UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: March 31, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | March 31, 2016 |

| | |

| | | | Single Sector Fixed Income Funds |

| | | | Dynamic Emerging Markets Debt |

| | | | Emerging Markets Debt |

| | | | High Yield |

| | | | High Yield Floating Rate |

| | | | Investment Grade Credit |

| | | | Local Emerging Markets Debt |

| | | | U.S. Mortgages |

Goldman Sachs Single Sector Fixed Income Funds

| n | | DYNAMIC EMERGING MARKETS DEBT |

| n | | HIGH YIELD FLOATING RATE |

| n | | INVESTMENT GRADE CREDIT |

| n | | LOCAL EMERGING MARKETS DEBT |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Investment Process | | | 1 | |

| |

Market Review | | | 2 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 4 | |

| |

Schedules of Investments | | | 50 | |

| |

Financial Statements | | | 128 | |

| |

Financial Highlights | | | 136 | |

| |

Notes to the Financial Statements | | | 150 | |

| |

Report of Independent Registered Public Accounting Firm | | | 190 | |

| |

Other Information | | | 191 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS SINGLE SECTOR FIXED INCOME FUNDS

What Differentiates the Goldman Sachs Asset Management Fixed Income Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our fixed income investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

A key element of our fixed income investment philosophy is to evaluate the broadest global opportunity set to capture relative value across sectors and instruments. Our globally integrated investment process involves managing dynamically along the risk/return spectrum, as we continue to develop value-added strategies through:

| n | | Assess relative value among securities and sectors |

| n | | Leverage the vast resources of GSAM in selecting securities for each portfolio |

| n | | Team approach to decision making |

| n | | Manage risk by avoiding significant sector and interest rate bets |

| n | | Careful management of yield curve strategies — while closely managing portfolio duration |

Fixed Income portfolios that:

| | n | | Include domestic and global investment options, income opportunities, and access to areas of specialization such as high yield | |

| | n | | Capitalize on GSAM’s industry-renowned credit research capabilities | |

| | n | | Use a risk-managed framework to seek total return, recognizing the importance of investors’ capital accumulation goals as well as their need for income | |

1

MARKET REVIEW

Goldman Sachs Single Sector Fixed Income Funds

Market Review

Shifting expectations about global economic growth, central bank monetary policy and commodities prices influenced the performance of the global fixed income markets during the 12 months ended March 31, 2016 (the “Reporting Period”).

When the Reporting Period began in April 2015, the performance of spread, or non-government bond, sectors was mixed. U.S. Treasury yields rose as U.S. economic data improved, including positive surprises in inflation and retail sales. First quarter 2015 U.S. Gross Domestic Product (“GDP”) was revised upwards from -0.7% to a seasonally adjusted annualized rate of -0.2%. The upward revision stemmed in part from stronger than estimated consumer spending and inventory data. U.S. dollar gains hit a roadblock during the second calendar quarter on uncertainty around the Federal Reserve’s (the “Fed”) plans for raising interest rates in 2015. The Eurozone’s economic progress took a back seat to the seemingly intractable challenges surrounding Greece.

In the third quarter of 2015, spread sectors underperformed U.S. Treasuries as the outlook for the global economy grew cloudy. Investors focused on slowing economic growth in China, the devaluation of the Chinese renminbi and an unexpected increase in market volatility. Oil and commodities prices dropped to new lows, partly because of falling demand from China. The U.S. dollar appreciated modestly during the third calendar quarter on cautious optimism that the Fed was on track to raise rates in 2015. However, the Fed chose to leave rates unchanged at its September 2015 policy meeting, citing conditions in the global economy. Although the U.S. economy continued to improve, economic growth in other developed countries softened, and emerging markets economies broadly weakened. Despite accommodative monetary policies by many global central banks, inflation remained subdued in the world’s major economies.

In the fourth quarter of 2015, spread sectors generated positive returns. Outside the U.S., the global monetary policy environment remained highly accommodative, with the European Central Bank (“ECB”) lowering interest rates into negative territory and expanding its stimulus program. The U.S. dollar gained on expectations the Fed would hike interest rates, which it did at its December 2015 policy meeting. During the fourth calendar quarter, the U.S. economy continued to display a positive growth trend, but economic growth in other developed countries had softened by the end of 2015. At the same time, growth in emerging markets countries broadly weakened, largely due to commodity price declines and concerns about the slowing Chinese economy.

The first quarter of 2016 was very much a tale of two halves. Spread sectors sold off significantly from January to mid-February 2016 and then largely retraced their losses by the end of March 2016. Volatility early in the first calendar quarter was driven by an increase in a number of perceived risks, such as slowing Chinese economic activity, the possibility of persistent oil oversupply, and deteriorating corporate bond fundamentals as the U.S. credit cycle entered its later stage. Some of these risks eased in the second half of the first calendar quarter, as economic news from China improved, U.S. oil production showed signs of slowing, and commodity prices appeared to stabilize. Global central banks remained accommodative. The Bank of Japan, in a surprise move at its January 2016 policy meeting, introduced a -0.1% interest rate, reaffirming its commitment to achieving a 2% inflation target. The ECB shifted its focus from currency depreciation to credit creation by leaving the deposit rate unchanged, expanding its asset purchase program to include purchases of non-financial corporate credit and announcing a new series of easing measures in the form of targeted

2

MARKET REVIEW

long-term refinancing operations (“TLTRO II”). (TLTRO II is designed to offer attractive long-term funding conditions to Eurozone banks to further ease private sector credit conditions and to stimulate credit creation.) In the U.S., Fed statements during March 2016 suggested U.S. interest rates would remain lower for longer than previously expected. After a sustained period of appreciation, the U.S. dollar weakened during the first calendar quarter due to generally tighter financial conditions, mixed U.S. economic data and the Fed’s more dovish commentary. (Dovish commentary tends to imply lower interest rates.)

For the Reporting Period overall, sovereign emerging markets debt and asset-backed securities slightly outperformed U.S Treasuries. Mortgage-backed securities and commercial mortgage-backed securities generally performed in line with U.S. Treasuries, while investment grade corporate bonds and agencies underperformed. High yield corporate bonds significantly underperformed Treasuries. The U.S. Treasury yield curve, or spectrum of maturities, flattened during the Reporting Period. Both short-term and long-term yields rose during the Reporting Period, but long-term yields rose less. Intermediate-term U.S. Treasury yields actually declined modestly, with the yield on the bellwether 10-year U.S. Treasury declining approximately 15 basis points to end the Reporting Period at 1.77%. (A basis point is 1/100th of a percentage point.)

Looking Ahead

At the end of the Reporting Period, we expected a continuation of trends seen in the early months of 2016: 1) modest global economic growth; 2) extreme monetary policy measures helping to support gradual economic improvement in Europe and Japan; and 3) a backdrop of rising U.S. inflation, rising debt in China and unpredictable politics globally.

Overall, we believe global economic growth may be stuck in low gear. After a modestly stronger year for the U.S., Europe and Japan in 2015, we expect some softening in 2016. In terms of monetary policy, we believe the economic benefits of negative interest rates in Europe and Japan and a strong U.S. dollar are questionable, and investors appear increasingly focused on the potential negatives. Indeed, we see the ECB’s policy decision in March 2016 as shifting its emphasis away from negative rates and currency depreciation and toward stimulating domestic demand through the credit channel. In Japan, the corporate bond market is relatively small and government bond purchases are already at what we consider to be extreme levels, which we believe could limit the Bank of Japan’s options. As a result, we think further rate cuts are possible. In the U.S., the Fed has adjusted its approach, reducing the number of projected interest rate hikes in 2016 from four to two, while emphasizing risks from soft global economic growth and continued strength of the U.S. dollar. In terms of the emerging markets, we believe they remain broadly at risk from developments in China.

At the end of the Reporting Period, we considered the environment positive for selective exposure to corporate bonds, emerging markets debt and other higher yielding sectors of the fixed income market. At the same time, however, the volatility in the first quarter of 2016 reaffirmed our sense that markets are fragile and longer-term risks are growing. As a result, we remained biased to staying nimble overall with an emphasis on higher credit quality.

3

PORTFOLIO RESULTS

Goldman Sachs Dynamic Emerging Markets Debt Fund

Investment Objective

The Fund seeks a high level of total return consisting of income and capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Fixed Income Investment Management Team discusses the Goldman Sachs Dynamic Emerging Markets Debt Fund’s (the “Fund”) performance and positioning for the 12-month period ended March 31, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated average annual total returns, without sales charges, of 0.15%, -0.70%, 0.39%, 0.29% and -0.20%, respectively. These returns compare to the 0.99% average annual total return of the Fund’s benchmark, the Dynamic Emerging Markets Debt Fund Composite Index (the “Index”), which is comprised 50% of the J.P. Morgan Government Bond Index — Emerging Markets (GBI-EMSM) Global Diversified Index (Gross, USD, Unhedged), 25% of the J.P. Morgan Emerging Markets Bond Index (EMBISM) Global Diversified Index (Gross, USD, Unhedged) and 25% of the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBISM) Broad Diversified Index (Gross, USD, Unhedged) during the same time period. The components of the Fund’s blended benchmark, the J.P. Morgan GBI-EMSM Global Diversified Index, J.P. Morgan EMBISM Global Diversified Index and J.P. Morgan CEMBISM Broad Diversified Index, generated average annual total returns of -1.65%, 4.18% and 2.80%, respectively, during the Reporting Period. |

| Q | | What economic and market factors most influenced emerging markets debt as a whole during the Reporting Period? |

| A | | When the Reporting Period began during the second quarter of 2015, external emerging markets debt (i.e., bonds issued by emerging markets countries that are denominated in U.S. dollars or in another developed markets currency) recorded a small decline, with Argentina, Uruguay and Peru posting the weakest results in the J.P. Morgan EMBISM Global Diversified Index. External emerging markets debt also retreated during the third calendar quarter, led by declines in Ecuador, Zambia and Iraq. In the fourth calendar quarter, external emerging markets debt posted a modest gain, with Venezuela, Argentina and Ecuador generating the strongest results. External emerging markets debt again recorded positive returns during the first quarter of 2016, with leading contributions made by Ecuador, Brazil and Kenya. For the Reporting Period overall, external emerging markets debt, as represented by the J.P. Morgan EMBISM Global Diversified Index, returned 4.18%. Sovereign spreads (that is, the difference in yields between external emerging markets debt and U.S. Treasuries) widened by approximately 40 basis points to close the Reporting Period 409 basis points wider than U.S. Treasury securities. (A basis point is 1/100th of a percentage point.) |

| | Local emerging markets debt (i.e., bonds issued by emerging markets countries that are denominated in the local currency) recorded a small decline during the second quarter of 2015, with losses driven by changes in local interest rates that were partially offset by modest currency appreciation. In the third calendar quarter, local emerging markets debt declined significantly, pressured by currency depreciation versus the U.S. dollar and, to a lesser extent, by changes in local interest rates. Local emerging markets debt ended the fourth quarter of 2015 relatively flat, with results divided rather evenly between changes in local interest rates and currency depreciation versus the U.S. dollar. In the first quarter of 2016, local emerging markets debt generated positive returns, driven primarily by currency appreciation versus the U.S. dollar and, to a lesser extent, by changes in local interest rates. For the Reporting Period overall, local emerging markets debt, as represented by the J.P. Morgan GBI-EMSM Global Diversified Index, posted a return of -1.65%. |

| | Corporate emerging markets debt, as represented by the J.P. Morgan CEMBISM Broad Diversified Index, advanced during the Reporting Period, generating a return of 2.80%. Corporate spreads (that is, the difference in yields between corporate emerging markets debt and U.S. Treasuries) widened by approximately 49 basis points to close the |

4

PORTFOLIO RESULTS

| | Reporting Period 420 basis points wider than U.S. Treasury securities. The emerging markets corporate bond sector saw approximately $212 billion of gross new issuance during the Reporting Period, of which approximately $47 billion was issued between the beginning of 2016 and the end of the Reporting Period.1 Meanwhile, J.P. Morgan revised its global emerging markets corporate default rate forecast from 5.4% in March 2015 to 3.5% in March 2016. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s currency selection detracted from relative performance. |

| | Sector positioning and issue selection among emerging markets corporate bonds added to relative returns. Country and issue selection among external emerging markets debt also contributed positively during the Reporting Period. In addition, country and issue selection among local emerging markets bonds positively impacted results. |

| Q | | Which segments of emerging markets debt most significantly affected Fund performance? |

| A | | During the Reporting Period, the Fund’s long position in the Mexican peso (accomplished through the use of forward foreign currency exchange contracts) detracted from relative performance. The Mexican peso depreciated against the U.S. dollar amid overall emerging markets currency weakness. We believe Mexico remains closely tied to the U.S. economy and may therefore benefit should U.S. economic growth continue to improve. |

| | The Fund was also hurt by an underweight position in Hungarian local debt during the Reporting Period. Despite relatively strong economic growth and a tight labor market, Hungary’s central bank cut its main policy interest rate by 15 basis points to 1.20% in March 2016. At the end of the Reporting Period, the Fund maintained a moderate underweight in Hungarian local rates as we believe inflation may pick up in the coming months given the economy is growing faster than market expectations. |

| | Conversely, the Fund’s position in Brazilian local interest rates (accomplished mainly through inflation-linked bonds) added to relative performance during the Reporting Period. Brazilian bonds rallied in early 2016 on the back of a potential change in its government and the prospects of more market friendly leadership. The Fund also benefited from its underweights in the Chinese renminbi and South Korean won (accomplished through the use of forward foreign currency exchange contracts) as fears about China’s slowing economic growth pressured the currencies of many Southeast Asian countries. In addition, Fund performance was helped by an overweight position in Venezuelan external bonds, positioning that we adopted because of valuations. In our view, Venezuelan external debt had been pressured by low oil prices, and the market had priced in a high probability of default. We believed these assets had the potential of a strong recovery, and we considered their potential return attractive. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | The Fund’s U.S. duration and yield curve positioning did not have a meaningful impact on relative returns during the Reporting Period. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates a spectrum of maturities. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund invested in U.S. Treasury futures, Eurodollar futures, forward foreign currency exchange contracts, interest rate swaps, total return swaps, credit default swaps, cross currency swaps, non-deliverable currency forwards and structured notes. U.S. Treasury futures were used to manage U.S. interest rate duration. Eurodollar futures were used to express our views on the direction of interest rates and to facilitate specific duration and yield curve strategies. Eurodollar futures are contracts that have underlying assets linked to time deposits denominated in U.S. dollars at banks outside the U.S. Forward foreign currency exchange contracts were used for hedging purposes or to express a positive view on a given currency. Interest rate swaps were used to express our views on the direction of a country’s interest rates. Cross-currency swaps were employed to express relative value views on given currencies as well as our views on the direction of a country’s interest rates. Credit default swaps were used to implement specific credit-related investment strategies. Total return swaps and structured notes were used in place of buying a local currency denominated bond when a particular market was otherwise inaccessible or as a more efficient means of gaining access to a local market. Non-deliverable currency forwards were used to gain exposure to a particular country and also to take advantage of relative value opportunities. Derivatives may be used in combination with cash securities to implement our views in the Fund. |

5

PORTFOLIO RESULTS

| | During the Reporting Period, we used credit default swaps to gain exposure to Chinese external debt, which slightly detracted from performance. The Fund’s use of forward foreign currency exchange contracts to take a long position in the Mexican peso also had a negative impact on the Fund’s performance during the Reporting Period. |

| | Contributing positively to the Fund’s results was its use of interest rate swaps, which we used along with sovereign local bonds to obtain exposure to Brazil. Additionally, the Fund’s positioning in the Brazilian real and Taiwan dollar, implemented via forward foreign exchange contracts, added to the Fund’s performance. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | During the Reporting Period, we slightly increased the Fund’s already overweight position in the Dominican Republic’s external debt. We held an overweight position relative to the Index because of low government debt/Gross Domestic Product (“GDP”) levels and the country’s improving fiscal balance. In our opinion, the Dominican Republic’s current account has improved dramatically on the back of lower oil prices, higher remittances, a pickup in tourism revenue and stronger exports to the U.S. We also increased the Fund’s overweight in Colombian external bonds, which we believed were trading at relatively cheap levels, and its overweight in Colombian local interest rates because of our positive view of the country’s strong policy framework, which includes a structural fiscal balance rule and an inflation targeting regime. In addition, during the Reporting Period, we decreased the size of the Fund’s overweight compared to the Index in Thai local interest rates, shifting it from a large overweight to a smaller overweight position, even as overall inflation remained low. In our view, Thailand’s current account has benefited from the low oil price environment and a moderate recovery in the Thai economy, supported by somewhat improved fiscal spending and increased numbers of tourists during the Reporting Period. Also, we reduced the size of the Fund’s overweight in Costa Rican external debt given the country’s lack of fiscal adjustment. (A fiscal adjustment is a reduction in the government’s primary budget deficit. It can result from a reduction in government expenditures, an increase in tax revenues or both.) We increased the Fund’s underweight in Turkish local interest rates, as ongoing political uncertainties could delay the execution of economic policies aimed at reducing external vulnerabilities. During the Reporting Period, we increased the Fund’s underweight in China (implemented via a credit default swap) as a hedge against broader concerns about China’s shadow banking system, non-performing loans, slowdown in economic growth and potential policy mistakes. Our rationale also includes challenging fiscal and debt dynamics, erosion of foreign exchange reserves and increasing corporate leverage. Additionally, during the Reporting Period, we increased the Fund’s short positions in Asian currencies, as we continue to believe that stagnating economic growth in China may well cause continued weakness in Asian foreign exchange markets. We increased exposure to the Russian ruble. After tactically trading the Russian ruble early in the Reporting Period, we started increasing exposure in September 2015. We believe the Russian ruble looks relatively inexpensive based on a number of variables, such as its real effective exchange rate, Russia’s improving current account and diminished investment outflows. We also believe that geopolitical risks, which had previously been a concern, have begun to ease. (The real effective exchange rate is the weighted average of a country’s currency relative to a basket of other major currencies adjusted for the effects of inflation. The weights are determined by comparing the relative trade balances, in terms of one country’s currency, with each other country.) |

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was overweight relative to the Index in Dominican Republic external debt, as the government has implemented significant fiscal reforms and reduced the fiscal deficit. We believe lower energy prices should further benefit the country’s current account. The Fund was also overweight Colombian external bonds. In addition, at the end of the Reporting Period, the Fund was underweight compared to the Index in Turkish external debt, as geopolitics and domestic politics continue to cloud Turkey’s outlook. Ongoing political uncertainties could delay the execution of economic policies aimed at reducing external vulnerabilities, improving the investment climate and reactivating economic growth. |

| | The Fund held a large overweight relative to the Index in Brazilian local interest rates, and we continued to look for value in long-dated inflation-linked debt. In addition, the Fund was overweight Polish local interest rates, as core inflation continued to trend downward, opening the door for potential easing by the country’s central bank. The Fund was underweight compared to the Index in Malaysian local interest rates based on our concerns about depleting reserves, deterioration in the trade balance and challenging political |

6

PORTFOLIO RESULTS

| | dynamics. At the end of the Reporting Period, the Fund maintained a moderate underweight in Hungarian local interest rates as we believe inflation will pick up in the coming months given the economy is growing above potential. |

| | In terms of corporate bonds, the Fund held selective overweights in companies with what we considered to be solid balance sheets. Overall, we favored defensive non-cyclical companies, such as bottlers and certain telecommunications companies, which have comparable spreads to cyclical names that we view as riskier. The Fund also had overweight positions relative to the Index in certain utilities companies, which we consider defensive in nature and that typically generate strong, stable cash flows. In addition, the Fund was underweight in financial services companies based on our concerns about their limited disclosure regarding balance sheet asset quality, funding risks when banks rely on the wholesale funding markets as well as macro risks. |

| | In terms of currencies, we maintained the Fund’s exposure to emerging market currencies, with the Fund’s largest long position held in the Mexico peso and its largest short position held in the Chinese renminbi. We remain negative on the macroeconomic outlook of China, and specifically the country’s growth trajectory and outflows. At the end of Reporting Period, we also had a negative outlook on Southeast Asian currencies, such as the New Taiwan dollar, which stand to suffer from slowing economic growth in China given that their business models are built around Chinese demand. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | The global macroeconomic environment remained challenging at the end of the Reporting Period, but we think it is more positive for external emerging markets debt than market sentiment suggests. The external debt markets weakened amid the 2015 commodities slump, China’s economic slowdown, U.S. dollar strengthening and concerns around Fed policy tightening. However, at the end of the Reporting Period, we believed valuations had stabilized and the asset class was likely to provide investors with adequate compensation for the potential challenges ahead. In addition, we do not expect significant deterioration in external bond valuations if the Fed raises rates during 2016, given that the Fed has been telegraphing its intentions. As for oil prices, while weakness may persist in the near term, we expect prices to find a better balance in late 2016. Overall, we believe external emerging markets debt will be a “bond picker’s market” throughout 2016 with returns dispersed amongst countries. In our view, it will be important to identify the prospective winners and losers stemming from the decline in commodity prices, to recognize which markets may benefit from structural changes in China and to find the potential beneficiaries of an improving U.S. economy. We believe positive returns are likely to come from finding those countries that have been mispriced by the market and by focusing on what we consider to be “hotspots” in the emerging markets, such as Brazil and Turkey. |

| | In terms of local emerging markets debt at the end of the Reporting Period, we believed China concerns and oil prices, along with geopolitics, would likely be key performance drivers in the near term. Although these clouds continue to hang over the emerging markets, we did not see signs of a crisis on the horizon. Indeed, we believed at the end of the Reporting Period that 2016 would be the year when emerging markets growth and emerging markets currencies stabilized. We do not anticipate a rapid rebound or a V-shaped recovery. Rather, we expect local emerging markets debt may turn the corner after three consecutive years of declining valuations and downward growth projections. The risks to our view at the end of the Reporting Period included policy mistakes, populism, depletion of reserves and the impact of interest rate hikes on struggling emerging markets economies, should their central banks choose to follow the Fed’s example. Broadly speaking, we believe local emerging markets debt may well become an attractive investment in 2016. Nevertheless, we expect to see continued idiosyncratic challenges in countries such as Brazil. Hence, having a longer-term investment horizon is, in our view, key, as we cannot rule out further negative headlines and market volatility. We plan to continue our discerning approach, focusing on identifying countries that remain mispriced, as we think local emerging markets debt valuations have stabilized in many cases and should be able to provide adequate compensation for potential challenges in the near term. |

| | We continued to have a cautious outlook on emerging markets corporate bonds given challenging operating conditions, including low commodities prices and currency fluctuations. That said, we continued to see opportunities and have a positive view on emerging markets companies with less leverage and more attractive valuations than comparable developed market companies. In our view, the corporate balance sheets of numerous emerging markets issuers remain solid, with limited near-term rollover needs, though liquidity in emerging markets corporate debt has generally been below that of emerging markets sovereign debt. |

7

FUND BASICS

Dynamic Emerging Markets Debt Fund

as of March 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015–

March 31, 2016 | | Fund Total

Return

(based

on NAV)1 | | | Dynamic Emerging Markets Debt Fund Composite Index2 | | | J.P. Morgan

GBI-EMSM

Global

Diversified

Index3 | | | J.P. Morgan

EMBISM

Global

Diversified

Index4 | | | J.P. Morgan

CEMBISM

Broad

Diversified

Index5 | | | 30-Day

Standardized

Subsidized

Yield6 | | | 30-Day

Standardized Unsubsidized

Yield6 | |

| | Class A | | | 0.15 | % | | | 0.99 | % | | | -1.65 | % | | | 4.18 | % | | | 2.80 | % | | | 4.56 | % | | | 3.22 | % |

| | Class C | | | -0.70 | | | | 0.99 | | | | -1.65 | | | | 4.18 | | | | 2.80 | | | | 3.98 | | | | 2.59 | |

| | Institutional | | | 0.39 | | | | 0.99 | | | | -1.65 | | | | 4.18 | | | | 2.80 | | | | 5.12 | | | | 3.71 | |

| | Class IR | | | 0.29 | | | | 0.99 | | | | -1.65 | | | | 4.18 | | | | 2.80 | | | | 4.93 | | | | 3.54 | |

| | | Class R | | | -0.20 | | | | 0.99 | | | | -1.65 | | | | 4.18 | | | | 2.80 | | | | 4.43 | | | | 3.03 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Dynamic Emerging Markets Debt Fund Composite Index is a composite of the J.P. Morgan Government Bond Index — Emerging Markets (GBI-EMSM) Global Diversified Index (Gross USD, Unhedged) (50%), the J.P. Morgan Emerging Markets Bond Index (EMBISM) Global Diversified Index (Gross, USD, Unhedged) (25%), and the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBISM) Broad Diversified Index (Gross, USD, Unhedged) (25%). |

| | 3 | | The J.P. Morgan GBI-EMSM Global Diversified Index (with dividends reinvested) is an unmanaged index of debt instruments of 16 emerging countries. The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 4 | | The J.P. Morgan EMBISM Global Diversified Index is an unmanaged index of debt instruments of 50 emerging countries. The index figures do not reflect any deduction for fees or taxes. It is not possible to invest directly in an index. |

| | 5 | | The J.P. Morgan CEMBISM Broad Diversified Index tracks total returns of U.S. dollar-denominated debt instruments issued by corporate entities in emerging markets countries. The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 6 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

8

FUND BASICS

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS7 |

| | | For the period ended 3/31/16 | | One Year | | | Since Inception | | | Inception Date |

| | Class A | | | -4.29 | % | | | -4.16 | % | | 5/31/13 |

| | Class C | | | -1.69 | | | | -3.24 | | | 5/31/13 |

| | Institutional | | | 0.39 | | | | -2.19 | | | 5/31/13 |

| | Class IR | | | 0.29 | | | | -2.38 | | | 5/31/13 |

| | | Class R | | | -0.20 | | | | -2.76 | | | 5/31/13 |

| | 7 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 4.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund will charge a 2% redemption fee on the redemption of shares (including by exchange) held for 30 calendar days or less. The performance figures do not reflect the deduction of the redemption fee. If reflected, the redemption fee would reduce the performance quoted. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS8 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.24 | % | | | 3.45 | % |

| | Class C | | | 1.99 | | | | 3.66 | |

| | Institutional | | | 0.90 | | | | 2.57 | |

| | Class IR | | | 1.00 | | | | 2.77 | |

| | | Class R | | | 1.49 | | | | 3.27 | |

| | 8 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

9

FUND BASICS

| | | | | | | | | | |

| | TOP TEN COUNTRY ALLOCATION9 | |

| | | | | Percentage of Net Assets | |

| | | | | as of 3/31/16 | | | as of 3/31/15 | |

| | Mexico | | | 11.5 | % | | | 10.4 | % |

| | Brazil | | | 8.1 | | | | 7.9 | |

| | Poland | | | 8.0 | | | | 2.3 | |

| | Colombia | | | 7.3 | | | | 4.2 | |

| | Indonesia | | | 7.0 | | | | 6.2 | |

| | United States | | | 5.5 | | | | 5.9 | |

| | South Africa | | | 4.6 | | | | 2.6 | |

| | Russia | | | 4.5 | | | | 2.5 | |

| | Dominican Republic | | | 3.6 | | | | 3.4 | |

| | Turkey | | | 3.4 | | | | 6.4 | |

| | | Other | | | 36.4 | | | | 51.6 | |

| | 9 | | The percentage shown for each investment category reflects the value of investments in that country as a percentage of net assets. The table does not include repurchase agreements of 6.6% as of 3/31/16 and 9.8% as of 3/31/15. The table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

10

GOLDMAN SACHS DYNAMIC EMERGING MARKETS DEBT FUND

Performance Summary

March 31, 2016

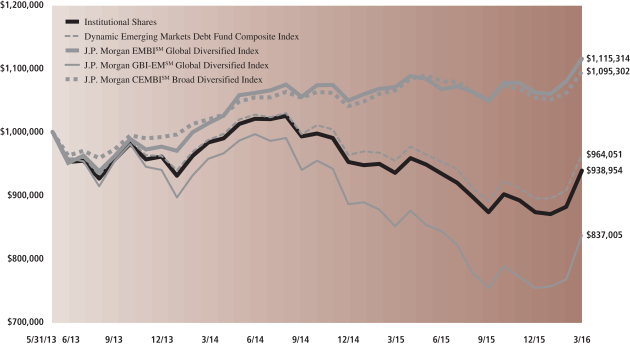

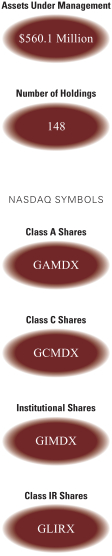

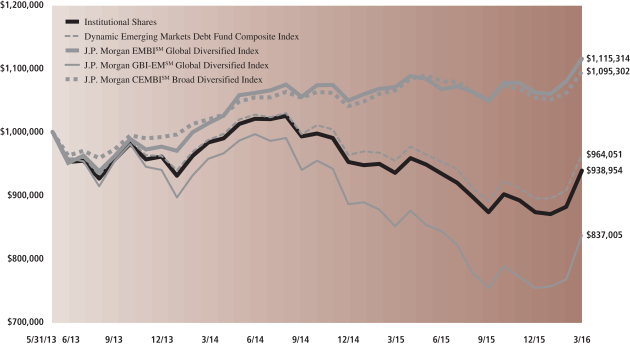

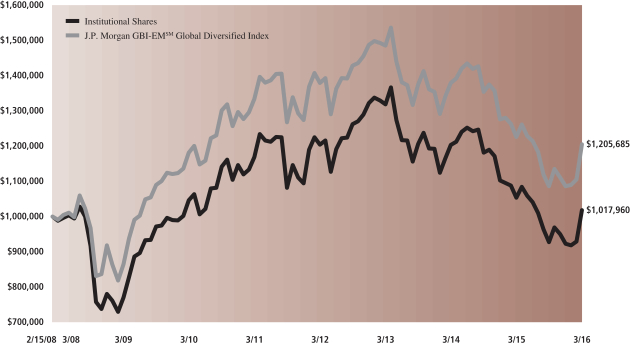

The following graph shows the value, as of March 31, 2016, of a $1,000,000 investment made on May 31, 2013 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Dynamic Emerging Markets Debt Fund Composite Index, which is comprised of J.P. Morgan EMBISM Global Diversified Index, J.P. Morgan GBI-EMSM Global Diversified Index and J.P. Morgan CEMBISM Broad Diversified Index. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of Class A, Class C, Class IR and Class R Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decisions regarding issuer/industry/country investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Dynamic Emerging Markets Debt Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from May 31, 2013 through March 31, 2016.

| | | | | | |

| Average Annual Total Return through March 31, 2016 | | | One Year | | | Since Inception |

Class A (Commenced May 31, 2013) | | | | | | |

Excluding sales charges | | | 0.15% | | | -2.60% |

Including sales charges | | | -4.29% | | | -4.16% |

|

Class C (Commenced May 31, 2013) | | | | | | |

Excluding contingent deferred sales charges | | | -0.70% | | | -3.24% |

Including contingent deferred sales charges | | | -1.69% | | | -3.24% |

|

Institutional (Commenced May 31, 2013) | | | 0.39% | | | -2.19% |

|

Class IR (Commenced May 31, 2013) | | | 0.29% | | | -2.38% |

|

Class R (Commenced May 31, 2013) | | | -0.20% | | | -2.76% |

|

11

PORTFOLIO RESULTS

Goldman Sachs Emerging Markets Debt Fund

Investment Objective

The Fund seeks a high level of total return consisting of income and capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Fixed Income Investment Management Team discusses the Goldman Sachs Emerging Markets Debt Fund’s (the “Fund”) performance and positioning for the 12-month period ended March 31, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated average annual total returns, without sales charges, of 4.43%, 3.57%, 4.70% and 4.60%, respectively. These returns compare to the 4.18% average annual total return of the Fund’s benchmark, the J.P. Morgan Emerging Markets Bond Index (EMBISM) Global Diversified Index (Gross, USD, Unhedged) (the “Index”), during the same time period. |

| | During the period since their inception on July 31, 2015 through March 31, 2016, the Fund’s Class R6 Shares generated a cumulative total return, without sales charges, of 4.41% compared to the 4.03% cumulative total return of the Index. |

| Q | | What economic and market factors most influenced emerging markets debt as a whole during the Reporting Period? |

| A | | When the Reporting Period began during the second quarter of 2015, external emerging markets debt recorded a small decline, with Argentina, Uruguay and Peru posting the weakest results in the J.P. Morgan EMBISM Global Diversified Index. External emerging markets debt also retreated during the third calendar quarter, led by declines in Ecuador, Zambia and Iraq. In the fourth calendar quarter, external emerging markets debt posted a modest gain, with Venezuela, Argentina and Ecuador generating the strongest results. External emerging markets debt again recorded positive returns during the first quarter of 2016, with leading contributions made by Ecuador, Brazil and Kenya. |

| | For the Reporting Period overall, external emerging markets debt, as represented by the Index, returned 4.18%. Sovereign spreads (that is, the difference in yields between external emerging markets debt and U.S. Treasuries) widened by approximately 40 basis points to close the Reporting Period 409 basis points wider than U.S. Treasury securities. (A basis point is 1/100th of a percentage point.) The weakest performing emerging external debt markets during the Reporting Period, as represented by the Index, were (in U.S. dollar terms1) Belize (-26.86%), Zambia (-13.29%) and Iraq (-9.50%). The top performing emerging external debt markets were Ukraine (+108.40%), Belarus (+22.42%) and Venezuela (+22.26%). |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund benefited from country and issue selection of external emerging markets bonds. Issue selection among emerging markets corporate bonds also added to relative returns. In addition, the Fund’s performance was enhanced by sector positioning in external emerging markets debt and emerging markets corporate bonds. |

| | Conversely, the Fund was hurt by our active currency management through which the Fund takes positions in local currencies (accomplished through the use of forward foreign currency exchange contracts as well as bonds denominated in local currencies). Our U.S. duration and yield curve strategy also detracted from relative results. Duration is a measure of the Fund’s sensitivity to changes in interest rates. Yield curve indicates a spectrum of maturities. |

| Q | | Which segments of emerging markets debt most significantly affected Fund performance? |

| A | | During the Reporting Period, the Fund benefited from its tactical trading of Venezuelan external debt. While we remain concerned about the country’s deteriorating |

| 1 | | All regional and market returns are in U.S. dollar terms (unless otherwise specified), are based on country-specific stock market indices and reflect the reinvestment of any dividends if applicable. |

12

PORTFOLIO RESULTS

| | fundamentals, we took advantage of what we considered to be attractive opportunities to add to the Fund’s overweight position relative to the Index. |

| | A long position in the Mexican peso (accomplished through the use of forward foreign currency exchange contracts) detracted from relative performance during the Reporting Period. The Mexican peso depreciated against the U.S. dollar amid overall emerging markets currency weakness. We believe that Mexico remains closely tied to the U.S. economy and may therefore benefit should U.S. economic growth continue to improve. In addition, the Fund was hurt by its overweight in Sri Lankan external debt. The overweight was driven by a number of factors, including that Sri Lanka has been a beneficiary of lower oil prices (oil is one third of the country’s imports). In addition, our growth outlook was positive as Sri Lanka’s economy improved and its government invested in infrastructure. That said, during the Reporting Period, the Sri Lankan financial minister revised the fiscal deficit higher. The International Monetary Fund has warned the country that it should have tighter monetary and fiscal policies, and it called during the Reporting Period for structural reforms to support economic stability. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | The Fund’s U.S. duration and yield curve positioning detracted from relative returns. For most of the Reporting Period, we tactically shifted the Fund’s duration position on the U.S. Treasury yield curve between a slightly long duration position to a slightly short position, ending the Reporting Period with a slightly short duration position. We made these tactical shifts because we believed the Federal Reserve (the “Fed”) might be inclined to hike interest rates in the near term because of strong U.S. economic data. However, after a single rate increase in December 2015, the Fed maintained a dovish stance amid volatility in the global financial markets. (A dovish stance tends to imply a commitment to lower interest rates.) |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund invested in U.S. Treasury futures, Eurodollar futures, forward foreign currency exchange contracts, interest rate swaps, credit default swaps, non-deliverable currency forwards and structured notes. U.S. Treasury futures were used to manage U.S. interest rate duration. Eurodollar futures were used to express our views on the direction of interest rates and to facilitate specific duration and yield curve strategies. Eurodollar futures are contracts that have underlying assets linked to time deposits denominated in U.S. dollars at banks outside the U.S. Forward foreign currency exchange contracts were used for hedging purposes or to express a positive view on a given currency. Interest rate swaps were used to express our views on the direction of a country’s interest rates. Credit default swaps and structured notes were used in place of buying a local currency denominated bond when a particular market was otherwise inaccessible or as a more efficient means of gaining access to a local market. Non-deliverable currency forwards were used to gain exposure to a particular country. Derivatives may be used in combination with cash securities to implement our views in the Fund. |

| | During the Reporting Period, we used credit default swaps to gain exposure to Chinese external debt, which slightly detracted from performance. In addition, the Fund’s use of forward foreign currency exchange contracts to take a long position in the Mexican peso had a negative impact on the Fund’s performance during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | During the Reporting Period, we shifted the Fund from an underweight relative to the Index in Colombian external debt to an overweight position. In addition, we increased the Fund’s underweight compared to the Index in Peruvian external debt. Also, given Costa Rica’s lack of fiscal adjustment, we reduced the size of the Fund’s overweight in Costa Rican external debt. (A fiscal adjustment is a reduction in the government’s primary budget deficit. It can result from a reduction in government expenditures, an increase in tax revenues or both.) We increased the Fund’s overweight in Hungarian external debt, which appeared to us to be attractive on a relative basis. During the Reporting Period, we increased the Fund’s underweight in Chinese external debt (implemented via a credit default swap) relative to the Index. This positioning is a hedge against broader concerns about China’s shadow banking system, non-performing loans, slowdown in economic growth and potential policy mistakes. Our rationale also includes challenging fiscal and debt dynamics, erosion of foreign exchange reserves and increasing corporate leverage. |

13

PORTFOLIO RESULTS

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, against the backdrop of the European Central Bank’s significant quantitative easing program, certain Eastern European external debt, such as Hungary external bonds, appeared to us to be attractive on a relative basis. Accordingly, we positioned the Fund with an overweight position in Hungarian external debt. Hungary has a basic balance of payments surplus of 10% of Gross Domestic Product (“GDP”) (including account transfers from the European Union). In addition, solid economic growth has led to Hungary gaining a greater market share within the European Union, and the country’s ability to service its debt is relatively strong, in our view. |

| | The Fund also maintained an overweight in Dominican Republic and Colombian external debt at the end of the Reporting Period. The government of the Dominican Republic has implemented significant fiscal reforms and has reduced its fiscal deficit. Additionally, we believe lower energy prices should further benefit the country’s current account. In terms of Colombia, we believe its external bonds are trading at relatively cheap levels. We also think Colombia’s strong policy framework is a positive for the country’s external bonds. Although the drop in oil prices has had a negative impact on Colombia, its flexible currency regime has helped the country adjust. |

| | Looking ahead, we expect the markets to scrutinize the agendas of incoming administrations. Therefore, at the end of the Reporting Period, the Fund was positioned with a small overweight in Indonesian external debt and a large underweight in Turkish external debt. In Turkey, geopolitics and domestic politics continue to cloud the country’s outlook. Ongoing political uncertainties could delay the execution of economic policies aimed at reducing external vulnerabilities, improving the investment climate and reactivating economic growth. The Fund also maintained an underweight in Malaysian quasi-sovereign debt, as we remain concerned about depletion of the country’s foreign exchange reserves, deterioration of its trade balance and challenging political dynamics within the country. |

| | Finally, we retained our focus on seeking the cheapest valuations. In our view, Venezuelan external bond prices imply a material probability of restructuring as they hovered close to their all-time lows at the end of the Reporting Period. However, we believed they offered the possibility of significant recovery in an event of default. Accordingly, at the end of the Reporting Period, the Fund held an overweight position relative to the Index in Venezuelan external debt. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | The global macroeconomic environment remained challenging at the end of the Reporting Period, but we think it is more positive for external emerging markets debt than market sentiment suggests. The external debt markets weakened amid the 2015 commodities slump, China’s economic slowdown, U.S. dollar strengthening and concerns around Fed policy tightening. However, at the end of the Reporting Period, we believed valuations had stabilized and the asset class was likely to provide investors with adequate compensation for the potential challenges ahead. In addition, we do not expect significant deterioration in external bond valuations if the Fed raises rates during 2016, given that the Fed has been telegraphing its intentions. As for oil prices, while weakness may persist in the near term, we expect prices to find a better balance in late 2016. |

| | Overall, we believe external emerging markets debt will be a “bond picker’s market” throughout 2016 with returns dispersed amongst countries. In our view, it will be important to identify the prospective winners and losers stemming from the decline in commodity prices, to recognize which markets may benefit from structural changes in China and to find the potential beneficiaries of an improving U.S. economy. We believe positive returns may well come from finding those countries that have been mispriced by the market and by focusing on what we consider to be “hotspots” in the emerging markets, such as Brazil and Turkey. |

14

FUND BASICS

Emerging Markets Debt Fund

as of March 31, 2016

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015– March 31, 2016 | | Fund Total Return

(based on NAV)1 | | | J.P. Morgan EMBISM

Global Diversified

Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | 4.43 | % | | | 4.18 | % | | | 4.56 | % | | | 4.53 | % |

| | Class C | | | 3.57 | | | | 4.18 | | | | 4.04 | | | | 4.01 | |

| | Institutional | | | 4.70 | | | | 4.18 | | | | 5.12 | | | | 5.08 | |

| | | Class IR | | | 4.60 | | | | 4.18 | | | | 5.03 | | | | 4.99 | |

| | | | | |

| | | | | | | | | | | | | | | |

| | | July 31, 2015– March 31, 2016 | | | | | | | | | | | | |

| | | Class R6 | | | 4.41 | % | | | 4.03 | % | | | 5.14 | % | | | 5.10 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The J.P. Morgan EMBISM Global Diversified Index (Gross, USD, Unhedged) is an unmanaged index of debt instruments of 50 emerging countries. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

15

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 3/31/16 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -0.25 | % | | | 4.86 | % | | | 6.44 | % | | | 8.36 | % | | 8/29/03 |

| | Class C | | | 2.54 | | | | 5.04 | | | | N/A | | | | 6.10 | | | 9/29/06 |

| | Institutional | | | 4.70 | | | | 6.19 | | | | 7.29 | | | | 9.14 | | | 8/29/03 |

| | Class IR | | | 4.60 | | | | 6.09 | | | | N/A | | | | 5.89 | | | 7/30/10 |

| | | Class R6 | | | N/A | | | | N/A | | | | N/A | | | | 4.41 | | | 7/31/15 |

| | 4 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 4.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. The Fund will charge a 2% redemption fee on the redemption of shares (including by exchange) held for 30 calendar days or less. The performance figures do not reflect the deduction of the redemption fee. If reflected, the redemption fee would reduce the performance quoted. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.24 | % | | | 1.25 | % |

| | Class C | | | 1.99 | | | | 2.00 | |

| | Institutional | | | 0.90 | | | | 0.91 | |

| | Class IR | | | 0.99 | | | | 1.00 | |

| | | Class R6 | | | 0.88 | | | | 0.89 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 29, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

16

FUND BASICS

| | | | | | | | | | |

| | TOP TEN COUNTRY ALLOCATION6 | |

| | | | | Percentage of Net Assets | |

| | | | | as of 3/31/16 | | | as of 3/31/15 | |

| | United States | | | 8.3 | % | | | 14.7 | % |

| | Mexico | | | 5.5 | | | | 5.1 | |

| | Indonesia | | | 5.1 | | | | 3.4 | |

| | Dominican Republic | | | 5.1 | | | | 5.3 | |

| | Hungary | | | 4.4 | | | | 0.7 | |

| | Brazil | | | 3.9 | | | | 3.7 | |

| | Venezuela | | | 3.7 | | | | 3.4 | |

| | Colombia | | | 3.6 | | | | 2.5 | |

| | Chile | | | 3.3 | | | | 3.8 | |

| | Costa Rica | | | 2.9 | | | | 3.6 | |

| | | Other | | | 51.3 | | | | 53.4 | |

| | 6 | | The percentage shown for each investment category reflects the value of investments in that country as a percentage of net assets. The table does not include repurchase agreements of 6.7% as of 3/31/16 and 1.0% as of 3/31/15. The table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

17

GOLDMAN SACHS EMERGING MARKETS DEBT FUND

Performance Summary

March 31, 2016

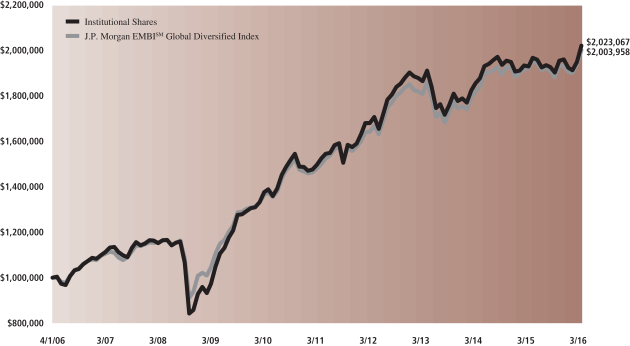

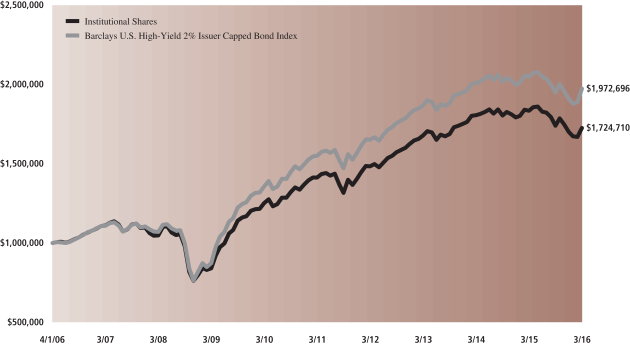

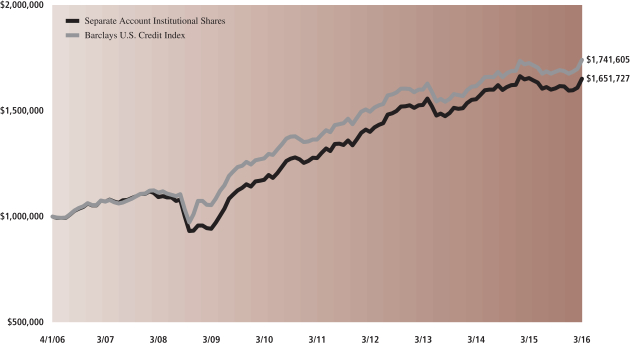

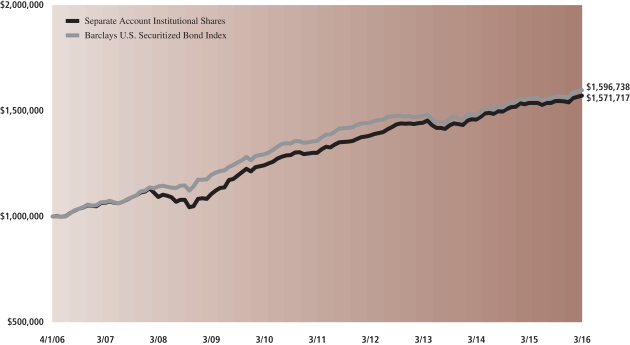

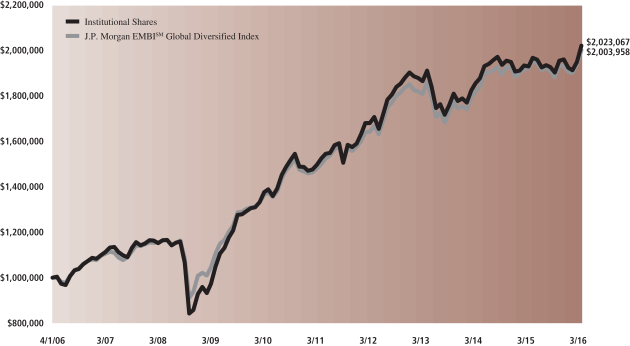

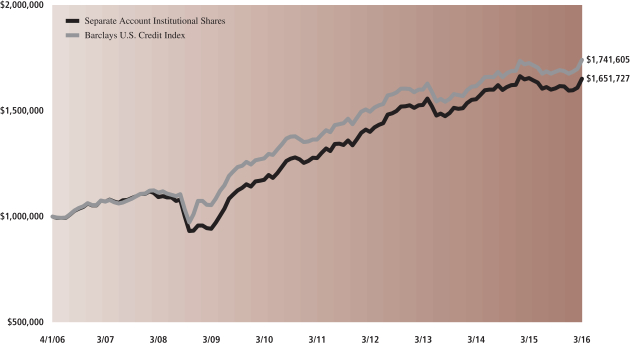

The following graph shows the value, as of March 31, 2016, of a $1,000,000 investment made on April 1, 2006 in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the J.P. Morgan EMBISM Global Diversified Index, is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of Class A, Class C, Class IR, and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decisions regarding issuer/industry/country investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Emerging Markets Debt Fund’s 10 Year Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from April 1, 2006 through March 31, 2016.

| | | | | | | | | | | | | | |

| Average Annual Total Return through March 31, 2016 | | | One Year | | | | Five Years | | | | Ten Years | | | Since Inception |

Class A (Commenced August 29, 2003) | | | | | | | | | | | | | | |

Excluding sales charges | | | 4.43% | | | | 5.83% | | | | 6.93% | | | 8.75% |

Including sales charges | | | -0.25% | | | | 4.86% | | | | 6.44% | | | 8.36% |

|

Class C (Commenced September 29, 2006) | | | | | | | | | | | | | | |

Excluding contingent deferred sales charges | | | 3.57% | | | | 5.04% | | | | N/A | | | 6.10% |

Including contingent deferred sales charges | | | 2.54% | | | | 5.04% | | | | N/A | | | 6.10% |

|

Institutional (Commenced August 29, 2003) | | | 4.70% | | | | 6.19% | | | | 7.29% | | | 9.14% |

|

Class IR (Commenced July 30, 2010) | | | 4.60% | | | | 6.09% | | | | N/A | | | 5.89% |

|

Class R6 (Commenced July 31, 2015) | | | N/A | | | | N/A | | | | N/A | | | 4.41%* |

|

| * | | Total return for periods of less than one year represents cumulative total return. |

18

PORTFOLIO RESULTS

Goldman Sachs High Yield Fund

Investment Objective

The Fund seeks a high level of current income and may also consider the potential for capital appreciation.

Portfolio Management Discussion and Analysis

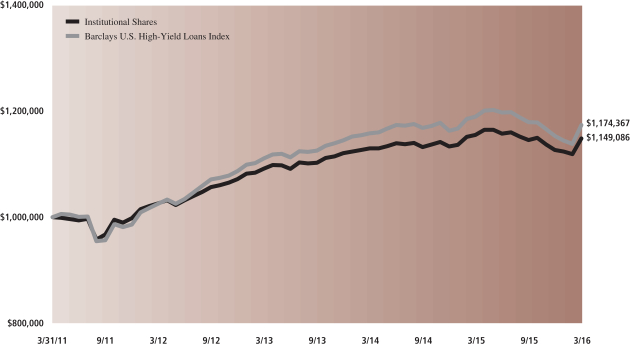

Below, the Goldman Sachs High Yield Fixed Income Investment Management Team discusses the Goldman Sachs High Yield Fund’s (the “Fund”) performance and positioning the 12-month period ended March 31, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

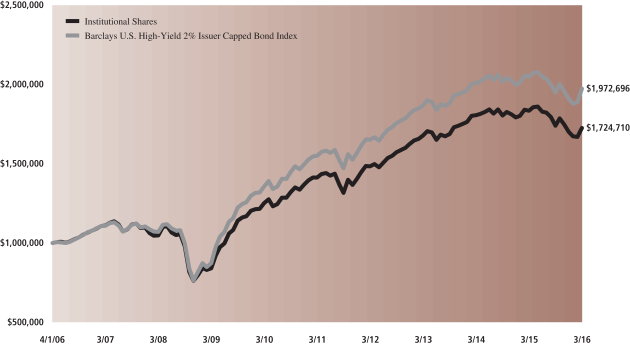

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service, IR and R Shares generated average annual total returns, without sales charges, of -6.33%, -7.01%, -5.98%, -6.35%, -6.08%, and -6.57%, respectively. These returns compare to the -3.65% average annual total return of the Fund’s benchmark, the Barclays U.S. High- Yield, 2% Issuer Capped Bond Index (the “Index”), during the same time period. |

| | During the period since their inception on July 31, 2015 through March 31, 2016, the Fund’s Class R6 Shares generated a cumulative total return, without sales charges, of -5.29% compared to the -3.10% cumulative total return of the Index. |

| Q | | What economic and market factors most influenced the high yield corporate bond market as a whole during the Reporting Period? |

| A | | During the second quarter of 2015, when the Reporting Period started, high yield corporate bond prices fell. After generating robust positive returns during April and May 2015, they retreated in June 2015, as volatility increased and geopolitical concerns resurfaced. High yield corporate bond prices also declined during the third calendar quarter, as global economic growth concerns, sector-specific issues and a sharp drop in commodities prices fueled uncertainty and drove higher levels of volatility. High yield corporate bond prices retreated during the fourth calendar quarter, selling off significantly in November and December 2015 amid continued pressure on oil prices and uncertainty surrounding a Federal Reserve (the “Fed”) rate hike. After a rough start to 2016, high yield corporate bond prices rallied beginning in the second half of February 2016 to generate a solidly positive return in the first quarter of 2016. |

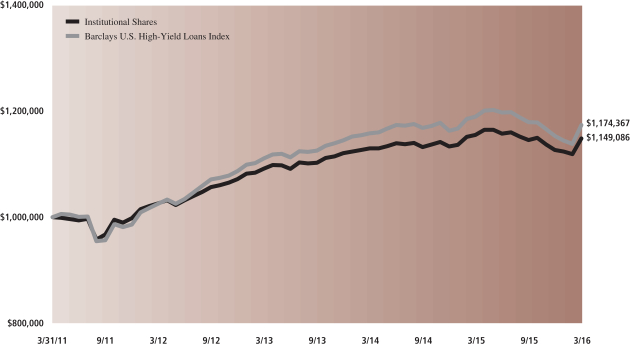

| | For the Reporting Period overall, higher quality BBB-rated credits outperformed lower-quality credits. Option adjusted spreads widened approximately 191 basis points, ending the Reporting Period at 656 basis points. (The option adjusted spread is a measurement tool for evaluating price differences between similar products with different embedded options. A basis point is 1/100th of a percentage point.) High yield corporate bonds underperformed high yield loans, as represented by the Barclays U.S. High-Yield Loans Index. |

| | In terms of issuance, approximately $95.5 billion of new high yield corporate bonds were priced during the second quarter of 2015, with refinancing the primary use of the proceeds. In the third calendar quarter, approximately $59.7 billion of new high yield corporate bonds came to market, a quarter-over-quarter decline of 38% and the lowest quarterly total since the second quarter of 2012 when approximately $54.7 billion were priced. The proceeds during the third calendar quarter were used for both refinancing and acquisition financing. During the fourth quarter of 2015, approximately $42.3 billion of new high yield corporate bonds were priced, with the proceeds used primarily for refinancing. In the first quarter of 2016, approximately $51.2 billion of new high yield corporate bonds came to market, a quarter-over-quarter increase of 23%. The proceeds during the first calendar quarter were used for refinancing, acquisition financing and general corporate financing. |

| | Demand was weak during the Reporting Period, with high yield corporate bond mutual funds experiencing approximately $14.5 billion of investment outflows. The default rate for high yield corporate bonds rose but remained low in historical terms, helped by healthier corporate balance sheets. For 2015 overall, there were 29 defaults among high yield issuers, affecting approximately $23.6 billion in high yield corporate bonds. In the first quarter of 2016, there were 17 defaults among high yield issuers, affecting |

19

PORTFOLIO RESULTS

| | approximately $24.1 billion in high yield corporate bonds. The 12-month par-weighted default high yield corporate bond rate through March 31, 2016 was 3.22%.1 |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund was hurt by sector positioning and individual issue selection. The Fund’s performance was also hampered by its overall credit quality positioning. |

| | Conversely, the Fund’s duration positioning added to its relative results during the Reporting Period. (Duration is a measure of a portfolio’s sensitivity to changes in interest rates.) The Fund’s duration strategy is primarily implemented via interest rate swaps and/or futures. |

| Q | | Which segments within high yield most significantly affected Fund performance? |

| A | | The Fund was hurt by its lower credit quality bias during the Reporting Period. More specifically, the Fund’s overweight relative to the Index in CCC-rated credits and its underweight in BB-rated credits detracted from relative returns. BB-rated credits outperformed CCC-rated credits during the Reporting Period. An overweight in non-rated credits also dampened relative performance. In addition, the Fund was hindered by its exposure to high yield loans. On the positive side, the Fund’s overweight in emerging markets debt added to performance. |

| | In terms of sector positioning, the Fund’s underweights in chemicals and energy, along with an overweight position in cable and satellite television, detracted from performance. Conversely, the Fund benefited from its overweight positions in commercial services, packaging and building materials. |

| | With regard to individual issue selection, Fund performance was hurt by its overweights in Intelsat, a communications satellite services provider; Vanguard Natural Resources, an oil and natural gas exploration company; and American Energy — Marcellus, LLC, which acquires, develops and operates oil and natural gas properties located in the Marcellus Shale in northern West Virginia. The Fund’s lack of exposure to Energy XXI Gulf Coast and its underweight in California Resources — both oil and natural gas producers — added to relative results. The Fund also benefited from its overweight in Samson Investment Company, the largest privately held company of crude oil and natural gas in the U.S. |

| Q | | Did the Fund’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s duration and yield curve positioning added to its performance versus the Index. More specifically, the Fund benefited from its neutral duration positioning relative to the Index, which it held for most of the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | To hedge against currency risk (that is, the risk that certain currencies might fluctuate in value), the Fund employed forward foreign exchange currency contracts during the Reporting Period. Additionally, a specialized index of credit default swaps (“CDX”) was used to manage the beta of the Fund on an active basis. It was also used as a cost-efficient instrument to help manage the Fund’s cash position. We employ CDX contracts as a way to gain credit exposure by being short credit protection, when the Fund experiences significant cash inflows. The Fund used U.S. Treasury futures, Eurodollar futures and interest rate swaps to facilitate specific duration and yield curve strategies. Eurodollar futures are contracts that have underlying assets linked to time deposits denominated in U.S. dollars at banks outside the U.S. Derivatives may be used in combination with cash securities to implement our views in the Fund. Overall, the use of derivatives had a negative impact on the Fund’s performance during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | During the Reporting Period, we continued to increase the Fund’s credit quality, favoring B-rated and BB-rated credits. At the same time, we steadily reduced the Fund’s exposure to CCC-rated credits through selective selling in some of the most economically sensitive industry segments. Overall, we had a preference at the end of the Reporting Period for U.S. cyclical industries that appear to be enjoying healthy growth, such as those in consumer-oriented and real estate-related sectors, as well as certain defensive industries, including cellular telecommunications and cable. At the same time, we were cautious about making allocations to cyclical sectors that are sensitive to global economic growth worries, such as technology, chemicals and metals and mining. During the Reporting Period, we found what we view as attractive opportunities in European high yield corporate bonds that we believe may benefit from European Central Bank stimulus |

20

PORTFOLIO RESULTS

| | and the early stages of an economic rebound in Europe. In addition, we found value in high yield loans, which we consider less vulnerable to oil price movements and have a higher overall quality profile than high yield corporate bonds. |

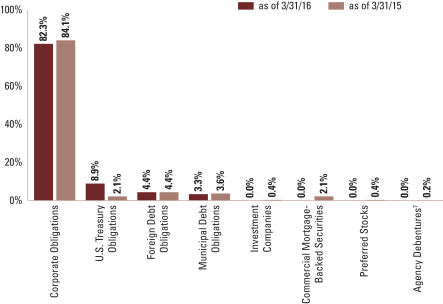

| Q | | How was the Fund positioned relative to its benchmark index at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund was overweight relative to the Index in cellular telecommunications, emerging markets corporate bonds and building materials. It was underweight compared to the Index in metals and mining, gas distribution utilities and electric utilities. We favored BBB-rated credits and maintained the Fund’s modest exposure to CCC-rated credits at the end of the Reporting Period. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we had a cautiously positive outlook for high yield corporate bonds. However, in the near term, we expect the asset class to face heightened commodity and equity market volatility, ongoing concerns about global economic growth, and tightening financial conditions. Additional risks that may stem from macro or geopolitical developments to create a broad-based “risk-off” environment include concerns about renewed weakness in Europe or further escalation in economic growth concerns out of China. |

| | Looking ahead, we expect spreads to be generally unchanged at the end of 2016 relative to where they were at the end of the Reporting Period. Although we believe defaults are likely to accelerate in 2016, we maintained a positive view at the end of the Reporting Period on specific consumer-facing sectors where corporate fundamentals are relatively robust. The pickup in defaults during 2016, we believe, will likely be led by energy and metals/mining companies, with some contagion spreading to distressed credits in other industries. Meanwhile, we expect mergers and acquisitions activity to slow and for corporate management teams to become less willing to engage in shareholder friendly activities. |

| | At the end of the Reporting Period, we believed the performance of high yield corporate bonds in the near term may well be driven by oil prices, lending conditions, central bank policy, global economic growth and liquidity. Our view of these drivers have led us to adopt “closer to home” positioning, with a preference for U.S. service-related and consumer-related credits as well as those credits with exposure to deleveraging stories. For similar reasons, the Fund was underweight commodities-related credits at the end of the Reporting Period. |

21

FUND BASICS

High Yield Fund

as of March 31, 2016

| | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 1, 2015– March 31, 2016 | | Fund Total Return

(based on NAV)1 | | | Barclays U.S.

High-Yield 2%

Issuer Capped Bond

Index2 | | | 30-Day

Standardized

Subsidized Yield3 | | | 30-Day

Standardized

Unsubsidized Yield3 | |

| | Class A | | | -6.33 | % | | | -3.65 | % | | | 5.58 | % | | | 5.58 | % |

| | Class C | | | -7.01 | | | | -3.65 | | | | 5.10 | | | | 5.09 | |

| | Institutional | | | -5.98 | | | | -3.65 | | | | 6.19 | | | | 6.18 | |

| | Service | | | -6.35 | | | | -3.65 | | | | 5.69 | | | | 5.68 | |

| | Class IR | | | -6.08 | | | | -3.65 | | | | 6.10 | | | | 6.10 | |

| | | Class R | | | -6.57 | | | | -3.65 | | | | 5.60 | | | | 5.59 | |

| | | | | |

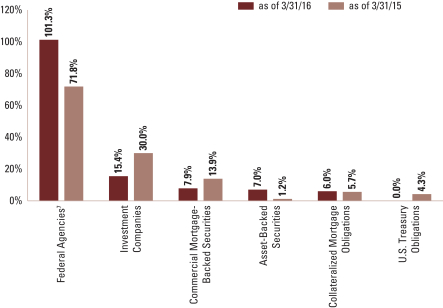

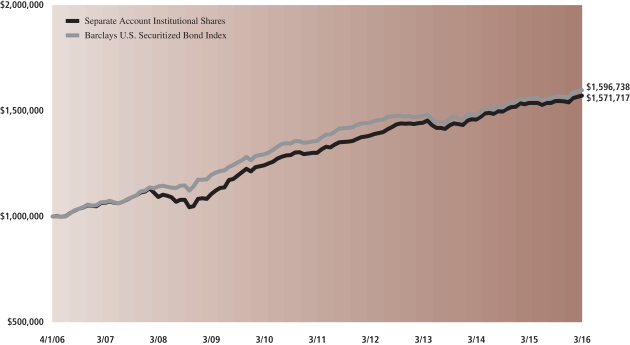

| | | | | | | | | | | | | | | |