UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: February 29, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | February 29, 2016 |

| | |

| | | | Fundamental Equity Growth Funds |

| | | | Capital Growth |

| | | | Concentrated Growth |

| | | | Dynamic U.S. Equity* |

| | | | Flexible Cap Growth |

| | | | Focused Growth |

| | | | Growth Opportunities |

| | | | Small/Mid Cap Growth |

| | | | Strategic Growth |

| | | | Technology Opportunities** |

*Effective after the close of business on April 30, 2015, the Goldman Sachs U.S Equity Fund was renamed the Goldman Sachs Dynamic U.S. Equity Fund.

**Effective after the close of business on July 31, 2015, the Goldman Sachs Technology Tollkeeper Fund was renamed the Goldman Sachs Technology Opportunities Fund

Goldman Sachs Fundamental Equity Growth Funds

| n | | TECHNOLOGY OPPORTUNITIES |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Investment Process | | | 1 | |

| |

Market Review | | | 2 | |

| |

Portfolio Management Discussions | | | 5 | |

| |

Schedules of Investments | | | 59 | |

| |

Financial Statements | | | 78 | |

| |

Financial Highlights | | | 88 | |

| |

Notes to Financial Statements | | | 106 | |

| |

Other Information | | | 126 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS FUNDAMENTAL EQUITY GROWTH FUNDS

What Differentiates the Goldman Sachs Growth Team’s Investment Process?

For over 30 years, the Goldman Sachs Growth Team has consistently applied a three-step investment process based on our belief that wealth is created through the long-term ownership of growing businesses.

| n | | Make decisions as long-term business owners rather than as stock traders |

| n | | Perform in-depth, fundamental research |

| n | | Focus on long-term structural and competitive advantages |

Result

Performance driven by the compounding growth of businesses over time — not short-term market movements

Long-term participation in growing businesses — less reliance on macroeconomic predictions, market timing, sector rotation or momentum

Identify high quality growth businesses. Some required investment criteria include:

| n | | Established brand names |

| n | | Recurring revenue streams |

| n | | Long product life cycles |

| n | | Favorable long-term growth prospects |

Result

Investments in businesses that we believe are strategically positioned for consistent, sustainable long-term growth

| n | | Perform rigorous valuation analysis of every potential investment |

| n | | Use valuation tools and analytics to ensure that the high-quality business franchises we have identified also represent sound investments |

Result

Good investment decisions based on solid understanding of what each business is worth

Attractive buying opportunities as the stock prices of quality growth businesses fluctuate over time

1

MARKET REVIEW

Goldman Sachs Fundamental Equity Growth Funds

Market Review

Overall, U.S. equities struggled during the six months ended February 29, 2016 (the “Reporting Period”) amidst persistent volatility. The Standard & Poor’s 500® Index (the “S&P 500 Index”) ended the Reporting Period with a decline of 0.92%. The Russell 3000® Index generated a return of -2.20%. Central bank policy, a commodity price sell-off, geopolitical tensions, and China and global economic growth concerns were the key themes impacting U.S. equities throughout the Reporting Period.

Following a volatile summer, U.S. equities tumbled further in September 2015, alongside other global equity markets. Equity markets continued to fret about weak macroeconomic data from China and the global implications of that data. Further, the U.S. Federal Reserve (the “Fed”) elected not to raise interest rates in September 2015, thus seemingly reaffirming persistent concerns about the many sources of economic instability and slowing economic growth. Still, domestic economic news was rather positive. U.S. economic growth for the second quarter of 2015 was revised up to an annualized rate of 3.9%, led by stronger consumer and construction spending. Job growth for August 2015 was slightly below consensus expectations, but the unemployment rate continued to decline.

October 2015 saw a strong rebound for U.S. equities. U.S. equity markets maintained their focus on the timing of the Fed’s initial rate hike, and expectations of “lift off,” the term used for that initial rate hike, in December 2015 increased following comments from the Fed regarding solid consumer spending and strength in the housing market. U.S. Gross Domestic Product (“GDP”) growth for the third quarter of 2015 came in at 1.5%, which was generally in line with consensus expectations.

The S&P 500 Index finished November 2015 roughly flat, although this masked a mid-month sell-off, as market expectations of a December 2015 rate hike rose significantly and dampened investor sentiment following a strong October 2015 non-farm payrolls report and hawkish comments from Fed members at the Fed’s October 2015 meeting. However, the message that the U.S. economy was strong enough to withstand higher interest rates, along with an emphasis by the Fed that any tightening would be gradual, sparked a rally in the U.S. equity markets. Economic data was also relatively strong in November 2015, with third quarter 2015 GDP revised up to 2.1%. In December 2015, the Fed finally delivered, as largely expected by markets, and voted unanimously for a 25 basis point hike in the targeted federal funds rate, its first rate hike since 2006. (A basis point is 1/100th of a percentage point.) The fairly dovish language in the Fed’s announcement, which re-emphasized “gradual” adjustments to policy going forward, helped to somewhat assuage the markets. (Dovish language or action tends to be that which is not strong or aggressive (opposite of hawkish).)

Early in 2016, U.S. equities were embroiled in what was a global rout, triggered by investor concerns of an intensifying economic slowdown in China and exacerbated by a plunge in oil prices to less than $30 per barrel, the lowest level since 2003. The Fed’s statement in January 2016 acknowledged the risks from international markets and tightening financial conditions on the U.S. economy. Its statement was also somewhat bearish on economic growth, noting that activity had slowed in 2015. Indeed, U.S. GDP economic growth had slowed in the fourth quarter of 2015 according to preliminary estimates, expanding by just 0.7%, thus bringing the 2015 annual growth rate to 2.4%. While the Fed acknowledged further recovery in the U.S. labor market, its language on its inflation outlook was more dovish.

Market sentiment appeared to improve in February 2016 as central banks outside of the U.S. increasingly acknowledged rising economic risks and sent a more dovish signal, fueling

2

MARKET REVIEW

market expectations of further easing. For example, European Central Bank president Mario Draghi hinted at further stimulus. The People’s Bank of China signaled further monetary easing and a 50 basis point cut in its reserve requirement ratio for banks. Fed Chair Janet Yellen similarly released generally dovish remarks, stressing that the Fed was not on a “pre-set” path for hikes. U.S. equities were also supported during the month by strong U.S. economic data, rallying as fourth quarter 2015 GDP was revised up to 1.0%, coming in above consensus expectations. Also, the U.S. unemployment rate declined to an eight-year low of 4.9%, while retail sales increased 0.2% in January 2016, with the less volatile core retail sales figure increasing 0.6%. Further adding support to the U.S. equity market in the latter half of February 2016 was the oil price recovery, albeit modest, from its trough point on news of talks between oil producers to cap production.

For the Reporting Period overall, all market capitalizations posted negative returns, but large-cap companies performed least poorly, followed by mid-cap companies. Small-cap companies were weakest. Growth stocks outpaced value stocks within the large-cap segment of the U.S. equity market, but value stocks outperformed growth stocks in the mid-cap and small-cap segments of the U.S. equity market. (All as measured by Russell Investments indices.)

Looking Ahead

At the end of the Reporting Period, we expected positive, but below average, returns for global equities in 2016 overall in light of modest economic growth forecasts and rising valuations in some areas of the market. However, in our view, equities still looked more attractive than other asset classes in a persistently low-return environment.

After dipping in 2015, we expect global economic growth to increase modestly in 2016, which we think will be enough to sustain corporate profitability and allow stock prices to move higher. In our view, central banks are likely to remain accommodative given still-fragile global economic growth, which we also see as helpful for equity markets. Even in the U.S., where Fed policy has moved toward normalization, we do not expect to see much negative impact from what are likely to be gradual interest rate increases given continued strength in the housing and labor markets. However, the strong U.S. dollar may well remain a headwind for U.S. multinational markets.

While the macro outlook remains benign, U.S. credit and equities reflect some typical late-cycle signs, such as more shareholder-friendly actions, an increase in merger and acquisition activity and a pick-up in leverage, all of which tend to coincide with an environment lacking top-line, or revenue, growth. Higher equity valuations are also consistent with late-cycle indicators. In part due to years of ultra-low interest rates, U.S. equity market valuations have risen toward fair value, in our opinion, with some areas looking particularly vulnerable if companies cannot deliver growth.

One common theme across the developed markets is that we believe domestically-focused companies in the major regions could benefit from increasing domestic consumption while being more insulated from currency volatility. In the U.S., we expect that the strong dollar could continue to be a headwind for many globally-exposed companies but believe the consumer remains healthy.

We also believe that some extraordinary dynamics in the U.S. equity market in 2015 may have set up investment opportunities for 2016. The extremely narrow trading breadth of the market hit a 30-year low. For example, just ten stocks accounted for approximately 40% of the total positive contribution to the S&P 500 Index return in 2015. Also, value stocks notably

3

MARKET REVIEW

underperformed growth stocks in 2015. We expect some broadening of the market and reversal of these trends in 2016, as investors focus on the risk of high-priced stocks as well as on the relative attractiveness of the hundreds of stocks trading below the market multiple.

Regardless of market direction, our fundamental, bottom-up stock selection continues to drive our process, rather than headlines or sentiment. We maintain confidence in the companies the Funds own and believe they have the potential to outperform relative to the broader market regardless of economic growth conditions. As always, we maintain our focus on seeking to invest in companies that we believe will generate long-term growth in today’s ever-changing market conditions.

|

| |

| Changes to the Funds’ Portfolio Management Team during the Reporting Period |

| |

| In September 2015, as part of our ongoing commitment to identify strong talent and invest in our team, we added three new members to the investment team. Jessica Katz joins the firm as a Vice President, serving as a Sector Portfolio Manager in the industrials sector across the market capitalization range. Jessica has 10 years of industry experience and joins us from Eaton Vance, where she served as a member on the Large Cap Growth Team, covering the industrials and energy sectors. Prior to Eaton Vance, she held a variety of roles at Fidelity Investments, including equity research. Jessica now works alongside our current Sector Portfolio Managers, Gerald Maris and Diego Lozada-Ghirardi. Additionally, we took the opportunity to deepen the talent on our team by inviting Himanshu Gupta and Juhi Kashyap to join us as Research Analysts. Both Himanshu and Juhi join as Associates from within the firm. Himanshu has supported the Growth Team in a broader research capacity within GSAM over the past five years. He continues to work with our health care Sector Portfolio Managers, Timothy Leahy and Anant Padmanabhan. Juhi now works directly with Daniel Zimmerman to cover the financials sector. She started her career in the firm’s Investment Banking Division covering financial institutions. |

4

PORTFOLIO RESULTS

Goldman Sachs Capital Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments. Since the Fund’s inception, the Goldman Sachs Growth Equity Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Equity Investment Team discusses the Goldman Sachs Capital Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 29, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service, IR, R and R6 Shares generated cumulative total returns, without sales charges, of -4.97%, -5.35%, -4.83%, -5.03%, -4.89%, -5.10% and -4.80%, respectively. These returns compare to the -1.22% cumulative total return of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall detracted from the Fund’s performance relative to the Russell Index during the Reporting Period. Sector allocation as a whole also detracted, albeit much more modestly. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Detracting from the Fund’s relative results most was weak stock selection in the health care, information technology and consumer staples sectors. The only two sectors to contribute positively to the Fund’s relative performance during the Reporting Period were energy and materials, wherein effective stock selection drove results. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in global apparel company PVH, biotechnology firm Vertex Pharmaceuticals and molecular diagnostics company Cepheid. |

| | PVH was the top detractor from the Fund’s results during the Reporting Period. Weakness in the U.S. retail environment, high promotions in the industry, and currency headwinds pressured the company’s results. Despite these concerns, which we see as short-term in nature, we believed at the end of the Reporting Period that PVH remained a leading franchise with dominant market share, strong pricing power and solid fundamentals. Particularly, we believe that established brand names Tommy Hilfiger and Calvin Klein have demonstrated international strength and have been a key source of growth. In our view, PVH was undervalued relative to its peers at the end of the Reporting Period, and we remained optimistic on what we see as the company’s significant free cash flow generation ability, quality of management and return potential. |

| | Vertex Pharmaceuticals was a top detractor from the Fund’s performance during the Reporting Period. Primarily, its weakness was driven, in our view, by fourth quarter 2015 results that were below consensus expectations. The company attributed part of the miss to a slowdown in new patient growth due to clinic capacity restraints, creating a patient backlog. We believe Vertex Pharmaceuticals boasts strong underlying fundamentals and a promising product pipeline with significant short-term and long-term catalysts. At the end of the Reporting Period, we believed the company, led by what we consider to be a capable management team, could continue to see growth given its dominant market share in its space and given geographic expansionary efforts that have contributed to meaningful profitability. |

5

PORTFOLIO RESULTS

| | Cepheid’s release of its third quarter 2015 earnings negatively pressured its share price during the Reporting Period. Its management cited the integration and productivity implications of doubling its U.S. salesforce as the primary driver behind its earnings miss. By the end of the Reporting Period, we believed the company had more time to train and integrate its new salesforce and thus further believed the company was poised well for growth. We maintained confidence in the actions its management was taking to accelerate the company’s growth profile. In our view, Cepheid remained the dominant molecular diagnostics platform at the end of the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in data center real estate investment trust (“REIT”) Equinix, flavor food products manufacturer McCormick and tobacco company Philip Morris International. |

| | Equinix was a strong contributor to the Fund’s performance during the Reporting Period. The company announced high quality results for the second and third quarters of 2015, as secular growth in enterprise spending helped drive organic revenue growth and bookings to record levels. Also, solid performance in all regions in which the REIT operates led Equinix to raise guidance across key metrics during the Reporting Period, which was well received by the markets. In our view, Equinix continued at the end of the Reporting Period to present a favorable outlook, as pricing has been net positive in the low churn rate, or turnover, environment. Going forward, we believe Equinix may further benefit from its recurring revenue business model, steady demand environment, and integration of recent acquisitions that we believe could unlock significant synergies. |

| | Shares of McCormick rose, as the company benefited from strong fourth quarter 2015 results, with earnings coming in slightly above consensus estimates. The positive results were driven by a broad improvement in organic growth across its consumer and industrial businesses. At the end of the Reporting Period, we were encouraged by the better earnings visibility and improving momentum in McCormick’s consumer business. We believed the company might benefit from the secular growth in healthy cooking and the stabilization of private label competitors across many of its core spice categories. We further believed the company had the ability to continue to unlock growth given its global expansion efforts and product popularity. Finally, in our view, |

| | McCormick is led by a quality management team, which is capable of producing strong results moving forward. |

| | Philip Morris International was a top contributor to the Fund’s results, as the company executed well and reported solid third and fourth quarter 2015 earnings. At the end of the Reporting Period, we thought Philip Morris International was back on track fundamentally, with underlying momentum continuing to build. In our view, the company is among the highest quality large-cap consumer staples companies, with strong pricing power driving faster profit growth, what we consider to be an attractive margin and return profile, and a compelling dividend yield. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We initiated a Fund position in fast-food retail giant McDonald’s. We believe improving sales and reductions in costs should lead to earnings upside and margin expansion. We further think that McDonald’s reduction in capital expenditures and further refranchising could lead to improving return on invested capital and free up additional capital to repurchase stock. In our view, McDonald’s is a high quality franchise with a proficient management team and what we consider to be attractive opportunities to drive top-line growth and earnings. |

| | We established a Fund position in Reynolds American, which is a holding company that manufactures and sells cigarettes in the U.S. We believe the industry backdrop remains favorable for tobacco companies. In our view, Reynolds American is well positioned to benefit from this industry backdrop during the next few years. |

| | Conversely, we exited the Fund’s position in research-based biopharmaceutical company AbbVie. While we continue to like the company, we believe the risk/reward opportunities are greater within others in the industry. |

| | We sold the Fund’s position in consumer products company Colgate-Palmolive. While we believe Colgate-Palmolive to be a quality business, we think there are better opportunities with more encouraging catalysts elsewhere in the industry. Additionally, we believe it is possible that Colgate-Palmolive could see an earnings decrease in the near term, as foreign |

6

PORTFOLIO RESULTS

| | currency pressures continue to impact the company. As a result, we decided to exit the position and pursue higher conviction ideas. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to information technology increased and its allocations to consumer staples and financials decreased relative to the Russell Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had an overweighted position relative to the Russell Index in the consumer discretionary sector. On the same date, the Fund had underweighted positions compared to the Russell Index in consumer staples, health care and industrials. The Fund was rather neutrally weighted to the Russell Index in energy, financials, information technology and materials and had no position at all in utilities or telecommunication services at the end of the Reporting Period. |

7

FUND BASICS

Capital Growth Fund

as of February 29, 2016

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2015–February 29, 2016 | | Fund Total Return

(based on NAV)1 | | | Russell 1000®

Growth Index2 | |

| | Class A | | | -4.97 | % | | | -1.22 | % |

| | Class C | | | -5.35 | | | | -1.22 | |

| | Institutional | | | -4.83 | | | | -1.22 | |

| | Service | | | -5.03 | | | | -1.22 | |

| | Class IR | | | -4.89 | | | | -1.22 | |

| | Class R | | | -5.10 | | | | -1.22 | |

| | | Class R6 | | | -4.80 | | | | -1.22 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Russell 1000® Growth Index (with dividends reinvested) is an unmanaged index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -3.66 | % | | | 10.99 | % | | | 6.49 | % | | | 9.04 | % | | 4/20/90 |

| | Class C | | | 0.17 | | | | 11.41 | | | | 6.30 | | | | 5.21 | | | 8/15/97 |

| | Institutional | | | 2.36 | | | | 12.69 | | | | 7.52 | | | | 6.41 | | | 8/15/97 |

| | Service | | | 1.79 | | | | 12.13 | | | | 6.98 | | | | 5.89 | | | 8/15/97 |

| | Class IR | | | 2.19 | | | | 12.53 | | | | N/A | | | | 6.93 | | | 11/30/07 |

| | Class R | | | 1.66 | | | | 11.96 | | | | N/A | | | | 6.40 | | | 11/30/07 |

| | | Class R6 | | | N/A | | | | N/A | | | | N/A | | | | -3.96 | | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end or cumulative total returns for periods less than 1 year. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.15 | % | | | 1.49 | % |

| | Class C | | | 1.90 | | | | 2.25 | |

| | Institutional | | | 0.75 | | | | 1.09 | |

| | Service | | | 1.25 | | | | 1.60 | |

| | Class IR | | | 0.90 | | | | 1.24 | |

| | Class R | | | 1.40 | | | | 1.74 | |

| | | Class R6 | | | 0.73 | | | | 1.07 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least December 29, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/29/165 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 6.0 | % | | Computers & Peripherals |

| | MasterCard, Inc. Class A | | | 2.8 | | | IT Services |

| | Facebook, Inc. Class A | | | 2.7 | | | Internet Software & Services |

| | Amazon.com, Inc. | | | 2.6 | | | Internet & Catalog Retail |

| | The Home Depot, Inc. | | | 2.4 | | | Specialty Retail |

| | The Walt Disney Co. | | | 2.3 | | | Media |

| | Alphabet, Inc. Class A | | | 2.2 | | | Internet Software & Services |

| | Alphabet, Inc. Class C | | | 2.2 | | | Internet Software & Services |

| | Honeywell International, Inc. | | | 2.0 | | | Aerospace & Defense |

| | | The Coca-Cola Co. | | | 1.9 | | | Beverages |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

9

FUND BASICS

| | |

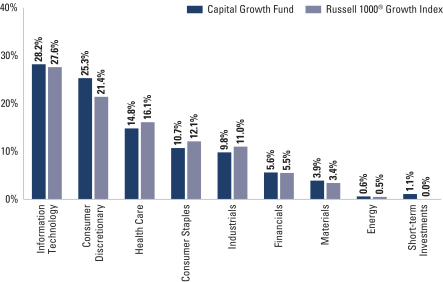

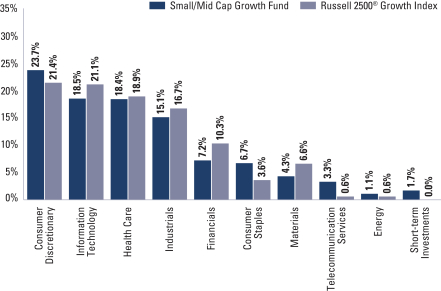

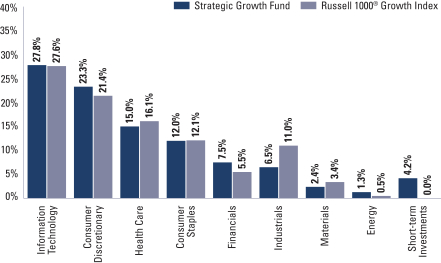

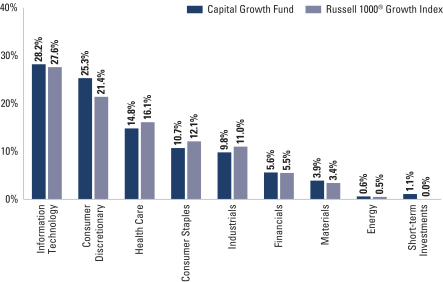

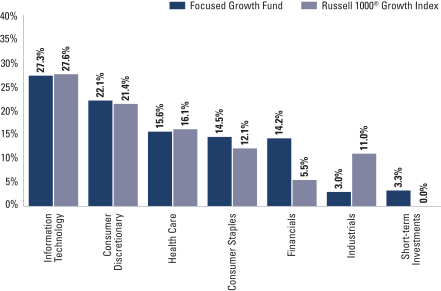

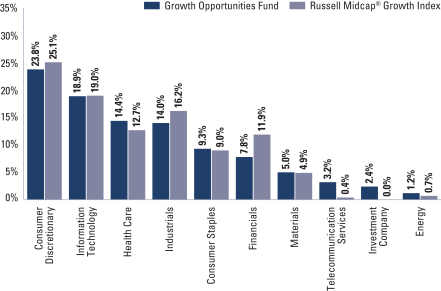

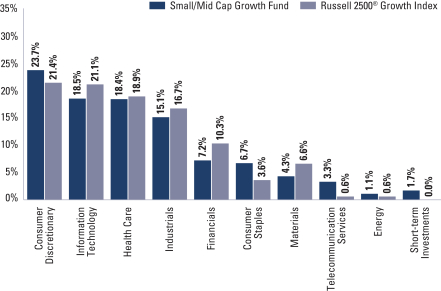

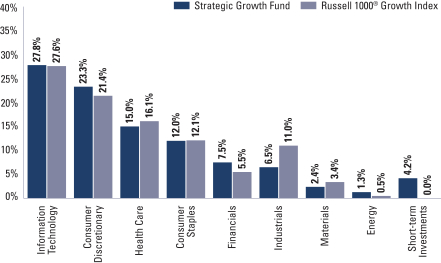

| FUND VS. BENCHMARK SECTOR ALLOCATION6 |

| As of February 29, 2016 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

10

PORTFOLIO RESULTS

Goldman Sachs Concentrated Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments. The Fund typically holds 30-45 high quality growth companies and tends to be more concentrated in individual holdings, industries and sectors than the typical broadly diversified large-cap growth fund. Since the Fund’s inception, the Goldman Sachs Growth Equity Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Equity Investment Team discusses the Goldman Sachs Concentrated Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 29, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR, R and R6 Shares generated cumulative total returns, without sales charges, of -5.49%, -5.87%, -5.30%, -5.36%, -5.55% and -5.28%, respectively. These returns compare to the -1.22% cumulative total return of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall detracted from the Fund’s performance relative to the Russell Index during the Reporting Period. Sector allocation as a whole also detracted, albeit much more modestly. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Challenging stock selection in the information technology, health care and consumer staples sectors detracted from the Fund’s relative results most during the Reporting Period. The only sector to contribute positively to the Fund’s relative performance during the Reporting Period was financials, wherein effective stock selection drove results. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in global apparel company PVH, education loan provider SLM (“Sallie Mae”) and biotechnology firm Vertex Pharmaceuticals. |

| | PVH was the top detractor from the Fund’s results during the Reporting Period. Weakness in the U.S. retail environment, high promotions in the industry, and currency headwinds, including a strong U.S. dollar, pressured the company’s results. Despite these concerns, which we see as short-term in nature, we believed at the end of the Reporting Period that PVH remained a leading franchise with dominant market share, strong pricing power and solid fundamentals. Particularly, we believe that established brand names Tommy Hilfiger and Calvin Klein have demonstrated international strength and have been a key source of growth. In our view, PVH was undervalued relative to its peers at the end of the Reporting Period, and we remained optimistic on what we see as the company’s significant free cash flow generation ability, quality of management and return potential. |

| | Shares of Sallie Mae were weak during the Reporting Period because of political uncertainty around policies in education financing. However, the company reported third quarter 2015 results with earnings ahead of market estimates. At the end of the Reporting Period, we believed Sallie Mae continued to demonstrate dominant and growing share in its market, with |

11

PORTFOLIO RESULTS

| | a quality and tenured management team. The company was also well positioned, in our view, to benefit from macro-oriented trends, such as the rise in interest rates and in financial activity. |

| | Vertex Pharmaceuticals was a top detractor from the Fund’s performance during the Reporting Period. Primarily, its weakness was driven, in our view, by fourth quarter 2015 results that were below consensus expectations. The company attributed part of the miss to a slowdown in new patient growth due to clinic capacity restraints, creating a patient backlog. We believe Vertex Pharmaceuticals boasts strong underlying fundamentals and a promising product pipeline with significant short-term and long-term catalysts. At the end of the Reporting Period, we believed the company, led by what we consider to be a capable management team, could continue to see growth given its dominant market share in its space and given geographic expansionary efforts that have contributed to meaningful profitability. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in data center real estate investment trust (“REIT”) Equinix, online social media platform Facebook and flavor food products manufacturer McCormick. |

| | Equinix was a strong contributor to the Fund’s performance during the Reporting Period. The company announced high quality results for the second and third quarters of 2015, as secular growth in enterprise spending helped drive organic revenue growth and bookings to record levels. Also, solid performance in all regions in which the REIT operates led Equinix to raise guidance across key metrics during the Reporting Period, which was well received by the markets. In our view, Equinix continued at the end of the Reporting Period to present a favorable outlook, as pricing has been net positive in the low churn rate, or turnover, environment. Going forward, we believe Equinix may further benefit from its recurring revenue business model, steady demand environment, and integration of recent acquisitions that we believe could unlock significant synergies. |

| | Facebook was a top positive contributor to the Fund’s relative results during the Reporting Period. The company reported strong fourth quarter 2015 results in January 2016, underpinned by advertisement revenue growth well above market expectations. At the end of the Reporting Period, we remained positive on Facebook’s high operating expenditures, at what we consider to be manageable levels, which we think should allow the company to invest aggressively in substantial growth opportunities and simultaneously increase expected earnings. We think additional tailwinds in the form of lower and decreasing tax rates may further benefit the company in coming years. In our view, Facebook’s strong fundamentals, high barriers to entry, robust contribution from Instagram, and strong demand for its business across most segments and geographies warrant a constructive outlook on its long-term growth prospects. |

| | Shares of McCormick rose, as the company benefited from strong fourth quarter 2015 results, with earnings coming in slightly above consensus estimates. According to the company management, the positive results were driven by a broad improvement in organic growth across its consumer and industrial businesses. At the end of the Reporting Period, we were encouraged by the better earnings visibility and improving momentum in McCormick’s consumer business. We believed the company might benefit from the secular growth in healthy cooking and the stabilization of private label competitors across many of its core spice categories. We further believed the company had the ability to continue to unlock growth given its global expansion efforts and product popularity. Finally, in our view, McCormick is led by a quality management team, which is capable of producing strong results moving forward. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We initiated a Fund position in Stryker, a medical technology company. We believe there are numerous earnings and growth levers during the next two years that could yield meaningful upside. Notably, we see potential benefit from its powerful new product cycle, the Mako robotics platform for knee implants, competitors going through merger integrations, and its recent European investments. In our view, Stryker may also benefit from plans to significantly reduce its selling, general and administrative costs in early 2016. With what we consider to be substantial drivers to growth and momentum across its business, we are positive on Stryker’s long-term outlook. |

12

PORTFOLIO RESULTS

| | We established a Fund position in Danaher, a medical and industrial products manufacturer. Danaher released third quarter 2015 results that beat market expectations, reaffirmed its 2015 earnings guidance and released 2016 guidance that was in line with then-current consensus estimates. At the time of purchase, we believed Danaher’s near-term to medium-term earnings were depressed relative to the synergies from its acquisition of Pall. We also believed the company’s organic growth should garner a scarcity premium. Further, in our view, the company should merit a higher premium relative to its peers as so much of its earnings growth is anticipated to come from self-help, i.e. synergies, rather than macroeconomic factors. |

| | Conversely, we eliminated the Fund’s position in information storage company EMC. While we continue to like the company, near-term volatility around its acquisition by Dell and long-term issues driven by a backlog of orders led us to use our proceeds toward other opportunities where we believe the risk/reward profile is more compelling. |

| | We sold the Fund’s position in consumer products company Colgate-Palmolive. While we believe Colgate-Palmolive to be a quality business, we think there are better opportunities with more encouraging catalysts elsewhere in the industry. Additionally, we believe it is possible that Colgate-Palmolive could see an earnings decrease in the near term, as foreign currency pressures continue to impact the company. As a result, we decided to exit the position and pursue higher conviction ideas. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer discretionary increased as did its position in cash and its allocations to consumer staples, energy, financials and information technology decreased relative to the Russell Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

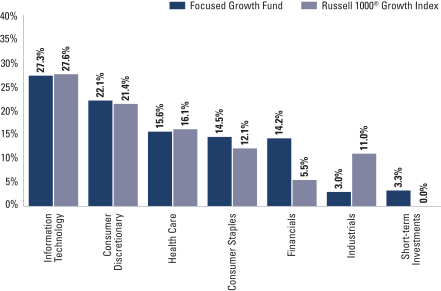

| A | | At the end of the Reporting Period, the Fund had overweighted positions relative to the Russell Index in the financials, consumer discretionary and information technology sectors. On the same date, the Fund had underweighted positions compared to the Russell Index in industrials, materials and health care. The Fund was rather neutrally weighted relative to the Russell Index in consumer staples and energy and had no position at all in the utilities and telecommunication services sectors at the end of the Reporting Period. |

13

FUND BASICS

Concentrated Growth Fund

as of February 29, 2016

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2015–February 29, 2016 | | Fund Total Return

(based on NAV)1 | | | Russell 1000®

Growth Index2 | |

| | Class A | | | -5.49 | % | | | -1.22 | % |

| | Class C | | | -5.87 | | | | -1.22 | |

| | Institutional | | | -5.30 | | | | -1.22 | |

| | Class IR | | | -5.36 | | | | -1.22 | |

| | Class R | | | -5.55 | | | | -1.22 | |

| | | Class R6 | | | -5.28 | | | | -1.22 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Russell 1000® Growth Index (with dividends reinvested) is an unmanaged index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -4.20 | % | | | 9.83 | % | | | 6.15 | % | | | 6.93 | % | | 9/03/02 |

| | Class C | | | -0.45 | | | | 10.27 | | | | 5.96 | | | | 6.57 | | | 9/03/02 |

| | Institutional | | | 1.75 | | | | 11.53 | | | | 7.19 | | | | 7.81 | | | 9/03/02 |

| | Class IR | | | 1.65 | | | | 11.37 | | | | N/A | | | | 5.88 | | | 11/30/07 |

| | Class R | | | 1.06 | | | | 10.81 | | | | N/A | | | | 5.37 | | | 11/30/07 |

| | | Class R6 | | | N/A | | | | N/A | | | | N/A | | | | -3.14 | | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end or cumulative total returns for periods less than 1 year. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.22 | % | | | 1.60 | % |

| | Class C | | | 1.97 | | | | 2.35 | |

| | Institutional | | | 0.82 | | | | 1.20 | |

| | Class IR | | | 0.97 | | | | 1.35 | |

| | Class R | | | 1.47 | | | | 1.87 | |

| | | Class R6 | | | 0.80 | | | | 1.18 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least December 29, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/29/165 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 7.5 | % | | Computers & Peripherals |

| | Facebook, Inc. Class A | | | 4.9 | | | Internet Software & Services |

| | Alphabet, Inc. Class A | | | 4.1 | | | Internet Software & Services |

| | Costco Wholesale Corp. | | | 3.9 | | | Food & Staples Retailing |

| | American Tower Corp. | | | 3.6 | | | Real Estate Investment Trusts |

| | Amazon.com, Inc. | | | 3.3 | | | Internet & Catalog Retail |

| | Starbucks Corp. | | | 3.1 | | | Hotels, Restaurants & Leisure |

| | Equinix, Inc. | | | 3.0 | | | Real Estate Investment Trusts |

| | MasterCard, Inc. Class A | | | 3.0 | | | IT Services |

| | | Allergan PLC | | | 2.9 | | | Pharmaceuticals |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

15

FUND BASICS

| | |

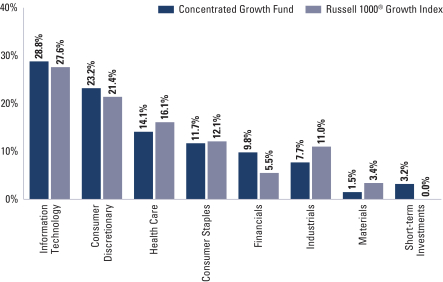

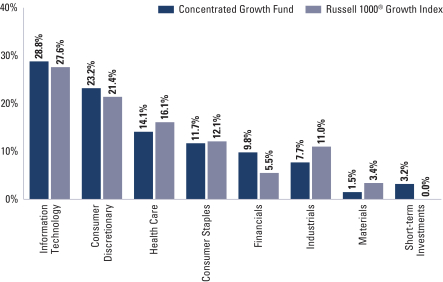

| FUND VS. BENCHMARK SECTOR ALLOCATION6 |

| As of February 29, 2016 | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

16

PORTFOLIO RESULTS

Goldman Sachs Dynamic U.S. Equity Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments. Since the Fund’s inception, the Goldman Sachs Growth Equity Investment Team and the Goldman Sachs Fundamental Equity Value Investment Team have focused on several key investment criteria that they believe can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Teams strive to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Equity Investment Team and the Goldman Sachs Value Equity Investment Team discuss the Goldman Sachs Dynamic U.S. Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended February 29, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service, IR, R and R6 Shares generated cumulative total returns, without sales charges, of -7.33%, -7.61%, -7.09%, -7.17%, -7.35% and -7.07%, respectively. These returns compare to the -0.92% cumulative total return of the Fund’s benchmark, the Standard & Poor’s 500® Index (the “S&P 500 Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall detracted from the Fund’s performance relative to the S&P 500 Index during the Reporting Period. Sector allocation as a whole also detracted, albeit more modestly. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | Challenging stock selection in energy, information technology and financials detracted from the Fund’s relative results most. Having an overweighted allocation to financials, which significantly lagged the S&P 500 Index during the Reporting Period, and having an underweighted exposure to information technology, which outpaced the S&P 500 Index during the Reporting Period, also hurt performance. The only sector to contribute positively to the Fund’s relative performance during the Reporting Period was materials, wherein effective stock selection drove results. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in oil and gas exploration and production company Southwestern Energy, car rental company Hertz Global Holdings and financial institution Bank of America. |

| | Southwestern Energy was a top detractor from the Fund’s relative performance during the Reporting Period. Exceptionally warm fall and winter weather that added to concerns of an oversupplied natural gas market was the major headwind that led to the stock’s poor performance, as natural gas prices declined substantially. Broad-based declines in global commodities weakened investor appetite for stocks with direct commodity exposure. The company’s third quarter 2015 earnings came in ahead of consensus expectations, driven by higher than expected production metrics coupled with lower operating costs. However, challenging natural gas liquid and natural gas pricing caused shares to underperform following the earnings release. The company similarly reported fourth quarter 2015 earnings that beat consensus due to better than expected gas price realizations and midstream revenues. However, further capital expenditure cuts in 2016 led investors to anticipate a |

17

PORTFOLIO RESULTS

| | larger decline in production than previously expected, and Southwestern Energy’s shares fell following the release. At the end of the Reporting Period, we continued to believe that Southwestern Energy has an underappreciated resource base, specifically in the Marcellus and Fayetteville shales, and that its newly acquired assets from Chesapeake Energy further strengthen the company’s position and growth opportunities. Additionally, we remained positive on the company’s operational leverage to higher natural gas prices and encouraged by its management team’s commitment to capital efficiency amidst challenging macro fundamentals. |

| | Hertz Global Holdings was a top detractor from the Fund’s relative results during the Reporting Period. Its shares initially came under pressure after the company reported third quarter 2015 results that were below market expectations, driven by weaker than expected pricing trends in the U.S. caused by increased airport competition. Its sharp decline in share price in the latter half of the Reporting Period seemed to be driven more by investor fears related to macroeconomic conditions than by industry or stock-specific fundamentals. If the U.S. were to enter a span of slower economic growth, travel trends would likely soften and pressure car rental volumes and prices. A weaker demand environment could also pressure used car prices, which might cause the company to dispose of cars at lower residual values. Despite our positive long-term view of the company’s operational improvement initiatives, available capital deployment options and cost reduction opportunities, we sold the Fund’s position in Hertz Global Holdings by the end of the Reporting Period in favor of stocks with what we believed to have less economic sensitivity. |

| | Banks underperformed broadly during the Reporting Period, in our opinion due to a decline in credit quality in the energy industry and concerns of contagion into other industries, such as metals/mining and industrials, moving forward. In addition, the 10-year U.S. Treasury yield moved below 2% during the Reporting Period, leading to a flattening of the yield curve, or a narrowing of yield differentials between the yields of long-term and shorter-term securities. Bank of America, impacted by these trends, was no exception to the industry’s broad underperformance. That said, at the end of the Reporting Period, we believed Bank of America could benefit from rising long-term and short-term rates. While we are aware of the macro risks present, we continued to be optimistic regarding Bank of America and positive on the stock’s discounted valuation. Overall, we were also positive on Bank of America’s leverage to a strengthening U.S. economy, and we continued to find the stock compelling from a risk/reward perspective. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the S&P 500 Index from positions in industrial conglomerate General Electric, athletic footwear, apparel and equipment company Nike and data center real estate investment trust (“REIT”) Equinix. |

| | General Electric was the top positive contributor to the Fund’s relative results during the Reporting Period. The company reported third quarter 2015 earnings results that exceeded consensus expectations, driven by strong organic revenue growth and operating margin improvement. Additionally, its shares rose after General Electric’s long-awaited announcement about spinning off its majority stake in Synchrony Financial to existing shareholders. Further, in December 2015, General Electric held its 2016 outlook meeting, which included a projection of high single-digit earnings growth through 2018, achieved through above-average organic revenue growth, share repurchases, divestitures, and synergies from the company’s acquisition of Alstom Energy. At the end of the Reporting Period, we remained optimistic on the company’s growth prospects, as a strong backlog of orders and accretive synergies from recent transactions could be supportive to earnings in a potentially slow global economic growth environment, in our view. |

| | Towards the end of December 2015, Nike reported solid fiscal second quarter results with accelerated growth in orders from the previous quarter. In our view, the company also continued to see broad-based momentum, notably in China, where its business remains strong. This worldwide growth, along with Nike’s introduction of new footwear, has allowed it to gain market share in an otherwise difficult macroeconomic and secular environment. Despite an inventory build-up from a port strike earlier in 2015, which we view as a near-term headwind, we expected, at the end of the Reporting Period, room for margin expansion through the company’s rising average selling prices. We also maintained our belief in the strength and quality of Nike’s franchise and remained positive at the end of the Reporting Period on the company’s long-term growth potential. |

| | Equinix was a strong contributor to the Fund’s performance during the Reporting Period. The company announced high quality results for the second and third quarters of 2015, as secular growth in enterprise spending helped drive organic revenue growth and bookings to record levels. Also, solid |

18

PORTFOLIO RESULTS

| | performance in all regions in which the REIT operates led Equinix to raise guidance across key metrics during the Reporting Period, which was well received by the markets. In our view, Equinix continued at the end of the Reporting Period to present a favorable outlook, as pricing has been net positive in the low churn rate, or turnover, environment. Going forward, we believe Equinix may further benefit from its recurring revenue business model, steady demand environment, and integration of recent acquisitions that could unlock significant synergies. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | | We initiated a Fund position in online social media platform Facebook during the Reporting Period. The company reported strong fourth quarter 2015 results in January 2016, underpinned by advertisement revenue growth well above market expectations. At the end of the Reporting Period, we remained positive on Facebook’s high operating expenditures, at what we consider to be manageable levels, which we think should allow the company to invest aggressively in substantial growth opportunities and simultaneously increase expected earnings. We think additional tailwinds in the form of lower and decreasing tax rates may further benefit the company in coming years. In our view, Facebook’s strong fundamentals, high barriers to entry, robust contribution from Instagram, and strong demand for its business across most segments and geographies warrant a constructive outlook on its long-term growth prospects. |

| | We established a Fund position in MasterCard. We believe current macro trends are supportive of financial services and that MasterCard could be a key beneficiary. In particular, the company has deep exposure to emerging markets, where consumer card spending has seen recovery and is supported by promotional government efforts. In our view, MasterCard has a high quality management team and, given what we consider to be a favorable industry backdrop, a high quality business franchise. Given what we view as MasterCard’s attractive valuation, we sought to take advantage of what we view as a favorable risk/reward opportunity. |

| | Conversely, we sold the Fund’s position in financial services company American International Group (“AIG”). We believe any complications with respect to its newly announced strategic plan could add negative pressure to the stock, as major changes within such a complex organization take time to harmonize, in our view. We took the opportunity to exit the Fund’s position in AIG to pursue higher conviction ideas. |

| | We exited the Fund’s position in Boeing, a designer and manufacturer of commercial jetliners, military defense and spaceflight worldwide. During the Reporting Period, Boeing issued 2016 revenue and earnings guidance that was below consensus expectations, driven by commercial aircraft delivery timing and lower margins. Boeing has historically been conservative when issuing forward guidance, so this is not unusual. Though we continue to like the company, we believe the risk/reward profile for Boeing is less compelling and thus we felt it prudent to eliminate the position and pursue higher conviction investment opportunities. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer discretionary, energy, health care, information technology and materials increased and its allocations to consumer staples, financials, industrials and telecommunication services decreased compared to the S&P 500 Index. |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had overweighted positions relative to the S&P 500 Index in financials and consumer discretionary. On the same date, the Fund had underweighted positions compared to the S&P 500 Index in industrials, utilities, health care, and was rather neutrally weighted to the S&P 500 Index in information technology, materials, energy and consumer staples. The Fund had no position at all in telecommunication services at the end of the Reporting Period. |

19

FUND BASICS

Dynamic U.S. Equity Fund

as of February 29, 2016

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2015–February 29, 2016 | | Fund Total Return

(based on NAV)1 | | | S&P 500® Index2 | |

| | Class A | | | -7.33 | % | | | -0.92 | % |

| | Class C | | | -7.61 | | | | -0.92 | |

| | Institutional | | | -7.09 | | | | -0.92 | |

| | Class IR | | | -7.17 | | | | -0.92 | |

| | Class R | | | -7.35 | | | | -0.92 | |

| | | Class R6 | | | -7.07 | | | | -0.92 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P 500® Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| | Class A | | | -7.55 | % | | | 9.16 | % | | | 10.09 | % | | 11/30/09 |

| | Class C | | | -3.85 | | | | 9.58 | | | | 10.28 | | | 11/30/09 |

| | Institutional | | | -1.79 | | | | 10.84 | | | | 11.56 | | | 11/30/09 |

| | Class IR | | | -2.02 | | | | 10.66 | | | | 11.37 | | | 11/30/09 |

| | Class R | | | -2.41 | | | | 10.13 | | | | 10.84 | | | 11/30/09 |

| | | Class R6 | | | N/A | | | | N/A | | | | -4.31 | | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end or cumulative total returns for periods less than 1 year. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

20

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.22 | % | | | 2.81 | % |

| | Class C | | | 1.97 | | | | 3.56 | |

| | Institutional | | | 0.82 | | | | 2.42 | |

| | Class IR | | | 0.97 | | | | 2.63 | |

| | Class R | | | 1.47 | | | | 3.10 | |

| | | Class R6 | | | 0.80 | | | | 2.40 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least December 29, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 2/29/165 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | JPMorgan Chase & Co. | | | 4.7 | % | | Commercial Banks |

| | Bank of America Corp. | | | 3.8 | | | Commercial Banks |

| | EMC Corp. | | | 3.6 | | | Computers & Peripherals |

| | Amazon.com, Inc. | | | 3.4 | | | Internet & Catalog Retail |

| | Pfizer, Inc. | | | 3.4 | | | Pharmaceuticals |

| | Whole Foods Market, Inc. | | | 3.4 | | | Food & Staples Retailing |

| | Apple, Inc. | | | 3.4 | | | Computers & Peripherals |

| | Facebook, Inc. Class A | | | 3.1 | | | Internet Software & Services |

| | Allergan PLC | | | 3.0 | | | Pharmaceuticals |

| | | MasterCard, Inc. Class A | | | 3.0 | | | IT Services |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

21

FUND BASICS

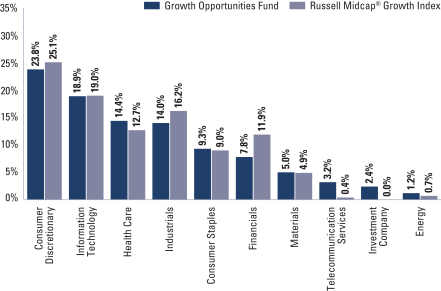

|

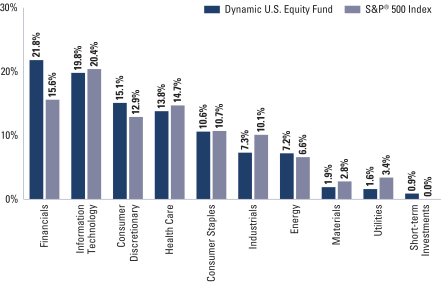

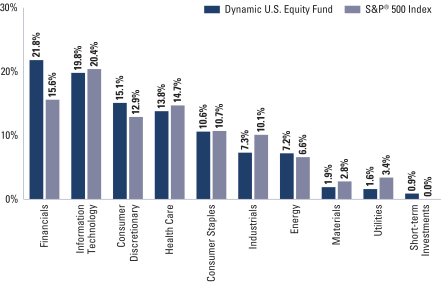

| FUND VS. BENCHMARK SECTOR ALLOCATION6 |

| As of February 29, 2016 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

22

PORTFOLIO RESULTS

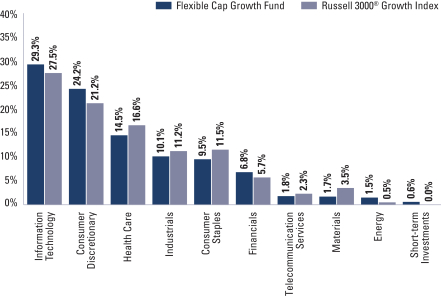

Goldman Sachs Flexible Cap Growth Fund

Portfolio Composition

The Fund invests primarily in U.S. equity investments in small-, mid- and large-capitalization issuers. Since the Fund’s inception, the Goldman Sachs Growth Equity Investment Team has focused on several key investment criteria that it believes can drive a company’s growth over the long term. These characteristics are: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management. The Team strives to purchase these companies at reasonable valuations in order to capture the full benefits of their growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Growth Equity Investment Team discusses the Goldman Sachs Flexible Cap Growth Fund’s (the “Fund”) performance and positioning for the six-month period ended February 29, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR, R and R6 Shares generated cumulative total returns, without sales charges, of -6.95%, -7.34%, -6.80%, -6.81%, -7.11% and -6.80%, respectively. These returns compare to the -2.20% cumulative total return of the Fund’s benchmark, the Russell 3000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Stock selection overall detracted from the Fund’s performance relative to the Russell Index during the Reporting Period. Sector allocation as a whole also detracted, albeit much more modestly. |

| Q | | Which equity market sectors most significantly affected Fund performance? |

| A | | The sectors that detracted most from the Fund’s relative results during the Reporting Period were information technology, consumer staples, industrials and health care, wherein stock selection proved challenging. The only sector to contribute positively to the Fund’s relative performance during the Reporting Period was financials, wherein effective stock selection drove results. |

| Q | | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | | Detracting most from the Fund’s results relative to its benchmark index were positions in home furnishing retailer Restoration Hardware Holdings, global apparel company PVH and molecular diagnostics company Cepheid. |

| | Restoration Hardware Holdings was the top detractor from the Fund’s relative performance during the Reporting Period. The company’s share price declined after it reported disappointing third quarter 2015 revenues, citing weaker performance in oil-exposed regions as the main driver. The company’s shares experienced further declines in the fourth quarter of 2015 when the company missed on its previous earnings guidance, reporting a significant decline in earnings per share year over year. Despite this recent weakness, we believed at the end of the Reporting Period that Restoration Hardware Holdings was poised for greater sales growth moving forward. We also believed the company could benefit from some of its ongoing initiatives, such as promotions and new store openings. |

| | PVH was a top detractor from the Fund’s results during the Reporting Period. Weakness in the U.S. retail environment, high promotions in the industry, and currency headwinds pressured the company’s results. Despite these concerns, which we see as short-term in nature, we believed at the end of the Reporting Period that PVH remained a leading franchise with dominant market share, strong pricing power and solid fundamentals. Particularly, established brand |

23

PORTFOLIO RESULTS

| | names Tommy Hilfiger and Calvin Klein have demonstrated international strength and have been a key source of growth. In our view, PVH was undervalued relative to its peers at the end of the Reporting Period, and we remained optimistic on what we see as the company’s significant free cash flow generation ability, quality of management and return potential. |

| | Cepheid’s release of its third quarter 2015 earnings negatively pressured its share price during the Reporting Period. Its management cited the integration and productivity implications of doubling its U.S. salesforce as the primary driver behind its earnings miss. By the end of the Reporting Period, we believed the company had more time to train and integrate its new salesforce and thus further believed the company was poised well for growth. We maintained confidence in the actions its management was taking to accelerate the company’s growth profile. In our view, Cepheid remained the dominant molecular diagnostics platform at the end of the Reporting Period. |

| Q | | What were some of the Fund’s best-performing individual stocks? |

| A | | The Fund benefited most relative to the Russell Index from positions in retail bakery café Panera Bread, data center real estate investment trust (“REIT”) Equinix and flavor food products manufacturer McCormick. |

| | Panera Bread Company was the top positive contributor to the Fund’s relative returns during the Reporting Period. The company’s share price declined early in the Reporting Period after its management decided to not provide commentary on 2016 guidance when it released its third quarter 2015 earnings. However, its share price recovered later in the Reporting Period, as fourth quarter 2015 results were released, highlighting better sales and restaurant margins. Additionally, Panera Bread guided 2016 earnings upward, which included consensus estimates at the high end of guidance. At the end of the Reporting Period, we remained positive on the company and believed store upgrades and increased marketing efforts should continue to drive traffic to a company that we believe has a strong secular opportunity in the fast-casual dining industry. |

| | Equinix was a strong contributor to the Fund’s performance during the Reporting Period. The company announced high quality results for the second and third quarters of 2015, as secular growth in enterprise spending helped drive organic revenue growth and bookings to record levels. Also, solid performance in all regions in which the REIT operates led Equinix to raise guidance across key metrics during the Reporting Period, which was well received by the markets. In our view, Equinix continued at the end of the Reporting Period to present a favorable outlook, as pricing has been net positive in the low churn rate, or turnover, environment. Going forward, we believe Equinix may further benefit from its recurring revenue business model, steady demand environment, and integration of recent acquisitions that could unlock significant synergies. |

| | Shares of McCormick rose, as the company benefited from strong fourth quarter 2015 results, with earnings coming in slightly above consensus estimates. According to the company management, the positive results were driven by a broad improvement in organic growth across its consumer and industrial businesses. At the end of the Reporting Period, we were encouraged by the better earnings visibility and improving momentum in McCormick’s consumer business. We believed the company might benefit from the secular growth in healthy cooking and the stabilization of private label competitors across many of its core spice categories. We further believed the company had the ability to continue to unlock growth given its global expansion efforts and product popularity. Finally, in our view, McCormick is led by a quality management team, which is capable of producing strong results moving forward. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

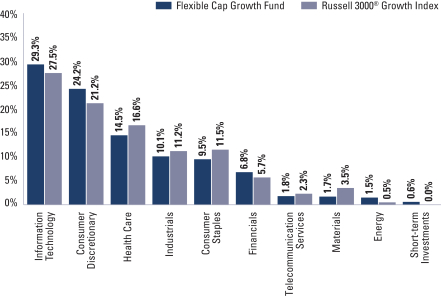

| Q | | Did the Fund make any significant purchases or sales during the Reporting Period? |