UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | December 31, 2015 |

| | |

| | | | Select Satellite Funds |

| | | | Absolute Return Tracker |

| | | | Commodity Strategy |

| | | | Dynamic Allocation |

| | | | Dynamic Commodity Strategy |

| | | | Managed Futures Strategy |

| | | | Global Real Estate Securities |

| | | | International Real Estate Securities |

| | | | Real Estate Securities |

Goldman Sachs Select Satellite Funds

| n | | ABSOLUTE RETURN TRACKER |

| n | | DYNAMIC COMMODITY STRATEGY |

| n | | MANAGED FUTURES STRATEGY |

| n | | GLOBAL REAL ESTATE SECURITIES |

| n | | INTERNATIONAL REAL ESTATE SECURITIES |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 6 | |

| |

Schedules of Investments | | | 60 | |

| |

Financial Statements | | | 88 | |

| |

Financial Highlights | | | 96 | |

| |

Notes to Financial Statements | | | 112 | |

| |

Report of Independent Registered Public Accounting Firm | | | 147 | |

| |

Other Information | | | 148 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS SELECT SATELLITE FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectuses.

The Goldman Sachs Absolute Return Tracker Fund seeks to deliver long-term total return consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds. The Fund’s Investment Adviser believes that hedge funds derive a large portion of their returns from exposure to sources of market risk (“Market Exposures”) and “Trading Strategies” involving long and/or short positions in Market Exposures and/or individual securities or baskets of securities. In seeking to meet its investment objective, the Fund uses a dynamic investment process to seek to identify the appropriate weights to Market Exposures and Trading Strategies that approximate the return and risk patterns of specific hedge fund sub-strategies. The Investment Adviser then applies a quantitative methodology, in combination with a qualitative overlay, to assess the appropriate weight to each Market Exposure and Trading Strategy. The Fund may seek to establish long and/or short positions in a multitude of Market Exposures. However, from time to time, regulatory constraints or other considerations may prevent the Fund from precisely replicating the returns of the Market Exposures and Trading Strategies. The Fund does not intend to outperform market returns, even during periods of sustained increases in the prices of stocks and bonds.

The Fund seeks to gain exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “ART Subsidiary”). The ART Subsidiary primarily obtains its commodity exposure by investing in commodity-linked derivative instruments (which may include total return swaps on commodity indexes, sub-indexes and single commodities, as well as commodity (U.S. or foreign) futures, commodity options and commodity-linked notes). The ART Subsidiary will also invest in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions, and foreign currency transactions (including forward contracts). The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. Over-the-counter transactions are subject to less government regulation and supervision. The Fund may also hold significant amounts of U.S. Treasury or short-term instruments. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is subject to the risks associated with short selling of securities, which involves leverage of the Fund’s assets and presents various other risks. The Fund may be obligated to cover its short position at a higher price than the short price, resulting in a loss. Losses on short sales are potentially unlimited as a loss occurs when the value of a security sold short increases. The Fund is not appropriate for all investors. The Investment Adviser’s use of quantitative models to execute the Fund’s investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes.

The investment program of the Fund is speculative, entails substantial risks and includes alternative investment techniques not employed by traditional mutual funds. The Fund should not be relied upon as a complete investment program. The Fund’s investment techniques (if they do not perform as designed) may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested, and there can be no assurance that the investment objective of the Fund will be achieved.

The Goldman Sachs Commodity Strategy Fund seeks to maintain substantial economic exposure to the performance of the commodities markets. The Fund primarily gains exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary primarily obtains its commodity exposure by investing in commodity-linked swaps (which may include total return swaps). The Subsidiary also

1

GOLDMAN SACHS SELECT SATELLITE FUNDS

invests in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s borrowing and use of derivatives result in leverage, which can make the Fund more volatile. Over-the-counter transactions are subject to less government regulation and supervision. The Fund may hold significant amounts of U.S. Treasury or short-term investments. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Investments in mortgage-backed securities are subject to prepayment risk, the risk that in a declining interest rate environment the Fund’s underlying mortgages may be prepaid, causing the Fund to have to reinvest at lower interest rates. Foreign investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The investment program of the Fund is speculative, entails substantial risks and includes asset classes and investment techniques not employed by more traditional mutual funds. The Fund should not be relied upon as a complete investment program. There can be no assurance that the investment objective of the Fund will be achieved.

The Goldman Sachs Dynamic Allocation Fund invests primarily in exchange-traded funds (“ETFs”), stocks and derivative instruments, including futures and swaps, that provide exposure to a broad spectrum of asset classes, including but not limited to equities (both in U.S. and non-U.S. companies), fixed income (U.S. and non-U.S., investment grade and high yield) and commodities. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. The Fund’s borrowing and use of derivatives result in leverage, which can make the Fund more volatile. Over-the-counter transactions are subject to less government regulation and supervision. The Fund may also hold significant amounts of U.S. Treasury or short-term instruments. The Fund’s equity investments are subject to market risk, which means that the value of its investments may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The Fund’s fixed income investments are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. The Fund seeks to gain exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “DAF Subsidiary”). The DAF Subsidiary primarily obtains its commodity exposure by investing in commodity-linked derivative instruments, which may include but are not limited to total return swaps, commodity (U.S. or foreign) futures and commodity-linked notes. The DAF Subsidiary may also invest in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions, and foreign currency transactions (including forward contracts). The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund’s investments in other investment companies (including ETFs) subject it to additional expenses. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the

2

GOLDMAN SACHS SELECT SATELLITE FUNDS

Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The investment program of the Fund is speculative, entails substantial risks and includes asset classes and investment techniques not employed by more traditional mutual funds. The Fund should not be relied upon as a complete investment program. There can be no assurance that the investment objective of the Fund will be achieved.

The Goldman Sachs Dynamic Commodity Strategy Fund seeks to maintain substantial economic exposure to the performance of the commodities markets. The Fund primarily gains exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “Subsidiary”) and in commodity index-linked structured notes. The Subsidiary primarily obtains its commodity exposure by investing in commodity-linked derivative instruments (which may include total return swaps). The Subsidiary also invests in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The Fund is subject to tax risk as a result of its investments in the Subsidiary and in commodity index-linked structured notes, as the Fund has not received a private letter ruling from the Internal Revenue Service (“IRS”) concluding that income and gains from such investments are “qualifying income.” The IRS has suspended granting such private letter rulings, and the Fund cannot rely on private letter rulings granted to other taxpayers. The tax treatment of investments in the Subsidiary and in commodity index-linked structured notes may be adversely affected by future legislation and/or IRS guidance. While the Fund has obtained an opinion of counsel regarding such investments, if the IRS were to successfully assert that the Fund’s income from such investments was not “qualifying income,” in which case the Fund would fail to qualify as a regulated investment company, the Fund would be subject to federal and state income tax on all of its taxable income at regular corporate tax rates with no deduction for any distributions paid to shareholders, which would significantly adversely affect the returns to Fund shareholders.

Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s borrowing and use of derivatives may result in leverage, and may make the Fund more volatile. Over-the-counter transactions are subject to less governmental regulation and supervision. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Investments in mortgage-backed and other asset-backed securities are subject to prepayment risk, the risk that in a declining interest rate environment the Fund’s underlying mortgages may be prepaid, causing the Fund to have to reinvest at lower interest rates. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund may invest in non-investment grade securities, which involve greater price volatility and present greater risks than higher rated fixed income securities. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The investment program of the Fund is speculative, entails substantial risks and includes asset classes and investment techniques not employed by more traditional mutual funds. The Fund should not be relied upon as a complete investment program. There can be no assurance that the investment objective of the Fund will be achieved.

The Goldman Sachs Managed Futures Strategy Fund implements a trend-following strategy that takes long and/or short positions in a wide range of asset classes, including equities, fixed income,

3

GOLDMAN SACHS SELECT SATELLITE FUNDS

commodities and currencies, among others, to seek long-term absolute return. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, call, and extension risk. The Fund’s equity investments are subject to market risk, which means that the value of its investments may go up or down in response to the prospects of individual companies, particular industry sectors and/or general economic conditions. Different investment styles tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. Managed futures strategies have historically offered the potential for stronger performance in extreme bull and bear markets and weaker performance in range-bound and sharply reversing markets. Foreign and emerging market investments may be more volatile and less liquid than investments in U.S. securities and will be subject to the risks of currency fluctuation and adverse economic or political developments. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Derivative investments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. Over-the-counter transactions are subject to less government regulation and supervision. The Fund’s borrowing and use of derivatives may result in leverage, which can make the Fund more volatile. The Fund is subject to tax risk as a result of its investments in commodity-linked structured notes, as the Fund has not received a private letter ruling from the Internal Revenue Service (“IRS”) concluding that income and gains from such investments are “qualifying income.” The IRS has suspended granting such private letter rulings, and the Fund cannot rely on private letter rulings granted to other taxpayers. The tax treatment of investments in commodity-linked structured notes may be adversely affected by future legislation and/or IRS guidance. While the Fund has obtained an opinion of counsel regarding such investments, if the IRS were to successfully assert that the Fund’s income from such investments was not “qualifying income,” in which case the Fund would fail to qualify as a regulated investment company, the Fund would be subject to federal and state income tax on all of its taxable income at regular corporate tax rates with no deduction for any distributions paid to shareholders, which would significantly adversely affect the returns to Fund shareholders. The tax treatment of commodity-linked derivative instruments may be adversely affected by future legislation or regulatory developments. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The investment program of the Fund is speculative, entails substantial risks and includes asset classes and investment techniques not employed by more traditional mutual funds. The Fund should not be relied upon as a complete investment program. There can be no assurance that the investment objective of the Fund will be achieved.

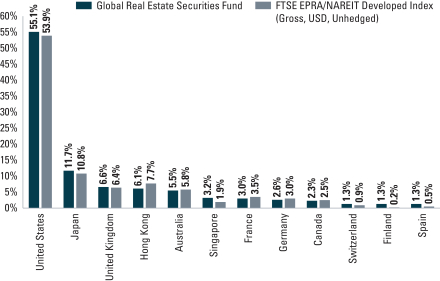

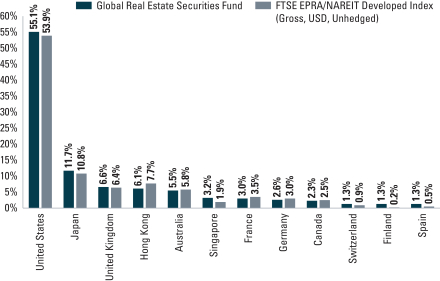

The Goldman Sachs Global Real Estate Securities Fund invests primarily in a portfolio of equity investments in issuers that are primarily engaged in or related to the real estate industry, including real

estate investment trusts (“REITs”), within and outside the United States. Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities

4

GOLDMAN SACHS SELECT SATELLITE FUNDS

and are subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund concentrates its investments in the real estate industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting this industry than if its investments were more diversified across different industries, and its performance may be substantially different from that of the broader stock market. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of mid- and small-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

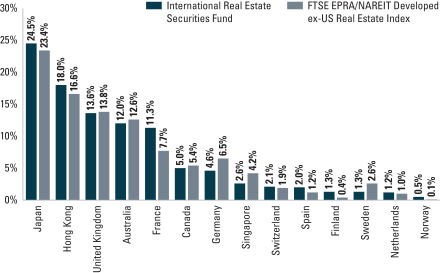

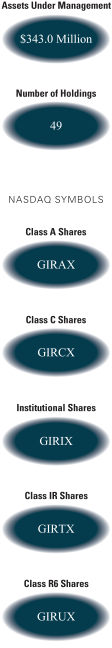

The Goldman Sachs International Real Estate Securities Fund invests primarily in a portfolio of equity investments in issuers that are primarily engaged in or related to the real estate industry outside the United States, including real estate investment trusts (“REITs”). Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund concentrates its investments in the real estate industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting this industry than if its investments were more diversified across different industries, and its performance may be substantially different from that of the broader stock market. The Fund is subject to market risk, which means that the value of the securities in which the Fund invests. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

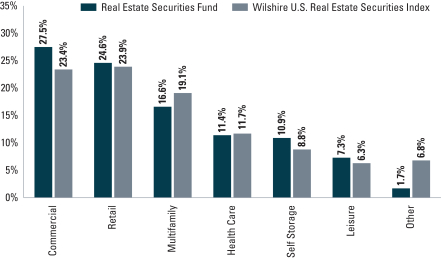

The Goldman Sachs Real Estate Securities Fund invests primarily in a portfolio of equity investments in issuers that are primarily engaged in or related to the real estate industry, including real estate investment trusts (“REITs”). Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Because the Fund concentrates its investments in the real estate industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting this industry than if its investments were more diversified across different industries, and its performance may be substantially different from that of the broader stock market. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

5

PORTFOLIO RESULTS

Goldman Sachs Absolute Return Tracker Fund

Investment Objective

The Fund seeks to deliver long-term total return consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies (“QIS”) Team discusses the Goldman Sachs Absolute Return Tracker Fund’s (the “Fund”) performance and positioning for the 12-month period ended December 31, 2015 (“the Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated average annual total returns, without sales charges, of -2.45%, -3.20%, -2.18%, -2.23% and -2.71%, respectively. These returns compare to the -3.64% average annual total return of the Fund’s benchmark, the HFRX Global Hedge Fund Index (net of management, administrative and performance/incentive fees) (the “HFRX Global Hedge Fund Index”)1, during the same time period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of -2.98%. This return compares to the -4.82% cumulative total return of the Index during the same period. |

| Q | | What economic and market factors most influenced the hedge fund asset class as a whole during the Reporting Period? |

| A | | Hedge funds, as measured by the HFRX Global Hedge Fund Index, overall generated modestly negative returns during the Reporting Period. Event driven hedge funds posted losses for the Reporting Period, with the HFRX Event Driven Index returning -6.94% during the Reporting Period. Among event driven hedge funds, performance was particularly weak among distressed restructuring-focused funds. Relative value hedge funds also posted negative returns during the Reporting Period, with the HFRX Relative Value Arbitrage Index returning -3.10%. Energy infrastructure funds lost most among relative value hedge funds amid steep declines in oil prices during 2015. Equity long/short hedge funds, as measured by the HFRX Equity Hedge Index, lost ground |

| | 1 | | The HFRX Global Hedge Fund Index is a trademark of Hedge Fund Research, Inc. (“HFR”). HFR has not participated in the formation of the Fund. HFR does not endorse or approve the Fund or make any recommendation with respect to investing in the Fund. |

| | as well, returning -2.33% during the Reporting Period, with gains in the first half of 2015 being erased by a weak second half of the calendar year. Within equity long/short hedge funds, fundamental value managers performed the worst. Global macro hedge funds were the least weak, though also down, with the HFRX Macro/CTA Index returning -1.96% during the Reporting Period. Among macro hedge funds, commodity managers focused on metals struggled the most. |

| | As the Reporting Period began, hedge funds were broadly down, with the HFRX Global Hedge Fund Index declining 0.29% for the first month of the new year. January 2015 was an eventful start to the year in financial markets, with continued declines in oil prices, depreciation of the euro on the back of the European Central Bank’s announcement of new plans for quantitative easing as well as the election of the Syriza party in Greece. Additionally, the Swiss franc appreciated sharply upon the Swiss National Bank’s decision to abandon the cap against the euro, and the U.S. dollar continued to rally. For the month, only global macro hedge funds posted gains, with trend-following funds faring particularly well driven by strong trends in currencies. In a turnaround, hedge funds were up in February 2015, with the HFRX Global Hedge Fund Index gaining 2.02% for the month. Global equities rallied, as international developed markets posted strong performance, and the S&P 500 Index recovered January 2015’s losses. Yields rose on U.S. Treasuries; high yield credit spreads tightened during the month; and the U.S. dollar posted mixed performance against global currencies. Each of the major sub-strategies gained ground in February 2015, though trend-following funds within the global macro sub-strategy struggled with the reversal of medium-term trends in fixed income and currencies. In March 2015, hedge fund performance moderated, but the HFRX Global Hedge Fund Index still gained 0.33% for the month. Indeed, despite a decline in U.S. equities, three of the |

6

PORTFOLIO RESULTS

| | four major sub-strategies represented in the HFRX Global Hedge Fund Index were up in March 2015. |

| | Modest performance continued in April 2015, with the HFRX Global Hedge Fund Index up 0.21% for the month. Despite the choppy performance across financial markets in April 2015, three of the four major sub-strategies were up for the month. After 11 consecutive months of gains through March 2015, the global macro sub-strategy struggled in April 2015, with trend-following funds losing ground given reversals in European equities and developed market government bonds. Similarly in May 2015, hedge funds were slightly up, with the HFRX Global Hedge Fund Index gaining 0.26% for the month. Event driven, macro and relative value sub-indices were up in May 2015, while equity long/short hedge funds were slightly down, with performance especially weak among fundamental growth managers. Hedge funds posted losses in June 2015, with the HFRX Global Hedge Fund Index declining 1.24% for the month. All four major sub-strategies were down for the month. The global macro sub-strategy declined most on the back of price reversals in currencies, fixed income and commodities. |

| | Hedge funds were flat overall in July 2015, with the HFRX Global Hedge Fund Index returning -0.03% for the month. Event driven and equity long/short hedge funds lost ground during the month, while global macro funds and relative value funds posted positive performance. Indeed, after challenged performance in the second calendar quarter amid heightened volatility across currency, commodities and fixed income markets, the macro sub-index recovered 2.31% in July 2015 on the back of strong trending behavior across commodities and currencies. August 2015 was a challenging month for hedge funds, with the HFRX Global Hedge Fund Index returning -2.21%, the largest one-month decline in four years. All four major sub-strategies lost ground against a backdrop of heightened volatility across global markets, weakening Chinese economic data, a broad sell-off in equities and further speculation on the timing of a rate hike by the Federal Reserve (the “Fed”). September 2015 was another challenging month for hedge funds, with the HFRX Global Hedge Fund Index returning -2.07%. All four major sub-strategies against lost ground against a backdrop of continued volatility across global financial markets, further declines in global equities and commodities, and the announcement of the Fed’s decision to postpone an interest rate hike. Throughout the quarter, fundamental growth funds within the equity long/short sub-strategy were particularly weak. |

| | Hedge funds posted positive performance overall in October 2015, with the HFRX Global Hedge Fund Index returning 1.46%. Global equities rebounded in October 2015, while government bonds posted mixed performance on the back of weak economic data out of the U.K. and Japan, along with dovish posturing from the European Central Bank. Three of the four major sub-strategies were up for the month, while the global macro sub-strategy lost ground in October 2015, with trend-following managers impacted by reversals in commodities, mixed performance of the U.S. dollar against global currencies, and broad price reversals across asset classes. Hedge funds posted mixed performance in November 2015, with the HFRX Global Hedge Fund Index returning -0.72% during the month. Global equities were mixed across regions in November 2015, while the U.S. dollar rallied, commodities largely sold off, and U.S. yields rose across the curve in anticipation of a potential Fed interest rate hike in December 2015. The relative value and event driven sub-strategies lost ground as credit spreads widened, while the equity long/short sub-strategy was flat overall. The global macro sub-strategy was up for the month with trend-following funds benefiting from strong trends in commodities and currencies. Hedge funds were challenged in December, with the HFRX Global Hedge Fund Index returning -1.33%. Global equities and commodities sold off in December, while the U.S. dollar gave up some strength but still finished the year up against global currencies. All four major hedge fund sub-strategies declined in December 2015, with the relative value sub-index falling the most. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | We believe hedge funds derive a large portion of their returns from exposure to sources of market risk. The Fund uses a quantitative methodology in combination with a qualitative overlay to seek to identify the Market Exposures, or sources of market risk, that approximate the return and risk patterns of specific hedge fund sub-strategies. The Fund’s quantitative methodology seeks to allocate the Fund’s exposure to each Hedge Fund Sub-Strategy such that the Fund’s investment results approximate the return and risk patterns of a diversified universe of hedge funds. During the Reporting Period, two of the four Hedge Fund Sub-Strategies employed by the Fund contributed positively to performance on an absolute basis, while one was relatively flat and the other detracted. |

| | The Fund’s Relative Value Hedge Fund Sub-Strategy contributed most positively to the Fund’s performance on an absolute basis, followed by the Event Driven Hedge Fund |

7

PORTFOLIO RESULTS

| | Sub-Strategy. Within both of these Hedge Fund Sub-Strategies, long exposure to put options on the S&P 500® Index and long positions in high yield credit contributed positively to returns. There were no detractors from returns for either of these Hedge Fund Sub-Strategies. |

| | The Fund’s Macro Hedge Fund Sub-Strategy had a rather neutral impact on the Fund’s returns on an absolute basis. Long exposure to a broad commodities index detracted most from returns, as commodity prices tumbled during the Reporting Period. Conversely, the trend strategy contributed positively to absolute results. Within the trend strategy in which the Fund invests, short positions in the Canadian dollar against the U.S. dollar, in crude oil and in natural gas contributed most positively to absolute results. |

| | The Fund’s Equity Long/Short Hedge Fund Sub-Strategy detracted the most from the Fund’s returns on an absolute basis. The Fund’s long exposure to emerging markets equities and its short position in U.S. growth equities hurt returns the most. |

| | In addition to the asset classes mentioned above, the Fund was invested in a variety of developed and emerging market equities, short-term interest rates, developed market government bonds, currencies and commodities during the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used exchange-traded index futures contracts to gain exposure to U.S. large-cap and small-cap equities, non-U.S. developed market equities including those in Europe, the U.K. and Japan, commodities, government bonds and short-term interest rates. The Fund used currency forward contracts to gain exposure to select developed and emerging market currencies of non-U.S. developed markets. The Fund trades exchange-traded securities and over-the-counter total return swaps to gain exposure to U.S. large-cap and small-cap equities. The Fund used total return swaps to get exposure to commodity indices. The Fund had used a total return swap to gain exposure to a basket of single-name stocks to which hedge funds had large investments according to 13F filings with the Securities and Exchange Commission (“SEC”). However, the Fund trades the individual underlying stocks outright. The Fund also used listed put options to gain exposure to U.S. large-cap equities. Lastly, the Fund used exchange-traded credit default swaps to gain exposure to North American high yield credit markets. Overall, the use of derivatives had a positive impact on the Fund’s performance during the Reporting Period. |

| Q | | Were there any changes made in the Fund’s investment strategy during the Reporting Period? |

| A | | During the Reporting Period, we added a Commodity Cross-Market Momentum strategy within the Macro Hedge Fund Sub-Strategy employed by the Fund. The Commodity Cross-Market Momentum strategy seeks to capture trends across commodity markets on a market-neutral basis by taking long and short positions in commodities based on their relative momentum. |

| Q | | How was the Fund positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had a 47% allocation to the Equity Long/Short Hedge Fund Sub-Strategy, 22% to the Macro Hedge Fund Sub-Strategy, 21% to the Relative Value Hedge Fund Sub-Strategy and 10% to the Event Driven Hedge Fund Sub-Strategy. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | In July 2015, Matt Hoehn, previously vice president and portfolio manager of the Fund within the QIS Customized Beta Strategies (“CBS”) team, left to pursue a different opportunity within Goldman Sachs Asset Management. Matt shared portfolio management responsibilities for the Fund strategy with Gary Chropuvka, managing director and QIS team member since 1999. Gary is the head of the QIS Customized Beta Strategies team as well as the Alternative Investment Strategies and Tax-Advantaged Core Strategies businesses within QIS. Gary continues to manage the Fund with Alex Chung, vice president, who has been with the QIS team since 2010 and has 11 years of investment experience as of December 31, 2015. |

| Q | | What is the Fund’s tactical view and strategy going forward? |

| A | | In the coming months, we intend to remain focused on the Fund’s investment objective of seeking to deliver long-term total return consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds. We understand that the hedge fund industry is dynamic, and to keep pace, we seek to understand trends in the hedge fund industry by digesting information from a number of sources, including hedge fund return databases, prime brokerage reports, hedge fund consultants, regulatory filings and other public sources. Additionally, we emphasize ongoing research and continued process and model enhancement, which we can implement through our scalable, robust technological platform. |

8

FUND BASICS

Absolute Return Tracker Fund

as of December 31, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2015–December 31, 2015 | | Fund Total Return

(based on NAV)1 | | | HFRX Global Hedge

Fund Index2 | |

| | Class A | | | -2.45 | % | | | -3.64 | % |

| | Class C | | | -3.20 | | | | -3.64 | |

| | Institutional | | | -2.18 | | | | -3.64 | |

| | Class IR | | | -2.23 | | | | -3.64 | |

| | | Class R | | | -2.71 | | | | -3.64 | |

| | | |

| | | | | | | | | |

| | | July 31, 2015–December 31, 2015 | | | | | | |

| | | Class R6 | | | -2.98 | % | | | -4.82 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies, including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. The index is investable through products managed by HFR Asset Management, LLC that track HFRX Indices. The HFRX Global Hedge Fund Index is a trademark of HFR. HFR has not participated in the formation of the Fund. HFR does not endorse or approve the Fund or make any recommendation with respect to investing in the Fund. |

| | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| | Class A | | | -7.78 | % | | | 0.09 | % | | | -0.86 | % | | 5/30/08 |

| | Class C | | | -4.16 | | | | 0.48 | | | | -0.86 | | | 5/30/08 |

| | Institutional | | | -2.18 | | | | 1.60 | | | | 0.27 | | | 5/30/08 |

| | Class IR | | | -2.23 | | | | 1.45 | | | | 0.13 | | | 5/30/08 |

| | Class R | | | -2.71 | | | | 0.96 | | | | -0.37 | | | 5/30/08 |

| | | Class R6 | | | N/A | | | | N/A | | | | -2.98 | | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end and cumulative total returns for periods less than one year. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares, and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.20 | % | | | 1.75 | % |

| | Class C | | | 1.95 | | | | 2.50 | |

| | Institutional | | | 0.80 | | | | 1.35 | |

| | Class IR | | | 0.96 | | | | 1.50 | |

| | Class R | | | 1.45 | | | | 2.00 | |

| | | Class R6 | | | 0.78 | | | | 1.33 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least July 31, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

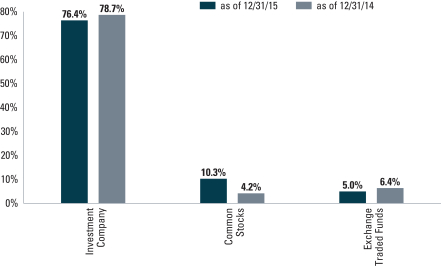

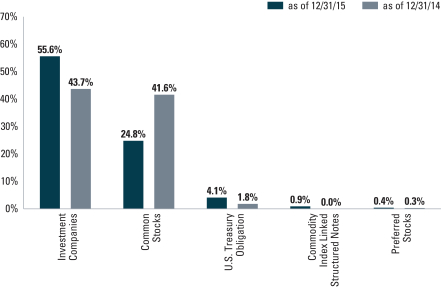

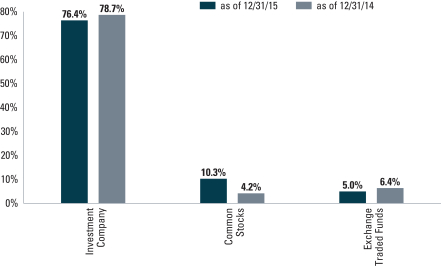

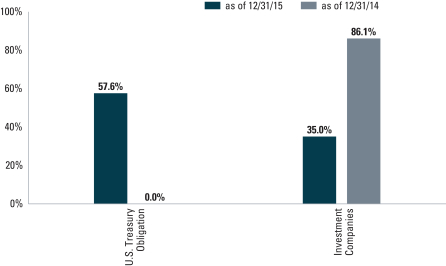

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. Underlying sector allocations of exchange traded funds and investment companies held by the Fund are not reflected in the graph above. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The above graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information Section of the Schedule of Investments. |

10

GOLDMAN SACHS ABSOLUTE RETURN TRACKER FUND

Performance Summary

December 31, 2015

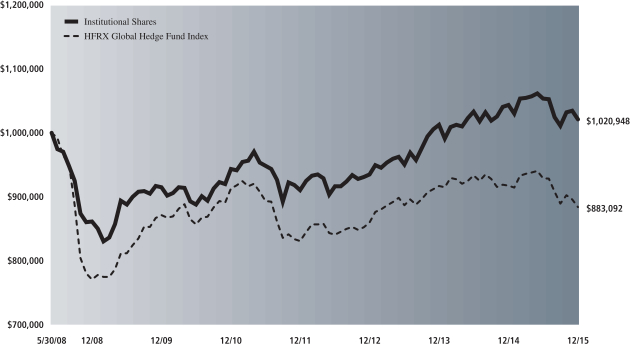

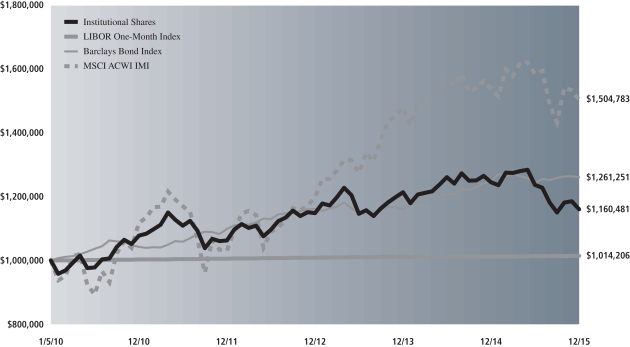

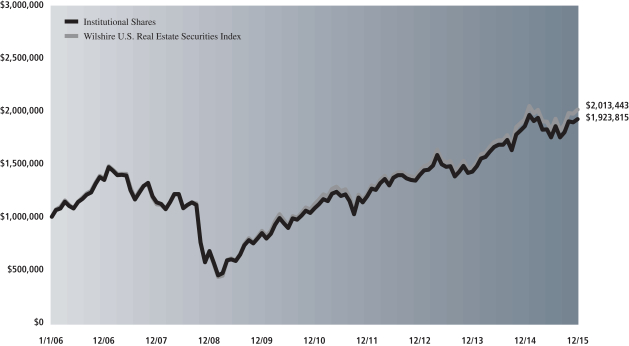

The following graph shows the value as of December 31, 2015, of a $1,000,000 investment made on May 30, 2008 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark the HFRX Global Hedge Fund Index (net of management, administrative and performance/incentive fees), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of Class A, Class C, Class IR, Class R and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decision regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund.

| | | | |

| Absolute Return Tracker Fund’s Lifetime Performance | | | | |

Performance of a $1,000,000 Investment, with distributions reinvested, from May 30, 2008 through December 31, 2015.

| | | | | | | | | | |

| Average Annual Total Return through December 31, 2015 | | | One Year | | | | Five Years | | | Since Inception |

Class A (Commenced May 30, 2008) | | | | | | | | | | |

Excluding sales charges | | | -2.45% | | | | 1.24% | | | -0.12% |

Including sales charges | | | -7.78% | | | | 0.09% | | | -0.86% |

|

Class C (Commenced May 30, 2008) | | | | | | | | | | |

Excluding contingent deferred sales charges | | | -3.20% | | | | 0.48% | | | -0.86% |

Including contingent deferred sales charges | | | -4.16% | | | | 0.48% | | | -0.86% |

|

Institutional (Commenced May 30, 2008) | | | -2.18% | | | | 1.60% | | | 0.27% |

|

Class IR (Commenced May 30, 2008) | | | -2.23% | | | | 1.45% | | | 0.13% |

|

Class R (Commenced May 30, 2008) | | | -2.71% | | | | 0.96% | | | -0.37% |

|

Class R6 (Commenced July 31, 2015) | | | N/A | | | | N/A | | | -2.98%* |

|

| * | | Total return for periods of less than one year represents cumulative total return. |

11

GOLDMAN SACHS COMMODITY STRATEGY FUND

What Differentiates the Goldman Sachs Commodity Investment Process?

At Goldman Sachs Asset Management, L.P. (“GSAM”), the goal of our commodity investment process is to provide consistent, strong performance by actively managing our portfolios within a research-intensive, risk-managed framework.

Goldman Sachs’ Commodity Investment Process

Our commodity investment process emphasizes the importance of both short-term, tactical opportunities and long-term investment views. Our team-based approach to managing the Fund ensures continuity and idea sharing among some of the industry’s most experienced fixed income specialists. We pursue strong, consistent performance across commodity markets through:

The Goldman Sachs Commodity Strategy Fund primarily gains exposure to the performance of the commodity markets through investment in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary invests primarily in commodity-linked swaps (which may include total return swaps), as well as other commodity-linked securities and derivative instruments that provide exposure to the performance of the commodities markets, and in fixed income and debt instruments. The Fund’s portfolio is designed to provide exposure that corresponds to the investment return of assets that trade in the commodity markets without direct investment in physical commodities.

The Fund implements enhanced cash strategies that capitalize on GSAM’s global fixed income expertise. The Fixed Income Team will employ the full spectrum of capabilities offered, including bottom-up strategies (credit, mortgages, governments /municipals, high yield, and emerging markets debt) and top-down strategies (duration, cross-sector, currency and country) in an attempt to enhance the return of the Fund.

A Commodity Fund that:

| n | | Provides exposure to the commodity markets without direct investment in physical commodities |

| n | | Utilizes commodity-linked swaps that provide economic exposure to movements in commodity prices |

12

PORTFOLIO RESULTS

Goldman Sachs Commodity Strategy Fund

Investment Objective

The Fund seeks long-term total return.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Commodities Team discusses the Goldman Sachs Commodity Strategy Fund’s (the “Fund”) performance and positioning for the 12-month period ended December 31, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated average annual total returns, without sales charges, of -32.43%, -32.95%, -32.38%, -32.15% and -32.88%, respectively. These returns compare to the -32.86% average annual total return of the Fund’s benchmark, the S&P GSCI® Total Return Index (Gross, USD, Unhedged, formerly the Goldman Sachs Commodity Index) (the “S&P GSCI®”), during the same period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of -21.23%. This return compares to the -21.67% cumulative total return of the S&P GSCI® during the same period. |

| Q | | What economic and market factors most influenced the commodities markets as a whole during the Reporting Period? |

| A | | Commodities markets, as measured by the S&P GSCI®, experienced great challenges during the Reporting Period overall, returning -32.86%. By comparison, the S&P 500® Index and the U.S. Dollar Index (“DXY”) returned 1.38% and 9.3%, respectively.1 |

| | In our opinion, weaknesses in the commodities markets during the Reporting Period can be attributed to several macro factors. The U.S. dollar continued to strengthen, fueled by improving economic indicators in the U.S. and the anticipation of central bank policy divergence with the U.S. Federal Reserve (the “Fed”) beginning to raise its target interest rate in December 2015. Outside the U.S., the trend of monetary policy easing intensified with the European Central Bank and the Bank of Japan continuing their respective programs of quantitative easing. Further, Chinese economic data continued to disappoint, with its government attempting to smoothly transition into a slower growth economy. |

| Q | | Which commodity subsectors were weakest during the Reporting Period? |

| A | | The energy component of the S&P GSCI® was weakest, returning -41.5% during the Reporting Period. The persisting global oversupply in crude oil weakened prices. Global production remained elevated, and the latest OPEC (“Organization of the Petroleum Exporting Countries”) meeting in December 2015 yielded no cuts to production. Additionally, shale production cuts in the U.S. underwhelmed the market (i.e. fell short of broad consensus hopes). Natural gas prices also fell, as strong production and an unusually warm start to the 2015-16 winter kept inventories at seasonally high levels. |

| | The industrial metals subsector, as measured by the S&P GSCI® Industrial Metals Index, returned -24.5% for the Reporting Period overall. Prices declined broadly, as the Chinese economy, the largest consumer of industrial metals, continued to show signs of deceleration. Additionally, the strengthening U.S. dollar weighed on prices of dollar-denominated commodities. |

| | Agriculture was also down, with the S&P GSCI® Agriculture Index declining 16.9% for the Reporting Period. Grains continued to weaken as the 2015 U.S. harvest progressed at healthy levels and weak export data against a backdrop of an already well-supplied market increased the expected carryover in supply to next year. Additionally, favorable changes in the weather in South America and potential increases in Argentinean exports further bolstered forecasted inventories. |

| | The precious metals subsector of the S&P GSCI® retuned -11.1% during the Reporting Period. Precious metals prices |

| | 1 | | The S&P 500® Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The DXY is a measure of the general international value on of the U.S. dollar as calculated by averaging the exchange rates between the U.S. dollar and six major world currencies. |

13

PORTFOLIO RESULTS

| | weakened ahead of the first interest rate hike by the Fed in nearly a decade. Increasing interest rates tend to make non-yielding assets like gold less attractive to investors. |

| Q | | Which commodity subsectors were strongest during the Reporting Period? |

| A | | None of the commodity subsectors posted a positive return during the Reporting Period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | While absolute returns disappointed, the Fund generated returns that performed in line with the S&P GSCI® during the Reporting Period. The Fund extensively employed deferred positioning along the futures curves across the commodities markets in 2015, attempting to exploit more persistent contango found at the front of the futures curves, where the S&P GSCI® sits, in a broadly negative Reporting Period for commodities. (Contango is defined as a common market condition in which futures prices get progressively higher in the distant delivery months, often reflecting carrying costs. In other words, the nearby contract is trading at a lower price than the futures contract, such that one is rolling each month at a higher price.) In short, our enhanced roll-timing strategies via exposure to commodity index-linked swaps contributed positively to returns during the Reporting Period. Our enhanced cash management strategy also added value during the Reporting Period. |

| Q | | How did the Fund’s enhanced roll-timing strategies impact performance during the Reporting Period? |

| A | | Our enhanced roll-timing strategies contributed positively to the Fund’s performance via exposure to commodity index-linked swaps. We employ an approach whereby we do not take active views on individual commodities but rather gain Fund exposure to commodities through investments whose performance is linked to commodity indices. |

| | We often implement commodity roll-timing strategies by deviating from the S&P GSCI® roll convention, which typically calls for rolling forward exposure at the front, or near-month, end of the futures curve on a monthly basis. The roll occurs during business days 5 through 9. To the extent our team believes fundamental or technical developments will impact the futures roll-timing decision, we will incorporate those views into the portfolio by electing to roll positions earlier, later, forward or in different weights versus the S&P GSCI® roll. Roll-timing strategies employed may include 1) alternative roll date modifications, which avoid the market impact of plain vanilla S&P GSCI® rolls during business days 5 to 9; 2) forward exposure roll modifications, which avoid the market impact of plain vanilla S&P GSCI® rolls and move exposure out the curve to mitigate the returns impact often associated with persistent contango; and 3) seasonal roll modifications, which take advantage of seasonal relationships in commodity markets to increase returns. During most of the Reporting Period, we employed a forward roll-timing strategy that rolled commodity exposures underlying the S&P GSCI® a few months out on the futures curve instead of rolling at the very front of the futures curve. |

| | The Fund’s deferred positioning across the commodities curves contributed positively to relative results in 2015. Returns were driven primarily by deferred crude oil, both West Texas Intermediate (“WTI”) and Brent, exposure and natural gas exposure. Persistently oversupplied crude oil markets, coupled with elevated production, helped pressure WTI crude oil inventories in the U.S. and Brent crude oil inventories globally. Natural gas inventories also maintained seasonally elevated levels, driven by strong production as well as by a very mild start, in terms of weather, to the 2015-16 winter. Elevated inventories, in turn, pressured the front end of the futures curve as storage became more costly. |

| Q | | How did you implement the Fund’s enhanced cash management strategy? |

| A | | In addition to seeking value through management of the commodities portion of the Fund’s portfolio, we also attempt to add a modest amount of excess return through thoughtful management of collateral held in the Fund. The cash portion of the Fund’s portfolio is typically allocated to high-grade collateral that includes U.S. Treasury securities, agency debentures, mortgage-backed securities and short-term fixed income instruments. During the Reporting Period, we favored high quality government and agency securities for the Fund’s collateral allocation. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | As mentioned earlier in some detail, the Fund used commodity index-linked total return swaps in implementing our enhanced roll-timing strategies in order to gain exposure |

14

PORTFOLIO RESULTS

| | to the commodities markets. In implementing our enhanced cash management strategy, the Fund used futures, interest rate swaps and forward sales contracts, which are agency mortgage-backed derivatives used in purchasing a future issuance of agency mortgage-backed securities. The use of these instruments is integral to the Fund’s investment strategy, which realized negative absolute returns during the Reporting Period. |

| Q | | Did you make any changes in the Fund’s strategy or allocations during the Reporting Period? |

| A | | The Fund continued to hold exposure to the commodities markets primarily in the form of swaps linked to the S&P GSCI®. In the beginning of the Reporting Period, the Fund held six months forward exposure to the S&P GSCI®. In May 2015, the Fund shifted to a 25%/75% blend of three months forward and six months forward exposure in the futures curve across all commodities held in the S&P GSCI® via customized swaps on the S&P GSCI®. In October 2015, the Fund shifted to the front month exposure aligned with the S&P GSCI®. In December 2015, the Fund shifted to 25% six months forward exposure to the S&P GSCI®. |

| Q | | How was the Fund positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund’s positioning was deferred 25% six months forward across the stack of commodities curves. As described earlier, the Fund held exposure to the commodities underlying the S&P GSCI® through customized swaps in the Subsidiary and held no deferred commodity exposure at the end of the Reporting Period. (The Subsidiary has the same objective as the Fund, but unlike the Fund, it may invest, without limitation, in commodity index-linked securities, such as swaps and futures, that provide exposure to the performance of the commodity markets.) |

| | The cash portion of the Fund’s portfolio was allocated across various fixed income sectors, with an emphasis on the higher quality, lower volatility segments of the market, such as U.S. government and government-sponsored bonds. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | | What is the Fund’s view and strategy going forward? |

| A | | At the end of the Reporting Period, we held a bearish view toward many commodity markets, such as crude oil, natural gas, grains, gold and base metals. Crude oil markets remain in surplus, and we expect a new, higher volatility regime to replace the earlier, lower volatility in prices. Shale oil is the new balancing power, in our view, and we expect oil prices to eventually stabilize around a price that reflects shale oil’s marginal cost of production. We believe that natural gas prices may also continue to decline, as inventories remain seasonally high given an unusually warm winter through the end of 2015. Gold may underperform the S&P GSCI® as we expect the Fed to continue raising target interest rates. In our opinion, base metals may be further pressured by the continued slowdown in Chinese economic growth and industrial demand. We also believe that grain prices may weaken looking ahead to the South American harvest, as favorable changes to the weather, coupled with an expected increase in exports from Argentina, may bolster market supply. Irrespective of directionality, however, we believe the market will continue to hold opportunities for the active, relative value investor, especially amid a heightened volatility regime. Historically, volatility moves prices away from fundamentals and affords opportunities to the active investor. |

15

FUND BASICS

Commodity Strategy Fund

as of December 31, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2015–December 31, 2015 | | Fund Total Return

(based on NAV)1 | | | S&P GSCI®2 | |

| | Class A | | | -32.43 | % | | | -32.86 | % |

| | Class C | | | -32.95 | | | | -32.86 | |

| | Institutional | | | -32.38 | | | | -32.86 | |

| | Class IR | | | -32.15 | | | | -32.86 | |

| | | Class R | | | -32.88 | | | | -32.86 | |

| | | |

| | | | | | | | | |

| | | July 31, 2015–December 31, 2015 | | Fund Total Return

(based on NAV)1 | | | S&P GSCI®2 | |

| | | Class R6 | | | -21.23 | % | | | -21.67 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P GSCI® is an unmanaged composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. Individual components qualify for inclusion in the S&P GSCI® on the basis of liquidity and are weighted by their respective world production quantities. The figures for the S&P GSCI® do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 12/31/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| | Class A | | | -35.41 | % | | | -15.62 | % | | | -11.53 | % | | 3/30/07 |

| | Class C | | | -33.20 | | | | -15.46 | | | | -11.72 | | | 3/30/07 |

| | Institutional | | | -32.38 | | | | -14.62 | | | | -10.80 | | | 3/30/07 |

| | Class IR | | | -32.15 | | | | -14.63 | | | | -13.41 | | | 11/30/07 |

| | Class R | | | -32.88 | | | | -15.11 | | | | -13.89 | | | 11/30/07 |

| | | Class R6 | | | N/A | | | | N/A | | | | -21.23 | | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end or cumulative total returns for periods less than one year. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 4.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.98 | % | | | 1.11 | % |

| | Class C | | | 1.72 | | | | 1.87 | |

| | Institutional | | | 0.63 | | | | 0.78 | |

| | Class IR | | | 0.71 | | | | 0.87 | |

| | Class R | | | 1.22 | | | | 1.37 | |

| | | Class R6 | | | 0.61 | | | | 0.76 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least July 31, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

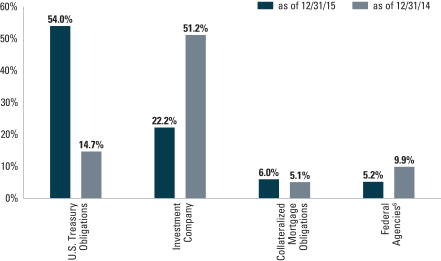

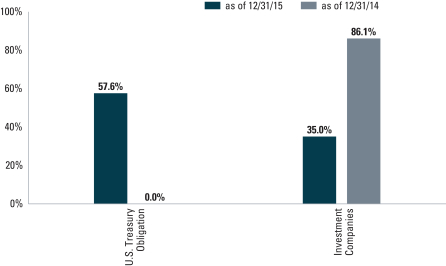

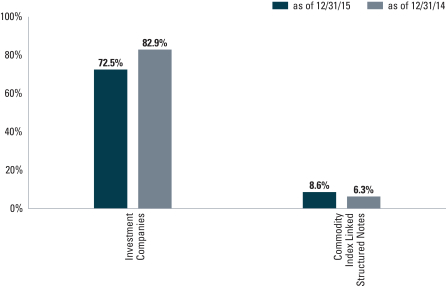

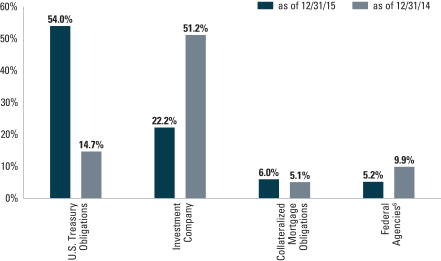

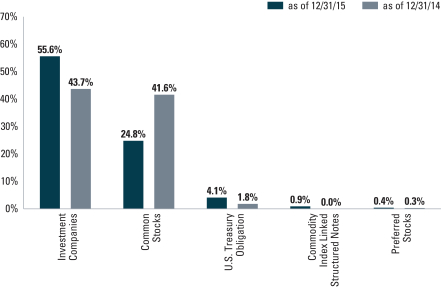

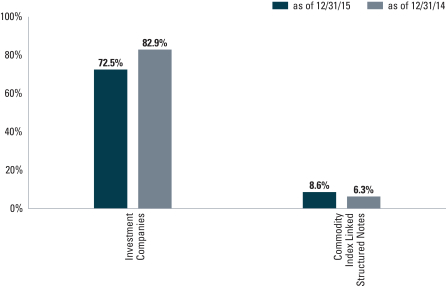

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. Underlying sector allocations of Investment Companies held by the Fund are not reflected in the graph above. Consequently, the graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | 6 | | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) or Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the United States Government. |

17

GOLDMAN SACHS COMMODITY STRATEGY FUND

Performance Summary

December 31, 2015

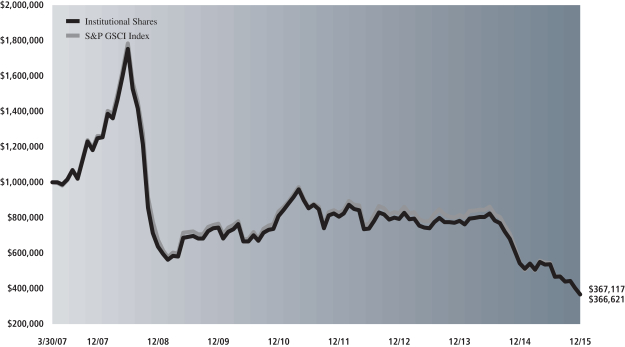

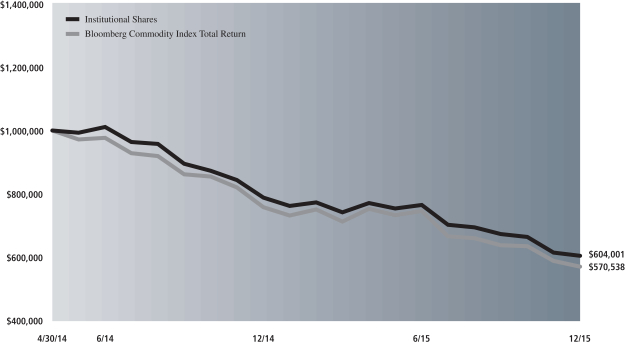

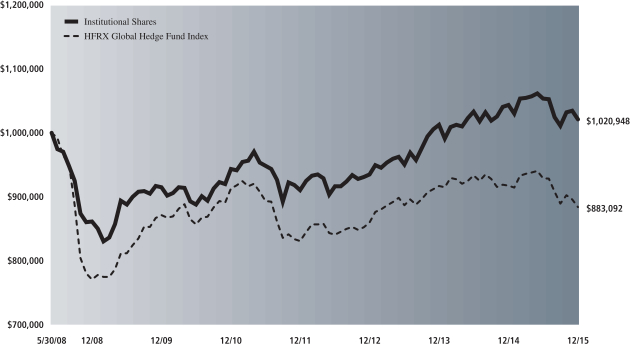

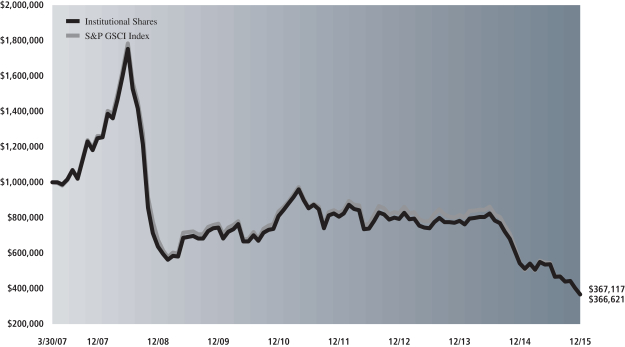

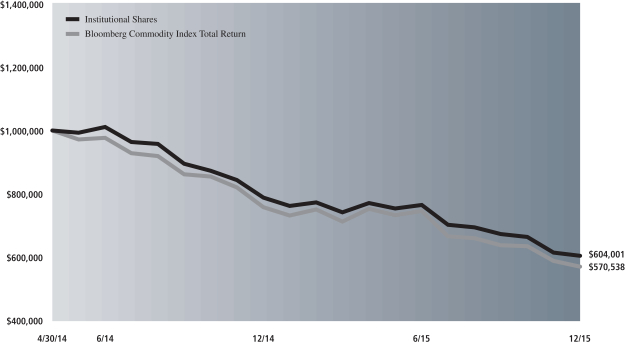

The following graph shows the value as of December 31, 2015, of a $1,000,000 investment made on March 30, 2007 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the S&P GSCI® Total Return Index (Gross, USD, Unhedged) (“S&P GSCI Index”), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of Class A, Class C, Class IR, Class R and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Investment Adviser’s decision regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund.

| | |

| Commodity Strategy Fund’s Lifetime Performance | | |

Performance of a $1,000,000 Investment, with distributions reinvested, from March 30, 2007 through December 31, 2015.

| | | | | | | | | | |

| Average Annual Total Return through December 31, 2015 | | | One Year | | | | Five Years | | | Since Inception |

Class A (Commenced March 30, 2007) | | | | | | | | | | |

Excluding sales charges | | | -32.43% | | | | -14.85% | | | -11.06% |

Including sales charges | | | -35.41% | | | | -15.62% | | | -11.53% |

|

Class C (Commenced March 30, 2007) | | | | | | | | | | |

Excluding contingent deferred sales charges | | | -32.95% | | | | -15.46% | | | -11.72% |

Including contingent deferred sales charges | | | -33.20% | | | | -15.46% | | | -11.72% |

|

Institutional (Commenced March 30, 2007) | | | -32.38% | | | | -14.62% | | | -10.80% |

|

Class IR (Commenced November 30, 2007) | | | -32.15% | | | | -14.63% | | | -13.41% |

|

Class R (Commenced November 30, 2007) | | | -32.88% | | | | -15.11% | | | -13.89% |

|

Class R6 (Commenced July 31, 2015) | | | N/A | | | | N/A | | | -21.23%* |

|

| * | | Total return for periods of less than one year represents cumulative total return. |

18

PORTFOLIO RESULTS

Goldman Sachs Dynamic Allocation Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies (“QIS”) Team discusses the Goldman Sachs Dynamic Allocation Fund’s (the “Fund”) performance and positioning for the 12 month period ended December 31, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

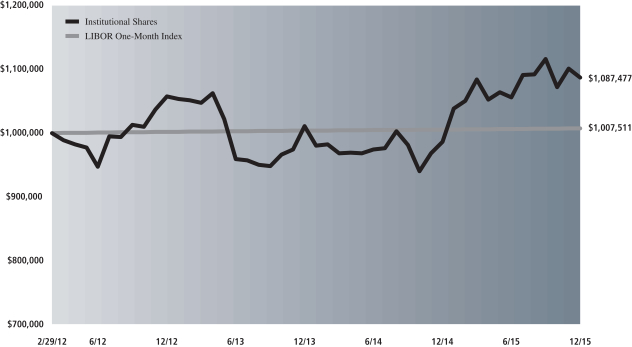

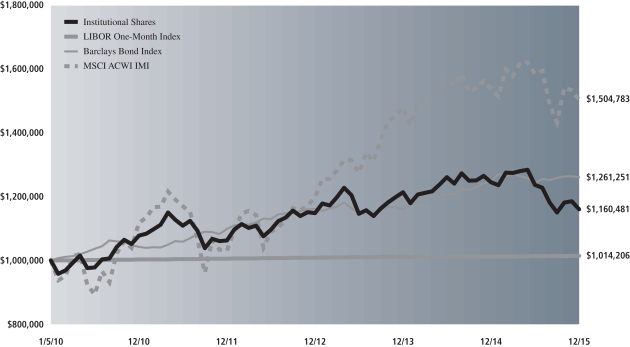

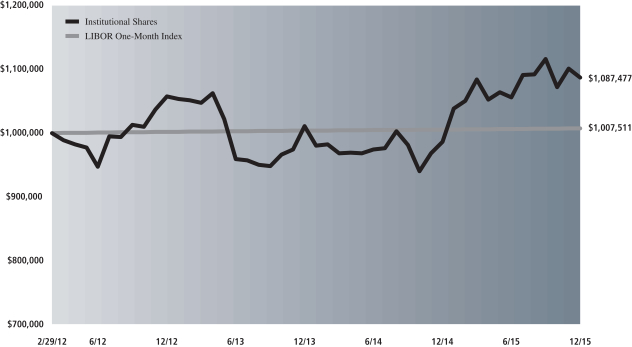

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated average annual total returns, without sales charges, of -7.17%, -7.82%, -6.84%, -6.90% and -7.35%, respectively. These returns compare to the 0.18% average annual total return of the Fund’s benchmark, the Bank of America Merrill Lynch USD LIBOR One-Month Constant Maturity Index (the “LIBOR One-Month Index”). The Dynamic Allocation Fund Composite Index, comprised 60% of the MSCI All Country World Index Investable Market Index (Net, USD, Unhedged) (“MSCI ACWI IMI”) and 40% of the Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Barclays Bond Index”), returned -0.71% during the same period. The MSCI ACWI IMI and Barclays Bond Index posted average annual total returns of -2.19% and 1.02%, respectively, during the same period. |

| | Since their inception on July 31, 2015, the Fund’s Class R6 Shares generated a cumulative total return, without sales charge, of -5.48%. This return compares to the 0.08% cumulative total return of the LIBOR One-Month Index during the same period. The Dynamic Allocation Fund Composite Index returned -3.17% during the same period. The MSCI ACWI IMI and Barclays Bond Index posted cumulative total returns of -5.70% and 0.42%, respectively, during the same period. |

| | The Fund’s overall annualized volatility was 7.42% during the Reporting Period. To compare, the overall annualized volatility of the S&P 500® Index during the same time period was 15.43%. |

| Q | | What were the primary contributors to and detractors from the Fund’s performance based on your team’s asset allocation decisions during the Reporting Period? |

| A | | The Fund seeks to achieve its investment objective by investing primarily in exchange-traded funds (“ETFs”), stocks, futures, swaps, structured notes and other derivatives that provide exposure to a broad spectrum of asset classes, including but not limited to equities (both in U.S. and non-U.S. companies), fixed income (U.S. and non-U.S., investment grade and high yield) and commodities. Our team manages the Fund dynamically by changing its allocations to these asset classes based on our tactical views and in response to changing market conditions. Our team uses a disciplined, rigorous and quantitative approach, in combination with a qualitative overlay, in allocation to and within the asset classes in which the Fund invests. Allocations are adjusted within the Fund at least monthly based on continuous analysis to help determine which investments are relatively attractive and provide the best opportunities for growth in any given period of time. Since the markets represented by each investment are constantly changing, so are the Fund’s allocations. |

| | Overall, the Fund realized negative returns during the Reporting Period. Allocations to U.S. equities and emerging market equities detracted most from performance, as these asset classes performed weakly during the Reporting Period. These detractors were partially offset by allocations to Japanese equities and Australian equities, which contributed most positively to the Fund’s performance. |

19

PORTFOLIO RESULTS

| Q | | How did the Goldman Sachs Market Sentiment Indicator factor into risk allocation decisions that were made during the Reporting Period? |

| A | | The Goldman Sachs Market Sentiment Indicator (“MSI”) is a proprietary tool that analyzes how the markets will potentially respond to future global changes in financial, economic and sociopolitical events. With the help of the MSI, the Fund seeks to mitigate risk in unstable markets by reducing volatility. |

| | Shifts in central bank policy, global economic growth concerns centering around China, and the sell-off in commodities were key themes affecting the markets throughout 2015. In January 2015, the MSI was elevated but still below our de-risking level. Heightened volatility in core asset classes and developed international market currencies contributed to the elevated MSI level as a result of the dramatic appreciation of the Swiss franc. Throughout February and March 2015, the MSI stabilized amid mixed global equity market performance. By late June 2015, the MSI detected heightened levels of overall market distress, in part on the heels of the ongoing uncertainty surrounding Greece and whether or not it would remain in the euro. This led us to de-risk the Fund in July 2015. The Fund continued gradually decreasing its risk exposure until September 2015. After spiking in August 2015, the MSI steadily retreated through the fourth calendar quarter until mid-December 2015, when declines in high yield credit, driven by concerns about liquidity and persistent declines in oil prices, reverberated across global markets. The Fund ended the Reporting Period slightly below its full-risk target. |