/18/2020 | | 250,000 | | 247,336 | |

Citigroup,

Sr. Unscd. Notes | | 2.65 | | 10/26/2020 | | 1,250,000 | | 1,231,498 | |

Citigroup,

Sr. Unscd. Notes | | 2.88 | | 7/24/2023 | | 500,000 | | 481,213 | |

Citigroup,

Sr. Unscd. Notes | | 3.67 | | 7/24/2028 | | 500,000 | | 469,326 | |

Citigroup,

Sr. Unscd. Notes | | 3.88 | | 1/24/2039 | | 60,000 | | 53,343 | |

Citigroup,

Sr. Unscd. Notes | | 4.08 | | 4/23/2029 | | 100,000 | | 96,566 | |

Citigroup,

Sr. Unscd. Notes | | 4.65 | | 7/23/2048 | | 150,000 | | 145,520 | |

Citigroup,

Sr. Unscd. Notes | | 4.65 | | 7/30/2045 | | 350,000 | | 335,965 | |

Citigroup,

Sr. Unscd. Notes | | 5.88 | | 1/30/2042 | | 400,000 | | 453,357 | |

Citigroup,

Sr. Unscd. Notes | | 6.63 | | 1/15/2028 | | 100,000 | | 114,034 | |

Citigroup,

Sub. Notes | | 4.05 | | 7/30/2022 | | 250,000 | | 251,308 | |

Citigroup,

Sub. Notes | | 5.50 | | 9/13/2025 | | 500,000 | | 525,193 | |

Citizens Bank,

Sr. Unscd. Notes | | 2.45 | | 12/4/2019 | | 500,000 | | 496,358 | |

Cooperatieve Rabobank,

Gtd. Notes | | 3.95 | | 11/9/2022 | | 1,000,000 | | 991,606 | |

Cooperatieve Rabobank,

Sr. Unscd. Notes | | 2.50 | | 1/19/2021 | | 400,000 | | 391,406 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

Credit Suisse,

Sr. Unscd. Notes | | 4.38 | | 8/5/2020 | | 1,000,000 | | 1,016,634 | |

Credit Suisse Group Funding,

Gtd. Notes | | 3.75 | | 3/26/2025 | | 500,000 | | 479,314 | |

Credit Suisse Group Funding,

Gtd. Notes | | 4.88 | | 5/15/2045 | | 280,000 | | 274,830 | |

Deutsche Bank,

Sr. Unscd. Notes | | 4.25 | | 10/14/2021 | | 290,000 | | 287,884 | |

Development Bank of Japan,

Sr. Unscd. Notes | | 2.00 | | 10/19/2021 | | 500,000 | | 481,225 | |

Discover Bank,

Sr. Unscd. Notes | | 3.45 | | 7/27/2026 | | 500,000 | | 461,037 | |

Discover Bank,

Sr. Unscd. Notes | | 4.25 | | 3/13/2026 | | 400,000 | | 389,952 | |

Fifth Third Bancorp,

Sr. Unscd. Notes | | 3.50 | | 3/15/2022 | | 600,000 | | 595,463 | |

First Tennessee Bank,

Sr. Unscd. Notes | | 2.95 | | 12/1/2019 | | 500,000 | | 497,750 | |

Goldman Sachs Group,

Sr. Unscd. Bonds | | 4.22 | | 5/1/2029 | | 200,000 | | 194,360 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 2.35 | | 11/15/2021 | | 500,000 | | 481,493 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 2.60 | | 4/23/2020 | | 500,000 | | 495,043 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 2.75 | | 9/15/2020 | | 1,000,000 | | 988,660 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 3.63 | | 1/22/2023 | | 500,000 | | 494,387 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 3.75 | | 5/22/2025 | | 1,000,000 | | 969,693 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 3.81 | | 4/23/2029 | | 150,000 | | 141,067 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 3.85 | | 1/26/2027 | | 730,000 | | 700,331 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 4.41 | | 4/23/2039 | | 100,000 | | 94,048 | |

Goldman Sachs Group,

Sr. Unscd. Notes | | 6.25 | | 2/1/2041 | | 700,000 | | 815,296 | |

Goldman Sachs Group,

Sub. Notes | | 4.25 | | 10/21/2025 | | 130,000 | | 126,570 | |

Goldman Sachs Group,

Sub. Notes | | 6.75 | | 10/1/2037 | | 500,000 | | 583,330 | |

HSBC Holdings,

Sr. Unscd. Notes | | 3.40 | | 3/8/2021 | | 600,000 | | 597,266 | |

HSBC Holdings,

Sr. Unscd. Notes | | 3.90 | | 5/25/2026 | | 295,000 | | 283,749 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

HSBC Holdings,

Sr. Unscd. Notes | | 5.10 | | 4/5/2021 | | 750,000 | | 775,992 | |

HSBC Holdings,

Sub. Notes | | 4.25 | | 3/14/2024 | | 500,000 | | 493,831 | |

HSBC Holdings,

Sub. Notes | | 6.50 | | 5/2/2036 | | 850,000 | | 975,671 | |

Industrial & Commercial Bank of China,

Sr. Unscd. Notes | | 2.45 | | 10/20/2021 | | 500,000 | | 479,915 | |

Industrial & Commercial Bank of China,

Sr. Unscd. Notes | | 2.91 | | 11/13/2020 | | 300,000 | | 294,607 | |

ING Groep,

Sr. Unscd. Notes | | 3.15 | | 3/29/2022 | | 300,000 | | 291,994 | |

Intesa Sanpaolo,

Gtd. Bonds | | 5.25 | | 1/12/2024 | | 400,000 | | 385,783 | |

JPMorgan Chase & Co,

Sr. Unscd. Notes | | 3.80 | | 7/23/2024 | | 140,000 | | 139,221 | |

JPMorgan Chase & Co,

Sr. Unscd. Notes | | 4.20 | | 7/23/2029 | | 150,000 | | 147,923 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 2.25 | | 1/23/2020 | | 1,000,000 | | 988,332 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 2.40 | | 6/7/2021 | | 1,240,000 | | 1,208,538 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 2.78 | | 4/25/2023 | | 300,000 | | 290,467 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 3.09 | | 4/26/2021 | | 300,000 | | 298,918 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 3.20 | | 1/25/2023 | | 1,000,000 | | 979,483 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 3.30 | | 4/1/2026 | | 500,000 | | 472,709 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 3.51 | | 1/23/2029 | | 135,000 | | 126,096 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 3.90 | | 1/23/2049 | | 105,000 | | 91,597 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 3.96 | | 11/15/2048 | | 200,000 | | 175,802 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 4.01 | | 4/23/2029 | | 200,000 | | 194,208 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 4.25 | | 10/15/2020 | | 500,000 | | 507,852 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 4.26 | | 2/22/2048 | | 400,000 | | 369,686 | |

JPMorgan Chase & Co.,

Sr. Unscd. Notes | | 6.40 | | 5/15/2038 | | 650,000 | | 782,946 | |

JPMorgan Chase & Co.,

Sub. Notes | | 3.63 | | 12/1/2027 | | 500,000 | | 467,113 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

JPMorgan Chase & Co.,

Sub. Notes | | 3.88 | | 9/10/2024 | | 500,000 | | 491,688 | |

JPMorgan Chase & Co.,

Sub. Notes | | 4.13 | | 12/15/2026 | | 500,000 | | 490,556 | |

KeyBank,

Sr. Unscd. Notes | | 3.30 | | 6/1/2025 | | 400,000 | | 384,573 | |

KeyBank,

Sub. Notes | | 6.95 | | 2/1/2028 | | 100,000 | | 117,727 | |

KFW,

Govt. Gtd. Bonds | | 0.00 | | 6/29/2037 | | 250,000 | c | 129,320 | |

KFW,

Govt. Gtd. Bonds | | 2.13 | | 6/15/2022 | | 320,000 | | 309,200 | |

KFW,

Govt. Gtd. Bonds | | 4.00 | | 1/27/2020 | | 1,000,000 | | 1,013,428 | |

KFW,

Govt. Gtd. Notes | | 1.50 | | 6/15/2021 | | 765,000 | | 735,363 | |

KFW,

Govt. Gtd. Notes | | 1.63 | | 3/15/2021 | | 1,900,000 | | 1,839,260 | |

KFW,

Govt. Gtd. Notes | | 2.00 | | 5/2/2025 | | 1,100,000 | | 1,022,178 | |

KFW,

Govt. Gtd. Notes | | 2.13 | | 3/7/2022 | | 620,000 | b | 600,714 | |

KFW,

Govt. Gtd. Notes | | 2.38 | | 12/29/2022 | | 305,000 | | 295,810 | |

Korea Development Bank,

Sr. Unscd. Notes | | 2.75 | | 3/19/2023 | | 300,000 | | 287,801 | |

Landwirtschaftliche Rentenbank,

Govt. Gtd. Notes | | 2.38 | | 6/10/2025 | | 500,000 | | 474,952 | |

Lloyds Banking Group,

Sr. Unscd. Notes | | 4.55 | | 8/16/2028 | | 500,000 | | 483,682 | |

Llyods Banking Group,

Sub. Notes | | 4.58 | | 12/10/2025 | | 820,000 | | 792,153 | |

Manufacturers & Traders Trust Co.,

Sr. Unscd. Notes | | 2.10 | | 2/6/2020 | | 500,000 | | 493,494 | |

Mitsubishi UFJ Financial Group,

Sr. Unscd. Notes | | 3.00 | | 2/22/2022 | | 500,000 | | 490,310 | |

Mitsubishi UFJ Financial Group,

Sr. Unscd. Notes | | 3.54 | | 7/26/2021 | | 300,000 | | 300,462 | |

Mitsubishi UFJ Financial Group,

Sr. Unscd. Notes | | 3.68 | | 2/22/2027 | | 500,000 | | 482,772 | |

Mitsubishi UFJ Financial Group,

Sr. Unscd. Notes | | 3.76 | | 7/26/2023 | | 300,000 | | 298,666 | |

Mitsubishi UFJ Financial Group,

Sr. Unscd. Notes | | 4.29 | | 7/26/2038 | | 200,000 | | 195,157 | |

Mizuho Financial Group,

Sr. Unscd. Bonds | | 2.27 | | 9/13/2021 | | 500,000 | | 481,339 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

Mizuho Financial Group,

Sr. Unscd. Bonds | | 2.84 | | 9/13/2026 | | 500,000 | | 453,412 | |

Morgan Stanley,

Sr. Unscd. Notes | | 3.13 | | 1/23/2023 | | 150,000 | | 145,307 | |

Morgan Stanley,

Sr. Unscd. Notes | | 3.63 | | 1/20/2027 | | 380,000 | | 359,479 | |

Morgan Stanley,

Sr. Unscd. Notes | | 3.75 | | 2/25/2023 | | 500,000 | | 496,779 | |

Morgan Stanley,

Sr. Unscd. Notes | | 3.77 | | 1/24/2029 | | 180,000 | | 170,793 | |

Morgan Stanley,

Sr. Unscd. Notes | | 4.00 | | 7/23/2025 | | 500,000 | | 491,494 | |

Morgan Stanley,

Sr. Unscd. Notes | | 4.38 | | 1/22/2047 | | 500,000 | | 467,180 | |

Morgan Stanley,

Sr. Unscd. Notes | | 5.50 | | 1/26/2020 | | 1,000,000 | | 1,026,651 | |

Morgan Stanley,

Sr. Unscd. Notes | | 7.25 | | 4/1/2032 | | 300,000 | | 380,208 | |

Morgan Stanley,

Sub. Notes | | 3.95 | | 4/23/2027 | | 500,000 | | 473,281 | |

Morgan Stanley,

Sub. Notes | | 4.10 | | 5/22/2023 | | 500,000 | | 499,962 | |

National Australia Bank,

Sr. Unscd. Bonds | | 2.50 | | 7/12/2026 | | 500,000 | | 446,736 | |

National Australia Bank,

Sr. Unscd. Notes | | 2.63 | | 7/23/2020 | | 260,000 | | 256,842 | |

Northern Trust,

Sub. Notes | | 3.95 | | 10/30/2025 | | 846,000 | | 853,825 | |

Oesterreichische Kontrollbank,

Govt. Gtd. Notes | | 1.50 | | 10/21/2020 | | 500,000 | | 485,461 | |

PNC Bank,

Sr. Unscd. Notes | | 2.60 | | 7/21/2020 | | 500,000 | | 494,100 | |

PNC Bank,

Sr. Unscd. Notes | | 2.63 | | 2/17/2022 | | 500,000 | | 485,483 | |

PNC Bank,

Sub. Notes | | 3.80 | | 7/25/2023 | | 500,000 | | 497,376 | |

Royal Bank of Canada,

Sr. Unscd. Bonds | | 2.15 | | 3/6/2020 | | 750,000 | | 740,723 | |

Royal Bank of Scotland Group,

Sub. Bonds | | 6.13 | | 12/15/2022 | | 300,000 | | 310,639 | |

Royal Bank Scotland Group,

Sr. Unscd. Notes | | 4.80 | | 4/5/2026 | | 500,000 | | 493,689 | |

Santander UK,

Sr. Unscd. Notes | | 2.38 | | 3/16/2020 | | 750,000 | | 740,820 | |

Santander UK Group Holdings,

Sr. Unscd. Notes | | 2.88 | | 10/16/2020 | | 500,000 | | 493,126 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

Skandinaviska Enskilda,

Sr. Unscd. Notes | | 1.88 | | 9/13/2021 | | 250,000 | | 238,153 | |

State Street,

Sr. Unscd. Notes | | 2.55 | | 8/18/2020 | | 310,000 | | 306,834 | |

State Street,

Sr. Unscd. Notes | | 3.55 | | 8/18/2025 | | 290,000 | | 283,563 | |

State Street,

Sr. Unscd. Notes | | 3.70 | | 11/20/2023 | | 250,000 | | 250,051 | |

Sumitomo Mitsui Banking,

Gtd. Bonds | | 3.00 | | 1/18/2023 | | 290,000 | | 281,801 | |

Sumitomo Mitsui Financial Group,

Sr. Unscd. Notes | | 3.45 | | 1/11/2027 | | 160,000 | | 151,639 | |

Sumitomo Mitsui Financial Group,

Sr. Unscd. Notes | | 3.78 | | 3/9/2026 | | 500,000 | | 487,370 | |

SunTrust Bank,

Sr. Unscd. Bonds | | 2.25 | | 1/31/2020 | | 500,000 | | 494,244 | |

SunTrust Bank,

Sr. Unscd. Notes | | 2.75 | | 5/1/2023 | | 500,000 | | 479,376 | |

Toronto-Dominion Bank,

Sr. Unscd. Notes | | 2.50 | | 12/14/2020 | | 500,000 | | 492,452 | |

Toronto-Dominion Bank,

Sr. Unscd. Notes | | 3.00 | | 6/11/2020 | | 500,000 | | 498,617 | |

Toronto-Dominion Bank,

Sr. Unscd. Notes | | 3.50 | | 7/19/2023 | | 350,000 | | 348,658 | |

U.S. Bancorp,

Sr. Unscd. Notes | | 3.00 | | 3/15/2022 | | 900,000 | | 886,430 | |

US Bank,

Sr. Unscd. Notes | | 3.40 | | 7/24/2023 | | 350,000 | | 347,015 | |

Wells Fargo & Co.,

Sr. Unscd. Notes | | 2.10 | | 7/26/2021 | | 620,000 | | 595,459 | |

Wells Fargo & Co.,

Sr. Unscd. Notes | | 3.07 | | 1/24/2023 | | 470,000 | | 455,519 | |

Wells Fargo & Co.,

Sr. Unscd. Notes | | 3.55 | | 9/29/2025 | | 500,000 | | 480,580 | |

Wells Fargo & Co.,

Sub. Notes | | 4.10 | | 6/3/2026 | | 500,000 | | 487,608 | |

Wells Fargo & Co.,

Sub. Notes | | 4.30 | | 7/22/2027 | | 500,000 | | 491,922 | |

Wells Fargo & Co.,

Sub. Notes | | 4.65 | | 11/4/2044 | | 1,000,000 | | 942,669 | |

Wells Fargo & Co.,

Sub. Notes | | 4.75 | | 12/7/2046 | | 500,000 | | 478,060 | |

Wells Fargo & Co.,

Sub. Notes, Ser. M | | 3.45 | | 2/13/2023 | | 500,000 | | 488,852 | |

Wells Fargo Bank,

Sr. Unscd. Notes | | 2.15 | | 12/6/2019 | | 500,000 | | 494,959 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Banks - 6.5% (continued) | | | | | |

Wells Fargo Bank,

Sr. Unscd. Notes | | 3.33 | | 7/23/2021 | | 350,000 | | 348,862 | |

Westpac Banking,

Sr. Unscd. Notes | | 2.60 | | 11/23/2020 | | 1,000,000 | | 985,774 | |

Westpac Banking,

Sr. Unscd. Notes | | 2.85 | | 5/13/2026 | | 200,000 | | 183,967 | |

| | 77,817,003 | |

Beverage Products - .6% | | | | | |

Anheuser-Busch InBev Finance,

Gtd. Notes | | 2.63 | | 1/17/2023 | | 500,000 | | 474,029 | |

Anheuser-Busch InBev Finance,

Gtd. Notes | | 2.65 | | 2/1/2021 | | 549,063 | | 538,532 | |

Anheuser-Busch InBev Finance,

Gtd. Notes | | 3.65 | | 2/1/2026 | | 615,000 | | 584,233 | |

Anheuser-Busch InBev Finance,

Gtd. Notes | | 3.70 | | 2/1/2024 | | 500,000 | | 490,668 | |

Anheuser-Busch InBev Finance,

Gtd. Notes | | 4.00 | | 1/17/2043 | | 700,000 | | 591,005 | |

Anheuser-Busch InBev Finance,

Gtd. Notes | | 4.70 | | 2/1/2036 | | 590,000 | | 564,259 | |

Anheuser-Busch InBev Worldwide,

Gtd. Notes | | 4.00 | | 4/13/2028 | | 500,000 | | 480,495 | |

Anheuser-Busch InBev Worldwide,

Gtd. Notes | | 4.60 | | 4/15/2048 | | 500,000 | | 451,876 | |

Coca-Cola,

Sr. Unscd. Notes | | 3.30 | | 9/1/2021 | | 750,000 | | 754,978 | |

Diageo Investment,

Gtd. Notes | | 4.25 | | 5/11/2042 | | 250,000 | | 248,202 | |

Keurig Dr Pepper,

Gtd. Notes | | 4.06 | | 5/25/2023 | | 215,000 | a | 213,929 | |

Molson Coors Brewing,

Gtd. Notes | | 2.10 | | 7/15/2021 | | 500,000 | | 478,983 | |

Molson Coors Brewing,

Gtd. Notes | | 4.20 | | 7/15/2046 | | 150,000 | | 126,871 | |

PepsiCo,

Sr. Unscd. Notes | | 2.15 | | 10/14/2020 | | 810,000 | | 796,264 | |

PepsiCo,

Sr. Unscd. Notes | | 3.50 | | 7/17/2025 | | 500,000 | | 493,854 | |

PepsiCo,

Sr. Unscd. Notes | | 4.45 | | 4/14/2046 | | 210,000 | | 211,565 | |

| | 7,499,743 | |

Building Materials - .0% | | | | | |

Johnson Controls International,

Sr. Unscd. Notes | | 5.13 | | 9/14/2045 | | 100,000 | | 99,529 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Building Materials - .0% (continued) | | | | | |

Owens Corning,

Sr. Unscd. Notes | | 7.00 | | 12/1/2036 | | 137,000 | | 153,280 | |

| | 252,809 | |

Chemicals - .3% | | | | | |

Celanese US Holdings,

Gtd. Notes | | 4.63 | | 11/15/2022 | | 350,000 | | 357,347 | |

Dow Chemical,

Sr. Unscd. Notes | | 4.25 | | 11/15/2020 | | 300,000 | | 303,895 | |

E.I. du Pont de Nemours & Co.,

Sr. Unscd. Notes | | 2.80 | | 2/15/2023 | | 250,000 | | 242,254 | |

E.I. du Pont de Nemours & Co.,

Sr. Unscd. Notes | | 4.15 | | 2/15/2043 | | 300,000 | | 269,750 | |

Eastman Chemical,

Sr. Unscd. Notes | | 3.80 | | 3/15/2025 | | 378,000 | | 367,005 | |

LYB International Finance,

Gtd. Notes | | 4.00 | | 7/15/2023 | | 350,000 | | 350,277 | |

Methanex,

Sr. Unscd. Notes | | 3.25 | | 12/15/2019 | | 465,000 | | 462,436 | |

Mosaic,

Sr. Unscd. Notes | | 4.25 | | 11/15/2023 | | 300,000 | | 301,855 | |

Nutrien,

Sr. Unscd. Notes | | 3.63 | | 3/15/2024 | | 500,000 | | 483,116 | |

Nutrien,

Sr. Unscd. Notes | | 5.25 | | 1/15/2045 | | 500,000 | | 495,072 | |

Praxair,

Sr. Unscd. Notes | | 2.45 | | 2/15/2022 | | 400,000 | | 388,199 | |

Sherwin-Williams,

Sr. Unscd. Notes | | 4.50 | | 6/1/2047 | | 100,000 | | 90,147 | |

| | 4,111,353 | |

Commercial & Professional Services - .2% | | | | | |

Cleveland Clinic Foundation,

Unscd. Bonds | | 4.86 | | 1/1/2114 | | 150,000 | | 149,885 | |

Ecolab,

Sr. Unscd. Notes | | 2.70 | | 11/1/2026 | | 250,000 | | 229,122 | |

Ecolab,

Sr. Unscd. Notes | | 4.35 | | 12/8/2021 | | 164,000 | | 168,283 | |

Moody's,

Sr. Unscd. Notes | | 3.25 | | 6/7/2021 | | 250,000 | | 248,664 | |

President & Fellows of Harvard College,

Unscd. Bonds | | 3.15 | | 7/15/2046 | | 750,000 | | 638,238 | |

S&P Global,

Gtd. Notes | | 4.40 | | 2/15/2026 | | 230,000 | | 234,517 | |

Stanford Unversity,

Unscd. Bonds | | 3.65 | | 5/1/2048 | | 30,000 | | 28,030 | |

Total System Services,

Sr. Unscd. Notes | | 4.80 | | 4/1/2026 | | 500,000 | | 510,062 | |

19

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Commercial & Professional Services - .2% (continued) | | | | | |

University of Southern California,

Sr. Unscd. Notes | | 5.25 | | 2/15/2041 | | 40,000 | | 44,620 | |

William Marsh Rice University,

Unscd. Bonds | | 3.57 | | 5/15/2045 | | 250,000 | | 229,377 | |

| | 2,480,798 | |

Commercial Mortgage Pass-Through Ctfs. - 1.9% | | | | | |

CFCRE Commercial Mortgage Trust,

Ser. 2017-C8, Cl. A4 | | 3.57 | | 6/15/2050 | | 500,000 | | 485,898 | |

Citigroup Commercial Mortgage Trust,

Ser. 2014-GC23, Cl. A4 | | 3.62 | | 7/10/2047 | | 1,000,000 | | 995,797 | |

Commercial Mortgage Trust,

Ser. 2013-CR11, Cl. B | | 5.16 | | 10/10/2046 | | 750,000 | | 775,064 | |

Commercial Mortgage Trust,

Ser. 2014-CR16, Cl. A4 | | 4.05 | | 4/10/2047 | | 200,000 | | 203,280 | |

Commercial Mortgage Trust,

Ser. 2016-CR28, Cl. A4 | | 3.76 | | 2/10/2049 | | 1,035,000 | | 1,025,407 | |

Federal Home Loan Mortgage Corp,

Multifamily Structured Pass Through Certificates Ser. K039, Cl. A2 | | 3.30 | | 7/25/2024 | | 1,000,000 | d | 994,857 | |

Federal Home Loan Mortgage Corp.,

Multifamily Structured Pass Through Certificates, Ser. K047, Cl. A | | 3.33 | | 5/25/2025 | | 1,000,000 | d | 991,782 | |

Federal Home Loan Mortgage Corp.,

Multifamily Structured Pass Through Certificates, Ser. K056, Cl. A2 | | 2.53 | | 5/25/2026 | | 1,300,000 | d | 1,212,820 | |

Federal National Mortgage Association,

Ser. 2017-M12, Cl. A2 | | 3.08 | | 6/25/2027 | | 975,000 | d | 929,842 | |

Federal National Mortgage Association,

Ser. 2017-M8, Cl. A1 | | 2.65 | | 5/5/2027 | | 687,302 | d | 670,143 | |

Federal National Mortgage Association,

Ser. 2018-M1, Cl. A2 | | 2.99 | | 12/25/2027 | | 1,000,000 | d | 945,434 | |

Federal National Mortgage Association,

Ser. 2018-M10, Cl. A2 | | 3.39 | | 7/1/2028 | | 750,000 | d | 728,012 | |

GS Mortgage Securities Trust,

Ser. 2014-GC18, Cl. A3 | | 3.80 | | 1/10/2047 | | 500,000 | | 503,606 | |

GS Mortgage Securities Trust,

Ser. 2015-GC28, Cl. AAB | | 3.21 | | 2/10/2048 | | 750,000 | | 742,732 | |

J.P. Morgan Chase Commercial Mortgage Securities Trust,

Ser. 2012-LC9, Cl. A5 | | 2.84 | | 12/15/2047 | | 1,000,000 | | 971,991 | |

JPMBB Commercial Mortgage Securities Trust,

Ser. 2013-C15, Cl. A5 | | 4.13 | | 11/15/2045 | | 500,000 | | 511,948 | |

JPMBB Commercial Mortgage Securities Trust,

Ser. 2014-C24, Cl. A5 | | 3.64 | | 11/15/2047 | | 725,000 | | 719,827 | |

20

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Commercial Mortgage Pass-Through Ctfs. - 1.9% (continued) | | | | | |

JPMBB Commercial Mortgage Securities Trust,

Ser. 2015-C33, Cl. A4 | | 3.77 | | 12/15/2048 | | 2,000,000 | | 1,986,325 | |

Morgan Stanley Bank of America Merrill Lynch Trust,

Ser. 2015-C20, Cl. A4 | | 3.25 | | 2/15/2048 | | 1,175,000 | | 1,136,697 | |

Morgan Stanley Capital I Trust,

Ser. 2012-C4, Cl. AS | | 3.77 | | 3/15/2045 | | 720,000 | | 722,060 | |

SG Commercial Mortgage Securities Trust,

Ser. 2016-C5, Cl. A4 | | 3.06 | | 10/10/2048 | | 2,000,000 | | 1,884,122 | |

UBS-Barclays Commercial Mortgage Trust,

Ser. 2013-C6, Cl. A4 | | 3.24 | | 4/10/2046 | | 1,412,000 | | 1,395,943 | |

Wells Fargo Commercial Mortgage Trust,

Ser. 2017-RC1, Cl. A2 | | 3.12 | | 1/15/2060 | | 500,000 | | 493,565 | |

Wells Fargo Commercial Mortgage Trust,

Ser. 2018-C44 | | 4.21 | | 5/15/2051 | | 900,000 | | 910,524 | |

WF-RBS Commercial Mortgage Trust,

Ser. 2013-C14, Cl. ASB | | 2.98 | | 6/15/2046 | | 472,005 | | 468,359 | |

| | 22,406,035 | |

Consumer Discretionary - .1% | | | | | |

Carnival,

Gtd. Notes | | 3.95 | | 10/15/2020 | | 300,000 | | 303,724 | |

Hasbro,

Sr. Unscd. Notes | | 3.15 | | 5/15/2021 | | 450,000 | | 444,034 | |

Marriott International,

Sr. Unscd. Notes, Ser. N | | 3.13 | | 10/15/2021 | | 600,000 | | 591,966 | |

| | 1,339,724 | |

Consumer Durables & Apparel - .0% | | | | | |

Nike,

Sr. Unscd. Notes | | 2.25 | | 5/1/2023 | | 300,000 | | 284,705 | |

Nike,

Sr. Unscd. Notes | | 3.63 | | 5/1/2043 | | 300,000 | | 267,007 | |

| | 551,712 | |

Consumer Staples - .2% | | | | | |

Church & Dwight Co.,

Sr. Unscd. Notes | | 3.95 | | 8/1/2047 | | 300,000 | | 263,015 | |

Clorox,

Sr. Unscd. Notes | | 3.80 | | 11/15/2021 | | 200,000 | | 202,249 | |

Colgate-Palmolive,

Sr. Unscd. Notes | | 2.45 | | 11/15/2021 | | 500,000 | | 488,992 | |

Newell Rubbermaid,

Sr. Unscd. Notes | | 5.50 | | 4/1/2046 | | 350,000 | | 302,274 | |

21

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Consumer Staples - .2% (continued) | | | | | |

Procter & Gamble,

Sr. Unscd. Notes | | 2.30 | | 2/6/2022 | | 500,000 | | 487,081 | |

Unilever Capital,

Gtd. Notes | | 5.90 | | 11/15/2032 | | 250,000 | | 301,336 | |

| | 2,044,947 | |

Diversified Financials - .6% | | | | | |

Aercap Ireland,

Gtd. Notes | | 3.50 | | 5/26/2022 | | 500,000 | | 487,697 | |

AerCap Ireland Capital,

Gtd. Notes | | 3.95 | | 2/1/2022 | | 500,000 | | 495,359 | |

Affiliated Managers Group,

Sr. Unscd. Notes | | 3.50 | | 8/1/2025 | | 250,000 | | 237,148 | |

Air Lease,

Sr. Unscd. Notes | | 3.75 | | 2/1/2022 | | 100,000 | | 99,513 | |

American Express,

Sub. Notes | | 3.63 | | 12/5/2024 | | 500,000 | | 489,098 | |

Ares Capital,

Sr. Unscd. Notes | | 3.50 | | 2/10/2023 | | 300,000 | | 286,638 | |

Blackrock,

Sr. Unscd. Notes | | 3.50 | | 3/18/2024 | | 250,000 | | 249,441 | |

Blackrock,

Sr. Unscd. Notes, Ser. 2 | | 5.00 | | 12/10/2019 | | 250,000 | | 255,406 | |

CME Group,

Sr. Unscd. Notes | | 3.00 | | 3/15/2025 | | 250,000 | | 238,867 | |

GE Capital International Funding,

Gtd. Notes | | 4.42 | | 11/15/2035 | | 1,000,000 | | 865,511 | |

Intercontinental Exchange,

Gtd. Notes | | 4.00 | | 10/15/2023 | | 350,000 | | 356,584 | |

Intercontinental Exchange,

Sr. Unscd. Notes | | 4.25 | | 9/21/2048 | | 75,000 | | 70,395 | |

Invesco Finance,

Gtd. Notes | | 4.00 | | 1/30/2024 | | 250,000 | | 249,708 | |

Jefferies Group,

Sr. Unscd. Debs. | | 6.45 | | 6/8/2027 | | 35,000 | | 37,187 | |

Jefferies Group,

Sr. Unscd. Notes | | 5.13 | | 1/20/2023 | | 150,000 | | 154,562 | |

Legg Mason,

Sr. Unscd. Notes | | 5.63 | | 1/15/2044 | | 200,000 | | 196,153 | |

Nasdaq,

Sr. Unscd. Notes | | 4.25 | | 6/1/2024 | | 250,000 | | 251,445 | |

Nomura Holdings,

Sr. Unscd. Notes | | 6.70 | | 3/4/2020 | | 350,000 | | 365,053 | |

Synchrony Financial,

Sr. Unscd. Notes | | 4.25 | | 8/15/2024 | | 500,000 | | 475,479 | |

TD Ameritrade Holding,

Sr. Unscd. Notes | | 2.95 | | 4/1/2022 | | 200,000 | | 195,556 | |

22

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Diversified Financials - .6% (continued) | | | | | |

Visa,

Sr. Unscd. Notes | | 2.20 | | 12/14/2020 | | 400,000 | | 391,948 | |

Visa,

Sr. Unscd. Notes | | 3.65 | | 9/15/2047 | | 55,000 | | 49,367 | |

Visa,

Sr. Unscd. Notes | | 4.15 | | 12/14/2035 | | 270,000 | | 270,853 | |

Visa,

Sr. Unscd. Notes | | 4.30 | | 12/14/2045 | | 200,000 | | 198,367 | |

| | 6,967,335 | |

Educational Services - .0% | | | | | |

California Institute of Technology,

Unscd. Bonds | | 4.32 | | 8/1/2045 | | 110,000 | | 110,022 | |

Electronic Components - .2% | | | | | |

Allegion US Holding,

Gtd. Notes | | 3.20 | | 10/1/2024 | | 400,000 | | 370,632 | |

Arrow Electronics,

Sr. Unscd. Notes | | 4.50 | | 3/1/2023 | | 500,000 | | 505,605 | |

Corning,

Sr. Unscd. Notes | | 4.38 | | 11/15/2057 | | 50,000 | | 40,802 | |

Emerson Electric,

Sr. Unscd. Notes | | 2.63 | | 2/15/2023 | | 260,000 | | 250,561 | |

Fortive,

Sr. Unscd. Notes | | 2.35 | | 6/15/2021 | | 250,000 | | 241,905 | |

Keysight Technologies,

Sr. Unscd. Notes | | 3.30 | | 10/30/2019 | | 500,000 | | 499,386 | |

| | 1,908,891 | |

Energy - 2.8% | | | | | |

Anadarko Petroleum,

Sr. Unscd. Notes | | 6.45 | | 9/15/2036 | | 150,000 | | 163,236 | |

Anadarko Petroleum,

Sr. Unscd. Notes | | 6.60 | | 3/15/2046 | | 250,000 | | 277,317 | |

Apache,

Sr. Unscd. Notes | | 6.00 | | 1/15/2037 | | 212,000 | | 224,939 | |

Baker Hughes,

Sr. Unscd. Notes, Ser. WI | | 3.20 | | 8/15/2021 | | 382,000 | | 378,703 | |

BP Capital Markets,

Gtd. Notes | | 2.50 | | 11/6/2022 | | 800,000 | | 768,348 | |

BP Capital Markets,

Gtd. Notes | | 3.25 | | 5/6/2022 | | 700,000 | | 693,398 | |

BP Capital Markets,

Gtd. Notes | | 3.28 | | 9/19/2027 | | 610,000 | | 575,076 | |

BP Capital Markets America,

Gtd. Notes | | 3.80 | | 9/21/2025 | | 300,000 | | 294,324 | |

BP Capital Markets America,

Gtd. Notes | | 3.94 | | 9/21/2028 | | 300,000 | | 296,585 | |

23

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Energy - 2.8% (continued) | | | | | |

Canadian Natural Resources,

Sr. Unscd. Notes | | 3.90 | | 2/1/2025 | | 250,000 | | 243,143 | |

Canadian Natural Resources,

Sr. Unscd. Notes | | 6.25 | | 3/15/2038 | | 200,000 | | 225,955 | |

Cenovus Energy,

Sr. Unscd. Notes | | 4.25 | | 4/15/2027 | | 500,000 | b | 472,278 | |

Chevron,

Sr. Unscd. Notes | | 2.42 | | 11/17/2020 | | 640,000 | | 631,151 | |

Chevron,

Sr. Unscd. Notes | | 2.95 | | 5/16/2026 | | 295,000 | | 278,017 | |

Chevron,

Sr. Unscd. Notes | | 3.33 | | 11/17/2025 | | 165,000 | | 160,232 | |

CNOOC Finance 2013,

Gtd. Notes | | 3.00 | | 5/9/2023 | | 500,000 | | 478,046 | |

Columbia Pipeline Group,

Gtd. Notes | | 3.30 | | 6/1/2020 | | 500,000 | | 498,096 | |

Concho Resources,

Gtd. Notes | | 4.30 | | 8/15/2028 | | 400,000 | | 390,964 | |

Concho Resources,

Gtd. Notes | | 4.85 | | 8/15/2048 | | 250,000 | | 238,386 | |

Concho Resources,

Gtd. Notes | | 4.88 | | 10/1/2047 | | 60,000 | | 56,922 | |

ConocoPhillips,

Gtd. Notes | | 4.95 | | 3/15/2026 | | 150,000 | | 159,391 | |

ConocoPhillips,

Gtd. Notes | | 5.95 | | 3/15/2046 | | 250,000 | | 304,948 | |

ConocoPhillips Holding,

Sr. Unscd. Notes | | 6.95 | | 4/15/2029 | | 125,000 | | 154,277 | |

Devon Energy,

Sr. Unscd. Notes | | 5.85 | | 12/15/2025 | | 71,000 | | 75,592 | |

Ecopetrol,

Sr. Unscd. Notes | | 7.38 | | 9/18/2043 | | 300,000 | | 336,750 | |

Enable Midstream Partners,

Sr. Unscd. Notes | | 5.00 | | 5/15/2044 | | 250,000 | | 217,834 | |

Enbridge,

Sr. Unscd. Notes | | 4.25 | | 12/1/2026 | | 500,000 | | 492,160 | |

Enbridge Energy Partners,

Sr. Unscd. Notes | | 5.50 | | 9/15/2040 | | 370,000 | | 379,811 | |

Enbridge Energy Partners,

Sr. Unscd. Notes | | 5.88 | | 10/15/2025 | | 250,000 | | 272,433 | |

Energy Transfer Partners,

Gtd. Notes | | 5.15 | | 2/1/2043 | | 500,000 | | 442,186 | |

Enterprise Products,

Gtd. Notes | | 4.25 | | 2/15/2048 | | 75,000 | | 66,556 | |

Enterprise Products Operating,

Gtd. Notes | | 3.35 | | 3/15/2023 | | 600,000 | | 588,134 | |

24

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Energy - 2.8% (continued) | | | | | |

Enterprise Products Operating,

Gtd. Notes | | 3.70 | | 2/15/2026 | | 200,000 | | 193,345 | |

Enterprise Products Operating,

Gtd. Notes | | 4.90 | | 5/15/2046 | | 500,000 | | 487,088 | |

EOG Resources,

Sr. Unscd. Notes | | 3.90 | | 4/1/2035 | | 400,000 | | 375,445 | |

Exxon Mobil,

Sr. Unscd. Notes | | 2.22 | | 3/1/2021 | | 500,000 | | 488,689 | |

Exxon Mobil,

Sr. Unscd. Notes | | 4.11 | | 3/1/2046 | | 500,000 | | 483,455 | |

Halliburton,

Sr. Unscd. Bonds | | 3.80 | | 11/15/2025 | | 415,000 | | 404,352 | |

Hess,

Sr. Unscd. Notes | | 4.30 | | 4/1/2027 | | 250,000 | | 235,530 | |

Hess,

Sr. Unscd. Notes | | 5.60 | | 2/15/2041 | | 250,000 | | 239,639 | |

HollyFrontier,

Sr. Unscd. Bonds | | 5.88 | | 4/1/2026 | | 480,000 | | 501,861 | |

Kerr-McGee,

Gtd. Notes | | 6.95 | | 7/1/2024 | | 300,000 | | 336,244 | |

Kinder Morgan,

Gtd. Notes | | 4.30 | | 3/1/2028 | | 500,000 | | 484,304 | |

Kinder Morgan Energy Partner,

Gtd. Notes | | 5.00 | | 10/1/2021 | | 300,000 | | 309,558 | |

Kinder Morgan Energy Partners,

Gtd. Notes | | 3.50 | | 9/1/2023 | | 500,000 | | 486,895 | |

Kinder Morgan Energy Partners,

Gtd. Notes | | 5.00 | | 3/1/2043 | | 300,000 | | 277,144 | |

Kinder Morgan Energy Partners,

Gtd. Notes | | 7.40 | | 3/15/2031 | | 350,000 | | 402,159 | |

Marathon Oil,

Sr. Unscd. Notes | | 6.60 | | 10/1/2037 | | 300,000 | | 341,536 | |

Marathon Petroleum,

Sr. Unscd. Notes | | 4.75 | | 9/15/2044 | | 500,000 | | 460,232 | |

MPLX,

Sr. Unscd. Notes | | 4.50 | | 4/15/2038 | | 105,000 | | 93,838 | |

MPLX,

Sr. Unscd. Notes | | 4.88 | | 12/1/2024 | | 500,000 | | 512,685 | |

MPLX,

Sr. Unscd. Notes | | 4.90 | | 4/15/2058 | | 115,000 | | 100,764 | |

MPLX,

Sr. Unscd. Notes | | 5.20 | | 3/1/2047 | | 130,000 | | 123,357 | |

Nexen Energy,

Gtd. Notes | | 5.88 | | 3/10/2035 | | 125,000 | | 139,562 | |

Noble Energy,

Sr. Unscd. Notes | | 3.90 | | 11/15/2024 | | 500,000 | | 486,649 | |

25

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Energy - 2.8% (continued) | | | | | |

Noble Energy,

Sr. Unscd. Notes | | 4.15 | | 12/15/2021 | | 539,000 | | 543,260 | |

Occidental Petroleum,

Sr. Unscd. Bonds | | 3.00 | | 2/15/2027 | | 300,000 | | 281,495 | |

Occidental Petroleum,

Sr. Unscd. Notes | | 4.10 | | 2/15/2047 | | 310,000 | | 285,542 | |

Occidental Petroleum,

Sr. Unscd. Notes, Ser. 1 | | 4.10 | | 2/1/2021 | | 400,000 | | 405,674 | |

ONEOK,

Gtd. Notes | | 4.00 | | 7/13/2027 | | 300,000 | | 288,157 | |

ONEOK Partners,

Gtd. Notes | | 5.00 | | 9/15/2023 | | 500,000 | | 515,403 | |

ONEOK Partners,

Gtd. Notes | | 6.85 | | 10/15/2037 | | 60,000 | | 68,081 | |

Petroleos Mexicanos,

Gtd. Bonds | | 5.50 | | 6/27/2044 | | 500,000 | | 387,950 | |

Petroleos Mexicanos,

Gtd. Notes | | 4.88 | | 1/18/2024 | | 500,000 | | 476,905 | |

Petroleos Mexicanos,

Gtd. Notes | | 5.35 | | 2/12/2028 | | 195,000 | a | 174,213 | |

Petroleos Mexicanos,

Gtd. Notes | | 6.00 | | 3/5/2020 | | 500,000 | | 507,495 | |

Petroleos Mexicanos,

Gtd. Notes | | 6.35 | | 2/12/2048 | | 500,000 | a | 416,950 | |

Petroleos Mexicanos,

Gtd. Notes | | 6.50 | | 3/13/2027 | | 570,000 | | 553,755 | |

Petroleos Mexicanos,

Gtd. Notes | | 6.75 | | 9/21/2047 | | 400,000 | | 345,560 | |

Phillips 66,

Gtd. Notes | | 4.88 | | 11/15/2044 | | 202,000 | | 196,685 | |

Pioneer Natural Resources,

Sr. Unscd. Notes | | 3.95 | | 7/15/2022 | | 500,000 | | 501,192 | |

Plains All American Pipeline,

Sr. Unscd. Notes | | 3.85 | | 10/15/2023 | | 300,000 | | 291,974 | |

Plains All American Pipeline,

Sr. Unscd. Notes | | 4.90 | | 2/15/2045 | | 250,000 | | 221,578 | |

Regency Energy Partners,

Gtd. Notes | | 4.50 | | 11/1/2023 | | 750,000 | | 755,960 | |

Sabine Pass Liquefaction,

Sr. Scd. Notes | | 5.00 | | 3/15/2027 | | 600,000 | | 603,238 | |

Sabine Pass Liquefaction,

Sr. Scd. Notes | | 5.63 | | 4/15/2023 | | 300,000 | | 316,144 | |

Shell International Finance,

Gtd. Notes | | 1.88 | | 5/10/2021 | | 485,000 | | 468,834 | |

Shell International Finance,

Gtd. Notes | | 2.88 | | 5/10/2026 | | 185,000 | | 173,092 | |

26

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Energy - 2.8% (continued) | | | | | |

Shell International Finance,

Gtd. Notes | | 3.25 | | 5/11/2025 | | 560,000 | | 540,296 | |

Shell International Finance,

Gtd. Notes | | 4.13 | | 5/11/2035 | | 260,000 | | 253,513 | |

Spectra Energy Partners,

Sr. Unscd. Notes | | 5.95 | | 9/25/2043 | | 200,000 | | 219,415 | |

Statoil,

Gtd. Notes | | 2.65 | | 1/15/2024 | | 500,000 | | 477,232 | |

Suncor Energy,

Sr. Unscd. Notes | | 4.00 | | 11/15/2047 | | 50,000 | | 45,045 | |

Suncor Energy,

Sr. Unscd. Notes | | 6.50 | | 6/15/2038 | | 300,000 | | 353,302 | |

Sunoco Logistics Partners Operations,

Gtd. Notes | | 3.45 | | 1/15/2023 | | 200,000 | | 193,318 | |

Sunoco Logistics Partners Operations,

Gtd. Notes | | 4.95 | | 1/15/2043 | | 200,000 | | 172,630 | |

Sunoco Logistics Partners Operations,

Gtd. Notes | | 5.40 | | 10/1/2047 | | 110,000 | | 100,517 | |

Tennessee Gas Pipeline,

Gtd. Debs. | | 7.63 | | 4/1/2037 | | 70,000 | | 85,066 | |

Total Capital,

Gtd. Notes | | 4.45 | | 6/24/2020 | | 450,000 | | 458,630 | |

Total Capital International,

Gtd. Notes | | 3.75 | | 4/10/2024 | | 340,000 | | 341,347 | |

TransCanada Pipelines,

Sr. Unscd. Notes | | 3.75 | | 10/16/2023 | | 500,000 | | 496,029 | |

TransCanada Pipelines,

Sr. Unscd. Notes | | 4.88 | | 5/15/2048 | | 60,000 | | 58,152 | |

TransCanada Pipelines,

Sr. Unscd. Notes | | 6.20 | | 10/15/2037 | | 75,000 | | 83,775 | |

TransCanada Pipelines,

Sr. Unscd. Notes | | 7.63 | | 1/15/2039 | | 300,000 | | 384,242 | |

Valero Energy,

Gtd. Notes | | 7.50 | | 4/15/2032 | | 170,000 | | 208,781 | |

Valero Energy,

Sr. Unscd. Notes | | 6.63 | | 6/15/2037 | | 315,000 | | 361,611 | |

Williams,

Sr. Unscd. Notes | | 3.75 | | 6/15/2027 | | 150,000 | | 139,933 | |

Williams,

Sr. Unscd. Notes | | 4.00 | | 9/15/2025 | | 100,000 | | 96,807 | |

Williams,

Sr. Unscd. Notes | | 4.13 | | 11/15/2020 | | 500,000 | | 504,775 | |

Williams,

Sr. Unscd. Notes | | 6.30 | | 4/15/2040 | | 400,000 | | 426,143 | |

| | 33,579,215 | |

27

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Environmental Control - .1% | | | | | |

Republic Services,

Sr. Unscd. Notes | | 5.25 | | 11/15/2021 | | 500,000 | | 525,275 | |

Waste Management,

Gtd. Notes | | 3.50 | | 5/15/2024 | | 500,000 | | 489,163 | |

| | 1,014,438 | |

Financials - .0% | | | | | |

Brookfield Asset Management,

Sr. Unscd. Notes | | 4.00 | | 1/15/2025 | | 250,000 | | 245,250 | |

Food Products - .4% | | | | | |

Campbell Soup,

Sr. Unscd. Notes | | 3.30 | | 3/19/2025 | | 400,000 | | 364,992 | |

Campbell Soup,

Sr. Unscd. Notes | | 4.15 | | 3/15/2028 | | 80,000 | b | 73,763 | |

Conagra Brands,

Sr. Unscd. Notes | | 3.20 | | 1/25/2023 | | 165,000 | | 159,555 | |

Conagra Brands,

Sr. Unscd. Notes | | 4.85 | | 11/1/2028 | | 100,000 | | 99,901 | |

Conagra Brands,

Sr. Unscd. Notes | | 5.30 | | 11/1/2038 | | 60,000 | | 58,287 | |

Conagra Brands,

Sr. Unscd. Notes | | 5.40 | | 11/1/2048 | | 60,000 | | 57,775 | |

General Mills,

Sr. Unscd. Notes | | 4.20 | | 4/17/2028 | | 110,000 | b | 106,513 | |

General Mills,

Sr. Unscd. Notes | | 5.40 | | 6/15/2040 | | 300,000 | | 301,856 | |

JM Smucker,

Sr. Unscd. Notes | | 2.50 | | 3/15/2020 | | 500,000 | | 495,522 | |

Kellogg,

Sr. Unscd. Notes | | 2.65 | | 12/1/2023 | | 300,000 | | 281,880 | |

Kellogg,

Sr. Unscd. Notes | | 4.15 | | 11/15/2019 | | 400,000 | | 404,261 | |

Kraft Heinz Foods,

Gtd. Notes | | 2.80 | | 7/2/2020 | | 390,000 | | 386,112 | |

Kraft Heinz Foods,

Gtd. Notes | | 4.38 | | 6/1/2046 | | 400,000 | | 334,697 | |

Kraft Heinz Foods,

Gtd. Notes | | 6.75 | | 3/15/2032 | | 525,000 | | 600,258 | |

Kroger,

Gtd. Notes | | 7.50 | | 4/1/2031 | | 400,000 | | 479,841 | |

Kroger,

Sr. Unscd. Notes | | 3.30 | | 1/15/2021 | | 300,000 | | 298,784 | |

Kroger,

Sr. Unscd. Notes | | 3.70 | | 8/1/2027 | | 300,000 | b | 282,141 | |

Sysco,

Gtd. Notes | | 5.38 | | 9/21/2035 | | 200,000 | | 214,661 | |

28

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Food Products - .4% (continued) | | | | | |

Tyson Foods,

Gtd. Bonds | | 5.15 | | 8/15/2044 | | 250,000 | | 248,157 | |

| | 5,248,956 | |

Foreign/Governmental - 3.0% | | | | | |

African Development Bank,

Sr. Unscd. Notes | | 1.38 | | 2/12/2020 | | 500,000 | | 490,515 | |

African Development Bank,

Sr. Unscd. Notes | | 2.38 | | 9/23/2021 | | 500,000 | | 490,358 | |

African Development Bank,

Sr. Unscd. Notes | | 2.63 | | 3/22/2021 | | 500,000 | | 495,228 | |

African Development Bank,

Sr. Unscd. Notes | | 3.00 | | 9/20/2023 | | 300,000 | | 297,752 | |

Alberta Government,

Sr. Unscd. Notes | | 1.90 | | 12/6/2019 | | 500,000 | | 494,472 | |

Asian Development Bank,

Sr. Unscd. Notes | | 1.75 | | 6/8/2021 | | 500,000 | | 483,968 | |

Asian Development Bank,

Sr. Unscd. Notes | | 1.75 | | 9/13/2022 | | 295,000 | | 280,524 | |

Asian Development Bank,

Sr. Unscd. Notes | | 2.00 | | 1/22/2025 | | 1,000,000 | b | 932,928 | |

Asian Development Bank,

Sr. Unscd. Notes | | 2.75 | | 3/17/2023 | | 500,000 | | 492,325 | |

Asian Development Bank,

Sr. Unscd. Notes | | 2.75 | | 1/19/2028 | | 90,000 | b | 86,155 | |

Chilean Government,

Sr. Unscd. Notes | | 3.13 | | 3/27/2025 | | 500,000 | | 479,470 | |

Colombian Government,

Sr. Unscd. Bonds | | 5.00 | | 6/15/2045 | | 500,000 | | 474,005 | |

Colombian Government,

Sr. Unscd. Notes | | 3.88 | | 4/25/2027 | | 500,000 | | 477,125 | |

Council of Europe,

Sr. Unscd. Notes | | 1.75 | | 11/14/2019 | | 500,000 | | 494,474 | |

European Bank for Reconstruction & Development,

Sr. Unscd. Bonds | | 1.75 | | 11/26/2019 | | 1,000,000 | | 988,605 | |

European Investment Bank,

Sr. Unscd. Bonds | | 2.88 | | 9/15/2020 | | 1,000,000 | | 998,064 | |

European Investment Bank,

Sr. Unscd. Notes | | 1.88 | | 2/10/2025 | | 1,000,000 | b | 923,111 | |

European Investment Bank,

Sr. Unscd. Notes | | 2.00 | | 3/15/2021 | | 1,000,000 | | 976,431 | |

European Investment Bank,

Sr. Unscd. Notes | | 2.25 | | 3/15/2022 | | 500,000 | | 486,381 | |

European Investment Bank,

Sr. Unscd. Notes | | 2.38 | | 5/24/2027 | | 500,000 | | 466,037 | |

European Investment Bank,

Sr. Unscd. Notes | | 2.50 | | 3/15/2023 | | 305,000 | | 296,909 | |

29

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Foreign/Governmental - 3.0% (continued) | | | | | |

European Investment Bank,

Sr. Unscd. Notes | | 2.88 | | 12/15/2021 | | 300,000 | | 298,107 | |

European Investment Bank,

Unscd. Notes | | 2.88 | | 8/15/2023 | | 500,000 | | 493,945 | |

Export-Import Bank of Korea,

Sr. Unscd. Notes | | 1.88 | | 10/21/2021 | | 500,000 | | 475,883 | |

Export-Import Bank of Korea,

Sr. Unscd. Notes | | 4.00 | | 1/14/2024 | | 500,000 | | 503,033 | |

Finnish Government,

Sr. Unscd. Bonds | | 6.95 | | 2/15/2026 | | 25,000 | | 30,005 | |

FMS Wertmanagement,

Govt. Gtd. Notes | | 1.75 | | 3/17/2020 | | 750,000 | | 738,109 | |

Hungarian Government,

Sr. Unscd. Notes | | 6.38 | | 3/29/2021 | | 500,000 | | 530,229 | |

Hungarian Government,

Sr. Unscd. Notes | | 7.63 | | 3/29/2041 | | 300,000 | | 408,536 | |

Indonesian Government,

Sr. Unscd. Notes | | 2.95 | | 1/11/2023 | | 300,000 | | 284,115 | |

Indonesian Government,

Sr. Unscd. Notes | | 3.50 | | 1/11/2028 | | 300,000 | b | 270,569 | |

Indonesian Government,

Sr. Unscd. Notes | | 4.35 | | 1/11/2048 | | 300,000 | b | 257,333 | |

Inter-American Development Bank,

Sr. Unscd. Notes | | 2.13 | | 1/15/2025 | | 1,000,000 | | 940,303 | |

Inter-American Development Bank,

Sr. Unscd. Notes | | 2.13 | | 1/18/2022 | | 370,000 | | 358,998 | |

Inter-American Development Bank,

Sr. Unscd. Notes | | 3.13 | | 9/18/2028 | | 300,000 | | 295,369 | |

Inter-American Development Bank,

Unscd. Notes | | 1.63 | | 5/12/2020 | | 400,000 | | 392,342 | |

Inter-American Development Bank,

Unscd. Notes | | 2.50 | | 1/18/2023 | | 225,000 | | 219,741 | |

International Bank For Reconstruction & Development,

Sr. Unscd. Bonds | | 7.63 | | 1/19/2023 | | 300,000 | | 352,910 | |

International Bank For Reconstruction & Development,

Sr. Unscd. Notes | | 1.38 | | 9/20/2021 | | 430,000 | | 410,423 | |

International Bank For Reconstruction & Development,

Sr. Unscd. Notes | | 1.75 | | 4/19/2023 | | 500,000 | b | 472,776 | |

International Bank For Reconstruction & Development,

Sr. Unscd. Notes | | 1.88 | | 4/21/2020 | | 500,000 | | 492,638 | |

International Bank For Reconstruction & Development,

Sr. Unscd. Notes | | 2.50 | | 7/29/2025 | | 1,000,000 | | 957,996 | |

30

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Foreign/Governmental - 3.0% (continued) | | | | | |

International Bank For Reconstruction & Development,

Sr. Unscd. Notes | | 3.00 | | 9/27/2023 | | 300,000 | | 299,574 | |

International Bank For Reconstruction & Development,

Unscd. Bonds | | 2.75 | | 7/23/2021 | | 1,000,000 | | 992,764 | |

International Bank For Reconstruction & Development,

Unscd. Notes | | 2.00 | | 1/26/2022 | | 620,000 | | 599,900 | |

International Finance,

Sr. Unscd. Bonds | | 1.63 | | 7/16/2020 | | 200,000 | | 195,542 | |

International Finance,

Sr. Unscd. Notes | | 1.13 | | 7/20/2021 | | 300,000 | | 285,123 | |

Israeli Government,

Govt. Gtd. Bonds | | 5.50 | | 9/18/2023 | | 450,000 | | 497,982 | |

Italian Government,

Sr. Unscd. Notes | | 6.88 | | 9/27/2023 | | 400,000 | | 429,691 | |

Japan Bank for International Cooperation,

Govt. Gtd. Bonds | | 1.88 | | 7/21/2026 | | 500,000 | | 445,831 | |

Japan Bank for International Cooperation,

Govt. Gtd. Notes | | 1.88 | | 4/20/2021 | | 490,000 | | 474,018 | |

Japan Bank for International Cooperation,

Govt. Gtd. Notes | | 2.75 | | 1/21/2026 | | 750,000 | | 713,899 | |

Mexican Government,

Sr. Unscd. Notes | | 3.60 | | 1/30/2025 | | 250,000 | | 237,375 | |

Mexican Government,

Sr. Unscd. Notes | | 3.63 | | 3/15/2022 | | 500,000 | | 494,750 | |

Mexican Government,

Sr. Unscd. Notes | | 4.15 | | 3/28/2027 | | 345,000 | | 328,914 | |

Mexican Government,

Sr. Unscd. Notes | | 4.60 | | 1/23/2046 | | 600,000 | | 520,356 | |

Mexican Government,

Sr. Unscd. Notes | | 5.55 | | 1/21/2045 | | 850,000 | | 842,996 | |

Panamanian Government,

Sr. Unscd. Bonds | | 4.50 | | 4/16/2050 | | 200,000 | | 184,800 | |

Panamanian Government,

Sr. Unscd. Bonds | | 5.20 | | 1/30/2020 | | 200,000 | | 204,677 | |

Panamanian Government,

Sr. Unscd. Bonds | | 6.70 | | 1/26/2036 | | 400,000 | | 481,000 | |

Peruvian Government,

Sr. Unscd. Bonds | | 6.55 | | 3/14/2037 | | 370,000 | | 452,325 | |

Peruvian Government,

Sr. Unscd. Bonds | | 7.35 | | 7/21/2025 | | 500,000 | | 603,750 | |

31

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Foreign/Governmental - 3.0% (continued) | | | | | |

Philippine Government,

Sr. Unscd. Bonds | | 3.70 | | 2/2/2042 | | 400,000 | b | 355,940 | |

Philippine Government,

Sr. Unscd. Bonds | | 10.63 | | 3/16/2025 | | 800,000 | | 1,085,242 | |

Polish Government,

Sr. Unscd. Notes | | 5.00 | | 3/23/2022 | | 650,000 | | 680,768 | |

Province of Alberta Canada,

Sr. Unscd. Notes | | 3.30 | | 3/15/2028 | | 80,000 | | 78,029 | |

Province of British Columbia Canada,

Sr. Unscd. Bonds, Ser. USD2 | | 6.50 | | 1/15/2026 | | 925,000 | | 1,090,305 | |

Province of Manitoba Canada,

Unscd. Debs. | | 8.88 | | 9/15/2021 | | 450,000 | | 514,086 | |

Province of Ontario Canada,

Sr. Unscd. Notes | | 3.40 | | 10/17/2023 | | 150,000 | | 150,396 | |

Province of Quebec Canada,

Bonds, Ser. NJ | | 7.50 | | 7/15/2023 | | 200,000 | | 233,683 | |

Province of Quebec Canada,

Sr. Unscd. Debs., Ser. PD | | 7.50 | | 9/15/2029 | | 550,000 | | 740,921 | |

Uruguayan Government,

Sr. Unscd. Bonds | | 4.98 | | 4/20/2055 | | 105,000 | | 97,650 | |

Uruguayan Government,

Sr. Unscd. Bonds | | 7.63 | | 3/21/2036 | | 300,000 | b | 387,225 | |

Uruguayan Government,

Sr. Unscd. Notes | | 4.50 | | 8/14/2024 | | 400,000 | b | 404,588 | |

| | 35,892,297 | |

Forest Products & Other - .1% | | | | | |

International Paper,

Sr. Unscd. Notes | | 3.65 | | 6/15/2024 | | 400,000 | | 396,404 | |

International Paper,

Sr. Unscd. Notes | | 4.40 | | 8/15/2047 | | 250,000 | | 216,669 | |

| | 613,073 | |

Health Care - 2.8% | | | | | |

Abbott Laboratories,

Sr. Unscd. Notes | | 2.90 | | 11/30/2021 | | 600,000 | | 589,690 | |

Abbott Laboratories,

Sr. Unscd. Notes | | 4.90 | | 11/30/2046 | | 250,000 | | 258,840 | |

AbbVie,

Sr. Unscd. Notes | | 2.90 | | 11/6/2022 | | 1,000,000 | | 969,009 | |

AbbVie,

Sr. Unscd. Notes | | 3.60 | | 5/14/2025 | | 170,000 | | 162,442 | |

AbbVie,

Sr. Unscd. Notes | | 4.25 | | 11/14/2028 | | 110,000 | | 106,264 | |

AbbVie,

Sr. Unscd. Notes | | 4.30 | | 5/14/2036 | | 235,000 | | 210,130 | |

AbbVie,

Sr. Unscd. Notes | | 4.45 | | 5/14/2046 | | 330,000 | | 289,776 | |

32

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value ($) | |

Bonds and Notes - 100.4% (continued) | | | | | |

Health Care - 2.8% (continued) | | | | | |

AbbVie,

Sr. Unscd. Notes | | 4.88 | | 11/14/2048 | | 110,000 | | 101,450 | |

Actavis Funding,

Gtd. Notes | | 3.00 | | 3/12/2020 | | 795,000 | | 791,812 | |

Actavis Funding,

Gtd. Notes | | 3.80 | | 3/15/2025 | | 500,000 | | 482,492 | |

Actavis Funding,

Gtd. Notes | | 4.75 | | 3/15/2045 | | 400,000 | | 376,091 | |

Aetna,

Sr. Unscd. Notes | | 4.75 | | 3/15/2044 | | 250,000 | | 236,944 | |

Aetna,

Sr. Unscd. Notes | | 6.63 | | 6/15/2036 | | 150,000 | | 176,640 | |

Amgen,

Sr. Unscd. Notes | | 2.60 | | 8/19/2026 | | 1,000,000 | | 896,488 | |

Amgen,

Sr. Unscd. Notes | | 4.10 | | 6/15/2021 | | 500,000 | | 507,216 | |

Amgen,

Sr. Unscd. Notes | | 4.66 | | 6/15/2051 | | 300,000 | | 277,898 | |

Anthem,

Sr. Unscd. Notes | | 3.30 | | 1/15/2023 | | 500,000 | | 489,606 | |

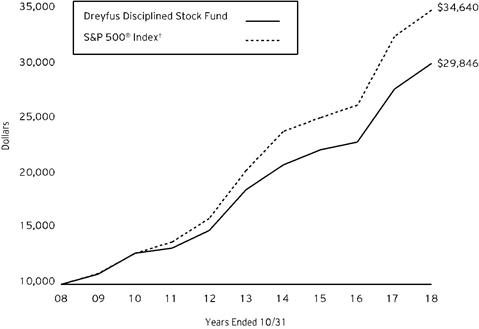

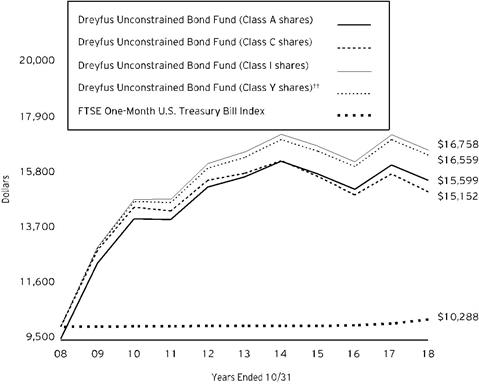

Anthem,