UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: September 30, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | September 30, 2015 |

| | |

| | | | Multi Sector Fixed Income Funds |

| | | | Bond Fund |

| | | | Core Fixed Income |

| | | | Global Income |

| | | | Strategic Income |

Goldman Sachs Multi Sector Fixed Income Funds

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 3 | |

| |

Market Review | | | 4 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 6 | |

| |

Schedules of Investments | | | 28 | |

| |

Financial Statements | | | 104 | |

| |

Financial Highlights | | | 108 | |

| |

Notes to the Financial Statements | | | 116 | |

| |

Other Information | | | 147 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS MULTI SECTOR FIXED INCOME FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Bond Fund invests primarily in fixed income securities, including U.S. government securities, corporate debt securities, privately issued mortgage-backed securities, asset-backed securities, high yield non-investment grade securities and fixed income securities of issuers located in emerging countries. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic and political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all).

The Goldman Sachs Core Fixed Income Fund invests primarily in fixed income securities, including U.S. government securities, corporate debt securities, privately issued mortgage-backed securities and asset-backed securities. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic and political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all).

The Goldman Sachs Global Income Fund invests primarily in a portfolio of fixed income securities of U.S. and foreign issuers. The Fund’s investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Issuers of sovereign debt may be unable or unwilling to repay principal or interest when due. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative

1

GOLDMAN SACHS MULTI SECTOR FIXED INCOME FUNDS

instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all). The Fund may invest heavily in investments in particular countries or regions and may be subject to greater losses than if it were less concentrated in a particular country or region. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Strategic Income Fund invests in a broadly diversified portfolio of U.S. and foreign investment grade and non-investment grade fixed income investments including, but not limited to: U.S. government securities, non-U.S. sovereign debt, agency securities, corporate debt securities, agency and non-agency mortgage-backed securities, asset-backed securities, custodial receipts, municipal securities, loan participations and loan assignments and convertible securities. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Investments in mortgage-backed securities are also subject to, among other risks, prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). High yield, lower rated investments involve greater price volatility, are less liquid and present greater risks than higher rated fixed income securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The Fund is also subject to the risk that the issuers of sovereign debt or the government authorities that control the payment of debt may be unable or unwilling to repay principal or interest when due. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in bonds of similar projects or in particular types of municipal securities. The Fund may invest in loans directly, through loan assignments, or indirectly, by purchasing participations or sub-participations from financial institutions. Indirect purchases may subject the Fund to greater delays, expenses and risks than direct obligations in the case that a borrower fails to pay scheduled principal and interest. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is subject to the risks associated with implementing short positions. Taking short positions involves leverage of the Fund’s assets and presents various other risks. Losses on short positions are potentially unlimited as a loss occurs when the value of an asset with respect to which the Fund has a short position increases.

The Investment Adviser will not manage the investment program of the Fund by reference to a benchmark index (i.e., unconstrained). By removing benchmark constraints, the Fund is able to invest across the global fixed income spectrum without regard to sector, quality, maturity or market capitalization limitations, including in asset classes in which more traditional or benchmark-constrained fixed income funds do not typically invest (or do not invest to such an extent). Due to this flexible strategy, the Fund’s risk exposure may vary, and the Fund may underperform traditional fixed income indices. There can be no assurance that the discretionary element of the investment processes of the Investment Adviser will be exercised in a manner that is successful or that is not adverse to the Fund, or that the Fund will outperform more traditional or benchmark-constrained fixed income funds.

2

GOLDMAN SACHS MULTI SECTOR FIXED INCOME FUNDS

What Differentiates the Goldman Sachs Asset Management Fixed Income Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our fixed income investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

A key element of our fixed income investment philosophy is to evaluate the broadest global opportunity set to capture relative value across sectors and instruments. Our globally integrated investment process involves managing dynamically along the risk/return spectrum, as we continue to develop value-added strategies through:

| n | | Assess relative value among sectors (such as mortgage-backed and corporate debt securities) and sub-sectors |

| n | | Leverage the vast resources of GSAM in selecting securities for each portfolio |

| n | | Team approach to decision making |

| n | | Manage risk by avoiding significant sector and interest rate bets |

| n | | Careful management of yield curve strategies — while closely managing portfolio duration |

Fixed Income portfolios that:

| | n | | Include domestic and global investment options, income opportunities, and access to areas of specialization | |

| | n | | Capitalize on GSAM’s industry-renowned credit research capabilities | |

| | n | | Use a risk-managed framework to seek total return, recognizing the importance of investors’ capital accumulation goals as well as their need for income | |

The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

3

MARKET REVIEW

Goldman Sachs Multi Sector Fixed Income Funds

Market Review

Shifting expectations about global economic growth and the timing of a potential Federal Reserve (“Fed”) interest rate hike, along with falling commodities prices, appear to have influenced the performance of the global fixed income markets during the six months ended September 30, 2015 (the “Reporting Period”).

When the Reporting Period began in April 2015, the performance of spread, or non-government bond, sectors was mixed. U.S. Treasury yields rose, as U.S. economic data improved, including positive surprises in inflation and retail sales. First quarter 2015 U.S. Gross Domestic Product (“GDP”) was revised upwards from -0.7% to a seasonally adjusted annualized rate of -0.2%. The upward revision stemmed in part from stronger than estimated consumer spending and inventory data. U.S. dollar gains hit a roadblock during the second calendar quarter on uncertainty around the Fed’s plans for raising interest rates in 2015. The Eurozone’s economic progress took a back seat to the seemingly intractable challenges surrounding Greece.

In the third quarter of 2015, spread sectors underperformed U.S. Treasuries as the outlook for the global economy grew cloudy. Investors focused on slowing economic growth in China, the devaluation of the Chinese renminbi and an unexpected increase in market volatility. Oil and commodities prices dropped to new lows, partly because of falling demand from China. Uncertainty about the timing of potential Fed policy tightening became an increasingly key theme. Surprisingly to many, the Fed chose to leave rates unchanged at its September 2015 policy meeting, citing conditions in the global economy. Although the U.S. economy continued to improve, economic growth in other developed countries softened and emerging markets economies broadly weakened. Despite accommodative monetary policies by many global central banks, inflation remained subdued in the world’s major economies.

For the Reporting Period overall, U.S. Treasuries performed strongly, outpacing other fixed income sectors with the exception of asset-backed securities. High yield corporate bonds underperformed U.S. Treasuries the most, followed by investment grade corporate bonds, sovereign emerging market debt and agency securities. Commercial mortgage-backed securities and residential mortgage-backed securities also underperformed U.S. Treasuries, albeit more modestly. The U.S. Treasury yield curve, or spectrum of maturities, steepened during the Reporting Period, as longer-term yields rose more than intermediate-term yields, and shorter-term yields edged down. The yield on the bellwether 10-year U.S. Treasury rose approximately 18 basis points to 2.04%. (A basis point is 1/100th of a percentage point.)

Looking Ahead

At the end of the Reporting Period, we had not changed our broadly positive view for the global economy, though we did see less cause for optimism. We believe the economic slowdown in the emerging markets is constraining global economic growth overall. Further, in our view, U.S. and European economic momentum is moderating, and Japan is facing stronger headwinds. The risks of policy missteps in China have manifested, in our view, raising the prospect of further volatility in the fixed income markets. Additionally, we think the benefits of lower oil prices are fading, with no end in sight for the downward trend in the commodities markets.

We believed, at the end of the Reporting Period, that the U.S. economy was caught in the cross-currents of domestic strength and global weakness. In our view, the U.S. is likely to

4

MARKET REVIEW

benefit from labor market tightening as well as from improvements in the housing market and in retail sales. Risks include tight financial conditions and weak global demand, while production cuts in the energy sector could have an impact on capital expenditures. Although the Fed may yet raise rates in 2015, we believe the odds of a delay are growing.

In the Eurozone, economic growth momentum appears to have flattened. The Syrian refugee crisis seems to have replaced worries about a potential Greek exit as the dominant policy challenge. We think the European Central Bank is likely to expand its quantitative easing in early 2016. In the U.K., we expect economic growth data to remain positive and believe an interest rate hike by the Bank of England in early 2016 is possible. However, we do not expect the U.K. central bank to move before the Fed acts. Japan faces a possible relapse into recession, and we believe the Bank of Japan will probably ease again in the near term. In the emerging markets, economic growth has weakened under the combined pressures of the commodities slump, China’s economic slowdown, U.S. dollar strength and fears of Fed policy tightening.

5

PORTFOLIO RESULTS

Goldman Sachs Bond Fund

Investment Objective

The Fund seeks a total return consisting of capital appreciation and income that exceeds the total return of the Barclays U.S. Aggregate Bond Index.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Bond Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of -0.08%, -0.55%, 0.09%, -0.17%, 0.04% and -0.21%, respectively. These returns compare to the -0.47% cumulative total return of the Fund’s benchmark, the Barclays U.S. Aggregate Bond Index (the “Barclays Index”), during the same time period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of 0.35%. This return compares to the 0.53% cumulative total return of the Barclays Index during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning strategy contributed positively to relative performance during the Reporting Period. The duration strategy is primarily implemented via interest rate swaps and/or futures. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. |

| | Our top-down currency strategy further boosted the Fund’s relative results. In our currency strategy, positions in several developed market currencies proved beneficial during the Reporting Period, particularly having underweighted positions in the Japanese yen, Canadian dollar and Australian dollar. The currency strategy is primarily implemented via currency forwards. Bottom-up individual issue selection overall added value as well. |

| | Our cross-sector strategy detracted from Fund performance during the Reporting Period. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Implemented via our cross-sector strategy, the Fund’s overweighted exposure to corporate credit detracted from relative results. Credit spreads, or the yield differential between corporate bonds and duration-equivalent U.S. Treasuries, widened during the Reporting Period amidst heavy market volatility. An allocation to tax-exempt Puerto Rican municipal debt also dampened results, as spreads widened due largely to increased concerns about the commonwealth’s ability to meet its debt obligations. |

| | Individual issue selection of structured debt within the corporate credit sector added value. Tactical trades within our government/swaps strategy and selection of U.S. dollar-denominated emerging market debt also contributed positively to relative results. The government/swaps selections strategy is primarily implemented via currency forwards. There were no meaningful detractors from a security selection perspective during the Reporting Period. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning contributed positively to its results during the Reporting Period. We maintained a short U.S. duration position relative to the Barclays Index during the second quarter of 2015, which helped as government yields rose broadly on stronger economic data and expectations that the |

6

PORTFOLIO RESULTS

| | Federal Reserve (the “Fed”) would raise interest rates in 2015. In August 2015, we removed the short U.S. duration position and moved to a rather neutral position relative to the Barclays Index as volatility picked up early in the month. We then shifted to a modestly longer duration position than that of the Barclays Index in September 2015, ahead of the Fed’s meeting, due to tightening financial conditions and our view that the Fed was not likely to raise rates. We maintained a bullish bias regarding the Fed’s monetary policy, but toward the end of the Reporting Period, we returned to a more neutral duration position in the Fund compared to that of the Barclays Index as yields moved lower amid Fed rhetoric indicating its bias toward hiking rates in late 2015. At the end of the Reporting Period, we expected the Fed to raise interest rates either in December 2015 or early in 2016, as international headwinds such as low commodity prices and volatility in Asia skewed risks, in our view, toward a later hike. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | As market conditions warranted during the Reporting Period, currency transactions were carried out using primarily over-the-counter (“OTC”) spot and forward foreign exchange contracts as well as purchased OTC options. Currency transactions were used as we sought both to enhance returns and to hedge the Fund’s portfolio against currency exchange rate fluctuations. Also, Treasury futures were used as warranted to facilitate specific duration, yield curve and country strategies; swaptions (or options on interest rate swap contracts) to express an outright term structure view and manage volatility (term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds); credit default swaps to manage exposure to fluctuations in credit spreads (or the differential in yields between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating); and interest rate swaps to manage exposure to fluctuations in interest rates. The Fund also used forward sales contracts to help manage duration. Overall, we employ derivatives and similar instruments for the efficient management of the Fund’s portfolio. Derivatives and similar instruments allow us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. Derivatives are used in combination with cash securities to implement our views in the Fund. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | As mentioned earlier, we adjusted the Fund’s U.S. duration position during the Reporting Period as market conditions and perceptions around Fed policy shifted. |

| | From a sector perspective, we increased the Fund’s already overweighted exposure to corporate credit on our expectations that global economic growth is likely to improve. We maintained the Fund’s underweighted exposure to agency mortgage-backed securities on our view that valuations within the sector remained unattractive relative to other fixed income sectors amid high prepayment speeds. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2015? |

| A | | At the end of September 2015, the Fund had overweighted allocations relative to the Barclays Index on a market-value weighted basis in asset-backed securities, high yield corporate bonds and investment grade corporate bonds. The Fund also had modest exposure to municipal bonds, which is a sector not represented in the Barclays Index. The Fund had underweighted exposure relative to the Barclays Index in U.S. government securities and, to a lesser extent, in residential mortgage-backed securities. The Fund held rather neutral positions compared to the Barclays Index in quasi-government securities, commercial mortgage-backed securities, covered bonds and emerging market debt. (Covered bonds are debt securities backed by cash flows from mortgage loans or public sector loans.) The Fund also maintained a position in cash at the end of the Reporting Period. The Fund maintained a rather neutral overall duration compared to the Barclays Index at the end of the Reporting Period. |

7

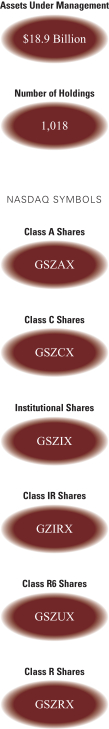

FUND BASICS

Bond Fund

as of September 30, 2015

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015–

September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays

U.S. Aggregate

Bond Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | -0.08 | % | | | -0.47 | % | | | 1.81 | % | | | 1.54 | % |

| | Class C | | | -0.55 | | | | -0.47 | | | | 1.14 | | | | 0.86 | |

| | Institutional | | | 0.09 | | | | -0.47 | | | | 2.22 | | | | 1.94 | |

| | Service | | | -0.17 | | | | -0.47 | | | | 1.68 | | | | 1.39 | |

| | Class IR | | | 0.04 | | | | -0.47 | | | | 2.13 | | | | 1.85 | |

| | | Class R | | | -0.21 | | | | -0.47 | | | | 1.64 | | | | 1.35 | |

| | | | | | | | | | | | | | | | | | | |

| | | July 31, 2015–

September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays U.S. Aggregate

Bond Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | | Class R6 | | | 0.35 | % | | | 0.53 | % | | | 2.17 | % | | | 1.90 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

FUND BASICS

| | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 9/30/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| | Class A | | | -2.20 | % | | | 3.14 | % | | | 4.33 | % | | 11/30/06 |

| | Class C | | | -0.17 | | | | 3.16 | | | | 3.99 | | | 11/30/06 |

| | Institutional | | | 1.94 | | | | 4.30 | | | | 5.14 | | | 11/30/06 |

| | Service | | | 1.43 | | | | 3.79 | | | | 4.96 | | | 6/20/07 |

| | Class IR | | | 1.85 | | | | 4.11 | | | | 4.88 | | | 11/30/07 |

| | Class R6 | | | N/A | | | | N/A | | | | 0.35 | | | 7/31/15 |

| | | Class R | | | 1.34 | | | | 3.65 | | | | 4.40 | | | 11/30/07 |

| | 4 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end . They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares was 4.5%, which is not reflected in the average annual total return figures shown. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.79 | % | | | 1.12 | % |

| | Class C | | | 1.54 | | | | 1.87 | |

| | Institutional | | | 0.45 | | | | 0.78 | |

| | Service | | | 0.95 | | | | 1.29 | |

| | Class IR | | | 0.54 | | | | 0.87 | |

| | Class R6 | | | 0.43 | | | | 0.76 | |

| | | Class R | | | 1.04 | | | | 1.38 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

9

FUND BASICS

| | |

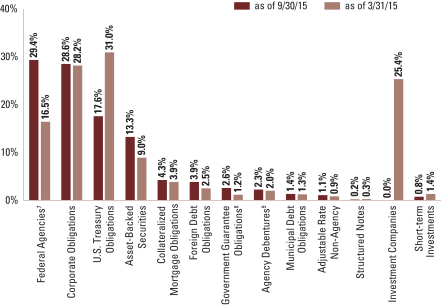

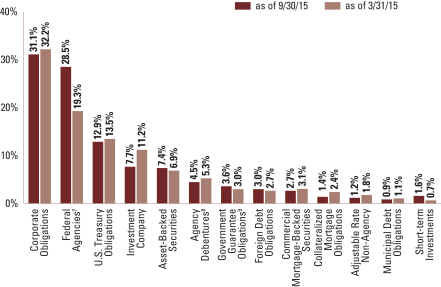

| SECTOR ALLOCATIONS6 |

| Percentage of Net Assets |

| | 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 7 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| | 8 | | “Government Guarantee Obligations” are guaranteed by a foreign government guarantee program and are backed by the full faith and credit of the United States or the government of a foreign country. |

| | 9 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

10

PORTFOLIO RESULTS

Goldman Sachs Core Fixed Income Fund

Investment Objective

The Fund seeks a total return consisting of capital appreciation and income that exceeds the total return of the Barclays U.S. Aggregate Bond Index.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Core Fixed Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service, IR and R Shares generated cumulative total returns, without sales charges, of -0.61%, -0.97%, -0.44%, -0.68%, -0.49% and -0.73%, respectively. These returns compare to the -0.47% cumulative total return of the Fund’s benchmark, the Barclays U.S. Aggregate Bond Index (the “Barclays Index”), during the same period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of 0.29%. This return compares to the 0.53% cumulative total return of the Barclays Index during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning strategy detracted from relative performance during the Reporting Period. The duration strategy is primarily implemented via interest rate swaps and/or futures. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates the spectrum of maturities within a particular sector. |

| | Our top-down currency strategy was the primary positive contributor to Fund performance during the Reporting Period. In our currency strategy, underweighted positions in the euro and Japanese yen and an overweighted position in the U.S. dollar versus the Canadian dollar proved particularly beneficial during the Reporting Period. The currency strategy is primarily implemented via currency forwards. Our country strategy contributed as well, driven by a long European rates strategy. The country strategy is primarily implemented via interest rate swaps and/or futures. |

| | Our top-down cross-sector strategy and our bottom-up individual issue selection overall produced mixed results. Our cross-sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Implemented via our cross-sector strategy, the Fund’s underweighted exposure compared to the Barclays Index in emerging market debt, mortgage-backed securities and government/swaps securities contributed positively to relative results. During the Reporting Period, emerging market debt posted weak performance, as sovereign spreads, or yield differentials to U.S. Treasuries, widened on heightened global volatility and the economic slowdown in China. Similarly, agency mortgage-backed securities underperformed the Barclays Index, as mortgage spreads widened in response to increased volatility. In the government/swaps sector, being underweight U.S. Treasuries hurt, as these securities outperformed the Barclays Index amidst a flight to safety. The government/swaps selection strategy is primarily implemented via interest rate swaps and/or futures. Conversely, having an overweighted allocation to corporate bonds detracted from relative results. We maintained the Fund overweight based on our view that there is macroeconomic support for the corporate credit sector. However, during the Reporting Period, investment grade corporate bond spreads widened, and credit overall weakened due to high issuance and heightened global volatility. An overweight to agency securities, which lagged the Barclays Index during the Reporting Period, also detracted from the Fund’s relative results. |

| | Individual issue selection amongst structured products within the corporate credit sector, particularly in the banking and financial industries, contributed positively to relative results. Selection of mortgage-backed security passthroughs and |

11

PORTFOLIO RESULTS

| | tactical trades on the mid- to long-term end of the U.S. dollar curve added value as well. However, individual issue selection among investment grade corporate bonds overall dampened relative performance. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | Tactical management of the Fund’s duration and yield curve positioning detracted from its results during the Reporting Period. We maintained a short U.S. duration position relative to the Barclays Index throughout the Reporting Period based on what we viewed as improving inflation indicators, generally strong economic data releases and our expectation that the Federal Reserve (the “Fed”) would raise rates in either late 2015 or early 2016. That said, we reduced the short position toward the end of the Reporting Period as our view began trending more toward a neutral duration position given our growing expectation that the Fed would postpone raising interest rates due to what proved to be subdued inflation, heightened global volatility and depressed commodity prices. However, the fact that the Fed did not raise rates in September 2015 as we, along with many others, originally expected and because U.S. Treasury yields did not increase in reaction to positive economic data during the summer of 2015, the Fund’s short U.S. duration position hurt performance. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | As market conditions warranted during the Reporting Period, currency transactions were carried out using primarily over-the-counter (“OTC”) spot and forward foreign exchange contracts as well as purchased OTC options. Currency transactions were used as we sought both to enhance returns and to hedge the Fund’s portfolio against currency exchange rate fluctuations. Also, Treasury and international government bond futures, Eurodollar futures and other futures contracts were used as warranted to facilitate specific duration, yield curve and country strategies; swaptions (or options on interest rate swap contracts) to express an outright term structure view and manage volatility (term structure, most often depicted as a yield curve, refers to the term structure of interest rates, which is the relationship between the yield to maturity and the time to maturity for pure discount bonds); credit default swaps to manage exposure to fluctuations in credit spreads (or the differential in yields between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating); and interest rate swaps to manage exposure to fluctuations in interest rates. The Fund also used forward sales contracts to help manage duration. Overall, we employ derivatives and similar instruments for the efficient management of the Fund’s portfolio. Derivatives and similar instruments allow us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | As mentioned earlier, we shifted the Fund’s short U.S. duration position toward a rather neutral stance toward the end of the Reporting Period due to an increase in volatility. |

| | From a sector perspective, we maintained the Fund’s overweighted exposure relative to the Barclays Index to corporate credit. Within the sector, we maintained a modest overweight in the Fund to investment grade credit based on our view that there is a supportive macroeconomic outlook in the developed markets despite the greater global volatility. We also maintained a bias toward lower-rated securities within the intermediate segment of the corporate term structure. |

| | We maintained the Fund’s underweighted exposure to agency mortgage-backed securities during the Reporting Period based on our belief that the sector faces headwinds, including increased supply and reduced demand. However, within the sector, we did maintain a modest overweight in the Fund to agency multi-family mortgage-backed securities. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2015? |

| A | | At the end of September 2015, the Fund had its most overweighted allocations relative to the Barclays Index on a market-value weighted basis in asset-backed securities and investment grade corporate bonds (with an emphasis on the financials and industrials industries). The Fund also had a more modestly overweighted exposure at the end of the Reporting Period to quasi-government securities. The Fund had its most underweighted exposure relative to the Barclays Index in U.S. government securities. The Fund maintained rather neutral exposures relative to the Barclays Index to commercial mortgage-backed securities, residential mortgage-backed securities, covered bonds, high yield corporate bonds and emerging market debt. (Covered bonds are debt securities backed by cash flows from mortgage loans or public sector loans.) The Fund had a sizable position in cash and cash equivalents at the end of September 2015. The Fund maintained a rather neutral overall duration compared to the Barclays Index at the end of the Reporting Period. |

12

FUND BASICS

Core Fixed Income Fund

as of September 30, 2015

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015–

September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays

U.S. Aggregate

Bond Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | -0.61 | % | | | -0.47 | % | | | 1.73 | % | | | 1.64 | % |

| | Class C | | | -0.97 | | | | -0.47 | | | | 1.06 | | | | 0.97 | |

| | Institutional | | | -0.44 | | | | -0.47 | | | | 2.13 | | | | 2.05 | |

| | Service | | | -0.68 | | | | -0.47 | | | | 1.64 | | | | 1.55 | |

| | Class IR | | | -0.49 | | | | -0.47 | | | | 2.04 | | | | 1.96 | |

| | | Class R | | | -0.73 | | | | -0.47 | | | | 1.55 | | | | 1.46 | |

| | | | | | | | | | | | | | | | | | | |

| | | July 31, 2015–

September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays U.S. Aggregate

Bond Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | | Class R6 | | | 0.29 | % | | | 0.53 | % | | | 2.05 | % | | | 1.96 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 9/30/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -1.90 | % | | | 2.37 | % | | | 3.39 | % | | | 4.75 | % | | 5/1/97 |

| | Class C | | | 0.07 | | | | 2.41 | | | | 3.02 | | | | 4.05 | | | 8/15/97 |

| | Institutional | | | 2.18 | | | | 3.53 | | | | 4.14 | | | | 5.44 | | | 1/5/94 |

| | Service | | | 1.77 | | | | 3.01 | | | | 3.63 | | | | 4.88 | | | 3/13/96 |

| | Class IR | | | 2.19 | | | | 3.44 | | | | N/A | | | | 3.77 | | | 11/30/07 |

| | Class R6 | | | N/A | | | | N/A | | | | N/A | | | | 0.29 | | | 7/31/15 |

| | | Class R | | | 1.58 | | | | 2.93 | | | | N/A | | | | 3.27 | | | 11/30/07 |

| | 4 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end . They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares was 4.5%, which is not reflected in the average annual total return figures shown. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.78 | % | | | 0.81 | % |

| | Class C | | | 1.53 | | | | 1.56 | |

| | Institutional | | | 0.44 | | | | 0.47 | |

| | Service | | | 0.94 | | | | 0.97 | |

| | Class IR | | | 0.53 | | | | 0.58 | |

| | Class R6 | | | 0.42 | | | | 0.45 | |

| | | Class R | | | 1.03 | | | | 1.07 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

14

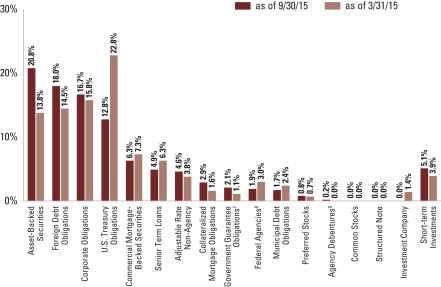

FUND BASICS

| | |

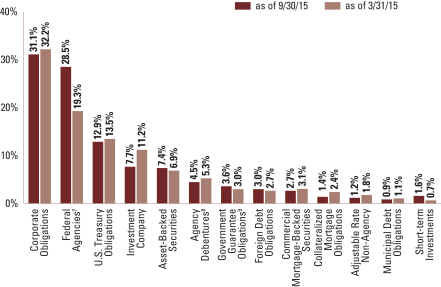

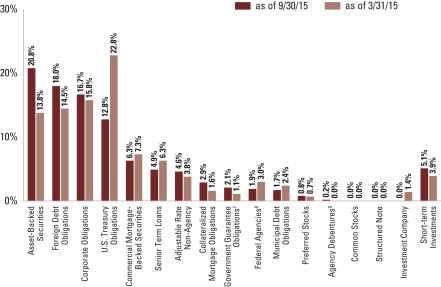

| SECTOR ALLOCATIONS6 |

| Percentage of Net Assets |

| | 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 7 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| | 8 | | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

| | 9 | | “Government Guarantee Obligations” are guaranteed by a foreign government guarantee program and are backed by the full faith and credit of the United States or the government of a foreign country. |

15

PORTFOLIO RESULTS

Goldman Sachs Global Income Fund

Investment Objective

The Fund seeks a high total return, emphasizing current income, and, to a lesser extent, providing opportunities for capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Fixed Income Investment Management Team discusses the Goldman Sachs

Global Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of -0.89%, -1.35%, -0.72%, -0.97% and -0.77%, respectively. These returns compare to the -0.91% cumulative total return of the Fund’s benchmark, the Barclays Global Aggregate Bond Index (Gross, USD, hedged) (the “Barclays Index”), during the same time period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of 0.17%. This return compares to the 0.32% cumulative total return of the Barclays Index during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The primary contributor to the Fund’s performance was our country strategy. Within our country strategy, our five-year/ five-year relative value trading, implemented via the use of interest rate swaps, proved most effective. (The strategy looks at various countries, both developed and emerging market, for relative value opportunities.) In particular, the Fund’s exposure to the European interest rate curve proved effective. Such positioning more than offset the detracting impact of positioning in Brazil and the U.S. during the Reporting Period. Additionally, several relative value trades strongly benefited results, especially our long Japanese yen 10-year/20-year position versus short U.S. dollar and euro 10-year/20-year trade and our long euro five-year rates position versus short U.S. 10-year rates trade. The Fund’s long position in Canadian 10-year rates versus short position in U.S. 10-year rates trade also added value. These relative value trades boosted results, as expectations of an interest rate hike in the U.S. were pushed further into the future based on worsening global macroeconomic data. The country strategy is primarily implemented via interest rate swaps and/or futures. |

| | To a more modest degree, our duration strategy also contributed positively to the Fund’s results. The duration strategy is primarily implemented via interest rate swaps and/or futures. Duration is a measure of the Fund’s sensitivity to changes in interest rates. |

| | Detracting from the Fund’s performance were our cross-sector and currency strategies. Our cross sector strategy is one in which we invest Fund assets across a variety of fixed income sectors, including some that may not be included in the Fund’s benchmark. Within our currency strategy, the Fund’s long position in the Mexican peso detracted the most. The Mexican peso depreciated against the U.S. dollar through most of the Reporting Period, partially due to the flight to U.S. dollar safety seen in the wake of August 2015 volatility. The Fund’s long position in the New Zealand dollar also dampened relative results. The currency strategy is primarily implemented via currency forwards. |

| | Individual issue selection produced mixed results during the Reporting Period. These strategies reflect any active views we take on these particular sectors. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | The Fund’s overweight to corporate spreads compared to the Barclays Index, implemented via our cross-sector strategy, was the primary detractor from the Fund’s results. In August 2015, increased market volatility drove a broad risk-off sentiment among investors and pushed expectations of an interest rate hike by the Federal Reserve (“Fed”) further out. |

16

PORTFOLIO RESULTS

| | In turn, corporate spreads, or yield differentials to U.S. Treasuries, widened especially dramatically in September 2015. High yield corporate bonds sold off for a fourth consecutive month in September 2015 amidst pressures from increased volatility. An overweight relative to the Barclays Index in commercial mortgage-backed securities also hurt. These detractors were partially offset by the Fund’s underweighted exposure to emerging market debt, which contributed positively. |

| | Individual issue selection within the emerging market debt sector detracted from the Fund’s results during the Reporting Period, owing mostly to the Fund’s overweight to Mexican government debt as well as to positions in Columbia and Indonesia. |

| | Conversely, bottom-up individual issue selection of corporate bonds boosted the Fund’s relative results during the Reporting Period. More specifically, selection of structured products within the corporate bond sector — such as those of Halcyon Loan Advisors or collateralized loan obligations from Shackleton — helped. Specific selection of credits within investment grade utilities and high yield financials contributed positively as well. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | The combined effect of the Fund’s duration and yield curve positioning contributed positively to results during the Reporting Period. The Fund’s duration strategy is actively managed and constantly monitored in an effort to generate greater performance and reduced risk through volatile markets. We tactically adjusted the Fund’s duration position throughout the Reporting Period as market conditions shifted. For example, the Fund’s long German duration position, implemented via what are known as Bobl futures contracts, in July 2015 was particularly beneficial to relative results. Detracting somewhat was our shifting from a long U.S. duration position relative to the Barclays Index at the end of March 2015 to a short U.S. duration position relative to the Barclays Index by the end of April 2015 and then to an even shorter relative position in June 2015 before extending duration slightly, though staying shorter than that of the Barclays Index, by the end of the Reporting Period. As mentioned earlier, duration is a measure of the Fund’s sensitivity to changes in interest rates. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | We used derivatives and similar instruments for the efficient management of the Fund. These derivatives and similar instruments allowed us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. Derivatives are used in combination with cash securities to implement our views in the Fund. |

| | During the Reporting Period, we used interest rate and bond exchange traded futures contracts to implement duration and country strategies within the Fund, especially in the U.S., Eurozone, U.K. and Japanese markets. Currency transactions were carried out using primarily over-the-counter (“OTC”) spot and forward foreign exchange contracts as well as by purchasing OTC options. Currency transactions were used as we sought both to enhance returns and to hedge the Fund’s portfolio against currency exchange rate fluctuations. Interest rate and credit default swaps were also used as cost-efficient instruments to help grant us greater precision and versatility in the management of active strategies. Forward sales contracts were used to implement currency transactions based on our active views and for hedging purposes. Written option contracts were used to implement active views within our top-down and bottom-up selection strategies and for hedging purposes. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | As mentioned earlier, we transitioned from a long U.S. duration position in comparison to that of the Barclays Index to a short U.S. duration position, held for most of the Reporting Period. We made this shift because we felt the market was being too bearish on the U.S. economy and that interest rates were likely to rise sooner than the consensus expected. |

| | Within the investment grade corporate bond sector, we modestly reduced the Fund’s exposure to the financials industry, as we feel this segment is increasingly affected by the idiosyncratic risk of regulation, and increased its exposure to industrials. We moved to an increasingly underweighted allocation to emerging market debt during the |

17

PORTFOLIO RESULTS

| | Reporting Period, as the global macroeconomic environment became of heightened concern to us, especially with the market volatility evident in August 2015. We also reduced the Fund’s exposure to quasi-government securities during the Reporting Period. We increased the Fund’s cash position during the Reporting Period. |

| | From a country perspective, on a market-value weighted basis, we increased the Fund’s exposure relative to the Barclays Index to Japan and the U.S. and decreased its relative weightings in the U.K. and in the Eurozone overall, primarily in Germany. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of September 2015? |

| A | | At the end of September 2015, on a market-value weighted basis, the Fund had overweighted allocations relative to the Barclays Index in asset-backed securities, commercial mortgage-backed securities and investment grade corporate bonds. The Fund had underweighted exposure relative to the Barclays Index in government securities, covered bonds, quasi-government securities and emerging market debt. (Covered bonds are debt securities backed by cash flows from mortgage loans or public sector loans.) The Fund was rather neutrally weighted compared to the Barclays Index in residential mortgage-backed securities and had no position in high yield corporate bonds at the end of the Reporting Period. The Fund also had a notable position in cash at the end of the Reporting Period. |

| | From a country perspective, on a market-value weighted basis, the Fund was overweight relative to the Barclays Index in the U.S. The Fund was underweight compared to the Barclays Index in Japan and the U.K. The Fund was relatively neutrally weighted to the Eurozone overall, but within the region, was overweight Germany and Italy, underweight France and rather neutral to the remaining markets at the end of the Reporting Period. The Fund was also relatively neutrally weighted at the end of the Reporting Period to Australia, Canada, Denmark, Norway and Sweden. The Fund had a modestly shorter duration than the Barclays Index at the end of the Reporting Period. |

18

FUND BASICS

Global Income Fund

as of September 30, 2015

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015–

September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays Global

Aggregate Bond

(Gross, USD,

Hedged) Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | -0.89 | % | | | -0.91 | % | | | 0.79 | % | | | 0.62 | % |

| | Class C | | | -1.35 | | | | -0.91 | | | | 0.09 | | | | -0.09 | |

| | Institutional | | | -0.72 | | | | -0.91 | | | | 1.16 | | | | 0.98 | |

| | Service | | | -0.97 | | | | -0.91 | | | | 0.66 | | | | 0.48 | |

| | | Class IR | | | -0.77 | | | | -0.91 | | | | 1.07 | | | | 0.89 | |

| | | | | | | | | | | | | | | | | | | |

| | | July 31, 2015–

September 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Barclays Global

Aggregate Bond

(Gross, USD,

Hedged) Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | | Class R6 | | | 0.17 | % | | | 0.32 | % | | | 0.94 | % | | | 0.76 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Barclays Global Aggregate Bond (Gross, USD, Hedged) Index, an unmanaged index, provides a broad based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

19

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 9/30/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -2.42 | % | | | 2.52 | % | | | 3.64 | % | | | 5.32 | % | | 8/2/91 |

| | Class C | | | -0.48 | | | | 2.53 | | | | 3.25 | | | | 3.97 | | | 8/15/97 |

| | Institutional | | | 1.69 | | | | 3.67 | | | | 4.40 | | | | 5.75 | | | 8/1/95 |

| | Service | | | 1.11 | | | | 3.12 | | | | 3.87 | | | | 5.45 | | | 3/12/97 |

| | Class IR | | | 1.52 | | | | 3.54 | | | | N/A | | | | 3.68 | | | 7/30/10 |

| | | Class R6 | | | N/A | | | | N/A | | | | N/A | | | | 0.17 | | | 7/31/15 |

| | 4 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Prior to July 29, 2009, the maximum initial sales charge applicable to Class A Shares was 4.5%, which is not reflected in the average annual total return figures shown. Because Institutional, Service, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.03 | % | | | 1.18 | % |

| | Class C | | | 1.77 | | | | 1.93 | |

| | Institutional | | | 0.70 | | | | 0.84 | |

| | Service | | | 1.20 | | | | 1.34 | |

| | Class IR | | | 0.77 | | | | 0.90 | |

| | | Class R6 | | | 0.68 | | | | 0.82 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

20

FUND BASICS

| | | | | | | | | | |

| | CURRENCY ALLOCATION6 | |

| | | | | Percentage of Net Assets | |

| | | | | as of 9/30/15 | | | as of 3/31/15 | |

| | U.S. Dollar | | | 50.4 | % | | | 50.0 | % |

| | Euro | | | 23.3 | | | | 27.6 | |

| | Japanese Yen | | | 12.4 | | | | 11.0 | |

| | British Pound | | | 4.8 | | | | 5.8 | |

| | Canadian Dollar | | | 2.4 | | | | 3.4 | |

| | Mexican Peso | | | 2.2 | | | | 3.5 | |

| | South Korean Won | | | 0.6 | | | | 0.8 | |

| | Australian Dollar | | | 0.4 | | | | 0.5 | |

| | South African Rand | | | 0.3 | | | | 0.4 | |

| | Danish Krone | | | 0.1 | | | | 0.2 | |

| | Polish Zloty | | | 0.1 | | | | 0.1 | |

| | | Czech Koruna | | | 0.1 | | | | 0.1 | |

| | 6 | | The percentage shown for each currency reflects the value of investments in that category as a percentage of net assets. Figures in the table may not sum to 100% due to the exclusion of other assets and liabilities. The table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

21

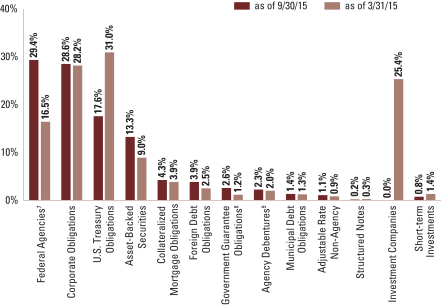

PORTFOLIO RESULTS

Goldman Sachs Strategic Income Fund

Investment Objective

The Fund seeks total return comprised of income and capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Investment Management Team discusses the Goldman Sachs Strategic Income Fund’s (the “Fund”) performance and positioning for the six-month period ended September 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of -0.37%, -0.74%, -0.20%, -0.24% and -0.49%, respectively. These returns compare to the 0.14% cumulative total return of the Fund’s benchmark, the BofA Merrill Lynch U.S. Dollar 3-Month LIBOR Constant Maturity Index (the “LIBOR Index”), during the same period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of -1.11%. This return compares to the 0.05% cumulative total return of the LIBOR Index during the same period. |

| | We note that the Fund’s benchmark being the LIBOR Index is a means of emphasizing that the Fund has an unconstrained strategy. That said, this Fund employs a benchmark agnostic strategy and thus comparisons to a benchmark index are not particularly relevant. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s performance during the Reporting Period was individual issue selection. These strategies reflect any active views we take on these particular sectors. |

| | Within our top-down strategies, our currency and country strategies contributed positively to Fund performance. Within our currency strategy, the Fund benefited most from an underweighted position in a basket of Asian currencies, including the Chinese renminbi, South Korean won and New Taiwan dollar. Within our country strategy, the Fund benefited from long duration positions in Canada and Europe versus a short U.S. duration position. |

| | The Fund’s duration strategy contributed positively, albeit modestly to its performance. Duration is a measure of the Fund’s sensitivity to changes in interest rates. |

| Q | | Which fixed income market sectors most significantly affected Fund performance? |

| A | | Individual issue selection within the corporate bond and municipal debt sectors detracted. Throughout the Reporting Period, the broad corporate bond sector, both investment grade and high yield, experienced significant spread widening, meaning the differential in yields between these sectors and U.S. Treasuries increased. Within the municipal debt sector, exposure to Puerto Rico debt hurt most, as there was significant downward price movement following comments in June 2015 by the commonwealth’s governor indicating that its current debt was unsustainable and there was a need for a debt restructure. At the end of the Reporting Period, the commonwealth was continuing to explore various options to restructure its outstanding debt. |

| | Conversely, individual issue selection within the government/swaps sector contributed positively to the Fund’s performance. In particular, the Fund benefited from its yield curve steepening positions within the sector. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | The combined effect of the Fund’s tactical duration and yield curve positioning contributed positively, albeit modestly, to results during the Reporting Period. The Fund particularly benefited from a long duration in European interest rates toward the beginning of the Reporting Period and from a long duration position in U.S. interest rates toward the end of |

22

PORTFOLIO RESULTS

| | the Reporting Period, the latter position being established based on our view that the Federal Reserve (the “Fed”) would not raise interest rates following its September 2015 meeting. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | We used derivatives and similar instruments for the efficient management of the Fund. These derivatives and similar instruments allowed us to manage interest rate, credit and currency risks more effectively by allowing us both to hedge and to apply active investment views with greater versatility and to afford greater risk management precision than we would otherwise be able to implement. |