UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: September 30, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | September 30, 2015 |

| | |

| | | | Municipal Fixed Income Funds |

| | | | Dynamic Municipal Income* |

| | | | High Yield Municipal |

| | | | Short Duration Tax-Free |

*Effective after the close of business on December 18, 2014, the Goldman Sachs Municipal Income Fund’s name changed to the “Goldman Sachs Dynamic Municipal Income Fund.”

Goldman Sachs Municipal Fixed Income Funds

| n | | DYNAMIC MUNICIPAL INCOME |

| n | | SHORT DURATION TAX-FREE |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 2 | |

| |

Market Review | | | 3 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 5 | |

| |

Schedules of Investments | | | 20 | |

| |

Financial Statements | | | 72 | |

| |

Financial Highlights | | | 76 | |

| |

Notes to the Financial Statements | | | 82 | |

| |

Other Information | | | 98 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS MUNICIPAL FIXED INCOME FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

Effective after the close of business on December 18, 2014, the Fund’s name changed to the “Goldman Sachs Dynamic Municipal Income Fund.”

The Goldman Sachs Dynamic Municipal Income Fund invests primarily in municipal securities, the interest on which is exempt from regular federal income tax. The Fund may invest up to 100% of its net assets in private activity bonds, whose income may be subject to the federal alternative minimum tax. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities. Because the Fund may invest heavily in investments in particular states and sectors, the Fund is subject to greater risk of loss as a result of adverse events affecting those states and sectors than if its investments were not so concentrated. The Fund may be adversely impacted by changes in tax law rates and policies, and is not suited for IRAs or other tax-exempt or deferred accounts.

The Goldman Sachs High Yield Municipal Fund invests primarily in high yield municipal securities that, at the time of purchase, are medium quality or non-investment grade, the interest on which is exempt from regular federal income tax. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, call and extension risk. High yield, lower rated investments involve greater price volatility and present greater risks, including greater liquidity risk, than higher rated fixed income securities. The Fund is subject to the risk that the liquidity of particular issuers or industries, or of all securities within a particular investment category, will shrink or disappear as a result of adverse economic, market or political events or adverse investor perception. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities. Because the Fund may invest heavily in investments in particular sectors (for example, specific types of municipal securities) or states, the Fund is subject to greater risk of loss as a result of adverse events affecting those sectors or states than if its investments were not so concentrated. The Fund may invest in securities whose income is subject to the federal alternative minimum tax and state income tax. The Fund may be adversely impacted by changes in tax law rates and policies, and is not suited for IRAs or other tax exempt or deferred accounts. Certain shareholders, including clients or affiliates of the investment adviser, may from time to time own or control a significant percentage of the Fund’s shares. Redemptions by these shareholders of their shares of the Fund may impact the Fund’s liquidity and NAV. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Short Duration Tax-Free Fund invests primarily in municipal securities, the interest on which is exempt from regular federal income tax and is not a tax preference item under the federal alternative minimum tax. The Fund may invest up to 20% of its portfolio in private activity bonds whose income may be subject to the federal alternative minimum tax and taxable investments. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities. Because the Fund may invest heavily in investments in particular states and sectors, the Fund is subject to greater risk of loss as a result of adverse events affecting those states and sectors than if its investments were not so concentrated. The Fund may be adversely impacted by changes in tax law rates and policies, and is not suited for IRAs or other tax-exempt or deferred accounts.

1

GOLDMAN SACHS MUNICIPAL FIXED INCOME FUNDS

What Differentiates the Goldman Sachs Asset Management Fixed Income Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our fixed income investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

A key element of our fixed income investment philosophy is to evaluate the broadest global opportunity set to capture relative value across sectors and instruments. Our globally integrated investment process involves managing dynamically along the risk/return spectrum, as we continue to develop value-added strategies through:

| n | | Assess relative value among securities and sectors |

| n | | Leverage the vast resources of GSAM in selecting securities for each portfolio |

| n | | Team approach to decision making |

| n | | Manage risk by avoiding significant sector and interest rate bets |

| n | | Careful management of yield curve strategies — while closely managing portfolio duration |

Fixed Income portfolios that:

| | n | | Include domestic investment options, tax-free income opportunities, and access to areas of specialization such as high yield securities | |

| | n | | Capitalize on GSAM’s industry-renowned credit research capabilities | |

| | n | | Use a risk-managed framework to seek total return, recognizing the importance of investors’ capital accumulation goals as well as their need for income | |

2

MARKET REVIEW

Goldman Sachs Municipal Fixed Income Funds

Market Review

The municipal bond market recorded positive returns during the six months ended September 30, 2015 (the “Reporting Period”) despite rising yields and modestly unfavorable supply and demand dynamics.

When the Reporting Period began in the second quarter of 2015, municipal bond prices retreated as yields rose across the yield curve. (Yield curve indicates a spectrum of maturities.) During the third calendar quarter and through the end of the Reporting Period, uncertainty about the Federal Reserve’s (the “Fed”) interest rate policy helped drive up municipal bond prices.

For the Reporting Period overall, shorter-term municipal yields edged up, while longer-term municipal yields rose more significantly. As a result, the municipal yield curve steepened. The yield on a two-year AAA-rated municipal security rose six basis points to 0.55%; the yield on a 10-year AAA-rated municipal security rose seven basis points to 2.03%; and the yield on a 30-year AAA-rated municipal security increased 24 basis points to 3.04%. (A basis point is 1/100th of a percentage point.) By comparison, the yield on a two-year U.S. Treasury security rose seven basis points to 0.63%; the yield on a 10-year U.S. Treasury rose 11 basis points to 2.04%; and the yield on a 30-year U.S. Treasury security increased 32 basis points to 2.85%. (Source: GSAM, MMD and Bloomberg.)

Market technicals, or supply and demand factors, were modestly unsupportive during the Reporting Period. Primary market issuance was strong, with approximately $200 billion of new supply for the Reporting Period overall. However, demand was weak. Municipal bond mutual funds saw average investment outflows of $200 million per week during the second quarter of 2015. Outflows persisted and even escalated during the third quarter of 2015. (Source: Lipper.)

Overall, credit quality in the municipal bond market remained strong during the Reporting Period. Nevertheless, pockets of weakness generated negative headlines. On June 28, 2015, Puerto Rico Governor Alejandro Garcia Padilla gave an interview to The New York Times in which he said the commonwealth “cannot pay its roughly $72 billion in debts.” These words shifted Puerto Rico’s course from a focused effort on finding liquidity and balancing the budget toward the possibility of a default. Credit ratings agencies responded to Padilla’s comments with multiple notch downgrades. As the Reporting Period progressed, Puerto Rico continued to implement significant measures to address its financial difficulties, including legislation that would allow for the issuance of tax anticipation notes and an increase in petroleum taxes as well as a tax reform proposal that could potentially provide additional revenues. Also during the Reporting Period, credit rating agencies downgraded New Jersey after a revenue shortfall led the state to make a reduced payment to its pension funds. Meanwhile, Illinois grappled with its pension and budgetary issues. In more positive news, state revenues overall expanded during the Reporting Period, with most states working toward solid budget plans that would potentially enhance financial reserves and provide tax breaks. One such example was New York state, which is one of the municipal bond market’s bellwether issuers. California also remained on an upward trajectory, as revenues came in ahead of budget for the state’s 2014-2015 fiscal year.

3

MARKET REVIEW

High Yield Municipals

During the Reporting Period, the high yield municipal bond market underperformed the investment grade municipal bond market. The main drivers of underperformance among high yield municipal bonds were the special tax and transportation sectors. Both sectors fell by more than 10% during the Reporting Period. As mentioned previously, Puerto Rico was the subject of significant negative news, which led to substantial volatility for the credit. Uncertainty around Puerto Rico’s restructuring plan caused it to underperform the Barclays High Yield Municipal Index for the Reporting Period as a whole.

Looking Ahead

At the end of the Reporting Period, municipal bond market technicals appeared to be moving in a more favorable direction, as primary market issuance slowed — though we believe this trend could possibly reverse toward the end of 2015. We also believe the tax environment should continue to be supportive for municipal bonds, even if interest rates remain low. That said, strong U.S. economic data, supported by recent Fed statements, suggest to us that rates may rise during the latter part of 2015. Higher rates, in our view, could make the tax exempt benefits of municipal bonds even more attractive and could boost the relative performance of the asset class. Meanwhile, we anticipate an increase in infrastructure investment by states and municipalities, and we expect their governments to take advantage of continued low interest rates to issue debt. We also expect to see more headlines around pension cost escalation, as this remains a serious challenge for some states and localities.

In the months ahead, we intend to maintain our approach in which we focus on seeking attractive risk/return opportunities across maturities along the municipal bond yield curve and inclusive of all credit qualities. We will continue seeking to keep the Funds invested in the most tax-efficient manner possible.

4

PORTFOLIO RESULTS

Goldman Sachs Dynamic Municipal Income Fund1

Investment Objective

The Fund seeks a high level of current income that is exempt from regular federal income tax.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Municipal Fixed Income Investment Management Team discusses the Goldman Sachs Dynamic Municipal Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of -0.27%, -0.71%, -0.16%, -0.34% and -0.15%, respectively. These returns compare to the 0.80% cumulative total return of the Fund’s benchmark, the Barclays Municipal Bond 1-10 Year Blend Index (the “Index”), during the same time period. To compare, the Fund’s former benchmark, the Barclays Municipal Bond Index, generated a 0.75% cumulative total return during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s exposure to longer maturity securities detracted from relative performance, as the municipal yield curved steepened, meaning the differential between longer-term and shorter-term yields widened. The Fund’s yield curve strategy detracted from relative returns. (Yield curve is a spectrum of maturities.) |

| On | | the positive side, the Fund’s sector positioning and bottom-up issue selection added to relative results. |

| Q | | Which municipal bond market sectors most significantly affected Fund performance during the Reporting Period? |

| A | | As municipal credit concerns increased in response to negative headlines about Puerto Rico, the Fund was hurt by its overweight position relative to the Index in lower credit quality B-rated municipal bonds. Conversely, the Fund benefited from its overweight position in hospital bonds, as this sector recorded strong gains during the Reporting Period. |

| Q | | How did duration and yield curve positioning decisions affect the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund suffered due to its yield curve positioning relative to the Index. More specifically, the Fund was hurt by its exposure to the longer- maturity segment of the municipal yield curve as the yield curve steepened. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period as a whole? |

| A | | During the Reporting Period overall, the Fund used municipal inverse variable rate securities to take advantage of the steepness of the municipal yield curve, wherein yields on shorter-term maturity municipal bonds were lower than those on longer-term maturity municipal bonds. These securities have an inverse relationship to short-term interest rates — the interest rate they pay generally increases as short-term interest rates fall and vice versa — and they therefore have the potential to increase or decrease the Fund’s income. In addition, the Fund used municipal credit default swaps as we sought to capture the upside potential of select securities that were trading below what we considered their intrinsic value. Also, to manage against potential changes in interest rates, the Fund employed interest rate swap contracts during the Reporting Period. Derivatives did not have a material impact, on a net basis, on the Fund’s performance during the Reporting Period. |

| Q | | What changes did you make in the Fund’s weightings and investments during the Reporting Period? |

| A | | During the Reporting Period, we increased the Fund’s exposure to university and general obligation bonds. We decreased its allocation to hospital credits and lease-backed bonds. In addition, we reduced the Fund’s exposure to higher |

5

PORTFOLIO RESULTS

| | credit quality A-rated issues and lower credit quality B-rated issues. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund held a longer duration position compared to that of the Index. It was underweight relative to the Index in higher credit quality investment grade municipal bonds and overweight in BBB- rated and other lower credit quality issues. Compared to the Index, the Fund was overweight in Puerto Rico, California and Texas municipal bonds and underweight in New York municipal bonds. |

6

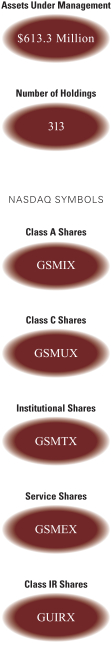

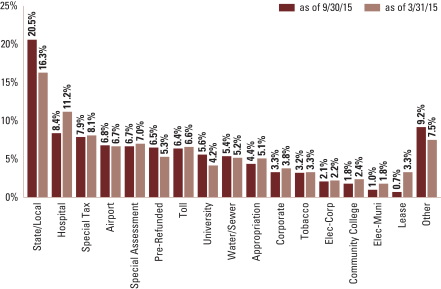

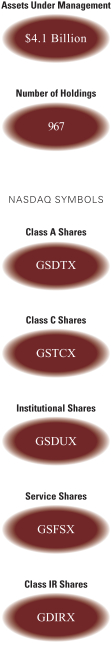

FUND BASICS

Dynamic Municipal Income Fund

as of September 30, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015–

September 30, 2015 | | Fund Total Return (based

on NAV)1 | | | Barclays Municipal

Bond 1-10

Yr Blend Index2 | | | Barclays Municipal

Bond Index3 | | | 30-Day Standardized Subsidized

Yield4 | | | 30-Day Standardized Unsubsidized Yield4 | | | 30-Day Taxable Equivalent Yield5 | |

| | Class A | | | -0.27 | % | | | 0.80 | % | | | 0.75 | % | | | 2.36 | % | | | 2.17 | % | | | 4.17 | % |

| | Class C | | | -0.71 | | | | 0.80 | | | | 0.75 | | | | 1.71 | | | | 1.51 | | | | 3.02 | |

| | Institutional | | | -0.16 | | | | 0.80 | | | | 0.75 | | | | 2.79 | | | | 2.60 | | | | 4.93 | |

| | Service | | | -0.34 | | | | 0.80 | | | | 0.75 | | | | 2.30 | | | | 2.10 | | | | 4.06 | |

| | | Class IR | | | -0.15 | | | | 0.80 | | | | 0.75 | | | | 2.70 | | | | 2.50 | | | | 4.77 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Fund’s performance benchmark was changed from the Barclays Municipal Bond Index to the Barclays Municipal Bond 1-10 Year Blend Index because Goldman Sachs Asset Management believes it is a more appropriate benchmark against which to measure the Fund’s performance, in light of changes to the Fund’s investment strategies. |

| | 3 | | The Barclays Municipal Bond Index is an unmanaged broad-based total return index composed of approximately 40,000 investment grade, fixed rate, and tax-exempt issues, with a remaining maturity of at least one year. The Barclays Municipal Bond Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 4 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| | 5 | | The 30-Day Taxable Equivalent Yield of the Fund is calculated by dividing the current 30-Day Standardized Subsidized Yield by 1 minus the highest 2013 federal income tax rate of 43.4%. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS6 |

| | | For the period ended 9/30/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -2.77 | % | | | 3.24 | % | | | 3.53 | % | | | 4.61 | % | | 7/20/93 |

| | Class C | | | -0.74 | | | | 3.26 | | | | 3.15 | | | | 3.73 | | | 8/15/97 |

| | Institutional | | | 1.36 | | | | 4.37 | | | | 4.28 | | | | 4.89 | | | 8/15/97 |

| | Service | | | 0.87 | | | | 3.85 | | | | 3.74 | | | | 4.39 | | | 8/15/97 |

| | | Class IR | | | 1.27 | | | | 4.26 | | | | N/A | | | | 4.67 | | | 7/30/10 |

| | 6 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares of the Fund was 4.5%, which is not reflected in the figures shown. Because Institutional Shares, Service Shares and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS7 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.78 | % | | | 1.01 | % |

| | Class C | | | 1.53 | | | | 1.76 | |

| | Institutional | | | 0.44 | | | | 0.67 | |

| | Service | | | 0.94 | | | | 1.16 | |

| | | Class IR | | | 0.53 | | | | 0.76 | |

| | 7 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

8

FUND BASICS

|

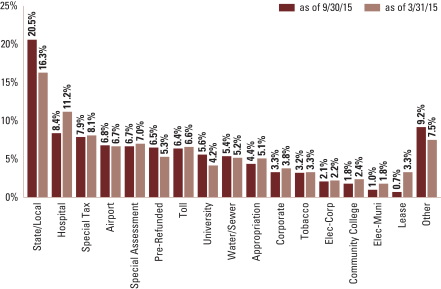

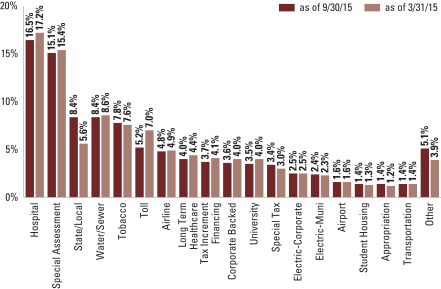

| SECTOR ALLOCATION8 |

| Percentage of Market Value |

| | 8 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

9

PORTFOLIO RESULTS

Goldman Sachs High Yield Municipal Fund

Investment Objective

The Fund seeks a high level of current income that is exempt from regular federal income tax and may also consider the potential for capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Municipal Fixed Income Investment Management Team discusses the Goldman Sachs High Yield Municipal Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 0.17%, -0.21%, 0.31% and 0.29%, respectively. These returns compare to the -0.32% cumulative total return of the Fund’s benchmark, the Goldman Sachs High Yield Municipal Fund Composite Index (“High Yield Municipal Composite”), during the same time period. |

| | | The High Yield Municipal Fund Composite is composed 60% of the Barclays Municipal High Yield Bond Index and 40% of the Barclays Municipal Bond Index (with dividends reinvested), which generated cumulative total returns of -1.07% and 0.75%, respectively, during the Reporting Period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund benefited from its underweight position compared to the High Yield Municipal Composite in Puerto Rico municipal bonds. Individual issue selection within the tobacco sector also contributed positively. |

| | | Conversely, the Fund’s holdings of longer maturity securities detracted from relative performance, as the municipal yield curve steepened during the Reporting Period, meaning the differential between longer-term and shorter-term yields widened. (Yield curve is a spectrum of maturities.) In addition, the Fund’s tactical management of its duration positioning detracted from relative results. (Duration is a measure of the Fund’s sensitivity to changes in interest rates.) |

| Q | | Which municipal bond market sectors most significantly affected Fund performance? |

| A | | The Fund’s overweight position relative to the High Yield Municipal Composite in the hospital sector added to relative returns, as hospital bonds recorded strong gains during the Reporting Period. The Fund’s underweight position in Puerto Rico bonds also enhanced results, as the commonwealth’s debt generated a negative absolute return in the High Yield Municipal Composite. |

| Q | | How did duration and yield curve positioning decisions affect the Fund’s performance? |

| A | | During the Reporting Period, the tactical management of the Fund’s duration positioning versus that of the High Yield Municipal Composite detracted from relative performance. Although the Fund benefited from a shorter duration position when municipal yields rose during May and June 2015, the same positioning hurt performance as municipal yields fell in the latter part of the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used municipal credit default swaps as we sought to capture the upside potential of select securities that were trading below what we considered their intrinsic value. Also during the Reporting Period, the Fund used municipal inverse variable rate securities to take advantage of the steepness of the municipal yield curve, wherein yields on shorter-term maturity municipal bonds were lower than those on longer-term maturity municipal bonds. These securities have an inverse relationship to short-term interest rates — the interest rate they pay generally increases as short-term interest rates fall and vice versa — and they therefore have the potential to increase or decrease the Fund’s income. In addition, the Fund employed interest rate swaps, tied to LIBOR (London interbank offered rates, which are floating interest rates widely used as reference rates in bank, corporate and government lending agreements), to manage the Fund’s duration position. The use of interest rate swaps had a positive impact on the Fund’s performance during the Reporting Period. |

10

PORTFOLIO RESULTS

| Q | | What changes did you make in the Fund’s weightings and investments during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s duration position fluctuated between approximately 8.00 years and 6.50 years and ended the Reporting Period at 7.63 years. We reduced the Fund’s exposure to hospital bonds but maintained an overweight position relative to the High Yield Municipal Composite. We also decreased the Fund’s exposure to toll road bonds. We increased the Fund’s allocation to the municipal debt of Illinois and decreased its exposure to the municipal debt of Florida. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was overweight relative to the High Yield Municipal Composite in the hospital and special assessment sectors. Compared to the High Yield Municipal Composite, the Fund was underweight higher credit quality AAA-rated and AA-rated issues and overweight lower credit quality BBB-rated issues. |

11

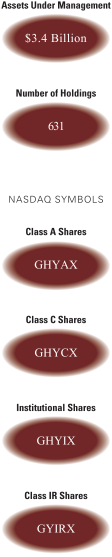

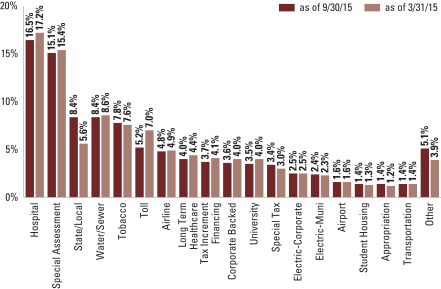

FUND BASICS

High Yield Municipal Fund

as of September 30, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015–

September 30, 2015 | | Fund Total

Return

(based

on NAV)1 | | | Goldman

Sachs

High Yield

Municipal

Fund

Composite

Index2 | | | Barclays

Municipal

High Yield

Bond Index3 | | | Barclays

Municipal

Bond Index4 | | | 30-Day

Standardized

Subsidized

Yield5 | | | 30-Day

Standardized

Unsubsidized

Yield5 | | | 30-Day

Taxable

Equivalent

Yield6 | |

| | Class A | | | 0.17 | % | | | -0.32 | % | | | -1.07 | % | | | 0.75 | % | | | 3.18 | % | | | 3.12 | % | | | 5.62 | % |

| | Class C | | | -0.21 | | | | -0.32 | | | | -1.07 | | | | 0.75 | | | | 2.58 | | | | 2.52 | | | | 4.56 | |

| | Institutional | | | 0.31 | | | | -0.32 | | | | -1.07 | | | | 0.75 | | | | 3.62 | | | | 3.61 | | | | 6.40 | |

| | | Class IR | | | 0.29 | | | | -0.32 | | | | -1.07 | | | | 0.75 | | | | 3.57 | | | | 3.51 | | | | 6.31 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Goldman Sachs High Yield Municipal Fund Composite Index is comprised of the Barclays Municipal High Yield Bond Index (60%) (with dividends reinvested) and the Barclays Municipal Bond Index (40%) (with dividends reinvested). |

| | 3 | | The Barclays Municipal High Yield Bond Index is an unmanaged index made up of bonds that are non-investment grade, unrated, or rated below Ba1 by Moody’s Investors Service with a remaining maturity of at least one year. The Barclays Municipal High Yield Bond Index does not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 4 | | The Barclays Municipal Bond Index is an unmanaged broad-based total return index composed of approximately 40,000 investment grade, fixed rate, and tax-exempt issues, with a remaining maturity of at least one year. The Barclays Municipal Bond Index does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 5 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| | 6 | | The 30-Day Taxable Equivalent Yield of the Fund is calculated by dividing the current 30-Day Standardized Subsidized Yield by 1 minus the highest 2013 federal income tax rate of 43.4%. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS7 |

| | | For the period ended 9/30/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -2.45 | % | | | 4.67 | % | | | 2.54 | % | | | 4.33 | % | | 4/3/00 |

| | Class C | | | 0.36 | | | | 4.86 | | | | 2.25 | | | | 3.86 | | | 4/3/00 |

| | Institutional | | | 2.32 | | | | 5.96 | | | | 3.34 | | | | 5.01 | | | 4/3/00 |

| | | Class IR | | | 2.39 | | | | 5.94 | | | | N/A | | | | 6.51 | | | 7/30/10 |

| | 7The | | Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 4.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund will charge a 2% redemption fee on the redemption of shares (including by exchange) held for 60 calendar days or less. The performance figures do not reflect the deduction of the redemption fee. If reflected, the redemption fee would reduce the performance quoted. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS8 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.86 | % | | | 0.93 | % |

| | Class C | | | 1.61 | | | | 1.68 | |

| | Institutional | | | 0.57 | | | | 0.59 | |

| | | Class IR | | | 0.61 | | | | 0.68 | |

| | 8The | | expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

13

FUND BASICS

|

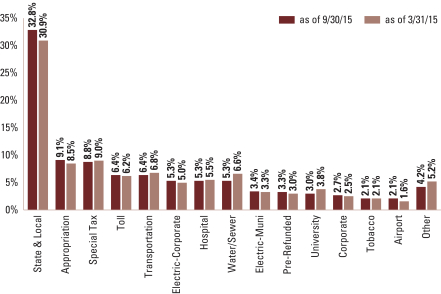

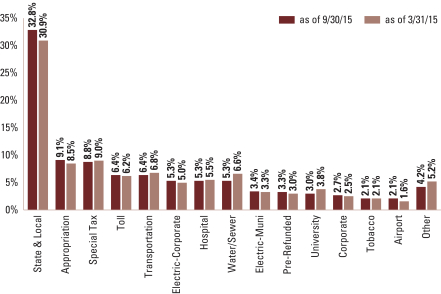

| SECTOR ALLOCATION9 |

| Percentage of Market Value |

| | 9 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

14

PORTFOLIO RESULTS

Goldman Sachs Short Duration Tax-Free Fund

Investment Objective

The Fund seeks a high level of current income, consistent with relatively low volatility of principal, that is exempt from regular federal income tax.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Municipal Fixed Income Investment Management Team discusses the Goldman Sachs Short Duration Tax-Free Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of -0.14%, -0.34%, 0.03%, -0.22% and -0.01%, respectively. These returns compare to the 0.66% cumulative total return of the Fund’s benchmark, the Barclays Municipal Bond 1-3 Year Blend Index (the “Index”), during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund suffered due to its holdings of longer-term securities, as the municipal yield curve steepened during the Reporting Period, meaning the differential between longer-term and shorter-term yields widened. The Fund’s duration and yield curve strategy also detracted from relative results. (Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve is a spectrum of maturities.) |

| On | the positive side, the Fund’s sector positioning and bottom-up issue selection added to relative returns. |

| Q | | Which municipal bond market sectors most significantly affected Fund performance? |

| A | | Although sector positioning added to relative performance overall, the Fund was hurt by its holdings of Puerto Rico bonds. These investments detracted from Fund returns as Puerto Rico’s debt experienced significant volatility amidst persistent headline news. |

| The | Fund benefited from its exposure to local general obligation bonds. Positioning in the toll road sector also added to returns. Additionally, individual issue selection among pre-refunded bonds bolstered results. (Pre-refunding, also known as advance refunding, is a procedure in which a municipality issues a second bond at a lower interest rate, and uses the proceeds from the sale of the second bond to invest in “escrow collateral” for the first bond. The escrow collateral is typically in Treasury securities. Pre-refunded municipal bonds no longer represent the credit risk profile of the original borrower, and given the high credit quality of the escrow collateral, they often increase in value — sometimes significantly.) |

| Q | | How did duration and yield curve positioning decisions affect the Fund’s performance? |

| A | | During the Reporting Period, the Fund’s duration positioning detracted from relative performance. The Fund held a longer duration position relative to the Index at the beginning of the Reporting Period, which hurt performance as shorter-maturity municipal yields — especially those in the two-year portion of the municipal yield curve — rose, particularly during May 2015. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund used municipal inverse variable rate securities to seek to take advantage of the steepness of the municipal yield curve, wherein yields on shorter-term maturity municipal bonds were lower than those on longer-term maturity municipal bonds. These securities have an inverse relationship to short-term interest rates — the interest rate they pay generally increases as short-term interest rates fall and vice versa — and they therefore have the potential to increase or decrease the Fund’s income. In addition, the Fund used municipal credit default swaps as we sought to capture the upside potential of select securities that were trading below what we considered their intrinsic value. Derivatives did not have a material impact, on a net basis, on the Fund’s performance during the Reporting Period. |

15

PORTFOLIO RESULTS

| Q | | What changes did you make in the Fund’s weightings and investments during the Reporting Period? |

| A | | During the Reporting Period, we shifted the Fund from a longer duration position relative to that of the Index to a comparatively short duration position. We reduced the Fund’s exposure to water and sewer credits. We increased the Fund’s exposure to general obligation bonds during the Reporting Period. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had a short duration position compared to that of the Index. It was slightly underweight relative to the Index in higher credit quality AAA-rated issues, and it was overweight BBB-rated issues and other lower credit quality rated municipal bonds. In addition, the Fund was overweight in Illinois, Texas and Puerto Rico municipal bonds at the end of the Reporting Period. |

16

FUND BASICS

Short Duration Tax-Free Fund

as of September 30, 2015

| | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015– September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays

Municipal 1–3

Year Blend

Index2 | | | 30-Day

Standardized

Subsidized

Yield3 | | | 30-Day

Standardized

Unsubsidized

Yield3 | | | 30-Day Taxable

Equivalent

Yield4 | |

| | Class A | | | -0.14 | % | | | 0.66 | % | | | 0.76 | % | | | 0.73 | % | | | 1.34 | % |

| | Class C | | | -0.34 | | | | 0.66 | | | | 0.38 | | | | 0.00 | | | | 0.67 | |

| | Institutional | | | 0.03 | | | | 0.66 | | | | 1.11 | | | | 1.08 | | | | 1.96 | |

| | Service | | | -0.22 | | | | 0.66 | | | | 0.61 | | | | 0.58 | | | | 1.08 | |

| | | Class IR | | | -0.01 | | | | 0.66 | | | | 1.02 | | | | 0.99 | | | | 1.80 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Municipal 1-3 Year Blend Index (with dividends reinvested), an unmanaged index, represents investment grade municipal bonds with maturities greater than one year and less than 4 years, and does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| | 4 | | The 30-Day Taxable Equivalent Yield of the Fund is calculated by dividing the current 30-Day Standardized Subsidized Yield by 1 minus the highest 2013 federal income tax rate of 43.4%. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS5 |

| | | For the period ended 9/30/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -1.40 | % | | | 0.80 | % | | | 2.10 | % | | | 2.70 | % | | 5/1/97 |

| | Class C | | | -0.96 | | | | 0.69 | | | | 1.67 | | | | 2.03 | | | 8/15/97 |

| | Institutional | | | 0.43 | | | | 1.43 | | | | 2.62 | | | | 3.35 | | | 10/1/92 |

| | Service | | | -0.07 | | | | 0.95 | | | | 2.11 | | | | 2.82 | | | 9/20/94 |

| | | Class IR | | | 0.34 | | | | 1.34 | | | | N/A | | | | 1.38 | | | 7/30/10 |

| | 5 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 1.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (0.65% if redeemed within 12 months of purchase). Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares of the Fund was 2.0%, which is not reflected in the figures shown. Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS6 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.73 | % | | | 0.76 | % |

| | Class C | | | 1.13 | | | | 1.51 | |

| | Institutional | | | 0.39 | | | | 0.41 | |

| | Service | | | 0.89 | | | | 0.92 | |

| | | Class IR | | | 0.48 | | | | 0.51 | |

| | 6 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

18

FUND BASICS

|

| SECTOR ALLOCATION7 |

| Percentage of Market Value |

| | 7 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

19

GOLDMAN SACHS DYNAMIC MUNICIPAL INCOME FUND

Schedule of Investments

September 30, 2015 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – 97.5% | |

| | Alabama – 2.4% | |

| Alabama State Port Authority RB for Docks Facilities Series 2010

(A-/NR) |

|

| $ | 2,500,000 | | | | 5.750 | % | | | 10/01/30 | | | $ | 2,930,050 | |

| Alexander City Special Care Facilities Financing Authority

Medical Facilities RB for Russell Hospital Corp. Series 2006 A

(BB-/NR) |

|

| | 1,780,000 | | | | 5.750 | | | | 12/01/36 | | | | 1,800,666 | |

| Auburn University General Fee RB Refunding Series 2015 A

(AA-/Aa2) |

|

| | 1,205,000 | | | | 4.000 | | | | 06/01/19 | | | | 1,329,862 | |

| Health Care Authority RB for Baptist Health Series 2006 D

(BBB+/A3) |

|

| | 575,000 | | | | 5.000 | | | | 11/15/17 | | | | 577,743 | |

| | 100,000 | | | | 5.000 | | | | 11/15/21 | | | | 100,485 | |

| Jefferson County Senior Lien Sewer RB Warrants Series 2013 A

(AGM) (AA/A2) |

|

| | 350,000 | | | | 5.000 | | | | 10/01/44 | | | | 373,240 | |

| Jefferson County Subordinate Lien Sewer RB Warrants

Series 2013 D (BBB-/NR) |

|

| | 1,000,000 | | | | 5.000 | | | | 10/01/21 | | | | 1,094,540 | |

| | 3,000,000 | | | | 6.000 | | | | 10/01/42 | | | | 3,349,950 | |

| | 3,000,000 | | | | 6.500 | | | | 10/01/53 | | | | 3,429,060 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 14,985,596 | |

| | |

| | Arizona – 1.9% | |

| Arizona Health Facilities Authority Hospital RB for Banner

Health Series 2007 B (AA-/NR)(a) |

|

| | 5,150,000 | | | | 1.000 | | | | 01/01/37 | | | | 4,473,341 | |

| Arizona State University System RB Refunding Series 2015 B

(AA/Aa3) |

|

| | 3,000,000 | | | | 5.000 | | | | 07/01/19 | | | | 3,421,440 | |

| Maricopa County Arizona Pollution Control Corp. PCRB

Refunding for El Paso Electric Co. Project Series 2009 A

(BBB/Baa1) |

|

| | 2,200,000 | | | | 7.250 | | | | 02/01/40 | | | | 2,500,894 | |

| Yavapai County IDA Solid Waste Disposal RB for Waste

Management, Inc. Project Series 2003 A-2 (AMT) (A-/NR)(b) |

|

| | 1,410,000 | | | | 1.600 | | | | 03/01/18 | | | | 1,393,207 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 11,788,882 | |

| | |

| | Arkansas – 0.7% | |

| Arkansas State Development Finance Authority Hospital RB

Refunding for Washington Regional Medical Center

Series 2015 B (NR/Baa1) |

|

| | 770,000 | | | | 3.000 | | | | 02/01/18 | | | | 791,090 | |

| | 1,845,000 | | | | 3.000 | | | | 02/01/19 | | | | 1,898,579 | |

| Arkansas State Development Finance Authority RB for Single

Family Mortgage-Backed Securities Series 2008 B (AMT)

(GNMA) (FNMA) (AA+/NR) |

|

| | 505,000 | | | | 5.500 | | | | 07/01/23 | | | | 530,321 | |

| City of Little Rock Sewer RB Refunding Series 2015 (NR/Aa3) | |

| | 1,000,000 | | | | 4.000 | | | | 04/01/21 | | | | 1,118,930 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 4,338,920 | |

| | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | California – 17.8% | |

| Alameda County Oakland Unified School District GO Refunding

Bonds Series 2015 (NR/NR) |

|

| $ | 1,500,000 | | | | 5.000 | % | | | 08/01/19 | | | $ | 1,677,075 | |

| California Educational Facilities Authority RB for California

Institute of Technology Series 2009 (AA-/Aa2) |

|

| | 5,000,000 | | | | 5.000 | | | | 11/01/39 | | | | 5,640,150 | |

| California Health Facilities Financing Authority RB for

Providence Health & Services Series 2008 C (AA-/Aa3)(c) |

|

| | 1,000,000 | | | | 6.500 | | | | 10/01/18 | | | | 1,170,280 | |

| California Municipal Finance Authority Student Housing RB for

Bowles Hall Foundation Series 2015 A (NR/Baa3) |

|

| | 400,000 | | | | 5.000 | | | | 06/01/35 | | | | 433,424 | |

| California State Various Purpose GO Bonds Series 2009

(AA-/Aa3) |

|

| | 5,000,000 | | | | 5.250 | | | | 10/01/25 | | | | 5,784,300 | |

| | 5,000,000 | | | | 6.500 | | | | 04/01/33 | | | | 5,950,050 | |

| | 2,750,000 | | | | 6.000 | | | | 04/01/38 | | | | 3,205,867 | |

| California State Various Purpose GO Bonds Series 2010

(AA-/Aa3) |

|

| | 1,250,000 | | | | 6.000 | | | | 03/01/33 | | | | 1,501,337 | |

| | 1,500,000 | | | | 5.500 | | | | 03/01/40 | | | | 1,735,410 | |

| California Statewide Communities Development Authority

Community Facilities District No. 2007-01 Special Tax

Refunding for Orinda Wilder Project Series 2015 (NR/NR) |

|

| | 345,000 | | | | 5.000 | | | | 09/01/30 | | | | 365,155 | |

| | 375,000 | | | | 5.000 | | | | 09/01/37 | | | | 387,716 | |

| California Statewide Communities Development Authority RB

for Enloe Medical Center Series 2008 (CAL MTG INS)

(AA-/NR) |

|

| | 1,435,000 | | | | 5.750 | | | | 08/15/38 | | | | 1,603,010 | |

| California Statewide Communities Development Authority RB

for Sutter Health Series 2011 A (AA-/Aa3) |

|

| | 2,000,000 | | | | 6.000 | | | | 08/15/42 | | | | 2,336,440 | |

| California Statewide Community Development Authority Water

& Wastewater RB Balance Series 2004 (AGM) (AA/A2) |

|

| | 15,000 | | | | 5.250 | | | | 10/01/19 | | | | 15,049 | |

| Citrus Community College District GO Bonds Capital

Appreciation for Election of 2004 Series 2009 C (AA-/Aa2)(d) |

|

| | 3,500,000 | | | | 0.000 | | | | 06/01/34 | | | | 1,617,700 | |

| Fullerton Community Facilities District No. 1 Special Tax

Refunding Bonds for Amerige Heights Series 2012 (A-/NR) |

|

| | 500,000 | | | | 5.000 | | | | 09/01/32 | | | | 552,090 | |

| Golden State Tobacco Securitization Corp. California Tobacco

Settlement RB Asset-Backed Bonds for Capital Appreciation

Subseries 2007 B (CCC+/NR)(d) |

|

| | 18,000,000 | | | | 0.000 | | | | 06/01/47 | | | | 1,609,200 | |

| Golden State Tobacco Securitization Corp. California Tobacco

Settlement RB Asset-Backed Bonds for Capital Appreciation

Subseries 2007 C (CCC/NR)(d) |

|

| | 19,500,000 | | | | 0.000 | | | | 06/01/47 | | | | 734,955 | |

| Golden State Tobacco Securitization Corp. California Tobacco

Settlement RB Asset-Backed Bonds Series 2007 A-1 (B/B3) |

|

| | 2,500,000 | | | | 4.500 | | | | 06/01/27 | | | | 2,396,850 | |

| Los Angeles Community College District GO Bonds for 2008

Election Series 2010 C (AA+/Aa1) |

|

| | 5,000,000 | | | | 5.250 | | | | 08/01/39 | | | | 5,770,700 | |

| | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS DYNAMIC MUNICIPAL INCOME FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | California – (continued) | |

| Los Angeles County Metropolitan Transportation Authority RB

Refunding for Union Station Project Series 2004 D (AMBAC)

(A+/A1)(a) |

|

| $ | 2,100,000 | | | | 0.436 | % | | | 07/01/27 | | | $ | 2,004,338 | |

| Menifee Union School District Riverside County GO Bonds

Capital Appreciation for Election of 2008 Series 2009 C

(ASSURED GTY) (AA/Aa3)(d) |

|

| | 2,000,000 | | | | 0.000 | | | | 08/01/37 | | | | 775,320 | |

| | 4,500,000 | | | | 0.000 | | | | 08/01/38 | | | | 1,655,460 | |

| | 4,500,000 | | | | 0.000 | | | | 08/01/39 | | | | 1,573,470 | |

| Merced City School District GO Bonds Capital Appreciation for

Election of 2003 Series 2005 (NATL-RE) (AA-/NR)(d) |

|

| | 1,205,000 | | | | 0.000 | | | | 08/01/26 | | | | 850,091 | |

| M-S-R Energy Authority Gas RB Series 2009 A (A-/NR) | |

| | 1,750,000 | | | | 6.500 | | | | 11/01/39 | | | | 2,304,750 | |

�� | M-S-R Energy Authority Gas RB Series 2009 C (A-/NR) | |

| | 3,500,000 | | | | 6.125 | | | | 11/01/29 | | | | 4,406,815 | |

| Mt. Diablo Unified School District GO Bonds Capital

Appreciation for Election of 2010 Series 2010 A (AGM)

(AA/Aa3)(e) |

|

| | 5,000,000 | | | | 0.000 | | | | 08/01/35 | | | | 4,064,100 | |

| Ontario Redevelopment Financing Authority Lease RB for

Capital Projects Series 2007 (AMBAC) (AA-/WR) |

|

| | 1,110,000 | | | | 5.250 | | | | 08/01/22 | | | | 1,199,377 | |

| Palomar Pomerado Health COPS Series 2009 (BB+/Ba1) | |

| | 2,500,000 | | | | 6.750 | | | | 11/01/39 | | | | 2,768,275 | |

| Palomar Pomerado Health GO Bonds Capital Appreciation for

Election of 2004 Series 2009 A (ASSURED GTY) (AA/A2)(d) |

|

| | 2,150,000 | | | | 0.000 | | | | 08/01/31 | | | | 1,101,832 | |

| | 4,150,000 | | | | 0.000 | | | | 08/01/32 | | | | 2,018,768 | |

| | 3,500,000 | | | | 0.000 | | | | 08/01/33 | | | | 1,617,000 | |

| Palomar Pomerado Health GO Bonds Capital Appreciation for

Election of 2004 Series 2009 A (ASSURED GTY) (AA/A2)(e) |

|

| | 6,450,000 | | | | 0.000 | | | | 08/01/38 | | | | 6,750,119 | |

| Port of Oakland RB Refunding Senior Lien Series 2012 P

(AMT) (A+/A2) |

|

| | 4,000,000 | | | | 5.000 | | | | 05/01/31 | | | | 4,428,600 | |

| River Islands Public Financing Authority Community Facilities

District No. 2003-1 Special Tax Refunding Bonds

Series 2015 A-1 (NR/NR) |

|

| | 5,000,000 | | | | 5.000 | | | | 09/01/27 | | | | 5,122,450 | |

| Sacramento County Sanitation District Financing Authority RB

Refunding for Sacramento County Regional Series 2007 B

(NATL-RE FGIC) (AA/Aa3)(a) |

|

| | 5,000,000 | | | | 0.747 | | | | 12/01/35 | | | | 4,463,550 | |

| San Diego County Water Authority COPS Series 2008 A (AGM)

(AA/Aa2)(c) |

|

| | 830,000 | | | | 5.000 | | | | 05/01/18 | | | | 921,267 | |

| San Diego County Water Authority COPS Series 2008 A (AGM)

(AA+/Aa2) |

|

| | 4,170,000 | | | | 5.000 | | | | 05/01/33 | | | | 4,529,162 | |

| San Diego Unified School District GO Bonds for Election of 2008

Series 2010 C (AA-/Aa3)(d) |

|

| | 5,000,000 | | | | 0.000 | | | | 07/01/39 | | | | 1,795,950 | |

| | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | California – (continued) | |

| San Francisco City & County Airport Commission San Francisco

International Airport RB Refunding Second Series 2013 A

(AMT) (A+/A1) |

|

| $ | 2,000,000 | | | | 5.500 | % | | | 05/01/28 | | | $ | 2,351,200 | |

| San Joaquin Hills Transportation Corridor Agency RB Refunding

for Capital Appreciation Series 1997 A (NATL-RE) (AA-/A3)(d) |

|

| | 1,605,000 | | | | 0.000 | | | | 01/15/26 | | | | 1,064,003 | |

| San Joaquin Hills Transportation Corridor Agency RB Refunding

for Toll Road Senior Lien Series 2014 A (BBB-/NR) |

|

| | 1,000,000 | | | | 5.000 | | | | 01/15/29 | | | | 1,101,250 | |

| University of California Regents Medical Center Pooled RB

Refunding Series 2007 C-2 (NATL-RE) (AA-/Aa3)(a) |

|

| | 5,000,000 | | | | 0.955 | | | | 05/15/43 | | | | 4,394,850 | |

| Vernon California Redevelopment Agency Tax Allocation for

Industrial Redevelopment Project Series 2005 (NATL-RE)

(AA-/A3) |

|

| | 725,000 | | | | 5.250 | | | | 09/01/19 | | | | 725,682 | |

| West Contra Costa Unified School District GO Bonds Capital

Appreciation for Election of 2002 Series 2004 C

(NATL-RE FGIC) (AA-/A3)(d) |

|

| | 1,175,000 | | | | 0.000 | | | | 08/01/25 | | | | 834,849 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 109,309,286 | |

| | |

| | Colorado – 2.2% | |

| Colorado Health Facilities Authority RB Refunding for Covenant

Retirement Communities, Inc. Series 2015 A (BBB+/NR) |

|

| | 550,000 | | | | 2.000 | | | | 12/01/16 | | | | 555,159 | |

| | 625,000 | | | | 4.000 | | | | 12/01/19 | | | | 665,844 | |

| Denver City & County Airport RB Series 2013 A (AMT) (A/A2) | |

| | 5,000,000 | | | | 5.500 | | | | 11/15/29 | | | | 5,769,350 | |

| Denver Colorado Health and Hospital Authority Healthcare RB

Series B (BBB/NR)(a) |

|

| | 5,000,000 | | | | 1.317 | | | | 12/01/33 | | | | 4,632,300 | |

| E-470 Public Highway Authority RB Series 2010 A

(BBB+/Baa1)(d) |

|

| | 6,000,000 | | | | 0.000 | | | | 09/01/40 | | | | 2,034,480 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 13,657,133 | |

| | |

| | Delaware – 1.4% | |

| New Castle County Delaware GO Bonds Series 2015 (AAA/Aaa) | |

| | 5,000,000 | | | | 5.000 | | | | 10/01/26 | | | | 6,239,150 | |

| University of Delaware RB Series 2015 (AA+/Aa1) | |

| | 1,805,000 | | | | 5.000 | | | | 11/01/33 | | | | 2,100,136 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 8,339,286 | |

| | |

| | District of Columbia – 1.2% | |

| District of Columbia Tobacco Settlement Financing Corp. RB

Asset-Backed Bonds Series 2001 (A/A1) |

|

| | 95,000 | | | | 6.250 | | | | 05/15/24 | | | | 95,679 | |

| District of Columbia Tobacco Settlement Financing Corp. RB

Asset-Backed Bonds Series 2001 (BBB/Baa1) |

|

| | 1,000,000 | | | | 6.500 | | | | 05/15/33 | | | | 1,220,720 | |

| District of Columbia Water & Sewer Authority RB Public Utility

Senior Lien Series 2009 A (AA+/Aa2)(c) |

|

| | 5,000,000 | | | | 6.000 | | | | 10/01/18 | | | | 5,761,550 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 7,077,949 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS DYNAMIC MUNICIPAL INCOME FUND

Schedule of Investments (continued)

September 30, 2015 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | Florida – 8.8% | |

| Arbor Greene Community Development District Special

Assessment Refunding Series 2006 (A/NR) |

|

| $ | 895,000 | | | | 5.000 | % | | | 05/01/19 | | | $ | 936,626 | |

| Bartram Park Community Development District Special

Assessment RB Refunding for City of Jacksonville Florida

Senior Lien Series 2015 A-1 (BBB/NR) |

|

| | 500,000 | | | | 4.250 | | | | 05/01/29 | | | | 496,420 | |

| | 500,000 | | | | 4.500 | | | | 05/01/35 | | | | 500,015 | |

| Citizens Property Insurance Corp. Senior Secured RB for High

Risk Account Series 2009 A-1 (A+/A1) |

|

| | 3,650,000 | | | | 5.500 | | | | 06/01/17 | | | | 3,929,006 | |

| City of Cape Coral Water & Sewer RB Refunding Series 2015

(A/A1) |

|

| | 1,000,000 | | | | 4.000 | | | | 10/01/34 | | | | 1,024,020 | |

| Coconut Cay Community Development District Special

Assessment Series 2006 (NR/NR) |

|

| | 840,000 | | | | 5.375 | | | | 05/01/36 | | | | 842,352 | |

| Country Walk Community Development District Special

Assessment RB Refunding Senior Lien Series 2015 A-1

(BBB+/NR) |

|

| | 215,000 | | | | 2.875 | | | | 05/01/21 | | | | 213,955 | |

| | 220,000 | | | | 3.000 | | | | 05/01/22 | | | | 217,662 | |

| | 225,000 | | | | 3.250 | | | | 05/01/23 | | | | 222,464 | |

| | 235,000 | | | | 3.375 | | | | 05/01/24 | | | | 232,321 | |

| | 245,000 | | | | 3.500 | | | | 05/01/25 | | | | 241,854 | |

| Covington Park Florida Community Development District Special

Assessment Refunding for Capital Improvement Series 2005

(BBB/NR) |

|

| | 340,000 | | | | 5.000 | | | | 05/01/21 | | | | 341,187 | |

| Crossings At Fleming Island Community Development District

RB Refunding Series 2007 (NATL-RE) (AA-/A3) |

|

| | 125,000 | | | | 4.750 | | | | 10/01/36 | | | | 128,461 | |

| Florida State Municipal Power Agency RB Series 2009 A

(A+/A2) |

|

| | 1,000,000 | | | | 6.250 | | | | 10/01/31 | | | | 1,184,100 | |

| Greater Orlando Aviation Authority Airport Facilities RB

Refunding for Jetblue Airways Corp. Project Series 2013

(AMT) (NR/NR) |

|

| | 920,000 | | | | 5.000 | | | | 11/15/36 | | | | 938,032 | |

| Greater Orlando Aviation Authority RB Refunding Series 2012 A

(AMT) (AA-/Aa3) |

|

| | 2,000,000 | | | | 5.000 | | | | 10/01/21 | | | | 2,339,520 | |

| Hamal Florida Community Development District Special

Assessment for Refunding and Improvement Series 2006 A

(NATL-RE) (AA-/A3) |

|

| | 2,755,000 | | | | 5.375 | | | | 05/01/22 | | | | 2,823,572 | |

| Heritage Landing Community Development District Special

Assessment Refunding Bonds Series 2015 (BBB/NR) |

|

| | 585,000 | | | | 3.375 | | | | 05/01/23 | | | | 577,401 | |

| | 605,000 | | | | 3.500 | | | | 05/01/24 | | | | 596,566 | |

| | 630,000 | | | | 3.625 | | | | 05/01/25 | | | | 620,260 | |

| | 650,000 | | | | 3.750 | | | | 05/01/26 | | | | 639,178 | |

| High Ridge Quantum Community Development District Special

Assessment for Boyton Beach Series 2005 A (NR/NR) |

|

| | 1,630,000 | | | | 5.750 | | | | 05/01/35 | | | | 1,631,614 | |

| | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | Florida – (continued) | |

| Hollywood Community Redevelopment Agency RB for Beach

CRA Series 2004 (A-/A3) |

|

| $ | 275,000 | | | | 5.625 | % | | | 03/01/24 | | | $ | 275,423 | |

| Lakewood Ranch Stewardship District Special Assessment RB

for Lakewood Centre North Project Series 2015 (NR/NR) |

|

| | 1,000,000 | | | | 4.250 | | | | 05/01/25 | | | | 985,060 | |

| | 1,735,000 | | | | 4.875 | | | | 05/01/35 | | | | 1,752,801 | |

| | 985,000 | | | | 4.875 | | | | 05/01/45 | | | | 987,266 | |

| Longleaf Community Development District Special Assessment

Refunding Series 2006 (NR/NR)(f) |

|

| | 1,185,000 | | | | 5.375 | | | | 05/01/30 | | | | 805,800 | |

| Meadow Pines Community Development District Special

Assessment Refunding Bonds Senior Lien Series 2014 1

(A-/NR) |

|

| | 750,000 | | | | 4.450 | | | | 05/01/30 | | | | 775,920 | |

| Miami Special Obligation Non-Ad Valorem RB Refunding

Series 2011 A (AGM) (AA/A2) |

|

| | 1,200,000 | | | | 6.000 | | | | 02/01/30 | | | | 1,425,144 | |

| | 1,500,000 | | | | 6.000 | | | | 02/01/31 | | | | 1,780,605 | |

| Miami Special Obligation RB Refunding for Port of Miami

Tunnel Project Series 2012 (A/A2)(g) |

|

| | 5,000,000 | | | | 5.000 | | | | 03/01/30 | | | | 5,659,500 | |

| Miami-Dade County Florida Aviation RB Refunding RMKT

03/17/08 Series 2003 E (AMT) (NATL-RE) (AA-/NR) |

|

| | 575,000 | | | | 5.250 | | | | 10/01/16 | | | | 601,381 | |

| Miromar Lakes Community Development District Capital

Impovement RB Refunding Series 2015 (NR/NR) |

|

| | 1,000,000 | | | | 3.500 | | | | 05/01/20 | | | | 984,610 | |

| North Sumter County Utility Dependent District RB Series 2010

(AGM) (AA/A2) |

|

| | 1,250,000 | | | | 5.375 | | | | 10/01/40 | | | | 1,407,575 | |

| Pentathlon Community Development District Special Assessment

Revenue Refunding Series 2012 (A-/NR) |

|

| | 1,330,000 | | | | 4.500 | | | | 11/01/33 | | | | 1,370,392 | |

| Port Everglades Authority RB for Port Facilities Series 1986

(ETM) (AA+/Aaa)(c) |

|

| | 710,000 | | | | 7.125 | | | | 11/01/16 | | | | 736,881 | |

| Randal Park Community Development District Special

Assessment RB Series 2015 (NR/NR) |

|

| | 875,000 | | | | 4.250 | | | | 11/01/25 | | | | 853,265 | |

| St. Petersburg Health Facilities Authority RB Refunding for All

Children’s Hospital Series 2009 A (AA-/Aa3)(c) |

|

| | 2,000,000 | | | | 6.500 | | | | 11/15/19 | | | | 2,441,040 | |

| Tampa Palms Open Space & Transportation Community

Development District Special Assessment Refunding for

Capital Improvement Area 7 Project Series 2004 (NATL-RE)

(AA-/A3) |

|

| | 875,000 | | | | 4.500 | | | | 05/01/18 | | | | 916,265 | |

| Thousand Oaks Community Development District Special

Assessment Series 2005 A-1 (NR/NR) |

|

| | 815,000 | | | | 5.350 | | | | 05/01/35 | | | | 815,562 | |

| TSR Community Development District Special Assessment RB

for Village 1 Project Series 2015 (NR/NR) |

|

| | 435,000 | | | | 3.625 | | | | 11/01/20 | | | | 435,435 | |

| | 530,000 | | | | 4.375 | | | | 11/01/25 | | | | 528,060 | |

| | |

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS DYNAMIC MUNICIPAL INCOME FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | Florida – (continued) | |

| Turnbull Creek Community Development District Senior Special

Assessment Refunding Bonds Series 2015 A-1 (BBB/NR) |

|

| $ | 1,000,000 | | | | 4.250 | % | | | 05/01/31 | | | $ | 987,630 | |

| Verano #1 Community Development District Special Assessment

Bonds for District #1 Project Series 2015 (NR/NR) |

|

| | 750,000 | | | | 4.750 | | | | 11/01/25 | | | | 744,053 | |

| Verona Walk Community Development District Special

Assessment Senior Lien RB Refunding for Capital

Improvement Series 2013 A-1 (A/NR) |

|

| | 500,000 | | | | 4.250 | | | | 05/01/30 | | | | 503,205 | |

| Village Community Development District No. 6 Special

Assessment Series 2007 (NR/NR) |

|

| | 1,680,000 | | | | 5.250 | | | | 05/01/37 | | | | 1,751,551 | |

| Waters Edge Community Development District Capital

Improvement RB Refunding Senior Lien Series 2015 A-1

(BBB+/NR) |

|

| | 2,150,000 | | | | 4.000 | | | | 05/01/31 | | | | 2,101,152 | |

| Wynnfield Lakes Community Development District Special

Assessment Refunding Bonds Series 2014 (A-/NR) |

|

| | 1,470,000 | | | | 4.500 | | | | 05/01/36 | | | | 1,500,370 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 53,802,532 | |

| | |

| | Georgia – 1.7% | |

| Atlanta Airport RB Refunding Series 2012 C (AMT) (A+/Aa3) | |

| | 1,250,000 | | | | 5.000 | | | | 01/01/27 | | | | 1,418,612 | |

| Metropolitan Atlanta Rapid Transit Authority Sales Tax RB

Series 2009 A (AA+/Aa3) |

|

| | 4,075,000 | | | | 5.250 | | | | 07/01/36 | | | | 4,607,847 | |

| Milledgeville & Baldwin County Development Authority Student

Housing RB Refunding for Georgia College & State University

Foundation Property V, LLC Project Series 2007 (AMBAC)

(A+/WR)(a) |

|

| | 5,000,000 | | | | 0.840 | | | | 10/01/33 | | | | 4,469,650 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 10,496,109 | |

| | |

| | Guam – 0.4% | |

| Guam Government Limited Obligation GO Bonds Section 30

Series 2009 A (BBB+/NR) |

|

| | 850,000 | | | | 5.625 | | | | 12/01/29 | | | | 954,388 | |

| | 750,000 | | | | 5.750 | | | | 12/01/34 | | | | 839,640 | |

| Guam Power Authority RB 2014 Series A (AGM) (AA/A2) | |

| | 325,000 | | | | 5.000 | | | | 10/01/39 | | | | 367,130 | |

| | 250,000 | | | | 5.000 | | | | 10/01/44 | | | | 280,235 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 2,441,393 | |

| | |

| | Idaho – 0.2% | |

| Idaho Health Facilities Authority RB for St. Luke’s Health

System Project Series 2008 (A-/A3) |

|

| | 1,000,000 | | | | 6.750 | | | | 11/01/37 | | | | 1,140,510 | |

| | |

| | Illinois – 9.0% | |

| Chicago Illinois Board of Education GO Bonds Capital

Appreciation for School Reform Series 1998 B-1 (NATL-RE

FGIC) (AA-/A3)(d) |

|

| | 1,775,000 | | | | 0.000 | | | | 12/01/26 | | | | 974,298 | |

| Chicago Illinois Board of Education GO Bonds Refunding

Series 2015 A (BB/NR)(b) |

|

| | 5,000,000 | | | | 4.020 | | | | 03/01/17 | | | | 4,919,550 | |

| | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | State-Specific Municipal Debt Obligations – (continued) | |

| | Illinois – (continued) | |

| Chicago Illinois Board of Education GO Bonds Series 2015 C

(BB/NR) |

|