n Value Line Strategic Asset Management Trust

Notes to Financial Statements

June 30, 2008 (Unaudited)

1. Significant Accounting Policies

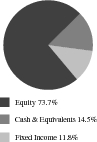

Value Line Strategic Asset Management Trust (the “Trust”) is an open-end diversified management investment company registered under the Investment Company Act of 1940, as amended, which seeks to achieve a high total investment return consistent with reasonable risk by investing primarily in a broad range of common stocks, bonds and money market instruments. The Trust will attempt to achieve its objective by following an asset allocation strategy based on data derived from computer models for the stock and bond markets that shifts the assets of the Trust among equity, debt and money market securities as the models indicate and its investment adviser, Value Line, Inc. (the “Adviser”), deems appropriate.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements.

(A) Security Valuation

Securities listed on a securities exchange are valued at the closing sales prices on the date as of which the net asset value is being determined. Securities traded on the NASDAQ Stock market are valued at the NASDAQ Official Closing Price. In the absence of closing sales prices for such securities and for securities traded in the over-the-counter market, the security is valued at the midpoint between the latest available and representative asked and bid prices.

The Board of Trustees has determined that the value of bonds and other fixed-income securities be calculated on the valuation date by reference to valuations obtained from an independent pricing service which determines valuations for normal institutional-size trading units of debt securities, without exclusive reliance upon quoted prices. This service takes into account appropriate factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data in determining valuations.

Short-term instruments with maturities of 60 days or less at the date of purchase are valued at amortized cost which approximates market value. Short-term instruments with maturities greater than 60 days at the date of purchase are valued at the midpoint between the latest available and representative asked and bid prices, and commencing 60 days prior to maturity such securities are valued at amortized cost.

Securities for which market quotations are not readily available or that are not readily marketable and all other assets of the Fund are valued at fair value as the Board of Trustees may determine in good faith. In addition, the Trust may use the fair value of a security when the closing market price on the primary exchange where the security is traded no longer accurately reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer.

(B) Repurchase Agreements

In connection with transactions in repurchase agreements, the Trust’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Trust’s policy to mark-to-market the collateral on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Trust has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

(C) Federal Income Taxes

It is the Trust’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no provision for federal income tax is required.

(D) Dividends and Distributions

It is the Trust’s policy to distribute to its shareholders, as dividends and as capital gains distributions, all the net investment income for the year and all the net capital gains realized by the Trust, if any. Such distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. All dividends or distributions will be payable in shares of the Trust at the net asset value on the ex-dividend date. This policy is, however, subject to change at any time by the Board of Trustees.

(E) Securities Transactions and Income

Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are

11

n Value Line Strategic Asset Management Trust

Notes to Financial Statements (Continued)

June 30, 2008 (Unaudited)

recorded on the identified cost basis. Interest income on investments, adjusted for amortization of discount and premium, is earned from settlement date and recognized on the accrual basis. Dividend income is recorded on the ex-dividend date.

(F) Foreign Currency Translation

The books and records of the Trust are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange on the valuation date. The Trust does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Trust, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments are included in realized gain/ (loss) on investments and changes in unrealized appreciation/ (depreciation) on investments.

(G) Representations and Indemnifications

In the normal course of business the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

(H) Accounting for Real Estate Investment Trusts

The Trust owns shares of Real Estate Investment Trusts (“REITs”) which report information on the source of their distributions annually. Distributions received from REITs during the year which represent a return of capital are recorded as a reduction of cost and distributions which represent a capital gain dividend are recorded as a realized long-term capital gain on investments.

(I) Foreign Taxes

The Trust may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Trust will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

| 2. Trust Share Transactions, Dividends and Distributions |

Shares of the Trust are available to the public only through the purchase of certain contracts issued by The Guardian Insurance and Annuity Company, Inc. (GIAC). Transactions in shares of beneficial interest in the Trust were as follows:

| | | | Six Months Ended

June 30, 2008

(Unaudited)

| | Year Ended

December 31, 2007

|

|---|

| Shares sold | | | | | 171,065 | | | | 359,185 | |

| Shares issued in reinvestment of dividends and distributions | | | | | — | | | | 3,130,664 | |

| Shares repurchased | | | | | (2,066,205 | ) | | | (5,067,551 | ) |

| Net decrease | | | | | (1,895,140 | ) | | | (1,577,702 | ) |

| Dividends per share from net investment income | | | | $ | — | | | $ | 0.241 | |

| Distributions per share from net realized gains | | | | $ | — | | | $ | 2.754 | |

3. Purchases and Sales of Securities

Purchases and sales of investment securities, excluding short-term investments, were as follows:

| | | | Six Months Ended

June 30, 2008

(Unaudited)

|

|---|

PURCHASES: | | | | | | |

| U.S. Treasury and U.S. Government Agency Obligations | | | | $ | 11,505,003 | |

| Other Investment Securities | | | | | 39,996,107 | |

| | | | | $ | 51,501,110 | |

SALES: | | | | | | |

| U.S. Treasury and U.S. Government Agency Obligations | | | | $ | 13,000,000 | |

| Other Investment Securities | | | | | 93,006,828 | |

| | | | | $ | 106,006,828 | |

12

n Value Line Strategic Asset Management Trust

Notes to Financial Statements (Continued)

June 30, 2008 (Unaudited)

4. Income Taxes (unaudited)

At June 30, 2008, information on the tax components of capital is as follows:

| Cost of investments for tax purposes | | | | $ | 410,648,580 | |

|---|

| Gross tax unrealized appreciation | | | | $ | 137,770,745 | |

| Gross tax unrealized depreciation | | | | | (12,106,675 | ) |

| Net tax unrealized appreciation on investments | | | | $ | 125,664,070 | |

| 5. Investment Advisory Fee, Service and Distribution Fees and Transactions with Affiliates |

An advisory fee of $1,386,340 was paid or payable to Value Line, Inc. (the “Adviser”), the Trust’s investment adviser, for the six months ended June 30, 2008. This was computed at the rate of 1/2 of 1% of the average daily net assets of the Trust during the period and paid monthly. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services, office space, equipment and compensation of administrative, bookkeeping, and clerical personnel necessary for managing the affairs of the Trust. The Adviser also provides persons, satisfactory to the Trust’s Board of Trustees, to act as officers and employees of the Trust and pays their salaries and wages. Direct expenses of the Trust are charged to the Trust while common expenses of the Value Line Funds are allocated proportionately based upon the funds’ respective net assets. The Trust bears all other costs and expenses.

The Trust has a Service and Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, for the payment of certain expenses incurred by Value Line Securities, Inc. (the “Distributor”), a wholly-owned subsidiary of Value Line, Inc., in advertising, marketing, and distributing the Trust’s shares and for servicing the Trust’s shareholders at an annual rate of 0.40% of the Trust’s average daily net assets. For the six months ended June 30, 2008, fees amounting to $1,109,072, before fee waivers, were accrued under the Plan. Effective May 1, 2007 and 2008, the Distributor contractually agreed to waive 0.15% of the Trust’s 12b-1 fee for one year periods. The fees waived amounted to $415,902. The Distributor has no right to recoup previously waived amounts.

Certain officers and directors of the Adviser and Distributor are also officers and Trustees of the Trust.

On June 30, 2008, Value Line, Inc. reorganized its investment management division into EULAV Asset Management, LLC (”EULAV“), a newly formed wholly-owned subsidiary. As part of the reorganization, each advisory agreement was transferred from Value Line, Inc. to EULAV and EULAV replaced Value Line, Inc. as the Fund’s investment adviser. The portfolio managers, who are now employees of EULAV, have not changed as a result of the reorganization.

13

n Value Line Strategic Asset Management Trust

Factors Considered by the Board in Approving the Investment Advisory Agreement for Value Line Strategic Asset Management Trust (Unaudited) |

The Investment Company Act of 1940 (the “1940 Act”) requires the Board of Trustees, including a majority of Trustees who are not interested persons of the Value Line Strategic Asset Management Trust (the “Fund”), as that term is defined in the 1940 Act (the “Independent Trustees”), annually to consider the investment advisory agreement (the “Agreement”) between the Fund and its investment adviser, Value Line, Inc.1 (“Value Line”). As required by the 1940 Act, the Board requested and Value Line provided such information as the Board deemed to be reasonably necessary to evaluate the terms of the Agreement. At meetings held throughout the year, including the meeting specifically focused upon the review of the Agreement, the Independent Trustees met in executive sessions separately from the non-Independent Trustee of the Fund and any officers of Value Line. In selecting Value Line and approving the continuance of the Agreement, the Independent Trustees relied upon the assistance of counsel to the Independent Trustees.

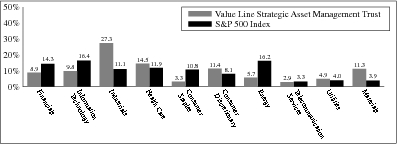

Both in the meetings which specifically addressed the approval of the Agreement and at other meetings held during the course of the year, the Board, including the Independent Trustees, received materials relating to Value Line’s investment and management services under the Agreement. These materials included information on (i) the investment performance of the Fund, compared to a peer group of funds consisting of the Fund and all mixed-asset target allocation growth funds underlying variable insurance products regardless of asset size or primary channel of distribution (the “Performance Universe”), and its benchmark index, each as classified by Lipper Inc., an independent evaluation service (“Lipper”); (ii) sales and redemption data with respect to the Fund; (iii) the general investment outlook in the markets in which the Fund invests; (iv) arrangements with respect to the distribution of the Fund’s shares; (v) the allocation of the Fund’s brokerage (none of which was effected through any affiliate of Value Line); and (vi) the overall nature, quality and extent of services provided by Value Line.

As part of the review of the continuance of the Agreement, the Board requested, and Value Line provided, additional information in order to evaluate the quality of Value Line’s services and the reasonableness of its fees under the Agreement. In a separate executive session, the Independent Trustees reviewed information, which included data comparing: (i) the Fund’s management fee rate, transfer agent and custodian fee rates, service fee (including 12b-1 fees) rates, and the rate of the Fund’s other non-management fees, to those incurred by a peer group of funds consisting of the Fund and 8 other mixed-asset target allocation growth funds underlying variable insurance products, as selected objectively by Lipper (“Expense Group”), and a peer group of funds consisting of the Fund, the Expense Group and all other mixed-asset target allocation growth funds underlying variable insurance products (excluding outliers), as selected objectively by Lipper (“Expense Universe”); (ii) the Fund’s expense ratio to those of its Expense Group and Expense Universe; and (iii) the Fund’s investment performance over various time periods to the average performance of the Performance Universe as well as the Lipper Mixed-Target Allocation Growth Index (the “Lipper Index”). In the separate executive session, the Independent Trustees also reviewed information regarding: (a) Value Line’s financial results and condition, including Value Line’s and certain of its affiliates’ profitability from the services that have been performed for the Fund as well as the Value Line family of funds; (b) the Fund’s current investment management staffing; and (c) the Fund’s potential for achieving economies of scale. In support of its review of the statistical information, the Board was provided with a detailed description of the methodology used by Lipper to determine the Expense Group, the Expense Universe and the Performance Universe to prepare its information.

The following summarizes matters considered by the Board in connection with its renewal of the Agreement. However, the Board did not identify any single factor as all-important or controlling, and the summary does not detail all the matters that were considered.

1 On June 30, 2008, Value Line, Inc., the Fund’s former investment adviser, reorganized its investment management division into EULAV Asset Management, LLC, a newly formed wholly-owned subsidiary located at 220 East 42nd Street, New York, NY 10017. As part of the reorganization, the Fund’s investment advisory agreement was transferred from Value Line to EULAV and EULAV replaced Value Line as the Fund’s investment adviser. Value Line, Inc. is referred to as the investment adviser in this document because at the time of the meeting of the Board of Trustees discussed herein Value Line, Inc. remained the Fund’s investment adviser.

14

n Value Line Strategic Asset Management Trust

Factors Considered by the Board in Approving the Investment Advisory Agreement for Value Line Strategic Asset Management Trust (Unaudited) (Continued) |

Investment Performance. The Board reviewed the Fund’s overall investment performance and compared it to its Performance Universe and the Lipper Index. The Board noted that the Fund outperformed both the Performance Universe average and the Lipper Index for the one-year, three-year, five-year and ten-year periods ended December 31, 2007. The Board also noted that the Fund’s outperformance of the Performance Universe average and the Lipper Index for the one-year period ended December 31, 2007 was significant.

Value Line’s Personnel and Methods. The Board reviewed the background of the portfolio manager responsible for the daily management of the Fund’s portfolio, seeking to achieve the Fund’s investment objective and adhering to the Fund’s investment strategy. The Independent Trustees also engaged in discussions with Value Line’s senior management responsible for the overall functioning of the Fund’s investment operations. Based on this review, the Board concluded that the Fund’s management team and Value Line’s overall resources were well developed and that Value Line had investment management capabilities and personnel essential to performing its duties under the Agreement.

Management Fee and Expenses. The Board considered Value Line’s fee under the Agreement relative to the management fees charged by its Expense Group and Expense Universe averages. The Fund’s management fee rate for the most recent fiscal year was lower than both the Expense Group average and the Expense Universe average. Based on these factors, the Board determined that the Fund’s management fee rate payable to Value Line under the Agreement does not constitute fees that are so disproportionately large as to bear no reasonable relationship to the services rendered and that could not have been the product of arm’s-length bargaining, and concluded that the management fee rate under the Agreement is fair and reasonable.

The Board also considered the Fund’s total expense ratio relative to its Expense Group and Expense Universe averages. The Board noted that, effective May 23, 2006, Value Line Securities, Inc., the Fund’s principal underwriter, voluntarily agreed to waive a portion of the Fund’s Rule 12b-1 fee, effectively reducing the Fund’s Rule 12b-1 fee rate from 0.40% to 0.25% of the Fund’s average daily net assets. The Board also noted that Value Line Securities, Inc. contractually agreed to waive the same percentage of the Fund’s Rule 12b-1 fee for a one-year period ended April 30, 2008 so that it could not be changed without the Board’s approval during the contractual waiver period, and that Value Line Securities, Inc. has agreed to extend this contractual 12b-1 fee waiver through April 30, 2009. As a result of this contractual Rule 12b-1 fee waiver, the Board noted that the Fund’s total expense ratio (after giving effect to this waiver) was less than that of both the Expense Group average and the Expense Universe average and concluded that the average expense ratio was satisfactory for the purpose of approving the continuance of the Agreement for the coming year.

Nature and Quality of Other Services. The Board considered the nature, quality, cost and extent of other services provided by Value Line and its affiliate, Value Line Securities, Inc., the Fund’s principal underwriter. At meetings held throughout the year, the Board reviewed the effectiveness of Value Line’s overall compliance program, as well as the services provided by Value Line Securities, Inc. The Board also reviewed the services provided by Value Line and its affiliate in supervising third party service providers. Based on this review, the Board concluded that the nature, quality, cost and extent of such other services provided by Value Line and its affiliate were satisfactory, reliable and beneficial to the Fund’s shareholders.

Profitability. The Board considered the level of Value Line’s profits with respect to the management of the Fund, including the impact of certain actions taken during prior years. These actions included Value Line’s review of its methodology in allocating certain of its costs to the management of each fund, Value Line’s reduction (voluntary in some instances and contractual in other instances) of management and/or Rule 12b-1 fees for certain funds, Value Line’s termination of the use of soft dollar research, and the cessation of trading through its affiliate, Value Line Securities, Inc. Based on a review of these actions and Value Line’s overall profitability, the Board concluded that Value Line’s profits from management of the Fund, including the financial results derived from the Fund, were within a range the Board considered reasonable.

Other Benefits. The Board also considered the character and amount of other direct and incidental benefits received by Value Line and its affiliates from their association with the Fund. The Board concluded that potential “fall-out” benefits that Value Line and its affiliates may receive, such as greater name recognition, appear to be reasonable, and may in some cases benefit the Fund.

Economies of Scale. The Board noted that, given the current and anticipated size of the Fund, any perceived and potential economies of scale were not yet a significant consideration for the Fund and the addition of break points was determined not to be necessary at this time.

15

n Value Line Strategic Asset Management Trust

Factors Considered by the Board in Approving the Investment Advisory Agreement for Value Line Strategic Asset Management Trust (Unaudited) (Continued) |

Fees and Services Provided for Other Comparable Funds/Accounts Managed by Value Line and its Affiliates. In addition to comparing the Fund’s management fee rate to unaffiliated mutual funds included in the Fund’s Expense Group and Expense Universe, the Board was informed by Value Line that Value Line and its affiliates do not manage any investment companies comparable to the Fund.

Conclusion. The Board, in light of Value Line’s overall performance, considered it appropriate to continue to retain Value Line as the Fund’s investment adviser. Based on their evaluation of all material factors deemed relevant, and with the advice of independent counsel, the Board concluded that the Fund’s Agreement is fair and reasonable and voted to approve the continuation of the Agreement for another year.

16

n Value Line Strategic Asset Management Trust

Form N-Q

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Voting

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Trust voted these proxies during the most recent 12-month period ended June 30 is available through the Trust’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

17

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-2(c) under the Act (17 CFR 270.30a-2(c) ) based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report, are appropriately designed to ensure that material information relating to the registrant is made known to such officers and are operating effectively. |

| (b) | The registrant’s principal executive officer and principal financial officer have determined that there have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including corrective actions with regard to significant deficiencies and material weaknesses. |

Item 12. Exhibits.

| (a) | (1) Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT. |

(2) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

| attached hereto as Exhibit 99.906.CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Mitchell E. Appel, President |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Mitchell E. Appel, President, Principal Executive Officer |

By: | /s/ Emily D. Washington |

| Emily D. Washington, Treasurer, Principal Financial Officer |

Date: September 3, 2008