UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number _811-05276_

Value Line Strategic Asset Management Trust

(Exact name of registrant as specified in charter)

7 Times Square, New York, N.Y. 10036

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 212-907-1900

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Item I. Reports to Stockholders.

A copy of the Semi-Annual Report to Stockholders for the period ended 6/30/14

is included with this Form.

| | |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

| | | | |

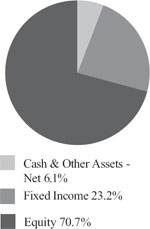

Stephen E. Grant, Portfolio Manager Liane Rosenberg, Director of Fixed Income Jeffrey D. Geffen, Portfolio Manager Objective: High total investment return consistent with reasonable risk Inception Date: October 1, 1987 Net Assets at June 30, 2014: $339,675,380 Portfolio Composition at June 30, 2014: (Percentage of Total Net Assets) | | | An Update from Fund Management (Unaudited) PRESIDENT’S LETTER Dear Shareholders: We are pleased to present you with this semi-annual report for Value Line Strategic Asset Management Trust (the “Trust”) for the six months ended June 30, 2014. The six months ended June 30, 2014 were rewarding ones for the Trust, as it generated solid absolute gains. Most notably, perhaps, the Trust outpaced its peers for the one-, three-, five- and ten-year periods ended June 30, 2014, as noted by leading independent mutual fund advisory service Lipper Inc.1 (mixed asset target allocation growth category). On the following pages, the Trust’s portfolio managers discuss the management of the Trust during the semi-annual period. The discussion highlights key factors influencing recent performance of the Trust. You will also find a schedule of investments and financial statements for the Trust. Before reviewing the performance of your mutual fund investment, we encourage you to take a brief look at the major factors affecting the financial markets over the six months ended June 30, 2014, especially given the newsworthy events of the semi-annual period. Economic Review U.S. real Gross Domestic Product (GDP) got off to a slow start in 2014, contracting at a 2.9% annualized rate from January through March. This was the biggest decline in the pace of U.S. economic growth since the first quarter of 2009. Part of the decline was due to the unusually harsh winter weather conditions throughout much of the nation. In turn, consumer spending grew at the weakest pace in five years, restrained further by a drop in health care outlays. Such low health care spending was largely unexpected, as the U.S. Bureau of Economic Analysis had earlier estimated that major provisions of President Obama’s signature health care law would result in increased medical spending by consumers. Second quarter GDP numbers are widely expected to show a significant increase over those of the first quarter, supported by what many anticipate to be some upside surprises in the labor and housing markets as well as in consumer confidence. Inflation remained modest through the semi-annual period though inching up to hover around the Federal Reserve’s (the Fed’s) target of 2.0%. The headline Consumer Price Index (CPI) rose 2.1% over the 12 months ended June 30, 2014 before seasonal adjustment. Core inflation, which excludes food and energy and which is the price measure tied to consumer spending watched most closely by the Fed, was up 1.9% in June 2014 from a year earlier. Limited wage growth was a key contributor to the relatively benign inflation scenario. The U.S. saw moderate but unspectacular job growth. While the unemployment rate declined from 6.7% at the close of 2013 to 6.1% at the end of June 2014, job creation was lackluster, with hiring generally concentrated in sectors representative of low-wage jobs. Still, the consumer looked more positively on the U.S. economy overall, with the Consumer Confidence Index rising from 78.1 in December 2013 to 85.2 in June 2014, its highest level since January 2008. Consumers indicated that they expect business conditions to improve, and their assessment of the job market also grew more favorable. Against this backdrop of disappointing economic growth but declining unemployment and still modest inflation, the Fed left the targeted federal funds rate unchanged throughout the semi-annual period. By the end of June 2014, the majority of Fed governors saw the first interest rate hike likely to occur in 2015. Despite expectations for improved economic activity in the second half of 2014, Fed Chair Janet Yellen reaffirmed the Fed’s commitment to maintaining accommodative monetary policy until a more robust recovery can be sustained. While there were pockets of economic strength and lower unemployment, these trends were not as strong as the Fed had hoped. Meanwhile, the Fed’s bond-buying program was tapered by $10 billion per month each month since January 2014, with the wind-down targeted for completion in October 2014. |

| | | | |

About information in this report:

| ● | It is important to consider the Trust’s investment objectives, risks, fees and expenses before investing. All funds involve some risk, including possible loss of the principal amount invested. |

| VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST | 1 |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

Equity Market Review

U.S. equities, as measured by the S&P 500® Index2, posted a solid gain of 7.13% during the six months ended June 30, 2014, despite the weak U.S. economic data early in the calendar year. Indeed, even with a weak January 2014, the S&P 500® Index experienced a sixth consecutive quarterly gain, a record not matched since 1998. The U.S. equity market’s climb to new highs through the end of June 2014, amidst low volatility and improved economic data in the second calendar quarter, was supported by many U.S. corporate earnings announcements reflecting top-line growth, even as overall management guidance for 2014 was less optimistic than consensus.

All ten sectors of the S&P 500® Index posted positive absolute performance for the semi-annual period, with the utilities, energy and health care sectors leading the way. Consumer discretionary, industrials, telecommunication services and financials were the weakest sectors during the semi-annual period.

Fixed Income Market Review

In contrast to a challenging 2013, the broad U.S. fixed income market, as measured by the Barclays U.S. Aggregate Bond Index3, posted a solid positive return of 3.93% during the semi-annual period. The yield curve flattened, as intermediate-term and longer-term yields declined and shorter-term maturities edged up. The yield on the bellwether 10-year U.S. Treasury note fell approximately 51 basis points during the semi-annual period, while the yield on the 30-year U.S. Treasury declined approximately 62 basis points. (A basis point is 1/100th of a percentage point.) The 30-year U.S. Treasury bond’s especially strong performance stemmed both from low inflation and from a flood of buyers looking for relative safety away from the comparatively slower economic growth seen in the European Union and the BRIC nations (Brazil, Russia, India and China).

Weak first quarter GDP, lackluster job growth and inflation hovering around the Fed’s target level of 2% kept interest rates low during the semi-annual period. A combination of low interest rates and low market volatility led many investors on a search for yield, benefiting the performance of spread, or non-U.S. Treasury, sectors, particularly in the middle and lower credit rating bands, and causing U.S. Treasuries to lag in comparison. Corporate bonds, both investment grade and high yield, and securitized debt most significantly outperformed U.S. Treasuries during the semi-annual period. Another factor supporting investors’ heightened risk tolerance was the progress made in several European countries toward better economic conditions.

* * *

We thank you for trusting us to be a part of your long-term, comprehensive investment strategy. We appreciate your confidence in the Value Line Funds and look forward to serving your investment needs in the years ahead just as we have been helping to secure generations’ financial futures for more than 60 years—based on solid fundamentals, sound investment principles and the power of disciplined and rigorous analytics. If you have any questions or would like additional information on other Value Line Funds, we invite you to visit us at www.vlfunds.com, newly redesigned to be even more informative, user-friendly and comprehensive.

Sincerely,

Mitchell Appel

President of the Value Line Funds

Past performance does not guarantee future results. Investment return and principal value of an investment can fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and that current performance may be lower or higher than the performance data quoted. Investors should carefully consider the investment objective, risks, charges and expense of a fund.

| 2 | VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

| 1 | Lipper Rankings represent the funds’ ranking within its Lipper asset class peer group and are based on total return performance and do not reflect the effect of sales charges. Although a fund may outperform peers when compared to Lipper peer groups, the returns for that time period may still be negative. Rankings shown include management fees and are provided by Lipper Inc., a leading independent performance analysis service. This information is provided for educational purposes only and should not be considered investment advice. Lipper ratings are not intended to predict future results, and Lipper does not guarantee the accuracy of this information. Past performance is no guarantee of future results. |

| 2 | The S&P 500® Index consists of 500 stocks which are traded on the New York Stock Exchange, American Stock Exchange and the NASDAQ National Market System and is representative of the broad stock market. This is an unmanaged index and does not reflect charges, expenses or taxes, and it is not possible to directly invest in this index. |

| 3 | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS. |

| VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST | 3 |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

INVESTMENT OBJECTIVE AND STRATEGY

The Trust’s investment objective is to achieve a high total investment return, consistent with reasonable risk.

To achieve the Trust’s objective, the Adviser invests in a broad range of common stocks, bonds and money market instruments in accordance with an asset allocation strategy based primarily on data derived from proprietary computer models for the stock and bond markets, which Value Line, Inc. developed. The Adviser attempts to achieve the Trust’s investment objective by following an asset allocation strategy that enables the Adviser to periodically shift the assets of the Trust among three types of securities: (a) common stocks, (b) debt securities with maturities of more than one year that are principally rated investment grade (i.e., within the four highest categories of a nationally recognized statistical rating organization) and (c) money market instruments (debt securities with maturities of less than one year). On occasion, the Trust may invest in BBB-rated debt securities, which may have certain speculative characteristics and in debt securities issued or guaranteed by the U.S. government, its agencies and instrumentalities, including mortgage-backed securities issued by government sponsored enterprises. While the Trust is actively managed by the Adviser, the Adviser relies primarily on the rankings of companies by the Value Line TimelinessTM Ranking System or the Value Line PerformanceTM Ranking System in selecting securities for purchase or sale.

Manager Discussion of Trust Performance

Below, Value Line Strategic Asset Management Trust portfolio managers Stephen E. Grant, Jeffrey D. Geffen and Liane Rosenberg discuss the Trust’s performance and positioning for the six months ended June 30, 2014.

How did the Trust perform during the semi-annual period?

The Trust generated a cumulative total return of 4.57% during the six months ended June 30, 2014. This compares to the 6.03% return of the Trust’s blended benchmark, comprised 60% of the S&P 500® Index and 40% of the Barclays U.S. Aggregate Bond Index (the “Barclays Index”), during the same semi-annual period.

What key factors were responsible for the Trust’s performance during the six-month reporting period?

The Trust posted solid absolute returns but lagged the blended benchmark due primarily to an average 8% of total net assets held in cash during the six-month period, which yielded little more than zero. Partially offsetting this detractor was effective asset allocation. Throughout the six-month reporting period, the Trust was underweighted in fixed income and overweighted in equities. With U.S. equities, as measured by the S&P 500® Index, up 7.13% during the semi-annual period, and bonds, as measured by the Barclays Index, posting a return of 3.93%, this asset allocation clearly added value.

Also, while the semi-annual period ended June 30, 2014 saw gains for the equity market, value stocks outperformed growth stocks, and large-cap stocks outperformed small-cap stocks. Relative to the S&P 500® Index, both of these factors acted as headwinds to results, as the equity portion of the Trust concentrates its holdings on growth-oriented stocks and on stocks with an average market capitalization well below that of the S&P 500® Index.

Which equity market sectors most significantly affected Trust performance?

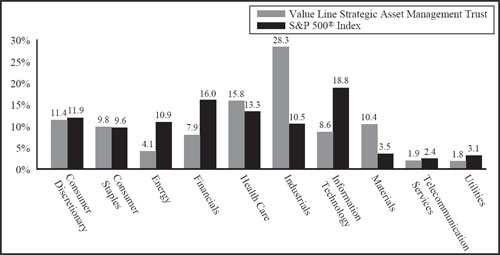

The equity portion of the Trust lagged its equity benchmark, the S&P 500® Index, during the semi-annual period. Stock selection in information technology, materials, energy and industrials detracted from the equity portion of the Trust’s performance most during the semi-annual period. Having underweighted allocations to the strongly performing information technology and energy sectors and having an overweighted exposure to the weaker industrials sector also hurt.

In information technology, the equity portion of the Trust held an underweighted position in Apple and no positions in several other strongly performing large-cap stocks in the sector, including Microsoft, Intel and Facebook, each of which saw their shares climb double-digits during the semi-annual period. In materials, positions in FMC, a diversified research company in the chemical industry, and Scotts Miracle-Gro, a lawn and garden products and services company, disappointed most. In energy, an underweighted exposure to the oil services industry particularly hurt, as the equity portion of the Trust held no positions in either Schlumberger or Halliburton, both of which saw robust gains during the semi-annual period. In industrials, positions in railroad systems operator Kansas City Southern and electronic instruments manufacturer Ametek each dampened results, as each saw share price declines during the semi-annual period.

Partially offsetting these detractors were the positive contributions made by effective stock selection in the financials and telecommunication services sectors. Having an underweighted allocation to the weakly-performing financials sector also helped. In financials, not holding positions in laggards Citigroup and JPMorgan Chase buoyed relative performance. In telecommunication services, a position in wireless communications infrastructure owner and operator SBA Communications was a particularly strong performer.

| 4 | VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

Which stocks detracted significantly from the Trust’s performance during the semi-annual period?

During the semi-annual period, among the stocks that detracted most from the equity portion of the Trust’s relative performance were TJX Companies, a discount apparel and home fashion retailer; LKQ, an automotive products and services wholesaler; and Wolverine World Wide, a branded footwear and performance leathers manufacturer. Each suffered during the semi-annual period from quarterly earnings reports that were weaker than forecast.

What were some of the Trust’s best-performing individual stocks?

Among the individual stocks that contributed most to the equity portion of the Trust’s relative results were life science equipment firm Idexx Laboratories, specialty pharmaceuticals firm Allergan and biopharmaceutical company Alexion Pharmaceuticals.

Shares of Idexx Laboratories rose on continued strong earnings results that drove a 600%-plus gain in its stock price since we established a Trust position in its shares in 2003. Allergan benefited from a takeover bid from Valeant Pharmaceuticals International. Alexion maintained the strong operating performance that has driven an approximately 1,000% gain in its stock since the Trust purchased its shares seven years ago.

Did the equity portion of the Trust make any significant purchases or sales?

During the semi-annual period, we initiated a position in the equity portion of the Trust in consumer products manufacturing giant Procter & Gamble in recognition of its consistent long-term growth record in earnings and stock price, generated by its powerful product portfolio.

We sold the equity portion of the Trust’s position in natural food supermarket owner and operator Whole Foods Market because its quarterly earnings reports began to disappoint. We also exited the equity portion of the Trust’s position in Internet exchange services provider Equinix because of reduced consistency and predictability in its earnings and stock price.

Were there any notable changes in the equity portion of the Trust’s weightings during the six-month period?

There were no material changes in the equity portion of the Trust’s sector weightings during the six-month period ended June 30, 2014.

How was the equity portion of the Trust positioned relative to its benchmark index at the end of June 2014?

As of June 30, 2014, the Trust was overweighted relative to the S&P 500® Index in the industrials and materials sectors. The Trust was underweighted relative to the S&P 500® Index in the energy, financials and information technology sectors on the same date.

What was the duration strategy of the fixed income portion of the Trust?

We kept the fixed income portion of the Trust’s duration only modestly short relative to that of the Barclays Index—a difference of approximately 1/4 year. The reason for this relatively neutral stance was the market’s moderate volatility and the 10-year U.S. Treasury yield’s trading range of approximately +/- 25 basis points that was in play, especially during the second calendar quarter. (A basis point is 1/100th of a percentage point.) Duration is a measure of the Trust’s sensitivity to changes in interest rates.

While duration positioning had an overall neutral impact on results during the semi-annual period, yield curve positioning detracted. Longer duration assets were the best performers during the semi-annual period, and the fixed income portion of the Trust had an underweighted exposure to the long-term end of the yield curve. Yield curve indicates the spectrum of maturities within a particular sector.

Which fixed income market segments most significantly affected Trust performance?

Overall, the fixed income portion of the Trust performed in line with its benchmark, the Barclays Index. The biggest positive contributors to performance were investment grade and high yield corporate bonds. During the semi-annual period, higher risk assets outperformed lower risk assets, and the fixed income portion of the Trust was significantly overweight investment grade corporate bonds relative to the Barclays Index, while maintaining a significant underweight to U.S. Treasuries. Investment grade corporate bonds outperformed U.S. Treasuries by approximately 300 basis points during the semi-annual period. Within corporate credit, we also maintained an out-of-benchmark exposure to high yield corporate bonds. This high yield corporate bond exposure had a positive impact on relative results, as high yield corporate bonds outperformed the Barclays Index by approximately 150 basis points during the semi-annual period. As U.S. Treasuries, particularly those on the short-term end of the yield curve, were the weakest performers during the semi-annual period, the fixed income portion of the Trust’s underweight to these holdings proved prudent as well.

| VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST | 5 |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

Were there any notable changes in the fixed income portion of the Trust’s weightings during the six-month period?

The most significant sector shifts in the fixed income portion of the Trust encompassed a reduction in U.S. Treasuries with a similar incremental increase in corporate bonds, both investment grade and high yield. To a more modest degree, exposure to securitized assets edged up, with the increased exposure coming from commercial mortgage-backed securities. We also modestly increased the fixed income portion of the Trust’s exposures to sovereign debt and taxable municipal bonds during the six-month period.

How was the fixed income portion of the Trust positioned relative to its benchmark index at the end of June 2014?

As of June 30, 2014, the fixed income portion of the Trust was overweight relative to the Barclays Index in investment grade corporate bonds and in securitized debt. It also maintained its out-of-benchmark exposure to high yield corporate bonds. The fixed income portion of the Trust was underweight relative to the Barclays Index in U.S. Treasuries and supranational agency debt and was rather neutrally weighted to the benchmark index in asset-backed securities, sovereign debt and taxable municipal bonds on the same date.

How did the Trust’s overall asset allocation shift from beginning to end of the reporting period?

In allocating assets, we are guided by Value Line’s proprietary asset allocation model. At December 31, 2013, the Trust had weightings of approximately 70% in stocks, 22% in fixed income securities and 8% in cash equivalents. By the end of June 2014, allocation had changed little, with Value Line’s proprietary asset allocation model remaining positive on stocks. At June 30, 2014, the Trust had weightings of approximately 70.5% in stocks, 23.5% in fixed income securities and 6% in cash equivalents.

How did the Trust use derivatives and similar instruments during the reporting period?

The Trust did not use derivatives during the reporting period.

What is your tactical view and strategy for the months ahead?

Regardless of market conditions, in the equity portion of the Trust, we intend to stay true to our time-tested investment discipline going forward, seeking to invest in companies that have demonstrated a solid history of consistent growth in both their earnings and stock price. In our view, these companies possess attractive portfolios of proprietary products and services that give them strong market positions and make them less vulnerable to swings in national and international economic conditions. At the same time, we believe the underlying stocks of these companies tend to be less volatile than the average stock in the S&P 500® Index. By maintaining our investment discipline, the Trust has historically provided a smoother ride to investors than its peer group averages. Putting aside short-term ebbs and flows in the equity market, we believe the equity portion of the Trust’s investments are likely to continue to provide superior returns to our shareholders over the long term.

As for the fixed income market, how far the U.S. economy rebounds from its weak first calendar quarter may well be a key determinant for the asset class’ performance going forward. Any shift in Federal Reserve (Fed) policy, either more or less accommodative, or in its timing for an increase in interest rates is almost sure to affect the fixed income market. Key economic variables likely to affect Fed policy include not only broad economic growth but also job creation, unemployment rates and inflation pressures. Given this view, at the end of the semi-annual period, we continued to favor corporate bonds over U.S. Treasuries within the fixed income portion of the Trust. We especially liked corporate bonds rated BBB, or mid-grade credits, for their incremental yield. That said, given how tight spreads, or yield differentials, were at the end of the semi-annual period and given the fixed income portion of the Trust’s overweighted allocation, we would not be inclined to increase exposure to corporate bonds but intend to maintain exposure near levels held at the end of June 2014.

If stock prices and/or interest rates increase, we could become more neutral toward stocks in our asset allocation. If stock prices or interest rates fall, we could become more bullish on stocks and look to reduce exposure to high yield corporate bonds.

As always, we intend to stay true to our time-tested investment discipline going forward.

| 6 | VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

Top Ten Holdings (As of 6/30/2014)

| | Percentage of |

| Company | Total Net Assets |

| SBA Communications Corp. Class A | 1.33% |

| EQT Corp. | 1.32% |

| Sigma-Aldrich Corp. | 1.27% |

| AMETEK, Inc. | 1.26% |

| Alliance Data Systems Corp. | 1.24% |

| O’Reilly Automotive, Inc. | 1.20% |

| Stericycle, Inc. | 1.19% |

| Canadian National Railway Co. | 1.15% |

| Thermo Fisher Scientific, Inc. | 1.11% |

| Henry Schein, Inc. | 1.11% |

Equity Sector Weightings vs. Index (As of 6/30/2014)

| VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST | 7 |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

Average Annual Total Returns (For periods ended 6/30/2014)

| | | | | | | |

| | Year | | | | | |

| | to | | | | | |

| | Date | 1 | 3 | 5 | 10 | Since Inception |

| | (not annualized) | Yr | Yrs | Yrs | Yrs | 10/01/1987 |

| Value Line Strategic Asset Management Trust | 4.57% | 17.25% | 12.12% | 14.80% | 8.00% | 10.01% |

60/40 S&P 500® Index/Barclays Capital Aggregate Bond Index | 6.03% | 16.23% | 11.88% | 13.26% | 4.67% | 8.43% |

All performance data quoted is historical and the results represent past performance and neither guarantee nor predict future investment results. To obtain performance data current to the most recent month (available within 7 business days of the most recent month end), please call (800) 221-3253 or visit www.guardianinvestor.com. Current performance may be higher or lower than the performance quoted here. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

Total return figures are historical and assume the reinvestment of dividends and distributions and the deduction of all Trust expenses. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Trust will be lower to reflect separate account and contract/policy charges. The return figures shown do not reflect the deduction of taxes that a contract owner may pay on distributions or redemption of units.

| 8 | VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST |

¢ Value Line Strategic Asset Management Trust (Unaudited) | Semiannual Report To Contractowners |

Trust Expenses

By investing in the Trust, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges on purchase payments, reinvested dividends, or other distributions; redemption fees and exchange fees; and (2) ongoing costs, including, as applicable, management fees; distribution and/or service (12b-1) fees; and other Trust expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested on January 1, 2014 and held for six months ended June 30, 2014.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

| | | | | |

| | Beginning | Ending | Expenses | |

| | Account Value | Account Value | Paid During | Annualized |

| | January 1, 2014 | June 30, 2014 | Period* | Expense Ratio |

| Actual | $1,000 | $1,045.75 | $4.42 | 0.87% |

| Hypothetical (5% return before expenses) | $1,000 | $1,020.47 | $4.37 | 0.87% |

| * | Expenses are equal to the Trust’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the Trust’s most recent fiscal half-year). This expense ratio may differ from the expense ratio shown in the financial highlights. |

| VALUE LINE STRATEGIC ASSET MANAGEMENT TRUST | 9 |

| ¢ | Value Line Strategic Asset Management Trust |

| | Schedule of Investments | | | |

June 30, 2014 (Unaudited) | | | |

| Shares | | | Value |

| | | | | | | |

| | Common Stocks — 70.7% | | | |

| Consumer Discretionary — 8.0% | | | |

| | 6,400 | | AutoZone, Inc. * | | $ | 3,431,936 |

| | 48,000 | | BorgWarner, Inc. | | | 3,129,120 |

| | 36,000 | | Brinker International, Inc. | | | 1,751,400 |

| | 20,000 | | Buckle, Inc. (The) (1) | | | 887,200 |

| | 22,000 | | Domino’s Pizza, Inc. | | | 1,607,980 |

| | 6,000 | | Genuine Parts Co. | | | 526,800 |

| | 89,000 | | LKQ Corp. * | | | 2,375,410 |

| | 27,000 | | O’Reilly Automotive, Inc. * | | | 4,066,200 |

| | 16,000 | | Starbucks Corp. | | | 1,238,080 |

| | 65,000 | | TJX Companies, Inc. (The) | | | 3,454,750 |

| | 56,000 | | Wolverine World Wide, Inc. | | | 1,459,360 |

| | 42,000 | | Yum! Brands, Inc. | | | 3,410,400 |

| | | | | | | 27,338,636 |

| Consumer Staples — 6.9% | | | |

| | 16,900 | | British American Tobacco PLC ADR | | 2,012,452 |

| | 9,000 | | Bunge Ltd. | | | 680,760 |

| | 50,000 | | Church & Dwight Co., Inc. | | | 3,497,500 |

| | 10,000 | | Costco Wholesale Corp. | | | 1,151,600 |

| | 17,000 | | Energizer Holdings, Inc. | | | 2,074,510 |

| | 126,000 | | Flowers Foods, Inc. | | | 2,656,080 |

| | 38,000 | | General Mills, Inc. | | | 1,996,520 |

| | 56,000 | | Hormel Foods Corp. | | | 2,763,600 |

| | 30,000 | | PepsiCo, Inc. | | | 2,680,200 |

| | 24,000 | | Procter & Gamble Co. (The) | | | 1,886,160 |

| | 35,000 | | Reynolds American, Inc. | | | 2,112,250 |

| | | | | | | 23,511,632 |

| Energy — 2.9% | | | |

| | 42,000 | | EQT Corp. | | | 4,489,800 |

| | 34,000 | | FMC Technologies, Inc. * | | | 2,076,380 |

| | 42,000 | | Noble Energy, Inc. | | | 3,253,320 |

| | | | | | | 9,819,500 |

| Financials — 5.6% | | | |

| | 11,200 | | Affiliated Managers Group, Inc. * | | | 2,300,480 |

| | 37,000 | | AFLAC, Inc. | | | 2,303,250 |

| | 36,000 | | American Tower Corp. REIT | | | 3,239,280 |

| | 12,000 | | Arch Capital Group Ltd. * | | | 689,280 |

| | 3,400 | | Bank of Montreal | | | 250,206 |

| | 3,200 | | BlackRock, Inc. | | | 1,022,720 |

| | 9,000 | | M&T Bank Corp. | | | 1,116,450 |

| | 20,000 | | ProAssurance Corp. | | | 888,000 |

| | 28,800 | | Royal Bank of Canada | | | 2,057,184 |

| | 3,800 | | Stifel Financial Corp. * | | | 179,930 |

| | 16,000 | | T. Rowe Price Group, Inc. | | | 1,350,560 |

| | 22,568 | | Toronto-Dominion Bank (The) | | | 1,160,221 |

| | 46,000 | | Wells Fargo & Co. | | | 2,417,760 |

| | | | | | | 18,975,321 |

| Health Care — 11.2% | | | |

| | 20,200 | | Alexion Pharmaceuticals, Inc. * | | | 3,156,250 |

| | 17,400 | | Allergan, Inc. | | | 2,944,428 |

| | 15,000 | | C.R. Bard, Inc. | | | 2,145,150 |

| | 32,000 | | Catamaran Corp. * | | | 1,413,120 |

| | 54,200 | | Cerner Corp. * | | | 2,795,636 |

| | 50,000 | | DENTSPLY International, Inc. | | | 2,367,500 |

| | 42,000 | | Express Scripts Holding Co. * | | | 2,911,860 |

| | 31,800 | | Henry Schein, Inc. * | | | 3,773,706 |

| | 27,800 | | IDEXX Laboratories, Inc. * | | | 3,713,246 |

| | 15,000 | | McKesson Corp. | | | 2,793,150 |

| | 8,000 | | Mednax, Inc. * | | | 465,200 |

| Shares | | | | | Value |

| Health Care — 11.2% (Continued) | | | |

| | 13,200 | | Mettler-Toledo International, Inc. * | | $ | 3,341,976 |

| | 50,000 | | Novo Nordisk A/S ADR | | | 2,309,500 |

| | 32,000 | | Thermo Fisher Scientific, Inc. | | | 3,776,000 |

| | | | | | | 37,906,722 |

| Industrials — 20.0% | | | |

| | 13,000 | | Acuity Brands, Inc. | | | 1,797,250 |

| | 81,575 | | AMETEK, Inc. | | | 4,264,741 |

| | 60,000 | | Canadian National Railway Co. | | | 3,901,200 |

| | 34,000 | | CLARCOR, Inc. | | | 2,102,900 |

| | 13,000 | | Clean Harbors, Inc. * | | | 835,250 |

| | 43,200 | | Danaher Corp. | | | 3,401,136 |

| | 46,000 | | Donaldson Co., Inc. | | | 1,946,720 |

| | 8,000 | | EnerSys | | | 550,320 |

| | 12,400 | | Esterline Technologies Corp. * | | | 1,427,488 |

| | 22,000 | | General Dynamics Corp. | | | 2,564,100 |

| | 42,000 | | IDEX Corp. | | | 3,391,080 |

| | 14,600 | | IHS, Inc. Class A * | | | 1,980,782 |

| | 28,500 | | ITT Corp. | | | 1,370,850 |

| | 12,600 | | J.B. Hunt Transport Services, Inc. | | | 929,628 |

| | 22,000 | | Kansas City Southern | | | 2,365,220 |

| | 24,200 | | Kirby Corp. * | | | 2,834,788 |

| | 22,000 | | Parker Hannifin Corp. | | | 2,766,060 |

| | 10,600 | | Precision Castparts Corp. | | | 2,675,440 |

| | 41,500 | | Republic Services, Inc. | | | 1,575,755 |

| | 24,000 | | Roper Industries, Inc. | | | 3,504,240 |

| | 34,000 | | Stericycle, Inc. * | | | 4,026,280 |

| | 8,000 | | Teledyne Technologies, Inc. * | | | 777,360 |

| | 34,000 | | Toro Co. (The) | | | 2,162,400 |

| | 26,000 | | Union Pacific Corp. | | | 2,593,500 |

| | 28,000 | | United Technologies Corp. | | | 3,232,600 |

| | 12,600 | | Valmont Industries, Inc. (1) | | | 1,914,570 |

| | 13,000 | | W.W. Grainger, Inc. | | | 3,305,510 |

| | 76,500 | | Waste Connections, Inc. | | | 3,714,075 |

| | | | | | | 67,911,243 |

| Information Technology — 6.1% | | | |

| | 23,000 | | Accenture PLC Class A | | | 1,859,320 |

| | 15,000 | | Alliance Data Systems Corp. * | | | 4,218,750 |

| | 30,600 | | Amphenol Corp. Class A | | | 2,948,004 |

| | 2,800 | | Anixter International, Inc. | | | 280,196 |

| | 19,000 | | ANSYS, Inc. * | | | 1,440,580 |

| | 28,000 | | Apple, Inc. | | | 2,602,040 |

| | 48,000 | | Cognizant Technology Solutions Corp. | | | |

| | | | Class A * | | | 2,347,680 |

| | 20,000 | | MasterCard, Inc. Class A | | | 1,469,400 |

| | 53,600 | | Salesforce.com, Inc. * | | | 3,113,088 |

| | 4,900 | | WEX, Inc. * | | | 514,353 |

| | | | | | | 20,793,411 |

| Materials — 7.4% | | | |

| | 12,000 | | Airgas, Inc. | | | 1,306,920 |

| | 25,000 | | AptarGroup, Inc. | | | 1,675,250 |

| | 14,000 | | Ball Corp. | | | 877,520 |

| | 27,000 | | Crown Holdings, Inc. * | | | 1,343,520 |

| | 33,400 | | Ecolab, Inc. | | | 3,718,756 |

| | 44,000 | | FMC Corp. | | | 3,132,360 |

| | 5,400 | | NewMarket Corp. | | | 2,117,394 |

| | 24,000 | | Praxair, Inc. | | | 3,188,160 |

| | 19,000 | | Scotts Miracle-Gro Co. (The) Class A | | | 1,080,340 |

| | 42,400 | | Sigma-Aldrich Corp. | | | 4,302,752 |

| | 31,000 | | Valspar Corp. (The) | | | 2,361,890 |

| | | | | | | 25,104,862 |

| 10 | See Notes to Financial Statements. |

| Value Line Strategic Asset Management Trust |

| | Schedule of Investments (Continued) | | | |

| | | | |

| June 30, 2014 (Unaudited) | | | |

| Shares | | | | | Value |

| | | | | | | |

| Common Stocks — 70.7% (Continued) | |

| Telecommunication Services — 1.3% | | | |

| | 44,000 | | SBA Communications Corp. Class A * | | $ | 4,501,200 |

| Utilities — 1.3% | | | |

| | 46,800 | | ITC Holdings Corp. | | | 1,707,264 |

| | 21,000 | | South Jersey Industries, Inc. | | | 1,268,610 |

| | 31,000 | | Wisconsin Energy Corp. | | | 1,454,520 |

| | | | | | | 4,430,394 |

| | | | Total Common Stocks | | | |

| | | | (Cost $93,878,652) | | | 240,292,921 |

| | | | | | |

| | | | | Value |

| | Asset-Backed Securities — 0.2% | | | |

| $ | 243,707 | | Ford Credit Auto Lease Trust, Series | | | |

| | | | 2013-B, Class A2B, 0.42%, 1/15/16 (2) | 243,791 |

| | 250,000 | | Honda Auto Receivables Owner Trust, | | | |

| | | | Series 2013-4, Class A3, 0.69%, 9/18/17 | 250,453 |

| | | | Total Asset-Backed Securities | | | |

| | | | (Cost $494,185) | | | 494,244 |

| | | | | | | |

| | Commercial Mortgage-Backed Securities — 1.4% | | | |

| | 300,000 | | Banc of America Commercial Mortgage | |

| | | | Trust, Series 2006-2, Class A4, 5.92%, | |

| | | | 5/10/45 (2) | | | 321,500 |

| | 206,384 | | Bear Stearns Commercial Mortgage | | | |

| | | | Securities Trust, Series 2007-T26, | | | |

| | | | Class A4, 5.47%, 1/12/45 (2) | | | 227,299 |

| | 250,000 | | Citigroup Commercial Mortgage Trust, | |

| | | | Series 2006-C5, Class A4, 5.43%, | | | |

| | | | 10/15/49 | | | 271,169 |

| | 450,000 | | Commercial Mortgage Trust, Series | | | |

| | | | 2007-GG9, Class A4, 5.44%, 3/10/39 | 491,025 |

| | 250,000 | | FHLMC Multifamily Structured | | | |

| | | | Pass-Through Certificates, Series K710, | |

| | | | Class A2, 1.88%, 5/25/19 | | | 250,236 |

| | 200,000 | | FREMF Mortgage Trust, Series 2012-K711, | |

| | | | Class B, 3.68%, 8/25/45 (2) (3) | | | 207,373 |

| | 250,000 | | FREMF Mortgage Trust, Series 2014-K715, | |

| | | | Class B, 4.12%, 2/25/46 (2) (3) | | | 261,659 |

| | 400,000 | | GNMA, Series 2013-12, Class B, 2.45%, | |

| | | | 11/16/52 (2) | | | 378,588 |

| | 350,000 | | GS Mortgage Securities Trust, Series | | | |

| | | | 2006-GG6, Class A4, 5.55%, 4/10/38 (2) | 369,785 |

| | 191,561 | | JP Morgan Chase Commercial Mortgage | |

| | | | Securities Trust, Series 2007-CB20, | | | |

| | | | Class A1A, 5.75%, 2/12/51 (2) | | | 213,905 |

| | 273,075 | | ML-CFC Commercial Mortgage Trust, | |

| | | | Series 2006-4, Class A1A, 5.17%, | | | |

| | | | 12/12/49 | | | 294,877 |

| | 250,000 | | ML-CFC Commercial Mortgage Trust, | |

| | | | Series 2006-4, Class A3, 5.17%, 12/12/49 | 269,033 |

| | 250,000 | | ML-CFC Commercial Mortgage Trust, | |

| | | | Series 2007-6, Class A4, 5.49%, | | | |

| | | | 3/12/51 (2) | | | 274,590 |

| | 250,000 | | Morgan Stanley Bank of America Merrill | |

| | | | Lynch Trust, Series 2012-C5, Class A4, | |

| | | | 3.18%, 8/15/45 | | | 252,597 |

| | | | | | |

| | | | | Value |

| | Commercial Mortgage-Backed | | | |

| | Securities — 1.4% (Continued) | | | |

| $ | 200,000 | | Morgan Stanley Bank of America Merrill | | | |

| | | | Lynch Trust, Series 2012-C6, Class A4, | | | |

| | | | 2.86%, 11/15/45 | | $ | 196,699 |

| | 246,355 | | Thornburg Mortgage Securities Trust, Series | | | |

| | | | 2005-1, Class A3, 2.24%, 4/25/45 (2) | | | 249,991 |

| | 250,000 | | Wells Fargo Commercial Mortgage Trust, | | | |

| | | | Series 2013-LC12, Class B, 4.44%, | | | |

| | | | 7/15/46 (2) | | | 261,418 |

| | | | Total Commercial Mortgage-Backed | | | |

| | | | Securities (Cost $4,872,929) | | | 4,791,744 |

| | | | |

| | Corporate Bonds & Notes — 9.9% | | | |

| Basic Materials — 0.6% | | | |

| | 200,000 | | ArcelorMittal, Senior Unsecured Notes, | | | |

| | | | 5.00%, 2/25/17 | | | 211,500 |

| | 250,000 | | Celanese U.S. Holdings LLC, Guaranteed | | | |

| | | | Notes, 4.63%, 11/15/22 | | | 251,250 |

| | 150,000 | | Glencore Funding LLC, Guaranteed Notes, | | | |

| | | | 4.13%, 5/30/23 (3) | | | 150,651 |

| | 250,000 | | LYB International Finance B.V., Guaranteed | | | |

| | | | Notes, 4.00%, 7/15/23 | | | 262,454 |

| | 300,000 | | Mosaic Co. (The), Senior Unsecured Notes, | | | |

| | | | 5.45%, 11/15/33 | | | 336,161 |

| | 150,000 | | Southern Copper Corp., Senior Unsecured | | | |

| | | | Notes, 7.50%, 7/27/35 | | | 174,619 |

| | 150,000 | | Steel Dynamics, Inc., Guaranteed Notes, | | | |

| | | | 6.13%, 8/15/19 | | | 163,125 |

| | 250,000 | | Vale Overseas Ltd., Guaranteed Notes, | | | |

| | | | 5.63%, 9/15/19 | | | 281,176 |

| | 100,000 | | Vale S.A., Senior Unsecured Notes, 5.63%, | | | |

| | | | 9/11/42 | | | 97,970 |

| | | | | | | 1,928,906 |

| Communications — 1.2% | | | |

| | 250,000 | | America Movil S.A.B. de C.V., Senior | | | |

| | | | Unsecured Notes, 3.13%, 7/16/22 | | | 246,000 |

| | 100,000 | | CenturyLink, Inc., Series P, Senior | | | |

| | | | Unsecured Notes, 7.60%, 9/15/39 | | | 100,375 |

| | 250,000 | | Comcast Corp., Guaranteed Notes, 4.25%, | | | |

| | | | 1/15/33 | | | 256,809 |

| | 250,000 | | DIRECTV Holdings LLC/DIRECTV | | | |

| | | | Financing Co., Inc., Guaranteed Notes, | | | |

| | | | 3.80%, 3/15/22 | | | 258,154 |

| | 350,000 | | MetroPCS Wireless, Inc., Guaranteed Notes, | | | |

| | | | 6.63%, 11/15/20 | | | 373,625 |

| | 200,000 | | Motorola Solutions, Inc., Senior Unsecured | | | |

| | | | Notes, 6.00%, 11/15/17 | | | 227,092 |

| | 250,000 | | Netflix, Inc., Senior Unsecured Notes, | | | |

| | | | 5.75%, 3/1/24 (3) | | | 261,250 |

| | 200,000 | | Rogers Communications, Inc., Guaranteed | | | |

| | | | Notes, 5.00%, 3/15/44 | | | 208,562 |

| | 250,000 | | Telefonica Emisiones SAU, Guaranteed | | | |

| | | | Notes, 5.88%, 7/15/19 | | | 289,847 |

| | 250,000 | | Time Warner, Inc., Guaranteed Notes, | | | |

| | | | 3.15%, 7/15/15 | | | 256,895 |

| | 500,000 | | Time Warner, Inc., Guaranteed Notes, | | | |

| | | | 4.70%, 1/15/21 | | | 553,649 |

| | 250,000 | | Verizon Communications, Inc., Senior | | | |

| | | | Unsecured Notes, 1.25%, 11/3/14 | | | 250,758 |

| See Notes to Financial Statements. | 11 |

| Value Line Strategic Asset Management Trust |

| | Schedule of Investments (Continued) | | | |

| | | | | | | |

| June 30, 2014 (Unaudited) | | | |

| | | | | Value |

| | | | | | | |

| | Corporate Bonds & Notes — 9.9% (Continued) | | | |

| Communications — 1.2% (Continued) | | | |

| $ | 300,000 | | Verizon Communications, Inc., Senior | | | |

| | | | Unsecured Notes, 2.50%, 9/15/16 | | $ | 309,223 |

| | 500,000 | | Viacom, Inc., Senior Unsecured Notes, | | | |

| | | | 3.88%, 12/15/21 | | | 523,695 |

| | | | | | | 4,115,934 |

| Consumer, Cyclical — 0.6% | | | |

| | 250,000 | | CVS Caremark Corp., Senior Unsecured | | | |

| | | | Notes, 6.60%, 3/15/19 | | | 294,353 |

| | 250,000 | | D.R. Horton, Inc., Guaranteed Notes, | | | |

| | | | 6.50%, 4/15/16 | | | 270,625 |

| | 250,000 | | Delphi Corp., Guaranteed Notes, 6.13%, | | | |

| | | | 5/15/21 | | | 279,400 |

| | 100,000 | | Kia Motors Corp., Senior Unsecured | | | |

| | | | Notes, 3.63%, 6/14/16 (3) | | | 104,710 |

| | 150,000 | | Lennar Corp., Series B, Guaranteed | | | |

| | | | Notes, 5.60%, 5/31/15 | | | 155,250 |

| | 270,000 | | Macy’s Retail Holdings, Inc., Guaranteed | | | |

| | | | Notes, 4.38%, 9/1/23 (1) | | | 286,125 |

| | 150,000 | | Nissan Motor Acceptance Corp., Senior | | | |

| | | | Unsecured Notes, 2.35%, 3/4/19 (3) | | | 151,061 |

| | 200,000 | | Starwood Hotels & Resorts Worldwide, | | | |

| | | | Inc., Senior Unsecured Notes, 7.38%, | | | |

| | | | 11/15/15 | | | 217,686 |

| | 250,000 | | Wynn Las Vegas LLC/Wynn Las Vegas | | | |

| | | | Capital Corp., Senior Unsecured Notes, | | | |

| | | | 5.38%, 3/15/22 | | | 260,312 |

| | | | | | | 2,019,522 |

| Consumer, Non-cyclical — 1.3% | | | |

| | 500,000 | | AbbVie, Inc., Senior Unsecured Notes, | | | |

| | | | 2.00%, 11/6/18 | | | 499,381 |

| | 150,000 | | ADT Corp. (The), Senior Unsecured | | | |

| | | | Notes, 2.25%, 7/15/17 | | | 148,125 |

| | 200,000 | | Amgen, Inc., Senior Unsecured Notes, | | | |

| | | | 2.50%, 11/15/16 | | | 207,152 |

| | 250,000 | | Anheuser-Busch InBev Finance, Inc., | | | |

| | | | Guaranteed Notes, 4.63%, 2/1/44 | | | 260,105 |

| | 150,000 | | Boston Scientific Corp., Senior Unsecured | | | |

| | | | Notes, 2.65%, 10/1/18 | | | 153,335 |

| | 250,000 | | Celgene Corp., Senior Unsecured Notes, | | | |

| | | | 2.30%, 8/15/18 | | | 254,045 |

| | 250,000 | | Constellation Brands, Inc., Guaranteed | | | |

| | | | Notes, 7.25%, 5/15/17 | | | 286,563 |

| | 150,000 | | Edwards Lifesciences Corp., Senior | | | |

| | | | Unsecured Notes, 2.88%, 10/15/18 | | | 153,285 |

| | 300,000 | | HCA, Inc., Senior Secured Notes, 6.50%, | | | |

| | | | 2/15/20 | | | 337,500 |

| | 260,000 | | Humana, Inc., Senior Unsecured Notes, | | | |

| | | | 3.15%, 12/1/22 | | | 255,162 |

| | 500,000 | | Kroger Co. (The), Senior Unsecured | | | |

| | | | Notes, 3.40%, 4/15/22 | | | 506,777 |

| 1,000,000 | | Medco Health Solutions, Inc., Senior | | | |

| | | | Unsecured Notes, 2.75%, 9/15/15 | | | 1,023,910 |

| | 350,000 | | Mylan, Inc., Senior Unsecured Notes, | | | |

| | | | 1.35%, 11/29/16 | | | 350,583 |

| | | | | | | 4,435,923 |

| | | | | Value |

| Energy — 1.1% | | | |

| $ | 150,000 | | Anadarko Petroleum Corp., Senior | | | |

| | | | Unsecured Notes, 6.38%, 9/15/17 | | $ | 172,701 |

| | 250,000 | | DCP Midstream Operating L.P., | | | |

| | | | Guaranteed Notes, 2.50%, 12/1/17 | | | 257,173 |

| | 250,000 | | Devon Energy Corp., Senior Unsecured | | | |

| | | | Notes, 1.20%, 12/15/16 | | | 250,758 |

| | 150,000 | | Energy Transfer Partners L.P., Senior | | | |

| | | | Unsecured Notes, 9.00%, 4/15/19 | | | 191,688 |

| | 200,000 | | Ensco PLC, Senior Unsecured Notes, | | | |

| | | | 4.70%, 3/15/21 | | | 217,878 |

| | 250,000 | | Enterprise Products Operating LLC, | | | |

| | | | Guaranteed Notes, 5.70%, 2/15/42 | | | 291,451 |

| | 300,000 | | Halliburton Co., Senior Unsecured Notes, | | | |

| | | | 6.15%, 9/15/19 | | | 357,948 |

| | 100,000 | | Hess Corp., Senior Unsecured Notes, | | | |

| | | | 5.60%, 2/15/41 | | | 116,279 |

| | 250,000 | | Kinder Morgan Energy Partners L.P., | | | |

| | | | Senior Unsecured Notes, 2.65%, 2/1/19 | | | 253,023 |

| | 100,000 | | Petrobras Global Finance B.V., Guaranteed | | | |

| | | | Notes, 3.11%, 3/17/20 (1) (2) | | | 102,745 |

| | 200,000 | | Petrobras Global Finance B.V., Guaranteed | | | |

| | | | Notes, 6.25%, 3/17/24 | | | 212,880 |

| | 245,000 | | Phillips 66, Guaranteed Notes, 2.95%, | | | |

| | | | 5/1/17 | | | 256,768 |

| | 97,000 | | Plains Exploration & Production Co., | | | |

| | | | Guaranteed Notes, 6.88%, 2/15/23 | | | 113,490 |

| | 150,000 | | Rowan Companies, Inc., Guaranteed | | | |

| | | | Notes, 7.88%, 8/1/19 | | | 183,190 |

| | 250,000 | | Spectra Energy Partners L.P., Senior | | | |

| | | | Unsecured Notes, 4.75%, 3/15/24 | | | 270,853 |

| | 200,000 | | Tesoro Corp., Guaranteed Notes, 4.25%, | | | |

| | | | 10/1/17 | | | 209,000 |

| | 150,000 | | Valero Energy Corp., Guaranteed Notes, | | | |

| | | | 6.63%, 6/15/37 | | | 186,380 |

| | 150,000 | | Whiting Petroleum Corp., Guaranteed | | | |

| | | | Notes, 5.00%, 3/15/19 | | | 157,875 |

| | | | | | | 3,802,080 |

| Financial — 4.3% | | | |

| | 200,000 | | Aircastle Ltd., Senior Unsecured Notes, | | | |

| | | | 4.63%, 12/15/18 | | | 206,000 |

| | 200,000 | | Ally Financial, Inc., Guaranteed Notes, | | | |

| | | | 4.63%, 6/26/15 | | | 206,500 |

| | 250,000 | | American Express Co., Senior Unsecured | | | |

| | | | Notes, 0.82%, 5/22/18 (2) | | | 251,868 |

| | 250,000 | | American International Group, Inc., | | | |

| | | | Senior Unsecured Notes, 3.38%, 8/15/20 | | | 259,784 |

| | 200,000 | | Australia & New Zealand Banking | | | |

| | | | Group Ltd., Subordinated Notes, 4.50%, | | | |

| | | | 3/19/24 (3) | | | 205,279 |

| | 150,000 | | Bancolombia S.A., Senior Unsecured | | | |

| | | | Notes, 5.95%, 6/3/21 | | | 165,375 |

| | 200,000 | | Bank of America Corp., Senior Unsecured | | | |

| | | | Notes, 4.00%, 4/1/24 | | | 204,106 |

| | 300,000 | | Bank of America Corp. MTN, Series L, | | | |

| | | | Senior Unsecured Notes, 5.65%, 5/1/18 | | | 340,061 |

| | 200,000 | | Bank of China Hong Kong Ltd., Senior | | | |

| | | | Unsecured Notes, 3.75%, 11/8/16 (3) | | | 209,615 |

| | 150,000 | | Bank of New York Mellon Corp. (The), | | | |

| | | | Senior Unsecured Notes, 5.45%, 5/15/19 | | | 172,842 |

| 12 | See Notes to Financial Statements. |

| Value Line Strategic Asset Management Trust |

| | Schedule of Investments (Continued) | | | |

| | | | | | | |

| June 30, 2014 (Unaudited) | | | |

| | | Value |

| | | | | | | |

| | Corporate Bonds & Notes — 9.9% (Continued) | | | |

| | | | | | | |

| Financial — 4.3% (Continued) | | | |

| $ | 250,000 | | Berkshire Hathaway, Inc., Senior Unsecured | | | |

| | | | Notes, 3.75%, 8/15/21 | | $ | 267,707 |

| | 200,000 | | BlackRock, Inc., Series 2, Senior Unsecured | | | |

| | | | Notes, 5.00%, 12/10/19 | | | 228,284 |

| | 350,000 | | BPCE S.A., Guaranteed Notes, 2.50%, | | | |

| | | | 12/10/18 | | | 354,783 |

| | 250,000 | | Branch Banking & Trust Co., Senior | | | |

| | | | Unsecured Notes, 1.05%, 12/1/16 | | | 250,607 |

| | 100,000 | | CIT Group, Inc., Senior Unsecured Notes, | | | |

| | | | 5.00%, 5/15/17 | | | 106,563 |

| | 250,000 | | Citigroup, Inc., Senior Unsecured Notes, | | | |

| | | | 1.70%, 7/25/16 | | | 253,286 |

| | 100,000 | | Citigroup, Inc., Subordinated Notes, | | | |

| | | | 5.30%, 5/6/44 | | | 104,305 |

| | 100,000 | | CNA Financial Corp., Senior Unsecured | | | |

| | | | Notes, 3.95%, 5/15/24 | | | 102,915 |

| | 250,000 | | Cooperatieve Centrale Raiffeisen- | | | |

| | | | Boerenleenbank BA, Guaranteed | | | |

| | | | Notes, 3.95%, 11/9/22 | | | 254,157 |

| | 150,000 | | Deutsche Bank AG, Senior Unsecured | | | |

| | | | Notes, 1.40%, 2/13/17 | | | 150,762 |

| | 100,000 | | Digital Realty Trust L.P., Guaranteed | | | |

| | | | Notes, 5.25%, 3/15/21 (1) | | | 107,423 |

| | 250,000 | | EPR Properties, Guaranteed Notes, | | | |

| | | | 5.25%, 7/15/23 | | | 260,065 |

| | 200,000 | | First Horizon National Corp., Senior | | | |

| | | | Unsecured Notes, 5.38%, 12/15/15 | | | 211,572 |

| | 580,000 | | Ford Motor Credit Co. LLC, Senior | | | |

| | | | Unsecured Notes, 4.38%, 8/6/23 | | | 619,399 |

| | 250,000 | | General Electric Capital Corp. MTN, | | | |

| | | | Senior Unsecured Notes, 1.00%, | | | |

| | | | 8/11/15 (2) | | | 251,792 |

| | 500,000 | | General Electric Capital Corp. MTN, | | | |

| | | | Senior Unsecured Notes, 3.35%, | | | |

| | | | 10/17/16 | | | 527,550 |

| | 300,000 | | Goldman Sachs Group, Inc. (The), | | | |

| | | | Senior Unsecured Notes, 5.75%, | | | |

| | | | 10/1/16 | | | 330,085 |

| | 200,000 | | Goldman Sachs Group, Inc. (The), | | | |

| | | | Subordinated Notes, 6.75%, 10/1/37 | | | 240,607 |

| | 200,000 | | Hartford Financial Services Group, Inc. | | | |

| | | | (The), Senior Unsecured Notes, 4.00%, | | | |

| | | | 10/15/17 | | | 215,813 |

| | 150,000 | | Hospitality Properties Trust, Senior | | | |

| | | | Unsecured Notes, 4.65%, 3/15/24 | | | 157,185 |

| | 250,000 | | Host Hotels & Resorts L.P., Senior | | | |

| | | | Unsecured Notes, 5.25%, 3/15/22 | | | 275,610 |

| | 200,000 | | HSBC Holdings PLC, Senior Unsecured | | | |

| | | | Notes, 4.88%, 1/14/22 | | | 224,448 |

| | 150,000 | | Itau Unibanco Holding S.A., Subordinated | | | |

| | | | Notes, 5.50%, 8/6/22 | | | 153,630 |

| | 150,000 | | Jefferies Group LLC, Senior Unsecured | | | |

| | | | Notes, 8.50%, 7/15/19 | | | 187,500 |

| | 200,000 | | Jefferies Group LLC, Senior Unsecured | | | |

| | | | Notes, 6.25%, 1/15/36 | | | 209,294 |

| | 500,000 | | JPMorgan Chase & Co., Senior Unsecured | | | |

| | | | Notes, 3.45%, 3/1/16 | | | 521,760 |

| | | | | Value |

| Financial — 4.3% (Continued) | | | |

| $ | 300,000 | | JPMorgan Chase & Co., Senior Unsecured | | | |

| | | | Notes, 3.20%, 1/25/23 | | $ | 297,862 |

| | 500,000 | | KeyCorp. MTN, Senior Unsecured Notes, | | | |

| | | | 5.10%, 3/24/21 | | | 566,552 |

| | 100,000 | | Macquarie Bank Ltd., Senior Unsecured | | | |

| | | | Notes, 5.00%, 2/22/17 (3) | | | 108,980 |

| | 500,000 | | Morgan Stanley GMTN, Senior Unsecured | | | |

| | | | Notes, 5.50%, 7/28/21 | | | 574,413 |

| | 250,000 | | Nomura Holdings, Inc. GMTN, Senior | | | |

| | | | Unsecured Notes, 2.75%, 3/19/19 | | | 254,325 |

| | 250,000 | | PNC Bank NA, Senior Unsecured Notes, | | | |

| | | | 1.30%, 10/3/16 | | | 252,386 |

| | 1,000,000 | | Private Export Funding Corp., Series HH, | | | |

| | | | 1.45%, 8/15/19 | | | 978,648 |

| | 250,000 | | ProLogis L.P., Guaranteed Notes, 2.75%, | | | |

| | | | 2/15/19 | | | 254,714 |

| | 250,000 | | Regions Financial Corp., Senior Unsecured | | | |

| | | | Notes, 2.00%, 5/15/18 | | | 249,120 |

| | 250,000 | | Royal Bank of Scotland Group PLC, | | | |

| | | | Senior Unsecured Notes, 1.88%, 3/31/17 | | | 252,227 |

| | 250,000 | | Santander Holdings USA, Inc., Senior | | | |

| | | | Unsecured Notes, 3.00%, 9/24/15 | | | 256,784 |

| | 100,000 | | Standard Chartered PLC, Subordinated | | | |

| | | | Notes, 5.70%, 3/26/44 (3) | | | 104,816 |

| | 1,000,000 | | Wachovia Corp., Senior Unsecured Notes, | | | |

| | | | 0.50%, 6/15/17 (2) | | | 998,630 |

| | 150,000 | | Weyerhaeuser Co., Senior Unsecured Notes, | | | |

| | | | 7.38%, 10/1/19 | | | 184,708 |

| | 150,000 | | Weyerhaeuser Co., Senior Unsecured Notes, | | | |

| | | | 6.95%, 10/1/27 | | | 188,140 |

| | 250,000 | | XLIT Ltd., Guaranteed Notes, 5.25%, | | | |

| | | | 12/15/43 | | | 274,917 |

| | | | | | | 14,585,754 |

| Industrial — 0.4% | | | |

| | 100,000 | | Lafarge S.A., Senior Unsecured Notes, | | | |

| | | | 6.20%, 7/9/15 (3) | | | 104,750 |

| | 300,000 | | Masco Corp., Senior Unsecured Notes, | | | |

| | | | 6.13%, 10/3/16 | | | 330,375 |

| | 250,000 | | Rock-Tenn Co., Guaranteed Notes, 4.90%, | | | |

| | | | 3/1/22 | | | 272,874 |

| | 200,000 | | Textron, Inc., Senior Unsecured Notes, | | | |

| | | | 6.20%, 3/15/15 | | | 208,157 |

| | 500,000 | | Union Pacific Corp., Senior Unsecured | | | |

| | | | Notes, 2.95%, 1/15/23 | | | 498,276 |

| | | | | | | 1,414,432 |

| Technology — 0.2% | | | |

| | 50,000 | | Altera Corp., Senior Unsecured Notes, | | | |

| | | | 1.75%, 5/15/17 | | | 50,558 |

| | 200,000 | | Altera Corp., Senior Unsecured Notes, | | | |

| | | | 2.50%, 11/15/18 | | | 203,072 |

| | 150,000 | | Intel Corp., Senior Unsecured Notes, | | | |

| | | | 4.25%, 12/15/42 | | | 146,969 |

| | 150,000 | | Oracle Corp., Senior Unsecured Notes, | | | |

| | | | 5.00%, 7/8/19 | | | 171,061 |

| | 100,000 | | Seagate HDD Cayman, Guaranteed Notes, | | | |

| | | | 4.75%, 1/1/25 (3) | | | 99,250 |

| | 200,000 | | Xerox Corp., Senior Unsecured Notes, | | | |

| | | | 2.80%, 5/15/20 | | | 199,677 |

| | | | | | | 870,587 |

| See Notes to Financial Statements. | 13 |

¢ | Value Line Strategic Asset Management Trust |

| | Schedule of Investments (Continued) | | |

| | | | | | |

| June 30, 2014 (Unaudited) | | |

| Principal | | | | |

| Amount | | | | Value |

| | | | | | |

| | Corporate Bonds & Notes — 9.9% (Continued) | | |

| Utilities — 0.2% | | |

| $ | 500,000 | | Commonwealth Edison Co., 4.00%, 8/1/20 | | $ | 539,721 |

| | | | Total Corporate Bonds & Notes | | | |

| | | | (Cost $33,060,149) | | | 33,712,859 |

| | | | | | | |

| Foreign Government Obligations — 0.2% | | | |

| | | | | | | |

| | 250,000 | | Mexico Government International Bond, | | | |

| | | | Senior Unsecured Notes, 5.13%, | | | |

| | | | 1/15/20 (1) | | | 283,250 |

| | 250,000 | | Poland Government International Bond, | | | |

| | | | Senior Unsecured Notes, 4.00%, 1/22/24 | | | 259,375 |

| | | | Total Foreign Government Obligations | | | |

| | | | (Cost $522,158) | | | 542,625 |

| | | | | | | |

| | Long-Term Municipal Securities — 0.4% | | | |

| | 400,000 | | City of New York, General Obligation | | | |

| | | | Unlimited, Subser. D2, 2.60%, 8/1/20 | | | 402,484 |

| | 250,000 | | City of New York, General Obligation | | | |

| | | | Unlimited, Subser. D2, 2.30%, 8/1/19 | | | 250,950 |

| | 130,000 | | City of Norfolk, Taxable Build America | | | |

| | | | Bonds, General Obligation Unlimited, | | | |

| | | | Series B, 5.91%, 3/1/29 | | | 158,759 |

| | 70,000 | | County of Clark, Build America Bonds, | | | |

| | | | General Obligation Limited, Series B1, | | | |

| | | | 5.21%, 6/1/16 | | | 75,727 |

| | 250,000 | | Dallas Independent School District | | | |

| | | | Qualified School Construction Notes, | | | |

| | | | General Obligation Limited, 5.05%, | | | |

| | | | 8/15/33 | | | 266,650 |

| | 75,000 | | University of Alabama, Build America | | | |

| | | | Bonds, General Obligation Unlimited, | | | |

| | | | Revenue Bonds, Series B, 5.20%, | | | |

| | | | 10/1/30 | | | 81,311 |

| | | | Total Long-Term Municipal | | | |

| | | | Securities (Cost $1,206,662) | | | 1,235,881 |

| | | | | | | |

| | U.S. Government Agency Obligations �� 7.9% | | | |

| | 500,000 | | FHLMC, 1.00%, 3/8/17 (1) | | | 501,724 |

| | 1,300,000 | | FHLMC, 1.25%, 5/12/17 | | | 1,313,188 |

| | 500,000 | | FHLMC, 1.00%, 7/28/17 | | | 500,307 |

| | 1,500,000 | | FHLMC, 1.75%, 5/30/19 (1) | | | 1,505,631 |

| | 117,226 | | FHLMC, Series 3538, Class BA, 4.50%, | | | |

| | | | 10/15/27 | | | 119,599 |

| | 178,376 | | FHLMC, Series 4151, Class PA, 2.00%, | | | |

| | | | 1/15/33 | | | 176,556 |

| | 361,877 | | FHLMC Gold PC Pool #G05447, 4.50%, | | | |

| | | | 5/1/39 | | | 391,748 |

| | 60,436 | | FHLMC Gold PC Pool #G08488, 3.50%, | | | |

| | | | 4/1/42 | | | 62,202 |

| | 416,503 | | FHLMC Gold PC Pool #J13885, 3.50%, | | | |

| | | | 12/1/25 | | | 441,493 |

| | 542,160 | | FHLMC Gold PC Pool #J17969, 3.00%, | | | |

| | | | 2/1/27 | | | 562,648 |

| | 489,544 | | FHLMC Gold PC Pool #Q23725, 4.00%, | | | |

| | | | 12/1/43 | | | 519,319 |

| | 88,024 | | FHLMC Gold Pool #C04038, 3.50%, | | | |

| | | | 6/1/42 | | | 90,595 |

| | | | | |

| Principal | | | | |

| Amount | | | | Value |

| | | | | |

| | U.S. Government Agency | | |

| | Obligations — 7.9% (Continued) | | |

| $ | 34,799 | | FHLMC Gold Pool #G08479, 3.50%, | | |

| | | | 3/1/42 | | $ | 35,815 |

| | 14,439 | | FHLMC Gold Pool #G18155, 5.00%, | | | |

| | | | 10/1/21 | | | 15,583 |

| | 52,533 | | FHLMC Gold Pool #G18160, 5.00%, | | | |

| | | | 11/1/21 | | | 56,745 |

| | 130,472 | | FHLMC Gold Pool #G18420, 3.00%, | | | |

| | | | 1/1/27 | | | 135,402 |

| | 49,691 | | FHLMC Gold Pool #J00975, 5.00%, | | | |

| | | | 1/1/21 | | | 53,682 |

| | 13,356 | | FHLMC Gold Pool #J03589, 5.00%, | | | |

| | | | 10/1/21 | | | 14,294 |

| | 213,434 | | FHLMC Pool #A96409, 3.50%, 1/1/41 | | | 219,669 |

| | 132 | | FNMA, 4.00%, 8/1/14 | | | 140 |

| | 500,000 | | FNMA, 0.38%, 12/21/15 | | | 500,544 |

| | 22,810 | | FNMA, 4.00%, 4/1/24 | | | 24,390 |

| | 275,679 | | FNMA, 4.00%, 3/1/25 | | | 295,286 |

| | 159,676 | | FNMA, 4.00%, 6/1/26 | | | 169,903 |

| | 559,507 | | FNMA, 3.50%, 7/1/26 | | | 593,683 |

| | 233,840 | | FNMA, 4.00%, 7/1/26 | | | 250,540 |

| | 41,365 | | FNMA, 4.50%, 7/1/40 | | | 44,831 |

| | 9,029 | | FNMA, 4.50%, 8/1/40 | | | 9,786 |

| | 10,235 | | FNMA, 4.50%, 9/1/40 | | | 11,089 |

| | 99,645 | | FNMA, 4.50%, 10/1/40 | | | 108,024 |

| | 480,012 | | FNMA, 4.50%, 2/1/41 | | | 520,087 |

| | 172,511 | | FNMA, 4.50%, 3/1/41 | | | 186,979 |

| | 15,729 | | FNMA, 4.50%, 4/1/41 | | | 17,041 |

| | 175,042 | | FNMA, 4.50%, 4/1/41 | | | 189,649 |

| | 366,581 | | FNMA, 4.50%, 4/1/41 | | | 397,170 |

| | 170,435 | | FNMA, 4.50%, 4/1/41 | | | 184,669 |

| | 460,268 | | FNMA Pool #255667, 5.00%, 3/1/25 | | | 511,451 |

| | 5,836 | | FNMA Pool #745275, 5.00%, 2/1/36 | | | 6,491 |

| | 350,739 | | FNMA Pool #890236, 4.50%, 8/1/40 | | | 380,007 |

| | 667,831 | | FNMA Pool #995245, 5.00%, 1/1/39 | | | 742,095 |

| | 446,936 | | FNMA Pool #AA7720, 4.00%, 8/1/39 | | | 474,988 |

| | 256,777 | | FNMA Pool #AB1259, 5.00%, 7/1/40 | | | 285,649 |

| | 104,758 | | FNMA Pool #AB3218, 3.50%, 7/1/31 | | | 109,545 |

| | 457,385 | | FNMA Pool #AB4449, 4.00%, 2/1/42 | | | 486,642 |

| | 603,651 | | FNMA Pool #AB5472, 3.50%, 6/1/42 | | | 622,355 |

| | 383,907 | | FNMA Pool #AB6286, 2.50%, 9/1/27 | | | 390,514 |

| | 641,213 | | FNMA Pool #AB8144, 5.00%, 4/1/37 | | | 713,199 |

| | 930,299 | | FNMA Pool #AD6374, 5.00%, 5/1/40 | | | 1,035,185 |

| | 9,528 | | FNMA Pool #AE0385, 4.00%, 9/1/40 | | | 10,126 |

| | 8,368 | | FNMA Pool #AE5024, 4.00%, 12/1/40 | | | 8,893 |

| | 139,181 | | FNMA Pool #AH6186, 4.00%, 2/1/41 | | | 147,917 |

| | 379,357 | | FNMA Pool #AH8932, 4.50%, 4/1/41 | | | 411,190 |

| | 48,792 | | FNMA Pool #AI5737, 4.50%, 6/1/41 | | | 52,885 |

| | 358,876 | | FNMA Pool #AJ6932, 3.00%, 11/1/26 | | | 373,246 |

| | 457,865 | | FNMA Pool #AO2961, 4.00%, 5/1/42 | | | 487,139 |

| | 392,803 | | FNMA Pool #AO4137, 3.50%, 6/1/42 | | | 404,974 |

| | 68,151 | | FNMA Pool #AO4299, 3.50%, 8/1/42 | | | 70,262 |

| | 32,170 | | FNMA Pool #AO6770, 3.50%, 6/1/42 | | | 33,167 |

| | 817,921 | | FNMA Pool #AP1340, 3.50%, 7/1/42 | | | 843,264 |

| | 412,725 | | FNMA Pool #AQ0287, 3.00%, 10/1/42 | | | 408,205 |

| | 472,206 | | FNMA Pool #AT0969, 3.00%, 4/1/43 | | | 467,035 |

| | 1,103,419 | | FNMA Pool #AT8849, 4.00%, 6/1/43 | | | 1,172,677 |

| | 197,726 | | FNMA Pool #AU6043, 3.00%, 9/1/43 | | | 195,561 |

| | 342,461 | | FNMA Pool #AU7025, 3.00%, 11/1/43 | | | 338,710 |

| | 338,222 | | FNMA Pool #AU8070, 3.50%, 9/1/43 | | | 348,702 |

| | 281,841 | | FNMA Pool #AU8846, 3.00%, 11/1/43 | | | 278,755 |

| See Notes to Financial Statements. |

| Value Line Strategic Asset Management Trust |

| | | |

| | Schedule of Investments (Continued) | | |

| | | | | | |

| June 30, 2014 (Unaudited) | | |

| Principal | | | | |

| Amount | | | | Value |

| | | |

| | U.S. Government Agency | | |

| | Obligations — 7.9% (Continued) | | |

| $ | 250,000 | | FNMA Pool TBA, 3.50%, 7/1/44 | | $ | 257,344 |

| | 200,000 | | FNMA Pool TBA, 4.50%, 7/1/44 | | | 216,594 |

| | 261,122 | | GNMA, 4.25%, 2/20/37 | | | 264,445 |

| | 393,990 | | GNMA, 3.00%, 4/16/39 | | | 405,702 |

| | 629,880 | | GNMA II Pool #MA1090, 3.50%, 6/20/43 | | | 657,156 |

| | 290,484 | | GNMA II Pool #MA1520, 3.00%, 12/20/43 | | | 293,709 |

| | 2,043,133 | | GNMA Pool #4016, 5.50%, 8/20/37 | | | 2,290,372 |

| | 256,319 | | GNMA Pool #650494, 5.50%, 1/15/36 | | | 287,657 |

| | 239,093 | | GNMA Pool #MA1375, 3.50%, 10/20/43 | | | 249,447 |

| | | | Total U.S. Government Agency | | | |

| | | | Obligations (Cost $26,311,064) | | | 26,953,266 |

| | | | | | | |

| | U.S. Treasury Obligations — 3.2% | | | |

| | 1,400,000 | | U.S. Treasury Bonds, 6.13%, 11/15/27 | | | 1,922,593 |

| | 850,000 | | U.S. Treasury Bonds, 4.50%, 5/15/38 | | | 1,033,547 |

| | 800,000 | | U.S. Treasury Bonds, 4.38%, 5/15/40 | | | 959,375 |

| | 150,000 | | U.S. Treasury Bonds, 2.88%, 5/15/43 | | | 137,063 |

| | 100,000 | | U.S. Treasury Bonds, 3.63%, 8/15/43 | | | 105,625 |

| | 50,000 | | U.S. Treasury Notes, 0.25%, 2/15/15 | | | 50,055 |

| | 250,000 | | U.S. Treasury Notes, 0.38%, 6/30/15 | | | 250,586 |

| | 300,000 | | U.S. Treasury Notes, 0.38%, 4/30/16 | | | 299,906 |

| | 150,000 | | U.S. Treasury Notes, 1.75%, 5/31/16 | | | 153,797 |

| | 250,000 | | U.S. Treasury Notes, 1.50%, 6/30/16 | | | 255,156 |

| | 150,000 | | U.S. Treasury Notes, 1.00%, 10/31/16 | | | 151,406 |

| | 500,000 | | U.S. Treasury Notes, 0.88%, 6/15/17 | | | 500,195 |

| | 500,000 | | U.S. Treasury Notes, 1.88%, 10/31/17 | | | 513,867 |

| | 250,000 | | U.S. Treasury Notes, 2.63%, 4/30/18 | | | 263,067 |

| | 300,000 | | U.S. Treasury Notes, 2.25%, 7/31/18 | | | 310,969 |

| | 800,000 | | U.S. Treasury Notes, 1.38%, 9/30/18 | | | 799,000 |

| | 1,400,000 | | U.S. Treasury Notes, 1.75%, 10/31/18 | | | 1,419,907 |

| | 100,000 | | U.S. Treasury Notes, 1.00%, 8/31/19 | | | 96,594 |

| | 350,000 | | U.S. Treasury Notes, 2.63%, 8/15/20 | | | 364,219 |

| | 150,000 | | U.S. Treasury Notes, 2.13%, 8/31/20 | | | 151,547 |

| | 300,000 | | U.S. Treasury Notes, 2.00%, 11/30/20 | | | 299,836 |

| | 150,000 | | U.S. Treasury Notes, 2.13%, 8/15/21 | | | 149,906 |

| | 250,000 | | U.S. Treasury Notes, 2.00%, 2/15/22 | | | 246,113 |

| | 300,000 | | U.S. Treasury Notes, 2.50%, 5/15/24 | | | 299,578 |

| | | | Total U.S. Treasury Obligations | | | |

| | | | (Cost $9,950,238) | | | 10,733,907 |

| | | | | |

| Shares | | | | Value |

| | | | | | |

| | Short-Term Investments — 6.2% | | |

| Money Market Funds — 6.2% | | |

| | 21,149,211 | | State Street Institutional Liquid Reserves | | |

| | | | Fund | | $ | 21,149,211 |

| | | | Total Short-Term Investments | | | |

| | | | (Cost $21,149,211) | | | 21,149,211 |

| | | | Total Investments — 100.1% | | | |

| | | | (Cost $191,445,248) | | $ | 339,906,658 |

| Excess Of Liabilities Over Cash And Other | | | |

| Assets – (0.1)% | | | (231,278) |

| Net Assets – 100.0% | | $ | 339,675,380 |

| Net Asset Value Per Outstanding Share | | | |

| ($339,675,380 ÷ 14,021,578 shares outstanding) | | $ | 24.23 |

| * | Non-income producing. |

| (1) | A portion or all of the security was held on loan. As of June 30, 2014, the market value of the securities on loan was $4,983,873. |

| (2) | The rate shown on floating rate securities is the rate at the end of the reporting period. |

| (3) | Pursuant to Rule 144A under the Securities Act of 1933, this security can only be sold to qualified institutional investors. |

| ADR | American Depositary Receipt. |

| FHLMC | Federal Home Loan Mortgage Corp. |

| FNMA | Federal National Mortgage Association. |

| GMTN | Global Medium Term Note. |

| GNMA | Government National Mortgage Association. |

| MTN | Medium Term Note. |

| REIT | Real Estate Investment Trust. |

| TBA | To Be Announced. |

The following table summarizes the inputs used to value the Trust’s investments in securities as of June 30, 2014 (See Note 1B):

| | | | | | | | | | | | | |

| Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks* | | $ | 240,292,921 | | | $ | — | | | $ | — | | | $ | 240,292,921 | |

| Asset-Backed Securities | | | — | | | | 494,244 | | | | — | | | | 494,244 | |

| Commercial Mortgage-Backed Securities | | | — | | | | 4,791,744 | | | | — | | | | 4,791,744 | |

| Corporate Bonds & Notes* | | | — | | | | 33,712,859 | | | | — | | | | 33,712,859 | |

| Foreign Government Obligations | | | — | | | | 542,625 | | | | — | | | | 542,625 | |

| Long-Term Municipal Securities | | | — | | | | 1,235,881 | | | | — | | | | 1,235,881 | |

| U.S. Government Agency Obligations | | | — | | | | 26,953,266 | | | | — | | | | 26,953,266 | |

| U.S. Treasury Obligations | | | — | | | | 10,733,907 | | | | — | | | | 10,733,907 | |

| Short-Term Investments | | | — | | | | 21,149,211 | | | | — | | | | 21,149,211 | |

| Total Investments in Securities | | $ | 240,292,921 | | | $ | 99,613,737 | | | $ | — | | | $ | 339,906,658 | |

*See Schedule of Investments for further classification.

See Notes to Financial Statements. | 15 |

| ¢ | Value Line Strategic Asset Management Trust |

| | | | |

| Statement of Assets and Liabilities | | | |

| | | | |

| June 30, 2014 (Unaudited) | | | |

| | | | |

| ASSETS: | | | |

| Investment securities, at value (Cost - $191,445,248) (securities on loan, at value, $4,983,873) | | $ | 339,906,658 | |

| Cash | | | 565,814 | |

| Cash collateral received for securities on loan (Note 1K) | | | 5,069,838 | |

| Interest and dividends receivable | | | 675,783 | |

| Receivable for securities sold | | | 58,243 | |

| Prepaid expenses | | | 16,072 | |

| Receivable for securities lending income | | | 4,456 | |

| Receivable for trust shares sold | | | 863 | |

| Total Assets | | | 346,297,727 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable upon return of securities on loan (Note 1K) | | | 5,069,838 | |

| Payable for securities purchased | | | 1,171,936 | |

| Payable for trust shares redeemed | | | 139,378 | |

| Accrued expenses: | | | | |

| Advisory fee | | | 139,598 | |

| Service and distribution plan fees | | | 69,799 | |

| Directors’ fees and expenses | | | 1,006 | |

| Other | | | 30,792 | |

| Total Liabilities | | | 6,622,347 | |

| Net Assets | | $ | 339,675,380 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Shares of beneficial interest, at $0.01 par value (authorized unlimited, outstanding 14,021,578 shares) | | $ | 140,216 | |

| Additional paid-in capital | | | 140,480,923 | |

| Undistributed net investment income | | | 2,663,297 | |

| Accumulated net realized gain on investments and foreign currency | | | 47,929,534 | |

| Net unrealized appreciation of investments | | | 148,461,410 | |

| Net Assets | | $ | 339,675,380 | |

| | | | | |

| Net Asset Value Per Outstanding Share ($339,675,380 ÷ 14,021,578 shares outstanding) | | $ | 24.23 | |

| Statement of Operations | | | |

| | | | |

| For the Six Months Ended | | | |

| June 30, 2014 (Unaudited) | | | |

| | | | |

| INVESTMENT INCOME: | | | |

| Dividends (net of foreign withholding tax of $20,017) | | $ | 1,384,770 | |

| Interest | | | 1,112,272 | |

| Securities lending income | | | 17,547 | |

| Total Income | | | 2,514,589 | |

| | | | | |

| Expenses: | | | | |

| Advisory fee | | | 839,780 | |

| Service and distribution plan fees | | | 671,824 | |

| Auditing and legal fees | | | 77,895 | |

| Custodian fees | | | 44,103 | |

| Trustees’ fees and expenses | | | 36,231 | |

| Insurance | | | 18,486 | |

| Printing and postage | | | 9,117 | |

| Other | | | 18,521 | |

| Total Expenses Before Fees Waived (Note 5) | | | 1,715,957 | |

| Less: Service and Distribution Plan Fees Waived | | | (251,934 | ) |

| Net Expenses | | | 1,464,023 | |

| Net Investment Income | | | 1,050,566 | |

Net Realized and Unrealized Gain on Investments and Foreign Exchange Transactions: | | | | |

| Net Realized Gain | | | 9,775,498 | |

| Change in Net Unrealized Appreciation/ | | | | |

| (Depreciation) | | | 4,211,522 | |

Net Realized Gain and Change in Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Exchange Transactions | | | 13,987,020 | |

| Net Increase in Net Assets from Operations | | $ | 15,037,586 | |

| | |

| 16 | See Notes to Financial Statements. |

| ¢ | Value Line Strategic Asset Management Trust |

| | |

| Statement of Changes in Net Assets |

| | | | | | | |

| | | Six Months Ended | | | Year Ended | |

| | | June 30, 2014 | | | December 31, | |

| | | (unaudited) | | | 2013 | |

Operations: | | | | | | |

| Net investment income | | $ | 1,050,566 | | | $ | 1,615,771 | |

| Net realized gain on investments and foreign currency | | | 9,775,498 | | | | 38,134,883 | |

| Change in net unrealized appreciation/(depreciation) on investments and foreign currency translations | | | 4,211,522 | | | | 25,785,629 | |

| Net increase in net assets from operations | | | 15,037,586 | | | | 65,536,283 | |

| Distributions to Shareholders from: | | | | | | | | |

| Net investment income | | | — | | | | (2,744,889 | ) |

| Net realized gain from investment transactions | | | — | | | | (26,671,126 | ) |

| Total distributions | | | — | | | | (29,416,015 | ) |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Proceeds from sale of trust shares | | | 1,257,779 | | | | 3,907,578 | |

| Proceeds from reinvestment of dividends and distributions to shareholders | | | — | | | | 29,416,015 | |

| Cost of trust shares redeemed | | | (21,121,841 | ) | | | (46,769,892 | ) |

| Net decrease in net assets from trust share transactions | | | (19,864,062 | ) | | | (13,446,299 | ) |

| Total increase/(decrease) in net assets | | | (4,826,476 | ) | | | 22,673,969 | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 344,501,856 | | | | 321,827,887 | |

| End of period | | $ | 339,675,380 | | | $ | 344,501,856 | |

| Undistributed net investment income included in net assets, at end of period | | $ | 2,663,297 | | | $ | 1,612,731 | |

| | |

| See Notes to Financial Statements. | 17 |

| ¢ | Value Line Strategic Asset Management Trust |

Selected data for a share of beneficial interest outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | | | | |

| | | June 30, 2014 | | | Years Ended December 31, | |

| | | (unaudited) | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Net asset value, beginning of period | | $ | 23.17 | | | $ | 20.87 | | | $ | 18.52 | | | $ | 17.96 | | | $ | 15.72 | | | $ | 14.36 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.08 | | | | 0.12 | | | | 0.19 | | | | 0.13 | | | | 0.11 | | | | 0.14 | |

Net gains on securities (both realized and unrealized) | | | 0.98 | | | | 4.22 | | | | 2.64 | | | | 0.54 | | | | 2.27 | | | | 2.67 | |