Ameriprise Financial, Inc. 2025 Global Long-Term Incentive Award Program Guide IMPORTANT: 2025 Long-Term Incentive Award Program Guide Coverage This Guide covers both (1) outstanding Awards granted prior to January 1, 2025, and (2) Awards granted on or after January 1, 2025. By accepting an award granted on or after January 1, 2025, you are consenting to the terms of this Guide applying to outstanding Awards granted prior to January 1, 2025. THIS DOCUMENT IS PART OF A PROSPECTUS COVERING SECURITIES THAT HAVE BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933. © 2025 Ameriprise Financial, Inc. All rights reserved. Revision: January 2025 Exhibit 10.9

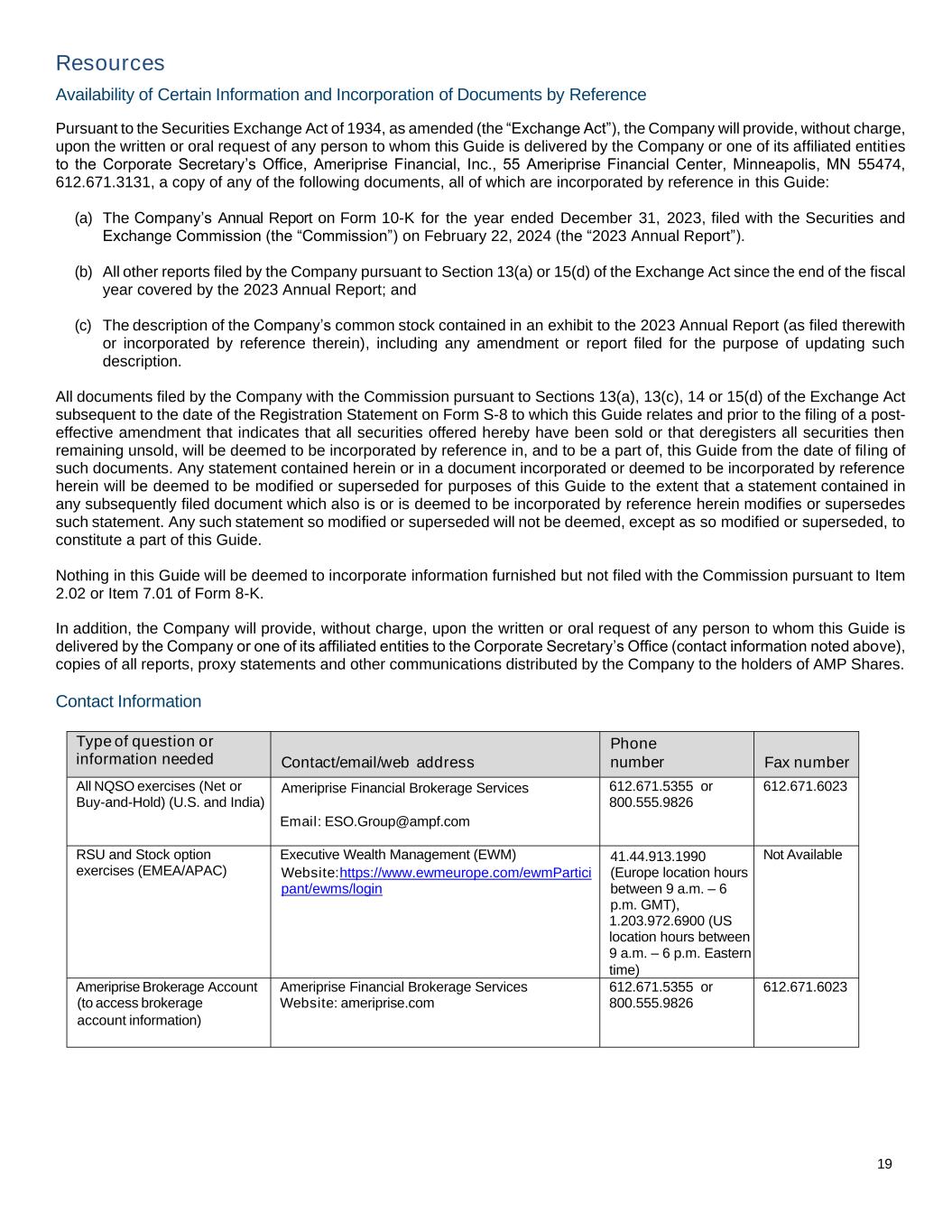

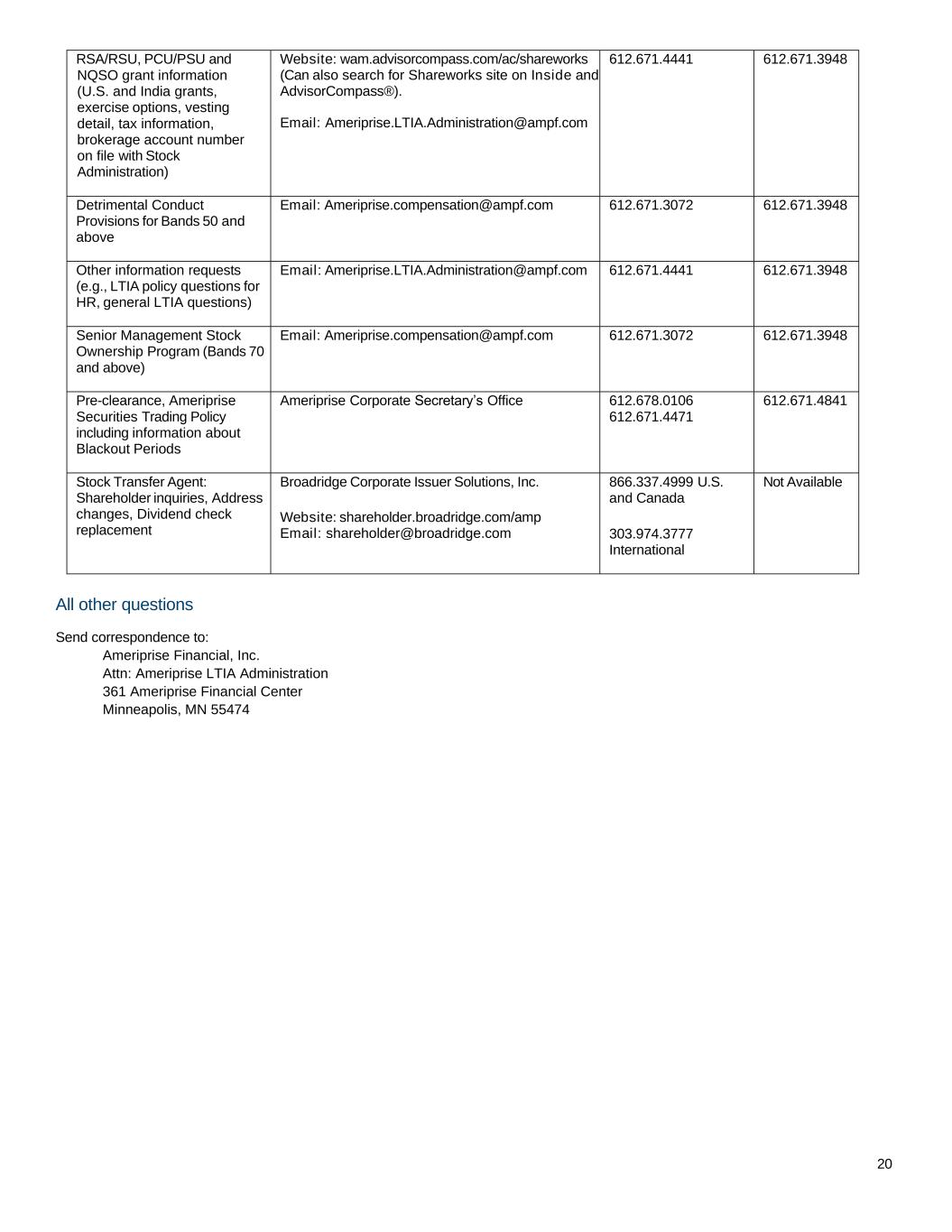

1 Table of Contents Long-Term Incentive Award Program ................................................................................................................................................. 2 LTIA Program Overview .................................................................................................................................................................. 2 Summary of the Types of Awards under the Plan ............................................................................................................................. 3 Restricted Stock Awards .................................................................................................................................................................... 4 Valuing RSA Grants ......................................................................................................................................................................... 4 Vesting ............................................................................................................................................................................................ 4 Quarterly Dividends ......................................................................................................................................................................... 4 Treatment of RSAs upon Certain Events .......................................................................................................................................... 4 Restricted Stock Units ........................................................................................................................................................................ 4 Valuing RSU Grants ........................................................................................................................................................................ 5 Vesting ............................................................................................................................................................................................ 5 Quarterly Dividend Equivalents ........................................................................................................................................................ 5 Treatment of RSUs upon Certain Events .......................................................................................................................................... 5 Non-Qualified Stock Options .............................................................................................................................................................. 5 Valuing NQSO Grants ...................................................................................................................................................................... 6 Vesting ............................................................................................................................................................................................ 6 Requirements for Exercising NQSOs ............................................................................................................................................... 6 Steps for Exercising Vested NQSOs – U.S. and India ...................................................................................................................... 6 Steps for Exercising Vested NQSOs – EMEA/APAC ........................................................................................................................ 7 Treatment of NQSOs upon Certain Events ....................................................................................................................................... 8 Performance Stock Units .................................................................................................................................................................... 8 Performance Cash Units .................................................................................................................................................................... 8 Legal Compliance .............................................................................................................................................................................. 8 Tax Implications for LTIAs (U.S. citizens and residents only).............................................................................................................. 9 RSAs and RSUs: Income & Employment Tax Implications ............................................................................................................... 9 NQSOs: Income and Employment Tax Implications ....................................................................................................................... 10 Multi-State Taxation Process ......................................................................................................................................................... 10 Section 409A of the Code .............................................................................................................................................................. 10 Treatment of LTIAs upon Certain Events ........................................................................................................................................ 11 Key Definitions Relating to Treatment upon Certain Events ........................................................................................................... 11 Part-Time Employment Status ....................................................................................................................................................... 12 Leave of Absence .......................................................................................................................................................................... 12 Employment Termination ............................................................................................................................................................... 12 Qualified Retirement ...................................................................................................................................................................... 13 Death ............................................................................................................................................................................................ 14 Disability Termination ................................................................................................................................................................... 14 Transfer between Business Segments ........................................................................................................................................... 14 Transfer from Field Eligible Employee to Franchise Advisor ........................................................................................................... 14 Rehire ........................................................................................................................................................................................... 14 Situations of Detrimental Conduct (Bands 50 and above) (U.S. only) ............................................................................................. 15 Compensation Recovery and Malus Policies ................................................................................................................................. 15 Change in Control of the Company ................................................................................................................................................ 15 Payments to Certain U.S. Taxpayers upon a Change in Control of the Company ........................................................................... 16 Administrative Information about this Guide ...................................................................................................................................... 16 About this Guide ............................................................................................................................................................................ 16 About the Illustrations .................................................................................................................................................................... 17 Award Confirmation Materials ........................................................................................................................................................ 17 Governing Award Documents ........................................................................................................................................................ 17 AMP Shares Available for Grant under the Plan ............................................................................................................................. 17 Plan Administration ........................................................................................................................................................................ 18 Performance-Based Compensation ............................................................................................................................................... 18 Adjustments upon Changes in Capitalization ................................................................................................................................. 18 Tax Withholding ............................................................................................................................................................................. 18 Assignment and Transfer ............................................................................................................................................................... 18 Amendment ................................................................................................................................................................................... 18 Term of the Plan ............................................................................................................................................................................ 18 Resources ....................................................................................................................................................................................... 19 Availability of Certain Information and Incorporation of Documents by Reference ........................................................................... 19 Contact Information ....................................................................................................................................................................... 19 All other questions ......................................................................................................................................................................... 20

2 Long-Term Incentive Award Program The Long-Term Incentive Award (“LTIA”) program is a critical component of Ameriprise’s total compensation strategy and designed to align Participants’ financial interests with those of the shareholders of Ameriprise Financial, Inc. (the “Company”). LTIAs are an essential element to aligning our high-performing and high potential employees to the company’s future success and play a significant role in our ability to attract, reward, incent and retain top talent. LTIAs are equity-based or cash-based incentive awards (i.e., non-qualified stock options, restricted stock awards, restricted stock units, performance cash units, performance stock units and other equity-based awards) issued pursuant to the Ameriprise Financial 2005 Incentive Compensation Plan, as amended and restated April 26, 2023 (the “Plan”) to certain employees, non-employee directors and independent contractors of the Company and its affiliates as defined in the Plan (“Participants”). All LTIAs are recommended for approval by the Compensation and Benefits Committee of the Company’s Board of Directors (the “Board”) or the Committee’s duly authorized delegate (the “Committee”). The timing and process for approval and issuance of such awards will be governed by the Ameriprise Financial Long-Term Incentive Award Policy – Grant Practices and Procedures. Once the recommended awards are approved and granted, they are then communicated to employees by their leaders, as well as by email notification and online award agreement. LTIA Program Overview Restricted Stock Awards (“RSAs”), Non-qualified Stock Options (“NQSOs”), Restricted Stock Unit Awards (“RSUs”), Performance Stock Units (“PSUs”), Performance Cash Units (“PCUs”) and other share-based Awards (collectively, “Awards” or “LTIAs”) are issued pursuant to the terms of the Plan at the discretion and subject to the administration of the Committee. All Awards issued under the Plan will contain the general terms set forth in the applicable provisions of this 2025 Long-Term Incentive Award Program Guide (this “Guide”). The specific terms of an individual Award will be contained in the Shareworks (U.S. and India), or Executive Wealth Management (“EWM”) (EMEA/APAC) online award agreement or certificate delivered to the Participant in connection with the grant of an Award. All Awards are subject to the terms and conditions of the Plan, the Guide, and the Award detail, as well as any administrative guidelines or interpretations by the Committee under the Plan, and any such guidelines or interpretations are hereby incorporated into this Guide by reference and made a part of this Guide. PSUs and PCUs will also be subject to the terms and conditions of the PSU Supplement to this Guide or the PCU Supplement to this Guide, as applicable. The Plan provides that Awards may be settled in cash and/or in shares of Company common stock (“AMP Shares”) or other property, which will be communicated upon receipt of the Award. As used in this Guide, the term “shares” refers to the common shares of the Company having a par value of $.01 per share, or the shares of any other stock of any other class into which such shares may thereafter be changed. The chart on the following page summarizes the key features of the types of awards granted under the LTIA program. This Guide describes awards management expects to recommend for grant and may not cover the specific features of every award. However, this Guide is intended to cover the terms of the vast majority of Awards, and you may generally rely on it for the governance of your awards unless the Company communicates something different to you in writing. If the terms of awards granted changes from what is described in this Guide, the LTIA Administration Group will provide you with detailed information regarding any changes. Detailed information about various award types, tax implications and other award features is contained in the following sections.

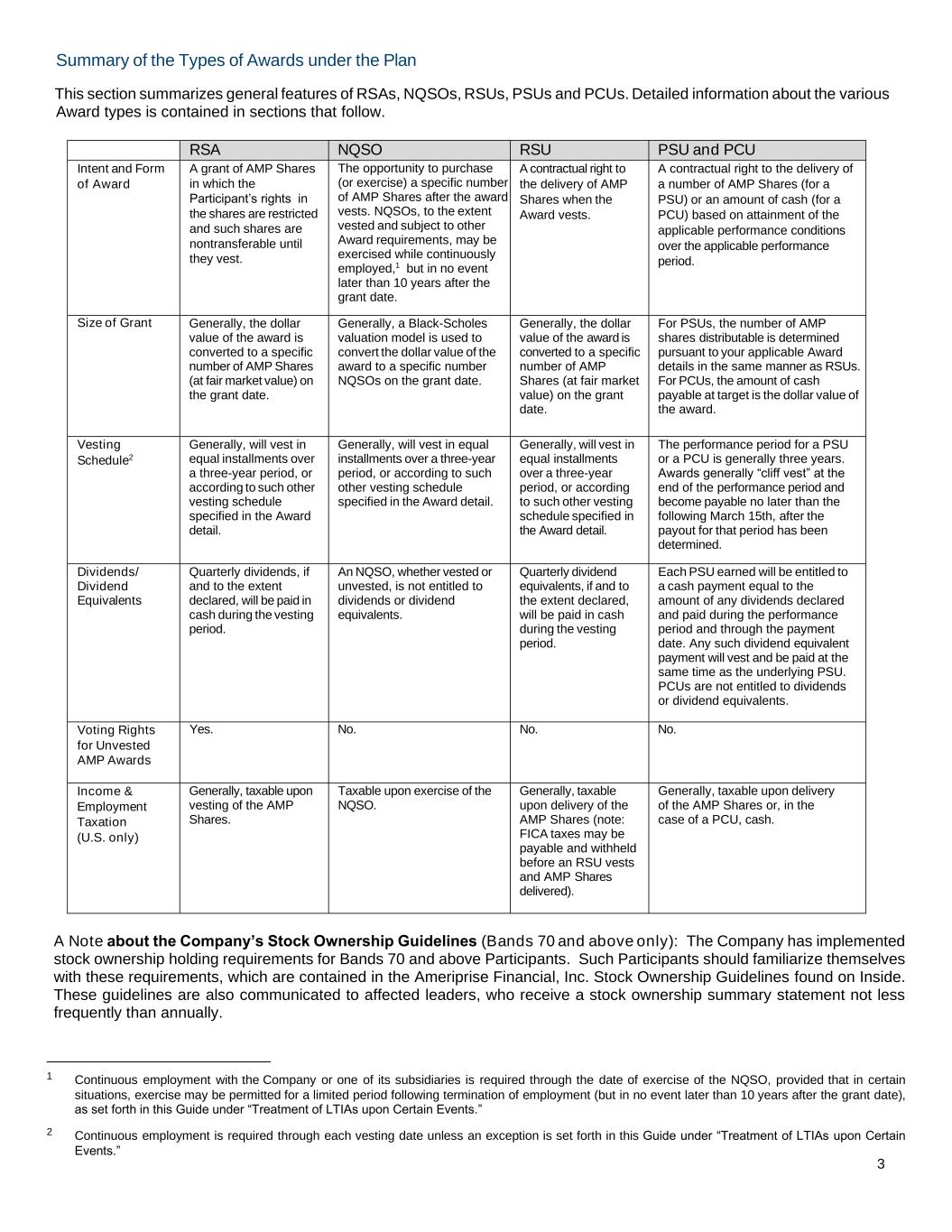

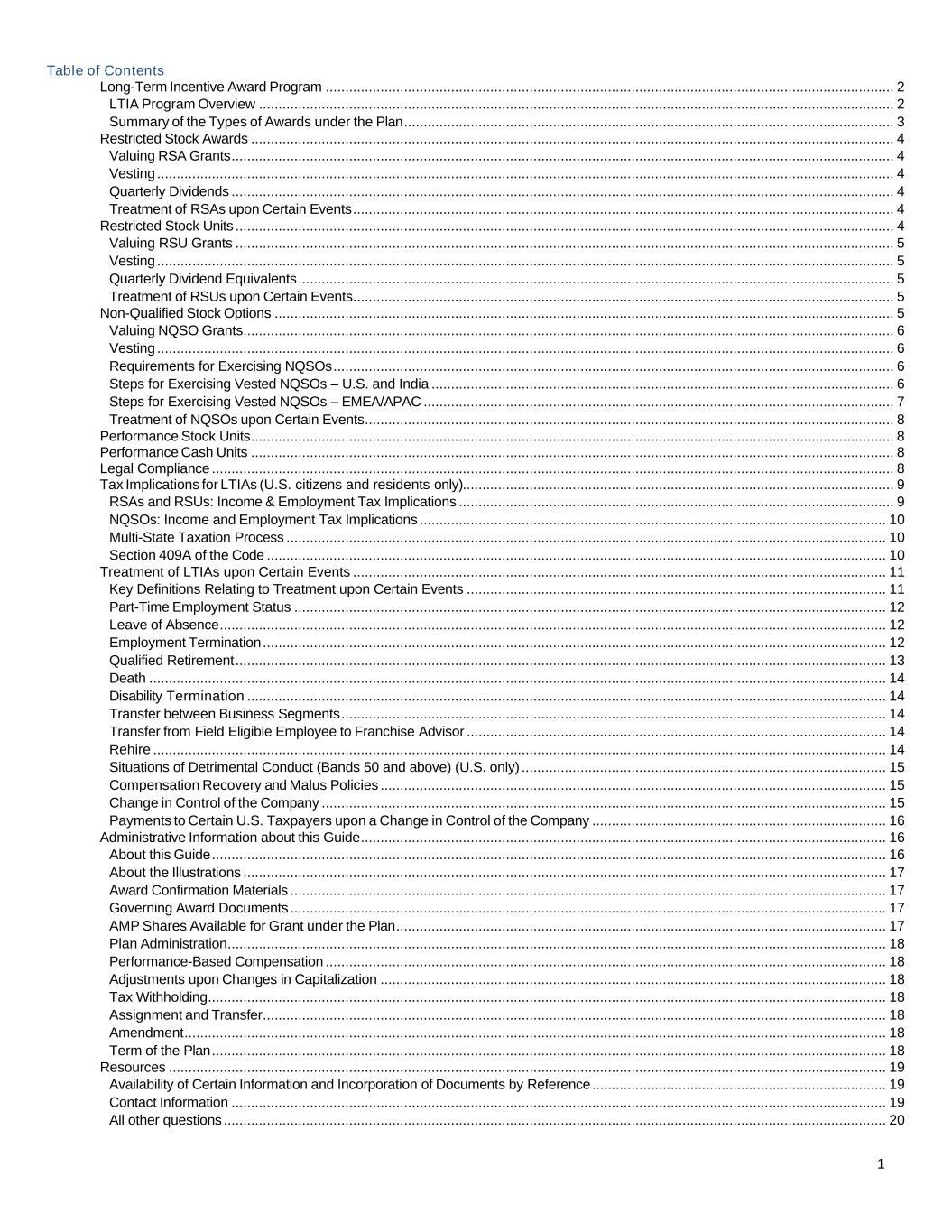

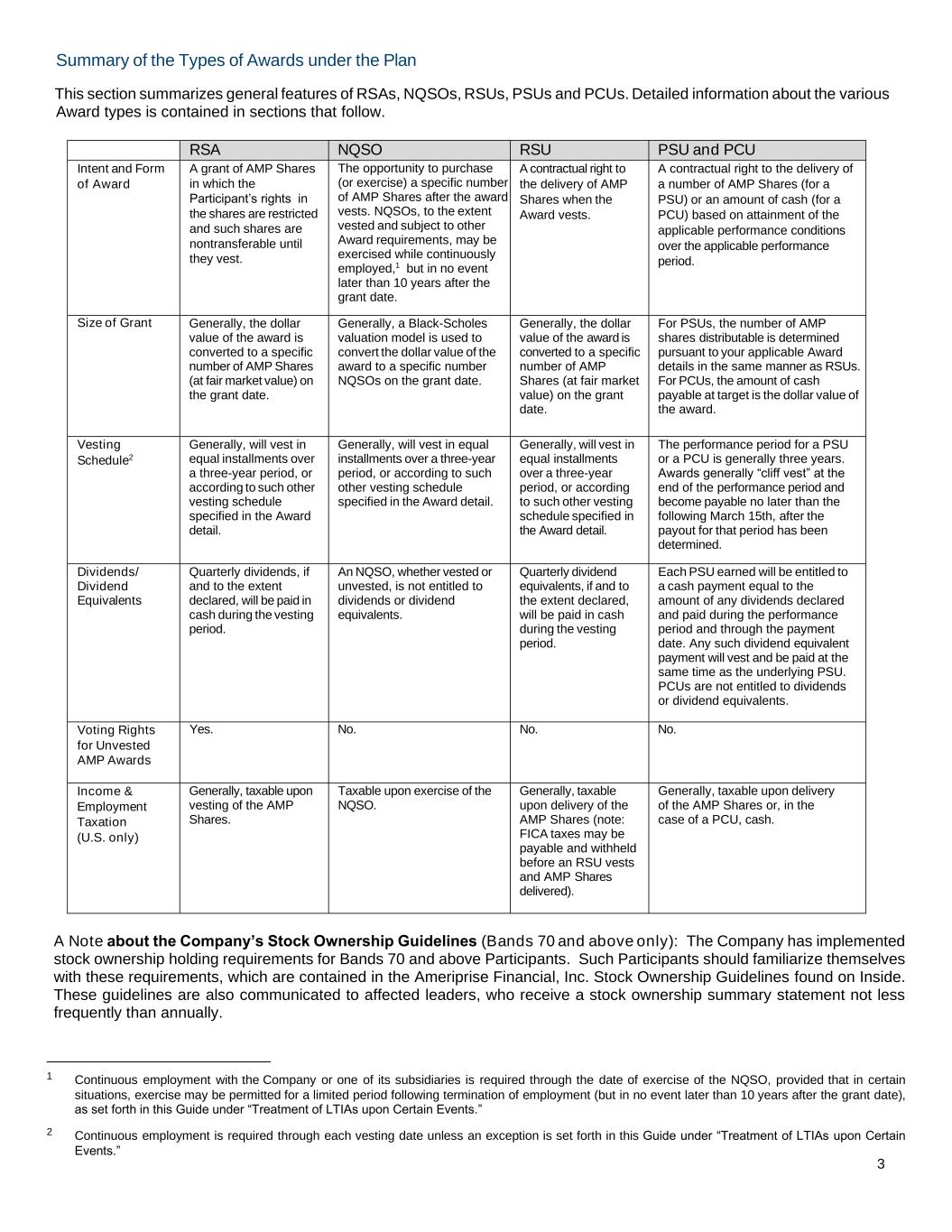

3 Summary of the Types of Awards under the Plan This section summarizes general features of RSAs, NQSOs, RSUs, PSUs and PCUs. Detailed information about the various Award types is contained in sections that follow. RSA NQSO RSU PSU and PCU Intent and Form of Award A grant of AMP Shares in which the Participant’s rights in the shares are restricted and such shares are nontransferable until they vest. The opportunity to purchase (or exercise) a specific number of AMP Shares after the award vests. NQSOs, to the extent vested and subject to other Award requirements, may be exercised while continuously employed,1 but in no event later than 10 years after the grant date. A contractual right to the delivery of AMP Shares when the Award vests. A contractual right to the delivery of a number of AMP Shares (for a PSU) or an amount of cash (for a PCU) based on attainment of the applicable performance conditions over the applicable performance period. Size of Grant Generally, the dollar value of the award is converted to a specific number of AMP Shares (at fair market value) on the grant date. Generally, a Black-Scholes valuation model is used to convert the dollar value of the award to a specific number NQSOs on the grant date. Generally, the dollar value of the award is converted to a specific number of AMP Shares (at fair market value) on the grant date. For PSUs, the number of AMP shares distributable is determined pursuant to your applicable Award details in the same manner as RSUs. For PCUs, the amount of cash payable at target is the dollar value of the award. Vesting Schedule2 Generally, will vest in equal installments over a three-year period, or according to such other vesting schedule specified in the Award detail. Generally, will vest in equal installments over a three-year period, or according to such other vesting schedule specified in the Award detail. Generally, will vest in equal installments over a three-year period, or according to such other vesting schedule specified in the Award detail. The performance period for a PSU or a PCU is generally three years. Awards generally “cliff vest” at the end of the performance period and become payable no later than the following March 15th, after the payout for that period has been determined. Dividends/ Dividend Equivalents Quarterly dividends, if and to the extent declared, will be paid in cash during the vesting period. An NQSO, whether vested or unvested, is not entitled to dividends or dividend equivalents. Quarterly dividend equivalents, if and to the extent declared, will be paid in cash during the vesting period. Each PSU earned will be entitled to a cash payment equal to the amount of any dividends declared and paid during the performance period and through the payment date. Any such dividend equivalent payment will vest and be paid at the same time as the underlying PSU. PCUs are not entitled to dividends or dividend equivalents. Voting Rights for Unvested AMP Awards Yes. No. No. No. Income & Employment Taxation (U.S. only) Generally, taxable upon vesting of the AMP Shares. Taxable upon exercise of the NQSO. Generally, taxable upon delivery of the AMP Shares (note: FICA taxes may be payable and withheld before an RSU vests and AMP Shares delivered). Generally, taxable upon delivery of the AMP Shares or, in the case of a PCU, cash. A Note about the Company’s Stock Ownership Guidelines (Bands 70 and above only): The Company has implemented stock ownership holding requirements for Bands 70 and above Participants. Such Participants should familiarize themselves with these requirements, which are contained in the Ameriprise Financial, Inc. Stock Ownership Guidelines found on Inside. These guidelines are also communicated to affected leaders, who receive a stock ownership summary statement not less frequently than annually. 1 Continuous employment with the Company or one of its subsidiaries is required through the date of exercise of the NQSO, provided that in certain situations, exercise may be permitted for a limited period following termination of employment (but in no event later than 10 years after the grant date), as set forth in this Guide under “Treatment of LTIAs upon Certain Events.” 2 Continuous employment is required through each vesting date unless an exception is set forth in this Guide under “Treatment of LTIAs upon Certain Events.”

4 Restricted Stock Awards An RSA is a grant of AMP Shares. On the date of grant, your rights to the shares are restricted and you may not sell, assign, or otherwise transfer the shares until they vest, which is contingent upon you remaining employed with the Company or one of its subsidiaries through each vesting date. Once vested, you receive the AMP Shares free from such restrictions. Quarterly dividends, if any, are paid on your unvested AMP Shares during the vesting period. You have full voting rights for all your unvested AMP Shares. Valuing RSA Grants The value of an RSA share at vesting is equal to the Company’s closing share price as reported on the New York Stock Exchange on the vesting date, or if there is no reported closing price on the vesting date, then the closing price as reported by the New York Stock Exchange on the last previous day on which such closing price was reported. For example, if 150 restricted AMP Shares vest in January and the closing AMP Share price at vesting is $100, the pretax value of these AMP Shares would be $15,000 ($100 x 150 = $15,000). (See the “About the Illustrations” section in this Guide for an important disclosure.) Vesting RSAs generally vest in equal installments over a three-year period, starting with the first anniversary of the grant date and ending on the third anniversary of the grant date. The Award detail you receive with your RSA will include a personalized vesting schedule. Upon a vesting date, the restrictions will lapse on the number of AMP Shares specified in your Award to vest on such date. Any required tax withholding will be paid by withholding AMP Shares from the number of shares that vest on such date. The net AMP Shares that will be in your account following vesting will be the number of AMP Shares specified in your Award to vest on such date less the number of AMP Shares necessary to satisfy any tax withholding requirements. Once the restrictions have lapsed and the required tax withholdings have been satisfied, you may sell, assign, or otherwise transfer your AMP Shares at any time, subject to securities laws governing insider trading, short-swing profit rules and Company stock ownership and retention guidelines and black-out periods. You are responsible for knowing and abiding by the applicable laws and Company policies regarding your stock and stock-based awards. Quarterly Dividends Cash dividends paid on AMP Shares, as declared by the Board, are paid quarterly during the vesting period. The dividend payment amount is determined each quarter and stated as a per-share amount that is multiplied by the number of unvested AMP Shares in your award. For example, if a quarterly dividend is $1.00 per share and you have 500 unvested AMP Shares, your quarterly dividend payment would equal $500 ($1.00 x 500 = $500). To change the address where your dividend check is mailed, to request a dividend check replacement or to set-up electronic payment, contact the Transfer Agent, Broadridge. Contact information can be found in the “Contact Information” section in this Guide. Treatment of RSAs upon Certain Events For information on the treatment of RSAs upon a Qualified Retirement, employment termination, leave of absence, etc., please see the “Treatment of LTIAs upon Certain Events” section in this Guide. Restricted Stock Units Under an RSU, AMP Shares are not issued to you on the grant date. Instead, upon the grant of an RSU Award, the Company will deliver the gross number of RSUs to your Shareworks or EWM account showing the total number of RSUs granted and the applicable vesting schedule for such RSU Award, with the RSU representing the Company’s contractual obligation to issue a specified number of AMP Shares to you at the end of the vesting period applicable to your Award. During this period, you receive quarterly dividend equivalent payments that are the equivalent value of any AMP Share dividends that are declared and paid during such calendar quarter. Any such dividend equivalents will be paid to you as soon as practicable following the payment to shareholders of the related dividend, but in no event later than 75 days following such date. You do not have voting rights for shares under any unvested portion of the RSU until such shares become vested and are issued to you.

5 Valuing RSU Grants RSUs are valued in the same manner as RSAs. For example, the value of an RSU share at vesting is equal to the Company’s closing share price as reported on the New York Stock Exchange composite tape on the vesting date or if there is no reported closing price on the vesting date, then the closing price as reported by the New York Stock Exchange on the last previous day on which such closing price was reported. If 150 restricted AMP Shares vest in January and the closing AMP Share price at vesting is $100, the pretax value of these AMP Shares would be $15,000 ($100 x 150 = $15,000). (See the “About the Illustrations” section in this Guide for an important disclosure.) Vesting RSUs generally vest in equal installments over a three-year period, starting with the first anniversary of the grant date and ending on the third anniversary of the grant date. The Award detail you receive with your RSU will include a personalized vesting schedule. Upon a vesting date, the restrictions will lapse on the number of AMP Shares specified in your Award to vest on such date. For U.S. taxpayers, any required tax withholding will be paid by withholding AMP Shares from the number of shares that vest on such scheduled vesting date. The net AMP Shares that will be in your account following vesting will be the number of AMP Shares specified in your Award detail to vest on such date less the number of AMP Shares necessary to satisfy any tax withholding requirements. Outside of the U.S., where as a result of the vesting of your RSU Award, your employer has obligations to account for tax on your behalf under relevant regulations, in accordance with the authorization in your Award Certificate, Ameriprise will instruct Broadridge to sell to the Company, on your behalf, such number of your AMP Shares acquired on vesting as is considered appropriate in order to generate sufficient sale proceeds to comply with relevant withholding obligations. Once the restrictions have lapsed and the required tax withholdings have been satisfied, you may sell your AMP Shares at any time, subject to securities laws governing insider trading, short- swing profit rules and Company stock ownership and retention guidelines and black-out periods. You are responsible for knowing and abiding by the applicable laws and Company policies regarding your stock and stock-based awards. As explained in greater detail in the section in this Guide titled “RSAs and RSUs: Income & Employment Tax Implications,” please note that in some instances FICA (Social Security and Medicare) taxes may be payable either before an Award vests and/or before you receive AMP Shares. Quarterly Dividend Equivalents Unlike RSAs, RSUs are not entitled to receive payment of any AMP Share dividends, as declared by the Board, during the scheduled vesting period. However, RSUs are entitled to receive a dividend equivalent payment from the Company equal to the amount of the AMP Share dividends that are paid to shareholders during the scheduled vesting period. For example, if a quarterly dividend is $1.00 per share and you have 500 unvested AMP Shares, your quarterly dividend equivalent payment would equal $500 ($1.00 x 500 = $500). Treatment of RSUs upon Certain Events For information about how your RSUs will be treated upon certain events, such as a Qualified Retirement, employment termination, leave of absence, etc., please see “Treatment of LTIAs upon Certain Events.” Non-Qualified Stock Options An NQSO gives you the right to purchase a specified number of AMP Shares at the exercise price set forth in the Award, subject to continuous employment and other vesting requirements and exercise period limitations. The exercise price is equal to the closing stock price as reported on the New York Stock Exchange composite tape on the grant date. Once an NQSO becomes vested, you determine when to exercise the option (before its expiration) and how to pay for the option exercise. Unless your Award detail provides otherwise, an NQSO expires on the date that is 10 years after the date of grant, or upon your earlier termination of employment with the Company or one of its subsidiaries, provided that in certain situations, you may be permitted to exercise the NQSO for a limited period following termination of employment and prior to its award expiration date (please see the “Treatment of LTIAs upon Certain Events” section in this Guide). “Non-qualified” refers to the tax treatment of the option under the U.S. Internal Revenue Code of 1986, as amended (the “Code”).

6 Valuing NQSO Grants NQSOs earn value if the Company’s stock price increases above the exercise price. Once an NQSO becomes vested, you have the right to pay the exercise price to exercise the option and acquire the AMP Shares. For example, assume that 500 vested NQSOs were granted at the exercise price of $50 per share and the price of an AMP Share increases to $100. If you decided to exercise the NQSO, the pre-tax gain on these options would be $25,000 (($100 - $50 = $50) x 500 = $25,000). (See the “About the Illustrations” section in this Guide for an important disclosure.) Vesting NQSOs generally become vested and available for exercise in equal installments over a three-year period, starting with the first anniversary of the grant date and ending on the third anniversary of the grant date. The Award detail you receive in connection with an NQSO grant will include a personalized vesting schedule. Requirements for Exercising NQSOs Generally, you may exercise the vested portion of an NQSO as soon as it vests or at any subsequent time prior to its award expiration date. It is your responsibility to track your NQSO expiration date(s), including any early expiration of your NQSO in connection with the termination of your employment, to ensure you realize any value through a timely exercise. As with any investment decision, you are strongly urged to consult with your personal financial advisor before exercising an NQSO. Follow these requirements to exercise the vested portion of NQSOs: ➢ (U.S. and India only) The execution of an NQSO exercise requires you to have a valid non-qualified Ameriprise (AMP) brokerage account. If you do not have one, contact your advisor or call the Ameriprise Advisor Center at 1-877-370- 3950 to set up an account. There is no fee to open a brokerage account with Ameriprise Financial Brokerage Services (“AFBS”), and you will pay a reduced commission if AFBS sells shares on your behalf. Regular brokerage account maintenance fees apply. Initiating an NQSO exercise without having an AMP brokerage account can delay the ability to exercise your NQSOs. ➢ Confirm that you are not in a blackout period (Band 50 and above, franchise regional vice presidents, regional vice presidents, and employees otherwise notified that they are subject to blackout). A quarterly blackout period applies to certain Participants when the trading window closes and remains closed for approximately four weeks, as declared, until the Company’s earnings for the preceding quarter are made public. Other blackout periods may apply as determined by the Corporate Secretary’s Office. Participants who are subject to the regular quarterly blackouts (and any other blackouts) on trading in Ameriprise securities, including the exercise of NQSOs, will receive emails from the Corporate Secretary informing them of the dates on which the blackout will begin and end, as well as the related policy requirements. ➢ Additional Notice and Approval Requirements (For Bands 50 and above and certain other Participants only) • Provide required notice. Band 50 and above Participants are required to provide advance notice to their Executive Leadership Team leader if their cumulative exercise request exceeds more than 40% of the Participant’s available AMP NQSOs within any 90-day period. • Obtain required pre-clearance. Section 16 Officers and other members of the Executive Leadership Team are required to obtain pre-clearance before exercising options. The Corporate Secretary’s Office will provide you with an email explaining the pre-clearance process. It is important to understand, however, that pre-clearance may not be granted, depending on the facts and circumstances. Steps for Exercising Vested NQSOs – U.S. and India ➢ Sign into your account with Shareworks to exercise your stock options. Indicate how you plan to pay for the AMP Shares you are purchasing by exercising the option and any required tax withholdings. You may pay the exercise cost (the per-share exercise price multiplied by the number of shares) and required tax withholdings using one of these payment options (in U.S. dollars): • Net Exercise : ▪ Instruct AFBS, our exclusive broker, to withhold a portion of the exercised shares equal in fair market value to the exercise cost plus any required tax withholdings to the Company in lieu of paying the exercise price in

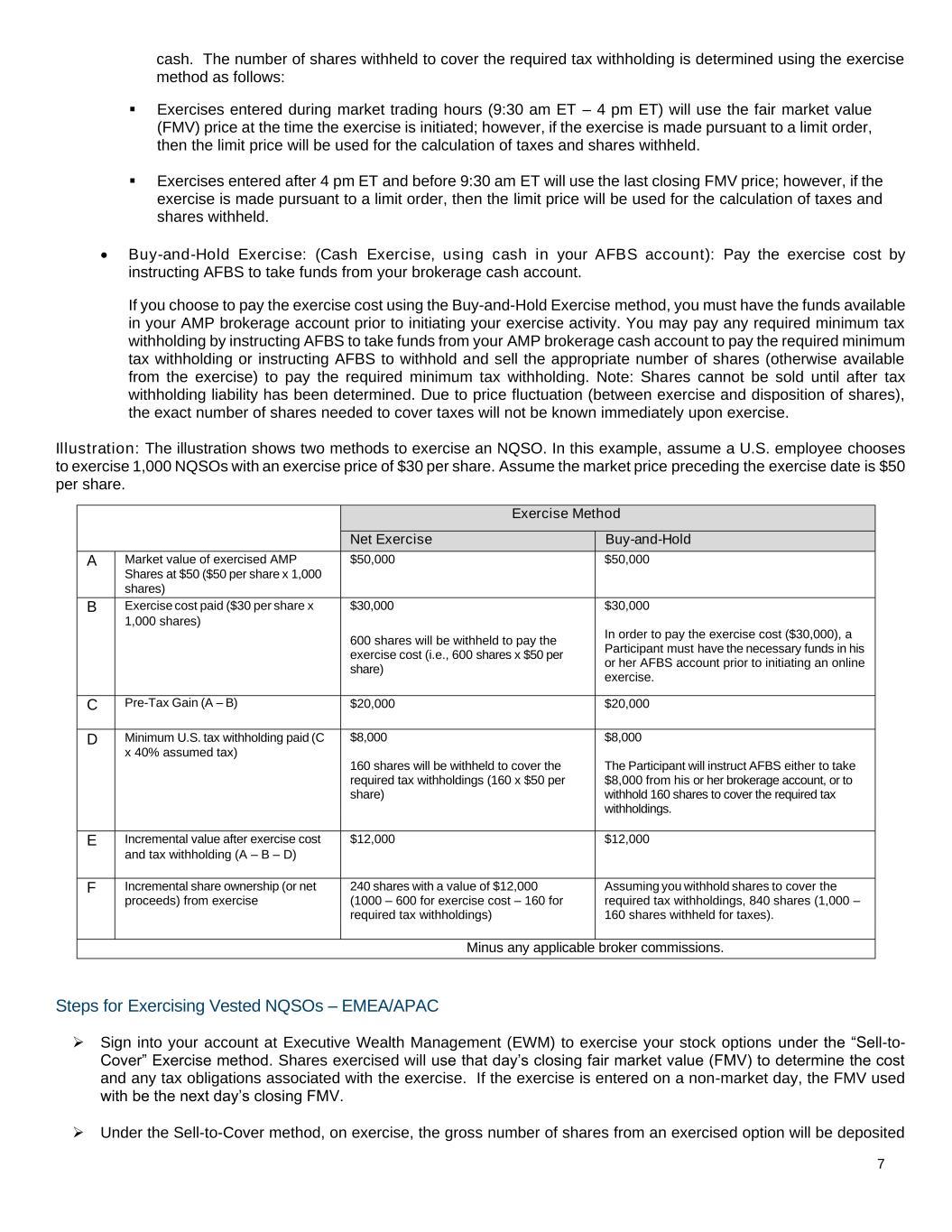

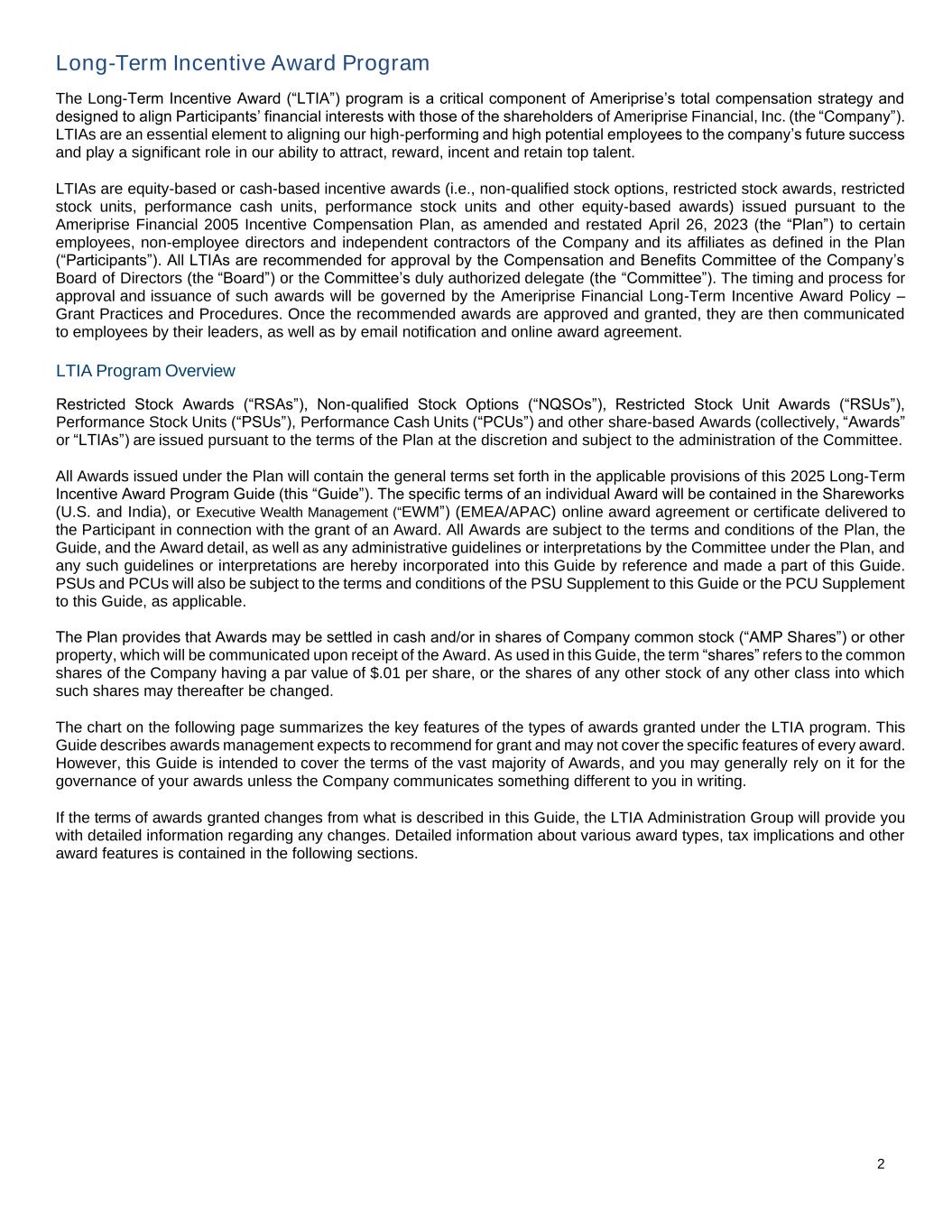

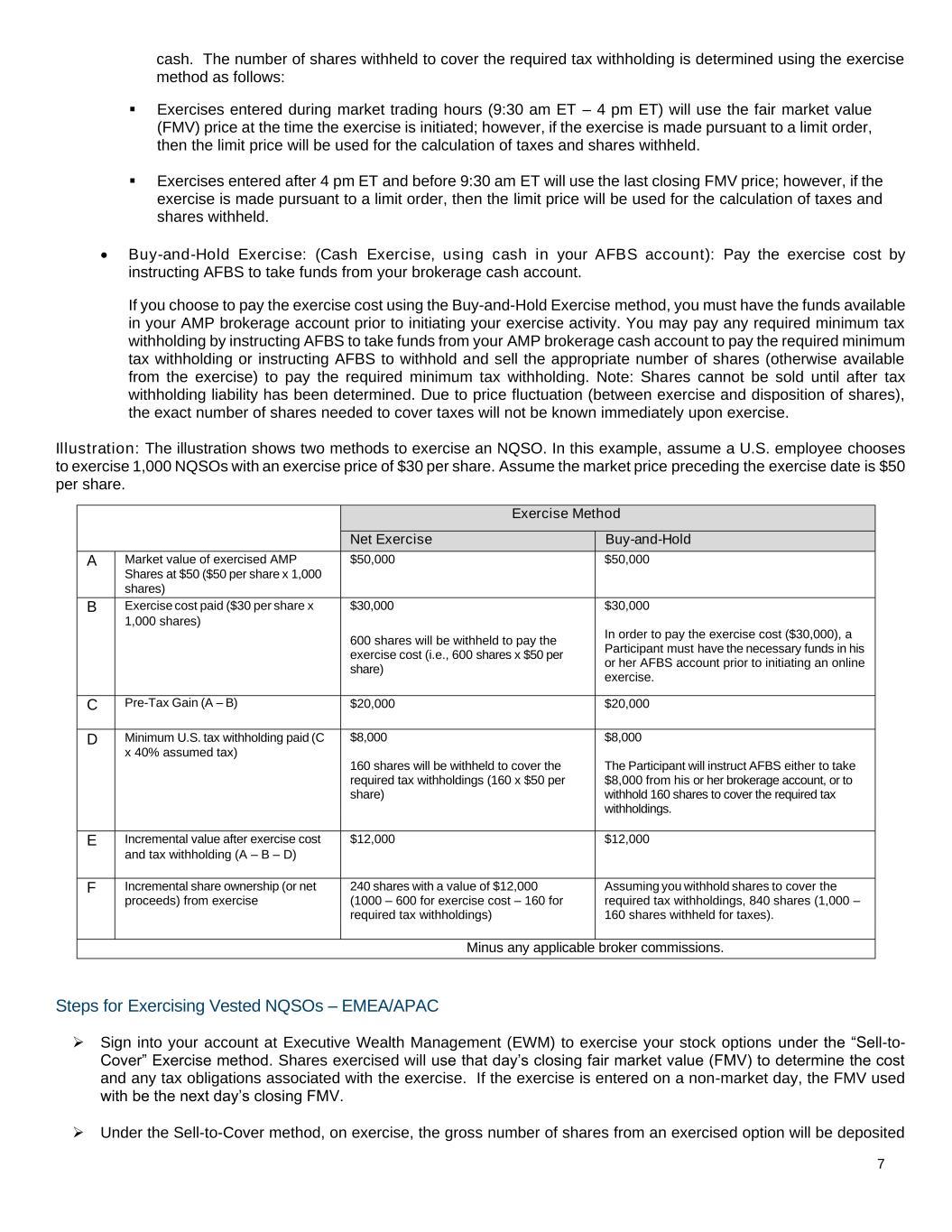

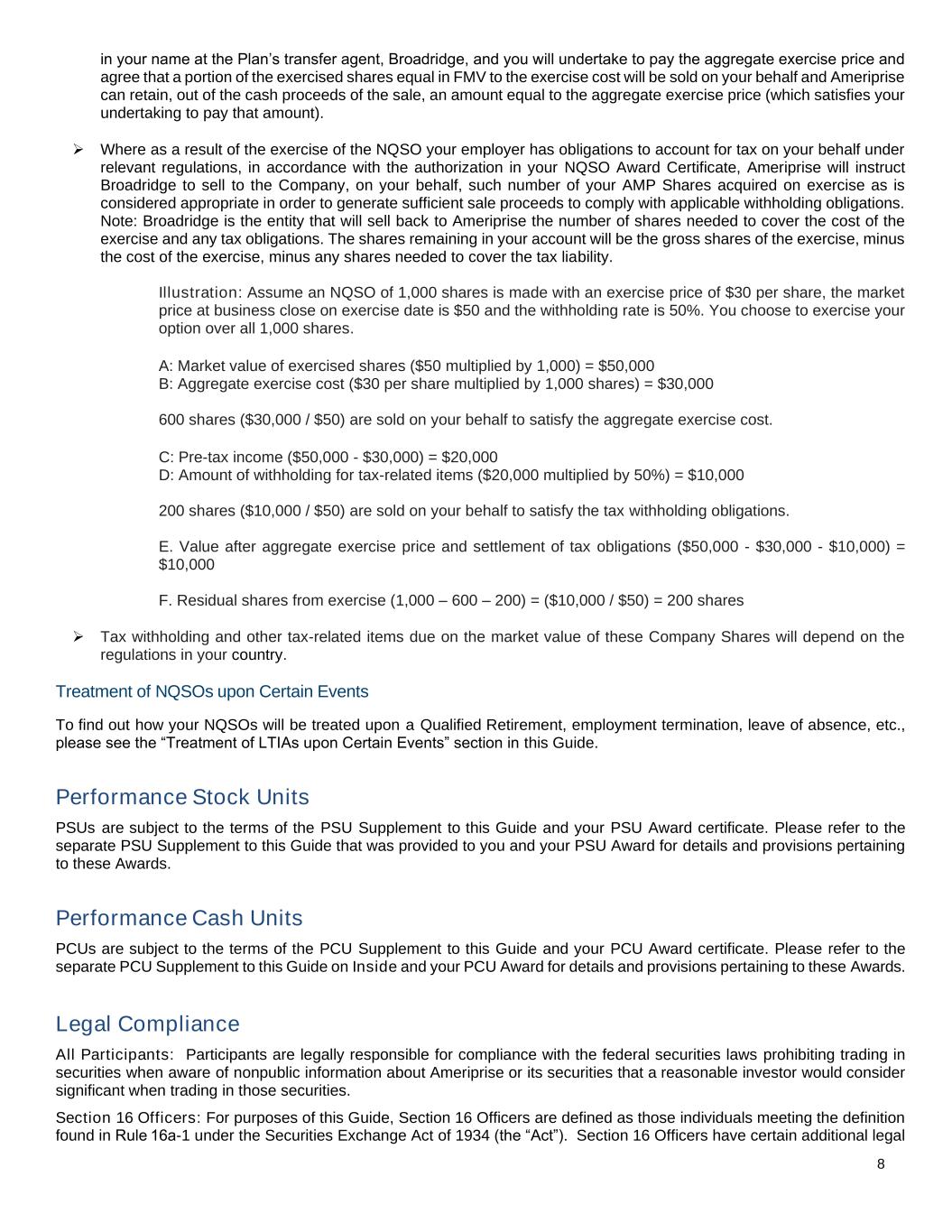

7 cash. The number of shares withheld to cover the required tax withholding is determined using the exercise method as follows: ▪ Exercises entered during market trading hours (9:30 am ET – 4 pm ET) will use the fair market value (FMV) price at the time the exercise is initiated; however, if the exercise is made pursuant to a limit order, then the limit price will be used for the calculation of taxes and shares withheld. ▪ Exercises entered after 4 pm ET and before 9:30 am ET will use the last closing FMV price; however, if the exercise is made pursuant to a limit order, then the limit price will be used for the calculation of taxes and shares withheld. • Buy-and-Hold Exercise: (Cash Exercise, using cash in your AFBS account): Pay the exercise cost by instructing AFBS to take funds from your brokerage cash account. If you choose to pay the exercise cost using the Buy-and-Hold Exercise method, you must have the funds available in your AMP brokerage account prior to initiating your exercise activity. You may pay any required minimum tax withholding by instructing AFBS to take funds from your AMP brokerage cash account to pay the required minimum tax withholding or instructing AFBS to withhold and sell the appropriate number of shares (otherwise available from the exercise) to pay the required minimum tax withholding. Note: Shares cannot be sold until after tax withholding liability has been determined. Due to price fluctuation (between exercise and disposition of shares), the exact number of shares needed to cover taxes will not be known immediately upon exercise. Illustration: The illustration shows two methods to exercise an NQSO. In this example, assume a U.S. employee chooses to exercise 1,000 NQSOs with an exercise price of $30 per share. Assume the market price preceding the exercise date is $50 per share. Steps for Exercising Vested NQSOs – EMEA/APAC ➢ Sign into your account at Executive Wealth Management (EWM) to exercise your stock options under the “Sell-to- Cover” Exercise method. Shares exercised will use that day’s closing fair market value (FMV) to determine the cost and any tax obligations associated with the exercise. If the exercise is entered on a non-market day, the FMV used with be the next day’s closing FMV. ➢ Under the Sell-to-Cover method, on exercise, the gross number of shares from an exercised option will be deposited Exercise Method Net Exercise Buy-and-Hold A Market value of exercised AMP Shares at $50 ($50 per share x 1,000 shares) $50,000 $50,000 B Exercise cost paid ($30 per share x 1,000 shares) $30,000 600 shares will be withheld to pay the exercise cost (i.e., 600 shares x $50 per share) $30,000 In order to pay the exercise cost ($30,000), a Participant must have the necessary funds in his or her AFBS account prior to initiating an online exercise. C Pre-Tax Gain (A – B) $20,000 $20,000 D Minimum U.S. tax withholding paid (C x 40% assumed tax) $8,000 160 shares will be withheld to cover the required tax withholdings (160 x $50 per share) $8,000 The Participant will instruct AFBS either to take $8,000 from his or her brokerage account, or to withhold 160 shares to cover the required tax withholdings. E Incremental value after exercise cost and tax withholding (A – B – D) $12,000 $12,000 F Incremental share ownership (or net proceeds) from exercise 240 shares with a value of $12,000 (1000 – 600 for exercise cost – 160 for required tax withholdings) Assuming you withhold shares to cover the required tax withholdings, 840 shares (1,000 – 160 shares withheld for taxes). Minus any applicable broker commissions.

8 in your name at the Plan’s transfer agent, Broadridge, and you will undertake to pay the aggregate exercise price and agree that a portion of the exercised shares equal in FMV to the exercise cost will be sold on your behalf and Ameriprise can retain, out of the cash proceeds of the sale, an amount equal to the aggregate exercise price (which satisfies your undertaking to pay that amount). ➢ Where as a result of the exercise of the NQSO your employer has obligations to account for tax on your behalf under relevant regulations, in accordance with the authorization in your NQSO Award Certificate, Ameriprise will instruct Broadridge to sell to the Company, on your behalf, such number of your AMP Shares acquired on exercise as is considered appropriate in order to generate sufficient sale proceeds to comply with applicable withholding obligations. Note: Broadridge is the entity that will sell back to Ameriprise the number of shares needed to cover the cost of the exercise and any tax obligations. The shares remaining in your account will be the gross shares of the exercise, minus the cost of the exercise, minus any shares needed to cover the tax liability. Illustration: Assume an NQSO of 1,000 shares is made with an exercise price of $30 per share, the market price at business close on exercise date is $50 and the withholding rate is 50%. You choose to exercise your option over all 1,000 shares. A: Market value of exercised shares ($50 multiplied by 1,000) = $50,000 B: Aggregate exercise cost ($30 per share multiplied by 1,000 shares) = $30,000 600 shares ($30,000 / $50) are sold on your behalf to satisfy the aggregate exercise cost. C: Pre-tax income ($50,000 - $30,000) = $20,000 D: Amount of withholding for tax-related items ($20,000 multiplied by 50%) = $10,000 200 shares ($10,000 / $50) are sold on your behalf to satisfy the tax withholding obligations. E. Value after aggregate exercise price and settlement of tax obligations ($50,000 - $30,000 - $10,000) = $10,000 F. Residual shares from exercise (1,000 – 600 – 200) = ($10,000 / $50) = 200 shares ➢ Tax withholding and other tax-related items due on the market value of these Company Shares will depend on the regulations in your country. Treatment of NQSOs upon Certain Events To find out how your NQSOs will be treated upon a Qualified Retirement, employment termination, leave of absence, etc., please see the “Treatment of LTIAs upon Certain Events” section in this Guide. Performance Stock Units PSUs are subject to the terms of the PSU Supplement to this Guide and your PSU Award certificate. Please refer to the separate PSU Supplement to this Guide that was provided to you and your PSU Award for details and provisions pertaining to these Awards. Performance Cash Units PCUs are subject to the terms of the PCU Supplement to this Guide and your PCU Award certificate. Please refer to the separate PCU Supplement to this Guide on Inside and your PCU Award for details and provisions pertaining to these Awards. Legal Compliance All Participants: Participants are legally responsible for compliance with the federal securities laws prohibiting trading in securities when aware of nonpublic information about Ameriprise or its securities that a reasonable investor would consider significant when trading in those securities. Section 16 Officers: For purposes of this Guide, Section 16 Officers are defined as those individuals meeting the definition found in Rule 16a-1 under the Securities Exchange Act of 1934 (the “Act”). Section 16 Officers have certain additional legal

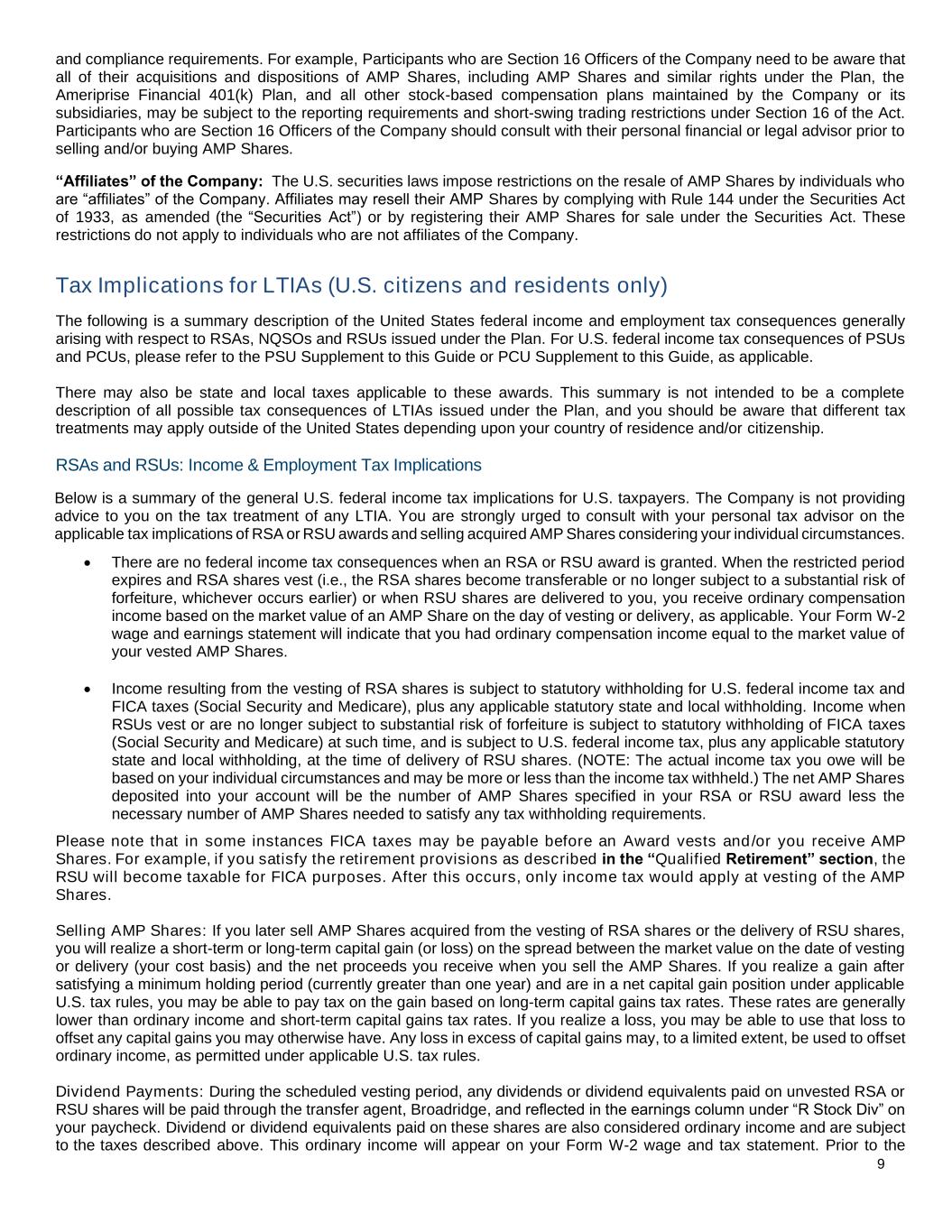

9 and compliance requirements. For example, Participants who are Section 16 Officers of the Company need to be aware that all of their acquisitions and dispositions of AMP Shares, including AMP Shares and similar rights under the Plan, the Ameriprise Financial 401(k) Plan, and all other stock-based compensation plans maintained by the Company or its subsidiaries, may be subject to the reporting requirements and short-swing trading restrictions under Section 16 of the Act. Participants who are Section 16 Officers of the Company should consult with their personal financial or legal advisor prior to selling and/or buying AMP Shares. “Affiliates” of the Company: The U.S. securities laws impose restrictions on the resale of AMP Shares by individuals who are “affiliates” of the Company. Affiliates may resell their AMP Shares by complying with Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) or by registering their AMP Shares for sale under the Securities Act. These restrictions do not apply to individuals who are not affiliates of the Company. Tax Implications for LTIAs (U.S. citizens and residents only) The following is a summary description of the United States federal income and employment tax consequences generally arising with respect to RSAs, NQSOs and RSUs issued under the Plan. For U.S. federal income tax consequences of PSUs and PCUs, please refer to the PSU Supplement to this Guide or PCU Supplement to this Guide, as applicable. There may also be state and local taxes applicable to these awards. This summary is not intended to be a complete description of all possible tax consequences of LTIAs issued under the Plan, and you should be aware that different tax treatments may apply outside of the United States depending upon your country of residence and/or citizenship. RSAs and RSUs: Income & Employment Tax Implications Below is a summary of the general U.S. federal income tax implications for U.S. taxpayers. The Company is not providing advice to you on the tax treatment of any LTIA. You are strongly urged to consult with your personal tax advisor on the applicable tax implications of RSA or RSU awards and selling acquired AMP Shares considering your individual circumstances. • There are no federal income tax consequences when an RSA or RSU award is granted. When the restricted period expires and RSA shares vest (i.e., the RSA shares become transferable or no longer subject to a substantial risk of forfeiture, whichever occurs earlier) or when RSU shares are delivered to you, you receive ordinary compensation income based on the market value of an AMP Share on the day of vesting or delivery, as applicable. Your Form W-2 wage and earnings statement will indicate that you had ordinary compensation income equal to the market value of your vested AMP Shares. • Income resulting from the vesting of RSA shares is subject to statutory withholding for U.S. federal income tax and FICA taxes (Social Security and Medicare), plus any applicable statutory state and local withholding. Income when RSUs vest or are no longer subject to substantial risk of forfeiture is subject to statutory withholding of FICA taxes (Social Security and Medicare) at such time, and is subject to U.S. federal income tax, plus any applicable statutory state and local withholding, at the time of delivery of RSU shares. (NOTE: The actual income tax you owe will be based on your individual circumstances and may be more or less than the income tax withheld.) The net AMP Shares deposited into your account will be the number of AMP Shares specified in your RSA or RSU award less the necessary number of AMP Shares needed to satisfy any tax withholding requirements. Please note that in some instances FICA taxes may be payable before an Award vests and/or you receive AMP Shares. For example, if you satisfy the retirement provisions as described in the “Qualified Retirement” section, the RSU will become taxable for FICA purposes. After this occurs, only income tax would apply at vesting of the AMP Shares. Selling AMP Shares: If you later sell AMP Shares acquired from the vesting of RSA shares or the delivery of RSU shares, you will realize a short-term or long-term capital gain (or loss) on the spread between the market value on the date of vesting or delivery (your cost basis) and the net proceeds you receive when you sell the AMP Shares. If you realize a gain after satisfying a minimum holding period (currently greater than one year) and are in a net capital gain position under applicable U.S. tax rules, you may be able to pay tax on the gain based on long-term capital gains tax rates. These rates are generally lower than ordinary income and short-term capital gains tax rates. If you realize a loss, you may be able to use that loss to offset any capital gains you may otherwise have. Any loss in excess of capital gains may, to a limited extent, be used to offset ordinary income, as permitted under applicable U.S. tax rules. Dividend Payments: During the scheduled vesting period, any dividends or dividend equivalents paid on unvested RSA or RSU shares will be paid through the transfer agent, Broadridge, and reflected in the earnings column under “R Stock Div” on your paycheck. Dividend or dividend equivalents paid on these shares are also considered ordinary income and are subject to the taxes described above. This ordinary income will appear on your Form W-2 wage and tax statement. Prior to the

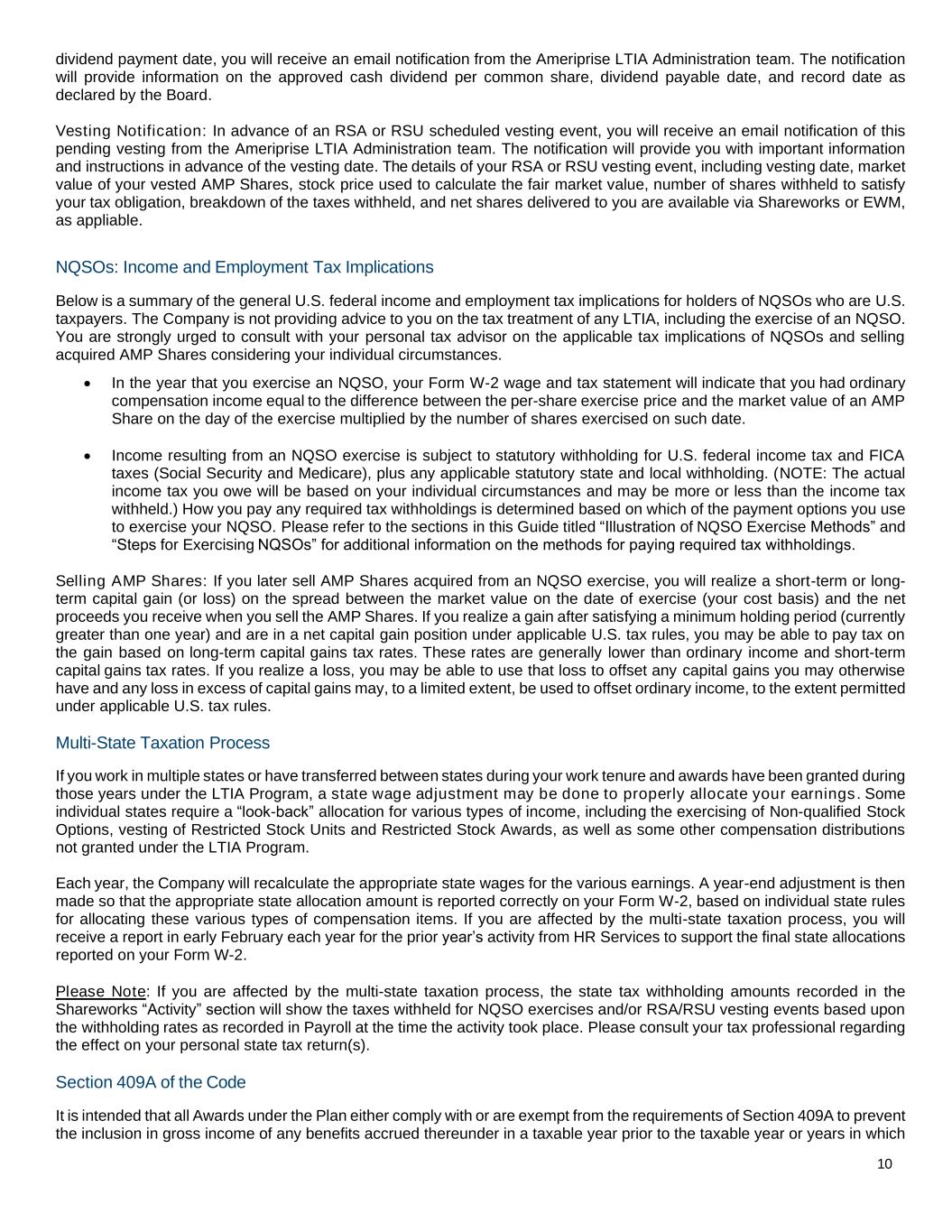

10 dividend payment date, you will receive an email notification from the Ameriprise LTIA Administration team. The notification will provide information on the approved cash dividend per common share, dividend payable date, and record date as declared by the Board. Vesting Notification: In advance of an RSA or RSU scheduled vesting event, you will receive an email notification of this pending vesting from the Ameriprise LTIA Administration team. The notification will provide you with important information and instructions in advance of the vesting date. The details of your RSA or RSU vesting event, including vesting date, market value of your vested AMP Shares, stock price used to calculate the fair market value, number of shares withheld to satisfy your tax obligation, breakdown of the taxes withheld, and net shares delivered to you are available via Shareworks or EWM, as appliable. NQSOs: Income and Employment Tax Implications Below is a summary of the general U.S. federal income and employment tax implications for holders of NQSOs who are U.S. taxpayers. The Company is not providing advice to you on the tax treatment of any LTIA, including the exercise of an NQSO. You are strongly urged to consult with your personal tax advisor on the applicable tax implications of NQSOs and selling acquired AMP Shares considering your individual circumstances. • In the year that you exercise an NQSO, your Form W-2 wage and tax statement will indicate that you had ordinary compensation income equal to the difference between the per-share exercise price and the market value of an AMP Share on the day of the exercise multiplied by the number of shares exercised on such date. • Income resulting from an NQSO exercise is subject to statutory withholding for U.S. federal income tax and FICA taxes (Social Security and Medicare), plus any applicable statutory state and local withholding. (NOTE: The actual income tax you owe will be based on your individual circumstances and may be more or less than the income tax withheld.) How you pay any required tax withholdings is determined based on which of the payment options you use to exercise your NQSO. Please refer to the sections in this Guide titled “Illustration of NQSO Exercise Methods” and “Steps for Exercising NQSOs” for additional information on the methods for paying required tax withholdings. Selling AMP Shares: If you later sell AMP Shares acquired from an NQSO exercise, you will realize a short-term or long- term capital gain (or loss) on the spread between the market value on the date of exercise (your cost basis) and the net proceeds you receive when you sell the AMP Shares. If you realize a gain after satisfying a minimum holding period (currently greater than one year) and are in a net capital gain position under applicable U.S. tax rules, you may be able to pay tax on the gain based on long-term capital gains tax rates. These rates are generally lower than ordinary income and short-term capital gains tax rates. If you realize a loss, you may be able to use that loss to offset any capital gains you may otherwise have and any loss in excess of capital gains may, to a limited extent, be used to offset ordinary income, to the extent permitted under applicable U.S. tax rules. Multi-State Taxation Process If you work in multiple states or have transferred between states during your work tenure and awards have been granted during those years under the LTIA Program, a state wage adjustment may be done to properly allocate your earnings. Some individual states require a “look-back” allocation for various types of income, including the exercising of Non-qualified Stock Options, vesting of Restricted Stock Units and Restricted Stock Awards, as well as some other compensation distributions not granted under the LTIA Program. Each year, the Company will recalculate the appropriate state wages for the various earnings. A year-end adjustment is then made so that the appropriate state allocation amount is reported correctly on your Form W-2, based on individual state rules for allocating these various types of compensation items. If you are affected by the multi-state taxation process, you will receive a report in early February each year for the prior year’s activity from HR Services to support the final state allocations reported on your Form W-2. Please Note: If you are affected by the multi-state taxation process, the state tax withholding amounts recorded in the Shareworks “Activity” section will show the taxes withheld for NQSO exercises and/or RSA/RSU vesting events based upon the withholding rates as recorded in Payroll at the time the activity took place. Please consult your tax professional regarding the effect on your personal state tax return(s). Section 409A of the Code It is intended that all Awards under the Plan either comply with or are exempt from the requirements of Section 409A to prevent the inclusion in gross income of any benefits accrued thereunder in a taxable year prior to the taxable year or years in which

11 such amount would otherwise be distributed or made available to the Participant. All Awards under the Plan shall be administered and interpreted in a manner that is consistent with such intention and the Company’s Policy Regarding Section 409A Compliance. Notwithstanding any other provision of this Guide to the contrary, to the extent that an Award constitutes nonqualified deferred compensation to which Section 409A applies: (1) payments under such Award shall be made at a time and in a manner that satisfies the requirements of Section 409A and guidance of general applicability issued thereunder, including the provisions of Section 409A(a)(2)(B) to the extent distributions to any employee are required to be delayed six months; (2) references to “termination of employment” and similar terms mean the date that the Participant first incurs a “separation from service” within the meaning of Section 409A; and (3) payment shall be made as soon as administratively practicable following the permissible payment event, but in no event later than the end of the year in which the permissible payment event occurs, or, if later, by the 15th day of the third month following the date of the permissible payment event (and the Participant will not be permitted, either directly or indirectly, to designate the year of payment). If any payment that would otherwise be made under an Award is required to be delayed by reason of this section, such payment shall be made at the earliest date permitted by Section 409A. The amount of any delayed payment shall be the amount that would have been paid prior to the delay and shall be paid without interest. Notwithstanding the foregoing, the Company makes no representation that Awards granted under the Plan comply with or qualify for an exemption from Section 409A and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by a Participant on account of noncompliance with Section 409A. Treatment of LTIAs upon Certain Events Existing practices regarding the treatment of outstanding RSAs, RSUs, and NQSOs under certain circumstances are described below. For the treatment of outstanding PSUs and PCUs, please refer to the PSU Supplement to this Guide or PCU Supplement to this Guide, as applicable. The Committee may amend the following practices for any or all outstanding and future LTIAs. For specific information about the treatment of your LTIAs, please see the applicable section of this Guide that describes the following specific events: • Part-time employment status • Leave of absence • Employment termination • Qualified Retirement • Death • Disability Termination • Transfer between business segments • Transfer from field eligible employee to franchise advisor • Rehire • Situations of Detrimental Conduct (Band 50 and above) • Compensation Recovery and Malus Policies • Change in Control of the Company Key Definitions Relating to Treatment upon Certain Events • “Disability” means a mental or physical condition which, in the opinion of the Committee, renders a Participant unable or incompetent to carry out the job responsibilities which such Participant held or tasks to which such Participant was assigned at the time the disability was incurred and which is expected to be permanent or for an indefinite period of not less than six months. With respect to any Award that constitutes deferred compensation under Code Section 409A and is subject to Code Section 409A, the Committee may not find that a Disability exists with respect to the applicable Participant unless, in the Committee’s opinion, such Participant is also “disabled” within the meaning of Code Section 409A. • “Last Day Worked” means the date on which a participant undergoes a “separation from service” from the Company (and its affiliates), as defined under Section 409A of the Code, and as determined in accordance with the Company’s Policy regarding Section 409A Compliance. Typically, this means that your Last Day Worked will be the same date as the date your employment with the Company terminates. However, if there is an extended period when you are no longer actively providing services to the Company prior to your date of termination of employment (e.g., any contractual non-working notice period, any period of “garden leave”, or any other extended non-working period), the Company shall have the exclusive discretion to determine that the date of your Last Date Worked is earlier than the date of termination of your employment. The Company will disregard short term absences due to sickness and PTO when determining your Last Day Worked. Your Last Day Worked will not be before the date you have served or been given notice to terminate your employment. If your Last Day Worked is earlier than your date of termination of

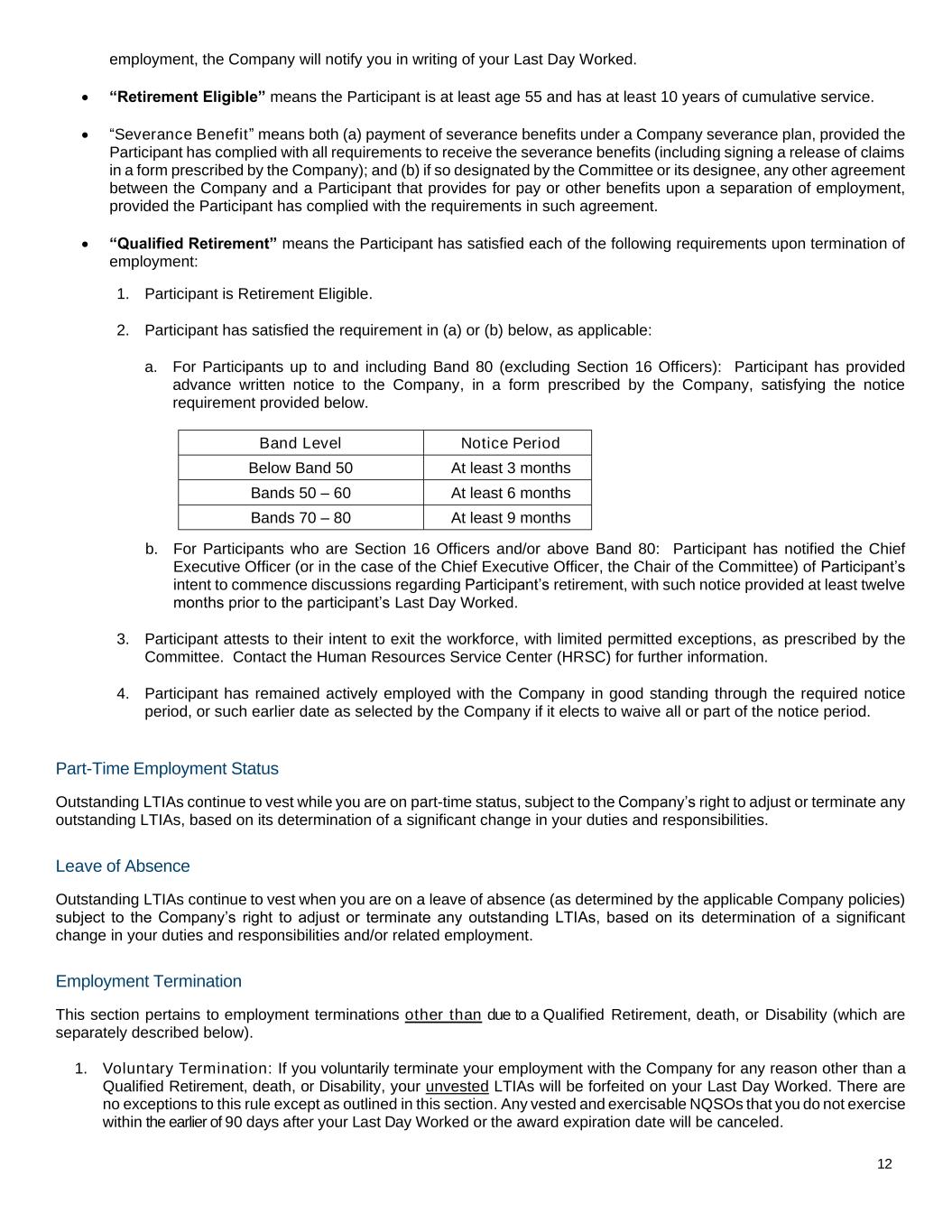

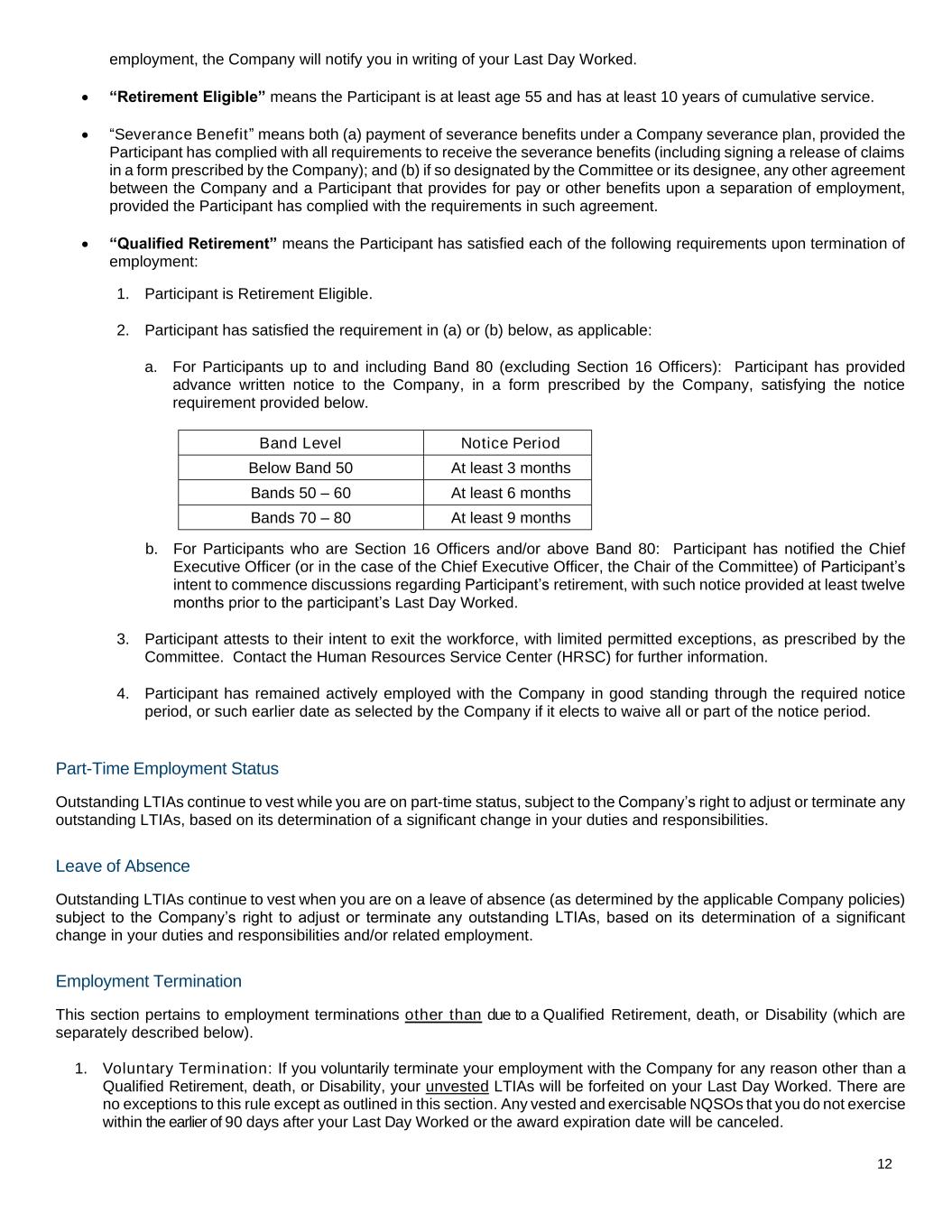

12 employment, the Company will notify you in writing of your Last Day Worked. • “Retirement Eligible” means the Participant is at least age 55 and has at least 10 years of cumulative service. • “Severance Benefit” means both (a) payment of severance benefits under a Company severance plan, provided the Participant has complied with all requirements to receive the severance benefits (including signing a release of claims in a form prescribed by the Company); and (b) if so designated by the Committee or its designee, any other agreement between the Company and a Participant that provides for pay or other benefits upon a separation of employment, provided the Participant has complied with the requirements in such agreement. • “Qualified Retirement” means the Participant has satisfied each of the following requirements upon termination of employment: 1. Participant is Retirement Eligible. 2. Participant has satisfied the requirement in (a) or (b) below, as applicable: a. For Participants up to and including Band 80 (excluding Section 16 Officers): Participant has provided advance written notice to the Company, in a form prescribed by the Company, satisfying the notice requirement provided below. Band Level Notice Period Below Band 50 At least 3 months Bands 50 – 60 At least 6 months Bands 70 – 80 At least 9 months b. For Participants who are Section 16 Officers and/or above Band 80: Participant has notified the Chief Executive Officer (or in the case of the Chief Executive Officer, the Chair of the Committee) of Participant’s intent to commence discussions regarding Participant’s retirement, with such notice provided at least twelve months prior to the participant’s Last Day Worked. 3. Participant attests to their intent to exit the workforce, with limited permitted exceptions, as prescribed by the Committee. Contact the Human Resources Service Center (HRSC) for further information. 4. Participant has remained actively employed with the Company in good standing through the required notice period, or such earlier date as selected by the Company if it elects to waive all or part of the notice period. Part-Time Employment Status Outstanding LTIAs continue to vest while you are on part-time status, subject to the Company’s right to adjust or terminate any outstanding LTIAs, based on its determination of a significant change in your duties and responsibilities. Leave of Absence Outstanding LTIAs continue to vest when you are on a leave of absence (as determined by the applicable Company policies) subject to the Company’s right to adjust or terminate any outstanding LTIAs, based on its determination of a significant change in your duties and responsibilities and/or related employment. Employment Termination This section pertains to employment terminations other than due to a Qualified Retirement, death, or Disability (which are separately described below). 1. Voluntary Termination: If you voluntarily terminate your employment with the Company for any reason other than a Qualified Retirement, death, or Disability, your unvested LTIAs will be forfeited on your Last Day Worked. There are no exceptions to this rule except as outlined in this section. Any vested and exercisable NQSOs that you do not exercise within the earlier of 90 days after your Last Day Worked or the award expiration date will be canceled.

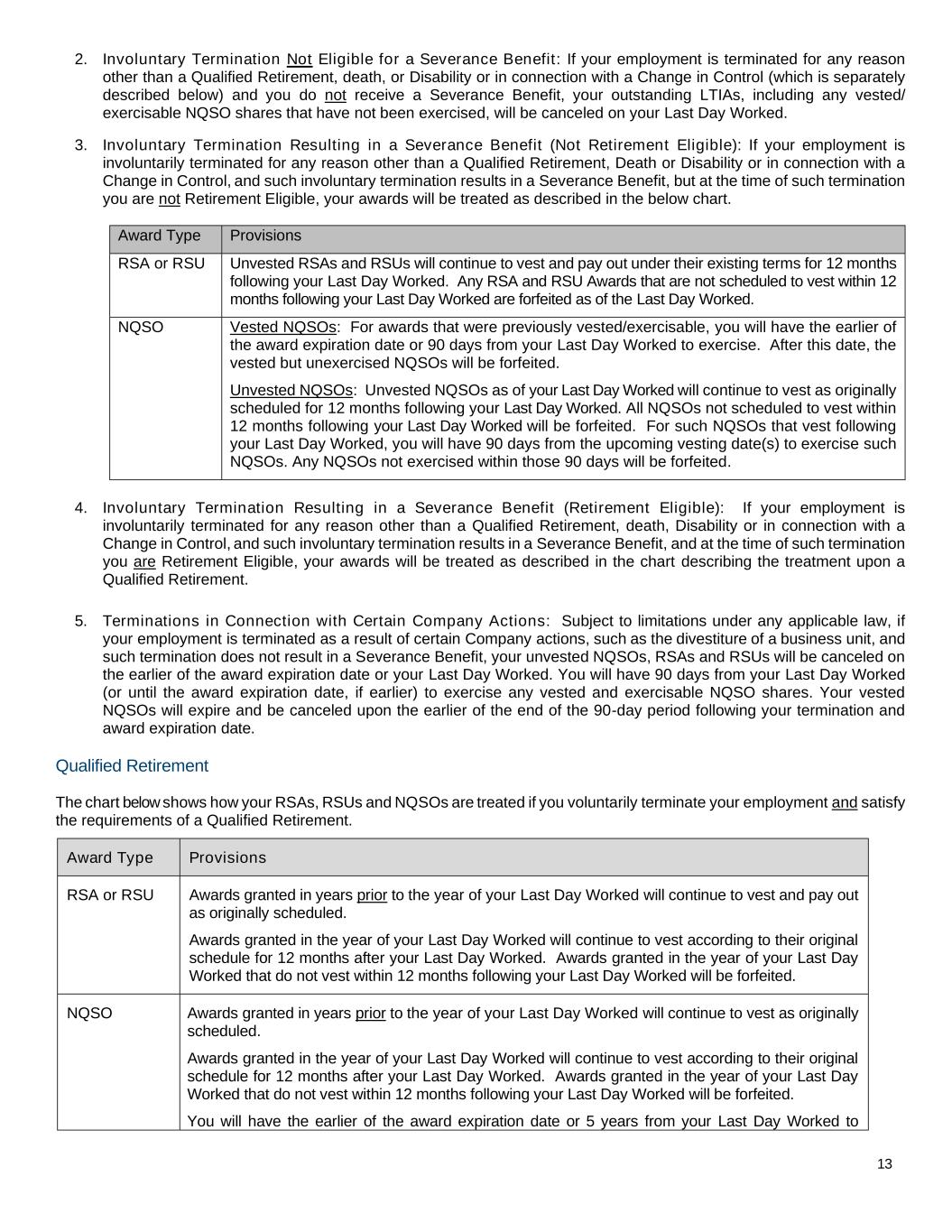

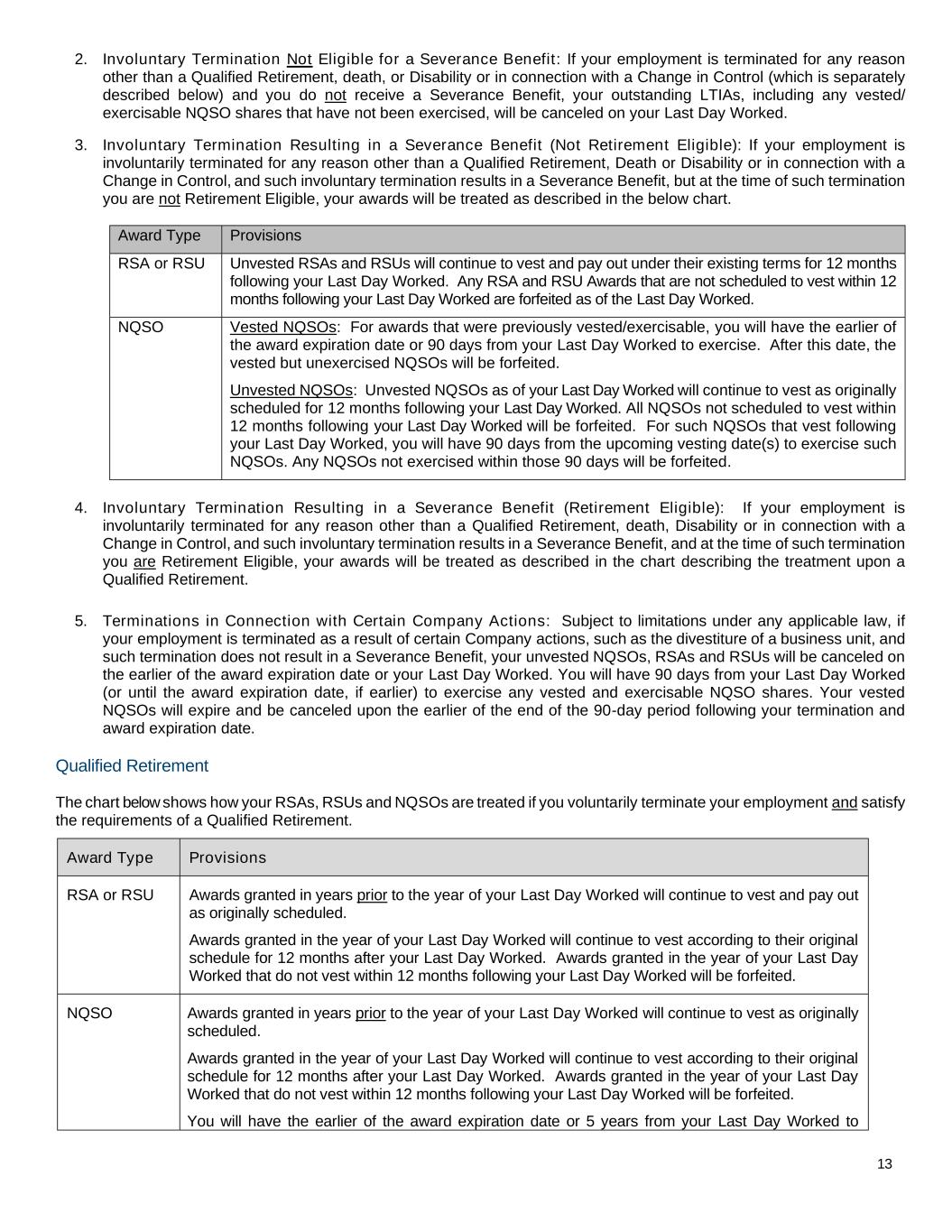

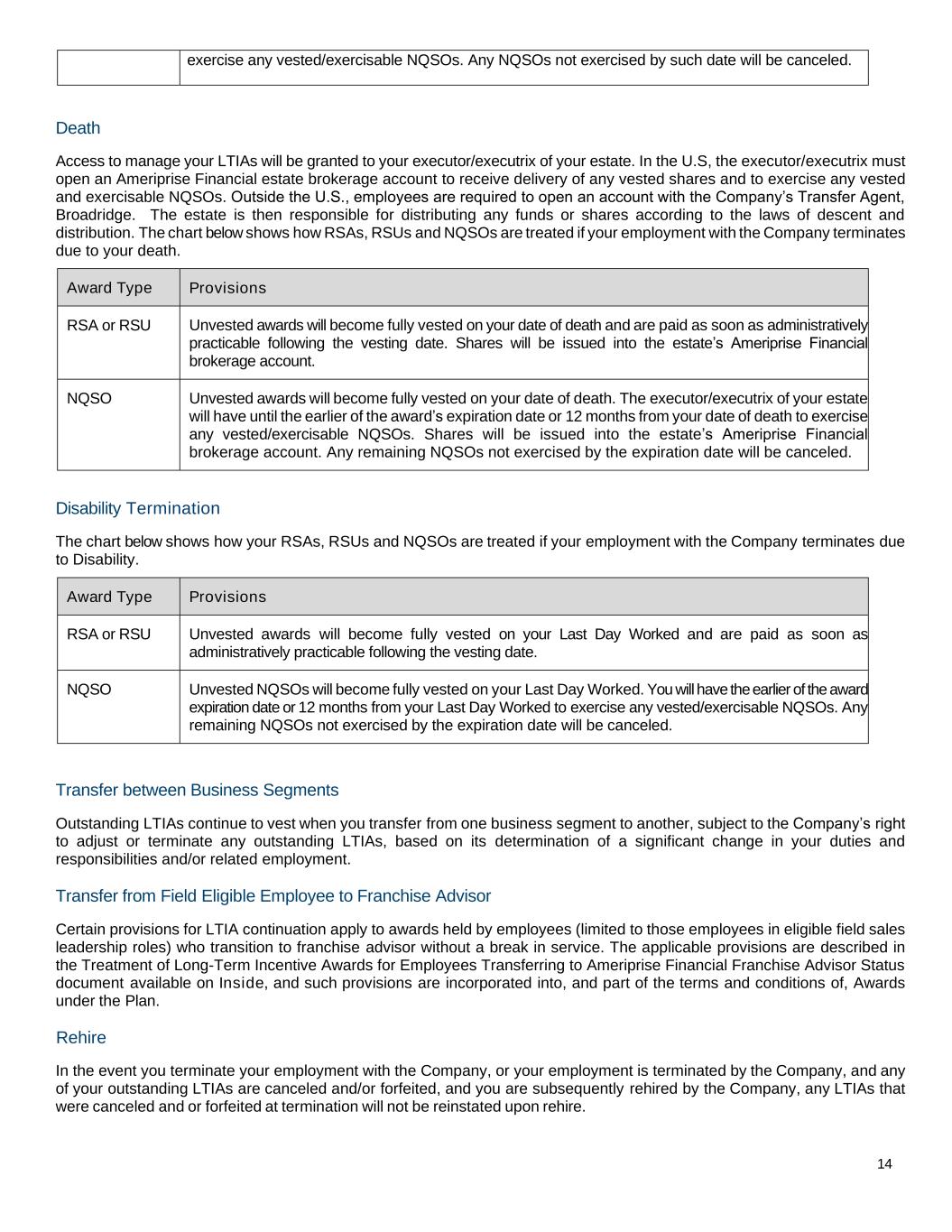

13 2. Involuntary Termination Not Eligible for a Severance Benefit: If your employment is terminated for any reason other than a Qualified Retirement, death, or Disability or in connection with a Change in Control (which is separately described below) and you do not receive a Severance Benefit, your outstanding LTIAs, including any vested/ exercisable NQSO shares that have not been exercised, will be canceled on your Last Day Worked. 3. Involuntary Termination Resulting in a Severance Benefit (Not Retirement Eligible): If your employment is involuntarily terminated for any reason other than a Qualified Retirement, Death or Disability or in connection with a Change in Control, and such involuntary termination results in a Severance Benefit, but at the time of such termination you are not Retirement Eligible, your awards will be treated as described in the below chart. Award Type Provisions RSA or RSU Unvested RSAs and RSUs will continue to vest and pay out under their existing terms for 12 months following your Last Day Worked. Any RSA and RSU Awards that are not scheduled to vest within 12 months following your Last Day Worked are forfeited as of the Last Day Worked. NQSO Vested NQSOs: For awards that were previously vested/exercisable, you will have the earlier of the award expiration date or 90 days from your Last Day Worked to exercise. After this date, the vested but unexercised NQSOs will be forfeited. Unvested NQSOs: Unvested NQSOs as of your Last Day Worked will continue to vest as originally scheduled for 12 months following your Last Day Worked. All NQSOs not scheduled to vest within 12 months following your Last Day Worked will be forfeited. For such NQSOs that vest following your Last Day Worked, you will have 90 days from the upcoming vesting date(s) to exercise such NQSOs. Any NQSOs not exercised within those 90 days will be forfeited. 4. Involuntary Termination Resulting in a Severance Benefit (Retirement Eligible): If your employment is involuntarily terminated for any reason other than a Qualified Retirement, death, Disability or in connection with a Change in Control, and such involuntary termination results in a Severance Benefit, and at the time of such termination you are Retirement Eligible, your awards will be treated as described in the chart describing the treatment upon a Qualified Retirement. 5. Terminations in Connection with Certain Company Actions: Subject to limitations under any applicable law, if your employment is terminated as a result of certain Company actions, such as the divestiture of a business unit, and such termination does not result in a Severance Benefit, your unvested NQSOs, RSAs and RSUs will be canceled on the earlier of the award expiration date or your Last Day Worked. You will have 90 days from your Last Day Worked (or until the award expiration date, if earlier) to exercise any vested and exercisable NQSO shares. Your vested NQSOs will expire and be canceled upon the earlier of the end of the 90-day period following your termination and award expiration date. Qualified Retirement The chart below shows how your RSAs, RSUs and NQSOs are treated if you voluntarily terminate your employment and satisfy the requirements of a Qualified Retirement. Award Type Provisions RSA or RSU Awards granted in years prior to the year of your Last Day Worked will continue to vest and pay out as originally scheduled. Awards granted in the year of your Last Day Worked will continue to vest according to their original schedule for 12 months after your Last Day Worked. Awards granted in the year of your Last Day Worked that do not vest within 12 months following your Last Day Worked will be forfeited. NQSO Awards granted in years prior to the year of your Last Day Worked will continue to vest as originally scheduled. Awards granted in the year of your Last Day Worked will continue to vest according to their original schedule for 12 months after your Last Day Worked. Awards granted in the year of your Last Day Worked that do not vest within 12 months following your Last Day Worked will be forfeited. You will have the earlier of the award expiration date or 5 years from your Last Day Worked to

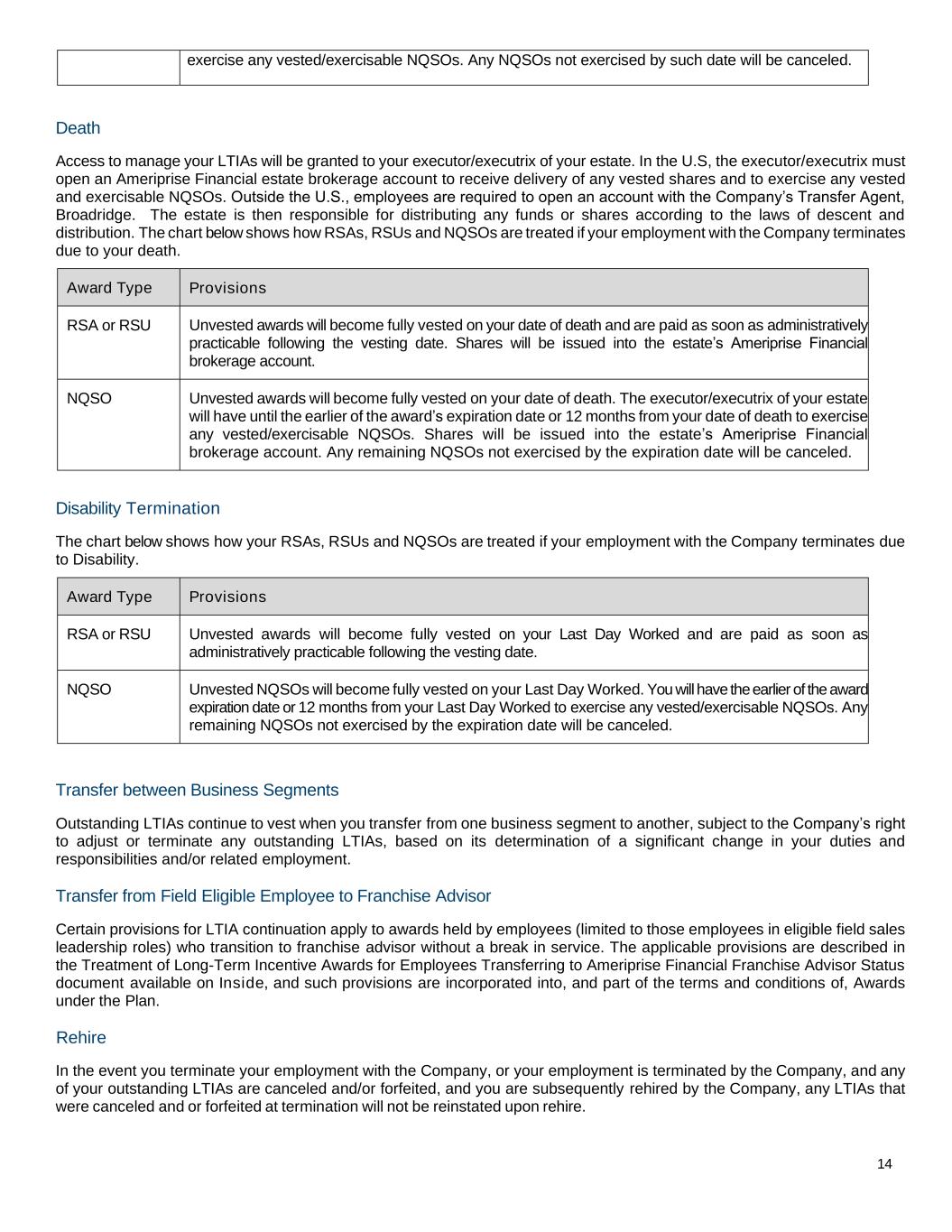

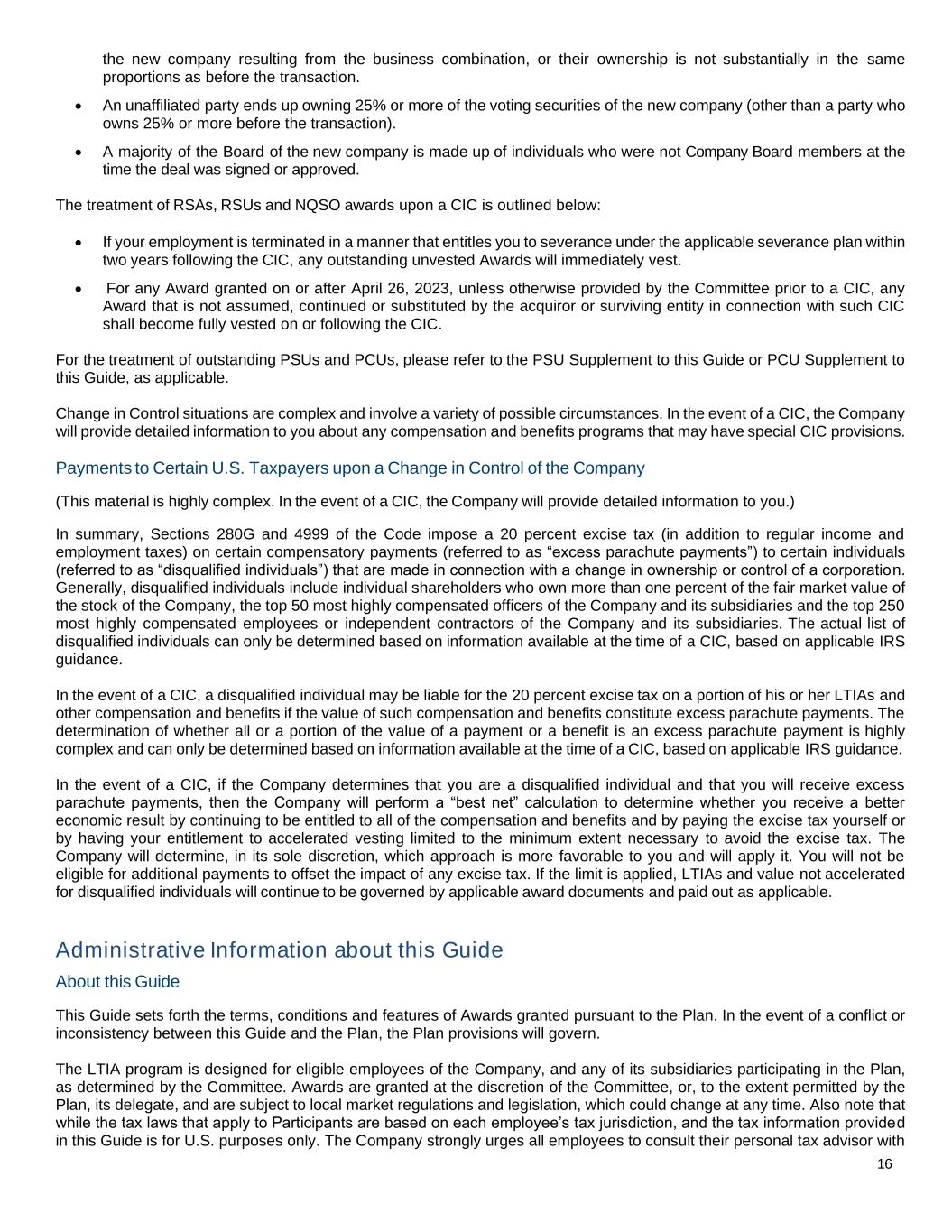

14 exercise any vested/exercisable NQSOs. Any NQSOs not exercised by such date will be canceled. Death Access to manage your LTIAs will be granted to your executor/executrix of your estate. In the U.S, the executor/executrix must open an Ameriprise Financial estate brokerage account to receive delivery of any vested shares and to exercise any vested and exercisable NQSOs. Outside the U.S., employees are required to open an account with the Company’s Transfer Agent, Broadridge. The estate is then responsible for distributing any funds or shares according to the laws of descent and distribution. The chart below shows how RSAs, RSUs and NQSOs are treated if your employment with the Company terminates due to your death. Award Type Provisions RSA or RSU Unvested awards will become fully vested on your date of death and are paid as soon as administratively practicable following the vesting date. Shares will be issued into the estate’s Ameriprise Financial brokerage account. NQSO Unvested awards will become fully vested on your date of death. The executor/executrix of your estate will have until the earlier of the award’s expiration date or 12 months from your date of death to exercise any vested/exercisable NQSOs. Shares will be issued into the estate’s Ameriprise Financial brokerage account. Any remaining NQSOs not exercised by the expiration date will be canceled. Disability Termination The chart below shows how your RSAs, RSUs and NQSOs are treated if your employment with the Company terminates due to Disability. Award Type Provisions RSA or RSU Unvested awards will become fully vested on your Last Day Worked and are paid as soon as administratively practicable following the vesting date. NQSO Unvested NQSOs will become fully vested on your Last Day Worked. You will have the earlier of the award expiration date or 12 months from your Last Day Worked to exercise any vested/exercisable NQSOs. Any remaining NQSOs not exercised by the expiration date will be canceled. Transfer between Business Segments Outstanding LTIAs continue to vest when you transfer from one business segment to another, subject to the Company’s right to adjust or terminate any outstanding LTIAs, based on its determination of a significant change in your duties and responsibilities and/or related employment. Transfer from Field Eligible Employee to Franchise Advisor Certain provisions for LTIA continuation apply to awards held by employees (limited to those employees in eligible field sales leadership roles) who transition to franchise advisor without a break in service. The applicable provisions are described in the Treatment of Long-Term Incentive Awards for Employees Transferring to Ameriprise Financial Franchise Advisor Status document available on Inside, and such provisions are incorporated into, and part of the terms and conditions of, Awards under the Plan. Rehire In the event you terminate your employment with the Company, or your employment is terminated by the Company, and any of your outstanding LTIAs are canceled and/or forfeited, and you are subsequently rehired by the Company, any LTIAs that were canceled and or forfeited at termination will not be reinstated upon rehire.

15 Situations of Detrimental Conduct (Bands 50 and above) (U.S. only) To protect the interests of the Company and all employees, the Company has implemented Detrimental Conduct Provisions, affecting Plan Participants in Bands 50 and above. These provisions support the multi-year performance objectives of LTIAs, and such provisions are incorporated into, and part of the terms and conditions of, Awards under the Plan. Detrimental Conduct Provisions specify how LTIAs and LTIA payments will be handled in the event a Band 50 or above employee joins a defined competitor (“Competition”), leaves and solicits business customers, solicits or hires Ameriprise Financial employees, discloses confidential information or trade secrets, denigrates the Company or Company employees or otherwise engages in conduct that is against the Company’s interests during certain time periods, in each case, as defined by the Company (each, a “Restricted Activity”). For Bands 50 and 60 Participants: Competition during employment or the six-month period after termination of employment or engaging in any Restricted Activity during the twelve-month period after termination of employment results in the cancellation of all outstanding Awards and repayment of any gain realized upon the exercise of NQSOs (as of the exercise date), any payments made or shares delivered under PSUs or PCUs and any shares delivered under RSAs and RSUs, in each case, during the twelve months prior to, and the 90 days following, your termination of employment. For Bands 70 and above Participants: Competition during employment or the twelve-month period after termination of employment or engaging in any Restricted Activity during the twelve-month period after termination of employment results in the cancellation of all outstanding Awards and repayment of any gain realized upon the exercise of NQSOs (as of the exercise date), any payments made or shares delivered under PSUs or PCUs and any shares delivered under RSAs and RSUs, in each case, during the two years prior to, and the 90 days following, your termination of employment. Please note: This is a summary of the Detrimental Conduct Provisions that apply to LTIAs generally. Please review the Consent to the Application of Forfeiture and Detrimental Conduct Provisions to Long-Term Incentive Awards and/or any other restrictive covenant agreements between you and the Company or any of its subsidiaries for the specific detrimental conduct provisions and/or restrictive covenants that apply to your Awards. Compensation Recovery and Malus Policies In certain circumstances, the Company may clawback or apply malus to certain awards, as provided by Company policies or applicable regulations, including pursuant to the following: • The Ameriprise Financial, Inc. Policy for the Recovery of Erroneously Awarded Compensation, effective as of Oct. 2, 2023 (applicable to Section 16 Officers) • Ameriprise Financial, Inc. Incentive Compensation Recoupment Policy, as amended and restated as of Dec. 4, 2019 (applicable to ELT members) • The Columbia Threadneedle Investments, EMEA Remuneration Policy Please review the terms of these policies, copies of which can be obtained from the LTIA Administration Group, for more information. Change in Control of the Company The Plan’s provisions regarding a Change in Control of the Company (a “CIC”) have been designed to preserve earned or anticipated compensation and benefits if a CIC were to occur. The goal of the Plan’s CIC provisions is to help you maintain your focus on your work during the uncertainty that accompanies a potential CIC. Generally, as the term is used in this Guide, a CIC includes the following: 1. A third party acquires 25% or more of the Company’s common shares or voting securities. 2. A majority of the Company’s Board is replaced within any 12-month period. 3. The consummation of certain mergers, reorganizations, consolidations, and sales of assets. 4. The consummation of a complete liquidation or dissolution of the Company. If a merger or other business combination transaction between the Company and another party occurs, a CIC will occur if any of the following conditions are present: • Parties who were Ameriprise Financial shareholders before the transaction own 50% or less of the voting securities of

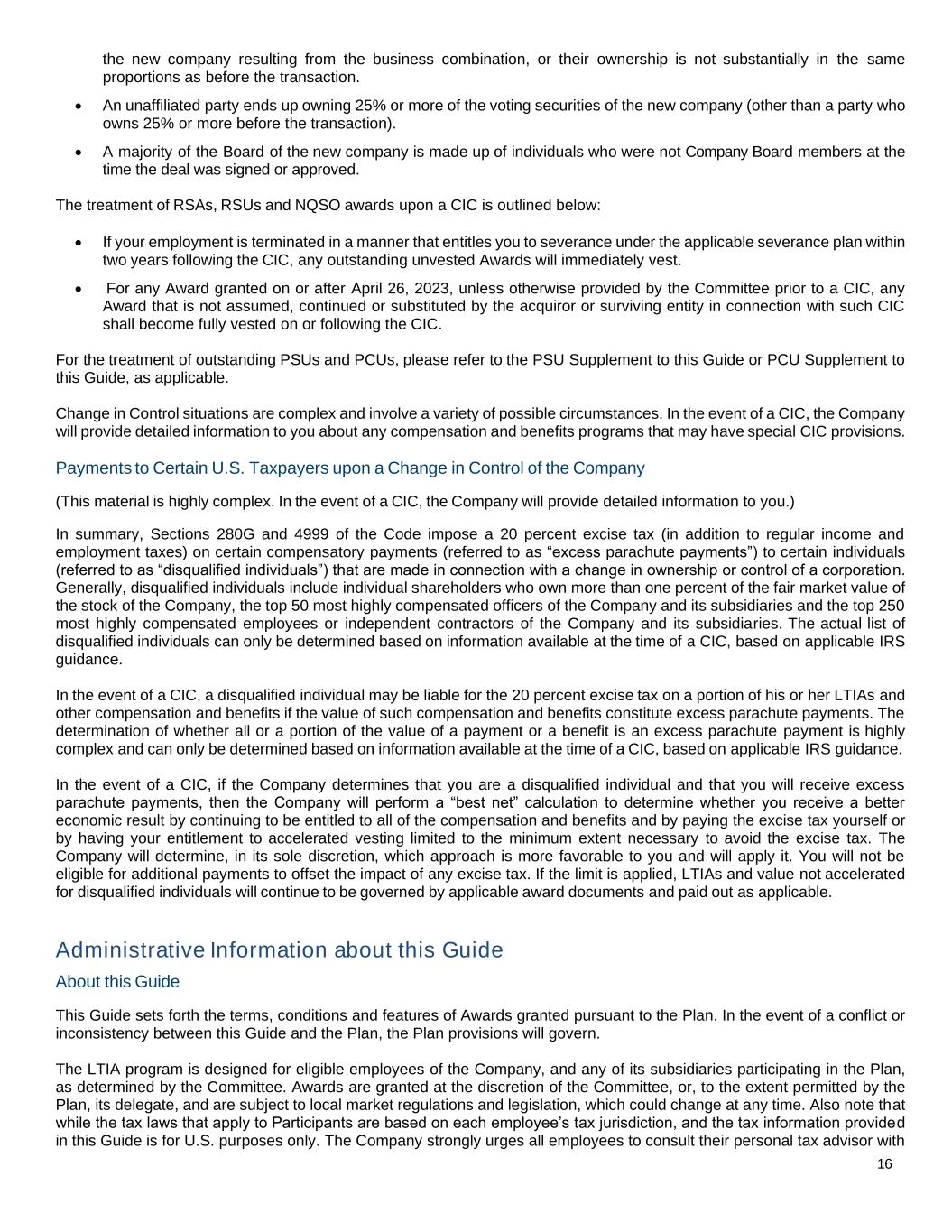

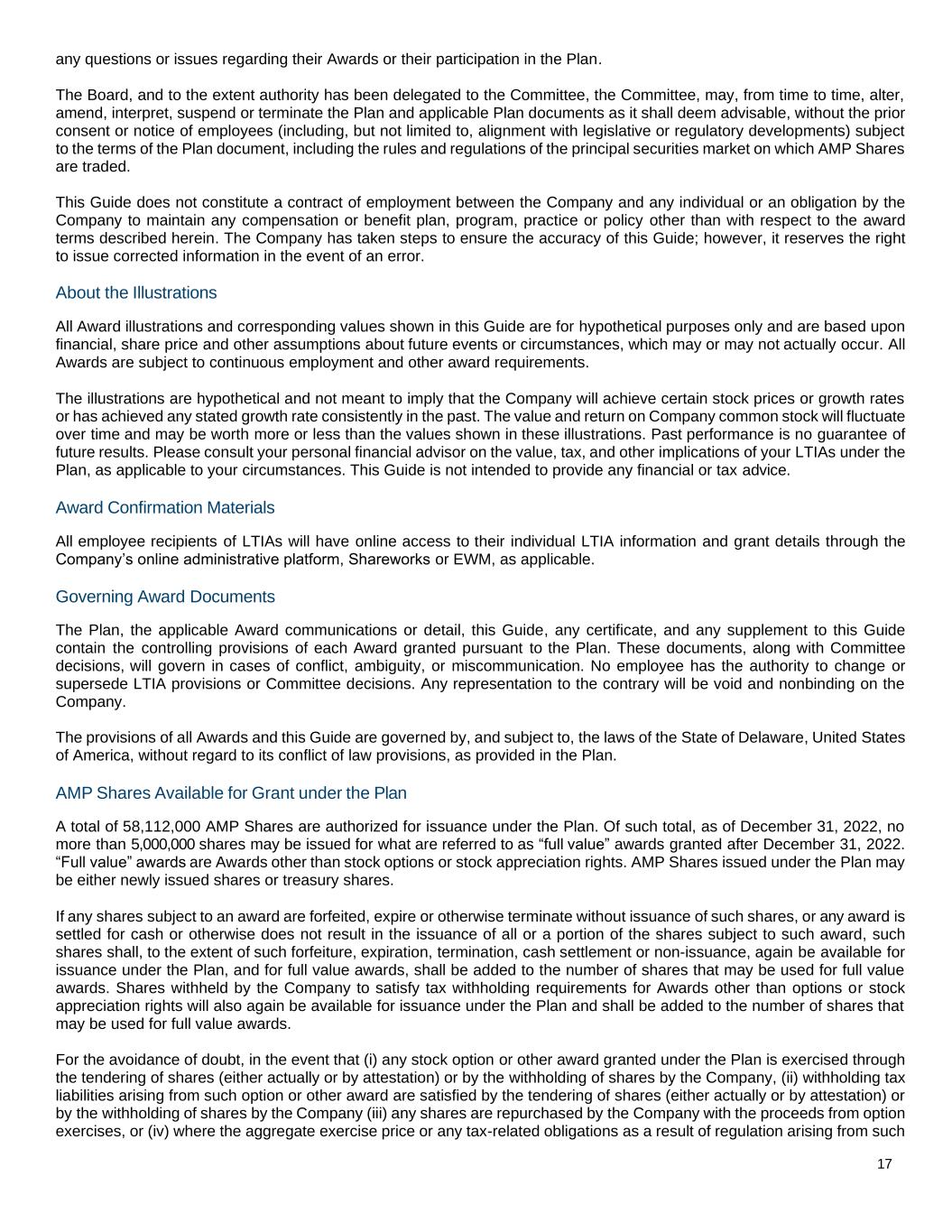

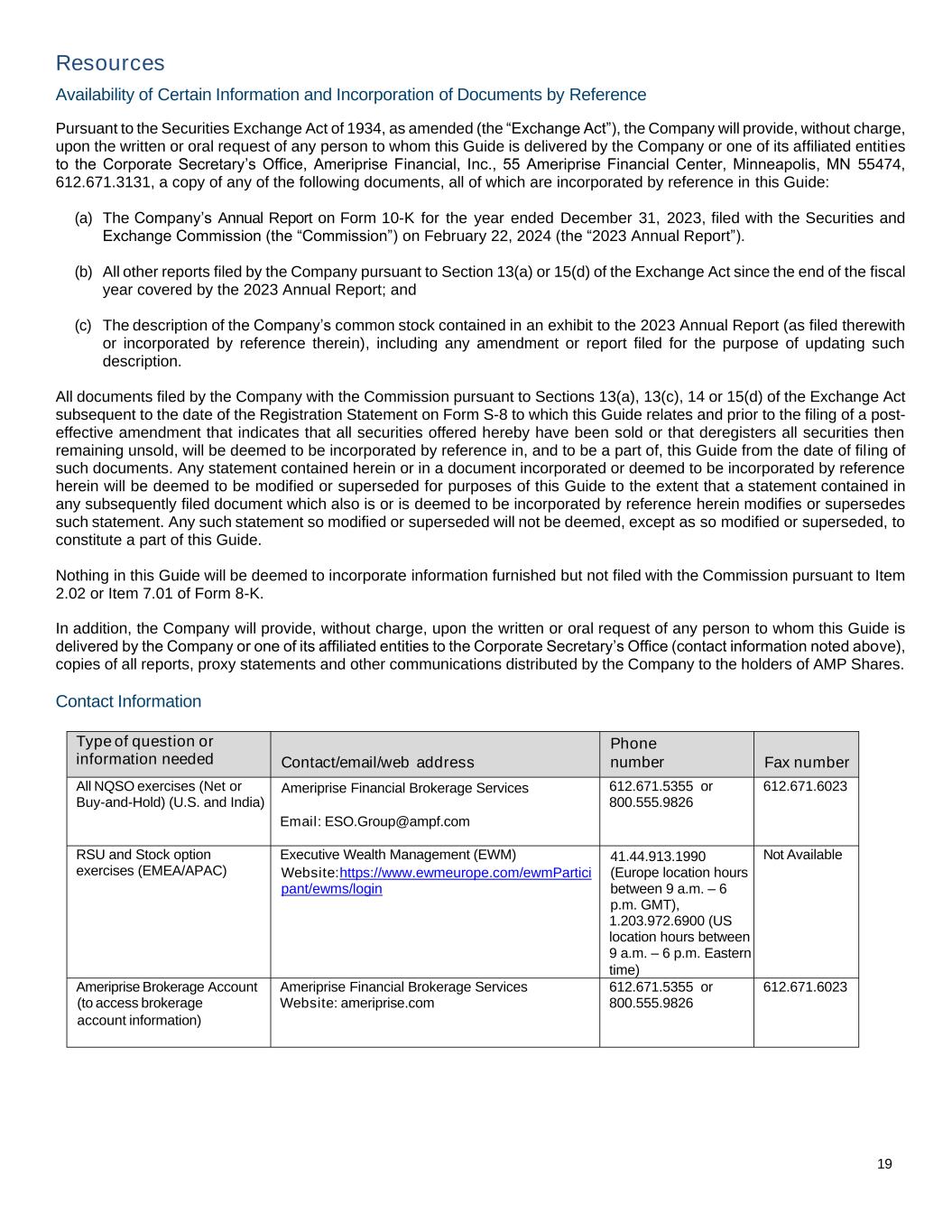

16 the new company resulting from the business combination, or their ownership is not substantially in the same proportions as before the transaction. • An unaffiliated party ends up owning 25% or more of the voting securities of the new company (other than a party who owns 25% or more before the transaction). • A majority of the Board of the new company is made up of individuals who were not Company Board members at the time the deal was signed or approved. The treatment of RSAs, RSUs and NQSO awards upon a CIC is outlined below: • If your employment is terminated in a manner that entitles you to severance under the applicable severance plan within two years following the CIC, any outstanding unvested Awards will immediately vest. • For any Award granted on or after April 26, 2023, unless otherwise provided by the Committee prior to a CIC, any Award that is not assumed, continued or substituted by the acquiror or surviving entity in connection with such CIC shall become fully vested on or following the CIC. For the treatment of outstanding PSUs and PCUs, please refer to the PSU Supplement to this Guide or PCU Supplement to this Guide, as applicable. Change in Control situations are complex and involve a variety of possible circumstances. In the event of a CIC, the Company will provide detailed information to you about any compensation and benefits programs that may have special CIC provisions. Payments to Certain U.S. Taxpayers upon a Change in Control of the Company (This material is highly complex. In the event of a CIC, the Company will provide detailed information to you.) In summary, Sections 280G and 4999 of the Code impose a 20 percent excise tax (in addition to regular income and employment taxes) on certain compensatory payments (referred to as “excess parachute payments”) to certain individuals (referred to as “disqualified individuals”) that are made in connection with a change in ownership or control of a corporation. Generally, disqualified individuals include individual shareholders who own more than one percent of the fair market value of the stock of the Company, the top 50 most highly compensated officers of the Company and its subsidiaries and the top 250 most highly compensated employees or independent contractors of the Company and its subsidiaries. The actual list of disqualified individuals can only be determined based on information available at the time of a CIC, based on applicable IRS guidance. In the event of a CIC, a disqualified individual may be liable for the 20 percent excise tax on a portion of his or her LTIAs and other compensation and benefits if the value of such compensation and benefits constitute excess parachute payments. The determination of whether all or a portion of the value of a payment or a benefit is an excess parachute payment is highly complex and can only be determined based on information available at the time of a CIC, based on applicable IRS guidance. In the event of a CIC, if the Company determines that you are a disqualified individual and that you will receive excess parachute payments, then the Company will perform a “best net” calculation to determine whether you receive a better economic result by continuing to be entitled to all of the compensation and benefits and by paying the excise tax yourself or by having your entitlement to accelerated vesting limited to the minimum extent necessary to avoid the excise tax. The Company will determine, in its sole discretion, which approach is more favorable to you and will apply it. You will not be eligible for additional payments to offset the impact of any excise tax. If the limit is applied, LTIAs and value not accelerated for disqualified individuals will continue to be governed by applicable award documents and paid out as applicable. Administrative Information about this Guide About this Guide This Guide sets forth the terms, conditions and features of Awards granted pursuant to the Plan. In the event of a conflict or inconsistency between this Guide and the Plan, the Plan provisions will govern. The LTIA program is designed for eligible employees of the Company, and any of its subsidiaries participating in the Plan, as determined by the Committee. Awards are granted at the discretion of the Committee, or, to the extent permitted by the Plan, its delegate, and are subject to local market regulations and legislation, which could change at any time. Also note that while the tax laws that apply to Participants are based on each employee’s tax jurisdiction, and the tax information provided in this Guide is for U.S. purposes only. The Company strongly urges all employees to consult their personal tax advisor with