UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman Sachs & Co. LLC | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code:(312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2020 |

| | |

| | | | Dividend Focus Funds |

| | | | Income Builder |

| | | | Rising Dividend Growth |

It is our intention that beginning on January 1, 2021, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a Fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from a Fund electronically by calling the applicable toll-free number below or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge. If you hold shares of a Fund directly with the Fund’s transfer agent, you can inform the transfer agent that you wish to receive paper copies of reports by callingtoll-free 800-621-2550 for Institutional, Class R6 and Class P shareholders or800-526-7384 for all other shareholders. If you hold shares of a Fund through a financial intermediary, please contact your financial intermediary to make this election. Your election to receive reports in paper will apply to all Goldman Sachs Funds held in your account if you invest through your financial intermediary or all Goldman Sachs Funds held with the Funds’ transfer agent if you invest directly with the transfer agent.

Goldman Sachs Dividend Focus Funds

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

Goldman Sachs Dividend Focus Funds

Recent Market Events related to COVID-19

While this semi-annual report covers the six month period ended April 30, 2020, we want to describe some more recent events through the end of May.

An outbreak of a novel strain of coronavirus (COVID-19) has emerged globally. The outbreak of COVID-19 has prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, curfews and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, and disruption in manufacturing and supply chains. While governments have already taken unprecedented action to limit disruption to the financial system, global financial markets have experienced and may continue to experience significant volatility resulting from the spread of and subsequent intervening measures intended to limit the spread of COVID-19. The Fund could be negatively impacted if the value of a portfolio holding were harmed by such political or economic conditions, events, or actions. The full extent of the impact of COVID-19 on the Fund’s performance cannot be determined at this time and will depend on future developments, including the duration and the continued spread of the outbreak. Goldman Sachs Asset Management’s long-term commitment to you, our Fund shareholders, remains unchanged. We encourage you to maintain perspective and stay current with timely commentary and investment insights by visiting gsam.com.

i

FUND BASICS

Income Builder Fund

as of April 30, 2020

| | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | | | | | |

| | | | |

| | | November 1, 2019–April 30, 2020 | | Fund Total Return

(based on NAV)1 | | | Russell 1000®

Value Index2 | | | ICE BofAML BB to B U.S. High

Yield Constrained Index3 | |

| | | | |

| | Class A | | | -5.70 | % | | | -13.66 | % | | | -6.20 | % |

| | Class C | | | -6.06 | | | | -13.66 | | | | -6.20 | |

| | Institutional | | | -5.52 | | | | -13.66 | | | | -6.20 | |

| | Investor | | | -5.59 | | | | -13.66 | | | | -6.20 | |

| | Class P | | | -5.51 | | | | -13.66 | | | | -6.20 | |

| | | Class R6 | | | -5.52 | | | | -13.66 | | | | -6.20 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. This index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. It is not possible to invest directly in an unmanaged index. |

| 3 | | The BofAML BB to B U.S. High Yield Constrained Index contains all securities in the ICE BofAML U.S. High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on apro-rata basis. Similarly, the face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1

FUND BASICS

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 4/30/204 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Johnson & Johnson | | | 1.5 | % | | Pharmaceuticals |

| | Chevron Corp. | | | 1.0 | | | Oil, Gas & Consumable Fuels |

| | Cisco Systems, Inc. | | | 0.9 | | | Communications Equipment |

| | Verizon Communications, Inc. | | | 0.9 | | | Diversified Telecommunication Services |

| | Eli Lilly & Co. | | | 0.8 | | | Pharmaceuticals |

| | The Home Depot, Inc. | | | 0.8 | | | Specialty Retail |

| | Comcast Corp. Class A | | | 0.8 | | | Media |

| | Microsoft Corp. | | | 0.8 | | | Software |

| | Medtronic PLC | | | 0.8 | | | Health Care Equipment & Supplies |

| | | Linde PLC | | | 0.7 | | | Chemicals |

| 4 | | The top 10 holdings may not be representative of the Fund’s future investments. |

| | | | | | |

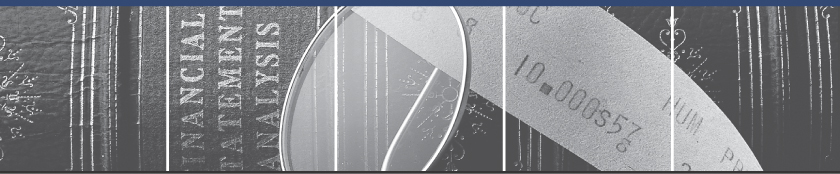

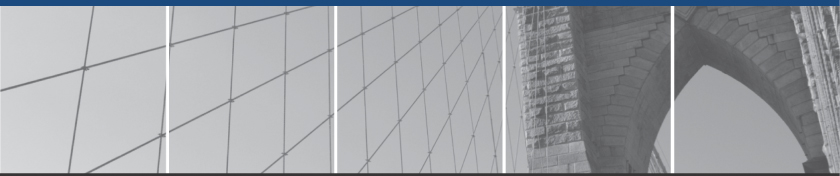

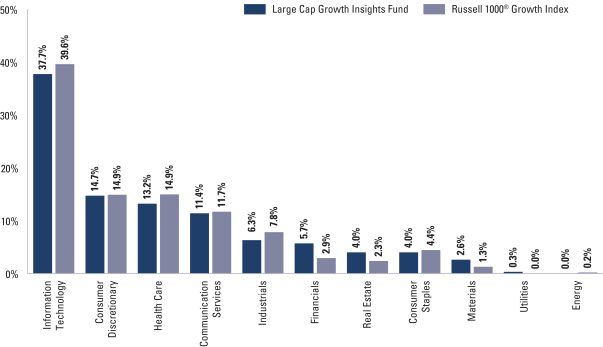

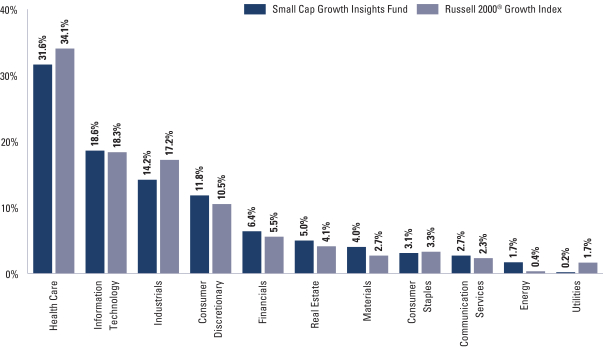

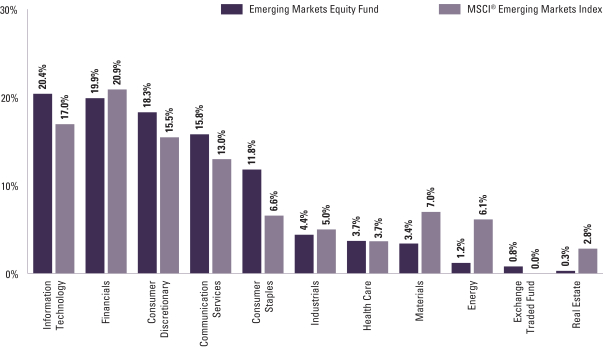

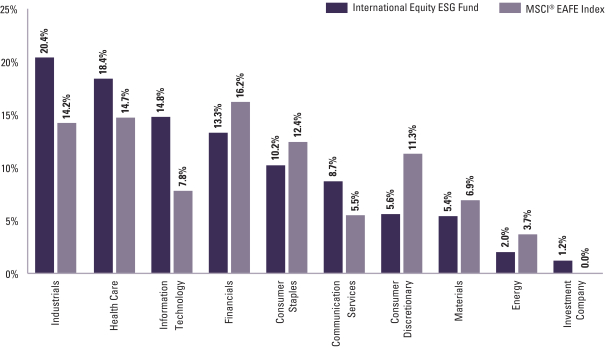

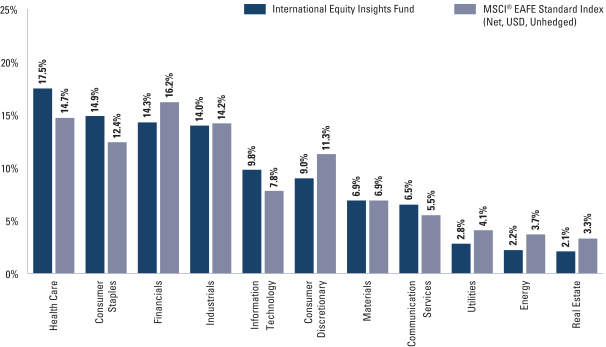

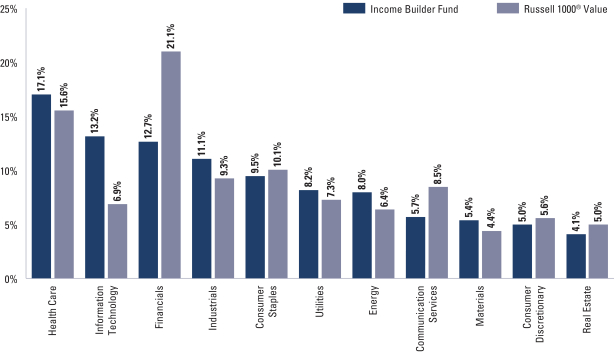

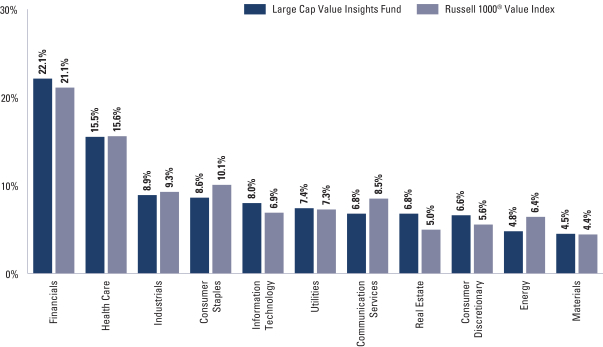

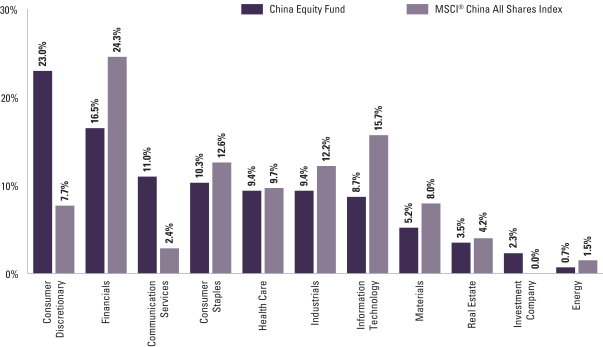

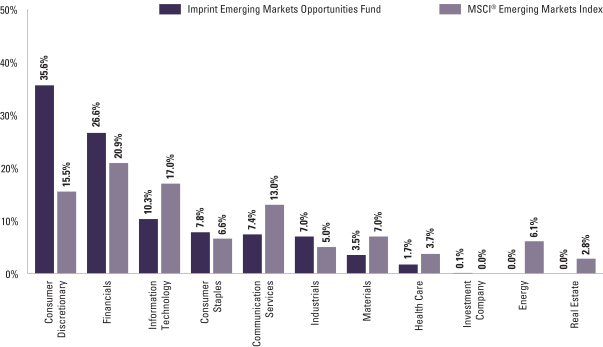

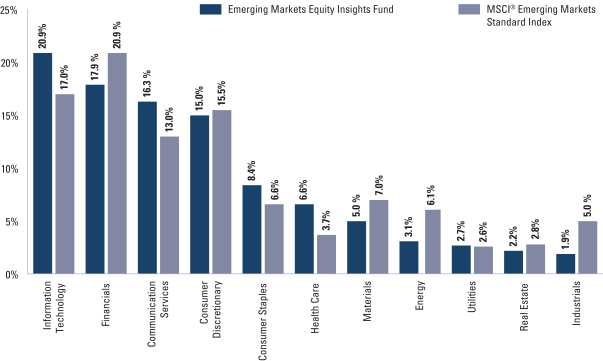

| FUND’S EQUITY SECTOR ALLOCATIONS VS. BENCHMARK5 |

| |

| As of April 30, 2020 | | |

| 5 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s Equity investments market value (excluding investments in the securities lending reinvestment vehicle, if any). Investments in the securities lending reinvestment vehicle represented 0.8% of the Fund’s net assets as of April 30, 2020. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

2

FUND BASICS

|

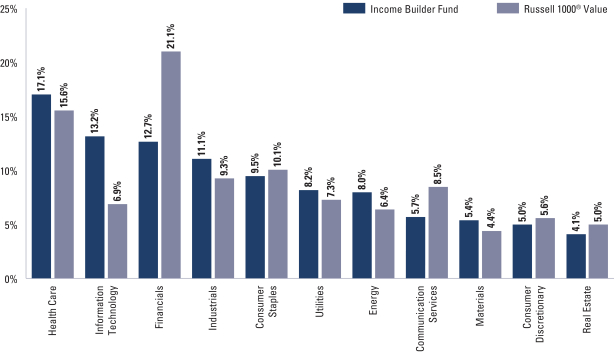

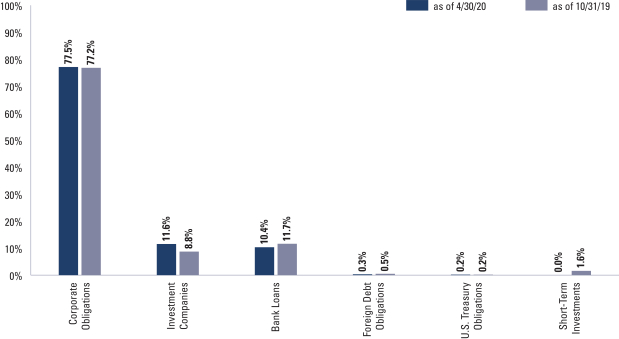

| FUND’S FIXED INCOME FUND COMPOSITION6 |

| 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund’s Fixed Income investments. Short-term investments represent commercial paper. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

3

FUND BASICS

Rising Dividend Growth Fund

as of April 30, 2020

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | November 1, 2019–April 30, 2020 | | Fund Total Return

(based on NAV)1 | | | S&P 500 Index2 | |

| | | |

| | Class A | | | -12.53 | % | | | -3.16 | % |

| | Class C | | | -12.90 | | | | -3.16 | |

| | Institutional | | | -12.43 | | | | -3.16 | |

| | Investor | | | -12.49 | | | | -3.16 | |

| | Class P | | | -12.43 | | | | -3.16 | |

| | Class R | | | -12.64 | | | | -3.16 | |

| | | Class R6 | | | -12.44 | | | | -3.16 | |

| 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | | The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 4/30/203 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Activision Blizzard, Inc. | | | 2.2 | % | | Entertainment |

| | Comcast Corp. Class A | | | 2.0 | | | Media |

| | Enterprise Products Partners LP | | | 2.0 | | | Oil, Gas & Consumable Fuels |

| | The Walt Disney Co. | | | 1.8 | | | Entertainment |

| | UnitedHealth Group, Inc. | | | 1.6 | | | Health Care Providers & Services |

| | Danaher Corp. | | | 1.6 | | | Health Care Equipment & Supplies |

| | Microsoft Corp. | | | 1.5 | | | Software |

| | Magellan Midstream Partners LP | | | 1.5 | | | Oil, Gas & Consumable Fuels |

| | MPLX LP | | | 1.4 | | | Oil, Gas & Consumable Fuels |

| | | The Home Depot, Inc. | | | 1.4 | | | Specialty Retail |

| 3 | | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

|

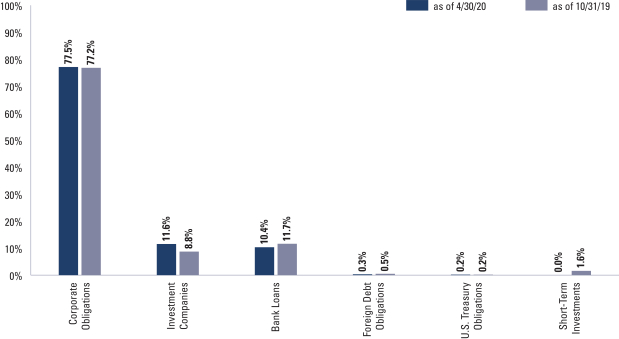

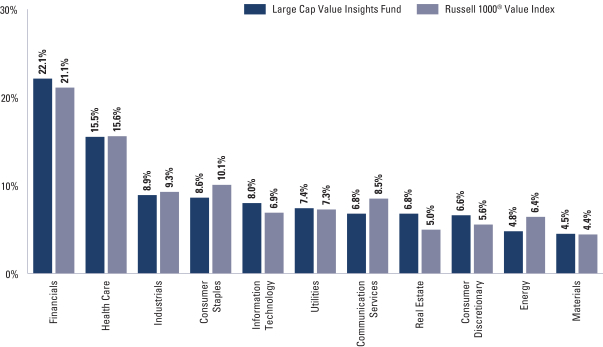

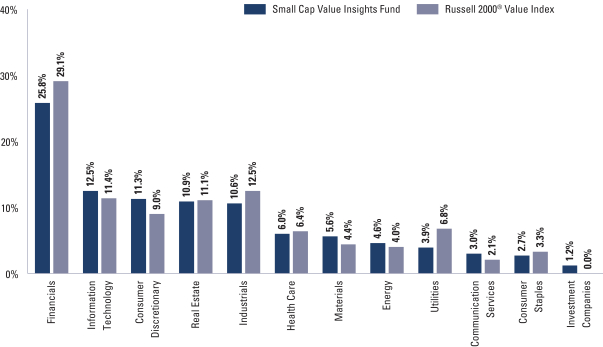

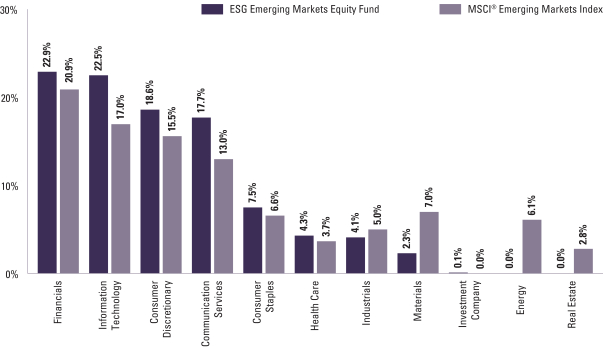

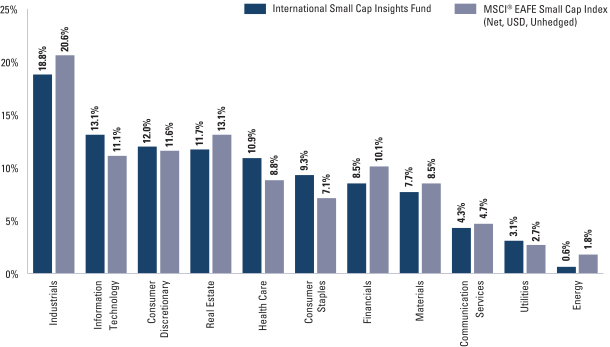

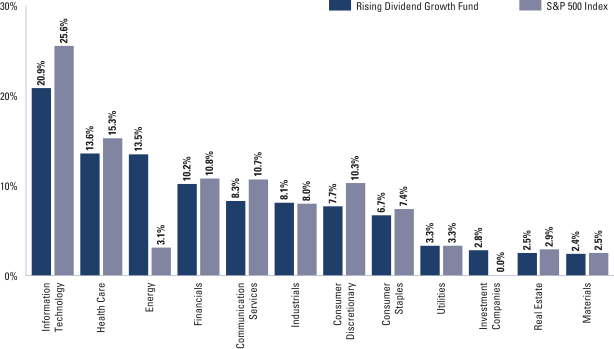

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

|

| As of April 30, 2020 |

| 4 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

5

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments

April 30, 2020 (Unaudited)

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Common Stocks – 35.7% | |

| Aerospace & Defense – 0.5% | |

| | 23,714 | | | Northrop Grumman Corp. | | $ | 7,841,508 | |

| | |

| Banks – 2.0% | |

| | 120,840 | | | JPMorgan Chase & Co. | | | 11,571,638 | |

| | 2,377,373 | | | Lloyds Banking Group PLC ADR | | | 3,732,476 | |

| | 39,003 | | | M&T Bank Corp. | | | 4,371,456 | |

| | 167,676 | | | Truist Financial Corp. | | | 6,257,668 | |

| | 224,892 | | | Wells Fargo & Co. | | | 6,533,113 | |

| | | | | | | | |

| | | | | | | 32,466,351 | |

| | |

| Beverages – 0.5% | |

| | 178,531 | | | TheCoca-Cola Co. | | | 8,192,788 | |

| | |

| Biotechnology – 0.2% | |

| | 15,148 | | | Amgen, Inc. | | | 3,623,705 | |

| | |

| Capital Markets – 1.1% | |

| | 11,434 | | | BlackRock, Inc. | | | 5,740,325 | |

| | 178,423 | | | Morgan Stanley | | | 7,035,219 | |

| | 51,969 | | | Singapore Exchange Ltd. ADR | | | 5,268,617 | |

| | | | | | | | |

| | | | | | | 18,044,161 | |

| | |

| Chemicals – 1.0% | |

| | 21,141 | | | Ecolab, Inc. | | | 4,090,784 | |

| | 63,972 | | | Linde PLC | | | 11,770,208 | |

| | | | | | | | |

| | | | | | | 15,860,992 | |

| | |

| Commercial Services & Supplies – 0.4% | |

| | 89,733 | | | Republic Services, Inc. | | | 7,029,683 | |

| | |

| Communications Equipment – 1.1% | |

| | 349,781 | | | Cisco Systems, Inc. | | | 14,823,719 | |

| | 136,517 | | | Juniper Networks, Inc. | | | 2,948,767 | |

| | | | | | | | |

| | | | | | | 17,772,486 | |

| | |

| Construction & Engineering – 0.3% | |

| | 248,896 | | | Vinci SA ADR | | | 5,060,056 | |

| | |

| Containers & Packaging – 0.5% | |

| | 248,520 | | | International Paper Co. | | | 8,511,810 | |

| | |

| Diversified Telecommunication Services – 0.9% | |

| | 249,224 | | | Verizon Communications, Inc. | | | 14,317,919 | |

| | |

| Electric Utilities – 0.9% | |

| | 875,805 | | | Enel SpA ADR | | | 5,916,063 | |

| | 21,338 | | | NextEra Energy, Inc. | | | 4,931,638 | |

| | 64,936 | | | Xcel Energy, Inc. | | | 4,127,332 | |

| | | | | | | | |

| | | | | | | 14,975,033 | |

| | |

| Electrical Equipment – 0.6% | |

| | 551,790 | | | Schneider Electric SE ADR | | | 10,023,265 | |

| | |

| Electronic Equipment, Instruments & Components – 0.5% | |

| | 75,856 | | | National Instruments Corp. | | | 2,914,388 | |

| | 56,583 | | | TE Connectivity Ltd. | | | 4,156,587 | |

| | | | | | | | |

| | | | | | | 7,070,975 | |

| | |

|

| Common Stocks – (continued) | |

| Energy Equipment & Services – 0.1% | |

| | 117,569 | | | Baker Hughes Co. | | | 1,640,088 | |

| | |

| Entertainment – 0.3% | |

| | 50,189 | | | The Walt Disney Co. | | | 5,427,940 | |

| | |

| Equity Real Estate Investment Trusts (REITs) – 1.5% | |

| | 16,554 | | | Alexandria Real Estate Equities, Inc. | | | 2,600,468 | |

| | 32,607 | | | American Tower Corp. | | | 7,760,466 | |

| | 30,260 | | | AvalonBay Communities, Inc. | | | 4,930,867 | |

| | 50,268 | | | Camden Property Trust | | | 4,427,103 | |

| | 158,519 | | | Hudson Pacific Properties, Inc. | | | 3,896,397 | |

| | | | | | | | |

| | | | | | | 23,615,301 | |

| | |

| Food & Staples Retailing – 0.3% | |

| | 128,219 | | | The Kroger Co. | | | 4,053,003 | |

| | |

| Food Products – 0.9% | |

| | 89,376 | | | Mondelez International, Inc. Class A | | | 4,597,501 | |

| | 93,039 | | | Nestle SA ADR | | | 9,778,399 | |

| | | | | | | | |

| | | | | | | 14,375,900 | |

| | |

| Health Care Equipment & Supplies – 1.2% | |

| | 124,505 | | | Medtronic PLC | | | 12,155,423 | |

| | 55,978 | | | Zimmer Biomet Holdings, Inc. | | | 6,700,567 | |

| | | | | | | | |

| | | | | | | 18,855,990 | |

| | |

| Health Care Providers & Services – 1.2% | |

| | 180,412 | | | CVS Health Corp. | | | 11,104,359 | |

| | 25,902 | | | UnitedHealth Group, Inc. | | | 7,575,558 | |

| | | | | | | | |

| | | | | | | 18,679,917 | |

| | |

| Hotels, Restaurants & Leisure – 0.7% | |

| | 56,652 | | | McDonald’s Corp. | | | 10,625,649 | |

| | |

| Household Products – 1.0% | |

| | 38,504 | | | Kimberly-Clark Corp. | | | 5,332,034 | |

| | 93,818 | | | The Procter & Gamble Co. | | | 11,058,328 | |

| | | | | | | | |

| | | | | | | 16,390,362 | |

| | |

| Industrial Conglomerates – 0.4% | |

| | 46,865 | | | Honeywell International, Inc. | | | 6,650,143 | |

| | |

| Insurance – 1.0% | |

| | 65,727 | | | Chubb Ltd. | | | 7,099,173 | |

| | 33,261 | | | The Travelers Cos., Inc. | | | 3,366,346 | |

| | 168,012 | | | Zurich Insurance Group AG ADR | | | 5,290,698 | |

| | | | | | | | |

| | | | | | | 15,756,217 | |

| | |

| IT Services – 0.5% | |

| | 17,919 | | | Accenture PLC Class A | | | 3,318,420 | |

| | 38,189 | | | Fidelity National Information Services, Inc. | | | 5,036,747 | |

| | | | | | | | |

| | | | | | | 8,355,167 | |

| | |

| Machinery – 0.8% | |

| | 46,968 | | | Deere & Co. | | | 6,813,178 | |

| | 46,221 | | | Stanley Black & Decker, Inc. | | | 5,093,554 | |

| | | | | | | | |

| | | | | | | 11,906,732 | |

| | |

| | |

| 6 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Common Stocks – (continued) | |

| Media – 0.8% | |

| | 194,739 | | | Bright Pattern Holding Co. | | $ | 253,160 | |

| | 328,845 | | | Comcast Corp. Class A | | | 12,374,437 | |

| | | | | | | | |

| | | | | | | 12,627,597 | |

| | |

| Metals & Mining – 0.5% | |

| | 157,963 | | | Rio Tinto PLC ADR | | | 7,296,311 | |

| | |

| Multi-Utilities – 1.4% | |

| | 88,932 | | | Ameren Corp. | | | 6,469,803 | |

| | 60,599 | | | CMS Energy Corp. | | | 3,459,597 | |

| | 105,761 | | | National Grid PLC ADR | | | 6,193,364 | |

| | 64,346 | | | Public Service Enterprise Group, Inc. | | | 3,262,985 | |

| | 27,635 | | | Sempra Energy | | | 3,422,595 | |

| | | | | | | | |

| | | | | | | 22,808,344 | |

| | |

| Oil, Gas & Consumable Fuels – 2.8% | |

| | 201,194 | | | Antero Midstream Corp. | | | 955,672 | |

| | 263,599 | | | BP PLC ADR | | | 6,273,656 | |

| | 172,219 | | | Chevron Corp. | | | 15,844,148 | |

| | 600,957 | | | Energy Transfer LP | | | 5,048,039 | |

| | 300,620 | | | Enterprise Products Partners LP | | | 5,278,887 | |

| | 140,772 | | | Plains All American Pipeline LP | | | 1,243,017 | |

| | 304,118 | | | Royal Dutch Shell PLC ADR Class A(a) | | | 10,075,429 | |

| | | | | | | | |

| | | | | | | 44,718,848 | |

| | |

| Personal Products – 0.3% | |

| | 106,821 | | | Unilever NV | | | 5,279,094 | |

| | |

| Pharmaceuticals – 3.6% | |

| | 95,686 | | | AstraZeneca PLC ADR | | | 5,002,464 | |

| | 101,271 | | | Bristol-Myers Squibb Co. | | | 6,158,289 | |

| | 82,715 | | | Eli Lilly & Co. | | | 12,791,048 | |

| | 163,521 | | | Johnson & Johnson | | | 24,534,691 | |

| | 113,924 | | | Novartis AG ADR | | | 9,652,781 | |

| | | | | | | | |

| | | | | | | 58,139,273 | |

| | |

| Road & Rail – 1.0% | |

| | 33,310 | | | Norfolk Southern Corp. | | | 5,699,341 | |

| | 62,405 | | | Union Pacific Corp. | | | 9,971,695 | |

| | | | | | | | |

| | | | | | | 15,671,036 | |

| | |

| Semiconductors & Semiconductor Equipment – 1.3% | |

| | 23,756 | | | Analog Devices, Inc. | | | 2,603,658 | |

| | 150,022 | | | Intel Corp. | | | 8,998,319 | |

| | 73,904 | | | Texas Instruments, Inc. | | | 8,578,037 | |

| | | | | | | | |

| | | | | | | 20,180,014 | |

| | |

| Software – 0.8% | |

| | 68,320 | | | Microsoft Corp. | | | 12,243,627 | |

| | |

| Specialty Retail – 1.1% | |

| | 54,306 | | | Lowe’s Cos., Inc. | | | 5,688,553 | |

| | 56,960 | | | The Home Depot, Inc. | | | 12,521,517 | |

| | | | | | | | |

| | | | | | | 18,210,070 | |

| | |

| Technology Hardware, Storage & Peripherals – 0.7% | |

| | 38,071 | | | Apple, Inc. | | | 11,185,260 | |

| | |

|

| Common Stocks – (continued) | |

| Technology – Software/Services(b)(c) – 0.0% | |

| | 194,739 | | | Aspect Software, Inc. Class B | | | 48,685 | |

| | |

| Tobacco – 0.4% | |

| | 90,672 | | | Philip Morris International, Inc. | | | 6,764,131 | |

| | |

| Water Utilities – 0.6% | |

| | 78,688 | | | American Water Works Co., Inc. | | | 9,575,543 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $544,928,639) | | $ | 571,870,974 | |

| | |

| | | | | | |

| Shares | | Dividend

Rate | | Value | |

|

| Preferred Stocks(d) – 0.5% | |

| Capital Markets(e) – 0.3% | |

Morgan Stanley (3M USD LIBOR + 3.708%) | |

| 183,597 | | 6.375% | | $ | 4,929,579 | |

| |

| Diversified Telecommunication Services – 0.1% | |

Qwest Corp. | |

| 43,276 | | 6.500 | | | 1,004,003 | |

| |

| Insurance(e) – 0.1% | |

Delphi Financial Group, Inc. (3M USD LIBOR + 3.190%) | |

| 143,849 | | 4.882 | | | 2,517,358 | |

| |

| TOTAL PREFERRED STOCKS | |

| (Cost $8,780,988) | | $ | 8,450,940 | |

| |

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – 49.6% | |

| Advertising(d)(f) – 0.2% | |

| | Lamar Media Corp. | |

| $ | 600,000 | | | | 3.750 | % | | | 02/15/28 | | | $ | 552,000 | |

| | Outfront Media Capital LLC/Outfront Media Capital Corp. | |

| | 360,000 | | | | 5.000 | | | | 08/15/27 | | | | 341,100 | |

| | Terrier Media Buyer, Inc. | |

| | 2,850,000 | | | | 8.875 | | | | 12/15/27 | | | | 2,337,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,230,100 | |

| | |

| Aerospace & Defense(d) – 0.9% | |

| | Arconic, Inc. | |

| | 2,242,000 | | | | 5.400 | | | | 04/15/21 | | | | 2,284,037 | |

| | Boeing Co. | |

| | 3,432,000 | | | | 5.150 | | | | 05/01/30 | | | | 3,432,000 | |

| | 3,432,000 | | | | 5.805 | | | | 05/01/50 | | | | 3,432,000 | |

| | Bombardier, Inc.(f) | |

| | 1,125,000 | | | | 7.500 | | | | 12/01/24 | | | | 745,313 | |

| | 3,301,000 | | | | 7.500 | | | | 03/15/25 | | | | 2,129,145 | |

| | TransDigm, Inc. | |

| | 365,000 | | | | 6.500 | | | | 05/15/25 | | | | 324,850 | |

| | 3,300,000 | | | | 5.500 | (f) | | | 11/15/27 | | | | 2,755,500 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 15,102,845 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 7 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments(continued)

April 30, 2020 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Agriculture – 0.7% | |

| | BAT Capital Corp.(d) | |

| $ | 10,000,000 | | | | 4.390 | % | | | 08/15/37 | | | $ | 10,158,100 | |

| | MHP SE | |

| | 330,000 | | | | 7.750 | | | | 05/10/24 | | | | 320,822 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 10,478,922 | |

| | |

| Airlines(f) – 0.1% | |

| | Air Canada Pass ThroughTrust Series 2013-1, Class B | |

| | 1,617,143 | | | | 5.375 | | | | 05/15/21 | | | | 1,441,586 | |

| | |

| Automotive – 1.2% | |

| | American Axle & Manufacturing, Inc.(d) | |

| | 1,000 | | | | 6.250 | | | | 04/01/25 | | | | 750 | |

| | Cooper Standard Automotive, Inc.(d) | |

| | 1,350,000 | | | | 5.625 | | | | 11/15/26 | | | | 918,000 | |

| | Dealer Tire LLC/DT Issuer LLC(d)(f) | |

| | 2,934,000 | | | | 8.000 | | | | 02/01/28 | | | | 2,046,465 | |

| | Delphi Technologies PLC(f) | |

| | 4,100,000 | | | | 5.000 | | | | 10/01/25 | | | | 3,833,500 | |

| | Ford Motor Co. | |

| | 1,464,000 | | | | 8.500 | | | | 04/21/23 | | | | 1,451,208 | |

| | Ford Motor Credit Co. LLC | |

| | 2,500,000 | | | | 5.875 | | | | 08/02/21 | | | | 2,458,425 | |

| | 1,600,000 | | | | 4.140 | (d) | | | 02/15/23 | | | | 1,476,134 | |

| | 400,000 | | | | 4.687 | (d) | | | 06/09/25 | | | | 354,332 | |

| | General Motors Co.(d) | |

| | 3,000,000 | | | | 6.600 | | | | 04/01/36 | | | | 2,799,900 | |

| | Panther BF Aggregator 2 LP/Panther Finance Co., Inc.(d)(f) | |

| | 1,850,000 | | | | 8.500 | | | | 05/15/27 | | | | 1,567,875 | |

| | The Goodyear Tire & Rubber Co.(d) | |

| | 3,050,000 | | | | 5.125 | | | | 11/15/23 | | | | 2,790,750 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 19,697,339 | |

| | |

| Banks – 3.6% | |

| | Akbank Turk A/S(d)(e)(5 Year USD Swap + 5.026%) | |

| | 320,000 | | | | 7.200 | | | | 03/16/27 | | | | 292,400 | |

| | Banco do Brasil SA(d)(e)(10 Year CMT + 4.398%) | |

| | 560,000 | | | | 6.250 | | | | 04/15/49 | | | | 462,088 | |

| | Banco Mercantil del Norte SA(d)(e)(f)(5 Year CMT + 4.967%) | |

| | 680,000 | | | | 6.750 | | | | 09/27/49 | | | | 536,860 | |

| Banco Santander Mexico SA Institucion de Banca Multiple Grupo

Financiero Santand(f) |

|

| | 250,000 | | | | 5.375 | | | | 04/17/25 | | | | 256,563 | |

| | Bank of America Corp.(d)(e) (3M USD LIBOR + 3.898%) | |

| | 4,000,000 | | | | 6.100 | | | | 03/17/49 | | | | 4,231,080 | |

| | BBVA Bancomer SA(d)(e)(5 Year CMT + 2.650%) | |

| | 530,000 | | | | 5.125 | | | | 01/18/33 | | | | 453,812 | |

| | BNP Paribas SA(f) | |

| | 2,700,000 | | | | 4.375 | | | | 05/12/26 | | | | 2,884,761 | |

| | CIT Group, Inc.(d) | |

| | 4,025,000 | | | | 5.250 | | | | 03/07/25 | | | | 3,964,625 | |

| | Citigroup, Inc.(d)(e) | |

| | (3M USD LIBOR + 4.517%) | |

| | 1,890,000 | | | | 6.250 | | | | 08/15/49 | | | | 2,010,487 | |

| | (SOFR + 3.914%) | |

| | 900,000 | | | | 4.412 | | | | 03/31/31 | | | | 1,033,875 | |

| | |

|

| Corporate Obligations – (continued) | |

| Banks – (continued) | |

| | Credit Bank of Moscow Via CBOM Finance PLC(f) | |

| 260,000 | | | | 4.700 | | | | 01/29/25 | | | | 247,325 | |

| | Credit Suisse Group AG(d)(e)(f) | |

| | (5 Year CMT + 3.293%) | |

| | 1,150,000 | | | | 5.100 | | | | 01/24/49 | | | | 1,032,154 | |

| | (5 Year USD Swap + 4.598%) | |

| | 4,025,000 | | | | 7.500 | | | | 12/11/49 | | | | 4,236,469 | |

| | Deutsche Bank AG(d)(e) | |

| | (5 year CMT + 4.524%) | |

| | 800,000 | | | | 6.000 | | | | 10/30/49 | | | | 576,000 | |

| | (5 Year USD Swap + 2.248%) | |

| | 2,000,000 | | | | 4.296 | | | | 05/24/28 | | | | 1,795,000 | |

| | FirstRand Bank Ltd.(d)(e)(5 Year USD Swap + 3.561%) | |

| | 320,000 | | | | 6.250 | | | | 04/23/28 | | | | 304,500 | |

| | Grupo Aval Ltd.(d)(f) | |

| | 340,000 | | | | 4.375 | | | | 02/04/30 | | | | 283,050 | |

| | ING Groep NV(d)(e)(5 Year USD Swap + 4.446%) | |

| | 5,000,000 | | | | 6.500 | | | | 04/16/49 | | | | 4,975,000 | |

| | Intesa Sanpaolo SpA(f) | |

| | 8,000,000 | | | | 5.017 | | | | 06/26/24 | | | | 7,850,000 | |

| | Itau Unibanco Holding SA(d)(e)(5 Year CMT + 3.981%) | |

| | 500,000 | | | | 6.125 | | | | 12/12/49 | | | | 463,750 | |

| | JPMorgan Chase & Co.(d)(e) | |

| | (3M USD LIBOR + 3.330%) | |

| | 4,000,000 | | | | 6.125 | | | | 04/30/49 | | | | 4,099,720 | |

| | (3M USD LIBOR + 3.800%) | |

| | 2,700,000 | | | | 5.300 | | | | 08/01/49 | | | | 2,561,544 | |

| | Morgan Stanley, Inc.(d)(e) (3M USD LIBOR + 3.610%) | |

| | 2,731,000 | | | | 4.829 | | | | 07/15/49 | | | | 2,464,727 | |

| | Royal Bank of Scotland Group PLC | |

| | 2,675,000 | | | | 3.875 | | | | 09/12/23 | | | | 2,799,521 | |

| | 2,975,000 | | | | 6.000 | | | | 12/19/23 | | | | 3,231,454 | |

| | Turkiye Vakiflar Bankasi TAO | |

| | 200,000 | | | | 6.000 | | | | 11/01/22 | | | | 186,313 | |

| | UBS Group AG(d)(e)(5 Year USD Swap + 4.590%) | |

| | 4,000,000 | | | �� | 6.875 | | | | 08/07/49 | | | | 4,100,000 | |

| | United Bank for Africa PLC | |

| | 470,000 | | | | 7.750 | | | | 06/08/22 | | | | 414,188 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 57,747,266 | |

| | |

| Beverages – 0.9% | |

| | Anadolu Efes Biracilik Ve Malt Sanayii A/S | |

| | 350,000 | | | | 3.375 | | | | 11/01/22 | | | | 333,922 | |

| Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide,

Inc.(d) |

|

| | 3,000,000 | | | | 4.700 | | | | 02/01/36 | | | | 3,328,830 | |

| | Anheuser-Busch InBev Worldwide, Inc.(d) | |

| | 3,000,000 | | | | 4.150 | | | | 01/23/25 | | | | 3,340,260 | |

| | Central American Bottling Corp.(d) | |

| | 480,000 | | | | 5.750 | | | | 01/31/27 | | | | 469,800 | |

| | Constellation Brands, Inc.(d) | |

| | 2,700,000 | | | | 3.700 | | | | 12/06/26 | | | | 2,894,211 | |

| | Keurig Dr Pepper, Inc.(d) | |

| | 2,000,000 | | | | 4.057 | | | | 05/25/23 | | | | 2,142,660 | |

| | 1,055,000 | | | | 3.200 | | | | 05/01/30 | | | | 1,124,968 | |

| | 308,000 | | | | 3.800 | | | | 05/01/50 | | | | 327,715 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 13,962,366 | |

| | |

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Building Materials(d) – 0.8% | |

| | BMC East LLC(f) | |

| $ | 2,750,000 | | | | 5.500 | % | | | 10/01/24 | | | $ | 2,612,500 | |

| | Builders FirstSource, Inc.(f) | |

| | 1,507,000 | | | | 6.750 | | | | 06/01/27 | | | | 1,559,745 | |

| | 940,000 | | | | 5.000 | | | | 03/01/30 | | | | 813,100 | |

| | Cemex SAB de CV | |

| | 490,000 | | | | 5.700 | | | | 01/11/25 | | | | 443,572 | |

| | 230,000 | | | | 7.750 | | | | 04/16/26 | | | | 214,602 | |

| | Cornerstone Building Brands, Inc.(f) | |

| | 2,780,000 | | | | 8.000 | | | | 04/15/26 | | | | 2,335,200 | |

| | Griffon Corp. | |

| | 2,168,000 | | | | 5.750 | | | | 03/01/28 | | | | 2,059,600 | |

| | Masonite International Corp.(f) | |

| | 2,075,000 | | | | 5.375 | | | | 02/01/28 | | | | 1,976,437 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 12,014,756 | |

| | |

| Chemicals – 0.8% | |

| | Air Products and Chemicals, Inc.(d) | |

| | 484,000 | | | | 2.800 | | | | 05/15/50 | | | | 491,531 | |

| | Ingevity Corp.(d)(f) | |

| | 2,775,000 | | | | 4.500 | | | | 02/01/26 | | | | 2,448,937 | |

| | Kraton Polymers LLC/Kraton Polymers Capital Corp.(d)(f) | |

| | 1,900,000 | | | | 7.000 | | | | 04/15/25 | | | | 1,828,750 | |

| | OCI NV(d)(f) | |

| | 1,250,000 | | | | 5.250 | | | | 11/01/24 | | | | 1,243,750 | |

| | Polyone Corp.(d)(f) | |

| | 1,953,000 | | | | 5.750 | | | | 05/15/25 | | | | 1,977,413 | |

| | PQ Corp.(d)(f) | |

| | 3,400,000 | | | | 6.750 | | | | 11/15/22 | | | | 3,421,250 | |

| | Sasol Financing USA LLC(d) | |

| | 200,000 | | | | 6.500 | | | | 09/27/28 | | | | 131,000 | |

| | WR Grace & Co-Conn(f) | |

| | 1,800,000 | | | | 5.125 | | | | 10/01/21 | | | | 1,811,250 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 13,353,881 | |

| | |

| Coal(d) – 0.0% | |

| | Mongolian Mining Corp./Energy Resources LLC | |

| | 330,000 | | | | 9.250 | | | | 04/15/24 | | | | 198,413 | |

| | |

| Commercial Services – 1.5% | |

| | Allied Universal Holdco LLC/Allied Universal Finance Corp.(d)(f) | |

| | 2,557,000 | | | | 6.625 | | | | 07/15/26 | | | | 2,643,299 | |

| | 3,020,000 | | | | 9.750 | | | | 07/15/27 | | | | 3,061,525 | |

| GEMS MENASA Cayman Ltd./GEMS Education Delaware

LLC(d)(f) |

|

| | 1,800,000 | | | | 7.125 | | | | 07/31/26 | | | | 1,652,063 | |

| | Global Liman Isletmeleri(d) | |

| | 200,000 | | | | 8.125 | | | | 11/14/21 | | | | 100,125 | |

| | IHS Markit Ltd.(d)(f) | |

| | 5,675,000 | | | | 4.750 | | | | 02/15/25 | | | | 6,144,209 | |

| | Prime Security Services Borrower LLC/Prime Finance, Inc.(f) | |

| | 3,550,000 | | | | 5.250 | | | | 04/15/24 | | | | 3,474,562 | |

| | Refinitiv US Holdings, Inc.(d)(f) | |

| | 3,000,000 | | | | 8.250 | | | | 11/15/26 | | | | 3,258,750 | |

| | Techem Verwaltungsgesellschaft 674 MBH(d) | |

| EUR | 760,000 | | | | 6.000 | | | | 07/30/26 | | | | 830,764 | |

| | |

|

| Corporate Obligations – (continued) | |

| Commercial Services – (continued) | |

| | The ADT Security Corp. | |

| $ | 1,850,000 | | | | 4.125 | | | | 06/15/23 | | | | 1,810,687 | |

| | The Hertz Corp.(d)(f) | |

| | 2,000,000 | | | | 6.000 | | | | 01/15/28 | | | | 360,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 23,335,984 | |

| | |

| Computers(d) – 1.0% | |

| | Banff Merger Sub, Inc.(f) | |

| | 1,000,000 | | | | 9.750 | | | | 09/01/26 | | | | 887,500 | |

| | Dell International LLC/EMC Corp.(f) | |

| | 5,000,000 | | | | 8.100 | | | | 07/15/36 | | | | 6,093,850 | |

| | Hewlett Packard Enterprise Co. | |

| | 3,000,000 | | | | 6.200 | | | | 10/15/35 | | | | 3,557,850 | |

| | Presidio Holdings, Inc.(f) | |

| | 2,095,000 | | | | 8.250 | | | | 02/01/28 | | | | 2,068,812 | |

| | Western Digital Corp. | |

| | 3,000,000 | | | | 4.750 | | | | 02/15/26 | | | | 3,060,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 15,668,012 | |

| | |

| Distribution & Wholesale(d)(f) – 0.8% | |

| | Core & Main Holdings LP(g)(PIK 9.375%, Cash 8.625%) | |

| | 3,000,000 | | | | 8.625 | | | | 09/15/24 | | | | 2,940,000 | |

| | IAA, Inc. | |

| | 750,000 | | | | 5.500 | | | | 06/15/27 | | | | 747,187 | |

| | Performance Food Group, Inc. | |

| | 2,150,000 | | | | 5.500 | | | | 06/01/24 | | | | 2,096,250 | |

| | 1,150,000 | | | | 5.500 | | | | 10/15/27 | | | | 1,086,750 | |

| | Resideo Funding, Inc. | |

| | 3,282,000 | | | | 6.125 | | | | 11/01/26 | | | | 2,878,045 | |

| | Univar Solutions USA, Inc. | |

| | 3,200,000 | | | | 5.125 | | | | 12/01/27 | | | | 3,152,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 12,900,232 | |

| | |

| Diversified Financial Services – 2.8% | |

| | AerCap Holdings NV(d)(e)(5 Year CMT + 4.535%) | |

| | 1,825,000 | | | | 5.875 | | | | 10/10/79 | | | | 1,204,500 | |

| | Air Lease Corp.(d) | |

| | 2,750,000 | | | | 3.750 | | | | 06/01/26 | | | | 2,427,397 | |

| | Ally Financial, Inc. | |

| | 4,000,000 | | | | 8.000 | | | | 11/01/31 | | | | 4,895,000 | |

| | Alpha Holding SA(d)(f) | |

| | 200,000 | | | | 9.000 | | | | 02/10/25 | | | | 136,750 | |

| | Avolon Holdings Funding Ltd.(d)(f) | |

| | 3,450,000 | | | | 5.250 | | | | 05/15/24 | | | | 3,020,716 | |

| | CoBank ACB(d)(e) (3M USD LIBOR + 4.660%) | |

| | 5,350,000 | | | | 6.250 | | | | 10/01/49 | | | | 5,273,120 | |

| | Curo Group Holdings Corp.(d)(f) | |

| | 2,125,000 | | | | 8.250 | | | | 09/01/25 | | | | 1,715,938 | |

| Global Aircraft Leasing Co. Ltd.(d)(f)(g)(PIK 7.250%, Cash

6.500%) |

|

| | 1,750,000 | | | | 6.500 | | | | 09/15/24 | | | | 1,045,625 | |

| | LPL Holdings, Inc.(d)(f) | |

| | 487,000 | | | | 5.750 | | | | 09/15/25 | | | | 480,913 | |

| | 1,350,000 | | | | 4.625 | | | | 11/15/27 | | | | 1,275,750 | |

| | Lukoil Securities BV(f) | |

| | 500,000 | | | | 3.875 | | | | 05/06/30 | | | | 499,063 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments(continued)

April 30, 2020 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Diversified Financial Services – (continued) | |

| | Nationstar Mortgage Holdings, Inc.(d)(f) | |

| $ | 3,050,000 | | | | 8.125 | % | | | 07/15/23 | | | $ | 2,928,000 | |

| | Navient Corp. | |

| | 3,000,000 | | | | 5.500 | | | | 01/25/23 | | | | 2,775,000 | |

| | Oilflow SPV 1 DAC | |

| | 551,250 | | | | 12.000 | | | | 01/13/22 | | | | 418,950 | |

| | Park Aerospace Holdings Ltd.(d)(f) | |

| | 2,235,000 | | | | 5.250 | | | | 08/15/22 | | | | 2,048,869 | |

| | Quicken Loans, Inc.(d)(f) | |

| | 2,000,000 | | | | 5.750 | | | | 05/01/25 | | | | 1,957,342 | |

| | Raymond James Financial, Inc.(d) | |

| | 900,000 | | | | 4.650 | | | | 04/01/30 | | | | 1,007,901 | |

| | Springleaf Finance Corp. | |

| | 2,600,000 | | | | 6.125 | | | | 05/15/22 | | | | 2,567,500 | |

| | 3,500,000 | | | | 7.125 | | | | 03/15/26 | | | | 3,268,125 | |

| | 1,800,000 | | | | 5.375 | (d) | | | 11/15/29 | | | | 1,503,000 | |

| | The Charles Schwab Corp.(d)(e) | |

| | (3M USD LIBOR + 3.315%) | |

| | 2,195,000 | | | | 4.625 | | | | 03/01/49 | | | | 2,124,299 | |

| | (5 year CMT + 4.971%) | |

| | 1,250,000 | | | | 5.375 | | | | 06/01/49 | | | | 1,287,725 | |

| | Visa, Inc.(d) | |

| | 450,000 | | | | 2.700 | | | | 04/15/40 | | | | 466,808 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 44,328,291 | |

| | |

| Electrical – 0.5% | |

| | Calpine Corp.(d)(f) | |

| | 3,100,000 | | | | 4.500 | | | | 02/15/28 | | | | 2,999,250 | |

| | Eskom Holdings SOC Ltd. | |

| | 200,000 | | | | 5.750 | | | | 01/26/21 | | | | 178,500 | |

| | 630,000 | | | | 6.350 | (h) | | | 08/10/28 | | | | 562,472 | |

| | Listrindo Capital B.V.(d) | |

| | 520,000 | | | | 4.950 | | | | 09/14/26 | | | | 486,850 | |

| | LLPL Capital Pte Ltd. | |

| | 442,198 | | | | 6.875 | | | | 02/04/39 | | | | 449,384 | |

| | Minejesa Capital B.V. | |

| | 260,000 | | | | 4.625 | | | | 08/10/30 | | | | 247,000 | |

| | NRG Energy, Inc.(d) | |

| | 2,800,000 | | | | 3.750 | (f) | | | 06/15/24 | | | | 2,871,540 | |

| | 140,000 | | | | 7.250 | | | | 05/15/26 | | | | 150,500 | |

| | 115,000 | | | | 5.750 | | | | 01/15/28 | | | | 123,625 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 8,069,121 | |

| | |

| Energy-Alternate Sources(d) – 0.1% | |

| | Enviva Partners LP/Enviva Partners Finance Corp.(f) | |

| | 1,400,000 | | | | 6.500 | | | | 01/15/26 | | | | 1,464,750 | |

| | Greenko Dutch B.V. | |

| | 690,000 | | | | 5.250 | | | | 07/24/24 | | | | 608,062 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 2,072,812 | |

| | |

| Engineering & Construction – 0.1% | |

| | Aeropuertos Dominicanos Siglo XXI SA(d) | |

| | 630,000 | | | | 6.750 | | | | 03/30/29 | | | | 516,600 | |

| | GMR Hyderabad International Airport Ltd. | |

| | 660,000 | | | | 5.375 | | | | 04/10/24 | | | | 568,425 | |

| | IHS Netherlands Holdco B.V.(d)(f) | |

| | 200,000 | | | | 7.125 | | | | 03/18/25 | | | | 180,000 | |

| | |

|

| Corporate Obligations – (continued) | |

| Engineering & Construction – (continued) | |

| | Mexico City Airport Trust(d) | |

| $ | 520,000 | | | | 5.500 | % | | | 10/31/46 | | | $ | 429,406 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 1,694,431 | |

| | |

| Entertainment(d) – 0.5% | |

| | AMC Entertainment Holdings, Inc. | |

| | 4,200,000 | | | | 5.875 | | | | 11/15/26 | | | | 934,500 | |

| | Banijay Entertainment SASU(f) | |

| | 1,800,000 | | | | 5.375 | | | | 03/01/25 | | | | 1,660,500 | |

| | Motion Bondco DAC(f) | |

| | 3,250,000 | | | | 6.625 | | | | 11/15/27 | | | | 2,591,875 | |

| | Scientific Games International, Inc.(f) | |

| | 1,000,000 | | | | 5.000 | | | | 10/15/25 | | | | 871,250 | |

| | 2,100,000 | | | | 8.250 | | | | 03/15/26 | | | | 1,585,500 | |

| | 500,000 | | | | 7.000 | | | | 05/15/28 | | | | 358,750 | |

| | Vail Resorts, Inc. Co.(f) | |

| | 247,000 | | | | 6.250 | | | | 05/15/25 | | | | 255,645 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 8,258,020 | |

| | |

| Environmental(d)(f) – 0.3% | |

| | GFL Environmental, Inc. | |

| | 570,000 | | | | 7.000 | | | | 06/01/26 | | | | 598,500 | |

| | 730,000 | | | | 5.125 | | | | 12/15/26 | | | | 757,375 | |

| | 858,000 | | | | 8.500 | | | | 05/01/27 | | | | 933,075 | |

| | Stericycle, Inc. | |

| | 1,950,000 | | | | 5.375 | | | | 07/15/24 | | | | 1,954,875 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 4,243,825 | |

| | |

| Food & Drug Retailing(d) – 1.4% | |

| Albertsons Cos., Inc./Safeway, Inc./New Albertsons

LP/Albertsons LLC(f) |

|

| | 550,000 | | | | 3.500 | | | | 02/15/23 | | | | 544,500 | |

| | 2,595,000 | | | | 4.625 | | | | 01/15/27 | | | | 2,607,975 | |

| | 1,995,000 | | | | 5.875 | | | | 02/15/28 | | | | 2,064,825 | |

| | 502,000 | | | | 4.875 | | | | 02/15/30 | | | | 507,020 | |

| | Arcor SAIC | |

| | 110,000 | | | | 6.000 | | | | 07/06/23 | | | | 88,275 | |

| | B&G Foods, Inc. | |

| | 4,020,000 | | | | 5.250 | | | | 04/01/25 | | | | 4,070,250 | |

| | Kraft Heinz Foods Co. | |

| | 3,198,000 | | | | 5.000 | | | | 07/15/35 | | | | 3,422,077 | |

| | 2,592,000 | | | | 4.375 | | | | 06/01/46 | | | | 2,458,375 | |

| | Post Holdings, Inc.(f) | |

| | 5,984,000 | | | | 4.625 | | | | 04/15/30 | | | | 5,864,320 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 21,627,617 | |

| | |

| Food Service(d)(f) – 0.0% | |

| | Aramark Services, Inc. | |

| | 620,000 | | | | 6.375 | | | | 05/01/25 | | | | 641,700 | |

| | |

| Forest Products&Paper(d) – 0.1% | |

| | Mercer International, Inc. | |

| | 1,850,000 | | | | 7.375 | | | | 01/15/25 | | | | 1,792,188 | |

| | |

| Gaming(d)(f) – 0.4% | |

| | Boyd Gaming Corp. | |

| | 2,950,000 | | | | 4.750 | | | | 12/01/27 | | | | 2,540,687 | |

| | |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Gaming(d)(f) – (continued) | |

| | Station Casinos LLC | |

| $ | 3,273,000 | | | | 4.500 | % | | | 02/15/28 | | | $ | 2,618,400 | |

| | Wynn Macau Ltd. | |

| | 550,000 | | | | 5.125 | | | | 12/15/29 | | | | 530,750 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 5,689,837 | |

| | |

| Gas(d) – 0.3% | |

| | AmeriGas Partners LP/AmeriGas Finance Corp. | |

| | 4,125,000 | | | | 5.875 | | | | 08/20/26 | | | | 4,217,812 | |

| | |

| Health Care Products(d)(f) – 0.0% | |

| | Hill-Rom Holdings, Inc. | |

| | 400,000 | | | | 4.375 | | | | 09/15/27 | | | | 409,000 | |

| | |

| Healthcare Providers & Services – 2.6% | |

| | Centene Corp.(d) | |

| | 2,840,000 | | | | 4.250 | | | | 12/15/27 | | | | 2,817,196 | |

| | 1,500,000 | | | | 3.375 | | | | 02/15/30 | | | | 1,500,000 | |

| | Acadia Healthcare Co., Inc.(d) | |

| | 2,732,000 | | | | 6.500 | | | | 03/01/24 | | | | 2,595,400 | |

| | Centene Corp.(d)(f) | |

| | 2,840,000 | | | | 4.250 | | | | 12/15/27 | | | | 2,970,782 | |

| | 1,500,000 | | | | 3.375 | | | | 02/15/30 | | | | 1,517,070 | |

| | Charles River Laboratories International, Inc.(d)(f) | |

| | 650,000 | | | | 4.250 | | | | 05/01/28 | | | | 655,688 | |

| | CHS/Community Health Systems, Inc.(d) | |

| | 1,990,000 | | | | 6.250 | | | | 03/31/23 | | | | 1,870,600 | |

| | Encompass Health Corp.(d) | |

| | 1,200,000 | | | | 4.500 | | | | 02/01/28 | | | | 1,200,000 | |

| | HCA, Inc. | |

| | 8,870,000 | | | | 5.000 | | | | 03/15/24 | | | | 9,621,910 | |

| | 250,000 | | | | 5.875 | (d) | | | 02/15/26 | | | | 279,375 | |

| | MEDNAX, Inc.(d)(f) | |

| | 3,650,000 | | | | 5.250 | | | | 12/01/23 | | | | 3,477,318 | |

| | Select Medical Corp.(d)(f) | |

| | 1,700,000 | | | | 6.250 | | | | 08/15/26 | | | | 1,623,500 | |

| | Tenet Healthcare Corp. | |

| | 5,600,000 | | | | 8.125 | | | | 04/01/22 | | | | 5,628,000 | |

| | 2,000,000 | | | | 6.250 | (d)(f) | | | 02/01/27 | | | | 1,970,000 | |

| | Universal Health Services, Inc.(d)(f) | |

| | 2,650,000 | | | | 5.000 | | | | 06/01/26 | | | | 2,696,216 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 40,423,055 | |

| | |

| Holding Companies-Diversified(d) – 0.0% | |

| | KOC Holding A/S | |

| | 700,000 | | | | 6.500 | | | | 03/11/25 | | | | 686,219 | |

| | |

| Home Builders – 0.7% | |

| Brookfield Residential Properties, Inc./Brookfield Residential US

Corp.(d)(f) |

|

| | 1,642,000 | | | | 4.875 | | | | 02/15/30 | | | | 1,354,650 | |

| | Installed Building Products, Inc.(d)(f) | |

| | 800,000 | | | | 5.750 | | | | 02/01/28 | | | | 768,000 | |

| | Lennar Corp.(d) | |

| | 1,825,000 | | | | 4.125 | | | | 01/15/22 | | | | 1,831,844 | |

| | M/I Homes, Inc.(d)(f) | |

| | 1,378,000 | | | | 4.950 | | | | 02/01/28 | | | | 1,212,640 | |

| | |

|

| Corporate Obligations – (continued) | |

| Home Builders – (continued) | |

| | PulteGroup, Inc. | |

| 3,000,000 | | | | 7.875 | | | | 06/15/32 | | | | 3,450,000 | |

| | TRI Pointe Group, Inc.(d) | |

| | 1,850,000 | | | | 5.250 | | | | 06/01/27 | | | | 1,665,000 | |

| | Williams Scotsman International, Inc.(d)(f) | |

| | 1,350,000 | | | | 6.875 | | | | 08/15/23 | | | | 1,358,437 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 11,640,571 | |

| | |

| Household Products(d) – 0.1% | |

| | Spectrum Brands, Inc. | |

| | 1,800,000 | | | | 5.750 | | | | 07/15/25 | | | | 1,795,500 | |

| | |

| Housewares(d) – 0.0% | |

| | Turkiye Sise ve Cam Fabrikalari A/S | |

| | 530,000 | | | | 6.950 | | | | 03/14/26 | | | | 511,119 | |

| | |

| Insurance – 0.8% | |

| | Acrisure LLC/Acrisure Finance, Inc.(d)(f) | |

| | 1,550,000 | | | | 10.125 | | | | 08/01/26 | | | | 1,565,500 | |

| | Fidelity & Guaranty Life Holdings, Inc.(d)(f) | |

| | 2,850,000 | | | | 5.500 | | | | 05/01/25 | | | | 3,003,187 | |

| | HUB International Ltd.(d)(f) | |

| | 1,760,000 | | | | 7.000 | | | | 05/01/26 | | | | 1,749,000 | |

| | Prudential Financial, Inc.(d)(e) (3M USD LIBOR + 3.920%) | |

| | 4,300,000 | | | | 5.625 | | | | 06/15/43 | | | | 4,438,159 | |

| | Transatlantic Holdings, Inc. | |

| | 75,000 | | | | 8.000 | | | | 11/30/39 | | | | 110,062 | |

| | USI, Inc.(d)(f) | |

| | 1,850,000 | | | | 6.875 | | | | 05/01/25 | | | | 1,854,625 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 12,720,533 | |

| | |

| Internet – 2.0% | |

| | 21Vianet Group, Inc. | |

| | 400,000 | | | | 7.875 | | | | 10/15/21 | | | | 365,024 | |

| | Booking Holdings, Inc.(d) | |

| | 3,494,000 | | | | 4.100 | | | | 04/13/25 | | | | 3,699,098 | |

| | 2,850,000 | | | | 4.625 | | | | 04/13/30 | | | | 3,158,028 | |

| | Expedia Group, Inc.(d)(f) | |

| | 1,160,000 | | | | 6.250 | | | | 05/01/25 | | | | 1,181,750 | |

| | Getty Images, Inc.(d)(f) | |

| | 250,000 | | | | 9.750 | | | | 03/01/27 | | | | 185,625 | |

| | Go Daddy Operating Co. LLC/GD Finance Co., Inc.(d)(f) | |

| | 1,305,000 | | | | 5.250 | | | | 12/01/27 | | | | 1,340,887 | |

| | GrubHub Holdings, Inc.(d)(f) | |

| | 3,400,000 | | | | 5.500 | | | | 07/01/27 | | | | 3,179,000 | |

| | Match Group, Inc.(d)(f) | |

| | 2,379,000 | | | | 4.125 | | | | 08/01/30 | | | | 2,307,630 | |

| | Netflix, Inc.(d)(f) | |

| | 350,000 | | | | 4.875 | | | | 06/15/30 | | | | 373,625 | |

| | NortonLifeLock, Inc.(d)(f) | |

| | 4,000,000 | | | | 5.000 | | | | 04/15/25 | | | | 4,040,000 | |

| | Twitter, Inc.(d)(f) | |

| | 4,305,000 | | | | 3.875 | | | | 12/15/27 | | | | 4,283,475 | |

| | Uber Technologies, Inc.(d)(f) | |

| | 3,000,000 | | | | 7.500 | | | | 11/01/23 | | | | 3,003,750 | |

| | VeriSign, Inc.(d) | |

| | 4,000,000 | | | | 5.250 | | | | 04/01/25 | | | | 4,369,920 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 31,487,812 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments(continued)

April 30, 2020 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Iron/Steel – 0.2% | |

| | ABJA Investment Co. Pte Ltd. | |

| $ | 650,000 | | | | 5.950 | % | | | 07/31/24 | | | $ | 579,719 | |

| | Cleveland-Cliffs, Inc.(d) | |

| | 1,038,000 | | | | 5.750 | | | | 03/01/25 | | | | 731,790 | |

| | 2,250,000 | | | | 5.875 | | | | 06/01/27 | | | | 1,406,250 | |

| | Vale Overseas Ltd. | |

| | 300,000 | | | | 6.250 | | | | 08/10/26 | | | | 327,300 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,045,059 | |

| | |

| Leisure Time(d)(f) – 0.2% | |

| | Sabre GLBL, Inc. | |

| | 2,405,000 | | | | 9.250 | | | | 04/15/25 | | | | 2,540,281 | |

| | |

| Lodging(d) – 0.0% | |

| | Fortune Star BVI Ltd. | |

| | 340,000 | | | | 5.250 | | | | 03/23/22 | | | | 327,569 | |

| | |

| Machinery-Diversified(d)(f) – 0.0% | |

| | Titan Acquisition Ltd./Titan Co-Borrower LLC | |

| | 588,000 | | | | 7.750 | | | | 04/15/26 | | | | 546,840 | |

| | |

| Media – 4.8% | |

| | Altice Financing SA(d) | |

| | 200,000 | | | | 7.500 | | | | 05/15/26 | | | | 208,500 | |

| | AMC Networks, Inc.(d) | |

| | 1,800,000 | | | | 4.750 | | | | 08/01/25 | | | | 1,651,500 | |

| | CCO Holdings LLC/CCO Holdings Capital Corp.(d)(f) | |

| | 3,000,000 | | | | 5.875 | | | | 05/01/27 | | | | 3,120,000 | |

| | 4,980,000 | | | | 4.750 | | | | 03/01/30 | | | | 5,079,600 | |

| Charter Communications Operating LLC/Charter

Communications Operating Capital(d) |

|

| | 12,000,000 | | | | 6.384 | | | | 10/23/35 | | | | 15,471,000 | |

| | Clear Channel Worldwide Holdings, Inc.(d)(f) | |

| | 2,033,000 | | | | 9.250 | | | | 02/15/24 | | | | 1,692,473 | |

| | CSC Holdings LLC | |

| | 985,000 | | | | 5.250 | | | | 06/01/24 | | | | 1,030,556 | |

| | 5,450,000 | | | | 5.500 | (d)(f) | | | 05/15/26 | | | | 5,613,500 | |

| | Cumulus Media New Holdings, Inc.(d)(f) | |

| | 2,680,000 | | | | 6.750 | | | | 07/01/26 | | | | 2,177,500 | |

| | Diamond Sports Group LLC/Diamond Sports Finance Co.(d)(f) | |

| | 1,590,000 | | | | 5.375 | | | | 08/15/26 | | | | 1,208,400 | |

| | 3,345,000 | | | | 6.625 | | | | 08/15/27 | | | | 1,806,300 | |

| | DISH DBS Corp. | |

| | 6,300,000 | | | | 5.875 | | | | 07/15/22 | | | | 6,315,750 | |

| | Entercom Media Corp.(d)(f) | |

| | 2,300,000 | | | | 7.250 | | | | 11/01/24 | | | | 1,437,500 | |

| | 4,250,000 | | | | 6.500 | | | | 05/01/27 | | | | 3,134,375 | |

| | Gray Television, Inc.(d)(f) | |

| | 2,125,000 | | | | 7.000 | | | | 05/15/27 | | | | 2,140,937 | |

| | iHeartCommunications, Inc.(d)(f) | |

| | 1,450,000 | | | | 5.250 | | | | 08/15/27 | | | | 1,319,500 | |

| | 550,000 | | | | 4.750 | | | | 01/15/28 | | | | 481,250 | |

| | Meredith Corp.(d) | |

| | 2,610,000 | | | | 6.875 | | | | 02/01/26 | | | | 2,218,500 | |

| | Nexstar Broadcasting, Inc.(d)(f) | |

| | 1,500,000 | | | | 5.625 | | | | 07/15/27 | | | | 1,425,000 | |

| | Scripps Escrow, Inc.(d)(f) | |

| | 1,050,000 | | | | 5.875 | | | | 07/15/27 | | | | 887,250 | |

| | |

|

| Corporate Obligations – (continued) | |

| Media – (continued) | |

| | Sinclair Television Group, Inc.(d)(f) | |

| 2,100,000 | | | | 5.875 | | | | 03/15/26 | | | | 1,816,500 | |

| | Sirius XM Radio, Inc.(d)(f) | |

| | 1,085,000 | | | | 4.625 | | | | 07/15/24 | | | | 1,101,275 | |

| | TEGNA, Inc.(d)(f) | |

| | 2,300,000 | | | | 4.625 | | | | 03/15/28 | | | | 2,052,750 | |

| | The E.W. Scripps Co.(d)(f) | |

| | 1,875,000 | | | | 5.125 | | | | 05/15/25 | | | | 1,603,125 | |

| | Videotron Ltd.(d)(f) | |

| | 5,125,000 | | | | 5.375 | | | | 06/15/24 | | | | 5,406,875 | |

| | Virgin Media Secured Finance PLC(d) | |

| GBP | 4,000,000 | | | | 4.875 | | | | 01/15/27 | | | | 4,993,060 | |

| | Ziggo Bond Co. B.V.(d)(f) | |

| EUR | 675,000 | | | | 3.375 | | | | 02/28/30 | | | | 693,926 | |

| $ | 500,000 | | | | 5.125 | | | | 02/28/30 | | | | 492,500 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 76,579,402 | |

| | |

| Mining – 1.2% | |

| | Constellium SE(d)(f) | |

| | 2,100,000 | | | | 5.875 | | | | 02/15/26 | | | | 1,942,500 | |

| | First Quantum Minerals Ltd.(d)(f) | |

| | 4,000,000 | | | | 7.250 | | | | 04/01/23 | | | | 3,590,000 | |

| | FMG Resources August 2006 Pty Ltd.(d)(f) | |

| | 2,325,000 | | | | 4.750 | | | | 05/15/22 | | | | 2,327,906 | |

| | Freeport-McMoRan, Inc.(d) | |

| | 2,950,000 | | | | 3.875 | | | | 03/15/23 | | | | 2,938,938 | |

| | 2,000,000 | | | | 5.400 | | | | 11/14/34 | | | | 1,860,000 | |

| | Glencore Finance Canada Ltd.(f) | |

| | 3,000,000 | | | | 5.550 | | | | 10/25/42 | | | | 3,066,990 | |

| | Novelis Corp.(d)(f) | |

| | 2,100,000 | | | | 5.875 | | | | 09/30/26 | | | | 2,042,250 | |

| | 2,400,000 | | | | 4.750 | | | | 01/30/30 | | | | 2,136,000 | |

| | Vedanta Resources Finance II PLC(d)(f) | |

| | 200,000 | | | | 9.250 | | | | 04/23/26 | | | | 78,750 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 19,983,334 | |

| | |

| Office(d) – 0.1% | |

| | CDW LLC/CDW Finance Corp. | |

| | 1,440,000 | | | | 4.125 | | | | 05/01/25 | | | | 1,454,400 | |

| | |

| Oil Field Services – 0.9% | |

| | Antero Resources Corp.(d) | |

| | 6,500,000 | | | | 5.125 | | | | 12/01/22 | | | | 4,290,000 | |

| | Cenovus Energy, Inc.(d) | |

| | 153,000 | | | | 3.000 | | | | 08/15/22 | | | | 135,338 | |

| | 1,412,000 | | | | 3.800 | | | | 09/15/23 | | | | 1,180,517 | |

| | Chesapeake Energy Corp. | |

| | 2,000,000 | | | | 5.500 | | | | 09/15/26 | | | | 100,000 | |

| | Compania General Combust(d) | |

| | 590,000 | | | | 9.500 | | | | 11/07/21 | | | | 364,694 | |

| | DNO ASA(d)(f) | |

| | 420,000 | | | | 8.375 | | | | 05/29/24 | | | | 273,420 | |

| | Ensign Drilling, Inc.(d)(f) | |

| | 1,400,000 | | | | 9.250 | | | | 04/15/24 | | | | 406,000 | |

| | Geopark Ltd.(d)(f) | |

| | 200,000 | | | | 5.500 | | | | 01/17/27 | | | | 125,375 | |

| | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Oil Field Services – (continued) | |

| | Kosmos Energy Ltd.(d) | |

| $ | 500,000 | | | | 7.125 | % | | | 04/04/26 | | | $ | 306,563 | |

| | Laredo Petroleum, Inc.(d) | |

| | 2,213,000 | | | | 9.500 | | | | 01/15/25 | | | | 951,590 | |

| | MEG Energy Corp.(d)(f) | |

| | 2,480,000 | | | | 7.125 | | | | 02/01/27 | | | | 1,698,800 | |

| | Nabors Industries Ltd.(d)(f) | |

| | 840,000 | | | | 7.250 | | | | 01/15/26 | | | | 344,400 | |

| | Nexen, Inc. | |

| | 5,000 | | | | 6.400 | | | | 05/15/37 | | | | 6,973 | |

| | 50,000 | | | | 7.500 | | | | 07/30/39 | | | | 80,094 | |

| | Noble Holding International Ltd.(d) | |

| | 840,000 | | | | 7.750 | | | | 01/15/24 | | | | 2,100 | |

| | 1,975,000 | | | | 7.875 | (f) | | | 02/01/26 | | | | 459,187 | |

| | Petrobras Global Finance B.V.(i) | |

| | 500,000 | | | | 6.850 | | | | 06/05/15 | | | | 467,500 | |

| | Petroleos Mexicanos | |

| EUR | 220,000 | | | | 2.500 | | | | 08/21/21 | | | | 228,279 | |

| | Range Resources Corp.(d) | |

| $ | 846,000 | | | | 5.875 | | | | 07/01/22 | | | | 761,400 | |

| | Sunoco LP/Sunoco Finance Corp.(d) | |

| | 545,000 | | | | 5.500 | | | | 02/15/26 | | | | 523,200 | |

| | Tecpetrol SA(d) | |

| | 770,000 | | | | 4.875 | | | | 12/12/22 | | | | 593,862 | |

| | Transocean, Inc.(d)(f) | |

| | 2,070,000 | | | | 8.000 | | | | 02/01/27 | | | | 786,600 | |

| USA Compression Partners LP/USA Compression Finance

Corp.(d) |

|

| | 1,300,000 | | | | 6.875 | | | | 04/01/26 | | | | 1,066,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 15,151,892 | |

| | |

| Packaging – 2.0% | |

| | ARD Finance SA(d)(g) (PIK 5.750%, Cash 5.000%) | |

| EUR | 1,850,000 | | | | 5.000 | | | | 06/30/27 | | | | 1,824,590 | |

| | (PIK 7.250%, Cash 6.500%) | |

| $ | 3,950,000 | | | | 6.500 | (f) | | | 06/30/27 | | | | 3,693,250 | |

| | Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc.(d)(f) | |

| | 6,000,000 | | | | 6.000 | | | | 02/15/25 | | | | 5,970,000 | |

| | 650,000 | | | | 5.250 | | | | 08/15/27 | | | | 631,312 | |

| | Berry Global, Inc.(d)(f) | |

| | 2,200,000 | | | | 4.500 | | | | 02/15/26 | | | | 2,172,500 | |

| | 2,000,000 | | | | 5.625 | | | | 07/15/27 | | | | 2,065,000 | |

| | Graphic Packaging International LLC(f) | |

| | 646,000 | | | | 3.500 | | | | 03/15/28 | | | | 616,930 | |

| | LABL Escrow Issuer LLC(d)(f) | |

| | 1,750,000 | | | | 6.750 | | | | 07/15/26 | | | | 1,758,750 | |

| | Mauser Packaging Solutions Holding Co.(d)(f) | |

| | 2,150,000 | | | | 5.500 | | | | 04/15/24 | | | | 1,978,000 | |

| | 965,000 | | | | 7.250 | | | | 04/15/25 | | | | 753,906 | |

| | Owens-Brockway Glass Container, Inc.(f) | |

| | 1,750,000 | | | | 5.875 | | | | 08/15/23 | | | | 1,811,250 | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer

LLC/Reynolds Group Issuer Lu(d)(f) |

|

| | 190,000 | | | | 7.000 | | | | 07/15/24 | | | | 190,475 | |

| | |

|

| Corporate Obligations – (continued) | |

| Packaging – (continued) | |

| | Sealed Air Corp.(f) | |

| 2,000,000 | | | | 5.250 | (d) | | | 04/01/23 | | | | 2,060,000 | |

| | 1,300,000 | | | | 4.000 | (d) | | | 12/01/27 | | | | 1,280,500 | |

| | 1,843,000 | | | | 6.875 | | | | 07/15/33 | | | | 2,029,604 | |

| | Trivium Packaging Finance B.V.(d)(f) | |

| | 1,075,000 | | | | 5.500 | | | | 08/15/26 | | | | 1,101,875 | |

| | 1,300,000 | | | | 8.500 | | | | 08/15/27 | | | | 1,353,625 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 31,291,567 | |

| | |

| Pharmaceuticals(d) – 1.7% | |

| | Bausch Health Cos., Inc.(f) | |

| | 65,000 | | | | 5.875 | | | | 05/15/23 | | | | 64,025 | |

| | 4,000,000 | | | | 9.000 | | | | 12/15/25 | | | | 4,340,000 | |

| | 1,350,000 | | | | 5.000 | | | | 01/30/28 | | | | 1,296,000 | |

| | 1,350,000 | | | | 5.250 | | | | 01/30/30 | | | | 1,336,500 | |

| | Becton Dickinson & Co. | |

| | 2,000,000 | | | | 2.894 | | | | 06/06/22 | | | | 2,049,740 | |

| | 3,375,000 | | | | 3.363 | | | | 06/06/24 | | | | 3,593,633 | |

| | CVS Health Corp. | |

| | 2,775,000 | | | | 3.700 | | | | 03/09/23 | | | | 2,942,499 | |

| | 4,715,000 | | | | 3.750 | | | | 04/01/30 | | | | 5,230,995 | |

| | HLF Financing S.a.r.l. LLC/Herbalife International, Inc.(f) | |

| | 2,745,000 | | | | 7.250 | | | | 08/15/26 | | | | 2,662,650 | |

| | Mylan NV | |

| | 3,000,000 | | | | 3.950 | | | | 06/15/26 | | | | 3,175,500 | |

| | Vizient, Inc.(f) | |

| | 580,000 | | | | 6.250 | | | | 05/15/27 | | | | 604,650 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 27,296,192 | |

| | |

| Pipelines – 3.1% | |

| | Buckeye Partners LP(d) | |

| | 2,100,000 | | | | 4.350 | | | | 10/15/24 | | | | 1,937,649 | |

| | 1,835,000 | | | | 4.125 | (f) | | | 03/01/25 | | | | 1,697,375 | |

| | 2,801,000 | | | | 3.950 | | | | 12/01/26 | | | | 2,489,389 | |

| | 929,000 | | | | 4.125 | | | | 12/01/27 | | | | 833,778 | |

| | 1,217,000 | | | | 4.500 | (f) | | | 03/01/28 | | | | 1,095,300 | |

| | Cheniere Energy Partners LP(d)(f) | |

| | 1,800,000 | | | | 4.500 | | | | 10/01/29 | | | | 1,656,000 | |

| | DCP Midstream Operating LP(f) | |

| | 4,000,000 | | | | 6.750 | | | | 09/15/37 | | | | 2,360,000 | |

| | Energy Transfer Operating LP | |

| | 4,000,000 | | | | 4.250 | (d) | | | 03/15/23 | | | | 3,964,600 | |

| | 2,985,000 | | | | 6.625 | | | | 10/15/36 | | | | 2,956,075 | |

| Enterprise Products Operating LLC(d)(e) (3M USD LIBOR +

2.778%) |

|

| | 1,000,000 | | | | 4.358 | | | | 06/01/67 | | | | 774,610 | |

| | Genesis Energy LP/Genesis Energy Finance Corp.(d) | |

| | 3,500,000 | | | | 6.000 | | | | 05/15/23 | | | | 3,062,500 | |

| | 2,010,000 | | | | 7.750 | | | | 02/01/28 | | | | 1,708,500 | |

| | Kinder Morgan Energy Partners LP | |

| | 7,000,000 | | | | 7.300 | | | | 08/15/33 | | | | 8,746,570 | |

| | NGPL PipeCo LLC(d)(f) | |

| | 1,315,000 | | | | 4.375 | | | | 08/15/22 | | | | 1,318,866 | |

| | Plains All American Pipeline LP/PAA Finance Corp.(d) | |

| | 3,000,000 | | | | 3.600 | | | | 11/01/24 | | | | 2,824,590 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments(continued)

April 30, 2020 (Unaudited)

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Pipelines – (continued) | |

| Targa Resources Partners LP/Targa Resources Partners Finance

Corp.(d) |

|

| $ | 5,000,000 | | | | 5.125 | % | | | 02/01/25 | | | $ | 4,500,000 | |

| | The Williams Cos., Inc. | |

| | 7,000,000 | | | | 7.500 | | | | 01/15/31 | | | | 8,180,410 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 50,106,212 | |

| | |

| Real Estate Investment Trust – 1.9% | |

| | American Tower Corp. | |

| | 2,250,000 | | | | 5.000 | | | | 02/15/24 | | | | 2,516,602 | |

| Brookfield Property REIT, Inc./BPR Cumulus LLC/BPR Nimbus

LLC/GGSI Sellco LL(d)(f) |

|

| | 600,000 | | | | 5.750 | | | | 05/15/26 | | | | 482,026 | |

| | Country Garden Holdings Co. Ltd.(d) | |

| | 650,000 | | | | 6.500 | | | | 04/08/24 | | | | 657,719 | |

| | Crown Castle International Corp. | |

| | 2,250,000 | | | | 5.250 | | | | 01/15/23 | | | | 2,457,697 | |

| | 300,000 | | | | 4.150 | (d) | | | 07/01/50 | | | | 349,917 | |

| | Growthpoint Properties International Pty Ltd. | |

| | 270,000 | | | | 5.872 | | | | 05/02/23 | | | | 254,644 | |

| | IRSA Propiedades Comerciales SA(d) | |

| | 540,000 | | | | 8.750 | | | | 03/23/23 | | | | 265,262 | |

| | Kaisa Group Holdings Ltd. | |

| | 320,000 | | | | 11.750 | | | | 02/26/21 | | | | 321,900 | |

| Ladder Capital Finance Holdings LLLP/Ladder Capital Finance

Corp.(d)(f) |

|

| | 2,500,000 | | | | 5.875 | | | | 08/01/21 | | | | 2,215,625 | |

| | 4,000,000 | | | | 5.250 | | | | 03/15/22 | | | | 3,300,000 | |

| | 2,027,000 | | | | 4.250 | | | | 02/01/27 | | | | 1,449,305 | |

| | MPT Operating Partnership LP/MPT Finance Corp.(d) | |

| | 4,000,000 | | | | 6.375 | | | | 03/01/24 | | | | 4,128,280 | |

| | 3,000,000 | | | | 5.000 | | | | 10/15/27 | | | | 3,059,160 | |

| | NE Property B.V.(d) | |

| EUR | 470,000 | | | | 1.750 | | | | 11/23/24 | | | | 444,713 | |

| | Realogy Group LLC/Realogy Co-Issuer Corp.(d)(f) | |

| $ | 1,600,000 | | | | 4.875 | | | | 06/01/23 | | | | 1,216,000 | |

| | 1,950,000 | | | | 9.375 | | | | 04/01/27 | | | | 1,365,000 | |

| | SBA Communications Corp.(d)(f) | |

| | 2,637,000 | | | | 3.875 | | | | 02/15/27 | | | | 2,689,740 | |

| | Scenery Journey Ltd.(d) | |

| | 310,000 | | | | 13.000 | | | | 11/06/22 | | | | 284,425 | |

| | Starwood Property Trust, Inc.(d) | |

| | 2,700,000 | | | | 4.750 | | | | 03/15/25 | | | | 2,281,500 | |

| | VICI Properties LP/VICI Note Co., Inc.(d)(f) | |

| | 1,526,000 | | | | 3.500 | | | | 02/15/25 | | | | 1,436,348 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 31,175,863 | |

| | |

| Retailing – 1.9% | |

| | 1011778 BC ULC/New Red Finance, Inc.(d)(f) | |

| | 3,000,000 | | | | 5.000 | | | | 10/15/25 | | | | 3,007,500 | |

| | Asbury Automotive Group, Inc.(d)(f) | |

| | 246,000 | | | | 4.500 | | | | 03/01/28 | | | | 203,565 | |

| | Beacon Roofing Supply, Inc.(d)(f) | |

| | 2,907,000 | | | | 4.875 | | | | 11/01/25 | | | | 2,558,160 | |

| | Burlington Coat Factory Warehouse Corp.(d)(f) | |

| | 684,000 | | | | 6.250 | | | | 04/15/25 | | | | 695,970 | |

| | |

|

| Corporate Obligations – (continued) | |

| Retailing – (continued) | |

| | eG Global Finance PLC(d)(f) | |

| 3,800,000 | | | | 6.750 | | | | 02/07/25 | | | | 3,458,000 | |

| | Eurotorg LLC Via Bonitron DAC | |

| | 410,000 | | | | 8.750 | | | | 10/30/22 | | | | 395,778 | |

| | IRB Holding Corp.(d)(f) | |

| | 2,710,000 | | | | 6.750 | | | | 02/15/26 | | | | 2,235,750 | |

| | Lowe’s Cos., Inc.(d) | |

| | 7,237,000 | | | | 5.125 | | | | 04/15/50 | | | | 9,415,771 | |

| | PetSmart, Inc.(d)(f) | |

| | 2,800,000 | | | | 5.875 | | | | 06/01/25 | | | | 2,814,000 | |

| | Suburban Propane Partners LP/Suburban Energy Finance Corp.(d) | |

| | 550,000 | | | | 5.500 | | | | 06/01/24 | | | | 541,750 | |

| | The Home Depot, Inc.(d) | |

| | 1,170,000 | | | | 3.350 | | | | 04/15/50 | | | | 1,290,031 | |

| | Yum! Brands, Inc.(d)(f) | |

| | 63,000 | | | | 7.750 | | | | 04/01/25 | | | | 68,985 | |

| | 3,064,000 | | | | 4.750 | | | | 01/15/30 | | | | 3,125,280 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 29,810,540 | |

| | |

| Semiconductors – 0.9% | |

| | Amkor Technology, Inc.(d)(f) | |

| | 1,398,000 | | | | 6.625 | | | | 09/15/27 | | | | 1,446,930 | |

| | Broadcom, Inc.(d)(f) | |

| | 4,000,000 | | | | 3.625 | | | | 10/15/24 | | | | 4,215,160 | |

| | 3,117,000 | | | | 5.000 | | | | 04/15/30 | | | | 3,497,492 | |

| | Microchip Technology, Inc. | |

| | 2,000,000 | | | | 3.922 | | | | 06/01/21 | | | | 2,032,144 | |

| | NXP BV/NXP Funding LLC(f) | |

| | 3,000,000 | | | | 4.125 | | | | 06/01/21 | | | | 3,064,050 | |

| | Qorvo, Inc.(d)(f) | |

| | 750,000 | | | | 4.375 | | | | 10/15/29 | | | | 746,250 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 15,002,026 | |

| | |

| Software(d) – 0.8% | |

| | Castle US Holding Corp.(f) | |

| | 2,824,000 | | | | 9.500 | | | | 02/15/28 | | | | 2,640,440 | |

| | Fiserv, Inc. | |

| | 2,775,000 | | | | 3.200 | | | | 07/01/26 | | | | 2,972,746 | |

| | Nuance Communications, Inc. | |

| | 3,000,000 | | | | 5.625 | | | | 12/15/26 | | | | 3,157,500 | |

| | Open Text Corp.(f) | |

| | 1,105,000 | | | | 3.875 | | | | 02/15/28 | | | | 1,071,850 | |

| | Oracle Corp. | |

| | 1,405,000 | | | | 3.600 | | | | 04/01/50 | | | | 1,594,394 | |

| | PTC, Inc.(f) | |

| | 4,000 | | | | 3.625 | | | | 02/15/25 | | | | 3,950 | |

| | SS&C Technologies, Inc.(f) | |

| | 850,000 | | | | 5.500 | | | | 09/30/27 | | | | 875,500 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 12,316,380 | |

| | |

| Technology – Hardware(d)(f) – 0.1% | |

| | NXP BV | |

| | 982,000 | | | | 3.400 | | | | 05/01/30 | | | | 985,604 | |

| | |

| Telecommunication Services – 4.5% | |

| | Altice France SA(d)(f) | |

| | 5,000,000 | | | | 7.375 | | | | 05/01/26 | | | | 5,250,000 | |

| | |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | |

Principal

Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

| Telecommunication Services – (continued) | |

| | AT&T, Inc.(d) | |

| $ | 3,000,000 | | | | 5.250 | % | | | 03/01/37 | | | $ | 3,553,770 | |

| | CenturyLink, Inc. | |

| | 1,450,000 | | | | 5.125 | (d)(f) | | | 12/15/26 | | | | 1,386,563 | |

| | 2,870,000 | | | | 7.650 | | | | 03/15/42 | | | | 2,905,875 | |

| | Cincinnati Bell, Inc.(d)(f) | |

| | 2,000,000 | | | | 7.000 | | | | 07/15/24 | | | | 2,000,000 | |

| | CommScope, Inc.(d)(f) | |

| | 2,675,000 | | | | 5.500 | | | | 06/15/24 | | | | 2,380,750 | |

| | 1,100,000 | | | | 6.000 | | | | 03/01/26 | | | | 1,100,000 | |

| | Digicel Group Two Ltd.(d)(f) | |

| | 1,845,000 | | | | 8.250 | | | | 09/30/22 | | | | 55,488 | |

| | Intelsat Jackson Holdings SA(d)(f) | |

| | 4,800,000 | | | | 8.000 | | | | 02/15/24 | | | | 4,896,000 | |

| | 3,000,000 | | | | 8.500 | | | | 10/15/24 | | | | 1,725,000 | |

| | MTN Mauritius Investments Ltd. | |

| | 420,000 | | | | 6.500 | | | | 10/13/26 | | | | 403,069 | |

| | Nokia of America Corp. | |

| | 3,000,000 | | | | 6.450 | | | | 03/15/29 | | | | 3,097,500 | |

| | Qwest Corp. | |

| | 4,780,000 | | | | 6.750 | | | | 12/01/21 | | | | 4,994,813 | |

| | Sprint Capital Corp. | |

| | 1,150,000 | | | | 8.750 | | | | 03/15/32 | | | | 1,618,625 | |

| | Sprint Corp. | |

| | 10,039,000 | | | | 7.875 | | | | 09/15/23 | | | | 11,281,326 | |

| | T-Mobile USA, Inc.(d) | |

| | 3,000,000 | | | | 4.000 | | | | 04/15/22 | | | | 3,063,750 | |

| | 6,000,000 | | | | 6.500 | | | | 01/15/26 | | | | 6,322,500 | |

| | 1,896,000 | | | | 4.500 | (f) | | | 04/15/50 | | | | 2,193,994 | |

| | Telecom Argentina SA(d) | |

| | 340,000 | | | | 6.500 | | | | 06/15/21 | | | | 307,700 | |

| | 310,000 | | | | 8.000 | (f) | | | 07/18/26 | | | | 248,291 | |

| | Telecom Italia Capital SA | |

| | 3,025,000 | | | | 7.200 | | | | 07/18/36 | | | | 3,353,969 | |

| | 1,000,000 | | | | 7.721 | | | | 06/04/38 | | | | 1,151,250 | |

| | Telecom Italia SpA(f) | |

| | 5,000,000 | | | | 5.303 | | | | 05/30/24 | | | | 5,168,750 | |

| | Verizon Communications, Inc. | |

| | 3,000,000 | | | | 5.250 | | | | 03/16/37 | | | | 3,986,040 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 72,445,023 | |

| | |

| Toys/Games/Hobbies(d) – 0.1% | |

| | Mattel, Inc. | |

| | 2,475,000 | | | | 3.150 | | | | 03/15/23 | | | | 2,301,750 | |

| | |

| Transportation – 0.0% | |

| | MV24 Capital B.V.(f) | |

| | 335,260 | | | | 6.748 | | | | 06/01/34 | | | | 282,771 | |

| | Rumo Luxembourg S.a.r.l.(d) | |

| | 240,000 | | | | 5.875 | | | | 01/18/25 | | | | 236,700 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 519,471 | |

| | |

| | TOTAL CORPORATE OBLIGATIONS | |

| | (Cost $835,989,547) | | | | | | | $ | 794,320,570 | |

| | |

|

| Mortgage-Backed Obligations(e) – 0.0% | |

| Collateralized Mortgage Obligation – 0.0% | |

| Sequential Floating Rate – 0.0% | |

| Merrill Lynch Alternative Note Asset TrustSeries 2007-OAR3,

Class A1 (1M LIBOR + 0.190%) |

|

| $ | 225,391 | | | | 1.137 | % | | | 07/25/47 | | | $ | 186,197 | |

| | (Cost $87,339) | |

| | |

| | |

|

| Foreign Debt Obligations – 0.2% | |

| Sovereign – 0.2% | |

| | Ecuador Government International Bond | |

| $ | 490,000 | | | | 10.750 | % | | | 03/28/22 | | | $ | 153,125 | |

| | 330,000 | | | | 7.950 | | | | 06/20/24 | | | | 102,630 | |

| | Republic of Angola | |

| | 300,000 | | | | 9.500 | | | | 11/12/25 | | | | 141,750 | |

| | Republic of Argentina | |

| | 380,000 | | | | 4.625 | | | | 01/11/23 | | | | 106,756 | |

| | Republic of Egypt | |

| EUR | 590,000 | | | | 4.750 | | | | 04/11/25 | | | | 566,945 | |

| | Republic of Nigeria | |

| $ | 690,000 | | | | 6.500 | | | | 11/28/27 | | | | 519,872 | |

| | Republic of Sri Lanka(f) | |

| | 630,000 | | | | 6.350 | | | | 06/28/24 | | | | 371,658 | |

| | Republic of Turkey | |

| | 760,000 | | | | 6.125 | | | | 10/24/28 | | | | 692,550 | |

| | Ukraine Government Bond | |

| | 680,000 | | | | 7.750 | | | | 09/01/23 | | | | 644,300 | |

| | |

| | TOTAL FOREIGN DEBT OBLIGATIONS | |

| | (Cost $4,655,071) | | | | | | | $ | 3,299,586 | |

| | |

| | | | | | | | | | | | | | |

|

| Bank Loans(e)(j) – 6.7% | |

| Aerospace – 0.2% | |

| | TransDigm, Inc. (1M LIBOR + 2.250%) | |

| $ | 4,261,511 | | | | 2.654 | % | | | 12/09/25 | | | $ | 3,720,171 | |

| | |

| Automotive – 0.1% | |

| | Adient US LLC (3M LIBOR + 4.000%) | |

| | 1,955,287 | | | | 6.889 | | | | 05/06/24 | | | | 1,753,658 | |

| | |

| Automotive – Parts – 0.2% | |

| | Tenneco, Inc. (1M LIBOR + 3.000%) | |

| | 4,463,699 | | | | 3.404 | | | | 10/01/25 | | | | 3,453,787 | |

| | |