1 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Threadneedle Deferral Plan 2024 Deferred Stock Unit and Deferred Stock Option Programme Guide IMPORTANT: 2024 Threadneedle Deferral Plan Deferred Stock Unit and Deferred Stock Option Programme Guide Coverage This Guide covers both (1) outstanding Awards granted prior to January 1, 2025, and (2) Awards granted on or after January 1, 2025. By accepting an award granted on or after January 1, 2025, you are consenting to the terms of this Guide applying to outstanding Awards granted prior to January 1, 2025. Exhibit 10.27

2 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Introduction Programmes Overview The Deferred Stock Unit and Deferred Stock Option Award Programmes (the “Programmes”), components of the Threadneedle Deferral Plan, are designed to align participants’ interests with those of the shareholders of Ameriprise Financial, Inc. (“Company”). By providing a stake in the Company’s future success, the incentive awards provided under the Programmes are considered essential in our efforts to attract and retain talented employees of Columbia Threadneedle Investments based in Europe, the Middle East and Asia Pacific (“Columbia Threadneedle”). This Deferred Stock Unit and Deferred Stock Option Programme Guide (the “Guide”) provides information about the Deferred Stock Unit and Deferred Stock Option Awards. This Guide does not cover the specific features of other awards that may be granted under the Threadneedle Deferral Plan, which may have terms that are different than those described in this Guide. Eligibility This Guide is only applicable to Columbia Threadneedle employees based in the EMEA and APAC regions. Governing Award Documents Awards of Deferred Stock Options and Deferred Stock Units (“Awards”) are issued pursuant to the terms of the Ameriprise Financial 2005 Incentive Compensation Plan, as amended and restated (the “Ameriprise 2005 Incentive Compensation Plan”), subject to the Threadneedle Deferral Plan and administration by the Columbia Threadneedle EMEA Remuneration Committee (“Committee”). All Awards are recommended for approval by the Company’s Compensation and Benefits Committee (“CBC”) or its duly authorized delegate. Awards issued under these Programmes shall contain the general terms set forth in this Guide. The specific terms of individual Awards will be contained in the Award Certificate(s) delivered to participants in the Programmes (“Participants”). All Awards are subject to the terms and conditions of the Ameriprise 2005 Incentive Compensation Plan, the Award Certificate(s), the Threadneedle Deferral Plan, this Guide and any administrative guidelines or interpretations by the CBC or the Committee and any such guidelines or interpretations are incorporated into this Guide by reference and made a part of this Guide. These documents, along with CBC and Committee decisions, will govern in cases of conflict, ambiguity or miscommunication. No employee has the authority to change or supersede the Programme provisions or CBC or Committee decisions. Any representation to the contrary will be void and non-binding on the Company. Deferred Stock Units Programme A Deferred Stock Unit represents the Company’s intent to provide a specified number of Company shares upon vesting over a three-year period. Your account is not funded, and you do not have voting rights for the shares promised under the Deferred Stock Units (or additional Deferred Stock Units from dividend equivalents) until the actual Company shares are distributed to you. As used in this Guide, the term “shares” refers to the shares of the Company having a par value of $.01 per share, or the shares of any other stock of any other class into which such shares may thereafter be changed.

3 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Dividends and Dividend Equivalents Dividend equivalents will be credited as additional Deferred Stock Units as dividends are declared by the Company’s Board of Directors (usually quarterly). Vesting Schedule Generally, Deferred Stock Units will vest in equal annual installments over a three-year period, or such other vesting schedule as specified at the time of grant. Payments Upon vesting of Deferred Stock Units (including any additional Deferred Stock Units from dividend equivalents), you will receive the number of Company shares from the Deferred Stock Units that have vested. Tax obligations (such as tax withholding and other tax-related items) due on the market value of these Company shares will depend on the regulations in your country of residence. Where your employer has obligations to account for tax on your behalf under relevant regulations, the Company will instruct Broadridge to sell to the Company, on your behalf, such number of your Company shares acquired on vesting as is considered appropriate in order to generate sufficient sale proceeds to comply with applicable tax obligations. Following this sale, your Broadridge account will reflect the remaining number of vested shares after having settled such applicable tax-related obligations (“DSU Sell-to-Cover Methodology”). Deferred Stock Options Programme A Deferred Stock Option gives you the right to purchase a specified number of Company shares at the exercise price set forth in your Award materials, subject to continuous employment and vesting requirements. The exercise price is equal to the closing price of a Company share as reported on the New York Stock Exchange composite tape on the grant date. Once a Deferred Stock Option becomes vested, you determine when to exercise the Deferred Stock Option (before its expiration, which is generally 10 years from the grant date, or earlier upon the occurrence of certain events) (please see the “Treatment of Deferred Stock Options and Deferred Stock Units Upon Certain Events” section of this Guide). Valuing Deferred Stock Options Deferred Stock Options earn value when the Company’s share price increases above the exercise price. Once a Deferred Stock Option becomes vested, you have the right to exercise the Deferred Stock Option. Example: assume that 500 vested Deferred Stock Options were granted at the exercise price of $50 per share and the Company’s share price increases to $100. A: Market value of exercised option ($100 * 500) = $50,000 B: Pre-tax value realized = $25,000 (($100 - $50 = $50) x 500 = $25,000). (See the “About the Illustrations” section in this Guide for an important disclosure.) Vesting Generally, Deferred Stock Options will vest and become exercisable in equal annual installments over a three-year period, or another vesting schedule as specified and are subject to continued employment and award requirements.

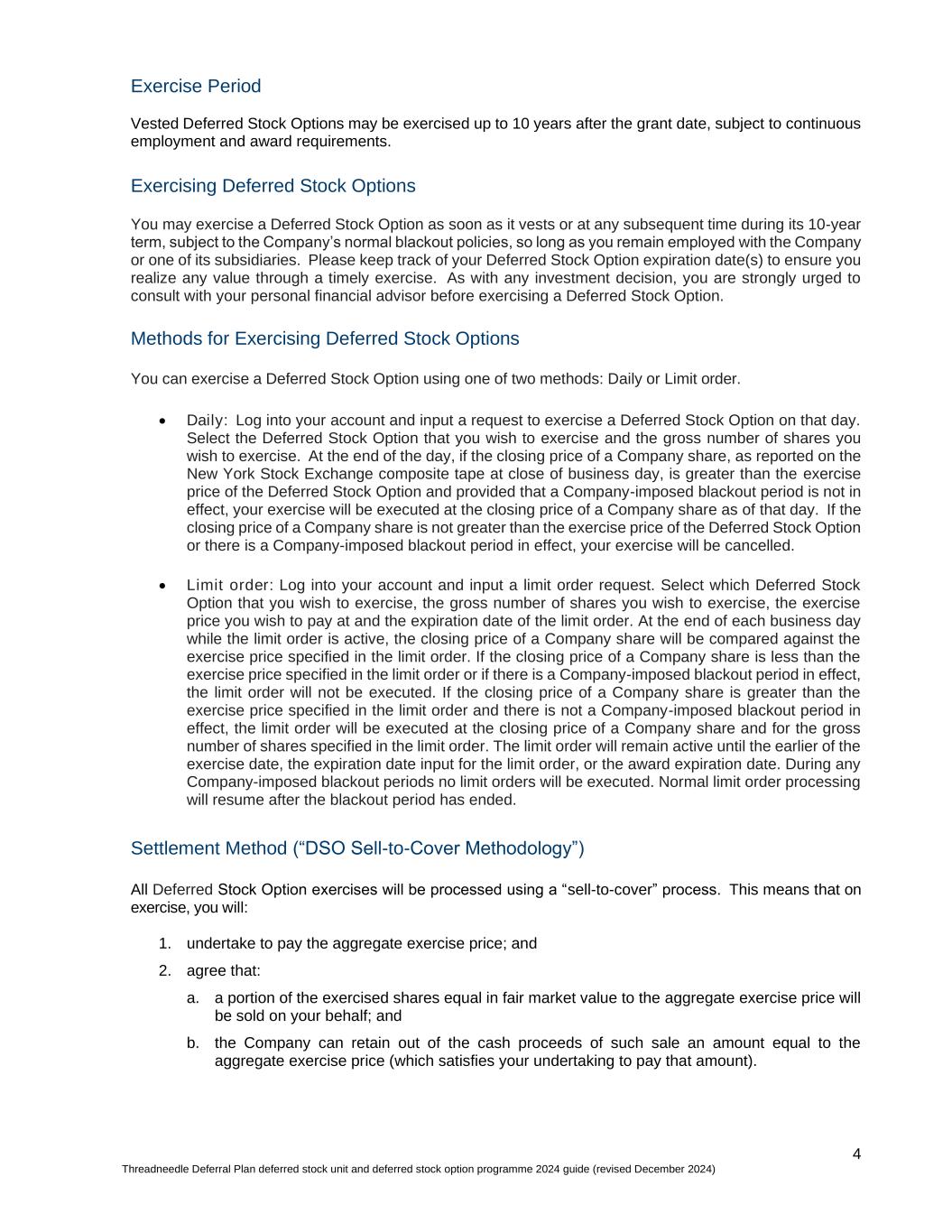

4 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Exercise Period Vested Deferred Stock Options may be exercised up to 10 years after the grant date, subject to continuous employment and award requirements. Exercising Deferred Stock Options You may exercise a Deferred Stock Option as soon as it vests or at any subsequent time during its 10-year term, subject to the Company’s normal blackout policies, so long as you remain employed with the Company or one of its subsidiaries. Please keep track of your Deferred Stock Option expiration date(s) to ensure you realize any value through a timely exercise. As with any investment decision, you are strongly urged to consult with your personal financial advisor before exercising a Deferred Stock Option. Methods for Exercising Deferred Stock Options You can exercise a Deferred Stock Option using one of two methods: Daily or Limit order. • Daily: Log into your account and input a request to exercise a Deferred Stock Option on that day. Select the Deferred Stock Option that you wish to exercise and the gross number of shares you wish to exercise. At the end of the day, if the closing price of a Company share, as reported on the New York Stock Exchange composite tape at close of business day, is greater than the exercise price of the Deferred Stock Option and provided that a Company-imposed blackout period is not in effect, your exercise will be executed at the closing price of a Company share as of that day. If the closing price of a Company share is not greater than the exercise price of the Deferred Stock Option or there is a Company-imposed blackout period in effect, your exercise will be cancelled. • Limit order: Log into your account and input a limit order request. Select which Deferred Stock Option that you wish to exercise, the gross number of shares you wish to exercise, the exercise price you wish to pay at and the expiration date of the limit order. At the end of each business day while the limit order is active, the closing price of a Company share will be compared against the exercise price specified in the limit order. If the closing price of a Company share is less than the exercise price specified in the limit order or if there is a Company-imposed blackout period in effect, the limit order will not be executed. If the closing price of a Company share is greater than the exercise price specified in the limit order and there is not a Company-imposed blackout period in effect, the limit order will be executed at the closing price of a Company share and for the gross number of shares specified in the limit order. The limit order will remain active until the earlier of the exercise date, the expiration date input for the limit order, or the award expiration date. During any Company-imposed blackout periods no limit orders will be executed. Normal limit order processing will resume after the blackout period has ended. Settlement Method (“DSO Sell-to-Cover Methodology”) All Deferred Stock Option exercises will be processed using a “sell-to-cover” process. This means that on exercise, you will: 1. undertake to pay the aggregate exercise price; and 2. agree that: a. a portion of the exercised shares equal in fair market value to the aggregate exercise price will be sold on your behalf; and b. the Company can retain out of the cash proceeds of such sale an amount equal to the aggregate exercise price (which satisfies your undertaking to pay that amount).

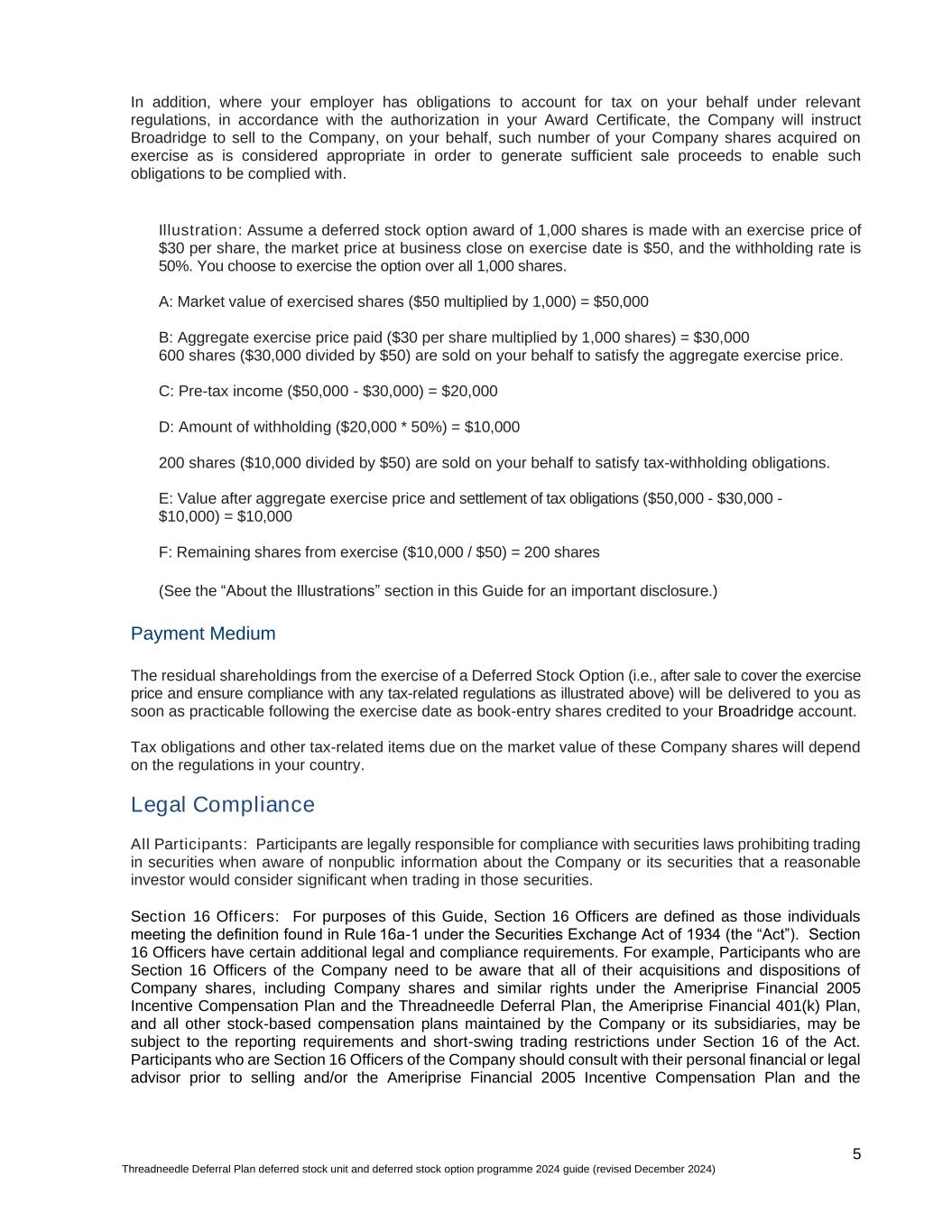

5 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) In addition, where your employer has obligations to account for tax on your behalf under relevant regulations, in accordance with the authorization in your Award Certificate, the Company will instruct Broadridge to sell to the Company, on your behalf, such number of your Company shares acquired on exercise as is considered appropriate in order to generate sufficient sale proceeds to enable such obligations to be complied with. Illustration: Assume a deferred stock option award of 1,000 shares is made with an exercise price of $30 per share, the market price at business close on exercise date is $50, and the withholding rate is 50%. You choose to exercise the option over all 1,000 shares. A: Market value of exercised shares ($50 multiplied by 1,000) = $50,000 B: Aggregate exercise price paid ($30 per share multiplied by 1,000 shares) = $30,000 600 shares ($30,000 divided by $50) are sold on your behalf to satisfy the aggregate exercise price. C: Pre-tax income ($50,000 - $30,000) = $20,000 D: Amount of withholding ($20,000 * 50%) = $10,000 200 shares ($10,000 divided by $50) are sold on your behalf to satisfy tax-withholding obligations. E: Value after aggregate exercise price and settlement of tax obligations ($50,000 - $30,000 - $10,000) = $10,000 F: Remaining shares from exercise ($10,000 / $50) = 200 shares (See the “About the Illustrations” section in this Guide for an important disclosure.) Payment Medium The residual shareholdings from the exercise of a Deferred Stock Option (i.e., after sale to cover the exercise price and ensure compliance with any tax-related regulations as illustrated above) will be delivered to you as soon as practicable following the exercise date as book-entry shares credited to your Broadridge account. Tax obligations and other tax-related items due on the market value of these Company shares will depend on the regulations in your country. Legal Compliance All Participants: Participants are legally responsible for compliance with securities laws prohibiting trading in securities when aware of nonpublic information about the Company or its securities that a reasonable investor would consider significant when trading in those securities. Section 16 Officers: For purposes of this Guide, Section 16 Officers are defined as those individuals meeting the definition found in Rule 16a-1 under the Securities Exchange Act of 1934 (the “Act”). Section 16 Officers have certain additional legal and compliance requirements. For example, Participants who are Section 16 Officers of the Company need to be aware that all of their acquisitions and dispositions of Company shares, including Company shares and similar rights under the Ameriprise Financial 2005 Incentive Compensation Plan and the Threadneedle Deferral Plan, the Ameriprise Financial 401(k) Plan, and all other stock-based compensation plans maintained by the Company or its subsidiaries, may be subject to the reporting requirements and short-swing trading restrictions under Section 16 of the Act. Participants who are Section 16 Officers of the Company should consult with their personal financial or legal advisor prior to selling and/or the Ameriprise Financial 2005 Incentive Compensation Plan and the

6 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Threadneedle Deferral Plan. “Affiliates” of the Company: The U.S. securities laws impose restrictions on the resale of the Company’s shares by individuals who are “affiliates” of the Company. Affiliates may resell their Company shares by complying with Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) or by registering their Company shares for sale under the Securities Act. These restrictions do not apply to individuals who are not affiliates of the Company. Treatment of Deferred Stock Units and Deferred Stock Options Upon Certain Events Existing policies regarding the treatment of outstanding, unvested Deferred Stock Units and Deferred Stock Options under certain circumstances are described below. The Committee may amend the following practices for any outstanding and future Deferred Stock Units and Deferred Stock Options. For specific information about the treatment of your Deferred Stock Units and Deferred Stock Options, please see the applicable section that describes the following specific events: • Leave of Absence • Employment termination • Qualified Retirement • Disability Termination • Death • Transfers Between Business Segments • Malus/Clawback • Change in Control of the Company Key Definitions Relating to Treatment upon Certain Events • “Book-Entry” means a system of tracking ownership of securities where no physical certificate is given to investors. Securities are tracked electronically, rather than in paper form, allowing investors to trade or transfer securities without having to present a paper certificate as proof of ownerships. • “Disability” means a mental or physical condition which, in the opinion of the Committee, renders a Participant unable or incompetent to carry out the job responsibilities which such Participant held or tasks to which such Participant was assigned at the time the disability was incurred and which is expected to be permanent or for an indefinite period of not less than six months. With respect to any Award that constitutes deferred compensation under U.S. Internal Revenue Code (the “Code”) Section 409A and is subject to Code Section 409A, the Committee may not find that a Disability exists with respect to the applicable Participant unless, in the Committee’s opinion, such Participant is also “disabled” within the meaning of Code Section 409A. • “Last Day Worked” means the date on which a participant undergoes a “separation from service” from the Company (and its affiliates), as defined under Section 409A of the Code, and as determined in accordance with the Company’s Policy regarding Section 409A Compliance. Typically, this means that your Last Day Worked will be the same date as the date your employment with the Company terminates. However, if there is an extended period when you are no longer actively providing services to the Company prior to your date of termination of employment (e.g., any contractual non-working notice period, any period of “garden leave”, or any other extended non- working period), the Company shall have the exclusive discretion to determine that the date of your Last Date Worked is earlier than the date of termination of your employment. The Company will disregard short term absences due to sickness and PTO when determining your Last Day Worked. Your Last Day Worked will not be before the date you have served or been given notice to terminate

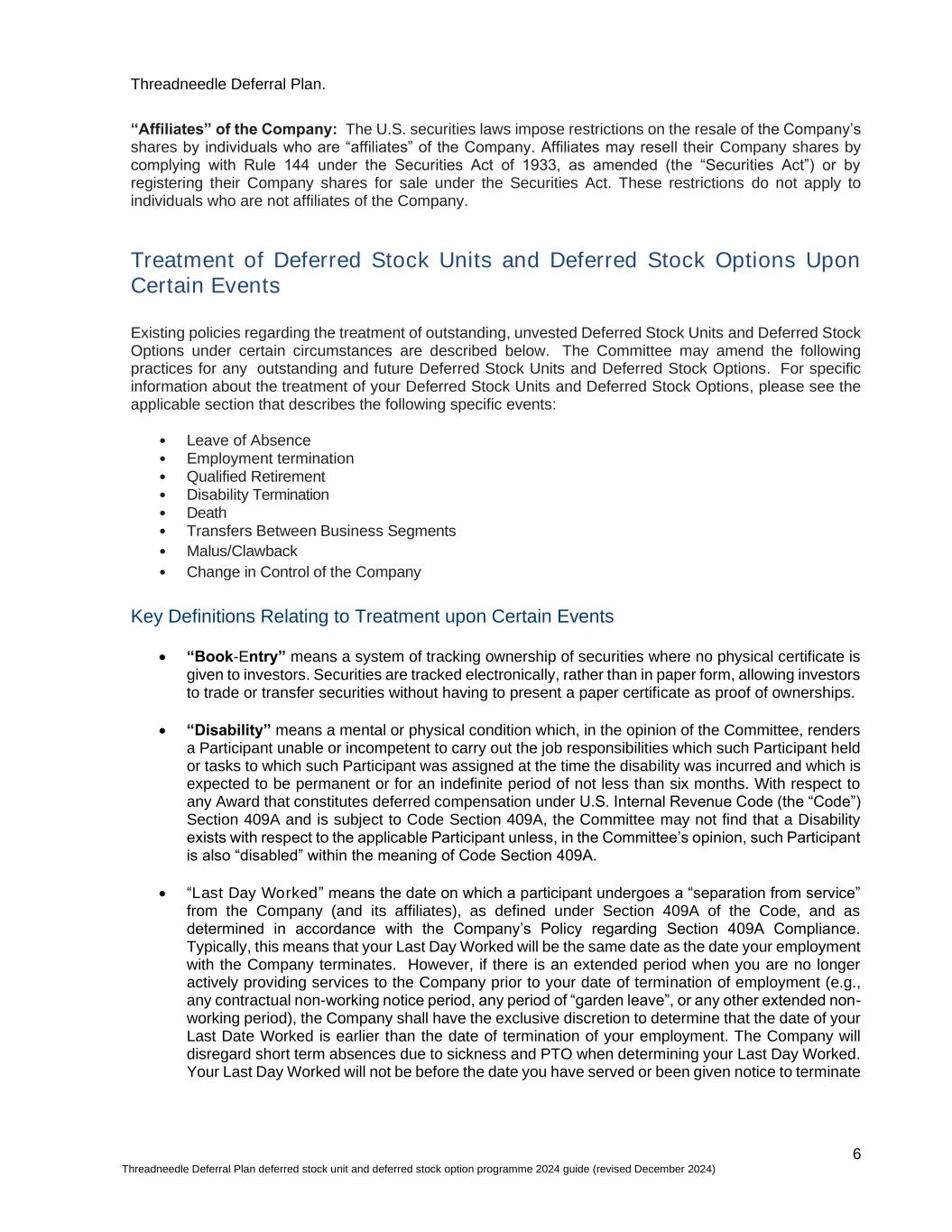

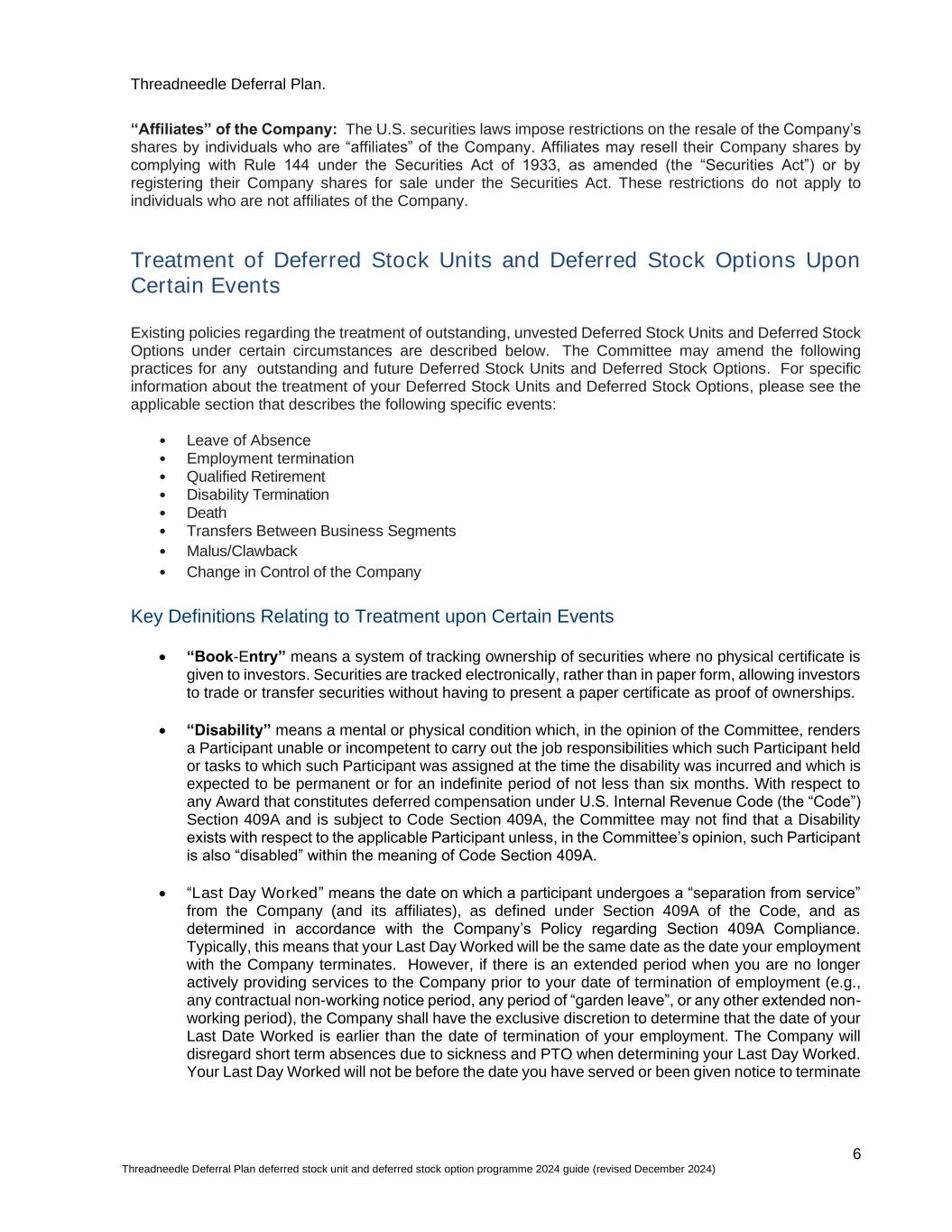

7 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) your employment. If your Last Day Worked is earlier than your date of termination of employment, the Company will notify you in writing of your Last Day Worked. • “Retirement Eligible” means the Participant is at least age 55 and has at least 10 years of cumulative service with the Company. • “Severance Benefit” means both (a) payment of severance benefits under a Company severance plan, provided the Participant has complied with all requirements to receive the severance benefits (including signing a release of claims in a form prescribed by the Company); and (b) if so designated by the CBC or its designee, any other agreement between the Company and a Participant that provides for pay or other benefits upon a separation of employment, provided the Participant has complied with the requirements in such agreement. • “Qualified Retirement” means the Participant has satisfied each of the following requirements upon termination of employment: 1. Participant is Retirement Eligible. 2. Participant has satisfied the requirement in (a) or (b) below, as applicable: a. For Participants up to and including Band 80 (excluding Section 16 Officers): Participant has provided advance written notice to the Company, in a form prescribed by the Company, satisfying the notice requirement provided below. Band Level Notice Period Below Band 50 At least 3 months Bands 50 – 60 At least 6 months Bands 70 – 80 At least 9 months b. For Participants who are Section 16 Officers and/or above Band 80: Participant has notified the Chief Executive Officer (or in the case of the Chief Executive Officer, the Chair of the CBC) of Participant’s intent to commence discussions regarding Participant’s retirement, with such notice provided at least twelve months prior to the Participant’s last day of employment. 3. Participant attests to their intent to exit the workforce, with limited permitted exceptions, as prescribed by the CBC. Contact the Human Resources Service Center (HRSC) for further information. 4. Participant has remained actively employed with the Company in good standing through the required notice period, or such earlier date as selected by the Company if it elects to waive all or part of the notice period. Leave of Absence Deferred Stock Units and Deferred Stock Options continue to vest when you are on a leave of absence (as determined by the applicable Company policies) subject to the Company’s right to adjust or terminate any outstanding Deferred Stock Units and Deferred Stock Options in its discretion, based on a significant change in your duties and responsibilities and/or related employment, and subject to applicable laws. Employment Termination This section pertains to employment terminations other than due to a Qualified Retirement, death, or

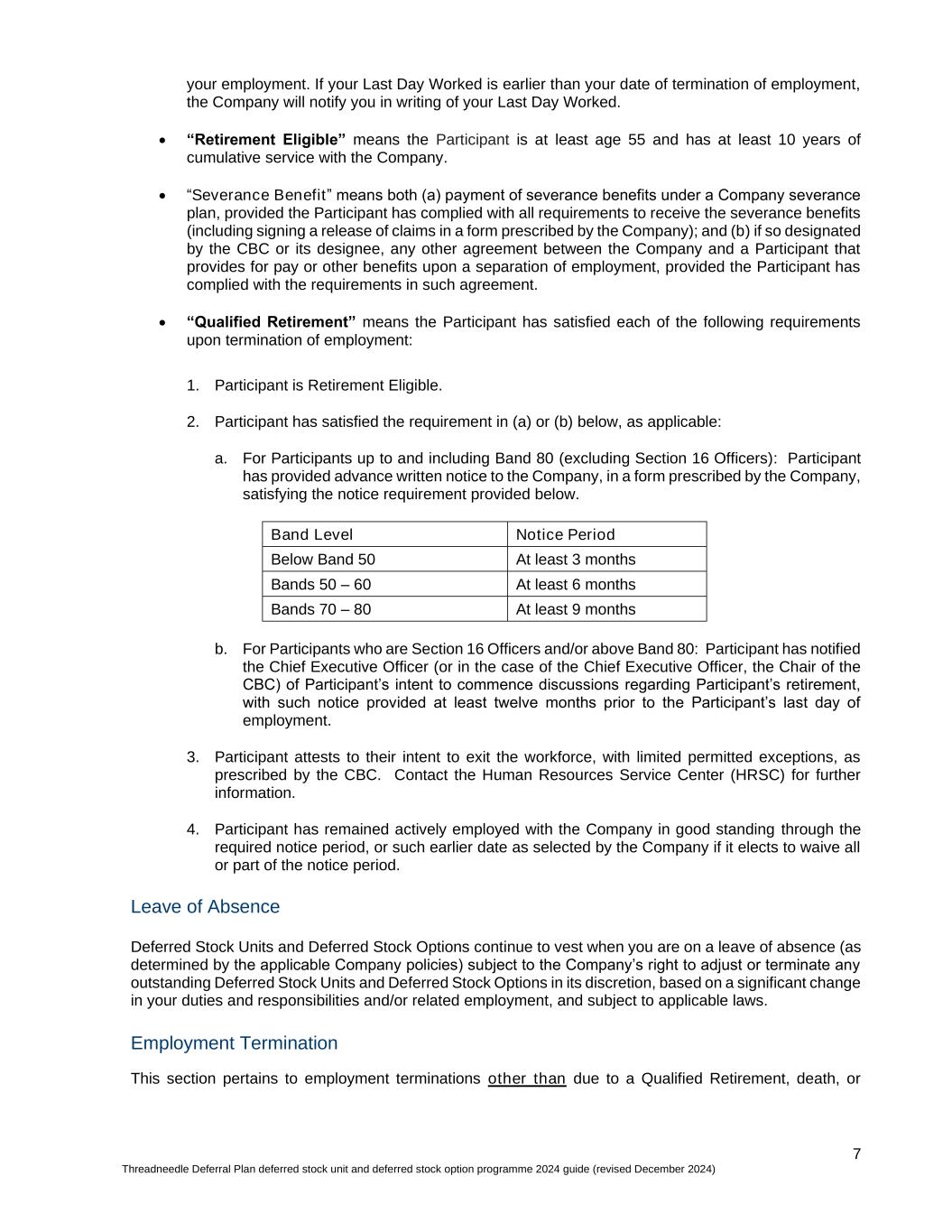

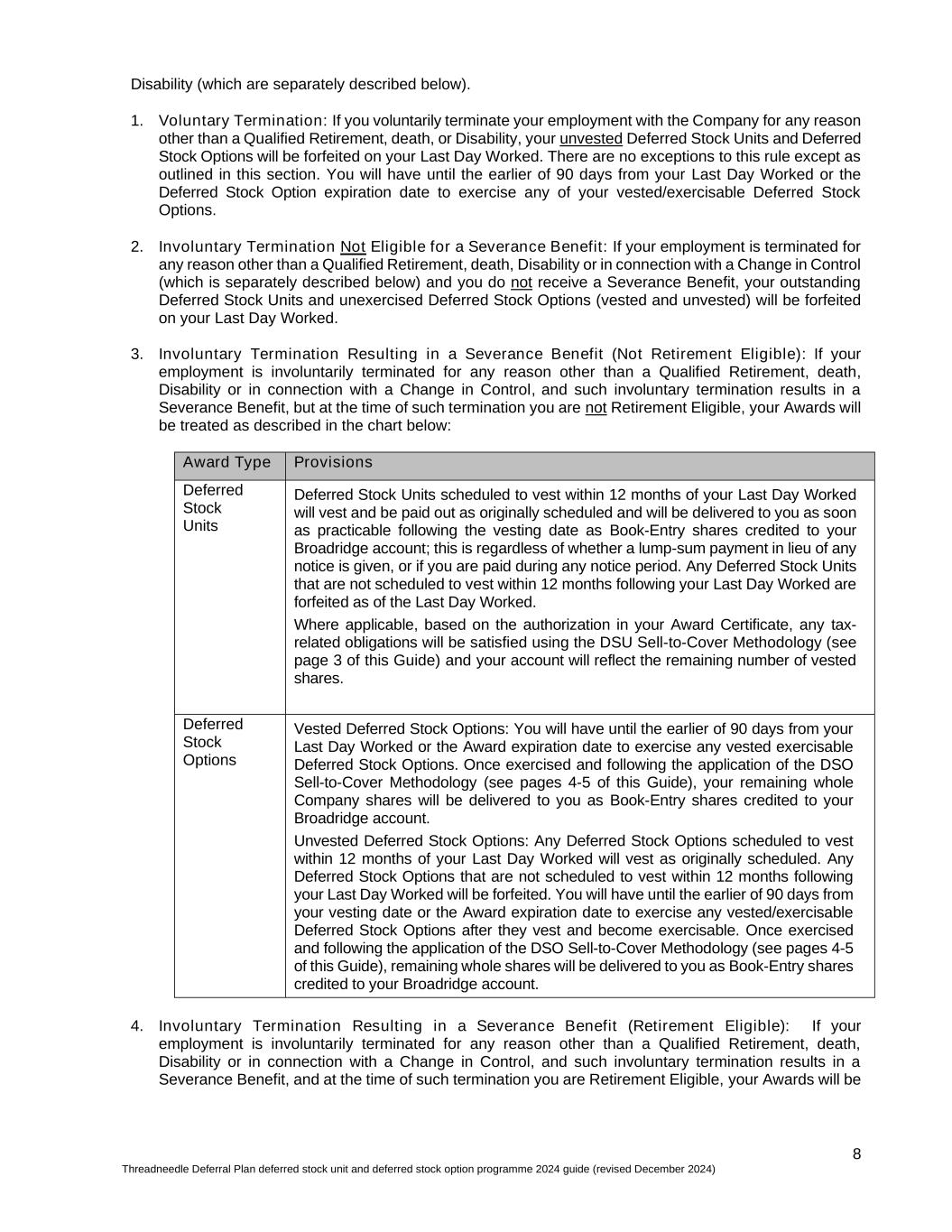

8 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Disability (which are separately described below). 1. Voluntary Termination: If you voluntarily terminate your employment with the Company for any reason other than a Qualified Retirement, death, or Disability, your unvested Deferred Stock Units and Deferred Stock Options will be forfeited on your Last Day Worked. There are no exceptions to this rule except as outlined in this section. You will have until the earlier of 90 days from your Last Day Worked or the Deferred Stock Option expiration date to exercise any of your vested/exercisable Deferred Stock Options. 2. Involuntary Termination Not Eligible for a Severance Benefit: If your employment is terminated for any reason other than a Qualified Retirement, death, Disability or in connection with a Change in Control (which is separately described below) and you do not receive a Severance Benefit, your outstanding Deferred Stock Units and unexercised Deferred Stock Options (vested and unvested) will be forfeited on your Last Day Worked. 3. Involuntary Termination Resulting in a Severance Benefit (Not Retirement Eligible): If your employment is involuntarily terminated for any reason other than a Qualified Retirement, death, Disability or in connection with a Change in Control, and such involuntary termination results in a Severance Benefit, but at the time of such termination you are not Retirement Eligible, your Awards will be treated as described in the chart below: Award Type Provisions Deferred Stock Units Deferred Stock Units scheduled to vest within 12 months of your Last Day Worked will vest and be paid out as originally scheduled and will be delivered to you as soon as practicable following the vesting date as Book-Entry shares credited to your Broadridge account; this is regardless of whether a lump-sum payment in lieu of any notice is given, or if you are paid during any notice period. Any Deferred Stock Units that are not scheduled to vest within 12 months following your Last Day Worked are forfeited as of the Last Day Worked. Where applicable, based on the authorization in your Award Certificate, any tax- related obligations will be satisfied using the DSU Sell-to-Cover Methodology (see page 3 of this Guide) and your account will reflect the remaining number of vested shares. Deferred Stock Options Vested Deferred Stock Options: You will have until the earlier of 90 days from your Last Day Worked or the Award expiration date to exercise any vested exercisable Deferred Stock Options. Once exercised and following the application of the DSO Sell-to-Cover Methodology (see pages 4-5 of this Guide), your remaining whole Company shares will be delivered to you as Book-Entry shares credited to your Broadridge account. Unvested Deferred Stock Options: Any Deferred Stock Options scheduled to vest within 12 months of your Last Day Worked will vest as originally scheduled. Any Deferred Stock Options that are not scheduled to vest within 12 months following your Last Day Worked will be forfeited. You will have until the earlier of 90 days from your vesting date or the Award expiration date to exercise any vested/exercisable Deferred Stock Options after they vest and become exercisable. Once exercised and following the application of the DSO Sell-to-Cover Methodology (see pages 4-5 of this Guide), remaining whole shares will be delivered to you as Book-Entry shares credited to your Broadridge account. 4. Involuntary Termination Resulting in a Severance Benefit (Retirement Eligible): If your employment is involuntarily terminated for any reason other than a Qualified Retirement, death, Disability or in connection with a Change in Control, and such involuntary termination results in a Severance Benefit, and at the time of such termination you are Retirement Eligible, your Awards will be

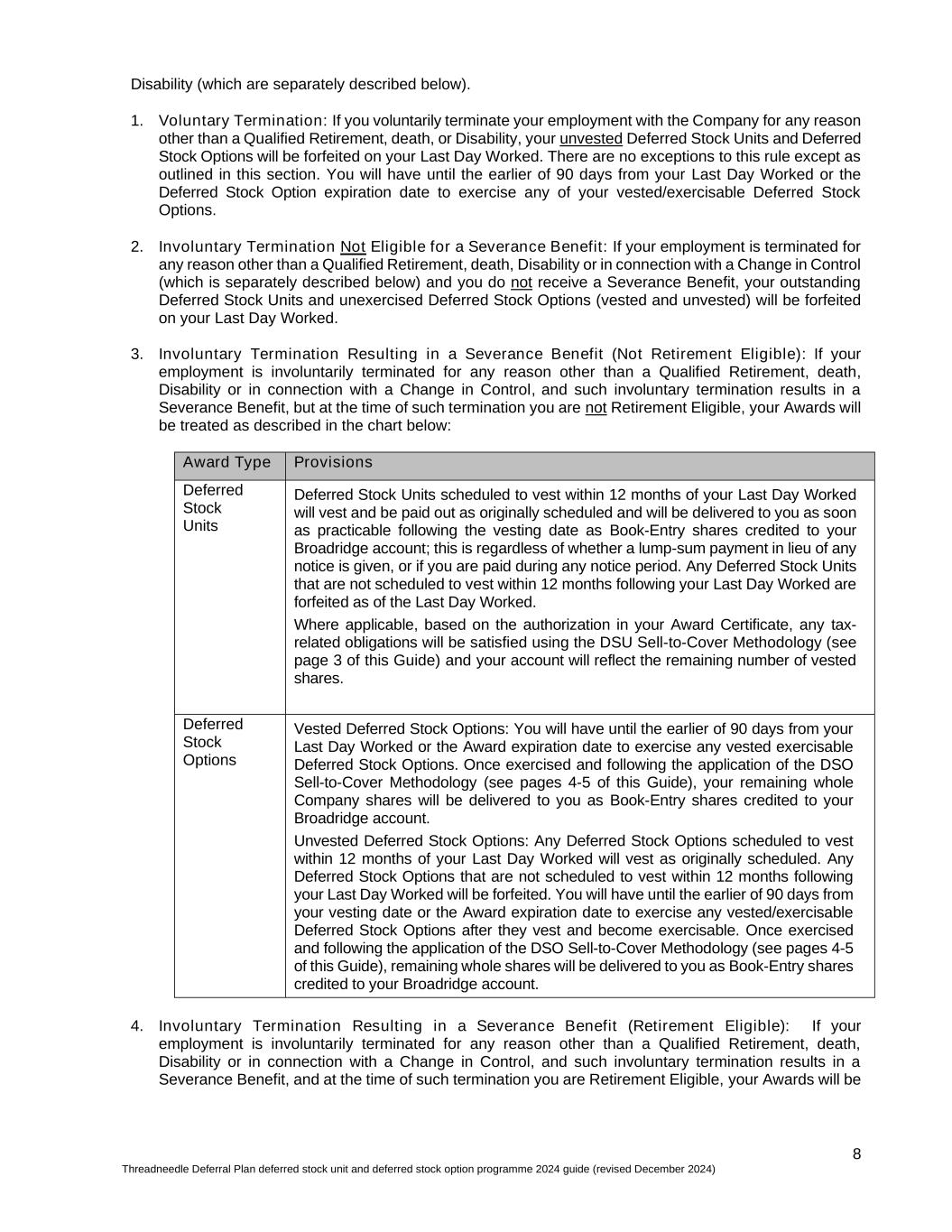

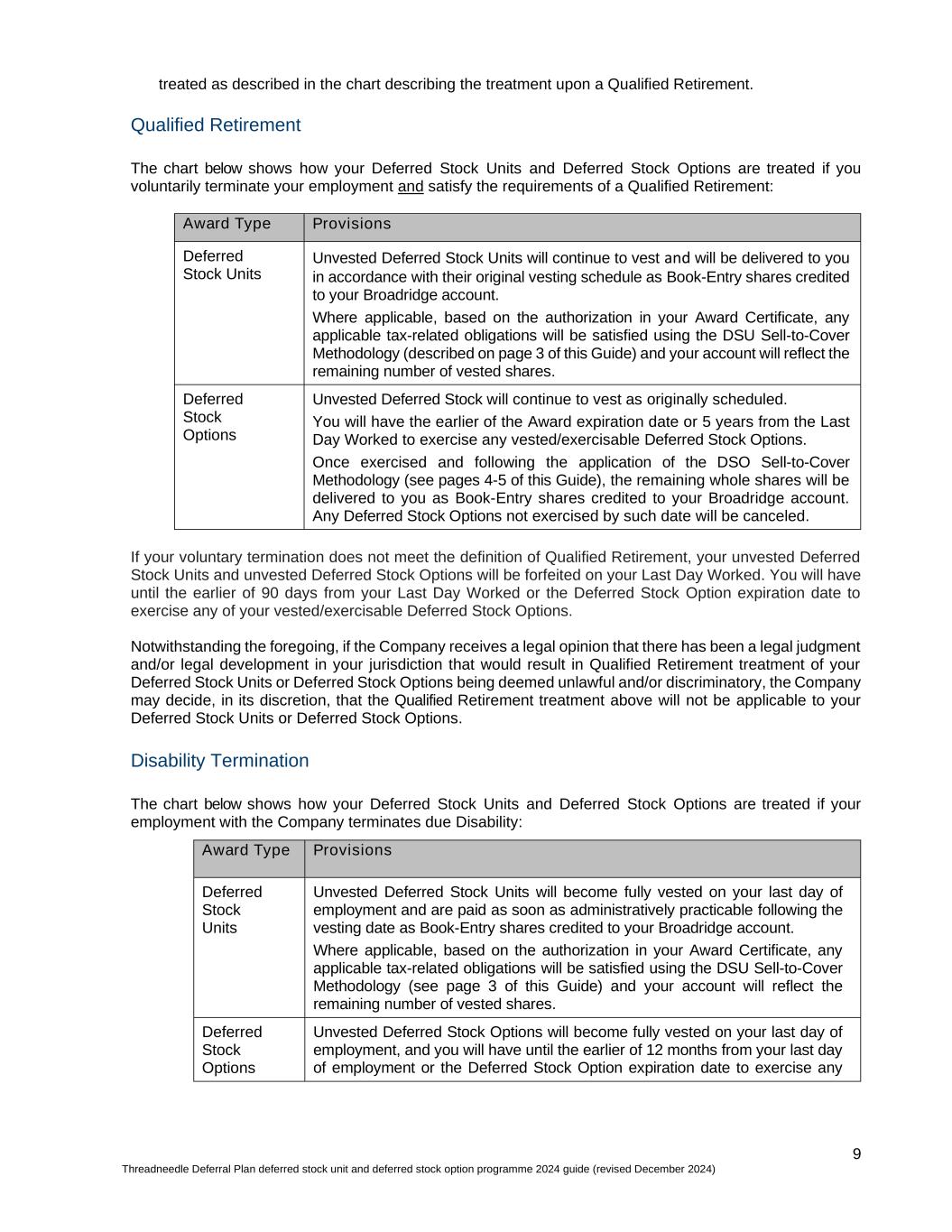

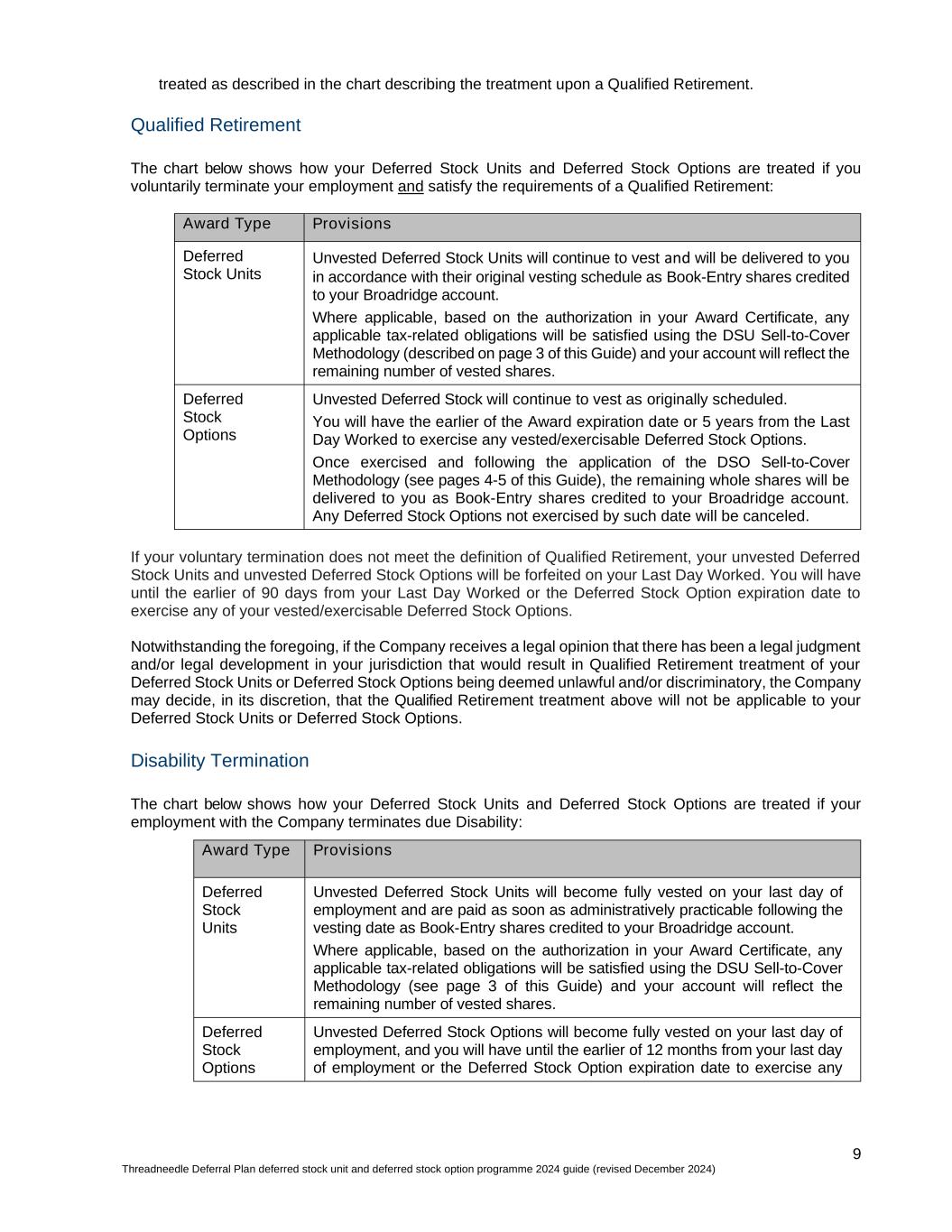

9 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) treated as described in the chart describing the treatment upon a Qualified Retirement. Qualified Retirement The chart below shows how your Deferred Stock Units and Deferred Stock Options are treated if you voluntarily terminate your employment and satisfy the requirements of a Qualified Retirement: Award Type Provisions Deferred Stock Units Unvested Deferred Stock Units will continue to vest and will be delivered to you in accordance with their original vesting schedule as Book-Entry shares credited to your Broadridge account. Where applicable, based on the authorization in your Award Certificate, any applicable tax-related obligations will be satisfied using the DSU Sell-to-Cover Methodology (described on page 3 of this Guide) and your account will reflect the remaining number of vested shares. Deferred Stock Options Unvested Deferred Stock will continue to vest as originally scheduled. You will have the earlier of the Award expiration date or 5 years from the Last Day Worked to exercise any vested/exercisable Deferred Stock Options. Once exercised and following the application of the DSO Sell-to-Cover Methodology (see pages 4-5 of this Guide), the remaining whole shares will be delivered to you as Book-Entry shares credited to your Broadridge account. Any Deferred Stock Options not exercised by such date will be canceled. If your voluntary termination does not meet the definition of Qualified Retirement, your unvested Deferred Stock Units and unvested Deferred Stock Options will be forfeited on your Last Day Worked. You will have until the earlier of 90 days from your Last Day Worked or the Deferred Stock Option expiration date to exercise any of your vested/exercisable Deferred Stock Options. Notwithstanding the foregoing, if the Company receives a legal opinion that there has been a legal judgment and/or legal development in your jurisdiction that would result in Qualified Retirement treatment of your Deferred Stock Units or Deferred Stock Options being deemed unlawful and/or discriminatory, the Company may decide, in its discretion, that the Qualified Retirement treatment above will not be applicable to your Deferred Stock Units or Deferred Stock Options. Disability Termination The chart below shows how your Deferred Stock Units and Deferred Stock Options are treated if your employment with the Company terminates due Disability: Award Type Provisions Deferred Stock Units Unvested Deferred Stock Units will become fully vested on your last day of employment and are paid as soon as administratively practicable following the vesting date as Book-Entry shares credited to your Broadridge account. Where applicable, based on the authorization in your Award Certificate, any applicable tax-related obligations will be satisfied using the DSU Sell-to-Cover Methodology (see page 3 of this Guide) and your account will reflect the remaining number of vested shares. Deferred Stock Options Unvested Deferred Stock Options will become fully vested on your last day of employment, and you will have until the earlier of 12 months from your last day of employment or the Deferred Stock Option expiration date to exercise any

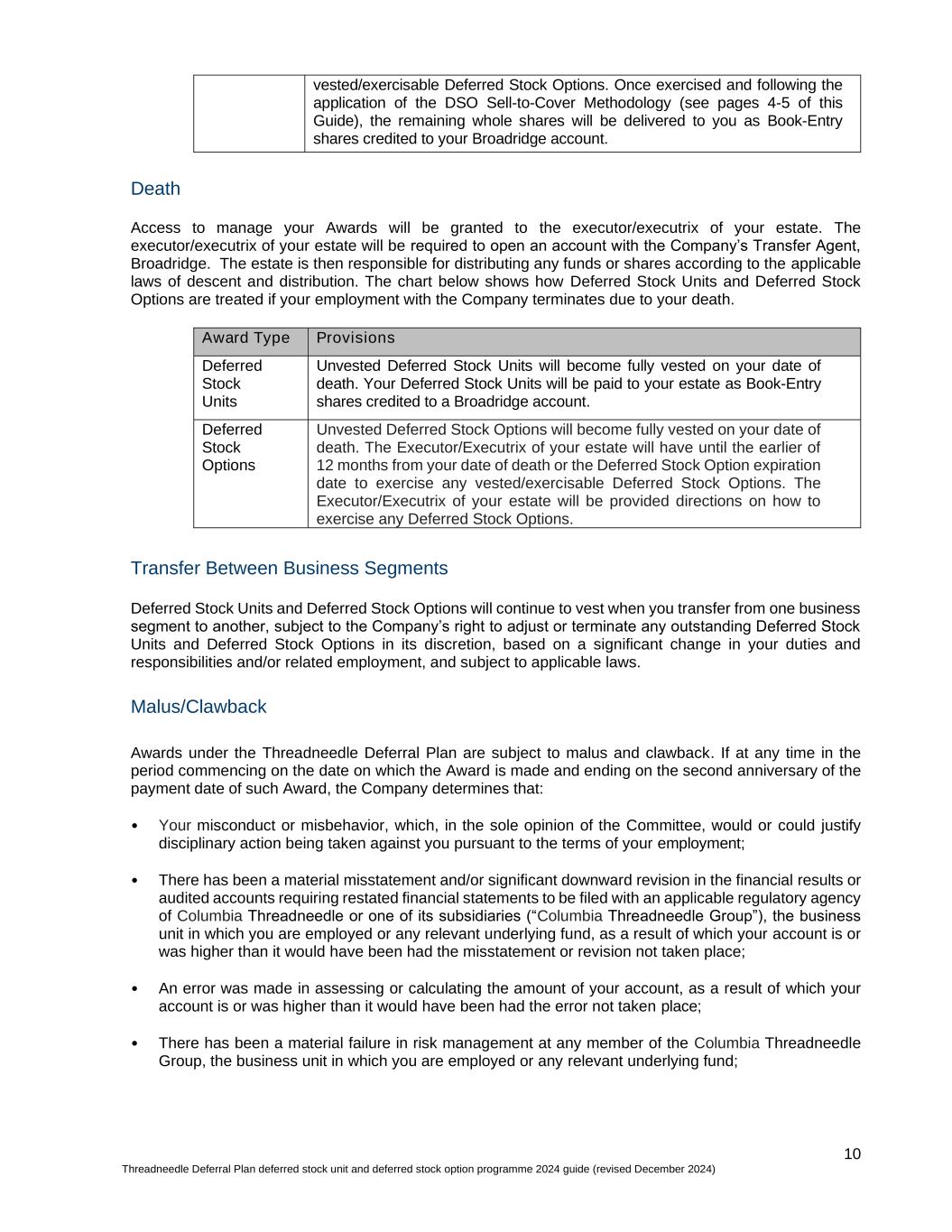

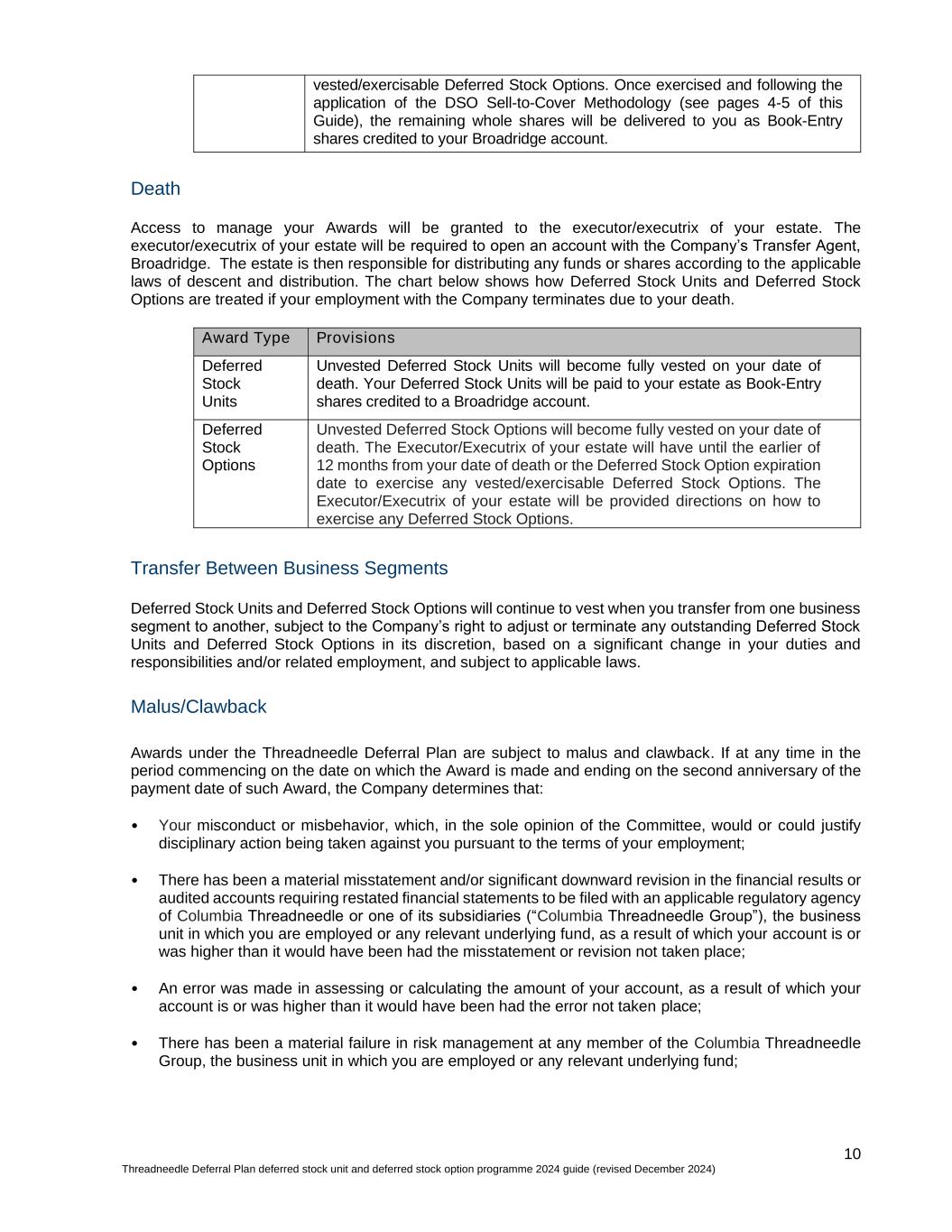

10 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) vested/exercisable Deferred Stock Options. Once exercised and following the application of the DSO Sell-to-Cover Methodology (see pages 4-5 of this Guide), the remaining whole shares will be delivered to you as Book-Entry shares credited to your Broadridge account. Death Access to manage your Awards will be granted to the executor/executrix of your estate. The executor/executrix of your estate will be required to open an account with the Company’s Transfer Agent, Broadridge. The estate is then responsible for distributing any funds or shares according to the applicable laws of descent and distribution. The chart below shows how Deferred Stock Units and Deferred Stock Options are treated if your employment with the Company terminates due to your death. Award Type Provisions Deferred Stock Units Unvested Deferred Stock Units will become fully vested on your date of death. Your Deferred Stock Units will be paid to your estate as Book-Entry shares credited to a Broadridge account. Deferred Stock Options Unvested Deferred Stock Options will become fully vested on your date of death. The Executor/Executrix of your estate will have until the earlier of 12 months from your date of death or the Deferred Stock Option expiration date to exercise any vested/exercisable Deferred Stock Options. The Executor/Executrix of your estate will be provided directions on how to exercise any Deferred Stock Options. Transfer Between Business Segments Deferred Stock Units and Deferred Stock Options will continue to vest when you transfer from one business segment to another, subject to the Company’s right to adjust or terminate any outstanding Deferred Stock Units and Deferred Stock Options in its discretion, based on a significant change in your duties and responsibilities and/or related employment, and subject to applicable laws. Malus/Clawback Awards under the Threadneedle Deferral Plan are subject to malus and clawback. If at any time in the period commencing on the date on which the Award is made and ending on the second anniversary of the payment date of such Award, the Company determines that: • Your misconduct or misbehavior, which, in the sole opinion of the Committee, would or could justify disciplinary action being taken against you pursuant to the terms of your employment; • There has been a material misstatement and/or significant downward revision in the financial results or audited accounts requiring restated financial statements to be filed with an applicable regulatory agency of Columbia Threadneedle or one of its subsidiaries (“Columbia Threadneedle Group”), the business unit in which you are employed or any relevant underlying fund, as a result of which your account is or was higher than it would have been had the misstatement or revision not taken place; • An error was made in assessing or calculating the amount of your account, as a result of which your account is or was higher than it would have been had the error not taken place; • There has been a material failure in risk management at any member of the Columbia Threadneedle Group, the business unit in which you are employed or any relevant underlying fund;

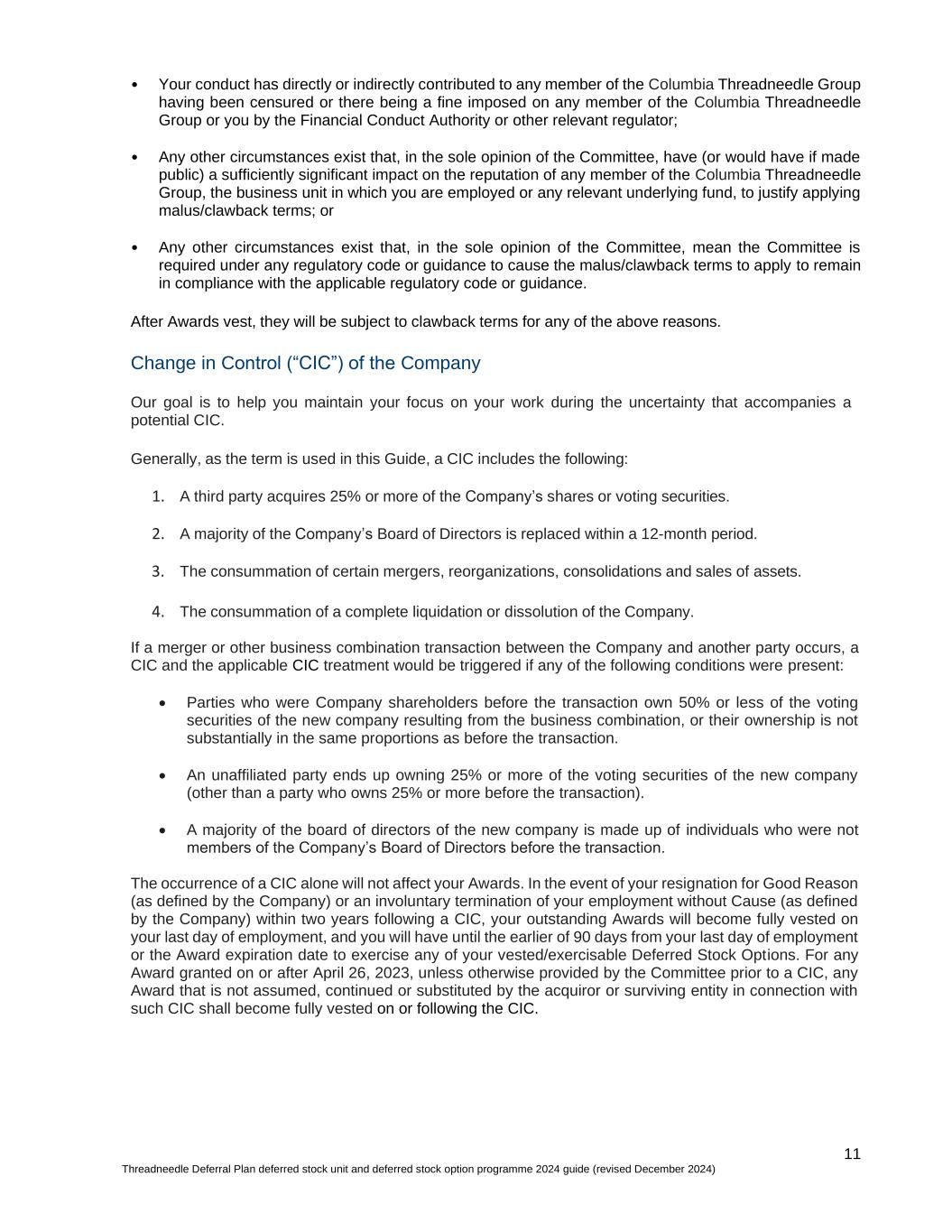

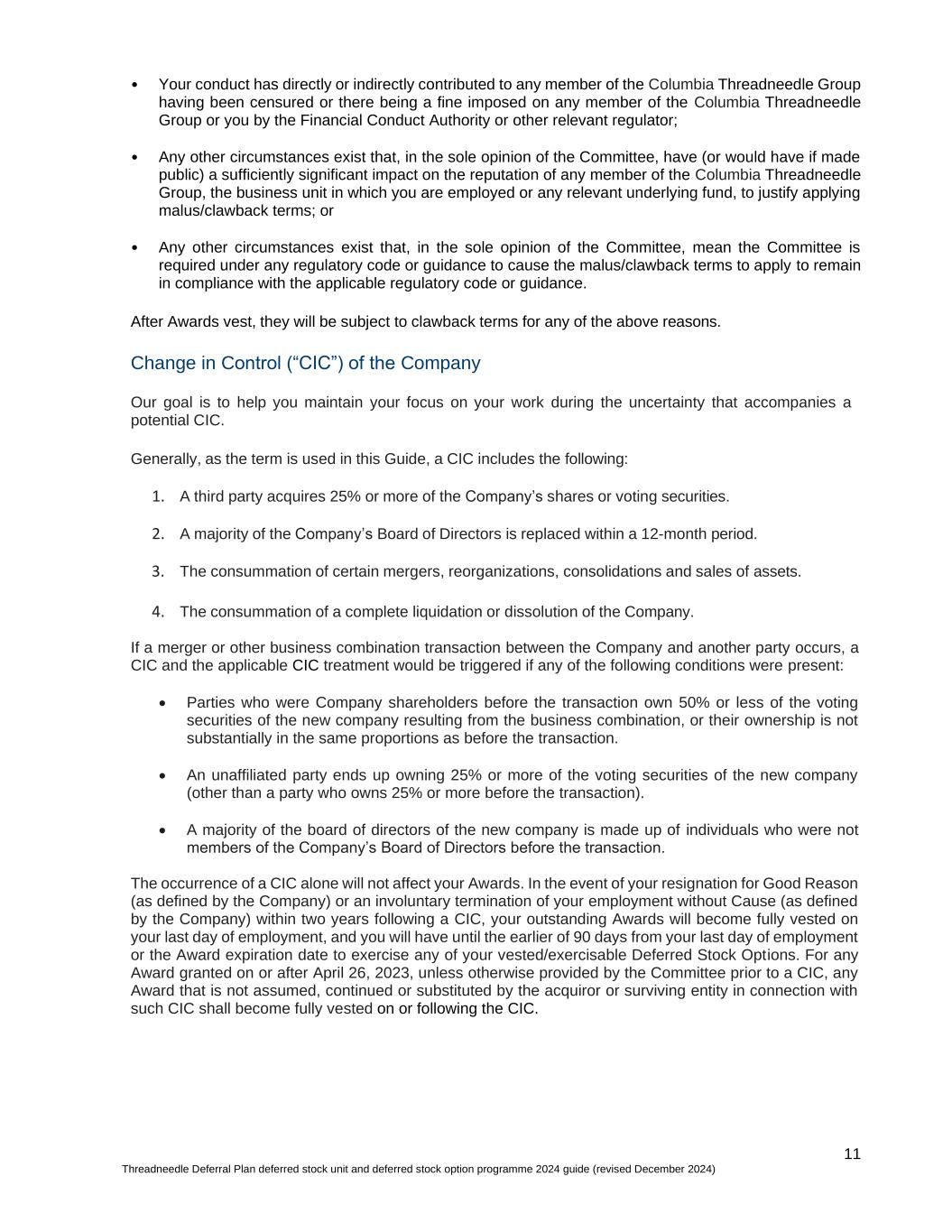

11 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) • Your conduct has directly or indirectly contributed to any member of the Columbia Threadneedle Group having been censured or there being a fine imposed on any member of the Columbia Threadneedle Group or you by the Financial Conduct Authority or other relevant regulator; • Any other circumstances exist that, in the sole opinion of the Committee, have (or would have if made public) a sufficiently significant impact on the reputation of any member of the Columbia Threadneedle Group, the business unit in which you are employed or any relevant underlying fund, to justify applying malus/clawback terms; or • Any other circumstances exist that, in the sole opinion of the Committee, mean the Committee is required under any regulatory code or guidance to cause the malus/clawback terms to apply to remain in compliance with the applicable regulatory code or guidance. After Awards vest, they will be subject to clawback terms for any of the above reasons. Change in Control (“CIC”) of the Company Our goal is to help you maintain your focus on your work during the uncertainty that accompanies a potential CIC. Generally, as the term is used in this Guide, a CIC includes the following: 1. A third party acquires 25% or more of the Company’s shares or voting securities. 2. A majority of the Company’s Board of Directors is replaced within a 12-month period. 3. The consummation of certain mergers, reorganizations, consolidations and sales of assets. 4. The consummation of a complete liquidation or dissolution of the Company. If a merger or other business combination transaction between the Company and another party occurs, a CIC and the applicable CIC treatment would be triggered if any of the following conditions were present: • Parties who were Company shareholders before the transaction own 50% or less of the voting securities of the new company resulting from the business combination, or their ownership is not substantially in the same proportions as before the transaction. • An unaffiliated party ends up owning 25% or more of the voting securities of the new company (other than a party who owns 25% or more before the transaction). • A majority of the board of directors of the new company is made up of individuals who were not members of the Company’s Board of Directors before the transaction. The occurrence of a CIC alone will not affect your Awards. In the event of your resignation for Good Reason (as defined by the Company) or an involuntary termination of your employment without Cause (as defined by the Company) within two years following a CIC, your outstanding Awards will become fully vested on your last day of employment, and you will have until the earlier of 90 days from your last day of employment or the Award expiration date to exercise any of your vested/exercisable Deferred Stock Options. For any Award granted on or after April 26, 2023, unless otherwise provided by the Committee prior to a CIC, any Award that is not assumed, continued or substituted by the acquiror or surviving entity in connection with such CIC shall become fully vested on or following the CIC.

12 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Additional Information Relating to Awards Beneficiary Designation The beneficiary for your account is automatically set up to your estate. Risk of Participation As previously noted, your Awards are subject to vesting. As a result, under certain circumstances set out above, you may forfeit any unvested portion of your Awards. Fluctuation in the value of Ameriprise Financial common stock will affect the value of your stock awards, and the stock awards issued under the Threadneedle Deferral Plan may have a greater or lower value than their original value. The Threadneedle Deferral Plan is unfunded, and all payments are made out of the general assets of TAM UK International Holdings Limited (“Threadneedle”). Threadneedle is not required to establish any special or separate fund or to make any other segregation of assets to assure the payment of any amount under the Threadneedle Deferral Plan. Payments under the Threadneedle Deferral Plan are neither subordinate nor superior to the claims of Columbia Threadneedle’s general creditors. Amounts deferred under the Threadneedle Deferral Plan may be used for any Columbia Threadneedle corporate purpose. You and anyone claiming under or through you have no security interest in any such corporate assets or in any proceeds therefrom. Administrative Information about this Guide About this Guide This Guide sets forth the terms, conditions and features of Awards made to Columbia Threadneedle employees pursuant to the terms of the Ameriprise 2005 Incentive Compensation Plan, subject to the Threadneedle Deferral Plan. The provisions of all Awards and this Guide are governed by, and subject to, the laws of the State of Delaware, United States of America, without regard to its conflict of law provisions, as provided in the Ameriprise 2005 Incentive Compensation Plan and to the Threadneedle Deferral Plan. The Programmes are designed for Columbia Threadneedle employees, as determined by the CBC, upon the recommendation of the Committee. Awards are granted at the discretion of the CBC and the Committee, and are subject to local market regulations and legislation, which could change at any time. The Company strongly urges all employees to consult their personal tax advisor with any questions or issues regarding their participation in the Programmes. The general nature of the Awards and their terms and conditions are described here, but the information contained in this Guide is for general guidance only and is not intended to be a complete description of the Awards. In the event of any conflict between the terms of the Threadneedle Deferral Plan or an Award Certificate and this Guide, the terms of the Threadneedle Deferral Plan or Award Certificate will control. And in the event of any conflict between the Ameriprise 2005 Incentive Compensation Plan and the Threadneedle Deferral Plan, an Award Certificate or this Guide, the terms of the Ameriprise 2005 Incentive Compensation Plan will control. This Guide does not constitute a contract of employment between the Company or Columbia Threadneedle and any individual or an obligation by the Company or Columbia Threadneedle to

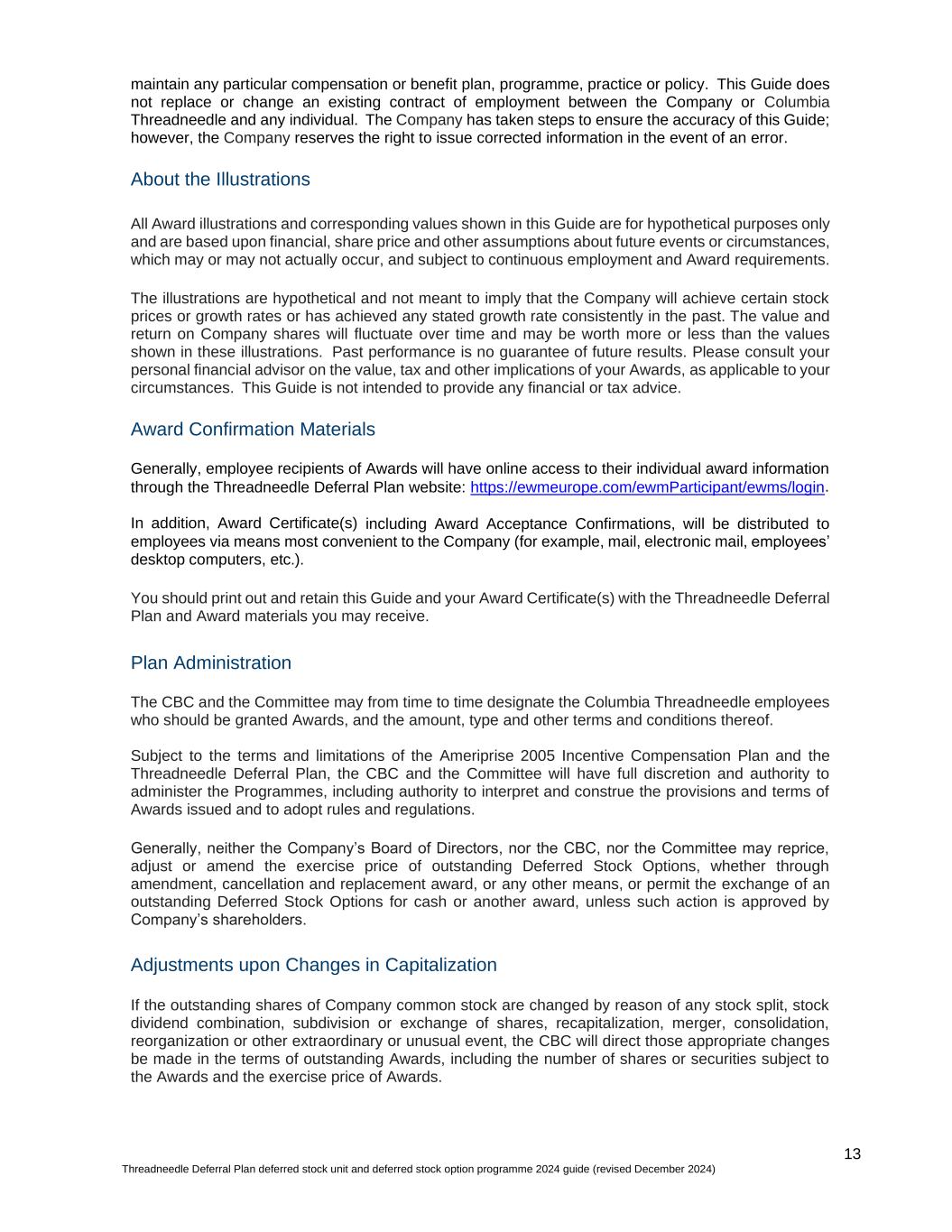

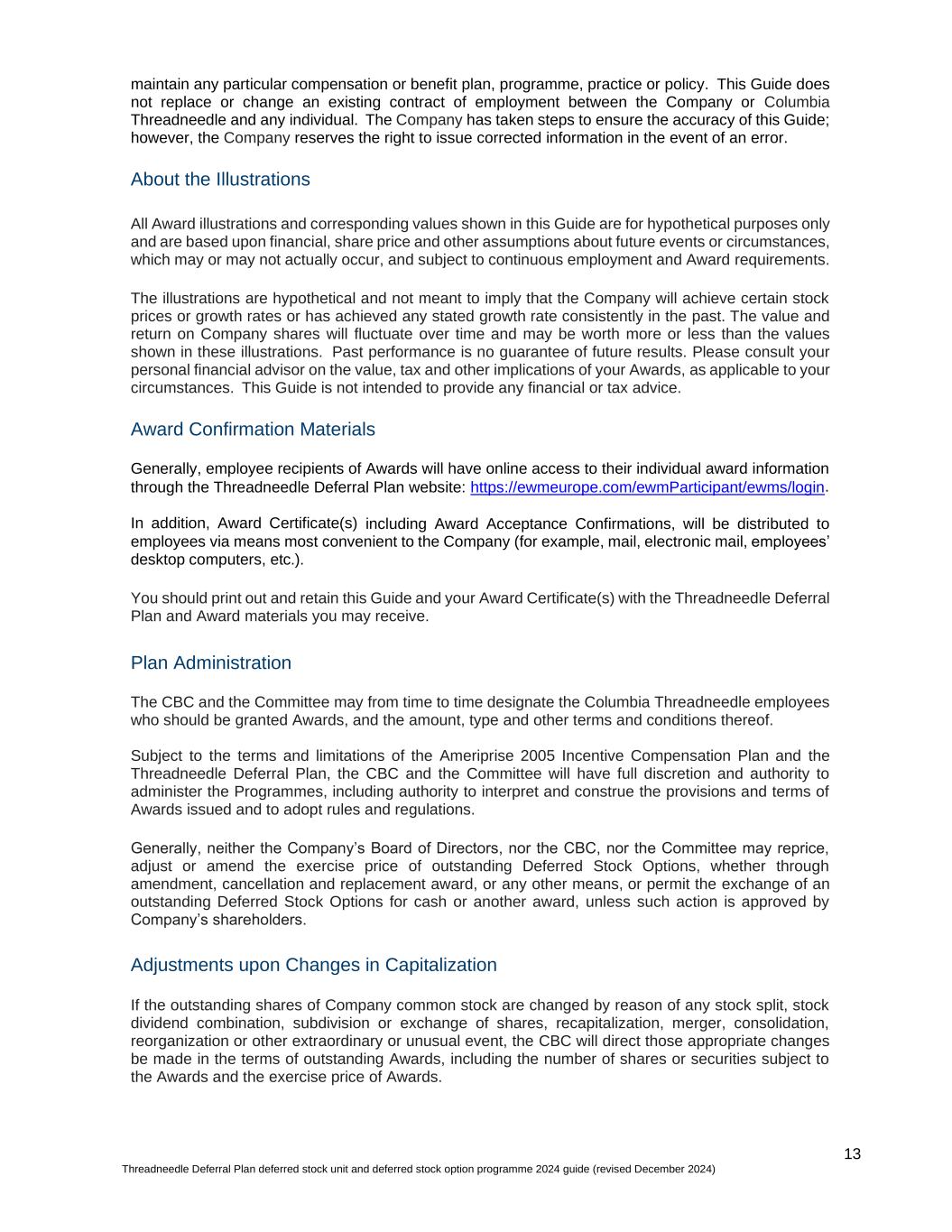

13 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) maintain any particular compensation or benefit plan, programme, practice or policy. This Guide does not replace or change an existing contract of employment between the Company or Columbia Threadneedle and any individual. The Company has taken steps to ensure the accuracy of this Guide; however, the Company reserves the right to issue corrected information in the event of an error. About the Illustrations All Award illustrations and corresponding values shown in this Guide are for hypothetical purposes only and are based upon financial, share price and other assumptions about future events or circumstances, which may or may not actually occur, and subject to continuous employment and Award requirements. The illustrations are hypothetical and not meant to imply that the Company will achieve certain stock prices or growth rates or has achieved any stated growth rate consistently in the past. The value and return on Company shares will fluctuate over time and may be worth more or less than the values shown in these illustrations. Past performance is no guarantee of future results. Please consult your personal financial advisor on the value, tax and other implications of your Awards, as applicable to your circumstances. This Guide is not intended to provide any financial or tax advice. Award Confirmation Materials Generally, employee recipients of Awards will have online access to their individual award information through the Threadneedle Deferral Plan website: https://ewmeurope.com/ewmParticipant/ewms/login. In addition, Award Certificate(s) including Award Acceptance Confirmations, will be distributed to employees via means most convenient to the Company (for example, mail, electronic mail, employees’ desktop computers, etc.). You should print out and retain this Guide and your Award Certificate(s) with the Threadneedle Deferral Plan and Award materials you may receive. Plan Administration The CBC and the Committee may from time to time designate the Columbia Threadneedle employees who should be granted Awards, and the amount, type and other terms and conditions thereof. Subject to the terms and limitations of the Ameriprise 2005 Incentive Compensation Plan and the Threadneedle Deferral Plan, the CBC and the Committee will have full discretion and authority to administer the Programmes, including authority to interpret and construe the provisions and terms of Awards issued and to adopt rules and regulations. Generally, neither the Company’s Board of Directors, nor the CBC, nor the Committee may reprice, adjust or amend the exercise price of outstanding Deferred Stock Options, whether through amendment, cancellation and replacement award, or any other means, or permit the exchange of an outstanding Deferred Stock Options for cash or another award, unless such action is approved by Company’s shareholders. Adjustments upon Changes in Capitalization If the outstanding shares of Company common stock are changed by reason of any stock split, stock dividend combination, subdivision or exchange of shares, recapitalization, merger, consolidation, reorganization or other extraordinary or unusual event, the CBC will direct those appropriate changes be made in the terms of outstanding Awards, including the number of shares or securities subject to the Awards and the exercise price of Awards.

14 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Tax and Other Related Considerations The tax and related obligations of any Awards granted and payments made under the Plan including Income tax, employee’s portion of social insurance, payroll tax, fringe benefits tax, payment on account or other tax-related items related to your participation in the Threadneedle Deferral Plan depends on your country and on your specific circumstances. The Company is not able to guarantee or ensure any particular tax or other withholding outcome. Therefore, we strongly recommend that you consult your personal tax advisor to determine your treatment under the Threadneedle Deferral Plan. Assignment and Transfer Awards may not be sold, pledged, assigned, hypothecated, transferred or disposed of in any manner other than by will or by the laws of descent or distribution, except as permitted by the CBC. Plan Termination, Amendment or Modification The Company’s Board of Directors, the CBC and the Committee may, from time to time, alter, amend, interpret, suspend or terminate the Ameriprise 2005 Incentive Compensation Plan, the Award Certificate(s), the Threadneedle Deferral Plan, this Guide and applicable related documents as they shall deem advisable, without the prior consent or notice of employees (including, but not limited to, alignment with legislative or regulatory developments) subject to the terms of the applicable document, including the rules and regulations of the principal securities market on which Company shares are traded. The Company’s Board of Directors may at any time suspend or discontinue the Ameriprise 2005 Incentive Compensation Plan and/or the Threadneedle Deferral Plan or revise or amend them in any way. In addition, certain amendments to the Ameriprise 2005 Incentive Compensation Plan require shareholder approval.

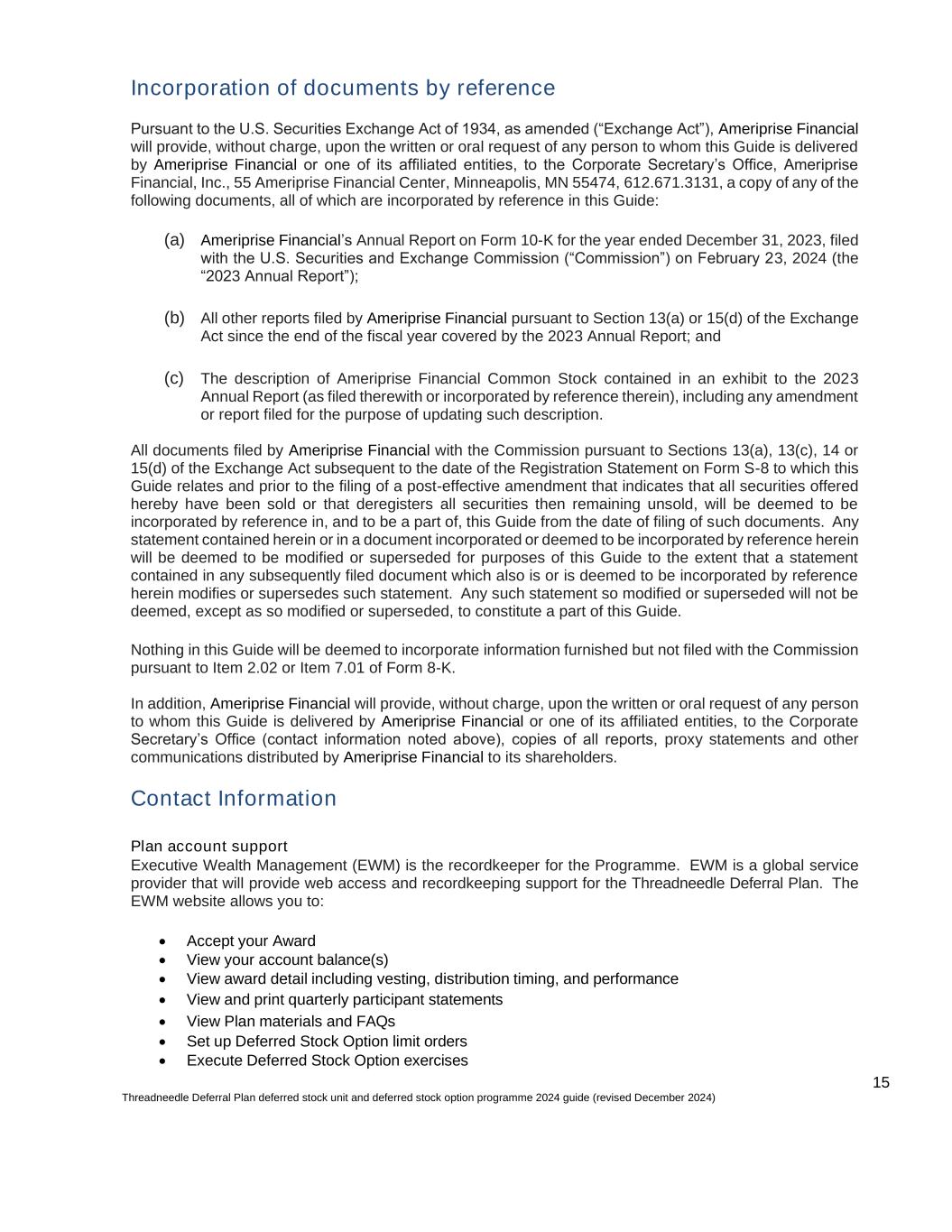

15 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Incorporation of documents by reference Pursuant to the U.S. Securities Exchange Act of 1934, as amended (“Exchange Act”), Ameriprise Financial will provide, without charge, upon the written or oral request of any person to whom this Guide is delivered by Ameriprise Financial or one of its affiliated entities, to the Corporate Secretary’s Office, Ameriprise Financial, Inc., 55 Ameriprise Financial Center, Minneapolis, MN 55474, 612.671.3131, a copy of any of the following documents, all of which are incorporated by reference in this Guide: (a) Ameriprise Financial’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (“Commission”) on February 23, 2024 (the “2023 Annual Report”); (b) All other reports filed by Ameriprise Financial pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the 2023 Annual Report; and (c) The description of Ameriprise Financial Common Stock contained in an exhibit to the 2023 Annual Report (as filed therewith or incorporated by reference therein), including any amendment or report filed for the purpose of updating such description. All documents filed by Ameriprise Financial with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of the Registration Statement on Form S-8 to which this Guide relates and prior to the filing of a post-effective amendment that indicates that all securities offered hereby have been sold or that deregisters all securities then remaining unsold, will be deemed to be incorporated by reference in, and to be a part of, this Guide from the date of filing of such documents. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes of this Guide to the extent that a statement contained in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this Guide. Nothing in this Guide will be deemed to incorporate information furnished but not filed with the Commission pursuant to Item 2.02 or Item 7.01 of Form 8-K. In addition, Ameriprise Financial will provide, without charge, upon the written or oral request of any person to whom this Guide is delivered by Ameriprise Financial or one of its affiliated entities, to the Corporate Secretary’s Office (contact information noted above), copies of all reports, proxy statements and other communications distributed by Ameriprise Financial to its shareholders. Contact Information Plan account support Executive Wealth Management (EWM) is the recordkeeper for the Programme. EWM is a global service provider that will provide web access and recordkeeping support for the Threadneedle Deferral Plan. The EWM website allows you to: • Accept your Award • View your account balance(s) • View award detail including vesting, distribution timing, and performance • View and print quarterly participant statements • View Plan materials and FAQs • Set up Deferred Stock Option limit orders • Execute Deferred Stock Option exercises

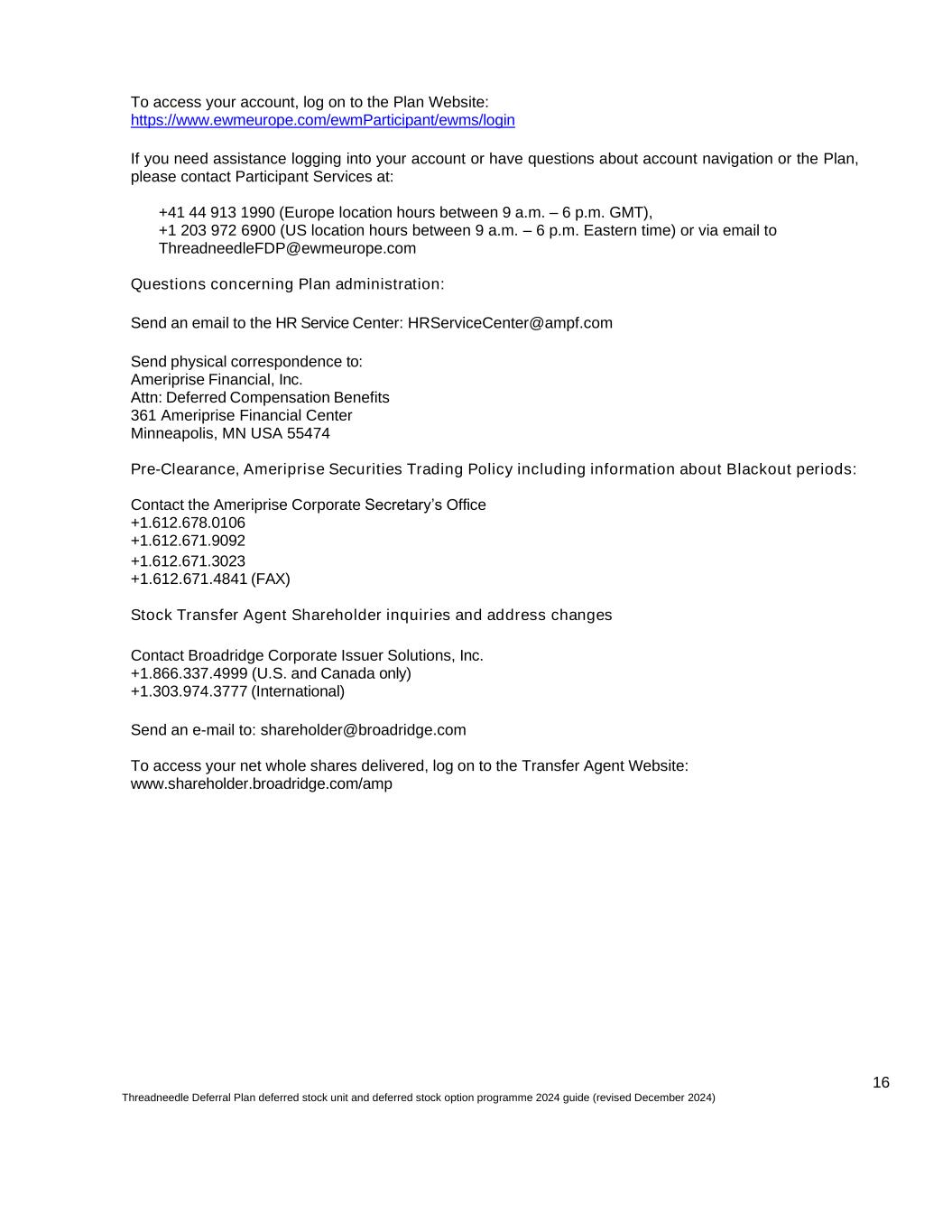

16 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) To access your account, log on to the Plan Website: https://www.ewmeurope.com/ewmParticipant/ewms/login If you need assistance logging into your account or have questions about account navigation or the Plan, please contact Participant Services at: +41 44 913 1990 (Europe location hours between 9 a.m. – 6 p.m. GMT), +1 203 972 6900 (US location hours between 9 a.m. – 6 p.m. Eastern time) or via email to ThreadneedleFDP@ewmeurope.com Questions concerning Plan administration: Send an email to the HR Service Center: HRServiceCenter@ampf.com Send physical correspondence to: Ameriprise Financial, Inc. Attn: Deferred Compensation Benefits 361 Ameriprise Financial Center Minneapolis, MN USA 55474 Pre-Clearance, Ameriprise Securities Trading Policy including information about Blackout periods: Contact the Ameriprise Corporate Secretary’s Office +1.612.678.0106 +1.612.671.9092 +1.612.671.3023 +1.612.671.4841 (FAX) Stock Transfer Agent Shareholder inquiries and address changes Contact Broadridge Corporate Issuer Solutions, Inc. +1.866.337.4999 (U.S. and Canada only) +1.303.974.3777 (International) Send an e-mail to: shareholder@broadridge.com To access your net whole shares delivered, log on to the Transfer Agent Website: www.shareholder.broadridge.com/amp

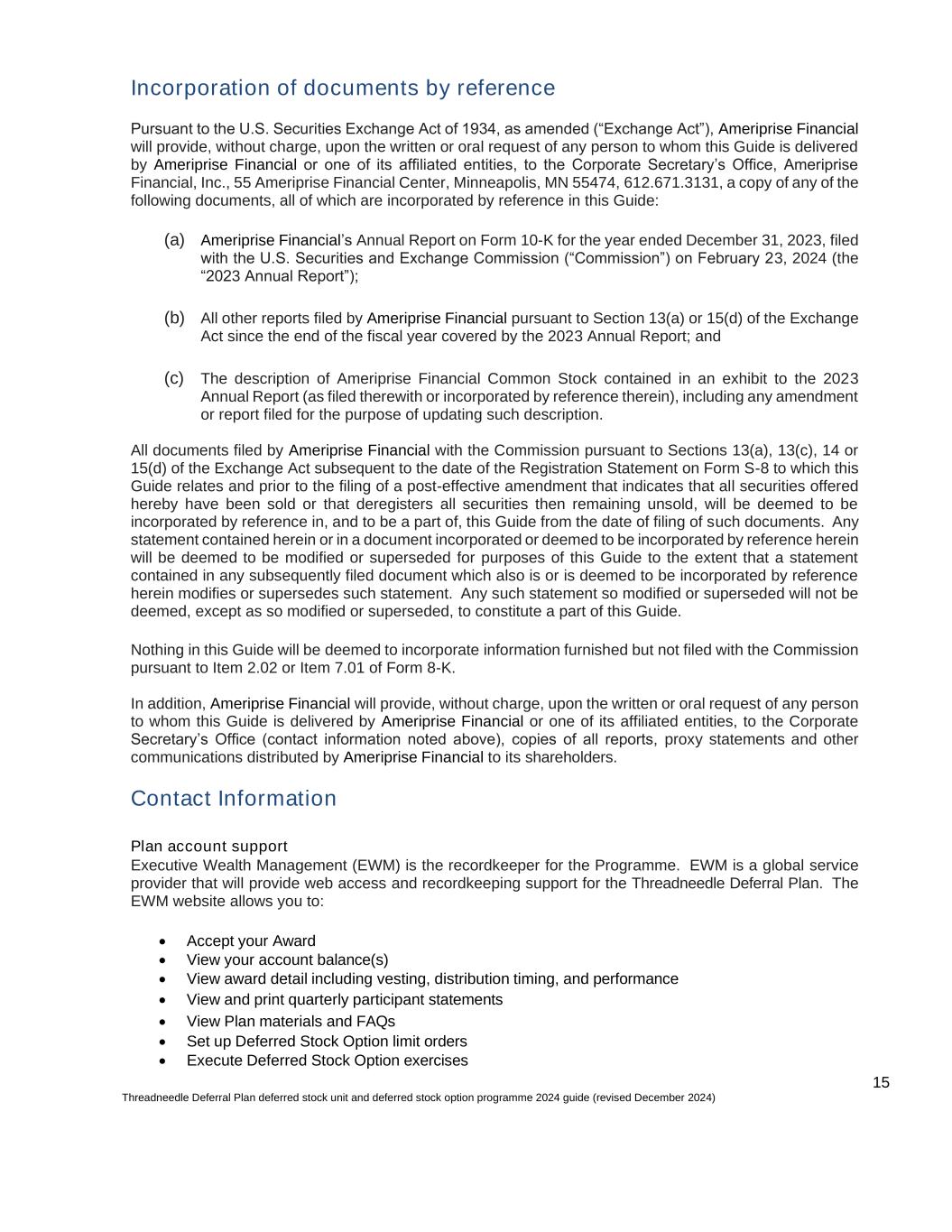

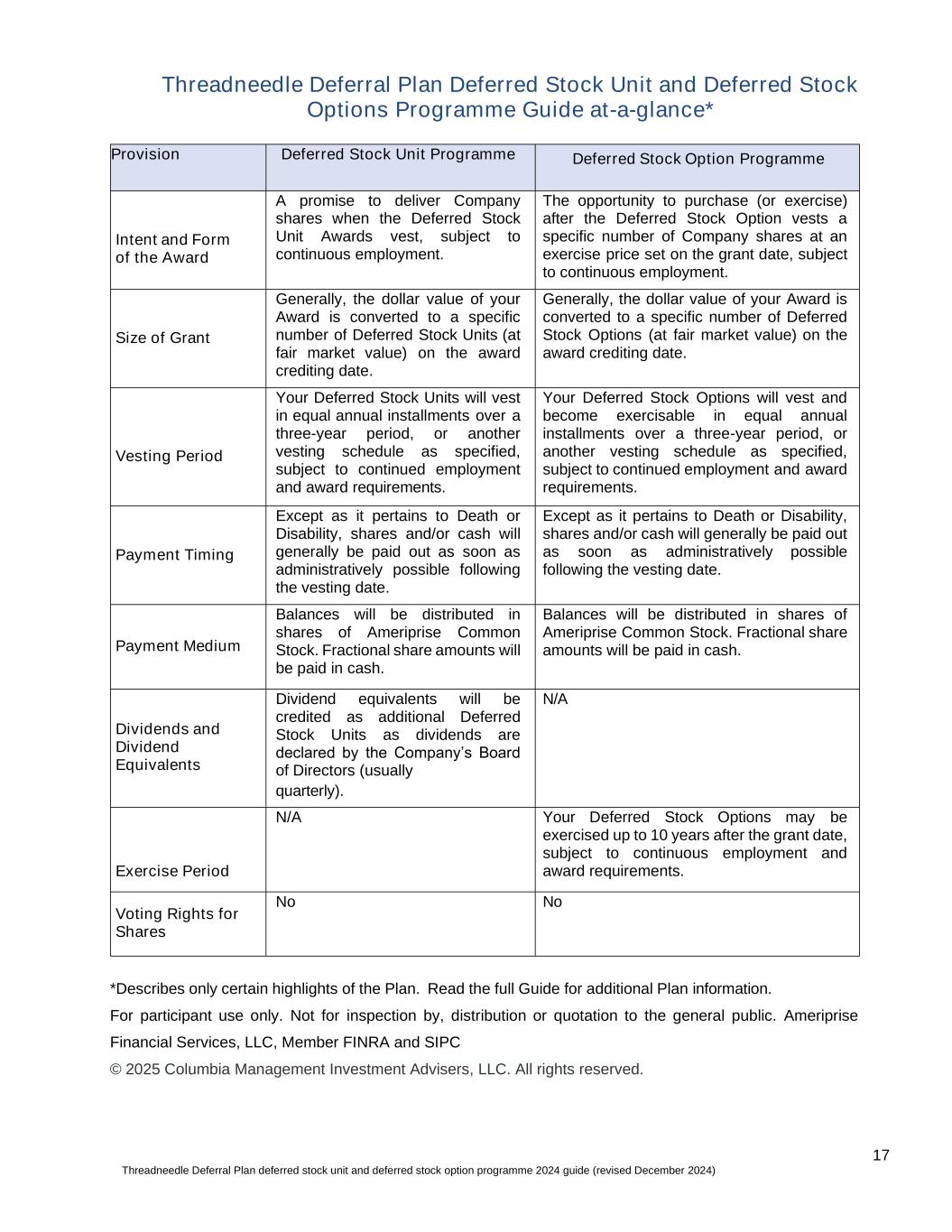

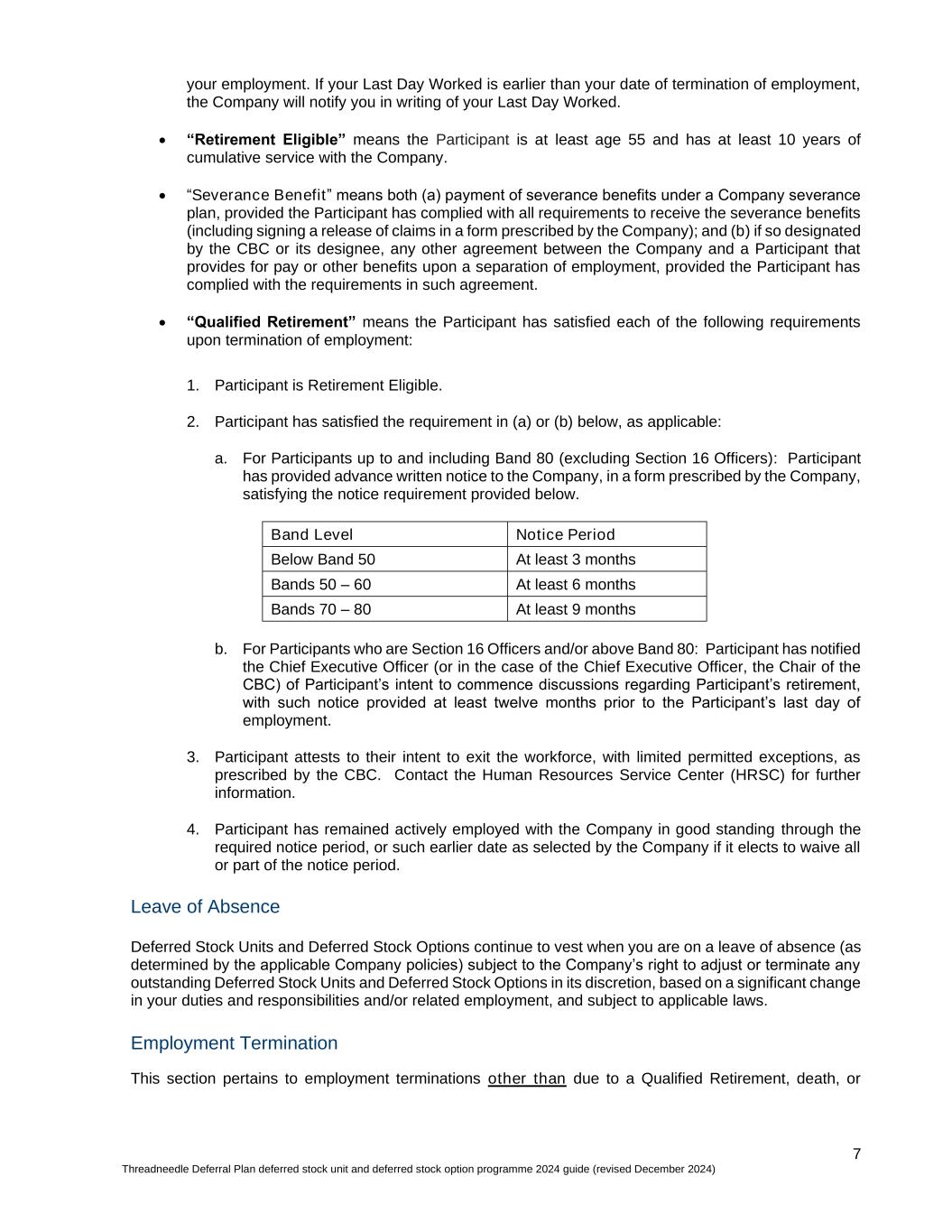

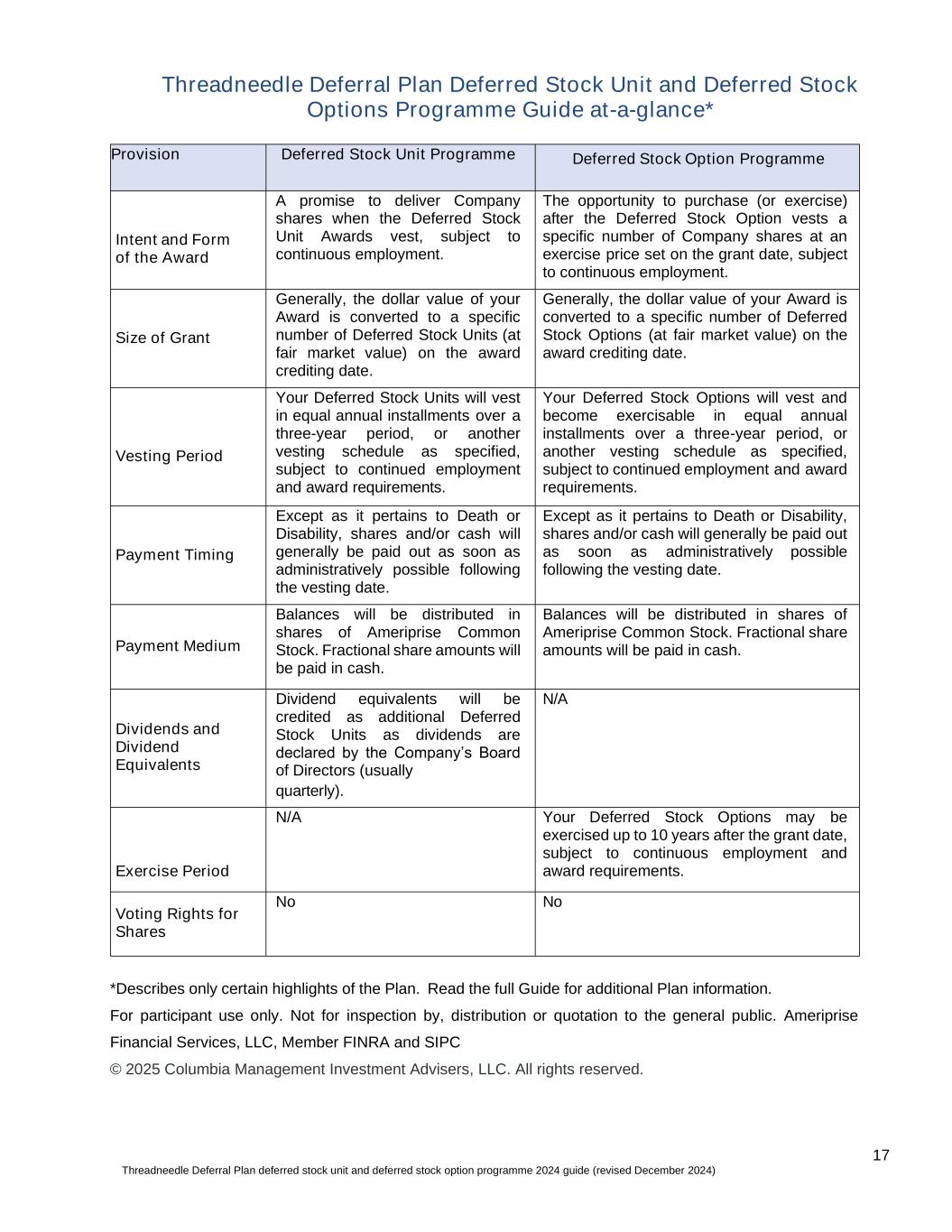

17 Threadneedle Deferral Plan deferred stock unit and deferred stock option programme 2024 guide (revised December 2024) Threadneedle Deferral Plan Deferred Stock Unit and Deferred Stock Options Programme Guide at-a-glance* Provision Deferred Stock Unit Programme Deferred Stock Option Programme Intent and Form of the Award A promise to deliver Company shares when the Deferred Stock Unit Awards vest, subject to continuous employment. The opportunity to purchase (or exercise) after the Deferred Stock Option vests a specific number of Company shares at an exercise price set on the grant date, subject to continuous employment. Size of Grant Generally, the dollar value of your Award is converted to a specific number of Deferred Stock Units (at fair market value) on the award crediting date. Generally, the dollar value of your Award is converted to a specific number of Deferred Stock Options (at fair market value) on the award crediting date. Vesting Period Your Deferred Stock Units will vest in equal annual installments over a three-year period, or another vesting schedule as specified, subject to continued employment and award requirements. Your Deferred Stock Options will vest and become exercisable in equal annual installments over a three-year period, or another vesting schedule as specified, subject to continued employment and award requirements. Payment Timing Except as it pertains to Death or Disability, shares and/or cash will generally be paid out as soon as administratively possible following the vesting date. Except as it pertains to Death or Disability, shares and/or cash will generally be paid out as soon as administratively possible following the vesting date. Payment Medium Balances will be distributed in shares of Ameriprise Common Stock. Fractional share amounts will be paid in cash. Balances will be distributed in shares of Ameriprise Common Stock. Fractional share amounts will be paid in cash. Dividends and Dividend Equivalents Dividend equivalents will be credited as additional Deferred Stock Units as dividends are declared by the Company’s Board of Directors (usually quarterly). N/A Exercise Period N/A Your Deferred Stock Options may be exercised up to 10 years after the grant date, subject to continuous employment and award requirements. Voting Rights for Shares No No *Describes only certain highlights of the Plan. Read the full Guide for additional Plan information. For participant use only. Not for inspection by, distribution or quotation to the general public. Ameriprise Financial Services, LLC, Member FINRA and SIPC © 2025 Columbia Management Investment Advisers, LLC. All rights reserved.