UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-05426 |

AIM Investment Funds (Invesco Investment Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

| | | | |

| Registrant’s telephone number, including area code: | | (713) 626-1919 | | |

| | | | | | |

| Date of fiscal year end: | | 10/31 | | | | |

| | | |

| Date of reporting period: | | 10/31/22 | | | | |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| | |

| | |

| Annual Report to Shareholders | | October 31, 2022 |

Invesco Balanced-Risk Allocation Fund

Nasdaq:

A: ABRZX ∎ C: ABRCX ∎ R: ABRRX ∎ Y: ABRYX ∎ R5: ABRIX ∎ R6: ALLFX

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the fiscal year ended October 31, 2022, Class A shares of Invesco Balanced-Risk Allocation Fund (the Fund), at net asset value (NAV), outperformed the Custom Invesco Balanced-Risk Allocation Style Index, the Fund’s style-specific benchmark. | |

Your Fund’s long-term performance appears later in this report. | |

| |

Fund vs. Indexes | |

Total returns, 10/31/21 to 10/31/22, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | -13.99 | % |

Class C Shares | | | -14.57 | |

Class R Shares | | | -14.21 | |

Class Y Shares | | | -13.78 | |

Class R5 Shares | | | -13.72 | |

Class R6 Shares | | | -13.69 | |

S&P 500 Index▼ (Broad Market Index) | | | -14.61 | |

Custom Invesco Balanced-Risk Allocation Style Index∎ (Style-Specific Index) | | | -16.98 | |

Lipper Alternative Global Macro Funds Index¨ (Peer Group Index) | | | -11.64 | |

| |

Source(s): ▼RIMES Technologies Corp.; ∎Invesco, RIMES Technologies Corp.; ¨Lipper Inc. | | | | |

Market conditions and your Fund

For the fiscal year ended October 31, 2022, the Fund at NAV reported negative absolute performance as two of the macro factors in which the Fund invests: growth (equities) and defensive (fixed-income) detracted from Fund performance. The Fund invests in derivatives, such as swaps, options, and futures, which are expected to correspond to the performance of US and international fixed-income, equity and commodity markets. The strategic allocation portion of the investment process involves first selecting representative assets for each asset class from a universe of more than 50 assets. Next, we seek to construct the portfolio so that an approximately equal amount of risk comes from our three asset classes: growth (equities), defensive (fixed-income) and real return (commodities). Tactical adjustments to the Fund’s portfolio are then made on a monthly basis to try and take advantage of short-term market dynamics.

The Fund’s strategic exposure to the growth macro factor, obtained through the use of swaps and futures, detracted from results for the fiscal year, with five of the six markets in which the Fund invests delivering negative returns as a consequence of the resurgence of inflation and central bank efforts to combat the strongest rise in prices in decades. Amongst the equity markets that the Fund invests in, only the UK was able to post positive results as the sector make-up of that market had a higher exposure to sectors that performed well in this environment including energy and staples. Japan equities were a very mild detractor as the Bank of Japan (BOJ) bucked the trend of other central banks by not raising rates and maintaining a very accommodative policy. US large- and small-caps fell over the fiscal year both as a result of aggressive hiking by the US Federal

Reserve as well as a sector make-up that tilted toward growth-oriented sectors like technology, which were relative underperformers. European equities fell on rate hikes and inflationary pressures as well as the war between Russia and Ukraine, which has raised fears of energy security and the follow through impact on economic activity. Emerging markets were the lead detractor from the Fund’s absolute performance within the growth macro factor largely on the poor performance of China, which continues to struggle with COVID-19 outbreaks and economic shutdowns resulting from their zero COVID-19 policy. Tactical shifts in the Fund’s positioning through the fiscal year proved difficult as there was no persistent performance month-to-month, which made getting on the right side of the trend a challenge.

The Fund’s strategic exposure to the real return macro factor, obtained through the use of swaps, futures and commodity-linked notes contributed to the Fund’s absolute performance for the fiscal year. Our motivation for holding commodities has been to help offset weakness in equity and fixed-income performance during periods of unexpected inflation. In aggregate, that is the result we achieved even though performance was mixed across the commodity complexes. Contribution to returns was led by the energy complex as prices for oil, distillates and natural gas all rose over the fiscal year. The price behavior for energy was spurred not only by tight supply issues stemming from longstanding underinvestment and the additional pressures brought through Russia’s invasion of Ukraine, but also on what has been steady demand. Agricultural commodities also bolstered results as adverse weather impacted crops such as the soy complex and corn. Corn prices also saw an increase from the Russia/ Ukraine war in that Ukraine is a major producer

of corn along its border with Russia and as grain embargoes were put into place. Metals did not fare as well over the fiscal year. Concerns that the aggressive central bank hiking would plunge economies into recession led to demand destruction for industrial metals like aluminum and copper, both of which saw prices fall. Gold and silver prices also fell on a combination of a strong dollar and higher real rates. Tactical shifts over the fiscal year in the real return macro factor produced modest losses for the Fund as strong early period commodity performance became volatile later in the fiscal year creating whipsaw losses.

The Fund’s strategic exposure to the defensive macro factor, obtained through the use of swaps and futures, was the largest detractor from the Fund’s absolute performance during the fiscal year due to a combination of strong inflation readings and aggressive actions by central banks. Japan government bonds were the top performer among the Fund’s defensive macro factor holdings, turning in a flat result for the fiscal year. The BOJ’s approach of not joining other major central banks in raising rates in the fiscal year and lower inflation readings than the rest of the world left yields relatively unchanged over the fiscal year. The remaining bond markets in which the Fund invests, including Australia, Canada, UK, US and Germany, generated losses as their respective central banks hiked rates to the highest levels in at least a decade and as inflation climbed to the highest readings in several decades. Periods of high inflation and higher rates are damaging to bond returns as their fixed coupon payments become less attractive, which has a downward impact on bond prices. Tactical shifts in the defense macro factor produced gains for the Fund in the fiscal year as factors such as the rising inflation and rate environment led our models to be underweight in these exposures.

Please note that our strategy is principally implemented with derivative instruments that include futures, options, commodity-linked notes and total return swaps. Therefore, all or most of the performance of the strategy, both positive and negative, can be attributed to these instruments. Derivatives can be a cost-effective way to gain exposure to asset classes. However, derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities.

Thank you for your continued investment in Invesco Balanced-Risk Allocation Fund. As always, we welcome your comments and questions.

Portfolio manager(s):

Mark Ahnrud

John Burrello

Chris Devine

Scott Hixon

Christian Ulrich

| | |

| 2 | | Invesco Balanced-Risk Allocation Fund |

Scott Wolle

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | |

| 3 | | Invesco Balanced-Risk Allocation Fund |

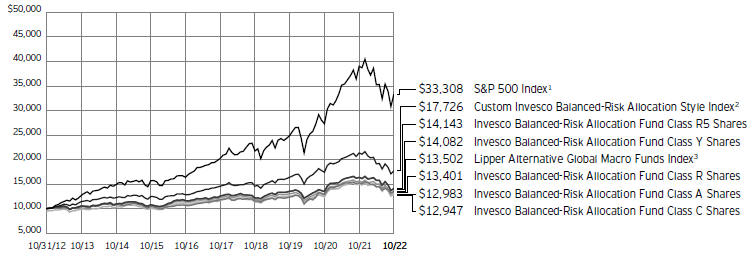

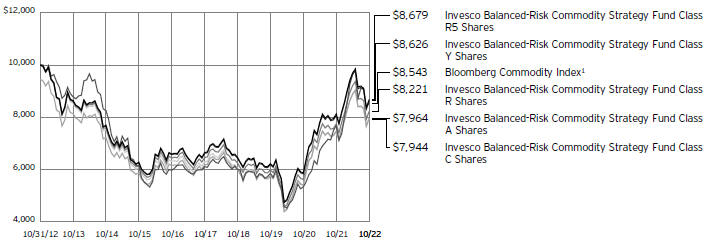

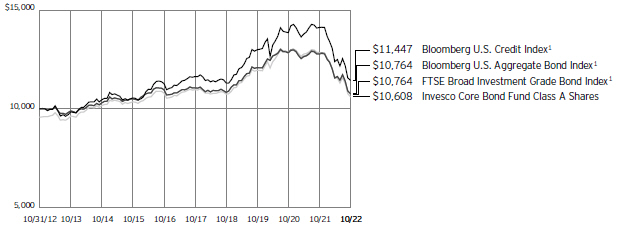

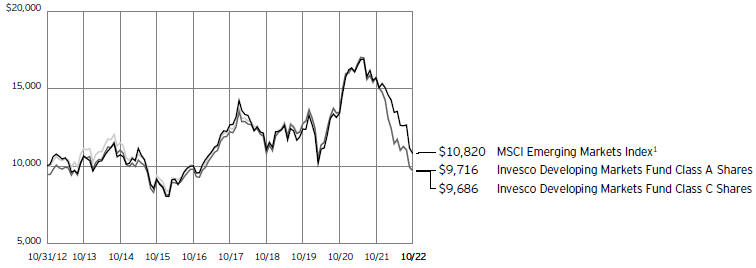

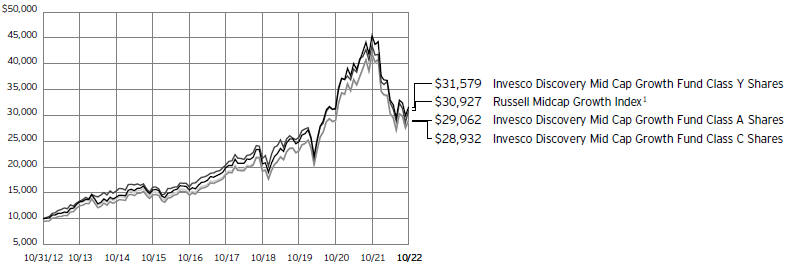

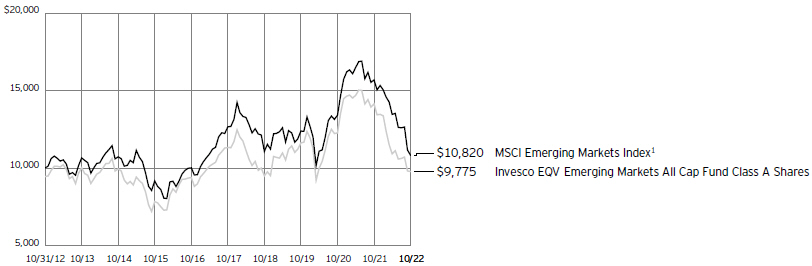

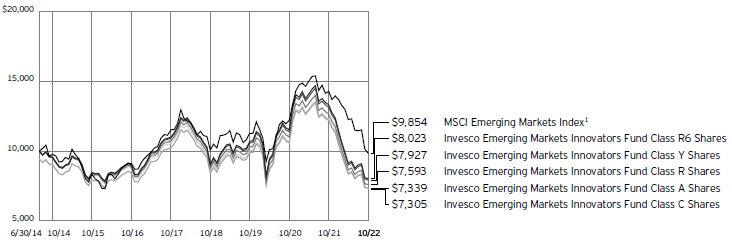

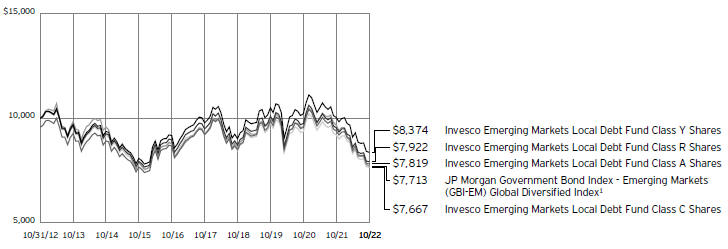

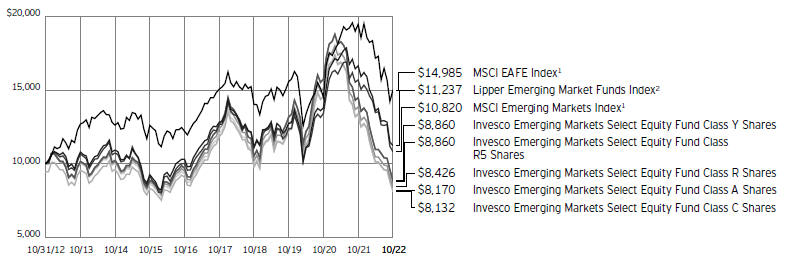

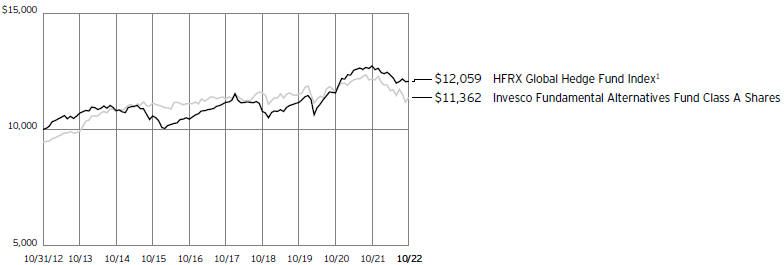

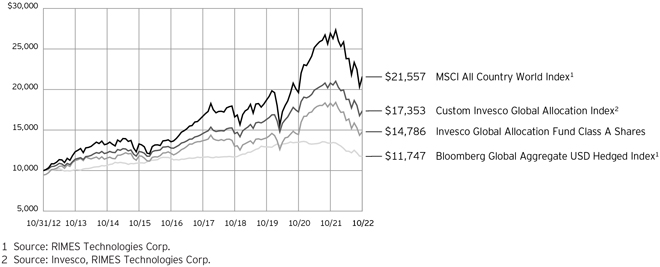

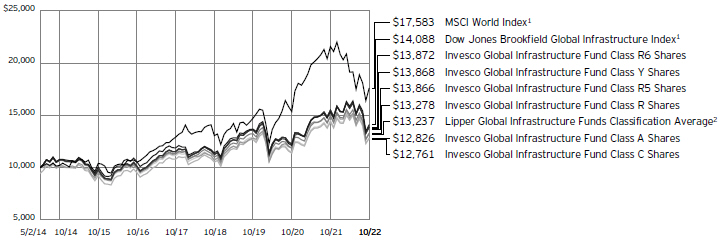

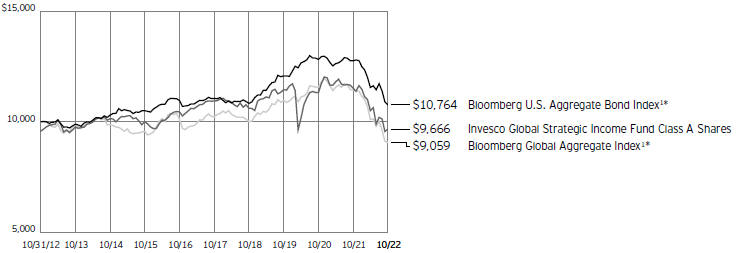

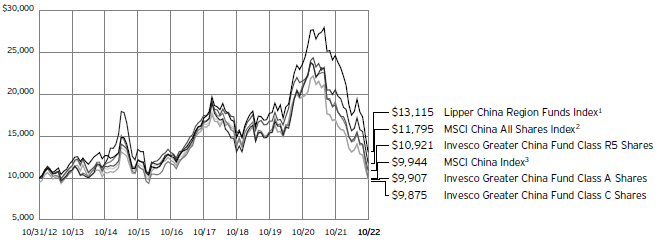

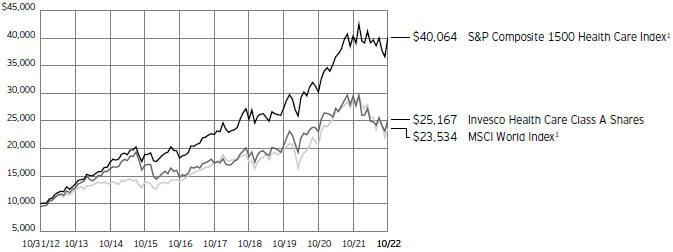

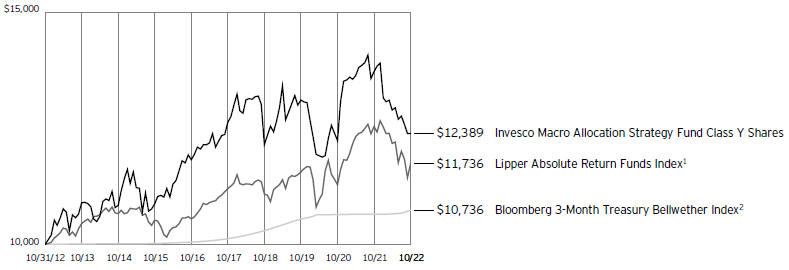

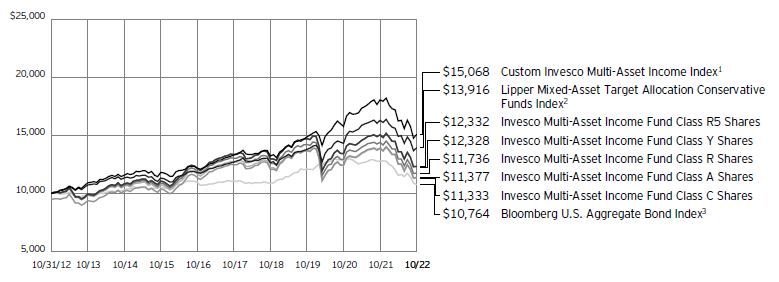

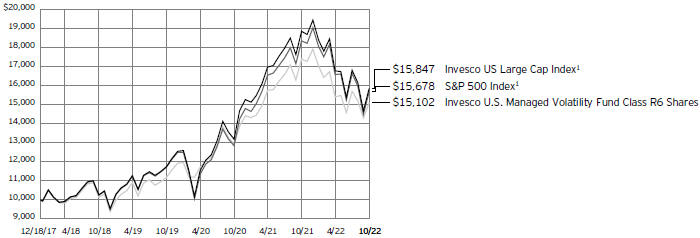

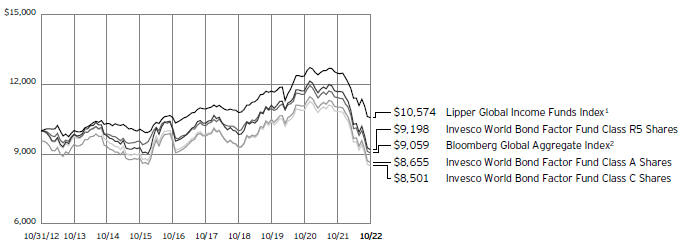

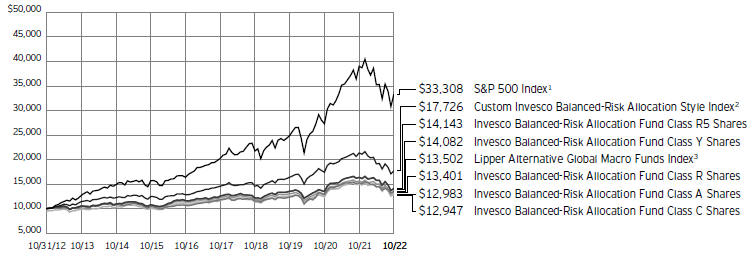

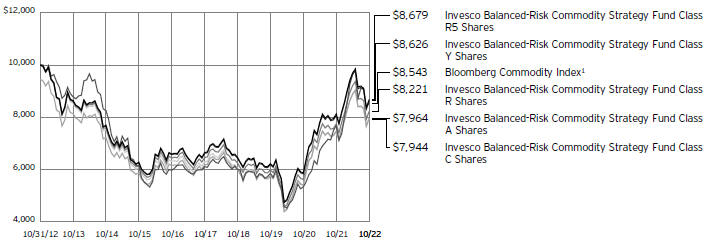

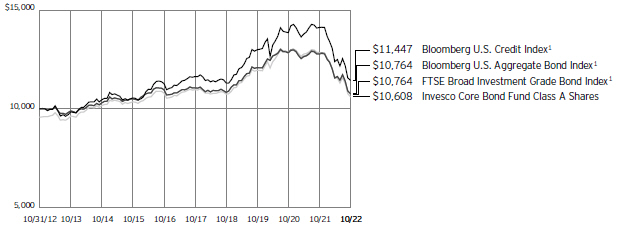

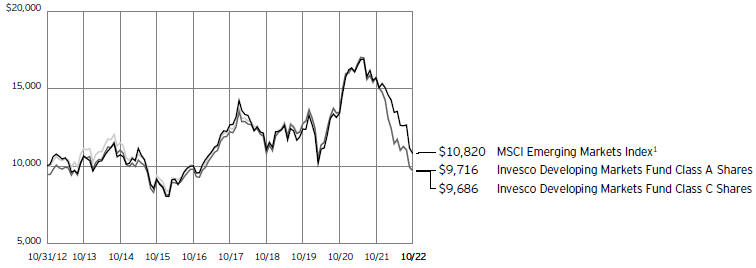

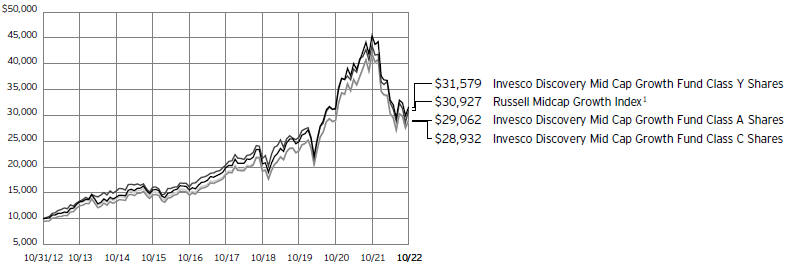

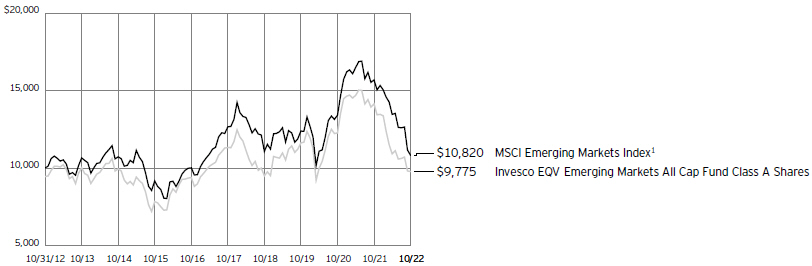

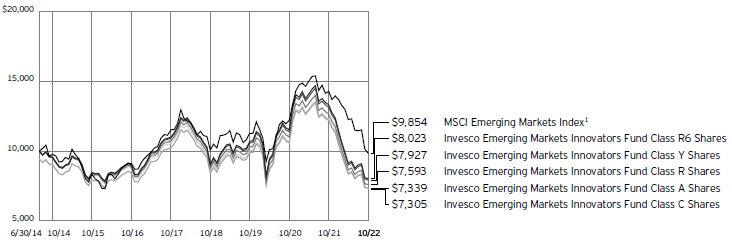

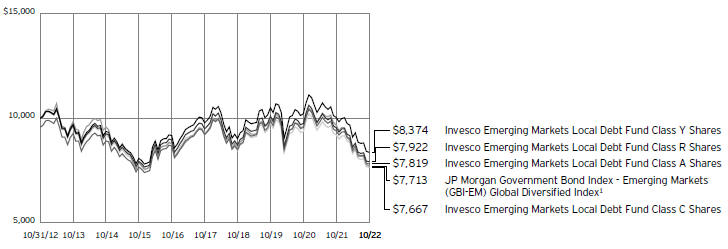

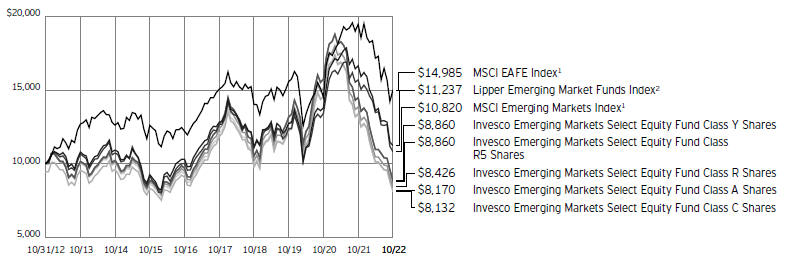

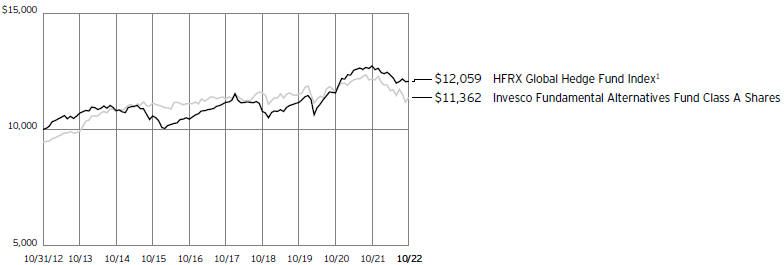

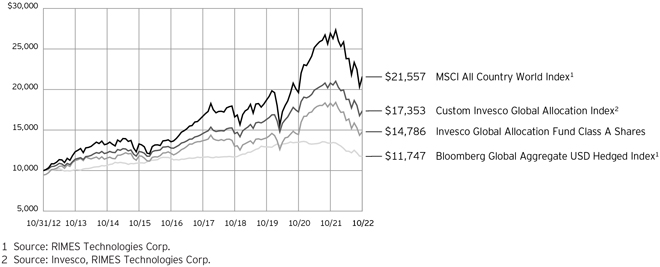

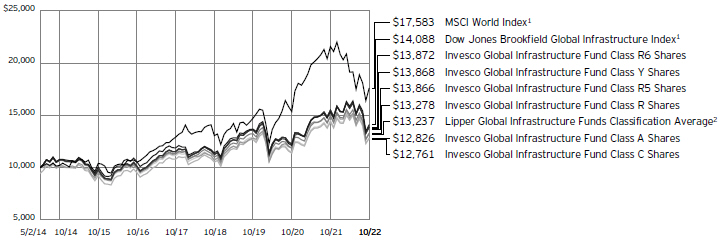

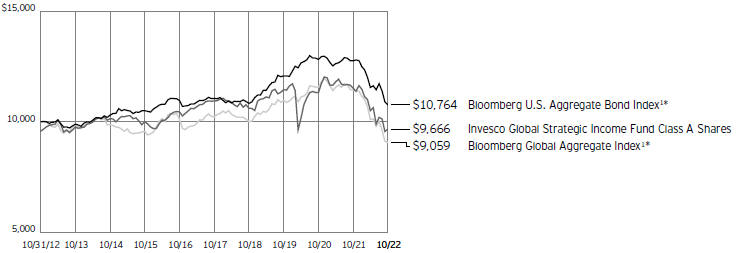

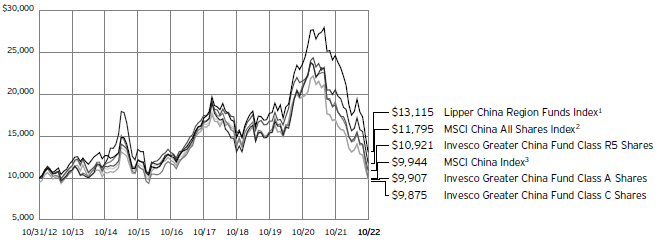

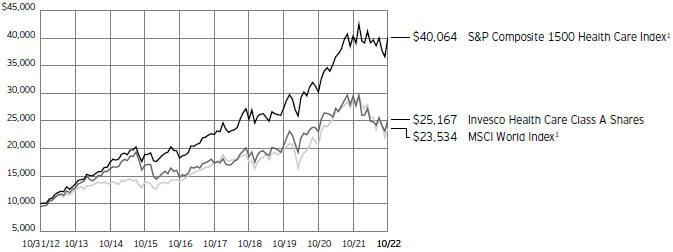

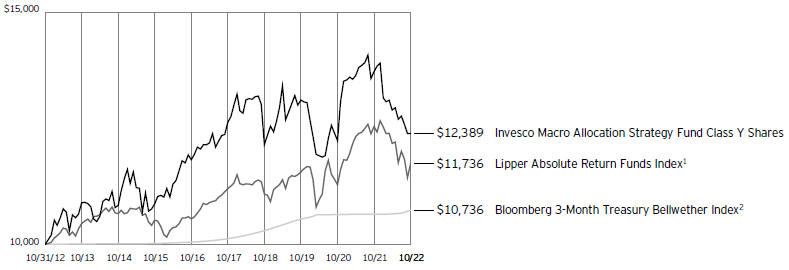

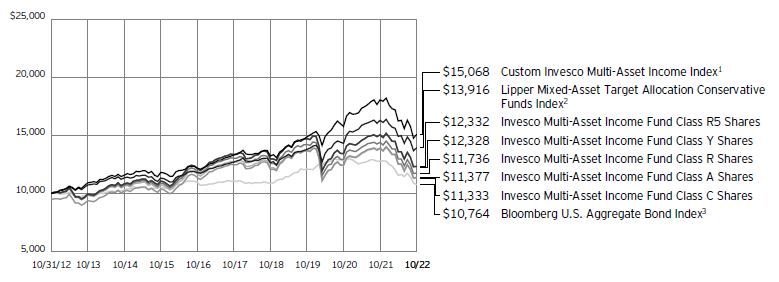

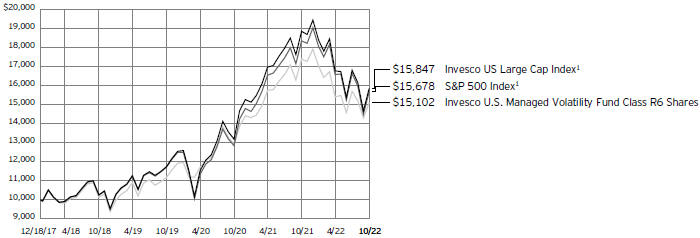

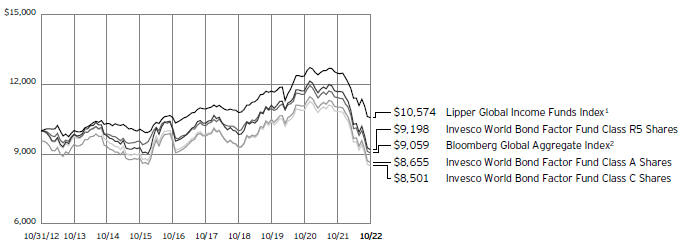

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 10/31/12

1 Source: RIMES Technologies Corp.

2 Source: Invesco, RIMES Technologies Corp.

3 Source: Lipper Inc.

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| | |

| 4 | | Invesco Balanced-Risk Allocation Fund |

| | | | |

| |

Average Annual Total Returns | |

As of 10/31/22, including maximum applicable sales charges | |

Class A Shares | | | | |

Inception (6/2/09) | | | 5.07 | % |

10 Years | | | 2.64 | |

5 Years | | | 0.91 | |

1 Year | | | -18.69 | |

Class C Shares | | | | |

Inception (6/2/09) | | | 5.03 | % |

10 Years | | | 2.62 | |

5 Years | | | 1.32 | |

1 Year | | | -15.25 | |

Class R Shares | | | | |

Inception (6/2/09) | | | 5.24 | % |

10 Years | | | 2.97 | |

5 Years | | | 1.80 | |

1 Year | | | -14.21 | |

Class Y Shares | | | | |

Inception (6/2/09) | | | 5.78 | % |

10 Years | | | 3.48 | |

5 Years | | | 2.31 | |

1 Year | | | -13.78 | |

Class R5 Shares | | | | |

Inception (6/2/09) | | | 5.81 | % |

10 Years | | | 3.53 | |

5 Years | | | 2.35 | |

1 Year | | | -13.72 | |

Class R6 Shares | | | | |

Inception (9/24/12) | | | 3.45 | % |

10 Years | | | 3.61 | |

5 Years | | | 2.44 | |

1 Year | | | -13.69 | |

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees

and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| | |

| 5 | | Invesco Balanced-Risk Allocation Fund |

Supplemental Information

Invesco Balanced-Risk Allocation Fund’s investment objective is to provide total return with a low to moderate correlation to traditional financial market indices.

| ∎ | Unless otherwise stated, information presented in this report is as of October 31, 2022, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| ∎ | The Custom Invesco Balanced-Risk Allocation Style Index is composed of 60% MSCI World Index and 40% Bloomberg U.S. Aggregate Bond Index. Effective December 1, 2009, the fixed income component of the Custom Balanced-Risk Allocation Style Index changed from the JP Morgan GBI Global (Traded) Index to the Bloomberg U.S. Aggregate Bond Index. The MSCI World Index is considered representative of stocks of developed countries. The index return is computed using the net return, which withholds applicable taxes for non-resident investors. The Bloomberg U.S. Aggregate Bond Index is considered representative of the US investment-grade, fixed-rate bond market. The JP Morgan GBI Global (Traded) Index is considered representative of fixed-rate debt of developed government bond markets. |

| ∎ | The Lipper Alternative Global Macro Funds Index is an unmanaged index considered representative of alternative global macro funds tracked by Lipper. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

|

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

|

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| | |

| 6 | | Invesco Balanced-Risk Allocation Fund |

Fund Information

Target Risk Contribution and Notional Asset Weights as of October 31, 2022

| | | | | | | | | | |

| Asset Class | | Target Risk Contribution* | | Notional

Asset

Weights** |

Equities and Options | | | | 25.72 | % | | | | 44.99 | % |

Fixed Income | | | | 36.59 | | | | | 68.32 | |

Commodities | | | | 37.69 | | | | | 25.49 | |

Total | | | | 100.00 | % | | | | 138.80 | % |

| * | Reflects the risk that each asset class is expected to contribute to the overall risk of the Fund as measured by standard deviation and estimates of risk based on historical data. Standard deviation measures the annualized fluctuations (volatility) of monthly returns. |

| ** | Proprietary models determine the Notional Asset Weights necessary to achieve the Target Risk Contributions. Total Notional Asset Weight greater than 100% is achieved through derivatives and other instruments that create leverage. |

| | |

| 7 | | Invesco Balanced-Risk Allocation Fund |

Consolidated Schedule of Investments

October 31, 2022

| | | | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | | Principal Amount (000) | | | Value | |

|

| |

U.S. Treasury Securities–34.46% | | | | | | | | | | | | | | | | |

U.S. Treasury Bills–13.69%(a) | | | | | | | | | | | | | | | | |

U.S. Treasury Bills | | | 1.71 | % | | | 12/08/2022 | | | $ | 95,800 | | | $ | 95,630,647 | |

|

| |

U.S. Treasury Bills | | | 2.84 | % | | | 01/26/2023 | | | | 91,000 | | | | 90,134,249 | |

|

| |

U.S. Treasury Bills | | | 3.39 | % | | | 03/09/2023 | | | | 63,400 | | | | 62,457,735 | |

|

| |

| | | | | | | | | | | | | | | 248,222,631 | |

|

| |

| | | | |

U.S. Treasury Floating Rate Notes–20.77% | | | | | | | | | | | | | | | | |

U.S. Treasury Floating Rate Notes (3 mo. U.S. Treasury Bill Money Market Yield Rate - 0.02%)(b) | | | 4.09 | % | | | 01/31/2024 | | | | 114,500 | | | | 114,487,008 | |

|

| |

U.S. Treasury Floating Rate Notes (3 mo. U.S. Treasury Bill Money Market Yield Rate - 0.08%)(b) | | | 4.04 | % | | | 04/30/2024 | | | | 128,300 | | | | 128,113,689 | |

|

| |

U.S. Treasury Floating Rate Notes (3 mo. U.S. Treasury Bill Money Market Yield Rate + 0.04%)(b) | | | 4.15 | % | | | 07/31/2024 | | | | 134,000 | | | | 133,869,651 | |

|

| |

| | | | | | | | | | | | | | | 376,470,348 | |

|

| |

Total U.S. Treasury Securities (Cost $625,471,229) | | | | | | | | | | | | | | | 624,692,979 | |

|

| |

| | | | |

| | | | | | Expiration

Date | | | | | | | |

Commodity-Linked Securities–3.77% | | | | | | | | | | | | | | | | |

Canadian Imperial Bank of Commerce EMTN, U.S. Federal Funds Effective Rate minus 0.02% (linked to the Canadian Imperial Bank of Commerce Custom 7 Agriculture Commodity Index, multiplied by 2) (Canada)(c)(d) | | | | | | | 11/30/2022 | | | | 22,850 | | | | 32,296,681 | |

|

| |

RBC Capital Markets LLC, Commodity-Linked Notes, U.S. Federal Funds Effective Rate minus 0.04% (linked to the RBC Enhanced Agricultural Basket 07 Excess Return Index) (Canada)(c)(d) | | | | | | | 12/05/2022 | | | | 25,600 | | | | 36,062,128 | |

|

| |

Total Commodity-Linked Securities (Cost $61,278,726) | | | | | | | | | | | | | | | 68,358,809 | |

|

| |

| | | | |

| | | | | | | | | Shares | | | | |

Money Market Funds–53.89% | | | | | | | | | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class, 3.07%(e)(f) | | | | | | | | | | | 263,828,894 | | | | 263,828,894 | |

|

| |

Invesco Liquid Assets Portfolio, Institutional Class, 3.03%(e)(f) | | | | | | | | | | | 60,960,429 | | | | 60,972,621 | |

|

| |

Invesco Liquidity Funds PLC, Invesco US Dollar Liquidity Portfolio (Ireland), Institutional Class, 3.16%(e)(f) | | | | | | | | | | | 174,522,956 | | | | 174,522,956 | |

|

| |

Invesco Treasury Obligations Portfolio, Institutional Class, 3.12%(e)(f) | | | | | | | | | | | 380,000,000 | | | | 380,000,000 | |

|

| |

Invesco Treasury Portfolio, Institutional Class, 3.08%(e)(f) | | | | | | | | | | | 97,546,164 | | | | 97,546,164 | |

|

| |

Total Money Market Funds (Cost $976,864,608) | | | | | | | | | | | | | | | 976,870,635 | |

|

| |

| | | | |

Options Purchased–1.84% | | | | | | | | | | | | | | | | |

(Cost $26,462,914)(g) | | | | | | | | | | | | | | | 33,248,201 | |

|

| |

TOTAL INVESTMENTS IN SECURITIES–93.96% (Cost $1,690,077,477) | | | | | | | | | | | | | | | 1,703,170,624 | |

|

| |

OTHER ASSETS LESS LIABILITIES–6.04% | | | | | | | | | | | | | | | 109,426,676 | |

|

| |

NET ASSETS–100.00% | | | | | | | | | | | | | | $ | 1,812,597,300 | |

|

| |

Investment Abbreviations:

EMTN – European Medium-Term Notes

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 8 | | Invesco Balanced-Risk Allocation Fund |

Notes to Consolidated Schedule of Investments:

| (a) | Security traded on a discount basis. The interest rate shown represents the discount rate at the time of purchase by the Fund. |

| (b) | Interest or dividend rate is redetermined periodically. Rate shown is the rate in effect on October 31, 2022. |

| (c) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at October 31, 2022 was $68,358,809, which represented 3.77% of the Fund’s Net Assets. |

| (d) | The Reference Entity Components table below includes additional information regarding the underlying components of certain reference entities that are not publicly available. |

| (e) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended October 31, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

October 31, 2021 | | | Purchases at Cost | | | Proceeds from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain | | | Value

October 31, 2022 | | | Dividend Income | |

| | | | | | | |

| Investments in Affiliated Money Market Funds: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class | | $ | 389,413,824 | | | $ | 727,002,206 | | | $ | (852,587,136 | ) | | $ | - | | | $ | - | | | | $263,828,894 | | | | $2,454,884 | |

| | | | | | | |

Invesco Liquid Assets Portfolio, Institutional Class | | | 129,916,815 | | | | 519,287,290 | | | | (588,207,517 | ) | | | (95,866 | ) | | | 71,899 | | | | 60,972,621 | | | | 643,279 | |

| | | | | | | |

Invesco Liquidity Funds PLC, Invesco US Dollar Liquidity Portfolio, Institutional Class | | | 143,068,345 | | | | 1,043,364,213 | | | | (1,011,909,602 | ) | | | - | | | | - | | | | 174,522,956 | | | | 1,639,040 | |

| | | | | | | |

Invesco Treasury Obligations Portfolio, Institutional Class | | | 524,000,000 | | | | - | | | | (144,000,000 | ) | | | - | | | | - | | | | 380,000,000 | | | | 3,670,414 | |

| | | | | | | |

Invesco Treasury Portfolio, Institutional | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Class | | | 156,128,941 | | | | 830,859,664 | | | | (889,442,441 | ) | | | - | | | | - | | | | 97,546,164 | | | | 531,848 | |

| | | | | | | |

Total | | $ | 1,342,527,925 | | | $ | 3,120,513,373 | | | $ | (3,486,146,696 | ) | | $ | (95,866 | ) | | $ | 71,899 | | | | $976,870,635 | | | | $8,939,465 | |

| (f) | The rate shown is the 7-day SEC standardized yield as of October 31, 2022. |

| (g) | The table below details options purchased. |

Open Exchange-Traded Index Options Purchased

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Type of

Contract | | | Expiration

Date | | | Number of

Contracts | | | Exercise Price | | | Notional Value* | | | Value |

Equity Risk | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EURO STOXX 50 Index | | | Put | | | | 12/16/2022 | | | | 120 | | | | EUR | | | | 3,800.00 | | | | EUR | | | | 4,560,000 | | | $ 263,863 |

EURO STOXX 50 Index | | | Put | | | | 12/16/2022 | | | | 120 | | | | EUR | | | | 3,900.00 | | | | EUR | | | | 4,680,000 | | | 357,193 |

EURO STOXX 50 Index | | | Put | | | | 05/19/2023 | | | | 120 | | | | EUR | | | | 3,500.00 | | | | EUR | | | | 4,200,000 | | | 241,686 |

EURO STOXX 50 Index | | | Put | | | | 06/16/2023 | | | | 130 | | | | EUR | | | | 3,600.00 | | | | EUR | | | | 4,680,000 | | | 336,855 |

EURO STOXX 50 Index | | | Put | | | | 07/21/2023 | | | | 120 | | | | EUR | | | | 3,400.00 | | | | EUR | | | | 4,080,000 | | | 238,484 |

EURO STOXX 50 Index | | | Put | | | | 08/18/2023 | | | | 130 | | | | EUR | | | | 3,500.00 | | | | EUR | | | | 4,550,000 | | | 320,796 |

EURO STOXX 50 Index | | | Put | | | | 09/15/2023 | | | | 120 | | | | EUR | | | | 3,350.00 | | | | EUR | | | | 4,020,000 | | | 245,600 |

EURO STOXX 50 Index | | | Put | | | | 10/20/2023 | | | | 120 | | | | EUR | | | | 3,200.00 | | | | EUR | | | | 3,840,000 | | | 209,548 |

EURO STOXX 50 Index | | | Put | | | | 03/17/2023 | | | | 130 | | | | EUR | | | | 4,150.00 | | | | EUR | | | | 5,395,000 | | | 704,029 |

EURO STOXX 50 Index | | | Put | | | | 01/20/2023 | | | | 130 | | | | EUR | | | | 4,000.00 | | | | EUR | | | | 5,200,000 | | | 516,716 |

EURO STOXX 50 Index | | | Put | | | | 02/17/2023 | | | | 120 | | | | EUR | | | | 3,600.00 | | | | EUR | | | | 4,320,000 | | | 198,520 |

EURO STOXX 50 Index | | | Put | | | | 04/21/2023 | | | | 120 | | | | EUR | | | | 3,700.00 | | | | EUR | | | | 4,440,000 | | | 306,555 |

FTSE 100 Index | | | Put | | | | 05/19/2023 | | | | 50 | | | | GBP | | | | 7,225.00 | | | | GBP | | | | 3,612,500 | | | 230,507 |

FTSE 100 Index | | | Put | | | | 06/16/2023 | | | | 50 | | | | GBP | | | | 7,375.00 | | | | GBP | | | | 3,687,500 | | | 286,700 |

FTSE 100 Index | | | Put | | | | 07/21/2023 | | | | 50 | | | | GBP | | | | 6,950.00 | | | | GBP | | | | 3,475,000 | | | 199,830 |

FTSE 100 Index | | | Put | | | | 08/18/2023 | | | | 50 | | | | GBP | | | | 7,200.00 | | | | GBP | | | | 3,600,000 | | | 267,204 |

FTSE 100 Index | | | Put | | | | 09/15/2023 | | | | 50 | | | | GBP | | | | 7,000.00 | | | | GBP | | | | 3,500,000 | | | 230,220 |

FTSE 100 Index | | | Put | | | | 10/20/2023 | | | | 50 | | | | GBP | | | | 6,800.00 | | | | GBP | | | | 3,400,000 | | | 207,571 |

FTSE 100 Index | | | Put | | | | 11/18/2022 | | | | 50 | | | | GBP | | | | 6,900.00 | | | | GBP | | | | 3,450,000 | | | 22,936 |

FTSE 100 Index | | | Put | | | | 12/16/2022 | | | | 50 | | | | GBP | | | | 6,800.00 | | | | GBP | | | | 3,400,000 | | | 38,131 |

FTSE 100 Index | | | Put | | | | 01/20/2023 | | | | 50 | | | | GBP | | | | 7,350.00 | | | | GBP | | | | 3,675,000 | | | 192,089 |

FTSE 100 Index | | | Put | | | | 02/17/2023 | | | | 50 | | | | GBP | | | | 7,175.00 | | | | GBP | | | | 3,587,500 | | | 160,552 |

FTSE 100 Index | | | Put | | | | 03/17/2023 | | | | 50 | | | | GBP | | | | 7,025.00 | | | | GBP | | | | 3,512,500 | | | 148,797 |

FTSE 100 Index | | | Put | | | | 04/21/2023 | | | | 50 | | | | GBP | | | | 7,250.00 | | | | GBP | | | | 3,625,000 | | | 221,906 |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 9 | | Invesco Balanced-Risk Allocation Fund |

Open Exchange-Traded Index Options Purchased–(continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Type of

Contract | | Expiration

Date | | Number of

Contracts | | Exercise Price | | | Notional Value* | | | Value |

MSCI Emerging Markets Index | | Put | | 04/21/2023 | | 75 | | | USD | | | | 1,110.00 | | | | USD | | | | 8,325,000 | | | $ 1,888,125 |

MSCI Emerging Markets Index | | Put | | 05/19/2023 | | 75 | | | USD | | | | 1,030.00 | | | | USD | | | | 7,725,000 | | | 1,336,875 |

MSCI Emerging Markets Index | | Put | | 06/16/2023 | | 75 | | | USD | | | | 1,030.00 | | | | USD | | | | 7,725,000 | | | 1,362,750 |

MSCI Emerging Markets Index | | Put | | 07/21/2023 | | 70 | | | USD | | | | 975.00 | | | | USD | | | | 6,825,000 | | | 994,700 |

MSCI Emerging Markets Index | | Put | | 08/18/2023 | | 70 | | | USD | | | | 970.00 | | | | USD | | | | 6,790,000 | | | 987,350 |

MSCI Emerging Markets Index | | Put | | 09/15/2023 | | 70 | | | USD | | | | 950.00 | | | | USD | | | | 6,650,000 | | | 926,800 |

MSCI Emerging Markets Index | | Put | | 10/20/2023 | | 70 | | | USD | | | | 850.00 | | | | USD | | | | 5,950,000 | | | 588,700 |

MSCI Emerging Markets Index | | Put | | 11/18/2022 | | 75 | | | USD | | | | 1,210.00 | | | | USD | | | | 9,075,000 | | | 2,600,250 |

MSCI Emerging Markets Index | | Put | | 12/16/2022 | | 75 | | | USD | | | | 1,170.00 | | | | USD | | | | 8,775,000 | | | 2,355,375 |

MSCI Emerging Markets Index | | Put | | 01/20/2023 | | 75 | | | USD | | | | 1,180.00 | | | | USD | | | | 8,850,000 | | | 2,410,875 |

MSCI Emerging Markets Index | | Put | | 02/17/2023 | | 75 | | | USD | | | | 1,170.00 | | | | USD | | | | 8,775,000 | | | 2,302,125 |

MSCI Emerging Markets Index | | Put | | 03/17/2023 | | 75 | | | USD | | | | 1,130.00 | | | | USD | | | | 8,475,000 | | | 1,999,500 |

Nikkei 225 Index | | Put | | 06/09/2023 | | 28 | | | JPY | | | | 25,500.00 | | | | JPY | | | | 714,000,000 | | | 218,434 |

Nikkei 225 Index | | Put | | 06/09/2023 | | 28 | | | JPY | | | | 26,000.00 | | | | JPY | | | | 728,000,000 | | | 248,562 |

Nikkei 225 Index | | Put | | 09/08/2023 | | 28 | | | JPY | | | | 25,750.00 | | | | JPY | | | | 721,000,000 | | | 297,522 |

Nikkei 225 Index | | Put | | 09/08/2023 | | 28 | | | JPY | | | | 26,500.00 | | | | JPY | | | | 742,000,000 | | | 350,247 |

Nikkei 225 Index | | Put | | 09/08/2023 | | 28 | | | JPY | | | | 27,750.00 | | | | JPY | | | | 777,000,000 | | | 457,581 |

Nikkei 225 Index | | Put | | 12/08/2023 | | 28 | | | JPY | | | | 25,000.00 | | | | JPY | | | | 700,000,000 | | | 310,703 |

Nikkei 225 Index | | Put | | 12/09/2022 | | 28 | | | JPY | | | | 27,250.00 | | | | JPY | | | | 763,000,000 | | | 115,808 |

Nikkei 225 Index | | Put | | 12/09/2022 | | 28 | | | JPY | | | | 26,750.00 | | | | JPY | | | | 749,000,000 | | | 82,854 |

Nikkei 225 Index | | Put | | 03/10/2023 | | 28 | | | JPY | | | | 28,500.00 | | | | JPY | | | | 798,000,000 | | | 357,779 |

Nikkei 225 Index | | Put | | 03/10/2023 | | 28 | | | JPY | | | | 25,500.00 | | | | JPY | | | | 714,000,000 | | | 139,346 |

Nikkei 225 Index | | Put | | 03/10/2023 | | 28 | | | JPY | | | | 25,750.00 | | | | JPY | | | | 721,000,000 | | | 151,585 |

Nikkei 225 Index | | Put | | 06/09/2023 | | 28 | | | JPY | | | | 27,250.00 | | | | JPY | | | | 763,000,000 | | | 340,832 |

S&P 500 Index | | Put | | 05/19/2023 | | 8 | | | USD | | | | 4,075.00 | | | | USD | | | | 3,260,000 | | | 270,840 |

S&P 500 Index | | Put | | 06/16/2023 | | 8 | | | USD | | | | 4,050.00 | | | | USD | | | | 3,240,000 | | | 270,840 |

S&P 500 Index | | Put | | 08/18/2023 | | 9 | | | USD | | | | 4,100.00 | | | | USD | | | | 3,690,000 | | | 347,310 |

S&P 500 Index | | Put | | 09/15/2023 | | 9 | | | USD | | | | 3,900.00 | | | | USD | | | | 3,510,000 | | | 278,190 |

S&P 500 Index | | Put | | 10/20/2023 | | 8 | | | USD | | | | 3,625.00 | | | | USD | | | | 2,900,000 | | | 182,440 |

S&P 500 Index | | Put | | 11/18/2022 | | 8 | | | USD | | | | 4,450.00 | | | | USD | | | | 3,560,000 | | | 459,320 |

S&P 500 Index | | Put | | 12/16/2022 | | 8 | | | USD | | | | 4,475.00 | | | | USD | | | | 3,580,000 | | | 474,400 |

S&P 500 Index | | Put | | 01/20/2023 | | 8 | | | USD | | | | 4,650.00 | | | | USD | | | | 3,720,000 | | | 599,640 |

S&P 500 Index | | Put | | 02/17/2023 | | 9 | | | USD | | | | 4,375.00 | | | | USD | | | | 3,937,500 | | | 450,495 |

S&P 500 Index | | Put | | 03/17/2023 | | 8 | | | USD | | | | 4,225.00 | | | | USD | | | | 3,380,000 | | | 319,080 |

S&P 500 Index | | Put | | 04/21/2023 | | 8 | | | USD | | | | 4,425.00 | | | | USD | | | | 3,540,000 | | | 439,840 |

S&P 500 Index | | Put | | 07/21/2023 | | 8 | | | USD | | | | 3,750.00 | | | | USD | | | | 3,000,000 | | | 184,840 |

Total Index Options Purchased | | | | | | | | | | | | | | | | | | | | | | | | $33,248,201 |

| * | Notional Value is calculated by multiplying the Number of Contracts by the Exercise Price by the multiplier. |

Open Futures Contracts(a)

| | | | | | | | | | | | | | | | | | | | |

|

| |

| Long Futures Contracts | | Number of

Contracts | | | Expiration

Month | | | Notional Value | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

|

| |

Commodity Risk | | | | | | | | | | | | | | | | | | | | |

|

| |

Brent Crude | | | 426 | | | | December-2022 | | | $ | 38,774,520 | | | $ | 2,627,257 | | | $ | 2,627,257 | |

|

| |

Gasoline Reformulated Blendstock Oxygenate Blending | | | 392 | | | | November-2022 | | | | 41,583,125 | | | | 802,879 | | | | 802,879 | |

|

| |

Low Sulphur Gas Oil | | | 32 | | | | December-2022 | | | | 3,263,200 | | | | 282,777 | | | | 282,777 | |

|

| |

Natural Gas | | | 197 | | | | November-2022 | | | | 12,519,350 | | | | (3,507,892 | ) | | | (3,507,892 | ) |

|

| |

New York Harbor Ultra-Low Sulfur Diesel | | | 289 | | | | November-2022 | | | | 44,596,226 | | | | 2,307,068 | | | | 2,307,068 | |

|

| |

WTI Crude | | | 458 | | | | January-2023 | | | | 38,517,800 | | | | 547,869 | | | | 547,869 | |

|

| |

Subtotal | | | | | | | | | | | | | | | 3,059,958 | | | | 3,059,958 | |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 10 | | Invesco Balanced-Risk Allocation Fund |

Open Futures Contracts(a)–(continued)

| | | | | | | | | | | | | | | | | | | | |

|

| |

| Long Futures Contracts | | Number of

Contracts | | | Expiration

Month | | | Notional

Value | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

|

| |

Equity Risk | | | | | | | | | | | | | | | | | | | | |

|

| |

E-Mini Russell 2000 Index | | | 1,010 | | | | December-2022 | | | $ | 93,576,500 | | | $ | (2,591,155 | ) | | $ | (2,591,155 | ) |

|

| |

EURO STOXX 50 Index | | | 30 | | | | December-2022 | | | | 1,072,646 | | | | (12,029 | ) | | | (12,029 | ) |

|

| |

FTSE 100 Index | | | 100 | | | | December-2022 | | | | 8,150,878 | | | | (424,740 | ) | | | (424,740 | ) |

|

| |

MSCI Emerging Markets Index | | | 740 | | | | December-2022 | | | | 31,583,200 | | | | (4,577,141 | ) | | | (4,577,141 | ) |

|

| |

Nikkei 225 Index | | | 63 | | | | December-2022 | | | | 11,672,551 | | | | 51,590 | | | | 51,590 | |

|

| |

Subtotal | | | | | | | | | | | | | | | (7,553,475 | ) | | | (7,553,475 | ) |

|

| |

Interest Rate Risk | | | | | | | | | | | | | | | | | | | | |

|

| |

Australia 10 Year Bonds | | | 3,815 | | | | December-2022 | | | | 289,126,538 | | | | (3,762,807 | ) | | | (3,762,807 | ) |

|

| |

Canada 10 Year Bonds | | | 2,965 | | | | December-2022 | | | | 267,760,818 | | | | (4,127,680 | ) | | | (4,127,680 | ) |

|

| |

Euro-Bund | | | 1,382 | | | | December-2022 | | | | 189,075,967 | | | | (9,547,674 | ) | | | (9,547,674 | ) |

|

| |

Japan 10 Year Bonds | | | 137 | | | | December-2022 | | | | 137,069,101 | | | | 156,456 | | | | 156,456 | |

|

| |

Long Gilt | | | 2,085 | | | | December-2022 | | | | 244,200,692 | | | | (13,668,873 | ) | | | (13,668,873 | ) |

|

| |

U.S. Treasury Long Bonds | | | 893 | | | | December-2022 | | | | 107,606,500 | | | | (13,139,466 | ) | | | (13,139,466 | ) |

|

| |

Subtotal | | | | | | | | | | | | | | | (44,090,044 | ) | | | (44,090,044 | ) |

|

| |

Subtotal–Long Futures Contracts | | | | | | | | | | | | | | | (48,583,561 | ) | | | (48,583,561 | ) |

|

| |

| | | | | |

Short Futures Contracts | | | | | | | | | | | | | | | | | | | | |

|

| |

Equity Risk | | | | | | | | | | | | | | | | | | | | |

|

| |

E-Mini S&P 500 Index | | | 104 | | | | December-2022 | | | | (20,191,600 | ) | | | (1,095,452 | ) | | | (1,095,452 | ) |

|

| |

Total Futures Contracts | | | | | | | | | | | | | | $ | (49,679,013 | ) | | $ | (49,679,013 | ) |

|

| |

| (a) | Futures contracts collateralized by $65,895,001 cash held with Merrill Lynch International, the futures commission merchant. |

Open Over-The-Counter Total Return Swap Agreements(a)(b)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Pay/

Receive | | Reference Entity(c) | | Fixed Rate | | | Payment Frequency | | Number of Contracts | | | Maturity Date | | Notional Value | | | Upfront

Payments

Paid

(Received) | | Value | | | Unrealized

Appreciation

(Depreciation) | |

Commodity Risk | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | J.P. Morgan Contag Beta Gas Oil Excess Return Index | | | 0.25 | % | | Monthly | | | 94,300 | | | March-2023 | | | USD | | | | 41,198,472 | | | $– | | $ | 284,758 | | | $ | 284,758 | |

Merrill Lynch International | | Receive | | MLCX Natural Gas Annual Excess Return Index | | | 0.25 | | | Monthly | | | 151,000 | | | June-2023 | | | USD | | | | 20,070,074 | | | – | | | 0 | | | | 0 | |

Morgan Stanley Capital Services LLC | | Receive | | S&P GSCI Aluminum Dynamic Index Excess Return | | | 0.30 | | | Monthly | | | 78,000 | | | July-2023 | | | USD | | | | 8,112,101 | | | – | | | 8,174 | | | | 8,174 | |

Royal Bank of Canada | | Receive | | RBC Enhanced Agricultural Basket 07 Excess Return Index | | | 0.35 | | | Monthly | | | 235,000 | | | May-2023 | | | USD | | | | 30,391,869 | | | – | | | 0 | | | | 0 | |

Subtotal – Appreciation | | | | | | | | | | | | | | | | | | | | | | | | | | – | | | 292,932 | | | | 292,932 | |

| | | | | | | | | | | |

Commodity Risk | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Barclays Bank PLC | | Receive | | Barclays Commodity Strategy 1452 Excess Return Index | | | 0.26 | | | Monthly | | | 2,700 | | | November-2022 | | | USD | | | | 1,689,448 | | | – | | | (24,024 | ) | | | (24,024 | ) |

Canadian Imperial Bank of Commerce | | Receive | | Canadian Imperial Bank of Commerce Dynamic Roll LME Copper Excess Return Index 2 | | | 0.27 | | | Monthly | | | 260,000 | | | August-2023 | | | USD | | | | 24,014,562 | | | – | | | (387,010 | ) | | | (387,010 | ) |

Subtotal – Depreciation | | | | | | | | | | | | | | | | | | | | | | | | | | – | | | (411,034 | ) | | | (411,034 | ) |

Total – Total Return Swap Agreements | | | | | | | | | | | | | | | | | | | $– | | $ | (118,102 | ) | | $ | (118,102 | ) |

| (a) | Open Over-The-Counter Total Return Swap Agreements are collateralized by cash held with the swap Counterparties in the amount of $3,540,000. |

| (b) | The Fund receives or pays payments based on any positive or negative return on the Reference Entity, respectively. |

| (c) | The Reference Entity Components table below includes additional information regarding the underlying components of certain reference entities that are not publicly available. |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 11 | | Invesco Balanced-Risk Allocation Fund |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Open Over-The-Counter Total Return Swap Agreements(a)(b) | |

|

| |

| Counterparty | | Pay/

Receive | | | Reference

Entity(c) | | Floating

Rate Index | | | Payment

Frequency | | | Number

of

Contracts | | | Maturity Date | | | Notional Value | | | Upfront

Payments

Paid

(Received) | | Value | | | Unrealized

Appreciation

(Depreciation) | |

|

| |

| | | | | | | | | | | |

Equity Risk | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | Invesco U.S. Low Volatility Total Return Index | |

| SOFR +

0.050% |

| | | Monthly | | | | 3,400 | | | | November-2022 | | | | USD | | | | 19,021,130 | | | $– | | $ | 1,203,868 | | | $ | 1,203,868 | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | Invesco US Large Cap Broad Quality Total Return Index | |

| SOFR +

0.280% |

| | | Monthly | | | | 2,350 | | | | November-2022 | | | | USD | | | | 19,152,101 | | | – | | | 813,898 | | | | 813,898 | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | MSCI EMU Minimum Volatility Index | |

| 1 mo.

EURIBOR

- 0.400% |

| | | Monthly | | | | 9,600 | | | | March-2023 | | | | EUR | | | | 26,015,328 | | | – | | | 904,225 | | | | 904,225 | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | MSCI EMU Momentum Index | |

| 1 mo.

EURIBOR

- 0.360% |

| | | Monthly | | | | 5,900 | | | | December-2022 | | | | EUR | | | | 26,419,244 | | | – | | | 1,247,576 | | | | 1,247,576 | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | MSCI Japan Minimum Volatility Index | |

| TONAR -

0.400% |

| | | Monthly | | | | 57,066 | | | | February-2023 | | | | JPY | | | | 150,665,653 | | | – | | | 18,398 | | | | 18,398 | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | MSCI Japan Minimum Volatility Index | |

| TONAR -

0.420% |

| | | Monthly | | | | 100,000 | | | | January-2023 | | | | JPY | | | | 264,020,000 | | | – | | | 32,240 | | | | 32,240 | |

|

| |

| | | | | | | | | | | |

BNP Paribas S.A. | | | Receive | | | MSCI Japan Quality Index | |

| TONAR -

0.330% |

| | | Monthly | | | | 47,594 | | | | February-2023 | | | | JPY | | | | 124,345,512 | | | – | | | 38,352 | | | | 38,352 | |

|

| |

| | | | | | | | | | | |

Citibank, N.A. | | | Receive | | | MSCI Japan Minimum Volatility Index | |

| TONAR -

0.420% |

| | | Monthly | | | | 1,794,732 | | | | January-2023 | | | | JPY | | | | 4,738,451,426 | | | – | | | 578,630 | | | | 578,630 | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | | Receive | | | MSCI Emerging Markets Minimum Volatility Index | |

| SOFR +

0.700% |

| | | Monthly | | | | 13,104 | | | | December-2022 | | | | USD | | | | 21,845,154 | | | – | | | 92,121 | | | | 92,121 | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | | Receive | | | MSCI Japan Minimum Volatility Index | |

| TONAR -

0.390% |

| | | Monthly | | | | 686,810 | | | | January-2023 | | | | JPY | | | | 1,813,315,762 | | | – | | | 221,431 | | | | 221,431 | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | | Receive | | | MSCI Japan Minimum Volatility Index | |

| TONAR -

0.400% |

| | | Monthly | | | | 81,392 | | | | February-2023 | | | | JPY | | | | 214,891,158 | | | – | | | 26,241 | | | | 26,241 | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | | Receive | | | MSCI Japan Quality Index | |

| TONAR -

0.300% |

| | | Monthly | | | | 697,469 | | | | January-2023 | | | | JPY | | | | 1,822,228,433 | | | – | | | 562,028 | | | | 562,028 | |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 12 | | Invesco Balanced-Risk Allocation Fund |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Open Over-The-Counter Total Return Swap Agreements(a)(b)–(continued) | |

|

| |

| Counterparty | | Pay/

Receive | | Reference

Entity(c) | | Floating

Rate

Index | | Payment

Frequency | | Number of

Contracts | | | Maturity Date | | | Notional Value | | | Upfront

Payments

Paid

(Received) | | Value | | | Unrealized

Appreciation

(Depreciation) | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | Receive | | MSCI Japan Quality Index | | TONAR -

0.310% | | Monthly | | | 150,000 | | | | January-2023 | | | | JPY | | | | 391,894,500 | | | $– | | $ | 120,872 | | | $ | 120,872 | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | Receive | | MSCI Japan Quality Index | | TONAR -

0.330% | | Monthly | | | 1,800,000 | | | | January-2023 | | | | JPY | | | | 4,702,734,000 | | | – | | | 1,450,459 | | | | 1,450,459 | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | Receive | | MSCI Japan Quality Index | | TONAR -

0.330% | | Monthly | | | 64,937 | | | | February-2023 | | | | JPY | | | | 169,656,354 | | | – | | | 52,327 | | | | 52,327 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco UK Broad Low Volatility Net Total Return Index | | SONIA +

0.190% | | Monthly | | | 2,605 | | | | November-2022 | | | | GBP | | | | 11,497,428 | | | – | | | 483,083 | | | | 483,083 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco UK Broad Price Momentum Net Total Return Index | | SONIA +

0.190% | | Monthly | | | 1,966 | | | | November-2022 | | | | GBP | | | | 10,506,599 | | | – | | | 375,226 | | | | 375,226 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco UK Broad Price Momentum Net Total Return Index | | SONIA +

0.190% | | Monthly | | | 1,960 | | | | November-2022 | | | | GBP | | | | 10,474,534 | | | – | | | 374,080 | | | | 374,080 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco UK Broad Price Momentum Net Total Return Index | | SONIA +

0.230% | | Monthly | | | 224 | | | | November-2022 | | | | GBP | | | | 1,197,090 | | | – | | | 42,752 | | | | 42,752 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco UK Broad Quality Net Total Return Index | | SONIA +

0.230% | | Monthly | | | 1,760 | | | | November-2022 | | | | GBP | | | | 10,479,304 | | | – | | | 437,718 | | | | 437,718 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco UK Broad Quality Net Total Return Index | | SONIA +

0.230% | | Monthly | | | 180 | | | | November-2022 | | | | GBP | | | | 1,071,747 | | | – | | | 44,767 | | | | 44,767 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | Invesco US Large Cap Broad Price Momentum Total Return Index | | SOFR +

0.280% | | Monthly | | | 3,000 | | | | November-2022 | | | | USD | | | | 20,407,410 | | | – | | | 1,575,636 | | | | 1,575,636 | |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 13 | | Invesco Balanced-Risk Allocation Fund |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Open Over-The-Counter Total Return Swap Agreements(a)(b)–(continued) | |

|

| |

| Counterparty | | Pay/

Receive | | Reference

Entity(c) | | Floating

Rate Index | | | Payment

Frequency | | | Number of

Contracts | | | Maturity Date | | | Notional Value | | | Upfront

Payments

Paid

(Received) | | Value | | | Unrealized

Appreciation

(Depreciation) | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | MSCI Emerging Markets Minimum Volatility Index | |

| SOFR +

0.680% |

| | | Monthly | | | | 1,344 | | | | December-2022 | | | | USD | | | | 2,240,529 | | | $– | | $ | 9,448 | | | $ | 9,448 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | MSCI Emerging Markets Minimum Volatility Index | |

| SOFR +

0.700% |

| | | Monthly | | | | 3,000 | | | | January-2023 | | | | USD | | | | 5,001,180 | | | – | | | 21,090 | | | | 21,090 | |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | Receive | | MSCI Emerging Markets Minimum Volatility Index | |

| SOFR +

0.790% |

| | | Monthly | | | | 7,580 | | | | January-2023 | | | | USD | | | | 12,636,315 | | | – | | | 53,287 | | | | 53,287 | |

|

| |

| | | | | | | | | | | |

Merrill Lynch International | | Receive | | Invesco UK Broad Low Volatility Net Total Return Index | |

| SONIA +

0.190% |

| | | Monthly | | | | 2,395 | | | | November-2022 | | | | GBP | | | | 10,570,572 | | | – | | | 444,140 | | | | 444,140 | |

|

| |

| | | | | | | | | | | |

Merrill Lynch International | | Receive | | Invesco UK Broad Quality Net Total Return Index | |

| SONIA +

0.190% |

| | | Monthly | | | | 1,760 | | | | November-2022 | | | | GBP | | | | 10,479,304 | | | – | | | 437,718 | | | | 437,718 | |

|

| |

| | | | | | | | | | | |

Merrill Lynch International | | Receive | | MSCI Emerging Markets Minimum Volatility Index | |

| SOFR +

0.680% |

| | | Monthly | | | | 1,455 | | | | November-2022 | | | | USD | | | | 2,425,572 | | | – | | | 10,229 | | | | 10,229 | |

|

| |

| | | | | | | | | | | |

Merrill Lynch International | | Receive | | MSCI Emerging Markets Minimum Volatility Index | |

| SOFR+

0.720% |

| | | Monthly | | | | 8,017 | | | | March-2023 | | | | USD | | | | 13,364,820 | | | – | | | 56,359 | | | | 56,359 | |

|

| |

| | | | | | | | | | | |

Merrill Lynch International | | Receive | | MSCI EMU Quality Volatility Index | |

| 1 mo.

EURIBOR

- 0.250% |

| | | Monthly | | | | 7,700 | | | | January-2023 | | | | EUR | | | | 26,039,783 | | | – | | | 788,832 | | | | 788,832 | |

|

| |

| | | | | | | | | |

Subtotal - Appreciation | | | | | | | | | | | | | | | | | | | | | | | | | | – | | | 12,517,031 | | | | 12,517,031 | |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 14 | | Invesco Balanced-Risk Allocation Fund |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Open Over-The-Counter Total Return Swap Agreements(a)(b)–(continued) | |

|

| |

| Counterparty | | Pay/

Receive | | | Reference

Entity(c) | | Floating

Rate

Index | | | Payment

Frequency | | | Number of

Contracts | | | Maturity Date | | | Notional Value | | | Upfront

Payments

Paid

(Received) | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

|

| |

Equity Risk | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| |

| | | | | | | | | | | |

Goldman Sachs International | | | Receive | | | Invesco Emerging Markets + Korea Large Cap Broad Price Momentum Net Total Return Index | |

| SOFR +

0.760% |

| | | Monthly | | | | 1,590 | | | | November-2022 | | | | USD | | | | 9,503,684 | | | | $– | | | $ | (123,491 | ) | | $ | (123,491 | ) |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | | Receive | | | Invesco Emerging Markets + Korea Large Cap Broad Price Momentum Net Total Return Index | |

| SOFR +

0.550% |

| | | Monthly | | | | 7,510 | | | | November-2022 | | | | USD | | | | 44,888,472 | | | | – | | | | (583,282 | ) | | | (583,282 | ) |

|

| |

| | | | | | | | | | | |

J.P. Morgan Chase Bank, N.A. | | | Receive | | | Invesco Emerging Markets + Korea Large Cap Broad Price Momentum Net Total Return Index | |

| SOFR+

0.680% |

| | | Monthly | | | | 600 | | | | January-2023 | | | | USD | | | | 3,586,296 | | | | – | | | | (46,600 | ) | | | (46,600 | ) |

|

| |

Subtotal - Depreciation | | | | | | | | | | | | | | | | | | | | | | | | | | | – | | | | (753,373 | ) | | | (753,373 | ) |

|

| |

Total - Total Return Swap Agreements | | | | | | | | | | | | | | | | $– | | | $ | 11,763,658 | | | $ | 11,763,658 | |

|

| |

| (a) | Open Over-The-Counter Total Return Swap Agreements are collateralized by cash held with the swap Counterparties in the amount of $3,540,000. |

| (b) | The Fund receives or pays payments based on any positive or negative return on the Reference Entity, respectively. |

| (c) | The Reference Entity Components table below includes additional information regarding the underlying components of certain reference entities that are not publicly available. |

| | | | |

| Reference Entity Components |

|

|

| Reference Entity | | Underlying Components | | Percentage |

|

|

| | |

| Canadian Imperial Bank of Commerce Custom 7 Agriculture Commodity Index | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Coffee | | 6.14% |

| |

| | |

| | Corn | | 8.08 |

| |

| | |

| | Cotton | | 18.63 |

| |

| | |

| | Lean Hogs | | 0.49 |

| |

| | |

| | Live Cattle | | 0.88 |

| |

| | |

| | Soybean | | 18.59 |

| |

| | |

| | Soybean Oil | | 14.00 |

| |

| | |

| | Soymeal | | 20.29 |

| |

| | |

| | Sugar | | 6.22 |

| |

| | |

| | Wheat | | 6.68 |

| |

| | |

| | Total | | 100.00% |

| |

| | |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 15 | | Invesco Balanced-Risk Allocation Fund |

| | | | |

| Reference Entity Components–(continued) |

|

|

| Reference Entity | | Underlying Components | | Percentage |

|

|

| | |

| RBC Enhanced Agricultural Basket 07 Excess Return Index | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Coffee | | 6.14% |

| |

| | |

| | Corn | | 8.08 |

| |

| | |

| | Cotton | | 18.63 |

| |

| | |

| | Lean Hogs | | 0.49 |

| |

| | |

| | Live Cattle | | 0.88 |

| |

| | |

| | Soybean | | 18.59 |

| |

| | |

| | Soybean Oil | | 14.00 |

| |

| | |

| | Soymeal | | 20.29 |

| |

| | |

| | Sugar | | 6.22 |

| |

| | |

| | Wheat | | 6.68 |

| |

| | |

| | Total | | 100.00% |

| |

| | |

| | |

J.P. Morgan Contag Beta Gas Oil Excess Return Index | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Gas Oil | | 100.00% |

| |

| | |

| | |

MLCX Natural Gas Annual Excess Return Index | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Natural Gas | | 100.00% |

| |

| | |

| | |

S&P GSCI Aluminum Dynamic Roll Index Excess Return | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Aluminum | | 100.00% |

| |

| | |

| | |

Barclays Commodity Strategy 1452 Excess Return Index | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Copper | | 100.00% |

| |

| | |

| | |

| Canadian Imperial Bank of Commerce Dynamic Roll LME Copper Excess Return Index 2 | | | | |

| | |

| | Long Futures Contracts | | |

| |

| | |

| | Copper | | 100.00% |

| |

| | |

| | |

| Abbreviations: |

| |

| EMU | | –European Economic and Monetary Union |

| EUR | | –Euro |

| EURIBOR | | –Euro Interbank Offered Rate |

| GBP | | –British Pound Sterling |

| JPY | | –Japanese Yen |

| SOFR | | –Secured Overnight Financing Rate |

| SONIA | | –Sterling Overnight Index Average |

| TONAR | | –Tokyo Overnight Average Rate |

| USD | | –U.S. Dollar |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 16 | | Invesco Balanced-Risk Allocation Fund |

Consolidated Statement of Assets and Liabilities

October 31, 2022

| | | | |

Assets: | | | | |

| |

Investments in unaffiliated securities, at value

(Cost $713,212,869) | | $ | 726,299,989 | |

|

| |

| |

Investments in affiliated money market funds, at value (Cost $976,864,608) | | | 976,870,635 | |

|

| |

Other investments: | | | | |

Swaps receivable – OTC | | | 19,958 | |

|

| |

Unrealized appreciation on swap agreements – OTC | | | 12,809,963 | |

|

| |

Deposits with brokers: | | | | |

Cash collateral – exchange-traded futures contracts | | | 65,895,001 | |

|

| |

Cash collateral – OTC Derivatives | | | 3,540,000 | |

|

| |

Cash | | | 11,227,936 | |

|

| |

Foreign currencies, at value (Cost $26,761,162) | | | 27,020,662 | |

|

| |

Receivable for: | | | | |

Fund shares sold | | | 728,515 | |

|

| |

Dividends | | | 2,415,857 | |

|

| |

Interest | | | 144,840 | |

|

| |

Investment for trustee deferred compensation and retirement plans | | | 464,633 | |

|

| |

Other assets | | | 74,524 | |

|

| |

Total assets | | | 1,827,512,513 | |

|

| |

| |

Liabilities: | | | | |

Other investments: | | | | |

Variation margin payable - futures contracts | | | 6,995,641 | |

|

| |

Swaps payable – OTC | | | 2,989,734 | |

|

| |

Unrealized depreciation on swap agreements-OTC | | | 1,164,407 | |

|

| |

Payable for: | | | | |

Fund shares reacquired | | | 2,030,467 | |

|

| |

Accrued fees to affiliates | | | 1,077,694 | |

|

| |

Accrued trustees’ and officers’ fees and benefits | | | 1,436 | |

|

| |

Accrued other operating expenses | | | 140,398 | |

|

| |

Trustee deferred compensation and retirement plans | | | 515,436 | |

|

| |

Total liabilities | | | 14,915,213 | |

|

| |

Net assets applicable to shares outstanding | | $ | 1,812,597,300 | |

|

| |

| | | | |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 2,042,884,957 | |

|

| |

Distributable earnings (loss) | | | (230,287,657 | ) |

|

| |

| | $ | 1,812,597,300 | |

|

| |

| |

Net Assets: | | | | |

Class A | | $ | 852,411,928 | |

|

| |

Class C | | $ | 100,108,616 | |

|

| |

Class R | | $ | 16,270,138 | |

|

| |

Class Y | | $ | 792,547,449 | |

|

| |

Class R5 | | $ | 12,873,720 | |

|

| |

Class R6 | | $ | 38,385,449 | |

|

| |

|

Shares outstanding, no par value, with an unlimited number of shares authorized: | |

Class A | | | 103,416,264 | |

|

| |

Class C | | | 13,073,758 | |

|

| |

Class R | | | 2,027,848 | |

|

| |

Class Y | | | 93,736,603 | |

|

| |

Class R5 | | | 1,521,516 | |

|

| |

Class R6 | | | 4,522,802 | |

|

| |

Class A: | | | | |

Net asset value per share | | $ | 8.24 | |

|

| |

Maximum offering price per share

(Net asset value of $8.24 ÷ 94.50%) | | $ | 8.72 | |

|

| |

Class C: | | | | |

Net asset value and offering price per share | | $ | 7.66 | |

|

| |

Class R: | | | | |

Net asset value and offering price per share | | $ | 8.02 | |

|

| |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 8.46 | |

|

| |

Class R5: | | | | |

Net asset value and offering price per share | | $ | 8.46 | |

|

| |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 8.49 | |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 17 | | Invesco Balanced-Risk Allocation Fund |

Consolidated Statement of Operations

For the year ended October 31, 2022

| | | | |

Investment income: | | | | |

| |

Interest | | $ | 9,017,500 | |

|

| |

Dividends from affiliated money market funds (net of foreign withholding taxes of $223,188) | | | 8,939,465 | |

|

| |

Total investment income | | | 17,956,965 | |

|

| |

| |

Expenses: | | | | |

Advisory fees | | | 19,210,676 | |

|

| |

Administrative services fees | | | 314,409 | |

|

| |

Custodian fees | | | 155,001 | |

|

| |

Distribution fees: | | | | |

Class A | | �� | 2,462,592 | |

|

| |

Class C | | | 1,347,978 | |

|

| |

Class R | | | 86,952 | |

|

| |

Transfer agent fees – A, C, R and Y | | | 2,602,424 | |

|

| |

Transfer agent fees – R5 | | | 14,718 | |

|

| |

Transfer agent fees – R6 | | | 13,873 | |

|

| |

Trustees’ and officers’ fees and benefits | | | 35,248 | |

|

| |

Registration and filing fees | | | 145,060 | |

|

| |

Reports to shareholders | | | 63,812 | |

|

| |

Professional services fees | | | 98,874 | |

|

| |

Other | | | 923,305 | |

|

| |

Total expenses | | | 27,474,922 | |

|

| |

Less: Fees waived and/or expense offset arrangement(s) | | | (814,679 | ) |

|

| |

Net expenses | | | 26,660,243 | |

|

| |

Net investment income (loss) | | | (8,703,278 | ) |

|

| |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Unaffiliated investment securities | | | 22,389,586 | |

|

| |

Affiliated investment securities | | | 71,899 | |

|

| |

Foreign currencies | | | (11,797,136 | ) |

|

| |

Futures contracts | | | (238,084,688 | ) |

|

| |

Swap agreements | | | (91,398,926 | ) |

|

| |

| | | (318,819,265 | ) |

|

| |

Change in net unrealized appreciation (depreciation) of: | | | | |

Unaffiliated investment securities | | | 18,797,063 | |

|

| |

Affiliated investment securities | | | (95,866 | ) |

|

| |

Foreign currencies | | | 346,207 | |

|

| |

Futures contracts | | | (7,544,637 | ) |

|

| |

Swap agreements | | | 7,949,922 | |

|

| |

| | | 19,452,689 | |

|

| |

Net realized and unrealized gain (loss) | | | (299,366,576 | ) |

|

| |

Net increase (decrease) in net assets resulting from operations | | $ | (308,069,854 | ) |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 18 | | Invesco Balanced-Risk Allocation Fund |

Consolidated Statement of Changes in Net Assets

For the years ended October 31, 2022 and 2021

| | | | | | | | |

| | | 2022 | | | 2021 | |

|

| |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (8,703,278 | ) | | $ | (29,679,403 | ) |

|

| |

Net realized gain (loss) | | | (318,819,265 | ) | | | 484,770,750 | |

|

| |

Change in net unrealized appreciation | | | 19,452,689 | | | | 14,666,344 | |

|

| |

Net increase (decrease) in net assets resulting from operations | | | (308,069,854 | ) | | | 469,757,691 | |

|

| |

| | |

Distributions to shareholders from distributable earnings: | | | | | | | | |

Class A | | | (225,061,518 | ) | | | (10,563,728 | ) |

|

| |

Class C | | | (34,535,946 | ) | | | (1,416,700 | ) |

|

| |

Class R | | | (3,731,479 | ) | | | (148,478 | ) |

|

| |

Class Y | | | (220,623,925 | ) | | | (15,303,622 | ) |

|

| |

Class R5 | | | (3,417,238 | ) | | | (246,913 | ) |

|

| |

Class R6 | | | (9,736,632 | ) | | | (2,626,550 | ) |

|

| |

Total distributions from distributable earnings | | | (497,106,738 | ) | | | (30,305,991 | ) |

|

| |

| | |

Share transactions–net: | | | | | | | | |

Class A | | | 127,096,042 | | | | 91,241,745 | |

|

| |

Class C | | | (13,473,598 | ) | | | (235,030,332 | ) |

|

| |

Class R | | | 4,973,468 | | | | (364,637 | ) |

|

| |

Class Y | | | 85,280,229 | | | | (125,674,098 | ) |

|

| |

Class R5 | | | 1,621,069 | | | | (1,898,401 | ) |

|

| |

Class R6 | | | 5,266,488 | | | | (131,933,646 | ) |

|

| |

Net increase (decrease) in net assets resulting from share transactions | | | 210,763,698 | | | | (403,659,369 | ) |

|

| |

Net increase (decrease) in net assets | | | (594,412,894 | ) | | | 35,792,331 | |

|

| |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 2,407,010,194 | | | | 2,371,217,863 | |

|

| |

End of year | | $ | 1,812,597,300 | | | $ | 2,407,010,194 | |

|

| |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 19 | | Invesco Balanced-Risk Allocation Fund |

Consolidated Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value,

beginning

of period | | Net

investment

income

(loss)(a) | | Net gains

(losses) on securities

(both

realized and

unrealized) | | Total from

investment

operations | | Dividends

from net

investment

income | | Distributions

from net

realized

gains | | Total

distributions | | Net asset

value, end

of period | | Total

return (b) | | Net assets,

end of period

(000’s omitted) | | Ratio of

expenses

to average net assets

with fee waivers

and/or

expenses

absorbed | | Ratio of

expenses

to average net

assets without

fee waivers

and/or

expenses

absorbed | | Ratio of net

investment

income

(loss)

to average

net assets | | Portfolio

turnover (c) |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/22 | | | $ | 12.09 | | | | $ | (0.04 | ) | | | $ | (1.29 | ) | | | $ | (1.33 | ) | | | $ | (1.43 | ) | | | $ | (1.09 | ) | | | $ | (2.52 | ) | | | $ | 8.24 | | | | | (13.99 | )% | | | $ | 852,412 | | | | | 1.31 | % | | | | 1.35 | % | | | | (0.47 | )% | | | | 92 | % |

Year ended 10/31/21 | | | | 10.12 | | | | | (0.15 | ) | | | | 2.25 | | | | | 2.10 | | | | | (0.13 | ) | | | | - | | | | | (0.13 | ) | | | | 12.09 | | | | | 20.91 | | | | | 1,093,094 | | | | | 1.31 | | | | | 1.33 | | | | | (1.26 | ) | | | | 16 | |

Year ended 10/31/20 | | | | 11.33 | | | | | (0.05 | ) | | | | 0.01 | | | | | (0.04 | ) | | | | (0.67 | ) | | | | (0.50 | ) | | | | (1.17 | ) | | | | 10.12 | | | | | (0.55 | ) | | | | 831,513 | | | | | 1.24 | | | | | 1.30 | | | | | (0.53 | ) | | | | 81 | |

Year ended 10/31/19 | | | | 10.21 | | | | | 0.10 | | | | | 1.02 | | | | | 1.12 | | | | | - | | | | | - | | | | | - | | | | | 11.33 | | | | | 10.97 | | | | | 968,345 | | | | | 1.24 | | | | | 1.29 | | | | | 0.95 | | | | | 11 | |

Year ended 10/31/18 | | | | 11.28 | | | | | 0.03 | | | | | (0.40 | ) | | | | (0.37 | ) | | | | - | | | | | (0.70 | ) | | | | (0.70 | ) | | | | 10.21 | | | | | (3.57 | ) | | | | 1,016,131 | | | | | 1.21 | | | | | 1.27 | | | | | 0.32 | | | | | 116 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/22 | | | | 11.36 | | | | | (0.11 | ) | | | | (1.19 | ) | | | | (1.30 | ) | | | | (1.31 | ) | | | | (1.09 | ) | | | | (2.40 | ) | | | | 7.66 | | | | | (14.57 | ) | | | | 100,109 | | | | | 2.06 | | | | | 2.10 | | | | | (1.22 | ) | | | | 92 | |

Year ended 10/31/21 | | | | 9.50 | | | | | (0.22 | ) | | | | 2.12 | | | | | 1.90 | | | | | (0.04 | ) | | | | - | | | | | (0.04 | ) | | | | 11.36 | | | | | 20.04 | | | | | 167,794 | | | | | 2.06 | | | | | 2.08 | | | | | (2.01 | ) | | | | 16 | |

Year ended 10/31/20 | | | | 10.69 | | | | | (0.12 | ) | | | | 0.00 | | | | | (0.12 | ) | | | | (0.57 | ) | | | | (0.50 | ) | | | | (1.07 | ) | | | | 9.50 | | | | | (1.36 | ) | | | | 349,294 | | | | | 1.99 | | | | | 2.05 | | | | | (1.28 | ) | | | | 81 | |

Year ended 10/31/19 | | | | 9.70 | | | | | 0.02 | | | | | 0.97 | | | | | 0.99 | | | | | - | | | | | - | | | | | - | | | | | 10.69 | | | | | 10.21 | | | | | 527,251 | | | | | 1.99 | | | | | 2.04 | | | | | 0.20 | | | | | 11 | |

Year ended 10/31/18 | | | | 10.83 | | | | | (0.04 | ) | | | | (0.39 | ) | | | | (0.43 | ) | | | | - | | | | | (0.70 | ) | | | | (0.70 | ) | | | | 9.70 | | | | | (4.31 | ) | | | | 735,308 | | | | | 1.96 | | | | | 2.02 | | | | | (0.43 | ) | | | | 116 | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/22 | | | | 11.82 | | | | | (0.07 | ) | | | | (1.25 | ) | | | | (1.32 | ) | | | | (1.39 | ) | | | | (1.09 | ) | | | | (2.48 | ) | | | | 8.02 | | | | | (14.21 | ) | | | | 16,270 | | | | | 1.56 | | | | | 1.60 | | | | | (0.72 | ) | | | | 92 | |

Year ended 10/31/21 | | | | 9.90 | | | | | (0.17 | ) | | | | 2.19 | | | | | 2.02 | | | | | (0.10 | ) | | | | - | | | | | (0.10 | ) | | | | 11.82 | | | | | 20.52 | | | | | 17,666 | | | | | 1.56 | | | | | 1.58 | | | | | (1.51 | ) | | | | 16 | |

Year ended 10/31/20 | | | | 11.10 | | | | | (0.08 | ) | | | | 0.02 | | | | | (0.06 | ) | | | | (0.64 | ) | | | | (0.50 | ) | | | | (1.14 | ) | | | | 9.90 | | | | | (0.77 | ) | | | | 15,202 | | | | | 1.49 | | | | | 1.55 | | | | | (0.78 | ) | | | | 81 | |

Year ended 10/31/19 | | | | 10.02 | | | | | 0.07 | | | | | 1.01 | | | | | 1.08 | | | | | - | | | | | - | | | | | - | | | | | 11.10 | | | | | 10.78 | | | | | 18,343 | | | | | 1.49 | | | | | 1.54 | | | | | 0.70 | | | | | 11 | |

Year ended 10/31/18 | | | | 11.11 | | | | | 0.01 | | | | | (0.40 | ) | | | | (0.39 | ) | | | | - | | | | | (0.70 | ) | | | | (0.70 | ) | | | | 10.02 | | | | | (3.82 | ) | | | | 19,989 | | | | | 1.46 | | | | | 1.52 | | | | | 0.07 | | | | | 116 | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/22 | | | | 12.34 | | | | | (0.02 | ) | | | | (1.31 | ) | | | | (1.33 | ) | | | | (1.46 | ) | | | | (1.09 | ) | | | | (2.55 | ) | | | | 8.46 | | | | | (13.66 | ) | | | | 792,547 | | | | | 1.06 | | | | | 1.10 | | | | | (0.22 | ) | | | | 92 | |

Year ended 10/31/21 | | | | 10.33 | | | | | (0.12 | ) | | | | 2.29 | | | | | 2.17 | | | | | (0.16 | ) | | | | - | | | | | (0.16 | ) | | | | 12.34 | | | | | 21.18 | | | | | 1,062,698 | | | | | 1.06 | | | | | 1.08 | | | | | (1.01 | ) | | | | 16 | |

Year ended 10/31/20 | | | | 11.55 | | | | | (0.03 | ) | | | | 0.01 | | | | | (0.02 | ) | | | | (0.70 | ) | | | | (0.50 | ) | | | | (1.20 | ) | | | | 10.33 | | | | | (0.34 | ) | | | | 1,000,148 | | | | | 0.99 | | | | | 1.05 | | | | | (0.28 | ) | | | | 81 | |

Year ended 10/31/19 | | | | 10.37 | | | | | 0.13 | | | | | 1.05 | | | | | 1.18 | | | | | - | | | | | - | | | | | - | | | | | 11.55 | | | | | 11.38 | | | | | 1,431,442 | | | | | 0.99 | | | | | 1.04 | | | | | 1.20 | | | | | 11 | |

Year ended 10/31/18 | | | | 11.43 | | | | | 0.06 | | | | | (0.42 | ) | | | | (0.36 | ) | | | | - | | | | | (0.70 | ) | | | | (0.70 | ) | | | | 10.37 | | | | | (3.42 | ) | | | | 1,718,473 | | | | | 0.96 | | | | | 1.02 | | | | | 0.57 | | | | | 116 | |

Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/22 | | | | 12.35 | | | | | (0.02 | ) | | | | (1.31 | ) | | | | (1.33 | ) | | | | (1.47 | ) | | | | (1.09 | ) | | | | (2.56 | ) | | | | 8.46 | | | | | (13.72 | ) | | | | 12,874 | | | | | 1.04 | | | | | 1.08 | | | | | (0.20 | ) | | | | 92 | |

Year ended 10/31/21 | | | | 10.34 | | | | | (0.12 | ) | | | | 2.30 | | | | | 2.18 | | | | | (0.17 | ) | | | | - | | | | | (0.17 | ) | | | | 12.35 | | | | | 21.22 | | | | | 16,750 | | | | | 1.02 | | | | | 1.04 | | | | | (0.97 | ) | | | | 16 | |

Year ended 10/31/20 | | | | 11.56 | | | | | (0.03 | ) | | | | 0.02 | | | | | (0.01 | ) | | | | (0.71 | ) | | | | (0.50 | ) | | | | (1.21 | ) | | | | 10.34 | | | | | (0.26 | ) | | | | 15,707 | | | | | 0.94 | | | | | 1.00 | | | | | (0.23 | ) | | | | 81 | |

Year ended 10/31/19 | | | | 10.38 | | | | | 0.14 | | | | | 1.04 | | | | | 1.18 | | | | | - | | | | | - | | | | | - | | | | | 11.56 | | | | | 11.37 | | | | | 45,497 | | | | | 0.92 | | | | | 0.97 | | | | | 1.27 | | | | | 11 | |

Year ended 10/31/18 | | | | 11.43 | | | | | 0.07 | | | | | (0.42 | ) | | | | (0.35 | ) | | | | - | | | | | (0.70 | ) | | | | (0.70 | ) | | | | 10.38 | | | | | (3.34 | ) | | | | 50,691 | | | | | 0.92 | | | | | 0.98 | | | | | 0.61 | | | | | 116 | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/22 | | | | 12.38 | | | | | (0.01 | ) | | | | (1.32 | ) | | | | (1.33 | ) | | | | (1.47 | ) | | | | (1.09 | ) | | | | (2.56 | ) | | | | 8.49 | | | | | (13.62 | ) | | | | 38,385 | | | | | 0.97 | | | | | 1.01 | | | | | (0.13 | ) | | | | 92 | |

Year ended 10/31/21 | | | | 10.37 | | | | | (0.11 | ) | | | | 2.30 | | | | | 2.19 | | | | | (0.18 | ) | | | | - | | | | | (0.18 | ) | | | | 12.38 | | | | | 21.26 | | | | | 49,008 | | | | | 0.95 | | | | | 0.97 | | | | | (0.90 | ) | | | | 16 | |

Year ended 10/31/20 | | | | 11.59 | | | | | (0.02 | ) | | | | 0.02 | | | | | 0.00 | | | | | (0.72 | ) | | | | (0.50 | ) | | | | (1.22 | ) | | | | 10.37 | | | | | (0.21 | ) | | | | 159,353 | | | | | 0.86 | | | | | 0.92 | | | | | (0.15 | ) | | | | 81 | |

Year ended 10/31/19 | | | | 10.40 | | | | | 0.15 | | | | | 1.04 | | | | | 1.19 | | | | | - | | | | | - | | | | | - | | | | | 11.59 | | | | | 11.44 | | | | | 255,753 | | | | | 0.87 | | | | | 0.92 | | | | | 1.32 | | | | | 11 | |

Year ended 10/31/18 | | | | 11.44 | | | | | 0.07 | | | | | (0.41 | ) | | | | (0.34 | ) | | | | - | | | | | (0.70 | ) | | | | (0.70 | ) | | | | 10.40 | | | | | (3.24 | ) | | | | 398,406 | | | | | 0.86 | | | | | 0.92 | | | | | 0.67 | | | | | 116 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

See accompanying Notes to Consolidated Financial Statements which are an integral part of the financial statements.

| | |

| 20 | | Invesco Balanced-Risk Allocation Fund |

Notes to Consolidated Financial Statements

October 31, 2022

NOTE 1–Significant Accounting Policies