UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2015 |

| | |

| | | | Tactical Tilt Implementation Fund |

Goldman Sachs Tactical Tilt Implementation Fund

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 3 | |

| |

Schedule of Investments | | | 9 | |

| |

Financial Statements | | | 13 | |

| |

Financial Highlights | | | 16 | |

| |

Notes to the Financial Statements | | | 18 | |

| |

Other Information | | | 32 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Principal Investment Strategies and Risks

The Goldman Sachs Tactical Tilt Implementation Fund seeks long-term total return by investing in any one or in any combination of the following: U.S. and foreign equity securities, pooled investment vehicles, including affiliated domestic and international fixed income funds (“underlying funds”), fixed income instruments, including debt issued by U.S. and foreign governments, their agencies, instrumentalities, sponsored entities, and political subdivisions, notes, debt participations and non-investment grade securities (commonly known as “junk bonds”), derivatives and commodity investments, primarily through a wholly-owned subsidiary of the Portfolio organized as a company under the laws of the Cayman Islands (the “Subsidiary”).

Different investment styles (e.g., Tactical Tilt Recommendations) tend to shift in and out of favor, and at times the Portfolio may underperform other funds that invest in similar asset classes. The Portfolio’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging market investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic and political developments. The Portfolio’s investments in other investment companies (including exchange-traded funds, exchange-traded notes), publicly-traded partnerships and real estate investment trusts subject it to additional expenses. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. High yield, lower rated investments can have greater price volatility, are less liquid and present greater risks (including risks of default) than higher rated fixed income securities. The Portfolio may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities. Any guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio is also subject to the risk that the issuers of sovereign debt or the government authorities that control the payment of debt may be unable or unwilling to repay principal or interest when due. The Portfolio may invest in loans directly or indirectly, by purchasing participations or sub-participations from financial institutions. Indirect purchases may subject the Portfolio to greater delays, expenses and risks than direct obligations in the case that a borrower fails to pay scheduled principal and interest. At times, the Portfolio may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Portfolio may invest in non-investment grade securities, which involve greater price volatility and present greater risks than higher rated fixed income securities. The Portfolio may concentrate its investments in a specific industry (only in the event that that industry represents 20% or more of the Portfolio’s benchmark index at the time of investment), subjecting it to greater risk of loss as a result of adverse economic, business or other developments affecting that industry.

Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. Over-the-counter transactions are subject to less governmental regulation and supervision. Taking short positions involves leverage of the Portfolio’s assets and presents various other risks. Losses on short positions are potentially unlimited as a loss occurs when the value of an asset with respect to which the Portfolio has a short position increases. The Portfolio is “non-diversified” and may invest a larger percentage of its assets in fewer issuers than “diversified” funds. Accordingly, the Portfolio may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments. The Subsidiary primarily obtains its commodity exposure by investing in commodity index-linked derivative instruments

1

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

(which may include total return and excess return swaps). The Portfolio is subject to the risk that exposure to the commodities markets may subject the Portfolio to greater volatility than investments in traditional securities. The Portfolio is subject to tax risk as a result of its investments in the Subsidiary and in commodity index-linked structured notes, as the Portfolio has not received a private letter ruling from the Internal Revenue Service (“IRS”) concluding that income and gains from such investments are “qualifying income.” The IRS has suspended granting such private letter rulings, and the Portfolio cannot rely on private letter rulings granted to other taxpayers. The tax treatment of investments in the Subsidiary and in commodity index-linked structured notes may be adversely affected by future legislation and/or IRS guidance. While the Portfolio has obtained an opinion of counsel regarding such investments, if the IRS were to successfully assert that the Portfolio’s income from such investments was not “qualifying income,” in which case the Portfolio would fail to qualify as a regulated investment company, the Portfolio would be subject to federal and state income tax on all of its taxable income at regular corporate tax rates with no deduction for any distributions paid to shareholders, which would significantly adversely affect the returns to Portfolio shareholders.

The investment program of the Portfolio is speculative, entails substantial risks and includes asset classes and investment techniques not employed by more traditional mutual funds. The Portfolio should not be relied upon as a complete investment program. There can be no assurance that the investment objective of the Portfolio will be achieved.

2

PORTFOLIO RESULTS

Goldman Sachs Tactical Tilt Implementation Fund

Investment Objective and Principal Strategy

The Portfolio seeks long-term total return.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Portfolio Solutions Team discusses the Goldman Sachs Tactical Tilt Implementation Fund’s (the “Portfolio”) performance and positioning for the six-month period ended April 30, 2015 (the “Reporting Period”).

| Q | | How did the Portfolio perform during the Reporting Period? |

| A | | During the Reporting Period, the Portfolio’s Class I shares generated a cumulative total return, without sales charges, of 7.29%. This return compares to the 0.13% cumulative total return of the Portfolio’s benchmark, the Bank of America Merrill Lynch U.S. Dollar Three-Month LIBOR Constant Maturity Index (the “Index”), during the same time period. |

| Q | | What economic and market factors most influenced the Portfolio during the Reporting Period? |

| A | | Unfolding divergence in central bank monetary policy and in economic growth across countries and regions around the globe, particularly in the developed markets, was a dominant theme impacting the various asset classes through most of the Reporting Period, moderating slightly in April 2015 on the heels of global economic growth concerns and a lackluster first quarter 2015 U.S. Gross Domestic Product (“GDP”) report. In early 2015, central bank actions around the world surprised the markets, bringing riskier asset classes back into favor for a time, with 14 global central banks announcing easing measures in January 2015 alone. In the U.S., the Federal Reserve (the “Fed”), which had ended its quantitative easing asset purchases on schedule at the end of October 2014, adopted a dovish tone at its March 2015 policy meeting, lowering its forecasts for interest rates and U.S. GDP. (A dovish tone tends to suggest lower interest rates.) In Europe, accommodative monetary policy and a generally positive economic growth outlook contributed positively to equity performance, though European stocks began to lag developed market equities toward the end of the Reporting Period as a result of ongoing Greek debt negotiations. Global government fixed income markets — as measured by the Citigroup World Government Bond Index (hedged to USD) — were up 3.28% for the Reporting Period overall, driven by weaker global economic data. Geopolitical events, including talks on the lifting of Iranian sanctions as well as ongoing crises in the Middle East, caused renewed turbulence in the commodities markets. Commodities declined during the Reporting Period, as oil prices remained depressed amid a global supply glut. Meanwhile, the U.S. dollar strengthened against major global currencies, propelled by falling U.S. jobless claims, a political power shift in Greece and the Chinese central bank’s cut in the daily reference rate for the Chinese yuan. At the end of the Reporting Period, economic conditions in China remained comparatively weaker but were offset somewhat by expectations of further easing and improved domestic demand. |

| Q | | What key factors were responsible for the Portfolio’s performance during the Reporting Period? |

| A | | The Portfolio benefited most from its currency allocations during the Reporting Period. More specifically, the Portfolio’s long position in the U.S. dollar relative to the Japanese yen added to relative returns. As mentioned previously, the U.S. dollar strengthened significantly versus other world currencies during the Reporting Period. Meanwhile, the Japanese yen continued to weaken after the Bank of Japan announced it would expand its purchases of Japanese government bonds and market participants anticipated further significant stimulus in 2015. In addition, the Portfolio’s short position in the euro relative to the U.S. dollar performed strongly, as the euro declined versus the U.S. dollar for a tenth consecutive month in April 2015. The euro’s slide persisted amidst worries about Greece’s financial situation and its continued membership in the European Union as well as amidst stimulus measures announced by the European Central Bank (“ECB”) in January 2015. |

3

PORTFOLIO RESULTS

| | | The largest detractor from Portfolio performance during the Reporting Period was a U.S. equity hedge, which was maintained because of potential downside risks we perceived, including weak European economic data, concern about upcoming elections in the Eurozone and ongoing Greek debt negotiations. Earlier in the Reporting Period, Ebola also posed a key tail risk to our economic and financial market outlook. While the probability of an Ebola outbreak in the U.S. was very low, any increase in likelihood could have had negative repercussions on the U.S. economy and the financial markets. This U.S. equity hedge positioning hampered results, as U.S. stocks, as represented by the S&P 500® Index, posted gains during the Reporting Period. In addition, the positive performance of the Portfolio’s long position in Spanish equities was offset by its short position in French equities, which detracted. |

| Q | | How was the Portfolio positioned at the beginning of the Reporting Period? |

| A | | At the beginning of the Reporting Period, the Portfolio had 29.39% of its total net assets invested in equity-related investments; 41.78% of its total net assets invested in fixed income-related investments; 28.60% of its total net assets invested in currency-related investments; and 0.23% of its total net assets invested in commodity-related investments. None of the Portfolio’s total net assets were invested in cash and cash equivalents at the beginning of the Reporting Period. The above sector breakout is inclusive of derivative exposure across all asset classes. |

| Q | | How did you tactically manage the Portfolio’s allocations during the Reporting Period? |

| A | | During the Reporting Period, in response to shifting macroeconomic and market dynamics, we made a number of changes to the Portfolio’s equity-related, currency-related and fixed income-related exposures. The Portfolio’s equity positioning was predicated largely on our geopolitical and macroeconomic views, particularly of Eurozone countries — predominantly Spain — and Japan, and was based on where we perceived improved risk/reward potential opportunities. A position was established in Taiwan because of what we considered low valuations and improving corporate earnings. We managed the Portfolio’s currency related-exposures based on our views of global divergence, with several positions established to maintain the Portfolio’s long positioning in the U.S. dollar, as it continued to appreciate relative to the currencies of other developed markets. Overall, the Portfolio’s positioning continued to express our positive views about U. S. economic fundamentals and the strengthening U.S. dollar, especially as concern increased about muted global economic growth and weak economic data in developed markets outside the U.S. Within the Portfolio’s fixed income- related exposures, we maintained the Portfolio’s long position in U.S. high yield corporate bonds and U.S. high yield loans because we believed low yields, an improving U.S. economy and potential Fed tightening were likely to push yields up slowly. We maintained a bearish view on commodities. That said, the Portfolio entered into positions to capture our views on the energy market, including how the drop in oil prices might affect certain economies. We also sought to take advantage of the potential mispricing of energy-related securities due to what we considered overly pessimistic default rate scenarios. |

| Q | | How did the Portfolio use derivatives and similar instruments during the Reporting Period? |

| A | | The Portfolio used equity futures and foreign currency forward contracts to express active investment views with greater versatility across regional equity markets, global market sectors and the currency markets. The Portfolio also employed options on equity indices to tactically adjust the amount of equity and downside risk in seeking greater risk management precision, primarily to express views on the U.S. and Japan during the Reporting Period. |

| Q | | How was the Portfolio positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Portfolio had 31.53% of its total net assets invested in equity-related investments; 44.47% of its total net assets invested in fixed income-related investments; and 40.42% of its total net assets invested in currency-related investments. The Portfolio’s equity-related and currency-related exposures were increased through the use of options on equity and equity indices and the use of currency forwards. Cash and cash equivalents, along with options positions, accounted for 16.40% of the Portfolio’s total net assets at the end of the Reporting Period.1 At the end of the Reporting Period, none of the Portfolio’s total net assets were invested in commodity-related investments. The above sector breakout is inclusive of derivative exposure across all asset classes. |

| | 1 | | The Portfolio also maintains a larger cash base, which it uses, as necessary, to cover options and other derivatives positions that are not fully funded. Thus, the Portfolio has significant cash positions that are not included in its strategic allocation so as to avoid double-counting its positions in cash and cash equivalents and the capital it has set aside to cover options and other derivatives positions. |

4

PORTFOLIO RESULTS

| Q | | What is the Portfolio’s tactical asset allocation view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we continued to position the Portfolio for a strengthening U.S. economic recovery in spite of what we considered short-term weakness. We maintain our view that the Fed will tighten monetary policy in the second half of this year, and we expect above-trend growth in the U.S. economy, gradually rising yields and slowly normalizing inflation. Amidst mixed European and Japanese economic data and a broad shift toward dovish central bank monetary policy (which stands in contrast to the potential of near-term Fed tightening), we believe the strong commitments of the European Central bank (ECB) and Bank of Japan bode well, and we continue to monitor signs of economic recovery. In the months ahead, we believe market volatility is likely to offer attractive tactical opportunities, which may allow us to take advantage of different market, economic and geopolitical dynamics. |

5

FUND BASICS

Tactical Tilt Implementation Fund

as of April 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2014–April 30, 2015 | | Portfolio Total Return

(based on NAV)1 | | | LIBOR Index2 | |

| | | Institutional | | | 7.29 | % | | | 0.13 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Bank of America Merrill Lynch U.S. Dollar Three-Month LIBOR Constant Maturity Index tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 3/31/15 | | One Year | | Since Inception | | | Inception Date | |

| | | Institutional | | N/A | | | 6.00 | % | | | 7/31/14 | |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

6

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.91 | % | | | 1.17 | % |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Portfolio’s waivers and/or expense limitations will remain in place through at least February 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

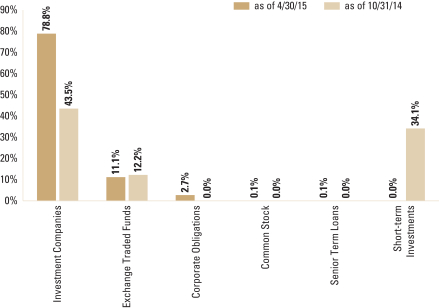

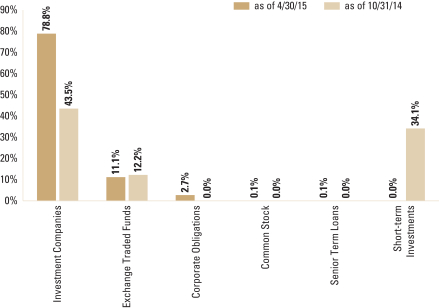

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Portfolio’s Net Assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

7

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Index Definitions

Bank of America Merrill Lynch U.S. Dollar Three-Month LIBOR Constant Maturity Index is based on the assumed purchase of a synthetic instrument having three months to maturity and with a coupon equal to the closing quote for three-month LIBOR. That issue is sold the following day (priced at a yield equal to the current day closing three-month LIBOR rate) and is rolled into a new three-month instrument. The index, therefore, will always have a constant maturity equal to exactly three months.

Citigroup World Government Bond Index (hedged to USD) measures the performance of fixed rate, local currency, investment grade sovereign bonds. It is a widely used benchmark that (on April 30, 2015) comprises sovereign debt from more than 20 countries, denominated in a variety of currencies.

S&P 500® Index is a U.S. stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ. The S&P 500® Index components and their weightings are determined by S&P Dow Jones Indices.

8

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Schedule of Investments

April 30, 2015 (Unaudited)

| | | | | | | | | | | | | | |

Principal Amount | | | Interest Rate | | | Maturity Date | | | Value | |

| | | | | | | | | | | | | | |

| | Corporate Obligations – 2.7% | |

| | Building Materials(a)(b) – 0.0% | |

| Zachry Holdings, Inc. | |

| $ | 350,000 | | | | 7.500 | % | | | 02/01/20 | | | $ | 346,938 | |

| | |

| | Energy – Coal(a)(b) – 0.1% | |

| Peabody Energy Corp. | |

| | 1,800,000 | | | | 10.000 | | | | 03/15/22 | | | | 1,521,000 | |

| | |

| | Energy – Exploration & Production – 2.2% | |

| Antero Resources Corp.(b) | |

| | 1,900,000 | | | | 5.375 | | | | 11/01/21 | | | | 1,919,000 | |

| Baytex Energy Corp.(a)(b) | |

| | 1,750,000 | | | | 5.125 | | | | 06/01/21 | | | | 1,706,250 | |

| Bonanza Creek Energy, Inc.(b) | |

| | 1,000,000 | | | | 6.750 | | | | 04/15/21 | | | | 1,015,000 | |

| California Resources Corp.(b) | |

| | 2,400,000 | | | | 6.000 | | | | 11/15/24 | | | | 2,259,120 | |

| Carrizo Oil & Gas, Inc.(b) | |

| | 2,050,000 | | | | 7.500 | | | | 09/15/20 | | | | 2,162,750 | |

| | 150,000 | | | | 6.250 | | | | 04/15/23 | | | | 152,063 | |

| Chaparral Energy, Inc.(b) | |

| | 3,400,000 | | | | 8.250 | | | | 09/01/21 | | | | 2,745,500 | |

| Chesapeake Energy Corp.(b) | |

| | 3,000,000 | | | | 5.375 | | | | 06/15/21 | | | | 2,880,000 | |

| Comstock Resources, Inc.(a)(b) | |

| | 1,800,000 | | | | 10.000 | | | | 03/15/20 | | | | 1,759,500 | |

| Concho Resources, Inc.(b) | |

| | 1,850,000 | | | | 5.500 | | | | 04/01/23 | | | | 1,884,687 | |

| CrownRock LP/CrownRock Finance, Inc.(a)(b) | |

| | 2,650,000 | | | | 7.750 | | | | 02/15/23 | | | | 2,802,375 | |

| Denbury Resources, Inc.(b) | |

| | 1,800,000 | | | | 5.500 | | | | 05/01/22 | | | | 1,714,500 | |

| Diamondback Energy, Inc.(b) | |

| | 2,800,000 | | | | 7.625 | | | | 10/01/21 | | | | 3,031,000 | |

| Endeavor Energy Resources LP/EER Finance, Inc.(a)(b) | |

| | 500,000 | | | | 8.125 | | | | 09/15/23 | | | | 517,500 | |

| EP Energy LLC/Everest Acquisition Finance, Inc.(b) | |

| | 1,900,000 | | | | 9.375 | | | | 05/01/20 | | | | 2,033,000 | |

| Gulfport Energy Corp.(b) | |

| | 1,850,000 | | | | 7.750 | | | | 11/01/20 | | | | 1,956,375 | |

| Halcon Resources Corp.(b) | |

| | 2,375,000 | | | | 9.750 | | | | 07/15/20 | | | | 1,953,437 | |

| Jones Energy Holdings LLC/Jones Energy Finance Corp.(b) | |

| | 2,400,000 | | | | 6.750 | | | | 04/01/22 | | | | 2,376,000 | |

| Laredo Petroleum, Inc.(b) | |

| | 2,400,000 | | | | 7.375 | | | | 05/01/22 | | | | 2,556,000 | |

| | 650,000 | | | | 6.250 | | | | 03/15/23 | | | | 671,125 | |

| Linn Energy LLC/Linn Energy Finance Corp.(b) | |

| | 3,100,000 | | | | 8.625 | | | | 04/15/20 | | | | 2,828,750 | |

| Magnum Hunter Resources Corp.(b) | |

| | 1,500,000 | | | | 9.750 | | | | 05/15/20 | | | | 1,365,000 | |

| Matador Resources Co.(a)(b) | |

| | 450,000 | | | | 6.875 | | | | 04/15/23 | | | | 462,375 | |

| MEG Energy Corp.(a)(b) | |

| | 3,750,000 | | | | 6.500 | | | | 03/15/21 | | | | 3,698,437 | |

| Memorial Production Partners LP/Memorial Production Finance

Corp.(b) |

|

| | 1,750,000 | | | | 7.625 | | | | 05/01/21 | | | | 1,715,000 | |

| | |

| | | | | | | | | | | | | | |

| | Corporate Obligations – (continued) | |

| | Energy – Exploration & Production – (continued) | |

| Newfield Exploration Co. | |

| $ | 1,000,000 | | | | 5.625 | % | | | 07/01/24 | | | $ | 1,062,500 | |

| | 450,000 | | | | 5.375 | (b) | | | 01/01/26 | | | | 466,875 | |

| Oasis Petroleum, Inc.(b) | |

| | 2,750,000 | | | | 6.875 | | | | 03/15/22 | | | | 2,805,000 | |

| Parsley Energy LLC/Parsley Finance Corp.(a)(b) | |

| | 1,850,000 | | | | 7.500 | | | | 02/15/22 | | | | 1,928,625 | |

| Penn Virginia Corp.(b) | |

| | 2,300,000 | | | | 8.500 | | | | 05/01/20 | | | | 2,248,250 | |

| Rice Energy, Inc.(b) | |

| | 1,850,000 | | | | 6.250 | | | | 05/01/22 | | | | 1,868,500 | |

| Rosetta Resources, Inc.(b) | |

| | 2,750,000 | | | | 5.875 | | | | 06/01/24 | | | | 2,739,687 | |

| Sanchez Energy Corp.(b) | |

| | 1,650,000 | | | | 7.750 | | | | 06/15/21 | | | | 1,722,188 | |

| Seven Generations Energy Ltd.(a)(b) | |

| | 1,750,000 | | | | 8.250 | | | | 05/15/20 | | | | 1,868,825 | |

| | 450,000 | | | | 6.750 | | | | 05/01/23 | | | | 456,278 | |

| SM Energy Co.(b) | |

| | 2,950,000 | | | | 6.500 | | | | 11/15/21 | | | | 3,068,000 | |

| Vanguard Natural Resourses LLC/VNR Finance Corp.(b) | |

| | 1,650,000 | | | | 7.875 | | | | 04/01/20 | | | | 1,637,625 | |

| Whiting Petroleum Corp.(b) | |

| | 1,850,000 | | | | 5.750 | | | | 03/15/21 | | | | 1,891,625 | |

| | 550,000 | | | | 6.250 | (a) | | | 04/01/23 | | | | 568,563 | |

| WPX Energy, Inc.(b) | |

| | 1,150,000 | | | | 6.000 | | | | 01/15/22 | | | | 1,132,750 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 73,630,035 | |

| | |

| | Energy – Services – 0.2% | |

| Atwood Oceanics, Inc.(b) | |

| | 2,300,000 | | | | 6.500 | | | | 02/01/20 | | | | 2,242,500 | |

| CVR Refining LLC/Coffeyville Finance, Inc.(b) | |

| | 1,200,000 | | | | 6.500 | | | | 11/01/22 | | | | 1,212,000 | |

| Forum Energy Technologies, Inc.(b) | |

| | 872,000 | | | | 6.250 | | | | 10/01/21 | | | | 828,400 | |

| FTS International, Inc.(a)(b) | |

| | 850,000 | | | | 6.250 | | | | 05/01/22 | | | | 680,000 | |

| Transocean, Inc. | | | | | | | | | |

| | 3,350,000 | | | | 6.375 | | | | 12/15/21 | | | | 2,952,187 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 7,915,087 | |

| | |

| | Pipelines(b) – 0.2% | |

| Sabine Pass Liquefaction LLC | |

| | 4,300,000 | | | | 5.625 | | | | 04/15/23 | | | | 4,364,500 | |

| Targa Resources Partners LP/Targa Resources Partners Finance

Corp. |

|

| | 3,100,000 | | | | 5.250 | | | | 05/01/23 | | | | 3,138,750 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 7,503,250 | |

| | |

| | TOTAL CORPORATE OBLIGATIONS | |

| | (Cost $89,258,784) | | | | | | | $ | 90,916,310 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Schedule of Investments (continued)

April 30, 2015 (Unaudited)

| | | | | | | | | | | | | | |

Principal Amount | | | Interest Rate | | | Maturity Date | | | Value | |

| | | | | | | | | | | | | | |

| | Senior Term Loans(c) – 0.1% | |

| | Energy – 0.1% | | | | | | | | | |

| American Energy – Marcellus LLC | |

| $ | 2,275,000 | | | | 8.500 | % | | | 08/04/21 | | | $ | 1,639,433 | |

| CITGO Holding, Inc. | |

| | 1,247,500 | | | | 9.500 | | | | 05/12/18 | | | | 1,256,856 | |

| Magnum Hunter Resources Corp. | |

| | 1,197,494 | | | | 8.500 | | | | 10/22/19 | | | | 1,191,507 | |

| | |

| | TOTAL SENIOR TERM LOANS | |

| | (Cost $4,171,885) | | | | | | | $ | 4,087,796 | |

| | |

| | | | | | | | |

| Shares | | | Description | | Value | |

| | | | | | | | |

| | Exchange Traded Funds – 11.1% | |

| | 10,185,442 | | | iShares MSCI Taiwan ETF | | $ | 167,448,666 | |

| | 6,169,648 | | | SPDR S&P Bank ETF | | | 209,212,764 | |

| | |

| | TOTAL EXCHANGE TRADED FUNDS | | | | |

| | (Cost $358,633,073) | | $ | 376,661,430 | |

| | |

| | | | | | | | |

| Shares | | Rate | | | Value | |

| | | | | | | | |

| Investment Companies(d) – 78.8% | |

Goldman Sachs Financial Square Government Fund – FST Shares | |

| 1,254,034,944 | | | 0.006 | % | | $ | 1,254,034,944 | |

| Goldman Sachs High Yield Floating Rate Fund – Institutional Shares | |

| 56,604,755 | | | 0.001 | % | | | 564,915,456 | |

| Goldman Sachs High Yield Fund – Institutional Shares | |

| 121,853,044 | | | 0.001 | % | | | 837,130,413 | |

| |

| TOTAL INVESTMENT COMPANIES | |

| (Cost $2,660,235,729) | | | $ | 2,656,080,813 | |

| |

| | | | | | | | |

| Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stock* – 0.1% | |

| | Oil, Gas & Consumable Fuels – 0.1% | |

| | 1,304,945 | | | Halcon Resources Corp. | | | | |

| | (Cost $1,785,470) | | $ | 1,944,368 | |

| | |

| | | | | | | | | | | | | | |

| Contracts | | | Exercise Rate | | | Expiration Date | | | Value | |

| | | | | | | | | | | | | | |

| | Options Purchased – 0.3% | |

| | Options on Equities | | | | | | | | | |

| Citibank NA Call – Topix Index Strike Price 1,575.67 | |

| | 13,340,978 | | | | 1,575.670 | % | | | 09/11/15 | | | | | |

| | (Cost $8,414,964) | | | $ | 9,250,123 | |

| | |

| | TOTAL INVESTMENTS – 93.1% | | | | | |

| | (Cost $3,122,499,905) | | | | | | | $ | 3,138,940,840 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 6.9% |

| | | 232,329,461 | |

| | |

| | NET ASSETS – 100.0% | | | $ | 3,371,270,301 | |

| | |

| | | | | | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | Exempt from registration under Rule 144A of the Securities Act of 1933. Under procedures approved by the Board of Trustees, such securities have been determined to be liquid by the investment adviser and may be resold, normally to qualified institutional buyers in transactions exempt from registration. Total market value of Rule 144A securities amounts to $18,316,665, which represents approximately 0.5% of net assets as of April 30, 2015. |

(b) | | Security with “Call” features with resetting interest rates. Maturity dates disclosed are the final maturity dates. |

(c) | | Senior Term Loans often require prepayments from excess cash flows or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity may be substantially less than the stated maturities shown. The stated interest rate represents the weighted average interest rate of all contracts within the senior loan facility on April 30, 2015. Senior Term Loans typically have rates of interest which are predetermined either daily, monthly, quarterly or semi-annually by reference to a base lending rate, plus a premium. These base lending rates are primarily the London-Interbank Offered Rate (“LIBOR”), and secondarily the prime rate offered by one or more major United States banks (the “Prime Rate”) and the certificate of deposit (“CD”) rate or other base lending rates used by commercial lenders. |

(d) | | Represents Affiliated Funds. |

| | |

|

Currency Abbreviations: |

AUD | | —Australian Dollar |

CHF | | —Swiss Franc |

DKK | | —Danish Krone |

EUR | | —Euro |

GBP | | —British Pound |

HKD | | —Hong Kong Dollar |

ILS | | —Israeli Shekel |

INR | | —Indian Rupee |

JPY | | —Japanese Yen |

NOK | | —Norwegian Krone |

NZD | | —New Zealand Dollar |

SEK | | —Swedish Krona |

SGD | | —Singapore Dollar |

USD | | —U.S. Dollar |

| | |

Investment Abbreviations: |

ETF | | —Exchange Traded Fund |

LLC | | —Limited Liability Company |

LP | | —Limited Partnership |

|

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

|

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At April 30, 2015, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | |

| | |

| Counterparty | | Contracts to

Buy/Sell | | Settlement Date | | | Current Value | | | Unrealized Gain | |

Morgan Stanley & Co. International PLC | | AUD/USD | | | 06/17/15 | | | $ | 12,848,463 | | | $ | 470,263 | |

| | CHF/USD | | | 06/17/15 | | | | 16,707,858 | | | | 1,206,160 | |

| | DKK/USD | | | 06/17/15 | | | | 2,812,564 | | | | 155,935 | |

| | EUR/USD | | | 06/17/15 | | | | 135,478,926 | | | | 5,664,601 | |

| | GBP/USD | | | 06/17/15 | | | | 35,101,188 | | | | 1,181,680 | |

| | HKD/USD | | | 06/17/15 | | | | 40,528,725 | | | | 31,335 | |

| | ILS/USD | | | 06/17/15 | | | | 1,004,922 | | | | 36,841 | |

| | JPY/USD | | | 06/17/15 | | | | 30,024,485 | | | | 472,410 | |

| | NOK/USD | | | 06/17/15 | | | | 1,153,839 | | | | 103,219 | |

| | NZD/USD | | | 06/17/15 | | | | 265,872 | | | | 9,650 | |

| | SEK/USD | | | 06/17/15 | | | | 5,504,174 | | | | 196,882 | |

| | SGD/USD | | | 06/17/15 | | | | 2,514,376 | | | | 122,896 | |

| | | USD/JPY | | | 06/17/15 | | | | 13,583,503 | | | | 42,232 | |

| TOTAL | | | $ | 9,694,104 | |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| | | | | | | | | | | | | | |

| Counterparty | | Contracts to

Buy/Sell | | Settlement Date | | | Current Value | | | Unrealized Loss | |

Morgan Stanley & Co. International PLC | | INR/USD | | | 06/17/15 | | | $ | 206,526,485 | | | $ | (3,985,269 | ) |

| | USD/AUD | | | 06/17/15 | | | | 223,987,857 | | | | (6,411,589 | ) |

| | USD/CHF | | | 06/17/15 | | | | 16,707,858 | | | | (840,455 | ) |

| | USD/DKK | | | 06/17/15 | | | | 2,812,564 | | | | (79,426 | ) |

| | USD/EUR | | | 06/17/15 | | | | 565,746,421 | | | | (19,654,348 | ) |

| | USD/GBP | | | 06/17/15 | | | | 35,101,188 | | | | (632,365 | ) |

| | USD/HKD | | | 06/17/15 | | | | 5,302,848 | | | | (4,136 | ) |

| | USD/ILS | | | 06/17/15 | | | | 1,004,922 | | | | (32,932 | ) |

| | USD/JPY | | | 06/17/15 | | | | 744,826,025 | | | | (7,994,498 | ) |

| | USD/NOK | | | 06/17/15 | | | | 1,153,840 | | | | (53,417 | ) |

| | USD/NZD | | | 06/17/15 | | | | 265,872 | | | | (9,805 | ) |

| | USD/SEK | | | 06/17/15 | | | | 5,504,174 | | | | (94,029 | ) |

| | | USD/SGD | | | 06/17/15 | | | | 2,514,375 | | | | (92,267 | ) |

| TOTAL | | | $ | (39,884,536 | ) |

FUTURES CONTRACTS — At April 30, 2015, the Fund had the following futures contracts:

| | | | | | | | | | | | | | |

| Type | | Number of

Contracts

Long (Short) | | | Expiration Date | | Current Value | | | Unrealized Gain (Loss) | |

H-Shares Index | | | 453 | | | May 2015 | | $ | 42,277,974 | | | $ | (472,799 | ) |

IBEX 35 Index | | | 3,367 | | | May 2015 | | | 429,268,483 | | | | (12,732,612 | ) |

Mini MSCI Emerging Market | | | (3,952 | ) | | June 2015 | | | (205,247,120 | ) | | | (16,067,130 | ) |

Topix Index | | | 1,532 | | | June 2015 | | | 203,817,588 | | | | 7,627,224 | |

| TOTAL | | | $ | (21,645,317 | ) |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Schedule of Investments (continued)

April 30, 2015 (Unaudited)

|

| ADDITIONAL INVESTMENT INFORMATION (continued) |

WRITTEN OPTIONS CONTRACTS — At April 30, 2015, the Fund had the following written options:

OPTIONS ON EQUITIES CONTRACTS

| | | | | | | | | | | | | | | | | | |

| Counterparty | | Description | | Contracts | | | Expiration

Date | | | Strike

Price | | | Value | |

Bank of America Securities LLC | | Put - SPDR Energy Select Sector ETF | | | 250,000 | | | | 01/15/16 | | | | 71.865 | % | | $ | (542,529 | ) |

Barclays Bank PLC | | Put - SPDR S&P Bank ETF | | | 1,133,800 | | | | 09/18/15 | | | | 33.510 | | | | (1,471,379 | ) |

Citibank NA | | Put - FTSE/MIB Index | | | 736 | | | | 06/19/15 | | | | 21,500 | | | | (805,757 | ) |

| | Call - Topix Index | | | 13,340,978 | | | | 09/11/15 | | | | 1,733.240 | | | | (2,703,711 | ) |

| | Put - SPDR S&P Bank ETF | | | 4,084,017 | | | | 09/18/15 | | | | 31.485 | | | | (2,648,910 | ) |

| | Put - SPDR Energy Select Sector ETF | | | 1,481,395 | | | | 01/15/16 | | | | 66.125 | | | | (1,814,901 | ) |

Deutsche Bank AG | | Put - SPDR Energy Select Sector ETF | | | 350,000 | | | | 01/15/16 | | | | 71.289 | | | | (718,066 | ) |

| | Put - SPDR Energy Select Sector ETF | | | 375,000 | | | | 01/15/16 | | | | 69.820 | | | | (665,856 | ) |

Morgan Stanley & Co. International PLC | | Put - FTSE/MIB Index | | | 668 | | | | 06/19/15 | | | | 19,000 | | | | (133,136 | ) |

| | Put - FTSE/MIB Index | | | 166 | | | | 06/19/15 | | | | 19,500 | | | | (46,132 | ) |

| | Put - FTSE/MIB Index | | | 1,427 | | | | 06/19/15 | | | | 17,500 | | | | (108,156 | ) |

| | | Put - SPDR S&P Bank ETF | | | 450,000 | | | | 09/18/15 | | | | 33.300 | | | | (544,540 | ) |

| TOTAL (Premium Received $33,319,448) | | | 21,468,187 | | | | | | | | | | | $ | (12,203,073 | ) |

WRITTEN OPTIONS CONTRACTS — For the period ended April 30, 2015, the Fund had the following written options activity:

OPTIONS ON EQUITY CONTRACTS

| | | | | | | | |

| | | Contracts | | | Premiums

Received | |

Contracts Outstanding October 31, 2014 | | | 1,086 | | | $ | 3,510,010 | |

Contracts Written | | | 21,467,101 | | | | 29,809,438 | |

Contracts Outstanding April 30, 2015 | | | 21,468,187 | | | $ | 33,319,448 | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Consolidated Statement of Assets and Liabilities(a)

April 30, 2015 (Unaudited)

| | | | | | |

| | | | | | |

| | Assets: | | | | |

| | Investments of unaffiliated issuers, at value (cost $462,264,176) | | $ | 482,860,027 | |

| | Investments of affiliated issuers, at value ($2,660,235,729) | | | 2,656,080,813 | |

| | Cash | | | 128,389,828 | |

| | Foreign currencies, at value (cost $1,732,039) | | | 1,805,066 | |

| | Unrealized gain on forward foreign currency exchange contracts | | | 9,694,104 | |

| | Receivables: | | | | |

| | Collateral on certain derivative contracts(b) | | | 107,115,762 | |

| | Fund shares sold | | | 42,221,177 | |

| | Dividends and interest | | | 7,274,927 | |

| | Deferred offering costs | | | 37,073 | |

| | Reimbursement from investment adviser | | | 28,502 | |

| | Total assets | | | 3,435,507,279 | |

| | | | | | |

| | Liabilities: | | | | |

| | Written option contracts, at value (premium received $33,319,448) | | | 12,203,073 | |

| | Unrealized loss on forward foreign currency exchange contracts | | | 39,884,536 | |

| | Variation margin on certain derivative contracts | | | 1,628,222 | |

| | Payables: | | | | |

| | Investments purchased | | | 5,426,786 | |

| | Collateral on certain derivative contracts(c) | | | 2,650,938 | |

| | Management fees | | | 1,106,985 | |

| | Investments purchased on an extended — settlement basis | | | 831,000 | |

| | Fund shares redeemed | | | 275,400 | |

| | Distribution and Service fees and Transfer Agent fees | | | 105,915 | |

| | Payable for offering costs | | | 62,000 | |

| | Accrued expenses and other liabilities | | | 62,123 | |

| | Total liabilities | | | 64,236,978 | |

| | | | | | |

| | Net Assets: | | | | |

| | Paid-in capital | | | 3,245,434,273 | |

| | Undistributed net investment income | | | 3,306,307 | |

| | Accumulated net realized gain | | | 136,735,134 | |

| | Net unrealized loss | | | (14,205,413 | ) |

| | NET ASSETS | | $ | 3,371,270,301 | |

| | Shares Outstanding $0.001 par value (unlimited shares authorized): | | | 321,950,942 | |

| | Net asset value, offering and redemption price per share: | | | $10.47 | |

| | (a) | | Statement of Assets and Liabilities for the Fund is consolidated and includes the balances of a wholly owned subsidiary, Goldman Sachs Cayman Commodity TTIF Fund Ltd. Accordingly, all interfund balances and transactions have been eliminated. |

| | (b) | | Includes amounts segregated for initial margin requirements and/or collateral on futures, options and forward foreign currency transactions of $51,270,000, $24,374,824 and $31,220,000, respectively. |

| | (c) | | Represents restricted cash relating to initial margin on options transactions. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Consolidated Statement of Operations(a)

For the Six Months Ended April 30, 2015 (Unaudited)

| | | | | | |

| | | | | | |

| | Investment income: | |

| | Dividends — affiliated issuers | | $ | 24,020,590 | |

| | Dividends — unaffiliated issuers | | | 1,745,697 | |

| | Interest | | | 975,597 | |

| | Total investment income | | | 26,741,884 | |

| | | | | | |

| | Expenses: | |

| | Management fees | | | 8,335,207 | |

| | Transfer Agent fees | | | 451,587 | |

| | Professional fees | | | 86,569 | |

| | Custody, accounting and administrative services | | | 80,752 | |

| | Amortization of offering costs | | | 74,549 | |

| | Printing and mailing costs | | | 27,643 | |

| | Trustee fees | | | 13,963 | |

| | Other | | | 22,299 | |

| | Total expenses | | | 9,092,569 | |

| | Less — expense reductions | | | (3,493,202 | ) |

| | Net expenses | | | 5,599,367 | |

| | NET INVESTMENT INCOME | | | 21,142,517 | |

| | | | | | |

| | Realized and unrealized gain (loss): | |

| | Capital gain distributions from Affiliated Underlying Funds | | | 8,648,766 | |

| | Net realized gain (loss) from: | | | | |

| | Investments — unaffiliated issuers | | | (19,993,733 | ) |

| | Investments — affiliated issuers | | | (734,242 | ) |

| | Futures contracts | | | 57,404,585 | |

| | Forward foreign currency exchange contracts | | | 111,092,460 | |

| | Foreign currency transactions | | | (160,286 | ) |

| | Net change in unrealized gain (loss) on: | | | | |

| | Investments — unaffiliated issuers | | | 32,809,961 | |

| | Investments — affiliated issuers | | | (5,163,924 | ) |

| | Futures contracts | | | (27,552,683 | ) |

| | Written options | | | 21,660,518 | |

| | Forward foreign currency exchange contracts | | | (40,096,147 | ) |

| | Foreign currency translation | | | 91,845 | |

| | Net realized and unrealized gain | | | 138,007,120 | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 159,149,637 | |

| | (a) | | Statement of Operations for the Fund is consolidated and includes the balances of a wholly owned subsidiary, Goldman Sachs Cayman Commodity TTIF Fund Ltd. Accordingly, all interfund balances and transactions have been eliminated. |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Consolidated Statements of Changes in Net Assets(a)

| | | | | | | | | | |

| | | | | For the

Six Months Ended

April 30, 2015

(Unaudited) | | | For the Fiscal

Year Ended

October 31, 2014(b) | |

| | From operations: | | | | | | | | |

| | Net investment income | | $ | 21,142,517 | | | $ | 4,457,148 | |

| | Net realized gain (loss) | | | 156,257,550 | | | | (20,730,489 | ) |

| | Net change in unrealized gain (loss) | | | (18,250,430 | ) | | | 4,045,017 | |

| | Net increase (decrease) in net assets resulting from operations | | | 159,149,637 | | | | (12,228,324 | ) |

| | | | | | | | | | |

| | Distributions to shareholders: | | | | | | | | |

| | From net investment income | | | (21,152,095 | ) | | | — | |

| | | | | | | | | | |

| | From share transactions: | | | | | | | | |

| | Proceeds from sales of shares | | | 1,777,993,480 | | | | 1,539,888,063 | |

| | Reinvestment of distributions | | | 21,045,722 | | | | — | |

| | Cost of shares redeemed | | | (88,317,392 | ) | | | (5,108,790 | ) |

| | Net increase in net assets resulting from share transactions | | | 1,710,721,810 | | | | 1,534,779,273 | |

| | TOTAL INCREASE | | | 1,848,719,352 | | | | 1,522,550,949 | |

| | | | | | | | | | |

| | Net assets: | | | | | | | | |

| | Beginning of period | | | 1,522,550,949 | | | | — | |

| | End of period | | $ | 3,371,270,301 | | | $ | 1,522,550,949 | |

| | Undistributed net investment income | | $ | 3,306,307 | | | $ | 3,315,885 | |

| | (a) | | Statement of Changes for the Fund is consolidated and includes the balances of a wholly owned subsidiary, Goldman Sachs Cayman Commodity TTIF Fund Ltd. Accordingly, all interfund balances and transactions have been eliminated. |

| | (b) | | Commenced operations on July 31, 2014 |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Financial Highlights

Selected Data for a Share Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Income (loss) from

Investment Operations | | | | |

| | | Year - Share Class | | Net asset

value,

beginning

of period | | | Net

investment

income(a) | | | Net realized

and unrealized

gain (loss) | | | Total from

investment

operations | | | Distribution

to shareholders from net

investment

income | |

| | FOR THE SIX MONTHS ENDED APRIL 30, (UNAUDITED) | |

| | 2015 - Institutional | | $ | 9.87 | | | $ | 0.09 | | | $ | 0.62 | | | $ | 0.71 | | | $ | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | FOR THE PERIOD ENDED OCTOBER 31, | |

| | 2014 - Institutional (Commenced operations July 31, 2014) | | | 10.00 | | | | 0.04 | | | | (0.17 | ) | | | (0.13 | ) | | | — | |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Assumes investment at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the net asset value at the end of the period and no sales or redemption charges. Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| | (d) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value, end

of period | | | | | Total

return(b) | | | | | Net assets,

end of

period

(in 000s) | | | | | Ratio of

net expenses

to average

net assets(c) | | | | | Ratio of

total expenses

to average

net assets(c) | | | | | Ratio of

net investment

income

to average

net assets(c) | | | | | Portfolio

turnover

rate(d) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 10.47 | | | | | | 7.29 | % | | | | $ | 3,371,270 | | | | | | 0.50 | % | | | | | 0.80 | % | | | | | 1.87 | % | | | | | 20 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9.87 | | | | | | (1.30 | ) | | | | | 1,522,551 | | | | | | 0.63 | | | | | | 0.86 | | | | | | 1.63 | | | | | | 45 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Notes to Financial Statements

April 30, 2015 (Unaudited)

Goldman Sachs Trust (the “Trust”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. Goldman Sachs Tactical Tilt Implementation Fund (the “Portfolio”) is a non-diversified fund and currently offers one class of shares — Institutional Shares. The Portfolio commenced operations on July 31, 2014. Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman, Sachs & Co. (“Goldman Sachs”), serves as investment adviser to the Portfolio pursuant to a management agreement (the “Agreement”) with the Trust.

|

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions.

A. Basis of Consolidation for the Goldman Sachs Tactical Tilt Implementation Fund — The Goldman Sachs Cayman Commodity TTIF Fund Ltd. (the “Subsidiary”), a Cayman Islands exempted company, was incorporated on July 31, 2014 and is currently a wholly-owned subsidiary of the Tactical Tilt Implementation Fund. The Subsidiary acts as an investment vehicle for the Fund to enable the Fund to gain exposure to certain types of commodity-linked derivative instruments. The Fund is the sole shareholder of the Subsidiary pursuant to a subscription agreement dated as of July 31, 2014, and it is intended that the Fund will remain the sole shareholder and will continue to control the Subsidiary. Under the Articles of Association of the Subsidiary, shares issued by the Subsidiary confer upon a shareholder the right to vote at general meetings of the Subsidiary and certain rights in connection with any winding-up or repayment of capital, as well as the right to participate in the profits or assets of the Subsidiary. All inter-fund balances and transactions have been eliminated in consolidation. As of April 30, 2015, the Fund’s net assets were $3,371,270,301, of which, $51,868,786, or 1.5%, represented the Subsidiary’s net assets.

B. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

C. Investment Income and Investments — Investment income includes interest income and dividend income, net of any foreign withholding taxes, less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations. Any foreign capital gains tax is accrued daily based upon net unrealized gains, and is payable upon sale of such investments. For derivative contracts, realized gains and losses are recorded upon settlement of the contract.

D. Expenses — Expenses incurred directly by the Fund are charged to the Fund, and certain expenses incurred by the Trust that may not solely relate to the Fund are allocated to the Fund and the other funds of the Trust on a straight-line and/or pro-rata basis depending upon the nature of the expenses and are accrued daily.

E. Offering Costs — Offering costs paid in connection with the offering of shares of the Portfolio are being amortized on a straight-line basis over 12 months from the date of commencement of operations.

F. Federal Taxes and Distributions to Shareholders — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies (mutual funds) and to distribute each year substantially all of its investment company taxable income and capital gains to its shareholders. Accordingly, the Fund is not required to make any provisions for the payment of federal income tax. Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income and distributions from net capital gains, if any, are declared and paid annually.

18

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

|

| 2. SIGNIFICANT ACCOUNTING POLICIES (continued) |

The Subsidiary is classified as a controlled foreign corporation under the Code. Therefore, the Tactical Tilt Implementation Fund is required to increase its taxable income by its share of the Subsidiary’s income. Net losses of the Subsidiary cannot be deducted by the Fund in the current period nor carried forward to offset taxable income in future periods.

Net capital losses are carried forward to future fiscal years and may be used to the extent allowed by the Code to offset any future capital gains. Losses that are carried forward will retain their character as either short-term or long-term capital losses. Utilization of capital loss carryforwards will reduce the requirement of future capital gains distributions. The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. The source of the Fund’s distributions may be shown in the accompanying financial statements as either from net investment income, net realized gain or capital. Certain components of the Fund’s net assets on the Consolidated Statement of Assets and Liabilities reflect permanent GAAP/tax differences based on the appropriate tax character.

G. Foreign Currency Translation — The accounting records and reporting currency of the Fund is maintained in U.S. dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollars using the current exchange rates at the close of each business day. The effect of changes in foreign currency exchange rates on investments is included within net realized and unrealized gain (loss) on investments. Changes in the value of other assets and liabilities as a result of fluctuations in foreign exchange rates are included in the Consolidated Statement of Operations within net change in unrealized gain (loss) on foreign currency transactions. Transactions denominated in foreign currencies are translated into U.S. dollars on the date the transaction occurred, the effects of which are included within net realized gain (loss) on foreign currency transactions.

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS |

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).

The Trustees have adopted Valuation Procedures that govern the valuation of the portfolio investments held by the Funds, including investments for which market quotations are not readily available. The Trustees have delegated to GSAM day-to-day responsibility for implementing and maintaining internal controls and procedures related to the valuation of the Funds’ portfolio investments. To assess the continuing appropriateness of pricing sources and methodologies, GSAM regularly performs price verification procedures and issues challenges as necessary to third party pricing vendors or brokers, and any differences are reviewed in accordance with the Valuation Procedures.

A. Level 1 and Level 2 Fair Value Investments — The valuation techniques and significant inputs used in determining the fair values for investments classified as Level 1 and Level 2 are as follows:

Debt Securities — Debt securities for which market quotations are readily available are valued daily on the basis of quotations supplied by dealers or an independent pricing service approved by the Trustees. The pricing services may use valuation models or matrix pricing, which consider: (i) yield or price with respect to bonds that are considered comparable in characteristics such as

19

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Notes to Financial Statements (continued)

April 30, 2015 (Unaudited)

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

rating, interest rate and maturity date or (ii) quotations from securities dealers to determine current value. Short-term debt obligations that mature in sixty days or less and that do not exhibit signs of credit deterioration are valued at amortized cost, which approximates fair value. With the exception of treasury securities of G8 countries (not held in money market funds), which are generally classified as Level 1, these investments are generally classified as Level 2 of the fair value hierarchy.

i. Senior Term Loans — Senior term loans (“Loans”) are interests in amounts owed by corporate, governmental, or other borrowers to lenders or lending syndicates. Loans are arranged through private negotiations between the borrower and one or more financial institutions (“Lenders”). The Fund’s investments in Loans are in the form of either participations in Loans (“Participations”) or assignments of all or a portion of Loans from third parties (“Assignments”). With respect to Participations, the Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participations and only upon receipt by the Lender of the payments from the borrower. The Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement with respect to Participations. Conversely, Assignments result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement.

Equity Securities — Equity securities and investment companies traded on a United States (“U.S.”) securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If there is no sale or official closing price or it is believed by the investment adviser to not represent fair value, equity securities and exchange traded investment companies are valued at the last bid price for long positions and at the last ask price for short positions. Investments in investment companies (other than those that are exchange traded) are valued at the NAV on the valuation date. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price. Securities traded on certain foreign securities exchanges are valued daily at fair value determined by an independent fair value service (if available) under Valuation Procedures approved by the Trustees and consistent with applicable regulatory guidance. The independent fair value service takes into account multiple factors including, but not limited to, movements in the securities markets, certain depositary receipts, futures contracts and foreign currency exchange rates that have occurred subsequent to the close of the foreign securities exchange. These investments are generally classified as Level 2 of the fair value hierarchy.

Underlying Funds (Including Money Market Funds) — Investments in the Underlying Funds are valued at the NAV per share of the Institutional Share class (FST for Money Market Funds) of each Underlying Fund on the day of valuation. Since certain underlying funds (exclusive of Money Market Funds) invest primarily in other mutual funds that fluctuate in value, the Funds’ shares will correspondingly fluctuate in value. These investments are generally classified as Level 1 of the fair value hierarchy.

The Underlying Funds may invest in debt securities which, if market quotations are readily available, are valued daily on the basis of quotations supplied by dealers or an independent pricing service approved by the Trustees. The pricing services may use valuation models or matrix pricing, which consider: (i) yield or price with respect to bonds that are considered comparable in characteristics such as rating, interest rate and maturity date or (ii) quotations from securities dealers to determine current value. Short-term debt obligations that mature in sixty days or less and that do not exhibit signs of credit deterioration are valued at amortized cost, which approximates fair value. With the exception of treasury securities of G8 countries (not held in money market funds), which are generally classified as Level 1, these investments are generally classified as Level 2 of the fair value hierarchy.

The Underlying Funds may invest in equity securities and investment companies. Investments in equity securities and investment companies traded on a U.S. securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If there is no sale or official closing price, or it is believed by the investment adviser to not represent fair value, equity securities and exchange traded investment companies are valued at the last bid price for long positions

20

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

and at the last ask price for short positions. Investments in investment companies (other than those that are exchange traded) are valued at the NAV on the valuation date. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price. Securities traded on certain foreign securities exchanges are valued daily at fair value determined by an independent fair value service (if available) under Valuation Procedures approved by the Trustees and consistent with applicable regulatory guidance. The independent fair value service takes into account multiple factors including, but not limited to, movements in the securities markets, certain depositary receipts, futures contracts and foreign currency exchange rates that have occurred subsequent to the close of the foreign securities exchange. These investments are generally classified as Level 2 of the fair value hierarchy.

Derivative Contracts — A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. The Fund enters into derivative transactions to hedge against changes in interest rates, securities prices, and/or currency exchange rates, to increase total return, or to gain access to certain markets or attain exposure to other underliers.

Exchange-traded derivatives, including futures contracts, are valued at the last sale or settlement price and typically fall within Level 1 of the fair value hierarchy. Over-the-counter (“OTC”) and centrally cleared derivatives are valued using market transactions and other market evidence, including market-based inputs to models, calibration to market-clearing transactions, broker or dealer quotations, or other alternative pricing sources. Where models are used, the selection of a particular model to value OTC and centrally cleared derivatives depends upon the contractual terms of, and specific risks inherent in, the instrument, as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, yield curves, credit curves, measures of volatility, voluntary and involuntary prepayment rates, loss severity rates and correlations of such inputs. For OTC and centrally cleared derivatives that trade in liquid markets, model inputs can generally be verified and model selection does not involve significant management judgment. OTC and centrally cleared derivatives are classified within Level 2 of the fair value hierarchy when significant inputs are corroborated by market evidence.

i. Forward Contracts — A forward contract is a contract between two parties to buy or sell an asset at a specified price on a future date. A forward contract settlement can occur on a cash or delivery basis. Forward contracts are marked-to-market daily using independent vendor prices, and the change in value, if any, is recorded as an unrealized gain or loss.

A forward foreign currency contract is a forward contract in which the Fund agrees to receive or deliver a fixed quantity of one currency for another, at a pre-determined price at a future date. All forward foreign currency exchange contracts are marked-to-market daily at the applicable forward rate. Non-deliverable forward foreign currency exchange contracts are settled with the counterparty in cash without the delivery of foreign currency.

ii. Futures Contracts — Futures contracts are contracts to buy or sell a standardized quantity of a specified commodity or security and are valued based on exchanged settlement prices or independent market quotes. Futures contracts are valued at the last settlement price, or in the absence of a sale, the last bid price for long positions and at the last ask price for short positions, at the end of each day on the board of trade or exchange upon which they are traded. Upon entering into a futures contract, the Fund deposits cash or securities in an account on behalf of the broker in an amount sufficient to meet the initial margin requirement. Subsequent payments are made or received by the Fund equal to the daily change in the contract value and are recorded as variation margin receivable or payable with a corresponding offset to unrealized gains or losses.

iii. Options — When the Fund writes call or put options, an amount equal to the premium received is recorded as a liability and is subsequently marked-to-market to reflect the current value of the option written. Swaptions are options on interest rate swap contracts.

Upon the purchase of a call option or a put option by the Fund, the premium paid is recorded as an investment and subsequently marked-to-market to reflect the current value of the option. Certain options may be purchased with premiums to be determined on a future date. The premiums for these options are based upon implied volatility parameters at specified terms.

21

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

Notes to Financial Statements (continued)

April 30, 2015 (Unaudited)

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

Short Term Investments — Short-term investments having a maturity of 60 days or less are generally valued at amortized cost which approximates fair market value. These investments are classified as Level 2 of the fair value hierarchy.

i. Repurchase Agreements — Repurchase agreements involve the purchase of securities subject to the seller’s agreement to repurchase the securities at a mutually agreed upon date and price, under the terms of a Master Repurchase Agreement (“MRA”). During the term of a repurchase agreement, the value of the underlying securities held as collateral on behalf of the Fund, including accrued interest, is required to exceed the value of the repurchase agreement, including accrued interest. The gross value of repurchase agreements is included in the Consolidated Statements of Assets and Liabilities for financial reporting purposes. The underlying securities for all repurchase agreements are held at the Fund’s custodian or designated sub-custodians under tri-party repurchase agreements.

An MRA governs transactions between the Fund and select counterparties. An MRA contains provisions for, among other things, initiation, income payments, events of default and maintenance of securities for repurchase agreements. An MRA also permits offsetting with collateral to create one single net payment in the event of default or similar events, including the bankruptcy or insolvency of a counterparty.

If the seller defaults, the Fund could suffer a loss to the extent that the proceeds from the sale of the underlying securities and other collateral held by the Fund are less than the repurchase price and the Fund’s costs associated with delay and enforcement of the repurchase agreement. In addition, in the event of default or insolvency of the seller, a court could determine that the Fund’s interest in the collateral is not enforceable, resulting in additional losses to the Fund.

Pursuant to exemptive relief granted by the Securities and Exchange Commission (“SEC”) and terms and conditions contained therein, the Fund, together with other funds of the Trust and registered investment companies having management agreements with GSAM or its affiliates, may transfer uninvested cash into joint accounts, the daily aggregate balance of which is invested in one or more repurchase agreements. Under these joint accounts, the Fund maintains pro-rata credit exposure to the underlying repurchase agreements’ counterparties. With the exception of certain transaction fees, the Fund is not subject to any expenses in relation to these investments.

B. Level 3 Fair Value Investments — To the extent that significant inputs to valuation models and other alternative pricing sources are unobservable, or if quotations are not readily available, or if GSAM believes that such quotations do not accurately reflect fair value, the fair value of the Fund’s investments may be determined under Valuation Procedures approved by the Trustees. GSAM, consistent with its procedures and applicable regulatory guidance, may make an adjustment to the most recent valuation prices of either domestic or foreign securities in light of significant events to reflect what it believes to be the fair value of the securities at the time of determining the Fund’s NAV. Significant events which could affect a large number of securities in a particular market may include, but are not limited to: significant fluctuations in U.S. or foreign markets; market dislocations; market disruptions; or unscheduled market closings. Significant events which could also affect a single issuer may include, but are not limited to: corporate actions such as reorganizations, mergers and buy-outs; ratings downgrades; and bankruptcies. To the extent investments are valued using single source broker quotations obtained directly from the broker or passed through from third party pricing vendors, such investments are classified as Level 3 investments.

GSAM did not develop the unobservable inputs (examples include but are not limited to single source broker quotations, third party pricing, etc.) for the valuation of Level 3 Assets and Liabilities.

22

GOLDMAN SACHS TACTICAL TILT IMPLEMENTATION FUND

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

C. Fair Value Hierarchy — The following is a summary of the Fund’s investments and derivatives classified in the fair value hierarchy as of April 30, 2015:

| | | | | | | | | | | | |

| | | |

| Investment Type | | Level 1 | | | Level 2 | | | Level 3 | |

| Assets | | | | | | | | | | | | |

Common Stock and/or Other Equity Investments(a) | | | | | | | | | | | | |

North America | | $ | 1,944,368 | | | $ | — | | | $ | — | |

Fixed Income | | | | | | | | | | | | |

Corporate Obligations | | | — | | | | 90,916,310 | | | | — | |

Senior Term Loans | | | — | | | | 4,087,796 | | | | — | |

Exchange Traded Funds | | | 376,661,430 | | | | — | | | | — | |

Investment Companies | | | 2,656,080,813 | | | | — | | | | — | |