UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Equity Funds

For investors seeking long-term capital appreciation potential.

Annual Report

October 31, 2011

| | | | | | | | | | |

| | | Share Class / Ticker Symbol |

| | | | | |

| Fund Name | | Class A | | Class B | | Class C | | Class R3 | | Class I |

Nuveen International Fund | | FAIAX | | FNABX | | FIACX | | ARQIX | | FAICX |

Nuveen International Select Fund | | ISACX | | — | | ICCSX | | ISRCX | | ISYCX |

Nuveen Quantitative Enhanced Core Equity Fund | | FQCAX | | — | | FQCCX | | — | | FQCYX |

Nuveen Tactical Market Opportunities Fund | | NTMAX | | — | | NTMCX | | — | | FGTYX |

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

These are perplexing times for investors. The global economy continues to struggle. The solutions being implemented in the eurozone to deal with the debt crises of many of its member countries are not yet seen as sufficient by the financial markets. The political paralysis in the U.S. has prevented the compromises necessary to deal with the fiscal imbalance and government spending priorities. The efforts by individual consumers, governments and financial institutions to reduce their debts are increasing savings but reducing demand for the goods and services that drive employment. These developments are undermining the rebuilding of confidence by consumers, corporations and investors that is so essential to a resumption of economic growth.

Although it is painfully slow, progress is being made. In Europe, the turnover of a number of national governments reflects the realization by politicians and voters alike that leaders who practiced business as usual had to be replaced by leaders willing to face problems and accept the hard choices needed to resolve them. The recent coordinated efforts by central banks in the U.S. and Europe to provide liquidity to the largest European banks indicates that these monetary authorities are committed to facilitating a recovery in the European banking sector.

In the U.S., the failure of the congressionally appointed Debt Reduction Committee was a blow to those who hoped for a bipartisan effort to finally begin addressing the looming fiscal crisis. Nevertheless, Congress and the administration cannot ignore the issue for long. The Bush era tax cuts are scheduled to expire on December 31, 2012, and six months later the $1.2 trillion of mandatory across-the-board spending cuts under the Budget Control Act of 2011 begin to go into effect. Any legislative modification would require bipartisan support and the prospects for a bipartisan solution are unclear. The impact of these two developments would be a mixed blessing: a meaningful reduction in the annual budget deficit at the cost of slowing the economic recovery.

It is in these particularly volatile markets that professional investment management is most important. Skillful investment teams who have experienced challenging markets and remain committed to their investment disciplines are critical to the success of an investor’s long-term objectives. In fact, many long-term investment track records are built during challenging markets when managers are able to protect investors against these economic crosscurrents. Experienced investment teams know that volatile markets put a premium on companies and investment ideas that will weather the short-term volatility and that compelling values and opportunities are opened up when markets overreact to negative developments. By maintaining appropriate time horizons, diversification and relying on practiced investment teams, we believe that investors can achieve their long-term investment objectives.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

December 21, 2011

Portfolio Managers’ Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

The Nuveen International Fund (formerly known as First American International Fund) is managed by a team of managers associated with three different sub-advisers: Nuveen Asset Management, LLC, an affiliate of Nuveen Investments; Altrinisic Global Advisors, LLC; and Hansberger Global Investors, Inc.

The Nuveen International Select Fund (formerly known as First American International Select Fund) is managed by a team of managers associated with four different sub-advisers: Nuveen Asset Management, LLC, an affiliate of Nuveen Investments; Altrinsic Global Advisors, LLC; Hansberger Global Investors, Inc.; and Lazard Asset Management LLC.

The Nuveen Quantitative Enhanced Core Equity Fund (formerly known as First American Quantitative Large Cap Core Fund and Nuveen Quantitative Large Cap Core Fund) is managed by a team of managers from Nuveen Asset Management, LLC, an affiliate of Nuveen Investments. Effective May 16, 2011, the Fund changed its name from the Nuveen Quantitative Large Cap Core Fund to Nuveen Quantitative Enhanced Core Equity Fund. There were no changes in the Fund’s investment objectives, policies or portfolio management personnel.

Nuveen Tactical Market Opportunities Fund (formerly known as First American Tactical Market Opportunities Fund) is managed by a team of managers from Nuveen Asset Management, LLC, an affiliate of Nuveen Investments.

On the following pages, the portfolio management teams for the Funds examine economic and equity market conditions, key investment strategies and the Funds’ performance for the twelve-month period ended October 31, 2011.

What factors affected the economic and equity market environments during the twelve-month reporting period ended October 31, 2011?

During this period, the U.S. economy’s recovery from recession remained slow. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by continuing to hold the benchmark fed funds rate at the record low level of zero to 0.25% that it had established in December 2008. At its November 2011 meeting (shortly after the end of this reporting period), the central bank reaffirmed its opinion that economic conditions would likely warrant keeping this rate at “exceptionally low levels” at least through mid-2013. The Fed also said that it would continue its program to extend the average maturity of its U.S. Treasury holdings by purchasing $400 billion of these securities with maturities of six to thirty years and selling an equal amount of U.S. Treasury securities with maturities of three years or less. The goals of this program, which the Fed

expects to complete by the end of June 2012, are to lower longer-term interest rates, support a stronger economic recovery, and help ensure that inflation remains at levels consistent with the Fed’s mandates of maximum employment and price stability.

In the third quarter of 2011, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew at an annualized rate of 2.0%, the best growth number since the fourth quarter of 2010 and the ninth consecutive quarter of positive growth. The Consumer Price Index (CPI) rose 3.5% year-over-year as of October 2011, while the core CPI (which excludes food and energy) increased 2.1%, edging just above the Fed’s unofficial objective of 2.0% or lower for this inflation measure. Unemployment numbers remained high, as October 2011 marked the seventh straight month with a national jobless number of 9.0% or higher. However, after the reporting period came to a close, the U.S. unemployment rate fell to 8.6% in November 2011. While the dip was a step in the right direction, it was partly due to a number of individuals dropping out of the hunt for work. The housing market also continued to be a major weak spot. For the twelve months ended September 2011 (the most recent data available at the time this report was prepared), the average home price in the Standard & Poor’s/Case-Shiller Index lost 3.6%, with 18 of the 20 major metropolitan areas reporting losses. In addition, the U.S. economic picture continued to be clouded by concerns about the European debt crisis and efforts to reduce the federal deficit.

The ongoing economic uncertainty and the continual resurfacing of the European debt issue caused a high degree of volatility in the equity markets. The first half of the period saw dramatic gains for stocks and other risk assets fueled by signs of an improving economy. However, as the summer progressed, markets fell back sharply. For much of August and September, stocks traded lower before staging a comeback in the final month of the period. Over the course of the full reporting period, larger U.S. companies generally had stronger returns than their smaller sized and overseas counterparts.

Nuveen International Fund

How did the Fund perform during the twelve-month period ended October 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year, five-year and ten-year periods ended October 31, 2011. The Fund’s Class A Shares at net asset value (NAV) modestly underperformed the MSCI EAFE Index and outperformed Lipper classification average over the twelve-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide long-term capital appreciation by investing primarily in equity securities of foreign issuers that trade in U.S. or foreign markets, depositary receipts representing shares of foreign issuers, and exchange-traded funds and other investment companies that provide exposure to foreign issuers. Two of the Fund’s sub-advisers, Altrinsic Global Advisors, LLC, and Hansberger Global Investors, Inc., select stocks for the Fund according to the developed markets growth and developed markets value styles,

respectively. At the same time, the Fund’s third sub-adviser, Nuveen Asset Management, LLC, maintains strategic oversight of the Fund, which includes allocating assets among the sub-advisers (including itself), tactically adjusting the overall portfolio balance and country emphasis using index-related investments, and selecting stocks in the infrastructure sector.

Our most successful strategy for the Fund during the fiscal year was an underweight stance in Europe, which averaged 5% below the index weight. In particular, we minimized the Fund’s exposure to stocks from the eurozone’s most troubled economies — Greece, Ireland, Italy, Portugal and Spain — because we have long anticipated Europe’s sovereign debt problem. Likewise, we also avoided stocks of European banks, as they have meaningful exposure to the debt from these countries. During the period, European stocks took a sharp downturn as investors were sorely disappointed by the inability of politicians to gain a meaningful consensus on how to effectively deal with the issue. In contrast to the eurozone underweight, the Fund successfully emphasized countries like Sweden and the United Kingdom. Although monetary disruptions in the euro area would potentially harm many other nations, the U.K.’s ability to conduct its own monetary policy, plus its heavy exposure to international resources stocks, made it a safer position in our opinion. We favored Sweden because it is likewise relatively unencumbered by euro issues, as well as having a robust export-oriented industrial sector.

Our positioning in Japan also proved beneficial over the period. We held an underweight allocation to Japan early on, which aided results as its market dropped sharply in reaction to the earthquake and ensuing nuclear plant disaster in March. Following the initial steep market decline, we moved to an overweight in Japan, which proved beneficial as the Japanese market did stabilize. The country benefited from the very aggressive liquidity provided by the Bank of Japan in the wake of the disaster and the economic stimulus provided by its rebuilding efforts.

The Fund’s performance was also helped by our emphasis on significant materials producing and exporting nations, including Canada and Australia. We overweighted these countries because we continued to believe that demand, particularly for metals and minerals, would outpace supply. Indeed, heavy demand for raw materials around the world made this a successful strategy to employ. The overweight to Canada in particular was a plus as its market was more stable during the summer’s downturn. Our overweight to Australia produced slightly more mixed results, but ended the period as a positive contributor. Early on, Australia’s market lagged after its reserve bank tightened monetary policy at the same time the country was hit with devastating floods. Although Australia’s market faltered slightly, we continued to maintain our overweight based on attractive stock valuations and market fundamentals. We also favored Australia because the country is a large coal producer, a commodity that is not as impacted as oil by speculation and reduced demand. Australia’s market provided better results in the second half of the reporting period.

Offsetting these areas of strength was our overweight of approximately 3% in emerging markets, mostly through the portfolio’s positions in Brazil and China. In aggregate, emerging markets underperformed developed markets over this reporting period. Early in the period, we believed Chinese stocks had fallen back from their high level of overvaluation and that select companies in Brazil looked attractive. However, these two

key emerging markets produced disappointing returns in the first half of the period despite strong growth in their economies. Building inflationary pressures in each country led to various monetary policy tightening measures that ended up restraining performance in these markets. Although the policy steps were effective and the emerging markets staged a brief comeback in March, the situation was short-lived. As concerns about the European sovereign debt situation and a global growth slowdown escalated in mid-summer, emerging markets took another big hit. In particular, China slowed dramatically due to the export-oriented nature of its economy and concerns of speculative bubbles that could disrupt the economy by producing a “hard landing” from China’s continuing strong growth. We had continued to dramatically overweight China as we anticipated it would hold up better than it did as the country continued to re-direct toward internal growth.

Throughout the period, we also invested in equity and currency futures contracts. These futures were used as an overlay strategy to adjust the exposures created by our multi-manager framework so that the overall Fund had the desired exposures to key markets. Long and short futures contracts were used to implement various tactical market and hedging strategies. For example, in response to the concerns about the future of the euro due to the European Central Bank policies, we emphasized dollar versus euro-based investing. At the end of the period, this contributed a small benefit to returns. We initiated and still maintained at the end of the period a short position on the euro and a positive position on the dollar. Throughout the period, we also used equity contracts to underweight both India and Mexico at various times, which produced a modest benefit.

Because of our ongoing concerns about a positive resolution in Europe, we maintained the Fund’s approximately 5% underweight to developed nations, especially in the eurozone. At the end of the reporting period, the Fund had a 9% underweight in Europe, including a significant tilt away from France. We believe the fiscal austerity measures required to receive funding aid and the elevated cost of debt financing are likely to further constrain growth. This may continue to weigh on the performance of these economies and markets in the coming year. Therefore, we’ve shifted the Fund’s allocations primarily to other developed nations, while maintaining a small overexposure to emerging markets. Within the developed markets, we are continuing to focus on countries that have shown good organic growth lately. We continue to be modestly optimistic about global growth prospects while recognizing that the investing climate has many investors worried. Because of our concerns about spreading risk from the European situation, we expect to continue to underweight banks and other financial stocks until we see resolution of the heavy sovereign debt loads. Meanwhile, we will continue to emphasize commodities-based economies in the Fund, especially those involved in the metals, minerals and energy sectors. In emerging markets, we are emphasizing select companies in Brazil, which we believe will perform well despite the country’s inflation problem. We have also initiated a position in a portfolio of gold producers as a hedge.

Nuveen International Select Fund

How did the Fund perform during the twelve-month period ended October 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year and since inception periods ended October 31, 2011. The Fund’s Class A Shares at net asset value (NAV) underperformed the MSCI All Country World Investable Market Index (ex US) and the Lipper classification average over the twelve-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide long-term capital appreciation by investing primarily in equity securities of foreign issuers that trade in U.S. or foreign markets, depositary receipts representing shares of foreign issuers, and exchange-traded funds and other investment companies that provide exposure to foreign issuers. Three of the Fund’s sub-advisers, Altrinsic Global Advisors, LLC; Hansberger Global Investors, Inc.; and Lazard Asset Management LLC, select stocks for the Fund according to the developed markets growth, developed markets value or emerging market styles, respectively. At the same time, the Fund’s fourth sub-adviser, Nuveen Asset Management, LLC, maintains strategic oversight of the Fund, which includes allocating assets among the sub-advisers (including itself), tactically adjusting the overall portfolio balance and country emphasis using index-related investments and selecting stocks in the infrastructure sector.

During the period, the primary cause of the Fund’s underperformance was its overweight to emerging markets. Although we significantly pulled back the overweight, it was still detrimental as these markets in aggregate underperformed developed markets over this time frame. Early in the period, the Fund moved to an overweight in China because we believed its stocks had fallen back from their high level of overvaluation. We also held a modest overweight to Brazil and an underweight to India. However, these three key emerging markets produced disappointing returns in the first half of the period despite strong growth in their economies. Building inflationary pressures in each country led to various monetary policy tightening measures that ended up restraining performance in these markets. Although the policy steps were effective and the emerging markets staged a brief comeback in March, the situation was short-lived. As concerns about the European sovereign debt situation and a global growth slowdown escalated in mid-summer, emerging markets took another big hit. In particular, China slowed dramatically due to the export-oriented nature of its economy and concerns of speculative bubbles that could disrupt the economy by producing a “hard landing” from China’s continuing strong growth. We had continued to dramatically overweight China as we anticipated it would hold up better than it did as the country continued to re-direct toward internal growth.

Also within the emerging markets, our significant overweight to Russia had mixed results, but in the end proved detrimental to the Fund’s performance. In the first part of the fiscal year, the overweight stance in Russia generated positive returns. As a low-cost producer of oil, Russia benefited from the rising cost of commodities that peaked in late spring.

However, stocks in Russia, which are generally driven by demand for energy from Europe and China and the price of energy globally, retreated based on the slowdown in energy prices that persisted throughout the summer. We maintained the Fund’s overweight because we believed that Russia’s low-cost producers would continue to perform well even if prices didn’t maintain their highs.

On the positive side, our most successful strategy by far in the Fund was our underweight to Europe, which averaged 5% below the index during the fiscal year. In particular, we minimized the Fund’s exposure to stocks from the eurozone’s most troubled economies — Greece, Ireland, Italy, Portugal and Spain — because we have long anticipated Europe’s sovereign debt problem. Likewise, we also avoided stocks of European banks, as they have meaningful exposure to the debt from these countries. During the period, European stocks took a sharp downturn as investors were sorely disappointed by the inability of politicians to gain a meaningful consensus on how to effectively deal with the issue. In contrast to the eurozone underweight, the Fund successfully emphasized countries like Sweden and the United Kingdom. Although monetary disruptions in the euro area would potentially harm many other nations, the U.K.’s ability to conduct its own monetary policy, plus its heavy exposure to international resources stocks, made it a safer position. We favored Sweden because it is likewise relatively unencumbered by euro issues, as well as having a robust export-oriented industrial sector.

Our positioning in Japan also proved beneficial over the period. We held an underweight allocation to Japan early on, which aided results as its market dropped sharply in reaction to the earthquake and ensuing nuclear plant disaster in March. Following the initial steep market decline, we moved to an overweight in Japan, which proved beneficial as the Japanese market did stabilize. The country benefited from the very aggressive liquidity provided by the Bank of Japan in the wake of the disaster and the economic stimulus provided by its rebuilding efforts.

The Fund’s performance also benefited from an emphasis on significant materials producing and exporting nations, including Canada and Australia. We overweighted these countries because we continued to believe that demand, particularly for metals and minerals, would outpace supply. Indeed, heavy demand for raw materials around the world made this a successful strategy to employ. The overweight to Canada in particular was a plus as its market was more stable during the summer’s downturn. Our overweight to Australia produced slightly more mixed results, but ended the period as a positive contributor. Early on, Australia’s market lagged after its reserve bank tightened monetary policy at the same time the country was hit with devastating floods. Although Australia’s market faltered slightly, we continued to maintain our overweight based on attractive stock valuations and market fundamentals. We also favored Australia because the country is a large coal producer, a commodity that is not as impacted by speculation and reduced demand as oil. Australia’s market provided better results in the second half of the reporting period.

Throughout the period, we also invested in equity and currency futures contracts. These futures were used as an overlay strategy to adjust the exposures created by our multi-manager framework so that the overall Fund had the desired exposures to key markets. Long and short futures contracts were used to implement various tactical market

and hedging strategies. For example, in response to the concerns about the future of the euro due to the European Central Bank policies, we emphasized dollar versus euro-based investing. We initiated and still maintain a short position on the euro and a positive position on the dollar.

Because of our ongoing concerns about a positive resolution in Europe, we are maintaining the Fund’s underweight to developed nations, especially in the eurozone. At the end of the reporting period, the Fund had a 9% underweight in Europe. We believe the fiscal austerity measures required to receive funding aid and the elevated cost of debt financing are likely to further constrain growth. This may continue to weigh on the performance of these economies and markets in the coming year. Therefore, we’ve shifted the Fund’s allocations to other developed and emerging market nations. Within the developed markets, we are continuing to focus on countries that have shown good organic growth lately. We continue to be modestly optimistic about global growth prospects while recognizing that the investing climate has many investors worried. Because of our concerns about spreading risk from the European situation, we expect to continue to underweight banks and other financial stocks until we see resolution of the heavy sovereign debt loads. Meanwhile, we will continue to emphasize commodities-based economies in the Fund, especially those involved in the metals, minerals and energy sectors.

Within emerging markets, we continue to hold an overweight position, particularly in the Pacific Rim, comprised of many small positions in countries such as Indonesia, Malaysia, Korea, Turkey and Russia as well as a modest overweight to China. Many of these countries are relatively less export oriented and we believe may be more reliant on internal growth and less sensitive to events in Europe. Conversely, we hold an underweight position in Taiwan because of its position as a major exporter of electronic and consumer products. In addition, we are maintaining a large overweight to select companies in Brazil, which we believe will perform well despite the country’s inflation problem. We have also initiated a position in a portfolio of gold producers as a hedge.

Nuveen Quantitative Enhanced Core Equity Fund

How did the Fund perform during the twelve-month period ended October 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year and since inception periods ended October 31, 2011. The Fund’s Class A Shares at net asset value (NAV) underperformed the S&P 500 Index over the twelve-month period, but outperformed the Lipper classification average.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund’s goal is to provide, over the long term, a total return that exceeds the return of the S&P 500 Index. In attempting to achieve this goal, the Fund primarily invests in the common stocks of companies that have market capitalizations at the time of purchase

within the range of the companies in the S&P 500 Index. To select specific stocks, we use proprietary models that help establish quantitative links between economic and market variables, investment factors and equity market returns. Our proprietary models analyze macroeconomic and market data and other statistics to determine what we believe will be the key drivers of performance in the current economy. We use historical analysis of these drivers to estimate equity market returns and the relative contribution to these returns from a comprehensive list of investment factors. We then evaluate each stock in the investable universe to determine its sensitivity to each factor and estimate a potential contribution for each stock. Our goal is to build an optimized portfolio that targets the highest expected returns, while using the proprietary models and processes described above to maintain as tight a control as possible on overall risk.

During the reporting period, performance benefited from our shifts toward stocks with several characteristics that we believed were most in favor. Our tilt toward the lower end of the S&P 500 Index’s market capitalization range was the Fund’s most significant style position, and by far the most successful strategy throughout the period. For example, the Fund’s geometric weighted average market capitalization of $41 billion was below the $48 billion calculated for the S&P 500 Index at fiscal year-end. Two other style moves were beneficial for the Fund during the period. We successfully emphasized companies with higher quality balance sheets, as measured by their lower debt-to-equity ratios, on average, during the period. We also were rewarded for our avoidance of stocks that had a high percentage of their outstanding shares being traded, which to many indicates a higher level of speculation.

In terms of the sector component of our strategy, the Fund benefited from successful relative positions in financials and basic materials. The financial sector was the worst-performing sector over this time frame. For three-fourths of the fiscal year, we successfully underweighted financials (particularly large banks) in the Fund, which our models first signaled to do in late 2007 due to weaker prospects across the sector. While we held this significant underweight, the sector fell more than 22% in August. The drop was notably worse than the broad market because of concerns that large financial institutions would suffer significant losses due to write-downs of European nations’ debts. Toward the end of the fiscal year, we made a shift back to overweighting financials when their prices were very inexpensive by historical standards. Our models indicated that continued accommodative monetary policy by the Federal Reserve might benefit profitability at banks. Financial stocks performed extremely well in the final month of the period. The Fund’s performance also benefited from an overweight in the basic materials sector, particularly metals and chemicals. Heavy demand around the world for raw materials made this emphasis a successful strategy to employ. As always, the Fund’s sector positions were consistent with our efforts to control risk exposure as tightly as possible.

Unfortunately, the Fund’s unfavorable results among other style and sector themes offset some of the above-mentioned areas of strength. For example, the Fund was negatively impacted by our tilt toward the value style through our emphasis on stocks with a higher ratio of book value to market value, and value stocks underperformed during this period. In terms of sectors, the biggest negative contribution to performance came from significantly underweighting consumer stocks, both in the staples and discretionary

groups. Our models indicated this underweight stance based on poor readings for unemployment, consumer sentiment and personal income growth. However, investors saw opportunities for consumer spending to increase from very depressed levels and bid these stocks, especially discretionaries, up during the year.

Mis-timed weightings in the technology sector also dragged slightly on performance. We started the year with an emphasis on cyclical stocks and a substantial overweight to technology. Although we were optimistic about business spending in technology, the sector’s performance was relatively flat. After the outlooks for business investment and manufacturing activity fell off abruptly in mid-summer and the markets became significantly more volatile, our models indicated a shift to an underweight. However, after the technology sector took a nosedive, it bounced back quickly to end with relatively good performance.

Our timing in energy also caused slightly negative results as the sector was by far the top-performing area of the index, advancing more than 17% during the fiscal year. We started the period with an underweight and missed out on the sector’s strong gains as oil prices rose significantly. After March, we moved to an overweight in energy stocks as our models indicated that stock prices had not increased enough in relation to the high cost of oil. However, when oil prices fell from around $113 per barrel to just below $80, these stocks experienced tremendous downside. The segment’s relative performance since we moved to an overweight at the end of March has been negative.

Performance was also hurt by our average underweight in health care stocks, particularly large pharmaceuticals. These stocks performed well during the period due to their above-average dividend yields and investors renewed interest in the segment.

We continue to monitor key indicators that have historically signified which stocks will perform best in the current environment. With the economic conditions in the United States remaining difficult and concerns abounding about Europe’s debt crisis, we expect the Federal Reserve will continue with its very accommodative monetary policy. While we believe the economics for businesses and consumers are stabilizing, companies will likely face only modest opportunities for increasing profits as cost reductions have, for the most part, taken place. We’ll continue to watch for opportunities in individual sectors and investing styles that are likely to do well in a low-growth environment, such as value investing. Also, the Fund continues to be postured with a bias toward smaller companies within the S&P 500, as many of these are less sensitive to global conditions.

Throughout the period, we also invested in S&P 500 Index futures contracts, which were used to convert cash into the equivalent of an S&P 500 Index holding. This helped to minimize tracking error to the Fund’s benchmark index resulting from cash flow activity and tactical portfolio management positioning.

Nuveen Tactical Market Opportunities Fund

How did the Fund perform during the twelve-month period ended October 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for since inception period ended October 31, 2011.

The Fund’s Class A Shares at net asset value (NAV) outperformed the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index and the Lipper classification average over the period from the Fund’s inception on February 24, 2011, through October 31, 2011.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide investors with the potential for a positive total return over a reasonable period of time, regardless of market conditions. To accomplish this, the Fund invests in a variety of assets and periodically adjusts its allocations to fixed income, equities and cash. Other asset classes, such as currencies and commodities, are held at times to take advantage of market opportunities or to further diversify the Fund.

During this initial period for the Fund, its fixed-income component provided the biggest contribution to positive performance. The fixed-income allocation generally consisted of long duration U.S. Treasury securities, as well as exchange-traded funds (ETFs) in various fixed-income sectors, such as investment-grade credit, high-yield bonds, emerging market debt, mortgage-backed securities and preferred stock. We also included short U.S. Treasury futures at the front end of the yield curve as a view on market rates and also as a hedge for other fixed-income securities. High-yield, municipal bond and preferred stock ETFs, as well as 30-year U.S. Treasury securities, were the primary positive contributors in the fixed-income portfolio during this period.

The Fund’s equity component also provided a significant positive contribution to performance. The equity allocation included several long positions in index futures and ETFs. Overall, the Fund benefited from long positions in Germany, the S&P 500 Index, South Africa, emerging markets and Chile as well as a short position in Spain.

Long positions in Switzerland and Hong Kong detracted from the Fund’s performance. In addition, short positions in the Russell 2000 Index, the Morgan Stanley Capital International Europe, Australasia and Far East (MSCI EAFE) Index and the NASDAQ Composite Index also hindered results. Although these short positions underperformed, they were utilized as part of spread trades with positions in other countries, and did not necessarily reflect a negative outlook on the broad market. Rather, these spread trades are used to express a view of relative performance between countries, while attempting to reduce the overall volatility of the Fund.

As previously mentioned, the fixed-income component consisted of U.S. Treasury securities and a variety of fixed-income ETFs representing various sectors such as investment-grade credit, high-yield bonds, mortgage-backed securities, emerging market debt and preferred stock. These securities are held in various proportions at different times, and are a primary component of the Fund’s strategy. ETF rotation within fixed income is an ongoing process to take advantage of market conditions, the outlook for fixed-income sectors and relative yield advantages.

The equity component of the Fund generally consisted of long or short futures contracts as well as country and sector ETFs. While net equity exposure remained constrained, gross exposure was significant and reflected a view of relative country performance. These views were generally expressed with futures spread trades such as long S&P 500 Index/short Russell 2000 Index, long Germany equities/short Spanish equities and long

Indian equities/short Korean and Taiwanese equities, to name a few. Other securities, such as high-yield and preferred stock ETFs, provided equity-like exposure yet were not included in the net and gross equity market value calculation. When evaluating the proper equity risk exposure, the weights of these fixed-income ETFs are considered. From a positioning perspective, we have reduced the Fund’s net exposure to equities in general while maintaining positions in emerging markets such as Russia and spread trades such as long China/short India and long Taiwan/short Nasdaq.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Equity investments are subject to market risk. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets.

These Funds are actively managed, and each at times may use a proprietary quantitative process that projects individual stock performance based on multiple factors and current economic conditions. Stocks selected using this process could underperform if the performance of the considered factors differs from historic norms. There is no guarantee that the Funds will achieve their investment objectives. The advisor’s asset allocation decisions may be incorrect and could adversely affect Fund performance. The Funds may be exposed to the risks of the underlying securities held by an exchange-traded fund (ETF) and may bear a proportionate share of the ETF’s expenses. Derivative investing may involve a high degree of financial risk, including the risk that the loss on a derivative may be greater than the principal amount invested. The use of leverage through the use of derivatives may magnify this risk. Debt securities typically decrease in value when interest rates rise. This risk is greater for longer-term debt securities. Lower-rated and nonrated securities present a greater risk of loss to principal and interest rate than higher-rated securities. Commodity prices may be highly volatile and are affected by factors such as changes in demand, disruption in supply, and hedging and trading strategies of other market participants. Each of these asset classes may be less liquid and more volatile.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Fund Performance and Expense Ratios (Unaudited)

The Fund Performance and Expense Ratios for each Fund are shown on the following eight pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

Effective January 18, 2011, Class R Shares and Class Y Shares, previously offered by FAF Advisors, Inc., were renamed Class R3 Shares and Class I Shares, respectively.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waivers or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen International Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of October 31, 2011

| | | | | | | | | | | | |

| |

| | | Average Annual | |

| | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | -3.93% | | | | -2.72% | | | | 3.67% | |

Class A Shares at maximum Offering Price | | | -9.45% | | | | -3.87% | | | | 3.06% | |

MSCI EAFE Index* | | | -3.64% | | | | -1.95% | | | | 6.19% | |

Lipper International Large-Cap Growth Fund Classification Average* | | | -5.48% | | | | -1.12% | | | | 5.47% | |

| | | |

Class B Shares w/o CDSC** | | | -4.64% | | | | -3.46% | | | | 2.88% | |

Class B Shares w/CDSC** | | | -9.40% | | | | -3.63% | | | | 2.88% | |

Class C Shares | | | -4.71% | | | | -3.44% | | | | 2.89% | |

Class R3 Shares | | | -4.10% | | | | -2.89% | | | | 3.42% | |

Class I Shares | | | -3.90% | | | | -2.52% | | | | 3.90% | |

Latest Calendar Quarter – Average Annual Total Returns as of September 30, 2011

| | | | | | | | | | | | |

| |

| | | Average Annual | |

| | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | -8.79% | | | | -3.60% | | | | 3.05% | |

Class A Shares at maximum Offering Price | | | -14.06% | | | | -4.74% | | | | 2.44% | |

Class B Shares w/o CDSC** | | | -9.46% | | | | -4.35% | | | | 2.27% | |

Class B Shares w/CDSC** | | | -13.99% | | | | -4.52% | | | | 2.27% | |

Class C Shares | | | -9.45% | | | | -4.32% | | | | 2.28% | |

Class R3 Shares | | | -9.04% | | | | -3.79% | | | | 2.80% | |

Class I Shares | | | -8.54% | | | | -3.36% | | | | 3.31% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios | | | Net

Expense

Ratios | |

Class A Shares | | | 1.66% | | | | 1.50% | |

Class B Shares | | | 2.41% | | | | 2.25% | |

Class C Shares | | | 2.41% | | | | 2.25% | |

Class R3 Shares | | | 1.91% | | | | 1.75% | |

Class I Shares | | | 1.41% | | | | 1.25% | |

The Fund’s adviser has contractually agreed to waive fees and reimburse expenses through February 29, 2012, so that total annual Fund operating expenses, after waivers and excluding any acquired Fund fees and expenses, do not exceed 1.49%, 2.24%, 2.24%, 1.74% and 1.24%, respectively, for Class A, Class B, Class C, Class R3 and Class I Shares. Fee waivers and expense reimbursements will not be terminated prior to that time without with approval of the Fund’s Board of Directors.

| * | Refer to the Glossary of Terms Used in this Report for definitions. |

| ** | Class B Shares are available only upon the exchange of Class B Shares from another Nuveen mutual fund for which U.S. Bancorp Fund Services, LLC serves as transfer agent or for purposes of dividend reinvestment, but Class B shares are not available for new accounts or for additional investment into existing accounts. |

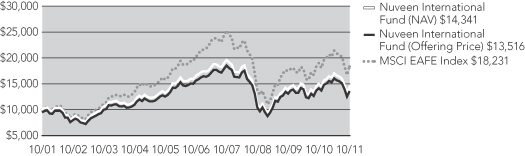

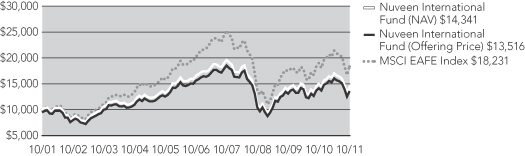

Growth of an Assumed $10,000 Investment as of October 31, 2011 — Class A Shares

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen International Select Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of October 31, 2011

| | | | | | | | |

| |

| | | Average Annual | |

| | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares at NAV | | | -6.70% | | | | -1.47% | |

Class A Shares at maximum Offering Price | | | -12.05% | | | | -2.66% | |

MSCI All Country World Investable Market Index (ex US)** | | | -4.25% | | | | -1.11% | |

Lipper International Large-Cap Growth Fund Classification Average** | | | -5.48% | | | | -2.12% | |

| | |

Class C Shares | | | -7.45% | | | | -2.21% | |

Class R3 Shares | | | -8.54% | | | | -2.07% | |

Class I Shares | | | -6.60% | | | | -1.23% | |

Latest Calendar Quarter – Average Annual Total Returns as of September 30, 2011

| | | | | | | | |

| |

| | | Average Annual | |

| | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares at NAV | | | -12.03% | | | | -3.31% | |

Class A Shares at maximum Offering Price | | | -17.04% | | | | -4.50% | |

Class C Shares | | | -12.70% | | | | -4.03% | |

Class R3 Shares | | | -13.70% | | | | -3.89% | |

Class I Shares | | | -11.83% | | | | -3.07% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | |

| |

| | | Expense

Ratios | |

Class A Shares | | | 1.50% | |

Class C Shares | | | 2.25% | |

Class R3 Shares | | | 1.75% | |

Class I Shares | | | 1.25% | |

The Fund’s adviser has contractually agreed to waive fees and reimburse other Fund expenses through February 29, 2012, so that total annual Fund operating expenses, after waivers and excluding any acquired Fund fees and expenses, do not exceed 1.49%, 2.24%, 1.74%, and 1.24%, respectively, for Class A, Class C, Class R3, and Class I Shares. Fee waivers and expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors.

| * | Since inception returns are from 12/21/06. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. |

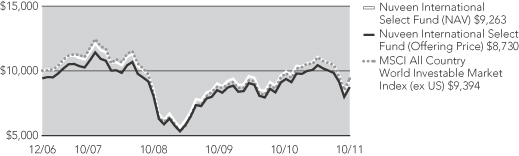

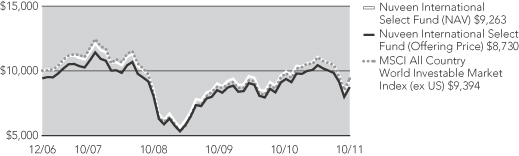

Growth of an Assumed $10,000 Investment as of October 31, 2011 — Class A Shares

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Quantitative Enhanced Core Equity Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of October 31, 2011

| | | | | | | | |

| |

| | | Average Annual | |

| | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares | | | 6.50% | | | | -2.06% | |

S&P 500 Index** | | | 8.09% | | | | -1.31% | |

Lipper Large Cap Core Fund Classification Average** | | | 5.39% | | | | -2.03% | |

| | |

Class C Shares | | | 5.76% | | | | -2.77% | |

Class I Shares | | | 6.79% | | | | -1.80% | |

Latest Calendar Quarter – Average Annual Total Returns as of September 30, 2011

| | | | | | | | |

| |

| | | Average Annual | |

| | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares | | | -0.27% | | | | -4.50% | |

Class C Shares | | | -1.00% | | | | -5.20% | |

Class I Shares | | | -0.03% | | | | -4.26% | |

Class A Shares have no sales charge and are available only through fee-based programs and certain retirement plans. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios | | | Net

Expense

Ratios | |

Class A Shares | | | 0.99% | | | | 0.71% | |

Class C Shares | | | 1.74% | | | | 1.46% | |

Class I Shares | | | 0.74% | | | | 0.46% | |

The Fund’s adviser has contractually agreed to waive fees and reimburse expenses through February 29, 2012, so that total annual Fund operating expenses, after waivers and excluding any acquired Fund fees and expenses, do not exceed 0.70%, 1.45%, and 0.45%, respectively, for Class A, Class C and Class I Shares. Fee waivers and expense reimbursements will not be terminated prior to that time without with approval of the Fund’s Board of Directors.

| * | Since inception returns are from 7/31/07. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. |

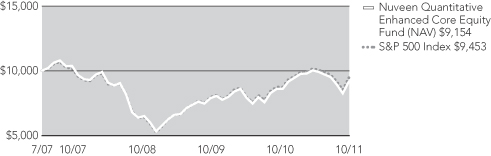

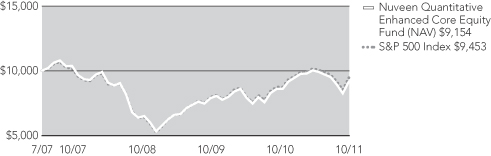

Growth of an Assumed $10,000 Investment as of October 31, 2011 — Class A Shares

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Tactical Market Opportunities Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of October 31, 2011*

| | | | | | | | |

| | | Average Annual | |

| | |

| | | 1-Year* | | | Since

Inception* | |

Class A Shares at NAV | | | 6.61% | | | | 6.89% | |

Class A Shares at maximum Offering Price | | | 0.45% | | | | 3.49% | |

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index** | | | 0.13% | | | | 0.12% | |

Lipper Flexible Portfolio Fund Classification Average** | | | 3.69% | | | | 6.40% | |

| | |

Class C Shares | | | 5.87% | | | | 6.08% | |

Class I Shares | | | 6.95% | | | | 7.18% | |

Latest Calendar Quarter – Average Annual Total Returns as of September 30, 2011

| | | | | | | | |

| | | Average Annual | |

| | |

| | | 1-Year* | | | Since

Inception* | |

Class A Shares at NAV | | | 6.07% | | | | 6.58% | |

Class A Shares at maximum Offering Price | | | 0.00% | | | | 3.03% | |

Class C Shares | | | 5.33% | | | | 5.79% | |

Class I Shares | | | 6.41% | | | | 6.89% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios | | | Net

Expense

Ratios | |

Class A Shares | | | 3.60% | | | | 1.39% | |

Class C Shares | | | 4.35% | | | | 2.14% | |

Class I Shares | | | 3.35% | | | | 1.14% | |

The Fund’s adviser has contractually agreed to waive fees and reimburse expenses through February 29, 2012, so that total annual Fund operating expenses, after waivers and excluding any acquired Fund fees and expenses, do not exceed 1.20%, 1.95%, and 0.95%, respectively, for Class A, Class C and Class I Shares. Fee waivers and expense reimbursements will not be terminated prior to that time without with approval of the Fund’s Board of Directors.

| * | Since inception returns for Class A, Class C and Class I Shares, and for the comparative index and Lipper classification average, are from 12/30/09. Class I Share returns are actual. The returns for Class A and Class C Shares are actual for the periods since class inception on 2/24/11; returns prior to class inception are Class I Share returns adjusted for differences in sales charges and expense, which are primarily differences in distribution and service fees. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. |

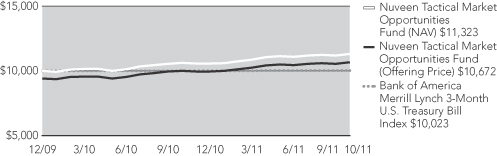

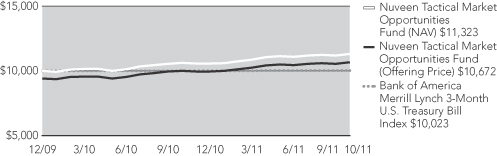

Growth of an Assumed $10,000 Investment as of October 31, 2011 — Class A Shares*

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Holding Summaries (Unaudited) as of October 31, 2011

This data relates to the securities held in each Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

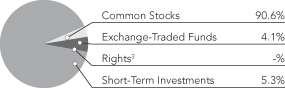

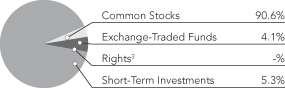

Nuveen International Fund

Portfolio Allocation1

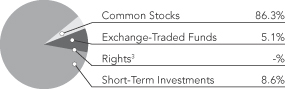

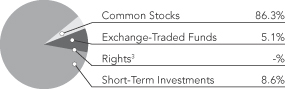

Nuveen International Select Fund

Portfolio Allocation1

| | | | |

| Portfolio Composition1 | | | |

| Financials | | | 14.3% | |

| Industrials | | | 11.7% | |

| Energy | | | 10.2% | |

| Consumer Staples | | | 9.4% | |

| Consumer Discretionary | | | 8.9% | |

| Information Technology | | | 7.6% | |

| Materials | | | 7.5% | |

| Health Care | | | 7.2% | |

| Utilities | | | 6.1% | |

| Short-Term Investments | | | 7.8% | |

| Other | | | 9.3% | |

| | | | |

| Portfolio Composition1 | | | |

| Financials | | | 21.3% | |

| Industrials | | | 10.4% | |

| Information Technology | | | 9.9% | |

| Consumer Staples | | | 9.8% | |

| Energy | | | 8.9% | |

| Materials | | | 8.7% | |

| Consumer Discretionary | | | 7.0% | |

| Utilities | | | 5.5% | |

| Telecommunication Services | | | 5.4% | |

| Short-Term Investments | | | 8.6% | |

| Other | | | 4.5% | |

| | | | |

| Country Allocation1 | | | |

| Japan | | | 16.7% | |

| United Kingdom | | | 15.9% | |

| United States | | | 13.4% | |

| Switzerland | | | 9.4% | |

| Germany | | | 8.5% | |

| Canada | | | 4.7% | |

| France | | | 4.2% | |

| Hong Kong | | | 2.6% | |

| Australia | | | 2.4% | |

| Ireland | | | 2.1% | |

| Italy | | | 2.0% | |

| Other | | | 18.1% | |

| | | | |

| Top Five Common Stock Holdings2 | |

| Roche Holding | | | 2.1% | |

| Canon | | | 1.8% | |

| Nestle | | | 1.8% | |

| GlaxoSmithKline | | | 1.6% | |

| Adidas | | | 1.4% | |

| | | | |

| Country Allocation1 | |

| United States | | | 16.5% | |

| Japan | | | 10.5% | |

| United Kingdom | | | 9.5% | |

| Brazil | | | 7.2% | |

| Switzerland | | | 5.8% | |

| Germany | | | 5.3% | |

| South Korea | | | 4.0% | |

| Canada | | | 3.9% | |

| South Africa | | | 3.2% | |

| Hong Kong | | | 2.7% | |

| France | | | 2.6% | |

| China | | | 2.5% | |

| Russia | | | 2.4% | |

| Australia | | | 2.2% | |

| India | | | 2.0% | |

| Other | | | 19.7% | |

| | | | |

| Top Five Common Stock Holdings2 | |

| Roche Holding | | | 1.4% | |

| Cielo | | | 1.2% | |

| Redecard | | | 1.2% | |

| Canon | | | 1.2% | |

| Banco do Brasil | | | 1.1% | |

| 1 | As a percentage of total investments (excluding investments in derivatives) as of October 31, 2011. Holdings are subject to change. |

| 2 | As a percentage of total common stocks as of October 31, 2011. Holdings are subject to change. |

| 3 | Rounds to less than 0.1%. |

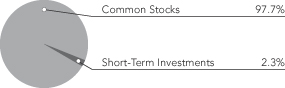

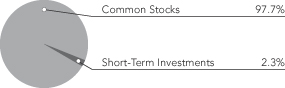

Nuveen Quantitative Enhanced Core Equity Fund

Portfolio Allocation1

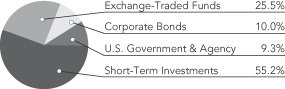

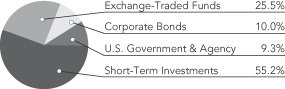

Nuveen Tactical Market Opportunities Fund

Portfolio Allocation3

| | | | |

| Portfolio Composition1 | | | |

| Financials | | | 18.8% | |

| Information Technology | | | 17.4% | |

| Energy | | | 14.9% | |

| Heath Care | | | 12.0% | |

| Industrials | | | 8.2% | |

| Consumer Staples | | | 8.1% | |

| Consumer Discretionary | | | 7.6% | |

| Utilities | | | 5.6% | |

| Short-Term Investments | | | 2.3% | |

| Other | | | 5.1% | |

| | | | |

| Top Five Common Stock Holdings2 | |

| Exxon Mobil | | | 4.1% | |

| Microsoft | | | 2.7% | |

| Chevron | | | 2.7% | |

| Apple | | | 2.3% | |

| AT&T | | | 2.3% | |

| 1 | As a percentage of total investments (excluding investments purchased with collateral from securities lending and investments in derivatives) as of October 31, 2011. Holdings are subject to change. |

| 2 | As a percentage of total common stocks as of October 31, 2011. Holdings are subject to change. |

| 3 | As a percentage of total investments (excluding investments in derivatives) as of October 31, 2011. Holdings are subject to change. |

Expense Examples (Unaudited)

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

Nuveen International Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance | |

| | | A Shares | | | B Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | B Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (5/1/11) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (10/31/11) | | $ | 845.60 | | | $ | 842.80 | | | $ | 842.10 | | | $ | 845.50 | | | $ | 845.20 | | | | | $ | 1,017.49 | | | $ | 1,013.66 | | | $ | 1,013.71 | | | $ | 1,016.43 | | | $ | 1,018.80 | |

| Expenses Incurred During Period | | $ | 6.93 | | | $ | 10.40 | | | $ | 10.40 | | | $ | 8.00 | | | $ | 5.77 | | | | | $ | 7.58 | | | $ | 11.37 | | | $ | 11.37 | | | $ | 8.74 | | | $ | 6.31 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.49%, 2.24%, 2.24%, 1.72% and 1.24% for Classes A, B, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nuveen International Select Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance | |

| | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (5/1/11) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (10/31/11) | | $ | 836.50 | | | $ | 832.90 | | | $ | 835.30 | | | $ | 836.80 | | | | | $ | 1,017.85 | | | $ | 1,014.06 | | | $ | 1,016.74 | | | $ | 1,019.06 | |

| Expenses Incurred During Period | | $ | 6.76 | | | $ | 10.21 | | | $ | 7.77 | | | $ | 5.65 | | | | | $ | 7.43 | | | $ | 11.22 | | | $ | 8.54 | | | $ | 6.21 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.46%, 2.21%, 1.68% and 1.22% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nuveen Quantitative Enhanced Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance | |

| | | A Shares | | | C Shares | | | I Shares | | | | | A Shares | | | C Shares | | | I Shares | |

| Beginning Account Value (5/1/11) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (10/31/11) | | $ | 912.10 | | | $ | 908.70 | | | $ | 913.50 | | | | | $ | 1,021.68 | | | $ | 1,017.90 | | | $ | 1,022.94 | |

| Expenses Incurred During Period | | $ | 3.37 | | | $ | 6.98 | | | $ | 2.17 | | | | | $ | 3.57 | | | $ | 7.37 | | | $ | 2.29 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .70%, 1.45% and .45% for Classes A, C and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nuveen Tactical Market Opportunities Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance | |

| | | A Shares | | | C Shares | | | I Shares | | | | | A Shares | | | C Shares | | | I Shares | |

| Beginning Account Value (5/1/11) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (10/31/11) | | $ | 1,022.80 | | | $ | 1,019.20 | | | $ | 1,024.60 | | | | | $ | 1,019.41 | | | $ | 1,015.63 | | | $ | 1,020.47 | |

| Expenses Incurred During Period | | $ | 5.86 | | | $ | 9.67 | | | $ | 4.80 | | | | | $ | 5.85 | | | $ | 9.65 | | | $ | 4.79 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.15%, 1.90% and .94%, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Report of

Independent Registered

Public Accounting Firm

The Board of Directors and Shareholders

Nuveen International Fund (formerly First American International Fund)

Nuveen International Select Fund (formerly First American International Select Fund)

Nuveen Quantitative Enhanced Core Equity Fund (formerly First American Quantitative Large Cap Core Fund)

Nuveen Tactical Market Opportunities Fund (formerly First American Tactical Market Opportunities Fund)

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments of Nuveen International Fund (formerly First American International Fund), Nuveen International Select Fund (formerly First American International Select Fund), Nuveen Quantitative Enhanced Core Equity Fund (formerly First American Quantitative Large Cap Core Fund), and Nuveen Tactical Market Opportunities Fund (formerly First American Tactical Market Opportunities Fund) (series of Nuveen Investment Funds, Inc., formerly First American Investment Funds, Inc.) (collectively, the ”Funds”) as of October 31, 2011, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2011, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Nuveen International Fund (formerly First American International Fund), Nuveen International Select Fund (formerly First American International Select Fund), Nuveen Quantitative Enhanced Core Equity Fund (formerly First American Quantitative Large Cap Core Fund), and Nuveen Tactical Market Opportunities Fund (formerly First American Tactical Market Opportunities Fund) at October 31, 2011, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

December 28, 2011

Portfolio of Investments

Nuveen International Fund

(formerly known as First American International Fund)

October 31, 2011

| | | | | | | | | | | | | | |

| Shares | | | Description p | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | COMMON STOCKS – 87.8% | | | | | | | | | | |

| | | | | |

| | | | Australia – 2.3% | | | | | | | | | | |

| | | | | |

| | 64,649 | | | APA Group | | | | | | | | $ | 294,830 | |

| | | | | |

| | 42,246 | | | Asciano Group | | | | | | | | | 67,535 | |

| | | | | |

| | 52,219 | | | Australian Infrastructure Fund | | | | | | | | | 103,668 | |

| | | | | |

| | 48,361 | | | DUET Group | | | | | | | | | 84,282 | |

| | | | | |

| | 9,069 | | | Macquarie Atlas Roads Group — | | | | | | | | | 13,430 | |

| | | | | |

| | 49,890 | | | MAp Group | | | | | | | | | 178,021 | |

| | | | | |

| | 5,462 | | | QR National | | | | | | | | | 18,871 | |

| | | | | |

| | 21,751 | | | SP AusNet | | | | | | | | | 22,679 | |

| | | | | |

| | 63,072 | | | Spark Infrastructure Group | | | | | | | | | 80,359 | |

| | | | | |

| | 87,736 | | | Transurban Group | | | | | | | | | 481,273 | |

| | | | | |

| | 32,103 | | | Woodside Petroleum | | | | | | | | | 1,222,384 | |

| | | | | |

| | 42,462 | | | WorleyParsons | | | | | | | | | 1,232,445 | |

| | | | Total Australia | | | | | | | | | 3,799,777 | |

| | | | Austria – 0.4% | | | | | | | | | | |

| | | | | |

| | 25,435 | | | Erste Group Bank | | | | | | | | | 542,235 | |

| | | | | |

| | 579 | | | Flughafen Wien | | | | | | | | | 26,024 | |

| | | | | |

| | 4,760 | | | Oesterreichische Post | | | | | | | | | 143,560 | |

| | | | | |

| | 224 | | | Verbund AG | | | | | | | | | 6,505 | |

| | | | Total Austria | | | | | | | | | 718,324 | |

| | | | Belgium – 0.6% | | | | | | | | | | |

| | | | | |

| | 17,528 | | | Anheuser-Busch InBev | | | | | | | | | 972,035 | |

| | | | | |

| | 718 | | | Elia System Operator | | | | | | | | | 29,136 | |

| | | | Total Belgium | | | | | | | | | 1,001,171 | |

| | | | Brazil – 1.5% | | | | | | | | | | |

| | | | | |

| | 9,189 | | | Companhia de Concessoes Rodoviarias | | | | | | | | | 253,268 | |

| | | | | |

| | 3,656 | | | Companhia de Gas de Sao Paulo, Class A | | | | | | | | | 74,745 | |

| | | | | |

| | 3,060 | | | Companhia de Saneamento Basico do Estado de Sao Paulo – ADR | | | | | | | | | 166,036 | |

| | | | | |

| | 658 | | | Companhia de Saneamento de Minas Gerais | | | | | | | | | 12,303 | |

| | | | | |

| | 840 | | | Companhia de Transmissao de Energia Electrica Paulista | | | | | | | | | 24,224 | |

| | | | | |

| | 32,550 | | | Companhia Energetica de Minas Gerais – ADR | | | | | | | | | 554,652 | |

| | | | | |

| | 686 | | | Companhia Energetica do Ceara-COELCE, Class A | | | | | | | | | 13,865 | |

| | | | | |

| | 3,970 | | | Companhia Paranaense de Energia-Copel – ADR | | | | | | | | | 80,115 | |

| | | | | |

| | 950 | | | CPFL Energia – ADR | | | | | | | | | 24,690 | |

| | | | | |

| | 5,941 | | | EcoRodovias Infraestructura e Logistica — | | | | | | | | | 44,812 | |

| | | | | |

| | 20,866 | | | Energias do Brasil | | | | | | | | | 451,144 | |

| | | | | |

| | 29,856 | | | Itau Unibanco Holding – ADR | | | | | | | | | 570,847 | |

| | | | | |

| | 6,728 | | | Santos Brasil Participacoes | | | | | | | | | 99,734 | |

| | | | | |

| | 8,441 | | | Wilson Sons – BDR | | | | | | | | | 120,947 | |

| | | | Total Brazil | | | | | | | | | 2,491,382 | |

| | | | Canada – 4.6% | | | | | | | | | | |

| | | | | |

| | 4,758 | | | Agrium | | | | | | | | | 391,536 | |

| | | | | |

| | 14,611 | | | Algonquin Power & Utilities | | | | | | | | | 82,088 | |

| | | | | |

| | 2,406 | | | ATCO, Class I | | | | | | | | | 146,955 | |

| | | | | |

| | 16,196 | | | Bank of Nova Scotia | | | | | | | | | 852,072 | |

Portfolio of Investments

Nuveen International Fund (continued)

October 31, 2011

| | | | | | | | | | | | | | |

| Shares | | | Description p | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | Canada (continued) | | | | | | | | | | |

| | | | | |

| | 1,878 | | | Brookfield Renewable Power Fund | | | | | | | | $ | 51,455 | |

| | | | | |

| | 30,847 | | | Cameco | | | | | | | | | 661,051 | |

| | | | | |

| | 25,561 | | | Cenovus Energy | | | | | | | | | 875,498 | |

| | | | | |