UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2015 |

| | |

| | | | Fundamental Emerging Markets Equity Funds |

| | | | Asia Equity |

| | | | BRIC |

| | | | Emerging Markets Equity |

| | | | N-11 Equity |

Goldman Sachs Fundamental Emerging Markets Equity Funds

| n | | EMERGING MARKETS EQUITY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 3 | |

| |

Market Review | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 6 | |

| |

Schedules of Investments | | | 30 | |

| |

Financial Statements | | | 42 | |

| |

Financial Highlights | | | 46 | |

| |

Notes to Financial Statements | | | 54 | |

| |

Other Information | | | 68 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUNDAMENTAL EMERGING MARKETS EQUITY FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Asia Equity Fund invests primarily in a diversified portfolio of equity investments in Asian issuers (excluding Japanese issuers). The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because of its exposure to Asian issuers, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events that may occur in Asian countries. The securities of mid- and small-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

The Goldman Sachs BRIC Fund invests primarily in a portfolio of equity investments in Brazil, Russia, India and China (“BRIC countries”) or in issuers that participate in the markets of the BRIC countries. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/ or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because of its exposure to the BRIC countries, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events that may occur in those countries. Because the Fund may invest heavily in specific sectors, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting such sectors. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest a larger percentage of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Emerging Markets Equity Fund invests primarily in a diversified portfolio of equity investments in emerging country issuers. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The securities markets of emerging countries have less government regulation and are subject to less extensive accounting and financial reporting requirements than the markets of more developed countries. Because the Fund may invest heavily in specific sectors, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting such sectors. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

The Goldman Sachs N-11 Equity Fund invests primarily in a portfolio of equity investments that are tied economically to the “N-11 countries” or in issuers that participate in the markets of the following N-11 countries: Bangladesh, Egypt, Indonesia, Mexico, Nigeria, Pakistan, Philippines, South Korea, Turkey and Vietnam. While Iran is among the N-11 countries, the Fund will not invest in issuers organized under the laws of Iran, or domiciled in Iran, or in certain other issuers as necessary to comply

1

GOLDMAN SACHS FUNDAMENTAL EMERGING MARKETS EQUITY FUNDS

with U.S. economic sanctions against Iran. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Such securities are also subject to foreign custody risk. Because of its exposure to the N-11 countries, the Fund is subject to greater risk of loss as a result of adverse securities markets, exchange rates and social, political, regulatory or economic events that may occur in those countries. The N-11 countries generally have smaller economies or less developed capital markets than traditional emerging markets countries, and, as a result, the risks of investing in these countries are magnified. Because the Fund may invest heavily in specific sectors, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting such sectors. The Fund may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Fund’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest a larger percentage of its assets in fewer issuers than “diversified” mutual funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

2

GOLDMAN SACHS FUNDAMENTAL EMERGING MARKETS EQUITY FUNDS

What Differentiates Goldman Sachs’ Fundamental Emerging Markets Equity Investment Process?

Goldman Sachs’ Fundamental Emerging Markets Equity investment process is based on the belief that strong, consistent results are best achieved through expert stock selection, performed by our dedicated Emerging Markets Team that works together on a global scale. Our deep, diverse and experienced team of research analysts and portfolio managers combines local insights with global, industry-specific expertise to identify its best investment ideas.

| n | | The Emerging Markets Equity research team, based in the United States, United Kingdom, Japan, China, Korea, Singapore, Brazil, India, and Australia focuses on long- term business and management quality |

| n | | Proprietary, bottom-up research is the key driver of our investment process |

| n | | Analysts collaborate regularly to leverage regional and industry-specific research and insights |

| n | | Members of each local investment team are aligned by sector and are responsible for finding ideas with the best risk-adjusted upside in their respective areas of coverage |

| n | | The decision-making process includes active participation in frequent and regular research meetings |

| n | | The Emerging Market Equity team benefits from the country and currency expertise of our Global Emerging Markets Debt and Currency teams |

| n | | Security selections are aligned with levels of investment conviction and risk-adjusted upside |

| n | | Continual risk monitoring identifies various risks at the stock and portfolio level and assesses whether they are intended and justified |

| n | | Dedicated portfolio construction team assists in ongoing monitoring and adjustment of the Funds |

Emerging markets equity portfolios that strive to offer:

| | n | | Access to markets across emerging markets | |

| | n | | Disciplined approach to stock selection | |

| | n | | Optimal risk/return profiles | |

3

MARKET REVIEW

Goldman Sachs Fundamental Emerging

Markets Equity Funds

Market Review

Emerging markets equities advanced during the six-month period ended April 30, 2015 (the “Reporting Period”). The Morgan Stanley Capital International (MSCI®) Emerging Markets Index (Net, USD, Unhedged) (the “MSCI® EM Index”) posted a return of 3.92%.* However, emerging markets equities lagged developed markets equities, as measured by the MSCI® Europe, Australasia, Far East (EAFE) Index, with relatively tepid performance of emerging market equities for most of the Reporting Period reflecting concerns about slowing economic growth, particularly in China, and the impact of weak commodity prices, particularly the sharp decline in oil prices.

During the Reporting Period, China’s Gross Domestic Product (“GDP”) growth slowed to 7% for the first quarter of 2015, down from 7.3% for calendar year 2014, while many other economic indicators similarly deteriorated. However, the Chinese central bank took a number of steps toward easing its monetary policy during the Reporting Period. Most notably, perhaps, in April 2015, the People’s Bank of China (“PBOC”) slashed its reserve requirement ratio by 100 basis points to 18.5% for the largest banks, which is the lowest level since 2012. (A basis point is 1/100th of a percentage point. The reserve requirement ratio is the portion, expressed as a percent, of depositors’ balances banks must have on hand as cash. This is a requirement determined by a country’s central bank. The reserve ratio affects the money supply in a country.) Chinese equities soared on the news, sparking a sharp rally in emerging markets equities broadly in April 2015. Indeed, significant outperformance of Chinese equities accounted for most of the gains of the MSCI® EM Index for the Reporting Period as a whole.

As for oil prices, the international Brent crude oil benchmark price fell steadily from a high of $115 per barrel in June 2014 to a low of $47 per barrel in January 2015 before rebounding to almost $70 per barrel by the end of April 2015. In turn, big commodity-exporting countries, including Brazil and Russia, as well as the energy sector of the MSCI® EM Index, were negatively impacted by the low oil prices for most of the Reporting Period. However, both countries’ equity markets and the broader MSCI® EM Index rallied with the rebound in oil prices in April 2015. The utilities, materials, consumer staples and telecommunication services sectors also posted negative returns during the Reporting Period.

Information technology was the best performing sector in the MSCI® EM Index during the Reporting Period in part due to robust merger and acquisition activity. The financials sector also notably outperformed the MSCI® EM Index, driven largely by many Chinese financials stocks that rose with strong Chinese equity market performance.

From a country perspective, China and Hungary were by a wide margin the best performing individual country constituents of the MSCI® EM Index for the Reporting Period overall, while Greece, Colombia, Brazil, Turkey and Mexico each posted double-digit negative returns.

| * | | All index returns are expressed in U.S. dollar terms. |

4

MARKET REVIEW

Looking Ahead

As the equity bull market enters its seventh year, we believe the global economy may be nearing several inflection points and new equity market leaders may well emerge. For example, we believe the U.S. economy has strengthened to the point where the Federal Reserve (the “Fed”) may prepare to raise interest rates for the first time since June 2006. The euro has depreciated to match the European Central Bank’s (“ECB”) near zero interest rate, and European banks are lending again after years of deleveraging. In Japan, inflation is taking hold, wages are rising and consumption may be about to pick up. It is widely anticipated that India’s re-accelerating GDP growth will likely eclipse China’s slowing economic growth rate this year. In our view, the macroeconomic themes behind many of these changes — diverging monetary policies, currency movements, low oil prices and structural reforms — affect nearly every company’s earnings and stock price in a different way.

Naturally, we believe new equity market leaders are likely to emerge from the changing economic landscape. But, in our view, the best performing stocks and stock markets may not necessarily be in the countries or industries with the highest economic growth, and yesterday’s laggards are not always ready to be tomorrow’s leaders. Furthermore, earnings multiples have increased, leaving few bargains, in our opinion. Indeed, because earnings multiples have already expanded, we believe earnings growth will become an increasingly important driver of stock performance in the months ahead. The sometimes offsetting or contradicting effects of macroeconomic conditions are likely to make top-down calls more difficult, but we believe the true impact may be revealed in corporate earnings. In our view, more expensive equities, lower return expectations and offsetting macroeconomic influences create a stock-picker’s market and one in which portfolios that outperform may look different from the broader market. Even when sector and country weightings are similar, a closer look may reveal differentiation through concentration, market capitalization, quality or other characteristics. The past year or so was challenging for most active managers, but we think that is about to change.

In all, we think global equity returns for calendar year 2015 may be slightly below their long-term average, but are still likely to compare favorably with other asset classes. As always, we maintain our focus on seeking high-quality equity investments trading at what we believe to be compelling valuations and intend to stay true to our long-term discipline as we seek to navigate potentially volatile markets ahead.

5

PORTFOLIO RESULTS

Goldman Sachs Asia Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Asia ex Japan Equity Portfolio Management Team discusses the Goldman Sachs Asia Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 12.33%, 11.91%, 12.59% and 12.50%, respectively. These returns compare to the 10.45% cumulative total return of the Fund’s benchmark, the MSCI® All Country Asia ex-Japan Index (Net, USD, Unhedged) (the “Index”), during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund outperformed the Index on a relative basis during the Reporting Period, primarily attributable to individual stock selection. From a country perspective, effective stock selection in South Korea, Taiwan and India contributed most positively. Stock selection in China was the only major detractor from the Fund’s relative results during the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Index from holdings in Cheil Industries, Amorepacific and Kweichow Moutai. |

| | | The top individual stock contributor to the Fund’s results during the Reporting Period was Cheil Industries, a South Korean manufacturer and seller of chemicals and electronic materials. Cheil Industries, partially owned by Samsung Electronics, is widely seen as the de facto holding company of Samsung Group, and the stock outperformed the Index during the Reporting Period amid increasing anticipation that the company may indeed become Samsung Group’s holding company in the future. However, as the company’s valuations began to overshoot the fundamentals of its underlying business divisions, we exited from the Fund’s position, taking profits. |

| | | Another significant positive contributor was Amorepacific, a leading cosmetics company in South Korea with approximately 30 brands across cosmetics, personal care and health care. The company, a newly established position for the Fund during the Reporting Period, has been gaining both market and mind share in China against competitors, such as L’Oreal and Estee Lauder, perhaps due to its positioning as an Asian brand catering to the Asian demographic’s needs. (Mind share is the amount of consumer awareness or popularity surrounding a particular product, service or company compared to its competitors.) We believe Amorepacific has significant multi-year growth potential given improving brand awareness in China and further expansion potential into the Southeast Asian market. Furthermore, it has been gaining momentum toward robust revenue growth and margin expansion after successful channel and brand restructuring in both South Korea and China and, in our view, could continue to benefit from the Chinese consumers’ tourism in South Korea. |

| | | Kweichow Moutai, the largest white spirit company in China, positioned at the premium end of the market, was a new position for the Fund during the Reporting Period and a strong contributor to the Fund’s relative results. We initiated the position, as we believed its valuation at the time of purchase was at a significant discount to its domestic and international peers, and we see re-rating potential largely driven by sequential earnings improvement, enforcement of the A-H shares through-train1, and the ongoing state-owned |

| | 1 | | The A-H shares through-train refers to the Shanghai-Hong Kong Stock Connect, a pilot program for establishing mutual stock market access between Mainland China and Hong Kong, announced in April 2014 by Premier Li Keqiang at the Boao Forum for Asia and officially launched in November 2014. The new cross-border investment channel enables individual investors from Hong Kong and overseas to invest directly in designated securities listed on the Shanghai Stock Exchange and domestic investors from Mainland China to invest directly in designated securities listed on the Stock Exchange of Hong Kong, through their respective local brokers for the first time. A shares refers to shares issued by companies incorporated in Mainland China. They are listed on the Shanghai and Shenzhen Stock Exchanges and quoted in renminbi. They are not listed on the Hong Kong Stock Exchange. H shares refers to shares issued by companies incorporated in Mainland China and listed on the Hong Kong Stock Exchange. |

6

PORTFOLIO RESULTS

| | enterprise reform process. Given its unparalleled brand equity and scarcity in supply, Kweichow Moutai may command higher margins versus its peers. Brand equity is defined as the value premium that a company realizes from a product with a recognizable name as compared to its generic equivalent. (Re-rating is when the market changes its view of a company sufficiently to make calculation ratios, such as its price/ earnings ratio, substantially higher or lower.) Following the anti-corruption drive that dampened demand from government sectors, we believe we are seeing a stabilization of channel inventory level and retail prices. We believe this could contribute to the company’s recovery, especially if demand from the private and mass sectors proves resilient. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Hong Kong-based casino and hotel operator Galaxy Entertainment Group, Chinese web services company Baidu.com and South Korean bank holding company Hana Financial Group. |

| | | Galaxy Entertainment Group, which operates casino, hotel and other entertainment facilities in Macau, detracted most from the Fund’s results. It underperformed the Index during the Reporting Period on a murky outlook for the overall gaming industry in Macau amid a continuing anti-corruption campaign in China. At the end of the Reporting Period, we still considered the company to be better positioned than many of its peers to defend and compete for market share, especially given its new casino opening in the Cotai area. |

| | | Baidu.com detracted from the Fund’s results after a weak quarter ending in March 2015, even as such results were expected given the Chinese renminbi’s depreciation in late February 2015 and the deterioration of the company’s business amidst a growing proportion of mobile traffic. Further, the company’s guidance for the second calendar quarter was not particularly exciting. Still, at the end of the Reporting Period, we maintained our belief that Baidu.com is one of the few names that has built its own closed-loop ecosystem, and therefore, it should be able to maintain its business without external factors or outside aid. In other words, we believe Baidu.com should be able to achieve future growth supported almost solely by the growing number of Chinese Internet users. |

| | | Hana Financial Group underperformed the Index, reflecting the concerns of net interest margin compression going forward given that the central bank of South Korea is expected to further cut its benchmark interest rates. While we expect the South Korean banking sector broadly to continue to be pressured in the months ahead, we also believed at the end of the Reporting Period that Hana Financial Group should be more resilient than some of its peers, should the turnaround of its merged entity with Korea Exchange Bank and the stabilization of its employer and labor union relationship be realized. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | The sectors that contributed most positively to the Fund’s performance relative to the Index were consumer staples, industrials and materials, where stock selection in each boosted relative results. In consumer staples, the Fund’s holding in Amorepacific, mentioned earlier, was the strongest positive contributor. In industrials, a holding in Cheil Industries, also mentioned earlier, boosted results most. In materials, a position in OCI Materials was an outstanding performer. OCI Materials manufactures and supplies various advanced materials and special gases in South Korea and internationally. OCI Materials’ products are used in the manufacturing process of semiconductors, thin film transistor liquid crystal displays (“TFT-LCD”) and solar cells and film deposition. |

| | | The biggest detractors from the Fund’s relative results during the Reporting Period were the financials, information technology and health care sectors. Having an underweighted allocation to financials, which outperformed the Index during the Reporting Period, hurt most. At an individual stock level, Hana Financial Group, mentioned earlier, disappointed most. Weak stock selection drove lagging performance most in the information technology sector, with a position in Baidu.com, also mentioned earlier, the largest detractor from relative returns. Both having an overweighted allocation to and stock selection within the health care sector dampened the Fund’s relative results. The Fund’s position in Aurobindo Pharma, which manufactures generic pharmaceuticals and active pharmaceutical ingredients, detracted most within the health care sector. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives to hedge positions or as part of an active management strategy. |

7

PORTFOLIO RESULTS

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | In addition to the purchases already mentioned, we initiated a Fund position in China Merchants Bank, a Chinese financials company, during the Reporting Period, in seeking to gain exposure to the Chinese financials industry than for company-specific reasons. The Chinese government and its central bank have been fueling its weak macroeconomic environment by implementing a wide range of accommodative measures, including the cut in banks’ reserve requirement ratio (discussed in detail in the Market Review) and quantitative easing by the People’s Bank of China (“PBOC”) and bond issuance by local governments. We believe quantitative easing in China will help ease concerns about weak loan growth and deteriorating asset quality. In our view, China Merchants Bank, with its exposure to the securities business, should be able to leverage its strength in the capital markets under a more market-oriented financials industry better than its peers. |

| | We sold the Fund’s position in China Cinda Asset Management (H-shares) (“CINDA”), a Chinese asset management firm in the financials sector. With authorities appearing slow to tackle non-performing loans (“NPLs”) within the banking industry, incremental bad debt formation is accelerating, which is forcing the government to address the issue with the intention of spreading out the risk across the broader capital market. In our view, this may require CINDA to pay competitive costs under the new environment. Although we still believe that “bad banks” will play a leading role in absorbing the system’s NPLs, they are now faced with a more challenging situation, where return on invested capital much less clear than before. (“Bad banks” are banks set up to buy the bad loans of a bank with significant nonperforming assets at market price. By transferring the bad assets of an institution to the bad bank, the banks clear their balance sheet of toxic assets but would be forced to take write downs. Shareholders and bondholders stand to lose money from this solution (but not depositors). Banks that become insolvent as a result of the process can be recapitalized, nationalized or liquidated.) |

| | We exited the Fund’s position in Sun Hung Kai Properties, a Hong Kong-based real estate owner, developer and operator. In our view, the Hong Kong property market has already entered into a structural downturn, as it reached the point where inbound travelers from China have no more than an incremental impact on retailers in Hong Kong. Also, we believe property development in China has shown clear deceleration, as consumers’ purchasing power has failed to catch up with supply growth. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Most sector weights are usually established within a relatively narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure to consumer staples and financials increased, and its allocations to consumer discretionary, information technology and utilities decreased. |

| | Similarly, allocations to countries are directly the result of various stock selection decisions. During the Reporting Period, the Fund’s allocations to Taiwan and Singapore increased, and its exposure to India and Thailand decreased. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted exposure to China, the Philippines, South Korea and India compared to the Index. On the same date, the Fund had underweighted exposure relative to the Index to Hong Kong, Singapore, Malaysia and Taiwan and had rather neutral exposure relative to the Index in Thailand and Indonesia. |

| | From a sector allocation perspective, the Fund had overweighted positions relative to the Index in the consumer staples, health care, consumer discretionary and materials sectors at the end of the Reporting Period. On the same date, the Fund had underweighted positions compared to the Index in the financials, telecommunication services, and energy sectors and was relatively neutrally weighted compared to the Index in information technology and industrials. |

| | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

8

FUND BASICS

Asia Equity Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI® All Country Asia

ex-Japan Index

(Net, USD, Unhedged)2 | |

| | Class A | | | 12.33 | % | | | 10.45 | % |

| | Class C | | | 11.91 | | | | 10.45 | |

| | Institutional | | | 12.59 | | | | 10.45 | |

| | | Class IR | | | 12.50 | | | | 10.45 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI® All Country Asia ex-Japan Index (net, USD, unhedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The MSCI® All Country Asia ex-Japan Index consists of the following 10 developed and emerging market country indices: China, Hong Kong, India, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan, and Thailand. This index is net of dividends re-invested after deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. This series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to nonresident individuals who do not benefit from double taxation treaties. MSCI® Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 3/31/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date | |

| | Class A | | | 1.44 | % | | | 4.12 | % | | | 6.16 | % | | | 2.47 | % | | | 7/08/94 | |

| | Class C | | | 5.61 | | | | 4.53 | | | | 5.95 | | | | 1.74 | | | | 8/15/97 | |

| | Institutional | | | 7.77 | | | | 5.74 | | | | 7.18 | | | | 2.54 | | | | 2/02/96 | |

| | | Class IR | | | 7.62 | | | | N/A | | | | N/A | | | | 6.37 | | | | 2/28/14 | |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.72 | % | | | 2.23 | % |

| | Class C | | | 2.47 | | | | 2.99 | |

| | Institutional | | | 1.31 | | | | 1.86 | |

| | | Class IR | | | 1.44 | | | | 1.99 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/155 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Tencent Holdings Ltd. | | | 5.1 | % | | Software & Services | | China |

| | AIA Group Ltd. | | | 4.3 | | | Insurance | | Hong Kong |

| | Kweichow Moutai Co. Ltd. | | | 3.9 | | | Food, Beverage & Tobacco | | China |

| | Industrial & Commercial Bank of China Ltd. Class H | | | 3.4 | | | Banks | | China |

| | China Merchants Bank Co. Ltd. Class H | | | 3.0 | | | Banks | | China |

| | Amorepacific Corp. | | | 2.8 | | | Household & Personal Products | | South Korea |

| | Sino Biopharmaceutical Ltd. | | | 2.6 | | | Pharmaceuticals, Biotechnology

& Life Sciences | | Hong Kong |

| | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 2.5 | | | Semiconductors &

Semiconductor Equipment | | Taiwan |

| | CJ CheilJedang Corp. | | | 2.4 | | | Food, Beverage & Tobacco | | South Korea |

| | | DBS Group Holdings Ltd. | | | 2.3 | | | Banks | | Singapore |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

10

FUND BASICS

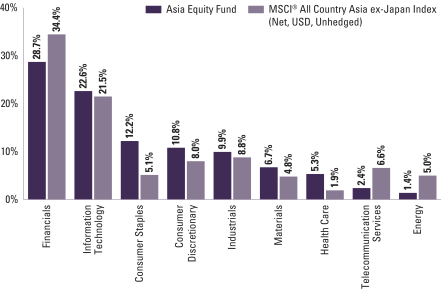

|

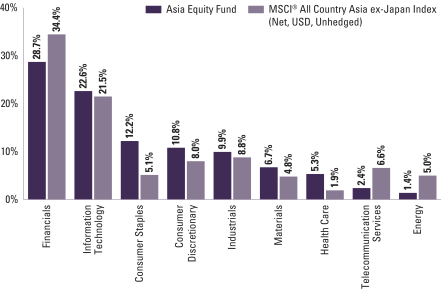

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

PORTFOLIO RESULTS

Goldman Sachs BRIC Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs BRIC Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 8.77%, 8.33%, 8.92% and 8.91%, respectively. These returns compare to the 9.00% cumulative total return of the Fund’s benchmark, the MSCI® BRIC Index (Net, USD, Unhedged) (the “Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund produced solid positive absolute returns but modestly underperformed the Index on a relative basis during the Reporting Period. Stock selection and positioning in China and Russia detracted, slightly more than offsetting the positive contribution of effective stock selection in India and Brazil. Having an underweighted allocation to Brazil, which posted double-digit negative returns during the Reporting Period, also helped. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Russian bank Sberbank, Brazilian insurance and brokerage holding company BB Segurigade and Russian food retailer Magnit. |

| | The Fund’s holding in Sberbank detracted most from the Fund’s relative results during the Reporting Period. Russia’s largest bank was weighed down by the continued impact of sanctions on the nation, prompting us to eliminate the Fund’s position by the end of the Reporting Period. |

| | BB Segurigade detracted from the Fund’s relative returns. The macroeconomic environment in Brazil deteriorated during the Reporting Period, weighing on the Brazilian equity market broadly, and BB Segurigade performed in line with the broader market. Indeed, the company’s performance was weak despite reporting sound fourth quarter 2014 results and reaffirming its 2015 guidance. By the end of the Reporting Period, we had trimmed the Fund’s position in BB Segurigade but maintained a sizable position in the company, as it has been able to increase its market share in new pension contribution and insurance premiums by leveraging the existing client base of Banco do Brasil, its parent company. Magnit, the largest food retailer in Russia, also detracted from the Fund’s relative returns during the Reporting Period. The European and U.S. sanctions on Russia — as well as the drop in oil prices — pushed the Russian economy into recession. The company reported solid results for the fourth quarter of 2014 but was negatively affected by these geopolitical factors and by the sharp fall in the ruble. Still, as the dominant player within the food retail industry in Russia, we believe Magnit can benefit from current weakness by gaining market share using its scale to source cheaper products and by continuing to grow its store footprint. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The strongest contributors to the Fund’s performance during the Reporting Period were Indian automotive components supplier Bosch, Hong Kong stock exchange Hong Kong Exchanges & Clearing and Indian non-banking finance company Bajaj Finance. |

| | Bosch outperformed the Index during the Reporting Period due to a pick-up in growth in the passenger cars and heavy commercial vehicle segments of its business. We trimmed the Fund’s position in Bosch following sustained outperformance, but maintained a positive view on the company at the end of the Reporting Period given what we believed was its potential for continued strong growth in an improving demand environment. |

12

PORTFOLIO RESULTS

| | Hong Kong Exchanges & Clearing, Asia’s second largest stock exchange in terms of market capitalization, was a new purchase for the Fund during the Reporting Period. Its stock outperformed the Index during the Reporting Period, as the consensus expects meaningful scaling up of volumes through Shanghai-Hong Kong Stock Connect1 in 2015, which could be a catalyst for strong financial performance. |

| | Bajaj Finance, an Indian non-banking finance company engaged in consumer finance, small and medium enterprise finance and commercial lending, was a strong contributor to the Fund’s relative results. The company performed well as measured by loan growth, margins and asset quality relative to its peers. Improving consumer sentiment and a strong outlook on consumer durable sales provided a positive backdrop to Bajaj Finance’s consumer lending business. While we trimmed the Fund’s position in Bajaj Finance, taking some profits during the first quarter of 2015, we maintained an overweight position in the company based on what we considered to be its healthy return ratios and attractive valuations. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | Weak stock selection in the financials, information technology and industrials sectors detracted most from the Fund’s performance relative to the Index during the Reporting Period. At an individual stock level, the Fund’s position in Sberbank, Russia’s largest bank, already mentioned, was the largest detractor within the financials sector. Within information technology, the Fund’s position in Alibaba, the Chinese e-commerce giant, detracted most from performance during the Reporting Period. In industrials, the Fund’s holding in Globaltrans Investment, a company engaged in transportation and logistics, detracted most from returns. |

| | On the positive side, effective stock selection in consumer discretionary boosted the Fund’s results most during the Reporting Period. Notably, the Fund’s holding in Bosch, mentioned earlier, was the strongest contributor within the consumer discretionary sector. Additionally, having underweighted allocations to the energy and materials sectors, each of which significantly underperformed the Index during the Reporting Period, contributed positively to the Fund’s relative results. To a more modest degree, stock selection within energy and materials also added value. In energy, the Fund’s holding in PetroBras, the Brazilian multinational energy corporation, was the strongest positive contributor. In materials, the Fund’s position in Alrosa, a Russian group of diamond mining companies, was a particularly strong performer. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund gained exposure to select stocks through equity-linked notes and participatory notes. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | In addition to the purchase of Hong Kong Exchanges & Clearing, mentioned earlier, we initiated a Fund position in Kweichow Moutai, the largest white spirit company in China, positioned at the premium end of the market. We initiated the position, as we believed its valuation at the time of purchase was at a significant discount to its domestic and international peers, and we see re-rating potential largely driven by sequential earnings improvement, enforcement of the A-H shares through-train1, and the ongoing state-owned enterprise reform process. Given its unparalleled brand equity and scarcity in supply, Kweichow Moutai may command higher margins versus its peers. Brand equity is defined as the value premium that a company realizes from a product with a recognizable name as compared to its generic equivalent. (Re-rating is when the market changes its view of a company sufficiently to make calculation ratios, such as its price/earnings ratio, substantially higher or lower.) Following the anti-corruption drive that dampened demand from government sectors, we believe we are seeing a stabilization of channel inventory level and retail prices. We believe this could contribute to the company’s recovery, especially if demand from the private and mass sector proves resilient. |

| | 1 | | The A-H shares through-train refers to the Shanghai-Hong Kong Stock Connect, a pilot program for establishing mutual stock market access between Mainland China and Hong Kong, announced in April 2014 by Premier Li Keqiang at the Boao Forum for Asia and officially launched in November 2014. The new cross-border investment channel enables individual investors from Hong Kong and overseas to invest directly in designated securities listed on the Shanghai Stock Exchange and domestic investors from Mainland China to invest directly in designated securities listed on the Stock Exchange of Hong Kong, through their respective local brokers for the first time. A shares refers to shares issued by companies incorporated in Mainland China. They are listed on the Shanghai and Shenzhen Stock Exchanges and quoted in renminbi. They are not listed on the Hong Kong Stock Exchange. H shares refers to shares issued by companies incorporated in Mainland China and listed on the Hong Kong Stock Exchange. |

13

PORTFOLIO RESULTS

| | | As already mentioned, we trimmed the Fund’s position in BB Segurigade and sold its holding in Sberbank during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Most sector weights are usually established within a narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure relative to the Index in consumer staples, telecommunication services and financials increased, and its allocations relative to the Index to information technology, industrials and consumer discretionary decreased. |

| | | Resulting from various stock selection decisions, the Fund’s exposure relative to the Index to China and Brazil increased, and its allocations relative to the Index to India and Russia decreased. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | Effective early March 2015, Prashant Khemka, CFA, Managing Director and Chief Investment Officer of Emerging Markets Equity, was named as a portfolio manager of the Fund. Basak Yavuz, CFA, Executive Director, was also named as a portfolio manager for the Fund. Basak has been with the Fundamental Equity team since 2011 and brings 17 years of investment experience in both emerging and frontier markets. Alina Chiew, CFA, Managing Director, will no longer be a portfolio manager of the Fund. Alina will continue to serve as Head of the Greater China Equity Team. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted exposure to India, underweighted exposure to China and Brazil and a rather neutral exposure relative to the Index in Russia. |

| | | From a sector perspective, the Fund had overweighted allocations to consumer staples, health care, information technology, consumer discretionary and financials compared to the Index at the end of the Reporting Period. On the same date, the Fund had underweighted exposure to the energy, telecommunication services, materials, utilities and industrials sectors. |

| | | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

14

FUND BASICS

BRIC Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI® BRIC Index

(Net, USD, Unhedged)2 | |

| | Class A | | | 8.77 | % | | | 9.00 | % |

| | Class C | | | 8.33 | | | | 9.00 | |

| | Institutional | | | 8.92 | | | | 9.00 | |

| | | Class IR | | | 8.91 | | | | 9.00 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI® BRIC Index (Net, USD, Unhedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the following four emerging market country indices: Brazil, Russia, India and China. This series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI® Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 3/31/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date | |

| | Class A | | | -0.86 | % | | | -2.56 | % | | | 3.45 | % | | | 6/30/06 | |

| | Class C | | | 3.11 | | | | -2.19 | | | | 3.33 | | | | 6/30/06 | |

| | Institutional | | | 5.38 | | | | -1.05 | | | | 4.53 | | | | 6/30/06 | |

| | | Class IR | | | 5.18 | | | | N/A | | | | -0.11 | | | | 8/31/10 | |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.66 | % | | | 2.04 | % |

| | Class C | | | 2.41 | | | | 2.79 | |

| | Institutional | | | 1.26 | | | | 1.63 | |

| | | Class IR | | | 1.41 | | | | 1.79 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/155 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Tencent Holdings Ltd. | | | 9.2 | % | | Software & Services | | China |

| | iShares China Large-Cap ETF | | | 4.2 | | | Exchange Traded Fund | | United States |

| | Agricultural Bank of China Ltd. Class H | | | 3.8 | | | Banks | | China |

| | Industrial & Commercial Bank of China Ltd. Class H | | | 3.6 | | | Banks | | China |

| | Kweichow Moutai Co. Ltd. | | | 3.5 | | | Food, Beverage & Tobacco | | China |

| | BB Seguridade Participacoes SA | | | 3.1 | | | Insurance | | Brazil |

| | Sino Biopharmaceutical Ltd. | | | 3.0 | | | Pharmaceuticals,

Biotechnology & Life

Sciences | | Hong Kong |

| | AMBEV SA | | | 2.9 | | | Food, Beverage & Tobacco | | Brazil |

| | China Construction Bank Corp. Class H | | | 2.9 | | | Banks | | China |

| | | Hong Kong Exchanges and Clearing Ltd. | | | 2.7 | | | Diversified Financials | | Hong Kong |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

16

FUND BASICS

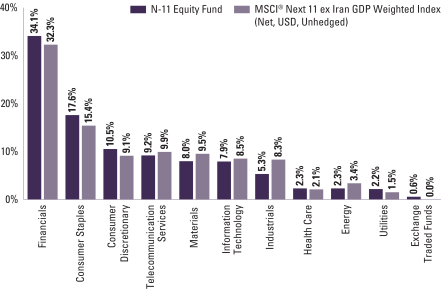

|

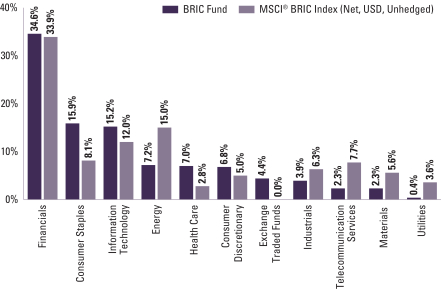

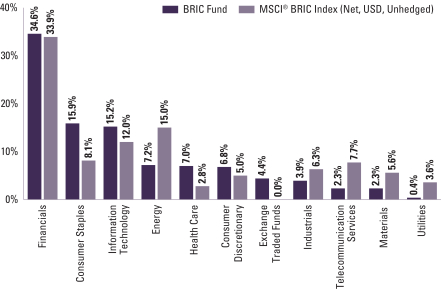

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

17

PORTFOLIO RESULTS

Goldman Sachs Emerging Markets Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs Emerging Markets Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 6.50%, 6.05%, 6.67%, 6.44% and 6.64%, respectively. These returns compare to the 3.92% cumulative total return of the Fund’s benchmark, the MSCI® Emerging Markets Index (Net, USD, Unhedged) (the “Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund outperformed the Index on a relative basis during the Reporting Period. Effective stock selection in India, South Korea and Taiwan benefited the Fund’s performance most. Such positive contributors were only partially offset by the detracting effect of weak stock selection in China and Russia. Having exposure to Georgia, which is not a component of the Index and which significantly underperformed the Index, also hurt. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The strongest contributors to the Fund’s performance during the Reporting Period were Cheil Industries, PCHome Online and Hong Kong Exchanges & Clearing. |

| | | The top individual stock contributor to the Fund’s results during the Reporting Period was Cheil Industries, a South Korean manufacturer and seller of chemicals and electronic materials. Cheil Industries, partially owned by Samsung Electronics, is widely seen as the de facto holding company of Samsung Group, and the stock outperformed the Index during the Reporting Period amid increasing anticipation that the company may indeed become Samsung Group’s holding company in the future. However, as the company’s valuations began to overshoot the fundamentals of its underlying business divisions, we exited from the Fund’s position, taking profits. |

| | | PCHome Online, a leading e-commerce service provider in Taiwan, was a key positive contributor to the Fund’s results during the Reporting Period. The company outperformed the Index on optimism surrounding warehouse additions, the launch of PCHomestore (an online cosmetics store) and faster growth in its consumer to consumer platform, known as Ruten. |

| | | Hong Kong Exchanges & Clearing, Asia’s second largest stock exchange in terms of market capitalization, was a new purchase for the Fund during the Reporting Period. Its stock outperformed the Index during the Reporting Period, as the consensus expects meaningful scaling up of volumes through Shanghai-Hong Kong Stock Connect1 in 2015, which could be a catalyst for strong financial performance. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Sberbank, Samsung Electronics and Galaxy Entertainment. |

| | 1 | | The A-H shares through-train refers to the Shanghai-Hong Kong Stock Connect, a pilot program for establishing mutual stock market access between Mainland China and Hong Kong, announced in April 2014 by Premier Li Keqiang at the Boao Forum for Asia and officially launched in November 2014. The new cross-border investment channel enables individual investors from Hong Kong and overseas to invest directly in designated securities listed on the Shanghai Stock Exchange and domestic investors from Mainland China to invest directly in designated securities listed on the Stock Exchange of Hong Kong, through their respective local brokers for the first time. A shares refers to shares issued by companies incorporated in Mainland China. They are listed on the Shanghai and Shenzhen Stock Exchanges and quoted in renminbi. They are not listed on the Hong Kong Stock Exchange. H shares refers to shares issued by companies incorporated in Mainland China and listed on the Hong Kong Stock Exchange. |

18

PORTFOLIO RESULTS

| | | The Fund’s holding in Sberbank detracted most from the Fund’s relative results during the Reporting Period. Russia’s largest bank was weighed down by the continued impact of sanctions on the nation, prompting us to eliminate the Fund’s position by the end of the Reporting Period. |

| | | South Korean electronics equipment and products manufacturer, Samsung Electronics, detracted from relative results during the Reporting Period driven by the Fund’s underweighted position in the stock. The stock performed strongly during the Reporting Period despite reporting disappointing third quarter 2014 results, impacted, in turn, by a slump in operating margins. Its management guided to higher earnings in the fourth quarter of 2014, and the market was pricing in strong dynamic random-access memory (“DRAM”) growth in 2015. Positive analyst sentiment provided a catalyst to the company’s share price performance. |

| | | Galaxy Entertainment Group is a Hong Kong-based operator of casino, hotel and other entertainment facilities in Macau. It underperformed the Index during the Reporting Period on a murky outlook for the overall gaming industry in Macau amid a continuing anti-corruption campaign in China. At the end of the Reporting Period, we still considered the company to be better positioned than many of its peers to defend and compete for market share, especially given its new casino opening in the Cotai area. |

| Q | | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | Relative to the Index, strong stock selection within the consumer staples, industrials and consumer discretionary sectors contributed most positively to the Fund’s performance. In consumer staples, the Fund’s holding in Amorepacific, a leading cosmetic, personal care and health care company in South Korea, was the strongest contributor. In industrials, the Fund’s position in Cheil Industries, already mentioned, was an outstanding performer. In consumer discretionary, the Fund’s holding in Bosch, an Indian automotive components supplier, boosted Fund results most. |

| | | Conversely, weak stock selection in financials, health care and materials detracted most from the Fund’s relative results during the Reporting Period. In financials, the Fund’s position in Sberbank, already mentioned, was the largest detractor from relative returns. In health care, the Fund’s position in Hong Kong’s Dawnrays Pharmaceutical Holdings, principally engaged in the development, manufacturing and sales of cephalosporin antibiotics and system specific medicines, was the biggest disappointment. In materials, the Fund’s position in Mexichem, a Mexican company producing and selling chemical products, detracted most from returns. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund used equity-linked notes and participatory notes to gain exposure to select stocks. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | In addition to the purchase of Hong Kong Exchanges & Clearing, mentioned earlier, we initiated a Fund position in Kweichow Moutai, the largest white spirit company in China, positioned at the premium end of the market. We initiated the position, as we believed its valuation at the time of purchase was at a significant discount to its domestic and international peers, and we see re-rating potential largely driven by sequential earnings improvement, enforcement of the A-H shares through-train1, and the ongoing state-owned enterprise reform process. Given its unparalleled brand equity and scarcity in supply, Kweichow Moutai may command higher margins versus its peers. Brand equity is defined as the value premium that a company realizes from a product with a recognizable name as compared to its generic equivalent. (Re-rating is when the market changes its view of a company sufficiently to make calculation ratios, such as its price/ earnings ratio, substantially higher or lower.) Following the anti-corruption drive that dampened demand from government sectors, we believe we are seeing a stabilization of channel inventory level and retail prices. We believe this could contribute to the company’s recovery, especially if demand from the private and mass sectors proves resilient. |

| | | We established a Fund position in Amorepacific in the consumer staples sector. A leading cosmetics company in South Korea with approximately 30 brands across cosmetics, personal care and health care, Amorepacific has been gaining both market and mind share in China against competitors, such as L’Oreal and Estee Lauder, perhaps due to its positioning as an Asian brand catering to the Asian demographic’s needs. We believe Amorepacific has significant multi-year growth potential given improving brand awareness in China and further expansion potential into the Southeast Asian market. Furthermore, it has been gaining momentum toward robust revenue growth and |

19

PORTFOLIO RESULTS

| | margin expansion after successful channel and brand restructuring in both South Korea and China and, in our view, could continue to benefit from the Chinese consumers’ tourism in South Korea. |

| | | We exited the Fund’s position in Hanjin Kal within the South Korean industrials sector. Hanjin Kal is a holding company with subsidiaries in the South Korean travel industry, including airline, hotel, travel-related services and real estate. We believed Hanjin Kal has been a direct beneficiary of strong tourism in South Korea, and its stock significantly outperformed the Index during the Reporting Period. We decided to sell the Fund’s position, taking profits, as its valuation began to seem rich, in our view, relative to other opportunities in this sector. |

| | | We eliminated the Fund’s position in Qualicorp, a company that operates as a healthcare benefits administrator and health management services provider in Brazil. Brazilian equities broadly suffered during the first quarter of 2015, led by the health care sector. Qualicorp, in particular, underperformed, and thus we made the decision to sell. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | Most sector weights are usually established within a narrow range from the Index, as our team prefers to make decisions at the individual stock level, where we believe we can generate more added value. That said, during the Reporting Period, the Fund’s exposure relative to the Index to consumer staples, financials and telecommunication services increased, and its allocations relative to the Index to information technology, industrials and utilities decreased. |

| | | Similarly, allocations to countries are directly the result of various stock selection decisions. As such, the Fund’s exposure relative to the Index in Taiwan, Singapore and Greece increased, and its allocations relative to the Index to South Korea, India and China decreased. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | Effective early March 2015, Prashant Khemka, CFA, Managing Director and Chief Investment Officer of Emerging Markets Equity, was named as a portfolio manager of the Fund. Basak Yavuz, CFA, Executive Director, was also named as a portfolio manager for the Fund. Basak has been with the Fundamental Equity team since 2011 and brings 17 years of investment experience in both emerging and frontier markets. Alina Chiew, CFA, Managing Director, will no longer be a portfolio manager of the Fund. Alina will continue to serve as Head of the Greater China Equity Team. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted exposures to India, Peru, Taiwan and Indonesia and underweighted exposures to South Korea, China, Malaysia and South Africa relative to the Index. On the same date, the Fund was relatively neutrally weighted to the Index in the remaining components of the Index and had exposure to several equity markets that are not components of the Index, including Singapore and Georgia. |

| | | From a sector allocation perspective, the Fund had overweighted positions relative to the Index in consumer discretionary, consumer staples, health care, financials and information technology at the end of the Reporting Period. The Fund had underweighted positions compared to the Index in the energy, telecommunication services, materials, utilities and industrials sectors at the end of the Reporting Period. |

| | | As always, we remained focused on individual stock selection, with sector and country positioning being a secondary, closely-monitored effect. |

20

FUND BASICS

Emerging Markets Equity Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI® Emerging

Markets Index

(Net, USD, Unhedged)2 | |

| | Class A | | | 6.50 | % | | | 3.92 | % |

| | Class C | | | 6.05 | | | | 3.92 | |

| | Institutional | | | 6.67 | | | | 3.92 | |

| | Service | | | 6.44 | | | | 3.92 | |

| | | Class IR | | | 6.64 | | | | 3.92 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI® Emerging Markets Index (Net, USD, Unhedged) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of January 1, 2015 the MSCI® Emerging Markets Index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. This Index offers an exhaustive representation of the emerging markets by targeting all companies with a market capitalization within the top 85% of their investable equity universe, subject to a global minimum size requirement. It is based on the Global Investable Market Indices methodology. This series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI® Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 3/31/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -0.62 | % | | | 0.40 | % | | | 6.36 | % | | | 6.02 | % | | 12/15/97 |

| | Class C | | | 3.47 | | | | 0.79 | | | | 6.16 | | | | 5.68 | | | 12/15/97 |

| | Institutional | | | 5.65 | | | | 1.95 | | | | 7.39 | | | | 6.90 | | | 12/15/97 |

| | Service | | | 5.15 | | | | 1.44 | | | | 6.86 | | | | 6.25 | | | 12/15/97 |

| | | Class IR | | | 5.44 | | | | N/A | | | | N/A | | | | 2.97 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

21

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.64 | % | | | 1.94 | % |

| | Class C | | | 2.40 | | | | 2.69 | |

| | Institutional | | | 1.24 | | | | 1.54 | |

| | Service | | | 1.75 | | | | 2.04 | |

| | | Class IR | | | 1.40 | | | | 1.69 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/155 |

| | | Holding | | % of Total

Net Assets | | | Line of Business | | Country |

| | Tencent Holdings Ltd. | | | 3.2 | % | | Software & Services | | China |

| | Kweichow Moutai Co. Ltd. | | | 3.0 | | | Food, Beverage & Tobacco | | China |

| | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 3.0 | | | Semiconductors &

Semiconductor Equipment | | Taiwan |

| | PChome Online, Inc. | | | 2.8 | | | Software & Services | | Taiwan |

| | Amorepacific Corp. | | | 2.5 | | | Household & Personal Products | | South Korea |

| | Airports of Thailand PCL | | | 2.0 | | | Transportation | | Thailand |

| | Naspers Ltd. Class N | | | 1.8 | | | Media | | South Africa |

| | PT Bank Central Asia Tbk | | | 1.6 | | | Banks | | Indonesia |

| | BB Seguridade Participacoes SA | | | 1.5 | | | Insurance | | Brazil |

| | | Hong Kong Exchanges and Clearing Ltd. | | | 1.5 | | | Diversified Financials | | Hong Kong |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

22

FUND BASICS

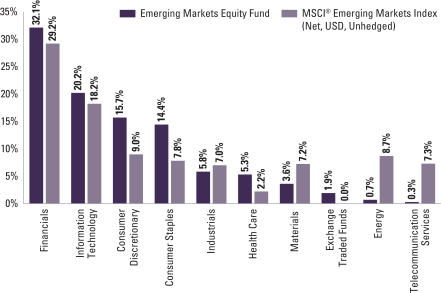

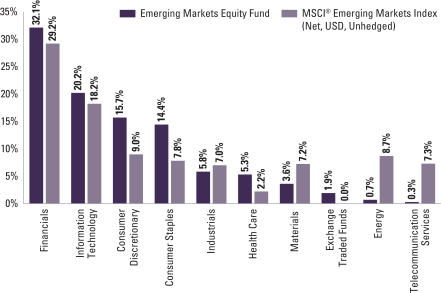

|

| FUND VS. BENCHMARK SECTOR ALLOCATIONS6 |

| As of April 30, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

23

PORTFOLIO RESULTS

Goldman Sachs N-11 Equity Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Emerging Markets Equity Portfolio Management Team discusses the Goldman Sachs N-11 Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of -7.19%, -7.46%, -6.89% and -6.98%, respectively. These returns compare to the -6.56% cumulative total return of the Fund’s benchmark, the MSCI® Next 11 ex Iran GDP Weighted Index (Net, USD, Unhedged) (the “Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund modestly underperformed the Index during the Reporting Period. The Fund’s stock selection and positioning in Mexico, Pakistan and Indonesia detracted most. Such detractors were only partially offset by the positive contributions of effective stock selection in South Korea, Turkey and the Philippines. Having an overweighted allocation to the Philippines, which significantly outpaced the Index during the Reporting Period, also helped. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to the Index were positions in Genomma Lab Internacional, Telecom Egypt and Grupo Financiero Banorte. |

| | Genomma Lab Internacional, a Mexican specialty pharmaceuticals company, was the largest detractor from the Fund’s relative results during the Reporting Period. The company missed consensus expectations with its earnings declining, as they were negatively impacted by destocking, or inventory reduction, in the pharmaceuticals industry and by currency effects. |